| Delaware | 001-41406 | 47-2409192 | ||||||

| (State or Other Jurisdiction | (Commission File Number) | (IRS Employer | ||||||

| of Incorporation) | Identification No.) | |||||||

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, par value $0.01 per share | EHAB | New York Stock Exchange | ||||||

Exhibit Number |

Description | |||||||

| 104 | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document. | |||||||

| ENHABIT, INC. | ||||||||

| By: | /s/ Dylan Black | |||||||

| Name: | Dylan Black | |||||||

| Title: | General Counsel | |||||||

| ($ in millions, except per share data) | Q4 | '24 vs. '23 | ||||||||||||||||||

| 2024 | 2023 | |||||||||||||||||||

| Home health net service revenue | $200.4 | $209.5 | (4.3)% | |||||||||||||||||

| Hospice net service revenue | 57.8 | 51.1 | 13.1% | |||||||||||||||||

| Total net service revenue | $258.2 | $260.6 | (0.9)% | |||||||||||||||||

| % of revenue | % of revenue | |||||||||||||||||||

| Cost of service | 51.5% | $133.1 | 51.2% | $133.5 | (0.3)% | |||||||||||||||

| Gross margin | 48.5% | 125.1 | 48.8% | 127.1 | (1.6)% | |||||||||||||||

| General and administrative expenses | 38.7% | 99.8 | 38.9% | 101.4 | (1.6)% | |||||||||||||||

| Total operating expenses | 90.2% | $232.9 | 90.1% | $234.9 | (0.9)% | |||||||||||||||

| Net income attributable to noncontrolling interests | $0.2 | $0.5 | ||||||||||||||||||

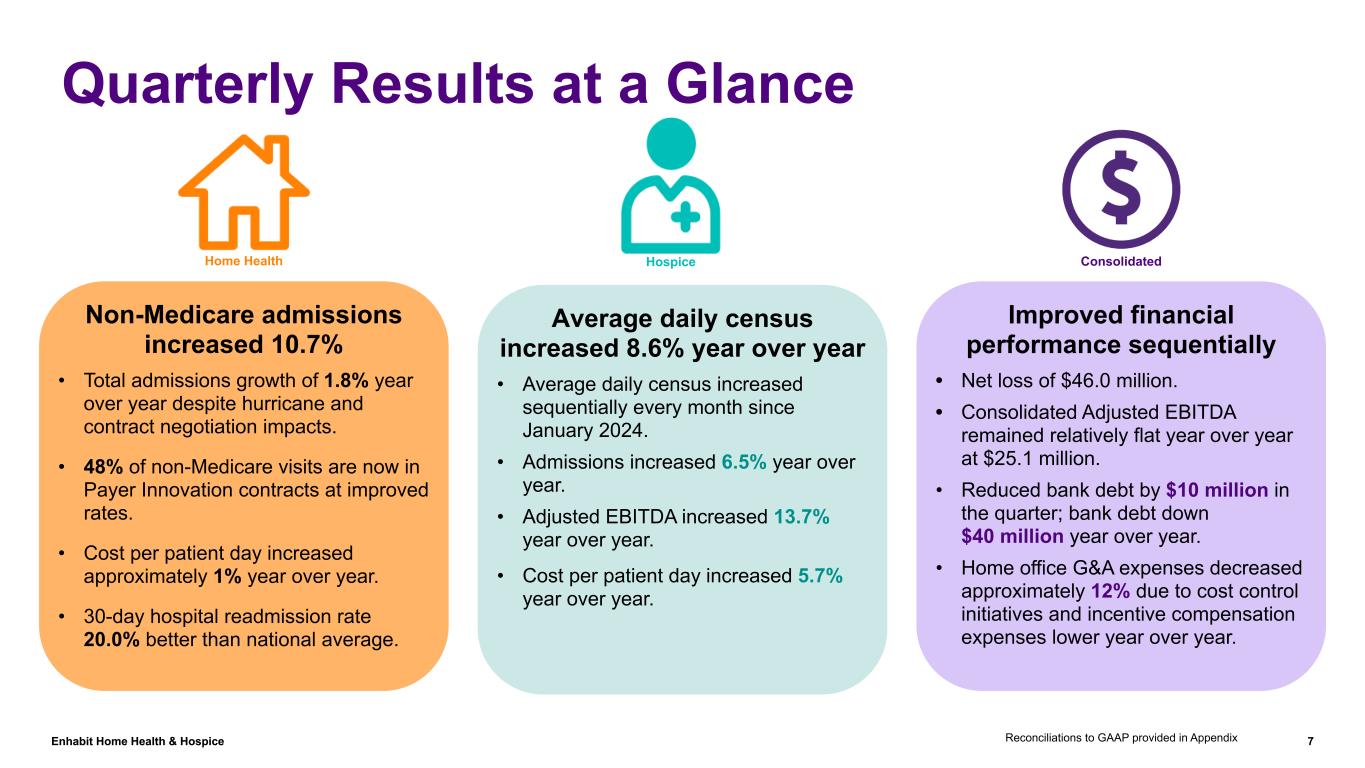

| Adjusted EBITDA | $25.1 | $25.2 | (0.4)% | |||||||||||||||||

| Adjusted EBITDA margin | 9.7% | 9.7% | ||||||||||||||||||

| Impairment of goodwill | $53.8 | $— | N/A | |||||||||||||||||

| Net loss attributable to Enhabit, Inc. | $(46.0) | $(6.4) | (618.8)% | |||||||||||||||||

| Reported diluted EPS | $(0.92) | $(0.13) | (618.8)% | |||||||||||||||||

| Adjusted diluted EPS | $0.04 | $0.06 | (33.3)% | |||||||||||||||||

| ($ in millions) | Q4 | '24 vs. '23 | |||||||||

| 2024 | 2023 | ||||||||||

| Net service revenue: | |||||||||||

| Medicare | $117.3 | $130.9 | (10.4) | % | |||||||

| Non-Medicare | 80.8 | 76.8 | 5.2 | % | |||||||

Private duty(1) |

2.3 | 1.8 | 27.8 | % | |||||||

| Home health net service revenue | 200.4 | 209.5 | (4.3) | % | |||||||

| Cost of service | 105.5 | 109.4 | (3.6) | % | |||||||

| Gross margin | 47.4 | % | 47.8 | % | |||||||

| General and administrative expenses | 59.1 | 59.3 | (0.3) | % | |||||||

| Net income attributable to noncontrolling interests | 0.3 | 0.5 | (40.0) | % | |||||||

| Adjusted EBITDA | $35.5 | $40.3 | (11.9) | % | |||||||

| % Adj. EBITDA margin | 17.7 | % | 19.2 | % | |||||||

| Operational metrics (actual amounts) | |||||||||||

| Medicare: | |||||||||||

| Admissions | 23,121 | 25,090 | (7.8) | % | |||||||

| Recertifications | 16,300 | 18,970 | (14.1) | % | |||||||

| Completed episodes | 39,104 | 44,305 | (11.7) | % | |||||||

| Average daily census | 19,818 | 22,416 | (11.6) | % | |||||||

| Visits | 560,002 | 639,744 | (12.5) | % | |||||||

| Visits per episode | 14.3 | 14.4 | (0.7) | % | |||||||

| Revenue per episode | $3,000 | $2,955 | 1.5 | % | |||||||

| Non-Medicare: | |||||||||||

| Admissions | 29,810 | 26,917 | 10.7 | % | |||||||

| Recertifications | 13,541 | 13,058 | 3.7 | % | |||||||

| Average daily census | 19,968 | 19,222 | 3.9 | % | |||||||

| Visits | 533,618 | 522,641 | 2.1 | % | |||||||

| Total: | |||||||||||

| Admissions | 52,931 | 52,007 | 1.8 | % | |||||||

| Same-store total admissions growth | 1.7 | % | |||||||||

| Recertifications | 29,841 | 32,028 | (6.8) | % | |||||||

| Same-store total recertifications growth | (6.9) | % | |||||||||

| Average daily census | 39,786 | 41,638 | (4.4) | % | |||||||

| Visits | 1,093,620 | 1,162,385 | (5.9) | % | |||||||

| Visits per episode | 13.9 | 14.3 | (2.8) | % | |||||||

| Cost per visit | $95 | $92 | 3.3 | % | |||||||

| Revenue per patient day | $54.7 | $54.7 | 0.1 | % | |||||||

| Cost per patient day | $28.8 | $28.6 | 0.9 | % | |||||||

| (1) Private duty represents long-term comprehensive hourly nursing medical care. | |||||||||||

| ($ in millions) | Q4 | '24 vs. '23 | ||||||||||||

| 2024 | 2023 | |||||||||||||

| Net service revenue | $ | 57.8 | $ | 51.1 | 13.1% | |||||||||

| Cost of service | 27.6 | 24.0 | 15.0% | |||||||||||

| Gross margin | 52.2% | 53.0% | ||||||||||||

| General and administrative expenses | $ | 17.0 | $ | 15.4 | 10.4% | |||||||||

| Net income attributable to noncontrolling interests | $ | (0.1) | $ | — | ||||||||||

| Adjusted EBITDA | $ | 13.3 | $ | 11.7 | 13.7% | |||||||||

| % Adj. EBITDA margin | 23.0% | 22.9% | ||||||||||||

| Operational metrics (actual amounts) | ||||||||||||||

| Total admissions | 3,059 | 2,872 | 6.5% | |||||||||||

| Same-store total admissions growth | 4.4% | |||||||||||||

| Patient days | 343,063 | 315,870 | 8.6% | |||||||||||

| Discharged average length of stay | 110 | 102 | 7.8% | |||||||||||

| Average daily census | 3,729 | 3,433 | 8.6% | |||||||||||

| Revenue per patient day | $ | 168.6 | $ | 161.8 | 4.2% | |||||||||

| Cost per patient day | $ | 80.4 | $ | 76.1 | 5.7% | |||||||||

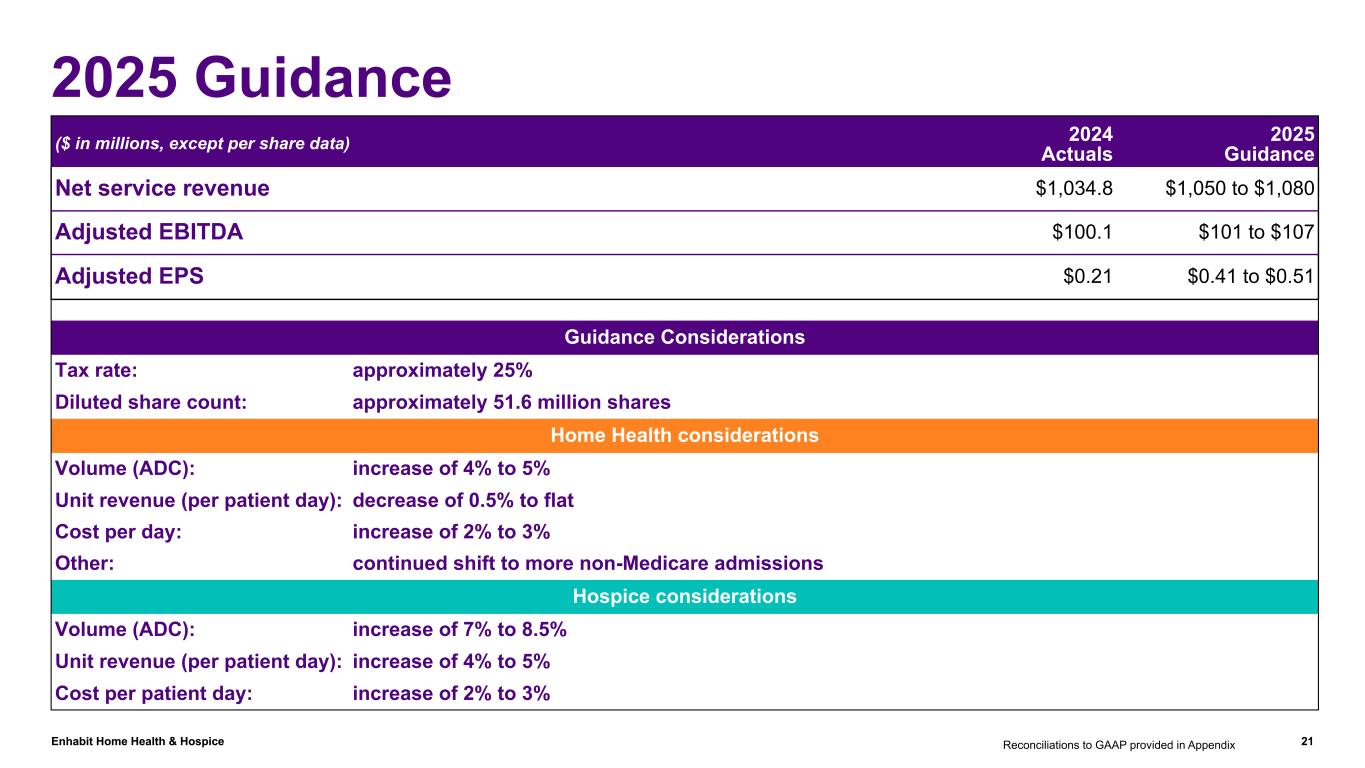

| Full-year 2025 | Guidance | |||||||

| Net service revenue | between $1,050 to $1,080 million |

|||||||

| Adjusted EBITDA | between $101 to $107 million |

|||||||

| Adjusted EPS | between $0.41 to $0.51 |

|||||||

| Three Months Ended December 31, | Year Ended December 31, |

||||||||||||||||||||||

| (in millions, except per share data) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net service revenue | $ | 258.2 | $ | 260.6 | $ | 1,034.8 | $ | 1,046.3 | |||||||||||||||

| Cost of service, excluding depreciation and amortization | 133.1 | 133.5 | 530.8 | 535.6 | |||||||||||||||||||

| General and administrative expenses | 104.6 | 114.5 | 425.9 | 441.6 | |||||||||||||||||||

| Depreciation and amortization | 7.9 | 7.7 | 31.5 | 30.9 | |||||||||||||||||||

| Impairment of goodwill | 53.8 | — | 161.7 | 85.8 | |||||||||||||||||||

| Operating (loss) income | (41.2) | 4.9 | (115.1) | (47.6) | |||||||||||||||||||

| Interest expense and amortization of debt discounts and fees | 10.1 | 12.3 | 42.9 | 43.0 | |||||||||||||||||||

| Other income | — | — | — | (0.2) | |||||||||||||||||||

| Loss before income taxes and noncontrolling interests | (51.3) | (7.4) | (158.0) | (90.4) | |||||||||||||||||||

| Benefit from income taxes | (5.5) | (1.5) | (4.0) | (11.4) | |||||||||||||||||||

| Net loss | (45.8) | (5.9) | (154.0) | (79.0) | |||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 0.2 | 0.5 | 2.2 | 1.5 | |||||||||||||||||||

| Net loss attributable to Enhabit, Inc. | $ | (46.0) | $ | (6.4) | $ | (156.2) | $ | (80.5) | |||||||||||||||

| Weighted average common shares outstanding: | |||||||||||||||||||||||

| Basic | 50.2 | 50.0 | 50.2 | 49.9 | |||||||||||||||||||

| Diluted | 50.2 | 50.0 | 50.2 | 49.9 | |||||||||||||||||||

| Loss per common share: | |||||||||||||||||||||||

| Basic loss per share attributable to Enhabit, Inc. common stockholders | $ | (0.92) | $ | (0.13) | $ | (3.11) | $ | (1.61) | |||||||||||||||

| Diluted loss per share attributable to Enhabit, Inc. common stockholders | $ | (0.92) | $ | (0.13) | $ | (3.11) | $ | (1.61) | |||||||||||||||

| (in millions) | December 31, 2024 |

December 31, 2023 |

|||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 28.4 | $ | 27.4 | |||||||

| Restricted cash | 1.9 | 2.4 | |||||||||

| Accounts receivable, net of allowances | 149.2 | 164.7 | |||||||||

| Prepaid expenses and other current assets | 13.2 | 15.6 | |||||||||

| Total current assets | 192.7 | 210.1 | |||||||||

| Property and equipment, net | 17.7 | 19.0 | |||||||||

| Operating lease right-of-use assets | 52.8 | 57.5 | |||||||||

| Goodwill | 900.0 | 1,061.7 | |||||||||

| Intangible assets, net | 58.1 | 80.0 | |||||||||

| Other long-term assets | 4.7 | 5.3 | |||||||||

| Total assets | $ | 1,226.0 | $ | 1,433.6 | |||||||

| Liabilities and Stockholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Current portion of long-term debt | $ | 22.8 | $ | 22.5 | |||||||

| Current portion of operating lease liabilities | 12.3 | 11.8 | |||||||||

| Accounts payable | 6.7 | 7.6 | |||||||||

| Accrued payroll | 37.1 | 38.5 | |||||||||

| Refunds due patients and other third-party payers | 5.4 | 8.2 | |||||||||

| Accrued medical insurance | 5.5 | 8.4 | |||||||||

| Other current liabilities | 36.4 | 40.7 | |||||||||

| Total current liabilities | 126.2 | 137.7 | |||||||||

| Long-term debt, net of current portion | 492.6 | 530.1 | |||||||||

| Long-term operating lease liabilities, net of current portion | 41.8 | 45.7 | |||||||||

| Deferred income tax liabilities | 11.5 | 17.1 | |||||||||

| Other long-term liabilities | — | 1.3 | |||||||||

| Total liabilities | 672.1 | 731.9 | |||||||||

| Redeemable noncontrolling interests | 5.0 | 5.0 | |||||||||

| Stockholders’ equity: | |||||||||||

| Total Enhabit, Inc. stockholders’ equity | 523.5 | 669.7 | |||||||||

| Noncontrolling interests | 25.4 | 27.0 | |||||||||

| Total stockholders’ equity | 548.9 | 696.7 | |||||||||

| Total liabilities and stockholders’ equity | $ | 1,226.0 | $ | 1,433.6 | |||||||

| Year Ended December 31, |

|||||||||||

| (in millions) | 2024 | 2023 | |||||||||

| Cash flows from operating activities: | |||||||||||

| Net loss | $ | (154.0) | $ | (79.0) | |||||||

| Adjustments to reconcile net loss to net cash provided by operating activities— | |||||||||||

| Depreciation and amortization | 31.5 | 30.9 | |||||||||

| Amortization of debt related costs | 1.5 | 2.1 | |||||||||

| Impairment of goodwill | 161.7 | 85.8 | |||||||||

| Stock-based compensation | 11.7 | 8.9 | |||||||||

Deferred income taxes |

(5.7) | (11.6) | |||||||||

| Other, net | (0.6) | (0.4) | |||||||||

| Changes in assets and liabilities, net of acquisitions — | |||||||||||

| Accounts receivable, net of allowances | 15.5 | (14.6) | |||||||||

| Prepaid expenses and other assets | 3.1 | 19.1 | |||||||||

| Accounts payable | (1.0) | 3.8 | |||||||||

| Accrued payroll | (2.3) | 3.0 | |||||||||

| Other liabilities | (10.2) | 0.4 | |||||||||

| Net cash provided by operating activities | 51.2 | 48.4 | |||||||||

| Cash flows from investing activities: | |||||||||||

| Acquisition of businesses, net of cash acquired | — | (2.8) | |||||||||

| Purchases of property and equipment, including capitalized software costs | (3.8) | (3.5) | |||||||||

| Other | 1.4 | 1.0 | |||||||||

| Net cash used in investing activities | (2.4) | (5.3) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Principal payments on debt | (20.0) | (20.0) | |||||||||

| Payments on revolving credit facility | (20.0) | (10.0) | |||||||||

| Principal payments under finance lease obligations | (3.6) | (3.4) | |||||||||

| Debt issuance costs | — | (3.2) | |||||||||

| Distributions paid to noncontrolling interests of consolidated affiliates | (3.7) | (3.2) | |||||||||

| Other | (1.0) | (0.7) | |||||||||

| Net cash used in financing activities | (48.3) | (40.5) | |||||||||

| Increase in cash, cash equivalents, and restricted cash | 0.5 | 2.6 | |||||||||

| Cash, cash equivalents, and restricted cash at beginning of year | 29.8 | 27.2 | |||||||||

| Cash, cash equivalents, and restricted cash at end of year | $ | 30.3 | $ | 29.8 | |||||||

| Reconciliation of Diluted Earnings Per Share to Adjusted Diluted Earnings Per Share | |||||||||||||||||||||||

| Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Diluted earnings per share, as reported | $ | (0.92) | $ | (0.13) | $ | (3.11) | $ | (1.61) | |||||||||||||||

| Adjustments, net of tax: | |||||||||||||||||||||||

| Impairment of goodwill | 0.89 | — | 2.82 | 1.50 | |||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

0.02 | 0.18 | 0.20 | 0.32 | |||||||||||||||||||

Income tax adjustments(2) |

0.06 | 0.01 | 0.31 | 0.02 | |||||||||||||||||||

Adjusted diluted earnings per share(3) |

$ | 0.04 | $ | 0.06 | $ | 0.21 | $ | 0.22 | |||||||||||||||

| Reconciliation of Adjusted EBITDA to Adjusted Diluted Earnings Per Share | |||||||||||||||||||||||||||||

| Three Months Ended December 31, | |||||||||||||||||||||||||||||

| 2024 | |||||||||||||||||||||||||||||

| Adjustments | |||||||||||||||||||||||||||||

| (in millions, except per share data) | As Reported | Impairment of Goodwill | Unusual or Nonrecurring Items That are Not Typical of Ongoing Operations | Income Tax Adjustments(3) |

As Adjusted(4) |

||||||||||||||||||||||||

Adjusted EBITDA(1) |

$ | 25.1 | $ | — | $ | — | $ | — | $ | 25.1 | |||||||||||||||||||

| Interest expense and amortization of debt discounts and fees | (10.1) | — | — | — | (10.1) | ||||||||||||||||||||||||

| Depreciation and amortization | (7.9) | — | — | — | (7.9) | ||||||||||||||||||||||||

| Gain on disposal of assets | 0.2 | — | — | — | 0.2 | ||||||||||||||||||||||||

| Impairment of goodwill | (53.8) | 53.8 | — | — | — | ||||||||||||||||||||||||

| Stock-based compensation | (3.9) | — | — | — | (3.9) | ||||||||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(2) |

(1.1) | — | 1.1 | — | — | ||||||||||||||||||||||||

| Loss (income) before income taxes | (51.5) | 53.8 | 1.1 | — | 3.4 | ||||||||||||||||||||||||

| Benefit from (provision for) income taxes | 5.5 | (9.3) | (0.2) | 3.0 | (1.0) | ||||||||||||||||||||||||

| Net income (loss) attributable to Enhabit, Inc. | $ | (46.0) | $ | 44.5 | $ | 0.9 | $ | 3.0 | $ | 2.4 | |||||||||||||||||||

Diluted earnings per share(4) |

$ | (0.92) | $ | 0.89 | $ | 0.02 | $ | 0.06 | $ | 0.04 | |||||||||||||||||||

| Diluted shares | 50.2 | 50.2 | |||||||||||||||||||||||||||

| Reconciliation of Adjusted EBITDA to Adjusted Diluted Earnings Per Share | |||||||||||||||||||||||

| Three Months Ended December 31, | |||||||||||||||||||||||

| 2023 | |||||||||||||||||||||||

| Adjustments | |||||||||||||||||||||||

| (in millions, except per share data) | As Reported | Unusual or Nonrecurring Items That are Not Typical of Ongoing Operations | Income Tax Adjustments(3) |

As Adjusted | |||||||||||||||||||

Adjusted EBITDA(1) |

$ | 25.2 | $ | — | $ | — | $ | 25.2 | |||||||||||||||

| Interest expense and amortization of debt discounts and fees | (12.3) | — | — | (12.3) | |||||||||||||||||||

| Depreciation and amortization | (7.7) | — | — | (7.7) | |||||||||||||||||||

| Stock-based compensation | (1.7) | — | — | (1.7) | |||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(2) |

(11.4) | 11.4 | — | — | |||||||||||||||||||

| (Loss) income before income taxes | (7.9) | 11.4 | — | 3.5 | |||||||||||||||||||

| Benefit from (provision for) income taxes | 1.5 | (2.2) | 0.3 | (0.4) | |||||||||||||||||||

| Net (loss) income attributable to Enhabit, Inc. | $ | (6.4) | $ | 9.2 | $ | 0.3 | $ | 3.1 | |||||||||||||||

Diluted earnings per share(4) |

$ | (0.13) | $ | 0.18 | $ | 0.01 | $ | 0.06 | |||||||||||||||

| Diluted shares | 50.0 | 50.0 | |||||||||||||||||||||

| Reconciliation of Adjusted EBITDA to Adjusted Diluted Earnings Per Share | |||||||||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||||||||||

| 2024 | |||||||||||||||||||||||||||||

| Adjustments | |||||||||||||||||||||||||||||

| (in millions, except per share data) | As Reported | Impairment of Goodwill | Unusual or Nonrecurring Items That are Not Typical of Ongoing Operations | Income Tax Adjustments(3) |

As Adjusted | ||||||||||||||||||||||||

Adjusted EBITDA(1) |

$ | 100.1 | $ | — | $ | — | $ | — | $ | 100.1 | |||||||||||||||||||

| Interest expense and amortization of debt discounts and fees | (42.9) | — | — | — | (42.9) | ||||||||||||||||||||||||

| Depreciation and amortization | (31.5) | — | — | — | (31.5) | ||||||||||||||||||||||||

| Gain on disposal of assets | 0.7 | — | — | — | 0.7 | ||||||||||||||||||||||||

| Impairment of goodwill | (161.7) | 161.7 | — | — | — | ||||||||||||||||||||||||

| Stock-based compensation | (11.7) | — | — | — | (11.7) | ||||||||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations (2) |

(13.2) | — | 13.2 | — | — | ||||||||||||||||||||||||

| (Loss) income before income taxes | (160.2) | 161.7 | 13.2 | — | 14.7 | ||||||||||||||||||||||||

| Benefit from (provision for) income taxes | 4.0 | (20.3) | (3.4) | 15.8 | (3.9) | ||||||||||||||||||||||||

| Net (loss) income attributable to Enhabit, Inc. | $ | (156.2) | $ | 141.4 | $ | 9.8 | $ | 15.8 | $ | 10.8 | |||||||||||||||||||

Diluted earnings per share(4) |

$ | (3.11) | $ | 2.82 | $ | 0.20 | $ | 0.31 | $ | 0.21 | |||||||||||||||||||

| Diluted shares | 50.2 | 50.4 | |||||||||||||||||||||||||||

| Reconciliation of Adjusted EBITDA to Adjusted Diluted Earnings Per Share | |||||||||||||||||||||||||||||

| Year Ended December 31, | |||||||||||||||||||||||||||||

| 2023 | |||||||||||||||||||||||||||||

| Adjustments | |||||||||||||||||||||||||||||

| (in millions, except per share data) | As Reported | Impairment of Goodwill | Unusual or Nonrecurring Items That are Not Typical of Ongoing Operations | Income Tax Adjustments(3) |

As Adjusted | ||||||||||||||||||||||||

Adjusted EBITDA(1) |

$ | 97.6 | $ | — | $ | — | $ | — | $ | 97.6 | |||||||||||||||||||

| Interest expense and amortization of debt discounts and fees | (43.0) | — | — | — | (43.0) | ||||||||||||||||||||||||

| Depreciation and amortization | (30.9) | — | — | — | (30.9) | ||||||||||||||||||||||||

| Gain on disposal of assets | 0.3 | — | — | — | 0.3 | ||||||||||||||||||||||||

| Impairment of goodwill | (85.8) | 85.8 | — | — | — | ||||||||||||||||||||||||

| Stock-based compensation | (8.9) | — | — | — | (8.9) | ||||||||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(2) |

(21.2) | — | 21.2 | — | — | ||||||||||||||||||||||||

| (Loss) income before income taxes | (91.9) | 85.8 | 21.2 | — | 15.1 | ||||||||||||||||||||||||

| Benefit from (provision for) income taxes | 11.4 | (11.1) | (5.1) | 0.9 | (3.9) | ||||||||||||||||||||||||

| Net (loss) income attributable to Enhabit, Inc. | $ | (80.5) | $ | 74.7 | $ | 16.1 | $ | 0.9 | $ | 11.2 | |||||||||||||||||||

Diluted earnings per share(4) |

$ | (1.61) | $ | 1.50 | $ | 0.32 | $ | 0.02 | $ | 0.22 | |||||||||||||||||||

| Diluted shares | 49.9 | 49.9 | |||||||||||||||||||||||||||

| Reconciliation of Net Loss to Adjusted EBITDA | |||||||||||||||||||||||

| Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net loss | $ | (45.8) | $ | (5.9) | $ | (154.0) | $ | (79.0) | |||||||||||||||

| Interest expense and amortization of debt discounts and fees | 10.1 | 12.3 | 42.9 | 43.0 | |||||||||||||||||||

| Benefit from income taxes | (5.5) | (1.5) | (4.0) | (11.4) | |||||||||||||||||||

| Depreciation and amortization | 7.9 | 7.7 | 31.5 | 30.9 | |||||||||||||||||||

| Gain on disposal of assets | (0.2) | — | (0.7) | (0.3) | |||||||||||||||||||

| Impairment of goodwill | 53.8 | — | 161.7 | 85.8 | |||||||||||||||||||

| Stock-based compensation | 3.9 | 1.7 | 11.7 | 8.9 | |||||||||||||||||||

| Net income attributable to noncontrolling interests | (0.2) | (0.5) | (2.2) | (1.5) | |||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

1.1 | 11.4 | 13.2 | 21.2 | |||||||||||||||||||

| Adjusted EBITDA | $ | 25.1 | $ | 25.2 | $ | 100.1 | $ | 97.6 | |||||||||||||||

| Reconciliation of Net Cash Provided by Operating Activities to Adjusted EBITDA | |||||||||||||||||||||||

| Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net cash provided by operating activities | $ | (4.1) | $ | 2.8 | $ | 51.2 | $ | 48.4 | |||||||||||||||

| Interest expense excluding amortization of debt discounts and fees | 9.7 | 11.2 | 41.4 | 40.9 | |||||||||||||||||||

| Current portion of (benefit from) provision for income taxes | 0.2 | (3.0) | 1.7 | 0.2 | |||||||||||||||||||

| Change in assets and liabilities, excluding derivative instrument | 18.4 | 3.1 | (5.2) | (11.9) | |||||||||||||||||||

| Net income attributable to noncontrolling interests | (0.2) | (0.5) | (2.2) | (1.5) | |||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

1.1 | 11.4 | 13.2 | 21.2 | |||||||||||||||||||

| Other | — | 0.2 | — | 0.3 | |||||||||||||||||||

| Adjusted EBITDA | $ | 25.1 | $ | 25.2 | $ | 100.1 | $ | 97.6 | |||||||||||||||

| Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow | |||||||||||||||||||||||

| Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||||||||||

| (in millions) | 2024 | 2023 | 2024 | 2023 | |||||||||||||||||||

| Net cash provided by operating activities | $ | (4.1) | $ | 2.8 | $ | 51.2 | $ | 48.4 | |||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

1.1 | 11.4 | 13.2 | 21.2 | |||||||||||||||||||

| Capital expenditures for maintenance | (0.6) | 0.2 | (3.7) | (3.4) | |||||||||||||||||||

| Other working capital adjustments | (0.7) | (2.5) | (3.5) | (4.2) | |||||||||||||||||||

| Distributions paid to noncontrolling interests of consolidated affiliates | (1.5) | (0.7) | (3.7) | (3.2) | |||||||||||||||||||

| Adjusted free cash flow | $ | (5.8) | $ | 11.2 | $ | 53.5 | $ | 58.8 | |||||||||||||||

| Reconciliation of Gross Margin to Adjusted EBITDA Margin | |||||||||||||||||||||||

| Three Months Ended December 31, |

Year Ended December 31, |

||||||||||||||||||||||

| 2024 | 2023 | 2024 | 2023 | ||||||||||||||||||||

| Gross margin as a percentage of revenue | 48.5 | % | 48.8 | % | 48.7 | % | 48.8 | % | |||||||||||||||

| General and administrative expenses | (40.5) | % | (43.9) | % | (41.2) | % | (42.2) | % | |||||||||||||||

| Gains on disposal of assets | (0.1) | % | — | % | (0.1) | % | — | % | |||||||||||||||

| Stock-based compensation | 1.5 | % | 0.6 | % | 1.1 | % | 0.8 | % | |||||||||||||||

| Noncontrolling interests | (0.1) | % | (0.2) | % | (0.2) | % | (0.1) | % | |||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

0.4 | % | 4.4 | % | 1.3 | % | 2.0 | % | |||||||||||||||

| Adjusted EBITDA Margin | 9.7 | % | 9.7 | % | 9.7 | % | 9.3 | % | |||||||||||||||