UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): April 2, 2024

SDCL EDGE Acquisition Corporation

(Exact name of registrant as specified in its charter)

| Cayman Islands | 001-40980 | 98-1583135 | ||

|

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(I.R.S. Employer Identification No.) |

|

60 East 42nd Street, Suite 1100, New York, NY |

10165 |

|

| (Address of principal executive offices) | (Zip Code) |

(212) 488-5509

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☒ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant | SEDA.U | New York Stock Exchange LLC |

||

| Class A ordinary shares, par value $0.0001 per share | SEDA | New York Stock Exchange LLC | ||

| Redeemable warrants, each whole warrant exercisable for one Class A ordinary share at an exercise price of $11.50 | SEDA.WS | New York Stock Exchange LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

SDCL EDGE Acquisition Corporation (“SEDA”) is furnishing an updated investor presentation dated April 2024 that is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein. The investor presentation updates the investor presentation previously filed as Exhibit 99.3 to Current Report on Form 8-K on February 20, 2024.

The information in this Current Report on Form 8-K furnished pursuant to Item 7.01, including Exhibit 99.1, shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liability under that section, and it shall not be deemed incorporated by reference in any filing under the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. By filing this Current Report on Form 8-K and furnishing this information pursuant to Item 7.01, SEDA makes no admission as to the materiality of any information in this Current Report on Form 8-K, including Exhibit 99.1, that is required to be disclosed solely by Regulation FD.

Important Information and Where to Find It

In connection with the business combination agreement executed by, among others, SEDA and Specialty Copper Listco Plc (“PubCo”) on February 20, 2024 (the “Business Combination”), PubCo expects to publicly file with the United States Securities and Exchange Commission (the “SEC”) a preliminary proxy statement/prospectus (a “Proxy Statement/Prospectus”). A definitive Proxy Statement/Prospectus will be mailed to holders of SEDA’s ordinary shares as of a record date to be established for voting on the Business Combination and other matters as described in the Proxy Statement/Prospectus. The Proxy Statement/Prospectus will include information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies to SEDA’s shareholders in connection with the Business Combination. SEDA may also file other documents regarding the Business Combination with the SEC. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF SEDA ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS, THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND ALL OTHER RELEVANT DOCUMENTS FILED OR THAT WILL BE FILED WITH THE SEC IN CONNECTION WITH THE MERGER, INCLUDING ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION.

Investors and security holders will be able to obtain free copies of the Proxy Statement/Prospectus and all other relevant documents filed or that will be filed with the SEC by SEDA through the website maintained by the SEC at www.sec.gov. In addition, the documents filed by SEDA may be obtained free of charge from SEDA’s website at www.sdcledge.com or by written request to SEDA at SDCL EDGE Acquisition Corporation, 60 East 42nd Street, Suite 1100, New York, NY 10165, Attn: Francesca Lorenzini.

Participants in the Solicitation

SEDA, and certain of their respective directors and officers may be deemed to be participants in the solicitation of proxies from SEDA’s shareholders in connection with the Business Combination. Information about SEDA’s directors and executive officers and their ownership of SEDA’s securities is set forth in SEDA’s filings with the SEC, including SEDA’s Annual Report on Form 10-K for the year ended December 31, 2022, which was filed with the SEC on March 30, 2023. Additional information regarding the interests of those persons and other persons who may be deemed participants in the Business Combination may be obtained by reading the Proxy Statement/Prospectus regarding the Business Combination when it becomes available. You may obtain free copies of these documents as described in the preceding paragraph.

No Offer or Solicitation

This Current Report on Form 8-K and the information contained herein do not constitute an offer to sell or the solicitation of an offer to buy any security, commodity or instrument or related derivative, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration or qualification under the securities laws of any such jurisdiction. No offer of securities in the United States or to or for the account or benefit of U.S. persons (as defined in Regulation S under the Securities Act) shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act, or an exemption therefrom. Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act.

Forward Looking Statements

This Current Report on Form 8-K contains certain forward-looking statements within the meaning of the federal securities laws with respect to the Business Combination between SEDA, cunova GmbH (“Cunova”) and the KME specialty aerospace business (the “Aerospace Business”, together with Cunova, the “Target”), including but are not limited to, statements regarding the benefits of the transaction, the anticipated timing of the transaction, the products offered by the Target and the markets in which it operates, the Target’s projected future results (including EBITDA and cash flow). These forward-looking statements generally are identified by the words “project,” “expect,” “anticipate,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this document, including but not limited to: (a) the outcome of any legal proceedings that may be instituted in connection with the Business Combination; (b) delays in obtaining, adverse contained in, or the inability to obtain necessary regulatory approvals or complete regulatory reviews required to complete the Business Combination; (c) the risk that the Business Combination disrupts Cunova’s or the Aerospace Business’s current plans and operations; (d) the inability of Cunova to recognize the anticipated benefits of the Business Combination, including its acquisition of the Aerospace Business, which may be affected by, among other things, competition, the ability of the combined company to grow and manage growth profitably with customers and suppliers and retain key employees; (e) the risk that Cunova’s or the Aerospace Business’s projected pipeline of projects and production capacity do not meet Cunova’s or the Aerospace Business’s proposed timeline or that such pipeline fails to be met at all; (f) costs related to the Business Combination; (g) the risk that the Business Combination does not close in the second quarter of 2024 or does not close at all; (h) changes in the applicable laws or regulations; (i) the possibility that Cunova, the Aerospace Business, or the combined company may be adversely affected by other economic, business, and/or competitive factors; (j) economic uncertainty caused by the impacts of geopolitical conflicts, including Russia’s invasion of Ukraine and the ongoing conflicts in the Middle East; (k) economic uncertainty due to rising levels of inflation and interest rates; (l) the risk that the approval of the shareholders of SEDA for the Business Combination is not obtained; (m) the risk that any current or future equity or debt transactions are not completed prior to the closing of the Business Combination; (n) the risk that even if any current or future equity or debt transactions are completed, they will not be sufficient to satisfy the minimum cash condition set forth in the definitive documentation in connection with the Business Combination and/or fund the combined company’s execution on its near-term project pipeline allowing the combined company to scale its operations; (o) the amount of redemption requests made by SEDA’s shareholders and the amount of funds remaining in SEDA’s trust account after satisfaction of such requests prior to the closing of the Business Combination; (p) SEDA’s, Cunova’s, the Aerospace Business and the other parties to the definitive documentation in connection with the Business Combination ability to satisfy the conditions to closing the Business Combination; and (q) the ability to maintain listing of SEDA’s securities on the NYSE. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” section of SEDA’s forthcoming registration statement on Form F-4, the proxy statement/prospectus contained therein, SEDA’s Annual Report on Form 10-K, SEDA’s Quarterly Reports on Form 10-Q and other documents filed by the Target or SEDA from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Target and SEDA assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Neither the Target nor SEDA gives any assurance that either the Target or SEDA will achieve its expectations. The inclusion of any statement in this communication does not constitute an admission by the Target or SEDA or any other person that the events or circumstances described in such statement are material.

Item 9.01 Financial Statements and Exhibits.

| (d) | Exhibits. |

| Exhibit No. | Description | |

| 99.1* | Investor Presentation |

| * | Furnished herewith. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: April 2, 2024 | SDCL EDGE Acquisition Corporation | |

| By: | /s/ Ned Davis | |

| Name: | Ned Davis | |

| Title: | Chief Financial Officer | |

Exhibit 99.1

[JM] Investor Presentation Strictly Private & Confidential April 2024

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL Disclaimer Strictly Private & Confidential 2 This presentation (the “Presentation”) has been prepared by SDCL EDGE Acquisition Corporation (the “SEDA,” “us” or “we”) and is provided on a confidential basis solely to recipients that are “accredited investors” (as defined in Rule 506 of Regulation D) (any such recipient, together with its subsidiaries and affiliates, the “Recipient”) solely for their own benefit and internal use and only for purposes of considering the opportunity to participate in the proposed private placement (the “Proposed Transaction”) in connection with the potential initial business combination (the “Initial Business Combination”) of SEDA with the prospective target businesses (the “Target” or the “Company”). Any reproduction, publication or distribution of this Presentation, in whole or in part, or the disclosure of its contents, without SEDA’s prior written consent, is strictly prohibited. This disclaimer and the requirement for strict confidentiality shall apply without prejudice to any other confidentiality obligations to which you are subject. By accepting this Presentation, you hereby agree to be bound by and comply with the restrictions contained herein. By accepting and/or by reading this Presentation, the Recipient agrees and undertakes towards SEDA and the Target that it will not, and will cause its directors, officers, employees, representatives, advisors and consultants (the "Representatives") not to, disclose any type of information relating to SEDA or the Target. By accepting this Presentation, the Recipient agrees to maintain this information in the strictest confidence and to protect and safeguard this Presentation against any unauthorized publication or disclosure. Although SEDA reasonably believes the information contained in this Presentation related to SEDA and the Target is accurate in all material respects as of the date of this Presentation or the date to which the information contained in this Presentation makes reference to, neither SEDA, the Target nor any of their affiliates, directors, officers, shareholders, employees or advisers or any other person, makes any representation or warranty, either expressed or implied, as to the accuracy, completeness or reliability of the information contained herein or any other written, oral or other communications transmitted or otherwise made available to the Recipient in the course of its evaluation of the Initial Business Combination. SEDA and the Target further expressly disclaim any and all liability relating to or resulting from the use of this Presentation based on the accuracy or sufficiency thereof or on any errors, omissions or misstatements, negligent or otherwise, relating thereto. Accordingly, none of SEDA, the Target nor any of their affiliates, directors, officers, shareholders, employees or advisers or any other person shall be liable for any direct, indirect or consequential loss or suffered or incurred by any Recipient as a result of relying on any statement in or omission from this Presentation, and the Recipient hereby expressly disclaims such liability. In addition, the information contained in this Presentation is provided as of the date hereof and may change, and neither SEDA nor thdamagese Target undertakes any obligation to update such information, including in the event that such information becomes inaccurate or incomplete. Except to the extent required by law, neither SEDA, the Target nor any other person assumes responsibility for the accuracy or completeness of the information contained in this Presentation. Further, the information contained herein is preliminary, based on a range of assumptions, is provided for discussion purposes only, is only a summary of selected key information, is not complete, does not take into account all relevant economic and market factors, does not contain certain material information about the Proposed Transaction or the Initial Business Combination, including risk factors associated with the Target, SEDA, the Proposed Transaction or the Initial Business Combination, and is subject to change without notice. This Presentation is not intended to contain all the information that a person may desire in considering an investment in the Proposed Transaction. Any person seeking to make any such investment should consult with its own advisors (including but not limited to legal, regulatory, tax, business, financial and accounting advisors) to the extent necessary, and make its own investment decision and perform its own independent investigation and analysis of an investment in the Proposed Transaction and an analysis of the Initial Business Combination and the other transactions contemplated in this Presentation. The Recipient should not consider any information in this Presentation to be legal, investment, business, tax or accounting advice or a recommendation. The Recipient agrees that none of Sustainable Development Capital LLP (“SDCL”), SDCL EDGE Sponsor LLC (“Sponsor”) , the Target or any of their respective affiliates, directors, officers, employees, shareholders, advisors or agents shall have any liability for any misstatement or omission of fact or any opinion expressed herein. Any person consulting this Presentation should also carefully consider the risks and uncertainties described in the “Risk Factors” section of SEDA’s final prospectus dated October 28, 2021 relating to its initial public offering, and subsequent periodic filings with the U.S. Securities and Exchange Commission (the "SEC") on Form 10 - Q and Form 10 - K. Any actual terms of the opportunity may vary from what is discussed herein and may do so in a material manner. There can be no assurance, and neither SEDA nor Target gives any assurance, that SEDA or Target will achieve the desired results or that any investor will receive any return of or on capital. This Presentation shall neither constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which the offer, solicitation or sale would be unlawful prior to the registration qualification under the securities laws of any such jurisdiction. Neither the SEC nor any state or territorial securities commission has approved or disapproved of the securities or determined if this Presentation is truthful, accurate or complete. Certain statements, estimates, targets and projections contained in this Presentation may constitute “forward - looking statements” for purposes of the federal securities laws. Actual results may differ from their expectations, estimates and projections and consequently, you should not rely on those forward - looking statements as predictions of future events or future performance of SEDA or the Target. These forward - looking statements include, but are not limited to, statements regarding SEDA, the Target or their respective management teams’ conclusions, expectations, hopes, beliefs, intentions or strategies regarding the future and/or future events or circumstances. In addition, any statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying assumptions, are forward - looking statements. The words “addressing,” “anticipated,” “become,” “benefit,” “believe,” “creating,” “continues,” “covered,” “driven,” “enabling,” “expected,” “growing,” “implementing,” “improve,” “includes,” “increasing,” “intended,” “may,” “projected,” “provide,” “remain,” “resulting,” “shown,” “support,” “will,” and similar expressions may identify forward - looking statements, but the absence of these words or expressions does not mean that a statement is not forward - looking. Forward - looking statements in this Presentation may include, for illustrative and non - exhaustive purposes only, statements about: • SEDA’s ability to engage in and complete the Initial Business Combination; • SEDA’s expectations and estimates regarding the performance of the Target; • SEDA’s expectations and estimates regarding the markets and market participants relevant to the Target; • SEDA’s public securities’ potential liquidity and trading; • SEDA’s financial performance following its initial public offering; • Target’s ability to complete the acquisition of the Aerospace Business of KME Group by cunova GmbH (“cunova”); and • Target’s projected future operational and financial performance, including anticipated benefits of cunova’s acquisition of the Aerospace Business of KME Group and the proposed business combination between the Target and SEDA. April 2024

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN PART IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD BE UNLAWFUL Disclaimer 3 Strictly Private & Confidential Such forward - looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from those expressed or implied by such forward - looking statements. Such factors include, but are not limited to, various factors beyond management’s control, including other risks and uncertainties set forth in the section entitled “Risk Factors” in SEDA’s final prospectus dated October 28, 2021 relating to its initial public offering and other risks and uncertainties indicated from time to time in the definitive proxy statement to be delivered to SEDA shareholders and related registration statement of the Target on Form F - 4, including those set forth under “Risk Factors” therein, or as otherwise indicated from time to time in other documents filed or to be filed with the SEC by SEDA or the Target. Accordingly, any projections, modelling or analysis may differ materially and should not be viewed as factual and should not be relied upon as an accurate or complete prediction of future results, events or circumstances. Further, the information contained in this Presentation may derive, either in whole or in part, from various internal and external sources. No representation or warranty is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modeling or analysis or any other information contained in this Presentation. Any financial information in this Presentation (including specifically the projections) that are forward - looking statements are based on assumptions that are inherently subject to significant uncertainties and contingencies, many of which are beyond the Target's control. The assumptions and estimates underlying the projected results are inherently uncertain and are subject to a wide variety of significant business, economic and competitive risks and uncertainties that could cause actual results to differ materially from those contained in the projections. The financial information and data for cunova for the fiscal year ended December 31, 2023 and for the Aerospace Business for the fiscal years ended December 31, 2023 and 2022 contained in this Presentation is unaudited, based on draft statutory accounts, does not conform to Regulation S - X, and is subject to PCAOB audit. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in the final registration statement to be filed with the SEC and the definitive proxy statement/prospectus contained therein. In this presentation, we use a number of key operating metrics, including Full Added Value (FAV), and non - IFRS financial measures, including EBITDA, Adjusted EBITDA and ROCE, which we believe accurately, in all material respects, reflect the principal parameters of our historic performance. The financial measures EBITDA, Adjusted EBITDA, and ROCE, and measures calculated based on these measures, that are not prepared in accordance with accounting principles generally accepted in the United States ("GAAP") or international financial reporting standards (“IFRS”). These non - GAAP/non - IFRS measures, and other measures that are calculated using these non - GAAP/non - IFRS measures, are an addition, and not a substitute for or superior to measures of financial performance prepared in accordance with GAAP or IFRS and should not be considered as an alternative to operating income, net income or any other performance measures derived in accordance with GAAP or IFRS. The Target believes these non - GAAP/non - IFRS measures of financial results provide useful information to management and potential investors regarding certain financial and business trends relating to the Target's financial condition and results of operations. The Target believes that the use of these non - GAAP/non - IFRS financial measures provides an additional tool for potential investors to use in comparing the Target's financial condition and results of operations with other similar companies, many of which present similar non - GAAP/non - IFRS financial measures to investors. There are a number of limitations related to the use of these non - GAAP / non - IFRS financial measures and their nearest GAAP / IFRS equivalents. For example, the Target’s definitions of non - GAAP / non - IFRS financial measures may differ from non - GAAP / non - IFRS financial measures used by other companies and therefore the non - GAAP/non - IFRS measures in this Presentation may not be directly comparable to similarly titled measures of other companies. For reconciliations to the most directly comparable GAAP / IFRS measure, see Appendix A hereto. SEDA expresses current intentions only. The Presentation and the information contained in it do not constitute an offer capable of acceptance or intended to otherwise give rise to a binding contract. The Presentation and the information contained in it do not constitute a commitment of SEDA or the Target to engage in the Initial Business Combination or to underwrite or place any financing or securities in relation to any business combination. Unless and until a definitive agreement is entered into regarding the Initial Business Combination, SEDA and the Target will not be under any obligation whatsoever with respect to the Initial Business Combination, including, without limitation, to negotiate terms of the Initial Business Combination, except as specifically set forth herein. Signing of a business combination agreement with respect to the Initial Business Combination will be subject to the receipt of all necessary approvals, and the finalisation of relevant agreements for any acquisition to the satisfaction of SEDA and the Target. The information contained in this Presentation is based on present circumstances, economic and market conditions, assumptions, and beliefs. Neither SEDA or the Target has any obligation to update this Presentation or correct any inaccuracies or omissions it discovers following the date of this Presentation. SEDA is an “emerging growth company” as defined under the United States Securities Act of 1933, as amended (the “Securities Act”). SDCL is authorized and regulated in the United Kingdom by the Financial Conduct Authority. The information contained herein does not constitute or form part of, and should not be construed as, an offer or invitation to purchase, subscribe for, underwrite or otherwise acquire, any securities of SEDA or any other person nor should it or any part of it form the basis of, or be relied on in connection with, any contract to purchase or subscribe for any securities of SEDA or any other person or in connection with any other contract or commitment whatsoever. April 2024

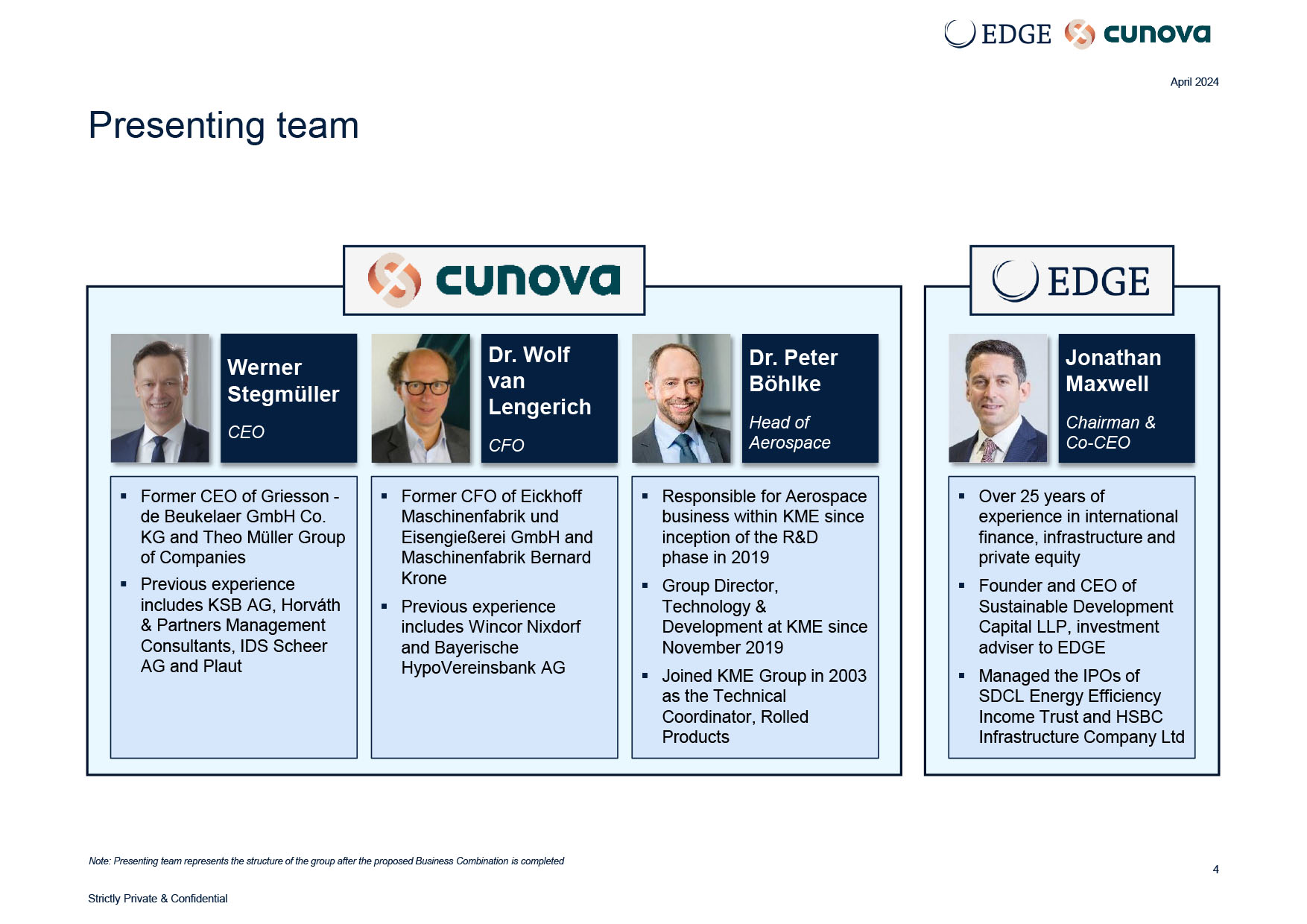

Presenting team 4 Werner Stegmüller CEO ▪ Former CEO of Griesson - de Beukelaer GmbH Co. KG and Theo Müller Group of Companies ▪ Previous experience includes KSB AG, Horváth & Partners Management Consultants, IDS Scheer AG and Plaut Dr. Wolf van Lengerich CFO ▪ Former CFO of Eickhoff Maschinenfabrik und Eisengießerei GmbH and Maschinenfabrik Bernard Krone ▪ Previous experience includes Wincor Nixdorf and Bayerische HypoVereinsbank AG ▪ Responsible for Aerospace business within KME since inception of the R&D phase in 2019 ▪ Group Director, Technology & Development at KME since November 2019 ▪ Joined KME Group in 2003 as the Technical Coordinator, Rolled Products Dr. Peter Böhlke Head of Aerospace ▪ Over 25 years of experience in international finance, infrastructure and private equity ▪ Founder and CEO of Sustainable Development Capital LLP, investment adviser to EDGE ▪ Managed the IPOs of SDCL Energy Efficiency Income Trust and HSBC Infrastructure Company Ltd Jonathan Maxwell Chairman & Co - CEO Note: Presenting team represents the structure of the group after the proposed Business Combination is completed Strictly Private & Confidential April 2024

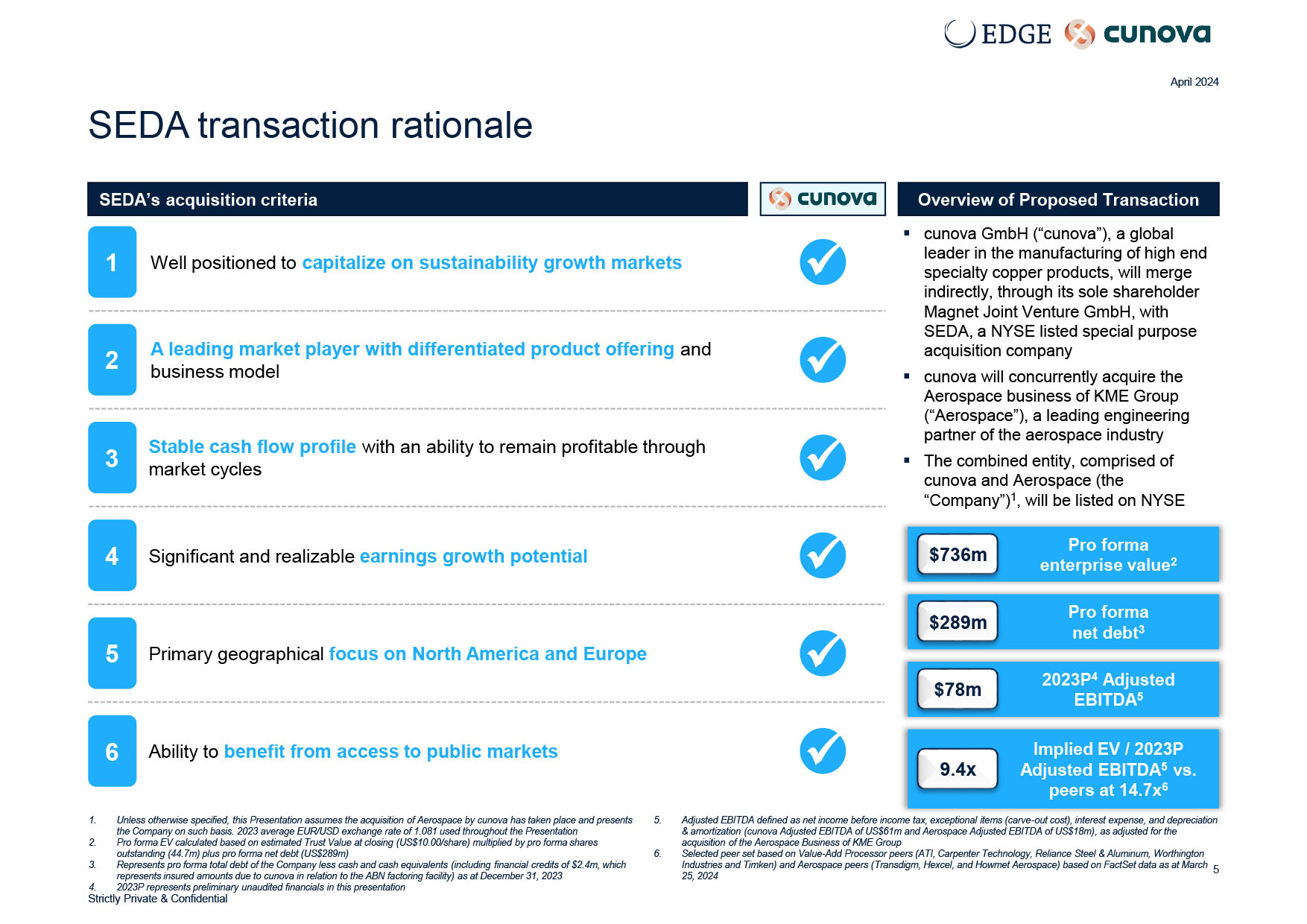

SEDA transaction rationale SEDA’s acquisition criteria 1 Well positioned to capitalize on sustainability growth markets x 2 A leading market player with differentiated product offering and business model x 3 Stable cash flow profile with an ability to remain profitable through market cycles x 4 Significant and realizable earnings growth potential x 5 Primary geographical focus on North America and Europe x 6 Ability to benefit from access to public markets x Overview of Proposed Transaction ▪ cunova GmbH (“cunova”), a global leader in the manufacturing of high end specialty copper products, will merge indirectly, through its sole shareholder Magnet Joint Venture GmbH, with SEDA, a NYSE listed special purpose acquisition company ▪ cunova will concurrently acquire the Aerospace business of KME Group (“Aerospace”), a leading engineering partner of the aerospace industry ▪ The combined entity, comprised of cunova and Aerospace (the “Company”) 1 , will be listed on NYSE Pro forma enterprise value 2 $736m Pro forma net debt 3 $289m Implied EV / 2023P Adjusted EBITDA 5 vs. peers at 14.7x 6 9.4x 2023P 4 Adjusted EBITDA 5 $78m Strictly Private & Confidential 1. Unless otherwise specified, this Presentation assumes the acquisition of Aerospace by cunova has taken place and presents the Company on such basis. 2023 average EUR/USD exchange rate of 1.081 used throughout the Presentation Pro forma EV calculated based on estimated Trust Value at closing (US$10.00/share) multiplied by pro forma shares outstanding (44.7m) plus pro forma net debt (US$289m) Represents pro forma total debt of the Company less cash and cash equivalents (including financial credits of $2.4m, which represents insured amounts due to cunova in relation to the ABN factoring facility) as at December 31, 2023 2023P represents preliminary unaudited financials in this presentation 2. 3. 4. 5. Adjusted EBITDA defined as net income before income tax, exceptional items (carve - out cost), interest expense, and depreciation & amortization (cunova Adjusted EBITDA of US$61m and Aerospace Adjusted EBITDA of US$18m), as adjusted for the acquisition of the Aerospace Business of KME Group Selected peer set based on Value - Add Processor peers (ATI, Carpenter Technology, Reliance Steel & Aluminum, Worthington Industries and Timken) and Aerospace peers (Transdigm, Hexcel, and Howmet Aerospace) based on FactSet data as at March 5 6. 25, 2024 April 2024

History of anticipating and meeting market needs across addressable markets and well positioned to capitalize on existing growth markets Key investment highlights 6 3 Consistent, through - the - cycle profitability with substantial long - term upside, supported by high returns and margins, low capital requirements and virtually no commodity price exposure Scarce public market opportunity for substantial long - term upside potential with direct exposure to the high - growth space exploration market – benefitting from proprietary IP that contributes a dynamic competitive positioning 1 Highly attractive entry valuation relative to peers, expected to be driven, in part, by historically higher trading multiples for aerospace businesses as the Company's businesses mix is expected to shift over the medium and long term 7 Outlook supported by strong market fundamentals across key end markets 2 Long - term relationships with blue chip customers – resulting in low churn and significant recurring revenue 4 Important contributor to sustainability and the energy transition in the electric vehicle and aerospace engine sectors 5 6 Strictly Private & Confidential April 2024

Company overview 1 Strictly Private & Confidential

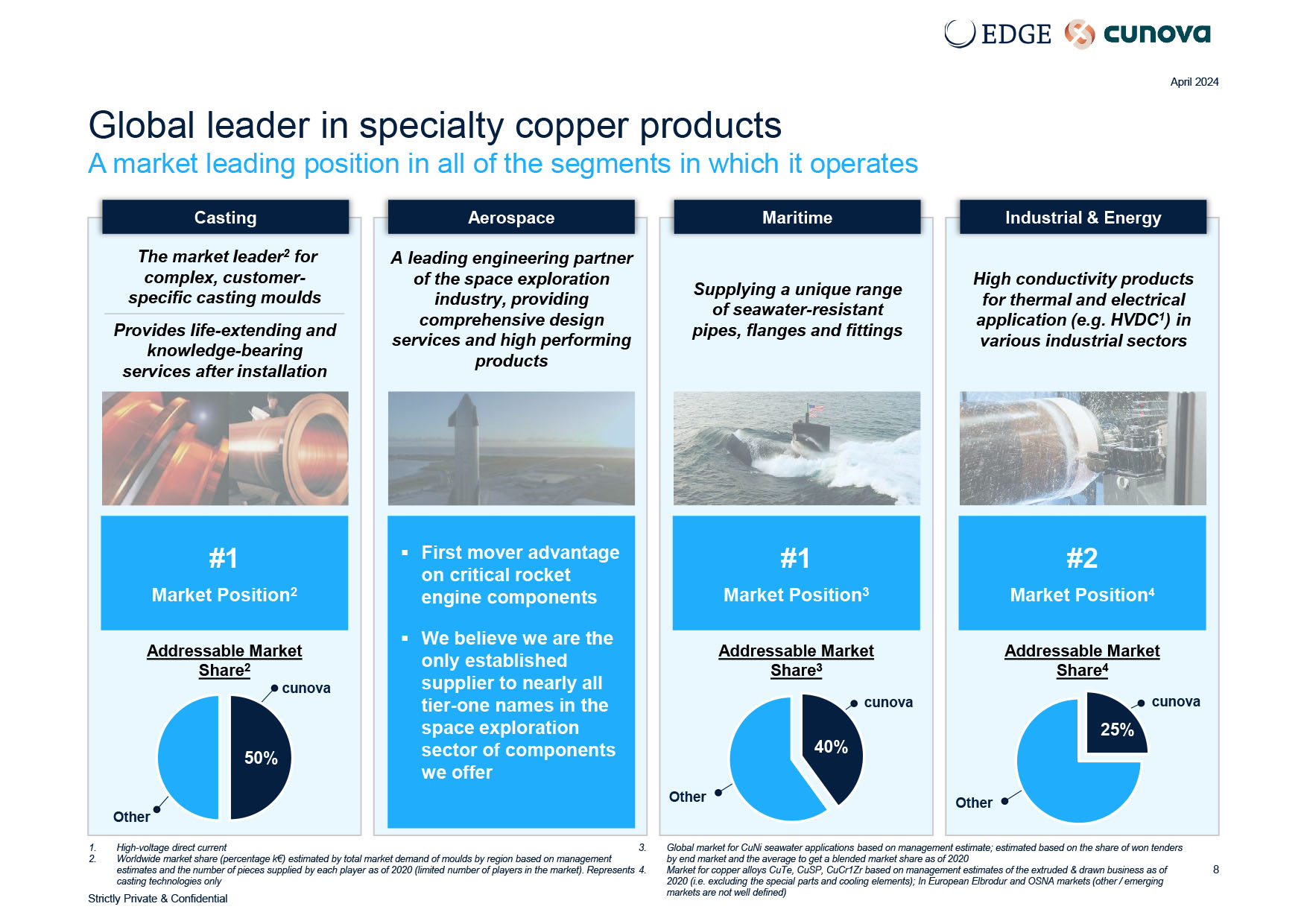

Strictly Private & Confidential Global leader in specialty copper products 8 The market leader 2 for complex, customer - specific casting moulds #1 Market Position 2 1. 2. High - voltage direct current 3. Worldwide market share (percentage k€) estimated by total market demand of moulds by region based on management estimates and the number of pieces supplied by each player as of 2020 (limited number of players in the market). Represents 4. casting technologies only Global market for CuNi seawater applications based on management estimate; estimated based on the share of won tenders by end market and the average to get a blended market share as of 2020 Market for copper alloys CuTe, CuSP, CuCr1Zr based on management estimates of the extruded & drawn business as of 2020 (i.e. excluding the special parts and cooling elements); In European Elbrodur and OSNA markets (other / emerging markets are not well defined) Supplying a unique range of seawater - resistant pipes, flanges and fittings #1 Market Position 3 Industrial & Energy High conductivity products for thermal and electrical application (e.g. HVDC 1 ) in various industrial sectors #2 Market Position 4 Addressable Market Share 3 Addressable Market Share 4 50% A market leading position in all of the segments in which it operates Casting Aerospace Maritime A leading engineering partner of the space exploration industry, providing comprehensive design services and high performing products ▪ First mover advantage on critical rocket engine components ▪ We believe we are the only established supplier to nearly all tier - one names in the space exploration sector of components we offer Provides life - extending and knowledge - bearing services after installation Addressable Market Share 2 cunova Other cunova cunova Other 40% Other 25% April 2024

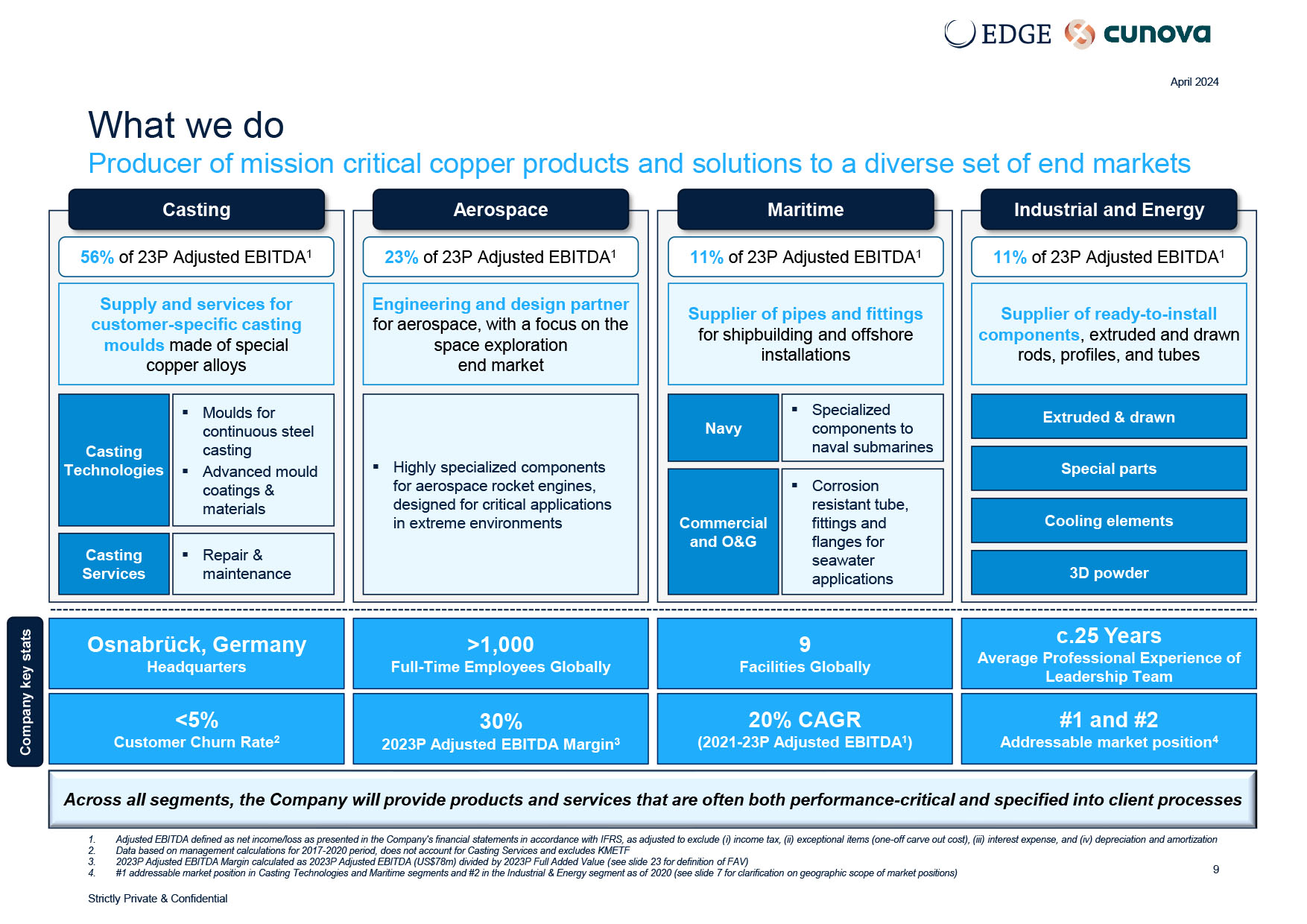

What we do 9 Supply and services for customer - specific casting moulds made of special copper alloys Casting Technologies ▪ Moulds for continuous steel casting ▪ Advanced mould coatings & materials Casting Services ▪ Repair & maintenance Supplier of pipes and fittings for shipbuilding and offshore installations Navy ▪ Specialized components to naval submarines Commercial and O&G ▪ Corrosion resistant tube, fittings and flanges for seawater applications Supplier of ready - to - install components , extruded and drawn rods, profiles, and tubes Extruded & drawn Engineering and design partner for aerospace, with a focus on the space exploration end market Producer of mission critical copper products and solutions to a diverse set of end markets Casting Aerospace Maritime Industrial and Energy 56% of 23P Adjusted EBITDA 1 23% of 23P Adjusted EBITDA 1 11% of 23P Adjusted EBITDA 1 11% of 23P Adjusted EBITDA 1 ▪ Highly specialized components for aerospace rocket engines, designed for critical applications in extreme environments Special parts Cooling elements 3D powder Across all segments, the Company will provide products and services that are often both performance - critical and specified into client processes Osnabrück, Germany Headquarters >1,000 Full - Time Employees Globally 9 Facilities Globally c.25 Years Average Professional Experience of Leadership Team <5% Customer Churn Rate 2 30% 2023P Adjusted EBITDA Margin 3 20% CAGR (2021 - 23P Adjusted EBITDA 1 ) #1 and #2 Addressable market position 4 Company key stats 1. 2. 3. 4. Adjusted EBITDA defined as net income/loss as presented in the Company's financial statements in accordance with IFRS, as adjusted to exclude (i) income tax, (ii) exceptional items (one - off carve out cost), (iii) interest expense, and (iv) depreciation and amortization Data based on management calculations for 2017 - 2020 period, does not account for Casting Services and excludes KMETF 2023P Adjusted EBITDA Margin calculated as 2023P Adjusted EBITDA (US$78m) divided by 2023P Full Added Value (see slide 23 for definition of FAV) #1 addressable market position in Casting Technologies and Maritime segments and #2 in the Industrial & Energy segment as of 2020 (see slide 7 for clarification on geographic scope of market positions) April 2024 Strictly Private & Confidential

Why we are needed – Casting 10 ▪ Casting products are consumable and have a regular service and replacement cycle , resulting in recurring revenue generation ▪ Essential to steelmaking process – both BF 1 and EAF 2 – yet a marginal portion (<0.5%) of a mill’s cost base ▪ The product quality of the moulds is of critical importance for the quality of the steel produced ▪ Moulds are often specialized to the client resulting in high switching costs 1. 2. 3. Blast Furnace (“BF”) Electric Arc Furnace (“EAF”) Casting of non - ferrous metals includes aluminum (for thin strip casting) Example applications Casting of flat steel Casting of long steel Casting of non - ferrous metals 3 We believe we are the leading supplier of an essential and bespoke consumable component to the steel industry Service Description Mould Casting April 2024 Strictly Private & Confidential

Why we are needed – Aerospace 11 ▪ We believe we are the only established supplier of the components we offer in the space exploration sector – first mover advantage ▪ Marginal portion of a rocket’s cost base representing critical engine components that allow for the reuse of rocket engines o This reusability contributes to resource efficiency in the aerospace industry – a primary objective across the sector ▪ Reputation for quality and reliability ▪ Based on the performance of existing products, we are currently exploring expanding to other parts of the engine Rocket engine components We believe we are the only established supplier capable of providing rocket engine components critical to reusability 1 Description Example applications Aerospace 1. Strictly Private & Confidential KME market intelligence April 2024

Why we are needed – Maritime & Industrial & Energy ▪ We believe we are a top producer of corrosion resistant tube, fittings and flanges for seawater applications ▪ Products designed for durability and longevity ▪ Loyal customer base – trusted supplier to key western navies ▪ Trusted supplier of key components to a variety of high tech industries: o Sputter targets for LED screens o Parts for HVDC power transmission o Cooling of EAF and BF o Copper alloy powder for 3D printing ▪ Potential for continuous expansion of product offerings driven by growth in end markets and R&D into other applications (e.g. hollow profile rods for water cooled EV 1 motors) Offshore O&G platforms Naval submarines Hollow profiles rods for liquid cooled EV motors HVDC transmission 3D printing Commercial shipbuilding Desalination plants Industrial & Energy Maritime Description Example applications EAF cooling Sputter targets for LED screens 1. 12 Strictly Private & Confidential Electric Vehicle (“EV”) April 2024

Barriers to entry with spec’d in designs, high market share, know - how, customer comfort, on - site technical consultants, and a comprehensive patent portfolio covering niche industries Market standard in reliability with a long and proven track record of quality in our end markets Value - add repair and maintenance services enhancing client relationships and increasing our market understanding Why we win Ability to meaningfully impact sustainability and cost metrics of customers Price insensitive customers due to products being mission critical and making up a small component of their overall cost structure Strong and diverse customer base with c.1,000 customers per year across 4 continents 1 Constant innovation based on deep understanding of customers’ applications resulting in new solutions for the challenges of customers With our first mover advantage , we believe we are the only established supplier of key components to nearly all tier - one names in the space exploration sector April 2024 Our unrelenting focus on quality and innovation – in end markets where consistency and reliability are critical – separate us from the competition and drive recurring revenue and growth opportunities 1 2 3 4 5 6 7 8 1. Based on average annual number of unique customers from January 1, 2020 to September 18, 2023 13 Strictly Private & Confidential

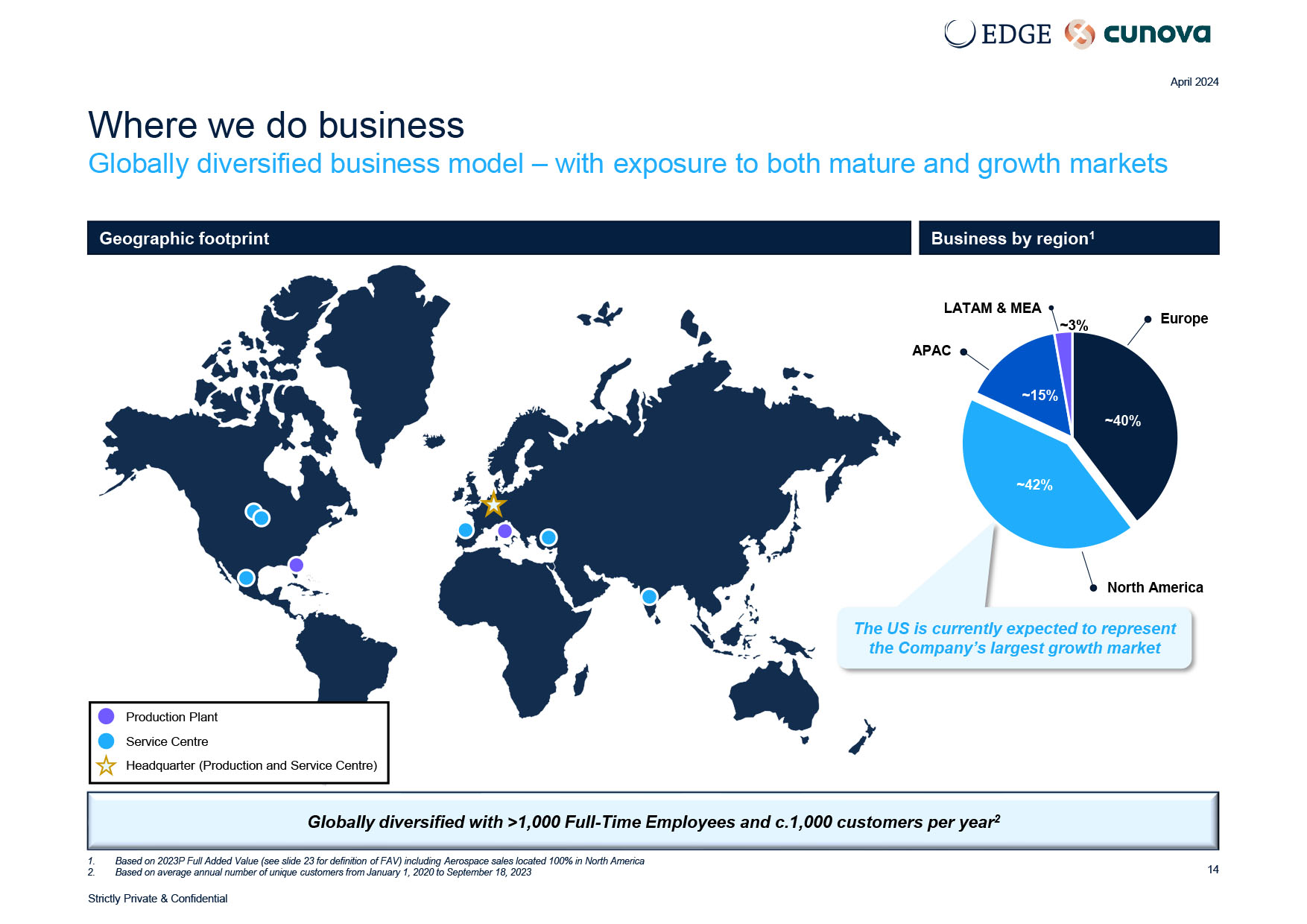

April 2024 Globally diversified with >1,000 Full - Time Employees and c.1,000 customers per year 2 Where we do business Globally diversified business model – with exposure to both mature and growth markets Geographic footprint Business by region 1 Europe APAC LATAM & MEA Production Plant Service Centre Headquarter (Production and Service Centre) North America The US is currently expected to represent the Company’s largest growth market 1. Based on 2023P Full Added Value (see slide 23 for definition of FAV) including Aerospace sales located 100% in North America ~42% 14 2. Based on average annual number of unique customers from January 1, 2020 to September 18, 2023 Strictly Private & Confidential ~15% ~40% ~3%

Key investment highlights 2 Strictly Private & Confidential

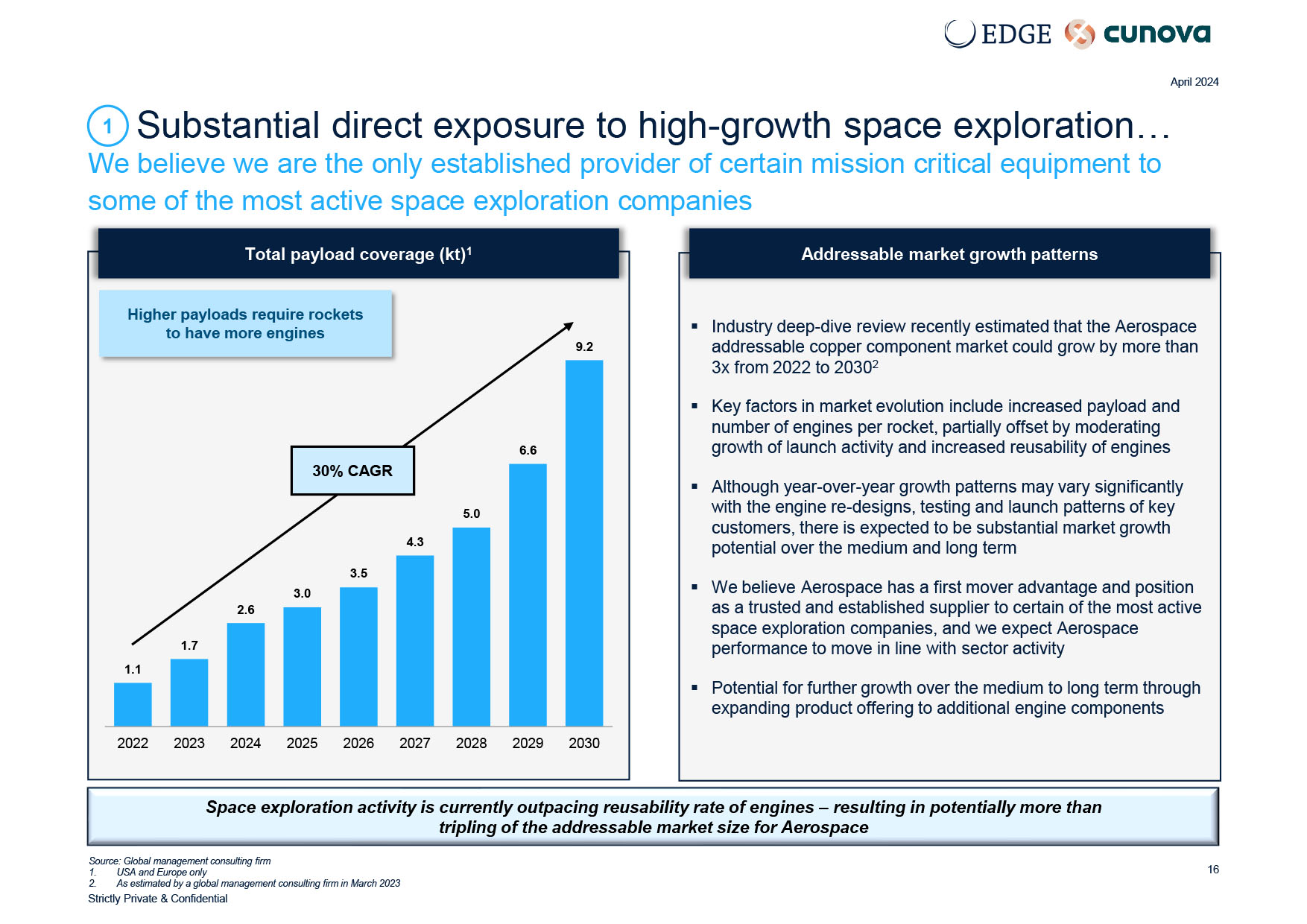

1.1 1.7 2.6 3.0 3.5 4.3 5.0 6.6 9.2 2022 2023 2024 2025 2026 2027 2028 2029 2030 Space exploration activity is currently outpacing reusability rate of engines – resulting in potentially more than tripling of the addressable market size for Aerospace Substantial direct exposure to high - growth space exploration… 16 April 2024 We believe we are the only established provider of certain mission critical equipment to some of the most active space exploration companies 1 Source: Global management consulting firm 1. USA and Europe only Higher payloads require rockets to have more engines 30% CAGR ▪ Industry deep - dive review recently estimated that the Aerospace addressable copper component market could grow by more than 3 x from 2022 to 2030 2 ▪ Key factors in market evolution include increased payload and number of engines per rocket, partially offset by moderating growth of launch activity and increased reusability of engines ▪ Although year - over - year growth patterns may vary significantly with the engine re - designs, testing and launch patterns of key customers, there is expected to be substantial market growth potential over the medium and long term ▪ We believe Aerospace has a first mover advantage and position as a trusted and established supplier to certain of the most active space exploration companies, and we expect Aerospace performance to move in line with sector activity ▪ Potential for further growth over the medium to long term through expanding product offering to additional engine components Total payload coverage (kt) 1 Addressable market growth patterns 2. As estimated by a global management consulting firm in March 2023 Strictly Private & Confidential

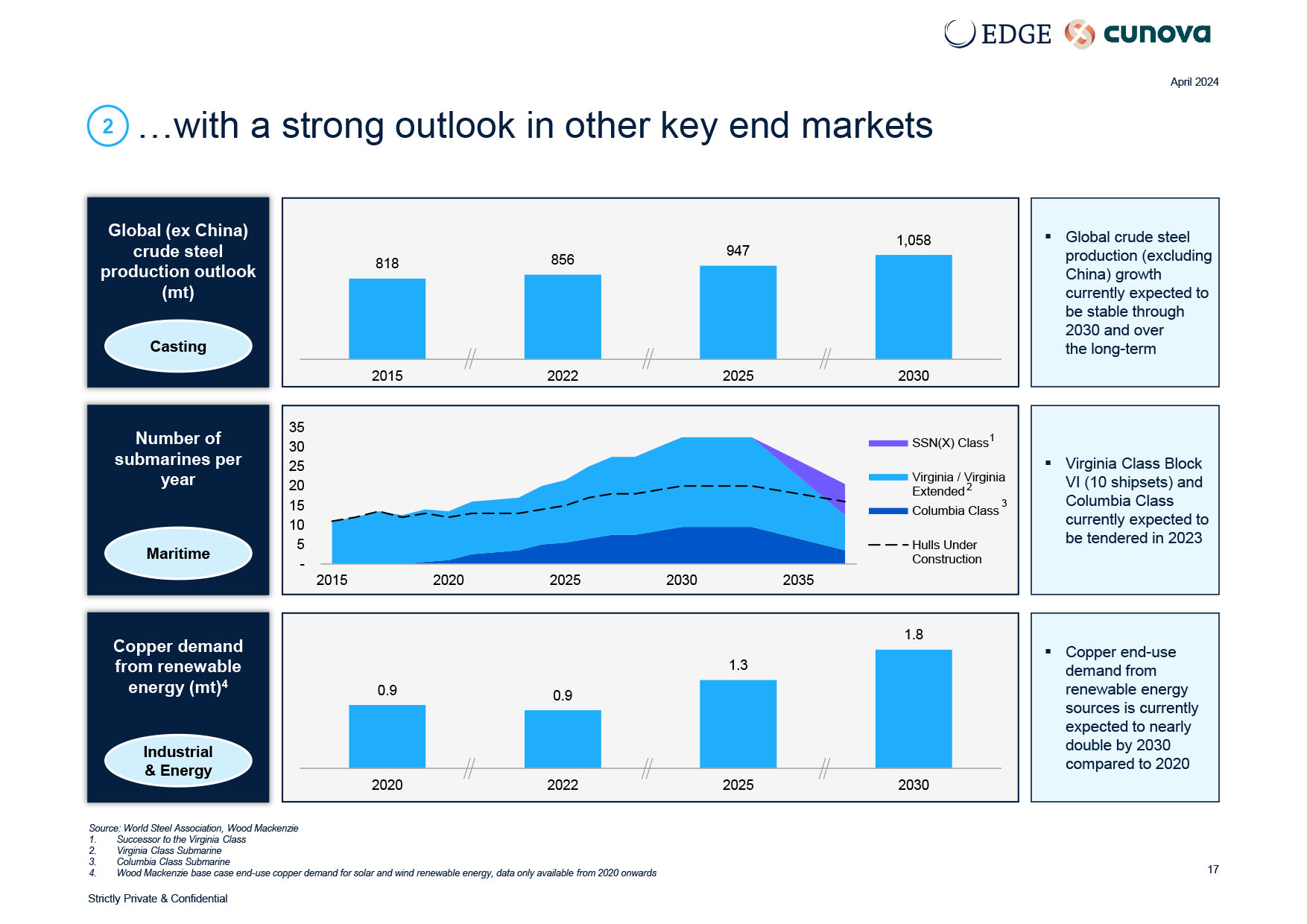

0.9 0.9 1.3 1.8 2020 2022 2025 2030 - 35 30 25 20 15 10 5 2015 2020 2025 2030 2035 Hulls Under Construction …with a strong outlook in other key end markets April 2024 2 Global (ex China) crude steel production outlook (mt) Casting Source: World Steel Association, Wood Mackenzie 1. 2. 3. Successor to the Virginia Class Virginia Class Submarine Columbia Class Submarine ▪ Global crude steel production (excluding China) growth currently expected to be stable through 2030 and over the long - term ▪ Virginia Class Block VI (10 shipsets) and Columbia Class currently expected to be tendered in 2023 ▪ Copper end - use demand from renewable energy sources is currently expected to nearly double by 2030 compared to 2020 Number of submarines per year Maritime Copper demand from renewable energy (mt) 4 Industrial & Energy SSN(X) Class 1 17 4. Wood Mackenzie base case end - use copper demand for solar and wind renewable energy, data only available from 2020 onwards Strictly Private & Confidential Virginia / Virginia Extended 2 Columbia Class 3 818 856 947 1,058 2015 2022 2025 2030

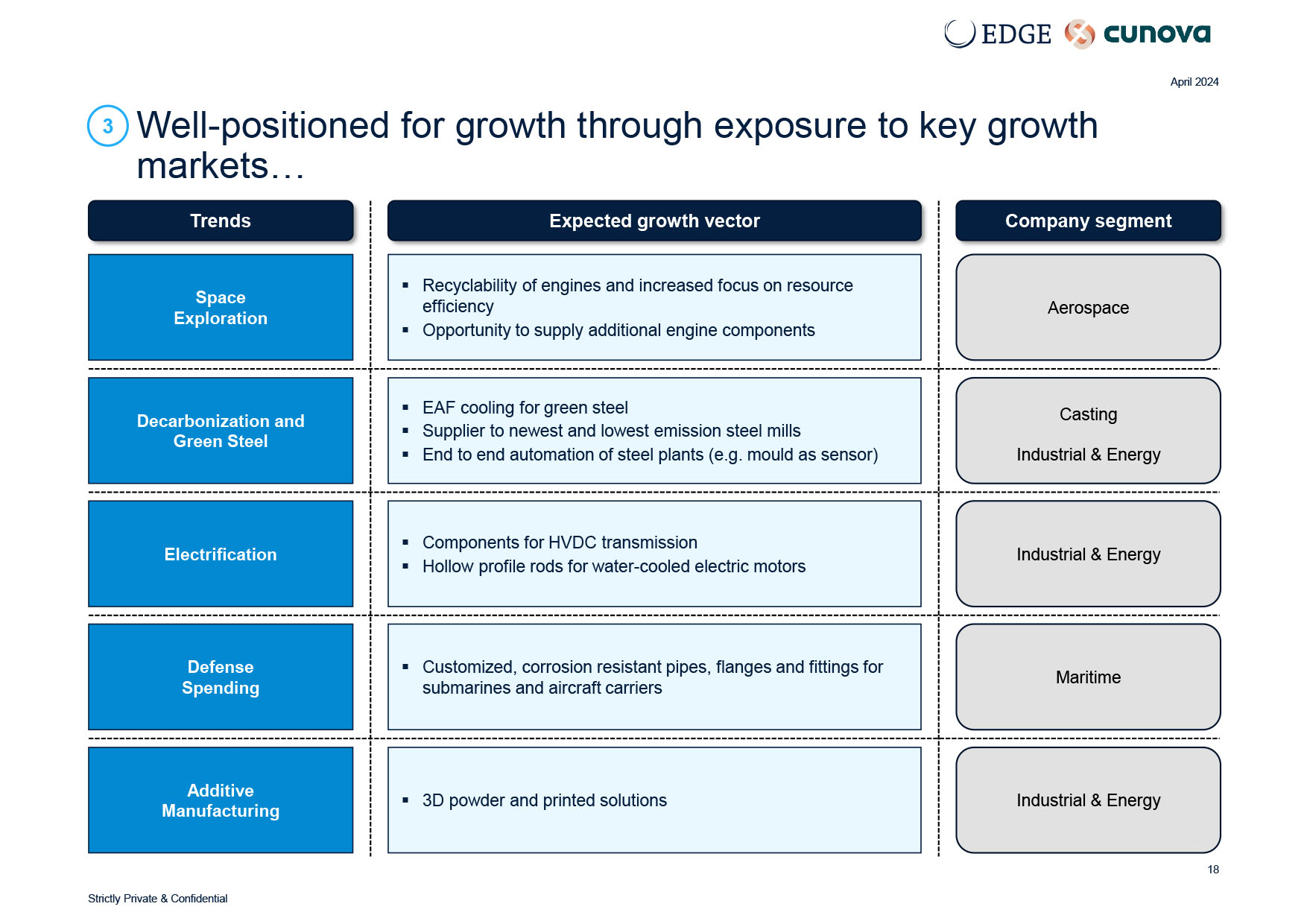

Well - positioned for growth through exposure to key growth markets… April 2024 3 Company segment Aerospace Expected growth vector ▪ Recyclability of engines and increased focus on resource efficiency ▪ Opportunity to supply additional engine components Trends Space Exploration Casting Industrial & Energy ▪ EAF cooling for green steel ▪ Supplier to newest and lowest emission steel mills ▪ End to end automation of steel plants (e.g. mould as sensor) Decarbonization and Green Steel Industrial & Energy ▪ Components for HVDC transmission ▪ Hollow profile rods for water - cooled electric motors Electrification Maritime ▪ Customized, corrosion resistant pipes, flanges and fittings for submarines and aircraft carriers Defense Spending Industrial & Energy ▪ 3D powder and printed solutions Additive Manufacturing 18 Strictly Private & Confidential

Optimization of sales and agents network Expand Casting Services coverage “going down the caster” Increase Casting penetration in India by local manufacturing Continue improving efficiency at flagship plant in Osnabrück Expand into aluminium casting market with copper - based casting sleeves Expand capacity in crucible production to meet expected increase in titanium casting demand Approach to innovation ▪ Given the highly customized product offerings and importance placed by the customer on quality and reliability, constant innovation is important to developing tailor - made solutions that meet customer needs ▪ An effective R&D function is critical to building market share in new and growing applications ▪ Innovation is supported by a full integration of capabilities through ongoing dialogue with customers and learnings from casting services ▪ A portfolio of approximately 30 patents and a significant R&D pipeline …supported by organic growth initiatives April 2024 A history of innovation and anticipating customer needs and market trends 3 Product growth initiatives / R&D pipeline Copper Powder MRI Components HVDC Transmission EAF Cooling Ramp - up Smart Mould EV Motor Cooling EV Super Charging Printed Welding Cap Field test Concept Near - term planned operational growth initiatives Additional addressable components 19 Strictly Private & Confidential

Long - term relationships with blue chip customers… April 2024 With c.1,000 customers per year 1 , the Company has a diversified customer base – including premier names in each of its end markets 4 Casting Technologies Casting Services Aerospace Established supplier to nearly all tier - one players 2 Maritime Industrial and Energy 1. Based on average annual number of unique customers from January 1, 2020 to September 18, 2023 20 2. Aerospace customer list is redacted due to customer confidentiality requirement Strictly Private & Confidential

…driven by our track record of product reliability April 2024 4 Tailor made products often specified into manufacturers’ product designs Trusted supplier to US, UK, French and Italian navies 1 >30 year average length of key casting customers 2 <5% customer churn across the portfolio 3 High switching costs and low share of total costs drive high levels of recurring revenue ▪ Most of the components produced have a “zero - failure” tolerance – their performance is mission critical to our customers ▪ We believe substitution risk is low given the importance of reliability to our customers and our products typically represent a small portion of the total cost of the customer’s product ▪ The trust of our customers is, therefore, one of our most important assets and gives us a distinct competitive advantage that drives significant recurring revenue 1 2 3 4 Majority of the 25 largest steel companies source from cunova 4 5 The Company’s casting moulds account for <0.5% of steel production costs 5 6 Aerospace products typically represent a marginal allocation of the client’s capex budget 7 Key Aerospace customers seeking to increase content through engine coverage 8 21 4. 5. Ranking of top steel - producing companies in 2022 by the World Steel Association Based on management’s 2020 estimate Strictly Private & Confidential 1. 2. 3. Tier 2 supplier to US, UK, French and Italian navies Key casting customers based on long - standing customer relationships with Rizhao Steel, ArcelorMittal and Nucor Data based on management calculations for 2017 - 2020 period, does not account for Casting Services and excludes KMETF

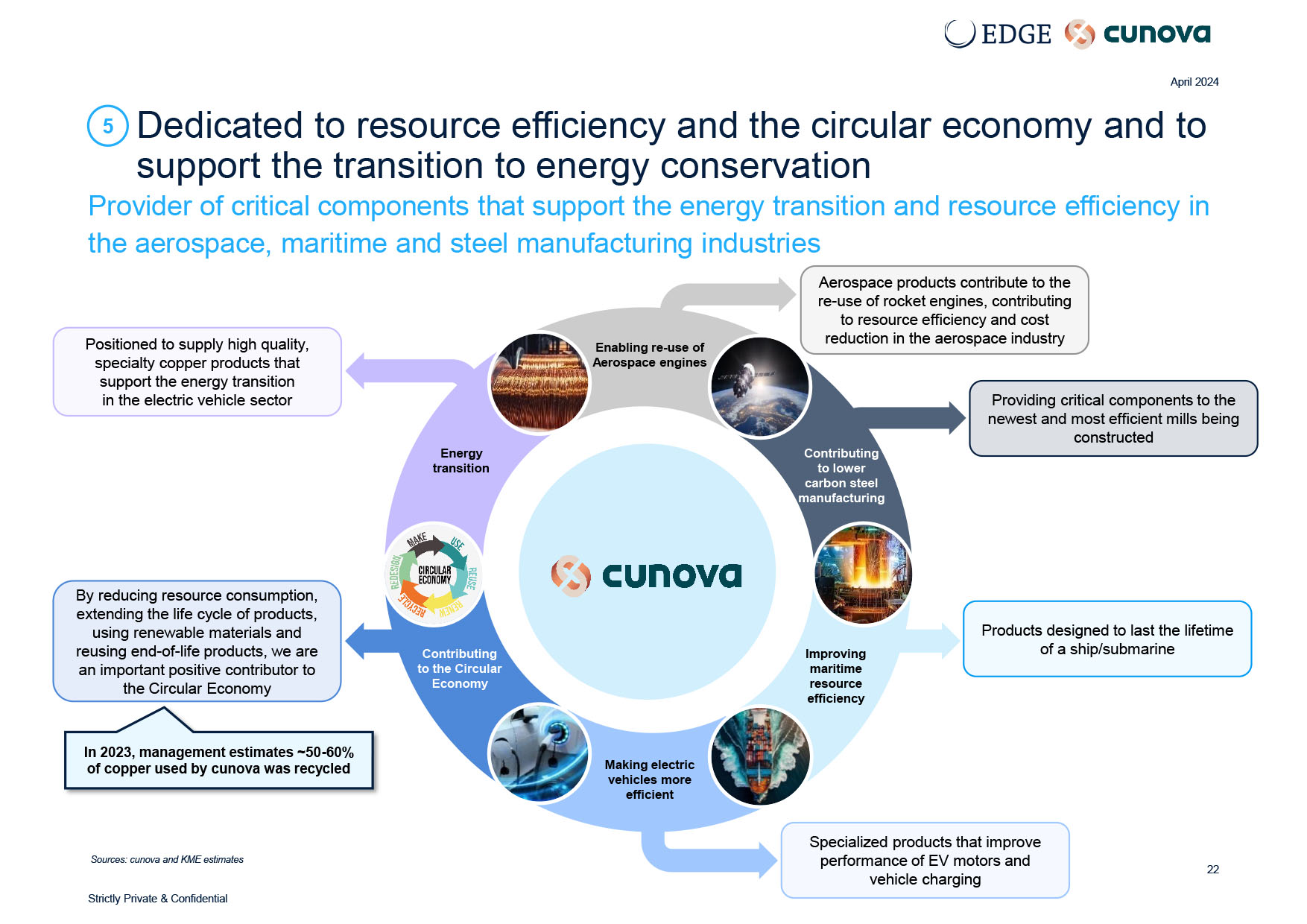

Dedicated to resource efficiency and the circular economy and to support the transition to energy conservation 22 April 2024 5 Sources: cunova and KME estimates Energy transition Improving maritime resource efficiency Making electric vehicles more efficient Contributing to the Circular Economy Positioned to supply high quality, specialty copper products that support the energy transition in the electric vehicle sector Provider of critical components that support the energy transition and resource efficiency in the aerospace, maritime and steel manufacturing industries Aerospace products contribute to the re - use of rocket engines, contributing to resource efficiency and cost reduction in the aerospace industry Providing critical components to the newest and most efficient mills being constructed Products designed to last the lifetime of a ship/submarine Specialized products that improve performance of EV motors and By reducing resource consumption, extending the life cycle of products, using renewable materials and reusing end - of - life products, we are an important positive contributor to the Circular Economy In 2023, management estimates ~50 - 60% of copper used by cunova was recycled Contributing to lower carbon steel manufacturing vehicle charging Strictly Private & Confidential Enabling re - use of Aerospace engines

- 6,000 8,000 10,000 12,000 2023P Copper Price (US$/mt) 55 65 78 26% 28% 30% 2 4 , 0 000 4 8 , 0 000 2021 Adjusted EBITDA (US$m) 2022 Adjusted EBITDA Margin (% of FAV) The Company passes its commodity costs through to customers, as demonstrated by its consistent margins through the recent commodity price cycle A business model that passes through commodity price risk 23 April 2024 6 Supply agreements Adjusted EBITDA 1 (US$m), Adjusted EBITDA margin (%) vs copper price (US$/mt) 2 Copper cash official LME price (US$/mt) ▪ Supply agreements are in place with KME and other suppliers for provision of material in accordance with pre - agreed specifications ▪ At the time the Company enters into a sales agreement with a customer, the Company only purchases the amount of material it requires from its suppliers ▪ The commodity price charged by the Company’s suppliers are passed through to the customer ▪ The Company also has the right to sell scrap to KME for recycling Source: FactSet 1. Adjusted EBITDA defined as net income before income tax, exceptional items (carve - out cost), interest expense, and depreciation & amortization 18% growth 2. Copper price data from January 1, 2021 to December 31, 2023 Strictly Private & Confidential 21% growth

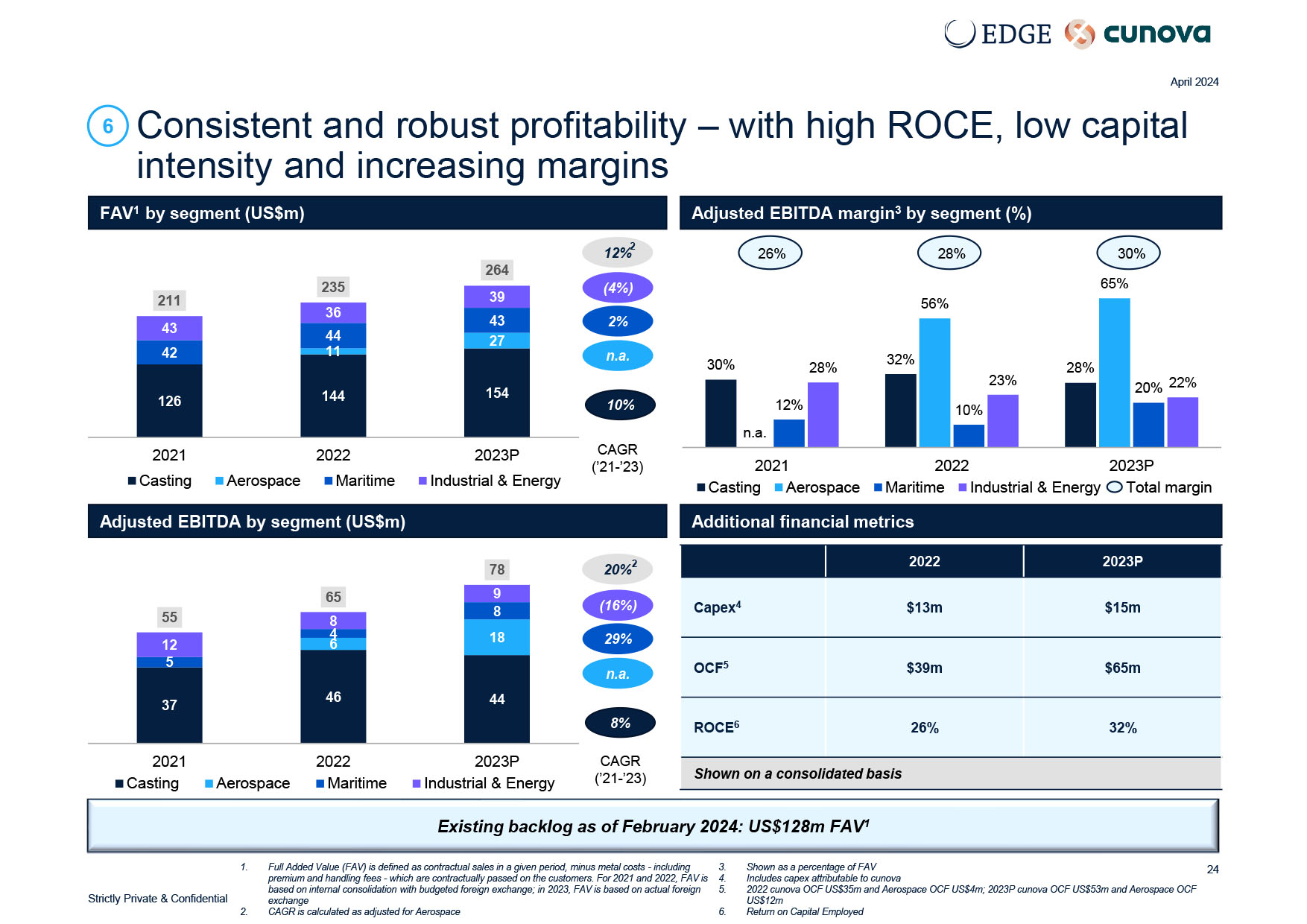

Strictly Private & Confidential Consistent and robust profitability – with high ROCE, low capital intensity and increasing margins 24 April 2024 6 FAV 1 by segment (US$m) Adjusted EBITDA margin 3 by segment (%) CAGR (’21 - ’23) 8% n.a. 29% (16%) 1. Full Added Value (FAV) is defined as contractual sales in a given period, minus metal costs - including 3 . premium and handling fees - which are contractually passed on the customers . For 2021 and 2022 , FAV is 4 . based on internal consolidation with budgeted foreign exchange ; in 2023 , FAV is based on actual foreign 5 . exchange CAGR is calculated as adjusted for Aerospace 2. Shown as a percentage of FAV Includes capex attributable to cunova 2022 cunova OCF US$35m and Aerospace OCF US$4m; 2023P cunova OCF US$53m and Aerospace OCF US$12m Return on Capital Employed 6. 2023P 2022 $15m $13m Capex 4 $65m $39m OCF 5 32% 26% ROCE 6 Shown on a consolidated basis Adjusted EBITDA by segment (US$m) Additional financial metrics CAGR (’21 - ’23) 10% n.a. 2% (4%) 12% 2 Existing backlog as of February 2024: US$128m FAV 1 126 144 154 27 42 44 11 43 43 36 39 211 235 264 2021 Casting Aerospace 2022 Maritime 2023P Industrial & Energy 46 44 6 18 5 37 8 12 8 4 9 55 65 78 20% 2 2021 Casting 2023P Industrial & Energy Aerospace 2022 Maritime 30% 32% 28% n.a. 56% 26% 28% 30% 65% 12% 10% 28% 23% 20% 22% 2023P Total margin 2021 2022 Casting Aerospace Maritime Industrial & Energy

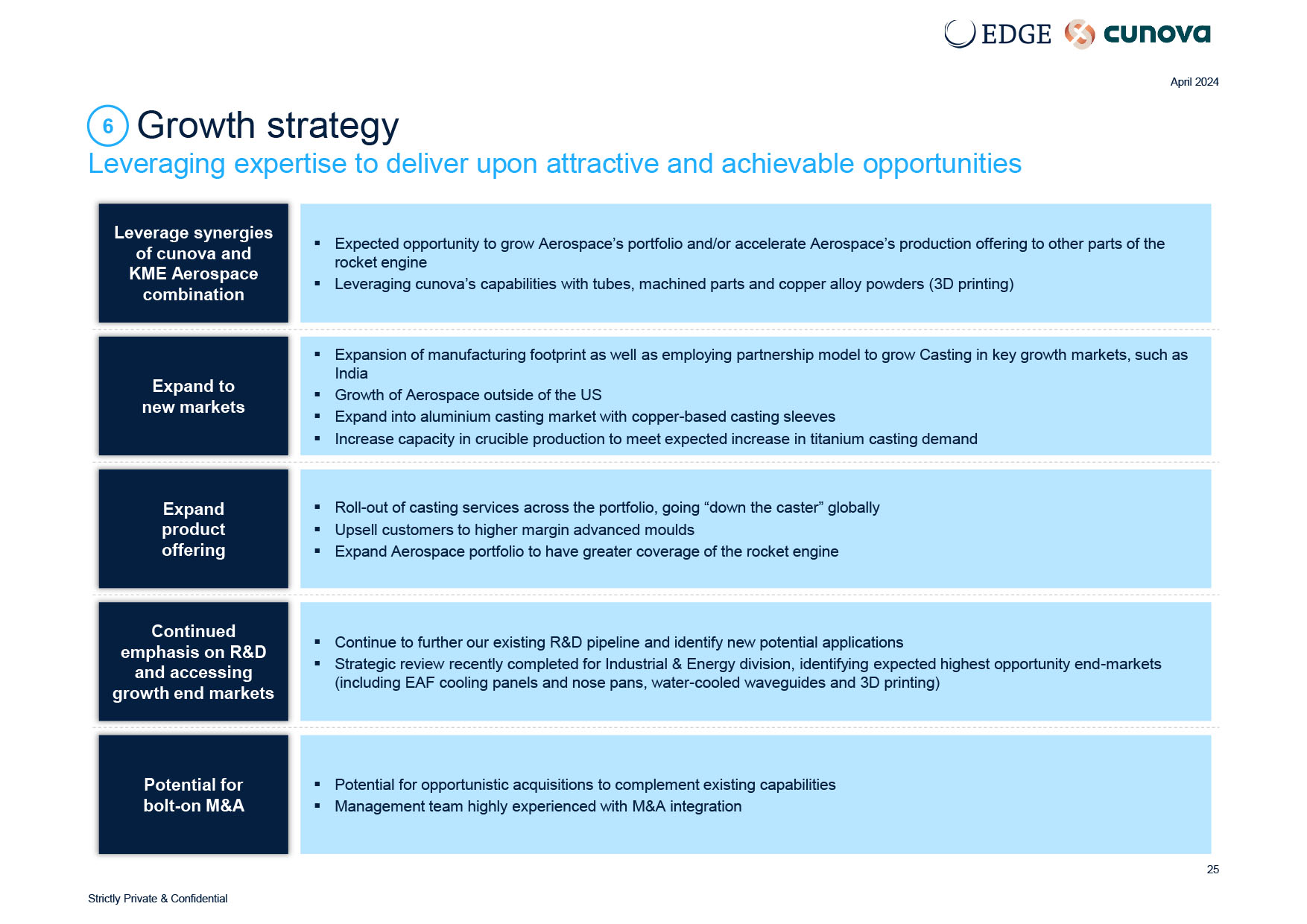

April 2024 Leveraging expertise to deliver upon attractive and achievable opportunities ▪ Expected opportunity to grow Aerospace’s portfolio and/or accelerate Aerospace’s production offering to other parts of the rocket engine ▪ Leveraging cunova’s capabilities with tubes, machined parts and copper alloy powders (3D printing) ▪ Expansion of manufacturing footprint as well as employing partnership model to grow Casting in key growth markets, such as India ▪ Growth of Aerospace outside of the US ▪ Expand into aluminium casting market with copper - based casting sleeves ▪ Increase capacity in crucible production to meet expected increase in titanium casting demand ▪ Roll - out of casting services across the portfolio, going “down the caster” globally ▪ Upsell customers to higher margin advanced moulds ▪ Expand Aerospace portfolio to have greater coverage of the rocket engine ▪ Continue to further our existing R&D pipeline and identify new potential applications ▪ Strategic review recently completed for Industrial & Energy division, identifying expected highest opportunity end - markets (including EAF cooling panels and nose pans, water - cooled waveguides and 3D printing) Leverage synergies of cunova and KME Aerospace combination ▪ Potential for opportunistic acquisitions to complement existing capabilities ▪ Management team highly experienced with M&A integration Expand to new markets Expand product offering Continued emphasis on R&D and accessing growth end markets Potential for bolt - on M&A Growth strategy 6 25 Strictly Private & Confidential

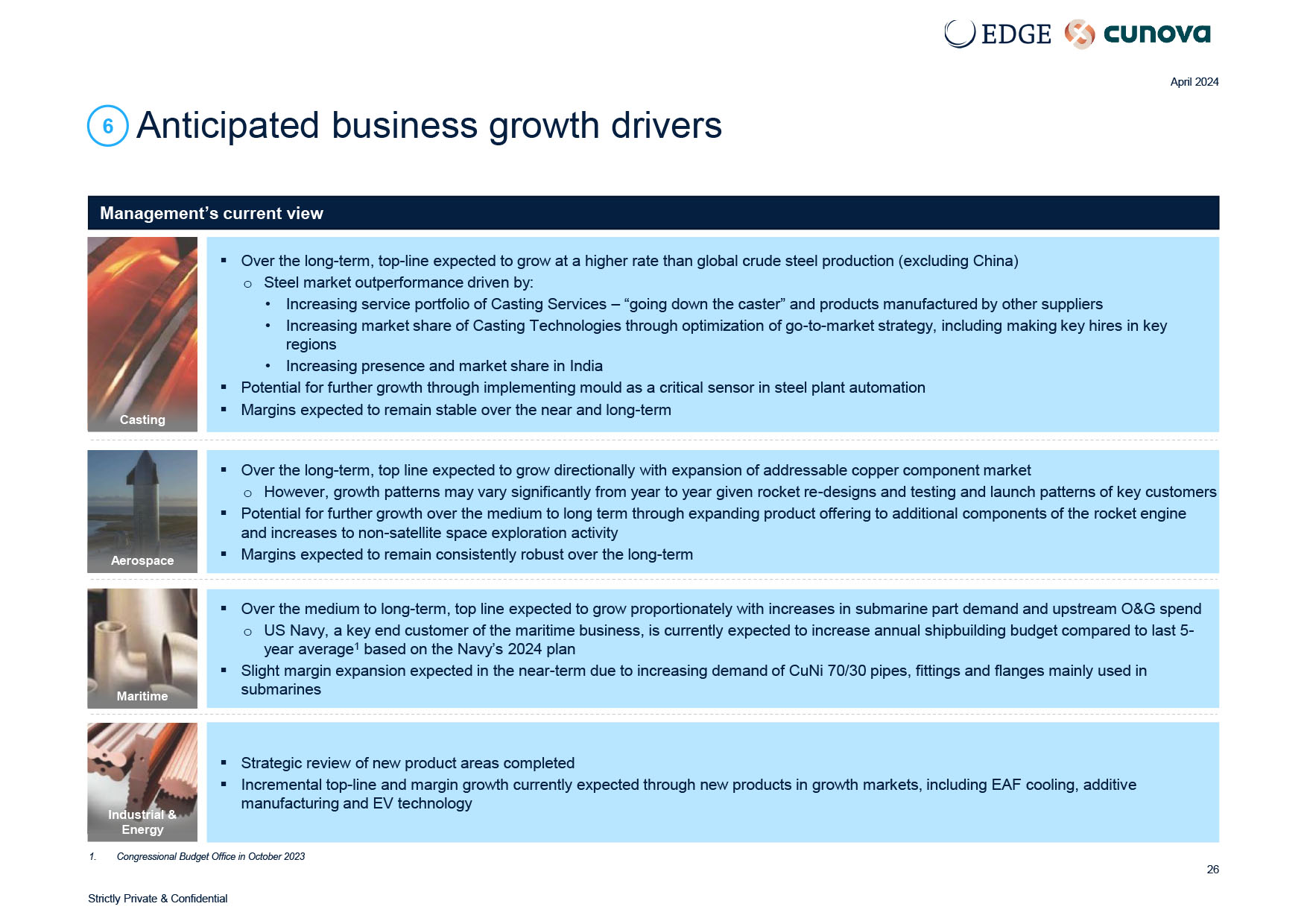

Anticipated business growth drivers April 2024 6 ▪ Over the long - term, top - line expected to grow at a higher rate than global crude steel production (excluding China) o Steel market outperformance driven by: • Increasing service portfolio of Casting Services – “going down the caster” and products manufactured by other suppliers • Increasing market share of Casting Technologies through optimization of go - to - market strategy, including making key hires in key regions • Increasing presence and market share in India ▪ Potential for further growth through implementing mould as a critical sensor in steel plant automation ▪ Margins expected to remain stable over the near and long - term Casting ▪ Over the long - term, top line expected to grow directionally with expansion of addressable copper component market o However, growth patterns may vary significantly from year to year given rocket re - designs and testing and launch patterns of key customers ▪ Potential for further growth over the medium to long term through expanding product offering to additional components of the rocket engine and increases to non - satellite space exploration activity ▪ Margins expected to remain consistently robust over the long - term Aerospace ▪ Over the medium to long - term, top line expected to grow proportionately with increases in submarine part demand and upstream O&G spend o US Navy, a key end customer of the maritime business, is currently expected to increase annual shipbuilding budget compared to last 5 - year average 1 based on the Navy’s 2024 plan ▪ Slight margin expansion expected in the near - term due to increasing demand of CuNi 70/30 pipes, fittings and flanges mainly used in submarines Maritime ▪ Strategic review of new product areas completed ▪ Incremental top - line and margin growth currently expected through new products in growth markets, including EAF cooling, additive manufacturing and EV technology Industrial & Energy 26 Strictly Private & Confidential Management’s current view 1. Congressional Budget Office in October 2023

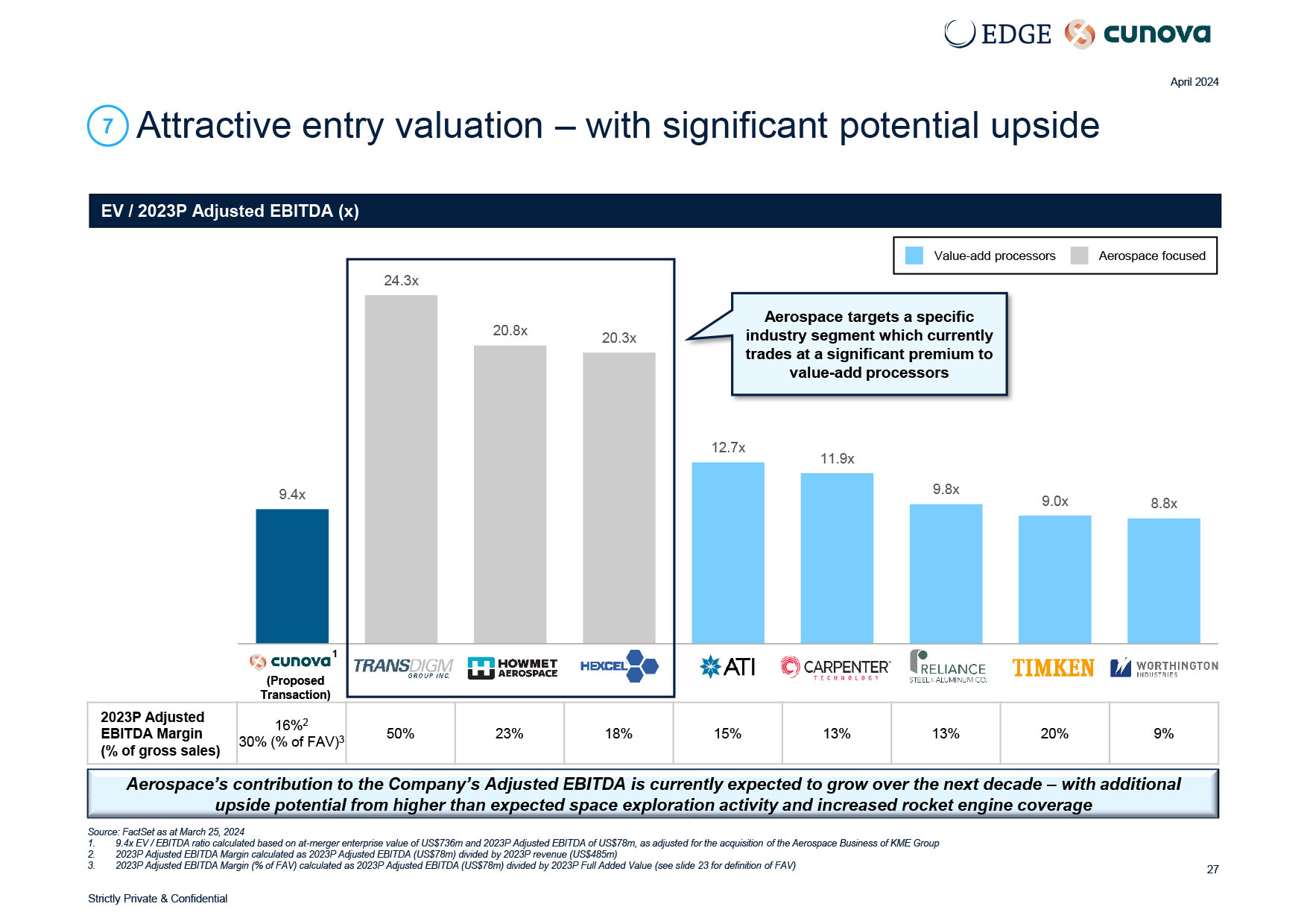

Attractive entry valuation – with significant potential upside April 2024 7 EV / 2023P Adjusted EBITDA (x) 1. 2. 9.4x EV / EBITDA ratio calculated based on at - merger enterprise value of US$736m and 2023P Adjusted EBITDA of US$78m, as adjusted for the acquisition of the Aerospace Business of KME Group 2023P Adjusted EBITDA Margin calculated as 2023P Adjusted EBITDA (US$78m) divided by 2023P revenue (US$485m) Aerospace’s contribution to the Company’s Adjusted EBITDA is currently expected to grow over the next decade – with additional upside potential from higher than expected space exploration activity and increased rocket engine coverage Source: FactSet as at March 25, 2024 Value - add processors Aerospace focused 8.8x 9.0x Aerospace targets a specific industry segment which currently trades at a significant premium to value - add processors 12.7x 11.9x 9.8x 20.3x 20.8x 24.3x 9.4x 1 (Proposed Transaction) 9% 20% 13% 13% 15% 18% 23% 50% 16% 2 30% (% of FAV) 3 2023P Adjusted EBITDA Margin (% of gross sales) 3. 2023P Adjusted EBITDA Margin (% of FAV) calculated as 2023P Adjusted EBITDA (US$78m) divided by 2023P Full Added Value (see slide 23 for definition of FAV) 27 Strictly Private & Confidential

Key takeaways April 2024 Attractive entry point with significant potential to increase value First mover advantage providing direct exposure to all tier - one space exploration companies – a sector we believe is currently positioned for substantial growth Established leader in all key segments – with high market share, recurring revenue and barriers to entry Robust fundamentals and strong outlook currently across all key end - markets – with identified initiatives underway to maximize exposure History of strong margins, through - the - cycle profitability, and cash flow generation Strong backing from KME , a global leader in copper products – a demonstration of confidence in the Company’s future Demonstrated leader in quality and innovation – driving low churn and recurring revenue Heightened strategic focus and accomplished management team Dedicated to resource efficiency and the circular economy and to support the transition to energy conservation x x x x x x x x x 28 Strictly Private & Confidential

3 Corporate history & transaction overview Strictly Private & Confidential

Corporate history: carve out process commenced 2020 30 April 2024 Proliferation of space exploration drives substantial growth at Aerospace New leadership team at cunova KME carves out KME Special Paragon acquires 55% interest in KME Special , with KME retaining 45% ownership Paragon provides institutional private equity support to enhance the KME Special carve - out process KME Special rebrands to cunova KME’s specialty copper business has been in operations since the 1920s 1 Proven track record as a successful and standalone business unit History of success of legacy cunova business KME Special carve - out, investment from Paragon & rebranding to cunova Continued improvement at cunova & transformational growth at Aerospace 1. 2. Internal KME estimate KME carved out KME Special in 2020; the merger between KME Special and Paragon closed in 2022; rebranding to cunova was completed in 2023 Enhanced strategic focus – benefiting from a lean organizational structure and high quality management team with a proven track record 1920s 1 2020 - 2022 2 2022 - 2023 2024 KME’s desire to rollover its equity in the Company (and increase its effective ownership of cunova) demonstrates its confidence in the Company and its long - term success Aerospace business Aerospace business Strictly Private & Confidential

Klaas Unteutsch Head of Melting & Casting Technologies 17 years experience • Head of Melting & Casting Technologies since March 2023 • Joined KME in April 2016 as the Commercial Director Jack A. Roser Head of Casting Services 23 years experience • Head of Casting services • Previously CEO and President of Roser Technologies, Inc which was acquired by cunova on January 1, 2022 Michael Volland Head of Maritime Applications 30 years experience • Head of Maritime Applications since January 2009 • Joined KME in February 1993 as Sales Manager and served in this position for more than 15 years Philip Schröder Head of Industrial and Energy Applications 13 years experience • Head of Industrial Applications since February 2024 • Previously Head of BU WeWire and Head of Sales at Coroplast for approx . 4 years Werner Stegmüller Chief Executive Officer Dr. Sascha Stempel Chief Operating Officer • COO since March 2023 • Previously COO of Brillux for >4 years 24 years experience Dr. Wolf van Lengerich Chief Financial Officer Refreshed and high - quality leadership team, with the management team averaging c.25 years of professional experience 31 April 2024 • CFO since August 2023 • Previously CFO of Eickhoff Maschinenfabrik und Eisengießerei for >3 years, Maschinenfabrik Bernard Krone for >4 years 20 years experience 31 years experience • CEO since January 2023 • Previously CEO of Griesson - de Beukelaer for 7 months & Theo Müller group of companies for >4 years Dr. Peter Böhlke Group Director, Technology & Development 23 years experience • Group Director, Technology & Development at KME since November 2019 • Joined KME in 2003 as the Technical Coordinator, Rolled Products Strictly Private & Confidential

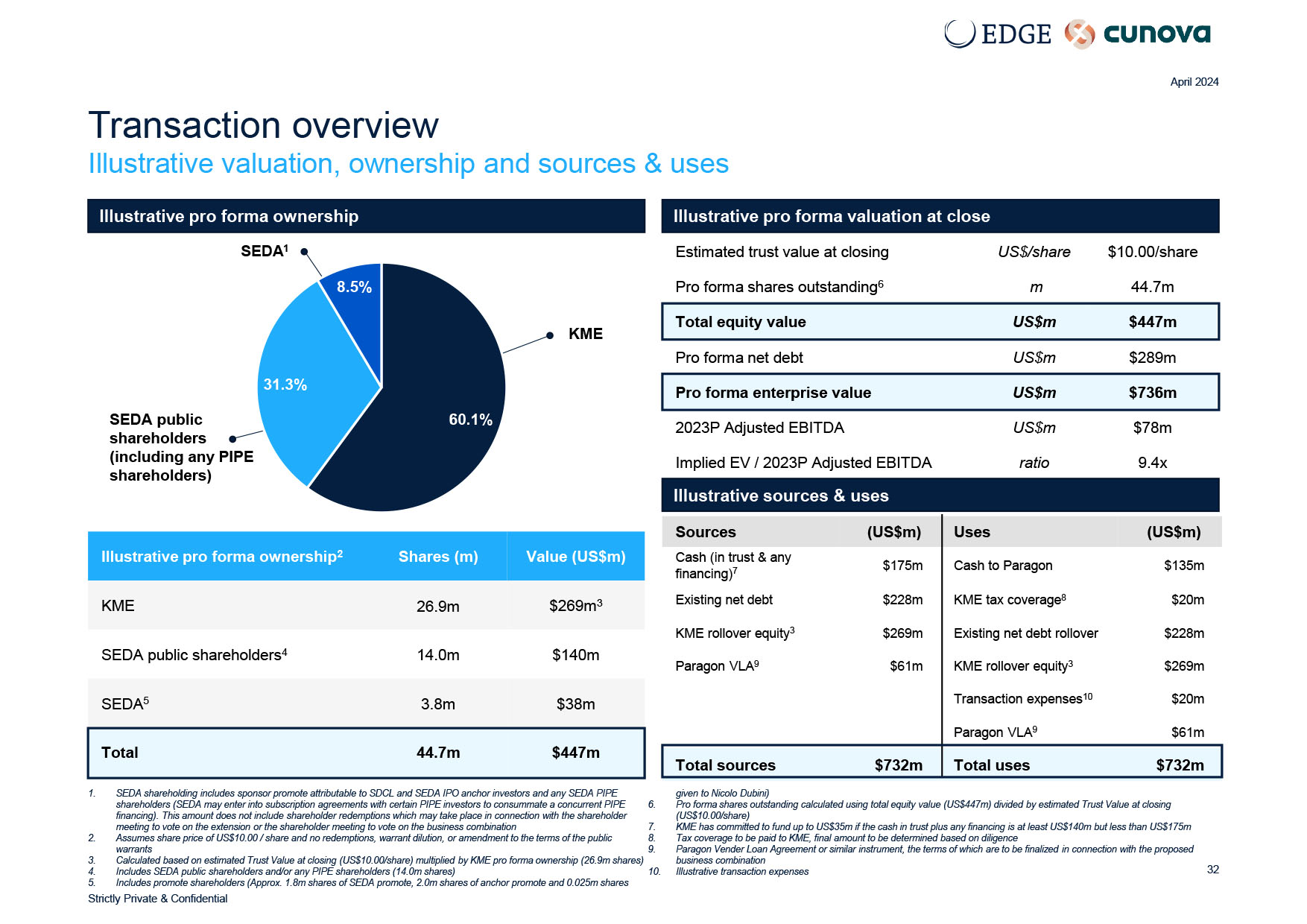

$10.00/share US$/share Estimated trust value at closing 44.7m m Pro forma shares outstanding 6 $447m US$m Total equity value $289m US$m Pro forma net debt $736m US$m Pro forma enterprise value $78m US$m 2023P Adjusted EBITDA 9.4x ratio Implied EV / 2023P Adjusted EBITDA Transaction overview Illustrative valuation, ownership and sources & uses April 2024 1. SEDA shareholding includes sponsor promote attributable to SDCL and SEDA IPO anchor investors and any SEDA PIPE shareholders (SEDA may enter into subscription agreements with certain PIPE investors to consummate a concurrent PIPE financing). This amount does not include shareholder redemptions which may take place in connection with the shareholder meeting to vote on the extension or the shareholder meeting to vote on the business combination Assumes share price of US$10.00 / share and no redemptions, warrant dilution, or amendment to the terms of the public warrants Calculated based on estimated Trust Value at closing (US$10.00/share) multiplied by KME pro forma ownership (26.9m shares) 2. 3. given to Nicolo Dubini) Pro forma shares outstanding calculated using total equity value (US$447m) divided by estimated Trust Value at closing (US$10.00/share) KME has committed to fund up to US$35m if the cash in trust plus any financing is at least US$140m but less than US$175m Tax coverage to be paid to KME, final amount to be determined based on diligence Paragon Vender Loan Agreement or similar instrument, the terms of which are to be finalized in connection with the proposed business combination 6. 7. 8. 9. KME SEDA public shareholders (including any PIPE shareholders) Illustrative pro forma ownership 32 4. 5. Includes SEDA public shareholders and/or any PIPE shareholders (14.0m shares) Includes promote shareholders (Approx. 1.8m shares of SEDA promote, 2.0m shares of anchor promote and 0.025m shares 10. Illustrative transaction expenses Strictly Private & Confidential Illustrative pro forma valuation at close Value (US$m) Shares (m) Illustrative pro forma ownership 2 $269m 3 26.9m KME $140m 14.0m SEDA public shareholders 4 $38m 3.8m SEDA 5 $447m 44.7m Total Illustrative sources & uses (US$m) Uses (US$m) Sources $135m Cash to Paragon $175m Cash (in trust & any financing) 7 $20m KME tax coverage 8 $228m Existing net debt $228m Existing net debt rollover $269m KME rollover equity 3 $269m KME rollover equity 3 $61m Paragon VLA 9 $20m Transaction expenses 10 $61m Paragon VLA 9 $732m Total uses $732m Total sources 60.1% 31.3% SEDA 1 8.5%

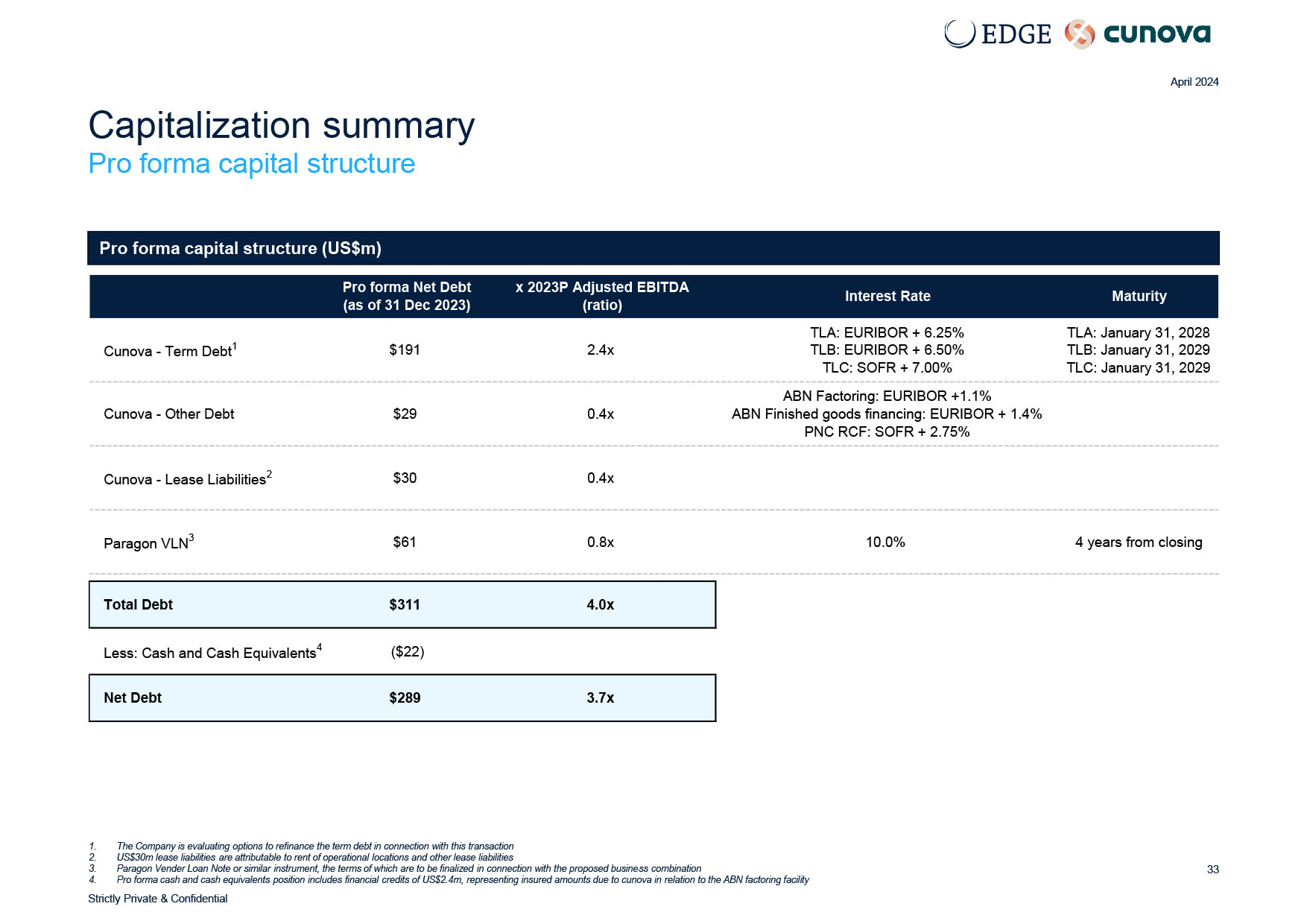

Capitalization summary Pro forma capital structure 33 April 2024 Pro forma capital structure (US$m) 1. 2. 3. The Company is evaluating options to refinance the term debt in connection with this transaction US$30m lease liabilities are attributable to rent of operational locations and other lease liabilities Paragon Vender Loan Note or similar instrument, the terms of which are to be finalized in connection with the proposed business combination TLA: January 31, 2028 TLA: EURIBOR + 6.25% TLB: January 31, 2029 TLC: January 31, 2029 TLB: EURIBOR + 6.50% TLC: SOFR + 7.00% 2.4x $191 Cunova - Term Debt 1 ABN Factoring: EURIBOR +1.1% ABN Finished goods financing: EURIBOR + 1.4% 0.4x $29 Cunova - Other Debt PNC RCF: SOFR + 2.75% 0.4x $30 Cunova - Lease Liabilities 2 4 years from closing 10.0% 0.8x $61 Paragon VLN 3 4.0x $311 Total Debt ($22) Less: Cash and Cash Equivalents 4 3.7x $289 Net Debt 4. Pro forma cash and cash equivalents position includes financial credits of US$2.4m, representing insured amounts due to cunova in relation to the ABN factoring facility Strictly Private & Confidential Pro forma Net Debt (as of 31 Dec 2023) x 2023P Adjusted EBITDA (ratio) Interest Rate Maturity

A Appendix Strictly Private & Confidential

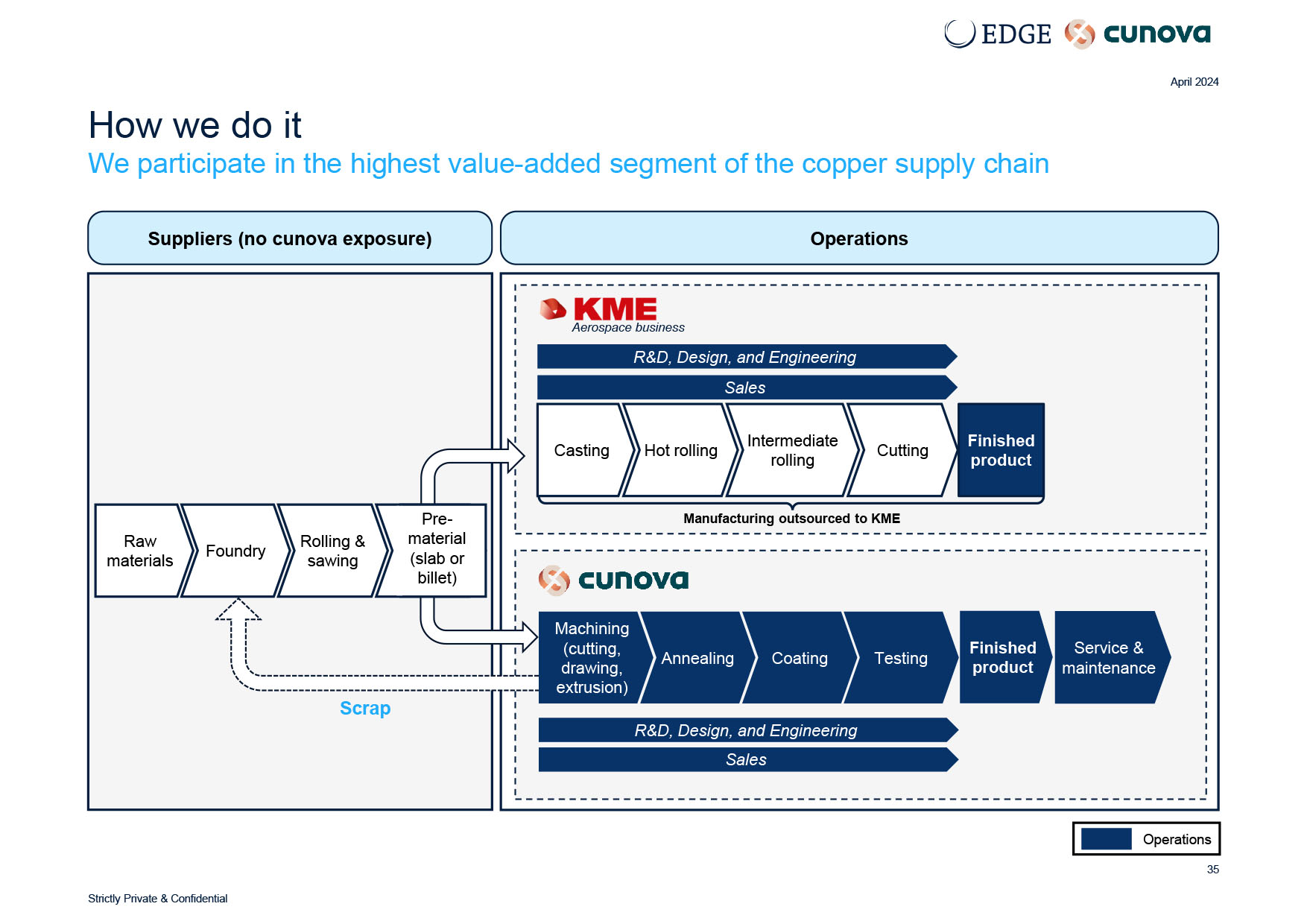

How we do it We participate in the highest value - added segment of the copper supply chain April 2024 Suppliers (no cunova exposure) Operations Scrap Rolling & sawing Foundry Raw materials Finished product Cutting Hot rolling rolling Casting Testing Annealing Coating R&D, Design, and Engineering Sales R&D, Design, and Engineering Sales + Intermediate Service & maintenance Manufacturing outsourced to KME Operations Finished product Aerospace business Machining (cutting, drawing, extrusion) 35 Strictly Private & Confidential Pre - material (slab or billet)

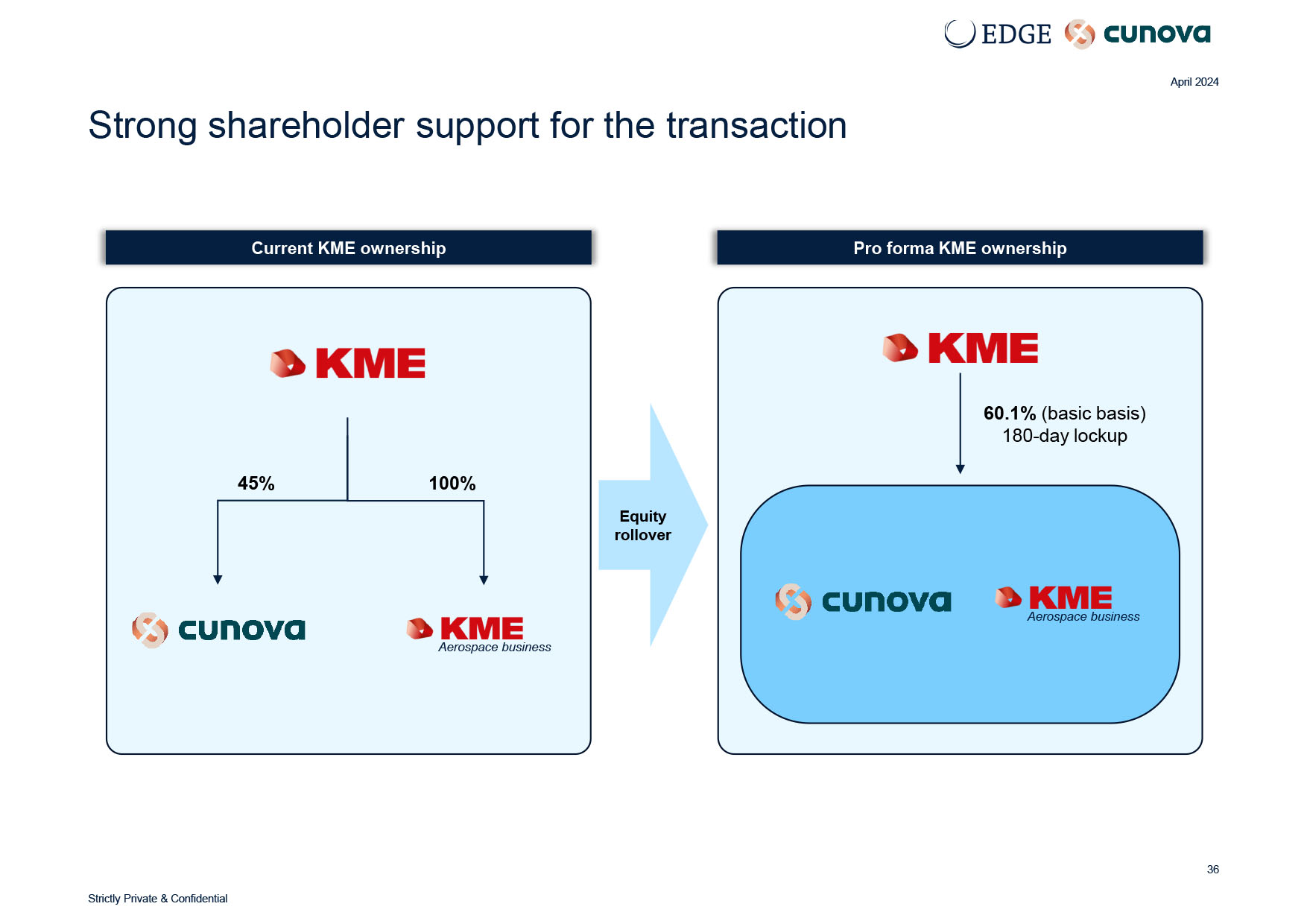

April 2024 45% 100% 60.1% (basic basis) 180 - day lockup Equity rollover Current KME ownership Pro forma KME ownership Strong shareholder support for the transaction Aerospace business 36 Strictly Private & Confidential Aerospace business

2023P 2022 2021 US$m 1 6 15 22 Net income 9 8 4 Income taxes 33 20 10 Interest expense 8 9 10 Depreciation & Amortization 56 52 47 EBITDA 5 7 8 Exceptional Items (carve - out cost) 61 59 55 Adjusted EBITDA 37 Strictly Private & Confidential Adjusted EBITDA reconciliation April 2024 1. Values may not add up due to rounding cunova Aerospace 2023P 2022 2021 US$m 1 12 4 - Net income 5 2 - Income taxes - - - Interest expense - - - Depreciation & Amortization 18 6 - EBITDA - - - Exceptional Items (carve - out cost) 18 6 - Adjusted EBITDA

ROCE reconciliation 1. 2. Values may not add up due to rounding Please see previous slide for the Adjusted EBITDA reconciliation 38 Strictly Private & Confidential April 2024 cunova Pro Forma 2023P 2022 2021 US$m 1 61 59 55 Adjusted EBITDA 2 (8) (9) (10) Depreciation & Amortization 52 51 45 Adjusted EBIT 379 369 n.a. Total Assets (157) (152) n.a. Total Current Liabilities 24% 23% n.a. ROCE 2023P 2022 2021 US$m 1 78 65 55 Adjusted EBITDA 2 (8) (9) (10) Depreciation & Amortization 70 57 45 Adjusted EBIT 379 369 n.a. Total Assets (157) (152) n.a. Total Current Liabilities 32% 26% n.a. ROCE

39