FALSE2024FY0001783180http://fasb.org/us-gaap/2024#OtherAssetsCurrent http://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#OtherAssetsCurrent http://fasb.org/us-gaap/2024#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#CostOfGoodsAndServicesSoldhttp://fasb.org/us-gaap/2024#CostOfGoodsAndServicesSoldhttp://fasb.org/us-gaap/2024#CostOfGoodsAndServicesSoldhttp://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2024#SellingGeneralAndAdministrativeExpensehttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesCurrent http://fasb.org/us-gaap/2024#OtherLiabilitiesNoncurrentiso4217:USDxbrli:sharesiso4217:USDxbrli:sharescarr:segmentxbrli:purecarr:countrycarr:trancheiso4217:EURiso4217:JPYcarr:affiliatecarr:lawsuitcarr:settlement00017831802024-01-012024-12-310001783180us-gaap:CommonStockMember2024-01-012024-12-310001783180carr:SeniorNotes4125Due2028Member2024-01-012024-12-310001783180carr:SeniorNotes4500Due2032Member2024-01-012024-12-3100017831802024-06-3000017831802025-01-310001783180us-gaap:ProductMember2024-01-012024-12-310001783180us-gaap:ProductMember2023-01-012023-12-310001783180us-gaap:ProductMember2022-01-012022-12-310001783180us-gaap:ServiceMember2024-01-012024-12-310001783180us-gaap:ServiceMember2023-01-012023-12-310001783180us-gaap:ServiceMember2022-01-012022-12-3100017831802023-01-012023-12-3100017831802022-01-012022-12-3100017831802024-12-3100017831802023-12-310001783180us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001783180us-gaap:CommonStockMember2021-12-310001783180us-gaap:TreasuryStockCommonMember2021-12-310001783180us-gaap:AdditionalPaidInCapitalMember2021-12-310001783180us-gaap:RetainedEarningsMember2021-12-310001783180us-gaap:NoncontrollingInterestMember2021-12-3100017831802021-12-310001783180us-gaap:RetainedEarningsMember2022-01-012022-12-310001783180us-gaap:NoncontrollingInterestMember2022-01-012022-12-310001783180us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-12-310001783180us-gaap:AdditionalPaidInCapitalMember2022-01-012022-12-310001783180us-gaap:TreasuryStockCommonMember2022-01-012022-12-310001783180us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001783180us-gaap:CommonStockMember2022-12-310001783180us-gaap:TreasuryStockCommonMember2022-12-310001783180us-gaap:AdditionalPaidInCapitalMember2022-12-310001783180us-gaap:RetainedEarningsMember2022-12-310001783180us-gaap:NoncontrollingInterestMember2022-12-3100017831802022-12-310001783180us-gaap:RetainedEarningsMember2023-01-012023-12-310001783180us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001783180us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-12-310001783180us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001783180us-gaap:TreasuryStockCommonMember2023-01-012023-12-310001783180us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310001783180us-gaap:CommonStockMember2023-12-310001783180us-gaap:TreasuryStockCommonMember2023-12-310001783180us-gaap:AdditionalPaidInCapitalMember2023-12-310001783180us-gaap:RetainedEarningsMember2023-12-310001783180us-gaap:NoncontrollingInterestMember2023-12-310001783180us-gaap:RetainedEarningsMember2024-01-012024-12-310001783180us-gaap:NoncontrollingInterestMember2024-01-012024-12-310001783180us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-12-310001783180us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001783180us-gaap:TreasuryStockCommonMember2024-01-012024-12-310001783180us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-12-310001783180us-gaap:CommonStockMember2024-12-310001783180us-gaap:TreasuryStockCommonMember2024-12-310001783180us-gaap:AdditionalPaidInCapitalMember2024-12-310001783180us-gaap:RetainedEarningsMember2024-12-310001783180us-gaap:NoncontrollingInterestMember2024-12-310001783180carr:ToshibaCarrierCorporationMembercarr:ToshibaCarrierCorporationMembercarr:ToshibaCorporationMember2022-08-010001783180carr:ChubbFireAndSecurityMemberus-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembercarr:FireAndSecuritySegmentMember2021-07-260001783180us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembercarr:ChubbFireAndSecurityMember2022-01-030001783180us-gaap:DisposalGroupDisposedOfBySaleNotDiscontinuedOperationsMembercarr:ChubbFireAndSecurityMember2022-01-012022-12-3100017831802020-04-032020-04-030001783180us-gaap:CustomerRelationshipsMembersrt:MinimumMember2024-12-310001783180us-gaap:CustomerRelationshipsMembersrt:MaximumMember2024-12-310001783180carr:PatentsAndTrademarksMembersrt:MinimumMember2024-12-310001783180carr:PatentsAndTrademarksMembersrt:MaximumMember2024-12-310001783180carr:MonitoringLinesMembersrt:MinimumMember2024-12-310001783180carr:MonitoringLinesMembersrt:MaximumMember2024-12-310001783180carr:ServicePortfoliosAndOtherMembersrt:MinimumMember2024-12-310001783180carr:ServicePortfoliosAndOtherMembersrt:MaximumMember2024-12-310001783180us-gaap:LandMember2024-12-310001783180us-gaap:LandMember2023-12-310001783180srt:MinimumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310001783180srt:MaximumMemberus-gaap:BuildingAndBuildingImprovementsMember2024-12-310001783180us-gaap:BuildingAndBuildingImprovementsMember2024-12-310001783180us-gaap:BuildingAndBuildingImprovementsMember2023-12-310001783180srt:MinimumMemberus-gaap:MachineryAndEquipmentMember2024-12-310001783180srt:MaximumMemberus-gaap:MachineryAndEquipmentMember2024-12-310001783180us-gaap:MachineryAndEquipmentMember2024-12-310001783180us-gaap:MachineryAndEquipmentMember2023-12-310001783180srt:MinimumMembercarr:RentalAssetsMember2024-12-310001783180srt:MaximumMembercarr:RentalAssetsMember2024-12-310001783180carr:RentalAssetsMember2024-12-310001783180carr:RentalAssetsMember2023-12-310001783180us-gaap:PropertyPlantAndEquipmentOtherTypesMember2024-12-310001783180us-gaap:PropertyPlantAndEquipmentOtherTypesMember2023-12-310001783180us-gaap:OperatingSegmentsMembercarr:HVACSegmentMember2022-12-310001783180us-gaap:OperatingSegmentsMembercarr:RefrigerationSegmentMember2022-12-310001783180us-gaap:CorporateNonSegmentMember2022-12-310001783180us-gaap:OperatingSegmentsMembercarr:HVACSegmentMember2023-01-012023-12-310001783180us-gaap:OperatingSegmentsMembercarr:RefrigerationSegmentMember2023-01-012023-12-310001783180us-gaap:CorporateNonSegmentMember2023-01-012023-12-310001783180us-gaap:OperatingSegmentsMembercarr:HVACSegmentMember2023-12-310001783180us-gaap:OperatingSegmentsMembercarr:RefrigerationSegmentMember2023-12-310001783180us-gaap:CorporateNonSegmentMember2023-12-310001783180us-gaap:OperatingSegmentsMembercarr:HVACSegmentMember2024-01-012024-12-310001783180us-gaap:OperatingSegmentsMembercarr:RefrigerationSegmentMember2024-01-012024-12-310001783180us-gaap:CorporateNonSegmentMember2024-01-012024-12-310001783180us-gaap:OperatingSegmentsMembercarr:HVACSegmentMember2024-12-310001783180us-gaap:OperatingSegmentsMembercarr:RefrigerationSegmentMember2024-12-310001783180us-gaap:CorporateNonSegmentMember2024-12-310001783180us-gaap:CustomerRelationshipsMember2024-12-310001783180us-gaap:CustomerRelationshipsMember2023-12-310001783180carr:PatentsAndTrademarksMember2024-12-310001783180carr:PatentsAndTrademarksMember2023-12-310001783180carr:ServicePortfoliosAndOtherMember2024-12-310001783180carr:ServicePortfoliosAndOtherMember2023-12-310001783180carr:SeniorNotes2242Due2025Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes2242Due2025Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes4.375DueMemberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes4.375DueMemberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes5.800Due2025Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes5.800Due2025Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes2493Due2027Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes2493Due2027Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes4125Due2028Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes4125Due2028Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes2722Due2030Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes2722Due2030Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes2700Due2031Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes2700Due2031Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes4500Due2032Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes4500Due2032Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes5.900DueMemberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes5.900DueMemberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes3.625Due2037Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes3.625Due2037Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes3377Due2040Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes3377Due2040Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes3577Due2050Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes3577Due2050Memberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:SeniorNotes6.200Due20541Memberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:SeniorNotes6.200Due20541Memberus-gaap:UnsecuredDebtMember2023-12-310001783180us-gaap:UnsecuredDebtMember2024-12-310001783180us-gaap:UnsecuredDebtMember2023-12-310001783180carr:TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2024-12-310001783180carr:TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2023-12-310001783180carr:OtherDebtMember2024-12-310001783180carr:OtherDebtMember2023-12-310001783180carr:VCSBusinessMember2024-01-022024-01-020001783180carr:SeniorNotesUSDDenominatedIssuedNovember2023Memberus-gaap:UnsecuredDebtMember2023-11-300001783180carr:SeniorNotes5.800Due2025Memberus-gaap:UnsecuredDebtMember2023-11-300001783180carr:SeniorNotes5.900Due2034Memberus-gaap:UnsecuredDebtMember2023-11-300001783180carr:SeniorNotes6.200Due2054Memberus-gaap:UnsecuredDebtMember2023-11-300001783180carr:SeniorNotesEuroDenominatedIssuedNovember2023Memberus-gaap:UnsecuredDebtMember2023-11-300001783180carr:SeniorNotes4.375Due2025Memberus-gaap:UnsecuredDebtMember2023-11-300001783180carr:SeniorNotes4125Due2028Memberus-gaap:UnsecuredDebtMember2023-11-300001783180carr:SeniorNotes4500Due2032Memberus-gaap:UnsecuredDebtMember2023-11-300001783180carr:TermLoanMemberus-gaap:UnsecuredDebtMember2023-11-300001783180carr:SeniorNotes5.800Due2025Memberus-gaap:UnsecuredDebtMember2024-06-300001783180carr:SeniorNotes5.800Due2025Memberus-gaap:UnsecuredDebtMember2024-06-012024-06-300001783180carr:SeniorNotes3.625Due2037Memberus-gaap:UnsecuredDebtMember2024-11-300001783180carr:SeniorNotes4.375Due2025Memberus-gaap:UnsecuredDebtMember2024-11-012024-11-300001783180carr:SeniorNotes4.375Due2025Memberus-gaap:UnsecuredDebtMember2024-11-300001783180carr:BridgeTermLoanFacilityMemberus-gaap:UnsecuredDebtMember2023-04-250001783180carr:BridgeTermLoanFacilityMemberus-gaap:BridgeLoanMemberus-gaap:SecuredOvernightFinancingRateSofrMember2023-04-252023-04-250001783180carr:BridgeTermLoanFacilityMemberus-gaap:BridgeLoanMemberus-gaap:UnsecuredDebtMember2023-04-250001783180carr:BridgeTermLoanFacilityMemberus-gaap:BridgeLoanMemberus-gaap:UnsecuredDebtMember2023-04-252023-04-250001783180carr:BridgeTermLoanFacilityMemberus-gaap:BridgeLoanMemberus-gaap:UnsecuredDebtMember2024-01-022024-01-020001783180carr:BridgeTermLoanFacilityEuroDenominatedTranche1Memberus-gaap:BridgeLoanMemberus-gaap:UnsecuredDebtMember2024-01-020001783180carr:BridgeTermLoanFacilityUSDDenominatedTrancheMemberus-gaap:BridgeLoanMemberus-gaap:UnsecuredDebtMember2024-01-020001783180carr:TheCreditAgreementMembercarr:DelayedDrawFacilityMemberus-gaap:LineOfCreditMember2023-05-190001783180carr:BridgeTermLoanFacilityEuroDenominatedTranche1Membercarr:DelayedDrawFacilityMemberus-gaap:LineOfCreditMember2023-05-192023-05-190001783180carr:BridgeTermLoanFacilityEuroDenominatedTranche1Membercarr:DelayedDrawFacilityMemberus-gaap:LineOfCreditMember2023-05-190001783180carr:BridgeTermLoanFacilityEuroDenominatedTranche2Membercarr:DelayedDrawFacilityMemberus-gaap:LineOfCreditMember2023-05-192023-05-190001783180carr:BridgeTermLoanFacilityEuroDenominatedTranche2Membercarr:DelayedDrawFacilityMemberus-gaap:LineOfCreditMember2023-05-190001783180carr:TheCreditAgreementMembercarr:DelayedDrawFacilityMemberus-gaap:LineOfCreditMemberus-gaap:SecuredOvernightFinancingRateSofrMember2023-05-192023-05-190001783180carr:DelayedDrawFacilityMemberus-gaap:LineOfCreditMember2023-05-190001783180carr:A364DayRevolverMemberus-gaap:UnsecuredDebtMember2024-05-172024-05-170001783180carr:A364DayRevolverMemberus-gaap:UnsecuredDebtMember2024-05-170001783180carr:A364DayRevolverMemberus-gaap:UnsecuredDebtMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-05-172024-05-170001783180carr:TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2022-07-152022-07-150001783180carr:TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2022-07-150001783180carr:TermLoanFacilityMemberus-gaap:UnsecuredDebtMembercarr:TokyoTermRiskFreeRateMember2022-07-152022-07-150001783180carr:TermLoanFacilityMemberus-gaap:UnsecuredDebtMember2022-07-252022-07-250001783180us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-200001783180us-gaap:RevolvingCreditFacilityMemberus-gaap:SecuredOvernightFinancingRateSofrMember2024-12-202024-12-200001783180us-gaap:RevolvingCreditFacilityMemberus-gaap:LineOfCreditMember2024-12-310001783180us-gaap:CommercialPaperMemberus-gaap:LineOfCreditMember2024-12-310001783180carr:ProjectFinancingArrangementsMembercarr:OtherDebtMember2024-01-012024-12-310001783180carr:ProjectFinancingArrangementsMembercarr:OtherDebtMember2023-01-012023-12-310001783180us-gaap:UnsecuredDebtMember2024-07-310001783180carr:SeniorNotes5.900Due2034Memberus-gaap:UnsecuredDebtMember2024-07-310001783180carr:SeniorNotes6.200Due2054Memberus-gaap:UnsecuredDebtMember2024-07-310001783180carr:SeniorNotes3577Due2050Memberus-gaap:UnsecuredDebtMember2024-07-310001783180us-gaap:UnsecuredDebtMember2024-07-012024-07-310001783180srt:WeightedAverageMember2024-12-310001783180carr:VCSBusinessMemberus-gaap:ForeignExchangeForwardMember2023-04-250001783180carr:VCSBusinessMemberus-gaap:ForeignExchangeForwardMember2023-01-012023-12-310001783180carr:VCSBusinessMemberus-gaap:ForeignExchangeForwardMember2024-01-022024-01-020001783180carr:VCSBusinessMemberus-gaap:InterestRateSwapMember2023-12-310001783180carr:VCSBusinessMemberus-gaap:InterestRateSwapMember2023-11-012023-11-300001783180carr:VCSBusinessMemberus-gaap:InterestRateSwapMember2024-12-310001783180us-gaap:CurrencySwapMember2024-12-310001783180us-gaap:FairValueMeasurementsRecurringMember2024-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001783180us-gaap:FairValueMeasurementsRecurringMember2023-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001783180us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:UnsecuredDebtMember2024-12-310001783180us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:UnsecuredDebtMember2024-12-310001783180us-gaap:CarryingReportedAmountFairValueDisclosureMemberus-gaap:UnsecuredDebtMember2023-12-310001783180us-gaap:EstimateOfFairValueFairValueDisclosureMemberus-gaap:UnsecuredDebtMember2023-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2023-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2023-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2024-01-012024-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-01-012024-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-01-012024-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetPriorServiceCostCreditMember2024-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentNetUnamortizedGainLossMember2024-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2024-12-310001783180us-gaap:SegmentContinuingOperationsMember2024-01-012024-12-310001783180us-gaap:SegmentContinuingOperationsMember2023-01-012023-12-310001783180us-gaap:SegmentContinuingOperationsMember2022-01-012022-12-310001783180us-gaap:SegmentDiscontinuedOperationsMember2024-01-012024-12-310001783180us-gaap:SegmentDiscontinuedOperationsMember2023-01-012023-12-310001783180us-gaap:SegmentDiscontinuedOperationsMember2022-01-012022-12-310001783180carr:DefinedBenefitPlanGrowthSeekingAssetsMember2024-12-310001783180carr:DefinedBenefitPlanIncomeGeneratingAndHedgingAssetsMember2024-12-310001783180us-gaap:FairValueInputsLevel1Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquitiesMember2024-12-310001783180us-gaap:FairValueInputsLevel2Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquitiesMember2024-12-310001783180us-gaap:FairValueInputsLevel3Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquitiesMember2024-12-310001783180carr:DefinedBenefitPlanEquitySecuritiesGlobalEquitiesMember2024-12-310001783180us-gaap:FairValueInputsLevel1Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2024-12-310001783180us-gaap:FairValueInputsLevel2Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2024-12-310001783180us-gaap:FairValueInputsLevel3Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2024-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2024-12-310001783180carr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2024-12-310001783180us-gaap:FairValueInputsLevel1Membercarr:FixedIncomeSecuritiesGovernmentsMember2024-12-310001783180us-gaap:FairValueInputsLevel2Membercarr:FixedIncomeSecuritiesGovernmentsMember2024-12-310001783180us-gaap:FairValueInputsLevel3Membercarr:FixedIncomeSecuritiesGovernmentsMember2024-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercarr:FixedIncomeSecuritiesGovernmentsMember2024-12-310001783180carr:FixedIncomeSecuritiesGovernmentsMember2024-12-310001783180us-gaap:FairValueInputsLevel1Membercarr:FixedIncomeSecuritiesCorporateBondsMember2024-12-310001783180us-gaap:FairValueInputsLevel2Membercarr:FixedIncomeSecuritiesCorporateBondsMember2024-12-310001783180us-gaap:FairValueInputsLevel3Membercarr:FixedIncomeSecuritiesCorporateBondsMember2024-12-310001783180carr:FixedIncomeSecuritiesCorporateBondsMember2024-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2024-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMember2024-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2024-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeSecuritiesMember2024-12-310001783180us-gaap:FixedIncomeSecuritiesMember2024-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanRealEstateMember2024-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanRealEstateMember2024-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanRealEstateMember2024-12-310001783180us-gaap:DefinedBenefitPlanRealEstateMember2024-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:OtherInvestmentsMember2024-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:OtherInvestmentsMember2024-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:OtherInvestmentsMember2024-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:OtherInvestmentsMember2024-12-310001783180us-gaap:OtherInvestmentsMember2024-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310001783180us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2024-12-310001783180us-gaap:FairValueInputsLevel1Member2024-12-310001783180us-gaap:FairValueInputsLevel2Member2024-12-310001783180us-gaap:FairValueInputsLevel3Member2024-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2024-12-310001783180carr:DefinedBenefitPlanAssetsExcludingOtherAssetsAndLiabilitiesMember2024-12-310001783180carr:OtherAssetsAndLiabilitiesMember2024-12-310001783180us-gaap:FairValueInputsLevel1Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquitiesMember2023-12-310001783180us-gaap:FairValueInputsLevel2Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquitiesMember2023-12-310001783180us-gaap:FairValueInputsLevel3Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquitiesMember2023-12-310001783180carr:DefinedBenefitPlanEquitySecuritiesGlobalEquitiesMember2023-12-310001783180us-gaap:FairValueInputsLevel1Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2023-12-310001783180us-gaap:FairValueInputsLevel2Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2023-12-310001783180us-gaap:FairValueInputsLevel3Membercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2023-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercarr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2023-12-310001783180carr:DefinedBenefitPlanEquitySecuritiesGlobalEquityFundsMember2023-12-310001783180us-gaap:FairValueInputsLevel1Membercarr:FixedIncomeSecuritiesGovernmentsMember2023-12-310001783180us-gaap:FairValueInputsLevel2Membercarr:FixedIncomeSecuritiesGovernmentsMember2023-12-310001783180us-gaap:FairValueInputsLevel3Membercarr:FixedIncomeSecuritiesGovernmentsMember2023-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMembercarr:FixedIncomeSecuritiesGovernmentsMember2023-12-310001783180carr:FixedIncomeSecuritiesGovernmentsMember2023-12-310001783180us-gaap:FairValueInputsLevel1Membercarr:FixedIncomeSecuritiesCorporateBondsMember2023-12-310001783180us-gaap:FairValueInputsLevel2Membercarr:FixedIncomeSecuritiesCorporateBondsMember2023-12-310001783180us-gaap:FairValueInputsLevel3Membercarr:FixedIncomeSecuritiesCorporateBondsMember2023-12-310001783180carr:FixedIncomeSecuritiesCorporateBondsMember2023-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:FixedIncomeSecuritiesMember2023-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:FixedIncomeSecuritiesMember2023-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:FixedIncomeSecuritiesMember2023-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:FixedIncomeSecuritiesMember2023-12-310001783180us-gaap:FixedIncomeSecuritiesMember2023-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanRealEstateMember2023-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanRealEstateMember2023-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanRealEstateMember2023-12-310001783180us-gaap:DefinedBenefitPlanRealEstateMember2023-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:OtherInvestmentsMember2023-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:OtherInvestmentsMember2023-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:OtherInvestmentsMember2023-12-310001783180us-gaap:OtherInvestmentsMember2023-12-310001783180us-gaap:FairValueInputsLevel1Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001783180us-gaap:FairValueInputsLevel2Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001783180us-gaap:FairValueInputsLevel3Memberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMemberus-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001783180us-gaap:DefinedBenefitPlanCashAndCashEquivalentsMember2023-12-310001783180us-gaap:FairValueInputsLevel1Member2023-12-310001783180us-gaap:FairValueInputsLevel2Member2023-12-310001783180us-gaap:FairValueInputsLevel3Member2023-12-310001783180us-gaap:FairValueMeasuredAtNetAssetValuePerShareMember2023-12-310001783180carr:DefinedBenefitPlanAssetsExcludingOtherAssetsAndLiabilitiesMember2023-12-310001783180carr:OtherAssetsAndLiabilitiesMember2023-12-310001783180carr:OtherFundsMember2024-01-012024-12-310001783180carr:OtherFundsMember2023-01-012023-12-3100017831802021-02-2800017831802024-10-3100017831802021-02-012024-12-310001783180us-gaap:AccumulatedTranslationAdjustmentMember2021-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2021-12-310001783180us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001783180us-gaap:AccumulatedTranslationAdjustmentMember2022-01-012022-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-01-012022-12-310001783180us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001783180us-gaap:AccumulatedTranslationAdjustmentMember2022-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2022-12-310001783180us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001783180us-gaap:AccumulatedTranslationAdjustmentMember2023-01-012023-12-310001783180us-gaap:AccumulatedDefinedBenefitPlansAdjustmentMember2023-01-012023-12-310001783180us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-12-310001783180us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310001783180us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-12-310001783180us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-12-310001783180us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-01-012024-12-310001783180us-gaap:AccumulatedTranslationAdjustmentMember2024-12-310001783180us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2024-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ProductMembercarr:HVACSegmentMember2024-01-012024-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ProductMembercarr:HVACSegmentMember2023-01-012023-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ProductMembercarr:HVACSegmentMember2022-01-012022-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembercarr:HVACSegmentMember2024-01-012024-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembercarr:HVACSegmentMember2023-01-012023-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembercarr:HVACSegmentMember2022-01-012022-12-310001783180us-gaap:OperatingSegmentsMembercarr:HVACSegmentMember2022-01-012022-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ProductMembercarr:RefrigerationSegmentMember2024-01-012024-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ProductMembercarr:RefrigerationSegmentMember2023-01-012023-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ProductMembercarr:RefrigerationSegmentMember2022-01-012022-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembercarr:RefrigerationSegmentMember2024-01-012024-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembercarr:RefrigerationSegmentMember2023-01-012023-12-310001783180us-gaap:OperatingSegmentsMemberus-gaap:ServiceMembercarr:RefrigerationSegmentMember2022-01-012022-12-310001783180us-gaap:OperatingSegmentsMembercarr:RefrigerationSegmentMember2022-01-012022-12-310001783180us-gaap:OperatingSegmentsMember2024-01-012024-12-310001783180us-gaap:OperatingSegmentsMember2023-01-012023-12-310001783180us-gaap:OperatingSegmentsMember2022-01-012022-12-310001783180us-gaap:IntersegmentEliminationMember2024-01-012024-12-310001783180us-gaap:IntersegmentEliminationMember2023-01-012023-12-310001783180us-gaap:IntersegmentEliminationMember2022-01-012022-12-3100017831802025-01-012024-12-310001783180us-gaap:EmployeeStockOptionMember2024-01-012024-12-310001783180carr:ShareBasedPaymentArrangementStockOptionsAndStockAppreciationRightsMember2024-01-012024-12-310001783180carr:ShareBasedPaymentArrangementStockOptionsAndStockAppreciationRightsMember2023-01-012023-12-310001783180carr:ShareBasedPaymentArrangementStockOptionsAndStockAppreciationRightsMember2022-01-012022-12-310001783180carr:ShareBasedPaymentArrangementStockOptionsAndStockAppreciationRightsMembersrt:MinimumMember2024-01-012024-12-310001783180carr:ShareBasedPaymentArrangementStockOptionsAndStockAppreciationRightsMembersrt:MaximumMember2024-01-012024-12-310001783180carr:ShareBasedPaymentArrangementStockOptionsAndStockAppreciationRightsMember2021-12-310001783180carr:ShareBasedPaymentArrangementStockOptionsAndStockAppreciationRightsMember2022-12-310001783180carr:ShareBasedPaymentArrangementStockOptionsAndStockAppreciationRightsMember2023-12-310001783180carr:ShareBasedPaymentArrangementStockOptionsAndStockAppreciationRightsMember2024-12-310001783180us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001783180us-gaap:RestrictedStockMember2021-12-310001783180us-gaap:RestrictedStockMember2022-01-012022-12-310001783180us-gaap:RestrictedStockMember2022-12-310001783180us-gaap:RestrictedStockMember2023-01-012023-12-310001783180us-gaap:RestrictedStockMember2023-12-310001783180us-gaap:RestrictedStockMember2024-01-012024-12-310001783180us-gaap:RestrictedStockMember2024-12-310001783180us-gaap:PerformanceSharesMember2024-01-012024-12-310001783180us-gaap:PerformanceSharesMember2021-12-310001783180us-gaap:PerformanceSharesMember2022-01-012022-12-310001783180us-gaap:PerformanceSharesMember2022-12-310001783180us-gaap:PerformanceSharesMember2023-01-012023-12-310001783180us-gaap:PerformanceSharesMember2023-12-310001783180us-gaap:PerformanceSharesMember2024-12-310001783180us-gaap:CorporateNonSegmentMember2022-01-012022-12-310001783180us-gaap:CostOfSalesMember2022-01-012022-12-310001783180us-gaap:CostOfSalesMember2023-01-012023-12-310001783180us-gaap:CostOfSalesMember2024-01-012024-12-310001783180us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-12-310001783180us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-12-310001783180us-gaap:SellingGeneralAndAdministrativeExpensesMember2024-01-012024-12-310001783180carr:VCSBusinessMemberus-gaap:ForeignExchangeForwardMember2024-01-012024-12-310001783180carr:VCSBusinessMemberus-gaap:ForeignExchangeForwardMember2022-01-012022-12-310001783180carr:ToshibaCarrierCorporationMember2023-01-012023-12-310001783180us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2021-12-310001783180us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-01-012022-12-310001783180us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2022-12-310001783180us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-01-012023-12-310001783180us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2023-12-310001783180us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-01-012024-12-310001783180us-gaap:ValuationAllowanceOfDeferredTaxAssetsMember2024-12-310001783180carr:TaxYears2025Through2029Member2024-12-310001783180carr:TaxYears2030Through2034Member2024-12-310001783180carr:TaxYears2035Through2044Member2024-12-310001783180carr:IndefiniteTaxYearsMember2024-12-310001783180us-gaap:SwissFederalTaxAdministrationFTAMember2023-12-310001783180us-gaap:SwissFederalTaxAdministrationFTAMember2023-01-012023-12-3100017831802024-01-012024-03-3100017831802024-10-012024-12-310001783180srt:MinimumMember2024-12-310001783180srt:MaximumMember2024-12-310001783180us-gaap:SeriesOfIndividuallyImmaterialBusinessAcquisitionsMember2024-01-012024-12-310001783180us-gaap:BridgeLoanMemberus-gaap:UnsecuredDebtMember2024-01-022024-01-020001783180carr:VCSBusinessMember2024-01-020001783180carr:VCSBusinessMember2024-01-022024-12-310001783180carr:VCSBusinessMember2024-12-310001783180carr:VCSBusinessMemberus-gaap:CustomerRelationshipsMember2024-01-022024-01-020001783180carr:VCSBusinessMemberus-gaap:TechnologyBasedIntangibleAssetsMembersrt:MinimumMember2024-01-022024-01-020001783180carr:VCSBusinessMemberus-gaap:TechnologyBasedIntangibleAssetsMembersrt:MaximumMember2024-01-022024-01-020001783180carr:VCSBusinessMemberus-gaap:TechnologyBasedIntangibleAssetsMember2024-01-022024-01-020001783180carr:VCSBusinessMemberus-gaap:TrademarksMember2024-01-022024-01-020001783180carr:VCSBusinessMembercarr:BacklogMember2024-01-022024-01-020001783180carr:VCSBusinessMemberus-gaap:OtherIntangibleAssetsMember2024-01-022024-01-020001783180carr:VCSBusinessMember2024-01-012024-12-310001783180carr:VCSBusinessMember2023-01-012023-12-310001783180carr:ToshibaCarrierCorporationMember2022-02-062022-02-060001783180carr:ToshibaCarrierCorporationMember2022-08-010001783180carr:ToshibaCarrierCorporationMember2022-01-012022-12-310001783180carr:ToshibaCarrierCorporationMember2023-12-310001783180us-gaap:DiscontinuedOperationsHeldforsaleMembercarr:FireSecurityBusinessesMember2024-01-012024-12-310001783180us-gaap:DiscontinuedOperationsHeldforsaleMembercarr:FireSecurityBusinessesMember2023-01-012023-12-310001783180us-gaap:DiscontinuedOperationsHeldforsaleMembercarr:FireSecurityBusinessesMember2022-01-012022-12-310001783180us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMembercarr:CommercialRefrigerationMember2023-12-310001783180us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMembercarr:AccessSolutionsMember2023-12-310001783180us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMembercarr:IndustrialFireMember2023-12-310001783180us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMembercarr:CommercialAndResidentialFireBusinessMember2023-12-310001783180us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMember2023-12-310001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:AccessSolutionsMember2024-06-022024-06-020001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:IndustrialFireToSentinelCapitalPartnersMember2024-07-012024-07-010001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:AccessSolutionsMember2024-07-012024-07-010001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:CommercialRefrigerationBusinessMember2024-10-012024-10-010001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:AccessSolutionsMember2024-10-012024-10-010001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:CommercialRefrigerationBusinessMember2024-12-022024-12-020001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:AccessSolutionsMember2024-12-022024-12-020001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:AccessSolutionsMember2024-06-020001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:IndustrialFireMember2024-07-010001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:CommercialRefrigerationMember2024-10-010001783180us-gaap:DiscontinuedOperationsDisposedOfBySaleMembercarr:CommercialAndResidentialFireBusinessMember2024-12-020001783180us-gaap:OperatingSegmentsMember2024-12-310001783180us-gaap:OperatingSegmentsMember2023-12-310001783180us-gaap:IntersegmentEliminationMember2024-12-310001783180us-gaap:IntersegmentEliminationMember2023-12-310001783180country:US2024-01-012024-12-310001783180country:US2023-01-012023-12-310001783180country:US2022-01-012022-12-310001783180country:US2024-12-310001783180country:US2023-12-310001783180srt:EuropeMember2024-01-012024-12-310001783180srt:EuropeMember2023-01-012023-12-310001783180srt:EuropeMember2022-01-012022-12-310001783180srt:EuropeMember2024-12-310001783180srt:EuropeMember2023-12-310001783180srt:AsiaPacificMember2024-01-012024-12-310001783180srt:AsiaPacificMember2023-01-012023-12-310001783180srt:AsiaPacificMember2022-01-012022-12-310001783180srt:AsiaPacificMember2024-12-310001783180srt:AsiaPacificMember2023-12-310001783180carr:OtherGeographicalRegionMember2024-01-012024-12-310001783180carr:OtherGeographicalRegionMember2023-01-012023-12-310001783180carr:OtherGeographicalRegionMember2022-01-012022-12-310001783180carr:OtherGeographicalRegionMember2024-12-310001783180carr:OtherGeographicalRegionMember2023-12-310001783180carr:HVACSegmentMember2024-12-310001783180us-gaap:RelatedPartyMemberus-gaap:ProductMember2024-01-012024-12-310001783180us-gaap:RelatedPartyMemberus-gaap:ProductMember2023-01-012023-12-310001783180us-gaap:RelatedPartyMemberus-gaap:ProductMember2022-01-012022-12-310001783180us-gaap:RelatedPartyMember2024-12-310001783180us-gaap:RelatedPartyMember2023-12-310001783180us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-12-310001783180us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-12-310001783180us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2024-01-012024-12-310001783180us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2023-01-012023-12-310001783180us-gaap:EquityMethodInvestmentNonconsolidatedInvesteeOrGroupOfInvesteesMember2022-01-012022-12-310001783180carr:AsbestosMattersMember2024-12-310001783180carr:AsbestosMattersMember2023-12-310001783180carr:AqueousFilmFormingFoamMember2024-12-310001783180carr:AqueousFilmFormingFoamMemberus-gaap:PendingLitigationMember2024-10-012024-10-310001783180carr:AqueousFilmFormingFoamMemberus-gaap:PendingLitigationMember2024-12-310001783180carr:AqueousFilmFormingFoamMemberus-gaap:PendingLitigationMember2024-12-312024-12-310001783180carr:KiddeFenwalInc.Memberus-gaap:PendingLitigationMembercarr:AqueousFilmFormingFoamMember2024-12-312024-12-310001783180carr:AqueousFilmFormingFoamMemberus-gaap:PendingLitigationMember2023-05-1400017831802023-05-1400017831802023-05-142023-05-1400017831802024-04-012024-06-3000017831802024-07-012024-09-3000017831802023-01-012023-03-3100017831802023-04-012023-06-3000017831802023-07-012023-09-3000017831802023-10-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________

FORM 10-K

________________________________________________

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Commission file number 001-39220

________________________________________________

CARRIER GLOBAL CORPORATION

(Exact name of registrant as specified in its charter)

________________________________________________

|

|

|

|

|

|

|

|

|

| Delaware |

|

83-4051582 |

| (State or Other Jurisdiction of Incorporation or Organization) |

|

(I.R.S. Employer Identification No.) |

13995 Pasteur Boulevard, Palm Beach Gardens, Florida 33418

(Address of principal executive offices, including zip code)

(561) 365-2000

(Registrant's telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock ($0.01 par value) |

|

CARR |

|

New York Stock Exchange |

| 4.125% Notes due 2028 |

|

CARR28 |

|

New York Stock Exchange |

| 4.500% Notes due 2032 |

|

CARR32 |

|

New York Stock Exchange |

|

|

|

|

|

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☒ No ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒. No ☐.

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

Emerging growth company |

☐ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐.

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The aggregate market value of the voting Common Stock held by non-affiliates of the Registrant as of June 30, 2024, the last business day of the Registrant's most recently completed second fiscal quarter, was approximately $53.2 billion, based on the New York Stock Exchange closing price for such shares on that date. Solely for purposes of this disclosure, shares of Common Stock held by executive officers and directors of the Registrant as of such date have been excluded because such persons may be deemed to be affiliates. This determination of executive officers and directors as affiliates is not necessarily a conclusive determination for any other purpose.

As of January 31, 2025, there were 868,339,902 shares of Common Stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Part III hereof incorporates by reference portions of the Registrant's definitive proxy statement related to its 2025 annual meeting of shareowners.

Index

Carrier Global Corporation and its subsidiaries' names, abbreviations thereof, logos and product and service designators are all either the registered or unregistered trademarks or trade names of Carrier Global Corporation and its subsidiaries. Names, abbreviations of names, logos and products and service designators of other companies are either the registered or unregistered trademarks or trade names of their respective owners. As used herein, the terms "we," "us," "our," "the Company" or "Carrier," unless the context otherwise requires, mean Carrier Global Corporation and its subsidiaries. References to internet websites in this Annual Report on Form 10-K (the "Annual Report") are provided for convenience only. Information available through these websites is not incorporated by reference into this Annual Report.

CAUTIONARY NOTE CONCERNING FACTORS THAT MAY AFFECT FUTURE RESULTS

This Annual Report contains statements which, to the extent they are not statements of historical or present fact, constitute "forward-looking statements" under the securities laws. From time to time, oral or written forward-looking statements may also be included in other information released to the public. These forward-looking statements are intended to provide management’s current expectations or plans for our future operating and financial performance, based on assumptions currently believed to be valid. Forward-looking statements can be identified by the use of words such as "believe," "expect," "expectations," "plans," "strategy," "prospects," "estimate," "project," "target," "anticipate," "will," "should," "see," "guidance," "outlook," "confident," "scenario" and other words of similar meaning in connection with a discussion of future operating or financial performance. Forward-looking statements may include, among other things, statements relating to future sales, earnings, cash flow, results of operations, uses of cash, share repurchases, tax rates and other measures of financial performance or potential future plans, strategies or transactions of Carrier, Carrier's plans with respect to our indebtedness and other statements that are not historical facts. All forward-looking statements involve risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. For those statements, we claim the protection of the safe harbor for forward-looking statements contained in the U.S. Private Securities Litigation Reform Act of 1995. Such risks, uncertainties and other factors include, without limitation:

•the effect of economic conditions in the industries and markets in which Carrier and our businesses operate in the U.S. and globally and any changes therein, including financial market conditions, inflationary cost pressures, fluctuations in commodity prices, interest rates and foreign currency exchange rates, levels of end market demand in construction, the impact of weather conditions, pandemic health issues, natural disasters and the financial condition of our customers and suppliers;

•challenges in the development, production, delivery, support, performance and realization of the anticipated benefits of advanced technologies and new products and services;

•future levels of capital spending and research and development spending;

•future availability of credit and factors that may affect such availability, including credit market conditions and Carrier's capital structure and credit ratings;

•the timing and scope of future repurchases of Carrier's common stock, including market conditions and the level of other investing activities and uses of cash;

•delays and disruption in the delivery of materials and services from suppliers;

•cost reduction efforts and restructuring costs and savings and other consequences thereof;

•new business and investment opportunities;

•the outcome of legal proceedings, investigations and other contingencies;

•the impact of pension plan assumptions on future cash contributions and earnings;

•the impact of the negotiation of collective bargaining agreements and labor disputes;

•the effect of changes in political conditions in the U.S. and other countries in which Carrier and our businesses operate, including the effect of changes in U.S. trade policies, on general market conditions, global trade policies, the imposition of tariffs, and currency exchange rates in the near term and beyond;

•the effect of changes in tax, environmental, regulatory (including among other things import/export) and other laws and regulations in the U.S. and other countries in which we and our businesses operate;

•the ability of Carrier to retain and hire key personnel;

•the scope, nature, impact or timing of acquisition and divestiture activity, such as our acquisition of the VCS Business (as defined below) and our portfolio transformation transactions, including among other things integration of acquired businesses into existing businesses and realization of synergies and opportunities for growth and innovation and incurrence of related costs;

•a determination by the U.S. Internal Revenue Service ("IRS") and other tax authorities that the Distribution (as defined below) or certain related transactions should be treated as taxable transactions; and

•risks associated with current and future indebtedness, as well as our ability to reduce indebtedness and the timing thereof.

This Annual Report includes important information as to risks, uncertainties and other factors that may cause actual results to differ materially from those expressed or implied in the forward-looking statements. See the Notes to the Consolidated Financial Statements in this Annual Report under the heading "Note 23 – Commitments and Contingent Liabilities," the sections entitled "Management's Discussion and Analysis of Financial Condition and Results of Operations" under the headings "Business Overview," "Results of Operations," "Liquidity and Financial Condition," and "Critical Accounting Estimates," and the section entitled "Risk Factors." This Annual Report also includes important information as to these factors in the "Business" section under the headings "General," "Other Matters Relating to Our Business as a Whole," and in the "Legal Proceedings" section. The forward-looking statements speak only as of the date of this report or, in the case of any document incorporated by reference, the date of that document. We undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law. Additional information as to factors that may cause actual results to differ materially from those expressed or implied in the forward-looking statements is disclosed from time to time in our other filings with the United States Securities and Exchange Commission ("SEC").

This Annual Report and our Quarterly Reports on Form 10-Q, Current Reports on Form 8-K and amendments to those reports are available free of charge through the Investors section of our Internet website (http://www.corporate.carrier.com) under the heading "SEC Filings" as soon as reasonably practicable after these reports are electronically filed with, or furnished to, the SEC. In addition, the SEC maintains an Internet website (http://www.sec.gov) containing reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC.

PART I

ITEM 1. BUSINESS

General

Carrier Global Corporation ("we" or "our" or the "Company") is a global leader in intelligent climate and energy solutions with a focus on providing differentiated, digitally-enabled lifecycle solutions to our customers. Our portfolio includes industry-leading brands such as Carrier, Viessmann, Toshiba, Automated Logic and Carrier Transicold that offer innovative heating, ventilating and air conditioning ("HVAC"), refrigeration and cold chain transportation solutions to help make the world safer and more comfortable. We also provide a broad array of related building services, including audit, design, installation, system integration, repair, maintenance and monitoring.

Through our performance-driven culture, we anticipate creating long-term shareowner value by investing strategically to strengthen our product position in homes, buildings and across the cold chain in order to drive profitable growth. We believe our business segments are well positioned to benefit from favorable secular trends, including the mega-trends of urbanization, population growth and demographic shifts, food security and safety, digitalization, global connectivity and energy efficiency. Coupled with our industry-leading brands and track record of innovation, we continue to provide market-leading solutions for our customers.

In addition, we continue to invest in product and technology innovation within our offerings as well as invest in new business models including Carrier Energy, our solution to reduce demands on power grids and energy infrastructure by better managing energy consumption and reducing end-customer energy costs. This new business model is also expected to provide a digital connection between the end-customers and Carrier, providing us with opportunities to offer services and aftermarket parts and components over the life of a product.

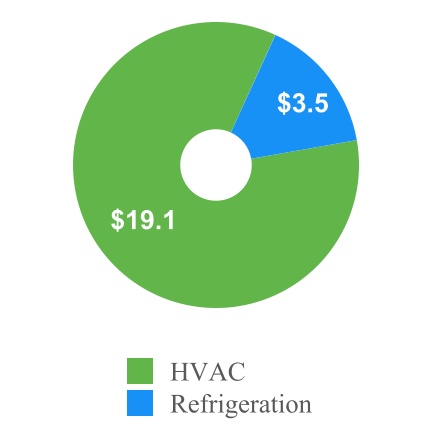

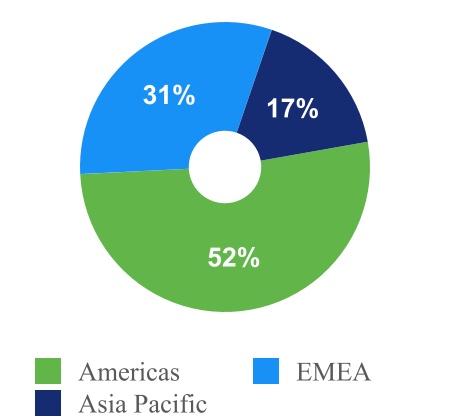

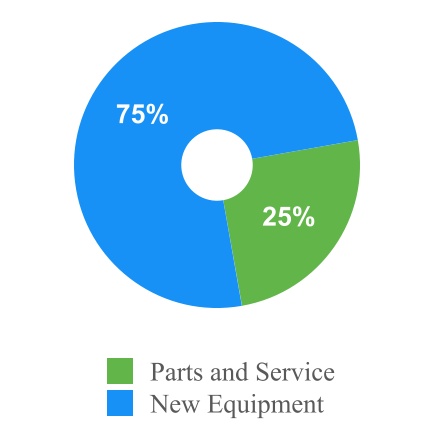

For the year ended December 31, 2024, our net sales were $22.5 billion and our operating profit was $2.6 billion. Our net sales for 2024 were derived from the Americas (52%), Europe, Middle East and Africa ("EMEA") (31%) and Asia-Pacific (17%). Our international operations, including U.S. export sales, represented approximately 50% of our net sales for 2024. During the same period, new equipment comprised 75% and parts and service comprised 25% of our net sales.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Sales by Segment * |

|

Net Sales by Region |

|

Sales by Type |

* Segment sales include inter-company sales.

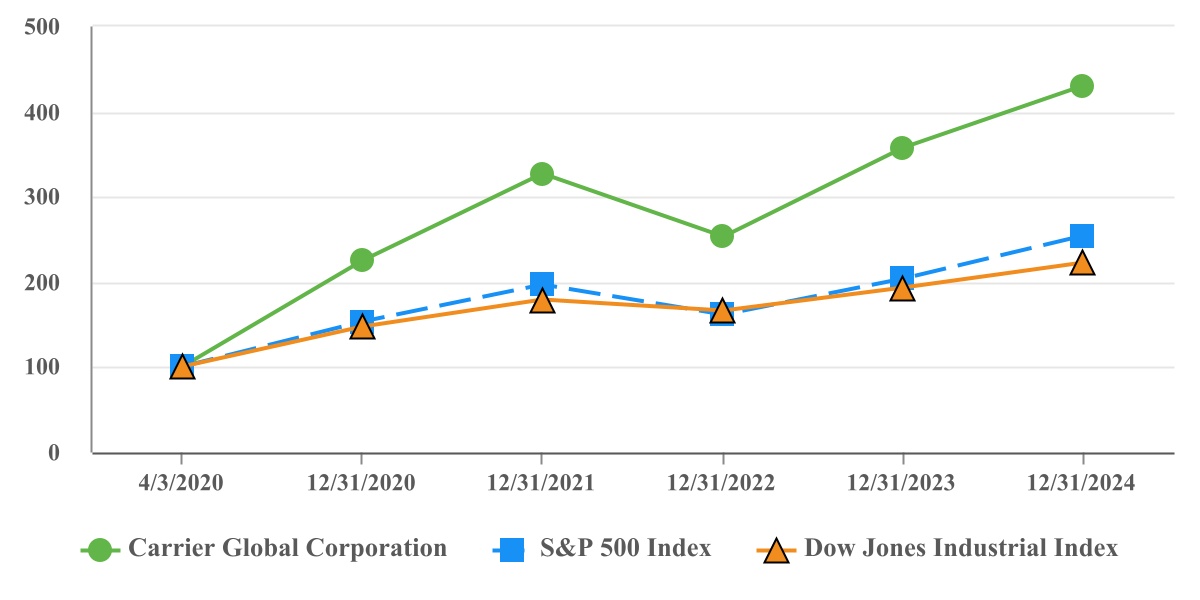

Separation from United Technologies Corporation

On April 3, 2020 (the "Distribution Date"), United Technologies Corporation, ("UTC"), since renamed RTX Corporation ("Raytheon Technologies Corporation" or "RTX") completed the spin-off of Carrier into an independent publicly traded company (the "Separation") through a pro rata distribution (the "Distribution") on a one-for-one basis of all of the outstanding shares of common stock of Carrier to UTC shareowners who held shares of UTC common stock as of the close of business on March 19, 2020, the record date of the Distribution. In addition, we entered into several agreements with UTC and Otis Worldwide Corporation ("Otis") that govern various aspects of the relationship among us, UTC and Otis following the Separation and Distribution. As of December 31, 2024, only certain portions of the Tax Matters Agreement ("TMA") remain in effect.

Business Segments

We globally manage our business operations through two segments: HVAC and Refrigeration. Each respective segment's major products, services and distribution methods are as follows:

The HVAC segment provides products, controls, services and solutions to meet the heating, cooling and ventilation needs of our customers while enhancing building performance, health and energy efficiency. Products and services include air conditioners, heating systems, heat pumps, building automation systems, aftermarket components, repair and maintenance services and rentals as well as modernization and upgrades through the product lifecycle. Our products and services cover a wide range of customers, including in the residential, commercial, education, healthcare, technology, retail, hospitality, data center, and infrastructure markets, among others. Products and solutions are sold directly to building contractors and owners and indirectly through joint ventures, independent sales representatives, distributors, wholesalers, dealers and retail outlets. Our established brands include Carrier, Viessmann, Toshiba, Automated Logic, Bryant, CIAT, Day & Night, Heil, NORESCO and Riello which offer an innovative and complete portfolio of products that provide numerous solutions for our customers. These products, in addition to the markets they serve, provide future service opportunities including replacement components, preventative and on-demand contractual maintenance and repair, digital monitoring and modifications/upgrades.

The Refrigeration segment provides products, services and monitoring for reliable transport and preservation of food, medicine and other perishable cargo. Products include trucks, trailers, shipping containers and intermodal applications to meet customer needs for both ground transport and ocean freight, while services include maintenance, repair, and monitoring. Products and services are sold directly to transportation companies and indirectly through joint ventures, independent sales representatives, distributors, wholesalers and dealers. Products and services are sold under established brand names, including Carrier Transicold and Sensitech. We provide customers the flexibility to select solutions from a very broad range of technologies including fossil fuel applications and electric solutions to best adhere to their objectives and preferences as well as regulatory requirements. In addition, our focus on digitalization and innovation is expanding our offering of service and aftermarket solutions, including on-demand and subscription-based monitoring of customer cargo. Through the lifecycle of the product, we also offer modifications and upgrades to the current installed base, improving energy efficiency, noise or other customer requirements.

Portfolio Transformation

In 2023, we began the journey to further simplify our company and accelerate our business strategy. Our actions transformed our business portfolio in an effort to establish us as a pure-play, global leader in intelligent climate and energy solutions. We believe that our greater focus on breakthrough innovation, electrification, energy-efficient solutions, the use of environmentally friendly refrigerants and connected ecosystems will further strengthen our global leadership position in our end-markets and provide responsible solutions for our customers.

On April 25, 2023, we announced that we entered into a Share Purchase Agreement (the “Agreement”) to acquire the climate solutions business (the "VCS Business") of Viessmann Group GmbH & Co. KG (“Viessmann”), a privately-held company. The VCS Business develops intelligent, integrated and sustainable technologies, including heat pumps, boilers, photovoltaic systems, home battery storage and digital solutions, primarily for residential customers in Europe. The acquisition was completed on January 2, 2024 and reported within our HVAC segment.

On June 2, 2024, we completed the sale of our Access Solutions business ("Access Solutions") to Honeywell International Inc. ("Honeywell") for cash proceeds of $5.0 billion. Access Solutions, historically reported in our Fire & Security segment, is a global supplier of physical security and digital access solutions supporting the hospitality, commercial, education and military markets. We recognized a net gain on the sale of $1.8 billion.

On July 1, 2024, we completed the sale of our Industrial Fire business ("Industrial Fire") for cash proceeds of $1.4 billion. Industrial Fire, historically reported in our Fire & Security segment, is a leading manufacturer of a full spectrum of fire detection and suppression solutions and services in critical high-hazard environments, including oil and gas, power generation, marine and offshore facilities, automotive, data centers and aircraft hangars. We recognized a net gain on the sale of $319 million.

On October 1, 2024, we completed the sale of our Commercial Refrigeration business ("CCR") for cash proceeds of $679 million. CCR, historically reported in our Refrigeration segment, is a global supplier of turnkey solutions for commercial refrigeration systems and services, with a primary focus on serving food retail customers, cold storage facilities and warehouses. We recognized a net gain on the sale of $292 million. The net proceeds received are subject to working capital and other adjustments provided in the stock purchase agreement.

On December 2, 2024, we completed the sale of our Commercial and Residential Fire business ("CRF Business") for cash proceeds of $2.9 billion. The CRF Business, historically reported in our Fire & Security segment, is a leading manufacturer of fire detection and alarm solutions for both commercial and residential applications. We recognized a net gain on the sale of $1.4 billion. The net proceeds received are subject to working capital and other adjustments provided in the stock purchase agreement.

Business Strategy

Our vision is to be a global leader in intelligent climate and energy solutions with a focus on providing differentiated, digitally-enabled lifecycle solutions to our customers. To achieve our vision, our core business strategy is to create innovative, differentiated products and solutions to provide a fully-integrated customer experience in order to be our customer’s preferred provider. We believe our strategy is supported by significant favorable secular trends, our industry-leading brands and track record of innovation. Our business strategy is built around the following pillars to drive long-term growth and deliver shareholder value:

Differentiated Products, Channels and Brands

Our strategy involves driving organic growth by further enhancing our proven track record of innovation, which is focused on designing smarter, more connected and more efficient sustainable systems and solutions. Our strategy also relies on our iconic, industry-leading brands and on strengthening our long-term relationships with channel partners and customers by offering solutions that anticipate customer needs with a focus on technologies related to energy efficiency, emissions, air quality, electrification, refrigerants with lower global warming potential and noise reduction.

Digitally-Enabled Lifecycle Solutions

We are focused on offering a comprehensive and differentiated suite of sustainable technologies and services. We expect that these solutions increase our total available market opportunity, enhance our predictive service and maintenance capabilities, strengthen our customer intimacy and increase aftermarket growth. Beginning with product design, our product offerings are moving towards digitally-enabled solutions that connect us to our customers throughout the product’s full lifecycle and help us grow our aftermarket sales. We plan to meet our customer’s needs by offering a wider-range of aftermarket products and services including replacement components, preventative and on-demand maintenance and repair, digital monitoring and modifications/upgrades. Our digitally-enabled lifecycle solutions include Abound, a cloud-based building platform that unlocks and unites building data to create healthy, sustainable and intelligent solutions for indoor spaces. It gathers data from disparate systems, sensors and sources; identifies opportunities to optimize performance; and works with healthy building solutions to improve occupant experiences. In addition, our Lynx digital platform, developed in collaboration with Amazon Web Services (“AWS”), allows customers to leverage data to enhance visibility, resiliency, agility and efficiency in the cold chain to reduce loss of cargo, lower operations costs and support real-time decisions.

Expand Portfolio with Energy Management Solutions

As power grids and transportation infrastructure shift from fossil fuels to renewables, we will continue to position ourselves as a leader in innovative solutions that reduce emissions and energy consumption and promote power grid stability. Our solutions range from residential home energy management to sustainable solutions for commercial and industrial buildings to optimized low noise and low gas emission transport solutions. With the addition of the VCS Business on January 2, 2024, we are well positioned to provide complete energy solutions globally. Our portfolio includes environmentally friendly refrigerants, high temperature heat pumps for use in industrial and commercial applications, natural refrigerant heat pumps for residential buildings and a connected ecosystem for homes including solar PV, batteries and a differentiated digital platform, all supported by extensive service and aftermarket offerings.

Strategic Capital Allocation

Our priorities for capital deployment include funding organic growth, acquisitions and capital returns to shareowners through a growing and sustainable dividend and share repurchases. We pursue potential acquisitions to complement existing products and services and to expand the range of technologies and solutions available to our customers. We leverage our global operations, the strength of our iconic, industry-leading brands and our success in creating valuable partnerships to focus on targeted expansion into new locations and channels where we believe that we can drive profitable growth. These drivers are supported by research and development activities with a focus on new product development and new technology innovation. In addition, Carrier Ventures, our global venture capital wholly-owned subsidiary, focuses on investments to accelerate the development of sustainable innovations and disruptive technologies to transform future building and cold chain management. It engages in strategic partnerships with high growth organizations as they invest in the development of technologies to innovate and commercialize the next generation of integrated offerings.

Other Matters Relating to Our Business as a Whole

Competitive Conditions

Each of our businesses is subject to significant competition from a number of companies throughout the world. Due to the nature of our products and services and the markets we serve, our competition can vary from regional or specialized companies to larger public or private companies.

The most significant competitive factors we face are technology differentiation, product performance, service, delivery schedule and price. Brand reputation, service to customers and quality are also important competitive factors for our products and services. While our competitive position varies among our products and services, we are a significant competitor with respect to each of our major product and service offerings. We believe that the loss of any individual contract or customer would not have a material adverse effect on our results.

Raw Materials and Supplies

We rely on suppliers and commodity markets to secure components and raw materials such as copper, aluminum and steel. In addition, we also use semi-conductors and other electronic components in the manufacture of our products. To maximize our buying effectiveness and leverage our scale, we have a central strategic sourcing group that consolidates purchases of certain materials and components across our business segments. We work closely with our suppliers to ensure availability of products and implement other cost savings initiatives. In addition, we continue to invest in our supply chain to improve its resilience with a focus on automation, dual sourcing of critical components and localized manufacturing when feasible.

Intellectual Property

We maintain a broad portfolio of patents, trademarks, copyrights, trade secrets, licenses and franchises related to our business to protect our research and development investments and to maintain our competitive advantages. We hold approximately 12,000 active patents and pending patent applications worldwide. From time to time, we take actions to protect our business by asserting our intellectual property rights against third-party infringement. We believe that we have taken reasonable measures to build and protect this portfolio of intellectual property rights, but we cannot be assured that these rights will not be challenged, found invalid or unenforceable.

Operating System

We plan to continue to foster operational, financial and commercial excellence to drive sales and earnings growth. With roots in our legacy manufacturing and business processes, the Carrier operating system — Carrier Excellence — is our continuous improvement framework that is expected to drive operational excellence across our businesses. Our Supplier Excellence program is intended to apply these same operating principles to our supply base and we continue to focus on strategic cost reductions through operational efficiency, digitalization, automation and supply chain productivity.

Joint Ventures and Strategic Relationships

Our joint ventures and strategic relationships are an important part of our business. We hold direct ownership interests in approximately 55 joint ventures, the financial results of which are accounted for by the equity method of accounting or the cost basis of accounting, of which 97% of such investments are in our HVAC segment. These relationships engage in distribution, manufacturing and product development activities and are integral to our business operations and growth strategy.

Seasonality

Demand for certain of our products and services is seasonal and can be impacted by weather conditions. For instance, sales and services of our HVAC products to residential customers have historically been higher in the second and third quarters of the calendar year, which represent the peak seasons for air conditioning-related sales in North America markets. A change in building and remodeling activity also can affect our financial performance. In addition, our financial performance may be influenced by the production and utilization of transport equipment, including truck production cycles in North America and Europe.

Compliance with the Regulation of our Business and Operations

We operate our businesses and sell our products all over the world. As a result, rapid changes in legislation, regulations and government policies affect our operations and business in the countries, regions and localities in which we operate and sell our products. International accords such as the Paris Agreement and the subsequent U.S. climate policies to meet its nationally determined contributions as well as local regulations in the U.S. reducing the use of fossil fuels in buildings all have the potential to impact our products and service offerings. Such changes, which can render our products and technologies non-compliant, involve refrigerants, noise levels, product and fire safety, hydrofluorocarbon emissions, fluorinated gases, hazardous substances and electric and electronic equipment waste. Increased fragmentation of regulatory requirements changes the manner in which we conduct our business and increases our costs because it necessitates the development of country or regional specific variants, monitoring of and compliance with those regulations and additional testing and certifications. In addition, our operations are subject to and affected by environmental regulations promulgated by federal, state and local authorities in the U.S. and by authorities with jurisdiction over our foreign operations. We have made, and will be required to continue to make, capital expenditures to design and upgrade our products to comply with or exceed environmental and other regulations and energy efficiency standards. However, we believe that the costs related to compliance requirements for environmental or other government regulations will not have a material adverse effect on our capital expenditures, financial results or competitive position.

Environmental Goals

As a global leader in intelligent climate and energy solutions, we are committed to making the world safer, sustainable and more comfortable. We have set ambitious sustainability goals to be reached by 2030, which include the following:

•Invest over $4 billion to develop intelligent climate and energy solutions that reduce environmental impacts,

•Avoid more than 1 gigaton of customer greenhouse gas emissions,

•Achieve carbon neutral operations,

•Reduce energy intensity by 10% across our operations,

•Develop water stewardship programs across our global operations, prioritizing water-scarce locations, and

•Promote sustainability and positively impact communities and our workforce through education, partnerships, programs and volunteering our time and talent.

Human Capital Management

At Carrier, we strive to connect our people to our purpose, our vision, our strategic priorities, our culture and each other, with the ultimate goal to engage our teams, drive success and create value for our customers and shareowners.

Culture and People

Our operating fundamentals - The Carrier Way, Leading People The Carrier Way, and Carrier Excellence – serve as a basis for how we operate our company and drive success, as One Team. The Carrier Way outlines our vision, values, and cultural behaviors. Leading People The Carrier Way sets expectations for people leaders and how we build the best teams. Carrier Excellence is our continuous improvement operating system, a mindset that focuses the organization on enhancing efficiency, and delivering high-quality outcomes across all facets of our business.

Our employees collaborate as one team across more than 50 countries. We develop and deploy best-in-class programs and practices, provide enriching career opportunities, listen to employee feedback and always challenge ourselves to do better. As of December 31, 2024, we had approximately 48,000 employees worldwide, of which 35% are located in the Americas, 36% are located in EMEA and 29% are located in Asia Pacific.

We are an employer of choice and we focus on our Build Best Teams cultural behavior priority through the deployment of our talent ecosystem that connects strategy, embeds talent in our culture and activates it through people programs, processes and leadership. One of our core values in The Carrier Way, inclusion, is fundamental to who we are and what we do. We aspire to have an inclusive culture where each and every employee can come to work, every day, feeling like they _belong, and can contribute to their fullest and greatest potential. We continuously evaluate, modify and enhance our recruitment and retention strategies as part of the overall management of our business.

Aligned to our fundamentals and talent ecosystem, we promote learning and development through technical and leadership programs, as well as tuition assistance to enhance our employees’ skills and abilities. Our offerings include an online platform, strategic partnerships and on-site technical training centers. We conduct annual leadership development reviews to identify future leaders and foster succession planning. We also renew our talent pipeline with internships and early career rotational programs. Through a strategic approach to human capital, we are creating an environment where employees thrive, belong, and contribute to a more sustainable and resilient world.

Employee Well-being, Health and Safety

Creating an environment where employees thrive includes prioritizing health, safety, and overall well-being. We are committed to maintaining world-class standards.

Our Environmental, Health and Safety program is focused on eliminating the risk of serious injuries, illness and fatalities to employees, contractors and customers during manufacturing, installation, servicing and other business activities. We apply rigorous standards to ensure that our operations and premises comply with national and local regulations and our incident reporting requirements. For 2024, our total recordable incident rate ("TRIR"), based upon the number of employee injuries per 200,000 hours worked, was 0.32 and our lost time incident rate ("LTIR") was 0.15.

Our global well-being programs support employees’ physical, mental and financial health, offering flexible benefits, mental health resources, hybrid-work and financial planning tools. Our total rewards philosophy is designed to align the compensation of our employees with individual and company performance and to provide the appropriate market-competitive incentives to attract, retain and motivate employees to achieve superior results.

We measure the Pulse of our workforce three times per year through company-wide employee surveys to help us understand how employees feel about working at Carrier and what we can do to improve their experience.

As of December 31, 2024, in the U.S., 90% of our approximately 4,000 production and maintenance employees were covered under six collective bargaining agreements with expiration dates ranging from 2025 to 2027. In Europe, approximately 16,200 employees are represented by a European Works Council and, at national and local levels, we inform and consult with 49 local works councils and with unions representing employees at approximately 40 sites. Relations with our labor unions and works councils are generally positive.

Corporate Information

Carrier was incorporated in Delaware in connection with the Separation on March 15, 2019. Our principal executive offices are located at 13995 Pasteur Boulevard, Palm Beach Gardens, Florida 33418, and our telephone number is (561) 365-2000. We maintain an Internet website at www.corporate.carrier.com.

ITEM 1A. RISK FACTORS

RISK FACTOR SUMMARY

Risks Related to Our Business

•Risks associated with our international operations could adversely affect our competitive position, results of operations, cash flows or financial condition.

•We are party to joint ventures and other strategic relationships, which may not be successful and may expose us to unique risks and restrictions.

•Risks associated with climate events, government regulations and incentives associated with climate events and mitigation efforts could adversely affect our business.

•Demand for our HVAC products and services is influenced by weather conditions and seasonality.

•Our business and financial performance depend on continued and substantial investments in our information and operational technology infrastructure, which may not yield anticipated benefits and which may be vulnerable to cyber-attacks.