Document

CERTAIN IDENTIFIED INFORMATION HAS BEEN EXCLUDED FROM THE EXHIBIT BECAUSE IT IS BOTH NOT MATERIAL AND WOULD LIKELY CAUSE COMPETITIVE HARM TO THE REGISTRANT IF PUBLICLY DISCLOSED. [***] INDICATES THAT INFORMATION HAS BEEN REDACTED.

EXECUTION VERSION

AMENDMENT NO. 5 TO

MASTER REPURCHASE AGREEMENT

This Amendment No. 5 (this “Amendment”), dated as of March 1, 2024, amends that certain Master Repurchase Agreement, dated as of September 25, 2020 (as amended by Amendment No. 1 to Master Repurchase Agreement, dated as of September 24, 2021, Amendment No. 2 to Master Repurchase Agreement, dated as of March 31, 2022, Amendment No. 3 to Master Repurchase Agreement, dated as of July 21, 2023, Amendment No. 4 to Master Repurchase Agreement, dated as of November 1, 2023, and as may be further amended, restated, supplemented, or otherwise modified from time to time, the “Repurchase Agreement”), between Barclays Bank PLC, as buyer (“Buyer”) and Rocket Mortgage, LLC (formerly known as Quicken Loans, LLC), as seller (“Seller”). Capitalized terms used herein but not otherwise defined shall have the meanings given to such terms in the Repurchase Agreement.

WHEREAS, Seller provided written notice to Buyer that, effective on or about July 31, 2021, the Seller shall change its legal name from “Quicken Loans, LLC”, a Michigan limited liability company to “Rocket Mortgage, LLC”, a Michigan limited liability company; and

WHEREAS, the parties hereto desire to amend the Repurchase Agreement as described below.

NOW, THEREFORE, pursuant to the provisions of the Repurchase Agreement concerning modification and amendment thereof, and in consideration of the amendments, agreements and other provisions herein contained and of certain other good and valuable consideration the receipt and sufficiency of which is hereby acknowledged by the parties hereto, it is hereby agreed between Buyer and Seller as follows:

Section 1.Amendments. Effective as of March 1, 2024, the Repurchase Agreement is hereby amended to delete the stricken text (indicated textually in the same manner as the following example: ) and to add the double-underlined text (indicated textually in the same manner as the following example: double-underlined text) as set forth in Exhibit A hereto.

Section 2.Fees and Expenses. Seller agrees to pay to Buyer all fees and out of pocket expenses incurred by Buyer in connection with this Amendment, including, without limitation, the Upfront Commitment Fee (as defined in the Pricing Side Letter) and all reasonable fees and out of pocket costs and expenses of the legal counsel to Buyer incurred in connection with this Amendment, in accordance with Section 22(b) of the Repurchase Agreement.

Section 3.Effectiveness of Amendment. The parties hereto agree that this Amendment shall not be effective until the execution and delivery of this Amendment by the parties hereto.

|

|

|

065037.0000232 DMS 303761581v4 |

1

Section 4.Effect of Amendment. Except as expressly amended and modified by this Amendment, all provisions of the Repurchase Agreement shall remain in full force and effect and all such provisions shall apply equally to the terms and conditions set forth herein. After this Amendment becomes effective, all references in the Repurchase Agreement (or in any other document relating to the Loans) to “this Agreement,” “hereof,” “herein” or words of similar effect referring to such Repurchase Agreement shall be deemed to be references to such Repurchase Agreement as amended by this Amendment. This Amendment shall not be deemed to expressly or impliedly waive, amend or supplement any provision of the Repurchase Agreement other than as set forth herein.

Section 5.Successors and Assigns. This Amendment shall be binding upon the parties hereto and their respective successors and assigns.

Section 6.Section Headings. The various headings and sub-headings of this Amendment are inserted for convenience only and shall not affect the meaning or interpretation of this Amendment or the Repurchase Agreement or any provision hereof or thereof.

Section 7.Representations. In order to induce Buyer to execute and deliver this Amendment, Seller hereby represents to Buyer that as of the date hereof (i) it is in full compliance with all of the terms and conditions of the Program Documents and remains bound by the terms thereof and (ii) no Default or Event of Default has occurred and is continuing under the Program Documents.

Section 8.GOVERNING LAW. THIS AMENDMENT SHALL BE CONSTRUED AND ENFORCED IN ACCORDANCE WITH, AND GOVERNED BY, THE LAWS OF THE STATE OF NEW YORK, WITHOUT GIVING EFFECT TO THE CONFLICT OF LAWS PRINCIPLES THEREOF (EXCEPT FOR SECTIONS 5-1401 AND 5-1402 OF THE NEW YORK GENERAL OBLIGATIONS LAW), AND THE OBLIGATIONS, RIGHTS AND REMEDIES OF THE PARTIES HEREUNDER SHALL BE DETERMINED IN ACCORDANCE WITH SUCH LAWS.

Section 9.Counterparts. This Amendment may be executed in any number of counterparts, all of which shall constitute one and the same instrument, and any party hereto may execute this Amendment by signing and delivering one or more counterparts. The parties intend that faxed signatures and electronically imaged signatures such as .pdf files shall constitute original signatures and are binding on all parties. The original documents shall be promptly delivered, if requested. The parties agree that this Amendment, any addendum, exhibit or amendment hereto or any other document necessary for the consummation of the transactions contemplated by this Amendment may be accepted, executed or agreed to through the use of an electronic signature in accordance with E-Sign, UETA and any applicable state law. Any document accepted, executed or agreed to in conformity with such laws will be binding on all parties hereto to the same extent as if it were physically executed and each party hereby consents to the use of any secure third party electronic signature capture service with appropriate document access tracking, electronic signature tracking and document retention as may be reasonably chosen by a signatory hereto, including but not limited to DocuSign.

[Signature Pages to Follow]

IN WITNESS WHEREOF, each undersigned party has caused this Amendment to be duly executed by one of its officers thereunto duly authorized as of the date and year first above written.

BARCLAYS BANK PLC, as Buyer

By: /s/ Grace Park Name: Grace Park Title: Managing Director ROCKET MORTGAGE, LLC, as Seller By: /s/ Brian Brown Name: Brian Brown Title: Treasurer

Signature Page to Amendment No. 5 to Barclays-Rocket Mortgage Master Repurchase Agreement

Signature Page to Amendment No. 5 to Barclays-Rocket Mortgage Master Repurchase Agreement

EXHIBIT A

CONFORMED THROUGH AMENDMENT NO. 5

DATED AS OF MARCH 1, 2024

|

|

|

|

MASTER REPURCHASE AGREEMENT

Dated as of September 25, 2020

Between:

BARCLAYS BANK PLC, as Buyer,

and

ROCKET MORTGAGE, LLC as Seller

|

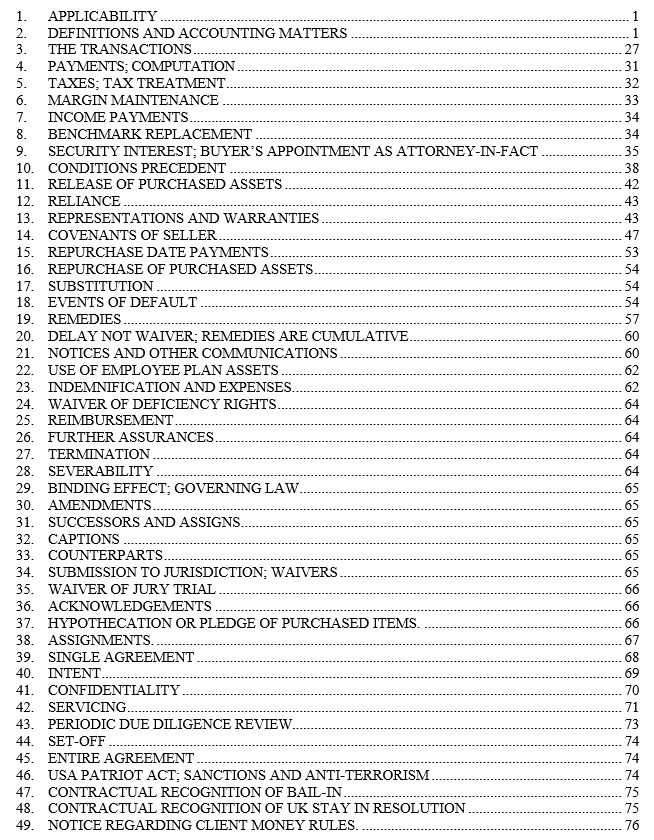

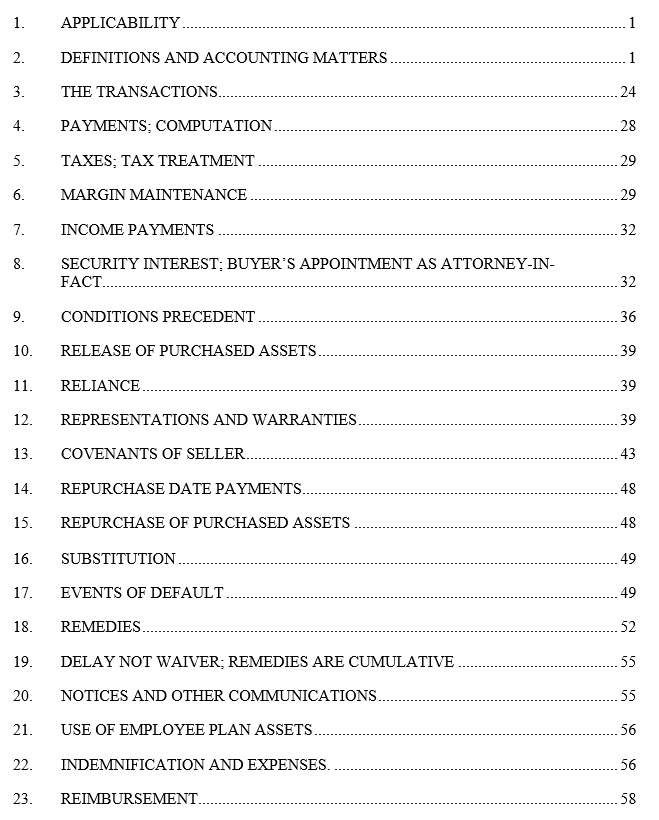

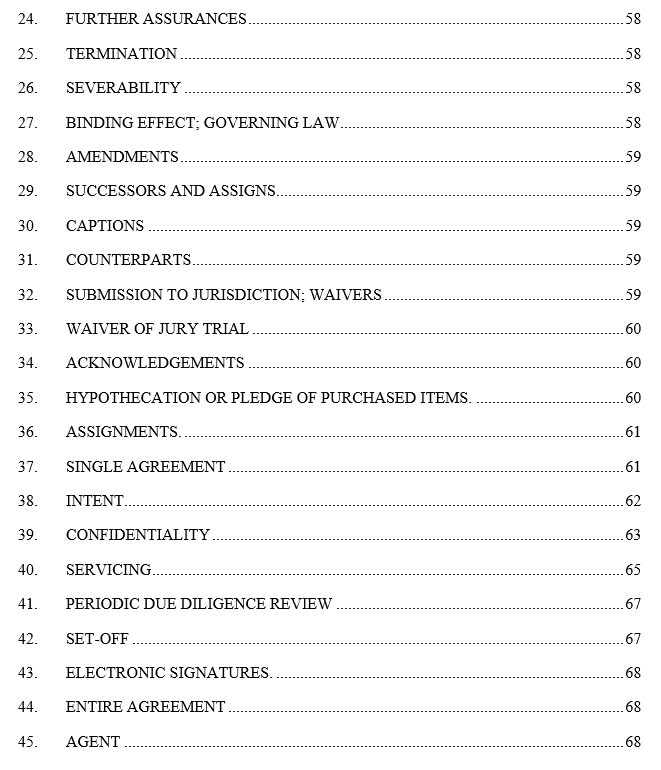

TABLE OF CONTENTS

SCHEDULES

SCHEDULE 1 Representations and Warranties re: Loans

SCHEDULE 2 Subsidiaries

SCHEDULE 12(c) Litigation

SCHEDULE 13(i) Related Party Transactions

EXHIBITS

EXHIBIT A Form of Quarterly Certification

EXHIBIT B Form of Instruction Letter

EXHIBIT C Buyer’s Wire Instructions

EXHIBIT D Form of Security Release Certification

MASTER REPURCHASE AGREEMENT, dated as of September 25, 2020, between Rocket Mortgage, LLC (formerly known as Quicken Loans, LLC), a Michigan limited liability company (the “Seller”), and Barclays Bank PLC, a public limited company formed under the laws of England and Wales (“Buyer”).

1.APPLICABILITY

Buyer shall, with respect to the Committed Amount, and may agree to, with respect to the Uncommitted Amount, from time to time enter into transactions in which the Seller sells to Buyer Eligible Loans against the transfer of funds by Buyer, with a simultaneous agreement by Buyer to sell to the Seller Purchased Assets by a date certain, against the transfer of funds by the Seller; provided, that the aggregate Outstanding Purchase Price shall not exceed, as of any date of determination, the Maximum Aggregate Purchase Price. Each such transaction shall be referred to herein as a “Transaction”, and, unless otherwise agreed in writing, shall be governed by this Agreement.

2.DEFINITIONS AND ACCOUNTING MATTERS

(a) Defined Terms. As used herein, the following terms have the following meanings (all terms defined in this Section 2 or in other provisions of this Agreement in the singular to have the same meanings when used in the plural and vice versa):

“Ability to Repay Rule” shall mean 12 CFR 1026.43(c), or any successor rule or regulation, including all applicable official staff commentary.

“Accepted Servicing Practices” shall mean with respect to any Loan, those accepted mortgage servicing practices (including collection procedures) of prudent mortgage lending institutions which service mortgage loans, as applicable, of the same type as the Loans in the jurisdiction where the related Mortgaged Property is located, and which are in accordance with applicable Agency servicing practices and procedures for Agency mortgage backed securities pool mortgages, as defined in the Agency Guidelines including future updates.

“Account Bank” shall mean JPMorgan Chase Bank, N.A.

“Accrual Period” means, with respect to each Monthly Payment Date for any Transaction, the immediately prior calendar month beginning with the first calendar day of such month to and including the last calendar day of such month; provided that with respect to the first Monthly Payment Date of a Transaction following the related Purchase Date, the Accrual Period shall commence on the related Purchase Date and provided further that the last Accrual Period shall end on the Termination Date.

“Adjustable Rate Loan” shall mean a Loan which provides for the adjustment of the Mortgage Interest Rate payable in respect thereto.

“Adjusted Tangible Net Worth” shall mean, with respect to any Person at any date, the excess of the total assets over the total liabilities of such Person on such date, each to be determined in accordance with GAAP consistent with those applied in the preparation of the Seller’s financial statements less the sum of the following (without duplication): (a) the book value of all investments in non-consolidated subsidiaries, and (b) any other assets of the Seller and consolidated Subsidiaries that would be treated as intangibles under GAAP including, without limitation, goodwill, research and development costs, trademarks, trade names, copyrights, patents, rights to refunds and indemnification and unamortized debt discount and expenses. Notwithstanding the foregoing, servicing rights shall be included in the calculation of total assets.

“Adjustment Date” shall mean with respect to each Adjustable Rate Loan, the date set forth in the related Note on which the Mortgage Interest Rate on the Loan is adjusted in accordance with the terms of the Note.

“Affiliate” shall mean, with respect to any Person, any other Person which, directly or indirectly, controls, is controlled by, or is under common control with, such Person, and which shall include any Subsidiary of such Person. For purposes of this definition, “control” (together with the correlative meanings of “controlled by” and “under common control with”) means possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of such Person, whether through the ownership of voting securities, by contract, or otherwise.

“Agency” shall mean Fannie Mae, Ginnie Mae or Freddie Mac, as the context may require.

“Agency Approval” shall have the meaning provided in Section 14(aa).

“Agency Audit” shall mean any Agency, HUD, FHA, VA or RHS audits, examinations, evaluations, monitoring reviews and reports of its origination and servicing operations (including those prepared on a contract basis for any such Agency, HUD, FHA, VA or RHS).

“Agency Eligible Loan” shall mean a Loan that is (i) originated in compliance with the applicable Agency Guidelines (other than for exceptions to the Agency Guidelines provided by the applicable Agency to Seller and is eligible for sale to or securitization by (or guaranty of securitization by)) an Agency or (ii) (a) an FHA Loan; (b) a VA Loan; (c) an RHS Loan, or (d) otherwise eligible for inclusion in a Ginnie Mae mortgage-backed security pool.

“Agency Guidelines” shall mean the Ginnie Mae Guide, the Fannie Mae Guide and/or the Freddie Mac Guide, the FHA Regulations, the VA Regulations and/or the Rural Housing Service Regulations, as the context may require, in each case as such guidelines have been or may be amended, supplemented or otherwise modified from time to time by Ginnie Mae, Fannie Mae, Freddie Mac, FHA, VA or RHS, as applicable.

“Agency Security” shall mean a mortgage-backed security issued or guaranteed by an Agency.

“Agency-Required eNote Legend” means the legend or paragraph required by Fannie Mae or Freddie Mac, as applicable, to be set forth in the text of an eNote, which includes the provisions set forth on Exhibit A to the Custodial and Disbursement Agreement, as may be amended from time to time by Fannie Mae or Freddie Mac, as applicable.

“Agent” shall mean Barclays, as agent hereunder.

“Agreement” shall mean this Master Repurchase Agreement (including all exhibits, schedules and other addenda hereto or thereto), as supplemented by the Pricing Side Letter, as it may be amended, restated, further supplemented or otherwise modified from time to time.

“ALTA” shall mean the American Land Title Association.

“Alternative Rate” means a per annum rate based on an index that is a commercially reasonable substitute for the then-current Benchmark, as determined by Buyer.

“Anti-Money Laundering Laws” shall have the meaning provided in Section 13(ee) hereof.

“Applicable Margin” shall have the meaning set forth in the Pricing Side Letter.

“Applicable Percentage” shall have the meaning assigned thereto in the Pricing Side Letter.

“Appraised Value” shall mean, with respect to any Loan, the lesser of (i) the value set forth on the appraisal made in connection with the origination of the related Loan as the value of the related Mortgaged Property, or (ii) the purchase price paid for the Mortgaged Property, provided, however, that in the case of a Loan the proceeds of which are not used for the purchase of the Mortgaged Property, such value shall be based solely on the appraisal made in connection with the origination of such Loan.

“Approvals” shall mean, with respect to the Seller, the approvals granted by the applicable Agency, FHA, VA, RHS or HUD, as applicable, designating the Seller as a Ginnie Mae-approved issuer, a Ginnie Mae-approved servicer, an FHA-approved mortgagee, a VA-approved lender, an RHS lender, an RHS servicer, a Fannie Mae-approved seller/servicer or a Freddie Mac-approved seller/servicer, as applicable, in good standing to the extent necessary for Seller to conduct its business in all material respects as it is then being conducted.

“Approved Title Insurance Company” shall mean a title insurance company as to which Buyer has not otherwise provided written notice to Seller that such title insurance company is not reasonably satisfactory to Buyer; provided, however, that Seller shall provide a list of Approved Title Insurance Companies at the reasonable request of Buyer.

“Asset Base” shall have the meaning assigned thereto in the Pricing Side Letter.

“Assignment and Acceptance” shall have the meaning provided in Section 38(a).

“Assignment of Mortgage” shall mean, with respect to any Mortgage, an assignment of the Mortgage, notice of transfer or equivalent instrument in recordable form, sufficient under the laws of the jurisdiction wherein the related Mortgaged Property is located to reflect the assignment of the Mortgage to Buyer.

“ATR Rules”: means the “ability to repay” rules specified in the federal Truth-in-Lending Act as amended pursuant to rulemaking authority provided under the federal Dodd-Frank Act which require lenders to make a reasonable, good-faith determination that a Mortgagor has an ability to repay the loan as determined by the following eight (8) underwriting factors: (i) current or reasonably expected income or assets (other than the value of the property that secures the loan) that the Mortgagor will rely on to repay the loan, (ii) current employment status (if the originator relies on employment income when assessing the Mortgagor’s ability to repay), (iii) monthly mortgage payment for the loan, (iv) monthly payment on any simultaneous loans secured by the same property, (v) monthly payments for property taxes and required insurance, and certain other costs related to the property such as homeowners association fees or ground rent, (vi) debts, alimony, and child-support obligations, (vii) monthly debt-to-income ratio or residual income, calculated using the total of all of the mortgage and nonmortgage obligations listed above, as a ratio of gross monthly income and (viii) credit history.

“Authoritative Copy” shall mean with respect to an eNote, the unique copy of such eNote that is within the Control of the Controller.

“Bail-In Action” means the exercise by the Bank of England (or any successor resolution authority) of any write-down or conversion power existing from time to time (including, without limitation, any power to amend or alter the maturity of eligible liabilities of an institution under resolution or amend the amount of interest payable under such eligible liabilities or the date on which interest becomes payable, including by suspending payment for a temporary period and together with any power to terminate and value transactions) under, and exercised in compliance with, any laws, regulations, rules or requirements in effect in the United Kingdom relating to the transposition of the European Banking Recovery and Resolution Directive as amended from time to time, including but not limited to, the Banking Act 2009 as amended from time to time, and the instruments, rules and standards created thereunder, pursuant to which Buyer’s obligations (or those of Buyer’s affiliates) can be reduced (including to zero), canceled or converted into shares, other securities, or other obligations of Buyer or any other person.

“Bankruptcy Code” shall mean Title 11 of the United States Code, Section 101 et seq., as amended from time to time.

“Barclays” shall mean Barclays Bank PLC.

“BCI” shall mean Barclays Capital Inc.

“Benchmark” means, initially, Term SOFR; provided that if a Benchmark Transition Event has occurred with respect to Term SOFR or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior Benchmark pursuant to Section 8.

“Benchmark Replacement” means the sum of:

(1)the alternate benchmark rate that has been selected by Agent giving due consideration to

a.any selection or recommendation of a replacement rate or the mechanism for determining such a rate by the Relevant Governmental Body at such time or

b.any evolving or then-prevailing market convention for determining a rate of interest for Dollar-denominated syndicated or bilateral credit facilities; and

(2)the Benchmark Replacement Adjustment.

provided that, if at any time, the Benchmark Replacement as so determined pursuant to clause (1) or (2) above would be less than the Floor, the Benchmark Replacement will be deemed to be the Floor for the purposes of this Agreement and any other Program Documents.

“Benchmark Replacement Adjustment” means, for each applicable Accrual Period, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by Buyer giving due consideration to the factors set forth in clauses (1)(a) and (1)(b) in the definition of Benchmark Replacement.

“Benchmark Replacement Conforming Changes” means, with respect to any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of “Accrual Period,” timing and frequency of determining rates and making payments of interest, timing of seller requests for repurchase, the applicability and length of lookback periods and other technical, administrative or operational matters) that the Agent decides may be appropriate to reflect the adoption and implementation of such Benchmark Replacement and to permit the administration thereof by the Agent in a manner substantially consistent with market practice (or, if the Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Agent determines that no market practice for the administration of the Benchmark Replacement exists, in such other manner of administration as the Agent decides is reasonably necessary in connection with the administration of this Agreement).

“Benchmark Replacement Date” means the date on which a Benchmark Replacement becomes effective pursuant to Section 8.

“Benchmark Transition Event” means, with respect to any then-current Benchmark, the occurrence of a public statement or publication of information by or on behalf of the administrator of the then-current Benchmark, the regulatory supervisor for the administrator of such Benchmark, the Board of Governors of the Federal Reserve System, the Federal Reserve Bank of New York, an insolvency official with jurisdiction over the administrator for such Benchmark, a resolution authority with jurisdiction over the administrator for such Benchmark or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark, announcing or stating that (a) such administrator has ceased or will cease on a specified date to provide all applicable tenors of such Benchmark, permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any applicable tenor of such Benchmark, (b) all applicable tenors of such Benchmark are or will no longer be representative of the underlying market and economic reality that such Benchmark is intended to measure and that representativeness will not be restored or that such Benchmark is or will not be in compliance or aligned with the International Organization of Securities Commissions Principals for Financial Benchmarks, (c) Agent determines in its sole discretion that, by reason of circumstances affecting the relevant market, adequate and reasonable means do not exist for ascertaining such Benchmark, or (d) Agent determines in its sole discretion that the adoption of any Change in Law or in the interpretation or application thereof shall make it unlawful for Buyer to accrue Price Differential based on such Benchmark.

“Business Day” means (A) any day other than (i) a Saturday or Sunday, (ii) a day upon which the New York Stock Exchange, the Federal Reserve Bank of New York, the Custodian’s offices, banking and savings and loan institutions in the State of New York, Michigan or Delaware, the City of New York or the State of California are required to be closed, or (iii) a day on which trading in securities on the New York Stock Exchange or any other major securities exchange in the United States is not conducted, and (B) with respect to any calculation of Term SOFR, a U.S. Government Securities Business Day.

“Capital Lease Obligations” shall mean, for any Person, all obligations of such Person to pay rent or other amounts under a lease of (or other agreement conveying the right to use) Property to the extent such obligations are required to be classified and accounted for as a capital lease on a balance sheet of such Person under GAAP, and, for purposes of this Agreement, the amount of such obligations shall be the capitalized amount thereof, determined in accordance with GAAP.

“Cash Equivalents” shall mean (a) securities with maturities of ninety (90) days or less from the date of acquisition issued or fully guaranteed or insured by the United States Government or any agency thereof, (b) certificates of deposit and eurodollar time deposits with maturities of ninety (90) days or less from the date of acquisition and overnight bank deposits of any commercial bank having capital and surplus in excess of $500,000,000, (c) repurchase obligations of any commercial bank satisfying the requirements of clause (b) of this definition, having a term of not more than seven days with respect to securities issued or fully guaranteed or insured by the United States Government, (d) commercial paper of a domestic issuer rated at least A-1 or the equivalent thereof by Standard and Poor’s Ratings Group (“S&P”) or P-1 or the equivalent thereof by Moody’s Investors Service, Inc. (“Moody’s”) and in either case maturing within ninety (90) days after the day of acquisition, (e) securities with maturities of ninety (90) days or less from the date of acquisition issued or fully guaranteed by any state, commonwealth or territory of the United States, by any political subdivision or taxing authority of any such state, commonwealth or territory or by any foreign government, the securities of which state, commonwealth, territory, political subdivision, taxing authority or foreign government (as the case may be) are rated at least A by S&P or A by Moody’s, (f) securities with maturities of ninety (90) days or less from the date of acquisition backed by standby letters of credit issued by any commercial bank satisfying the requirements of clause (b) of this definition, (g) shares of money market mutual or similar funds, (h) 70% of the unencumbered marketable securities in Seller’s accounts (or the account of Seller’s Affiliates), or (i) the aggregate amount of unused capacity available (taking into account applicable haircuts) under committed and uncommitted mortgage loan and mortgage-backed securities warehouse and servicing and servicer advance facilities, or lines of credit collateralized by mortgage or mortgage servicing rights assets for which the seller or borrower thereunder has adequate eligible collateral pledged or to pledge thereunder, or under unsecured lines of credit available to Seller.

“CEMA Consolidated Note” shall mean the original executed consolidated promissory note or other evidence of the consolidated indebtedness of a mortgagor/borrower with respect to a CEMA Loan and a Consolidation, Extension and Modification Agreement.

“CEMA Loan” shall mean a Loan originated in connection with a refinancing subject to a Consolidation, Extension and Modification Agreement and with respect to which the related Mortgaged Property is located in the State of New York.

“Change of Control” shall mean, with respect to the Seller, the acquisition by any other Person, or two or more other Persons acting as a group, of beneficial ownership (within the meaning of Rule 13d-3 of the Securities and Exchange Commission under the Securities Exchange Act of 1934, as amended) of outstanding shares of voting stock of the Seller at any time if after giving effect to such acquisition Rocket Companies, Inc. ceases to own, directly or indirectly, at least fifty-one percent (51%) of the voting power of Seller’s outstanding equity interests.

“Change in Law” means (a) the adoption of any Requirement of Law, rule or regulation after the date of this Agreement, (b) any change in any Requirement of Law, rule or regulation or in the interpretation or application thereof by any Governmental Authority after the date of this Agreement or (c) compliance by Buyer (or any Affiliate thereof) with any request, guideline or directive (whether or not having the force of law) of any Governmental Authority made or issued after the date of this Agreement.

“Closing Agent” shall mean, with respect to any Wet-Ink Transaction, an entity reasonably satisfactory to Buyer (which may be a title company or its agent, escrow company, attorney or other closing agent in accordance with local law and practice in the jurisdiction where the related Wet-Ink Loan is being originated) to which the proceeds of such Wet-Ink Transaction are to be wired pursuant to the instructions of Seller. Unless Buyer notifies Seller (electronically or in writing) that a Closing Agent is unsatisfactory, each Closing Agent utilized by Seller shall be deemed satisfactory; provided, that each of Title Source, Inc. and its Subsidiaries shall be deemed satisfactory to Buyer while it is an Affiliate of Seller and eligible to act as a closing agent under applicable Agency Guidelines, and provided further that Buyer shall instruct Custodian that no funds shall be transferred to the account of any Closing Agent after the date that is five (5) Business Days following the date that notice is delivered to Seller that such Closing Agent is unsatisfactory, and provided, further, that the Market Value shall be deemed to be zero with respect to each Loan, for so long as such Loan is a Wet-Ink Loan, as to which the proceeds of such Loan were wired to a Closing Agent with respect to which Buyer has notified Seller at least five (5) Business Days before funds are transferred to the account of such Closing Agent that such Closing Agent is not satisfactory.

“Closing Date” shall mean September 25, 2020.

“Code” shall mean the Internal Revenue Code of 1986, as amended from time to time.

“Collection Account” shall mean the following account at the Account Bank established by the Seller for the benefit of Buyer, “Rocket Mortgage, LLC as Trustee/Bailee for Barclays Bank PLC - P&I account – Account [***]”.

“Collection Account Control Agreement” shall mean the blocked account control agreement dated as of September 25, 2020, among Buyer, the Seller and the Account Bank, in form and substance acceptable to Buyer to be entered into with respect to the Collection Account, as the same may be amended, restated, supplemented or otherwise modified from time to time.

“Combined LTV” means the ratio of (i) the sum of (a) the outstanding principal balance of a Second Lien Loan on the origination date and (b) the outstanding principal balance of any other Loan with respect to the same Mortgaged Property on the origination date to (ii) the Appraised Value of the related Mortgaged Property.

“Committed Amount” shall have the meaning assigned thereto in the Pricing Side Letter.

“Confirmation” shall have the meaning assigned thereto in Section 3(a) hereof.

“Consolidation, Extension and Modification Agreement” shall mean the original executed consolidation, extension and modification agreement executed by a mortgagor/borrower in connection with a CEMA Loan.

“Contractual Obligation” shall mean as to any Person, any material provision of any agreement, instrument or other undertaking to which such Person is a party or by which it or any of its property is bound or any material provision of any security issued by such Person.

“Control” shall mean with respect to an eNote, the “control” of such eNote within the meaning of UETA and/or, as applicable, E-SIGN, which is established by reference to the MERS eRegistry and any party designated therein as the Controller.

“Control Failure” shall mean with respect to an eNote, (i) if the Controller status of the eNote shall not have been transferred to Buyer, (ii) Buyer shall otherwise not be designated as the Controller of such eNote in the MERS eRegistry, (iii) if the eVault shall have released the Authoritative Copy of an eNote in contravention of the requirements of the Custodial and Disbursement Agreement, or (iv) if the Custodian initiated any changes on the MERS eRegistry in contravention of the terms of the Custodial and Disbursement Agreement.

“Controller” shall mean with respect to an eNote, the party designated in the MERS eRegistry as the “Controller”, and who in such capacity shall be deemed to be “in control” or to be the “controller” of such eNote within the meaning of UETA or E-SIGN, as applicable.

“Cooperative Corporation” shall mean the cooperative apartment corporation that holds legal title to a Cooperative Project and grants occupancy rights to units therein to stockholders through Proprietary Leases or similar arrangements.

“Cooperative Loan” shall mean a Loan that is secured by a perfected security interest in Cooperative Shares and the related Proprietary Lease granting exclusive rights to occupy the related Cooperative Unit in the building owned by the related Cooperative Corporation.

“Cooperative Loan Documents” shall have the meaning assigned thereto in the Custodial and Disbursement Agreement.

“Cooperative Note” shall mean the original executed promissory note or other evidence of the indebtedness of a Mortgagor with respect to a Cooperative Loan.

“Cooperative Project” shall mean all real property owned by a Cooperative Corporation including the land, separate dwelling units and all common elements.

“Cooperative Shares” shall mean the shares of stock issued by a Cooperative Corporation and allocated to a Cooperative Unit and represented by a stock certificate.

“Cooperative Unit” shall mean a specific unit in a Cooperative Project.

“Costs” shall have the meaning provided in Section 23(a) hereof.

“COVID-19 Pandemic” means the global pandemic caused by the COVID-19 coronavirus, which commenced in December of 2019.

“COVID Responsive Change” means any change in applicable law, Agency Guidelines, Accepted Servicing Practices, or Underwriting Guidelines that occurs in response to the COVID-19 Pandemic, whether temporary or permanent, and including but not limited to the Coronavirus Aid, Relief, and Economic Security Act and responsive actions taken by any Agency or Governmental Authority relating thereto.

“Custodial and Disbursement Agreement” shall mean the Custodial and Disbursement Agreement, dated as of the date hereof, between the Seller, Buyer, Disbursement Agent and Custodian as the same shall be amended, restated, supplemented or otherwise modified and in effect from time to time.

“Custodial Loan Transmission” shall have the meaning assigned thereto in the Custodial and Disbursement Agreement.

“Custodian” shall mean Deutsche Bank National Trust Company, or its successors and permitted assigns, or such other custodian as may be mutually agreed to by Buyer and Seller.

“Default” shall mean an Event of Default or any event that, with the giving of notice or the passage of time or both, would become an Event of Default.

“Delegatee” shall mean with respect to an eNote, the party designated in the MERS eRegistry as the “Delegatee” or “Delegatee for Transfers”, who in such capacity is authorized by the Controller to perform certain MERS eRegistry transactions on behalf of the Controller such as Transfers of Control and Transfers of Control and Location.

“Disbursement Agent” means Deutsche Bank National Trust Company and its successors and permitted assigns, or such other entity as mutually agreed upon by Buyer and Seller.

“Document Deficient Loan” shall mean any closed Loan for which the Custodian has not received a complete Mortgage File from the Seller.

“Dollars” or “$” shall mean lawful money of the United States of America.

“Due Date” shall mean the day of the month on which the Monthly Payment is due on a Loan, exclusive of any days of grace.

“Due Diligence Review” shall mean the performance by Buyer of any or all of the reviews permitted under Section 43 hereof with respect to any or all of the Loans or the Seller or related parties, as desired by Buyer from time to time.

“eCommerce Laws” shall mean E-SIGN, UETA, any applicable state or local equivalent or similar laws and regulations, and any rules, regulations and guidelines promulgated under any of the foregoing.

“Economic and Trade Sanctions and Anti-Terrorism Laws” means any laws relating to terrorism, trade sanctions programs and embargoes, import/export licensing, money laundering, or bribery, all as amended, supplemented or replaced from time to time.

“Effective Date” shall mean the date upon which the conditions precedent set forth in Section 10(a) have been satisfied.

“Electronic Agent” shall mean MERSCORP Holdings, Inc., or its successor in interest or assigns.

“Electronic Record” shall mean with respect to an eMortgage Loan, the related eNote and all other documents comprising the Mortgage File electronically created and that are stored in an electronic format, if any.

“Electronic Security Failure” shall mean as such term is defined in the Custodial and Disbursement Agreement.

“Electronic Tracking Agreement” shall mean the electronic tracking agreement among Buyer, the Seller, MERSCORP Holdings, Inc. and MERS, in form and substance acceptable to Buyer to be entered into in the event that any of the Loans become MERS Loans, as the same may be amended, restated, supplemented or otherwise modified from time to time; provided that if no Loans are or will be MERS Loans, all references herein to the Electronic Tracking Agreement shall be disregarded.

“Electronic Transmission” shall mean the delivery of information in an electronic format acceptable to the applicable recipient thereof. An Electronic Transmission shall be considered written notice for all purposes hereof (except when a request or notice by its terms requires execution).

“Eligible Loan” shall mean a Loan (i) as to which the representations and warranties in Section 13(t) and 13(u) and Schedule 1 of this Agreement are true and correct in all material respects, (ii) that was originated in all material respects in accordance with the applicable Underwriting Guidelines or Agency Guidelines and (iii) contains all required Loan Documents without Exceptions unless otherwise waived electronically or in writing by Buyer. Except as otherwise permitted in the Pricing Side Letter, no Loan shall be an Eligible Loan:

1. that Buyer determines, in its good faith, reasonable discretion is not eligible for sale in the secondary market or for securitization without unreasonable credit enhancement;

2. as to which the related Mortgage File has been released from the possession of the Custodian under Section 5 of the Custodial and Disbursement Agreement to the Seller or its bailee for a period in excess of [***];

3. as to which the related Mortgage File has been released from the possession of the Custodian under Section 5(a) of the Custodial and Disbursement Agreement under any Transmittal Letter in excess of the longer of [***] and the time period stated in such Transmittal Letter for release;

4. in respect of which (a) the related Mortgaged Property is the subject of a foreclosure proceeding or (b) the related Note has been extinguished under relevant state law in connection with a judgment of foreclosure or foreclosure sale or otherwise;

5. if (a) the related Note or the related Mortgage is not genuine or is not the legal, valid, binding and enforceable obligation of the maker thereof, subject to no right of rescission, set-off, counterclaim or defense, or (b) such Mortgage, is not a valid, subsisting, enforceable and perfected Lien on the Mortgaged Property;

6. in respect of which the related Mortgagor is the subject of a bankruptcy proceeding;

7. if such Loan is [***] or more days past due;

8. if the Purchase Price of such Loan, when added to the aggregate Outstanding Purchase Price of all Purchased Assets that are then subject to Transactions, causes the aggregate Outstanding Purchase Price of all Purchased Assets that are then subject to a Transaction to exceed, as of any date of determination, the lesser of (a) the Maximum Aggregate Purchase Price and (b) the aggregate Asset Base of all Purchased Assets and all Eligible Loans proposed to be sold in such Transaction;

9. if such Loan is a Wet-Ink Loan and the Purchase Price of such Wet-Ink Loan when added to the aggregate Outstanding Purchase Price of all other Wet-Ink Loans that are then subject to outstanding Transactions hereunder, exceeds at any time [***] of the Maximum Aggregate Purchase Price;

10. if such Loan is secured by real property improved by manufactured housing;

11. if such Loan is a FHA § 203(k) Loan or an RHS Loan and the Purchase Price of such FHA § 203(d) Loan or RHS Loan when added to the aggregate Outstanding Purchase Price of all other FHA § 203(k) Loans and RHS Loans that are then subject to outstanding Transactions hereunder, exceeds at any time [***];

12. if such Loan is a CEMA Loan and the Purchase Price of such CEMA Loan when added to the aggregate Outstanding Purchase Price of all other CEMA Loans that are then subject to outstanding Transactions hereunder, exceeds at any time [***];

13. if such Loan is an eMortgage Loan;

14. if such Loan is a Jumbo Loan and the Purchase Price of such Jumbo Loan when added to the aggregate Outstanding Purchase Price of all other Jumbo Loans that are then subject to outstanding Transactions hereunder, exceeds at any time 15% of the Maximum Aggregate Purchase Price;

15. if such a Loan is a Second Lien Loan and the Purchase Price of such Second Lien Loan when added to the aggregate Outstanding Purchase Price of all other Second Lien Loans that are then subject to outstanding Transactions hereunder, exceeds at any time [***] of the Maximum Aggregate Purchase Price;

16. if such Loan has exceeded its Maximum Age Since Origination;

17. if such Loan is a Document Deficient Loan (unless it is a Wet-Ink Loan) or

18. if such Loan was issued to a Foreign National.

“eMortgage Loan” shall mean a Loan with respect to which there is an eNote and as to which some or all of the other documents comprising the related Mortgage File may be created electronically and not by traditional paper documentation with a pen and ink signature.

“eNote” shall mean, with respect to any eMortgage Loan, the electronically created and stored Note that is a Transferable Record.

“EO13224” shall have the meaning provided in Section 13(dd) hereof.

“ERISA” shall mean the Employee Retirement Income Security Act of 1974, as amended from time to time.

“ERISA Affiliate” shall mean any entity, whether or not incorporated, that is a member of any group of organizations described in Section 414(b) or (c) of the Code (or Section 414) (m) or (o) of the Code for purposes of Section 412 of the Code) of which the Seller is a member.

“Escrow Payments” shall mean, with respect to any Loan, the amounts constituting ground rents, taxes, assessments, water charges, sewer rents, municipal charges, mortgage insurance premiums, fire and hazard insurance premiums, condominium charges, and any other payments required to be escrowed by the Mortgagor with the Mortgagee pursuant to the terms of any Note or Mortgage or any other document.

“E-SIGN” shall mean the Electronic Signatures in Global and National Commerce Act, 15 U.S.C. § 7001 et seq.

“eNote Replacement Failure” shall have the meaning set forth in the Custodial and Disbursement Agreement.

“eVault” shall have the meaning assigned to it in the Custodial and Disbursement Agreement.

“Event of Default” shall have the meaning provided in Section 18 hereof.

“Exception” shall have the meaning assigned thereto in the Custodial and Disbursement Agreement.

“Exception Report” shall mean the report of Exceptions included as part of the Custodial Loan Transmission.

“Fannie Mae” shall mean the Federal National Mortgage Association or any successor thereto.

“Fannie Mae Guide” shall mean the Fannie Mae MBS Selling and Servicing Guide, as such guide may hereafter from time to time be amended.

“Fannie Mae Mortgage Loan” shall mean an Eligible Loan that is in compliance on the related Purchase Date with the eligibility requirements specified for the applicable Fannie Mae Program described in the Fannie Mae Guide.

“Fannie Mae Program” shall mean the Fannie Mae Guaranteed Mortgage-Backed Securities Programs, as described in the Fannie Mae Guide.

“FCA” shall mean the United Kingdom Financial Conduct Authority.

“FDIA” shall have the meaning provided in Section 40(c) hereof.

“FDICIA” shall have the meaning provided in Section 40(d) hereof.

“FEMA” shall mean the Federal Emergency Management Agency.

“FHA” shall mean the Federal Housing Administration, an agency within HUD, or any successor thereto and including the Federal Housing Commissioner and the Secretary of Housing and Urban Development where appropriate under the FHA Regulations.

“FHA §203(k) Loan” shall mean a closed-end first lien FHA Loan with the following characteristics:

(a) a portion of the proceeds of which will be used for the purpose of rehabilitating or repairing the related single family property;

(b) which satisfies the definition of “rehabilitation loan” under 24 C.F.R. 203.50(a); and

(c) the payment of which is insured by the FHA under the National Housing Act or with respect to which a commitment for such insurance has been issued by the FHA.

“FHA Act” shall mean the Federal Housing Administration Act.

“FHA Loan” shall mean a Loan that is eligible to be the subject of an FHA Mortgage Insurance Contract.

“FHA Mortgage Insurance” shall mean mortgage insurance authorized under Sections 203(b), 213, 221(d), 222, and 235 of the FHA Act and provided by the FHA.

“FHA Mortgage Insurance Contract” shall mean the contractual obligation of the FHA to insure a Loan.

“FHA Regulations” shall mean regulations promulgated by HUD under the Federal Housing Administration Act, codified in 24 Code of Federal Regulations, and other HUD issuances relating to FHA Loans, including the related handbooks, circulars, notices and mortgagee letters.

“Final Repurchase Date” shall mean any Repurchase Date on which the applicable Purchased Asset does not become subject to a Rollover Transaction.

“First Lien” shall mean with respect to each Mortgaged Property, the lien of the mortgage, deed of trust or other instrument securing a mortgage note which creates a first lien on the Mortgaged Property.

“Floor” shall have the meaning assigned thereto in the Pricing Side Letter.

“Foreign Buyer” shall have the meaning set forth in Section 5(c) hereof.

“Foreign National” shall mean any Mortgagor who is not (i) formed, organized or incorporated in, or a citizen of, the United States of America, (ii) a resident alien of the United States of America or (iii) a non-resident alien of the United States of America.

“Freddie Mac” shall mean the Federal Home Loan Mortgage Corporation, and its successors in interest.

“Freddie Mac Guide” means the Freddie Mac Sellers’ and Servicers’ Guide, as such guide may hereafter from time to time be amended.

“Freddie Mac Mortgage Loan” shall mean an Eligible Loan that is in compliance on the related Purchase Date with the eligibility requirements specified for the applicable Freddie Mac Program described in the Freddie Mac Guide.

“Freddie Mac Program” shall mean the Freddie Mac Home Mortgage Guarantor Program or the Freddie Mac FHA/VA Home Mortgage Guarantor Program, as described in the Freddie Mac Guide.

“GAAP” shall mean generally accepted accounting principles in effect from time to time in the United States of America.

“Ginnie Mae” shall mean the Government National Mortgage Association and its successors in interest, a wholly-owned corporate instrumentality of the government of the United States of America.

“Ginnie Mae Guide” shall mean the Ginnie Mae Mortgage-Backed Securities Guide, as such guide may hereafter from time to time be amended.

“Ginnie Mae Mortgage Loan” shall mean an Eligible Loan that is in compliance on the related Purchase Date with the eligibility requirements specified for the applicable Ginnie Mae Program in the applicable Ginnie Mae Guide.

“Ginnie Mae Program” shall mean the Ginnie Mae Mortgage-Backed Securities Programs, as described in the Ginnie Mae Guide.

“Ginnie Mae Security” means a modified pass-through mortgage-backed certificate guaranteed by Ginnie Mae, evidenced by a book-entry account in a depository institution having book-entry accounts at the Federal Reserve Bank of New York and backed by a pool of Ginnie Mae Mortgage Loans, in substantially the principal amount and with substantially the other terms as specified with respect to such Ginnie Mae Security in the related Takeout Commitment.

“Governmental Authority” shall mean with respect to any Person, any nation or government, any state or other political subdivision, agency or instrumentality thereof, any entity exercising executive, legislative, judicial, regulatory or administrative functions of or pertaining to government and any court or arbitrator having jurisdiction over the parties.

“Guarantee” shall mean, as to any Person, any obligation of such Person directly or indirectly guaranteeing any Indebtedness of any other Person or in any manner providing for the payment of any Indebtedness of any other Person or otherwise protecting the holder of such Indebtedness against loss (whether by virtue of partnership arrangements, by agreement to keep-well, to purchase assets, goods, securities or services, or to take-or-pay or otherwise), provided that the term “Guarantee” shall not include (i) endorsements for collection or deposit in the ordinary course of business, or (ii) obligations to make servicing advances for delinquent taxes and insurance, or other obligations in respect of a Mortgaged Property. The amount of any Guarantee of a Person shall be deemed to be the amount of the corresponding liability shown on such Person’s consolidated balance sheet calculated in accordance with GAAP as determined by such Person in good faith. The terms “Guarantee” and “Guaranteed” used as verbs shall have correlative meanings.

“H.15 (519)” means the weekly statistical release designated as such at http://www.federalreserve.gov/releases/h15/update/default.htm, or any successor publication, published by the Board of Governors of the Federal Reserve System.

“HARP Loan” shall mean a Loan that is eligible (including pursuant to exceptions or variances provided to Seller) for sale to, or securitization by, Fannie Mae or Freddie Mac that are (a) refinance mortgage loans originated pursuant to Fannie Mae’s Home Affordable Refinance Program as announced in Fannie Mae Announcement SEL-2011-12, as set forth in subsequent Announcements, FAQs, Selling Guide updates and Servicing Guide updates issued by Fannie Mae in connection with such program (“HARP 2.0”), or (b) refinance mortgage loans originated pursuant to HARP 2.0 as it applies to the Refi Plus option applicable to “same servicers”, as amended by the applicable variances delivered by Fannie Mae to Rocket Mortgage or (c) refinance mortgage loans originated pursuant to Freddie Mac’s Home Affordable Refinance Program (as such program is amended, supplemented or otherwise modified, from time to time) and referred to by Freddie Mac as a “Relief Refinance Mortgage”.

“Hash Value” shall mean with respect to an eNote, the unique, tamper-evident digital signature of such eNote that is stored with MERS.

“Hedging Arrangement” means any forward sales contract, forward trade contract, interest rate swap agreement, interest rate cap agreement or other contract pursuant to which Seller has protected itself from the consequences of a loss in the value of a Loan or its portfolio of Loans because of changes in interest rates or in the market value of mortgage loan assets.

“High Cost Loan” shall mean a Loan (a) classified as a “high cost” loan under the Home Ownership and Equity Protection Act of 1994; (b) classified as a “high cost,” “threshold,” “covered,” or “predatory” loan under any other applicable state, federal or local law (or a similarly classified loan using different terminology under a law, regulation or ordinance imposing heightened regulatory scrutiny or additional legal liability for residential mortgage loans having high interest rates, points and/or fees); or (c) having a percentage listed under the Indicative Loss Severity Column (the column that appears in the S&P Anti-Predatory Lending Law Update Table, included in the then-current S&P’s LEVELS® Glossary of Terms on Appendix E).

“HUD” shall mean the Department of Housing and Urban Development, or any federal agency or official thereof which may from time to time succeed to the functions thereof with regard to FHA Mortgage Insurance. The term “HUD,” for purposes of this Agreement, is also deemed to include subdivisions thereof such as the FHA and Ginnie Mae.

“IBA” shall mean the ICE Benchmark Administration.

“Income” shall mean, with respect to any Purchased Asset at any time until such Loan is repurchased by Seller in accordance with the terms of this Agreement, any principal and/or interest thereon and all dividends, sale proceeds (including, without limitation, any proceeds from the liquidation or securitization of such Purchased Asset or other disposition thereof) and other collections and distributions thereon (including, without limitation, any proceeds received in respect of mortgage insurance), but not including any commitment fees, origination fees and/or servicing fees accrued in respect of periods on or after the initial Purchase Date with respect to such Purchased Asset.

“Incremental Purchase Price” has the meaning assigned thereto in Section 3(i) hereof.

“Incremental Purchase Price Request” has the meaning assigned thereto in Section 3(i) hereof.

“Indebtedness” shall mean, for any Person: (a) obligations created, issued or incurred by such Person for borrowed money (whether by loan, the issuance and sale of debt securities or the sale of Property to another Person subject to an understanding or agreement, contingent or otherwise, to repurchase such Property from such Person); (b) obligations of such Person to pay the deferred purchase or acquisition price of Property or services, other than trade accounts payable (other than for borrowed money) arising, and accrued expenses incurred, in the ordinary course of business; (c) indebtedness of others secured by a Lien on the Property of such Person, whether or not the respective indebtedness so secured has been assumed by such Person; (d) obligations (contingent or otherwise) of such Person in respect of letters of credit or similar instruments issued or accepted by banks and other financial institutions for account of such Person; (e) Capital Lease Obligations of such Person; (f) obligations of such Person under repurchase agreements or like arrangements; (g) indebtedness of others Guaranteed by such Person; (h) all obligations of such Person incurred in connection with the acquisition or carrying of fixed assets by such Person; (i) indebtedness of general partnerships of which such Person is a general partner; and (j) any other indebtedness of such Person evidenced by a note, bond, debenture or similar instrument, provided that, for purposes of this definition, the following shall not be included as “Indebtedness”: loan loss reserves, deferred taxes arising from capitalized excess service fees, operating leases, liabilities associated with Seller’s or its Subsidiaries’ securitized Home Equity Conversion Mortgage (HECM) loan inventory where such securitization does not meet the GAAP criteria for sale treatment, obligations under Hedging Arrangements, obligations related to treasury management, brokerage or trading-related arrangements, or transactions for the sale and/or repurchase of Loans, or transactions related to the financing of recoverable servicing advances.

“Indemnified Party” shall have the meaning provided in Section 23(a) hereof.

“Instruction Letter” shall mean a letter agreement between the Seller and each Subservicer substantially in the form of Exhibit B attached hereto.

“Insured Closing Letter” shall mean, with respect to any Wet-Ink Loan that becomes subject to a Transaction, a letter of indemnification (which may be in the form of an insured closing letter, closing protection letter, or similar authorization letter) from an Approved Title Insurance Company, in any jurisdiction where such letters are permitted under applicable law and regulation, addressed to Seller or other applicable Qualified Originator, which is fully assignable to Buyer, with coverage that is customarily acceptable to Persons engaged in the origination of mortgage loans, identifying the Settlement Agent covered thereby, which may be in the form of a blanket letter.

“Intercreditor Agreement” shall mean that certain Intercreditor Agreement, dated as of April 4, 2012, by and among the Buyer, the Seller, One Reverse Mortgage, LLC, Credit Suisse First Boston Mortgage Capital LLC, UBS AG by and through its branch office at 1285 Avenue of the Americas, New York, New York, JP Morgan Chase Bank, National Association, Royal Bank of Canada, Bank of America, N.A., Citibank N.A., Morgan Stanley Bank, N.A., Jefferies Funding LLC, and Morgan Stanley Mortgage Capital Holdings LLC, as amended, restated, modified or supplemented and as the same shall be further amended, restated, supplemented or otherwise modified and in effect from time to time, and, as the context requires, the Joint Account Control Agreement and the Joint Securities Account Control Agreement.

“Interest Period” shall mean (a) for the purpose of the calculation of the first Price Differential Payment Amount, the period commencing on the Closing Date and ending on the last calendar day of the month in which the Closing Date occurs and (b) for the purpose of the calculation of each subsequent Price Differential Payment Amount, the period commencing on the first calendar day of the month immediately preceding such date and ending on the last calendar day of the month immediately preceding such date.

“Investment Company Act” shall mean the Investment Company Act of 1940, as amended, including all rules and regulations promulgated thereunder.

“IRS” shall have the meaning set forth in Section 5(c) hereof.

“Joint Account Control Agreement” shall mean the Joint Account Control Agreement, dated as of April 4, 2012, among the Buyer, the Seller, One Reverse Mortgage, LLC, Credit Suisse First Boston Mortgage Capital LLC, UBS AG by and through its branch office at 1285 Avenue of the Americas, New York, New York, JP Morgan Chase Bank, National Association, Royal Bank of Canada, Bank of America, N.A., Citibank N.A., Morgan Stanley Bank, N.A., Morgan Stanley Mortgage Capital Holdings LLC, Jefferies Funding LLC, and Deutsche Bank National Trust Company, as paying agent, as amended, restated, modified or supplemented and as the same shall be further amended, restated, supplemented or otherwise modified and in effect from time to time.

“Joint Securities Account Control Agreement” shall mean the Joint Securities Account Control Agreement, dated as of April 4, 2012, among the Buyer, the Seller, Credit Suisse First Boston Mortgage Capital LLC, UBS AG, by and through its branch office at 1285 Avenue of the Americas, New York, New York, JPMorgan Chase Bank, National Association, Royal Bank of Canada, Bank of America, N.A., Morgan Stanley Bank, N.A., Morgan Stanley Mortgage Capital Holdings LLC, Jefferies Funding LLC, One Reverse Mortgage, LLC, Citibank N.A., and Deutsche Bank National Trust Company, as securities intermediary, as amended, restated, modified or supplemented and as the same shall be further amended, restated, supplemented or otherwise modified and in effect from time to time.

“Jumbo Loan” shall mean an Eligible Loan that (i) has an original principal balance which exceeds Agency Guidelines for maximum general conventional loan amount, (ii) conforms with all requirements of the Underwriting Guidelines and (iii) has the benefit of the safe harbor from liability under the ATR Rules or a rebuttable presumption for such liability.

“Jumbo Loan Underwriting Guidelines” shall mean the written underwriting guidelines of Seller that govern the underwriting and program operations of each Jumbo Loan, which underwriting guidelines have been provided to Buyer and approved by Buyer prior to the applicable Purchase Date of any related Jumbo Loan, and any supplement, overlay, amendment or modification to such approved underwriting guidelines that have been approved by Buyer prior to the applicable Purchase Date of any related Jumbo Loan.

“Lien” shall mean any mortgage, lien, pledge, charge, security interest or similar encumbrance.

“Loan” shall mean a First Lien or Second Lien mortgage loan together with the Servicing Rights thereon, which the Custodian has been instructed to hold the related Mortgage File for Buyer pursuant to the Custodial and Disbursement Agreement, and which Loan includes, without limitation, (i) a Note, the related Mortgage and all other Loan Documents and (ii) all right, title and interest of the Seller in and to the Mortgaged Property covered by such Mortgage.

“Loan Documents” shall mean, with respect to a Loan, the documents comprising the Mortgage File for such Loan, including any Cooperative Loan Documents.

“Loan Schedule” shall mean a list in electronic format setting forth as to each Eligible Loan the fields mutually agreed to by Buyer and Seller, any other information reasonably required by Buyer and any other additional applicable information to be provided in the Loan Schedule pursuant to the Custodial and Disbursement Agreement.

“Loan-to-Value Ratio” or “LTV” shall mean with respect to any Loan, the ratio of the outstanding principal amount of such Loan at the time of origination to the Appraised Value of the related Mortgaged Property at origination of such Loan.

“Location” shall mean with respect to an eNote, the location of such eNote which is established by reference to the MERS eRegistry.

“Margin Call” shall have the meaning assigned thereto in Section 6(a) hereof.

“Margin Deficit” shall have the meaning assigned thereto in Section 6(a) hereof.

“Market Value” shall mean, with respect to any Purchased Asset as of any date of determination, the whole loan servicing released fair market value of such Purchased Asset on such date as determined in good faith by Buyer in its sole discretion, based on the pricing that Buyer (or an Affiliate thereof) uses for comparable mortgage loans and comparable mortgage loan sellers, taking into account such factors as Buyer deems appropriate, including, without limitation, the fair market value of any Agency Eligible Loans that may be sold in their entirety to an Agency or to other purchaser of Agency Eligible Loans under circumstances in which a seller is in default under the similar warehouse facilities and other available objective indications of value to the extent deemed by Buyer to be reliable and applicable to the related Purchased Asset and the Seller. Buyer’s good faith determination of Market Value will be conclusive and binding on the parties absent manifest error.

“Master Netting Agreement” means that certain Amended and Restated Global Netting and Security Agreement, dated as of July 21, 2023, among Buyer, Seller and certain Affiliates and Subsidiaries of Buyer, as the same shall be amended, supplemented or otherwise modified from time to time.

“Master Servicer Field” means, with respect to an eNote, the field entitled, “Master Servicer” in the MERS eRegistry.

“Material Adverse Effect” shall mean a material adverse change in Seller’s consolidated financial condition or business operations or Property, or other event which adversely affects the Seller’s ability to perform under the Program Documents to which it is a party or satisfy, in all material respects, its obligations, representations, warranties and covenants under the Program Documents to which it is a party, taken as a whole.

“Maturity Date” shall have the meaning assigned to such term in the Pricing Side Letter.

“Maximum Age Since Origination” shall have the meaning assigned thereto in the Pricing Side Letter.

“Maximum Aggregate Purchase Price” shall have the meaning assigned thereto in the Pricing Side Letter.

“Maximum Leverage Ratio” shall have the meaning assigned thereto in the Pricing Side Letter.

“MERS” shall mean Mortgage Electronic Registration Systems, Inc., a Delaware corporation, or any successor in interest thereto.

“MERS eDelivery” shall mean the transmission system operated by the Electronic Agent that is used to deliver eNotes, other Electronic Records and data from one MERS eRegistry member to another using a system-to-system interface and conforming to the standards of the MERS eRegistry.

“MERS eRegistry” shall mean the electronic registry operated by the Electronic Agent that acts as the legal system of record that identifies the Controller, Delegatee and Location of the Authoritative Copy of registered eNotes.

“MERS Identification Number” shall mean the number permanently assigned to each MERS Loan.

“MERS Loan” shall mean any Loan as to which the related Mortgage or Assignment of Mortgage has been recorded in the name of MERS, as agent for the holder from time to time of the Note.

“MERS System” shall mean the mortgage electronic registry system operated by the Electronic Agent that tracks changes in Mortgage ownership, mortgage servicers and servicing rights ownership.

“Minimum Adjusted Tangible Net Worth” shall have the meaning assigned to such term in the Pricing Side Letter.

“Minimum Liquidity Amount” shall have the meaning assigned to such term in the Pricing Side Letter.

“Modified Loan” shall mean an Eligible Loan that (a) is insured by the FHA or the RHS or guaranteed by the VA, (b) (1) was purchased out of a Ginnie Mae Security or from a third-party whole loan investor solely as a result of modifications to such Eligible Loan, or (2) was purchased out of a Ginnie Mae Security or from a third-party whole loan investor as a result of delinquent mortgage payments, but, without any loan modifications, subsequently became reperforming and (c) is a Ginnie Mae Mortgage Loan.

“Monthly Payment” shall mean the scheduled monthly payment of principal and interest on a Loan as adjusted in accordance with changes in the Mortgage Interest Rate pursuant to the provisions of the Note for an Adjustable Rate Loan.

“Moody’s” shall mean Moody’s Investors Service, Inc. or its successors in interest.

“Mortgage” shall mean with respect to a Loan, the mortgage, deed of trust or other instrument, which creates a First Lien or Second Lien, as applicable, on the fee simple or leasehold estate in such real property, which secures the Note.

“Mortgage File” shall have the meaning assigned thereto in the Custodial and Disbursement Agreement.

“Mortgage Interest Rate” shall mean the annual rate of interest borne on a Note, which shall be adjusted from time to time with respect to Adjustable Rate Loans.

“Mortgaged Property” shall mean the real property (including all improvements, buildings and fixtures thereon and all additions, alterations and replacements made at any time with respect to the foregoing) securing repayment of the debt evidenced by a Note or, in the case of any Cooperative Loan, the Cooperative Shares and the Proprietary Lease.

“Mortgagee” shall mean the record holder of a Note secured by a Mortgage.

“Mortgagor” shall mean the obligor or obligors on a Note, including any person who has assumed or guaranteed the obligations of the obligor thereunder.

“MSFTA” means that certain Master Securities Forward Transaction Agreement, dated as of October 14, 2011, by and between Barclays Capital Inc. and the Seller, as further amended by that certain Form of Amendment to Master Securities Forward Transaction Agreement to Conform with FINRA 4210, dated as of January 29, 2018, as such agreement may be amended, modified or supplemented from time to time.

“MRA Minimum Transfer Amount” shall have the meaning assigned thereto in Section 6(b) hereof.

“Net Forward Delivery Amount” has the meaning assigned thereto in the MSFTA.

“Net Forward Return Amount” has the meaning assigned thereto in the MSFTA.

“Net Income” shall mean, for any period, the net income of the applicable Person for such period as determined in accordance with GAAP.

“Note” shall mean, with respect to any Loan, the related promissory note, together with all riders thereto and amendments thereof or other evidence of such indebtedness of the related Mortgagor. For the avoidance of doubt, with respect to any Loan which is a CEMA Loan, the “Note” with respect to such Loan shall be the CEMA Consolidated Note.

“Obligations” shall mean (a) the Seller’s obligation to pay the Repurchase Price on the Repurchase Date and other obligations and liabilities of the Seller to Buyer, its Affiliates, or the Custodian arising under, or in connection with, the Program Documents, whether now existing or hereafter arising; (b) any and all sums paid by Buyer or on behalf of Buyer pursuant to the Program Documents in order to preserve any Purchased Asset or its interest therein; (c) in the event of any proceeding for the collection or enforcement of the Seller’s indebtedness, obligations or liabilities referred to in clause (a), the reasonable out-of-pocket expenses of retaking, holding, collecting, preparing for sale, selling or otherwise disposing of or realizing on any Purchased Asset, or of any exercise by Buyer or any Affiliate of Buyer of its rights under the Program Documents, including without limitation, reasonable attorneys’ fees and disbursements and court costs; and (d) the Seller’s indemnity obligations to Buyer pursuant to the Program Documents.

“OFAC” shall have the meaning provided in Section 13(dd) hereof.

“Other Taxes” shall mean any and all present or future stamp, court or documentary, intangible, recording, filing or similar Taxes or any excise, sales, goods and services or transfer taxes, charges or similar levies arising from any payment made hereunder or from the execution, delivery, performance, assignment, enforcement or registration of, from the receipt or perfection of a security interest under, or otherwise with respect to, any Program Document.

“Outstanding Purchase Price” means, for any Purchased Asset, as of any date of determination, the Purchase Price thereof, as reduced by any amount thereof repaid to the Purchaser pursuant to the terms of the Agreement and as increased by any Incremental Purchase Price related to such Purchased Asset.

“Parent Company” means a corporation or other entity owning at least 50% of the outstanding shares of voting stock of Seller.

“Person” shall mean any individual, corporation, company, voluntary association, partnership, joint venture, limited liability company, trust, unincorporated association or government (or any agency, instrumentality or political subdivision thereof).

“Plan” shall mean any “employee pension benefit plan” (as such term is defined in Section 3(2) of ERISA), including any single-employer plan or multiemployer plan (as such terms are defined in Section 400(a)(15) and in Section 4001(a)(3) of ERISA, respectively), that is subject to Title IV of ERISA or Section 412 of the Code.

“PMI Policy” or “Primary Insurance Policy” shall mean a policy of primary mortgage guaranty insurance issued by a Qualified Insurer.

“Post-Default Rate” shall mean, in respect of the Repurchase Price for any Transaction or any other amount under this Agreement, or any other Program Document that is not paid when due to Buyer (whether at stated maturity, by acceleration or mandatory prepayment or otherwise), a rate per annum during the period from and including the due date to but excluding the date on which such amount is paid in full equal to [***], plus the Pricing Rate otherwise applicable to such Loan.

“Price Differential” shall mean, with respect to each Transaction as of any date of determination, the aggregate amount obtained by daily application of the Pricing Rate (or during the continuation of an Event of Default, by daily application of the Post-Default Rate) for such Transaction to the Purchase Price for such Transaction on a 360-day-per-year basis for the actual number of days elapsed during the period commencing on (and including) the Purchase Date and ending on (but excluding) the date of determination (reduced by any amount of such Price Differential in respect of such period previously paid by the Seller to Buyer with respect to such Transaction).

“Price Differential Payment Amount” shall have the meaning provided in Section 4(c) hereof.

“Pricing Rate” shall, as of any date of determination, be an amount equal to the sum of (i) the greater of (a) the Benchmark and (b) the Floor plus (ii) the Applicable Margin. The Pricing Rate is calculated on the basis of a 360-day year and the actual number of days elapsed between the Purchase Date and the Repurchase Date.

“Pricing Side Letter” shall mean the most recently executed pricing side letter, between the Seller and Buyer referencing this Agreement and setting forth the pricing terms and certain additional terms with respect to this Agreement, as the same may be amended, restated, supplemented or otherwise modified from time to time, and the terms of which are incorporated herein as if fully set forth.

“Program Documents” shall mean this Agreement, the Custodial and Disbursement Agreement, any Servicing Agreement, the Pricing Side Letter, any Instruction Letter, the Intercreditor Agreement, the Joint Securities Account Control Agreement, the Joint Account Control Agreement, the Electronic Tracking Agreement, the Collection Account Control Agreement, the Master Netting Agreement and any other agreement entered into by the Seller, on the one hand, and Buyer and/or any of its Affiliates or Subsidiaries (or Custodian on its behalf) on the other, in connection herewith or therewith.

“Prohibited Person” shall have the meaning provided in Section 13(dd) hereof.

“Property” shall mean any right or interest in or to property of any kind whatsoever, whether real, personal or mixed and whether tangible or intangible.

“Proprietary Lease” shall mean a lease on (or occupancy agreement with respect to) a Cooperative Unit evidencing the possessory interest of the owner of the Cooperative Shares or Seller in such Cooperative Unit.

“Purchase Date” shall mean, with respect to each Transaction, the date on which Purchased Assets are sold by the Seller to Buyer hereunder.

“Purchase Price” shall mean the price at which Purchased Assets are transferred by the Seller to Buyer in a Transaction, which shall be equal to the product of (i) the Applicable Percentage and (ii) the lesser of (A) the outstanding principal amount of the related Purchased Assets and (B) the Market Value of the related Purchased Assets.

“Purchased Assets” shall mean any of the following assets sold by the Seller to Buyer in a Transaction on a servicing-released basis: the Loans purchased by Buyer on the related Purchase Date, together with the related Servicing Records, the related Servicing Rights (which were sold by the Seller and purchased by Buyer on the related Purchase Date), and with respect to each Loan, Seller’s rights under any Insured Closing Letter, such other property, rights, titles or interest as are specified on a related Transaction Notice, and all instruments, chattel paper, and general intangibles comprising or relating to all of the foregoing. The term “Purchased Assets” with respect to any Transaction at any time shall also include Substitute Assets delivered pursuant to Section 17 hereof.

“Purchased Items” shall have the meaning assigned thereto in Section 9(a) hereof.

“QM Rule” shall mean 12 CFR 1026.43(d) or (e), or any successor rule or regulation, including all applicable official staff commentary.

“Qualified Insurer” shall mean an insurance company duly qualified as such under the laws of each applicable state in which Mortgaged Property it insures is located, duly authorized and licensed in each such state to transact the applicable insurance business and to write the insurance provided, and approved as an insurer by Fannie Mae and Freddie Mac, if required, and which is approved by Buyer.

“Qualified Mortgage” shall mean a Loan that satisfies the criteria for a “qualified mortgage” as set forth in the QM Rule.

“Qualified Originator” shall mean an originator of Loans which is acceptable under the Agency Guidelines.

“Reacquired Assets” shall have the meaning assigned thereto in Section 17.

“Recognition Agreement” shall mean, with respect to a Cooperative Loan, an agreement executed by a Cooperative Corporation which, among other things, acknowledges the lien of the Mortgage on the Mortgaged Property in question.

“Records” shall mean all instruments, agreements and other books, records, and reports and data generated by other media for the storage of information maintained by the Seller or any other person or entity with respect to a Purchased Asset. Records shall include, without limitation, the Notes, any Mortgages, the Mortgage Files, the Servicing File, and any other instruments necessary to document or service a Loan that is a Purchased Asset, including, without limitation, the complete payment and modification history of each Loan that is a Purchased Asset.

“Register” shall have the meaning provided in Section 38(d) hereof.

“Related Security” shall have the meaning assigned thereto in Section 9(a) hereof.

“Relevant Governmental Body” shall mean the Federal Reserve Board and/or the Federal Reserve Bank of New York, or a committee officially endorsed or convened by the Federal Reserve Board and/or the Federal Reserve Bank of New York or any successor thereto.

“Repurchase Date” shall mean the date on which the Seller is to repurchase the Purchased Assets subject to a Transaction from Buyer which shall be the earliest of (i) the 12th day of the month following the related Purchase Date (or if such date is not a Business Day, the following Business Day), (ii) the Termination Date, (iii) the date set forth in the applicable Confirmation, (iv) any date determined by application of the provisions of Section 3(f) or Section 19, or (v) at the conclusion of the Maximum Age Since Origination for any Eligible Loan purchased hereunder.