Document

Exhibit 99.1

Serve Robotics Announces First Quarter 2025 Results

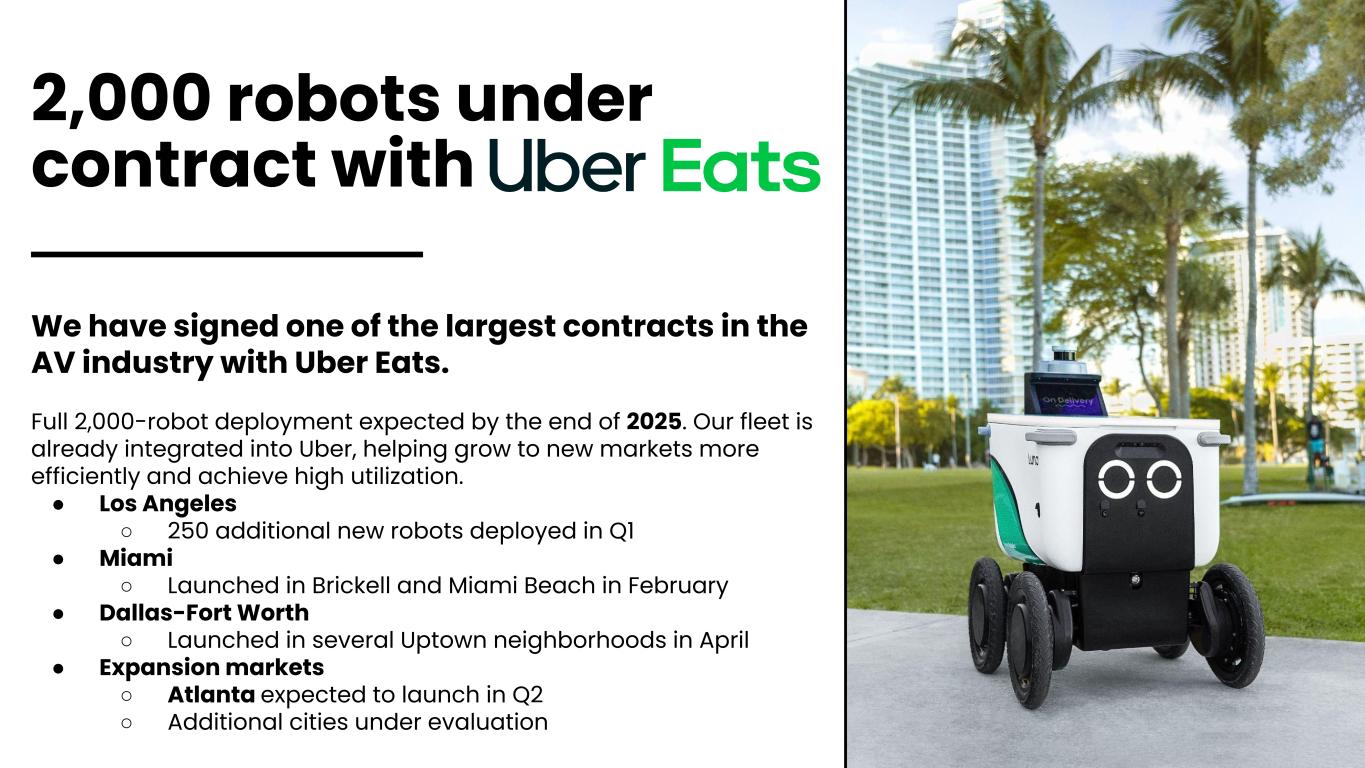

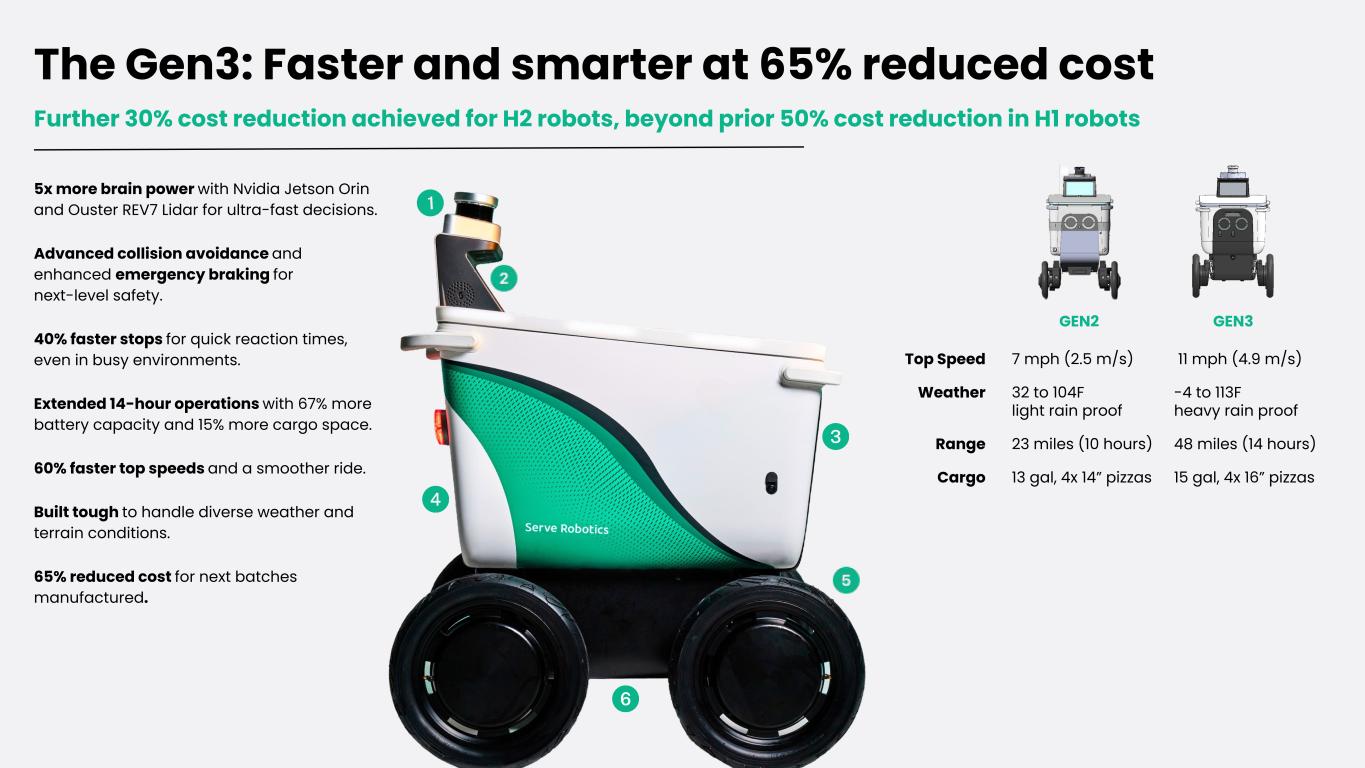

•Successfully built and deployed 250 new third-generation robots, enhancing operational scale and efficiency

•Continued geographic expansion into Miami and Dallas metros; Atlanta launch on track

•First quarter revenue of $440 thousand, a 150% increase versus Q4 2024

•Unlocking the value of Serve’s software and data platform; recurring revenue generation expected in Q2

•Strengthened balance sheet with $91.5 million in new capital, ending the quarter with a record $198 million cash position

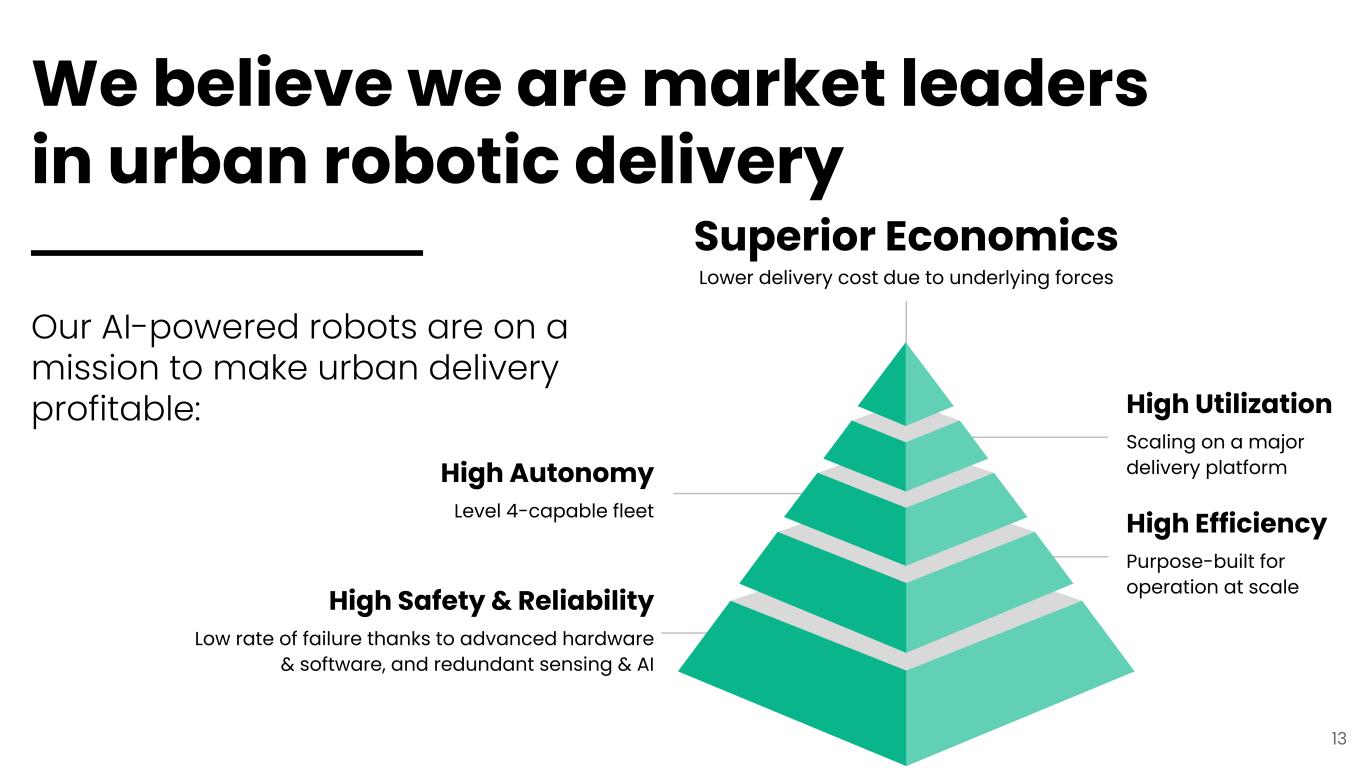

SAN FRANCISCO, May 08, 2025 -- Serve Robotics Inc. (the “Company” or “Serve”) (Nasdaq: SERV), a leading autonomous sidewalk delivery company, today announced financial results for the first quarter ended March 31, 2025.

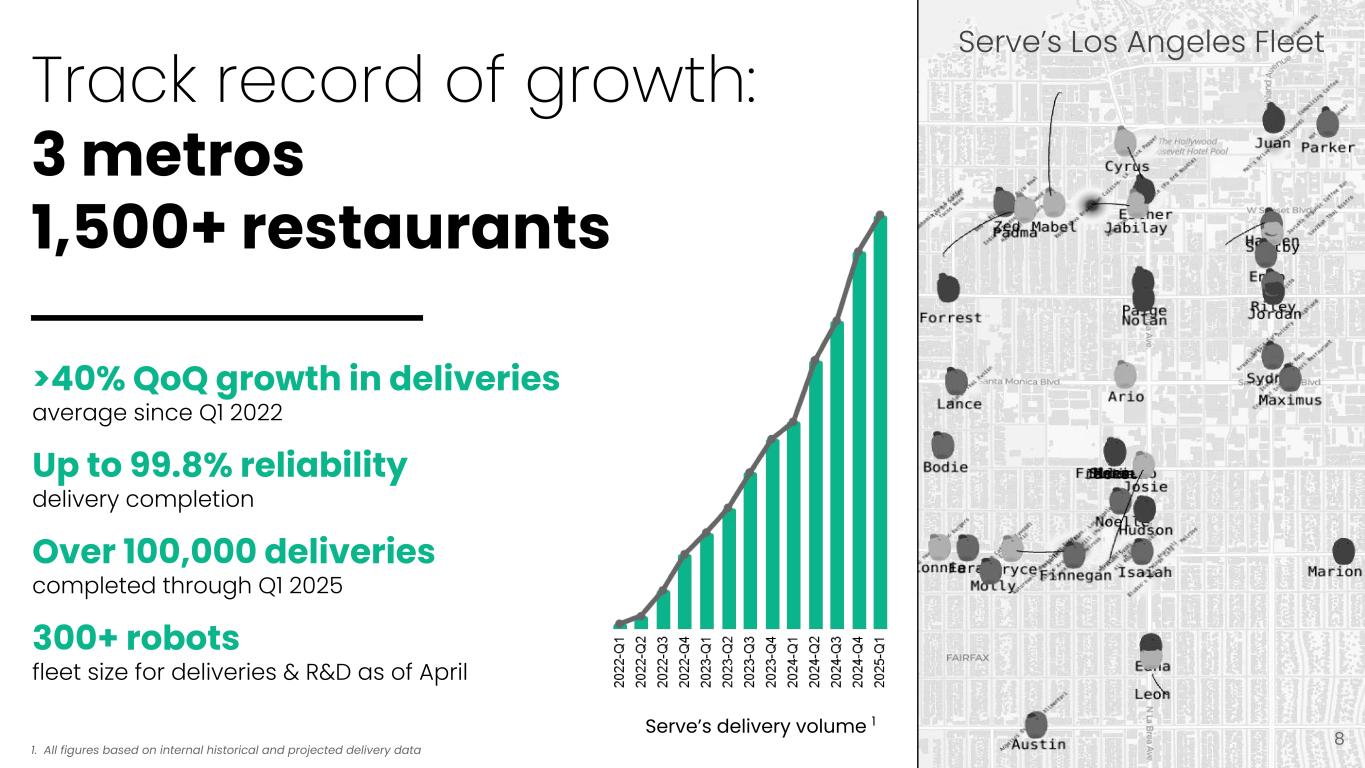

“We had a strong start to the year, meeting our key Q1 objectives—including the successful build of 250 new third-generation robots and the launch of new markets,” said Dr. Ali Kashani, Serve Robotics' Co-founder and CEO. “With this momentum, we remain on track to deploy 2,000 robots by year-end. Our ability to maintain high delivery quality while rapidly expanding delivery volume, geographic reach, and merchant partnerships reflects our team's relentless focus and execution.”

Business Highlights

•Continued Fleet Growth: Successfully built over 250 new third-generation robots by the end of Q1. Daily supply hours increased by over 40% compared to Q4 2024 as the new robots gradually deployed.

•Continued Volume Growth: During the first quarter, delivery volume increased over 75% between the first and last weeks of the quarter, driven by increased capacity and utilization. Growth achieved while maintaining high delivery quality and extending our track record of up to 99.8% average delivery completion.

•Expanded Reach: Launched two new metros since the start of the year, Miami and Dallas, and significantly expanded our footprint in the Los Angeles market. Currently serving over 320,000 households around the country, a 110% increase since December 2024.

•More Partners and Merchants: Expanded partnerships to a total of over 1,500 merchants today, which represents a 50% increase quarter-over-quarter and a 5x increase year-over-year.

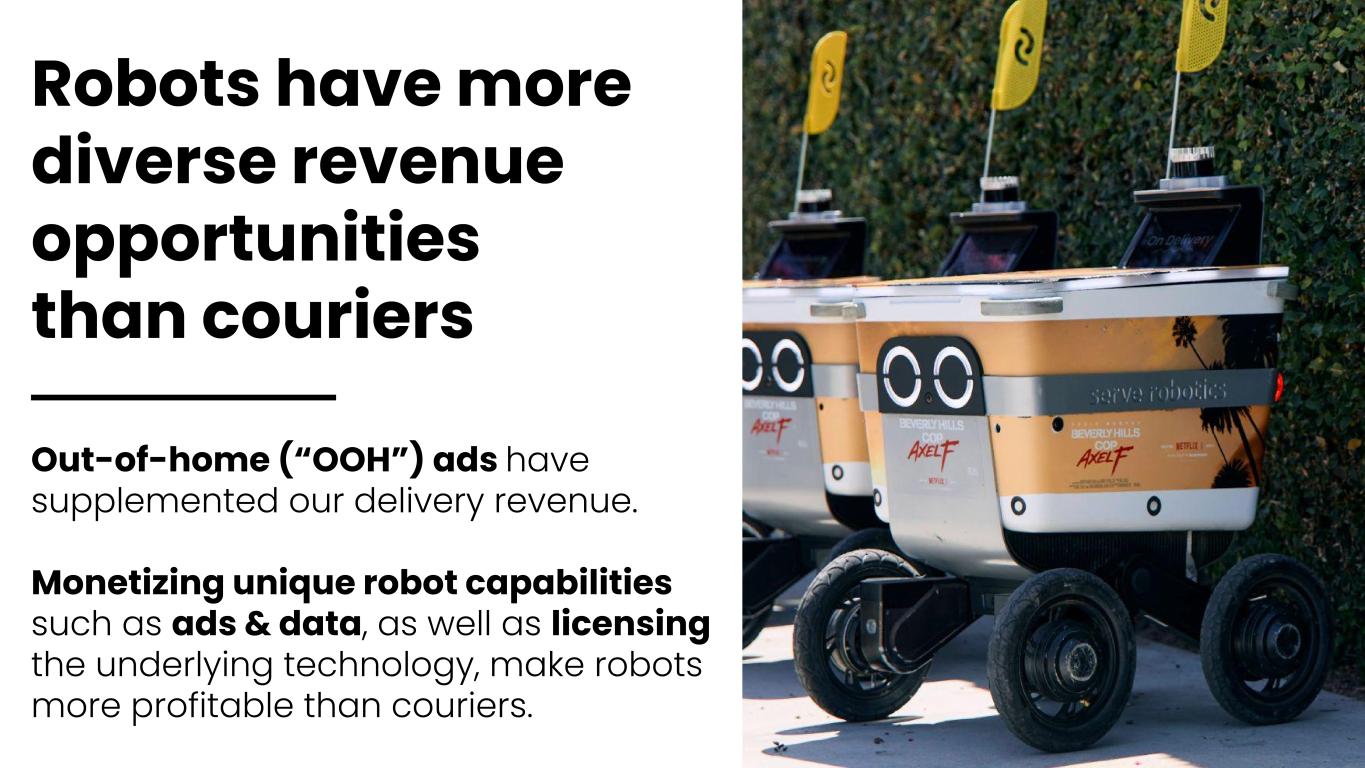

•Software and Data Platform: Formalized efforts to monetize Serve’s data and software platform, to be led by newly appointed VP, Scott Wagoner. Key new customers, including a top-tier European automaker and a middle-mile autonomous trucking company, expected to generate recurring software income to broaden our revenue streams.

Financial Highlights

•Revenue: Revenue for first quarter 2025 increased 150% on a sequential basis to $440 thousand. Beginning this quarter, we’ve consolidated Delivery and Branding Revenue under Fleet Revenues to better reflect monetization of our deployed fleet assets.

•Balance Sheet: Record cash position of $198 million as of March 31, 2025, providing runway through the end of 2026.

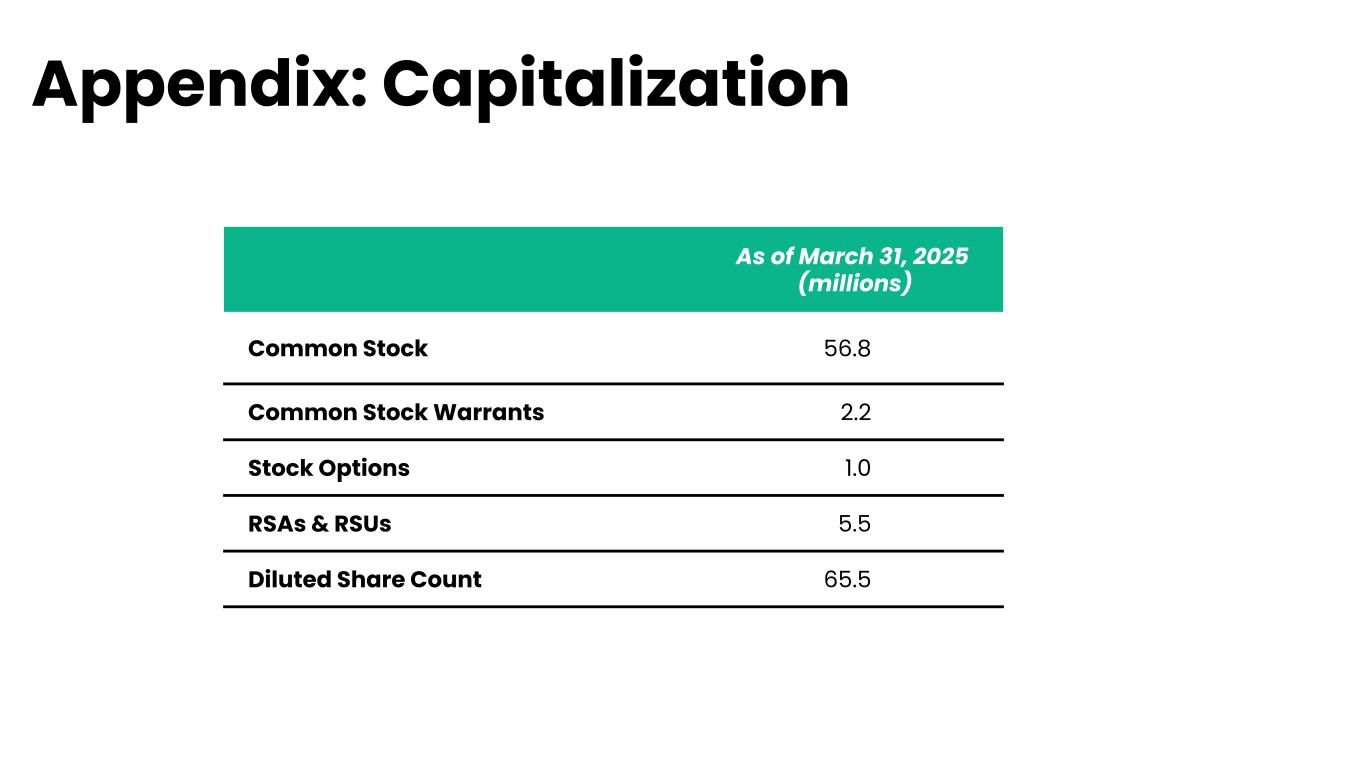

•Outstanding Shares: Approximately 57 million shares of common stock outstanding as of March 31, 2025.

Outlook

•Outlook unchanged: Serve continues to project an annualized revenue run-rate of $60-$80 million once the 2,000-robot fleet is fully deployed and reaches target utilization, anticipated during 2026.

•Fleet deployment acceleration anticipated in 2H: At least 700 reduced-cost third-generation robots expected to be built in Q3 and the remainder in Q4.

•Guidance for Q2: We are guiding to Q2 2025 total revenue in the range of $600 - $700 thousand, representing anticipated growth of approximately 35-60% quarter-over-quarter. This guidance includes estimated delivery volume growth of approximately 60-75% quarter-over-quarter.

Quarterly Conference Call

Company management will host a conference call and webcast today at 2:00 p.m. PT / 5:00 p.m. ET to discuss the financial results and provide a corporate update. A live webcast and replay can be accessed from the investor relations page of Serve Robotics’ website at investors.serverobotics.com.

Individuals interested in listening to the conference call may do so by dialing 646-307-1963 and referencing conference ID 2458762.

About Serve

Serve develops advanced, AI-powered, low-emissions sidewalk delivery robots that endeavor to make delivery sustainable and economical. Spun off from Uber in 2021 as an independent company, Serve has completed tens of thousands of deliveries for enterprise partners such as Uber Eats and 7-Eleven. Serve has scalable multi-year contracts, including a signed agreement to deploy up to 2,000 delivery robots on the Uber Eats platform across multiple U.S. markets.

For further information about Serve (Nasdaq: SERV), please visit www.serverobotics.com or follow us on social media via X (Twitter), Instagram, or LinkedIn @serverobotics.

Supplemental Financial Information

The key metrics and financial tables outlined below are metrics that provide management with additional understanding of the drivers of business performance and the Company’s ability to deliver stockholder return. Investors should not place undue reliance on these metrics as indicators of future or expected results. The Company’s presentation of these metrics may differ from similarly titled metrics presented by other companies and therefore comparability may be limited.

Table 1

Key Metrics

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

Daily Active Robots (1) |

73 |

|

57 |

|

39 |

Daily Supply Hours (2) |

648 |

|

455 |

|

300 |

(1)Daily Active Robots: The Company defines daily active robots as the average number of robots performing daily deliveries during the period.

(2)Daily Supply Hours: The Company defines daily supply hours as the average number of hours the Company’s robots are ready to accept offers and perform daily deliveries during the period.

Table 2

Disaggregation of Revenue

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

| Software services |

$ |

228,847 |

|

|

$ |

— |

|

|

$ |

851,101 |

|

| Fleet services |

211,618 |

|

|

175,842 |

|

|

95,610 |

|

|

$ |

440,465 |

|

|

$ |

175,842 |

|

|

$ |

946,711 |

|

Forward Looking Statements

This Serve Robotics Inc. press release contains “forward-looking statements,” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the context of the statement and generally arise when we or our management are discussing our beliefs, estimates or expectations. Such statements generally include the words “believes,” “plans,” “intends,” “targets,” “may,” “could,” “should,” “will,” “expects,” “estimates,” “suggests,” “anticipates,” “outlook,” “continues,” "guidance," or similar expressions. These statements are not historical facts or guarantees of future performance, but represent management’s belief at the time the statements were made regarding future events which are subject to certain risks, uncertainties and other factors, many of which are outside of our control. Actual results and outcomes may differ materially from what is expressed or forecast in such forward-looking statements. Forward-looking statements include, without limitation, statements regarding the Company’s partnership with Magna, timing of the Company’s robot deployment, the Company’s ability to expand to additional markets, capabilities of the Company’s robots, outcomes of planned acquisitions, and the Company’s timing and ability to scale to commercial production.

The forward-looking statements contained in this investor presentation are also subject to other risks and uncertainties, including those more fully described in our filings with the Securities and Exchange Commission (“SEC”), including in the sections entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations'' in our Annual Report on Form 10-K for the year ended December 31, 2024, and in the Company’s subsequent SEC filings.

The Company can give no assurance that the plans, intentions, expectations or strategies as reflected in or suggested by those forward-looking statements will be attained or achieved. The forward-looking statements in this presentation are based on information available to the Company as of the date hereof, and the Company disclaims any obligation to update any forward-looking statements, except as required by law. These forward-looking statements should not be relied upon as representing the Company’s views as of any date subsequent to the date of this presentation.

Non-GAAP Measures of Financial Performance

To supplement the company’s financial statements, which are presented on the basis of U.S. generally accepted accounting principles (GAAP), the following non-GAAP measures of financial performance are included in this release: non-GAAP cost of sales, non-GAAP general and administrative expense, non-GAAP research and development expense, non-GAAP operations expense, non-GAAP sales and marketing expense, non-GAAP operating expense, adjusted EBITDA, non-GAAP net loss and non-GAAP earnings per share.

The company believes that providing this non-GAAP information in addition to the GAAP financial information allows investors to view the financial results in the way the company views its operating results. The company also believes that providing this information allows investors to not only better understand the company's financial performance, but also, better evaluate the information used by management to evaluate and measure such performance.

As such, the company believes that disclosing non-GAAP financial measures to the readers of its financial statements provides the reader with useful supplemental information that allows for greater transparency in the review of the company’s financial and operational performance. The company defines its non-GAAP measures by excluding stock-based compensation.

Reconciliations of GAAP to these adjusted non-GAAP financial measures are included in the tables presented. When analyzing the company's operating results, investors should not consider non-GAAP measures as substitutes for the comparable financial measures prepared in accordance with GAAP.

To the extent that the company presents any forward-looking non-GAAP financial measures, the company does not present a quantitative reconciliation of such measures to the most directly comparable GAAP financial measure (or otherwise present such forward-looking GAAP measures) because it is impractical to do so.

Contacts

Media

Aduke Thelwell

Head of Communications & Investor Relations

Serve Robotics

aduke.thelwell@serverobotics.com

347-464-8510

Investor Relations

investor.relations@serverobotics.com

Table 3

Serve Robotics Inc.

Condensed Consolidated Balance Sheets

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2025 |

|

December 31,

2024 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash |

$ |

197,758,836 |

|

|

$ |

123,266,437 |

|

| Accounts receivable |

381,455 |

|

|

86,805 |

|

| Inventory |

— |

|

|

309,711 |

|

| Prepaid expenses |

1,112,309 |

|

|

1,396,874 |

|

| Other receivables |

717,714 |

|

|

191,643 |

|

| Total current assets |

199,970,314 |

|

|

125,251,470 |

|

| Property and equipment, net |

14,279,402 |

|

|

11,963,461 |

|

| Operating lease right-of-use assets |

1,927,493 |

|

|

1,807,705 |

|

| Other non-current assets |

417,407 |

|

|

578,237 |

|

| Total assets |

$ |

216,594,616 |

|

|

$ |

139,600,873 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY (DEFICIT) |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

3,654,931 |

|

|

$ |

4,901,665 |

|

| Accrued liabilities |

890,294 |

|

|

654,466 |

|

| Deferred revenue |

— |

|

|

20,097 |

|

| Operating lease liabilities, current |

712,562 |

|

|

666,136 |

|

| Financing lease liabilities, current |

— |

|

|

564,383 |

|

| Total current liabilities |

5,257,787 |

|

|

6,806,747 |

|

| Operating lease liabilities, non-current |

1,173,161 |

|

|

1,113,212 |

|

| Total liabilities |

6,430,948 |

|

|

7,919,959 |

|

|

|

|

|

| Stockholders’ equity (deficit): |

|

|

|

| Ordinary and preferred shares |

5,682 |

|

|

5,127 |

|

| Additional paid-in capital |

330,899,711 |

|

|

239,201,220 |

|

| Subscription receivable |

— |

|

|

|

| Accumulated deficit |

(120,741,725) |

|

|

(107,525,433) |

|

| Total stockholders’ equity (deficit) |

210,163,668 |

|

|

131,680,914 |

|

| Total liabilities and stockholders’ equity (deficit) |

$ |

216,594,616 |

|

|

$ |

139,600,873 |

|

Table 4

Serve Robotics Inc.

Condensed Consolidated Statement of Operations

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

| Revenues |

$ |

440,465 |

|

|

$ |

175,842 |

|

|

$ |

946,711 |

|

| Cost of revenues |

1,908,773 |

|

|

831,884 |

|

|

352,438 |

|

| Gross profit (loss) |

(1,468,308) |

|

|

(656,042) |

|

|

594,273 |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

| General and administrative |

4,749,952 |

|

|

5,231,433 |

|

|

1,008,071 |

|

| Operations |

1,667,641 |

|

|

959,244 |

|

|

540,974 |

|

| Research and development |

6,879,851 |

|

|

6,820,691 |

|

|

6,638,441 |

|

| Sales and marketing |

238,933 |

|

|

(90,675) |

|

|

118,236 |

|

| Total operating expenses |

13,536,377 |

|

|

12,920,693 |

|

|

8,305,722 |

|

|

|

|

|

|

|

| Loss from operations |

(15,004,685) |

|

|

(13,576,735) |

|

|

(7,711,449) |

|

|

|

|

|

|

|

| Interest income |

1,791,796 |

|

|

490,096 |

|

|

9,994 |

|

| Interest expense |

(3,403) |

|

|

(32,856) |

|

|

(1,336,516) |

|

| Total other income (expense) |

1,788,393 |

|

|

457,240 |

|

|

(1,326,522) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Provision for income taxes |

- |

|

|

- |

|

|

- |

|

| Net loss |

$ |

(13,216,292) |

|

|

$ |

(13,119,495) |

|

|

$ |

(9,037,971) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding - basic and diluted |

56,319,299 |

|

36,658,834 |

|

|

24,556,343 |

| Net loss per common share - basic and diluted |

$ |

(0.23) |

|

|

$ |

(0.36) |

|

|

$ |

(0.37) |

|

Table 5

Table 5

Serve Robotics Inc.

Condensed Consolidated Statement of Cash Flows

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

2025 |

|

2024 |

| Cash flows from operating activities: |

|

|

|

| Net loss |

$ |

(13,216,292) |

|

|

$ |

(9,037,971) |

|

| Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

| Depreciation |

474,632 |

|

|

17,923 |

|

| Stock-based compensation |

3,879,367 |

|

|

4,255,432 |

|

| Amortization of debt discount |

- |

|

|

1,212,836 |

|

| Interest on recourse loan |

- |

|

|

3,987 |

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable |

(294,650) |

|

|

(263,075) |

|

| Inventory |

- |

|

|

37,814 |

|

| Prepaid expenses |

284,565 |

|

|

47,359 |

|

Other receivables |

(526,071) |

|

|

- |

|

| Accounts payable |

(266,683) |

|

|

(325,541) |

|

| Accrued liabilities |

235,828 |

|

|

(82,168) |

|

Deferred revenue |

(20,097) |

|

|

68,899 |

|

Operating lease liabilities, net |

(13,413) |

|

|

(13,875) |

|

| Net cash used in operating activities |

(9,462,814) |

|

|

(4,078,380) |

|

| Cash flows from investing activities: |

|

|

|

| Purchase of property and equipment |

(3,460,913) |

|

|

(3,340) |

|

| Other non-current assets |

160,830 |

|

|

- |

|

| Net cash used in investing activities |

(3,300,083) |

|

|

(3,340) |

|

| Cash flows from financing activities: |

|

|

|

| Proceeds from issuance of common stock common stock pursuant to securities purchase, net of offering costs |

75,846,941 |

|

|

- |

|

| Proceeds from short-swing profit disgorgement |

47,970 |

|

|

- |

|

Proceeds from exercise of warrants |

11,787,204 |

|

|

5,832 |

|

Proceeds from convertible notes payable, net of offering costs |

- |

|

|

4,844,625 |

|

Proceeds from exercise of options |

137,564 |

|

|

- |

|

Repayments of note payable |

- |

|

|

(250,000) |

|

Repayments of notes payable, related party |

- |

|

|

(70,000) |

|

Repayment of financing lease liability |

(564,383) |

|

|

(28,011) |

|

| Net cash provided by financing activities |

87,255,296 |

|

|

4,502,446 |

|

| Net change in cash and cash equivalents |

$ |

74,492,399 |

|

|

$ |

420,726 |

|

| Cash and cash equivalents at beginning of period |

$ |

123,266,437 |

|

|

$ |

6,756 |

|

| Cash and cash equivalents at end of period |

$ |

197,758,836 |

|

|

$ |

427,482 |

|

Table 6

Reconciliation of GAAP Net Losses to Adjusted EBITDA

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

| Net loss on GAAP basis |

(13,216,292) |

|

|

(13,119,495) |

|

|

(7,063,386) |

|

| Interest income |

1,791,796 |

|

|

490,096 |

|

|

9,994 |

|

|

|

|

|

|

|

| Interest expense |

(3,403) |

|

|

(32,856) |

|

|

(1,336,516) |

|

| Depreciation |

474,632 |

|

|

273,152 |

|

|

17,923 |

|

| Stock-based compensation |

3,879,367 |

|

|

4,624,446 |

|

|

4,255,432 |

|

| Adjusted EBITDA |

(7,073,900) |

|

|

(7,764,657) |

|

|

(4,116,553) |

|

Table 7

Reconciliation of GAAP Measures to Non-GAAP Measures

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

March 31, 2025 |

|

December 31, 2024 |

|

March 31, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| GAAP general & administrative expense |

$ |

4,749,952 |

|

|

$ |

5,231,433 |

|

|

$ |

1,008,071 |

|

| Stock-based compensation |

1,824,199 |

|

|

2,217,477 |

|

|

6,596 |

|

| Non-GAAP general and administrative expense |

2,925,753 |

|

|

3,013,956 |

|

|

1,001,475 |

|

|

|

|

|

|

|

| GAAP operations expense |

$ |

1,667,641 |

|

|

$ |

959,244 |

|

|

$ |

540,974 |

|

| Stock-based compensation |

80,496 |

|

|

(45,153) |

|

|

6,511 |

|

|

|

|

|

|

|

| Non-GAAP operations expense |

1,397,883 |

|

|

1,004,397 |

|

|

534,463 |

|

|

|

|

|

|

|

| GAAP research and development expense |

$ |

6,879,851 |

|

|

$ |

6,820,691 |

|

|

$ |

6,638,441 |

|

| Stock-based compensation |

1,928,181 |

|

|

2,445,589 |

|

|

4,239,748 |

|

| Non-GAAP research and development expense |

4,951,670 |

|

|

4,375,102 |

|

|

2,398,693 |

|

|

|

|

|

|

|

| GAAP sales and marketing expense |

$ |

238,933 |

|

|

$ |

(90,675) |

|

|

$ |

118,236 |

|

| Stock-based compensation |

46,491 |

|

|

6,533 |

|

|

2,577 |

|

| Non-GAAP sales and marketing expense |

192,442 |

|

|

(97,208) |

|

|

115,659 |

|

|

|

|

|

|

|

| GAAP operating expense |

$ |

13,536,377 |

|

|

$ |

12,920,693 |

|

|

$ |

8,305,722 |

|

| Stock-based compensation |

3,879,367 |

|

|

4,624,446 |

|

|

4,255,432 |

|

|

|

|

|

|

|

| Non-GAAP operating expenses |

9,467,748 |

|

|

8,296,247 |

|

|

4,050,290 |

|

|

|

|

|

|

|

| GAAP net loss |

$ |

(13,216,292) |

|

|

$ |

(13,119,495) |

|

|

$ |

(9,037,971) |

|

| Stock-based compensation |

3,879,367 |

|

|

4,624,446 |

|

|

4,255,432 |

|

|

|

|

|

|

|

| Non-GAAP net loss |

(9,147,663) |

|

|

(8,495,049) |

|

|

(4,782,539) |

|

|

|

|

|

|

|

| Weighted average common shares outstanding - basic and diluted |

56,319,299 |

|

|

36,658,834 |

|

|

24,556,343 |

|

GAAP basic and diluted net loss per

Common share |

$ |

(0.23) |

|

|

$ |

(0.36) |

|

|

$ |

(0.37) |

|

Non-GAAP basic and diluted net loss per

Common share |

$ |

(0.16) |

|

|

$ |

(0.23) |

|

|

$ |

(0.19) |

|