| ☒ | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

||||

| ☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 | ||||

| Delaware | 86-3906032 | |||||||||||||

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|||||||||||||

| 399 Park Avenue, | New York, | NY | 10022 | ||||||||

| (address of principal executive offices) | |||||||||||

| Title of each class | Trading symbol(s) | Name of each exchange on which registered | ||||||||||||

| Class A common stock | OWL | New York Stock Exchange | ||||||||||||

| Large accelerated filer | ☒ | Accelerated filer | o |

|||||||||||

| Non-accelerated filer | o |

Smaller reporting company | o |

|||||||||||

| Emerging growth company | o |

|||||||||||||

| Class | Outstanding at August 2, 2023 | |||||||

| Class A common stock, par value $0.0001 | 454,557,594 | |||||||

| Class B common stock, par value $0.0001 | — | |||||||

| Class C common stock, par value $0.0001 | 633,520,277 | |||||||

| Class D common stock, par value $0.0001 | 319,132,127 | |||||||

| Page | ||||||||

| Assets Under Management or AUM | Refers to the assets that we manage, and are generally equal to the sum of (i) net asset value (“NAV”); (ii) drawn and undrawn debt; (iii) uncalled capital commitments; (iv) total managed assets for certain Real Estate products; and (v) par value of collateral for collateralized loan obligations (“CLOs”). |

|||||||

| Annual Report | Refers to our annual report for the year ended December 31, 2022, filed with the SEC on Form 10-K on February 27, 2023. |

|||||||

| our BDCs | Refers to our business development companies, as regulated under the Investment Company Act of 1940, as amended: Blue Owl Capital Corporation (NYSE: OBDC) (“OBDC”), Blue Owl Capital Corporation II (“OBDC II”), Blue Owl Capital Corporation III (“OBDC III”), Blue Owl Technology Finance Corp. (“OTF”), Blue Owl Technology Finance Corp. II (“OTF II”), Blue Owl Credit Income Corp. (“OCIC”) and Blue Owl Technology Income Corp. (“OTIC”). | |||||||

| Blue Owl, the Company, the firm, we, us, and our | Refers to the Registrant and its consolidated subsidiaries. | |||||||

| Blue Owl Carry | Refers to Blue Owl Capital Carry LP. | |||||||

| Blue Owl GP | Refers collectively to Blue Owl Capital GP Holdings LLC and Blue Owl Capital GP LLC, which are directly or indirectly wholly owned subsidiaries of the Registrant that hold the Registrants interests in the Blue Owl Operating Partnerships. | |||||||

| Blue Owl Holdings | Refers to Blue Owl Capital Holdings LP. | |||||||

| Blue Owl Operating Group | Refers collectively to the Blue Owl Operating Partnerships and their consolidated subsidiaries. | |||||||

| Blue Owl Operating Group Units | Refers collectively to a unit in each of the Blue Owl Operating Partnerships. | |||||||

| Blue Owl Operating Partnerships | Refers to Blue Owl Carry and Blue Owl Holdings, collectively. | |||||||

| Blue Owl Securities | Refers to Blue Owl Securities LLC, a Delaware limited liability company. Blue Owl Securities is a broker-dealer registered with the SEC, a member of FINRA and the SIPC. Blue Owl Securities is wholly owned by Blue Owl and provides distribution services to all Blue Owl Divisions. |

|||||||

| Business Combination | Refers to the transactions contemplated by the business combination agreement dated as of December 23, 2020 (as the same has been or may be amended, modified, supplemented or waived from time to time), by and among Altimar Acquisition Corporation, Owl Rock Capital Group LLC, Owl Rock Capital Feeder LLC, Owl Rock Capital Partners LP and Neuberger Berman Group LLC, which transactions were completed on May 19, 2021. |

|||||||

| Business Combination Date | Refers to May 19, 2021, the date on which the Business Combination was completed. | |||||||

| Class A Shares | Refers to the Class A common stock, par value $0.0001 per share, of the Registrant. | |||||||

| Class B Shares | Refers to the Class B common stock, par value $0.0001 per share, of the Registrant. | |||||||

| Class C Shares | Refers to the Class C common stock, par value $0.0001 per share, of the Registrant. | |||||||

| Class D Shares | Refers to the Class D common stock, par value $0.0001 per share, of the Registrant. | |||||||

| Class E Shares | Refers to the Class E common stock, par value $0.0001 per share, of the Registrant. | |||||||

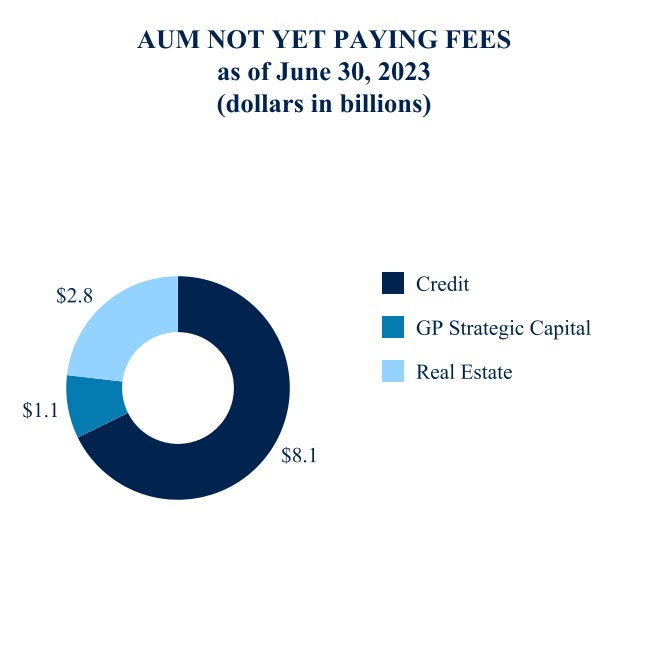

| Credit | Refers to our Credit platform that offers private credit solutions to middle-market companies through our investment strategies: diversified lending, technology lending, first lien lending, opportunistic lending, and also includes our adjacent investment strategy liquid credit, which focuses on the management of CLOs. | |||||||

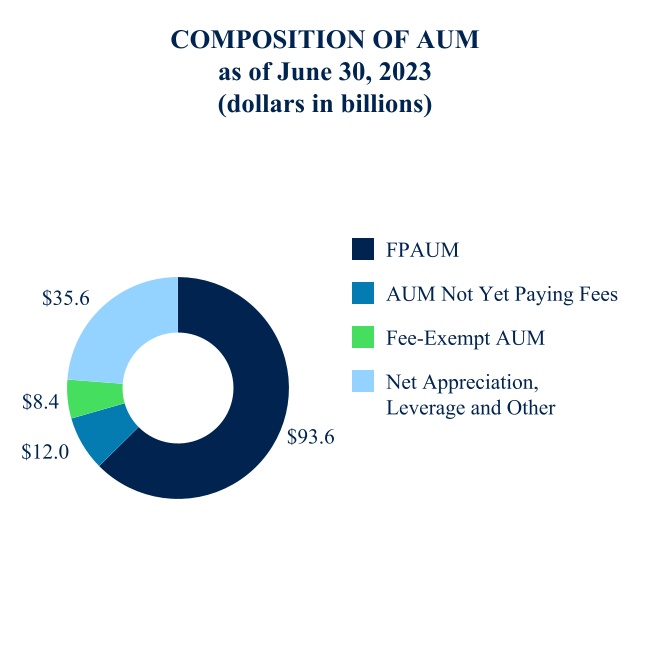

| Fee-Paying AUM or FPAUM | Refers to the AUM on which management fees are earned. For our BDCs, FPAUM is generally equal to total assets (including assets acquired with debt but excluding cash). For our other Credit products, excluding CLOs, FPAUM is generally equal to NAV or investment cost. FPAUM also includes uncalled committed capital for products where we earn management fees on such uncalled committed capital. For CLOs, FPAUM is generally equal to the par value of collateral. For our GP Strategic Capital products, FPAUM for the GP minority stakes strategy is generally equal to capital commitments during the investment period and the cost of unrealized investments after the investment period. For GP Strategic Capitals’ other strategies, FPAUM is generally equal to investment cost. For Real Estate, FPAUM is generally equal to a combination of capital commitments and cost of unrealized investments during the investment period and the cost of unrealized investments after the investment period; however, for certain Real Estate products FPAUM is based on NAV. | |||||||

| Financial Statements | Refers to our consolidated and combined financial statements included in this report. | |||||||

| GAAP | Refers to U.S. generally accepted accounting principles. | |||||||

| GP Strategic Capital | Refers to our GP Strategic Capital platform that primarily focuses on acquiring equity stakes in, and providing debt financing to, large, multi-product private equity and private credit firms through two existing investment strategies: GP minority stakes and GP debt financing, and also include our professional sports minority stakes. | |||||||

| NYSE | Refers to the New York Stock Exchange. | |||||||

| our products | Refers to the products that we manage, including our BDCs, private funds, CLOs and managed accounts. | |||||||

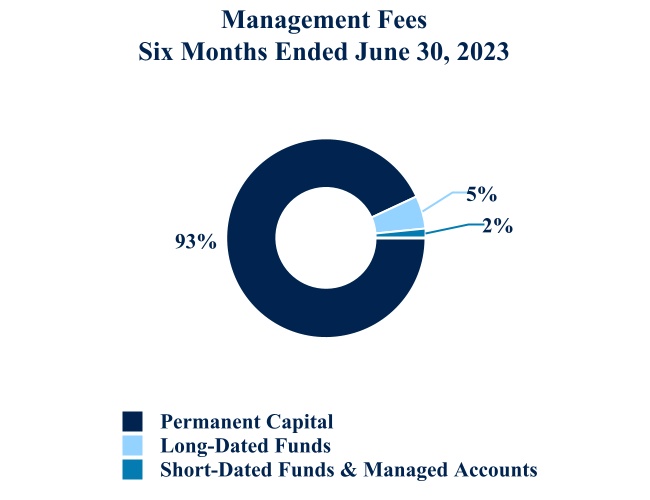

| Part I Fees | Refers to quarterly performance income on the net investment income of our BDCs and similarly structured products, subject to a fixed hurdle rate. These fees are classified as management fees throughout this report, as they are predictable and recurring in nature, not subject to repayment, and cash-settled each quarter. | |||||||

| Part II Fees | Generally refers to fees from our BDCs and similarly structured products that are paid in arrears as of the end of each measurement period when the cumulative aggregate realized capital gains exceed the cumulative aggregate realized capital losses and aggregate unrealized capital depreciation, less the aggregate amount of Part II Fees paid in all prior years since inception. Part II Fees are classified as realized performance income throughout this report. | |||||||

| Permanent Capital | Refers to AUM in products that do not have ordinary redemption provisions or a requirement to exit investments and return the proceeds to investors after a prescribed period of time. Some of these products, however, may be required or can elect to return all or a portion of capital gains and investment income, and some may have periodic tender offers or redemptions. Permanent Capital includes certain products that are subject to management fee step downs or roll-offs or both over time. |

|||||||

| Principals | Refers to our founders and senior members of management who hold, or in the future may hold, Class B Shares and Class D Shares. Class B Shares and Class D Shares collectively represent 80% of the total voting power of all shares. |

|||||||

| Real Estate | Refers, unless context indicates otherwise, to our Real Estate platform that primarily focuses on providing investors with predictable current income, and potential for appreciation, while focusing on limiting downside risk through a unique net lease strategy. | |||||||

| Registrant | Refers to Blue Owl Capital Inc. | |||||||

| SEC | Refers to the U.S. Securities and Exchange Commission. | |||||||

| Tax Receivable Agreement or TRA | Refers to the Amended and Restated Tax Receivable Agreement, dated as of October 22, 2021, as may be amended from time to time by and among the Registrant, Blue Owl Capital GP LLC, the Blue Owl Operating Partnerships and each of the Partners (as defined therein) party thereto. | |||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Net Income (Loss) Attributable to Blue Owl Capital Inc. | $ | 12,859 | $ | (1,126) | $ | 21,176 | $ | (12,941) | |||||||||||||||

Fee-Related Earnings(1) |

$ | 244,597 | $ | 197,064 | $ | 470,496 | $ | 368,447 | |||||||||||||||

Distributable Earnings(1) |

$ | 227,016 | $ | 180,402 | $ | 436,030 | $ | 336,128 | |||||||||||||||

|

Blue Owl

AUM: $149.6 billion

FPAUM: $93.6 billion

| ||||||||||||||

|

Credit

AUM: $73.8 billion

FPAUM: $52.1 billion

|

GP Strategic Capital

AUM: $50.9 billion

FPAUM: $28.5 billion

|

Real Estate

AUM: $24.8 billion

FPAUM: $13.1 billion

|

||||||||||||

|

Diversified Lending

Commenced 2016

AUM: $43.1 billion

FPAUM: $27.0 billion

|

GP Minority Stakes

Commenced 2010

AUM: $48.7 billion

FPAUM: $27.5 billion

|

Net Lease

Commenced 2009

AUM: $24.8 billion

FPAUM: $13.1 billion

|

||||||||||||

|

Technology Lending

Commenced 2018

AUM: $17.7 billion

FPAUM: $13.8 billion

|

GP Debt Financing

Commenced 2019

AUM: $1.6 billion

FPAUM: $0.8 billion

|

|||||||||||||

|

First Lien Lending

Commenced 2018

AUM: $3.5 billion

FPAUM: $2.8 billion

|

Professional Sports

Minority Stakes

Commenced 2021

AUM: $0.6 billion

FPAUM: $0.2 billion

|

|||||||||||||

|

Opportunistic Lending

Commenced 2020

AUM: $2.4 billion

FPAUM: $1.5 billion

|

||||||||||||||

|

Liquid Credit

Commenced 2022

AUM: $7.1 billion

FPAUM: $7.0 billion

|

||||||||||||||

| Three Months Ended June 30, 2023 | Three Months Ended June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | Credit | GP Strategic Capital | Real Estate |

Total | Credit | GP Strategic Capital | Real Estate |

Total | |||||||||||||||||||||||||||||||||||||||

| Beginning Balance | $ | 71,617 | $ | 49,167 | $ | 23,590 | $ | 144,374 | $ | 44,775 | $ | 41,153 | $ | 16,090 | $ | 102,018 | |||||||||||||||||||||||||||||||

| Acquisition | — | — | — | — | 6,529 | — | — | 6,529 | |||||||||||||||||||||||||||||||||||||||

| New capital raised | 1,529 | 184 | 1,150 | 2,863 | 3,015 | 3,958 | 208 | 7,181 | |||||||||||||||||||||||||||||||||||||||

| Change in debt | 716 | — | 201 | 917 | 3,142 | — | — | 3,142 | |||||||||||||||||||||||||||||||||||||||

| Distributions | (842) | (409) | (209) | (1,460) | (380) | (219) | (100) | (699) | |||||||||||||||||||||||||||||||||||||||

| Change in value / other | 773 | 1,992 | 94 | 2,859 | (254) | 782 | 441 | 969 | |||||||||||||||||||||||||||||||||||||||

| Ending Balance | $ | 73,793 | $ | 50,934 | $ | 24,826 | $ | 149,553 | $ | 56,827 | $ | 45,674 | $ | 16,639 | $ | 119,140 | |||||||||||||||||||||||||||||||

| Six Months Ended June 30, 2023 | Six Months Ended June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | Credit | GP Strategic Capital | Real Estate |

Total | Credit | GP Strategic Capital | Real Estate |

Total | |||||||||||||||||||||||||||||||||||||||

| Beginning Balance | $ | 68,607 | $ | 48,510 | $ | 21,085 | $ | 138,202 | $ | 39,227 | $ | 39,906 | $ | 15,362 | $ | 94,495 | |||||||||||||||||||||||||||||||

| Acquisition | — | — | — | — | 6,529 | — | — | 6,529 | |||||||||||||||||||||||||||||||||||||||

| New capital raised | 3,469 | 504 | 2,689 | 6,662 | 4,953 | 5,524 | 568 | 11,045 | |||||||||||||||||||||||||||||||||||||||

| Change in debt | 1,655 | — | 696 | 2,351 | 6,760 | — | — | 6,760 | |||||||||||||||||||||||||||||||||||||||

| Distributions | (1,605) | (1,111) | (416) | (3,132) | (664) | (977) | (265) | (1,906) | |||||||||||||||||||||||||||||||||||||||

| Change in value / other | 1,667 | 3,031 | 772 | 5,470 | 22 | 1,221 | 974 | 2,217 | |||||||||||||||||||||||||||||||||||||||

| Ending Balance | $ | 73,793 | $ | 50,934 | $ | 24,826 | $ | 149,553 | $ | 56,827 | $ | 45,674 | $ | 16,639 | $ | 119,140 | |||||||||||||||||||||||||||||||

| Three Months Ended June 30, 2023 | Three Months Ended June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | Credit | GP Strategic Capital | Real Estate |

Total | Credit | GP Strategic Capital | Real Estate |

Total | |||||||||||||||||||||||||||||||||||||||

| Beginning Balance | $ | 51,150 | $ | 28,561 | $ | 11,922 | $ | 91,633 | $ | 32,658 | $ | 23,651 | $ | 9,275 | $ | 65,584 | |||||||||||||||||||||||||||||||

| Acquisition | — | — | — | — | 6,501 | — | — | 6,501 | |||||||||||||||||||||||||||||||||||||||

| New capital raised / deployed | 1,001 | 234 | 1,279 | 2,514 | 2,898 | 3,023 | 121 | 6,042 | |||||||||||||||||||||||||||||||||||||||

| Fee basis step down | — | (333) | — | (333) | — | — | — | — | |||||||||||||||||||||||||||||||||||||||

| Distributions | (765) | — | (141) | (906) | (381) | 4 | (113) | (490) | |||||||||||||||||||||||||||||||||||||||

| Change in value / other | 691 | — | 24 | 715 | (267) | — | 147 | (120) | |||||||||||||||||||||||||||||||||||||||

| Ending Balance | $ | 52,077 | $ | 28,462 | $ | 13,084 | $ | 93,623 | $ | 41,409 | $ | 26,678 | $ | 9,430 | $ | 77,517 | |||||||||||||||||||||||||||||||

| Six Months Ended June 30, 2023 | Six Months Ended June 30, 2022 | ||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | Credit | GP Strategic Capital | Real Estate |

Total | Credit | GP Strategic Capital | Real Estate |

Total | |||||||||||||||||||||||||||||||||||||||

| Beginning Balance | $ | 49,041 | $ | 28,772 | $ | 10,997 | $ | 88,810 | $ | 32,029 | $ | 21,212 | $ | 8,203 | $ | 61,444 | |||||||||||||||||||||||||||||||

| Acquisition | — | — | — | — | 6,501 | — | — | 6,501 | |||||||||||||||||||||||||||||||||||||||

New capital raised / deployed (1) |

3,022 | 226 | 2,357 | 5,605 | 5,098 | 6,360 | 1,198 | 12,656 | |||||||||||||||||||||||||||||||||||||||

Fee basis step down (1) |

— | (333) | — | (333) | — | (898) | — | (898) | |||||||||||||||||||||||||||||||||||||||

| Distributions | (1,497) | (203) | (292) | (1,992) | (659) | 4 | (274) | (929) | |||||||||||||||||||||||||||||||||||||||

| Change in value / other | 1,511 | — | 22 | 1,533 | (1,560) | — | 303 | (1,257) | |||||||||||||||||||||||||||||||||||||||

| Ending Balance | $ | 52,077 | $ | 28,462 | $ | 13,084 | $ | 93,623 | $ | 41,409 | $ | 26,678 | $ | 9,430 | $ | 77,517 | |||||||||||||||||||||||||||||||

| MoIC | IRR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | Year of Inception |

AUM | Capital Raised (4) |

Invested Capital (5) |

Realized Proceeds (6) |

Unrealized Value (7) |

Total Value |

Gross (8) | Net (9) | Gross (10) | Net (11) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Diversified Lending (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Capital Corporation | 2016 | $ | 14,975 | $ | 5,970 | $ | 5,970 | $ | 2,554 | $ | 5,917 | $ | 8,471 | 1.62x | 1.45x | 13.0 | % | 9.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Capital Corporation II (2) | 2017 | $ | 2,590 | $ | 1,333 | $ | 1,306 | $ | 364 | $ | 1,291 | $ | 1,655 | NM | 1.30x | NM | 7.3 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Capital Corporation III | 2020 | $ | 4,044 | $ | 1,812 | $ | 1,812 | $ | 282 | $ | 1,846 | $ | 2,128 | 1.22x | 1.21x | 12.6 | % | 11.6 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Credit Income Corp. (2) | 2020 | $ | 13,982 | $ | 6,156 | $ | 5,860 | $ | 466 | $ | 5,872 | $ | 6,338 | NM | 1.08x | NM | 7.7 | % | |||||||||||||||||||||||||||||||||||||||||||||||

| Technology Lending (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Technology Finance Corp. | 2018 | $ | 7,185 | $ | 3,250 | $ | 3,250 | $ | 514 | $ | 3,429 | $ | 3,943 | 1.34x | 1.25x | 12.6 | % | 9.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Technology Finance Corp. II | 2021 | $ | 6,527 | $ | 4,054 | $ | 1,222 | $ | 40 | $ | 1,252 | $ | 1,292 | NM | NM | NM | NM | ||||||||||||||||||||||||||||||||||||||||||||||||

| First Lien Lending (3) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl First Lien Fund Levered | 2018 | $ | 2,765 | $ | 1,161 | $ | 912 | $ | 218 | $ | 940 | $ | 1,158 | 1.33x | 1.28x | 10.8 | % | 8.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl First Lien Fund Unlevered | 2019 | $ | 231 | $ | 224 | $ | 156 | $ | 34 | $ | 143 | $ | 177 | 1.18x | 1.14x | 5.8 | % | 4.4 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| MoIC | IRR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | Year of Inception |

AUM | Capital Raised |

Invested Capital (2) |

Realized Proceeds (3) |

Unrealized Value (4) |

Total Value |

Gross (5) | Net (6) | Gross (7) | Net (8) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| GP Minority Stakes (1) | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl GP Stakes I | 2011 | $ | 807 | $ | 1,284 | $ | 1,266 | $ | 672 | $ | 610 | $ | 1,282 | 1.16x | 1.01x | 3.0 | % | 0.2 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl GP Stakes II | 2014 | $ | 3,078 | $ | 2,153 | $ | 1,857 | $ | 672 | $ | 2,238 | $ | 2,910 | 1.86x | 1.57x | 14.8 | % | 9.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl GP Stakes III | 2015 | $ | 9,103 | $ | 5,318 | $ | 3,268 | $ | 3,159 | $ | 4,902 | $ | 8,061 | 3.03x | 2.47x | 31.2 | % | 23.8 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl GP Stakes IV | 2018 | $ | 14,673 | $ | 9,041 | $ | 5,864 | $ | 3,928 | $ | 6,962 | $ | 10,890 | 2.21x | 1.86x | 76.6 | % | 48.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl GP Stakes V | 2020 | $ | 13,675 | $ | 12,852 | $ | 2,609 | $ | 498 | $ | 2,787 | $ | 3,285 | 1.47x | 1.26x | 52.9 | % | 27.7 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| MoIC | IRR | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| (dollars in millions) | Year of Inception | AUM | Capital Raised | Invested Capital (3) |

Realized Proceeds (4) |

Unrealized Value (5) |

Total Value |

Gross (6) | Net (7) | Gross (8) | Net (9) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Net Lease | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Real Estate Fund IV (1) | 2017 | $ | 1,148 | $ | 1,250 | $ | 1,250 | $ | 1,412 | $ | 569 | $ | 1,981 | 1.75x | 1.57x | 26.0 | % | 21.1 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Real Estate Net Lease Property Fund | 2019 | $ | 6,829 | $ | 3,388 | $ | 3,388 | $ | 776 | $ | 3,732 | $ | 4,508 | 1.27x | 1.24x | 15.3 | % | 13.9 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Real Estate Fund V (1) | 2020 | $ | 3,790 | $ | 2,500 | $ | 2,137 | $ | 649 | $ | 2,000 | $ | 2,649 | 1.32x | 1.24x | 30.1 | % | 23.0 | % | ||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Real Estate Net Lease Trust (2) | 2022 | $ | 3,558 | $ | 1,418 | $ | 1,418 | $ | 21 | $ | 1,383 | $ | 1,404 | NM | NM | NM | NM | ||||||||||||||||||||||||||||||||||||||||||||||||

| Blue Owl Real Estate Fund VI (1) | 2022 | $ | 3,989 | $ | 3,686 | $ | 193 | $ | 1 | $ | 193 | $ | 194 | NM | NM | NM | NM | ||||||||||||||||||||||||||||||||||||||||||||||||

| Three Months Ended June 30, | |||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | $ Change | ||||||||||||||

| Revenues | |||||||||||||||||

Management fees, net (includes Part I Fees of $91,938 and $46,346) |

$ | 371,829 | $ | 284,325 | $ | 87,504 | |||||||||||

| Administrative, transaction and other fees | 45,108 | 42,921 | 2,187 | ||||||||||||||

| Total Revenues, Net | 416,937 | 327,246 | 89,691 | ||||||||||||||

| Expenses | |||||||||||||||||

| Compensation and benefits | 208,281 | 218,118 | (9,837) | ||||||||||||||

| Amortization of intangible assets | 115,917 | 64,885 | 51,032 | ||||||||||||||

| General, administrative and other expenses | 51,482 | 54,389 | (2,907) | ||||||||||||||

| Total Expenses | 375,680 | 337,392 | 38,288 | ||||||||||||||

| Other Income (Loss) | |||||||||||||||||

| Net gains (losses) on investments | 3,030 | (123) | 3,153 | ||||||||||||||

| Interest expense, net | (13,568) | (15,051) | 1,483 | ||||||||||||||

| Change in TRA liability | 10,116 | 1,370 | 8,746 | ||||||||||||||

| Change in warrant liability | 450 | 20,723 | (20,273) | ||||||||||||||

| Change in earnout liability | (1,844) | (208) | (1,636) | ||||||||||||||

| Total Other Income (Loss) | (1,816) | 6,711 | (8,527) | ||||||||||||||

| Income (Loss) Before Income Taxes | 39,441 | (3,435) | 42,876 | ||||||||||||||

| Income tax expense | 5,402 | 5,631 | (229) | ||||||||||||||

| Consolidated and Combined Net Income (Loss) | 34,039 | (9,066) | 43,105 | ||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (21,180) | 7,940 | (29,120) | ||||||||||||||

| Net Income (Loss) Attributable to Blue Owl Capital Inc. | $ | 12,859 | $ | (1,126) | $ | 13,985 | |||||||||||

| Six Months Ended June 30, | |||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | $ Change | ||||||||||||||

| Revenues | |||||||||||||||||

Management fees, net (includes Part I Fees of $177,802 and $93,085) |

$ | 730,654 | $ | 531,957 | $ | 198,697 | |||||||||||

| Administrative, transaction and other fees | 76,763 | 71,266 | 5,497 | ||||||||||||||

| Realized performance income | 506 | — | 506 | ||||||||||||||

| Total Revenues, Net | 807,923 | 603,223 | 204,700 | ||||||||||||||

| Expenses | |||||||||||||||||

| Compensation and benefits | 405,899 | 412,010 | (6,111) | ||||||||||||||

| Amortization of intangible assets | 186,808 | 126,411 | 60,397 | ||||||||||||||

| General, administrative and other expenses | 107,616 | 97,683 | 9,933 | ||||||||||||||

| Total Expenses | 700,323 | 636,104 | 64,219 | ||||||||||||||

| Other Income (Loss) | |||||||||||||||||

| Net gains (losses) on investments | 3,642 | (118) | 3,760 | ||||||||||||||

| Interest expense, net | (27,141) | (27,885) | 744 | ||||||||||||||

| Change in TRA liability | 8,152 | (8,282) | 16,434 | ||||||||||||||

| Change in warrant liability | (1,500) | 38,481 | (39,981) | ||||||||||||||

| Change in earnout liability | (2,838) | (704) | (2,134) | ||||||||||||||

| Total Other Income (Loss) | (19,685) | 1,492 | (21,177) | ||||||||||||||

| Income (Loss) Before Income Taxes | 87,915 | (31,389) | 119,304 | ||||||||||||||

| Income tax expense | 11,842 | 593 | 11,249 | ||||||||||||||

| Consolidated and Combined Net Income (Loss) | 76,073 | (31,982) | 108,055 | ||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (54,897) | 19,041 | (73,938) | ||||||||||||||

| Net Income (Loss) Attributable to Blue Owl Capital Inc. | $ | 21,176 | $ | (12,941) | $ | 34,117 | |||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| FRE revenues | $ | 401,476 | $ | 317,811 | $ | 778,879 | $ | 590,409 | |||||||||||||||

| FRE expenses | 154,732 | 122,106 | 306,362 | 223,841 | |||||||||||||||||||

| Net income (loss) allocated to noncontrolling interests included in Fee-Related Earnings | (2,147) | 1,359 | (2,021) | 1,879 | |||||||||||||||||||

| Fee-Related Earnings | $ | 244,597 | $ | 197,064 | $ | 470,496 | $ | 368,447 | |||||||||||||||

| Distributable Earnings | $ | 227,016 | $ | 180,402 | $ | 436,030 | $ | 336,128 | |||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Credit Strategies | |||||||||||||||||||||||

| Diversified lending | $ | 155,086 | $ | 108,909 | $ | 301,181 | $ | 214,361 | |||||||||||||||

| Technology lending | 48,097 | 23,803 | 95,787 | 46,833 | |||||||||||||||||||

| First lien lending | 4,748 | 3,973 | 9,233 | 7,654 | |||||||||||||||||||

| Opportunistic lending | 2,475 | 2,730 | 4,875 | 4,271 | |||||||||||||||||||

| Liquid credit | 6,136 | 6,295 | 13,654 | 6,295 | |||||||||||||||||||

| Management Fees, Net | 216,542 | 145,710 | 424,730 | 279,414 | |||||||||||||||||||

| Administrative, transaction and other fees | 18,509 | 23,396 | 26,033 | 37,869 | |||||||||||||||||||

| FRE Revenues - Credit Strategies | 235,051 | 169,106 | 450,763 | 317,283 | |||||||||||||||||||

| GP Strategic Capital Strategies | |||||||||||||||||||||||

| GP minority stakes | 130,424 | 124,434 | 260,720 | 226,534 | |||||||||||||||||||

| GP debt financing | 3,626 | 3,366 | 7,377 | 6,458 | |||||||||||||||||||

| Professional sports minority stakes | 565 | 513 | 967 | 1,013 | |||||||||||||||||||

| Management Fees, Net | 134,615 | 128,313 | 269,064 | 234,005 | |||||||||||||||||||

| Administrative, transaction and other fees | 1,306 | 1,168 | 2,509 | 2,739 | |||||||||||||||||||

| FRE Revenues - GP Strategic Capital Strategies | 135,921 | 129,481 | 271,573 | 236,744 | |||||||||||||||||||

| Real Estate Strategies | |||||||||||||||||||||||

| Net lease | 30,442 | 19,224 | 56,399 | 36,382 | |||||||||||||||||||

| Management Fees, Net | 30,442 | 19,224 | 56,399 | 36,382 | |||||||||||||||||||

| Administrative, transaction and other fees | 62 | — | 144 | — | |||||||||||||||||||

| FRE Revenues - Real Estate Strategies | 30,504 | 19,224 | 56,543 | 36,382 | |||||||||||||||||||

| Total FRE Revenues | $ | 401,476 | $ | 317,811 | $ | 778,879 | $ | 590,409 | |||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| FRE compensation and benefits | $ | 115,621 | $ | 85,809 | $ | 219,221 | $ | 160,778 | |||||||||||||||

| FRE general, administrative and other expenses | 39,111 | 36,297 | 87,141 | 63,063 | |||||||||||||||||||

| Total FRE Expenses | $ | 154,732 | $ | 122,106 | $ | 306,362 | $ | 223,841 | |||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| GAAP Net Income (Loss) Attributable to Class A Shares | $ | 12,859 | $ | (1,126) | $ | 21,176 | $ | (12,941) | |||||||||||||||

| Net income (loss) attributable to noncontrolling interests | 21,180 | (7,940) | 54,897 | (19,041) | |||||||||||||||||||

| Income tax expense | 5,402 | 5,631 | 11,842 | 593 | |||||||||||||||||||

| GAAP Income (Loss) Before Income Taxes | $ | 39,441 | $ | (3,435) | $ | 87,915 | $ | (31,389) | |||||||||||||||

| Net income (loss) allocated to noncontrolling interests included in Fee-Related Earnings | (2,147) | 1,359 | (2,021) | 1,879 | |||||||||||||||||||

| Strategic Revenue-Share Purchase consideration amortization | 9,770 | 8,922 | 19,539 | 17,844 | |||||||||||||||||||

| Realized performance income | — | — | (506) | — | |||||||||||||||||||

| Realized performance compensation | — | — | 177 | — | |||||||||||||||||||

| Equity-based compensation - other | 32,204 | 24,293 | 67,832 | 41,819 | |||||||||||||||||||

| Equity-based compensation - acquisition related | 20,897 | 62,139 | 41,576 | 122,793 | |||||||||||||||||||

| Equity-based compensation - Business Combination grants | 17,725 | 18,253 | 34,693 | 36,674 | |||||||||||||||||||

| Acquisition-related cash earnout amortization | 6,498 | 16,111 | 12,596 | 32,193 | |||||||||||||||||||

| Capital-related compensation | 1,860 | 850 | 3,558 | 1,680 | |||||||||||||||||||

| Amortization of intangible assets | 115,917 | 64,885 | 186,808 | 126,411 | |||||||||||||||||||

| Transaction Expenses | 3,701 | 4,737 | 3,817 | 7,162 | |||||||||||||||||||

| Expense support | (3,085) | 5,661 | (5,173) | 12,873 | |||||||||||||||||||

| Net gains (losses) on investments | (3,030) | 123 | (3,642) | 118 | |||||||||||||||||||

| Change in TRA liability | (10,116) | (1,370) | (8,152) | 8,282 | |||||||||||||||||||

| Change in warrant liability | (450) | (20,723) | 1,500 | (38,481) | |||||||||||||||||||

| Change in earnout liability | 1,844 | 208 | 2,838 | 704 | |||||||||||||||||||

| Interest expense, net | 13,568 | 15,051 | 27,141 | 27,885 | |||||||||||||||||||

| Fee-Related Earnings | 244,597 | 197,064 | 470,496 | 368,447 | |||||||||||||||||||

| Realized performance income | — | — | 506 | — | |||||||||||||||||||

| Realized performance compensation | — | — | (177) | — | |||||||||||||||||||

| Interest expense, net | (13,568) | (15,045) | (27,141) | (27,879) | |||||||||||||||||||

| Taxes and TRA payments | (4,013) | (1,617) | (7,654) | (4,440) | |||||||||||||||||||

| Distributable Earnings | 227,016 | 180,402 | 436,030 | 336,128 | |||||||||||||||||||

| Interest expense, net | 13,568 | 15,045 | 27,141 | 27,879 | |||||||||||||||||||

| Taxes and TRA payments | 4,013 | 1,617 | 7,654 | 4,440 | |||||||||||||||||||

| Fixed assets depreciation and amortization | 2,581 | 241 | 4,503 | 459 | |||||||||||||||||||

| Adjusted EBITDA | $ | 247,178 | $ | 197,305 | $ | 475,328 | $ | 368,906 | |||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| GAAP Revenues | $ | 416,937 | $ | 327,246 | $ | 807,923 | $ | 603,223 | |||||||||||||||

| Strategic Revenue-Share Purchase consideration amortization | 9,770 | 8,922 | 19,539 | 17,844 | |||||||||||||||||||

| Realized performance income | — | — | (506) | — | |||||||||||||||||||

| Reimbursed expenses | (25,231) | (18,357) | (48,077) | (30,658) | |||||||||||||||||||

| FRE Revenues | $ | 401,476 | $ | 317,811 | $ | 778,879 | $ | 590,409 | |||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| GAAP Compensation and Benefits | $ | 208,281 | $ | 218,118 | $ | 405,899 | $ | 412,010 | |||||||||||||||

| Realized performance compensation | — | — | (177) | — | |||||||||||||||||||

| Equity-based compensation - other | (32,204) | (23,984) | (67,832) | (41,097) | |||||||||||||||||||

| Equity-based compensation - acquisition related | (20,897) | (62,139) | (41,576) | (122,793) | |||||||||||||||||||

| Equity-based compensation - Business Combination grants | (17,725) | (18,253) | (34,693) | (36,674) | |||||||||||||||||||

| Acquisition-related cash earnout amortization | (6,498) | (16,111) | (12,596) | (32,193) | |||||||||||||||||||

| Capital-related compensation | (1,860) | (849) | (3,558) | (1,679) | |||||||||||||||||||

| Reimbursed expenses | (13,476) | (10,973) | (26,246) | (16,796) | |||||||||||||||||||

| FRE Compensation and Benefits | $ | 115,621 | $ | 85,809 | $ | 219,221 | $ | 160,778 | |||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| GAAP General, Administrative and Other Expenses | $ | 51,482 | $ | 54,389 | $ | 107,616 | $ | 97,683 | |||||||||||||||

| Equity-based compensation - other | — | (309) | — | (722) | |||||||||||||||||||

| Transaction Expenses | (3,701) | (4,737) | (3,817) | (7,162) | |||||||||||||||||||

| Expense support | 3,085 | (5,661) | 5,173 | (12,873) | |||||||||||||||||||

| Reimbursed expenses | (11,755) | (7,385) | (21,831) | (13,863) | |||||||||||||||||||

| FRE General, Administrative and Other Expenses | $ | 39,111 | $ | 36,297 | $ | 87,141 | $ | 63,063 | |||||||||||||||

| Six Months Ended June 30, | |||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | $ Change | ||||||||||||||

| Net cash provided by (used in): | |||||||||||||||||

| Operating activities | $ | 359,094 | $ | 245,494 | $ | 113,600 | |||||||||||

| Investing activities | (56,896) | (175,111) | 118,215 | ||||||||||||||

| Financing activities | (328,956) | (64,220) | (264,736) | ||||||||||||||

| Net Change in Cash and Cash Equivalents | $ | (26,758) | $ | 6,163 | $ | (32,921) | |||||||||||

| Exhibit Number | Description | |||||||

4.2* |

||||||||

4.3* |

||||||||

First Amendment to the Amended and Restated Credit Agreement, dated as of June 29, 2023, by and among Blue Owl Finance LLC, Blue Owl Capital Holdings LP, Blue Owl Capital Carry LP, the subsidiary guarantors party thereto, the several banks and other financial institutions or entities party thereto and MUFG Bank, Ltd. (incorporated by reference to Exhibit 1.1. of Blue Owl Capital Inc. Current Report on Form 8-K filed on June 29, 2023)

|

||||||||

10.2* |

||||||||

10.3*† |

||||||||

10.4*† |

||||||||

31.1* |

||||||||

31.2* |

||||||||

31.3* |

||||||||

32.1** |

||||||||

32.2** |

||||||||

32.3** |

||||||||

| 101* | Interactive data files pursuant to Rule 405 of Regulation S-T, formatted in Inline XBRL (eXtensible Business Reporting Language): (i) the Consolidated and Combined Statements of Financial Condition as of June 30, 2023 and December 31, 2022, (ii) the Consolidated and Combined Statements of Operations for the three and six months ended June 30, 2023 and 2022, (iii) the Consolidated and Combined Statements of Changes in Stockholders’ Equity for the three and six months ended June 30, 2023 and 2022, (iv) the Consolidated and Combined Statements of Cash Flows for the six months ended June 30, 2023 and 2022, and (v) the Notes to the Consolidated and Combined Financial Statements |

|||||||

| 104* | Cover Page Interactive Data File (formatted as Inline XBRL and contained in Exhibit 101) | |||||||

| * | Filed herewith | |||||||

| ** | Furnished herewith. This certification is not deemed filed by the SEC and is not to be incorporated by reference in any filing we make under the Securities Act of 1933 or the Securities Exchange Act of 1934, irrespective of any general incorporation language in any filings | |||||||

| † | The Company has redacted provisions or terms of this exhibit pursuant to Item 601(b)(10)(iv) of Regulation S-K. The Company agrees to furnish an unredacted copy of the exhibit to the SEC upon its request. | |||||||

Date: August 7, 2023 |

Blue Owl Capital Inc. | ||||||||||

| By: | /s/ Alan Kirshenbaum | ||||||||||

| Alan Kirshenbaum | |||||||||||

| Chief Financial Officer | |||||||||||

| Page | |||||

Consolidated and Combined Statements of Financial Condition as of June 30, 2023 and December 31, 2022 |

|||||

Consolidated and Combined Statements of Operations for the three and six months ended June 30, 2023 and 2022 |

|||||

Consolidated and Combined Statements of Changes in Stockholders’ Equity for the three and six months ended June 30, 2023 and 2022 |

|||||

Consolidated and Combined Statements of Cash Flows for the six months ended June 30, 2023 and 2022 |

|||||

| Notes to Consolidated and Combined Financial Statements | |||||

| June 30, 2023 |

December 31, 2022 |

||||||||||

| Assets | |||||||||||

| Cash and cash equivalents | $ | 41,321 | $ | 68,079 | |||||||

| Due from related parties | 336,170 | 357,921 | |||||||||

Investments (includes $55,415 and $16,922 at fair value and $360,581 and $315,304 of investments in the Company’s products, respectively) |

361,917 | 317,231 | |||||||||

| Operating lease assets | 276,469 | 224,411 | |||||||||

| Strategic Revenue-Share Purchase consideration, net | 438,400 | 457,939 | |||||||||

| Deferred tax assets | 759,772 | 757,234 | |||||||||

| Intangible assets, net | 2,218,614 | 2,405,422 | |||||||||

| Goodwill | 4,205,159 | 4,205,159 | |||||||||

| Other assets, net | 114,044 | 99,679 | |||||||||

| Total Assets | $ | 8,751,866 | $ | 8,893,075 | |||||||

| Liabilities | |||||||||||

| Debt obligations, net | $ | 1,754,969 | $ | 1,624,771 | |||||||

| Accrued compensation | 217,188 | 309,644 | |||||||||

| Operating lease liabilities | 302,672 | 239,844 | |||||||||

TRA liability (includes $112,830 and $120,587 at fair value, respectively) |

836,331 | 820,960 | |||||||||

| Warrant liability, at fair value | 10,050 | 8,550 | |||||||||

| Earnout liability, at fair value | 89,338 | 172,070 | |||||||||

| Deferred tax liabilities | 36,063 | 41,791 | |||||||||

| Accounts payable, accrued expenses and other liabilities | 133,735 | 126,559 | |||||||||

| Total Liabilities | 3,380,346 | 3,344,189 | |||||||||

Commitments and Contingencies (Note 11) |

|||||||||||

| Stockholders’ Equity | |||||||||||

Class A Shares, par value $0.0001 per share, 2,500,000,000 authorized, 454,557,594 and 445,131,351 issued and outstanding, respectively |

45 | 45 | |||||||||

Class C Shares, par value $0.0001 per share, 1,500,000,000 authorized, 633,520,277 and 629,402,505 issued and outstanding, respectively |

63 | 63 | |||||||||

Class D Shares, par value $0.0001 per share, 350,000,000 authorized, 319,132,127 and 319,132,127 issued and outstanding, respectively |

32 | 32 | |||||||||

| Additional paid-in capital | 2,359,830 | 2,293,903 | |||||||||

| Accumulated deficit | (788,525) | (689,345) | |||||||||

| Total Stockholders’ Equity Attributable to Blue Owl Capital Inc. | 1,571,445 | 1,604,698 | |||||||||

| Stockholders’ equity attributable to noncontrolling interests | 3,800,075 | 3,944,188 | |||||||||

| Total Stockholders’ Equity | 5,371,520 | 5,548,886 | |||||||||

| Total Liabilities and Stockholders’ Equity | $ | 8,751,866 | $ | 8,893,075 | |||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Revenues | |||||||||||||||||||||||

Management fees, net (includes Part I Fees of $91,938, $46,346, $177,802 and $93,085 respectively) |

$ | 371,829 | $ | 284,325 | $ | 730,654 | $ | 531,957 | |||||||||||||||

| Administrative, transaction and other fees | 45,108 | 42,921 | 76,763 | 71,266 | |||||||||||||||||||

| Realized performance income | — | — | 506 | — | |||||||||||||||||||

| Total Revenues, Net | 416,937 | 327,246 | 807,923 | 603,223 | |||||||||||||||||||

| Expenses | |||||||||||||||||||||||

| Compensation and benefits | 208,281 | 218,118 | 405,899 | 412,010 | |||||||||||||||||||

| Amortization of intangible assets | 115,917 | 64,885 | 186,808 | 126,411 | |||||||||||||||||||

| General, administrative and other expenses | 51,482 | 54,389 | 107,616 | 97,683 | |||||||||||||||||||

| Total Expenses | 375,680 | 337,392 | 700,323 | 636,104 | |||||||||||||||||||

| Other Income (Loss) | |||||||||||||||||||||||

| Net gains (losses) on investments | 3,030 | (123) | 3,642 | (118) | |||||||||||||||||||

| Interest expense, net | (13,568) | (15,051) | (27,141) | (27,885) | |||||||||||||||||||

| Change in TRA liability | 10,116 | 1,370 | 8,152 | (8,282) | |||||||||||||||||||

| Change in warrant liability | 450 | 20,723 | (1,500) | 38,481 | |||||||||||||||||||

| Change in earnout liability | (1,844) | (208) | (2,838) | (704) | |||||||||||||||||||

| Total Other Income (Loss) | (1,816) | 6,711 | (19,685) | 1,492 | |||||||||||||||||||

| Income (Loss) Before Income Taxes | 39,441 | (3,435) | 87,915 | (31,389) | |||||||||||||||||||

| Income tax expense | 5,402 | 5,631 | 11,842 | 593 | |||||||||||||||||||

| Consolidated and Combined Net Income (Loss) | 34,039 | (9,066) | 76,073 | (31,982) | |||||||||||||||||||

| Net (income) loss attributable to noncontrolling interests | (21,180) | 7,940 | (54,897) | 19,041 | |||||||||||||||||||

| Net Income (Loss) Attributable to Blue Owl Capital Inc. | $ | 12,859 | $ | (1,126) | $ | 21,176 | $ | (12,941) | |||||||||||||||

| Earnings (Loss) per Class A Share | |||||||||||||||||||||||

| Basic | $ | 0.03 | $ | 0.00 | $ | 0.05 | $ | (0.03) | |||||||||||||||

| Diluted | $ | 0.02 | $ | 0.00 | $ | 0.04 | $ | (0.03) | |||||||||||||||

| Weighted-Average Class A Shares | |||||||||||||||||||||||

Basic(1) |

459,396,686 | 422,631,967 | 457,801,762 | 419,896,221 | |||||||||||||||||||

| Diluted | 1,430,966,523 | 1,407,843,503 | 1,430,462,269 | 419,896,221 | |||||||||||||||||||

| Blue Owl Capital Inc. | |||||||||||||||||||||||

Consolidated and Combined Statements of Changes in Stockholders’ Equity (Unaudited) | |||||||||||||||||||||||

| (Dollars in Thousands, Except Per Share Data) | |||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Class A Shares Par Value | |||||||||||||||||||||||

| Beginning balance | $ | 45 | $ | 41 | $ | 45 | $ | 40 | |||||||||||||||

| Class C Shares and Common Units exchanged for Class A Shares | — | 1 | — | 2 | |||||||||||||||||||

| Ending Balance | $ | 45 | $ | 42 | $ | 45 | $ | 42 | |||||||||||||||

| Class C Shares Par Value | |||||||||||||||||||||||

| Beginning balance | $ | 64 | $ | 67 | $ | 63 | $ | 67 | |||||||||||||||

| Settlement of Oak Street Earnout Units | — | — | 1 | — | |||||||||||||||||||

| Class C Shares and Common Units exchanged for Class A Shares | (1) | (1) | (1) | (1) | |||||||||||||||||||

| Ending Balance | $ | 63 | $ | 66 | $ | 63 | $ | 66 | |||||||||||||||

| Class D Shares Par Value | |||||||||||||||||||||||

| Beginning balance | $ | 32 | $ | 32 | $ | 32 | $ | 32 | |||||||||||||||

| Ending Balance | $ | 32 | $ | 32 | $ | 32 | $ | 32 | |||||||||||||||

| Additional Paid-in Capital | |||||||||||||||||||||||

| Beginning balance | $ | 2,328,516 | $ | 2,166,232 | $ | 2,293,903 | $ | 2,160,934 | |||||||||||||||

| Equity classified contingent consideration in connection with Wellfleet Acquisition | (969) | — | (969) | — | |||||||||||||||||||

| Deferred taxes on capital transactions | 18,213 | 33,351 | 10,160 | 42,990 | |||||||||||||||||||

| TRA liability on capital transactions | (22,535) | (40,897) | (23,523) | (55,765) | |||||||||||||||||||

| Exercise of warrants | — | — | — | 2 | |||||||||||||||||||

| Equity-based compensation | 3,055 | 4,959 | 7,563 | 7,740 | |||||||||||||||||||

| Withholding taxes on vested RSUs | (160) | (179) | (1,555) | (393) | |||||||||||||||||||

| Class A Share repurchases | — | — | — | (24,238) | |||||||||||||||||||

| Reallocation between additional paid-in capital and noncontrolling interests due to changes in Blue Owl Operating Group ownership | 33,710 | 50,808 | 74,251 | 83,004 | |||||||||||||||||||

| Ending Balance | $ | 2,359,830 | $ | 2,214,274 | $ | 2,359,830 | $ | 2,214,274 | |||||||||||||||

| Accumulated Deficit | |||||||||||||||||||||||

| Beginning balance | $ | (738,949) | $ | (549,826) | $ | (689,345) | $ | (497,506) | |||||||||||||||

| Cash dividends declared on Class A Shares | (62,435) | (40,775) | (120,356) | (81,280) | |||||||||||||||||||

| Comprehensive income (loss) | 12,859 | (1,126) | 21,176 | (12,941) | |||||||||||||||||||

| Ending Balance | $ | (788,525) | $ | (591,727) | $ | (788,525) | $ | (591,727) | |||||||||||||||

| Total Stockholders' Equity Attributable to Blue Owl Capital Inc. | $ | 1,571,445 | $ | 1,622,687 | $ | 1,571,445 | $ | 1,622,687 | |||||||||||||||

| Stockholders’ Equity Attributable to Noncontrolling Interests | |||||||||||||||||||||||

| Beginning balance | $ | 3,879,630 | $ | 4,128,298 | $ | 3,944,188 | $ | 4,184,003 | |||||||||||||||

| Equity-based compensation | 61,075 | 90,132 | 125,880 | 174,150 | |||||||||||||||||||

| Contributions | 9,952 | 5,630 | 19,777 | 10,761 | |||||||||||||||||||

| Distributions | (137,800) | (100,566) | (267,158) | (201,604) | |||||||||||||||||||

| Withholding taxes on vested RSUs | (253) | (395) | (3,259) | (914) | |||||||||||||||||||

| Reallocation between additional paid-in capital and noncontrolling interests due to changes in Blue Owl Operating Group ownership | (33,709) | (50,808) | (74,250) | (83,004) | |||||||||||||||||||

| Comprehensive income (loss) | 21,180 | (7,940) | 54,897 | (19,041) | |||||||||||||||||||

| Ending Balance | $ | 3,800,075 | $ | 4,064,351 | $ | 3,800,075 | $ | 4,064,351 | |||||||||||||||

| Total Stockholders' Equity | $ | 5,371,520 | $ | 5,687,038 | $ | 5,371,520 | $ | 5,687,038 | |||||||||||||||

| Cash Dividends Paid per Class A Share | $ | 0.14 | $ | 0.10 | $ | 0.27 | $ | 0.20 | |||||||||||||||

| Blue Owl Capital Inc. | |||||||||||||||||||||||

Consolidated and Combined Statements of Changes in Stockholders’ Equity (Unaudited) | |||||||||||||||||||||||

| (Dollars in Thousands, Except Per Share Data) | |||||||||||||||||||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Number of Class A Shares | |||||||||||||||||||||||

| Beginning balance | 445,872,226 | 407,639,908 | 445,131,351 | 404,919,411 | |||||||||||||||||||

| Class A Share repurchases | — | — | — | (2,000,000) | |||||||||||||||||||

| Shares delivered on vested RSUs | 81,917 | 124,148 | 506,850 | 225,270 | |||||||||||||||||||

| Class C Shares and Common Units exchanged for Class A Shares | 8,603,451 | 12,338,436 | 8,919,393 | 16,957,611 | |||||||||||||||||||

| Exercise of warrants | — | — | — | 200 | |||||||||||||||||||

| Ending Balance | 454,557,594 | 420,102,492 | 454,557,594 | 420,102,492 | |||||||||||||||||||

| Number of Class C Shares | |||||||||||||||||||||||

| Beginning balance | 642,123,728 | 670,147,025 | 629,402,505 | 674,766,200 | |||||||||||||||||||

| Class C Shares and Common Units exchanged for Class A Shares | (8,603,451) | (12,338,436) | (8,919,393) | (16,957,611) | |||||||||||||||||||

| Settlement of Oak Street Earnout Units | — | — | 13,037,165 | — | |||||||||||||||||||

| Ending Balance | 633,520,277 | 657,808,589 | 633,520,277 | 657,808,589 | |||||||||||||||||||

| Number of Class D Shares | |||||||||||||||||||||||

| Beginning balance | 319,132,127 | 319,132,127 | 319,132,127 | 319,132,127 | |||||||||||||||||||

| Ending Balance | 319,132,127 | 319,132,127 | 319,132,127 | 319,132,127 | |||||||||||||||||||

| Six Months Ended June 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| Cash Flows from Operating Activities | |||||||||||

| Consolidated and combined net income (loss) | $ | 76,073 | $ | (31,982) | |||||||

| Adjustments to reconcile consolidated and combined net income (loss) to net cash from operating activities: | |||||||||||

| Amortization of intangible assets | 186,808 | 126,411 | |||||||||

| Equity-based compensation | 144,101 | 201,286 | |||||||||

| Depreciation and amortization of fixed assets | 4,503 | 459 | |||||||||

| Amortization of debt discounts and deferred financing costs | 2,260 | 2,150 | |||||||||

| Amortization of investment discounts and premiums | — | 12 | |||||||||

| Non-cash lease expense | 10,771 | 2,884 | |||||||||

| Payment of earnout liability in excess of acquisition-date fair value | (7,406) | — | |||||||||

| Net gains on investments, net of dividends | (3,642) | 118 | |||||||||

| Change in TRA liability | (8,152) | 8,282 | |||||||||

| Change in warrant liability | 1,500 | (38,481) | |||||||||

| Change in earnout liability | 2,838 | 704 | |||||||||

| Deferred income taxes | 1,889 | (3,840) | |||||||||

| Changes in operating assets and liabilities: | |||||||||||

| Due from related parties | 21,751 | (51,976) | |||||||||

| Strategic Revenue-Share Purchase consideration | 19,539 | 17,844 | |||||||||

| Other assets, net | (987) | 759 | |||||||||

| Accrued compensation | (99,928) | (11,036) | |||||||||

| Accounts payable, accrued expenses and other liabilities | 7,176 | 21,900 | |||||||||

| Net Cash Provided by Operating Activities | 359,094 | 245,494 | |||||||||

| Cash Flows from Investing Activities | |||||||||||

| Purchases of fixed assets | (15,853) | (27,839) | |||||||||

| Purchases of investments | (49,684) | (34,992) | |||||||||

| Proceeds from investment sales and maturities | 8,641 | 2,174 | |||||||||

| Cash consideration paid for acquisitions, net of cash consideration received | — | (114,454) | |||||||||

| Net Cash Used in Investing Activities | (56,896) | (175,111) | |||||||||

| Cash Flows from Financing Activities | |||||||||||

| Proceeds from debt obligations | 604,802 | 395,060 | |||||||||

| Debt issuance costs | (5,777) | (8,531) | |||||||||

| Repayments of debt obligations, including retirement costs | (474,998) | (153,000) | |||||||||

| Payment of earnout liability up to acquisition-date fair value | (79,134) | — | |||||||||

| Equity-classified RSUs settled in cash | (3,186) | — | |||||||||

| Withholding taxes on vested RSUs | (4,814) | (1,307) | |||||||||

| Dividends paid on Class A Shares | (120,356) | (81,280) | |||||||||

| Proceeds from exercise of warrants | — | 2 | |||||||||

| Class A Share repurchases | — | (24,238) | |||||||||

| Contributions from noncontrolling interests | 21,665 | 10,678 | |||||||||

| Distributions to noncontrolling interests | (267,158) | (201,604) | |||||||||

| Net Cash Used in Financing Activities | (328,956) | (64,220) | |||||||||

| Net Increase (Decrease) in Cash and Cash Equivalents | (26,758) | 6,163 | |||||||||

| Cash and cash equivalents, beginning of period | 68,079 | 42,567 | |||||||||

| Cash and Cash Equivalents, End of Period | $ | 41,321 | $ | 48,730 | |||||||

| Supplemental Information | |||||||||||

| Cash paid for interest | $ | 35,135 | $ | 18,823 | |||||||

| Cash paid for income taxes | $ | 9,249 | $ | 1,882 | |||||||

| June 30, 2023 | ||||||||

| Class A Shares | 454,557,594 | |||||||

| Class C Shares | 633,520,277 | |||||||

| Class D Shares | 319,132,127 | |||||||

| RSUs | 25,464,881 | |||||||

| Private Placement Warrants | 5,000,000 | |||||||

| Units | June 30, 2023 | |||||||

| GP Units | 454,557,594 | |||||||

| Common Units | 952,652,404 | |||||||

| Incentive Units | 34,013,081 | |||||||

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Number of shares purchased pursuant to the Programs | — | — | — | 2,000,000 | |||||||||||||||||||

| Number of RSUs withheld to satisfy tax withholding obligations | 39,640 | 50,189 | 358,946 | 107,170 | |||||||||||||||||||

| (dollars in thousands) | June 30, 2023 |

December 31, 2022 |

Remaining Weighted-Average Amortization Period as of June 30, 2023 | ||||||||||||||

| Intangible assets, gross: | |||||||||||||||||

| Investment management agreements | $ | 2,222,320 | $ | 2,222,320 | 12.1 years | ||||||||||||

| Investor relationships | 459,500 | 459,500 | 9.2 years | ||||||||||||||

Trademarks(1) |

94,400 | 94,400 | 0.0 years | ||||||||||||||

| Total intangible assets, gross | 2,776,220 | 2,776,220 | |||||||||||||||

| Accumulated amortization: | |||||||||||||||||

| Investment management agreements | (381,270) | (290,816) | |||||||||||||||

| Investor relationships | (81,936) | (60,630) | |||||||||||||||

| Trademarks | (94,400) | (19,352) | |||||||||||||||

| Total accumulated amortization | (557,606) | (370,798) | |||||||||||||||

| Total Intangible Assets, Net | $ | 2,218,614 | $ | 2,405,422 | |||||||||||||

| (dollars in thousands) | ||||||||

| Period | Amortization | |||||||

| July 1, 2023 to December 31, 2023 | $ | 112,913 | ||||||

| 2024 | 223,942 | |||||||

| 2025 | 219,739 | |||||||

| 2026 | 205,907 | |||||||

| 2027 | 191,731 | |||||||

| Thereafter | 1,264,382 | |||||||

| Total | $ | 2,218,614 | ||||||

| June 30, 2023 | |||||||||||||||||||||||||||||

| (dollars in thousands) |

Maturity

Date

|

Aggregate

Facility

Size

|

Outstanding

Debt

|

Amount Available |

Net Carrying Value |

||||||||||||||||||||||||

| 2028 Notes | 5/26/2028 | $ | 59,800 | $ | 59,800 | $ | — | $ | 58,679 | ||||||||||||||||||||

| 2031 Notes | 6/10/2031 | 700,000 | 700,000 | — | 686,319 | ||||||||||||||||||||||||

| 2032 Notes | 2/15/2032 | 400,000 | 400,000 | — | 392,279 | ||||||||||||||||||||||||

| 2051 Notes | 10/7/2051 | 350,000 | 350,000 | — | 337,692 | ||||||||||||||||||||||||

| Revolving Credit Facility | 6/29/2028 | 1,550,000 | 280,000 | 1,263,339 | 280,000 | ||||||||||||||||||||||||

| Total | $ | 3,059,800 | $ | 1,789,800 | $ | 1,263,339 | $ | 1,754,969 | |||||||||||||||||||||

| December 31, 2022 | |||||||||||||||||||||||||||||

| (dollars in thousands) |

Maturity

Date

|

Aggregate

Facility

Size

|

Outstanding

Debt

|

Amount Available |

Net Carrying Value |

||||||||||||||||||||||||

| 2031 Notes | 6/10/2031 | $ | 700,000 | $ | 700,000 | $ | — | $ | 685,474 | ||||||||||||||||||||

| 2032 Notes | 2/15/2032 | 400,000 | 400,000 | — | 391,819 | ||||||||||||||||||||||||

| 2051 Notes | 10/7/2051 | 350,000 | 350,000 | — | 337,478 | ||||||||||||||||||||||||

| Revolving Credit Facility | 6/15/2027 | 1,115,000 | 210,000 | 899,876 | 210,000 | ||||||||||||||||||||||||

| Total | $ | 2,565,000 | $ | 1,660,000 | $ | 899,876 | $ | 1,624,771 | |||||||||||||||||||||

| (dollars in thousands) | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||

| Lease Cost | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||

| Operating lease cost | $ | 9,155 | $ | 3,661 | $ | 17,326 | $ | 7,112 | ||||||||||||||||||

| Short term lease cost | 66 | 491 | 128 | 806 | ||||||||||||||||||||||

| Net Lease Cost | $ | 9,221 | $ | 4,152 | $ | 17,454 | $ | 7,918 | ||||||||||||||||||

| (dollars in thousands) | Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||||

| Supplemental Lease Cash Flow Information | 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||||

| Cash paid for amounts included in the measurement of lease liabilities: | ||||||||||||||||||||||||||

| Operating cash flows for operating leases | $ | 3,531 | $ | 3,027 | $ | 6,683 | $ | 5,034 | ||||||||||||||||||

| Right-of-use assets obtained in exchange for lease obligations: | ||||||||||||||||||||||||||

| Operating leases | $ | 41,856 | $ | 1,290 | $ | 77,789 | $ | 4,273 | ||||||||||||||||||

| Lease Term and Discount Rate | June 30, 2023 | December 31, 2022 | ||||||||||||

| Weighted-average remaining lease term: | ||||||||||||||

| Operating leases | 13.0 years | 13.0 years | ||||||||||||

| Weighted-average discount rate: | ||||||||||||||

| Operating leases | 5.3 | % | 4.0 | % | ||||||||||

| (dollars in thousands) | ||||||||

| Future Maturity of Operating Lease Payments | Operating Leases |

|||||||

| July 1, 2023 to December 31, 2023 | $ | 8,427 | ||||||

| 2024 | 7,153 | |||||||

| 2025 | 33,166 | |||||||

| 2026 | 35,829 | |||||||

| 2027 | 35,382 | |||||||

| Thereafter | 326,850 | |||||||

| Total Lease Payments | 446,807 | |||||||

| Imputed interest | (144,135) | |||||||

| Total Lease Liabilities | $ | 302,672 | ||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Credit Strategies | |||||||||||||||||||||||

| Diversified lending | $ | 155,086 | $ | 108,909 | $ | 301,181 | $ | 214,361 | |||||||||||||||

| Technology lending | 48,097 | 23,803 | 95,787 | 46,833 | |||||||||||||||||||

| First lien lending | 4,748 | 3,973 | 9,233 | 7,654 | |||||||||||||||||||

| Opportunistic lending | 2,475 | 2,730 | 4,875 | 4,271 | |||||||||||||||||||

| Liquid credit | 6,136 | 6,295 | 13,654 | 6,295 | |||||||||||||||||||

| Management Fees, Net | 216,542 | 145,710 | 424,730 | 279,414 | |||||||||||||||||||

| Administrative, transaction and other fees | 32,833 | 35,653 | 52,924 | 60,875 | |||||||||||||||||||

| Total GAAP Revenues - Credit Strategies | 249,375 | 181,363 | 477,654 | 340,289 | |||||||||||||||||||

| GP Strategic Capital Strategies | |||||||||||||||||||||||

| GP minority stakes | 130,424 | 124,434 | 260,720 | 226,534 | |||||||||||||||||||

| GP debt financing | 3,626 | 3,366 | 7,377 | 6,458 | |||||||||||||||||||

| Professional sports minority stakes | 565 | 513 | 967 | 1,013 | |||||||||||||||||||

| Strategic Revenue-Share Purchase consideration amortization | (9,770) | (8,922) | (19,539) | (17,844) | |||||||||||||||||||

| Management Fees, Net | 124,845 | 119,391 | 249,525 | 216,161 | |||||||||||||||||||

| Administrative, transaction and other fees | 9,200 | 7,268 | 17,605 | 10,391 | |||||||||||||||||||

| Total GAAP Revenues - GP Strategic Capital Strategies | 134,045 | 126,659 | 267,130 | 226,552 | |||||||||||||||||||

| Real Estate Strategies | |||||||||||||||||||||||

| Net lease | 30,442 | 19,224 | 56,399 | 36,382 | |||||||||||||||||||

| Management Fees, Net | 30,442 | 19,224 | 56,399 | 36,382 | |||||||||||||||||||

| Administrative, transaction and other fees | 3,075 | — | 6,234 | — | |||||||||||||||||||

| Realized performance income | — | — | 506 | — | |||||||||||||||||||

| Total GAAP Revenues - Real Estate Strategies | 33,517 | 19,224 | 63,139 | 36,382 | |||||||||||||||||||

| Total GAAP Revenues | $ | 416,937 | $ | 327,246 | $ | 807,923 | $ | 603,223 | |||||||||||||||

| Six Months Ended June 30, | |||||||||||

| (dollars in thousands) | 2023 | 2022 | |||||||||

| Management Fees Receivable | |||||||||||

| Beginning balance | $ | 262,059 | $ | 168,057 | |||||||

| Ending balance | $ | 220,678 | $ | 209,944 | |||||||

| Administrative, Transaction and Other Fees Receivable | |||||||||||

| Beginning balance | $ | 44,060 | $ | 19,535 | |||||||

| Ending balance | $ | 35,639 | $ | 24,741 | |||||||

| Realized Performance Income Receivable | |||||||||||

| Beginning balance | $ | 1,132 | $ | 10,496 | |||||||

| Ending balance | $ | — | $ | — | |||||||

| Unearned Management Fees | |||||||||||

| Beginning balance | $ | 9,389 | $ | 10,299 | |||||||

| Ending balance | $ | 8,545 | $ | 9,826 | |||||||

| Six Months Ended June 30, | |||||||||||

| (dollars in thousands) | 2023 | 2022 | |||||||||

| Beginning Balance | $ | 457,939 | $ | 495,322 | |||||||

| Amortization | (19,539) | (17,844) | |||||||||

| Ending Balance | $ | 438,400 | $ | 477,478 | |||||||

| (dollars in thousands) | June 30, 2023 |

December 31, 2022 |

|||||||||

| Fixed assets, net: | |||||||||||

| Leasehold improvements | $ | 73,301 | $ | 61,741 | |||||||

| Furniture and fixtures | 12,175 | 10,922 | |||||||||

| Computer hardware and software | 6,209 | 3,171 | |||||||||

| Accumulated depreciation and amortization | (9,151) | (4,644) | |||||||||

| Fixed assets, net | 82,534 | 71,190 | |||||||||

| Receivables | 9,884 | 11,935 | |||||||||

| Prepaid expenses | 6,919 | 6,099 | |||||||||

| Unamortized debt issuance costs on revolving credit facilities | 10,244 | 6,328 | |||||||||

| Other assets | 4,463 | 4,127 | |||||||||

| Total | $ | 114,044 | $ | 99,679 | |||||||

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||

| (dollars in thousands) | 2023 | 2022 | 2023 | 2022 | |||||||||||||||||||

| Acquisition related | |||||||||||||||||||||||

| Oak Street Earnout Units | $ | 20,089 | $ | 61,328 | $ | 39,957 | $ | 121,982 | |||||||||||||||

| Wellfleet Earnout Shares | 808 | 811 | 1,619 | 811 | |||||||||||||||||||

| Total acquisition related | 20,897 | 62,139 | 41,576 | 122,793 | |||||||||||||||||||

| Incentive Units | 37,372 | 34,164 | 76,846 | 61,326 | |||||||||||||||||||

| RSUs | 12,557 | 8,382 | 25,679 | 17,167 | |||||||||||||||||||

| Equity-Based Compensation Expense | $ | 70,826 | $ | 104,685 | $ | 144,101 | $ | 201,286 | |||||||||||||||

| Corresponding tax benefit | $ | 230 | $ | 152 | $ | 472 | $ | 304 | |||||||||||||||

| Fair value of RSUs settled in Class A Shares | $ | 850 | $ | 1,459 | $ | 6,706 | $ | 2,759 | |||||||||||||||

| Fair value of RSUs withheld to satisfy tax withholding obligations | $ | 414 | $ | 574 | $ | 4,814 | $ | 1,307 | |||||||||||||||

| (dollars in thousands) | June 30, 2023 |

December 31, 2022 |

|||||||||

Loans, at amortized cost (includes $257,500 and $252,225 of investments in the Company’s products, respectively) |

$ | 258,836 | $ | 254,152 | |||||||

| Equity investments in the Company's products, equity method | 47,666 | 46,157 | |||||||||

Equity investments in the Company's products, at fair value |

52,985 | 14,079 | |||||||||

| Investments in the Company's CLOs, at fair value | 2,430 | 2,843 | |||||||||

| Total | $ | 361,917 | $ | 317,231 | |||||||

| June 30, 2023 | ||||||||||||||||||||||||||

| (dollars in thousands) | Level I | Level II | Level III | Total | ||||||||||||||||||||||

| Investments, at Fair Value | ||||||||||||||||||||||||||

| Equity investments in the Company's products | $ | — | $ | 52,985 | $ | — | $ | 52,985 | ||||||||||||||||||

| CLOs | — | — | 2,430 | 2,430 | ||||||||||||||||||||||

| Total Assets, at Fair Value | $ | — | $ | 52,985 | $ | 2,430 | $ | 55,415 | ||||||||||||||||||

| Liabilities, at Fair Value | ||||||||||||||||||||||||||

| TRA liability | $ | — | $ | — | $ | 112,830 | $ | 112,830 | ||||||||||||||||||

| Warrant liability | — | — | 10,050 | 10,050 | ||||||||||||||||||||||

| Earnout liability | — | 586 | 88,752 | 89,338 | ||||||||||||||||||||||

| Total Liabilities, at Fair Value | $ | — | $ | 586 | $ | 211,632 | $ | 212,218 | ||||||||||||||||||

| December 31, 2022 | ||||||||||||||||||||||||||

| (dollars in thousands) | Level I | Level II | Level III | Total | ||||||||||||||||||||||

| Investments, at Fair Value | ||||||||||||||||||||||||||

| Equity investments in the Company's products | $ | — | $ | 14,079 | $ | — | $ | 14,079 | ||||||||||||||||||

| CLOs | — | — | 2,843 | 2,843 | ||||||||||||||||||||||

| Total Assets, at Fair Value | $ | — | $ | 14,079 | $ | 2,843 | $ | 16,922 | ||||||||||||||||||

| Liabilities, at Fair Value | ||||||||||||||||||||||||||

| TRA liability | $ | — | $ | — | $ | 120,587 | $ | 120,587 | ||||||||||||||||||

| Warrant liability | — | — | 8,550 | 8,550 | ||||||||||||||||||||||

| Earnout liability | — | — | 172,070 | 172,070 | ||||||||||||||||||||||

| Total Liabilities, at Fair Value | $ | — | $ | — | $ | 301,207 | $ | 301,207 | ||||||||||||||||||

| (dollars in thousands) | Level III Assets | ||||||||||||||||||||||

| Investment in CLOs | |||||||||||||||||||||||

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Beginning balance | $ | 2,678 | $ | — | $ | 2,843 | $ | — | |||||||||||||||

| Net gains (losses) | (248) | — | (413) | — | |||||||||||||||||||

| Ending Balance | $ | 2,430 | $ | — | $ | 2,430 | $ | — | |||||||||||||||

| Change in net unrealized gains (losses) on assets still recognized at the reporting date | $ | (248) | $ | — | $ | (413) | $ | — | |||||||||||||||

| Three Months Ended June 30, 2023 | Level III Liabilities | ||||||||||||||||||||||

| (dollars in thousands) | TRA Liability | Warrant Liability | Earnout Liability | Total | |||||||||||||||||||

| Beginning balance | $ | 122,951 | $ | 10,500 | $ | 91,814 | $ | 225,265 | |||||||||||||||

| Settlements | — | — | (5,000) | (5,000) | |||||||||||||||||||

| Net (gains) losses | (10,121) | (450) | 1,938 | (8,633) | |||||||||||||||||||

| Ending Balance | $ | 112,830 | $ | 10,050 | $ | 88,752 | $ | 211,632 | |||||||||||||||

| Change in net unrealized (gains) losses on liabilities still recognized at the reporting date | $ | (10,121) | $ | (450) | $ | 1,935 | $ | (8,636) | |||||||||||||||

| Six Months Ended June 30, 2023 | Level III Liabilities | ||||||||||||||||||||||

| (dollars in thousands) | TRA Liability | Warrant Liability | Earnout Liability | Total | |||||||||||||||||||

| Beginning balance | $ | 120,587 | $ | 8,550 | $ | 172,070 | $ | 301,207 | |||||||||||||||

| Settlements | — | — | (86,250) | (86,250) | |||||||||||||||||||

| Net (gains) losses | (7,757) | 1,500 | 2,932 | (3,325) | |||||||||||||||||||

| Ending Balance | $ | 112,830 | $ | 10,050 | $ | 88,752 | $ | 211,632 | |||||||||||||||

| Change in net unrealized (gains) losses on liabilities still recognized at the reporting date | $ | (7,757) | $ | 1,500 | $ | 2,808 | $ | (3,449) | |||||||||||||||

| Three Months Ended June 30, 2022 | Level III Liabilities | ||||||||||||||||||||||

| (dollars in thousands) | TRA Liability | Warrant Liability | Earnout Liability | Total | |||||||||||||||||||

| Beginning balance | $ | 120,978 | $ | 18,800 | $ | 144,296 | $ | 284,074 | |||||||||||||||

| Issuances | — | — | 14,751 | 14,751 | |||||||||||||||||||

| Net (gains) losses | (1,370) | (7,706) | 208 | (8,868) | |||||||||||||||||||

| Ending Balance | $ | 119,608 | $ | 11,094 | $ | 159,255 | $ | 289,957 | |||||||||||||||

| Change in net unrealized (gains) losses on liabilities still recognized at the reporting date | $ | (1,370) | $ | (7,706) | $ | 208 | $ | (8,868) | |||||||||||||||

| Six Months Ended June 30, 2022 | Level III Liabilities | ||||||||||||||||||||||

| (dollars in thousands) | TRA Liability | Warrant Liability | Earnout Liability | Total | |||||||||||||||||||

| Beginning balance | $ | 111,325 | $ | 25,750 | $ | 143,800 | $ | 280,875 | |||||||||||||||

| Issuances | — | — | 14,751 | 14,751 | |||||||||||||||||||

| Net losses (gains) | 8,283 | (14,656) | 704 | (5,669) | |||||||||||||||||||

| Ending Balance | $ | 119,608 | $ | 11,094 | $ | 159,255 | $ | 289,957 | |||||||||||||||

| Change in net unrealized (gains) losses on liabilities still recognized at the reporting date | $ | 8,283 | $ | (14,656) | $ | 704 | $ | (5,669) | |||||||||||||||

| (dollars in thousands) | Fair Value | Valuation Technique | Significant Unobservable Inputs | Range | Weighted Average | Impact to Valuation from an Increase in Input | ||||||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||||||||

| CLOs | $ | 2,430 | Discounted cash flow | Yield | 18 | % | - | 22% | 20 | % | Decrease | |||||||||||||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||||||||||||||

| TRA liability | $ | 112,830 | Discounted cash flow | Discount Rate | 11 | % | - | 11% | 11 | % | Decrease | |||||||||||||||||||||||||||||||||

| Warrant liability | 10,050 | Monte Carlo Simulation | Volatility | 30 | % | - | 30% | 30 | % | Increase | ||||||||||||||||||||||||||||||||||

| Earnout liability: | ||||||||||||||||||||||||||||||||||||||||||||

| Oak Street Earnouts | 79,822 | Discounted cash flow | Discount Rate | 16 | % | 16% | 16 | % | Decrease | |||||||||||||||||||||||||||||||||||

| Wellfleet Earnouts | 8,930 | Discounted cash flow | Discount Rate | 6 | % | - | 6% | 6 | % | Decrease | ||||||||||||||||||||||||||||||||||

| 88,752 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities, at Fair Value | $ | 211,632 | ||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Fair Value | Valuation Technique | Significant Unobservable Inputs | Range | Weighted Average | Impact to Valuation from an Increase in Input | ||||||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||||||||

| CLOs | $ | 2,843 | Discounted cash flow | Yield | 16 | % | 19% | 17 | % | Decrease | ||||||||||||||||||||||||||||||||||

| Liabilities | ||||||||||||||||||||||||||||||||||||||||||||

| TRA liability | $ | 120,587 | Discounted cash flow | Discount Rate | 11 | % | - | 11% | 11 | % | Decrease | |||||||||||||||||||||||||||||||||

| Warrant liability | 8,550 | Monte Carlo simulation | Volatility | 34 | % | 34% | 34 | % | Increase | |||||||||||||||||||||||||||||||||||

| Earnout liability: | ||||||||||||||||||||||||||||||||||||||||||||

| Oak Street Earnouts | 158,497 | Monte Carlo simulation | Revenue Volatility | 50 | % | 50% | 50 | % | Increase | |||||||||||||||||||||||||||||||||||

| Discount rate | 17 | % | - | 17% | 17 | % | Decrease | |||||||||||||||||||||||||||||||||||||

| Wellfleet Earnouts | 13,573 | Discounted cash flow | Discount rate | 6 | % | 6% | 6 | % | Decrease | |||||||||||||||||||||||||||||||||||

| 172,070 | ||||||||||||||||||||||||||||||||||||||||||||

| Total Liabilities, at Fair Value | $ | 301,207 | ||||||||||||||||||||||||||||||||||||||||||

| (dollars in thousands) | Potential Payments Under the Tax Receivable Agreement |

|||||||

| July 1, 2023 to December 31, 2023 | $ | — | ||||||

| 2024 | 30,264 | |||||||

| 2025 | 52,639 | |||||||

| 2026 | 53,720 | |||||||

| 2027 | 79,002 | |||||||

| Thereafter | 743,738 | |||||||

| Total Payments | 959,363 | |||||||

| Less adjustment to fair value for contingent consideration | (123,032) | |||||||

| Total TRA Liability | $ | 836,331 | ||||||

| (dollars in thousands) | June 30, 2023 | December 31, 2022 | |||||||||

| Management fees | $ | 220,678 | $ | 262,059 | |||||||

| Realized performance income | — | 1,132 | |||||||||

| Administrative fees | 35,639 | 44,060 | |||||||||

| Other expenses paid on behalf of the Company’s products and other related parties | 79,853 | 50,670 | |||||||||

| Due from Related Parties | $ | 336,170 | $ | 357,921 | |||||||

| Basic | Diluted | ||||||||||

Class A Shares(1) |

Included | Included | |||||||||

| Class B Shares | None outstanding | None outstanding | |||||||||

| Class C Shares and Class D Shares | Non-economic voting shares of the Registrant | Non-economic voting shares of the Registrant | |||||||||

Vested RSUs(1) |

Contingently issuable shares | Contingently issuable shares | |||||||||

| Unvested RSUs | Excluded | Treasury stock method | |||||||||

Warrants(2) |

Excluded | Treasury stock method | |||||||||

Compensation-classified Wellfleet Earnout Shares(3) |

Excluded | Excluded | |||||||||

Contingent consideration-classified Wellfleet Earnout Shares(3) |

Excluded | Excluded | |||||||||

| Potentially Dilutive Instruments of the Blue Owl Operating Group: | |||||||||||

Vested Common Units and Incentive Units(4) |

Excluded | If-converted method | |||||||||

Unvested Incentive Units(4) |

Excluded | The Company first applies the treasury stock method to determine the number of units that would have been issued, then applies the if-converted method to the resulting number of units | |||||||||

Oak Street Earnout Units(5) |

Excluded | Contingently issuable shares If-converted method |

|||||||||

| Three Months Ended June 30, 2023 | Net Income Attributable to Class A Shares | Weighted-Average Class A Shares Outstanding | Earnings Per Class A Share | Weighted-Average Number of Antidilutive Instruments | |||||||||||||||||||

| (dollars in thousands, except per share amounts) | |||||||||||||||||||||||

| Basic | $ | 12,859 | 459,396,686 | $ | 0.03 | ||||||||||||||||||

| Effect of dilutive securities: | |||||||||||||||||||||||

| Unvested RSUs | — | 4,821,670 | — | ||||||||||||||||||||

| Warrants | — | — | 5,000,000 | ||||||||||||||||||||

| Vested Common Units | 12,854 | 958,419,552 | — | ||||||||||||||||||||

| Vested Incentive Units | — | — | 8,288,243 | ||||||||||||||||||||

| Unvested Incentive Units | — | — | 24,913,535 | ||||||||||||||||||||

| Oak Street Earnout Units | — | 8,328,615 | — | ||||||||||||||||||||

| Diluted | $ | 25,713 | 1,430,966,523 | $ | 0.02 | ||||||||||||||||||

| Six Months Ended June 30, 2023 | Net Loss Attributable to Class A Shares | Weighted-Average Class A Shares Outstanding | Earnings Per Class A Share | Weighted-Average Number of Antidilutive Instruments | |||||||||||||||||||

| (dollars in thousands, except per share amounts) | |||||||||||||||||||||||

| Basic | $ | 21,176 | 457,801,762 | $ | 0.05 | ||||||||||||||||||

| Effect of dilutive securities: | |||||||||||||||||||||||

| Unvested RSUs | — | 4,993,091 | — | ||||||||||||||||||||

| Warrants | — | — | 5,000,000 | ||||||||||||||||||||

| Vested Common Units | 37,135 | 959,932,856 | — | ||||||||||||||||||||

| Vested Incentive Units | — | — | 7,352,805 | ||||||||||||||||||||

| Unvested Incentive Units | — | — | 24,964,715 | ||||||||||||||||||||

| Oak Street Earnout Units | — | 7,734,560 | — | ||||||||||||||||||||

| Diluted | $ | 58,311 | 1,430,462,269 | $ | 0.04 | ||||||||||||||||||

| Three Months Ended June 30, 2022 | Net Loss Attributable to Class A Shares | Weighted-Average Class A Shares Outstanding | Loss Per Class A Share | Weighted-Average Number of Antidilutive Instruments | |||||||||||||||||||

| (dollars in thousands, except per share amounts) | |||||||||||||||||||||||

| Basic | $ | (1,126) | 422,631,967 | $ | 0.00 | ||||||||||||||||||

| Effect of dilutive securities: | |||||||||||||||||||||||

| Unvested RSUs | — | — | 10,771,348 | ||||||||||||||||||||

| Warrants | — | — | 14,159,048 | ||||||||||||||||||||

| Compensation-classified Wellfleet Earnout Shares | — | — | 862,275 | ||||||||||||||||||||

| Contingent consideration-classified Wellfleet Earnout Shares | — | — | 78,393 | ||||||||||||||||||||

| Vested Common Units | (5,304) | 985,211,536 | — | ||||||||||||||||||||

| Vested Incentive Units | — | — | 804,207 | ||||||||||||||||||||

| Unvested Incentive Units | — | — | 24,517,020 | ||||||||||||||||||||

| Oak Street Earnout Units | — | — | 26,074,330 | ||||||||||||||||||||

| Diluted | $ | (6,430) | 1,407,843,503 | $ | 0.00 | ||||||||||||||||||

| Six Months Ended June 30, 2022 | Net Loss Attributable to Class A Shares | Weighted-Average Class A Shares Outstanding | Loss Per Class A Share | Weighted-Average Number of Antidilutive Instruments | |||||||||||||||||||

| (dollars in thousands, except per share amounts) | |||||||||||||||||||||||

| Basic | $ | (12,941) | 419,896,221 | $ | (0.03) | ||||||||||||||||||

| Effect of dilutive securities: | |||||||||||||||||||||||

| Unvested RSUs | — | — | 10,760,867 | ||||||||||||||||||||

| Warrants | — | — | 14,159,109 | ||||||||||||||||||||

| Compensation-classified Wellfleet Earnout Shares | — | — | 433,519 | ||||||||||||||||||||

| Contingent consideration-classified Wellfleet Earnout Shares | — | — | 39,413 | ||||||||||||||||||||

| Vested Common Units | — | — | 988,739,805 | ||||||||||||||||||||

| Vested Incentive Units | — | — | 529,222 | ||||||||||||||||||||

| Unvested Incentive Units | — | — | 24,646,105 | ||||||||||||||||||||

| Oak Street Earnout Units | — | — | 26,074,330 | ||||||||||||||||||||

| Diluted | $ | (12,941) | 419,896,221 | $ | (0.03) | ||||||||||||||||||

14 | ||

| (I) or (we) assign and transfer this Note to: |

(Insert assignee’s last name

|

||||

|

(Insert assignee’s soc. sec. or tax I.D. no.)

|

|||||

(Print or type assignee’s name, address and zip code) | |||||

Signature Guarantee: |

||||||||