Document

SelectQuote, Inc. Reports First Quarter of Fiscal Year 2026 Results

First Quarter of Fiscal Year 2026 – Consolidated Earnings Highlights

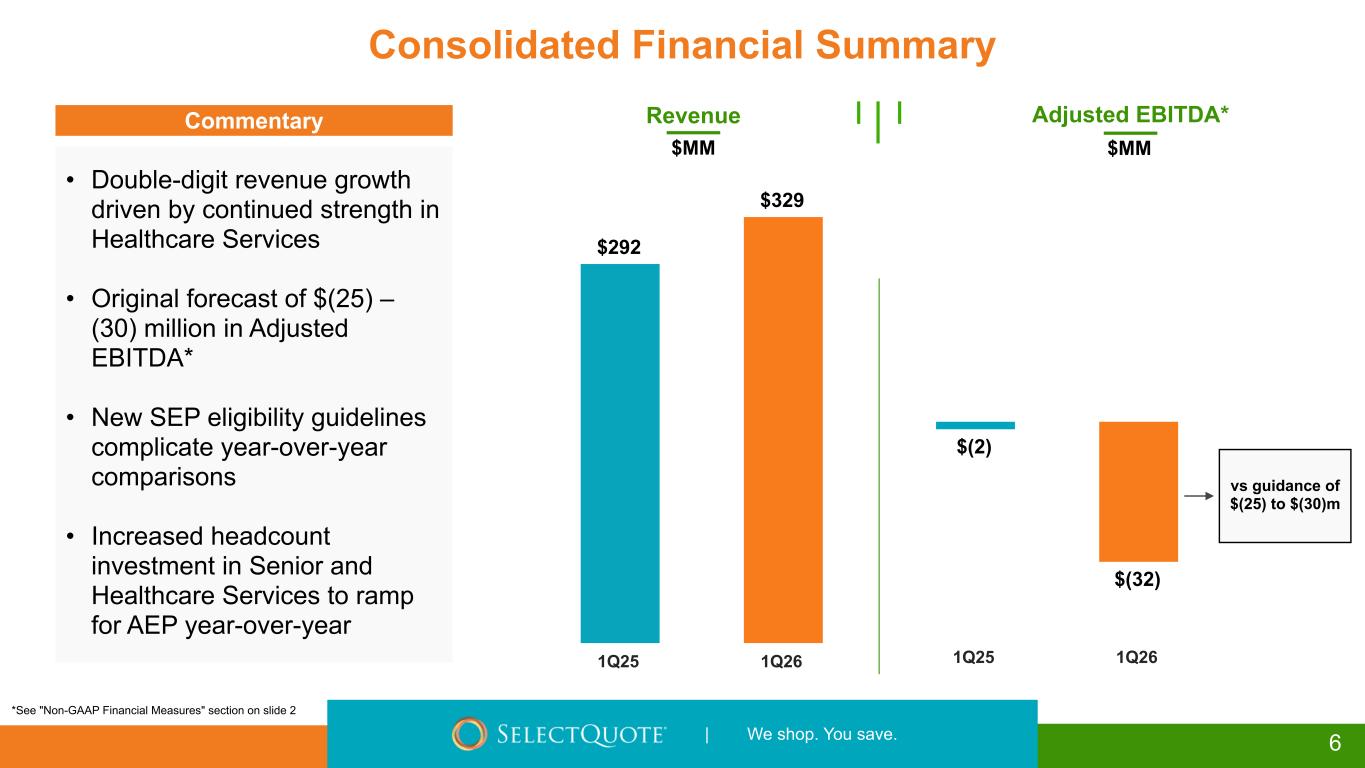

•Revenue of $328.8 million

•Net loss of $30.5 million

•Adjusted EBITDA* of $(32.1) million

First Quarter Fiscal Year 2026 – Segment Highlights

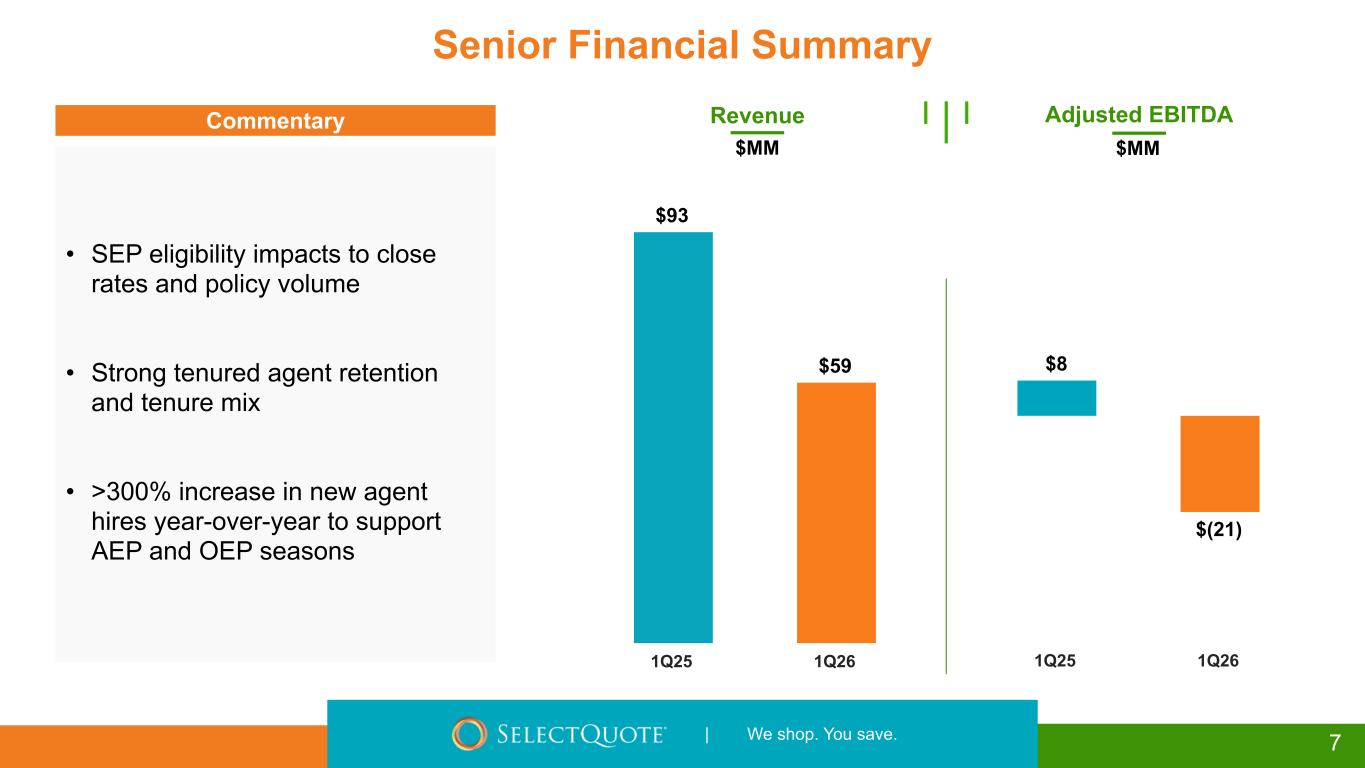

Senior

•Revenue of $59.0 million

•Adjusted EBITDA of $(21.0) million

•Approved Medicare Advantage policies of 62,510

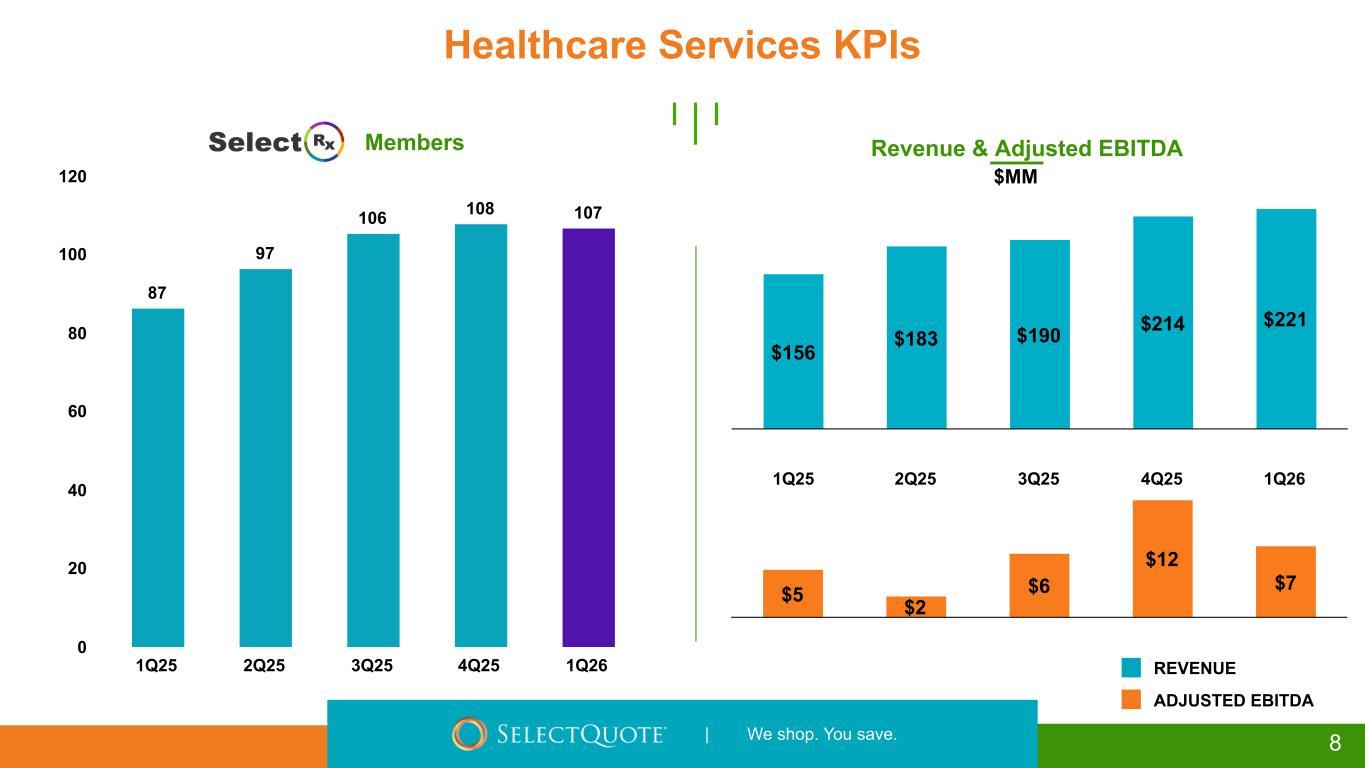

Healthcare Services

•Revenue of $221.4 million

•Adjusted EBITDA of $7.2 million

•106,914 SelectRx members

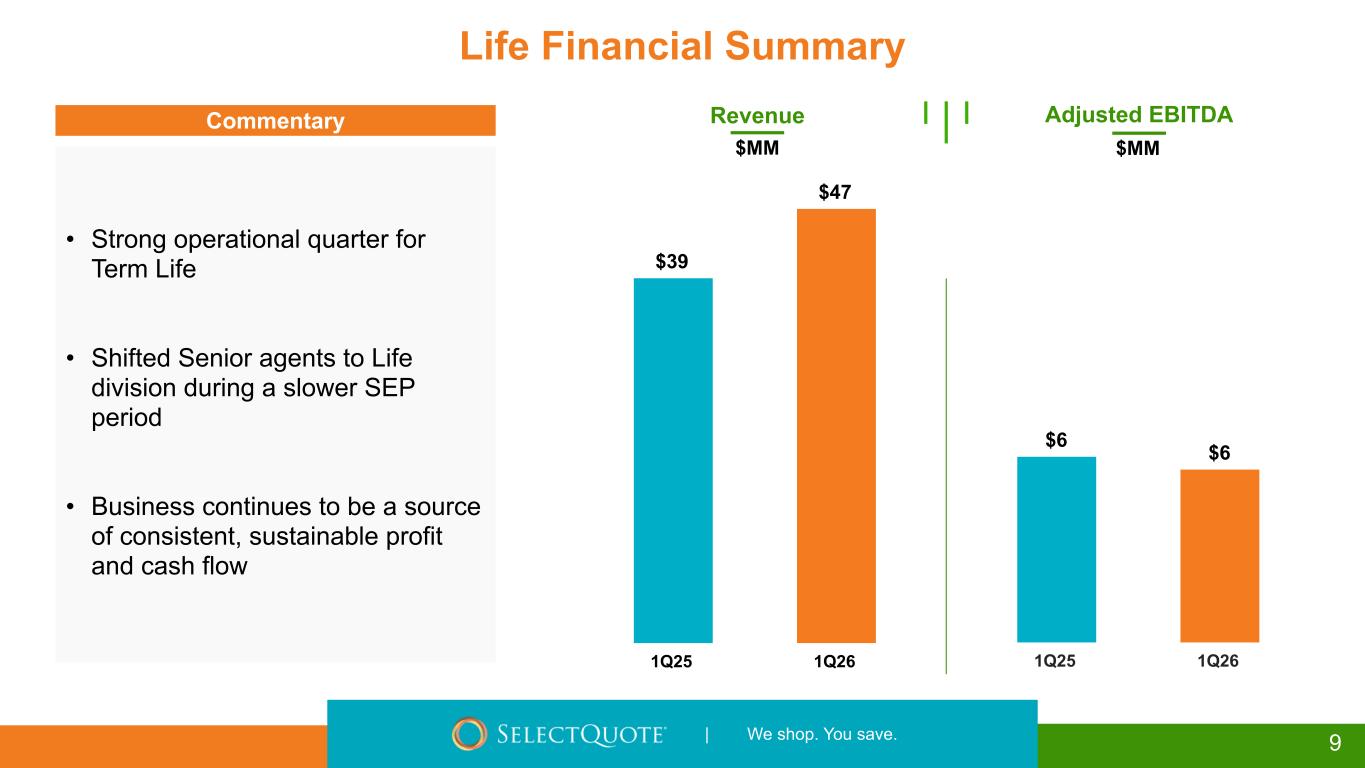

Life

•Revenue of $46.6 million

•Adjusted EBITDA of $5.6 million

OVERLAND PARK, Kan., November 6, 2025--(BUSINESS WIRE)--SelectQuote, Inc. (NYSE: SLQT) reported consolidated revenue for the first quarter of fiscal year 2026 of $328.8 million compared to consolidated revenue for the first quarter of fiscal year 2025 of $292.3 million. Consolidated net loss for the first quarter of fiscal year 2026 was $30.5 million compared to consolidated net loss for the first quarter of fiscal year 2025 of $44.5 million. Finally, consolidated Adjusted EBITDA* for the first quarter of fiscal year 2026 was $(32.1) million compared to consolidated Adjusted EBITDA* for the first quarter of fiscal year 2025 of $(1.7) million.

Tim Danker, SelectQuote Chief Executive Officer, remarked “The strength of our integrated healthcare model was exhibited again in our fiscal first quarter. Early work to prepare for new eligibility parameters in this year’s Medicare Advantage special election period was evident in our Senior business. We successfully reallocated resources and agents for the expected decline in volume and, as a result, performed well in the quarter and more importantly positioned our Senior business for another strong season. We firmly maintain our view that SelectQuote’s Medicare Advantage business has durable competitive advantage and flexibility to drive strong results in a range of environments. While the past three years have presented different challenges and opportunities, SelectQuote has excelled and validated our visibility and confidence in the generation of return and cash flow in our Senior distribution business.”

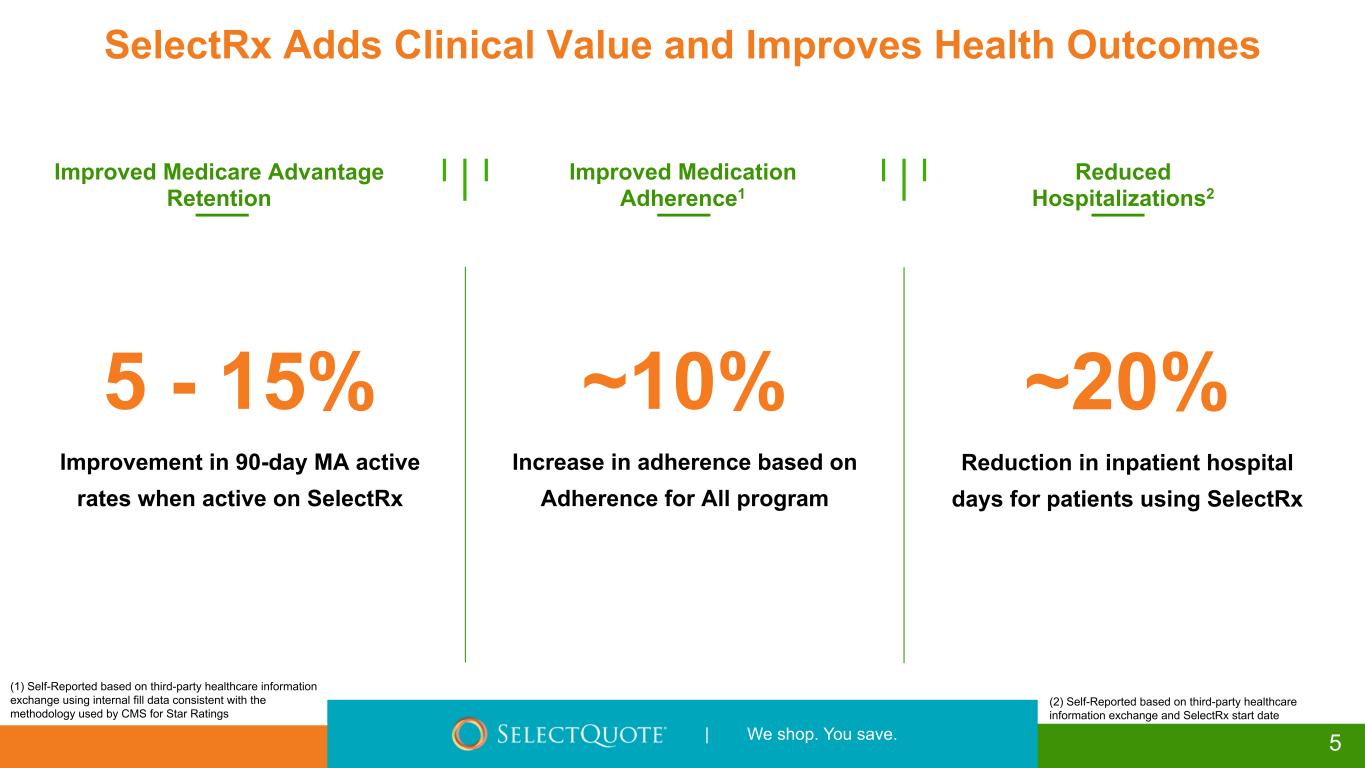

Mr. Danker added, “Our Healthcare Services business also continues to perform well, serving over 100,000 SelectRx members with convenient drug delivery that drives improved health outcomes. Our value-added prescription drug delivery and patient adherence pharmacy offers real, differentiated value to both the patient and the insurance payor. When our data and service approach provides better care, patients win, and do so at more efficient cost to the overall healthcare system. We continue to see SelectQuote as a healthcare services ecosystem that can create system-wide value in a range of use cases. In this quarter, SelectQuote generated a revenue to customer acquisition cost (CAC) ratio of 6.4x, which is an all-time high and nearly 40% higher than it was a year ago. While profitability is our ultimate north star, we view this metric as a strong indicator on how we are helping our customers with more and more, each and every year.”

* See “Non-GAAP Financial Measures” below.

Mr. Danker concluded, “At this time, we are not changing our fiscal 2026 financial outlook of $1.65 to $1.75 billion in revenue and $120 to $150 million in Adjusted EBITDA*. In Healthcare Services, a temporary reimbursement rate headwind in our SelectRx business impacted this quarter and we expect will drive adjusted EBITDA around breakeven for the segment in the fiscal second quarter. SelectQuote and our PBM partners are committed to the significant value provided to patients of SelectRx, and we expect Healthcare Services to exit fiscal 2026 at an Adjusted EBITDA run rate in the $40 to $50 million range.”

Segment Results

We currently have three reportable segments: 1) Senior, 2) Healthcare Services and 3) Life. The performance measures of the segments include total revenue and adjusted EBITDA. Costs of commissions and other services revenue, cost of goods sold-pharmacy revenue, marketing and advertising, selling, general, and administrative, and technical development operating expenses that are directly attributable to a segment are reported within the applicable segment. Indirect costs of revenue, marketing and advertising, selling, general, and administrative, and technical development operating expenses are allocated to each segment based on varying metrics such as headcount. Adjusted EBITDA is our segment profit measure to evaluate the operating performance of our business. We define Adjusted EBITDA as net income (loss) before income tax expense (benefit) plus interest expense, depreciation and amortization, changes in fair value of warrant liabilities, and certain add-backs for non-cash or non-recurring expenses, including restructuring and share-based compensation expenses. Adjusted EBITDA margin is calculated as adjusted EBITDA divided by revenue.

Senior

Financial Results

The following table provides the financial results for the Senior segment for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

| (in thousands) |

|

|

|

|

|

2025 |

|

2024 |

|

% Change |

| Revenue |

|

|

|

|

|

$ |

58,996 |

|

|

$ |

92,908 |

|

|

(37) |

% |

| Adjusted EBITDA |

|

|

|

|

|

(21,036) |

|

|

7,724 |

|

|

(372) |

% |

| Adjusted EBITDA Margin |

|

|

|

|

|

(36) |

% |

|

8 |

% |

|

|

Operating Metrics

Submitted Policies

Submitted policies are counted when an individual completes an application with our licensed agent and provides authorization to the agent to submit the application to the insurance carrier partner. The applicant may have additional actions to take before the application will be reviewed by the insurance carrier.

The following table shows the number of submitted policies for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

2025 |

|

2024 |

|

% Change |

| Medicare Advantage |

|

|

|

|

|

70,240 |

|

102,281 |

|

(31) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All other (1) |

|

|

|

|

|

17,174 |

|

16,256 |

|

6 |

% |

| Total |

|

|

|

|

|

87,414 |

|

118,537 |

|

(26) |

% |

(1) Represents the submitted policies for Medicare supplement, dental, vision and hearing, prescription drug plan and other.

* See “Non-GAAP Financial Measures” below.

Approved Policies

Approved policies represents the number of submitted policies that were approved by our insurance carrier partners for the identified product during the indicated period. Not all approved policies will go in force.

The following table shows the number of approved policies for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

2025 |

|

2024 |

|

% Change |

| Medicare Advantage |

|

|

|

|

|

62,510 |

|

91,680 |

|

(32) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All other (1) |

|

|

|

|

|

13,876 |

|

12,979 |

|

7 |

% |

| Total |

|

|

|

|

|

76,386 |

|

104,659 |

|

(27) |

% |

(1) Represents the approved policies for Medicare supplement, dental, vision and hearing, prescription drug plan and other.

Lifetime Value of Commissions per Approved Policy

Lifetime value of commissions per approved policy represents commissions estimated to be collected over the estimated life of an approved policy based on multiple factors, including but not limited to, contracted commission rates, carrier mix and expected policy persistency with applied constraints. The lifetime value of commissions per approved policy is equal to the sum of the commission revenue due upon the initial sale of a policy, and when applicable, an estimate of future renewal commissions.

The following table shows the lifetime value of commissions per approved policy for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

| (dollars per policy): |

|

|

|

|

|

2025 |

|

2024 |

|

% Change |

| Medicare Advantage |

|

|

|

|

|

$ |

769 |

|

|

$ |

812 |

|

|

(5) |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

All other(1) |

|

|

|

|

|

133 |

|

165 |

|

(19) |

% |

|

|

|

|

|

|

|

|

|

|

|

(1) Represents the weighted average LTV per approved policy.

Healthcare Services

Financial Results

The following table provides the financial results for the Healthcare Services segment for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

| (in thousands) |

|

|

|

|

|

2025 |

|

2024 |

|

% Change |

| Revenue |

|

|

|

|

|

$ |

221,351 |

|

|

$ |

155,739 |

|

|

42 |

% |

| Adjusted EBITDA |

|

|

|

|

|

7,212 |

|

|

4,878 |

|

|

48 |

% |

| Adjusted EBITDA Margin |

|

|

|

|

|

3 |

% |

|

3 |

% |

|

|

Operating Metrics

Members

The total number of SelectRx members represents the amount of active customers to which an order has been shipped and the prescriptions per day represents the total average prescriptions shipped per business day. These two metrics are the primary drivers of revenue for Healthcare Services.

The following table shows the total number of SelectRx members as of the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

September 30, 2024 |

|

|

|

|

| Total SelectRx Members |

|

106,914 |

|

86,521 |

|

|

|

|

The total number of SelectRx members increased by 24% as of September 30, 2025, compared to September 30, 2024, due to our strategy to grow SelectRx membership.

The following table shows the average prescriptions shipped per day for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

2025 |

|

2024 |

|

|

|

|

Prescriptions Per Day |

|

31,378 |

|

24,998 |

|

|

|

|

Combined Senior and Healthcare Services - Consumer Per Unit Economics

Combined Senior and Healthcare Services consumer per unit economics represents total MA and MS commissions; other product commissions; other revenues, including revenues from Healthcare Services; and operating expenses associated with Senior and Healthcare Services, each shown per number of approved MA and MS policies over a given time period. Management assesses the business on a per-unit basis to help ensure that the revenue opportunity associated with a successful policy sale is attractive relative to the marketing acquisition cost. Because not all acquired leads result in a successful policy sale, all per-policy metrics are based on approved policies, which is the measure that triggers revenue recognition.

The MA and MS commission per MA/MS policy represents the LTV for policies sold in the period. Other commission per MA/MS policy represents the LTV for other products sold in the period, including DVH prescription drug plan, and other products, which management views as additional commission revenue on our agents’ core function of MA/MS policy sales. Pharmacy revenue per MA/MS policy represents revenue from SelectRx, and other revenue per MA/MS policy represents revenue from Population Health, production bonuses, marketing development funds, lead generation revenue, and adjustments from the Company’s reassessment of its cohorts’ transaction prices. Total operating expenses per MA/MS policy represents all of the operating expenses within Senior and Healthcare Services. The revenue to customer acquisition cost (“CAC”) multiple represents total revenue as a multiple of total marketing acquisition cost, which represents the direct costs of acquiring leads. These costs are included in marketing and advertising expense within the total operating expenses per MA/MS policy.

The following table shows combined Senior and Healthcare Services consumer per unit economics for the periods presented. Based on the seasonality of Senior and the fluctuations between quarters, we believe that the most relevant view of per unit economics is on a rolling 12-month basis. All per MA/MS policy metrics below are based on the sum of approved MA/MS policies, as both products have similar commission profiles.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended September 30, |

| (dollars per approved policy): |

2025 |

|

2024 |

|

|

| MA and MS approved policies |

565,529 |

|

|

621,040 |

|

|

|

| MA and MS commission per MA / MS policy |

$ |

884 |

|

|

$ |

919 |

|

|

|

| Other commission per MA/MS policy |

13 |

|

|

12 |

|

|

|

| Pharmacy revenue per MA/MS policy |

1,405 |

|

|

842 |

|

|

|

| Other revenue per MA/MS policy |

129 |

|

|

152 |

|

|

|

| Total revenue per MA / MS policy |

2,431 |

|

|

1,925 |

|

|

|

| Total operating expenses per MA / MS policy |

(2,147) |

|

|

(1,626) |

|

|

|

| Adjusted EBITDA per MA/MS policy |

$ |

284 |

|

|

$ |

299 |

|

|

|

| Adjusted EBITDA Margin per MA/MS policy |

12 |

% |

|

16 |

% |

|

|

| Revenue / CAC multiple |

6.4X |

|

4.6X |

|

|

Total revenue per MA/MS policy increased 26% for the twelve months ended September 30, 2025, compared to the twelve months ended September 30, 2024, primarily due to the increase in pharmacy revenue. Total operating expenses per MA/MS policy increased 32% for the twelve months ended September 30, 2025, compared to the twelve months ended September 30, 2024, driven by an increase in cost of goods sold-pharmacy revenue for Healthcare Services due to the growth of the business.

Life

Financial Results

The following table provides the financial results for the Life segment for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

| (in thousands) |

|

|

|

|

|

2025 |

|

2024 |

|

% Change |

| Revenue |

|

|

|

|

|

$ |

46,647 |

|

|

$ |

39,290 |

|

|

19 |

% |

| Adjusted EBITDA |

|

|

|

|

|

5,570 |

|

|

5,960 |

|

|

(7) |

% |

| Adjusted EBITDA Margin |

|

|

|

|

|

12 |

% |

|

15 |

% |

|

|

Operating Metrics

Life premium represents the total premium value for all policies that were approved by the relevant insurance carrier partner and for which the policy document was sent to the policyholder and payment information was received by the relevant insurance carrier partner during the indicated period. Because our commissions are earned based on a percentage of total premium, total premium volume for a given period is the key driver of revenue for our Life segment.

The following table shows term and final expense premiums for the periods presented:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

| (in thousands) |

|

|

|

|

|

|

2025 |

|

2024 |

|

% Change |

| Term Premiums |

|

|

|

|

|

|

$ |

19,443 |

|

|

$ |

15,218 |

|

|

28 |

% |

| Final Expense Premiums |

|

|

|

|

|

|

29,429 |

|

|

24,473 |

|

|

20 |

% |

| Total |

|

|

|

|

|

|

$ |

48,872 |

|

|

$ |

39,691 |

|

|

23 |

% |

Earnings Conference Call

SelectQuote, Inc. will host a conference call with the investment community on November 6, 2025 beginning at 8:30 a.m. ET. To register for this conference call, please use this link: https://registrations.events/direct/Q4I4247512. After registering, a confirmation will be sent via email, including dial-in details and unique conference call codes for entry. Registration is open through the live call, but to ensure you are connected for the full call we suggest registering at least 10 minutes before the start of the call. The event will also be webcasted live via our investor relations website https://ir.selectquote.com/investor-home/default.aspx.

Non-GAAP Financial Measures

This release includes certain non-GAAP financial measures intended to supplement, not substitute for, comparable GAAP measures. To supplement our financial statements presented in accordance with GAAP and to provide investors with additional information regarding our GAAP financial results, we have presented in this release Adjusted EBITDA, which, when presented on a consolidated basis, is a non-GAAP financial measure. This non-GAAP financial measure is not based on any standardized methodology prescribed by GAAP and is not necessarily comparable to any similarly titled measure presented by other companies. We define Adjusted EBITDA as net income (loss) plus interest expense, income taxes, depreciation and amortization, changes in fair value of warrant liabilities, and certain add-backs for non-cash or non-recurring expenses, including restructuring and share-based compensation expenses. The most directly comparable GAAP measure is net income (loss). We monitor and have presented in this release Adjusted EBITDA because it is a key measure used by our management and Board of Directors to understand and evaluate our operating performance, establish budgets, and develop operational goals for managing our business. In particular, we believe that excluding the impact of these expenses in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of our core operating performance.

A reconciliation of the differences between Adjusted EBITDA and its most directly comparable GAAP measure, net income (loss), is presented below on page 14. The Company is unable to provide a quantitative reconciliation of forward-looking Adjusted EBITDA to its most directly comparable GAAP measure without unreasonable effort because it is not possible to predict certain information included in the calculation of such GAAP measure, including the fair value of outstanding warrants to purchase shares of the Company's common stock. The unavailable information could have a significant impact on the Company’s GAAP financial results.

Forward Looking Statements

This release contains forward-looking statements. These forward-looking statements reflect our current views with respect to, among other things, future events and our financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “projection,” “would” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are not historical facts and are based on current expectations, estimates and projections about our industry, management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond our control. Accordingly, we caution you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties that are difficult to predict. Although we believe that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements.

There are or will be important factors that could cause our actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: our reliance on a limited number of insurance carrier partners and any potential termination of those relationships or failure to develop new relationships; existing and future laws and regulations affecting the health insurance market; changes in health insurance products offered by our insurance carrier partners and the health insurance market generally; insurance carriers offering products and services directly to consumers; changes to commissions paid by insurance carriers and underwriting practices; competition with brokers, exclusively online brokers and carriers who opt to sell policies directly to consumers; competition from government-run health insurance exchanges; developments in the U.S. health insurance system; our dependence on revenue from carriers in our senior segment and downturns in the senior health as well as life, automotive and home insurance industries; our ability to develop new offerings and penetrate new vertical markets; risks from third-party products; failure to enroll individuals during the Medicare

annual enrollment period; our ability to attract, integrate and retain qualified personnel; our dependence on lead providers and ability to compete for leads; failure to obtain and/or convert sales leads to actual sales of insurance policies; access to data from consumers and insurance carriers; accuracy of information provided from and to consumers during the insurance shopping process; cost-effective advertisement through internet search engines; ability to contact consumers and market products by telephone; global economic conditions, including inflation and tariffs; disruption to operations as a result of future acquisitions; significant estimates and assumptions in the preparation of our financial statements; impairment of goodwill; existing or potential litigation and other legal proceedings or inquiries, including the Department of Justice action alleging violations of the federal False Claims Act; our existing and future indebtedness; our ability to maintain compliance with our debt covenants; access to additional capital; failure to protect our intellectual property and our brand; fluctuations in our financial results caused by seasonality; accuracy and timeliness of commissions reports from insurance carriers; timing of insurance carriers’ approval and payment practices; factors that impact our estimate of the constrained lifetime value of commissions per policyholder; changes in accounting rules, tax legislation and other legislation; disruptions or failures of our technological infrastructure and platform; failure to maintain relationships with third-party service providers; cybersecurity breaches or other attacks involving our systems or those of our insurance carrier partners or third-party service providers; our ability to protect consumer information and other data; failure to market and sell Medicare plans effectively or in compliance with laws; and and other factors related to our pharmacy business, including manufacturing or supply chain disruptions, access to and demand for prescription drugs, contractual reimbursement rates, and regulatory changes or other industry developments that may affect our pharmacy operations. For a further discussion of these and other risk factors that could impact our future results and performance, see the section entitled “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended June 30, 2025 and subsequent periodic reports filed by us with the Securities and Exchange Commission. Accordingly, you should not place undue reliance on any such forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as otherwise required by law, we do not undertake any obligation to publicly update or review any forward-looking statement, whether as a result of new information, future developments or otherwise.

About SelectQuote:

Founded in 1985, SelectQuote (NYSE: SLQT) pioneered the model of providing unbiased comparisons from multiple, highly-rated insurance companies, allowing consumers to choose the policy and terms that best meet their unique needs. Two foundational pillars underpin SelectQuote’s success: a strong force of highly-trained and skilled agents who provide a consultative needs analysis for every consumer, and proprietary technology that sources and routes high-quality leads. Today, the Company operates an ecosystem offering high touchpoints for consumers across insurance, pharmacy, and virtual care.

With an ecosystem offering engagement points for consumers across insurance, Medicare, pharmacy, and value-based care, the company now has three core business lines: SelectQuote Senior, SelectQuote Healthcare Services, and SelectQuote Life. SelectQuote Senior serves the needs of a demographic that sees around 10,000 people turn 65 each day with a range of Medicare Advantage and Medicare Supplement plans. SelectQuote Healthcare Services is comprised of the SelectRx Pharmacy, a Patient-Centered Pharmacy Home™ (PCPH) accredited pharmacy, SelectPatient Management, a provider of chronic care management services, and Healthcare Select which proactively connects consumers with a wide breadth of healthcare services supporting their needs.

Investor Relations:

Sloan Bohlen

877-678-4083

investorrelations@selectquote.com

Media:

Matt Gunter

913-286-4931

matt.gunter@selectquote.com

Source: SelectQuote, Inc.

SELECTQUOTE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

June 30, 2025 |

|

| ASSETS |

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

| Cash, cash equivalents, and restricted cash |

$ |

14,461 |

|

|

$ |

35,733 |

|

|

|

|

|

|

|

| Accounts receivable, net of allowances of $11.6 million and $11.8 million, respectively |

104,485 |

|

|

151,388 |

|

|

| Commissions receivable-current |

193,395 |

|

|

132,077 |

|

|

| Other current assets |

19,622 |

|

|

21,844 |

|

|

| Total current assets |

331,963 |

|

|

341,042 |

|

|

|

|

|

|

|

| COMMISSIONS RECEIVABLE—Net |

786,434 |

|

|

818,751 |

|

|

| PROPERTY AND EQUIPMENT—Net |

14,377 |

|

|

14,577 |

|

|

| SOFTWARE—Net |

15,782 |

|

|

15,060 |

|

|

| OPERATING LEASE RIGHT-OF-USE ASSETS |

23,615 |

|

|

24,635 |

|

|

| INTANGIBLE ASSETS—Net |

1,689 |

|

|

1,973 |

|

|

| GOODWILL |

29,438 |

|

|

29,438 |

|

|

| OTHER ASSETS |

3,678 |

|

|

3,880 |

|

|

| TOTAL ASSETS |

$ |

1,206,976 |

|

|

$ |

1,249,356 |

|

|

|

|

|

|

|

| LIABILITIES, PREFERRED STOCK, AND SHAREHOLDERS’ EQUITY |

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

| Accounts payable |

$ |

34,567 |

|

|

$ |

59,205 |

|

|

| Accrued expenses |

50,001 |

|

|

13,856 |

|

|

| Accrued compensation and benefits |

49,816 |

|

|

58,788 |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating lease liabilities—current |

4,886 |

|

|

4,820 |

|

|

| Current portion of long-term debt |

68,337 |

|

|

68,523 |

|

|

| Contract liabilities |

1,971 |

|

|

698 |

|

|

| Other current liabilities |

6,152 |

|

|

7,020 |

|

|

| Total current liabilities |

215,730 |

|

|

212,910 |

|

|

| LONG-TERM DEBT, NET—less current portion |

324,812 |

|

|

316,589 |

|

|

|

|

|

|

|

| DEFERRED INCOME TAXES |

28,703 |

|

|

37,872 |

|

|

| OPERATING LEASE LIABILITIES |

24,812 |

|

|

25,982 |

|

|

| OTHER LIABILITIES |

65,993 |

|

|

80,485 |

|

|

| Total liabilities |

660,050 |

|

|

673,838 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2025 |

|

June 30, 2025 |

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PREFERRED STOCK: |

|

|

|

|

| Senior Non-Convertible Preferred Stock, $0.01 par value, 350,000 shares issued and outstanding as of September 30, 2025 and June 30, 2025, respectively, current liquidation preference of $380.4 million and $367.1 million as of September 30, 2025 and June 30, 2025. |

241,856 |

|

|

224,374 |

|

|

| SHAREHOLDERS’ EQUITY: |

|

|

|

|

| Common stock, $0.01 par value |

1,759 |

|

|

1,728 |

|

|

| Additional paid-in capital |

555,959 |

|

|

571,605 |

|

|

|

|

|

|

|

| Accumulated deficit |

(252,648) |

|

|

(222,189) |

|

|

|

|

|

|

|

| Total shareholders’ equity |

305,070 |

|

|

351,144 |

|

|

| TOTAL LIABILITIES, PREFERRED STOCK, AND SHAREHOLDERS’ EQUITY |

$ |

1,206,976 |

|

|

$ |

1,249,356 |

|

|

SELECTQUOTE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

2025 |

|

2024 |

|

|

|

|

| REVENUE: |

|

|

|

|

|

|

|

Commissions and other services |

$ |

110,267 |

|

|

$ |

139,380 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pharmacy |

218,544 |

|

|

152,883 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total revenue |

328,811 |

|

|

292,263 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OPERATING COSTS AND EXPENSES: |

|

|

|

|

|

|

|

Cost of commissions and other services revenue |

69,101 |

|

|

65,733 |

|

|

|

|

|

| Cost of goods sold—pharmacy revenue |

192,779 |

|

|

129,524 |

|

|

|

|

|

| Marketing and advertising |

61,947 |

|

|

63,764 |

|

|

|

|

|

| Selling, general, and administrative |

35,819 |

|

|

36,145 |

|

|

|

|

|

| Technical development |

9,911 |

|

|

9,074 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total operating costs and expenses |

369,557 |

|

|

304,240 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOSS FROM OPERATIONS |

(40,746) |

|

|

(11,977) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| INTEREST EXPENSE, NET |

(11,808) |

|

|

(23,031) |

|

|

|

|

|

CHANGE IN FAIR VALUE OF WARRANTS |

15,036 |

|

|

— |

|

|

|

|

|

| OTHER EXPENSE, NET |

(145) |

|

|

(12) |

|

|

|

|

|

| LOSS BEFORE INCOME TAX EXPENSE (BENEFIT) |

(37,663) |

|

|

(35,020) |

|

|

|

|

|

INCOME TAX EXPENSE (BENEFIT) |

(7,204) |

|

|

9,526 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| NET LOSS |

$ |

(30,459) |

|

|

$ |

(44,546) |

|

|

|

|

|

Senior Non-Convertible Preferred Stock accumulated dividends and accretion |

(17,482) |

|

|

— |

|

|

|

|

|

NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS |

$ |

(47,941) |

|

|

$ |

(44,546) |

|

|

|

|

|

|

|

|

|

|

|

|

|

NET LOSS ATTRIBUTABLE TO COMMON SHAREHOLDERS PER SHARE: |

|

|

|

|

|

|

|

| Basic |

$ |

(0.26) |

|

|

$ |

(0.26) |

|

|

|

|

|

| Diluted |

$ |

(0.26) |

|

|

$ |

(0.26) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| WEIGHTED-AVERAGE COMMON STOCK OUTSTANDING USED IN PER SHARE AMOUNTS: |

|

|

|

|

|

|

|

| Basic |

185,816 |

|

|

170,431 |

|

|

|

|

|

| Diluted |

185,816 |

|

|

170,431 |

|

|

|

|

|

|

|

|

|

|

|

|

|

| OTHER COMPREHENSIVE LOSS, NET OF TAX: |

|

|

|

|

|

|

|

Unrealized loss, net of related tax benefit of $0.0 million and $0.0 million |

— |

|

|

(39) |

|

|

|

|

|

Amount reclassified into earnings, net of related tax benefit of $0.0 million and $1.0 million |

— |

|

|

(2,746) |

|

|

|

|

|

OTHER COMPREHENSIVE LOSS |

— |

|

|

(2,785) |

|

|

|

|

|

| COMPREHENSIVE LOSS |

$ |

(30,459) |

|

|

$ |

(47,331) |

|

|

|

|

|

SELECTQUOTE, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

2025 |

|

2024 |

| CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

Net loss |

$ |

(30,459) |

|

|

$ |

(44,546) |

|

Adjustments to reconcile net loss to net cash, cash equivalents, and restricted cash used in operating activities: |

|

|

|

| Depreciation and amortization |

4,300 |

|

|

5,599 |

|

|

|

|

|

| Loss on disposal of property, equipment, and software |

— |

|

|

68 |

|

|

|

|

|

| Share-based compensation expense |

4,327 |

|

|

3,846 |

|

| Deferred income taxes |

(9,168) |

|

|

9,526 |

|

| Amortization of debt issuance costs and debt discount |

1,184 |

|

|

1,064 |

|

|

|

|

|

|

|

|

|

| Accrued interest payable in kind |

— |

|

|

5,289 |

|

| Change in fair value of warrants |

(15,036) |

|

|

— |

|

| Non-cash lease expense |

1,021 |

|

|

903 |

|

|

|

|

|

| Changes in operating assets and liabilities: |

|

|

|

| Accounts receivable, net |

46,902 |

|

|

50,501 |

|

| Commissions receivable |

(29,001) |

|

|

(38,466) |

|

| Other assets |

2,371 |

|

|

(3,516) |

|

| Accounts payable and accrued expenses |

11,395 |

|

|

12,761 |

|

| Operating lease liabilities |

(1,105) |

|

|

(1,127) |

|

| Other liabilities |

(8,354) |

|

|

(18,512) |

|

Net cash used in operating activities |

(21,623) |

|

|

(16,610) |

|

| CASH FLOWS FROM INVESTING ACTIVITIES: |

|

|

|

| Purchases of property and equipment |

(1,058) |

|

|

(442) |

|

|

|

|

|

| Purchases of software and capitalized software development costs |

(2,926) |

|

|

(2,132) |

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

(3,984) |

|

|

(2,574) |

|

| CASH FLOWS FROM FINANCING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Proceeds from revolving credit facility |

80,000 |

|

|

— |

|

| Payments on revolving credit facility |

(65,000) |

|

|

— |

|

| Payments on Term Loans |

(3,573) |

|

|

(8,471) |

|

|

|

|

|

|

|

|

|

| Payments on ABS Notes |

(4,543) |

|

|

— |

|

| Payments on other debt |

(112) |

|

|

(30) |

|

| Proceeds from common stock options exercised and employee stock purchase plan |

— |

|

|

38 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Payments of tax withholdings related to net share settlement of equity awards |

(2,460) |

|

|

(3,915) |

|

| Payments of debt issuance costs |

(72) |

|

|

(684) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by (used in) financing activities |

4,240 |

|

|

(13,062) |

|

| NET DECREASE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH |

(21,367) |

|

|

(32,246) |

|

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH —Beginning of period |

37,066 |

|

|

42,690 |

|

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH —End of period |

$ |

15,699 |

|

|

$ |

10,444 |

|

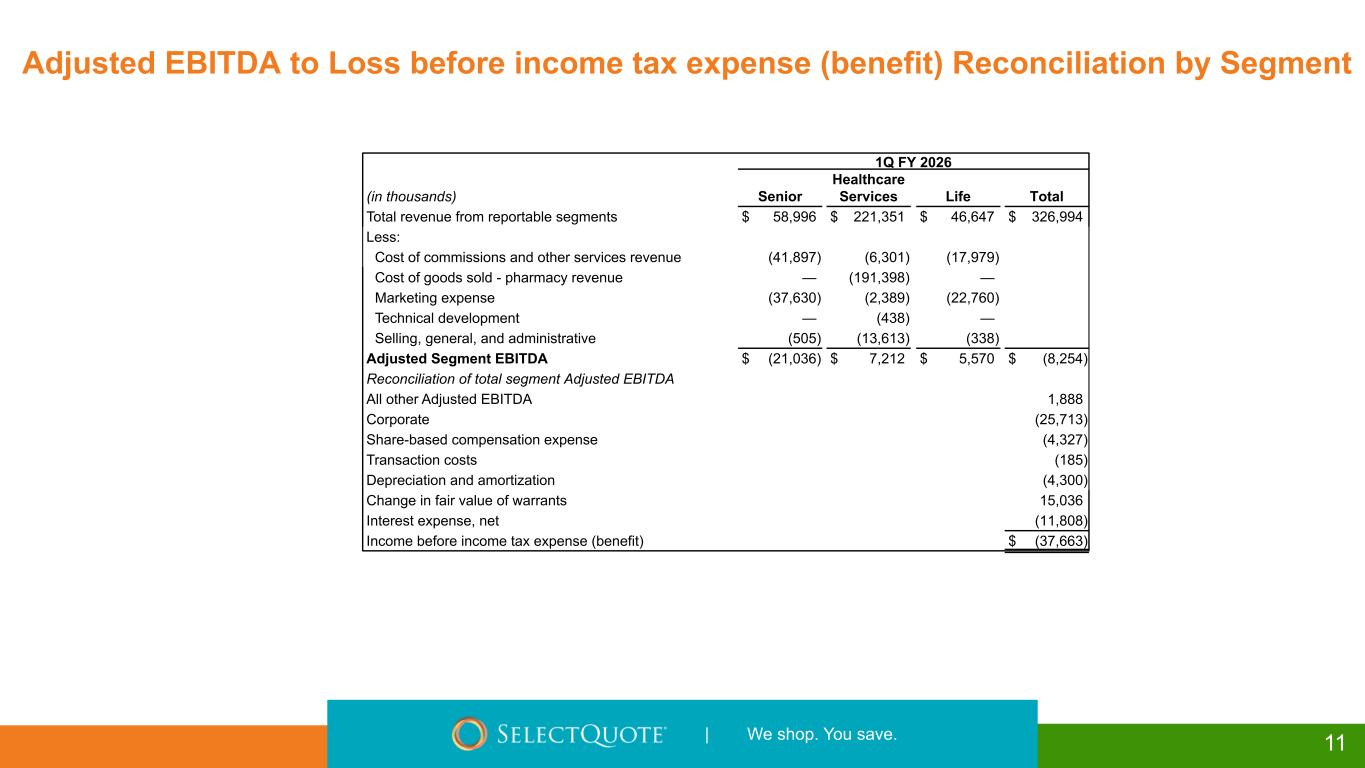

SELECTQUOTE, INC. AND SUBSIDIARIES

Adjusted EBITDA to Loss before income tax expense (benefit) Reconciliation by Segment

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2025 |

| (in thousands) |

Senior |

|

Healthcare Services |

|

Life |

|

Total |

| Total revenue from reportable segments |

$ |

58,996 |

|

|

$ |

221,351 |

|

|

$ |

46,647 |

|

|

$ |

326,994 |

|

| Less: |

|

|

|

|

|

|

|

| Cost of commissions and other services revenue |

(41,897) |

|

|

(6,301) |

|

|

(17,979) |

|

|

|

| Cost of goods sold - pharmacy revenue |

— |

|

|

(191,398) |

|

|

— |

|

|

|

| Marketing expense |

(37,630) |

|

|

(2,389) |

|

|

(22,760) |

|

|

|

| Technical development |

— |

|

|

(438) |

|

|

— |

|

|

|

| Selling, general, and administrative |

(505) |

|

|

(13,613) |

|

|

(338) |

|

|

|

| Adjusted Segment EBITDA |

$ |

(21,036) |

|

|

$ |

7,212 |

|

|

$ |

5,570 |

|

|

$ |

(8,254) |

|

| Reconciliation of total segment Adjusted EBITDA |

|

|

|

|

|

|

|

| All other Adjusted EBITDA |

|

|

|

|

|

|

1,888 |

|

| Corporate |

|

|

|

|

|

|

(25,713) |

|

| Share-based compensation expense |

|

|

|

|

|

|

(4,327) |

|

| Transaction costs |

|

|

|

|

|

|

(185) |

|

| Depreciation and amortization |

|

|

|

|

|

|

(4,300) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Change in fair value of warrants |

|

|

|

|

|

|

15,036 |

|

| Interest expense, net |

|

|

|

|

|

|

(11,808) |

|

| Loss before income tax expense (benefit) |

|

|

|

|

|

|

$ |

(37,663) |

|

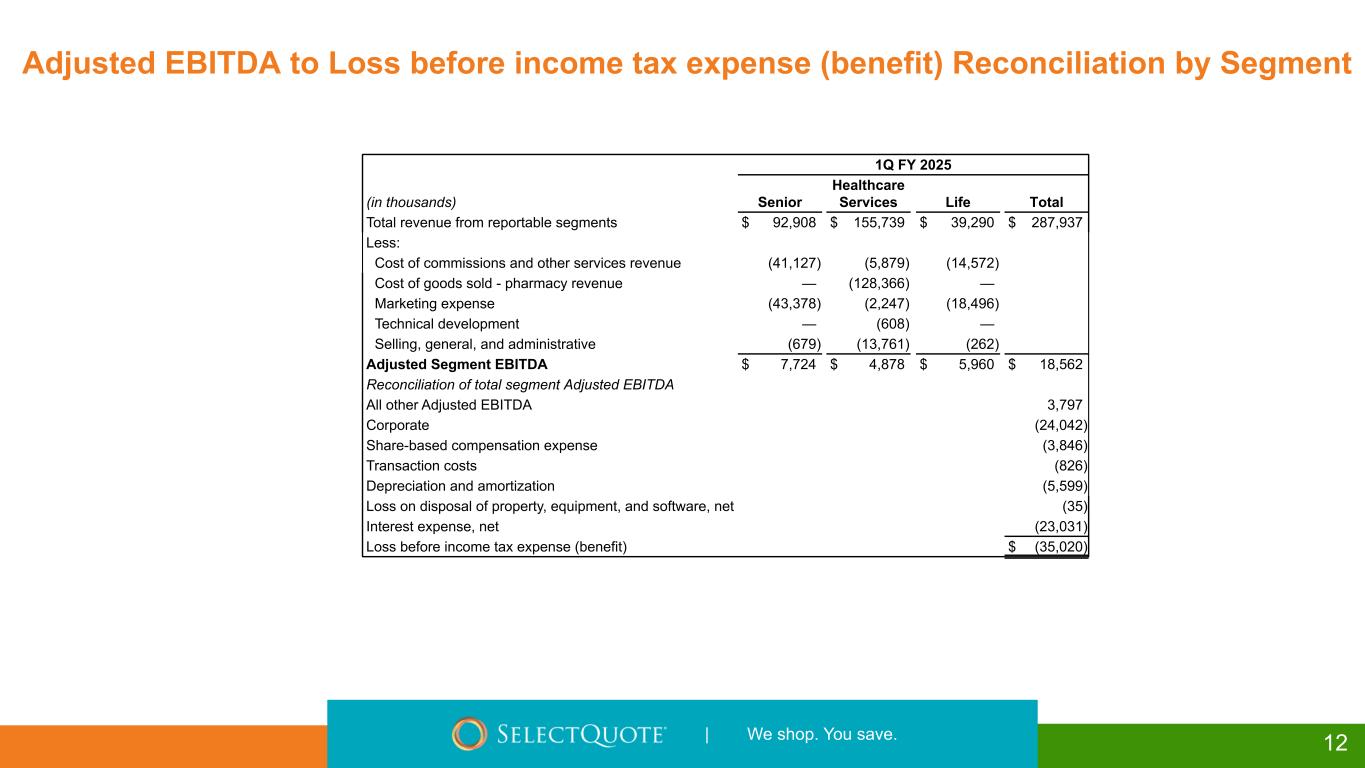

SELECTQUOTE, INC. AND SUBSIDIARIES

Adjusted EBITDA to Loss before income tax expense (benefit) Reconciliation by Segment

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, 2024 |

| (in thousands) |

Senior |

|

Healthcare Services |

|

Life |

|

Total |

| Total revenue from reportable segments |

$ |

92,908 |

|

|

$ |

155,739 |

|

|

$ |

39,290 |

|

|

$ |

287,937 |

|

| Less: |

|

|

|

|

|

|

|

| Cost of commissions and other services revenue |

(41,127) |

|

|

(5,879) |

|

|

(14,572) |

|

|

|

| Cost of goods sold - pharmacy revenue |

— |

|

|

(128,366) |

|

|

— |

|

|

|

| Marketing expense |

(43,378) |

|

|

(2,247) |

|

|

(18,496) |

|

|

|

| Technical development |

— |

|

|

(608) |

|

|

— |

|

|

|

| Selling, general, and administrative |

(679) |

|

|

(13,761) |

|

|

(262) |

|

|

|

| Adjusted Segment EBITDA |

$ |

7,724 |

|

|

$ |

4,878 |

|

|

$ |

5,960 |

|

|

$ |

18,562 |

|

| Reconciliation of total segment Adjusted EBITDA |

|

|

|

|

|

|

|

| All other Adjusted EBITDA |

|

|

|

|

|

|

3,797 |

|

| Corporate |

|

|

|

|

|

|

(24,042) |

|

| Share-based compensation expense |

|

|

|

|

|

|

(3,846) |

|

| Transaction costs |

|

|

|

|

|

|

(826) |

|

| Depreciation and amortization |

|

|

|

|

|

|

(5,599) |

|

| Loss on disposal of property, equipment, and software, net |

|

|

|

|

|

|

(35) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense, net |

|

|

|

|

|

|

(23,031) |

|

| Loss before income tax expense (benefit) |

|

|

|

|

|

|

$ |

(35,020) |

|

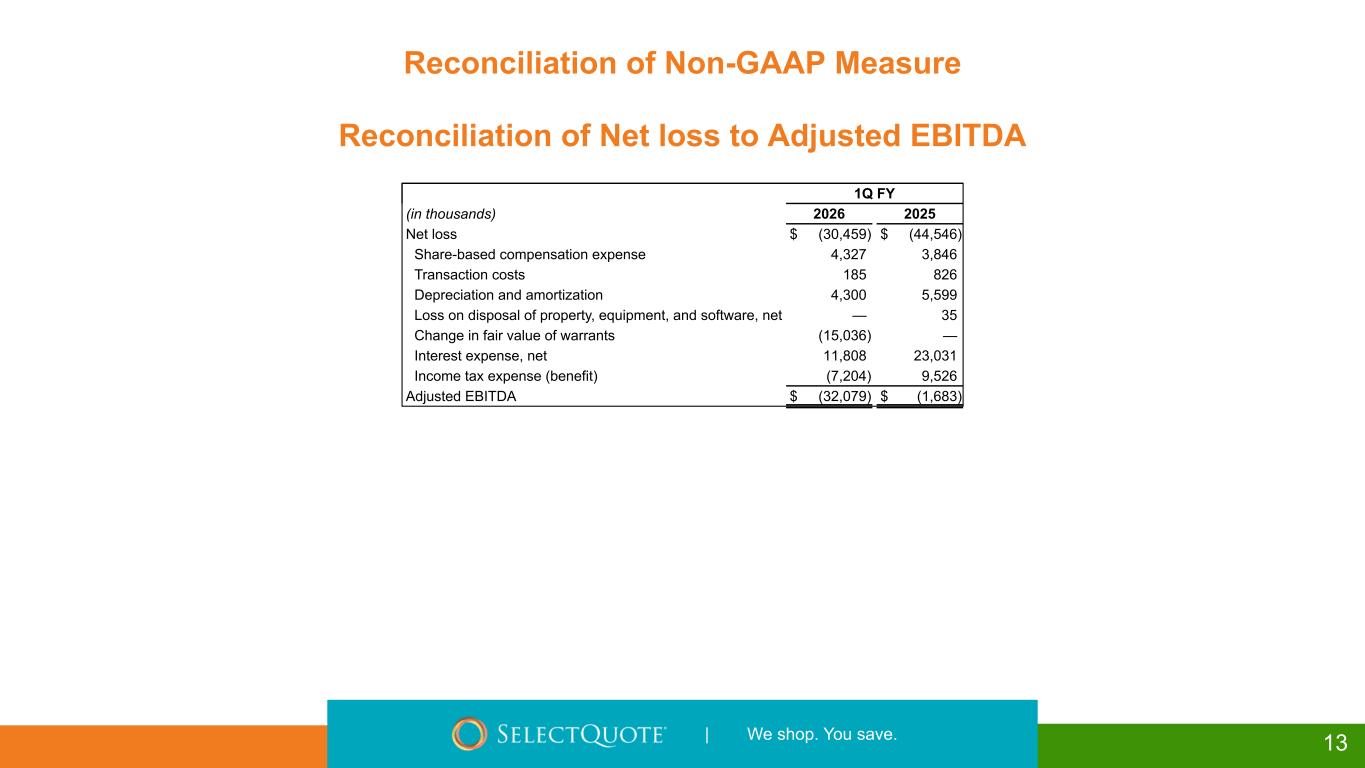

RECONCILIATION OF NON-GAAP MEASURE

SELECTQUOTE, INC. AND SUBSIDIARIES

Reconciliation of Net loss to Adjusted EBITDA

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

| (in thousands) |

2025 |

|

2024 |

| Net loss |

$ |

(30,459) |

|

|

$ |

(44,546) |

|

| Share-based compensation expense |

4,327 |

|

|

3,846 |

|

| Transaction costs |

185 |

|

|

826 |

|

| Depreciation and amortization |

4,300 |

|

|

5,599 |

|

| Loss on disposal of property, equipment, and software, net |

— |

|

|

35 |

|

| Change in fair value of warrants |

(15,036) |

|

|

— |

|

| Interest expense, net |

11,808 |

|

|

23,031 |

|

| Income tax expense (benefit) |

(7,204) |

|

|

9,526 |

|

| Adjusted EBITDA |

$ |

(32,079) |

|

|

$ |

(1,683) |

|

|

|

|

|

|

|

|

|