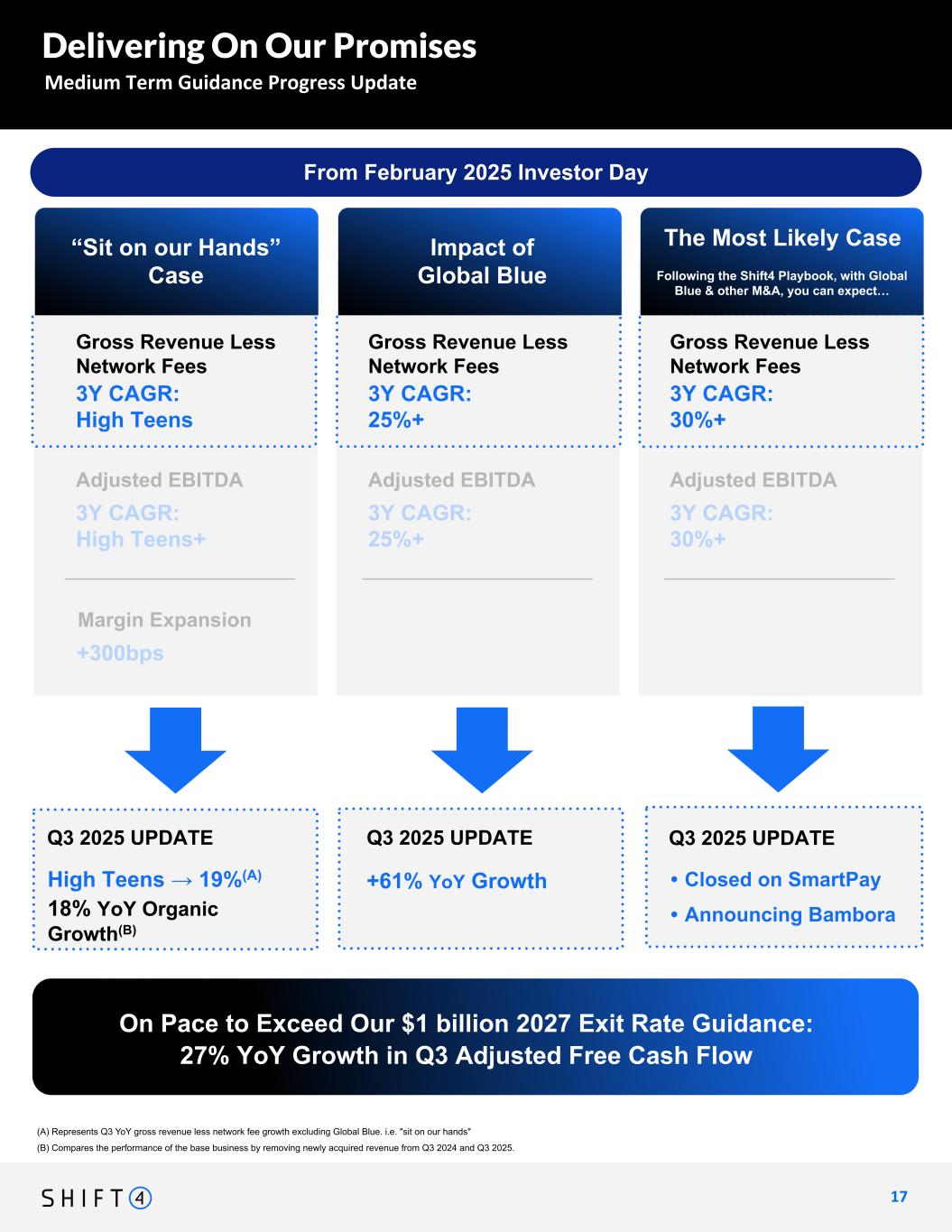

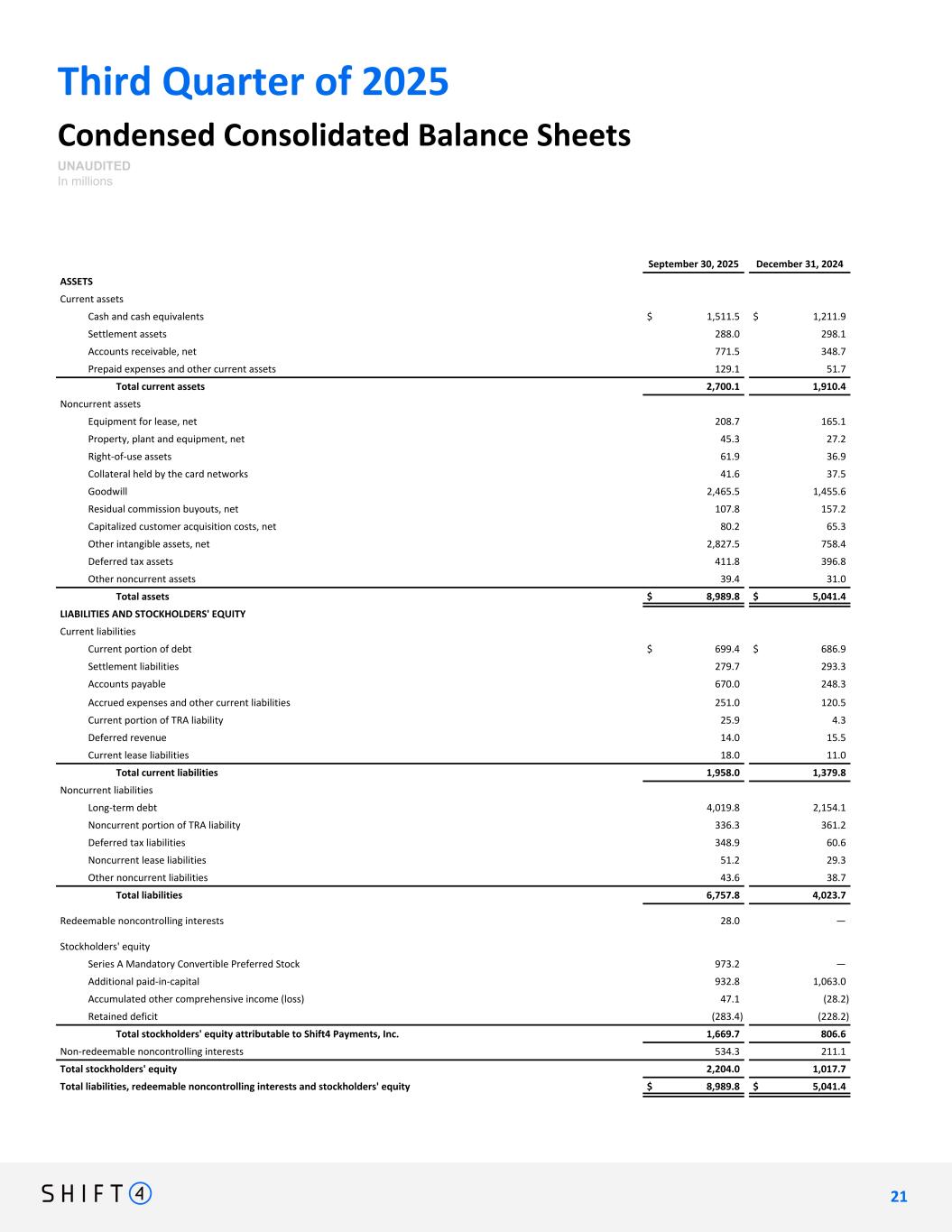

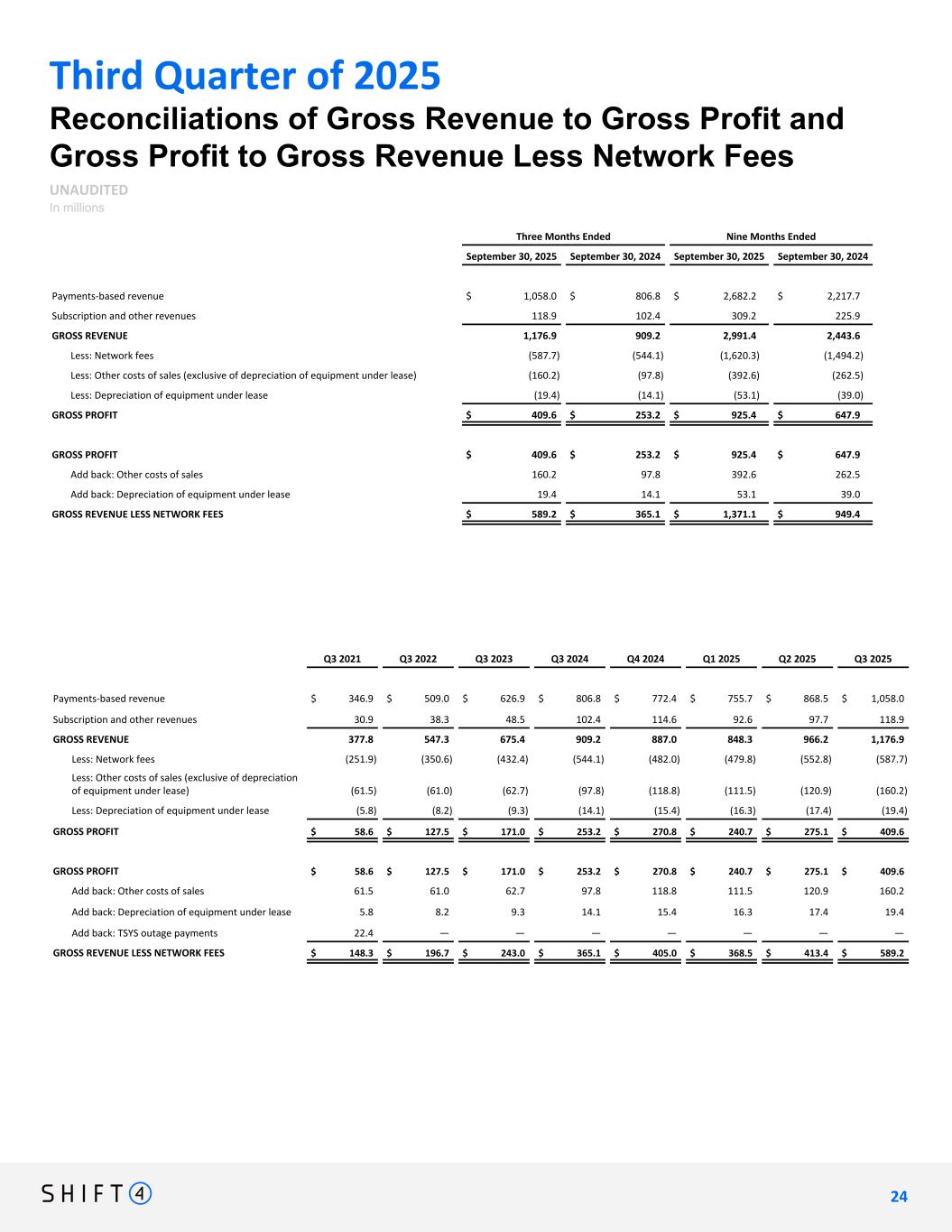

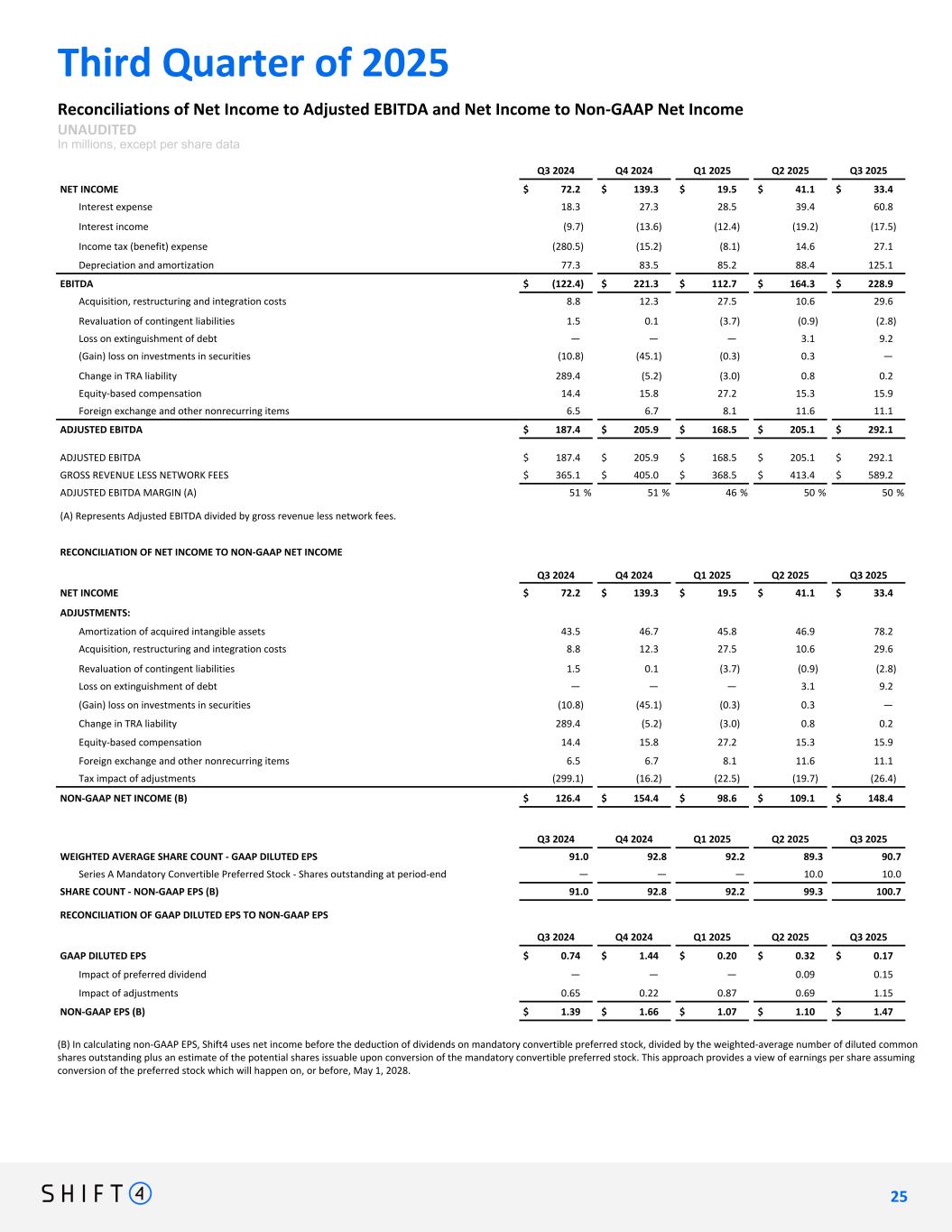

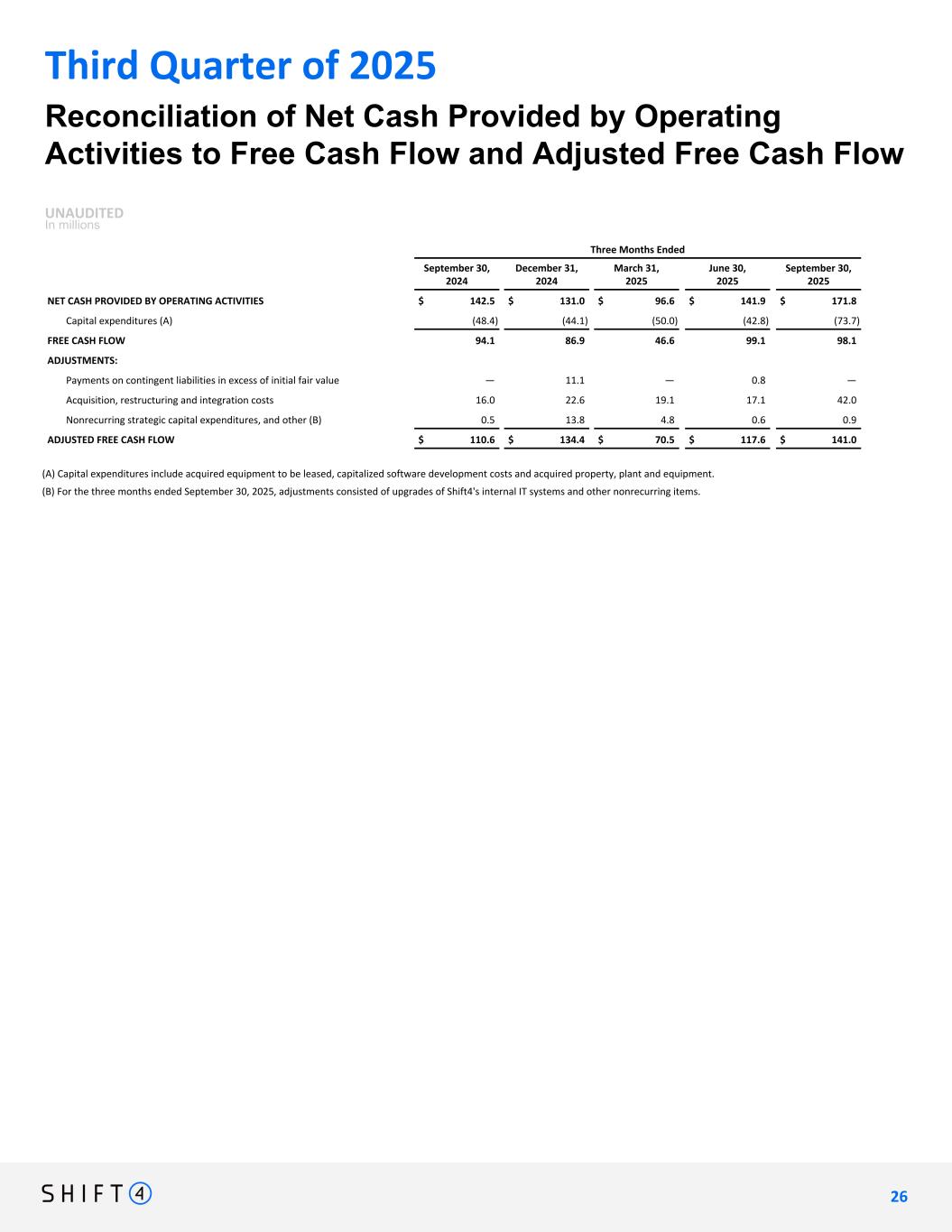

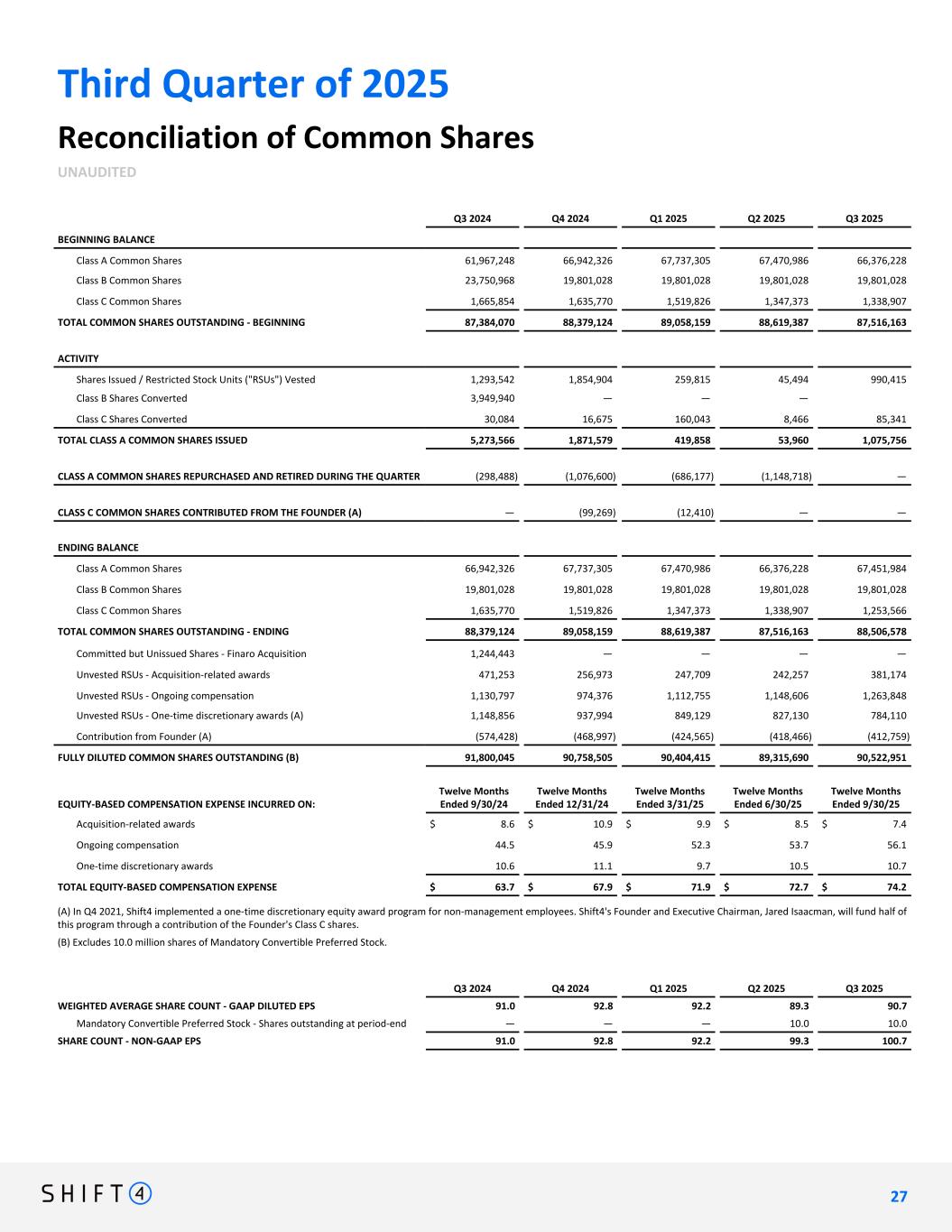

Non-GAAP Financial Measures and Key Performance Indicators Forward-Looking Statements We use supplemental measures of our performance which are derived from our consolidated financial information but which are not presented in our consolidated financial statements prepared in accordance with U.S. generally accepted accounting principles ("GAAP"). These non-GAAP financial measures include: gross revenue less network fees, which includes interchange and adjustment fees; non- GAAP net income; non-GAAP EPS; free cash flow; Adjusted Free Cash Flow; earnings before interest expense, interest income, income taxes, depreciation, and amortization (“EBITDA”); Adjusted EBITDA; Adjusted EBITDA conversion rate; and Adjusted EBITDA margin. Gross revenue less network fees represents a key performance metric that management uses to measure changes in the mix and value derived from our customer base as we continue to execute our strategy to expand our reach to serve larger, complex merchants. Non-GAAP net income represents net income adjusted for certain non-cash and other nonrecurring items that management believes are not indicative of ongoing operations, such as amortization of acquired intangible assets, acquisition, restructuring and integration costs, revaluation of contingent liabilities, loss on extinguishment of debt, impairment of intangible assets, gain (loss) on investments in securities, change in TRA liability, equity-based compensation expense, and foreign exchange and other nonrecurring items. Adjusted EBITDA is the primary financial performance measure used by management to evaluate its business and monitor results of operations. Adjusted EBITDA represents EBITDA further adjusted for certain non- cash and other nonrecurring items that management believes are not indicative of ongoing operations. These adjustments include acquisition, restructuring and integration costs, revaluation of contingent liabilities, loss on extinguishment of debt, gain (loss) on investments in securities, changes in TRA liability, equity-based compensation expense, and foreign exchange and other nonrecurring items. Adjusted EBITDA Margin represents Adjusted EBITDA divided by gross revenue less network fees. Free cash flow represents net cash provided by operating activities adjusted for certain non- discretionary capital expenditures. Adjusted Free Cash Flow represents free cash flow further adjusted for certain transactions that are not indicative of future operating cash flows, including acquisition, restructuring and integration costs, other nonrecurring expenses, and nonrecurring strategic capital expenditures that are not indicative of ongoing activities. We believe Adjusted Free Cash Flow is useful to measure the funds generated in a given period that are available to invest in the business, to repurchase stock and to make strategic decisions. The Adjusted EBITDA conversion rate is calculated as Adjusted Free Cash Flow divided by Adjusted EBITDA. We use non-GAAP financial measures to supplement financial information presented on a GAAP basis. We believe that excluding certain items from our GAAP results allows management to better understand our consolidated financial performance and, in the case of Adjusted Free Cash Flow, our liquidity, from period to period and better project our future consolidated financial performance as forecasts are developed at a level of detail different from that used to prepare GAAP-based financial measures. Moreover, we believe these non-GAAP financial measures provide our stakeholders with useful information to help them evaluate our operating results by facilitating an enhanced understanding of our operating performance and, in the case of Adjusted Free Cash Flow, our liquidity, and enabling them to make more meaningful period to period comparisons. There are limitations to the use of the non-GAAP financial measures presented in this letter. Our non-GAAP financial measures may not be comparable to similarly titled measures of other companies. Other companies, including companies in our industry, may calculate non-GAAP financial measures differently than we do, limiting the usefulness of those measures for comparative purposes. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition and results of operations. These forward-looking statements speak only as of the date of this letter. These statements are neither promises nor guarantees, but involve known and unknown risks, uncertainties and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements, including, but not limited to, the following: the substantial and increasingly intense competition worldwide in the financial services, payments and payment technology industries; potential changes in the competitive landscape, including disintermediation from other participants in the payments chain; the effect of global economic, political and other conditions on trends in consumer, business and government spending; fluctuations in inflation; our ability to anticipate and respond to changing industry trends and the needs and preferences of our merchants and consumers; our reliance on third-party vendors to provide products and services; risks associated with acquisitions; dispositions, and other strategic transactions; risks associated with our Series A Mandatory Convertible Preferred Stock; our inability to protect our IT systems and confidential information, as well as the IT systems of third parties we rely on, from continually evolving cybersecurity risks, security breaches or other technological risks; compliance with governmental regulation and other legal obligations, particularly related to privacy, data protection and information security, marketing across different markets where we conduct our business; risks associated with a The non-GAAP financial measures are not meant to be considered as indicators of performance, or in the case of Adjusted Free Cash Flow, as an indicator of liquidity, in isolation from or as a substitute for financial information prepared in accordance with GAAP, and should be read only in conjunction with financial information presented on a GAAP basis. Reconciliations of EBITDA, Adjusted EBITDA, gross revenue less network fees, non-GAAP net income, non-GAAP EPS, free cash flow and Adjusted Free Cash Flow to, in each case, its most directly comparable GAAP financial measure are presented in Appendix - Financial Information. For the full year 2025, we are unable to provide a reconciliation of Gross revenue less network fees, Adjusted EBITDA, and Adjusted Free Cash Flow to Gross Profit, Net Income, and net cash provided by operating activities, respectively, the nearest comparable GAAP measures, without unreasonable efforts. We encourage you to review the reconciliations in conjunction with the presentation of the non-GAAP financial measures for each of the periods presented. In future fiscal periods, we may exclude such items and may incur income and expenses similar to these excluded items. In addition, key performance indicators include volume, Blended Spread and margin. Volume is defined as the total dollar amount of payments that we deliver for settlement on behalf of our merchants. Included in volume are dollars routed via our international payments platform, alternative payment methods, including cryptocurrency, stored value, gift cards and stock donations, plus volume we route to third party merchant acquirers on behalf of strategic enterprise merchant relationships. We do maintain transaction processing on certain legacy platforms that are not defined as volume. Blended Spread represents the average yield Shift4 earns on the average volume processed for a given period after network fees. Blended Spread is calculated as payments-based revenue less gateway revenue and network fees for a given period divided by the volume processed for the same period. variety of laws and regulations, including those relating to financial services, money-laundering, anti-bribery, sanctions, and counter-terrorist financing, consumer protection and cryptocurrencies; our ability to continue to expand our share of the existing payment processing markets or expand into new markets; additional risks associated with our expansion into international operations, including compliance with and changes in foreign regulations governmental policies, as well as exposure to foreign exchange rates; our ability to integrate and interoperate our services and products with a variety of operating systems, software, devices, and web browsers; our dependence, in part, on our merchant and software partner relationships and strategic partnerships with various institutions to operate and grow our business; and the significant influence Jared Isaacman, our Executive Chairman and founder, has over us, including control over decisions that require the approval of stockholders, including a change in control, and the timing of any of the foregoing. These and other important factors discussed under the caption “Risk Factors” in Part I, Item 1A. in our Annual Report on Form 10-K for the fiscal year ended December 31, 2024, Part II, Item 1A. in our Quarterly Report on Form 10-Q for the period ended September 30, 2025, and our other filings with the Securities and Exchange Commission could cause actual results to differ materially from those indicated by the forward-looking statements made in this letter. Any such forward-looking statements represent management’s estimates as of the date of this letter. While we may elect to update such forward-looking statements at some point in the future, we disclaim any obligation to do so, even if subsequent events cause our views to change. 1 This letter contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Shift4 Payments, Inc. (“we,” “our,” the “Company,” or “Shift4”) intends such forward-looking statements to be covered by the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933, as amended and Section 21E of the Securities Exchange Act of 1934, as amended. All statements contained in this letter, other than statements of historical fact, including, without limitation, statements relating to our position as a leader within our industry; our future results of operations and financial position, business strategy and plans; the anticipated benefits of and costs associated with recent acquisitions; and objectives of management for future operations and activities, including, among others, statements regarding expected growth, international expansion, future capital expenditures, debt covenant compliance, financing activities, debt service obligations including the settlement of conversions of our 2025 Convertible Notes, our financial outlook and guidance for 2025 or any other period, including key performance indicators, anticipated synergies as a result of the Global Blue acquisition, and the timing of any of the foregoing are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue” or the negative of these terms or other similar expressions, though not all forward-looking statements can be identified by such terms or expressions.