Sable Offshore Corp. Investor Presentation November 2025

2 FORWARD LOOKING STATEMENTS The information in this presentation includes “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this presentation, the words “could,” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” “continue,” “plan,” “forecast,” “predict,” “potential,” “future,” “outlook,” and “target,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements will contain such identifying words. These statements are based on the current beliefs and expectations of Sable’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those described in the forward-looking statements. Factors that could cause Sable’s actual results to differ materially from those described in the forward-looking statements include: the ability to recommence production of the Santa Ynez Unit assets including the implementation of an offshore storage and treating vessel (“OS&T”) strategy, bringing oil to market, and the cost and time required therefor, and production levels once recommenced; availability of future financing; our financial performance, including liquidity estimates; production levels once recommenced; commodity price volatility; low prices for oil and/or natural gas; global economic conditions and inflation; increased operating costs; lack of availability of drilling and production equipment, supplies, services and qualified personnel; processing volumes and pipeline throughput; geographical concentration of operations; environmental and weather risks; regulatory changes and uncertainties; the uncertainty inherent in estimating oil and natural gas resources and in projecting future rates of production; reductions in cash flow and lack of access to capital; restrictions in existing or future debt agreements or structured or other financing arrangements; managing growth and integration of acquisitions, and failure to realize the expected value of acquisitions; the ability to recognize the anticipated benefits of the business combination; developments relating to our competitors and our industry; litigation, complaints and/or adverse publicity; privacy and data protection laws, privacy or data breaches, or loss of data; our ability to comply with laws and regulations applicable to our business; and other one-time events and other factors that can be found in Sable’s Annual Report on Form 10-K for the year ended December 31, 2024, and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are filed with the Securities and Exchange Commission and are available on Sable’s website (www.sableoffshore.com) and on the Securities and Exchange Commission’s website (www.sec.gov). Except as required by applicable law, Sable undertakes no obligation to publicly release the result of any revisions to these forward-looking statements to reflect the impact of events or circumstances that may arise after the date of this presentation. DISCLAIMER The Santa Ynez Unit assets discussed in this presentation restarted production in May 2025 and have not sold commercial quantities of hydrocarbons since such Santa Ynez Unit assets were shut in during June of 2015 when the only Onshore Pipeline transporting hydrocarbons produced from such Santa Ynez Unit assets to market ceased transportation. Since the May 2025 production restart, the oil produced has been transported via pipeline to storage tanks onshore at Sable’s Las Flores Canyon processing facility where it is being stored pending resumption of petroleum transportation through the Onshore Pipeline. There can be no assurance that the necessary approvals will be obtained that would allow the Onshore Pipeline to recommence transportation or the contemplated use of an Offshore Storage and Treating Vessel that would allow the Santa Ynez Unit assets to recommence sales. OIL AND GAS RESOURCE INFORMATION This presentation includes information regarding estimates of oil and natural gas resources attributable to the Santa Ynez Unit. None of the oil and gas resources attributable to the Santa Ynez Unit are currently classifiable as proved or other reserves because, since the cessation of operations on the pipeline transporting production from the assets, there has been no means to deliver production from the assets to market. Sable has obtained a report (the “NSAI Report”) from Netherland, Sewell & Associates, Inc. (“NSAI”), independent petroleum consultants, with respect to the net estimated contingent resources attributable to the acquired assets and the related pre-tax discounted (at 10%) future net contingent cash flow from such contingent resources, as of December 31, 2021, based on 12-month unweighted arithmetic average of the first-day-of-the-month prices for each month in the period from January to December 2021. As defined by the Society of Petroleum Engineers and used in the NSAI Report, “contingent resources” are those quantities of petroleum which are estimated, on a given date, to be potentially recoverable from known accumulations, but which are not currently considered to be commercially recoverable. Contingent resource estimates may be characterized further as 1C (low estimate), 2C (best estimate) and 3C (high estimate). The contingent resources reflected in the NSAI Report are, as stated in the report, category 1C (low estimate). The NSAI Report states that the estimates included in the report are contingent on (1) approval from federal, state and local regulators to restart production, (2) reestablishment of oil transportation systems to deliver production to market, and (3) commitment to restart the wells and facilities. The NSAI Report states that, if these contingencies are successfully addressed, some portion of the contingent resources estimated in the report may be reclassified as reserves but notes that the estimates have not been risked to account for the possibility that the contingencies are not successfully addressed. The NSAI Report does not address (1) the portion of the contingent resources that could be reclassified as reserves if the contingencies are successfully addressed or (2) whether or to what extent any of the contingent resources that could be so reclassified would be classified as proved, probable or possible reserves. As defined in the Society of Petroleum Engineers’ Petroleum Resources Management System (“PRMS”), "best estimate" is the most realistic assessment of recoverable quantities if only a single result were reported. There is at least a 50% probability that the quantities actually recovered will equal or exceed the “best estimate.” As defined in the PRMS, "low estimate" is a conservative estimate of the quantity that will actually be recovered from the accumulation by a project. There is at least a 90% probability that the quantities actually recovered will equal or exceed the “low estimate.” The resource estimates and related future cash flow information included in this presentation reflect management's estimates, based in part on the contingent resources estimated in the NSAI Report and supplemented by management's own estimates of contingent resources attributable to the acquired assets and using the pricing and other assumptions noted in this presentation, of the contingent resources and cash flow that may have been attributable to the acquired assets if the contingencies had been addressed successfully on the date as of which the information is presented. Resource engineering is a process of estimating underground accumulations of hydrocarbons that cannot be measured in an exact way. The accuracy of any resource or reserve estimate depends on the quality of available data, the interpretation of such data, and price and cost assumptions made by reserve engineers. In addition, the results of drilling, testing, and production activities may justify revisions of estimates that were made previously. If significant, such revisions could impact the combined company’s strategy and change the schedule of any production and development drilling. Accordingly, resource estimates may differ significantly from the quantities of oil and natural gas that are ultimately recovered. USE OF PROJECTIONS AND ESTIMATES This presentation contains financial projections and estimates for Sable, including with respect to its future capital expenditures, initial timing and production estimates and future cash costs. Sable’s auditors have not audited, reviewed, compiled or performed any procedures with respect to the projections and estimates for the purpose of their inclusion in this presentation, and, accordingly, no such auditors have expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this presentation. These projections and estimates are for illustrative purposes only and should not be relied upon as being necessarily indicative of future results. The assumptions and estimates underlying the projected information are inherently uncertain and are subject to a wide variety of significant business, regulatory, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projected information. Even if the assumptions and estimates are correct, projections and estimates are inherently uncertain due to a number of factors outside Sable’s control. Accordingly, there can be no assurance that the projected results are indicative of Sable’s future performance or that actual results will not differ materially from those presented in the projected information. Inclusion of the projected information in this presentation should not be regarded as a representation by any person, including, without limitation, Sable, that the results contained in the projected information will be achieved. Disclaimer

3 Premier offshore California asset paired with experienced management team Sable Offshore Corp. (NYSE: SOC) Santa Ynez Unit Las Flores Canyon Processing Facility Santa Ynez Unit (“SYU”) is a massive oil-weighted resource Three offshore platforms located in federal waters north of Santa Barbara, California Wholly owned onshore production treatment facilities Discovered in 1968 with significant production history. SYU produced 45,000 boe/d rate at shut-in in 2015 Production restarted on May 15, 2025 with significantly improved well tests compared to those at shut-in(1) >100 identified infill drilling and step-out opportunities, along with workovers and ESP(2) installation on existing wellbores High Quality Asset Sable management are well-qualified to operate Santa Ynez Exemplary track record of operating safely in California and offshore(3) Demonstrated expertise via numerous awards from state and federal agencies Sable is actively pursuing two options to extract value from SYU, including purchasing an Offshore Storage and Treating Vessel (“OS&T”) Highly- Qualified Stewards of the Asset (1) SYU-produced oil is being held in the Company’s storage tanks at LFC. Sable is evaluating and pursuing the purchase of an Offshore Storage and Treating vessel to process oil and gas production. Alternatively, Sable awaits final approval to resume petroleum transportation through the Las Flores Pipeline System as outlined in the Consent Decree. Initial restart of production is higher than expected sustained production and there is uncertainty regarding the amount and timing of production decline from recently opened wells. (2) Electric Submersible Pump. (3) While at Plains Exploration & Production, current Sable management team operated platforms included Irene at Point Pedernales and Hidalgo, Harvest and Hermosa at Point Arguello.

4 SYU History Premier offshore project developed by Exxon over 40+ years Discovered in 1968, over the course of 14 years Exxon consolidated more than a dozen offshore federal oil leases into a streamlined production unit known as SYU ─ SYU construction began in 1976 with Platform Hondo, with first production in 1981, followed by Platform Harmony and Platform Heritage (both online in 1994); both Harmony and Heritage have dedicated rigs for future development. Production was initially processed in federal waters in an OS&T from 1981 to 1994. ─ SYU includes 112 wells (90 producers, 12 injectors, 10 idle); sizable inventory of infill drilling and additional step-out drilling opportunities(1) ─ Platforms located 5 to 9 miles offshore Santa Barbara County in shallow water depths of 900-1,200’(2) SYU Development Background Wholly owned onshore oil and natural gas processing facility at Las Flores Canyon (not visible from highway) Shut in from June 2015 to May 2025 due to pipeline issue (Plains All- American Pipeline (“AAPL”) operated) ─ Production at all Exxon platforms and facilities was safely suspended. SYU was placed into a preserved state with regular inspections and maintenance ─ AAPL received Consent Decree and began work to resume petroleum transportation ─ Exxon acquired pipeline from AAPL Sable restarted production at SYU Platform Harmony in May 2025 and began flowing production to Las Flores Canyon(3) Sable is evaluating and pursuing an OS&T as an offtake alternative to LFC (1) Sable management have identified >100 infill drilling and step-out opportunities. (2) Primary Reservoir: Miocene Monterey formation (Sour low-gravity oil (4-26 API); Secondary Reservoirs: Oligocene and Eocene oil/gas sandstone (Sweet high-gravity oil (35 API). (3) SYU-produced oil is being held in the Company’s storage tanks at LFC while Sable awaits regulatory approvals to resume petroleum transportation through the Las Flores Pipeline System as outlined in the Consent Decree. Alternatively, Sable is evaluating and pursuing installing Offshore Storage & Treating vessel to process oil and gas production.

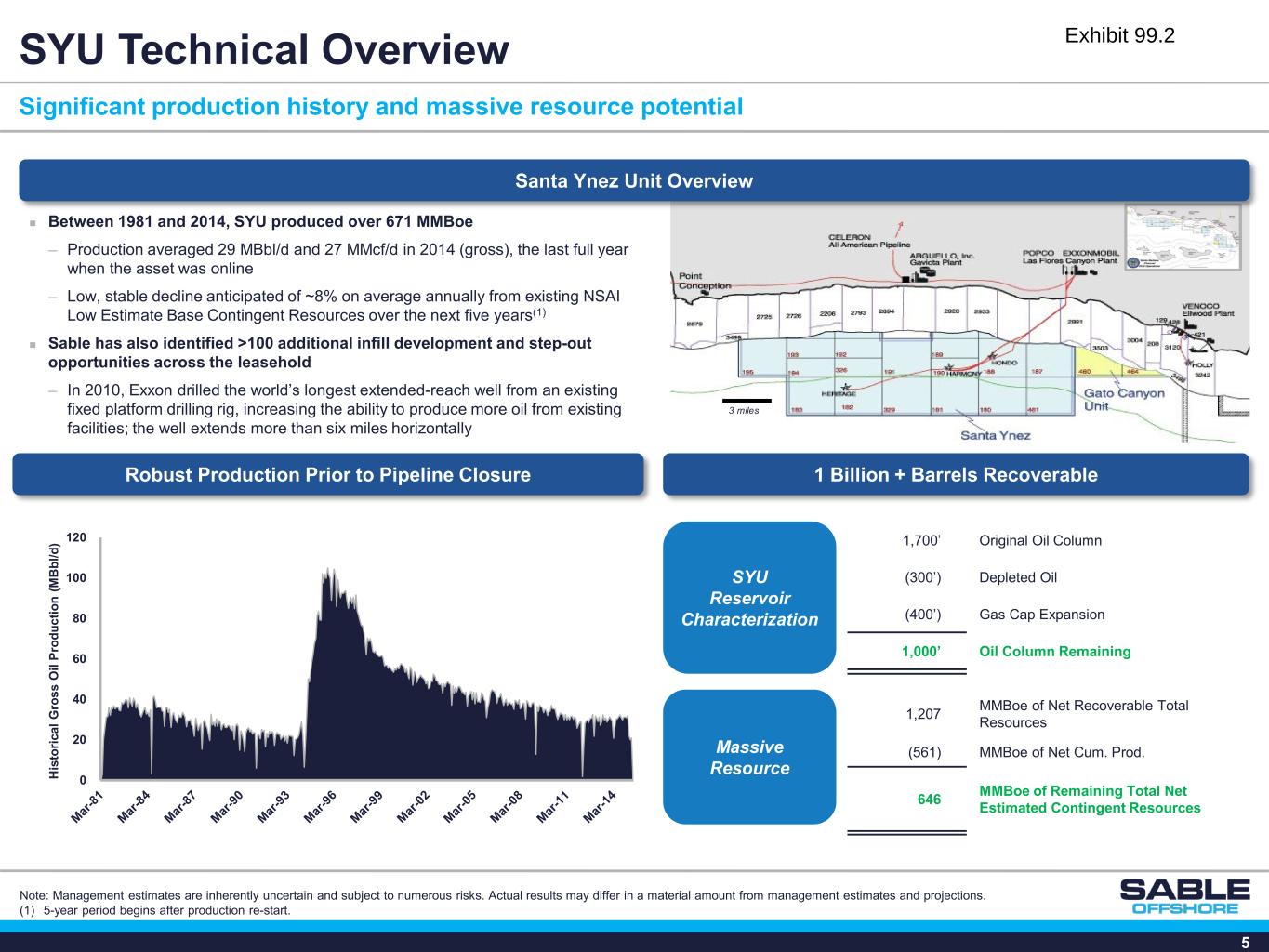

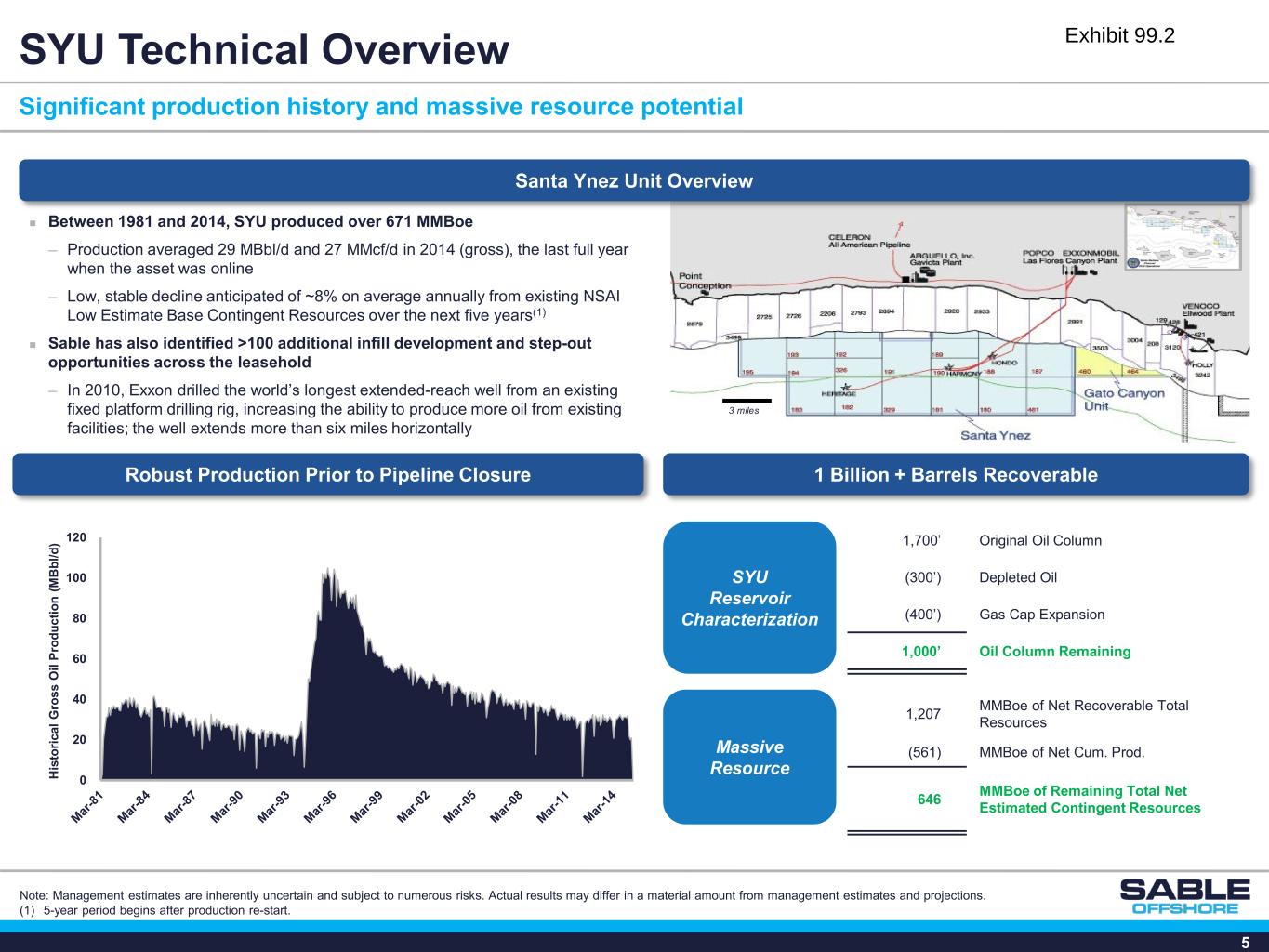

5 3 miles Santa Ynez Unit Overview SYU Technical Overview Significant production history and massive resource potential SYU Reservoir Characterization Massive Resource 1,700’ Original Oil Column (300’) Depleted Oil (400’) Gas Cap Expansion 1,000’ Oil Column Remaining 1,207 MMBoe of Net Recoverable Total Resources (561) MMBoe of Net Cum. Prod. 646 MMBoe of Remaining Total Net Estimated Contingent Resources Robust Production Prior to Pipeline Closure Between 1981 and 2014, SYU produced over 671 MMBoe ─ Production averaged 29 MBbl/d and 27 MMcf/d in 2014 (gross), the last full year when the asset was online ─ Low, stable decline anticipated of ~8% on average annually from existing NSAI Low Estimate Base Contingent Resources over the next five years(1) Sable has also identified >100 additional infill development and step-out opportunities across the leasehold ─ In 2010, Exxon drilled the world’s longest extended-reach well from an existing fixed platform drilling rig, increasing the ability to produce more oil from existing facilities; the well extends more than six miles horizontally 1 Billion + Barrels Recoverable 0 20 40 60 80 100 120 H is to ric al G ro ss O il Pr od uc tio n (M B bl /d ) Note: Management estimates are inherently uncertain and subject to numerous risks. Actual results may differ in a material amount from management estimates and projections. (1) 5-year period begins after production re-start.

6 Note: Line 324 and Line 325 were formerly known as Line 901 and Line 903, respectively. Santa Ynez Unit Overview SYU Acreage Overview SYU leases are all located in Federal waters Offshore Position ─ 16 Federal Leases, ~76,000 acres ─ First leased in 1969 ─ Product marketed through OS&T from 1981 – 1994 Santa Ynez Unit Agreement ─ Effective date: November 12, 1970 ─ Unit blocks: OCS-P 180, 181, 182, 183, 187, 188, 189, 190, 191, 192, 193, 194, 195, 326, 329, 461 ─ Sable operated, 100% WI, 83.6% NRI ─ Annual lease extensions granted by the Bureau of Safety and Environmental Enforcement and authorized well re-work during shut-in; supported by quarterly updates Onshore Position ─ ~1,480 surface acres, facilities occupy ~35 acres ─ Facilities 100% Sable owned Line 325: Permitted, Upgrades / Repairs Construction Completed (113 miles) Capitan Sable Offshore Las Flores Canyon Plant Los Angeles Refineries Bakersfield San Francisco Refineries Las Cruces Gaviota SLA Boundary State Waters Harmony Hondo Santa Ynez Unit Heritage Line 324: Permitted, Upgrades / Repairs Construction Completed (10.8 miles)

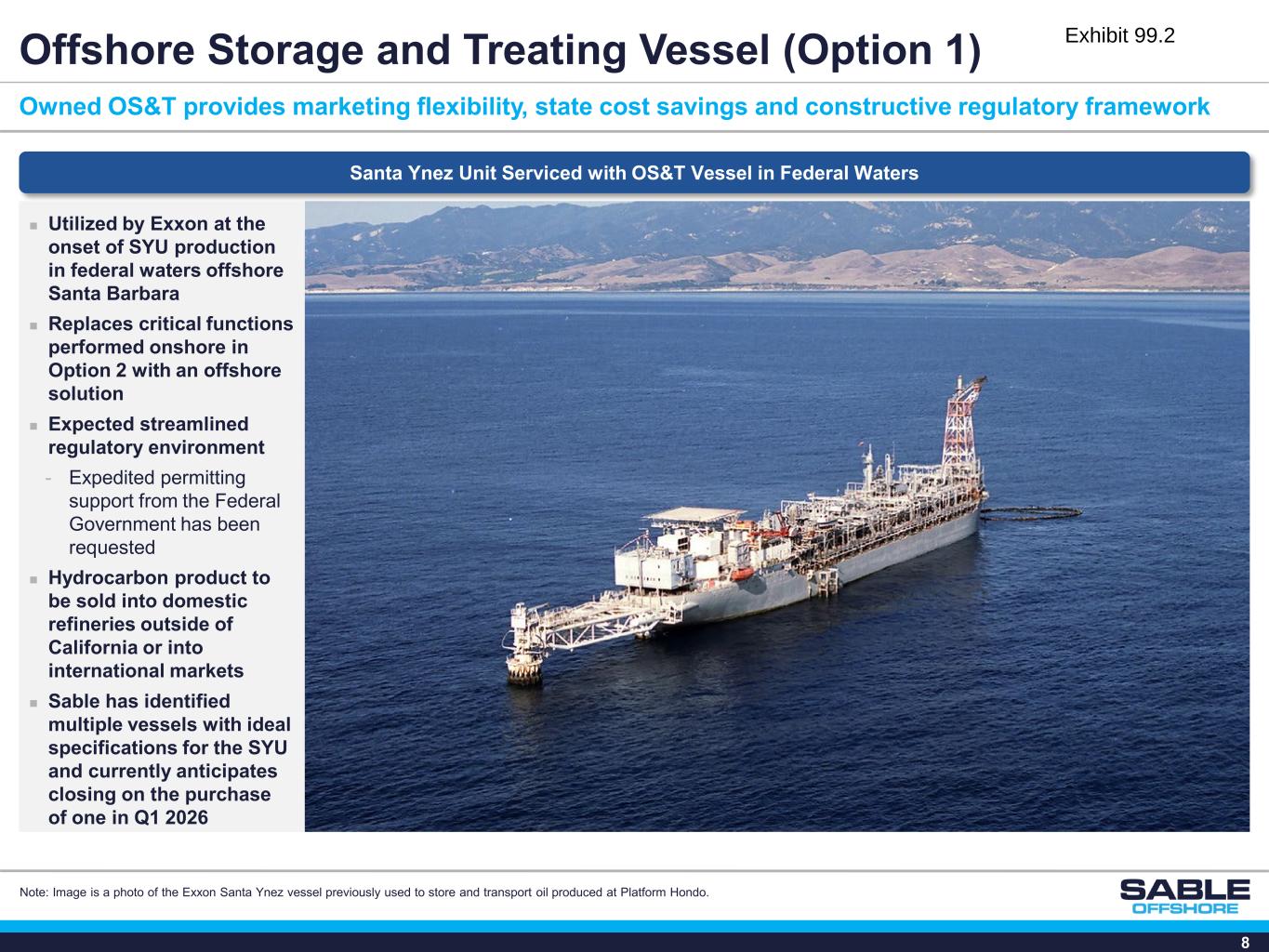

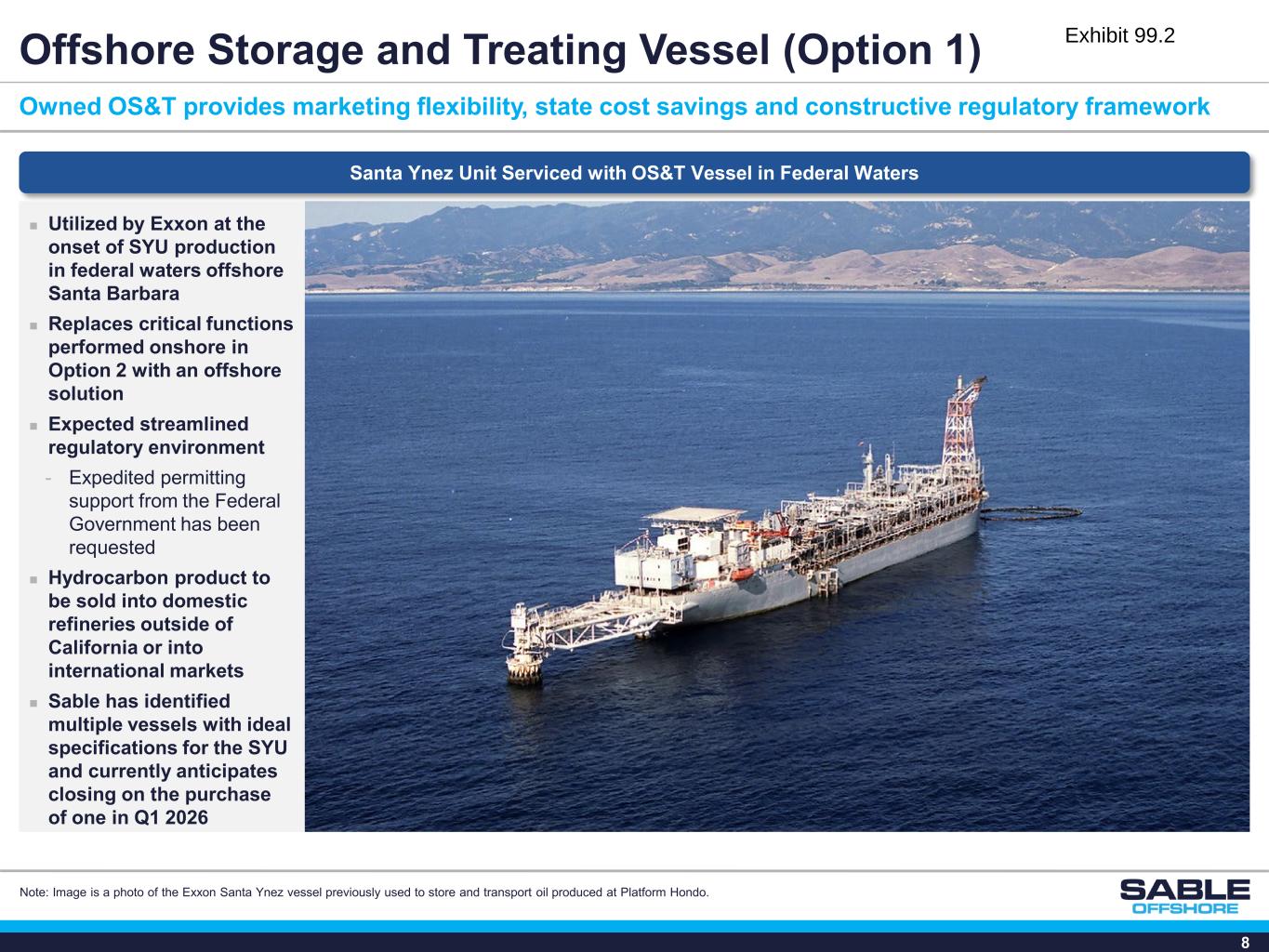

7 (1) Management estimates are inherently uncertain and subject to numerous risks. Actual results may differ in a material amount from management estimates and projections. Proposed development plan is based on market conditions and subject to annual Board approval. Note: Top image is a photo of the Exxon Santa Ynez vessel used to store and transport oil produced at Platform Hondo. Bottom image is a photo of Sable’s Las Flores Canyon onshore facility. SYU Offtake Options First sales estimate: Q4 2026 Utilizes offtake method from 1981-1994 ‒ Expedited permitting support from the Federal Government has been requested ‒ No state income taxes or production taxes payable to state or local jurisdictions ‒ Barrels not tied to California refinery pricing dynamics and can be marketed domestically outside of California or internationally to the highest bidder Sable is targeting purchasing an identified OS&T vessel by Q1 2026. Sable estimates that the total capital required to pursue an OS&T strategy, assuming the purchase of a vessel, and vessel and platform upgrades and installation, is approximately $450 million(1). Sable is working with the federal government, including BOEM, and on 10/9/2025, updated its Development and Production Plan to utilize an OS&T, and has requested an expedited clearance process Option 1: Owned Offshore Storage & Treating Vessel (2) Sable is actively evaluating and pursuing an OS&T vessel to extract value from the SYU First sales estimate: Q4 2025, subject to receipt of necessary approvals ‒ Utilizes processing and offtake method from 1994-2015 ‒ Leverages existing onshore infrastructure, including Las Flores Canyon Facility and Las Flores Pipeline System ‒ Barrels tied to California refinery system via Lines 324 and 325 ‒ Potential to immediately increase California domestic crude supply by approximately 15% Participates in Santa Barbara’s local, county, and state communities as a key stakeholder ‒ State income taxes, production taxes, and ad valorem taxes payable to state or local jurisdictions ‒ Prior operator was historically the largest taxpayer in Santa Barbara County ‒ Provides significant employment to California citizens with commitment to the local community ‒ Takes advantage of substantial capital investment and Best Available Technology for pipeline safety in California Option 2: Las Flores Canyon and Pipeline System

8 Santa Ynez Unit Serviced with OS&T Vessel in Federal Waters Offshore Storage and Treating Vessel (Option 1) Owned OS&T provides marketing flexibility, state cost savings and constructive regulatory framework Utilized by Exxon at the onset of SYU production in federal waters offshore Santa Barbara Replaces critical functions performed onshore in Option 2 with an offshore solution Expected streamlined regulatory environment - Expedited permitting support from the Federal Government has been requested Hydrocarbon product to be sold into domestic refineries outside of California or into international markets Sable has identified multiple vessels with ideal specifications for the SYU and currently anticipates closing on the purchase of one in Q1 2026 Note: Image is a photo of the Exxon Santa Ynez vessel previously used to store and transport oil produced at Platform Hondo.

9 Technical opportunity inventory is based on 80-acre drainage area, maturing field from original 120 acre spacing Future development strategy focuses on the high-quality Monterey Upper Siliceous reservoir in areas that have undergone increased diagenesis which leads to a more fractures, allowing for greater storage of oil and increased permeability Wellbores will be aligned to maximize contact with the primary fracture orientation for the field and average over 2,000’ gross perforations per well Undrilled Inventory New Drill Inventory Overview Monterey Type Log Top of Monterey Structure Legend Upper Siliceous 600’ Average Thickness Massive Chert 400’ Average Thickness Lower Calcareous 600’ Average Thickness Sand/Shale Middle Shale

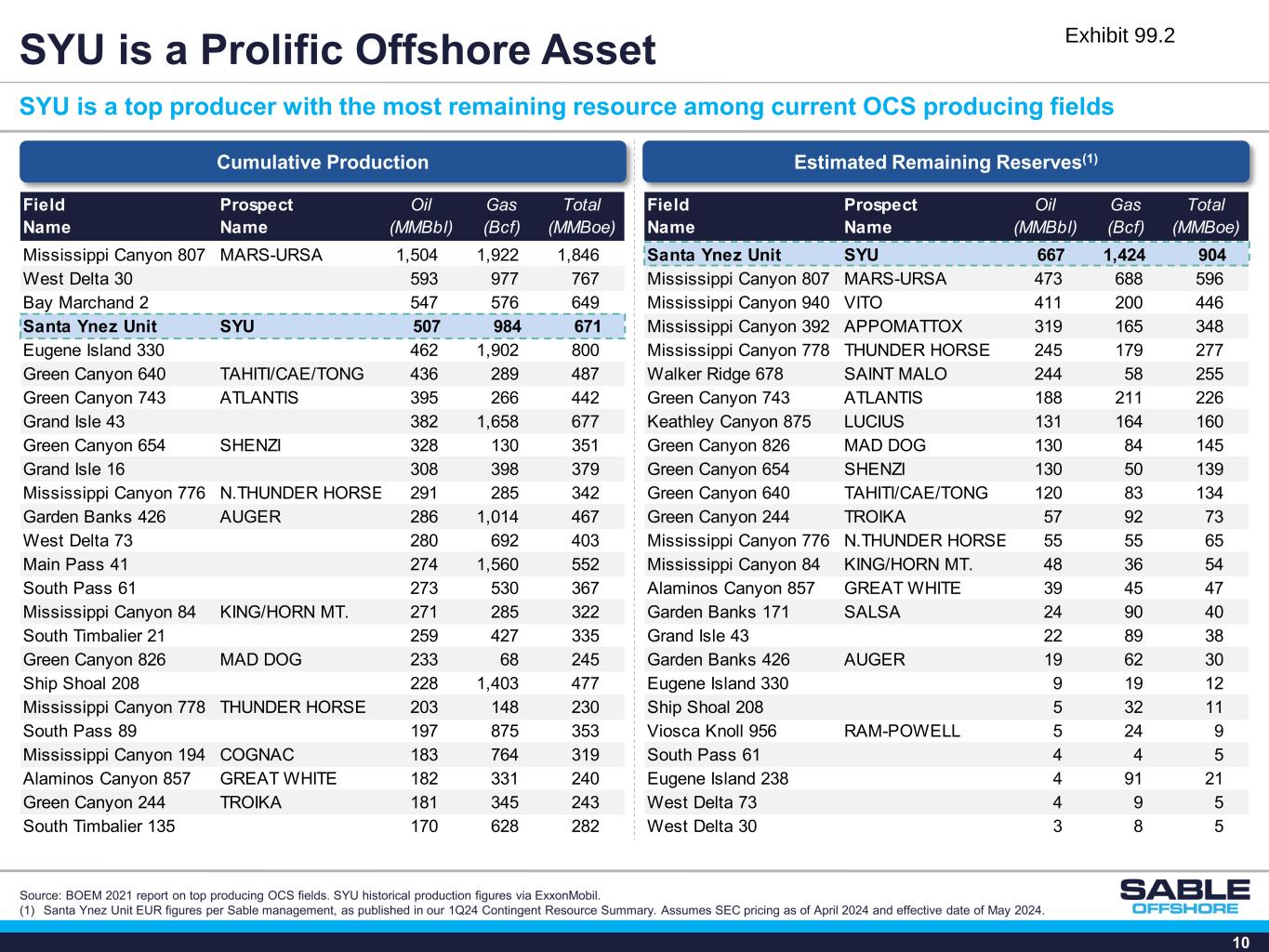

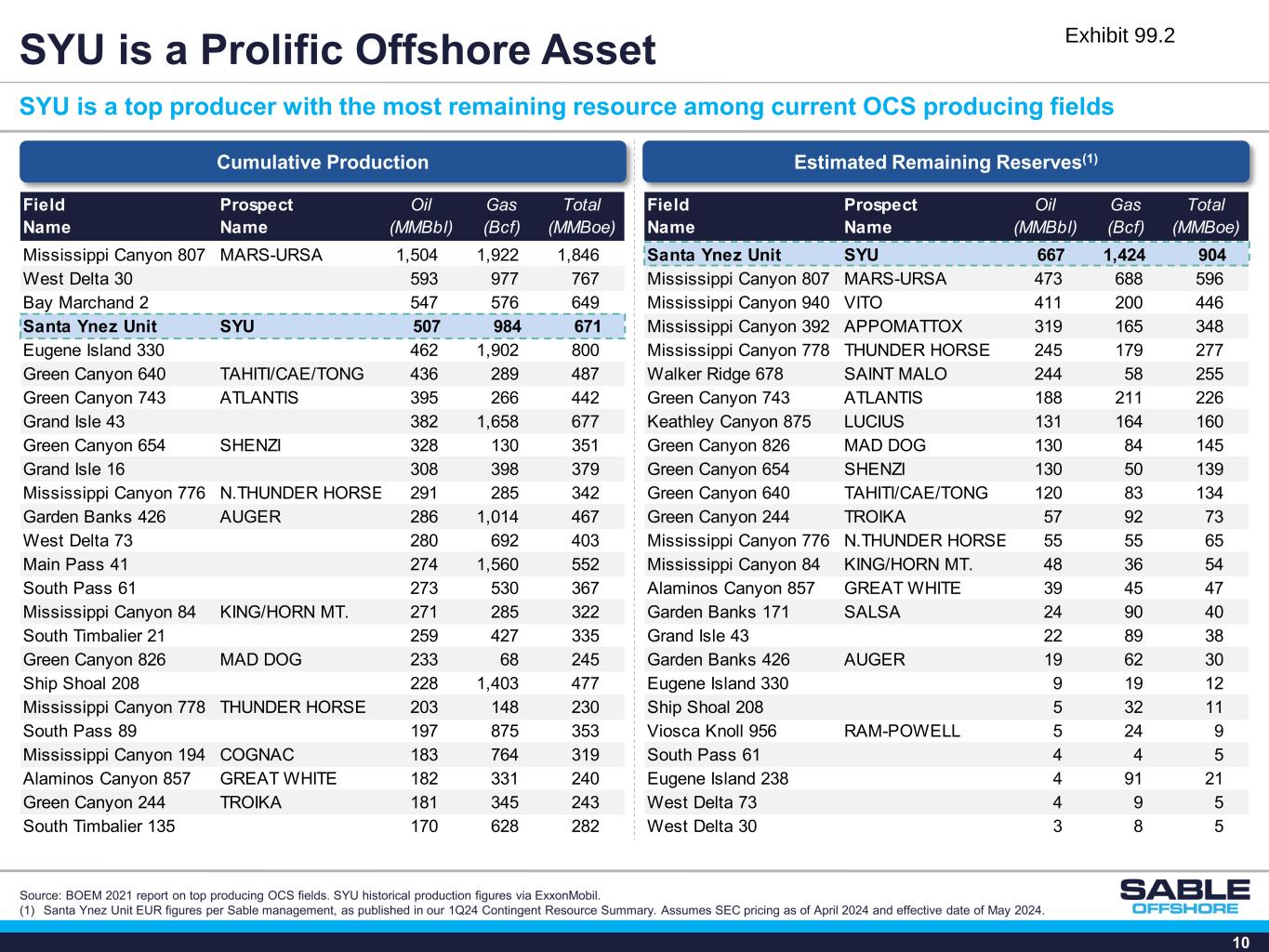

10 Field Name Prospect Name Oil (MMBbl) Gas (Bcf) Total (MMBoe) Santa Ynez Unit SYU 667 1,424 904 Mississippi Canyon 807 MARS-URSA 473 688 596 Mississippi Canyon 940 VITO 411 200 446 Mississippi Canyon 392 APPOMATTOX 319 165 348 Mississippi Canyon 778 THUNDER HORSE 245 179 277 Walker Ridge 678 SAINT MALO 244 58 255 Green Canyon 743 ATLANTIS 188 211 226 Keathley Canyon 875 LUCIUS 131 164 160 Green Canyon 826 MAD DOG 130 84 145 Green Canyon 654 SHENZI 130 50 139 Green Canyon 640 TAHITI/CAE/TONG 120 83 134 Green Canyon 244 TROIKA 57 92 73 Mississippi Canyon 776 N.THUNDER HORSE 55 55 65 Mississippi Canyon 84 KING/HORN MT. 48 36 54 Alaminos Canyon 857 GREAT WHITE 39 45 47 Garden Banks 171 SALSA 24 90 40 Grand Isle 43 22 89 38 Garden Banks 426 AUGER 19 62 30 Eugene Island 330 9 19 12 Ship Shoal 208 5 32 11 Viosca Knoll 956 RAM-POWELL 5 24 9 South Pass 61 4 4 5 Eugene Island 238 4 91 21 West Delta 73 4 9 5 West Delta 30 3 8 5 SYU is a Prolific Offshore Asset Cumulative Production Source: BOEM 2021 report on top producing OCS fields. SYU historical production figures via ExxonMobil. (1) Santa Ynez Unit EUR figures per Sable management, as published in our 1Q24 Contingent Resource Summary. Assumes SEC pricing as of April 2024 and effective date of May 2024. Estimated Remaining Reserves(1) SYU is a top producer with the most remaining resource among current OCS producing fields Field Name Prospect Name Oil (MMBbl) Gas (Bcf) Total (MMBoe) Mississippi Canyon 807 MARS-URSA 1,504 1,922 1,846 West Delta 30 593 977 767 Bay Marchand 2 547 576 649 Santa Ynez Unit SYU 507 984 671 Eugene Island 330 462 1,902 800 Green Canyon 640 TAHITI/CAE/TONG 436 289 487 Green Canyon 743 ATLANTIS 395 266 442 Grand Isle 43 382 1,658 677 Green Canyon 654 SHENZI 328 130 351 Grand Isle 16 308 398 379 Mississippi Canyon 776 N.THUNDER HORSE 291 285 342 Garden Banks 426 AUGER 286 1,014 467 West Delta 73 280 692 403 Main Pass 41 274 1,560 552 South Pass 61 273 530 367 Mississippi Canyon 84 KING/HORN MT. 271 285 322 South Timbalier 21 259 427 335 Green Canyon 826 MAD DOG 233 68 245 Ship Shoal 208 228 1,403 477 Mississippi Canyon 778 THUNDER HORSE 203 148 230 South Pass 89 197 875 353 Mississippi Canyon 194 COGNAC 183 764 319 Alaminos Canyon 857 GREAT WHITE 182 331 240 Green Canyon 244 TROIKA 181 345 243 South Timbalier 135 170 628 282

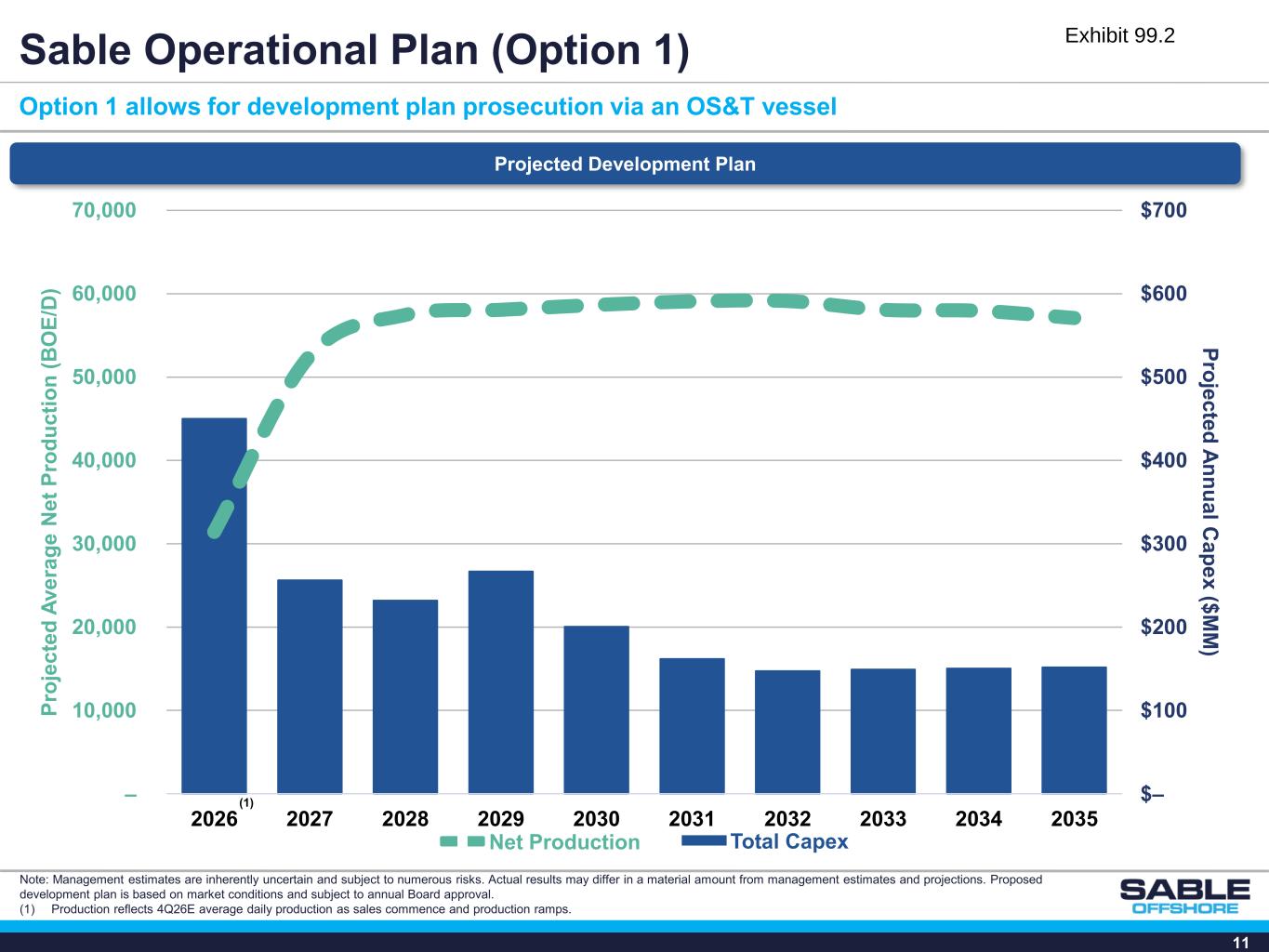

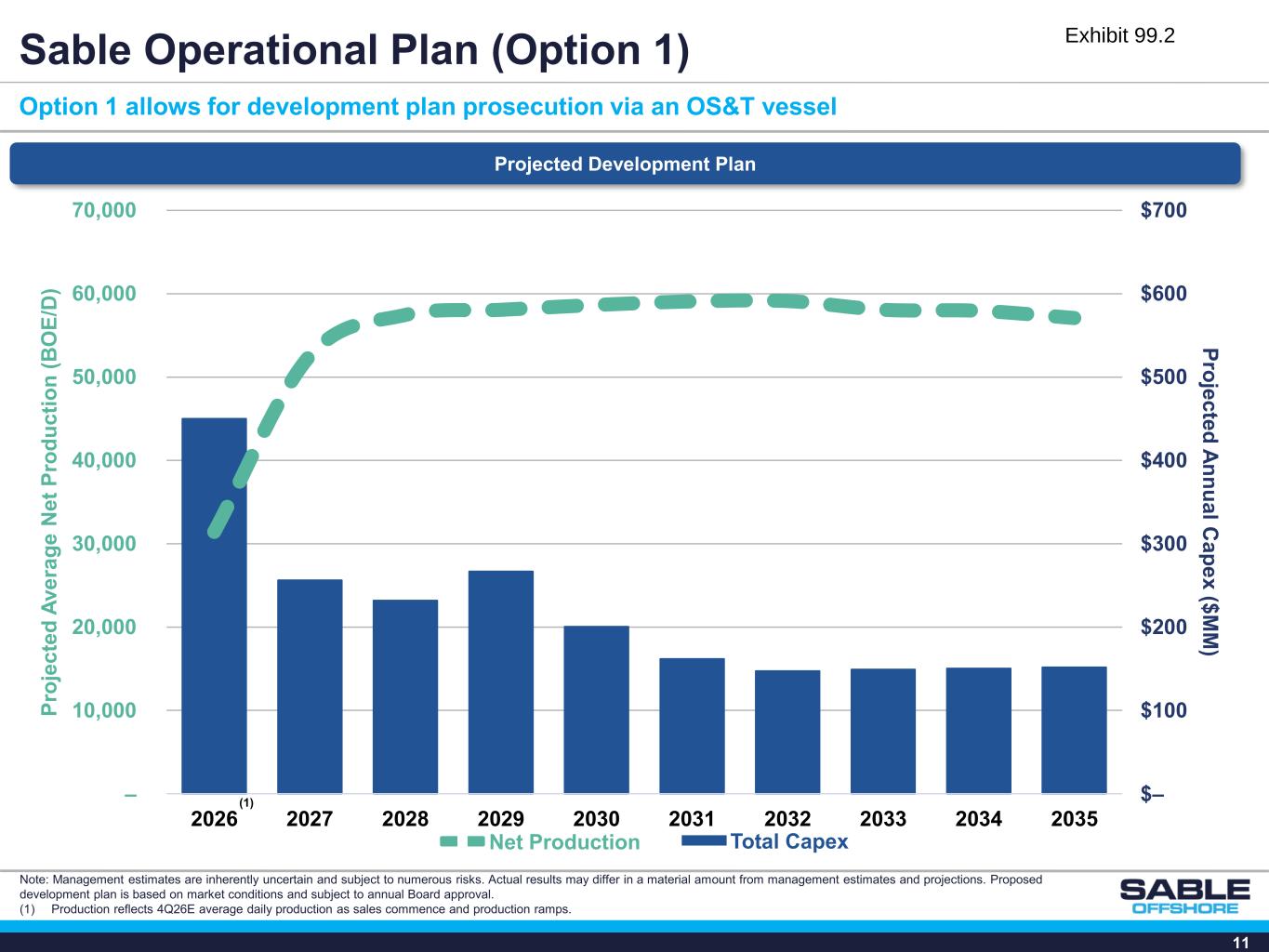

11 $– $100 $200 $300 $400 $500 $600 $700 – 10,000 20,000 30,000 40,000 50,000 60,000 70,000 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 P ro je c te d A n n u a l C a p e x ($ M M ) P ro je c te d A v e ra g e N e t P ro d u c ti o n ( B O E /D ) Sable Operational Plan (Option 1) Option 1 allows for development plan prosecution via an OS&T vessel Projected Development Plan Note: Management estimates are inherently uncertain and subject to numerous risks. Actual results may differ in a material amount from management estimates and projections. Proposed development plan is based on market conditions and subject to annual Board approval. (1) Production reflects 4Q26E average daily production as sales commence and production ramps. Net Production Total Capex (1)

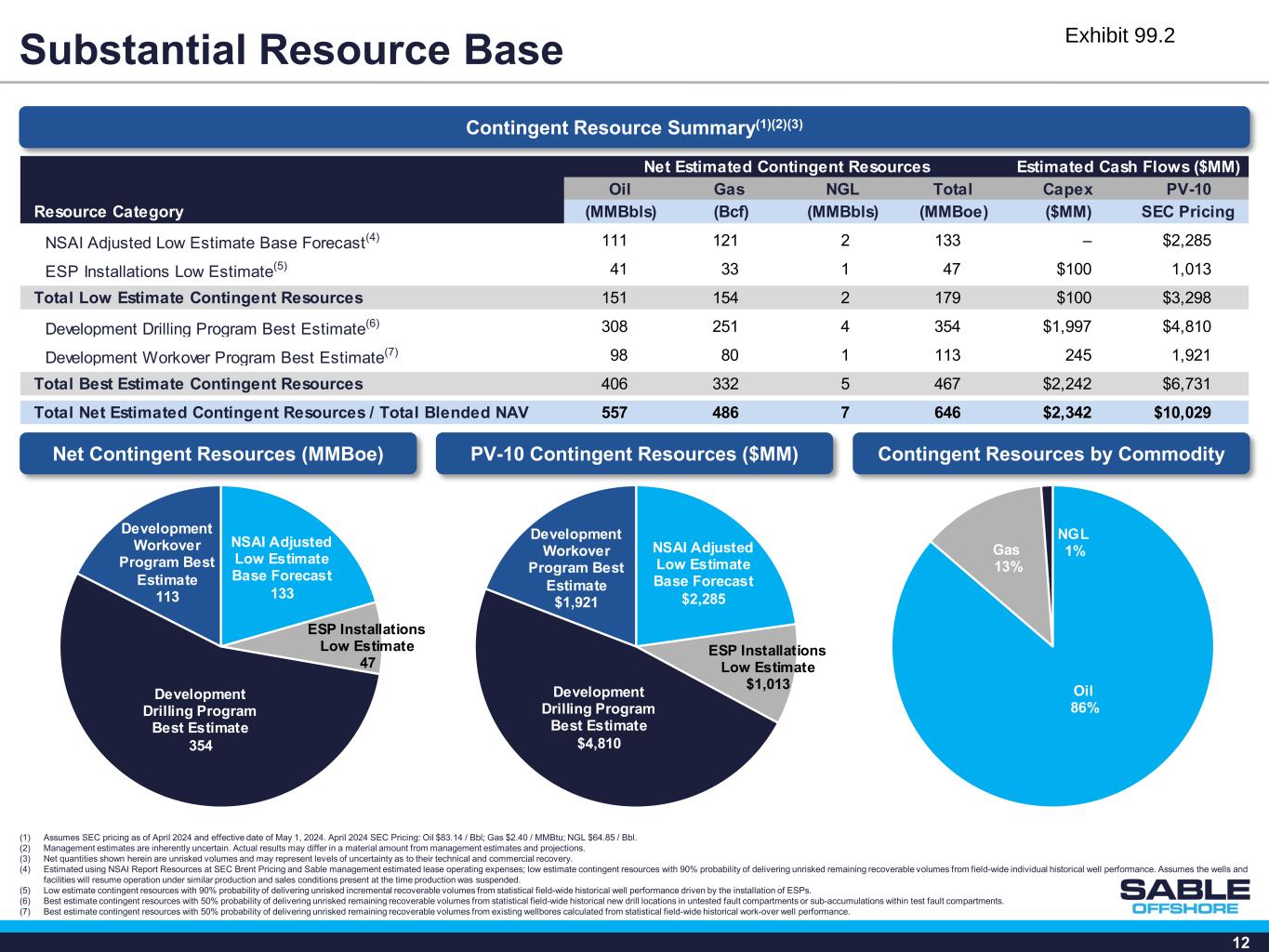

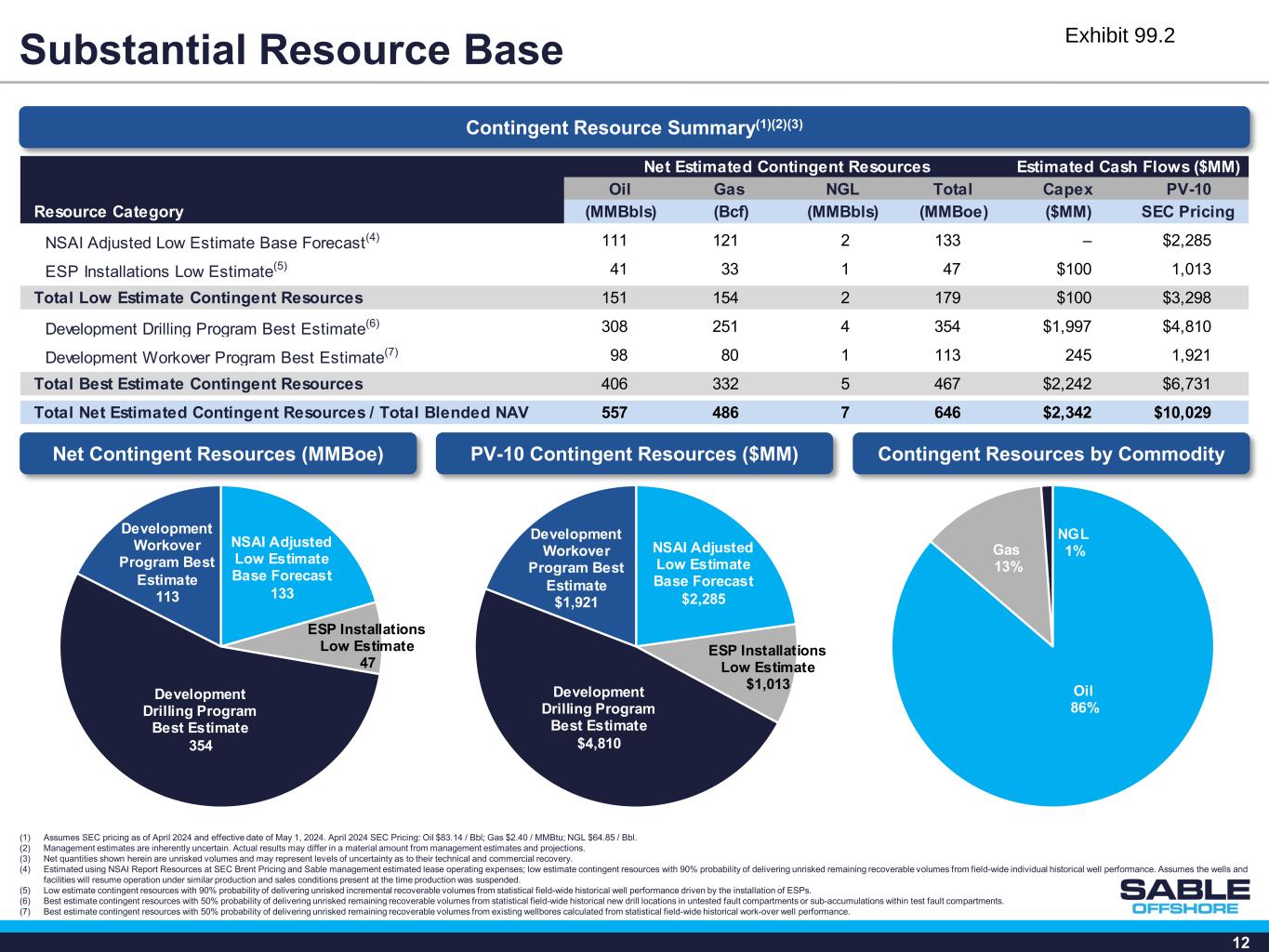

12 NSAI Adjusted Low Estimate Base Forecast 133 ESP Installations Low Estimate 47 Development Drilling Program Best Estimate 354 Development Workover Program Best Estimate 113 Contingent Resource Summary(1)(2)(3) Substantial Resource Base (1) Assumes SEC pricing as of April 2024 and effective date of May 1, 2024. April 2024 SEC Pricing: Oil $83.14 / Bbl; Gas $2.40 / MMBtu; NGL $64.85 / Bbl. (2) Management estimates are inherently uncertain. Actual results may differ in a material amount from management estimates and projections. (3) Net quantities shown herein are unrisked volumes and may represent levels of uncertainty as to their technical and commercial recovery. (4) Estimated using NSAI Report Resources at SEC Brent Pricing and Sable management estimated lease operating expenses; low estimate contingent resources with 90% probability of delivering unrisked remaining recoverable volumes from field-wide individual historical well performance. Assumes the wells and facilities will resume operation under similar production and sales conditions present at the time production was suspended. (5) Low estimate contingent resources with 90% probability of delivering unrisked incremental recoverable volumes from statistical field-wide historical well performance driven by the installation of ESPs. (6) Best estimate contingent resources with 50% probability of delivering unrisked remaining recoverable volumes from statistical field-wide historical new drill locations in untested fault compartments or sub-accumulations within test fault compartments. (7) Best estimate contingent resources with 50% probability of delivering unrisked remaining recoverable volumes from existing wellbores calculated from statistical field-wide historical work-over well performance. Net Contingent Resources (MMBoe) PV-10 Contingent Resources ($MM) Contingent Resources by Commodity Net Estimated Contingent Resources Estimated Cash Flows ($MM) Oil Gas NGL Total Capex PV-10 Resource Category (MMBbls) (Bcf) (MMBbls) (MMBoe) ($MM) SEC Pricing NSAI Adjusted Low Estimate Base Forecast(4) 111 121 2 133 – $2,285 ESP Installations Low Estimate(5) 41 33 1 47 $100 1,013 Total Low Estimate Contingent Resources 151 154 2 179 $100 $3,298 Development Drilling Program Best Estimate(6) 308 251 4 354 $1,997 $4,810 Development Workover Program Best Estimate(7) 98 80 1 113 245 1,921 Total Best Estimate Contingent Resources 406 332 5 467 $2,242 $6,731 Total Net Estimated Contingent Resources / Total Blended NAV 557 486 7 646 $2,342 $10,029 NSAI Adjusted Low Estimate Base Forecast $2,285 ESP Installations Low Estimate $1,013 Development Drilling Program Best Estimate $4,810 Development Workover Program Best Estimate $1,921 Oil 86% Gas 13% NGL 1%

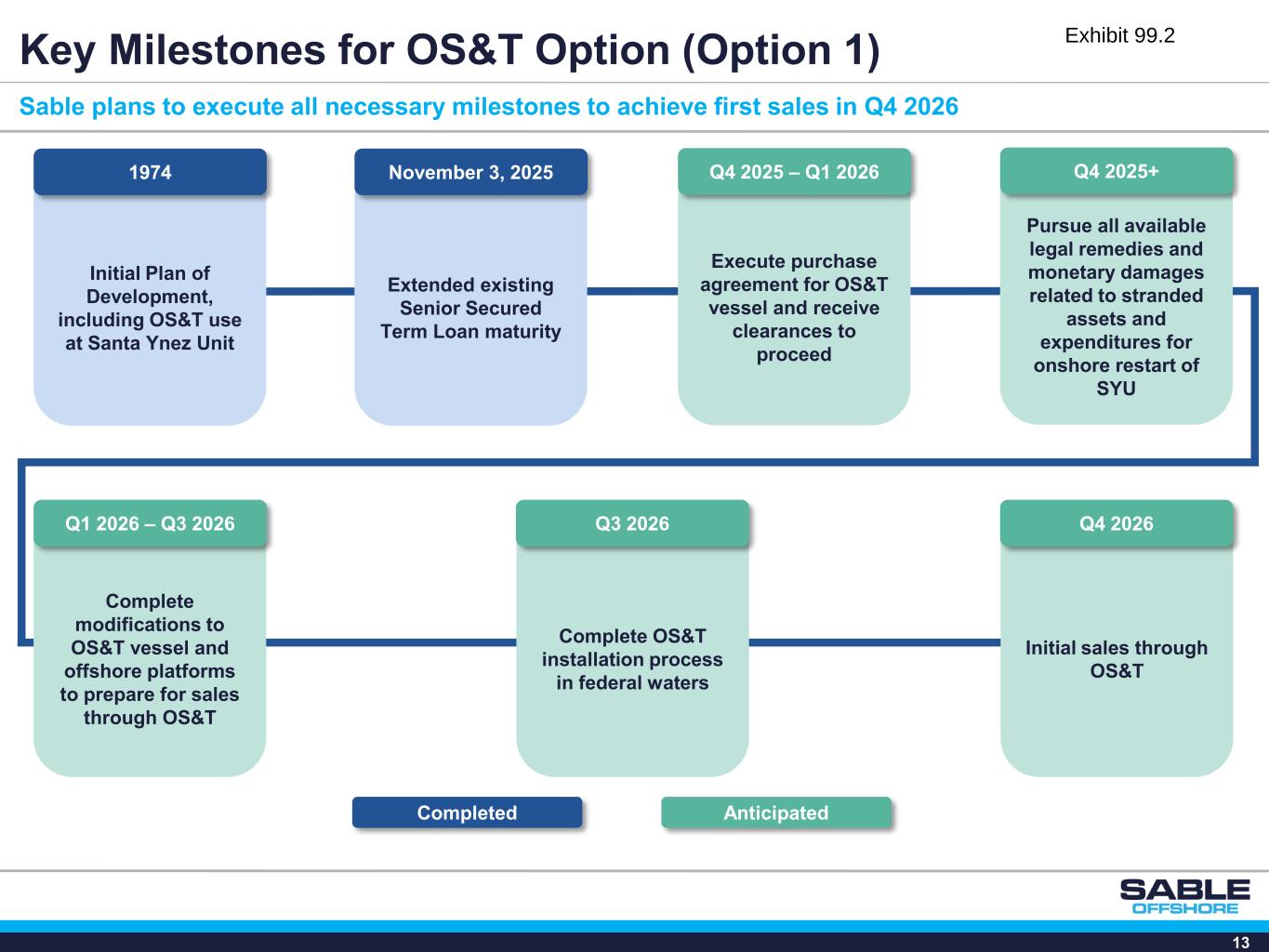

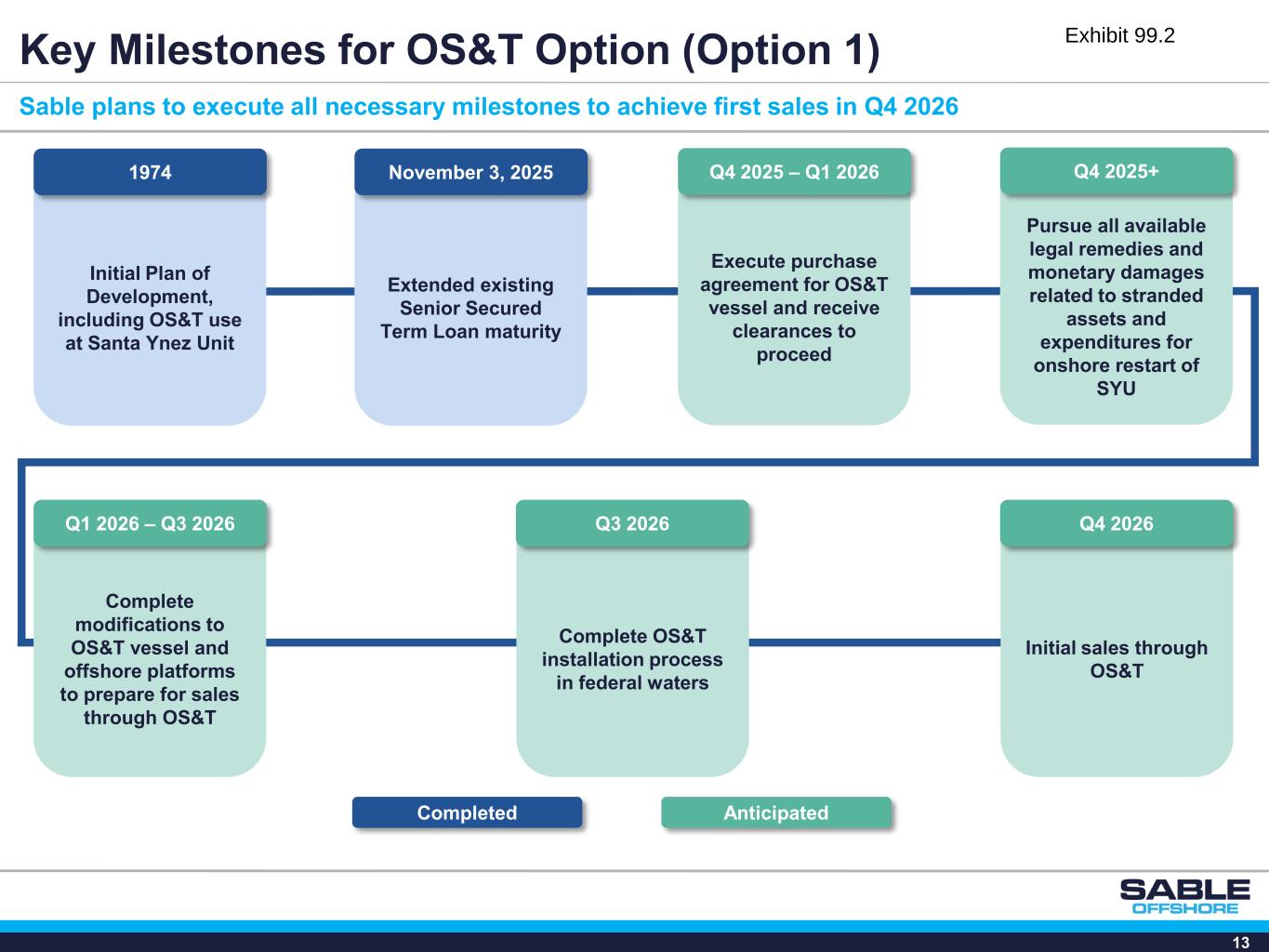

13 Key Milestones for OS&T Option (Option 1) Sable plans to execute all necessary milestones to achieve first sales in Q4 2026 Initial Plan of Development, including OS&T use at Santa Ynez Unit 1974 Execute purchase agreement for OS&T vessel and receive clearances to proceed Q4 2025 – Q1 2026 Completed Anticipated Complete modifications to OS&T vessel and offshore platforms to prepare for sales through OS&T Q1 2026 – Q3 2026 Pursue all available legal remedies and monetary damages related to stranded assets and expenditures for onshore restart of SYU Q4 2025+ Initial sales through OS&T Q4 2026 Complete OS&T installation process in federal waters Q3 2026 Extended existing Senior Secured Term Loan maturity November 3, 2025

14 Sable management team is an award-winning, safe, and prudent California Operator Two commendations from the Air Pollution Control District for Emissions Reductions and Use of Innovative Emissions Control Technology at the Arroyo Grande Oil Field “Due to PXP’s generosity and civic mindedness … [using] their facility, nearly 200 firefighters have received important Survival Training” – Ron Lawrence, Central Regional Training / Safety Captain LA County Fire Department “The Culver City Fire Department is forever grateful to Plains Exploration & Production Co. for their continued training support and expertise” – Tim Wilson, Captain / Training Officer, Culver City Fire Dept. Health, Safety, and Environmental Highlights Risk Management Partner to Local Communities Offshore California Highlights Sable Management has a track record of excellence as a safe and responsible steward of California’s onshore and offshore resources As PXP, owned / operated offshore Point Arguello (Harvest Platform, Hermosa Platform, and Hidalgo Platform) and Point Pedernales (Irene Platform) Onshore operations included Arroyo Grande, Los Angeles Basin, and San Joaquin Valley assets 2011: Occupational Excellence Achievement Award for 21 PXP locations 2009-2010: Perfect Record Award for operating 11,390 employee hours without occupational injury or illness involving days away from work 2009: National Industry Leadership Award 2007-2008: Occupational Excellence Achievement Awards for Outstanding Safety Practices Occupational Excellence Achievement Awards for Outstanding Safety Practices 2008-2004: Recipient of the Environmental Lease Maintenance Award 2006: Recipient of the Clean Lease Awards Division of Oil, Gas and Geothermal Resources (DOGGR) Lease Maintenance Award for Outstanding Safety and Lease Maintenance 12 years and 13 years in a row at Packard and San Vicente 2004: Received Santa Barbara County’s First and Only “Resolution for Good Operator” Recognizing PXP’s Outstanding Operating Performance 2008: Santa Barbara County Commendation for Outstanding Maintenance Practices at LOGP 2004: Ranked MMS’s Best Operator in the Pacific OCS for Safety of Platform and Pipeline Operations Onshore California Highlights 2010: Occupational Excellence Achievement Award for PXP’s California Los Angeles Basin San Vicente and Packard locations 2006: U.S. Bureau of Land Management Operator of the Year Award 2006: Best Management Practices National Award in Habitat Conservation (2) (1) (1) Minerals Management Service (MMS) was reorganized into Bureau of Ocean Energy Management (BOEM) and Bureau of Safety and Environmental Enforcement (BSEE) in 2011. (2) Division of Oil, Gas and Geothermal Resources (DOGGR) was reorganized into California Geologic Energy Management Division (CalGEM) in 2020. Platform Hondo Platform Harmony Platform Heritage

15 Option 1 (OS&T) - Updated Guidance Production (Q1 2027) Net Average Daily Production (BOE/D) 45,000 ‒ 55,000 Working Interest (%) 100.0% Average Net Revenue Interest (%) 83.6% Run-Rate Cash Costs ($ / BOE) (FY 2027) Lease Operating Expense $6.00 ‒ $8.00 Gathering, Processing & Transportation $1.50 ‒ $2.50 Estimated Brent Differential $4.00 ‒ $6.00 Cash General & Administrative $3.50 ‒ $4.50 Ad Valorem Taxes (% of Revenue) 0.01% ‒ 1.00% Operational Capex (FY2026) Total Capex ($MM) $425 ‒ $475 Note: Management estimates are inherently uncertain and subject to numerous risks. Actual results may differ in a material amount from management estimates and projections. Proposed development plan is based on market conditions and subject to annual Board approval. (1) Updated guidance amount is based on production levels at the time of the 2015 shut in, initial Harmony well results, the anticipated restart of production at Heritage and Hondo, management's best estimates based upon numerous technical data points such as bottom-hole pressures, material balance calculations and estimates, reservoir simulations, management experience operating producing assets offshore California, and planned capital expenditures. Deviations from the anticipated timing and magnitude of such assumptions may impact actual results. (2) Run-rate cash costs assume 50,000 Boe/d net production once all three platforms are online. Sable finalized a maturity extension of its existing Senior Secured Term Loan Sable is prioritizing an OS&T option to begin commercial sales from SYU as an alternative to the Las Flores Pipeline System ‒ Sable estimates that the total capital required to pursue an OS&T strategy, assuming the purchase of a vessel, vessel and platform upgrades and installation, is approximately $450 million Sable expects to achieve meaningful cost savings with the OS&T strategy ‒ Reduced LOE from refocusing LFC / Las Flores Pipeline System personnel to the OS&T vessel ‒ Waterborne marketing optionality provides access to more attractive Brent crude pricing realizations Sable is pursuing federal financial support for comprehensive debt financing to fund the business through first sales ‒ Sable estimates an average monthly cash burn rate of ~$25MM, excluding the capital expenditures required to prepare for the OS&T strategy, and is actively pursuing other avenues of financial support ahead of a broader debt refinancing Post-first sales, Sable plans to implement a hedging program and institute a shareholder return program in either Option 1 or Option 2 Updated Financial Guidance(1) Financial Overview Financial Commentary Option 2 (Pipeline) - Updated Guidance Production (Q1 2026) Net Average Daily Production (BOE/D) 45,000 ‒ 55,000 Working Interest (%) 100.0% Average Net Revenue Interest (%) 83.6% Run-Rate Cash Costs ($ / BOE) (FY 2026) Lease Operating Expense $8.00 ‒ $10.00 Gathering, Processing & Transportation $4.50 ‒ $5.50 Estimated Brent Differential $9.00 ‒ $11.00 Cash General & Administrative $3.50 ‒ $4.50 Severance & Ad Valorem Taxes (% of Revenue) 0.50% ‒ 1.00% Operational Capex (FY 2026) Total Capex ($MM) $240 ‒ $270 OS&T strategy estimated to achieve cost savings of ~$10/BOE relative to Option 2; potential for >$175MM annual savings assuming 50 MBOE/D of net production (2) (2)

16 Key Investment Highlights Sable management targeting long-term leverage ratios of ~1.0x to maximize flexibility for distributions and development Conservative Leverage Profile Low-cost, low-decline assets enable a shareholder return program via dividends and share repurchases Attractive Returns Modest reinvestment required in the near-term as Sable capitalizes on ESP installations and workovers on existing wellbores Primed for Low-Cost Production Growth De-risked reservoir first discovered in the 1960’s Potential for substantial growth with accelerated development Substantial Upside Oil sales contracts linked to Brent Crude Waterborne marketing optionality provides access to more attractive Brent crude pricing realizations Access to Infrastructure & End Markets 100% operated with favorable 16.4% royalty burdenHigh Operational Control Outstanding HS&E(1) and operational track record in California Significant opportunity for CCS utilizing existing assets HS&E Stewardship (1) Health, safety and environment. Santa Ynez Unit is a Differentiated, Value Driven Asset Premier asset and experienced management team drive shareholder value

Appendix

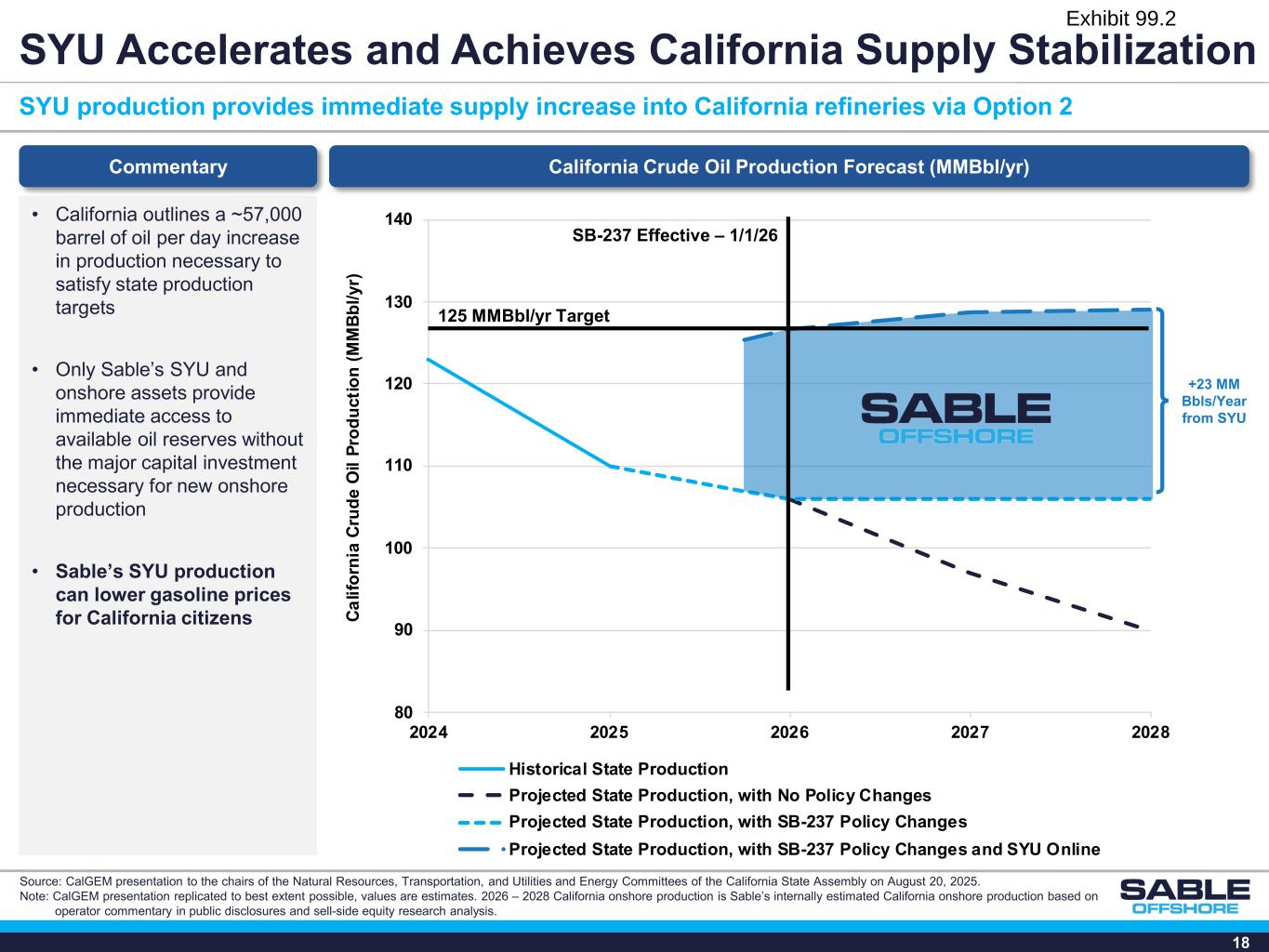

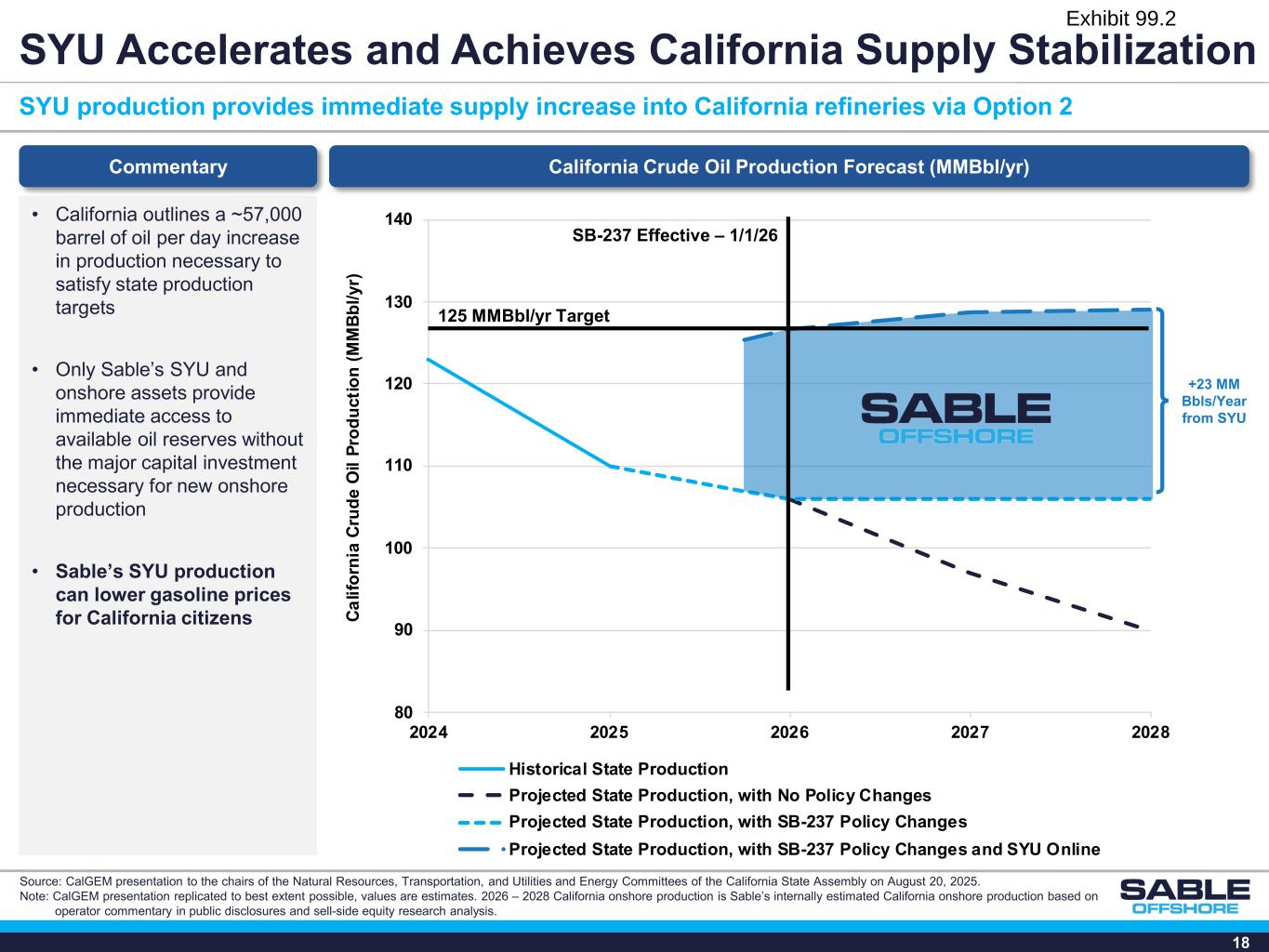

18 80 90 100 110 120 130 140 2024 2025 2026 2027 2028 Ca lif or ni a Cr ud e O il Pr od uc tio n (M M Bb l/y r) Historical State Production Projected State Production, with No Policy Changes Projected State Production, with SB-237 Policy Changes Projected State Production, with SB-237 Policy Changes and SYU Online SYU Accelerates and Achieves California Supply Stabilization SYU production provides immediate supply increase into California refineries via Option 2 California Crude Oil Production Forecast (MMBbl/yr) Source: CalGEM presentation to the chairs of the Natural Resources, Transportation, and Utilities and Energy Committees of the California State Assembly on August 20, 2025. Note: CalGEM presentation replicated to best extent possible, values are estimates. 2026 – 2028 California onshore production is Sable’s internally estimated California onshore production based on operator commentary in public disclosures and sell-side equity research analysis. SB-237 Effective – 1/1/26 125 MMBbl/yr Target Commentary • California outlines a ~57,000 barrel of oil per day increase in production necessary to satisfy state production targets • Only Sable’s SYU and onshore assets provide immediate access to available oil reserves without the major capital investment necessary for new onshore production • Sable’s SYU production can lower gasoline prices for California citizens +23 MM Bbls/Year from SYU

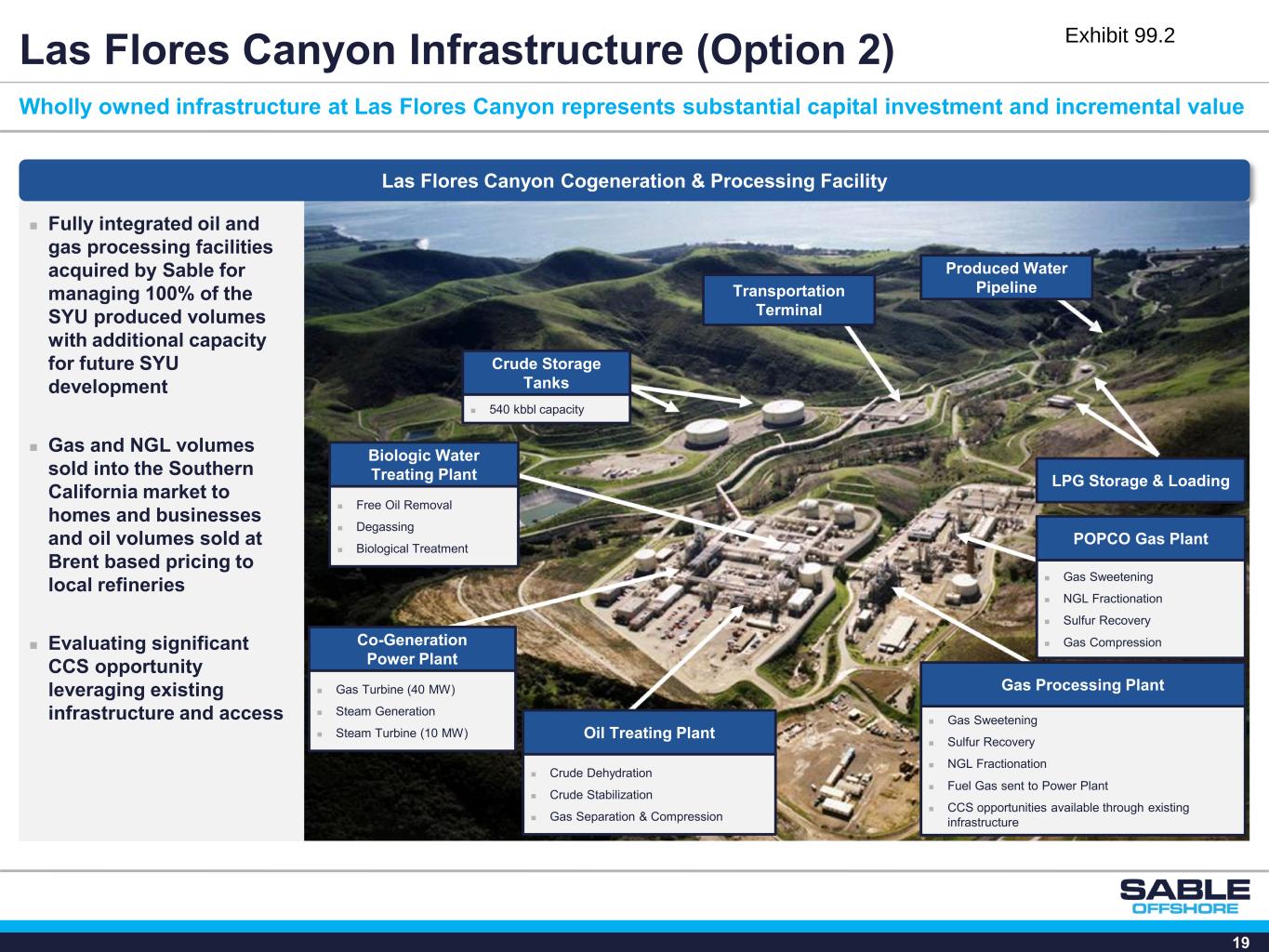

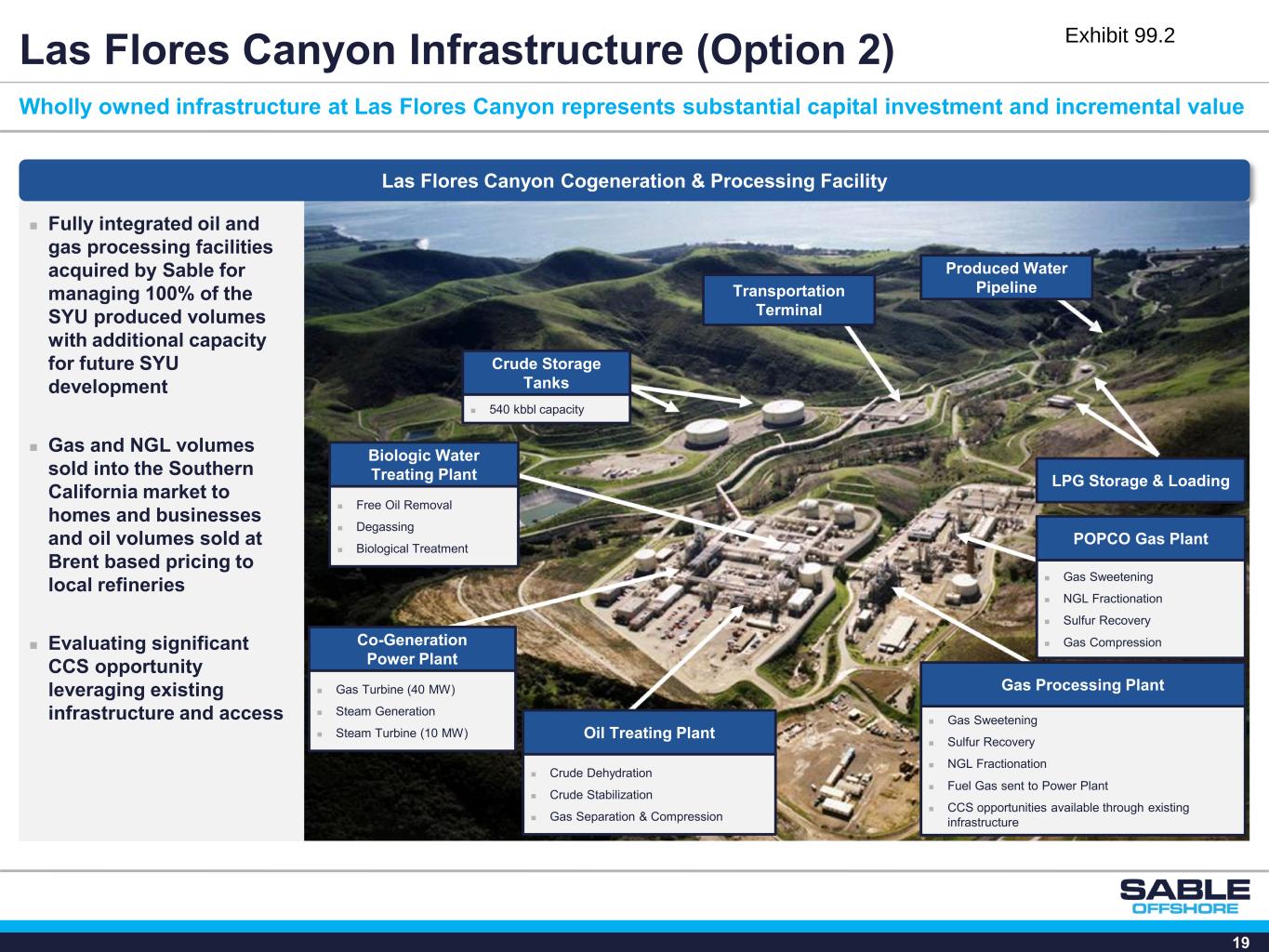

19 Las Flores Canyon Cogeneration & Processing Facility Las Flores Canyon Infrastructure (Option 2) Wholly owned infrastructure at Las Flores Canyon represents substantial capital investment and incremental value Fully integrated oil and gas processing facilities acquired by Sable for managing 100% of the SYU produced volumes with additional capacity for future SYU development Gas and NGL volumes sold into the Southern California market to homes and businesses and oil volumes sold at Brent based pricing to local refineries Evaluating significant CCS opportunity leveraging existing infrastructure and access Crude Storage Tanks Transportation Terminal Produced Water Pipeline Oil Treating Plant Co-Generation Power Plant Biologic Water Treating Plant Crude Dehydration Crude Stabilization Gas Separation & Compression Free Oil Removal Degassing Biological Treatment 540 kbbl capacity Gas Turbine (40 MW) Steam Generation Steam Turbine (10 MW) LPG Storage & Loading POPCO Gas Plant Gas Sweetening NGL Fractionation Sulfur Recovery Gas Compression Gas Processing Plant Gas Sweetening Sulfur Recovery NGL Fractionation Fuel Gas sent to Power Plant CCS opportunities available through existing infrastructure

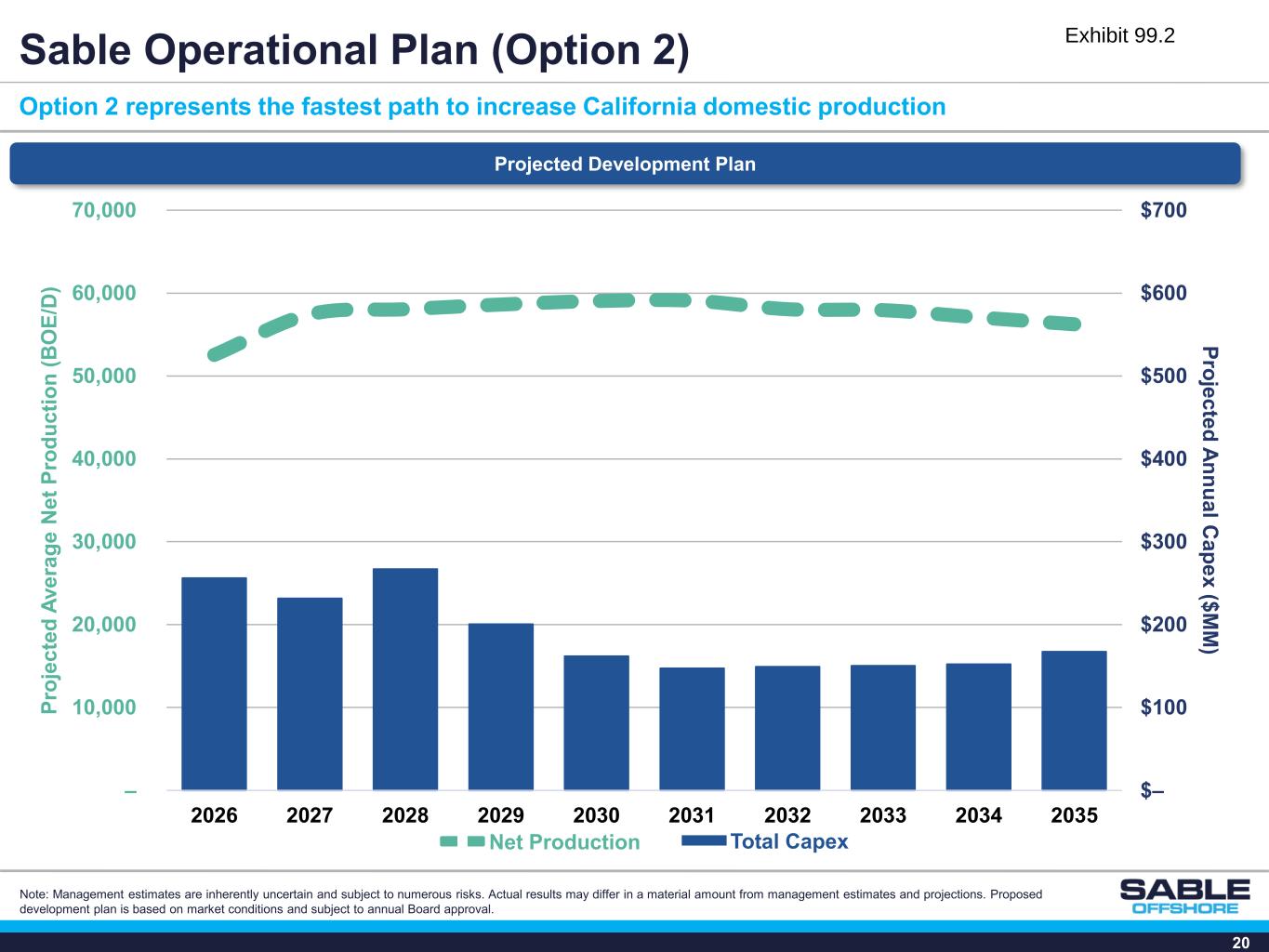

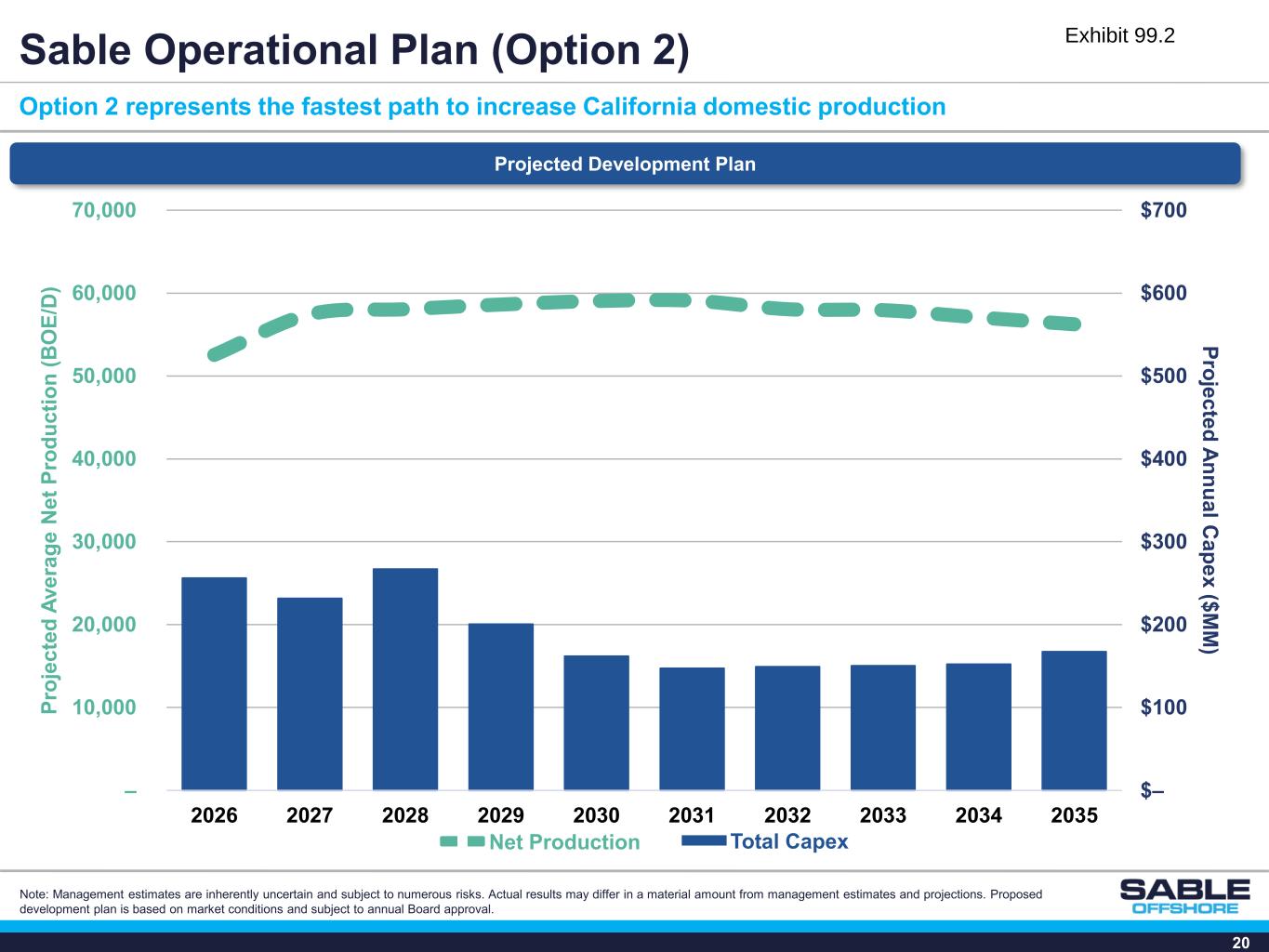

20 Sable Operational Plan (Option 2) Option 2 represents the fastest path to increase California domestic production Note: Management estimates are inherently uncertain and subject to numerous risks. Actual results may differ in a material amount from management estimates and projections. Proposed development plan is based on market conditions and subject to annual Board approval. $– $100 $200 $300 $400 $500 $600 $700 – 10,000 20,000 30,000 40,000 50,000 60,000 70,000 2026 2027 2028 2029 2030 2031 2032 2033 2034 2035 P ro je c te d A n n u a l C a p e x ($ M M ) P ro je c te d A v e ra g e N e t P ro d u c ti o n ( B O E /D ) Net Production Total Capex Projected Development Plan

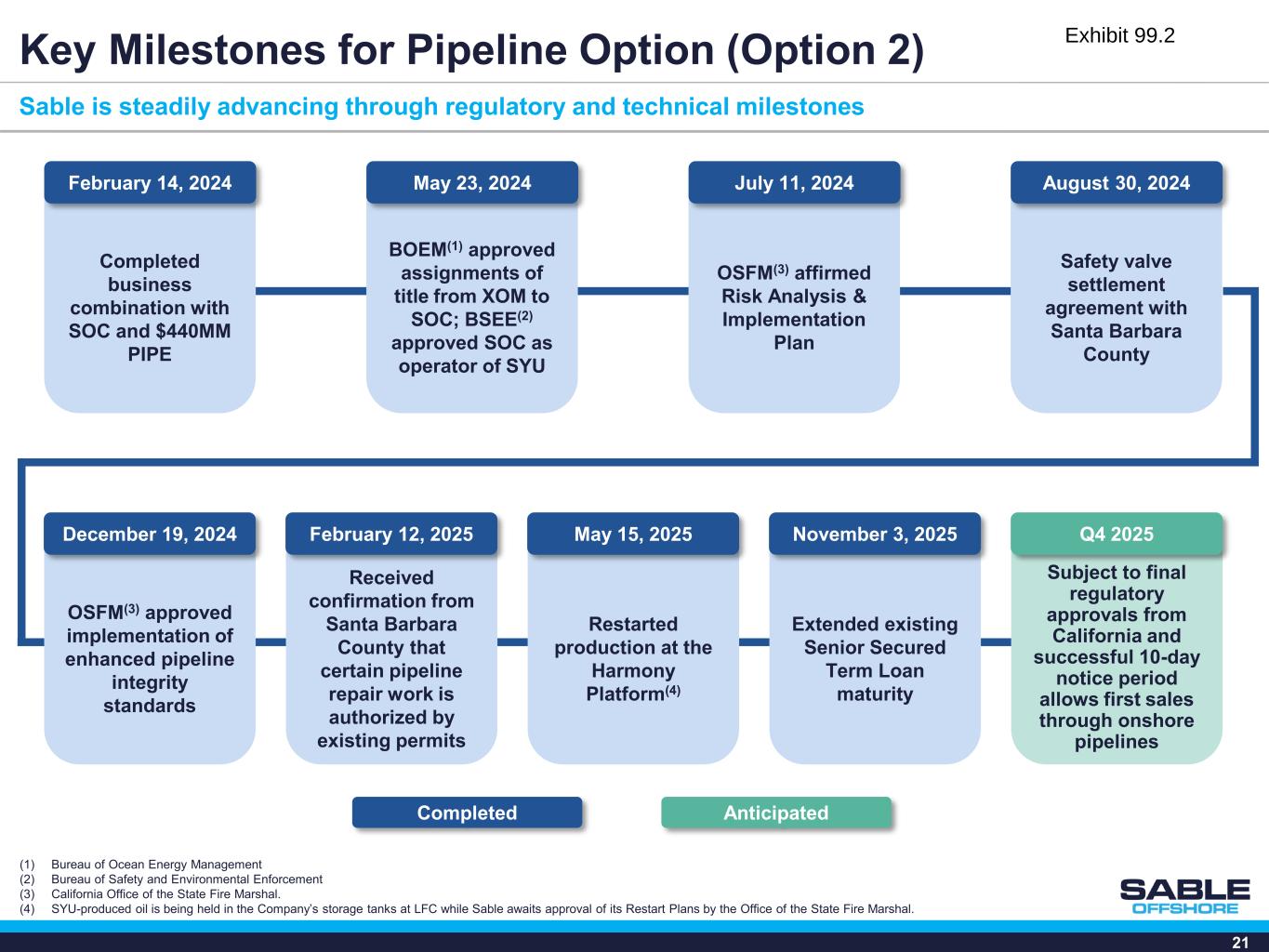

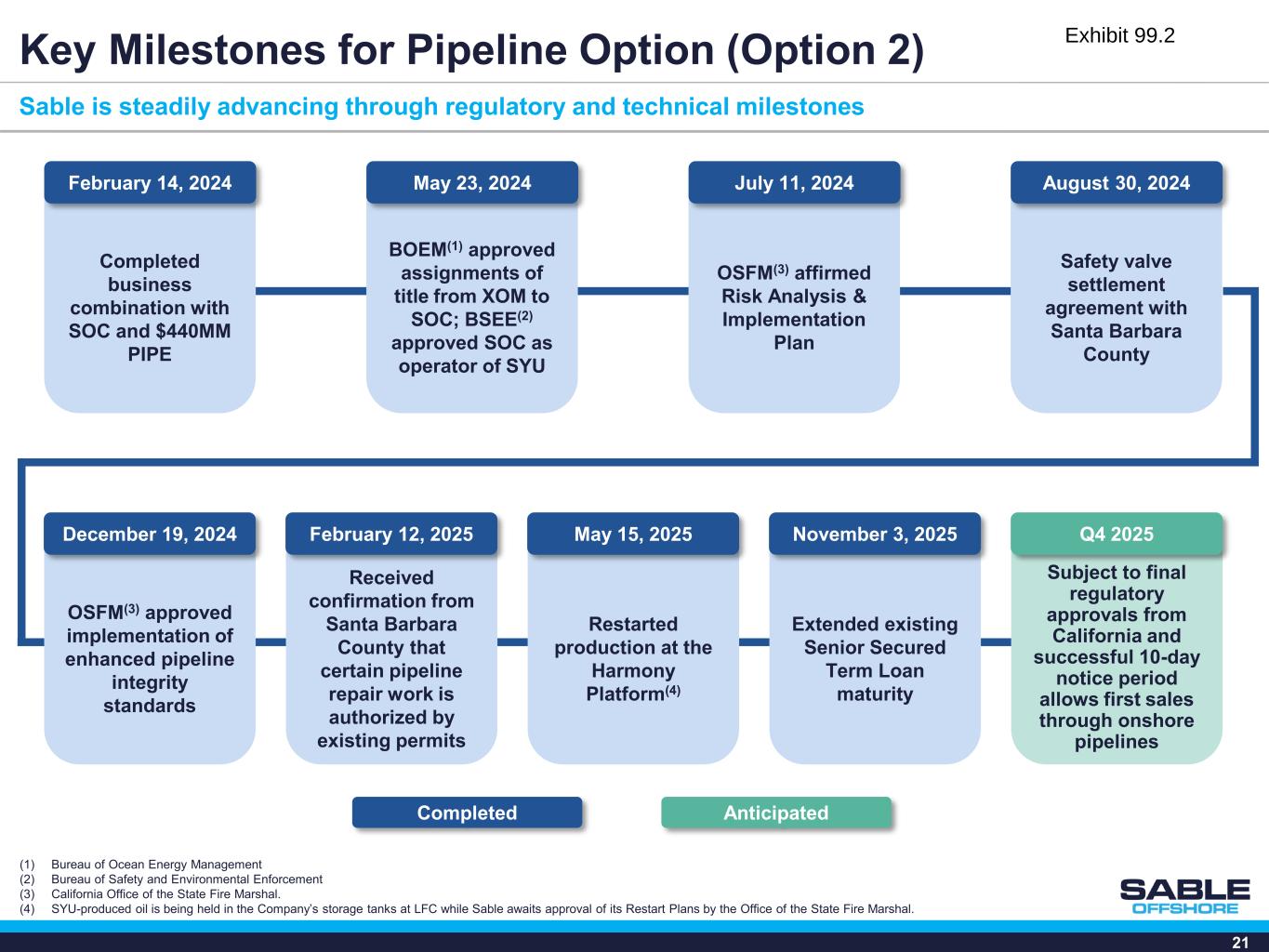

21 Key Milestones for Pipeline Option (Option 2) Sable is steadily advancing through regulatory and technical milestones Completed business combination with SOC and $440MM PIPE February 14, 2024 BOEM(1) approved assignments of title from XOM to SOC; BSEE(2) approved SOC as operator of SYU May 23, 2024 Safety valve settlement agreement with Santa Barbara County August 30, 2024 OSFM(3) approved implementation of enhanced pipeline integrity standards December 19, 2024 Completed Anticipated OSFM(3) affirmed Risk Analysis & Implementation Plan July 11, 2024 Received confirmation from Santa Barbara County that certain pipeline repair work is authorized by existing permits February 12, 2025 Subject to final regulatory approvals from California and successful 10-day notice period allows first sales through onshore pipelines Q4 2025 Restarted production at the Harmony Platform(4) May 15, 2025 (1) Bureau of Ocean Energy Management (2) Bureau of Safety and Environmental Enforcement (3) California Office of the State Fire Marshal. (4) SYU-produced oil is being held in the Company’s storage tanks at LFC while Sable awaits approval of its Restart Plans by the Office of the State Fire Marshal. Extended existing Senior Secured Term Loan maturity November 3, 2025