Document

GeneDx Reports Second Quarter 2025 Financial Results and Business Highlights

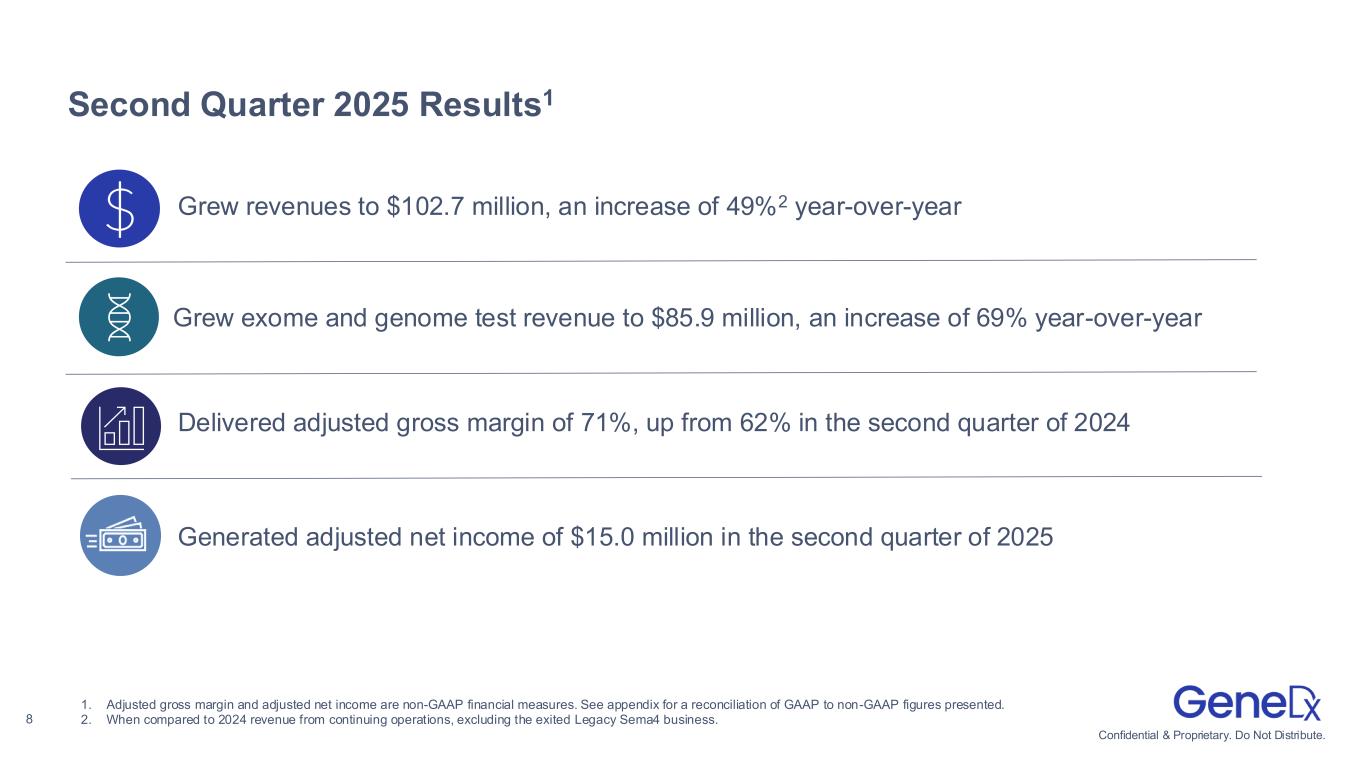

•Reported second quarter 2025 revenues of $102.7 million with 69% year-over-year growth of exome and genome test revenue

•Expanded adjusted gross margin to 71% and generated adjusted net income1 of $15.0 million for the second quarter 2025

•Raised guidance to deliver between $400 and $415 million in revenue with between 48% to 52% full year growth in exome and genome revenue

•Announced American Academy of Pediatrics (AAP) now recommends pediatricians use exome and genome testing as first-line for children with global developmental delay or intellectual disability

•Hosting conference call today at 8:30 a.m. ET

GAITHERSBURG, Md., July 29, 2025 — GeneDx Holdings Corp. (Nasdaq: WGS), a leader in delivering improved health outcomes through genomic insights, today reported its financial results for the second quarter of 2025.

“Crossing the $100 million revenue mark and delivering our fourth consecutive profitable quarter is a major milestone for GeneDx, putting us on a path for more growth at scale and enabling us to reach more patients while reducing unnecessary spend across the global healthcare system,” said Katherine Stueland, CEO of GeneDx. “Our strong second quarter performance was driven by our core business, underscoring its strength and resilience. These results, coupled with the ever-expanding opportunities ahead, including general pediatrics, demonstrate that we’re just beginning to deliver on the promise of how our technology can fundamentally change the way genomics can inform healthcare, shifting from reactive to proactive care.”

Second Quarter 2025 Financial Results (Unaudited)1,2

Revenues

•Revenues grew to $102.7 million, an increase of 49% year-over-year.

•Exome and genome test revenue grew to $85.9 million, an increase of 69% year-over-year.

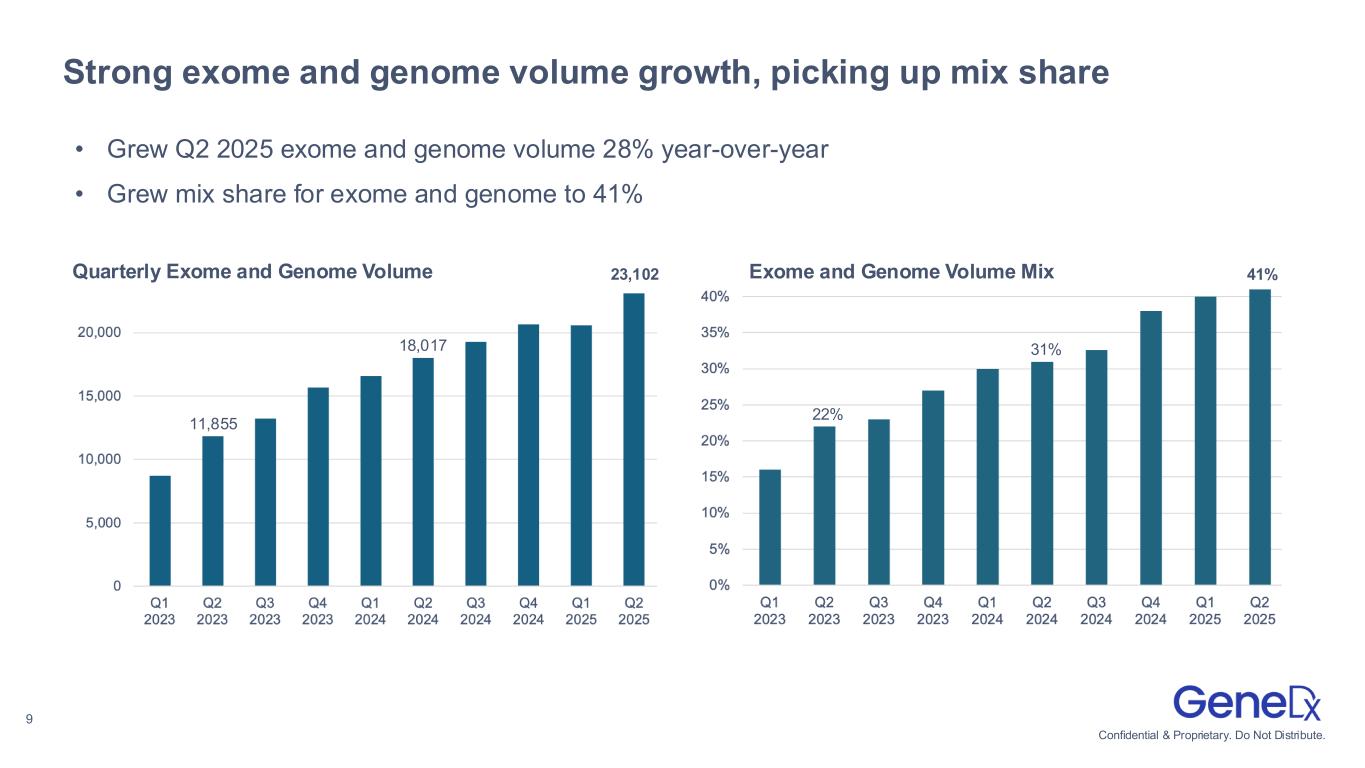

Exome and genome volume

•Exome and genome test results volume grew to 23,102, an increase of 28% year-over-year.

•Exome and genome represented 41% of all tests, up from 31% in the second quarter of 2024.

Gross margin

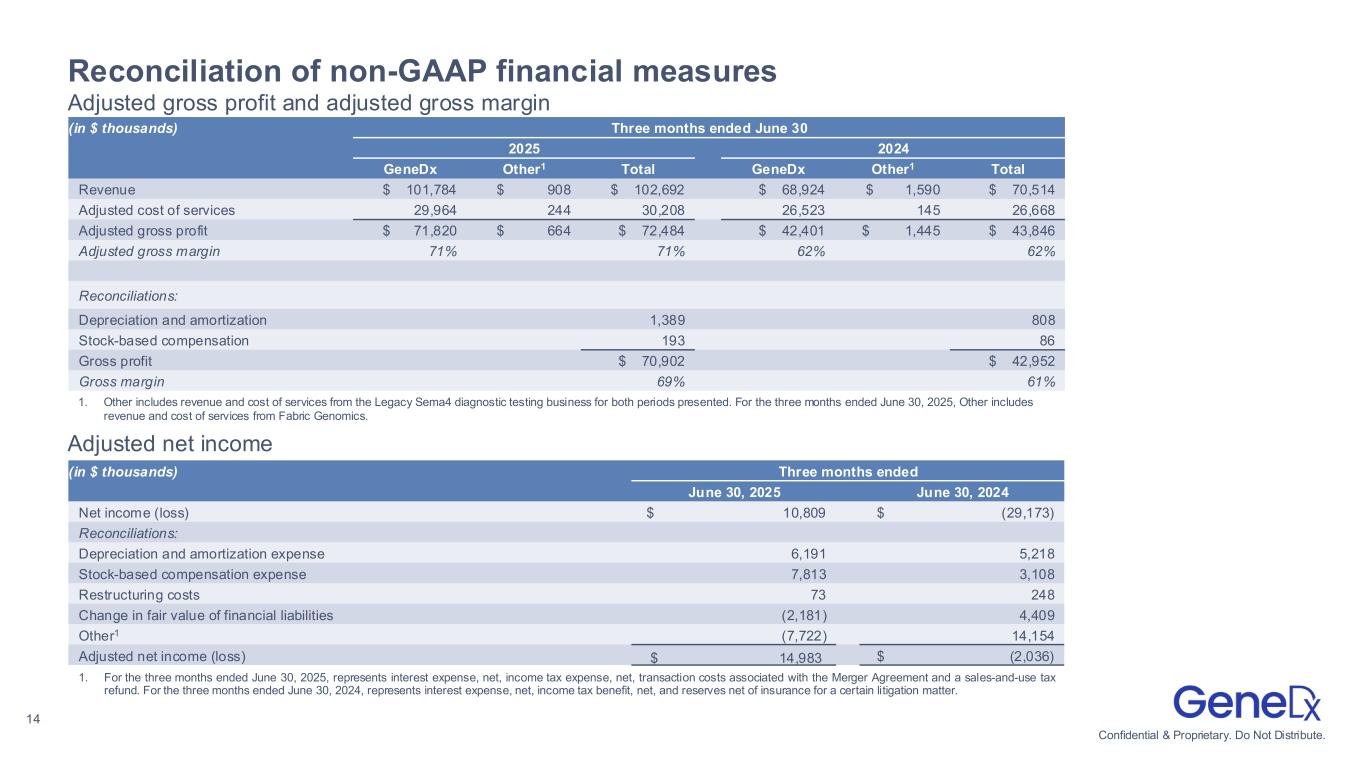

•Adjusted gross margin expanded to 71%, up from 62% in the second quarter of 2024.

◦Total GAAP gross margin was 69%.

Operating expenses

•Adjusted total operating expenses were $57.8 million, representing 56% of revenue in the second quarter of 2025, compared to 65% of revenue in the second quarter of 2024.

◦Total GAAP operating expenses were $61.9 million.

Net Income

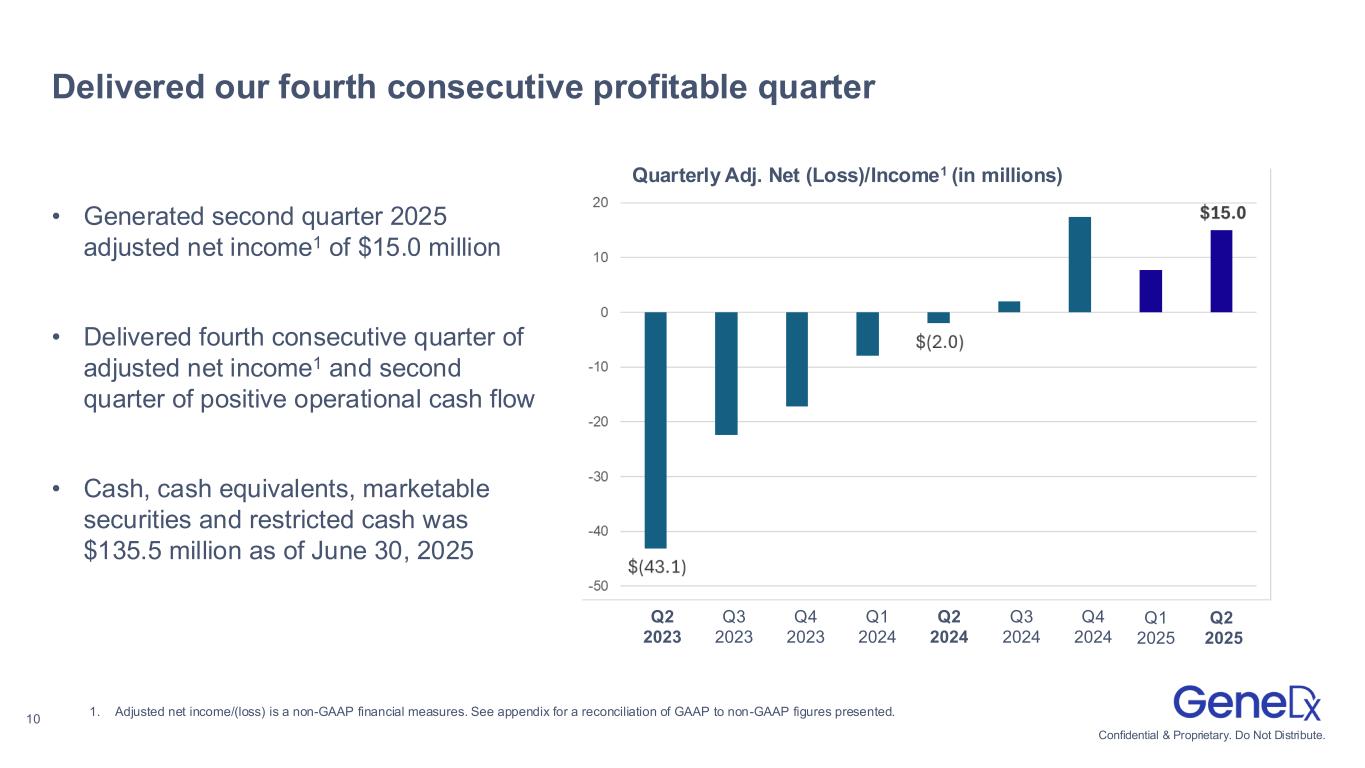

•Adjusted net income was $15.0 million compared to an adjusted net loss of $2.0 million in the second quarter of 2024.

◦GAAP net income was $10.8 million.

Cash position

•Cash, cash equivalents, marketable securities and restricted cash was $135.5 million as of June 30, 2025.

•Cash flow for the second quarter 2025 primarily included:

◦$33.2 million used to acquire Fabric Genomics, net of cash acquired, partially offset by;

◦$10.4 million in cash generated from operations.

1.Revenue and adjusted gross margin growth rates exclude revenue and costs of sales from the exited Legacy Sema4 diagnostic testing business.

2.Adjusted gross margin, adjusted total operating expenses and adjusted net income/(loss) are non-GAAP financial measures. See appendix for a reconciliation of GAAP to non-GAAP figures presented.

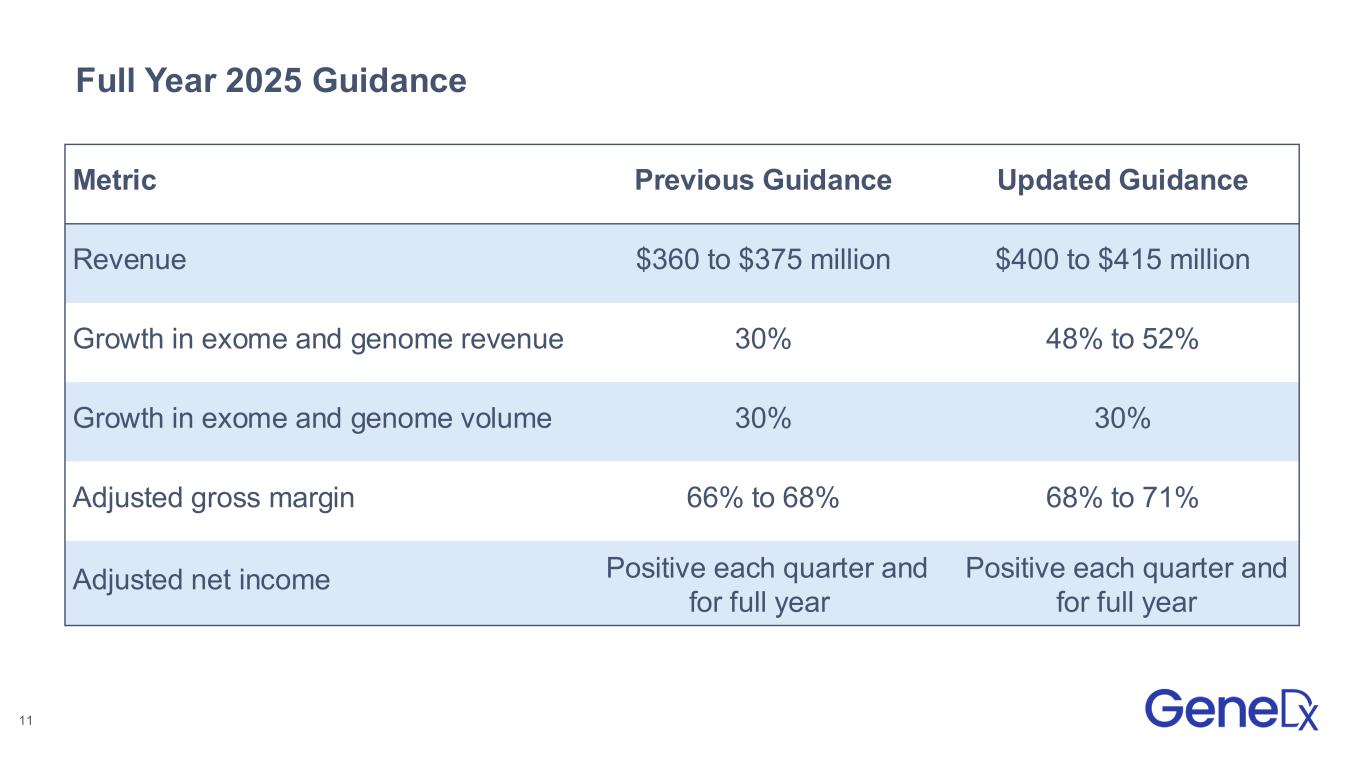

GeneDx Full Year 2025 Guidance

GeneDx has raised certain elements of its full year 2025 guidance and expects to deliver:

|

|

|

|

|

|

|

|

|

|

|

|

| Metric |

Previous Guidance |

|

Updated Guidance |

| Revenue |

$360 to $375 million |

|

$400 to $415 million |

| Growth in exome and genome revenue |

30% |

|

48% to 52% |

| Growth in exome and genome volume |

30% |

|

30% |

| Adjusted gross margin |

66% to 68% |

|

68% to 71% |

| Adjusted net income |

Positive each quarter and for full year |

|

Positive each quarter and for full year |

Second Quarter 2025 and Recent Business Highlights

Strategic Expansion and Market Access

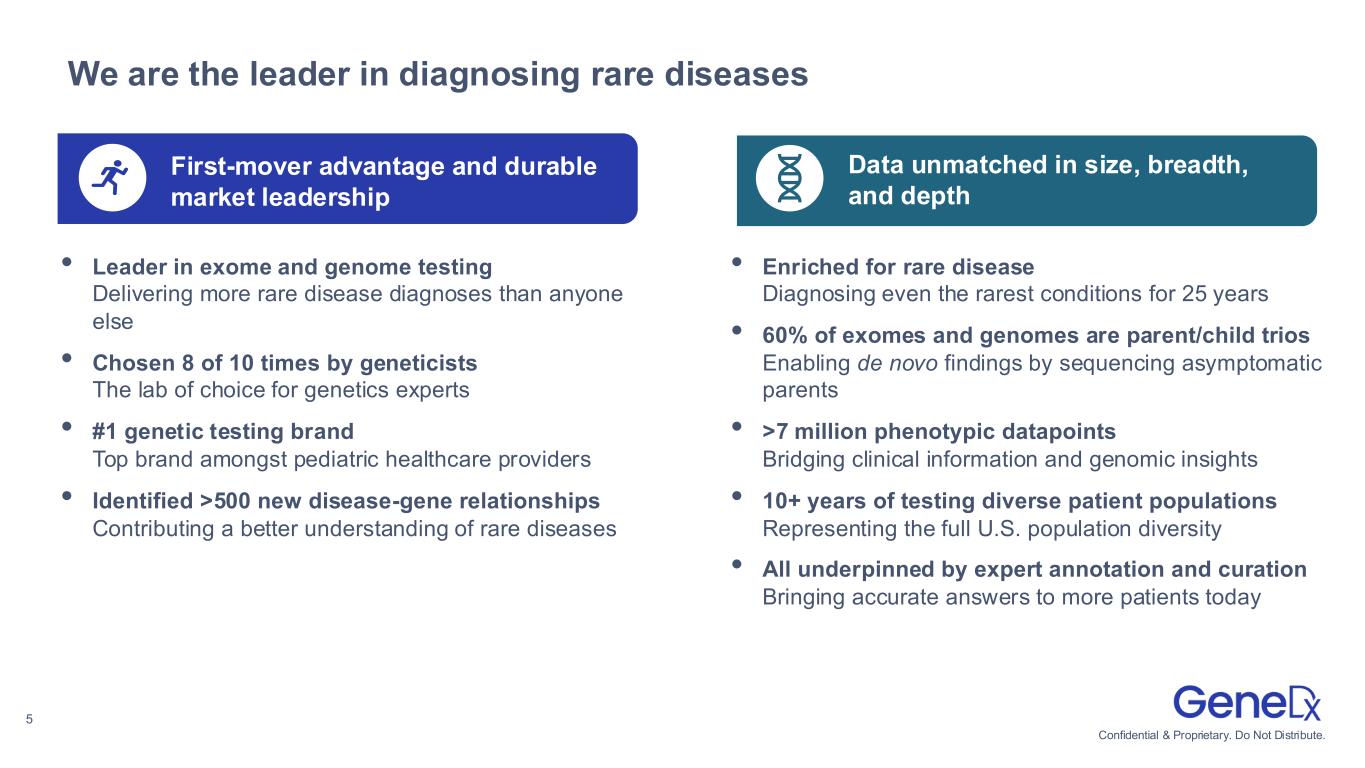

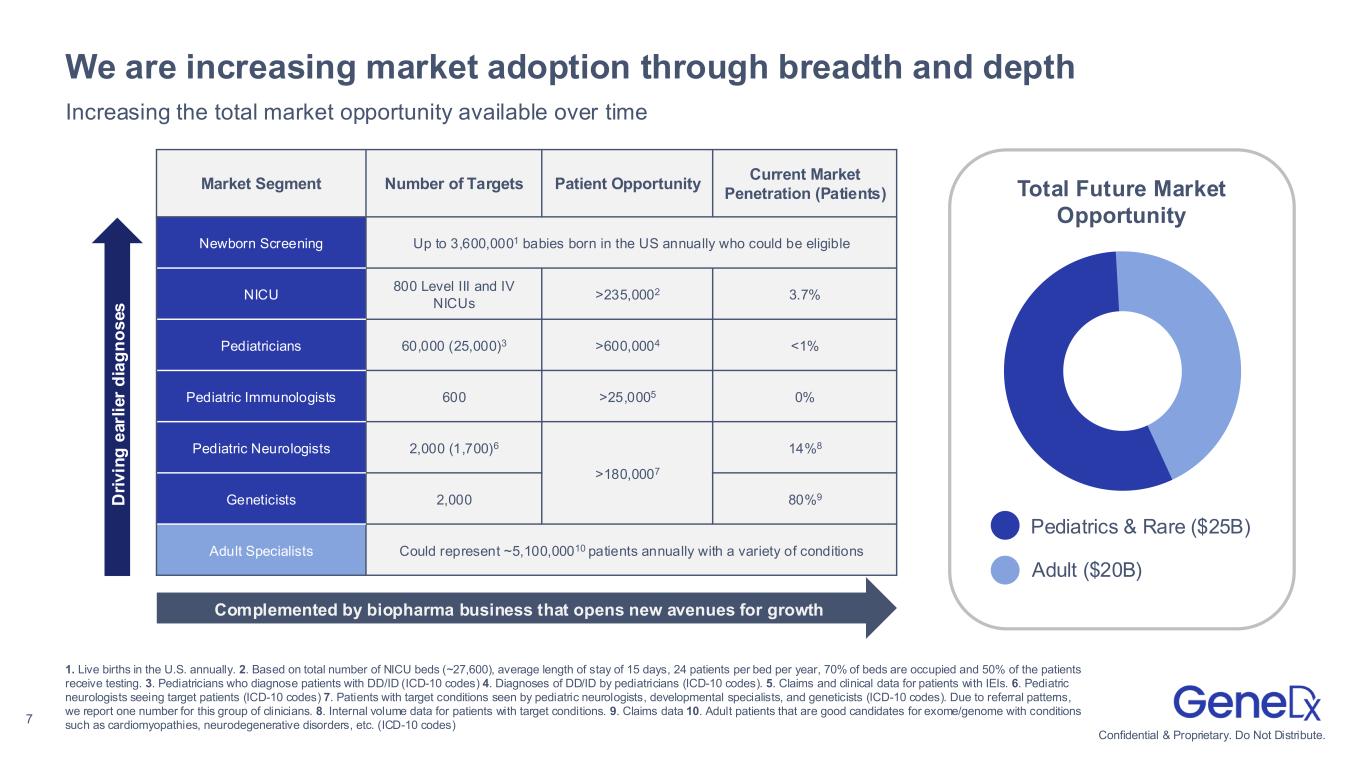

•Announced that the American Academy of Pediatrics now recommends exome and genome sequencing as first-tier tests for children with global developmental delay or intellectual disability, positioning pediatricians to offer exome and genome testing to their patients.

•Expanded commercial focus to include calling on providers treating children with inborn errors of immunity (IEI), a group of nearly 500 genetic disorders that impair immune function.

•Accelerated adoption of exome and genome sequencing coverage by state Medicaid programs, bringing the total states covering exome or genome sequencing in the pediatric outpatient setting to 35 with the recent addition of Colorado and Maine, and the total states covering rapid genome sequencing in the neonatal intensive care unit (NICU) to 17 with the recent addition of Virginia, Ohio, and Oklahoma.

Innovation & Clinical Leadership

•Acquired Fabric Genomics, enabling a hybrid centralized and decentralized model for delivering genomic insights globally.

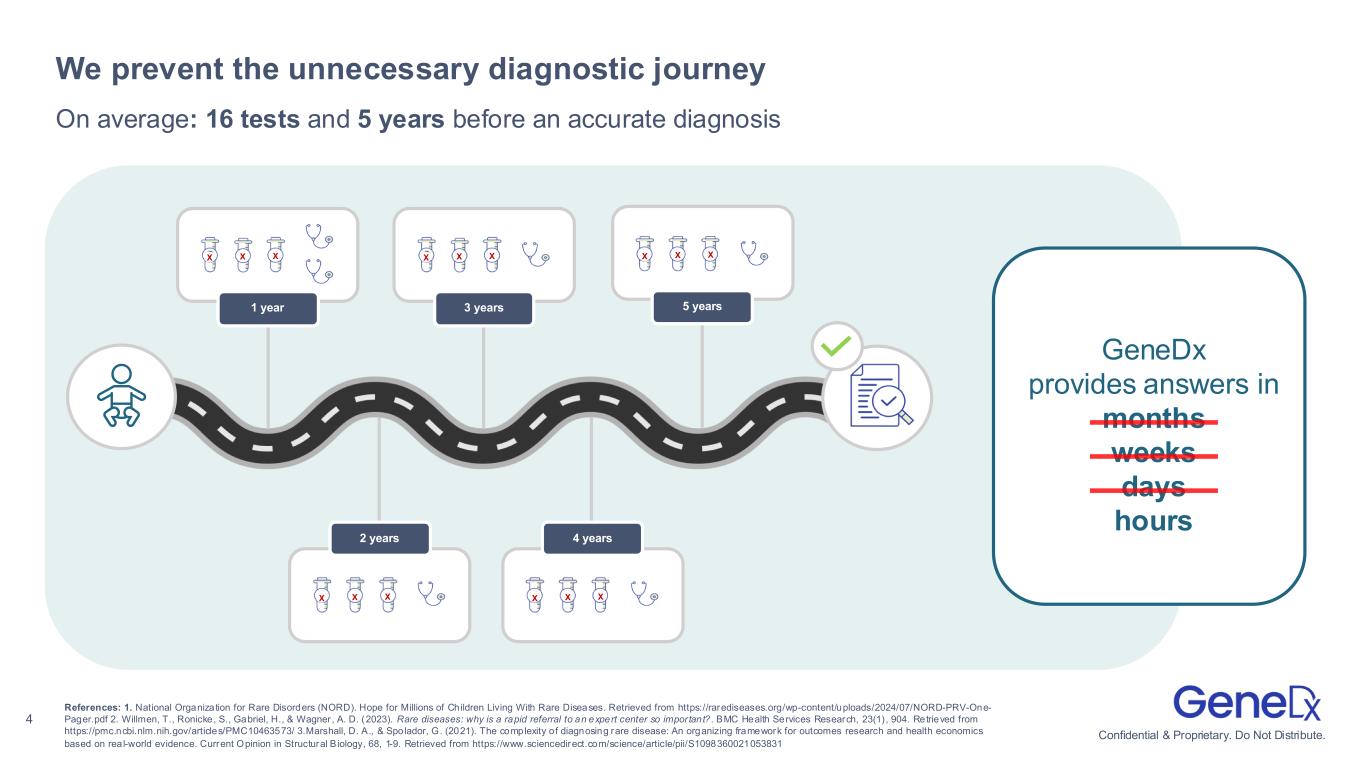

•Published SeqFirst study in the Journal of Pediatrics, showing rapid genomic testing reduced time to diagnosis from about 10 months to 13 days.

•Published data in the American Journal of Medical Genetics underscoring GeneDx’s leadership in leveraging artificial intelligence (AI) to increase diagnostic yield and improve healthcare for patients with genetic conditions.

Webcast and Conference Call Details

GeneDx will host a conference call today, July 29, 2025, at 8:30 a.m. Eastern Time. Investors interested in listening to the conference call are required to register online. A live and archived webcast of the event will be available on the “Events” section of the GeneDx investor relations website at https://ir.genedx.com/.

Forward-Looking Statements

This press release contains certain forward-looking statements within the meaning of the federal securities laws, including statements regarding our future performance, future operations, plans, objectives of management, and our market opportunity, including our expected full year 2025 reported revenue, volume, adjusted gross margin and adjusted net income. These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) our ability to implement business plans, goals and forecasts, and identify and realize additional opportunities, (ii) the risk of downturns and a changing regulatory landscape in the highly competitive healthcare industry, (iii) the size and growth of the market in which we operate, (iv) our ability to pursue our new strategic direction, and (v) our ability to utilize our artificial intelligence tools that we use in our clinical interpretation platform. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in the “Risk Factors” sections of our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the U.S. Securities and Exchange Commission (the “SEC”) on February 20, 2025, and our Quarterly Reports on Form 10-Q for the quarters ended March 31, 2025 and June 30, 2025, filed with the SEC on April 30, 2025 and July 29, 2025, respectively, and other documents filed by us from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations.

About GeneDx

At GeneDx (Nasdaq: WGS), we believe that everyone deserves personalized, targeted medical care—and that it all begins with a genetic diagnosis. Fueled by one of the world’s largest rare disease data sets, our industry-leading exome and genome tests translate complex genomic data into clinical answers that unlock personalized health plans, accelerate drug discovery, and improve health system efficiencies. For more information, please visit genedx.com and connect with us on LinkedIn, Facebook, and Instagram.

Investor Relations Contact:

Investors@GeneDx.com

Media Contact:

Press@GeneDx.com

Volume & Revenue 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2Q25 |

|

1Q25 |

|

4Q24 |

|

3Q24 |

|

2Q24 |

| Volumes |

|

|

|

|

|

|

|

|

|

| Whole exome, whole genome |

23,102 |

|

20,562 |

|

20,676 |

|

19,262 |

|

18,017 |

| Hereditary cancer |

2,677 |

|

2,725 |

|

3,486 |

|

4,672 |

|

5,482 |

| Other panels |

29,894 |

|

28,228 |

|

30,115 |

|

35,095 |

|

34,204 |

| Total |

55,673 |

|

51,515 |

|

54,277 |

|

59,029 |

|

57,703 |

|

|

|

|

|

|

|

|

|

|

| Revenue ($ millions) |

|

|

|

|

|

|

|

|

|

| Whole exome, whole genome |

$ |

85.9 |

|

|

$ |

71.4 |

|

|

$ |

78.8 |

|

|

$ |

60.0 |

|

|

$ |

50.7 |

|

| Hereditary cancer |

1.8 |

|

|

2.2 |

|

|

2.8 |

|

|

3.3 |

|

|

3.8 |

|

| Other panels |

12.1 |

|

|

12.1 |

|

|

12.3 |

|

|

13.8 |

|

|

13.3 |

|

| Data information |

2.0 |

|

|

1.4 |

|

|

1.4 |

|

|

(0.5) |

|

|

1.1 |

|

| Fabric Genomics |

0.9 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

| Total |

$ |

102.7 |

|

|

$ |

87.1 |

|

|

$ |

95.3 |

|

|

$ |

76.6 |

|

|

$ |

68.9 |

|

1.Excludes volume and revenue from the exited Legacy Sema4 diagnostic testing business.

Unaudited Select Financial Information (in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, 2025 |

|

Three months ended June 30, 2024 |

|

GeneDx |

|

Other1 |

|

Total |

|

GeneDx |

|

Other1 |

|

Total |

| Revenue |

$101,784 |

|

$908 |

|

$102,692 |

|

$68,924 |

|

$1,590 |

|

$70,514 |

| Adjusted cost of services |

29,964 |

|

244 |

|

30,208 |

|

26,523 |

|

145 |

|

26,668 |

| Adjusted gross profit (loss) |

$71,820 |

|

$664 |

|

$72,484 |

|

$42,401 |

|

$1,445 |

|

$43,846 |

| Adjusted gross margin % |

70.6% |

|

73.1% |

|

70.6% |

|

61.5% |

|

90.9% |

|

62.2% |

1.Other includes revenue and cost of services from the Legacy Sema4 diagnostic testing business for both periods presented. For the three months ended June 30, 2025, Other includes revenue and cost of services from Fabric Genomics.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, 2025 |

|

Reported |

|

Depreciation and amortization |

|

Stock-based compensation expense |

|

Restructuring costs |

|

Change in FV of financial liabilities |

|

|

|

Other |

|

Adjusted |

| Diagnostic test revenue |

$ |

99,823 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

99,823 |

|

| Other revenue |

2,869 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

2,869 |

|

| Total revenue |

102,692 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

102,692 |

|

| Cost of services |

31,790 |

|

|

(1,389) |

|

|

(193) |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

30,208 |

|

| Gross profit (loss) |

70,902 |

|

|

1,389 |

|

|

193 |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

72,484 |

|

| Gross margin |

69.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

70.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

15,079 |

|

|

(209) |

|

|

(1,422) |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

13,448 |

|

| Selling and marketing |

19,448 |

|

|

(1,298) |

|

|

(1,268) |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

16,882 |

|

| General and administrative |

27,415 |

|

|

(3,295) |

|

|

(4,930) |

|

|

(73) |

|

|

— |

|

|

|

|

8,342 |

|

|

27,459 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

8,960 |

|

|

6,191 |

|

|

7,813 |

|

|

73 |

|

|

— |

|

|

|

|

(8,342) |

|

|

14,695 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income (expense), net |

(817) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

817 |

|

|

— |

|

| Other income (expense), net |

2,420 |

|

|

— |

|

|

— |

|

|

— |

|

|

(2,181) |

|

|

|

|

49 |

|

|

288 |

|

| Income tax benefit |

246 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

(246) |

|

|

— |

|

| Net income |

$ |

10,809 |

|

|

$ |

6,191 |

|

|

$ |

7,813 |

|

|

$ |

73 |

|

|

$ |

(2,181) |

|

|

|

|

$ |

(7,722) |

|

|

$ |

14,983 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share* |

$ |

0.38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.52 |

|

| Diluted earnings per share* |

$ |

0.36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

0.50 |

|

*Basic and diluted earnings per share are calculated based on 28,579,704 and 29,753,933 weighted average shares outstanding for the three months ended June 30, 2025, respectively.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, 2024 |

|

Reported |

|

Depreciation and amortization |

|

Stock-based compensation expense |

|

Restructuring costs |

|

Change in FV of financial liabilities |

|

|

|

Other1 |

|

Adjusted |

| Diagnostic test revenue |

$ |

69,439 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

$ |

— |

|

|

$ |

69,439 |

|

| Other revenue |

1,075 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

1,075 |

|

| Total revenue |

70,514 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

70,514 |

|

| Cost of services |

27,562 |

|

|

(808) |

|

|

(86) |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

26,668 |

|

| Gross profit (loss) |

42,952 |

|

|

808 |

|

|

86 |

|

|

— |

|

|

— |

|

|

|

|

— |

|

|

43,846 |

|

| Gross margin |

60.9 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

62.2 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Research and development |

10,902 |

|

|

(211) |

|

|

(347) |

|

|

(35) |

|

|

— |

|

|

|

|

— |

|

|

10,309 |

|

| Selling and marketing |

16,585 |

|

|

(1,225) |

|

|

(368) |

|

|

(63) |

|

|

— |

|

|

|

|

— |

|

|

14,929 |

|

| General and administrative |

26,044 |

|

|

(2,974) |

|

|

(2,307) |

|

|

(150) |

|

|

— |

|

|

|

|

— |

|

|

20,613 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Loss from operations |

(10,579) |

|

|

5,218 |

|

|

3,108 |

|

|

248 |

|

|

— |

|

|

|

|

— |

|

|

(2,005) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income (expense), net |

(894) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

894 |

|

|

— |

|

| Other income (expense), net |

(17,890) |

|

|

— |

|

|

— |

|

|

— |

|

|

4,409 |

|

|

|

|

13,450 |

|

|

(31) |

|

| Income tax benefit |

190 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

(190) |

|

|

— |

|

| Net loss |

$ |

(29,173) |

|

|

$ |

5,218 |

|

|

$ |

3,108 |

|

|

$ |

248 |

|

|

$ |

4,409 |

|

|

|

|

$ |

14,154 |

|

|

$ |

(2,036) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic loss per share* |

$ |

(1.10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(0.08) |

|

| Diluted loss per share* |

$ |

(1.10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

$ |

(0.08) |

|

*Basic and diluted loss per share are calculated based on 26,617,955 diluted weighted average shares outstanding for the three months ended June 30, 2024.

1.Other represents interest expense, net, and income tax (expense) benefit for all periods presented. Other for the three months ended June 30, 2025 includes transaction costs related to the acquisition of Fabric Genomics. Other for the three months ended June 30, 2024 includes legal costs related to a legal settlement.

GeneDx Holdings Corp.

Condensed Consolidated Balance Sheets

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, 2025 (Unaudited) |

|

December 31, 2024 |

| Assets: |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

74,120 |

|

|

$ |

85,212 |

|

| Marketable securities |

60,438 |

|

|

55,973 |

|

| Accounts receivable |

48,028 |

|

|

37,629 |

|

|

|

|

|

| Inventory, net |

11,932 |

|

|

10,650 |

|

| Prepaid expenses and other current assets |

10,319 |

|

|

8,504 |

|

| Total current assets |

204,837 |

|

|

197,968 |

|

| Operating lease right-of-use assets |

24,978 |

|

|

25,613 |

|

| Property and equipment, net |

40,120 |

|

|

32,893 |

|

| Goodwill |

12,926 |

|

|

— |

|

| Intangible assets, net |

176,689 |

|

|

158,600 |

|

Other assets1 |

4,313 |

|

|

4,306 |

|

| Total assets |

$ |

463,863 |

|

|

$ |

419,380 |

|

| Liabilities and Stockholders’ Equity: |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable and accrued expenses |

$ |

49,239 |

|

|

$ |

30,983 |

|

|

|

|

|

| Short-term lease liabilities |

3,083 |

|

|

3,336 |

|

| Other current liabilities |

19,084 |

|

|

20,498 |

|

| Total current liabilities |

71,406 |

|

|

54,817 |

|

| Long-term debt, net of current portion |

51,683 |

|

|

51,913 |

|

| Long-term lease liabilities |

59,619 |

|

|

60,919 |

|

| Other liabilities |

3,275 |

|

|

5,519 |

|

| Deferred taxes |

747 |

|

|

965 |

|

| Total liabilities |

186,730 |

|

|

174,133 |

|

| Stockholders’ Equity: |

|

|

|

| Preferred stock |

— |

|

|

— |

|

| Class A common stock |

2 |

|

|

2 |

|

| Additional paid-in capital |

1,624,513 |

|

|

1,596,889 |

|

| Accumulated deficit |

(1,348,194) |

|

|

(1,352,474) |

|

| Accumulated other comprehensive income |

812 |

|

|

830 |

|

| Total stockholders’ equity |

277,133 |

|

|

245,247 |

|

| Total liabilities and stockholders’ equity |

$ |

463,863 |

|

|

$ |

419,380 |

|

1.Other assets includes $990 thousand of restricted cash as of both June 30, 2025 and December 31, 2024.

GeneDx Holdings Corp.

Condensed Consolidated Statements of Operations (Unaudited)

(in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended June 30, |

|

Six months ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Revenue |

|

|

|

|

|

|

|

| Diagnostic test revenue |

$ |

99,823 |

|

|

$ |

69,439 |

|

|

$ |

185,582 |

|

|

$ |

130,543 |

|

| Other revenue |

2,869 |

|

|

1,075 |

|

|

4,225 |

|

|

2,393 |

|

| Total revenue |

102,692 |

|

|

70,514 |

|

|

189,807 |

|

|

132,936 |

|

| Cost of services |

31,790 |

|

|

27,562 |

|

|

60,429 |

|

|

52,573 |

|

| Gross profit |

70,902 |

|

|

42,952 |

|

|

129,378 |

|

|

80,363 |

|

| Research and development |

15,079 |

|

|

10,902 |

|

|

27,656 |

|

|

22,469 |

|

| Selling and marketing |

19,448 |

|

|

16,585 |

|

|

37,764 |

|

|

32,670 |

|

| General and administrative |

27,415 |

|

|

26,044 |

|

|

59,549 |

|

|

49,463 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from operations |

8,960 |

|

|

(10,579) |

|

|

4,409 |

|

|

(24,239) |

|

|

|

|

|

|

|

|

|

| Non-operating income (expenses), net |

|

|

|

|

|

|

|

| Change in fair value of warrants and contingent liabilities |

2,181 |

|

|

(4,409) |

|

|

1,081 |

|

|

(10,510) |

|

| Interest expense, net |

(817) |

|

|

(894) |

|

|

(1,457) |

|

|

(1,491) |

|

| Other income (expense), net |

239 |

|

|

(13,481) |

|

|

448 |

|

|

(13,444) |

|

| Total non-operating income (expense), net |

1,603 |

|

|

(18,784) |

|

|

72 |

|

|

(25,445) |

|

| Income (loss) before income taxes |

10,563 |

|

|

(29,363) |

|

|

$ |

4,481 |

|

|

$ |

(49,684) |

|

| Income tax benefit (expense) |

246 |

|

|

190 |

|

|

(201) |

|

|

272 |

|

| Net income (loss) |

$ |

10,809 |

|

|

$ |

(29,173) |

|

|

$ |

4,280 |

|

|

$ |

(49,412) |

|

|

|

|

|

|

|

|

|

| Weighted average shares outstanding of Class A common stock - Basic |

28,579,704 |

|

|

26,617,955 |

|

|

28,365,018 |

|

26,340,063 |

| Earnings (loss) per share, Class A common stock- Basic |

$ |

0.38 |

|

|

$ |

(1.10) |

|

|

$ |

0.15 |

|

|

$ |

(1.88) |

|

Weighted average shares outstanding of Class A common stock - Diluted |

29,753,933 |

|

|

26,617,955 |

|

|

29,642,555 |

|

|

26,340,063 |

|

Earnings (loss) per share, Class A common stock- Diluted |

$ |

0.36 |

|

|

$ |

(1.10) |

|

|

$ |

0.14 |

|

|

$ |

(1.88) |

|

GeneDx Holdings Corp.

Condensed Consolidated Statements of Cash Flows (Unaudited)

(in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Six months ended June 30, |

|

2025 |

|

2024 |

|

|

| Operating activities |

|

|

|

|

|

| Net income (loss) |

$ |

4,280 |

|

|

$ |

(49,412) |

|

|

|

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

|

| Depreciation and amortization expense |

11,869 |

|

|

10,466 |

|

|

|

| Stock-based compensation expense |

11,796 |

|

|

2,657 |

|

|

|

| Change in fair value of warrants and contingent liabilities |

(1,081) |

|

|

10,510 |

|

|

|

| Deferred tax expense (benefit) |

202 |

|

|

(272) |

|

|

|

| Provision for excess and obsolete inventory |

123 |

|

|

109 |

|

|

|

| Legal reserves |

— |

|

|

13,450 |

|

|

|

| Change in third party payor reserves |

5,014 |

|

|

1,066 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

1,387 |

|

|

1,738 |

|

|

|

Change in operating assets and liabilities: |

|

|

|

|

|

| Accounts receivable |

(9,889) |

|

|

6,622 |

|

|

|

| Inventory |

(1,404) |

|

|

(1,654) |

|

|

|

| Accounts payable and accrued expenses |

7,199 |

|

|

(10,871) |

|

|

|

| Other assets and liabilities |

(8,894) |

|

|

(5,327) |

|

|

|

| Net cash provided by (used in) operating activities |

20,602 |

|

|

(20,918) |

|

|

|

| Investing activities |

|

|

|

|

|

| Acquisition of business, net of cash acquired |

(33,195) |

|

|

— |

|

|

|

| Purchases of property and equipment |

(8,498) |

|

|

(1,795) |

|

|

|

|

|

|

|

|

|

| Purchases of marketable securities |

(30,770) |

|

|

(29,381) |

|

|

|

| Proceeds from sales of marketable securities |

— |

|

|

598 |

|

|

|

| Proceeds from maturities of marketable securities |

26,705 |

|

|

8,720 |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

(45,758) |

|

|

(21,858) |

|

|

|

| Financing activities |

|

|

|

|

|

| Proceeds from offerings, net of issuance costs |

13,766 |

|

|

— |

|

|

|

| Proceeds from issuance of common stock pursuant to employee stock purchase plan |

1,262 |

|

|

— |

|

|

|

| Exercise of stock options |

800 |

|

|

161 |

|

|

|

| Long-term debt principal payments |

(602) |

|

|

— |

|

|

|

| Finance lease principal payments |

(1,162) |

|

|

(990) |

|

|

|

| Net cash provided by (used in) financing activities |

14,064 |

|

|

(829) |

|

|

|

Net decrease in cash, cash equivalents and restricted cash |

(11,092) |

|

|

(43,605) |

|

|

|

| Cash, cash equivalents and restricted cash, at beginning of period |

86,202 |

|

|

100,668 |

|

|

|

Cash, cash equivalents and restricted cash, at end of period (1) |

$ |

75,110 |

|

|

$ |

57,063 |

|

|

|

|

|

|

|

|

|

| Supplemental disclosures of cash flow information |

|

|

|

|

|

| Cash paid for interest |

$ |

3,210 |

|

|

$ |

4,033 |

|

|

|

| Cash paid for taxes |

$ |

920 |

|

|

$ |

557 |

|

|

|

| Stock consideration paid pursuant to exercise of Perceptive warrant |

$ |

— |

|

|

$ |

12,586 |

|

|

|

| Purchases of property and equipment in accounts payable and accrued expenses |

$ |

5,752 |

|

|

$ |

501 |

|

|

|

| Assets acquired under capital lease obligations |

$ |

— |

|

|

$ |

689 |

|

|

|

(1)Cash, cash equivalents and restricted cash at June 30, 2025 excludes marketable securities of $60.4 million.