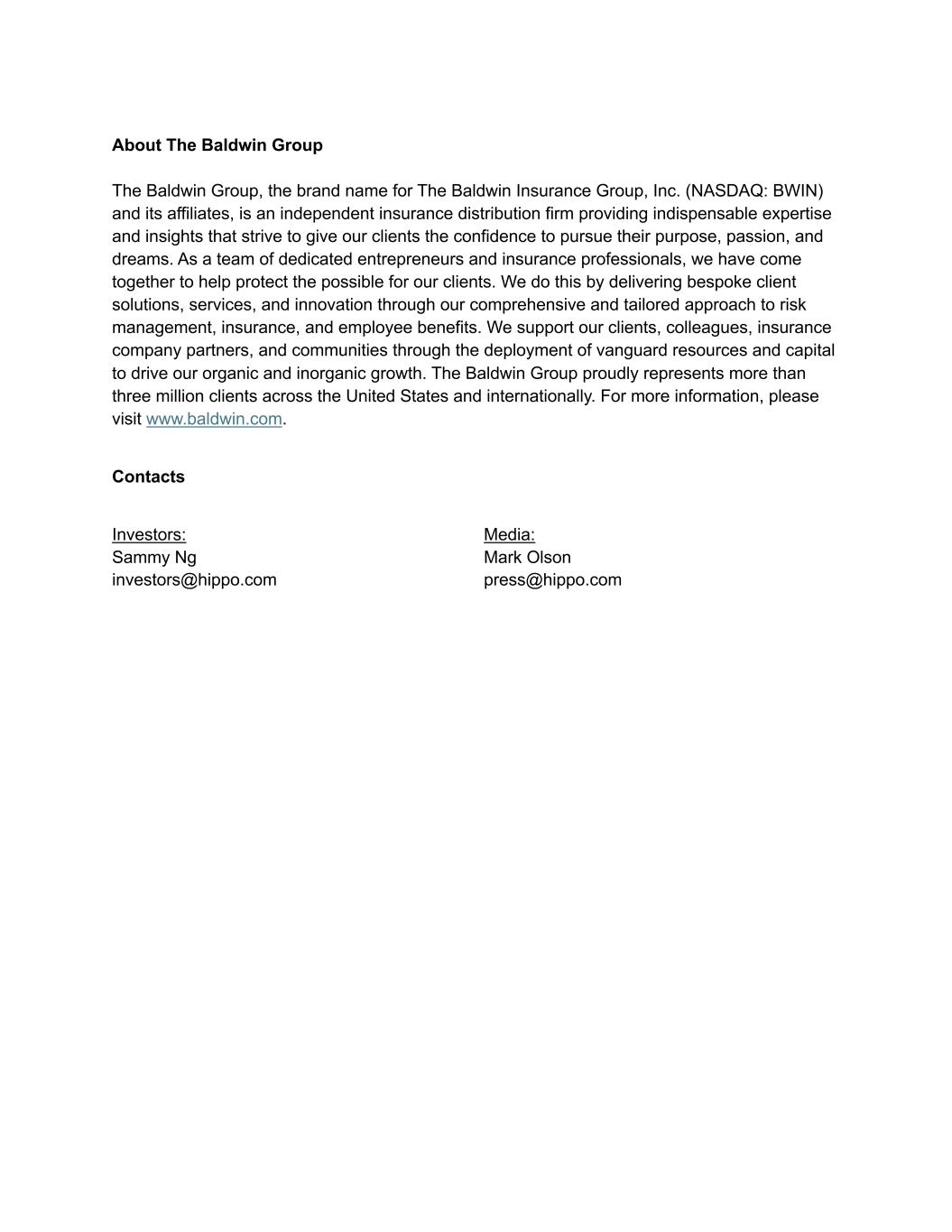

Disclaimer INVESTOR DAY 2025 2 This presentation includes the non-GAAP financial measure (including on a forward-looking basis) Adjusted EBITDA. Hippo defines Adjusted EBITDA, a non-GAAP financial measure, as net loss attributable to Hippo excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, net investment income, restructuring charges, impairment expense, gains and losses on sales of business, other non-cash fair market value adjustments, and contingent consideration for one of our acquisitions and other transactions that we consider to be unique in nature. Hippo excludes these items from Adjusted EBITDA because it does not consider them to be directly attributable to its underlying operating performance. This non-GAAP measure is an addition, and not a substitute for, or superior to, measures of financial performance prepared in accordance with GAAP and should not be considered as an alternative to net income, operating income or any other performance measures derived in accordance with GAAP. Reconciliations of non-GAAP measures to their most directly comparable GAAP counterparts are included in the Appendix to this presentation. Hippo believes that these non-GAAP measures of financial results (including on a forward-looking basis) provide useful supplemental information to investors about Hippo. Hippo’s management uses forward looking non- GAAP measures to evaluate Hippo’s projected financial and operating performance. However, there are a number of limitations related to the use of these non-GAAP measures and their nearest GAAP equivalents. For example, other companies may calculate non-GAAP measures differently, or may use other measures to calculate their financial performance, and therefore Hippo’s non-GAAP measures may not be directly comparable to similarly titled measures of other companies. This presentation also includes certain projections of non-GAAP financial measures. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, Hippo is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included, and no reconciliation of the forward-looking non-GAAP financial measures is included. This presentation also includes key operating and financial metrics including Gross Loss Ratio and Net Loss Ratio. We define Gross Loss Ratio expressed as a percentage, which is the ratio of the gross losses and loss adjustment expenses to the gross earned premium. We define Net Loss Ratio expressed as a percentage, which is the ratio of the net losses and loss adjustment expenses to the net earned premium. Non-GAAP Financial Measures Certain statements included in this presentation that are not historical facts are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding estimates and forecasts of financial results and other operating and performance metrics, our business strategy, our cost reduction efforts, the quality of our products and services, and the potential growth of our business, including our ability and timing to achieve profitability. These statements are based on the current expectations of Hippo’s management and are not predictions of actual performance. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions, and many actual events and circumstances are beyond the control of Hippo. These forward-looking statements are subject to a number of risks and uncertainties, including our ability to achieve or maintain profitability in the future; our ability to retain and expand our customer base and grow our business, including our builder network; our ability to manage growth effectively; risks relating to Hippo’s brand and brand reputation; denial of claims or our failure to accurately and timely pay claims; the effects of intense competition in the segments of the insurance industry in which we operate; the availability and adequacy of reinsurance, including at current coverage, limits or pricing; our ability to underwrite risks accurately and charge competitive yet profitable rates to our customers, and the sufficiency of the analytical models we use to assess and predict exposure to catastrophe losses; risks related to our proprietary technology and our digital platform; outages or interruptions or delays in services provided by our third party providers, including our data vendor; risks related to our intellectual property; the seasonal and cyclical nature of our business; the effects of severe weather events and other natural or man-made catastrophes, including the effects of climate change, global pandemics, and terrorism; any overall decline in economic activity; the effects of existing or new legal or regulatory requirements on our business, including with respect to maintenance of risk-based capital and financial strength ratings, data privacy and cybersecurity, and the insurance industry generally; and other risks set forth in the sections entitled “Risk Factors” in our Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. Forward-Looking Statements Safe Harbor

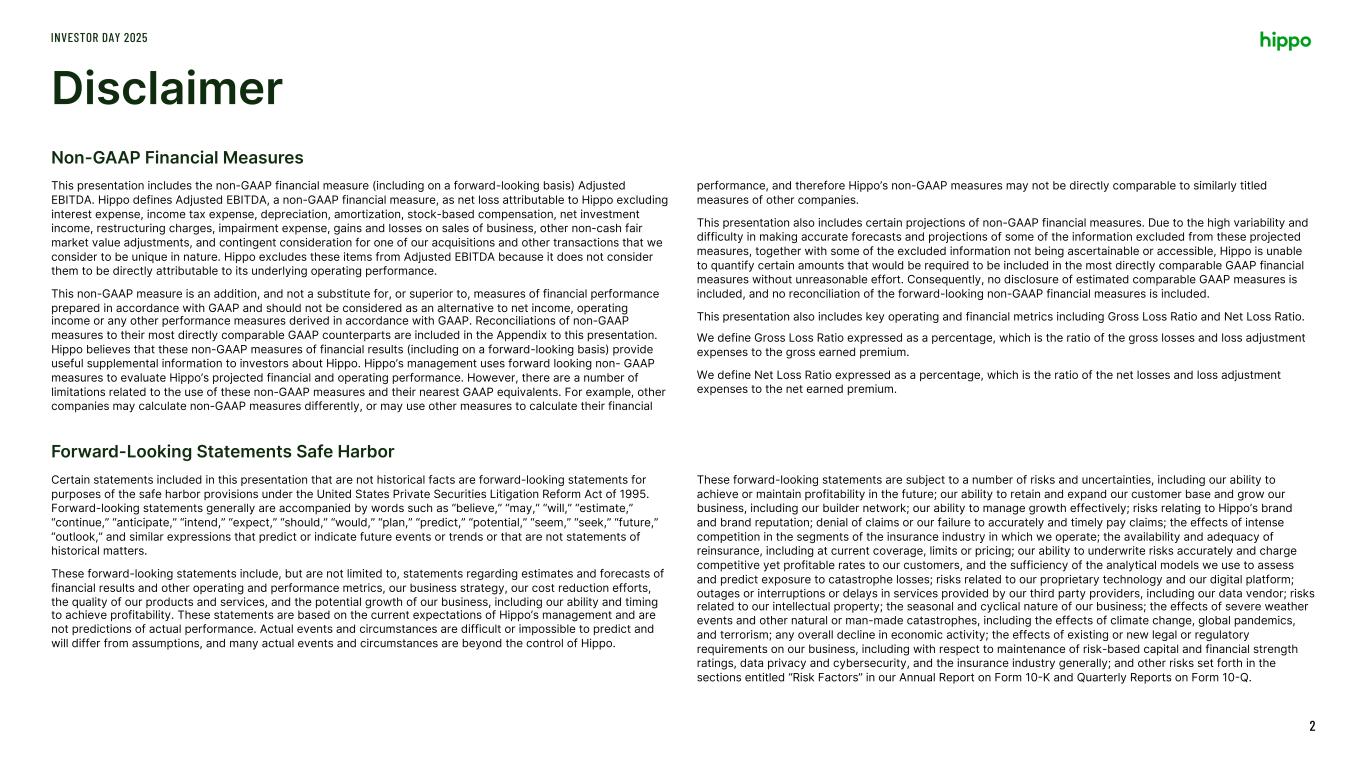

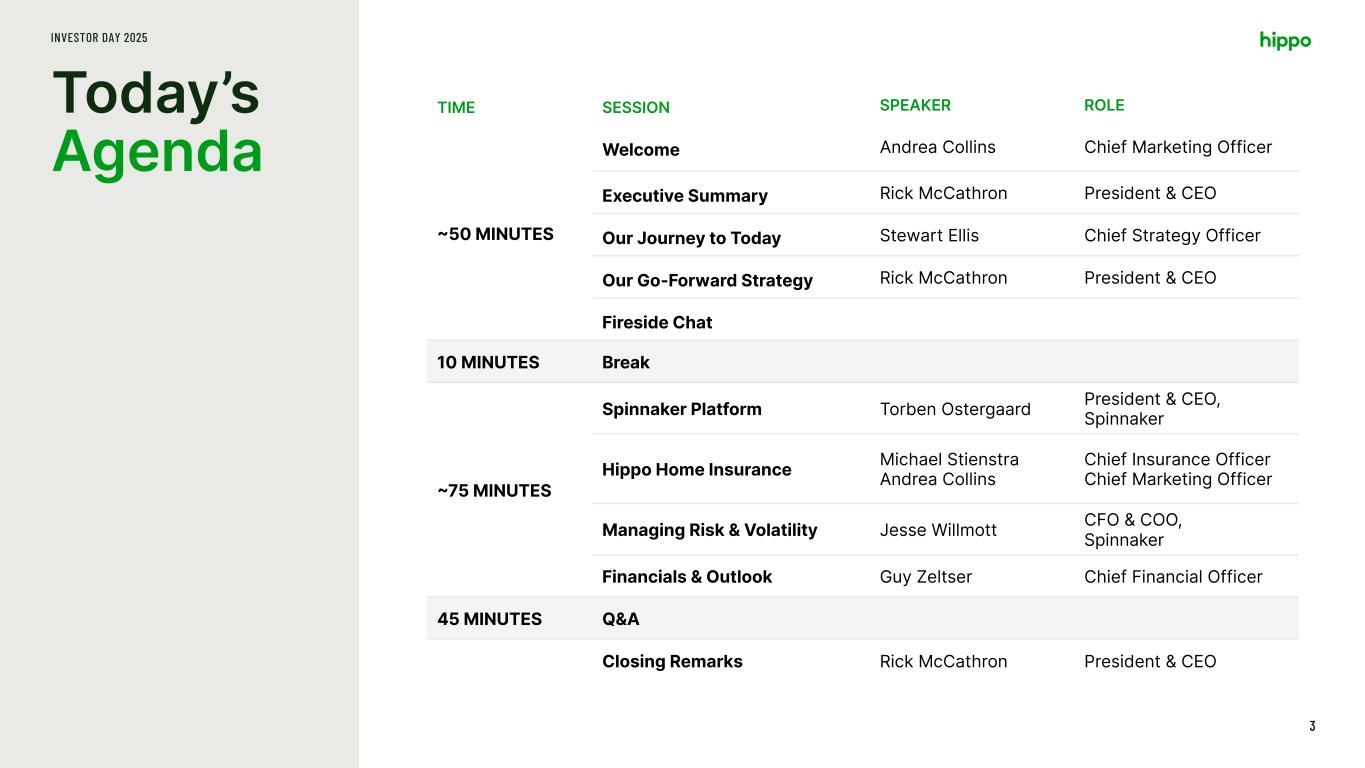

Today’s Agenda INVESTOR DAY 2025 3 TIME SESSION SPEAKER ROLE ~50 MINUTES Welcome Andrea Collins Chief Marketing Officer Executive Summary Rick McCathron President & CEO Our Journey to Today Stewart Ellis Chief Strategy Officer Our Go-Forward Strategy Rick McCathron President & CEO Fireside Chat 10 MINUTES Break ~75 MINUTES Spinnaker Platform Torben Ostergaard President & CEO, Spinnaker Hippo Home Insurance Michael Stienstra Andrea Collins Chief Insurance Officer Chief Marketing Officer Managing Risk & Volatility Jesse Willmott CFO & COO, Spinnaker Financials & Outlook Guy Zeltser Chief Financial Officer 45 MINUTES Q&A Closing Remarks Rick McCathron President & CEO

Rick McCathron President & Chief Executive Officer

Key Themes for Today INVESTOR DAY 2025 5 Primed to Deliver Consistent Bottom Line Growth with an Attractive Return on Equity and Lower Volatility Business Transformation Company Vision Proven Team Differentiated Products Over the past three years, delivered on aggressive financial goals while diversifying our risk Building a platform to source diversified, positively selected risk to deliver high return on equity at lower volatility Talented, experienced insurance leaders want to work at Hippo Competitive advantages in both Spinnaker platform and our homeowners MGA, our right to win Flexible Risk Management Track Record of Execution Shareholder Value Flexible business model that allows Hippo to capitalize on natural market cycles Consistently delivered on controllable guidance while reducing variability from cat events Driving shareholder value in the near- and long-term

Stewart Ellis Chief Strategy Officer

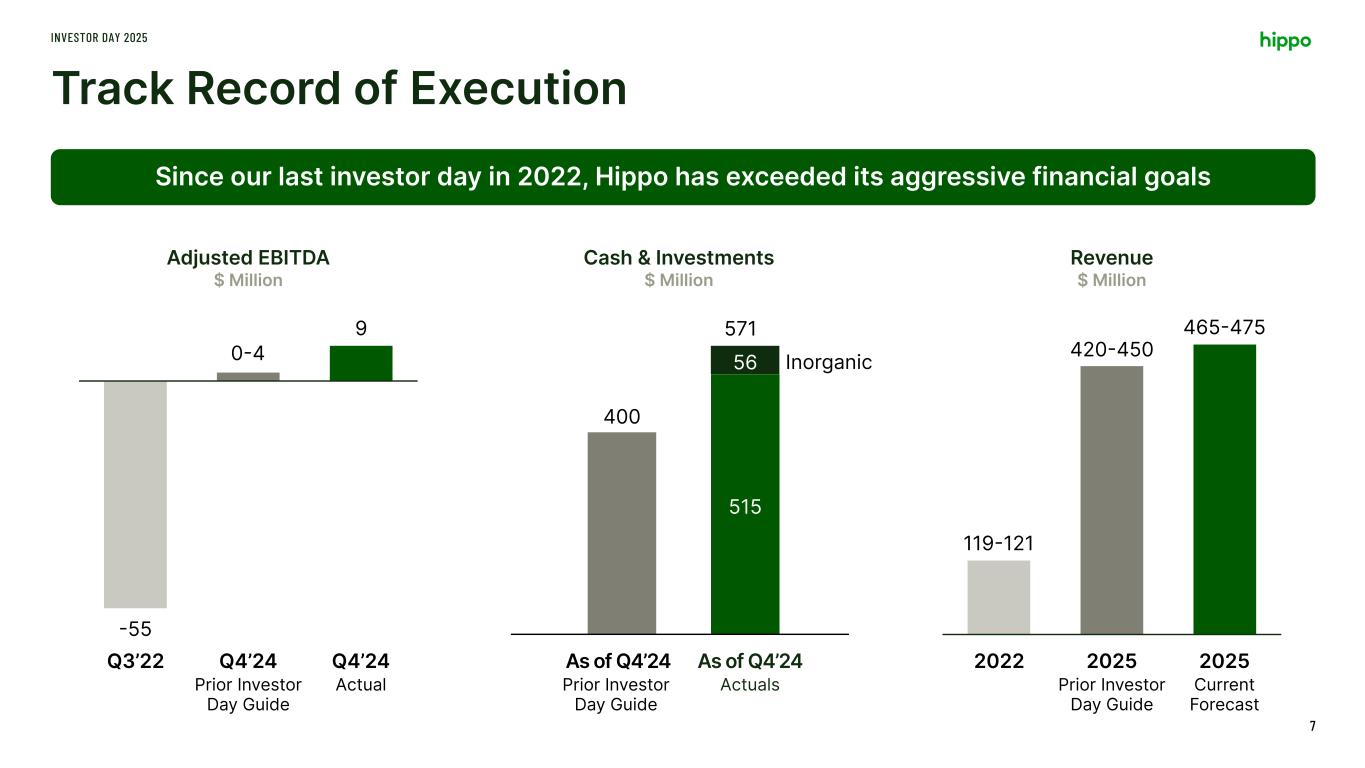

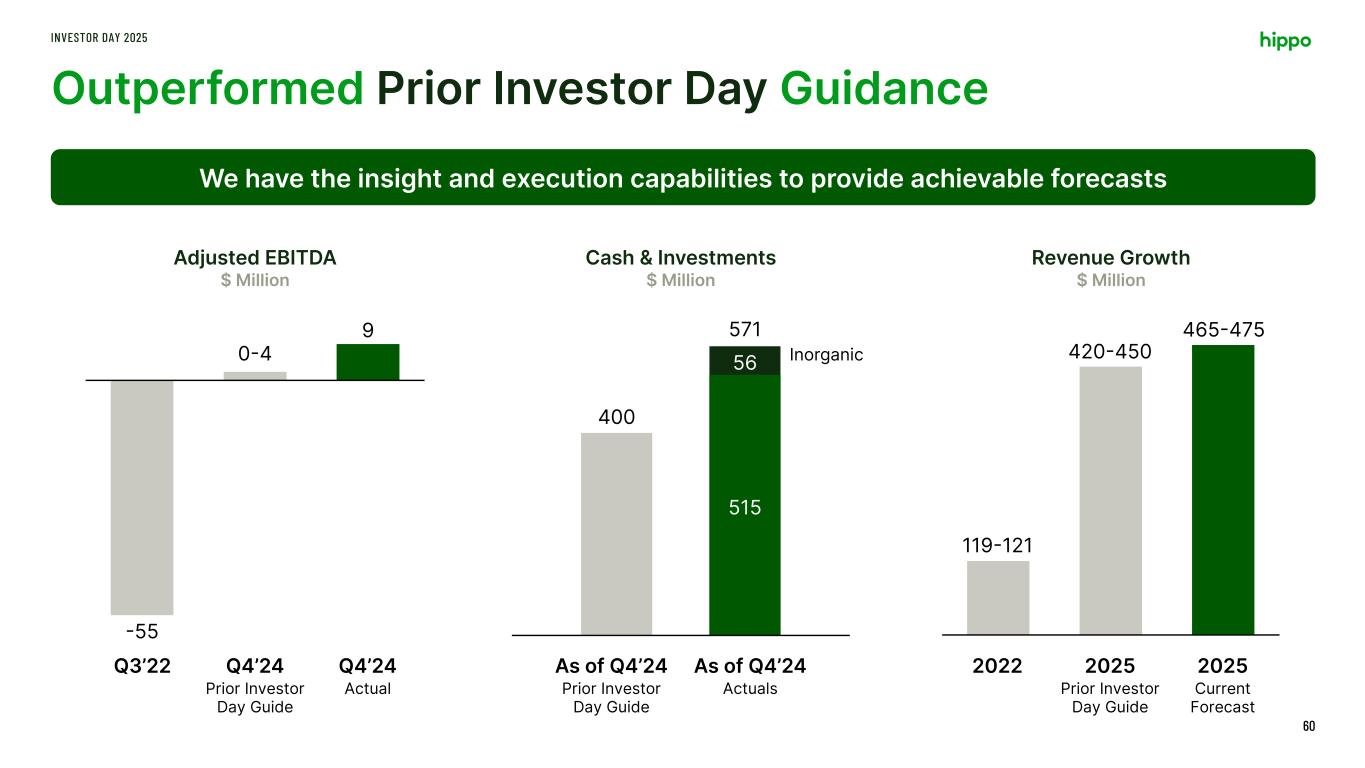

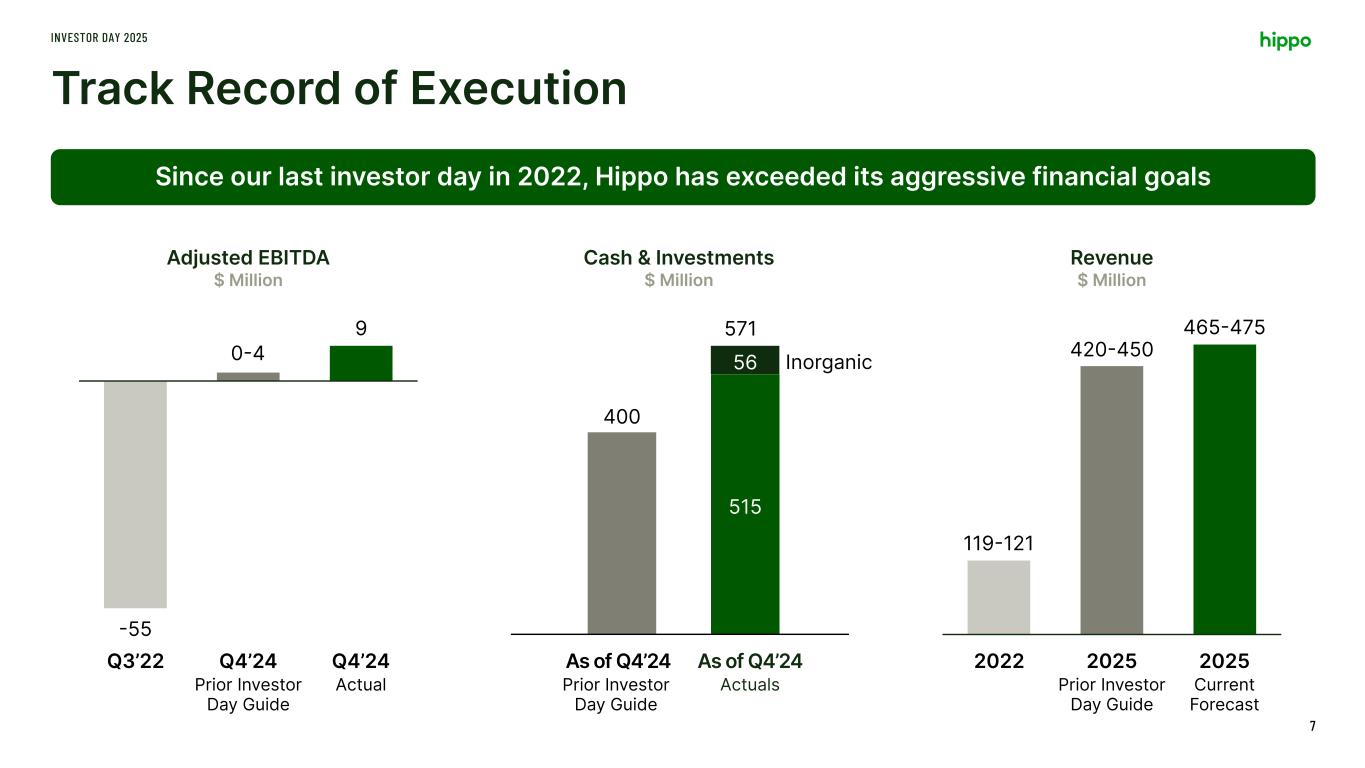

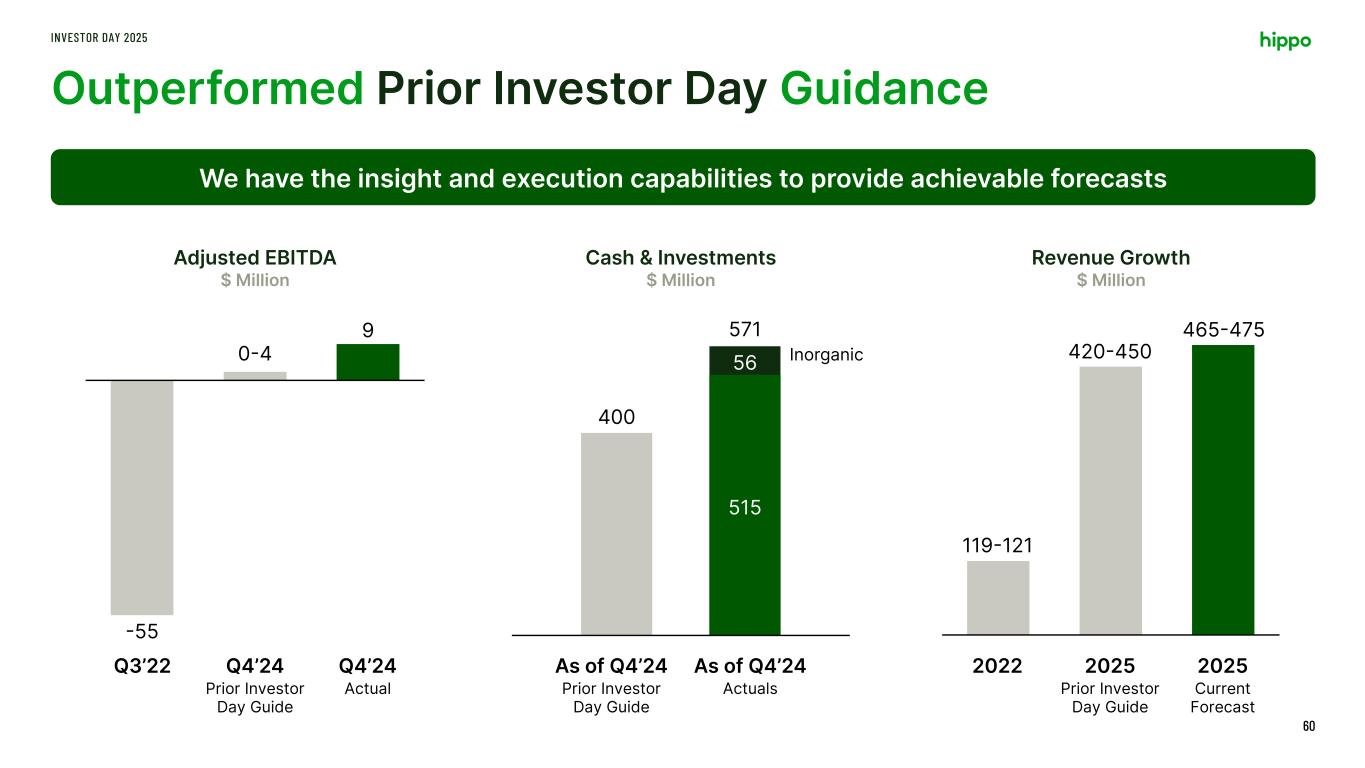

Track Record of Execution INVESTOR DAY 2025 7 Since our last investor day in 2022, Hippo has exceeded its aggressive financial goals 2022 2025 2025 Prior Investor Day Guide Current Forecast 119-121 420-450 465-475 Revenue $ Million -55 9 Q3’22 Q4’24 Q4’24 Prior Investor Day Guide Actual 0-4 Adjusted EBITDA $ Million 400 515 56 As of Q4’24 As of Q4’24 Prior Investor Day Guide Actuals Inorganic 571 Cash & Investments $ Million

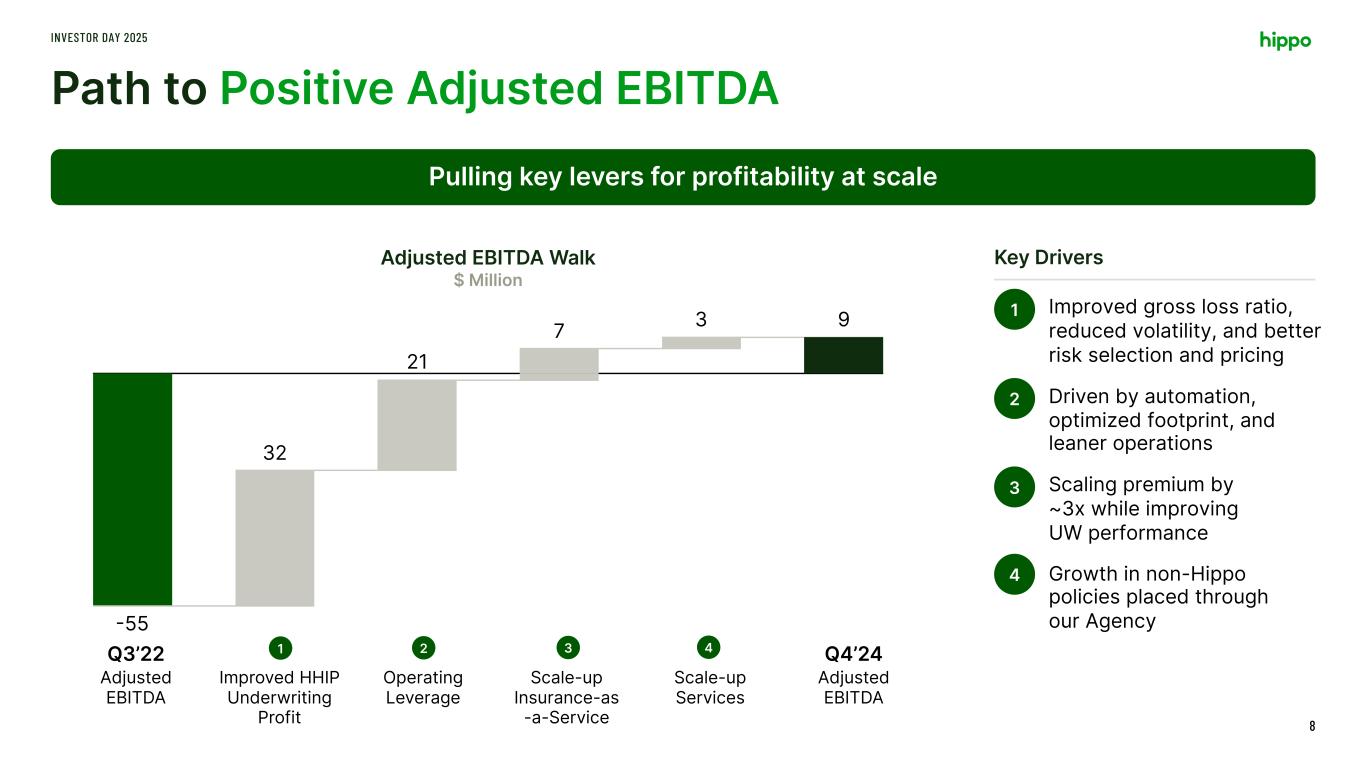

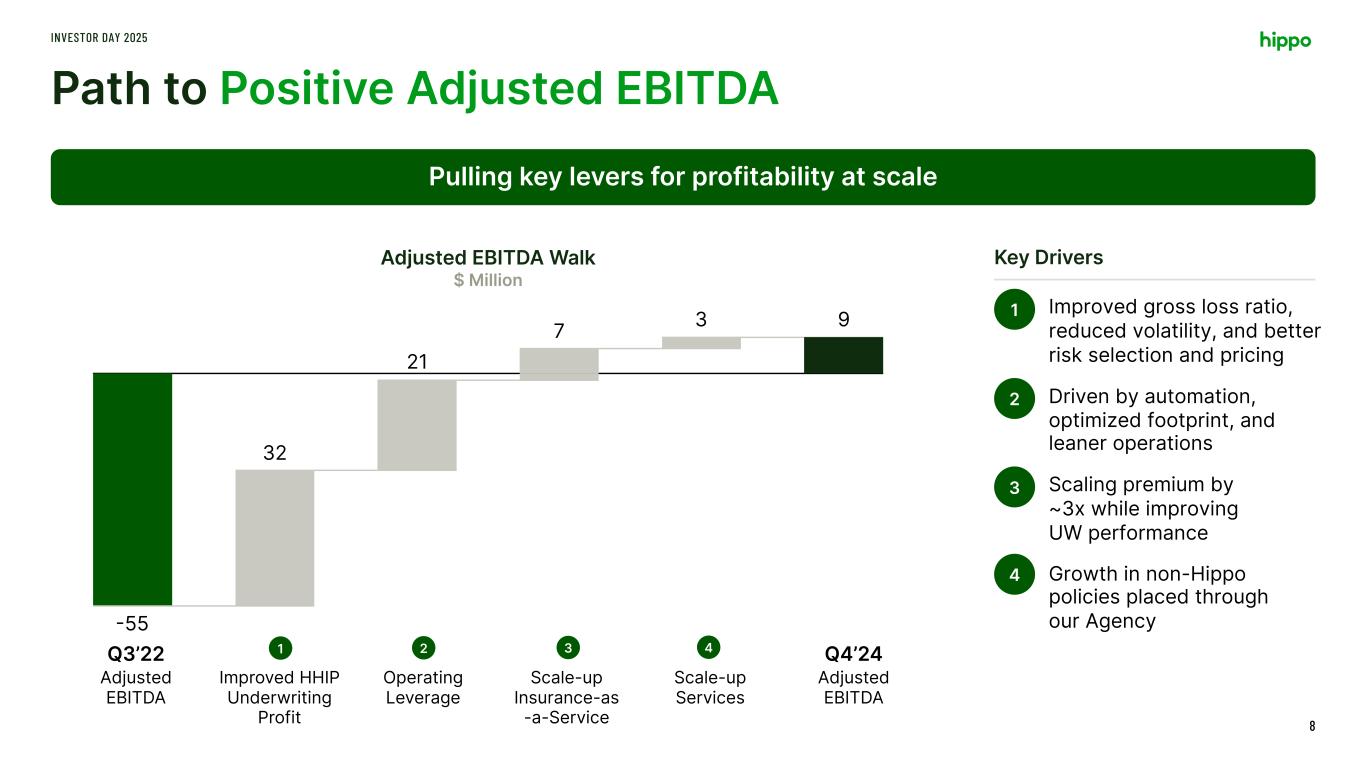

Path to Positive Adjusted EBITDA INVESTOR DAY 2025 8 Pulling key levers for profitability at scale Q3’22 Q4’24 Adjusted EBITDA Improved HHIP Underwriting Profit Operating Leverage Scale-up Insurance-as -a-Service Scale-up Services Adjusted EBITDA 32 21 7 -55 3 9 Improved gross loss ratio, reduced volatility, and better risk selection and pricing Driven by automation, optimized footprint, and leaner operations Scaling premium by ~3x while improving UW performance Growth in non-Hippo policies placed through our Agency Key Drivers 1 2 3 4 1 2 3 4 Adjusted EBITDA Walk $ Million

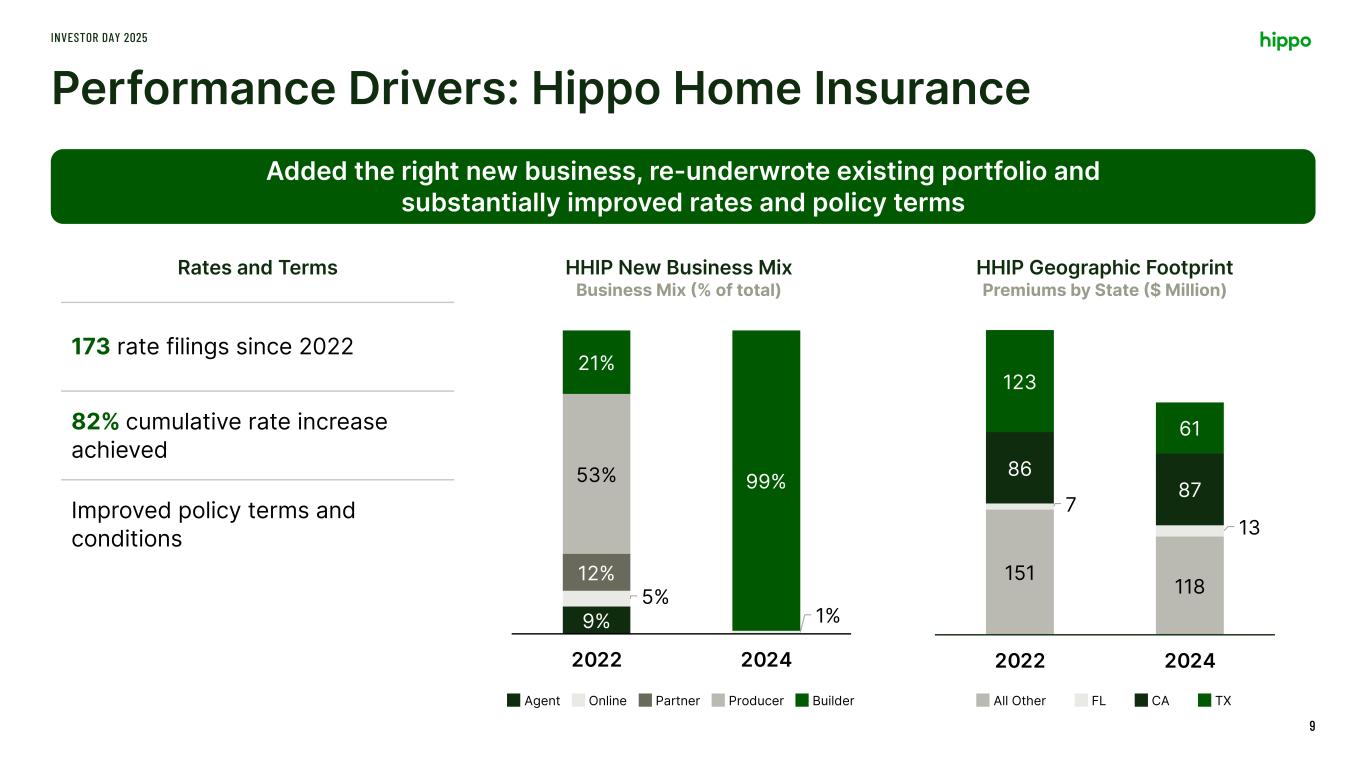

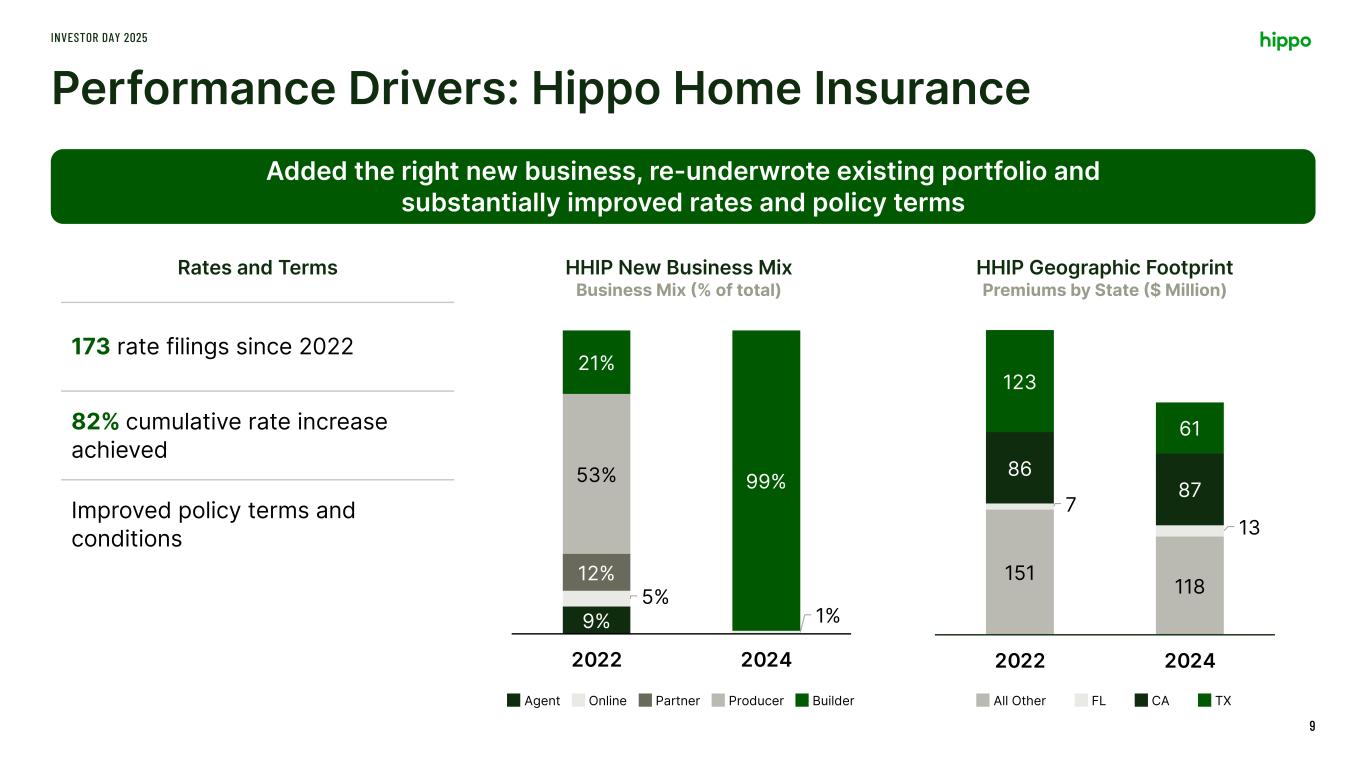

9% 5% 1% 12% 53% 21% 99% 2022 2024 Rates and Terms 173 rate filings since 2022 82% cumulative rate increase achieved Improved policy terms and conditions Performance Drivers: Hippo Home Insurance INVESTOR DAY 2025 9 Added the right new business, re-underwrote existing portfolio and substantially improved rates and policy terms 151 118 7 13 86 87 123 61 2022 2024 OnlineAgent Partner Producer Builder All Other FL CA TX HHIP New Business Mix Business Mix (% of total) HHIP Geographic Footprint Premiums by State ($ Million)

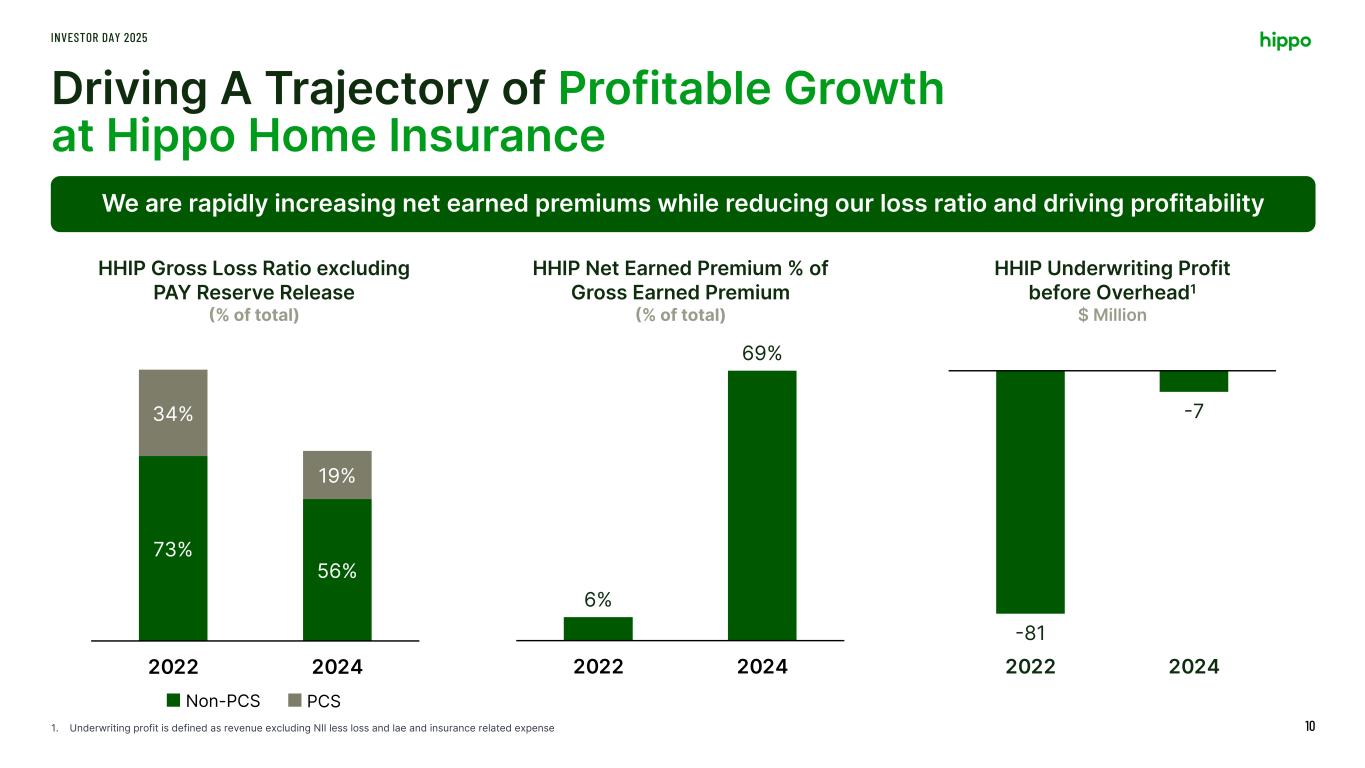

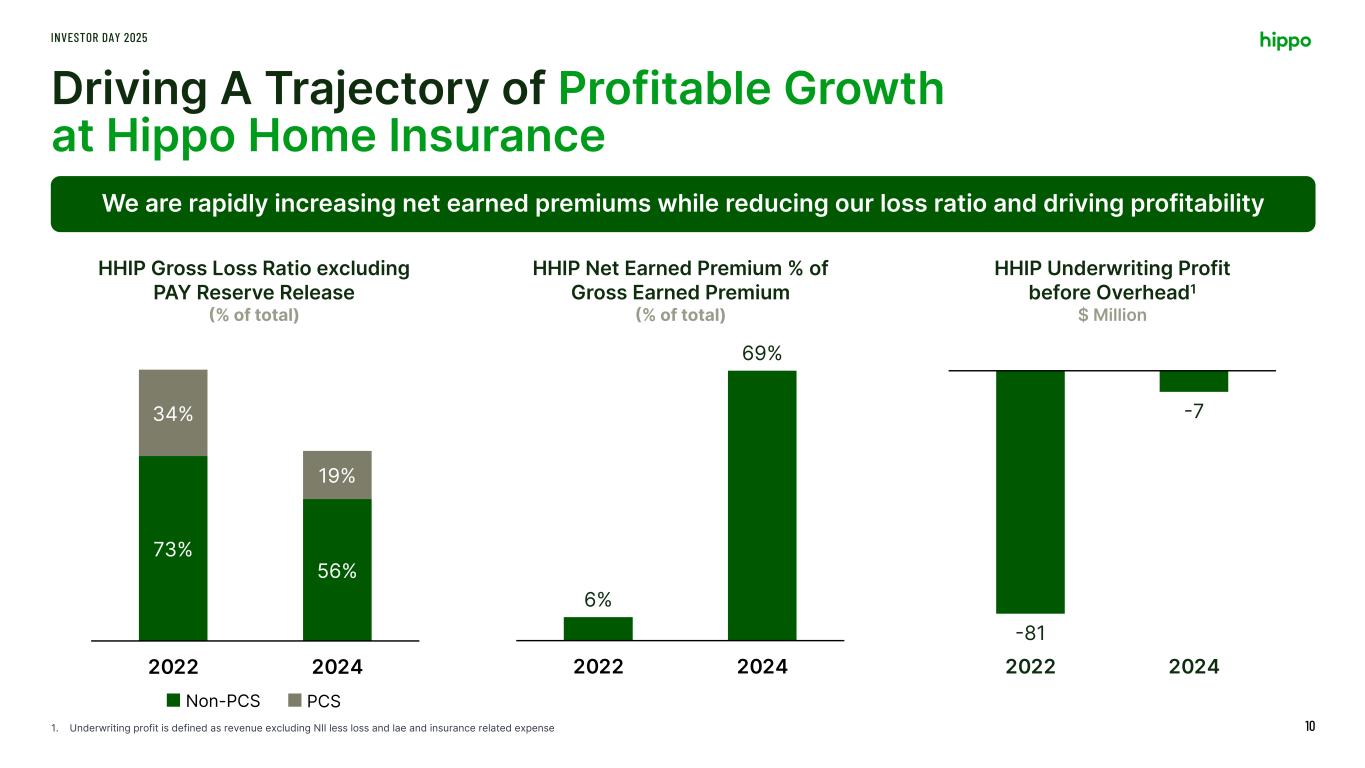

-81 -7 2022 2024 6% 69% 2022 2024 Driving A Trajectory of Profitable Growth at Hippo Home Insurance INVESTOR DAY 2025 10 We are rapidly increasing net earned premiums while reducing our loss ratio and driving profitability 73% 56% 34% 19% 2022 2024 HHIP Underwriting Profit before Overhead1 $ Million HHIP Gross Loss Ratio excluding PAY Reserve Release (% of total) HHIP Net Earned Premium % of Gross Earned Premium (% of total) Non-PCS PCS 1. Underwriting profit is defined as revenue excluding NII less loss and lae and insurance related expense

INVESTOR DAY 2025 We haven’t just been focusing on Hippo Homeowners… We’ve been building a differentiated franchise in Hybrid Fronting. 11

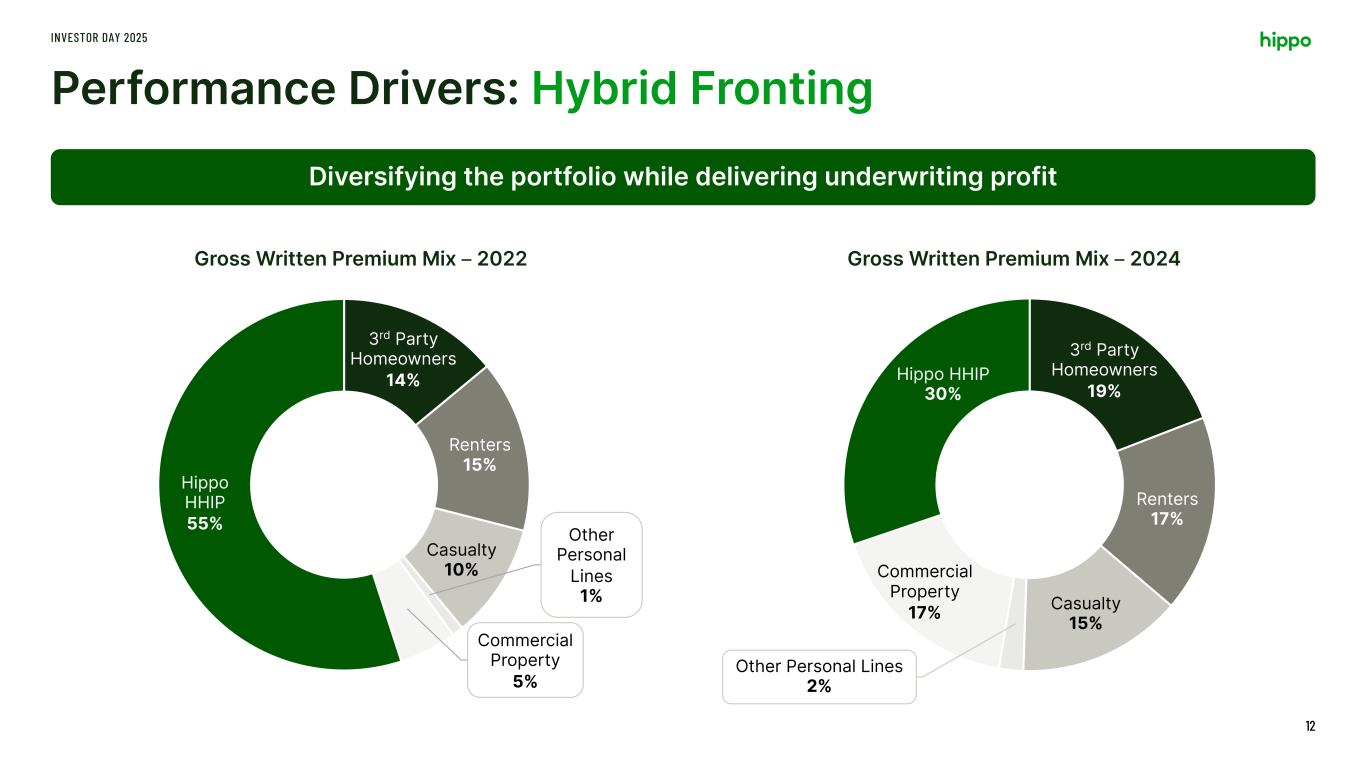

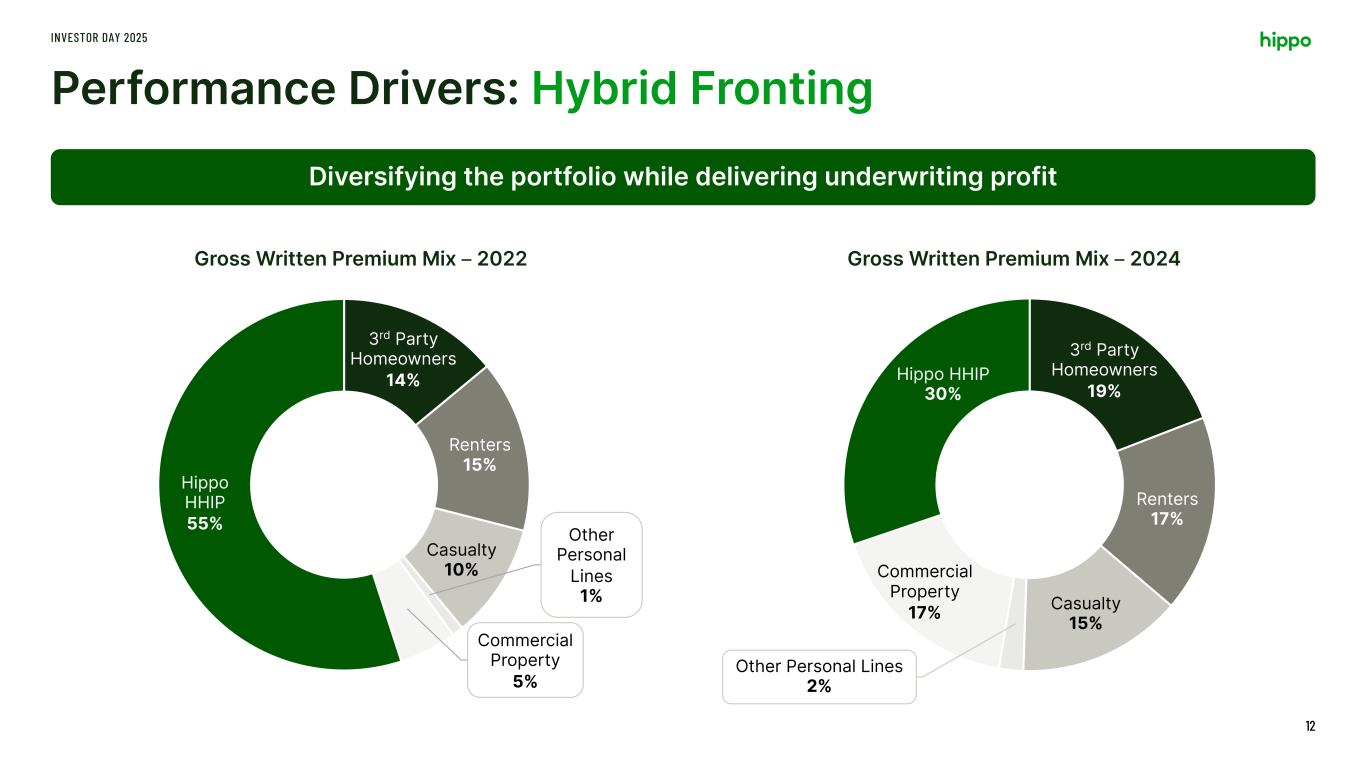

Performance Drivers: Hybrid Fronting INVESTOR DAY 2025 12 Diversifying the portfolio while delivering underwriting profit 3rd Party Homeowners 19% Renters 17% Casualty 15% Other Personal Lines 2% Commercial Property 17% Hippo HHIP 30% Gross Written Premium Mix – 2022 Gross Written Premium Mix – 2024 3rd Party Homeowners 14% Renters 15% Casualty 10% Other Personal Lines 1% Commercial Property 5% Hippo HHIP 55%

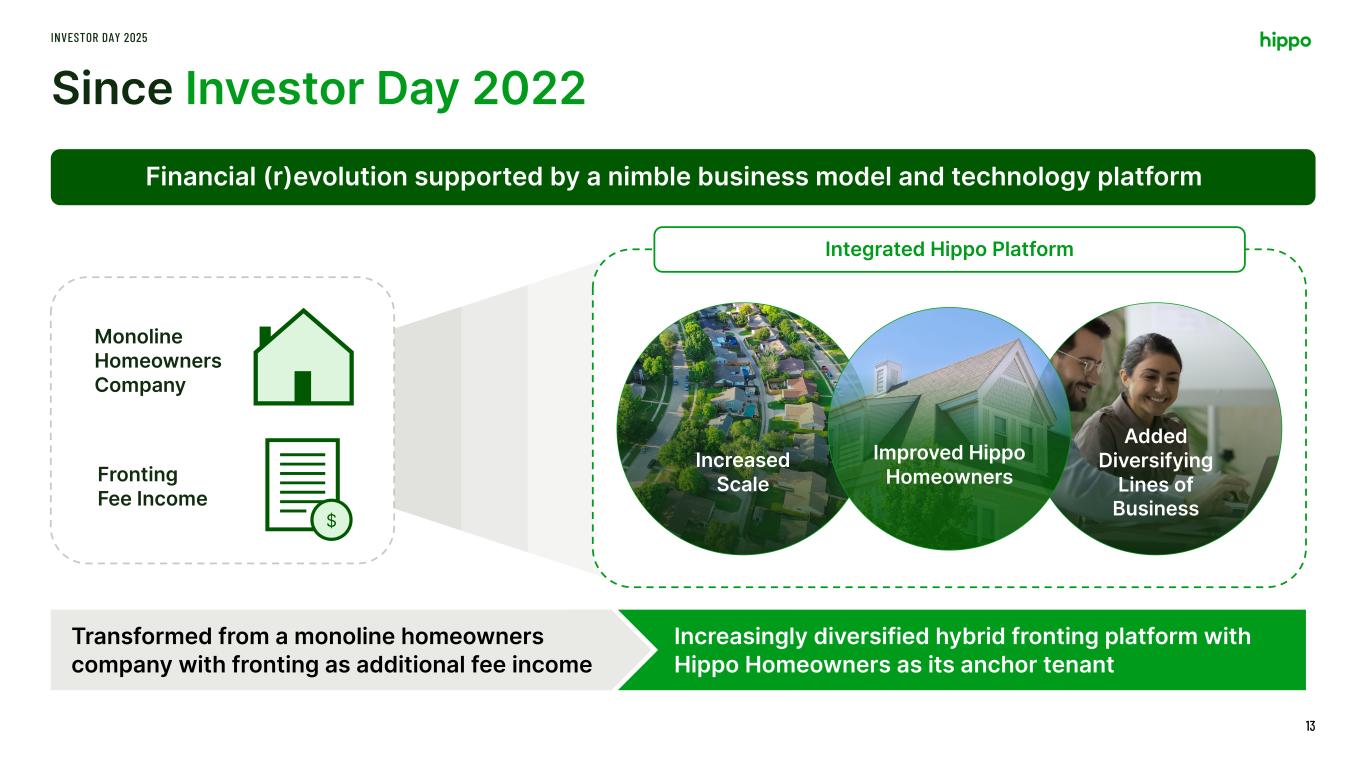

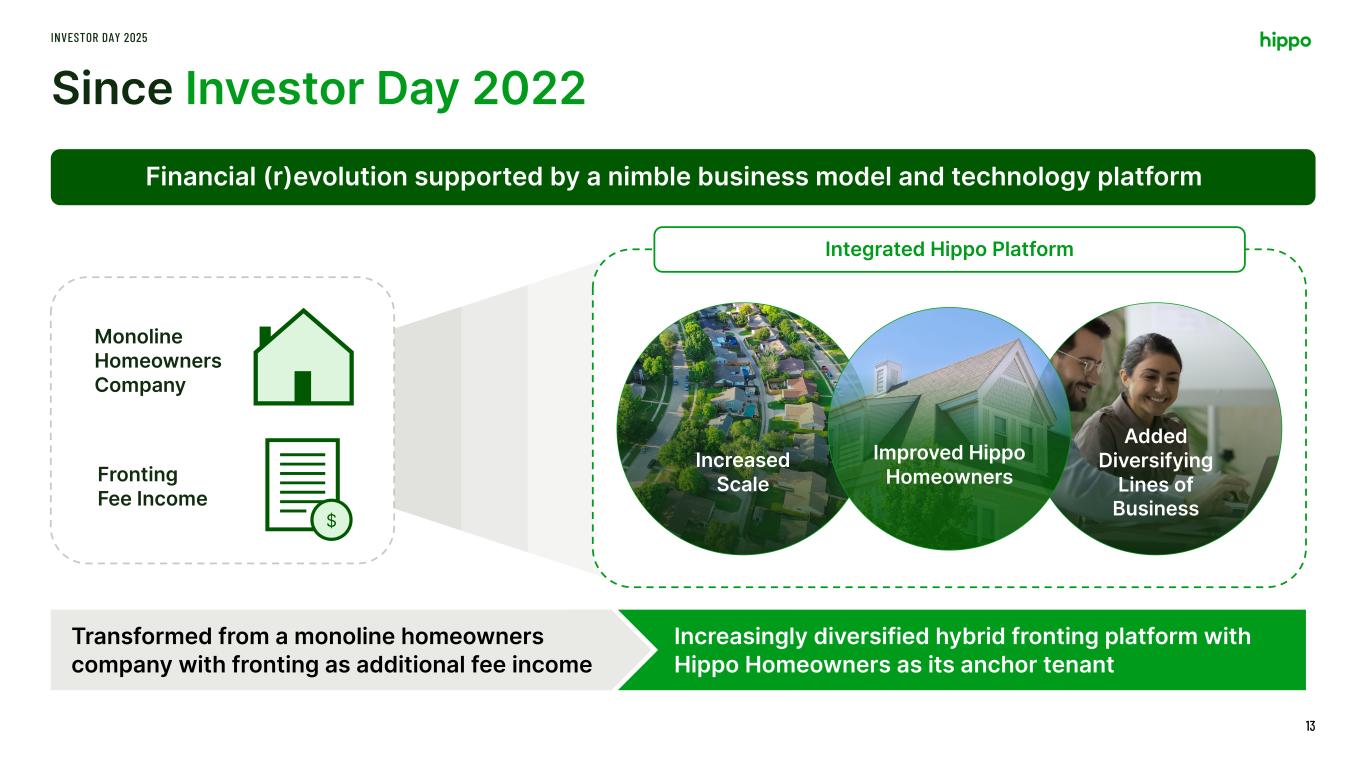

Since Investor Day 2022 INVESTOR DAY 2025 13 Financial (r)evolution supported by a nimble business model and technology platform Monoline Homeowners Company Fronting Fee Income Integrated Hippo Platform Increasingly diversified hybrid fronting platform with Hippo Homeowners as its anchor tenant Transformed from a monoline homeowners company with fronting as additional fee income $ Increased Scale Added Diversifying Lines of Business Improved Hippo Homeowners

Rick McCathron President & Chief Executive Officer

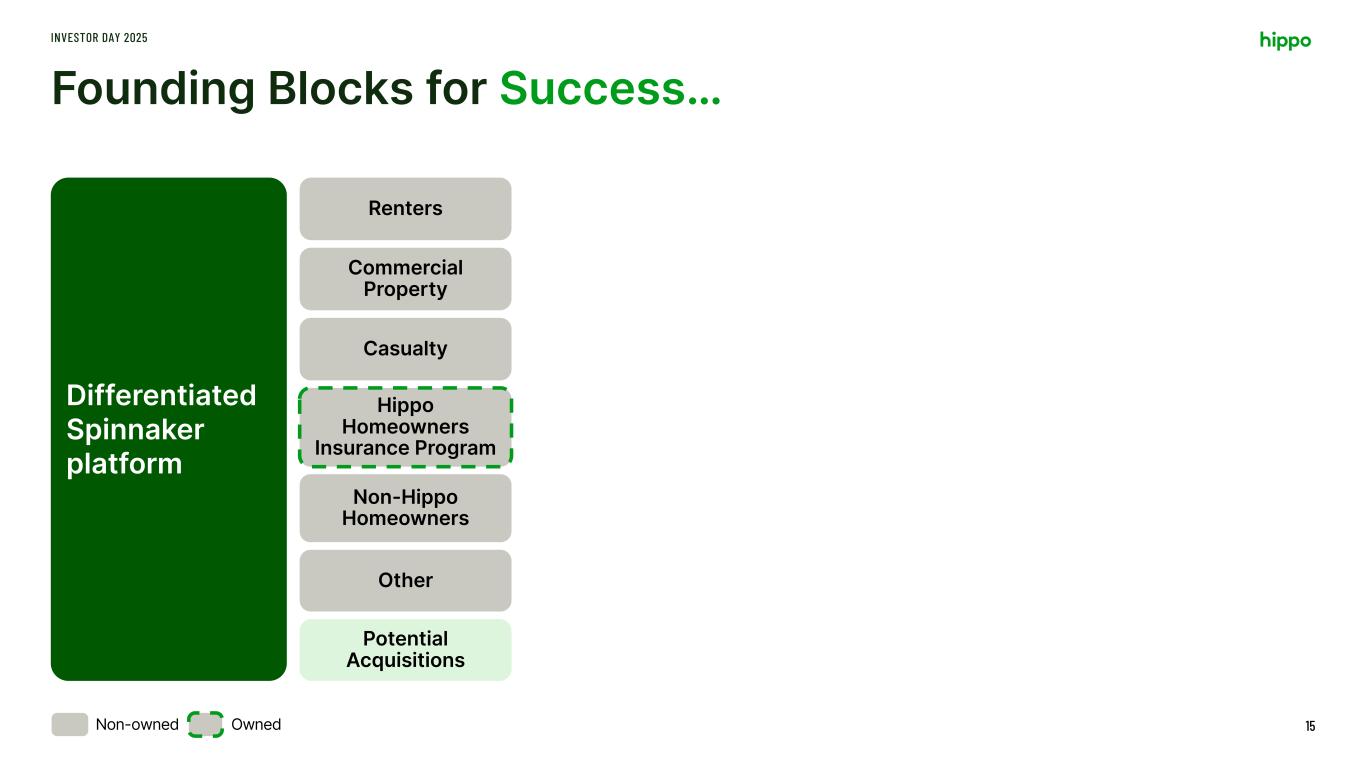

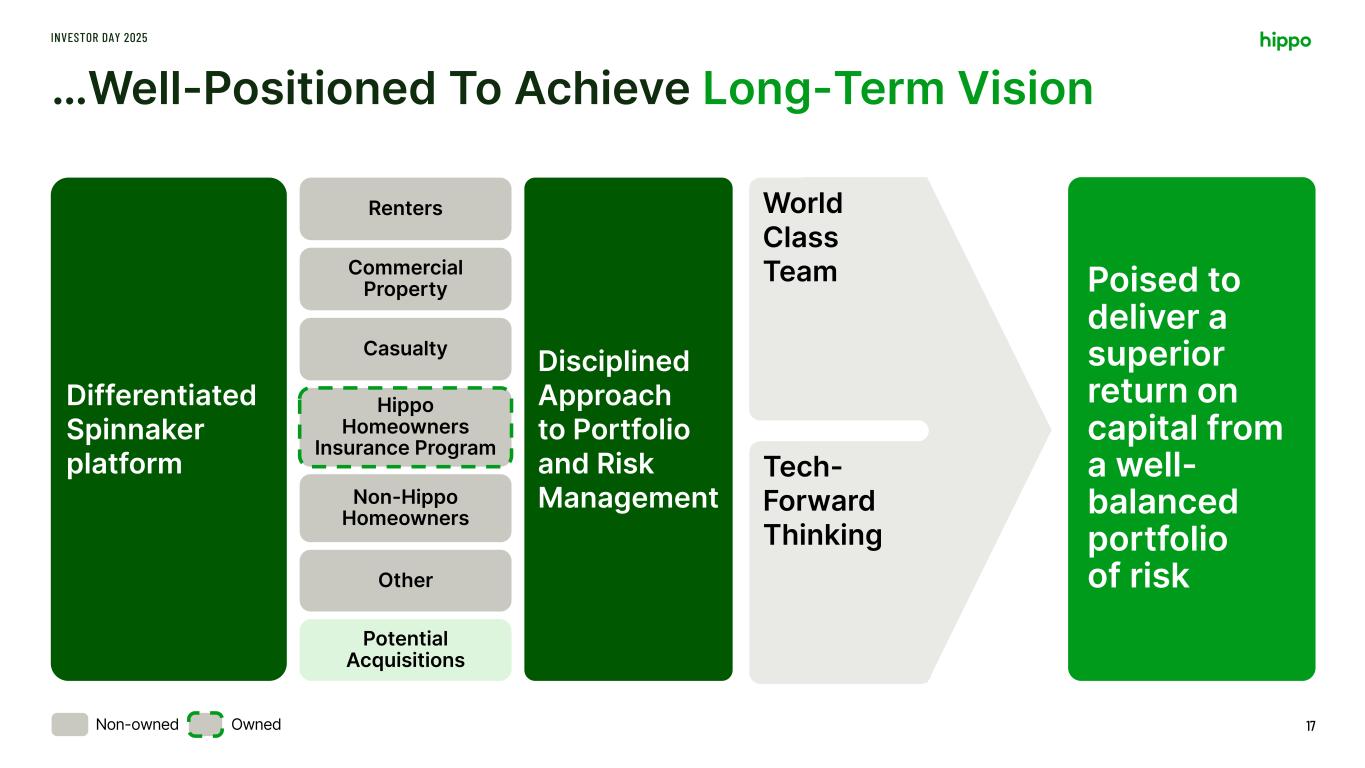

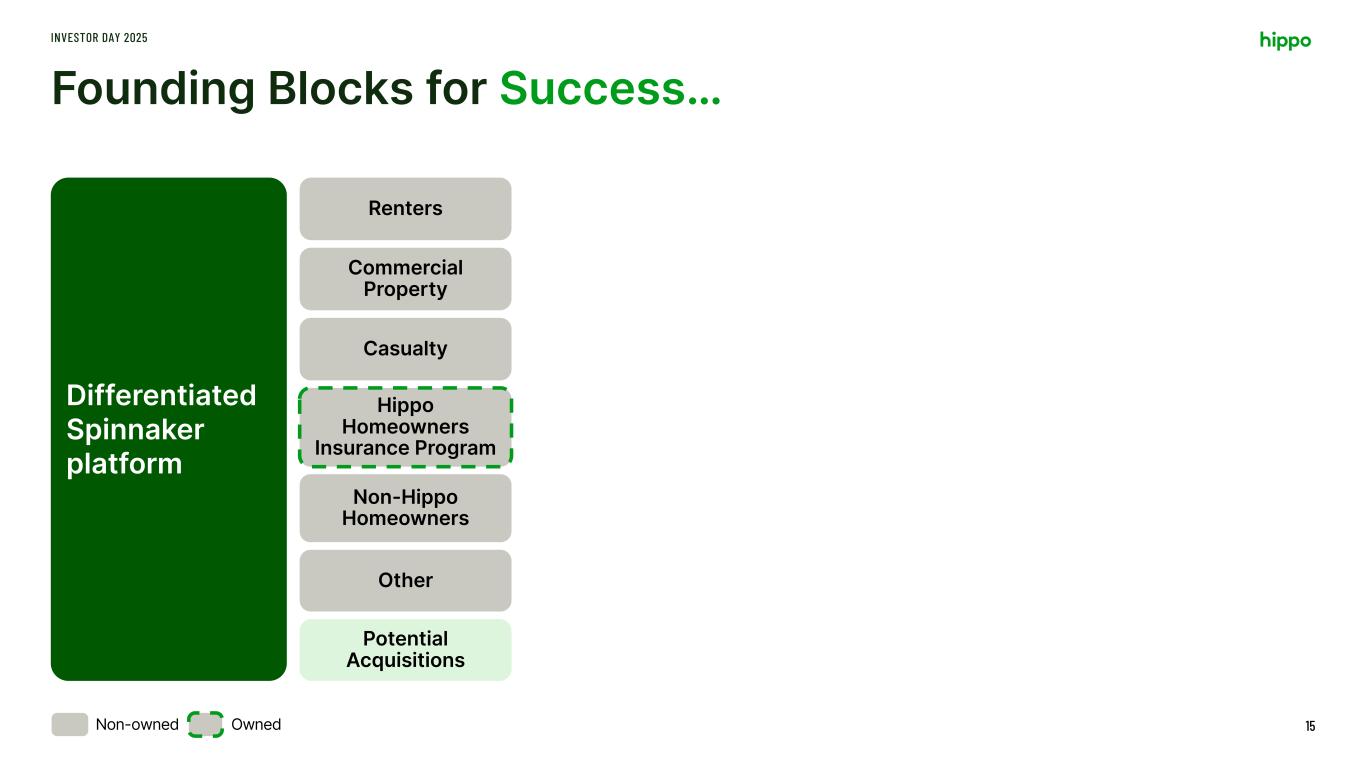

Founding Blocks for Success… INVESTOR DAY 2025 15 Differentiated Spinnaker platform Hippo Homeowners Insurance Program Renters Commercial Property Casualty Non-Hippo Homeowners Other Potential Acquisitions OwnedNon-owned

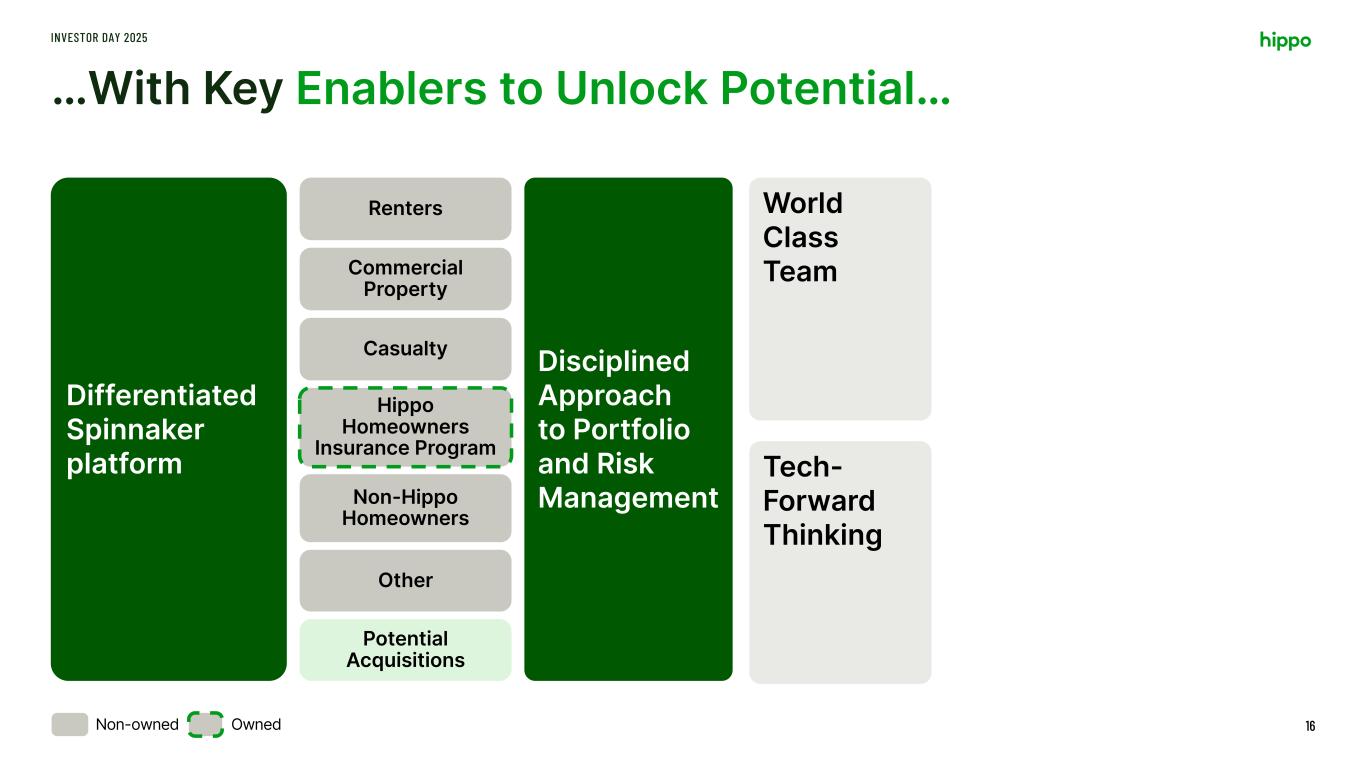

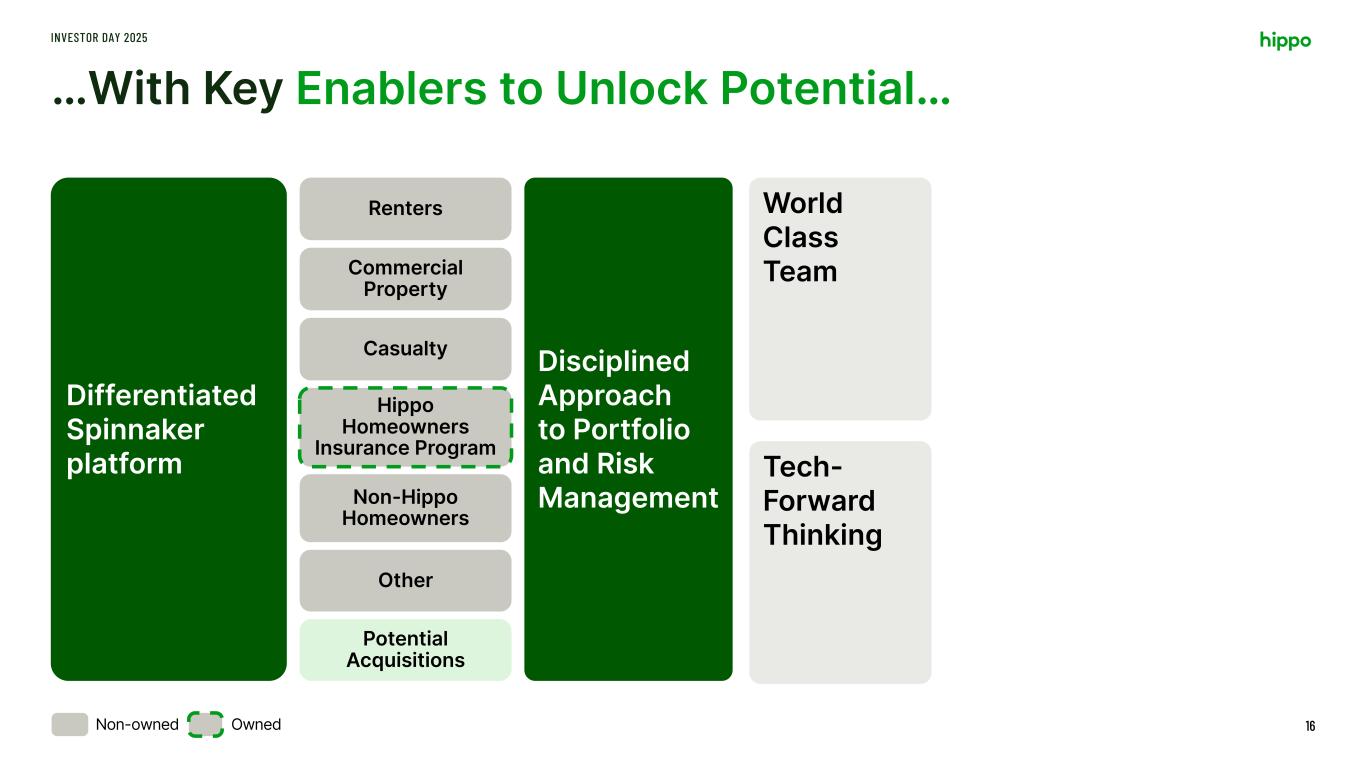

…With Key Enablers to Unlock Potential… INVESTOR DAY 2025 16 Differentiated Spinnaker platform Disciplined Approach to Portfolio and Risk Management Hippo Homeowners Insurance Program Renters Commercial Property Casualty Non-Hippo Homeowners Other Potential Acquisitions World Class Team Tech- Forward Thinking OwnedNon-owned

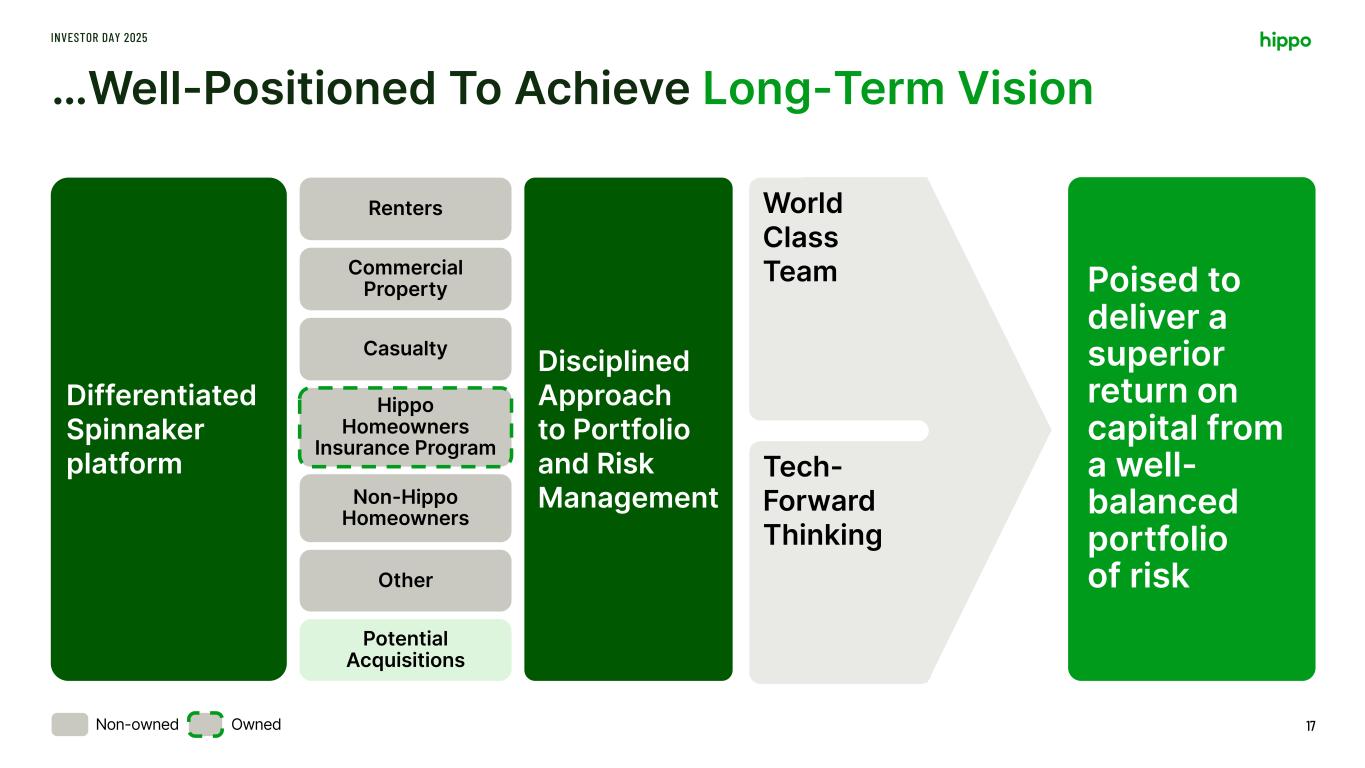

…Well-Positioned To Achieve Long-Term Vision INVESTOR DAY 2025 17OwnedNon-owned Differentiated Spinnaker platform Disciplined Approach to Portfolio and Risk Management Hippo Homeowners Insurance Program Renters Commercial Property Casualty Non-Hippo Homeowners Other Potential Acquisitions World Class Team Tech- Forward Thinking Poised to deliver a superior return on capital from a well- balanced portfolio of risk

Proven Team of Industry-Leading Talent INVESTOR DAY 2025 18 Today’s Speakers Years of Relevant Experience Rick McCathron President & Chief Executive Officer 32+ MERCURY INSURANCE, SUPERIOR ACCESS, FIRST CONNECT Stewart Ellis Chief Strategy Officer 25+ DLJ, EBAY Michael Stienstra GM & Chief Insurance Officer, HHIP 19+ CHUBB, QBE Torben Ostergaard President & CEO, Spinnaker 25+ USAA, HSBC Andrea Collins Chief Marketing Officer 20+ POLICYGENIUS, COWBELL Jesse Willmott CFO & COO, Spinnaker 20+ AON, PWC Richard Primerano Chief Reinsurance Officer 39+ RENAISSANCERE, SWISS RE, DELOITTE & TOUCHE, TRENWICK Re 23+ Jo Overline Chief Technology Officer SWINGDEV Paul Wigham Chief Risk Officer 35+ AIG, OSCAR Sara Garvey General Counsel 25+ CHUBB, AEGIS Guy Zeltser Chief Financial Officer 19+ MCKINSEY & COMPANY Laura Boettcher Chief Operations Officer 18+ Guy Carpenter, CompWest Insurance Kyle Ramsay Chief Product Officer 13+ NERDWALLET, LINKEDIN William Malone Vice President, Agency 16+ Chubb, The Hartford, Liberty Mutual Insurance Daniel Blanaru Chief Growth Officer 20+ LinkedIn, The Boston Consulting Group Tracy Letzerich Senior Vice President, Head of People 20+ Wheel, Deloitte

Technology-Forward Approach INVESTOR DAY 2025 19 Leveraging technology to improve the customer experience across Portfolio Management Driving portfolio management underwriting Operational Efficiencies Delivering seamless, integrated experience Differentiation at Scale Scaling the hybrid fronting platform in a differentiated way

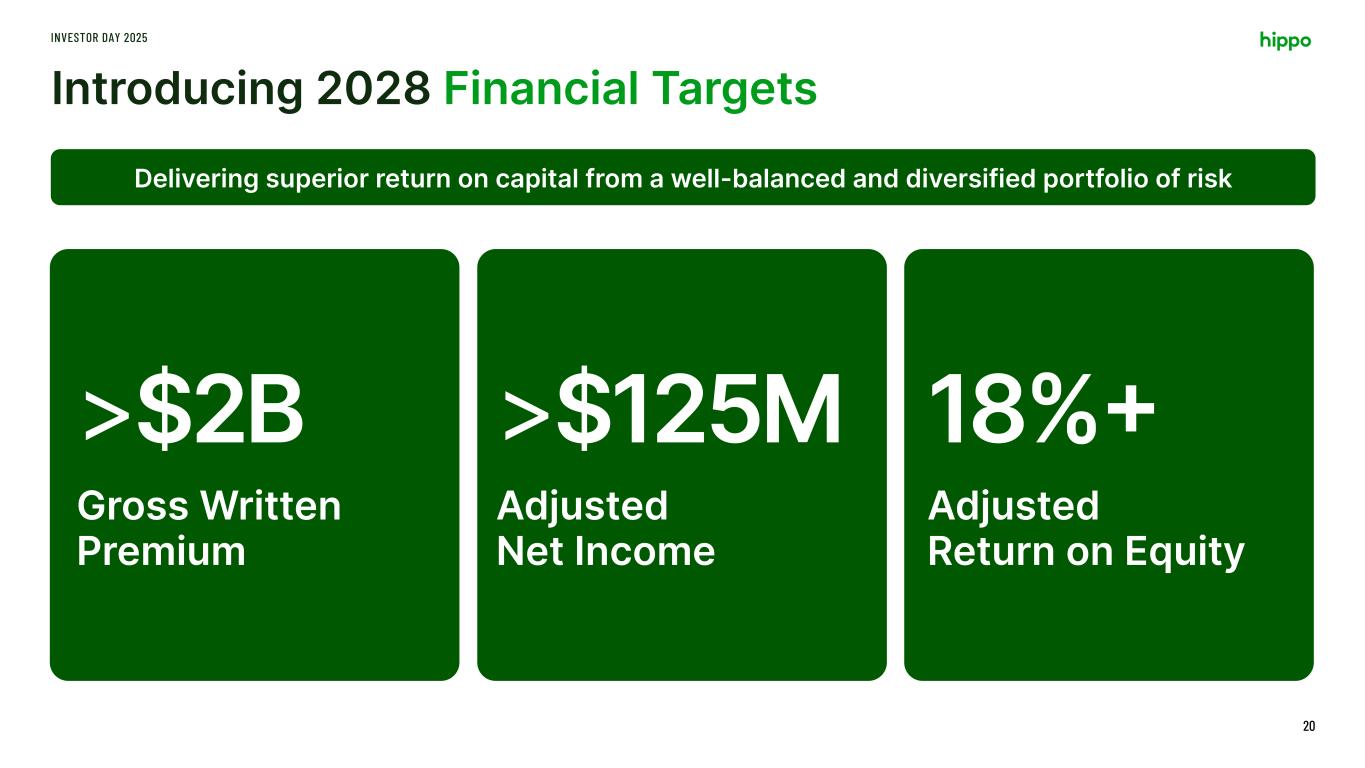

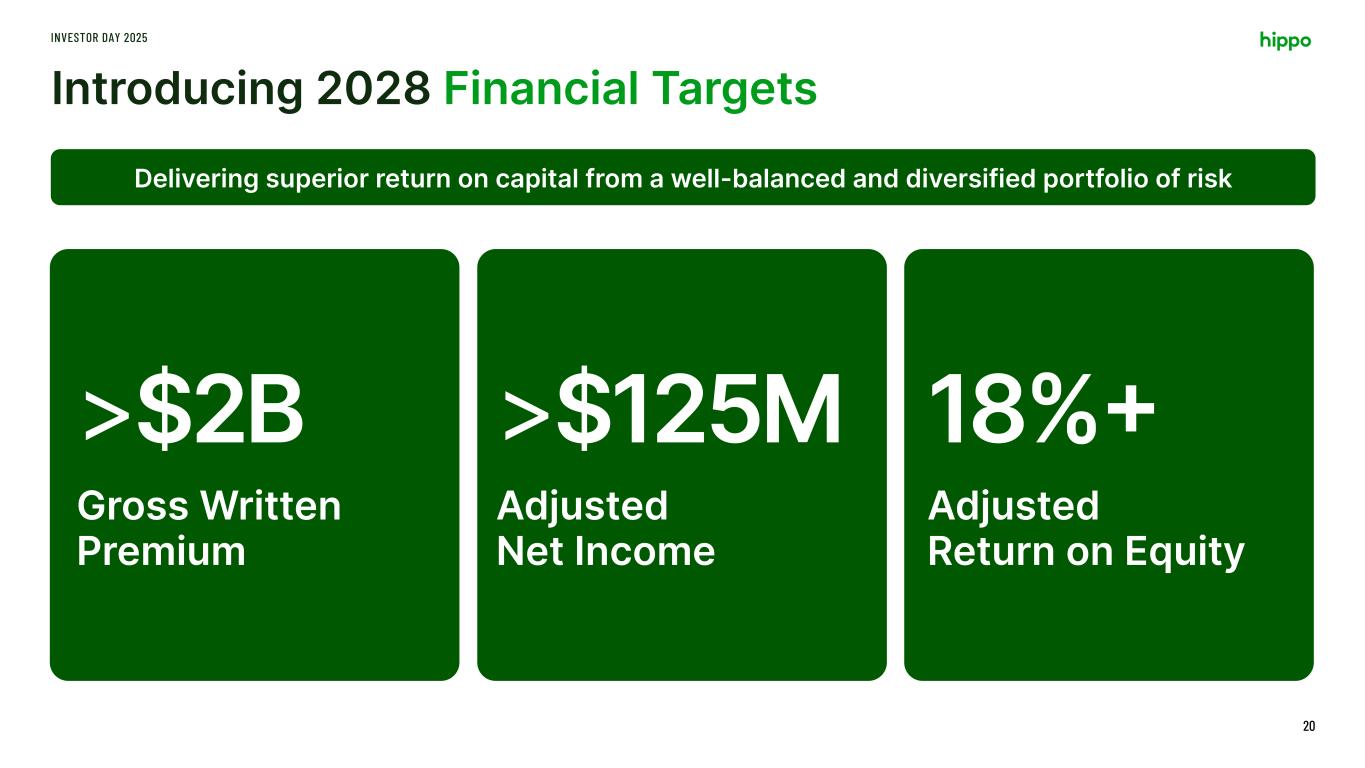

Introducing 2028 Financial Targets INVESTOR DAY 2025 20 Delivering superior return on capital from a well-balanced and diversified portfolio of risk Gross Written Premium Adjusted Net Income Adjusted Return on Equity >$2B >$125M 18%+

New Strategic Partner: The Baldwin Group INVESTOR DAY 2025 21 Launching a strategic partnership to accelerate the achievement of our long-term vision Hybrid Fronting Significant expansion of Spinnaker’s decade-long support of Baldwin MGAs to provide additional, diversifying premium for our portfolio of risk HHIP New Homes Access to the combined Westwood / Hippo builder distribution network will increase annual new construction leads by >3X Builder Distribution Baldwin to purchase Hippo’s builder distribution network for $100 million Allows Hippo to increase focus on underwriting, risk selection, and portfolio management while providing significant incremental capital to support our growth

INVESTOR DAY 2025 Fireside Chat 22

INVESTOR DAY 2025 Break 23

Torben Ostergaard President & CEO, Spinnaker

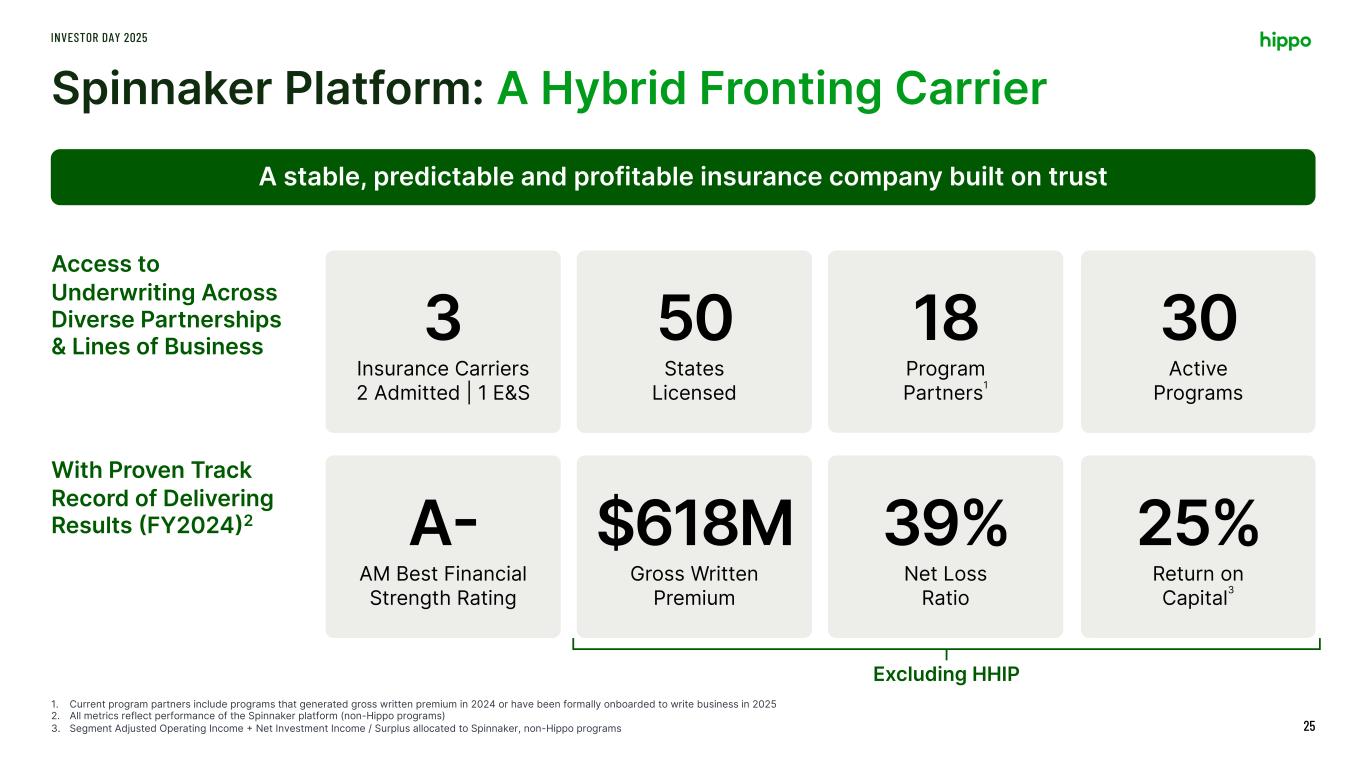

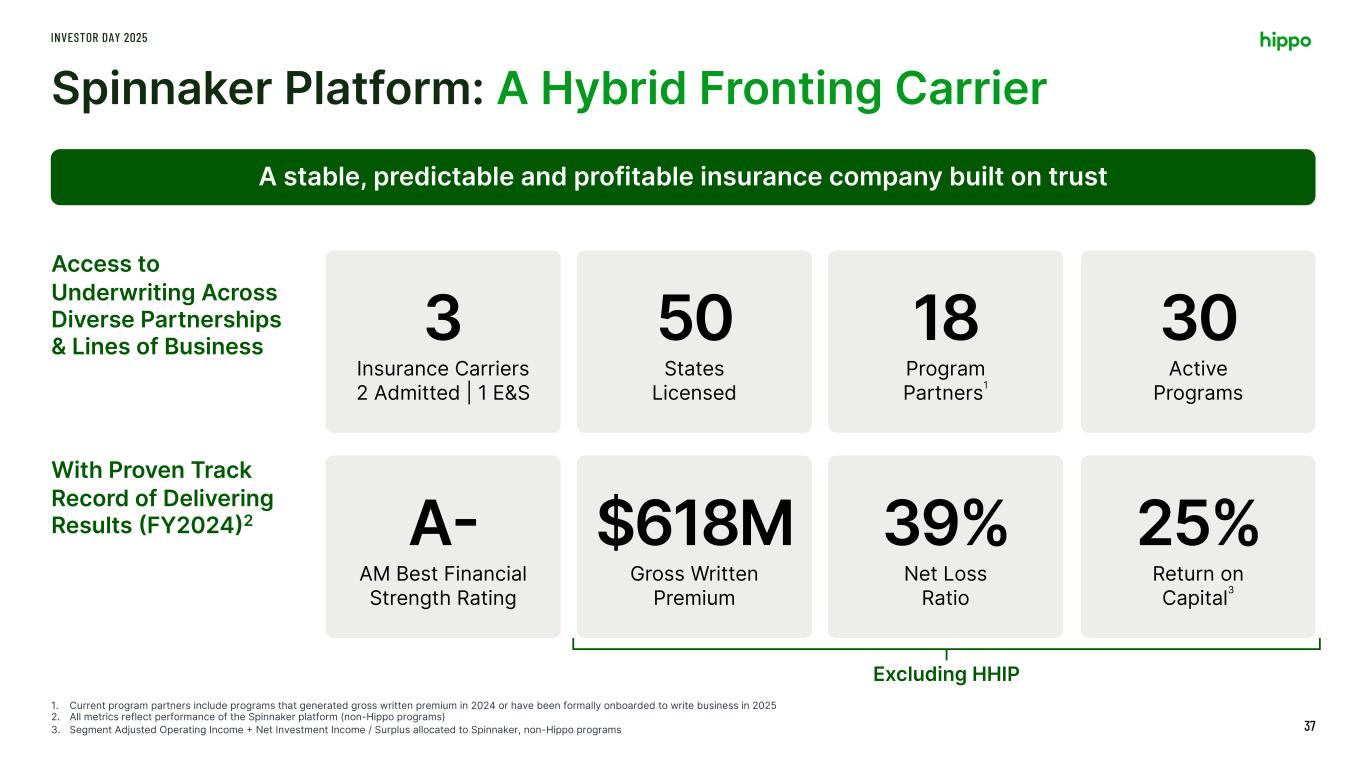

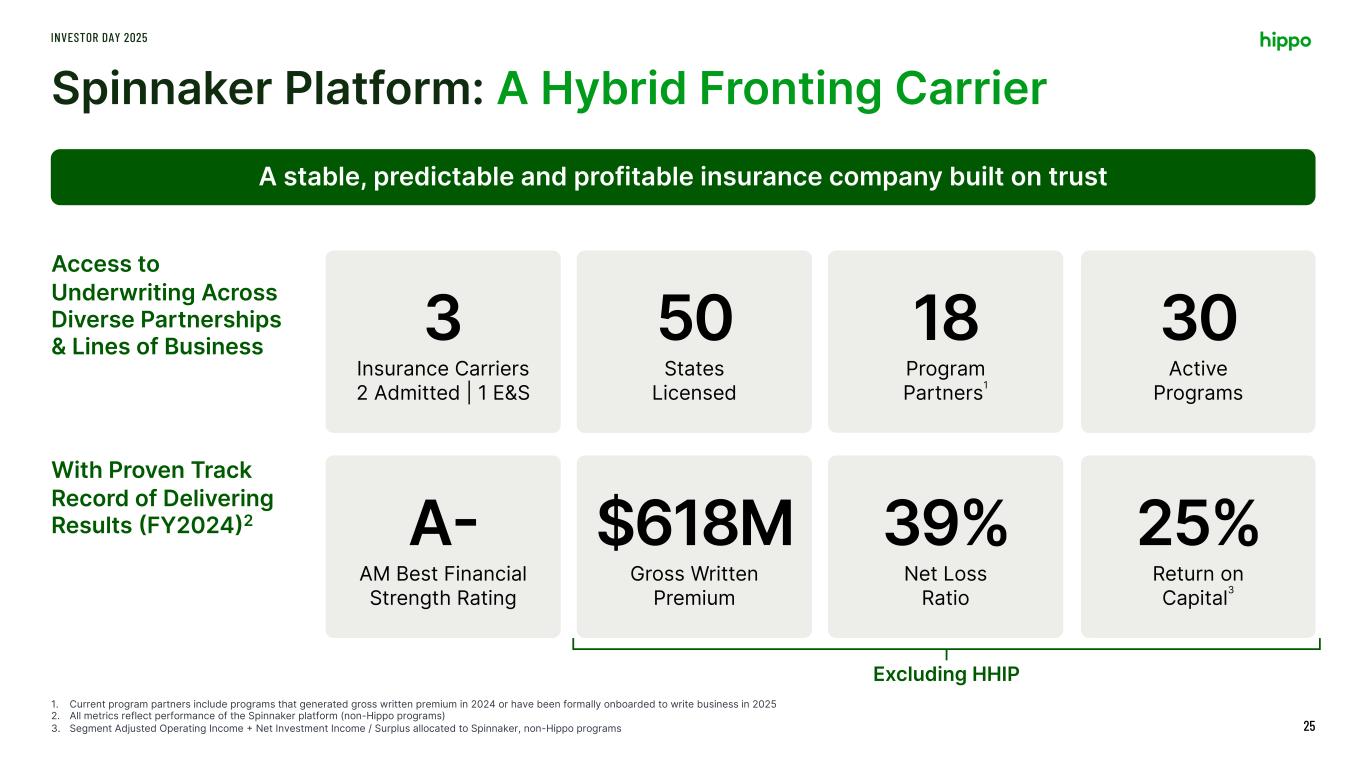

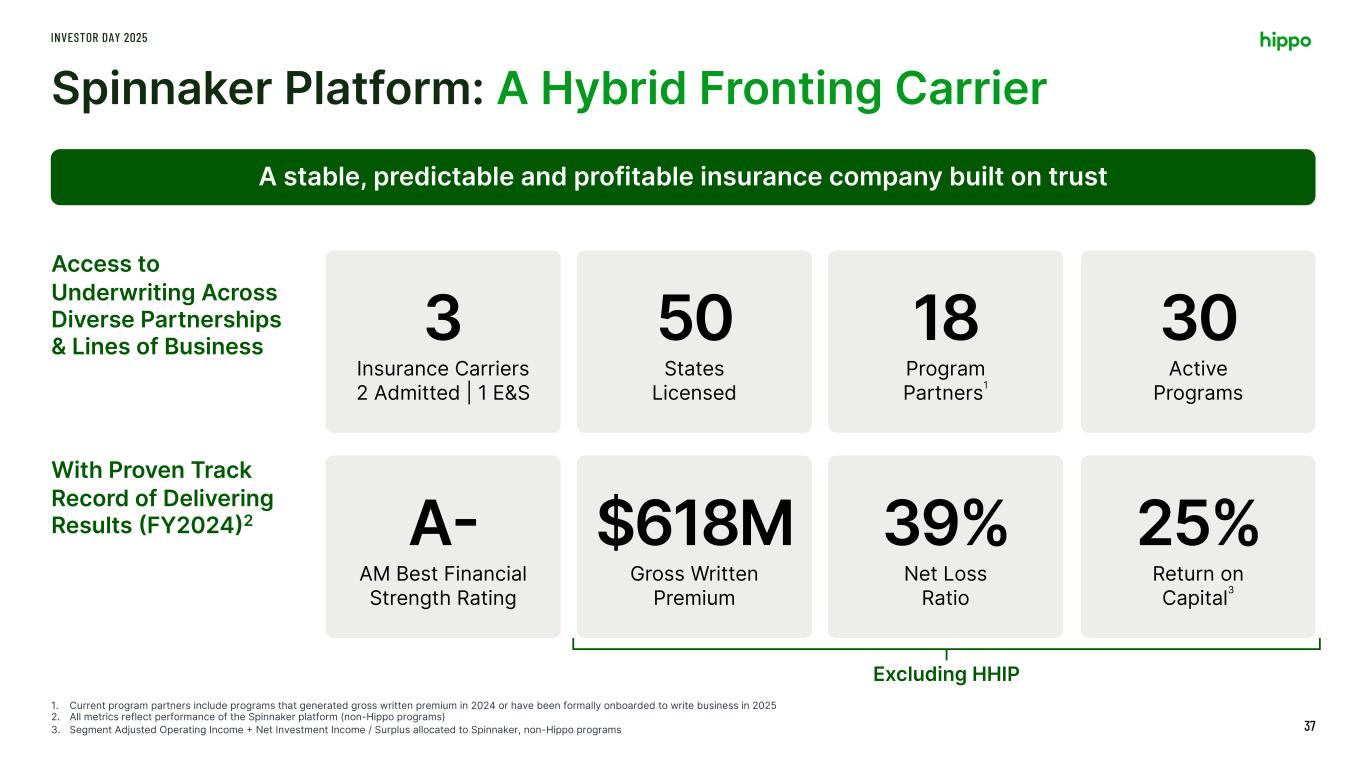

Spinnaker Platform: A Hybrid Fronting Carrier Access to Underwriting Across Diverse Partnerships & Lines of Business INVESTOR DAY 2025 25 A stable, predictable and profitable insurance company built on trust 3 Insurance Carriers 2 Admitted | 1 E&S 50 States Licensed 30 Active Programs A- AM Best Financial Strength Rating $618M Gross Written Premium 39% Net Loss Ratio With Proven Track Record of Delivering Results (FY2024)2 Excluding HHIP 1. Current program partners include programs that generated gross written premium in 2024 or have been formally onboarded to write business in 2025 2. All metrics reflect performance of the Spinnaker platform (non-Hippo programs) 3. Segment Adjusted Operating Income + Net Investment Income / Surplus allocated to Spinnaker, non-Hippo programs 18 Program Partners1 25% Return on Capital3

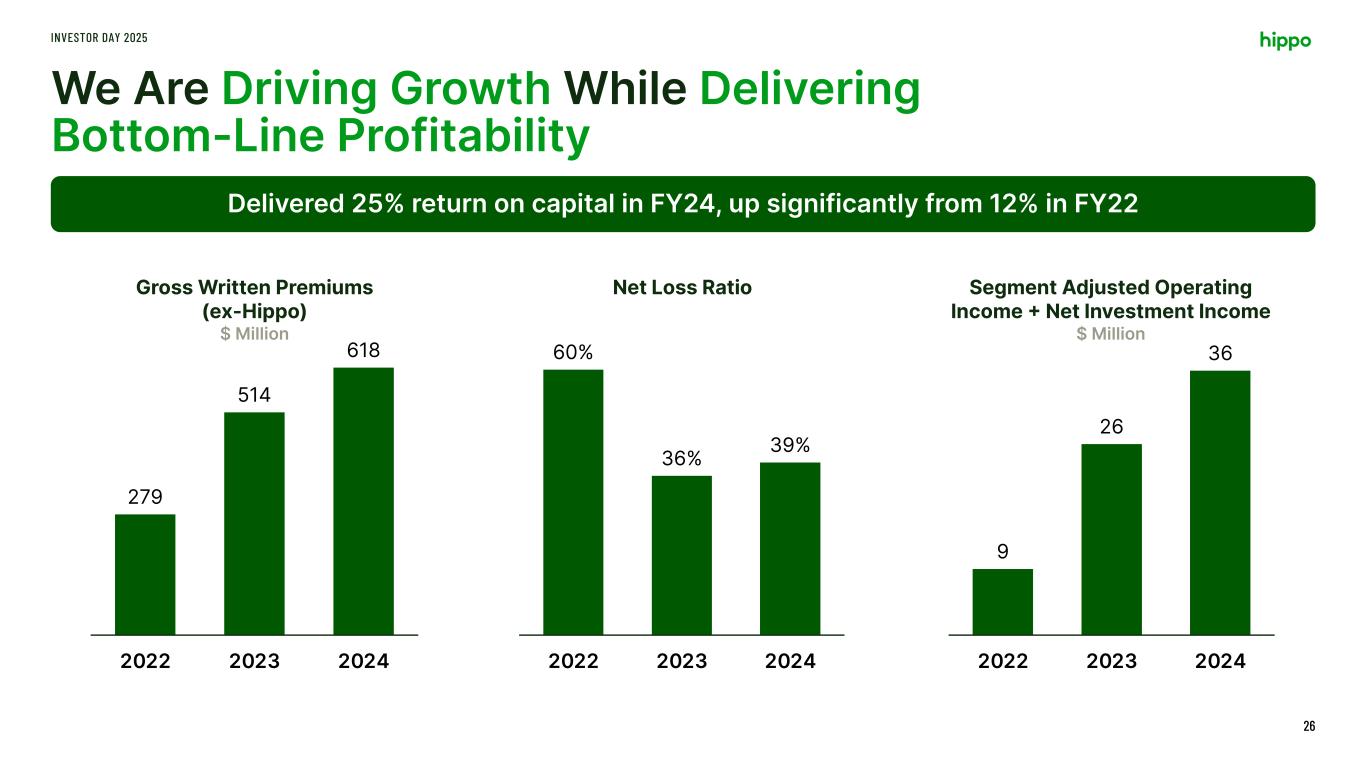

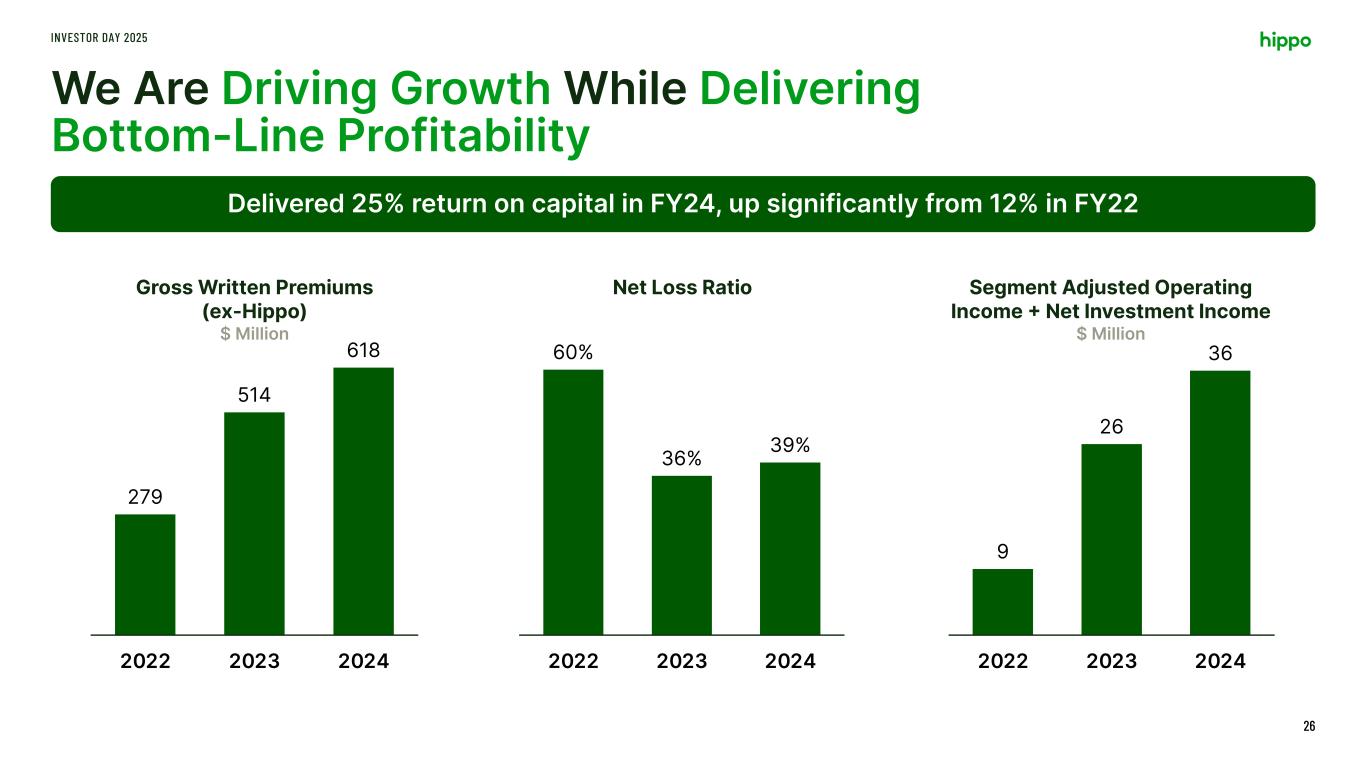

We Are Driving Growth While Delivering Bottom-Line Profitability INVESTOR DAY 2025 26 Delivered 25% return on capital in FY24, up significantly from 12% in FY22 279 514 618 2022 2023 2024 60% 36% 39% 2022 2023 2024 9 26 36 2022 2023 2024 Gross Written Premiums (ex-Hippo) $ Million Net Loss Ratio Segment Adjusted Operating Income + Net Investment Income $ Million

Fronting Platform of Choice for MGAs 27 Expertise Team of seasoned insurance professionals with proven ability to achieve results Risk Management Culture rooted in risk management, leveraging data and analytics to diversify and build trust Technology Advanced technology platform and integrated systems to deliver tailored solutions for customers INVESTOR DAY 2025 Trust A company built on trusted partnerships, financial strength and operational excellence

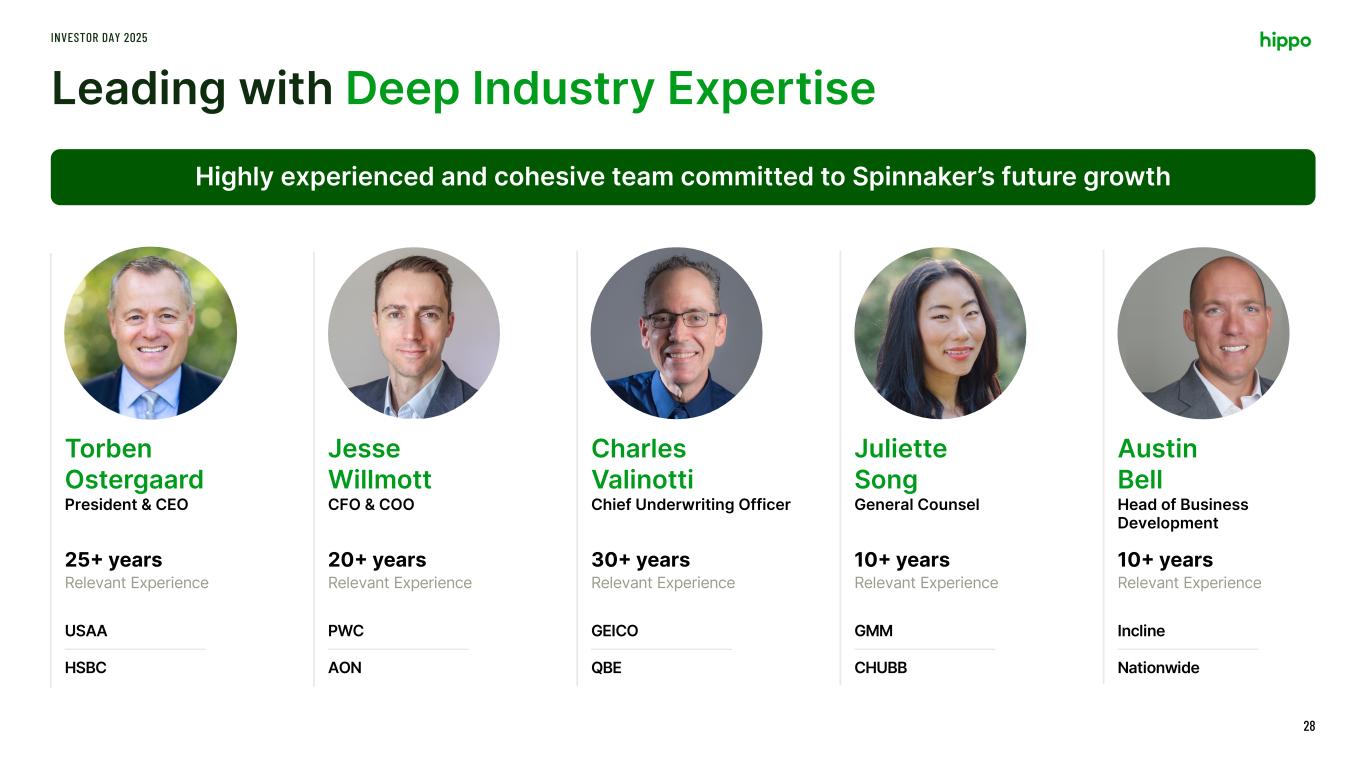

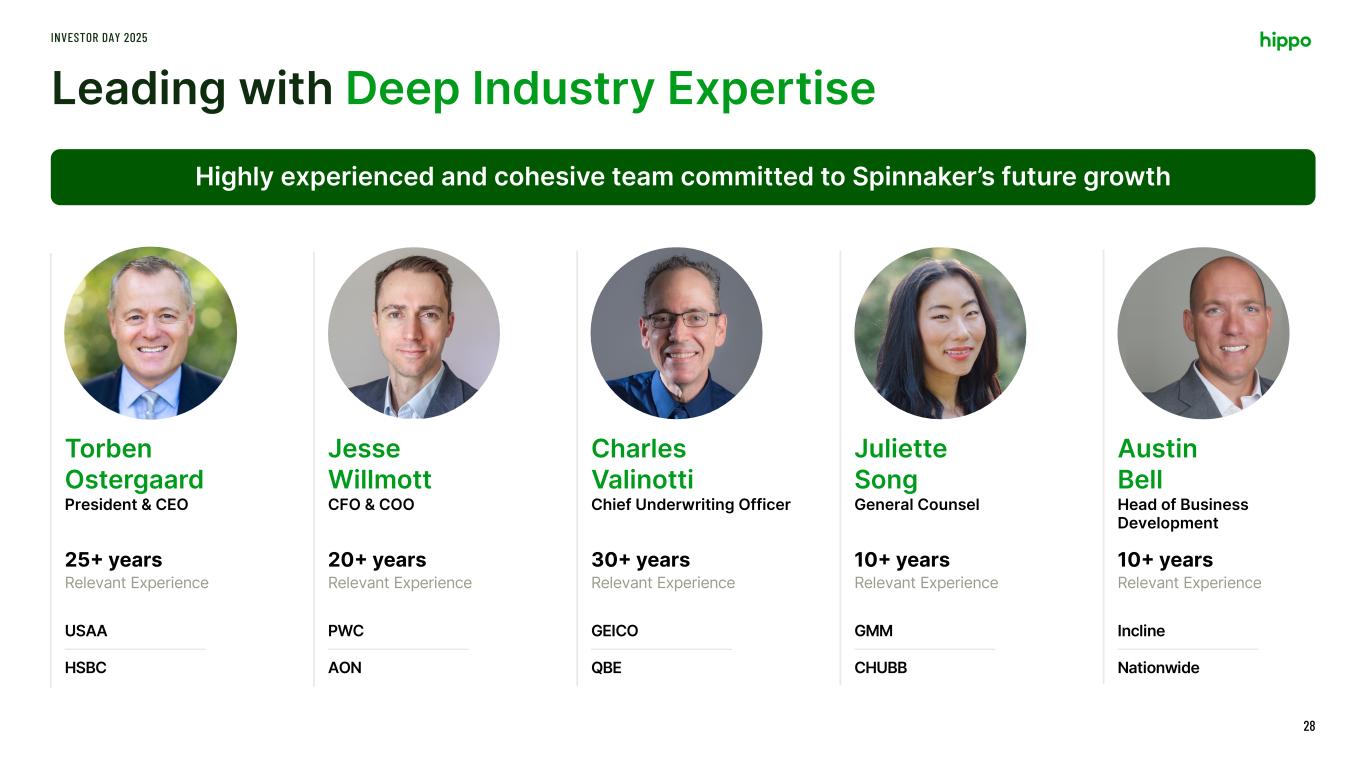

Leading with Deep Industry Expertise INVESTOR DAY 2025 28 Highly experienced and cohesive team committed to Spinnaker’s future growth USAA HSBC GEICO QBE GMM CHUBB PWC AON Incline Nationwide Torben Ostergaard President & CEO 25+ years Relevant Experience Jesse Willmott CFO & COO 20+ years Relevant Experience Charles Valinotti Chief Underwriting Officer 30+ years Relevant Experience Juliette Song General Counsel 10+ years Relevant Experience Austin Bell Head of Business Development 10+ years Relevant Experience

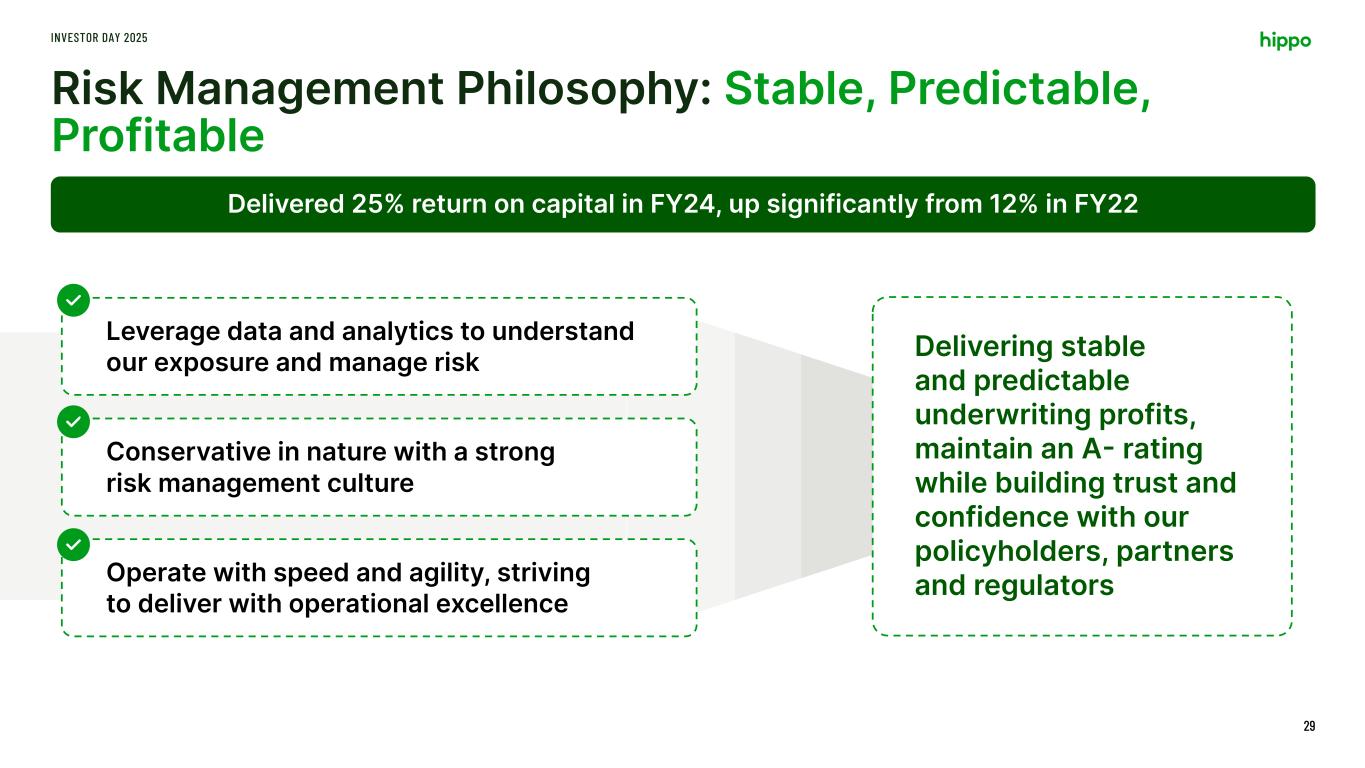

Risk Management Philosophy: Stable, Predictable, Profitable INVESTOR DAY 2025 29 Delivering stable and predictable underwriting profits, maintain an A- rating while building trust and confidence with our policyholders, partners and regulators Leverage data and analytics to understand our exposure and manage risk Conservative in nature with a strong risk management culture Operate with speed and agility, striving to deliver with operational excellence Delivered 25% return on capital in FY24, up significantly from 12% in FY22

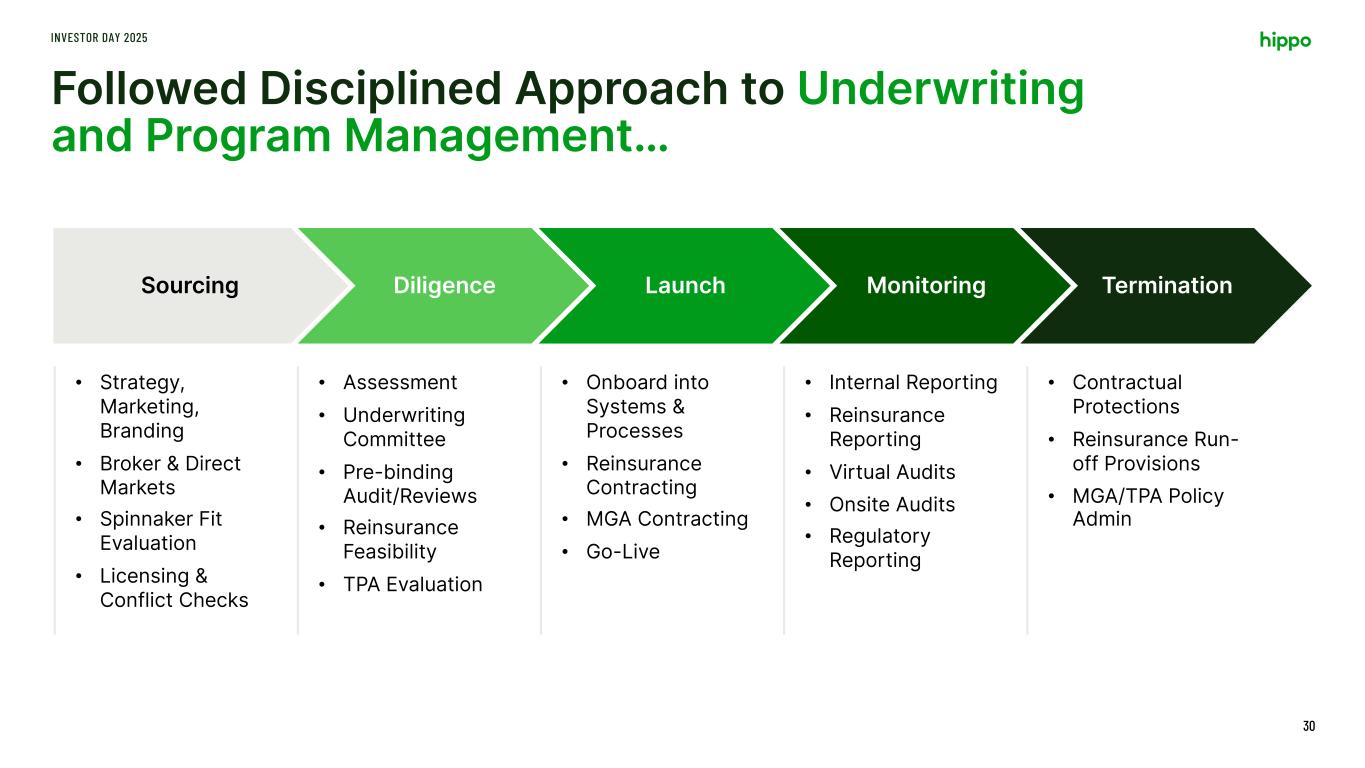

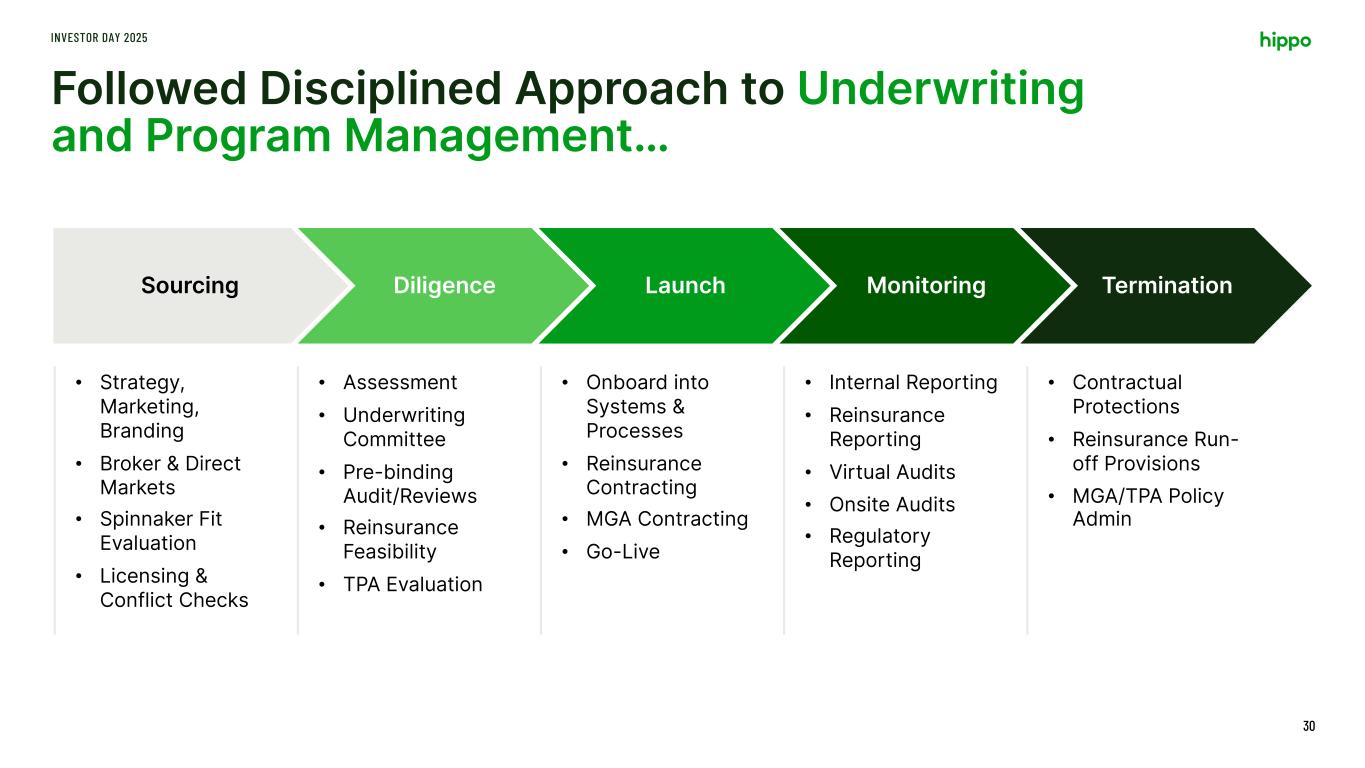

Followed Disciplined Approach to Underwriting and Program Management… INVESTOR DAY 2025 30 Sourcing Diligence Launch Monitoring Termination • Strategy, Marketing, Branding • Broker & Direct Markets • Spinnaker Fit Evaluation • Licensing & Conflict Checks • Assessment • Underwriting Committee • Pre-binding Audit/Reviews • Reinsurance Feasibility • TPA Evaluation • Onboard into Systems & Processes • Reinsurance Contracting • MGA Contracting • Go-Live • Internal Reporting • Reinsurance Reporting • Virtual Audits • Onsite Audits • Regulatory Reporting • Contractual Protections • Reinsurance Run- off Provisions • MGA/TPA Policy Admin

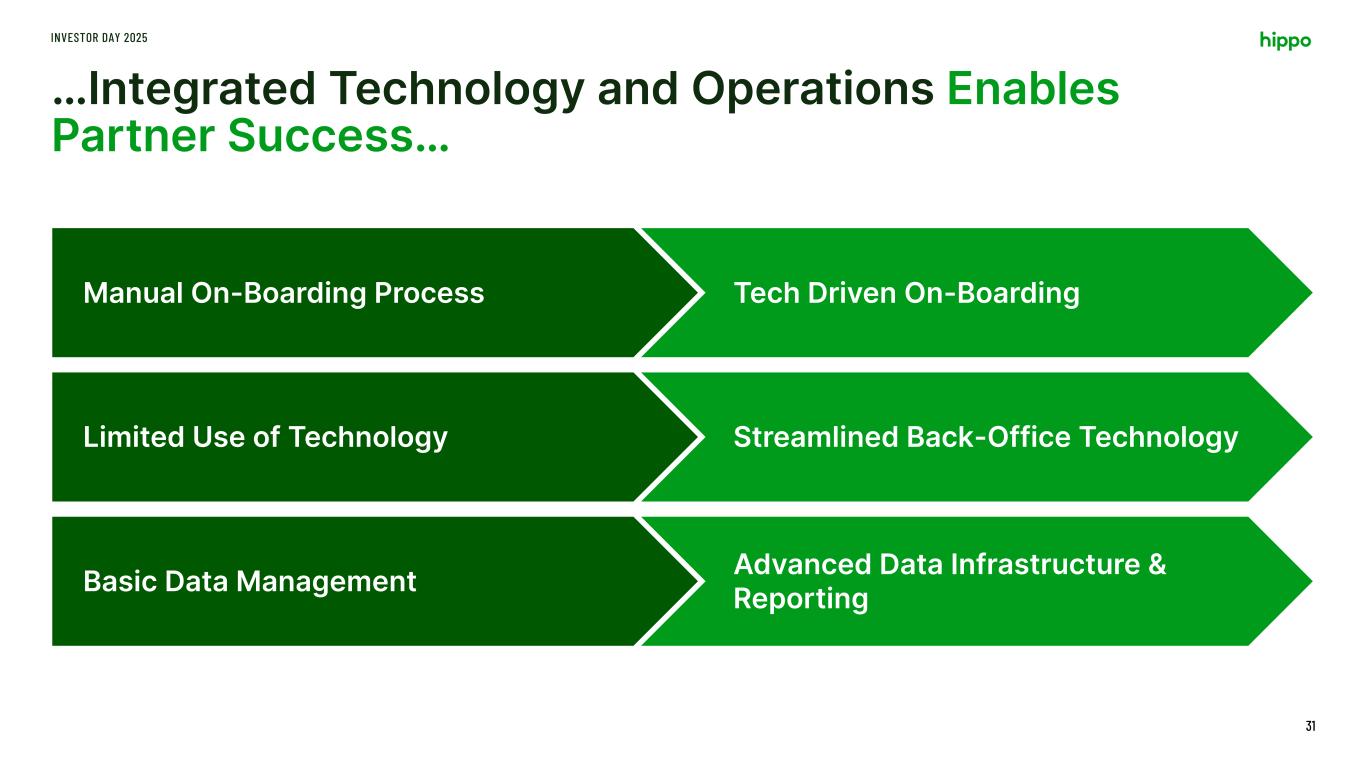

…Integrated Technology and Operations Enables Partner Success… INVESTOR DAY 2025 31 Tech Driven On-BoardingManual On-Boarding Process Streamlined Back-Office TechnologyLimited Use of Technology Advanced Data Infrastructure & ReportingBasic Data Management

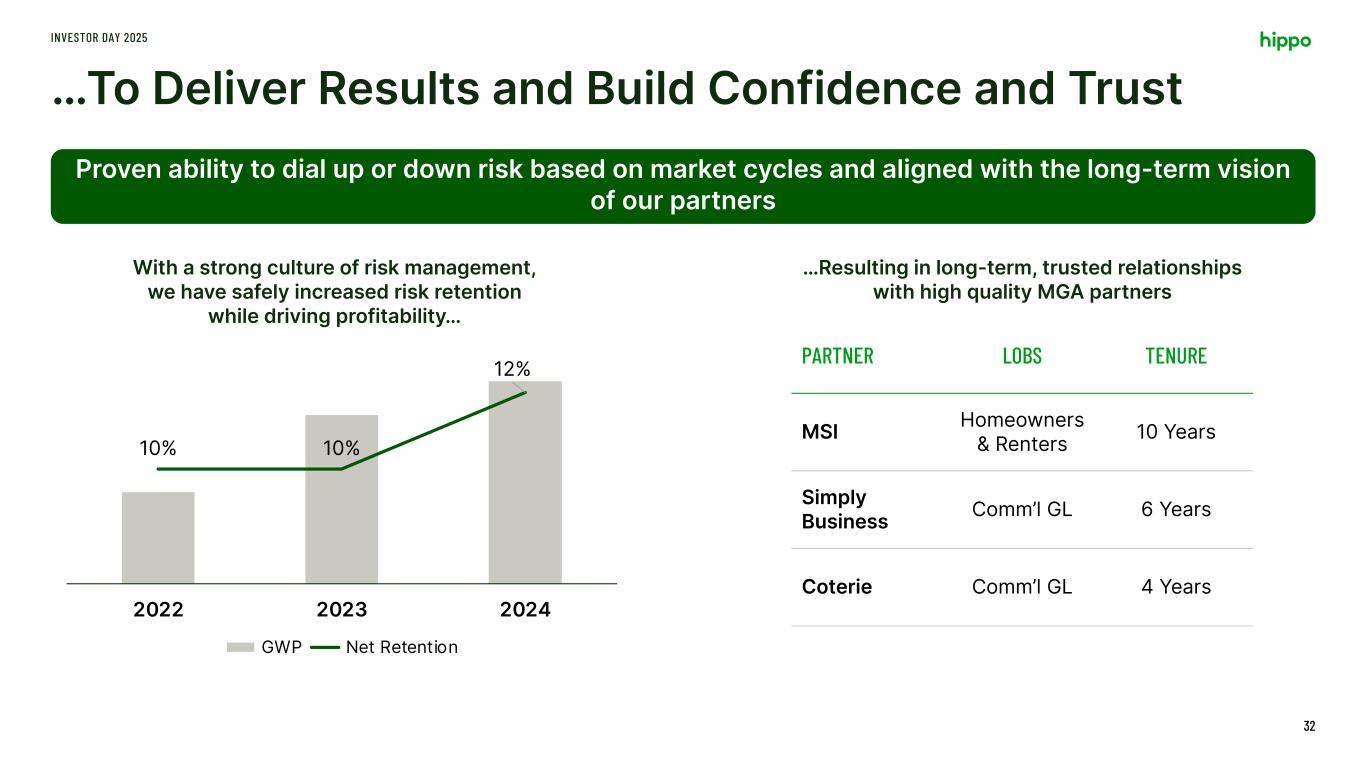

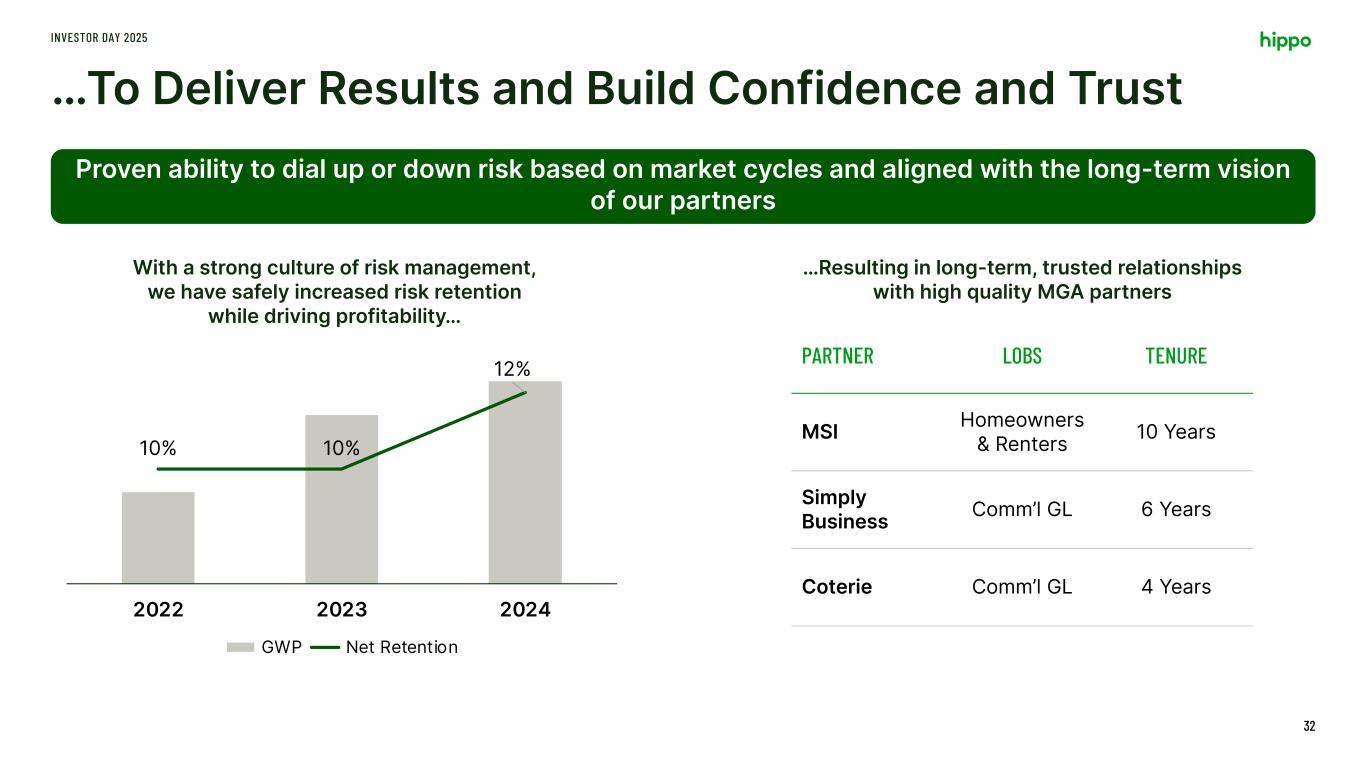

…To Deliver Results and Build Confidence and Trust INVESTOR DAY 2025 32 Proven ability to dial up or down risk based on market cycles and aligned with the long-term vision of our partners With a strong culture of risk management, we have safely increased risk retention while driving profitability… …Resulting in long-term, trusted relationships with high quality MGA partners PARTNER LOBS TENURE MSI Homeowners & Renters 10 Years Simply Business Comm’l GL 6 Years Coterie Comm’l GL 4 Years 10% 10% 12% 7% 8% 9% 10% 11% 12% 13% 0 100 200 300 400 500 600 700 2022 2023 2024 GWP Net Retention

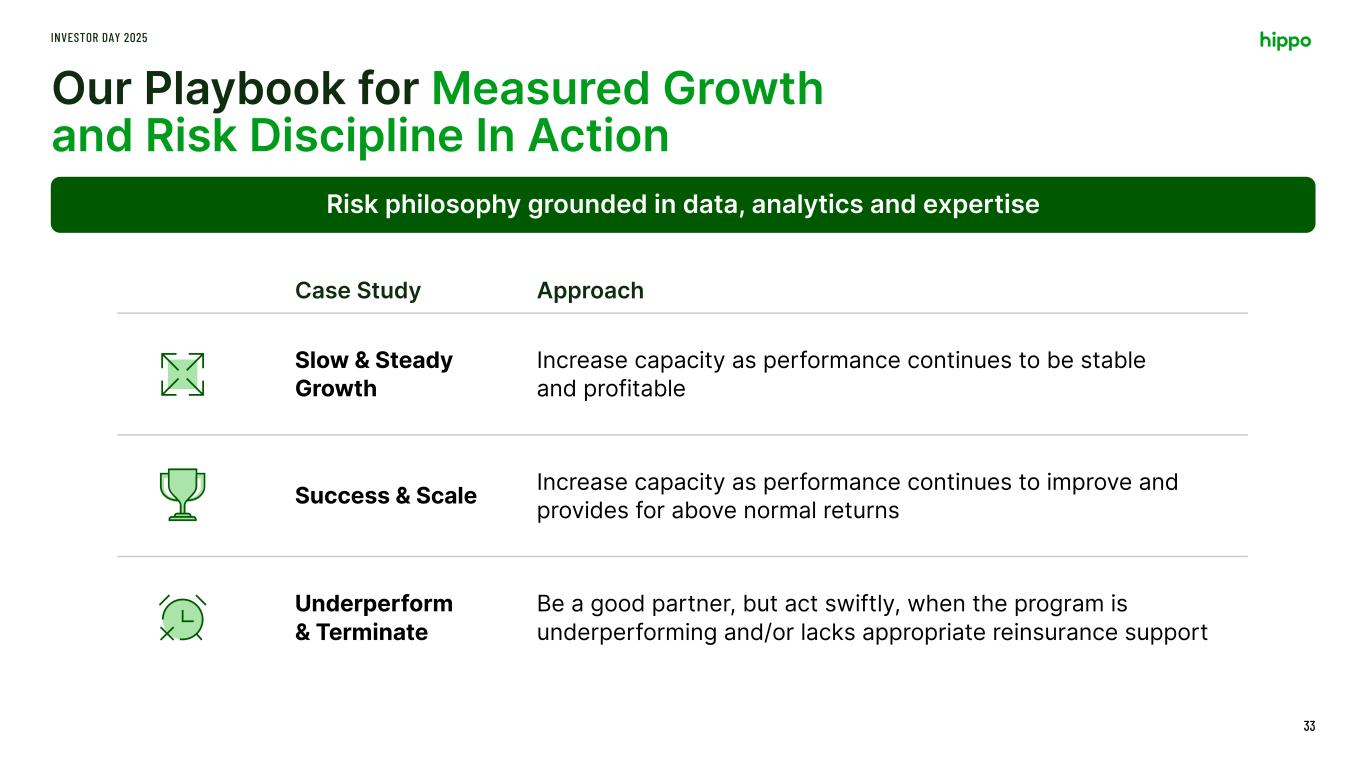

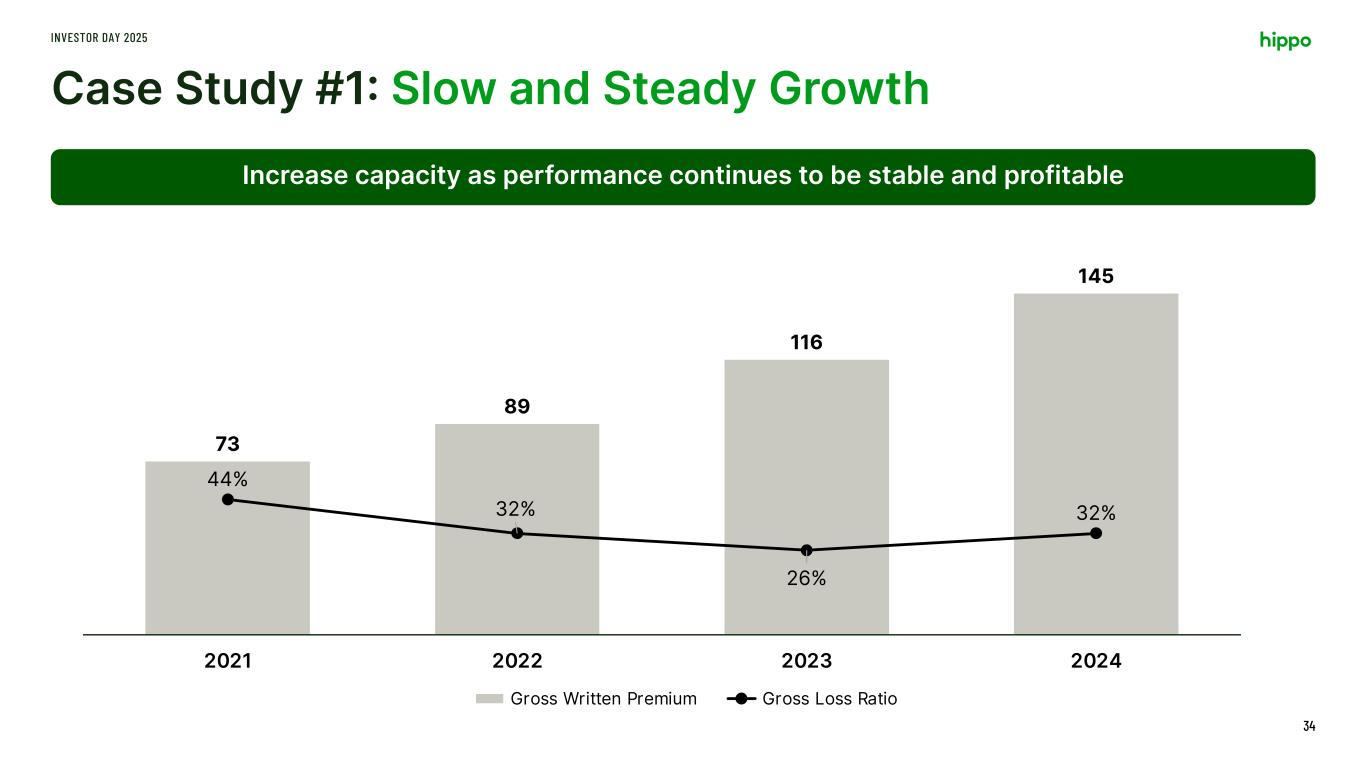

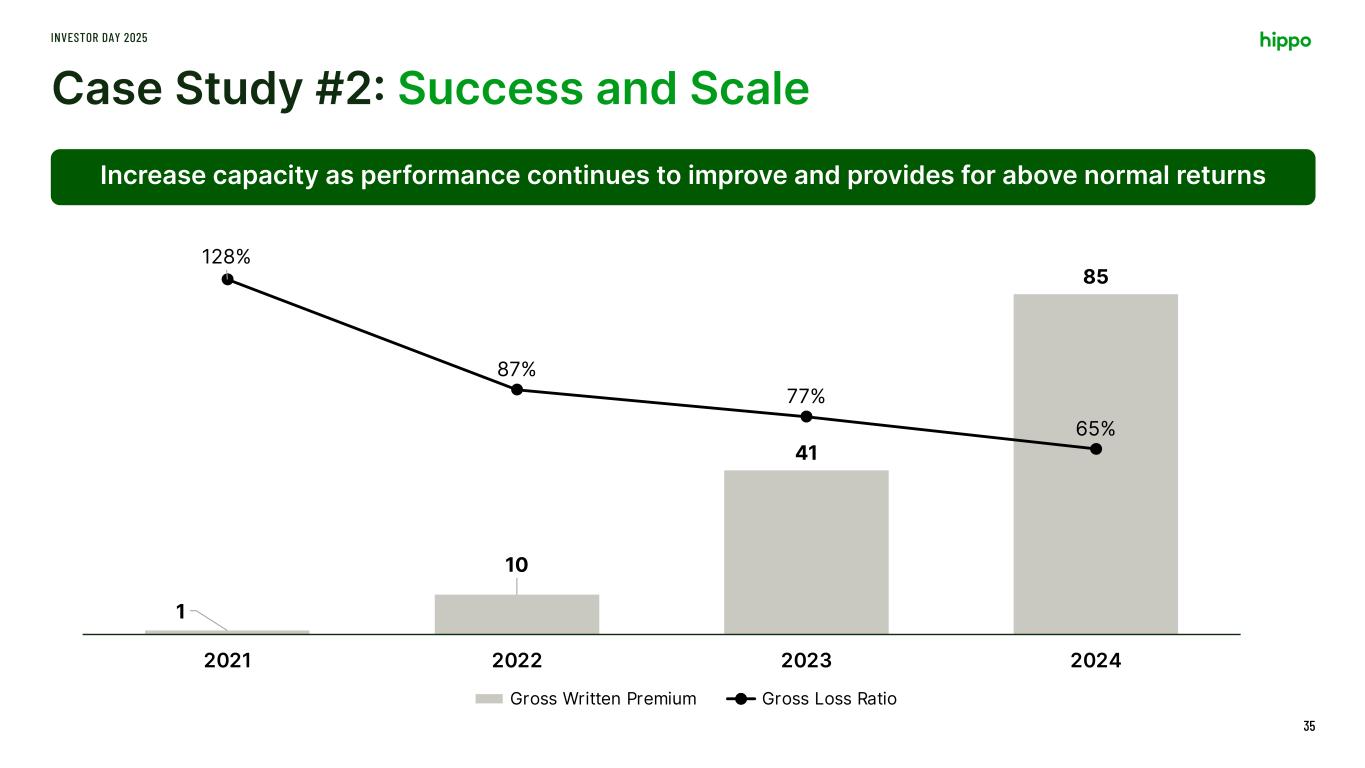

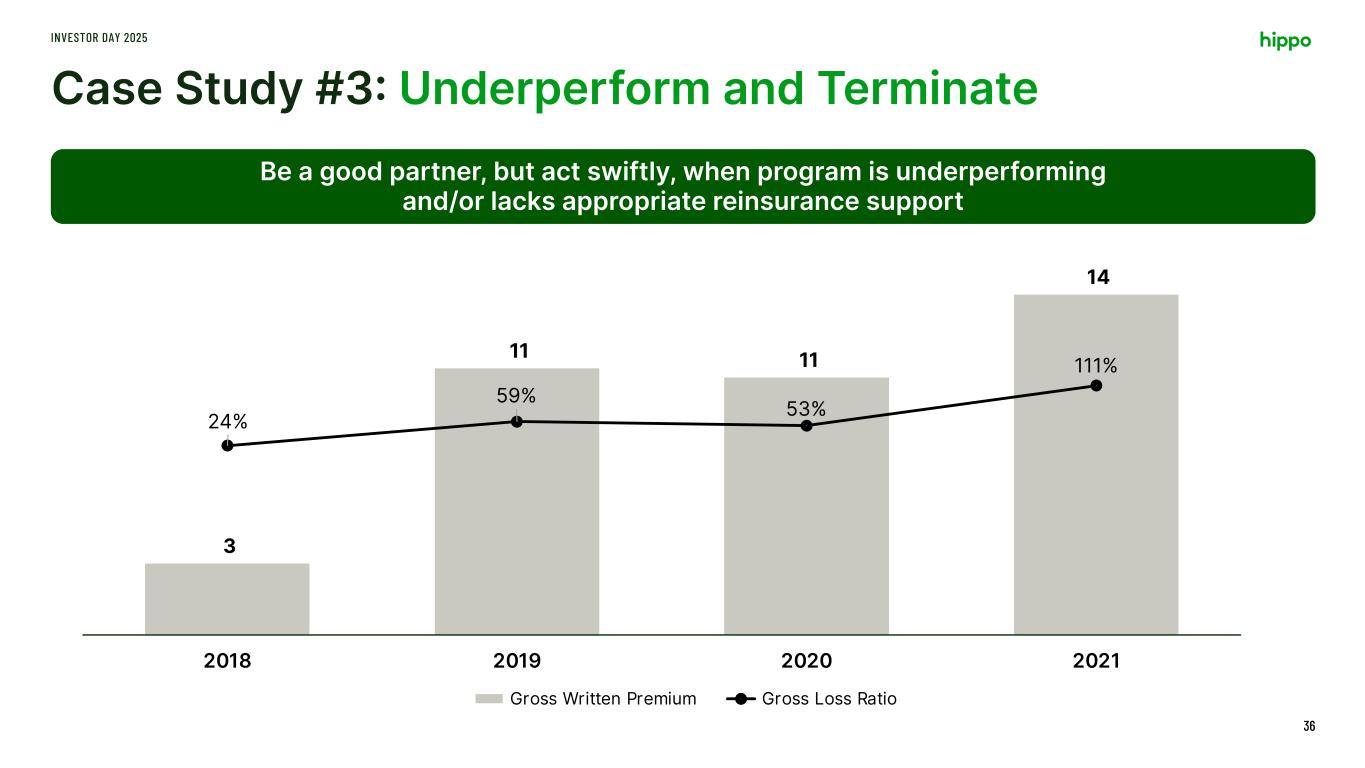

Our Playbook for Measured Growth and Risk Discipline In Action INVESTOR DAY 2025 33 Case Study Approach Slow & Steady Growth Increase capacity as performance continues to be stable and profitable Success & Scale Increase capacity as performance continues to improve and provides for above normal returns Underperform & Terminate Be a good partner, but act swiftly, when the program is underperforming and/or lacks appropriate reinsurance support Risk philosophy grounded in data, analytics and expertise

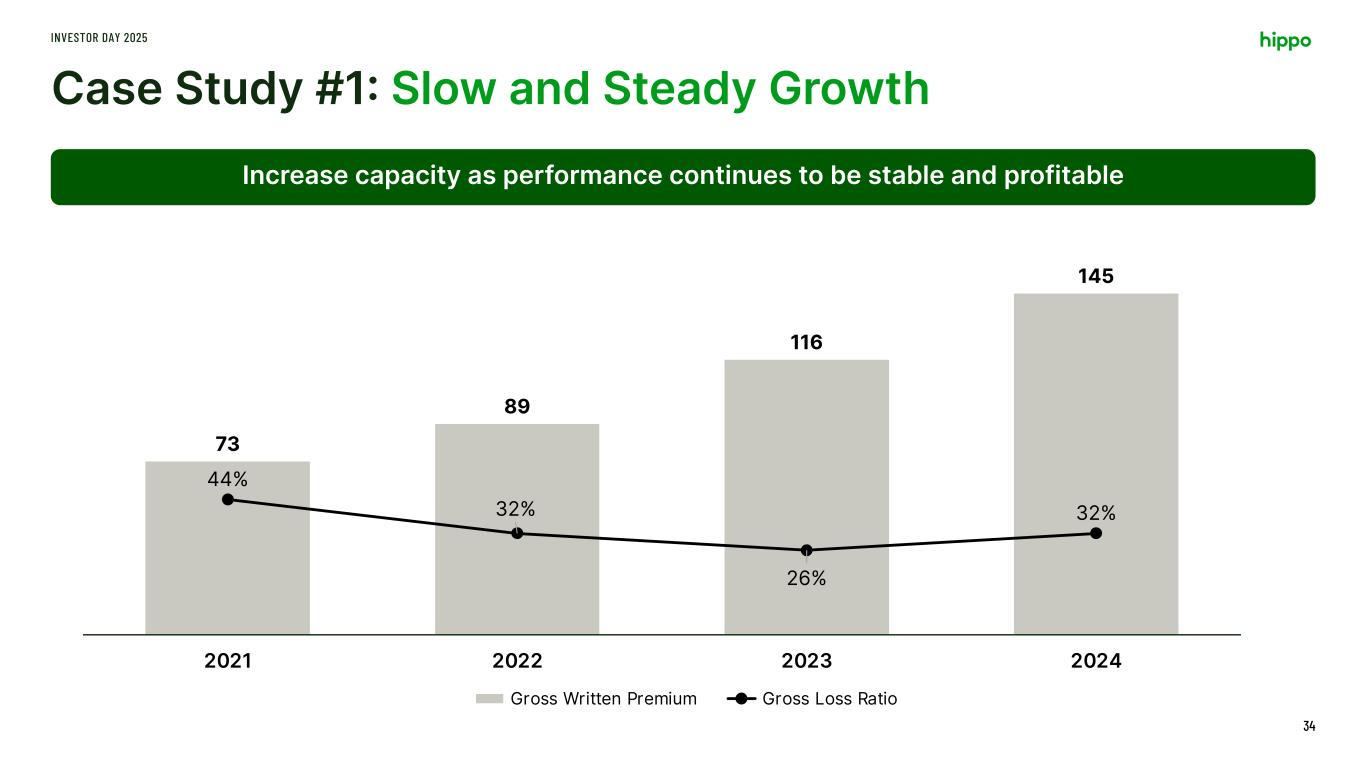

73 89 116 145 44% 32% 26% 32% -4% 16% 36% 56% 76% 96% 116% 0 20 40 60 80 100 120 140 160 2021 2022 2023 2024 Gross Written Premium Gross Loss Ratio Case Study #1: Slow and Steady Growth INVESTOR DAY 2025 34 Increase capacity as performance continues to be stable and profitable

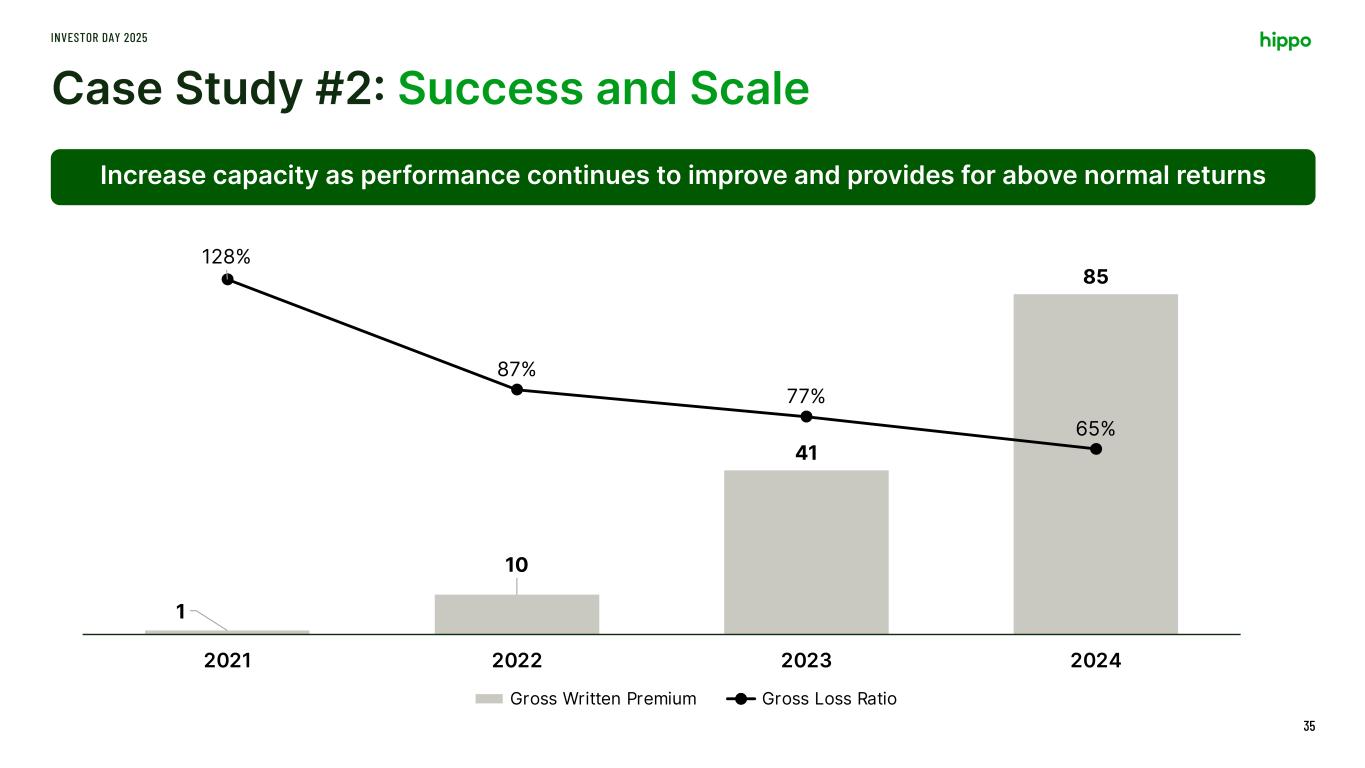

Case Study #2: Success and Scale INVESTOR DAY 2025 35 Increase capacity as performance continues to improve and provides for above normal returns 1 10 41 85 128% 87% 77% 65% -4% 16% 36% 56% 76% 96% 116% 0 10 20 30 40 50 60 70 80 90 2021 2022 2023 2024 Gross Written Premium Gross Loss Ratio

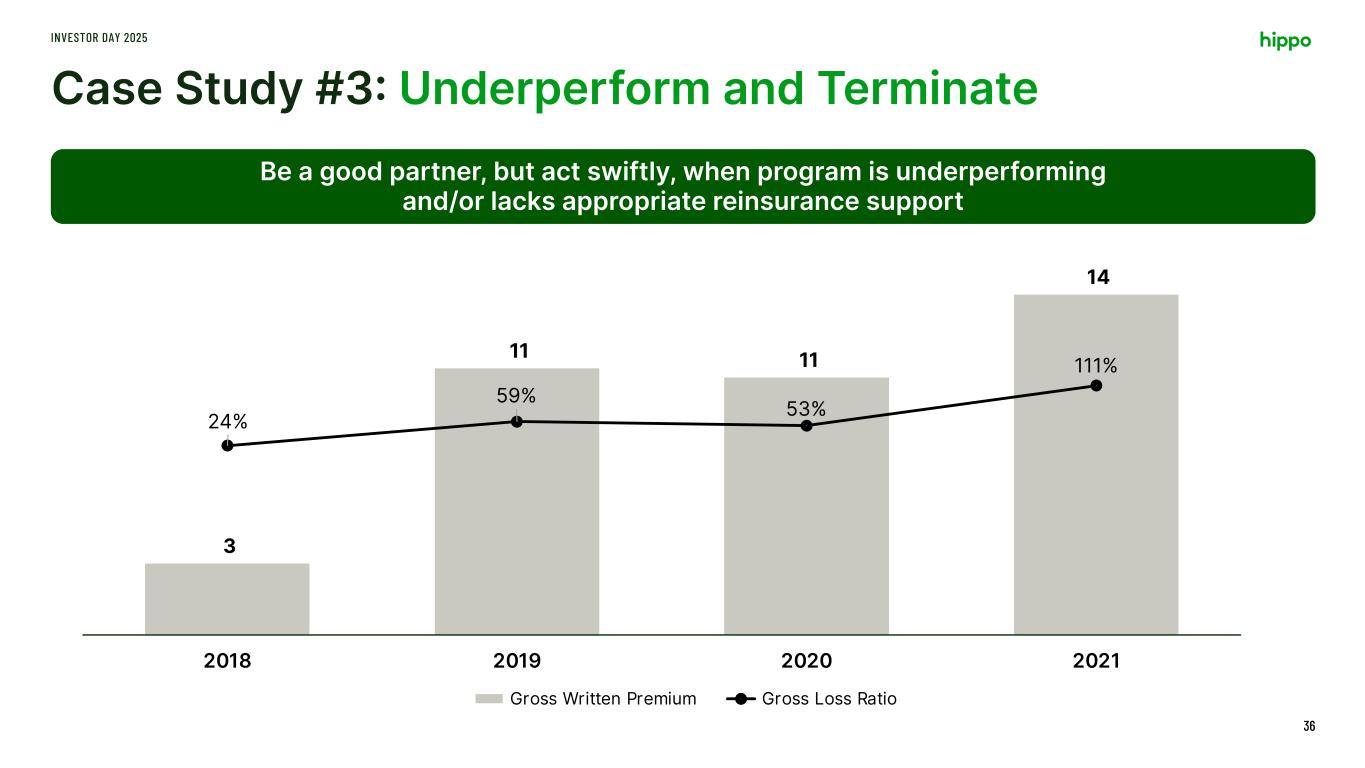

Case Study #3: Underperform and Terminate INVESTOR DAY 2025 36 Be a good partner, but act swiftly, when program is underperforming and/or lacks appropriate reinsurance support 3 11 11 14 24% 59% 53% 111% -250% -150% -50% 50% 150% 250% - 2 4 6 8 10 12 14 16 2018 2019 2020 2021 Gross Written Premium Gross Loss Ratio

Spinnaker Platform: A Hybrid Fronting Carrier Access to Underwriting Across Diverse Partnerships & Lines of Business INVESTOR DAY 2025 37 A stable, predictable and profitable insurance company built on trust 3 Insurance Carriers 2 Admitted | 1 E&S 50 States Licensed 30 Active Programs A- AM Best Financial Strength Rating $618M Gross Written Premium 39% Net Loss Ratio With Proven Track Record of Delivering Results (FY2024)2 Excluding HHIP 1. Current program partners include programs that generated gross written premium in 2024 or have been formally onboarded to write business in 2025 2. All metrics reflect performance of the Spinnaker platform (non-Hippo programs) 3. Segment Adjusted Operating Income + Net Investment Income / Surplus allocated to Spinnaker, non-Hippo programs 18 Program Partners1 25% Return on Capital3

Michael Stienstra GM & Chief Insurance Officer, HHIP

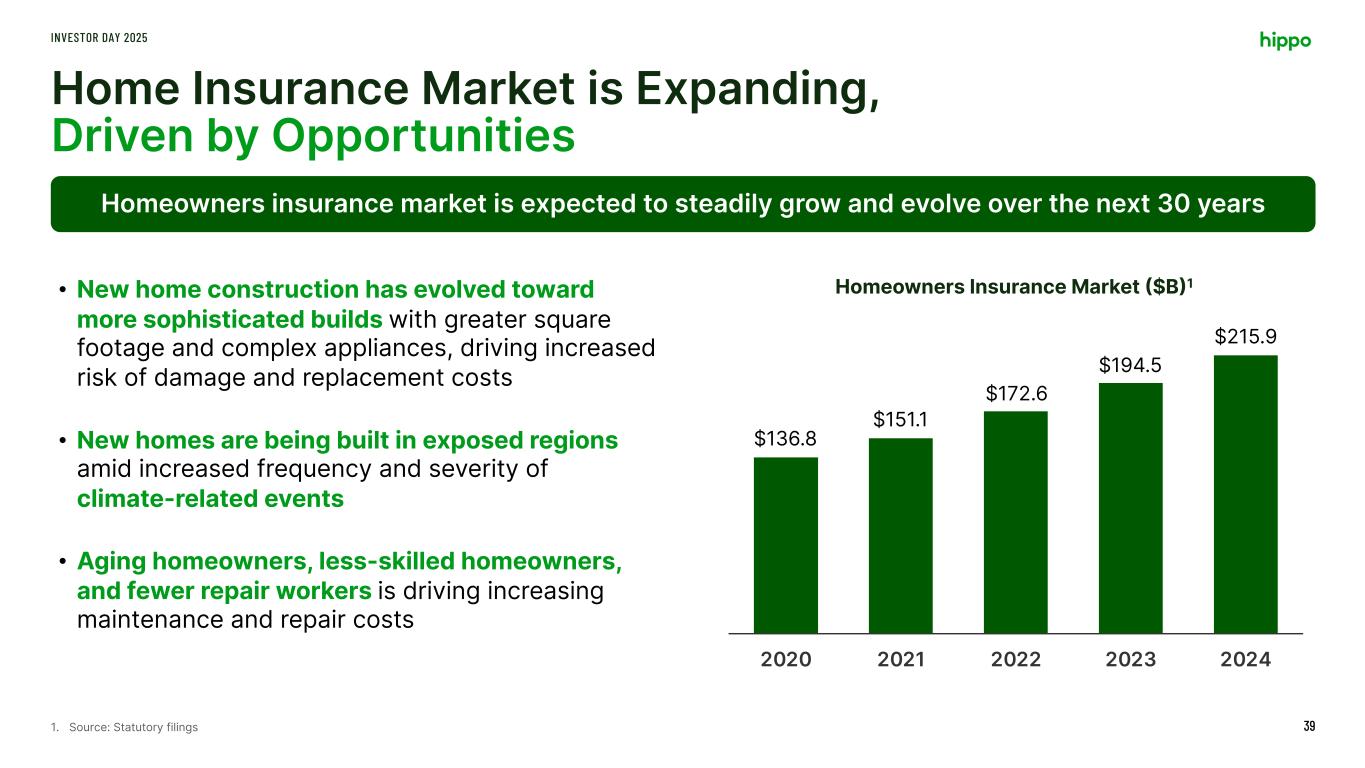

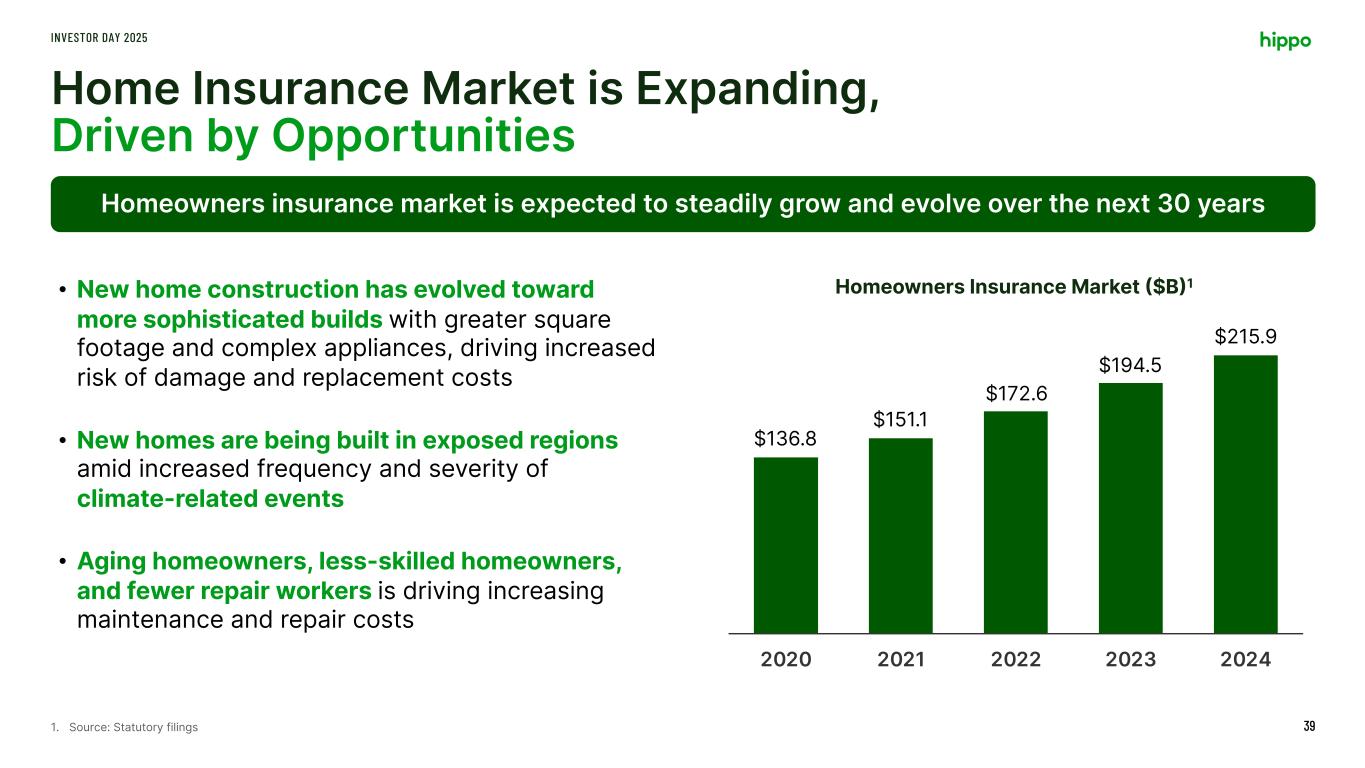

Home Insurance Market is Expanding, Driven by Opportunities • New home construction has evolved toward more sophisticated builds with greater square footage and complex appliances, driving increased risk of damage and replacement costs • New homes are being built in exposed regions amid increased frequency and severity of climate-related events • Aging homeowners, less-skilled homeowners, and fewer repair workers is driving increasing maintenance and repair costs INVESTOR DAY 2025 39 Homeowners insurance market is expected to steadily grow and evolve over the next 30 years 2020 2021 2022 2023 2024 $215.9 $194.5 $172.6 $151.1 $136.8 1. Source: Statutory filings Homeowners Insurance Market ($B)1

With Our Exceptional Offering, Hippo is Well-Positioned to Capture This Growth INVESTOR DAY 2025 40 Deep industry expertise Strong underwriting capabilities Supported by technology We want to make it easy for great homeowners to find affordable coverage. Location House Customer

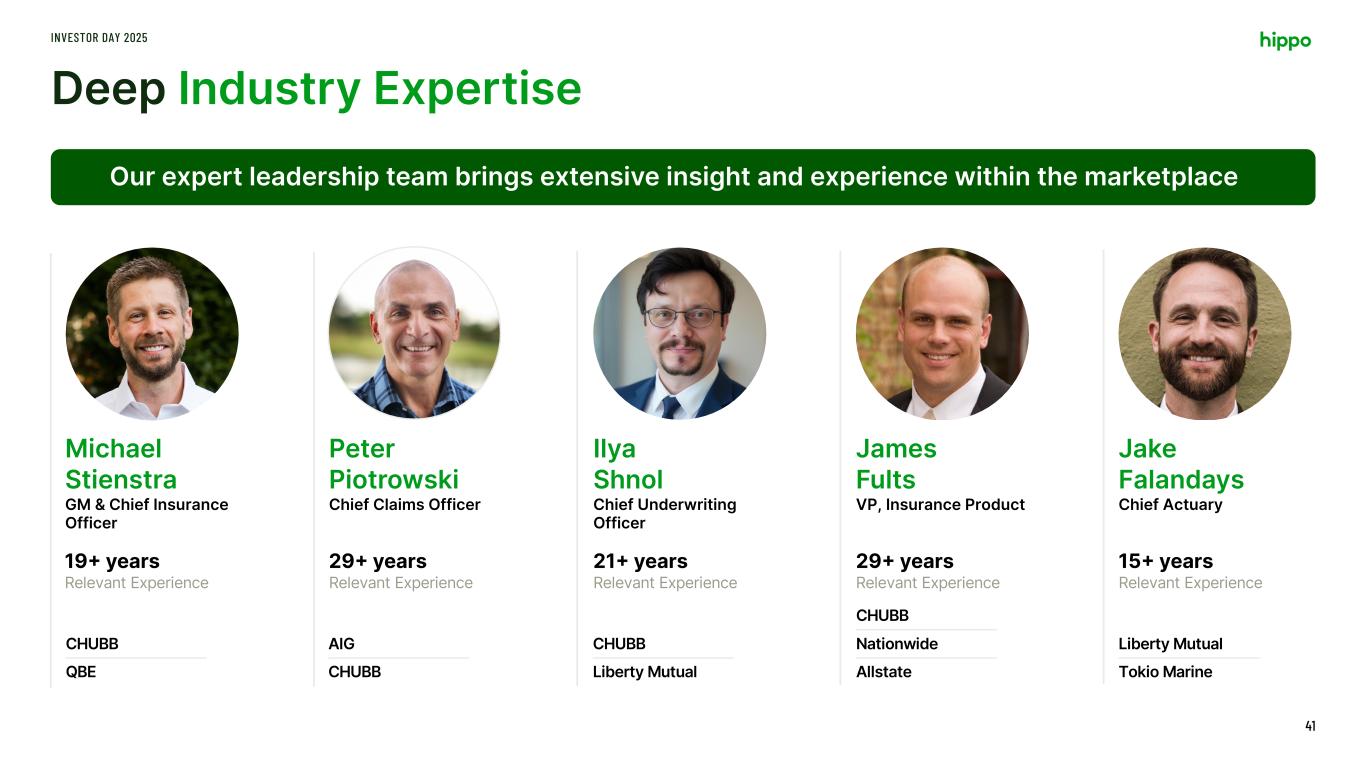

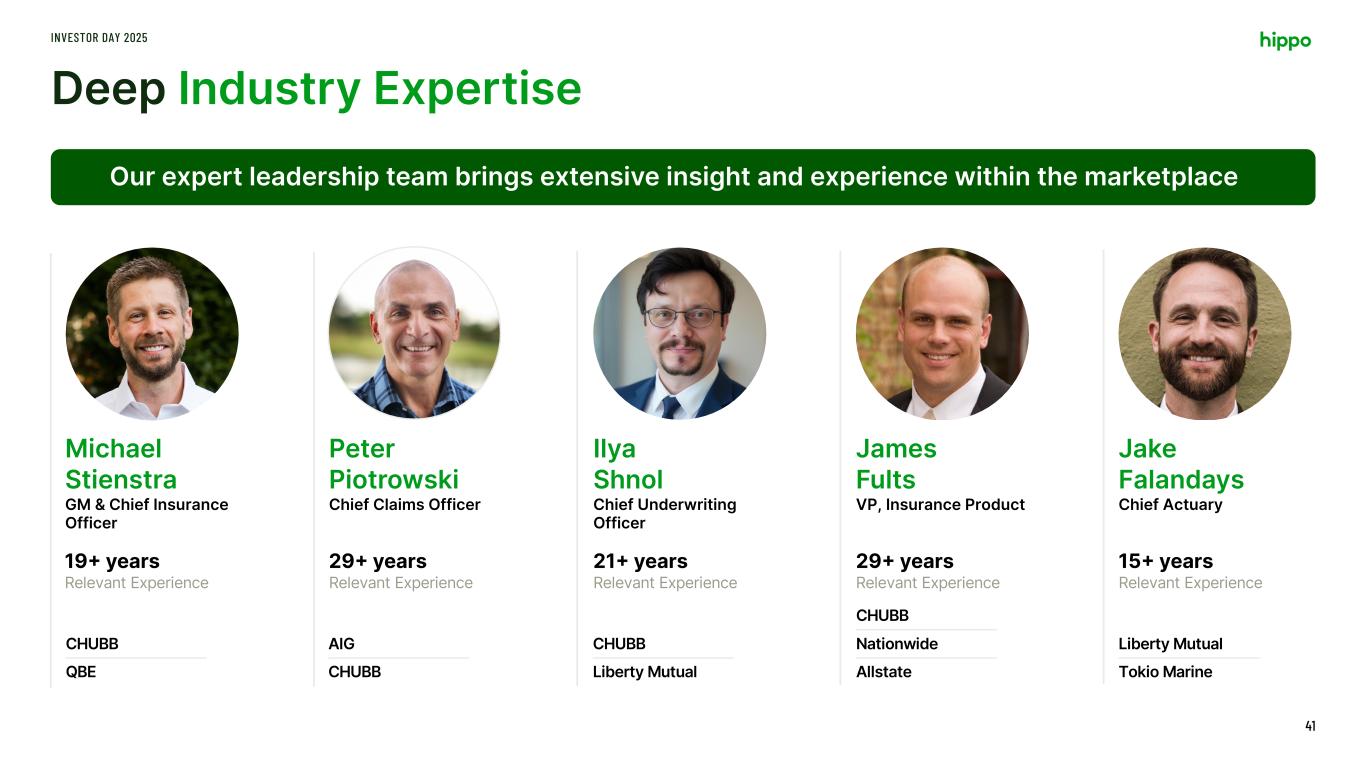

Deep Industry Expertise INVESTOR DAY 2025 41 Our expert leadership team brings extensive insight and experience within the marketplace Michael Stienstra GM & Chief Insurance Officer 19+ years Relevant Experience Peter Piotrowski Chief Claims Officer 29+ years Relevant Experience Ilya Shnol Chief Underwriting Officer 21+ years Relevant Experience James Fults VP, Insurance Product 29+ years Relevant Experience Jake Falandays Chief Actuary 15+ years Relevant Experience CHUBB QBE AIG CHUBB CHUBB Liberty Mutual CHUBB Nationwide Allstate Liberty Mutual Tokio Marine

INVESTOR DAY 2025 Since 2022, we have achieved better risk-based pricing while reducing our loss ratio, driving higher profits. 42

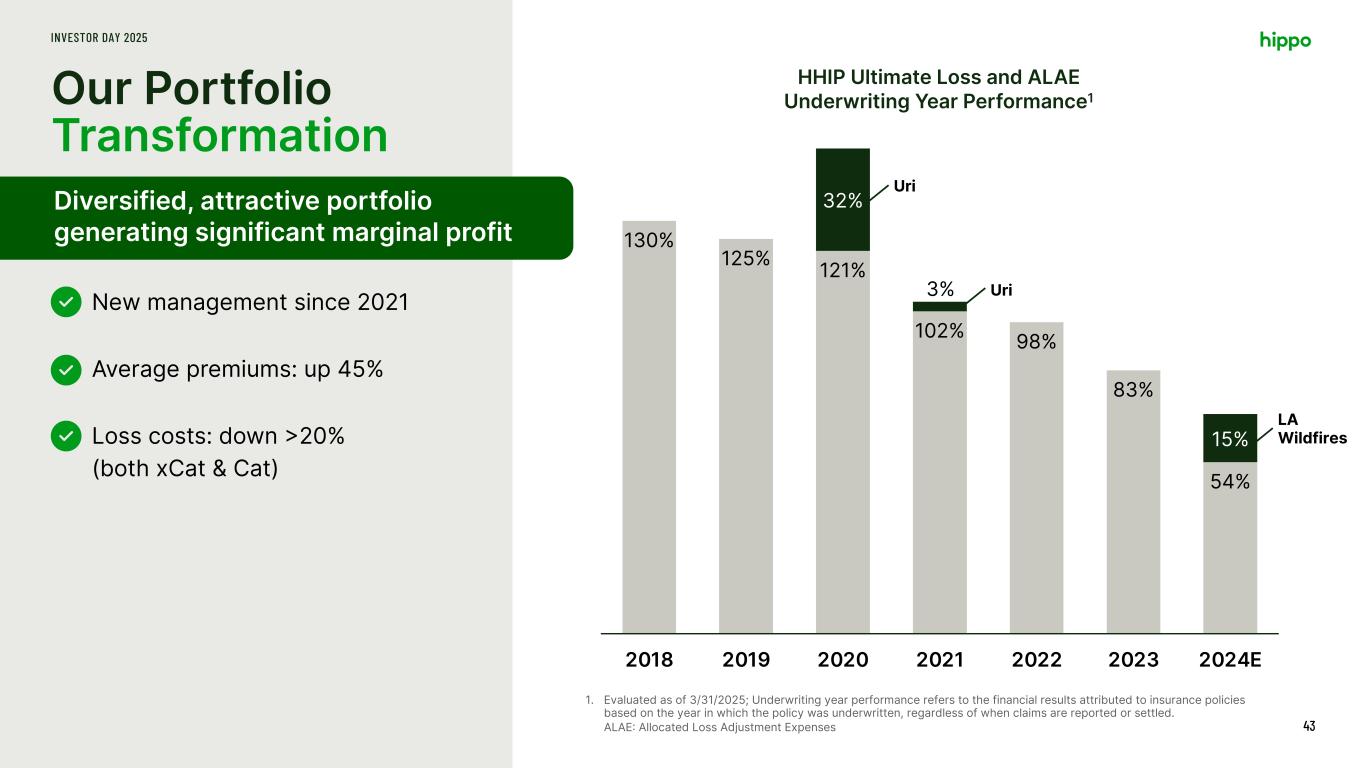

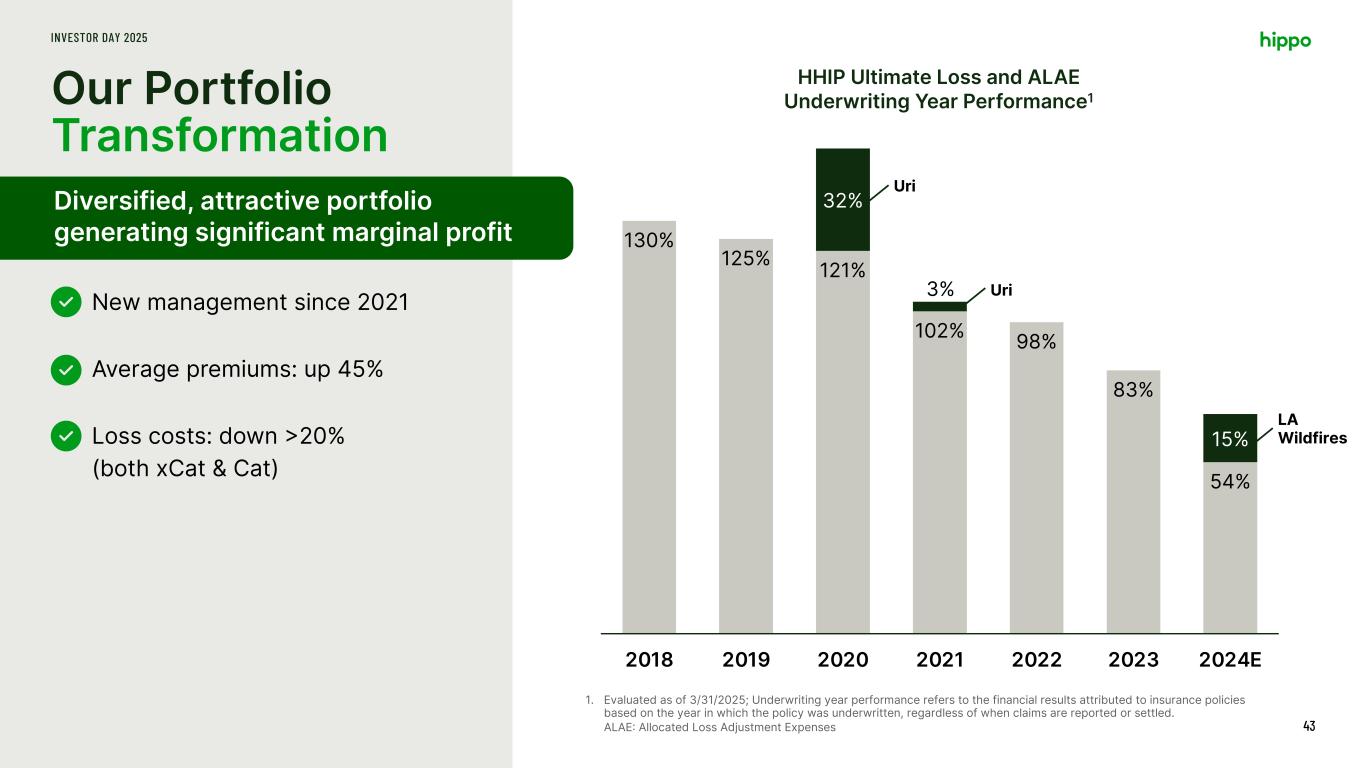

Our Portfolio Transformation INVESTOR DAY 2025 43 New management since 2021 Average premiums: up 45% Loss costs: down >20% (both xCat & Cat) Diversified, attractive portfolio generating significant marginal profit 1. Evaluated as of 3/31/2025; Underwriting year performance refers to the financial results attributed to insurance policies based on the year in which the policy was underwritten, regardless of when claims are reported or settled. ALAE: Allocated Loss Adjustment Expenses 130% 125% 121% 102% 98% 83% 54% 32% 3% 15% 2018 2019 2020 2021 2022 2023 2024E Uri Uri LA Wildfires HHIP Ultimate Loss and ALAE Underwriting Year Performance1

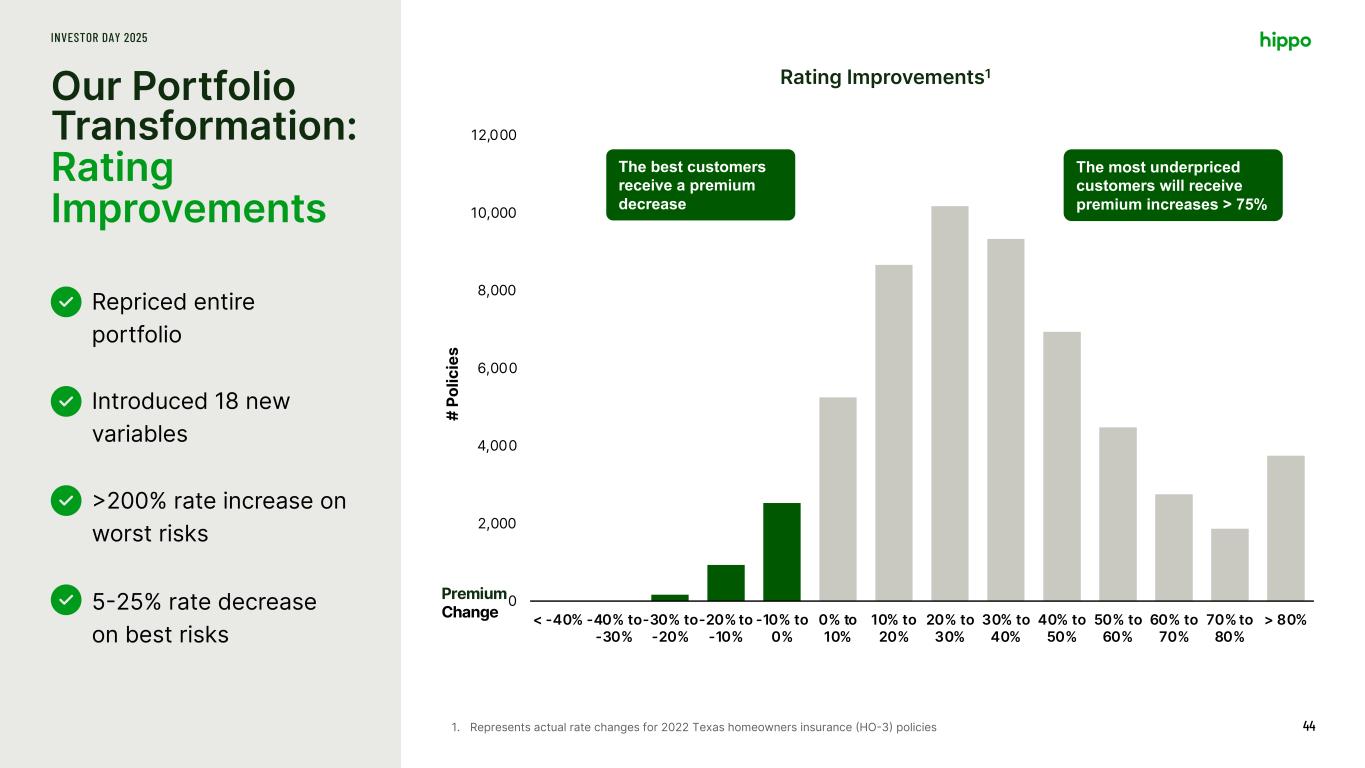

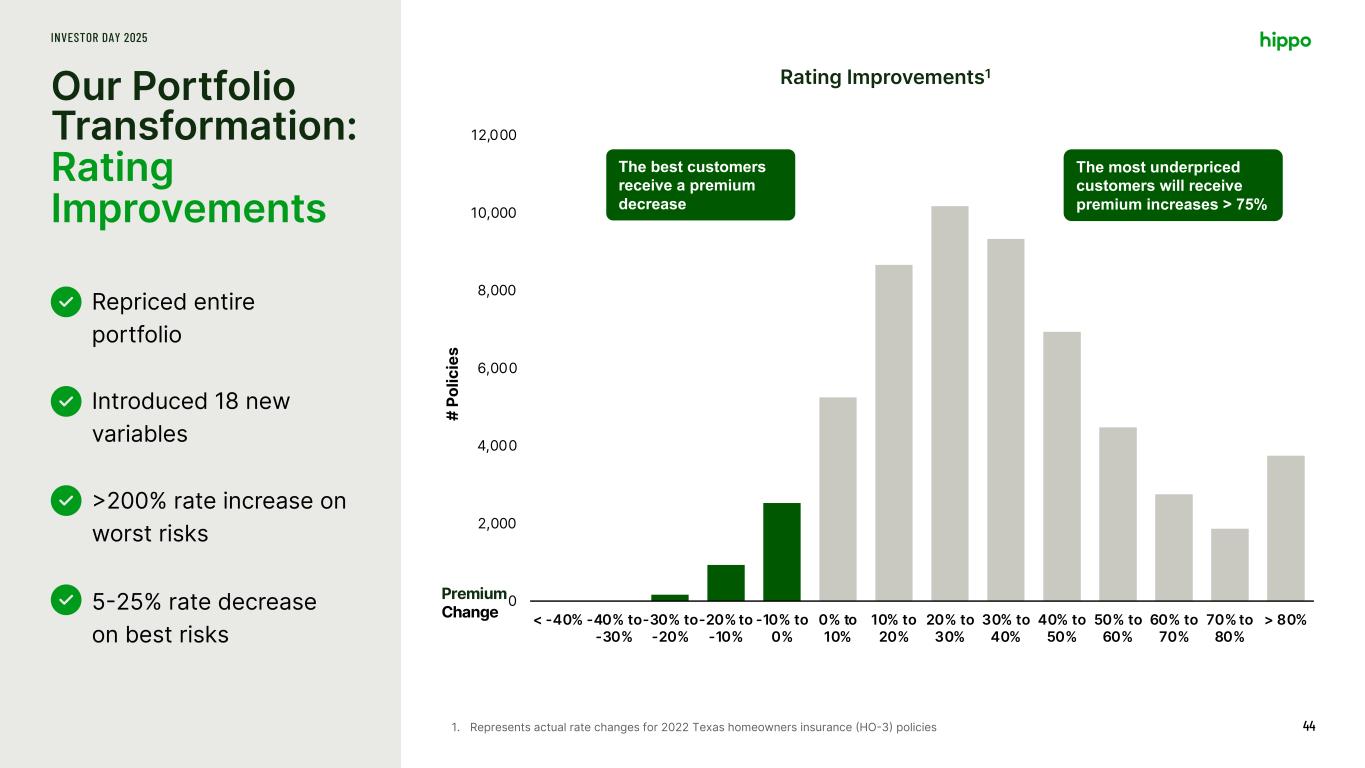

Our Portfolio Transformation: Rating Improvements INVESTOR DAY 2025 44 Repriced entire portfolio Introduced 18 new variables >200% rate increase on worst risks 5-25% rate decrease on best risks 0 2,000 4,000 6,000 8,000 10,000 12,000 < -40% -40% to -30% -30% to -20% -20% to -10% -10% to 0% 0% to 10% 10% to 20% 20% to 30% 30% to 40% 40% to 50% 50% to 60% 60% to 70% 70% to 80% > 80% # Po lic ie s Premium Change The best customers receive a premium decrease The most underpriced customers will receive premium increases > 75% 1. Represents actual rate changes for 2022 Texas homeowners insurance (HO-3) policies Rating Improvements1

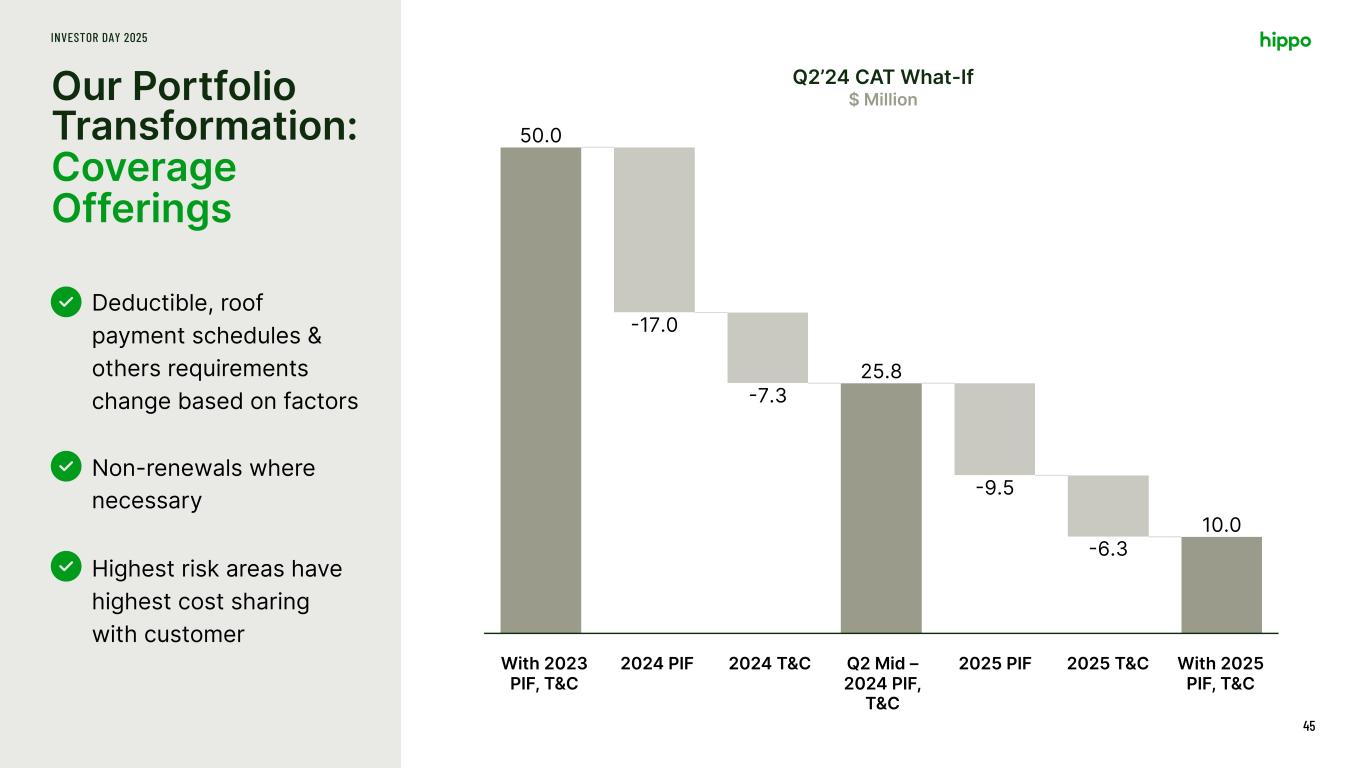

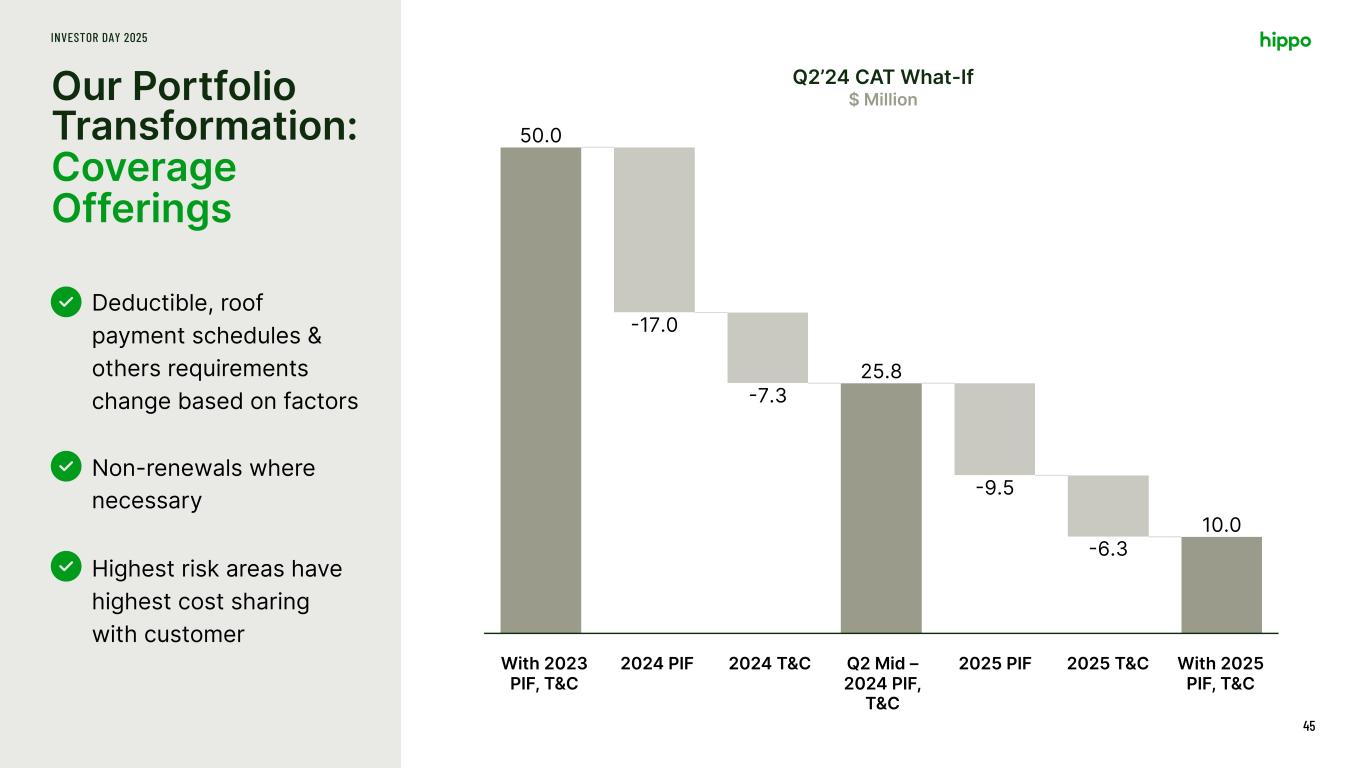

Our Portfolio Transformation: Coverage Offerings INVESTOR DAY 2025 45 Deductible, roof payment schedules & others requirements change based on factors Non-renewals where necessary Highest risk areas have highest cost sharing with customer 50.0 -17.0 -7.3 25.8 -9.5 -6.3 10.0 With 2023 PIF, T&C 2024 PIF 2024 T&C Q2 Mid - 2024 PIF, T&C 2025 PIF 2025 T&C With 2025 PIF, T&C Q2’24 CAT What-If $ Million With 2023 PIF, T&C 2024 PIF 2024 T&C Q2 Mid – 2024 PIF, T&C 2025 PIF 2025 T&C With 2025 PIF, T&C

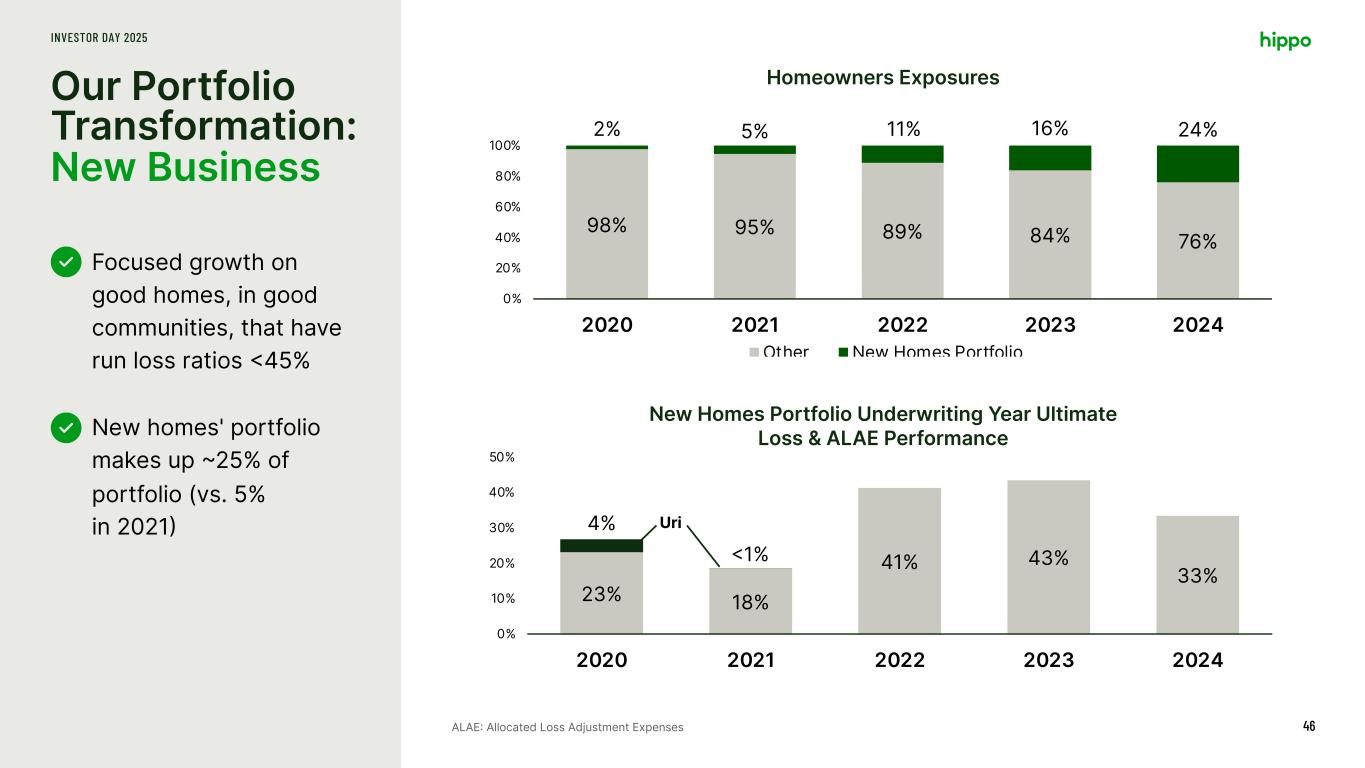

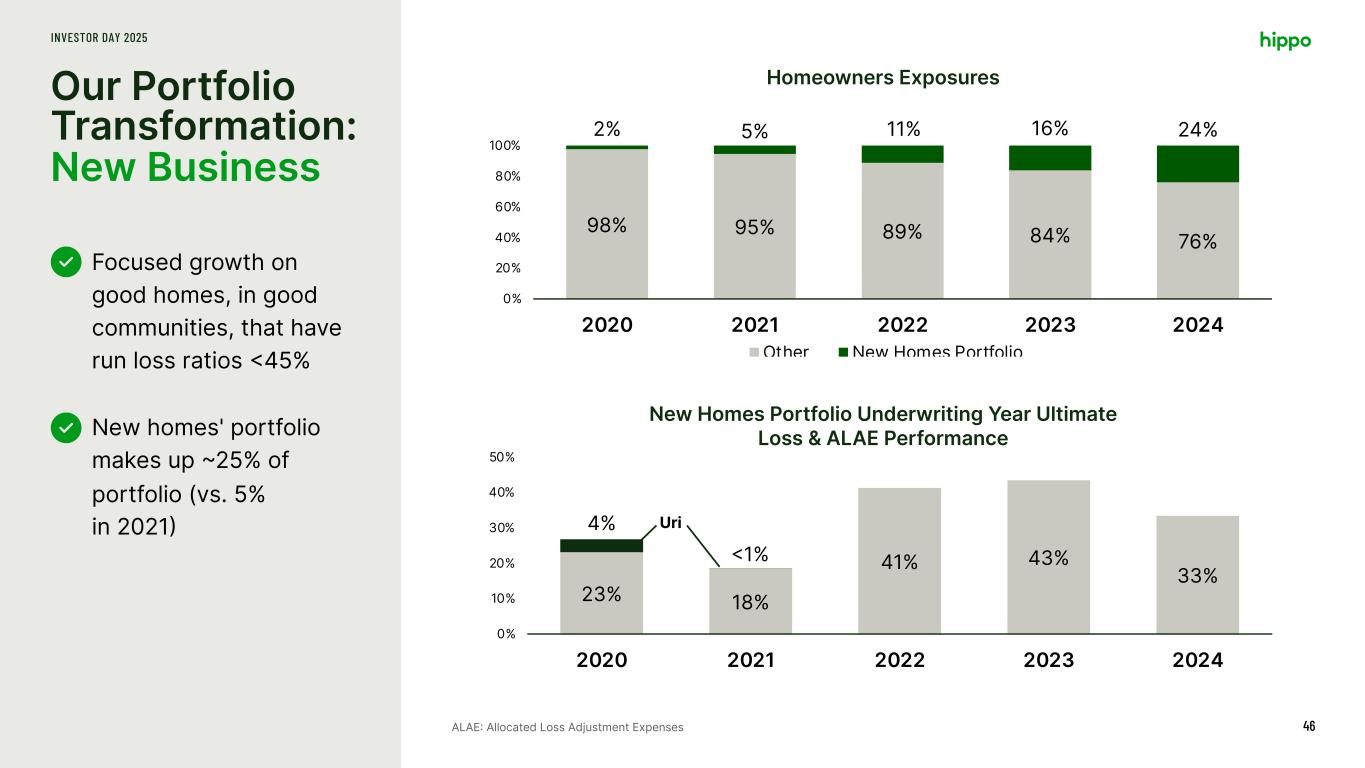

23% 18% 41% 43% 33% 4% <1% 0% 10% 20% 30% 40% 50% 2020 2021 2022 2023 2024 98% 95% 89% 84% 76% 2% 5% 11% 16% 24% 0% 20% 40% 60% 80% 100% 2020 2021 2022 2023 2024 Other New Homes Portfolio Our Portfolio Transformation: New Business INVESTOR DAY 2025 46 Focused growth on good homes, in good communities, that have run loss ratios <45% New homes' portfolio makes up ~25% of portfolio (vs. 5% in 2021) ALAE: Allocated Loss Adjustment Expenses Homeowners Exposures New Homes Portfolio Underwriting Year Ultimate Loss & ALAE Performance Uri

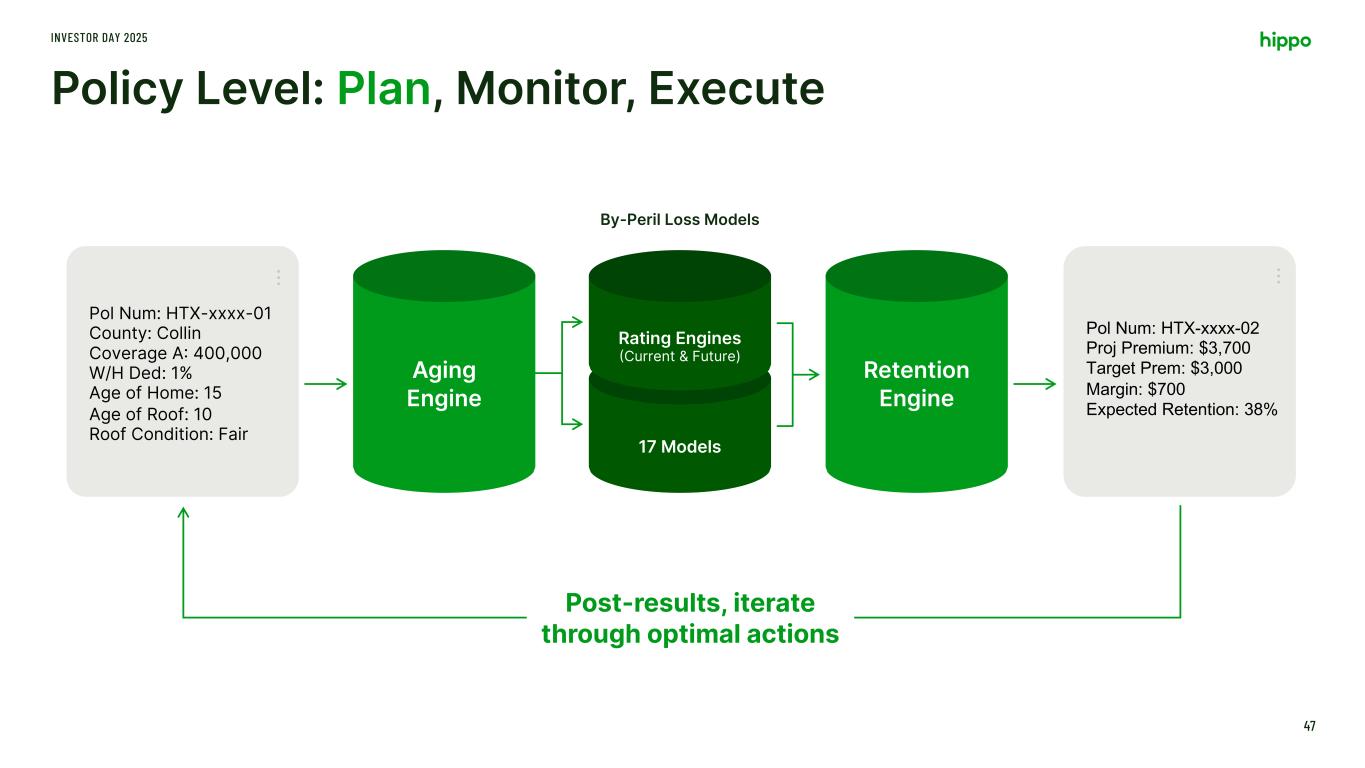

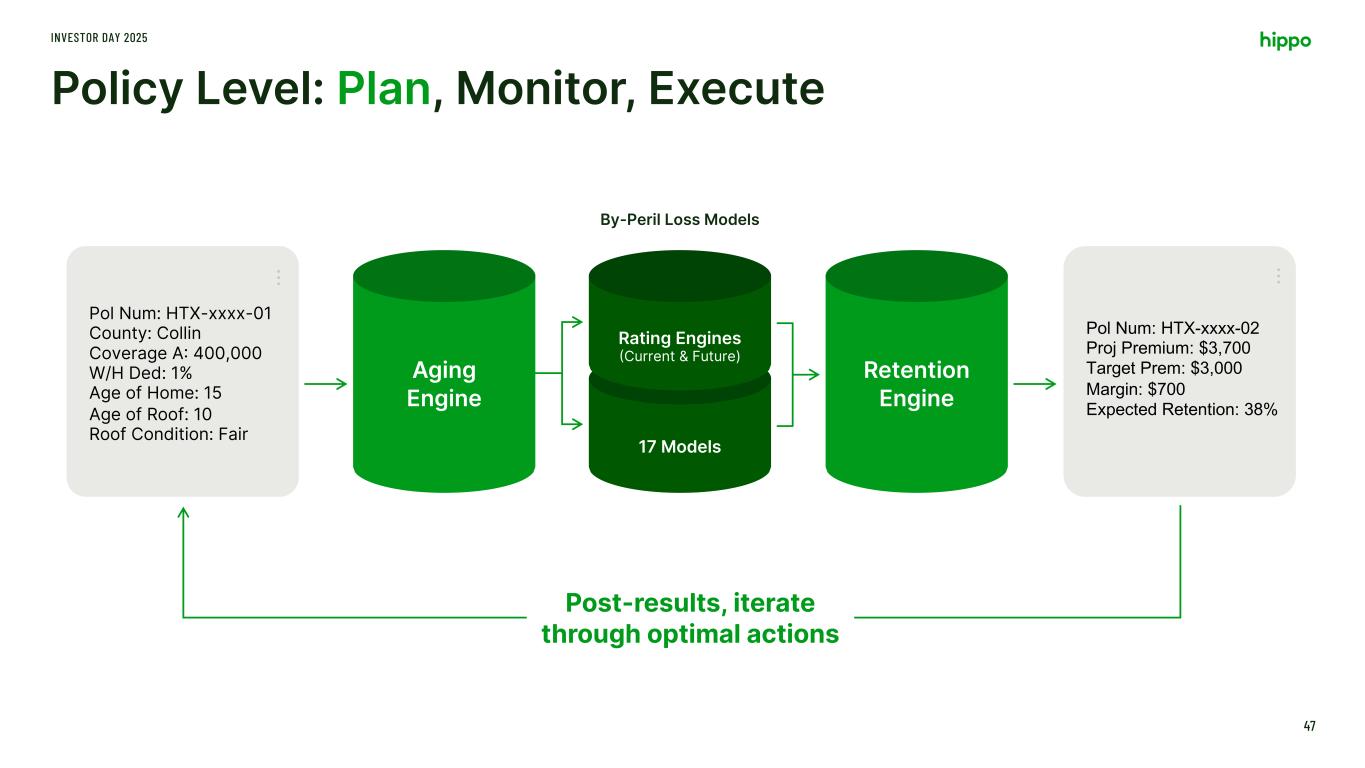

Rating Engines (Current & Future) 17 Models Policy Level: Plan, Monitor, Execute INVESTOR DAY 2025 47 Pol Num: HTX-xxxx-02 Proj Premium: $3,700 Target Prem: $3,000 Margin: $700 Expected Retention: 38% … Pol Num: HTX-xxxx-01 County: Collin Coverage A: 400,000 W/H Ded: 1% Age of Home: 15 Age of Roof: 10 Roof Condition: Fair … Post-results, iterate through optimal actions Aging Engine By-Peril Loss Models Retention Engine

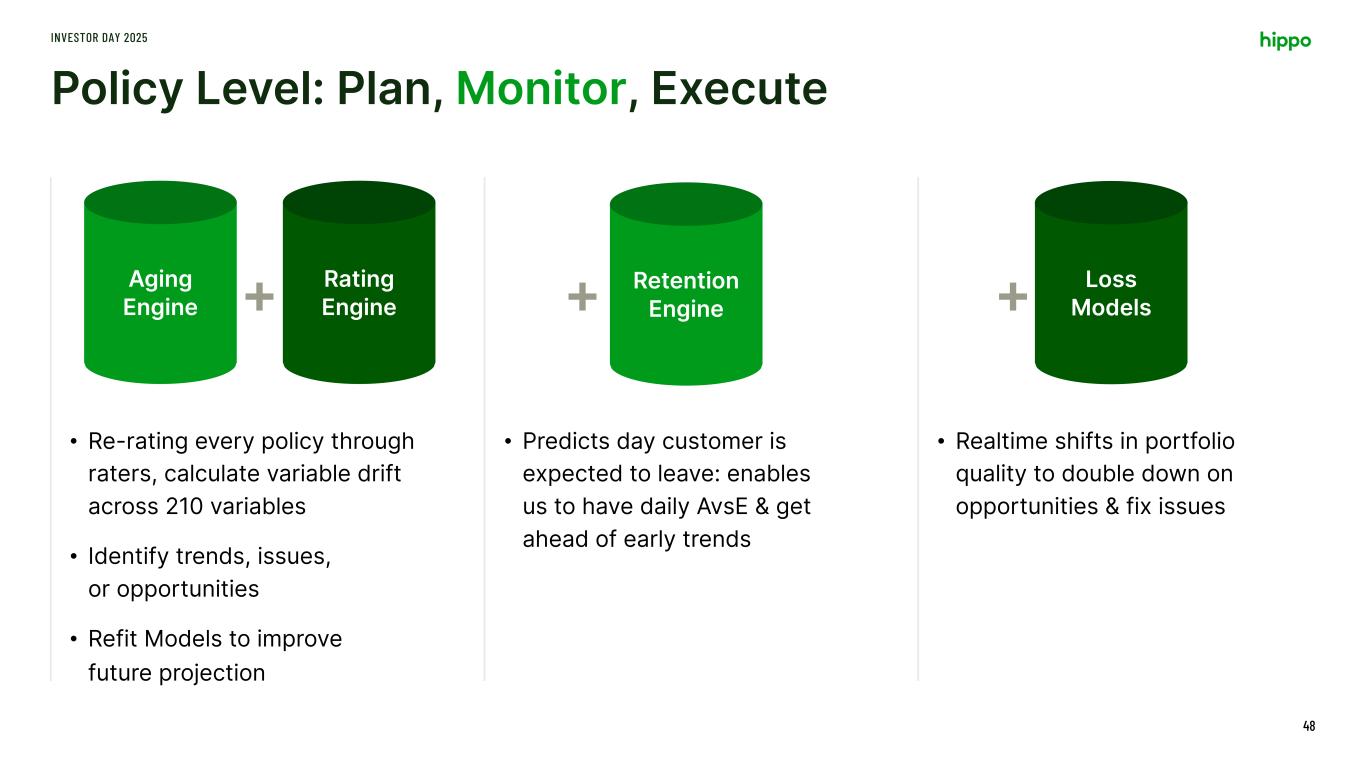

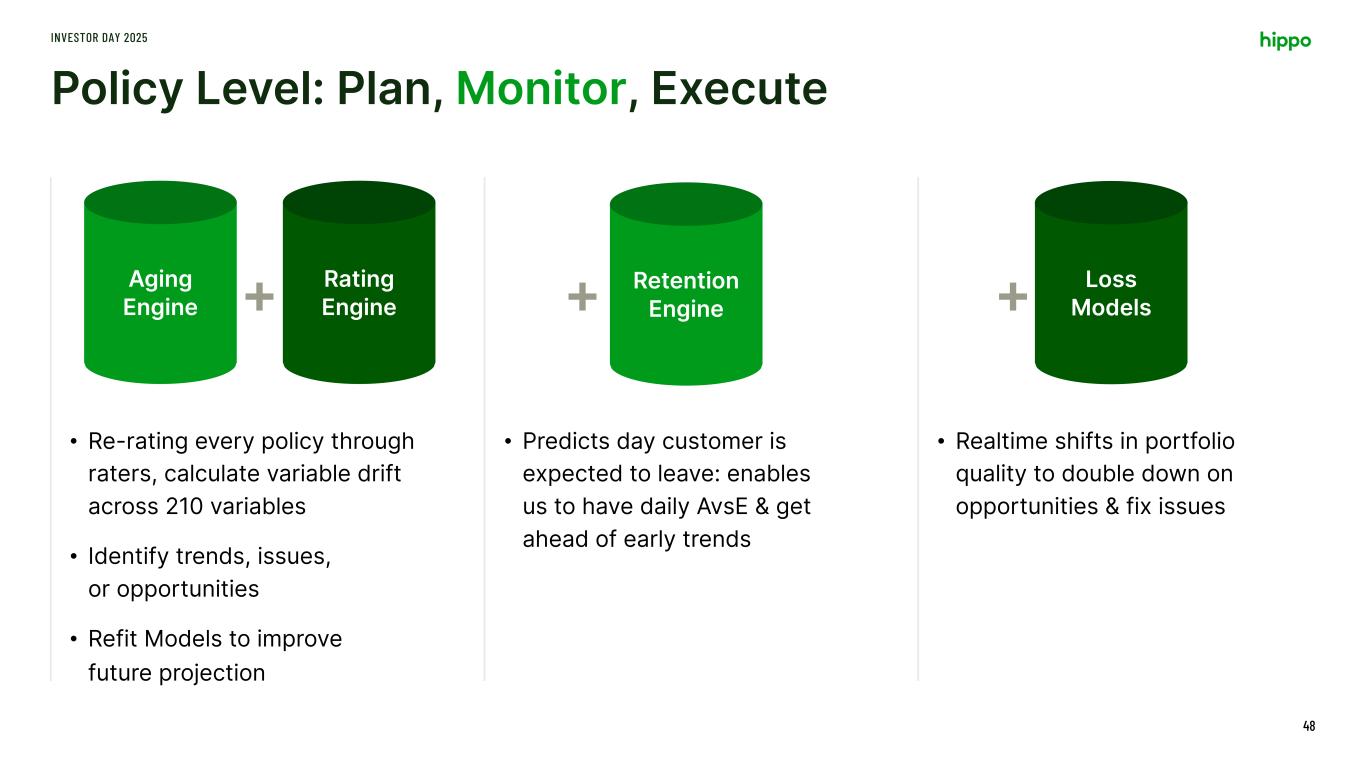

Retention Engine+Aging Engine Rating Engine Policy Level: Plan, Monitor, Execute INVESTOR DAY 2025 48 + + • Re-rating every policy through raters, calculate variable drift across 210 variables • Identify trends, issues, or opportunities • Refit Models to improve future projection • Predicts day customer is expected to leave: enables us to have daily AvsE & get ahead of early trends • Realtime shifts in portfolio quality to double down on opportunities & fix issues Loss Models

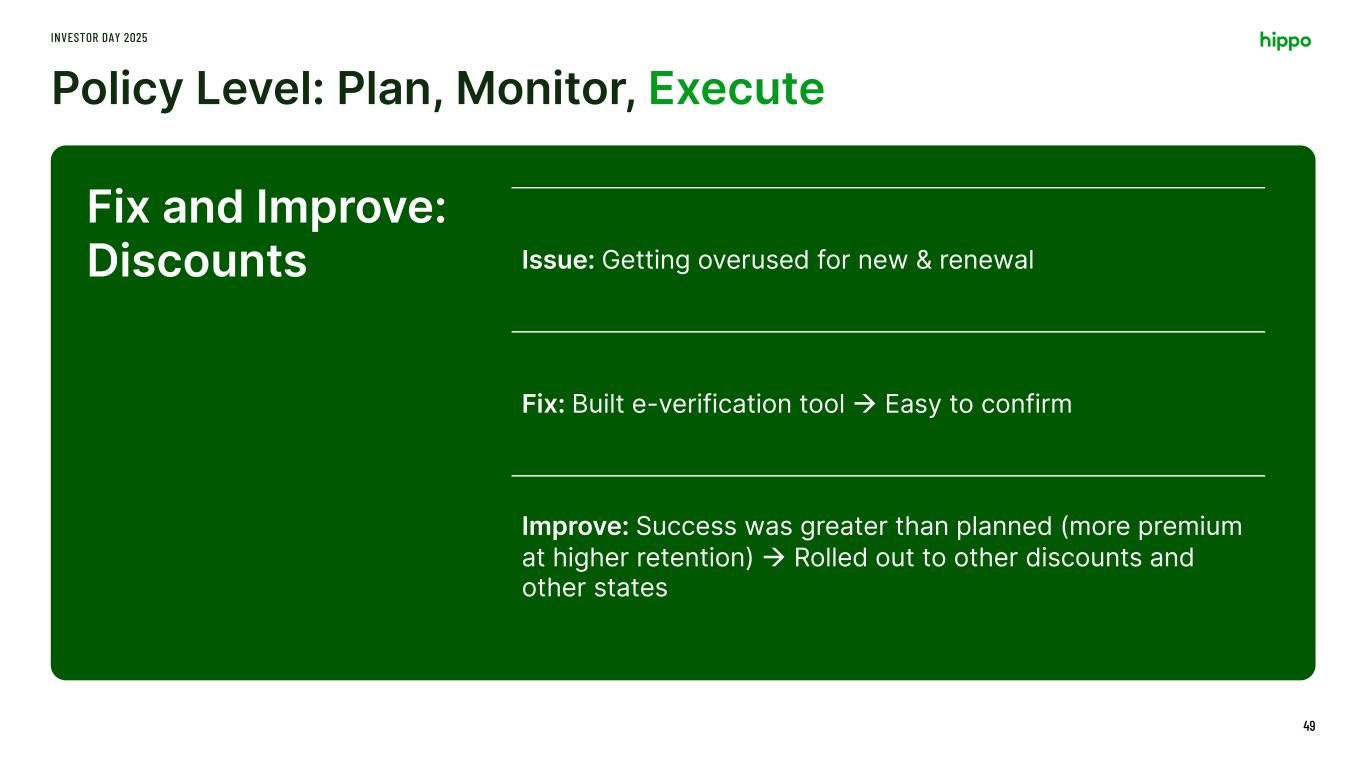

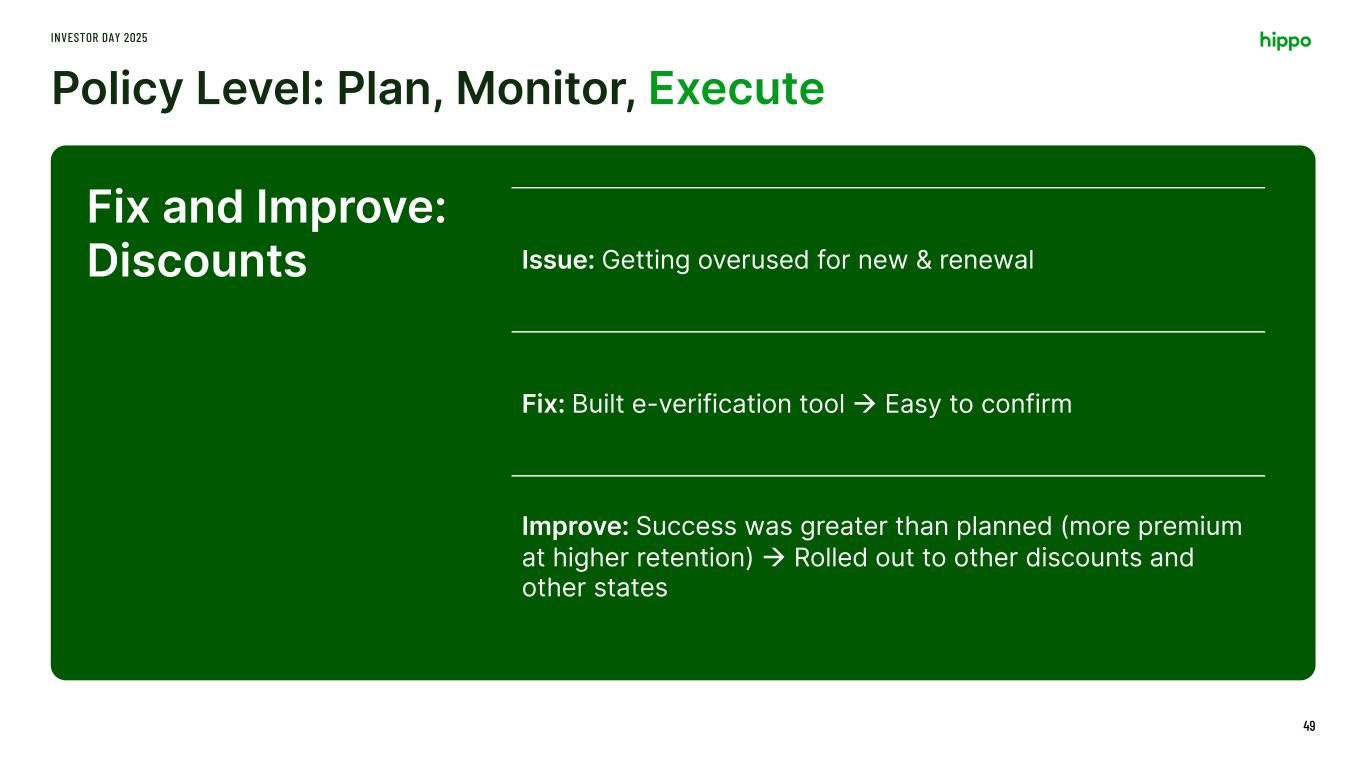

Policy Level: Plan, Monitor, Execute INVESTOR DAY 2025 49 Issue: Getting overused for new & renewal Fix: Built e-verification tool à Easy to confirm Improve: Success was greater than planned (more premium at higher retention) à Rolled out to other discounts and other states Fix and Improve: Discounts

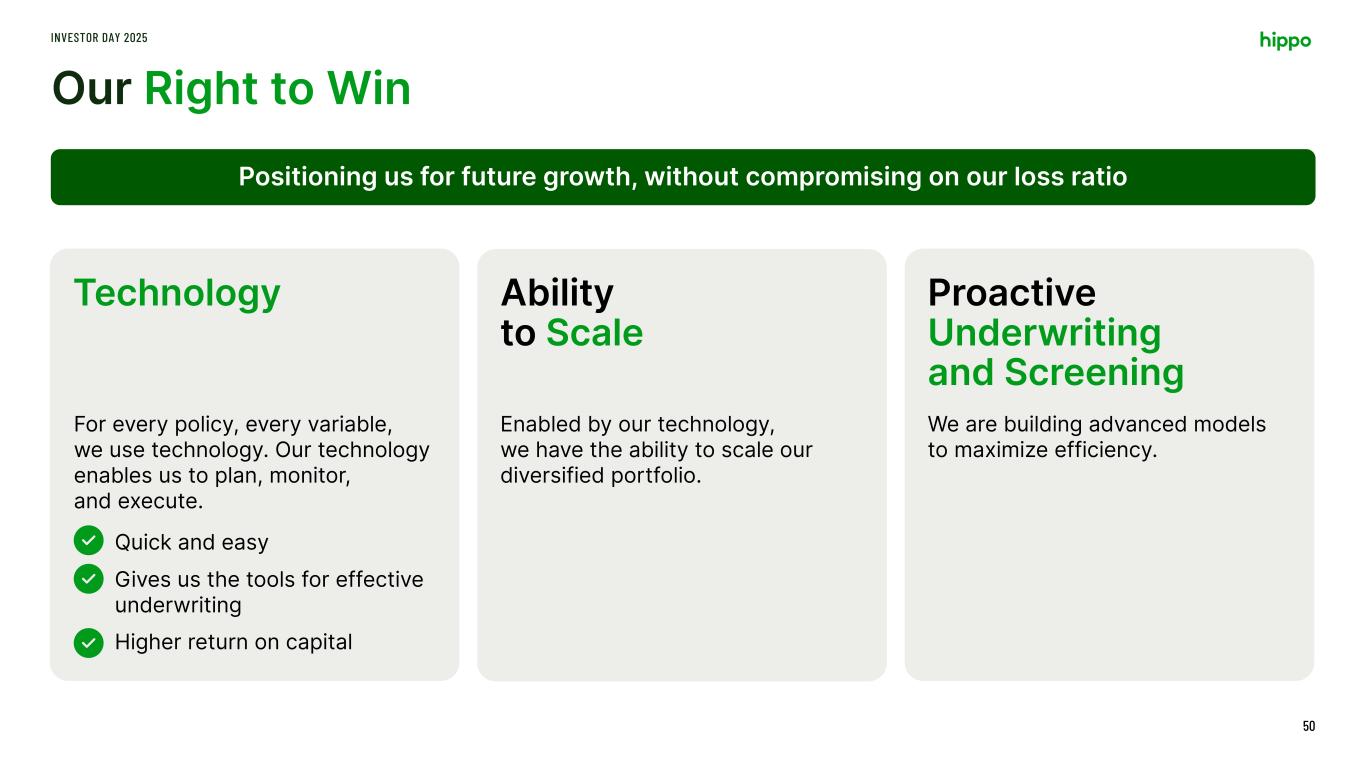

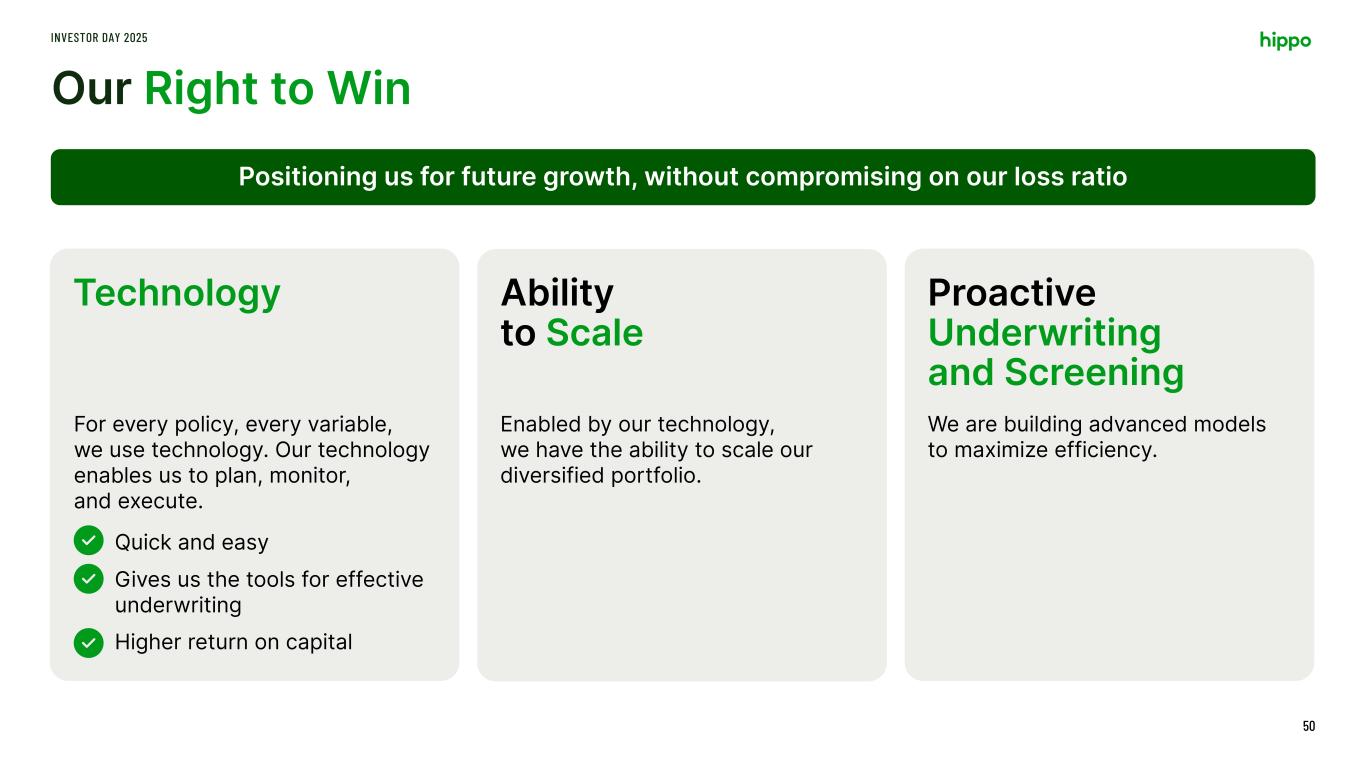

Our Right to Win INVESTOR DAY 2025 50 Technology For every policy, every variable, we use technology. Our technology enables us to plan, monitor, and execute. Quick and easy Gives us the tools for effective underwriting Higher return on capital Ability to Scale Enabled by our technology, we have the ability to scale our diversified portfolio. Proactive Underwriting and Screening We are building advanced models to maximize efficiency. Positioning us for future growth, without compromising on our loss ratio

Andrea Collins Chief Marketing Officer

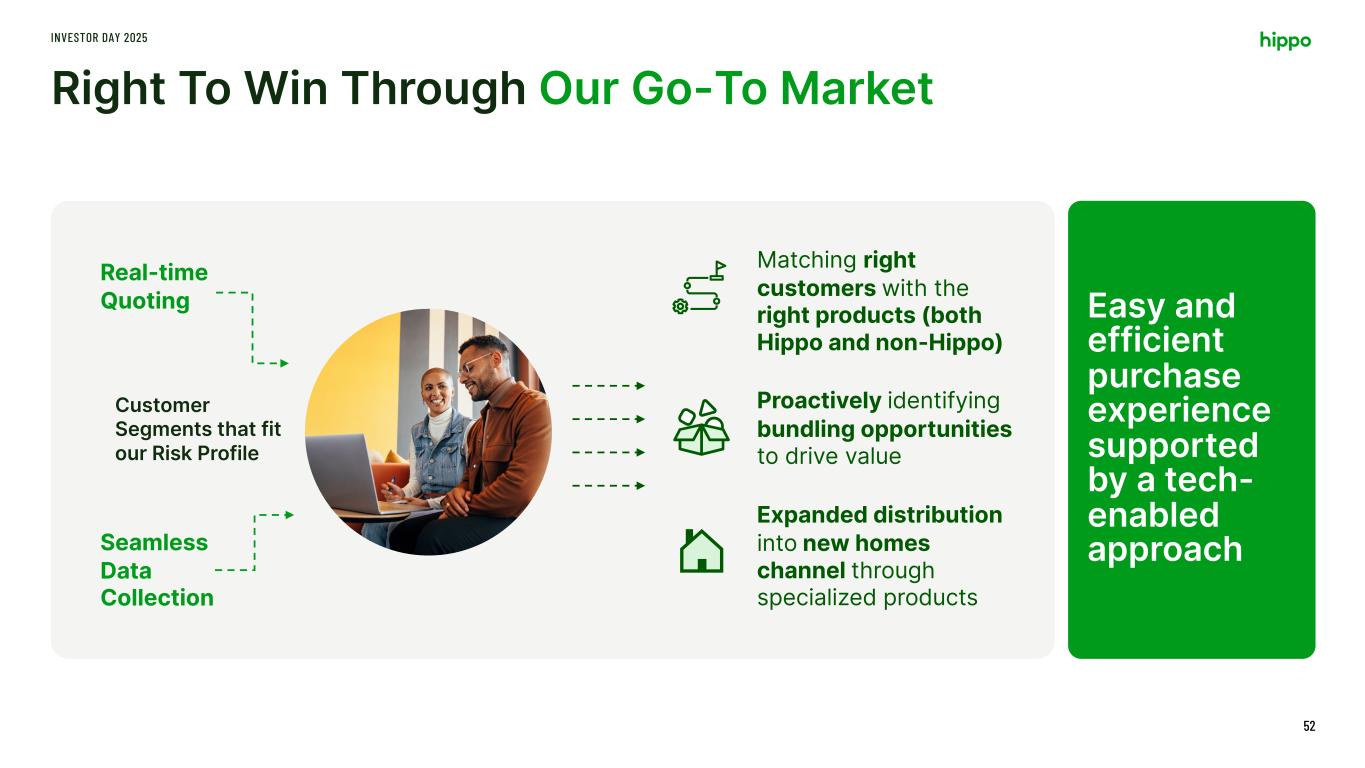

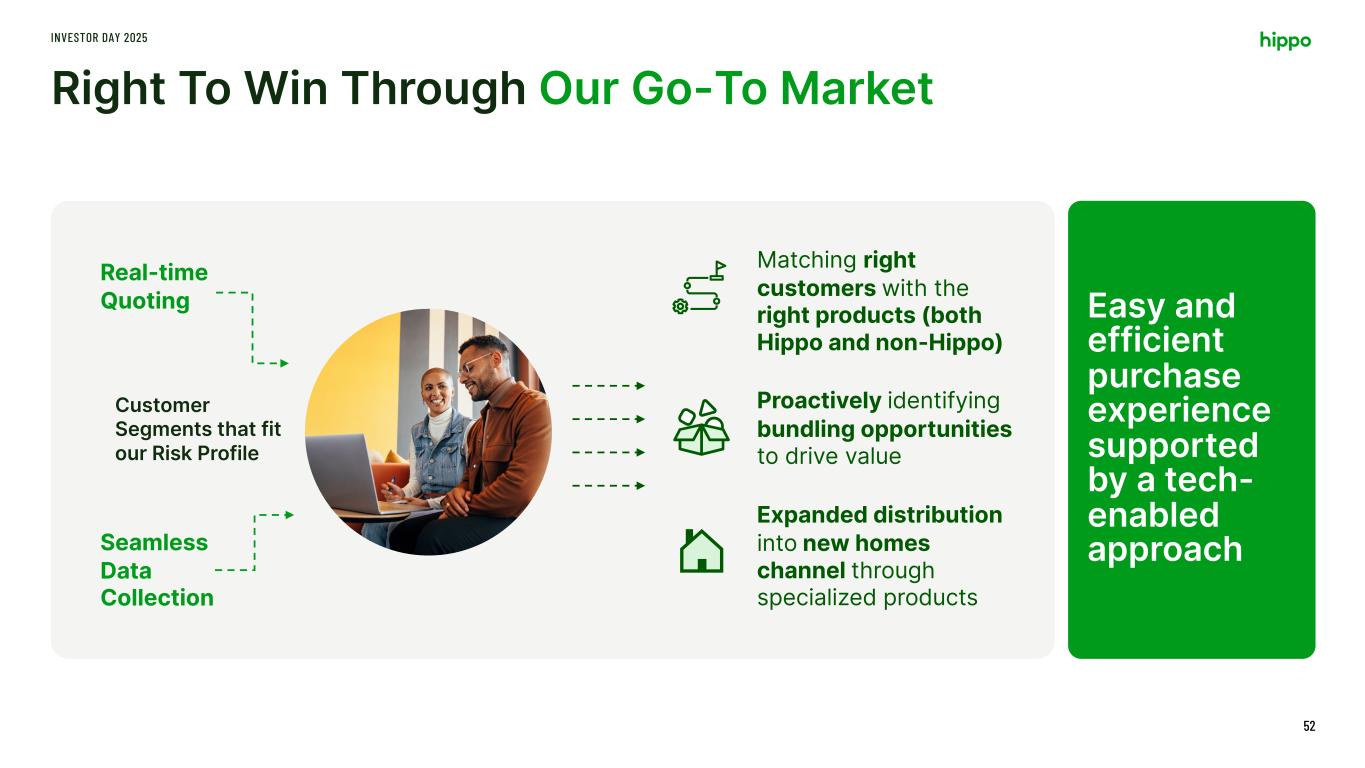

Right To Win Through Our Go-To Market INVESTOR DAY 2025 52 Real-time Quoting Seamless Data Collection Customer Segments that fit our Risk Profile Proactively identifying bundling opportunities to drive value Matching right customers with the right products (both Hippo and non-Hippo) Easy and efficient purchase experience supported by a tech- enabled approach Expanded distribution into new homes channel through specialized products

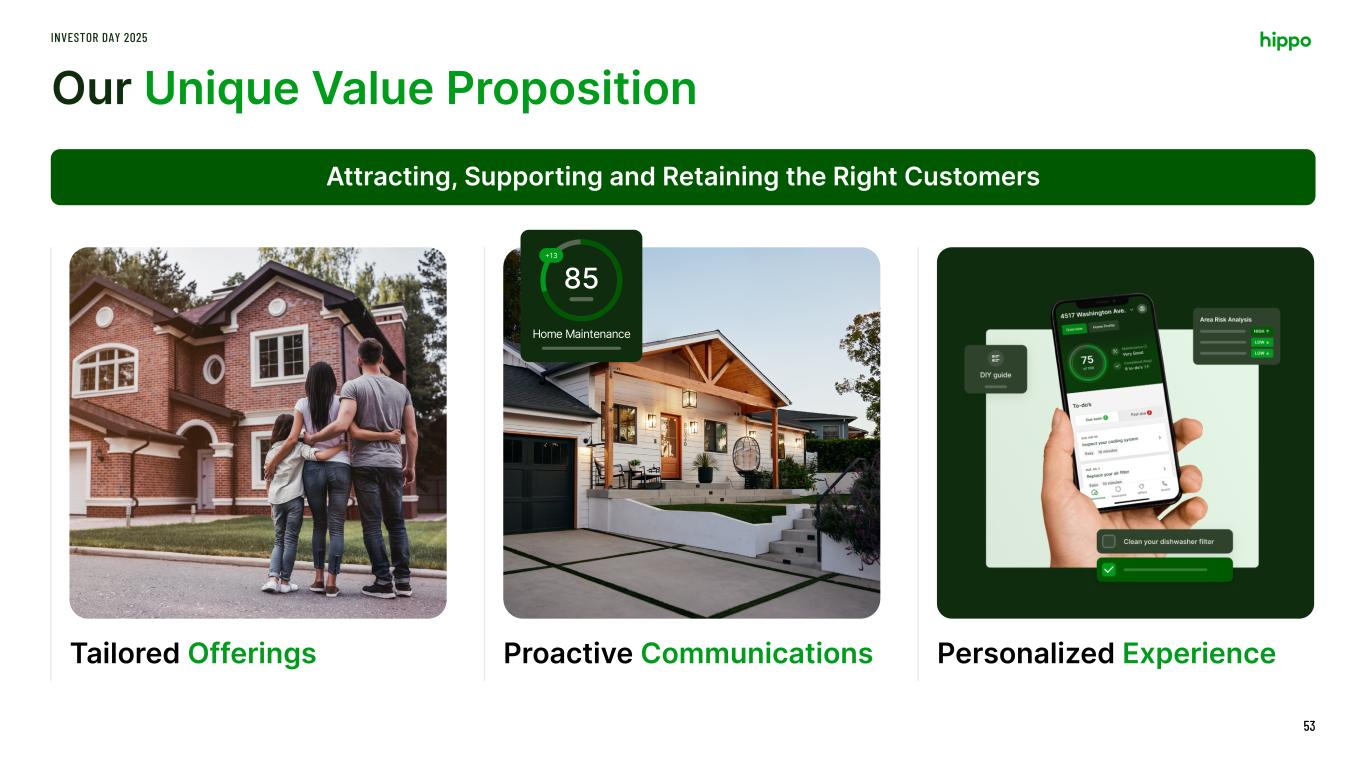

Our Unique Value Proposition INVESTOR DAY 2025 53 Tailored Offerings Proactive Communications Personalized Experience Attracting, Supporting and Retaining the Right Customers Home Maintenance 85 +13

Jesse Willmott CFO & COO, Spinnaker

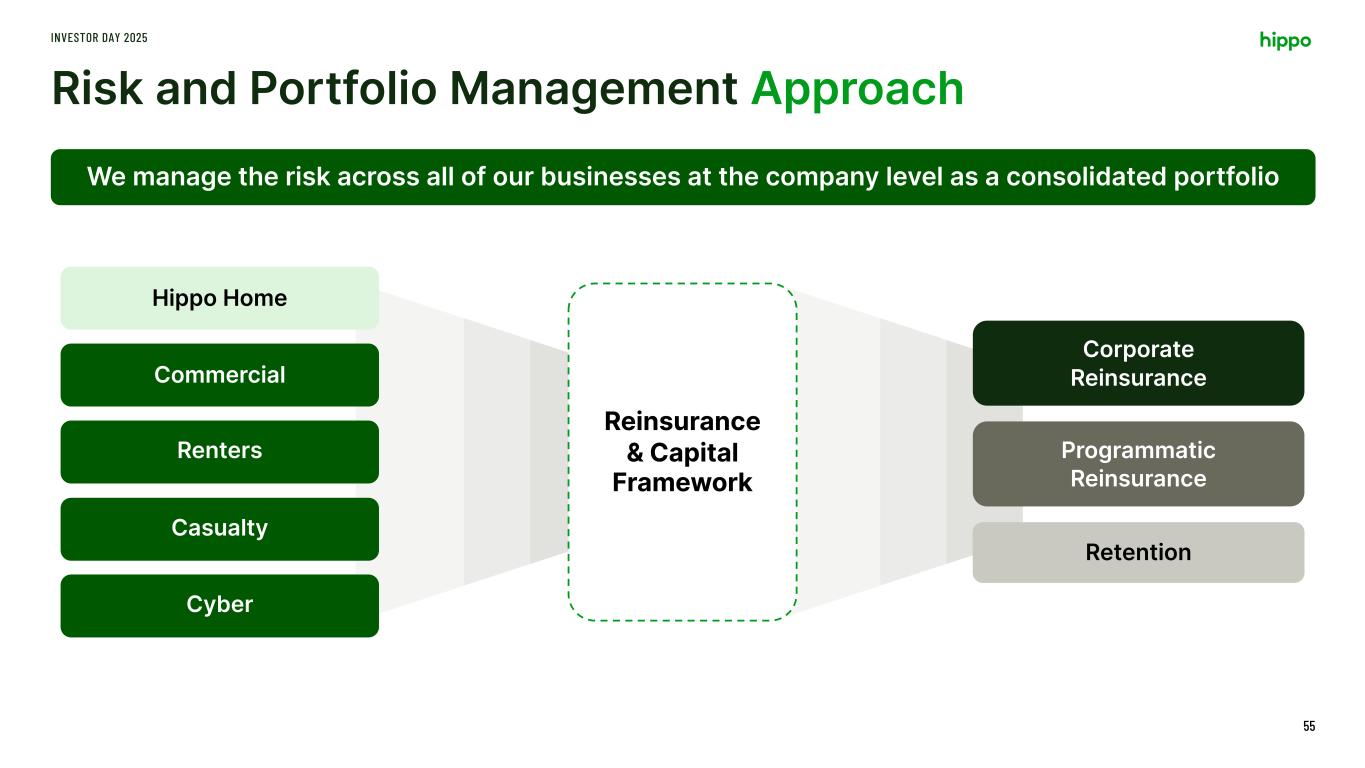

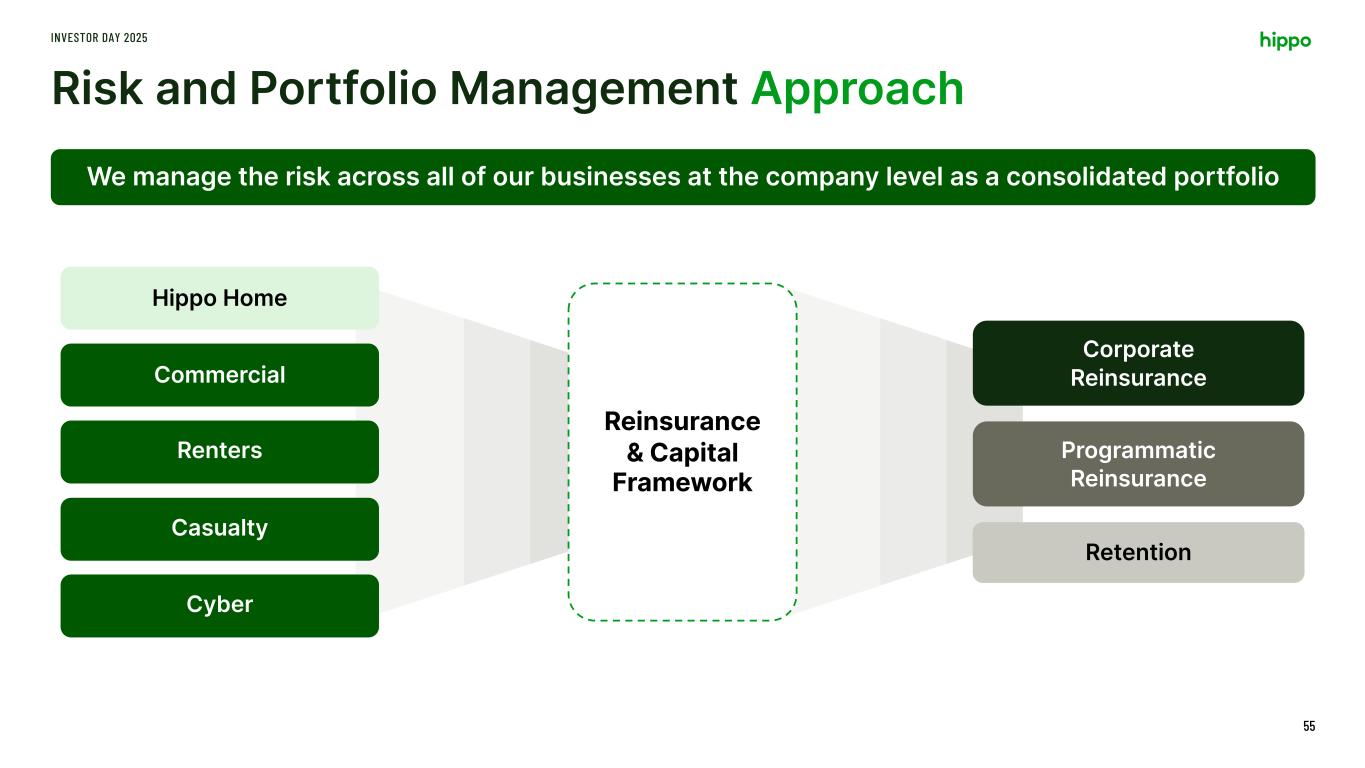

Risk and Portfolio Management Approach INVESTOR DAY 2025 55 We manage the risk across all of our businesses at the company level as a consolidated portfolio Reinsurance & Capital Framework Hippo Home Commercial Renters Casualty Cyber Programmatic Reinsurance Retention Corporate Reinsurance

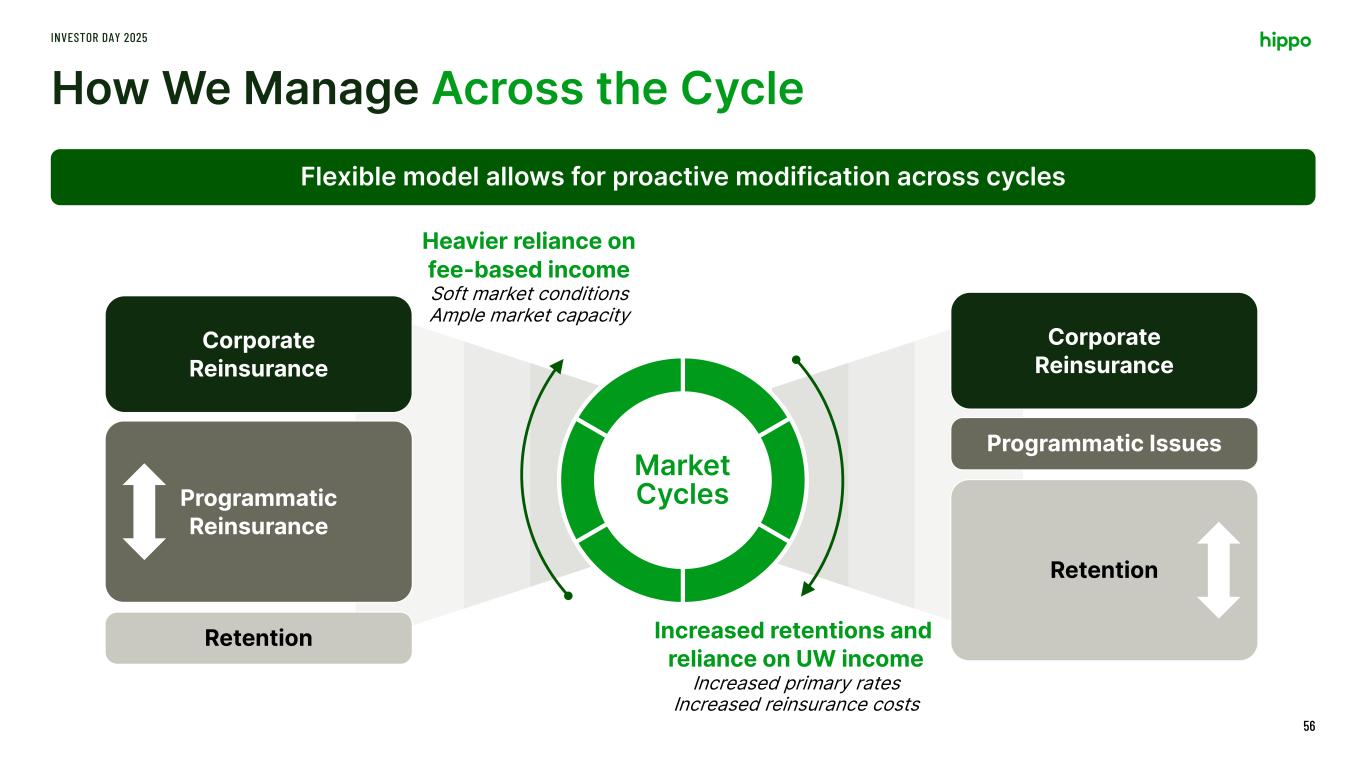

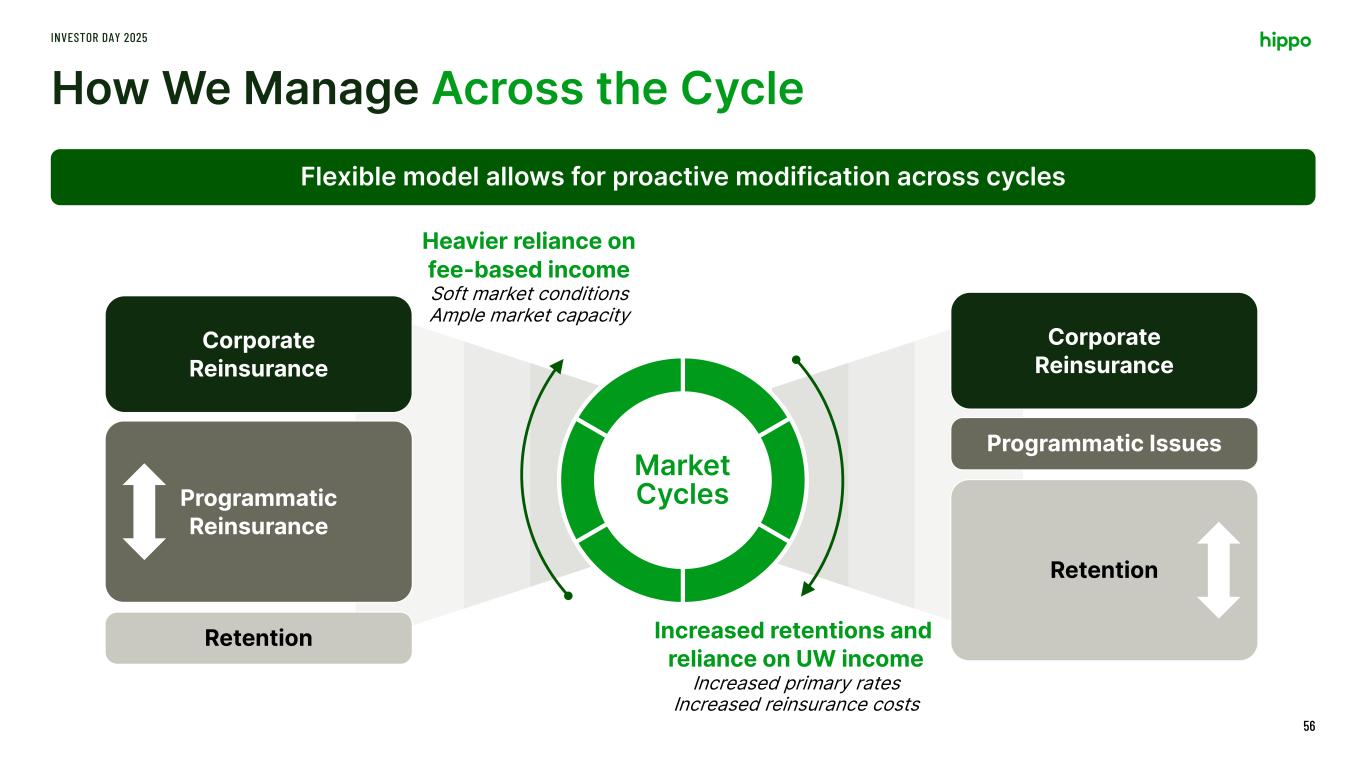

How We Manage Across the Cycle INVESTOR DAY 2025 56 Flexible model allows for proactive modification across cycles Retention Programmatic Issues Corporate Reinsurance Programmatic Reinsurance Retention Corporate Reinsurance Market Cycles Heavier reliance on fee-based income Soft market conditions Ample market capacity Increased retentions and reliance on UW income Increased primary rates Increased reinsurance costs

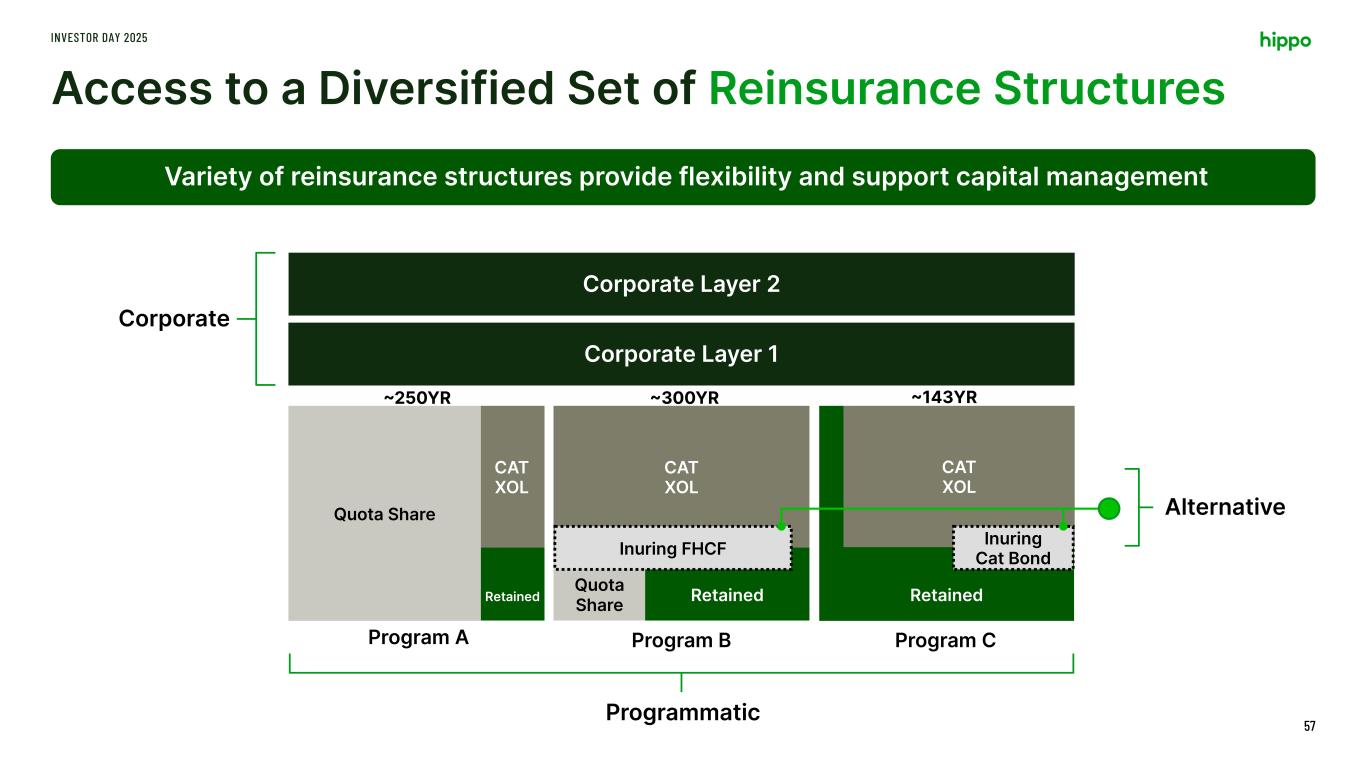

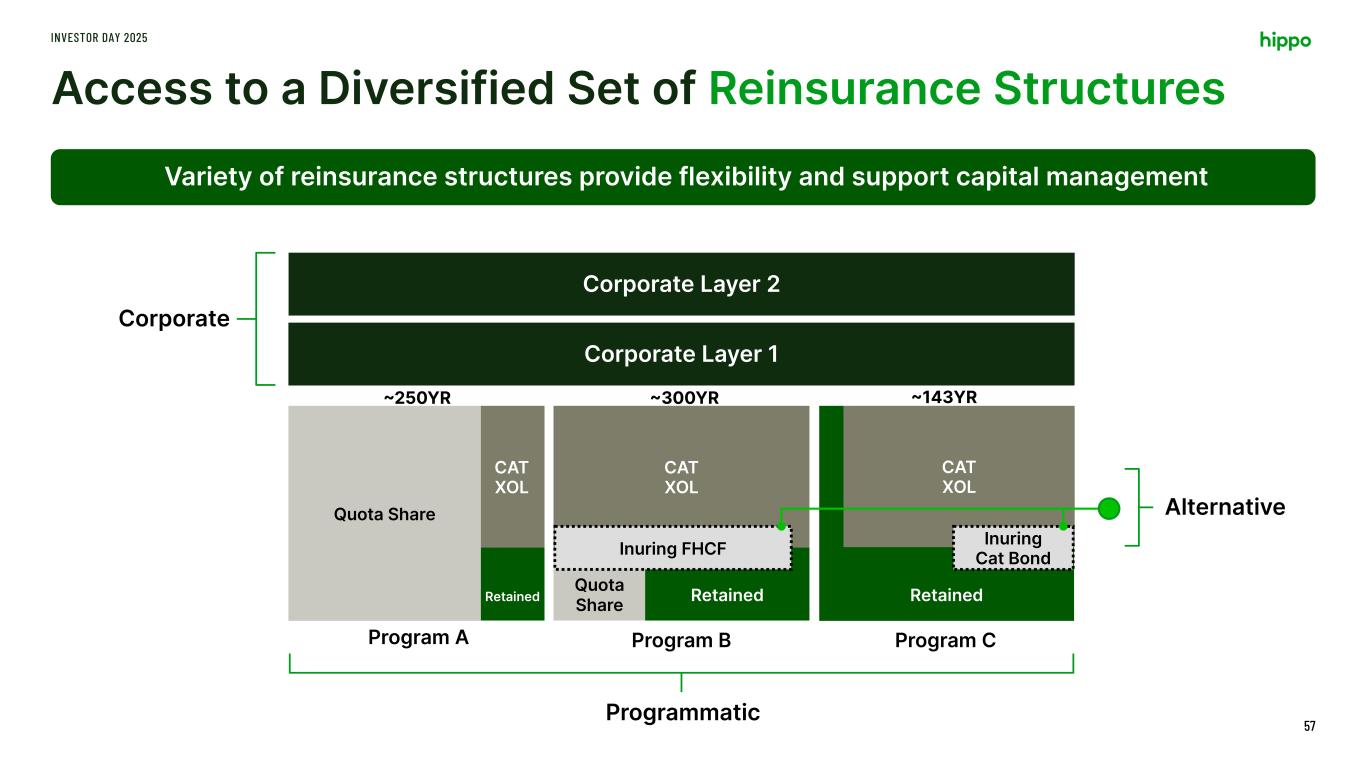

Access to a Diversified Set of Reinsurance Structures INVESTOR DAY 2025 57 Variety of reinsurance structures provide flexibility and support capital management Program A Program B Program C Corporate Layer 2 Corporate Layer 1 CAT XOL Retained Quota Share Retained CAT XOL CAT XOL Quota Share Retained ~250YR ~300YR ~143YR Corporate Programmatic Alternative Inuring Cat BondInuring FHCF

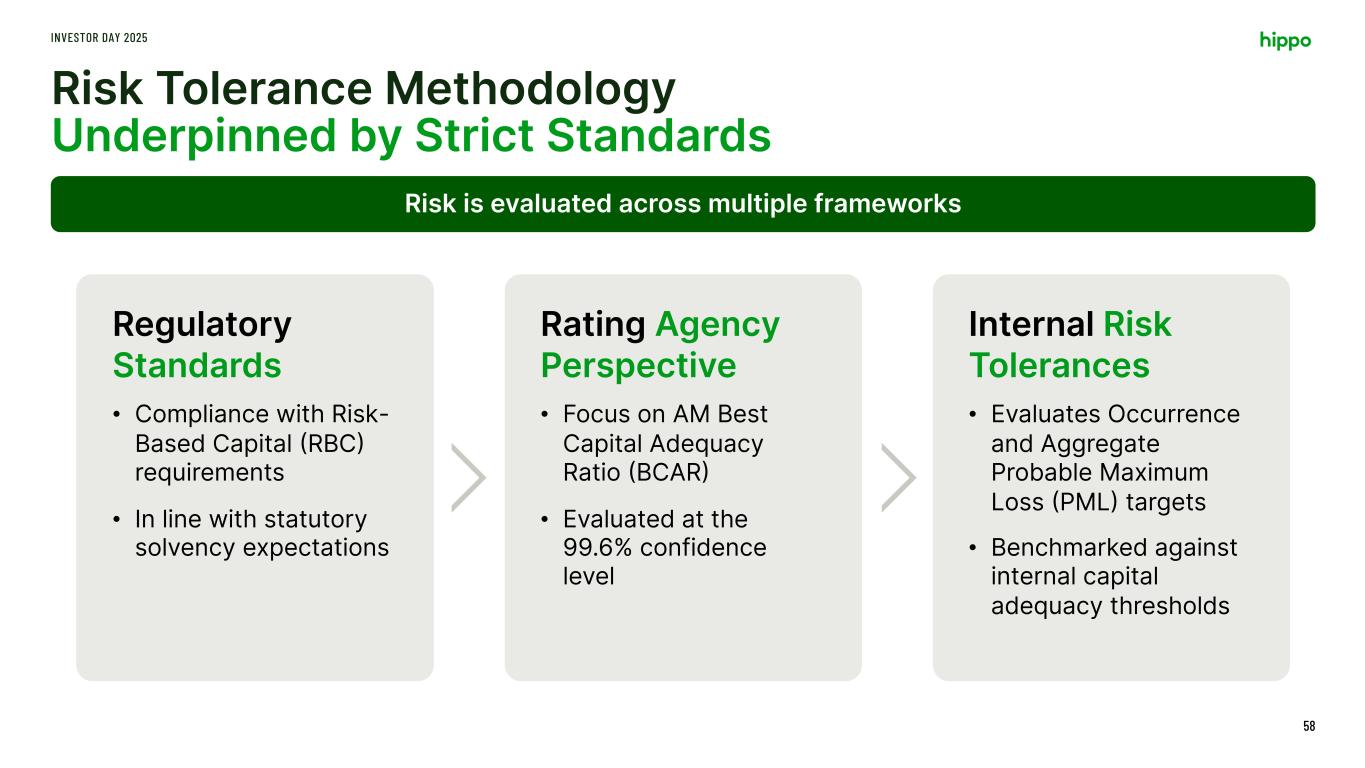

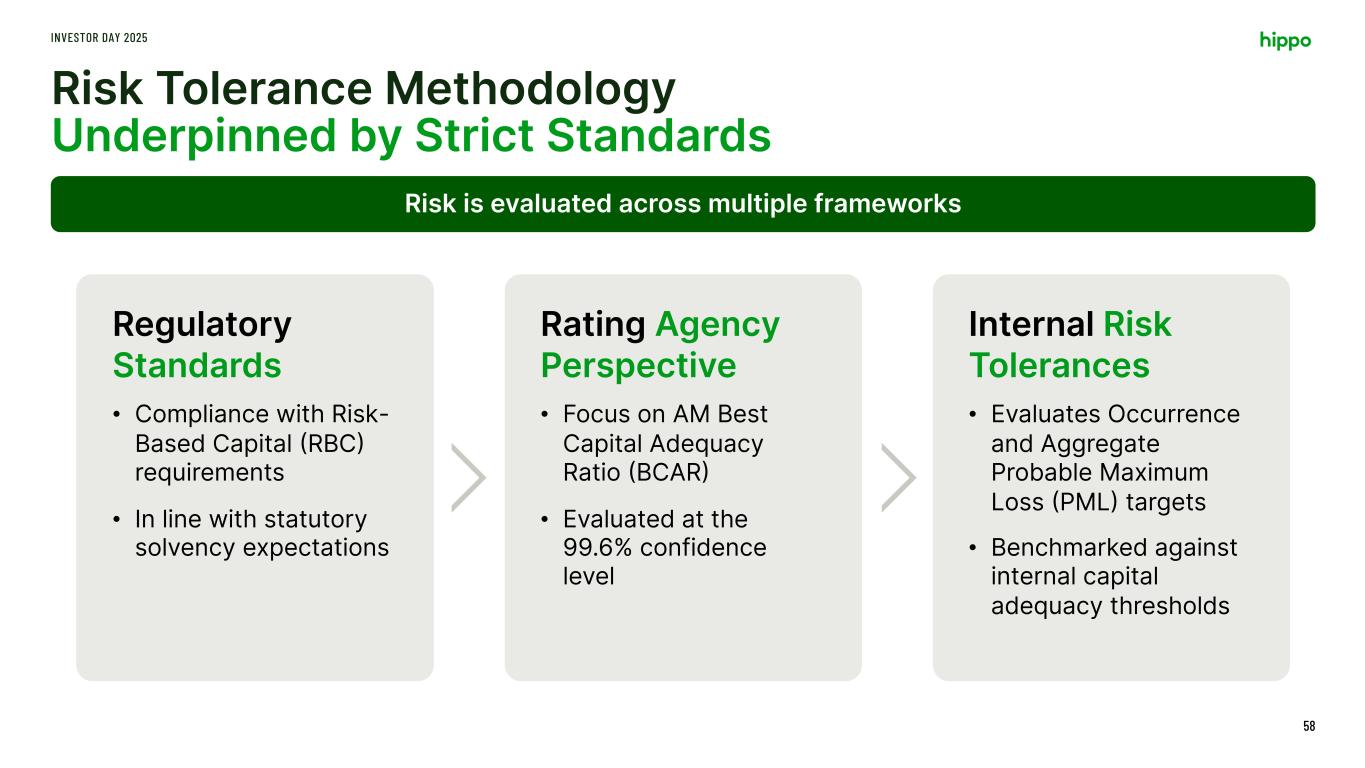

Risk Tolerance Methodology Underpinned by Strict Standards INVESTOR DAY 2025 58 Risk is evaluated across multiple frameworks Regulatory Standards Rating Agency Perspective Internal Risk Tolerances • Compliance with Risk- Based Capital (RBC) requirements • In line with statutory solvency expectations • Focus on AM Best Capital Adequacy Ratio (BCAR) • Evaluated at the 99.6% confidence level • Evaluates Occurrence and Aggregate Probable Maximum Loss (PML) targets • Benchmarked against internal capital adequacy thresholds

Guy Zeltser Chief Financial Officer

119-121 420-450 465-475 -55 9 Q3’22 Q4’24 Q4’24 Prior Investor Day Guide Actual Outperformed Prior Investor Day Guidance INVESTOR DAY 2025 60 We have the insight and execution capabilities to provide achievable forecasts 2022 2025 2025 Prior Investor Day Guide Current Forecast 400 515 56 As of Q4’24 As of Q4’24 Prior Investor Day Guide Actuals Inorganic 571 0-4 Adjusted EBITDA $ Million Cash & Investments $ Million Revenue Growth $ Million

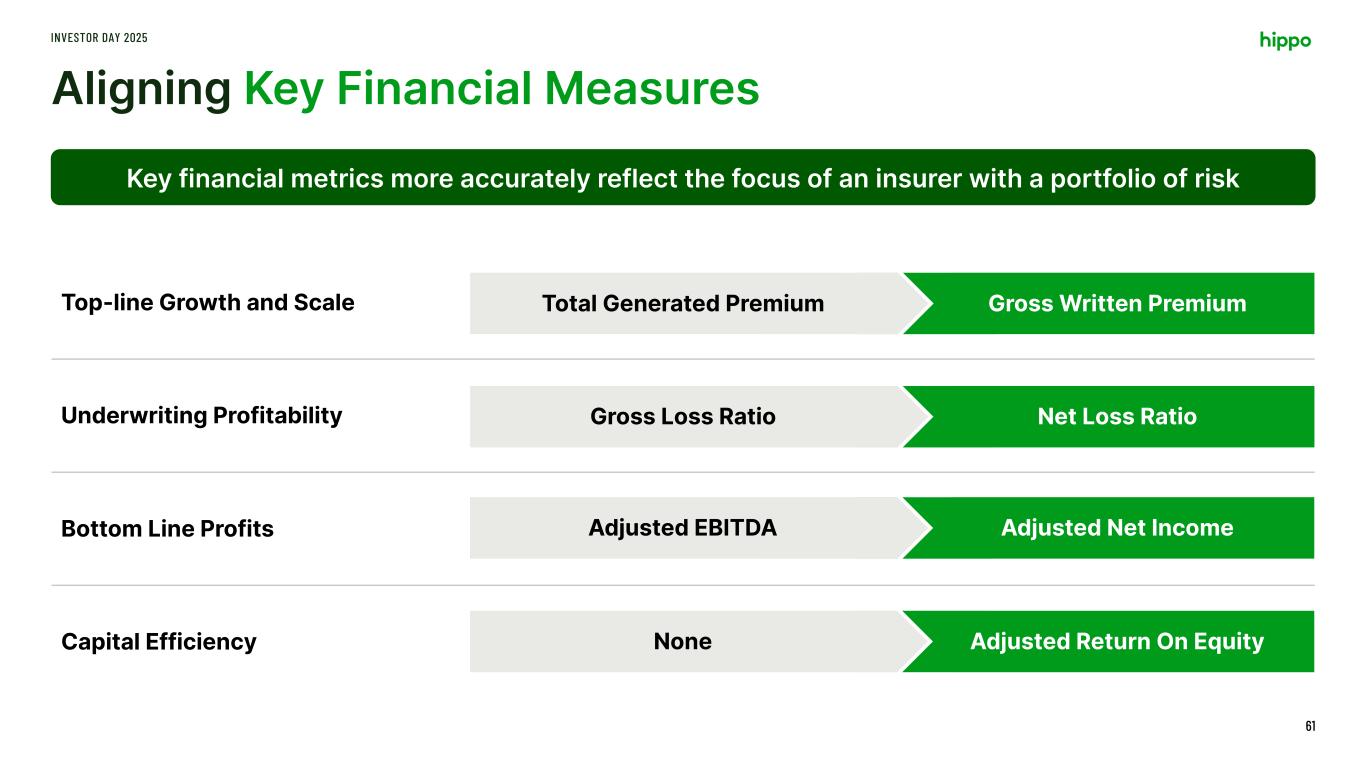

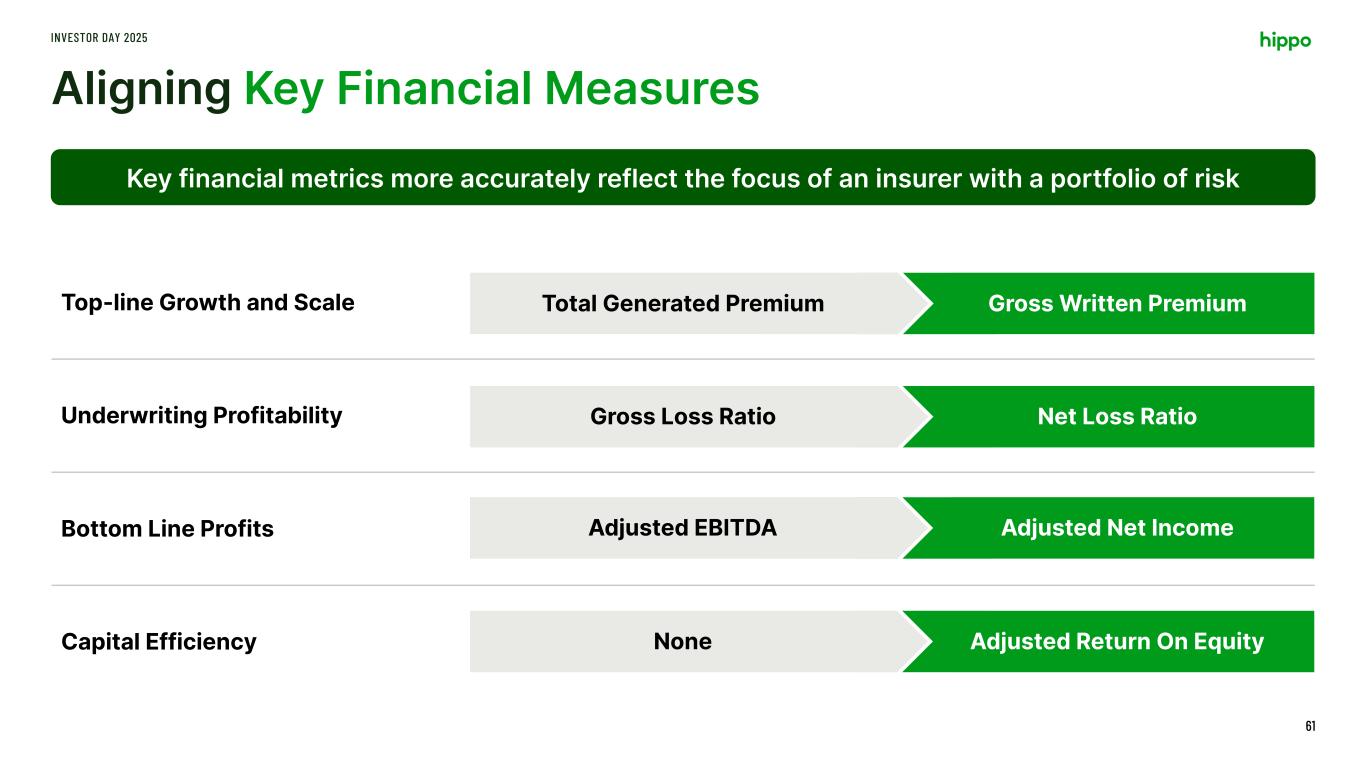

Aligning Key Financial Measures INVESTOR DAY 2025 61 Key financial metrics more accurately reflect the focus of an insurer with a portfolio of risk Top-line Growth and Scale Underwriting Profitability Bottom Line Profits Capital Efficiency Total Generated Premium Gross Written Premium Gross Loss Ratio Net Loss Ratio Adjusted EBITDA Adjusted Net Income Adjusted Return On EquityNone

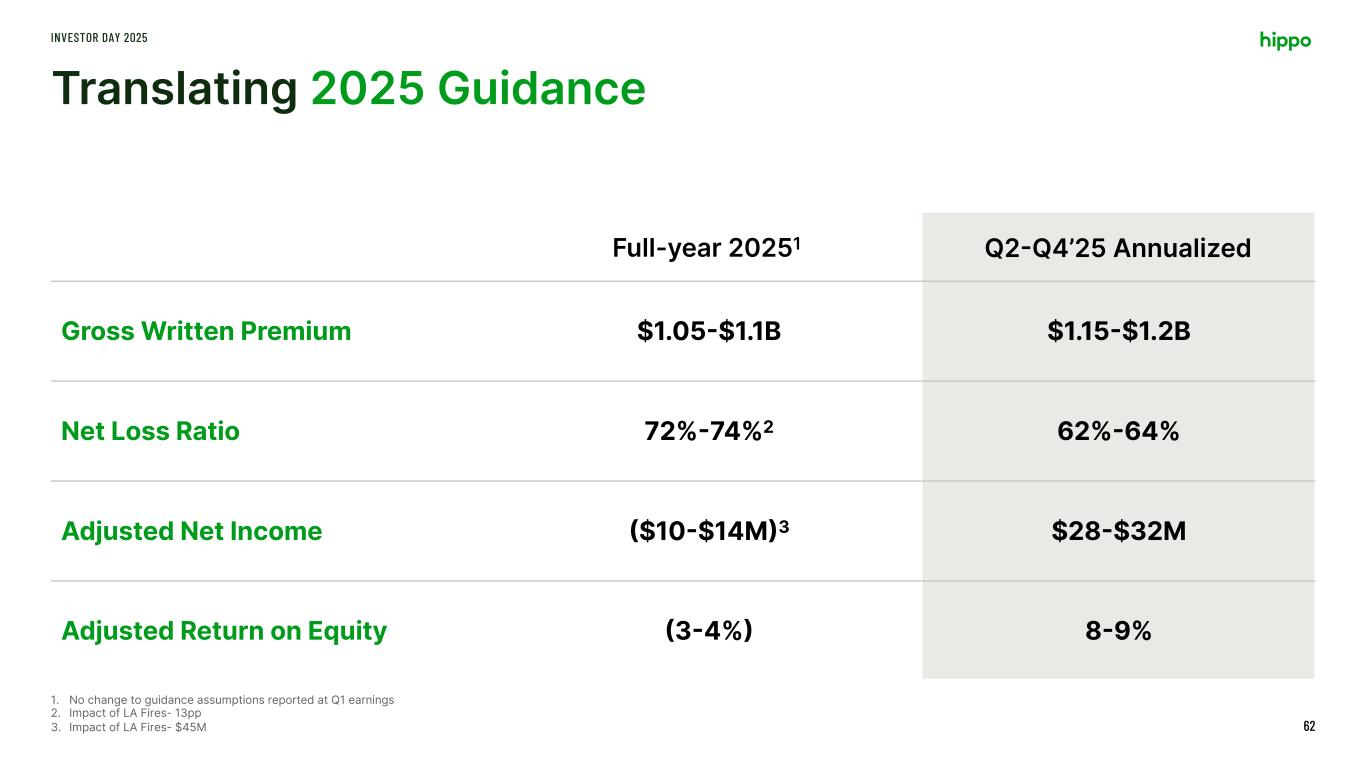

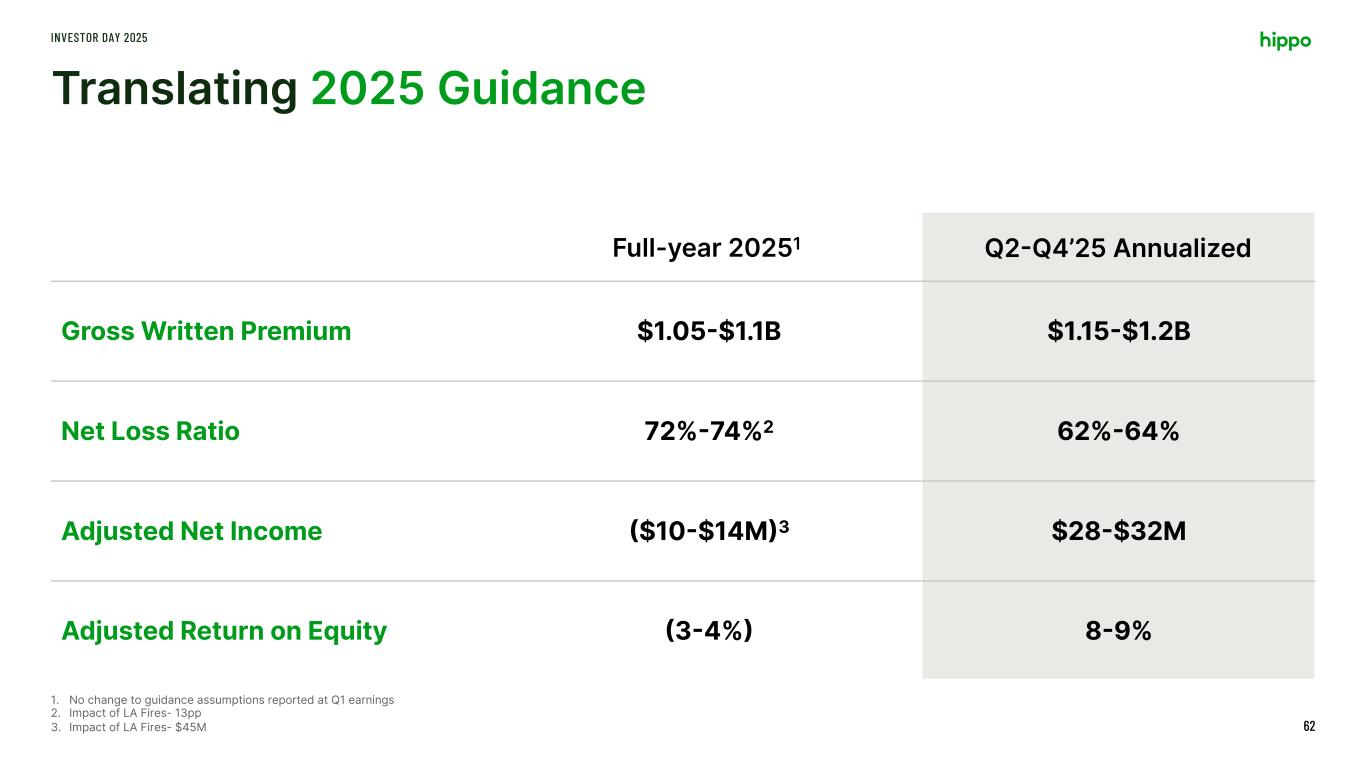

Translating 2025 Guidance INVESTOR DAY 2025 62 Gross Written Premium $1.05-$1.1B $1.15-$1.2B Net Loss Ratio 72%-74%2 62%-64% Adjusted Net Income ($10-$14M)3 $28-$32M Adjusted Return on Equity (3-4%) 8-9% Full-year 20251 Q2-Q4’25 Annualized 1. No change to guidance assumptions reported at Q1 earnings 2. Impact of LA Fires- 13pp 3. Impact of LA Fires- $45M

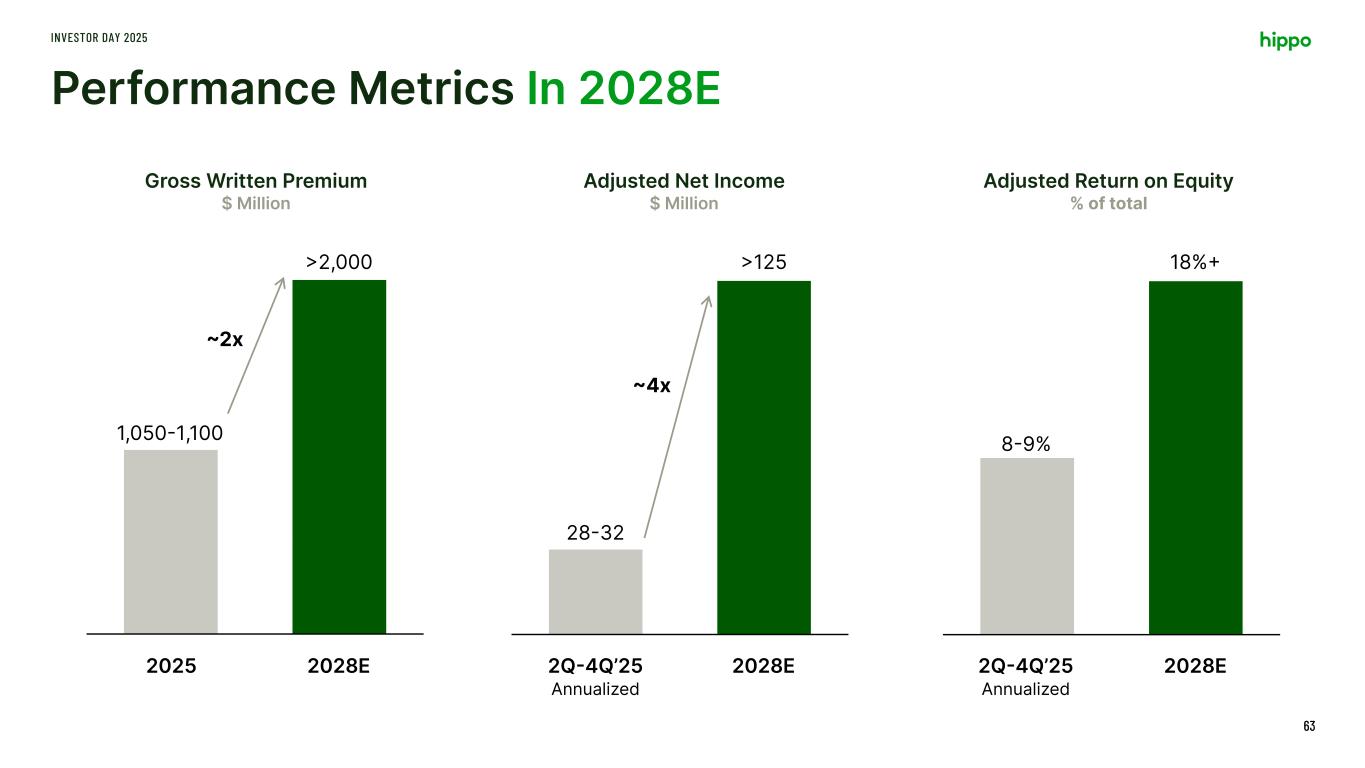

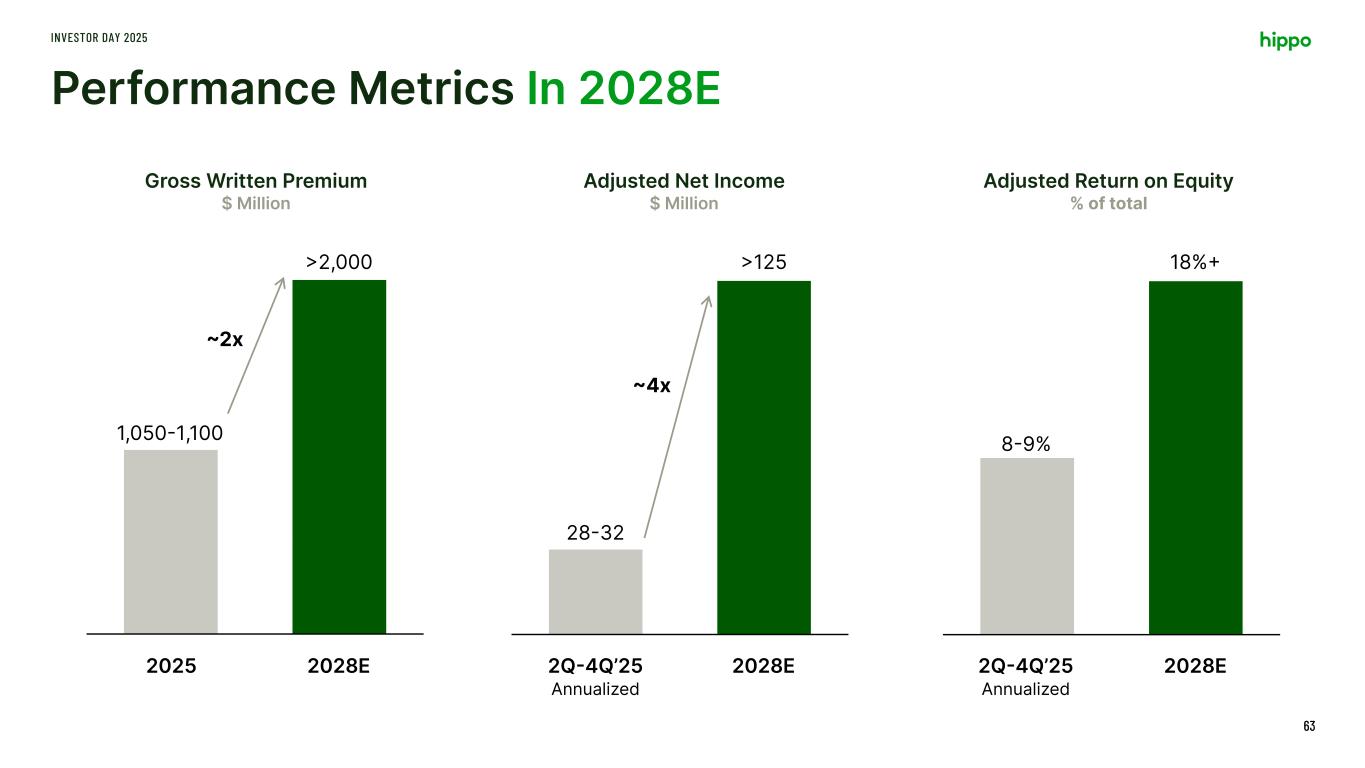

8-9% 18%+ Performance Metrics In 2028E INVESTOR DAY 2025 63 Gross Written Premium $ Million Adjusted Net Income $ Million Adjusted Return on Equity % of total 2025 2028E 1,050-1,100 >2,000 28-32 >125 ~2x 2Q-4Q’25 2028E Annualized 2Q-4Q’25 2028E Annualized ~4x

Doubling Top-line Premium by 2028 INVESTOR DAY 2025 64 Three-year growth assumptions are in-line with how the business is currently operating 2025 2028E Gross Written Premium Organic Growth from Existing non- Hippo programs New non-Hippo programs Scale-up of New Homes channel within Hippo MGA Hippo MGA outside New Homes Gross Written Premium Organic growth at slightly lower pace than achieved historically Adding programs in similar pace to last few years, aiming to diversify the lines of business Growing organically with existing partners, bolstered by strategic partnerships Focusing Hippo MGA growth outside New Homes in diversified states where fewer new homes are built Key Drivers 1 2 3 4 1 2 3 4 Gross Written Premium $ Million 1,050-1,100 >2,00022% 25-28E CAGR

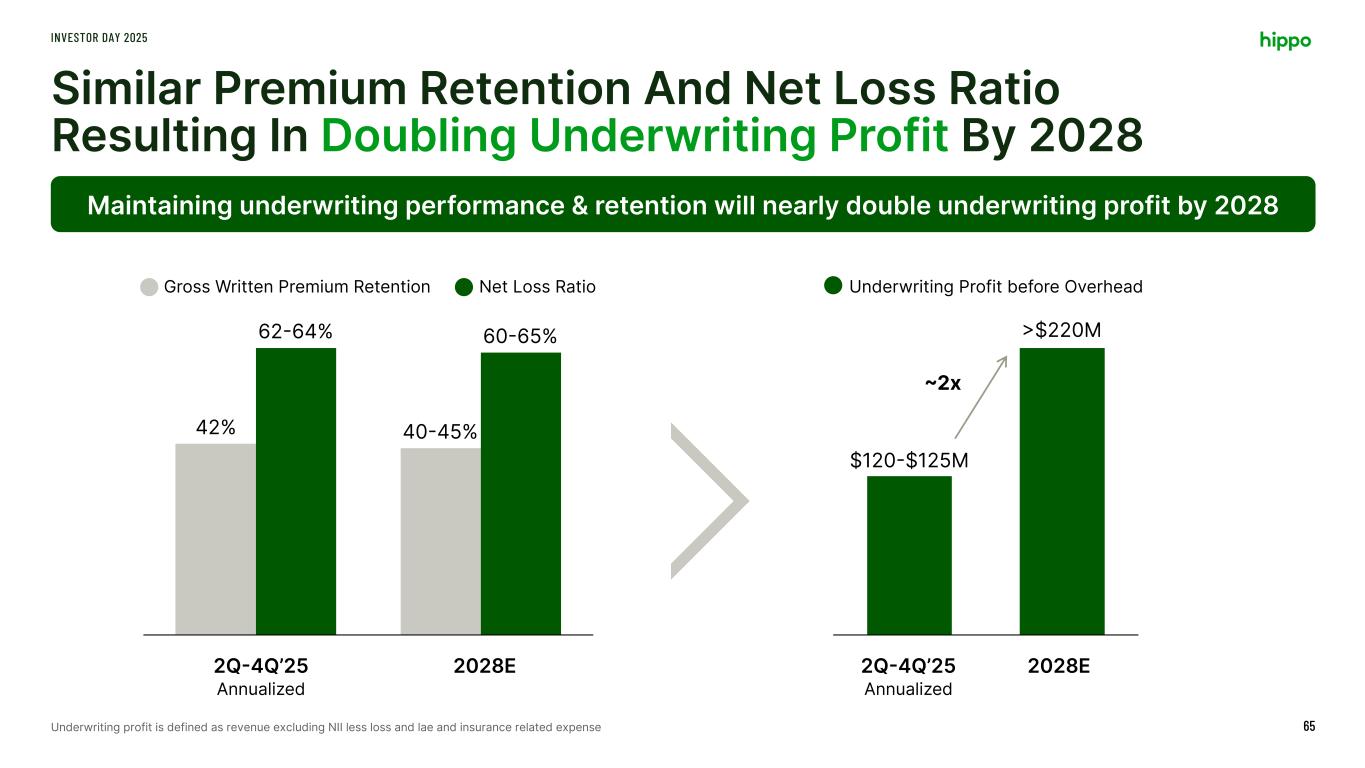

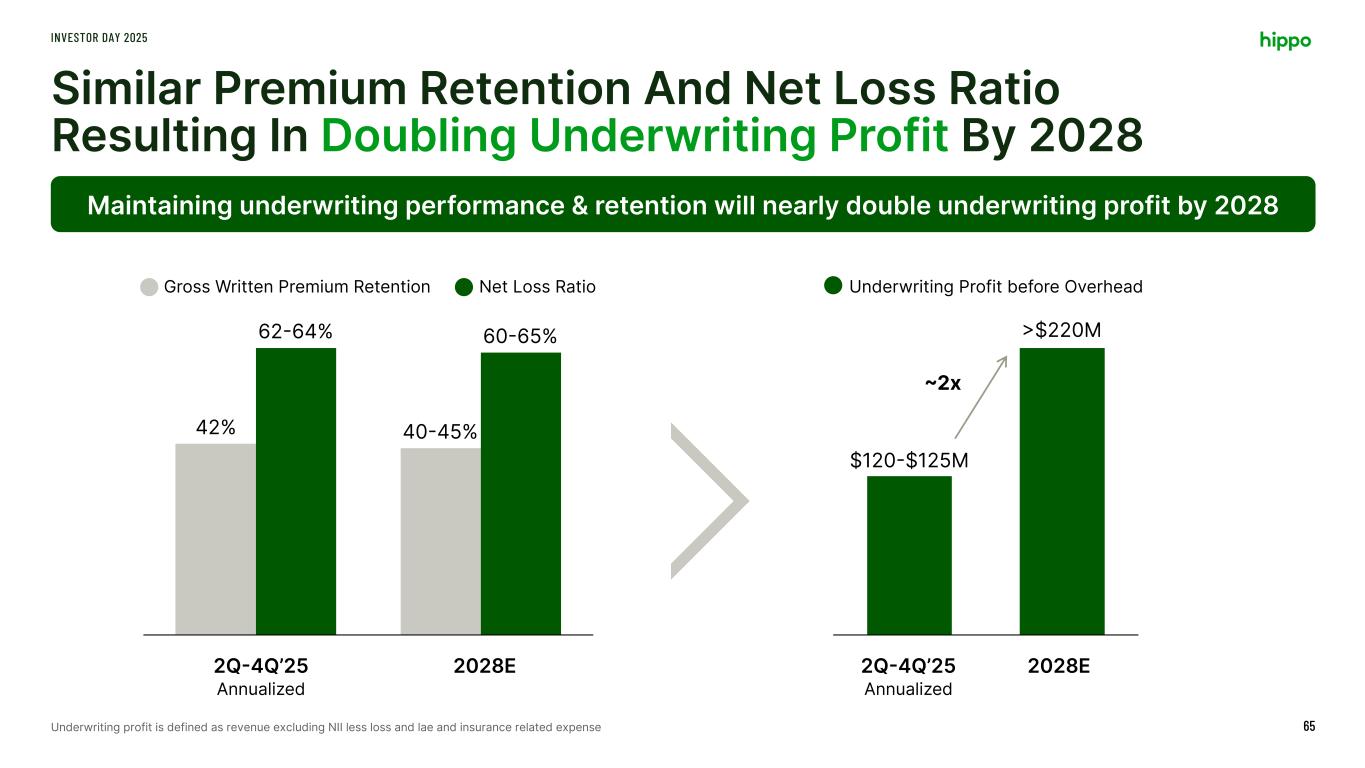

Similar Premium Retention And Net Loss Ratio Resulting In Doubling Underwriting Profit By 2028 INVESTOR DAY 2025 65 Maintaining underwriting performance & retention will nearly double underwriting profit by 2028 Net Loss RatioGross Written Premium Retention Underwriting Profit before Overhead ~2x $120-$125M >$220M 42% 62-64% 60-65% 40-45% 2Q-4Q’25 2028E Annualized 2Q-4Q’25 2028E Annualized Underwriting profit is defined as revenue excluding NII less loss and lae and insurance related expense

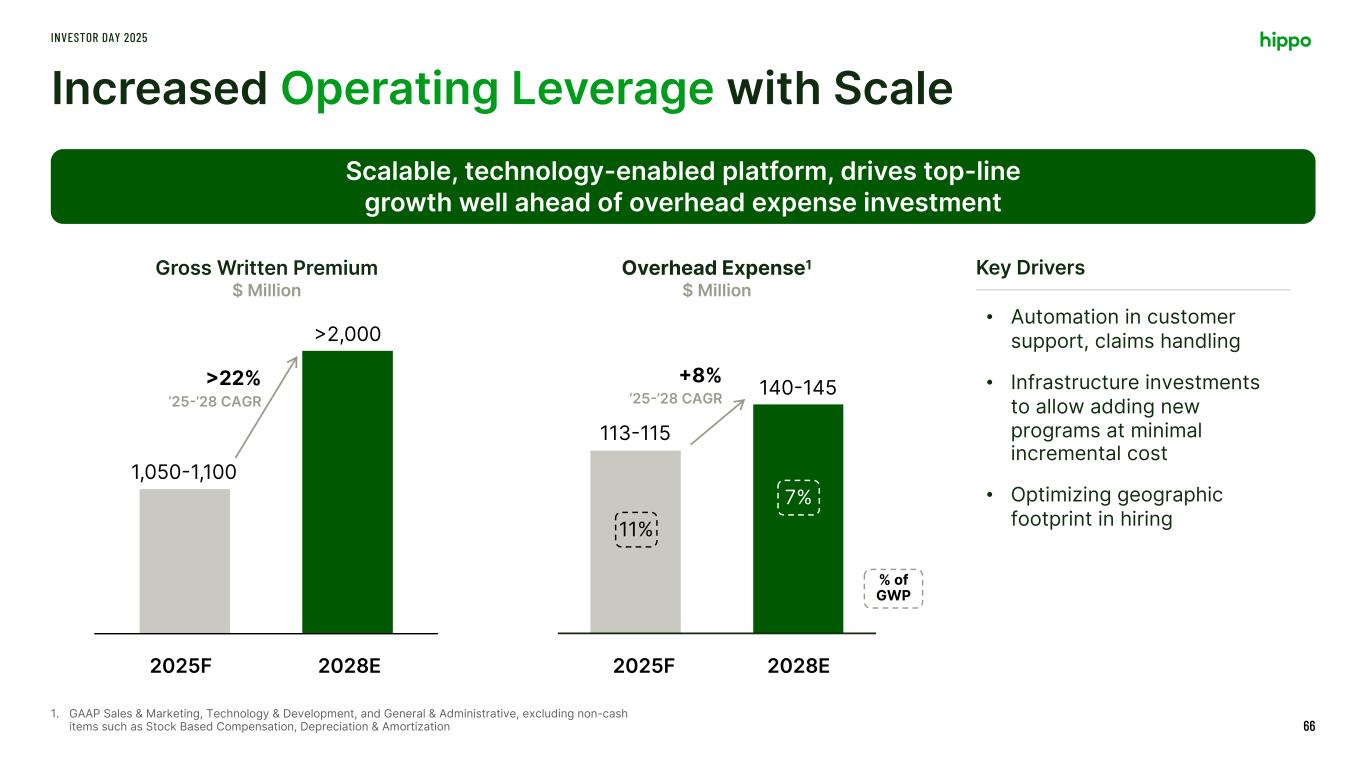

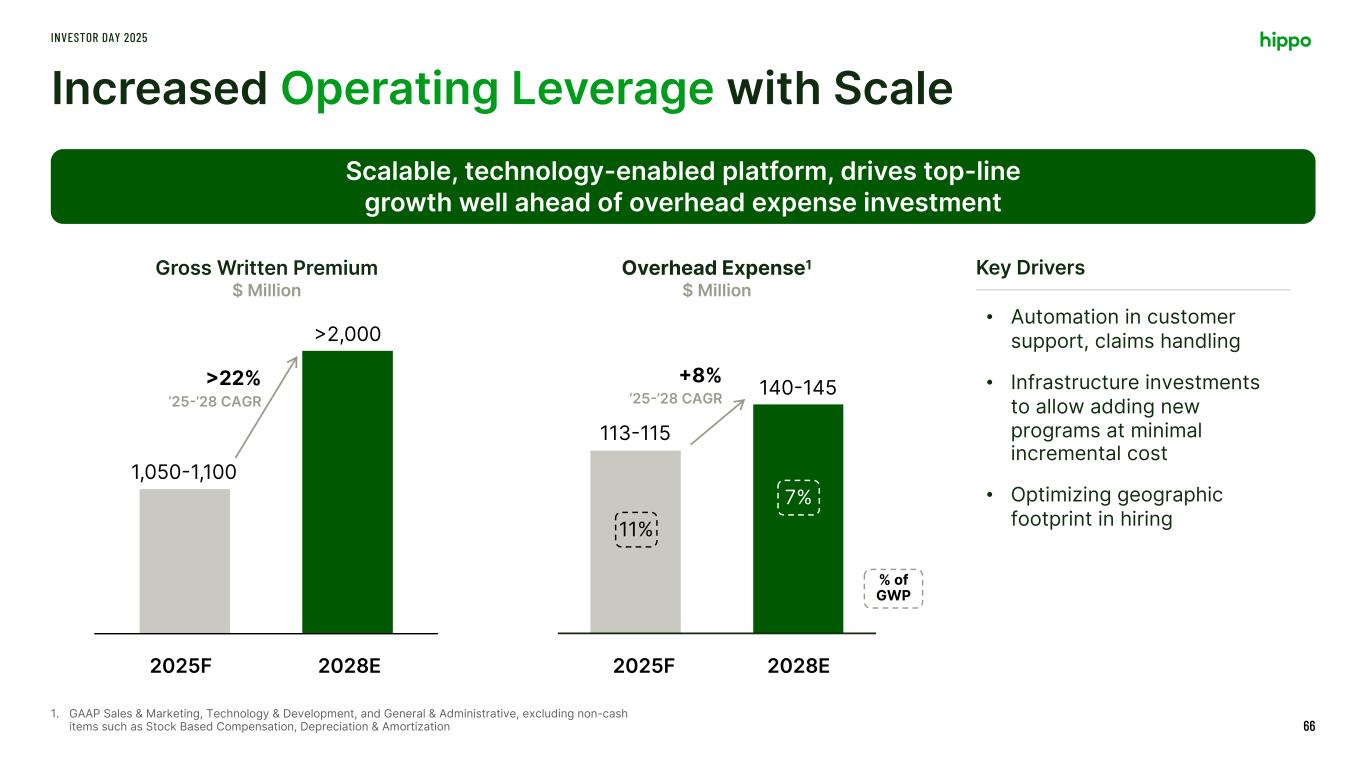

Increased Operating Leverage with Scale INVESTOR DAY 2025 66 Scalable, technology-enabled platform, drives top-line growth well ahead of overhead expense investment Key DriversGross Written Premium $ Million Overhead Expense1 $ Million 2025F 2028E % of GWP 2025F 2028E 1,050-1,100 >2,000 113-115 140-145>22% +8% 11% 7% ‘25-’28 CAGR‘25-’28 CAGR • Automation in customer support, claims handling • Infrastructure investments to allow adding new programs at minimal incremental cost • Optimizing geographic footprint in hiring 1. GAAP Sales & Marketing, Technology & Development, and General & Administrative, excluding non-cash items such as Stock Based Compensation, Depreciation & Amortization

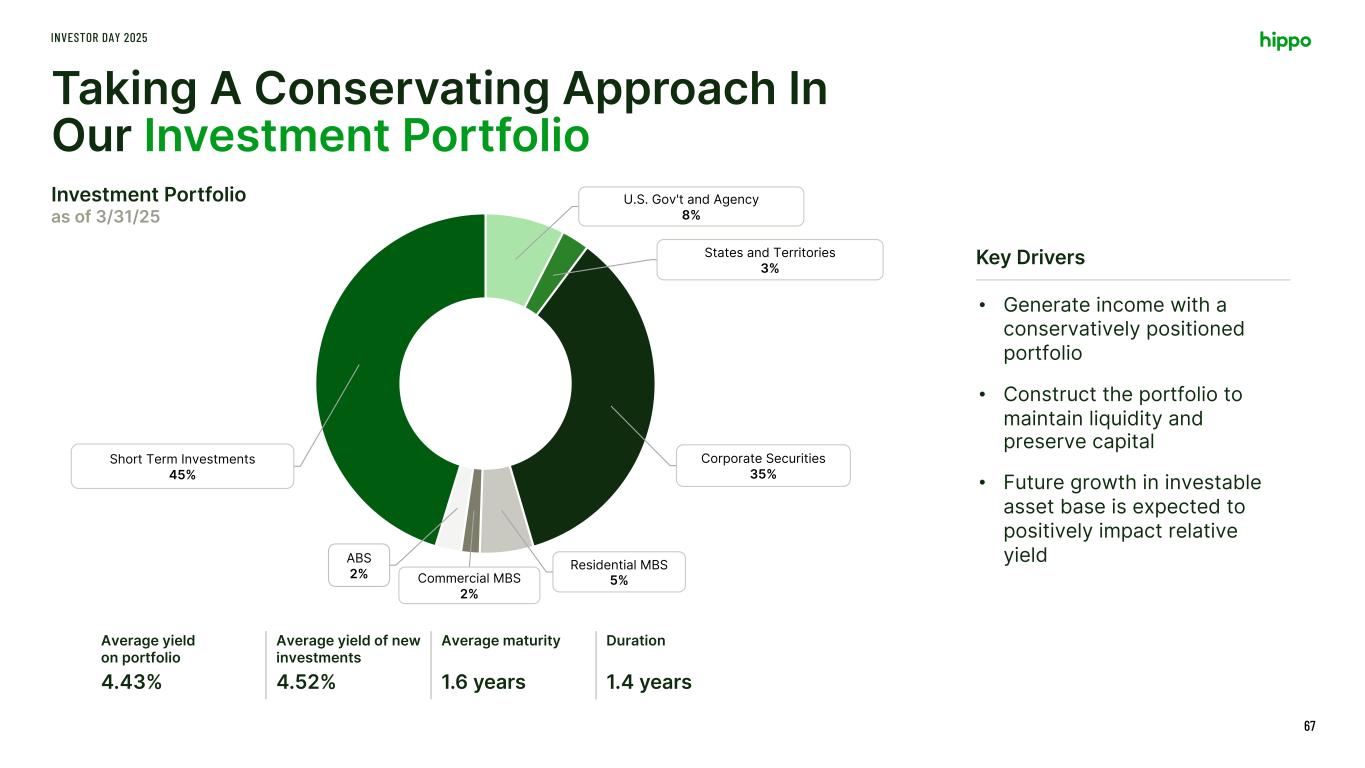

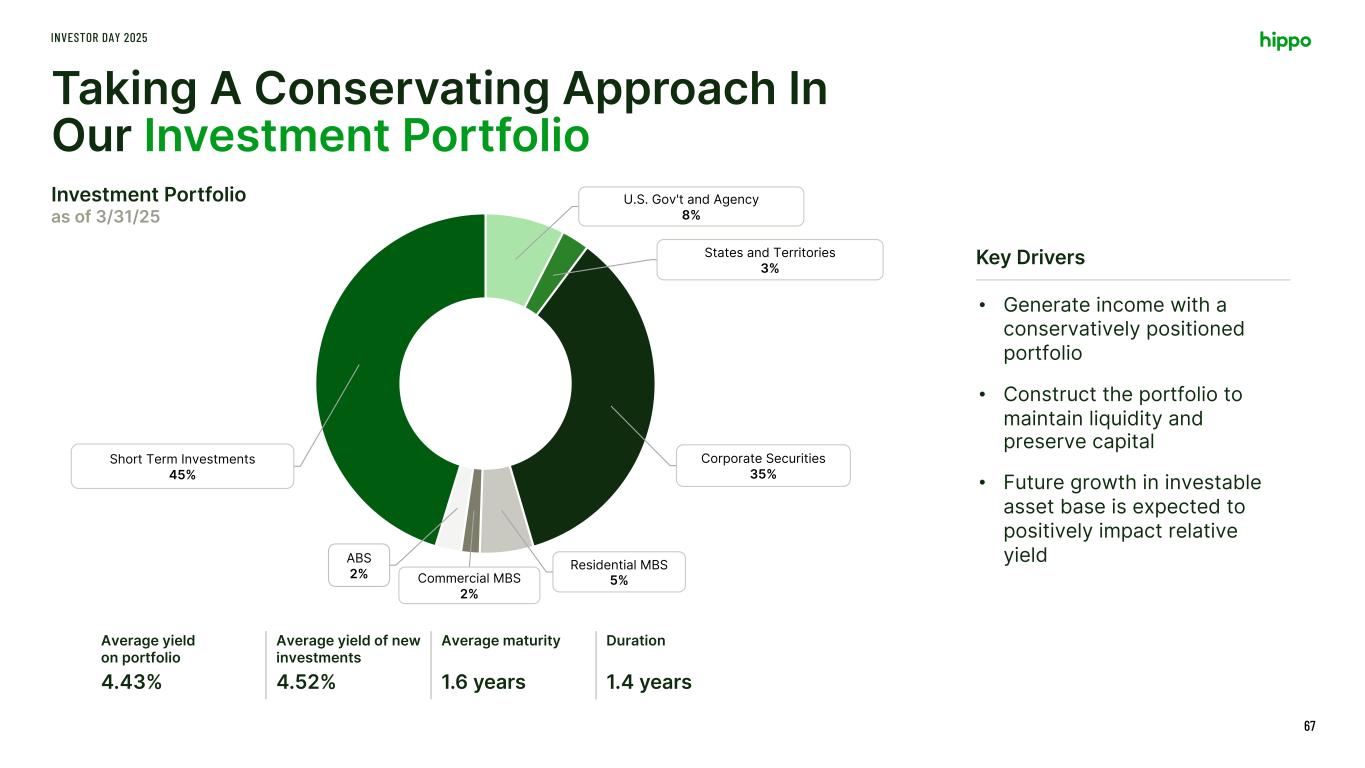

• Generate income with a conservatively positioned portfolio • Construct the portfolio to maintain liquidity and preserve capital • Future growth in investable asset base is expected to positively impact relative yield U.S. Gov't and Agency 8% States and Territories 3% Corporate Securities 35% Residential MBS 5%Commercial MBS 2% ABS 2% Short Term Investments 45% Taking A Conservating Approach In Our Investment Portfolio INVESTOR DAY 2025 67 Average yield on portfolio Average yield of new investments Average maturity Duration 4.43% 4.52% 1.6 years 1.4 years Investment Portfolio as of 3/31/25 Key Drivers

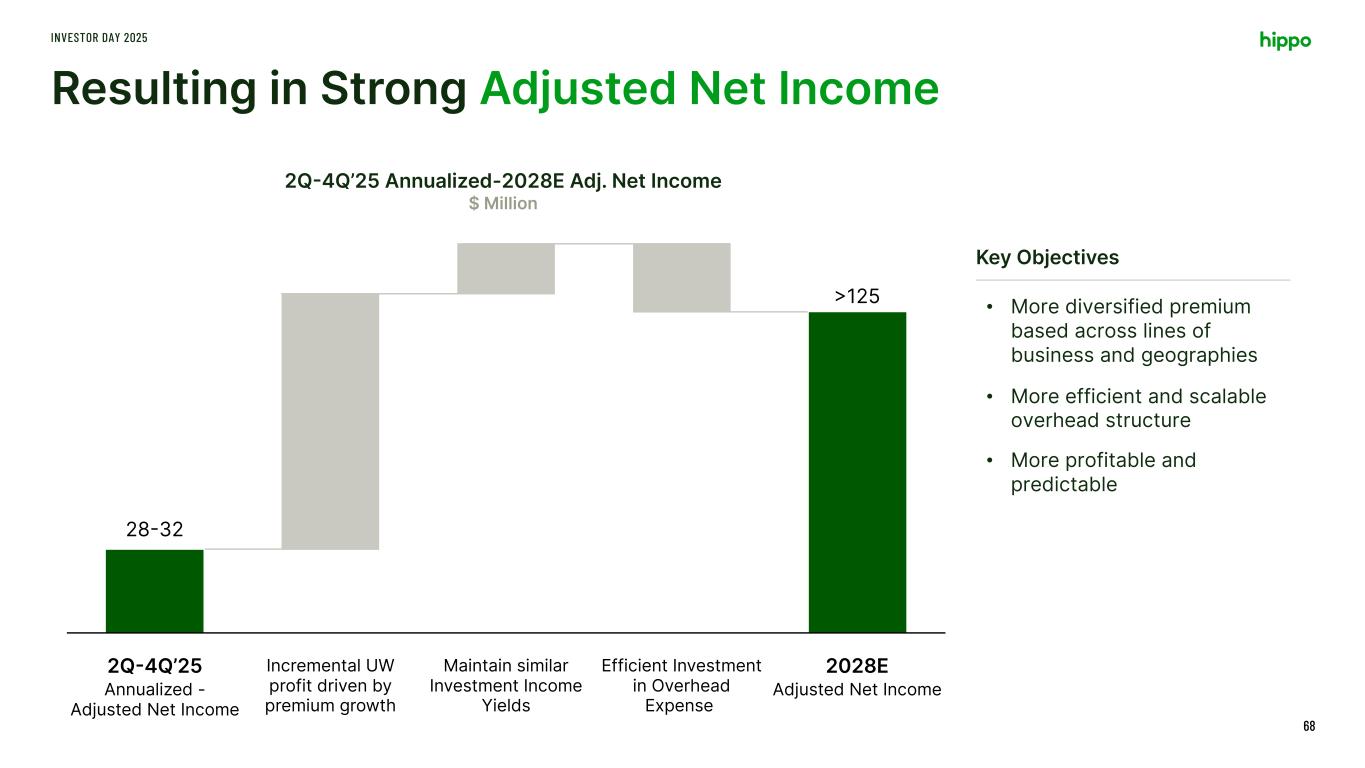

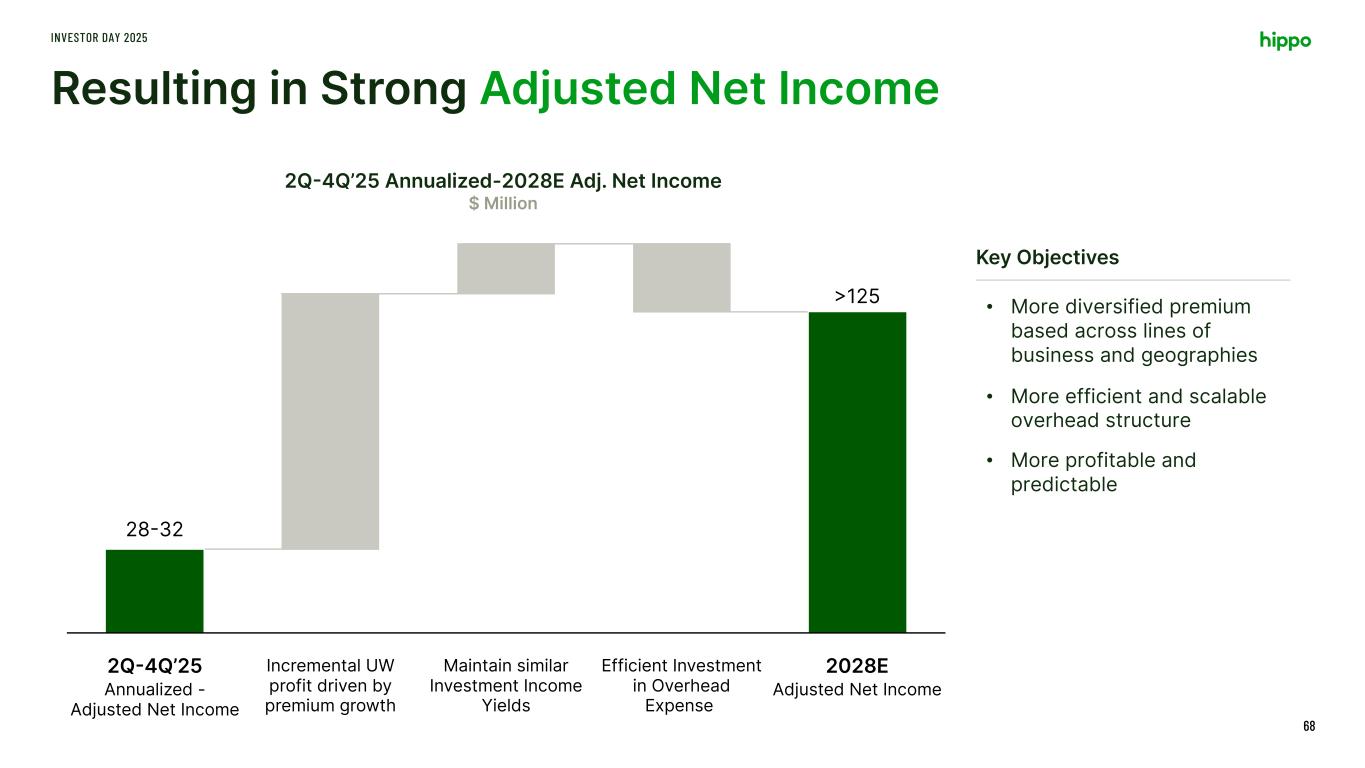

Resulting in Strong Adjusted Net Income INVESTOR DAY 2025 68 2Q-4Q’25 Annualized-2028E Adj. Net Income $ Million 28-32 >125 • More diversified premium based across lines of business and geographies • More efficient and scalable overhead structure • More profitable and predictable 2Q-4Q’25 Incremental UW profit driven by premium growth Maintain similar Investment Income Yields Efficient Investment in Overhead Expense 2028E Annualized - Adjusted Net Income Adjusted Net Income Key Objectives

Hippo’s Unique Capital Structure INVESTOR DAY 2025 69 The organization has been structured to optimize capital efficiency and access Unique capital structure with an MGA, captive reinsurer, and carrier More predictable future returns driven by a well- balanced portfolio Ability to leverage NOLs over the upcoming years

Delivering Long-Term Value INVESTOR DAY 2025 70 Driving value through focused and disciplined execution Strong Track Record of Execution Compelling and Achievable 2028 Targets Delivering Improved Earnings at Lower Volatility• Grew revenue 3.5x • Delivered positive adjusted EBITDA • Exceeded 2022 Investor Day financial goals • Alignment of key metrics • >$2B Gross Written Premium • >$125M Adjusted Net Income • 18%+ Adjusted Return on Equity • Differentiated products across MGA and Spinnaker platforms • Flexible risk management allows us to capitalize on natural market cycles

INVESTOR DAY 2025 Q&A 71

Rick McCathron President & Chief Executive Officer

Key Themes for Today INVESTOR DAY 2025 73 Primed to Deliver Consistent Bottom Line Growth with an Attractive Return on Equity and Lower Volatility Business Transformation Company Vision Proven Team Differentiated Products Over the past three years, delivered on aggressive financial goals while diversifying our risk Building a platform to source diversified, positively selected risk to deliver high return on equity at lower volatility Talented, experienced insurance leaders want to work at Hippo Competitive advantages in both Spinnaker platform and our homeowners MGA, our right to win Flexible Risk Management Track Record of Execution Shareholder Value Flexible business model that allows Hippo to capitalize on natural market cycles Consistently delivered on controllable guidance while reducing variability from cat events Driving shareholder value in the near- and long-term

Enjoy lunch Thank you for joining us

INVESTOR DAY 2025 Appendix 76

Definition of Non-GAAP measures included in this presentation INVESTOR DAY 2025 77 • Adjusted EBITDA: We define adjusted EBITDA as net income (loss) attributable to Hippo excluding interest expense, income tax expense, depreciation, amortization, stock-based compensation, net investment income, restructuring charges, impairment expense, other non-cash fair market value adjustments, contingent consideration for one of our acquisitions, and other transactions, which may include certain legal fees and settlement costs, that we consider to be unique in nature. • Adjusted Net Income (Loss): We define adjusted net income (loss) as net income (loss) attributable to Hippo excluding the impact of certain items that may not be indicative of underlying business trends, operating results, or future outlook, net of tax impact. We calculate the tax impact only on adjustments which would be included in calculating our income tax expense using the estimated tax rate at which the company received a deduction for these adjustments. We use adjusted net income (loss) as an internal performance measure in the management of our operations because we believe it gives our management and financial statement users useful insight into our results of operations and our underlying business performance. Adjusted net income (loss) does not reflect the overall profitably of our business and should not be viewed as a substitute for net income (loss) attributable to Hippo calculated in accordance with GAAP. Other companies may define adjusted net income (loss) differently.

Definition of Non-GAAP measures included in this presentation INVESTOR DAY 2025 78 • Adjusted Return on Equity: We define Adjusted Return on Equity as adjusted net income (loss) expressed on an annualized basis as a percentage of average beginning and ending Hippo stockholders’ equity during the period. We use annualized adjusted return on equity as an internal performance measure in the management of our operations because we believe it gives our management and financial statement users useful insight into our results of operations and our underlying business performance. Annualized adjusted return on equity should not be viewed as a substitute for return on equity calculated using unadjusted GAAP numbers, and other companies may define adjusted return on equity differently.

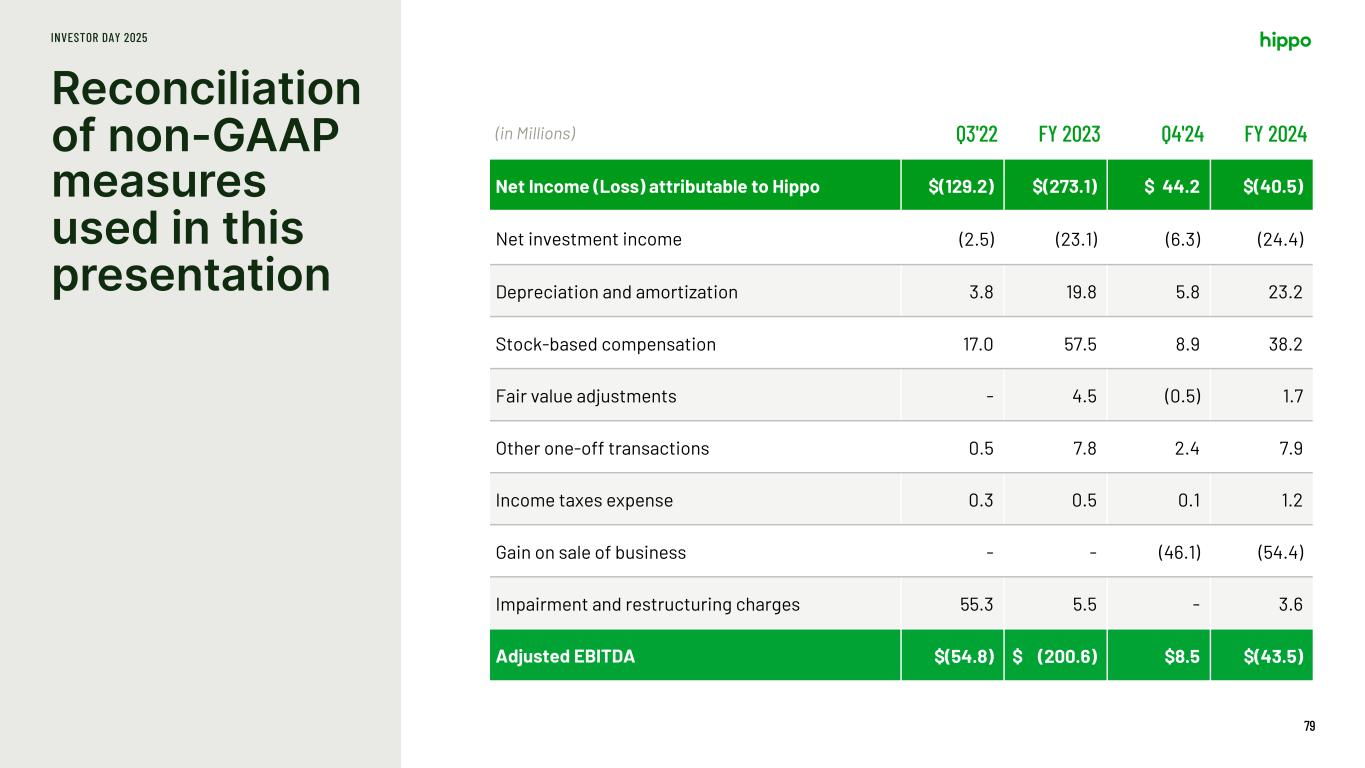

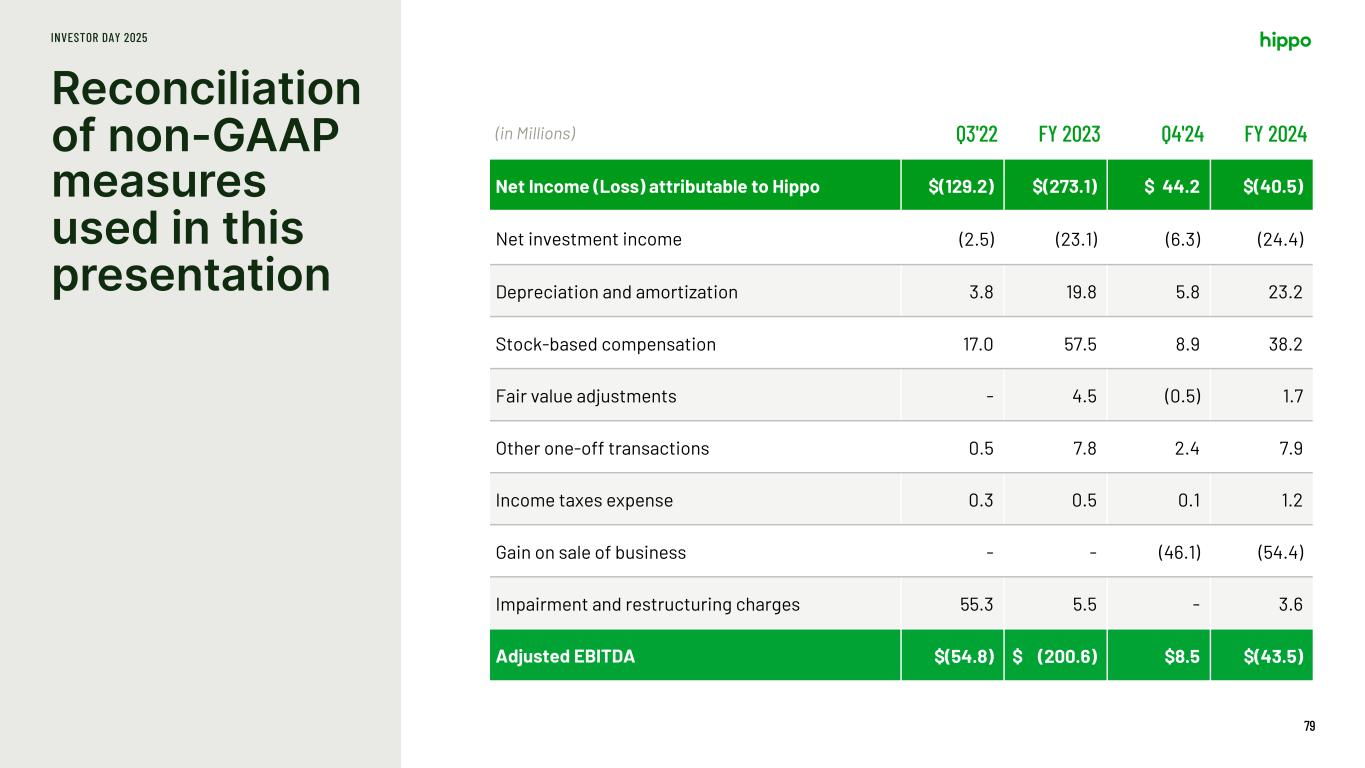

Reconciliation of non-GAAP measures used in this presentation INVESTOR DAY 2025 79 (in Millions) Q3'22 FY 2023 Q4'24 FY 2024 Net Income (Loss) attributable to Hippo $(129.2) $(273.1) $ 44.2 $(40.5) Net investment income (2.5) (23.1) (6.3) (24.4) Depreciation and amortization 3.8 19.8 5.8 23.2 Stock-based compensation 17.0 57.5 8.9 38.2 Fair value adjustments - 4.5 (0.5) 1.7 Other one-off transactions 0.5 7.8 2.4 7.9 Income taxes expense 0.3 0.5 0.1 1.2 Gain on sale of business - - (46.1) (54.4) Impairment and restructuring charges 55.3 5.5 - 3.6 Adjusted EBITDA $(54.8) $ (200.6) $8.5 $(43.5)

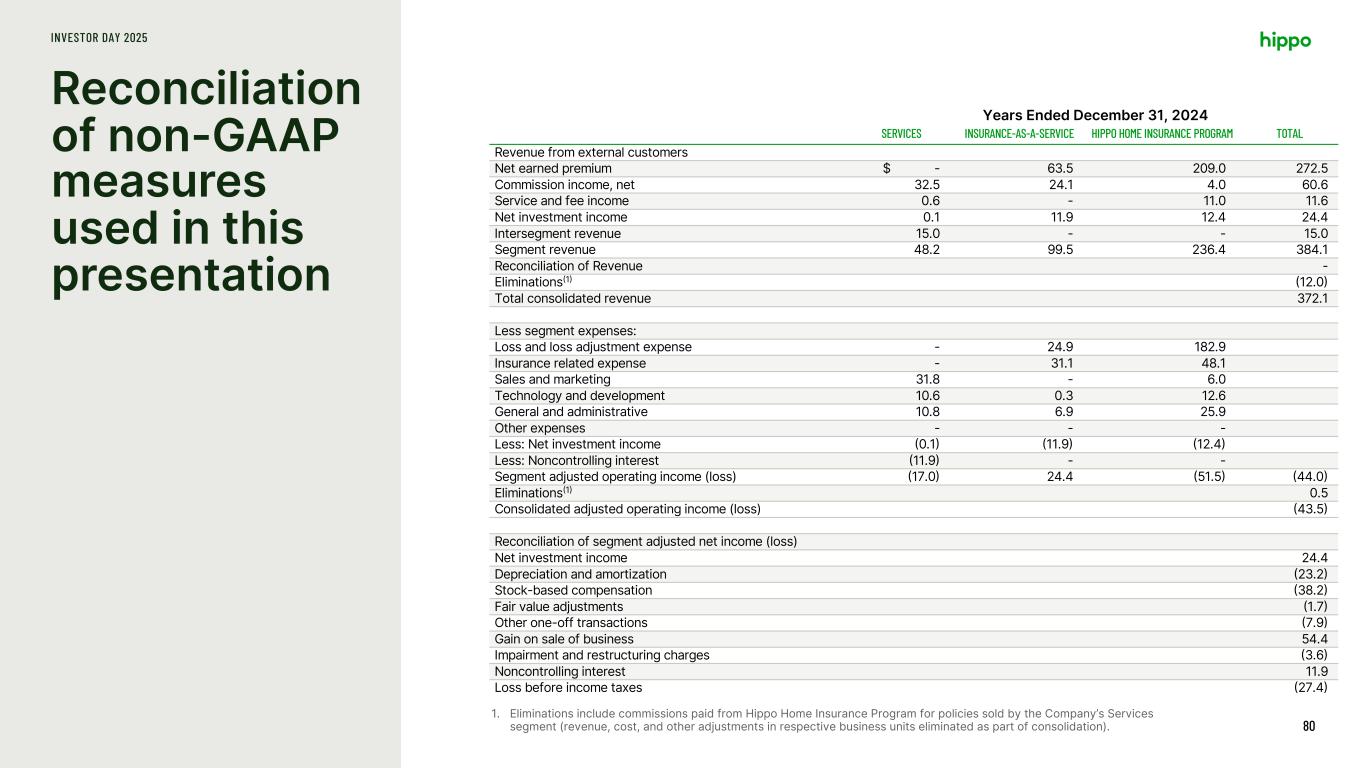

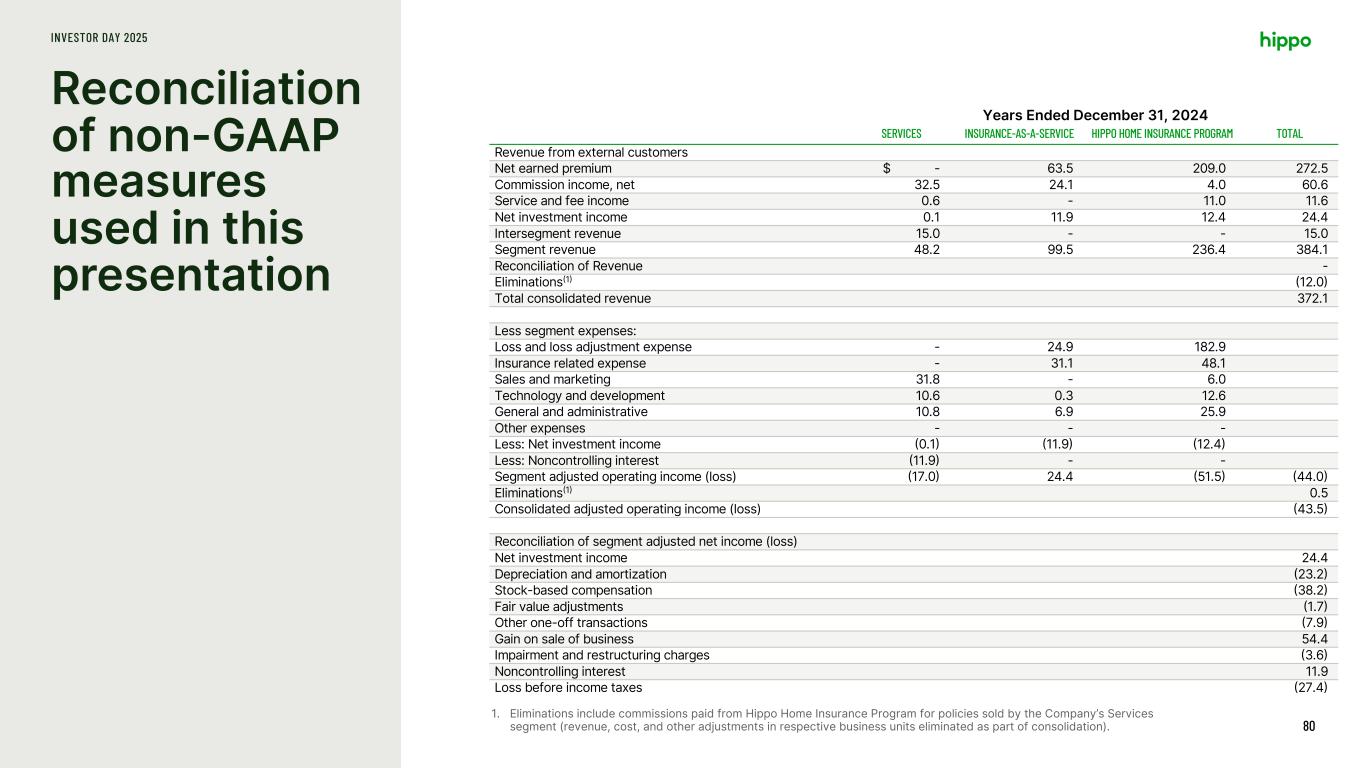

Years Ended December 31, 2024 SERVICES INSURANCE-AS-A-SERVICE HIPPO HOME INSURANCE PROGRAM TOTAL Revenue from external customers Net earned premium $ - 63.5 209.0 272.5 Commission income, net 32.5 24.1 4.0 60.6 Service and fee income 0.6 - 11.0 11.6 Net investment income 0.1 11.9 12.4 24.4 Intersegment revenue 15.0 - - 15.0 Segment revenue 48.2 99.5 236.4 384.1 Reconciliation of Revenue - Eliminations(1) (12.0) Total consolidated revenue 372.1 Less segment expenses: Loss and loss adjustment expense - 24.9 182.9 Insurance related expense - 31.1 48.1 Sales and marketing 31.8 - 6.0 Technology and development 10.6 0.3 12.6 General and administrative 10.8 6.9 25.9 Other expenses - - - Less: Net investment income (0.1) (11.9) (12.4) Less: Noncontrolling interest (11.9) - - Segment adjusted operating income (loss) (17.0) 24.4 (51.5) (44.0) Eliminations(1) 0.5 Consolidated adjusted operating income (loss) (43.5) Reconciliation of segment adjusted net income (loss) Net investment income 24.4 Depreciation and amortization (23.2) Stock-based compensation (38.2) Fair value adjustments (1.7) Other one-off transactions (7.9) Gain on sale of business 54.4 Impairment and restructuring charges (3.6) Noncontrolling interest 11.9 Loss before income taxes (27.4) Reconciliation of non-GAAP measures used in this presentation INVESTOR DAY 2025 80 1. Eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation).

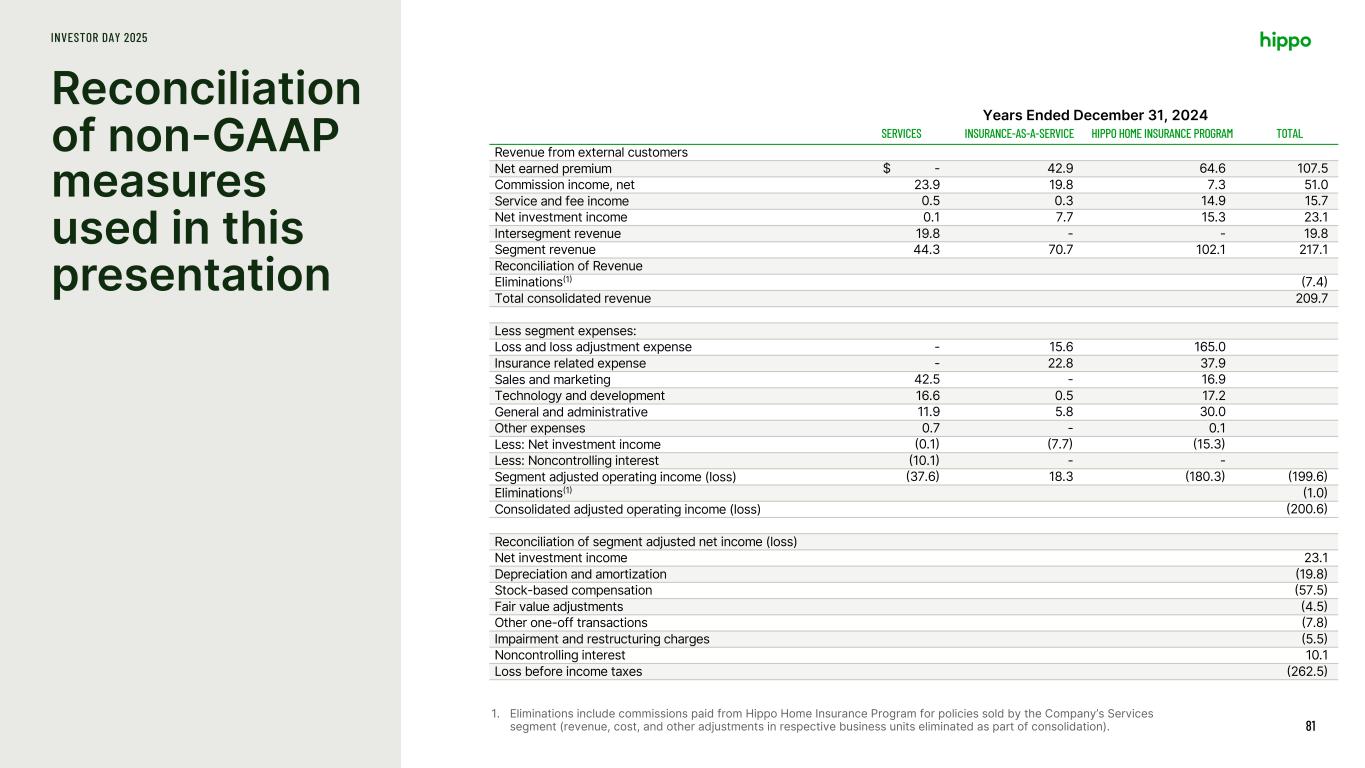

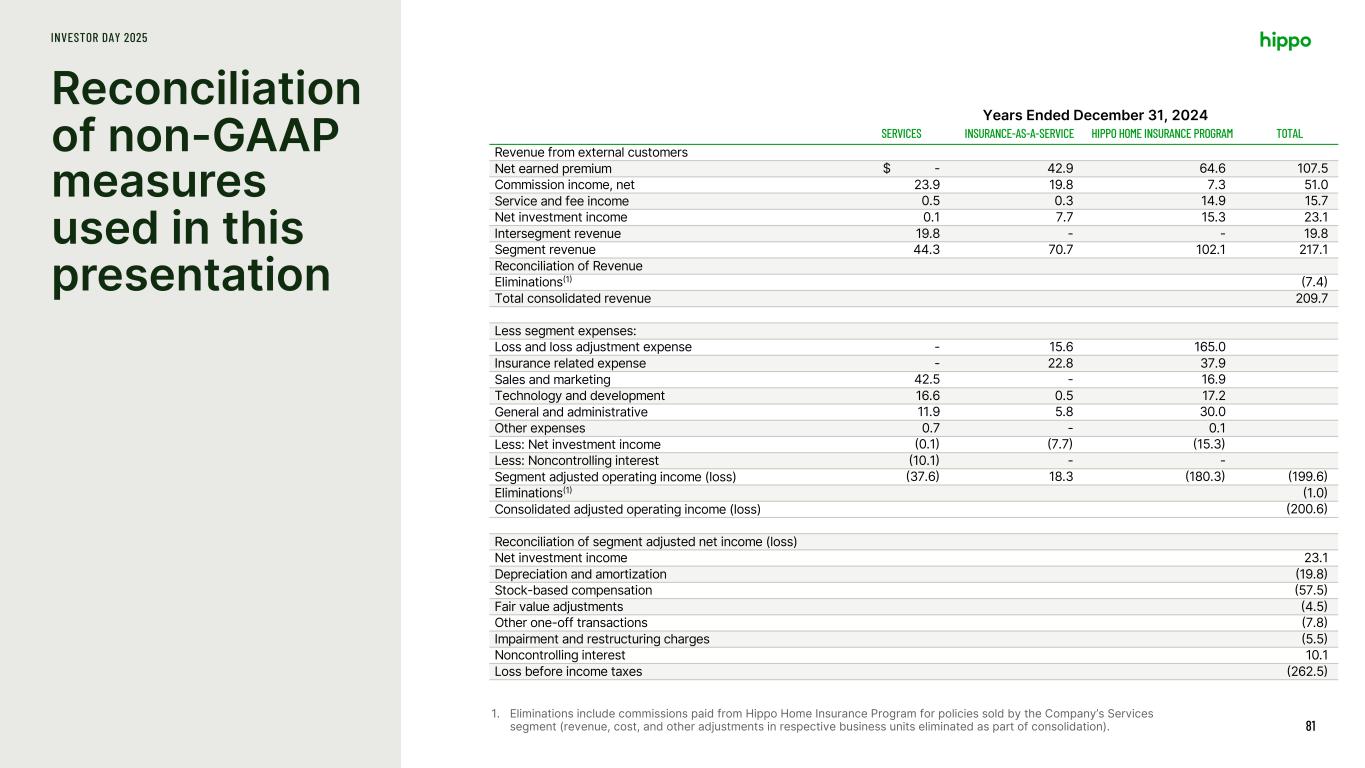

Reconciliation of non-GAAP measures used in this presentation INVESTOR DAY 2025 81 1. Eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation). Years Ended December 31, 2024 SERVICES INSURANCE-AS-A-SERVICE HIPPO HOME INSURANCE PROGRAM TOTAL Revenue from external customers Net earned premium $ - 42.9 64.6 107.5 Commission income, net 23.9 19.8 7.3 51.0 Service and fee income 0.5 0.3 14.9 15.7 Net investment income 0.1 7.7 15.3 23.1 Intersegment revenue 19.8 - - 19.8 Segment revenue 44.3 70.7 102.1 217.1 Reconciliation of Revenue Eliminations(1) (7.4) Total consolidated revenue 209.7 Less segment expenses: Loss and loss adjustment expense - 15.6 165.0 Insurance related expense - 22.8 37.9 Sales and marketing 42.5 - 16.9 Technology and development 16.6 0.5 17.2 General and administrative 11.9 5.8 30.0 Other expenses 0.7 - 0.1 Less: Net investment income (0.1) (7.7) (15.3) Less: Noncontrolling interest (10.1) - - Segment adjusted operating income (loss) (37.6) 18.3 (180.3) (199.6) Eliminations(1) (1.0) Consolidated adjusted operating income (loss) (200.6) Reconciliation of segment adjusted net income (loss) Net investment income 23.1 Depreciation and amortization (19.8) Stock-based compensation (57.5) Fair value adjustments (4.5) Other one-off transactions (7.8) Impairment and restructuring charges (5.5) Noncontrolling interest 10.1 Loss before income taxes (262.5)

Reconciliation of non-GAAP measures used in this presentation INVESTOR DAY 2025 82 1. Eliminations include commissions paid from Hippo Home Insurance Program for policies sold by the Company’s Services segment (revenue, cost, and other adjustments in respective business units eliminated as part of consolidation). Years Ended December 31, 2024 SERVICES INSURANCE-AS-A-SERVICE HIPPO HOME INSURANCE PROGRAM TOTAL Revenue from external customers Net earned premium $ - 22.5 20.0 42.5 Commission income, net 16.7 11.4 25.0 53.1 Service and fee income 0.9 - 13.0 13.9 Net investment income - 3.1 5.9 9.0 Intersegment revenue 19.3 - - 19.3 Segment revenue 36.9 37.0 63.9 137.8 Reconciliation of Revenue Eliminations(1) (18.1) Total consolidated revenue 119.7 Less segment expenses: Loss and loss adjustment expense - 13.4 85.4 Insurance related expense - 10.5 53.1 Sales and marketing 61.8 0.2 18.1 Technology and development 6.8 - 29.7 General and administrative 9.7 4.4 34.5 Other expenses 0.7 - - Less: Net investment income - (3.1) (5.9) Less: Noncontrolling interest (6.9) - - Segment adjusted operating income (loss) (49.0) 5.4 (162.8) (206.4) Eliminations(1) - Consolidated adjusted operating income (loss) (206.4) Reconciliation of segment adjusted net income (loss) Net investment income 9.0 Depreciation and amortization (15.2) Stock-based compensation (61.9) Fair value adjustments (0.1) Other one-off transactions (2.2) Impairment and restructuring charges (55.3) Noncontrolling interest 6.9 Loss before income taxes (325.2)