UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

December 2, 2025

Date of Report (Date of earliest event reported)

CSLM DIGITAL ASSET ACQUISITION CORP III, LTD

(Exact Name of Registrant as Specified in its Charter)

000-00000

| Cayman Islands | N/A00-0000000 | |

| (State or other jurisdiction of incorporation) |

(I.R.S. Employer Identification No.) |

| 2400 E. Commercial Boulevard, Suite 900 Ft. Lauderdale, FL |

33308 | |

| (Address of Principal Executive Offices) | (Zip Code) |

Registrant’s telephone number, including area code: (954) 315-9381

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one Class A ordinary share, par value $0.0001 per share, and one-half of one redeemable warrant | KOYNU | The Nasdaq Stock Market LLC | ||

| Class A ordinary shares, par value $0.0001 per share | KOYN | The Nasdaq Stock Market LLC | ||

| Warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 per share | KOYNW | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 7.01. | Regulation FD Disclosure. |

On December 2, 2025, CSLM Digital Asset Acquisition Corp III, Ltd, a special purpose acquisition company (the “Company”), and First Digital Group Ltd., a leading stablecoin and digital asset infrastructure provider (“First Digital”), issued a joint press release announcing that they have entered into a non-binding letter of intent for a potential business combination. A copy of the press release is attached as Exhibit 99.1 and a First Digital overview presentation is attached as Exhibit 99.2 hereto and incorporated by reference herein.

No assurances can be made that the Company and First Digital will successfully negotiate and enter into a definitive agreement, or that the proposed business combination will be consummated on the terms or timeframe currently contemplated, or at all. No assurances can be provided as to the entry into or timing of any definitive agreement or the consummation of any transaction. Any transaction would be subject to the completion of due diligence, the negotiation of a definitive agreement providing for the proposed business combination, satisfaction of the conditions negotiated therein, board and equity holder approval, regulatory approvals, and other customary conditions.

The information in this Item 7.01, including Exhibit 99.1 and Exhibit 99.2, is furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not be deemed to be incorporated by reference into the filings of the Company under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filings.

Additional Information and Where to Find It

If a definitive agreement is entered into in connection with the proposed business combination, the Company or a newly formed holding company will prepare a registration statement on Form F-4, which will include a preliminary proxy statement of the Company containing information about the proposed business combination and the respective businesses of the Company and First Digital, as well as the prospectus relating to a potential newly formed holding company’s securities to be issued to in connection with the completion of the proposed business combination., to be filed with the U.S. Securities and Exchange Commission (“SEC”). In an instance where a definitive agreement is executed and after the registration statement is declared effective, the proxy statement/prospectus will be mailed to the Company’s shareholders. The Company urges investors and other interested persons to read, when available, the proxy statement/prospectus, as well as other documents filed with the SEC, because these documents will contain important information about the proposed business combination. Such persons can also read the Company’s reports filed with the SEC for a description of the security holdings of its officers and directors and their respective interests as security holders in the consummation of the transactions described herein. The proxy statement/prospectus, once available, and the Company’s reports can be obtained, without charge, at the SEC’s website (http://www.sec.gov).

Participants in the Solicitation

The Company or a newly formed holding company, First Digital and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies of the Company’s shareholders in connection with the proposed business combination. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of the Company’s directors and officers in the Company’s reports filed with the SEC. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to the Company’s shareholders in connection with the proposed business combination will be set forth in the proxy statement/prospectus for the proposed business combination when available. Information concerning the interests of First Digital and the Company’s participants in the solicitation, which may, in some cases, be different than those of their respective equityholders generally, will be set forth in the proxy statement/prospectus relating to the proposed business combination when it becomes available.

Forward-Looking Statements:

This Current Report on Form 8-K and the exhibit hereto include “forward-looking statements” with respect to the Company and First Digital. All information in this press release concerning First Digital has been provided solely by First Digital and has not been independently verified by KOYN, which makes no representation or warranty as to the accuracy or completeness of such information and assumes no obligation to update the information in this press release, except as required by law. The expectations, estimates, and projections of the businesses of First Digital and the Company may differ from their actual results and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, expectations with respect to future performance and anticipated financial impacts of the proposed business combination, the satisfaction of the closing conditions to the proposed business combination, and the timing of the completion of the proposed business combination. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside of the control of First Digital and the Company and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the negotiations and any subsequent definitive agreements with respect to the proposed business combination, and the possibility that the terms and conditions set forth in any definitive agreements with respect to the proposed business combination may differ materially from the terms and conditions set forth in the letter of intent; (2) the outcome of any legal proceeding that is ongoing or may be instituted against the parties following the announcement of the proposed business combination and any definitive agreements with respect thereto; (3) the inability to complete the proposed transaction, including due to failure to obtain approval of the shareholders of First Digital and the Company or other conditions to closing; (4) the inability to obtain or maintain the listing of the post-acquisition company’s securities on the Nasdaq Stock Market LLC, the New York Stock Exchange, or another national securities exchange following the proposed business combination; (5) the risk that the proposed business combination disrupts current plans and operations as a result of the announcement and consummation of the proposed business combination; (6) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably and retain its key employees; (7) costs related to the proposed business combination; (8) changes in applicable laws or regulations; and (9) other risks and uncertainties included in documents filed or to be filed with the SEC by First Digital and the Company. The foregoing list of factors is not exclusive. You should not place undue reliance upon any forward-looking statements, which speak only as of the date made. First Digital and the Company do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in their expectations or any change in events, conditions, or circumstances on which any such statement is based, except as required by law. Past performance by First Digital’s or the Company’s management teams and their respective affiliates is not a guarantee of future performance. Therefore, you should not place undue reliance on the historical record of the performance of First Digital’s or the Company’s management teams or businesses associated with them as indicative of future performance of an investment or the returns that First Digital or the Company will, or are likely to, generate going forward.

No Offer or Solicitation

This Current Report on Form 8-K and the exhibit hereto shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed transaction. This Current Report on Form 8-K and the exhibit hereto shall also not constitute an offer to subscribe for, buy or sell, the solicitation of an offer to subscribe for, buy or sell or an invitation to subscribe for, buy or sell any securities or the solicitation of any vote or approval in any jurisdiction pursuant to or in connection with the proposed transactions or otherwise, nor shall there be any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

| Item 9.01. | Financial Statements and Exhibits. |

| (d) | Exhibits |

| Exhibit No. | Description | |

| 99.1 | Press release, dated December 2, 2025. | |

| 99.2 | Investor Presentation | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated December 2, 2025

| CSLM DIGITAL ASSET ACQUISITION CORP III, LTD | ||

| By: | /s/ Vikas Mittal | |

| Name: | Vikas Mittal | |

| Title: | Chief Financial Officer | |

Exhibit 99.1

CSLM Digital Asset Acquisition Corp III, Ltd. (Nasdaq: KOYN) and First Digital Group Ltd. Announce A Letter of Intent for a Proposed Business Combination to Create a Global Stablecoin and Digital Payments Leader

First Digital Group is a leading stablecoin and digital asset infrastructure provider, and the group

behind FDUSD - the #3 most-traded stablecoin globally - supported by a compliance-first, fully backed

trust framework and a rapidly expanding global payments and infrastructure ecosystem.

NEW YORK, NY and HONG KONG SAR Dec. 02, 2025 (GLOBE NEWSWIRE) — First Digital Group Ltd. (“First Digital” or the “company”) and CSLM Digital Asset Acquisition Corp III, Ltd. (“KOYN”), a publicly listed special purpose acquisition company, jointly announce that they have entered into a non-binding letter of intent (“LOI”) for a proposed business combination. Upon completion, the combined company is expected to be publicly listed on a national securities exchange in the United States.

First Digital Group: A Global Leader in Digital Asset Infrastructure

First Digital has established itself as one of the most progressive and fastest-growing innovators in digital finance, evolving from its roots in traditional trust and custody services into a global provider of institution-ready digital asset infrastructure. Founded in 2019 and restructured under Gibraltar-based First Digital Group Ltd. in 2022, the company now operates across multiple jurisdictions with a compliance-first operating model and a proven record of delivering secure, reliable, and scalable financial technology solutions.

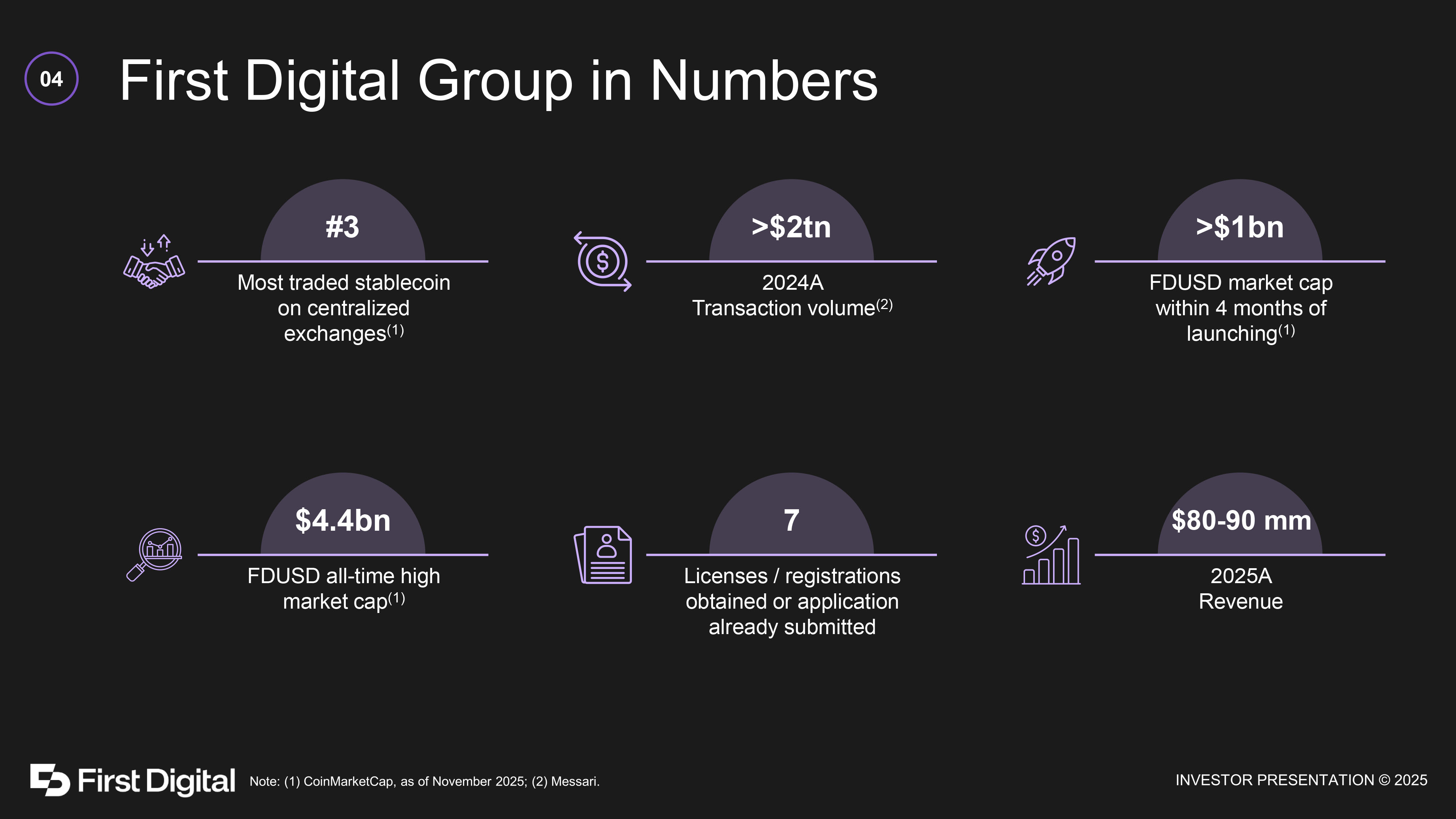

At the center of First Digital’s offering is FDUSD, a USD-denominated stablecoin fully backed by cash and cash equivalents held in a Hong Kong-registered, bankruptcy-remote trust structure. FDUSD has rapidly established itself as one of the most actively traded stablecoins on centralized exchanges, reaching more than US$1 billion in market capitalization within its first four months and later surpassing a peak circulation of more than US$4.4 billion as adoption accelerated. Supported by tier-1 exchange integrations and world-class liquidity partners, FDUSD has processed more than US$2 trillion in cumulative trading volume since launch, demonstrating deep liquidity and sustained demand across global markets. Fully backed by segregated reserves held with its licensed custodian affiliate and supported by independent monthly attestations and robust AML/KYC controls, FDUSD has become a trusted and scalable digital dollar for exchanges, institutional users, and on-chain payment applications.

First Digital operates a compliance-first regulated foundation with licenses, and registrations, in key financial centers. The company’s rapidly expanding product ecosystem includes stablecoin-as-a-service solutions for corporates, global stablecoin payment rails with real-time settlement capabilities, on-chain and off-chain APIs for commerce, swap services, custody, minting/redemption, and merchant tools, as well as infrastructure enabling cross-border settlement, remittances, and DeFi integrations. The company currently expects to report approximately US$80-$90 million in unaudited revenue for 2025, reinforcing its position as a leading force in the transition toward the modern digital asset economy.

First Digital are ready to launch Finance District - a decentralized finance ecosystem built on a foundation of institutional trust, which will mark a major milestone for First Digital. At its core is Prism, an agentic payments and settlement layer that allows autonomous AI agents and digital assistants to transact, settle, and distribute value at machine speed using FDUSD. This unlocks an entirely new category of AI-powered finance—enabling businesses to automate revenue flows, streamline operational costs, and participate in a rapidly expanding on-chain economy without compromising compliance or reliability. With Finance District, First Digital is positioning itself at the forefront of the next wave of DeFi, where programmable payments, community governance, and real-world utility converge to create the financial infrastructure of the autonomous economy.

For additional information about First Digital, please visit: https://1stdigital.com/ir-and-disclosures

Separately, First Digital had filed a writ of summons on April 3, 2025, in the High Court of the Hong Kong Special Administrative Region Court of First Instance initiating a defamation action against Sun Yuchen (a/k/a Justin Sun) in response to his public allegations. Additional information and publicly available filings regarding this matter can be found at: https://1stdigital.com/ir-and-disclosures

Strategic Rationale for the Proposed Business Combination

KOYN’s management team has deep experience across SPAC transactions, digital assets, and structured capital markets, and believes First Digital is uniquely positioned to become a global leader in a sector benefiting from intensifying global regulatory clarity for stablecoins; explosive growth in cross-border payments, remittances, and on-chain settlement; increasing institutional demand for fully backed, compliant, transparent stablecoins; and the shift toward Web3 payments infrastructure and programmable money. The combined company aims to accelerate First Digital’s international scaling, broaden its product suite, and further institutionalize its regulatory and compliance footprint.

Management Commentary

First Digital Founder & CEO Vincent Chok: Taking the world’s first APAC-rooted and emerging-market-focused USD stablecoin issuer public is a milestone not just for First Digital, but for the evolution of digital finance globally. We have spent years building the infrastructure of trust. Transparent reserves, regulated structures, and institution-ready rails, and today marks the beginning of the next chapter. With the launch of the Finance District and our agentic payments layer, Prism, later this year we are opening the door to real-time, AI-powered settlement and a new generation of programmable commerce. This proposed combination with KOYN positions us to scale globally and continue shaping the future of trusted digital dollars.”

CSLM Digital Asset Acquisition Corp III, Ltd Chairman Vik Mittal: “We are humbled to partner with a visionary of Vincent’s standing. Custody, integrity and trust. Programmable money collapses the world’s payment networks into one global dollar network. We’re finally rewriting the world’s financial rails from scratch. It’s been a long time coming.”

Definitive Documentation

The parties will announce additional details regarding the proposed business combination when a definitive agreement is executed. No assurances can be provided as to the entry into or timing of any definitive agreement or the consummation of any transaction. Any transaction would be subject to the completion of satisfactory due diligence, the negotiation of a definitive agreement and related ancillary agreements providing for the proposed business combination, satisfaction of the conditions negotiated therein, board and shareholder approvals, regulatory approvals and other customary conditions.

Advisors

Cohen & Company Capital Markets is serving as exclusive capital markets and M&A advisor to First Digital. Loeb & Loeb LLP is serving as legal counsel to KOYN. DLA Piper LLP (US) and DLA Piper UK LLP are serving as legal counsel to First Digital.

Additional Information and Where to Find It

If a definitive agreement is entered into in connection with the proposed business combination, the company or a newly formed holding company will prepare and file a proxy statement/prospectus with the SEC. KOYN urges investors and securityholders to read the proxy statement/prospectus and other documents filed with the SEC when they become available, as they will contain important information regarding the proposed business combination. The proxy statement will be distributed to holders of KOYN’s Class A Ordinary Shares in connection with KOYN’s solicitation of proxies for the vote by KOYN’s shareholders with respect to the proposed business combination and other matters as will described therein. All SEC filings will be available free of charge at www.sec.gov.

Participants in the Solicitation

KOYN, First Digital, and their respective directors, officers, and employees may be deemed participants under SEC rules in the solicitation of proxies in connection with the proposed business combination. Information about KOYN’s directors and officers is available in KOYN’s SEC filings.

Additional details regarding the interests of persons involved in the proposed business combination will be included in the proxy statement/prospectus when it becomes available.

Forward-Looking Statements

All information in this press release concerning First Digital has been provided solely by First Digital and has not been independently verified by KOYN, which makes no representation or warranty as to the accuracy or completeness of such information and assumes no obligation to update the information in this press release, except as required by law. This press release includes “forward-looking statements” with respect to KOYN and First Digital. The expectations, estimates, and projections of the businesses of First Digital and KOYN may differ from their actual results and consequently, you should not rely on these forward looking statements as predictions of future events. Words such as “expect,” “estimate,” “project,” “budget,” “forecast,” “anticipate,” “intend,” “plan,” “may,” “will,” “could,” “should,” “believes,” “predicts,” “potential,” “continue,” and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, expectations with respect to future performance and anticipated financial impacts of the proposed business combination the satisfaction of the closing conditions to the proposed business combination, and the timing of the completion of the proposed business combination. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results.

Most of these factors are outside of the control of KOYN and First Digital and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) the occurrence of any event, change or other circumstances that could give rise to the termination of the negotiations and any subsequent definitive agreements with respect to the proposed business combination, and the possibility that the terms and conditions set forth in any definitive agreements with respect to the proposed business combination may differ materially from the terms and conditions set forth in the letter of intent, (2) the outcome of any legal proceedings that may be instituted against the parties following the announcement of the proposed business combination and any definitive agreements with respect thereto; (3) the inability to complete the proposed business combination, including due to failure to obtain approval of the shareholders of KOYN and First Digital or other conditions to closing; (4) the inability to obtain or maintain the listing of the combined company’s securities on the Nasdaq Stock Market LLC, the New York Stock Exchange, or another national securities exchange following the proposed business combination; (5) the risk that the proposed business combination disrupts current plans and operations as a result of the announcement and consummation of the proposed business combination; (6) the ability to recognize the anticipated benefits of the proposed business combination, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably and retain its key employees; (7) costs related to the proposed business combination; (8) changes in applicable laws or regulations; and (9) other risks and uncertainties included in documents filed or to be filed with the SEC by KOYN, First Digital and the combined company. The foregoing list of factors is not exclusive. You should not place undue reliance upon any forward-looking statements, which speak only as of the date made. KOYN and First Digital do not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in their expectations or any change in events, conditions, or circumstances on which any such statement is based, except as required by law. Past performance by KOYN and First Digital is not a guarantee of future performance. Therefore, you should not place undue reliance on the historical record of the performance of KOYN and First Digital as indicative of future performance of an investment or the returns that KOYN and First Digital will, or are likely to, generate going forward.

No Offer or Solicitation

This press release shall not constitute a solicitation of a proxy, consent, or authorization with respect to any securities or in respect of the proposed business combination. This press release shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction where such offer, solicitation, or sale would be unlawful under the securities laws of any such jurisdiction.

About First Digital Group Ltd.

First Digital is a leading digital asset and stablecoin infrastructure provider, offering fully backed USD-denominated stablecoins, trust and custody services, global payment solutions, and white-label stablecoin issuance for enterprises. Its flagship product, FDUSD, is one of the world’s most traded stablecoins, supported by a compliance-first governance model, segregated trust structure, and monthly independent attestations. First Digital operates across multiple jurisdictions and maintains active licenses and registrations in key financial centers.

About CSLM Digital Asset Acquisition Corp III, Ltd.

KOYN is a publicly traded special purpose acquisition company focused on high-growth, frontier-technology sectors including digital assets, regulated financial infrastructure, and next-generation fintech. KOYN is led by an experienced SPAC team with a track record of sourcing, executing, and stewarding complex public-market transactions.

Investor & Media Contacts

samantha@yapglobal.com

Exhibit 99.2

1

Samantha Yap | YAP Global First Digital Group Compliance - first approach and highly liquid full backing Deep bench of talent with 90+ employees globally Leading stablecoin issuer based in Asia Comprehensive on - chain and off - chain strategy Development of an FDUSD economy and ecosystem Positioned to create a global stablecoin payments network 02 Key Highlights 03 Top 10 fiat - backed stablecoin by market cap with the 3rd highest exchange volumes , leveraging tier 1 industry partnerships (1) Massive addressable market – stablecoins are expected to represent $1tn market cap and $15tn of payments volumes by 2030 (2) Highly scalable technology infrastructure with proprietary APIs focused on open finance solutions Clear growth plan to expand globally providing (1) Stablecoin - as - a - Service and (2) Payments Solutions Compliance - first approach capitalizing on increasing regulatory certainty for stablecoins with a comprehensive roadmap Highly scalable and profitable business model which is well positioned to deliver attractive performance through - the - cycle Seasoned management team with a track record of scaling up businesses supported by a deep talent bench at the operational level First Digital Group in Numbers #3 Most traded stablecoin on centralized exchanges (1) >$2tn 2024A Transaction volume (2) >$1bn FDUSD market cap within 4 months of launching (1) $4.4bn FDUSD all - time high market cap (1) 7 Licenses / registrations obtained or application already submitted $80 - 90 mm 2025A Revenue 04

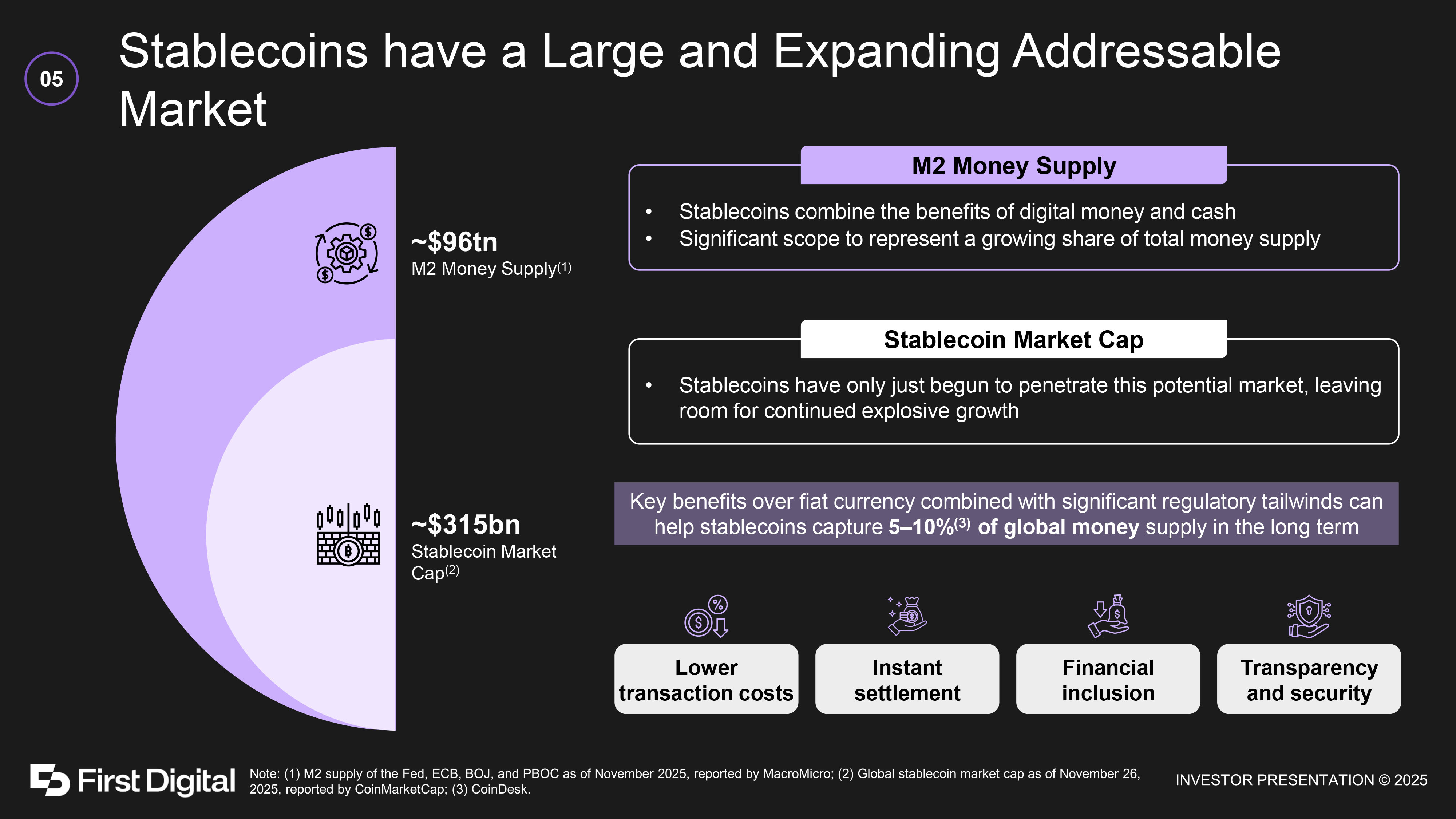

Stablecoins have a Large and Expanding Addressable Market 05 Key benefits over fiat currency combined with significant regulatory tailwinds can help stablecoins capture 5 – 10% ( 3 ) of global money supply in the long term Lower transaction costs Instant settlement Financial inclusion Transparency and security • Stablecoins combine the benefits of digital money and cash • Significant scope to represent a growing share of total money supply M2 Money Supply • Stablecoins have only just begun to penetrate this potential market, leaving room for continued explosive growth Stablecoin Market Cap Stablecoin Market Cap (2) M2 Money Supply (1)

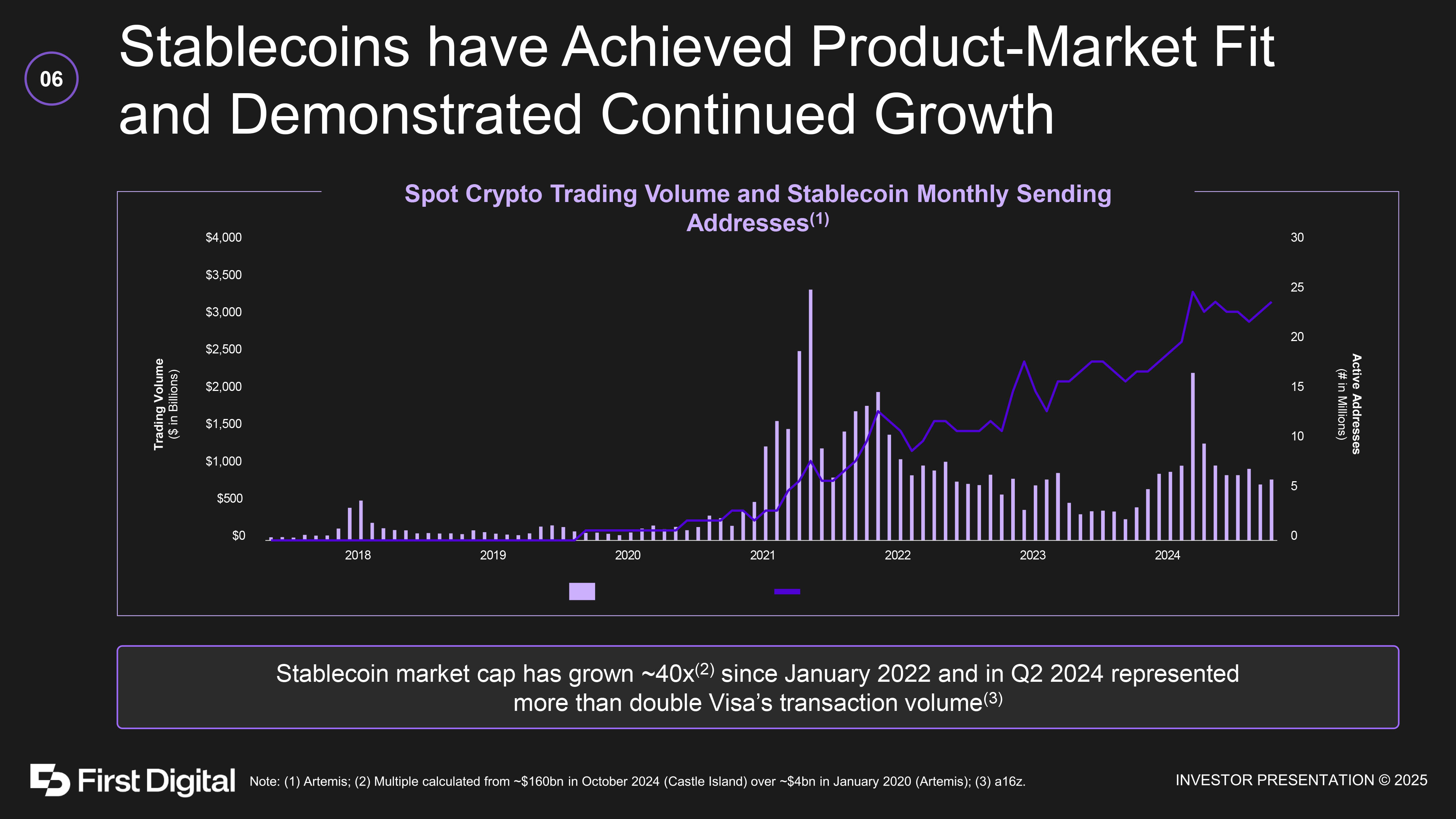

Stablecoins have Achieved Product - Market Fit and Demonstrated Continued Growth 06 Stablecoin market cap has grown ~40x (2) since January 2022 and in Q2 2024 represented more than double Visa’s transaction volume (3) 0 5 10 15 20 25 30 $0 $500 $1,000 $1,500 $2,000 $2,500 $3,000 $3,500 $4,000 2018 2019 2020 2021 2022 2023 2024 Trading Volume ($ in Billions) Active Addresses (# in Millions) Spot Crypto Trading Volume and Stablecoin Monthly Sending Addresses (1)

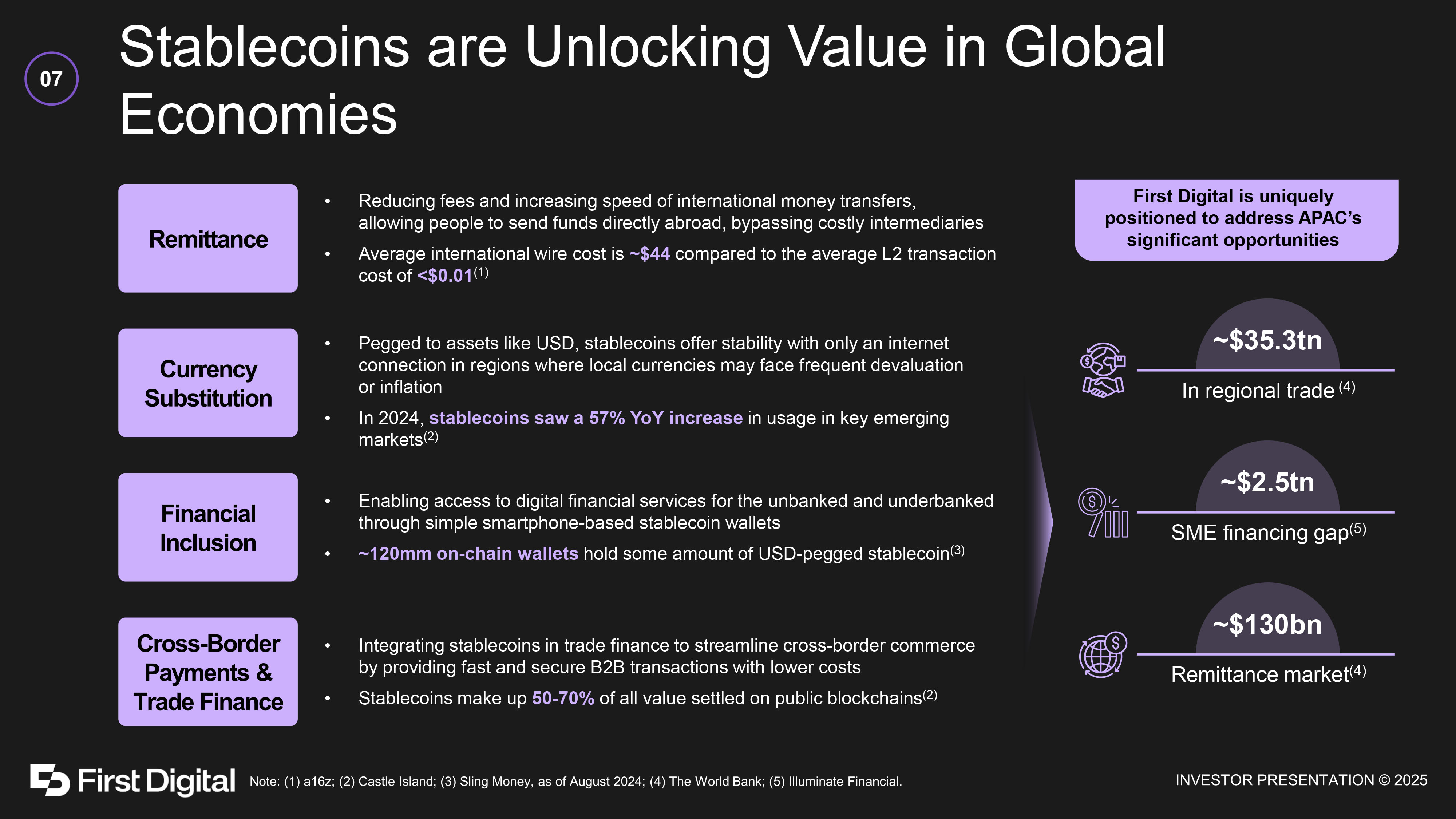

Stablecoins are Unlocking Value in Global Economies 07 • Reducing fees and increasing speed of international money transfers, allowing people to send funds directly abroad, bypassing costly intermediaries • Average international wire cost is ~$44 compared to the average L2 transaction cost of <$0.01 (1) • Pegged to assets like USD, stablecoins offer stability with only an internet connection in regions where local currencies may face frequent devaluation or inflation • In 2024, stablecoins saw a 57% YoY increase in usage in key emerging markets (2) • Enabling access to digital financial services for the unbanked and underbanked through simple smartphone - based stablecoin wallets • ~120mm on - chain wallets hold some amount of USD - pegged stablecoin (3) • Integrating stablecoins in trade finance to streamline cross - border commerce by providing fast and secure B2B transactions with lower costs • Stablecoins make up 50 - 70% of all value settled on public blockchains (2) First Digital is uniquely positioned to address APAC’s significant opportunities ~$35.3tn In regional trade (4) ~$2.5tn SME financing gap (5) ~$130bn Remittance market (4)

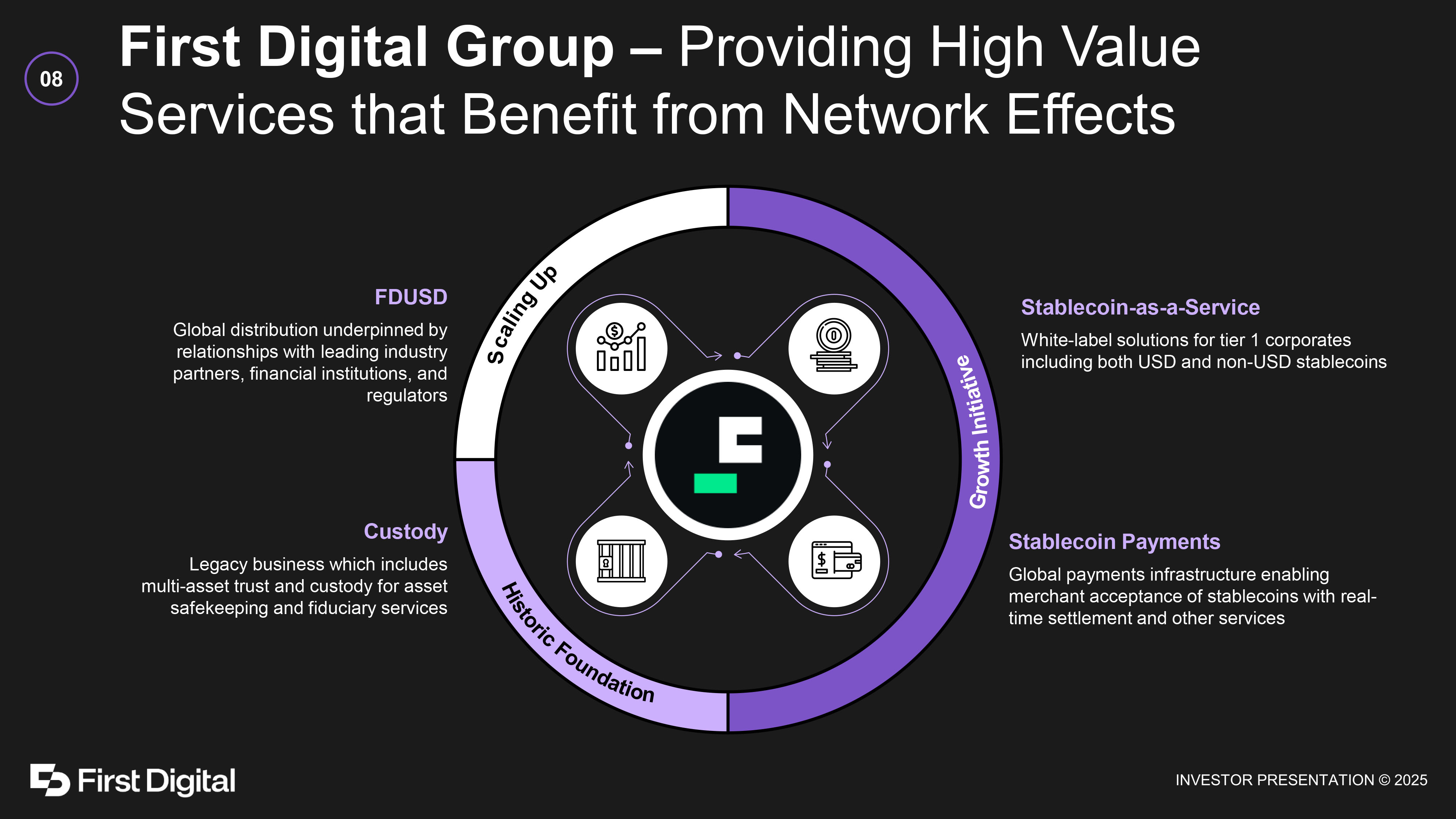

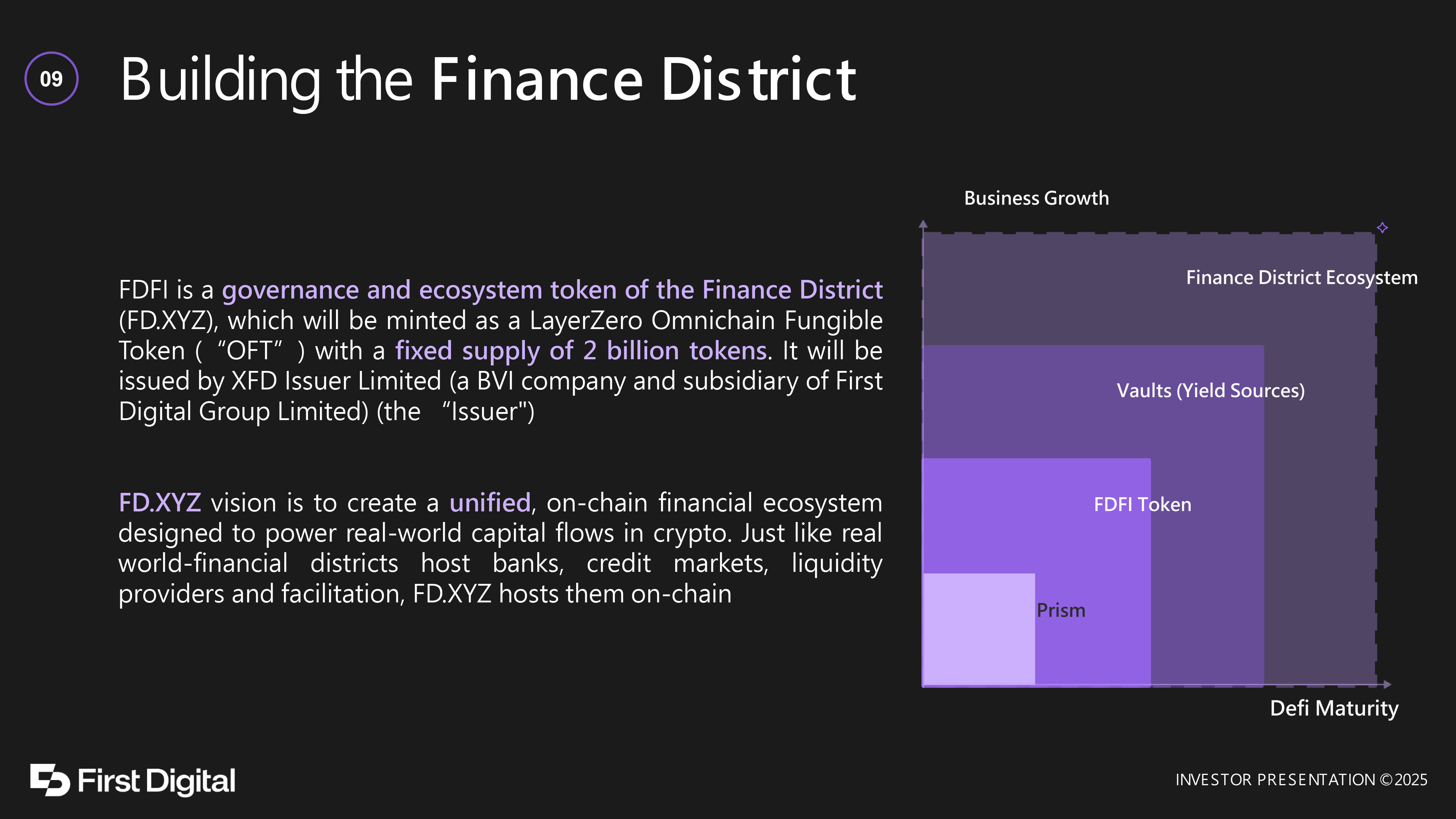

First Digital Group – Providing High Value Services that Benefit from Network Effects 08 Stablecoin - as - a - Service White - label solutions for tier 1 corporates including both USD and non - USD stablecoins Stablecoin Payments Global payments infrastructure enabling merchant acceptance of stablecoins with real - time settlement and other services Custody Legacy business which includes multi - asset trust and custody for asset safekeeping and fiduciary services FDUSD Global distribution underpinned by relationships with leading industry partners, financial institutions, and regulators Building the Finance District FDFI is a governance and ecosystem token of the Finance District (FD . XYZ), which will be minted as a LayerZero Omnichain Fungible Token (“OFT”) with a fixed supply of 2 billion tokens . It will be issued by XFD Issuer Limited (a BVI company and subsidiary of First Digital Group Limited) (the “Issuer") FD . XYZ vision is to create a unified , on - chain financial ecosystem designed to power real - world capital flows in crypto . Just like real world - financial districts host banks, credit markets, liquidity providers and facilitation, FD . XYZ hosts them on - chain 09

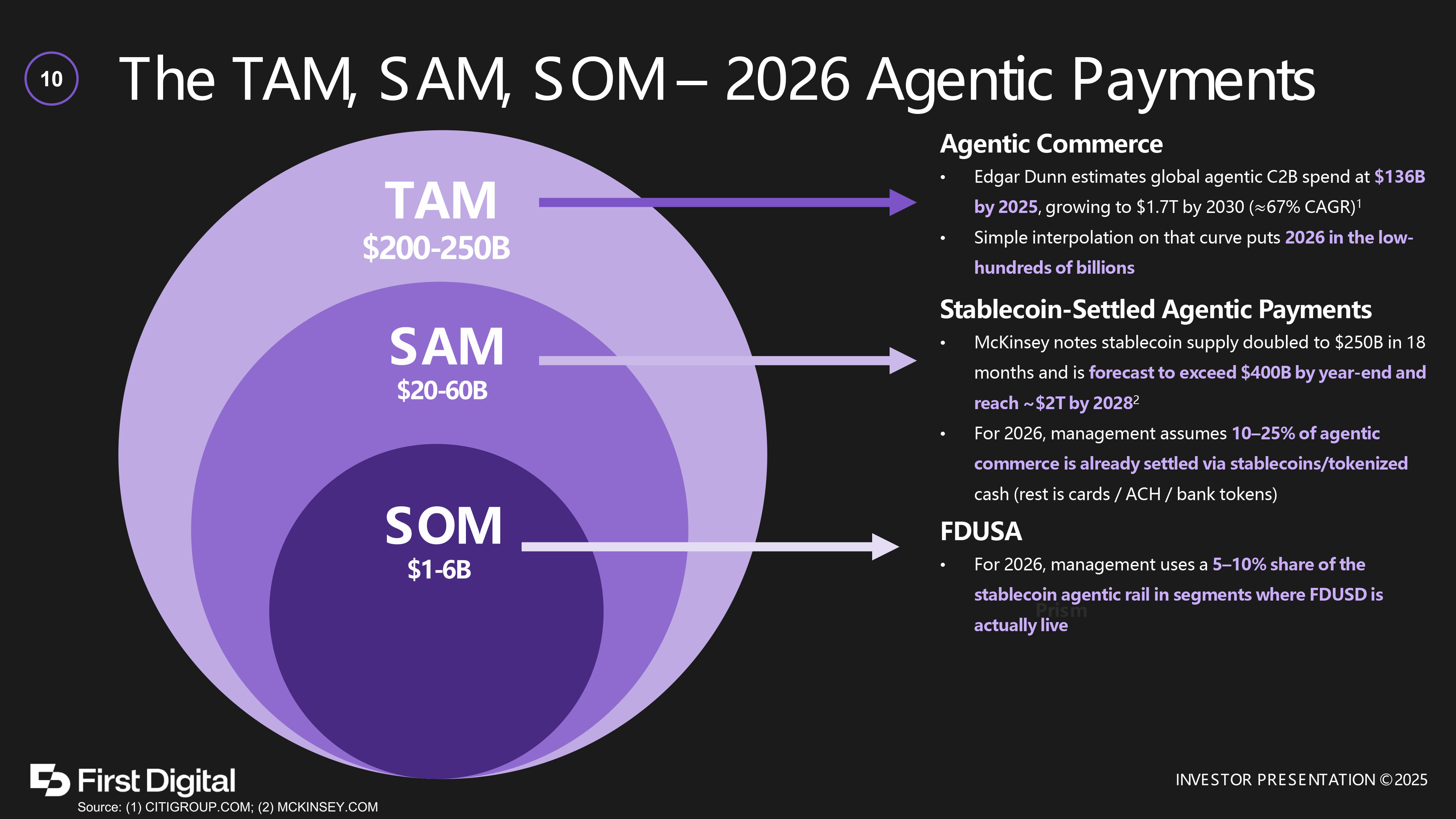

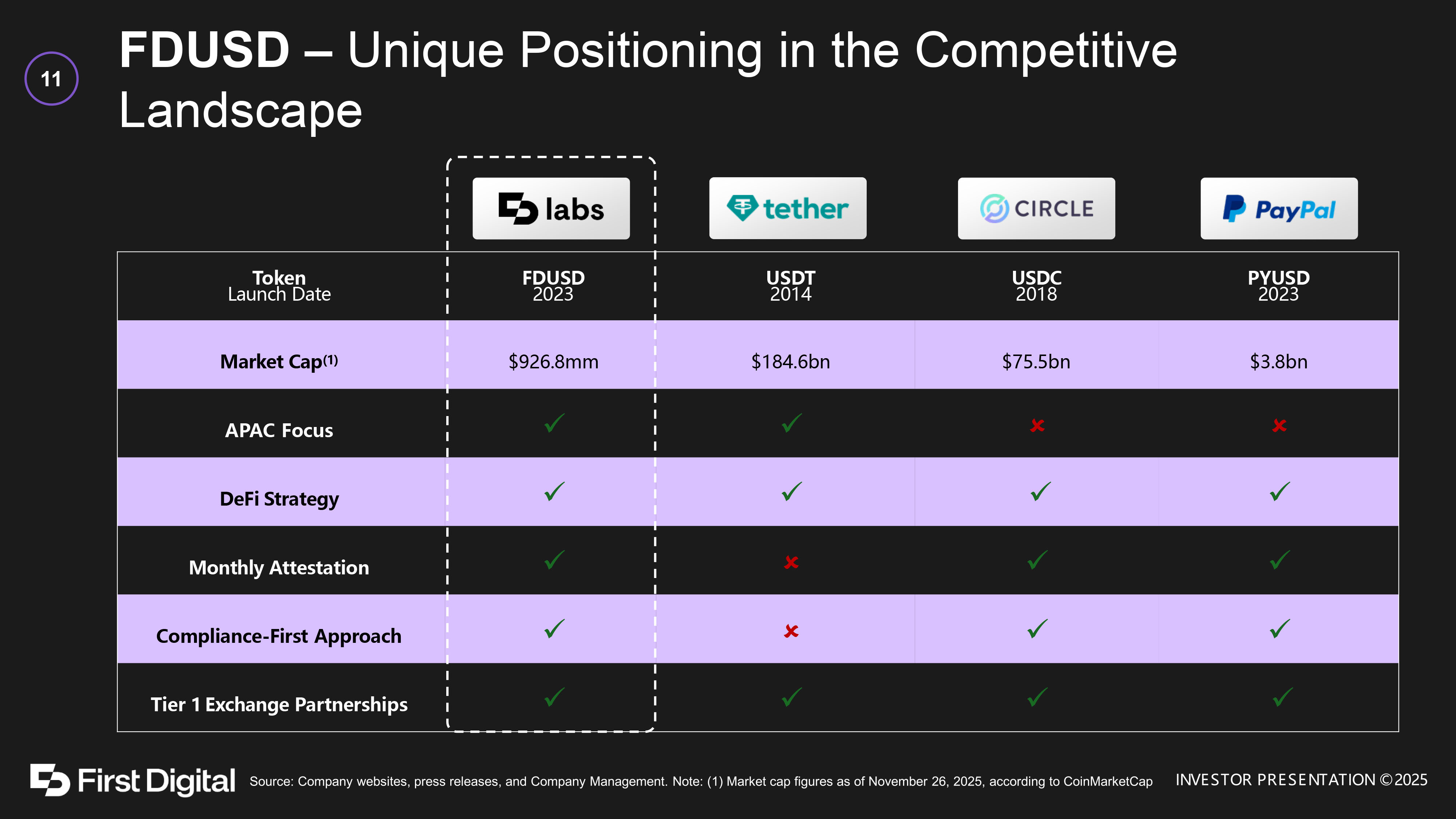

The TAM, SAM, SOM – 2026 Agentic Payments 10 Agentic Commerce • Edgar Dunn estimates global agentic C2B spend at $136B by 2025 , growing to $1.7T by 2030 ( ≈ 67% CAGR) 1 • Simple interpolation on that curve puts 2026 in the low - hundreds of billions Stablecoin - Settled Agentic Payments • McKinsey notes stablecoin supply doubled to $250B in 18 months and is forecast to exceed $400B by year - end and reach ~$2T by 2028 2 • For 2026, management assumes 10 – 25% of agentic commerce is already settled via stablecoins/tokenized cash (rest is cards / ACH / bank tokens) FDUSA • For 2026, management uses a 5 – 10% share of the stablecoin agentic rail in segments where FDUSD is actually live FDUSD – Unique Positioning in the Competitive Landscape 11 PYUSD 2023 USDC 2018 USDT 2014 FDUSD 2023 Token Launch Date $3.8bn $75.5bn $184.6bn $ 926.8mm Market Cap (1) x x APAC Focus x x x x DeFi Strategy x x x Monthly Attestation x x x Compliance - First Approach x x x x Tier 1 Exchange Partnerships

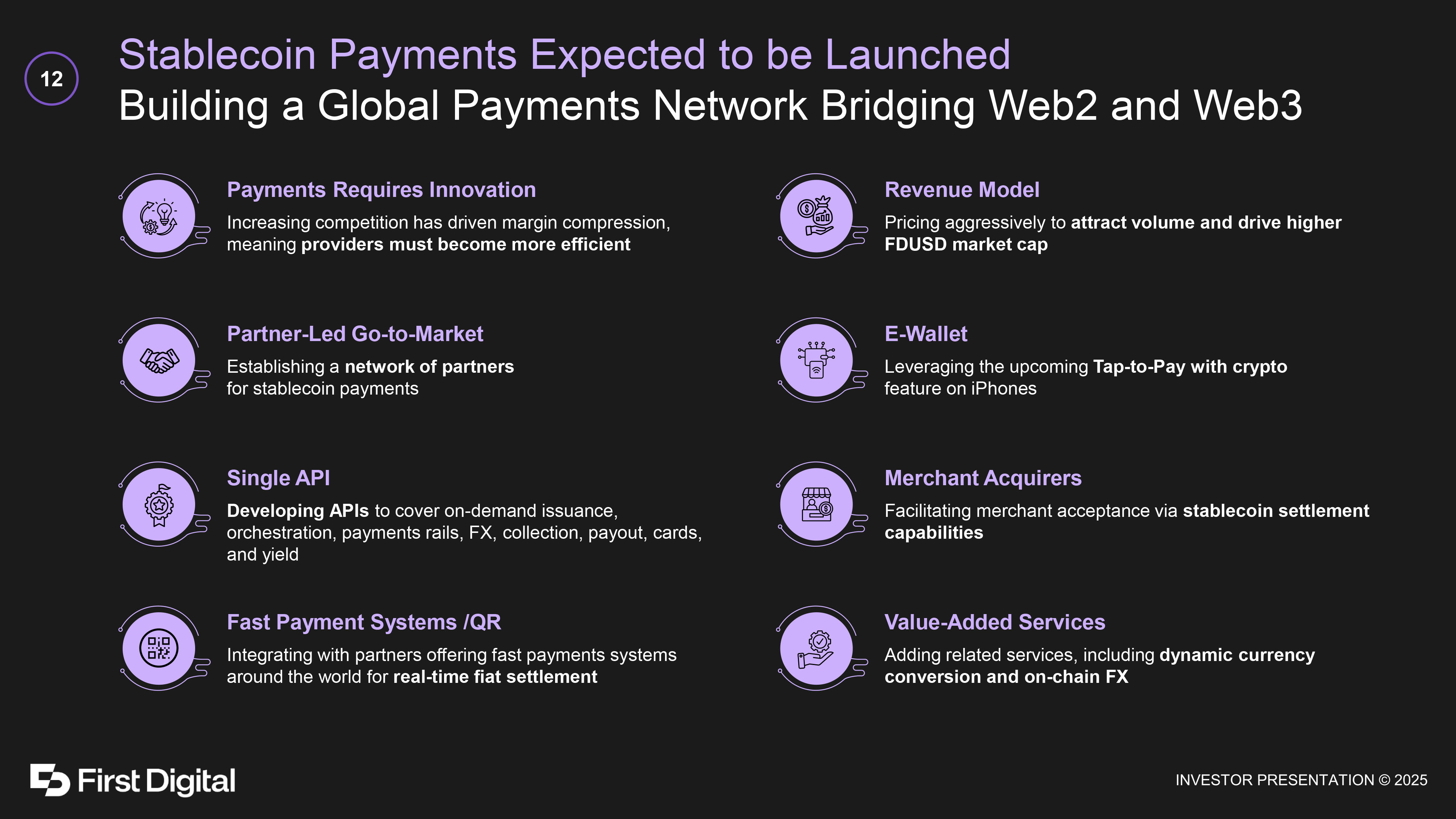

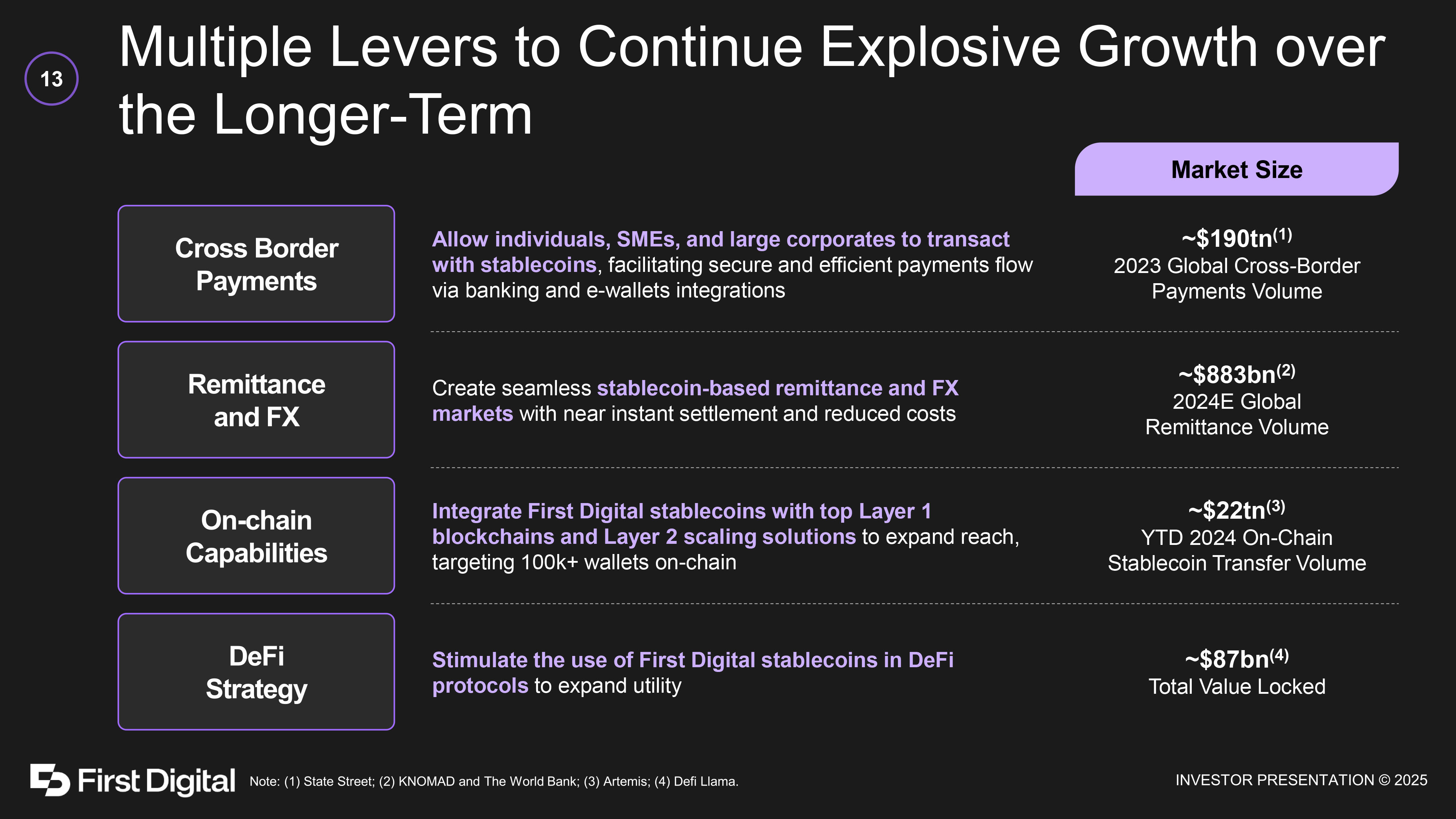

Stablecoin Payments Expected to be Launched Building a Global Payments Network Bridging Web2 and Web3 12 Payments Requires Innovation Increasing competition has driven margin compression, meaning providers must become more efficient Partner - Led Go - to - Market Establishing a network of partners for stablecoin payments Single API Developing APIs to cover on - demand issuance, orchestration, payments rails, FX, collection, payout, cards, and yield Fast Payment Systems /QR Integrating with partners offering fast payments systems around the world for real - time fiat settlement Revenue Model Pricing aggressively to attract volume and drive higher FDUSD market cap E - Wallet Leveraging the upcoming Tap - to - Pay with crypto feature on iPhones Merchant Acquirers Facilitating merchant acceptance via stablecoin settlement capabilities Value - Added Services Adding related services, including dynamic currency conversion and on - chain FX Multiple Levers to Continue Explosive Growth over the Longer - Term 13 Market Size Allow individuals, SMEs, and large corporates to transact with stablecoins , facilitating secure and efficient payments flow via banking and e - wallets integrations ~$190tn (1) 2023 Global Cross - Border Payments Volume Create seamless stablecoin - based remittance and FX markets with near instant settlement and reduced costs ~$883bn (2) 2024E Global Remittance Volume Integrate First Digital stablecoins with top Layer 1 blockchains and Layer 2 scaling solutions to expand reach, targeting 100k+ wallets on - chain ~$22tn (3) YTD 2024 On - Chain Stablecoin Transfer Volume Stimulate the use of First Digital stablecoins in DeFi protocols to expand utility ~$87bn (4) Total Value Locked

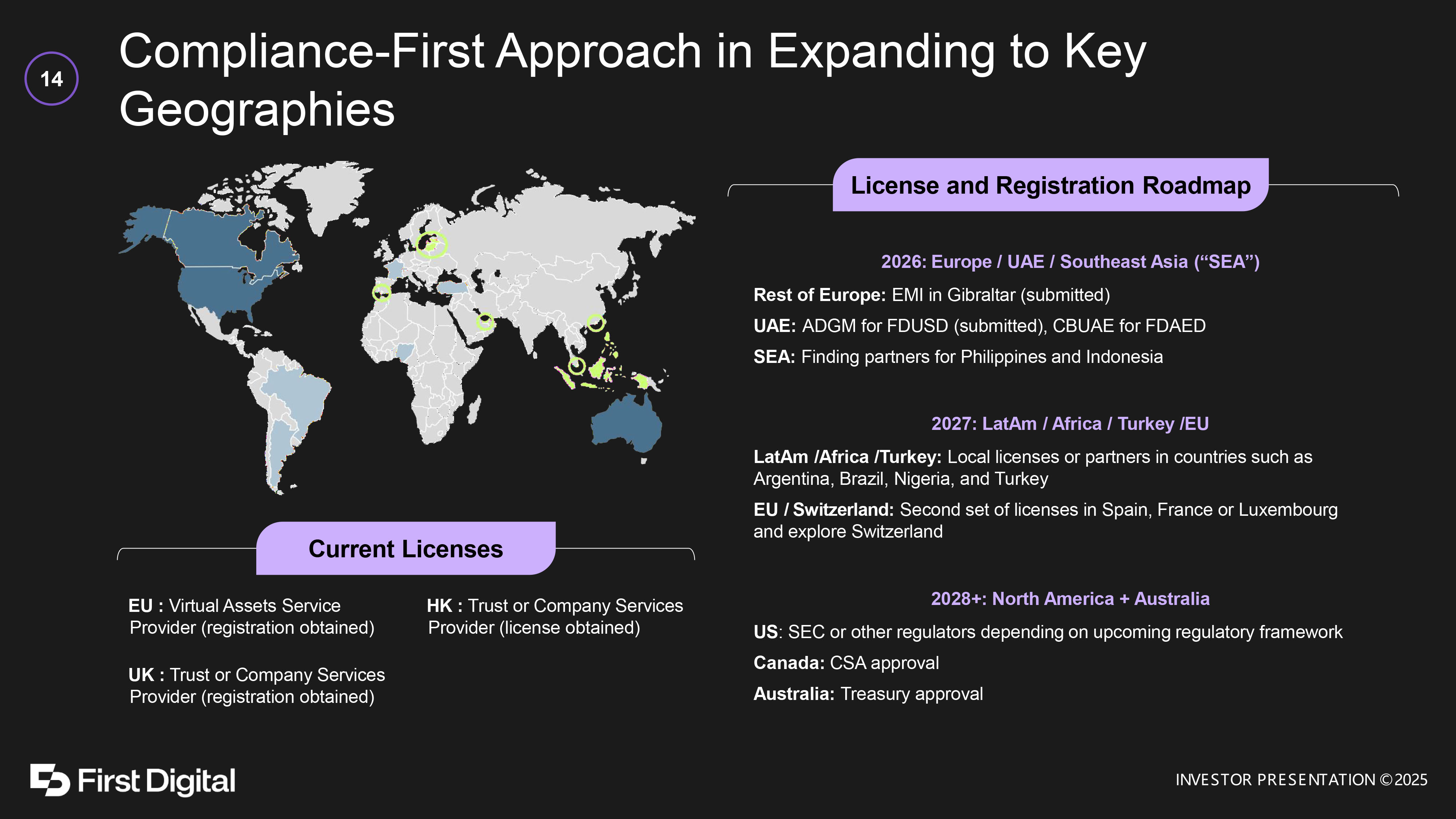

Compliance - First Approach in Expanding to Key Geographies 14 License and Registration Roadmap 2026: Europe / UAE / Southeast Asia (“SEA”) Rest of Europe: EMI in Gibraltar (submitted) UAE: ADGM for FDUSD (submitted), CBUAE for FDAED SEA: Finding partners for Philippines and Indonesia 2027: LatAm / Africa / Turkey /EU LatAm /Africa /Turkey: Local licenses or partners in countries such as Argentina, Brazil, Nigeria, and Turkey EU / Switzerland : Second set of licenses in Spain, France or Luxembourg and explore Switzerland 2028+: North America + Australia US : SEC or other regulators depending on upcoming regulatory framework Canada : CSA approval Australia: Treasury approval UK : Trust or Company Services Provider (registration obtained) EU : Virtual Assets Service Provider (registration obtained) HK : Trust or Company Services Provider (license obtained) Current Licenses Guided by a Strong Management Team Driving Sustained Success 15 Vincent Chok CEO • CEO of First Digital since inception • UBO of Legacy Trust • Leading the company from the development of traditional trust and custody solutions to stablecoins Gunnar Jaerv COO • Responsible for operations and product development • Building efficient operational infrastructure Michael Titus Legal Counsel • Principal of Titus Solicitors • Specialized in corporate, commercial, and IP law Janno Jaerv CTO • Responsible for First Digital’s tech stack • Over 20 years of experience in tech and engineering related roles • Previously worked at Foxway Aleck Lee CFO • Leading the Finance team • Previously served as the Asia CFO of LIFCO • Previously with PwC and Deloitte

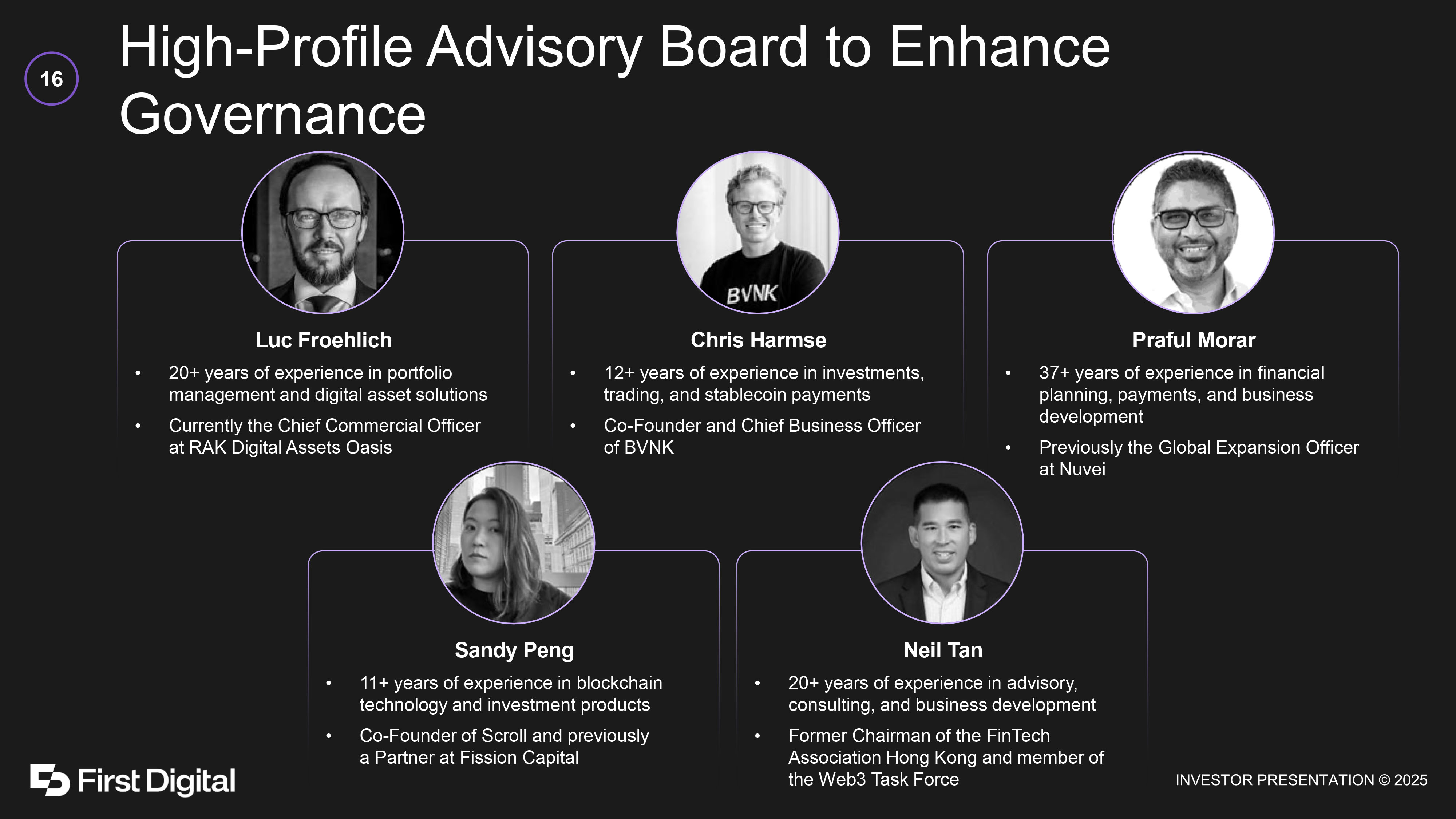

High - Profile Advisory Board to Enhance Governance 16 Luc Froehlich • 20+ years of experience in portfolio management and digital asset solutions • Currently the Chief Commercial Officer at RAK Digital Assets Oasis Chris Harmse • 12+ years of experience in investments, trading, and stablecoin payments • Co - Founder and Chief Business Officer of BVNK Praful Morar • 37+ years of experience in financial planning, payments, and business development • Previously the Global Expansion Officer at Nuvei Sandy Peng • 11+ years of experience in blockchain technology and investment products • Co - Founder of Scroll and previously a Partner at Fission Capital Neil Tan • 20+ years of experience in advisory, consulting, and business development • Former Chairman of the FinTech Association Hong Kong and member of the Web3 Task Force INVESTOR PRESENTATION © 2025 17 Disclaimer This presentation (this “Presentation”) is provided solely for information purposes only and does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity or debt, , nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction . No offering of securities will be made except by means of a prospectus meeting the requirements of the Securities Act of 1933 , as amended, or an exemption therefrom . The information contained herein does not purport to be all - inclusive . The data contained herein is derived from various internal and external sources . No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections or modeling or any other information contained herein . Any data on past performance or modeling contained herein is not an indication as to future performance . The Company assume no obligation to update the information in this Presentation, except as required by law . Furthermore, any and all trademarks and trade names referred to in this Presentation are the property of their respective owners . No Representation or Warranties All information provided is based upon conditions and assumptions as of the dates reflected herein and no representations or warranties of any kind, express or implied, are given in, or in respect of, this Presentation . To the fullest extent permitted by law in no circumstances will the Company or any of its respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith . Industry and market data used in this Presentation have been obtained from third - party industry publications and sources including reports by market research firms and company filings . The Company has not independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness . The data is subject to change . In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of the Company . Viewers of this Presentation should each make their own evaluation of the Company and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners . Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM, © or ® symbols, but the Company will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights . Forward Looking Statements This presentation contains forward - looking statements made pursuant to the Safe Harbor provisions under the United States Private Securities Litigation Reform Act of 1995 , including, but not limited to, statements regarding the Company’s expected future operating results ; financial performance and potential revenues, market cap, and exchange volume, business strategy, various addressable markets, anticipated trends, growth, and developments in markets in which it operates, the market adoption of its technology and products, the capabilities, performance, and advancement of its technology, products and services, its pro forma information and its future product development and roadmap . These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of the Company’s management and are not predictions of actual performance . Forward - looking statements generally are accompanied by words such as “believe,” may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect” “should,” “would,” “could,” “plan,” “predict” “potential,” “project,” “pro forma,” “seem,” “seek,” “future,” “outlook,” “model,” “target,” “goal,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters, although not all forward - looking statements will contain these identifying words . All forward - looking statements are based on current assumptions, expectations and beliefs, and involve substantial risks and uncertainties that may cause results, performance or achievement to materially differ from those expressed or implied by these forward - looking statements . These forward - looking statements should not be relied upon as representing the Company s assessments as of any date subsequent to the date of this Presentation . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction, or a definitive statement of fact or probability . Except as required by law, the Company does not undertake any obligation and does not intend to publicly update or revise any forward - looking statement, whether as a result of new information, future developments or otherwise . Use of Projections This Presentation contains projected financial information with respect to the Company . Such projected financial information constitutes forward - looking information and is for illustrative purposes only and should not be relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such financial forecast information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties . See “Forward - Looking Statements” above . Actual results may differ materially from the results contemplated by the financial forecast information contained in this Presentation, and the inclusion of such information in this Presentation should not be regarded as a representation by any person that the results reflected in such forecasts will be achieved . Financial Information ; Non - IFRS Financial Measures The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X . Accordingly, such information and data may be presented differently or materially differ from the Company’s audited financial information . In particular, all Company projected financial information included herein is preliminary and subject to risks and uncertainties . Any variation between the Company’s actual results and the projected financial information included herein may be material . This presentation also contains non - IFRS financial measures and key metrics relating to the Company’s projected future performance . A reconciliation of these non - IFRS financial measures to the corresponding IFRS measures on a forward - looking basis is not available because the various reconciling items are difficult to predict and subject to constant change . Information Regarding CSLM Digital Asset Acquisition Corp III, Ltd . All information in this presentation concerning First Digital Group Ltd . (“First Digital”) and its affiliates has been provided solely by First Digital and has not been independently verified by CSLM Digital Asset Acquisition Corp III, Ltd . ("KOYN") or any of its directors, officers, employees, advisors, or affiliates, none of whom make any representation or warranty, express or implied, or accept any responsibility or liability, as to the truth, accuracy, completeness, or reasonableness of such information or any other information contained herein . This presentation is provided solely for informational purposes, should not be relied upon for any investment, voting, or other transactional decision, and any such reliance is at the reader's sole risk .