Document

Sable Offshore Corp. Reports 2024 Financial and Operational Results

Houston, March 17, 2025 – Sable Offshore Corp. (“Sable,” or the “Company”)(NYSE: SOC) today announced its 2024 financial and operational results.

2024 Financial Highlights

•Reported a net loss of $617.3 million, primarily attributable to a non-cash change in fair value of warrant liabilities related to common share price and warrant price appreciation during the year, non-cash interest expense, and production restart related operating expenses.

•Ended the year with 89,310,996 shares of Common Stock outstanding after raising $773.8 million in gross equity proceeds in 2024.

•Concluded the year with outstanding debt of $833.5 million, inclusive of paid-in-kind interest, additional principal incurred from the debt amendment, and debt issuance costs.

•Ended the year with cash and cash equivalents balance of $300.4 million, exclusive of restricted cash balance of $35.4 million.

Fourth Quarter 2024 Operational Highlights

•Entered into an amendment to the Purchase and Sale Agreement, effectively extending the maturity date of the EM Term Loan by 60 days.

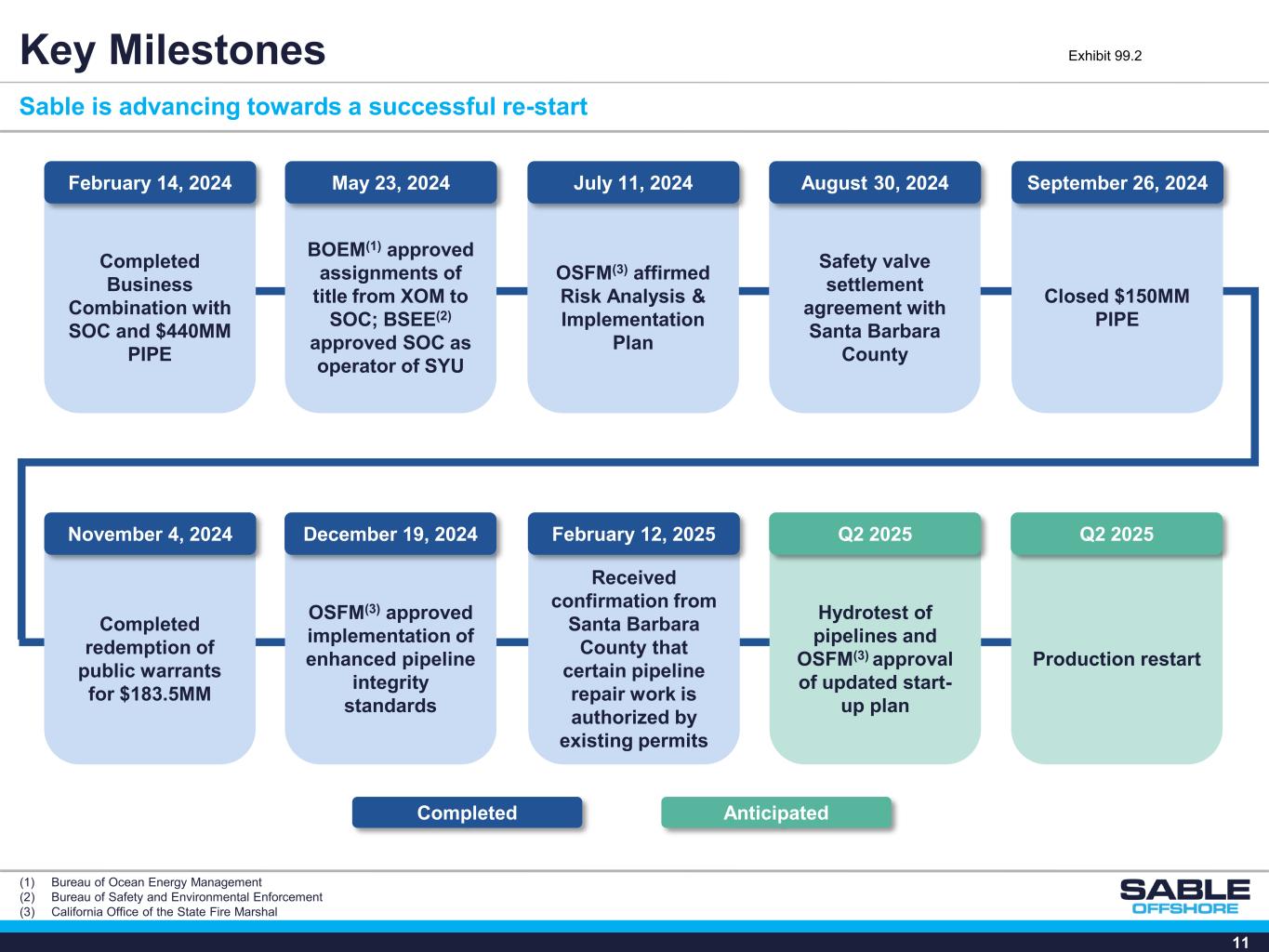

•Received approval from the California Office of the State Fire Marshal (“OSFM”) of Sable’s implementation of enhanced pipeline integrity standards for the Las Flores Pipeline System (the “Pipeline”), representing a significant milestone achievement in satisfying the requirements of the federal court ordered consent decree.

•Made significant progress in executing the anomaly repair program on the Pipeline.

Recent Events

•Received confirmation from the County of Santa Barbara, on February 12, 2025, that certain Pipeline anomaly repair work in the Coastal Zone is authorized by existing permits.

•The U.S. Department of Transportation Pipeline and Hazardous Materials Safety Administration (“PHMSA”), on February 11, 2025, delivered notices to the OSFM that PHMSA does not object to the OSFM’s approval of Sable’s implementation of enhanced pipeline integrity standards for the Pipeline.

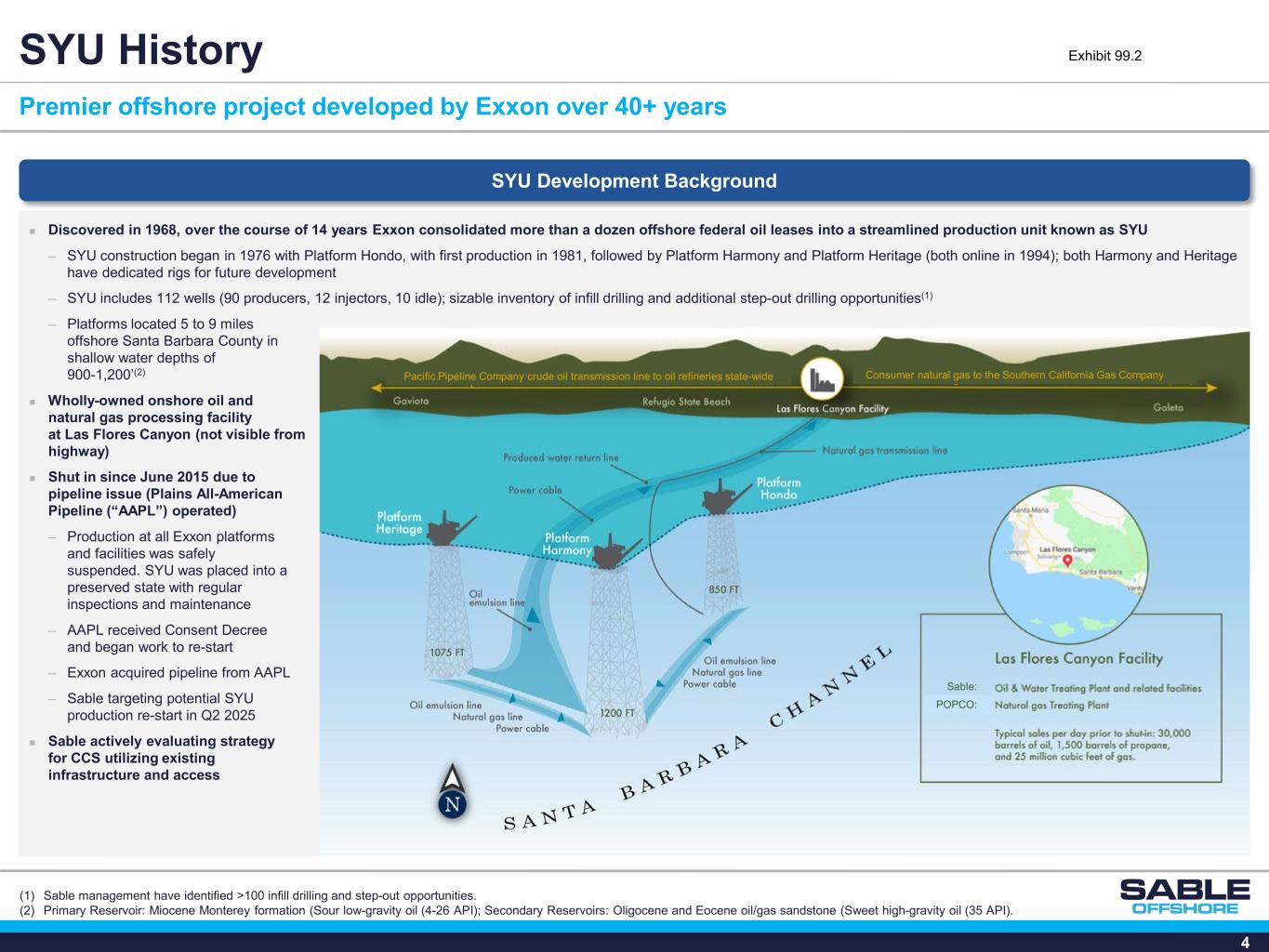

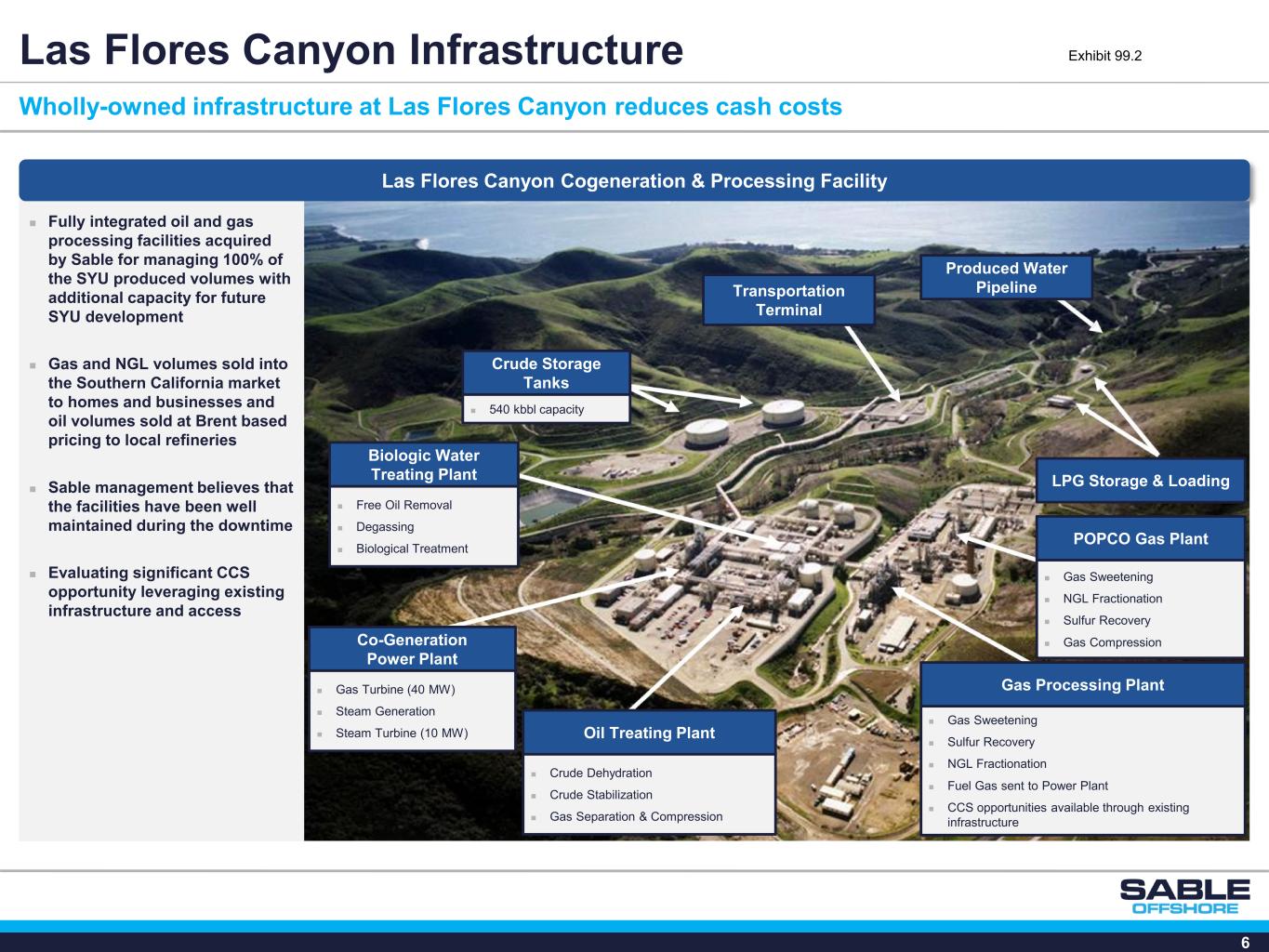

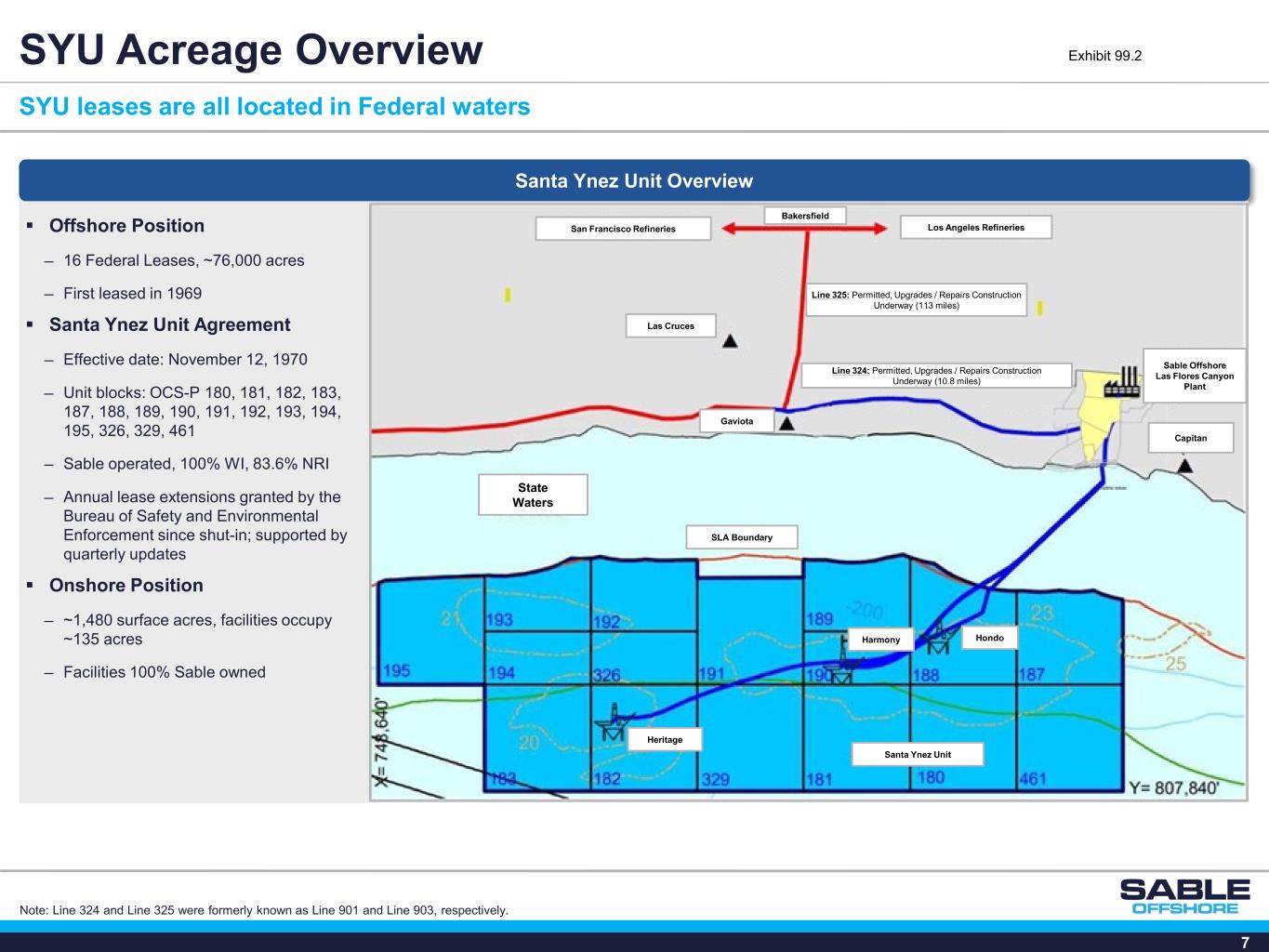

•Sable initiated hydrotesting of the Pipeline in early 2025 in advance of a potential restart of the SYU offshore platforms and associated Las Flores Canyon processing facilities.

Updated Guidance

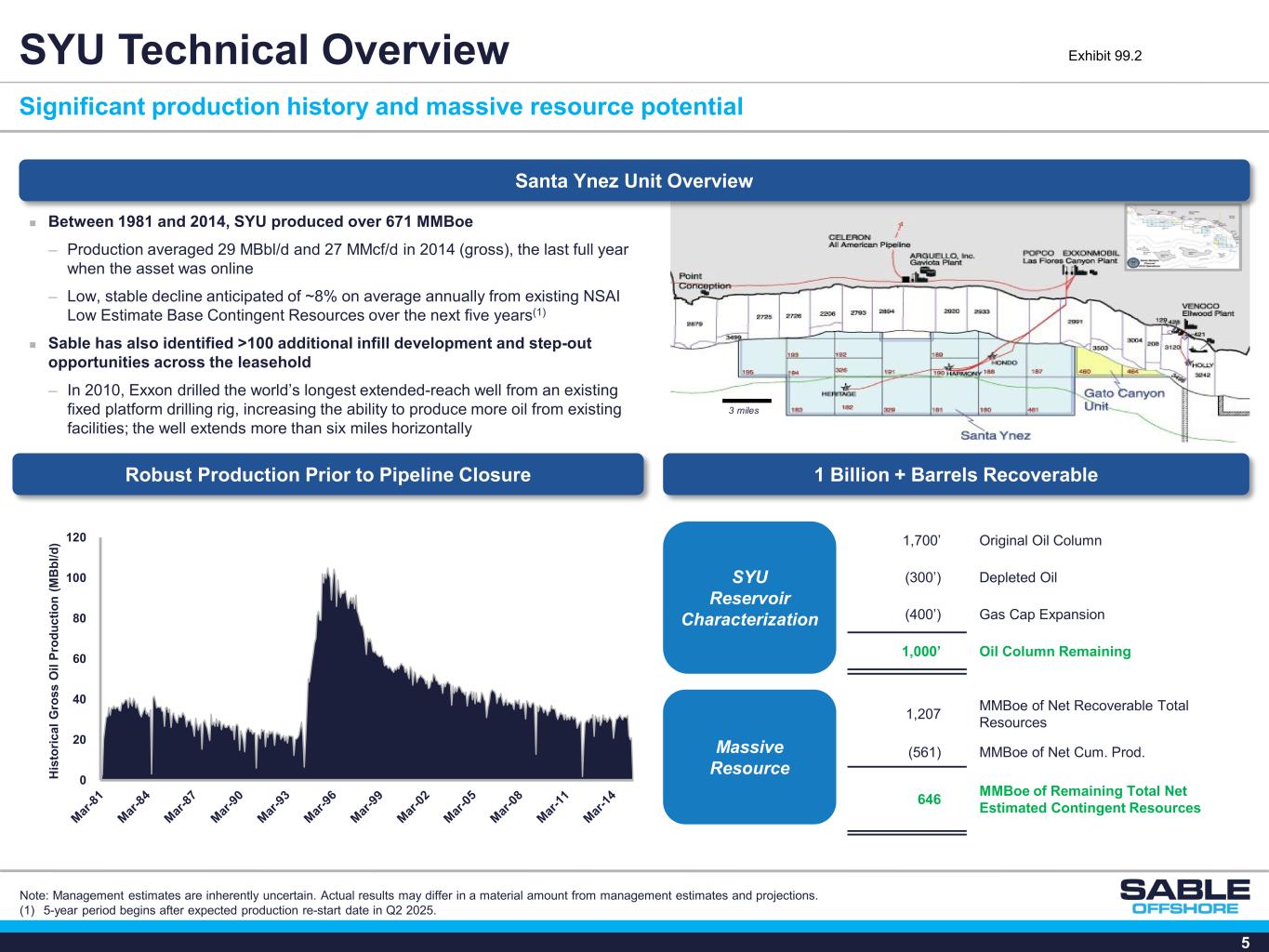

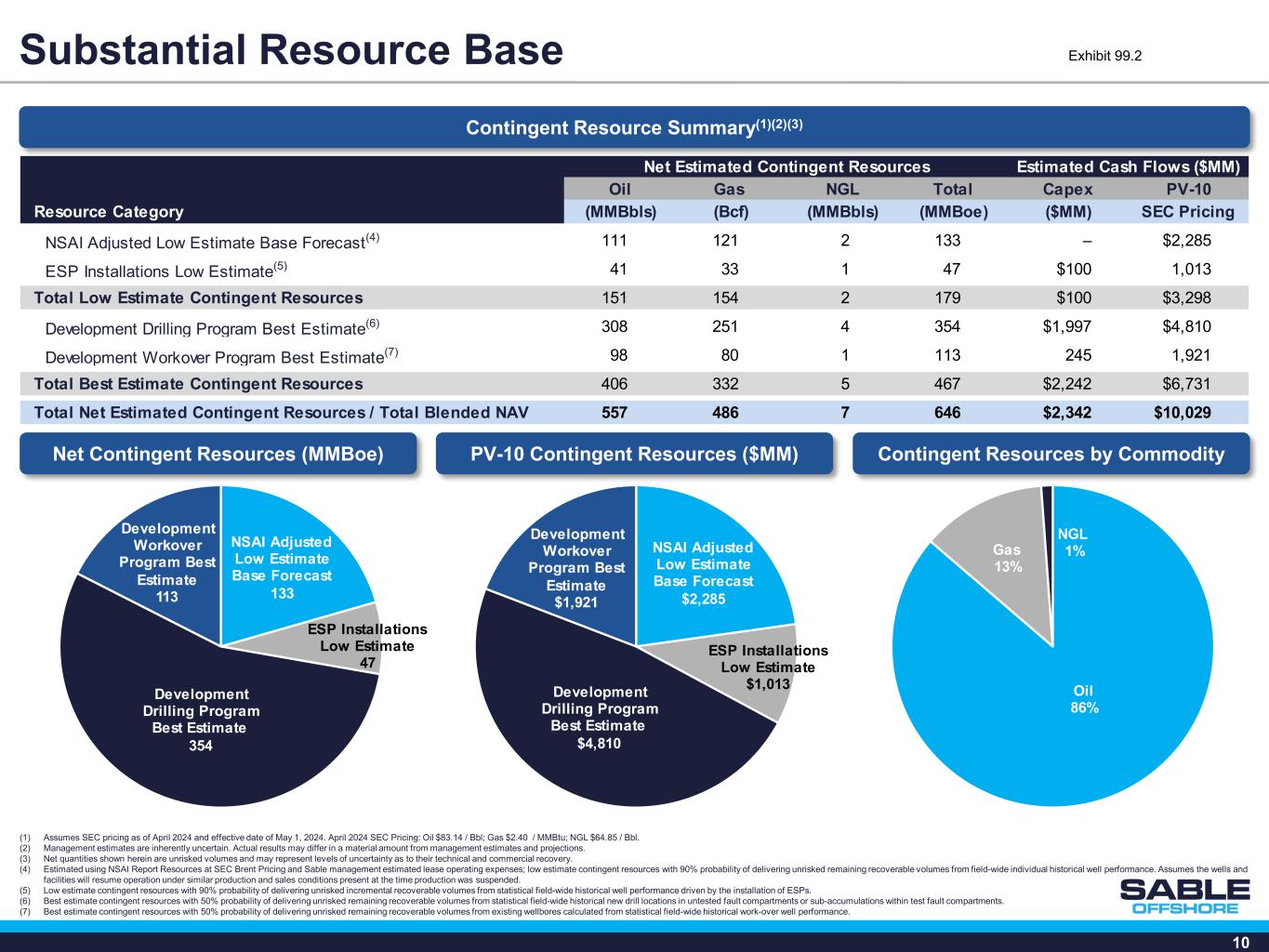

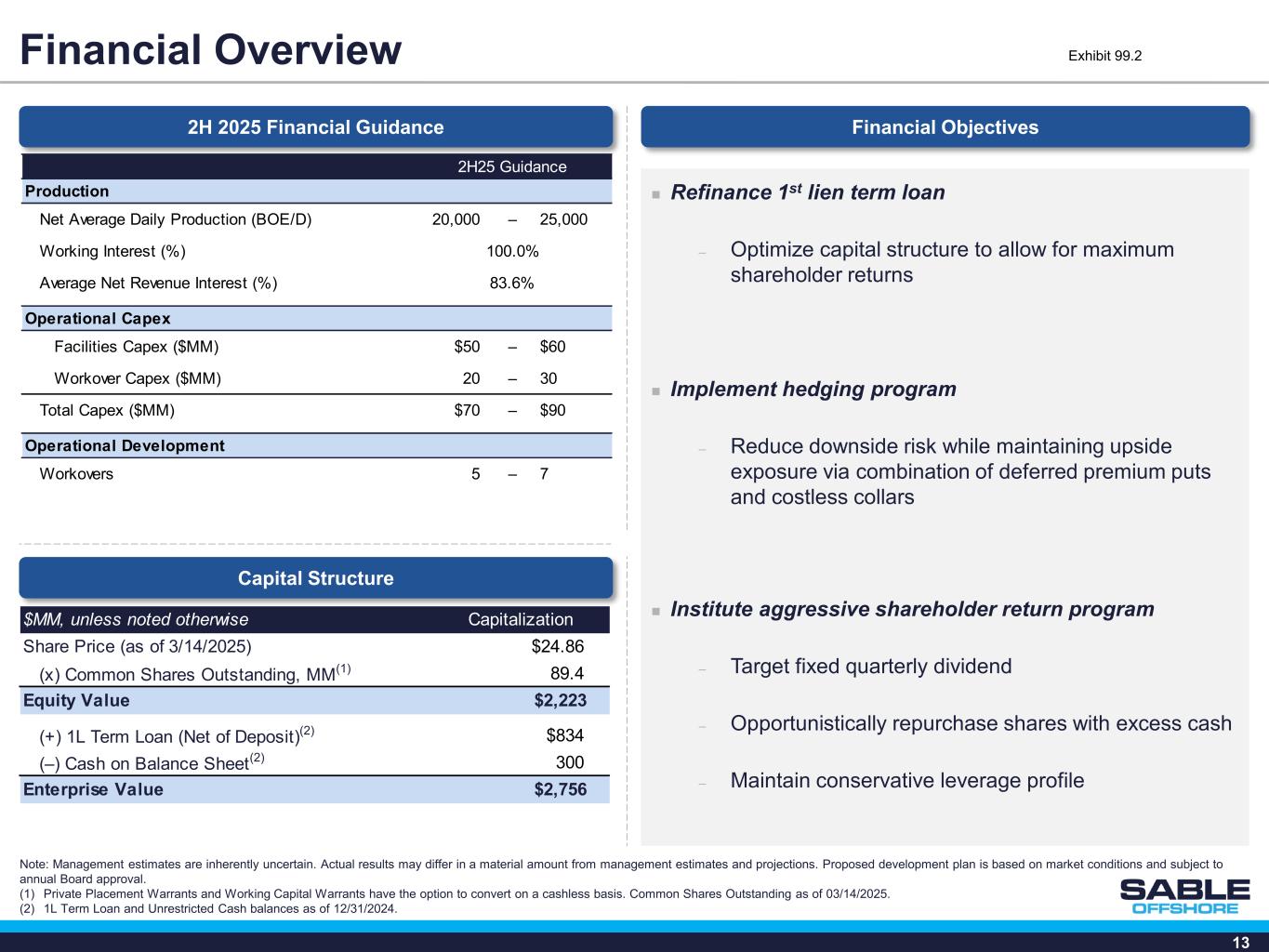

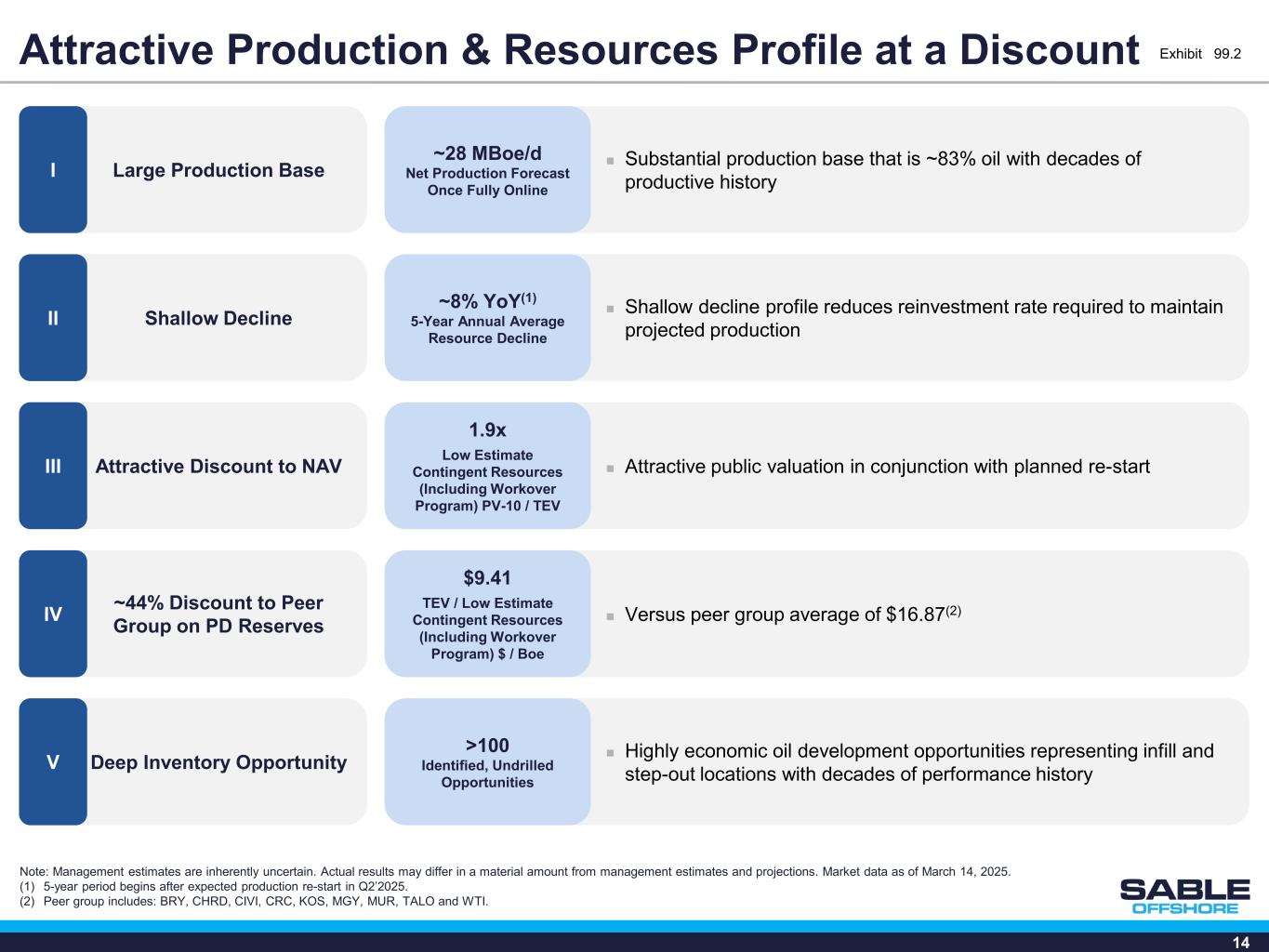

•We expect to restart production at the SYU offshore platforms in the second quarter of 2025 upon the completion of the anomaly repair program, hydrotest of the Pipeline, and OSFM approval of our updated start-up plan.

•Sable expects to sequentially restart the SYU offshore platforms, beginning with Harmony, followed by Heritage, and then Hondo.

•Sable issued updated capex and production guidance for the second half of 2025, which reflects remaining capital expenditure plans after the expected restart in the second quarter of 2025.

|

|

|

|

|

|

|

|

|

|

|

|

|

2H25 Guidance |

| Production |

| Net Average Daily Production (BOE/D) |

20,000 |

— |

|

25,000 |

| Working Interest (%) |

100.0% |

| Average NRI (%) |

83.6% |

| Operational Capex |

| Facilities Capex ($MM) |

$50 |

— |

$60 |

| Workover Capex ($MM) |

20 |

— |

30 |

| Total Capex ($MM) |

$70 |

— |

$90 |

| Operational Development |

| Workovers |

5 |

— |

7 |

Management Commentary

Sable’s Chairman and Chief Executive Officer, Jim Flores added, “The Sable team looks forward to finishing the restoration of the Pipeline to as-new condition and restarting production at the Santa Ynez Unit. The restart will provide low carbon intensity energy to California and enhance domestic energy security and affordability. Sable is excited to be a part of this solution.”

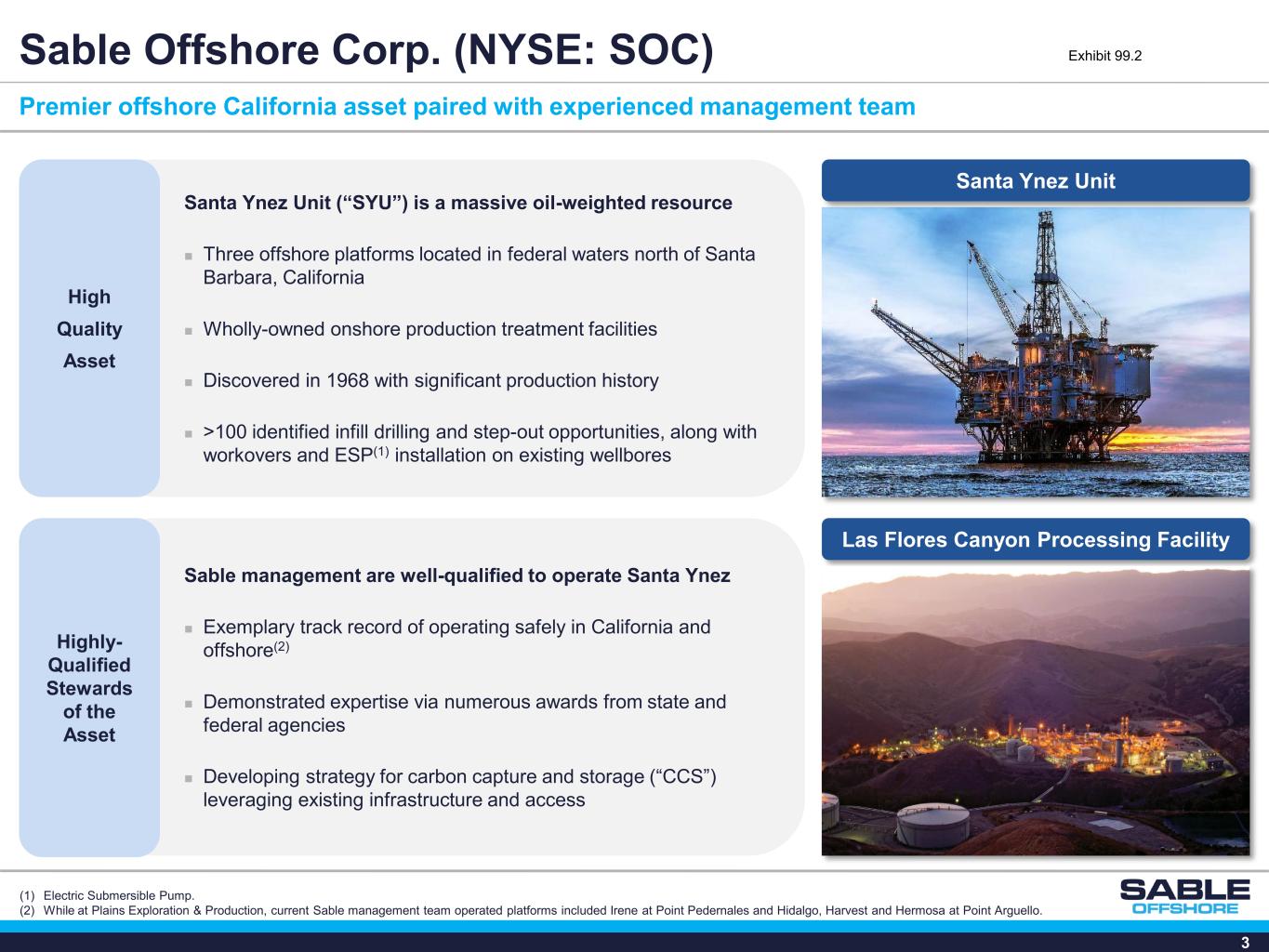

About Sable

Sable Offshore Corp. is an independent oil and gas company, headquartered in Houston, Texas, focused on responsibly developing the Santa Ynez Unit in federal waters offshore California. The Sable team has extensive experience safely operating in California.

Forward-Looking Statements

The information in this press release include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. When used in this press release, the words “could,” “should,” “will,” “ may,” “ believe,” “ anticipate,” “ intend,” “ estimate,” “expect,” “project,” “continue,” “plan,” forecast,” “predict,” “potential,” “future,” “outlook,” and “target,” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements will contain such identifying words. These statements are based on the current beliefs and expectations of Sable’s management and are subject to significant risks and uncertainties. Actual results may differ materially from those described in the forward-looking statements. Factors that could cause Sable’s actual results to differ materially from those described in the forward-looking statements include: the ability to recommence production of the SYU assets and the cost and time required therefor; global economic conditions and inflation; increased operating costs; lack of availability of drilling and production equipment, supplies, services and qualified personnel; geographical concentration of operations; environmental and weather risks; regulatory changes and uncertainties; litigation, complaints and/or adverse publicity; privacy and data protection laws, privacy or data breaches, or loss of data; our ability to comply with laws and regulations applicable to our business; and other one-time events and other factors that can be found in Sable’s Annual Report on Form 10-K for the year ended December 31, 2024, and any subsequent Quarterly Report on Form 10-Q or Current Report on Form 8-K, which are filed with the Securities and Exchange Commission and are available on Sable’s website (www.sableoffshore.com) and on the Securities and Exchange Commission’s website (www.sec.gov). Except as required by applicable law, Sable undertakes no obligation to publicly release the result of any revisions to these forward-looking statements to reflect the impact of events or circumstances that may arise after the date of this press release.

Disclaimers

Non-Producing Assets

The SYU assets have not produced commercial quantities of hydrocarbons since such assets were shut in during June of 2015 when the only pipeline transporting hydrocarbons produced from such assets to market ceased operations. There can be no assurance that the necessary permits will be obtained that would allow the pipeline to recommence transportation and allow the assets to recommence production. If Restart Production is not achieved by March 1, 2026, the terms of the asset acquisition with ExxonMobil Corporation would potentially result in the assets being reverted to ExxonMobil Corporation without any compensation to Sable therefor.

Contacts

Investor Contact:

Harrison Breaud

Vice President, Finance & Investor Relations

IR@sableoffshore.com

713-579-8111