0001820144FALSE2022FYP1MP3MP6MP1Mhttp://fasb.org/us-gaap/2022#DepreciationDepletionAndAmortizationhttp://fasb.org/us-gaap/2022#DepreciationDepletionAndAmortizationP10Yhttp://fasb.org/us-gaap/2022#AccountsPayableAndOtherAccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2022#QualifiedPlanMember

00018201442022-01-012022-12-310001820144us-gaap:CommonStockMember2022-01-012022-12-310001820144us-gaap:WarrantMember2022-01-012022-12-3100018201442022-06-30iso4217:USD00018201442023-03-14xbrli:shares00018201442022-12-3100018201442021-12-31iso4217:USDxbrli:shares00018201442021-01-012021-12-310001820144us-gaap:PreferredStockMember2022-12-310001820144us-gaap:CommonStockMember2022-12-310001820144us-gaap:CommonStockMembergrnd:SeriesYPreferredUnitsMember2022-12-310001820144us-gaap:CommonStockMembergrnd:SeriesXOrdinaryUnitsMember2022-12-310001820144srt:ScenarioPreviouslyReportedMemberus-gaap:PreferredStockMember2020-12-310001820144us-gaap:CommonStockMembersrt:ScenarioPreviouslyReportedMember2020-12-310001820144us-gaap:CommonStockMembersrt:ScenarioPreviouslyReportedMembergrnd:SeriesYPreferredUnitsMember2020-12-310001820144us-gaap:CommonStockMembersrt:ScenarioPreviouslyReportedMembergrnd:SeriesXOrdinaryUnitsMember2020-12-310001820144srt:ScenarioPreviouslyReportedMemberus-gaap:AdditionalPaidInCapitalMember2020-12-310001820144srt:ScenarioPreviouslyReportedMemberus-gaap:RetainedEarningsMember2020-12-310001820144srt:ScenarioPreviouslyReportedMember2020-12-310001820144us-gaap:CommonStockMembersrt:RestatementAdjustmentMember2020-12-310001820144us-gaap:CommonStockMembergrnd:SeriesXOrdinaryUnitsMembersrt:RestatementAdjustmentMember2020-12-310001820144us-gaap:AdditionalPaidInCapitalMembersrt:RestatementAdjustmentMember2020-12-310001820144srt:RestatementAdjustmentMember2020-12-310001820144us-gaap:CommonStockMember2020-12-310001820144us-gaap:CommonStockMembergrnd:SeriesXOrdinaryUnitsMember2020-12-310001820144us-gaap:AdditionalPaidInCapitalMember2020-12-310001820144us-gaap:RetainedEarningsMember2020-12-3100018201442020-12-310001820144us-gaap:RetainedEarningsMember2021-01-012021-12-310001820144us-gaap:CommonStockMember2021-01-012021-12-310001820144us-gaap:AdditionalPaidInCapitalMember2021-01-012021-12-310001820144srt:ScenarioPreviouslyReportedMemberus-gaap:PreferredStockMember2021-12-310001820144us-gaap:CommonStockMember2021-12-310001820144us-gaap:CommonStockMembergrnd:SeriesYPreferredUnitsMember2021-12-310001820144us-gaap:CommonStockMembergrnd:SeriesXOrdinaryUnitsMember2021-12-310001820144us-gaap:AdditionalPaidInCapitalMember2021-12-310001820144us-gaap:RetainedEarningsMember2021-12-310001820144us-gaap:RetainedEarningsMember2022-01-012022-12-310001820144us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001820144us-gaap:CommonStockMember2022-01-012022-12-310001820144srt:ScenarioPreviouslyReportedMemberus-gaap:PreferredStockMember2022-12-310001820144us-gaap:AdditionalPaidInCapitalMember2022-12-310001820144us-gaap:RetainedEarningsMember2022-12-31grnd:segment0001820144us-gaap:ComputerEquipmentMember2022-01-012022-12-310001820144us-gaap:FurnitureAndFixturesMember2022-01-012022-12-310001820144us-gaap:LeaseholdImprovementsMembersrt:MinimumMember2022-01-012022-12-310001820144us-gaap:LeaseholdImprovementsMembersrt:MaximumMember2022-01-012022-12-31grnd:reporting_unit0001820144us-gaap:SoftwareDevelopmentMember2022-01-012022-12-310001820144grnd:SubscriptionTermPeriodOneMember2022-01-012022-12-310001820144grnd:SubscriptionTermPeriodTwoMember2022-01-012022-12-310001820144grnd:SubscriptionTermPeriodThreeMember2022-01-012022-12-310001820144grnd:SubscriptionTermPeriodFourMember2022-01-012022-12-310001820144us-gaap:AccountsReceivableMembergrnd:MobileAppStore1Memberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-31xbrli:pure0001820144us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembergrnd:MobileAppStore2Member2022-01-012022-12-310001820144us-gaap:AccountsReceivableMembergrnd:MobileAppStore1Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001820144us-gaap:AccountsReceivableMemberus-gaap:CustomerConcentrationRiskMembergrnd:MobileAppStore2Member2021-01-012021-12-310001820144srt:MinimumMember2022-01-012022-12-310001820144srt:MaximumMember2022-01-012022-12-3100018201442021-01-010001820144us-gaap:LicenseAndServiceMember2022-01-012022-12-310001820144us-gaap:LicenseAndServiceMember2021-01-012021-12-310001820144us-gaap:AdvertisingMember2022-01-012022-12-310001820144us-gaap:AdvertisingMember2021-01-012021-12-310001820144country:US2022-01-012022-12-310001820144country:US2021-01-012021-12-310001820144country:GB2022-01-012022-12-310001820144country:GB2021-01-012021-12-310001820144grnd:OtherCountriesMember2022-01-012022-12-310001820144grnd:OtherCountriesMember2021-01-012021-12-310001820144us-gaap:EmployeeStockOptionMember2022-01-012022-12-310001820144grnd:CostOfGoodsAndServicesVendor1Memberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2022-01-012022-12-310001820144grnd:CostOfGoodsAndServicesVendor2Memberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2022-01-012022-12-310001820144us-gaap:SupplierConcentrationRiskMembergrnd:CostOfGoodsAndServicesVendor3Memberus-gaap:CostOfGoodsTotalMember2022-01-012022-12-310001820144grnd:CostOfGoodsAndServicesVendor1Memberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2021-01-012021-12-310001820144grnd:CostOfGoodsAndServicesVendor2Memberus-gaap:SupplierConcentrationRiskMemberus-gaap:CostOfGoodsTotalMember2021-01-012021-12-310001820144us-gaap:SupplierConcentrationRiskMembergrnd:CostOfGoodsAndServicesVendor3Memberus-gaap:CostOfGoodsTotalMember2021-01-012021-12-310001820144us-gaap:AccountsReceivableMembergrnd:AccountsReceivableCustomer1Memberus-gaap:CustomerConcentrationRiskMember2022-01-012022-12-310001820144us-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMembergrnd:AccountsPayableVendor1Member2022-01-012022-12-310001820144grnd:AccountsPayableVendor2Memberus-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMember2022-01-012022-12-310001820144us-gaap:AccountsPayableMembergrnd:AccountsPayableVendor3Memberus-gaap:SupplierConcentrationRiskMember2022-01-012022-12-310001820144us-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMembergrnd:AccountsPayableVendor4Member2022-01-012022-12-310001820144us-gaap:AccountsReceivableMembergrnd:AccountsReceivableCustomer1Memberus-gaap:CustomerConcentrationRiskMember2021-01-012021-12-310001820144us-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMembergrnd:AccountsPayableVendor1Member2021-01-012021-12-310001820144grnd:AccountsPayableVendor2Memberus-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMember2021-01-012021-12-310001820144us-gaap:AccountsPayableMembergrnd:AccountsPayableVendor3Memberus-gaap:SupplierConcentrationRiskMember2021-01-012021-12-310001820144us-gaap:AccountsPayableMemberus-gaap:SupplierConcentrationRiskMembergrnd:AccountsPayableVendor4Member2021-01-012021-12-3100018201442022-01-010001820144grnd:TigaMember2022-11-170001820144grnd:TigaMember2022-11-172022-11-170001820144grnd:GrindrCommonShareholdersMember2022-11-172022-11-1700018201442022-11-170001820144grnd:GrindrCommonShareholdersMember2022-11-170001820144grnd:LegacyGrindrMember2022-11-180001820144us-gaap:CommonStockMember2022-11-182022-11-180001820144grnd:SponsorMember2022-11-180001820144us-gaap:CommonStockMembergrnd:SponsorMember2022-11-180001820144grnd:IndependentDirectorsMember2022-11-1800018201442022-11-180001820144grnd:TigaMember2022-11-182022-11-180001820144grnd:TigaMember2022-11-180001820144grnd:SVParentMember2022-11-182022-11-1800018201442022-11-182022-11-180001820144grnd:FounderSharesMember2022-11-182022-11-180001820144grnd:LegacyGrindrMember2022-11-182022-11-180001820144grnd:SanVicenteEntitiesMember2020-01-012020-12-310001820144grnd:SeriesXOrdinaryUnitsMember2022-11-230001820144grnd:PromissoryNoteMember2022-11-150001820144grnd:GroupHoldingsMembergrnd:PromissoryNoteMember2022-11-150001820144grnd:SanVincenteEquityJointVentureLLCMembergrnd:PromissoryNoteMember2022-11-150001820144grnd:PromissoryNoteMember2022-11-1400018201442022-11-142022-11-140001820144grnd:SVCaymanMembergrnd:LegacyGrindrMember2022-11-152022-11-150001820144grnd:SVCaymanMembergrnd:LegacyGrindrMember2022-11-150001820144grnd:SVCaymanMemberus-gaap:CommonStockMember2022-11-180001820144grnd:SVCaymanMembergrnd:ForwardPurchaseWarrantsMember2022-11-180001820144us-gaap:ComputerEquipmentMember2022-12-310001820144us-gaap:ComputerEquipmentMember2021-12-310001820144us-gaap:FurnitureAndFixturesMember2022-12-310001820144us-gaap:FurnitureAndFixturesMember2021-12-310001820144us-gaap:LeaseholdImprovementsMember2022-12-310001820144us-gaap:LeaseholdImprovementsMember2021-12-310001820144us-gaap:TradeNamesMember2021-12-310001820144us-gaap:TradeNamesMember2022-12-310001820144us-gaap:CustomerRelationshipsMember2022-12-310001820144us-gaap:CustomerRelationshipsMember2022-01-012022-12-310001820144us-gaap:TechnologyBasedIntangibleAssetsMember2022-12-310001820144us-gaap:TechnologyBasedIntangibleAssetsMember2022-01-012022-12-310001820144us-gaap:CustomerRelationshipsMember2021-12-310001820144us-gaap:CustomerRelationshipsMember2021-01-012021-12-310001820144us-gaap:TechnologyBasedIntangibleAssetsMember2021-12-310001820144us-gaap:TechnologyBasedIntangibleAssetsMember2021-01-012021-12-310001820144us-gaap:DomesticCountryMember2022-12-310001820144us-gaap:StateAndLocalJurisdictionMember2022-12-310001820144us-gaap:StateAndLocalJurisdictionMember2021-12-310001820144grnd:CatapultGPIIMembergrnd:LegacyGrindrMember2021-04-272021-04-270001820144grnd:CatapultGPIIMember2022-11-182022-11-180001820144grnd:PromissoryNoteMember2021-04-270001820144grnd:PromissoryNoteMember2021-04-272021-04-270001820144grnd:PromissoryNoteMember2022-12-310001820144grnd:PromissoryNoteMember2021-12-310001820144grnd:CreditAgreementMemberus-gaap:LineOfCreditMember2020-06-100001820144grnd:CreditAgreementMemberus-gaap:LineOfCreditMember2022-06-102022-06-100001820144grnd:CreditAgreementMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001820144grnd:CreditAgreementMemberus-gaap:LineOfCreditMember2021-01-012021-12-310001820144grnd:CreditAgreementMemberus-gaap:LineOfCreditMember2020-06-102020-06-100001820144grnd:IndexRateMembergrnd:CreditAgreementMemberus-gaap:LineOfCreditMember2020-06-102020-06-100001820144grnd:SecuredOvernightFinancingRateSOFRMembergrnd:CreditAgreementMemberus-gaap:LineOfCreditMember2020-06-102020-06-100001820144grnd:SupplementalFacilityIIMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-11-140001820144grnd:IndexRateMembergrnd:SupplementalFacilityIIMemberus-gaap:LineOfCreditMember2020-06-102020-06-100001820144grnd:SupplementalFacilityIIMembergrnd:SecuredOvernightFinancingRateSOFRMemberus-gaap:LineOfCreditMember2020-06-102020-06-100001820144grnd:SecuredOvernightFinancingRateSOFRMembergrnd:CreditAgreementMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001820144grnd:SecuredOvernightFinancingRateSOFRMembergrnd:CreditAgreementMemberus-gaap:LineOfCreditMember2021-01-012021-12-310001820144us-gaap:InterestExpenseMembergrnd:CreditAgreementMemberus-gaap:LineOfCreditMember2021-12-310001820144grnd:CreditAgreementSecondAmdendmentMemberus-gaap:LineOfCreditMember2022-06-130001820144grnd:CreditAgreementSecondAmdendmentMemberus-gaap:LineOfCreditMember2022-01-012022-12-310001820144grnd:SupplementalFacilityIMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-11-140001820144grnd:SupplementalFacilityIMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-11-142022-11-140001820144grnd:SupplementalFacilityIIMemberus-gaap:SecuredDebtMemberus-gaap:LineOfCreditMember2022-11-142022-11-140001820144grnd:DebtCovenantPeriodOneMember2022-06-102022-06-100001820144grnd:DebtCovenantPeriodTwoMember2022-06-102022-06-100001820144grnd:DebtCovenantPeriodThreeMember2022-06-102022-06-100001820144grnd:CreditAgreementMemberus-gaap:LineOfCreditMember2022-12-310001820144grnd:CreditAgreementMemberus-gaap:LineOfCreditMember2021-12-310001820144grnd:PaycheckProtectionProgramLoanCARESActMember2020-04-240001820144grnd:PaycheckProtectionProgramLoanCARESActMember2021-10-012021-10-310001820144grnd:SeriesXOrdinaryUnitsMember2022-06-102022-06-100001820144grnd:SeriesXOrdinaryUnitsMember2022-06-1000018201442022-06-102022-06-100001820144grnd:SeriesXOrdinaryUnitsMembergrnd:LegacyGrindrMember2022-11-140001820144grnd:PromissoryNoteMembergrnd:SecondDistributionMember2022-11-140001820144grnd:PromissoryNoteMembergrnd:SecondDistributionMember2022-11-142022-11-140001820144grnd:GroupHoldingsMembergrnd:PromissoryNoteMember2022-11-140001820144grnd:SanVicenteEntitiesMembergrnd:PromissoryNoteMember2022-11-140001820144grnd:CatapultGPIIMember2022-11-142022-11-14grnd:lease00018201442018-11-012018-11-3000018201442022-10-152022-10-150001820144grnd:DatatilsynetMember2020-01-31grnd:complaint0001820144grnd:DatatilsynetMember2021-01-012021-01-31iso4217:NOK00018201442021-10-112021-10-110001820144grnd:DatatilsynetMember2021-12-012021-12-3100018201442022-11-1400018201442020-11-012020-11-300001820144grnd:PrivateWarrantsMembergrnd:TigaMembergrnd:SponsorMember2020-11-240001820144grnd:PublicWarrantsMembergrnd:TigaMember2020-11-240001820144grnd:PublicWarrantsMember2022-11-180001820144grnd:PrivateWarrantsMember2022-11-180001820144grnd:ForwardPurchaseWarrantsMember2022-11-180001820144grnd:BackstopWarrantsMember2022-11-180001820144grnd:PublicWarrantsMember2022-11-182022-11-180001820144grnd:ClassOfWarrantOrRightCommonStockPricePerShareOneMember2022-11-182022-11-180001820144grnd:ClassOfWarrantOrRightCommonStockPricePerShareOneMember2022-11-180001820144grnd:ClassOfWarrantOrRightCommonStockPricePerShareTwoMember2022-11-182022-11-180001820144grnd:ClassOfWarrantOrRightCommonStockPricePerShareTwoMember2022-11-180001820144grnd:PrivateWarrantsMember2022-11-182022-11-1800018201442022-11-192022-12-310001820144grnd:A2022EquityIncentivePlanMember2020-08-130001820144grnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-12-310001820144grnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144us-gaap:ShareBasedCompensationAwardTrancheOneMembergrnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-31grnd:vestingInstallment0001820144us-gaap:ShareBasedCompensationAwardTrancheTwoMembergrnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144grnd:ShareBasedPaymentArrangementTrancheNineMembergrnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144us-gaap:ShareBasedCompensationAwardTrancheThreeMembergrnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144grnd:ShareBasedPaymentArrangementTrancheSevenMembergrnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144grnd:ShareBasedPaymentArrangementTrancheSixMembergrnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144grnd:ShareBasedPaymentArrangementTrancheEightMembergrnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144grnd:ShareBasedPaymentArrangementTrancheFiveMembergrnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144grnd:ShareBasedPaymentArrangementTrancheFourMembergrnd:RestrictedStockUnitsTimeBasedAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144grnd:RestrictedStockUnitsMarketConditionAwardsMembersrt:ChiefExecutiveOfficerMember2022-01-012022-12-310001820144srt:ChiefFinancialOfficerMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-12-310001820144srt:ChiefFinancialOfficerMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144us-gaap:ShareBasedCompensationAwardTrancheTwoMembersrt:ChiefFinancialOfficerMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144srt:ChiefFinancialOfficerMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144srt:ChiefFinancialOfficerMembergrnd:ShareBasedPaymentArrangementTrancheFourMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144us-gaap:ShareBasedCompensationAwardTrancheOneMembersrt:ChiefFinancialOfficerMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144grnd:ShareBasedPaymentArrangementTrancheFiveMembersrt:ChiefFinancialOfficerMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144srt:ChiefFinancialOfficerMembergrnd:RestrictedStockUnitsMarketConditionAwardsMember2022-01-012022-12-310001820144grnd:RestrictedStockUnitsMarketConditionAwardsMember2022-12-310001820144grnd:RestrictedStockUnitsMarketConditionAwardsMember2022-01-012022-12-310001820144srt:DirectorMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144srt:DirectorMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144srt:DirectorMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144grnd:EmployeeMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144grnd:EmployeeMembergrnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144us-gaap:RestrictedStockUnitsRSUMember2021-12-310001820144us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001820144us-gaap:RestrictedStockUnitsRSUMember2022-12-310001820144grnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2020-08-130001820144grnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2022-12-310001820144grnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2021-12-310001820144us-gaap:EmployeeStockOptionMemberus-gaap:ShareBasedCompensationAwardTrancheOneMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2022-01-012022-12-310001820144us-gaap:EmployeeStockOptionMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2022-01-012022-12-310001820144us-gaap:EmployeeStockOptionMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2021-01-012021-12-310001820144us-gaap:EmployeeStockOptionMembersrt:MinimumMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2022-01-012022-12-310001820144us-gaap:EmployeeStockOptionMembersrt:MaximumMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2022-01-012022-12-310001820144us-gaap:EmployeeStockOptionMembersrt:MinimumMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2021-01-012021-12-310001820144us-gaap:EmployeeStockOptionMembersrt:MaximumMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2021-01-012021-12-310001820144us-gaap:EmployeeStockOptionMembersrt:MinimumMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2022-12-310001820144us-gaap:EmployeeStockOptionMembersrt:MaximumMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2022-12-310001820144us-gaap:EmployeeStockOptionMembersrt:MaximumMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2021-12-310001820144us-gaap:EmployeeStockOptionMembersrt:MinimumMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2021-12-310001820144srt:ScenarioPreviouslyReportedMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2020-12-310001820144srt:ScenarioPreviouslyReportedMembergrnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2020-01-012020-12-310001820144grnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMembersrt:RestatementAdjustmentMember2020-12-310001820144grnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2020-12-310001820144grnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2020-01-012020-12-310001820144grnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2021-01-012021-12-310001820144grnd:A2020EquityIncentivePlanMembergrnd:LegacyGrindrMember2022-01-012022-12-310001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2020-06-102020-06-10grnd:target0001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2020-06-102020-06-100001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2020-06-102020-06-100001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:PerformanceSharesMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembergrnd:CatapultGoliathMember2020-06-102020-06-100001820144grnd:SanVincenteEquityJointVentureLLCMembergrnd:ShareBasedPaymentArrangementTrancheFourMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2020-06-102020-06-100001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2021-01-012021-12-310001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2021-12-310001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2022-05-092022-05-090001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2022-05-092022-05-090001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:PerformanceSharesMemberus-gaap:ShareBasedCompensationAwardTrancheThreeMembergrnd:CatapultGoliathMember2022-05-092022-05-090001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2022-05-090001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:ShareBasedCompensationAwardTrancheOneMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2022-01-012022-12-310001820144grnd:SanVincenteEquityJointVentureLLCMemberus-gaap:ShareBasedCompensationAwardTrancheTwoMemberus-gaap:PerformanceSharesMembergrnd:CatapultGoliathMember2022-05-090001820144grnd:CatapultGoliathMember2022-11-182022-11-180001820144us-gaap:PerformanceSharesMembergrnd:LegacyGrindrMember2022-01-012022-12-310001820144us-gaap:PerformanceSharesMembergrnd:LegacyGrindrMember2021-01-012021-12-310001820144grnd:A2016PlanMembergrnd:LegacyGrindrMember2022-06-012022-06-300001820144grnd:A2016PlanMembergrnd:LegacyGrindrMember2022-12-012022-12-310001820144grnd:A2016PlanMembergrnd:LegacyGrindrMember2022-01-012022-12-310001820144grnd:A2016PlanMembergrnd:LegacyGrindrMember2022-12-310001820144grnd:A2016PlanMembergrnd:LegacyGrindrMember2021-12-310001820144srt:DirectorMembergrnd:LegacyGrindrMember2020-06-112020-06-110001820144srt:DirectorMembergrnd:LegacyGrindrMember2022-12-310001820144srt:DirectorMembergrnd:LegacyGrindrMember2021-12-310001820144us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001820144us-gaap:SellingGeneralAndAdministrativeExpensesMember2021-01-012021-12-310001820144us-gaap:ResearchAndDevelopmentExpenseMember2022-01-012022-12-310001820144us-gaap:ResearchAndDevelopmentExpenseMember2021-01-012021-12-310001820144us-gaap:MoneyMarketFundsMember2022-12-310001820144us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2022-12-310001820144us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2022-12-310001820144us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2022-12-310001820144us-gaap:FairValueInputsLevel1Member2022-12-310001820144us-gaap:FairValueInputsLevel2Member2022-12-310001820144us-gaap:FairValueInputsLevel3Member2022-12-310001820144us-gaap:MoneyMarketFundsMember2021-12-310001820144us-gaap:MoneyMarketFundsMemberus-gaap:FairValueInputsLevel1Member2021-12-310001820144us-gaap:FairValueInputsLevel2Memberus-gaap:MoneyMarketFundsMember2021-12-310001820144us-gaap:FairValueInputsLevel3Memberus-gaap:MoneyMarketFundsMember2021-12-310001820144us-gaap:FairValueInputsLevel1Member2021-12-310001820144us-gaap:FairValueInputsLevel2Member2021-12-310001820144us-gaap:FairValueInputsLevel3Member2021-12-310001820144grnd:PublicWarrantsMember2021-12-310001820144grnd:PrivateWarrantsMember2021-12-310001820144grnd:PublicWarrantsMember2022-01-012022-12-310001820144grnd:PrivateWarrantsMember2022-01-012022-12-310001820144grnd:PublicWarrantsMember2022-12-310001820144grnd:PrivateWarrantsMember2022-12-310001820144us-gaap:EmployeeStockOptionMember2021-01-012021-12-310001820144grnd:RestrictedStockUnitsTimeBasedAwardsMember2022-01-012022-12-310001820144grnd:RestrictedStockUnitsTimeBasedAwardsMember2021-01-012021-12-310001820144us-gaap:StockCompensationPlanMember2022-01-012022-12-310001820144us-gaap:StockCompensationPlanMember2021-01-012021-12-310001820144us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-12-310001820144us-gaap:RestrictedStockUnitsRSUMember2021-01-012021-12-310001820144us-gaap:WarrantMember2022-01-012022-12-310001820144us-gaap:WarrantMember2021-01-012021-12-31grnd:individual0001820144us-gaap:SubsequentEventMember2023-01-012023-01-310001820144us-gaap:SubsequentEventMember2023-02-012023-02-280001820144us-gaap:SubsequentEventMember2023-03-012023-03-170001820144us-gaap:SubsequentEventMember2023-01-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________

FORM 10-K

________________________

(Mark One)

|

|

|

|

|

|

x |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2022

OR

|

|

|

|

|

|

o |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission file number 001-39714

________________________

Grindr Inc.

(Exact name of registrant as specified in its charter)

________________________

|

|

|

|

|

|

|

|

|

| Delaware |

|

92-1079067 |

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

PO Box 69176750 N. San Vincente Blvd., Suite RE 1400

West Hollywood, California

|

|

90069 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(310) 776-6680

Registrant's telephone number, including area code

______________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, $0.0001 par value per share |

GRND |

New York Stock Exchange |

| Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share |

GRND.WS |

New York Stock Exchange |

Securities registered pursuant to section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act.

Yes o No x

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act.

Yes o No x

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes x No ☐

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☐ |

| Non-accelerated filer |

x |

Smaller reporting company |

x |

|

|

Emerging growth company |

x |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. o

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No x

The aggregate market value of voting stock held by non-affiliates of the Registrant on June 30, 2022, based on the closing price of $10.27 for shares of the Registrant’s Common Stock as reported by the New York Stock Exchange, was approximately $283,452,000. Shares of Common Stock beneficially owned by each executive officer, director, and holder of more than 10% of our common stock have been excluded in that such persons may be deemed to be affiliates. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

The registrant had outstanding 173,745,032 shares of common stock as of March 14, 2023.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the Registrant’s Proxy Statement for the 2023 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such Proxy Statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2022.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

Page |

| Special Note Regarding Forward-Looking Statements |

2 |

| Summary of Risk Factors |

4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

INTRODUCTORY NOTE

Grindr Inc., formerly known as Tiga Acquisition Corp. (“Tiga”), was originally incorporated under the Companies Law of the Cayman Islands on July 27, 2020, as a special purpose acquisition company formed for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or other similar business combination with one or more target businesses or entities. On November 18, 2022, we consummated the transactions contemplated by that certain Agreement and Plan of Merger, dated as of May 9, 2022 (the “Original Merger Agreement”) by and among Tiga, Grindr Group LLC, a Delaware limited liability company (“Legacy Grindr”), Tiga Merger Sub I LLC, a Delaware limited liability company and direct and wholly-owned subsidiary of Tiga (“Tiga Merger Sub”), and Tiga Merger Sub II LLC, a Delaware limited liability company and direct and wholly-owned subsidiary of Tiga (“Tiga Merger Sub II”), as amended by that certain First Amendment to Agreement and Plan of Merger, dated as of October 5, 2022, by and among Tiga, Tiga Merger Sub, Legacy Grindr and Tiga Merger Sub II (together with the Original Merger Agreement, the “Merger Agreement”). Pursuant to the terms of the Merger Agreement, we effected a business combination with Legacy Grindr through, among other transactions, (i) the merger of Tiga Merger Sub I with and into Legacy Grindr, with Legacy Grindr as the surviving entity (the “First Merger”), and promptly thereafter and as part of the same overall transaction as the First Merger, (ii) the merger of Legacy Grindr with and into Tiga Merger Sub II (the “Second Merger”), with Tiga Merger Sub II surviving the Second Merger as a wholly owned subsidiary of Tiga. We refer to the First Merger and the Second Merger and, collectively with the other transactions described in the Merger Agreement, as the “Business Combination.” In connection with the closing of the Business Combination, we changed our name to Grindr Inc.

Unless the context indicates otherwise, references in this Annual Report on Form 10-K to the “Company,” “Grindr,” “we,” “us,” “our” and similar terms refer to Grindr Inc. (f/k/a Tiga Acquisition Corp.) and its consolidated subsidiaries (including Legacy Grindr). References to “Tiga” refer to the predecessor company prior to the consummation of the Business Combination.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Some of the statements contained in this Annual Report on Form 10-K constitute forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. These forward-looking statements include statements regarding our intentions, beliefs and current expectations and projections concerning, among other things, results of operations, financial condition, liquidity, prospects, growth, strategies and the markets in which we operate. In some cases, you can identify these forward-looking statements by the use of terminology such as “outlook,” “believes,” “expects,” “potential,” “continues,” “may,” “will,” “should,” “could,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates” or the negative version of these words or other comparable words or phrases.

The forward-looking statements contained in this Annual Report on Form 10-K reflect our current views about the our business and future events and are subject to numerous known and unknown risks, uncertainties, assumptions and changes in circumstances that may cause its actual results to differ significantly from those expressed in any forward-looking statement. There are no guarantees that the transactions and events described will happen as described (or that they will happen at all). The following factors, among others, could cause actual results and future events to differ materially from those set forth or contemplated in the forward-looking statements:

•the success in retaining or recruiting, or changes required in, our directors, officers or key employees;

•the impact of the regulatory environment and complexities with compliance related to such environment, including maintaining compliance with privacy and data protection laws and regulations;

•the ability to respond to general economic conditions;

•factors relating to our and our subsidiaries’ business, operations and financial performance, including:

◦competition in the dating and social networking products and services industry;

◦the ability to maintain and attract users;

◦fluctuation in quarterly and yearly results;

◦the ability to adapt to changes in technology and user preferences in a timely and cost-effective manner;

◦the ability to protect systems and infrastructures from cyber-attacks and prevent unauthorized data access;

◦the dependence on the integrity of third-party systems and infrastructure; and

◦the ability to protect our intellectual property rights from unauthorized use by third parties.

•whether the concentration of our stock ownership and voting power limits our stockholders’ ability to influence corporate matters;

•the effects of the ongoing coronavirus (“COVID-19”) pandemic, the 2022 mpox outbreak, or other infectious diseases, health epidemics, pandemics and natural disasters on our business;

•the ability to maintain the listing of our common stock and public warrants on the New York Stock Exchange (“NYSE”); and

•the increasingly competitive environment in which we operate.

In addition, statements that “Grindr believes” or “we believe” and similar statements reflect our beliefs and opinions on the relevant subjects. These statements are based upon information available to us as of the date of this Annual Report on Form 10-K, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and such statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

While forward-looking statements reflect our good faith beliefs, they are not guarantees of future performance. Except to the extent required by applicable law, we are under no obligation (and expressly disclaim any such obligation) to update or revise our forward-looking statements whether as a result of new information, future events, or otherwise. For a further discussion of these and other factors that could cause our future results, performance or transactions to differ significantly from those expressed in any forward-looking statement, please see the section titled “Risk Factors.” You should not place undue reliance on any forward-looking statements, which are based only on information currently available to us (or to third parties making the forward-looking statements).

Summary of Risk Factors

The following is a summary of some of the risks and uncertainties that could materially adversely affect our business, financial condition and results of operations. This summary should be read together with the more detailed description of each risk factor disclosed under “Item 1A Risk Factors” contained in Part I of this Annual Report on Form 10-K.

Risks Related to our Brand, Products and Services, and Operations

•Our business depends on the strength and market perception of the Grindr brand.

•Changes to our existing products and services, or the development and introduction of new products and services, could fail to attract or retain users or generate revenue and profits.

•If we fail to retain existing users or add new users, or if our users decrease their level of engagement with our products and services or do not convert to paying users, our revenue, financial results and business may be significantly harmed.

•Inappropriate actions by certain of our users could be attributed to us and damage our brand or reputation, or subject us to regulatory inquiries, legal action, or other liabilities, which, in turn, could materially adversely affect our business.

•Unfavorable media coverage could materially and adversely affect our business, brand, or reputation.

•The online social networking industry in which we operate is highly competitive, and if we cannot compete effectively our business will suffer.

•Our quarterly operating results and other operating metrics may fluctuate from quarter to quarter, which makes these metrics difficult to predict.

•The distribution, marketing of, and access to our products and services depend, in large part, on third-party platforms and mobile application stores, among other third-party providers.

•Privacy concerns relating to our products and services and the use of user information could negatively impact our user base or user engagement, which could have a material and adverse effect on our business, financial condition, and results of operations.

•We rely primarily on the Apple App Store and Google Play Store as the channels for processing of payments. Any deterioration in our relationship with Apple, Google or other such third parties may negatively impact our business.

•Adverse social and political environments for the LGBTQ community in certain parts of the world, including actions by governments or other groups, could limit our geographic reach, business expansion, and user growth, any of which could materially and adversely affect our business, financial condition, and results of operation.

Risks Related to Information Technology Systems and Intellectual Property

•Security breaches, unauthorized access to or disclosure of our data or user data, or other data security incidents could expose us to liability, which could harm our reputation, generate negative publicity, and materially and adversely affect our business.

•Our success depends, in part, on the integrity of our information technology systems and infrastructures and on our ability to enhance, expand, and adapt these systems and infrastructures in a timely and cost-effective manner.

Risks Related to Regulation and Litigation

•We have identified a material weakness in our internal control over financial reporting which, if not corrected, could affect the reliability of our consolidated financial statements, and have other adverse consequences.

•Our success depends, in part, on our ability to access, collect, and use personal data about our users and to comply with applicable privacy and data protection laws and industry best practices.

•Investments in our business may be subject to U.S. foreign investment regulations.

•Our business is subject to complex and evolving U.S. and international laws and regulations

•The varying and rapidly evolving regulatory framework on privacy and data protection across jurisdictions could result in claims, changes to our business practices, monetary penalties, increased cost of operations, or declines in user growth or engagement, or otherwise harm our business.

•We are subject to litigation, regulatory and other government investigations, and adverse outcomes in such proceedings could have a materially adverse effect on our business, financial condition, and results of operation.

•Activities of our users or content made available by such users could subject us to liability.

Risks Related to Our Indebtedness

•Our indebtedness could materially adversely affect our financial condition, our ability to raise additional capital to fund our operations, and operate our business.

Risks Related to Ownership of our Securities

•We have a limited operating history and, as a result, our past results may not be indicative of future operating performance.

•Our reported financial results may be adversely affected by changes in accounting principles generally accepted in the United States.

•There is no guarantee that our warrants will be in the money at the time they become exercisable, and they may expire worthless.

•The requirements of being a public company may strain our resources, divert management’s attention and affect our ability to attract and retain executive management and qualified board members.

•We have incurred and expect to continue to incur significantly increased costs and devote substantial management time as a result of operating as a public company.

•We may be unable to maintain the listing of our securities on NYSE.

•The price of our securities may be volatile.

•Future resales of our Common Stock and/or Warrants may cause the market price of our securities to drop significantly, even if our business is doing well.

•Sales of our Common Stock and/or Warrants or the perception of such sales, by us or by significant stockholders could cause the market price for our securities to decline.

•We may be subject to securities litigation, which is expensive and could divert management attention.

•Reports published by analysts or the ceasing of publication of research or reports about us could adversely affect the price and trading volume of our securities.

•We do not intend to pay cash dividends for the foreseeable future.

General Risk Factors

•A downturn in the global economy or other adverse macroeconomic disruptions, including as a result of bank failures, especially in the U.S. and Europe, where a substantial majority of our revenue is generated could adversely harm our business.

•Our employees could engage in misconduct that materially adversely affects us.

PART I

Item 1. Business

Our Mission

Connect LGBTQ people with one another and the world.

Our Company

We are the world’s largest social network focused on the LGBTQ community with approximately 12.2 million monthly active users (“MAUs”) and approximately 788 thousand Paying Users (as defined below) in 2022. Our Paying Users were over 788 and 601 thousand for the years ended December 31, 2022 and December 31, 2021, respectively. According to the Frost & Sullivan Study commissioned by Grindr, we are the largest and most popular gay mobile app in the world, with more MAUs than other LGBTQ social networking applications. We enable our users to find and engage with each other, share content and experiences, and generally express themselves. We are a pioneer and leading influence on the lifestyle trends and discourse among the global LGBTQ community. We are devoted to providing a platform for social interactions for this vibrant community and to cultivating a safe and accepting environment where all are welcome and feel a sense of belonging. As a result, our platform has become a meaningful part of our users’ social lives and has embedded us at the center of the community as the preferred channel for broadening their connections and engaging with like-minded individuals within the LGBTQ community.

We believe Grindr fulfills crucial needs for the LGBTQ community. While the broader global landscape of social networks is highly competitive with many different platforms, there are few global platforms that focus solely on the LGBTQ community and addressing their unique needs, including LGBTQ centric social activities or heightened privacy. For many years and still even today, people from the LGBTQ community are often discriminated against, marginalized, and targeted. Few global platforms exist where these individuals can truly be their authentic selves and feel safe to express themselves freely. As a result, the queer community often have a difficult time finding other members of the community with similar interests, beliefs, or values. This experience can be isolating and disheartening.

Our platform enables the LGBTQ community to connect with each other and the world. Our platform has many distinct user segments—a diverse set of queer genders and sexualities, varied ages and demographics, various sub-communities, private and discreet users, and urban and rural users. Our users also have a range of motivations and use cases. Our platform helps our users find what they are looking for: casual dating, relationships and love, community and friendships, travel information, local and discovery, and beyond. By facilitating the connection of our users around the world, we believe we have the potential to help our community find each other and interact, advance global LGBTQ rights, and make the world a safer place for all LGBTQ people.

Our core product, the Grindr App, has become an integral part of the daily lives of millions of members of the LGBTQ community around the world, enabling them to discover and connect with each other effortlessly and anytime. The Grindr App offers a variety of location-based social features and functions, including identity expression (profile, photos, presence), connection (search, filters, the Cascade, Viewed Me), interaction (chat, media sharing), trust and safety tools across the experience, and subscriptions for premium features offering more access and control. Since our inception in 2009, we have continued to innovate our technologies to improve the Grindr app, adding new features and safety elements, which has allowed us to increase our MAUs and other metrics over the years. The Grindr App has MAUs in over 190 countries and territories, including developed markets such as the United States, the U.K., France, Spain, and Canada, and emerging markets such as Brazil, Mexico, India, Chile, and the Philippines, creating a high barrier to entry for our competitors.

We have attracted a highly engaged, and rapidly growing user base, as evidenced by the following:

•Approximately 12.2 million MAUs in 2022.

•Approximately 788 thousand Paying Users in 2022. Our Paying Users increased by 31.0% in 2022, as compared to 2021.

•MAUs in over 190 countries and territories in the world as of December 31, 2022.

•21 supported languages on Android and 9 on iOS as of December 31, 2022.

•On average, users on our platform sent over 308 million daily messages in 2022.

•Our profiles spent an average of 58 minutes per day each on the Grindr App in December 2022, which ranks us number one among apps focused on the LGBTQ community, according to the Frost & Sullivan Study commissioned by Grindr.

Our largest markets are currently North America and Europe, from which we derived 86.9% of our total revenue for the year ended December 31, 2022. After North America and Europe, Asia-Pacific makes up an additional 6.1% of our total revenue, and the remaining 4.6% and 2.4% are from other regions, including Latin America (comprising Central America and South America) and Australia, respectively, for the year ended December 31, 2022.

Our target market is the worldwide LGBTQ community, which comprises more than 538.4 million people globally that self-identify as LGBTQ and represented approximately 6.9% of the total global population as of December 31, 2021, according to the Frost & Sullivan Study commissioned by Grindr. With the progression of LGBTQ culture and increase in LGBTQ rights around the world, this growing and highly engaged community has had an increasingly stronger voice and has been enabled to pursue more diverse lifestyles, express its opinions, and advocate for equal rights. We are dedicated to creating value and a safe and accepting environment for the LGBTQ community.

We believe we have significant opportunities to leverage our unique brand to both broaden and deepen our market penetration and offer products and services that address the growing and changing needs of the global LGBTQ community. With this broader opportunity in mind, we have continued to expand our platform, which offers a unique combination of social networking functions, digital content, and other initiatives aimed at enriching and empowering the lives of the LGBTQ community, in the following ways:

•We help people find meaningful connections, whether it's casual dating, relationships and love, community and friendships, travel information, local and discovery, and beyond.

•Our platform builds community and friendships. Our user experience is essentially a world without walls, connecting one user to the next, allowing the community to see each other, many of whom sometimes feel unseen.

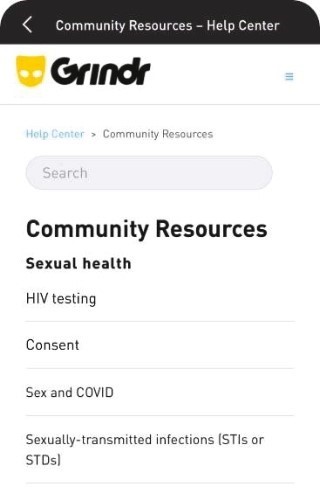

•We are advancing LGBTQ equality and safety. Our Grindr for Equality initiative, or G4E, has worked around the world for the safety and justice for the LGBTQ community. Coordinating with NGOs, governments, and nonprofits, G4E has worked to change and inform policy, increase access to vital healthcare services such as HIV testing, and bring valuable information to millions of people in over 50 languages.

•We bring empowerment through partnerships with organizations such as Aids/Lifecycle, National/Local Pride Organizations, and Voting Campaigns.

•We drive social influence with fun and engaging ways on social media channels to help the general population better understand our community, plight, and interconnectedness.

We believe our brand and logo have become mainstays of the global LGBTQ experience. According to the Morning Consult Survey, we are the best-known gay dating app among Gay, Bisexual, Transgender, and Queer people, with 85.0% brand awareness, as well as the best-known gay dating app among the general population. The strength of our brand has allowed us to grow our users virally and organically, as evidenced by the fact that our customer acquisition spend only comprised 0.3% of total revenue in 2022. This is a core feature of our business model. As our user base continues to grow worldwide, more connections are made, and our user engagement and revenue increase. These increases enable us to reinvest in our platform, building more product and safety features and, as a result, attract more users. This results in powerful network effects, driving user and revenue growth and reinforcing our brand awareness.

We currently generate revenue from two revenue streams—Direct Revenue and Indirect Revenue, both of which are driven by the Grindr app. Direct Revenue is revenue generated by our Paying Users who pay for subscriptions or add-ons to access premium features. While our app is free to use, our premium features enable our users to customize their ability to experience and use our platform. Indirect Revenue is generated by third parties who pay us for access to our users, such as advertising or partnerships. Our financial model has significant benefits and has experienced rapid revenue growth and profitability driven predominantly by organic user acquisition and the viral network effects enabled by our brand and market position.

•For the years ended December 31, 2022 and 2021, we generated:

◦Total revenue of $195.0 million and $145.8 million, respectively, representing year-over-year growth of 33.7%;

◦Net Income of $0.9 million and $5.1 million, respectively. The decrease for the year ended December 31, 2022 compared to the year ended December 31, 2021 was $(4.2) million, or (82.4)%; and

◦Adjusted EBITDA of $85.2 million and $77.1 million, respectively. The increase for the year ended December 31, 2022 compared to the year ended December 31, 2021 was $8.1 million, or 10.6%.

For a reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin to the most directly comparable GAAP financial measures, information about why we consider Adjusted EBITDA and Adjusted EBITDA Margin useful and a discussion of the material risks and limitations of these measures, see the section titled “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-GAAP Financial Measures.”

The Business Combination

Grindr's predecessor public company was originally incorporated in the Cayman Islands on September 18, 2017 under the name Tiga Acquisition Corp. (“Tiga”), a special-purpose acquisition company for the purpose of effecting a merger, capital stock exchange, asset acquisition, stock purchase, reorganization or engaging in any other similar business combination with one or more businesses or entities. Grindr was originally incorporated in February 2009 as a California limited liability company, and was subsequently held by Grindr Group LLC ("Legacy Grindr"), a Delaware limited liability company which was incorporated in April 2020.

Between November 17, 2022 and November 18, 2022, Legacy Grindr, Tiga, Tiga Merger Sub I LLC, a Delaware limited liability company and direct and wholly-owned subsidiary of Tiga (“Tiga Merger Sub”), and Tiga Merger Sub II LLC, a Delaware limited liability company and direct and wholly-owned subsidiary of Tiga, consummated the transactions contemplated by that certain Agreement and Plan of Merger, dated as of May 9, 2022 (the “Original Merger Agreement”), by and among Tiga, Legacy Grindr, Tiga Merger Sub, as amended by that certain First Amendment to Agreement and Plan of Merger, dated as of October 5, 2022, by and among Tiga, Tiga Merger Sub, Legacy Grindr and Tiga Merger Sub II (together with the Original Merger Agreement, the “Merger Agreement”), following its approval at an extraordinary general meeting of the shareholders of Tiga held on November 15, 2022. Pursuant to the terms of the Merger Agreement, a business combination of Legacy Grindr and Tiga was effected through, among other transactions, (i) the merger of Tiga Merger Sub I with and into Legacy Grindr, with Legacy Grindr as the surviving entity (the “First Merger”), and promptly thereafter and as part of the same overall transaction as the First Merger, (ii) the merger of Legacy Grindr with and into Tiga Merger Sub II (the “Second Merger”), with Tiga Merger Sub II surviving the Second Merger as a wholly owned subsidiary of Tiga. Prior to the closing of the business combination on November 18, 2022 (“Closing”), Tiga (i) changed its jurisdiction of incorporation from Cayman Islands to the State of Delaware by deregistering as an exempted company in the Cayman Islands and domesticating and continuing as a corporation incorporated under the laws of the State of Delaware and (ii) changed its name from Tiga Acquisition Corp. to Grindr Inc. (the “Business Combination”).

Unless the context indicates otherwise, references in this Annual Report to Form 10-K to the “Company,” “Grindr,” “we,” “us,” “our” and similar terms refer to Grindr, Inc. (f/k/a Tiga Acquisition Corp.) and its consolidated subsidiaries (including Legacy Grindr). References to “Tiga” refer to the predecessor company prior to Closing.

Market Overview

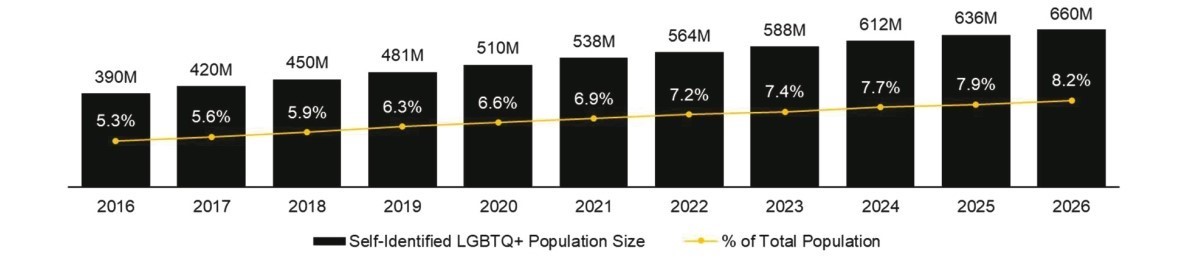

The global LGBTQ population has undergone steady growth in recent years, growing at a compound annual growth rate (“CAGR”) of 6.7% from 390.0 million in 2016 to 538.4 million in 2021, according to the Frost & Sullivan Study, which was commissioned by Grindr, of the global LGBTQ population. The Frost & Sullivan Study commissioned by Grindr estimated this growth trend will continue over the next five years, growing at a CAGR of 4.2% and reaching 659.9 million in 2026.

The global growth of the LGBTQ population is not just driven by overall population growth, but by the growing social acceptance level towards the LGBTQ community and the LGBTQ population’s willingness to express sexual orientation and gender identity. We believe increasing social acceptance of the LGBTQ community and more LGBTQ friendly political environments globally will continue to contribute to the increase in the number of people that self-identify as LGBTQ. This is evidenced by Frost & Sullivan’s estimate of the LGBTQ population’s percentage of the total population, growing from 5.3% in 2016 to 6.9% in 2021 to an estimated 8.2% by 2026. Additionally, the study also notes the LGBTQ population estimate may vary from country to country and in total, based on different cultural backgrounds, the political system of the country, economic development, and other factors.

We believe our global addressable market encompasses the entire LGBTQ population and not just LGBTQ singles, as we are a social network and our users frequently use our platform and services for more than just dating. For example, many of our users are in relationships but continue to use our app for travel or to stay connected with their friends or the broader LGBTQ community.

Estimated Self-identified LGBTQ Population and Proportion of Total Population

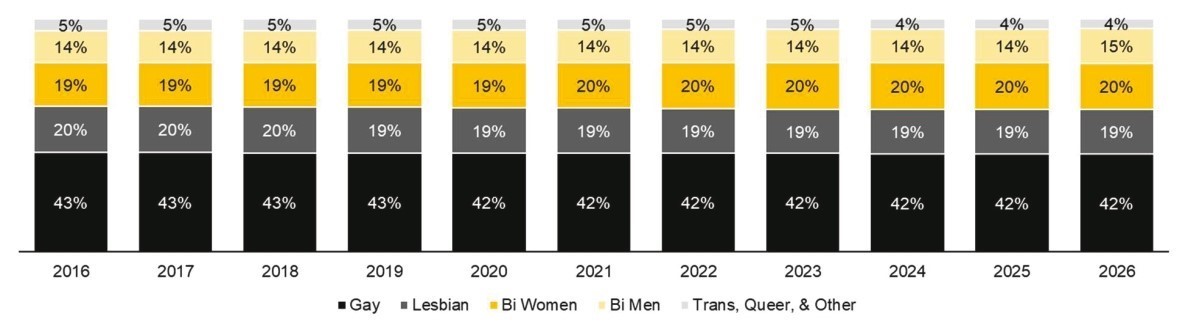

According to the Frost & Sullivan Study commissioned by Grindr, the GBTQ population make up the largest proportion of the overall LGBTQ population, comprising almost 81% of the total with 434.9 million people in 2021. The Frost & Sullivan Study commissioned by Grindr estimates the GBTQ population will continue to grow as a percentage of the overall LGBTQ population, with the percentage increasing to over 81% by 2026.

Estimated Self-Identified LGBTQ Population, Breakdown by Gender Identity

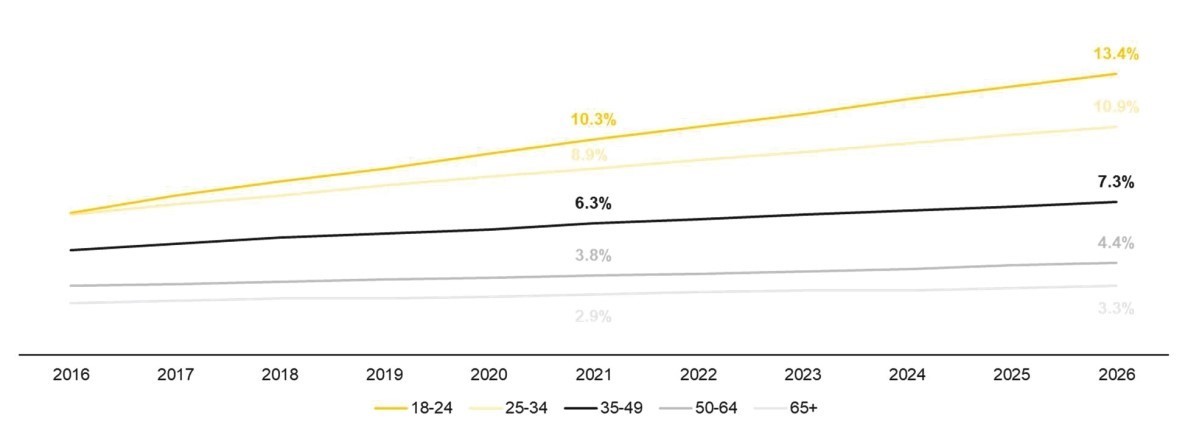

The self-identified LGBTQ population skews towards younger generations. According to the Frost & Sullivan Study commissioned by Grindr, self-identified LGBTQ 18-24 year olds are estimated at 10.3% of the total 18-24 year old global population in 2021, 25-34 year olds are estimated at 8.9%, and 35-49 year olds are estimated at 6.3%, respectively. These population percentages are expected to grow to 13.4% of the total 18-24 year old global population by 2026, 10.9% for 25-34 year olds, and 7.3% for 35-49 year olds, respectively.

Social development and rapidly changing points of view brought on by the growth of the Internet has objectively caused Gen Z, (18-24 year olds), to be exposed to more ideas, such as gender awareness and sexual orientation, earlier than previous generations in the same period. Younger generations are more gender fluid, with the definition of gender identity becoming more indistinct, blurring the boundary between the LGBTQ community and the heterosexual population. These younger generations are more likely to explore their sexuality, given more social acceptability of alternative sexual identities today and the ability to express different sexual identities.

Estimated Self-Identified LGBTQ Population Penetration Rate, Breakdown by Age Group (Medium Estimate)

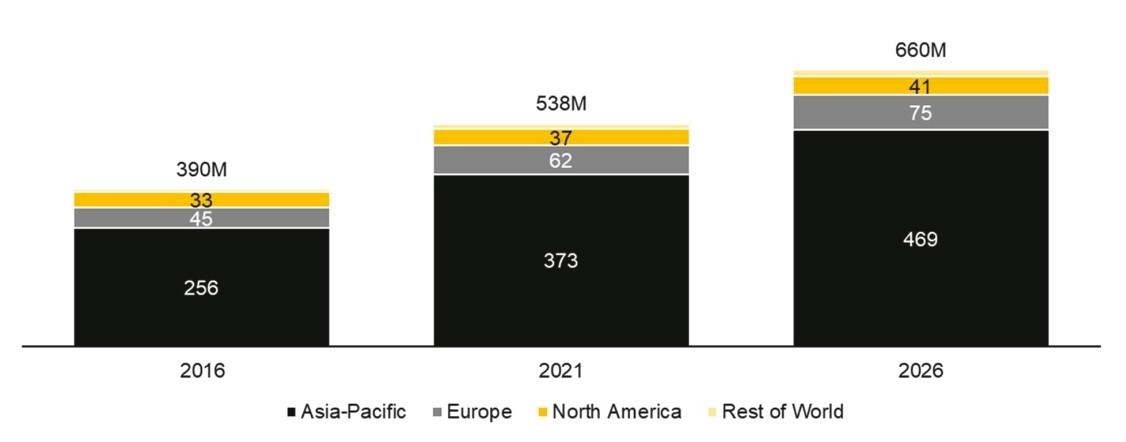

According to the Frost & Sullivan Study commissioned by Grindr, the total self-identified LGBTQ population and self-identified LGBTQ population penetration rate in most regions is expected to continue to increase over time. The self-identified LGBTQ population and penetration rate in North America will grow from 36.9 million and 9.9% in 2021 to 40.7 million and 10.7% in 2026, respectively. Europe will grow from 61.6 million and 8.2% in 2021 to 74.8 million and 10.0% in 2026, respectively. Asia will grow from 372.8 million and 8.0% in 2021 to 468.7 million and 9.6% in 2026, respectively. Latin America will grow from 56.8 million and 8.6% in 2021 to 62.1 million and 9.0% in 2026, respectively.

Estimated Self-identified LGBTQ Population, Breakdown by Region

Global LGBTQ Social Context

In recent decades, societies around the world have generally become more socially accepting of, and open to, LGBTQ culture and people, which has led to greater rights for members of the LGBTQ community. For example, the Netherlands was the first country to legalize same-sex marriage in 2000. According to various sources, as of April 2022, over 75 countries and territories have legalized same-sex marriage, including jurisdictions in every inhabited continent across the globe. Additionally, according to the ILGA World Report, same-sex sexual activities were legal in over 120 countries and territories worldwide, including all of the countries in North America and Europe and the majority of the countries in Asia and Latin America.

LGBTQ Population’s Consumption

We believe our user base represents a highly coveted demographic. According to the Frost & Sullivan Study commissioned by Grindr, data from the American Community Survey showed that same-sex couples have a higher median household income than opposite-sex couples, with male same-sex couples having the highest income. Educational attainment is an important social phenomenon, which is strongly linked to later success in terms of income, occupation, wealth, health, and life satisfaction. In the United States, male same-sex households are more likely to have at least a bachelor’s degree than opposite-sex households. In 2020, 57.5% of male same-sex households had at least a bachelor’s degree compared to 42.4% of opposite-sex households. As individuals, 55.1% of the gay and bisexual men population have at least a bachelor’s degree compared to 30.3% of the straight male population.

From a macro-level perspective, the more LGBTQ inclusion a country has, the more likely it is to be economically developed. LGBTQ inclusion and economic development are mutually reinforcing, and LGBTQ legal rights have a continued positive and statistically significant association with real GDP per capita after controlling for gender equality. Also, from the perspective of society, employers who treat LGBTQ people equally in the workplace will generally see positive business outcomes such as higher productivity of LGBTQ workers, notable improvements in health, lower costs, and a lower likelihood of employee turnover.

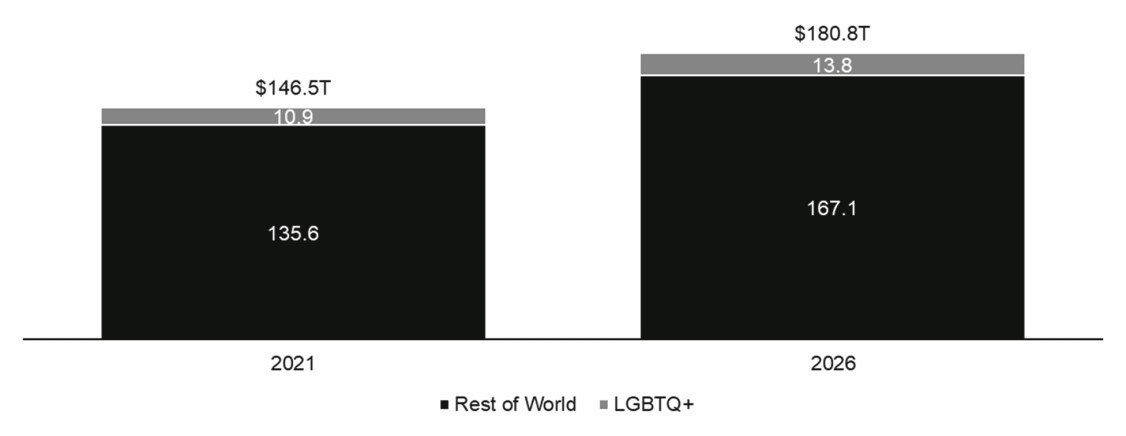

Estimated LGBTQ Population GDP at Purchasing Power Parity (“PPP”)

As the global pandemic caused by COVID-19 gradually improves, global GDP at purchasing power parity growth resumed upward trends in 2021 and experienced an estimated increase of 6.5%, according to the Frost & Sullivan Study commissioned by Grindr. Correspondingly, the estimated LGBTQ population GDP at PPP has also seen an increase, reaching $10.9 billion by the end of 2021.

GDP at PPP is the calculation of GDP taking relative costs and inflation into account.

Given this high purchasing power and economic potential, the LGBTQ community is an increasingly attractive demographic for marketers and advertisers. The scale of purchasing power associated with the LGBTQ demographic, coupled with a general interest to appeal to a younger demographic, have caused marketers to increase their focus on reaching this community. Some of the world’s largest corporations and brands have launched LGBTQ-themed or focused advertising campaigns, including Apple, Johnson & Johnson, GM, Coca-Cola, Campbell’s, American Express, Unilever, Marriott, Anheuser-Busch, and Hilton, just to name a few.

Our Products and Services

Our flagship product “Grindr,” or the Grindr App, is a mobile application with location-based connectivity features designed to help our users find one another and have meaningful interactions right here and now, or anywhere globally. The app is free to use, with premium subscription offerings for greater access to other users and control over the experience.

|

|

|

|

|

|

| Key features of our Grindr App include: |

|

Identity expression: users can create, manage, and control their identity, profile, and presence on the app. |

Connection: users can find and be found by those they are interested in; those nearby right now, or anywhere globally. |

Interaction: users can chat and interact with any profile instantly, in an open, fun, and engaging way. |

Trust and Safety: users receive guidance and tools to be safe across their experience. |

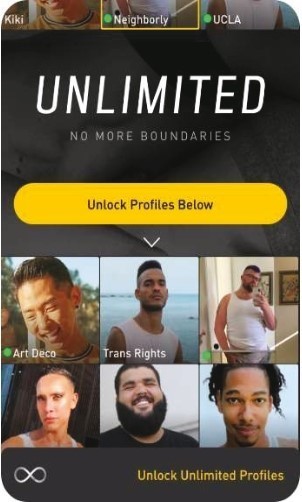

Premium: users can pay for greater access to more users and for more control over how they find one another and interact. |

We launched the Grindr App in 2009 to create a new way for gay men to find each other and form connections. Our initial differentiator was a cascade engine to help find other users nearby in an exciting and highly responsive app experience leading to high engagement and rapid organic growth. Our initial active user segment of gay men, our real-time and hyper-local use case of casual dating, and our industry-defining cascade user interface and open messaging connection model, combine to create a fun and highly engaging experience on the app. This engagement engine has fueled our rapid organic growth over time leading to more users, segments, geographies, and use cases.

Over time, we evolved into the world’s largest LGBTQ social network and we enable our users to engage on our platform in a variety of ways. We believe we have played an integral role in both establishing, defining, and developing the location-based dating industry and developing wider mainstream acceptance of LGBTQ individuals on a global basis.

User and Product Journey

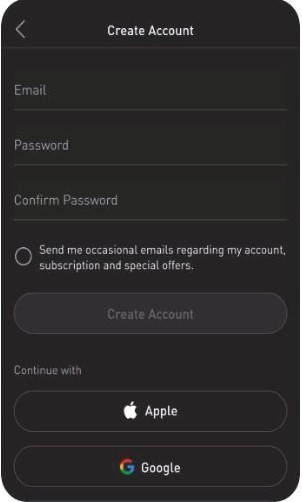

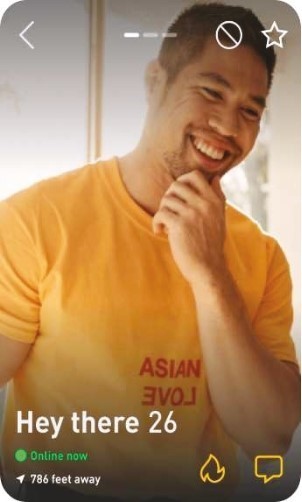

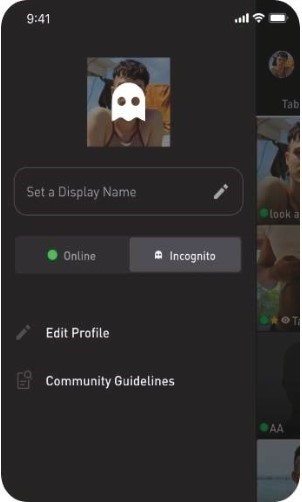

Identity expression: Getting started on Grindr is easy. Users create an account and profile that represents themselves and their identity on the platform. They create an account and verify important information to help maintain a trustworthy and safe environment on the app. Then they are able to create a rich, visual, personalized profile with a wide range of data and information about themselves, their interests, and motivations. This helps them express who they are, what they seek, and makes it easy for all to meet one another and form meaningful connections.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

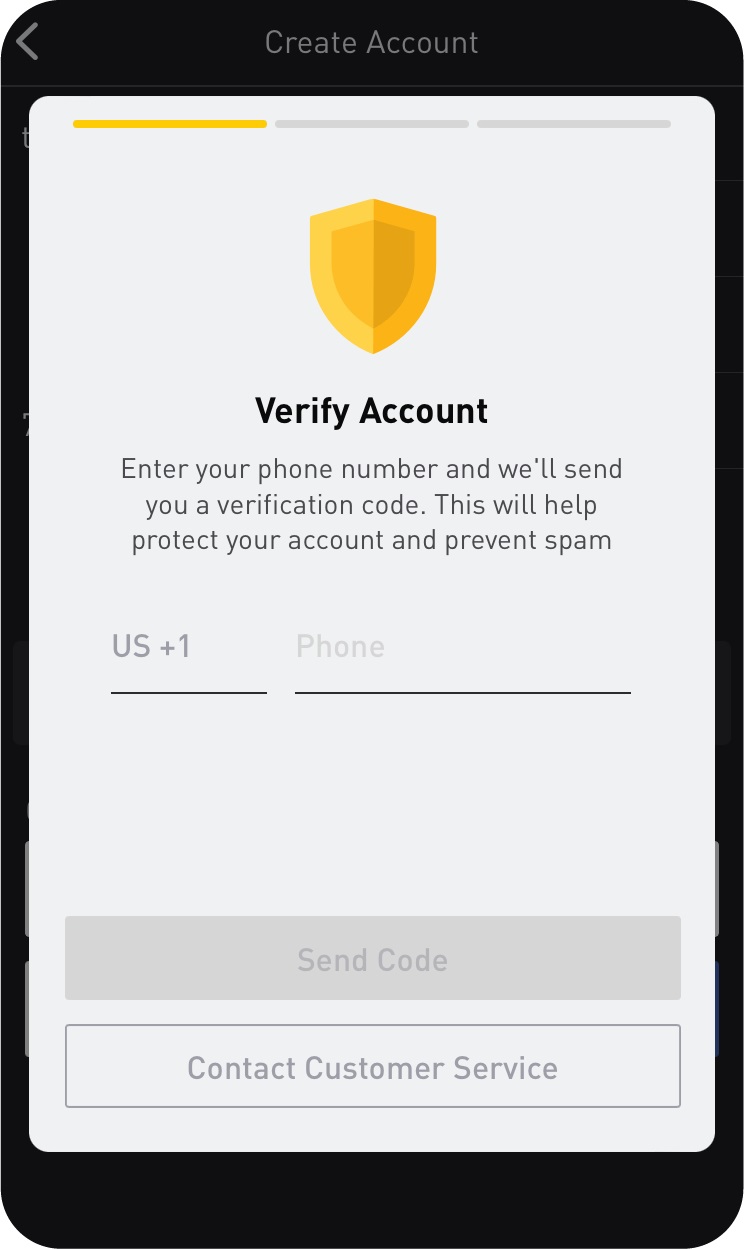

| 1. Sign up: New users create an account with their email, or through social media account authentication (e.g., Facebook, Google, Apple). |

|

|

|

|

|

2. Age verification: Users verify their age to confirm they are not a minor, and that they are eligible to use the Grindr service. |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 3. Human Verification: Users complete a human verification step to reduce the spam and bot activity on the app, and sign our Terms and Conditions of Service, as well as our Privacy and Cookie Policy. |

|

|

|

|

|

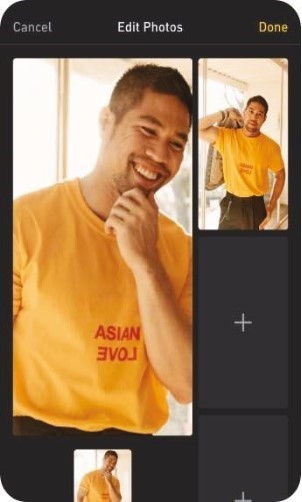

4. Profile Photos: Users create a rich profile expressing their identity, by first adding a visual representation of themselves through photos and media. |

|

|

|

| |

|

|

|

|

|

|

|

|

|

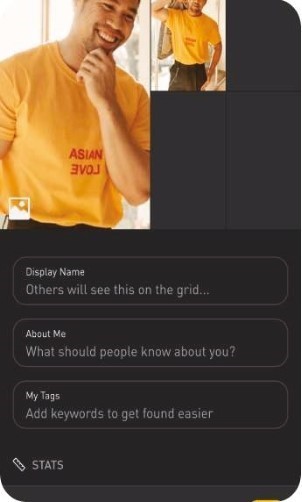

| 5. About Me: Users personalize their profile by adding a display name and custom “about me” narrative, enlivening their profile and helping them form more meaningful connections with others. |

|

|

|

|

|

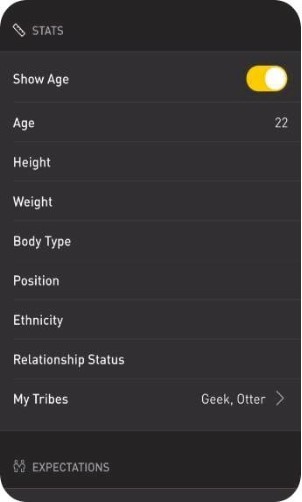

6. Stats: Users can optionally share key data such as age, height, tribe, body type, gender identity, ethnicity, relationship status, and self-reported sexual health information, to help them connect with others in the queer community. |

|

|

|

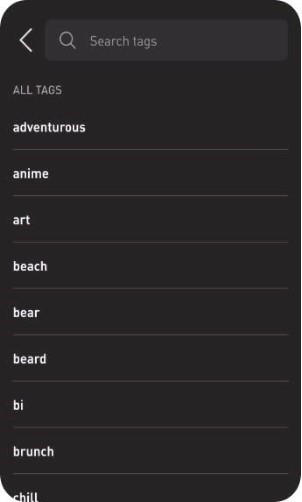

| 7. Tags: Users express their interests, identity, and community affiliation by adding tags to their profile. |

|

|

|

|

|

8. Complete Profile: Users’ completed profile is their chosen representation of themselves and their identity on the platform, and enables them to find and be found by those they are interested in. |

|

|

|

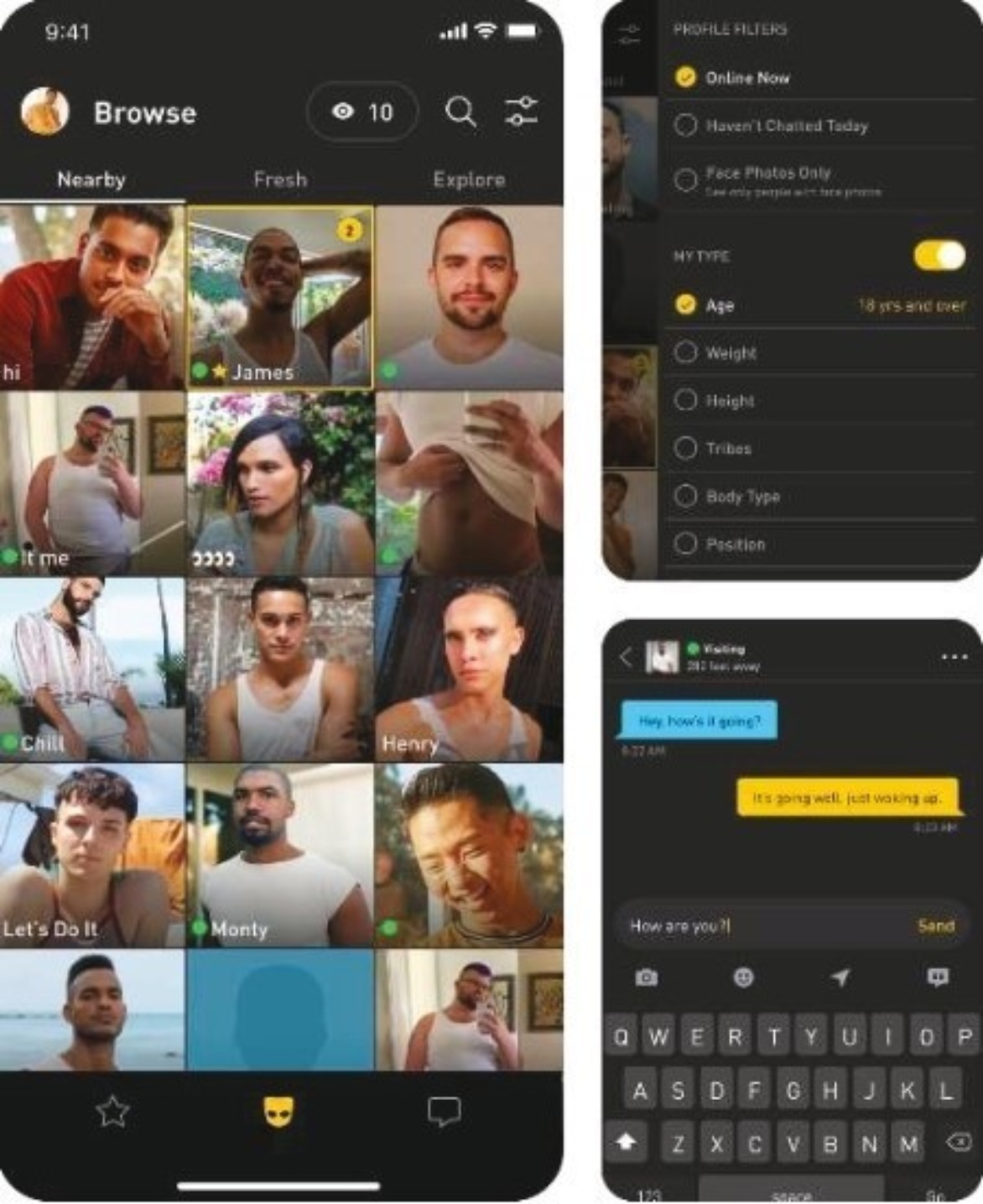

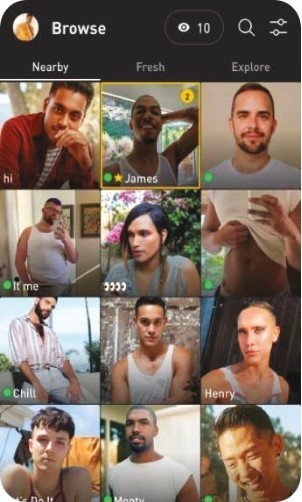

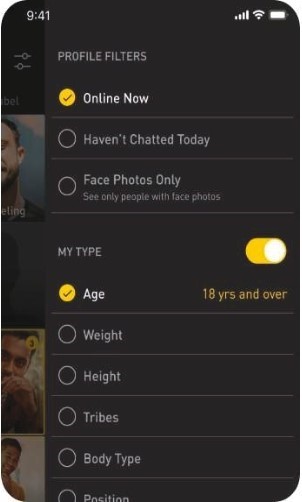

Connecting: Grindr helps users find meaningful connections easily and enjoyably. Grindr is unique in its “many-to-many” connection model: on “the cascade” (a grid of profiles nearby) users can actively browse many profiles at once, and be found by multiple others searching for them. They can browse, search, and filter profiles nearby or anywhere across the globe, based on identity, key characteristics, and interests. They are notified when others have viewed or expressed an interest in them (“taps”).

These connectivity features create multiple avenues to meaningful interactions quickly, easily, and in a fun and engaging way.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

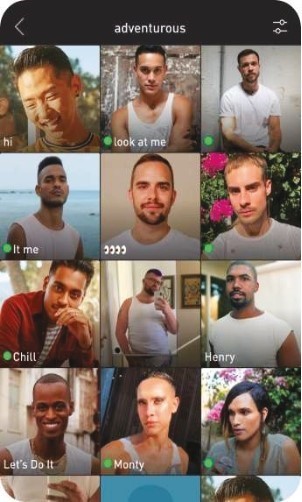

| 1. The Cascade: Users are instantly immersed in the community when they arrive on The Cascade: Grindr’s industry-defining user interface – a grid of profiles with location information, creating many connections quickly and easily. |

|

|

|

|

|

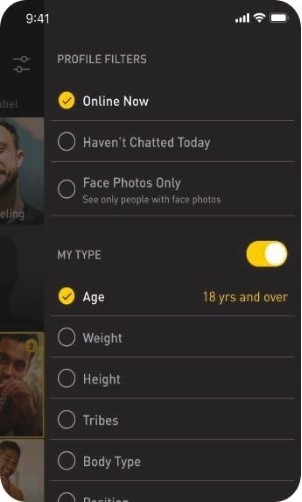

2. Filters: Users can personalize their cascade by filtering for key characteristics they are interested in. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 3. Search: Users can find others with specific interests and community affiliations by searching for others with specific tags on their profile. |

|

|

|

|

|

4. Tags: Users can find community by browsing custom cascades composed of profiles sharing the same tags. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 5. Explore: Users can also explore cascades of other users in locations across the globe, forming meaningful connections anywhere. |

|

|

|

|

|

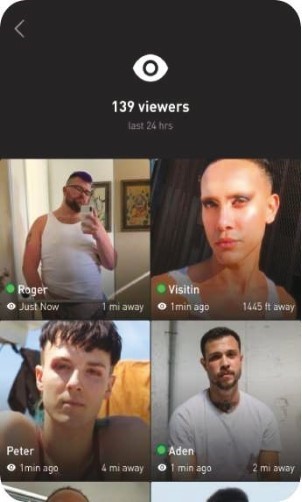

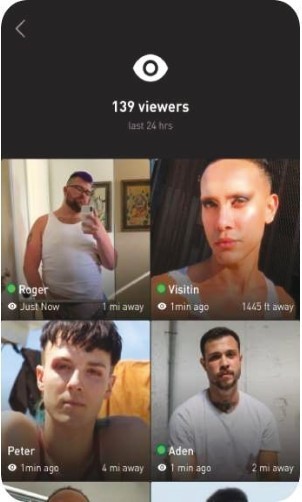

6. Viewed Me: Users can see those who may be interested in them, having recently viewed their profile. |

|

|

|

|

| 7. Taps: Users can express their interest in others by “tapping” the profile of someone they have viewed. |

|

|

|

|

|

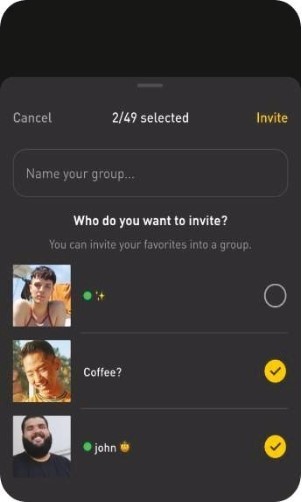

8. Favorites: Users can maintain meaningful connections by favoriting profiles, and seeing a custom cascade of all their favorites anytime. |

|

|

|

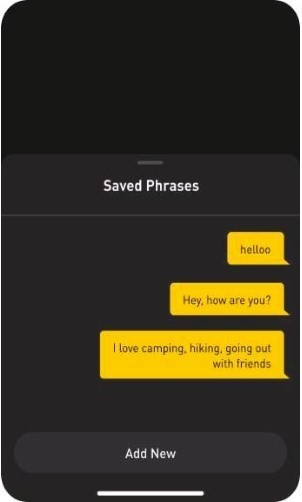

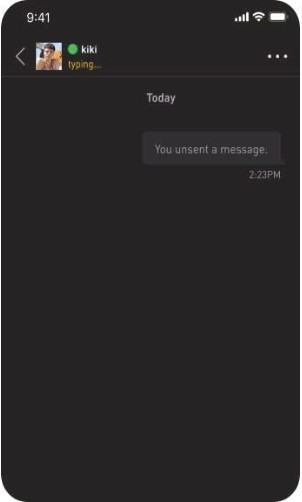

Interacting: Once users find one another, Grindr helps them form meaningful connections with a fun and engaging messaging experience. Grindr is unique in its open messaging model: users can initiate a message with any profile, regardless of whether interest has been expressed beforehand, a key aspect of our engagement engine. Within the messaging feature, users can form meaningful connections and deepen them over time by sharing rich media and with a variety of messaging formats.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

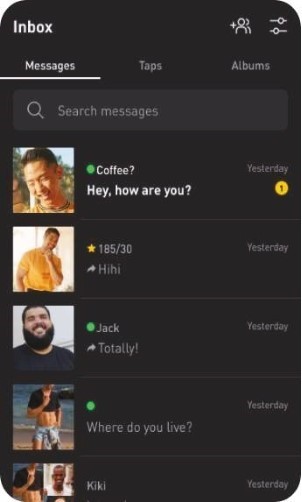

| 1. Open Messaging: users can interact with anyone of interest through our unique open messaging platform. They can initiate one or multiple messages from profiles on their cascades, or respond to messages sent to them. |

|

|

|

|

|

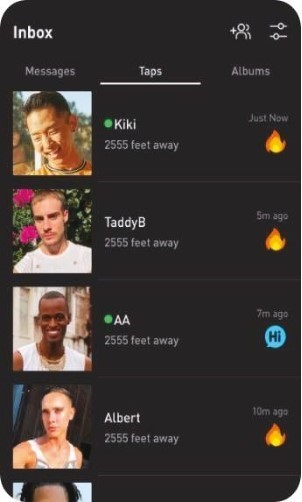

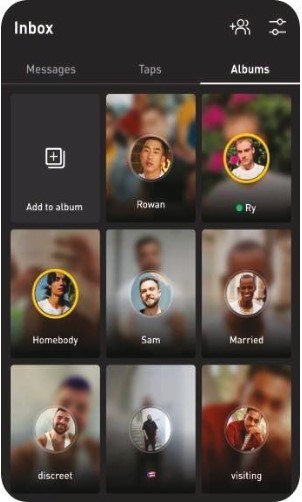

2. Inbox: Users manage the many messages they can send and receive through the inbox, with a special “taps” section for those who’ve expressed an interest in them. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

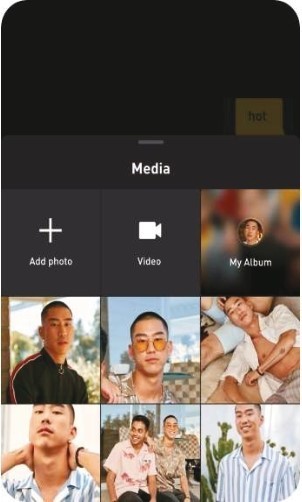

| 3. Share Photos: Users can have rich and meaningful interactions by sharing additional photos with one another through the messaging feature. |

|

|

|

|

|

4. Albums: Users can further meaningful interactions by creating private albums, which they can share with select individuals with whom they have a special connection. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

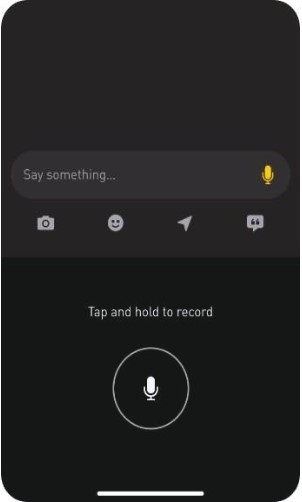

| 5. Share video and audio: Users can also deepen connections by sharing video or audio with one another through the messaging feature. |

|

|

|

|

|

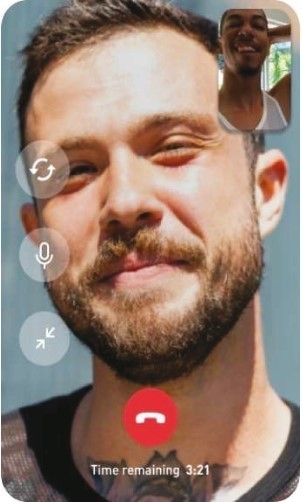

6. Live Video Calls: Users can also interact with live video calls to further get to know one another, or confirm their mutual interests. |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| 7. Group messaging: Multiple users can interact and meet one another through the group messaging feature. |

|

|

|

|

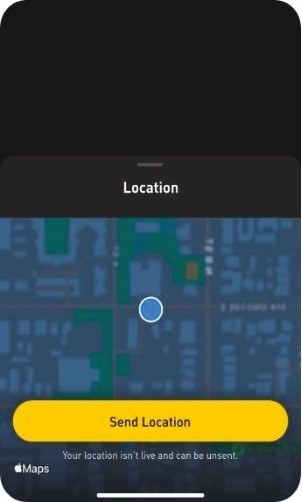

|

8. Location sharing: When users have built up a trusting connection, they can choose to share their location and make plans to meet in real life. |

|

|

|

|

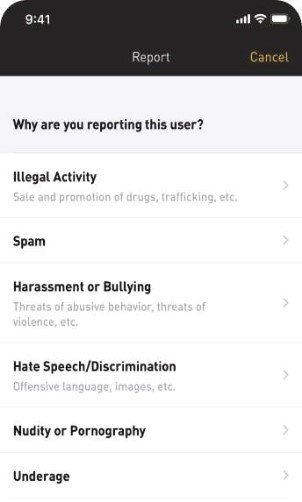

Safety and support: Creating a trustworthy and safe environment is central to the health of our platform and for our community. Grindr provides users with a variety of tools, features, proactive assistance, help and guidance across their experience to maintain the highest standards of trust and safety.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

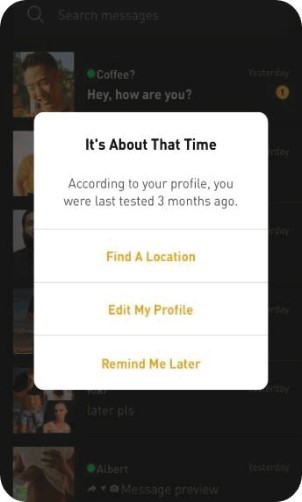

| 1. Sexual health + testing information: Users can express their sexual health and testing information on their profile, and view the same information from users who have chosen to share it. They can also choose to receive testing reminders to help maintain their health. |

|

|

|

|

|

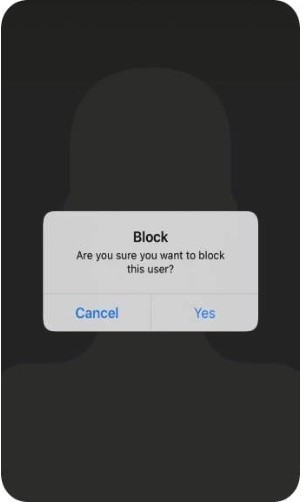

2. Blocking: Users may block other profiles if they are not having a positive or meaningful interaction. |

|

|

|

| |

|

|

|

|

|

|

|

|

|