| UNITED STATES | ||||||||||||||

| SECURITIES AND EXCHANGE COMMISSION | ||||||||||||||

| Washington, D.C. 20549 | ||||||||||||||

FORM 8-K | ||||||||||||||

| CURRENT REPORT | ||||||||||||||

| Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 | ||||||||||||||

Date of report (Date of earliest event reported): September 2, 2025 | ||||||||||||||

| ||||||||||||||

Academy Sports and Outdoors, Inc. | ||||||||||||||

(Exact name of registrant as specified in its charter) | ||||||||||||||

Delaware |

001-39589 |

85-1800912 |

||||||||||||

(State or other jurisdiction of |

(Commission |

(I.R.S. Employer |

||||||||||||

incorporation) |

File No.) |

Identification No.) |

||||||||||||

| 1800 North Mason Road | ||||||||||||||

Katy, Texas 77449 |

||||||||||||||

(Address of principal executive offices, including Zip Code) |

||||||||||||||

(281) 646-5200 |

||||||||||||||

(Registrant’s telephone number, including area code) |

||||||||||||||

Not Applicable |

||||||||||||||

| (Former name or former address, if changed since last report) | ||||||||||||||

| Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | ||||||||||||||

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||||||||||||

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||||||||||||

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | ||||||||||||||

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) | ||||||||||||||

| Securities registered pursuant to Section 12(b) of the Act: | ||||||||||||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||||||||

| Common Stock, $0.01 par value per share | ASO | The Nasdaq Stock Market LLC | ||||||||||||

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | ||||||||||||||

Emerging Growth Company ☐ |

||||||||||||||

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ | ||||||||||||||

| Exhibit No. | Description of Exhibit | |||||||

Academy Sports and Outdoors, Inc. Press Release, dated September 2, 2025. |

||||||||

Second Quarter 2025 Supplemental Presentation, dated September 2, 2025. |

||||||||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). | |||||||

ACADEMY SPORTS AND OUTDOORS, INC. | ||

Date: September 2, 2025 |

By: | /s/ | Brandy Treadway | |||||||||||

| Name: | Brandy Treadway | |||||||||||||

| Title: | Executive Vice President, Chief Legal Officer and Corporate Secretary | |||||||||||||

| ||

|

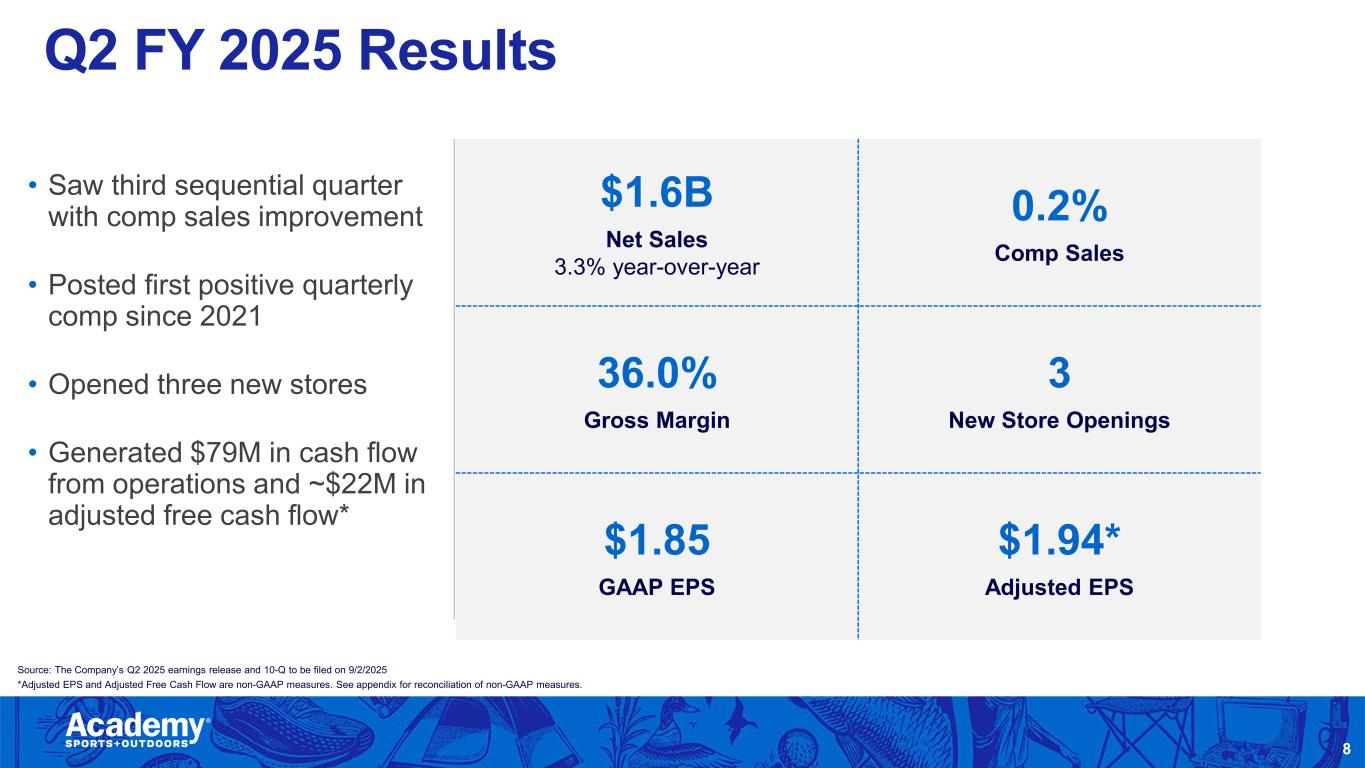

Second Quarter Operating Results

($ in millions, except per share data)

|

Thirteen Weeks Ended |

Change | ||||||||||||

| August 2, 2025 | August 3, 2024 | % | ||||||||||||

| Net sales | $ | 1,599.8 | $ | 1,549.0 | 3.3% | |||||||||

| Comparable sales | 0.2 | % | (6.9) | % | ||||||||||

| Income before income tax | $ | 164.8 | $ | 186.5 | (11.6)% | |||||||||

| Net income | $ | 125.4 | $ | 142.6 | (12.1)% | |||||||||

Adjusted net income (1) |

$ | 131.3 | $ | 148.6 | (11.6)% | |||||||||

| Earnings per common share, diluted | $ | 1.85 | $ | 1.95 | (5.1)% | |||||||||

Adjusted earnings per common share, diluted (1) |

$ | 1.94 | $ | 2.03 | (4.4)% | |||||||||

Year-to-Date Operating Results ($ in millions, except per share data) |

Twenty-Six Weeks Ended |

Change | ||||||||||||

| August 2, 2025 | August 3, 2024 | % | ||||||||||||

| Net sales | $ | 2,951.2 | $ | 2,913.2 | 1.3% | |||||||||

| Comparable sales | (1.7) | % | (6.4) | % | ||||||||||

| Income before income tax | $ | 227.9 | $ | 284.2 | (19.8)% | |||||||||

| Net Income | $ | 171.5 | $ | 219.1 | (21.7)% | |||||||||

Adjusted net income (1) |

$ | 182.9 | $ | 230.3 | (20.6)% | |||||||||

| Earnings per common share, diluted | $ | 2.52 | $ | 2.93 | (14.0)% | |||||||||

Adjusted earnings per common share, diluted (1) |

$ | 2.69 | $ | 3.08 | (12.7)% | |||||||||

| As of | Change | |||||||||||||

Balance Sheet ($ in millions) |

August 2, 2025 | August 3, 2024 | % | |||||||||||

| Cash and cash equivalents | $ | 300.9 | $ | 324.6 | (7.3)% | |||||||||

Merchandise inventories, net(1) |

$ | 1,587.6 | $ | 1,366.6 | 16.2% | |||||||||

| Long-term debt, net | $ | 481.7 | $ | 483.6 | (0.4)% | |||||||||

| Twenty-Six Weeks Ended | Change | |||||||||||||

Capital Allocation ($ in millions) |

August 2, 2025 | August 3, 2024 | % | |||||||||||

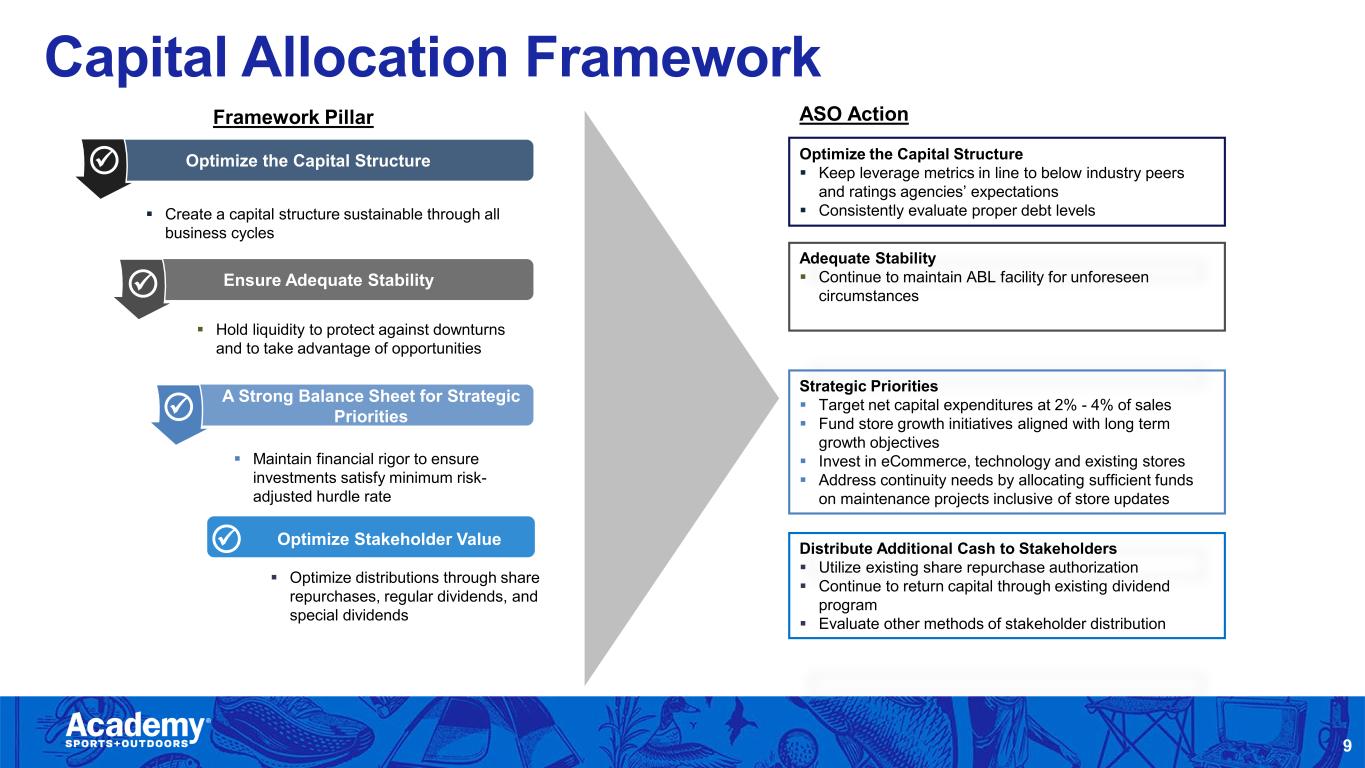

| Share repurchases | $ | 99.9 | $ | 222.3 | (55.1)% | |||||||||

| Dividends paid | $ | 17.4 | $ | 16.1 | 8.1% | |||||||||

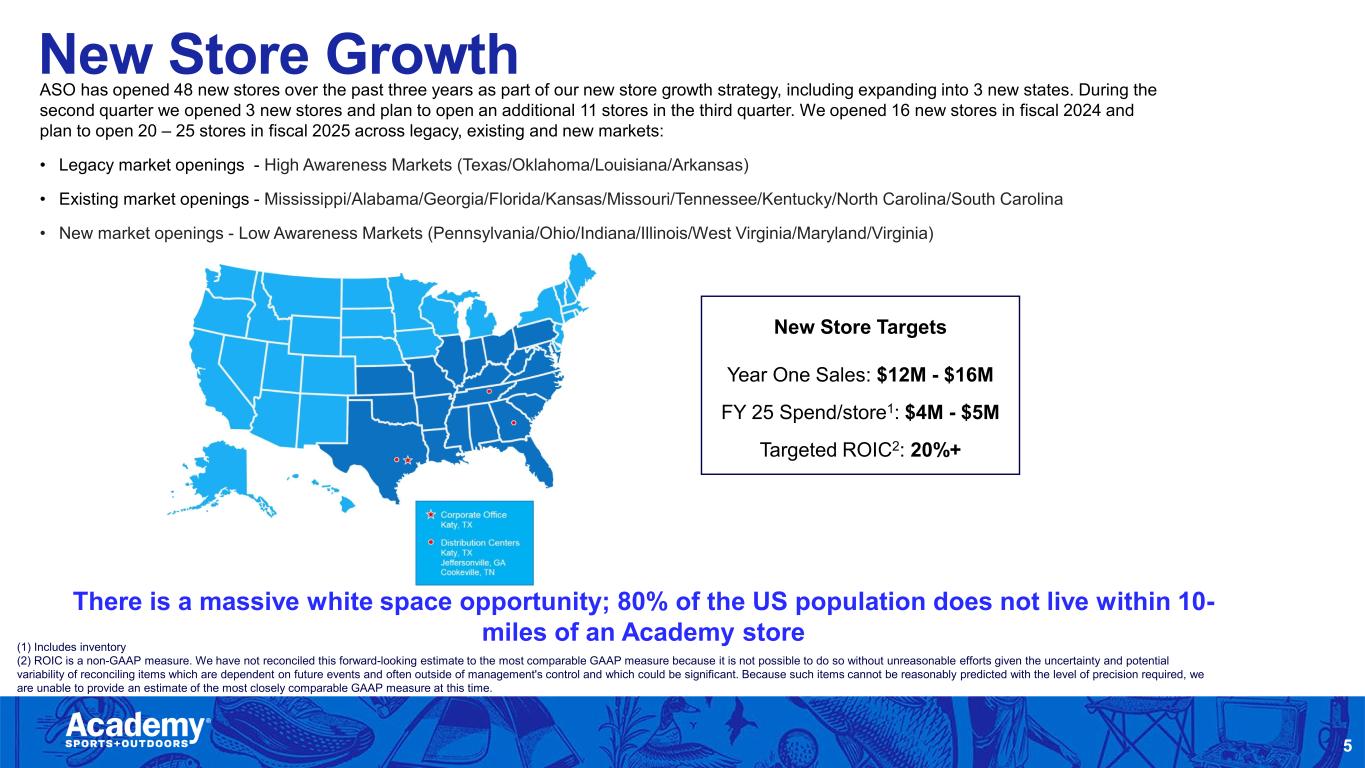

| Time Frame | Total stores open at beginning of the period | Number of stores opened during the period | Number of stores closed during the period | Total stores open at end of period | ||||||||||

| FY 2024 | 282 | 16 | — | 298 | ||||||||||

| 1st Quarter 2025 | 298 | 5 | — | 303 | ||||||||||

| 2nd Quarter 2025 | 303 | 3 | — | 306 | ||||||||||

Time Frame |

Total gross square feet open at beginning of the period | Gross square feet for stores opened during the period | Gross square feet for stores closed during the period | Total gross square feet at the end of the period | ||||||||||

| FY 2024 | 19,679 | 925 | — | 20,604 | ||||||||||

| 1st Quarter 2025 | 20,604 | 275 | — | 20,879 | ||||||||||

| 2nd Quarter 2025 | 20,879 | 191 | — | 21,070 | ||||||||||

Fiscal 2025 Guidance Q1 Update |

Updated Fiscal 2025 Guidance |

|||||||||||||

| (in millions, except per share amounts) | Low end | High End | Low end | High end | ||||||||||

| Net sales | $5,970 | $6,265 | $6,000 | $6,265 | ||||||||||

Comparable sales (1) |

(4.0) | % | 1.0 | % | (3.0) | % | 1.0 | % | ||||||

| Gross margin rate | 34.0 | % | 34.5 | % | 34.0 | % | 34.5 | % | ||||||

| GAAP net income | $350 | $410 | $360 | $410 | ||||||||||

Adjusted net income (2) |

$375 | $435 | $380 | $430 | ||||||||||

| GAAP earnings per common share, diluted | $5.10 | $5.90 | $5.30 | $6.00 | ||||||||||

Adjusted earnings per common share, diluted (2) |

$5.45 | $6.25 | $5.60 | $6.30 | ||||||||||

| Diluted weighted average common shares | ~69 | ~69 | ~68 | ~68 | ||||||||||

| Capital Expenditures | $180 | $220 | $180 | $220 | ||||||||||

Adjusted free cash flow (2), (3) |

$250 | $320 | $250 | $320 | ||||||||||

Investor Contact |

Media Contact | |||||||

| Dan Aldridge | Meredith Klein | |||||||

| VP, Investor Relations | VP, Communications | |||||||

| 832-739-4102 | 346-823-6615 | |||||||

| dan.aldridge@academy.com | meredith.klein@academy.com | |||||||

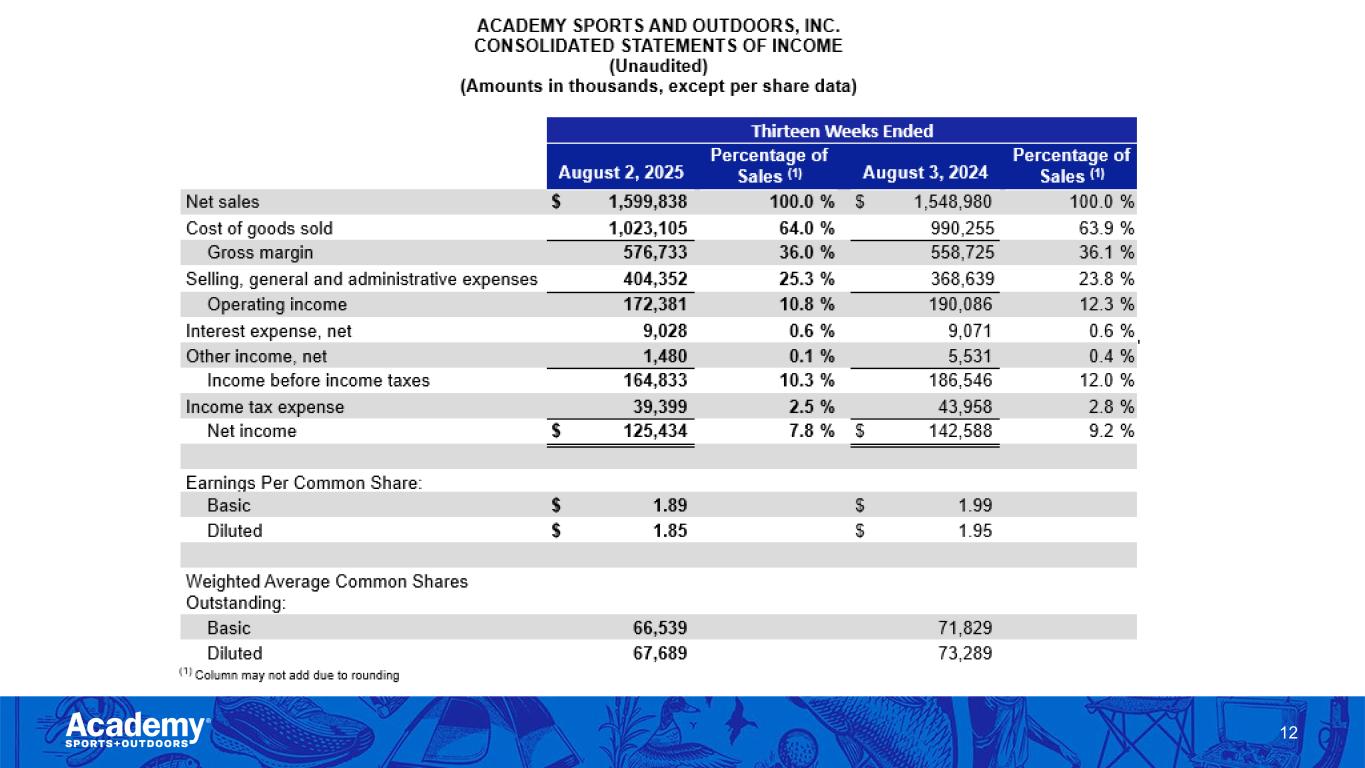

| Thirteen Weeks Ended | |||||||||||||||||||||||

| August 2, 2025 | Percentage of Sales (1) |

August 3, 2024 | Percentage of Sales (1) |

||||||||||||||||||||

| Net sales | $ | 1,599,838 | 100.0 | % | $ | 1,548,980 | 100.0 | % | |||||||||||||||

| Cost of goods sold | 1,023,105 | 64.0 | % | 990,255 | 63.9 | % | |||||||||||||||||

| Gross margin | 576,733 | 36.0 | % | 558,725 | 36.1 | % | |||||||||||||||||

| Selling, general and administrative expenses | 404,352 | 25.3 | % | 368,639 | 23.8 | % | |||||||||||||||||

| Operating income | 172,381 | 10.8 | % | 190,086 | 12.3 | % | |||||||||||||||||

| Interest expense, net | 9,028 | 0.6 | % | 9,071 | 0.6 | % | |||||||||||||||||

| Other income, net | 1,480 | 0.1 | % | 5,531 | 0.4 | % | |||||||||||||||||

| Income before income taxes | 164,833 | 10.3 | % | 186,546 | 12.0 | % | |||||||||||||||||

| Income tax expense | 39,399 | 2.5 | % | 43,958 | 2.8 | % | |||||||||||||||||

| Net income | $ | 125,434 | 7.8 | % | $ | 142,588 | 9.2 | % | |||||||||||||||

| Earnings Per Common Share: | |||||||||||||||||||||||

| Basic | $ | 1.89 | $ | 1.99 | |||||||||||||||||||

| Diluted | $ | 1.85 | $ | 1.95 | |||||||||||||||||||

| Weighted Average Common Shares Outstanding: | |||||||||||||||||||||||

| Basic | 66,539 | 71,829 | |||||||||||||||||||||

| Diluted | 67,689 | 73,289 | |||||||||||||||||||||

| Twenty-Six Weeks Ended | |||||||||||||||||||||||

| August 2, 2025 | Percentage of Sales (1) |

August 3, 2024 | Percentage of Sales (1) |

||||||||||||||||||||

| Net sales | $ | 2,951,247 | 100.0 | % | $ | 2,913,200 | 100.0 | % | |||||||||||||||

| Cost of goods sold | 1,915,645 | 64.9 | % | 1,898,681 | 65.2 | % | |||||||||||||||||

| Gross margin | 1,035,602 | 35.1 | % | 1,014,519 | 34.8 | % | |||||||||||||||||

| Selling, general and administrative expenses | 793,956 | 26.9 | % | 722,050 | 24.8 | % | |||||||||||||||||

| Operating income | 241,646 | 8.2 | % | 292,469 | 10.0 | % | |||||||||||||||||

| Interest expense, net | 18,072 | 0.6 | % | 18,557 | 0.6 | % | |||||||||||||||||

| Write off of deferred loan costs | — | — | % | 449 | 0.0 | % | |||||||||||||||||

| Other income, net | 4,287 | 0.1 | % | 10,735 | 0.4 | % | |||||||||||||||||

| Income before income taxes | 227,861 | 7.7 | % | 284,198 | 9.8 | % | |||||||||||||||||

| Income tax expense | 56,343 | 1.9 | % | 65,145 | 2.2 | % | |||||||||||||||||

| Net income | $ | 171,518 | 5.8 | % | $ | 219,053 | 7.5 | % | |||||||||||||||

| Earnings Per Common Share: | |||||||||||||||||||||||

| Basic | $ | 2.57 | $ | 3.00 | |||||||||||||||||||

| Diluted | $ | 2.52 | $ | 2.93 | |||||||||||||||||||

| Weighted Average Common Shares Outstanding: | |||||||||||||||||||||||

| Basic | 66,831 | 72,911 | |||||||||||||||||||||

| Diluted | 68,043 | 74,651 | |||||||||||||||||||||

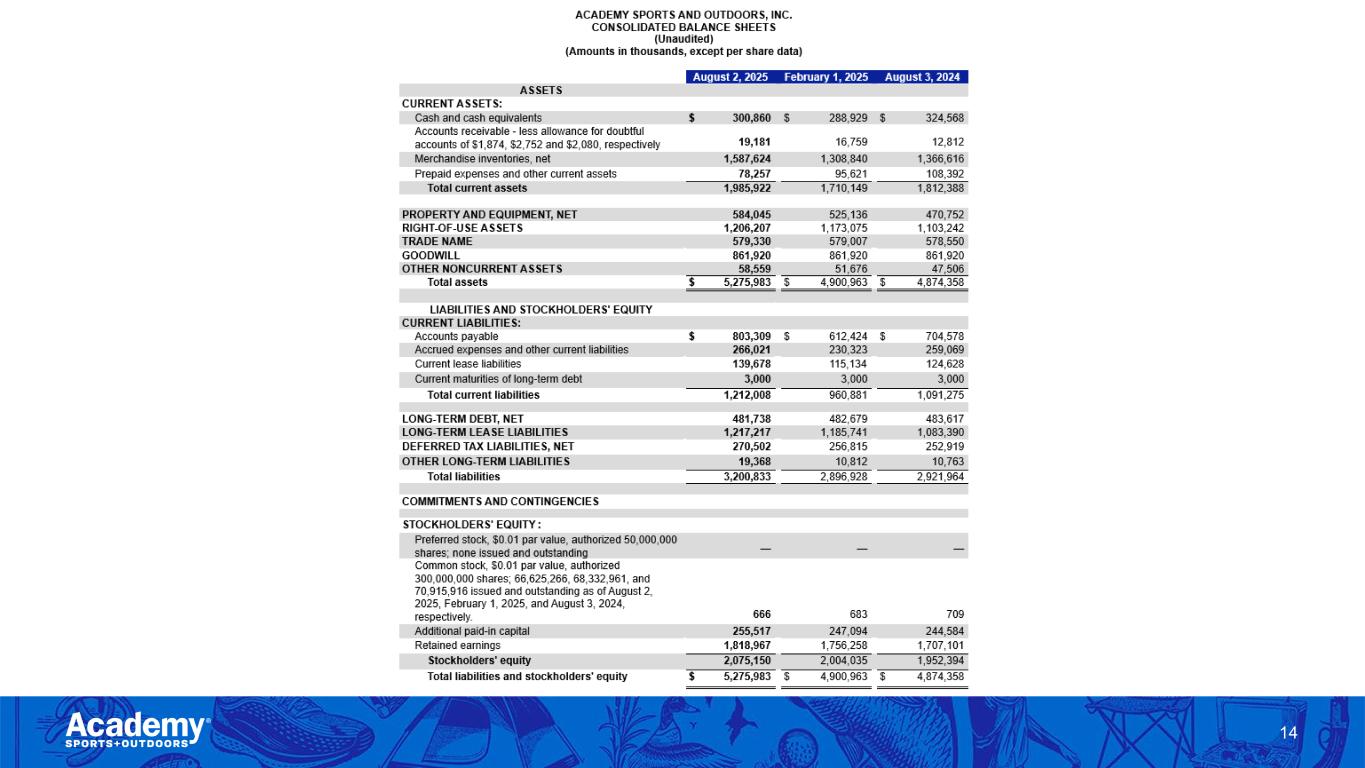

| August 2, 2025 | February 1, 2025 | August 3, 2024 | ||||||||||||||||||

| ASSETS | ||||||||||||||||||||

| CURRENT ASSETS: | ||||||||||||||||||||

| Cash and cash equivalents | $ | 300,860 | $ | 288,929 | $ | 324,568 | ||||||||||||||

| Accounts receivable - less allowance for doubtful accounts of $1,874, $2,752 and $2,080, respectively | 19,181 | 16,759 | 12,812 | |||||||||||||||||

| Merchandise inventories, net | 1,587,624 | 1,308,840 | 1,366,616 | |||||||||||||||||

| Prepaid expenses and other current assets | 78,257 | 95,621 | 108,392 | |||||||||||||||||

| Total current assets | 1,985,922 | 1,710,149 | 1,812,388 | |||||||||||||||||

| PROPERTY AND EQUIPMENT, NET | 584,045 | 525,136 | 470,752 | |||||||||||||||||

| RIGHT-OF-USE ASSETS | 1,206,207 | 1,173,075 | 1,103,242 | |||||||||||||||||

| TRADE NAME | 579,330 | 579,007 | 578,550 | |||||||||||||||||

| GOODWILL | 861,920 | 861,920 | 861,920 | |||||||||||||||||

| OTHER NONCURRENT ASSETS | 58,559 | 51,676 | 47,506 | |||||||||||||||||

| Total assets | $ | 5,275,983 | $ | 4,900,963 | $ | 4,874,358 | ||||||||||||||

| LIABILITIES AND STOCKHOLDERS' EQUITY | ||||||||||||||||||||

| CURRENT LIABILITIES: | ||||||||||||||||||||

| Accounts payable | $ | 803,309 | $ | 612,424 | $ | 704,578 | ||||||||||||||

| Accrued expenses and other current liabilities | 266,021 | 230,323 | 259,069 | |||||||||||||||||

| Current lease liabilities | 139,678 | 115,134 | 124,628 | |||||||||||||||||

| Current maturities of long-term debt | 3,000 | 3,000 | 3,000 | |||||||||||||||||

| Total current liabilities | 1,212,008 | 960,881 | 1,091,275 | |||||||||||||||||

| LONG-TERM DEBT, NET | 481,738 | 482,679 | 483,617 | |||||||||||||||||

| LONG-TERM LEASE LIABILITIES | 1,217,217 | 1,185,741 | 1,083,390 | |||||||||||||||||

| DEFERRED TAX LIABILITIES, NET | 270,502 | 256,815 | 252,919 | |||||||||||||||||

| OTHER LONG-TERM LIABILITIES | 19,368 | 10,812 | 10,763 | |||||||||||||||||

| Total liabilities | 3,200,833 | 2,896,928 | 2,921,964 | |||||||||||||||||

| COMMITMENTS AND CONTINGENCIES | ||||||||||||||||||||

STOCKHOLDERS' EQUITY : |

||||||||||||||||||||

| Preferred stock, $0.01 par value, authorized 50,000,000 shares; none issued and outstanding | — | — | — | |||||||||||||||||

| Common stock, $0.01 par value, authorized 300,000,000 shares; 66,625,266, 68,332,961, and 70,915,916 issued and outstanding as of August 2, 2025, February 1, 2025, and August 3, 2024, respectively. | 666 | 683 | 709 | |||||||||||||||||

| Additional paid-in capital | 255,517 | 247,094 | 244,584 | |||||||||||||||||

| Retained earnings | 1,818,967 | 1,756,258 | 1,707,101 | |||||||||||||||||

| Stockholders' equity | 2,075,150 | 2,004,035 | 1,952,394 | |||||||||||||||||

| Total liabilities and stockholders' equity | $ | 5,275,983 | $ | 4,900,963 | $ | 4,874,358 | ||||||||||||||

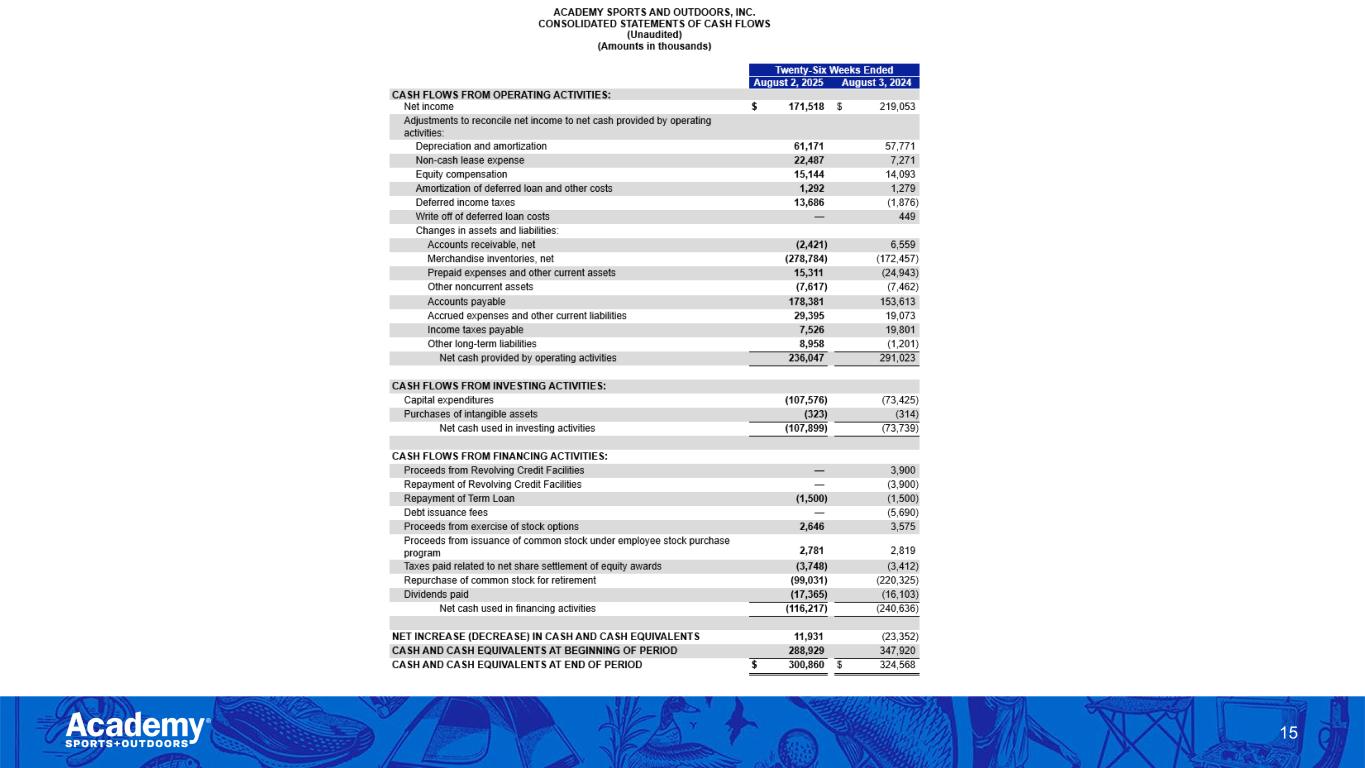

| Twenty-Six Weeks Ended | ||||||||||||||

| August 2, 2025 | August 3, 2024 | |||||||||||||

| CASH FLOWS FROM OPERATING ACTIVITIES: | ||||||||||||||

| Net income | $ | 171,518 | $ | 219,053 | ||||||||||

| Adjustments to reconcile net income to net cash provided by operating activities: | ||||||||||||||

| Depreciation and amortization | 61,171 | 57,771 | ||||||||||||

| Non-cash lease expense | 22,487 | 7,271 | ||||||||||||

| Equity compensation | 15,144 | 14,093 | ||||||||||||

| Amortization of deferred loan and other costs | 1,292 | 1,279 | ||||||||||||

| Deferred income taxes | 13,686 | (1,876) | ||||||||||||

| Write off of deferred loan costs | — | 449 | ||||||||||||

| Changes in assets and liabilities: | ||||||||||||||

| Accounts receivable, net | (2,421) | 6,559 | ||||||||||||

| Merchandise inventories, net | (278,784) | (172,457) | ||||||||||||

| Prepaid expenses and other current assets | 15,311 | (24,943) | ||||||||||||

| Other noncurrent assets | (7,617) | (7,462) | ||||||||||||

| Accounts payable | 178,381 | 153,613 | ||||||||||||

| Accrued expenses and other current liabilities | 29,395 | 19,073 | ||||||||||||

| Income taxes payable | 7,526 | 19,801 | ||||||||||||

| Other long-term liabilities | 8,958 | (1,201) | ||||||||||||

| Net cash provided by operating activities | 236,047 | 291,023 | ||||||||||||

| CASH FLOWS FROM INVESTING ACTIVITIES: | ||||||||||||||

| Capital expenditures | (107,576) | (73,425) | ||||||||||||

| Purchases of intangible assets | (323) | (314) | ||||||||||||

| Net cash used in investing activities | (107,899) | (73,739) | ||||||||||||

| CASH FLOWS FROM FINANCING ACTIVITIES: | ||||||||||||||

| Proceeds from Revolving Credit Facilities | — | 3,900 | ||||||||||||

| Repayment of Revolving Credit Facilities | — | (3,900) | ||||||||||||

| Repayment of Term Loan | (1,500) | (1,500) | ||||||||||||

| Debt issuance fees | — | (5,690) | ||||||||||||

| Proceeds from exercise of stock options | 2,646 | 3,575 | ||||||||||||

| Proceeds from issuance of common stock under employee stock purchase program | 2,781 | 2,819 | ||||||||||||

| Taxes paid related to net share settlement of equity awards | (3,748) | (3,412) | ||||||||||||

| Repurchase of common stock for retirement | (99,031) | (220,325) | ||||||||||||

| Dividends paid | (17,365) | (16,103) | ||||||||||||

| Net cash used in financing activities | (116,217) | (240,636) | ||||||||||||

| NET INCREASE (DECREASE) IN CASH AND CASH EQUIVALENTS | 11,931 | (23,352) | ||||||||||||

| CASH AND CASH EQUIVALENTS AT BEGINNING OF PERIOD | 288,929 | 347,920 | ||||||||||||

| CASH AND CASH EQUIVALENTS AT END OF PERIOD | $ | 300,860 | $ | 324,568 | ||||||||||

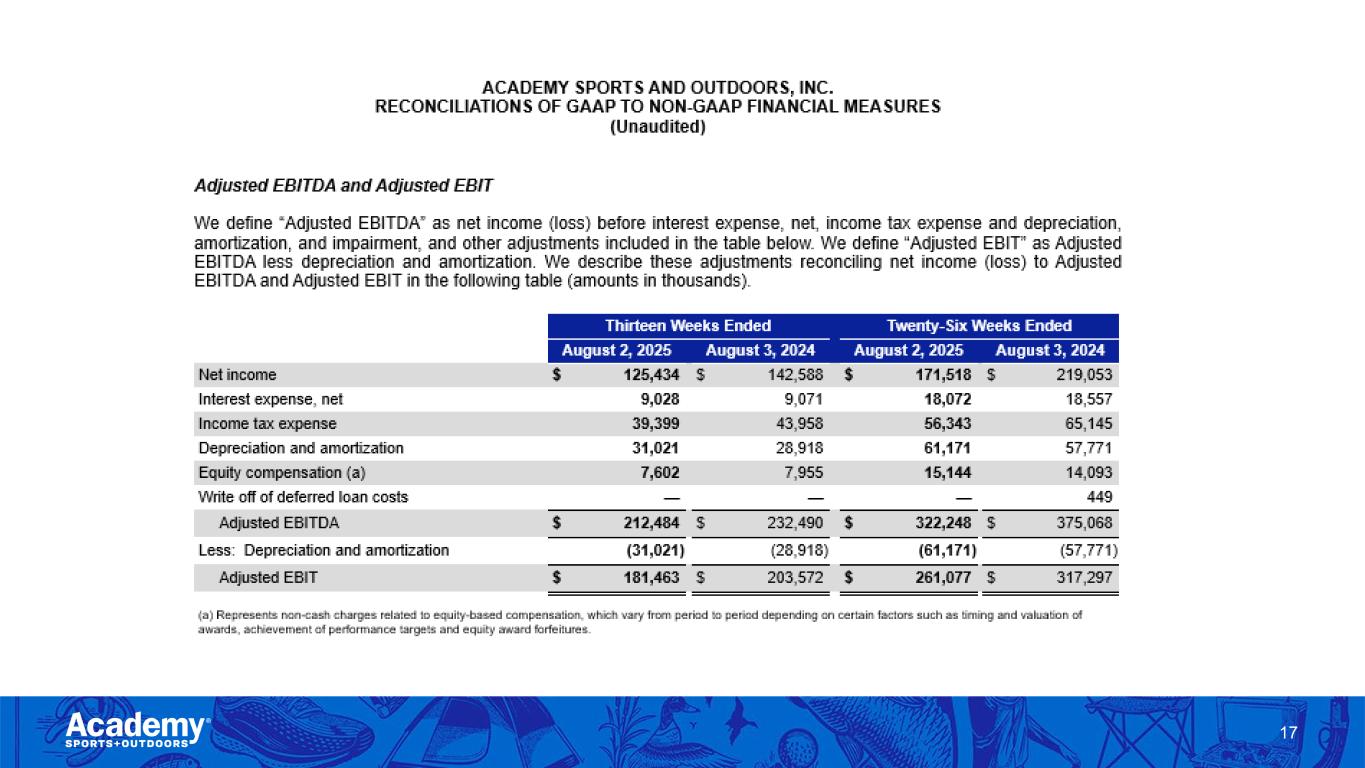

| Thirteen Weeks Ended | Twenty-Six Weeks Ended | ||||||||||||||||||||||||||||

| August 2, 2025 | August 3, 2024 | August 2, 2025 | August 3, 2024 | ||||||||||||||||||||||||||

| Net income | $ | 125,434 | $ | 142,588 | $ | 171,518 | $ | 219,053 | |||||||||||||||||||||

| Interest expense, net | 9,028 | 9,071 | 18,072 | 18,557 | |||||||||||||||||||||||||

| Income tax expense | 39,399 | 43,958 | 56,343 | 65,145 | |||||||||||||||||||||||||

| Depreciation and amortization | 31,021 | 28,918 | 61,171 | 57,771 | |||||||||||||||||||||||||

| Equity compensation (a) | 7,602 | 7,955 | 15,144 | 14,093 | |||||||||||||||||||||||||

| Write off of deferred loan costs | — | — | — | 449 | |||||||||||||||||||||||||

| Adjusted EBITDA | $ | 212,484 | $ | 232,490 | $ | 322,248 | $ | 375,068 | |||||||||||||||||||||

| Less: Depreciation and amortization | (31,021) | (28,918) | (61,171) | (57,771) | |||||||||||||||||||||||||

| Adjusted EBIT | $ | 181,463 | $ | 203,572 | $ | 261,077 | $ | 317,297 | |||||||||||||||||||||

| (a) Represents non-cash charges related to equity-based compensation, which vary from period to period depending on certain factors such as timing and valuation of awards, achievement of performance targets and equity award forfeitures. | |||||||||||||||||||||||||||||

| Thirteen Weeks Ended | Twenty-Six Weeks Ended | ||||||||||||||||||||||||||||

| August 2, 2025 | August 3, 2024 | August 2, 2025 | August 3, 2024 | ||||||||||||||||||||||||||

| Net income | $ | 125,434 | $ | 142,588 | $ | 171,518 | $ | 219,053 | |||||||||||||||||||||

| Equity compensation (a) | 7,602 | 7,955 | 15,144 | 14,093 | |||||||||||||||||||||||||

| Write off of deferred loan costs | — | — | — | 449 | |||||||||||||||||||||||||

| Tax effects of these adjustments (b) | (1,717) | (1,901) | (3,745) | (3,333) | |||||||||||||||||||||||||

| Adjusted Net Income | $ | 131,319 | $ | 148,642 | $ | 182,917 | $ | 230,262 | |||||||||||||||||||||

| Earnings per common share: | |||||||||||||||||||||||||||||

| Basic | $ | 1.89 | $ | 1.99 | $ | 2.57 | $ | 3.00 | |||||||||||||||||||||

| Diluted | $ | 1.85 | $ | 1.95 | $ | 2.52 | $ | 2.93 | |||||||||||||||||||||

| Adjusted earnings per common share: | |||||||||||||||||||||||||||||

| Basic | $ | 1.97 | $ | 2.07 | $ | 2.74 | $ | 3.16 | |||||||||||||||||||||

| Diluted | $ | 1.94 | $ | 2.03 | $ | 2.69 | $ | 3.08 | |||||||||||||||||||||

| Weighted average common shares outstanding: | |||||||||||||||||||||||||||||

| Basic | 66,539 | 71,829 | 66,831 | 72,911 | |||||||||||||||||||||||||

| Diluted | 67,689 | 73,289 | 68,043 | 74,651 | |||||||||||||||||||||||||

| (a) Represents non-cash charges related to equity-based compensation, which vary from period to period depending on certain factors such as timing and valuation of awards, achievement of performance targets and equity award forfeitures. | |||||||||||||||||||||||||||||

| (b) For the thirteen and twenty-six weeks ended August 2, 2025 and August 3, 2024, this represents the estimated tax effect (by using the projected full year tax rates for the respective years) of the total adjustments made to arrive at Adjusted Net Income. | |||||||||||||||||||||||||||||

| Low Range* | High Range* | |||||||||||||

| Fiscal Year Ending January 31, 2026 |

Fiscal Year Ending January 31, 2026 |

|||||||||||||

| Net Income | $ | 360.0 | $ | 410.0 | ||||||||||

Equity compensation (a) |

$ | 20.0 | $ | 20.0 | ||||||||||

| Adjusted Net Income | $ | 380.0 | $ | 430.0 | ||||||||||

| Earnings Per Common Share, Diluted | $ | 5.30 | $ | 6.00 | ||||||||||

Equity compensation (a) |

$ | 0.30 | $ | 0.30 | ||||||||||

| Adjusted Earnings Per Common Share, Diluted | $ | 5.60 | $ | 6.30 | ||||||||||

| * | Amounts presented have been rounded. | |||||||||||||

| (a) | Adjustments include non-cash charges related to equity-based compensation (as defined above), which may vary from period to period. | |||||||||||||

| Thirteen Weeks Ended | Twenty-Six Weeks Ended | |||||||||||||||||||||||||

| August 2, 2025 | August 3, 2024 | August 2, 2025 | August 3, 2024 | |||||||||||||||||||||||

| Net cash provided by operating activities | $ | 78,575 | $ | 91,346 | $ | 236,047 | $ | 291,023 | ||||||||||||||||||

| Net cash used in investing activities | (56,911) | (41,384) | (107,899) | (73,739) | ||||||||||||||||||||||

| Adjusted Free Cash Flow | $ | 21,664 | $ | 49,962 | $ | 128,148 | $ | 217,284 | ||||||||||||||||||