00017794742024FYfalse14559404404769http://fasb.org/us-gaap/2024#AssetImpairmentChargesiso4217:USDxbrli:sharesiso4217:USDxbrli:sharesxbrli:puremaps:financialInstitutionsmaps:segmentmaps:vote00017794742024-01-012024-12-310001779474us-gaap:CommonClassAMember2024-01-012024-12-310001779474us-gaap:WarrantMember2024-01-012024-12-3100017794742024-06-280001779474us-gaap:CommonClassAMember2025-03-050001779474maps:CommonClassVMember2025-03-0500017794742024-10-012024-12-310001779474maps:AnthonyBayMember2024-10-012024-12-310001779474maps:AnthonyBayMember2024-12-310001779474maps:GlenIbbottMember2024-10-012024-12-310001779474maps:GlenIbbottMember2024-12-310001779474maps:OlgaGonzalezMember2024-10-012024-12-310001779474maps:OlgaGonzalezMember2024-12-310001779474maps:BrendaFreemanMember2024-10-012024-12-310001779474maps:BrendaFreemanMember2024-12-310001779474maps:ScottGordonMember2024-10-012024-12-310001779474maps:ScottGordonMember2024-12-3100017794742024-12-3100017794742023-12-310001779474us-gaap:CommonClassAMember2023-12-310001779474us-gaap:CommonClassAMember2024-12-310001779474maps:CommonClassVMember2023-12-310001779474maps:CommonClassVMember2024-12-3100017794742023-01-012023-12-310001779474us-gaap:CommonClassAMember2023-01-012023-12-310001779474us-gaap:CommonStockMemberus-gaap:CommonClassAMember2022-12-310001779474us-gaap:CommonStockMembermaps:CommonClassVMember2022-12-310001779474us-gaap:AdditionalPaidInCapitalMember2022-12-310001779474us-gaap:RetainedEarningsMember2022-12-310001779474us-gaap:ParentMember2022-12-310001779474us-gaap:NoncontrollingInterestMember2022-12-3100017794742022-12-310001779474us-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001779474us-gaap:ParentMember2023-01-012023-12-310001779474us-gaap:NoncontrollingInterestMember2023-01-012023-12-310001779474us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001779474maps:ClassPUnitsMemberus-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-01-012023-12-310001779474maps:ClassPUnitsMemberus-gaap:AdditionalPaidInCapitalMember2023-01-012023-12-310001779474maps:ClassPUnitsMemberus-gaap:ParentMember2023-01-012023-12-310001779474maps:ClassPUnitsMemberus-gaap:NoncontrollingInterestMember2023-01-012023-12-310001779474maps:ClassPUnitsMember2023-01-012023-12-310001779474us-gaap:RetainedEarningsMember2023-01-012023-12-310001779474us-gaap:CommonStockMemberus-gaap:CommonClassAMember2023-12-310001779474us-gaap:CommonStockMembermaps:CommonClassVMember2023-12-310001779474us-gaap:AdditionalPaidInCapitalMember2023-12-310001779474us-gaap:RetainedEarningsMember2023-12-310001779474us-gaap:ParentMember2023-12-310001779474us-gaap:NoncontrollingInterestMember2023-12-310001779474us-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001779474us-gaap:ParentMember2024-01-012024-12-310001779474us-gaap:NoncontrollingInterestMember2024-01-012024-12-310001779474us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310001779474maps:ClassAUnitsMemberus-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310001779474maps:ClassAUnitsMemberus-gaap:CommonStockMembermaps:CommonClassVMember2024-01-012024-12-310001779474maps:ClassAUnitsMemberus-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001779474maps:ClassAUnitsMemberus-gaap:ParentMember2024-01-012024-12-310001779474maps:ClassAUnitsMemberus-gaap:NoncontrollingInterestMember2024-01-012024-12-310001779474maps:ClassAUnitsMember2024-01-012024-12-310001779474maps:ClassPUnitsMemberus-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-01-012024-12-310001779474maps:ClassPUnitsMemberus-gaap:AdditionalPaidInCapitalMember2024-01-012024-12-310001779474maps:ClassPUnitsMemberus-gaap:ParentMember2024-01-012024-12-310001779474maps:ClassPUnitsMemberus-gaap:NoncontrollingInterestMember2024-01-012024-12-310001779474maps:ClassPUnitsMember2024-01-012024-12-310001779474us-gaap:RetainedEarningsMember2024-01-012024-12-310001779474us-gaap:CommonStockMemberus-gaap:CommonClassAMember2024-12-310001779474us-gaap:CommonStockMembermaps:CommonClassVMember2024-12-310001779474us-gaap:AdditionalPaidInCapitalMember2024-12-310001779474us-gaap:RetainedEarningsMember2024-12-310001779474us-gaap:ParentMember2024-12-310001779474us-gaap:NoncontrollingInterestMember2024-12-310001779474us-gaap:ComputerEquipmentMember2024-12-310001779474us-gaap:FurnitureAndFixturesMember2024-12-310001779474us-gaap:PropertyPlantAndEquipmentMember2023-01-012023-12-310001779474us-gaap:LeaseholdImprovementsMember2023-01-012023-12-310001779474us-gaap:SoftwareDevelopmentMember2024-12-310001779474maps:EnhancementsMember2024-12-310001779474us-gaap:SoftwareDevelopmentMember2024-01-012024-12-310001779474us-gaap:SoftwareDevelopmentMember2023-01-012023-12-310001779474maps:PublicWarrantsMember2024-12-310001779474maps:PrivatePlacementWarrantMember2024-12-310001779474us-gaap:CommonClassAMember2021-06-160001779474maps:SalesDiscountMember2024-01-012024-12-310001779474maps:SalesDiscountMember2023-01-012023-12-310001779474us-gaap:PerformanceSharesMembersrt:MinimumMember2024-01-012024-12-310001779474us-gaap:PerformanceSharesMembersrt:MaximumMember2024-01-012024-12-310001779474srt:MaximumMember2024-01-012024-12-310001779474maps:FeaturedListingMember2024-01-012024-12-310001779474maps:FeaturedListingMember2023-01-012023-12-310001779474maps:BusinessSubscriptionAndOtherSolutionsMember2024-01-012024-12-310001779474maps:BusinessSubscriptionAndOtherSolutionsMember2023-01-012023-12-310001779474us-gaap:ServiceMember2024-01-012024-12-310001779474us-gaap:ServiceMember2023-01-012023-12-310001779474us-gaap:ProductAndServiceOtherMember2024-01-012024-12-310001779474us-gaap:ProductAndServiceOtherMember2023-01-012023-12-310001779474stpr:CAus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-12-310001779474stpr:CAus-gaap:GeographicConcentrationRiskMemberus-gaap:SalesRevenueNetMember2023-01-012023-12-310001779474maps:ReportableSegmentMember2024-01-012024-12-310001779474maps:ReportableSegmentMember2023-01-012023-12-310001779474maps:IrvineCorporateHeadquartersLeaseMember2024-01-012024-12-310001779474maps:IrvineCorporateHeadquartersLeaseMember2024-12-310001779474maps:SoftwareLicenseAgreementsMember2024-12-310001779474maps:SoftwareLicenseAgreementsMember2024-01-012024-12-310001779474maps:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001779474maps:PublicWarrantsMemberus-gaap:FairValueInputsLevel1Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2024-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:FairValueMeasurementsRecurringMember2023-12-310001779474us-gaap:FairValueMeasurementsRecurringMember2024-12-310001779474us-gaap:FairValueMeasurementsRecurringMember2023-12-310001779474maps:PublicWarrantsMember2023-12-310001779474maps:PrivatePlacementWarrantMember2023-12-310001779474maps:PublicWarrantsMember2024-01-012024-12-310001779474maps:PrivatePlacementWarrantMember2024-01-012024-12-310001779474maps:PublicWarrantsMember2022-12-310001779474maps:PrivatePlacementWarrantMember2022-12-310001779474maps:PublicWarrantsMember2023-01-012023-12-310001779474maps:PrivatePlacementWarrantMember2023-01-012023-12-310001779474us-gaap:WarrantMember2021-06-160001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2024-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExercisePriceMember2023-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2024-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputSharePriceMember2023-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMember2024-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputPriceVolatilityMember2023-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMember2024-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputExpectedTermMember2023-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2024-12-310001779474maps:PrivatePlacementWarrantMemberus-gaap:FairValueInputsLevel3Memberus-gaap:MeasurementInputRiskFreeInterestRateMember2023-12-310001779474maps:PrivatePlacementWarrantsMember2024-12-310001779474maps:PrivatePlacementWarrantsMember2023-12-310001779474us-gaap:TradeNamesMember2024-12-310001779474us-gaap:SoftwareDevelopmentMember2024-12-310001779474us-gaap:CustomerRelatedIntangibleAssetsMember2024-12-310001779474us-gaap:TradeNamesMember2023-12-310001779474us-gaap:SoftwareDevelopmentMember2023-12-310001779474us-gaap:CustomerRelatedIntangibleAssetsMember2023-12-310001779474maps:AbandonedCloudComputingArrangementMember2023-01-012023-12-310001779474maps:AbandonedCloudComputingArrangementMember2024-01-012024-12-310001779474maps:PublicWarrantsMember2021-07-1600017794742021-07-162021-07-160001779474us-gaap:CommonStockMember2021-07-160001779474maps:PrivatePlacementWarrantMember2021-07-162021-07-160001779474maps:PrivatePlacementWarrantMember2021-07-160001779474us-gaap:CommonClassAMember2021-07-160001779474maps:CommonClassVMember2024-01-012024-12-3100017794742021-06-150001779474maps:WMHUnitsMember2024-12-310001779474maps:CommonClassVMember2021-06-1600017794742021-06-162021-06-160001779474maps:ClassPUnitsMember2023-12-310001779474maps:ClassPUnitsMember2024-12-310001779474maps:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMember2024-12-310001779474maps:A2021EquityIncentivePlanMemberus-gaap:CommonClassAMember2024-01-012024-12-310001779474us-gaap:RestrictedStockUnitsRSUMember2023-12-310001779474us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001779474us-gaap:RestrictedStockUnitsRSUMember2024-12-310001779474us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001779474us-gaap:PerformanceSharesMember2024-01-012024-12-310001779474us-gaap:PhantomShareUnitsPSUsMember2024-11-072024-11-070001779474us-gaap:PhantomShareUnitsPSUsMember2024-11-070001779474us-gaap:PerformanceSharesMember2023-12-310001779474us-gaap:PerformanceSharesMember2024-12-310001779474us-gaap:PerformanceSharesMember2023-01-012023-12-310001779474us-gaap:SellingAndMarketingExpenseMember2024-01-012024-12-310001779474us-gaap:SellingAndMarketingExpenseMember2023-01-012023-12-310001779474us-gaap:ResearchAndDevelopmentExpenseMember2024-01-012024-12-310001779474us-gaap:ResearchAndDevelopmentExpenseMember2023-01-012023-12-310001779474us-gaap:GeneralAndAdministrativeExpenseMember2024-01-012024-12-310001779474us-gaap:GeneralAndAdministrativeExpenseMember2023-01-012023-12-310001779474maps:ClassVSharesMember2024-01-012024-12-310001779474maps:ClassVSharesMember2023-01-012023-12-310001779474maps:ClassPUnitsMember2024-01-012024-12-310001779474maps:ClassPUnitsMember2023-01-012023-12-310001779474us-gaap:RestrictedStockUnitsRSUMember2024-01-012024-12-310001779474us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-12-310001779474us-gaap:PerformanceSharesMember2024-01-012024-12-310001779474us-gaap:PerformanceSharesMember2023-01-012023-12-310001779474maps:PublicWarrantsMember2024-01-012024-12-310001779474maps:PublicWarrantsMember2023-01-012023-12-310001779474maps:PrivatePlacementWarrantMember2024-01-012024-12-310001779474maps:PrivatePlacementWarrantMember2023-01-012023-12-310001779474us-gaap:DomesticCountryMember2024-12-310001779474us-gaap:StateAndLocalJurisdictionMember2024-12-310001779474us-gaap:ForeignCountryMember2024-12-310001779474us-gaap:ResearchMemberus-gaap:DomesticCountryMember2024-12-310001779474stpr:CAus-gaap:ResearchMemberus-gaap:StateAndLocalJurisdictionMember2024-12-310001779474maps:SubleaseAgreementMember2022-06-012022-12-310001779474us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:RelatedPartyMembermaps:SubleaseAgreementMember2024-12-310001779474us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:RelatedPartyMembermaps:SubleaseAgreementMember2023-12-310001779474maps:SubleaseAgreementMember2024-01-012024-12-310001779474maps:SubleaseAgreementMember2023-01-012023-12-310001779474maps:SilverSpikeMembermaps:SilverSpikeSponsorMember2021-06-160001779474us-gaap:OtherAssetsMemberus-gaap:RelatedPartyMember2023-03-160001779474maps:SilverSpikeSponsorMember2023-03-162023-03-160001779474maps:SilverSpikeSponsorMember2023-03-160001779474us-gaap:RelatedPartyMember2024-12-310001779474us-gaap:RelatedPartyMember2023-12-310001779474us-gaap:PrepaidExpensesAndOtherCurrentAssetsMemberus-gaap:RelatedPartyMember2023-12-310001779474us-gaap:OtherAssetsMemberus-gaap:RelatedPartyMember2023-12-310001779474us-gaap:RelatedPartyMember2024-01-012024-12-310001779474maps:SilverSpikeHoldingsMember2024-01-012024-12-310001779474maps:SilverSpikeHoldingsMember2023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________________________________________

FORM 10-K

_______________________________________________________________________________

|

|

|

|

|

|

☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from ____ to ____

Commission file number 001-39021

_______________________________________________________________________________

WM TECHNOLOGY, INC.

(Exact name of registrant as specified in its charter)

_______________________________________________________________________________

|

|

|

|

|

|

|

|

|

| Delaware |

|

98-1605615 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

|

|

|

41 Discovery

Irvine, California

|

|

92618 |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

(844) 933-3627

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

| Title of each class |

Trading symbol(s) |

Name of each exchange on which registered |

| Class A Common Stock, $0.0001 par value per share |

MAPS |

The Nasdaq Global Select Market |

Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 per share |

MAPSW |

The Nasdaq Global Select Market |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☐ |

Accelerated filer |

☒ |

|

|

| Non-accelerated filer |

☐ |

Smaller reporting company |

☒ |

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management's assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C.7262(b)) by the registered public accounting firm that prepared or issued its audit report.☒

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of the voting and non-voting common equity held by non-affiliates of the registrant as of June 28, 2024, the last business day of the registrant’s most recently completed second fiscal quarter, was approximately $89.0 million based upon the closing price reported for such date on the Nasdaq Global Select Market.

As of March 5, 2025, there were 105,028,513 shares of the registrant’s Class A common stock outstanding and 49,319,542 shares of Class V common stock outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s Proxy Statement for the 2025 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K to the extent stated herein. Such proxy statement will be filed with the Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2024.

WM TECHNOLOGY, INC.

TABLE OF CONTENTS

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this report, including statements regarding our future results of operations and financial condition, business strategy and plans and objectives of management for future operations, are forward-looking statements. In some cases, forward-looking statements may be identified by words such as “anticipate,” “believe,” “continue,” “could,” “design,” “estimate,” “expect,” “intend,” “may,” “plan,” “potentially,” “predict,” “project,” “should,” “will,” “would,” or the negative of these terms or other similar expressions. These forward-looking statements include, but are not limited to, statements concerning the following:

•our financial and business performance, including key business metrics and any underlying assumptions thereunder;

•our market opportunity and our ability to acquire new clients and retain existing clients;

•our expectations and timing related to commercial product launches;

•the success of our go-to-market strategy;

•our ability to scale our business and expand our offerings;

•our competitive advantages and growth strategies;

•our future capital requirements and sources and uses of cash;

•our ability to obtain funding for our future operations;

•the impact of material weaknesses in our internal controls and our ability to remediate any such material weakness on the timing we anticipate, or at all;

•our ability to maintain our listing on the Nasdaq Stock Market LLC (“Nasdaq”);

•the impact of the restatement on our reputation and investor confidence in us and the increased possibility of legal proceedings and regulatory inquiries;

•the outcome of any known and unknown litigation and regulatory proceedings;

•changes in domestic and foreign business, market, financial, political and legal conditions;

•the effect of macroeconomic conditions, including, but not limited to inflation, tariffs, public health crises, uncertain credit and global financial markets, past and potential future disruptions in access to bank deposits or lending commitments due to bank failures; current and potential future geopolitical events, including the military conflicts between Russia and Ukraine and the state of war between Israel and Hamas and the related risk of a larger regional conflict; and the occurrence of a catastrophic event, including but not limited to severe weather, war, or terrorist attack;

•future global, regional or local economic and market conditions affecting the cannabis industry;

•the development, effects and enforcement of and changes to laws and regulations, including with respect to the cannabis and hemp industries;

•our ability to successfully capitalize on new and existing cannabis markets, including our ability to successfully monetize our solutions in those markets;

•our ability to manage future growth;

•our ability to effectively anticipate and address changes in the end-user market in the cannabis industry;

•our ability to develop new products and solutions, bring them to market in a timely manner and make enhancements to our platform and our ability to maintain and grow our two-sided marketplace, including our ability to acquire and retain paying clients;

•the effects of competition on our future business;

•our success in retaining or recruiting, or changes required in, officers, key employees or directors;

•cyber-attacks and security vulnerabilities; and

•the possibility that we may be adversely affected by other economic, business or competitive factors.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this Annual Report on Form 10-K primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition and operating results. The outcome of the events described in these forward-looking statements is subject to risks, uncertainties and other factors described in the section titled “Risk Factors.” Moreover, we operate in a very competitive and rapidly changing environment. New risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this Annual Report on Form 10-K.

The results, events and circumstances reflected in the forward-looking statements may not be achieved or occur, and actual results, events, or circumstances could differ materially from those described in the forward-looking statements.

In addition, statements that “we believe,” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this Annual Report on Form 10-K. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

The forward-looking statements made in this Annual Report on Form 10-K relate only to events as of the date on which the statements are made. We undertake no obligation to update any forward-looking statements made in this Annual Report on Form 10-K to reflect events or circumstances after the date of this Annual Report on Form 10-K or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions, or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures, or investments.

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We intend to announce material information to the public through filings with the Securities and Exchange Commission (“SEC”), the investor relations page on our website, which is located at ir.weedmaps.com, public conference calls, and public webcasts. The information disclosed through the foregoing channels could be deemed to be material information. As such, we encourage investors, the media, and others to follow the channels listed above and to review the information disclosed through such channels.

The information we post through these channels is not a part of this Annual Report on Form 10-K. Any updates to the list of disclosure channels through which we will announce information will be posted on the investor relations page on our website.

RISK FACTOR SUMMARY

Below is a summary of material factors that make an investment in our securities speculative or risky. Importantly, this summary does not address all of the risks and uncertainties that we face. Additional discussion of the risks and uncertainties summarized in this risk factor summary, as well as other risks and uncertainties that we face, can be found under the section titled “Risk Factors” as well as elsewhere in this Annual Report on Form 10-K and our other filings with the SEC. The below summary is qualified in its entirety by that more complete discussion of such risks and uncertainties. You should consider carefully the risks and uncertainties described under the section titled “Risk Factors” as part of your evaluation of an investment in our securities:

•As our costs increase, we may not be able to generate sufficient revenue to achieve profitability in the future.

•If we fail to retain our existing clients and consumers or to acquire new clients and consumers in a cost-effective manner, our revenue may decrease and our business may be harmed.

•We may fail to offer the optimal pricing of our products and solutions.

•If we fail to expand effectively into new markets, our revenue and business will be adversely affected.

•Competition from the illicit cannabis market could impact our ability to succeed.

•Our business is concentrated in California, and, as a result, our performance may be affected by factors unique to the California market.

•Litigation or legal proceedings could expose us to significant liabilities and have a negative impact on our reputation or business.

•Federal law enforcement may deem our clients to be in violation of U.S. federal law, and, in particular the Controlled Substances Act (“CSA”). A change in U.S. federal policy on cannabis enforcement and strict enforcement of federal cannabis laws against our clients would undermine our business model and materially affect our business and operations.

•Some of our clients or their listings currently and in the future may not be in compliance with licensing and related requirements under applicable laws and regulations. Allowing unlicensed or noncompliant businesses to access our products, or allowing businesses to use our solutions in a noncompliant manner, may subject us to legal or regulatory enforcement and negative publicity, which could adversely impact our business, operating results, financial condition, brand and reputation. In addition, allowing businesses that engage in false or deceptive advertising practices to use our solutions may subject us to negative publicity, which could have similar adverse impacts on us.

•We generally do not, and cannot, ensure that our clients will conduct their business activities in a manner compliant with such regulations and requirements, despite providing features to help support our clients’ compliance with the complex, disparate and constantly evolving regulations and other legal requirements applicable to the cannabis industry. As a result, federal, state, provincial or local government authorities may seek to bring criminal, administrative or regulatory enforcement actions against our clients, which could have a material adverse effect on our business, operating results or financial conditions, or could force us to cease operations.

•Our business is dependent on U.S. state laws and regulations.

•The rapid changes in the cannabis industry and applicable laws and regulations make predicting and evaluating our future prospects difficult, and may increase the risk that we will not be successful.

•Because our business is dependent, in part, upon continued market acceptance of cannabis by consumers, any negative trends could adversely affect our business operations.

•Expansion of our business is dependent, in part, on the continued legalization of cannabis.

•Our clients face challenges unique to the cannabis industry that can impact their financial health and long-term viability. If our clients struggle financially or do not remain viable, it can negatively impact our ability to generate new revenue, maintain existing revenue or collect on outstanding receivables.

•If clients and consumers using our platform fail to provide high-quality content that attracts consumers, we may not be able to generate sufficient consumer traffic to remain competitive.

•Our business is highly dependent upon our brand recognition and reputation, and the erosion or degradation of our brand recognition or reputation would likely adversely affect our business and operating results.

•We currently face intense competition in the cannabis information market, and we expect competition to further intensify as the cannabis industry continues to evolve.

•If we fail to manage our employee operations and organization effectively, our brand, business and operating results could be harmed.

•If we are unable to recruit, train, retain and motivate key personnel, we may not achieve our business objectives.

•We rely on search engine placement, syndicated content, paid digital advertising and social media marketing to attract a meaningful portion of our clients and consumers. If we are not able to generate traffic to our website through search engines and paid digital advertising, or increase the profile of our company brand through social media engagement, or are otherwise limited in our ability to conduct digital advertising by applicable laws, our ability to attract new clients may be impaired.

•If our current marketing model is not effective in attracting new clients, we may need to employ higher-cost sales and marketing methods to attract and retain clients, which could adversely affect our profitability.

•If the Apple App Store or Google Play limit the functionality or availability of our mobile application platform, including as a result of changes or violations of terms and conditions, access to and utilization of our platform may suffer.

•We may be unable to scale and adapt our existing technology and network infrastructure in a timely or effective manner to ensure that our platform is accessible, which would harm our reputation, business and operating results.

•Our payment system and the payment systems of our clients depend on third-party providers and are subject to evolving laws and regulations.

•We are dependent on our banking relations, and we may have difficulty accessing or consistently maintaining banking or other financial services due to our connection with the cannabis industry.

•We track certain performance metrics with internal tools and do not independently verify such metrics. Certain of our performance metrics are subject to inherent challenges in measurement, and real or perceived inaccuracies in such metrics may harm our reputation and negatively affect our business.

•Our ability to successfully drive engagement on our platform, as well as changes to our user engagement and advertising strategy and practices, pose risks to our business.

•Any security incident, including a distributed denial of service attack, ransomware attack, security breach or unauthorized data access could impair or incapacitate our information technology systems or those of third parties with whom we work and delay or interrupt service to our clients and consumers, harm our reputation, or subject us to significant liability.

•Governmental regulation of the internet continues to develop, and unfavorable changes could substantially harm our business and operating results.

•We have ongoing material weaknesses in our internal control over financial reporting as of December 31, 2024. If we are unable to remediate these material weaknesses or to develop and maintain an effective system of internal control over financial reporting, we may not be able to accurately report our financial results in a timely manner, which may adversely affect investor confidence in us and materially and adversely affect our business and operating results.

•We previously restated our financial statements for several quarters, which resulted in unanticipated costs and may adversely affect investor confidence, our stock price, our ability to raise capital, raise reputational issues and may subject us to additional risks and uncertainties, including the increased possibility of legal proceedings and regulatory inquiries

•Public statements from investors, including expressions of interest or proposals to purchase our company, may increase the volatility of, or otherwise have an adverse impact on, the market price of our Class A common stock.

•The trading price of our Class A Common Stock and certain of our Public Warrants have been, and may continue to be, volatile, and the value of our Class A Common Stock and such Warrants may decline.

PART I

ITEM 1. BUSINESS

Our Company

Founded in 2008, and headquartered in Irvine, California, WM Technology, Inc. operates a leading online cannabis marketplace for consumers together with a comprehensive set of eCommerce and compliance software solutions for cannabis businesses, which are sold to both storefront locations and delivery operators (“retailers”) and brands in the legalized cannabis markets in states and territories of the United States. Our comprehensive business-to-consumer and business-to-business suite of products afford cannabis retailers and brands of all sizes integrated tools to compliantly run their businesses and to reach, convert, and retain consumers.

WM Technology, Inc. was initially incorporated in the Cayman Islands on June 7, 2019 under the name “Silver Spike Acquisition Corp” (“Silver Spike”). Silver Spike was formed for the purpose of effecting a merger, amalgamation, share exchange, asset acquisition, share purchase, reorganization or similar business combination with one or more businesses. On June 16, 2021 (the “Closing Date”), Silver Spike consummated the business combination (the “Business Combination”), pursuant to that certain Agreement and Plan of Merger, dated December 10, 2020, by and among Silver Spike, Silver Spike Merger Sub LLC, a Delaware limited liability company and a wholly owned direct subsidiary of Silver Spike Acquisition Corp., WM Holding Company, LLC, a Delaware limited liability company (when referred to in its pre-Business Combination capacity, “Legacy WMH” and following the Business Combination, “WMH LLC”), and Ghost Media Group, LLC, a Nevada limited liability company. On the Closing Date, and in connection with the closing of the Business Combination, Silver Spike was domesticated and continues as a Delaware corporation, and changed its name to WM Technology, Inc.

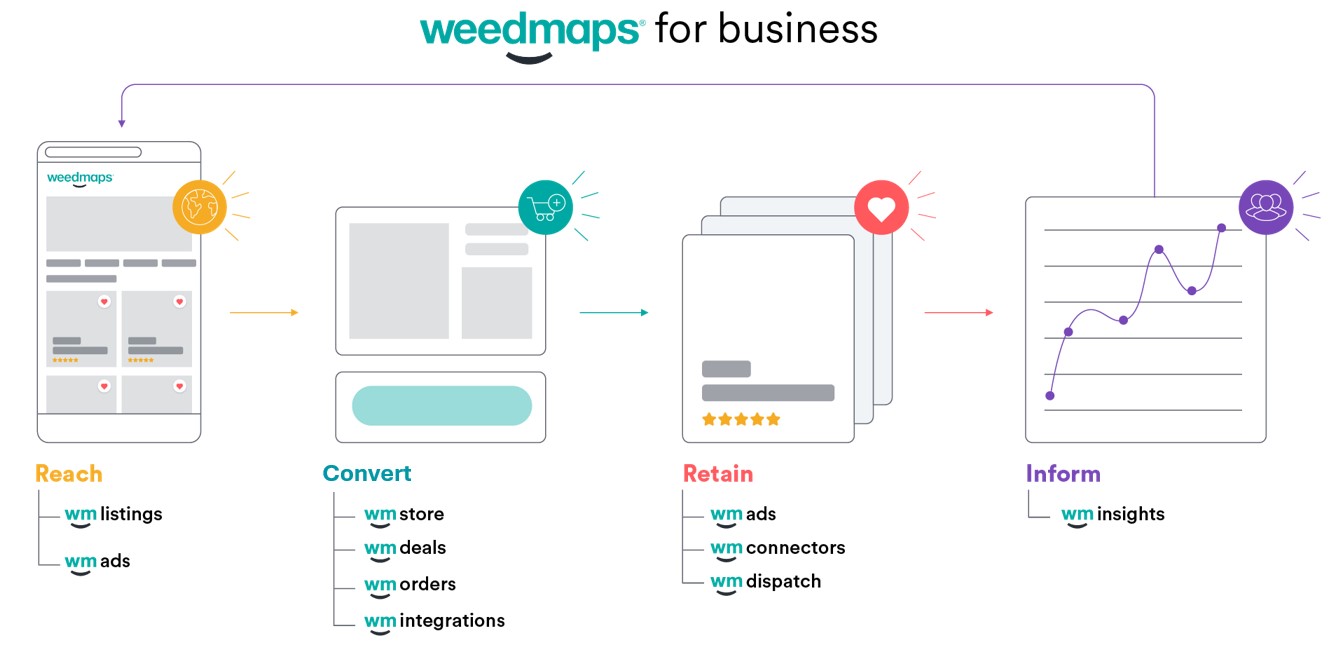

Our business primarily consists of our commerce-driven marketplace (“Weedmaps”), and our fully integrated suite of end-to-end Software-as-a-Service (“SaaS”) solutions software offering (“Weedmaps for Business”). The Weedmaps marketplace provides cannabis consumers with information regarding cannabis retailers and brands. In addition, the Weedmaps marketplace aggregates data from a variety of sources, including retailer point-of-sale (“POS”) solutions, to provide consumers with the ability to browse by strain, price, cannabinoids and other information regarding locally available cannabis products, through our website and mobile apps. The marketplace provides consumers with product discovery, access to deals and discounts, and reservation of products for pickup by consumers or delivery to consumers by participating retailers (retailers complete orders and process payments outside of the Weedmaps marketplace as Weedmaps serves only as a portal, passing a consumer’s inquiry to the dispensary). The marketplace also provides education and learning information to help newer consumers learn about the types of products to purchase. We believe the size, loyalty and engagement of our user base and the frequency of consumption of cannabis by our user base makes the Weedmaps marketplace highly valuable to our clients.

Weedmaps for Business, our SaaS offering, is a comprehensive set of eCommerce and compliance software solutions catered towards cannabis retailers, delivery services and brands that streamline front and back-end operations and help manage compliance needs. These tools support cannabis businesses at every stage in the consumer funnel, enabling them to:

•Strategically reach prospective cannabis consumers.

•Manage pickup, delivery and inventory in compliance with local regulations.

•Help improve the customer experience by creating online browsing and ordering functionality on a brand or retailer (including delivery) operator’s website.

•Foster customer loyalty and re-engage with segments of consumers.

•Leverage the Weedmaps for Business products in conjunction with any other preferred software solutions via integrations and application programming interfaces (“APIs”).

•Make informed marketing and merchandising decisions using performance analytics and consumer and brand insights to promote products to specific consumer groups.

We offer this functionality through a packaged software solution that includes (based on availability within any given market and state-level regulations) (i) a listing page with product menu on weedmaps.com, our iOS Weedmaps mobile application and our Android Weedmaps mobile application, which allows clients to disclose their license information, hours of operation, contact information, discount policies and other information that may be required under applicable state law, (ii) the ability to reserve products for pickup by consumers or delivery to consumers (either through weedmaps.com, on a white labeled WM Store website or third-party websites through our orders and menu embed product), (iii) customizable menus for brands, retailers and delivery operators to embed on their website, (iv) access to our APIs, including real-time connectivity between Weedmaps for Business to a POS to streamline workflows and promote compliance through accuracy and (v) analytics dashboards. We also offer add-on and a la carte products and services for additional fees, as discussed below.

The state-legal cannabis industry in the United States has grown consistently in recent years and was estimated to be between approximately $30-31 billion in 2024, according to Wall Street analyst estimates, and is expected by some estimates to grow to approximately $35 billion by 2027, assuming a continued pace of new state legalization, with 68% of U.S. adults in support of having legal access to cannabis. Currently, forty states, the District of Columbia, Puerto Rico, the Virgin Islands, Guam and the Northern Mariana have legalized some form of cannabis use for certain medical purposes. Twenty-four of those states, the District of Columbia, Guam and Northern Mariana have legalized cannabis for adults for non-medical purposes as well (sometimes referred to as adult or recreational use). Eight additional states have legalized forms of low-potency cannabis, for select medical conditions. Only two states continue to prohibit cannabis entirely. Despite expectations of growth, the regulated cannabis market in the United States is still nascent and fragmented, with significant challenges facing both consumers seeking to understand cannabis and find the right products for them and businesses seeking to operate compliantly and to effectively reach and market to cannabis consumers. Within the U.S., cannabis users (defined as adults, aged 21 and older, who have consumed cannabis in the past year) represent less than 22% of the total U.S. adult, aged 21 and older, population today (and less than 16% for those that consumed in the past month). On the client side, as of December 31, 2024, there were approximately 12,000 retail licenses across the United States with medical and/or adult-use regulations in place, which is an effective retail density of approximately one retail license per 21,750 residents across these markets in the aggregate, based on data available from individual governmental cannabis license databases and the U.S. Census Bureau estimates for both licenses and population.

In addition to these nascent consumer and business dynamics, cannabis itself is a highly complex, regulated and diverse, non-shelf stable consumer good that spans hundreds of strains and a growing set of form factors available for consumption, including flower, pre-rolls, vapes, edibles, tinctures and concentrates. Despite these complexities, consumers still expect the same product information, discovery and comparison options across multiple channels from cannabis businesses that they expect from other retailers or brands. These consumer expectations, coupled with the lack of normalized product information in the industry, in addition to the unique attributes of cannabis as a nascent and highly regulated consumer product, create significant challenges for retailers and brands who serve cannabis consumers. Retailers and brands must meet these consumer expectations and provide omni-channel engagement opportunities with the same (i) level of service, (ii) richness of product information, (iii) ability to compare prices, and (iv) ease of product and brand discovery that consumers would receive when researching other consumer product categories. Further, brands are limited in their ability to market and sell directly and need to find ways to communicate to consumers. At the same time, these businesses must comply with a rapidly evolving legal and regulatory landscape that differs by state and across cities and counties within each state, creating challenges in the ability to scale in a capital-efficient way.

Our Product and Solution Ecosystem

Our solutions are designed to address the challenges facing cannabis consumers and businesses. The Weedmaps marketplace allows cannabis consumers to search for and browse cannabis products from retailers and brands, and ultimately reserve products from certain local retailers, in a manner similar to other technology platforms with breadth and depth of product, brand and retailer selection. With Weedmaps for Business, we offer an end-to-end platform for licensed cannabis retailers to comply with state law.

We sell a monthly subscription offering to retailer and brand clients as well as upsell and add-on offerings to licensed clients.

Our current Weedmaps for Business monthly subscription package includes:

•WM Listings: A listing page with product menu for a retailer or brand on the Weedmaps marketplace, enabling our clients to be discovered by the marketplace’s users. This also allows clients to disclose their license information, hours of operation, contact information, discount policies and other information that may be required under applicable state law.

•WM Orders: Software for retailers to receive pickup and delivery orders directly from a Weedmaps listing and connect orders directly with a client’s point-of-sale (“POS”) system (for certain POS systems). The marketplace also enables brands to route customer purchase interest to a retailer that carries the brand’s product. After a dispensary receives the order request from the consumer, the dispensary and the consumer can continue to communicate, adjust items in the request, and handle any stock issues, prior to and while the dispensary processes and fulfills the order.

•WM Store: Customizable order and menus embed which allows retailers and brands to import their Weedmaps listing menu or product reservation functionality to their own white-labeled WM Store website or separately owned website. WM Store facilitates customer pickup or delivery orders and enables retailers to reach more customers by bringing the breadth of the Weedmaps marketplace to a client’s own website.

•WM Connectors: A centralized integration platform, including API tools, for easier menu management, automatic inventory updates and streamlined order fulfillment to enable clients to save time and more easily integrate into the WM Technology ecosystem and integrate with disparate software systems. This creates business efficiencies and improves the accuracy and timeliness of information across Weedmaps, creating a more positive experience for consumers and businesses.

•WM Insights: An insights and analytics platform for clients leveraging data across the Weedmaps marketplace and software solutions. WM Insights provides data and analytics on user engagement and traffic trends to a client’s listing page. For Brand clients, WM Insights allows them to monitor their brand and product rankings, identify retailers not carrying products and keep track of top brands and products by category and state.

We also offer other add-on products for additional fees, including:

•WM Ads: Ad solutions on the Weedmaps marketplace designed for clients to amplify their businesses and reach more highly engaged cannabis consumers throughout their buying journey including:

◦Featured Listings: Premium placement ad solutions on high visibility locations on the Weedmaps marketplace (desktop and mobile) to amplify our clients’ businesses and maximize clients’ listings and deal presence.

◦WM Deals: Discount and promotion pricing tools that let clients strategically reach prospective price-conscious cannabis customers with deals or discounts to drive conversion. In some jurisdictions, it is required by applicable law to showcase discounts.

◦Other ads solutions: Includes banner ads and promotion tiles on our marketplace as well as banner ads that can be tied to keyword searches. These products provide clients with targeted ad solutions in highly visible slots across our digital surfaces.

•WM Dispatch: Compliant, automated and optimized logistics and fulfillment last-mile delivery software (including driver apps) that helps clients manage their delivery fleets. This product streamlines the delivery experience from in-store to front-door.

We sell our Weedmaps for Business suite in the United States and have a limited number of non-monetized listings in several other countries including Austria, Canada, Germany, the Netherlands, Spain, Switzerland, and Uruguay. We operate in the United States, Canada and other foreign jurisdictions where medical and/or adult cannabis use is legal under state or national law. As of December 31, 2024, we actively operated in over 35 U.S. states and territories that have adult-use and/or medical-use regulations in place. We define actively operated markets as those U.S. states or territories with greater than $1,000 monthly revenue. Substantially all of our revenue was generated in the United States.

Our mission is to power a transparent and inclusive global cannabis economy. Our technology addresses the challenges facing both consumers seeking to understand cannabis products and businesses who serve cannabis users in a legally compliant fashion. Since our founding in 2008, Weedmaps has become a premier destination for cannabis consumers to discover and browse information regarding cannabis and cannabis products, permitting product discovery and order-ahead for pickup or delivery by participating retailers. Weedmaps for Business is a set of eCommerce-enablement tools designed to help retailers and brands get the best out of the Weedmaps’ consumer experience, create labor efficiencies and manage compliance needs.

We hold a strong belief in the importance of enabling safe, legal access to cannabis for consumers worldwide. We believe we offer the only comprehensive software platform that allows cannabis retailers to reach their target audience, quickly and cost effectively, addressing a wide range of needs. We are committed to building the software solutions that power cannabis businesses compliantly in the industry, to advocating for legalization, licensing and social equity of cannabis and to facilitating further learning through partnership with subject matter experts to provide detailed, accurate information about cannabis.

As we continue to expand the presence and increase the number of consumers on the Weedmaps marketplace and broaden our offerings, we generate more value for our business clients. As we continue to expand the presence and increase the number of cannabis businesses listed on weedmaps.com, we become a more compelling marketplace for consumers. To capitalize on the growth opportunities of our two-sided marketplace and solutions, we plan to continue making investments in raising brand awareness, increasing penetration within existing markets and expanding to new markets, as well as continuing to develop and monetize new solutions to extend the functionality of our platform. These investments serve to deepen the consumer experience with our platform and continue to provide a high level of support to our business clients.

While the cannabis industry is still in the early innings of what could be decades of growth, we have established a leading position and a recognized brand given our 16-year operating history. Over the coming years, we plan to continue expanding our solutions and service offerings.

Challenges in Our End-Markets

Despite cannabis being a large and growing sector in the United States, we believe that cannabis is unlike many other consumer goods and retail categories for a number of reasons:

•Cannabis as a regulated industry is still in a nascent stage of development.

•Cannabis users (defined as adults, aged 21 and older, who have consumed cannabis in the past year) represent less than 22% of the total U.S. adult, aged 21 and older, population today (and less than 16% for those that consumed in the past month)3 without a “typical” user profile.

•Regulations governing cannabis are complex and vary state-by-state and by city and county within states.

•Cannabis has wide variance in characteristics that make it complex for consumers to make an informed purchase decision.

•Cannabis is a perishable good with a lack of product homogeneity.

•Brands are only in the early stages of establishing a consumer presence.

•The illicit market continues to pose a major challenge, directly competing with licensed operators burdened by high taxes and complex regulations.

•The industry has experienced periods of price deflation, including over the past three years, impacting the financial performance of businesses across the value chain.

•Limited access to capital (relative to other industries) and limitations under Section 280E of the Internal Revenue Code of 1986, as amended (the “Code”) on deduction or credit for certain expenses of cannabis business can reduce the cash flow and liquidity of many industry participants.

Our Competitive Strengths

Since our founding in 2008, we have grown to become a leading provider of technology solutions to the cannabis industry by leveraging our competitive strengths, including:

•Long History as a Technology Leader Serving the Cannabis Industry. Founded in 2008, we have a long history and established relationships with cannabis businesses and consumers across the United States. This long history has given us several competitive advantages, such as scale, attractive operating margins and local insights into emerging consumer and business trends across many markets. Our policy expertise allows us to anticipate and react quickly to changes in cannabis regulations and informs all aspects of our business, including our product ideation, development and go-to-market strategies.

•Largest Two-Sided Platform for Cannabis Businesses and Consumers. With $184.5 million in revenues and 5,077 average monthly paying clients for the year ended December 31, 2024, we believe we are the largest two-sided platform for cannabis businesses and consumers in the United States. Increasing the number of users on our platform, generates more engagements, which we expect can more easily persuade our business clients to consolidate their service providers by switching to our value-priced Weedmaps for Business bundled solution. Increasing the number of businesses on our marketplace, allows us to be a more compelling platform for users. As more businesses and users join the platform, we gain a richer trove of industry data to perform market research and assist in product development and improvement. The result is a self-reinforcing, mutually beneficial, two-sided network effect, which we believe is difficult to replicate.

•A Fully-Integrated Solution Specific to the Cannabis Industry. We believe our Weedmaps for Business is the industry’s only comprehensive solution and incorporates embedded compliance functionality so that our clients comply with state law through integrated software solutions ranging from live menus, logistics and fulfillment, POS integrations, inventory management and data and analytics. We also believe we are the only platform servicing cannabis that combines both a scaled marketplace and software - most other technology providers offer software solutions without the marketplace or a marketplace without software. We also believe we offer the most comprehensive software platform that allows cannabis retailers to reach their target audience, quickly and cost effectively, addressing a wide range of needs. Our platform features self-service administrative functionality that enables clients to manage their listings page, including adding images, adjusting their menus, editing product information and responding to reviews as well as analyzing traffic trends.

•Unique and Growing Data Asset. As a result our established presence, scale and the breadth of product offerings that provide us with a high volume of retail-level information and user insights, we have a growing and unique first-party data asset. Currently, the cannabis industry has few reliable sources of fulsome datasets. Our data gives us insights on local market trends and the shape of the consumer journey from exploration and discovery to point of direct interaction with retailers across multiple retailers, brands and products. As our network of clients and consumers continues to grow, our data set will become deeper and richer, increasing its value and our potential monetization opportunities.

•Ability to Innovate Rapidly and Launch New Products Efficiently at Scale. We have an agile product innovation and deployment process. Our sales team frequently engages with our paid clients about the products they use, as well as their business objectives and performance. We constantly strive to generate product ideas through this deep engagement with our clients, as well as empirical research. During the initial development phases, we test a proposed offering with relevant areas of our business such as sales, compliance, legal, marketing and technology, and use the resulting cross-functional input to develop a clear business rationale and explicit articulation of the goals, client problems that need to be solved, compliance features that need to be incorporated, and potential product-market fit prior to the investment of developer time and company resources. We leverage reusable microservices architecture and modular technology that can be redeployed across multiple new offerings for quicker development cycles. This streamlined approach yields smaller initiatives requiring less investment, enabling us to deliver cost-effective product innovation at a rapid pace.

•Capital-Efficient Business Model with Historical Track Record of Positive Cash Flows. We operate a cloud-based platform, and unlike other cannabis-related businesses, we require minimal physical footprint and are not directly exposed to fluctuations in product input costs. We do not require real estate or other significant capital outlays to enter new markets. Our offerings can be efficiently customized to new markets to facilitate expansion, which provides significant flexibility to scale and enter new markets with minimal investment. The capital-efficiency of our business model is evidenced by our historical robust margin profile and, our track record of positive Adjusted EBITDA and cash flows from operating activities.

•Operationally-Focused Management Team with Deep Experience. Our executive leadership team has extensive and relevant professional experience spanning the technology, consumer, retail, legal and financial services industries, with a track record of operational execution and driving growth. Our Chief Executive Officer, Douglas Francis is a co-founder of WM Technology and, prior to 2024, had also served as Executive Chair. We believe our deep knowledge of our end-markets and broad-based operational expertise spanning several industry sectors provides a key competitive advantage in executing against our growth strategy.

Our Growth Strategy

As a leading marketplace and software platform, our goal is not only to grow our market share but to grow the entire market by promoting wider access to licensed cannabis, educating consumers on how to shop for cannabis and providing licensed operators with the tools they need to access users and grow their businesses. We believe we are well-positioned to capitalize on underlying growth across our end-markets by executing against our strategy as follows:

•Grow Our Two-Sided Marketplace. Our goal is to be the center of commerce for consumers seeking cannabis. To support this goal, we intend to continue growing the number of consumers on our platform through original content that educates, entertains, facilitates discovery of new products, increases awareness of our platform and encourages repeat usage. As we grow our users and user engagements, we will continue to engage with our clients to demonstrate the value we believe they receive on our platform and can convince more businesses to increase adoption of our Weedmaps for Business services through our Weedmaps for Business subscription offering and additional add-ons.

•Expand Our Existing Markets and Enter New Markets. We have a significant opportunity to grow our client base both within existing markets that are continuing to grow and new markets as they become open to regulated cannabis. We believe we are a nationally-recognized brand in the cannabis industry, and we are monetizing our platform in over 35 U.S. states and territories, as of December 31, 2024. Based on our internal research, we believe the minimum level of acceptable retail density to have a healthy and functioning licensed market is one licensed retailer per 10,000 residents. Many of the U.S. states where we operate today are still under-penetrated with low levels of licensed retail density based on our internal data. Despite recent and near term challenges, we believe that there are substantial growth opportunities for us in the long-term within our existing markets as retail licenses continue to be issued, and states move towards, and eventually beyond, the one retail license per 10,000 people ratio. As of December 31, 2024, there were approximately 12,000 existing retail and delivery licenses across the United States. Assuming no cap on the number of licenses issued or other restrictions on the number of licenses issued, if these same markets were to issue enough licenses to match a ratio of one retail license per 10,000 residents, approximately 22,000 new retail licenses would be issued. This may require continued liberalization of license restrictions across cities and counties within certain states where we do business today. In addition, we believe that legalization by additional states and eventually the U.S. government is inevitable. Assuming no other restrictions on the number of licenses issued, if the entire United States reached a minimum level of density of one retail license per 10,000 residents, the total universe of retail licenses would reach approximately 34,000, which is approximately 2.8 times the current count of retail licenses in the United States. If our assumptions and projections are correct, this represents a significant growth opportunity for us as every new retail license issued is an opportunity to onboard a new client onto our platform and increase their monthly spend as they leverage more of our services, solutions and upsell / add-on products.

•Expand Our Weedmaps for Business Solutions and Monetize Gross Merchandise Value (“GMV”) Consistent with Federal and State Laws. We intend to continue expanding our suite of valuable advertising and software solutions and the functionality of our Weedmaps for Business solutions through additional offerings of premium analytics and loyalty tools, among other solutions, which we intend to monetize through additional higher priced tiers within our subscription offering. We will continue to expand the availability of our POS integrations across additional states. We also are continuously improving the base-level functionality across our Weedmaps for Business solutions. We believe these initiatives will result in a more engaged client who utilizes more of our services across our platform and is more ripe for monetization opportunities over time. While we do not believe GMV is a driver of our revenue currently, GMV could represent significant monetization potential over time when and if U.S. federal regulations allow us to monetize our clients’ currently off-platform transaction activity through take-rates or payment fees.

•Pursue Strategic Acquisitions. We take a measured approach to acquisition-related growth. We intend to continue selectively pursuing opportunities to invest in and acquire technology offerings that either complement our existing products and services or allow us to accelerate our growth.

Competition

Our direct competitors for individual components or parts of our platform include cannabis-focused marketplace like Leafly (for retail listing pages), cannabis-focused technology companies like Dutchie and Jane Technologies and a variety of cannabis-focused marketing and advertising technology solutions. In addition, for our retail listing pages, our platform may also compete with current or potential products and solutions offered by internet search engines and advertising networks like Google, general two-sided networks like Yelp, various other newspaper, television and media companies, outdoor billboard advertising, and online merchant platforms, such as Shopify, Square and Lightspeed, or delivery companies like DoorDash. For example, in January 2025, DoorDash announced an expanded offering to allow customers of legal age to purchase hemp derived THC and CBD products from merchants. We believe that the principal competitive factors in our market include the scale of our network, comprehensiveness of offerings, ease of adoption and use, ability to facilitate compliance with the complex, disparate regulations applicable to businesses operating in the cannabis industry and the breadth and trustworthiness of information available to consumers and brand. We believe we compete favorably based on these factors. On May 16, 2024, President Biden announced that the U.S. Attorney General initiated proceedings to transfer cannabis from Schedule I to Schedule III, through a Notice of Proposed Rulemaking ("NPRM") published on May 21, 2024. Should cannabis ultimately be rescheduled to Schedule III, this decision is expected to have far reaching implications that are not yet fully understood. For example, rescheduling may increase competitors in this space if non-cannabis technology companies who have previously avoided the space now decide to enter the market.

For additional information about the risks to our business related to competition, see the section titled “Risk Factors—Risks Related to our Business and Industry—We currently face intense competition in the market and we expect competition to further intensify as the cannabis industry continues to evolve.”

Sales and Marketing

Sales

Our sales team is primarily based out of our Irvine, California headquarters. Members of our sales team are knowledgeable about the products and add-ons that we offer and assist new and existing clients with our platform.

We generate many leads for new listing pages through the applicable state cannabis regulators’ lists of licensees. Other leads are created from inbound requests by applicants for cannabis licenses to begin establishing their business’ presence on our platform pending an expected cannabis license.

Marketing

We believe the quality and strength of our platform is our most valuable marketing asset. Our marketing strategy, across both business-to-consumer and business-to-business commerce, consists of user acquisition, brand marketing, communications and field marketing.

Our key marketing efforts consist of driving awareness of the marketplace, new user acquisition, and increasing platform engagement with existing users. To drive awareness, we apply a range of strategies from broad integrated marketing campaigns, such as our work each year on April 20th (“420”), to local, on-the ground events in partnership with brands and retailers. While many traditional paid channels are still not available to cannabis industry brands (Google search and some social platforms for example) we have an evolving playbook of tactics to acquire new users that includes a combination of targeted out-of-home, programmatic display, and affiliate marketing campaigns. We augment our paid efforts with social media and search engine optimization tactics to drive organic traffic. To engage and retain existing users, we apply lifecycle tactics, leveraging our first party data to personalize touch points based on user interests.

We have reinvested in our own on-the-ground and field marketing presence and are increasing the types and cadence of client events. These events and in-store activations allow us to engage with consumers at the point of purchase and to engage directly with our clients, allowing us to understand each of their needs and challenges and foster goodwill.

Social Impact

To support the growth of an inclusive cannabis industry, we participate in policy panels and organize educational sessions to educate attendees about the importance of social equity programs and other policy initiatives that are designed to ensure the ability of people of color and those impacted by the war on drugs to participate in the legal cannabis markets that are opening (i.e. social equity licensing programs). We have drafted white papers and mock legislative provisions that were designed to support the enactment of social equity licensing programs and have advocated for state and local governments to enact social equity licensing programs. We have established a program, WM Teal, which stands for “Together for Equity Access and Legislation”, through which we provide free software, advertising, educational materials and training programs to applicants or licenses under social equity licensing programs.

Product Development

Our product development efforts focus on adding new features and solutions to our platform, as well as increasing the functionality and enhancing the ease of use of our platform. While we expect product development costs to increase as we continue to increase the functionality of our platform, we expect the percentage of total revenues represented by such costs to remain unchanged.

Intellectual Property

Our intellectual property and proprietary rights are valuable assets that are important to our business. In our efforts to safeguard our intellectual property, including copyrights, trade secrets, trademarks, patents and other forms of intellectual property rights, we rely on a combination of federal, state, common law and international rights in the jurisdictions in which we operate.

We have an ongoing trademark and service mark registration program pursuant to which we register our brand names, taglines and logos in the United States, Canada, the European Union and other jurisdictions to the extent we determine they are appropriate and cost-effective.

As of December 31, 2024, we have been issued trademark registrations in the United States, Canada, Japan, the European Union, the United Kingdom, Mexico and Australia. We have also been issued an international trademark registration with designation in Australia and the European Union for “Weedmaps.”

In addition to our numerous trademark applications and registrations, we have United States copyright registrations for our weedmaps.com website, “Grow One,” and two versions of our Lab API documentation. Further, we own several domain names, including: weedmaps.com, marijuana.com, cannabis.com, wmpolicy.com, themuseumofweed.com, wm-retail.com, wmforbusiness.com and WM.store. Our trademarks and domain names are material to our business and brand identity.

We also rely on non-disclosure agreements, invention assignment agreements, intellectual property assignment agreements, or license agreements with employees, independent contractors, consumers, software providers and other third parties, which protect and limit access to and use of our proprietary intellectual property.

Though we rely, in part, upon these legal and contractual protections, we believe that factors such as the skills and ingenuity of our employees, as well as the functionality and frequent enhancements to our platform are larger contributors to our success in the marketplace.

Circumstances outside our control could pose a threat to our intellectual property rights. For more information, refer to the section titled “Risk Factors—Risks Related to our Business and Industry.”

Seasonality

The cannabis industry has certain industry holidays that in recent years have resulted in increased purchases by cannabis consumers. Such “holidays” include, but are not limited to 420, July 10th and the Wednesday before Thanksgiving (“Green Wednesday”). Likewise, our clients will typically increase spend heading into these events. We also typically invest in marketing spend around these holidays which can create some seasonality in our sales and market expenses from quarter to quarter. While seasonality has not had a significant impact on our results in the past, our clients may experience seasonality in their businesses which in turn can impact the revenue generated from them. Our business may become more seasonal in the future and historical patterns in our business may not be a reliable indicator of future performance.

People Operations and Human Capital Resources

As of December 31, 2024, we had 440 full-time employees and 17 temporary employees, including 171 in engineering, product and design, 191 in sales and marketing and 95 in general and administrative. Of these employees, 450 are located in the United States and 7 are located in Canada.

We believe that being able to attract and retain top talent is both a strategic advantage for us and necessary to realize our mission of powering a transparent and inclusive global cannabis economy. Our position as a leading technology provider to the cannabis industry helps us attract high caliber candidates who are technically skilled and passionate about our mission and products. We devote substantial resources to this task. Our dedicated, best-in-class Talent Acquisition team is focused on finding and attracting diverse and capable talent, and our People & Workplace team is focused on making us a world class employer of choice for that talent once they get here. None of our employees are represented by a labor union or covered by collective bargaining agreements and we have not experienced any work stoppages.

Government Regulation

Numerous countries and territories have moved in recent years to regulate and tax cannabis, particularly medical cannabis. Most of these jurisdictions present complex regulatory regimes that require licensed operators to comply with substantial reporting, testing, packaging, distribution and security requirements.

United States and Territories

Notwithstanding the trend toward further state legalization, the U.S. government continues to categorize cannabis as a prohibited controlled substance, and accordingly the cultivation, processing, distribution, sale, advertisement of sale and possession by our customers violate federal law, as discussed further in the sections titled “Risk Factors—Risks Related to our Business and Industry.”

On January 4, 2018, then U.S. Attorney General Jeff Sessions issued a memorandum for all U.S. Attorneys (the “Sessions Memo”) rescinding certain past Department of Justice (“DOJ”) memoranda on cannabis law enforcement, including the Memorandum by former Deputy Attorney General James Michael Cole (the “Cole Memo”) issued on August 29, 2013, under the Obama administration. Describing the criminal enforcement of federal cannabis prohibitions against those complying with state cannabis regulatory systems as an inefficient use of federal investigative and prosecutorial resources, the Cole Memo gave federal prosecutors discretion not to prosecute state law compliant cannabis companies in states that were regulating cannabis, unless one or more of eight federal priorities were implicated, including use of cannabis by minors, violence, or the use of federal lands for cultivation. The Sessions Memo, which remains in effect, states that each U.S. Attorney’s Office should follow established principles that govern all federal prosecutions when deciding which cannabis activities to prosecute.

Since 2014, versions of the U.S. omnibus spending bill have included a provision prohibiting the DOJ, which includes the Drug Enforcement Administration (“DEA”), from using appropriated funds to prevent states from implementing their medical-use cannabis laws. Federal courts have held that the provision prohibits the DOJ from spending funds to prosecute individuals who engage in conduct permitted by state medical-use cannabis laws and who strictly comply with such laws.

Despite the Sessions Memo, the U.S. government has not prioritized the enforcement of those laws against cannabis companies complying with state law and their vendors, and has not since 2014. No reversal of that policy of prosecutorial discretion is expected under a Trump administration given his prior administrations actions on cannabis and statements while campaigning, although prosecutions against state-legal entities cannot be ruled out entirely at this time.