1 Ironton Operating Budget 2024 December 2024 Submission Exhibit 99.1

2 Table of Contents • Summary • Material Assumptions • Profit and Loss • Balance Sheet • Cash Flows • Financial Covenants

3 Summary • Ironton continues to go through the commissioning process and is anticipated to get to full utilization rates in the first half of 2024 in our base case • Full year operations are expected to generate $27.7mm in EBITDA with profitability improving throughout the year as the operation matures • Margins are expect to ramp from below zero in Q124 to the high 30s in Q424 (low 40s excluding management fees) • The budget includes $7mm of management fees for support services • EBITDA plus Capitalized Interest and the Contingency account reserves are anticipated to be sufficient to service all of 2024 interest payments and Debt Service Reserve funding requirements in 2024

4 Material Assumptions - Operations Assumption Metric Comments Production Start Date Dec-23 Production Ramp Period Additional detail provided herein Revenue 1.36 $/rPP lb Average sales price based on projected contracted sales, spot sales, and excluding coproducts and order fulfillment activities Operating Days 330 days max for 107MM nameplate Purification assumes ~90% uptime Pre-processing assumes ~75% uptime Average Feedstock Cost 0.24 $/rPP lb Includes costs of raw materials, tolling, and preprocessing Recycled PP Yield 91% Pre-operating estimate, actual results may differ Coproduct PE Yield 7% Pre-operating estimate, actual results may differ Coproduct Low PP Wax Yield 2% Pre-operating estimate, actual results may differ Corporate Support Service Management Fee $7MM Management fee includes charges to Ironton for shared services and can result in a maximum allocation of $14.8MM

5 Material Assumptions – Ramp of Operations Month Ramp Schedule Jan-24 50% Feb-24 50% Mar-24 75% Apr-24 75% May-24 75% Jun-24 100% Jul-24 100% Aug-24 100% Sep-24 100% Oct-24 100% Nov-24 100% Dec-24 100%

6 Material Assumptions – Working Capital / CapEx Assumption Metric Comments DSO 45 days Days sales outstanding DPO 30 days Days payables outstanding (trade payables) DIO 30 days Days inventory on hand Interest Income N/A None forecasted

7 Material Assumptions – Other Assumption Metric Comments Use of capitalized interest reserves Jun 2024 & Dec 2024 Cover full interest payment ($10.1MM) in Jun 2024 with projected remaining funds (~$0.5MM) used to cover a portion of Dec 2024 payment Use of contingency account All of 2024 Funds assumed to be used to cover Sr. Interest Payments after Sr. Capitalized Interest Reserve Account is consumed ($7.4MM of Sr. Interest in Dec 2024) Taxes N/A No taxable income expected to be attributed in 2024

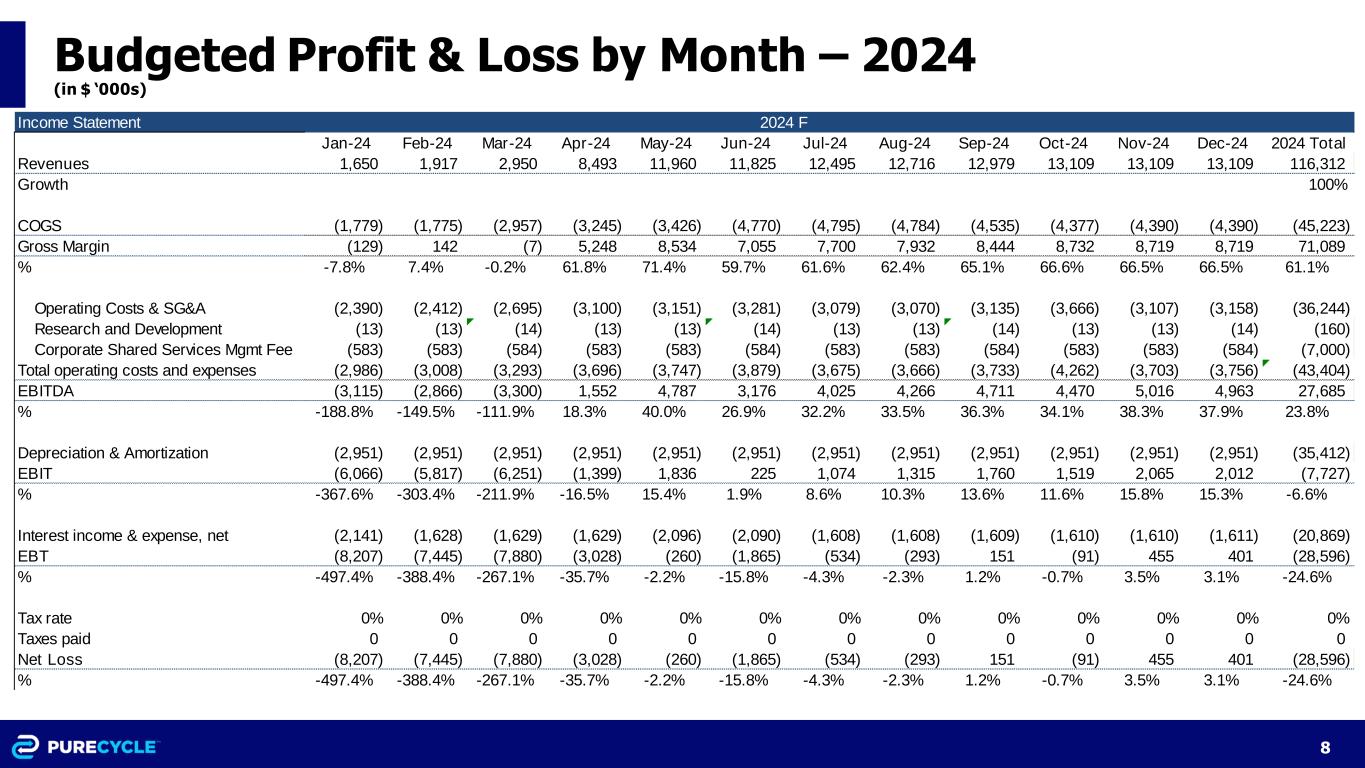

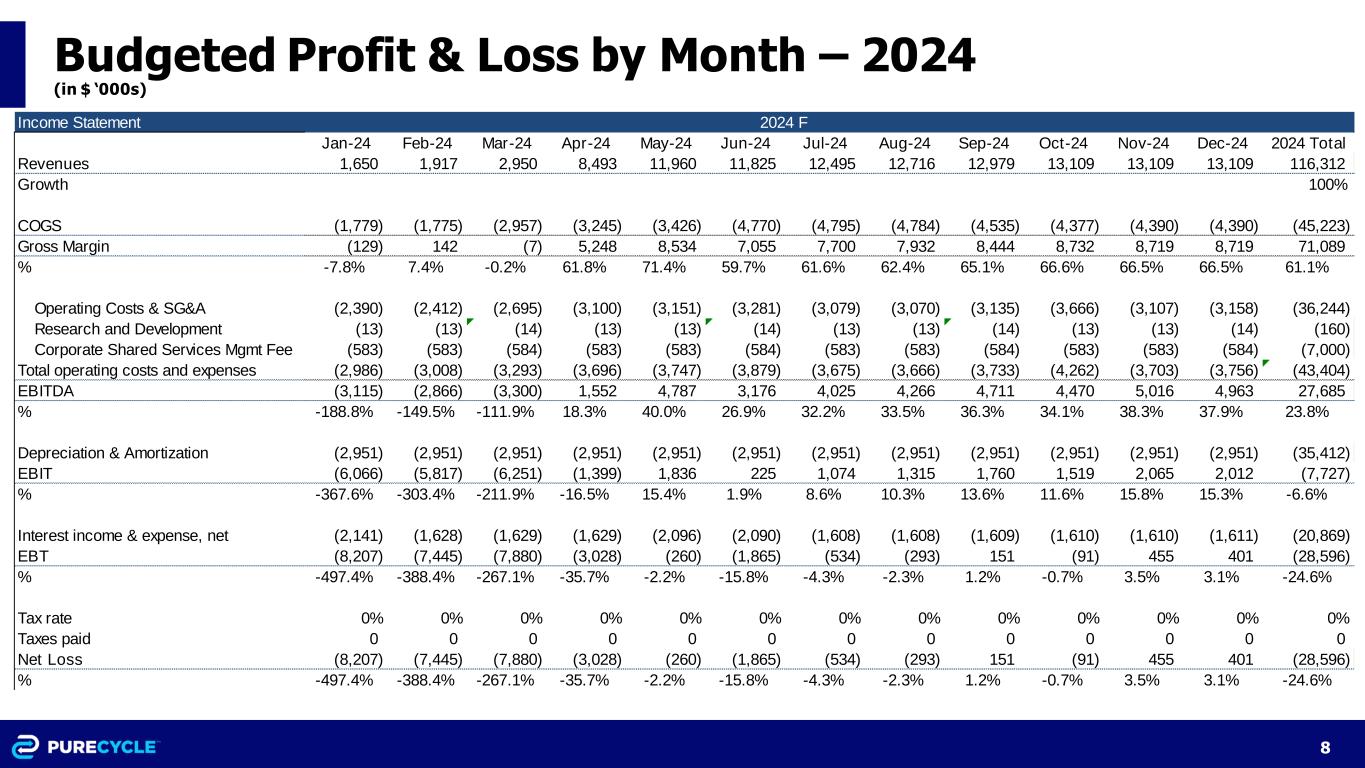

8 Budgeted Profit & Loss by Month – 2024 (in $ ‘000s) Income Statement Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 2024 Total Revenues 1,650 1,917 2,950 8,493 11,960 11,825 12,495 12,716 12,979 13,109 13,109 13,109 116,312 Growth 100% COGS (1,779) (1,775) (2,957) (3,245) (3,426) (4,770) (4,795) (4,784) (4,535) (4,377) (4,390) (4,390) (45,223) Gross Margin (129) 142 (7) 5,248 8,534 7,055 7,700 7,932 8,444 8,732 8,719 8,719 71,089 % -7.8% 7.4% -0.2% 61.8% 71.4% 59.7% 61.6% 62.4% 65.1% 66.6% 66.5% 66.5% 61.1% Operating Costs & SG&A (2,390) (2,412) (2,695) (3,100) (3,151) (3,281) (3,079) (3,070) (3,135) (3,666) (3,107) (3,158) (36,244) Research and Development (13) (13) (14) (13) (13) (14) (13) (13) (14) (13) (13) (14) (160) Corporate Shared Services Mgmt Fee (583) (583) (584) (583) (583) (584) (583) (583) (584) (583) (583) (584) (7,000) Total operating costs and expenses (2,986) (3,008) (3,293) (3,696) (3,747) (3,879) (3,675) (3,666) (3,733) (4,262) (3,703) (3,756) (43,404) EBITDA (3,115) (2,866) (3,300) 1,552 4,787 3,176 4,025 4,266 4,711 4,470 5,016 4,963 27,685 % -188.8% -149.5% -111.9% 18.3% 40.0% 26.9% 32.2% 33.5% 36.3% 34.1% 38.3% 37.9% 23.8% Depreciation & Amortization (2,951) (2,951) (2,951) (2,951) (2,951) (2,951) (2,951) (2,951) (2,951) (2,951) (2,951) (2,951) (35,412) EBIT (6,066) (5,817) (6,251) (1,399) 1,836 225 1,074 1,315 1,760 1,519 2,065 2,012 (7,727) % -367.6% -303.4% -211.9% -16.5% 15.4% 1.9% 8.6% 10.3% 13.6% 11.6% 15.8% 15.3% -6.6% Interest income & expense, net (2,141) (1,628) (1,629) (1,629) (2,096) (2,090) (1,608) (1,608) (1,609) (1,610) (1,610) (1,611) (20,869) EBT (8,207) (7,445) (7,880) (3,028) (260) (1,865) (534) (293) 151 (91) 455 401 (28,596) % -497.4% -388.4% -267.1% -35.7% -2.2% -15.8% -4.3% -2.3% 1.2% -0.7% 3.5% 3.1% -24.6% Tax rate 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% 0% Taxes paid 0 0 0 0 0 0 0 0 0 0 0 0 0 Net Loss (8,207) (7,445) (7,880) (3,028) (260) (1,865) (534) (293) 151 (91) 455 401 (28,596) % -497.4% -388.4% -267.1% -35.7% -2.2% -15.8% -4.3% -2.3% 1.2% -0.7% 3.5% 3.1% -24.6% 2024 F

9 Budgeted Balance Sheet by Month – 2024 (in $ ‘000s) Balance Sheet Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 2024 Total Cash in Liquidity Reserve 101,235 100,726 100,693 100,123 100,773 100,713 101,929 100,827 100,599 100,309 100,998 107,294 107,294 Other Restricted Cash 112,493 113,006 113,577 114,148 121,478 120,820 102,895 103,758 104,620 105,482 106,340 95,329 95,329 Receivables 1,650 2,876 4,425 12,740 17,940 17,738 18,743 19,074 19,469 19,664 19,664 19,664 19,664 Inventory 1,779 1,775 2,957 3,245 3,426 4,770 4,795 4,784 4,535 4,377 4,390 4,390 4,390 Prepaids and Other Assets 6,563 6,489 6,391 6,140 5,793 5,458 5,113 9,265 8,622 8,242 7,862 7,482 7,482 Operating ROU Asset 4,614 4,518 4,422 4,325 4,228 4,130 4,032 3,933 3,834 3,735 3,635 3,535 3,535 Fixed Assets 413,007 410,056 407,105 404,154 401,203 398,252 395,301 392,350 391,999 389,048 386,097 385,846 385,846 Total Assets 641,341 639,445 639,570 644,874 654,841 651,880 632,807 633,991 633,678 630,857 628,986 623,540 623,540 Accounts Payable 3,502 3,520 4,994 5,795 6,024 7,485 7,439 7,407 7,235 7,596 6,762 7,088 7,088 Accrued Expenses 19,000 19,000 19,000 19,000 19,000 19,000 19,000 19,000 21,600 19,000 19,000 21,700 21,700 Accrued Interest 3,530 5,061 6,593 8,125 10,123 1,972 3,484 4,996 6,508 8,020 9,533 1,492 1,492 Current Portion of Debt 6,975 6,975 6,975 6,975 6,975 7,225 7,225 7,225 7,225 7,225 7,225 16,730 16,730 Deferred Revenue 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 5,000 Operating ROU Liability 3,339 3,244 3,148 3,052 2,955 2,858 2,760 2,662 2,563 2,464 2,364 2,264 2,264 Bonds Payable 227,893 227,989 228,086 228,184 228,282 224,726 224,821 224,917 225,014 225,111 225,210 212,274 212,274 Other Noncurrent Liabilities 1,048 1,046 1,044 1,042 1,040 1,038 1,036 1,034 1,032 1,030 1,028 1,026 1,026 Due to Parent 343,344 347,344 352,344 358,344 366,344 375,344 355,344 355,344 350,944 348,944 345,944 348,644 348,644 Additional Paid-in Capital 223,380 223,380 223,380 223,380 223,380 223,380 223,380 223,380 223,380 223,380 223,380 223,380 223,380 Accumulated Deficit (195,669) (203,114) (210,994) (214,022) (214,282) (216,147) (216,681) (216,974) (216,823) (216,914) (216,459) (216,058) (216,058) Liabilities & Shareholder's Equity 641,342 639,446 639,570 644,875 654,841 651,880 632,808 633,991 633,678 630,857 628,986 623,540 623,540 2024 F

10 Budgeted Cash Flows by Month – 2024 (in $ ‘000s) Cash Flow Statement Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 2024 Total Cash Flow from Operations (CFO) Net income (8,207) (7,445) (7,880) (3,028) (260) (1,865) (534) (293) 151 (91) 455 401 (28,596) Addback D&A 2,951 2,951 2,951 2,951 2,951 2,951 2,951 2,951 2,951 2,951 2,951 2,951 35,412 Addback Lease Amort 95 96 96 97 97 98 98 99 99 99 100 100 1,174 Addback Accretion/Amort on Debt 96 96 97 98 98 119 95 96 97 98 98 119 1,207 Change in receivables (1,592) (1,226) (1,550) (8,315) (5,201) 203 (1,005) (332) (395) (195) 0 0 (19,606) Change in inventory 2,759 4 (1,182) (288) (181) (1,344) (25) 11 249 158 (13) 0 148 Change in prepaids and other assets 79 74 98 251 347 335 345 (4,152) 643 380 380 380 (840) Change in payables 2,733 18 1,474 801 229 1,461 (46) (32) (172) 361 (834) 326 6,319 Change in accrued expenses (1,538) 0 0 0 0 0 0 0 2,600 (2,600) 0 2,700 1,162 Change in accrued interest 1,998 1,532 1,532 1,532 1,998 (8,151) 1,512 1,512 1,512 1,512 1,512 (8,041) (40) ROU Liability Payments (95) (95) (96) (96) (97) (97) (98) (98) (99) (99) (100) (100) (1,170) CFO (722) (3,994) (4,460) (5,997) (18) (6,291) 3,294 (237) 7,637 2,574 4,549 (1,163) (4,830) Investing Cash Flow (CFI) CAPEX 0 0 0 0 0 0 0 0 (2,600) 0 0 (2,700) (5,300) CFI 0 0 0 0 0 0 0 0 (2,600) 0 0 (2,700) (5,300) Cash Flow from Financing Debt repayments 0 0 0 0 0 (3,425) 0 0 0 0 0 (3,550) (6,975) Finance lease payments (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (2) (24) Due to/from Parent for Working Capital 0 4,000 5,000 6,000 8,000 9,000 (20,000) 0 (7,000) (2,000) (3,000) 0 0 Equity from Parent for CapEx 0 0 0 0 0 0 0 0 2,600 0 0 2,700 5,300 CFI (2) 3,998 4,998 5,998 7,998 5,573 (20,002) (2) (4,402) (2,002) (3,002) (852) (1,699) Change in Cash (724) 4 538 1 7,980 (718) (16,708) (239) 635 572 1,547 (4,715) (11,829) Cash beginning 214,452 213,728 213,732 214,270 214,271 222,251 221,532 204,824 204,585 205,219 205,791 207,338 214,452 Cash end of month 213,728 213,732 214,270 214,271 222,251 221,532 204,824 204,585 205,219 205,791 207,338 202,623 202,623 2024 F

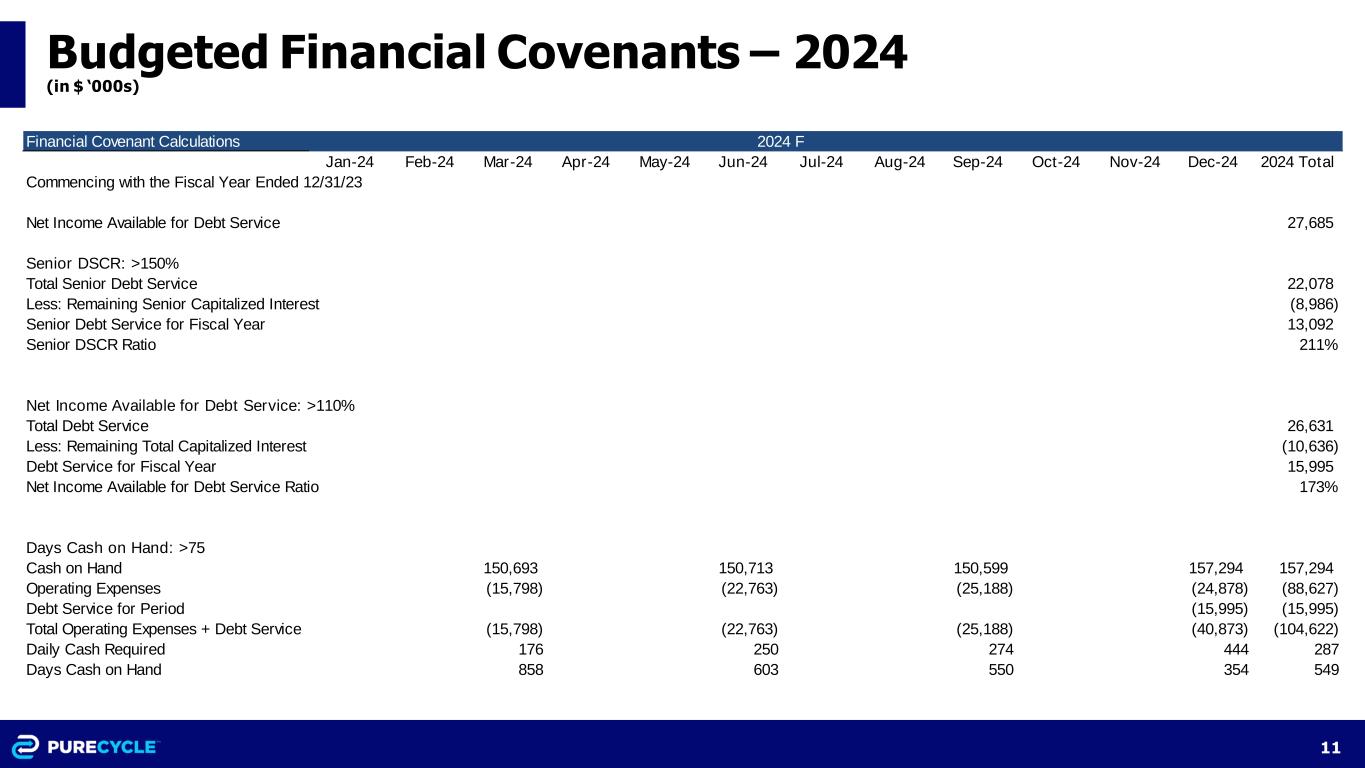

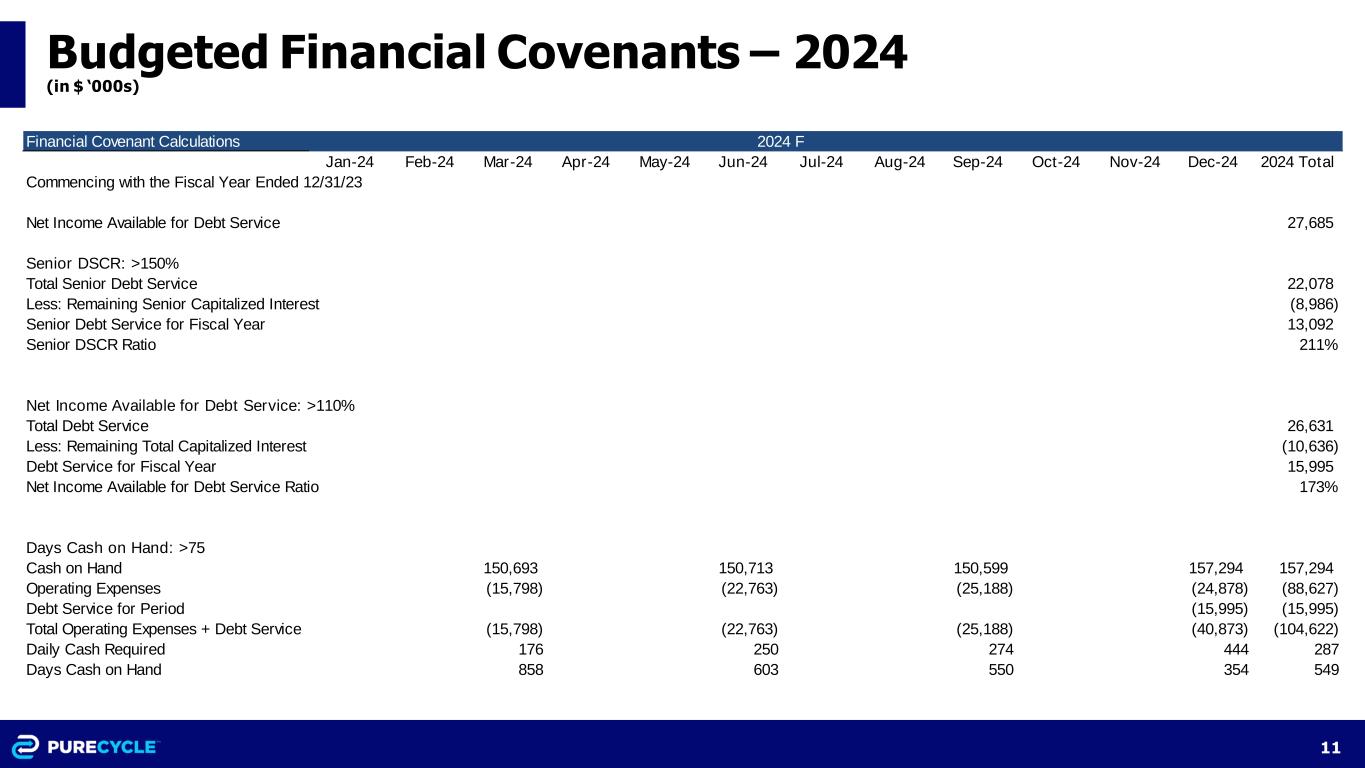

11 Budgeted Financial Covenants – 2024 (in $ ‘000s) Financial Covenant Calculations Jan-24 Feb-24 Mar-24 Apr-24 May-24 Jun-24 Jul-24 Aug-24 Sep-24 Oct-24 Nov-24 Dec-24 2024 Total Commencing with the Fiscal Year Ended 12/31/23 Net Income Available for Debt Service 27,685 Senior DSCR: >150% Total Senior Debt Service 22,078 Less: Remaining Senior Capitalized Interest (8,986) Senior Debt Service for Fiscal Year 13,092 Senior DSCR Ratio 211% Net Income Available for Debt Service: >110% Total Debt Service 26,631 Less: Remaining Total Capitalized Interest (10,636) Debt Service for Fiscal Year 15,995 Net Income Available for Debt Service Ratio 173% Days Cash on Hand: >75 Cash on Hand 150,693 150,713 150,599 157,294 157,294 Operating Expenses (15,798) (22,763) (25,188) (24,878) (88,627) Debt Service for Period (15,995) (15,995) Total Operating Expenses + Debt Service (15,798) (22,763) (25,188) (40,873) (104,622) Daily Cash Required 176 250 274 444 287 Days Cash on Hand 858 603 550 354 549 2024 F