Document

Exhibit 99.1

JOHANNESBURG, 29 August 2023: Sibanye Stillwater Limited (Sibanye-Stillwater or the Group) (JSE: SSW and NYSE: SBSW) is pleased to report operating results and consolidated interim financial statements for the six months ended 30 June 2023.

SALIENT FEATURES FOR THE SIX MONTHS ENDED 30 JUNE 2023

|

|

|

•Strategic commodity and geographical diversification - SA gold turnaround cushions impact of lower PGM prices |

•Strong financial position maintained - 0.01x Net debt: adjusted EBITDA*, net debt of only R262m (US$13.9m) |

•Interim dividend declared of 53 SA cps (11.19 US cents** per ADR) |

•SA gold operations: R5.5bn (US$332m) adjusted EBITDA turnaround year-on-year |

•SA PGM operations: Industry leading cost management. Moving down industry cost curve increases competitiveness |

•US PGM operations: Stillwater West mine shaft repaired, improved operating outlook for H2 2023 |

•Keliber lithium project on track to produce battery grade lithium hydroxide from 2025 - equity capital fully funded |

•Tailings storage facilities conformance with GISTM requirements |

•Well positioned for clean energy transition |

* Refer note 9.1 (footnote 5) of the consolidated interim financial statements

** Based on the closing exchange rate of R18.9400/US$ at 22 August 2023 from EquityRT

KEY STATISTICS – GROUP

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US dollar |

|

|

|

|

|

SA rand |

| Six months ended |

|

|

|

|

|

Six months ended |

| Jun 2022 |

Dec 2022 |

Jun 2023 |

|

KEY STATISTICS |

|

Jun 2023 |

Dec 2022 |

Jun 2022 |

|

|

|

|

GROUP |

|

|

|

|

| 782 |

|

344 |

|

407 |

|

US$m |

Basic earnings |

Rm |

7,423 |

|

6,380 |

|

12,016 |

|

| 775 |

|

350 |

|

324 |

|

US$m |

Headline earnings |

Rm |

5,891 |

|

6,484 |

|

11,938 |

|

| 1,465 |

|

1,045 |

|

776 |

|

US$m |

Adjusted EBITDA1 |

Rm |

14,147 |

|

18,550 |

|

22,561 |

|

| 803 |

|

359 |

|

427 |

|

US$m |

Profit for the period |

Rm |

7,786 |

|

6,639 |

|

12,341 |

|

| 15.40 |

|

17.33 |

|

18.21 |

|

R/US$ |

Average exchange rate using daily closing rate |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| TABLE OF CONTENTS |

Page |

|

Share data for the Six months ended 30 June 2023 |

|

|

|

|

|

|

|

|

Number of shares in issue |

|

|

|

|

- at 30 June 2023 |

2,830,567,264 |

|

|

|

- weighted average |

2,830,487,806 |

|

|

|

Free Float |

99 |

% |

|

|

|

Bloomberg/Reuters |

SSWSJ/SSWJ.J |

|

|

|

|

|

|

|

|

JSE Limited - (SSW) |

|

|

|

|

Price range per ordinary share (High/Low) |

R28.00 to R51.68 |

|

|

|

Average daily volume |

10,798,253 |

|

|

|

|

|

|

|

|

NYSE - (SBSW); one ADR represents four ordinary shares |

|

|

|

|

Price range per ADR (High/Low) |

US$6.12 to US$12.31 |

|

|

|

Average daily volume |

3,710,044 |

|

|

|

|

|

|

|

|

|

|

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 1

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| US dollar |

|

|

|

|

|

SA rand |

| Six months ended |

|

|

|

|

|

Six months ended |

| Jun 2022 |

Dec 2022 |

Jun 2023 |

|

KEY STATISTICS |

|

Jun 2023 |

Dec 2022 |

Jun 2022 |

|

|

|

|

AMERICAS REGION |

|

|

|

|

|

|

|

|

US PGM underground operations |

|

|

|

|

| 230,039 |

|

191,094 |

|

205,513 |

|

oz |

2E PGM production2,3 |

kg |

6,392 |

|

5,944 |

|

7,155 |

|

| 1,935 |

|

1,766 |

|

1,390 |

|

US$/2Eoz |

Average basket price |

R/2Eoz |

25,312 |

|

30,609 |

|

29,799 |

|

| 261 |

|

125 |

|

53 |

|

US$m |

Adjusted EBITDA1 |

Rm |

976 |

|

2,309 |

|

4,021 |

|

| 1,366 |

|

1,840 |

|

1,737 |

|

US$/2Eoz |

All-in sustaining cost4 |

R/2Eoz |

31,633 |

|

31,880 |

|

21,036 |

|

|

|

|

|

US PGM recycling |

|

|

|

|

| 361,333 |

|

237,441 |

|

162,452 |

|

oz |

3E PGM recycling2,3 |

kg |

5,053 |

|

7,385 |

|

11,239 |

|

| 2,906 |

|

3,274 |

|

2,735 |

|

US$/3Eoz |

Average basket price |

R/3Eoz |

49,804 |

|

56,747 |

|

44,752 |

|

| 39 |

|

39 |

|

20 |

|

US$m |

Adjusted EBITDA1 |

Rm |

371 |

|

676 |

|

598 |

|

|

|

|

|

SOUTHERN AFRICA (SA) REGION |

|

|

|

|

|

|

|

|

PGM operations |

|

|

|

|

| 823,806 |

|

843,658 |

|

799,182 |

|

oz |

4E PGM production3,5 |

kg |

24,857 |

|

26,241 |

|

25,623 |

|

| 2,817 |

|

2,434 |

|

1,867 |

|

US$/4Eoz |

Average basket price |

R/4Eoz |

34,006 |

|

42,188 |

|

43,379 |

|

| 1,374 |

|

956 |

|

649 |

|

US$m |

Adjusted EBITDA1 |

Rm |

11,794 |

|

16,983 |

|

21,152 |

|

| 1,179 |

|

1,179 |

|

1,083 |

|

US$/4Eoz |

All-in sustaining cost4 |

R/4Eoz |

19,716 |

|

20,431 |

|

18,160 |

|

|

|

|

|

Gold operations |

|

|

|

|

| 191,683 |

|

428,859 |

|

416,738 |

|

oz |

Gold produced |

kg |

12,962 |

|

13,339 |

|

5,962 |

|

| 1,864 |

|

1,720 |

|

1,921 |

|

US$/oz |

Average gold price |

R/kg |

1,124,871 |

|

958,232 |

|

922,851 |

|

| (202) |

|

(17) |

|

130 |

|

US$m |

Adjusted EBITDA1 |

Rm |

2,375 |

|

(440) |

|

(3,106) |

|

| 3,115 |

|

2,019 |

|

1,813 |

|

US$/oz |

All-in sustaining cost4 |

R/kg |

1,061,477 |

|

1,124,737 |

|

1,542,355 |

|

|

|

|

|

EUROPEAN REGION |

|

|

|

|

|

|

|

|

Sandouville nickel refinery6 |

|

|

|

|

| 4,565 |

|

2,277 |

|

3,493 |

|

tNi |

Nickel production7 |

tNi |

3,493 |

|

2,277 |

|

4,565 |

|

| 30,789 |

|

24,646 |

|

26,888 |

|

US$/tNi |

Nickel equivalent average basket price8 |

R/tNi |

489,635 |

|

427,120 |

|

474,144 |

|

| 4 |

|

(34) |

|

(35) |

|

US$m |

Adjusted EBITDA1 |

Rm |

(627) |

|

(553) |

|

61 |

|

| 29,896 |

|

38,333 |

|

37,486 |

|

US$/tNi |

Nickel equivalent sustaining cost9 |

R/tNi |

682,628 |

|

664,311 |

|

460,397 |

|

|

|

|

|

AUSTRALIAN REGION |

|

|

|

|

|

|

|

|

New Century zinc retreatment operation10 |

|

|

|

|

| — |

|

— |

|

24 |

|

ktZn |

Zinc metal produced (payable)11 |

ktZn |

24 |

|

— |

|

— |

|

| — |

|

— |

|

1,640 |

|

US$/tZn |

Average equivalent zinc concentrate price12 |

R/tZn |

29,871 |

|

— |

|

— |

|

| — |

|

— |

|

(28) |

|

US$m |

Adjusted EBITDA1 |

Rm |

(502) |

|

— |

|

— |

|

| — |

|

— |

|

2,418 |

|

US$/tZn |

All-in sustaining cost4 |

R/tZn |

44,030 |

|

— |

|

— |

|

1The Group reports adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) based on the formula included in the facility agreements for compliance with the debt covenant formula. Adjusted EBITDA may not be comparable to similarly titled measures of other companies. Adjusted EBITDA is not a measure of performance under IFRS and should be considered in addition to and not as a substitute for any other measure of financial performance and liquidity. For a reconciliation of profit before royalties and tax to adjusted EBITDA, see note 9.1 of the consolidated interim financial statements

2The US PGM operations’ underground production is converted to metric tonnes and kilograms, and performance is translated to SA rand (rand). In addition to the US PGM operations’ underground production, the operation treats various recycling material which is excluded from the 2E PGM production, average basket price and All-in sustaining cost statistics shown.

PGM recycling represents palladium, platinum and rhodium ounces fed to the furnace

3The Platinum Group Metals (PGM) production in the SA operations is principally platinum, palladium, rhodium and gold, referred to as 4E (3PGM+Au), and in the US underground operations

is principally platinum and palladium, referred to as 2E (2PGM) and US PGM recycling is principally platinum, palladium and rhodium referred to as 3E (3PGM)

4See “Salient features and cost benchmarks - Six months ” for the definition of All-in sustaining cost (AISC)

5The SA PGM production excludes the production associated with the purchase of concentrate (PoC) from third parties. For a reconciliation of the production including third party PoC,

refer to the "Reconciliation of operating cost excluding third party PoC for Total US and SA PGM, Total SA PGM and Marikana - Six months"

6The Sandouville nickel refinery processes nickel matte and is included in the Group results since the effective date of the acquisition on 4 February 2022

7The nickel production at the Sandouville nickel refinery operations is principally nickel metal and nickel salts (liquid form), together referred to as nickel equivalent products

8The nickel equivalent average basket price per tonne is the total nickel revenue adjusted for other income less non-product sales divided by the total nickel equivalent tonnes sold

9See "Salient features and cost benchmarks - Six months Sandouville nickel refinery" for a reconciliation of cost of sales before amortisation and depreciation to nickel equivalent sustaining cost

10New Century is a leading tailings management and rehabilitation company that currently owns and operates the New Century zinc tailings retreatment operation in Queensland, Australia. Amounts included since effective date of acquisition on 22 February 2023

11Zinc metal produced (payable) is the payable quantity of zinc metal produced after applying smelter content deductions

12Average equivalent zinc concentrate price is the total zinc sales revenue recognised at the price expected to be received excluding the fair value adjustments divided by the payable zinc metal sold

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 2

STATEMENT BY NEAL FRONEMAN, CHIEF EXECUTIVE OFFICER OF SIBANYE-STILLWATER

The Group financial and operating results for the six-months ended 30 June 2023 (H1 2023) reflect the challenging global macro-economic and turbulent geopolitical environment which has prevailed during 2023, with slowing global growth reducing demand for commodities, resulting in a significant decline in commodity prices other than gold during the period.

The operating environment has been equally demanding, with regional factors in our operating jurisdictions posing significant challenges. These regional factors include some which we have previously highlighted as “grey elephants” (highly probable, high impact yet often ignored global trends), such as climate change - causing extreme weather events which are becoming increasingly frequent globally, with severe storms disrupting our US PGM operations in mid-2022 and our New Century tailings operations in Australia in Q1 2023; social discontent - widespread strikes in France causing downtime at our Sandouville nickel refinery in Le Havre during H1 2023 and ongoing community and labour related disruptions common in South Africa. Moreover, the shortage of critical skills impacting the mining industry globally, continues to impact productivity and costs at our US PGM operation, and electricity disruptions and crime (cable theft and illegal mining) have intensified in South Africa.

In periods of change and disruption such as these, an intense focus on safety, which is a core Group value is particularly critical. The improvements in the Group safety performance achieved in 2022 were largely maintained during H1 2023. There was however a regression in Group safety lagging indicators during Q2 2023 which is receiving attention. This included three incidents at the SA gold operations during H1 2023 which resulted in the tragic loss of six colleagues (four contractors and two employees). While these tragic events have set us back, we remain resolute in our efforts towards Zero Harm in the workplace. The Board and management of Sibanye-Stillwater extend their sincere condolences to the family, friends, and loved ones of our departed colleagues.

We remain committed to continuous improvement in health and safety at our operations. This is a deliberate journey and whilst we have made progress, we continue to modify the strategy based on lessons learned and industry best practice to improve our risk approach, eliminate fatalities and improve incident statistics. The journey is not an easy one and requires a committed and sustained focus, but our optimism is supported by the performance of the SA PGM and US PGM operations, which operated without fatal incidents for H1 2023, and the European operations which recorded no recordable safety incidents for Q2 2023. A more detailed assessment of the H1 2023 safety performance can be found on page 5.

The Group has successfully managed various challenges in the last few years, and I am confident that we will again successfully navigate these challenges.

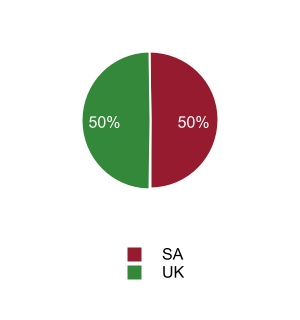

The appropriateness of our ongoing strategic evolution supporting our purpose "to safeguard global sustainability through our metals" and our strategic commodity and geographical diversification since 2016, was again evident during H1 2023.

The impacts of the precipitous decline in PGM prices and operational disruptions at our US and European regions, were cushioned by a significantly improved financial contribution from the SA gold operations. The normalisation of production after the industrial action and lock-out which resulted in operations being suspended for most of H1 2022 (during which the SA PGM operations provided the diversification benefits), ensured timeous exposure to the higher gold price during a period of strategic investment for the Group into the battery metals sector.

Our investments in future facing metals and the green economy in Europe, the US and Australia, are central to the delivery of our green metals and clean energy solutions strategic differentiator. These strategic investments are expected to make an increasing financial contribution to the Group in the second half of this decade, by positioning the Group to benefit from the future global energy transition and will further diversify the Group portfolio. We anticipate that these strategic investments will provide a critical offset against the declining contribution from the SA gold operations as they near the end of their reserve lives over this decade and are restructured in a phased manner.

Some of the previously mentioned regional challenges impacted negatively on our operations during H1 2023. Steps have and are being taken to address and mitigate these challenges and are detailed in the Safety and operating review on pages 7 to 12, as a result of which we expect these impacts to be minimised in H2 2023. Others were extremely well managed with the potential impact on the Group minimised.

The updated protocols implemented at the SA PGM and SA gold operations to address the elevated levels of load curtailment in particular have proven extremely effective, and proactive steps to minimise the potential impact of illegal mining and cable theft on production are starting to have significant impact in reducing the impact on operating results.

The increasing frequency and magnitude of load curtailment posed a significant risk going into 2023. The impact has however been successfully mitigated through the implementation of comprehensive protocols which include, inter alia, re-scheduling energy intensive activities to lower demand periods and utilising our installed generation capacity at our SA gold operations, with unutilised available capacity at our SA PGM processing operations also providing significant processing flexibility, which has enabled our SA PGM operations to avoid the build-up of ore stockpiles or “deferred production” as per our peers.

A more positive narrative has begun to emerge, suggesting an improvement in power availability and reduced load curtailment towards year end. A swift and decisive response from the private sector and general public in South Africa, following the lifting of regulatory thresholds on renewable projects for self-generation, has played a significant role in this, with over 4000 MW of private sector renewable energy estimated to have been installed in the last year. Our self-generation strategy has likewise progressed with our first renewables project, the 89MW Castle Wind Farm announced in July 2023 with earthworks on site now in progress. This is a measurable milestone in the implementation of our 600MW renewable energy programme, which is expected to be complete by 2026 and forecast to significantly reduce operating costs and our dependence on Eskom, as well as the carbon emissions attributable to a reliance on Eskom's coal-fired generation, which dominate our current scope 2 emissions.

Regional opportunities arising from our recognition of global multipolarity becoming a dominant trend (another grey elephant), have begun to yield benefits. The US Inflation Reduction Act of 2022 (IRA), which directs new federal spending toward reducing carbon emissions, lowering healthcare costs, funding the Internal Revenue Service, and improving taxpayer compliance aims to encourage procurement of critical supplies domestically or from free-trade partners amongst other things. Significant benefits are expected to flow from the IRA and similar legislation in Europe, where we have selectively chosen to build strategic platforms to develop our battery metals and recycling businesses.

In addition to the US department of Energy (DOE) conditional loan commitment to provide up to US$700 million in funding to the Rhyolite Ridge JV, the US PGM operations expect to qualify for an IRA credit (45X advanced manufacturing production credit) equal to 10% of qualifying production costs incurred for critical metals produced and sold after 31 December 2022, for a period of 10 years. During H1

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 3

2023, management recognised an IRA credit of US$25 million against operating costs.We are also starting to witness the growing geostrategic importance of Africa to meet the accelerating need for critical minerals in both the western and eastern worlds.

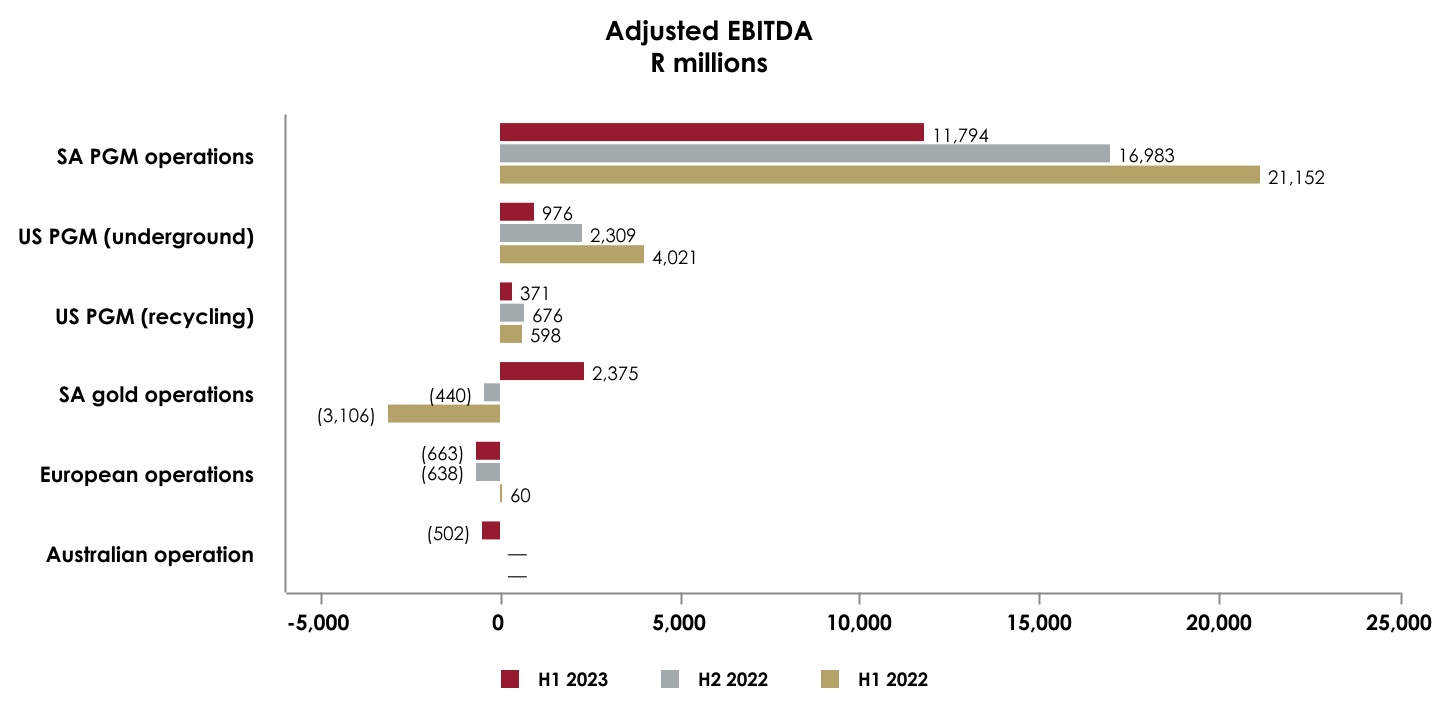

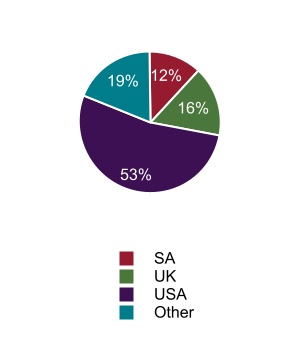

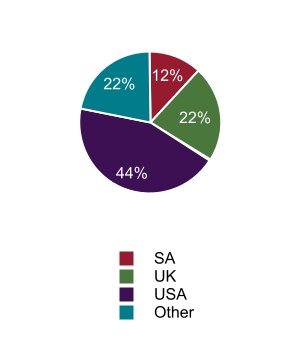

Group adjusted EBITDA of R14.1 billion (US$776 million) for H1 2023 was 37% lower than adjusted EBITDA of R22.6 billion (US$1.5 billion) for the comparable period in 2022, primarily reflecting the significant decline in PGM prices and regional operational challenges partly offset by the improved performance from the SA gold operations.

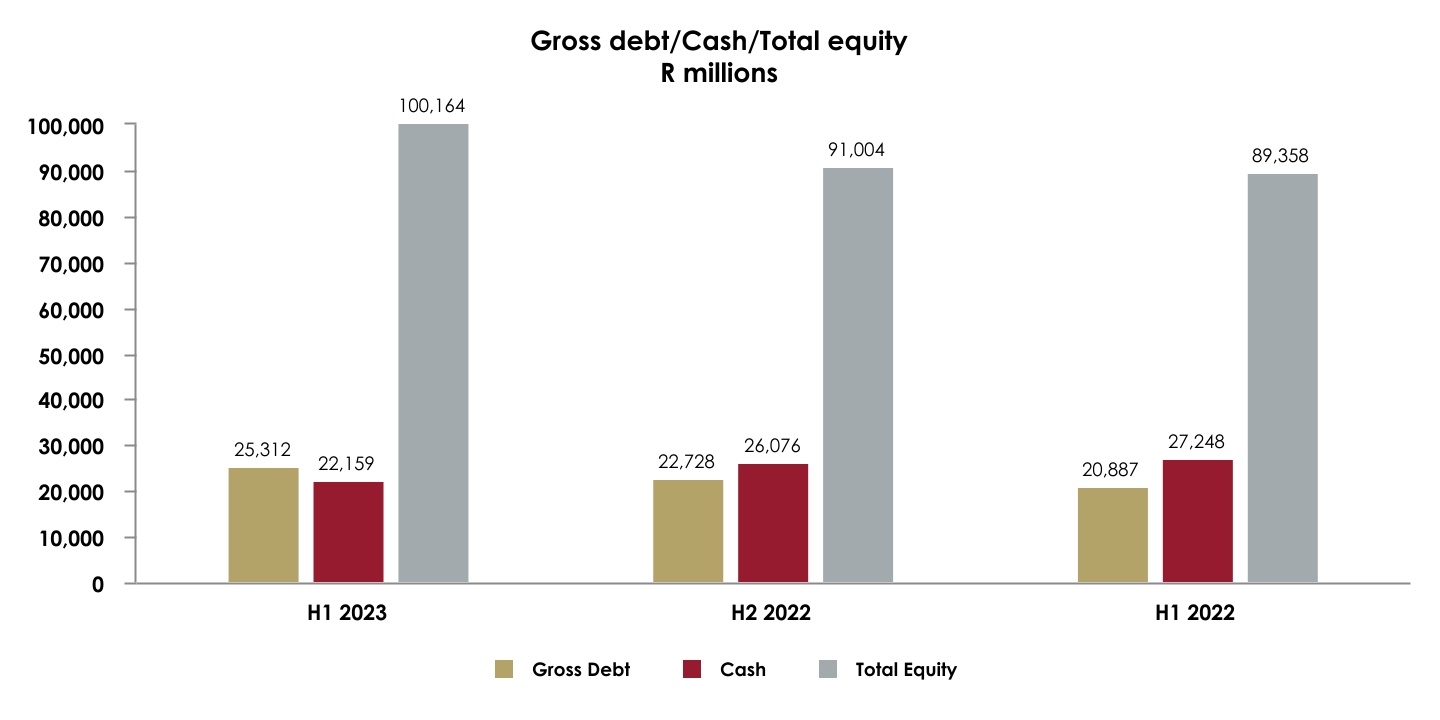

Continued capital allocation discipline has maintained the Group’s robust financial position. Cash and cash equivalents of R22.2 billion (US$1.2 billion) remain above the capital allocation framework reserve target of R20 billion, despite increased investment in our battery metals portfolio and a R3.6 billion (US$198 million) final payment to Anglo American Platinum for the Rustenburg operations (the absence of which will benefit future Rustenburg cash flow) during the period. Along with undrawn Revolving Credit Facilities (RCF) of R25.0 billion (US$1.3 billion), the Group has substantial financial headroom. These undrawn debt facilities include the dollar RCF, which was refinanced with strong support from a syndicate of global banks and increased from US$600 million to US$1 billion on improved terms during H1 2023, further enhancing Group liquidity and financial flexibility.

Cash and cash equivalents at the end of H1 2023 were marginally below borrowings (excluding non-recourse Burnstone debt) of R22.4 billion (US$1.2 billion), resulting in net debt of R262 million (US$14 million) and net debt: adjusted EBITDA ratio of 0.01x, which provides the Group with significant financial headroom to weather any further challenges as well as providing strategic optionality to capitalise on value accretive opportunities.

Profit for the period (after tax) of R7.8 billion (US$427 million) for H1 2023 was 37% lower than for H1 2022, with basic earnings per share (EPS) and headline earnings per share (HEPS) of 262 SA cents (14.4 US cents) and 208 SA cents (11.4 US cents), approximately 38% and 51% lower year-on-year respectively. The variance between EPS and HEPS primarily reflects an adjustment from EPS of R1.5 billion (US$82.0 million) related to non-cash foreign exchange gains arising from the once off accounting treatment of the deregistration of offshore subsidiaries acquired as part of the Lonmin transaction, during the period.

On the basis of the robust Group financial position, the Board of directors declared an interim dividend of R1.5 billion (US$79 million) (53 cents per share/US 11.2 cents** per ADR), equivalent to 35% of normalised earnings1 of R4.3 billion (US$235 million) for H1 2023, and at the upper end of the range of the Group dividend policy. This is in-line with the Group capital allocation framework and the Group commitment to delivering consistent shared value to stakeholders.

While the global macro-economic outlook remains uncertain, central bank rate hiking cycles in many economies appear to have reached or are nearing their peaks, and there are positive signs that a recession may be avoided, although low growth conditions are expected to continue well into 2024.

Global auto sales appear to be recovering, with recent forecasts for 2023 consistently being revised upwards. While this has yet to translate into a tangible increase in demand for PGMs or a recovery in recycling volumes, an implied improvement in PGM demand during H2 2023 would be supportive for spot PGM prices as destocking subsides.

Our robust financial position and diversification, places us well to not only endure through a period of low prices but to realise value from opportunities which may arise. While improvements are expected from our US and European operations and the integration of New Century as a managed operation in Sibanye-Stillwater yields benefits, the decline in commodity prices during H1 2023 has been severe and we are preparing for a lower phase in the commodity price cycle through a stringent focus on unit costs and a disciplined approach to the management of our assets. While we expect that a few tough quarters may be necessary while production is fully restored to plan levels at certain operations, we will be mindful of the operating environment and, where necessary, restructuring may be considered in areas where commercially viable operations cannot be sustained.

1 Normalised earnings is not a measure of performance under IFRS. As a result, it should not be considered in isolation or as alternatives to any other measure of financial performance presented in accordance with IFRS. Non-IFRS measures are the responsibility of the Board. Refer note 7 of the consolidated interim financial statements for the definition and reconciliation of normalised earnings

OPERATIONAL OVERVIEW

The SA PGM operations delivered another solid, consistent operating result for H1 2023, commendably managing the impact of elevated Eskom load curtailment and making significant progress in addressing cable theft during Q2 2023. Production of 848,723 4Eoz (including PoC), was flat compared to H1 2022, benefiting from a 24,195 4Eoz (95%) increase in PoC year-on-year, highlighting another relative advantage arising from our unutilised processing capacity. 4E PGM production (excluding PoC) of 799,182 4Eoz, was 3% lower than for H1 2022, but in line with H1 2022 if adjusted for the year-on-year decline in Kroondal production, which was primarily due to the planned closure of the Simunye shaft at the end of 2022. Costs were again well managed, with AISC (excluding PoC) of R19,716/4Eoz (US$1,083/4Eoz) for H1 2023, increasing by 9% year-on-year, significantly less than recent cost increases reported by industry peers.

The SA PGM operations continue to move down the industry cost curves through consistent, leading cost management. In so doing, they have not only increased their relative profitability and competitiveness, but also ensured greater margin protection than higher cost peers against lower PGM prices.

Production from the SA managed gold operations (excluding DRDGOLD) for H1 2023 of 10,411kg (334,721oz) increased by 233% year-on-year, with AISC of R1,113,391/kg (US$1,902/oz) 47% lower, mainly reflecting the recovery in production from the SA gold operations following the suspension of operations as a result of the industrial action and consequent lockout during H1 2022.

Disappointingly, the positive momentum that had been building at the SA gold operations, has been arrested by some significant operating incidents that occurred post 30 June 2023.

•On 12 July 2023, a fire at Driefontein 5 shaft disrupted operations at both Driefontein 1 and 5 shafts. Tragically, Mr Armando Matias (56) a development miner passed away as a result of the fire incident, during which he was separated from his team. Our heartfelt condolences are extended to the family and friends of our deceased colleague. Twenty-four employees were secure in various refuge bays and safely brought to surface. Whilst most of the crews at Driefontein 1 shaft returned to work and were operational by the beginning of August, the crews from the Driefontein 5 shaft area will only be reintroduced in a phased manner once the fire Is extinguished and the area becomes safe to operate in.

•Production constraints at the Kloof operations resulting from increased seismic activity which restricted access to higher grade production areas and ventilation and cooling constraints at Kloof 4 shaft during H1 2023, have been exacerbated by the shaft incident in late July 2023, which caused significant damage to infrastructure and resulted in the suspension of operations at the Kloof 4

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 4

shaft. The incident is under investigation and the extent of the damage is still being assessed. The full impact of the increased seismicity at Kloof 4, combined with constraints on cooling infrastructure and the shaft repairs required to resume operations at 4 shaft is being assessed.

Mined 2E PGM production from the US PGM operations of 205,513 2Eoz for H1 2023, was 11% lower year-on-year, with AISC of US$1,737/2Eoz, 27% higher than for H1 2022, primarily due to the shaft incident at the Stillwater West mine and ongoing critical skills shortages which continue to affect productivity and unit costs. These factors have also delayed implementation of the repositioning plan, which was announced in mid-2022, although we expect to resume planned implementation by Q4 2023.

The repositioning plan was a proactive response to the changing macro environment and worsening outlook for the palladium price, which we recognised in late 2021. The US PGM operations have delivered on the initial strategic intent and repaid the acquisition cost, hence repositioning the operations for long term profitability and sustainability to deliver optimal value, was deemed prudent. The US PGM operations were bought at the right time, during a low phase in the PGM price cycle, and under conservative PGM price assumptions at the time, so despite operational challenges currently impacting the operations, has not required a write down of the acquisition value.

3E PGM production from the US PGM recycling operation for H1 2023 halved year-on-year to 162,452 3Eoz. The global autocatalyst recycling industry has not recovered as anticipated at the beginning of 2023. The uncertain global economic outlook, recessionary concerns and higher interest rates have led to decreased consumer demand for new vehicles, with light duty vehicles (LDV) remaining in service for extended periods and fewer vehicles being scrapped. Furthermore, the global collection networks have contracted due to the residual impact of COVID-19 and lower PGM prices, leading to an accumulation of inventory within these networks. While there are positive signs of a recovery in global auto sales emerging, these are only expected to reflect in recovery in receipts and feed rates in 2024.

Nickel equivalent production from the Sandouville nickel refinery of 3,493 tonnes for H1 2023 and nickel equivalent sustaining cost of US$37,486/tNi (R682,628/tNi) were impacted by plant downtime of 50 production days during H1 2023, primarily due to equipment failure at the electro-winning circuit, supply chain constraints leading to a shortage of critical inputs and social unrest in France in the form of nationwide strikes. Repairs to the cathode units in the electro winning circuit are largely complete, with circuit availability and nickel recovery trends improving during Q2 2023. Legacy contracts with suppliers and customers are also being renegotiated by the new management team and working capital risks are being managed through the hedging of 70% of nickel purchases. The outlook for H2 2023, barring any unexpected disruptions, is therefore more positive.

Persistently high fixed and maintenance costs and the recent decline in the nickel price and deterioration in the medium-term outlook, has however prompted a review of the business case, which is scheduled for completion before year end. The outcome of this review and optimisation proposals will inform a decision on the way forward.

The strategic rationale for the Sandouville acquisition included the potential to provide a springboard for supply of battery metals and battery materials into the European ecosystem as well as a node for the development of a European recycling business.

Feasibility studies on the battery grade nickel sulphate, PGM autocatalyst recycling, and battery metals recycling projects, are also scheduled to progress to the next stages before the end of 2023.

The commitment and support for the Keliber lithium project from the Finnish Minerals Group, which represents and manages the Finnish State’s mining industry investments was confirmed in April 2023, when it elected to increase its holding in the Keliber project from 14% to 20% by subscribing for €54 million of the €104 million rights issue, which completed the financing of the equity component of the €588 million capital required for the full development of the project. With the equity capital component secured, securing debt funding for the remaining project capital is underway.

The construction of the Keliber lithium refinery is proceeding and we are confident that the concentrator and open cast mines will be developed in due course, ensuring integrated production and supply of battery grade lithium hydroxide from the Keliber project into what we expect is going to be a substantial market deficit in the second half of this decade.

It is worth noting the positive responses we have received from the French and Finnish governments as a result of our investments, with both countries having publicly prioritised the development of a national battery industry and supportive of our investments in these economies. Constructive engagements at the highest levels of Government are positive affirmations of support.

STRATEGIC DELIVERY

Good progress continues to be made in building our green metals and energy solutions business.

Following the classification of the Tiehm's buckwheat as an endangered species at the Rhyolite Ridge lithium project, an alternative mine plan and schedule that avoids all buckwheat, is subject to an updated feasibility study, with additional drilling being done to further define the orebody. While permitting risk remains, the climate has turned positive, and we consider this would have strategic advantage in terms of securing a leading position in developing the United States critical minerals value chain with a positive commercial return. The investment will only be advanced subject to intensive oversight of the technical status of the project. The Federal permitting process (NEPA) continues to advance with completion of the first public scoping period and progress towards publication of a draft EIS.

The integration of New Century into Sibanye-Stillwater is expected to be completed during H2 2023. A feasibility study on Mount Lyell (a previously operated copper mine) in Tasmania is underway and a decision on the option to acquire 100% of Mt Lyell from Vedanta Resources will be taken prior to its expiry on 5 November 2023.

Our involvement in the process to extend our copper portfolio into Zambia through our bid to acquire the Mopani operation is ongoing. A competitive process is underway to determine the successful bidder to enter into a phase of final due diligence and exclusive negotiation on the detailed terms.

OPERATING GUIDANCE FOR 2023*

Operating guidance for the US recycling operation, the SA gold operations and the Sandouville nickel refinery has been revised to reflect the impact of various events described in this report. The latest operating guidance for 2023 is as follows:

•Guidance for the US PGM operations is unchanged. Mined 2E PGM production is forecast to be between 460,000 2Eoz and 480,000 2Eoz, with AISC between US$1,550/2Eoz and US$1,650/2Eoz (R27,900/2Eoz to R29,700/2Eoz). Capital expenditure is forecast to be

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 5

between US$285 million and US$300 million (R5.1 billion to R5.4 billion), including approximately US$25 million (R450 million) project capital.

•3E PGM production from the US PGM recycling operations has been revised downwards to between 350,000 3Eoz and 400,000 3Eoz fed for the year. Capital expenditure is also forecast to be lower than previous guidance at US$1.4 million (R25 million).

•Forecast 4E PGM production from the SA PGM operations for 2023 remains unchanged at between 1.7 million 4Eoz and 1.8 million 4Eoz including approximately 60,000 4Eoz of third party PoC, with AISC between R20,800/4Eoz and R21,800/4Eoz (US$1,156/4Eoz to US$1,211/4Eoz) - excluding the cost of third party PoC. Capital expenditure is forecast at R5.4 billion (US$300 million) for the year, including project capital of R920 million (US$51 million) for the K4 project.

•Gold production from the managed SA gold operations (excluding DRDGOLD) for 2023 is forecast at between 19,500kg (625koz) and 20,500kg (660koz). This revised guidance reflects the estimated impact of a fire at Driefontein and the Kloof 4 shaft incident which occurred after 30 June 2023. The review of the marginal operations is ongoing considering operational constraints as well as sustained high levels of cost inflation. AISC is revised to be between R1,190,000/kg and R1,290,000/kg (US$2,056/oz to US$2,230/oz) due to lower production. Capital expenditure is forecast at R5.4 billion (US$300 million), including R1.6 billion (US$90 million) of project capital expenditure for the Burnstone project.

•Production from the Sandouville nickel refinery has been revised downward due to production constraints which affected H1 2023. Production is forecast at between 7.0 kilotonnes to 7.5 kilotonnes of nickel equivalent product (Ni) at a nickel equivalent AISC of between €33,715/tNi and €34,588/tNi (R657,000/tNi to R675,000/tNi) with capital expenditure of €14 million (R273million).

•Capital expenditure forecast for the Keliber lithium project for 2023 remains unchanged at €231 million (R4.5 billion).

*The guidance has been translated where relevant at an average exchange rate of R18.00/US$ and R19.50/€.

NEAL FRONEMAN

CHIEF EXECUTIVE OFFICER

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 6

SIBANYE-STILLWATER GROUP SAFETY AND OPERATING REVIEW

SAFETY

While zero harm remains our ultimate objective, our immediate goal continues to be eliminating fatal and serious incidents through our Fatal Elimination Strategy, which is comprised of the key pillars of: critical controls, critical lifesaving behaviours and critical management routines.

Group safety indicators were largely consistent year-on-year. The Group serious injury frequency rate (SIFR) improved from 3.05 (per million hours worked) for H1 2022 to 2.78 for H1 2023, a 9% improvement, with the lost time injury frequency rate (LTIFR) increasing by 5% from 4.56 to 4.77 and the total recordable injury frequency rate (TRIFR) increasing marginally from 5.39 to 5.45 for the same period.

Primarily as a result of the incident at the Burnstone project in April 2023, where four contractor employees were fatally injured when a surface waste rock conveyor which was under construction by a 3rd party collapsed, the Group fatal injury frequency rate (FIFR) (per million hours worked) regressed from 0.03 for H1 2022 to 0.07 for H1 2023.

We mourn the tragic loss of Puleng Masombuka (34 years old), Jonas Mofokeng (56), Cornelius van Wyk (50) and Afonso Nguenze (55) as a result of this incident.

On 28 June 2023, Richete Chitlango (55), a special team leader at Driefontein 5 shaft, passed away from injuries sustained in a fall of ground incident while engaged in underground cleaning operations during night shift. Together with the loss of Thabiso Ramotselisi, which was reported in our Q1 2023 results, this resulted in a total of six fatalities (four contractors and two employees) during H1 2023, compared with two during H1 2022.

The loss of our colleagues is deeply regretted, and the Board and management of Sibanye-Stillwater extend their sincere condolences to the loved ones, families and friends of our deceased colleagues. All incidents are being investigated along with relevant stakeholders and support is being provided to the families of the deceased.

While it was pleasing to note that the rest of the Group's operations achieved a fatal free first six months of the year, we continue to intensify the focus on safe production, building on improvements made and embedding our Fatal Elimination Strategy, ensuring improvements in safe performance and behaviour, to achieve sustainable real risk reduction across all our operations.

To support and intensify the Fatal Elimination Strategy, several leading indicators have been developed to monitor the effectiveness of the strategy. In particular, the Group's focus is on learning from high potential incidents (not only fatal incidents) to prevent recurrences, embedding a culture of reporting safety incidents, including near miss incidents and unsafe work conditions without hesitation and fear of retribution.

The Group high potential incident review committee meets at regular intervals, where leaders collectively share and assess the causes of significant incidents. The primary focus of this is to identify and share Group learnings in an effort to sustainably prevent repetitive incidents. Leading indicators being monitored, include measuring compliance to critical controls, critical life-saving behaviours and critical management routines. Of note is that at several operations, there has been an increase in self-stoppages by front line operators and supervisors. This is an encouraging trend, reflecting an enabled and supportive environment for these actions and, for the first time since consistent monitoring of workplace stoppages began, frontline stoppages by employees exceeded those of management. Empowered employees exercising self-stoppages contributes to mitigating potential harm.

Turning to the various operations, the US PGM operations safety performance for H1 2023 regressed, with reportable injuries increasing from 20 to 28 year-on-year resulting in the TRIFR increasing from 8.85 for H1 2022 to 12.61 for H1 2023.

The SA PGM operations also reported a slight regression in the safety performance for H1 2023 with the TRIFR increasing from 5.41 for H1 2022 to 5.48 for H1 2023, an increase of 1%. Pleasingly the SIFR improved by 26% from 3.20 for H1 2022 to 2.37 for H1 2023, one of the lowest SIFR recorded. In addition, the SA PGM mining operations were fatality free during H1 2023, with 9 million fatality free shifts reached on 19 June 2023, a significant and record achievement in these underground operations.

The SA gold operations safety performance regressed as a result of the six fatalities (four contractors and two employees) in three separate incidents in H1 2023 (one fatality in H1 2022) with the FIFR increasing from 0.056 for H1 2022 to 0.19 for H1 2023. This is a deeply disappointing regression, which is being addressed by the operationalisation of the Fatal Elimination Strategy. The TRIFR also regressed marginally from 4.76 for H1 2022 to 4.97 for H1 2023.

The European region (EU region) which includes both the Keliber lithium project and Sandouville, has been integrated into the Group's safety reporting processes. The European region had a TRIFR of 2.90 for H1 2023, a pleasing decrease as compared to 15.95 for H1 2022, which only included Sandouville at the time. Sandouville had 4 recordable incidents in H1 2022 and none in H1 2023. The TRIFR of the European operations is currently significantly lower than the Group average of 5.45, as a result of Sandouville being an industrial surface complex and construction of the refinery now commencing at the Keliber lithium project.

The integration of the recent acquisition of New Century Resources, is underway and New Century will be included in future Group safety statistics as the Australian region.

OPERATING REVIEW

Americas (US) region

US PGM operations

The US PGM operations were significantly impacted by the shaft incident at the Stillwater West mine in March 2023, where structural damage to the shaft prevented access below 50 level for eight weeks during H1 2023, resulting in lower production, higher AISC and a delay in the implementation of the optimisation plan. The shaft was repaired by 16 April 2023 and recommissioned by the end of April 2023. Approximately 24,600 2Eoz of production from the Stillwater West mine was directly impacted for H1 2023, with the implementation of the repositioning plan also affected.

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 7

Consequently, mined 2E PGM production from the US PGM operations of 205,513 2Eoz was 11% or 24,526 2Eoz lower than for H1 2022. In addition to the shaft incident impact, continuing critical skill shortages of miners, geologists, mechanics and artisans across the US operations and geological and geotechnical complexity at East Boulder, adversely impacted productivity.

The shortage of critical skills in mining is a global phenomenon which is expected to continue and intensify with many mining companies reporting similar issues and is exacerbated by the exceptionally low unemployment levels in the United States. Efforts to attract and retain critical mining and geological skills are in progress, however staff attrition rates remain high. We continue to work diligently to determine the reasons for the high turnover rate at the East Boulder mine and on retaining employees, as well as focus on recruitment for critical positions. To buffer the impact of the mechanics skills shortage, we have recently launched an in-house mechanics training program.

2E PGM production from the Stillwater mine of 123,412 2Eoz for H1 2023, was 14% lower than H1 2022, primarily due to the Stillwater West shaft incident and equipment unavailability due to a shortage of mechanics. Production from the East Boulder mine of 82,102 2Eoz was 5% lower than for H1 2022, with the mine continuing to be impacted by geological and geotechnical challenges as mining migrates to the west, with critical skills shortages affecting productivity.

Key focus areas for the US PGM operations include infrastructure maintenance scheduling, which is being overhauled, improving fleet availability, addressing the mining mix at East Boulder and minimising dilution, as well as implementing labour retention strategies.

AISC of US$1,737/2Eoz (R31,633/2Eoz) for H1 2023 was 27% higher than for H1 2022, primarily due to lower production, persistent inflationary pressures on stores and contractor costs, with both Ore Reserve Development (ORD) and sustaining capital higher. ORD increased by 34% from US$83 million (R1.3 billion) for H1 2022 to US$111 million (R2 billion) for H1 2023, primarily due to the reclassification of project development (project capital) to ORD, contractor premiums and higher development support costs, with ORD contributing US$541/2Eoz to AISC, US$181/2Eoz (R4,307/2Eoz) higher year-on-year. Sustaining capital increased by 75% to US$43 million or US$209/2Eoz (R3,815/2Eoz), US$103/2Eoz (R2,172/2Eoz) higher year-on-year as result of higher spending on ventilation improvements, transport and mining fleet replacement and ongoing spend on tailings storage facilities (TSF). Of significant benefit, in terms of the US Inflation Reduction Act (IRA) the US PGM operations would qualify for an IRA credit (45X Advanced Manufacturing Production Credit) equal to 10% of qualifying production costs incurred for critical minerals produced and sold after 31 December 2022, for a period of 10 years. During H1 2023, management recognised an IRA credit of US$25 million against operating costs.

Adjusted EBITDA of US$53 million (R976 million) for H1 2023 was 80% lower than adjusted EBITDA of US$261 million (R4.0 billion) for H1 2022, with 20% lower PGM 2Eoz sold year-on-year compounded by the 28% decrease in the average 2E PGM basket price for H1 2023 to US$1,390/2Eoz (R25,312/2Eoz).

Capital expenditure for H1 2023 increased by 24% year-on-year to US$176 million (R3.2 billion), with 87% (or US$154 million) of this amount spent on ORD and sustaining capital. Growth project capital was 36% lower at US$22 million (R403 million) in line with the US PGM repositioning plan of August 2022 with the completion of spending on the 56-level holing to the Benbow decline and the processing plant upgrade (with the first line successfully commissioned).

Total development for H1 2023 of 11,941 meters was 5% lower than for H1 2022, primarily due to no access below 50 level at the Stillwater West mine, due the shaft incident. Both primary and secondary development at the Stillwater mine was 7% and 10% lower respectively compared with H1 2022. It was pleasing to note that primary and secondary development at East Boulder increased by 6% to 923 metres and 2,742 metres respectively, consistent with the 2022 repositioning plan to increase mining flexibility through increased development. Project development reduced from 1,010 metres for H1 2022 to nil for H1 2023 following the decision to curtail further project capital expenditure at the Stillwater East mine with development now classified as ORD.

US PGM recycling operation

The global autocatalyst recycling industry has not recovered as anticipated at the beginning of 2023. The uncertain global economic outlook, recessionary concerns and higher interest rates have led to decreased consumer demand for new vehicles, with light duty vehicles (LDV) remaining in service for extended periods and fewer vehicles being scrapped. Furthermore, the global collection networks have contracted due to the residual impact of COVID-19 and lower PGM prices, leading to an accumulation of inventory within these networks.

Reflecting these factors, average volumes of spent autocatalysts fed at the US PGM recycling operation of 10.9 tonnes per day (tpd) for H1 2023, was 52% lower than for H1 2022. During H1 2023, 1,957 tonnes of recycled material was received and 1,979 tonnes fed.

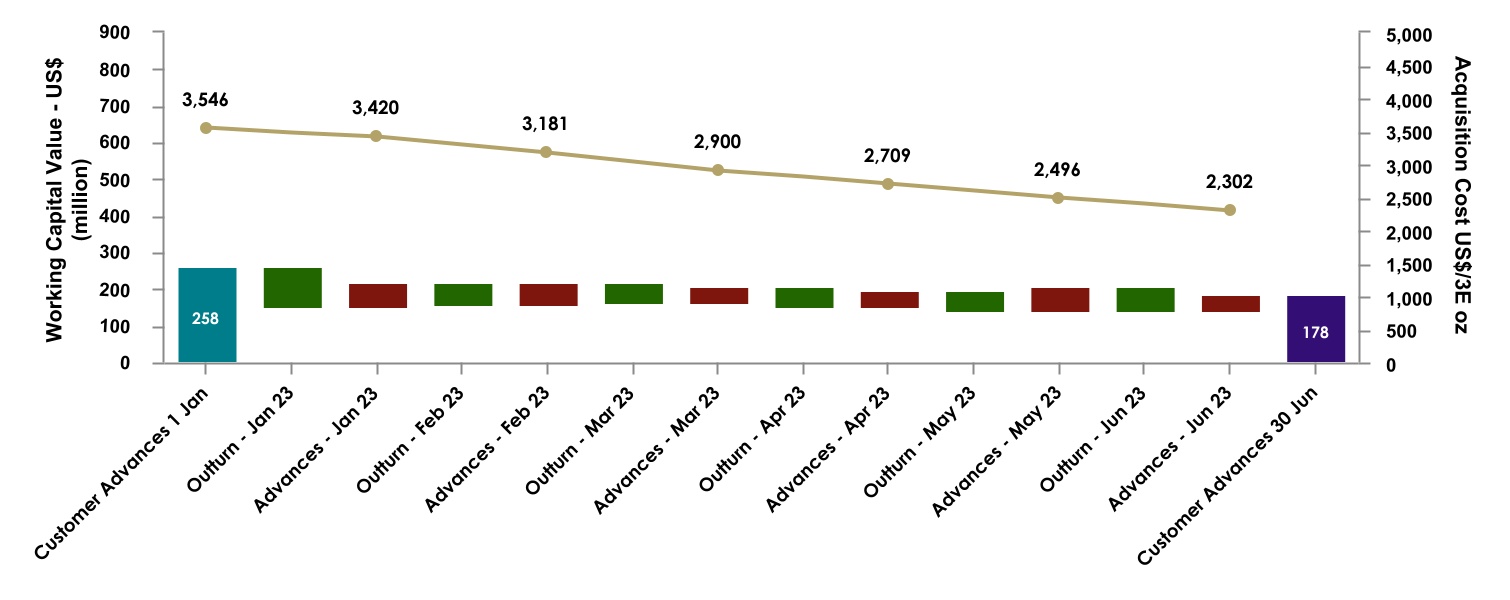

The recycling operation is currently expending approximately US$2 million per day (R36 million) on recycle advances, resulting in recycle advances of approximately US$178 million (R3.2 billion) at the end of H1 2023. At the end of H1 2023, approximately 27 tonnes of recycle inventory was on hand, a 97 tonne decrease versus the H1 2022 ending inventory of 124 tonnes. There was a positive cash inflow from recycling as inventory on hand reduced from US$320 million (R5.4 billion) at the beginning of H1 2023 to US$206 million (R3.8 billion) at the end of H1 2023.

Adjusted EBITDA from PGM recycling decreased by 49% year-on-year to US$20 million (R371 million) at a margin of 5%. The decrease was due to a 6% decrease in 3E PGM recycle basket price to US$2,735/3Eoz (R49,804/3Eoz) and 3E PGM sold declining by 58% to 153,446 3Eoz.

Increasing global auto sales reported recently have prompted upward revisions to sales forecasts for 2023 and are a promising leading indicator of future recycling volumes. The current environment remains challenging however and the recycling segment is actively pursuing volume-driven growth, including potentially venturing beyond conventional autocatalytic feed sources for opportunities.

Southern African (SA) region

SA PGM operations

The SA PGM operations produced a solid operational performance for H1 2023 with commendable management of the elevated levels of load curtailment during H1 2023. The Group's spare processing capacity is a strategic advantage, providing greater operational flexibility, which together with implementation of effective protocols, minimised the impact on production, with no ore stockpiles or "deferred production" recorded at the end of H1 2023, in contrast to some of our peers. 4E PGM production including third party purchase of concentrate (PoC) of 848,723 4Eoz for H1 2023, was in line with H1 2022. 4E PGM production excluding third party PoC of 799,182 4Eoz,

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 8

was 3% lower year-on-year. Surface production of 74,269 4Eoz for H1 2023 (excluding PoC) increased by 3% year-on-year partly offsetting a 4% decline in underground production to 724,913 4Eoz. The decline in underground production was primarily a result of the planned closure of Kroondal's Simunye shaft at the end of 2022. Concentrate purchases from third parties of 49,541 4Eoz for H1 2023 were significantly higher than for H1 2022.

Costs continue to be well managed, comparing favourably to industry peers who have recently reported double digit cost increases, particularly considering the 3% decline in production (excluding PoC) following the closure of Kroondal's Simunye shaft and the inclusion of development from the Marikana K4 project increasing AISC at the Marikana operation (in March 2022, K4 commenced stoping and development outside of the shaft infrastructure footprint resulting in ORD, working costs and sustaining capital ramping up). Inflationary effects (particularly imported commodities such as fuel and imported spares impacted by the weakening of the rand), were largely offset, with AISC (excluding PoC) of R19,716/4Eoz (US$1,083/4Eoz) only 9% higher year-on-year.

The increase in AISC reflects a 43% increase in ORD to R1.3 billion (US$74 million), R405 million (US$13 million) higher year-on-year. This was primarily due to ORD from the K4 project increasing the Marikana operation's overall ORD which increased by 58% year-on-year. AISC for H1 2023 also reflected 50% lower royalties paid compared to H1 2022 (R474 million or US$36 million lower year-on-year) and 12% higher by-product credits (R536 million or US$16 million higher year-on-year), primarily due to a higher chrome price.

AISC (including PoC) of R20,214/4Eoz (US$1,110/4Eoz) for H1 2023 was 8% higher than for H1 2022, due to a 45% increase in PoC cost to R1.6 billion (US$88 million) as per the detailed Marikana commentary (see below).

The average 4E PGM basket price for H1 2023 of R34,006/4Eoz (US$1,867/4Eoz) was 22% lower than for H1 2022, with average rhodium and palladium prices 51% and 36% lower respectively in US dollar terms compared to the same period in 2022, partly offset by the 18% depreciation of the rand versus the US dollar year-on-year. Adjusted EBITDA from the SA PGM operations of R11.8 billion (US$649 million) for H1 2023 was 44% lower than for H1 2022 due to the lower average 4E PGM basket price.

Capital expenditure for H1 2023 increased by 19% to R2.6 billion (US$141 million) compared to H1 2022. This increase was largely driven by a 43% increase in ORD to R1.3 billion (US$74 million), largely driven by Marikana where ORD increased by 58% due to the ramp up in ORD at K4), with sustaining capital 4% lower at R786 million (US$43 million) and project capital 9% higher at R441 million (US$24 million), with spending primarily on the Marikana K4 project.

PGM production from the Rustenburg operation of 314,471 4Eoz for H1 2023 was 3% higher than for H1 2022, with underground production 3% higher and surface production 7% higher year-on-year. Although the Rustenburg operation continues to be impacted by difficult ground conditions, underground production is picking up as mineable face is re-established after successfully developing through the Hex River fault at Bathopele. AISC of R18,323/4Eoz (US$1,006/4Eoz) was 4% lower year-on-year despite inflationary cost pressures on imported spares, steel related products, ammonia-based products, fuel and oil, with by-product credits 25% higher primarily due to 21% higher chrome prices, and royalties 57% lower as a result of lower PGM prices. The Rustenburg operation continues to move down the industry cost curve as a result of exemplary cost management.

PGM production from the Marikana operation for H1 2023 (including third party PoC) increased by 2% to 368,075 4Eoz, primarily due to a 95% increase in third party PoC processed of 49,541 4Eoz. PGM production (excluding PoC) declined by 5% to 318,534 4Eoz due to the combined effect of cable theft and load curtailment. AISC (excluding PoC) increased by 18% for H1 2023 to R22,286/4Eoz (US$1,224/4Eoz) due to lower production, inflationary cost pressures and most notably higher ORD expenditure, which increased by 58% to R987 million (US$54 million), primarily due to the K4 shaft development costs, which prior to March 2022 was classified as project capital. Since K4 commenced stoping and development operations outside the main shaft infrastructure in March 2023, on reef development was expensed in working costs with off reef development capitalised as ORD. Consequently, ORD at K4 increased from R65 million (US$4 million) in H1 2022 to R277 million (US$15 million) in H1 2023. While the K4 project remains in build-up phase, elevated ORD, sustaining and operating costs, coupled with lower ramping up production, will temporarily increase AISC at Marikana. AISC for H1 2023 (including PoC) increased by 13% to R23,012/4Eoz (US$1,264/4Eoz), due to PoC purchase costs which increased by 45% to R1.6 billion (US$88 million), R495 million (US$16 million) higher than for H1 2022 over the same period. Royalties declined by 43% to R278 million (US$15 million) as a result of the lower PGM prices.

The Kroondal operation performed largely in line with plan for H1 2023 with production of 83,516 4Eoz 18% lower than H1 2022 mainly due to planned closure of the Simunye shaft at the end of 2022. Sweeping and vamping operations are now being conducted at the Simunye shaft with excess crews transferring to the Marikana K4 operations to fill vacancies, in a phased manner. Adverse ground conditions at the two shafts (K6 and Bambanani) which are mining through the shear zone increased dilution and reduced the yield. AISC increased by 20% year-on-year to R17,877/4Eoz (US$982/4Eoz), mainly as a result of lower production as well as higher support costs, due to mining through the adverse ground conditions at the shear zone. Overhead costs associated with the Simunye shaft are expected to reduce as crews are transferred to the Marikana K4 project and full closure of Simunye is achieved. By-product credits were 25% lower due to lower chrome production associated with the closure of the Simunye shaft.

Attributable PGM production from Mimosa for H1 2023 of 57,342 4Eoz was in line with H1 2022. The focus at Mimosa has been to optimise the processing plant and recoveries, which has been successful, with the yield increasing in recent periods. Despite the stable production, AISC of US$1,278/4Eoz (R23,264/4Eoz) was 31% higher year-on-year, due to a 47% increase in sustaining capital to US$28 million (R510 million), primarily associated with the processing plant optimisation and construction of a new tailings storage facility (TSF) as the existing TSF is reaching its capacity. The Mimosa Plant optimisation and the new TSF were completed during H1 2023.

PGM production from Platinum Mile for H1 2023 of 25,319 4Eoz was 2% higher than for H1 2022, with steady throughput and recoveries. However, despite general inflationary costs pressures and increased sustaining capital, AISC increased by only 8% to R10,664/4Eoz (US$586/4Eoz). Project capital expenditure was R36 million (US$2 million) for H1 2023 as a result of expenditure on a chrome extraction plant which is planned to produce around 240,000 tonnes of chrome per year and is expected to be commissioned in December 2023. Total capital spend on the project is forecast to be R130 million.

H1 2023 chrome sales of 1,085 kilotonnes (kt) were 18% lower than for H1 2022 due to logistical issues affecting timing of transporting material from the Rustenburg operation as well as lower production from the Marikana and Kroondal operations. Chrome revenue of R2.2 billion (US$122 million) was however 23% higher year-on-year as a result of a 21% year-on-year increase in the average chrome price received to US$287/tonne for H1 2023.

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 9

The K4 project

The project is around 43% complete. Underground infrastructure development and electrical work is progressing well, and surface infrastructure is on track. K4 produced 7,063 4Eoz for H1 2023 with production expected to accelerate during H2 2023 as further ore drawpoints (boxholes) are re-commissioned. Project capital guidance of R920 million (US$51 million) is unchanged for 2023, with R387 million (US$21 million) spent for H1 2023.

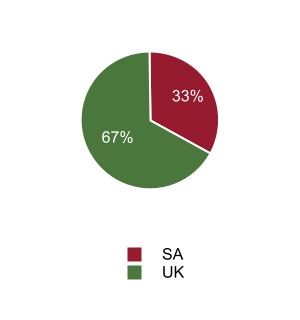

SA gold operations

The SA gold operations delivered a significantly improved operating and financial performance for H1 2023, with materially higher production and lower unit costs. This reflects the stabilisation of operations after the production build up during H2 2022, following the industrial action and lockout during H1 2022, which significantly impacted production and unit costs for the period. Normalisation of production in November 2022 secured exposure for the gold operations to the higher gold price and weaker rand during H1 2023, driving a significant financial turnaround by the managed SA gold operations (excluding DRDGOLD), with adjusted EBITDA increasing by R5.4 billion (US$335 million) year-on-year, from an adjusted EBITDA loss of R3.9 billion (US$256 million loss) for H1 2022 to an adjusted EBITDA gain of R1.4 billion (US$79 million) for H1 2023. This turnaround partially offset the impact of substantially lower PGM prices on the Group's profitability, confirming the value of these operations as a hedge against industrial economic downturn with the SA gold operations (including DRDGOLD) accounting for 17% of Group adjusted EBITDA for H1 2023.

Production from the managed SA gold operations (excluding DRDGOLD) for H1 2023 increased by 233% to 10,411kg (334,721oz), with production more reflective of normalised delivery under stable conditions. The period was not without its challenges however, with management having to contend with a significant increase in the frequency and extent of load curtailment which has persisted since the beginning of 2023 and continues to challenge normal operating procedures. The implementation of comprehensive mitigating protocols developed by operational management has proven effective, with load curtailment having little impact on production from the SA gold operations, although negatively impacting operating costs. In addition, elevated seismicity at both Kloof and Driefontein restricted access to high grade panels and resulted in selected loss of certain planned mining areas due to safety considerations, resulting in a number of crews not being able to mine as planned. Production at Beatrix was lower than planned due to disruptions caused by the S189 process. Surface production was also disrupted primarily due to the poor performance of a haulage contractor which led to the hiring of an additional contractor.

AISC (excluding DRDGOLD) declined by 47% year-on-year to R1,113,391/kg (US$1,902/oz), primarily due to the significant increase in H1 2023 gold production and sales from the managed SA gold operations. As mentioned, load curtailment is evident in increased costs associated with higher diesel consumption by installed generators to mitigate the impact of load curtailment on production. Above inflation increases in electricity tariffs (19% tariff increase) and consumables costs, including explosives, support, cyanide, fuel and contractor rates as well as expenditure related to enhanced safety standards in the equipping of mining panels (hydraulic rock prop support increased by 20% year-on-year) also impacted costs.

The benefits of a period of more stable production are evident in the turnaround in the SA gold operations (including DRDGOLD) assisted by record gold prices. The average gold price received for H1 2023 increased by 22% to R1,124,871/kg (US$1,921/oz) compared to H1 2022. Production from the SA gold operations (including DRDGOLD) for H1 2023 of 12,962kg (416,738oz), was 117% higher than for H1 2022, with AISC (including DRDGOLD) of R1,061,477/kg (US$1,813/oz), 31% lower year-on-year. Adjusted EBITDA (including DRDGOLD) increased from negative R3.1billion (US$202 million) for H1 2022 to positive R2.4 billion (US$130 million) for H1 2023.

Capital expenditure (excluding DRDGOLD) increased by 130% year-on-year to R2.7 billion (US$149 million) with ORD 199% higher at R1.4 billion(US$77 million) reflecting the normalisation of operations (H1 2022 had minimal capital expenditure due to the industrial action and lockout) and accelerated development to maintain flexibility, 30% higher sustaining capital of R410 million (US$23 million) and 128% higher project capital due to the ramp-up of activities at the Burnstone project post the 2022 industrial action. Capital expenditure (including DRDGOLD) for H1 2023 increased by 111% to R3.4 billion (US$185 million).

The Driefontein operation produced a strong performance in H1 2023 with gold production of 3,958kg (127,253oz), 166% higher year-on-year. Underground yields for H1 2023 were lower than for the comparable period in 2022 due to an increase in development to restore operational flexibility post the industrial action, resulting in a relative increase in lower grade development material milled and processed. In addition, elevated seismicity at Driefontein 4 and 8 shafts prevented access to several high-grade areas. Underground production of 3,884kg (124,873oz) for H1 2023 was 175% higher year-on-year with surface production of 74kg (2,379oz), 6% lower year-on-year, due to depletion of surface resources as planned. AISC of R1,068,855 (US$1,826/oz) was 37% lower year-on-year due to an 153% increase in gold sold. ORD increased by 202% year-on-year to R760 million (US$42 million).

Underground production from the Kloof operation of 3,579kg (115,067oz) for H1 2023 was 252% higher than for H1 2022, which was impacted by the industrial action. Kloof 4 shaft however continues to be impacted by high seismicity, which further impacted cooling and ventilation constraints, and led to the withdrawal of crews from some high-grade stopes due to safety concerns. Surface production of 207kg (6,655oz) for H1 2023 was 4% higher than for H1 2022 despite the closure of the KP1 plant in December 2022. AISC for H1 2023 of 1,201,379/kg (US$2,052/oz) was 47% lower year-on-year as a result of the increase in production and 185% increase in gold sold. ORD increased by 154% to R470 million (US$26 million) due to the ramp up of development post the H1 2022 industrial action. Project capital at the Kloof 4 deepening project was constrained in H1 2023 to R67 million (US$4 million).

Underground production from the Beatrix operation of 2,027 kg (65,170oz) for H1 2023 was substantially higher than production of 59kg (1,897oz) for H1 2022, due to safety stoppages at the end of 2021, which delayed the return to work in Q1 2022, the suspension of processing to allow remediation of the TSF and the industrial action. Production was 28% lower than for H2 2022 due to the disruption caused by the S189 process and the closure of the higher grade Beatrix 4 shaft in December 2022, which also reflects in a lower underground yield for H1 2023. AISC for H1 2023 decreased by 81% year-on-year to R1,048,556/kg (US$1,791/oz), due to the increase in production and gold sold, as well as the closure of the high cost Beatrix 4 shaft. ORD for H1 2023 increased by 442% to R168 million (US$9 million) due to normalisation of operations compared with the previously mentioned disruptions during H1 2022. Sustaining capital was however 40% lower year-on-year due to the planned closure of Beatrix 4 shaft in Q1 2023.

Gold production from the Cooke surface operation for H1 2023 increased by 60% to 568kg (18,262oz) year-on-year with AISC 9% higher year-on-year on the back of above inflation increases on chemicals and steel balls and higher aggregate purchase costs.

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 10

Gold production from DRDGOLD for H1 2023 decreased by 10% to 2,551kg (82,017oz) with tonnes milled declining by 25% and yield increasing by 21% year-on-year. The decrease in the tonnes milled is a result of load curtailment, the reclamation of final remnant and clean-up of material at operating sites nearing depletion at City Deep and East Rand Gold Operations (Ergo) on the East Rand and at Driefontein 5 at the Far West Gold Recoveries on the West Rand. The increase in yield is associated with higher grade remnant material that is typically encountered during the final stages of reclamation and clean up and the reclamation of high-grade sand material at Ergo. Lower tonnes milled coupled with above inflationary increases in the key consumables of electricity, diesel, steel, reagents and increased security costs as well as additional machine hire costs to enable the reclamation of the final remnant material resulted in operating costs per tonne milled increasing by 38% to R188/tonne (US$10/tonne). Despite this, AISC in H1 2023 only increased by 4% to R837,711/kg (US$1,431/oz) as a result of gold sold only decreasing by 10% year-on-year and sustaining capital 44% lower at R230 million (US13 million). Sustaining capital declined as a result of lower capital spent on the development of new reclamation sites to replace operating sites nearing completion. Project capital increased from R6 million (US$0.4 million) in H1 2022 to R427 million (US$23 million) in H1 2023 due primarily to the development of the 20 MW solar power plant project nearing completion at Ergo. The average rand gold price received by DRDGOLD in H1 2023 increased by 20% year-on-year to R1,114,073/kg (US$1,903/oz) with adjusted EBITDA increasing by 11% to R933 million (US$51 million).

Post H1 2023 the SA gold operations suffered two significant incidents, at Driefontein 5 shaft and Kloof 4 shaft, which will have a significant impact on these operations during H2 2023.

On 12 July 2023, a fire at Driefontein 5 shaft disrupted operations at both Driefontein 1 and 5 shafts. Tragically, Mr Armando Matias (56) a development miner passed away as a result of the fire incident during which he was separated from his team. Our heartfelt condolences are extended to the family, friends and co-workers of our colleague. This incident is being investigated together with the relevant stakeholders and appropriate support has been provided to his family and children. Twenty-four employees were safely rescued from various refuge bays and brought to surface.

Whilst most of the crews at Driefontein 1 were operational by the beginning of August, the Driefontein 5 crews will only be introduced in a phased manner once gasses from the fire have reduced to normal levels and the area is safe to operate in. All workplaces on the 11-raise line have been suspended as a result of the fire and current estimates are that this incident will result in production at D1 and D5 being around 900kg (29,000oz) lower than originally planned.

In a second incident, on 30 July 2023 during a standard safety trial run of the conveyance system at Kloof 4 shaft conducted prior to hoisting employees up the shaft, infrastructure damage occurred when the ascending counterweight to the conveyance encountered an unknown obstruction in the shaft, resulting in a number of ballast plates falling down the shaft. While no injuries occurred as a result of the incident, access via the shaft to underground levels between 39 and 46 levels has been restricted due to damage to the shaft infrastructure. The full impact of the increased seismicity at Kloof 4, combined with constraints on cooling infrastructure and the shaft repairs required to resume operations at 4 shaft is being assessed.

The Burnstone project

The Burnstone project, which was affected by the industrial action during H1 2022, was further impacted by the tragic incident in April 2023, which delayed the completion of the rock handling system by around four months. The Burnstone project is now 59% complete against a budget of 64% as a result of these delays, with the timeline to steady state production delayed from December 2025 to August 2026. The mill refurbishment contract has been awarded and surface infrastructure is advancing. At the end of H1 2023, there were 740 people on site. Project capital guidance has been reduced from R1.95 billion (US$73 million) for 2023 to R1.6 billion (US$89 million) with R819 million (US$45 million) spent in H1 2023.

European region

Sandouville nickel refinery

The Sandouville nickel refinery produced 2,705 tonnes (H1 2022: 3,499 tonnes) of nickel cathode and 788 tonnes of nickel salts for H1 2023 (H1 2022: 1,066 tonnes). Previously reported operational issues at the cathode unit continued during H1 2023, impacting production. Repairs were largely completed during H1 2023, with 50 out of 58 cathode cells operational by the end the period and operational stability and nickel recoveries improving. Further improvements in the operational performance are expected during H2 2023, should this stability be maintained. Production was also impacted by a shortage of key inputs such as carbonates, and nationwide strikes, resulting in 50 cumulative days of lost production. The scheduled annual production shutdown has been scheduled in October 2023 and has been taken into account in estimating H2 2023 production volumes.

The period was also impacted by consistently high input costs since the Russian invasion of Ukraine. Whilst input prices were lower by the end of H1 2023, they still haven’t returned to pre-conflict levels. The nickel-equivalent sustaining cost in H1 2023 was 25% higher year-on-year at US$37,486/tNi (R682,628/tNi) mainly as a result of lower production, above inflation input costs, particularly electricity and gas prices, and higher sustaining capital expenditure on plant maintenance and de-bottlenecking in order to achieve plant stability. This was offset by higher by-product credits of US$6 million (R110 million).

New management appointments during the period have already delivered positive outcomes, with a detailed optimisation study to improve plant performance is underway and completion expected before year-end and will be the basis for a decision on the viability of the refinery in its current product mix. Studies on PGM autocatalyst recycling, battery grade nickel sulphate and battery metals recycling projects, which were the basis for the acquisition of the Sandouville assets, are also scheduled to progress to the next stages before the end of 2023.

The 13% year-on-year decline of the nickel-equivalent average basket price in H1 2023 to US$26,888/tNi (R489,635/tNi) led to a €5 million (R95 million) write down of nickel inventory in H1 2023. In addition, spot cathode premiums have softened since the beginning of the year. The H1 2023 adjusted EBITDA loss was US$35 million (627 million).

Keliber lithium project

The construction of the Keliber lithium refinery commenced in Kokkola, Finland in March 2023.

Sibanye-Stillwater Operating and financial results | Six months ended 30 June 2023 11

Sibanye-Stillwater received the environmental permit for the Rapasaari mine and Päiväneva concentrator from the Regional State Administrative Agency for Western and Inland Finland (AVI), as announced on 6 February 2023. After assessing the 144 permit conditions, submission was made to the Vaasa Administrative Court to request changes to and/or clarification to six of the permit conditions. We also continue to engage and provide information to the court process at Vaasa Administrative Court after two other external appeals were lodged.

As announced on 25 April 2023, the Finnish Minerals Group, which represents and manages the Finnish State’s mining industry investments, confirmed its support for the project, increasing its holding in the Keliber lithium project from 14% to 20% by subscribing for €54 million of the €104 million rights issue.

Key developments in H1 2023

•The commencement of the earthworks for the Keliber lithium refinery (first phase of the Keliber lithium project) on 7 March 2023 with the concrete casting ceremony on 11 May 2023

•The earthworks, foundation and steel frame erection activities are progressing well. To date, several procurement contracts have been signed

•Negotiations to advance the debt financing for the remaining project capital is underway, post the successful conclusion of the €104 million rights issue in April 2023

•Recruitment has proceeded according to plan - with employee headcount reaching 60 people

•About 100 people on site including two main contractors. The preparations for training of the production personnel are ongoing, together with local educational institutes and key systems suppliers

•Exploration drilling progressed well with a total of 77 holes and 17,773 meters drilled at the key exploration target areas during H1 2023, delivering promising results. Regional lithium exploration, including seasonal boulder mapping and till sampling, commenced in June 2023

•Project capital expenditure estimate for the project remains unchanged at €588 million (R11.2 billion). Capital expenditure spent in H1 2023 was €65 million (R1.3 billion) with guidance for 2023 unchanged at €230 million (R4.5 billion)*

* The guidance has been translated where relevant at an average exchange rate of R18.00/US$ and R19.50/€

Australian region

New Century zinc retreatment operation.