Document

Exhibit 99.1

PureCycle Technologies Fourth Quarter and Fiscal Year Ending 2023 Update

Orlando, Fla. – March 5, 2024, – PureCycle Technologies, Inc. (Nasdaq: PCT), a U.S.-based company revolutionizing plastic recycling, today, announced a corporate update for the fourth quarter and fiscal year ending December 31, 2023.

Management Commentary

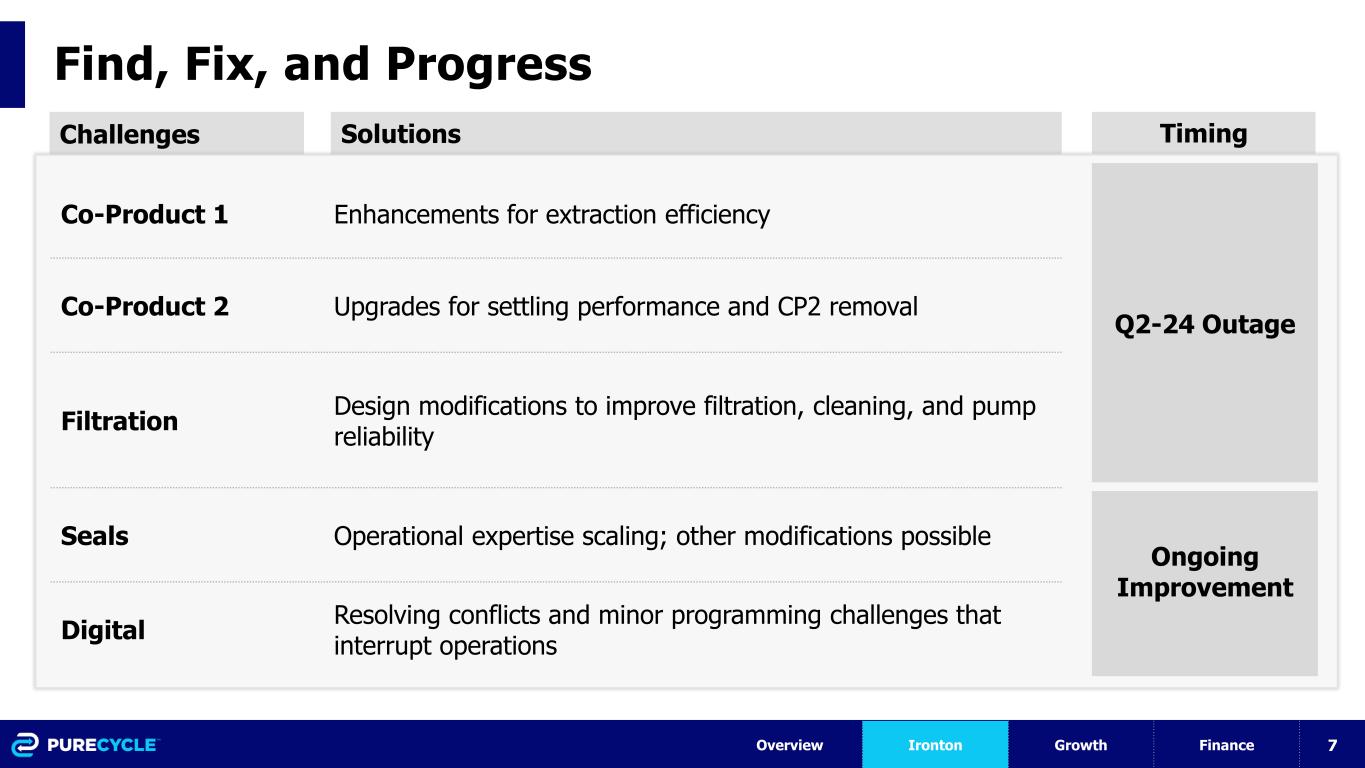

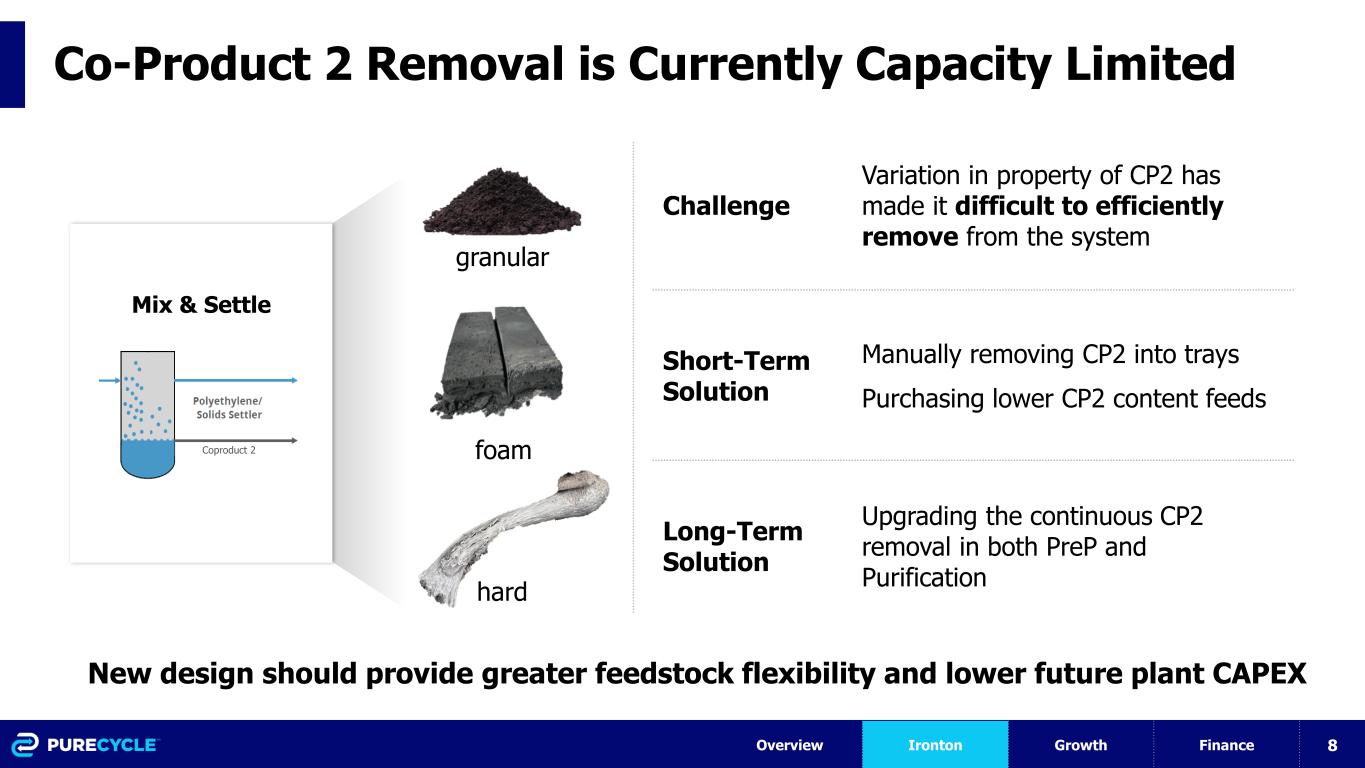

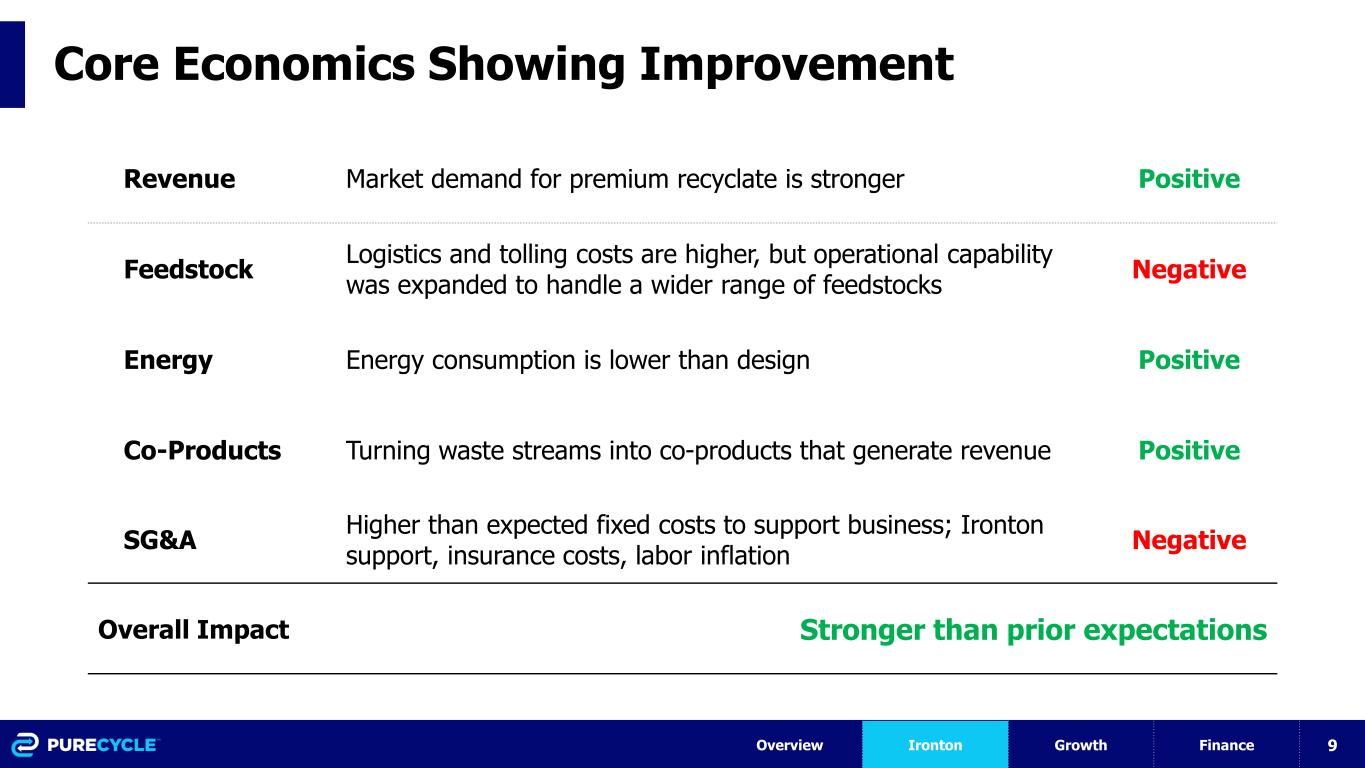

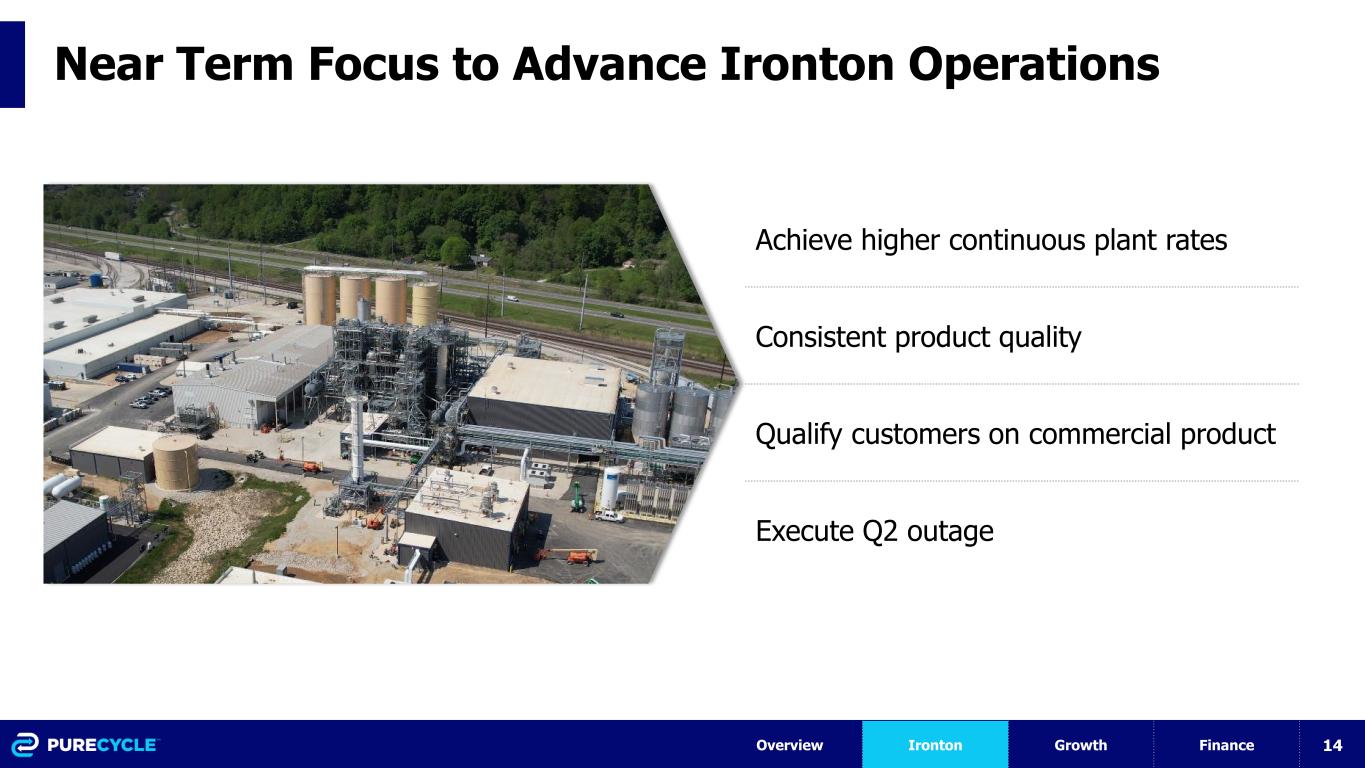

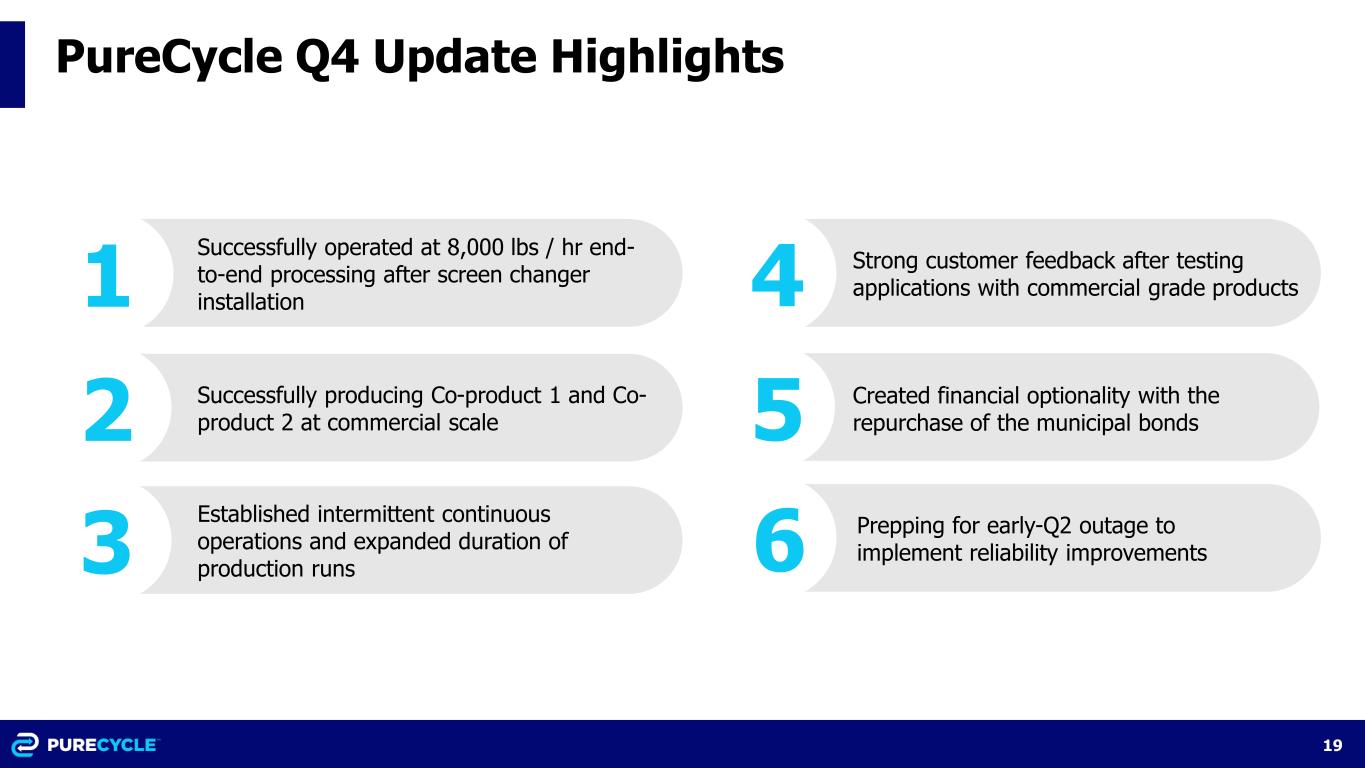

PureCycle Chief Executive Officer Dustin Olson said, “Our team made several improvements to the Ironton purification facility in the fourth quarter, which allowed us to make good progress towards continuously running the Ironton Facility at expected capacity rates. We continue to work through some limitations, such as the rate of displacement of co-product two from the system. Corrective engineering designs have been completed for an upgrade to the co-product area and work has already begun on the installation. I am proud of what the Ironton team has accomplished to date, and I am excited about our opportunities in 2024.”

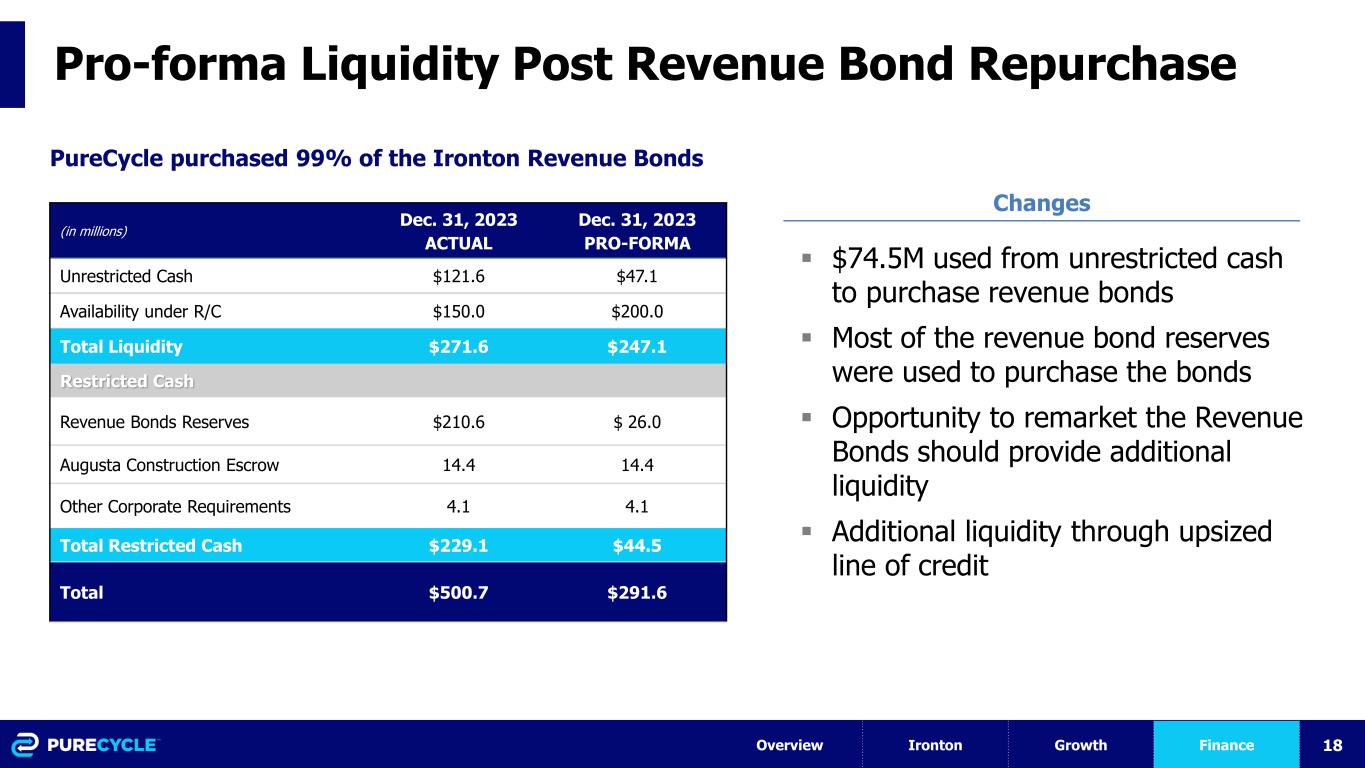

Olson added, “In early March, the Company purchased approximately 99% of its $249.5 million revenue bonds that were issued to fund construction of the Ironton Facility. The purchase of the revenue bonds removed substantially all restrictive covenants and events of default and should lead us to an improved capital structure with greater operational flexibility.”

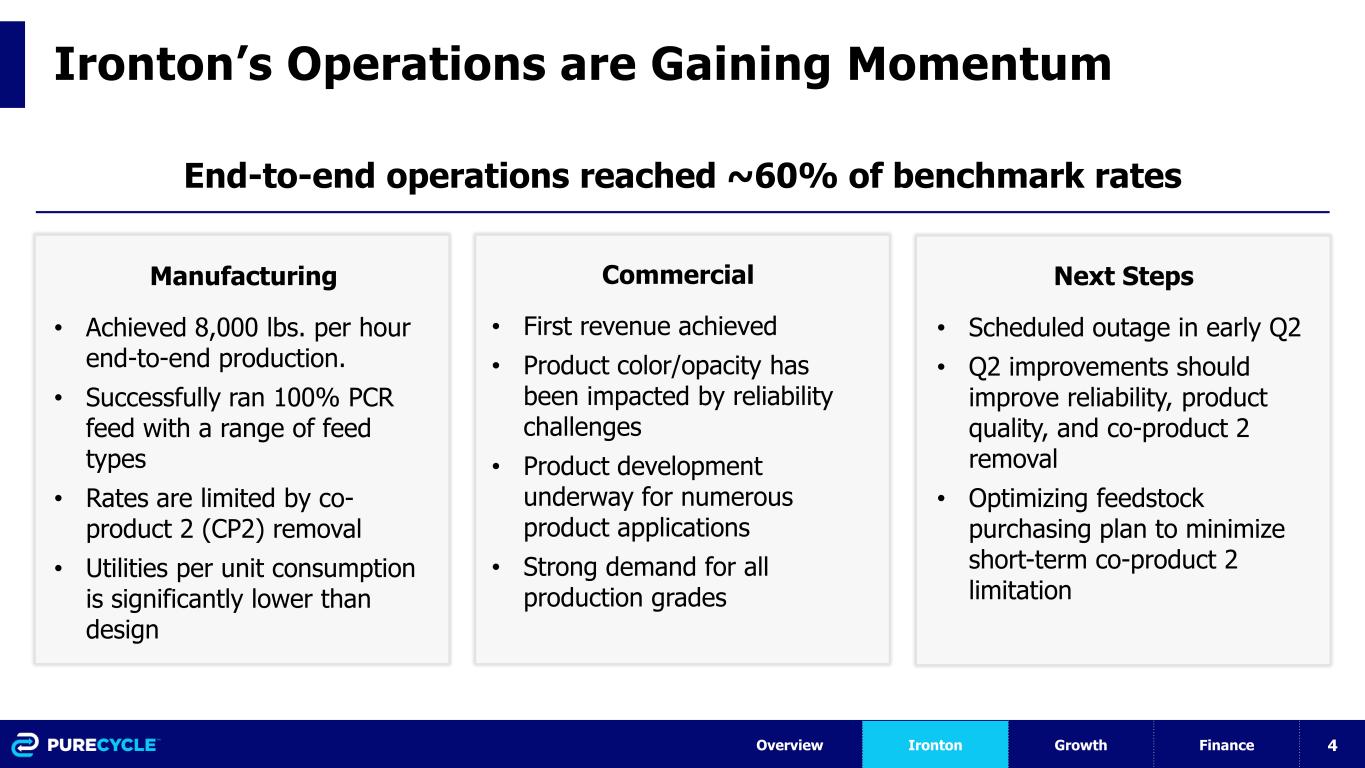

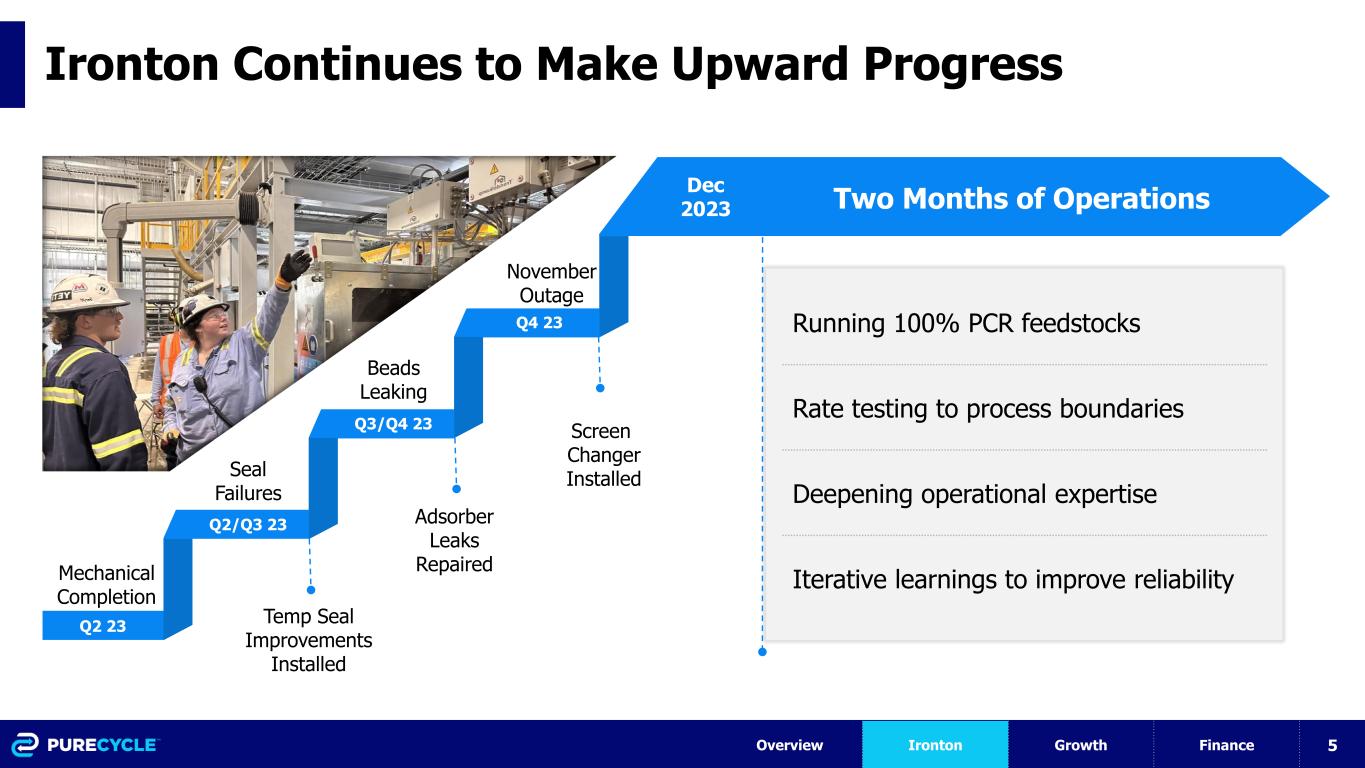

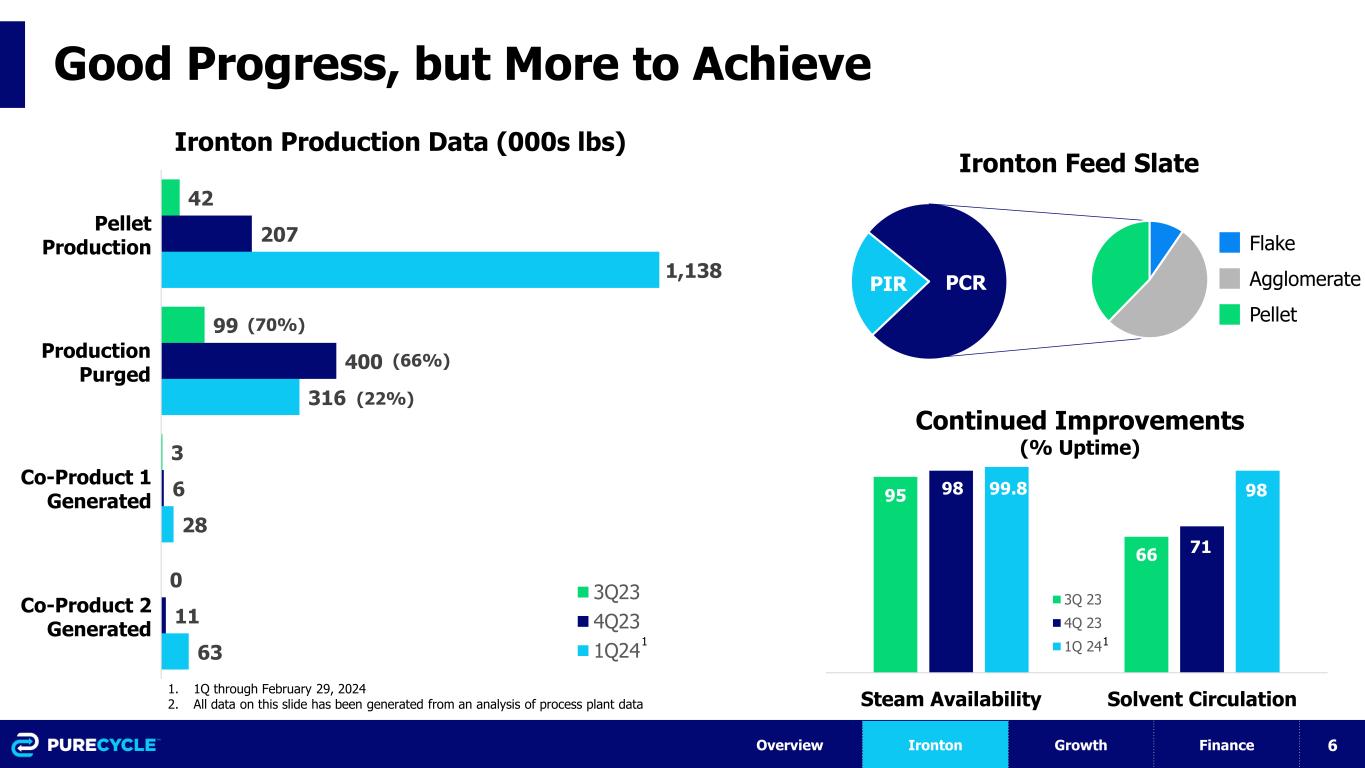

Ironton Facility Update

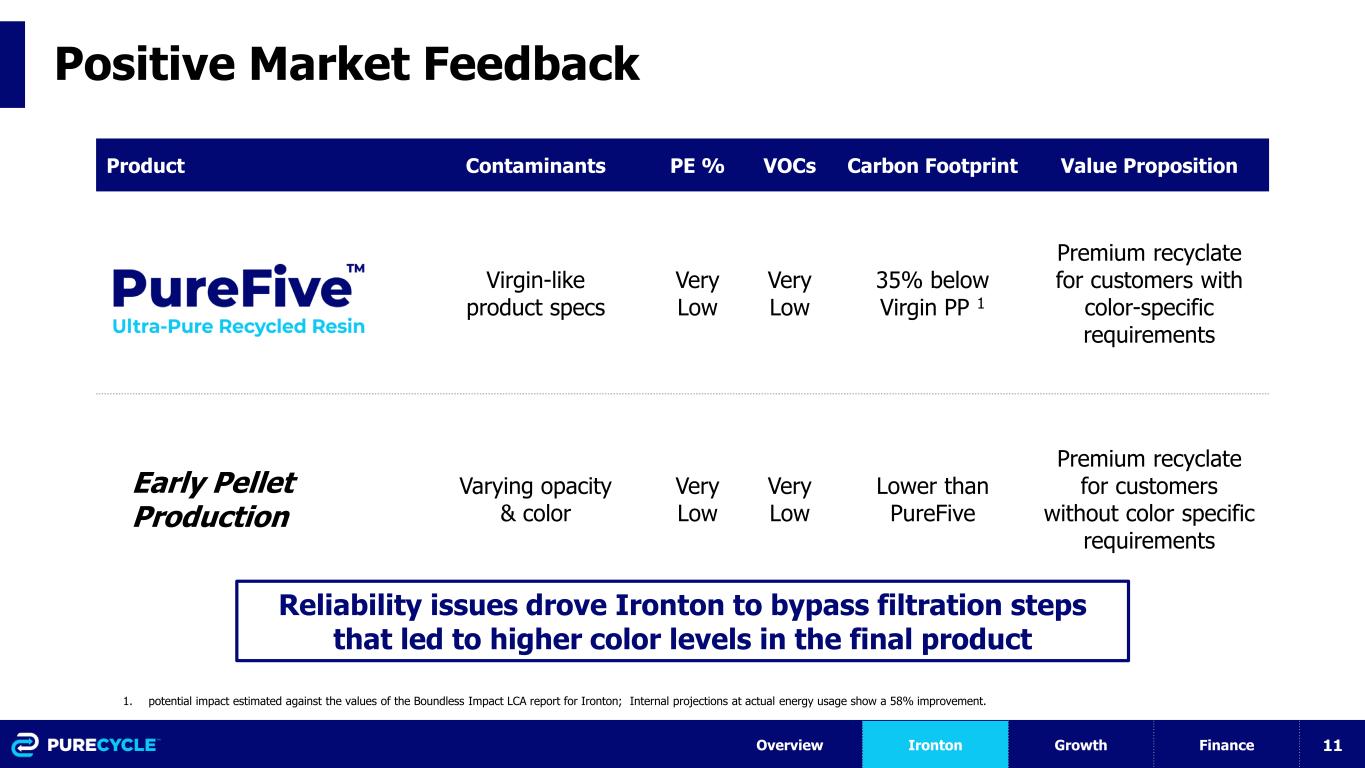

A majority of the fourth quarter was spent making improvements to the Ironton Facility, including the installation of an automatic screen changer on the final product extruder. Downtime in the fourth quarter plus a planned outage in November limited the total pellet production to approximately 200,000 pounds in the quarter. The improvements made during the outage have led to increases in production levels. The Company produced more than one million pounds of pellets in the first two months of 2024. The Company believes that it continues to make good progress towards sustained commercial operations.

Ironton Bond Purchase

As previously disclosed, the Company purchased $246.7 million of its $249.5 million Southern Ohio Port Authority revenue bonds, which included approximately 99% of the Series A issues, and 100% of each of the Series B and C issues. The purchase, which was completed on March 5, 2024, eliminated substantially all restrictive covenants and events of default.

Conference Call

The Company will hold a conference call on Wednesday, March 6 at 11:00 a.m. EST to provide an update on recent corporate developments, including activity from the fourth quarter.

Fourth Quarter 2023 Conference Call Details

Date: Wednesday, March 6, 2024

Time: 11:00 a.m. EST

Participant Link: PureCycle Technologies Fourth Quarter 2023 Update Call For participants interested in a listen-only webcast, please access the conference call using the above link.

For a calendar reminder, please click HERE.

The conference call will have a live Q&A session. For analyst participants who would like to ask management a question after prepared remarks, please click HERE. You will receive a number and a unique access pin.

During prepared remarks, management will try to answer investor questions submitted in advance. To submit a question, please send an e-mail to investorquestion@purecycle.com.

The corporate update will be available for replay by clicking HERE or through the Company’s website at www.purecycle.com. A replay of the conference call will be available after 3:00 p.m. EST until February 28, 2025.

###

PureCycle Contact

Christian Bruey

cbruey@purecycle.com

+1 (352) 745-6120

About PureCycle Technologies

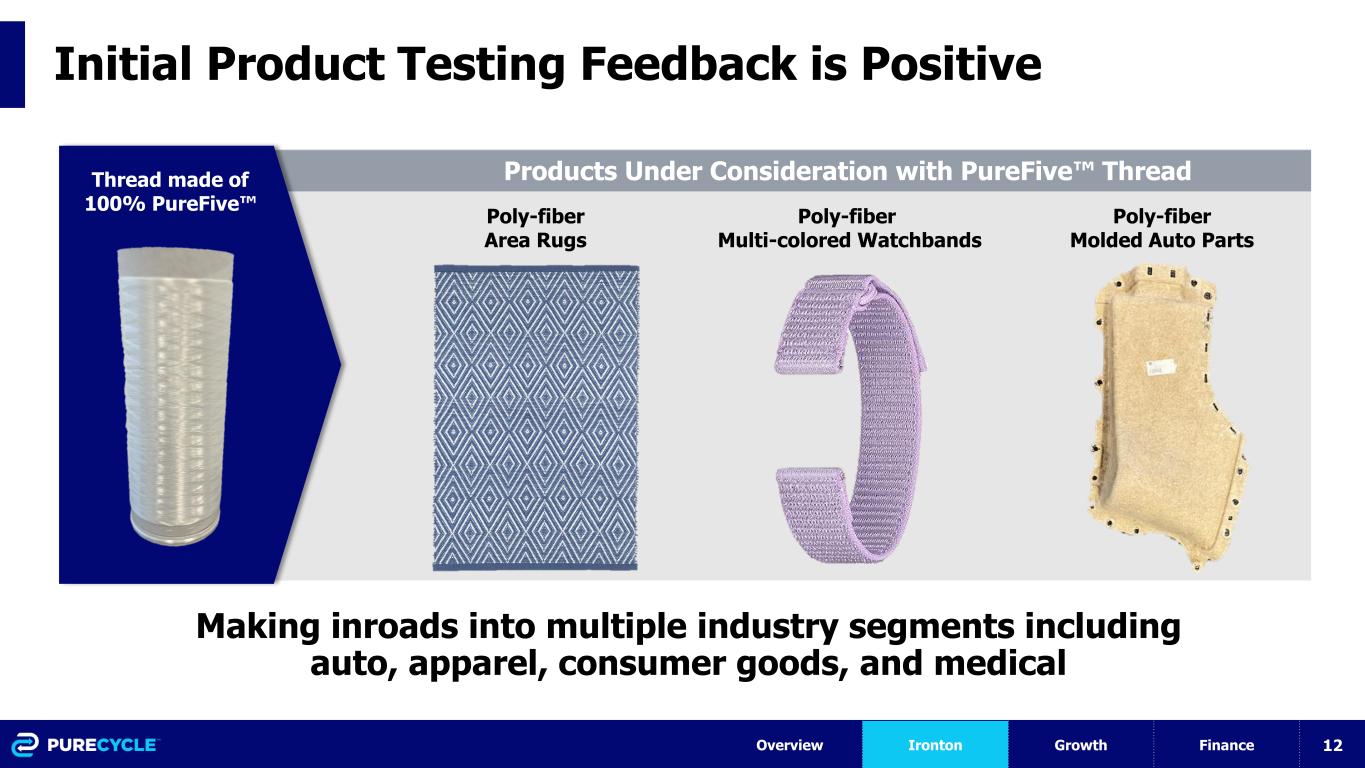

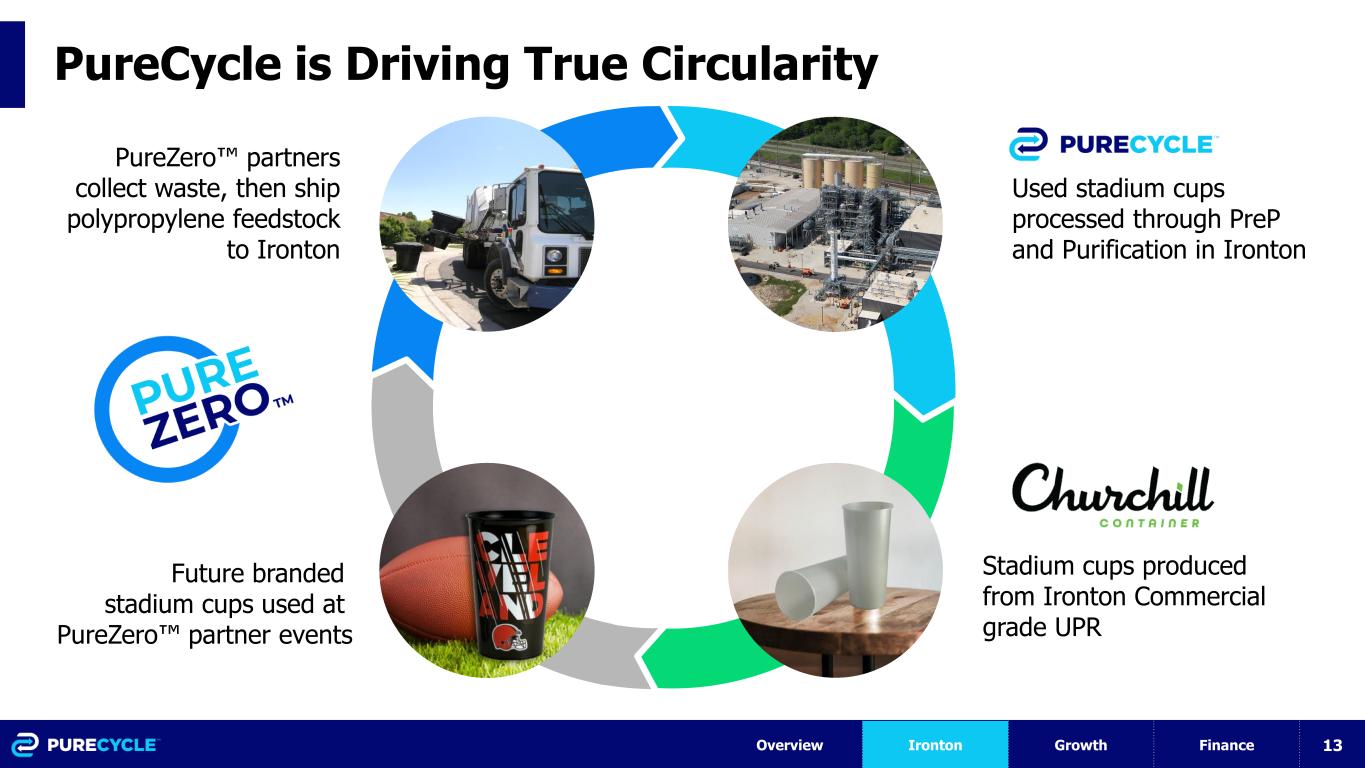

PureCycle Technologies LLC., a subsidiary of PureCycle Technologies, Inc., holds a global license for the only patented solvent-driven purification recycling technology, developed by The Procter & Gamble Company (P&G), that is designed to transform polypropylene plastic waste (designated as No. 5 plastic) into a continuously renewable resource. The unique purification process removes color, odor, and other impurities from No. 5 plastic waste resulting in an ultra-pure recycled (UPR) plastic that can be recycled and reused multiple times, changing our relationship with plastic. www.purecycle.com

Forward-Looking Statements

This press release contains forward-looking statements, including statements about the financial condition, results of operations, earnings outlook and prospects of PCT. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward-looking statements. Forward-looking statements generally relate to future events or PureCycle’s future financial or operating performance and may refer to projections and forecasts. Forward-looking statements are often identified by future or conditional words such as “plan,” “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “continue,” “could,” “may,” “might,” “possible,” “potential,” “predict,” “should,” “would” and other similar words and expressions (or the negative versions of such words or expressions), but the absence of these words does not mean that a statement is not forward-looking.

The forward-looking statements are based on the current expectations of PureCycle’s management and are inherently subject to uncertainties and changes in circumstances and their potential effects and speak only as of the date of this press release. There can be no assurance that future developments will be those that have been anticipated. These forward-looking statements involve a number of risks, uncertainties or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by these forward-looking statements.

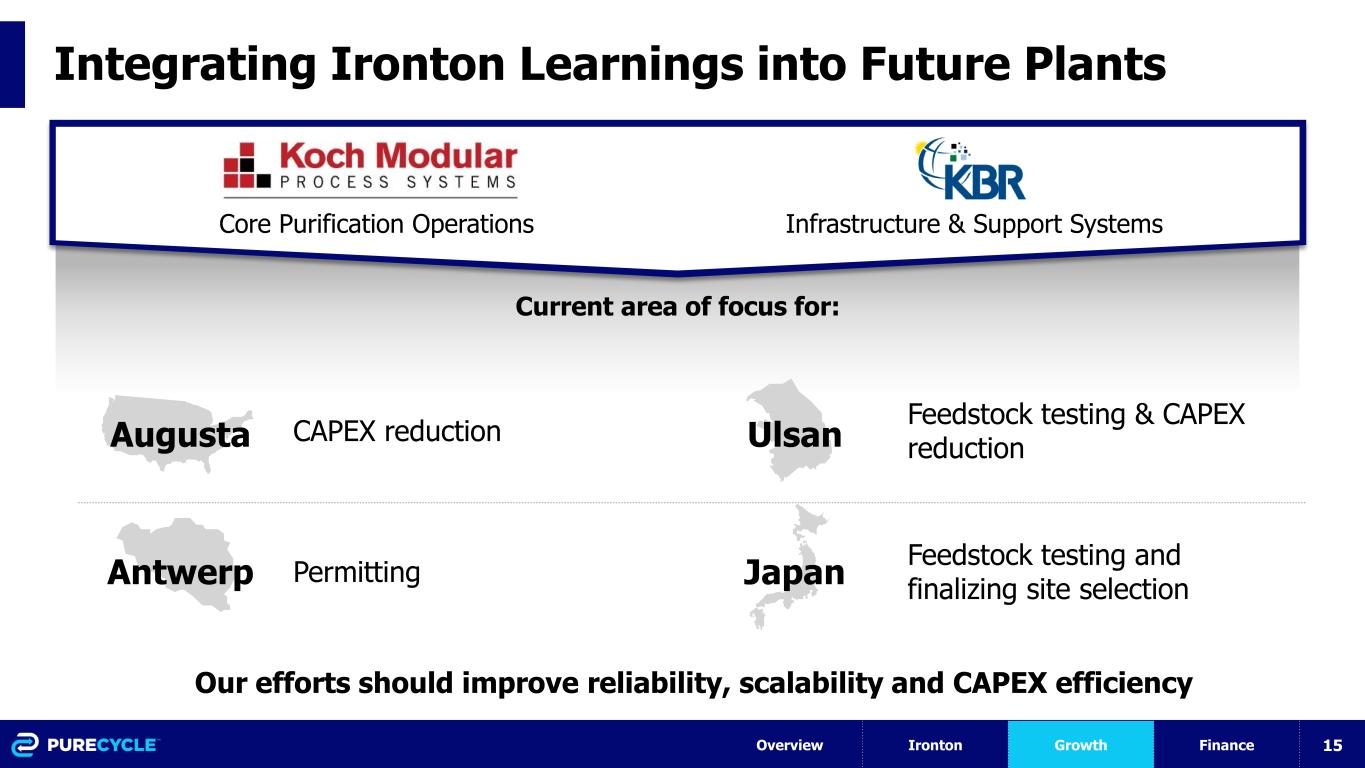

These risks and uncertainties include, but are not limited to, those factors described in the section entitled “Risk Factors” in each of PureCycle’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023 and PureCycle’s Quarterly Reports on Form 10-Q, those discussed and identified in other public filings made with the Securities and Exchange Commission by PureCycle and the following: PCT's ability to obtain funding for its operations and future growth and to continue as a going concern; PCT's ability to meet, and to continue to meet, applicable regulatory requirements for the use of PCT’s ultra-pure recycled (“UPR”) resin in food grade applications (including in the United States, Europe, Asia and other future international locations); PCT's ability to comply on an ongoing basis with the numerous regulatory requirements applicable to the UPR resin and PCT’s facilities (including in the United States, Europe, Asia and other future international locations); expectations and changes regarding PCT’s strategies and future financial performance, including its future business plans, expansion plans or objectives, prospective performance and opportunities and competitors, revenues, products and services, pricing, operating expenses, market trends, liquidity, cash flows and uses of cash, capital expenditures, and PCT’s ability to invest in growth initiatives; the ability of PCT’s first commercial-scale recycling facility in Lawrence County, Ohio (the “Ironton Facility”) to be appropriately certified by Leidos, following certain performance and other tests, and commence full-scale commercial operations in a timely and cost-effective manner or at all; PCT’s ability to meet, and to continue to meet, the requirements imposed upon it and its subsidiaries by the funding for its operations, including the funding for the Ironton Facility; PCT’s ability to minimize or eliminate the many hazards and operational risks at its manufacturing facilities that can result in potential injury to individuals, disrupt its business (including interruptions or disruptions in operations at its facilities), and subject PCT to liability and increased costs; PCT’s ability to complete the necessary funding with respect to, and complete the construction of, (i) its first U.S. multi-line facility, located in Augusta, Georgia; (ii) its first commercial-scale European plant located in Antwerp, Belgium and (iii) its first commercial-scale Asian plant located in Ulsan, South Korea, in a timely and cost-effective manner; PCT’s ability to establish, sort and process polypropylene plastic waste at its plastic waste prep facilities; PCT’s ability to maintain exclusivity under the Procter & Gamble Company license; the implementation, market acceptance and success of PCT’s business model and growth strategy; the success or profitability of PCT’s offtake arrangements; the ability to source feedstock with a high polypropylene content at a reasonable cost; PCT’s future capital requirements and sources and uses of cash; developments and projections relating to PCT’s competitors and industry; the outcome of any legal or regulatory proceedings to which PCT is, or may become, a party including the securities class action and putative class action cases; geopolitical risk and changes in applicable laws or regulations; the possibility that PCT may be adversely affected by other economic, business, and/or competitive factors, including rising interest rates, availability of capital, economic cycles, and other macro-economic impacts; turnover in employees and increases in employee-related costs; changes in the prices and availability of labor (including labor shortages), transportation and materials, including inflation, supply chain conditions and its related impact on energy and raw materials, and PCT’s ability to obtain them in a timely and cost-effective manner; any business disruptions due to political or economic instability, pandemics, armed hostilities (including the ongoing conflict between Russia and Ukraine and the current conflict in the Middle East); the potential impact of climate change on PCT, including physical and transition risks, higher regulatory and compliance costs, reputational risks, and availability of capital on attractive terms; and operational risk.