2024 First Quarter Results Earnings Presentation

GCM GROSVENOR | 2 GCM Grosvenor Reports Q1 2024 Results CHICAGO, May 7, 2024 – GCM Grosvenor (Nasdaq: GCMG), a leading global alternative asset management solutions provider, today reported results for the first fiscal quarter ended March 31, 2024. Dividend GCM Grosvenor's Board of Directors approved a $0.11 per share dividend payable on June 17, 2024 to shareholders on record June 3, 2024. Conference Call Management will host a webcast and conference call at 10:00 a.m. ET today to discuss the company’s results. The conference call will also be available via public webcast from the Public Shareholders section of GCM Grosvenor’s website at www.gcmgrosvenor.com/public- shareholders and a replay will be available on the website soon after the call’s completion. To listen to the live broadcast, participants are encouraged to go to the site 15 minutes prior to the scheduled call time in order to register. The call can also be accessed by dialing (888) 256-1007 / (929) 477-0448 and using the passcode: 7941066. About GCM Grosvenor GCM Grosvenor (Nasdaq: GCMG) is a global alternative asset management solutions provider with approximately $79 billion in assets under management across private equity, infrastructure, real estate, credit, and absolute return investment strategies. The firm has specialized in alternatives for more than 50 years and is dedicated to delivering value for clients by leveraging its cross-asset class and flexible investment platform. GCM Grosvenor’s experienced team of approximately 550 professionals serves a global client base of institutional and individual investors. The firm is headquartered in Chicago, with offices in New York, Toronto, London, Frankfurt, Tokyo, Hong Kong, Seoul and Sydney. For more information, visit: www.gcmgrosvenor.com. “The first quarter of 2024 was strong from the perspective of both our investment performance for clients and our business performance,” said Michael Sacks, Chairman and Chief Executive Officer of GCM Grosvenor. “The quarter was one of the strongest we have reported with regard to year-over-year increases in fundraising, Adjusted Net Income and Fee- Related Earnings growth.”

GCM GROSVENOR | 3 THIS PRESENTATION CONTAINS CERTAIN FORWARD- LOOKING STATEMENTS within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding the expected future performance of GCM Grosvenor’s business. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward- looking statements in this presentation, including without limitation, the historical performance of GCM Grosvenor's funds may not be indicative of GCM Grosvenor's future results; risks related to redemptions and termination of engagements; the variable nature of GCM Grosvenor's revenues; competition in GCM Grosvenor's industry; effects of government regulation or compliance failures; market, geopolitical and economic conditions; identification and availability of suitable investment opportunities; risks relating to our internal control over financial reporting; and risks related to the performance of GCM Grosvenor's investments. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” sections of the Annual Report on Form 10-K filed by GCM Grosvenor Inc. on February 29, 2024 and its other filings with the U.S. Securities and Exchange Commission. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward- looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and GCM Grosvenor assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise, except as required by law. Forward Looking Statements Media Contacts Tom Johnson and Abigail Ruck H/Advisors Abernathy tom.johnson@h-advisors.global/ abigail.ruck@h-advisors.global 212-371-5999 Public Shareholders Contact Stacie Selinger Head of Investor Relations sselinger@gcmlp.com 312-506-6583

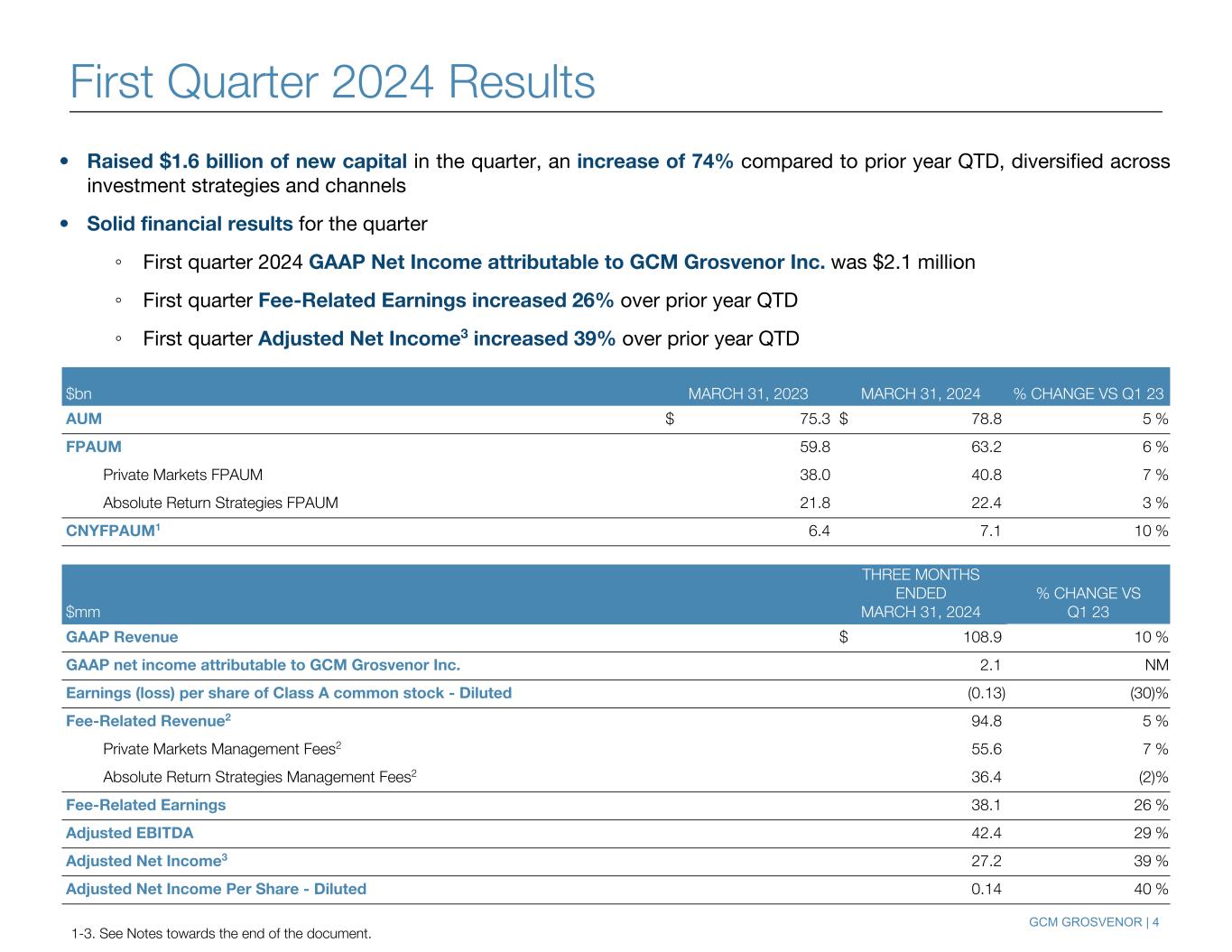

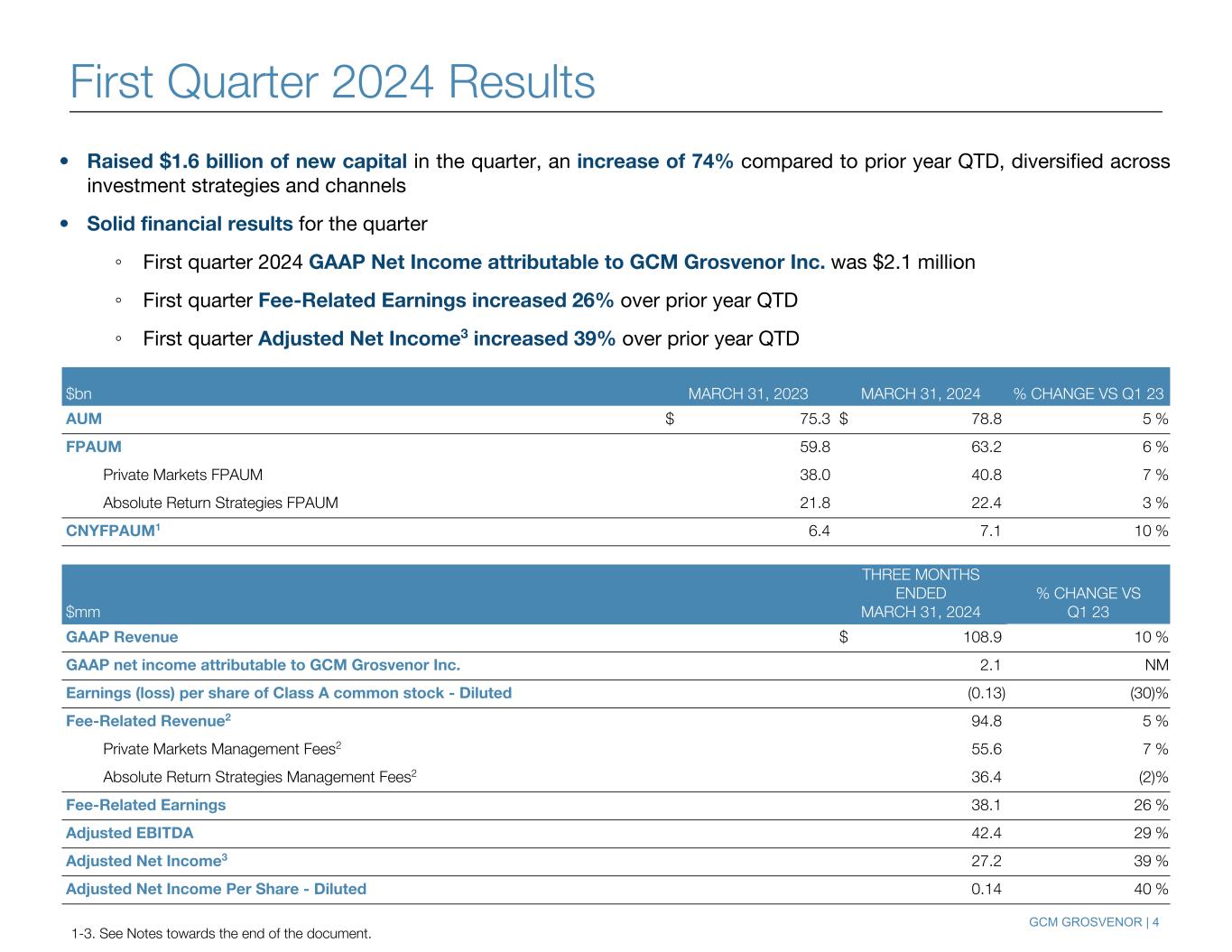

GCM GROSVENOR | 4 Third Quarter 2023 Results $bn MARCH 31, 2023 MARCH 31, 2024 % CHANGE VS Q1 23 AUM $ 75.3 $ 78.8 5 % FPAUM 59.8 63.2 6 % Private Markets FPAUM 38.0 40.8 7 % Absolute Return Strategies FPAUM 21.8 22.4 3 % CNYFPAUM1 6.4 7.1 10 % $mm THREE MONTHS ENDED MARCH 31, 2024 % CHANGE VS Q1 23 GAAP Revenue $ 99.1 $ 108.9 10 % GAAP net income attributable to GCM Grosvenor Inc. (1.2) 2.1 NM Earnings (loss) per share of Class A common stock - Diluted (0.10) (0.13) (30) % Fee-Related Revenue2 90.0 94.8 5 % Private Markets Management Fees2 51.8 55.6 7 % Absolute Return Strategies Management Fees2 37.1 36.4 (2) % Fee-Related Earnings 30.4 38.1 26 % Adjusted EBITDA 32.9 42.4 29 % Adjusted Net Income3 19.6 27.2 39 % Adjusted Net Income Per Share - Diluted 0.10 0.14 40 % • Raised $1.6 billion of new capital in the quarter, an increase of 74% compared to prior year QTD, diversified across investment strategies and channels • Solid financial results for the quarter ◦ First quarter 2024 GAAP Net Income attributable to GCM Grosvenor Inc. was $2.1 million ◦ First quarter Fee-Related Earnings increased 26% over prior year QTD ◦ First quarter Adjusted Net Income3 increased 39% over prior year QTD 1-3. See Notes towards the end of the document. First Quarter 2024 Results

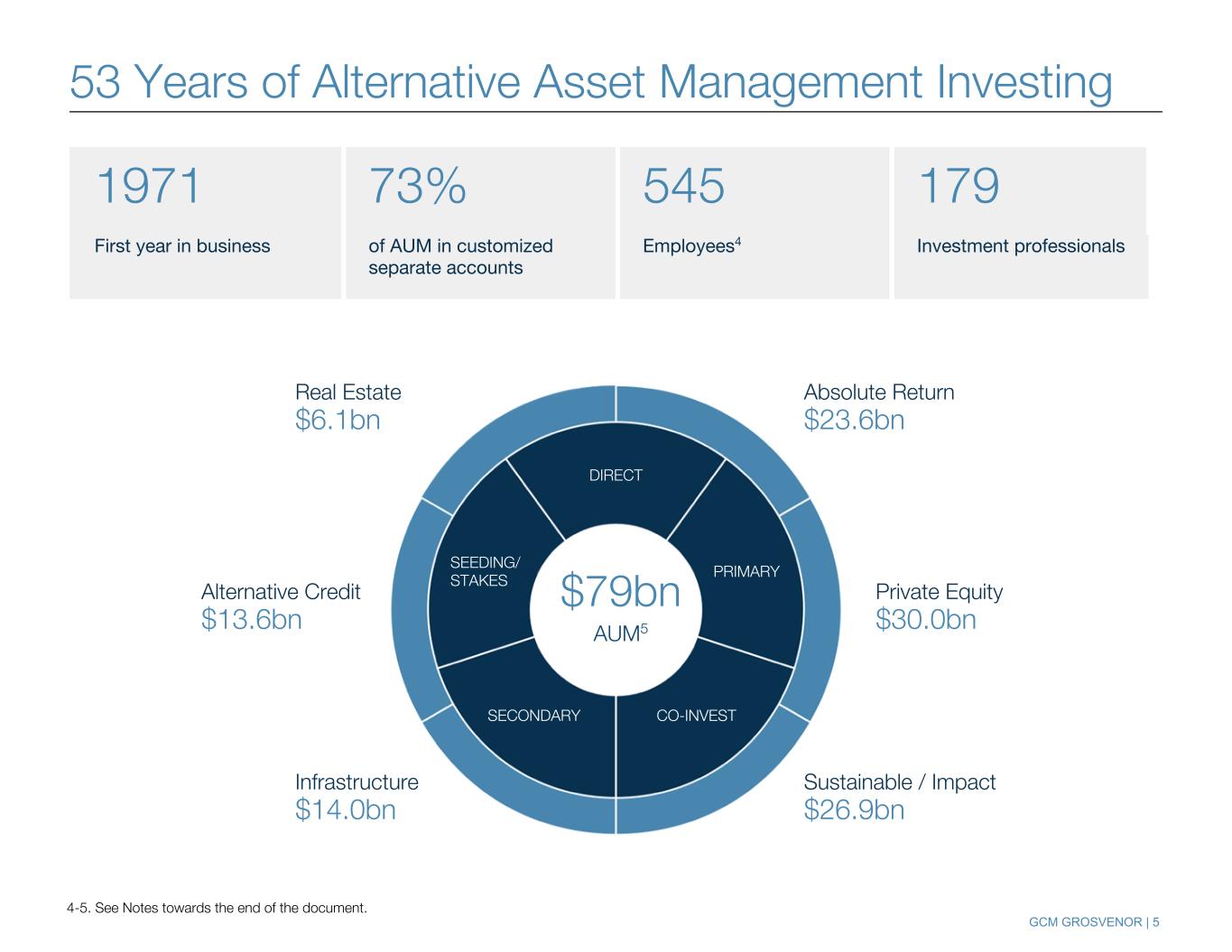

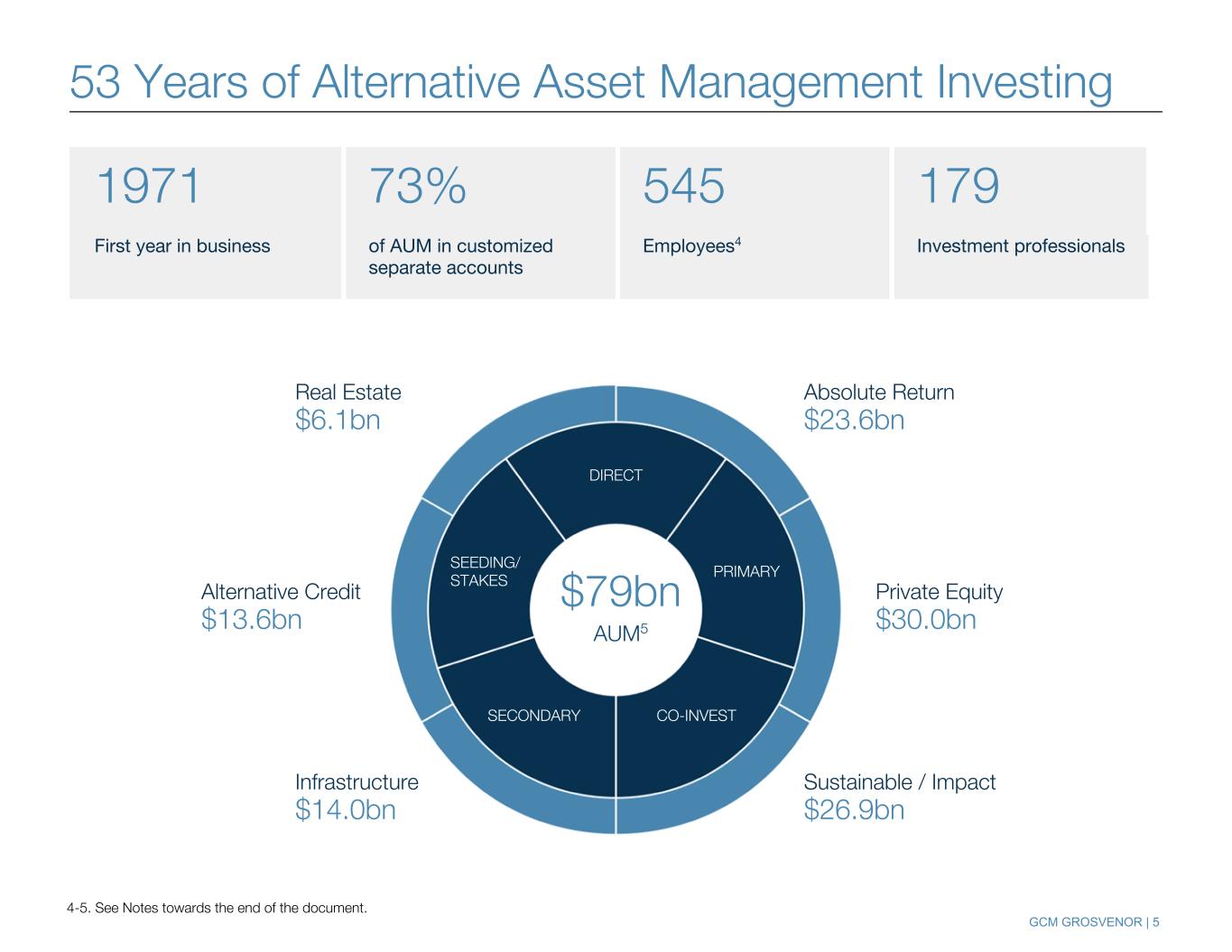

GCM GROSVENOR | 5 53 Years of Alternative Asset Management Investing Real Estate $6.1bn Absolute Return $23.6bn Private Equity $30.0bn Sustainable / Impact $26.9bn Alternative Credit $13.6bn Infrastructure $14.0bn 4-5. See Notes towards the end of the document. $79bn AUM5 1971 73% 545 179 First year in business of AUM in customized separate accounts Employees4 Investment professionals SEEDING/ STAKES DIRECT PRIMARY SECONDARY CO-INVEST

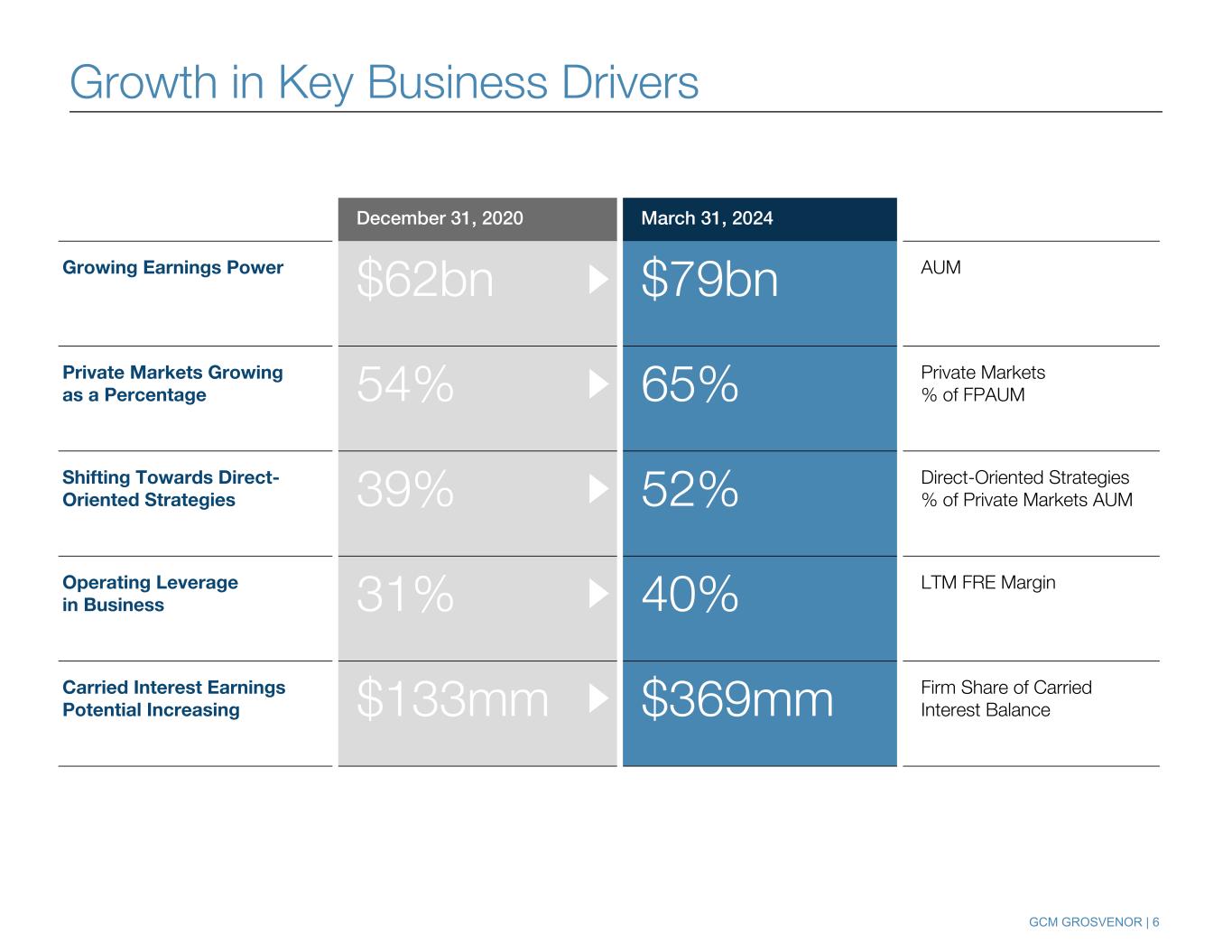

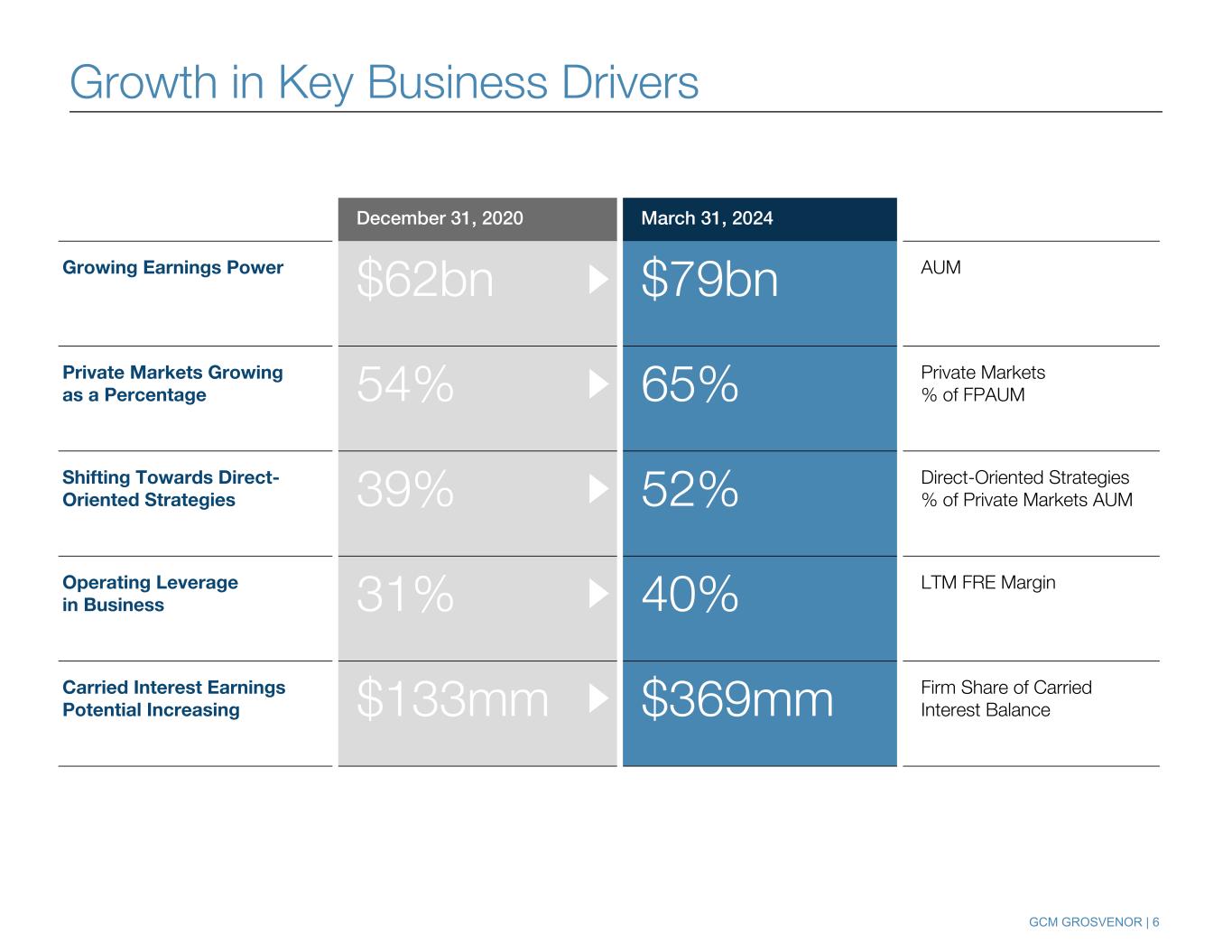

GCM GROSVENOR | 6 Growth in Key Business Drivers December 31, 2020 March 31, 2024 Growing Earnings Power $62bn $79bn AUM Private Markets Growing as a Percentage 54% 65% Private Markets % of FPAUM Shifting Towards Direct- Oriented Strategies 39% 52% Direct-Oriented Strategies % of Private Markets AUM Operating Leverage in Business 31% 40% LTM FRE Margin Carried Interest Earnings Potential Increasing $133mm $369mm Firm Share of Carried Interest Balance

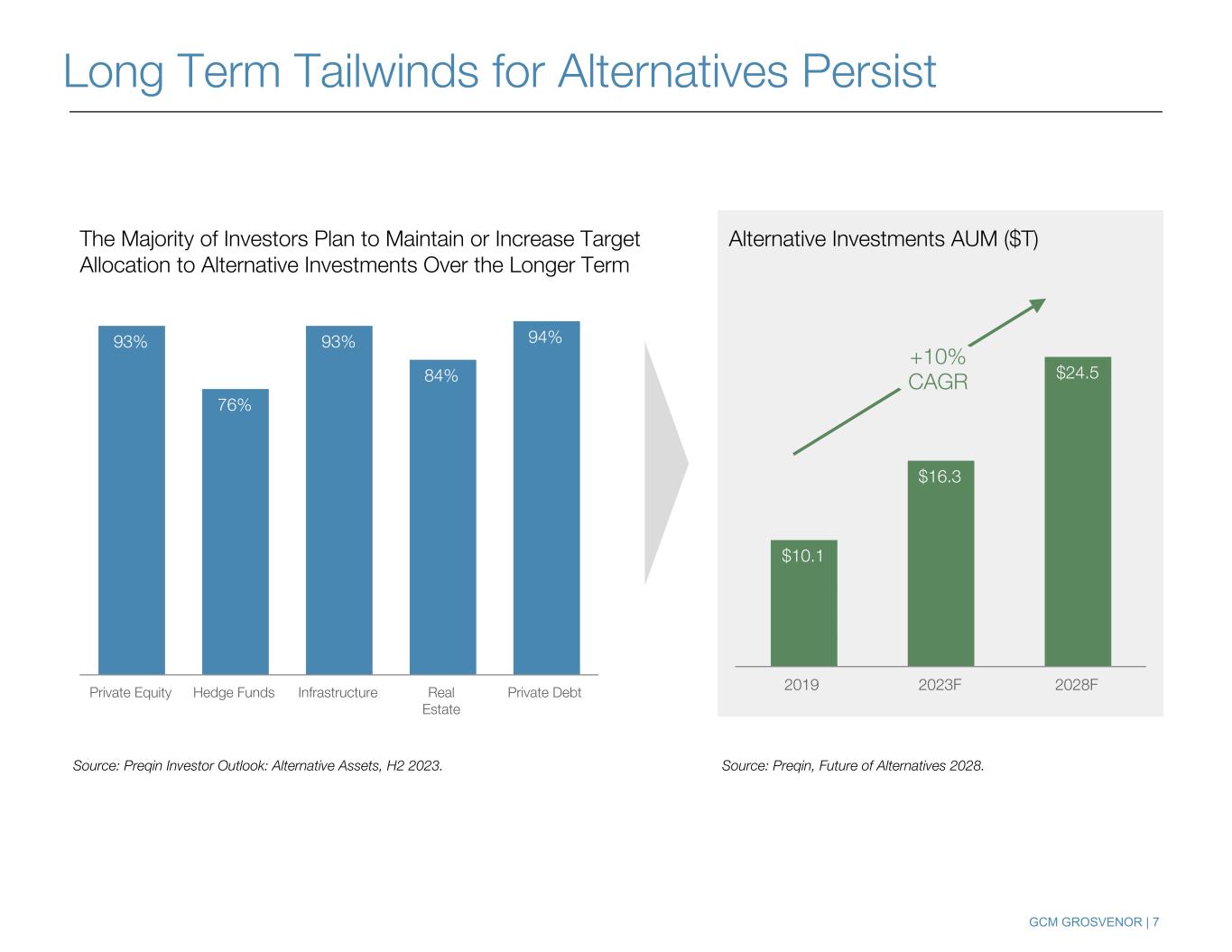

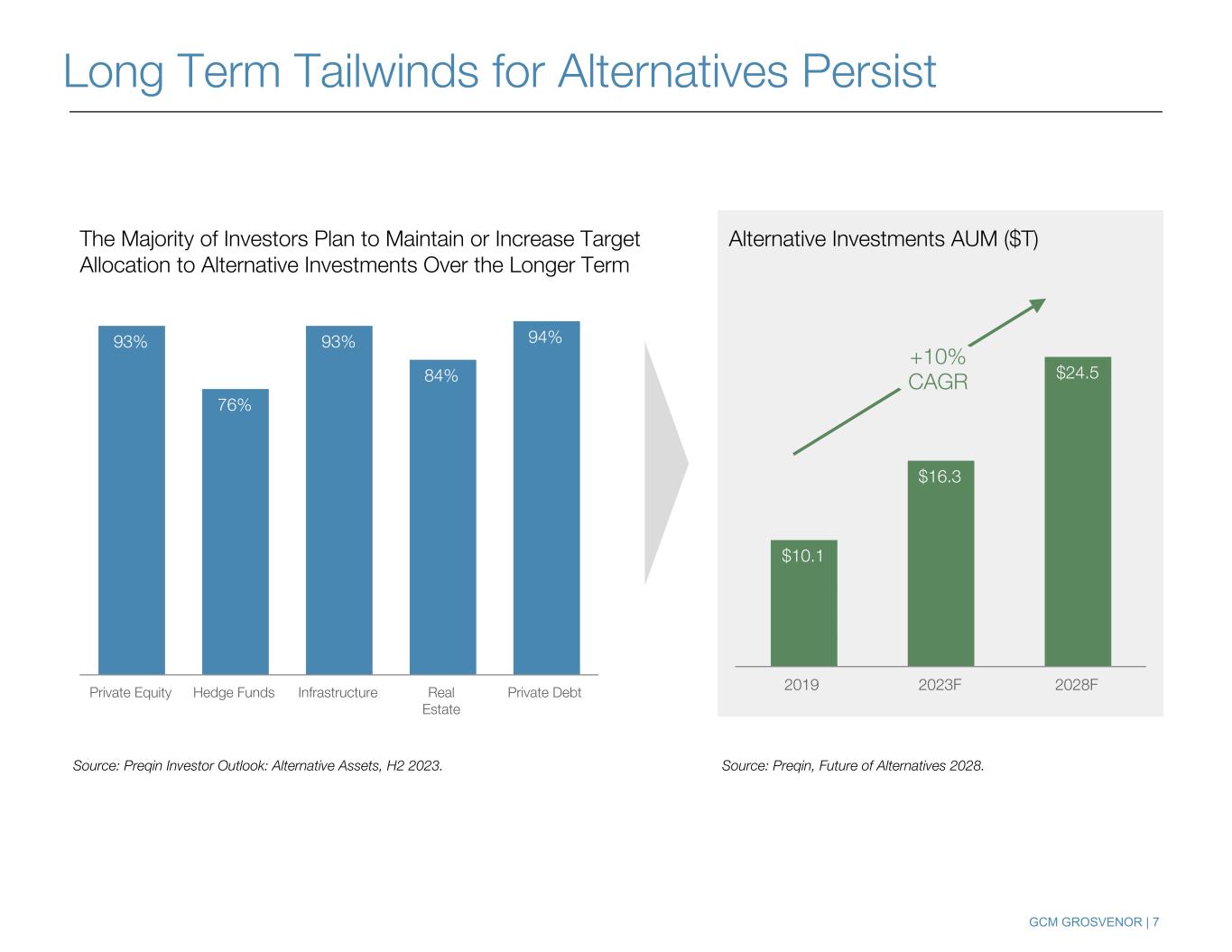

GCM GROSVENOR | 7 The Majority of Investors Plan to Maintain or Increase Target Allocation to Alternative Investments Over the Longer Term Long Term Tailwinds for Alternatives Persist Source: Preqin Investor Outlook: Alternative Assets, H2 2023. 93% 76% 93% 84% 94% Private Equity Hedge Funds Infrastructure Real Estate Private Debt $10.1 $16.3 $24.5 2019 2023F 2028F Alternative Investments AUM ($T) +10% CAGR Source: Preqin, Future of Alternatives 2028.

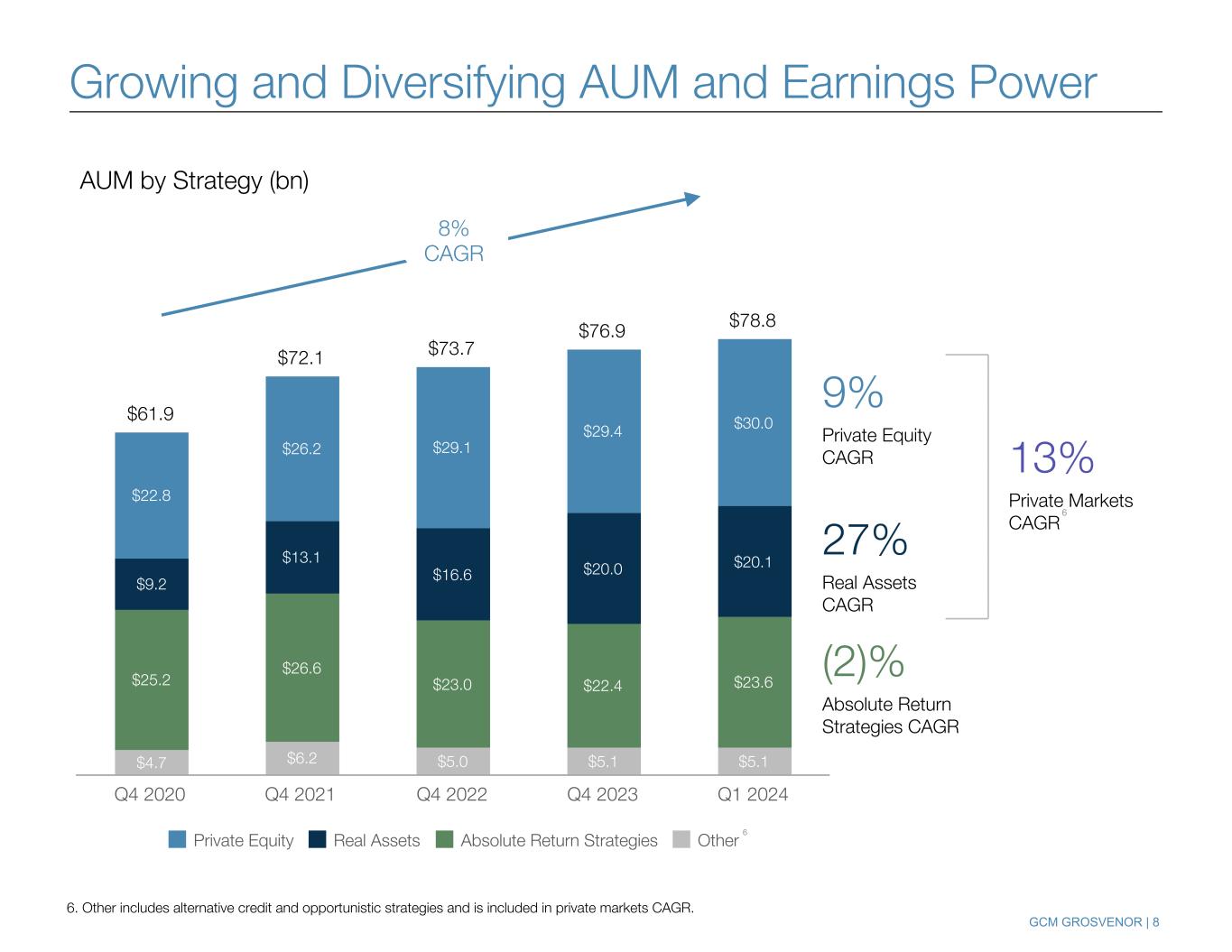

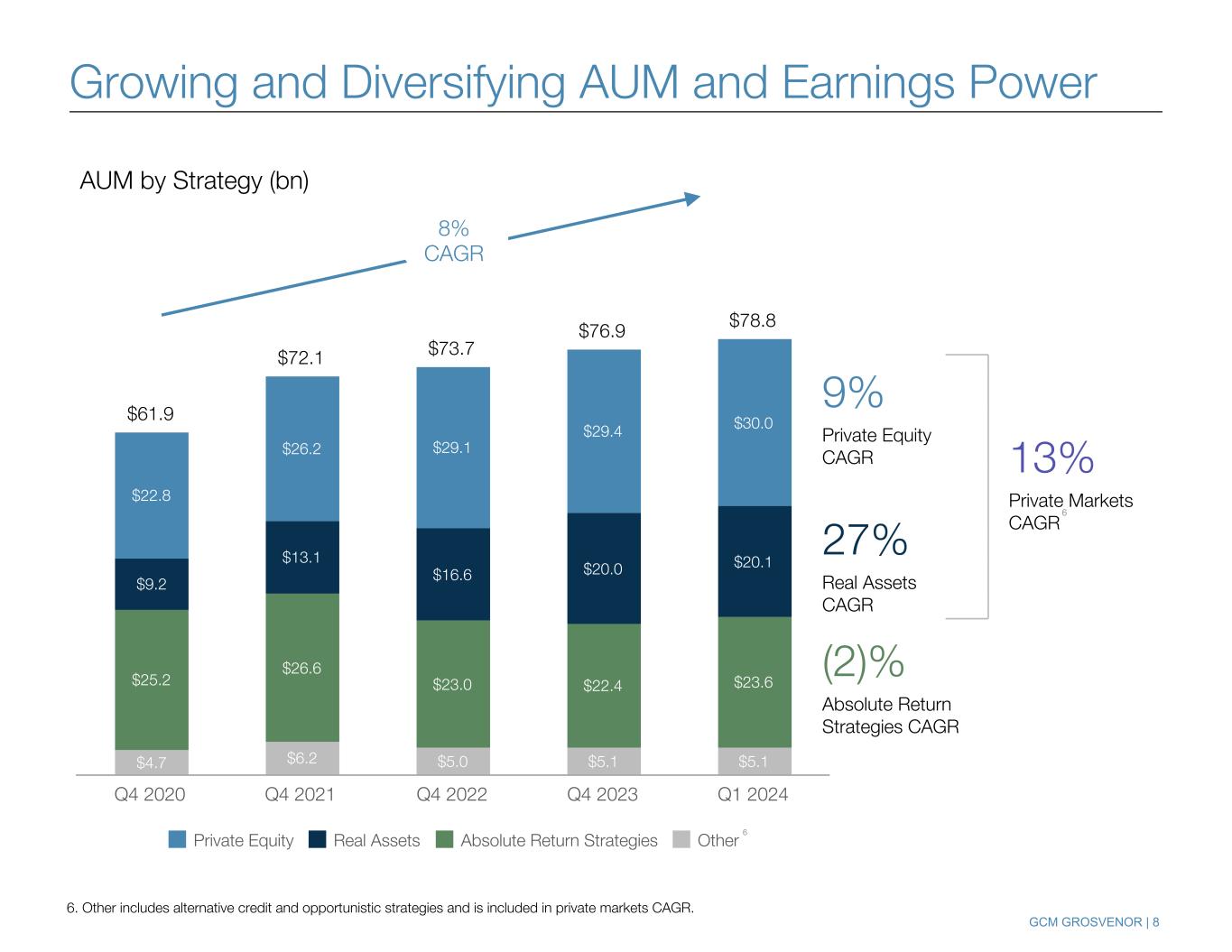

GCM GROSVENOR | 8 Growing and Diversifying AUM and Earnings Power $61.9 $72.1 $73.7 $76.9 $78.8 $4.7 $6.2 $5.0 $5.1 $5.1 $25.2 $26.6 $23.0 $22.4 $23.6 $9.2 $13.1 $16.6 $20.0 $20.1 $22.8 $26.2 $29.1 $29.4 $30.0 Private Equity Real Assets Absolute Return Strategies Other Q4 2020 Q4 2021 Q4 2022 Q4 2023 Q1 2024 9% Private Equity CAGR (2)% Absolute Return Strategies CAGR 27% Real Assets CAGR AUM by Strategy (bn) 6. Other includes alternative credit and opportunistic strategies and is included in private markets CAGR. 8% CAGR 13% Private Markets CAGR 6 6

GCM GROSVENOR | 9 Diversified Fundraising Drives Stability & Growth $7.0 $9.4 $7.8 $5.1 $5.7 $1.4 $1.0 $0.5 $0.2 $0.6 $1.4 $1.9 $0.5 $0.5 $0.8 $0.9 $1.6 $0.9 $1.0 $1.2 $3.5 $2.1 $2.7 $2.0 $3.0 $2.1 $3.1 $0.8 $1.3 Private Equity Infrastructure Real Estate Absolute Return Strategies Other 2020 2021 2022 2023 LTM 7. Other includes alternative credit and opportunistic strategies. 40% Pensions 18% Corporation 14% Government/Sovereign Entity 8% Individual Investor 7% Financial Institutions 6% Insurance 7% Other 54% Americas 25% EMEA 21% APAC LTM Fundraising LTM Fundraising 7 Diversified by Strategy Diversified by Channel Diversified by Geography (bn) $1.6bn Q1 2024 Fundraising

GCM GROSVENOR | 10 Customized Separate Accounts are Highly Valuable 8-9. See Notes toward the end of the document. Note: Illustrative client relationship assumes $100M initial account size and charged on scheduled ramp in and ramp down of capital. Assumes the client re- ups every fourth year and each subsequent account size increases by 25% (28% average size increase * 90% re-up success rate). FPAUM schedule for each account as a percentage of the total account size: Year 1: 33%, Year 2: 67%, Year 3: 100%, Year 4: 100%, Year 5: 95%, Year 6: 90%, Year 7: 85%, Year 8: 80%, Year 9: 75%, Year 10: 70%, Year 11: 60%, Year 12: 50%. YEARS FP A U M ($ M ) First Sale Second Sale Third Sale Fourth Sale 1 2 3 4 5 6 7 8 9 10 11 12 0 100 200 300 400 500 600 90% average re-up rate on initial sale 28% average size increase on each re-up Sticky Relationships 15 years average relationship across top 25 clients by AUM Illustrative client relationship assuming $100M initial account size 8 9

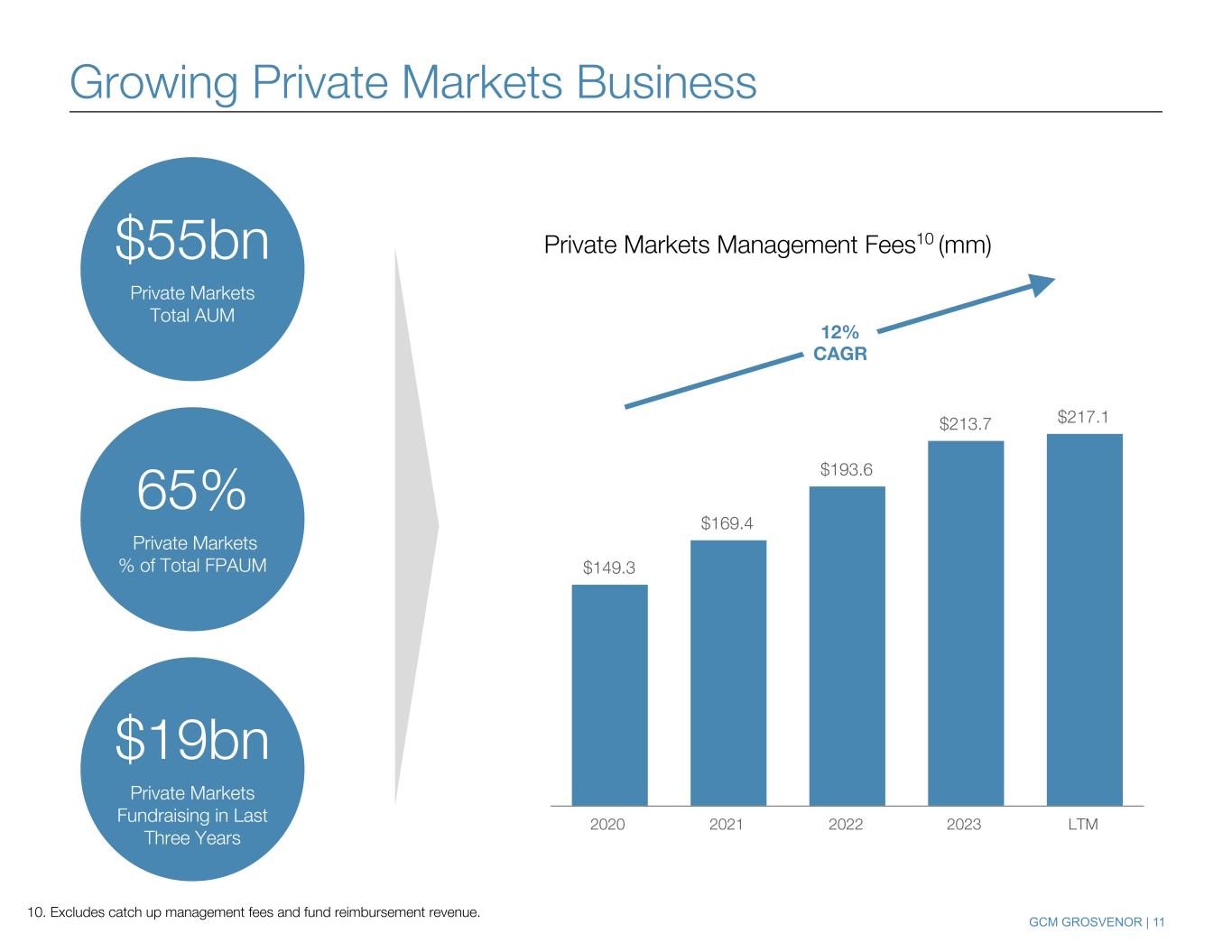

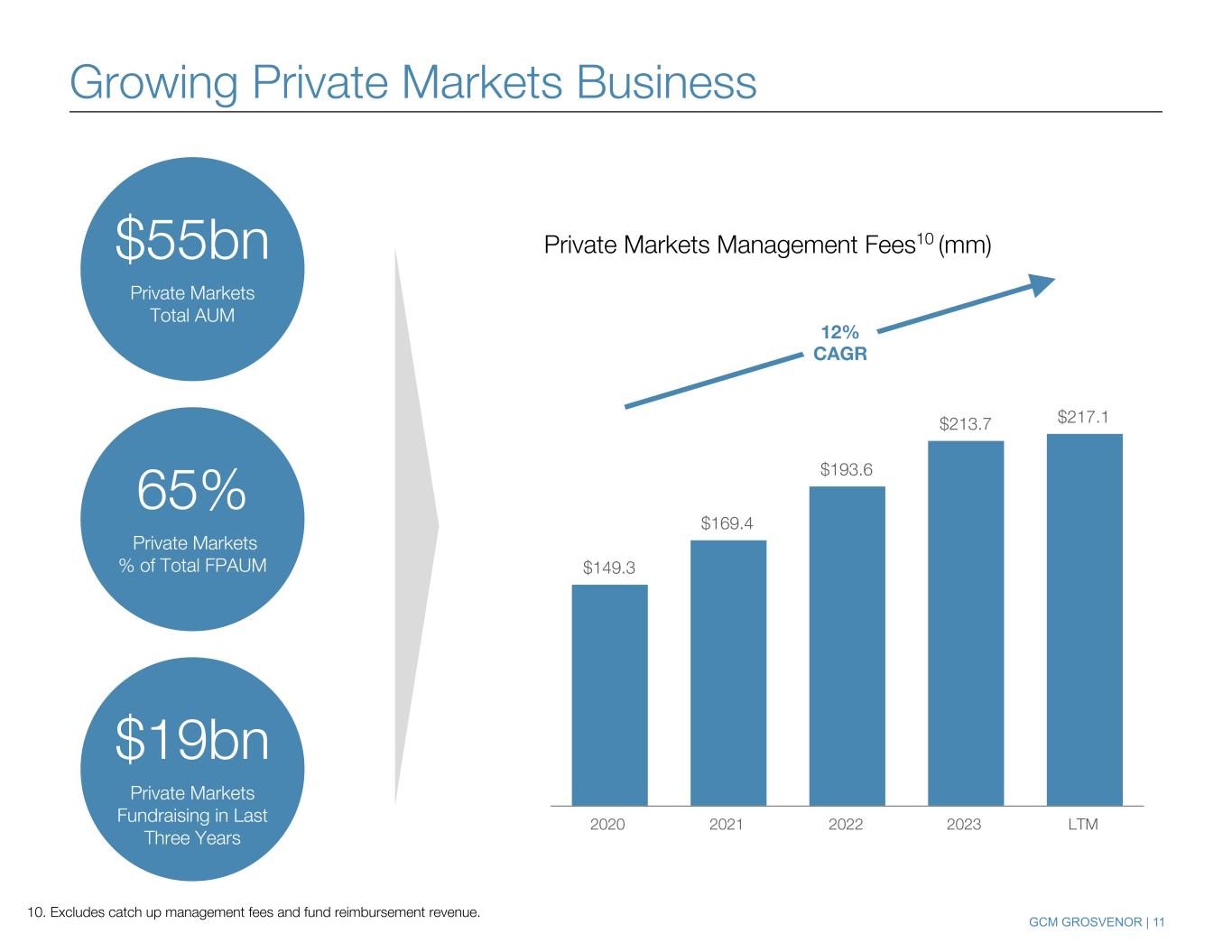

GCM GROSVENOR | 11 $149.3 $169.4 $193.6 $213.7 $217.1 2020 2021 2022 2023 LTM 10. Excludes catch up management fees and fund reimbursement revenue. 12% CAGR Growing Private Markets Business Private Markets Management Fees10 (mm) 65% Private Markets % of Total FPAUM $55bn Private Markets Total AUM $19bn Private Markets Fundraising in Last Three Years

GCM GROSVENOR | 12 $395 $779 133 369 262 410 Unrealized Carried Interest - Firm Share Unrealized Carried Interest - Non-Firm Share Q4 2020 Q1 2024 $131 $154 $494 31 68 270 100 86 224 Firm Share of Carried Interest by Vintage Year 2013 or Earlier 2014-2016 2017+ Unrealized Carried Interest by Vintage Year (mm)11 11. Represents consolidated view, including all NCI and compensation related awards. 140 programs with unrealized carried interest (mm) $ million 47% Firm Share 34% Firm Share 44% Firm Share 55% Firm Share 24% Firm Share Gr wing Carried Interest Earnings Power Total carried interest continues to experience strong growth, and the firm is keeping a larger share of that carry

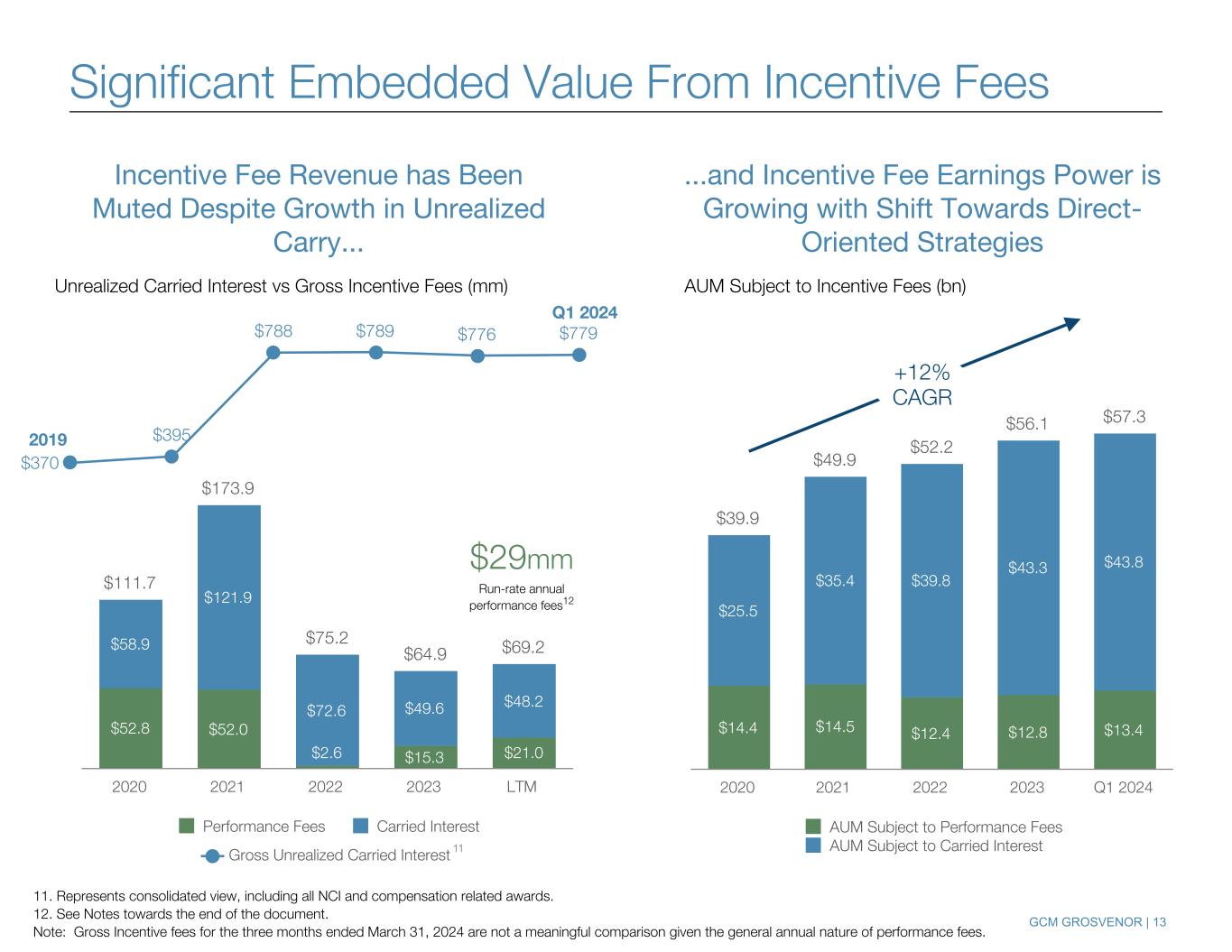

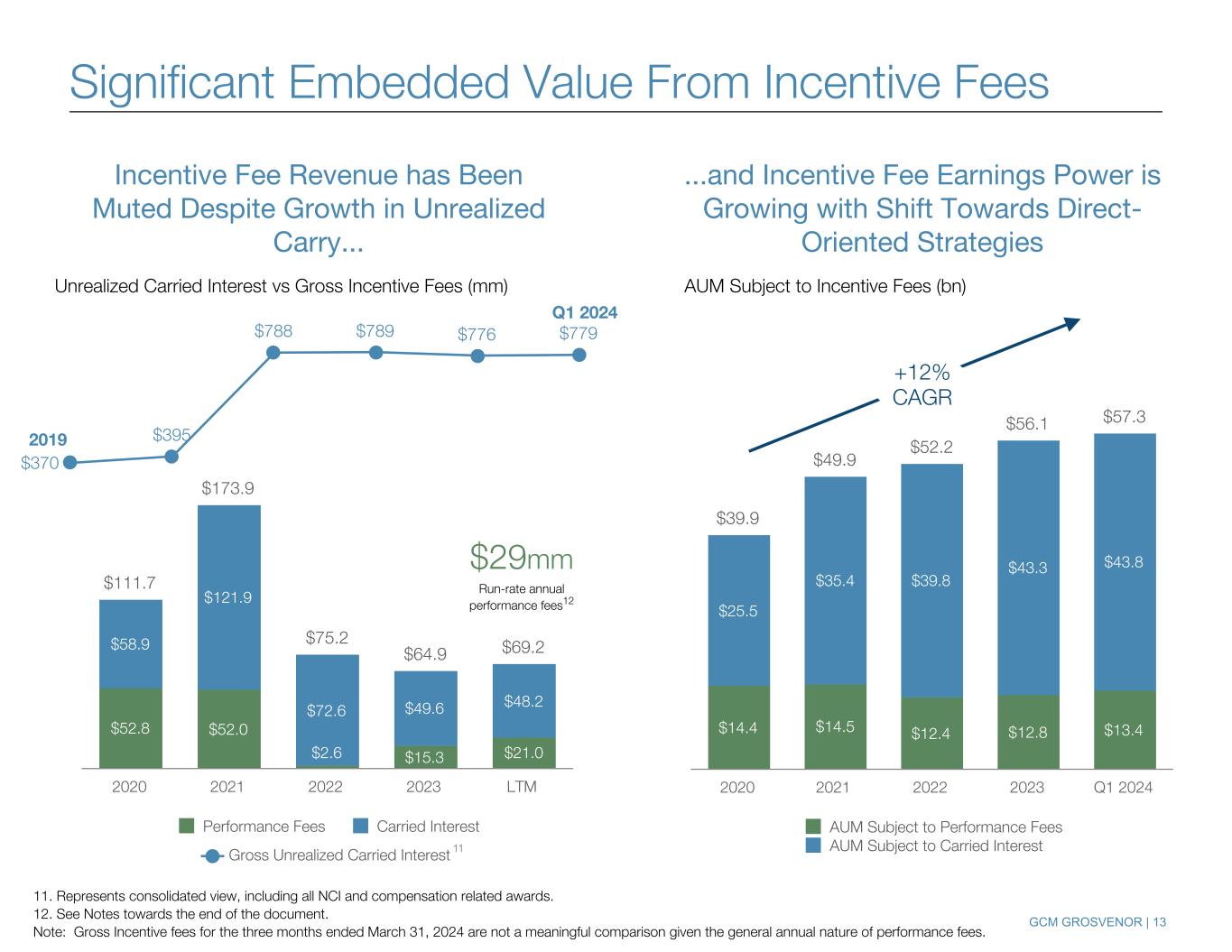

GCM GROSVENOR | 13 $370 $395 $788 $789 $776 $779 Gross Unrealized Carried Interest $111.7 $173.9 $75.2 $64.9 $69.2 $52.8 $52.0 $2.6 $15.3 $21.0 $58.9 $121.9 $72.6 $49.6 $48.2 Performance Fees Carried Interest 2020 2021 2022 2023 LTM Significant Embedded Value From Incentive Fees Unrealized Carried Interest vs Gross Incentive Fees (mm) 11. Represents consolidated view, including all NCI and compensation related awards. 12. See Notes towards the end of the document. Note: Gross Incentive fees for the three months ended March 31, 2024 are not a meaningful comparison given the general annual nature of performance fees. Incentive Fee Revenue has Been Muted Despite Growth in Unrealized Carry... ...and Incentive Fee Earnings Power is Growing with Shift Towards Direct- Oriented Strategies 11 2019 Q1 2024 AUM Subject to Incentive Fees (bn) $39.9 $49.9 $52.2 $56.1 $57.3 $14.4 $14.5 $12.4 $12.8 $13.4 $25.5 $35.4 $39.8 $43.3 $43.8 AUM Subject to Performance Fees AUM Subject to Carried Interest 2020 2021 2022 2023 Q1 2024 +12% CAGR $29mm Run-rate annual performance fees12

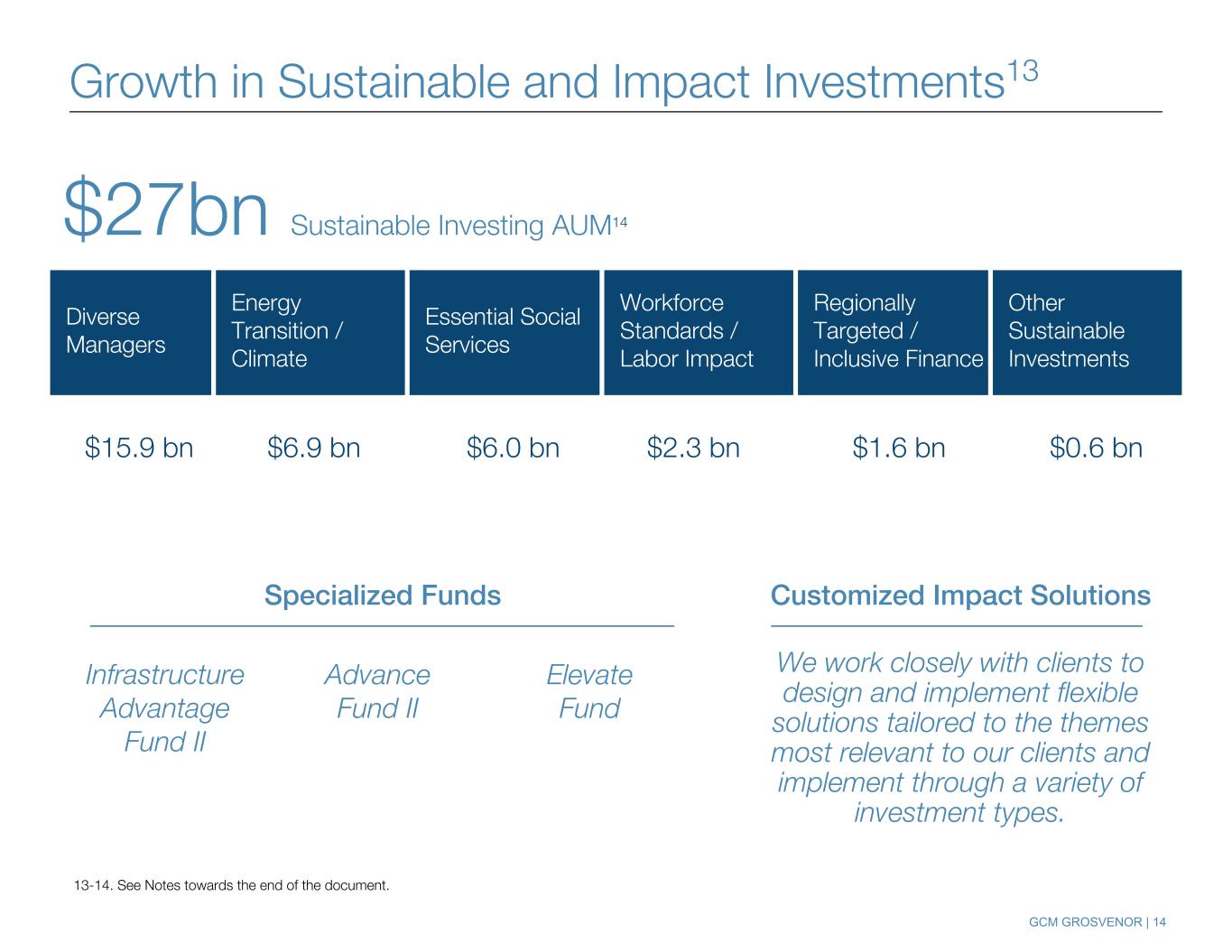

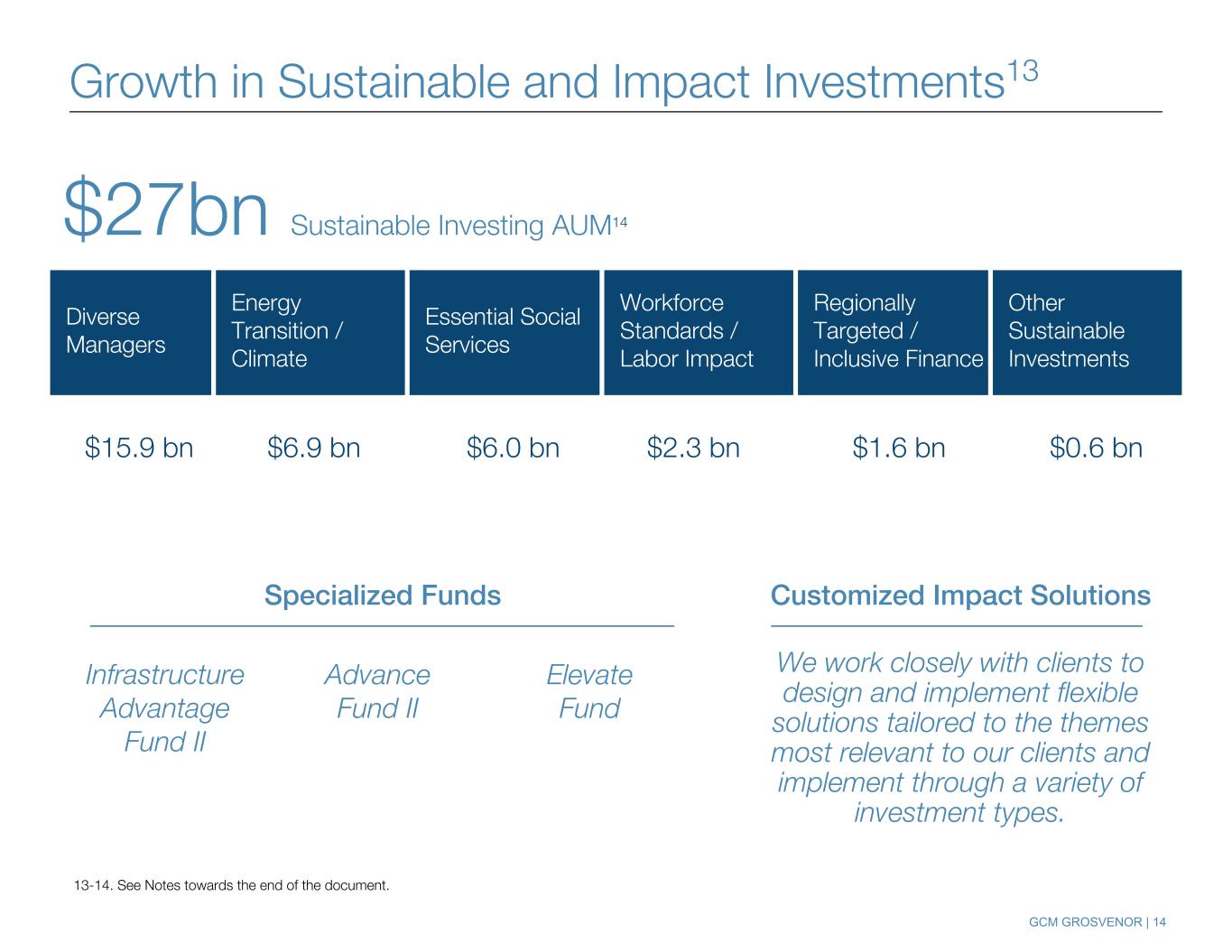

GCM GROSVENOR | 14 Diverse Managers Energy Transition / Climate Essential Social Services Workforce Standards / Labor Impact Regionally Targeted / Inclusive Finance Other Sustainable Investments $15.9 bn $1.6 bn$6.9 bn $2.3 bn $0.6 bn$6.0 bn Growth in Sustainable and Impact Investments13 13-14. See Notes towards the end of the document. $27bn Sustainable Investing AUM14 Specialized Funds Customized Impact Solutions We work closely with clients to design and implement flexible solutions tailored to the themes most relevant to our clients and implement through a variety of investment types. Advance Fund II Infrastructure Advantage Fund II Elevate Fund

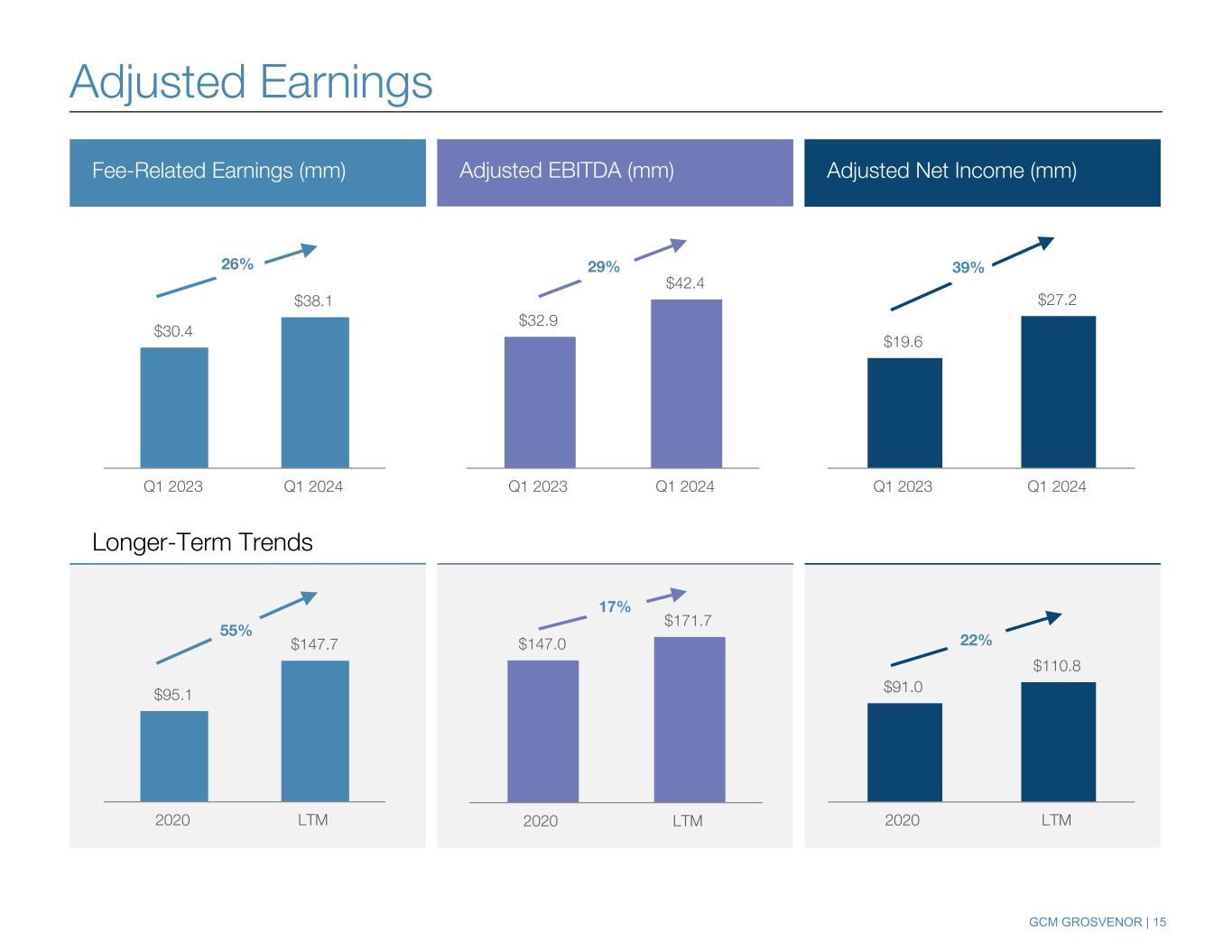

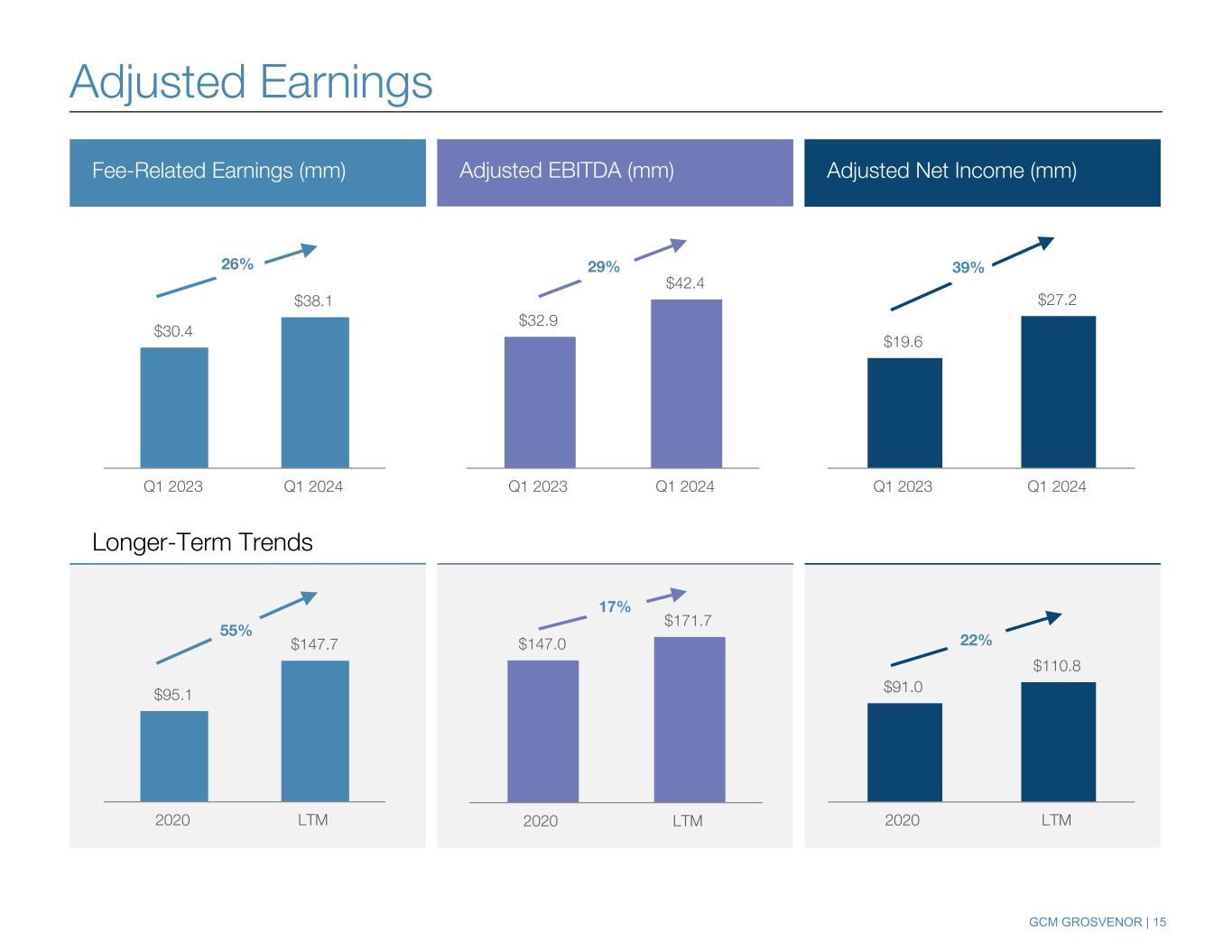

GCM GROSVENOR | 15 Adjusted Earnings Fee-Related Earnings (mm) Adjusted EBITDA (mm) Adjusted Net Income (mm) Longer-Term Trends $91.0 $110.8 91.0 110.8 2020 LTM $95.1 $147.7 2020 LTM $147.0 $171.7 2020 LTM 17% 22% 55% $19.6 $27.2 19.6 27.2 Q1 2023 Q1 2024 $30.4 $38.1 Q1 2023 Q1 2024 $32.9 $42.4 Q1 2023 Q1 2024 29% 39%26%

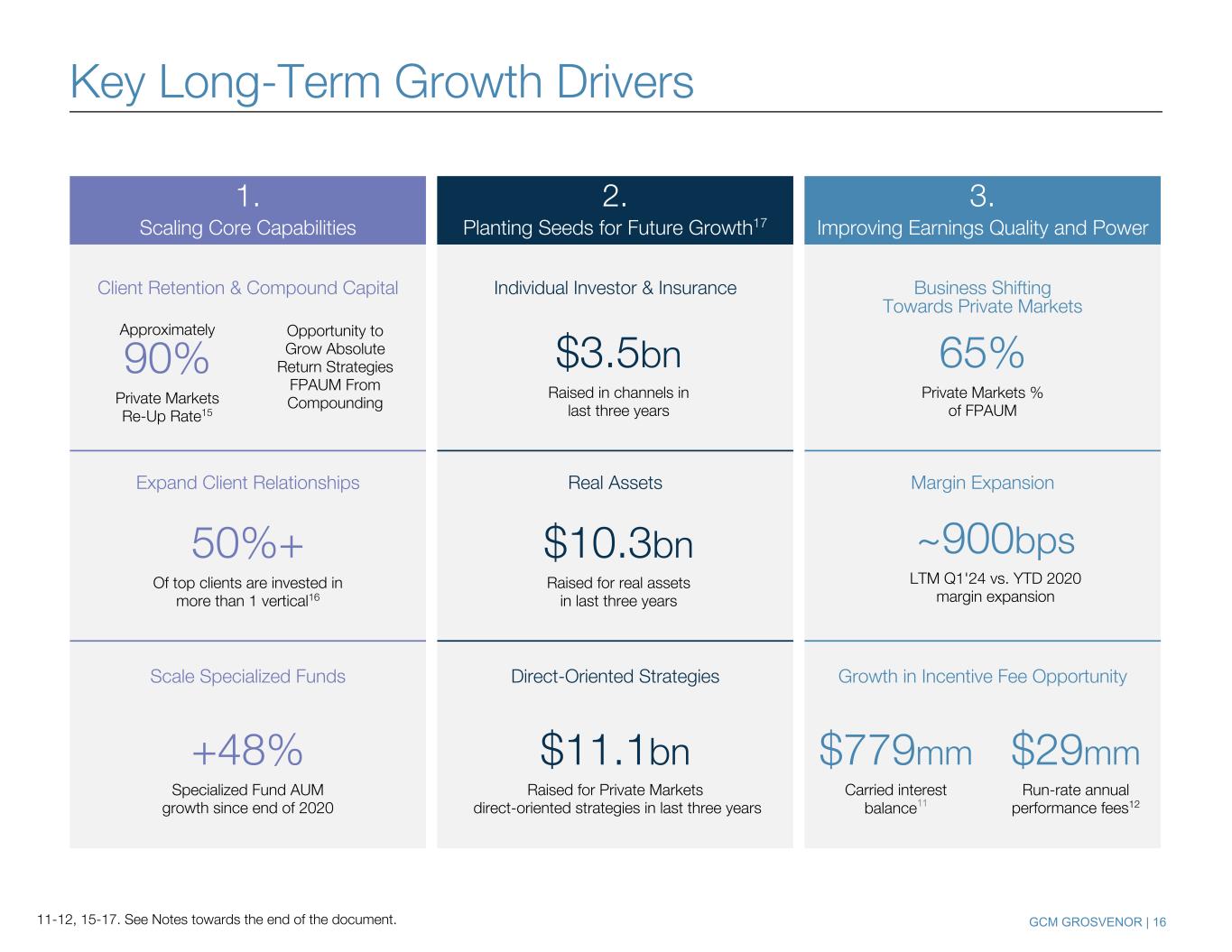

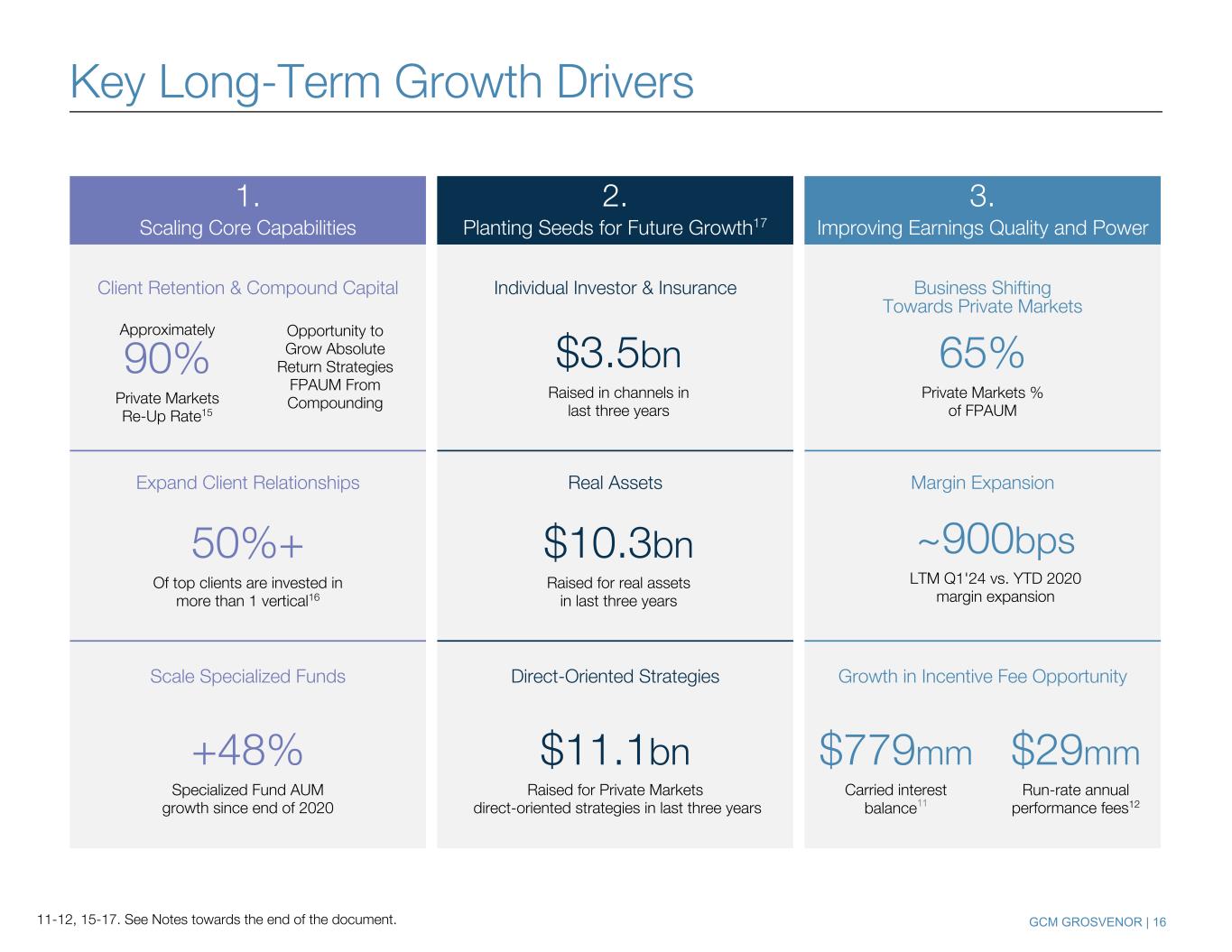

GCM GROSVENOR | 16 Business Shifting Towards Private Markets Key 2023 and Long-Term Growth Drivers 11-12, 15-17. See Notes towards the end of the document. Expand Client Relationships 50%+ Of top clients are invested in more than 1 vertical16 ~900bps LTM Q1'24 vs. YTD 2020 margin expansion Real Assets Margin Expansion Individual Investor & Insurance 1. Scaling Core Capabilities +48% Specialized Fund AUM growth since end of 2020 Approximately 90% Private Markets Re-Up Rate15 Opportunity to Grow Absolute Return Strategies FPAUM From Compounding Key Long-Term Growth Drivers 2. Planting Seeds for Future Growth17 3. Improving Earnings Quality and Power Scale Specialized Funds Direct-Oriented Strategies Growth in Incentive Fee Opportunity Client Retention & Compound Capital $3.5bn Raised in channels in last three years $10.3bn Raised for real assets in last three years $11.1bn Raised for Private Markets direct-oriented strategies in last three years 65% Private Markets % of FPAUM $779mm Carried interest balance11 $29mm Run-rate annual performance fees12

GCM GROSVENOR | 17 Supplemental Information

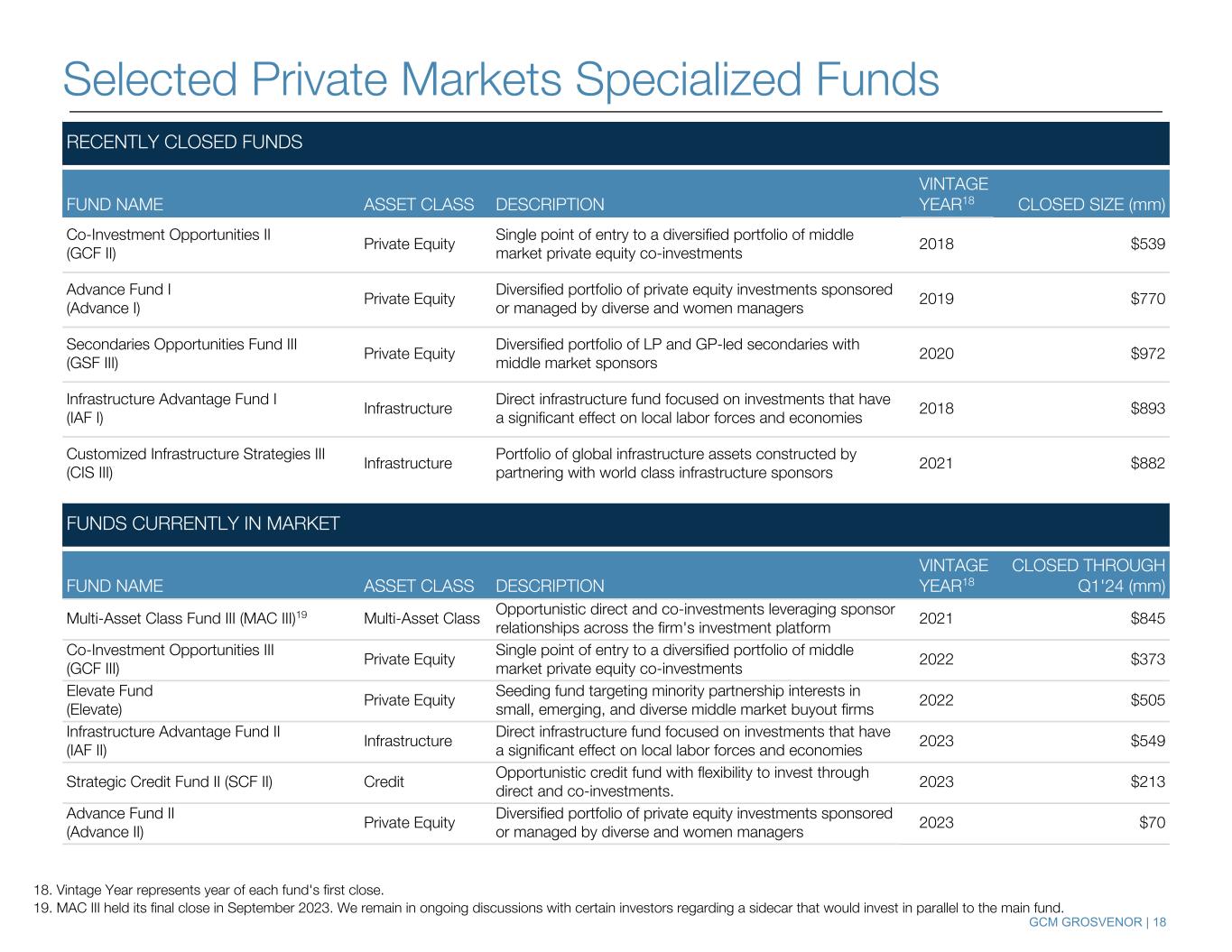

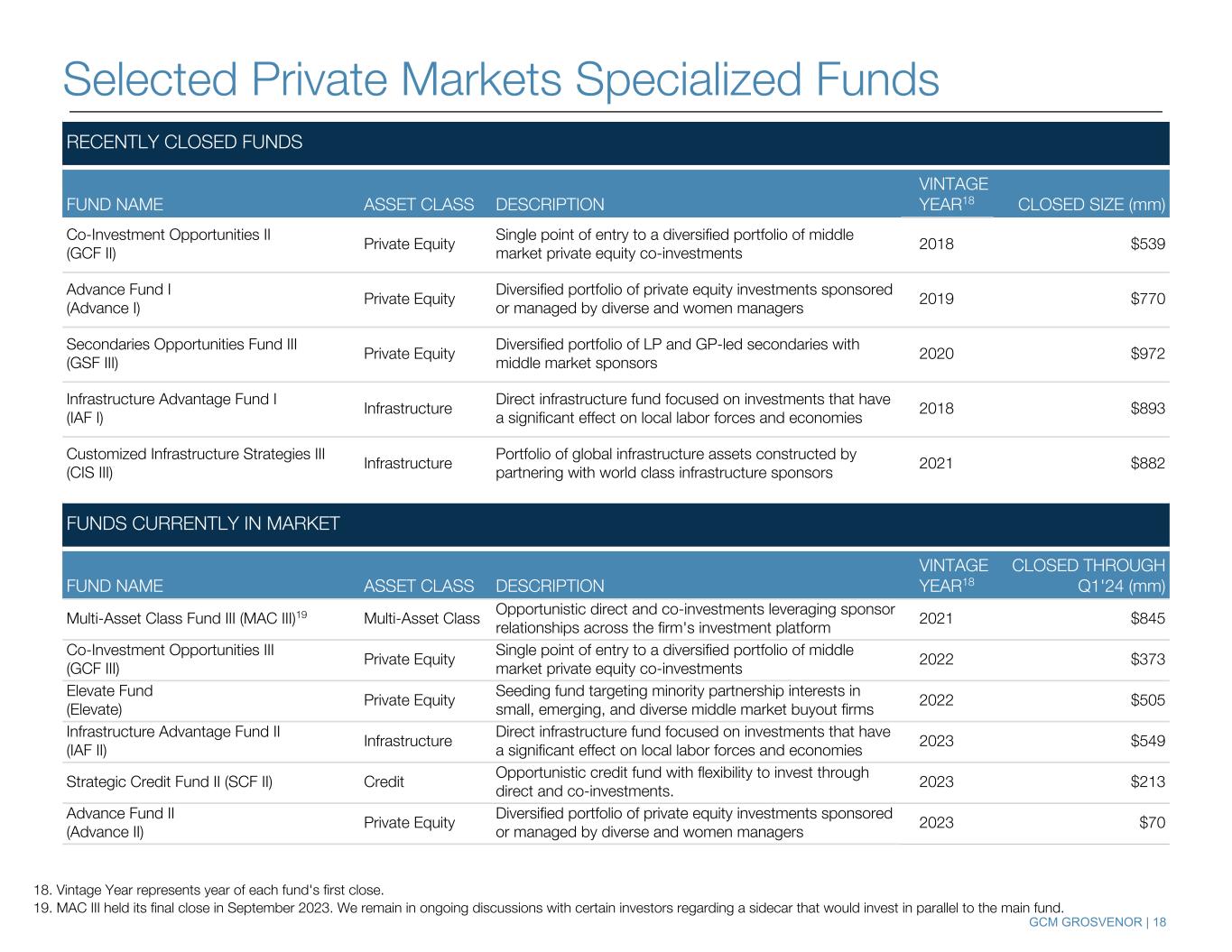

GCM GROSVENOR | 18 Selected Private Markets Specialized Funds RECENTLY CLOSED FUNDS FUND NAME ASSET CLASS DESCRIPTION VINTAGE YEAR18 CLOSED SIZE (mm) Co-Investment Opportunities II (GCF II) Private Equity Single point of entry to a diversified portfolio of middle market private equity co-investments 2018 $539 Advance Fund I (Advance I) Private Equity Diversified portfolio of private equity investments sponsored or managed by diverse and women managers 2019 $770 Secondaries Opportunities Fund III (GSF III) Private Equity Diversified portfolio of LP and GP-led secondaries with middle market sponsors 2020 $972 Infrastructure Advantage Fund I (IAF I) Infrastructure Direct infrastructure fund focused on investments that have a significant effect on local labor forces and economies 2018 $893 Customized Infrastructure Strategies III (CIS III) Infrastructure Portfolio of global infrastructure assets constructed by partnering with world class infrastructure sponsors 2021 $882 FUNDS CURRENTLY IN MARKET FUND NAME ASSET CLASS DESCRIPTION VINTAGE YEAR18 CLOSED THROUGH Q1'24 (mm) Multi-Asset Class Fund III (MAC III)19 Multi-Asset Class Opportunistic direct and co-investments leveraging sponsor relationships across the firm's investment platform 2021 $845 Co-Investment Opportunities III (GCF III) Private Equity Single point of entry to a diversified portfolio of middle market private equity co-investments 2022 $373 Elevate Fund (Elevate) Private Equity Seeding fund targeting minority partnership interests in small, emerging, and diverse middle market buyout firms 2022 $505 Infrastructure Advantage Fund II (IAF II) Infrastructure Direct infrastructure fund focused on investments that have a significant effect on local labor forces and economies 2023 $549 Strategic Credit Fund II (SCF II) Credit Opportunistic credit fund with flexibility to invest through direct and co-investments. 2023 $213 Advance Fund II (Advance II) Private Equity Diversified portfolio of private equity investments sponsored or managed by diverse and women managers 2023 $70 18. Vintage Year represents year of each fund's first close. 19. MAC III held its final close in September 2023. We remain in ongoing discussions with certain investors regarding a sidecar that would invest in parallel to the main fund.

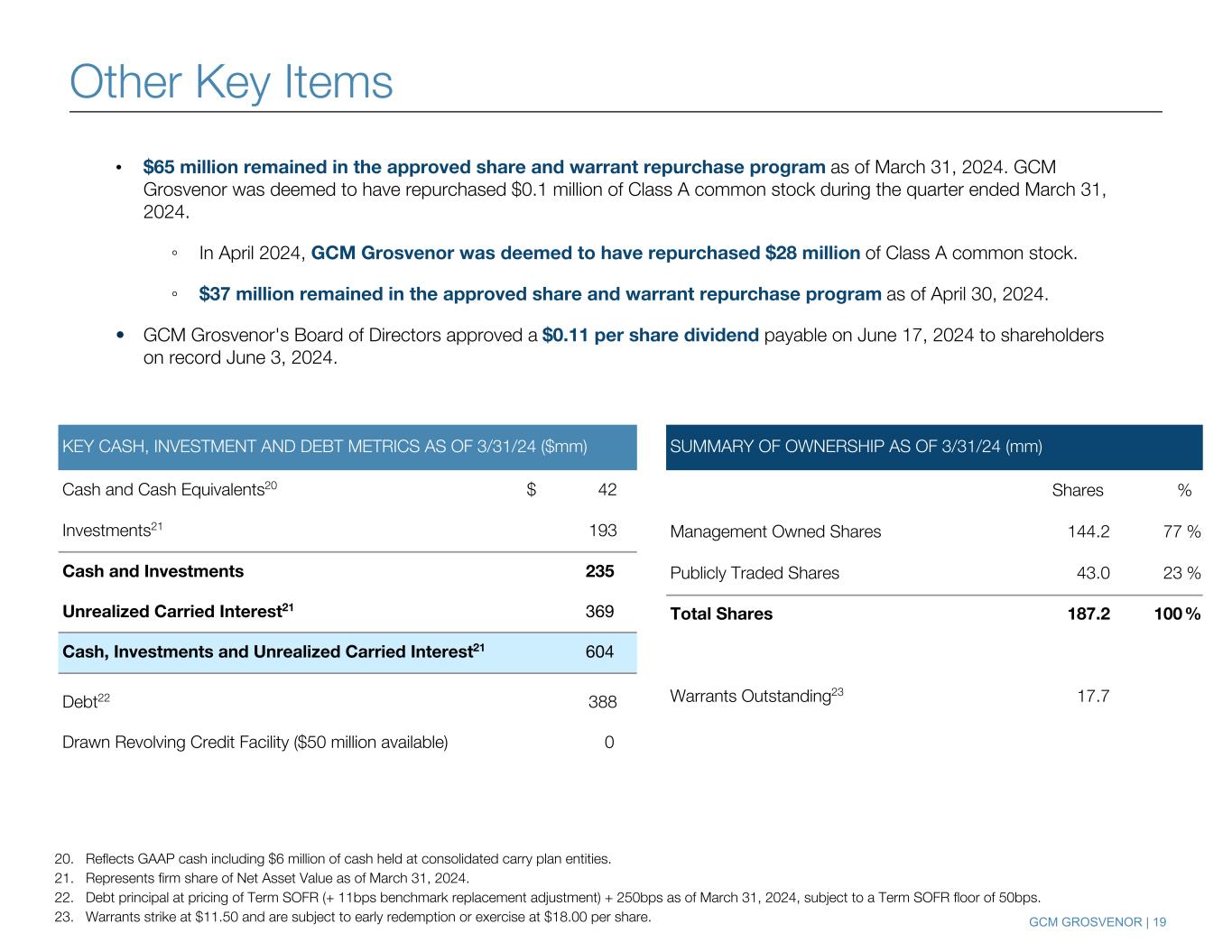

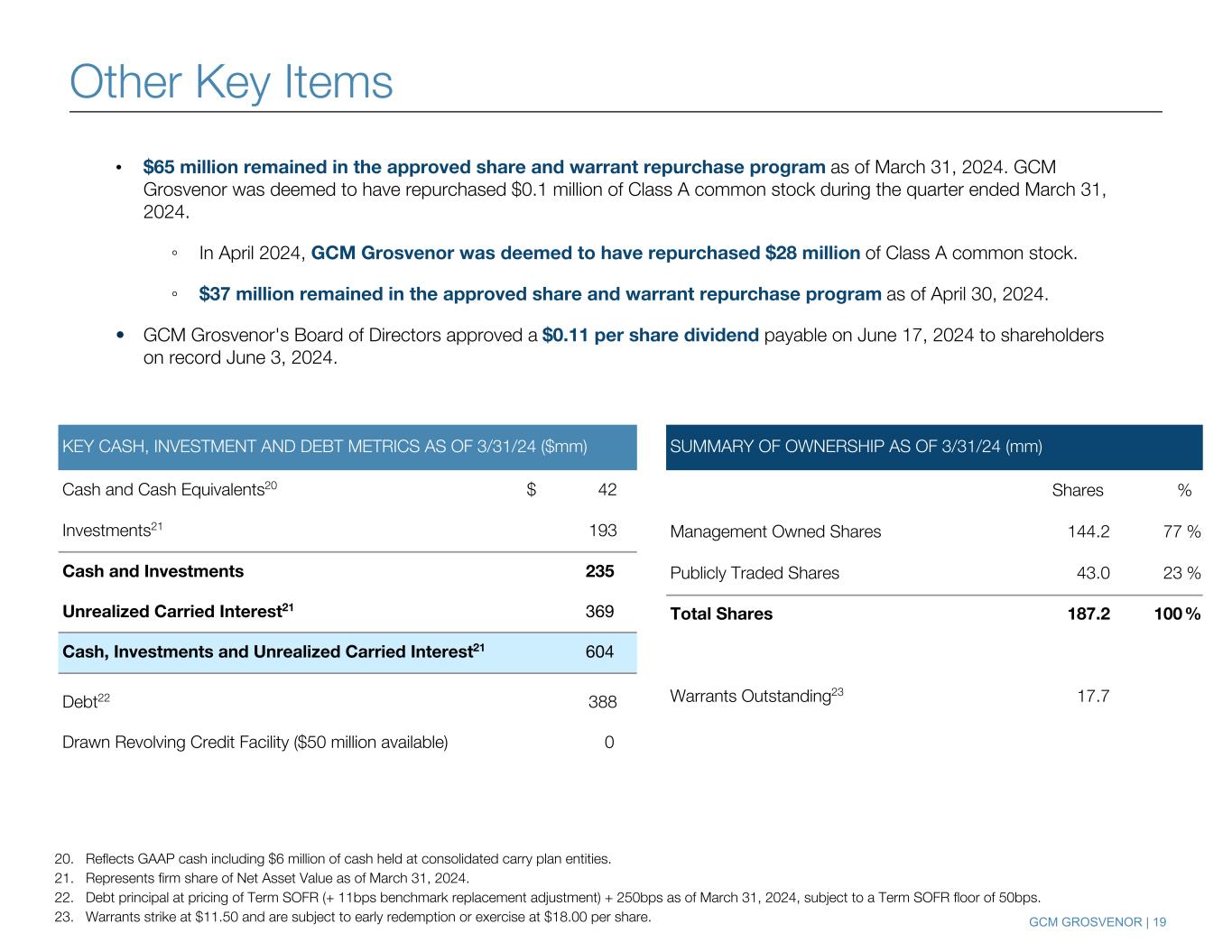

GCM GROSVENOR | 19 20. Reflects GAAP cash including $6 million of cash held at consolidated carry plan entities. 21. Represents firm share of Net Asset Value as of March 31, 2024. 22. Debt principal at pricing of Term SOFR (+ 11bps benchmark replacement adjustment) + 250bps as of March 31, 2024, subject to a Term SOFR floor of 50bps. 23. Warrants strike at $11.50 and are subject to early redemption or exercise at $18.00 per share. • $65 million remained in the approved share and warrant repurchase program as of March 31, 2024. GCM Grosvenor was deemed to have repurchased $0.1 million of Class A common stock during the quarter ended March 31, 2024. ◦ In April 2024, GCM Grosvenor was deemed to have repurchased $28 million of Class A common stock. ◦ $37 million remained in the approved share and warrant repurchase program as of April 30, 2024. • GCM Grosvenor's Board of Directors approved a $0.11 per share dividend payable on June 17, 2024 to shareholders on record June 3, 2024. SUMMARY OF OWNERSHIP AS OF 3/31/24 (mm) Shares % Management Owned Shares 144.2 77 % Publicly Traded Shares 43.0 23 % Total Shares 187.2 100 % Warrants Outstanding23 17.7 Other Key Items KEY CASH, INVESTMENT AND DEBT METRICS AS OF 3/31/24 ($mm) Cash and Cash Equivalents20 $ 42 Investments21 193 Cash and Investments 235 Unrealized Carried Interest21 369 Cash, Investments and Unrealized Carried Interest21 604 Debt22 388 Drawn Revolving Credit Facility ($50 million available) 0

GCM GROSVENOR | 20 $000, EXCEPT PER SHARE AMOUNTS AND WHERE OTHERWISE NOTED THREE MONTHS ENDED MAR 31, 2023 MAR 31, 2024 Revenues Management fees $ 92,245 $ 95,885 Incentive fees 5,815 10,118 Other operating income 1,056 2,863 Total operating revenues 99,116 108,866 Expenses Employee compensation and benefits 86,224 99,647 General, administrative and other 25,779 25,179 Total operating expenses 112,003 124,826 Operating loss (12,887) (15,960) Investment income 6,324 5,677 Interest expense (6,655) (5,923) Other income 714 553 Change in fair value of warrant liabilities (2,221) (2,144) Net other expense (1,838) (1,837) Loss before income taxes (14,725) (17,797) Provision for income taxes 422 1,110 Net loss (15,147) (18,907) Less: Net income attributable to noncontrolling interests in subsidiaries 2,773 1,302 Less: Net loss attributable to noncontrolling interests in GCMH (16,690) (22,333) Net income (loss) attributable to GCM Grosvenor Inc. $ (1,230) $ 2,124 Earnings (loss) per share of Class A common stock: Basic $ (0.03) $ 0.05 Diluted $ (0.10) $ (0.13) Weighted average shares of Class A common stock outstanding: Basic (in millions) 42.4 43.7 Diluted (in millions) 186.6 187.9 GAAP Statements of Income

GCM GROSVENOR | 21 2-3, 24-28. See Notes towards the end of the document. $000, except per share amounts and where otherwise noted THREE MONTHS ENDED ADJUSTED EBITDA MAR 31, 2023 MAR 31, 2024 Revenues Private markets strategies2 $ 51,802 $ 55,577 Absolute return strategies2 37,136 36,375 Management fees, net2 88,938 91,952 Administrative fees and other operating income 1,056 2,863 Fee-Related Revenue2 89,994 94,815 Less: Cash-based employee compensation and benefits, net25 (39,890) (36,987) General, administrative and other, net26 (19,727) (19,704) Fee-Related Earnings 30,377 38,124 Fee-Related Earnings Margin 34 % 40 % Incentive fees: Performance fees 244 5,987 Carried interest 5,571 4,131 Incentive fee related compensation and NCI: Cash-based incentive fee related compensation (737) (4,189) Carried interest compensation, net27 (3,217) (2,551) Carried interest attributable to noncontrolling interests (961) (585) Realized investment income, net of amount attributable to noncontrolling interests in subsidiaries28 555 591 Interest income 695 579 Other (income) expense 17 (26) Depreciation 347 305 Adjusted EBITDA 32,891 42,366 Adjusted EBITDA Margin 34 % 40 % ADJUSTED NET INCOME PER SHARE Adjusted EBITDA 32,891 42,366 Depreciation (347) (305) Interest expense (6,655) (5,923) Adjusted Pre-Tax Income 25,889 36,138 Adjusted income taxes3 (6,266) (8,926) Adjusted Net Income 19,623 27,212 Adjusted shares outstanding (in millions) 188.2 190.2 Adjusted Net Income per Share - diluted $ 0.10 $ 0.14 Summary of Non-GAAP Financial Measures24

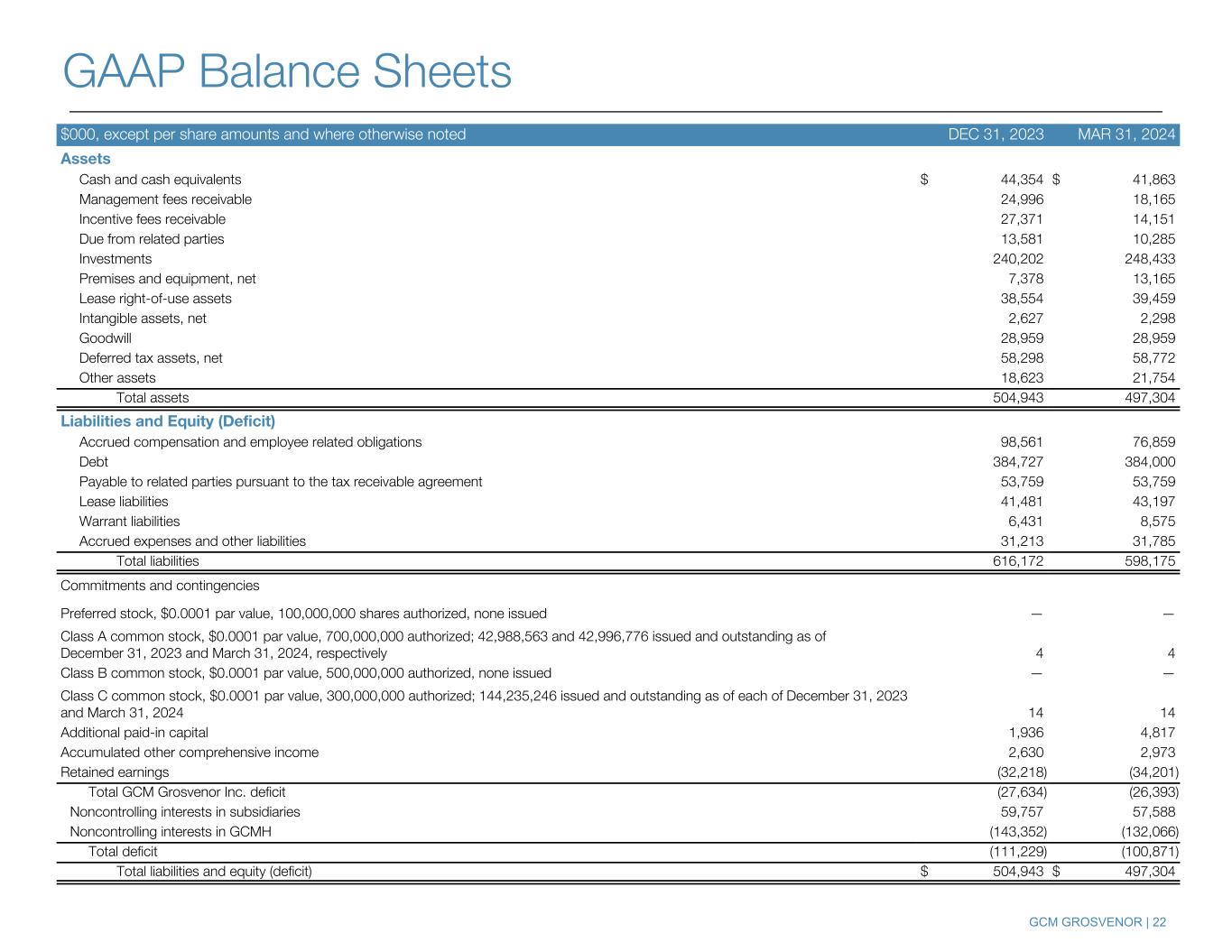

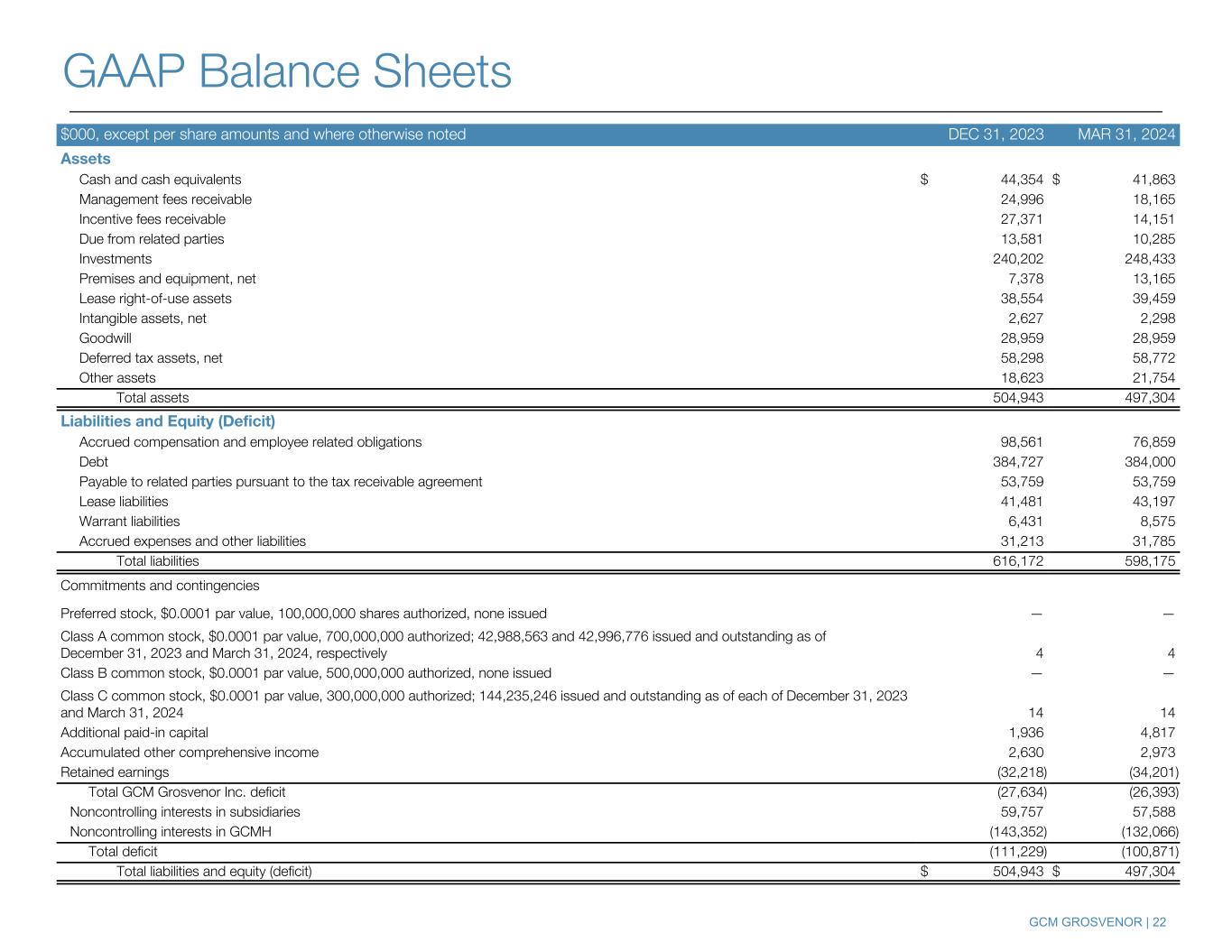

GCM GROSVENOR | 22 $000, except per share amounts and where otherwise noted DEC 31, 2023 MAR 31, 2024 Assets Cash and cash equivalents $ 44,354 $ 41,863 Management fees receivable 24,996 18,165 Incentive fees receivable 27,371 14,151 Due from related parties 13,581 10,285 Investments 240,202 248,433 Premises and equipment, net 7,378 13,165 Lease right-of-use assets 38,554 39,459 Intangible assets, net 2,627 2,298 Goodwill 28,959 28,959 Deferred tax assets, net 58,298 58,772 Other assets 18,623 21,754 Total assets 504,943 497,304 Liabilities and Equity (Deficit) Accrued compensation and employee related obligations 98,561 76,859 Debt 384,727 384,000 Payable to related parties pursuant to the tax receivable agreement 53,759 53,759 Lease liabilities 41,481 43,197 Warrant liabilities 6,431 8,575 Accrued expenses and other liabilities 31,213 31,785 Total liabilities 616,172 598,175 Commitments and contingencies Preferred stock, $0.0001 par value, 100,000,000 shares authorized, none issued — — Class A common stock, $0.0001 par value, 700,000,000 authorized; 42,988,563 and 42,996,776 issued and outstanding as of December 31, 2023 and March 31, 2024, respectively 4 4 Class B common stock, $0.0001 par value, 500,000,000 authorized, none issued — — Class C common stock, $0.0001 par value, 300,000,000 authorized; 144,235,246 issued and outstanding as of each of December 31, 2023 and March 31, 2024 14 14 Additional paid-in capital 1,936 4,817 Accumulated other comprehensive income 2,630 2,973 Retained earnings (32,218) (34,201) Total GCM Grosvenor Inc. deficit (27,634) (26,393) Noncontrolling interests in subsidiaries 59,757 57,588 Noncontrolling interests in GCMH (143,352) (132,066) Total deficit (111,229) (100,871) Total liabilities and equity (deficit) $ 504,943 $ 497,304 GAAP Balance Sheets

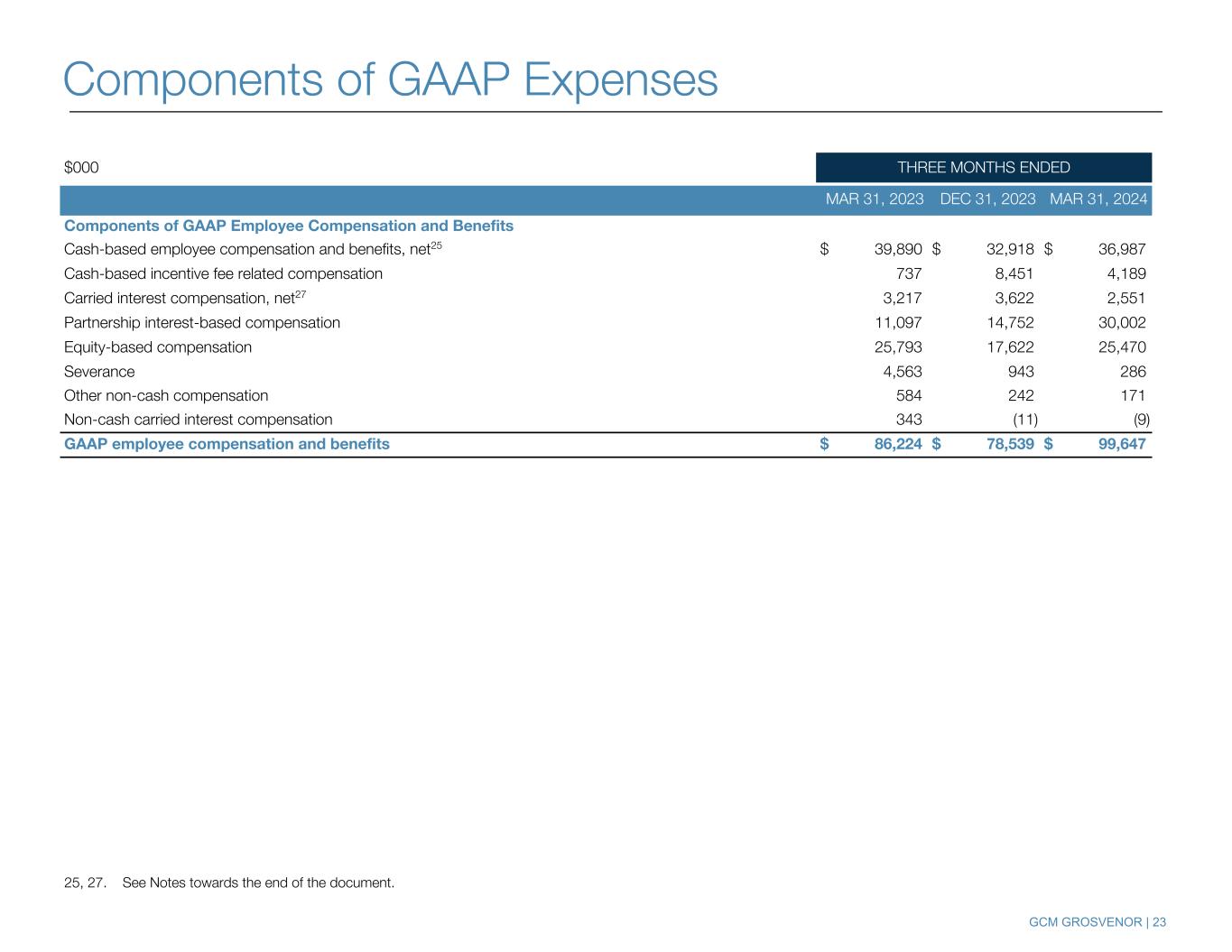

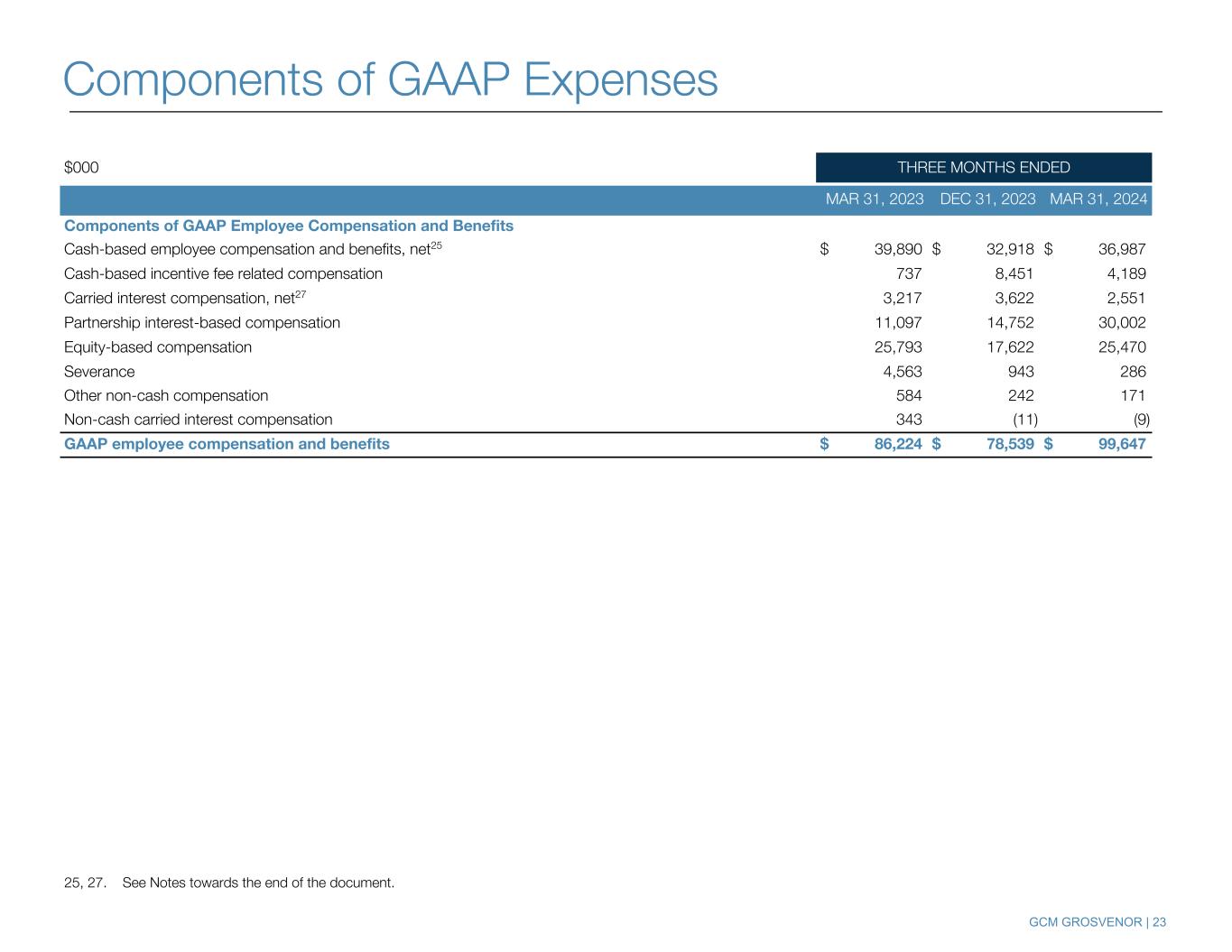

GCM GROSVENOR | 23 $000 THREE MONTHS ENDED MAR 31, 2023 DEC 31, 2023 MAR 31, 2024 Components of GAAP Employee Compensation and Benefits Cash-based employee compensation and benefits, net25 $ 39,890 $ 32,918 $ 36,987 Cash-based incentive fee related compensation 737 8,451 4,189 Carried interest compensation, net27 3,217 3,622 2,551 Partnership interest-based compensation 11,097 14,752 30,002 Equity-based compensation 25,793 17,622 25,470 Severance 4,563 943 286 Other non-cash compensation 584 242 171 Non-cash carried interest compensation 343 (11) (9) GAAP employee compensation and benefits $ 86,224 $ 78,539 $ 99,647 25, 27. See Notes towards the end of the document. Components of GAAP Expenses

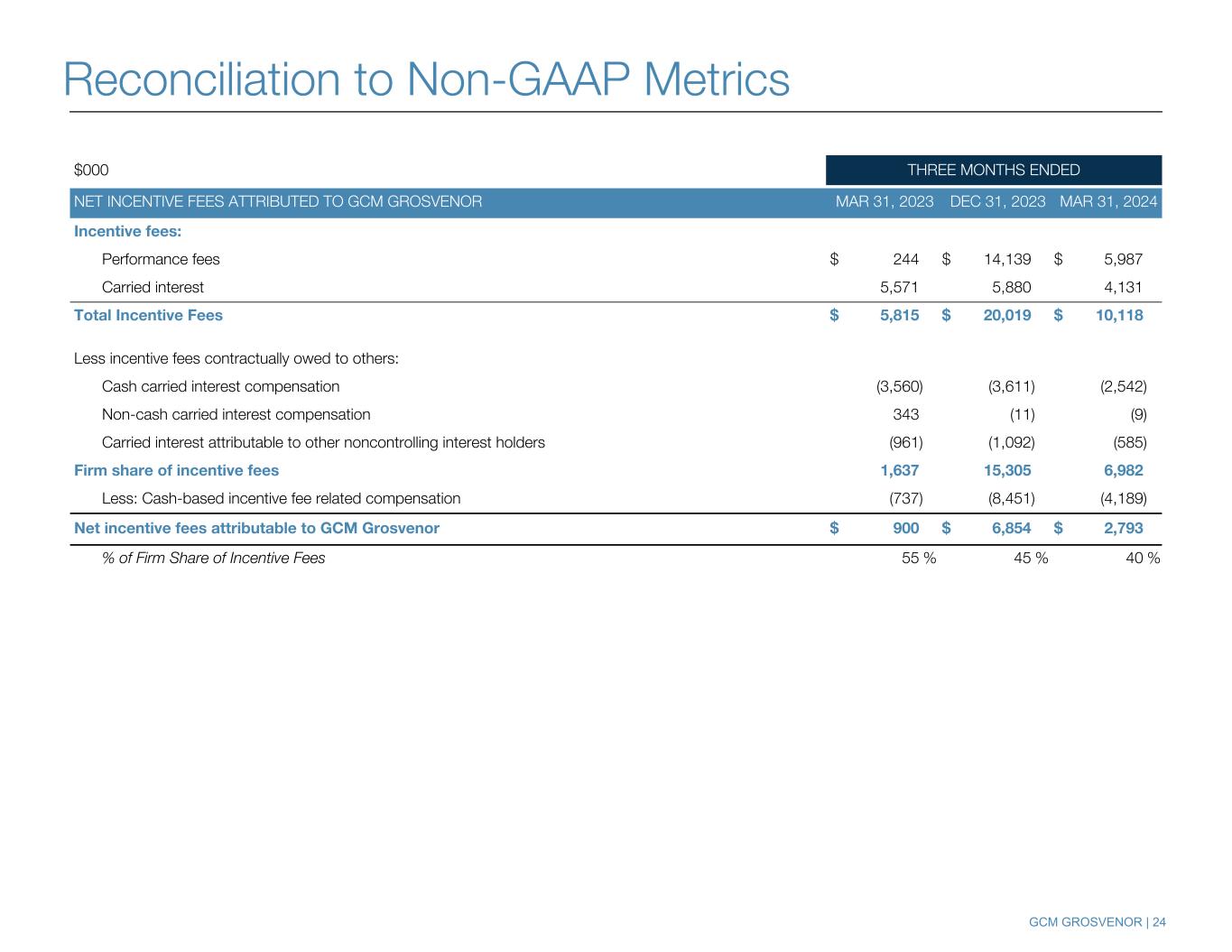

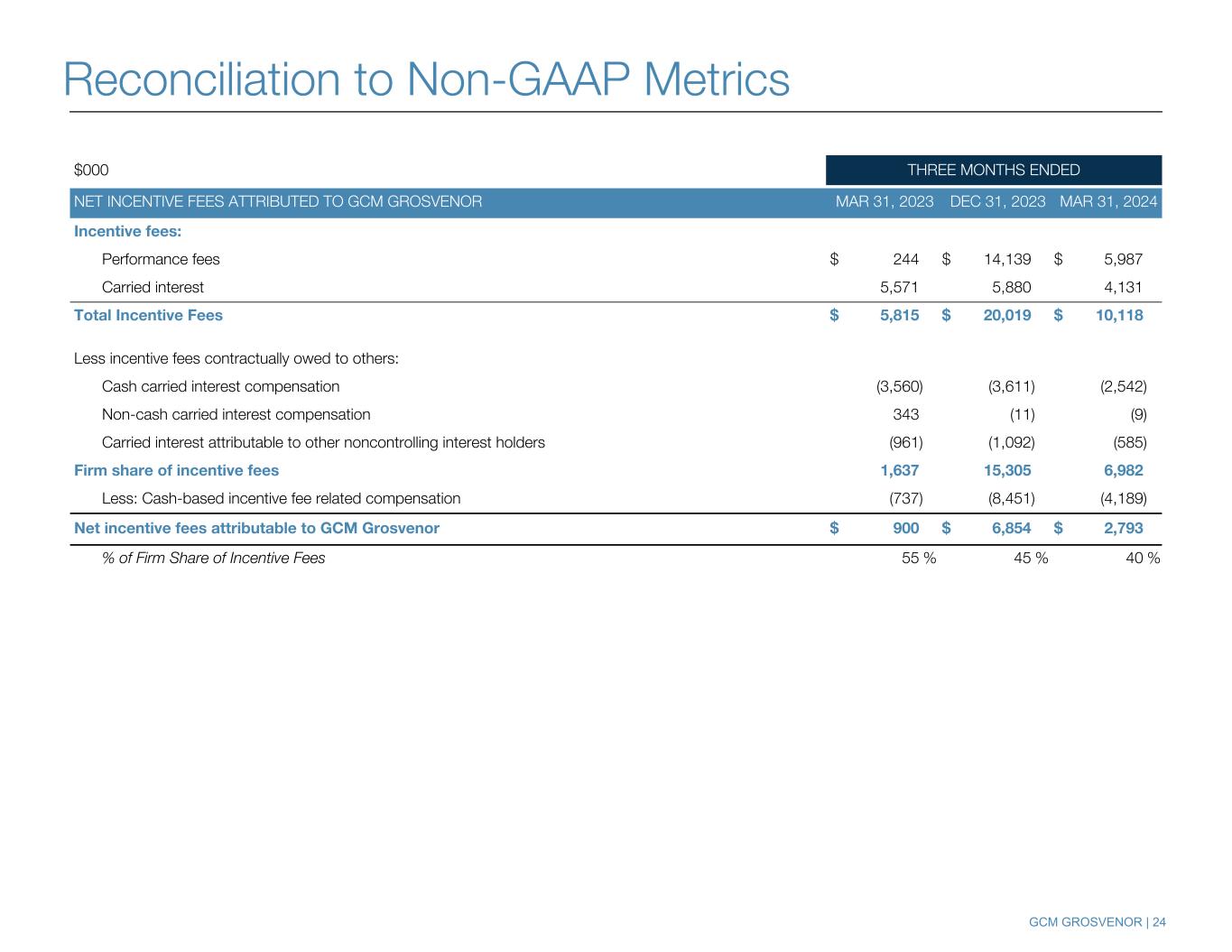

GCM GROSVENOR | 24 $000 THREE MONTHS ENDED NET INCENTIVE FEES ATTRIBUTED TO GCM GROSVENOR MAR 31, 2023 DEC 31, 2023 MAR 31, 2024 Incentive fees: Performance fees $ 244 $ 14,139 $ 5,987 Carried interest 5,571 5,880 4,131 Total Incentive Fees $ 5,815 $ 20,019 $ 10,118 Less incentive fees contractually owed to others: Cash carried interest compensation (3,560) (3,611) (2,542) Non-cash carried interest compensation 343 (11) (9) Carried interest attributable to other noncontrolling interest holders (961) (1,092) (585) Firm share of incentive fees 1,637 15,305 6,982 Less: Cash-based incentive fee related compensation (737) (8,451) (4,189) Net incentive fees attributable to GCM Grosvenor $ 900 $ 6,854 $ 2,793 % of Firm Share of Incentive Fees 55 % 45 % 40 % Reconciliation to Non-GAAP Metrics

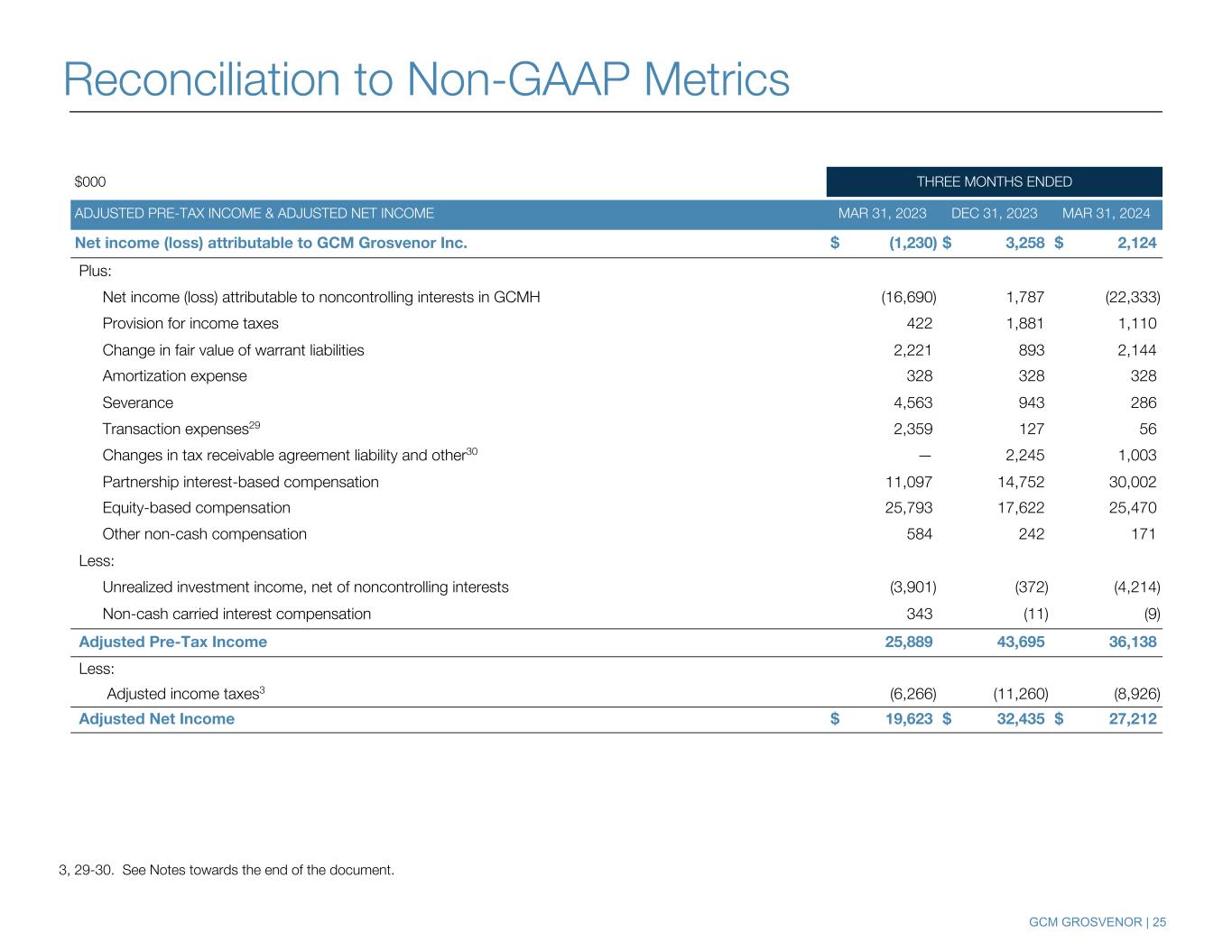

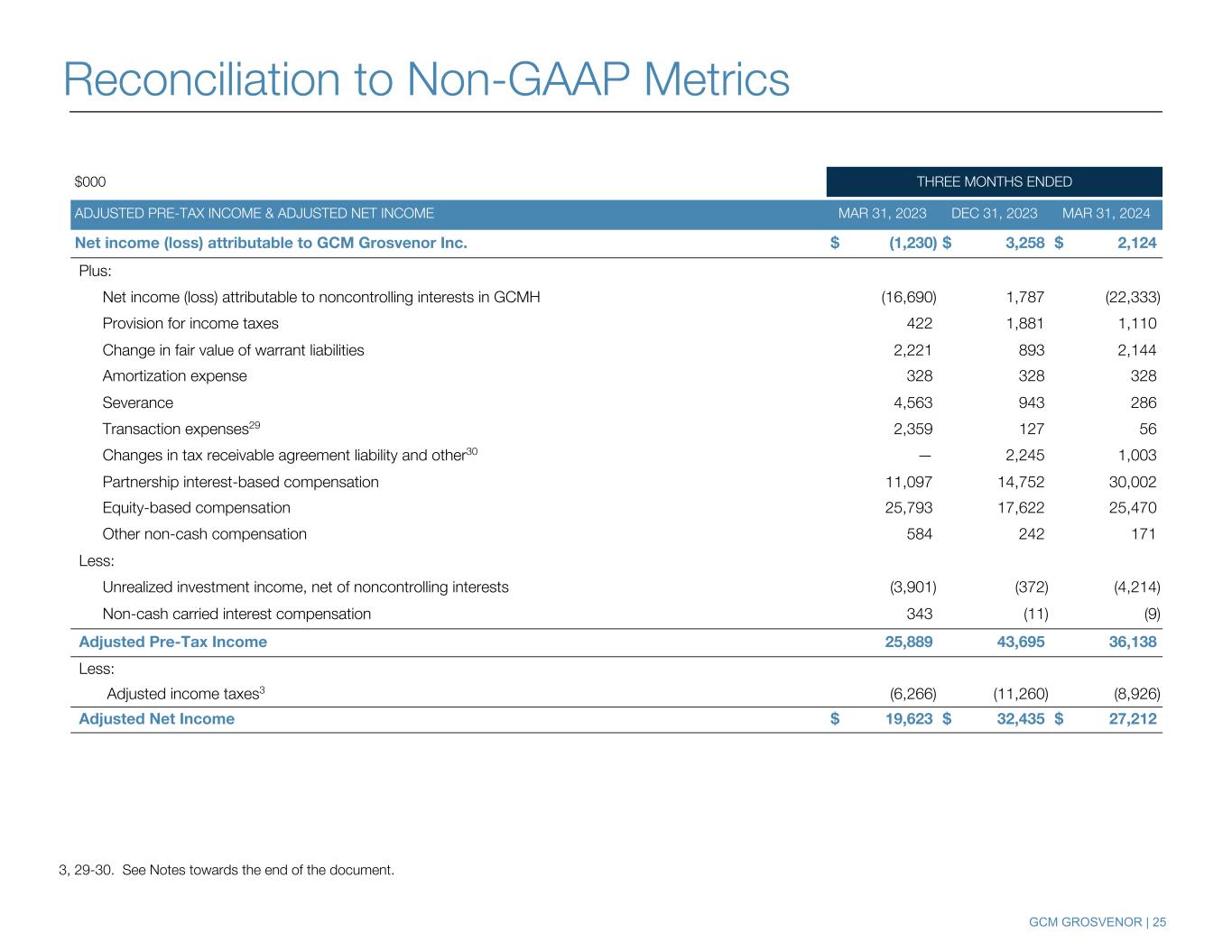

GCM GROSVENOR | 25 $000 THREE MONTHS ENDED ADJUSTED PRE-TAX INCOME & ADJUSTED NET INCOME MAR 31, 2023 DEC 31, 2023 MAR 31, 2024 Net income (loss) attributable to GCM Grosvenor Inc. $ (1,230) $ 3,258 $ 2,124 Plus: Net income (loss) attributable to noncontrolling interests in GCMH (16,690) 1,787 (22,333) Provision for income taxes 422 1,881 1,110 Change in fair value of warrant liabilities 2,221 893 2,144 Amortization expense 328 328 328 Severance 4,563 943 286 Transaction expenses29 2,359 127 56 Changes in tax receivable agreement liability and other30 — 2,245 1,003 Partnership interest-based compensation 11,097 14,752 30,002 Equity-based compensation 25,793 17,622 25,470 Other non-cash compensation 584 242 171 Less: Unrealized investment income, net of noncontrolling interests (3,901) (372) (4,214) Non-cash carried interest compensation 343 (11) (9) Adjusted Pre-Tax Income 25,889 43,695 36,138 Less: Adjusted income taxes3 (6,266) (11,260) (8,926) Adjusted Net Income $ 19,623 $ 32,435 $ 27,212 3, 29-30. See Notes towards the end of the document. Reconciliation to Non-GAAP Metrics

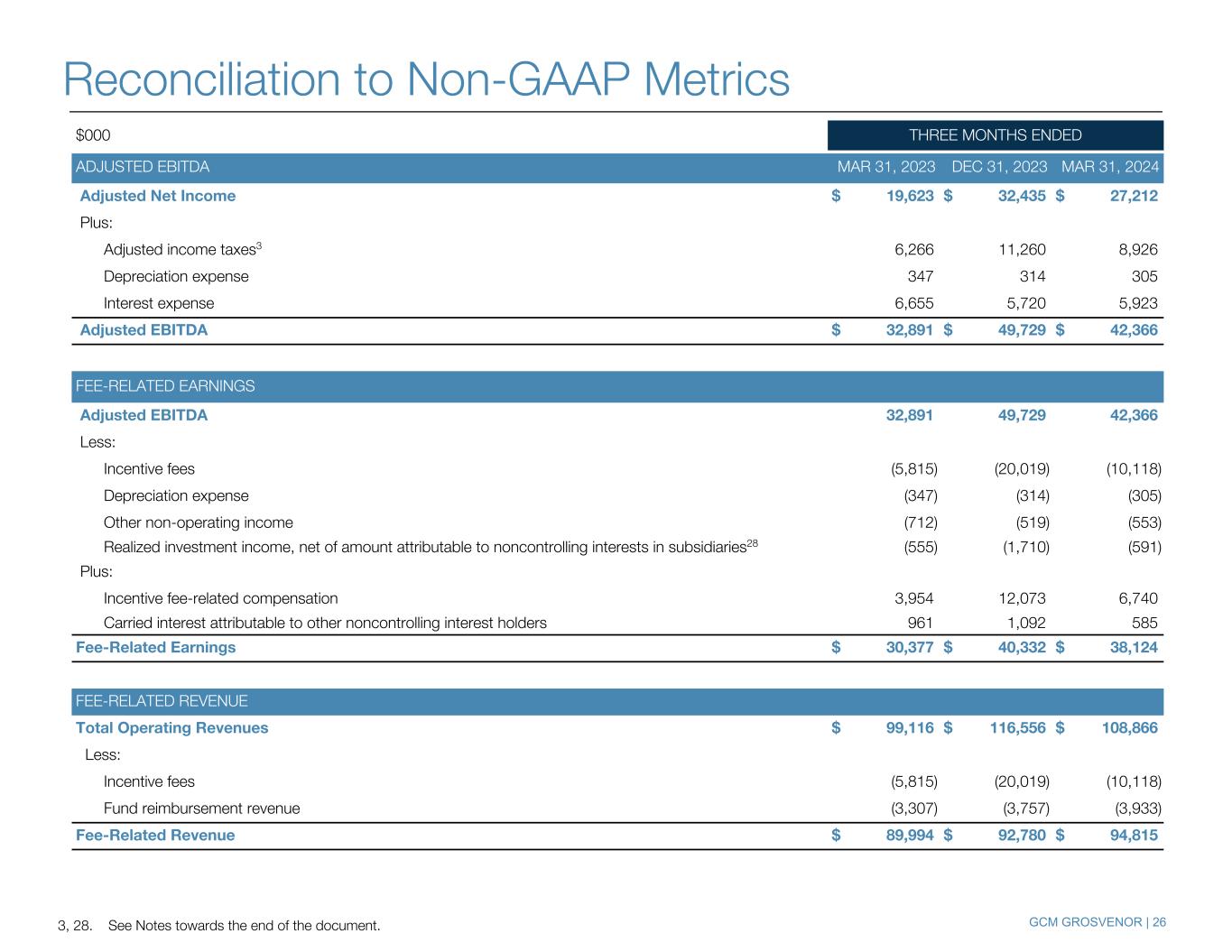

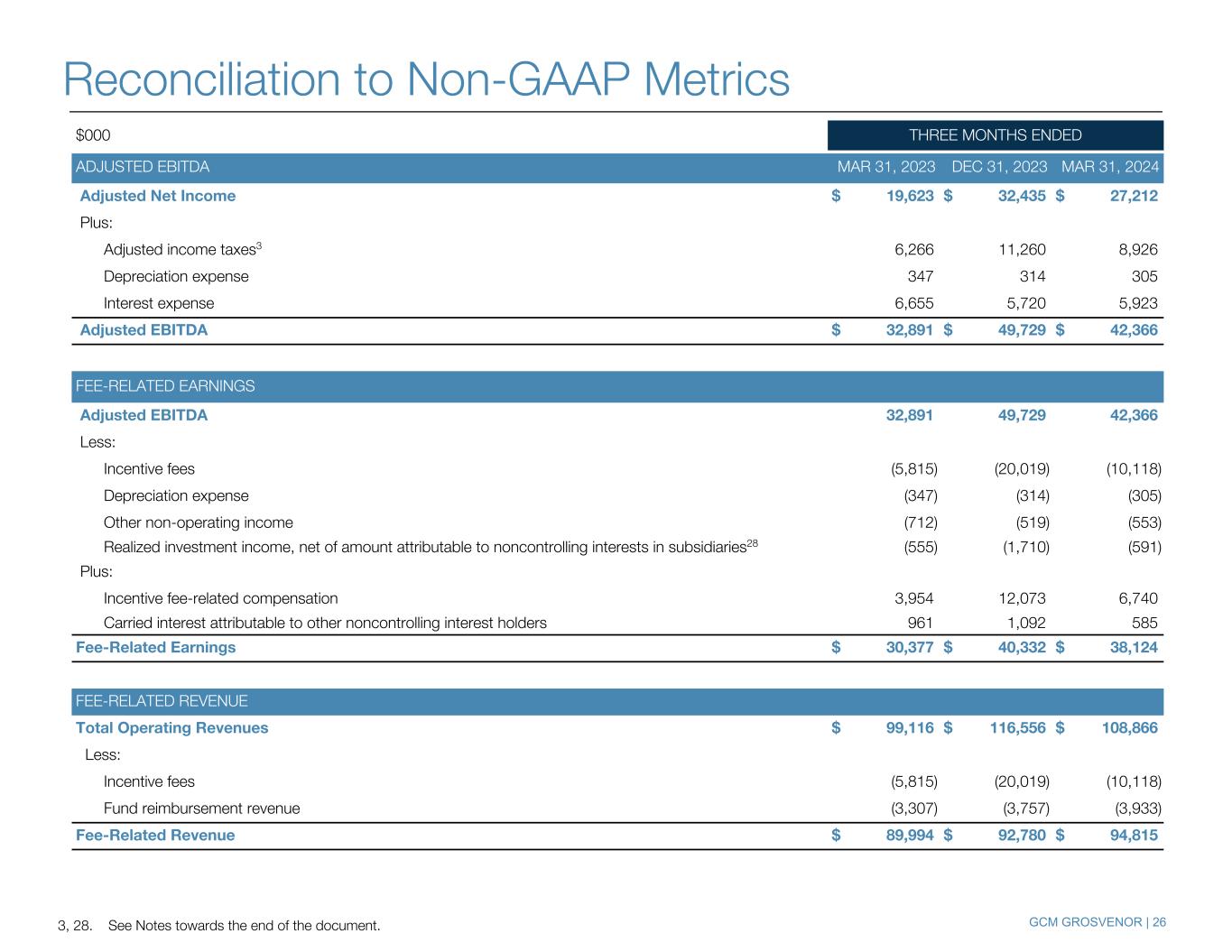

GCM GROSVENOR | 26 $000 THREE MONTHS ENDED ADJUSTED EBITDA MAR 31, 2023 DEC 31, 2023 MAR 31, 2024 Adjusted Net Income $ 19,623 $ 32,435 $ 27,212 Plus: Adjusted income taxes3 6,266 11,260 8,926 Depreciation expense 347 314 305 Interest expense 6,655 5,720 5,923 Adjusted EBITDA $ 32,891 $ 49,729 $ 42,366 FEE-RELATED EARNINGS Adjusted EBITDA 32,891 49,729 42,366 Less: Incentive fees (5,815) (20,019) (10,118) Depreciation expense (347) (314) (305) Other non-operating income (712) (519) (553) Realized investment income, net of amount attributable to noncontrolling interests in subsidiaries28 (555) (1,710) (591) Plus: Incentive fee-related compensation 3,954 12,073 6,740 Carried interest attributable to other noncontrolling interest holders 961 1,092 585 Fee-Related Earnings $ 30,377 $ 40,332 $ 38,124 FEE-RELATED REVENUE Total Operating Revenues $ 99,116 $ 116,556 $ 108,866 Less: Incentive fees (5,815) (20,019) (10,118) Fund reimbursement revenue (3,307) (3,757) (3,933) Fee-Related Revenue $ 89,994 $ 92,780 $ 94,815 3, 28. See Notes towards the end of the document. Reconciliation to Non-GAAP Metrics

GCM GROSVENOR | 27 $000, except per share amounts and where otherwise noted THREE MONTHS ENDED ADJUSTED NET INCOME PER SHARE MAR 31, 2023 DEC 31, 2023 MAR 31, 2024 Adjusted Net Income $ 19,623 $ 32,435 $ 27,212 Weighted-average shares of Class A common stock outstanding - basic (in millions) 42.4 43.2 43.7 Exchange of partnership units (in millions) 144.2 144.2 144.2 Assumed vesting of RSUs - incremental shares under the treasury stock method (in millions) — — — Weighted-average shares of Class A common stock outstanding - diluted (in millions) 186.6 187.5 187.9 Effective RSUs, if antidilutive for GAAP (in millions) 1.5 1.3 2.3 Adjusted shares - diluted (in millions) 188.2 188.8 190.2 Adjusted Net Income Per Share - diluted $ 0.10 $ 0.17 $ 0.14 Note: Amounts may not foot due to rounding. Reconciliation to Adjusted Net Income Per Share

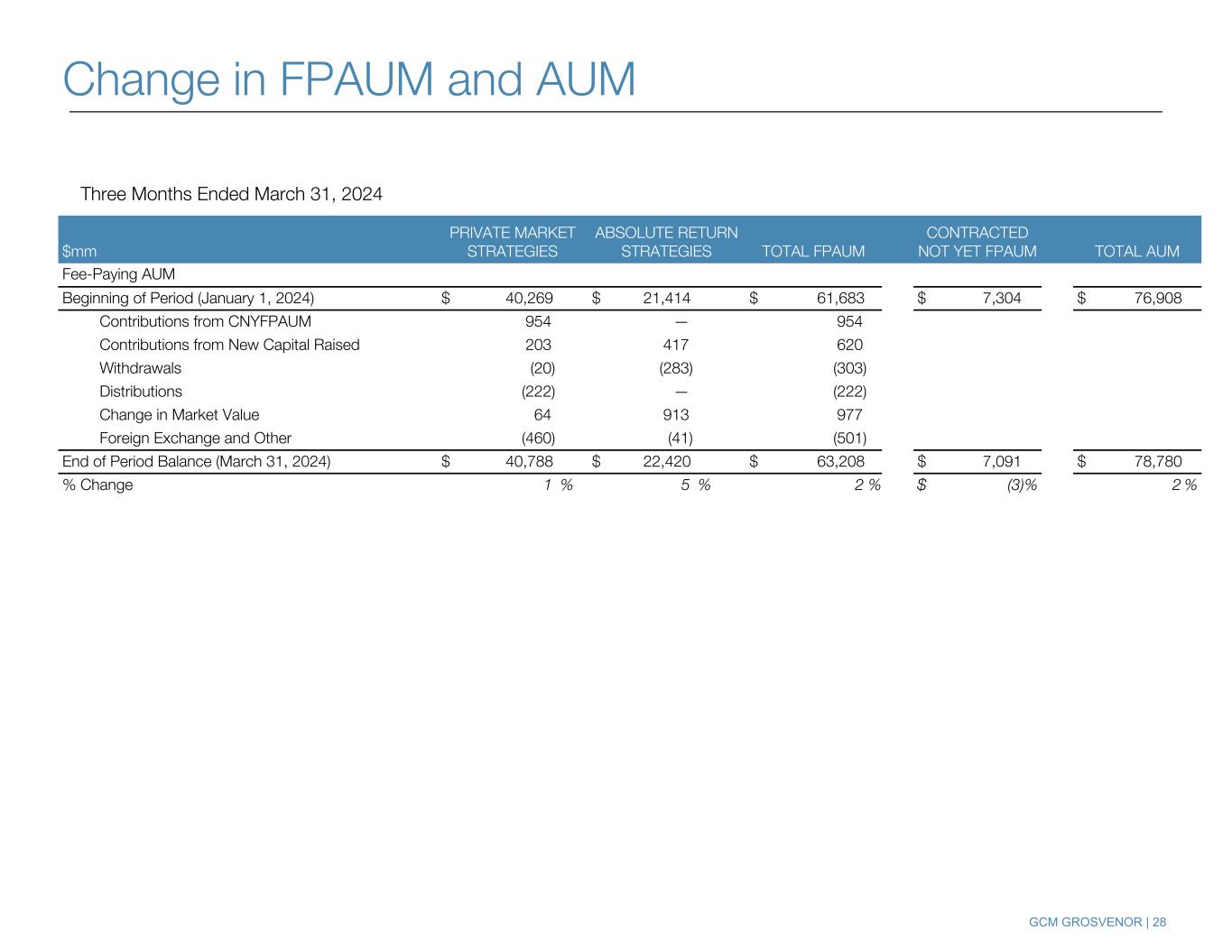

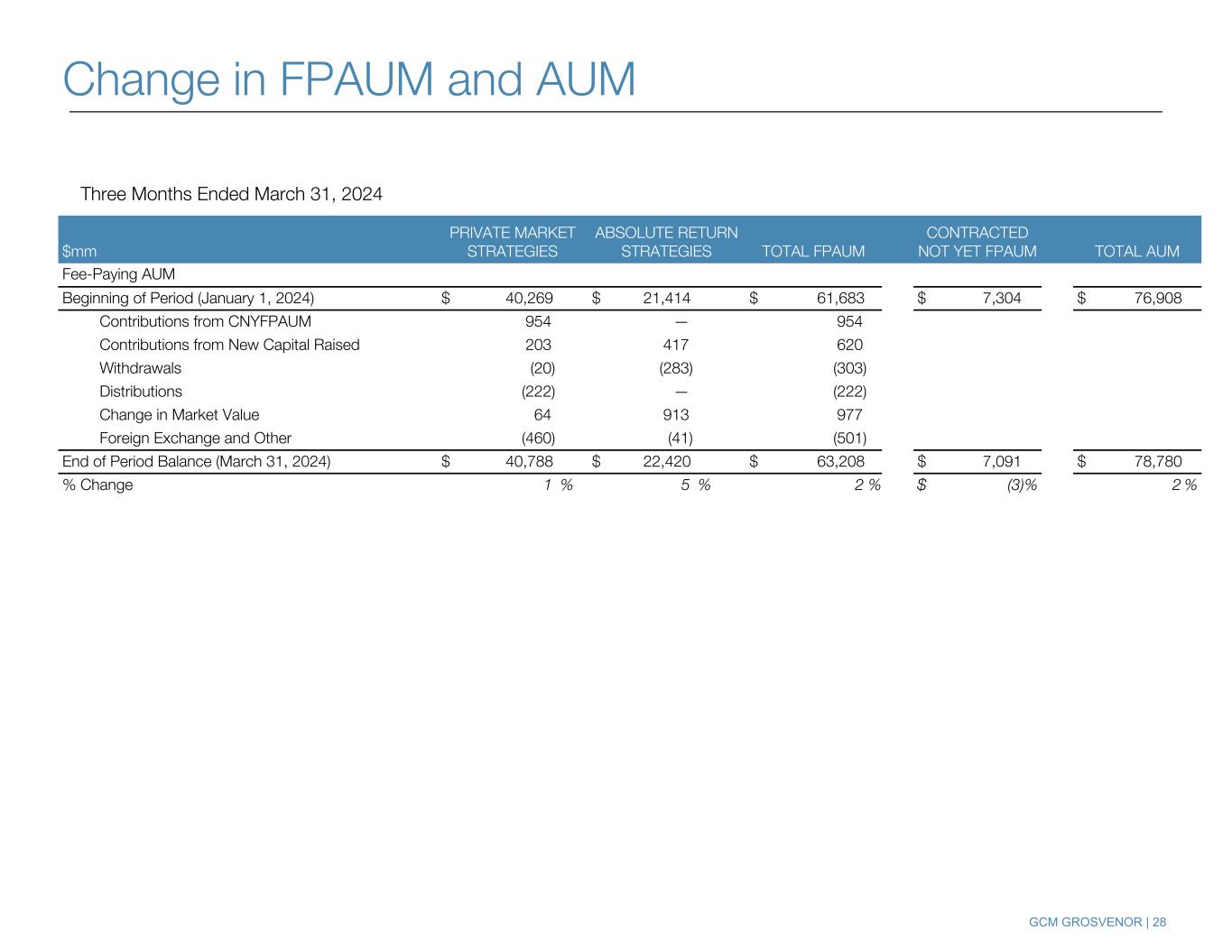

GCM GROSVENOR | 28 $mm PRIVATE MARKET STRATEGIES ABSOLUTE RETURN STRATEGIES TOTAL FPAUM CONTRACTED NOT YET FPAUM TOTAL AUM Fee-Paying AUM Beginning of Period (January 1, 2024) $ 40,269 $ 21,414 $ 61,683 $ 7,304 $ 76,908 Contributions from CNYFPAUM 954 — 954 Contributions from New Capital Raised 203 417 620 Withdrawals (20) (283) (303) Distributions (222) — (222) Change in Market Value 64 913 977 Foreign Exchange and Other (460) (41) (501) End of Period Balance (March 31, 2024) $ 40,788 $ 22,420 $ 63,208 $ 7,091 $ 78,780 % Change 1 % 5 % 2 % $ (3) % 2 % Three Months Ended March 31, 2024 Change in FPAUM and AUM

GCM GROSVENOR | 29 $000 THREE MONTHS ENDED MANAGEMENT FEES MAR 31, 2023 DEC 31, 2023 MAR 31, 2024 Private Markets Specialized Funds $ 19,450 $ 20,971 $ 21,001 Average Fee Rate31 0.79 % 0.77 % 0.77 % Customized Separate Accounts 32,352 34,090 34,576 Average Fee Rate 0.47 % 0.46 % 0.46 % Private Markets Management Fees 51,802 55,061 55,577 Average Fee Rate - Private Markets31 0.55 % 0.54 % 0.55 % Absolute Return Strategies Management Fees 37,136 36,244 36,375 Average Fee Rate - Absolute Return Strategies (Management Fee Only) 0.68 % 0.68 % 0.66 % Average Fee Rate - Absolute Return Strategies (Actual Management Fee + Run Rate Performance Fee at End of Period)32 0.79 % 0.79 % 0.78 % 2. Excludes fund reimbursement revenue. 31. Average fee rate excludes effect of catch-up management fees. 32. The run rate on annual performance fees reflects potential annual performance fees generated by performance fee-eligible AUM before any loss carryforwards, if applicable, at an 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies, and before cash-based incentive fee related compensation. The metric is calculated as the actual management fees during the period, plus the run rate performance fee from the end of the period, divided by the average fee- paying AUM over the period. Management Fee Detail2

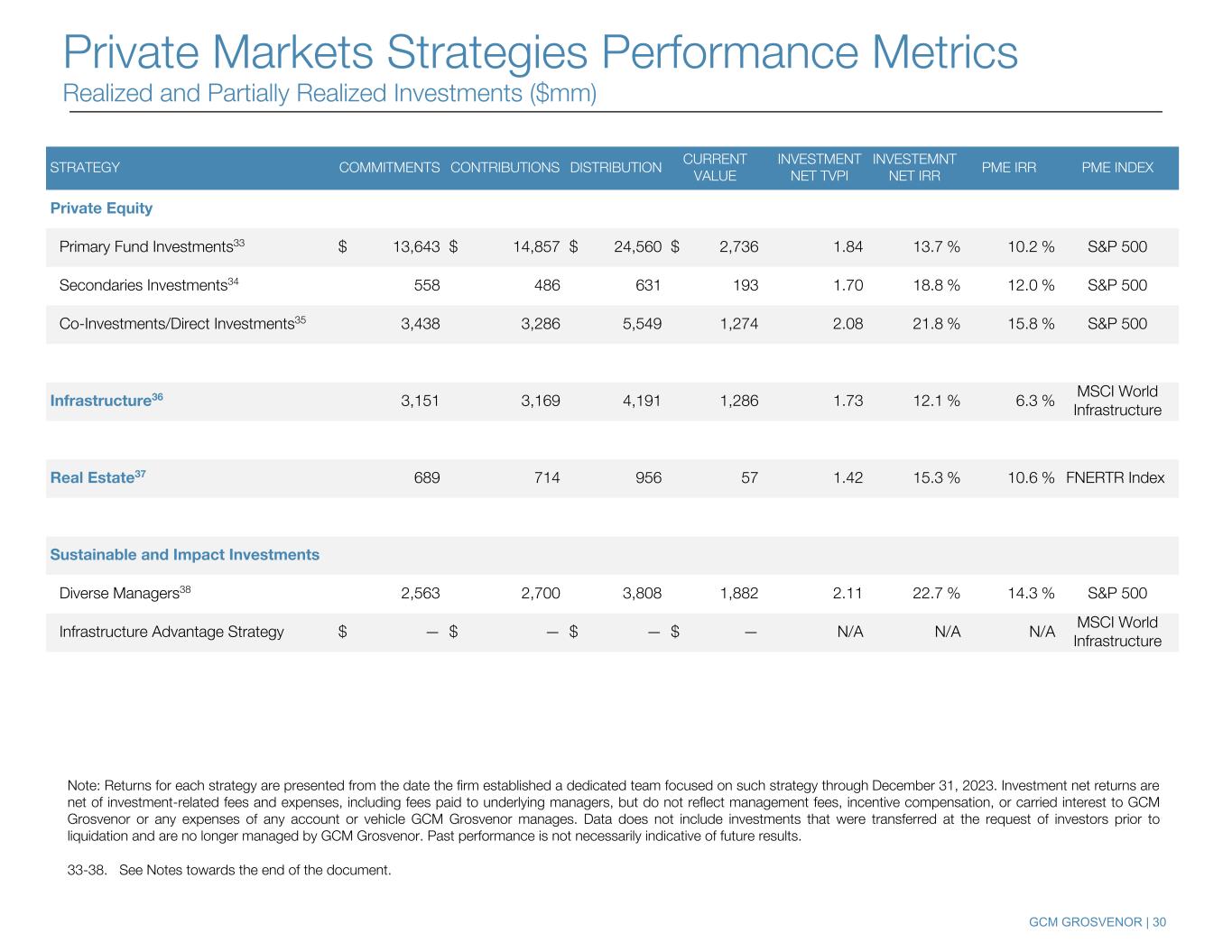

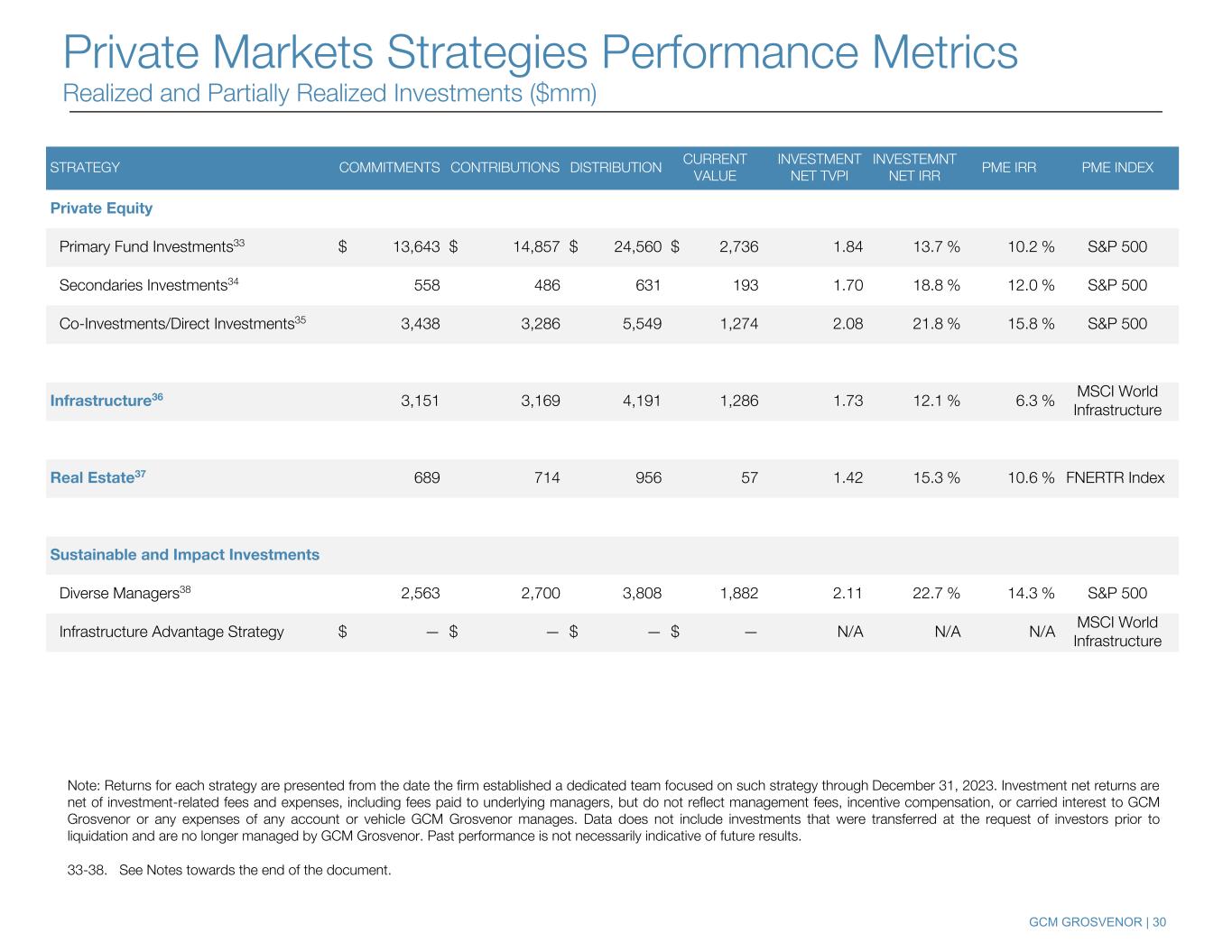

GCM GROSVENOR | 30 STRATEGY COMMITMENTS CONTRIBUTIONS DISTRIBUTION CURRENT VALUE INVESTMENT NET TVPI INVESTEMNT NET IRR PME IRR PME INDEX Private Equity Primary Fund Investments33 $ 13,643 $ 14,857 $ 24,560 $ 2,736 1.84 13.7 % 10.2 % S&P 500 Secondaries Investments34 558 486 631 193 1.70 18.8 % 12.0 % S&P 500 Co-Investments/Direct Investments35 3,438 3,286 5,549 1,274 2.08 21.8 % 15.8 % S&P 500 Infrastructure36 3,151 3,169 4,191 1,286 1.73 12.1 % 6.3 % MSCI World Infrastructure Real Estate37 689 714 956 57 1.42 15.3 % 10.6 % FNERTR Index Sustainable and Impact Investments Diverse Managers38 2,563 2,700 3,808 1,882 2.11 22.7 % 14.3 % S&P 500 Infrastructure Advantage Strategy $ — $ — $ — $ — N/A N/A N/A MSCI World Infrastructure Note: Returns for each strategy are presented from the date the firm established a dedicated team focused on such strategy through December 31, 2023. Investment net returns are net of investment-related fees and expenses, including fees paid to underlying managers, but do not reflect management fees, incentive compensation, or carried interest to GCM Grosvenor or any expenses of any account or vehicle GCM Grosvenor manages. Data does not include investments that were transferred at the request of investors prior to liquidation and are no longer managed by GCM Grosvenor. Past performance is not necessarily indicative of future results. 33-38. See Notes towards the end of the document. Private Markets Strategies Performance Metrics Realized and Partially Realized Investments ($mm)

GCM GROSVENOR | 31 STRATEGY COMMITMENTS CONTRIBUTIONS DISTRIBUTION CURRENT VALUE INVESTMENT NET TVPI INVESTEMNT NET IRR PME IRR PME INDEX Private Equity Primary Fund Investments33 $ 24,942 $ 23,328 $ 27,801 $ 10,560 1.64 12.7 % 10.8 % S&P 500 Secondary Investments34 2,023 1,798 967 1,688 1.48 16.6 % 12.5 % S&P 500 Co-Investments/Direct Investments35 8,042 7,619 5,817 7,090 1.69 17.8 % 13.9 % S&P 500 Infrastructure36 10,487 8,635 5,284 6,644 1.38 10.1 % 5.1 % MSCI World Infrastructure Real Estate37 4,654 3,400 1,712 2,276 1.17 8.6 % 5.9 % FNERTR Index Multi-Asset Class Programs 3,254 3,239 1,891 2,379 1.32 14.8 % N/A N/A Sustainable and Impact Investments Diverse Managers38 11,641 9,479 5,498 9,645 1.60 17.7 % 13.1 % S&P 500 Infrastructure Advantage Strategy $ 918 $ 840 $ 24 $ 1,060 1.29 12.7 % 2.5 % MSCI World Infrastructure Note: Returns for each strategy are presented from the date the firm established a dedicated team focused on such strategy through December 31, 2023. Investment net returns are net of investment-related fees and expenses, including fees paid to underlying managers, but do not reflect management fees, incentive compensation, or carried interest to GCM Grosvenor or any expenses of any account or vehicle GCM Grosvenor manages. Data does not include investments that were transferred at the request of investors prior to liquidation and are no longer managed by GCM Grosvenor. Past performance is not necessarily indicative of future results. 33-38. See Notes towards the end of the document. All Investments ($ million) Private Markets Strategies Performance Metrics All Invest ents ($mm)

GCM GROSVENOR | 32 AS OF MAR 31, 2024 THREE MONTHS ENDED ANNUALIZED RETURNS PERIODS ENDED MAR 31, 2024 Assets Under Management (bn) MAR 31, 2024 ONE YEAR THREE YEAR FIVE YEAR SINCE INCEPTION Gross Net Gross Net Gross Net Gross Net Gross Net Absolute Return Strategies (Overall) $ 23.6 4.3 % 4.1 % 11.1 % 10.3 % 4.2 % 3.5 % 6.1 % 5.4 % 6.9 % 5.8 % GCMLP Diversified Multi-Strategy Composite $ 11.2 4.8 % 4.6 % 12.3 % 11.5 % 5.0 % 4.2 % 6.7 % 5.9 % 7.8 % 6.5 % Note: Absolute Return Strategies (Overall) is since 1996. GCMLP Diversified Multi-Strategy Composite is since 1993. Absolute Return Strategies Performance

GCM GROSVENOR | 33 Data in the presentation is as of March 31, 2024 unless otherwise noted. 1. Of the $7.1 billion CNYFPAUM as of March 31, 2024, approximately $2.3 billion is subject to an agreed upon fee ramp in schedule that will result in management fees being charged on approximately $0.3 billion of such amount in the remainder of 2024, approximately $0.8 billion of such amount in 2025, and remaining approximately $1.2 billion in 2026 and beyond. With respect to approximately $4.8 billion of the $7.1 billion, management fees will be charged as such capital is invested, which will depend on a number of factors, including the availability of eligible investment opportunities. 2. Excludes fund reimbursement revenue. 3. Reflects a corporate and blended statutory tax rate of 24.7% and 24.2% applied to Adjusted Pre-Tax Income for the three months ended March 31, 2024 and 2023, respectively. The rate was adjusted from 24.2% to 24.7% in Q4 2023. The 24.7% and 24.2% are based on a federal statutory rate of 21.0% and a combined state, local and foreign rate net of federal benefits of 3.7% and 3.2%, respectively. 4. Employee data as of April 1, 2024. Individuals with dual responsibilities are counted only once. 5. Sustainable / Impact and Alternative Credit Investments overlap with investments in other strategies. 8. Re-up % for Private Markets customized separate accounts from January 1, 2018 through March 31, 2024. Average years between re-ups and re-up % increase for Private Markets customized separate accounts from January 1, 2018 through March 31, 2024. 9. Average increase on each re-up through December 31, 2023. 12. Run-Rate Annual Performance Fees reflect the potential annual performance fees generated by performance fee-eligible AUM before any loss carryforwards, if applicable, at an 8% gross return for both multi-strategy and credit strategies, and a 10% gross return for specialized opportunity strategies, and before cash-based incentive fee related compensation. The majority of run-rate annual performance fees relate to ARS. 13. Sustainable and Impact Investments AUM as of March 31, 2024. AUM related to certain Sustainable and Impact investments includes mark-to-market changes for funds that charge management fees based on commitments. Such increases in AUM do not increase FPAUM or revenue. The data regarding sustainable themes presented above and otherwise contained herein is based on the assessment of each such investment by GCM Grosvenor investment team members. The relevant investments are placed into categories that are generally consistent with the categories presented in the UN PRI Impact Investing Market Map. Primary fund assessments are based on whether a significant part of the expected strategy of the primary fund falls into a sustainable category. Co-investment categorizations are based either on categories represented by the co-investment sponsor or the underlying portfolio company. Diverse Manager investments include investments managed by or sponsored by a diverse manager, based on GCM Grosvenor’s definition of a diverse manager, which is determined by thresholds of manager economic ownership by diverse parties (race, gender, sexual orientation, veterans, disabled persons). There is significant subjectivity in placing an investment in a particular category, and conventions and methodologies used by GCM Grosvenor in categorizing investments and calculating the data presented may differ from those used by other investment managers. Additional information regarding these conventions and methodologies is available upon request. 14. Some investments are counted in more than one sustainable category. 15. For Private Markets customized separate accounts from January 1, 2018 through March 31, 2024. 16. Based on 50 largest clients by AUM as of March 31, 2024. 17. Last three years fundraising through March 31, 2024. 24. Adjusted EBITDA and Adjusted Net Income per share are non-GAAP financial measures. See Appendix for the reconciliations of our non-GAAP financial measures to the most comparable GAAP metric. 25. Excludes severance expenses of $4.6 million, $0.9 million and $0.3 million for the three months ended March 31, 2023, December 31, 2023 and March 31, 2024, respectively. Notes

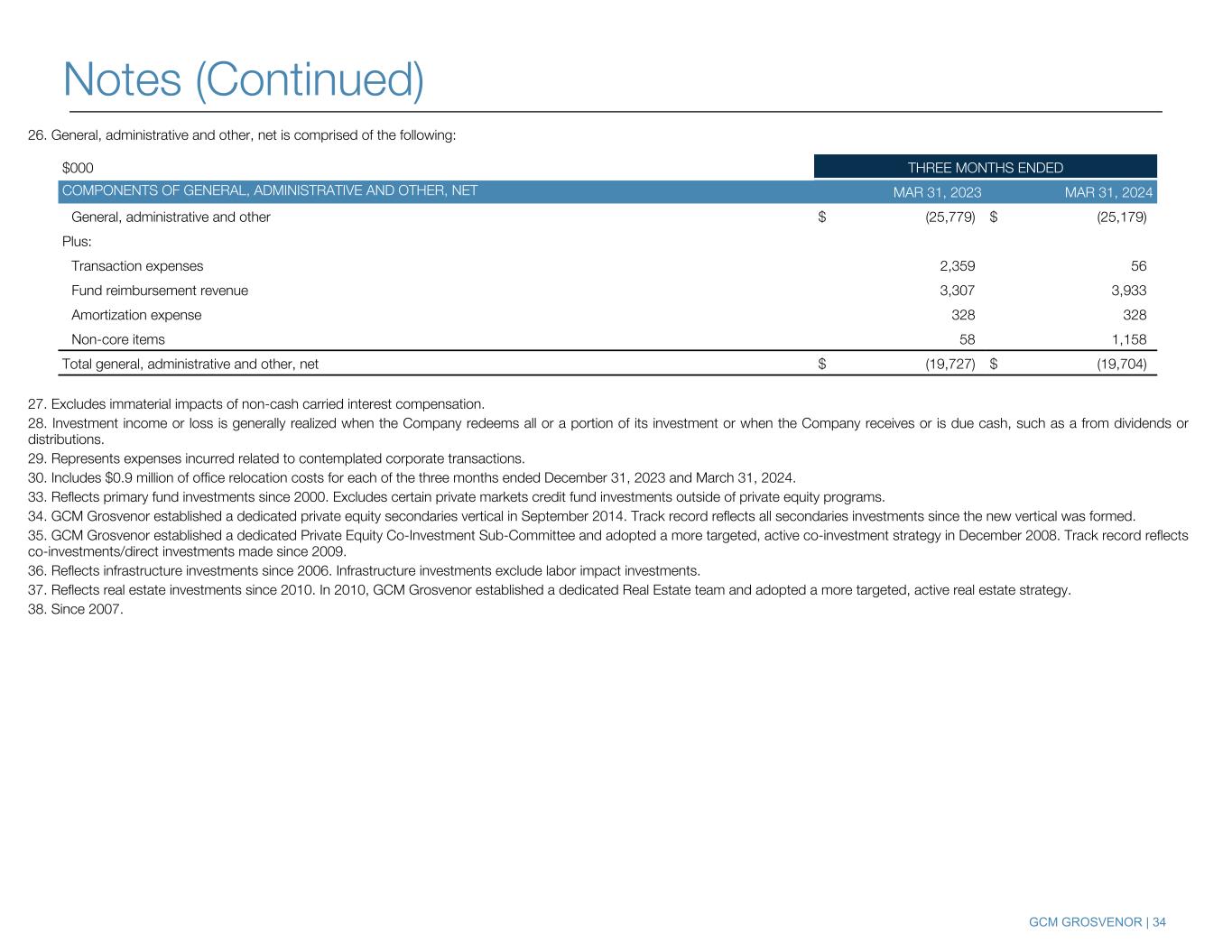

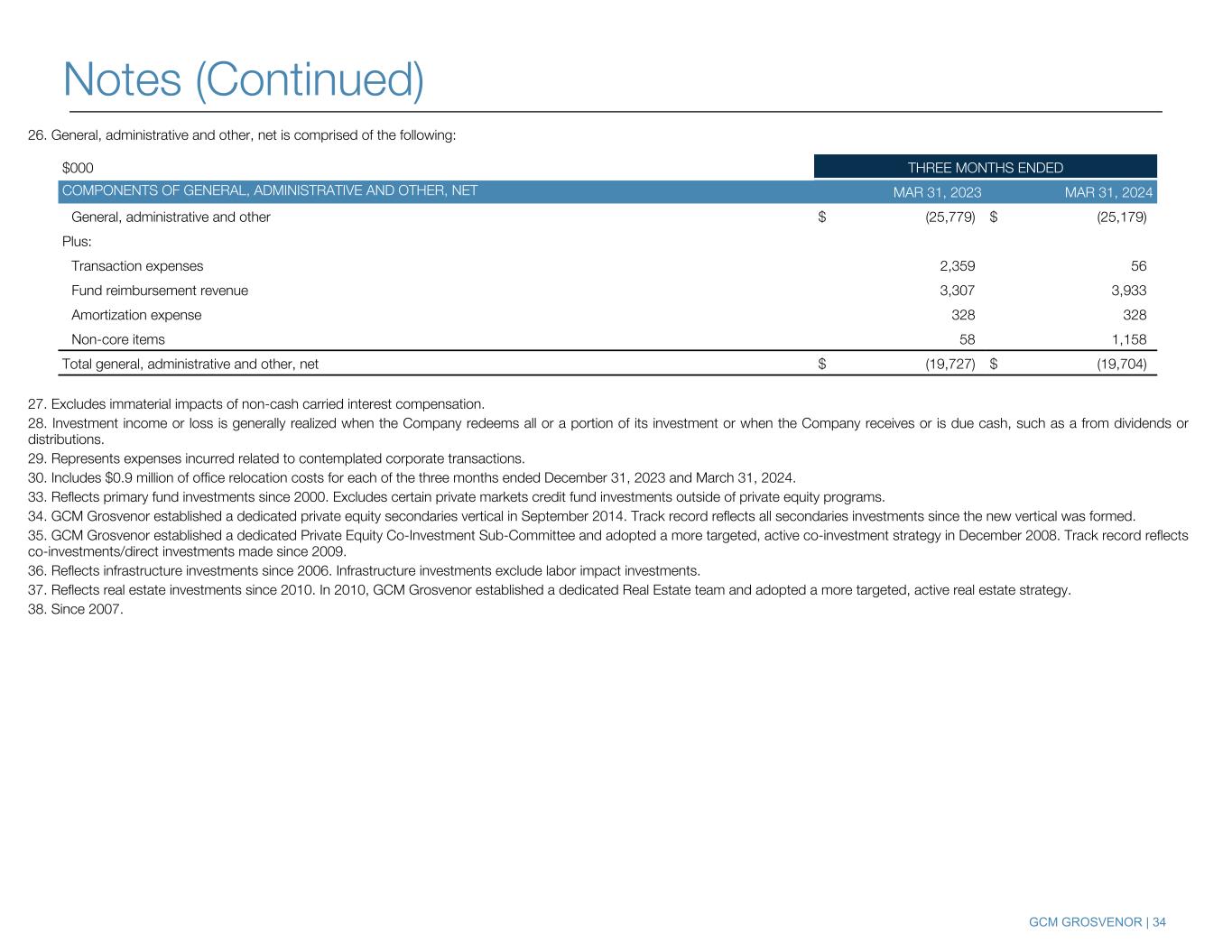

GCM GROSVENOR | 34 26. General, administrative and other, net is comprised of the following: 27. Excludes immaterial impacts of non-cash carried interest compensation. s immaterial. 28. Investment income or loss is generally realized when the Company redeems all or a portion of its investment or when the Company receives or is due cash, such as a from dividends or distributions. 29. Represents expenses incurred related to contemplated corporate transactions. 30. Includes $0.9 million of office relocation costs for each of the three months ended December 31, 2023 and March 31, 2024. 33. Reflects primary fund investments since 2000. Excludes certain private markets credit fund investments outside of private equity programs. 34. GCM Grosvenor established a dedicated private equity secondaries vertical in September 2014. Track record reflects all secondaries investments since the new vertical was formed. 35. GCM Grosvenor established a dedicated Private Equity Co-Investment Sub-Committee and adopted a more targeted, active co-investment strategy in December 2008. Track record reflects co-investments/direct investments made since 2009. 36. Reflects infrastructure investments since 2006. Infrastructure investments exclude labor impact investments. 37. Reflects real estate investments since 2010. In 2010, GCM Grosvenor established a dedicated Real Estate team and adopted a more targeted, active real estate strategy. 38. Since 2007. Notes (Continued) $000 THREE MONTHS ENDED COMPONENTS OF GENERAL, ADMINISTRATIVE AND OTHER, NET MAR 31, 2023 MAR 31, 2024 General, administrative and other $ (25,779) $ (25,179) Plus: Transaction expenses 2,359 56 Fund reimbursement revenue 3,307 3,933 Amortization expense 328 328 Non-core items 58 1,158 Total general, administrative and other, net $ (19,727) $ (19,704)

GCM GROSVENOR | 35 Adjusted Net Income is a non-GAAP measure that we present on a pre-tax and after-tax basis to evaluate our profitability. Adjusted Pre-Tax Income represents net income attributable to GCM Grosvenor Inc. including (a) net income (loss) attributable to GCMH, excluding (b) provision (benefit) for income taxes, (c) changes in fair value of derivatives and warrant liabilities, (d) amortization expense, (e) partnership interest-based and non-cash compensation, (f) equity-based compensation, including cash-settled equity awards (as we view the cash settlement as a separate capital transaction), (g) unrealized investment income, (h) changes in tax receivable agreement liability and (i) certain other items that we believe are not indicative of our core performance, including charges related to corporate transactions, employee severance, and office relocation costs. Adjusted Net Income represents Adjusted Pre-Tax Income fully taxed at each period's blended statutory tax rate. Adjusted Net Income Per Share is a non-GAAP measure that is calculated by dividing Adjusted Net Income by adjusted shares outstanding. Adjusted shares outstanding assumes the hypothetical full exchange of limited partnership interests in GCMH into Class A common stock of GCM Grosvenor Inc., the dilution from outstanding warrants for Class A common stock of GCM Grosvenor Inc. and the dilution from outstanding equity-based compensation. We believe adjusted net income per share is useful to investors because it enables them to better evaluate per-share performance across reporting periods. Adjusted EBITDA is a non-GAAP measure which represents Adjusted Net Income excluding (a) adjusted income taxes, (b) depreciation and amortization expense and (c) interest expense on our outstanding debt. Adjusted EBITDA Margin represents Adjusted EBITDA as a percentage of our total operating revenues, net of fund expense reimbursements. We believe Adjusted Pre-Tax Income, Adjusted Net Income and Adjusted EBITDA are useful to investors because they provide additional insight into the operating profitability of our core business across reporting periods. These measures (1) present a view of the economics of the underlying business as if GCMH Equityholders converted their interests to shares of Class A common stock and (2) adjust for certain non-cash and other activity in order to provide more comparable results of the core business across reporting periods. These measures are used by management in budgeting, forecasting and evaluating operating results. Fee-Related Revenue ("FRR") is a non-GAAP measure used to highlight revenues from recurring management fees and administrative fees. FRR represents total operating revenues less (a) incentive fees and (b) fund reimbursement revenue. We believe FRR is useful to investors because it provides additional insight into our relatively stable management fee base separate from incentive fee revenues, which tend to have greater variability. Fee-Related Earnings (“FRE”) is a non-GAAP measure used to highlight earnings from recurring management fees and administrative fees. FRE represents Adjusted EBITDA further adjusted to exclude (a) incentive fees and related compensation and (b) other non-operating income, and to include depreciation expense. We believe FRE is useful to investors because it provides additional insights into the management fee driven operating profitability of our business. FRE Margin represents FRE as a percentage of our management fee and other operating revenue, net of fund expense reimbursements. Net Incentive Fees Attributable to GCM Grosvenor is a non-GAAP measure used to highlight fees earned from incentive fees that are attributable to GCM Grosvenor. Net incentive fees represent incentive fees excluding (a) incentive fees contractually owed to others and (b) cash-based incentive fee related compensation. Net incentive fees provide investors useful information regarding the amount that such fees contribute to the Company’s earnings and are used by management in making compensation and capital allocation decisions. Certain Definitions and Use of Non-GAAP Financials and Key Performance Indicators

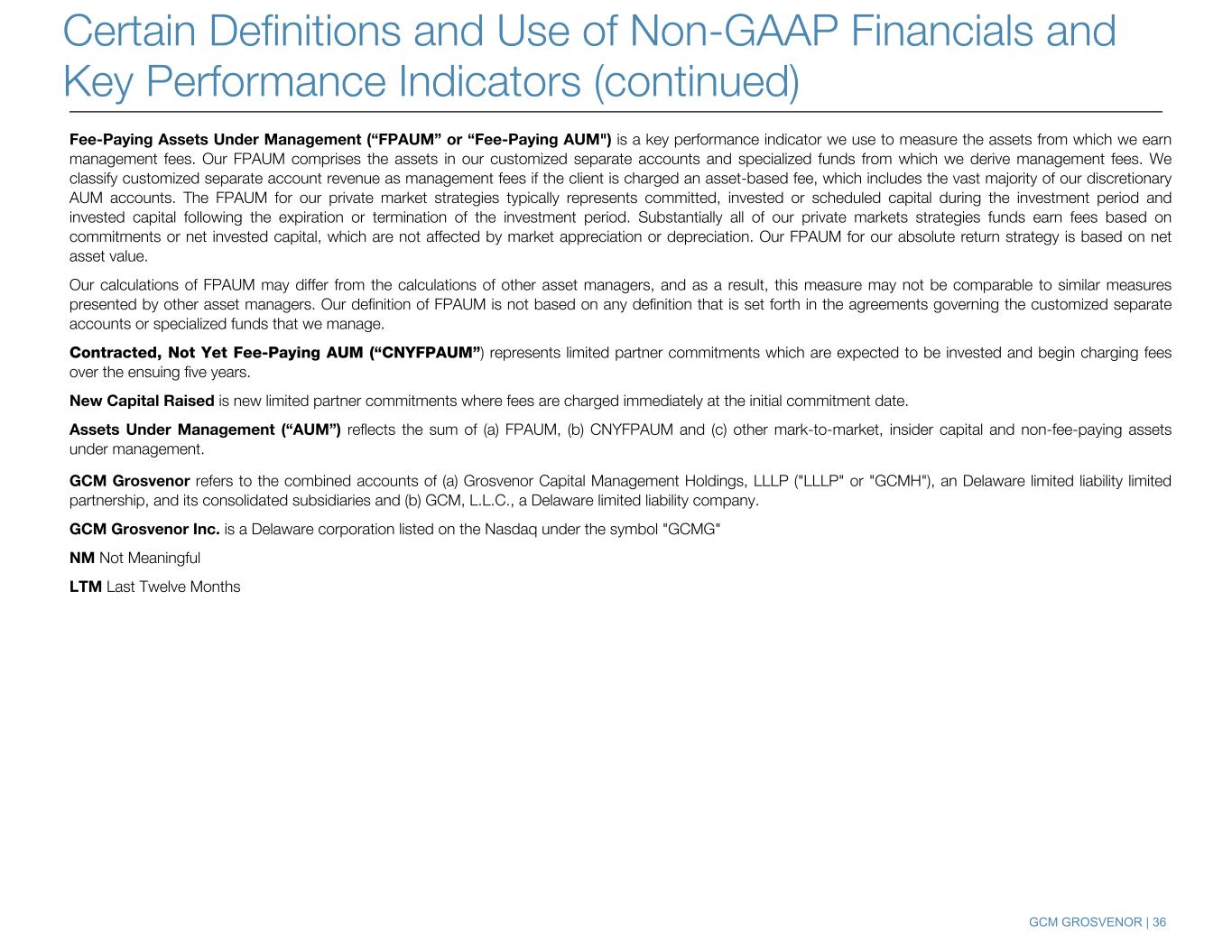

GCM GROSVENOR | 36 Fee-Paying Assets Under Management (“FPAUM” or “Fee-Paying AUM") is a key performance indicator we use to measure the assets from which we earn management fees. Our FPAUM comprises the assets in our customized separate accounts and specialized funds from which we derive management fees. We classify customized separate account revenue as management fees if the client is charged an asset-based fee, which includes the vast majority of our discretionary AUM accounts. The FPAUM for our private market strategies typically represents committed, invested or scheduled capital during the investment period and invested capital following the expiration or termination of the investment period. Substantially all of our private markets strategies funds earn fees based on commitments or net invested capital, which are not affected by market appreciation or depreciation. Our FPAUM for our absolute return strategy is based on net asset value. Our calculations of FPAUM may differ from the calculations of other asset managers, and as a result, this measure may not be comparable to similar measures presented by other asset managers. Our definition of FPAUM is not based on any definition that is set forth in the agreements governing the customized separate accounts or specialized funds that we manage. Contracted, Not Yet Fee-Paying AUM (“CNYFPAUM”) represents limited partner commitments which are expected to be invested and begin charging fees over the ensuing five years. New Capital Raised is new limited partner commitments where fees are charged immediately at the initial commitment date. Assets Under Management (“AUM”) reflects the sum of (a) FPAUM, (b) CNYFPAUM and (c) other mark-to-market, insider capital and non-fee-paying assets under management. GCM Grosvenor refers to the combined accounts of (a) Grosvenor Capital Management Holdings, LLLP ("LLLP" or "GCMH"), an Delaware limited liability limited partnership, and its consolidated subsidiaries and (b) GCM, L.L.C., a Delaware limited liability company. GCM Grosvenor Inc. is a Delaware corporation listed on the Nasdaq under the symbol "GCMG" NM Not Meaningful LTM Last Twelve Months Certain Definitions and Use of Non-GAAP Financials and Key Performance Indicators (continued)

GCM GROSVENOR | 37 Non-GAAP Financial Measures The non-GAAP financial measures contained in this presentation are not GAAP measures of GCM Grosvenor’s financial performance or liquidity and should not be considered as alternatives to net income (loss) as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP. A reconciliation of such non-GAAP measures to their most directly comparable GAAP measure is included elsewhere in this presentation. You are encouraged to evaluate each adjustment to non-GAAP financial measures and the reasons management considers it appropriate for supplemental analysis. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non- recurring items. In addition, these measures may not be comparable to similarly titled measures used by other companies in our industry or across different industries. This presentation includes certain projections of non-GAAP financial measures including fee-related earnings. Due to the high variability and difficulty in making accurate forecasts and projections of some of the information excluded from these projected measures, together with some of the excluded information not being ascertainable or accessible, GCM Grosvenor is unable to quantify certain amounts that would be required to be included in the most directly comparable GAAP financial measures without unreasonable effort. Consequently, no disclosure of estimated comparable GAAP measures is included and no reconciliation of the forward looking non GAAP financial measures is included. Share Repurchase Plan Authorization GCMG’s Board of Directors previously authorized a share repurchase plan, which may be used to repurchase outstanding Class A common stock and warrants in open market transactions, in privately negotiated transactions including with employees or otherwise, as well as to retire (by cash settlement or the payment of tax withholding amounts upon net settlement) equity-based awards granted under the Company’s Amended and Restated 2020 Incentive Award Plan (or any successor equity plan thereto). The Company is not obligated under the terms of plan to repurchase any of its Class A common stock or warrants, and the size and timing of these repurchases will depend on legal requirements, price, market and economic conditions and other factors. The plan has no expiration date and the plan may be suspended or terminated by the Company at any time without prior notice. Any outstanding shares of Class A common stock and any warrants repurchased as part of this plan will be cancelled. In February 2024, GCMG's Board of Directors increased the existing share repurchase authorization by $25 million, from $115 million to $140 million. Disclosures