Document

Hillman Reports Record Third Quarter 2025 Results

Increases FY 2025 Adj. EBITDA guidance; reiterates Net Sales and year-end leverage guidance

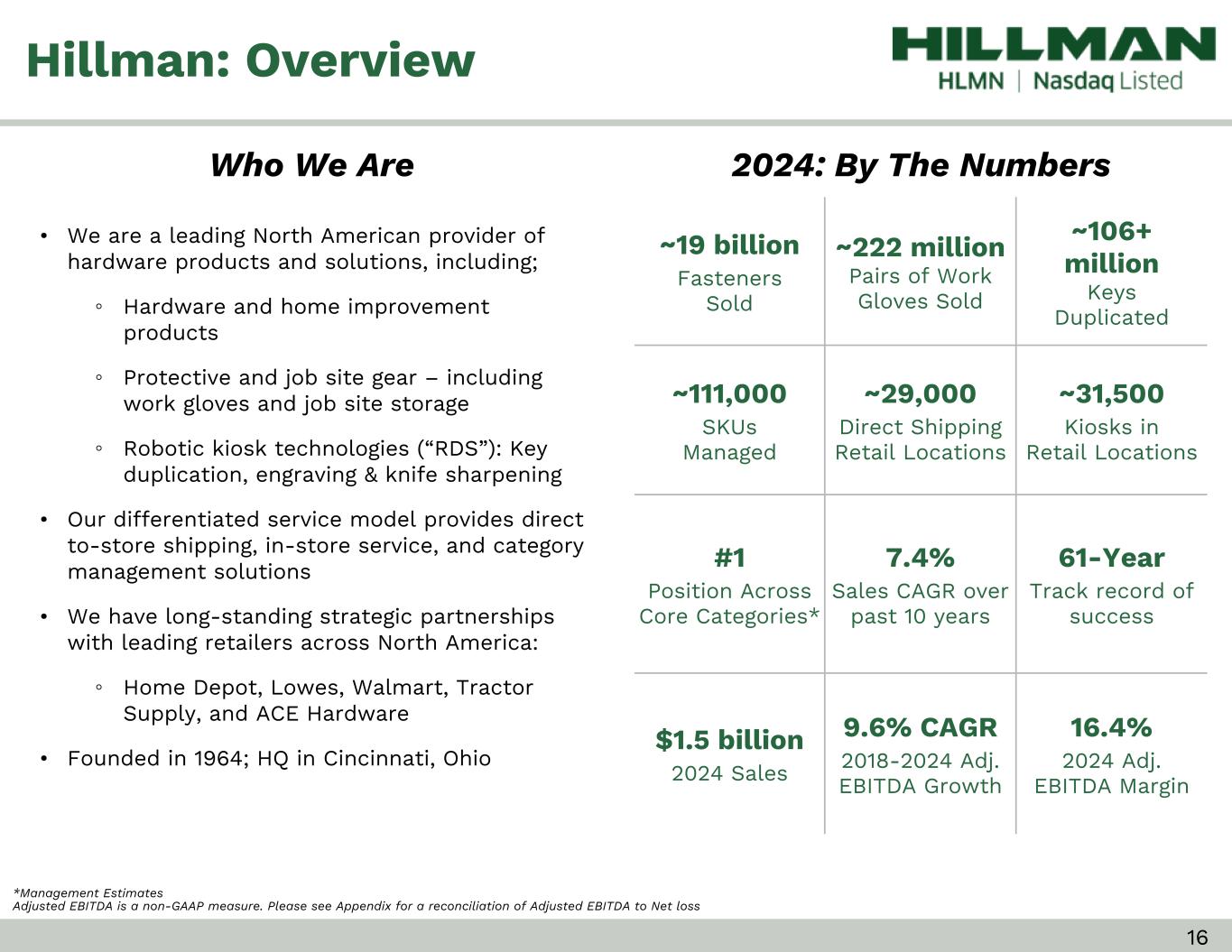

CINCINNATI, November 4, 2025 -- Hillman Solutions Corp. (Nasdaq: HLMN) (the “Company” or “Hillman”), a leading provider of hardware products and merchandising solutions, reported financial results for the thirteen and thirty-nine weeks ended September 27, 2025.

Third Quarter 2025 Highlights (Thirteen weeks ended September 27, 2025)

•Net sales increased 8.0% to a record $424.9 million compared to $393.3 million in the prior year quarter

•Net income totaled $23.2 million, or $0.12 per diluted share, compared to $7.4 million, or $0.04 per diluted share, in the prior year quarter

•Adjusted diluted EPS1 totaled $0.22 per diluted share compared to $0.13 per diluted share in the prior year quarter

•Adjusted EBITDA1 increased to a record $88.0 million compared to $64.8 million in the prior year quarter

•Net cash provided by operating activities was $26.2 million compared to $63.7 million in the prior year quarter

•Free Cash Flow1 totaled $9.1 million compared to $39.6 million in the prior year quarter

•Hillman repurchased approximately 325.6 thousand shares of its common stock at an average price of $9.72 per share, which totaled $3.2 million

Balance Sheet and Liquidity at September 27, 2025

•Gross debt was $709.5 million compared to $718.6 million on December 28, 2024

•Net debt1 was $671.8 million compared to $674.0 million on December 28, 2024

•Liquidity available totaled $276.9 million; consisting of $239.2 million of available borrowing under the revolving credit facility and $37.7 million of cash and equivalents

•Net debt1 to trailing twelve month Adjusted EBITDA improved to 2.5x at quarter end compared to 2.8x on December 28, 2024

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

1

Management Commentary

"During the quarter, we generated the highest Net Sales and Adjusted EBITDA in the 61-year history of Hillman," commented Jon Michael Adinolfi, President and CEO of Hillman. "I am especially proud of this team because we continue to execute and take great care of our customers despite market volume headwinds and tariff volatility. This business continues to demonstrate resilience given the nature of Hillman products used in everyday repair and maintenance projects around the home. As we look to the future, our improved leverage and healthy balance sheet have positioned us to finish the year strong. We continue to remain focused on sustainable long-term growth opportunities that drive shareholder value.”

Full Year 2025 Guidance - Updated

Based on year-to-date performance and its expectations for the remainder of the year, management is updating its guidance most recently provided on August 5, 2025 with Hillman's second quarter 2025 results.

|

|

|

|

|

|

|

|

|

|

Previous FY 2025 Guidance |

Updated FY 2025 Guidance |

| Net Sales |

$1.535 to $1.575 billion |

$1.535 to $1.575 billion |

Adjusted EBITDA1 |

$265 to $275 million |

$270 to $275 million |

| Year-end leverage |

2.4x leverage at year end |

2.4x leverage at year end |

Third Quarter 2025 Results Presentation

Hillman plans to host a conference call and webcast presentation today, November 4, 2025, at 8:30 a.m. Eastern Time to discuss its results. President and Chief Executive Officer Jon Michael Adinolfi and Chief Financial Officer Rocky Kraft will host the results presentation.

Date: Tuesday, November 4, 2025

Time: 8:30 a.m. Eastern Time

Listen-Only Webcast: https://edge.media-server.com/mmc/p/hyk9gbno

A webcast replay will be available approximately one hour after the conclusion of the call using the link above.

Hillman’s quarterly presentation and Form 10-Q are expected to be filed with the SEC and posted to its Investor Relations website, https://ir.hillmangroup.com, prior to the webcast presentation.

About Hillman Solutions Corp.

Hillman Solutions Corp. (“Hillman”) is a leading provider of hardware-related products and solutions to home improvement, hardware, and farm and fleet retailers across North America. Renowned for its commitment to customer service, Hillman has differentiated itself with its competitive moat built on direct-to-store shipping, a dedicated in-store sales and service team of over 1,200 professionals, and over 60 years of product and industry experience. Hillman’s extensive portfolio includes hardware solutions (fasteners, screws, nuts and bolts), protective solutions (work gloves, jobsite storage and protective gear), and robotic and digital solutions (key duplication and tag engraving). Leveraging its world-class distribution network, Hillman regularly earns vendor of the year recognition from top customers.

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

2

For more information on Hillman, visit www.hillman.com.

Forward-Looking Statements

All statements made in this press release that are considered to be forward-looking are made in good faith by the Company and are intended to qualify for the safe harbor from liability established by Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934, and the Private Securities Litigation Reform Act of 1995. You should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," “target”, “goal”, "may," "will," "could," "should," "believes," "predicts," "potential," "continue," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company’s expectations with respect to future performance. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Most of these factors are outside the Company's control and are difficult to predict. Factors that may cause such differences include, but are not limited to: (1) unfavorable economic conditions that may affect our and our customers’, suppliers’ and other business partners’ operations, financial condition and cash flows including spending on home renovation or construction projects, inflation, recessions, instability in the financial markets or credit markets; (2) increased supply chain costs, including tariffs, raw materials, sourcing, transportation and energy; (3) the highly competitive nature of the markets that we serve; (4) the ability to continue to innovate with new products and services; (5) seasonality; (6) large customer concentration; (7) the ability to recruit and retain qualified employees; (8) the outcome of any legal proceedings that may be instituted against the Company; (9) adverse changes in currency exchange rates; or (10) regulatory changes and potential legislation that could adversely impact financial results. The foregoing list of factors is not exclusive, and readers should also refer to those risks that are included in the Company’s filings with the Securities and Exchange Commission (“SEC”), including the Annual Report on Form 10-K filed on February 20, 2025. Given these uncertainties, current or prospective investors are cautioned not to place undue reliance on any such forward-looking statements.

Except as required by applicable law, the Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements in this communication to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

Contact:

Michael Koehler

Vice President of Investor Relations & Treasury

513-826-5495

IR@hillmangroup.com

1) Denotes Non-GAAP metric. For additional information, including our definitions, use of, and reconciliations of these metrics to the most directly comparable financial measures under GAAP, please see the reconciliations toward the end of the press release.

3

HILLMAN SOLUTIONS CORP.

Condensed Consolidated Statement of Net Loss, GAAP Basis

(dollars in thousands) Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

September 27, 2025 |

|

Thirteen Weeks Ended

September 28, 2024 |

|

Thirty-nine Weeks Ended

September 27, 2025 |

|

Thirty-nine Weeks Ended

September 28, 2024 |

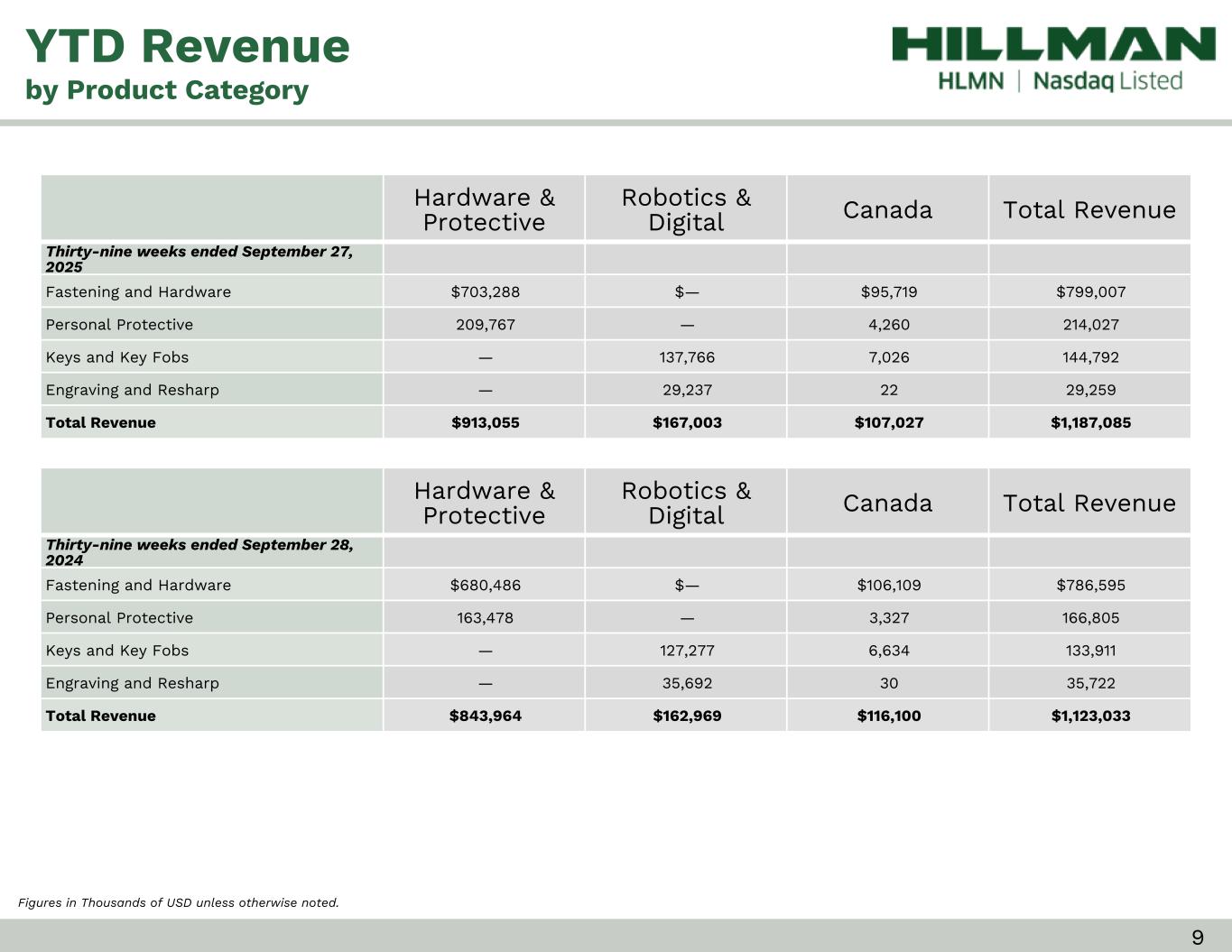

| Net sales |

$ |

424,939 |

|

|

$ |

393,296 |

|

|

$ |

1,187,085 |

|

|

$ |

1,123,033 |

|

| Cost of sales (exclusive of depreciation and amortization shown separately below) |

205,378 |

|

|

203,700 |

|

|

604,456 |

|

|

581,806 |

|

| Selling, warehouse, general and administrative expenses |

138,342 |

|

|

130,261 |

|

|

381,101 |

|

|

369,980 |

|

| Depreciation |

20,100 |

|

|

17,948 |

|

|

59,343 |

|

|

50,583 |

|

| Amortization |

15,265 |

|

|

15,354 |

|

|

45,937 |

|

|

45,857 |

|

| Other (income) expense |

(50) |

|

|

(881) |

|

|

(988) |

|

|

3 |

|

| Income from operations |

45,904 |

|

|

26,914 |

|

|

97,236 |

|

|

74,804 |

|

| Interest expense, net |

14,692 |

|

|

15,108 |

|

|

43,044 |

|

|

44,316 |

|

| Refinancing costs |

— |

|

|

— |

|

|

906 |

|

|

3,008 |

|

| Income before income taxes |

31,212 |

|

|

11,806 |

|

|

53,286 |

|

|

27,480 |

|

| Income tax expense |

8,020 |

|

|

4,372 |

|

|

14,579 |

|

|

9,003 |

|

| Net income |

$ |

23,192 |

|

|

$ |

7,434 |

|

|

$ |

38,707 |

|

|

$ |

18,477 |

|

|

|

|

|

|

|

|

|

| Basic income per share |

$ |

0.12 |

|

|

$ |

0.04 |

|

|

$ |

0.20 |

|

|

$ |

0.09 |

|

| Weighted average basic shares outstanding |

197,754 |

|

|

196,297 |

|

|

197,544 |

|

|

195,914 |

|

|

|

|

|

|

|

|

|

| Diluted income per share |

$ |

0.12 |

|

|

$ |

0.04 |

|

|

$0.19 |

|

$ |

0.09 |

|

| Weighted average diluted shares outstanding |

199,849 |

|

|

199,034 |

|

|

199,454 |

|

|

198,370 |

|

HILLMAN SOLUTIONS CORP.

Condensed Consolidated Balance Sheets

(dollars in thousands)

Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

| |

September 27, 2025 |

|

December 28, 2024 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

37,731 |

|

|

$ |

44,510 |

|

Accounts receivable, net of allowances of $1,414 ($2,827 - 2024) |

144,933 |

|

|

109,788 |

|

| Inventories, net |

460,089 |

|

|

403,673 |

|

| Other current assets |

28,375 |

|

|

15,213 |

|

| Total current assets |

671,128 |

|

|

573,184 |

|

Property and equipment, net of accumulated depreciation of $421,912 ($376,150 - 2024) |

235,114 |

|

|

224,174 |

|

| Goodwill |

830,098 |

|

|

828,553 |

|

Other intangibles, net of accumulated amortization of $577,051 ($530,398 - 2024) |

560,943 |

|

|

605,859 |

|

| Operating lease right of use assets |

79,187 |

|

|

81,708 |

|

| Other assets |

20,423 |

|

|

17,025 |

|

|

|

|

|

| Total assets |

$ |

2,396,893 |

|

|

$ |

2,330,503 |

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

162,358 |

|

|

$ |

139,057 |

|

| Current portion of debt and financing lease liabilities |

15,447 |

|

|

12,975 |

|

| Current portion of operating lease liabilities |

17,796 |

|

|

16,850 |

|

| Accrued expenses: |

|

|

|

| Salaries and wages |

33,837 |

|

|

34,977 |

|

| Pricing allowances |

7,567 |

|

|

7,651 |

|

| Income and other taxes |

7,320 |

|

|

10,377 |

|

|

|

|

|

| Other accrued liabilities |

28,867 |

|

|

31,843 |

|

| Total current liabilities |

273,192 |

|

|

253,730 |

|

| Long-term debt |

683,200 |

|

|

691,726 |

|

| Deferred tax liabilities |

135,579 |

|

|

124,611 |

|

| Operating lease liabilities |

67,739 |

|

|

71,474 |

|

| Other non-current liabilities |

7,053 |

|

|

6,591 |

|

| Total liabilities |

$ |

1,166,763 |

|

|

$ |

1,148,132 |

|

| Commitments and contingencies (Note 6) |

|

|

|

| Stockholders' equity: |

|

|

|

Common stock: $0.0001 par value, 500,000,000 shares authorized, 197,757,293 and 197,431,709 issued and outstanding in 2025, respectively and 196,705,710 shares issued and outstanding in 2024 |

20 |

|

|

20 |

|

Treasury stock, at cost, 325,584 shares in 2025 |

(3,165) |

|

|

— |

|

| Additional paid-in capital |

1,453,457 |

|

|

1,442,958 |

|

| Accumulated deficit |

(180,244) |

|

|

(218,951) |

|

| Accumulated other comprehensive loss |

(39,938) |

|

|

(41,656) |

|

| Total stockholders' equity |

1,230,130 |

|

|

1,182,371 |

|

| Total liabilities and stockholders' equity |

$ |

2,396,893 |

|

|

$ |

2,330,503 |

|

HILLMAN SOLUTIONS CORP.

Condensed Consolidated Statement of Cash Flows

(dollars in thousands)

Unaudited

|

|

|

|

|

|

|

|

|

|

|

|

| |

Thirty-nine Weeks Ended

September 27, 2025 |

|

Thirty-nine Weeks Ended

September 28, 2024 |

| Cash flows from operating activities: |

|

|

|

| Net income |

$ |

38,707 |

|

|

$ |

18,477 |

|

| Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

| Depreciation and amortization |

105,280 |

|

|

96,440 |

|

| Deferred income taxes |

9,791 |

|

|

(1,326) |

|

| Deferred financing and original issue discount amortization |

3,767 |

|

|

3,807 |

|

| Stock-based compensation expense |

10,739 |

|

|

9,742 |

|

| Customer bankruptcy reserve |

— |

|

|

7,757 |

|

| Loss on debt restructuring |

906 |

|

|

3,008 |

|

| Cash paid to third parties in connection with debt restructuring |

(906) |

|

|

(1,554) |

|

|

|

|

|

|

|

|

|

| Loss on disposal of property and equipment |

(135) |

|

|

56 |

|

| Change in fair value of contingent consideration |

(500) |

|

|

313 |

|

|

|

|

|

| Changes in operating items: |

|

|

|

| Accounts receivable, net |

(34,721) |

|

|

(22,906) |

|

| Inventories, net |

(53,925) |

|

|

(2,036) |

|

| Other assets |

(19,691) |

|

|

(142) |

|

| Accounts payable |

22,575 |

|

|

17,822 |

|

| Accrued salaries and wages |

(1,217) |

|

|

7,150 |

|

| Other accrued expenses |

(6,381) |

|

|

3,579 |

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

74,289 |

|

|

140,187 |

|

| Net cash from investing activities |

|

|

|

| Acquisition of business, net of cash received |

— |

|

|

(57,762) |

|

| Capital expenditures |

(55,347) |

|

|

(64,196) |

|

|

|

|

|

| Other investing activities |

(154) |

|

|

(211) |

|

| Net cash used for investing activities |

(55,501) |

|

|

(122,169) |

|

| Cash flows from financing activities: |

|

|

|

| Repayments of senior term loans |

(6,384) |

|

|

(4,255) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Financing fees |

— |

|

|

(33) |

|

| Borrowings on revolving credit loans |

109,000 |

|

|

77,000 |

|

| Repayments of revolving credit loans |

(122,000) |

|

|

(77,000) |

|

| Principal payments under finance lease obligations |

(4,156) |

|

|

(2,698) |

|

| Proceeds from exercise of stock options |

1,177 |

|

|

8,938 |

|

Repurchases of common stock |

(3,165) |

|

|

— |

|

| Payments of contingent consideration |

(199) |

|

|

(196) |

|

| Other financing activities |

142 |

|

|

(103) |

|

|

|

|

|

| Net cash (used for) provided by financing activities |

(25,585) |

|

|

1,653 |

|

| Effect of exchange rate changes on cash |

18 |

|

|

1,596 |

|

| Net (decrease) increase in cash and cash equivalents |

(6,779) |

|

|

21,267 |

|

| Cash and cash equivalents at beginning of period |

44,510 |

|

|

38,553 |

|

| Cash and cash equivalents at end of period |

$ |

37,731 |

|

|

$ |

59,820 |

|

Reconciliations of Non-GAAP Financial Measures to the Most Directly Comparable GAAP Financial Measures

The Company uses non-GAAP financial measures to analyze underlying business performance and trends. The Company believes that providing these non-GAAP financial measures enhances the Company’s and investors’ ability to compare the Company’s past financial performance with its current performance. These non-GAAP financial measures are provided as supplemental information to the financial measures presented in this press release that are calculated and presented in accordance with GAAP. Non-GAAP financial measures should not be considered a substitute for, or superior to, financial measures determined or calculated in accordance with GAAP. The Company’s definitions of its non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies. Because GAAP financial measures on a forward-looking basis are not accessible, and reconciling information is not available without unreasonable effort, reconciliations to GAAP financial measures are not provided for forward-looking non-GAAP measures. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results.

Non-GAAP financial measures such as consolidated adjusted EBITDA and Adjusted Diluted Earnings per Share (EPS) exclude from the relevant GAAP metrics items that neither relate to the ordinary course of the Company’s business, nor reflect the Company’s underlying business performance.

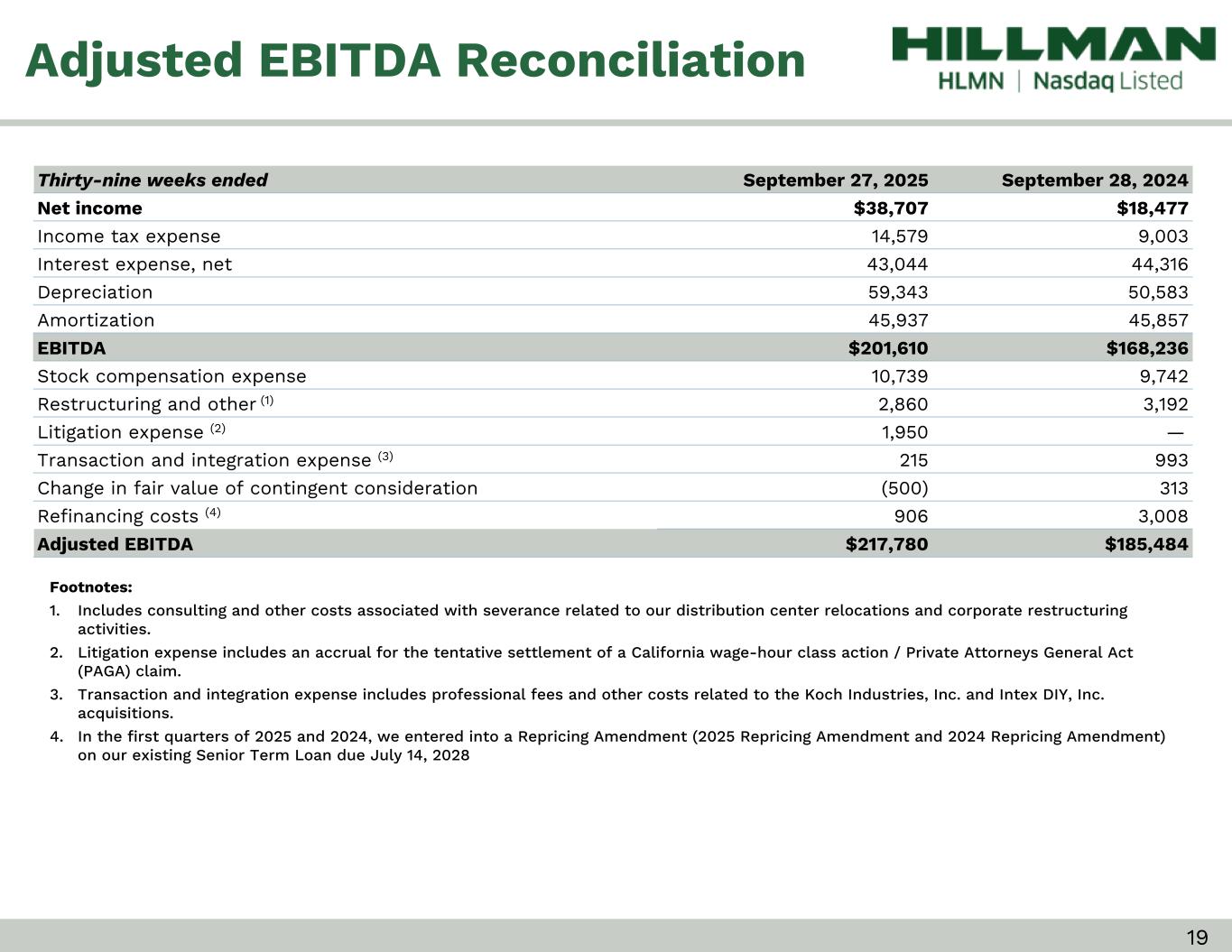

Reconciliation of Adjusted EBITDA (Unaudited)

(dollars in thousands)

Adjusted EBITDA is a non-GAAP financial measure and is the primary basis used to measure the operational strength and performance of our businesses as well as to assist in the evaluation of underlying trends in our businesses. This measure eliminates the significant level of noncash depreciation and amortization expense that results from the capital-intensive nature of our businesses and from intangible assets recognized in business combinations. It is also unaffected by our capital and tax structures, as our management excludes these results when evaluating our operating performance. Our management use this financial measure to evaluate our consolidated operating performance and the operating performance of our operating segments as well as to allocate resources and capital to our operating segments. Additionally, we believe that Adjusted EBITDA is useful to investors because it is one of the bases for comparing our operating performance with that of other companies in our industries, although our measure of Adjusted EBITDA may not be directly comparable to similar measures used by other companies.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

September 27, 2025 |

|

Thirteen Weeks Ended

September 28, 2024 |

|

Thirty-nine Weeks Ended

September 27, 2025 |

|

Thirty-nine Weeks Ended

September 28, 2024 |

| Net income |

$ |

23,192 |

|

|

$ |

7,434 |

|

|

$ |

38,707 |

|

|

$ |

18,477 |

|

| Income tax expense |

8,020 |

|

|

4,372 |

|

|

14,579 |

|

|

9,003 |

|

| Interest expense, net |

14,692 |

|

|

15,108 |

|

|

43,044 |

|

|

44,316 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation |

20,100 |

|

|

17,948 |

|

|

59,343 |

|

|

50,583 |

|

| Amortization |

15,265 |

|

|

15,354 |

|

|

45,937 |

|

|

45,857 |

|

|

|

|

|

|

|

|

|

| EBITDA |

$ |

81,269 |

|

|

$ |

60,216 |

|

|

$ |

201,610 |

|

|

$ |

168,236 |

|

|

|

|

|

|

|

|

|

| Stock compensation expense |

3,904 |

|

|

3,257 |

|

|

10,739 |

|

|

9,742 |

|

Restructuring and other (1) |

749 |

|

|

1,322 |

|

|

2,860 |

|

|

3,192 |

|

Litigation expense (2) |

1,950 |

|

|

— |

|

|

1,950 |

|

|

— |

|

Transaction and integration expense (3) |

87 |

|

|

477 |

|

|

215 |

|

|

993 |

|

| Change in fair value of contingent consideration |

67 |

|

|

(467) |

|

|

(500) |

|

|

313 |

|

Refinancing costs (4) |

— |

|

|

— |

|

|

906 |

|

|

3,008 |

|

|

|

|

|

|

|

|

|

| Total adjusting items |

6,757 |

|

|

4,589 |

|

|

16,170 |

|

|

17,248 |

|

| Adjusted EBITDA |

$ |

88,026 |

|

|

$ |

64,805 |

|

|

$ |

217,780 |

|

|

$ |

185,484 |

|

(1)Includes consulting and other costs associated with severance related to our distribution center relocations and corporate restructuring activities.

(2)Litigation expense includes an accrual for the tentative settlement of a California wage-hour class action / Private Attorneys General Act (PAGA) claim.

(3)Transaction and integration expense includes professional fees and other costs related to the Koch Industries, Inc. and Intex DIY, Inc. acquisitions.

(4)In the first quarters of 2025 and 2024, we entered into a Repricing Amendment (2025 Repricing Amendment and 2024 Repricing Amendment) on our existing Senior Term Loan due July 14, 2028.

Reconciliation of Adjusted Diluted Earnings Per Share

(in thousands, except per share data)

Unaudited

We define Adjusted Diluted EPS as reported diluted EPS excluding the effect of one-time, non-recurring activity and volatility associated with our income tax expense. The Company believes that Adjusted Diluted EPS provides further insight and comparability in operating performance as it eliminates the effects of certain items that are not comparable from one period to the next. The following is a reconciliation of reported diluted EPS from continuing operations to Adjusted Diluted EPS from continuing operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

September 27, 2025 |

|

Thirteen Weeks Ended

September 28, 2024 |

|

Thirty-nine Weeks Ended

September 27, 2025 |

|

Thirty-nine Weeks Ended

September 28, 2024 |

| Reconciliation to Adjusted Net Income |

|

|

|

|

|

|

|

| Net income |

$ |

23,192 |

|

|

$ |

7,434 |

|

|

$ |

38,707 |

|

|

$ |

18,477 |

|

Remove adjusting items (1) |

6,757 |

|

|

4,589 |

|

|

16,170 |

|

|

17,248 |

|

| Remove amortization expense |

15,265 |

|

|

15,354 |

|

|

45,937 |

|

|

45,937 |

|

Remove tax benefit on adjusting items and amortization expense (2) |

(1,967) |

|

|

(1,149) |

|

|

(4,864) |

|

|

(4,929) |

|

| Adjusted Net Income |

$ |

43,247 |

|

|

$ |

26,228 |

|

|

$ |

95,950 |

|

|

$ |

76,733 |

|

|

|

|

|

|

|

|

|

| Reconciliation to Adjusted Diluted Earnings per Share |

|

|

|

|

|

|

|

| Diluted Earnings per Share |

$ |

0.12 |

|

|

$ |

0.04 |

|

|

$ |

0.19 |

|

|

$ |

0.09 |

|

Remove adjusting items (1) |

0.03 |

|

|

0.02 |

|

|

0.08 |

|

|

0.09 |

|

| Remove amortization expense |

0.08 |

|

|

0.08 |

|

|

0.23 |

|

|

0.23 |

|

Remove tax benefit on adjusting items and amortization expense (2) |

(0.01) |

|

|

(0.01) |

|

|

(0.02) |

|

|

(0.02) |

|

| Adjusted Diluted Earnings per Share |

$ |

0.22 |

|

|

$ |

0.13 |

|

|

$ |

0.48 |

|

|

$ |

0.39 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted Shares, as reported |

199,849 |

|

|

199,034 |

|

|

199,454 |

|

|

198,370 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note: Adjusted EPS may not add due to rounding.

(1)Please refer to the "Reconciliation of Adjusted EBITDA" table above for additional information on adjusting items. See the "Per share impact of Adjusting Items" table below for the per share impact of each adjustment.

(2)We have calculated the income tax effect of the non-GAAP adjustments shown above at the applicable statutory rate of 25% for the U.S. and 26.2% for Canada except for the following items:

a.The tax impact of stock compensation expense was calculated using the statutory rate of 25%, excluding certain awards that are non-deductible.

b.The tax impact of acquisition and integration expense was calculated using the statutory rate of 25%, excluding certain charges that were non-deductible.

c.Amortization expense for financial accounting purposes was offset by the tax benefit of deductible amortization expense using the statutory rate of 25%.

(3)Diluted shares on a GAAP basis for the thirteen and thirty-nine weeks ended September 27, 2025 include the dilutive impact of 2,095 and 1,910 options and awards, respectfully. Diluted shares on a GAAP basis for the thirteen and thirty-nine weeks ended September 28, 2024 include the dilutive impact of 2,737 and 2,456 options and awards, respectfully.

Per Share Impact of Adjusting Items

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

September 27, 2025 |

|

Thirteen Weeks Ended

September 28, 2024 |

|

Thirty-nine Weeks Ended

September 27, 2025 |

|

Thirty-nine Weeks Ended

September 28, 2024 |

| Stock compensation expense |

|

$ |

0.02 |

|

|

$ |

0.02 |

|

|

$ |

0.05 |

|

|

$ |

0.05 |

|

| Restructuring and other costs |

|

0.00 |

|

0.01 |

|

0.01 |

|

0.02 |

|

| Litigation expense |

|

0.01 |

|

0.00 |

|

0.01 |

|

0.00 |

| Transaction and integration expense |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.01 |

| Change in fair value of contingent consideration |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.00 |

| Refinancing costs |

|

0.00 |

|

0.00 |

|

0.00 |

|

0.02 |

|

|

|

|

|

|

|

|

|

| Total adjusting items |

|

$ |

0.03 |

|

|

$ |

0.02 |

|

|

$ |

0.08 |

|

|

$ |

0.09 |

|

Note: Adjusting items may not add due to rounding.

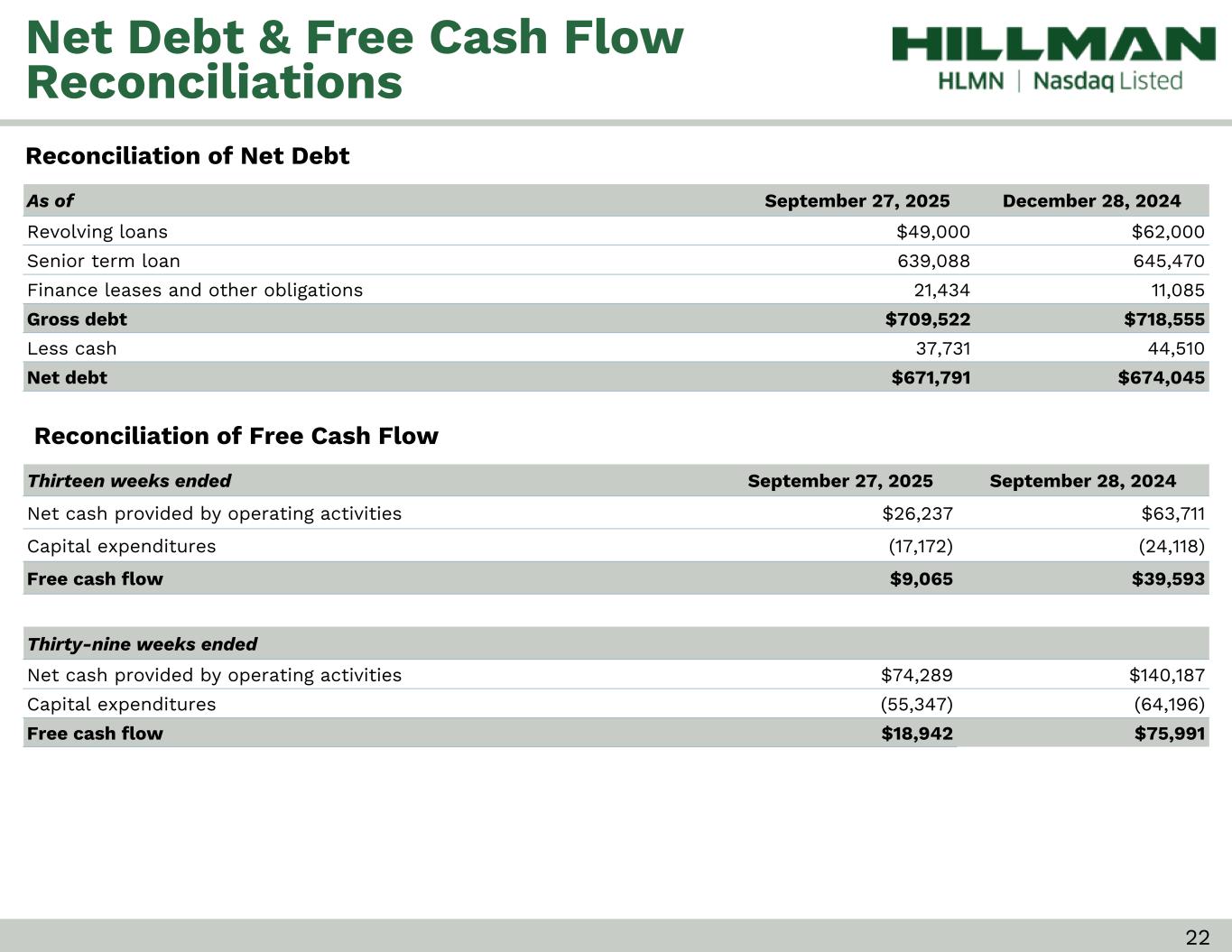

Reconciliation of Net Debt

We define Net Debt as reported gross debt less cash on hand. Net debt is not defined under U.S. GAAP and may not be computed the same as similarly titled measures used by other companies. The Company believes that Net Debt provides further insight and comparability into liquidity and capital structure. The following is the calculation of Net Debt:

|

|

|

|

|

|

|

|

|

|

|

|

|

September 27, 2025 |

|

December 28, 2024 |

| Revolving loans |

$ |

49,000 |

|

|

$ |

62,000 |

|

| Senior term loan, due 2028 |

639,088 |

|

|

645,470 |

|

| Finance leases and other obligations |

21,434 |

|

|

11,085 |

|

| Gross debt |

$ |

709,522 |

|

|

$ |

718,555 |

|

| Less cash |

37,731 |

|

|

44,510 |

|

| Net debt |

$ |

671,791 |

|

|

$ |

674,045 |

|

Reconciliation of Free Cash Flow

We calculate free cash flow as cash flows from operating activities less capital expenditures. Free cash flow is not defined under U.S. GAAP and may not be computed the same as similarly titled measures used by other companies. We believe free cash flow is an important indicator of how much cash is generated by our business operations and is a measure of incremental cash available to invest in our business and meet our debt obligations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Thirteen Weeks Ended

September 27, 2025 |

|

Thirteen Weeks Ended

September 28, 2024 |

|

Thirty-nine Weeks Ended

September 27, 2025 |

|

Thirty-nine Weeks Ended

September 28, 2024 |

| Net cash provided by operating activities |

$ |

26,237 |

|

|

$ |

63,711 |

|

|

$ |

74,289 |

|

|

$ |

140,187 |

|

| Capital expenditures |

(17,172) |

|

|

(24,118) |

|

|

(55,347) |

|

|

(64,196) |

|

| Free cash flow |

$ |

9,065 |

|

|

$ |

39,593 |

|

|

$ |

18,942 |

|

|

$ |

75,991 |

|

Source: Hillman Solutions Corp.

###