Document

Exhibit 99.1

Q3 2025 Open House: Opendoor 2.0 Charts Path to Profitability Through Software and AI

New CEO Kaz Nejatian commits to return the Company to profitability, accelerating transactions, rescaling while leveraging the existing cost structure and launching new AI-driven products to power the future of homeownership

SAN FRANCISCO, California - November 6, 2025 - Opendoor Technologies Inc. (Nasdaq: OPEN), a leading e-commerce platform for residential real estate transactions, today reported financial results for its third quarter ended September 30, 2025.

“We are refounding Opendoor as a software and AI company. In my first month as CEO, we've made a decisive break from the past -- returning to the office, eliminating reliance on consultants, and launching over a dozen AI-powered products and features that demonstrate our renewed velocity. Our business will succeed by building technology that makes selling, buying, and owning a home easier and more joyful -- not from charging high spreads and hoping the macro saves us,” said Kaz Nejatian, CEO of Opendoor.

Nejatian continued, “Our path to profitability is clear: transact with more sellers, strengthen our unit economics through better pricing and resale speed, and drive operational efficiency by being ruthless on expenses. By the end of next year, we will drive Opendoor to breakeven Adjusted Net Income on a 12-month go-forward basis.

We have three management objectives we believe are critical to reaching this goal. These measures are the same that we monitor internally and to which we hold ourselves accountable. If we can consistently execute and improve each of them, which you will be able to track, we expect to achieve our profitability target.”

|

|

|

|

|

|

|

|

|

Management Objective |

Why This Matters |

How You Can Hold Us Accountable |

| (1) Scale Acquisitions |

More volume means more revenue from transactions and ancillary services, plus better leverage of our cost base.

Market concentration creates a flywheel. When we own meaningful share in a market, we attract more inventory, which attracts more buyers, which attracts more sellers.

|

- Acquisition contract dashboard on accountable.opendoor.com, showing our acquisition goals through the end of 2026.

- To give you a sense of our progress, for the week ending September 15th we entered into contract to buy 120 homes; in the last week of October we entered into contract to buy 230 homes.

|

|

|

|

|

|

|

|

|

|

(2) Improve Unit Economics and Resale Velocity |

Speed and profitability per transaction determine whether we build a sustainable business or remain vulnerable to macro swings.

Higher profitability per transaction gives us the ability to decrease spreads embedded in our offers, which could lead to more acquisitions.

|

- % of Homes on the market for greater than 120 Days. (Reported quarterly).

- Product, feature & partnership launches tracked on accountable.opendoor.com

|

(3) Build Operating Leverage |

Scale transactions faster than fixed costs so each additional home adds accretive profit.

Automation and standardization reduce variability in customer experience, enable faster and more efficient closes, and ensure consistent quality across transactions.

|

- Except for the $15 million one-time make-whole cash award to the CEO, Fixed Operating Expenses hold relatively steady as we rescale volumes (Reported quarterly.)

- Trailing 12-month Operations expense as a % of trailing 12-month revenue holds relatively steady or decreases over time. (Reported quarterly.)

|

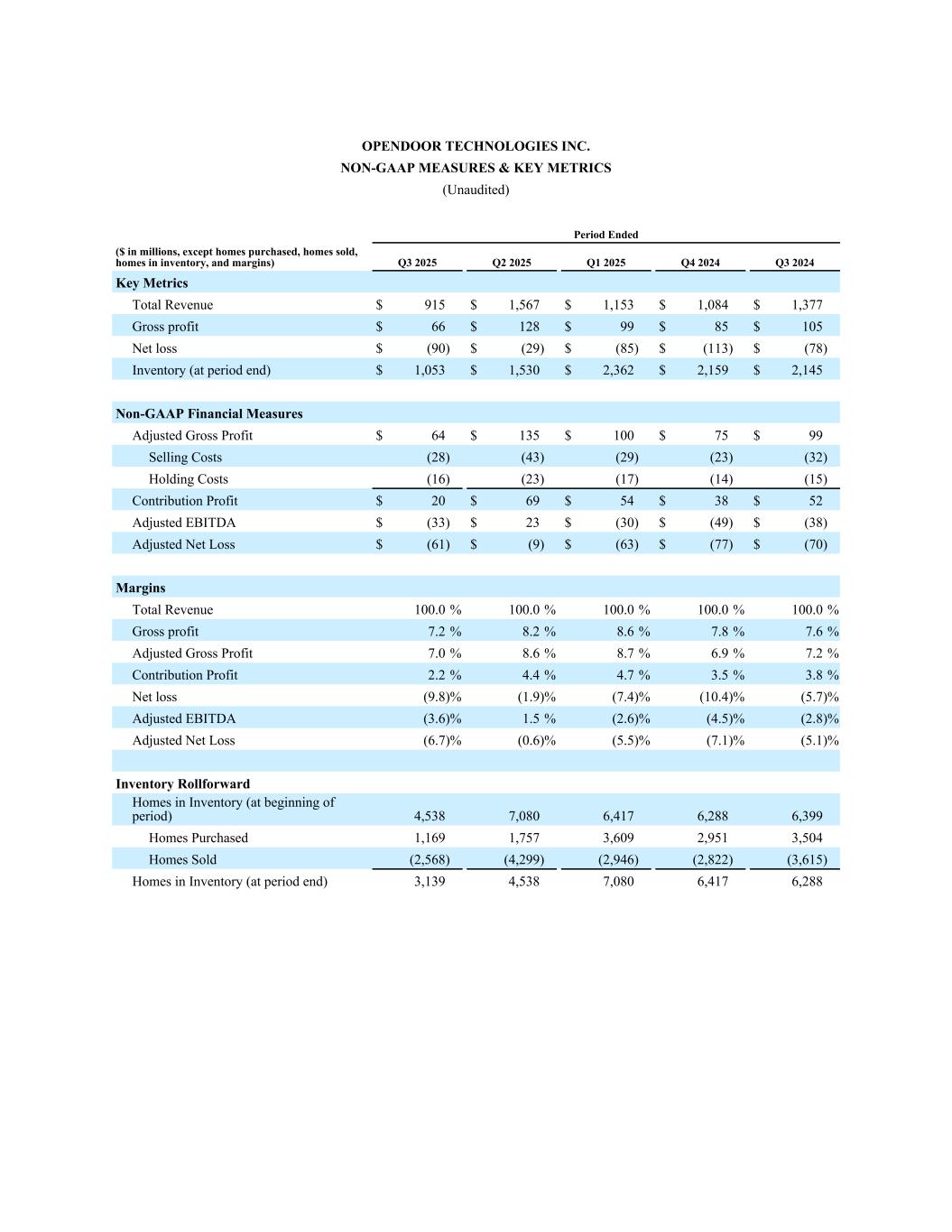

Third Quarter 2025 Key Highlights

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

(In millions, except percentages and non-dollar amounts) |

|

September 30,

2025 |

|

|

|

|

|

|

|

September 30,

2024 |

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

915 |

|

|

|

|

|

|

|

|

$ |

1,377 |

|

|

|

|

|

|

|

|

|

Gross profit |

|

$ |

66 |

|

|

|

|

|

|

|

|

$ |

105 |

|

|

|

|

|

|

|

|

|

| Gross Margin |

|

7.2 |

% |

|

|

|

|

|

|

|

7.6 |

% |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(90) |

|

|

|

|

|

|

|

|

$ |

(78) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homes sold |

|

2,568 |

|

|

|

|

|

|

|

|

3,615 |

|

|

|

|

|

|

|

|

|

| Homes purchased |

|

1,169 |

|

|

|

|

|

|

|

|

3,504 |

|

|

|

|

|

|

|

|

|

| Homes in inventory (at period end) |

|

3,139 |

|

|

|

|

|

|

|

|

6,288 |

|

|

|

|

|

|

|

|

|

| Inventory (at period end) |

|

$ |

1,053 |

|

|

|

|

|

|

|

|

$ |

2,145 |

|

|

|

|

|

|

|

|

|

Homes under contract to purchase (at period end) |

|

526 |

|

|

|

|

|

|

|

|

1,006 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial Highlights (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contribution Profit |

|

$ |

20 |

|

|

|

|

|

|

|

|

$ |

52 |

|

|

|

|

|

|

|

|

|

| Contribution Margin |

|

2.2 |

% |

|

|

|

|

|

|

|

3.8 |

% |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

(33) |

|

|

|

|

|

|

|

|

$ |

(38) |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA Margin |

|

(3.6) |

% |

|

|

|

|

|

|

|

(2.8) |

% |

|

|

|

|

|

|

|

|

| Adjusted Net Loss |

|

$ |

(61) |

|

|

|

|

|

|

|

|

$ |

(70) |

|

|

|

|

|

|

|

|

|

(1) See “—Use of Non-GAAP Financial Measures” for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

Financial Outlook

We are adjusting our traditional quarterly guidance as we rebuild Opendoor. Our results in the upcoming quarter are largely the outcome of us managing decisions that were made several months ago. We’re focused on making the right long-term decisions for the business, not managing to short-term guidance. What matters, and what we want to be held accountable for, are the actions we take from here and the results they drive over time.

That said, we want to provide you with the following guideposts:

•We are driving to Adjusted Net Income breakeven by the end of 2026, measured on a twelve-month go-forward basis.

•Q4 2025 Financial Outlook:

◦Acquisitions: Expected to increase at least 35% from Q3 2025 as product launches and pricing engine changes take hold.

◦Revenue: Expected to increase from the outlook we provided at Q2 2025 earnings, but decrease approximately 35% quarter-over-quarter due to low inventory levels from Q3 2025 reduced acquisition volumes.

◦Contribution Margin1: Near-term pressure as we clear old inventory; We believe we bottomed out in October and margins will improve for the remainder of the year, but Q4 2025 contribution margin will be below Q3 2025.

◦Adjusted EBITDA1: Q4 2025 loss expected in the high $40 millions to mid $50 millions.

You can follow our progress on home acquisition contracts and product and feature launches every single week at accountable.opendoor.com.

Conference Call and Webcast Details

Opendoor will host a webcast to discuss its financial results on November 6, 2025, at 2:00 p.m. Pacific Time. A live webcast of the call can be accessed from Opendoor’s Investor Relations website at https://investor.opendoor.com. An archived version of the webcast will be available from the same website after the call.

About Opendoor

Opendoor is a leading e-commerce platform for residential real estate transactions whose mission is to power life’s progress, one move at a time. Since 2014, Opendoor has provided people across the U.S. with a simple and certain way to sell and buy a home. Opendoor is a team of problem solvers, innovators, and operators who are leading the future of real estate. Opendoor currently operates in markets nationwide.

For more information, please visit www.opendoor.com

1 Opendoor has not provided a quantitative reconciliation of forecasted Contribution Profit to forecasted GAAP gross profit (loss), forecasted Contribution Margin to forecasted GAAP gross margin, nor a reconciliation of forecasted Adjusted EBITDA to forecasted GAAP net income (loss) within this press release because the Company is unable, without making unreasonable efforts, to calculate certain reconciling items with confidence. These items include, but are not limited to, inventory valuation adjustment and equity securities fair value adjustment. These items, which could materially affect the computation of forward-looking GAAP gross profit (loss), GAAP gross margin, and net income (loss), are inherently uncertain and depend on various factors, some of which are outside of the Company’s control. For more information regarding the non-GAAP financial measures discussed in this press release, please see “Use of Non-GAAP Financial Measures” following the financial tables below.

Forward Looking Statements

This press release contains certain forward-looking statements within the meaning of Section 27A the Private Securities Litigation Reform Act of 1995, as amended. All statements contained in this press release that do not relate to matters of historical fact should be considered forward-looking, including statements regarding whether we are able to reach breakeven Adjusted Net Income by the end of 2026 on a 12-month go-forward basis by transacting with more sellers, strengthening unit economics and driving operational efficiency; whether we are able to succeed by building technology that makes selling, buying, and owning a home easier and more joyful; whether we are able to achieve management’s objectives to scale acquisitions, improve unit economics and resale velocity, and build operating leverage; anticipated future results of operations and financial performance, including our fourth quarter of 2025, 2026 and 2027 financial outlook; our product offerings, including our ability to leverage AI to drive operational efficiency; the future health and status of our financial condition; and our business strategy and plans, including plans to continue to invest in and enhance our products. These forward-looking statements generally are identified by the words “anticipate”, “believe”, “contemplate”, “continue”, “could”, “estimate”, “expect”, “forecast”, “future”, “guidance”, “intend”, “may”, “might”, “opportunity”, “outlook”, “plan”, “possible”, “potential”, “predict”, “project”, “should”, “strategy”, “strive”, “target”, “vision”, “will”, or “would”, any negative of these words or other similar terms or expressions. The absence of these words does not mean that a statement is not forward-looking. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties that can cause actual results to differ materially from those in such forward-looking statements. The factors that could cause or contribute to actual future events to differ materially from the forward-looking statements in this press release include but are not limited to: the current and future health and stability of the economy, financial conditions and residential housing market, including any extended downturns or slowdowns; changes in general economic and financial conditions (including federal monetary policy, the imposition of tariffs and price or exchange controls, interest rates, inflation, actual or anticipated recession, home price fluctuations, and housing inventory), as well as the probability of such changes occurring, that impact demand for our products and services, lower our profitability or reduce our access to future financings; actual or anticipated fluctuations in our financial condition and results of operations; changes in projected operational and financial results; our real estate assets and increased competition in the U.S. residential real estate industry; our ability to operate and grow our core business products, including the ability to obtain sufficient financing and resell purchased homes; investment of resources to pursue strategies and develop new products and services that may not prove effective or that are not attractive to customers and/or partners or that do not allow us to compete successfully; our ability to acquire and resell homes profitably; our ability to grow market share in our existing markets or any new markets we may enter; our ability to leverage AI to drive operational efficiency; our ability to manage our growth effectively; our ability to expeditiously sell and appropriately price our inventory; our ability to access sources of capital, including debt financing and securitization funding to finance our real estate inventories and other sources of capital to finance operations and growth; our ability to maintain liquidity and to raise the funds necessary for any cash settlement upon conversion of our outstanding convertible notes or upon repurchasing our outstanding convertible notes; any dilutive effect on our common stock upon any settlement of our outstanding convertible notes through the conversion of notes into shares of our common stock; our ability to maintain and enhance our products and brand, and to attract customers; our ability to manage, develop and refine our digital platform, including our automated pricing and valuation technology; our ability to realize expected benefits from our restructuring and cost reduction efforts; our ability to comply with multiple listing service rules and requirements to access and use listing data, and to maintain or establish relationships with listings and data providers; our ability to obtain or maintain licenses and permits to support our current and future business operations; acquisitions, strategic partnerships, joint ventures, capital-raising activities or other corporate transactions or commitments by us or our competitors; actual or anticipated changes in technology, products, markets or services by us or our competitors; our ability to protect our brand and intellectual property; our success in retaining or recruiting, or changes required in, our officers, key employees and/or directors; the impact of the regulatory environment and potential regulatory instability within our industry and complexities with compliance related to such environment; any future impact of pandemics, epidemics, or other public health crises on our ability to operate, demand for our products and services, or general economic conditions; our ability to maintain our listing on the Nasdaq Global Select Market; changes in laws or government regulation affecting our business; the impact of pending or future litigation or regulatory actions; and the volatility in the price of our common stock.

The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described under the caption “Risk Factors” in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission (the “SEC”) on February 27, 2025, as updated by our Quarterly Report on Form 10-Q for the quarter ended June 30, 2025 and our Quarterly Report on Form 10-Q for the quarter ended September 30, 2025 and other filings with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and, except as required by law, we assume no obligation and do not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. We do not give any assurance that we will achieve our expectations.

Contact Information

Investors:

investors@opendoor.com

Media:

Contact Kaz on X @CanadaKaz (In millions, except percentages, homes sold, number of markets, homes purchased, and homes in inventory)

OPENDOOR TECHNOLOGIES INC.

FINANCIAL HIGHLIGHTS AND OPERATING METRICS

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

|

|

|

|

(In millions, except percentages and non-dollar amounts) |

|

September 30,

2025 |

|

June 30,

2025 |

|

March 31,

2025 |

|

December 31,

2024 |

|

September 30,

2024 |

|

|

|

|

|

|

|

|

| Revenue |

|

$ |

915 |

|

|

$ |

1,567 |

|

|

$ |

1,153 |

|

|

$ |

1,084 |

|

|

$ |

1,377 |

|

|

|

|

|

|

|

|

|

Gross profit |

|

$ |

66 |

|

|

$ |

128 |

|

|

$ |

99 |

|

|

$ |

85 |

|

|

$ |

105 |

|

|

|

|

|

|

|

|

|

| Gross Margin |

|

7.2 |

% |

|

8.2 |

% |

|

8.6 |

% |

|

7.8 |

% |

|

7.6 |

% |

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(90) |

|

|

$ |

(29) |

|

|

$ |

(85) |

|

|

$ |

(113) |

|

|

$ |

(78) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Homes sold |

|

2,568 |

|

|

4,299 |

|

|

2,946 |

|

|

2,822 |

|

|

3,615 |

|

|

|

|

|

|

|

|

|

| Homes purchased |

|

1,169 |

|

|

1,757 |

|

|

3,609 |

|

|

2,951 |

|

|

3,504 |

|

|

|

|

|

|

|

|

|

| Homes in inventory (at period end) |

|

3,139 |

|

|

4,538 |

|

|

7,080 |

|

|

6,417 |

|

|

6,288 |

|

|

|

|

|

|

|

|

|

| Inventory (at period end) |

|

$ |

1,053 |

|

|

$ |

1,530 |

|

|

$ |

2,362 |

|

|

$ |

2,159 |

|

|

$ |

2,145 |

|

|

|

|

|

|

|

|

|

Percentage of homes “on the market” for greater than 120 days (at period end) |

|

51 |

% |

|

36 |

% |

|

27 |

% |

|

46 |

% |

|

23 |

% |

|

|

|

|

|

|

|

|

Non-GAAP Financial Highlights (1) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Contribution Profit |

|

$ |

20 |

|

|

$ |

69 |

|

|

$ |

54 |

|

|

$ |

38 |

|

|

$ |

52 |

|

|

|

|

|

|

|

|

|

| Contribution Margin |

|

2.2 |

% |

|

4.4 |

% |

|

4.7 |

% |

|

3.5 |

% |

|

3.8 |

% |

|

|

|

|

|

|

|

|

| Adjusted EBITDA |

|

$ |

(33) |

|

|

$ |

23 |

|

|

$ |

(30) |

|

|

$ |

(49) |

|

|

$ |

(38) |

|

|

|

|

|

|

|

|

|

| Adjusted EBITDA Margin |

|

(3.6) |

% |

|

1.5 |

% |

|

(2.6) |

% |

|

(4.5) |

% |

|

(2.8) |

% |

|

|

|

|

|

|

|

|

| Adjusted Net Loss |

|

$ |

(61) |

|

|

$ |

(9) |

|

|

$ |

(63) |

|

|

$ |

(77) |

|

|

$ |

(70) |

|

|

|

|

|

|

|

|

|

(1) See “—Use of Non-GAAP Financial Measures” for further details and a reconciliation of such non-GAAP measures to their nearest comparable GAAP measures.

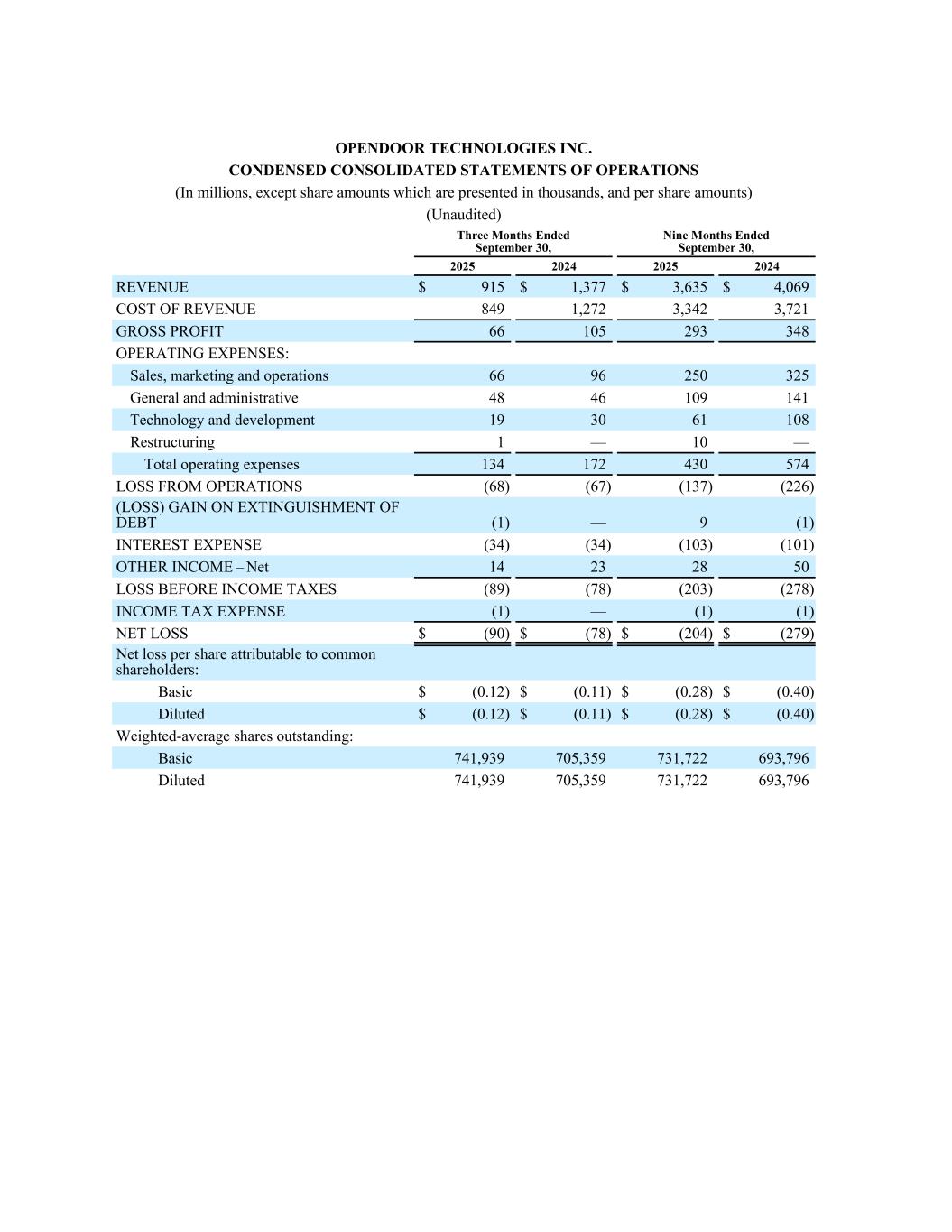

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In millions, except share amounts which are presented in thousands, and per share amounts)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended

September 30, |

|

September 30, 2025 |

|

June 30, 2025 |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

2025 |

|

2024 |

| REVENUE |

$ |

915 |

|

|

$ |

1,567 |

|

|

$ |

1,153 |

|

|

$ |

1,084 |

|

|

$ |

1,377 |

|

|

$ |

3,635 |

|

|

$ |

4,069 |

|

| COST OF REVENUE |

849 |

|

|

1,439 |

|

|

1,054 |

|

|

999 |

|

|

1,272 |

|

|

3,342 |

|

|

3,721 |

|

| GROSS PROFIT |

66 |

|

|

128 |

|

|

99 |

|

|

85 |

|

|

105 |

|

|

293 |

|

|

348 |

|

| OPERATING EXPENSES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales, marketing and operations |

66 |

|

|

86 |

|

|

98 |

|

|

88 |

|

|

96 |

|

|

250 |

|

|

325 |

|

| General and administrative |

48 |

|

|

28 |

|

|

33 |

|

|

41 |

|

|

46 |

|

|

109 |

|

|

141 |

|

| Technology and development |

19 |

|

|

21 |

|

|

21 |

|

|

33 |

|

|

30 |

|

|

61 |

|

|

108 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restructuring |

1 |

|

|

6 |

|

|

3 |

|

|

17 |

|

|

— |

|

|

10 |

|

|

— |

|

| Total operating expenses |

134 |

|

|

141 |

|

|

155 |

|

|

179 |

|

|

172 |

|

|

430 |

|

|

574 |

|

| LOSS FROM OPERATIONS |

(68) |

|

|

(13) |

|

|

(56) |

|

|

(94) |

|

|

(67) |

|

|

(137) |

|

|

(226) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (LOSS) GAIN ON EXTINGUISHMENT OF DEBT |

(1) |

|

|

10 |

|

|

— |

|

|

(1) |

|

|

— |

|

|

9 |

|

|

(1) |

|

| INTEREST EXPENSE |

(34) |

|

|

(36) |

|

|

(33) |

|

|

(32) |

|

|

(34) |

|

|

(103) |

|

|

(101) |

|

| OTHER INCOME – Net |

14 |

|

|

10 |

|

|

4 |

|

|

14 |

|

|

23 |

|

|

28 |

|

|

50 |

|

LOSS BEFORE INCOME TAXES |

(89) |

|

|

(29) |

|

|

(85) |

|

|

(113) |

|

|

(78) |

|

|

(203) |

|

|

(278) |

|

| INCOME TAX EXPENSE |

(1) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(1) |

|

|

(1) |

|

NET LOSS |

$ |

(90) |

|

|

$ |

(29) |

|

|

$ |

(85) |

|

|

$ |

(113) |

|

|

$ |

(78) |

|

|

$ |

(204) |

|

|

$ |

(279) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common shareholders: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.12) |

|

|

$ |

(0.04) |

|

|

$ |

(0.12) |

|

|

$ |

(0.16) |

|

|

$ |

(0.11) |

|

|

$ |

(0.28) |

|

|

$ |

(0.40) |

|

| Diluted |

$ |

(0.12) |

|

|

$ |

(0.04) |

|

|

$ |

(0.12) |

|

|

$ |

(0.16) |

|

|

$ |

(0.11) |

|

|

$ |

(0.28) |

|

|

$ |

(0.40) |

|

| Weighted-average shares outstanding: |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic |

741,939 |

|

|

729,484 |

|

|

723,542 |

|

|

716,317 |

|

|

705,359 |

|

|

731,722 |

|

|

693,796 |

|

| Diluted |

741,939 |

|

|

729,484 |

|

|

723,542 |

|

|

716,317 |

|

|

705,359 |

|

|

731,722 |

|

|

693,796 |

|

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED BALANCE SHEETS

(In millions, except share data)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30,

2025 |

|

December 31,

2024 |

| ASSETS |

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

| Cash and cash equivalents |

|

$ |

962 |

|

|

$ |

671 |

|

| Restricted cash |

|

490 |

|

|

92 |

|

| Marketable securities |

|

— |

|

|

8 |

|

| Escrow receivable |

|

9 |

|

|

6 |

|

|

|

|

|

|

| Real estate inventory, net |

|

1,053 |

|

|

2,159 |

|

Other current assets |

|

73 |

|

|

61 |

|

| Total current assets |

|

2,587 |

|

|

2,997 |

|

| PROPERTY AND EQUIPMENT – Net |

|

31 |

|

|

48 |

|

| RIGHT OF USE ASSETS |

|

9 |

|

|

18 |

|

| GOODWILL |

|

3 |

|

|

3 |

|

|

|

|

|

|

| OTHER ASSETS |

|

70 |

|

|

60 |

|

| TOTAL ASSETS |

|

$ |

2,700 |

|

|

$ |

3,126 |

|

| LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

|

|

| CURRENT LIABILITIES: |

|

|

|

| Accounts payable and other accrued liabilities |

|

$ |

91 |

|

|

$ |

92 |

|

| Non-recourse asset-backed debt – current portion |

|

374 |

|

|

432 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Convertible senior notes – current portion |

|

439 |

|

|

— |

|

| Interest payable |

|

9 |

|

|

3 |

|

| Lease liabilities – current portion |

|

1 |

|

|

2 |

|

| Total current liabilities |

|

914 |

|

|

529 |

|

| NON-RECOURSE ASSET-BACKED DEBT – Net of current portion |

|

966 |

|

|

1,492 |

|

| CONVERTIBLE SENIOR NOTES – Net of current portion |

|

— |

|

|

378 |

|

|

|

|

|

|

| LEASE LIABILITIES – Net of current portion |

|

7 |

|

|

13 |

|

| OTHER LIABILITIES |

|

2 |

|

|

1 |

|

| Total liabilities |

|

1,889 |

|

|

2,413 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SHAREHOLDERS’ EQUITY: |

|

|

|

|

Common stock, $0.0001 par value; 3,000,000,000 shares authorized; 771,534,057 and 719,990,121 shares issued, respectively; 771,534,057 and 719,990,121 shares outstanding, respectively |

|

— |

|

|

— |

|

| Additional paid-in capital |

|

4,740 |

|

|

4,438 |

|

| Accumulated deficit |

|

(3,929) |

|

|

(3,725) |

|

| Accumulated other comprehensive loss |

|

— |

|

|

— |

|

| Total shareholders’ equity |

|

811 |

|

|

713 |

|

| TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

$ |

2,700 |

|

|

$ |

3,126 |

|

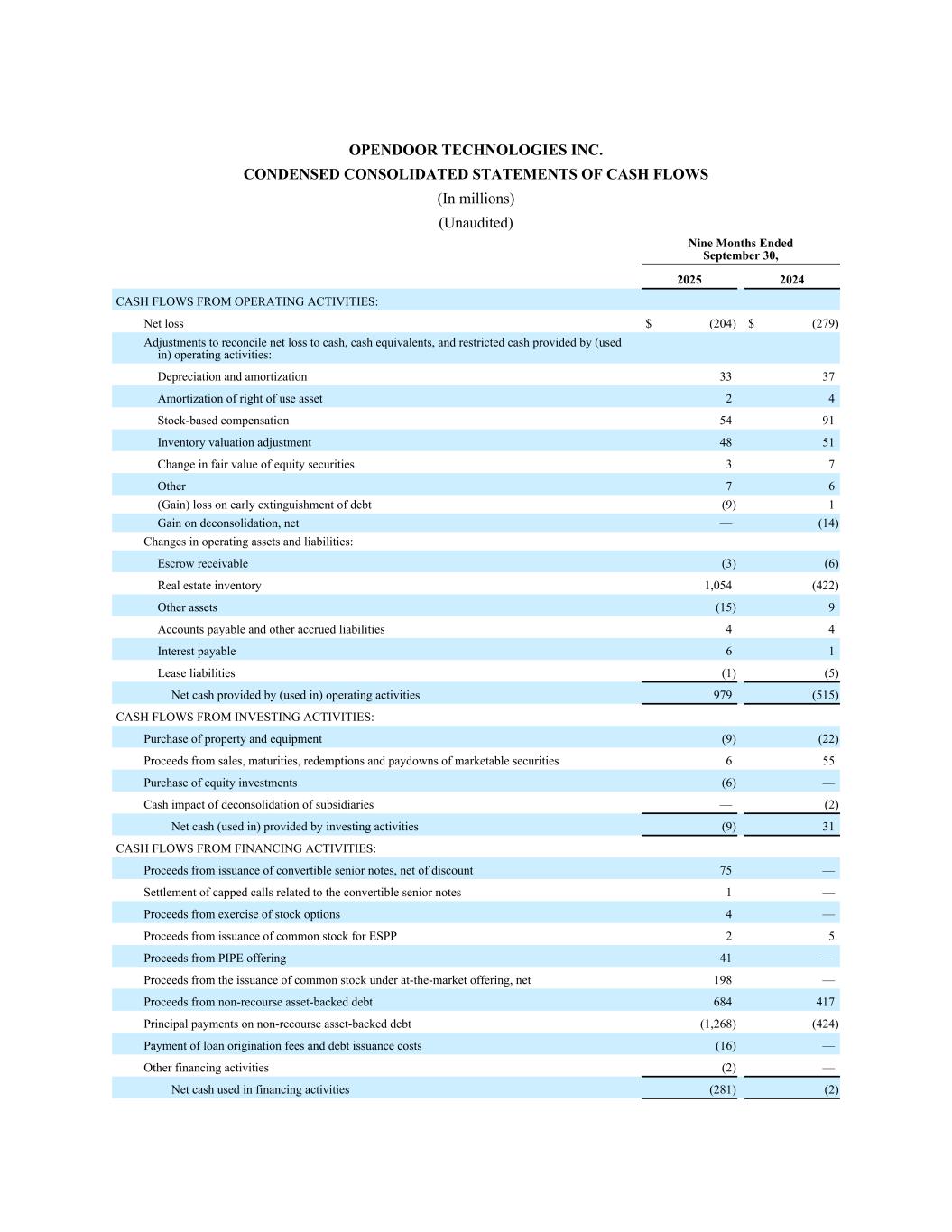

OPENDOOR TECHNOLOGIES INC.

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In millions)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended

September 30, |

|

2025 |

|

2024 |

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

| Net loss |

$ |

(204) |

|

|

$ |

(279) |

|

| Adjustments to reconcile net loss to cash, cash equivalents, and restricted cash provided by (used in) operating activities: |

|

|

|

| Depreciation and amortization |

33 |

|

|

37 |

|

| Amortization of right of use asset |

2 |

|

|

4 |

|

|

|

|

|

| Stock-based compensation |

54 |

|

|

91 |

|

|

|

|

|

|

|

|

|

| Inventory valuation adjustment |

48 |

|

|

51 |

|

|

|

|

|

|

|

|

|

| Change in fair value of equity securities |

3 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other |

7 |

|

|

6 |

|

|

|

|

|

|

|

|

|

| (Gain) loss on early extinguishment of debt |

(9) |

|

|

1 |

|

| Gain on deconsolidation, net |

— |

|

|

(14) |

|

| Changes in operating assets and liabilities: |

|

|

|

| Escrow receivable |

(3) |

|

|

(6) |

|

| Real estate inventory |

1,054 |

|

|

(422) |

|

| Other assets |

(15) |

|

|

9 |

|

| Accounts payable and other accrued liabilities |

4 |

|

|

4 |

|

| Interest payable |

6 |

|

|

1 |

|

| Lease liabilities |

(1) |

|

|

(5) |

|

| Net cash provided by (used in) operating activities |

979 |

|

|

(515) |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

| Purchase of property and equipment |

(9) |

|

|

(22) |

|

|

|

|

|

|

|

|

|

| Proceeds from sales, maturities, redemptions and paydowns of marketable securities |

6 |

|

|

55 |

|

| Purchase of equity investments |

(6) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Cash impact of deconsolidation of subsidiaries |

— |

|

|

(2) |

|

| Net cash (used in) provided by investing activities |

(9) |

|

|

31 |

|

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from issuance of convertible senior notes, net of discount |

75 |

|

|

— |

|

|

|

|

|

|

|

|

|

Settlement of capped calls related to the convertible senior notes |

1 |

|

|

— |

|

| Proceeds from exercise of stock options |

4 |

|

|

— |

|

| Proceeds from issuance of common stock for ESPP |

2 |

|

|

5 |

|

|

|

|

|

|

|

|

|

| Proceeds from PIPE offering |

41 |

|

|

— |

|

Proceeds from the issuance of common stock under at-the-market offering, net |

198 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from non-recourse asset-backed debt |

684 |

|

|

417 |

|

| Principal payments on non-recourse asset-backed debt |

(1,268) |

|

|

(424) |

|

|

|

|

|

|

|

|

|

| Payment of loan origination fees and debt issuance costs |

(16) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other financing activities |

(2) |

|

|

— |

|

| Net cash used in financing activities |

(281) |

|

|

(2) |

|

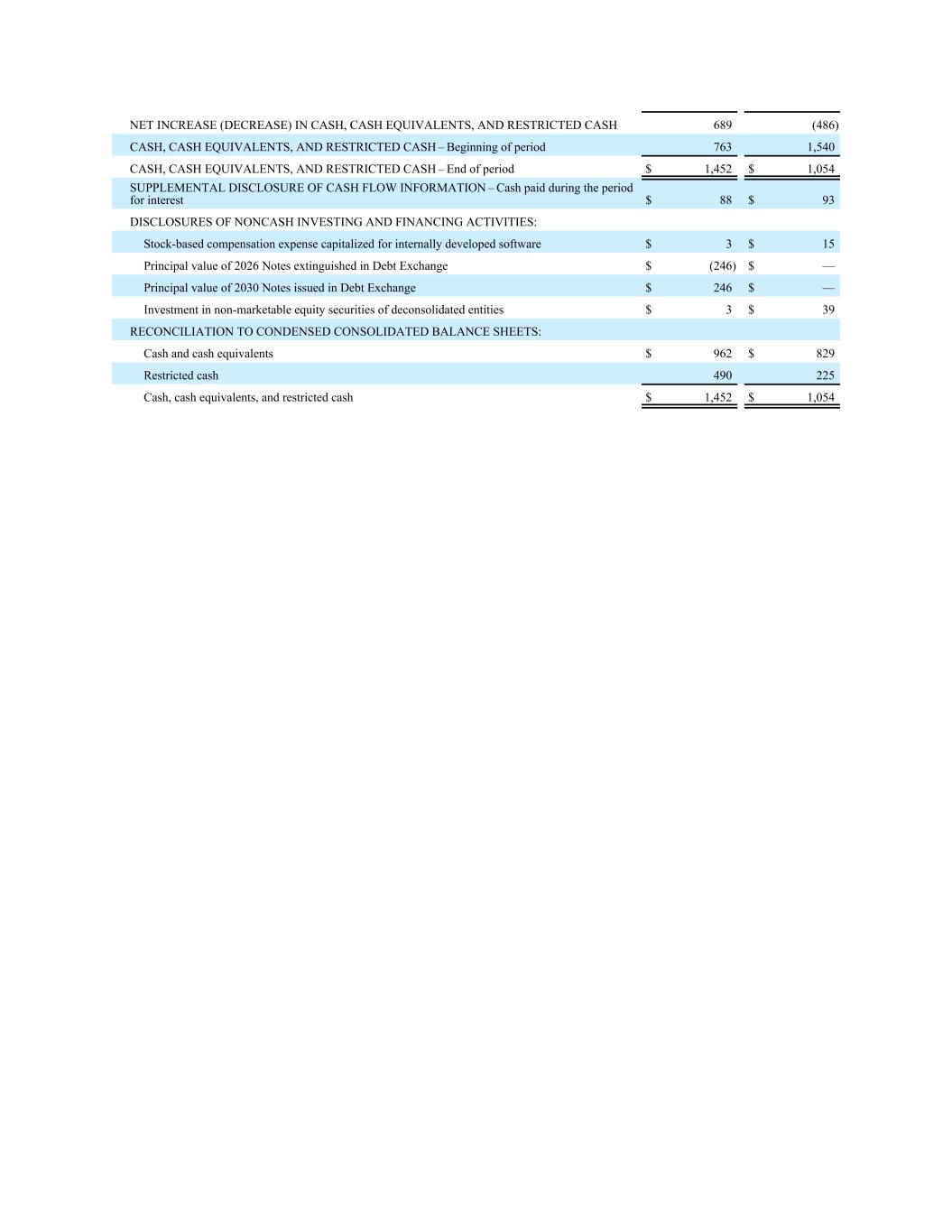

| NET INCREASE (DECREASE) IN CASH, CASH EQUIVALENTS, AND RESTRICTED CASH |

689 |

|

|

(486) |

|

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – Beginning of period |

763 |

|

|

1,540 |

|

| CASH, CASH EQUIVALENTS, AND RESTRICTED CASH – End of period |

$ |

1,452 |

|

|

$ |

1,054 |

|

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION – Cash paid during the period for interest |

$ |

88 |

|

|

$ |

93 |

|

| DISCLOSURES OF NONCASH INVESTING AND FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation expense capitalized for internally developed software |

$ |

3 |

|

|

$ |

15 |

|

Principal value of 2026 Notes extinguished in Debt Exchange |

$ |

(246) |

|

|

$ |

— |

|

Principal value of 2030 Notes issued in Debt Exchange |

$ |

246 |

|

|

$ |

— |

|

|

|

|

|

| Investment in non-marketable equity securities of deconsolidated entities |

$ |

3 |

|

|

$ |

39 |

|

| RECONCILIATION TO CONDENSED CONSOLIDATED BALANCE SHEETS: |

|

|

|

| Cash and cash equivalents |

$ |

962 |

|

|

$ |

829 |

|

| Restricted cash |

490 |

|

|

225 |

|

| Cash, cash equivalents, and restricted cash |

$ |

1,452 |

|

|

$ |

1,054 |

|

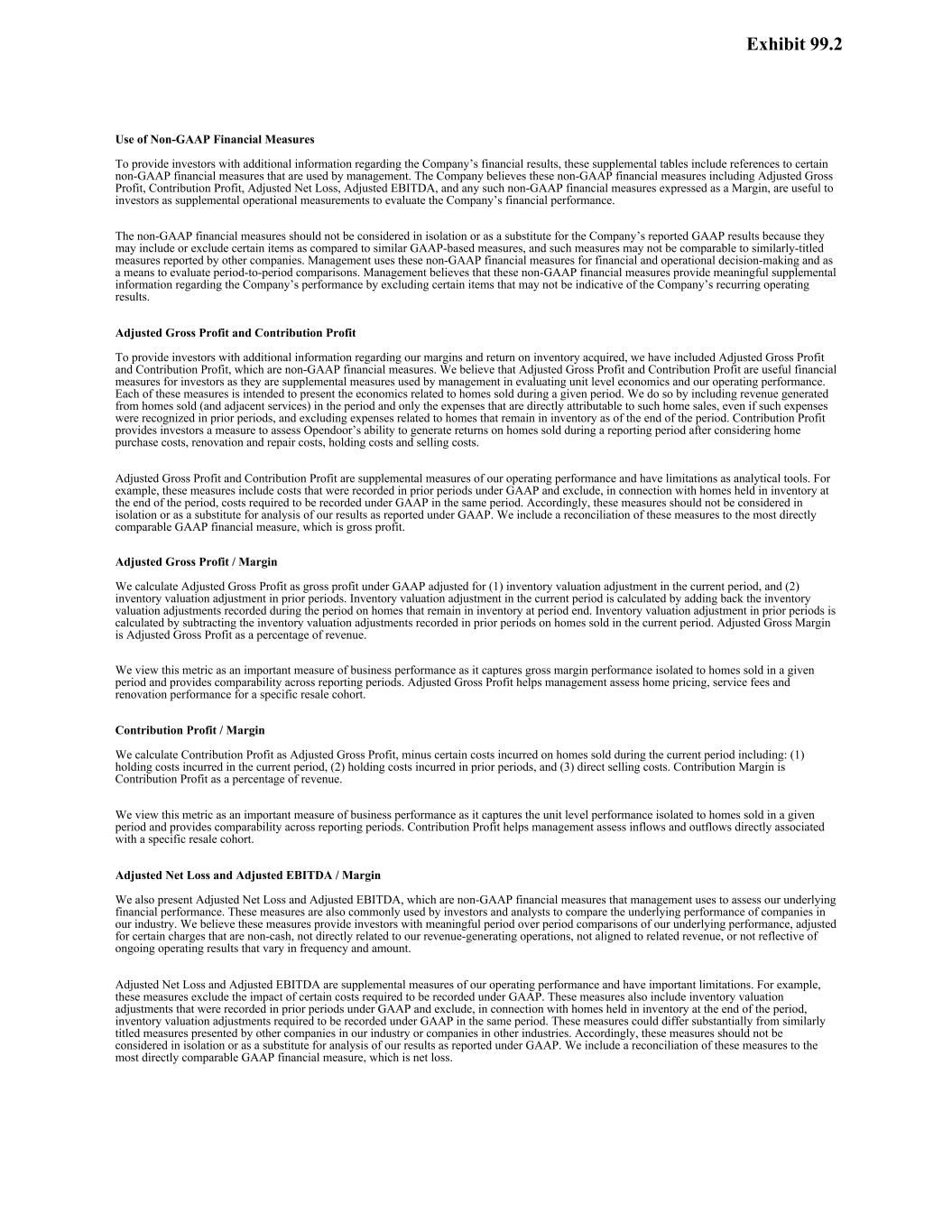

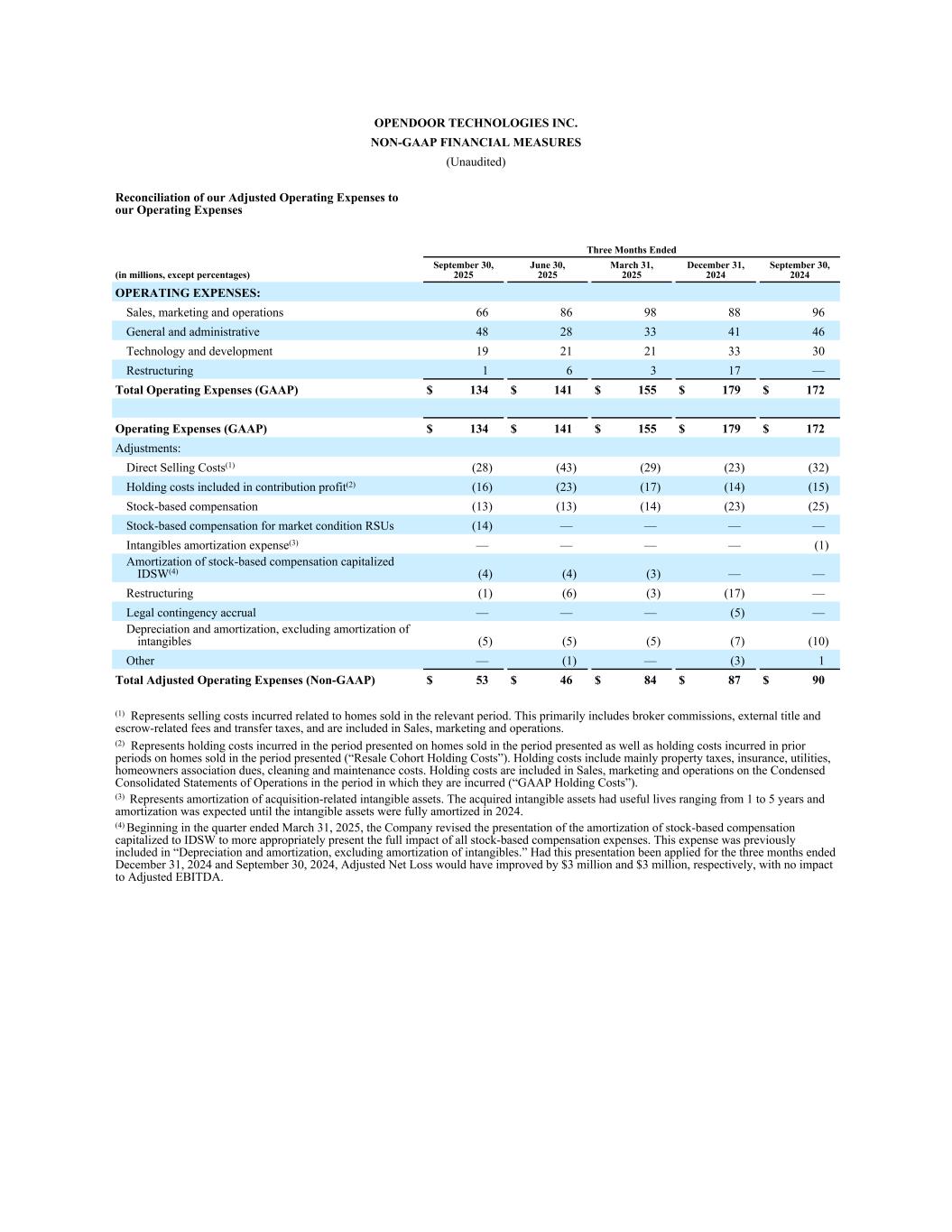

Use of Non-GAAP Financial Measures

To provide investors with additional information regarding the Company’s financial results, this press release includes references to certain non-GAAP financial measures that are used by management. The Company believes these non-GAAP financial measures including Adjusted Gross Profit, Contribution Profit, Adjusted Net Loss, Adjusted EBITDA, and any such non-GAAP financial measures expressed as a Margin, are useful to investors as supplemental operational measurements to evaluate the Company’s financial performance.

The non-GAAP financial measures should not be considered in isolation or as a substitute for the Company’s reported GAAP results because they may include or exclude certain items as compared to similar GAAP-based measures, and such measures may not be comparable to similarly-titled measures reported by other companies. Management uses these non-GAAP financial measures for financial and operational decision-making and as a means to evaluate period-to-period comparisons. Management believes that these non-GAAP financial measures provide meaningful supplemental information regarding the Company’s performance by excluding certain items that may not be indicative of the Company’s recurring operating results.

Adjusted Gross Profit and Contribution Profit

To provide investors with additional information regarding our margins and return on inventory acquired, we have included Adjusted Gross Profit and Contribution Profit, which are non-GAAP financial measures. We believe that Adjusted Gross Profit and Contribution Profit are useful financial measures for investors as they are supplemental measures used by management in evaluating unit level economics and our operating performance. Each of these measures is intended to present the economics related to homes sold during a given period. We do so by including revenue generated from homes sold (and adjacent services) in the period and only the expenses that are directly attributable to such home sales, even if such expenses were recognized in prior periods, and excluding expenses related to homes that remain in inventory as of the end of the period. Contribution Profit provides investors a measure to assess Opendoor’s ability to generate returns on homes sold during a reporting period after considering home purchase costs, renovation and repair costs, holding costs and selling costs.

Adjusted Gross Profit and Contribution Profit are supplemental measures of our operating performance and have limitations as analytical tools. For example, these measures include costs that were recorded in prior periods under GAAP and exclude, in connection with homes held in inventory at the end of the period, costs required to be recorded under GAAP in the same period. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is gross profit.

Adjusted Gross Profit / Margin

We calculate Adjusted Gross Profit as gross profit under GAAP adjusted for (1) inventory valuation adjustment in the current period, and (2) inventory valuation adjustment in prior periods. Inventory valuation adjustment in the current period is calculated by adding back the inventory valuation adjustments recorded during the period on homes that remain in inventory at period end. Inventory valuation adjustment in prior periods is calculated by subtracting the inventory valuation adjustments recorded in prior periods on homes sold in the current period. Adjusted Gross Margin is Adjusted Gross Profit as a percentage of revenue.

We view this metric as an important measure of business performance as it captures gross margin performance isolated to homes sold in a given period and provides comparability across reporting periods. Adjusted Gross Profit helps management assess home pricing, service fees and renovation performance for a specific resale cohort.

Contribution Profit / Margin

We calculate Contribution Profit as Adjusted Gross Profit, minus certain costs incurred on homes sold during the current period including: (1) holding costs incurred in the current period, (2) holding costs incurred in prior periods, and (3) direct selling costs. Contribution Margin is Contribution Profit as a percentage of revenue.

We view this metric as an important measure of business performance as it captures the unit level performance isolated to homes sold in a given period and provides comparability across reporting periods. Contribution Profit helps management assess inflows and outflows directly associated with a specific resale cohort.

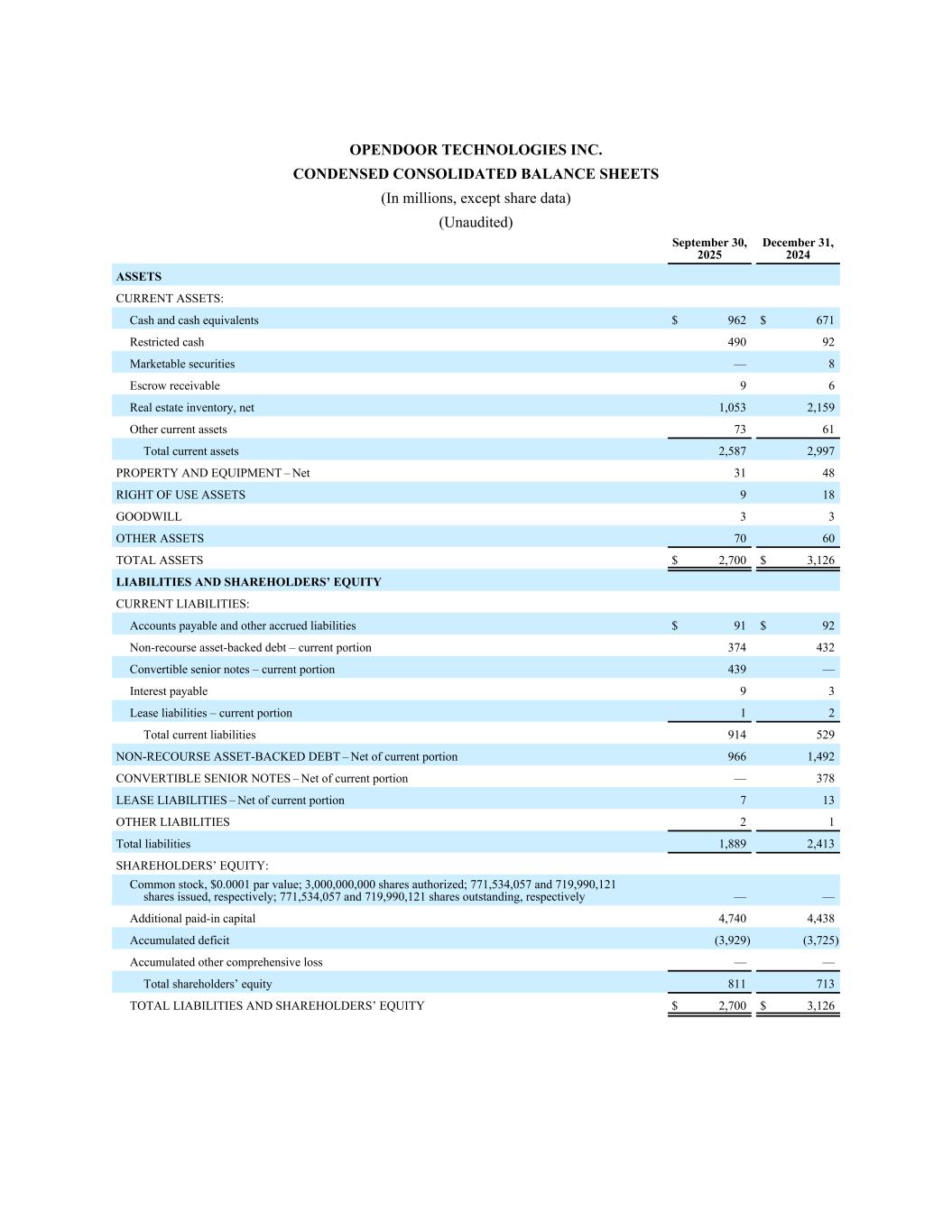

OPENDOOR TECHNOLOGIES INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(In millions, except percentages, and homes sold)

(Unaudited)

The following table presents a reconciliation of our Adjusted Gross Profit and Contribution Profit to our gross profit, which is the most directly comparable GAAP measure, for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended

September 30, |

| (in millions, except percentages and homes sold, or as noted) |

|

September 30, 2025 |

|

June 30, 2025 |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

2025 |

|

2024 |

| Revenue (GAAP) |

|

$ |

915 |

|

|

$ |

1,567 |

|

|

$ |

1,153 |

|

|

$ |

1,084 |

|

|

$ |

1,377 |

|

|

$ |

3,635 |

|

|

$ |

4,069 |

|

Gross profit (GAAP) |

|

$ |

66 |

|

|

$ |

128 |

|

|

$ |

99 |

|

|

$ |

85 |

|

|

$ |

105 |

|

|

$ |

293 |

|

|

$ |

348 |

|

| Gross Margin |

|

7.2 |

% |

|

8.2 |

% |

|

8.6 |

% |

|

7.8 |

% |

|

7.6 |

% |

|

8.1 |

% |

|

8.6 |

% |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventory valuation adjustment – Current Period(1)(2) |

|

15 |

|

|

21 |

|

|

13 |

|

|

6 |

|

|

10 |

|

|

29 |

|

|

33 |

|

Inventory valuation adjustment – Prior Periods(1)(3) |

|

(17) |

|

|

(14) |

|

|

(12) |

|

|

(16) |

|

|

(16) |

|

|

(23) |

|

|

(24) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted Gross Profit |

|

$ |

64 |

|

|

$ |

135 |

|

|

$ |

100 |

|

|

$ |

75 |

|

|

$ |

99 |

|

|

$ |

299 |

|

|

$ |

357 |

|

| Adjusted Gross Margin |

|

7.0 |

% |

|

8.6 |

% |

|

8.7 |

% |

|

6.9 |

% |

|

7.2 |

% |

|

8.2 |

% |

|

8.8 |

% |

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Direct selling costs(4) |

|

(28) |

|

|

(43) |

|

|

(29) |

|

|

(23) |

|

|

(32) |

|

|

(100) |

|

|

(109) |

|

Holding costs on sales – Current Period(5)(6) |

|

(4) |

|

|

(6) |

|

|

(5) |

|

|

(4) |

|

|

(6) |

|

|

(33) |

|

|

(30) |

|

Holding costs on sales – Prior Periods(5)(7) |

|

(12) |

|

|

(17) |

|

|

(12) |

|

|

(10) |

|

|

(9) |

|

|

(23) |

|

|

(14) |

|

Contribution Profit |

|

$ |

20 |

|

|

$ |

69 |

|

|

$ |

54 |

|

|

$ |

38 |

|

|

$ |

52 |

|

|

$ |

143 |

|

|

$ |

204 |

|

| Homes sold in period |

|

2,568 |

|

|

4,299 |

|

|

2,946 |

|

|

2,822 |

|

|

3,615 |

|

|

9,813 |

|

|

10,771 |

|

Contribution Profit per Home Sold (in thousands) |

|

$ |

8 |

|

|

$ |

16 |

|

|

$ |

18 |

|

|

$ |

13 |

|

|

$ |

14 |

|

|

$ |

15 |

|

|

$ |

19 |

|

| Contribution Margin |

|

2.2 |

% |

|

4.4 |

% |

|

4.7 |

% |

|

3.5 |

% |

|

3.8 |

% |

|

3.9 |

% |

|

5.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

________________

(1)Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value.

(2)Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end.

(3)Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented.

(4)Represents selling costs incurred related to homes sold in the relevant period. This primarily includes broker commissions, external title and escrow-related fees and transfer taxes, and are included in Sales, marketing and operations on the Condensed Consolidated Statements of Operations.

(5)Holding costs include mainly property taxes, insurance, utilities, homeowners association dues, cleaning and maintenance costs. Holding costs are included in Sales, marketing, and operations on the Condensed Consolidated Statements of Operations.

(6)Represents holding costs incurred in the period presented on homes sold in the period presented.

(7)Represents holding costs incurred in prior periods on homes sold in the period presented.

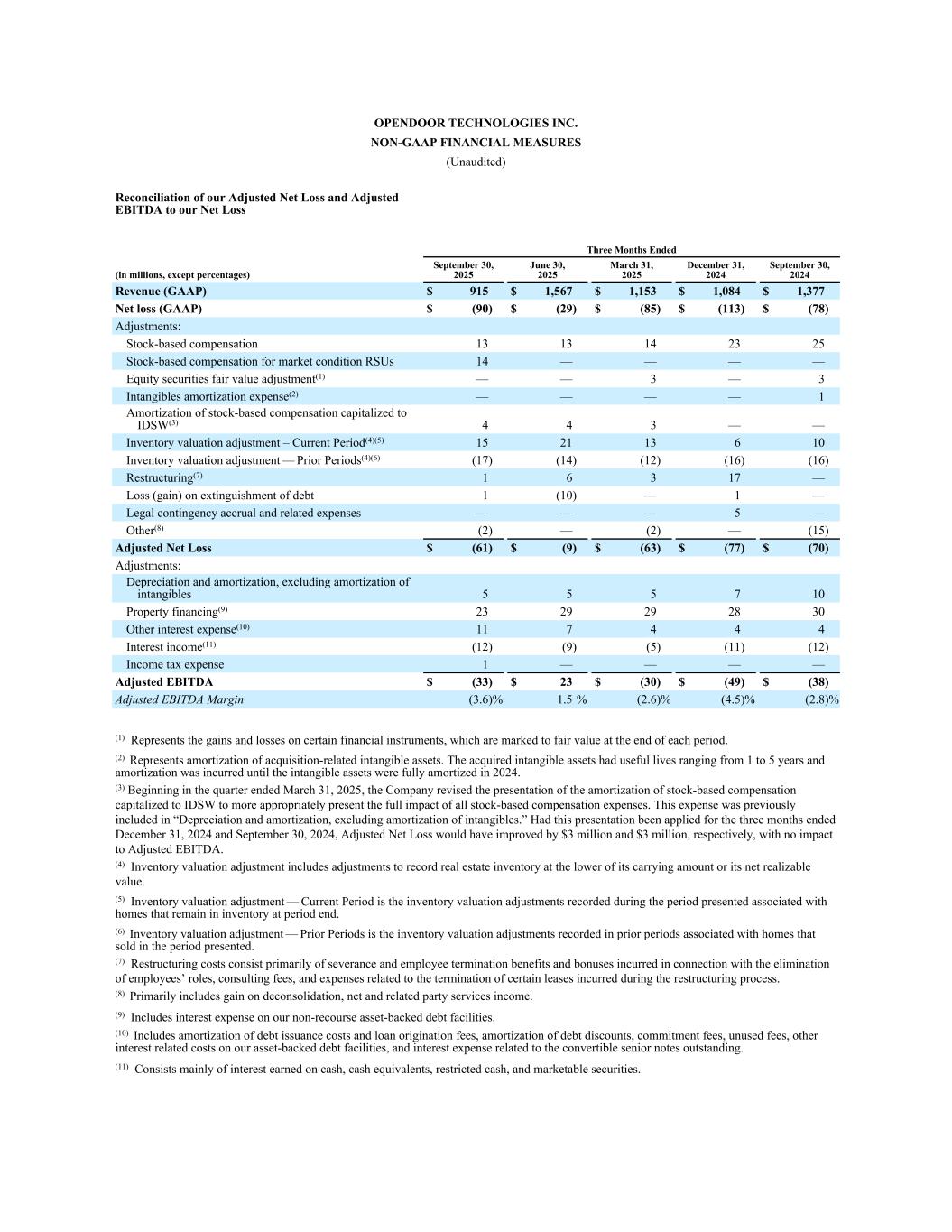

Adjusted Net Loss and Adjusted EBITDA

We also present Adjusted Net Loss and Adjusted EBITDA, which are non-GAAP financial measures that management uses to assess our underlying financial performance. These measures are also commonly used by investors and analysts to compare the underlying performance of companies in our industry. We believe these measures provide investors with meaningful period over period comparisons of our underlying performance, adjusted for certain charges that are non-cash, not directly related to our revenue-generating operations, not aligned to related revenue, or not reflective of ongoing operating results that vary in frequency and amount.

Adjusted Net Loss and Adjusted EBITDA are supplemental measures of our operating performance and have important limitations. For example, these measures exclude the impact of certain costs required to be recorded under GAAP. These measures also include inventory valuation adjustments that were recorded in prior periods under GAAP and exclude, in connection with homes held in inventory at the end of the period, inventory valuation adjustments required to be recorded under GAAP in the same period. These measures could differ substantially from similarly titled measures presented by other companies in our industry or companies in other industries. Accordingly, these measures should not be considered in isolation or as a substitute for analysis of our results as reported under GAAP. We include a reconciliation of these measures to the most directly comparable GAAP financial measure, which is net loss.

Adjusted Net Loss

We calculate Adjusted Net Loss as GAAP net loss adjusted to exclude non-cash expenses of stock-based compensation, equity securities fair value adjustment, intangibles amortization expense, and the amortization of stock-based compensation capitalized to internally developed software (“IDSW”). It excludes expenses that are not directly related to our revenue-generating operations such as restructuring and legal contingency accruals. It also excludes loss (gain) on extinguishment of debt as these expenses or gains were incurred as a result of decisions made by management to terminate or partially extinguish portions of our outstanding credit facilities or convertible senior notes early; these expenses are not reflective of ongoing operating results and vary in frequency and amount. Adjusted Net Loss also aligns the timing of inventory valuation adjustments recorded under GAAP to the period in which the related revenue is recorded in order to improve the comparability of this measure to our non-GAAP financial measures of unit economics, as described above. Our calculation of Adjusted Net Loss does not currently include the tax effects of the non-GAAP adjustments because our taxes and such tax effects have not been material to date.

Adjusted EBITDA / Margin

We calculated Adjusted EBITDA as Adjusted Net Loss adjusted for depreciation and amortization, property financing and other interest expense, interest income, and income tax expense. Adjusted EBITDA is a supplemental performance measure that our management uses to assess our operating performance and the operating leverage in our business. Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of revenue.

The following table presents a reconciliation of our Adjusted Net Loss and Adjusted EBITDA to our net loss, which is the most directly comparable GAAP measure, for the periods indicated:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended

September 30, |

| (in millions, except percentages) |

|

September 30, 2025 |

|

June 30, 2025 |

|

March 31, 2025 |

|

December 31, 2024 |

|

September 30, 2024 |

|

2025 |

|

2024 |

| Revenue (GAAP) |

|

$ |

915 |

|

|

$ |

1,567 |

|

|

$ |

1,153 |

|

|

$ |

1,084 |

|

|

$ |

1,377 |

|

|

$ |

3,635 |

|

|

$ |

4,069 |

|

| Net loss (GAAP) |

|

$ |

(90) |

|

|

$ |

(29) |

|

|

$ |

(85) |

|

|

$ |

(113) |

|

|

$ |

(78) |

|

|

$ |

(204) |

|

|

$ |

(279) |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stock-based compensation |

|

13 |

|

|

13 |

|

|

14 |

|

|

23 |

|

|

25 |

|

|

40 |

|

|

91 |

|

| Stock-based compensation for market condition RSUs |

|

14 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

14 |

|

|

— |

|

Equity securities fair value adjustment(1) |

|

— |

|

|

— |

|

|

3 |

|

|

— |

|

|

3 |

|

|

3 |

|

|

7 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Intangibles amortization expense(2) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

— |

|

|

4 |

|

Amortization of stock-based compensation capitalized to IDSW(3) |

|

4 |

|

|

4 |

|

|

3 |

|

|

— |

|

|

— |

|

|

11 |

|

|

— |

|

Inventory valuation adjustment – Current Period(4)(5) |

|

15 |

|

|

21 |

|

|

13 |

|

|

6 |

|

|

10 |

|

|

29 |

|

|

33 |

|

Inventory valuation adjustment — Prior Periods(4)(6) |

|

(17) |

|

|

(14) |

|

|

(12) |

|

|

(16) |

|

|

(16) |

|

|

(23) |

|

|

(24) |

|

Restructuring(7) |

|

1 |

|

|

6 |

|

|

3 |

|

|

17 |

|

|

— |

|

|

10 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss (gain) on extinguishment of debt |

|

1 |

|

|

(10) |

|

|

— |

|

|

1 |

|

|

— |

|

|

(9) |

|

|

1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Legal contingency accrual and related expenses |

|

— |

|

|

— |

|

|

— |

|

|

5 |

|

|

— |

|

|

— |

|

|

— |

|

Other(8) |

|

(2) |

|

|

— |

|

|

(2) |

|

|

— |

|

|

(15) |

|

|

(4) |

|

|

(14) |

|

Adjusted Net Loss |

|

$ |

(61) |

|

|

$ |

(9) |

|

|

$ |

(63) |

|

|

$ |

(77) |

|

|

$ |

(70) |

|

|

$ |

(133) |

|

|

$ |

(181) |

|

| Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization, excluding amortization of intangibles |

|

5 |

|

|

5 |

|

|

5 |

|

|

7 |

|

|

10 |

|

|

15 |

|

|

28 |

|

Property financing(9) |

|

23 |

|

|

29 |

|

|

29 |

|

|

28 |

|

|

30 |

|

|

81 |

|

|

88 |

|

Other interest expense(10) |

|

11 |

|

|

7 |

|

|

4 |

|

|

4 |

|

|

4 |

|

|

22 |

|

|

13 |

|

Interest income(11) |

|

(12) |

|

|

(9) |

|

|

(5) |

|

|

(11) |

|

|

(12) |

|

|

(26) |

|

|

(42) |

|

| Income tax expense |

|

1 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1 |

|

|

1 |

|

| Adjusted EBITDA |

|

$ |

(33) |

|

|

$ |

23 |

|

|

$ |

(30) |

|

|

$ |

(49) |

|

|

$ |

(38) |

|

|

$ |

(40) |

|

|

$ |

(93) |

|

| Adjusted EBITDA Margin |

|

(3.6) |

% |

|

1.5 |

% |

|

(2.6) |

% |

|

(4.5) |

% |

|

(2.8) |

% |

|

(1.1) |

% |

|

(2.3) |

% |

________________

(1)Represents the gains and losses on certain financial instruments, which are marked to fair value at the end of each period.

(2)Represents amortization of acquisition-related intangible assets. The acquired intangible assets had useful lives ranging from 1 to 5 years and amortization was incurred until the intangible assets were fully amortized in 2024.

(3)Beginning in the quarter ended March 31, 2025, the Company revised the presentation of the amortization of stock-based compensation capitalized to IDSW to more appropriately present the full impact of all stock-based compensation expenses. This expense was previously included in “Depreciation and amortization, excluding amortization of intangibles.” Had this presentation been applied for the three months ended December 31, 2024 and September 30, 2024, Adjusted Net Loss would have improved by $3 million and $3 million, respectively, and by $10 million for the nine months ended September 30, 2024, with no impact to Adjusted EBITDA.

(4)Inventory valuation adjustment includes adjustments to record real estate inventory at the lower of its carrying amount or its net realizable value.

(5)Inventory valuation adjustment — Current Period is the inventory valuation adjustments recorded during the period presented associated with homes that remain in inventory at period end.

(6)Inventory valuation adjustment — Prior Periods is the inventory valuation adjustments recorded in prior periods associated with homes that sold in the period presented.

(7)Restructuring costs consist primarily of severance and employee termination benefits and bonuses incurred in connection with the elimination of employees’ roles, consulting fees and expenses related to the termination of certain leases incurred during the restructuring process.

(8)Primarily includes gain on deconsolidation, net, and related party services income.

(9)Includes interest expense on our non-recourse asset-backed debt facilities.

(10)Includes amortization of debt issuance costs and loan origination fees, amortization of debt discounts, commitment fees, unused fees, other interest related costs on our asset-backed debt facilities, and interest expense related to the convertible senior notes outstanding.

(11)Consists mainly of interest earned on cash, cash equivalents, restricted cash and marketable securities.