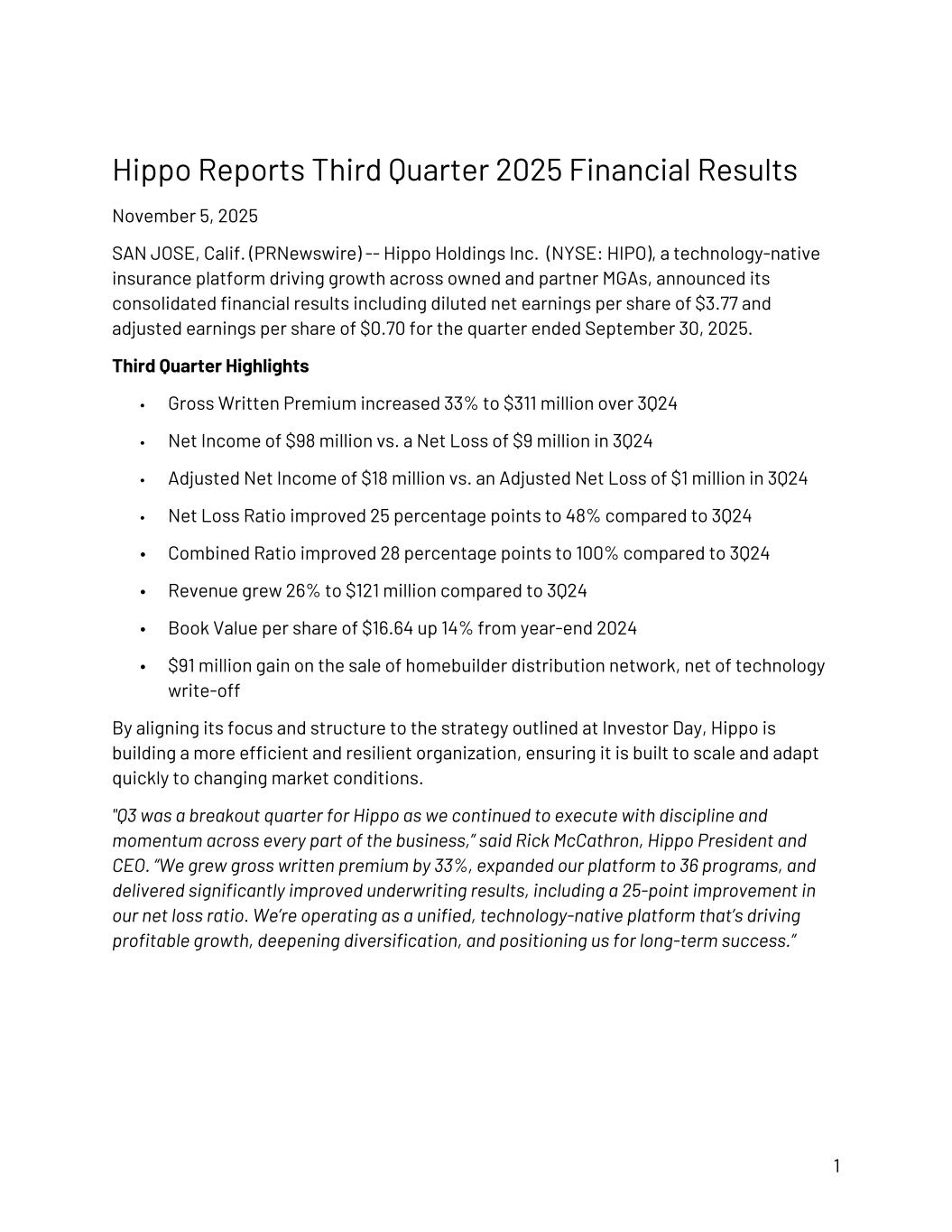

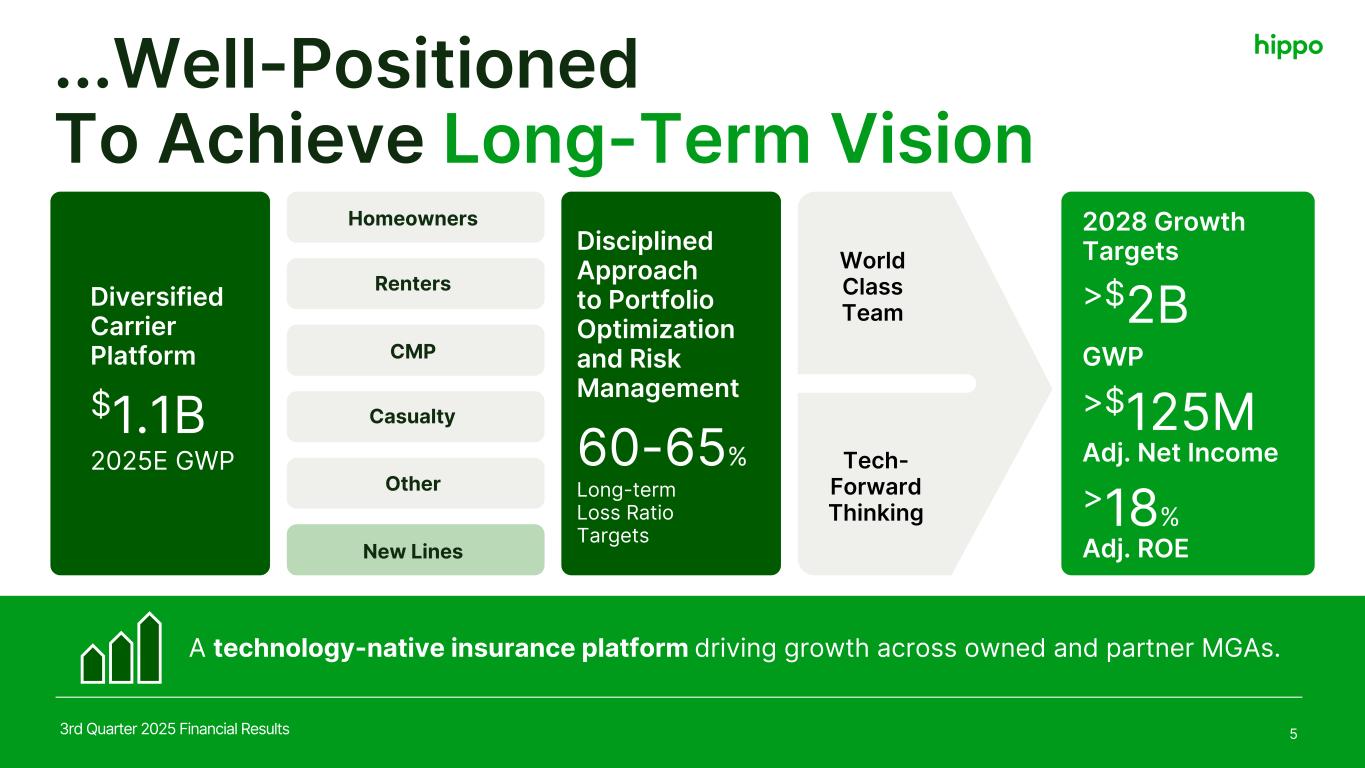

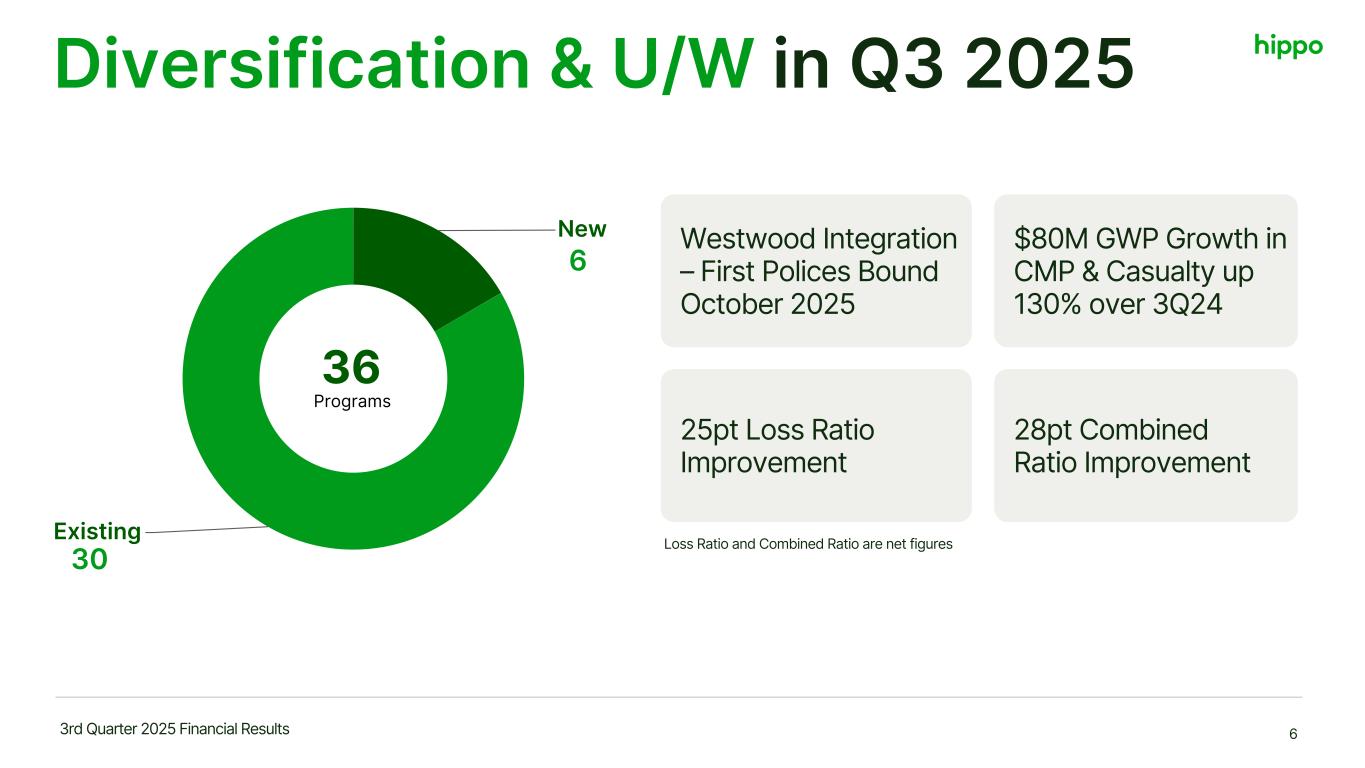

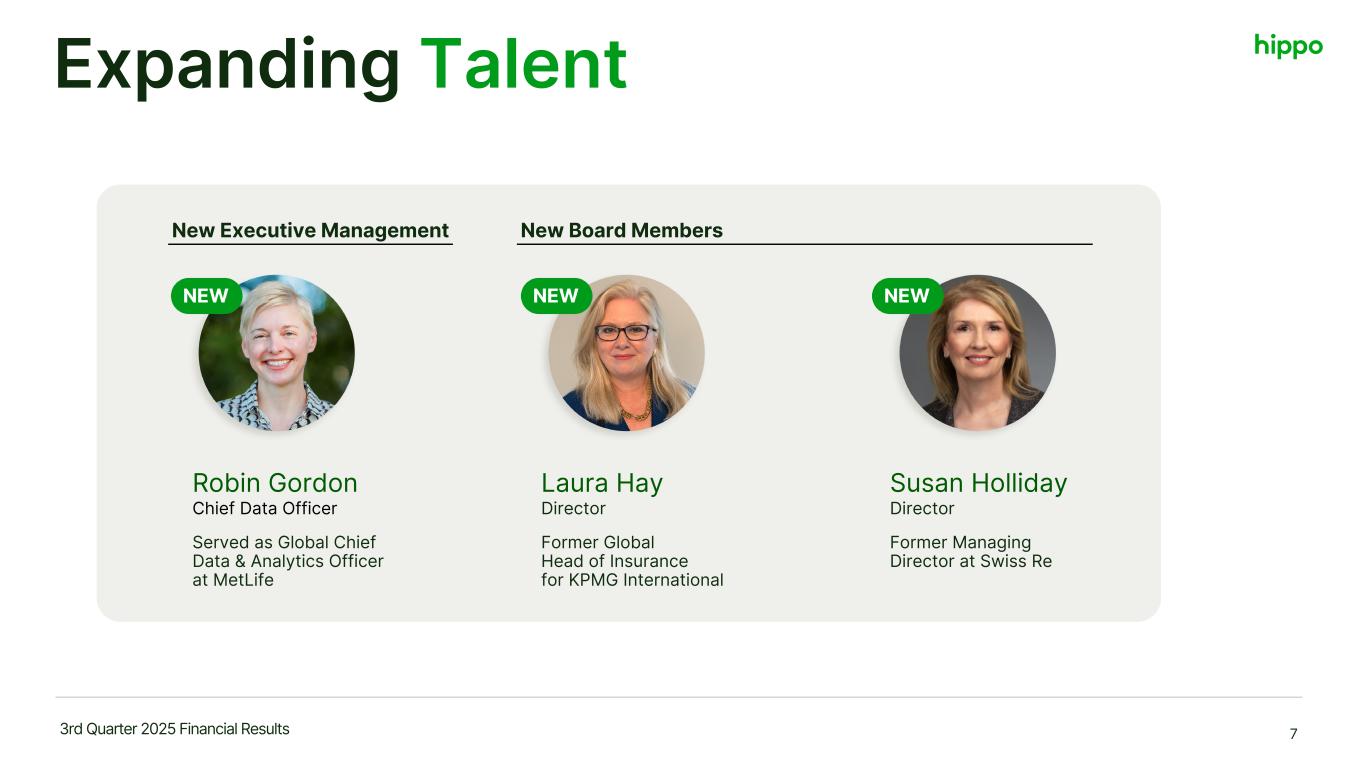

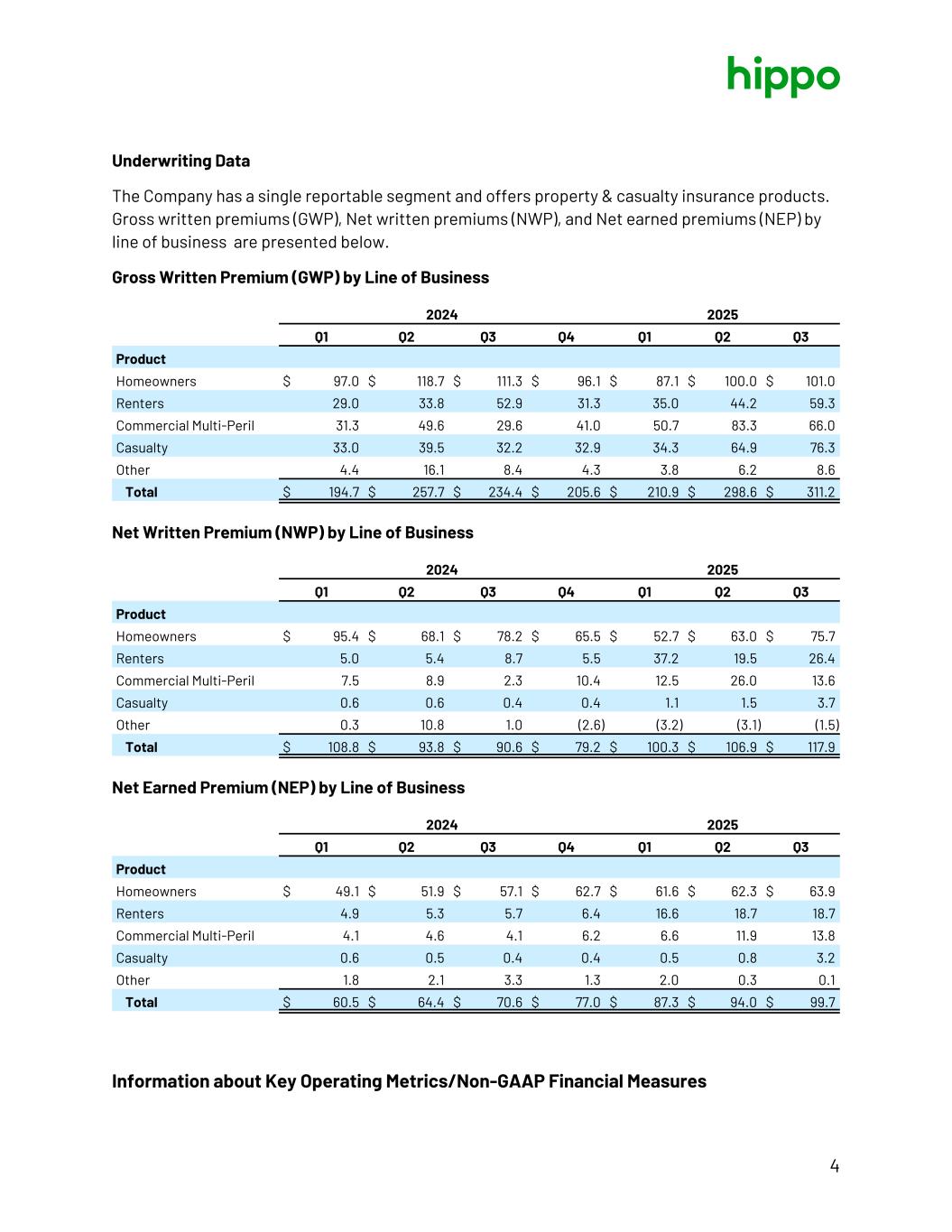

Hippo Reports Third Quarter 2025 Financial Results November 5, 2025 SAN JOSE, Calif. (PRNewswire) -- Hippo Holdings Inc. (NYSE: HIPO), a technology-native insurance platform driving growth across owned and partner MGAs, announced its consolidated financial results including diluted net earnings per share of $3.77 and adjusted earnings per share of $0.70 for the quarter ended September 30, 2025. Third Quarter Highlights • Gross Written Premium increased 33% to $311 million over 3Q24 • Net Income of $98 million vs. a Net Loss of $9 million in 3Q24 • Adjusted Net Income of $18 million vs. an Adjusted Net Loss of $1 million in 3Q24 • Net Loss Ratio improved 25 percentage points to 48% compared to 3Q24 • Combined Ratio improved 28 percentage points to 100% compared to 3Q24 • Revenue grew 26% to $121 million compared to 3Q24 • Book Value per share of $16.64 up 14% from year-end 2024 • $91 million gain on the sale of homebuilder distribution network, net of technology write-off By aligning its focus and structure to the strategy outlined at Investor Day, Hippo is building a more efficient and resilient organization, ensuring it is built to scale and adapt quickly to changing market conditions. "Q3 was a breakout quarter for Hippo as we continued to execute with discipline and momentum across every part of the business,” said Rick McCathron, Hippo President and CEO. “We grew gross written premium by 33%, expanded our platform to 36 programs, and delivered significantly improved underwriting results, including a 25-point improvement in our net loss ratio. We’re operating as a unified, technology-native platform that’s driving profitable growth, deepening diversification, and positioning us for long-term success.” 1

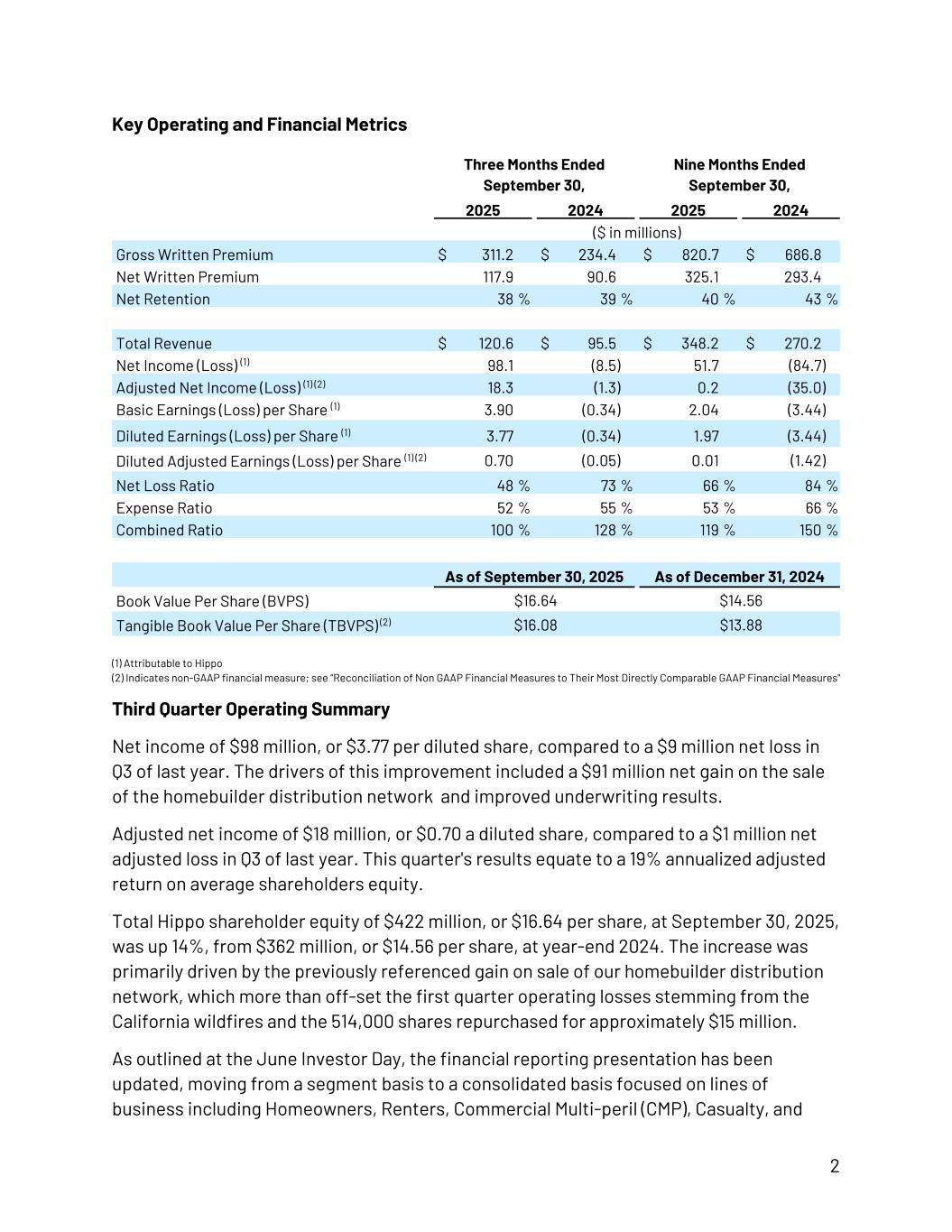

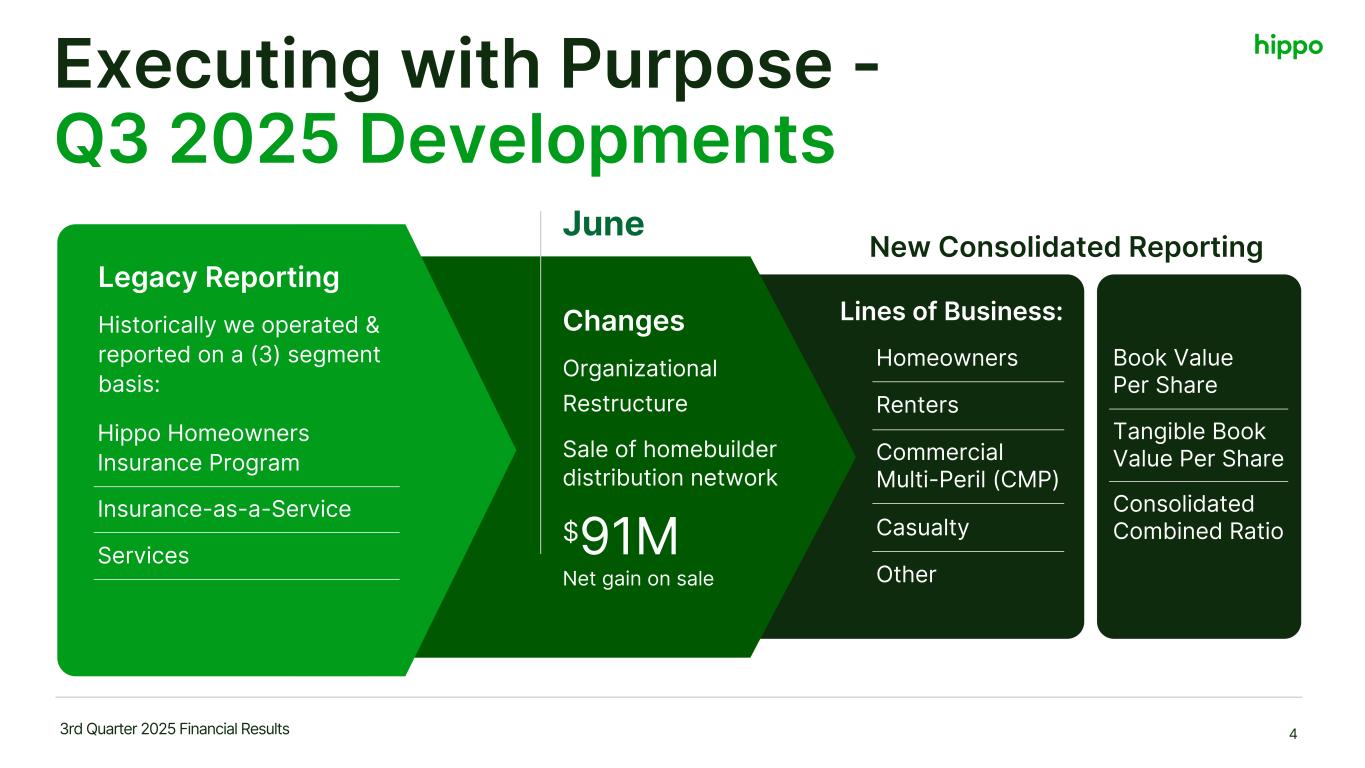

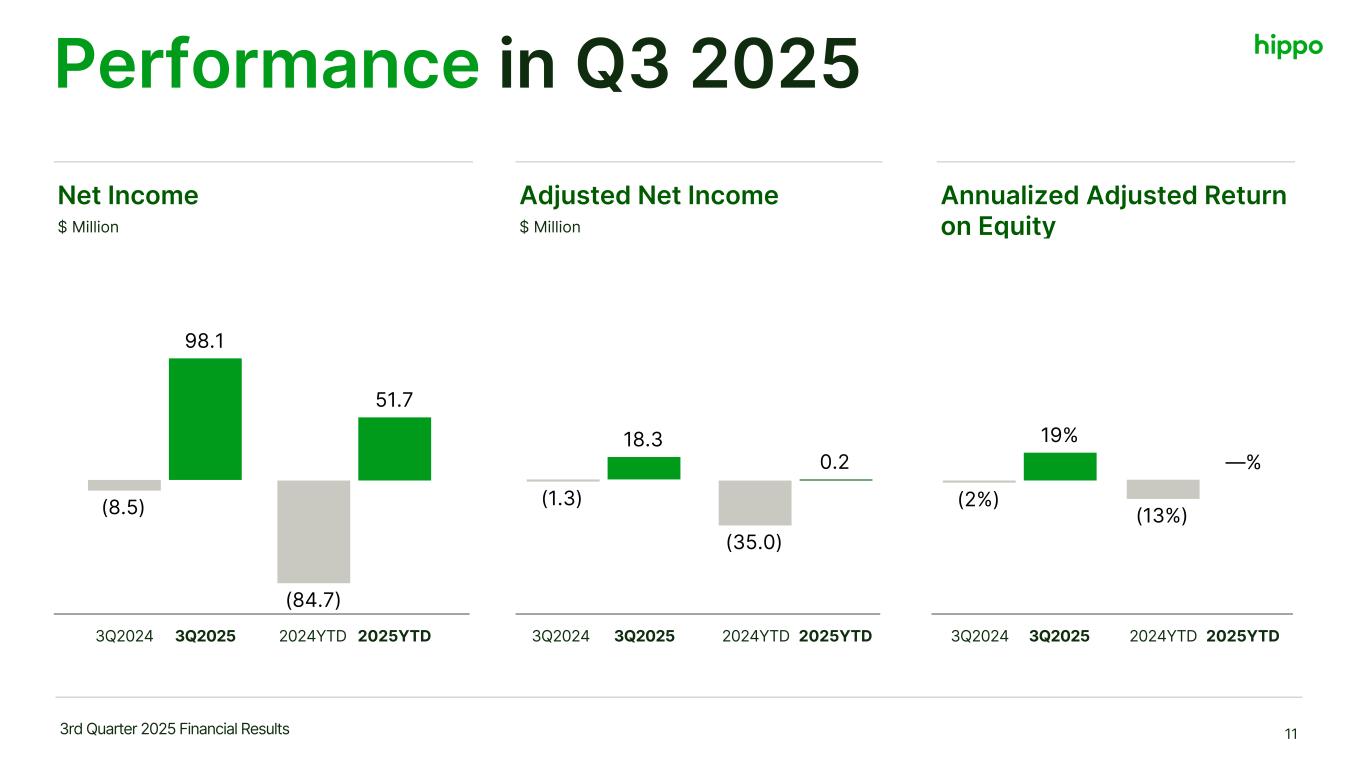

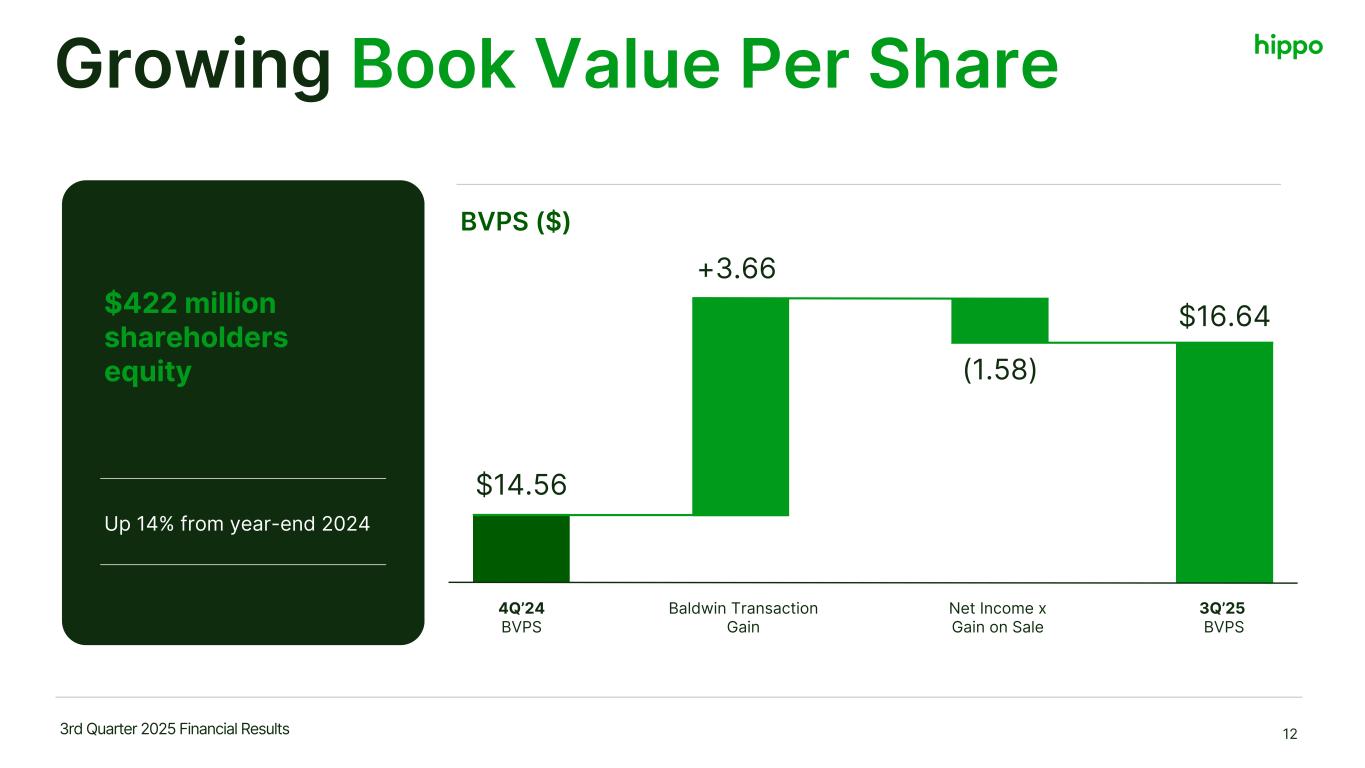

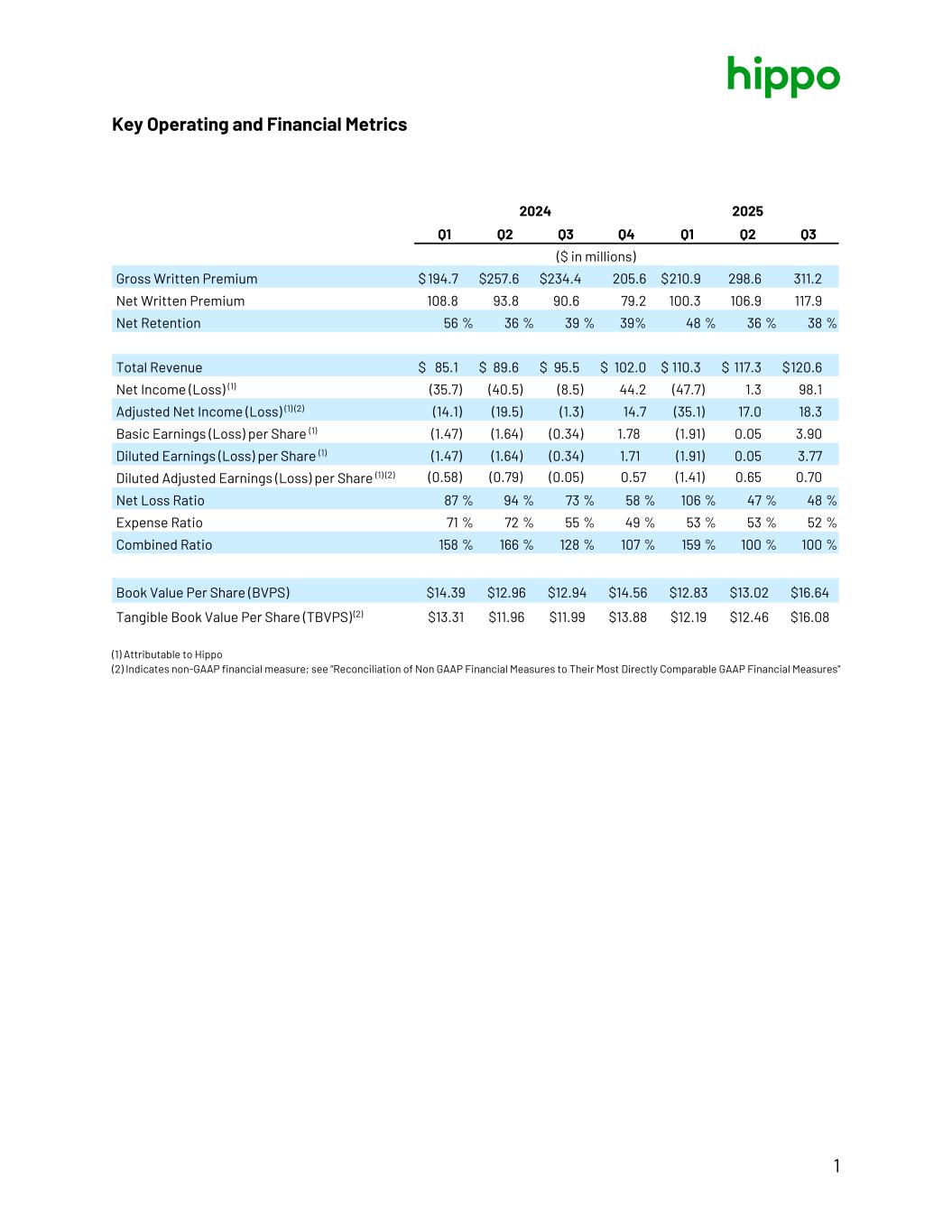

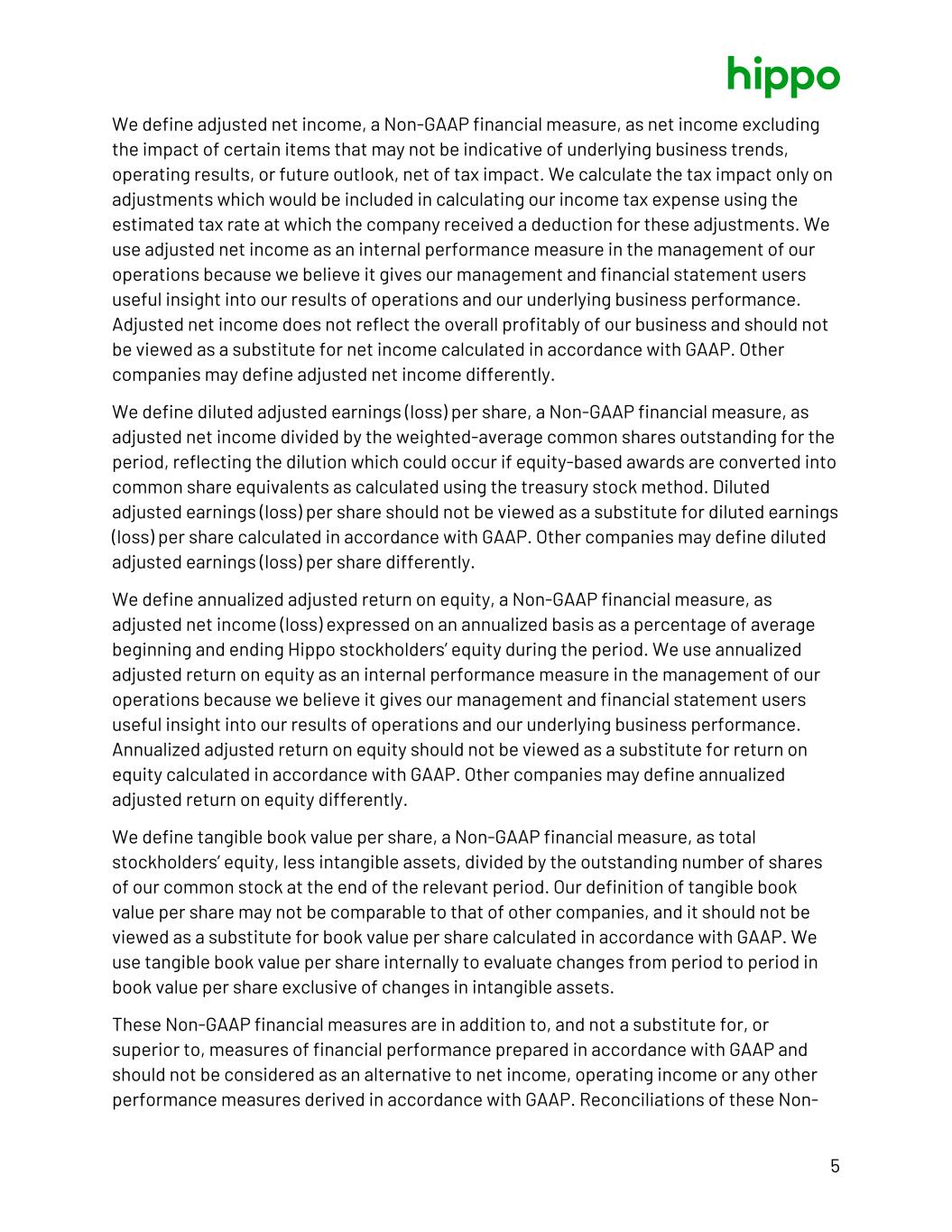

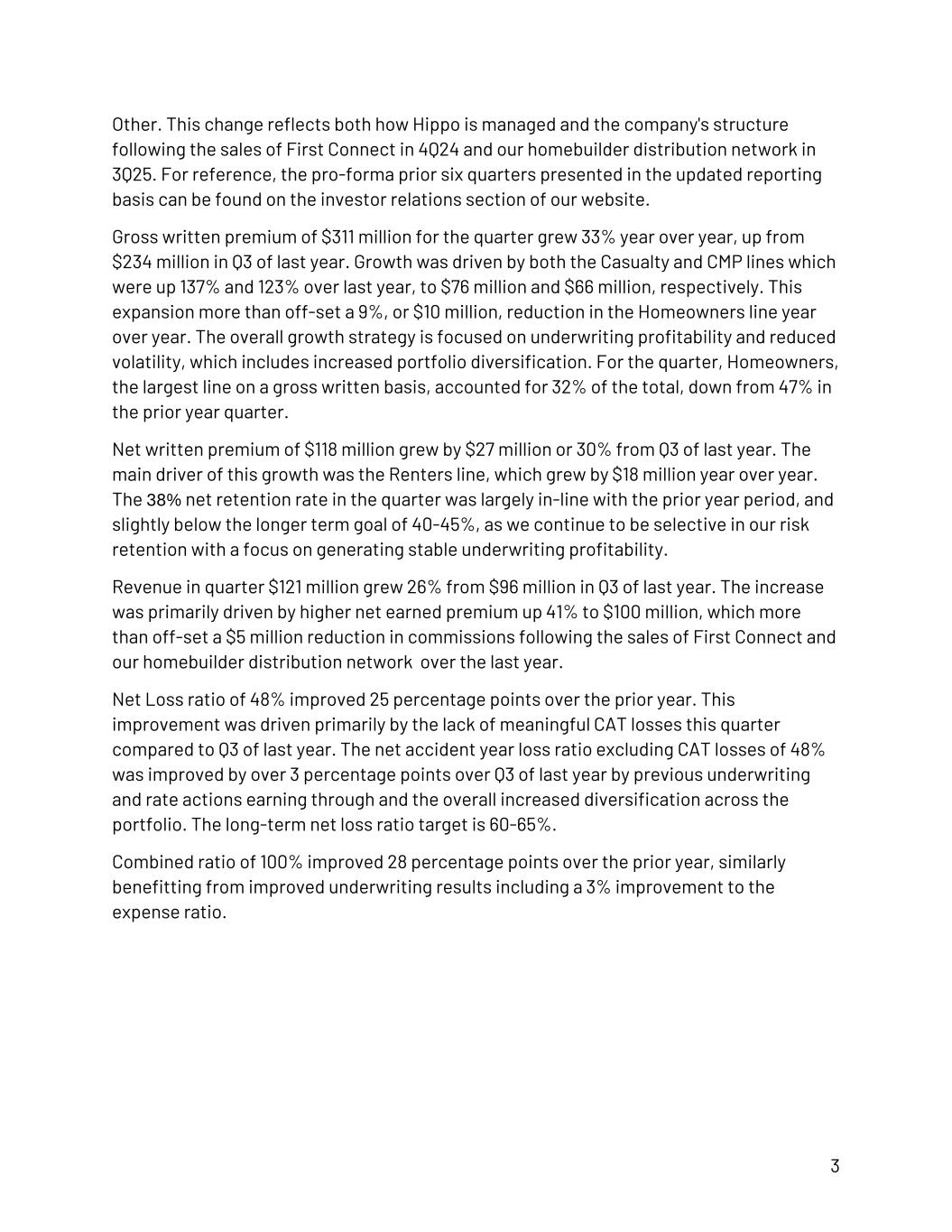

Key Operating and Financial Metrics Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 ($ in millions) Gross Written Premium $ 311.2 $ 234.4 $ 820.7 $ 686.8 Net Written Premium 117.9 90.6 325.1 293.4 Net Retention 38 % 39 % 40 % 43 % Total Revenue $ 120.6 $ 95.5 $ 348.2 $ 270.2 Net Income (Loss) (1) 98.1 (8.5) 51.7 (84.7) Adjusted Net Income (Loss) (1) (2) 18.3 (1.3) 0.2 (35.0) Basic Earnings (Loss) per Share (1) 3.90 (0.34) 2.04 (3.44) Diluted Earnings (Loss) per Share (1) 3.77 (0.34) 1.97 (3.44) Diluted Adjusted Earnings (Loss) per Share (1) (2) 0.70 (0.05) 0.01 (1.42) Net Loss Ratio 48 % 73 % 66 % 84 % Expense Ratio 52 % 55 % 53 % 66 % Combined Ratio 100 % 128 % 119 % 150 % As of September 30, 2025 As of December 31, 2024 Book Value Per Share (BVPS) $16.64 $14.56 Tangible Book Value Per Share (TBVPS) (2) $16.08 $13.88 (1) Attributable to Hippo (2) Indicates non-GAAP financial measure; see “Reconciliation of Non GAAP Financial Measures to Their Most Directly Comparable GAAP Financial Measures" Third Quarter Operating Summary Net income of $98 million, or $3.77 per diluted share, compared to a $9 million net loss in Q3 of last year. The drivers of this improvement included a $91 million net gain on the sale of the homebuilder distribution network and improved underwriting results. Adjusted net income of $18 million, or $0.70 a diluted share, compared to a $1 million net adjusted loss in Q3 of last year. This quarter's results equate to a 19% annualized adjusted return on average shareholders equity. Total Hippo shareholder equity of $422 million, or $16.64 per share, at September 30, 2025, was up 14%, from $362 million, or $14.56 per share, at year-end 2024. The increase was primarily driven by the previously referenced gain on sale of our homebuilder distribution network, which more than off-set the first quarter operating losses stemming from the California wildfires and the 514,000 shares repurchased for approximately $15 million. As outlined at the June Investor Day, the financial reporting presentation has been updated, moving from a segment basis to a consolidated basis focused on lines of business including Homeowners, Renters, Commercial Multi-peril (CMP), Casualty, and 2

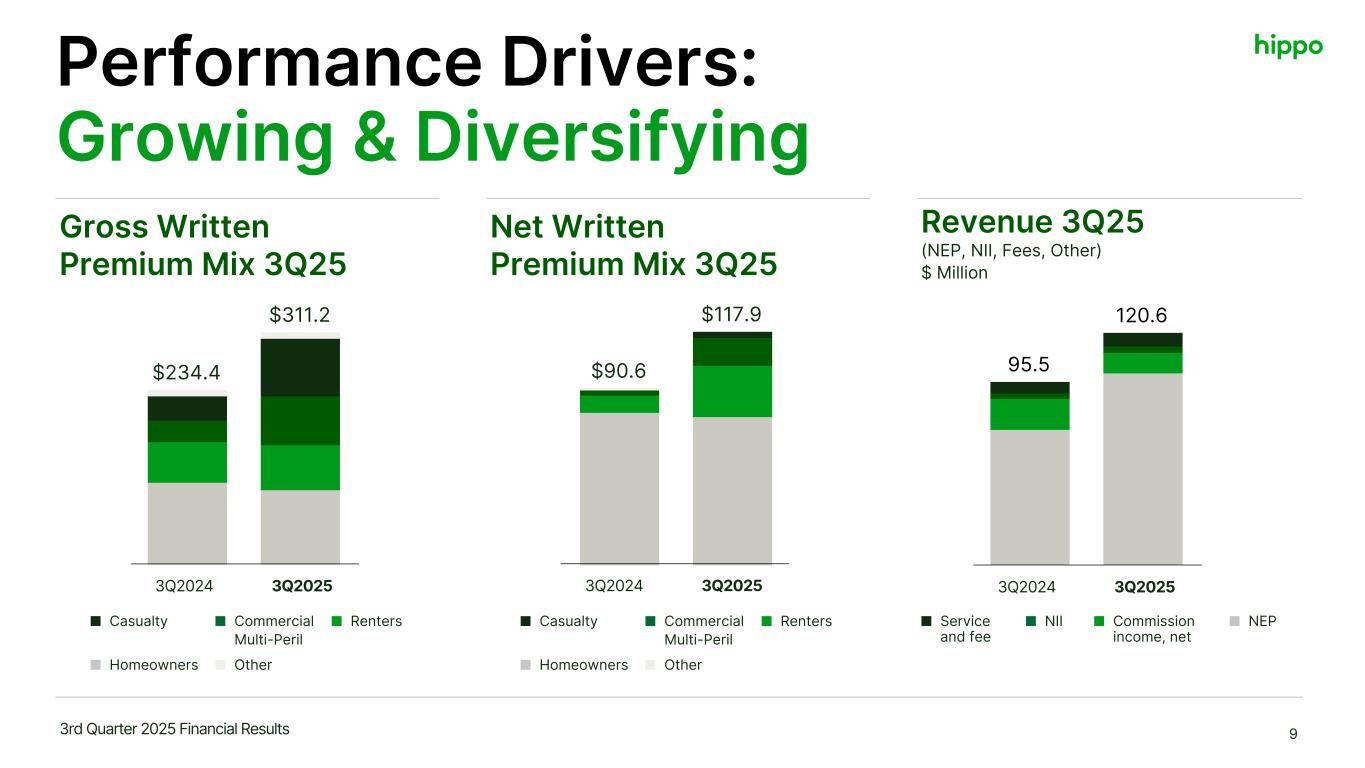

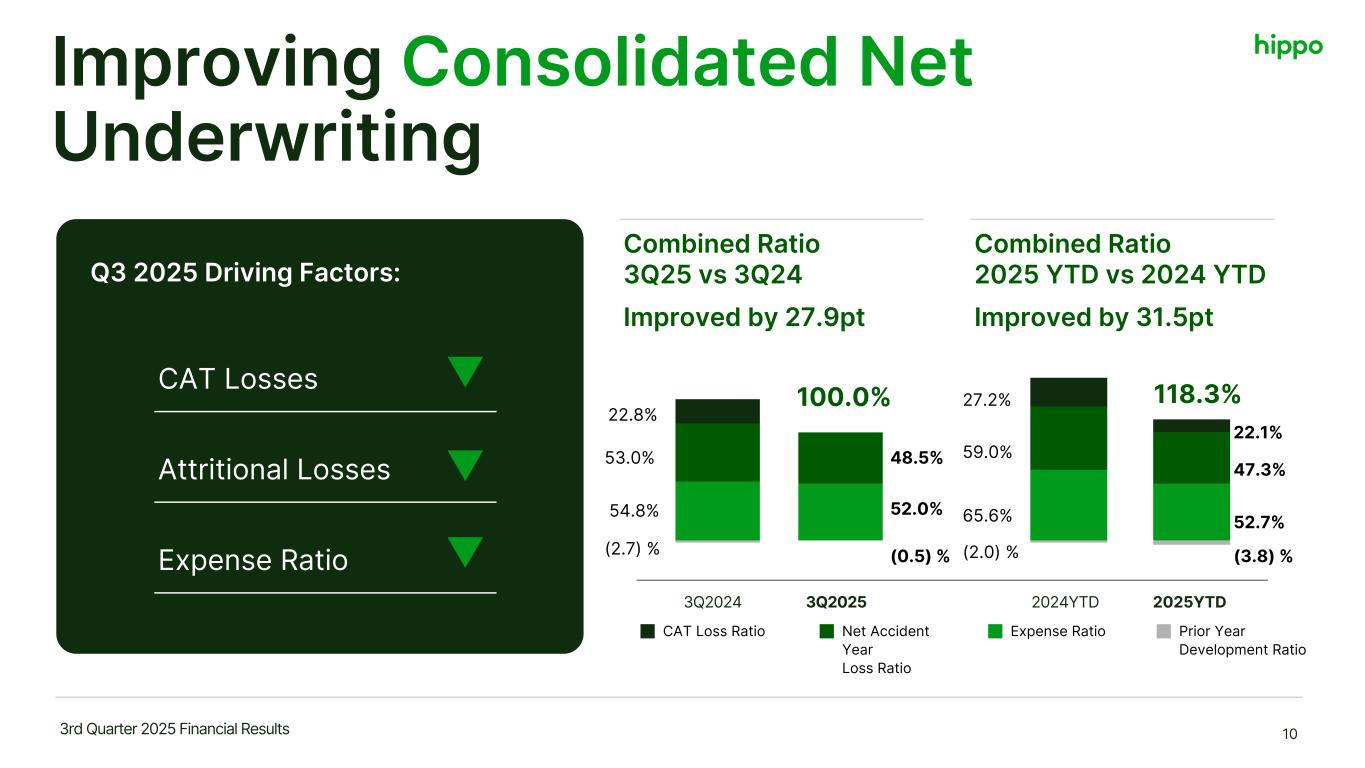

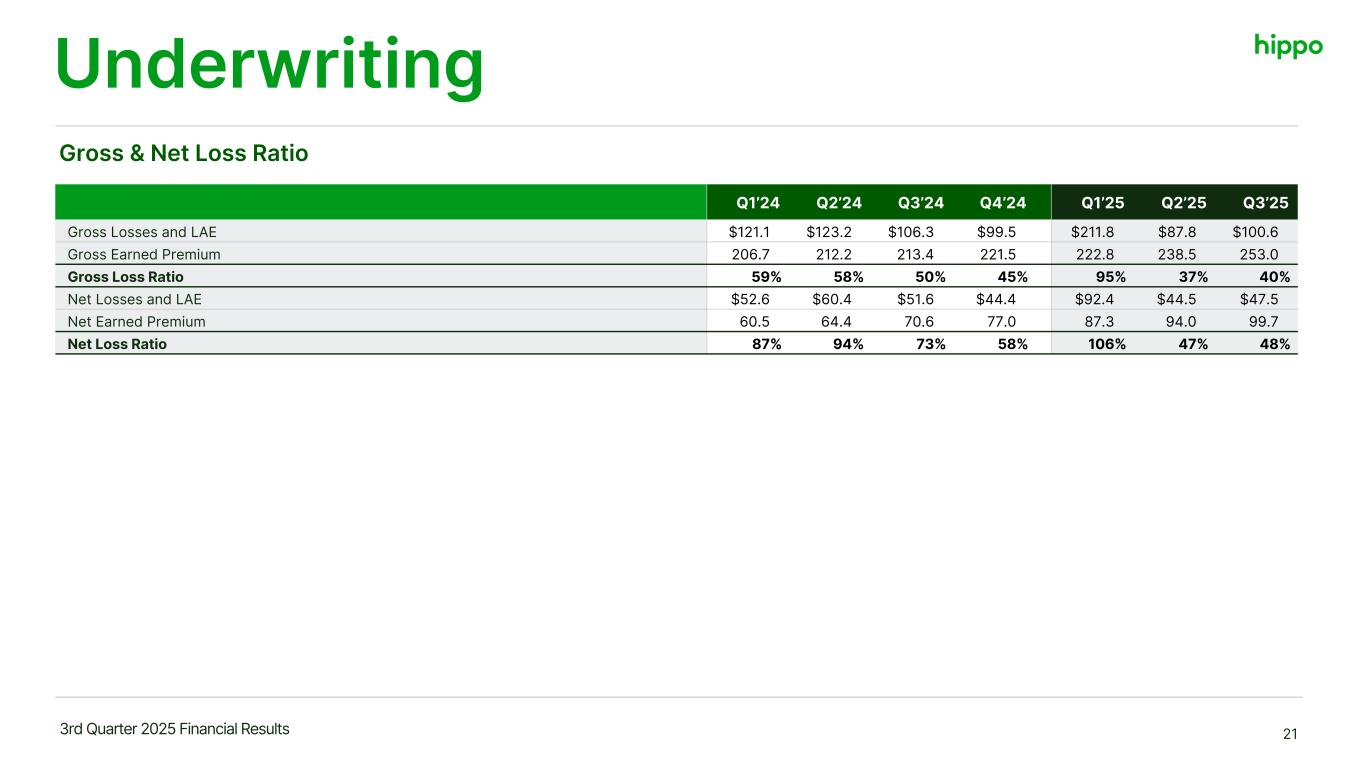

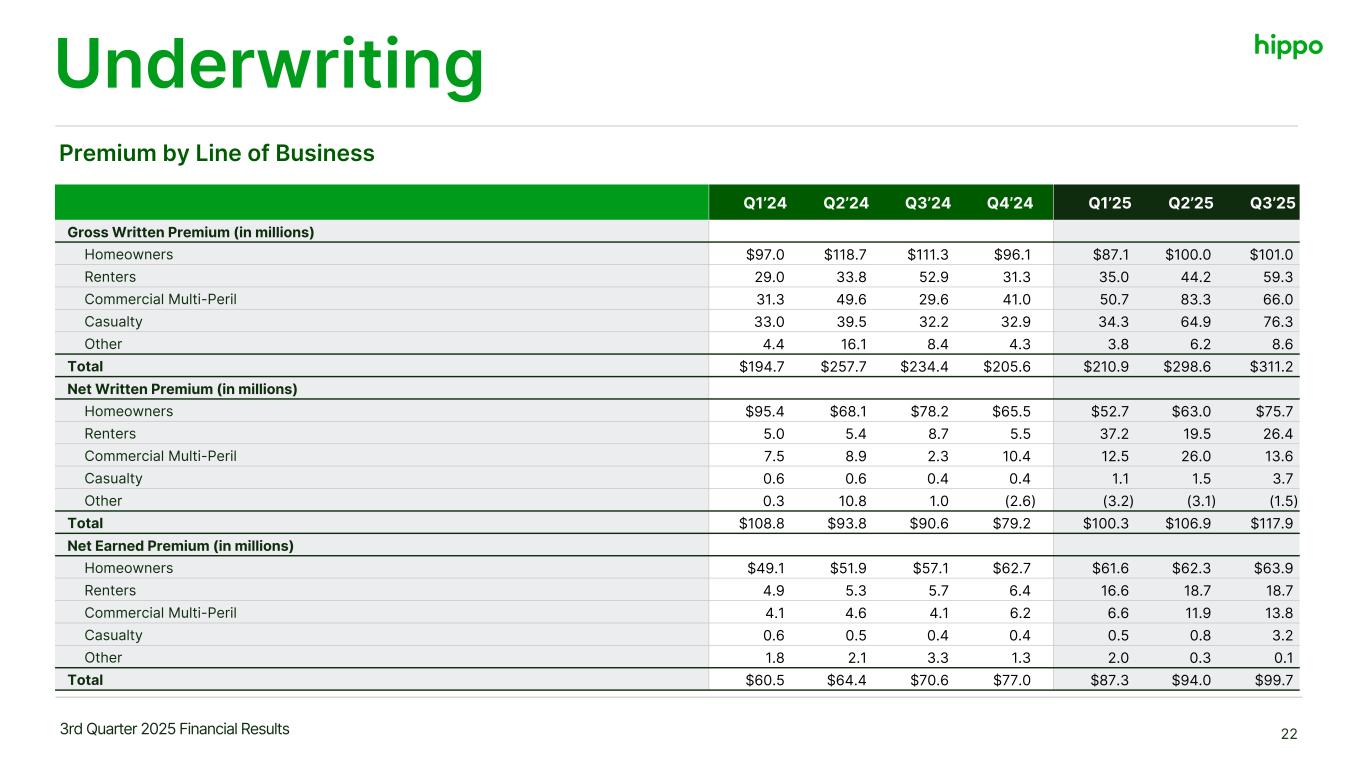

Other. This change reflects both how Hippo is managed and the company's structure following the sales of First Connect in 4Q24 and our homebuilder distribution network in 3Q25. For reference, the pro-forma prior six quarters presented in the updated reporting basis can be found on the investor relations section of our website. Gross written premium of $311 million for the quarter grew 33% year over year, up from $234 million in Q3 of last year. Growth was driven by both the Casualty and CMP lines which were up 137% and 123% over last year, to $76 million and $66 million, respectively. This expansion more than off-set a 9%, or $10 million, reduction in the Homeowners line year over year. The overall growth strategy is focused on underwriting profitability and reduced volatility, which includes increased portfolio diversification. For the quarter, Homeowners, the largest line on a gross written basis, accounted for 32% of the total, down from 47% in the prior year quarter. Net written premium of $118 million grew by $27 million or 30% from Q3 of last year. The main driver of this growth was the Renters line, which grew by $18 million year over year. The 38% net retention rate in the quarter was largely in-line with the prior year period, and slightly below the longer term goal of 40-45%, as we continue to be selective in our risk retention with a focus on generating stable underwriting profitability. Revenue in quarter $121 million grew 26% from $96 million in Q3 of last year. The increase was primarily driven by higher net earned premium up 41% to $100 million, which more than off-set a $5 million reduction in commissions following the sales of First Connect and our homebuilder distribution network over the last year. Net Loss ratio of 48% improved 25 percentage points over the prior year. This improvement was driven primarily by the lack of meaningful CAT losses this quarter compared to Q3 of last year. The net accident year loss ratio excluding CAT losses of 48% was improved by over 3 percentage points over Q3 of last year by previous underwriting and rate actions earning through and the overall increased diversification across the portfolio. The long-term net loss ratio target is 60-65%. Combined ratio of 100% improved 28 percentage points over the prior year, similarly benefitting from improved underwriting results including a 3% improvement to the expense ratio. 3

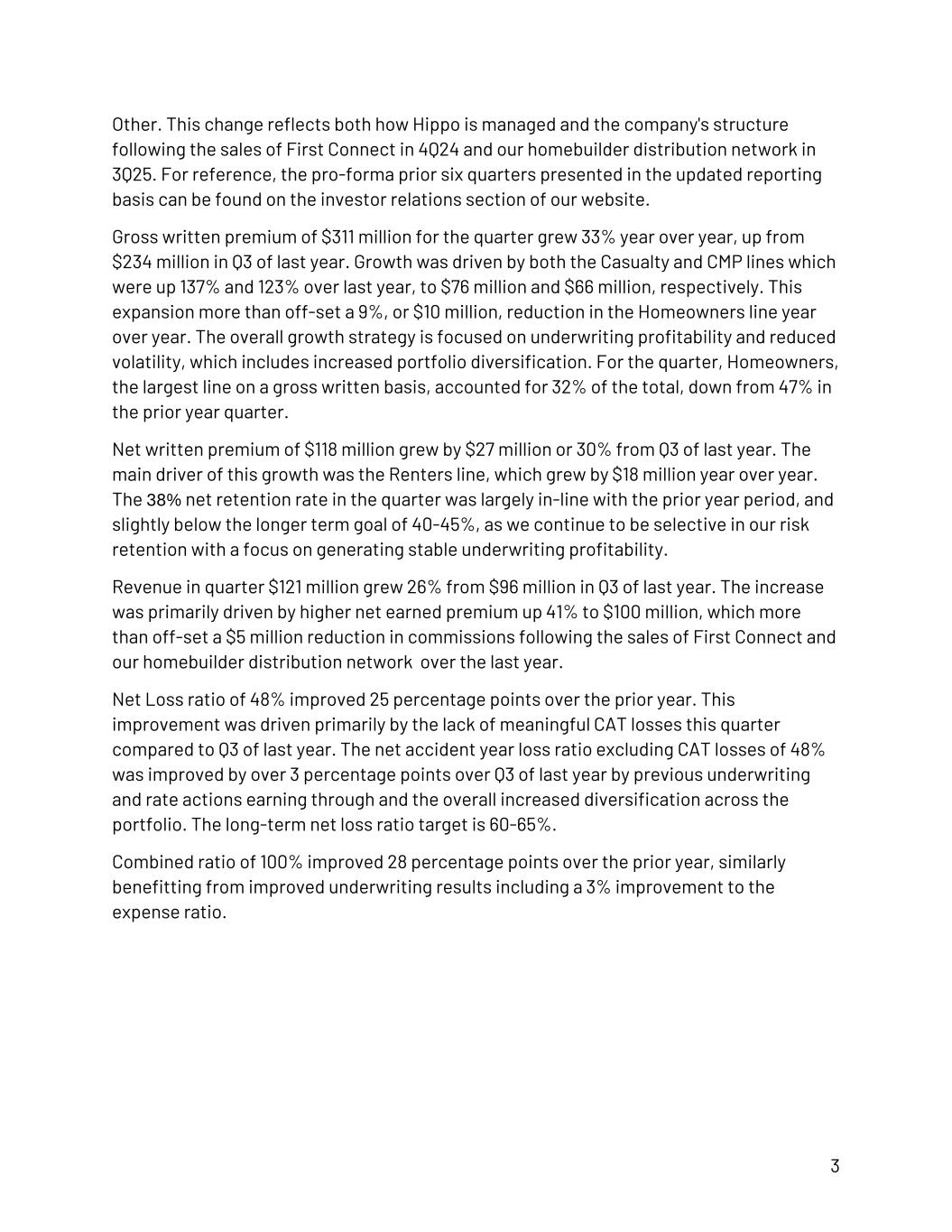

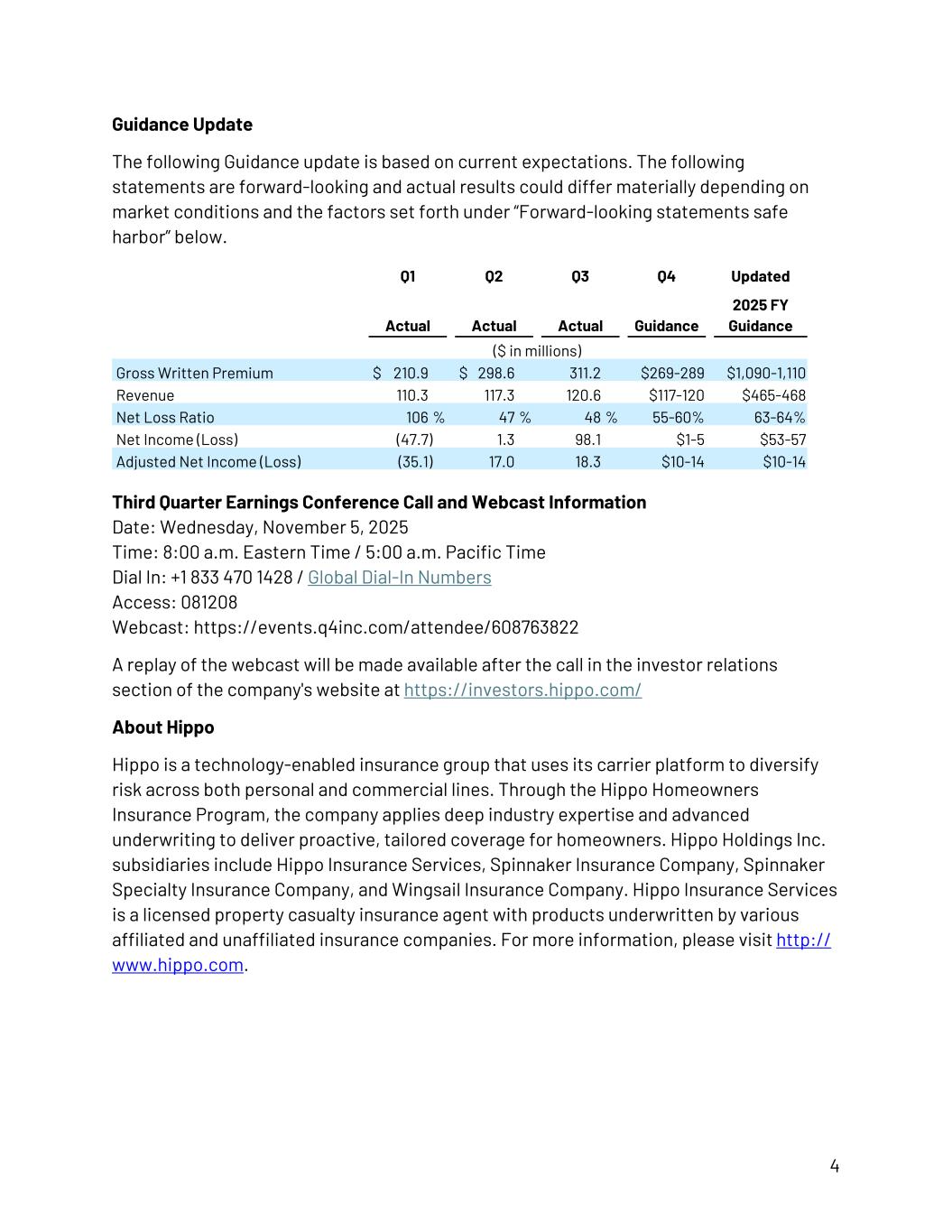

Guidance Update The following Guidance update is based on current expectations. The following statements are forward-looking and actual results could differ materially depending on market conditions and the factors set forth under “Forward-looking statements safe harbor” below. Q1 Q2 Q3 Q4 Updated Actual Actual Actual Guidance 2025 FY Guidance ($ in millions) Gross Written Premium $ 210.9 $ 298.6 311.2 $269-289 $1,090-1,110 Revenue 110.3 117.3 120.6 $117-120 $465-468 Net Loss Ratio 106 % 47 % 48 % 55-60% 63-64% Net Income (Loss) (47.7) 1.3 98.1 $1-5 $53-57 Adjusted Net Income (Loss) (35.1) 17.0 18.3 $10-14 $10-14 Third Quarter Earnings Conference Call and Webcast Information Date: Wednesday, November 5, 2025 Time: 8:00 a.m. Eastern Time / 5:00 a.m. Pacific Time Dial In: +1 833 470 1428 / Global Dial-In Numbers Access: 081208 Webcast: https://events.q4inc.com/attendee/608763822 A replay of the webcast will be made available after the call in the investor relations section of the company's website at https://investors.hippo.com/ About Hippo Hippo is a technology-enabled insurance group that uses its carrier platform to diversify risk across both personal and commercial lines. Through the Hippo Homeowners Insurance Program, the company applies deep industry expertise and advanced underwriting to deliver proactive, tailored coverage for homeowners. Hippo Holdings Inc. subsidiaries include Hippo Insurance Services, Spinnaker Insurance Company, Spinnaker Specialty Insurance Company, and Wingsail Insurance Company. Hippo Insurance Services is a licensed property casualty insurance agent with products underwritten by various affiliated and unaffiliated insurance companies. For more information, please visit http:// www.hippo.com. 4

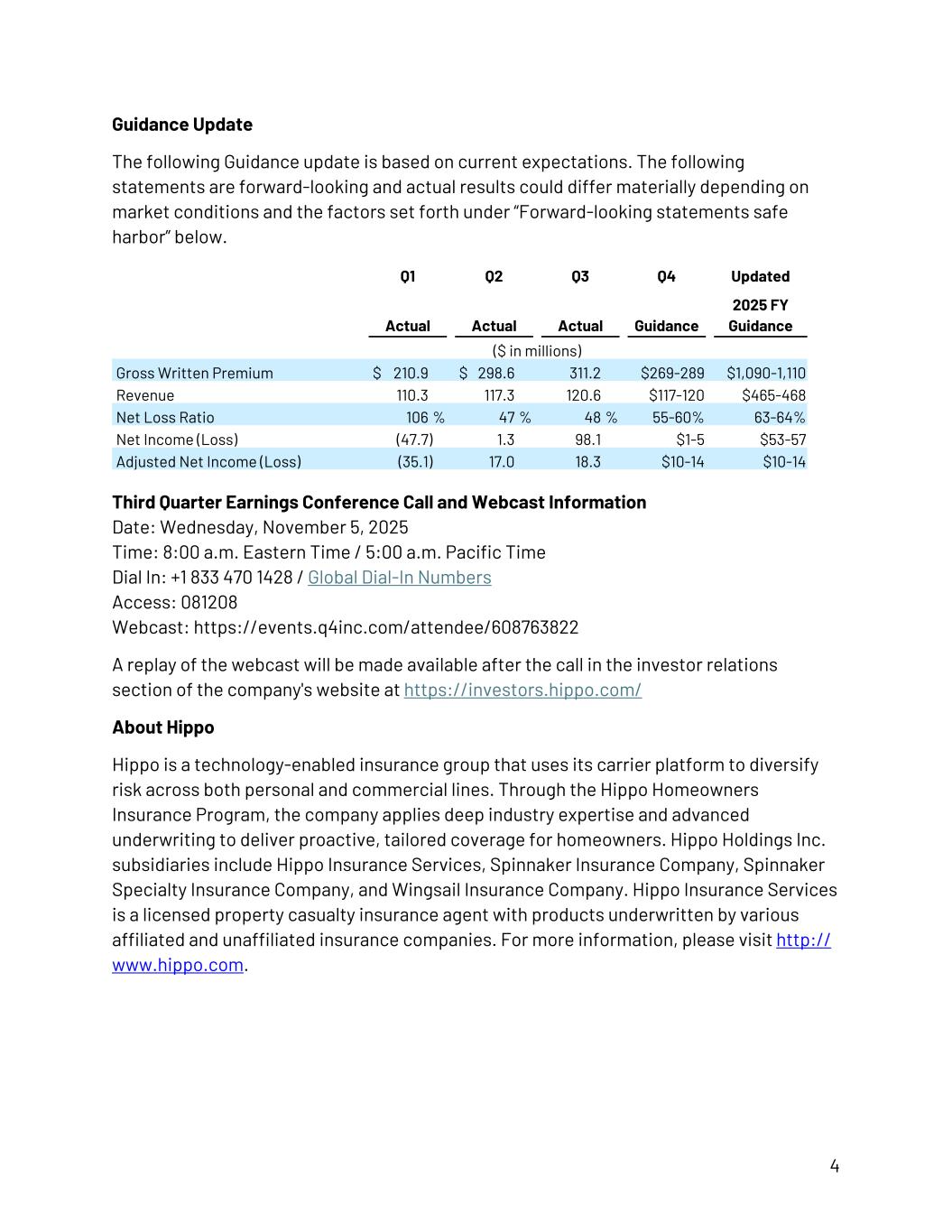

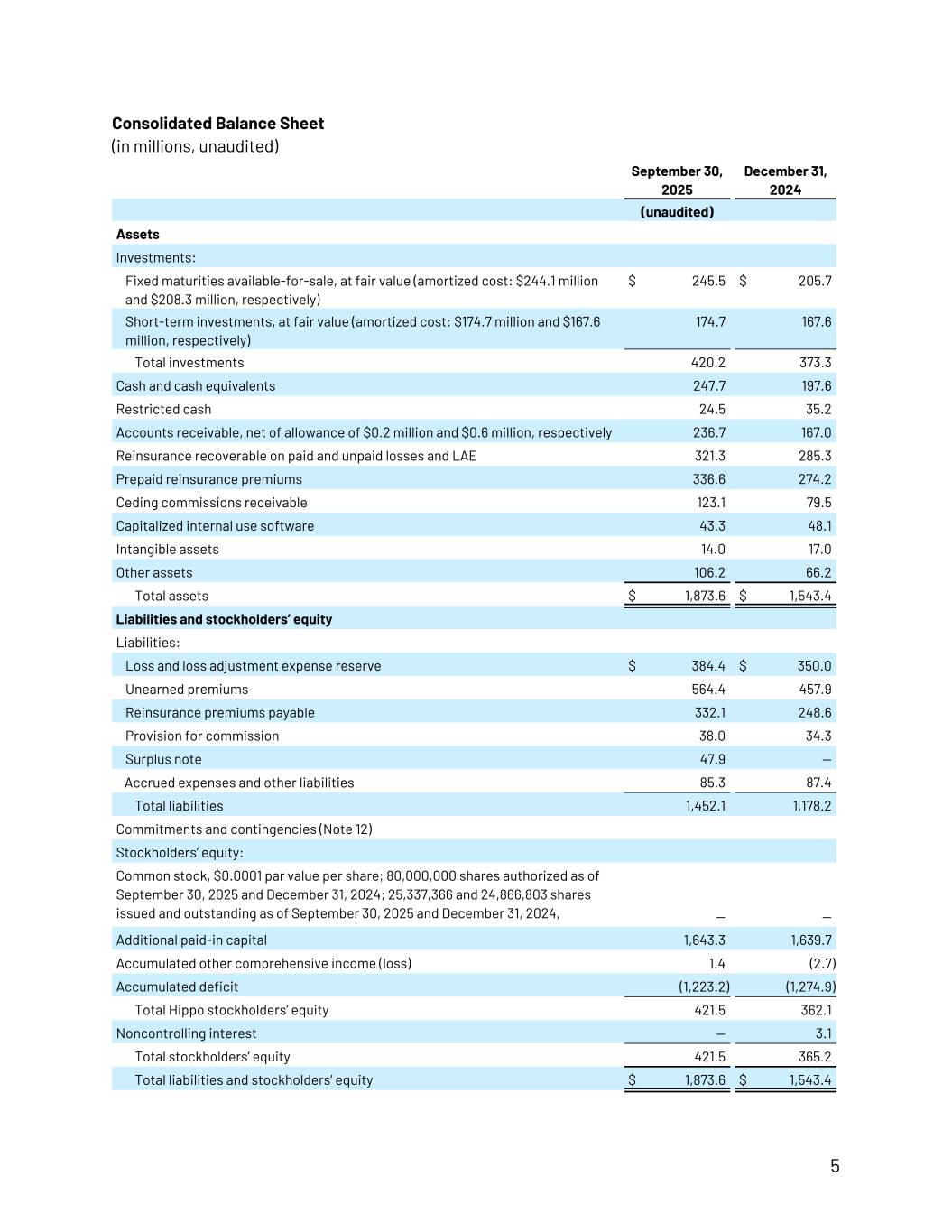

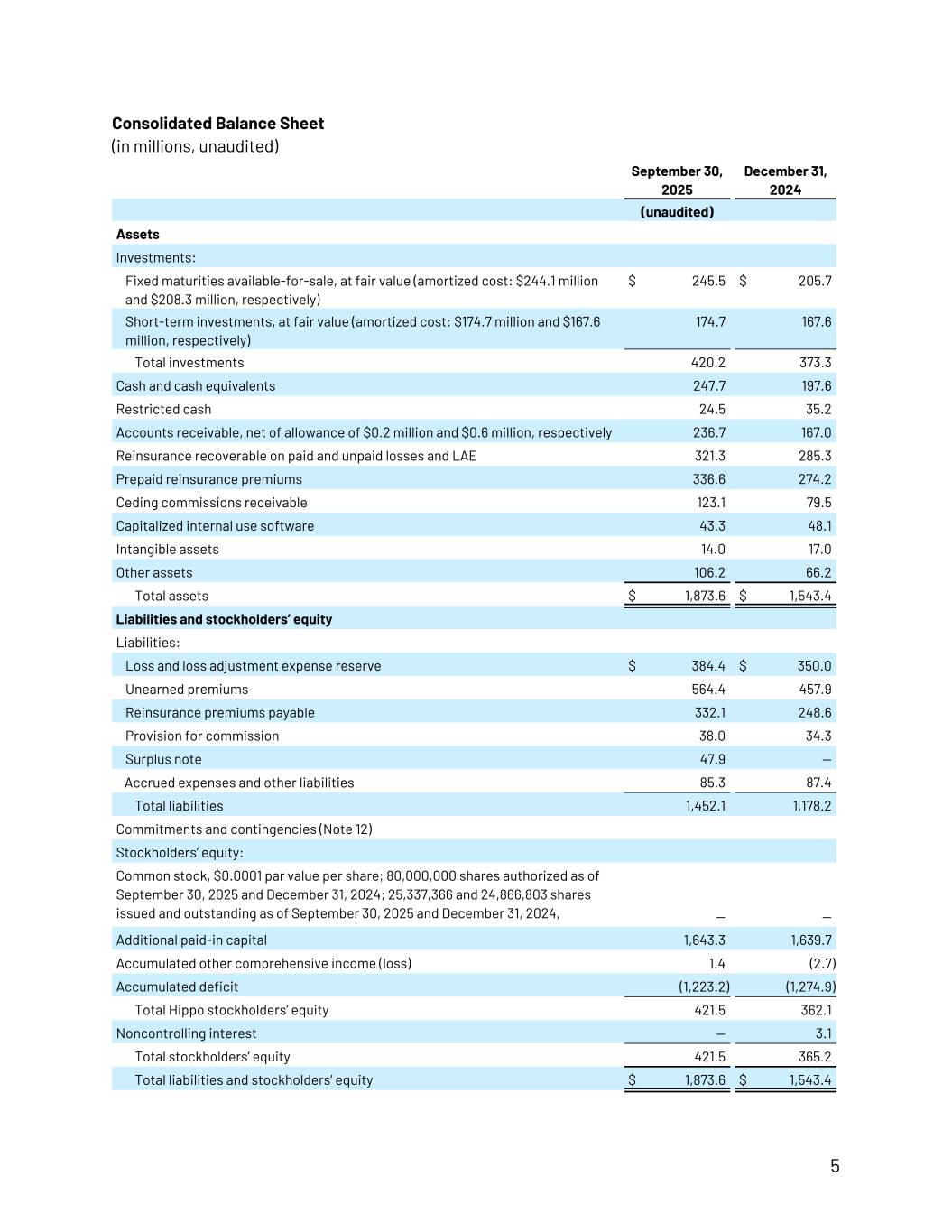

Consolidated Balance Sheet (in millions, unaudited) September 30, 2025 December 31, 2024 (unaudited) Assets Investments: Fixed maturities available-for-sale, at fair value (amortized cost: $244.1 million and $208.3 million, respectively) $ 245.5 $ 205.7 Short-term investments, at fair value (amortized cost: $174.7 million and $167.6 million, respectively) 174.7 167.6 Total investments 420.2 373.3 Cash and cash equivalents 247.7 197.6 Restricted cash 24.5 35.2 Accounts receivable, net of allowance of $0.2 million and $0.6 million, respectively 236.7 167.0 Reinsurance recoverable on paid and unpaid losses and LAE 321.3 285.3 Prepaid reinsurance premiums 336.6 274.2 Ceding commissions receivable 123.1 79.5 Capitalized internal use software 43.3 48.1 Intangible assets 14.0 17.0 Other assets 106.2 66.2 Total assets $ 1,873.6 $ 1,543.4 Liabilities and stockholders’ equity Liabilities: Loss and loss adjustment expense reserve $ 384.4 $ 350.0 Unearned premiums 564.4 457.9 Reinsurance premiums payable 332.1 248.6 Provision for commission 38.0 34.3 Surplus note 47.9 — Accrued expenses and other liabilities 85.3 87.4 Total liabilities 1,452.1 1,178.2 Commitments and contingencies (Note 12) Stockholders’ equity: Common stock, $0.0001 par value per share; 80,000,000 shares authorized as of September 30, 2025 and December 31, 2024; 25,337,366 and 24,866,803 shares issued and outstanding as of September 30, 2025 and December 31, 2024, respectively — — Additional paid-in capital 1,643.3 1,639.7 Accumulated other comprehensive income (loss) 1.4 (2.7) Accumulated deficit (1,223.2) (1,274.9) Total Hippo stockholders’ equity 421.5 362.1 Noncontrolling interest — 3.1 Total stockholders’ equity 421.5 365.2 Total liabilities and stockholders’ equity $ 1,873.6 $ 1,543.4 5

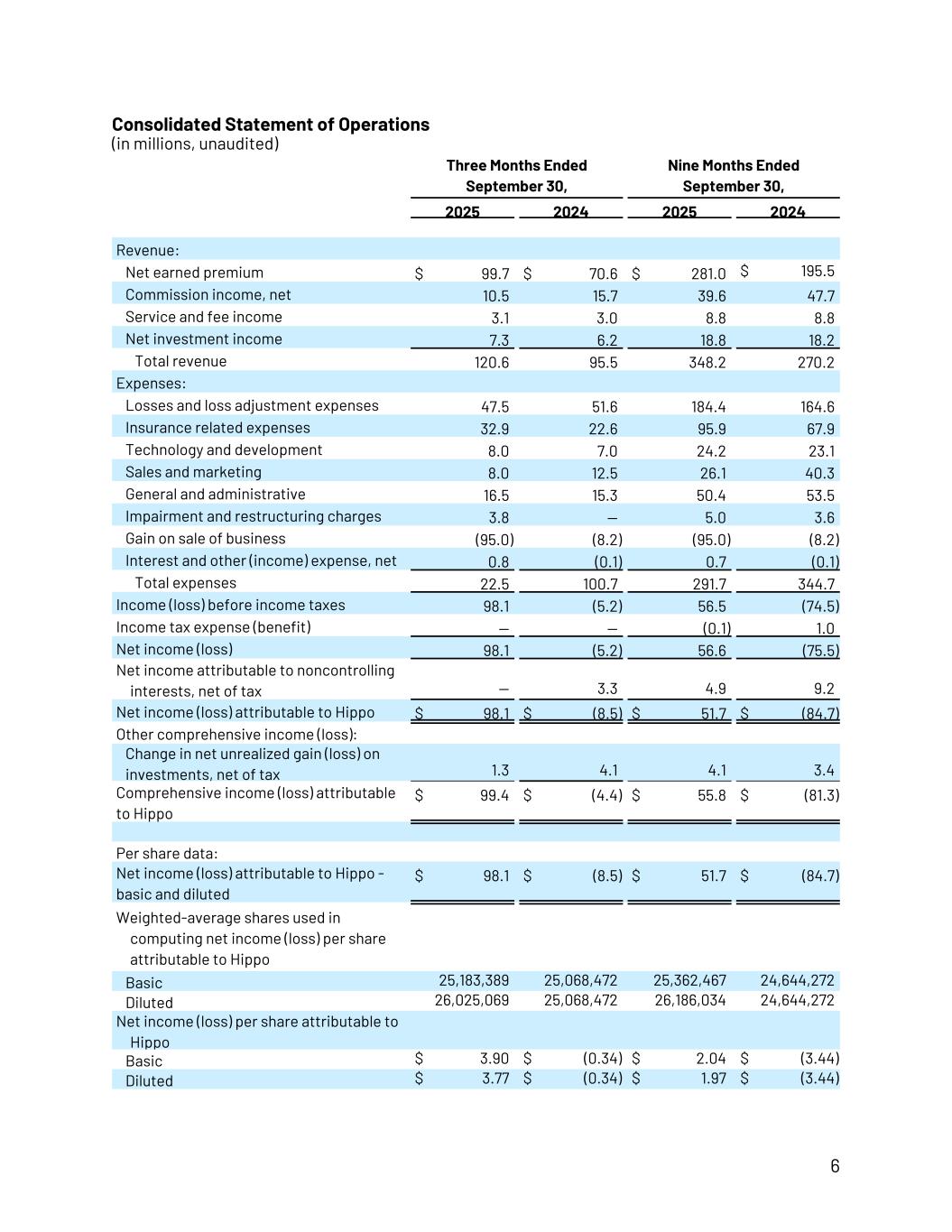

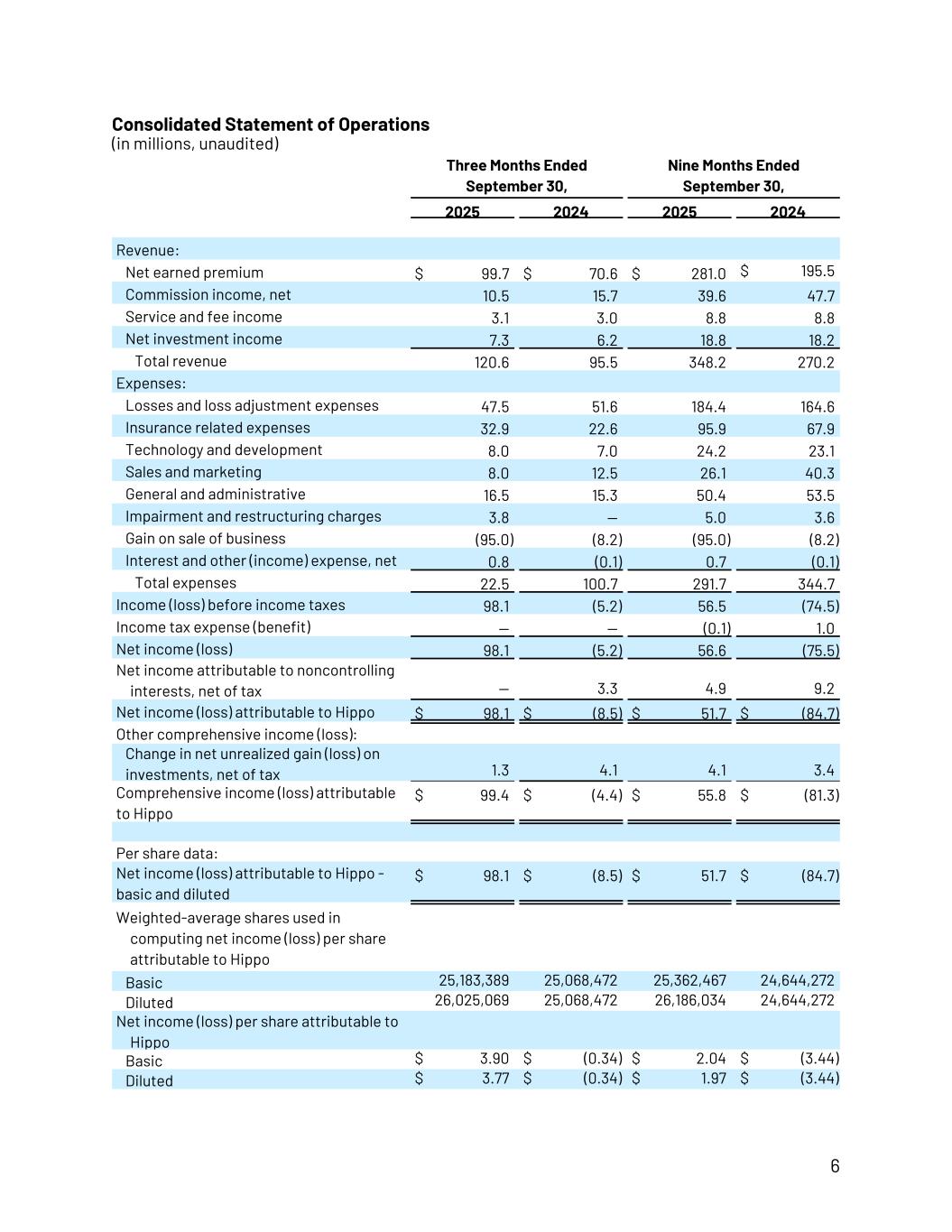

Consolidated Statement of Operations (in millions, unaudited) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Revenue: Net earned premium $ 99.7 $ 70.6 $ 281.0 $ 195.5 Commission income, net 10.5 15.7 39.6 47.7 Service and fee income 3.1 3.0 8.8 8.8 Net investment income 7.3 6.2 18.8 18.2 Total revenue 120.6 95.5 348.2 270.2 Expenses: Losses and loss adjustment expenses 47.5 51.6 184.4 164.6 Insurance related expenses 32.9 22.6 95.9 67.9 Technology and development 8.0 7.0 24.2 23.1 Sales and marketing 8.0 12.5 26.1 40.3 General and administrative 16.5 15.3 50.4 53.5 Impairment and restructuring charges 3.8 — 5.0 3.6 Gain on sale of business (95.0) (8.2) (95.0) (8.2) Interest and other (income) expense, net 0.8 (0.1) 0.7 (0.1) Total expenses 22.5 100.7 291.7 344.7 Income (loss) before income taxes 98.1 (5.2) 56.5 (74.5) Income tax expense (benefit) — — (0.1) 1.0 Net income (loss) 98.1 (5.2) 56.6 (75.5) Net income attributable to noncontrolling interests, net of tax — 3.3 4.9 9.2 Net income (loss) attributable to Hippo $ 98.1 $ (8.5) $ 51.7 $ (84.7) Other comprehensive income (loss): Change in net unrealized gain (loss) on investments, net of tax 1.3 4.1 4.1 3.4 Comprehensive income (loss) attributable to Hippo $ 99.4 $ (4.4) $ 55.8 $ (81.3) Per share data: Net income (loss) attributable to Hippo - basic and diluted $ 98.1 $ (8.5) $ 51.7 $ (84.7) Weighted-average shares used in computing net income (loss) per share attributable to Hippo Basic 25,183,389 25,068,472 25,362,467 24,644,272 Diluted 26,025,069 25,068,472 26,186,034 24,644,272 Net income (loss) per share attributable to Hippo Basic $ 3.90 $ (0.34) $ 2.04 $ (3.44) Diluted $ 3.77 $ (0.34) $ 1.97 $ (3.44) 6

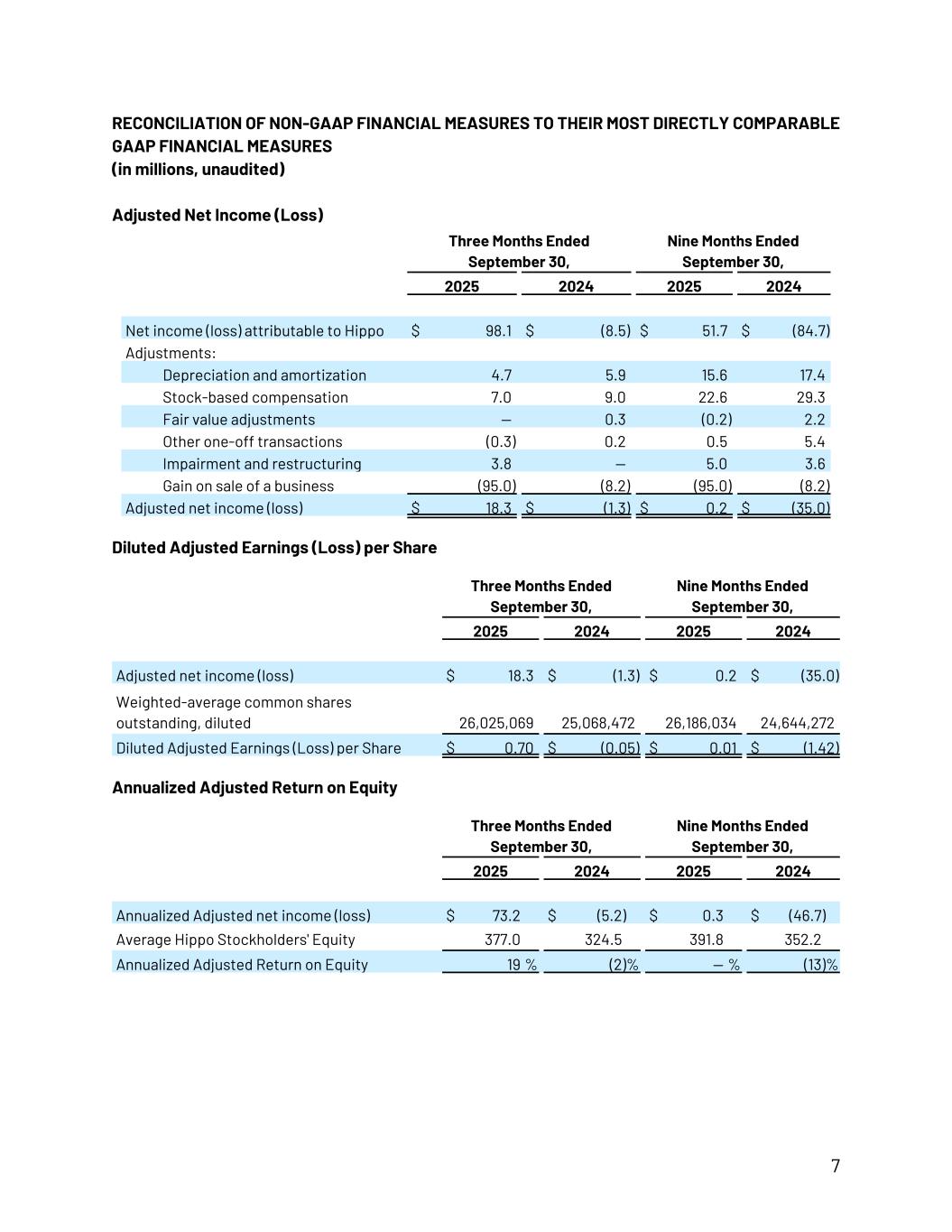

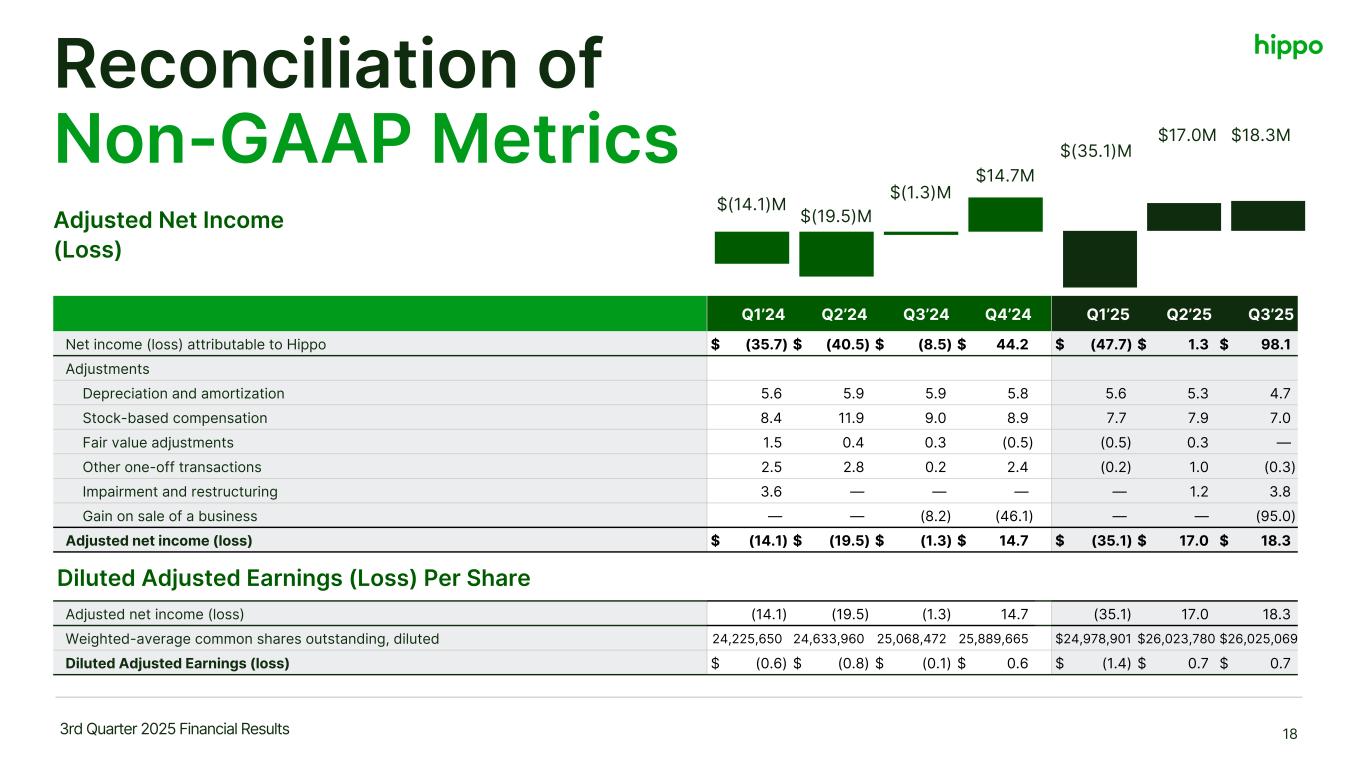

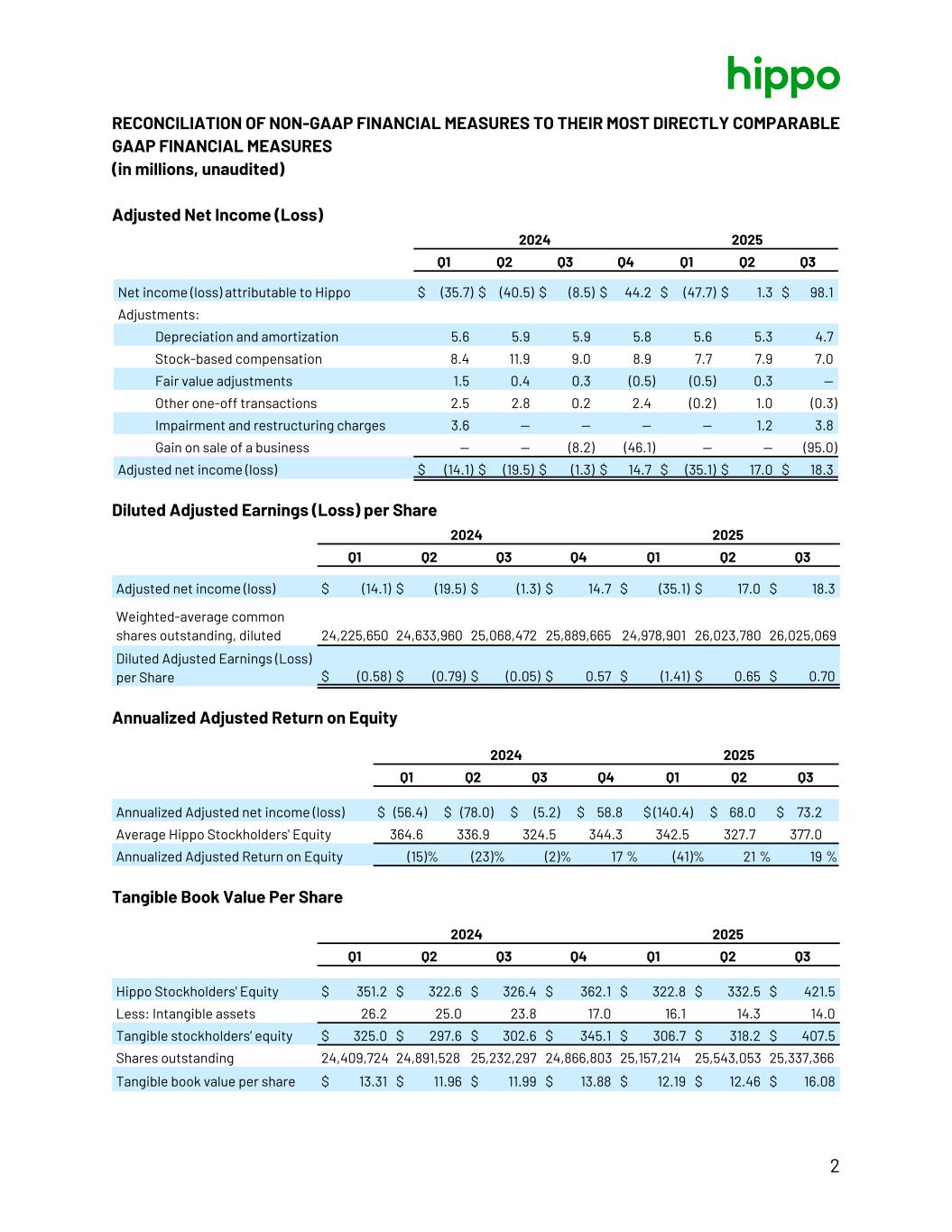

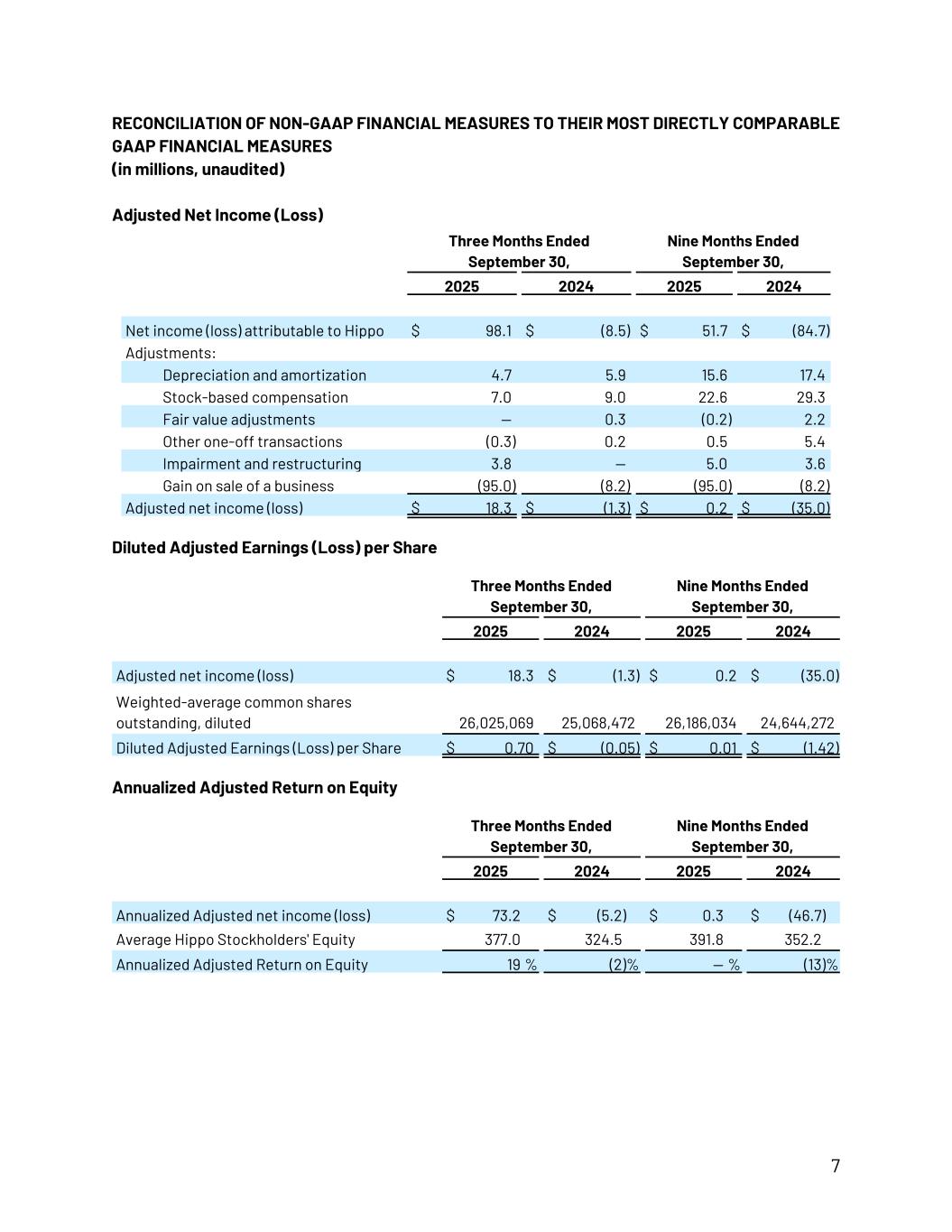

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES TO THEIR MOST DIRECTLY COMPARABLE GAAP FINANCIAL MEASURES (in millions, unaudited) Adjusted Net Income (Loss) Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net income (loss) attributable to Hippo $ 98.1 $ (8.5) $ 51.7 $ (84.7) Adjustments: Depreciation and amortization 4.7 5.9 15.6 17.4 Stock-based compensation 7.0 9.0 22.6 29.3 Fair value adjustments — 0.3 (0.2) 2.2 Other one-off transactions (0.3) 0.2 0.5 5.4 Impairment and restructuring 3.8 — 5.0 3.6 Gain on sale of a business (95.0) (8.2) (95.0) (8.2) Adjusted net income (loss) $ 18.3 $ (1.3) $ 0.2 $ (35.0) Diluted Adjusted Earnings (Loss) per Share Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Adjusted net income (loss) $ 18.3 $ (1.3) $ 0.2 $ (35.0) Weighted-average common shares outstanding, diluted 26,025,069 25,068,472 26,186,034 24,644,272 Diluted Adjusted Earnings (Loss) per Share $ 0.70 $ (0.05) $ 0.01 $ (1.42) Annualized Adjusted Return on Equity Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Annualized Adjusted net income (loss) $ 73.2 $ (5.2) $ 0.3 $ (46.7) Average Hippo Stockholders' Equity 377.0 324.5 391.8 352.2 Annualized Adjusted Return on Equity 19 % (2) % — % (13) % 7

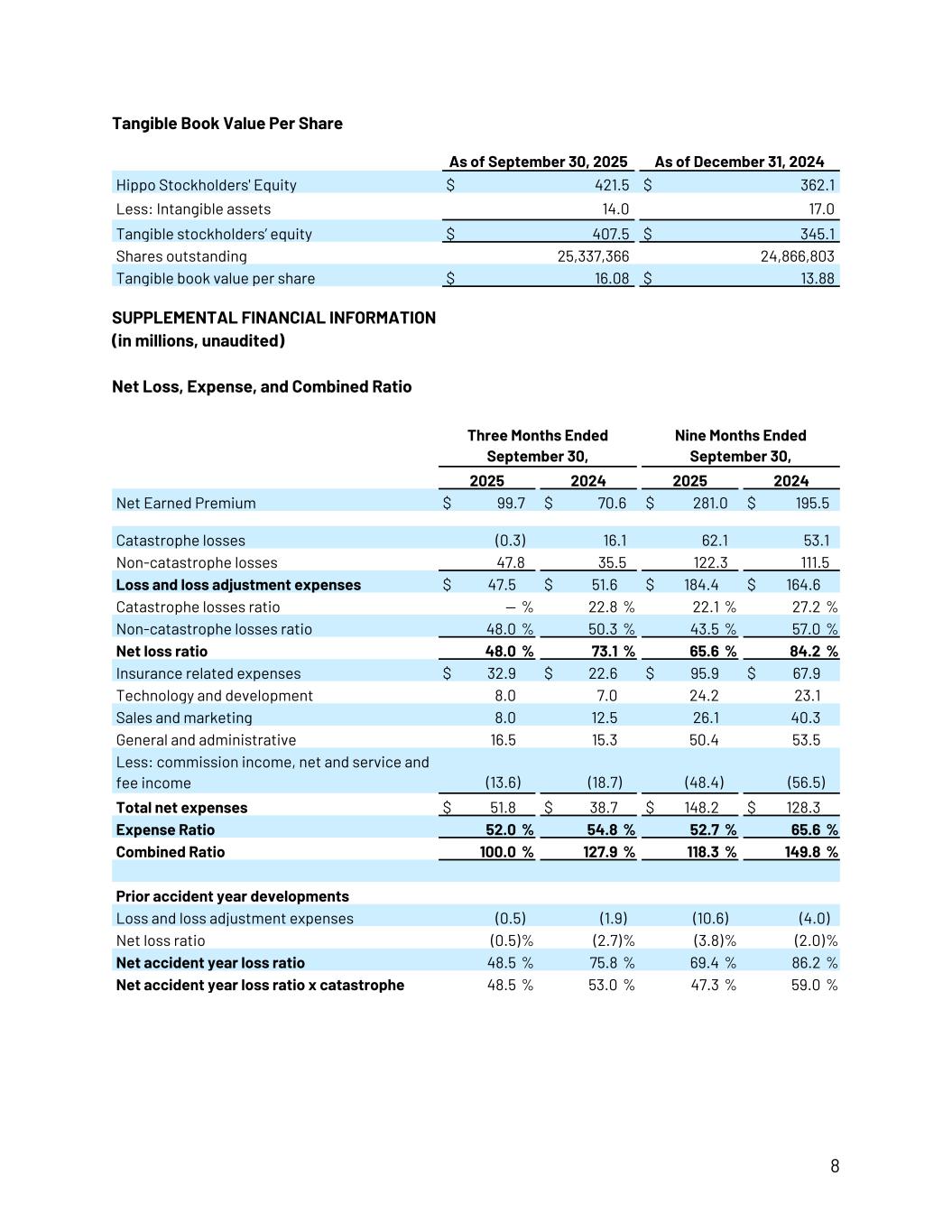

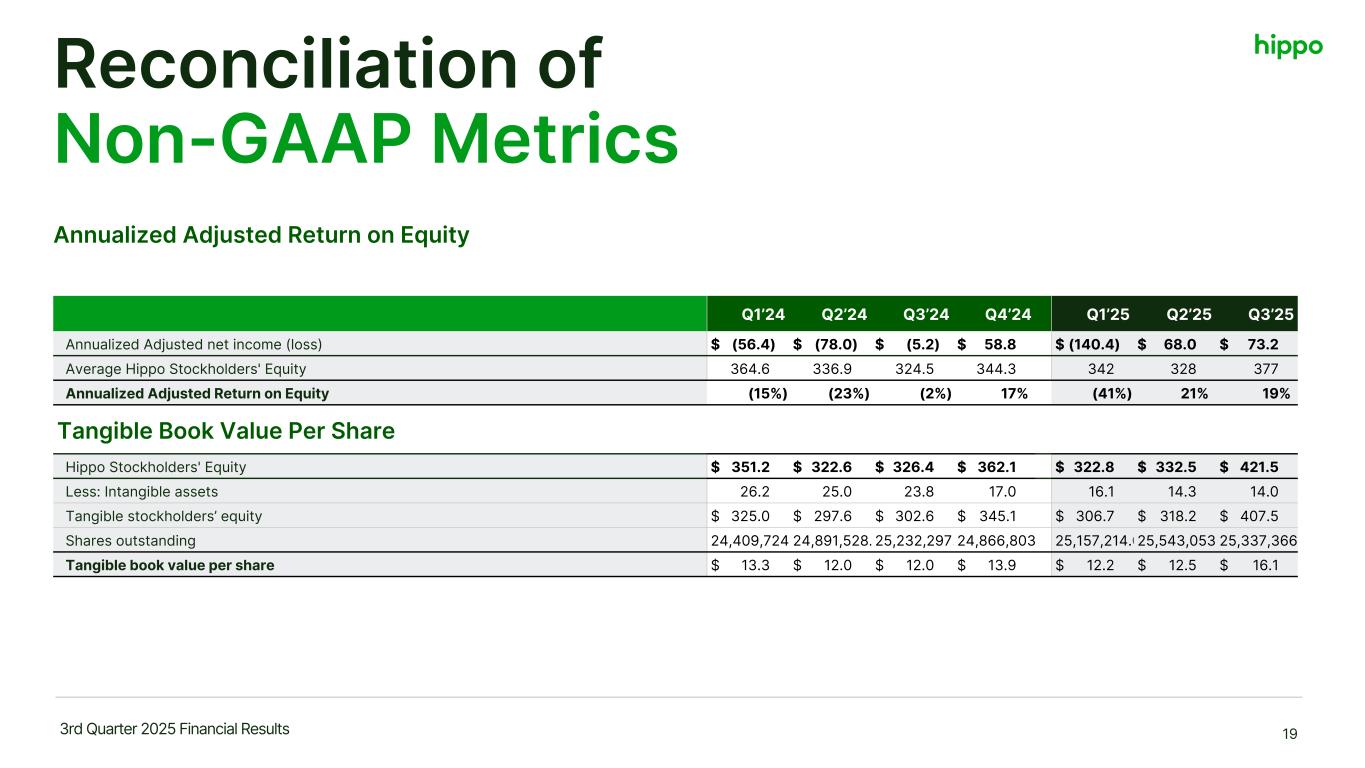

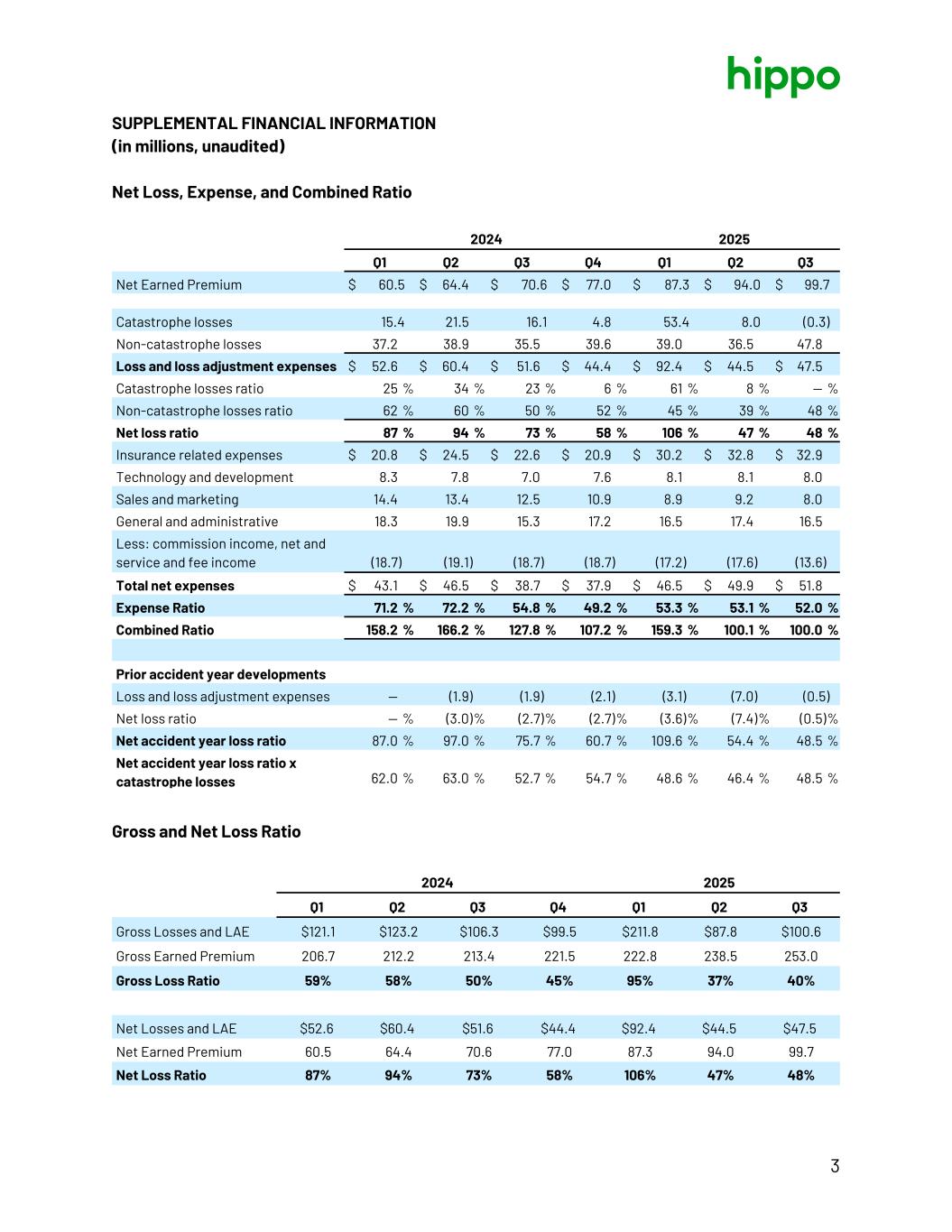

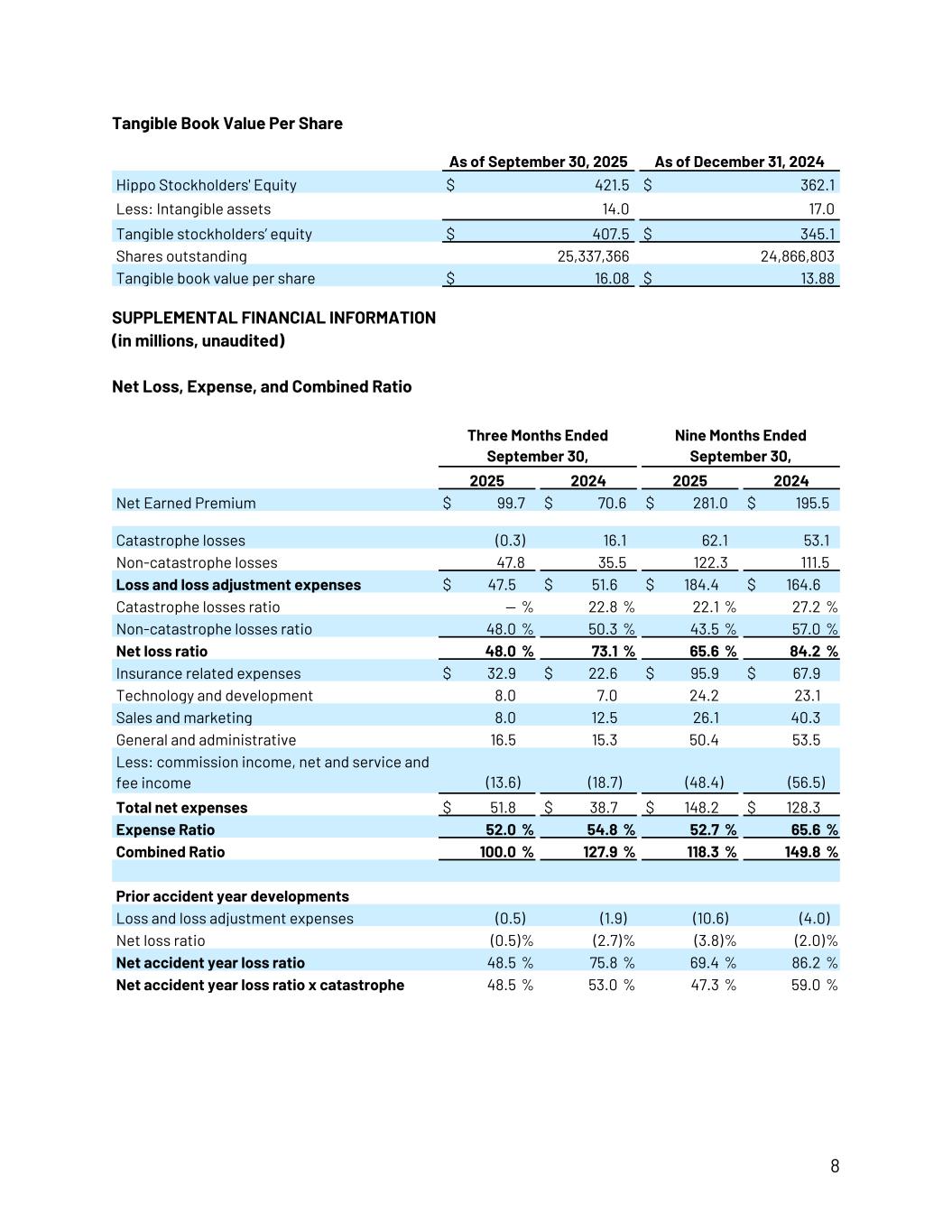

Tangible Book Value Per Share As of September 30, 2025 As of December 31, 2024 Hippo Stockholders' Equity $ 421.5 $ 362.1 Less: Intangible assets 14.0 17.0 Tangible stockholders’ equity $ 407.5 $ 345.1 Shares outstanding 25,337,366 24,866,803 Tangible book value per share $ 16.08 $ 13.88 SUPPLEMENTAL FINANCIAL INFORMATION (in millions, unaudited) Net Loss, Expense, and Combined Ratio Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Net Earned Premium $ 99.7 $ 70.6 $ 281.0 $ 195.5 Catastrophe losses (0.3) 16.1 62.1 53.1 Non-catastrophe losses 47.8 35.5 122.3 111.5 Loss and loss adjustment expenses $ 47.5 $ 51.6 $ 184.4 $ 164.6 Catastrophe losses ratio — % 22.8 % 22.1 % 27.2 % Non-catastrophe losses ratio 48.0 % 50.3 % 43.5 % 57.0 % Net loss ratio 48.0 % 73.1 % 65.6 % 84.2 % Insurance related expenses $ 32.9 $ 22.6 $ 95.9 $ 67.9 Technology and development 8.0 7.0 24.2 23.1 Sales and marketing 8.0 12.5 26.1 40.3 General and administrative 16.5 15.3 50.4 53.5 Less: commission income, net and service and fee income (13.6) (18.7) (48.4) (56.5) Total net expenses $ 51.8 $ 38.7 $ 148.2 $ 128.3 Expense Ratio 52.0 % 54.8 % 52.7 % 65.6 % Combined Ratio 100.0 % 127.9 % 118.3 % 149.8 % Prior accident year developments Loss and loss adjustment expenses (0.5) (1.9) (10.6) (4.0) Net loss ratio (0.5) % (2.7) % (3.8) % (2.0) % Net accident year loss ratio 48.5 % 75.8 % 69.4 % 86.2 % Net accident year loss ratio x catastrophe 48.5 % 53.0 % 47.3 % 59.0 % 8

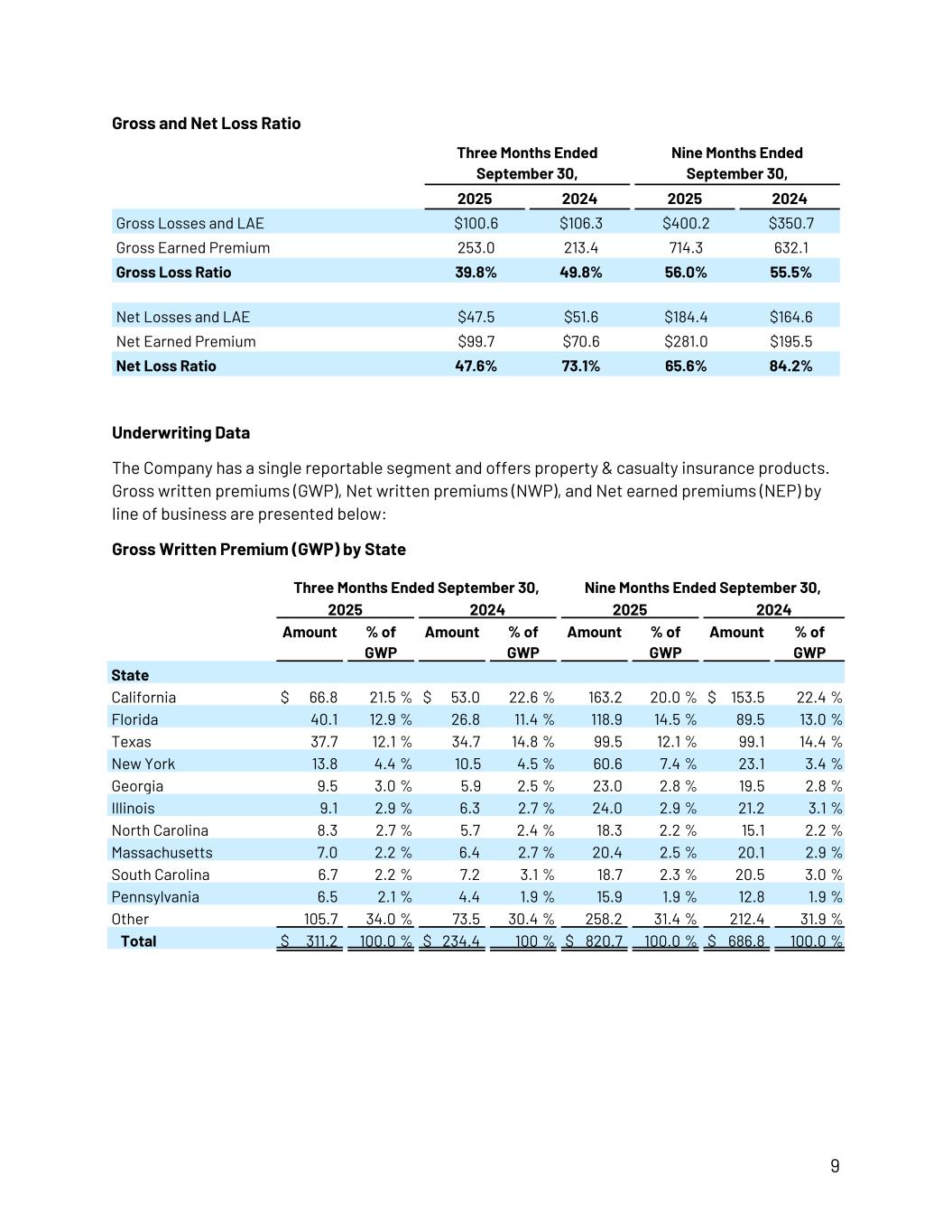

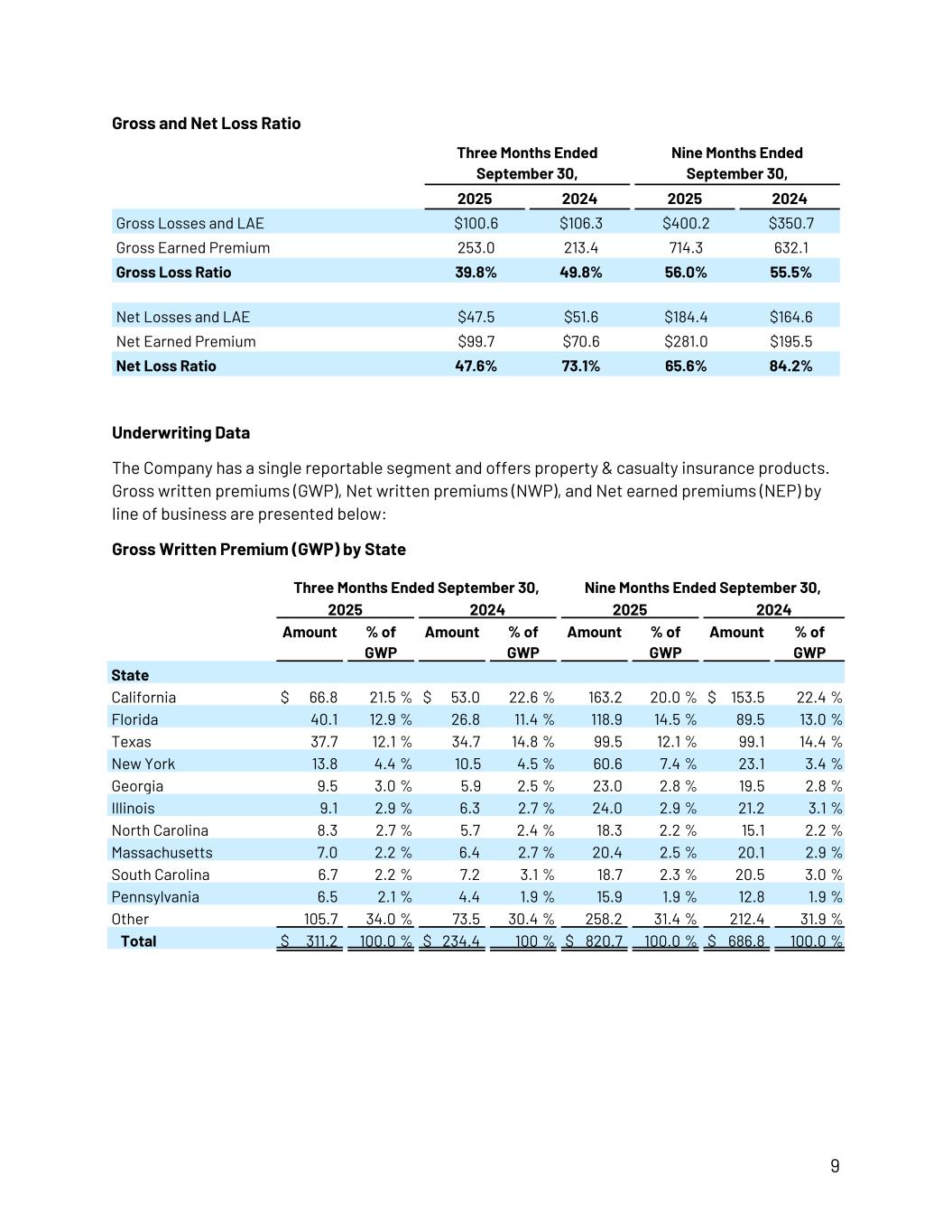

Gross and Net Loss Ratio Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Gross Losses and LAE $100.6 $106.3 $400.2 $350.7 Gross Earned Premium 253.0 213.4 714.3 632.1 Gross Loss Ratio 39.8% 49.8% 56.0% 55.5% Net Losses and LAE $47.5 $51.6 $184.4 $164.6 Net Earned Premium $99.7 $70.6 $281.0 $195.5 Net Loss Ratio 47.6% 73.1% 65.6% 84.2% Underwriting Data The Company has a single reportable segment and offers property & casualty insurance products. Gross written premiums (GWP), Net written premiums (NWP), and Net earned premiums (NEP) by line of business are presented below: Gross Written Premium (GWP) by State Three Months Ended September 30, Nine Months Ended September 30, 2025 2024 2025 2024 Amount % of GWP Amount % of GWP Amount % of GWP Amount % of GWP State California $ 66.8 21.5 % $ 53.0 22.6 % 163.2 20.0 % $ 153.5 22.4 % Florida 40.1 12.9 % 26.8 11.4 % 118.9 14.5 % 89.5 13.0 % Texas 37.7 12.1 % 34.7 14.8 % 99.5 12.1 % 99.1 14.4 % New York 13.8 4.4 % 10.5 4.5 % 60.6 7.4 % 23.1 3.4 % Georgia 9.5 3.0 % 5.9 2.5 % 23.0 2.8 % 19.5 2.8 % Illinois 9.1 2.9 % 6.3 2.7 % 24.0 2.9 % 21.2 3.1 % North Carolina 8.3 2.7 % 5.7 2.4 % 18.3 2.2 % 15.1 2.2 % Massachusetts 7.0 2.2 % 6.4 2.7 % 20.4 2.5 % 20.1 2.9 % South Carolina 6.7 2.2 % 7.2 3.1 % 18.7 2.3 % 20.5 3.0 % Pennsylvania 6.5 2.1 % 4.4 1.9 % 15.9 1.9 % 12.8 1.9 % Other 105.7 34.0 % 73.5 30.4 % 258.2 31.4 % 212.4 31.9 % Total $ 311.2 100.0 % $ 234.4 100 % $ 820.7 100.0 % $ 686.8 100.0 % 9

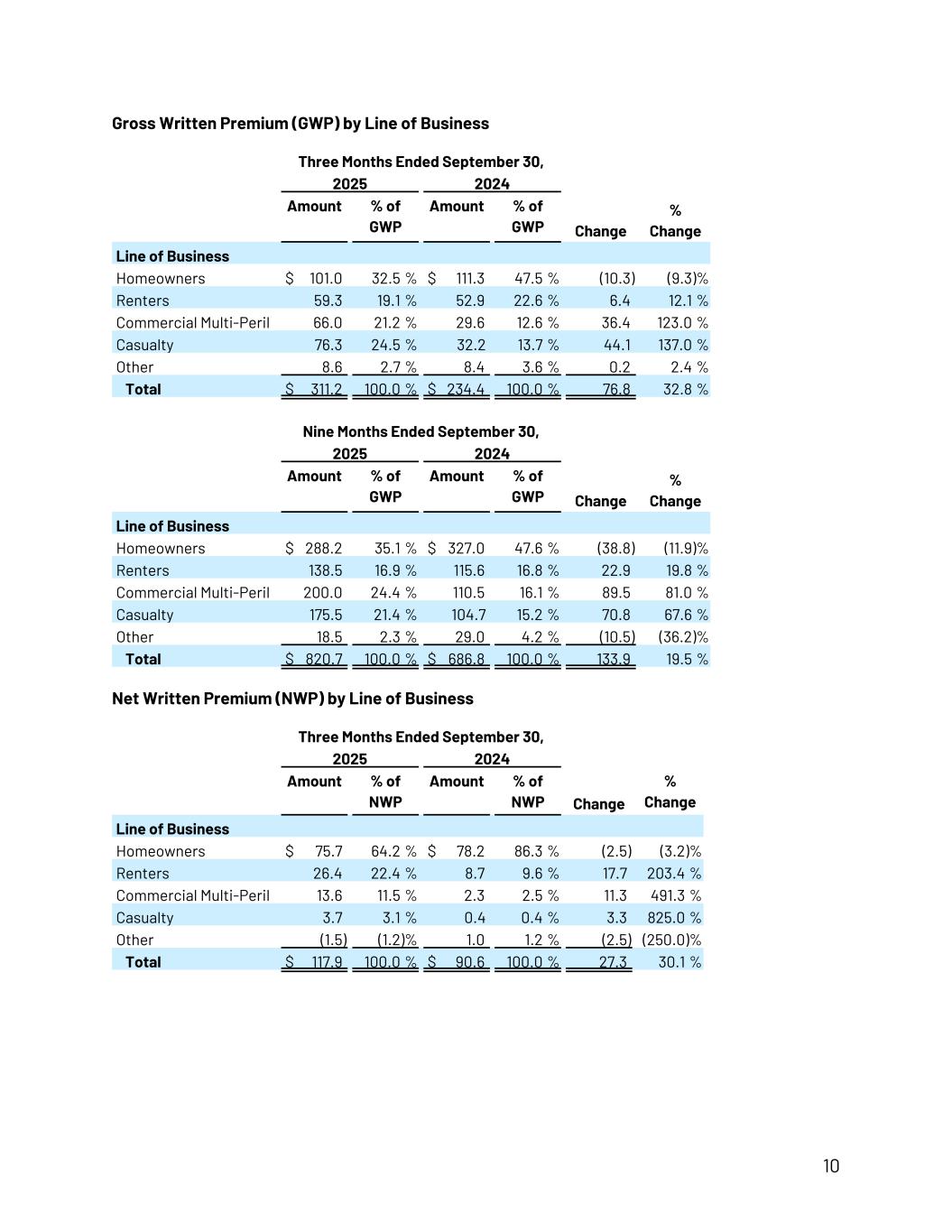

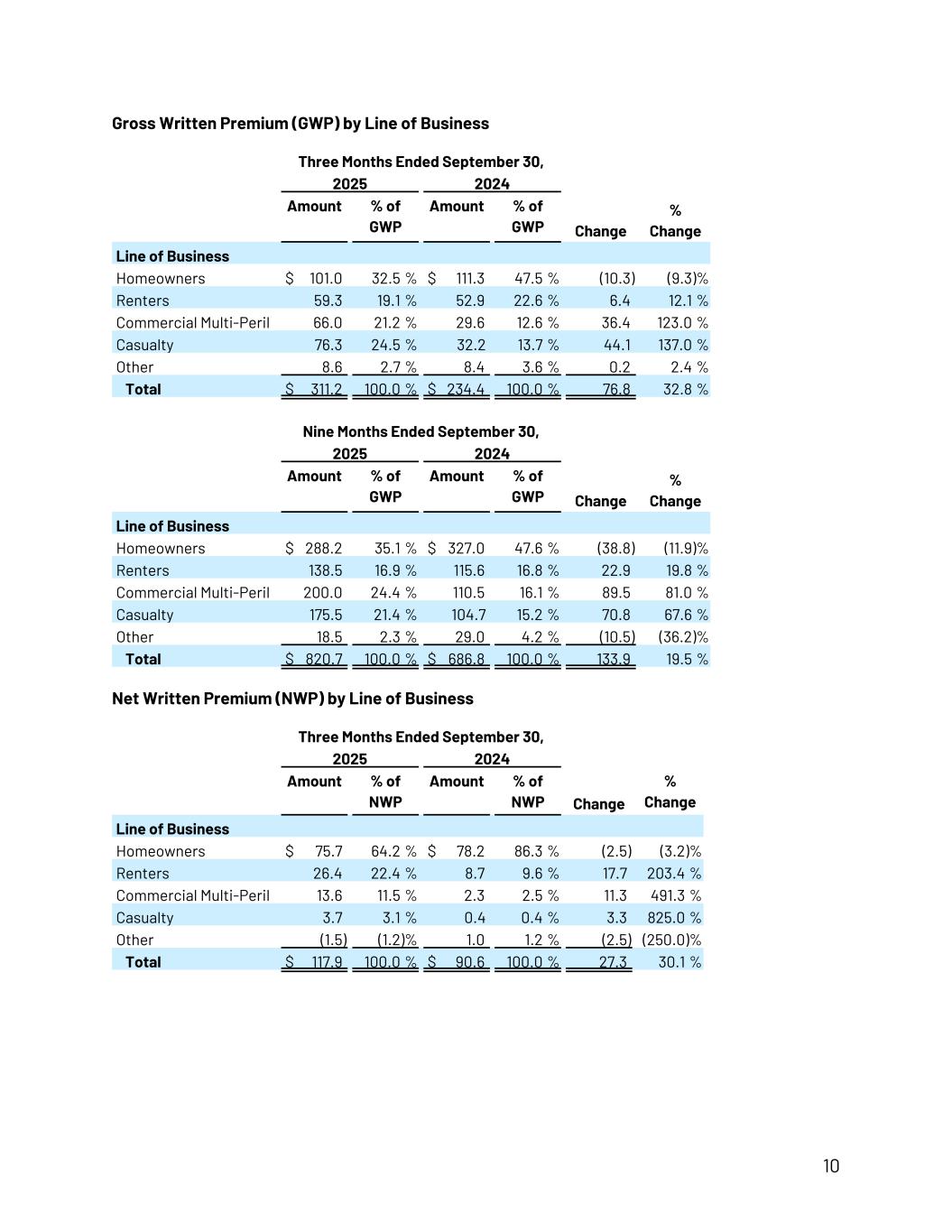

Gross Written Premium (GWP) by Line of Business Three Months Ended September 30, 2025 2024 Amount % of GWP Amount % of GWP Change % Change Line of Business Homeowners $ 101.0 32.5 % $ 111.3 47.5 % (10.3) (9.3) % Renters 59.3 19.1 % 52.9 22.6 % 6.4 12.1 % Commercial Multi-Peril 66.0 21.2 % 29.6 12.6 % 36.4 123.0 % Casualty 76.3 24.5 % 32.2 13.7 % 44.1 137.0 % Other 8.6 2.7 % 8.4 3.6 % 0.2 2.4 % Total $ 311.2 100.0 % $ 234.4 100.0 % 76.8 32.8 % Nine Months Ended September 30, 2025 2024 Amount % of GWP Amount % of GWP Change % Change Line of Business Homeowners $ 288.2 35.1 % $ 327.0 47.6 % (38.8) (11.9) % Renters 138.5 16.9 % 115.6 16.8 % 22.9 19.8 % Commercial Multi-Peril 200.0 24.4 % 110.5 16.1 % 89.5 81.0 % Casualty 175.5 21.4 % 104.7 15.2 % 70.8 67.6 % Other 18.5 2.3 % 29.0 4.2 % (10.5) (36.2) % Total $ 820.7 100.0 % $ 686.8 100.0 % 133.9 19.5 % Net Written Premium (NWP) by Line of Business Three Months Ended September 30, 2025 2024 Amount % of NWP Amount % of NWP Change % Change Line of Business Homeowners $ 75.7 64.2 % $ 78.2 86.3 % (2.5) (3.2) % Renters 26.4 22.4 % 8.7 9.6 % 17.7 203.4 % Commercial Multi-Peril 13.6 11.5 % 2.3 2.5 % 11.3 491.3 % Casualty 3.7 3.1 % 0.4 0.4 % 3.3 825.0 % Other (1.5) (1.2) % 1.0 1.2 % (2.5) (250.0) % Total $ 117.9 100.0 % $ 90.6 100.0 % 27.3 30.1 % 10

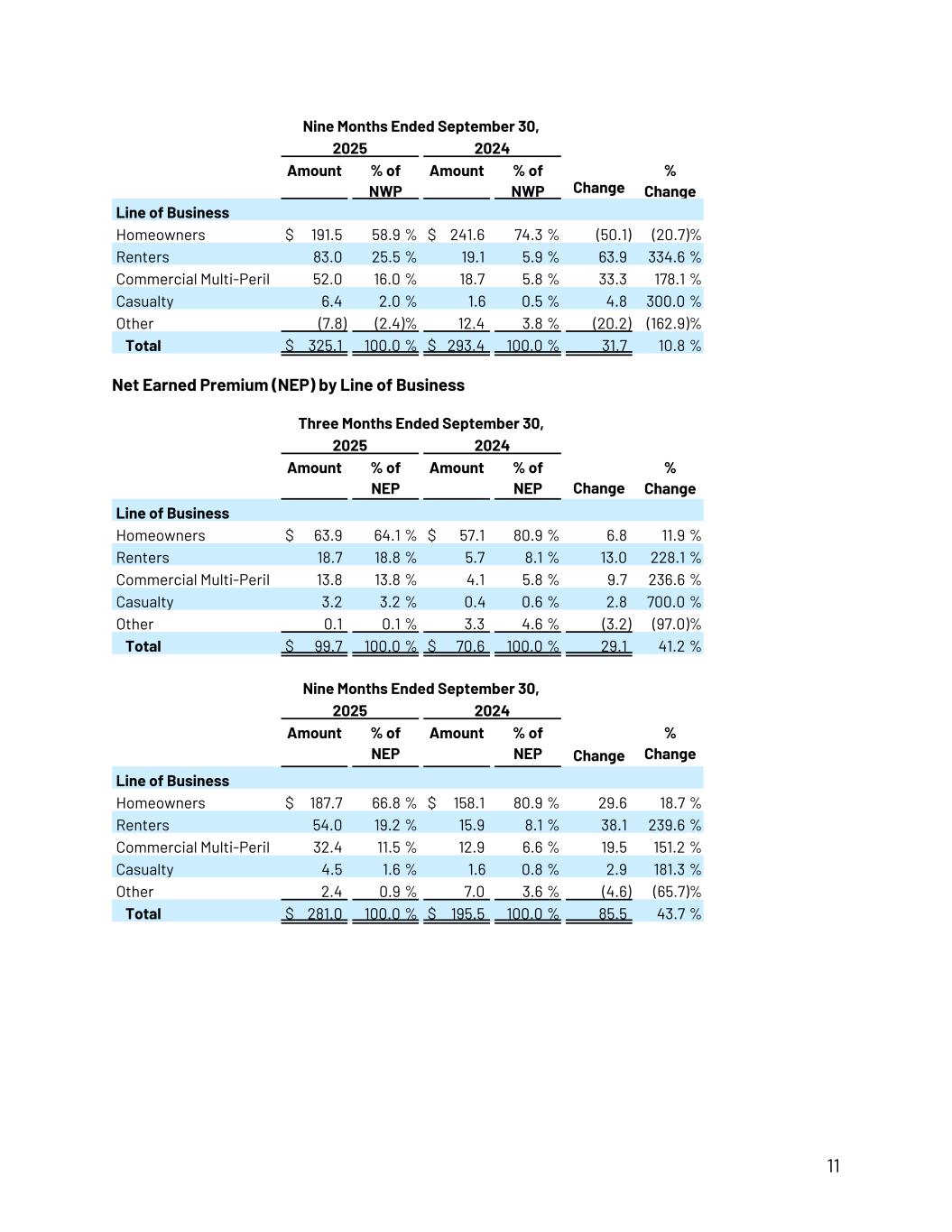

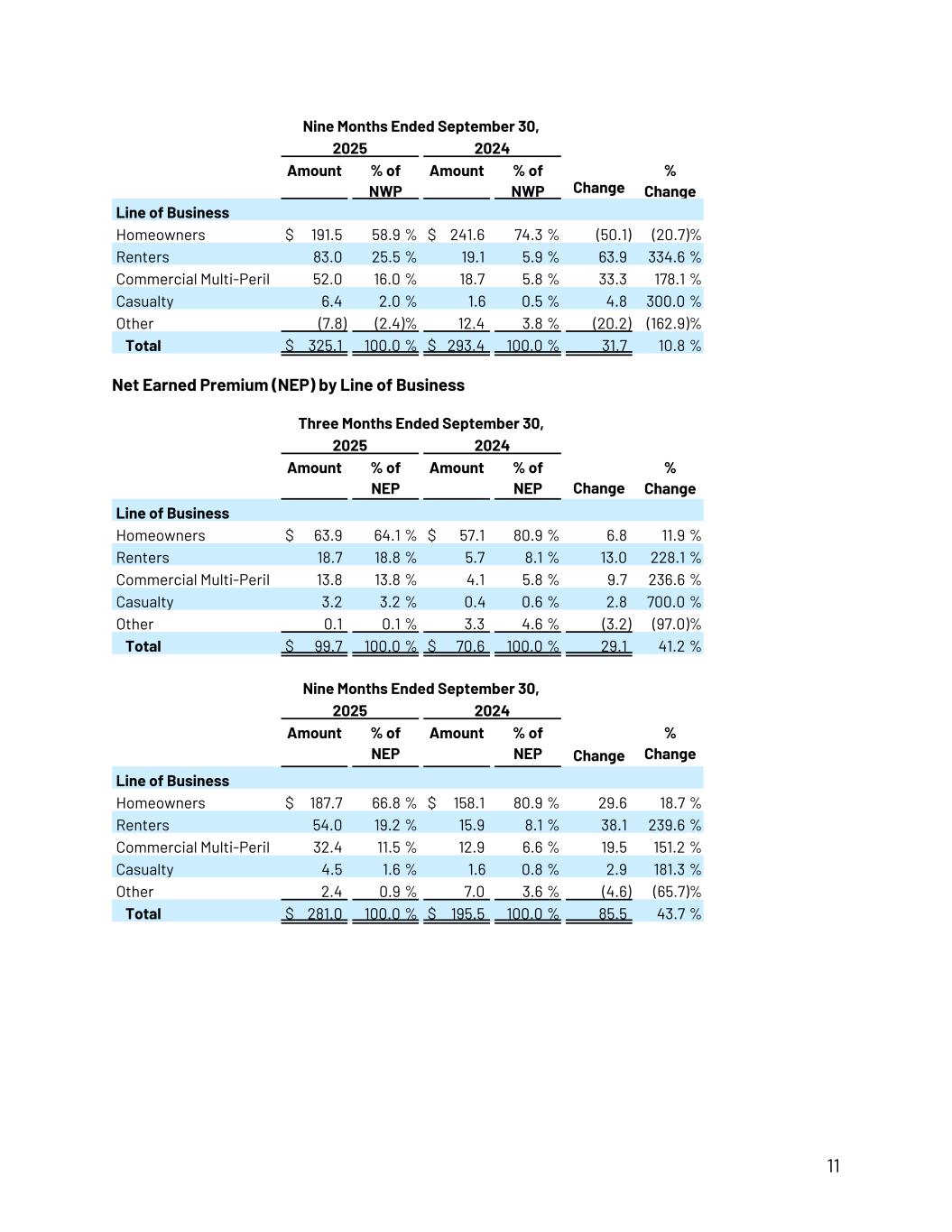

Nine Months Ended September 30, 2025 2024 Amount % of NWP Amount % of NWP Change % Change Line of Business Homeowners $ 191.5 58.9 % $ 241.6 74.3 % (50.1) (20.7) % Renters 83.0 25.5 % 19.1 5.9 % 63.9 334.6 % Commercial Multi-Peril 52.0 16.0 % 18.7 5.8 % 33.3 178.1 % Casualty 6.4 2.0 % 1.6 0.5 % 4.8 300.0 % Other (7.8) (2.4) % 12.4 3.8 % (20.2) (162.9) % Total $ 325.1 100.0 % $ 293.4 100.0 % 31.7 10.8 % Net Earned Premium (NEP) by Line of Business Three Months Ended September 30, 2025 2024 Amount % of NEP Amount % of NEP Change % Change Line of Business Homeowners $ 63.9 64.1 % $ 57.1 80.9 % 6.8 11.9 % Renters 18.7 18.8 % 5.7 8.1 % 13.0 228.1 % Commercial Multi-Peril 13.8 13.8 % 4.1 5.8 % 9.7 236.6 % Casualty 3.2 3.2 % 0.4 0.6 % 2.8 700.0 % Other 0.1 0.1 % 3.3 4.6 % (3.2) (97.0) % Total $ 99.7 100.0 % $ 70.6 100.0 % 29.1 41.2 % Nine Months Ended September 30, 2025 2024 Amount % of NEP Amount % of NEP Change % Change Line of Business Homeowners $ 187.7 66.8 % $ 158.1 80.9 % 29.6 18.7 % Renters 54.0 19.2 % 15.9 8.1 % 38.1 239.6 % Commercial Multi-Peril 32.4 11.5 % 12.9 6.6 % 19.5 151.2 % Casualty 4.5 1.6 % 1.6 0.8 % 2.9 181.3 % Other 2.4 0.9 % 7.0 3.6 % (4.6) (65.7) % Total $ 281.0 100.0 % $ 195.5 100.0 % 85.5 43.7 % 11

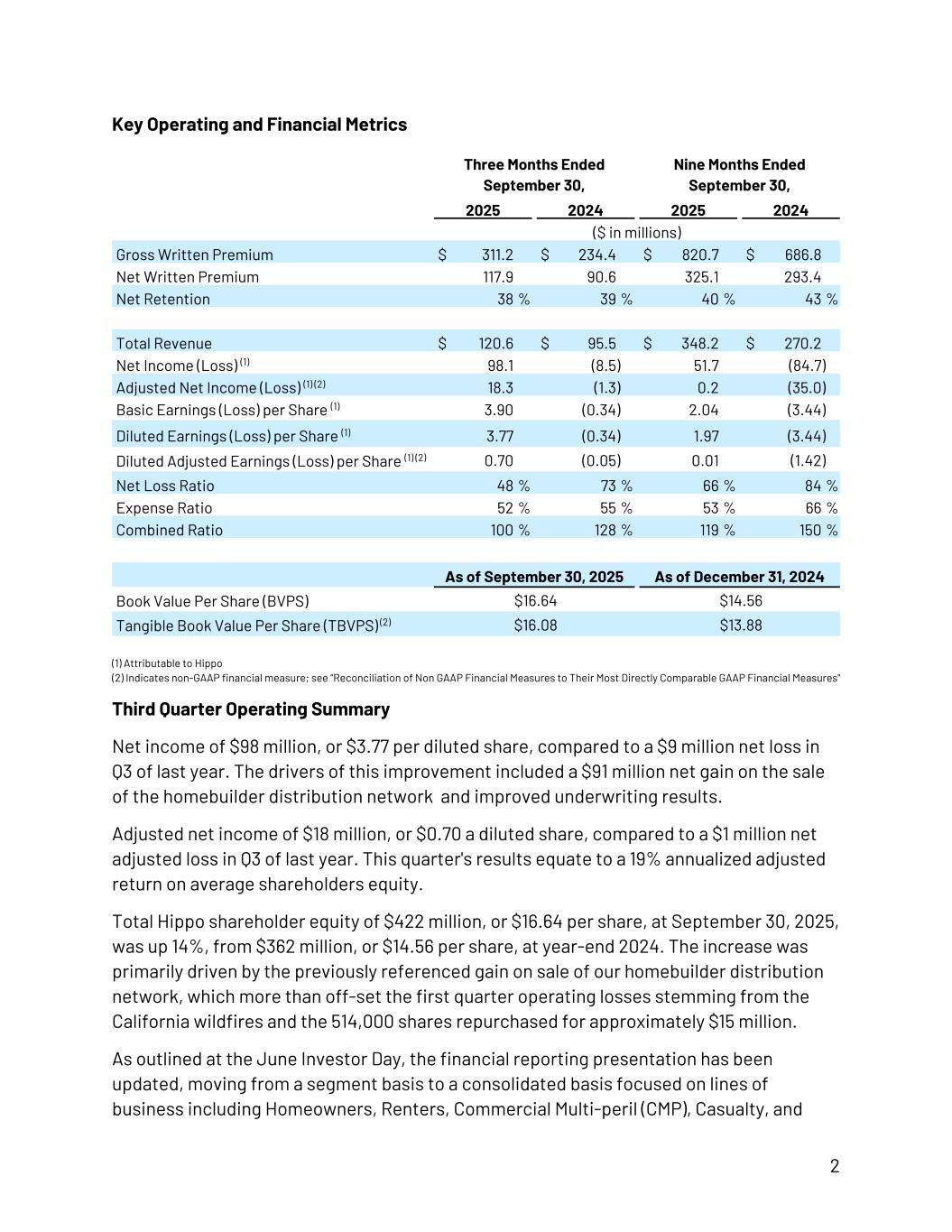

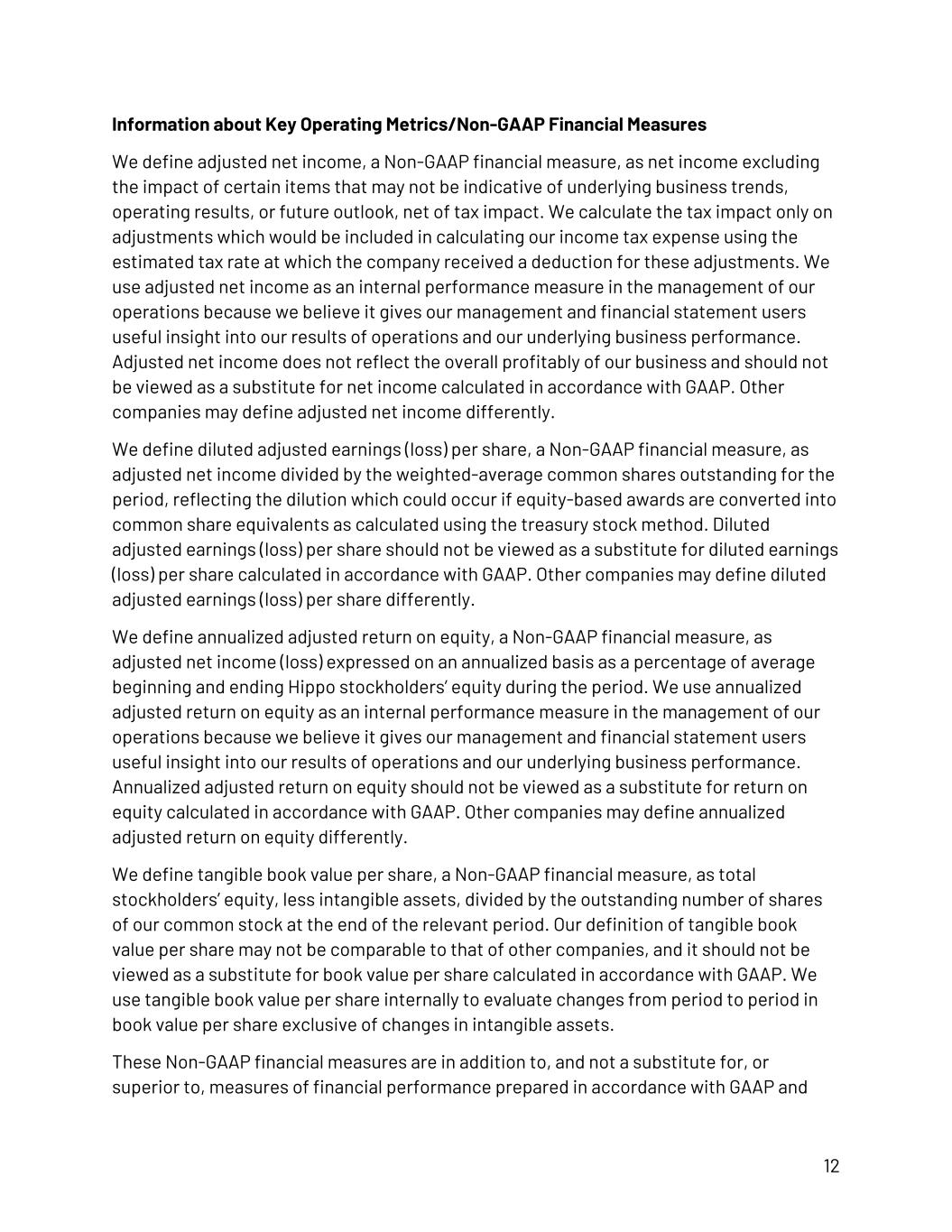

Information about Key Operating Metrics/Non-GAAP Financial Measures We define adjusted net income, a Non-GAAP financial measure, as net income excluding the impact of certain items that may not be indicative of underlying business trends, operating results, or future outlook, net of tax impact. We calculate the tax impact only on adjustments which would be included in calculating our income tax expense using the estimated tax rate at which the company received a deduction for these adjustments. We use adjusted net income as an internal performance measure in the management of our operations because we believe it gives our management and financial statement users useful insight into our results of operations and our underlying business performance. Adjusted net income does not reflect the overall profitably of our business and should not be viewed as a substitute for net income calculated in accordance with GAAP. Other companies may define adjusted net income differently. We define diluted adjusted earnings (loss) per share, a Non-GAAP financial measure, as adjusted net income divided by the weighted-average common shares outstanding for the period, reflecting the dilution which could occur if equity-based awards are converted into common share equivalents as calculated using the treasury stock method. Diluted adjusted earnings (loss) per share should not be viewed as a substitute for diluted earnings (loss) per share calculated in accordance with GAAP. Other companies may define diluted adjusted earnings (loss) per share differently. We define annualized adjusted return on equity, a Non-GAAP financial measure, as adjusted net income (loss) expressed on an annualized basis as a percentage of average beginning and ending Hippo stockholders’ equity during the period. We use annualized adjusted return on equity as an internal performance measure in the management of our operations because we believe it gives our management and financial statement users useful insight into our results of operations and our underlying business performance. Annualized adjusted return on equity should not be viewed as a substitute for return on equity calculated in accordance with GAAP. Other companies may define annualized adjusted return on equity differently. We define tangible book value per share, a Non-GAAP financial measure, as total stockholders’ equity, less intangible assets, divided by the outstanding number of shares of our common stock at the end of the relevant period. Our definition of tangible book value per share may not be comparable to that of other companies, and it should not be viewed as a substitute for book value per share calculated in accordance with GAAP. We use tangible book value per share internally to evaluate changes from period to period in book value per share exclusive of changes in intangible assets. These Non-GAAP financial measures are in addition to, and not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP and 12

should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of these Non- GAAP financial measures to their most directly comparable GAAP counterpart is included above. We believe that these non-GAAP measures of financial results provide useful supplemental information to investors about Hippo. Forward-looking statements safe harbor Certain statements included in this press release that are not historical facts are forward- looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as "believe," "may," "will," "estimate," "continue," "anticipate," "intend," "expect," "should," "would," "plan," "predict," "potential," "seem," "seek," "future," "outlook," and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial results and other operating and performance metrics, our business strategy, our cost reduction efforts, the quality of our products and services, and the potential growth of our business. These statements are based on the current expectations of Hippo's management and are not predictions of actual performance. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions, and many actual events and circumstances are beyond the control of Hippo. These forward- looking statements are subject to a number of risks and uncertainties, including our ability to navigate extensive insurance industry regulations and the scrutiny of state insurance regulators, our ability to achieve or maintain profitability in the future; our ability to retain and expand our customer base and grow our business, including our builder network; our ability to manage growth effectively; risks relating to Hippo's brand and brand reputation; denial of claims or our failure to accurately and timely pay claims; the effects of intense competition in the segments of the insurance industry in which we operate; the availability and adequacy of reinsurance, including at current coverage, limits or pricing; our ability to underwrite risks accurately and charge competitive yet profitable rates to our customers, and the sufficiency of the analytical models we use to assess and predict exposure to catastrophe losses; risks related to our proprietary technology and our digital platform; outages or interruptions or delays in services provided by our third party providers, including our data vendors; risks related to our intellectual property; the seasonal and cyclical nature of our business; the effects of severe weather events and other natural or man-made catastrophes, including the effects of climate change, global pandemics, and terrorism; any overall decline in economic activity; regulators' identification of errors in the policy forms we use, the rates we charge, and our customer communications including, but not limited to, cancellations, non-renewals and reinstatements through market conducts, complaints, or other inquiries; the effects of existing or new legal or 13

regulatory requirements on our business, including with respect to maintenance of risk- based capital and financial strength ratings, data privacy and cybersecurity, and the insurance industry generally; and other risks set forth in the sections entitled "Risk Factors" in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that Hippo does not presently know, or that Hippo currently believes are immaterial, that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Hippo's expectations, plans, or forecasts of future events and views as of the date of this press release. Hippo anticipates that subsequent events and developments will cause Hippo's assessments to change. However, while Hippo may elect to update these forward-looking statements at some point in the future, Hippo specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Hippo's assessments of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements. Contacts Investors: Charles Sebaski Investors@hippo.com Press: Mark Olson press@hippo.com 14