EXHIBIT 99.1 SALE AND PURCHASE AGREEMENT AMONGST MAXEON SOLAR TECHNOLOGIES, LTD. AND LUMETECH B.V. AND TCL SUNPOWER INTERNATIONAL PTE. LTD. DATED THE 18TH DAY OF FEBRUARY 2025

TABLE OF CONTENTS CLAUSE PAGE 1. DEFINITIONS AND INTERPRETATION ........................................................................................ 3 2. SALE OF THE SALE SHARES ....................................................................................................... 8 3. CONSIDERATION .......................................................................................................................... 9 4. CONDITIONS ................................................................................................................................ 10 5. COMPLETION .............................................................................................................................. 11 6. REPRESENTATIONS, WARRANTIES AND UNDERTAKINGS .................................................. 11 7. POST-COMPLETION ................................................................................................................... 12 8. CONFIDENTIALITY ...................................................................................................................... 14 9. MISCELLANEOUS ....................................................................................................................... 15 SCHEDULE 1 PARTICULARS OF THE TARGET GROUP ............................................................. 20 SCHEDULE 2 CONDITIONS PRECEDENT .................................................................................... 27 SCHEDULE 3 COMPLETION OBLIGATIONS ................................................................................. 29 SCHEDULE 4 SPECIFIC COMPLETION OBLIGATIONS ............................................................... 31 SCHEDULE 5 POST-COMPLETION UNDERTAKINGS .................................................................. 37 SCHEDULE 6 VENDOR WARRANTIES .......................................................................................... 41 SCHEDULE 7 PURCHASERS WARRANTIES ................................................................................ 42 SCHEDULE 8 LIMITATION OF THE VENDOR'S LIABILITIES ....................................................... 43 SCHEDULE 9 FORM OF NOVATION AGREEMENT ...................................................................... 44 SCHEDULE 10 FORM OF ASSET TRANSFER AGREEMENT .................................................... 49 SCHEDULE 11 FORM OF TRANSITIONAL SERVICES AGREEMENT ....................................... 54 SCHEDULE 12 SEQUENCE OF PAYMENTS ............................................................................... 60 SCHEDULE 13 LIST OF RELEVANT EMPLOYEES ..................................................................... 61 SCHEDULE 14 KNOWN PROCEEDINGS ..................................................................................... 63 SCHEDULE 15 CONSIDERATION BREAKDOWN ........................................................................ 66 SCHEDULE 16 FORM OF CHILEAN SHARE TRANSFER AGREEMENT ................................... 67

SALE AND PURCHASE AGREEMENT THIS AGREEMENT is made on the 18th day of February 2025 AMONGST: (1) MAXEON SOLAR TECHNOLOGIES, LTD. (Company Registration No. 201934268H), a company incorporated under the laws of Singapore and having its registered office at 8 Marina Bay Boulevard, #05-02, Marina Bay Financial Centre, Singapore 018981 (the "Vendor"); (2) LUMETECH B.V. (Company Registration No. 92031412), a company incorporated under the laws of the Netherlands, with its corporate seat in Amsterdam, the Netherlands and its place of business at Rhijnspoorplein 10, 1018 TX Amsterdam, the Netherlands ("Lumetech"); AND (3) TCL SUNPOWER INTERNATIONAL PTE. LTD. (Company Registration No. 202338490W), a company incorporated under the laws of Singapore and having its registered office at 6 Raffles Quay, #14-02, Singapore 048580 ("TCL Sunpower" and together with Lumetech, the "Purchasers"), (the Vendor and the Purchasers are hereinafter collectively referred to as the "Parties" and each, a "Party"). WHEREAS: (A) The Vendor is a company incorporated in Singapore which shares are listed and quoted on the NASDAQ Global Select Market and is the ultimate parent company of the Target Entities (as hereinafter defined), further details of which are set out in Schedule 1 of this Agreement. (B) The Target Entities are subsidiaries of the Vendor in the manner described below: (i) the Vendor directly holds 100% of the issued share capital of SunPower Energy Solutions France SAS ("SP France"), which in turn holds shares in the capital of Total Energie Do Brasil, SunPower Technologies France SAS, SunPower Manufacturing de Vernejoul SAS, Tenesol Venezuela, SunPower Corporation Southern Africa Proprietary Limited, SunPower Manufacturing Proprietary Ltd and SunPower Energy Systems Southern Africa (collectively, the "SP France Subsidiaries"); (ii) the Vendor indirectly holds 100% of the issued share capital of SunPower Bermuda Holdings ("SPBH"); (iii) SPBH and SunPower Systems Sarl ("SP SARL") hold 100% of the issued share capital of SunPower Malta Limited ("SPML") which in turn holds (1) 100% of the issued share capital of SunPower Corporation UK Limited, SunPower Corp Israel Ltd and Sgula (East) Green Energies Ltd, and (2) 99.95% of the issued share capital of Kozani Energy Malta Limited ("KEML") and Photovoltaic Park Malta Limited ("PPML") (collectively, the "SPML Subsidiaries"). The remaining 0.05% of the issued share capital of KEML and PPML are held by SP SARL; and (iv) SPBH holds 100% of the issued share capital of SP SARL, which in turn holds shares in the capital of SunPower Italia S.R.L., SunPower GmbH, SunPower Netherlands B.V., SunPower Energy Systems Spain S.L.U., SunPower Systems Belgium SRL, SunPower Corporation Australia Pty Limited, SunPower Corporation SpA, SunPower Energy Systems Korea, Maxeon Japan K.K, Maxeon Solar Products Mexico S. de R.L.de, C.V. and Maxeon Solar Systems Mexico S.de R.L. de C.V. As for Maxeon Solar Products Mexico S.de R.L. de C.V. and Maxeon Solar Systems Mexico S.de R.L. de C.V., (together, the "Mexican Entities"), SP SARL and Maxeon Rooster Holdco Ltd ("Maxeon Rooster") (an exempted company limited by shares incorporated in Bermuda, the issued share capital of which is wholly-owned directly and indirectly by

3 the Vendor) holds 99.998% and 0.002% of the issued partnership interests of the Mexican Entities respectively. (C) The Purchasers have agreed to purchase, and the Vendor has agreed to (i) sell the relevant Sale Shares (as hereinafter defined) of SP France, (ii) procure the sale by SPBH and SP SARL, jointly, of the relevant Sale Shares of SPML, (iii) procure the sale by SP SARL of the relevant Sale Shares of each of SunPower Italia S.R.L., SunPower GmbH, SunPower Netherlands B.V., SunPower Energy Systems Spain S.L.U., SunPower Systems Belgium SRL, SunPower Corporation Australia Pty Limited, SunPower Corporation SpA, SunPower Energy Systems Korea, Maxeon Japan K.K., KEML and PPML, and (iv) procure the sale by SP SARL and Maxeon Rooster, jointly, of the relevant Sale Shares of each of the Mexican Entities, in each case upon the terms and subject to the conditions set out in this Agreement. NOW IT IS HEREBY AGREED as follows: 1. DEFINITIONS AND INTERPRETATION 1.1 Definitions In this Agreement, unless the context otherwise requires: "Affiliates" in relation to any person, means any other person that directly or indirectly through one or more intermediaries controls or is controlled by, or is under common control with, that first-mentioned person. "Approvals" has the meaning ascribed to it in paragraph (f) of Schedule 2. "ASIC" has the meaning ascribed to it in paragraph 1(c) of Part J of Schedule 4. "Asset Transfer Agreement" means the asset transfer agreement in relation to the Restructuring, the agreed form of which is set out in Schedule 10, to be entered between MSPL, Maxeon Americas, Inc., the Vendor, SP SARL, SPC Australia, SP France, Maxeon Solar Products Mexico S. de R.L.de, C.V. and the Purchasers. "Authorised Persons" has the meaning ascribed to it in Clause 8.1(a). "Balance Payment" has the meaning ascribed to it in Schedule 12. "Business Day" means a day (other than a Saturday, Sunday or public holiday in the People's Republic of China, Singapore, Malta, the United Kingdom, Israel, Italy, Germany, the Netherlands, Madrid (Spain), Western Australia, Mexico, Belgium, Chile, Korea, Japan and France) on which commercial banks are generally open for business in the People's Republic of China, Singapore, Malta, the United Kingdom, Israel, Italy, Germany, the Netherlands, Madrid (Spain), Western Australia, Mexico, Belgium, Chile, Korea, Japan and France. "Capital Gains Schedules" has the meaning ascribed to it in paragraph 1(i) of Part B of Schedule 4. "Chilean Share Transfer Agreement" means the share transfer agreement of the Sale Shares of SunPower Corporation SpA in a form set out in Schedule 16. "Completion" means the completion of the sale and purchase of the Sale Shares by performance by the Parties of the obligations assumed by them respectively, under Clause 5. "Completion Date" means the date falling five (5) Business Days on which the last in time of the conditions of Schedule 2 is satisfied or waived in accordance with this Agreement (or such other date as may be agreed in writing between the Vendor and the Purchasers). "Consideration" has the meaning ascribed to it in Clause 3.1(a).

4 "Deposit" means the deposit of US$10,000,000 which was transferred to the Vendor on 27 November 2024. "Disclosure Updates" has the meaning ascribed to it in Clause 6.1(c). "Dutch Deed of Transfer" means the deed of sale, purchase of and transfer relating to the shares in the capital of SunPower Netherlands B.V. in a form to be agreed between the Vendor and the relevant Purchaser. "Dutch Notary" means any civil law notary (notaris) or assigned civil law notary (toegevoegd notaris) of Houthoff Coöperatief U.A., authorised to execute deeds in the protocol of such civil law notary or such civil law notary’s substitute. "Encumbrances" means any claim, charge, mortgage, lien, option, equity, power of sale, hypothecation, retention of title, right of pre-emption, right of first refusal or other third party right or security interest of any kind, other than any Permitted Encumbrances. "Italian Deed of Transfer" has the meaning ascribed to it in paragraph 1 of Part E of Schedule 5. "Italian Notary" means an Italian notary public duly authorised to act as such in Italy to be designated by the relevant Purchaser and notified to the Vendor. "KEML" means Kozani Energy Malta Limited, further details of which are set out in paragraph 12 of Part A of Schedule 1. "Known Proceedings" means the litigation proceedings involving the Target Group which are pending as of the date of this Agreement, further details of which are set out in Schedule 14 of this Agreement. "Long-Stop Date" has the meaning ascribed to it in Clause 4.4. "Maxeon Rooster" has the meaning ascribed to it in Recital (B)(iv). "Mexican Entities" has the meaning ascribed to it in Recital (B)(iv). "MSPL" means Maxeon Solar Pte. Ltd. (Company Registration No. 202010491K), a company incorporated under the laws of Singapore and having its registered office at 51 Bras Basah Road, #07-01, Lazada One Building, Singapore 189554. "Net Intercompany Debt" refers to the net intercompany debts owing from the Vendor Group to the Target Group outstanding as at the Completion Date, which shall exclude any intercompany amount arising from the indemnity by SPTN in connection with the Settlement Agreement (as defined in the Asset Transfer Agreement) under the Asset Transfer Agreement. "Novation Agreement" means the novation agreement in relation to the Restructuring, the agreed form of which is set out in Schedule 9, to be entered between, amongst others, the Vendor and/or its Affiliates and the Target Group. "ODI Approval" means the outbound direct investment approval from the PRC National Development and Reform Commission or its local agency and/or from the PRC Ministry of Commerce or its local agency and/or from the PRC State Administration of Foreign Exchange or its local agency, required to be obtained by the Purchaser(s) for their purchase of the Sale Shares.

5 "Permitted Encumbrance" means: (a) any charge or lien arising by operation of law, including in favour of a governmental authority and in the ordinary course of business, provided that no liability secured by such charge or lien is overdue for payment; (b) any retention of title arrangement arising in favour of a supplier to a Target Group Company in the ordinary course of business, provided that the Target Group Company is not in default in relation to the retention of title arrangement; or (c) any other Encumbrance which the Purchasers and Vendor agree in writing to be a permitted encumbrance. "PPML" means Photovoltaic Park Malta Limited, further details of which are set out in paragraph 13 of Part A of Schedule 1. "PRC" means the People’s Republic of China. "Purchaser Closing Deliverables" has the meaning ascribed to it in paragraph 2.1 of Schedule 3. "Purchaser Group Companies" and "Purchaser Group" means the Purchasers and their subsidiaries and "Purchaser Group Company" means any one of them. "Purchasers Warranties" means the representations and warranties on the part of the Purchasers specified in Schedule 7. "Relevant Employees" means the employees identified by the Parties set out in Schedule 13 of this Agreement who are immediately prior to Completion employed by the Vendor and/or its Affiliates (excluding the Target Group), and engaged in the business of the Target Group. "Restructuring" means the asset and liability restructuring to be undertaken by the Vendor and/or its Affiliates pursuant to which the Target Assets will be transferred, novated or assigned from certain subsidiaries of the Vendor not being the Target Group Companies, to the Target Group prior to Completion. "Sale Shares" means, collectively, (a) all of the issued and fully-paid ordinary shares in the capital of each Target Entity (other than the Mexican Entities) owned by the Vendor, SPBH or SP SARL (as the case may be), and (b) all of the partnership interests of each of the Mexican Entities owned by SP SARL and Maxeon Rooster, as established by the rules governing the distribution of capital applicable to this type of company under the Mexican General Corporations Law of 1934, as amended. "SIAC" has the meaning ascribed to it under Clause 9.19(b). "Spanish Deed of Transfer" has the meaning ascribed to it in Part H of Schedule 5. "Spanish Notary" means a Spanish notary public duly authorised to act as such in Spain to be designated by the relevant Purchaser and notified to the Vendor. "SPBH" has the meaning ascribed to it in Recital (B)(ii). "SPC Australia" means SunPower Corporation Australia Pty Limited, further details of which are set out in paragraph 5 of Part A of Schedule 1. "SP France" means SunPower Energy Solutions France SAS, further details of which are set out in paragraph 1 of Part A of Schedule 1. "SP France Subsidiaries" has the meaning ascribed to it in Recital (B)(i).

6 "SP Italy" means SunPower Italia S.R.L., further details of which are set out in paragraph 3 of Part A of Schedule 1 "SPML" means SunPower Malta Limited, further details of which are set out in paragraph 2 of Part A of Schedule 1. "SPML Subsidiaries" has the meaning ascribed to it in Recital (B)(iii). "SP SARL" has the meaning ascribed to it in Recital (B)(iii). "SP Spain" means SunPower Energy Systems Spain, S.L.U., further details of which are set out in paragraph 10 of Part A of Schedule 1. "Subsidiaries" means collectively, the SPML Subsidiaries (except for KEML and PPML) and the SP France Subsidiaries, whose particulars are set out in Part B of Schedule 1. "Surviving Provisions" means Clauses 3.3 (Refund of Deposit), 3.4 (Timing of Refund of Deposit), 8 (Confidentiality) and 9 (Miscellaneous). "Target Assets" means the obligations, rights, title and interest of certain subsidiaries of the Vendor not being the Target Group Companies, to be transferred, novated or assigned to the Target Group under the Restructuring, further details of which are set out in Schedules 1 to 4 of the Asset Transfer Agreement. "Target Entities" means the entities set out in Part A of Schedule 1 and "Target Entity" means any one of them. "Target Group" means collectively, the Target Entities and the Subsidiaries and "Target Group Company" means any one of them. "Term Sheet" means the term sheet dated 25 November 2024 entered into between the Vendor and TZE in relation to this Agreement. "Trademarks" means trademark registrations and applications for "SunPower" in all jurisdictions excluding the United States of America. The existing Trademarks are set out in Exhibit A to the Trademark Assignment Agreement. "Trademark Assignment Agreement" means the trademark assignment agreement dated 18 February 2025 entered into between TCL Sunpower and MSPL pursuant to which MSPL shall assign the Trademarks to TCL Sunpower with effect from the Completion Date. "Transaction Documents" means this Agreement, the Trademark Assignment Agreement, the Novation Agreement, the Asset Transfer Agreement and the Transitional Services Agreement. "Transferable Asset" has the meaning ascribed to it in the Term Sheet. "Transitional Services Agreement" means the transitional services agreement, the agreed form of which is set out in Schedule 11, to be entered between Lumetech and MSPL pursuant to which Lumetech and/or its Affiliates (which post-Completion shall include the Target Group) shall agree to provide certain global shared services to MSPL and/or its Affiliates, and vice versa. "TZE" means TCL Zhonghuan Renewable Energy Technology Co. Ltd. (Company Registration Number 911200001034137808), a company incorporated in People's Republic of China and having its registered office at No. 12, New Technology Industrial Park, Haitai East Road, Huayuan Industrial Zone (Outer Ring), Tianjin 300384, China, which is the holding company of the Purchasers. "Vendor Closing Deliverables" has the meaning ascribed to it in paragraph 1.1 of Schedule 3.

7 "Vendor Group" means collectively, the Vendor and its subsidiaries (excluding the Target Group). "Vendor Warranties" means the representations and warranties on the part of the Vendor specified in Schedule 6. 1.2 Currencies "A$" means the lawful currency for the time being of Australia. "CLP" means the lawful currency for the time being of Chile. "EUR" means the lawful currency for the time being of the Eurozone. "GBP" means the lawful currency for the time being of the United Kingdom. "JPY" means the lawful currency for the time being of Japan. "Mexican Peso" or "MXN" means the lawful currency for the time being of Mexico. "NIS" means the lawful currency for the time being of Israel. "KRW" means the lawful currency for the time being of South Korea. "Rands" means the lawful currency for the time being of South Africa. "R$" means the lawful currency for the time being of Brazil. "United States dollars" or "US$" or "$" means the lawful currency for the time being of the United States of America. "VEF" means the lawful currency for the time being of Venezuela. 1.3 Miscellaneous In this Agreement, unless the context otherwise requires: (a) any reference to "accounts" shall include, where relevant, the directors' and auditors' reports, relevant balance sheets and profit and loss accounts and related notes together with all documents which are or would be required by law to be annexed to the accounts of the company concerned to be laid before that company in general meeting in respect of the accounting reference period in question; (b) the words "subsidiary" and "holding company" shall have the meanings ascribed to them in Section 5 of the Companies Act 1967 of Singapore; (c) any reference to a document being in the "agreed form" shall mean that document in or substantially in the form agreed as at the date of this Agreement between the Parties hereto and executed or initialled by them or on their behalf for the purposes of identification; (d) any reference to "procure" shall mean an absolute obligation (and not a reasonable obligation) to cause or bring about; (e) if a period of time is specified as being from a given day or from the date of an act or event, it shall be calculated exclusive of that day and inclusive of the relevant last day of such period of time; (f) words importing the whole shall be treated as including a reference to any part thereof;

8 (g) references to the word "include" or "including" (or any similar term) are not to be construed as implying any limitation and general words introduced by the word "other" (or any similar term) shall not be given a restrictive meaning by reason of the fact that they are preceded by words indicating a particular class of acts, matters or things; (h) any thing or obligation to be done under this Agreement which is required or falls to be done on a stipulated day shall be done on the next succeeding Business Day, if the day upon which that thing or obligation is required or falls to be done falls on a day which is not a Business Day; (i) words importing the singular include the plural and vice versa, words importing any gender include every gender and references to time shall mean Singapore time; (j) references to a "person" include any company, limited liability partnership, partnership, business trust or unincorporated association (whether or not having separate legal personality) and references to a "company" include any company, corporation or other body corporate, wherever and however incorporated or established; (k) clause headings are for convenience of reference only and shall not affect the interpretation of this Agreement; and (l) the words "written" and "in writing" include any means of visible reproduction. 1.4 Liability of the Purchasers The Purchasers shall be jointly and severally responsible to perform and honour the obligations imposed or placed on the Purchasers and/or each Purchaser (as the case may be) in this Agreement. Likewise, the liability of the Purchasers under or in relation to this Agreement shall be joint and several. 2. SALE OF THE SALE SHARES 2.1 Sale of Sale Shares (a) The Vendor shall, in accordance with the terms and conditions of this Agreement, on Completion sell or procure the sale by SPBH, SP SARL and Maxeon Rooster (as the case may be) to the Purchasers, of all of the Sale Shares (and not part thereof), and the Purchasers shall purchase the Sale Shares free from all Encumbrances and with the benefit of all rights, benefits and entitlements attaching thereto as at the Completion Date and thereafter. (b) Of the Sale Shares, TCL Sunpower shall purchase the following: (i) 99.9% of each of the Mexican Entities; (ii) 100% of SunPower Corporation Australia Pty Limited; (iii) 100% of Maxeon Japan K.K.; (iv) 100% of SunPower Energy Systems Korea; and (v) 100% of SunPower Corporation SpA, Lumetech shall purchase all the other Sale Shares not purchased by TCL Sunpower above.

9 2.2 Net Intercompany Debt (a) It is contemplated that there will be Net Intercompany Debt owing from the Vendor Group to the Target Group as at the Completion Date. (b) The Parties hereby agree that the Net Intercompany Debt is not included in the Consideration and the Vendor Group shall novate the obligation to repay the Net Intercompany Debt to the Purchasers on the Completion Date, and the Purchasers hereby assume all of the Vendor Group's obligation to repay the Net Intercompany Debt and release and discharge the Vendor Group from the obligation to repay the Net Intercompany Debt as from and including the Completion Date. For the avoidance of doubt, in the event the Net Intercompany Debt exceeds US$120,000,000, the Net Intercompany Debt shall be treated as US$120,000,000. (c) The Purchasers undertake to the Vendor that they shall execute such documents and do all such acts and things to effect the novation of the obligation to repay the Net Intercompany Debt from the Vendor Group to the Purchasers. 3. CONSIDERATION 3.1 Purchase Consideration (a) The aggregate consideration for the sale of the Sale Shares to the Purchasers shall be equal to the sum of US$28,948,507 (the "Consideration"), of which: (i) US$18,085,484 shall be payable by Lumetech; and (ii) US$10,863,023 shall be payable by TCL Sunpower. (b) The Consideration shall be payable in accordance with Schedule 12. (c) A breakdown of the Consideration in respect of each Target Entity is set out in Schedule 15. 3.2 Method for Payment All payments to be made hereunder by the Purchasers shall be made by way of cashier's order or banker's draft in favour of the relevant person(s) or by bank transfer including by way of wire transfer credited for same day value to such bank account(s) in Singapore as the Vendor shall notify the Purchasers in writing or in such other manner as may be agreed in writing between the Vendor and the Purchasers. All payments to be made hereunder by the Purchasers shall be made in full without any withholding, deduction, set-off, counterclaim, restriction or condition of any kind whatsoever. 3.3 Refund of Deposit The Deposit made by the Purchasers is non-refundable other than: (a) in the event where Completion does not occur by reason of non-fulfilment of the condition referred to in paragraph (b) of Schedule 2; (b) where the Vendor enters into insolvency proceedings and is for such reason prevented from proceeding with Completion, in either of cases (a) or (b), the Deposit made by the Purchasers shall be refunded to the Purchasers along with interest at the effective federal funds rate of the United States of America on the Long-Stop Date, or the date of commencement of insolvency proceedings of the Vendor (as the case may be); or (c) in accordance with Schedule 12. 3.4 Timing of Refund of Deposit Any refund to be made in accordance with Clause 3.3(a) or (b) shall be made by the Vendor to the Purchasers within 60 days of the event triggering the refund.

10 4. CONDITIONS 4.1 Conditions Precedent Completion of the sale and purchase of the Sale Shares is conditional upon the conditions set out in Schedule 2 being satisfied or waived in accordance with Clause 4.2. 4.2 Waiver of Conditions Precedent (a) Subject to applicable laws and regulations, the Purchasers may in their sole and absolute discretion waive (in whole or in part) any or all of the conditions referred to in paragraph (i) of Schedule 2. (b) Subject to applicable laws and regulations, the Vendor may in its sole and absolute discretion waive (in whole or in part) the condition referred to in paragraph (a) of Schedule 2. (c) Subject to applicable laws and regulations, the Purchasers and Vendor may waive (in whole or in part) the condition referred to in paragraph (g) of Schedule 2. 4.3 Satisfaction of Conditions Precedent (a) The Purchasers shall procure the expeditious fulfilment of the conditions referred to in paragraphs (a), (f) (insofar as it applies to the Purchasers) and (g) of Schedule 2. The Purchasers shall keep the Vendor fully informed of any development relating to the conditions applicable to them and shall forthwith notify the Vendor upon the fulfilment of all such conditions and furnish to the Vendor documentary evidence to the reasonable satisfaction of the Vendor in respect thereof. (b) The Vendor shall procure the expeditious fulfilment of the conditions referred to in paragraphs (b), (c), (d), (e), (f) (insofar as it applies to the Vendor) and (g) of Schedule 2. The Vendor shall keep the Purchasers fully informed of any development relating to the conditions applicable to it and shall forthwith notify the Purchasers upon the fulfilment of all such conditions and furnish to the Purchasers documentary evidence to the reasonable satisfaction to the Purchasers in respect thereof. 4.4 Effect of Non-Fulfilment of Conditions Precedent In the event that any of the conditions referred to in Schedule 2 is not fulfilled or waived in accordance with Clause 4.2 (as the case may be) on or before 11:59 pm C.S.T. on 31 March 2025 or such other date as the Parties may mutually agree in writing ("Long-Stop Date") (except that the Parties agree that the Long-Stop Date shall be automatically extended by a period of 30 days or such other period as the Parties may mutually agree if the non-fulfilment of the condition referred to in paragraph (i) of Schedule 2 is attributable solely to the relevant governmental authority), this Agreement (other than the Surviving Provisions) shall lapse and cease to have further effect and all obligations and liabilities of the Parties hereunder shall cease and determine and no Party shall have any claim against the other Party, save in respect of any breach of Clause 4.3 or any other antecedent breach of this Agreement. 4.5 Treatment of Relevant Employees After the Completion Date, the Purchasers will have the right, at their sole discretion, to make offers of employment to any of the Relevant Employees, subject to applicable law.

11 5. COMPLETION 5.1 Date and Place Subject to the satisfaction or waiver (as the case may be) of the conditions in Schedule 2, Completion shall take place electronically on the Completion Date or at such other venue, time and/or date as the Parties may mutually agree in writing. 5.2 Obligations on Completion (a) On Completion, the Parties shall procure that their respective obligations specified in Schedule 3 are fulfilled. (b) The Parties agree that each Party shall no later than five (5) Business Days prior to the Completion Date (or such other date as may be agreed in writing between the Parties), deliver via email signed (if applicable) but unreleased and undated copies of the Vendor Closing Deliverables and the Purchaser Closing Deliverables respectively to the other Party or their representatives solely for the purpose of inspection. For the avoidance of doubt, each Party may mark their respective Vendor Closing Deliverables or Purchaser Closing Deliverables signature pages with the words "For Inspection Only". 5.3 Right to Terminate If any of the documents required to be delivered to any Party on Completion is not forthcoming for any reason or if in any other respect the provisions of Clause 5.2 and Schedule 3 are not fully complied with by any Party, the Party that is not in default shall be entitled (in addition to and without prejudice to all other rights and remedies available to it, including the right to claim damages): (a) to elect to terminate this Agreement (other than the Surviving Provisions) as against the other Party, without liability on the part of the terminating Party and Clause 9.6(b) shall apply; (b) to effect Completion so far as practicable having regard to the defaults which have occurred; (c) to specific performance of this Agreement; or (d) to fix a new date for Completion (not being more than 14 days after the Completion Date) in which case the foregoing provisions of this Clause 5.3 shall apply to Completion as so deferred. The Purchasers shall not be entitled in any circumstances to rescind or terminate this Agreement after Completion. The Deposit and any amount of Balance Payment made by the Purchaser(s) is non-refundable other than in the circumstances set out in Clause 3.3 above. 6. REPRESENTATIONS, WARRANTIES AND UNDERTAKINGS 6.1 Warranties by the Vendor (a) The Vendor represents and warrants to the Purchasers that, save as otherwise expressly provided to the Purchasers in this Agreement, each of the Vendor Warranties is as of the date of this Agreement, true, accurate and not misleading and will be true, accurate and not misleading as at Completion with reference to the facts and circumstances existing on the Completion Date. (b) Save for Clause 6.1 and Schedule 6, the Vendor makes no other representation or warranty, express or implied, to the Purchasers in relation to the Target Group, the Sale Shares, the Target Assets, or any matter arising out of or in connection with this Agreement and the Purchasers hereby acknowledge that they have not relied on or

12 been induced by any other representations or warranties made by the Vendor or its agents or representatives for the sale and purchase of the Sale Shares. (c) Between the date of this Agreement and the Completion Date, the Vendor shall be permitted to give the Purchasers notice in writing of any event, condition or circumstance which shall have occurred since the date of this Agreement that would cause any of the Vendor Warranties to become untrue or inaccurate or misleading in any respect, that would constitute a violation or breach of any of the Vendor Warranties (the "Disclosure Updates"). No such Disclosure Updates shall be deemed accepted by the Purchasers unless the Purchasers agree to such Disclosure Updates in writing, and if so accepted by the Purchasers, any Vendor Warranties repeated on the Completion Date will be subject to such Disclosure Updates. 6.2 Warranties by the Purchasers Each Purchaser represents and warrants to the Vendor that each of the Purchasers Warranties is as of the date of this Agreement, true, accurate and not misleading and will be true, accurate and not misleading as at Completion with reference to the facts and circumstances existing on the Completion Date. 6.3 Indemnity by the Purchasers The Purchasers hereby undertake to the Vendor that they shall ensure that upon and following Completion, no claim (whether in contract, tort or otherwise) shall be made against the Vendor by the Purchasers or any of the Target Group Companies, whether in connection with the sale and purchase of the Sale Shares, the Restructuring, or otherwise, other than as expressly provided for in this Agreement. In the event of any such claim, each Purchaser hereby unconditionally and irrevocably agrees to indemnify and keep the Vendor fully and effectively indemnified against any and all losses, liabilities, costs (including but not limited to all legal costs or attorney's fees on a full indemnity basis), charges, expenses, actions, proceedings, claims and demands which the Vendor may suffer or incur in connection with or arising from such a claim. 6.4 Limitation of the Vendor's Liability The provisions of Schedule 8 shall apply for breaches by the Vendor under this Agreement. 7. POST-COMPLETION 7.1 Post-Completion Purchasers' Undertakings (a) The Purchasers hereby undertake to the Vendor that following Completion, to the extent not finally determined as at the Completion Date, the Vendor and/or its Affiliates shall have the exclusive right to in good faith conduct all the correspondences, discussions, negotiations, proceedings, litigation and/or legal actions relating to each Known Proceeding, including to commence, pursue, settle, compromise, defend or avoid such dispute and/or appeal (or defend counterclaims), in this connection: (i) without limiting the foregoing in any way, the Purchasers shall not and shall procure that the Target Group shall not take any action relating to the Known Proceedings without the prior consultation with and the prior written consent of the Vendor and/or its Affiliates; (ii) the Purchasers shall and shall procure that the Target Group shall (i) provide full cooperation in good faith as requested by the Vendor and/or its Affiliates in connection with the Known Proceedings, and (ii) instruct its representatives to promptly provide to the Vendor and/or its Affiliates all documents, materials, communications, records, notices and/or other information relating to the Known Proceedings; and

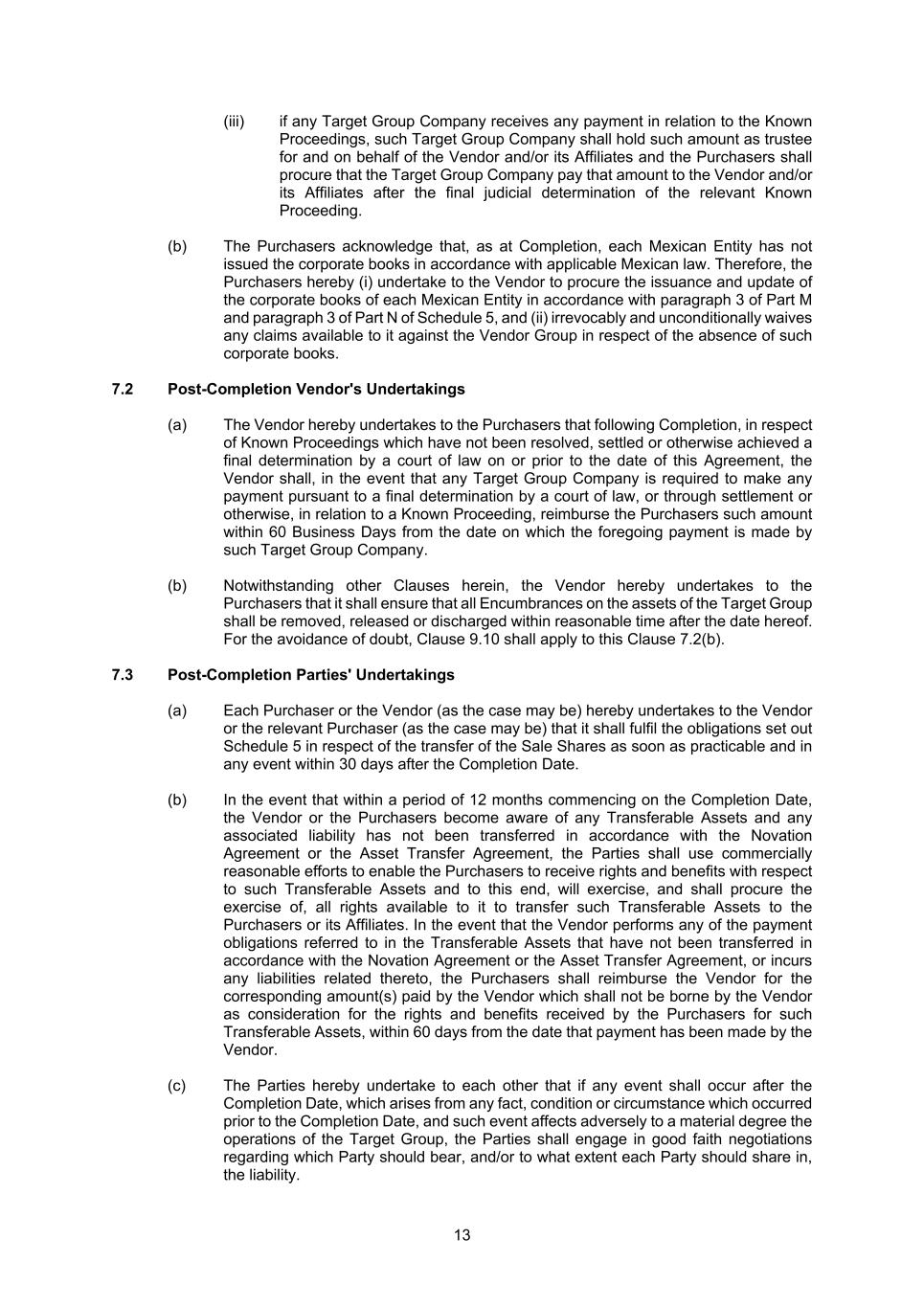

13 (iii) if any Target Group Company receives any payment in relation to the Known Proceedings, such Target Group Company shall hold such amount as trustee for and on behalf of the Vendor and/or its Affiliates and the Purchasers shall procure that the Target Group Company pay that amount to the Vendor and/or its Affiliates after the final judicial determination of the relevant Known Proceeding. (b) The Purchasers acknowledge that, as at Completion, each Mexican Entity has not issued the corporate books in accordance with applicable Mexican law. Therefore, the Purchasers hereby (i) undertake to the Vendor to procure the issuance and update of the corporate books of each Mexican Entity in accordance with paragraph 3 of Part M and paragraph 3 of Part N of Schedule 5, and (ii) irrevocably and unconditionally waives any claims available to it against the Vendor Group in respect of the absence of such corporate books. 7.2 Post-Completion Vendor's Undertakings (a) The Vendor hereby undertakes to the Purchasers that following Completion, in respect of Known Proceedings which have not been resolved, settled or otherwise achieved a final determination by a court of law on or prior to the date of this Agreement, the Vendor shall, in the event that any Target Group Company is required to make any payment pursuant to a final determination by a court of law, or through settlement or otherwise, in relation to a Known Proceeding, reimburse the Purchasers such amount within 60 Business Days from the date on which the foregoing payment is made by such Target Group Company. (b) Notwithstanding other Clauses herein, the Vendor hereby undertakes to the Purchasers that it shall ensure that all Encumbrances on the assets of the Target Group shall be removed, released or discharged within reasonable time after the date hereof. For the avoidance of doubt, Clause 9.10 shall apply to this Clause 7.2(b). 7.3 Post-Completion Parties' Undertakings (a) Each Purchaser or the Vendor (as the case may be) hereby undertakes to the Vendor or the relevant Purchaser (as the case may be) that it shall fulfil the obligations set out Schedule 5 in respect of the transfer of the Sale Shares as soon as practicable and in any event within 30 days after the Completion Date. (b) In the event that within a period of 12 months commencing on the Completion Date, the Vendor or the Purchasers become aware of any Transferable Assets and any associated liability has not been transferred in accordance with the Novation Agreement or the Asset Transfer Agreement, the Parties shall use commercially reasonable efforts to enable the Purchasers to receive rights and benefits with respect to such Transferable Assets and to this end, will exercise, and shall procure the exercise of, all rights available to it to transfer such Transferable Assets to the Purchasers or its Affiliates. In the event that the Vendor performs any of the payment obligations referred to in the Transferable Assets that have not been transferred in accordance with the Novation Agreement or the Asset Transfer Agreement, or incurs any liabilities related thereto, the Purchasers shall reimburse the Vendor for the corresponding amount(s) paid by the Vendor which shall not be borne by the Vendor as consideration for the rights and benefits received by the Purchasers for such Transferable Assets, within 60 days from the date that payment has been made by the Vendor. (c) The Parties hereby undertake to each other that if any event shall occur after the Completion Date, which arises from any fact, condition or circumstance which occurred prior to the Completion Date, and such event affects adversely to a material degree the operations of the Target Group, the Parties shall engage in good faith negotiations regarding which Party should bear, and/or to what extent each Party should share in, the liability.

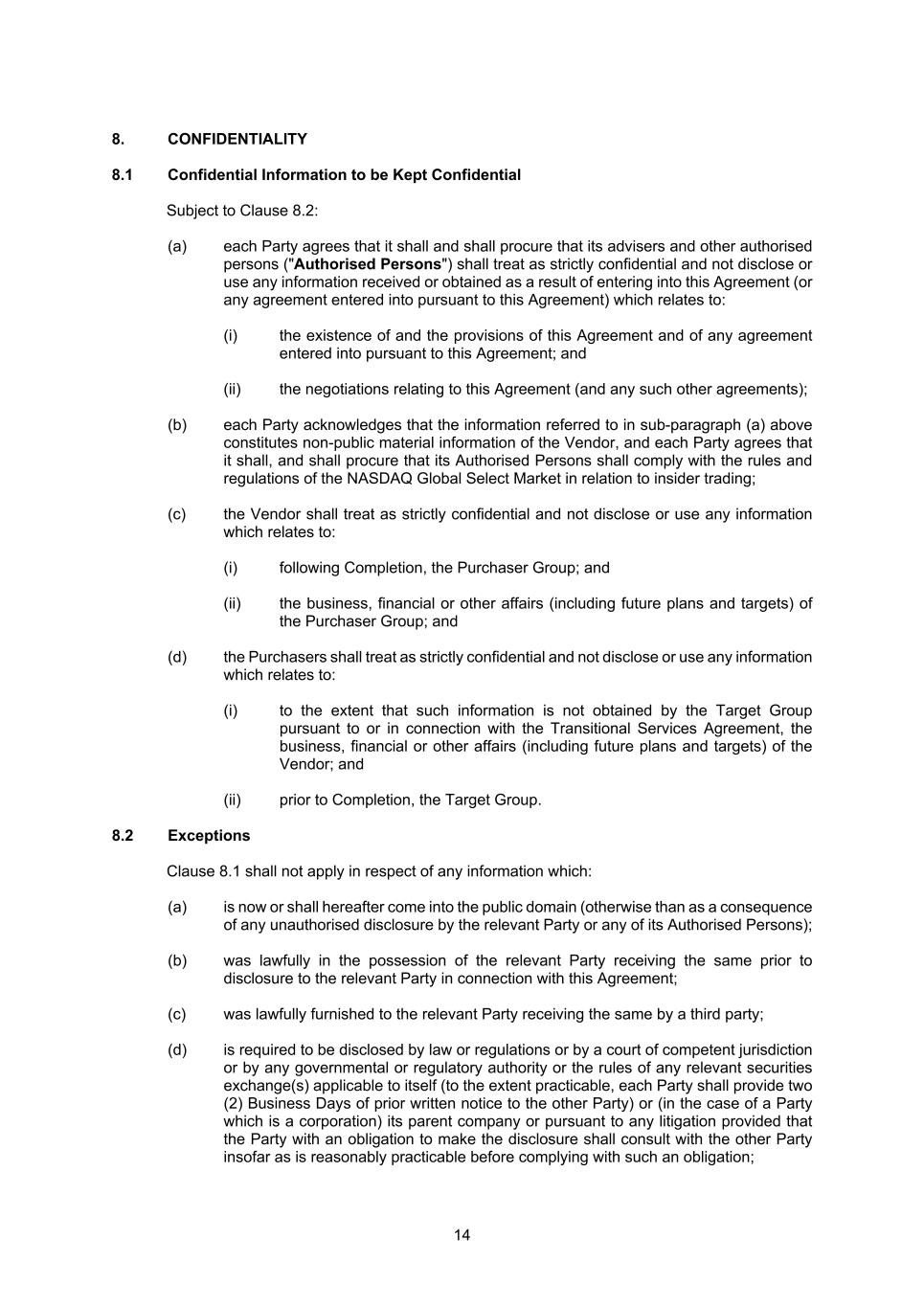

14 8. CONFIDENTIALITY 8.1 Confidential Information to be Kept Confidential Subject to Clause 8.2: (a) each Party agrees that it shall and shall procure that its advisers and other authorised persons ("Authorised Persons") shall treat as strictly confidential and not disclose or use any information received or obtained as a result of entering into this Agreement (or any agreement entered into pursuant to this Agreement) which relates to: (i) the existence of and the provisions of this Agreement and of any agreement entered into pursuant to this Agreement; and (ii) the negotiations relating to this Agreement (and any such other agreements); (b) each Party acknowledges that the information referred to in sub-paragraph (a) above constitutes non-public material information of the Vendor, and each Party agrees that it shall, and shall procure that its Authorised Persons shall comply with the rules and regulations of the NASDAQ Global Select Market in relation to insider trading; (c) the Vendor shall treat as strictly confidential and not disclose or use any information which relates to: (i) following Completion, the Purchaser Group; and (ii) the business, financial or other affairs (including future plans and targets) of the Purchaser Group; and (d) the Purchasers shall treat as strictly confidential and not disclose or use any information which relates to: (i) to the extent that such information is not obtained by the Target Group pursuant to or in connection with the Transitional Services Agreement, the business, financial or other affairs (including future plans and targets) of the Vendor; and (ii) prior to Completion, the Target Group. 8.2 Exceptions Clause 8.1 shall not apply in respect of any information which: (a) is now or shall hereafter come into the public domain (otherwise than as a consequence of any unauthorised disclosure by the relevant Party or any of its Authorised Persons); (b) was lawfully in the possession of the relevant Party receiving the same prior to disclosure to the relevant Party in connection with this Agreement; (c) was lawfully furnished to the relevant Party receiving the same by a third party; (d) is required to be disclosed by law or regulations or by a court of competent jurisdiction or by any governmental or regulatory authority or the rules of any relevant securities exchange(s) applicable to itself (to the extent practicable, each Party shall provide two (2) Business Days of prior written notice to the other Party) or (in the case of a Party which is a corporation) its parent company or pursuant to any litigation provided that the Party with an obligation to make the disclosure shall consult with the other Party insofar as is reasonably practicable before complying with such an obligation;

15 (e) is disclosed to professional advisers of the disclosing Party on terms that such professional advisers accept such information under a duty of confidentiality; or (f) is required to be disclosed in connection with the satisfaction of any of the conditions set out in Schedule 2. 8.3 Announcements Unless permitted under Clause 8.2, no announcement, press release or similar notifications in connection with the existence or the subject matter of this Agreement shall be made or issued by or on behalf of any Party without the prior written approval of the other Party acting reasonably, provided that adequate time for the review of such announcement, press release or similar notification will be given to the Party which approval is being sought. The Parties hereby acknowledge that the transactions contemplated under the Transaction Documents constitutes non-public material information and shall comply with the applicable insider trading rules while in possession of such information. 9. MISCELLANEOUS 9.1 Entire Agreement This Agreement embodies all the terms and conditions agreed upon between the Parties as to the subject matter of this Agreement and supersedes and cancels in all respects all previous agreements, letters, representations, warranties and undertakings, if any, between the Parties with respect to the subject matter hereof, whether such be written or oral. 9.2 No Reliance The Purchasers acknowledge that in entering into this Agreement, they have not relied on any representation, warranty or undertaking (except those expressly incorporated into this Agreement) made by or on behalf of the Vendor before or at the execution of this Agreement. Without prejudice to the generality of the foregoing, the Purchasers acknowledge that they have not relied upon, and will make no claim (whether in contract, tort or otherwise) hereafter in respect of, any such representation or promise or any budget, forecast or other financial projections supplied by or on behalf of the Vendor or any other information so supplied including, without limitation, any information memorandum or other information (written or oral) supplied to it by or on behalf of the Vendor or the Vendor's solicitors. The Purchasers waive all rights and remedies which, but for Clauses 9.1 and 9.2, might otherwise be available to them in respect of any such representation, warranty or undertaking. 9.3 Authority Nothing in this Agreement shall be deemed to create or constitute a partnership between the Parties hereto for the purposes of the law of partnership, any relevant income tax legislation or any other law or enactment and none of the Parties shall act or represent or hold itself out as having authority to act as an agent of or in any way bind or commit any of the other Parties to any obligations. 9.4 Releases Any liability to any Party under this Agreement may in whole or in part be released, compounded or compromised, or time or indulgence given, by such Party in its absolute discretion without in any way prejudicing or affecting its rights against the other Party in respect of the same. 9.5 No Implied Waivers The failure by any Party to exercise any right (including the right of rescission) or to require performance by the other Party or to claim a breach of any term of this Agreement shall not be deemed to be a waiver of such or any other rights or remedies available to it. Completion shall not constitute a waiver by the Purchasers or the Vendor (as the case may be) of their rights in

16 relation to any breach of any provision of this Agreement whether or not known to it at the Completion Date. 9.6 Continuing Effects of this Agreement (a) All provisions of this Agreement, in so far as the same shall not have been performed at Completion, shall remain in full force and effect notwithstanding Completion. (b) This Clause and all the Surviving Provisions shall remain binding on the Parties notwithstanding Completion and/or any rescission or termination of this Agreement by any Party and any rights or obligations of the Parties in respect of any breach of this Agreement accruing prior to, on or as a result of such termination or rescission shall continue to subsist notwithstanding such termination or rescission. 9.7 Successors and Assigns (a) This Agreement shall be binding on and shall inure to the benefit of each Party's successors and assigns. Any reference in this Agreement to any of the Parties shall be construed accordingly. (b) No Party may assign or transfer all or part of its rights or obligations under this Agreement without the prior written consent of the other Party. 9.8 Third Party Rights Save as expressly provided in this Agreement, no provision of this Agreement is enforceable by virtue of the Contracts (Rights of Third Parties) Act 2001 of Singapore by any person who is not a Party to this Agreement. 9.9 Time of Essence Any time, date or period mentioned in any provision of this Agreement may be extended by mutual agreement between the Parties in accordance with this Agreement or by agreement in writing but as regards any time, date or period originally fixed or any time, date or period so extended as aforesaid time shall be of the essence. 9.10 Further Assurance (a) Each Party shall, and shall use its best endeavours to, procure that any necessary third party shall, from time to time execute such documents and do all such acts and things as the other Party may reasonably require to give effect to the sale and purchase and the transactions contemplated herein. (b) Without limiting the generality of Clause 9.10(a) above, the Vendor shall, at the reasonable request of the Purchasers, use commercially reasonable efforts to (i) ensure that the Target Assets are transferred to the Purchasers or its Affiliates (to the extent that such Target Assets have not be transferred by the Completion Date), and (ii) assist with all necessary filings, applications, registrations or other actions with the relevant governmental authorities (as the case may be) in respect of the purchase of the Sale Shares. 9.11 Costs and Expenses (a) Save as otherwise provided herein, each Party shall bear and be responsible for its professional and other costs and expenses incurred in the preparation, negotiation and execution of this Agreement and all other documents in connection with this Agreement, including all other professional and other costs and expenses incurred in relation to the performance of its obligations under this Agreement.

17 (b) The Purchasers shall bear all stamp duty payable in connection with the purchase or sale of the respective Sale Shares. (c) Except for stamp duty which shall be payable in accordance with Clause 9.11(b) above, each Party shall be solely responsible for bearing and settling all taxes and levies that are applicable to its own income generated pursuant to this Agreement. The amount to be borne and paid shall be equivalent to the full amount of such taxes and levies. All payments payable under this Agreement shall be made in full without any deductions, save as otherwise required by applicable laws. In the event that any of the Target Entities are required, in line with applicable laws, to withhold certain taxes and levies in the jurisdiction where they are incorporated or established as a consequence of the equity transfer, the Purchasers shall procure that the Target Entities shall: (i) calculate the amount of withholding taxes and levies accurately, file the necessary tax returns on behalf of the Vendor in a timely manner, and ensure compliance with all relevant tax filing procedures; (ii) promptly furnish the Vendor with official tax receipts or other valid documentary evidence issued by the relevant taxing authority as proof of the payment of the withheld taxes and levies; and (iii) effect the payment of the withheld taxes and levies to the appropriate tax authorities and subsequently seek reimbursement from the Vendor for the amounts so paid within 30 Business Days after the payment is made. 9.12 Illegality (a) If any provision in this Agreement shall be held to be illegal, invalid or unenforceable, in whole or in part, the provision shall apply with whatever deletion or modification is necessary so that the provision is legal, valid and enforceable and gives effect to the commercial intention of the Parties. (b) To the extent that it is not possible to delete or modify the provision, in whole or in part, under Clause 9.12(a) then such provision or part of it shall, to the extent that it is illegal, invalid or unenforceable, be deemed not to form part of this Agreement and the legality, validity and enforceability of the remainder of this Agreement shall, subject to any deletion or modification made under Clause 9.12(a), not be affected. 9.13 No Purported Variation No purported variation of this Agreement shall be effective unless made in writing, refers specifically to this Agreement and is duly executed by all the Parties. 9.14 Construction As the Parties have participated in the drafting of this Agreement, the Parties agree that any applicable rule requiring the construction of this Agreement or any provision hereof against the Party drafting this Agreement shall not apply. 9.15 Communications (a) Notices To Be In Writing All notices, demands or other communications required or permitted to be given or made hereunder shall be in writing and delivered by hand, by courier or by prepaid registered post with recorded delivery, or by electronic mail addressed to the intended recipient thereof at its address or at its email address, and marked for the attention of such person (if any), designated by it to the other Party for the purposes of this Agreement or to such other address or email

18 address, and marked for the attention of such person, as a Party may from time to time duly notify the others in writing. (b) Contact Addresses and Numbers The initial physical and electronic mail addresses and contact person of the Parties for the purpose of this Agreement are specified below: The Vendor Address : 8 Marina Bay Boulevard, #05-02, Marina Bay Financial Centre, 018981 Singapore Attention : Legal Department E-mail address : LegalNotice@maxeon.com Lumetech Address : No. 12, New Technology Industrial Park, Haitai East Road, Huayuan Industrial Zone (Outer Ring), Tianjin 300384, China Attention : Bruce Zhou, Leon Xia, Wei Ren E-mail address : zhoubin@tzeco.com; leon.xia@tcl.com; renwei@tzeco.com TCL Sunpower Address : 6 Raffles Quay, #14-02, Singapore 04858 Attention : Eric Tsao E-mail address : zhilong.cao@tzeco.com (c) Deemed Delivery Date Any such notice, demand or communication shall be deemed to have been duly served: (i) in the case of delivery by hand or by courier, when delivered; (ii) in the case of electronic mail, at the time of transmission provided that the sender does not receive any indication that the electronic mail message has not been successfully transmitted to the intended recipient or has been delayed; and (iii) in the case of post, on the second Business Day after the date of posting (if sent by local mail) and on the seventh Business Day after the date of posting (if sent by air mail), provided that in each case where delivery by hand, by courier or by fax occurs on a day which is not a Business Day or after 6.00 p.m. on a Business Day, service shall be deemed to occur at 9.00 a.m. on the next following Business Day and in proving service, it shall be sufficient to show that personal delivery was made or that the envelope containing such notice was properly addressed, and duly stamped and posted or that the facsimile transmission was properly addressed and despatched.

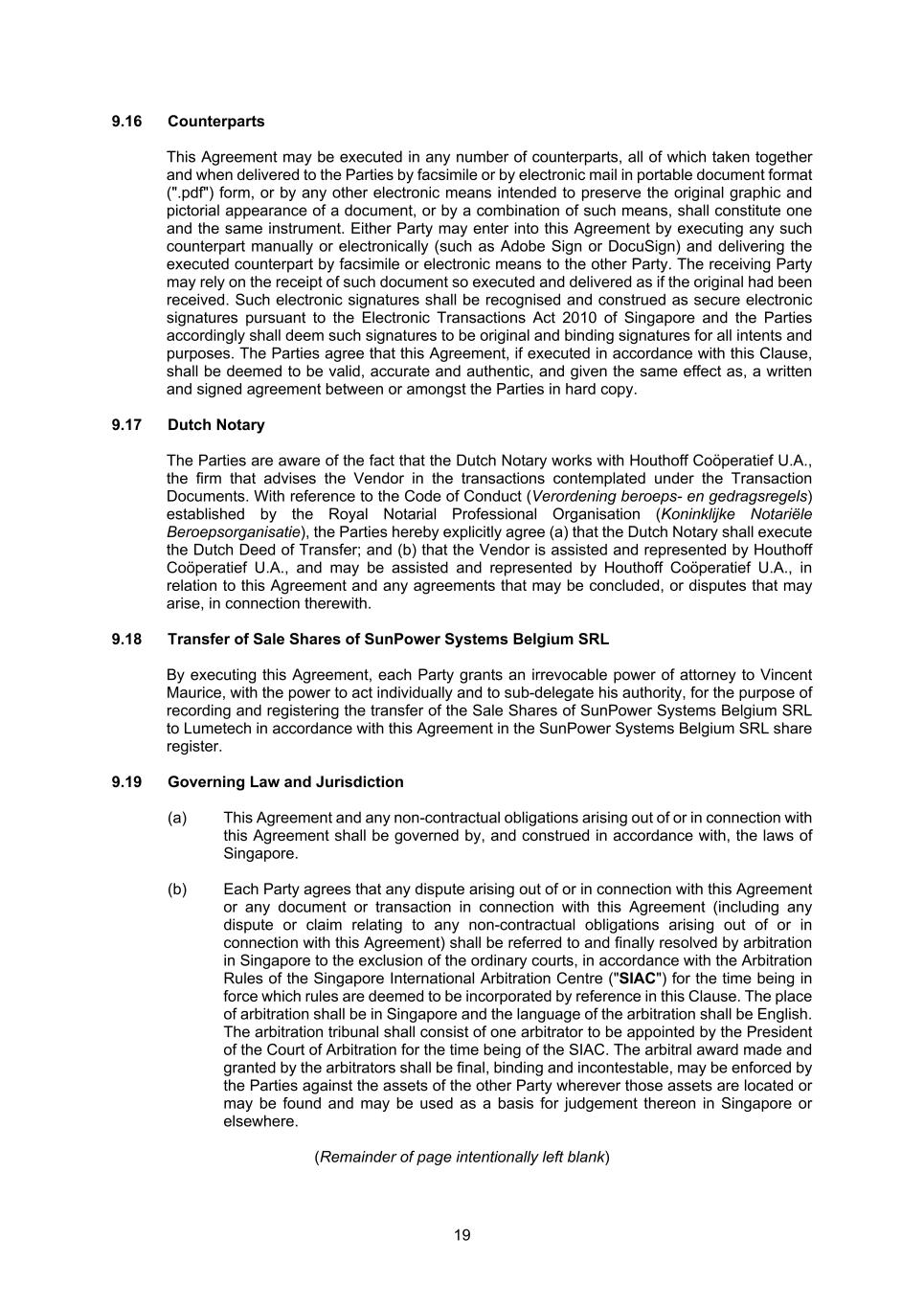

19 9.16 Counterparts This Agreement may be executed in any number of counterparts, all of which taken together and when delivered to the Parties by facsimile or by electronic mail in portable document format (".pdf") form, or by any other electronic means intended to preserve the original graphic and pictorial appearance of a document, or by a combination of such means, shall constitute one and the same instrument. Either Party may enter into this Agreement by executing any such counterpart manually or electronically (such as Adobe Sign or DocuSign) and delivering the executed counterpart by facsimile or electronic means to the other Party. The receiving Party may rely on the receipt of such document so executed and delivered as if the original had been received. Such electronic signatures shall be recognised and construed as secure electronic signatures pursuant to the Electronic Transactions Act 2010 of Singapore and the Parties accordingly shall deem such signatures to be original and binding signatures for all intents and purposes. The Parties agree that this Agreement, if executed in accordance with this Clause, shall be deemed to be valid, accurate and authentic, and given the same effect as, a written and signed agreement between or amongst the Parties in hard copy. 9.17 Dutch Notary The Parties are aware of the fact that the Dutch Notary works with Houthoff Coöperatief U.A., the firm that advises the Vendor in the transactions contemplated under the Transaction Documents. With reference to the Code of Conduct (Verordening beroeps- en gedragsregels) established by the Royal Notarial Professional Organisation (Koninklijke Notariële Beroepsorganisatie), the Parties hereby explicitly agree (a) that the Dutch Notary shall execute the Dutch Deed of Transfer; and (b) that the Vendor is assisted and represented by Houthoff Coöperatief U.A., and may be assisted and represented by Houthoff Coöperatief U.A., in relation to this Agreement and any agreements that may be concluded, or disputes that may arise, in connection therewith. 9.18 Transfer of Sale Shares of SunPower Systems Belgium SRL By executing this Agreement, each Party grants an irrevocable power of attorney to Vincent Maurice, with the power to act individually and to sub-delegate his authority, for the purpose of recording and registering the transfer of the Sale Shares of SunPower Systems Belgium SRL to Lumetech in accordance with this Agreement in the SunPower Systems Belgium SRL share register. 9.19 Governing Law and Jurisdiction (a) This Agreement and any non-contractual obligations arising out of or in connection with this Agreement shall be governed by, and construed in accordance with, the laws of Singapore. (b) Each Party agrees that any dispute arising out of or in connection with this Agreement or any document or transaction in connection with this Agreement (including any dispute or claim relating to any non-contractual obligations arising out of or in connection with this Agreement) shall be referred to and finally resolved by arbitration in Singapore to the exclusion of the ordinary courts, in accordance with the Arbitration Rules of the Singapore International Arbitration Centre ("SIAC") for the time being in force which rules are deemed to be incorporated by reference in this Clause. The place of arbitration shall be in Singapore and the language of the arbitration shall be English. The arbitration tribunal shall consist of one arbitrator to be appointed by the President of the Court of Arbitration for the time being of the SIAC. The arbitral award made and granted by the arbitrators shall be final, binding and incontestable, may be enforced by the Parties against the assets of the other Party wherever those assets are located or may be found and may be used as a basis for judgement thereon in Singapore or elsewhere. (Remainder of page intentionally left blank)

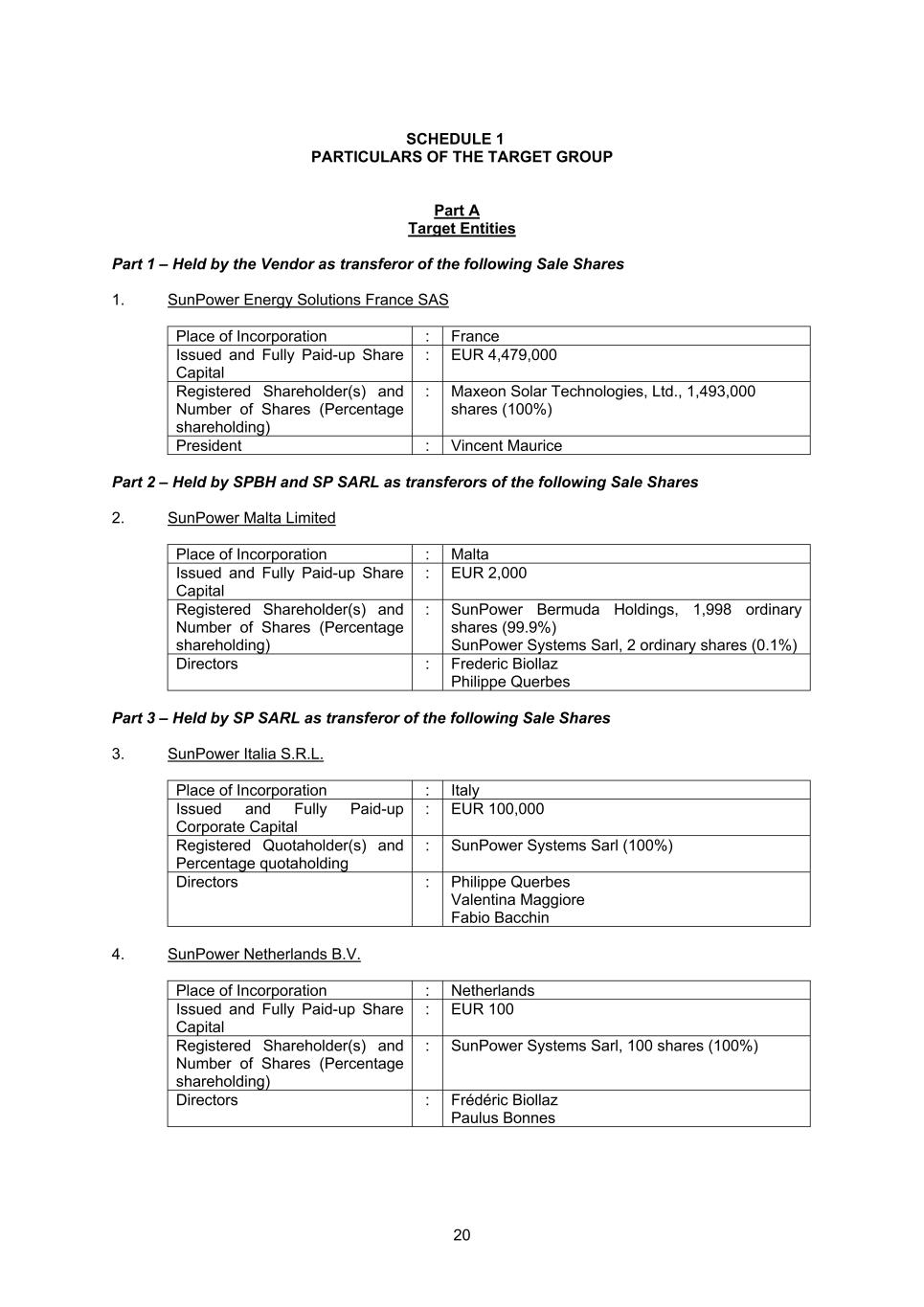

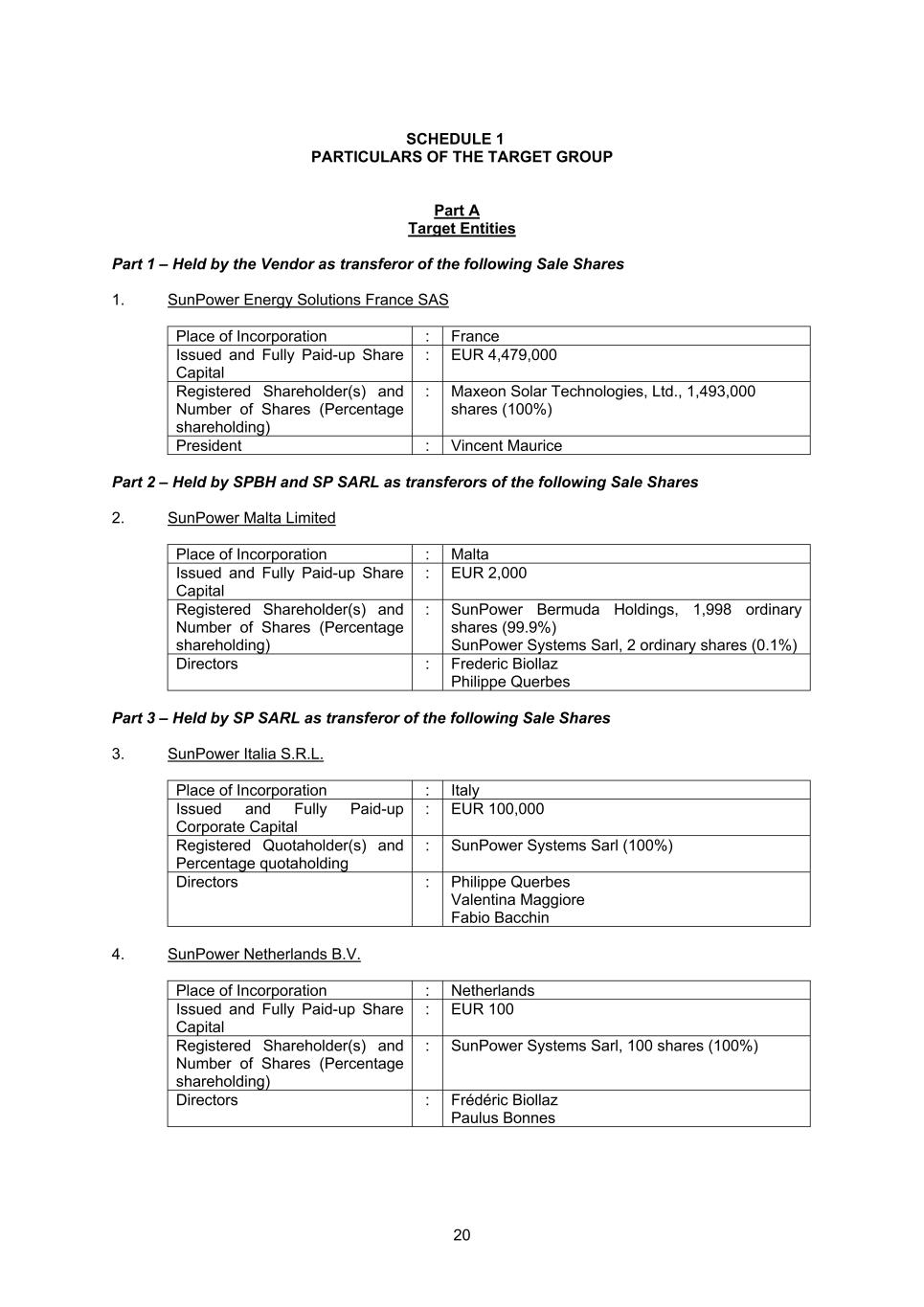

20 SCHEDULE 1 PARTICULARS OF THE TARGET GROUP Part A Target Entities Part 1 – Held by the Vendor as transferor of the following Sale Shares 1. SunPower Energy Solutions France SAS Place of Incorporation : France Issued and Fully Paid-up Share Capital : EUR 4,479,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : Maxeon Solar Technologies, Ltd., 1,493,000 shares (100%) President : Vincent Maurice Part 2 – Held by SPBH and SP SARL as transferors of the following Sale Shares 2. SunPower Malta Limited Place of Incorporation : Malta Issued and Fully Paid-up Share Capital : EUR 2,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Bermuda Holdings, 1,998 ordinary shares (99.9%) SunPower Systems Sarl, 2 ordinary shares (0.1%) Directors : Frederic Biollaz Philippe Querbes Part 3 – Held by SP SARL as transferor of the following Sale Shares 3. SunPower Italia S.R.L. Place of Incorporation : Italy Issued and Fully Paid-up Corporate Capital : EUR 100,000 Registered Quotaholder(s) and Percentage quotaholding : SunPower Systems Sarl (100%) Directors : Philippe Querbes Valentina Maggiore Fabio Bacchin 4. SunPower Netherlands B.V. Place of Incorporation : Netherlands Issued and Fully Paid-up Share Capital : EUR 100 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Systems Sarl, 100 shares (100%) Directors : Frédéric Biollaz Paulus Bonnes

21 5. SunPower Corporation Australia Pty Limited Place of Incorporation : Western Australia Issued and Fully Paid-up Share Capital : A$1,568,002.00 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Systems Sarl, 2,150,000 ordinary shares (100%) Directors : Stephen Straughair Lai Ping Wong 6. SunPower Corporation SpA Place of Incorporation : Chile Issued and Fully Paid-up Share Capital : CLP $49.319.067 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Systems Sarl, 1,000 shares (100%) Directors : Frederic Biollaz 7. SunPower Systems Belgium SRL Place of Incorporation : Belgium Issued and Fully Paid-up Share Capital i.e. Apport (contribution) : This type of company has no share capital. On the date of the last audited accounts (i.e. 31 December 2023), the shareholder's contribution amounted to EUR 18,550.00, of which EUR 6,200.00 was paid- up and is recorded as "unavailable contribution" Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Systems Sarl, 1,855 shares (100%) Directors : Frédéric Biollaz 8. Maxeon Japan K.K. Place of Incorporation : Japan Issued and Fully Paid-up Share Capital : JPY 5,000,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Systems Sarl, 100 shares (100%) Directors : Takehiko Fukuoka Peter Ashenbrenner Mark William Babcock (resigned as of 10 January 2024) 9. SunPower GmbH Place of Incorporation : Germany Issued and Fully Paid-up Share Capital : EUR 25,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Systems Sarl, 1 share (100%) Directors : Frédéric Biollaz Ralf Elias

22 10. SunPower Energy Systems Spain, S.L.U. Place of Incorporation : Spain Issued and Fully Paid-up Share Capital : EUR 3,600 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Systems Sarl, 3,600 shares (100%) Directors : Philippe Querbes 11. SunPower Energy Systems Korea Place of Incorporation : Republic of Korea Issued and Fully Paid-up Share Capital : KRW 700,000,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Systems Sarl, 70 000 shares (100%) Directors : Nil 12. Kozani Energy Malta Limited Place of Incorporation : Malta Issued and Fully Paid-up Share Capital : EUR 2,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Malta Limited, 1,999 ordinary A shares (99.95%) Sunpower Systems Sarl, 1 ordinary B share (0.05%) Directors : N.A. (this company is in dissolution and the liquidator is Nicholas Valenzia) 13. Photovoltaic Park Malta Limited Place of Incorporation : Malta Issued and Fully Paid-up Share Capital : EUR 2,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Malta Limited, 1,999 ordinary A shares (99.95%) Sunpower Systems Sarl, 1 ordinary B share (0.05%) Directors : N.A. (this company is in dissolution and the liquidator is Nicholas Valenzia)

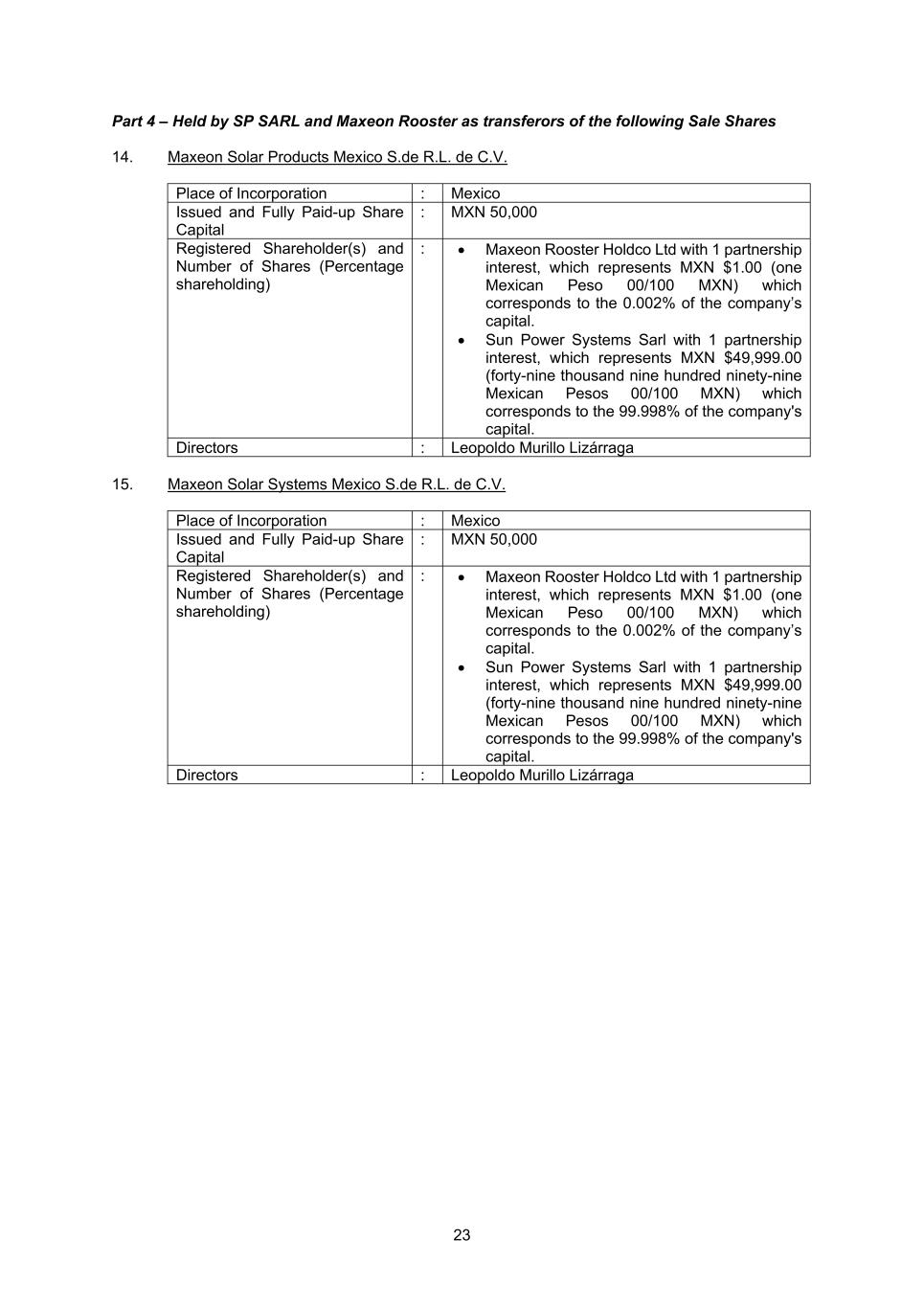

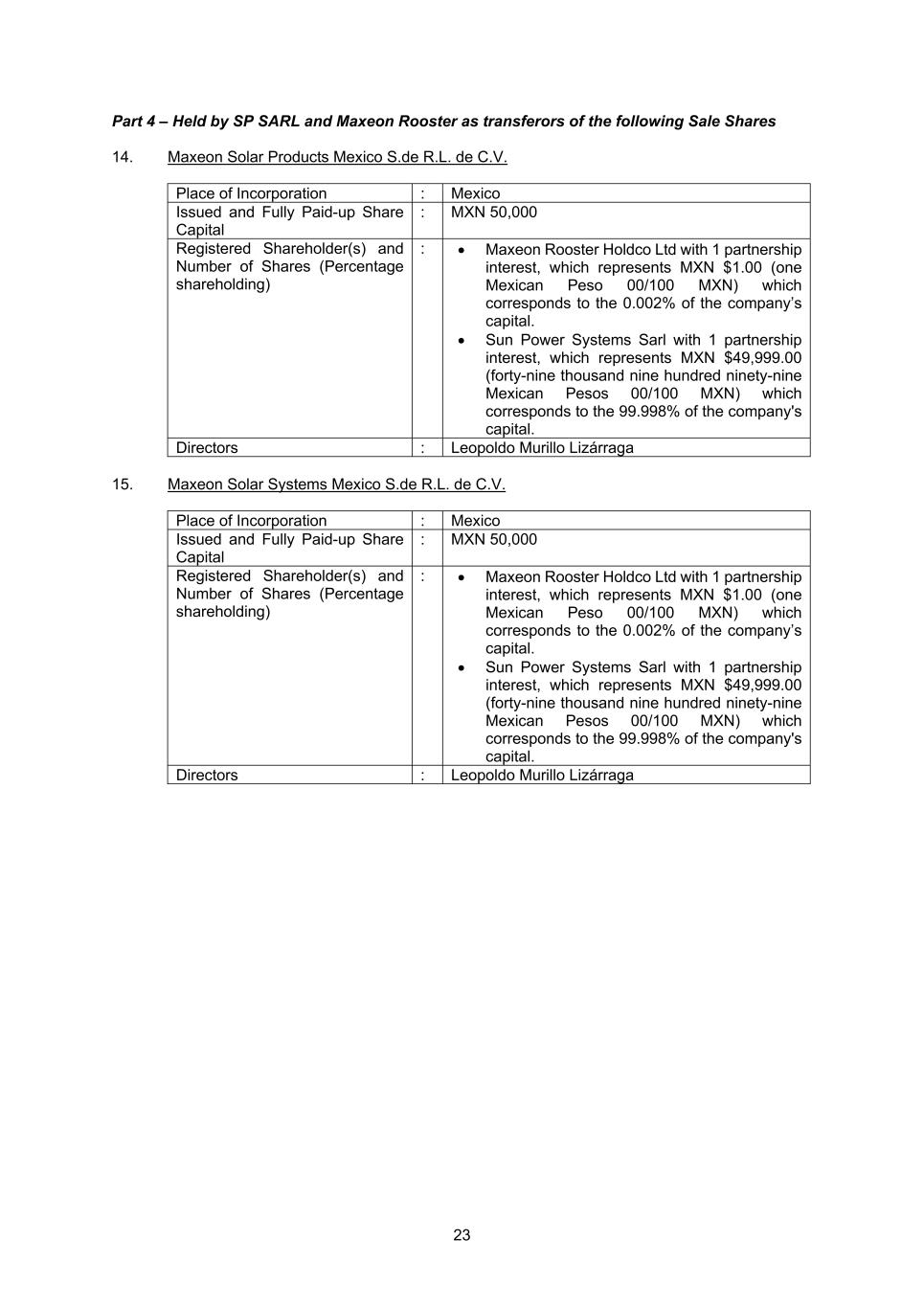

23 Part 4 – Held by SP SARL and Maxeon Rooster as transferors of the following Sale Shares 14. Maxeon Solar Products Mexico S.de R.L. de C.V. Place of Incorporation : Mexico Issued and Fully Paid-up Share Capital : MXN 50,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : • Maxeon Rooster Holdco Ltd with 1 partnership interest, which represents MXN $1.00 (one Mexican Peso 00/100 MXN) which corresponds to the 0.002% of the company’s capital. • Sun Power Systems Sarl with 1 partnership interest, which represents MXN $49,999.00 (forty-nine thousand nine hundred ninety-nine Mexican Pesos 00/100 MXN) which corresponds to the 99.998% of the company's capital. Directors : Leopoldo Murillo Lizárraga 15. Maxeon Solar Systems Mexico S.de R.L. de C.V. Place of Incorporation : Mexico Issued and Fully Paid-up Share Capital : MXN 50,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : • Maxeon Rooster Holdco Ltd with 1 partnership interest, which represents MXN $1.00 (one Mexican Peso 00/100 MXN) which corresponds to the 0.002% of the company’s capital. • Sun Power Systems Sarl with 1 partnership interest, which represents MXN $49,999.00 (forty-nine thousand nine hundred ninety-nine Mexican Pesos 00/100 MXN) which corresponds to the 99.998% of the company's capital. Directors : Leopoldo Murillo Lizárraga

24 Part B Subsidiaries Part 1 – SP France Subsidiaries 1. Total Energie Do Brasil Place of Incorporation : Brazil Issued and Fully Paid-up Share Capital : R$465 937 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Energy Solutions France SAS, 465 937 shares, 100% Directors : Nil 2. SunPower Technologies France SAS Place of Incorporation : France Issued and Fully Paid-up Share Capital : EUR 100,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Energy Solutions France SAS, 10,000 shares (100%) President : SunPower Energy Solutions France SAS (represented by Vincent Maurice) 3. SunPower Manufacturing de Vernejoul SAS Place of Incorporation : France Issued and Fully Paid-up Share Capital : EUR 100,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Energy Solutions France SAS, 10,000,000 shares (100%) President : SunPower Energy Solutions France SAS (represented by Vincent Maurice) 4. Tenesol Venezuela Place of Incorporation : Venezuela Issued and Fully Paid-up Share Capital : VEF 7,500,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : • Luis Raygada, 2 shares (0.026667%) • SunPower Energy Solutions France SAS, 74,98,000 shares (99.973333%) Directors : Nil 5. SunPower Corporation Southern Africa Proprietary Limited Place of Incorporation : RSA Issued and Fully Paid-up Share Capital : Rands 1,500,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Energy Solutions France SAS, 1,500,000 shares, 100% Directors : Vincent Maurice (Chairman) Philippes Querbes

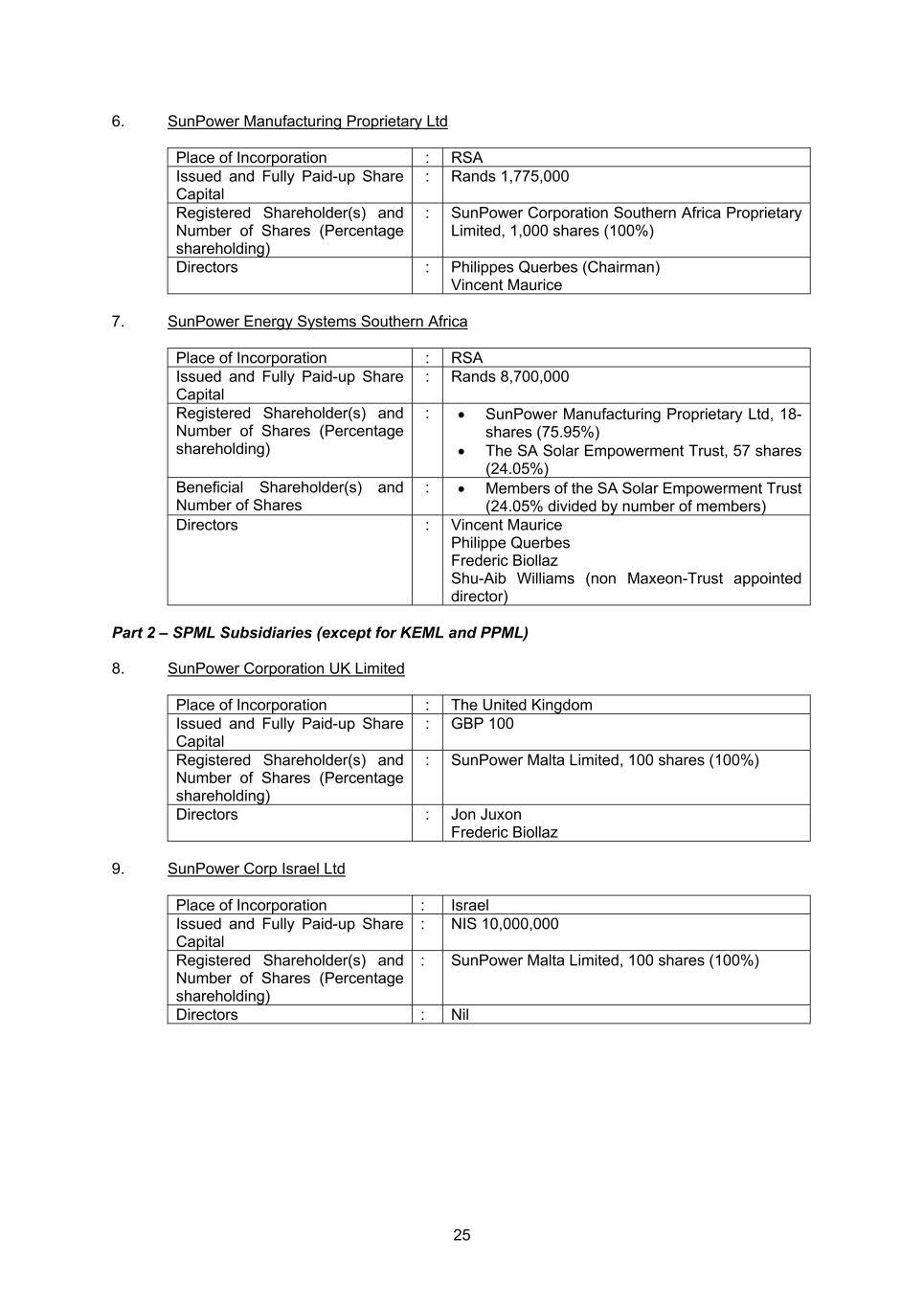

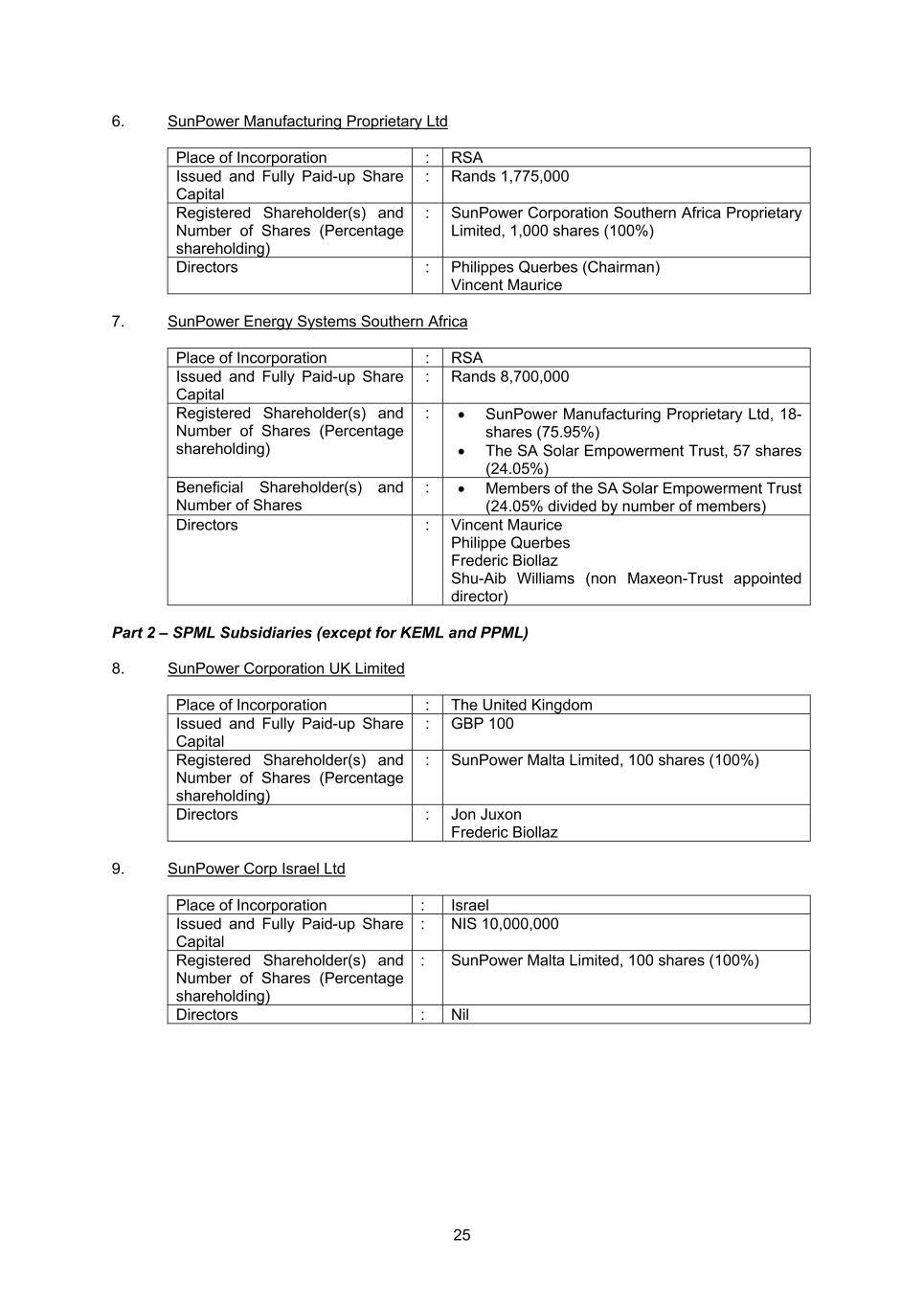

25 6. SunPower Manufacturing Proprietary Ltd Place of Incorporation : RSA Issued and Fully Paid-up Share Capital : Rands 1,775,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Corporation Southern Africa Proprietary Limited, 1,000 shares (100%) Directors : Philippes Querbes (Chairman) Vincent Maurice 7. SunPower Energy Systems Southern Africa Place of Incorporation : RSA Issued and Fully Paid-up Share Capital : Rands 8,700,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : • SunPower Manufacturing Proprietary Ltd, 18- shares (75.95%) • The SA Solar Empowerment Trust, 57 shares (24.05%) Beneficial Shareholder(s) and Number of Shares : • Members of the SA Solar Empowerment Trust (24.05% divided by number of members) Directors : Vincent Maurice Philippe Querbes Frederic Biollaz Shu-Aib Williams (non Maxeon-Trust appointed director) Part 2 – SPML Subsidiaries (except for KEML and PPML) 8. SunPower Corporation UK Limited Place of Incorporation : The United Kingdom Issued and Fully Paid-up Share Capital : GBP 100 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Malta Limited, 100 shares (100%) Directors : Jon Juxon Frederic Biollaz 9. SunPower Corp Israel Ltd Place of Incorporation : Israel Issued and Fully Paid-up Share Capital : NIS 10,000,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Malta Limited, 100 shares (100%) Directors : Nil

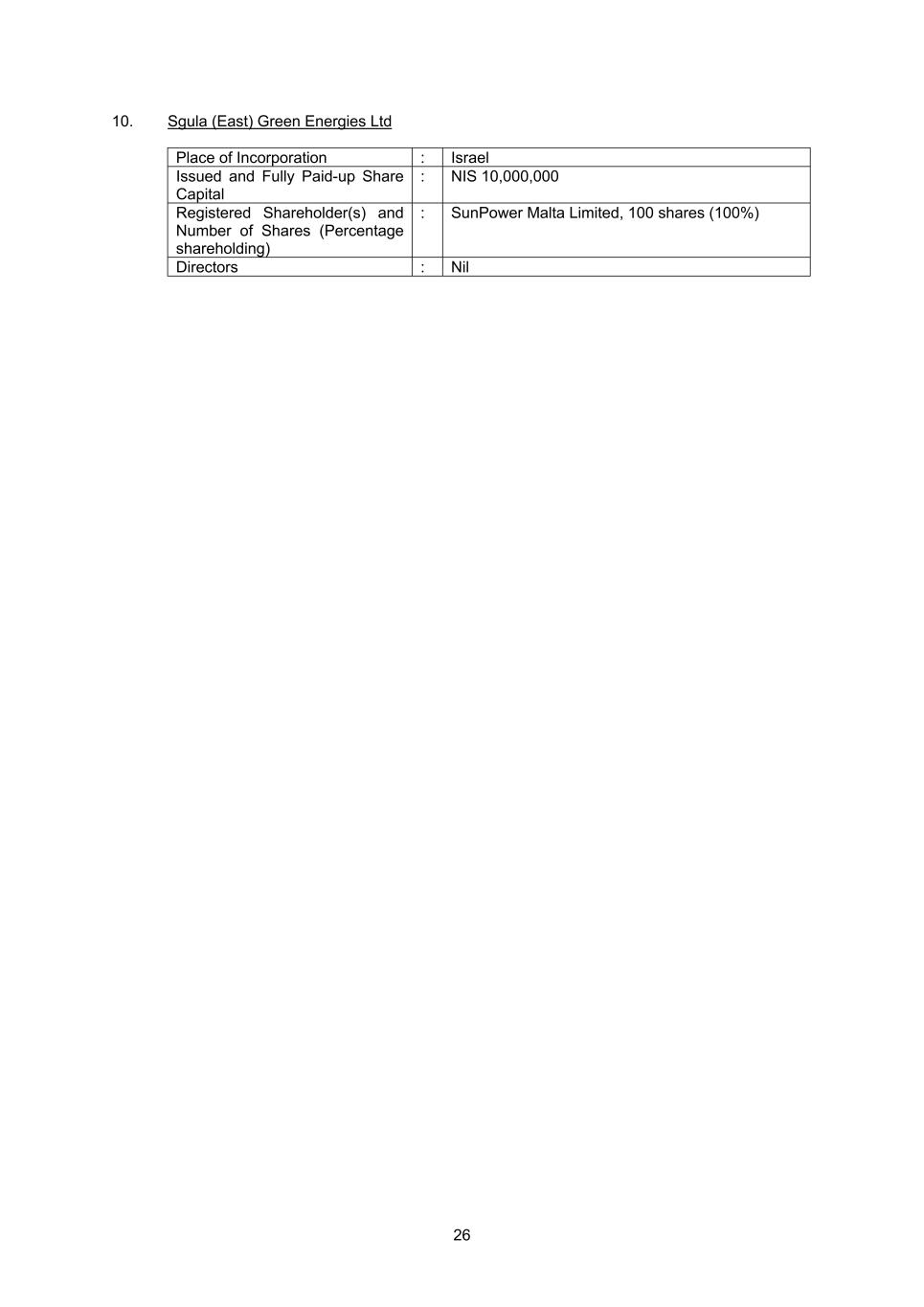

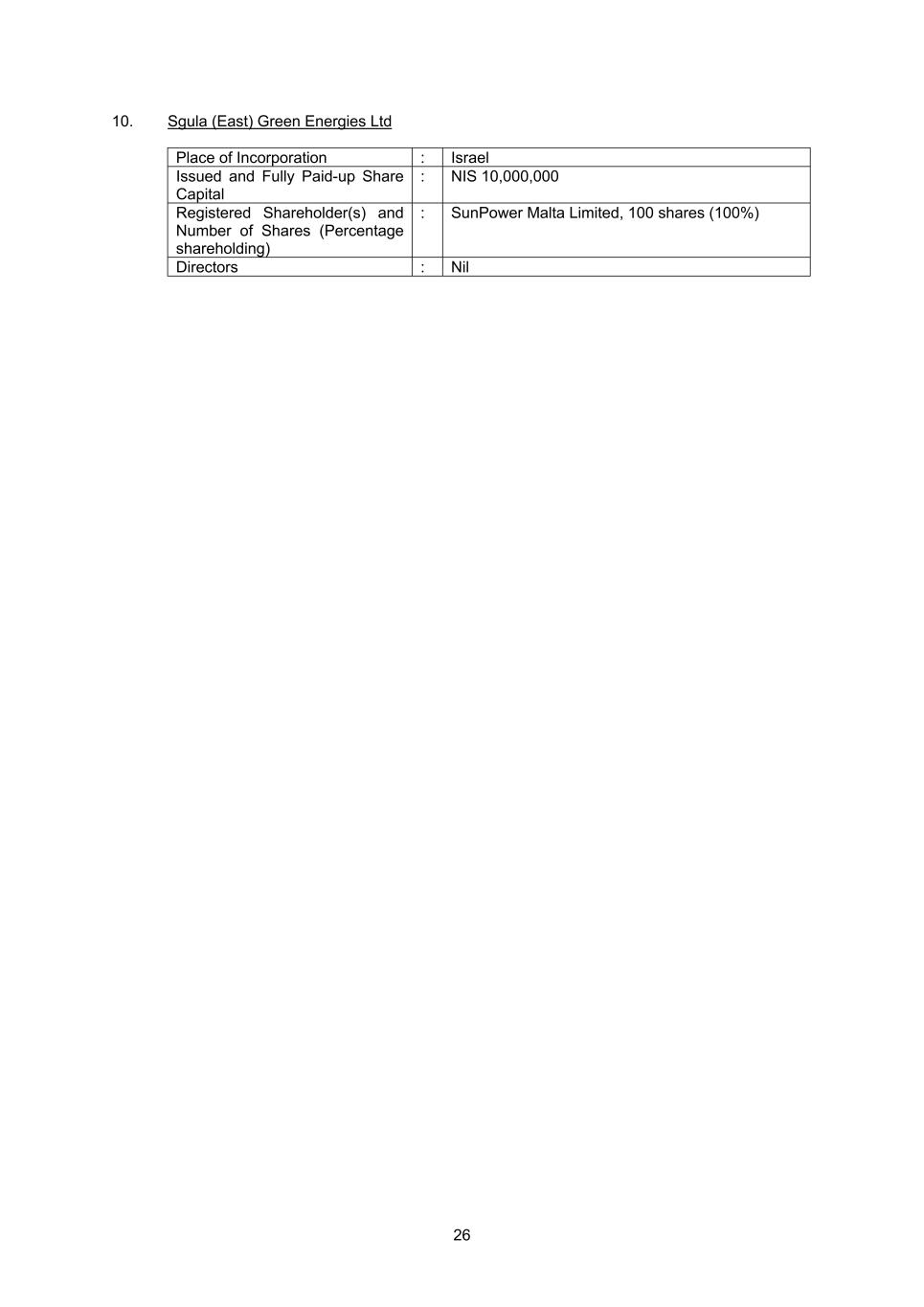

26 10. Sgula (East) Green Energies Ltd Place of Incorporation : Israel Issued and Fully Paid-up Share Capital : NIS 10,000,000 Registered Shareholder(s) and Number of Shares (Percentage shareholding) : SunPower Malta Limited, 100 shares (100%) Directors : Nil

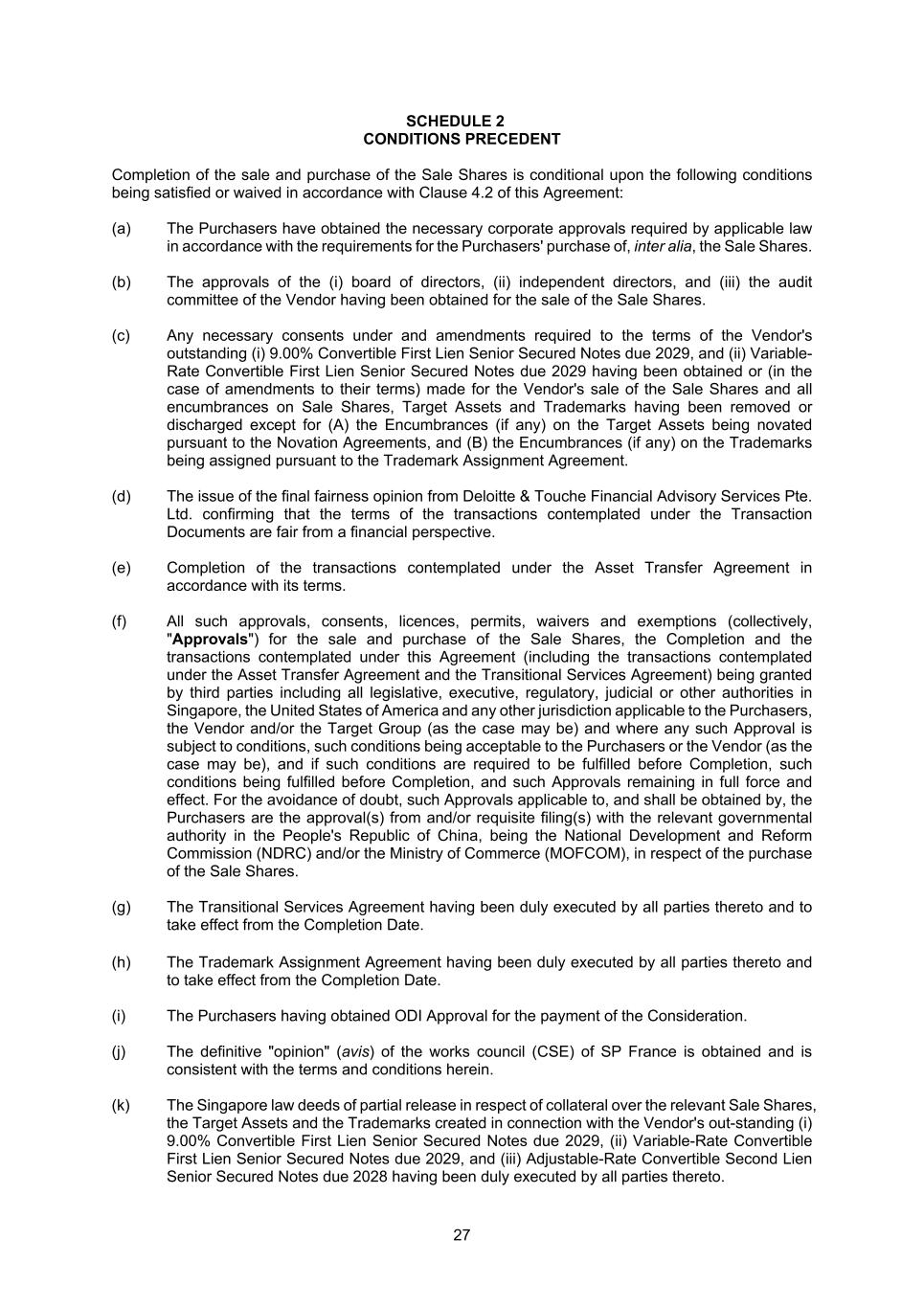

27 SCHEDULE 2 CONDITIONS PRECEDENT Completion of the sale and purchase of the Sale Shares is conditional upon the following conditions being satisfied or waived in accordance with Clause 4.2 of this Agreement: (a) The Purchasers have obtained the necessary corporate approvals required by applicable law in accordance with the requirements for the Purchasers' purchase of, inter alia, the Sale Shares. (b) The approvals of the (i) board of directors, (ii) independent directors, and (iii) the audit committee of the Vendor having been obtained for the sale of the Sale Shares. (c) Any necessary consents under and amendments required to the terms of the Vendor's outstanding (i) 9.00% Convertible First Lien Senior Secured Notes due 2029, and (ii) Variable- Rate Convertible First Lien Senior Secured Notes due 2029 having been obtained or (in the case of amendments to their terms) made for the Vendor's sale of the Sale Shares and all encumbrances on Sale Shares, Target Assets and Trademarks having been removed or discharged except for (A) the Encumbrances (if any) on the Target Assets being novated pursuant to the Novation Agreements, and (B) the Encumbrances (if any) on the Trademarks being assigned pursuant to the Trademark Assignment Agreement. (d) The issue of the final fairness opinion from Deloitte & Touche Financial Advisory Services Pte. Ltd. confirming that the terms of the transactions contemplated under the Transaction Documents are fair from a financial perspective. (e) Completion of the transactions contemplated under the Asset Transfer Agreement in accordance with its terms. (f) All such approvals, consents, licences, permits, waivers and exemptions (collectively, "Approvals") for the sale and purchase of the Sale Shares, the Completion and the transactions contemplated under this Agreement (including the transactions contemplated under the Asset Transfer Agreement and the Transitional Services Agreement) being granted by third parties including all legislative, executive, regulatory, judicial or other authorities in Singapore, the United States of America and any other jurisdiction applicable to the Purchasers, the Vendor and/or the Target Group (as the case may be) and where any such Approval is subject to conditions, such conditions being acceptable to the Purchasers or the Vendor (as the case may be), and if such conditions are required to be fulfilled before Completion, such conditions being fulfilled before Completion, and such Approvals remaining in full force and effect. For the avoidance of doubt, such Approvals applicable to, and shall be obtained by, the Purchasers are the approval(s) from and/or requisite filing(s) with the relevant governmental authority in the People's Republic of China, being the National Development and Reform Commission (NDRC) and/or the Ministry of Commerce (MOFCOM), in respect of the purchase of the Sale Shares. (g) The Transitional Services Agreement having been duly executed by all parties thereto and to take effect from the Completion Date. (h) The Trademark Assignment Agreement having been duly executed by all parties thereto and to take effect from the Completion Date. (i) The Purchasers having obtained ODI Approval for the payment of the Consideration. (j) The definitive "opinion" (avis) of the works council (CSE) of SP France is obtained and is consistent with the terms and conditions herein. (k) The Singapore law deeds of partial release in respect of collateral over the relevant Sale Shares, the Target Assets and the Trademarks created in connection with the Vendor's out-standing (i) 9.00% Convertible First Lien Senior Secured Notes due 2029, (ii) Variable-Rate Convertible First Lien Senior Secured Notes due 2029, and (iii) Adjustable-Rate Convertible Second Lien Senior Secured Notes due 2028 having been duly executed by all parties thereto.

28 (l) The obligation to repay the Net Intercompany Debt having been novated from the Vendor Group to the Purchasers to take effect from the Completion Date.

29 SCHEDULE 3 COMPLETION OBLIGATIONS 1. Vendor's Obligations on Completion 1.1 On Completion, the Vendor shall deliver, and shall procure that there be delivered, to the Purchasers the following: (a) a certified true copy of the board resolutions of the Vendor approving the sale of the Sale Shares and the execution of the Transaction Documents; and (b) duly executed originals of the Asset Transfer Agreement and the Transitional Services Agreement. All documents mentioned in sub-paragraphs (a) and (b) above and paragraph 3.1 below (insofar as it applies to the Vendor) are herein collectively referred to as "Vendor Closing Deliverables". 2. Purchasers' Obligations on Completion 2.1 On Completion, the relevant Purchaser shall deliver and shall procure that there be delivered to the Vendor: (a) certified true copies of corporate approvals required by applicable law of the relevant Purchaser: (i) approving the acquisition of the respective Sale Shares; and (ii) authorising the execution and delivery by any director of the relevant Purchaser of the Transaction Documents (in each case, only to the extent that the relevant Purchaser is a party to such agreement) and all other documents and agreements ancillary or pursuant to or in connection with the purchase of the Sale Shares; (b) a certified true copy of the corporate approvals required by applicable law of TZE approving the acquisition of the Sale Shares and authorising the execution and delivery by any director of TZE of the Transaction Documents (in each case, only to the extent that TZE is a party to such agreement); (c) duly executed originals of the Transitional Services Agreement and the Asset Transfer Agreement; and (d) payment, and evidence of payment, of the Balance Payment in accordance with Schedule 12. All documents mentioned in sub-paragraphs (a) to (d) above and paragraph 3.1 below (insofar as it applies to the relevant Purchaser) are herein collectively referred to as "Purchaser Closing Deliverables". 3. Parties' Obligations on Completion 3.1 On Completion, the relevant Purchaser or the Vendor (as the case may be) shall deliver and shall procure that there be delivered to the Vendor or the relevant Purchaser respectively: (a) in respect of the transfer of the relevant Sale Shares of SP France by the Vendor, the obligations set out in Part A of Schedule 4; (b) in respect of the transfer of the relevant Sale Shares of SPML by SPBH and SP SARL, the obligations set out in Part B of Schedule 4;

30 (c) in respect of the transfer of the relevant Sale Shares of KEML by SP SARL, the obligations set out in Part C of Schedule 4; (d) in respect of the transfer of the relevant Sale Shares of PPML by SP SARL, the obligations set out in Part D of Schedule 4; (e) in respect of the transfer of the relevant Sale Shares of SP Italy by SP SARL, the obligations set out in Part E of Schedule 4; (f) in respect of the transfer of the relevant Sale Shares of SunPower GmbH by SP SARL, the obligations set out in Part F of Schedule 4; (g) in respect of the transfer of the relevant Sale Shares of SunPower Netherlands B.V. by SP SARL, the obligations set out in Part G of Schedule 4; (h) in respect of the transfer of the relevant Sale Shares of SP Spain by SP SARL, the obligations set out in Part H of Schedule 4; (i) in respect of the transfer of the relevant Sale Shares of SunPower Systems Belgium SRL by SP SARL, the obligations set out in Part I of Schedule 4; (j) in respect of the transfer of the relevant Sale Shares of SPC Australia by SP SARL, the obligations set out in Part J of Schedule 4; (k) in respect of the transfer of the relevant Sale Shares of SunPower Corporation SpA by SP SARL, the obligations set out in Part K of Schedule 4; (l) in respect of the transfer of the relevant Sale Shares of SunPower Energy Systems Korea by SP SARL, the obligations set out in Part L of Schedule 4; (m) in respect of the transfer of the relevant Sale Shares of Maxeon Japan K.K. by SP SARL, the obligations set out in Part M of Schedule 4; (n) in respect of the transfer of the relevant Sale Shares of Maxeon Solar Products Mexico S. de R.L.de, C.V. by SP SARL and Maxeon Rooster, the obligations set out in Part N of Schedule 4; and (o) in respect of the transfer of the relevant Sale Shares of Maxeon Solar Systems Mexico S.de R.L. de C.V. by SP SARL and Maxeon Rooster, the obligations set out in Part O of Schedule 4.

31 SCHEDULE 4 SPECIFIC COMPLETION OBLIGATIONS In this Schedule 4, a reference to "the Purchaser" is a reference to the relevant Purchaser(s) purchasing the relevant Sale Shares. Part A Transfer of Sale Shares of SP France 1. On Completion, the Vendor shall deliver, and shall procure that there be delivered, to the Purchaser the following: (a) the duly executed Cerfa 2759 form to register the sale with the relevant tax authorities; (b) a movement order in order to register the sale in the share transfer register; and (c) a certificate of release of pledge. Part B Transfer of Sale Shares of SPML 1. On Completion, the Vendor shall deliver, and shall procure that there be delivered, to the Purchaser the following: (a) duly executed share transfer forms between SPBH and SP SARL (as transferors) and the Purchaser (as transferee) in respect of the transfer of the relevant Sale Shares in SPML to the Purchaser; (b) a certified copy of an updated register of members of SPML representing the transfer of the relevant Sale Shares in SPML to the Purchaser; (c) a copy of a resolution in writing of all the directors of SPML immediately prior to Completion Date (certified by an officer of SPML) approving with effect from and subject to Completion: (i) the transfer of the relevant Sale Shares by SPBH and SP SARL in SPML to the Purchaser; (ii) instructions to the company secretary of SPML to record the Purchaser as the holder of the relevant Sale Shares in SPML's register of members by updating the same; (iii) the updating of the SPML's register of members in order to reflect the transfer of the relevant Sale Shares in SPML in favour of the Purchaser; (iv) the issuance of share certificates to the Purchaser pursuant to the transfer of the relevant Sale Shares in SPML; (v) authorisation and instruction to the company secretary of SPML to proceed with the necessary filings with the Malta Business Registry to give effect to all of the relevant corporate changes pursuant to the transfer of the relevant Sale Shares in SPML to the Purchaser; (vi) the execution of any relevant statutory forms relating to the transfer of the relevant Sale Shares in SPML and the filing thereof with the Malta Business Registry; and (vii) any documents to be entered into by SPML and the transactions contemplated therein and authorising SPML's authorised representative for the purpose of the valid execution of such documents to be entered into by SPML;