12/31false2024Q10001808220xbrli:sharesiso4217:USDiso4217:USDxbrli:sharesgoco:stategoco:segmentxbrli:puregoco:votegoco:daygoco:claimgoco:position00018082202024-01-012024-03-310001808220us-gaap:CommonClassAMember2024-05-010001808220us-gaap:CommonClassBMember2024-05-0100018082202023-01-012023-03-3100018082202024-03-3100018082202023-12-310001808220us-gaap:RedeemableConvertiblePreferredStockMember2024-03-310001808220us-gaap:RedeemableConvertiblePreferredStockMember2023-12-310001808220us-gaap:CommonClassAMember2023-12-310001808220us-gaap:CommonClassAMember2024-03-310001808220us-gaap:CommonClassBMember2023-12-310001808220us-gaap:CommonClassBMember2024-03-310001808220us-gaap:ConvertiblePreferredStockMember2023-12-310001808220us-gaap:ConvertiblePreferredStockMember2024-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-12-310001808220us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2023-12-310001808220us-gaap:AdditionalPaidInCapitalMember2023-12-310001808220us-gaap:RetainedEarningsMember2023-12-310001808220us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001808220us-gaap:NoncontrollingInterestMember2023-12-310001808220us-gaap:RetainedEarningsMember2024-01-012024-03-310001808220us-gaap:NoncontrollingInterestMember2024-01-012024-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-03-310001808220us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-310001808220us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310001808220us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2024-01-012024-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-01-012024-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassBMember2024-03-310001808220us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2024-03-310001808220us-gaap:AdditionalPaidInCapitalMember2024-03-310001808220us-gaap:RetainedEarningsMember2024-03-310001808220us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310001808220us-gaap:NoncontrollingInterestMember2024-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassBMember2022-12-310001808220us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2022-12-310001808220us-gaap:AdditionalPaidInCapitalMember2022-12-310001808220us-gaap:RetainedEarningsMember2022-12-310001808220us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001808220us-gaap:NoncontrollingInterestMember2022-12-3100018082202022-12-310001808220us-gaap:RetainedEarningsMember2023-01-012023-03-310001808220us-gaap:NoncontrollingInterestMember2023-01-012023-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-03-310001808220us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-310001808220us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310001808220us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2023-01-012023-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-01-012023-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-03-310001808220us-gaap:CommonStockMemberus-gaap:CommonClassBMember2023-03-310001808220us-gaap:TreasuryStockCommonMemberus-gaap:CommonClassAMember2023-03-310001808220us-gaap:AdditionalPaidInCapitalMember2023-03-310001808220us-gaap:RetainedEarningsMember2023-03-310001808220us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310001808220us-gaap:NoncontrollingInterestMember2023-03-3100018082202023-03-3100018082202023-04-012023-06-3000018082202023-01-012023-12-310001808220us-gaap:TradeNamesMember2023-12-310001808220us-gaap:DevelopedTechnologyRightsMember2024-03-310001808220us-gaap:CustomerRelationshipsMember2024-03-310001808220us-gaap:TradeNamesMember2024-03-310001808220us-gaap:DevelopedTechnologyRightsMember2023-12-310001808220us-gaap:CustomerRelationshipsMember2023-12-310001808220us-gaap:SecuredDebtMember2024-03-310001808220us-gaap:SecuredDebtMember2023-12-310001808220goco:IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2019-12-310001808220goco:A2021IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2019-12-310001808220goco:A20212IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2019-12-310001808220goco:AlternateBaseRateMemberus-gaap:SecuredDebtMember2023-03-152023-03-150001808220goco:A2021IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMembergoco:SecuredOvernightFinancingRateSOFRMember2023-03-152023-03-150001808220goco:A20212IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMembergoco:SecuredOvernightFinancingRateSOFRMember2023-03-152023-03-150001808220goco:IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMembergoco:SecuredOvernightFinancingRateSOFRMember2023-03-152023-03-150001808220goco:AlternateBaseRateMembergoco:IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMembersrt:ScenarioForecastMember2024-09-012024-09-010001808220goco:AlternateBaseRateMembergoco:A20212IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMembersrt:ScenarioForecastMember2024-09-012024-09-010001808220goco:AlternateBaseRateMembergoco:A2021IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMembersrt:ScenarioForecastMember2024-09-012024-09-010001808220goco:IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:ScenarioForecastMember2024-09-012024-09-010001808220goco:A20212IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:ScenarioForecastMember2024-09-012024-09-010001808220goco:A2021IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrOvernightIndexSwapRateMembersrt:ScenarioForecastMember2024-09-012024-09-010001808220goco:ClassARevolvingCommitmentsMemberus-gaap:RevolvingCreditFacilityMember2024-03-110001808220goco:ClassBRevolvingCommitmentsMemberus-gaap:RevolvingCreditFacilityMember2024-03-110001808220goco:ClassARevolvingCommitmentsMemberus-gaap:RevolvingCreditFacilityMember2024-03-120001808220goco:NewClassARevolvingCommitmentsMemberus-gaap:RevolvingCreditFacilityMember2024-03-120001808220us-gaap:RevolvingCreditFacilityMembergoco:NewClassBRevolvingCommitmentsMember2024-03-120001808220goco:AlternateBaseRateMembergoco:ClassARevolvingCommitmentsMemberus-gaap:RevolvingCreditFacilityMember2024-03-122024-03-120001808220goco:ClassARevolvingCommitmentsMemberus-gaap:RevolvingCreditFacilityMembergoco:SecuredOvernightFinancingRateSOFRMember2024-03-122024-03-120001808220goco:AlternateBaseRateMembergoco:ClassBRevolvingCommitmentsMemberus-gaap:RevolvingCreditFacilityMember2024-03-122024-03-120001808220goco:ClassBRevolvingCommitmentsMemberus-gaap:RevolvingCreditFacilityMembergoco:SecuredOvernightFinancingRateSOFRMember2024-03-122024-03-120001808220us-gaap:SecuredDebtMemberus-gaap:SubsequentEventMember2024-04-122024-04-120001808220us-gaap:SecuredDebtMembersrt:ScenarioForecastMember2024-10-152024-10-150001808220goco:IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2023-12-310001808220goco:IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2024-03-310001808220goco:A2021IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2024-03-310001808220goco:A2021IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2023-12-310001808220goco:A20212IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2024-03-310001808220goco:A20212IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2023-12-310001808220us-gaap:RevolvingCreditFacilityMember2024-01-012024-03-310001808220us-gaap:RevolvingCreditFacilityMember2023-12-310001808220us-gaap:RevolvingCreditFacilityMember2024-03-310001808220us-gaap:SecuredDebtMemberus-gaap:SubsequentEventMember2024-04-120001808220us-gaap:SecuredDebtMembersrt:ScenarioForecastMember2024-08-300001808220us-gaap:SecuredDebtMemberus-gaap:SubsequentEventMember2024-04-042024-04-040001808220us-gaap:SecuredDebtMember2024-01-012024-03-310001808220goco:IncrementalTermLoanFacilityMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001808220us-gaap:SecuredDebtMembergoco:InitialTermLoanFacilityMember2024-01-012024-03-310001808220srt:MaximumMemberus-gaap:SecuredDebtMember2024-01-012024-03-310001808220us-gaap:SecuredDebtMembersrt:ScenarioForecastMember2024-07-012024-09-300001808220us-gaap:SecuredDebtMembersrt:ScenarioForecastMember2024-04-012024-06-300001808220us-gaap:SecuredDebtMembersrt:ScenarioForecastMember2024-10-012024-12-310001808220us-gaap:SecuredDebtMembersrt:ScenarioForecastMember2025-03-252025-03-250001808220us-gaap:CommonClassAMember2020-07-310001808220us-gaap:CommonClassBMember2020-07-3100018082202020-07-3100018082202020-07-012020-07-310001808220goco:ContinuingEquityOwnersAndPermittedTransfereesMember2020-07-012020-07-310001808220us-gaap:CommonClassAMember2020-07-012020-07-310001808220us-gaap:CommonClassBMember2020-07-012020-07-310001808220goco:GoHealthHoldingsLLCMember2020-07-012020-07-310001808220goco:GoHealthHoldingsLLCMember2024-01-012024-03-310001808220goco:GoHealthHoldingsLLCMember2023-01-012023-03-310001808220us-gaap:SeriesAPreferredStockMember2022-09-230001808220us-gaap:SeriesAPreferredStockMember2022-09-232022-09-230001808220us-gaap:RedeemableConvertiblePreferredStockMember2022-09-230001808220us-gaap:ConvertiblePreferredStockMember2022-09-230001808220us-gaap:SeriesAPreferredStockMember2024-03-310001808220us-gaap:CommonClassAMember2022-09-230001808220us-gaap:SeriesAPreferredStockMembersrt:MinimumMember2022-09-232022-09-2300018082202022-09-232022-09-230001808220srt:MaximumMember2022-09-2300018082202022-09-230001808220us-gaap:SellingAndMarketingExpenseMember2024-01-012024-03-310001808220us-gaap:SellingAndMarketingExpenseMember2023-01-012023-03-310001808220goco:ConsumerCareAndEnrollmentMember2024-01-012024-03-310001808220goco:ConsumerCareAndEnrollmentMember2023-01-012023-03-310001808220us-gaap:TechnologyServiceMember2024-01-012024-03-310001808220us-gaap:TechnologyServiceMember2023-01-012023-03-310001808220us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-03-310001808220us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-03-310001808220us-gaap:StockCompensationPlanMember2024-01-012024-03-310001808220us-gaap:StockCompensationPlanMember2023-01-012023-03-310001808220us-gaap:ConvertiblePreferredStockMember2024-01-012024-03-310001808220us-gaap:ConvertiblePreferredStockMember2023-01-012023-03-310001808220us-gaap:CommonClassBMember2024-01-012024-03-310001808220us-gaap:CommonClassBMember2023-01-012023-03-3100018082202020-07-170001808220goco:MedicareMembergoco:CommissionMember2024-01-012024-03-310001808220goco:MedicareMembergoco:CommissionMember2023-01-012023-03-310001808220goco:PartnerMarketingAndOtherRevenueMembergoco:MedicareMember2024-01-012024-03-310001808220goco:PartnerMarketingAndOtherRevenueMembergoco:MedicareMember2023-01-012023-03-310001808220goco:MedicareMembergoco:AgencyRevenueMember2024-01-012024-03-310001808220goco:MedicareMembergoco:AgencyRevenueMember2023-01-012023-03-310001808220goco:NonAgencyRevenueMembergoco:MedicareMember2024-01-012024-03-310001808220goco:NonAgencyRevenueMembergoco:MedicareMember2023-01-012023-03-310001808220goco:MedicareMember2024-01-012024-03-310001808220goco:MedicareMember2023-01-012023-03-310001808220goco:NonEncompassBPORevenueMembergoco:OtherRevenueMember2024-01-012024-03-310001808220goco:NonEncompassBPORevenueMembergoco:OtherRevenueMember2023-01-012023-03-310001808220us-gaap:ProductAndServiceOtherMembergoco:OtherRevenueMember2024-01-012024-03-310001808220us-gaap:ProductAndServiceOtherMembergoco:OtherRevenueMember2023-01-012023-03-310001808220goco:OtherRevenueMember2024-01-012024-03-310001808220goco:OtherRevenueMember2023-01-012023-03-310001808220us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2024-03-310001808220us-gaap:PrepaidExpensesAndOtherCurrentAssetsMember2023-12-310001808220goco:CommissionMember2023-12-310001808220goco:CommissionMember2022-12-310001808220goco:CommissionMember2024-01-012024-03-310001808220goco:CommissionMember2023-01-012023-03-310001808220goco:CommissionMember2024-03-310001808220goco:CommissionMember2023-03-310001808220goco:AetnaMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001808220goco:AetnaMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-310001808220us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembergoco:ElevanceHealthMember2024-01-012024-03-310001808220us-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMembergoco:ElevanceHealthMember2023-01-012023-03-310001808220goco:HumanaMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001808220goco:HumanaMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-310001808220goco:UnitedMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001808220goco:UnitedMemberus-gaap:SalesRevenueNetMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-03-310001808220goco:ThreeCustomersMembergoco:AccountsReceivableAndUnbilledReceivablesMemberus-gaap:CustomerConcentrationRiskMember2024-01-012024-03-310001808220goco:ThreeCustomersMembergoco:AccountsReceivableAndUnbilledReceivablesMemberus-gaap:CustomerConcentrationRiskMember2024-03-310001808220goco:ThreeCustomersMembergoco:AccountsReceivableAndUnbilledReceivablesMemberus-gaap:CustomerConcentrationRiskMember2023-01-012023-12-310001808220goco:ThreeCustomersMembergoco:AccountsReceivableAndUnbilledReceivablesMemberus-gaap:CustomerConcentrationRiskMember2023-12-310001808220us-gaap:PendingLitigationMember2020-09-012020-09-3000018082202024-03-132024-03-130001808220goco:NonexclusiveAircraftDryLeaseAgreementMember2024-01-012024-03-310001808220goco:NonexclusiveAircraftDryLeaseAgreementMember2024-03-310001808220goco:NonexclusiveAircraftDryLeaseAgreementMember2023-01-012023-03-3100018082202022-08-092022-08-09

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-Q

(Mark One)

|

|

|

|

|

|

| ☒ |

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended March 31, 2024

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

Commission File Number: 001-39390

GoHealth, Inc.

(Exact name of registrant as specified in its charter)

_________________________

|

|

|

|

|

|

| Delaware |

85-0563805 |

| (State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| 222 W Merchandise Mart Plaza, Suite 1750 |

60654 |

| Chicago, |

Illinois |

| (Address of principal executive offices) |

(Zip Code) |

(312) 386-8200

(Registrant’s telephone number, including area code)

N/A

(Former name, former address and former fiscal year, if changed since last report)

_________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange

on which registered |

Class A Common Stock,

$0.0001 par value per share |

|

GOCO |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

|

☐ |

Accelerated filer |

|

☒ |

| Non-accelerated filer |

|

☐ |

Smaller reporting company |

|

☒ |

|

|

|

Emerging growth company |

|

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

As of May 1, 2024, the registrant had 9,946,669 shares of Class A common stock, $0.0001 par value per share, outstanding and 12,781,528 shares of Class B common stock, $0.0001 par value per share, outstanding.

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE |

| PART I - FINANCIAL INFORMATION |

| ITEM 1. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ITEM 2. |

|

|

|

|

| ITEM 3. |

|

|

|

|

| ITEM 4. |

|

|

|

|

|

|

|

|

|

| PART II - OTHER INFORMATION |

| ITEM 1. |

|

|

|

|

| ITEM 1A. |

|

|

|

|

| ITEM 2. |

|

|

|

|

| ITEM 3. |

|

|

|

|

| ITEM 4. |

|

|

|

|

| ITEM 5. |

|

|

|

|

| ITEM 6. |

|

|

|

|

|

|

|

|

|

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Quarterly Report on Form 10-Q contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These forward-looking statements are made in reliance upon the safe harbor provision of the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical facts contained in this Quarterly Report on Form 10-Q may be forward-looking statements. Statements regarding our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding our expected growth, future capital expenditures and debt service obligations, are forward-looking statements.

In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “aims,” “expects,” “plans,” “anticipates,” “could,” “intends,” “targets,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “likely,” “future” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements in this Quarterly Report on Form 10-Q are only predictions, projections and other statements about future events that are based on current expectations and assumptions. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

These forward-looking statements speak only as of the date of this Quarterly Report on Form 10-Q and are subject to a number of important factors that could cause actual results to differ materially from those in the forward-looking statements, including the factors described in the sections titled “Summary Risk Factors,” “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (“2023 Annual Report on Form 10-K”) and in our other filings with the Securities and Exchange Commission.

You should read this Quarterly Report on Form 10-Q and the documents that we reference in this Quarterly Report on Form 10-Q completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise.

CERTAIN DEFINITIONS

As used in this Quarterly Report on Form 10-Q, unless the context otherwise requires:

•“We,” “us,” “our,” the “Company,” “GoHealth” and similar references refer to GoHealth, Inc., and unless otherwise stated, all of its direct and indirect subsidiaries, including GoHealth Holdings, LLC (“GHH, LLC”).

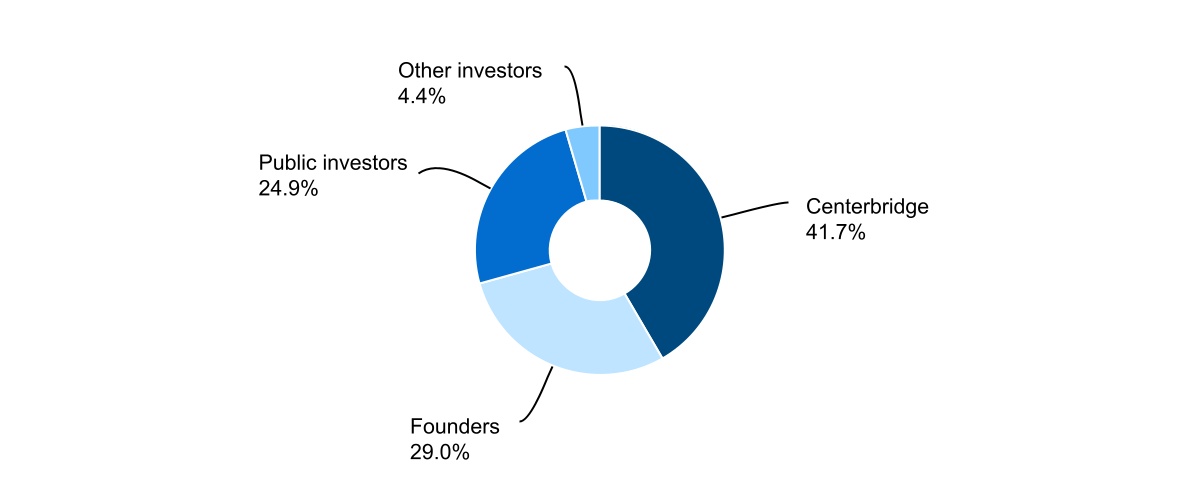

•“Blocker Company” refers to an entity affiliated with Centerbridge that was an indirect owner of LLC Interests in GHH, LLC prior to the Transactions and is taxable as a corporation for U.S. federal income tax purposes.

•“Blocker Shareholders” refer to entities affiliated with Centerbridge, the owners of the Blocker Company prior to the Transactions, who exchanged their interests in the Blocker Company for shares of our Class A common stock and cash in connection with the consummation of the Transactions.

•“Centerbridge” refers to certain investment funds and other entities affiliated with CCP III Cayman GP Ltd., a Cayman Islands exempted company over which CCP III Cayman GP Ltd. has voting control (including any such fund or entity formed to hold shares of Class A common stock for the Blocker Shareholders).

•“Continuing Equity Owners” refer collectively to direct or indirect holders of LLC Interests and our Class B common stock immediately following consummation of the Transactions, including Centerbridge, NVX Holdings, our Founders, the Former Profits Unit Holders and certain executive officers, employees and other minority investors and their respective permitted transferees who may, following the consummation of our IPO, exchange at each of their respective options (subject in certain circumstances to time-based vesting requirements and certain other restrictions), in whole or in part from time to time, their LLC Interests (along with an equal number of shares of Class B common stock (and such shares shall be immediately cancelled)) for, at our election (determined solely by our independent directors (within the meaning of the listing rules of The Nasdaq Global Market (the “Nasdaq Rules”) who are disinterested)), cash or newly-issued shares of our Class A common stock.

•“Founders” refer to Brandon M. Cruz, our Co-Founder and Co-Chairman of the Board of Directors and Clinton P. Jones, our Co-Founder and Co-Chairman of the Board of Directors.

•“Former Profits Unit Holders” refers collectively to certain of our directors and certain current and former officers and employees, in each case, who directly or indirectly held existing vested and unvested profits units, which were

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

1 |

comprised of profits units that have time-based vesting conditions and profits units that have performance-based vesting conditions, of GHH, LLC pursuant to GHH, LLC’s existing profits unit plan and who received LLC Interests in exchange for their profits units in connection with the Transactions. LLC Interests received in exchange for unvested profits units remain subject to their existing time-based vesting requirements. Profits units with performance-based vesting conditions fully vested as such conditions were met in connection with our IPO.

•“GHH, LLC Agreement” refers to GHH, LLC’s amended and restated limited liability company agreement, as further amended, which became effective substantially concurrently with or prior to the consummation of our IPO.

•“LLC Interests” refer to the common units of GHH, LLC, including those that we purchased with a portion of the net proceeds from our IPO.

•“Norvax” refers to Norvax, LLC, a Delaware limited liability company and a subsidiary of GHH, LLC.

•“NVX Holdings” refers to NVX Holdings, Inc., a Delaware corporation that is controlled by the Founders.

•“Transactions” refer to our IPO and certain organizational transactions that were effected in connection with our IPO, and the application of the net proceeds therefrom.

GoHealth, Inc. is a holding company and the sole managing member of GHH, LLC, and its principal asset consists of LLC Interests.

KEY TERMS AND PERFORMANCE INDICATORS; NON-GAAP FINANCIAL MEASURES

Throughout this Quarterly Report on Form 10-Q, we use a number of key terms and provide a number of key performance indicators used by management. We define these terms and key performance indicators as follows:

•“Adjusted EBITDA” represents, as applicable for the period, EBITDA as further adjusted for certain items discussed in Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

•“Adjusted EBITDA Margin” refers to Adjusted EBITDA divided by net revenues.

•“Adjusted Gross Margin per Submission” refers to Sales per Submission less Cost per Submission.

•“Cash Adjusted EBITDA” refers to Adjusted EBITDA plus a decrease or less an increase in the period over period change in net contract assets.

•“Cost of Submission” refers to the aggregate cost to convert prospects into Submissions during a particular period. Cost of Submission is comprised of revenue share, marketing and advertising expenses and consumer care and enrollment expenses, excluding share-based compensation expense, the impact of revenue adjustments recorded in the period, but relating to performance obligations satisfied in prior periods and such expenses related to Non-Encompass BPO Services.

•“Cost per Submission” refers to (x) the aggregate cost to convert prospects into Submissions for a particular period (comprised of revenue share, marketing and advertising expenses and consumer care and enrollment expenses, excluding share-based compensation expense and such expenses related to Non-Encompass BPO Services) divided by (y) number of Submissions for such period.

•“EBITDA” represents net income (loss) before interest expense, income tax expense (benefit) and depreciation and amortization expense.

•“LTV” refers to the Lifetime Value of Commissions, which we define as aggregate commissions estimated to be collected over the estimated life of all commissionable Submissions for the relevant period based on multiple factors, including but not limited to, contracted commission rates, health plan partner mix and expected policy persistency with applied constraints.

•“Non-Encompass BPO Services” refer to programs in which GoHealth-employed agents are dedicated to certain health plans and agencies we partner with outside of the Encompass operating model.

•“Sales per Submission” refers to (x) the sum of (i) aggregate commissions estimated to be collected over the estimated life of all commissionable Submissions for the relevant period based on multiple factors, including but not limited to, contracted commission rates, health plan partner mix and expected policy persistency with applied constraints, excluding revenue adjustments recorded in the period, but relating to performance obligations satisfied in prior periods,

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

2 |

(ii) non-agency revenue, and (iii) partner marketing and other revenue, divided by (y) the number of Submissions for such period.

•“Sales/Cost of Submission” refers to (x) the sum of (i) aggregate commissions estimated to be collected over the estimated life of all commissionable Submissions for the relevant period based on multiple factors, including but not limited to, contracted commission rates, health plan partner mix and expected policy persistency with applied constraints, excluding revenue adjustments recorded in the period, but relating to performance obligations satisfied in prior periods, (ii) non-agency revenue and (iii) partner marketing and other revenue, divided by (y) the aggregate cost to convert prospects into Submissions (comprised of revenue share, marketing and advertising expenses and consumer care and enrollment expenses, excluding share-based compensation expense) for such period. Sales and Cost of Submission exclude amounts related to Non-Encompass BPO Services.

•“Submission” refers to either (i) a completed application with our licensed agent that is submitted to the health plan partner and subsequently approved by the health plan partner during the indicated period, excluding applications through our Non-Encompass BPO Services or (ii) a transfer by our agent to the health plan partner through the Encompass operating model during the indicated period.

We use supplemental measures of our performance that are derived from our consolidated financial information, but which are not presented in our Condensed Consolidated Financial Statements prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). These non-GAAP financial measures include EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin. Adjusted EBITDA is the primary financial performance measure used by management to evaluate the business and monitor the results of operations. Sales per Submission, Cost per Submission and Adjusted Gross Margin per Submission are also presented on a non-GAAP basis and are key operating metrics used by management to understand the Company’s underlying financial performance and trends.

We use non-GAAP financial measures to supplement financial information presented on a GAAP basis. We believe that excluding certain items from our GAAP results allows management to better understand our consolidated financial performance from period to period and better project our future consolidated financial performance as forecasts are developed at a level of detail different from that used to prepare GAAP-based financial measures. Moreover, we believe these non-GAAP financial measures provide our stakeholders with useful information to help them evaluate our operating results by facilitating an enhanced understanding of our operating performance and enabling them to make more meaningful period to period comparisons. Adjusted EBITDA is used as a basis for certain compensation programs sponsored by the Company. There are limitations to the use of the non-GAAP financial measures presented in this Quarterly Report on Form 10-Q. For example, our non-GAAP financial measures may not be comparable to similarly titled measures of other companies. Other companies, including companies in our industry, may calculate non-GAAP financial measures differently than we do, limiting the usefulness of those measures for comparative purposes.

The non-GAAP financial measures are not meant to be considered as indicators of performance in isolation from or as a substitute for the most directly comparable financial measures prepared in accordance with GAAP and should be read only in conjunction with financial information presented on a GAAP basis. Reconciliations of each of EBITDA, Adjusted EBITDA, Sales per Submission, Cost per Submission and Adjusted Gross Margin per Submission to its most directly comparable GAAP financial measure are presented in the tables within Item 2. “Management’s Discussion and Analysis of Financial Condition and Results of Operations” of this Quarterly Report on Form 10-Q. We encourage you to review the reconciliations in conjunction with the presentation of the non-GAAP financial measures for each of the periods presented. In future periods, we may exclude similar items, may incur income and expenses similar to these excluded items and may include other expenses, costs and non-routine items.

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

3 |

|

|

|

| PART I - Financial Information |

|

|

|

| ITEM 1. FINANCIAL STATEMENTS. |

CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

GOHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except per share amounts, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended Mar. 31, |

|

|

|

|

2024 |

|

2023 |

|

|

|

|

| Net revenues |

|

185,600 |

|

|

183,158 |

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

| Revenue share |

|

38,013 |

|

|

45,462 |

|

|

|

|

|

| Marketing and advertising |

|

52,775 |

|

|

45,743 |

|

|

|

|

|

| Consumer care and enrollment |

|

47,861 |

|

|

42,027 |

|

|

|

|

|

| Technology |

|

10,550 |

|

|

9,543 |

|

|

|

|

|

| General and administrative |

|

16,919 |

|

|

22,618 |

|

|

|

|

|

| Amortization of intangible assets |

|

23,514 |

|

|

23,514 |

|

|

|

|

|

| Total operating expenses |

|

189,632 |

|

|

188,907 |

|

|

|

|

|

| Income (loss) from operations |

|

(4,032) |

|

|

(5,749) |

|

|

|

|

|

| Interest expense |

|

17,951 |

|

|

16,891 |

|

|

|

|

|

| Other (income) expense, net |

|

(566) |

|

|

(53) |

|

|

|

|

|

| Income (loss) before income taxes |

|

(21,417) |

|

|

(22,587) |

|

|

|

|

|

| Income tax (benefit) expense |

|

(71) |

|

|

(44) |

|

|

|

|

|

| Net income (loss) |

|

(21,346) |

|

|

(22,543) |

|

|

|

|

|

| Net income (loss) attributable to non-controlling interests |

|

(12,130) |

|

|

(13,364) |

|

|

|

|

|

| Net income (loss) attributable to GoHealth, Inc. |

|

$ |

(9,216) |

|

|

$ |

(9,179) |

|

|

|

|

|

Net loss per share (Note 7): |

|

|

|

|

|

|

|

|

| Net income (loss) per share of Class A common stock — basic and diluted |

|

$ |

(1.04) |

|

|

$ |

(1.12) |

|

|

|

|

|

| Weighted-average shares of Class A common stock outstanding — basic and diluted |

|

9,715 |

|

|

8,965 |

|

|

|

|

|

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

4 |

GOHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended Mar. 31, |

|

|

|

|

2024 |

|

2023 |

|

|

|

|

| Net income (loss) |

|

$ |

(21,346) |

|

|

$ |

(22,543) |

|

|

|

|

|

| Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

| Foreign currency translation adjustments |

|

(5) |

|

|

5 |

|

|

|

|

|

| Comprehensive income (loss) |

|

(21,351) |

|

|

(22,538) |

|

|

|

|

|

| Comprehensive income (loss) attributable to non-controlling interests |

|

(12,133) |

|

|

(13,361) |

|

|

|

|

|

| Comprehensive income (loss) attributable to GoHealth, Inc. |

|

$ |

(9,218) |

|

|

$ |

(9,177) |

|

|

|

|

|

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

5 |

GOHEALTH, INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(in thousands, except per share amounts, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mar. 31, 2024 |

|

Dec. 31, 2023 |

| Assets |

|

|

|

|

| Current assets: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

97,818 |

|

|

$ |

90,809 |

|

Accounts receivable, net of allowance for doubtful accounts of $6 in 2024 and $27 in 2023 |

|

9,226 |

|

|

250 |

|

| Commissions receivable - current |

|

269,799 |

|

|

336,215 |

|

| Prepaid expense and other current assets |

|

20,254 |

|

|

49,166 |

|

| Total current assets |

|

397,097 |

|

|

476,440 |

|

| Commissions receivable - non-current |

|

573,328 |

|

|

575,482 |

|

| Operating lease ROU asset |

|

21,008 |

|

|

21,995 |

|

| Other long-term assets |

|

2,118 |

|

|

2,256 |

|

| Property, equipment, and capitalized software, net |

|

28,667 |

|

|

26,843 |

|

| Intangible assets, net |

|

373,040 |

|

|

396,554 |

|

| Total assets |

|

$ |

1,395,258 |

|

|

$ |

1,499,570 |

|

| Liabilities, Redeemable Convertible Preferred Stock and Stockholders’ Equity |

|

|

|

|

| Current liabilities: |

|

|

|

|

| Accounts payable |

|

$ |

5,773 |

|

|

$ |

17,705 |

|

| Accrued liabilities |

|

66,595 |

|

|

86,254 |

|

| Commissions payable - current |

|

94,896 |

|

|

118,732 |

|

| Short-term operating lease liability |

|

5,309 |

|

|

5,797 |

|

| Deferred revenue |

|

38,723 |

|

|

52,403 |

|

| Current portion of long-term debt |

|

75,000 |

|

|

75,000 |

|

| Other current liabilities |

|

13,707 |

|

|

14,122 |

|

| Total current liabilities |

|

300,003 |

|

|

370,013 |

|

| Non-current liabilities: |

|

|

|

|

| Commissions payable - non-current |

|

201,653 |

|

|

203,255 |

|

| Long-term operating lease liability |

|

38,198 |

|

|

39,547 |

|

| Long-term debt, net of current portion |

|

410,324 |

|

|

422,705 |

|

| Other non-current liabilities |

|

9,247 |

|

|

9,095 |

|

| Total non-current liabilities |

|

659,422 |

|

|

674,602 |

|

Commitments and Contingencies (Note 11) |

|

|

|

|

Series A redeemable convertible preferred stock — $0.0001 par value; 50 shares authorized; 50 shares issued and outstanding as of both March 31, 2024 and December 31, 2023. Liquidation preference of $51.9 million and $50.9 million as of March 31, 2024 and December 31, 2023, respectively. |

|

50,193 |

|

|

49,302 |

|

| Stockholders’ equity: |

|

|

|

|

Class A common stock – $0.0001 par value; 1,100,000 shares authorized; 10,160 and 9,823 shares issued; 9,898 and 9,651 shares outstanding as of March 31, 2024 and December 31, 2023, respectively. |

|

1 |

|

|

1 |

|

Class B common stock – $0.0001 par value; 615,987 and 616,018 shares authorized; 12,783 and 12,814 shares issued and outstanding as of March 31, 2024 and December 31, 2023, respectively. |

|

1 |

|

|

1 |

|

Preferred stock – $0.0001 par value; 20,000 shares authorized (including 50 shares of Series A redeemable convertible preferred stock authorized and 200 shares of Series A-1 convertible preferred stock authorized); 50 shares issued and outstanding as of both March 31, 2024 and December 31, 2023. |

|

— |

|

|

— |

|

Series A-1 convertible preferred stock— $0.0001 par value; 200 shares authorized; no shares issued and outstanding as of both March 31, 2024 and December 31, 2023. |

|

— |

|

|

— |

|

Treasury stock – at cost; 262 and 173 shares of Class A common stock as of March 31, 2024 and December 31, 2023, respectively. |

|

(3,582) |

|

|

(2,640) |

|

| Additional paid-in capital |

|

659,080 |

|

|

654,059 |

|

| Accumulated other comprehensive income (loss) |

|

(129) |

|

|

(127) |

|

| Accumulated deficit |

|

(429,496) |

|

|

(420,280) |

|

| Total stockholders’ equity attributable to GoHealth, Inc. |

|

225,875 |

|

|

231,014 |

|

| Non-controlling interests |

|

159,765 |

|

|

174,639 |

|

| Total stockholders’ equity |

|

385,640 |

|

|

405,653 |

|

| Total liabilities, redeemable convertible preferred stock and stockholders’ equity |

|

$ |

1,395,258 |

|

|

$ |

1,499,570 |

|

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

6 |

GOHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS’ EQUITY

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended Mar. 31, 2024 |

|

|

Class A Common Stock |

|

Class B Common Stock |

|

Treasury Stock |

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Accumulated Other Comprehensive Income (Loss) |

|

Non-Controlling Interest |

|

Stockholders’ Equity |

| Balance at Jan. 1, 2024 |

|

9,823 |

|

|

$ |

1 |

|

|

12,814 |

|

|

$ |

1 |

|

|

(173) |

|

|

$ |

(2,640) |

|

|

$ |

654,059 |

|

|

$ |

(420,280) |

|

|

$ |

(127) |

|

|

$ |

174,639 |

|

|

$ |

405,653 |

|

| Net income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9,216) |

|

|

|

|

(12,130) |

|

|

(21,346) |

|

| Issuance of Class A common shares related to share-based compensation plans |

|

307 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

— |

|

| Share-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

3,172 |

|

|

|

|

|

|

|

|

3,172 |

|

| Foreign currency translation adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(2) |

|

|

(3) |

|

|

(5) |

|

| Class A common shares repurchased for employee tax withholdings |

|

|

|

|

|

|

|

|

|

(89) |

|

|

(942) |

|

|

|

|

|

|

|

|

|

|

(942) |

|

| Dividends accumulated on Series A redeemable convertible preferred stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

(892) |

|

|

|

|

|

|

|

|

(892) |

|

| Forfeitures of Time-Vesting Units |

|

|

|

|

|

(1) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

| Redemption of LLC Interests |

|

30 |

|

|

— |

|

|

(30) |

|

|

— |

|

|

|

|

|

|

2,741 |

|

|

|

|

|

|

(2,741) |

|

|

— |

|

| Balance at Mar. 31, 2024 |

|

10,160 |

|

|

$ |

1 |

|

|

12,783 |

|

|

$ |

1 |

|

|

(262) |

|

|

$ |

(3,582) |

|

|

$ |

659,080 |

|

|

$ |

(429,496) |

|

|

$ |

(129) |

|

|

$ |

159,765 |

|

|

$ |

385,640 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended Mar. 31, 2023 |

|

|

Class A Common Stock |

|

Class B Common Stock |

|

Treasury Stock |

|

|

|

|

|

|

|

|

|

|

|

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Shares |

|

Amount |

|

Additional Paid-In Capital |

|

Accumulated Deficit |

|

Accumulated Other Comprehensive Income (Loss) |

|

Non-Controlling Interest |

|

Stockholders’ Equity |

| Balance at Jan. 1, 2023 |

|

8,963 |

|

|

$ |

1 |

|

|

13,054 |

|

|

$ |

1 |

|

|

(13) |

|

|

$ |

(345) |

|

|

$ |

626,269 |

|

|

$ |

(357,023) |

|

|

$ |

(144) |

|

|

$ |

273,640 |

|

|

$ |

542,399 |

|

| Net income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(9,179) |

|

|

|

|

(13,364) |

|

|

(22,543) |

|

| Issuance of Class A common shares related to share-based compensation plans |

|

38 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

— |

|

| Share-based compensation expense |

|

|

|

|

|

|

|

|

|

|

|

|

|

4,444 |

|

|

|

|

|

|

|

|

4,444 |

|

| Foreign currency translation adjustments |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2 |

|

|

3 |

|

|

5 |

|

| Class A common shares repurchased for employee tax withholdings |

|

|

|

|

|

|

|

|

|

(7) |

|

|

(114) |

|

|

|

|

|

|

|

|

|

|

(114) |

|

| Dividends accumulated on Series A redeemable convertible preferred stock |

|

|

|

|

|

|

|

|

|

|

|

|

|

(892) |

|

|

|

|

|

|

|

|

(892) |

|

| Forfeitures of Time-Vesting Units |

|

|

|

|

|

(1) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

— |

|

| Redemption of LLC Interests |

|

1 |

|

|

— |

|

|

(1) |

|

|

— |

|

|

|

|

|

|

495 |

|

|

|

|

|

|

(495) |

|

|

— |

|

| Balance at Mar. 31, 2023 |

|

9,002 |

|

|

$ |

1 |

|

|

13,052 |

|

|

$ |

1 |

|

|

(20) |

|

|

$ |

(459) |

|

|

630,316 |

|

|

$ |

(366,202) |

|

|

$ |

(142) |

|

|

$ |

259,784 |

|

|

$ |

523,299 |

|

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

7 |

GOHEALTH, INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands, unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended Mar. 31, |

|

|

2024 |

|

2023 |

| Operating Activities |

|

|

|

|

| Net income (loss) |

|

$ |

(21,346) |

|

|

$ |

(22,543) |

|

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

| Share-based compensation |

|

1,783 |

|

|

4,444 |

|

| Depreciation and amortization |

|

2,732 |

|

|

2,753 |

|

| Amortization of intangible assets |

|

23,514 |

|

|

23,514 |

|

| Amortization of debt discount and issuance costs |

|

1,262 |

|

|

873 |

|

|

|

|

|

|

| Non-cash lease expense |

|

988 |

|

|

1,108 |

|

| Other non-cash items |

|

(67) |

|

|

(263) |

|

|

|

|

|

|

| Changes in assets and liabilities: |

|

|

|

|

| Accounts receivable |

|

(8,955) |

|

|

(21,231) |

|

| Commissions receivable |

|

68,616 |

|

|

94,645 |

|

| Prepaid expenses and other assets |

|

28,992 |

|

|

33,463 |

|

| Accounts payable |

|

(11,932) |

|

|

(3,863) |

|

| Accrued liabilities |

|

(33,242) |

|

|

(22,355) |

|

| Deferred revenue |

|

(13,680) |

|

|

(24,918) |

|

| Commissions payable |

|

(25,438) |

|

|

(45,706) |

|

| Operating lease liabilities |

|

(1,838) |

|

|

(3,285) |

|

| Other liabilities |

|

1,123 |

|

|

3,843 |

|

| Net cash provided by (used in) operating activities |

|

12,512 |

|

|

20,479 |

|

| Investing Activities |

|

|

|

|

| Purchases of property, equipment and software |

|

(4,556) |

|

|

(2,226) |

|

| Net cash provided by (used in) investing activities |

|

(4,556) |

|

|

(2,226) |

|

| Financing Activities |

|

|

|

|

| Repayment of borrowings |

|

— |

|

|

(1,391) |

|

| Payment of preferred stock dividends |

|

— |

|

|

(892) |

|

| Repurchase of shares to satisfy employee tax withholding obligations |

|

(942) |

|

|

(114) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

|

(942) |

|

|

(2,397) |

|

| Effect of exchange rate changes on cash and cash equivalents |

|

(5) |

|

|

5 |

|

| Increase (decrease) in cash and cash equivalents |

|

7,009 |

|

|

15,861 |

|

| Cash and cash equivalents at beginning of period |

|

90,809 |

|

|

16,464 |

|

| Cash and cash equivalents at end of period |

|

$ |

97,818 |

|

|

$ |

32,325 |

|

| Supplemental Disclosure of Cash Flow Information |

|

|

|

|

| Non-cash investing and financing activities: |

|

|

|

|

| Purchases of property, equipment and software included in accounts payable |

|

$ |

— |

|

|

$ |

124 |

|

The accompanying Notes are an integral part of these Condensed Consolidated Financial Statements.

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

8 |

GOHEALTH, INC.

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(In thousands, except per share amounts, unaudited)

1. DESCRIPTION OF BUSINESS AND SIGNIFICANT ACCOUNTING POLICIES

Description of Business

GoHealth is a leading health insurance marketplace and Medicare-focused digital health company whose purpose is to compassionately ensure consumers’ peace of mind when making healthcare decisions so they can focus on living life. With a widely scalable end-to-end platform and substantial presence in the Medicare landscape, we believe we are uniquely positioned as a trusted partner to the 65 million Medicare-eligible Americans, as well as the 11,000 Americans becoming eligible each day, as they navigate one of life's most important purchasing decisions. For many of these consumers, enrolling in a health insurance plan is confusing and difficult, and seemingly small differences between health plans may lead to significant out-of-pocket costs or lack of access to critical providers and medicines. We aim to simplify the process by offering education, comparison guidance, transparency and choice. This includes providing a large selection of leading health plan choices, advice informed by consumers’ specific needs, transparency of health plan benefits and fit, assistance accessing available government subsidies and a high-touch consumer care team. We partner with health plans across the nation that provide access to high quality health plans across all 50 states.

We primarily offer Medicare plans, including, but not limited to, Medicare Advantage, Medicare Supplement and prescription drug plans. Our proprietary technology platform leverages modern machine-learning algorithms, powered by over two decades of insurance purchasing behavior, to reimagine the process of matching a health plan to a consumer’s specific needs. Our unbiased, technology-driven marketplace coupled with highly skilled licensed agents has facilitated the enrollment of millions of consumers in Medicare plans since GoHealth’s inception. Health plan partners benefit from our platform by gaining access to the large and rapidly growing Medicare-eligible population. We believe health plan partners utilize our large-scale data, technology and efficient marketing processes to maximize scale and reduce their cost of submission, compared to health plan partner-employed agent workforces.

We believe our streamlined, consumer-centric Encompass operating model drives both high quality enrollments and a strong consumer experience. Our consumer-centric approach positions us to be a trusted, high-quality enrollment partner for both consumers and health plan partners.

Basis of Presentation and Significant Accounting Policies

The Company was incorporated in Delaware on March 27, 2020 for the purpose of facilitating an initial public offering (the “IPO”) and other related transactions in order to carry on the business of GHH, LLC, a Delaware limited liability company, and its controlled subsidiaries (collectively, “GHH, LLC”). Following the IPO and pursuant to a reorganization into a holding company structure, the Company is a holding company and its principal asset is a controlling equity interest in GHH, LLC. As the sole managing member of GHH, LLC, the Company operates and controls all of the business and affairs of GHH, LLC, and through GHH, LLC and its subsidiaries, conducts its business. As a result, the Company consolidates GHH, LLC’s financial results in its Condensed Consolidated Financial Statements and reports non-controlling interests for the economic interest in GHH, LLC held by the Continuing Equity Owners.

The accompanying Condensed Consolidated Financial Statements have been prepared in accordance with GAAP for interim financial information, but do not include all information and footnote disclosures required under GAAP for annual financial statements. The accompanying Condensed Consolidated Financial Statements and related notes should be read in conjunction with the audited Consolidated Financial Statements and related notes included in the Company’s 2023 Annual Report on Form 10-K, which was filed with the Securities and Exchange Commission on March 14, 2024. In the opinion of management, the interim Condensed Consolidated Financial Statements include all adjustments, consisting only of normal recurring adjustments, necessary for the fair presentation of the Company’s financial position, results of operations and cash flows as of the dates and for the periods presented. All intercompany transactions and balances are eliminated in consolidation.

“Consumer care and enrollment” on the Condensed Consolidated Statements of Operations, previously referred to as “customer care and enrollment” reflects a name change only and does not require any financial information to be reclassified from previous periods.

There have been no material changes to the Company’s significant accounting policies from those disclosed in the notes to the Company’s audited Consolidated Financial Statements as of and for the year ended December 31, 2023, which were included in the Company’s 2023 Annual Report on Form 10-K.

Use of Estimates

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

9 |

The preparation of the Condensed Consolidated Financial Statements in conformity with GAAP requires management to make certain estimates, judgments and assumptions that affect the reported amounts of assets and liabilities at the date of the Condensed Consolidated Financial Statements and the reported amounts of revenues and expenses during the reporting periods. The Company bases its estimates on historical experience and various other assumptions that management believes are reasonable under the circumstances, the results of which form the basis for making judgments about carrying values of assets and liabilities that are not readily apparent from other sources. Actual results could differ from those estimates.

Seasonality

The Medicare annual enrollment period (“AEP”) occurs from October 15th to December 7th. As a result, and in general, we experience an increase in the number of Submissions during the fourth quarter and an increase in expense related to the Medicare Submissions during the third and fourth quarters. Additionally, as a result of the annual Medicare Advantage open enrollment period that occurs from January 1st to March 31st, Medicare Submissions are typically second-highest in our first quarter. The second and third quarters are known as special election periods, during which Medicare Submissions are typically lowest. A significant portion of our marketing and advertising expenses is driven by the number of health insurance applications submitted through us. Marketing and advertising expenses are generally higher in the fourth quarter during AEP, but because commissions from approved consumers are paid to us over time, our operating cash flows could be adversely impacted by a substantial increase in marketing and advertising expenses as a result of a higher volume of Submissions during the fourth quarter or positively impacted by a substantial decline in marketing and advertising expenses as a result of lower volume of Submissions during the fourth quarter.

Segment Information

Operating segments are identified as components of an enterprise about which separate discrete financial information is available and reviewed regularly by the chief operating decision-maker (“CODM”). The Company’s CODM is its Chief Executive Officer who reviews financial information together with certain operating metrics principally to make decisions about how to allocate resources and to measure the Company’s performance. The Company has one operating and reportable segment.

Recent Accounting Pronouncements

In November 2023, the Financial Accounting Standards Board (the “FASB”) issued ASU 2023-07, Segment Reporting (Topic 280): Improvements to Reportable Segment Disclosures (“ASU 2023-07”), which aims to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. The amendments in ASU 2023-07 do not change how a public entity identifies its operating segments, aggregates those operating segments or applies the quantitative thresholds to determine its reportable segments. ASU 2023-07 is effective for fiscal years beginning after December 15, 2023, and for interim periods beginning after December 15, 2024, with early adoption permitted. The Company is currently assessing the impact on our related disclosures.

In December 2023, the FASB issued ASU 2023-09, Income Taxes (Topic 740): Improvements to Income Tax Disclosures ("ASU 2023-09"). ASU 2023-09 enhanced annual disclosures regarding the income tax rate reconciliation and income taxes paid information. For public business entities, ASU 2023-09 is effective for annual periods beginning after December 15, 2024. The Company is currently assessing the impact on our related disclosures.

2. FAIR VALUE MEASUREMENTS

The Company defines fair value as the price that would be received for an asset or paid to transfer a liability (an exit price) in the principal or most advantageous market for the asset or liability in an orderly transaction between market participants on the measurement date. Valuation techniques the Company uses to measure fair value maximize the use of observable inputs and minimize the use of unobservable inputs. The Company has applied the provisions of fair value accounting for purposes of computing the fair value of financial instruments for disclosure purposes as presented below.

|

|

|

|

|

|

|

|

|

| Level 1 Inputs |

|

Unadjusted quoted prices in active markets for identical assets or liabilities. |

| Level 2 Inputs |

|

Unadjusted quoted prices in active markets for similar assets or liabilities; unadjusted quoted prices for identical or similar assets or liabilities in markets that are not active; inputs other than quoted prices that are observable for the asset or liability. |

| Level 3 Inputs |

|

Unobservable inputs for the asset or liability. |

Fair Value Measurements

The carrying amount of certain financial instruments, including cash and cash equivalents, accounts receivable, unbilled receivables, accounts payable and accrued expenses approximate fair value due to the short maturity of these instruments. The carrying value of debt approximates fair value due to the variable nature of interest rates.

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

10 |

As part of the Company’s continued cost savings initiatives, the Company is actively looking to terminate or sublease certain office spaces and call centers. These actions resulted in operating lease impairment charges of $2.7 million during the second fiscal quarter of 2023. The Company recorded no operating lease impairment charges for the three months ended March 31, 2024 and 2023. The Company continues to evaluate its portfolio of properties, and thus it is possible that impairments could be identified in future periods, and such amounts could be material. The operating lease impairment charges reduce the carrying value of the associated right-of-use (“ROU”) assets and leasehold improvements to the estimated fair values. The fair values are estimated using a discounted cash flows approach based on forecasted future cash flows expected to be derived from the property based on current sublease market rent, which is considered a level 3 input in the fair value hierarchy, and other key assumptions such as future sublease market conditions and the discount rate.

During the twelve months ended December 31, 2023, the Company recorded indefinite-lived trade names impairment charges of $10.0 million. The Company recorded no indefinite-lived trade names impairment charges for the three months ended March 31, 2024 and 2023. Determination of the fair value of the indefinite-lived trade names involves estimates and assumptions which are considered a level 3 input in the fair value hierarchy. For more information, refer to Note 3 “Intangible Assets, Net.”

3. INTANGIBLE ASSETS, NET

Intangible Assets

Fourth Quarter 2023 Indefinite-Lived Intangible Asset Impairment Charges

In connection with its annual indefinite-lived impairment test performed as of November 30, 2023, the Company determined that the fair value of its indefinite-lived trade names no longer exceeded their carrying value. As a result, during the twelve months ended December 31, 2023, the Company recorded indefinite-lived trade names impairment charges of $10.0 million to write down the carrying value of the indefinite-lived trade names to their fair value of $73.0 million. Determination of fair value involves utilizing the relief-from-royalty under the income approach which contains significant estimates and assumptions including, among others, revenue projections as well as selecting appropriate royalty and discount rates, which are considered level 3 inputs in the fair value hierarchy. The indefinite-lived trade names impairment charge was a result of an increase in the discount rate driven by changes in forecast assumptions from the prior year. While the Company believes the judgments and assumptions are reasonable, different assumptions could change the estimated fair value and, therefore, additional impairments could be required. Weakening industry or economic trends, disruptions to the Company's business, changes in discount rate assumptions, unexpected significant changes or planned changes in the use of the assets or in the Company’s entity structure are all factors which may adversely impact the assumptions used in the valuation.

There was no impairment of intangible assets for the three months ended March 31, 2024 and 2023.

The gross carrying amounts, accumulated amortization and net carrying amounts of the Company’s definite-lived amortizable intangible assets, as well as its indefinite-lived intangible trade names, are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mar. 31, 2024 |

| (in thousands) |

|

Gross Carrying Amount |

|

Accumulated Amortization |

|

Net Carrying Amount |

| Developed technology |

|

$ |

496,000 |

|

|

$ |

322,400 |

|

|

$ |

173,600 |

|

| Customer relationships |

|

232,000 |

|

|

105,560 |

|

|

126,440 |

|

| Total intangible assets subject to amortization |

|

$ |

728,000 |

|

|

$ |

427,960 |

|

|

$ |

300,040 |

|

| Indefinite-lived trade names |

|

|

|

|

|

73,000 |

|

| Total intangible assets |

|

|

|

|

|

$ |

373,040 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dec. 31, 2023 |

| (in thousands) |

|

Gross Carrying Amount |

|

Accumulated Amortization |

|

Net Carrying Amount |

| Developed technology |

|

$ |

496,000 |

|

|

$ |

304,686 |

|

|

$ |

191,314 |

|

| Customer relationships |

|

232,000 |

|

|

99,760 |

|

|

132,240 |

|

| Total intangible assets subject to amortization |

|

$ |

728,000 |

|

|

$ |

404,446 |

|

|

$ |

323,554 |

|

| Indefinite-lived trade names |

|

|

|

|

|

73,000 |

|

| Total intangible assets |

|

|

|

|

|

$ |

396,554 |

|

As of March 31, 2024, expected amortization expense related to intangible assets for each of the five succeeding years is as follows:

|

|

|

|

|

|

|

|

|

| GoHealth, Inc. |

2024 Form 10-Q |

11 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

Developed Technology |

|

Customer Relationships |

|

Total |

|

|

| Remainder of 2024 |

|

$ |

53,143 |

|

|

$ |

17,400 |

|

|

$ |

70,543 |

|

|

|

| 2025 |

|

70,857 |

|

|

23,200 |

|

|

94,057 |

|

|

|

| 2026 |

|

49,600 |

|

|

23,200 |

|

|

72,800 |

|

|

|

| 2027 |

|

— |

|

|

23,200 |

|

|

23,200 |

|

|

|

| 2028 |

|

— |

|

|

23,200 |

|

|

23,200 |

|

|

|

| Thereafter |

|

— |

|

|

16,240 |

|

|

16,240 |

|

|

|

| Total |

|

$ |

173,600 |

|

|

$ |

126,440 |

|

|

$ |

300,040 |

|

|

|

4. LONG-TERM DEBT

The Company’s long-term debt consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

Mar. 31, 2024 |

|

Dec. 31, 2023 |

| Term Loan Facilities |

|

$ |

502,796 |

|

|

$ |

502,796 |

|

|

|

|

|

|

| Less: Unamortized debt discount and issuance costs |

|

(17,472) |

|

|

(5,091) |

|

| Total debt |

|

$ |

485,324 |

|

|

$ |

497,705 |

|

| Less: Current portion of long-term debt |

|

(75,000) |

|

|

(75,000) |

|

| Total long-term debt |

|

$ |

410,324 |

|

|

$ |

422,705 |

|

Maturities of long-term debt for each of the next five years is as follows:

|

|

|

|

|

|

|

|

|

|

|

| (in thousands) |

|

|

|

|

| Remainder of 2024 |

|

|

|

$ |

75,000 |

|

| 2025 |

|

|

|

427,796 |

|

| 2026 |

|

|

|

— |

|

| 2027 |

|

|

|

— |

|

| 2028 |

|

|

|

— |

|

| Thereafter |

|