Document

Enhabit Reports First Quarter 2023 Financial Results and Reaffirms Full-Year Guidance

Announces new national payor agreement and two new convener agreements with national reach effective May 1, 2023

Company to host a conference call tomorrow, May 10, 2023 at 10 AM EDT

DALLAS, TX – May 9, 2023 – Enhabit, Inc. (NYSE: EHAB), a leading home health and hospice care provider, today reported its results of operations for the first quarter ended March 31, 2023.

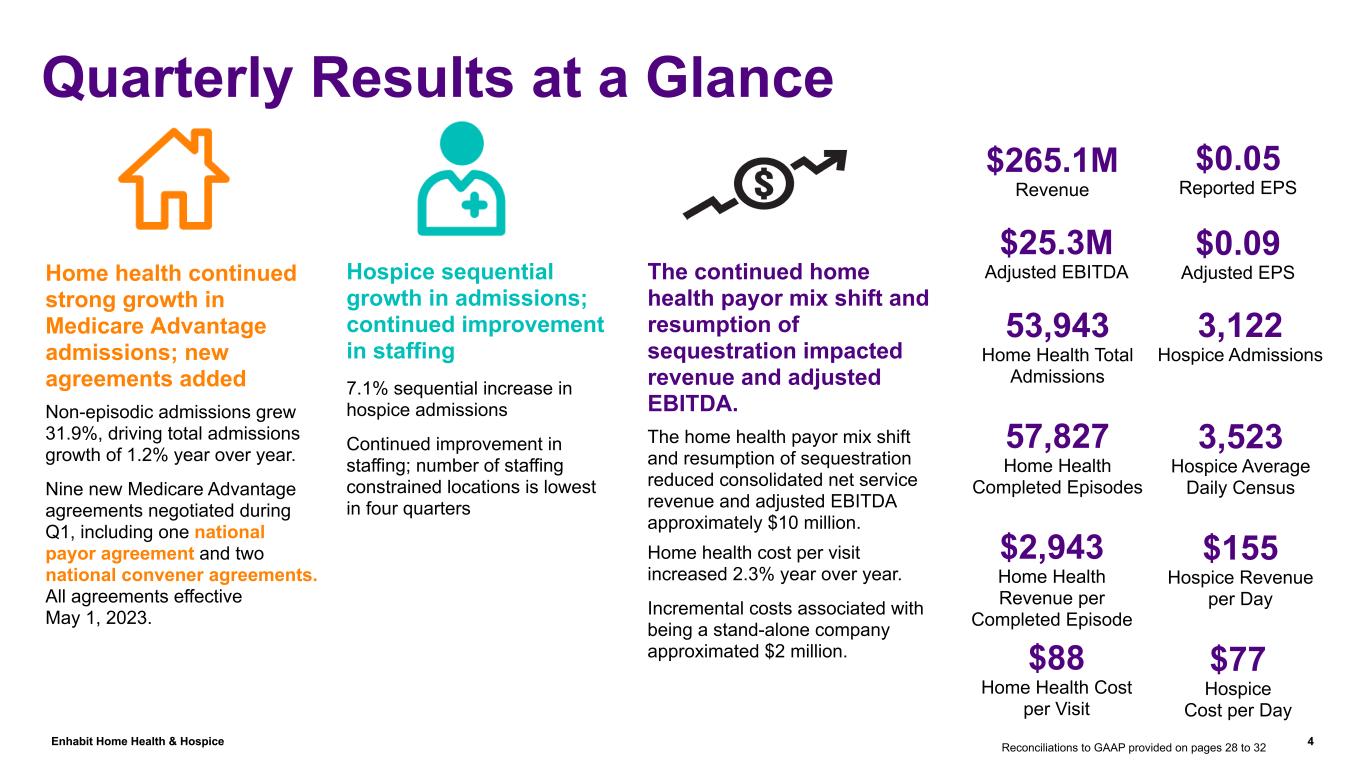

“The first quarter was underscored by progress in two of our critical success factors for 2023. Our sequential admissions growth for home health and hospice was possible due to our continued efforts in recruitment and retention of clinical staff and our payor innovation team negotiating a new national payor agreement and two convener agreements with national reach,” said Enhabit’s President and Chief Executive Officer, Barb Jacobsmeyer. “With our expansion of Medicare Advantage contracts and improved rates combined with reduced staffing capacity constraints, we expect to see improvements in our bottom line throughout 2023.”

QUARTERLY PERFORMANCE - CONSOLIDATED

•Net service revenue of $265.1 million

•Net income of $3.2 million

•Adjusted EBITDA of $25.3 million

•Earnings per diluted share of $0.05

•Adjusted earnings per diluted share of $0.09

RECENT COMPANY HIGHLIGHTS

•Executed new national agreement with Medicare Advantage payor plus two new agreements with conveners with national reach

•Continued strong growth in home health Medicare Advantage admissions with non-episodic admissions up 31.9% driving total admissions growth of 1.2% year over year

•Continued recruiting success adding 101 net new full-time nursing hires in the first quarter

•Further reduced staffing constrained hospice locations with continued implementation of case management model for nurses; hospice staffing constraints lowest in four quarters

•Acquired one home health location in Indiana and opened two de novo hospice locations in Texas in March

FINANCIAL RESULTS

Consolidated

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 |

'23 vs. '22 |

| ($ in millions, except per share data) |

2023 |

2022 |

| Home health net service revenue |

$ |

215.8 |

$ |

224.9 |

(4.0)% |

| Hospice net service revenue |

49.3 |

49.4 |

(0.2)% |

| Total net service revenue |

$ |

265.1 |

$ |

274.3 |

(3.4)% |

|

|

|

|

|

|

|

% of Revenue |

|

% of Revenue |

|

|

| Cost of services |

50.0% |

$ |

(132.6) |

47.3% |

$ |

(129.7) |

2.2% |

| Gross margin |

50.0% |

132.5 |

52.7% |

144.6 |

(8.4)% |

| General and administrative expenses |

40.2% |

(106.7) |

35.3% |

(96.9) |

10.1% |

| Operating expenses |

90.2% |

$ |

(239.3) |

82.6% |

$ |

(226.6) |

5.6% |

|

|

|

|

|

|

| Equity earnings / noncontrolling interests |

0.5 |

0.6 |

|

| Adjusted EBITDA |

$ |

25.3 |

$ |

47.0 |

(46.2)% |

| Adjusted EBITDA margin |

|

9.5% |

|

17.1% |

|

| Adjusted EPS |

$ |

0.09 |

$ |

0.56 |

(83.9)% |

The continued shift to more non-episodic admissions in home health and the resumption of sequestration reduced consolidated net service revenue and adjusted EBITDA approximately $10 million year over year.

Adjusted EBITDA decreased year over year primarily due to the continued shift to more non-episodic admissions in home health, the resumption of sequestration, and increased general and administrative expenses. General and administrative expenses were higher year over year primarily due to an increase in employee group medical claims, approximately $2 million of incremental costs associated with being a stand-alone company, vendor rebates received in the first quarter of 2022, and improved back office staffing in the field.

SEGMENT RESULTS

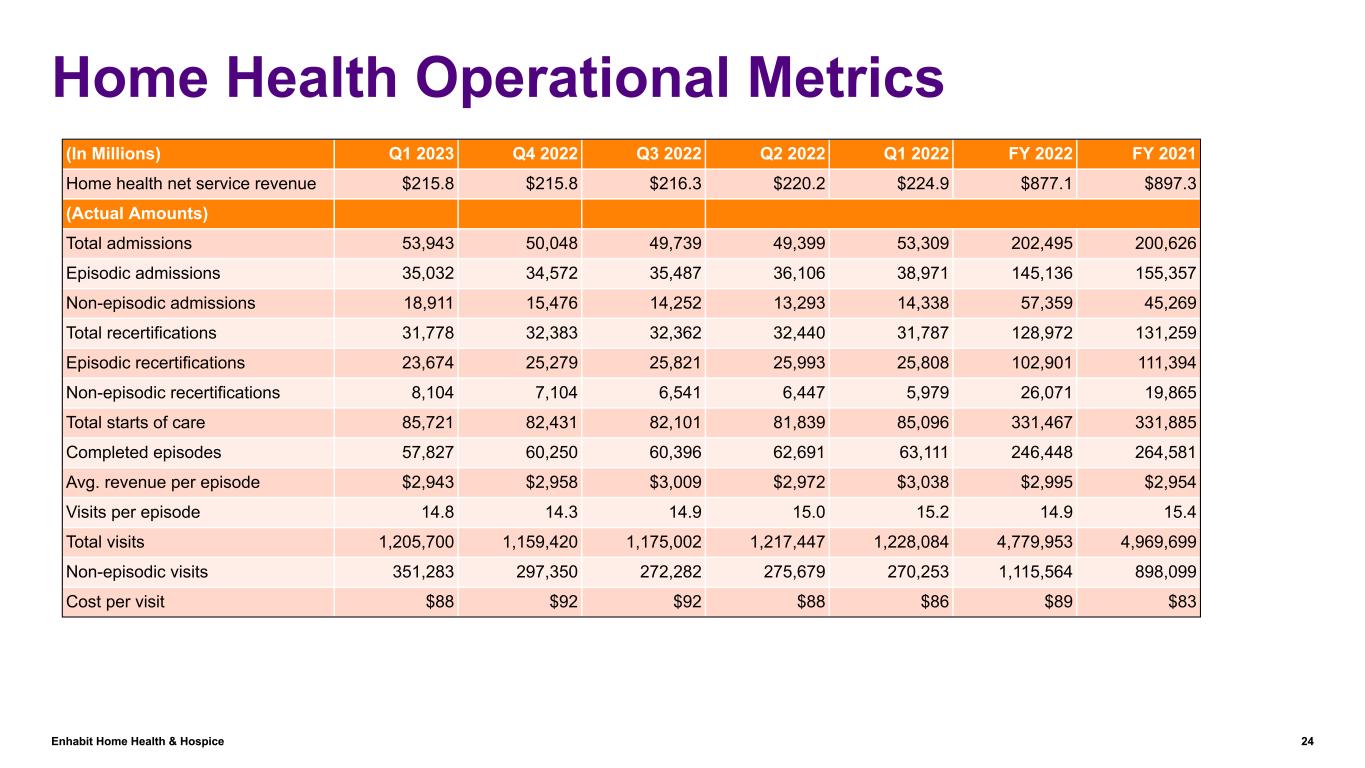

Home health

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 |

'23 vs. '22 |

| ($ in millions) |

|

2023 |

2022 |

| Net service revenue |

$ |

215.8 |

$ |

224.9 |

(4.0)% |

| Cost of services |

108.2 |

108.0 |

0.2% |

| Gross margin |

49.9% |

52.0% |

|

| General and administrative expenses |

$ |

62.9 |

$ |

58.7 |

7.2% |

| Non-controlling interest |

$ |

0.4 |

$ |

0.5 |

(20.0)% |

| Adjusted EBITDA |

$ |

44.3 |

$ |

57.7 |

(23.2)% |

| % Adj. EBITDA margin |

20.5% |

25.7% |

|

| Operational metrics (Actual Amounts) |

|

|

|

| Starts of care |

|

|

|

| Episodic admissions |

35,032 |

38,971 |

(10.1)% |

| Non-episodic admissions |

18,911 |

14,338 |

31.9% |

| Total admissions |

53,943 |

53,309 |

1.2% |

| Same-store total admissions growth |

|

|

—% |

| Episodic recertifications |

23,674 |

25,808 |

(8.3)% |

| Non-episodic recertifications |

8,104 |

5,979 |

35.5% |

| Total recertifications |

31,778 |

31,787 |

—% |

| Same-store total recertifications growth |

|

|

(0.5)% |

| Total starts of care |

85,721 |

85,096 |

0.7% |

| Completed episodes |

57,827 |

63,111 |

(8.4)% |

| Revenue per episode |

$ |

2,943 |

$ |

3,038 |

(3.1)% |

| Visits per episode |

14.8 |

15.2 |

(2.6)% |

| Total visits |

1,205,700 |

1,228,084 |

(1.8)% |

| Non-episodic visits |

351,283 |

270,253 |

30.0% |

| Cost per visit |

$ |

88 |

$ |

86 |

2.3% |

The year-over-year decrease in revenue was due primarily to the continued payor mix shift to more non-episodic admissions and the resumption of sequestration. Revenue per episode decreased year over year primarily due to the resumption of sequestration and the timing of completed episodes partially offset by a 0.7% increase in Medicare reimbursement rates.

Adjusted EBITDA decreased year over year primarily due to lower revenue and increased general and administrative expenses. General and administrative expenses increased primarily due to an increase in employee group medical claims, vendor rebates received in the first quarter of 2022, and improved back office staffing in the field. Cost per visit increased year over year primarily due to merit and market rate increases for clinical staff, increased contract labor, and increased costs associated with employee group medical claims partially offset by improved clinical productivity.

Hospice

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 |

'23 vs. '22 |

| ($ in millions) |

|

2023 |

2022 |

| Net service revenue |

$ |

49.3 |

$ |

49.4 |

(0.2)% |

| Cost of services |

24.4 |

21.7 |

12.4% |

| Gross margin |

50.5% |

56.1% |

|

| General and administrative expenses |

$ |

16.3 |

$ |

14.9 |

9.4% |

| Non-controlling interest |

$ |

0.1 |

$ |

0.1 |

—% |

| Adjusted EBITDA |

$ |

8.5 |

$ |

12.7 |

(33.1)% |

| % Adj. EBITDA margin |

17.2% |

25.7% |

|

| Operational metrics (Actual Amounts) |

|

|

|

| Total admissions |

3,122 |

3,246 |

(3.8)% |

| Same-store total admissions growth |

|

|

(11.3)% |

| Patient days |

317,027 |

319,834 |

(0.9)% |

| Discharged average length of stay |

114 |

108 |

5.6% |

| Average daily census |

3,523 |

3,554 |

(0.9)% |

| Revenue per day |

$ |

155 |

$ |

154 |

0.6% |

| Cost per day |

$ |

77 |

$ |

68 |

13.2% |

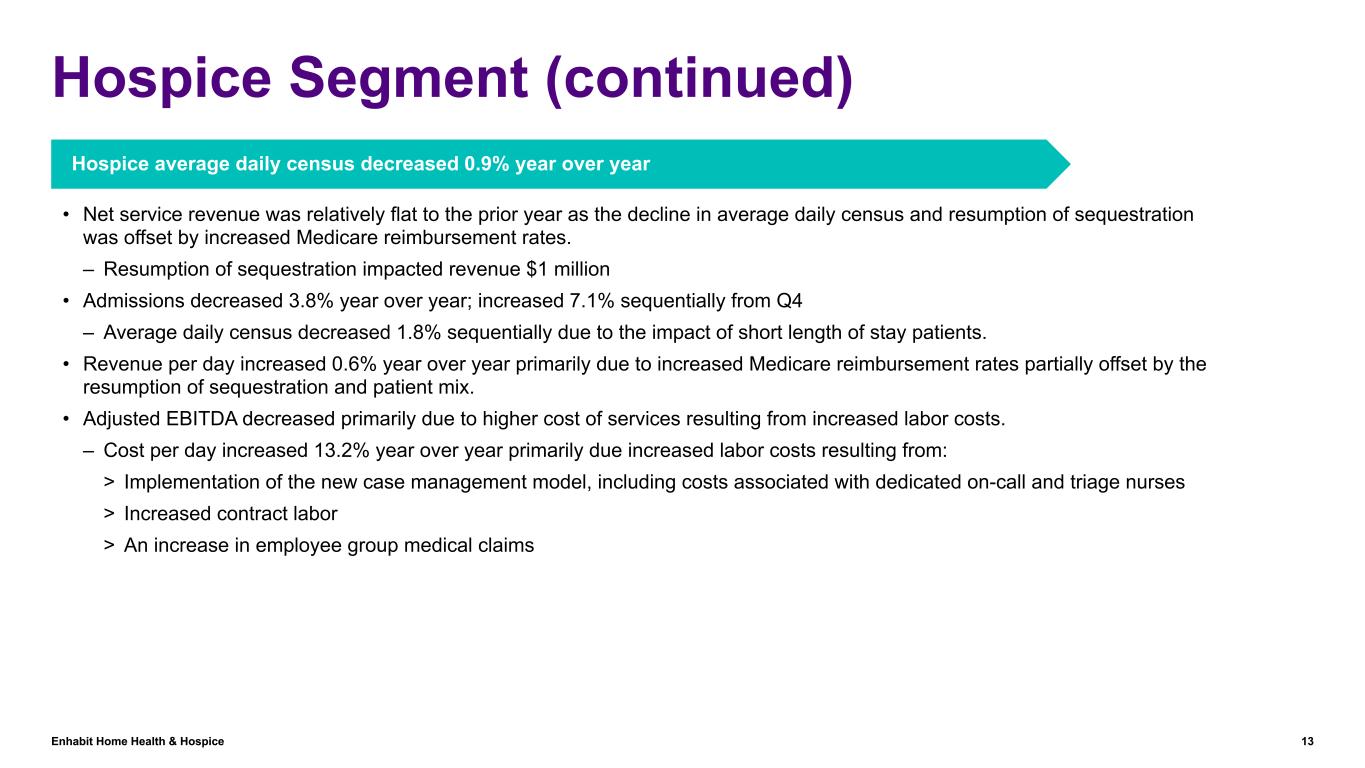

Net service revenue was relatively flat to the prior year as the decline in average daily census and resumption of sequestration was offset by increased Medicare reimbursement rates. Admissions decreased 3.8% year over year but increased 7.1% sequentially. Revenue per day increased year over year primarily due to increased Medicare reimbursement rates partially offset by the resumption of sequestration and patient mix.

Adjusted EBITDA decreased year over year primarily due to higher cost of services resulting from increased labor costs. Cost per day increased year over year primarily due to increased labor costs related to the implementation of the new case management model, including costs associated with dedicated on-call and triage nurses, increased contract labor, and an increase in employee group medical claims.

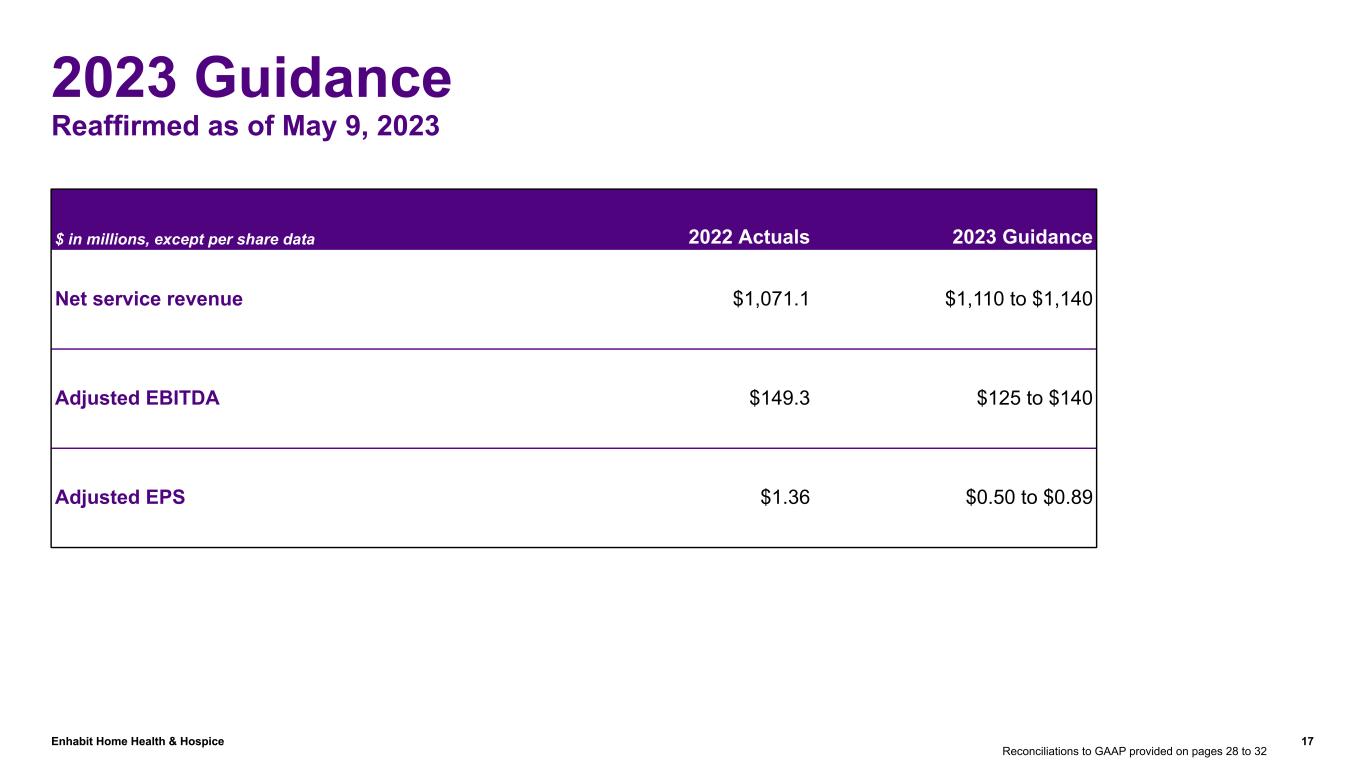

GUIDANCE

The Company reaffirmed its full-year 2023 guidance as follows:

|

|

|

|

|

|

|

|

|

| Full-year 2023 |

|

Guidance |

| Net Service Revenue |

|

between $1,110 and $1,140 million |

| Adjusted EBITDA |

|

between $125 and $140 million |

| Adjusted EPS |

|

between $0.50 and $0.89 |

For additional considerations regarding the Company’s 2023 guidance ranges, see the supplemental information posted on the Company’s website at http://investors.ehab.com. See also “Other Information” below for an explanation of why the Company does not provide guidance for comparable GAAP measures for adjusted EBITDA and adjusted EPS.

CONFERENCE CALL INFORMATION

The Company will host an investor conference call at 10 AM Eastern Time on May 10, 2023 to discuss its results for the first quarter of 2023. To access the live call by phone, dial toll-free (888) 660-6150 or international (929) 203-0843; the conference ID is 5248158. A simultaneous webcast of the call, along with supplemental information, may be accessed by visiting http://investors.ehab.com.

Following the call, a replay will be available at the same location.

ABOUT ENHABIT HOME HEALTH & HOSPICE

Enhabit Home Health & Hospice (Enhabit, Inc.) is a leading national home health and hospice provider working to expand what's possible for patient care in the home. Enhabit’s team of clinicians supports patients and their families where they are most comfortable, with a nationwide footprint spanning 253 home health locations and 107 hospice locations across 34 states. Enhabit leverages advanced technology and compassionate teams to deliver extraordinary patient care. For more information, visit ehab.com.

OTHER INFORMATION

Note regarding presentation of non-GAAP financial measures

The financial data contained in the press release and supplemental information includes non-GAAP financial measures as defined in Regulation G under the Securities Exchange Act of 1934, including adjusted EBITDA, adjusted EBITDA margin, leverage ratios, adjusted EPS, and adjusted free cash flow. Reconciliations of these non-GAAP financial measures to the most directly comparable financial measures calculated in accordance with GAAP are presented on the attached schedules. In reliance on the exception provided by Item 10(e)(1)(i)(B) of Regulation S-K, reconciliation of our guidance of adjusted EBITDA and adjusted EPS to their corresponding GAAP measures is not provided because the Company is unable to provide such reconciliation, without unreasonable effort, due to the inherent difficulty in predicting, with reasonable certainty, the future impact of items that are outside the control of the Company or otherwise non-indicative of its ongoing operating performance. Such items include, but are not limited to, gains or losses related to hedging instruments; loss on early extinguishment of debt; adjustments to its income tax provision (such as valuation allowance adjustments and settlements of income tax claims); and items related to corporate and facility restructurings. For the same reasons, the Company is unable to address the probable significance of the unavailable information.

Note regarding presentation of same-store comparisons

The Company uses “same-store” comparisons to explain the changes in certain performance metrics and line items within its financial statements. Same-store comparisons are calculated based on home health and hospice locations open throughout both the full current period and the immediately prior period presented. These comparisons include the financial results of market consolidation transactions in existing markets, as it is difficult to determine, with precision, the incremental impact of these transactions on the Company’s results of operations.

Enhabit, Inc. and Subsidiaries

Condensed Consolidated Statements of Income

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2023 |

|

2022 |

|

|

|

|

|

(In Millions, Except Per Share Data) |

| Net service revenue |

$ |

265.1 |

|

|

$ |

274.3 |

|

|

|

|

|

| Cost of service, excluding depreciation and amortization |

132.6 |

|

|

129.7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| General and administrative expenses |

110.5 |

|

|

100.7 |

|

|

|

|

|

| Depreciation and amortization |

7.8 |

|

|

8.5 |

|

|

|

|

|

| Operating income |

14.2 |

|

|

35.4 |

|

|

|

|

|

| Interest expense and amortization of debt discounts and fees |

9.5 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income taxes and noncontrolling interests |

4.7 |

|

|

35.4 |

|

|

|

|

|

| Income tax expense |

1.5 |

|

|

8.7 |

|

|

|

|

|

| Net income |

3.2 |

|

|

26.7 |

|

|

|

|

|

| Less: Net income attributable to noncontrolling interests |

0.5 |

|

|

0.6 |

|

|

|

|

|

| Net income attributable to Enhabit, Inc. |

$ |

2.7 |

|

|

$ |

26.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average common shares outstanding: |

|

|

|

|

|

|

|

| Basic |

49.8 |

|

|

49.6 |

|

|

|

|

|

| Diluted |

50.1 |

|

|

49.6 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per common share: |

|

|

|

|

|

|

|

| Basic earnings per share attributable to Enhabit, Inc. common stockholders |

$ |

0.05 |

|

|

$ |

0.53 |

|

|

|

|

|

| Diluted earnings per share attributable to Enhabit, Inc. common stockholders |

$ |

0.05 |

|

|

$ |

0.53 |

|

|

|

|

|

Enhabit, Inc. and Subsidiaries

Condensed Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

March 31,

2023 |

|

December 31,

2022 |

|

(In Millions) |

| Assets |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

37.6 |

|

|

$ |

22.9 |

|

| Restricted cash |

2.0 |

|

|

4.3 |

|

| Accounts receivable |

156.5 |

|

|

149.6 |

|

| Income tax receivable |

4.3 |

|

|

11.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Prepaid expenses and other current assets |

12.2 |

|

|

23.6 |

|

| Total current assets |

212.6 |

|

|

211.8 |

|

| Property and equipment, net |

19.0 |

|

|

20.4 |

|

| Operating lease right-of-use assets |

45.8 |

|

|

42.0 |

|

| Goodwill |

1,147.5 |

|

|

1,144.8 |

|

| Intangible assets, net |

97.1 |

|

|

102.6 |

|

| Other long-term assets |

5.0 |

|

|

5.2 |

|

| Total assets |

$ |

1,527.0 |

|

|

$ |

1,526.8 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

| Current portion of long-term debt |

$ |

22.7 |

|

|

$ |

23.1 |

|

| Current operating lease liabilities |

11.6 |

|

|

14.0 |

|

| Accounts payable |

6.2 |

|

|

3.8 |

|

| Accrued payroll |

47.7 |

|

|

35.5 |

|

| Refunds due patients and other third-party payors |

8.0 |

|

|

8.3 |

|

|

|

|

|

|

|

|

|

| Accrued medical insurance |

7.5 |

|

|

7.5 |

|

|

|

|

|

|

|

|

|

| Other current liabilities |

31.9 |

|

|

40.7 |

|

| Total current liabilities |

135.6 |

|

|

132.9 |

|

| Long-term debt, net of current portion |

549.7 |

|

|

560.0 |

|

| Long-term operating lease liabilities |

34.2 |

|

|

28.1 |

|

| Deferred income tax liabilities |

28.5 |

|

|

28.6 |

|

| Other long-term liabilities |

3.0 |

|

|

1.9 |

|

|

751.0 |

|

|

751.5 |

|

| Commitments and contingencies |

|

|

|

| Redeemable noncontrolling interests |

5.1 |

|

|

5.2 |

|

| Stockholders’ equity: |

|

|

|

| Enhabit, Inc. stockholders’ equity: |

744.3 |

|

|

741.7 |

|

| Noncontrolling interests |

26.6 |

|

|

28.4 |

|

| Total stockholders’ equity |

770.9 |

|

|

770.1 |

|

| Total liabilities and stockholders’ equity |

$ |

1,527.0 |

|

|

$ |

1,526.8 |

|

Enhabit, Inc. and Subsidiaries

Condensed Consolidated Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

2023 |

|

2022 |

|

|

(In Millions) |

|

| Cash flows from operating activities: |

|

|

|

|

| Net income |

$ |

3.2 |

|

|

$ |

26.7 |

|

|

| Adjustments to reconcile net income to net cash provided by operating activities— |

|

|

|

|

| Depreciation and amortization |

7.8 |

|

|

8.5 |

|

|

| Amortization of debt related costs |

0.3 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

1.5 |

|

|

1.3 |

|

|

| Deferred tax expense (benefit) |

0.3 |

|

|

(0.2) |

|

|

| Other, net |

— |

|

|

(0.2) |

|

|

| Changes in assets and liabilities, net of acquisitions— |

|

|

|

|

| Accounts receivable |

(6.7) |

|

|

(0.1) |

|

|

| Prepaid expenses and other assets |

18.1 |

|

|

(1.6) |

|

|

| Accounts payable |

2.3 |

|

|

(0.6) |

|

|

| Accrued payroll |

12.2 |

|

|

(1.6) |

|

|

| Other liabilities |

(9.4) |

|

|

9.2 |

|

|

| Net cash provided by operating activities |

29.6 |

|

|

41.4 |

|

|

| Cash flows from investing activities: |

|

|

|

|

| Acquisition of businesses, net of cash acquired |

(2.8) |

|

|

— |

|

|

| Purchases of property and equipment |

(0.6) |

|

|

(2.3) |

|

|

|

|

|

|

|

| Other, net |

0.2 |

|

|

0.9 |

|

|

| Net cash used in investing activities |

(3.2) |

|

|

(1.4) |

|

|

| Cash flows from financing activities: |

|

|

|

|

|

|

|

|

|

| Principal payments on term loan |

(5.0) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

| Payments on revolving credit facility |

(5.0) |

|

|

— |

|

|

| Distributions paid to noncontrolling interests of consolidated affiliates |

(2.5) |

|

|

(0.5) |

|

|

| Principal payments under finance lease obligations |

(1.0) |

|

|

(1.4) |

|

|

|

|

|

|

|

|

|

|

|

|

| Contributions from Encompass |

— |

|

|

23.5 |

|

|

| Distributions to Encompass |

— |

|

|

(55.8) |

|

|

| Contributions from noncontrolling interests of consolidated affiliates |

— |

|

|

7.4 |

|

|

| Other |

(0.5) |

|

|

|

|

| Net cash used in financing activities |

(14.0) |

|

|

(26.8) |

|

|

| Increase in cash, cash equivalents, and restricted cash |

12.4 |

|

|

13.2 |

|

|

| Cash, cash equivalents, and restricted cash at beginning of year |

27.2 |

|

|

8.0 |

|

|

| Cash, cash equivalents, and restricted cash at end of year |

$ |

39.6 |

|

|

$ |

21.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Enhabit, Inc. and Subsidiaries

Supplemental Information

Adjusted Earnings Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 |

|

|

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

| Earnings per share, as reported |

$ |

0.05 |

|

|

$ |

0.53 |

|

|

|

|

|

|

|

|

|

| Adjustments, net of tax: |

|

|

|

|

|

|

|

|

|

|

|

| Income tax adjustments |

0.01 |

|

|

— |

|

|

|

|

|

|

|

|

|

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

0.03 |

|

|

0.03 |

|

|

|

|

|

|

|

|

|

Adjusted earnings per share(2) |

$ |

0.09 |

|

|

$ |

0.56 |

|

|

|

|

|

|

|

|

|

(1) Unusual or nonrecurring items include costs associated with the strategic alternatives review, shareholder activism defense, and non-routine litigation.

(2) Adjusted EPS may not sum due to rounding.

Enhabit, Inc. and Subsidiaries

Supplemental Information

Adjusted Earnings Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 QTD |

|

2023 |

|

|

|

Adjustments |

|

|

|

As Reported |

|

Income Tax Adjustments |

|

Unusual or nonrecurring items that are not typical of ongoing operations |

|

|

|

|

|

As Adjusted |

|

(In Millions, Except Per Share Amounts) |

Adjusted EBITDA(1) |

$ |

25.3 |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

|

|

|

$ |

25.3 |

|

| Depreciation and amortization |

(7.8) |

|

|

— |

|

|

— |

|

|

|

|

|

|

(7.8) |

|

| Interest expense and amortization of debt discounts and fees |

(9.5) |

|

|

— |

|

|

— |

|

|

|

|

|

|

(9.5) |

|

| Gain on disposal of assets |

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

— |

|

| Stock-based compensation |

(1.5) |

|

|

— |

|

|

— |

|

|

|

|

|

|

(1.5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unusual or nonrecurring items that are not typical of ongoing operations(2) |

(2.3) |

|

|

— |

|

|

2.3 |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income tax expense |

4.2 |

|

|

— |

|

|

2.3 |

|

|

|

|

|

|

6.5 |

|

| Provision for income tax expense |

(1.5) |

|

|

0.4 |

|

|

(0.6) |

|

|

|

|

|

|

(1.7) |

|

| Net income attributable to Enhabit |

$ |

2.7 |

|

|

$ |

0.4 |

|

|

$ |

1.7 |

|

|

|

|

|

|

$ |

4.8 |

|

Diluted earnings per share(3) |

$ |

0.05 |

|

|

$ |

0.01 |

|

|

$ |

0.03 |

|

|

|

|

|

|

$ |

0.09 |

|

| Diluted shares used in calculation |

50.1 |

|

|

|

|

|

|

|

|

|

|

|

(1) Reconciliation to GAAP provided on page 12.

(2) Unusual or nonrecurring items include costs associated with the strategic alternatives review, shareholder activism defense, and non-routine litigation.

(3) Adjusted EPS may not sum due to rounding.

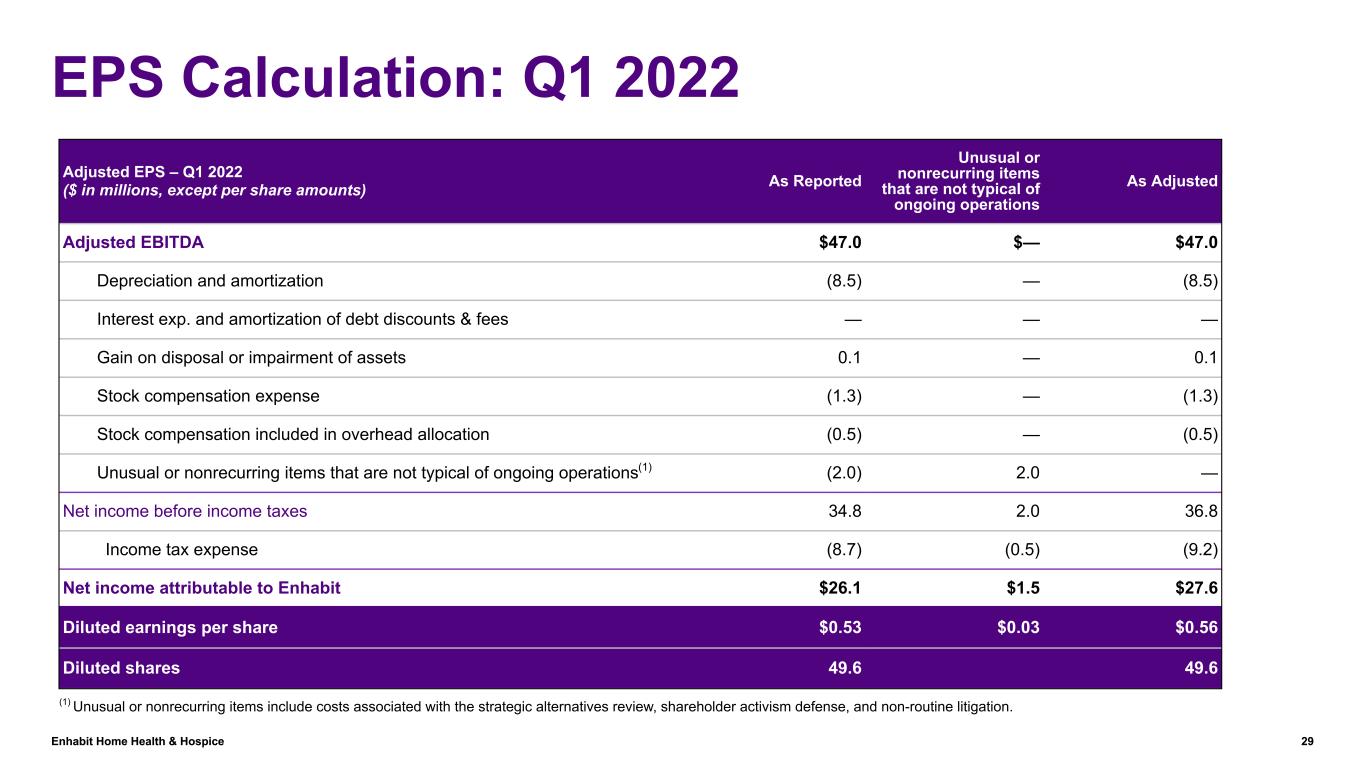

Enhabit, Inc. and Subsidiaries

Supplemental Information

Adjusted Earnings Per Share

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 QTD |

|

2022 |

|

|

|

|

|

Adjustments |

|

|

|

As Reported |

|

|

|

Unusual or nonrecurring items that are not typical of ongoing operations |

|

|

|

|

|

As Adjusted |

|

(In Millions, Except Per Share Amounts) |

Adjusted EBITDA(1) |

$ |

47.0 |

|

|

|

|

$ |

— |

|

|

|

|

|

|

$ |

47.0 |

|

| Depreciation and amortization |

(8.5) |

|

|

|

|

— |

|

|

|

|

|

|

(8.5) |

|

| Interest expense and amortization of debt discounts and fees |

— |

|

|

|

|

— |

|

|

|

|

|

|

— |

|

| Gain on disposal of assets |

0.1 |

|

|

|

|

— |

|

|

|

|

|

|

0.1 |

|

| Stock-based compensation |

(1.3) |

|

|

|

|

— |

|

|

|

|

|

|

(1.3) |

|

| Stock-based compensation included in overhead allocation |

(0.5) |

|

|

|

|

— |

|

|

|

|

|

|

(0.5) |

|

Unusual or nonrecurring items that are not typical of ongoing operations(2) |

(2.0) |

|

|

|

|

2.0 |

|

|

|

|

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income before income tax expense |

34.8 |

|

|

|

|

2.0 |

|

|

|

|

|

|

36.8 |

|

| Provision for income tax expense |

(8.7) |

|

|

|

|

(0.5) |

|

|

|

|

|

|

(9.2) |

|

| Net income attributable to Enhabit |

$ |

26.1 |

|

|

|

|

$ |

1.5 |

|

|

|

|

|

|

$ |

27.6 |

|

Diluted earnings per share(3) |

$ |

0.53 |

|

|

|

|

$ |

0.03 |

|

|

|

|

|

|

$ |

0.56 |

|

| Diluted shares used in calculation |

49.6 |

|

|

|

|

|

|

|

|

|

|

|

(1) Reconciliation to GAAP provided on page 12.

(2) Unusual or nonrecurring items include costs associated with the strategic alternatives review, shareholder activism defense, and non-routine litigation.

(3) Adjusted EPS may not sum due to rounding.

Enhabit, Inc. and Subsidiaries

Supplemental Information

Reconciliation of Net Income to Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2023 |

|

2022 |

|

|

|

|

|

(In Millions) |

| Net Income |

$ |

3.2 |

|

|

$ |

26.7 |

|

|

|

|

|

| Income tax expense |

1.5 |

|

|

8.7 |

|

|

|

|

|

| Interest expense and amortization of debt discounts and fees |

9.5 |

|

|

— |

|

|

|

|

|

| Depreciation and amortization |

7.8 |

|

|

8.5 |

|

|

|

|

|

| (Gain) loss on disposal or impairment of assets |

— |

|

|

(0.1) |

|

|

|

|

|

| Stock-based compensation |

1.5 |

|

|

1.3 |

|

|

|

|

|

| Stock-based compensation included in overhead allocation |

— |

|

|

0.5 |

|

|

|

|

|

| Net income attributable to noncontrolling interests |

(0.5) |

|

|

(0.6) |

|

|

|

|

|

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

2.3 |

|

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

$ |

25.3 |

|

|

$ |

47.0 |

|

|

|

|

|

(1) Unusual or nonrecurring items include costs associated with the strategic alternatives review, shareholder activism defense, and non-routine litigation.

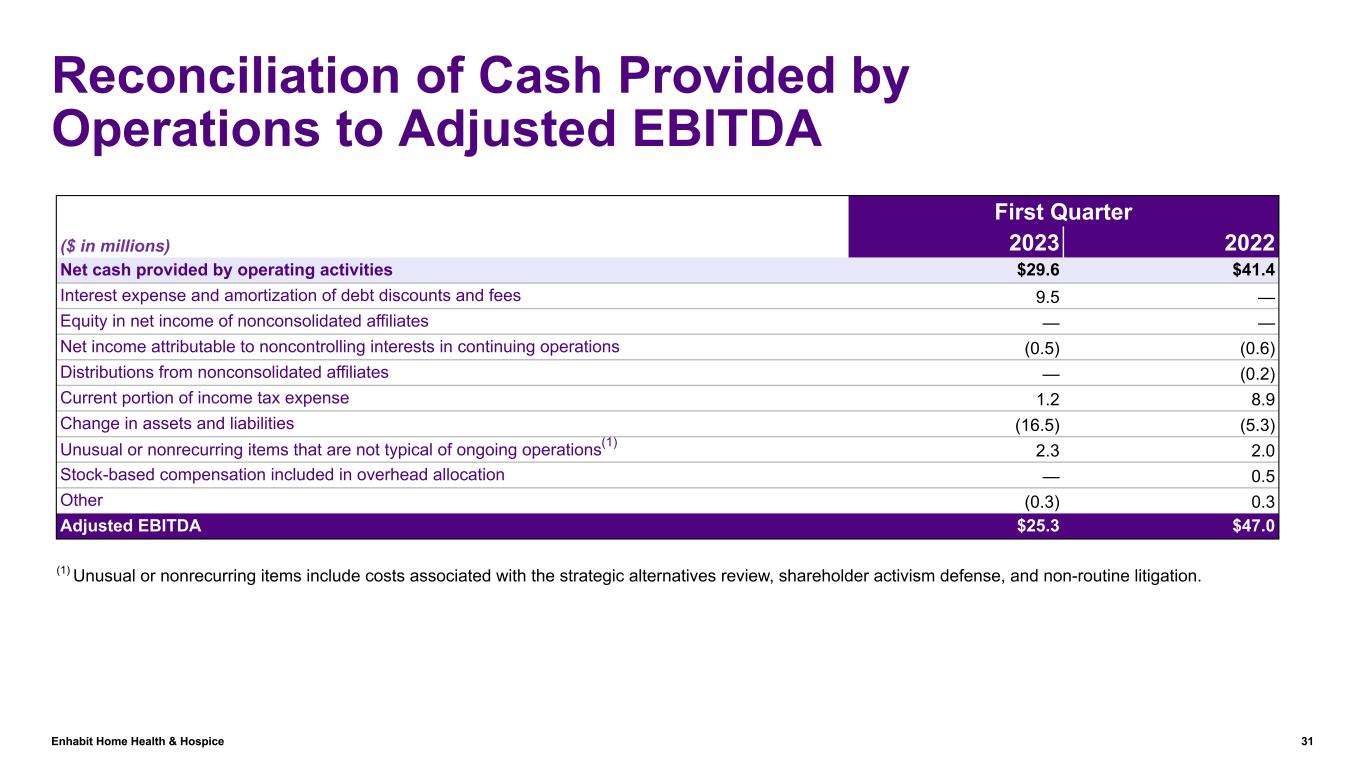

Reconciliation of Net Cash Provided by Operating Activities to Adjusted EBITDA

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended

March 31, |

|

|

|

2023 |

|

2022 |

|

|

|

|

|

(In Millions) |

| Net cash provided by operating activities |

$ |

29.6 |

|

|

$ |

41.4 |

|

|

|

|

|

| Interest expense and amortization of debt discounts and fees |

9.5 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Equity in net income of nonconsolidated affiliates |

— |

|

|

— |

|

|

|

|

|

| Net income attributable to noncontrolling interests in continuing operations |

(0.5) |

|

|

(0.6) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Distributions from nonconsolidated affiliates |

— |

|

|

(0.2) |

|

|

|

|

|

| Current portion of income tax expense |

1.2 |

|

|

8.9 |

|

|

|

|

|

| Change in assets and liabilities |

(16.5) |

|

|

(5.3) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

2.3 |

|

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation included in overhead allocation |

— |

|

|

0.5 |

|

|

|

|

|

| Other |

(0.3) |

|

|

0.3 |

|

|

|

|

|

| Adjusted EBITDA |

$ |

25.3 |

|

|

$ |

47.0 |

|

|

|

|

|

(1) Unusual or nonrecurring items include costs associated with the strategic alternatives review, shareholder activism defense, and non-routine litigation.

Enhabit, Inc. and Subsidiaries

Supplemental Information

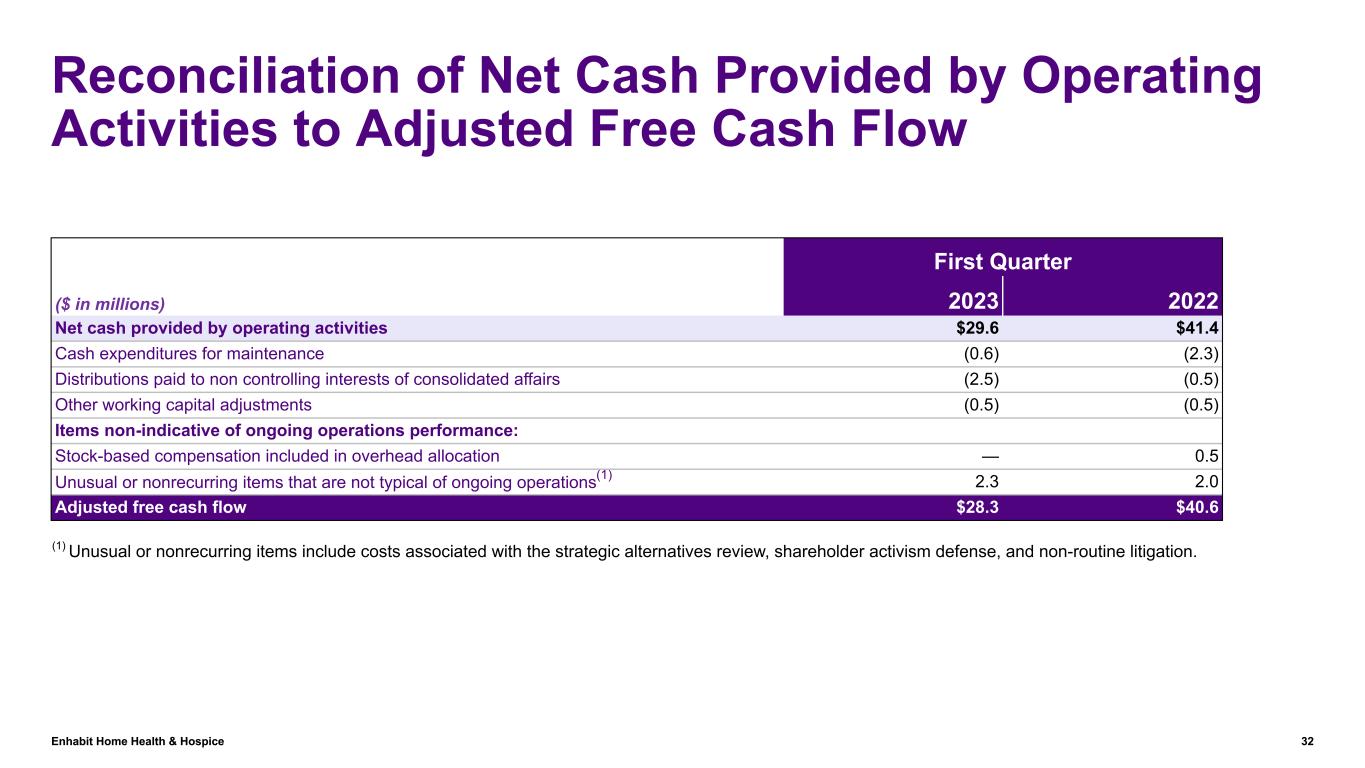

Reconciliation of Net Cash Provided by Operating Activities to Adjusted Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q1 |

|

|

|

|

| ($ in millions) |

|

2023 |

|

2022 |

|

|

|

|

|

|

| Net cash provided by operating activities |

|

$ |

29.6 |

|

|

$ |

41.4 |

|

|

|

|

|

|

|

| Capital expenditures for maintenance |

|

(0.6) |

|

|

(2.3) |

|

|

|

|

|

|

|

| Distributions paid to noncontrolling interests of consolidated affiliates |

|

(2.5) |

|

|

(0.5) |

|

|

|

|

|

|

|

| Other working capital adjustments |

|

(0.5) |

|

|

(0.5) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Items non-indicative of ongoing operating performance: |

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation included in overhead allocation |

|

— |

|

|

0.5 |

|

|

|

|

|

|

|

Unusual or nonrecurring items that are not typical of ongoing operations(1) |

|

2.3 |

|

|

2.0 |

|

|

|

|

|

|

|

| Adjusted free cash flow |

|

$ |

28.3 |

|

|

$ |

40.6 |

|

|

|

|

|

|

|

(1) Unusual or nonrecurring items include costs associated with the strategic alternatives review, shareholder activism defense, and non-routine litigation.

FORWARD-LOOKING STATEMENTS

Statements contained in this press release which are not historical facts, such as those relating to future events, projections, financial guidance, legislative or regulatory developments, strategy or growth opportunities, are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All such estimates, projections, and forward-looking information speak only as of the date hereof, and Enhabit undertakes no duty to publicly update or revise such forward-looking information, whether as a result of new information, future events, or otherwise. Such forward-looking statements are necessarily estimates based upon current information and involve a number of risks and uncertainties. Actual events or results may differ materially from those anticipated in these forward-looking statements as a result of a variety of factors. While it is impossible to identify all such factors, factors which could cause actual events or results to differ materially from those estimated by Enhabit include, but are not limited to, our ability to execute on our strategic plans, regulatory and other developments impacting the markets for our services, changes in reimbursement rates, general economic conditions, our ability to attract and retain key management personnel and healthcare professionals, potential disruptions or breaches of our or our vendors’ information systems, the outcome of litigation, our ability to successfully complete and integrate de novo developments, acquisitions, investments, and joint ventures, and our ability to control costs, particularly labor and employee benefit costs. Our Form 10K and subsequent quarterly reports on Form 10-Q, each of which can be found on the Company’s website at http://investors.ehab.com and the SEC’s website at www.sec.gov, discuss other risks and factors that could cause actual results to differ materially from those expressed or implied by any forward-looking statement in this press release. We urge you to consider all of the risks, uncertainties and factors identified above or discussed in such reports carefully in evaluating the forward-looking statements in this press release.

Investor Relations Contact

Mark Brewer

InvestorRelations@ehab.com

469-860-6061

Media Contact

Erin Volbeda

Media@ehab.com

972-338-5141