| Delaware | 001-41406 | 47-2409192 | ||||||

| (State or other jurisdiction | (Commission | (IRS Employer | ||||||

| of incorporation) | File Number) | Identification No.) | ||||||

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | ||||

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | ||||

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

||||

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

||||

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered | ||||||

| Common Stock, par value $0.01 per share | EHAB | New York Stock Exchange | ||||||

Exhibit Number |

Description | |||||||

| 104 | Cover Page Interactive Data File - the cover page iXBRL tags are embedded within the Inline XBRL document | |||||||

| ENHABIT, INC. | ||||||||

| By: | /s/ Dylan C. Black | |||||||

| Name: | Dylan C. Black | |||||||

| Title: | General Counsel | |||||||

| ($ in millions, except per share data) | Q2 | '23 vs. '22 | ||||||||||||||||||

| 2023 | 2022 | |||||||||||||||||||

| Home health net service revenue | $ | 213.8 | $ | 220.2 | (2.9)% | |||||||||||||||

| Hospice net service revenue | 48.5 | 47.8 | 1.5% | |||||||||||||||||

| Total net service revenue | $ | 262.3 | $ | 268.0 | (2.1)% | |||||||||||||||

| % of Revenue | % of Revenue | |||||||||||||||||||

| Cost of services | 51.7% | $ | (135.5) | 48.6% | $ | (130.3) | 4.0% | |||||||||||||

| Gross margin | 48.3% | 126.8 | 51.4% | 137.7 | (7.9)% | |||||||||||||||

| General & administrative expenses | 39.2% | (102.7) | 36.1% | (96.7) | 6.2% | |||||||||||||||

| Operating expenses | 90.8% | (238.2) | 84.7% | (227.0) | 4.9% | |||||||||||||||

| Other income | (0.1) | — | ||||||||||||||||||

| Equity earnings / noncontrolling interest | 0.3 | 0.7 | ||||||||||||||||||

| Adjusted EBITDA | $ | 23.9 | $ | 40.3 | (40.7)% | |||||||||||||||

| Adjusted EBITDA margin | 9.1% | 15.0% | ||||||||||||||||||

| Reported Diluted EPS | $ | (1.49) | $ | 0.41 | (467.7)% | |||||||||||||||

| Adjusted EPS | $ | 0.04 | $ | 0.47 | (91.5)% | |||||||||||||||

| ($ in millions) | Q2 | '23 vs. '22 | ||||||||||||

| 2023 | 2022 | |||||||||||||

| Net service revenue | $ | 213.8 | $ | 220.2 | (2.9)% | |||||||||

| Cost of services | 111.4 | 108.8 | 2.4% | |||||||||||

| Gross margin | 47.9% | 50.6% | ||||||||||||

| General & administrative expenses | $ | 59.4 | $ | 57.8 | 2.8% | |||||||||

| Other income | $ | (0.1) | $ | — | ||||||||||

| Equity earnings / noncontrolling interest | $ | 0.3 | $ | 0.6 | (50.0)% | |||||||||

| Adjusted EBITDA | $ | 42.8 | $ | 53.0 | (19.2)% | |||||||||

| % Adj. EBITDA margin | 20.0% | 24.1% | ||||||||||||

| Operational metrics (Actual Amounts) | ||||||||||||||

| Starts of care | ||||||||||||||

| Episodic admissions | 32,628 | 36,106 | (9.6)% | |||||||||||

| Non-episodic admissions | 18,347 | 13,293 | 38.0% | |||||||||||

| Total admissions | 50,975 | 49,399 | 3.2% | |||||||||||

| Same-store total admissions growth | 1.7% | |||||||||||||

| Episodic recertifications | 23,788 | 25,993 | (8.5)% | |||||||||||

| Non-episodic recertifications | 9,554 | 6,447 | 48.2% | |||||||||||

| Total recertifications | 33,342 | 32,440 | 2.8% | |||||||||||

| Same-store total recertifications growth | 2.2% | |||||||||||||

| Total starts of care | 84,317 | 81,839 | 3.0% | |||||||||||

| Completed episodes | 56,808 | 62,691 | (9.4)% | |||||||||||

| Revenue per episode | $ | 2,913 | $ | 2,972 | (2.0)% | |||||||||

| Visits per episode | 14.6 | 15.0 | (2.7)% | |||||||||||

| Total visits | 1,205,865 | 1,217,447 | (1.0)% | |||||||||||

| Non-episodic visits | 377,214 | 275,679 | 36.8% | |||||||||||

| Cost per visit | $ | 91 | $ | 88 | 3.4% | |||||||||

| ($ in millions) | Q2 | '23 vs. '22 | ||||||||||||

| 2023 | 2022 | |||||||||||||

| Net service revenue | $ | 48.5 | $ | 47.8 | 1.5% | |||||||||

| Cost of services | 24.1 | 21.5 | 12.1% | |||||||||||

| Gross margin | 50.3% | 55.0% | ||||||||||||

| General & administrative expenses | $ | 16.1 | $ | 15.5 | 3.9% | |||||||||

| Equity earnings / noncontrolling interest | $ | — | $ | 0.1 | ||||||||||

| Adjusted EBITDA | $ | 8.3 | $ | 10.7 | (22.4)% | |||||||||

| % Adj. EBITDA margin | 17.1% | 22.4% | ||||||||||||

| Operational metrics (Actual Amounts) | ||||||||||||||

| Total admissions | 2,837 | 2,835 | 0.1% | |||||||||||

| Same-store total admissions growth | (4.1)% | |||||||||||||

| Patient days | 311,465 | 313,718 | (0.7)% | |||||||||||

| Discharged average length of stay | 108 | 109 | (0.9)% | |||||||||||

| Average daily census | 3,423 | 3,447 | (0.7)% | |||||||||||

| Revenue per day | $ | 156 | $ | 152 | 2.6% | |||||||||

| Cost per day | $ | 77 | $ | 69 | 11.6% | |||||||||

| ($ in millions, except per share data) | ||||||||

| Full-Year 2023 | 2023 Original Guidance | 2023 Revised Guidance | ||||||

| Net Service Revenue | $1,110 to $1,140 | $1,057 to $1,065 | ||||||

| Adjusted EBITDA | $125 to $140 | $100 to $107 | ||||||

| Adjusted EPS | $0.50 to $0.89 | $0.28 to $0.46 | ||||||

| Three Months Ended June 30, | Six Months Ended June 30, | ||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| ($ in millions, except per share data) | |||||||||||||||||||||||

| Net service revenue | $ | 262.3 | $ | 268.0 | $ | 527.4 | $ | 542.3 | |||||||||||||||

| Cost of service, excluding depreciation and amortization | 135.5 | 130.3 | 268.1 | 260.0 | |||||||||||||||||||

| General and administrative expenses | 107.8 | 102.2 | 218.3 | 202.9 | |||||||||||||||||||

| Depreciation and amortization | 7.7 | 8.2 | 15.5 | 16.7 | |||||||||||||||||||

| Impairment of goodwill | 85.8 | — | 85.8 | — | |||||||||||||||||||

| Operating income | (74.5) | 27.3 | (60.3) | 62.7 | |||||||||||||||||||

| Interest expense and amortization of debt discounts and fees | 10.3 | 0.1 | 19.8 | 0.1 | |||||||||||||||||||

| Other income | (0.1) | — | (0.1) | — | |||||||||||||||||||

| (Loss) income before income taxes and noncontrolling interests | (84.7) | 27.2 | (80.0) | 62.6 | |||||||||||||||||||

| Income tax (benefit) expense | (10.6) | 6.4 | (9.1) | 15.1 | |||||||||||||||||||

| Net (loss) income | (74.1) | 20.8 | (70.9) | 47.5 | |||||||||||||||||||

| Less: Net income attributable to noncontrolling interests | 0.3 | 0.7 | 0.8 | 1.3 | |||||||||||||||||||

| Net (loss) income attributable to Enhabit, Inc. | $ | (74.4) | $ | 20.1 | $ | (71.7) | $ | 46.2 | |||||||||||||||

| Weighted average common shares outstanding: | |||||||||||||||||||||||

| Basic | 49.8 | 49.6 | 49.8 | 49.6 | |||||||||||||||||||

| Diluted | 49.8 | 49.6 | 49.8 | 49.6 | |||||||||||||||||||

| (Loss) earnings per common share: | |||||||||||||||||||||||

| Basic (loss) earnings per share attributable to Enhabit, Inc. common stockholders | $ | (1.49) | $ | 0.41 | $ | (1.44) | $ | 0.93 | |||||||||||||||

| Diluted (loss) earnings per share attributable to Enhabit, Inc. common stockholders | $ | (1.49) | $ | 0.41 | $ | (1.44) | $ | 0.93 | |||||||||||||||

| June 30, 2023 |

December 31, 2022 |

||||||||||

| ($ in millions) | |||||||||||

| Assets | |||||||||||

| Current assets: | |||||||||||

| Cash and cash equivalents | $ | 34.4 | $ | 22.9 | |||||||

| Restricted cash | 2.1 | 4.3 | |||||||||

| Accounts receivable | 147.6 | 149.6 | |||||||||

| Income tax receivable | 3.9 | 11.4 | |||||||||

| Prepaid expenses and other current assets | 11.6 | 23.6 | |||||||||

| Total current assets | 199.6 | 211.8 | |||||||||

| Property and equipment, net | 18.5 | 20.4 | |||||||||

| Operating lease right-of-use assets | 49.3 | 42.0 | |||||||||

| Goodwill | 1,061.7 | 1,144.8 | |||||||||

| Intangible assets, net | 91.2 | 102.6 | |||||||||

| Other long-term assets | 5.9 | 5.2 | |||||||||

| Total assets | $ | 1,426.2 | $ | 1,526.8 | |||||||

| Liabilities and Stockholders’ Equity | |||||||||||

| Current liabilities: | |||||||||||

| Current portion of long-term debt | $ | 22.5 | $ | 23.1 | |||||||

| Current operating lease liabilities | 11.7 | 14.0 | |||||||||

| Accounts payable | 5.4 | 3.8 | |||||||||

| Accrued payroll | 32.8 | 35.5 | |||||||||

| Refunds due patients and other third-party payors | 7.1 | 8.3 | |||||||||

| Accrued medical insurance | 8.2 | 7.5 | |||||||||

| Other current liabilities | 35.8 | 40.7 | |||||||||

| Total current liabilities | 123.5 | 132.9 | |||||||||

| Long-term debt, net of current portion | 539.3 | 560.0 | |||||||||

| Long-term operating lease liabilities | 37.5 | 28.1 | |||||||||

| Deferred income tax liabilities | 18.1 | 28.6 | |||||||||

| Other long-term liabilities | 0.6 | 1.9 | |||||||||

| 719.0 | 751.5 | ||||||||||

| Commitments and contingencies | |||||||||||

| Redeemable noncontrolling interests | 5.1 | 5.2 | |||||||||

| Stockholders’ equity: | |||||||||||

| Enhabit, Inc. stockholders’ equity: | 675.2 | 741.7 | |||||||||

| Noncontrolling interests | 26.9 | 28.4 | |||||||||

| Total stockholders’ equity | 702.1 | 770.1 | |||||||||

| Total liabilities and stockholders’ equity | $ | 1,426.2 | $ | 1,526.8 | |||||||

| Six Months Ended June 30, | |||||||||||

| 2023 | 2022 | ||||||||||

| ($ in millions) | |||||||||||

| Cash flows from operating activities: | |||||||||||

| Net (loss) income | $ | (70.9) | $ | 47.5 | |||||||

| Adjustments to reconcile net (loss) income to net cash provided by operating activities— | |||||||||||

| Depreciation and amortization | 15.5 | 16.7 | |||||||||

| Amortization of debt related costs | 0.5 | — | |||||||||

| Impairment of goodwill | 85.8 | — | |||||||||

| Stock-based compensation | 4.1 | 2.5 | |||||||||

| Deferred tax benefit | (11.0) | (1.4) | |||||||||

| Other, net | 0.9 | (0.6) | |||||||||

| Changes in assets and liabilities, net of acquisitions— | |||||||||||

| Accounts receivable | 1.9 | 13.4 | |||||||||

| Prepaid expenses and other assets | 19.2 | (2.7) | |||||||||

| Accounts payable | 1.5 | (0.8) | |||||||||

| Accrued payroll | (2.6) | 6.2 | |||||||||

| Other liabilities | (5.7) | (5.8) | |||||||||

| Net cash provided by operating activities | 39.2 | 75.0 | |||||||||

| Cash flows from investing activities: | |||||||||||

| Acquisition of businesses, net of cash acquired | (2.8) | — | |||||||||

| Purchases of property and equipment | (1.7) | (4.5) | |||||||||

| Other, net | 0.5 | 1.0 | |||||||||

| Net cash used in investing activities | (4.0) | (3.5) | |||||||||

| Cash flows from financing activities: | |||||||||||

| Principal borrowings on term loan | — | 400.0 | |||||||||

| Principal payments on term loan | (10.0) | — | |||||||||

| Principal payments on debt | — | (0.4) | |||||||||

| Borrowings on revolving credit facility | — | 170.0 | |||||||||

| Payments on revolving credit facility | (10.0) | — | |||||||||

| Principal payments under finance lease obligations | (1.8) | (2.6) | |||||||||

| Debt issuance costs | (1.1) | (4.4) | |||||||||

| Distributions paid to noncontrolling interests of consolidated affiliates | (2.5) | (0.7) | |||||||||

| Contributions from Encompass | — | 59.8 | |||||||||

| Distributions to Encompass | — | (654.9) | |||||||||

| Contributions from noncontrolling interests of consolidated affiliates | — | 7.4 | |||||||||

| Other | (0.5) | — | |||||||||

| Net cash used in financing activities | (25.9) | (25.8) | |||||||||

| Increase in cash, cash equivalents, and restricted cash | 9.3 | 45.7 | |||||||||

| Cash, cash equivalents, and restricted cash at beginning of year | 27.2 | 8.0 | |||||||||

| Cash, cash equivalents, and restricted cash at end of period | $ | 36.5 | $ | 53.7 | |||||||

| Three Months Ended June 30, | Six Months Ended June 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| Earnings per share, as reported | $ | (1.49) | $ | 0.41 | $ | (1.44) | $ | 0.93 | |||||||||||||||

| Adjustments, net of tax: | |||||||||||||||||||||||

| Impairment of goodwill | 1.50 | — | 1.50 | — | |||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

0.03 | 0.06 | 0.07 | 0.09 | |||||||||||||||||||

Income tax adjustments(2) |

— | — | 0.01 | — | |||||||||||||||||||

Adjusted earnings per share(3) |

$ | 0.04 | $ | 0.47 | $ | 0.14 | $ | 1.02 | |||||||||||||||

| Q2 QTD | |||||||||||||||||||||||||||||

| 2023 | |||||||||||||||||||||||||||||

| Adjustments | |||||||||||||||||||||||||||||

| As Reported | Impairment of Goodwill | Unusual or nonrecurring items that are not typical of ongoing operations | Income Tax Adjustments(3) |

As Adjusted | |||||||||||||||||||||||||

| ($ in millions, except per share data) | |||||||||||||||||||||||||||||

Adjusted EBITDA(1) |

$ | 23.9 | $ | — | $ | — | $ | — | $ | 23.9 | |||||||||||||||||||

| Impairment of goodwill | (85.8) | 85.8 | — | — | — | ||||||||||||||||||||||||

| Interest expense and amortization of debt discounts and fees | (10.3) | — | — | (10.3) | |||||||||||||||||||||||||

| Depreciation and amortization | (7.7) | — | — | — | (7.7) | ||||||||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(2) |

(2.6) | — | 2.6 | — | — | ||||||||||||||||||||||||

| Stock-based compensation | (2.6) | — | — | — | (2.6) | ||||||||||||||||||||||||

| Gain on disposal or impairment of assets | 0.1 | — | — | — | 0.1 | ||||||||||||||||||||||||

| Net loss before income tax expense, including noncontrolling interests | (85.0) | 85.8 | 2.6 | — | 3.4 | ||||||||||||||||||||||||

| Income tax benefit (expense) | 10.6 | (11.1) | (1.0) | 0.1 | (1.4) | ||||||||||||||||||||||||

| Net (loss) income attributable to Enhabit | $ | (74.4) | $ | 74.7 | $ | 1.6 | $ | 0.1 | $ | 2.0 | |||||||||||||||||||

Diluted earnings per share(4) |

$ | (1.49) | $ | 1.50 | $ | 0.03 | $ | — | $ | 0.04 | |||||||||||||||||||

| Diluted shares | 49.8 | 49.8 | |||||||||||||||||||||||||||

| Q2 QTD | |||||||||||||||||

| 2022 | |||||||||||||||||

| Adjustments | |||||||||||||||||

| As Reported | Unusual or nonrecurring items that are not typical of ongoing operations | As Adjusted | |||||||||||||||

| ($ in millions, except per share data) | |||||||||||||||||

Adjusted EBITDA(1) |

$ | 40.3 | $ | — | $ | 40.3 | |||||||||||

| Depreciation and amortization | (8.2) | — | (8.2) | ||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(2) |

(4.1) | 4.1 | — | ||||||||||||||

| Stock-based compensation | (1.2) | — | (1.2) | ||||||||||||||

| Stock-based compensation included in overhead allocation | (0.6) | — | (0.6) | ||||||||||||||

| Gain on disposal or impairment of assets | 0.4 | — | 0.4 | ||||||||||||||

| Interest expense and amortization of debt discounts and fees | (0.1) | — | (0.1) | ||||||||||||||

| Income before income tax expense | 26.5 | 4.1 | 30.6 | ||||||||||||||

| Provision for income tax expense | (6.4) | (1.0) | (7.4) | ||||||||||||||

| Net income attributable to Enhabit | $ | 20.1 | $ | 3.1 | $ | 23.2 | |||||||||||

Diluted earnings per share(3) |

$ | 0.41 | $ | 0.06 | $ | 0.47 | |||||||||||

| Diluted shares used in calculation | 49.6 | 49.6 | |||||||||||||||

| YTD | |||||||||||||||||||||||||||||

| 2023 | |||||||||||||||||||||||||||||

| Adjustments | |||||||||||||||||||||||||||||

| As Reported | Impairment of Goodwill | Unusual or nonrecurring items that are not typical of ongoing operations | Income Tax Adjustments(3) |

As Adjusted | |||||||||||||||||||||||||

| ($ in millions, except per share data) | |||||||||||||||||||||||||||||

Adjusted EBITDA(1) |

$ | 49.2 | $ | — | $ | — | $ | — | $ | 49.2 | |||||||||||||||||||

| Impairment of goodwill | (85.8) | 85.8 | — | — | — | ||||||||||||||||||||||||

| Interest expense and amortization of debt discounts and fees | (19.8) | — | — | — | (19.8) | ||||||||||||||||||||||||

| Depreciation and amortization | (15.5) | — | — | — | (15.5) | ||||||||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(2) |

(4.9) | — | 4.9 | — | — | ||||||||||||||||||||||||

| Stock-based compensation | (4.1) | — | — | — | (4.1) | ||||||||||||||||||||||||

| Gain on disposal or impairment of assets | 0.1 | — | — | — | 0.1 | ||||||||||||||||||||||||

| Net loss before income taxes, including noncontrolling interests | (80.8) | 85.8 | 4.9 | — | 9.9 | ||||||||||||||||||||||||

| Income tax benefit (expense) | 9.1 | (11.1) | (1.6) | 0.5 | (3.1) | ||||||||||||||||||||||||

| Net (loss) income attributable to Enhabit | $ | (71.7) | $ | 74.7 | $ | 3.3 | $ | 0.5 | $ | 6.8 | |||||||||||||||||||

Diluted earnings per share(4) |

$ | (1.44) | $ | 1.50 | $ | 0.07 | $ | 0.01 | $ | 0.14 | |||||||||||||||||||

| Diluted shares | 49.8 | 49.8 | |||||||||||||||||||||||||||

| YTD | |||||||||||||||||

| 2022 | |||||||||||||||||

| Adjustments | |||||||||||||||||

| As Reported | Unusual or nonrecurring items that are not typical of ongoing operations | As Adjusted | |||||||||||||||

| ($ in millions, except per share data) | |||||||||||||||||

Adjusted EBITDA(1) |

$ | 87.3 | $ | — | $ | 87.3 | |||||||||||

| Depreciation and amortization | (16.7) | — | (16.7) | ||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(2) |

(6.1) | 6.1 | — | ||||||||||||||

| Stock-based compensation | (2.5) | — | (2.5) | ||||||||||||||

| Stock-based compensation included in overhead allocation | (1.1) | — | (1.1) | ||||||||||||||

| Gain on disposal or impairment of assets | 0.5 | — | 0.5 | ||||||||||||||

| Interest expense and amortization of debt discounts and fees | (0.1) | — | (0.1) | ||||||||||||||

| Income before income tax expense | 61.3 | 6.1 | 67.4 | ||||||||||||||

| Provision for income tax expense | (15.1) | (1.5) | (16.6) | ||||||||||||||

| Net income attributable to Enhabit | $ | 46.2 | $ | 4.6 | $ | 50.8 | |||||||||||

Diluted earnings per share(3) |

$ | 0.93 | $ | 0.09 | $ | 1.02 | |||||||||||

| Diluted shares used in calculation | 49.6 | 49.6 | |||||||||||||||

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| ($ in millions) | |||||||||||||||||||||||

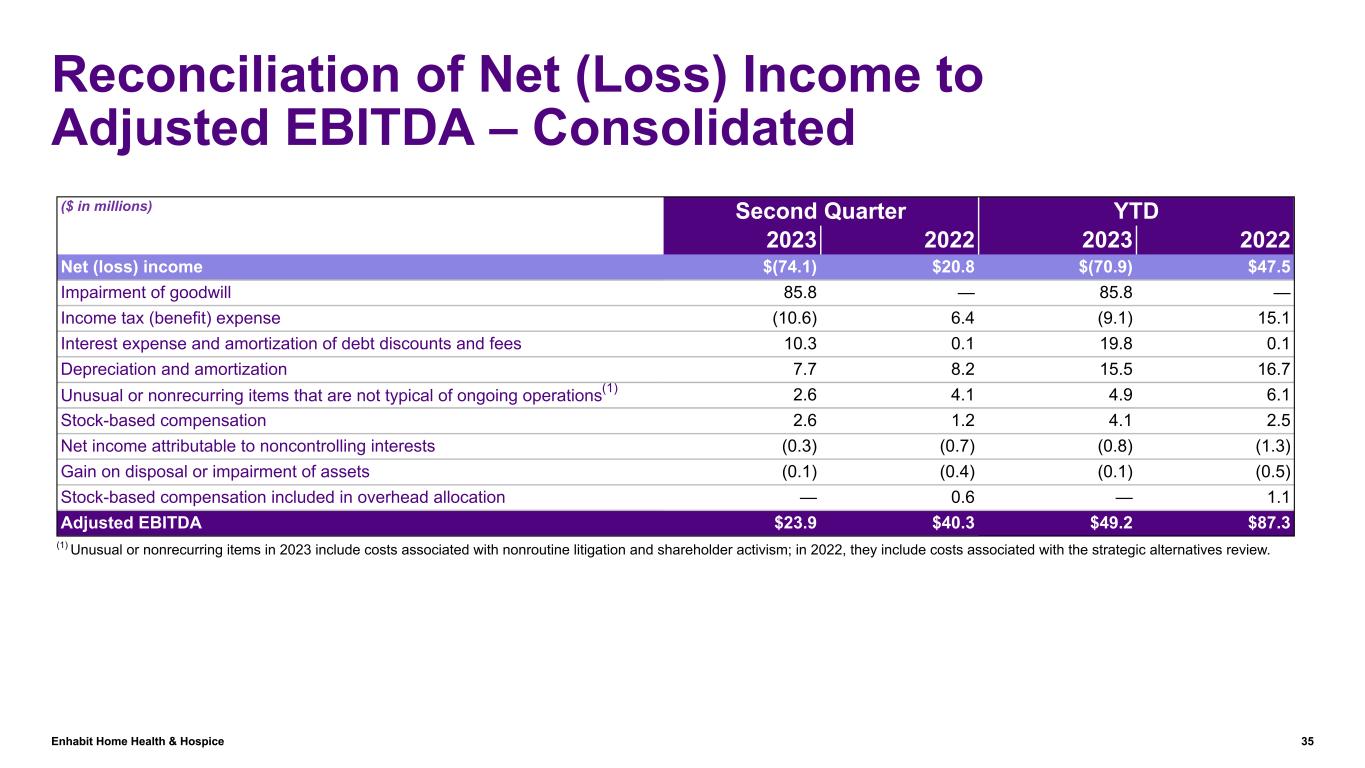

| Net (loss) income | $ | (74.1) | $ | 20.8 | $ | (70.9) | $ | 47.5 | |||||||||||||||

| Impairment of goodwill | 85.8 | — | 85.8 | — | |||||||||||||||||||

| Income tax (benefit) expense | (10.6) | 6.4 | (9.1) | 15.1 | |||||||||||||||||||

| Interest expense and amortization of debt discounts and fees | 10.3 | 0.1 | 19.8 | 0.1 | |||||||||||||||||||

| Depreciation and amortization | 7.7 | 8.2 | 15.5 | 16.7 | |||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

2.6 | 4.1 | 4.9 | 6.1 | |||||||||||||||||||

| Stock-based compensation | 2.6 | 1.2 | 4.1 | 2.5 | |||||||||||||||||||

| Net income attributable to noncontrolling interests | (0.3) | (0.7) | (0.8) | (1.3) | |||||||||||||||||||

| Gain on disposal or impairment of assets | (0.1) | (0.4) | (0.1) | (0.5) | |||||||||||||||||||

| Stock-based compensation included in overhead allocation | — | 0.6 | — | 1.1 | |||||||||||||||||||

| Adjusted EBITDA | $ | 23.9 | $ | 40.3 | $ | 49.2 | $ | 87.3 | |||||||||||||||

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| ($ in millions) | |||||||||||||||||||||||

| Net cash provided by operating activities | $ | 9.6 | $ | 33.6 | $ | 39.2 | $ | 75.0 | |||||||||||||||

| Interest expense, excluding amortization of debt discounts and fees | 10.1 | 0.1 | 19.3 | 0.1 | |||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

2.6 | 4.1 | 4.9 | 6.1 | |||||||||||||||||||

| Change in assets and liabilities, excluding derivative instruments | 1.2 | (5.0) | (15.0) | (10.3) | |||||||||||||||||||

| Current portion of income tax expense | 0.7 | 7.6 | 1.9 | 16.5 | |||||||||||||||||||

| Net income attributable to noncontrolling interests in continuing operations | (0.3) | (0.7) | (0.8) | (1.3) | |||||||||||||||||||

| Stock-based compensation included in overhead allocation | — | 0.6 | — | 1.1 | |||||||||||||||||||

| Other | — | — | (0.3) | 0.1 | |||||||||||||||||||

| Adjusted EBITDA | $ | 23.9 | $ | 40.3 | $ | 49.2 | $ | 87.3 | |||||||||||||||

| Three Months Ended June 30, |

Six Months Ended June 30, |

||||||||||||||||||||||

| 2023 | 2022 | 2023 | 2022 | ||||||||||||||||||||

| ($ in millions) | |||||||||||||||||||||||

| Net cash provided by operating activities | $ | 9.6 | $ | 33.6 | $ | 39.2 | $ | 75.0 | |||||||||||||||

| Capital expenditures for maintenance | (1.1) | (0.3) | (1.7) | (2.6) | |||||||||||||||||||

| Other working capital adjustments | (0.5) | (0.4) | (1.0) | (0.9) | |||||||||||||||||||

| Distributions paid to noncontrolling interests of consolidated affiliates | — | (0.2) | (2.5) | (0.7) | |||||||||||||||||||

| Items non-indicative of ongoing operating performance: | |||||||||||||||||||||||

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

2.6 | 4.1 | 4.9 | 6.1 | |||||||||||||||||||

| Stock-based compensation included in overhead allocation | — | 0.6 | — | 1.1 | |||||||||||||||||||

| Adjusted free cash flow | $ | 10.6 | $ | 37.4 | $ | 38.9 | $ | 78.0 | |||||||||||||||