false000180883400018088342025-12-012025-12-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

________________________________

FORM 8-K

________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): December 1, 2025

(Exact name of Registrant as Specified in Charter)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Georgia |

|

1-39628 |

|

85-2484385 |

(State or other Jurisdiction of Incorporation) |

|

(Commission File

Number)

|

|

(IRS Employer

Identification No.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| 256 W. Data Drive |

|

Draper, |

Utah |

|

84020-2315 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (385) 351-1369

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, $0.50 Par Value |

|

PRG |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On December 1, 2025, PROG Beach, LLC (the "Purchaser"), a wholly-owned subsidiary of PROG Holdings, Inc. (the "Company"), entered into a Unit Purchase Agreement (the "Purchase Agreement") with Purchasing Power Parent, LLC (the "Seller"), P-Squared, LLC, a wholly-owned subsidiary of the Seller (the "Acquired Entity"), and, solely to guarantee the Purchaser’s obligations under the Purchase Agreement, the Company.

Pursuant to the Purchase Agreement, the Purchaser has agreed to acquire all of the issued and outstanding equity interests of the Acquired Entity for cash consideration of $420 million. In addition, the Acquired Entity has approximately $330 million of non-recourse funding debt under its securitization and warehouse facilities that will remain in place following the closing of the transaction. The transaction is intended to result in the Company acquiring the Seller’s voluntary employee benefit program, which allows an employers’ workers to buy brand-name products and services through automatic payroll deductions without credit checks.

The Purchase Agreement contains customary representations, warranties, covenants, and obligations of the parties. In connection with the transaction, the Purchaser intends to obtain a representation and warranty insurance policy that provides coverage for certain breaches of the representations and warranties made by the Seller in the Purchase Agreement, subject to customary exclusions, deductibles, and other terms and conditions.

The Purchase Agreement provides that the closing of the transaction is subject to customary closing conditions, including, among other things, (i) the accuracy of each party’s representations and warranties (subject to customary materiality standards), (ii) each party’s compliance in all material respects with its pre-closing covenants, (iii) the expiration or termination of the waiting period (and any extension thereof) applicable to the consummation of the transaction under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, (iv) the absence of any law or governmental order preventing, making illegal, or prohibiting the consummation of, the transaction, (v) the absence of a material adverse effect that has occurred since the signing date and (vi) the delivery of customary closing deliverables.

The Company will fund the transaction with a combination of cash on hand and debt financing.

The Purchase Agreement contains customary termination provisions, including the right of either the Purchaser or the Seller to terminate if the closing of the transaction has not occurred within 120 days of the signing date.

The transaction is expected to close in early 2026.

The foregoing description of the Purchase Agreement is only a summary and is qualified in its entirety by reference to the full text of the Purchase Agreement, a copy of which will be filed as an exhibit to the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2025.

ITEM 7.01. REGULATION FD DISCLOSURE

On December 1, 2025, the Company issued a press release announcing the transaction, a copy of which is furnished as Exhibit 99.1 and is incorporated herein by reference.

In addition, on December 2, 2025, the Company will hold a conference call and make a simultaneous presentation to investors to discuss the transaction, a copy of which is furnished as Exhibit 99.2 and is incorporated herein by reference.

The information contained in this Item 7.01 of this Current Report on Form 8-K, as well as Exhibit 99.1 and Exhibit 99.2 referenced herein, shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits:

|

|

|

|

|

|

Exhibit No. |

Description |

|

|

|

|

|

|

104 |

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PROG Holdings, Inc. |

|

|

By: |

/s/ Todd King |

Date: |

December 2, 2025 |

|

Todd King

Chief Legal and Compliance Officer

|

EX-99.1

2

exhibit991-pressrelease121.htm

EX-99.1

Document

PROG Holdings to Acquire Purchasing Power

•Expands PROG Holdings’ growing ecosystem through a new, scalable customer acquisition channel that complements its existing payment solutions

•Creates access to an employee-focused consumer base with limited overlap across existing PROG customers, enabling substantial expansion of current and new offerings

•Generates new employer-client and partner opportunities

•Advances PROG Holdings’ long-term growth strategy to provide transparent and inclusive payment options to near- and below-prime consumers

SALT LAKE CITY, December 1, 2025 – PROG Holdings, Inc. (NYSE:PRG), the fintech holding company for Progressive Leasing, Four Technologies, and Build, today announced it has reached an agreement to acquire Purchasing Power, a leading voluntary employee benefit program provider allowing employees to purchase brand-name products and services through either automatic payroll deductions or allotments.

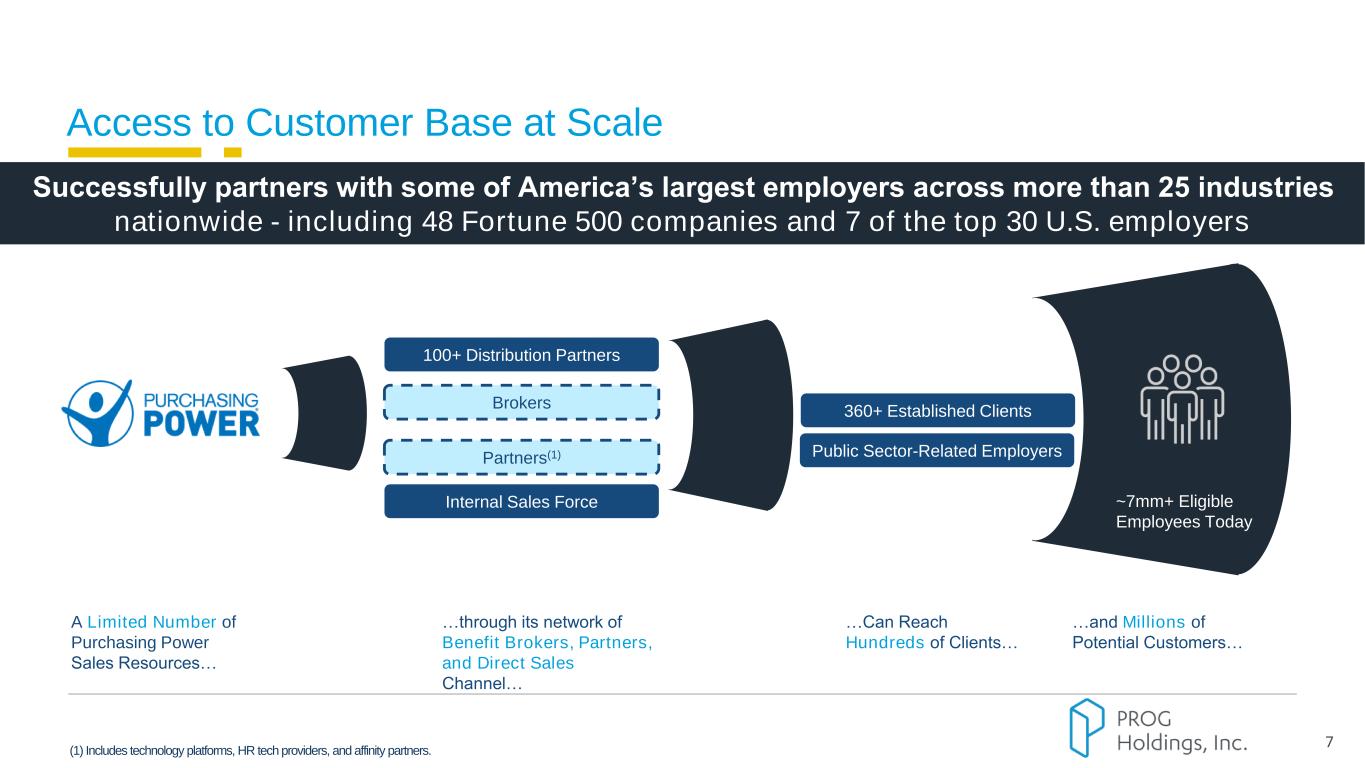

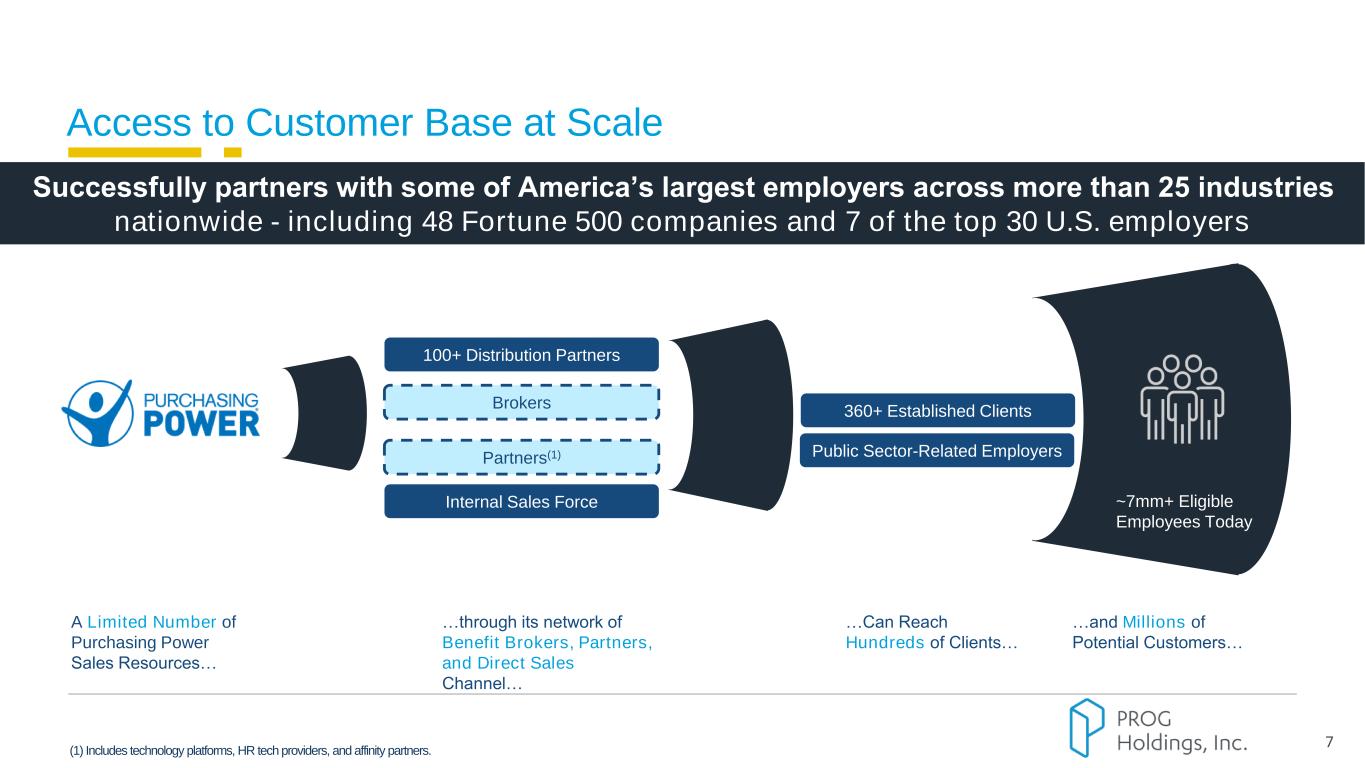

Purchasing Power successfully partners with some of America’s largest employers across more than 25 industries nationwide, including 48 Fortune 500 companies, seven of the top 30 U.S. employers, and many employers in the public sector. Through these relationships, more than seven million employees nationwide have access to its innovative purchasing and financial wellness offerings. The platform provides access to over 70,000 products and services through a broad network of suppliers and is powered by a proprietary payments infrastructure that connects directly to payroll systems, making payroll deduction simple and seamless for both employees and employers.

“Acquiring Purchasing Power adds a highly complementary and important new platform to our growing ecosystem of payment solutions, further diversifying our product portfolio and advancing our three-pillared strategy to Grow, Enhance and Expand,” said Steve Michaels, PROG Holdings President and Chief Executive Officer. “Together we expect to expand our offerings more quickly and effectively and reach more customers, becoming one of the most diversified providers of financial health and payment services to the near- and sub-prime market.”

The addition of Purchasing Power meaningfully expands PROG Holdings’ platform by broadening the ways consumers can access flexible, budget-friendly payment options across high-demand categories like electronics, home furnishings, fitness, travel, services, and more. The acquisition also strengthens PROG Holdings’ reach and relationships across its partner ecosystem as Purchasing Power brings more than 360 employer partnerships and a strong benefit-broker distribution channel.

PROG’s expanded scale will also allow for accelerated development of new products by leveraging the combined strengths of the businesses, which is expected to increase engagement, conversion and lifetime value of its customers.

In addition, the combination of the businesses will create opportunities for revenue synergies, cost efficiencies, improved decisioning capabilities and recoveries.

“Purchasing Power is excited to become part of the PROG Holdings family of companies. Both of our companies share a similar mission to improve the financial wellbeing of our customers by providing them with transparent and competitive payment options,” said Trey Loughran, Chief Executive Officer of Purchasing Power. “We believe PROG’s scale and resources will accelerate our growth and allow us to better serve our clients and customers. This transaction represents the next logical step in Purchasing Power’s evolution.”

Transaction Details

Under the terms of the transaction, PROG Holdings will acquire Purchasing Power for $420 million in cash, funded through a combination of cash on hand and debt financing. In addition, at the closing of the transaction, Purchasing Power will have approximately $330 million of non-recourse funding debt under its securitization and warehouse facilities that will remain in place. The transaction is expected to close in early 2026 following the receipt of requisite regulatory approvals and the satisfaction of other customary closing conditions.

Conference Call and Webcast

PROG Holdings will host a live webcast and conference call on Tuesday, December 2, 2025, at 8:30 AM ET to discuss the strategic and financial implications of the acquisition. To access the live webcast and accompanying presentation materials, visit https://edge.media-server.com/mmc/p/n63ajbsq or the Events and Presentations page of the PROG Holdings Investor Relations website, https://investor.progholdings.com/.

Advisors

Stephens Inc. is serving as financial advisor to PROG Holdings, Inc., and King & Spalding LLP is serving as legal counsel. Barclays is serving as financial advisor to Purchasing Power and Kirkland & Ellis LLP is serving as legal advisor.

About PROG Holdings, Inc.

PROG Holdings, Inc. (NYSE:PRG) is a fintech holding company headquartered in Salt Lake City, UT, that provides transparent and competitive payment options and inclusive consumer financial products. The Company owns Progressive Leasing, a leading provider of e-commerce, app-based, and in-store point-of-sale lease-to-own solutions, Four Technologies, provider of Buy Now, Pay Later payment options through its platform Four, and Build, provider of personal credit building products. More information on PROG Holdings' companies can be found at https://www.progholdings.com.

About Purchasing Power, LLC

Purchasing Power, LLC, is an Atlanta-based voluntary benefit company providing financial wellness solutions to employers, including a leading employee purchase program for consumer products and services using payroll deduction. Helping employees achieve financial flexibility, Purchasing Power is available to millions of people through large companies including Fortune 500s, associations and government agencies.

Forward Looking Statements

Statements in this news release regarding PROG Holdings, Inc. that are not historical facts are "forward-looking statements" that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “expect”, “believe”, “will” and similar forward-looking terminology. These risks and uncertainties include, among others, the risks and uncertainties discussed under "Risk Factors" in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 19, 2025. Statements in this press release that are "forward-looking" include, without limitation, statements regarding the impact of the transaction on the Company's ability to (i) expand its offerings to consumers more quickly and efficiently; (ii) reach more customers; (iii) strengthen its partner ecosystem; (iv) accelerate the development of new product offerings; (v) increase customer engagement, conversion and lifetime value; and (vi) accelerate the growth of the Purchasing Power Business, as well as other statements regarding the plans, intentions, expectations, objectives, goals and projections with respect to the proposed transaction, including future financial and operating results, and statements regarding the expected timing of the completion of the proposed transaction. However, there can be no assurance that such expectations will occur. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date of this press release. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this press release.

Investor Contact

John A. Baugh, CFA

Vice President, Investor Relations

john.baugh@progleasing.com

Media Contacts

PROG Holdings

Andy Watson

Senior Vice President, Marketing

andy.watson@progleasing.com

Purchasing Power

Nancy Bistritz-Balkan

Vice President, Marketing and Corporate Communications

nbbalkan@purchasingpower.com

EX-99.2

3

ex-992investorpresentati.htm

EX-99.2 INVESTOR PRESENTATION

ex-992investorpresentati

PROG Holdings, Inc. Announces Acquisition of Purchasing Power December 2, 2025 Exhibit 99.2

PROG Internal Forward Looking Statements Statements in this presentation regarding PROG Holdings, Inc. (the “Company”) and its expected acquisition of Purchasing Power that are not historical facts are "forward-looking statements" that involve risks and uncertainties which could cause actual results to differ materially from those contained in the forward-looking statements. Such forward-looking statements generally can be identified by the use of forward-looking terminology, such as “expected”, “continued”, “estimated”, “projected”, “anticipated” and similar forward-looking terminology. These risks and uncertainties include among others, the risks and uncertainties discussed under "Risk Factors" in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2024, filed with the SEC on February 19, 2025. Statements in this presentation that are "forward-looking" include, without limitation, statements regarding: (i) the expected revenue and Adjusted EBiTDA of Purchasing Power for 2026; (ii) the Company’s ability to drive sustained multi-year growth, including through the expansion of current and new offerings; (iii) earning-per-share accretion expected from the Company’s acquisition of Purchasing Power; (iv) the Company’s ability to rapidly deleverage its debt position following an acquisition of Purchasing Power and the estimated timing for returning to the Company’s targeted net leverage ratio range; (v) the Company’s capital allocation priorities, including its ability to continue to invest in its businesses, pursue accretive M&A opportunities and return capital to shareholders following an acquisition of Purchasing Power, or otherwise; and (vi) the timing of any closing of the Company’s acquisition of Purchasing Power, or the ability to close the transaction in any event, as well as other statements regarding the plans, intentions, expectations, objectives, goals and projections with respect to the proposed transaction, including future financial and operating results. Except as required by law, the Company undertakes no obligation to update these forward-looking statements to reflect subsequent events or circumstances after the date of this presentation. 2

PROG Internal PROG Holdings’ Mission 3 Mission To create a better today and unlock the possibilities of tomorrow through financial empowerment

PROG Internal Accelerates our Mission by Expanding Financial Access Through a New, Scalable Customer Acquisition Channel 4 Grow Expand Enhance Grow our GMV through existing merchant partners, new partners, and direct-to- consumer initiatives Expand our ecosystem to increase access and deliver more value to our customers Enhance our industry-leading consumer experience PROG Holdings has agreed to acquire Purchasing Power for $420M in cash; transaction expected to contribute between $50M and $60M of Adjusted EBiTDA(1) in 2026 (1) See Appendix for non-GAAP definitions.

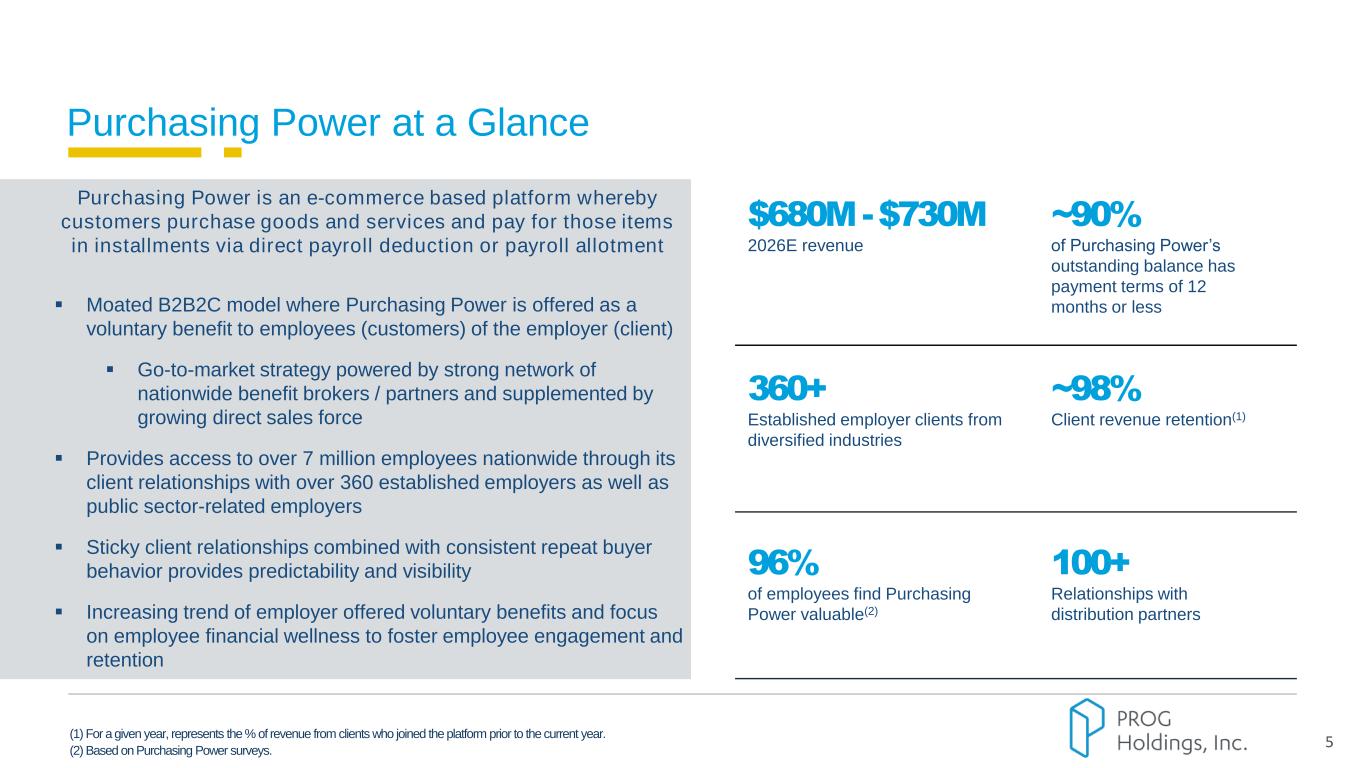

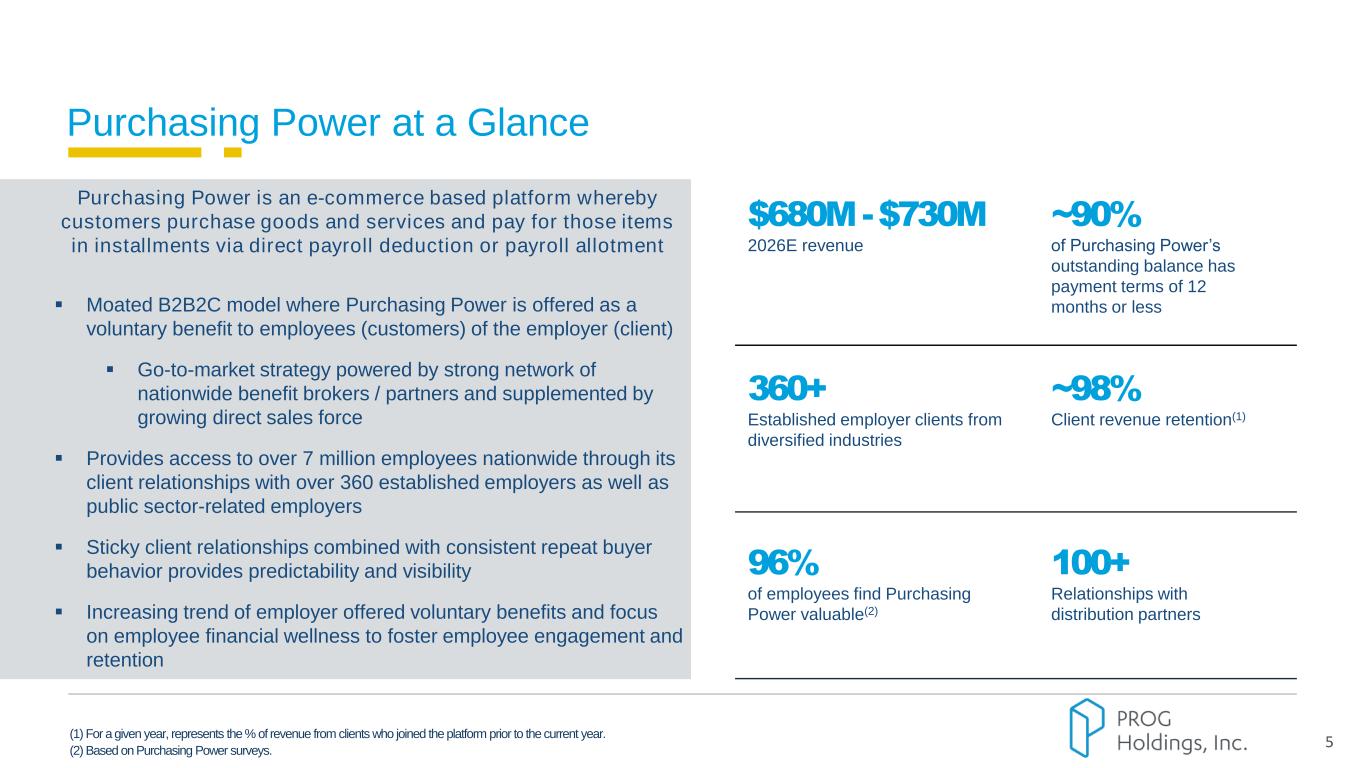

PROG Internal Purchasing Power at a Glance 5 Purchasing Power is an e-commerce based FinTech platform offering consumers a way to buy and pay for goods and services over time, directly from their paycheck $680M -$730M 2026E revenue ~90% of Purchasing Power’s outstanding balance has payment terms of 12 months or less 360+ Established employer clients from diversified industries ~98% Client revenue retention(1) 96% of employees find Purchasing Power valuable(2) 100+ Relationships with distribution partners Purchasing Power is an e-commerce based platform whereby customers purchase goods and services and pay for those items in installments via direct payroll deduction or payroll allotment ▪ Moated B2B2C model where Purchasing Power is offered as a voluntary benefit to employees (customers) of the employer (client) ▪ Go-to-market strategy powered by strong network of nationwide benefit brokers / partners and supplemented by growing direct sales force ▪ Provides access to over 7 million employees nationwide through its client relationships with over 360 established employers as well as public sector-related employers ▪ Sticky client relationships combined with consistent repeat buyer behavior provides predictability and visibility ▪ Increasing trend of employer offered voluntary benefits and focus on employee financial wellness to foster employee engagement and retention (1) For a given year, represents the % of revenue from clients who joined the platform prior to the current year. (2) Based on Purchasing Power surveys.

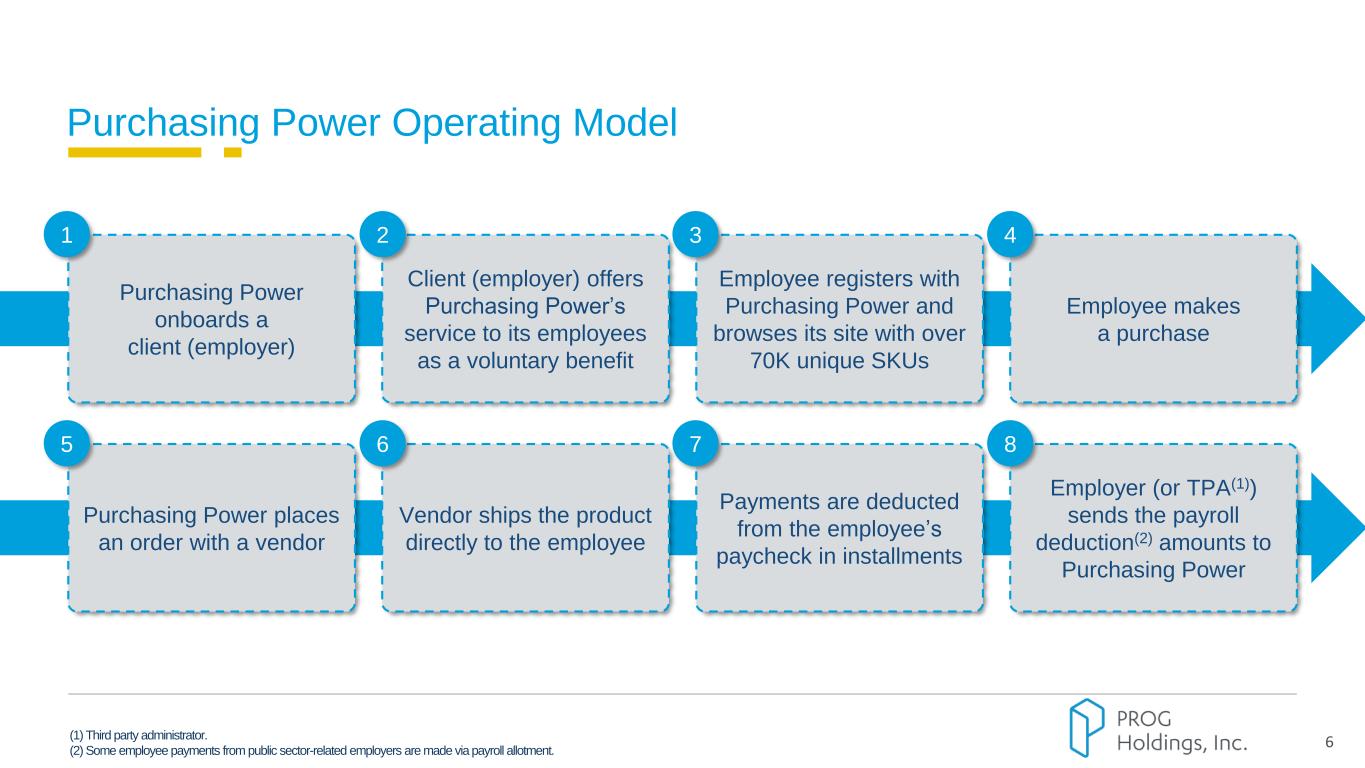

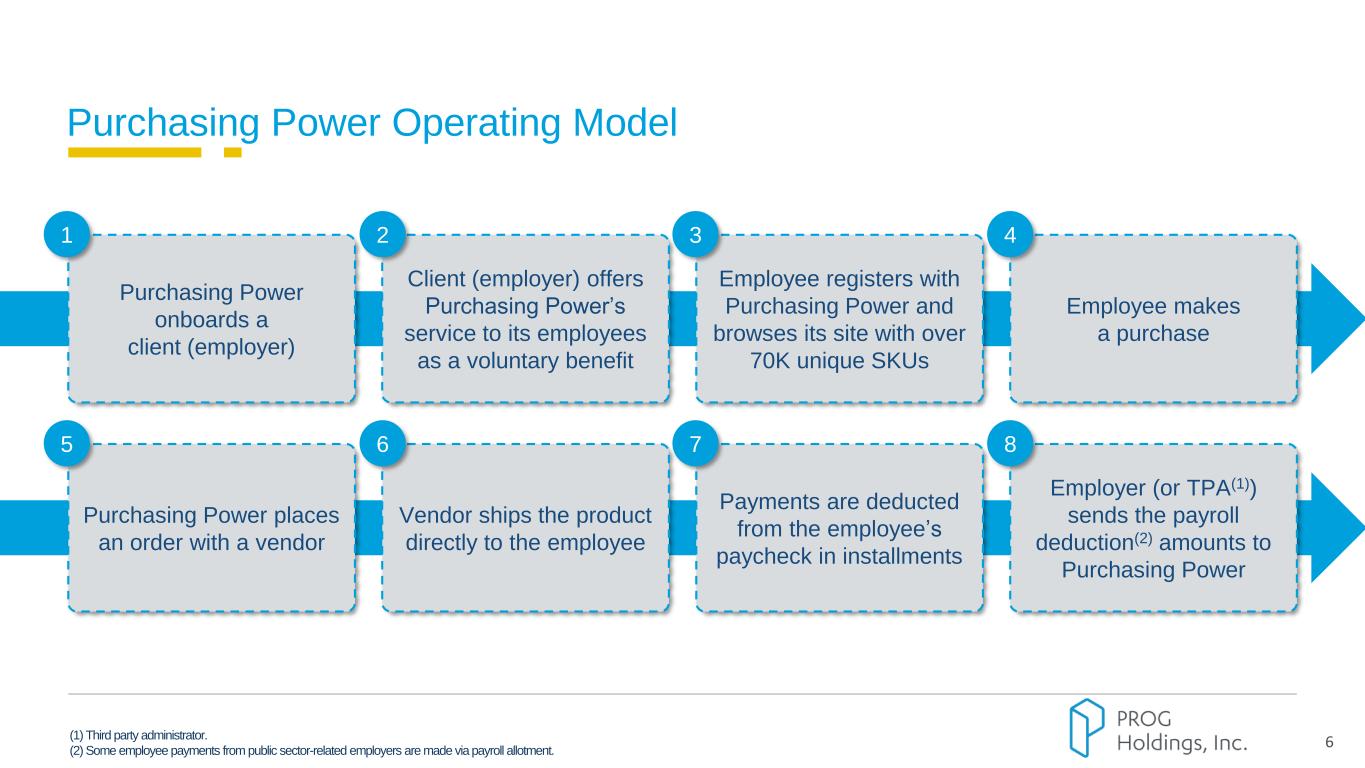

PROG Internal 6 Purchasing Power Operating Model Client (employer) offers Purchasing Power’s service to its employees as a voluntary benefit Employee registers with Purchasing Power and browses its site with over 70K unique SKUs Employee makes a purchase 2 3 4 Purchasing Power onboards a client (employer) 1 Vendor ships the product directly to the employee Payments are deducted from the employee’s paycheck in installments Employer (or TPA(1)) sends the payroll deduction(2) amounts to Purchasing Power 6 7 8 Purchasing Power places an order with a vendor 5 (1) Third party administrator. (2) Some employee payments from public sector-related employers are made via payroll allotment.

PROG Internal Access to Customer Base at Scale 7 100+ Distribution Partners Brokers Partners(1) Internal Sales Force 360+ Established Clients ~7mm+ Eligible Employees Today A Limited Number of Purchasing Power Sales Resources… …Can Reach Hundreds of Clients… …through its network of Benefit Brokers, Partners, and Direct Sales Channel… …and Millions of Potential Customers… (1) Includes technology platforms, HR tech providers, and affinity partners. Successfully partners with some of America’s largest employers across more than 25 industries nationwide - including 48 Fortune 500 companies and 7 of the top 30 U.S. employers Public Sector-Related Employers

PROG Internal Compelling Value Proposition to Clients and Customers 8 ~7mm+ eligible employees ~54% female / ~46% male; ~48 average age(2) ~80% of customers have <650 Credit Score Median household income of ~$78K(2) 360+ established employers, focusing on companies in industries with stable employee populations / low turnover and public sector-related employers Target employers with over 1K employees; average client has ~15K employees Diverse industry representation Sticky, embedded relationships; 98% client revenue retention rate(1) (1) For a given year, represents the % of revenue from clients who joined the platform prior to the current year. (2) Metrics are based on 1Q25 Experian Data. Benefit for Clients Eases financial stress and improves productivity Increases employee loyalty / retention Improves employee morale and job satisfaction Results in a free benefit at no cost to the employer Benefit for Customers Spending power known upfront Transparent, affordable payments Vast selection of brand name products and services Reduces financial stress Convenient payment method Client Base Customer Base

Breadth and Depth of Product Categories 9 Jewelry / Fashion / Beauty Outdoor / Fitness Electronics TV / Appliances Travel / Services Furniture / Décor Broad selection of dynamically priced SKUs across multiple categories with access to major brands and products supported by Purchasing Power’s robust supplier network

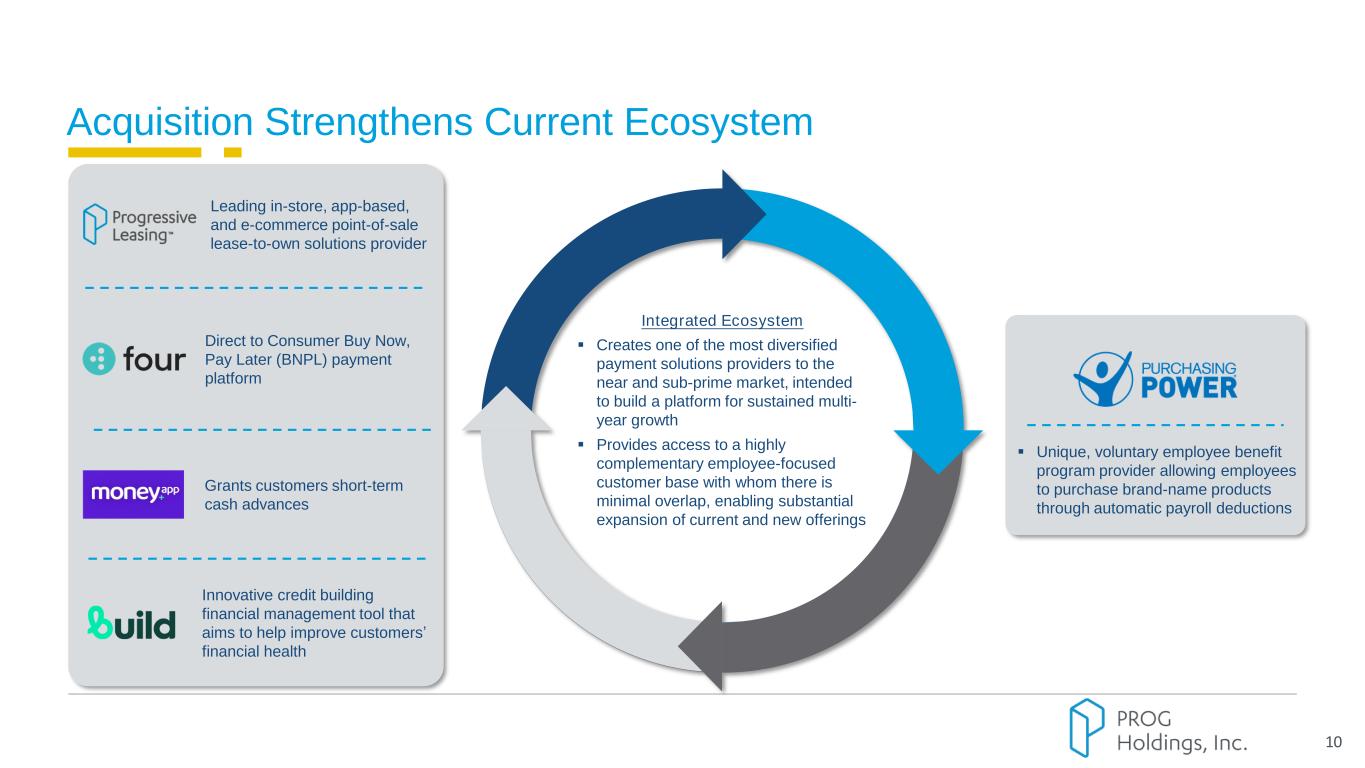

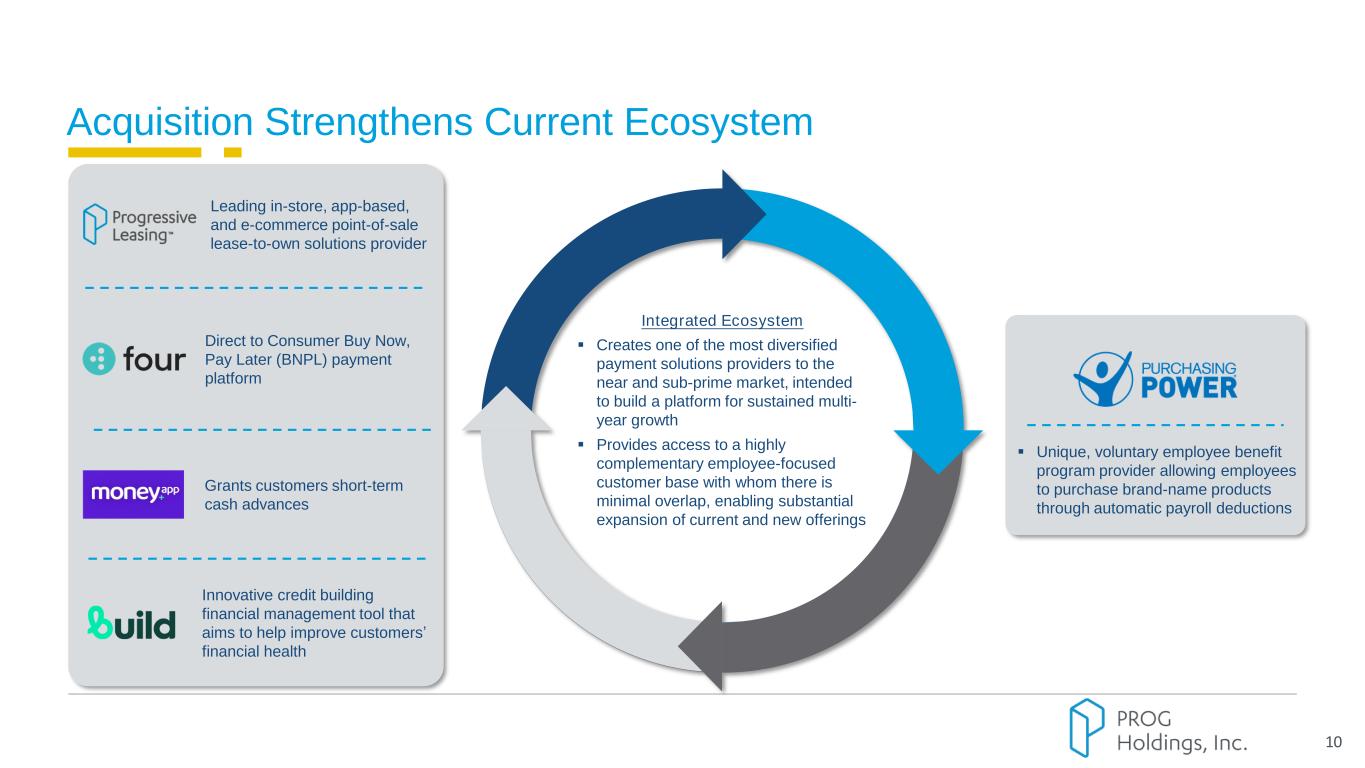

PROG Internal Acquisition Strengthens Current Ecosystem 10 Leading in-store, app-based, and e-commerce point-of-sale lease-to-own solutions provider Direct to Consumer Buy Now, Pay Later (BNPL) payment platform Innovative credit building financial management tool that aims to help improve customers’ financial health Integrated Ecosystem ▪ Creates one of the most diversified payment solutions providers to the near and sub-prime market, intended to build a platform for sustained multi- year growth ▪ Provides access to a highly complementary employee-focused customer base with whom there is minimal overlap, enabling substantial expansion of current and new offerings Grants customers short-term cash advances ▪ Unique, voluntary employee benefit program provider allowing employees to purchase brand-name products through automatic payroll deductions

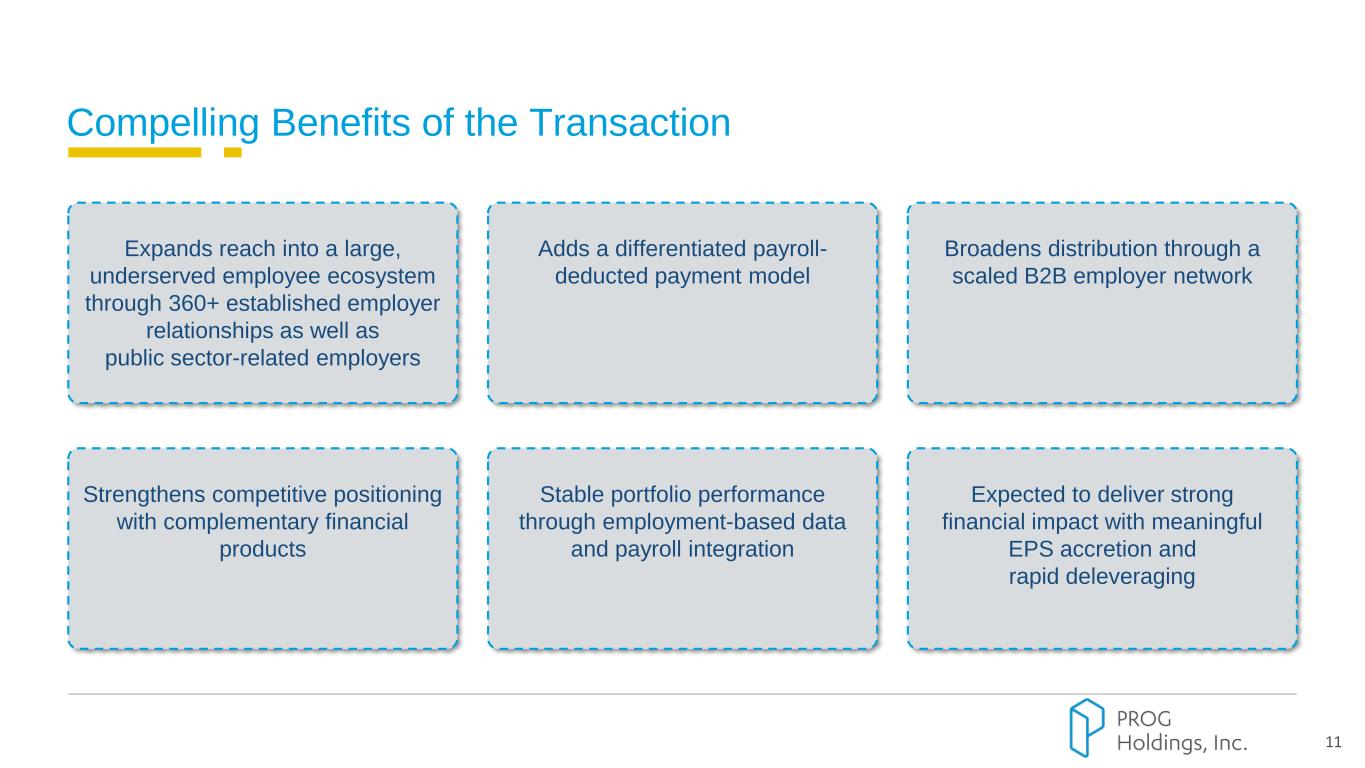

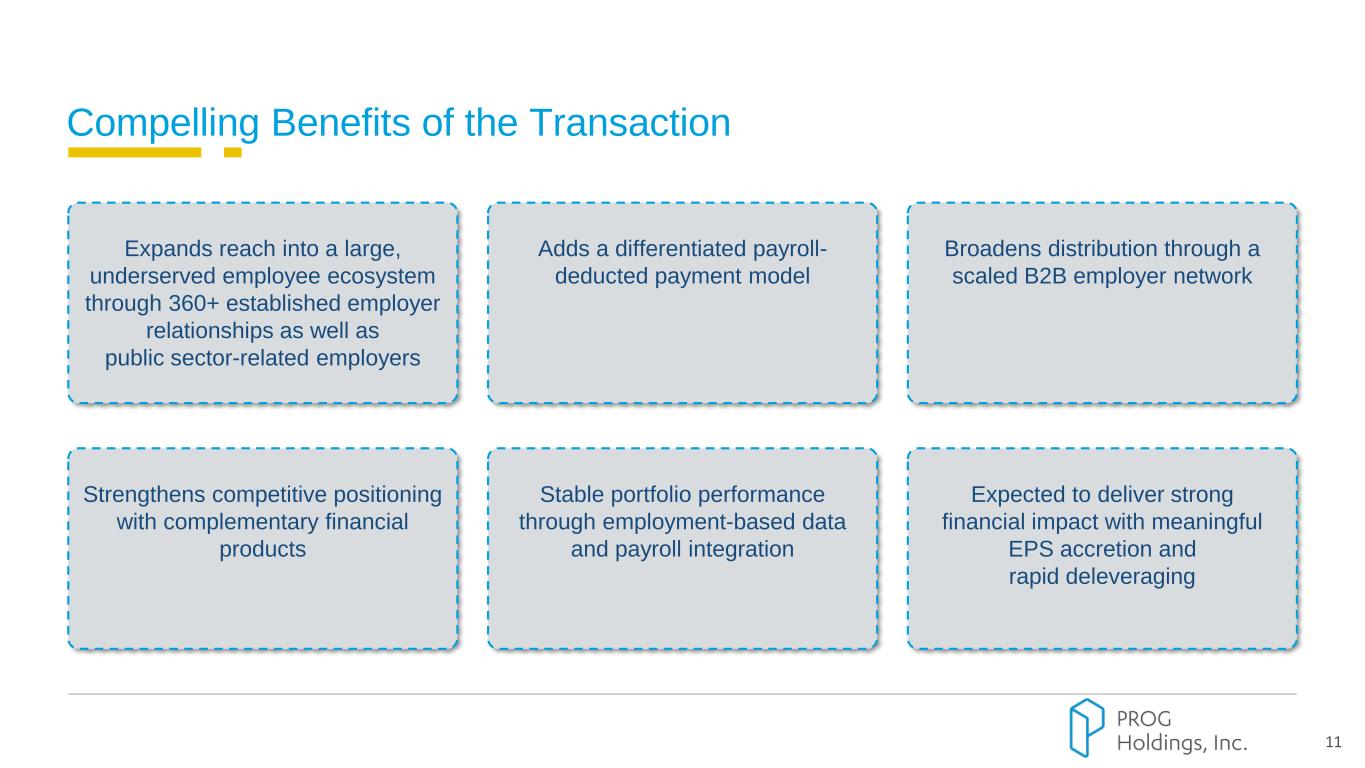

PROG Internal Compelling Benefits of the Transaction 11 Expands reach into a large, underserved employee ecosystem through 360+ established employer relationships as well as public sector-related employers Broadens distribution through a scaled B2B employer network Adds a differentiated payroll- deducted payment model Expected to deliver strong financial impact with meaningful EPS accretion and rapid deleveraging Stable portfolio performance through employment-based data and payroll integration Strengthens competitive positioning with complementary financial products

12 Capital Allocation Fuel Growth Return Excess Capital to Shareholders Explore Strategic M&A Opportunities ▪ Capital-efficient model that pairs self-funding with securitization ▪ Strategically reinvest in business and technologies ▪ Flexible funding capacity supporting strong GMV growth ▪ Explore adjacent products to further our financially empowering ecosystem strategy ▪ Entertain accretive acquisition opportunities ▪ Committed to returning excess capital to shareholders while managing toward our target net leverage(1) range of 1.5x – 2.0x(2) (1) See Appendix for non-GAAP definitions. (2) Excludes non-recourse funding debt.

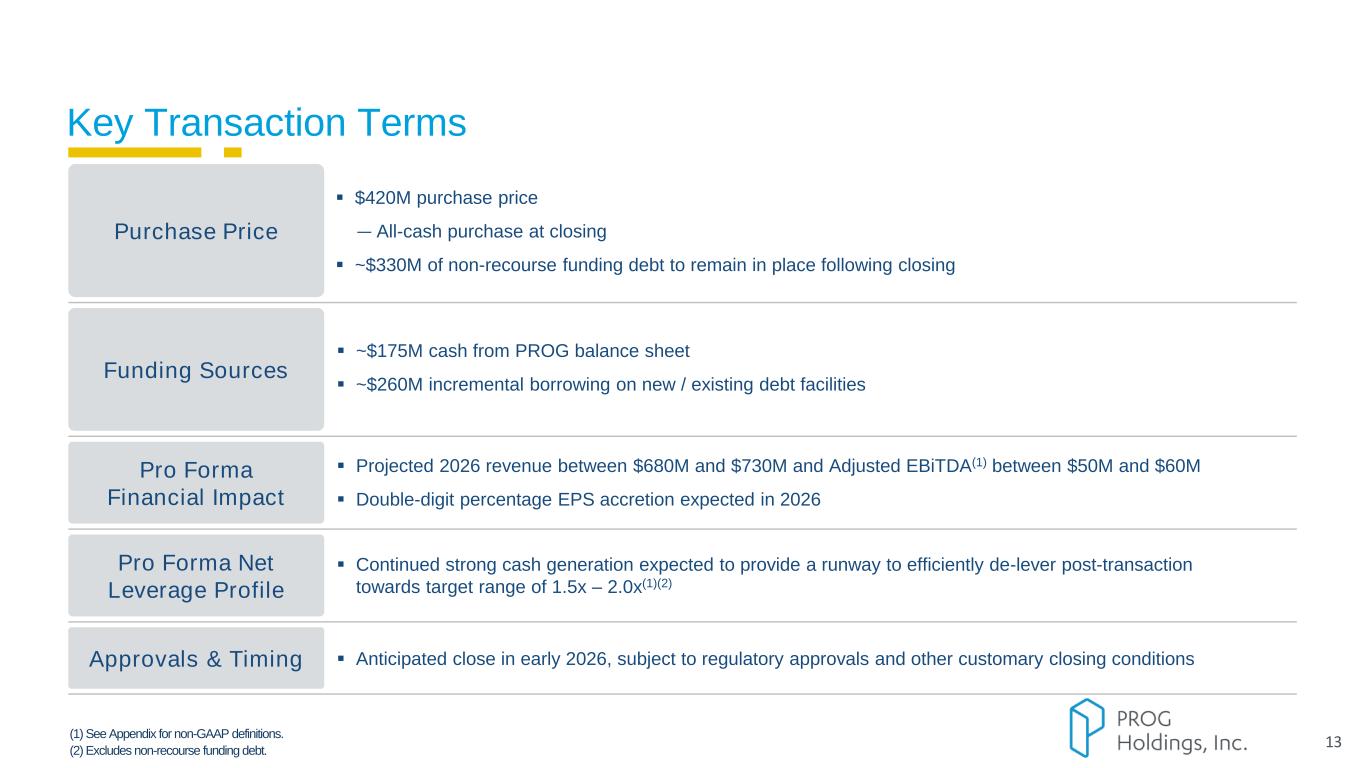

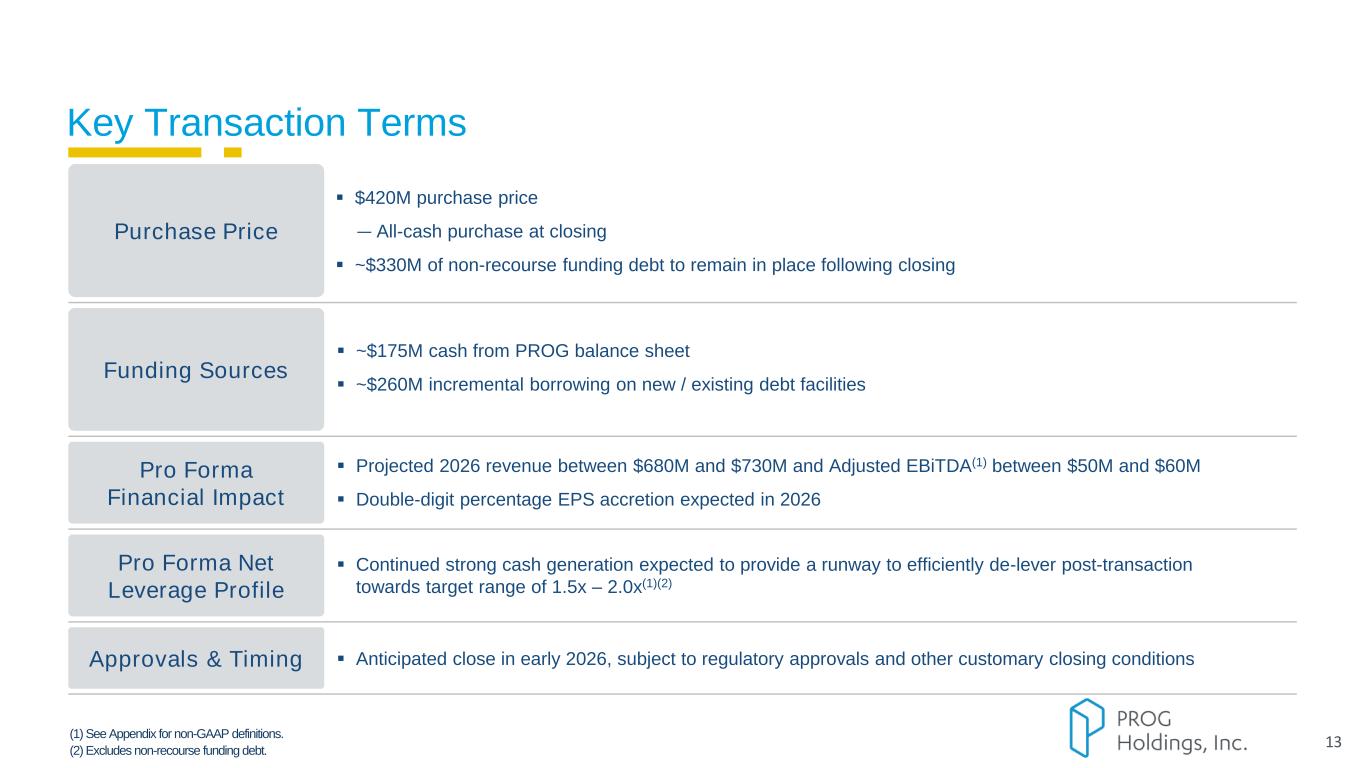

PROG Internal 13 Purchase Price ▪ $420M purchase price ― All-cash purchase at closing ▪ ~$330M of non-recourse funding debt to remain in place following closing Funding Sources ▪ ~$175M cash from PROG balance sheet ▪ ~$260M incremental borrowing on new / existing debt facilities Pro Forma Net Leverage Profile Approvals & Timing ▪ Anticipated close in early 2026, subject to regulatory approvals and other customary closing conditions ▪ Continued strong cash generation expected to provide a runway to efficiently de-lever post-transaction towards target range of 1.5x – 2.0x(1)(2) Key Transaction Terms Pro Forma Financial Impact ▪ Projected 2026 revenue between $680M and $730M and Adjusted EBiTDA(1) between $50M and $60M ▪ Double-digit percentage EPS accretion expected in 2026 (1) See Appendix for non-GAAP definitions. (2) Excludes non-recourse funding debt.

PROG Internal Appendix

PROG Internal Use of Non-GAAP Financial Measures This presentation contains financial measures that are not calculated in accordance with generally accepted accounting principles in the United States ("GAAP"), including (1) pro forma forecasted Adjusted EBiTDA for Purchasing Power for 2026, and (2) forecasted total net leverage ratio. Pro forma forecasted Adjusted EBiTDA for Purchasing Power for 2026 assumes the acquisition closes on January 2, 2026, and is calculated as Purchasing Power’s earnings before interest expense, net; depreciation on property and equipment; amortization of intangible assets; income taxes; restructuring charges; acquisition- related transaction fees; and stock-based compensation expense, less funded non-recourse debt net interest expense. Forecasted Total net leverage ratio is calculated as consolidated recourse debt less unrestricted cash, divided by consolidated Adjusted EBiTDA. Because of the inherent uncertainty related to these adjustments, management does not believe it is able to provide a meaningful forecast of the comparable GAAP measures or reconciliation to any forecasted GAAP measure without unreasonable effort. Management believes Adjusted EBiTDA and total net leverage ratio provide relevant and useful information, and are widely used by analysts, investors and competitors in our industry, as well as by our management, in assessing both operating performance and consolidated liquidity. However, non-GAAP financial measures should not be used as a substitute for, or considered superior to, measures of financial performance prepared in accordance with GAAP, such as the Company’s GAAP basis net earnings. Further, we caution investors that amounts presented in accordance with our definitions of Adjusted EBiTDA and total net leverage may not be comparable to similar measures disclosed by other companies because not all companies and analysts calculate these measures in the same manner. 15