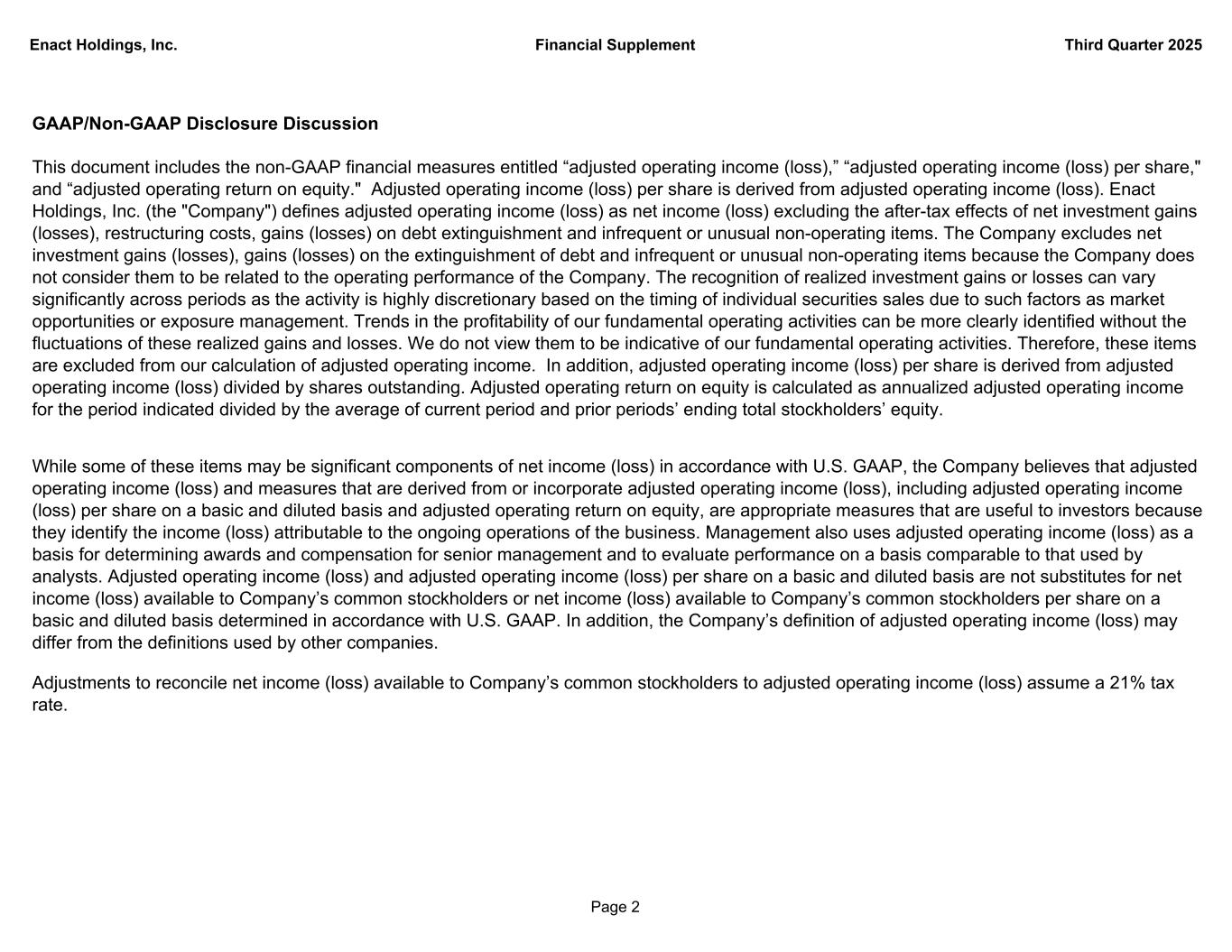

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 GAAP/Non-GAAP Disclosure Discussion This document includes the non-GAAP financial measures entitled “adjusted operating income (loss),” “adjusted operating income (loss) per share," and “adjusted operating return on equity." Adjusted operating income (loss) per share is derived from adjusted operating income (loss). Enact Holdings, Inc. (the "Company") defines adjusted operating income (loss) as net income (loss) excluding the after-tax effects of net investment gains (losses), restructuring costs, gains (losses) on debt extinguishment and infrequent or unusual non-operating items. The Company excludes net investment gains (losses), gains (losses) on the extinguishment of debt and infrequent or unusual non-operating items because the Company does not consider them to be related to the operating performance of the Company. The recognition of realized investment gains or losses can vary significantly across periods as the activity is highly discretionary based on the timing of individual securities sales due to such factors as market opportunities or exposure management. Trends in the profitability of our fundamental operating activities can be more clearly identified without the fluctuations of these realized gains and losses. We do not view them to be indicative of our fundamental operating activities. Therefore, these items are excluded from our calculation of adjusted operating income. In addition, adjusted operating income (loss) per share is derived from adjusted operating income (loss) divided by shares outstanding. Adjusted operating return on equity is calculated as annualized adjusted operating income for the period indicated divided by the average of current period and prior periods’ ending total stockholders’ equity. While some of these items may be significant components of net income (loss) in accordance with U.S. GAAP, the Company believes that adjusted operating income (loss) and measures that are derived from or incorporate adjusted operating income (loss), including adjusted operating income (loss) per share on a basic and diluted basis and adjusted operating return on equity, are appropriate measures that are useful to investors because they identify the income (loss) attributable to the ongoing operations of the business. Management also uses adjusted operating income (loss) as a basis for determining awards and compensation for senior management and to evaluate performance on a basis comparable to that used by analysts. Adjusted operating income (loss) and adjusted operating income (loss) per share on a basic and diluted basis are not substitutes for net income (loss) available to Company’s common stockholders or net income (loss) available to Company’s common stockholders per share on a basic and diluted basis determined in accordance with U.S. GAAP. In addition, the Company’s definition of adjusted operating income (loss) may differ from the definitions used by other companies. Adjustments to reconcile net income (loss) available to Company’s common stockholders to adjusted operating income (loss) assume a 21% tax rate. Page 2

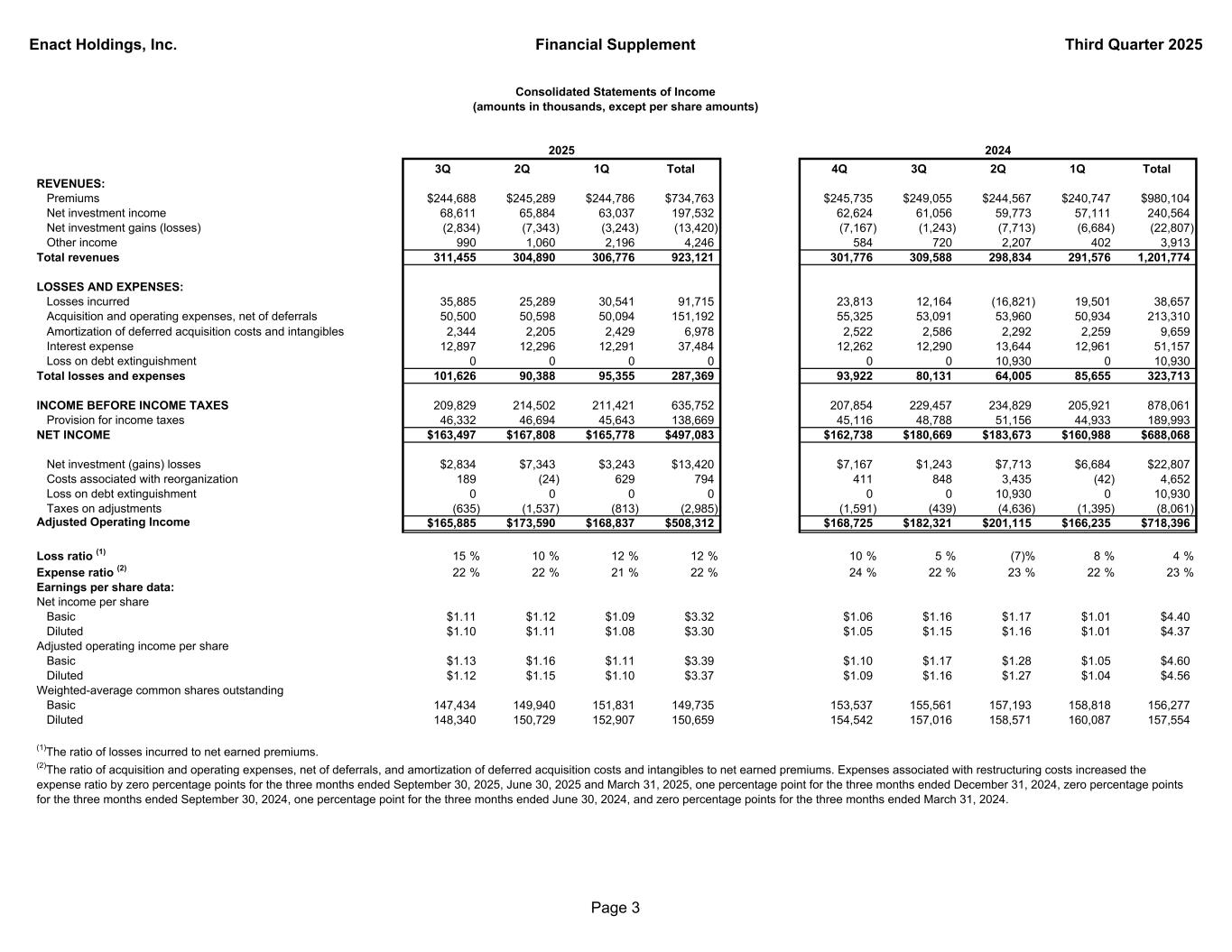

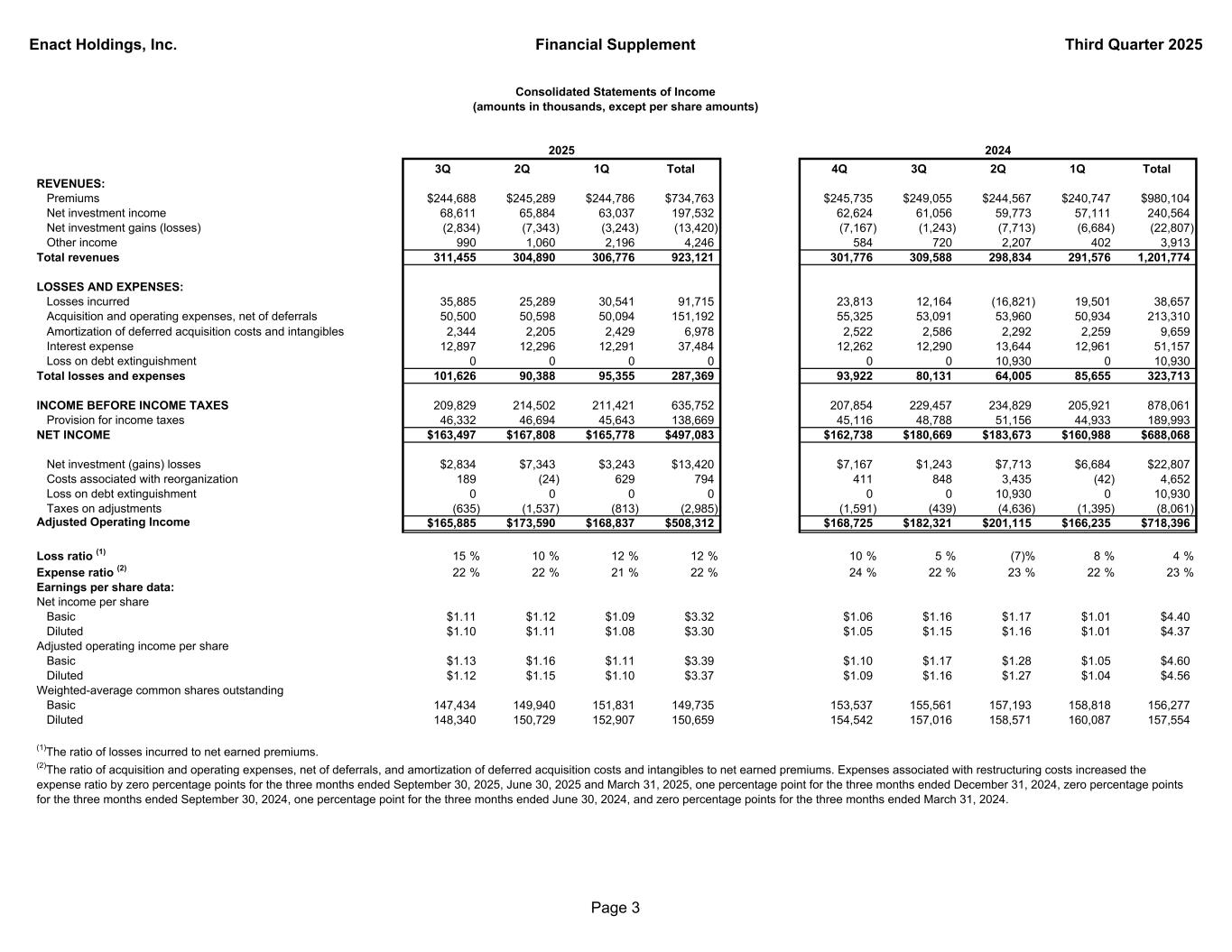

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 3Q 2Q 1Q Total 4Q 3Q 2Q 1Q Total REVENUES: Premiums $244,688 $245,289 $244,786 $734,763 $245,735 $249,055 $244,567 $240,747 $980,104 Net investment income 68,611 65,884 63,037 197,532 62,624 61,056 59,773 57,111 240,564 Net investment gains (losses) (2,834) (7,343) (3,243) (13,420) (7,167) (1,243) (7,713) (6,684) (22,807) Other income 990 1,060 2,196 4,246 584 720 2,207 402 3,913 Total revenues 311,455 304,890 306,776 923,121 301,776 309,588 298,834 291,576 1,201,774 LOSSES AND EXPENSES: Losses incurred 35,885 25,289 30,541 91,715 23,813 12,164 (16,821) 19,501 38,657 Acquisition and operating expenses, net of deferrals 50,500 50,598 50,094 151,192 55,325 53,091 53,960 50,934 213,310 Amortization of deferred acquisition costs and intangibles 2,344 2,205 2,429 6,978 2,522 2,586 2,292 2,259 9,659 Interest expense 12,897 12,296 12,291 37,484 12,262 12,290 13,644 12,961 51,157 Loss on debt extinguishment 0 0 0 0 0 0 10,930 0 10,930 Total losses and expenses 101,626 90,388 95,355 287,369 93,922 80,131 64,005 85,655 323,713 INCOME BEFORE INCOME TAXES 209,829 214,502 211,421 635,752 207,854 229,457 234,829 205,921 878,061 Provision for income taxes 46,332 46,694 45,643 138,669 45,116 48,788 51,156 44,933 189,993 NET INCOME $163,497 $167,808 $165,778 $497,083 $162,738 $180,669 $183,673 $160,988 $688,068 Net investment (gains) losses $2,834 $7,343 $3,243 $13,420 $7,167 $1,243 $7,713 $6,684 $22,807 Costs associated with reorganization 189 (24) 629 794 411 848 3,435 (42) 4,652 Loss on debt extinguishment 0 0 0 0 0 0 10,930 0 10,930 Taxes on adjustments (635) (1,537) (813) (2,985) (1,591) (439) (4,636) (1,395) (8,061) Adjusted Operating Income $165,885 $173,590 $168,837 $508,312 $168,725 $182,321 $201,115 $166,235 $718,396 Loss ratio (1) 15 % 10 % 12 % 12 % 10 % 5 % (7)% 8 % 4 % Expense ratio (2) 22 % 22 % 21 % 22 % 24 % 22 % 23 % 22 % 23 % Earnings per share data: Net income per share Basic $1.11 $1.12 $1.09 $3.32 $1.06 $1.16 $1.17 $1.01 $4.40 Diluted $1.10 $1.11 $1.08 $3.30 $1.05 $1.15 $1.16 $1.01 $4.37 Adjusted operating income per share Basic $1.13 $1.16 $1.11 $3.39 $1.10 $1.17 $1.28 $1.05 $4.60 Diluted $1.12 $1.15 $1.10 $3.37 $1.09 $1.16 $1.27 $1.04 $4.56 Weighted-average common shares outstanding Basic 147,434 149,940 151,831 149,735 153,537 155,561 157,193 158,818 156,277 Diluted 148,340 150,729 152,907 150,659 154,542 157,016 158,571 160,087 157,554 (2)The ratio of acquisition and operating expenses, net of deferrals, and amortization of deferred acquisition costs and intangibles to net earned premiums. Expenses associated with restructuring costs increased the expense ratio by zero percentage points for the three months ended September 30, 2025, June 30, 2025 and March 31, 2025, one percentage point for the three months ended December 31, 2024, zero percentage points for the three months ended September 30, 2024, one percentage point for the three months ended June 30, 2024, and zero percentage points for the three months ended March 31, 2024. 2024 (1)The ratio of losses incurred to net earned premiums. Consolidated Statements of Income (amounts in thousands, except per share amounts) 2025 Page 3

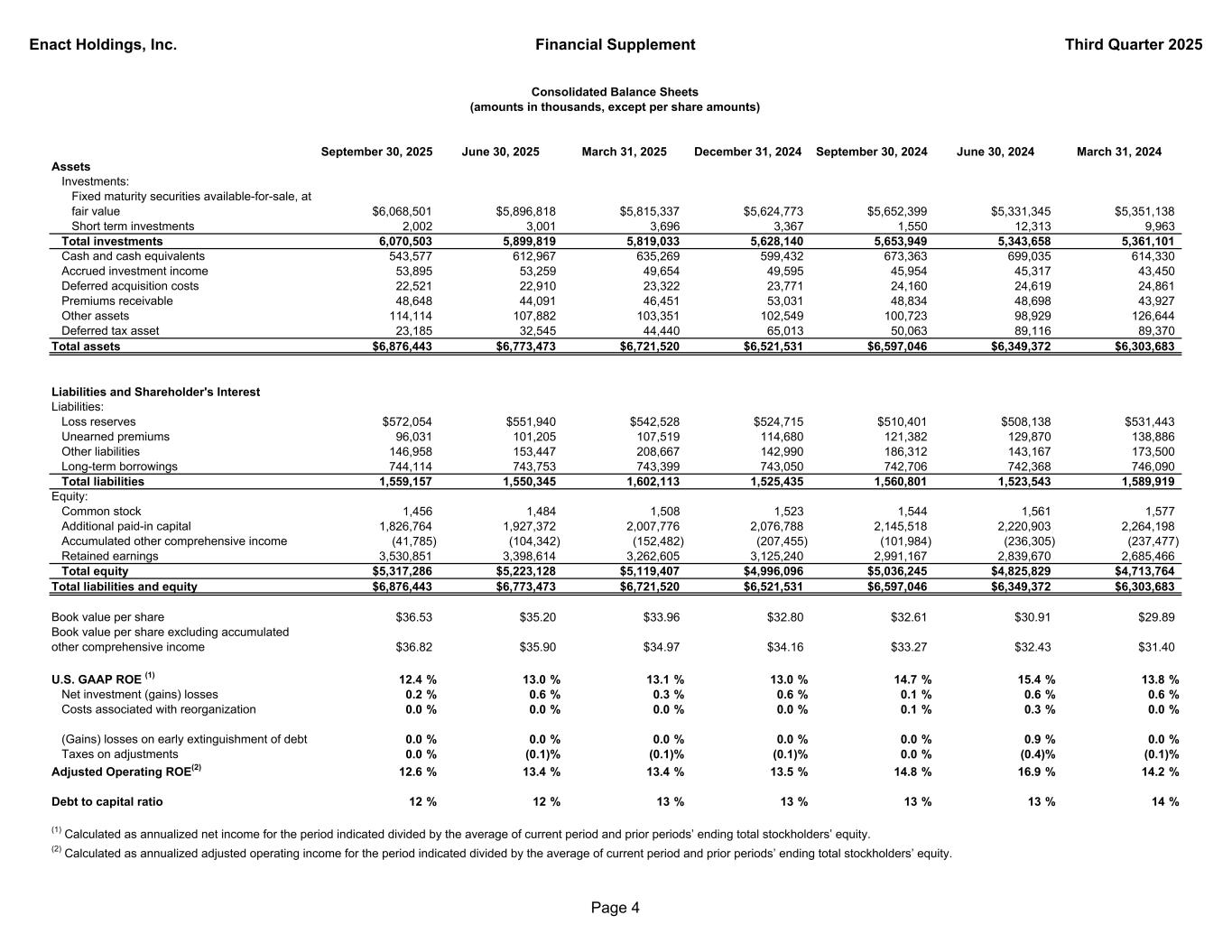

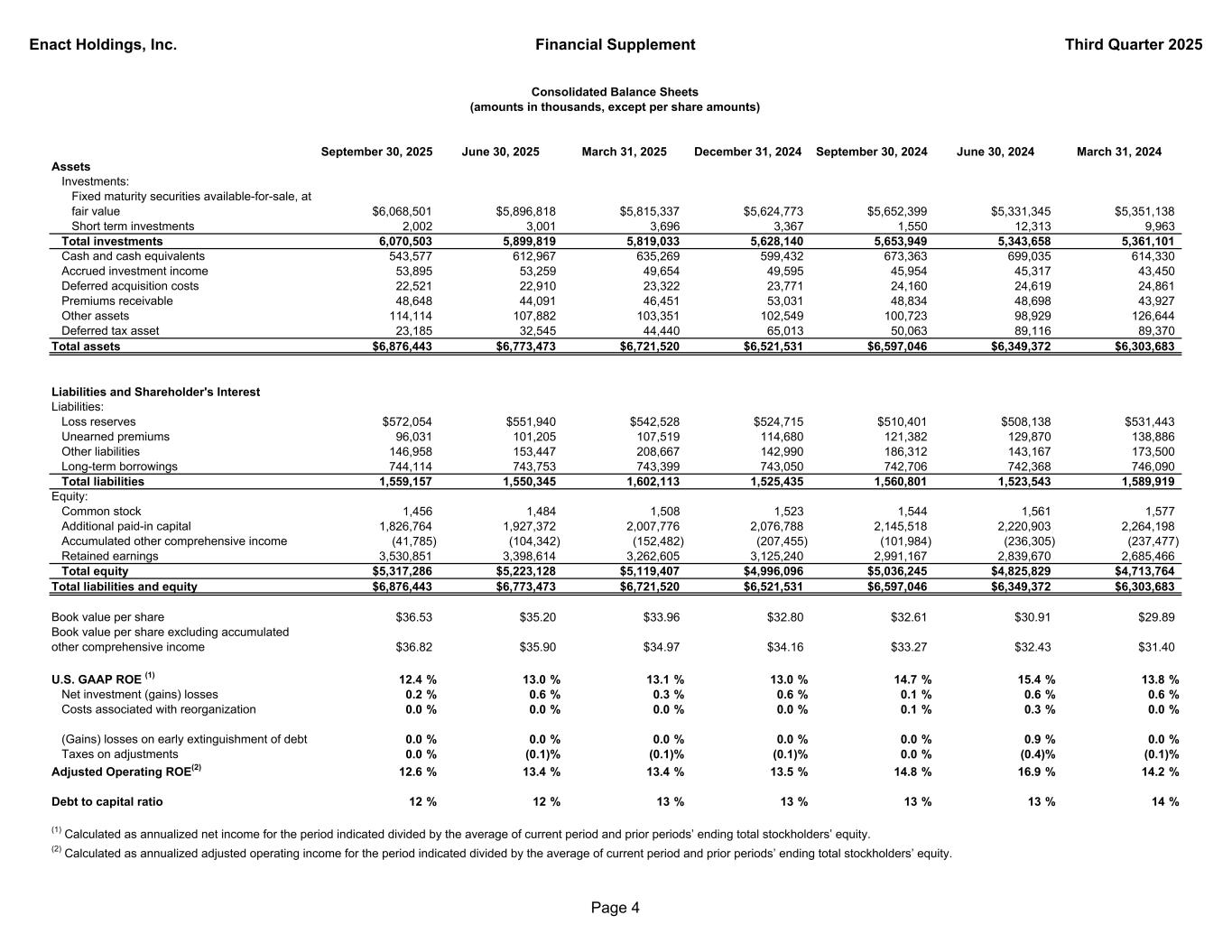

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 September 30, 2025 June 30, 2025 March 31, 2025 December 31, 2024 September 30, 2024 June 30, 2024 March 31, 2024 Assets Investments: Fixed maturity securities available-for-sale, at fair value $6,068,501 $5,896,818 $5,815,337 $5,624,773 $5,652,399 $5,331,345 $5,351,138 Short term investments 2,002 3,001 3,696 3,367 1,550 12,313 9,963 Total investments 6,070,503 5,899,819 5,819,033 5,628,140 5,653,949 5,343,658 5,361,101 Cash and cash equivalents 543,577 612,967 635,269 599,432 673,363 699,035 614,330 Accrued investment income 53,895 53,259 49,654 49,595 45,954 45,317 43,450 Deferred acquisition costs 22,521 22,910 23,322 23,771 24,160 24,619 24,861 Premiums receivable 48,648 44,091 46,451 53,031 48,834 48,698 43,927 Other assets 114,114 107,882 103,351 102,549 100,723 98,929 126,644 Deferred tax asset 23,185 32,545 44,440 65,013 50,063 89,116 89,370 Total assets $6,876,443 $6,773,473 $6,721,520 $6,521,531 $6,597,046 $6,349,372 $6,303,683 Liabilities and Shareholder's Interest Liabilities: Loss reserves $572,054 $551,940 $542,528 $524,715 $510,401 $508,138 $531,443 Unearned premiums 96,031 101,205 107,519 114,680 121,382 129,870 138,886 Other liabilities 146,958 153,447 208,667 142,990 186,312 143,167 173,500 Long-term borrowings 744,114 743,753 743,399 743,050 742,706 742,368 746,090 Total liabilities 1,559,157 1,550,345 1,602,113 1,525,435 1,560,801 1,523,543 1,589,919 Equity: Common stock 1,456 1,484 1,508 1,523 1,544 1,561 1,577 Additional paid-in capital 1,826,764 1,927,372 2,007,776 2,076,788 2,145,518 2,220,903 2,264,198 Accumulated other comprehensive income (41,785) (104,342) (152,482) (207,455) (101,984) (236,305) (237,477) Retained earnings 3,530,851 3,398,614 3,262,605 3,125,240 2,991,167 2,839,670 2,685,466 Total equity $5,317,286 $5,223,128 $5,119,407 $4,996,096 $5,036,245 $4,825,829 $4,713,764 Total liabilities and equity $6,876,443 $6,773,473 $6,721,520 $6,521,531 $6,597,046 $6,349,372 $6,303,683 Book value per share $36.53 $35.20 $33.96 $32.80 $32.61 $30.91 $29.89 Book value per share excluding accumulated other comprehensive income $36.82 $35.90 $34.97 $34.16 $33.27 $32.43 $31.40 U.S. GAAP ROE (1) 12.4 % 13.0 % 13.1 % 13.0 % 14.7 % 15.4 % 13.8 % Net investment (gains) losses 0.2 % 0.6 % 0.3 % 0.6 % 0.1 % 0.6 % 0.6 % Costs associated with reorganization 0.0 % 0.0 % 0.0 % 0.0 % 0.1 % 0.3 % 0.0 % (Gains) losses on early extinguishment of debt 0.0 % 0.0 % 0.0 % 0.0 % 0.0 % 0.9 % 0.0 % Taxes on adjustments 0.0 % (0.1)% (0.1)% (0.1)% 0.0 % (0.4)% (0.1)% Adjusted Operating ROE(2) 12.6 % 13.4 % 13.4 % 13.5 % 14.8 % 16.9 % 14.2 % Debt to capital ratio 12 % 12 % 13 % 13 % 13 % 13 % 14 % (2) Calculated as annualized adjusted operating income for the period indicated divided by the average of current period and prior periods’ ending total stockholders’ equity. (1) Calculated as annualized net income for the period indicated divided by the average of current period and prior periods’ ending total stockholders’ equity. Consolidated Balance Sheets (amounts in thousands, except per share amounts) Page 4

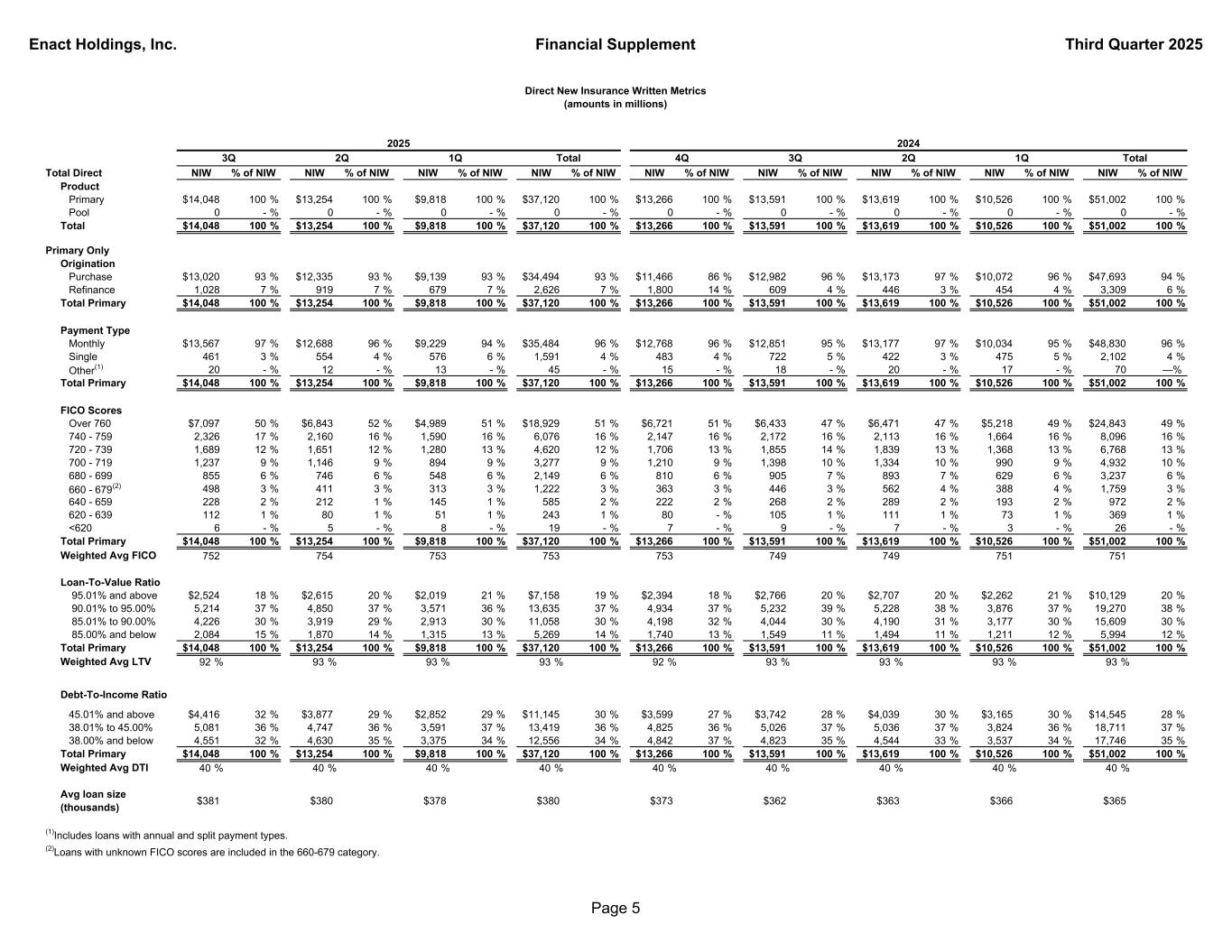

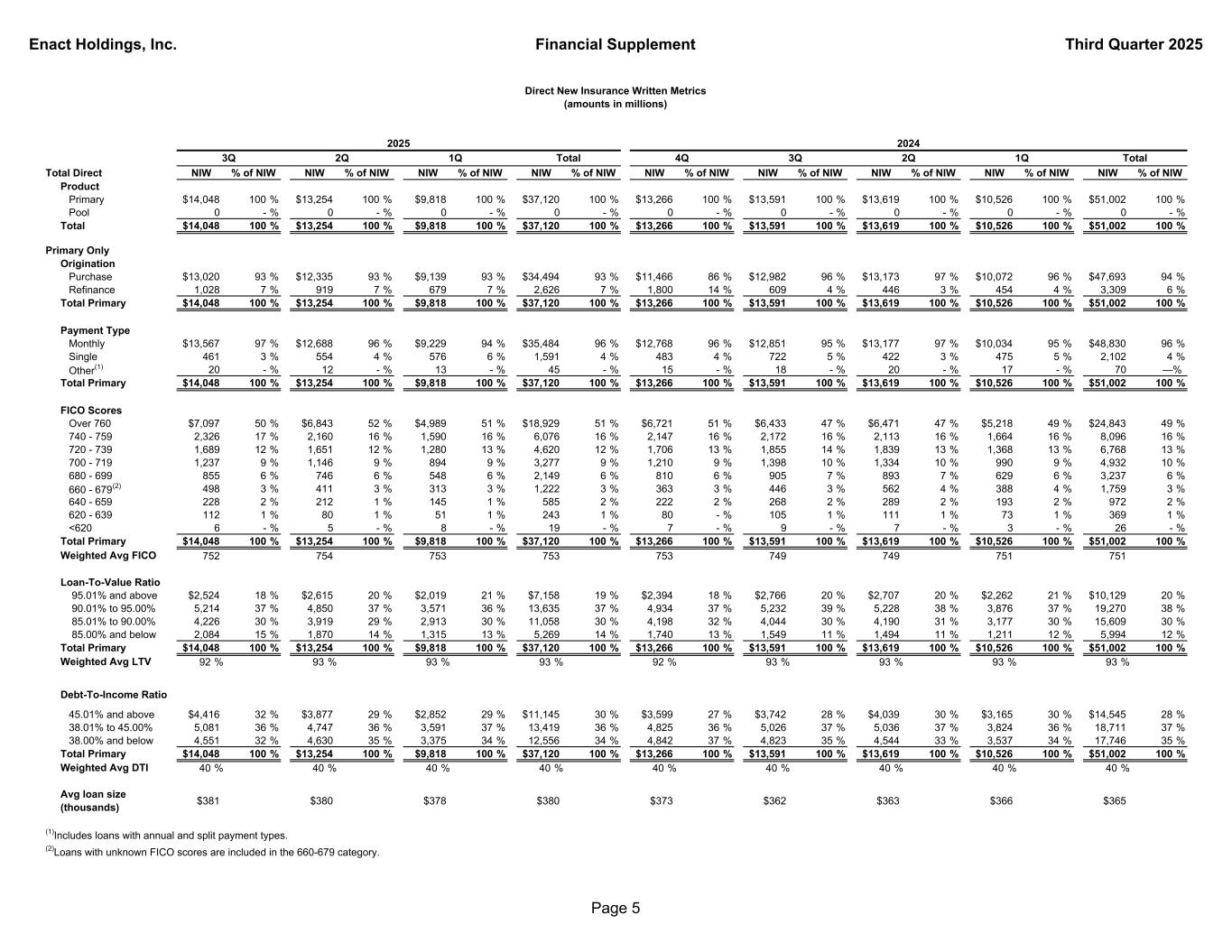

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 Total Direct NIW % of NIW NIW % of NIW NIW % of NIW NIW % of NIW NIW % of NIW NIW % of NIW NIW % of NIW NIW % of NIW NIW % of NIW Product Primary $14,048 100 % $13,254 100 % $9,818 100 % $37,120 100 % $13,266 100 % $13,591 100 % $13,619 100 % $10,526 100 % $51,002 100 % Pool 0 - % 0 - % 0 - % 0 - % 0 - % 0 - % 0 - % 0 - % 0 - % Total $14,048 100 % $13,254 100 % $9,818 100 % $37,120 100 % $13,266 100 % $13,591 100 % $13,619 100 % $10,526 100 % $51,002 100 % Primary Only Origination Purchase $13,020 93 % $12,335 93 % $9,139 93 % $34,494 93 % $11,466 86 % $12,982 96 % $13,173 97 % $10,072 96 % $47,693 94 % Refinance 1,028 7 % 919 7 % 679 7 % 2,626 7 % 1,800 14 % 609 4 % 446 3 % 454 4 % 3,309 6 % Total Primary $14,048 100 % $13,254 100 % $9,818 100 % $37,120 100 % $13,266 100 % $13,591 100 % $13,619 100 % $10,526 100 % $51,002 100 % Payment Type Monthly $13,567 97 % $12,688 96 % $9,229 94 % $35,484 96 % $12,768 96 % $12,851 95 % $13,177 97 % $10,034 95 % $48,830 96 % Single 461 3 % 554 4 % 576 6 % 1,591 4 % 483 4 % 722 5 % 422 3 % 475 5 % 2,102 4 % Other(1) 20 - % 12 - % 13 - % 45 - % 15 - % 18 - % 20 - % 17 - % 70 —% Total Primary $14,048 100 % $13,254 100 % $9,818 100 % $37,120 100 % $13,266 100 % $13,591 100 % $13,619 100 % $10,526 100 % $51,002 100 % FICO Scores Over 760 $7,097 50 % $6,843 52 % $4,989 51 % $18,929 51 % $6,721 51 % $6,433 47 % $6,471 47 % $5,218 49 % $24,843 49 % 740 - 759 2,326 17 % 2,160 16 % 1,590 16 % 6,076 16 % 2,147 16 % 2,172 16 % 2,113 16 % 1,664 16 % 8,096 16 % 720 - 739 1,689 12 % 1,651 12 % 1,280 13 % 4,620 12 % 1,706 13 % 1,855 14 % 1,839 13 % 1,368 13 % 6,768 13 % 700 - 719 1,237 9 % 1,146 9 % 894 9 % 3,277 9 % 1,210 9 % 1,398 10 % 1,334 10 % 990 9 % 4,932 10 % 680 - 699 855 6 % 746 6 % 548 6 % 2,149 6 % 810 6 % 905 7 % 893 7 % 629 6 % 3,237 6 % 660 - 679(2) 498 3 % 411 3 % 313 3 % 1,222 3 % 363 3 % 446 3 % 562 4 % 388 4 % 1,759 3 % 640 - 659 228 2 % 212 1 % 145 1 % 585 2 % 222 2 % 268 2 % 289 2 % 193 2 % 972 2 % 620 - 639 112 1 % 80 1 % 51 1 % 243 1 % 80 - % 105 1 % 111 1 % 73 1 % 369 1 % <620 6 - % 5 - % 8 - % 19 - % 7 - % 9 - % 7 - % 3 - % 26 - % Total Primary $14,048 100 % $13,254 100 % $9,818 100 % $37,120 100 % $13,266 100 % $13,591 100 % $13,619 100 % $10,526 100 % $51,002 100 % Weighted Avg FICO 752 754 753 753 753 749 749 751 751 Loan-To-Value Ratio 95.01% and above $2,524 18 % $2,615 20 % $2,019 21 % $7,158 19 % $2,394 18 % $2,766 20 % $2,707 20 % $2,262 21 % $10,129 20 % 90.01% to 95.00% 5,214 37 % 4,850 37 % 3,571 36 % 13,635 37 % 4,934 37 % 5,232 39 % 5,228 38 % 3,876 37 % 19,270 38 % 85.01% to 90.00% 4,226 30 % 3,919 29 % 2,913 30 % 11,058 30 % 4,198 32 % 4,044 30 % 4,190 31 % 3,177 30 % 15,609 30 % 85.00% and below 2,084 15 % 1,870 14 % 1,315 13 % 5,269 14 % 1,740 13 % 1,549 11 % 1,494 11 % 1,211 12 % 5,994 12 % Total Primary $14,048 100 % $13,254 100 % $9,818 100 % $37,120 100 % $13,266 100 % $13,591 100 % $13,619 100 % $10,526 100 % $51,002 100 % Weighted Avg LTV 92 % 93 % 93 % 93 % 92 % 93 % 93 % 93 % 93 % Debt-To-Income Ratio 45.01% and above $4,416 32 % $3,877 29 % $2,852 29 % $11,145 30 % $3,599 27 % $3,742 28 % $4,039 30 % $3,165 30 % $14,545 28 % 38.01% to 45.00% 5,081 36 % 4,747 36 % 3,591 37 % 13,419 36 % 4,825 36 % 5,026 37 % 5,036 37 % 3,824 36 % 18,711 37 % 38.00% and below 4,551 32 % 4,630 35 % 3,375 34 % 12,556 34 % 4,842 37 % 4,823 35 % 4,544 33 % 3,537 34 % 17,746 35 % Total Primary $14,048 100 % $13,254 100 % $9,818 100 % $37,120 100 % $13,266 100 % $13,591 100 % $13,619 100 % $10,526 100 % $51,002 100 % Weighted Avg DTI 40 % 40 % 40 % 40 % 40 % 40 % 40 % 40 % 40 % Avg loan size (thousands) $381 $380 $378 $380 $373 $362 $363 $366 $365 (2)Loans with unknown FICO scores are included in the 660-679 category. (1)Includes loans with annual and split payment types. Direct New Insurance Written Metrics (amounts in millions) 3Q Total1Q2Q 2024 4QTotal1Q3Q 2025 2Q Page 5

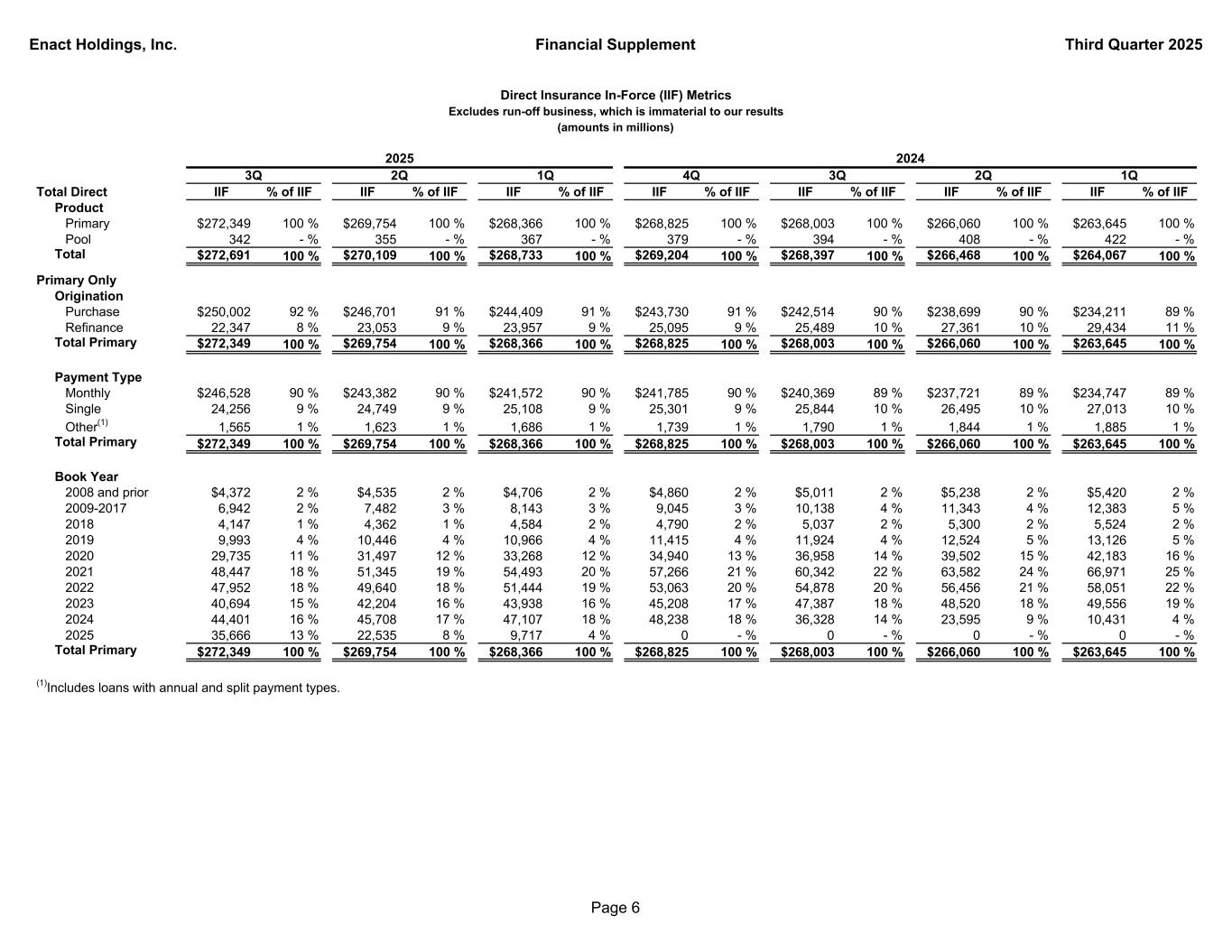

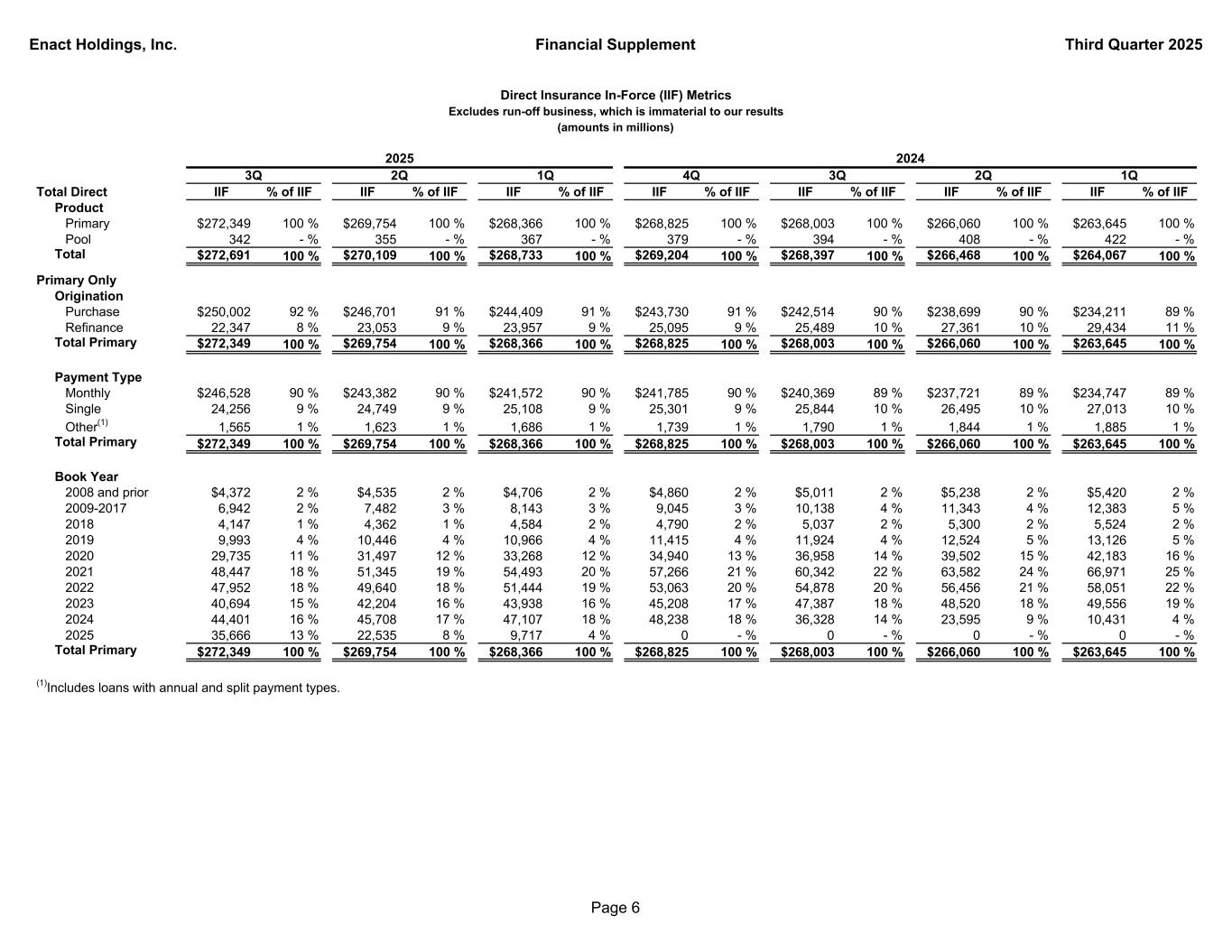

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 Total Direct IIF % of IIF IIF % of IIF IIF % of IIF IIF % of IIF IIF % of IIF IIF % of IIF IIF % of IIF Product Primary $272,349 100 % $269,754 100 % $268,366 100 % $268,825 100 % $268,003 100 % $266,060 100 % $263,645 100 % Pool 342 - % 355 - % 367 - % 379 - % 394 - % 408 - % 422 - % Total $272,691 100 % $270,109 100 % $268,733 100 % $269,204 100 % $268,397 100 % $266,468 100 % $264,067 100 % Primary Only Origination Purchase $250,002 92 % $246,701 91 % $244,409 91 % $243,730 91 % $242,514 90 % $238,699 90 % $234,211 89 % Refinance 22,347 8 % 23,053 9 % 23,957 9 % 25,095 9 % 25,489 10 % 27,361 10 % 29,434 11 % Total Primary $272,349 100 % $269,754 100 % $268,366 100 % $268,825 100 % $268,003 100 % $266,060 100 % $263,645 100 % Payment Type Monthly $246,528 90 % $243,382 90 % $241,572 90 % $241,785 90 % $240,369 89 % $237,721 89 % $234,747 89 % Single 24,256 9 % 24,749 9 % 25,108 9 % 25,301 9 % 25,844 10 % 26,495 10 % 27,013 10 % Other(1) 1,565 1 % 1,623 1 % 1,686 1 % 1,739 1 % 1,790 1 % 1,844 1 % 1,885 1 % Total Primary $272,349 100 % $269,754 100 % $268,366 100 % $268,825 100 % $268,003 100 % $266,060 100 % $263,645 100 % Book Year 2008 and prior $4,372 2 % $4,535 2 % $4,706 2 % $4,860 2 % $5,011 2 % $5,238 2 % $5,420 2 % 2009-2017 6,942 2 % 7,482 3 % 8,143 3 % 9,045 3 % 10,138 4 % 11,343 4 % 12,383 5 % 2018 4,147 1 % 4,362 1 % 4,584 2 % 4,790 2 % 5,037 2 % 5,300 2 % 5,524 2 % 2019 9,993 4 % 10,446 4 % 10,966 4 % 11,415 4 % 11,924 4 % 12,524 5 % 13,126 5 % 2020 29,735 11 % 31,497 12 % 33,268 12 % 34,940 13 % 36,958 14 % 39,502 15 % 42,183 16 % 2021 48,447 18 % 51,345 19 % 54,493 20 % 57,266 21 % 60,342 22 % 63,582 24 % 66,971 25 % 2022 47,952 18 % 49,640 18 % 51,444 19 % 53,063 20 % 54,878 20 % 56,456 21 % 58,051 22 % 2023 40,694 15 % 42,204 16 % 43,938 16 % 45,208 17 % 47,387 18 % 48,520 18 % 49,556 19 % 2024 44,401 16 % 45,708 17 % 47,107 18 % 48,238 18 % 36,328 14 % 23,595 9 % 10,431 4 % 2025 35,666 13 % 22,535 8 % 9,717 4 % 0 - % 0 - % 0 - % 0 - % Total Primary $272,349 100 % $269,754 100 % $268,366 100 % $268,825 100 % $268,003 100 % $266,060 100 % $263,645 100 % (1)Includes loans with annual and split payment types. 4Q 3Q1Q Direct Insurance In-Force (IIF) Metrics Excludes run-off business, which is immaterial to our results (amounts in millions) 1Q 2024 2Q3Q 2025 2Q Page 6

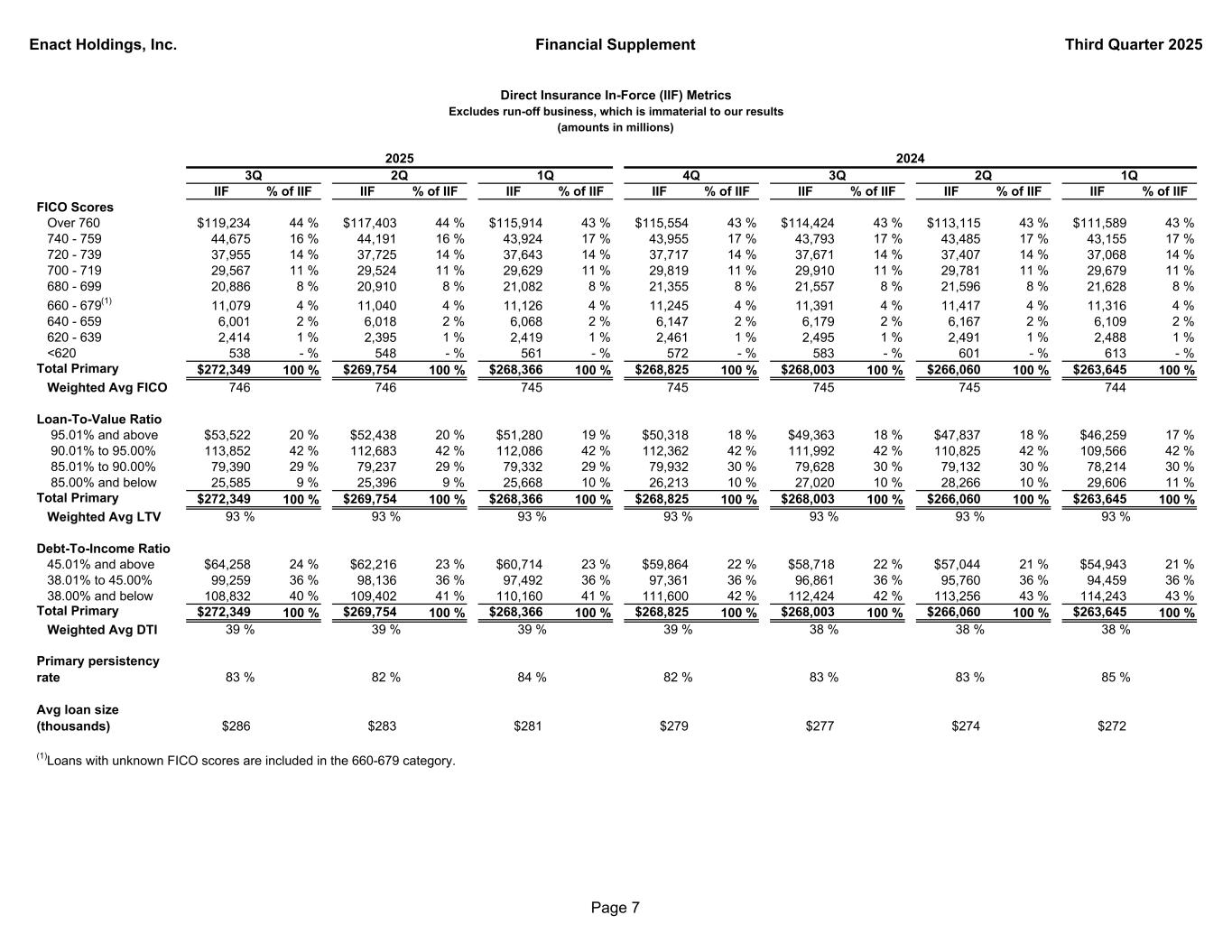

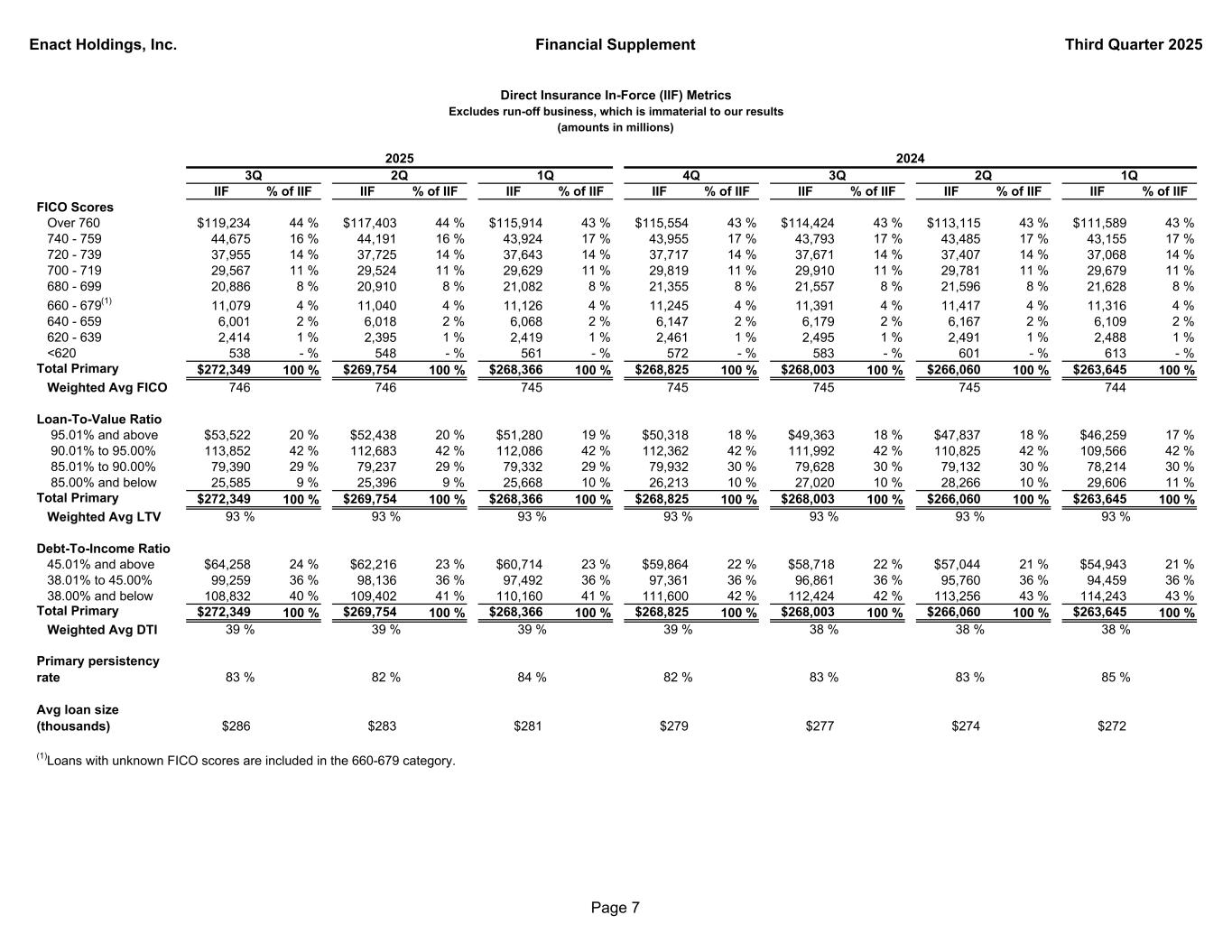

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 IIF % of IIF IIF % of IIF IIF % of IIF IIF % of IIF IIF % of IIF IIF % of IIF IIF % of IIF FICO Scores Over 760 $119,234 44 % $117,403 44 % $115,914 43 % $115,554 43 % $114,424 43 % $113,115 43 % $111,589 43 % 740 - 759 44,675 16 % 44,191 16 % 43,924 17 % 43,955 17 % 43,793 17 % 43,485 17 % 43,155 17 % 720 - 739 37,955 14 % 37,725 14 % 37,643 14 % 37,717 14 % 37,671 14 % 37,407 14 % 37,068 14 % 700 - 719 29,567 11 % 29,524 11 % 29,629 11 % 29,819 11 % 29,910 11 % 29,781 11 % 29,679 11 % 680 - 699 20,886 8 % 20,910 8 % 21,082 8 % 21,355 8 % 21,557 8 % 21,596 8 % 21,628 8 % 660 - 679(1) 11,079 4 % 11,040 4 % 11,126 4 % 11,245 4 % 11,391 4 % 11,417 4 % 11,316 4 % 640 - 659 6,001 2 % 6,018 2 % 6,068 2 % 6,147 2 % 6,179 2 % 6,167 2 % 6,109 2 % 620 - 639 2,414 1 % 2,395 1 % 2,419 1 % 2,461 1 % 2,495 1 % 2,491 1 % 2,488 1 % <620 538 - % 548 - % 561 - % 572 - % 583 - % 601 - % 613 - % Total Primary $272,349 100 % $269,754 100 % $268,366 100 % $268,825 100 % $268,003 100 % $266,060 100 % $263,645 100 % Weighted Avg FICO 746 746 745 745 745 745 744 Loan-To-Value Ratio 95.01% and above $53,522 20 % $52,438 20 % $51,280 19 % $50,318 18 % $49,363 18 % $47,837 18 % $46,259 17 % 90.01% to 95.00% 113,852 42 % 112,683 42 % 112,086 42 % 112,362 42 % 111,992 42 % 110,825 42 % 109,566 42 % 85.01% to 90.00% 79,390 29 % 79,237 29 % 79,332 29 % 79,932 30 % 79,628 30 % 79,132 30 % 78,214 30 % 85.00% and below 25,585 9 % 25,396 9 % 25,668 10 % 26,213 10 % 27,020 10 % 28,266 10 % 29,606 11 % Total Primary $272,349 100 % $269,754 100 % $268,366 100 % $268,825 100 % $268,003 100 % $266,060 100 % $263,645 100 % Weighted Avg LTV 93 % 93 % 93 % 93 % 93 % 93 % 93 % Debt-To-Income Ratio 45.01% and above $64,258 24 % $62,216 23 % $60,714 23 % $59,864 22 % $58,718 22 % $57,044 21 % $54,943 21 % 38.01% to 45.00% 99,259 36 % 98,136 36 % 97,492 36 % 97,361 36 % 96,861 36 % 95,760 36 % 94,459 36 % 38.00% and below 108,832 40 % 109,402 41 % 110,160 41 % 111,600 42 % 112,424 42 % 113,256 43 % 114,243 43 % Total Primary $272,349 100 % $269,754 100 % $268,366 100 % $268,825 100 % $268,003 100 % $266,060 100 % $263,645 100 % Weighted Avg DTI 39 % 39 % 39 % 39 % 38 % 38 % 38 % Primary persistency rate 83 % 82 % 84 % 82 % 83 % 83 % 85 % Avg loan size (thousands) $286 $283 $281 $279 $277 $274 $272 (1)Loans with unknown FICO scores are included in the 660-679 category. 4Q1Q Direct Insurance In-Force (IIF) Metrics Excludes run-off business, which is immaterial to our results (amounts in millions) 1Q2Q 2024 3Q3Q 2025 2Q Page 7

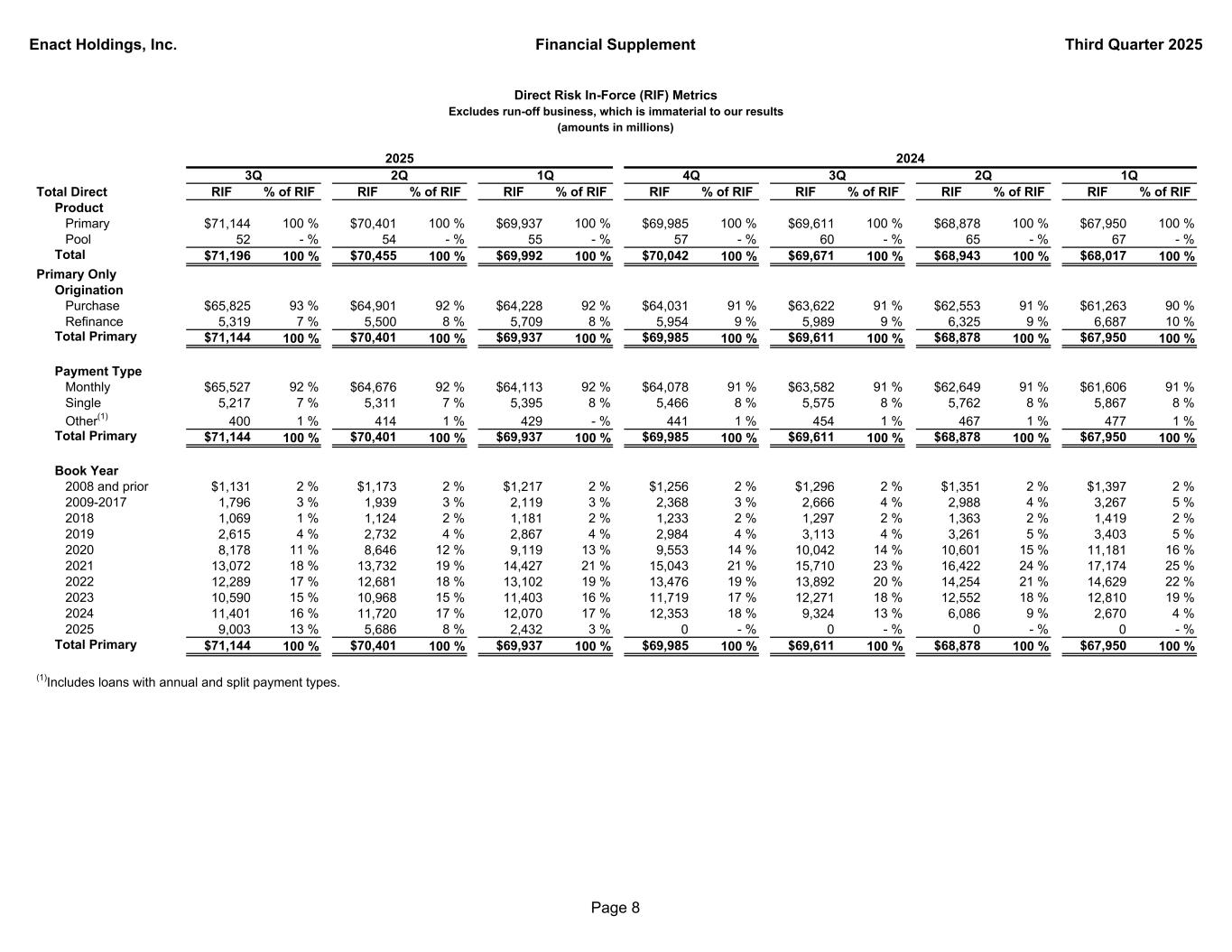

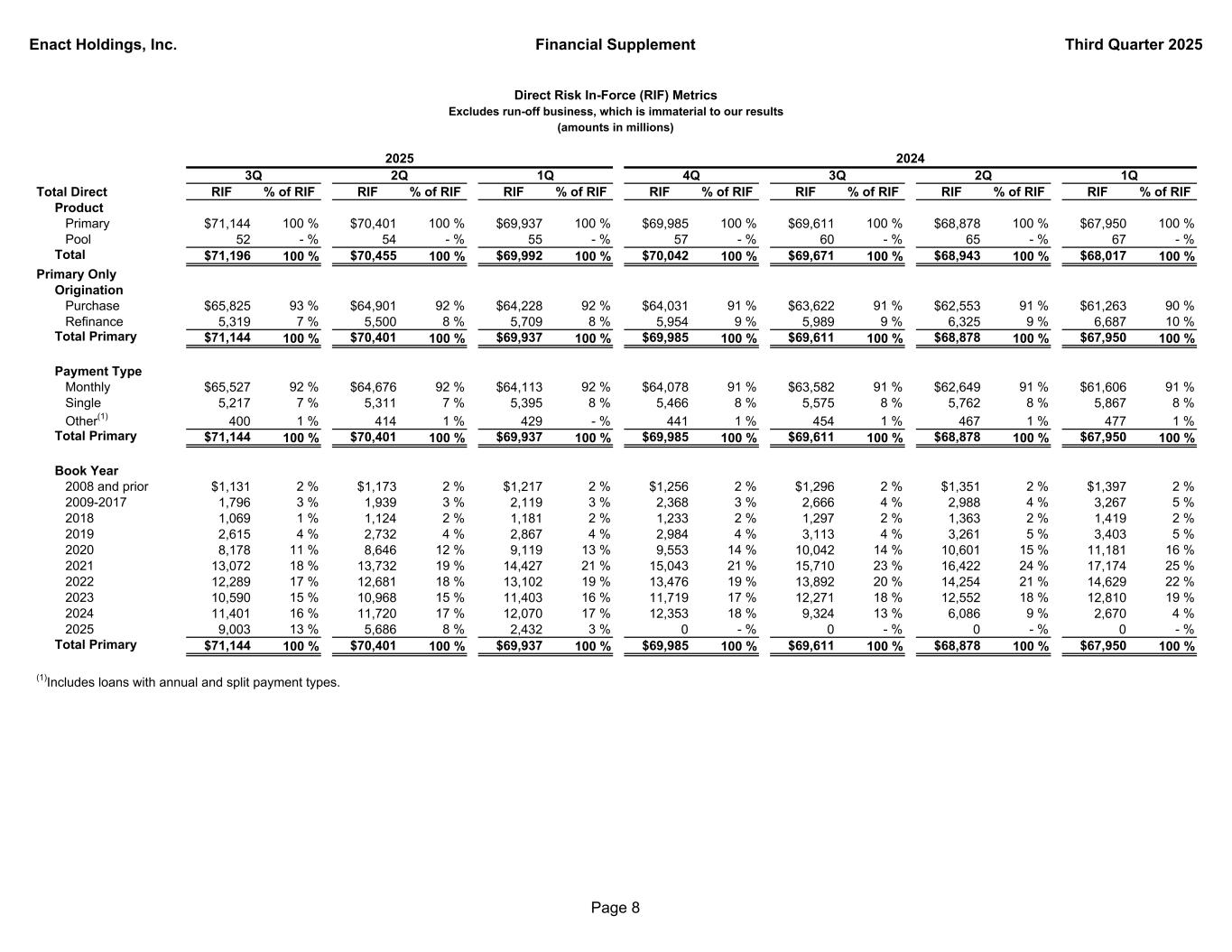

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 Total Direct RIF % of RIF RIF % of RIF RIF % of RIF RIF % of RIF RIF % of RIF RIF % of RIF RIF % of RIF Product Primary $71,144 100 % $70,401 100 % $69,937 100 % $69,985 100 % $69,611 100 % $68,878 100 % $67,950 100 % Pool 52 - % 54 - % 55 - % 57 - % 60 - % 65 - % 67 - % Total $71,196 100 % $70,455 100 % $69,992 100 % $70,042 100 % $69,671 100 % $68,943 100 % $68,017 100 % Primary Only Origination Purchase $65,825 93 % $64,901 92 % $64,228 92 % $64,031 91 % $63,622 91 % $62,553 91 % $61,263 90 % Refinance 5,319 7 % 5,500 8 % 5,709 8 % 5,954 9 % 5,989 9 % 6,325 9 % 6,687 10 % Total Primary $71,144 100 % $70,401 100 % $69,937 100 % $69,985 100 % $69,611 100 % $68,878 100 % $67,950 100 % Payment Type Monthly $65,527 92 % $64,676 92 % $64,113 92 % $64,078 91 % $63,582 91 % $62,649 91 % $61,606 91 % Single 5,217 7 % 5,311 7 % 5,395 8 % 5,466 8 % 5,575 8 % 5,762 8 % 5,867 8 % Other(1) 400 1 % 414 1 % 429 - % 441 1 % 454 1 % 467 1 % 477 1 % Total Primary $71,144 100 % $70,401 100 % $69,937 100 % $69,985 100 % $69,611 100 % $68,878 100 % $67,950 100 % Book Year 2008 and prior $1,131 2 % $1,173 2 % $1,217 2 % $1,256 2 % $1,296 2 % $1,351 2 % $1,397 2 % 2009-2017 1,796 3 % 1,939 3 % 2,119 3 % 2,368 3 % 2,666 4 % 2,988 4 % 3,267 5 % 2018 1,069 1 % 1,124 2 % 1,181 2 % 1,233 2 % 1,297 2 % 1,363 2 % 1,419 2 % 2019 2,615 4 % 2,732 4 % 2,867 4 % 2,984 4 % 3,113 4 % 3,261 5 % 3,403 5 % 2020 8,178 11 % 8,646 12 % 9,119 13 % 9,553 14 % 10,042 14 % 10,601 15 % 11,181 16 % 2021 13,072 18 % 13,732 19 % 14,427 21 % 15,043 21 % 15,710 23 % 16,422 24 % 17,174 25 % 2022 12,289 17 % 12,681 18 % 13,102 19 % 13,476 19 % 13,892 20 % 14,254 21 % 14,629 22 % 2023 10,590 15 % 10,968 15 % 11,403 16 % 11,719 17 % 12,271 18 % 12,552 18 % 12,810 19 % 2024 11,401 16 % 11,720 17 % 12,070 17 % 12,353 18 % 9,324 13 % 6,086 9 % 2,670 4 % 2025 9,003 13 % 5,686 8 % 2,432 3 % 0 - % 0 - % 0 - % 0 - % Total Primary $71,144 100 % $70,401 100 % $69,937 100 % $69,985 100 % $69,611 100 % $68,878 100 % $67,950 100 % (1)Includes loans with annual and split payment types. Direct Risk In-Force (RIF) Metrics Excludes run-off business, which is immaterial to our results (amounts in millions) 1Q2Q4Q 3Q 2024 1Q3Q 2025 2Q Page 8

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 RIF % of RIF RIF % of RIF RIF % of RIF RIF % of RIF RIF % of RIF RIF % of RIF RIF % of RIF FICO Scores Over 760 $30,991 44 % $30,502 43 % $30,093 43 % $29,985 43 % $29,644 43 % $29,219 43 % $28,703 42 % 740 - 759 11,709 16 % 11,579 17 % 11,493 17 % 11,494 17 % 11,423 17 % 11,305 17 % 11,167 17 % 720 - 739 10,058 14 % 9,983 14 % 9,939 14 % 9,949 14 % 9,912 14 % 9,809 14 % 9,669 14 % 700 - 719 7,728 11 % 7,701 11 % 7,711 11 % 7,746 11 % 7,751 11 % 7,688 11 % 7,629 11 % 680 - 699 5,432 8 % 5,432 8 % 5,464 8 % 5,523 8 % 5,553 8 % 5,540 8 % 5,524 8 % 660 - 679(1) 2,906 4 % 2,886 4 % 2,901 4 % 2,924 4 % 2,951 4 % 2,948 4 % 2,908 4 % 640 - 659 1,564 2 % 1,565 2 % 1,574 2 % 1,589 2 % 1,592 2 % 1,582 2 % 1,562 3 % 620 - 639 619 1 % 614 1 % 619 1 % 629 1 % 636 1 % 634 1 % 632 1 % <620 137 - % 139 - % 143 - % 146 - % 149 - % 153 - % 156 - % Total Primary $71,144 100 % $70,401 100 % $69,937 100 % $69,985 100 % $69,611 100 % $68,878 100 % $67,950 100 % Loan-To-Value Ratio 95.01% and above $15,374 22 % $15,034 21 % $14,682 21 % $14,428 21 % $14,141 20 % $13,722 20 % $13,250 20 % 90.01% to 95.00% 33,121 47 % 32,770 47 % 32,597 47 % 32,686 47 % 32,579 47 % 32,254 47 % 31,881 47 % 85.01% to 90.00% 19,589 27 % 19,558 28 % 19,583 28 % 19,729 28 % 19,649 28 % 19,510 28 % 19,265 28 % 85.00% and below 3,060 4 % 3,039 4 % 3,075 4 % 3,142 4 % 3,242 5 % 3,392 5 % 3,554 5 % Total Primary $71,144 100 % $70,401 100 % $69,937 100 % $69,985 100 % $69,611 100 % $68,878 100 % $67,950 100 % Debt-To-Income Ratio 45.01% and above $16,876 24 % $16,325 23 % $15,910 23 % $15,674 22 % $15,353 22 % $14,867 22 % $14,265 21 % 38.01% to 45.00% 25,765 36 % 25,463 36 % 25,273 36 % 25,226 36 % 25,052 36 % 24,706 36 % 24,289 36 % 38.00% and below 28,503 40 % 28,613 41 % 28,754 41 % 29,085 42 % 29,206 42 % 29,305 42 % 29,396 43 % Total Primary $71,144 100 % $70,401 100 % $69,937 100 % $69,985 100 % $69,611 100 % $68,878 100 % $67,950 100 % (1)Includes loans with annual and split payment types. 4Q Direct Risk In-Force (RIF) Metrics Excludes run-off business, which is immaterial to our results (amounts in millions) 1Q2Q 2024 3Q1Q3Q 2025 2Q Page 9

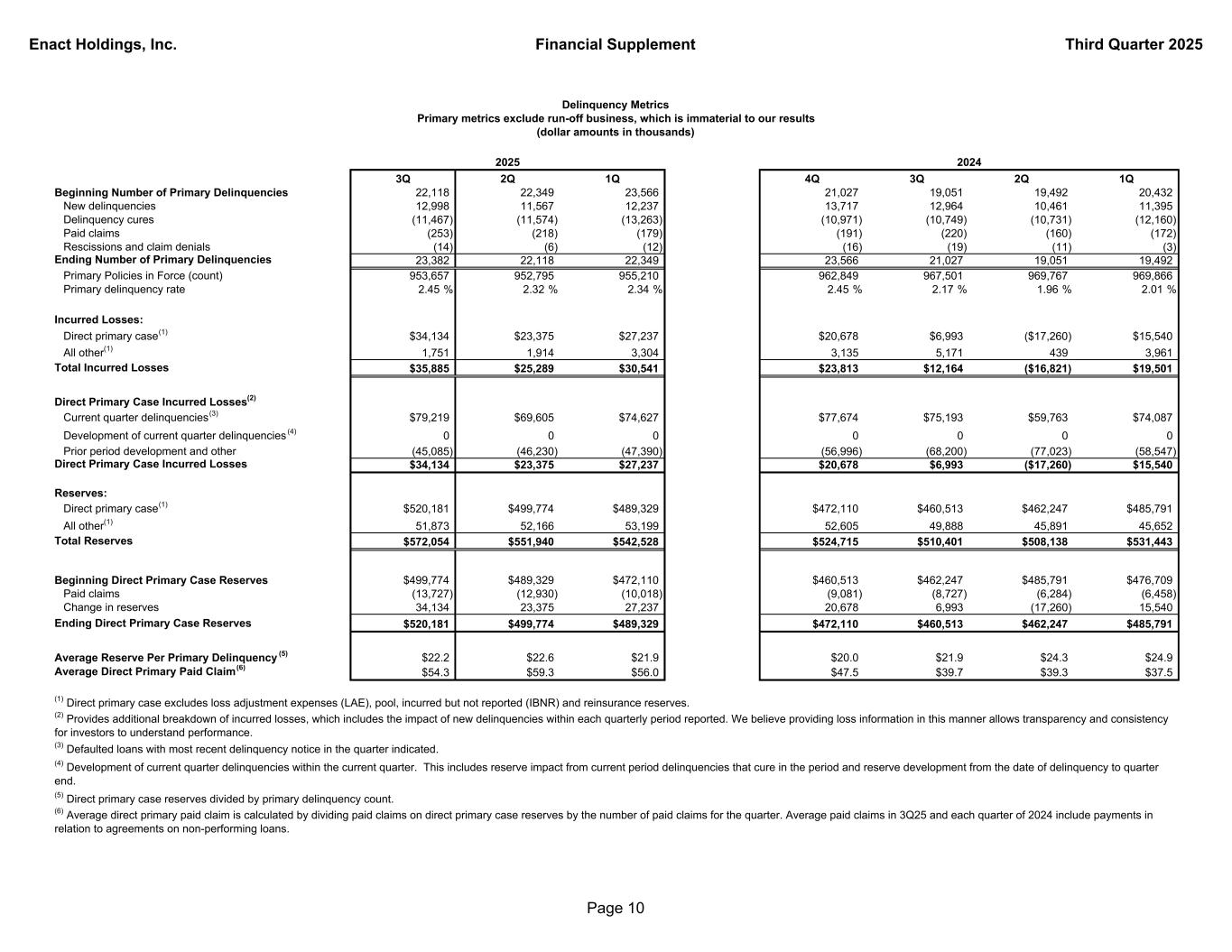

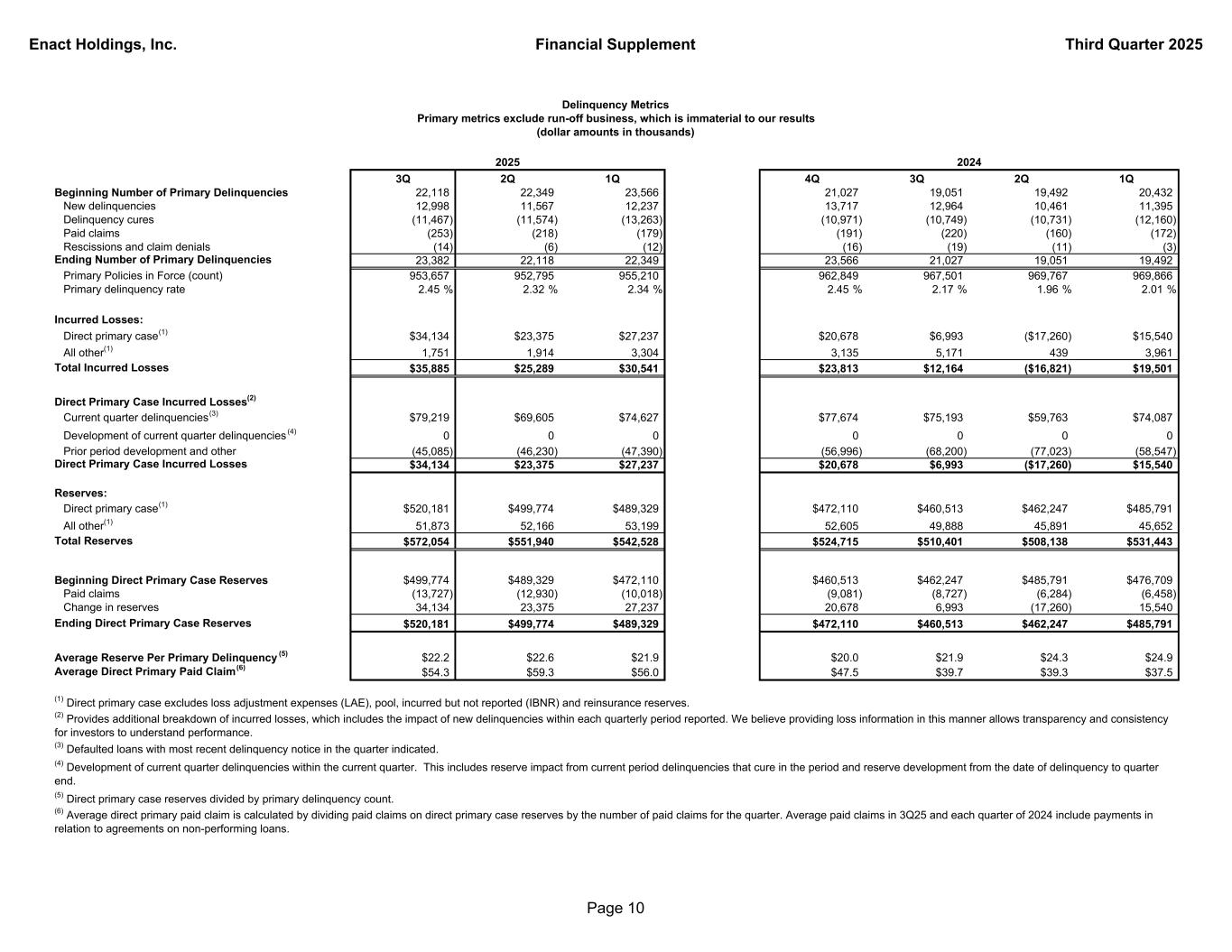

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 3Q 2Q 1Q 4Q 3Q 2Q 1Q Beginning Number of Primary Delinquencies 22,118 22,349 23,566 21,027 19,051 19,492 20,432 New delinquencies 12,998 11,567 12,237 13,717 12,964 10,461 11,395 Delinquency cures (11,467) (11,574) (13,263) (10,971) (10,749) (10,731) (12,160) Paid claims (253) (218) (179) (191) (220) (160) (172) Rescissions and claim denials (14) (6) (12) (16) (19) (11) (3) Ending Number of Primary Delinquencies 23,382 22,118 22,349 23,566 21,027 19,051 19,492 Primary Policies in Force (count) 953,657 952,795 955,210 962,849 967,501 969,767 969,866 Primary delinquency rate 2.45 % 2.32 % 2.34 % 2.45 % 2.17 % 1.96 % 2.01 % Incurred Losses: Direct primary case(1) $34,134 $23,375 $27,237 $20,678 $6,993 ($17,260) $15,540 All other(1) 1,751 1,914 3,304 3,135 5,171 439 3,961 Total Incurred Losses $35,885 $25,289 $30,541 $23,813 $12,164 ($16,821) $19,501 Direct Primary Case Incurred Losses(2) Current quarter delinquencies(3) $79,219 $69,605 $74,627 $77,674 $75,193 $59,763 $74,087 Development of current quarter delinquencies (4) 0 0 0 0 0 0 0 Prior period development and other (45,085) (46,230) (47,390) (56,996) (68,200) (77,023) (58,547) Direct Primary Case Incurred Losses $34,134 $23,375 $27,237 $20,678 $6,993 ($17,260) $15,540 Reserves: Direct primary case(1) $520,181 $499,774 $489,329 $472,110 $460,513 $462,247 $485,791 All other(1) 51,873 52,166 53,199 52,605 49,888 45,891 45,652 Total Reserves $572,054 $551,940 $542,528 $524,715 $510,401 $508,138 $531,443 Beginning Direct Primary Case Reserves $499,774 $489,329 $472,110 $460,513 $462,247 $485,791 $476,709 Paid claims (13,727) (12,930) (10,018) (9,081) (8,727) (6,284) (6,458) Change in reserves 34,134 23,375 27,237 20,678 6,993 (17,260) 15,540 Ending Direct Primary Case Reserves $520,181 $499,774 $489,329 $472,110 $460,513 $462,247 $485,791 Average Reserve Per Primary Delinquency (5) $22.2 $22.6 $21.9 $20.0 $21.9 $24.3 $24.9 Average Direct Primary Paid Claim (6) $54.3 $59.3 $56.0 $47.5 $39.7 $39.3 $37.5 Delinquency Metrics Primary metrics exclude run-off business, which is immaterial to our results (dollar amounts in thousands) 2024 (5) Direct primary case reserves divided by primary delinquency count. 2025 (6) Average direct primary paid claim is calculated by dividing paid claims on direct primary case reserves by the number of paid claims for the quarter. Average paid claims in 3Q25 and each quarter of 2024 include payments in relation to agreements on non-performing loans. (2) Provides additional breakdown of incurred losses, which includes the impact of new delinquencies within each quarterly period reported. We believe providing loss information in this manner allows transparency and consistency for investors to understand performance. (3) Defaulted loans with most recent delinquency notice in the quarter indicated. (1) Direct primary case excludes loss adjustment expenses (LAE), pool, incurred but not reported (IBNR) and reinsurance reserves. (4) Development of current quarter delinquencies within the current quarter. This includes reserve impact from current period delinquencies that cure in the period and reserve development from the date of delinquency to quarter end. Page 10

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 Percentage Reserved by Payment Status Delinquencies Case Reserves Risk In- Force Reserves as % of RIF Delinquencies Case Reserves Risk In- Force Reserves as % of RIF Delinquencies Case Reserves Risk In- Force Reserves as % of RIF 3 payments or less in default 11,969 $109 $806 14 % 12,712 $108 $849 13 % 11,132 $102 $715 14 % 4 - 11 payments in default 7,951 216 594 36 % 7,701 191 545 35 % 6,831 188 477 39 % 12 payments or more in default 3,462 195 250 78 % 3,153 173 213 81 % 3,064 171 202 85 % Total 23,382 $520 $1,650 32 % 23,566 $472 $1,607 29 % 21,027 $461 $1,394 33 % September 30, 2025 Missed Payment Status Tables - Direct Primary Excludes run-off business, which is immaterial to our results (dollar amounts in millions) December 31, 2024 September 30, 2024 Page 11

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 Top 10 States % RIF % Case Reserves (1) Delq Rate Top 10 MSAs / Metro Divisions % RIF % Case Reserves (1) Delq Rate Book Year RIF & Losses % RIF % Case Reserves (1) Delq Rate Cum Delq Rate (2) California 12% 13% 2.63% Phoenix, AZ MSA 3% 3% 2.66% Texas 9% 9% 2.64% Chicago-Naperville, IL MD 3% 4% 3.20% 2008 and prior 2% 8% 7.85% 5.55% Florida (3) 8% 13% 3.11% Atlanta, GA MSA 3% 3% 3.28% 2009-2017 3% 7% 4.85% 0.59% New York (3) 5% 9% 3.28% New York, NY MD 2% 5% 3.68% 2018 1% 4% 4.91% 0.92% Illinois (3) 4% 5% 3.01% Dallas, TX MD 2% 2% 2.34% 2019 4% 6% 3.17% 0.80% Arizona 4% 4% 2.57% Houston, TX MSA 2% 3% 3.27% 2020 11% 12% 2.20% 0.87% Michigan 4% 3% 2.20% Washington-Arlington, DC MD 2% 2% 2.27% 2021 18% 21% 2.45% 1.47% Georgia 3% 4% 3.07% Riverside-San Bernardino, CA MSA 2% 3% 3.32% 2022 17% 22% 2.69% 2.25% North Carolina 3% 2% 2.00% Los Angeles-Long Beach, CA MD 2% 3% 3.05% 2023 15% 14% 2.33% 1.96% Pennsylvania 3% 3% 2.23% Denver-Aurora-Lakewood, CO MSA 2% 1% 1.52% 2024 16% 6% 1.36% 1.24% All Other States (4) 45% 35% 2.16% All Other MSAs/MDs 77% 71% 2.34% 2025 13% 0% 0.18% 0.18% Total 100% 100% 2.45% Total 100% 100% 2.45% Total 100% 100% 2.45% 4.12% Top 10 States % RIF % Case Reserves (1) Delq Rate Top 10 MSAs / Metro Divisions % RIF % Case Reserves (1) Delq Rate Book Year RIF & Losses % RIF % Case Reserves (1) Delq Rate Cum Delq Rate (2) California 12% 12% 2.53% Phoenix, AZ MSA 3% 3% 2.41% Texas 9% 9% 2.64% Chicago-Naperville, IL MD 3% 4% 3.29% 2008 and prior 2% 10% 8.17% 5.55% Florida (3) 8% 12% 3.67% Atlanta, GA MSA 3% 3% 3.02% 2009-2016 2% 6% 4.75% 0.60% New York (3) 5% 10% 3.30% New York, NY MD 2% 6% 3.53% 2017 1% 4% 4.37% 0.84% Illinois (3) 4% 6% 2.96% Houston, TX MSA 2% 3% 3.58% 2018 2% 5% 4.66% 0.96% Arizona 4% 3% 2.35% Dallas, TX MD 2% 2% 2.38% 2019 4% 8% 3.31% 0.89% Michigan 4% 3% 2.14% Washington-Arlington, DC MD 2% 2% 2.03% 2020 14% 14% 2.14% 0.94% Georgia 3% 4% 3.02% Riverside-San Bernardino, CA MSA 2% 3% 3.25% 2021 21% 21% 2.25% 1.51% North Carolina 3% 2% 2.14% Los Angeles-Long Beach, CA MD 2% 2% 2.65% 2022 19% 20% 2.50% 2.18% Pennsylvania 3% 3% 2.17% Denver-Aurora-Lakewood, CO MSA 2% 1% 1.38% 2023 17% 10% 1.83% 1.64% All Other States (4) 45% 36% 2.10% All Other MSAs/MDs 77% 71% 2.35% 2024 18% 2% 0.49% 0.47% Total 100% 100% 2.45% Total 100% 100% 2.45% Total 100% 100% 2.45% 4.17% Top 10 States % RIF % Case Reserves (1) Delq Rate Top 10 MSAs / Metro Divisions % RIF % Case Reserves (1) Delq Rate Book Year RIF & Losses % RIF % Case Reserves (1) Delq Rate Cum Delq Rate (2) California 13% 12% 2.27% Phoenix, AZ MSA 3% 3% 2.10% Texas 9% 9% 2.64% Chicago-Naperville, IL MD 3% 4% 2.95% 2008 and prior 2% 12% 8.16% 5.55% Florida (3) 8% 11% 2.49% Atlanta, GA MSA 3% 3% 2.68% 2009-2016 2% 7% 4.30% 0.61% New York (3) 5% 11% 3.19% New York, NY MD 2% 6% 3.37% 2017 2% 4% 4.06% 0.83% Illinois (3) 4% 6% 2.67% Houston, TX MSA 2% 3% 3.92% 2018 2% 5% 4.23% 0.91% Arizona 4% 3% 2.05% Dallas, TX MD 2% 2% 2.29% 2019 4% 8% 3.02% 0.84% Michigan 4% 3% 1.90% Washington-Arlington, DC MD 2% 2% 1.95% 2020 14% 15% 1.92% 0.88% Georgia 3% 4% 2.48% Riverside-San Bernardino, CA MSA 2% 3% 2.92% 2021 23% 22% 1.90% 1.33% North Carolina 3% 2% 1.69% Los Angeles-Long Beach, CA MD 2% 2% 2.36% 2022 20% 18% 1.99% 1.77% Pennsylvania 3% 3% 2.11% Denver-Aurora-Lakewood, CO MSA 2% 1% 1.13% 2023 18% 8% 1.27% 1.18% All Other States (4) 44% 36% 1.92% All Other MSAs/MDs 77% 71% 2.06% 2024 13% 1% 0.27% 0.27% Total 100% 100% 2.17% Total 100% 100% 2.17% Total 100% 100% 2.17% 4.15% Delinquency Performance - Direct Primary Excludes run-off business, which is immaterial to our results September 30, 2024 (4) Includes the District of Columbia. September 30, 2025 (1) Direct primary case reserves exclude pool, loss adjustment expenses, incurred but not reported and reinsurance reserves. (2) Calculated as the sum of the number of policies where claims were ever paid to date and number of policies for loans currently in default divided by policies ever in-force. (3) Jurisdiction predominantly uses a judicial foreclosure process, which generally increases the amount of time it takes for a foreclosure to be completed. December 31, 2024 Page 12

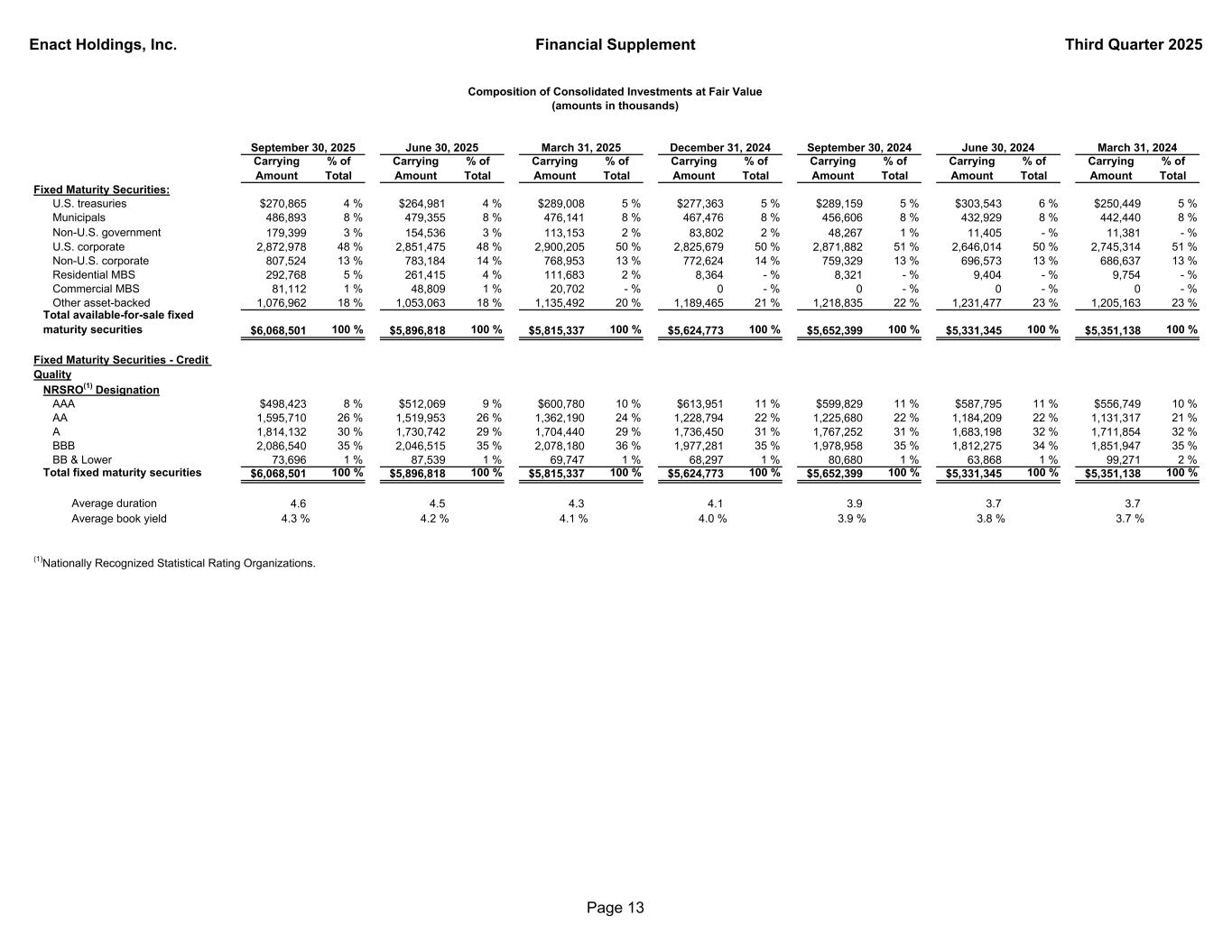

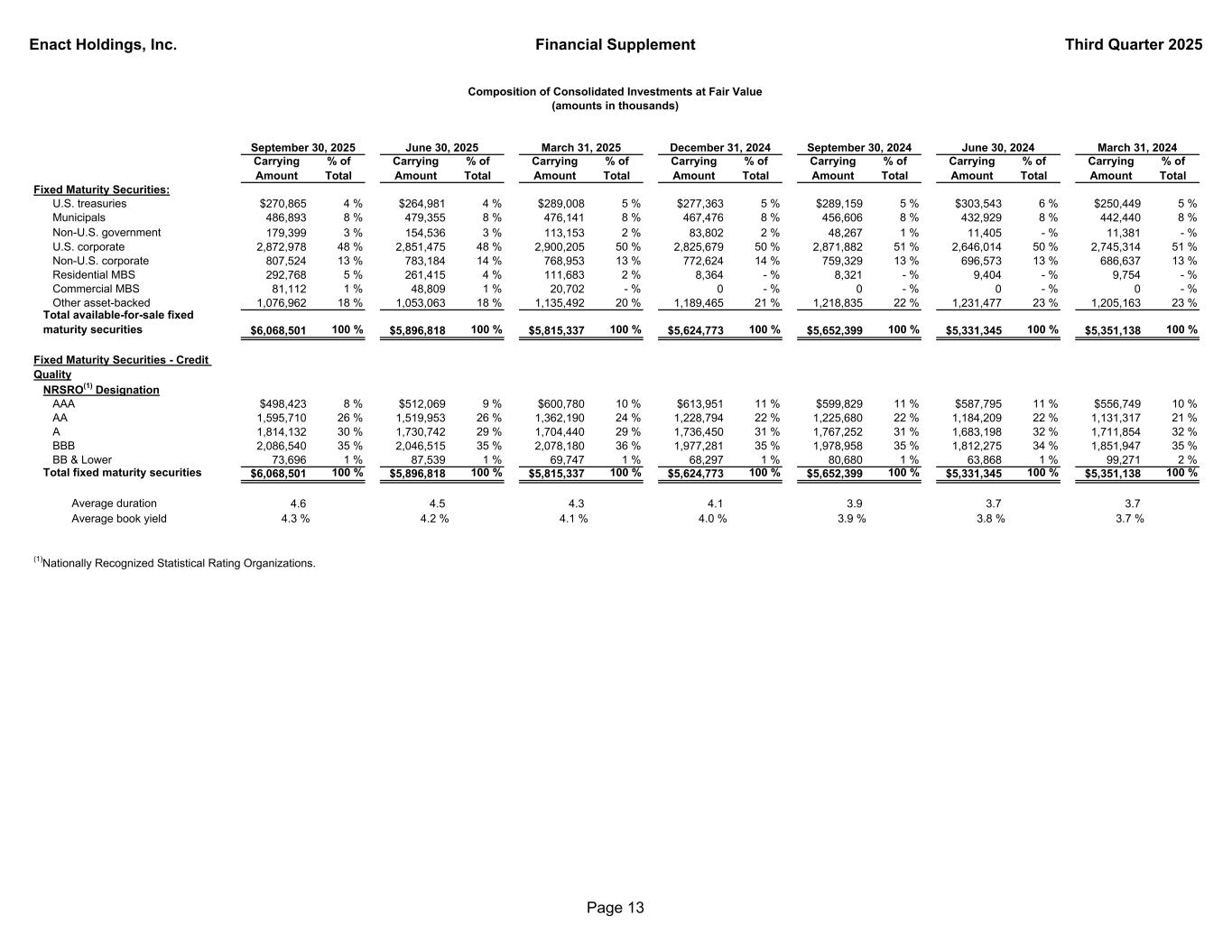

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 Carrying Amount % of Total Carrying Amount % of Total Carrying Amount % of Total Carrying Amount % of Total Carrying Amount % of Total Carrying Amount % of Total Carrying Amount % of Total Fixed Maturity Securities: U.S. treasuries $270,865 4 % $264,981 4 % $289,008 5 % $277,363 5 % $289,159 5 % $303,543 6 % $250,449 5 % Municipals 486,893 8 % 479,355 8 % 476,141 8 % 467,476 8 % 456,606 8 % 432,929 8 % 442,440 8 % Non-U.S. government 179,399 3 % 154,536 3 % 113,153 2 % 83,802 2 % 48,267 1 % 11,405 - % 11,381 - % U.S. corporate 2,872,978 48 % 2,851,475 48 % 2,900,205 50 % 2,825,679 50 % 2,871,882 51 % 2,646,014 50 % 2,745,314 51 % Non-U.S. corporate 807,524 13 % 783,184 14 % 768,953 13 % 772,624 14 % 759,329 13 % 696,573 13 % 686,637 13 % Residential MBS 292,768 5 % 261,415 4 % 111,683 2 % 8,364 - % 8,321 - % 9,404 - % 9,754 - % Commercial MBS 81,112 1 % 48,809 1 % 20,702 - % 0 - % 0 - % 0 - % 0 - % Other asset-backed 1,076,962 18 % 1,053,063 18 % 1,135,492 20 % 1,189,465 21 % 1,218,835 22 % 1,231,477 23 % 1,205,163 23 % Total available-for-sale fixed maturity securities $6,068,501 100 % $5,896,818 100 % $5,815,337 100 % $5,624,773 100 % $5,652,399 100 % $5,331,345 100 % $5,351,138 100 % Fixed Maturity Securities - Credit Quality NRSRO(1) Designation AAA $498,423 8 % $512,069 9 % $600,780 10 % $613,951 11 % $599,829 11 % $587,795 11 % $556,749 10 % AA 1,595,710 26 % 1,519,953 26 % 1,362,190 24 % 1,228,794 22 % 1,225,680 22 % 1,184,209 22 % 1,131,317 21 % A 1,814,132 30 % 1,730,742 29 % 1,704,440 29 % 1,736,450 31 % 1,767,252 31 % 1,683,198 32 % 1,711,854 32 % BBB 2,086,540 35 % 2,046,515 35 % 2,078,180 36 % 1,977,281 35 % 1,978,958 35 % 1,812,275 34 % 1,851,947 35 % BB & Lower 73,696 1 % 87,539 1 % 69,747 1 % 68,297 1 % 80,680 1 % 63,868 1 % 99,271 2 % Total fixed maturity securities $6,068,501 100 % $5,896,818 100 % $5,815,337 100 % $5,624,773 100 % $5,652,399 100 % $5,331,345 100 % $5,351,138 100 % Average duration 4.6 4.5 4.3 4.1 3.9 3.7 3.7 Average book yield 4.3 % 4.2 % 4.1 % 4.0 % 3.9 % 3.8 % 3.7 % (1)Nationally Recognized Statistical Rating Organizations. December 31, 2024 September 30, 2024 Composition of Consolidated Investments at Fair Value (amounts in thousands) March 31, 2024June 30, 2024March 31, 2025September 30, 2025 June 30, 2025 Page 13

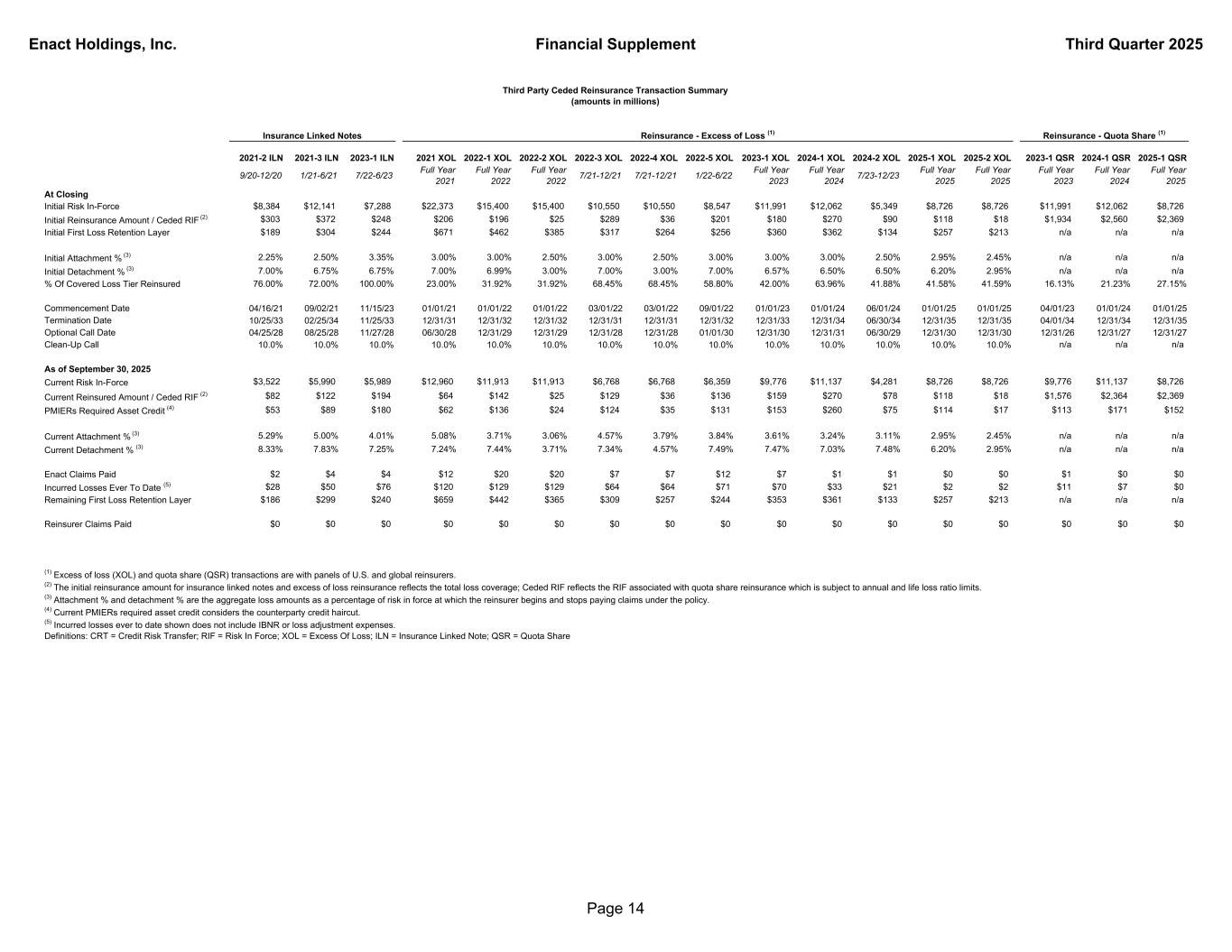

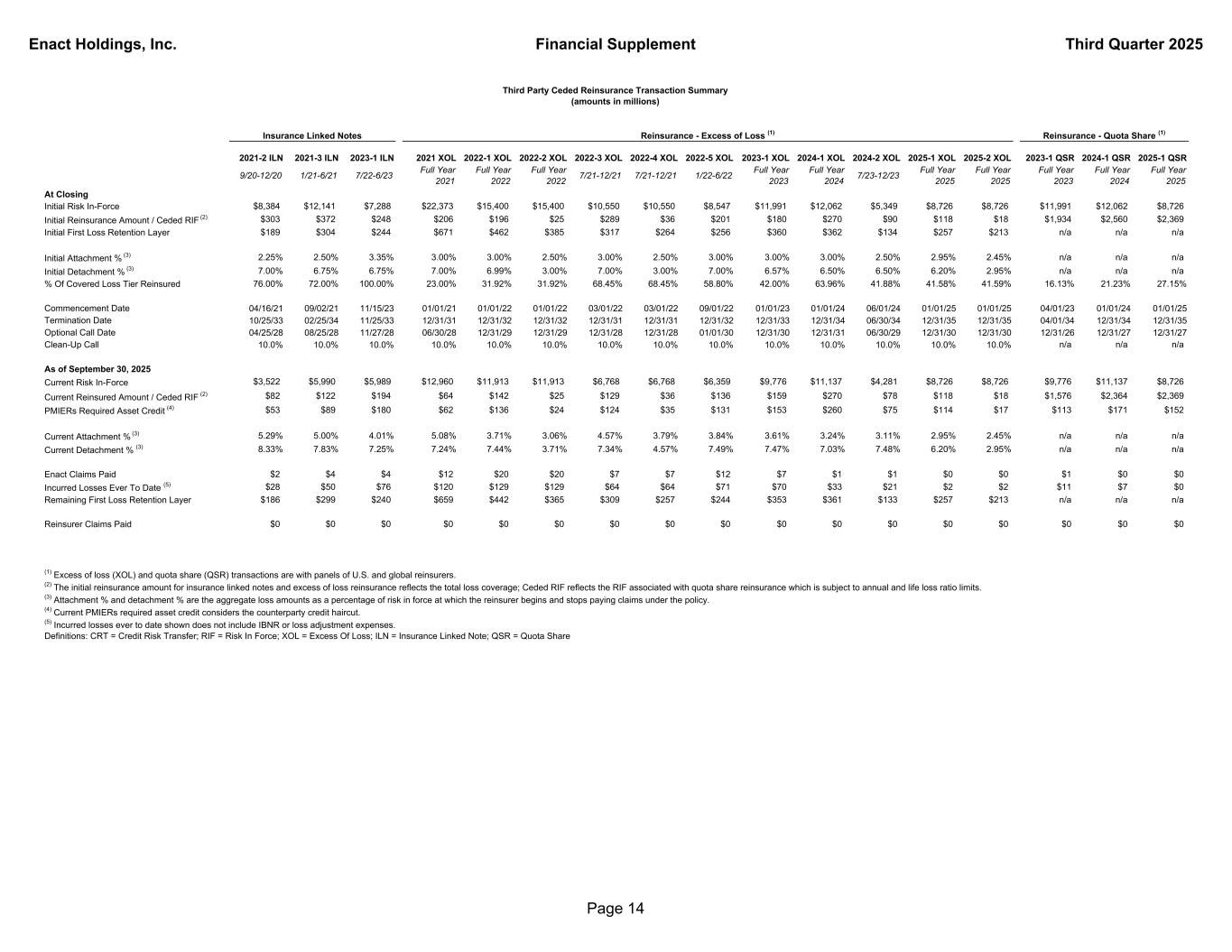

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 2021-2 ILN 2021-3 ILN 2023-1 ILN 2021 XOL 2022-1 XOL 2022-2 XOL 2022-3 XOL 2022-4 XOL 2022-5 XOL 2023-1 XOL 2024-1 XOL 2024-2 XOL 2025-1 XOL 2025-2 XOL 2023-1 QSR 2024-1 QSR 2025-1 QSR 9/20-12/20 1/21-6/21 7/22-6/23 Full Year 2021 Full Year 2022 Full Year 2022 7/21-12/21 7/21-12/21 1/22-6/22 Full Year 2023 Full Year 2024 7/23-12/23 Full Year 2025 Full Year 2025 Full Year 2023 Full Year 2024 Full Year 2025 At Closing Initial Risk In-Force $8,384 $12,141 $7,288 $22,373 $15,400 $15,400 $10,550 $10,550 $8,547 $11,991 $12,062 $5,349 $8,726 $8,726 $11,991 $12,062 $8,726 Initial Reinsurance Amount / Ceded RIF (2) $303 $372 $248 $206 $196 $25 $289 $36 $201 $180 $270 $90 $118 $18 $1,934 $2,560 $2,369 Initial First Loss Retention Layer $189 $304 $244 $671 $462 $385 $317 $264 $256 $360 $362 $134 $257 $213 n/a n/a n/a Initial Attachment % (3) 2.25% 2.50% 3.35% 3.00% 3.00% 2.50% 3.00% 2.50% 3.00% 3.00% 3.00% 2.50% 2.95% 2.45% n/a n/a n/a Initial Detachment % (3) 7.00% 6.75% 6.75% 7.00% 6.99% 3.00% 7.00% 3.00% 7.00% 6.57% 6.50% 6.50% 6.20% 2.95% n/a n/a n/a % Of Covered Loss Tier Reinsured 76.00% 72.00% 100.00% 23.00% 31.92% 31.92% 68.45% 68.45% 58.80% 42.00% 63.96% 41.88% 41.58% 41.59% 16.13% 21.23% 27.15% Commencement Date 04/16/21 09/02/21 11/15/23 01/01/21 01/01/22 01/01/22 03/01/22 03/01/22 09/01/22 01/01/23 01/01/24 06/01/24 01/01/25 01/01/25 04/01/23 01/01/24 01/01/25 Termination Date 10/25/33 02/25/34 11/25/33 12/31/31 12/31/32 12/31/32 12/31/31 12/31/31 12/31/32 12/31/33 12/31/34 06/30/34 12/31/35 12/31/35 04/01/34 12/31/34 12/31/35 Optional Call Date 04/25/28 08/25/28 11/27/28 06/30/28 12/31/29 12/31/29 12/31/28 12/31/28 01/01/30 12/31/30 12/31/31 06/30/29 12/31/30 12/31/30 12/31/26 12/31/27 12/31/27 Clean-Up Call 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% 10.0% n/a n/a n/a As of September 30, 2025 Current Risk In-Force $3,522 $5,990 $5,989 $12,960 $11,913 $11,913 $6,768 $6,768 $6,359 $9,776 $11,137 $4,281 $8,726 $8,726 $9,776 $11,137 $8,726 Current Reinsured Amount / Ceded RIF (2) $82 $122 $194 $64 $142 $25 $129 $36 $136 $159 $270 $78 $118 $18 $1,576 $2,364 $2,369 PMIERs Required Asset Credit (4) $53 $89 $180 $62 $136 $24 $124 $35 $131 $153 $260 $75 $114 $17 $113 $171 $152 Current Attachment % (3) 5.29% 5.00% 4.01% 5.08% 3.71% 3.06% 4.57% 3.79% 3.84% 3.61% 3.24% 3.11% 2.95% 2.45% n/a n/a n/a Current Detachment % (3) 8.33% 7.83% 7.25% 7.24% 7.44% 3.71% 7.34% 4.57% 7.49% 7.47% 7.03% 7.48% 6.20% 2.95% n/a n/a n/a Enact Claims Paid $2 $4 $4 $12 $20 $20 $7 $7 $12 $7 $1 $1 $0 $0 $1 $0 $0 Incurred Losses Ever To Date (5) $28 $50 $76 $120 $129 $129 $64 $64 $71 $70 $33 $21 $2 $2 $11 $7 $0 Remaining First Loss Retention Layer $186 $299 $240 $659 $442 $365 $309 $257 $244 $353 $361 $133 $257 $213 n/a n/a n/a Reinsurer Claims Paid $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 $0 Third Party Ceded Reinsurance Transaction Summary (amounts in millions) (1) Excess of loss (XOL) and quota share (QSR) transactions are with panels of U.S. and global reinsurers. (2) The initial reinsurance amount for insurance linked notes and excess of loss reinsurance reflects the total loss coverage; Ceded RIF reflects the RIF associated with quota share reinsurance which is subject to annual and life loss ratio limits. (3) Attachment % and detachment % are the aggregate loss amounts as a percentage of risk in force at which the reinsurer begins and stops paying claims under the policy. (4) Current PMIERs required asset credit considers the counterparty credit haircut. (5) Incurred losses ever to date shown does not include IBNR or loss adjustment expenses. Definitions: CRT = Credit Risk Transfer; RIF = Risk In Force; XOL = Excess Of Loss; ILN = Insurance Linked Note; QSR = Quota Share Reinsurance - Excess of Loss (1) Reinsurance - Quota Share (1)Insurance Linked Notes Page 14

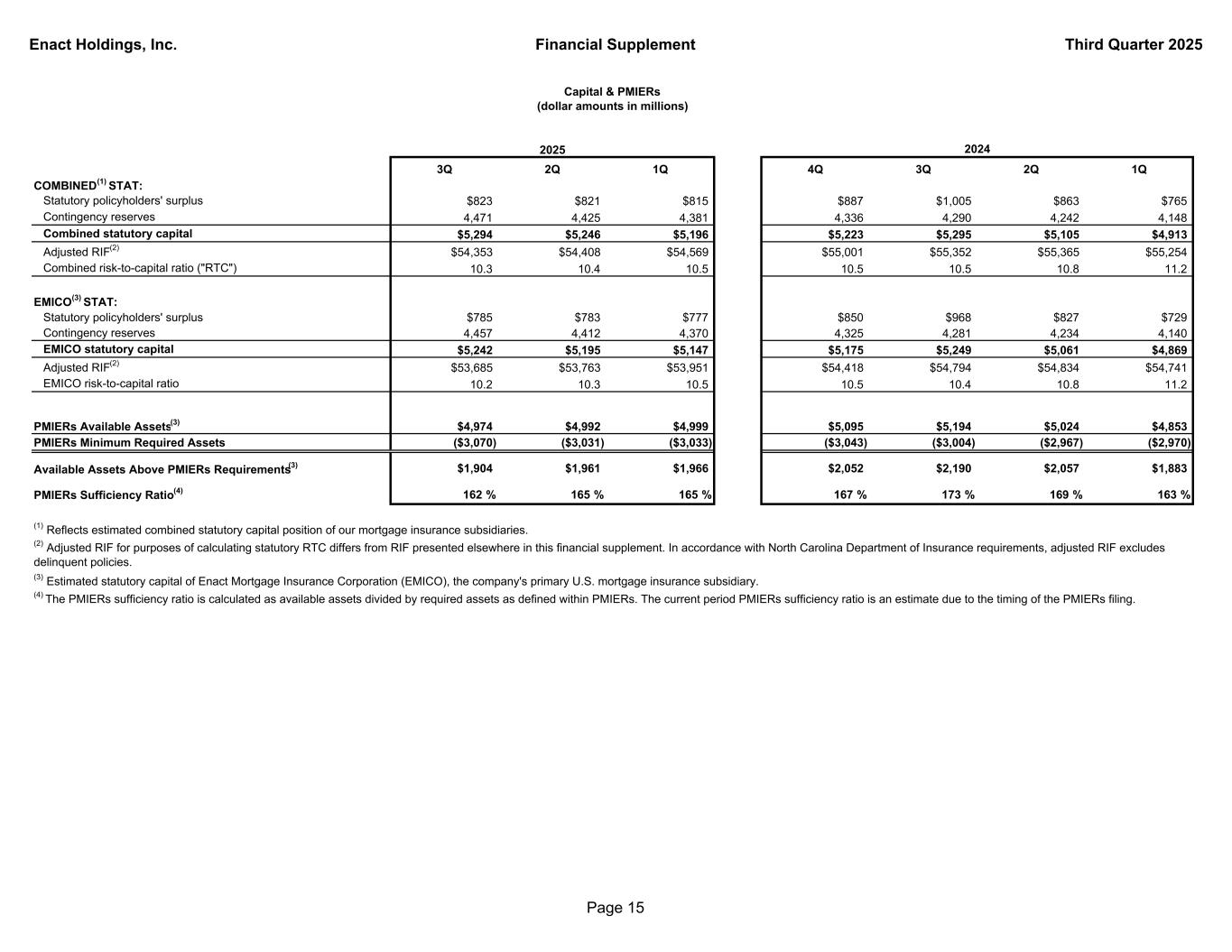

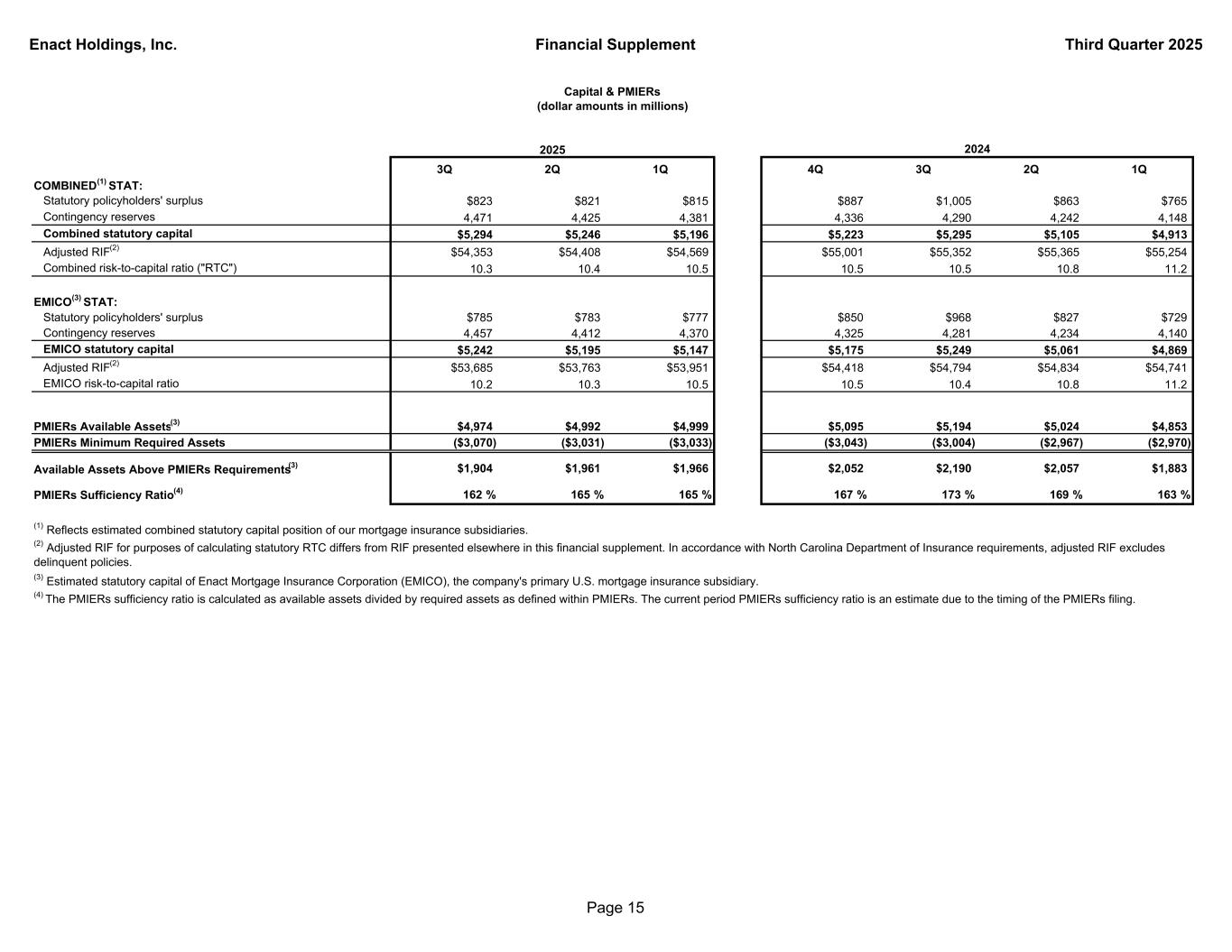

Enact Holdings, Inc. Financial Supplement Third Quarter 2025 3Q 2Q 1Q 4Q 3Q 2Q 1Q COMBINED(1) STAT: Statutory policyholders' surplus $823 $821 $815 $887 $1,005 $863 $765 Contingency reserves 4,471 4,425 4,381 4,336 4,290 4,242 4,148 Combined statutory capital $5,294 $5,246 $5,196 $5,223 $5,295 $5,105 $4,913 Adjusted RIF(2) $54,353 $54,408 $54,569 $55,001 $55,352 $55,365 $55,254 Combined risk-to-capital ratio ("RTC") 10.3 10.4 10.5 10.5 10.5 10.8 11.2 EMICO(3) STAT: Statutory policyholders' surplus $785 $783 $777 $850 $968 $827 $729 Contingency reserves 4,457 4,412 4,370 4,325 4,281 4,234 4,140 EMICO statutory capital $5,242 $5,195 $5,147 $5,175 $5,249 $5,061 $4,869 Adjusted RIF(2) $53,685 $53,763 $53,951 $54,418 $54,794 $54,834 $54,741 EMICO risk-to-capital ratio 10.2 10.3 10.5 10.5 10.4 10.8 11.2 PMIERs Available Assets(3) $4,974 $4,992 $4,999 $5,095 $5,194 $5,024 $4,853 PMIERs Minimum Required Assets ($3,070) ($3,031) ($3,033) ($3,043) ($3,004) ($2,967) ($2,970) Available Assets Above PMIERs Requirements(3) $1,904 $1,961 $1,966 $2,052 $2,190 $2,057 $1,883 PMIERs Sufficiency Ratio(4) 162 % 165 % 165 % 167 % 173 % 169 % 163 % (4) The PMIERs sufficiency ratio is calculated as available assets divided by required assets as defined within PMIERs. The current period PMIERs sufficiency ratio is an estimate due to the timing of the PMIERs filing. 2024 Capital & PMIERs (dollar amounts in millions) (3) Estimated statutory capital of Enact Mortgage Insurance Corporation (EMICO), the company's primary U.S. mortgage insurance subsidiary. (1) Reflects estimated combined statutory capital position of our mortgage insurance subsidiaries. (2) Adjusted RIF for purposes of calculating statutory RTC differs from RIF presented elsewhere in this financial supplement. In accordance with North Carolina Department of Insurance requirements, adjusted RIF excludes delinquent policies. 2025 Page 15