0001823608False00018236082025-11-102025-11-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 10, 2025

Amalgamated Financial Corp.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-40136 |

|

85-2757101 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification

No.) |

275 Seventh Avenue, New York, New York 10001

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (212) 895-8988

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

AMAL |

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR § 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR § 240.12b-2).

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On November 11, 2025, Amalgamated Financial Corp. (the "Company") will make presentations to certain institutional investors using the materials that are included as Exhibit 99.1 to this Current Report on Form 8-K (the "Investor Presentation"). The Company may use the Investor Presentation, possibly with modifications, in presentations from time to time thereafter to current and potential investors, analysts, lenders, business partners, acquisition candidates, customers, employees and others with an interest in the Company and its business.

We are furnishing this Current Report on November 10, 2025, after the close of the Nasdaq Stock Market, because November 11, 2025, is a federal holiday. By furnishing this Current Report on Form 8-K, including the Investor Presentation, the Company makes no admission as to the materiality of any information in this Report, including without limitation the Investor Presentation.

The information in this Item 7.01, including Exhibit 99.1 shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and shall not be deemed incorporated by reference into any filing with the Securities and Exchange Commission, except as expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits The following exhibit index lists the exhibits that are either filed or furnished with this Current Report on Form 8-K:

Exhibit Index

|

|

|

|

|

|

| Exhibit No. |

Description |

| 99.1 |

|

| 104 |

The cover page from this Current Report on Form 8-K, formatted in Inline XBRL. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AMALGAMATED FINANCIAL CORP. |

|

|

|

|

|

|

By: |

/s/ Priscilla Sims Brown |

|

|

Name: |

Priscilla Sims Brown |

|

|

Title: |

President and Chief Executive Officer |

|

|

|

|

| Date: November 10, 2025 |

|

|

|

EX-99.1

2

renewablelendingportfoli.htm

EX-99.1

renewablelendingportfoli

1 Amalgamated Financial Corp. Renewables Lending Portfolio Presentation November 2025

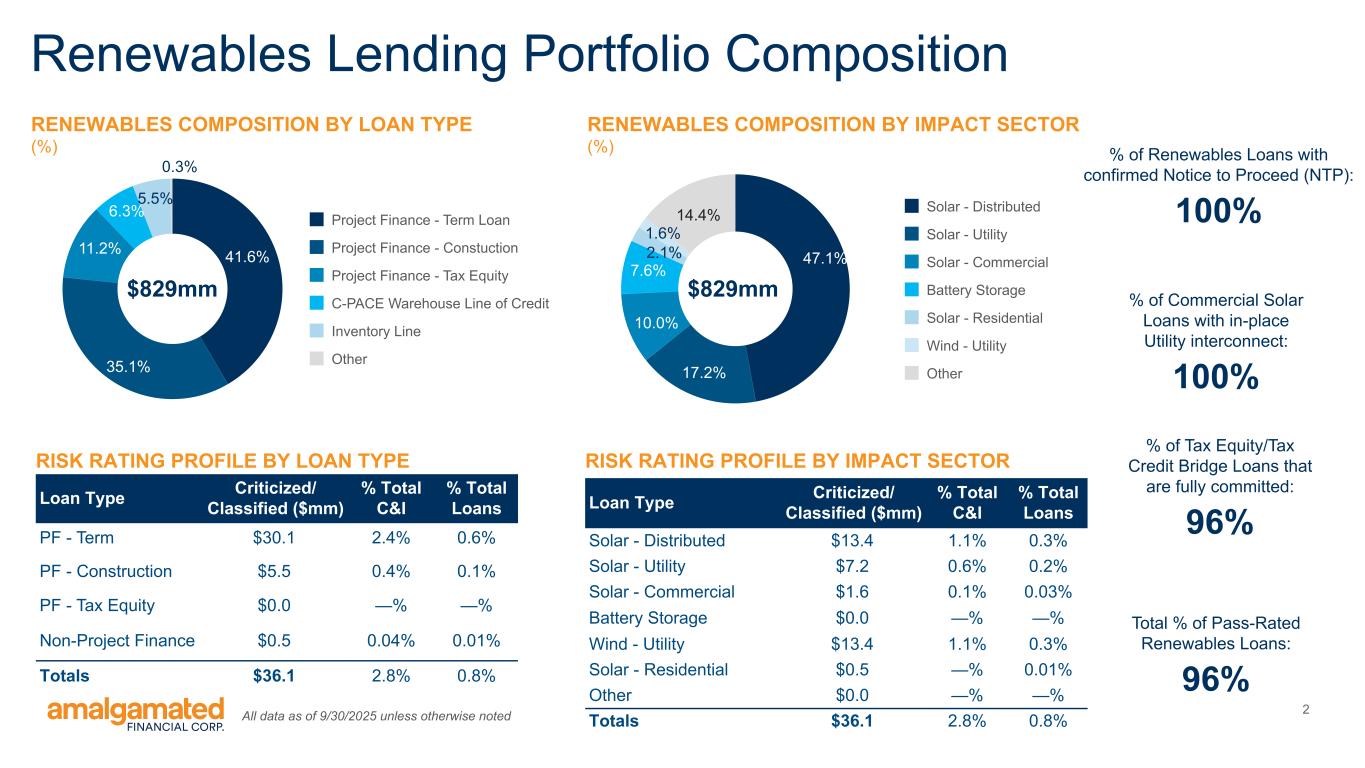

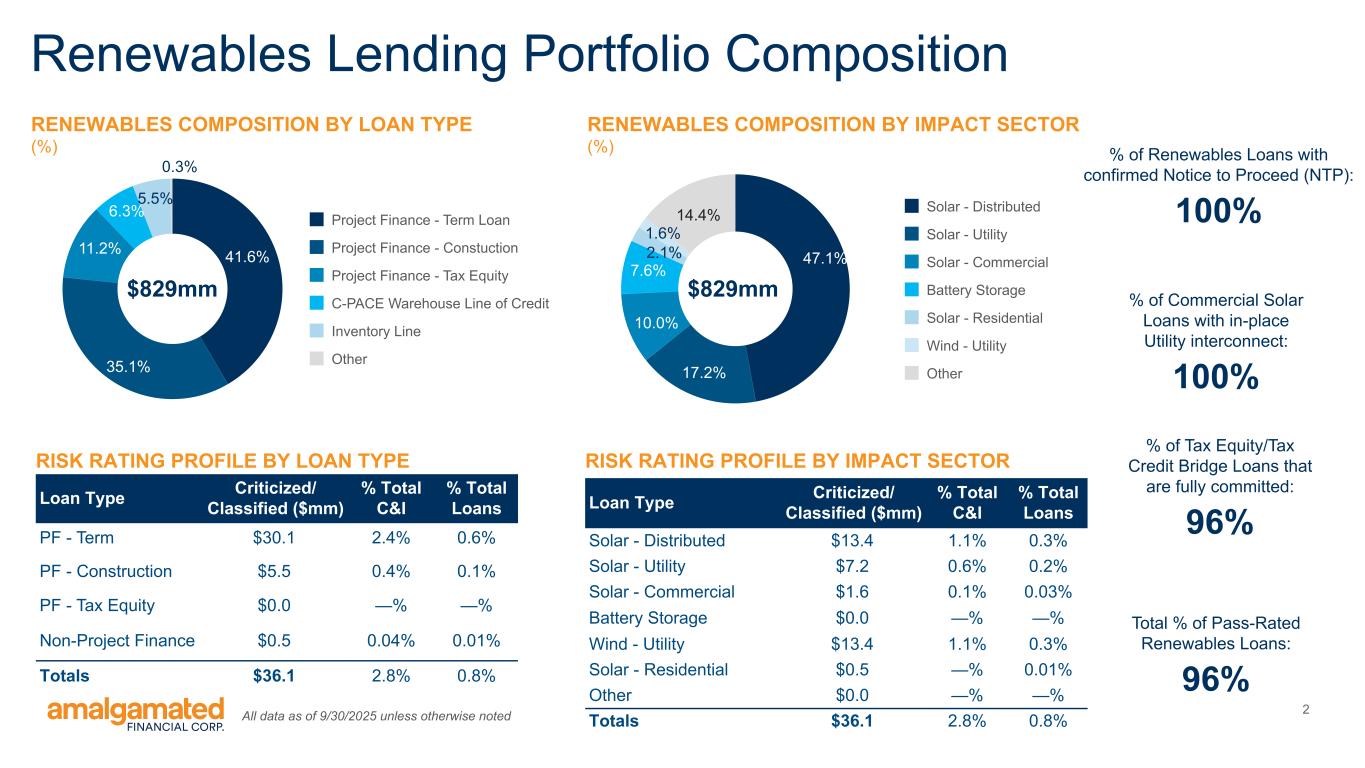

2 41.6% 35.1% 11.2% 6.3% 5.5% 0.3% Project Finance - Term Loan Project Finance - Constuction Project Finance - Tax Equity C-PACE Warehouse Line of Credit Inventory Line Other Renewables Lending Portfolio Composition RENEWABLES COMPOSITION BY LOAN TYPE (%) $829mm RISK RATING PROFILE BY LOAN TYPE Loan Type Criticized/ Classified ($mm) % Total C&I % Total Loans PF - Term $30.1 2.4% 0.6% PF - Construction $5.5 0.4% 0.1% PF - Tax Equity $0.0 —% —% Non-Project Finance $0.5 0.04% 0.01% Totals $36.1 2.8% 0.8% 47.1% 17.2% 10.0% 7.6% 2.1% 1.6% 14.4% Solar - Distributed Solar - Utility Solar - Commercial Battery Storage Solar - Residential Wind - Utility Other $829mm RENEWABLES COMPOSITION BY IMPACT SECTOR (%) RISK RATING PROFILE BY IMPACT SECTOR Loan Type Criticized/ Classified ($mm) % Total C&I % Total Loans Solar - Distributed $13.4 1.1% 0.3% Solar - Utility $7.2 0.6% 0.2% Solar - Commercial $1.6 0.1% 0.03% Battery Storage $0.0 —% —% Wind - Utility $13.4 1.1% 0.3% Solar - Residential $0.5 —% 0.01% Other $0.0 —% —% Totals $36.1 2.8% 0.8% Total % of Pass-Rated Renewables Loans: 96% % of Renewables Loans with confirmed Notice to Proceed (NTP): 100% % of Commercial Solar Loans with in-place Utility interconnect: 100% % of Tax Equity/Tax Credit Bridge Loans that are fully committed: 96% All data as of 9/30/2025 unless otherwise noted

3 15.7% 12.4% 10.7% 7.0% 5.7% 5.4% 3.7% 39.4% NY CA TX DC IL ME MA Other Renewables Portfolio Detail RENEWABLES LOAN PROJECT SITES SPLIT BY GEOGRAPHY1 (%) RENEWABLES LOAN TYPE BY MATURITY ($mm) $70 $184 $53 $40 $170 $73 $132 $59 $47 Project Finance - Term Loan Project Finance - Constuction Project Finance - Tax Equity C-PACE Warehouse Line of Credit Inventory Line Other 2025 2026 2027 2028 2029 2030 2031 2032 2033+ All data as of 9/30/2025 unless otherwise noted 1 Geographic split of Renewables loan projects calculated using data from 12/31/2024