First Quarter 2021 June

ProAssurance Overview *All data excludes NORCAL unless specifically referenced ProAssurance Investor Briefing | June 2021 3 Mission, Vision, & Values The ProAssurance Mission We exist to Protect Others.

Our Shared Vision We will be the best in the world at understanding and providing solutions for the risks our customers encounter as healers, innovators, employers, and professionals. Through an integrated family of companies, products, and services, we will be a trusted partner enabling those we serve to focus on their vital work. As the employer of choice, we embrace every day as a singular opportunity to reach for extraordinary outcomes, build and deepen superior relationships, and accomplish our mission with infectious enthusiasm and unbending integrity. Corporate Values Integrity | Leadership | Relationships | Enthusiasm 4ProAssurance Investor Briefing | June 2021 At a Glance All data as of 3/31/21.

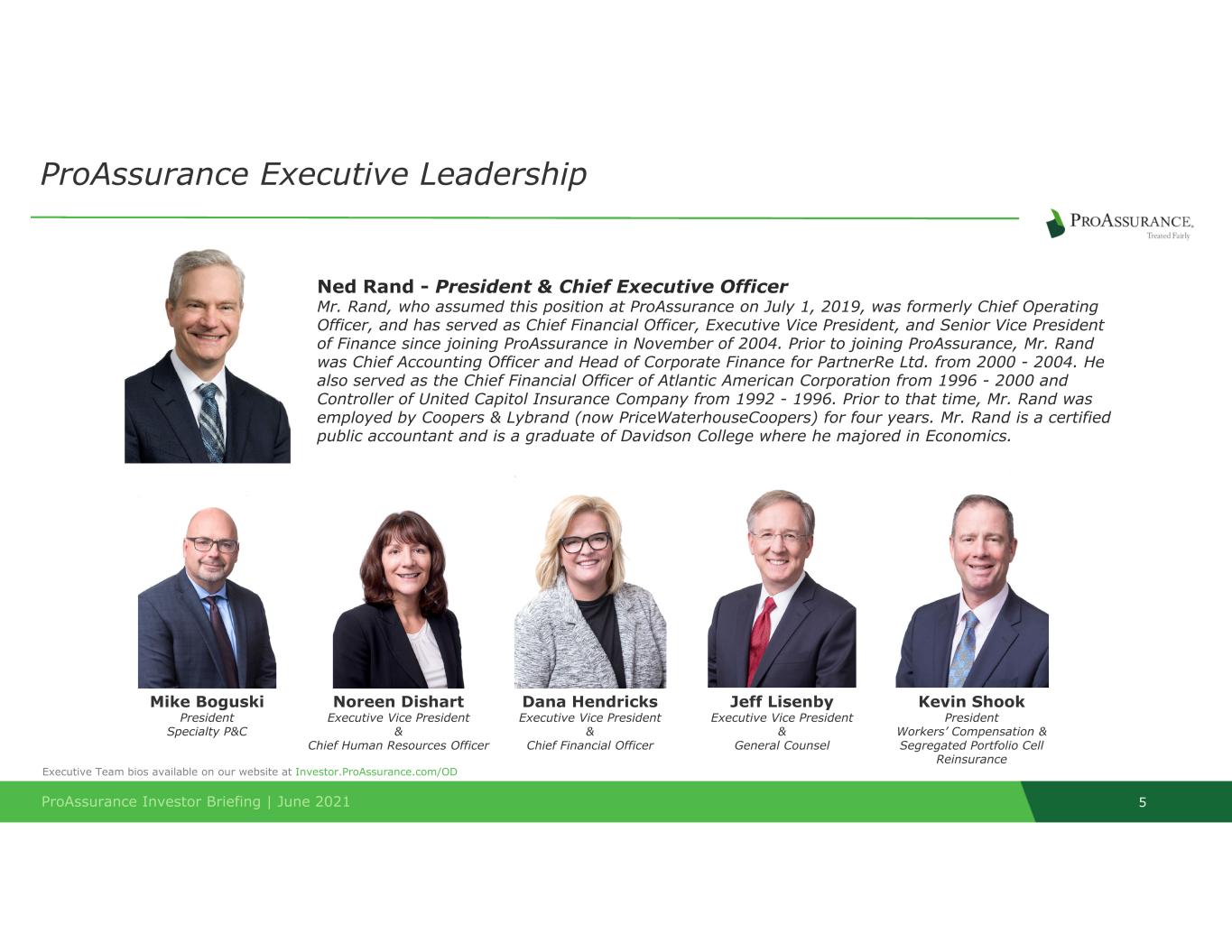

Office locations and employee counts include NORCAL. Business Unit Principal Offices Employees Lines of Business HCPL 11 641 Healthcare Professional Liability Medmarc 1 31 Medical Technology Liability Innovative Specialty Team 1 102 Professional Liability for Podiatrists, Chiropractors, & Dentists, and LawyerCare Eastern 9 241 Workers’ Compensation &Captive Facilities (all lines) PRA Corporate 1 125 Corporate functions (Accounting, Legal, etc.) • Healthcare-centric specialty insurance writer ◦ Specialty Property & Casualty ▪ Healthcare Professional Liability (HCPL) ▪ Life Sciences and Medical Technology Liability ▪ Innovative Specialty Team ◦ Workers' Compensation Insurance ◦ Segregated Portfolio Cell (SPC) Reinsurance ◦ Lloyd's of London Syndicates (1729 & 6131) • Total Assets: $4.7 billion • Shareholders' Equity: $1.3 billion • Claims-Paying Ratings ◦ A.M. Best: “A” (Excellent) ◦ Fitch: “A-” (Strong) • 21 locations, with operations in three countries ◦ 1,140 employees • Writing in 50 states & DC Corporate Headquarters Claims Offices Claims/Underwriting Offices Underwriting Offices Cayman Islands Lloyds ProAssurance Investor Briefing | June 2021 5 ProAssurance Executive Leadership Ned Rand - President & Chief Executive Officer Mr. Rand, who assumed this position at ProAssurance on July 1, 2019, was formerly Chief Operating Officer, and has served as Chief Financial Officer, Executive Vice President, and Senior Vice President of Finance since joining ProAssurance in November of 2004.

Prior to joining ProAssurance, Mr. Rand was Chief Accounting Officer and Head of Corporate Finance for PartnerRe Ltd. from 2000 - 2004. He also served as the Chief Financial Officer of Atlantic American Corporation from 1996 - 2000 and Controller of United Capitol Insurance Company from 1992 - 1996. Prior to that time, Mr. Rand was employed by Coopers & Lybrand (now PriceWaterhouseCoopers) for four years. Mr. Rand is a certified public accountant and is a graduate of Davidson College where he majored in Economics. Mike Boguski President Specialty P&C Noreen Dishart Executive Vice President & Chief Human Resources Officer Dana Hendricks Executive Vice President & Chief Financial Officer Jeff Lisenby Executive Vice President & General Counsel Kevin Shook President Workers’ Compensation & Segregated Portfolio Cell Reinsurance Executive Team bios available on our website at Investor.ProAssurance.com/OD ProAssurance Investor Briefing | June 2021 6 ProAssurance Board of Directors Director bios available on our website at Investor.ProAssurance.com/OD Maye Head Frei C M. James Gorrie N/C Ziad R. Haydar, MD C Edward L. Rand, Jr E Frank A. Spinosa, DPM N/C Katisha T. Vance, MD N/C A ‐ Audit Committee C ‐ Compensation Committee E ‐ Executive Committee N/C ‐ Nominating/Corporate Governance Committee Underlined ‐ Chair Scott C. Syphax C Samuel A. Di Piazza, Jr A Fabiola Cobarrubias, MD A Bruce D. Angiolillo A, C Kedrick D. Adkins, Jr A Thomas A.S. Wilson, Jr, MD Lead Director E, N/C W. Stancil Starnes Executive Chairman E

ProAssurance Investor Briefing | June 2021 7 ProAssurance Brand Profile Specialty P&C Healthcare Professional Liability Workers’ Comp Alternative Risk Transfer Medical Technology & Life Sciences Products Liability Legal Professional Liability ProAssurance Investor Briefing | June 2021 8 ProAssurance Specialty Property & Casualty Specialty P&C is comprised of three major divisions.

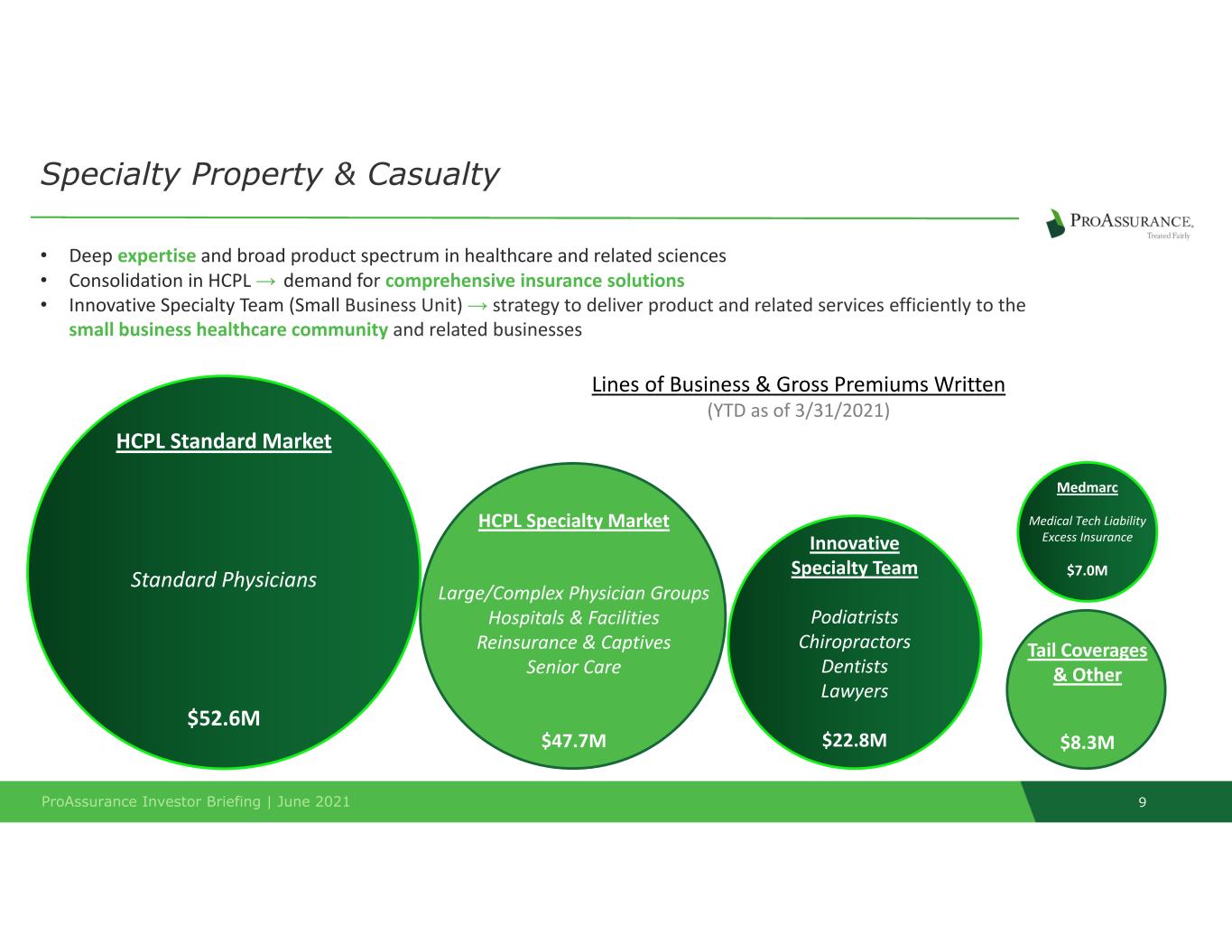

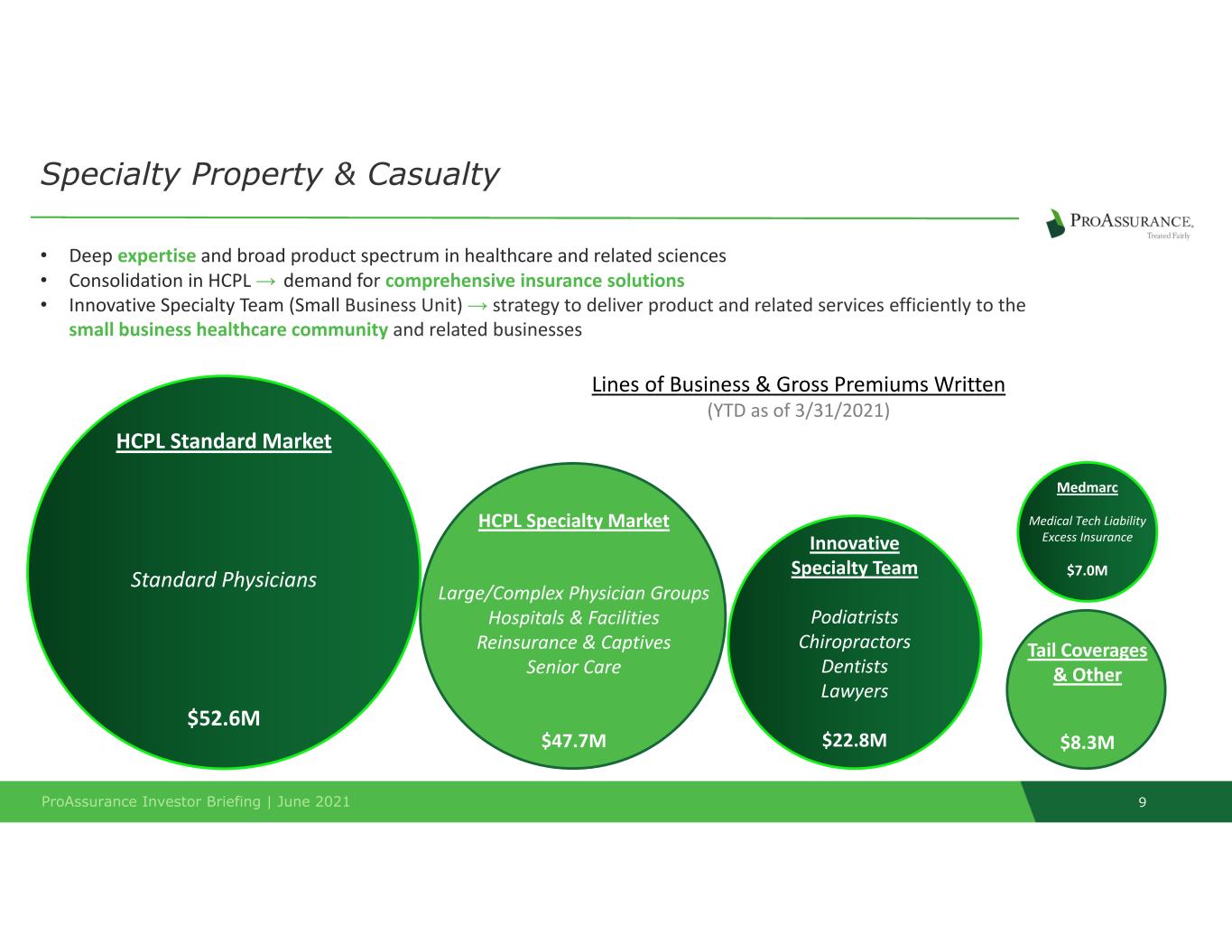

Healthcare Professional Liability (HCPL) offers coverage to healthcare providers and facilities. Excess and surplus coverage and alternative risk solutions (including reinsurance and loss portfolio transfers) are also included in HCPL. The Innovative Specialty Team (IST) provides coverage for a variety of professional specialties—podiatrists, chiropractors, dentists, and lawyers. Medmarc provides coverage for medical technology and life sciences companies that manufacture or distribute products. Eastern Alliance Workers’ Compensation Eastern Alliance Insurance Group is a specialty underwriter of workers’ compensation products and services for businesses and organizations located in the East, South, and Midwest regions of the United States. Eastern individually underwrites 13,000+ policies across 500+ types of business with premium sized up to $2 million+. Products include guaranteed cost policies, policyholder dividend policies, retrospectively‐rated policies, deductible policies, and alternative insurance solutions. Inova Re/Eastern Re SPC Reinsurance Inova Re/Eastern Re is an alternative insurance solution offering a stable, secure insurance environment with its Segregated Portfolio Company structure. Based in the Cayman Islands, Inova offers captive programs for both workers’ compensation and healthcare professional liability insurance in a variety of industries including, healthcare, forestry, staffing, construction/contracting, petroleum, marine and recreation, and social services. Lloyd’s Syndicates 1729 and 6131 This segment includes the results from our participation in Lloyd's of London Syndicate 1729 and Syndicate 6131. Syndicate 6131 is an SPA that underwrites on a quota share basis with Syndicate 1729. Syndicate 1729 underwrites risks over a wide range of property and casualty insurance and reinsurance lines while Syndicate 6131 focuses on contingency and specialty property business. ProAssurance Corporate Includes our investment operations, other than those reported in our Segregated Portfolio Cell Reinsurance and Lloyd's Syndicates segments, interest expense, and U.S. income taxes. This segment also includes non‐premium revenues generated outside of our insurance entities and corporate expenses. Company‐wide administrative departments reside in ProAssurance Corporate. ProAssurance Reports Financial Results in Five Segments 9ProAssurance Investor Briefing | June 2021 • Deep expertise and broad product spectrum in healthcare and related sciences • Consolidation in HCPL → demand for comprehensive insurance solutions • Innovative Specialty Team (Small Business Unit) → strategy to deliver product and related services efficiently to the small business healthcare community and related businesses Specialty Property & Casualty Core Physicians Podiatrists Chiropractors Dentists Lawyers HCPL Standard Market Standard Physicians $52.6M HCPL Specialty Market Large/Complex Physician Groups Hospitals & Facilities Reinsurance & Captives Senior Care $47.7M Innovative Specialty Team Podiatrists Chiropractors Dentists Lawyers $22.8M Tail Coverages & Other $8.3M Medmarc Medical Tech Liability Excess Insurance $7.0M Lines of Business & Gross Premiums Written (YTD as of 3/31/2021)

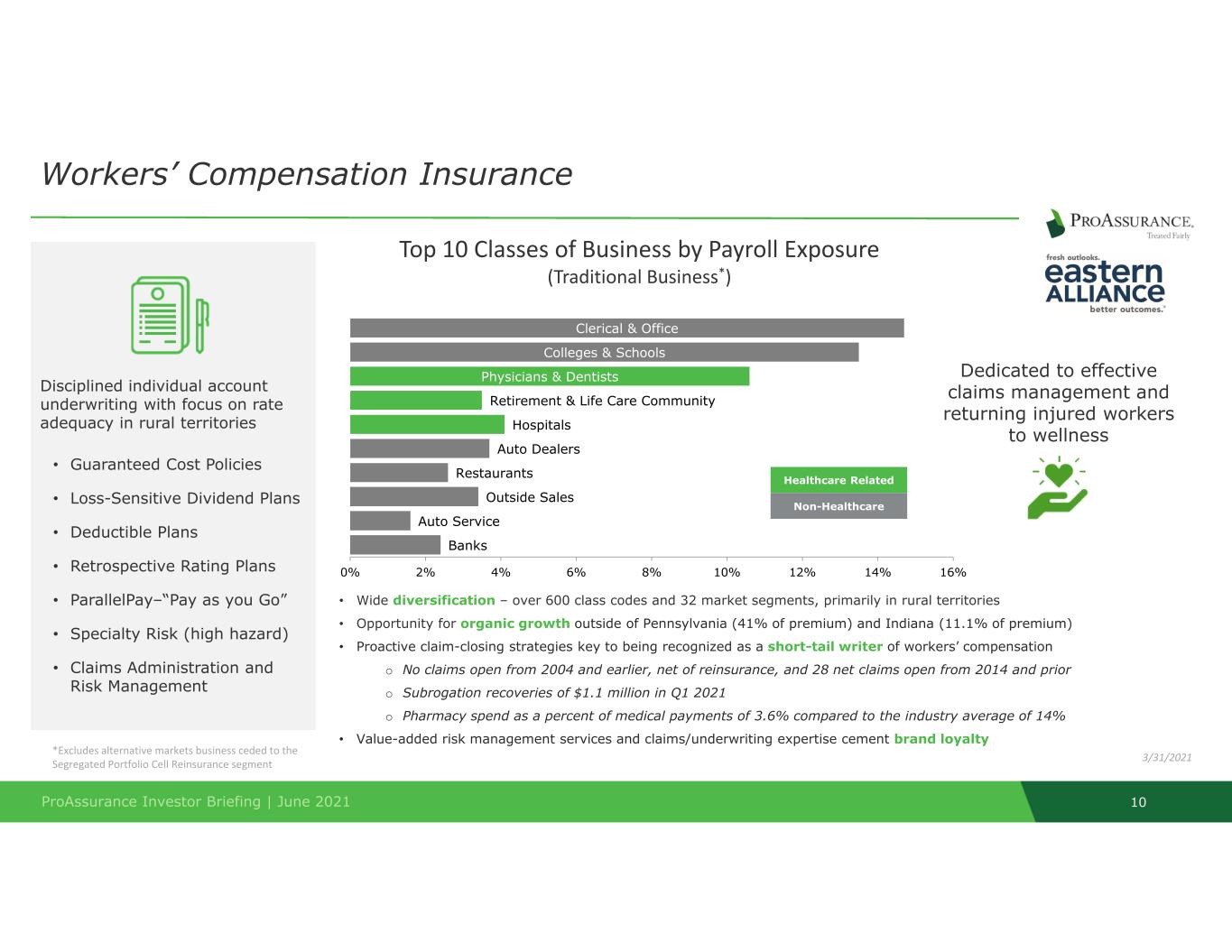

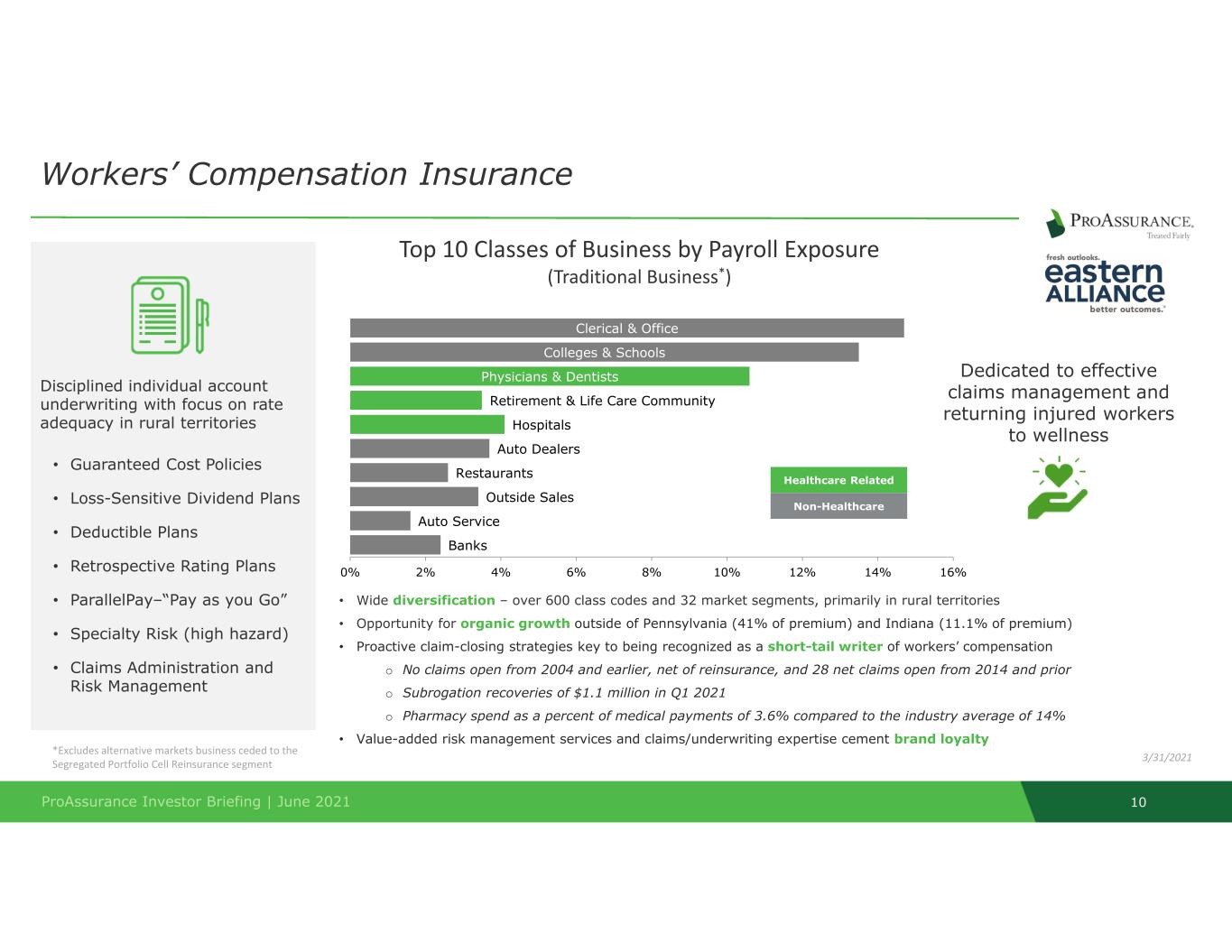

10ProAssurance Investor Briefing | June 2021 Disciplined individual account underwriting with focus on rate adequacy in rural territories • Guaranteed Cost Policies • Loss-Sensitive Dividend Plans • Deductible Plans • Retrospective Rating Plans • ParallelPay–“Pay as you Go” • Specialty Risk (high hazard) • Claims Administration and Risk Management Workers’ Compensation Insurance • Wide diversification – over 600 class codes and 32 market segments, primarily in rural territories • Opportunity for organic growth outside of Pennsylvania (41% of premium) and Indiana (11.1% of premium) • Proactive claim-closing strategies key to being recognized as a short-tail writer of workers’ compensation o No claims open from 2004 and earlier, net of reinsurance, and 28 net claims open from 2014 and prior o Subrogation recoveries of $1.1 million in Q1 2021 o Pharmacy spend as a percent of medical payments of 3.6% compared to the industry average of 14% • Value-added risk management services and claims/underwriting expertise cement brand loyalty Banks Auto Service Outside Sales Restaurants Auto Dealers Hospitals Retirement & Life Care Community Physicians & Dentists Colleges & Schools Clerical & Office 0% 2% 4% 6% 8% 10% 12% 14% 16% *Excludes alternative markets business ceded to the Segregated Portfolio Cell Reinsurance segment Dedicated to effective claims management and returning injured workers to wellness Healthcare Related Non-Healthcare 3/31/2021 Top 10 Classes of Business by Payroll Exposure (Traditional Business*)

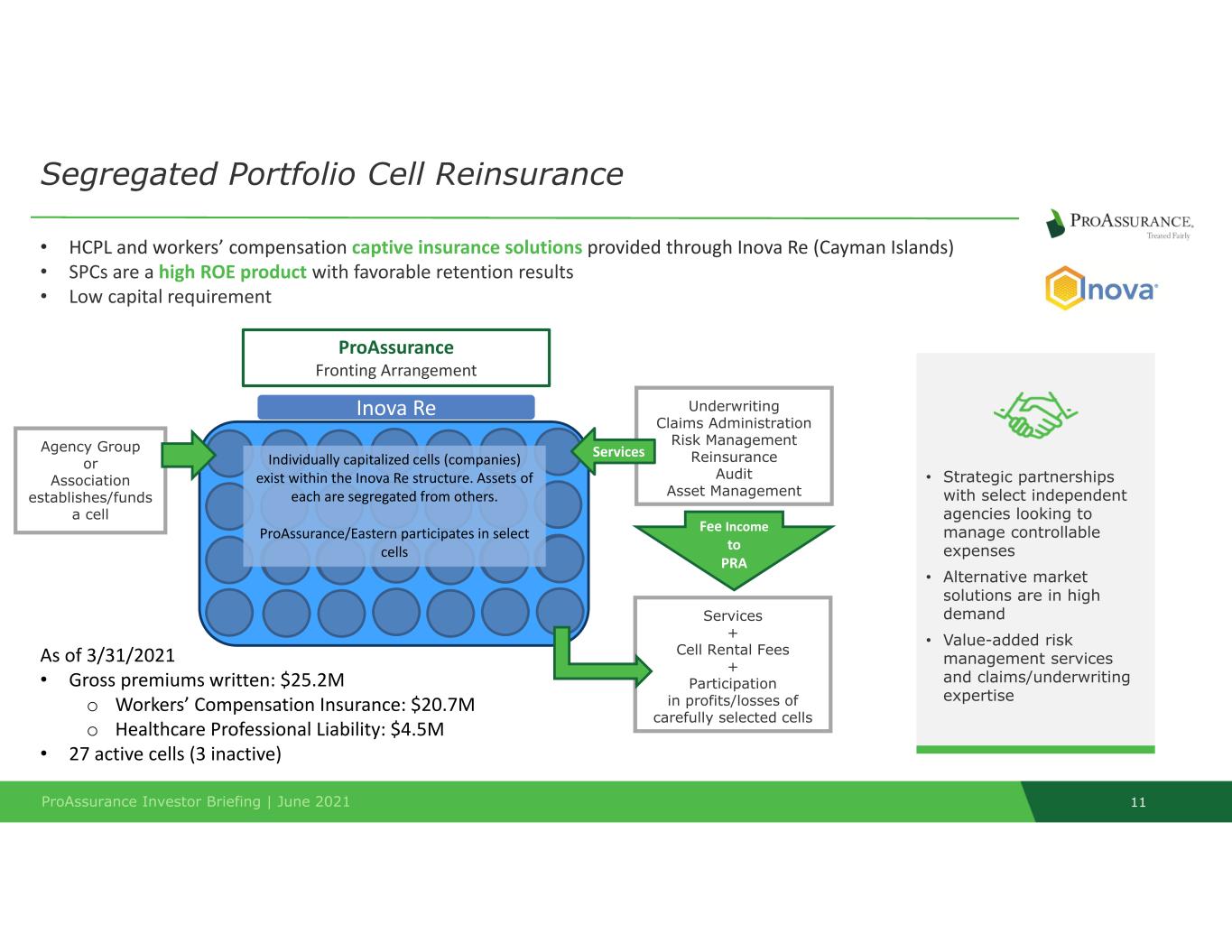

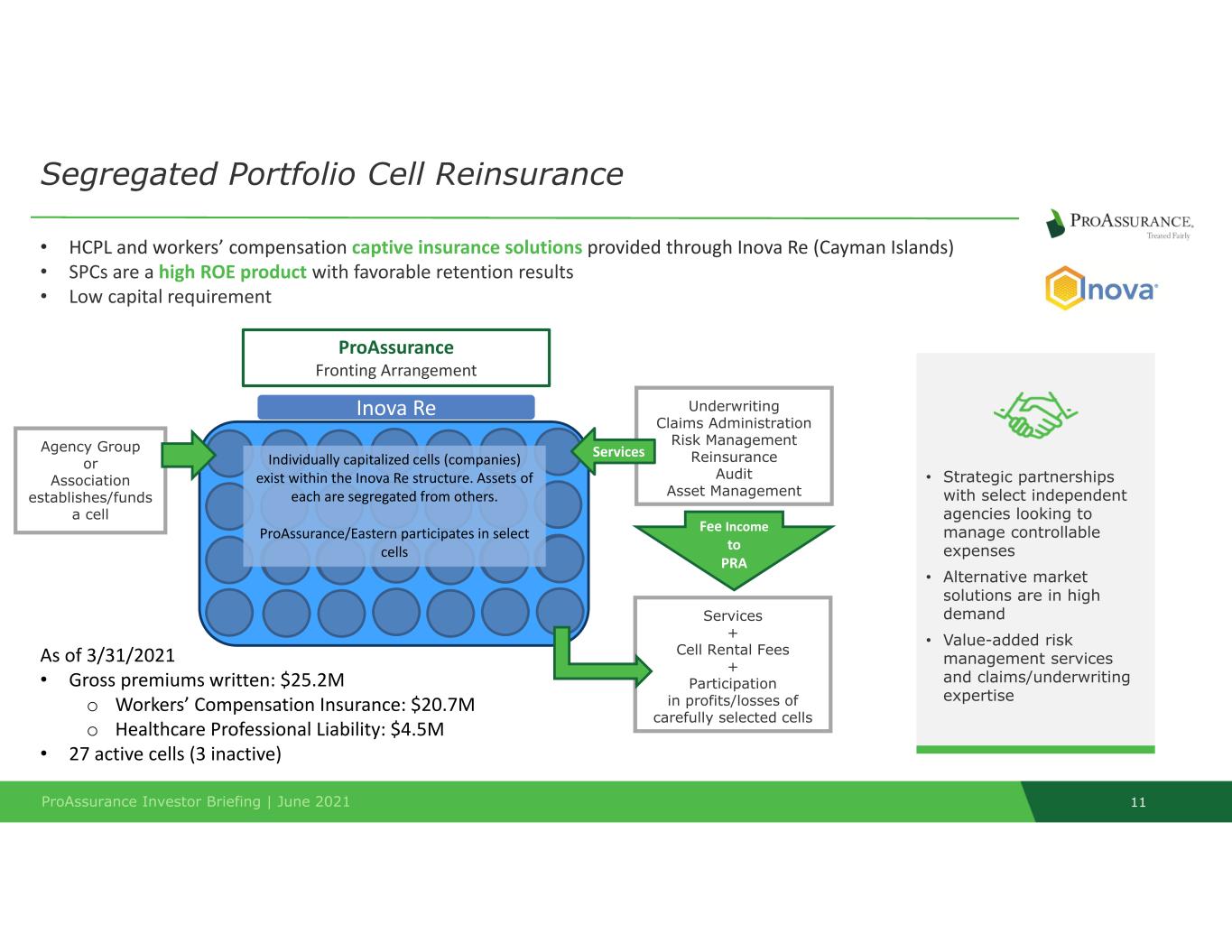

11ProAssurance Investor Briefing | June 2021 Segregated Portfolio Cell Reinsurance ProAssurance Fronting Arrangement Agency Group or Association establishes/funds a cell Underwriting Claims Administration Risk Management Reinsurance Audit Asset Management Services + Cell Rental Fees + Participation in profits/losses of carefully selected cells Fee Income to PRA • HCPL and workers’ compensation captive insurance solutions provided through Inova Re (Cayman Islands) • SPCs are a high ROE product with favorable retention results • Low capital requirement • Strategic partnerships with select independent agencies looking to manage controllable expenses • Alternative market solutions are in high demand • Value-added risk management services and claims/underwriting expertise Inova Re Services As of 3/31/2021 • Gross premiums written: $25.2M o Workers’ Compensation Insurance: $20.7M o Healthcare Professional Liability: $4.5M • 27 active cells (3 inactive) Individually capitalized cells (companies) exist within the Inova Re structure. Assets of each are segregated from others. ProAssurance/Eastern participates in select cells 12ProAssurance Investor Briefing | June 2021 Lloyd’s of London Syndicates ProAssurance Funds at Lloyd’s (FAL) $106.8 Million 1 Property Insurance (All Other - Mainly US) 30% Casualty (Mainly US) 23% Specialty 22% Facility (US) 10% General Liability (US) 6% Contingency 6% All Other Reinsurance (Mainly US) 3% Dale Underwriting Partners Independent, Owner‐Managed Syndicate at Lloyd’s Syndicate 1729 6131 PRA Participation 5% 2 50% 3 PRA share of 2021 Underwriting Capacity $13M $14M • Opportunity to invest alongside a recognized leader in Duncan Dale • Lloyd’s provides universal distribution and licensures • Westernization of international healthcare professional liability provides opportunities in new markets 1 Comprised of investment securities, cash, and cash equivalents deposited with Lloyd's as of 3/31/2021 2 We decreased our participation for the 2021 underwriting year from 29% to 5%, which will be reflected in our results beginning in Q2 2021 due to reporting on a one‐quarter lag.

3 We reduced our participation for the 2021 underwriting year from 100% to 50%. This will also be reflected in our results beginning Q2 2021.

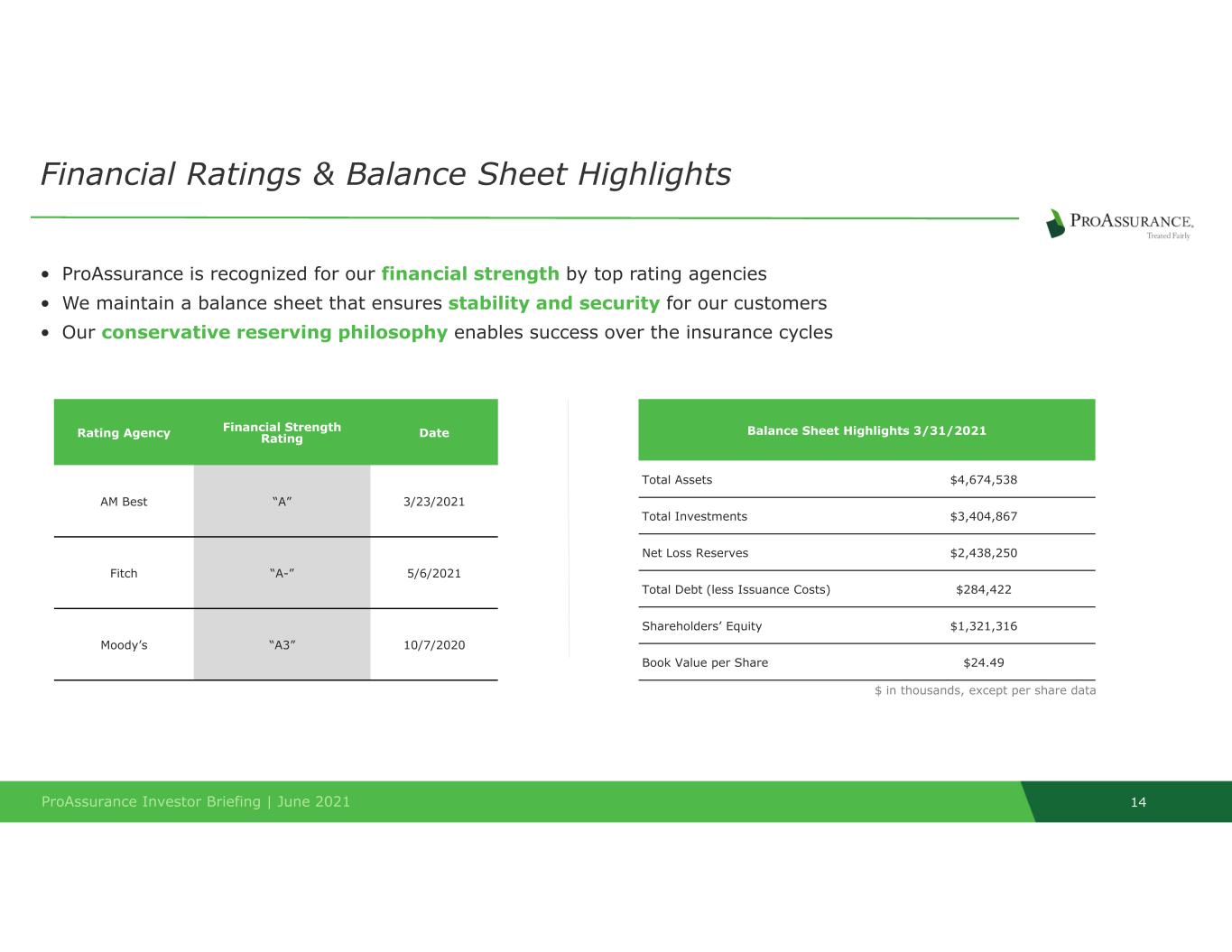

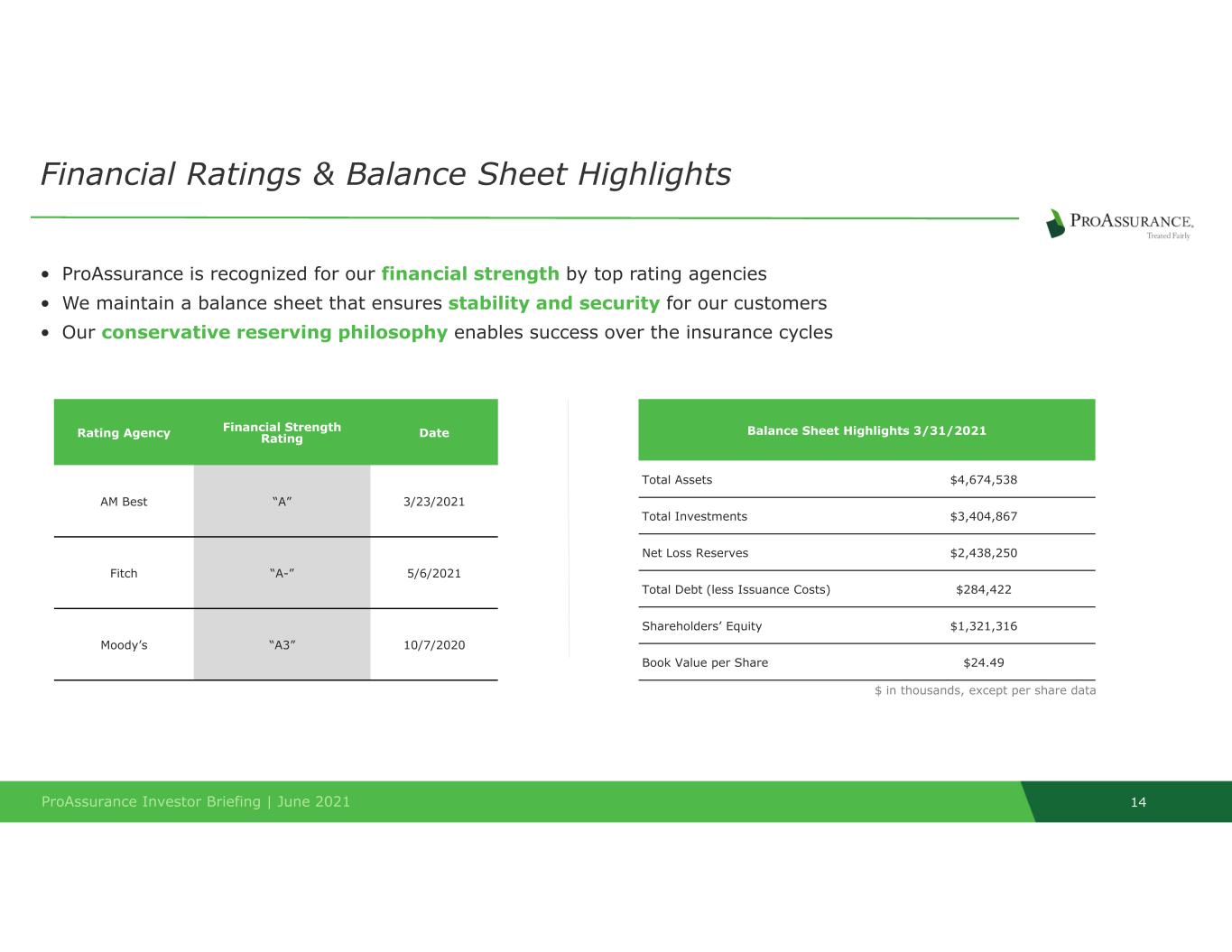

ProAssurance Investor Briefing | June 2021 13 Specialty P&C 57% Workers' Comp 34% Standard Physicians 21% ($52.6M) Specialty 19% ($47.7M) Small Business Unit 9% ($22.8M) Tail Coverages + Other 3% ($8.3M) Medical Technology Liability 3% ($7.0M) Segregated Portfolio Cell Reinsurance 10% ($25.2M) Workers' Compensation Insurance 29% ($72.3M) Lloyd's 6% ($14.1M) Specialty P&C 81% Workers' Comp 19% Standard Physicians 35% Specialty 5% Medical Technology Liability 2% Tail Coverages + Reinsurance 1% Small Business Unit 39% Segregated Portfolio Cell Reinsurance 4% Workers' Compensation Insurance 15% Premium allocated by line does not reflect inter-segment eliminations, and thus will not agree to total 2021 gross premiums written Consolidated Premiums, Policyholders & Distribution for 2021 Our Distribution Sources HCPL LPL Life Sciences Workers’ Comp Agent/Broker 76% 100% 100% 100% Direct 24% -- -- -- YTD 2021 Gross Premium: $224.7M Inforce 2021 Policyholder Count: 72,363* All Data as of 3/31/2021, subject to rounding *Excludes Lloyd’s of London 14ProAssurance Investor Briefing | June 2021 • ProAssurance is recognized for our financial strength by top rating agencies • We maintain a balance sheet that ensures stability and security for our customers • Our conservative reserving philosophy enables success over the insurance cycles Financial Ratings & Balance Sheet Highlights Balance Sheet Highlights 3/31/2021 Total Assets $4,674,538 Total Investments $3,404,867 Net Loss Reserves $2,438,250 Total Debt (less Issuance Costs) $284,422 Shareholders’ Equity $1,321,316 Book Value per Share $24.49 Rating Agency Financial Strength Rating Date AM Best “A” 3/23/2021 Fitch “A-” 5/6/2021 Moody’s “A3” 10/7/2020 $ in thousands, except per share data

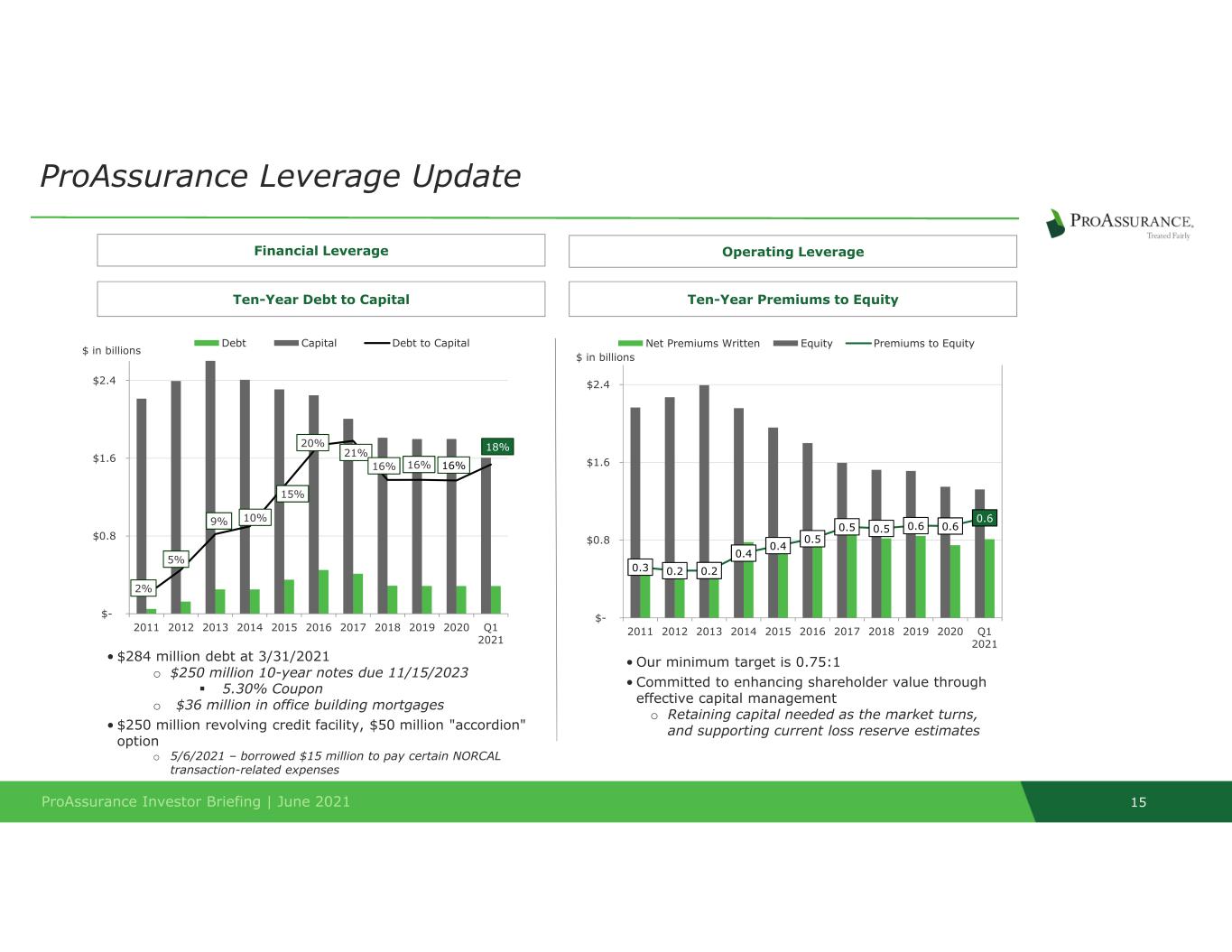

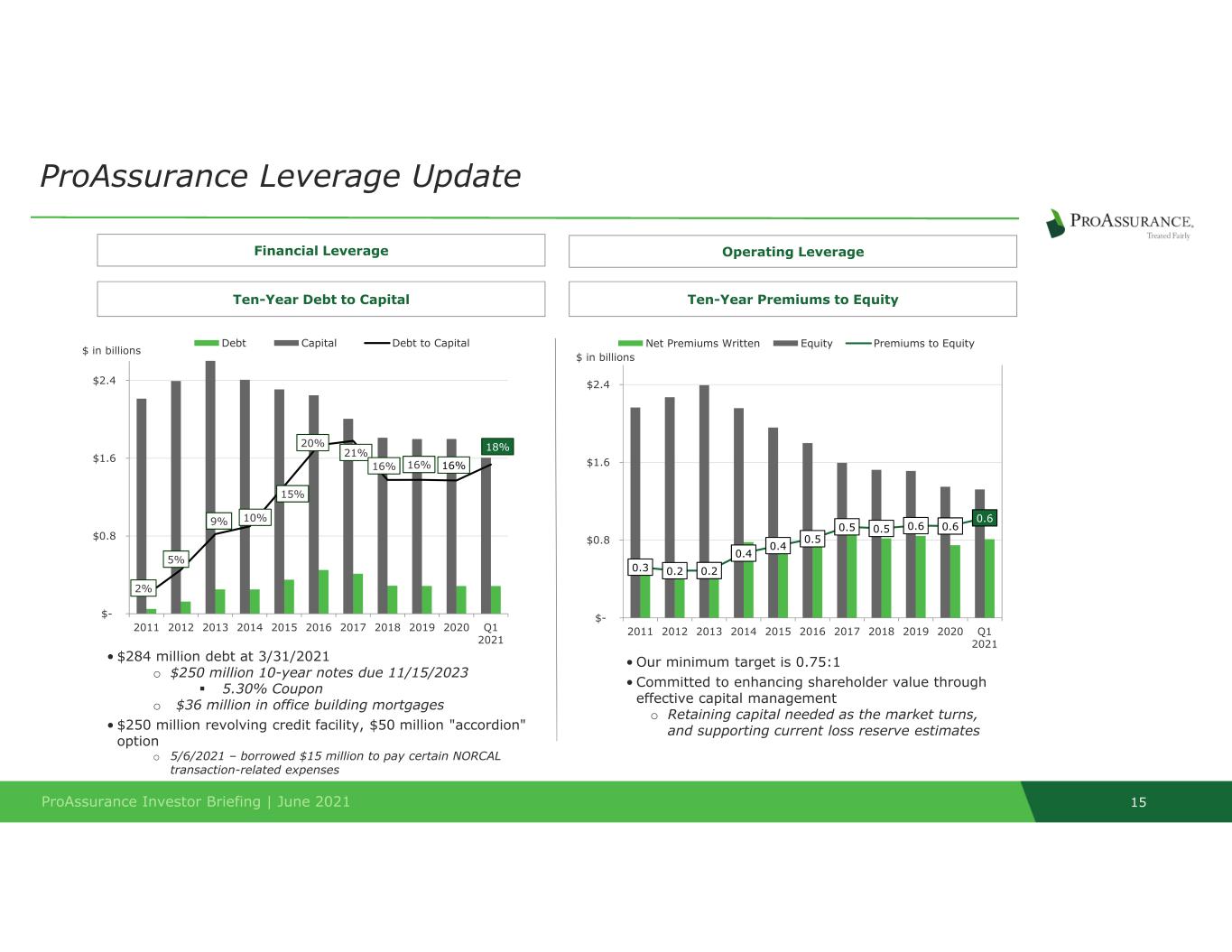

15ProAssurance Investor Briefing | June 2021 • $284 million debt at 3/31/2021 o $250 million 10-year notes due 11/15/2023 5.30% Coupon o $36 million in office building mortgages • $250 million revolving credit facility, $50 million "accordion" option o 5/6/2021 – borrowed $15 million to pay certain NORCAL transaction-related expenses ProAssurance Leverage Update Ten-Year Premiums to EquityTen-Year Debt to Capital • Our minimum target is 0.75:1 • Committed to enhancing shareholder value through effective capital management o Retaining capital needed as the market turns, and supporting current loss reserve estimates Financial Leverage Operating Leverage 2% 5% 9% 10% 15% 20% 21% 16% 16% 16% 18% $- $0.8 $1.6 $2.4 Q1 2021 2020201920182017201620152014201320122011 $ in billions Debt Capital Debt to Capital 0.3 0.2 0.2 0.4 0.4 0.5 0.5 0.5 0.6 0.6 0.6 $- $0.8 $1.6 $2.4 Q1 2021 2020201920182017201620152014201320122011 $ in billions Net Premiums Written Equity Premiums to Equity 16ProAssurance Investor Briefing | June 2021 Corporate 55% Asset Backed 27% State & Muni 12% Govt & Agency 4% Fixed Trading 2% • We maintain a conservative, highly-liquid investment philosophy • Effective stewardship of capital ensures a position of financial strength through turbulent market cycles • Allowed cash to build to support business operations and our May 5, 2021 acquisition of NORCAL Fixed Income 77% Equities & Equity Substitutes 13% Short Term (excluding cash) 8% BOLI 2% Investment Philosophy & Portfolio Overall Portfolio $3.4 Billion Fixed Income Portfolio $2.6 Billion 3/31/2021 Subject to rounding Details of our entire investment portfolio are available on our website at Investor.ProAssurance.com/CustomPage/Index?KeyGenPage=305596 28% 14% 10%8% 8% 8% 7% 6% 4% 4% 3% Fixed Maturity Securities Quality AAA A A+ BBB+ Below Investment Grade or Not Rated BBB A‐ AA‐ AA AA+ BBB‐

17ProAssurance Investor Briefing | June 2021 COVID-19 and the Markets We Serve • Healthcare Professional Liability (HCPL) ◦ Primary exposures in broader markets: misdiagnoses, complications from delayed elective procedures, and failure to prevent infection in Senior Care settings May be mitigated by support at state and federal levels for liability immunity for healthcare professionals doing their best in extraordinary circumstances ◦ Pre-tax $10 million IBNR reserve for COVID-19 established in the second quarter of 2020, no adjustments to date • Workers’ Compensation Insurance ◦ Primary exposures in broader markets: healthcare professionals ◦ Our rural underwriting strategy mitigates exposure to COVID-19 claims as compared to larger metro areas ◦ The majority of workers showing symptoms are able to return to work after two or three weeks ◦ Claim activity rising as workers return to full employment ◦ Fewer experienced workers being hired as unemployment benefits are greater than what some skilled workers can earn • Segregated Portfolio Cell Reinsurance (SPCR) ◦ Primary exposures in broader markets: consistent with HCPL and Workers’ Compensation, on a smaller scale SPCR business is ceded from the HCPL and Workers’ Compensation Insurance segments • Lloyd’s of London ◦ Primary exposures in broader markets: event cancellation, business interruption ◦ Most business interruption policies specifically exclude pandemics and other market-wide triggers. However, in January 2021, the Supreme Court of the United Kingdom ruled in favor of policyholders contesting denied business interruption coverage from insurers, despite policy language expressly excluding viral or disease events. The ruling has broad implications for insurers writing business interruption insurance, and for interpretation of contractual language. For more details, and for policyholder resources, visit our dedicated websites: ProAssurance.com/Covid‐19/ and EasternAlliance.com/Coronavirus_and_Workers_Comp/ 19ProAssurance Investor Briefing | June 2021 A Foundation in Excellence “From our earliest days, we have operated with a strategy both responsive to near‐term challenges and proactive to long‐term opportunity.” ‐Ned Rand President & CEO Superior brand identity and reputation in the market Specialization •Deep expertise and commitment to our customers throughout the insurance cycles enable us to outperform our peers over time Experienced & Collaborative Leadership •Average executive leadership tenure of 19 years with PRA or subsidiaries History of Successful M&A •Selective M&A with best‐in‐class partners, and nearly 20 transactions in our 45 year history Scope & Scale •Regional hubs combined with local knowledge of market dynamics and regulatory environments

Why We Will Be Successful

20ProAssurance Investor Briefing | June 2021 In 2020, We… Fo cu se d on U nd er w ri ti ng • Specialty Property & Casualty: o Completed the re‐underwriting of our HCPL Specialty book of business o Enhanced organizational structure and leadership Added new Senior Executive underwriting and actuarial leaders to our existing, experienced organization Established interdepartmental participation in complex and large account underwriting Delivered an enhanced HCPL underwriting structure focused on Standard Physicians and HCPL Specialty business Launched the Innovative Specialty Team to efficiently deliver our Small Business products o Implemented disciplined state strategy process for HCPL o Reduced exposure to volatile product lines, which have had an outsized effect on recent results Impact of re‐underwriting and enhanced risk selection on volatile classes: • Year‐over‐year, Senior Care premium levels reduced by 82%, and Correctional Healthcare premium levels reduced by 52% o Reduced current accident year net loss ratio for the year ended December 31, 2020 by 6.3 percentage points compared to year‐end 2019* as a result of re‐underwriting efforts • Workers’ Compensation Insurance: o Strong underwriting leadership with average management team tenure of over twenty years o Demonstrated ability to underwrite profitably throughout the evolving insurance and economic cycles o Rural underwriting strategy mitigated exposure to COVID‐19 claims as compared to larger metro areas All data as of 12/31/2020 *Excludes effects of the large national healthcare account (see previous disclosures) in 2019 and 2020, and the pre-tax $10M IBNR COVID-19 reserve in 2Q of 2020 We seek constantly to be more efficient and effective as an organization Here’s how we’re doing it 21ProAssurance Investor Briefing | June 2021 In 2020, We… • Specialty Property & Casualty o Achieved renewal rate gains outpacing severity o Improved product structure, terms, and conditions for complex risks o Secured average renewal pricing increases of: +10% in Specialty in 4Q, +15% full year 2020 +10% in Standard Physicians in 4Q, +11% full year 2020 • Workers’ Compensation Insurance o Maintained profitable pricing levels in a soft Workers’ Compensation Insurance market o Achieved average renewal pricing decrease of 4% in both 4Q and the full year 2020 in a competitive marketplace All data as of 12/31/2020 A ch ie ve d St ro ng R at e G ai ns We seek constantly to be more efficient and effective as an organization Here’s how we’re doing it

22ProAssurance Investor Briefing | June 2021 In 2020, We… • Implemented adjustments to our business model, including regional operating structure and staffing assignments o Streamlined organizational structure by reducing number of field offices by 50% in Specialty P&C (since July 2019) Executed a “spans and layers” overhaul to create a four‐region structure, leveraging regional expertise and promoting collaboration, with beneficial effects to policyholder and shareholder value creation. Added fifth region upon closure of NORCAL acquisition. Demarcated healthcare professional liability into Standard Physicians, Specialty Healthcare, and the Innovative Specialty Team, with specialized talent in each Restructured or terminated underperforming technology partnerships with vendors o In the third quarter of 2020, the Workers’ Compensation Insurance segment: Repositioned from five regions to three for more effective management of underwriting, risk management, and claims processing while maintaining our local service teams Integrated small business and underwriting support functions into one unit for each with dedicated leadership, improving submission turnaround time while continuing our individual account underwriting philosophy Realigned our previously stand‐alone captive team into our regional structure to improve accountability Streamlined marketing operations to extend more agency management responsibilities to decision makers in the underwriting process • Made use of technology to streamline operations and eliminate redundancies • Achieved approximately $22 million in expected pro‐forma annual expense reductions as compared to 2019 o $16 million in Specialty P&C o $5 million in Workers’ Compensation Insurance o $1 million in Corporate St re ng th en ed O ur O pe ra ti on al St ru ct ur e We seek constantly to be more efficient and effective as an organization Here’s how we’re doing it 23ProAssurance Investor Briefing | June 2021 To date in 2021… W e co nt in ue to e xe cu te o ur co m pr eh en si ve s tr at eg y • Specialty Property & Casualty: o Closed our acquisition of the NORCAL Group Adds ~$300 million* of business to our Standard Physicians line Adds ~$1.5 billion† to our investment portfolio Expands market share in profitable territories o Reduced our combined ratio by 6.5 percentage points Reflects improvement in both the net loss ratio and underwriting expense ratio o Improved retention in all lines of business except Specialty Healthcare, which will stabilize beginning in the second quarter o Secured average renewal rate increases of 6% during the quarter Standard Physicians: 6% Specialty Healthcare: 8% • Workers’ Compensation Insurance: o Reduced our combined ratio by 2.5 percentage points Reflects improvement in both the net loss ratio and underwriting expense ratio o Closed 18.2% of 2020 and prior claims during the first quarter o Closed 96.4% of all 2020 and 2021 reported COVID claims o Reduced general expenses by 16% We seek constantly to be more efficient and effective as an organization Here’s how we’re doing it *NAIC Data †NAIC before purchase accounting All data as of 3/31/2021

24ProAssurance Investor Briefing | June 2021 Cyclicality in Insurance Loss Trends Decelerate Market Softens Loss Trends Accelerate Market Hardens Catalyst Availability crisis Mergers & acquisitions Tort reform Competitors withdraw Underwriting criteria tightens Prices increase Pricing outpaces losses Combined ratios improve Favorable reserve development Competitors enter the market Prices decrease Underwriting criteria loosens Losses outpace pricing Combined ratios worsen Unfavorable reserve development For over forty years, ProAssurance and its predecessors have successfully navigated the peaks and valleys of the long cycles characteristic of our businesses.

Merger Update

ProAssurance Investor Briefing | June 2021 26 Physicians $647.3M Other HCP $98.3M Hospitals $46.2M Facilities $4.3M Physicians $299.5M Other HCP $89.4M Hospitals $45.8M Facilities $1.5M Physicians $347.8M Other HCP $8.9M Hospitals $0.4M Facilities $2.8M Source: 2020 NAIC filings for all MPL lines, figures subject to rounding $436.2M $359.9M $796.1M2020 DPW: Acquisition Creates the #3 HCPL Insurer in the U.S.

ProAssurance Investor Briefing | June 2021 27 Enhanced Scale and Capabilities1 • Positions company as #3 writer of MPL insurance in the industry • Enhances ProAssurance’s HCPL business: adds additional scale, capabilities and strong California presence • Ability to underwrite larger risks from integrated systems with national footprint Conservatively Priced and Financed Transaction3 • Attractive purchase price; modest impact to tangible book value per share • Additional consideration contingent on favorable reserve development relative to our expectation • Funded with a combination of cash on hand and contribution certificates Value Creation for Customers and All Key Stakeholders4 • Scaled platform to produce strong results driven by disciplined underwriting • Clear path to achieving identified expense synergies • Facilitates EPS and ROE accretive transaction as results / synergies are phased-in, with meaningful accretion thereafter Strong Strategic Alignment and Rationale5 • A shared commitment to the HCPL industry, provision of affordable coverage and the defense of physicians • Best in class talent supporting true nationwide platform • Adds attractive customer base and distribution at a time when the HCPL market is beginning to harden Product, Customer, & Geographic Diversification2 • Premier HCPL insurer with nationwide presence • Expanded product capabilities with broader geographic scale and efficiencies to address varying client needs (e.g. SPC / ART) • High touch model that drives retention using common distribution channels ProAssurance + NORCAL = A Stronger, Better Positioned HCPL Specialty Insurer 28ProAssurance Investor Briefing | June 2021 Integration Goals & Objectives • Build a true national platform and enhance state market leadership • Provide best in class service • Improve overall business quality and profitability • Improve bench strength by retaining the best talent • Establish an effective regional/field operating matrix • Enhance our data advantage • Drive a high performing, unified culture

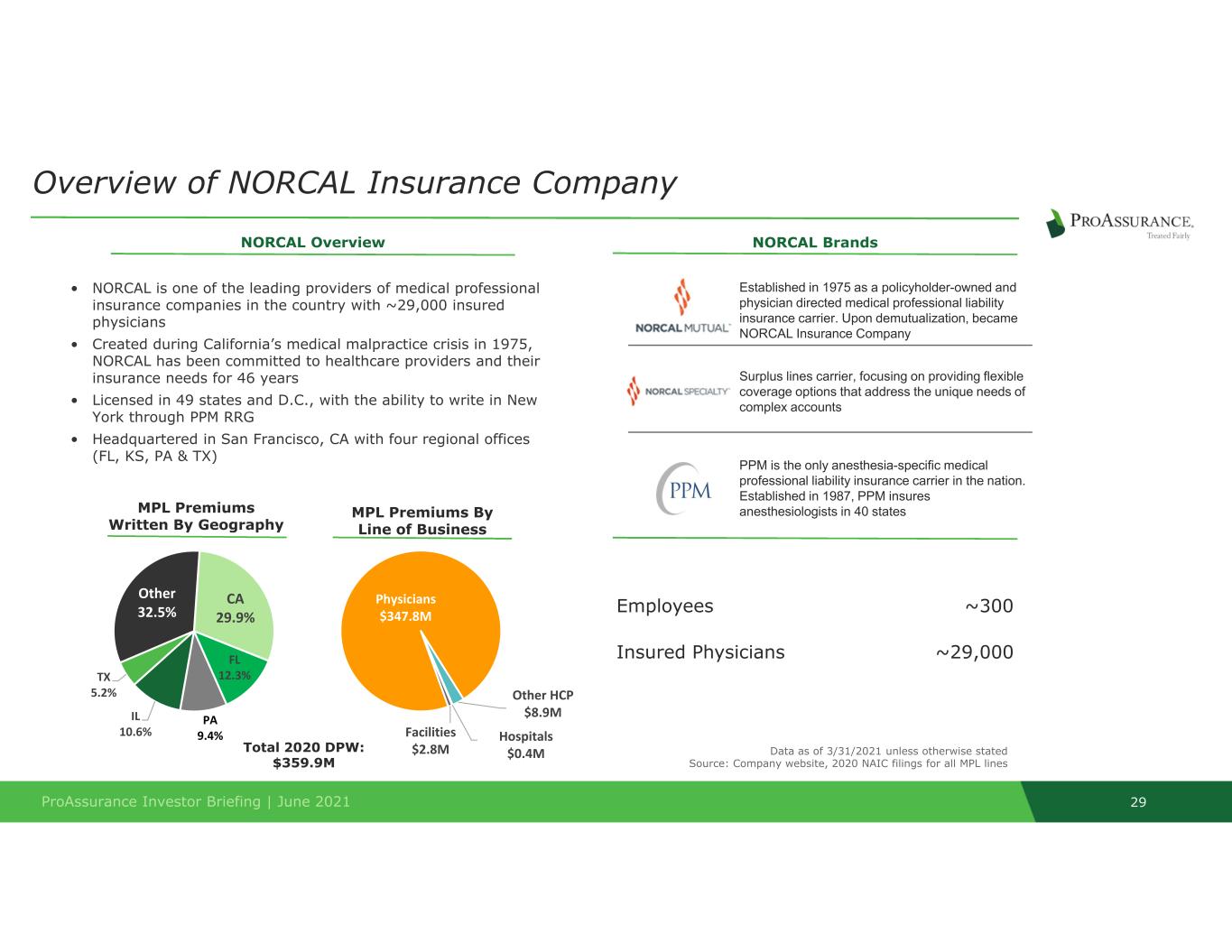

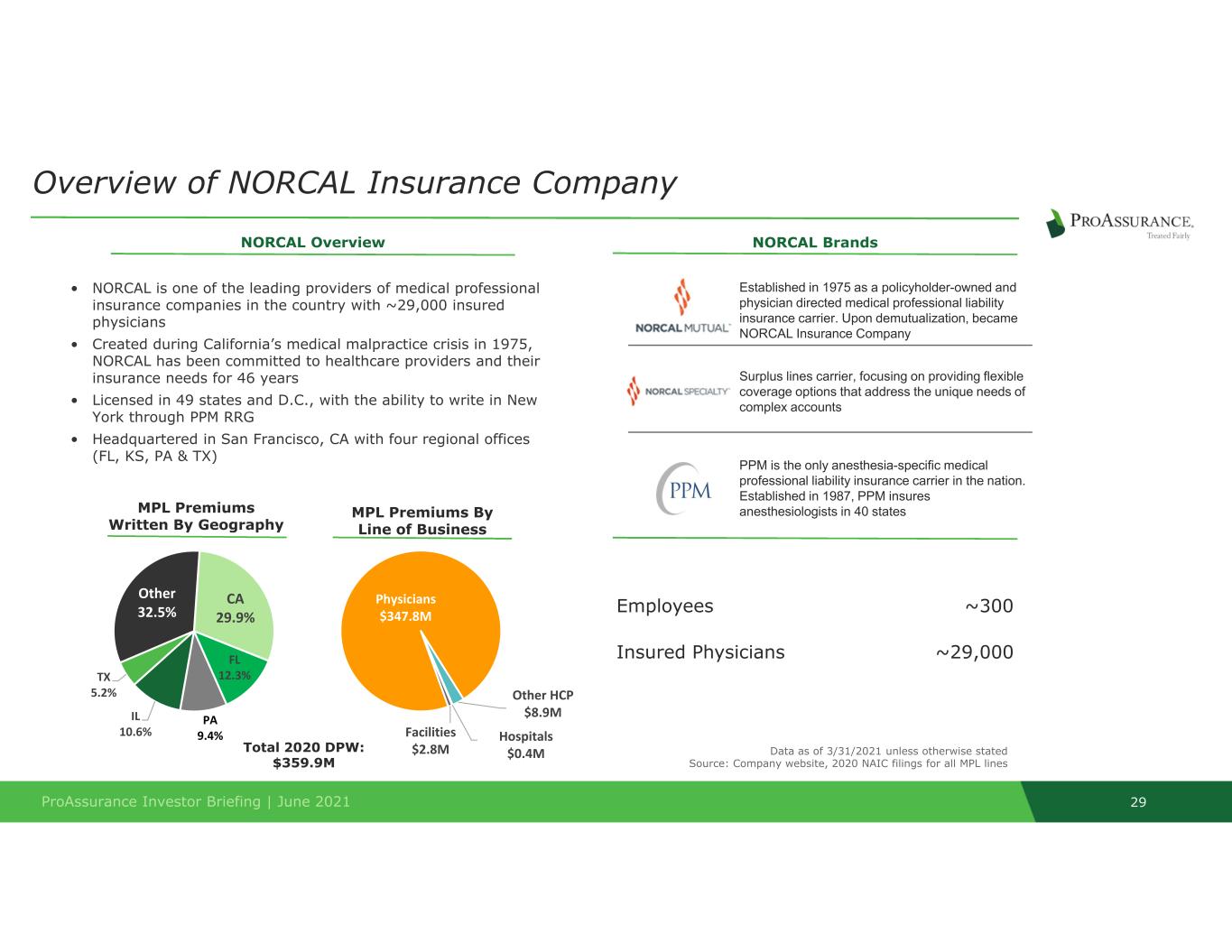

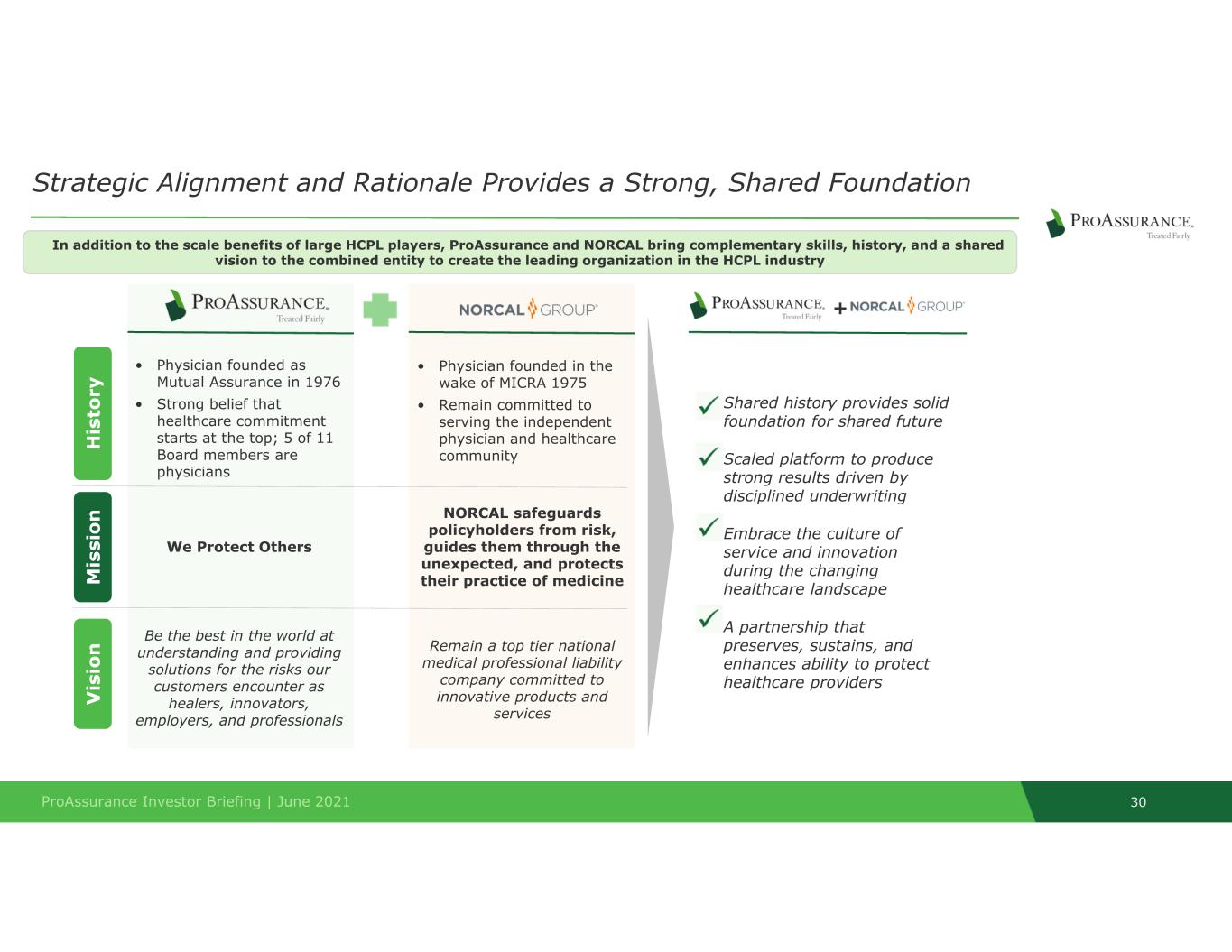

ProAssurance Investor Briefing | June 2021 29 Overview of NORCAL Insurance Company NORCAL Overview NORCAL Brands • NORCAL is one of the leading providers of medical professional insurance companies in the country with ~29,000 insured physicians • Created during California’s medical malpractice crisis in 1975, NORCAL has been committed to healthcare providers and their insurance needs for 46 years • Licensed in 49 states and D.C., with the ability to write in New York through PPM RRG • Headquartered in San Francisco, CA with four regional offices (FL, KS, PA & TX) Employees ~300 Insured Physicians ~29,000 MPL Premiums Written By Geography MPL Premiums By Line of Business Total 2020 DPW: $359.9M Data as of 3/31/2021 unless otherwise stated Source: Company website, 2020 NAIC filings for all MPL lines Physicians $347.8M Other HCP $8.9M Hospitals $0.4M Facilities $2.8M CA 29.9% FL 12.3% PA 9.4% IL 10.6% TX 5.2% Other 32.5% Established in 1975 as a policyholder-owned and physician directed medical professional liability insurance carrier. Upon demutualization, became NORCAL Insurance Company Surplus lines carrier, focusing on providing flexible coverage options that address the unique needs of complex accounts PPM is the only anesthesia-specific medical professional liability insurance carrier in the nation. Established in 1987, PPM insures anesthesiologists in 40 states ProAssurance Investor Briefing | June 2021 30 Strategic Alignment and Rationale Provides a Strong, Shared Foundation • Shared history provides solid foundation for shared future • Scaled platform to produce strong results driven by disciplined underwriting • Embrace the culture of service and innovation during the changing healthcare landscape • A partnership that preserves, sustains, and enhances ability to protect healthcare providers + In addition to the scale benefits of large HCPL players, ProAssurance and NORCAL bring complementary skills, history, and a shared vision to the combined entity to create the leading organization in the HCPL industry H is to ry • Physician founded as Mutual Assurance in 1976 • Strong belief that healthcare commitment starts at the top; 5 of 11 Board members are physicians • Physician founded in the wake of MICRA 1975 • Remain committed to serving the independent physician and healthcare community M is si o n We Protect Others NORCAL safeguards policyholders from risk, guides them through the unexpected, and protects their practice of medicine V is io n Be the best in the world at understanding and providing solutions for the risks our customers encounter as healers, innovators, employers, and professionals Remain a top tier national medical professional liability company committed to innovative products and services

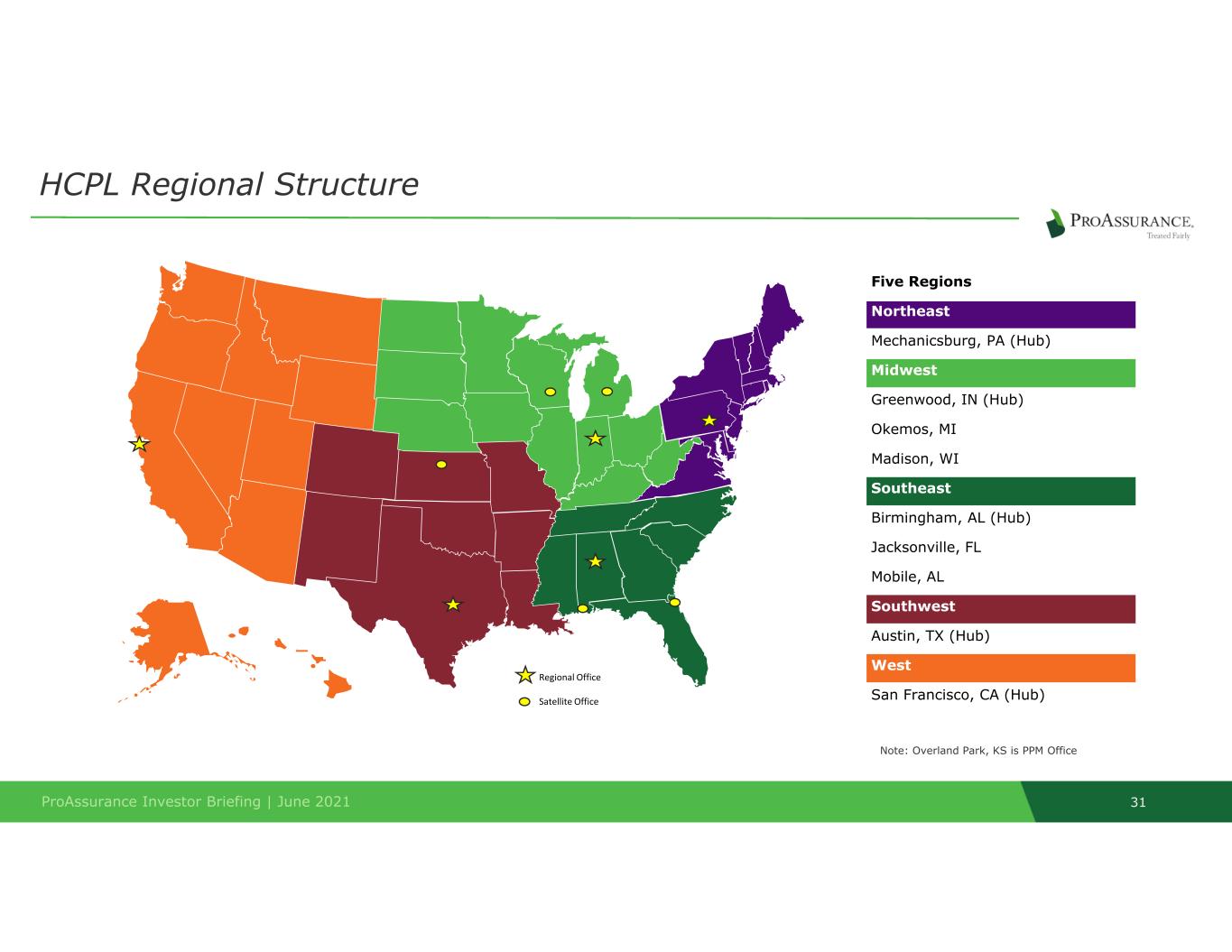

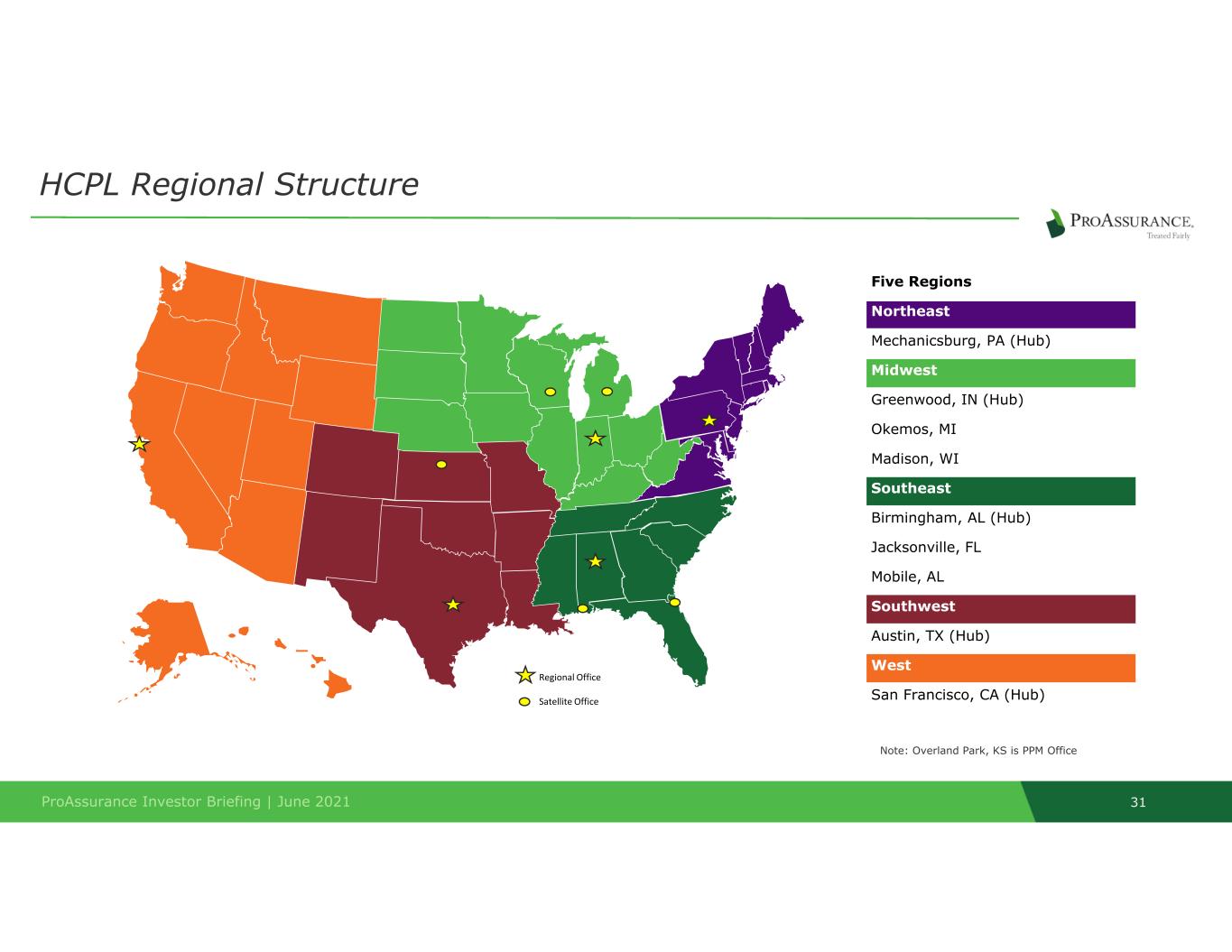

ProAssurance Investor Briefing | June 2021 31 HCPL Regional Structure Note: Overland Park, KS is PPM Office Regional Office Satellite Office Five Regions Northeast Mechanicsburg, PA (Hub) Midwest Greenwood, IN (Hub) Okemos, MI Madison, WI Southeast Birmingham, AL (Hub) Jacksonville, FL Mobile, AL Southwest Austin, TX (Hub) West San Francisco, CA (Hub)

ProAssurance Investor Briefing | June 2021 32 Combination with NORCAL Creates the #3 HCPL Insurer in the U.S. Source: 2020 NAIC filings for all MPL lines Pro Forma Top Ten Market Share by DPW ($ in millions) • Ability to attract and retain key talent • Specialized products focused on healthcare professionals • Competitive pricing through lower costs • Claim efficiencies and disciplined underwriting • NORCAL target market complements ProAssurance’s existing HCPL footprint, especially in the California market • NORCAL’s has a consistent track record of new business generation and very high retention rates Note: PRA premiums only reflect MPL business, as of 2020 1 Pro forma for the merger of TDC and Hospitals Ins. (closed in 2019) $1,714 16.3% $962 1 9.2% $796 7.6% $609 5.8% $523 5.0% $436 4.2% $425 4.0% $369 3.5% $360 3.4% $263 2.5% $170 1.6% $‐ $200 $400 $600 $800 $1,000 $1,200 $1,400 $1,600 $1,800 $2,000 ProAssurance Investor Briefing | June 2021 33 NORCAL Transaction Creates Value for Customers and Stakeholders Protecting More Physicians Financial Benefits • Combined company serves 86k+ healthcare professionals • Expanded product capabilities (admitted, E&S, and RRG capabilities) • Broader geographic scale with additional efficiencies to address varying client needs • Expanded platform allows for underwriting of larger risks from integrated systems with nationwide footprint • Significant annual pre-tax synergies of over $18mm • Synergies focused on removing redundancies and strengthening the business for go-forward strategy • Fully-phased in by the end of 2022 • Transaction will have modest impact to PRA’s book value and tangible book value per share • EPS and ROE accretive as results / synergies are phased-in, with meaningful accretion thereafter

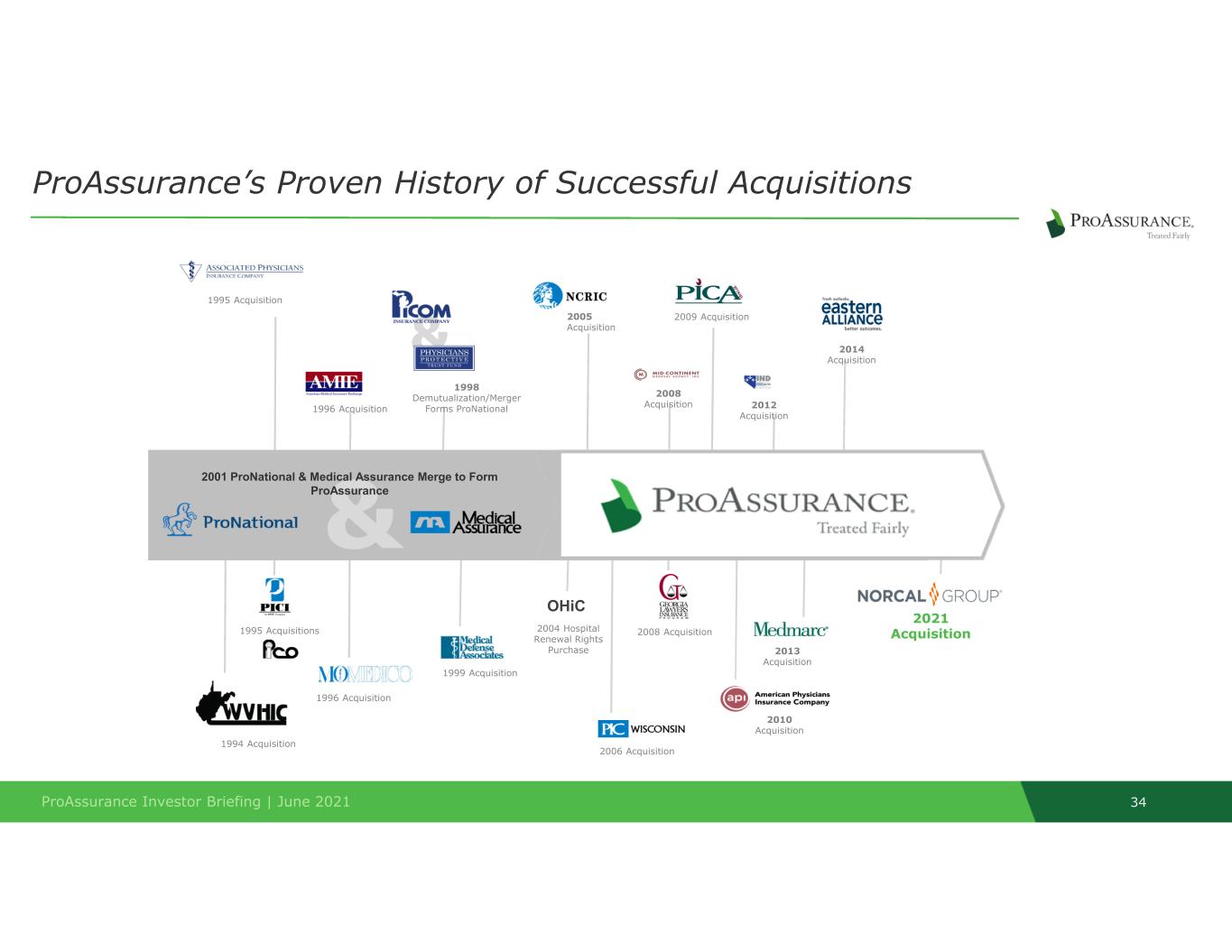

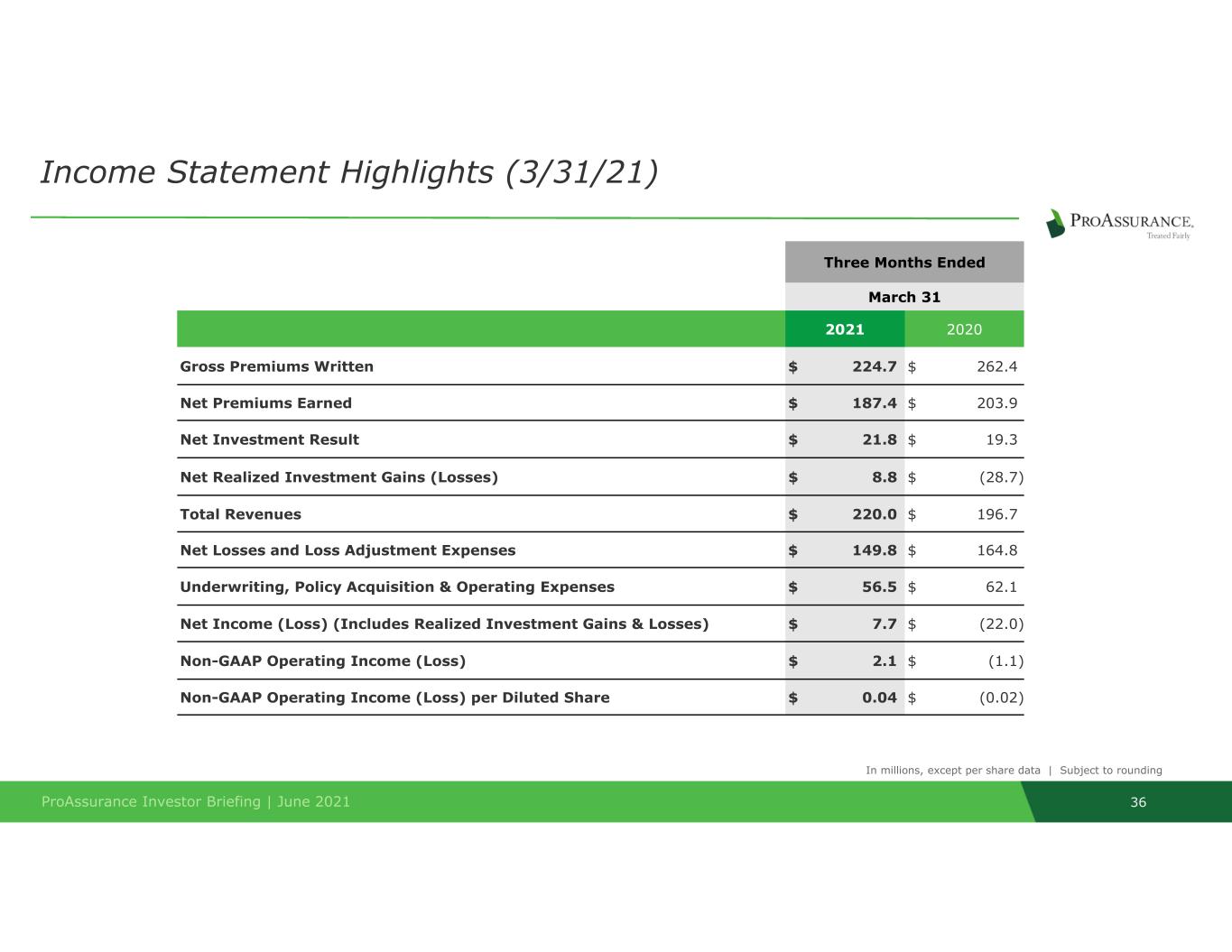

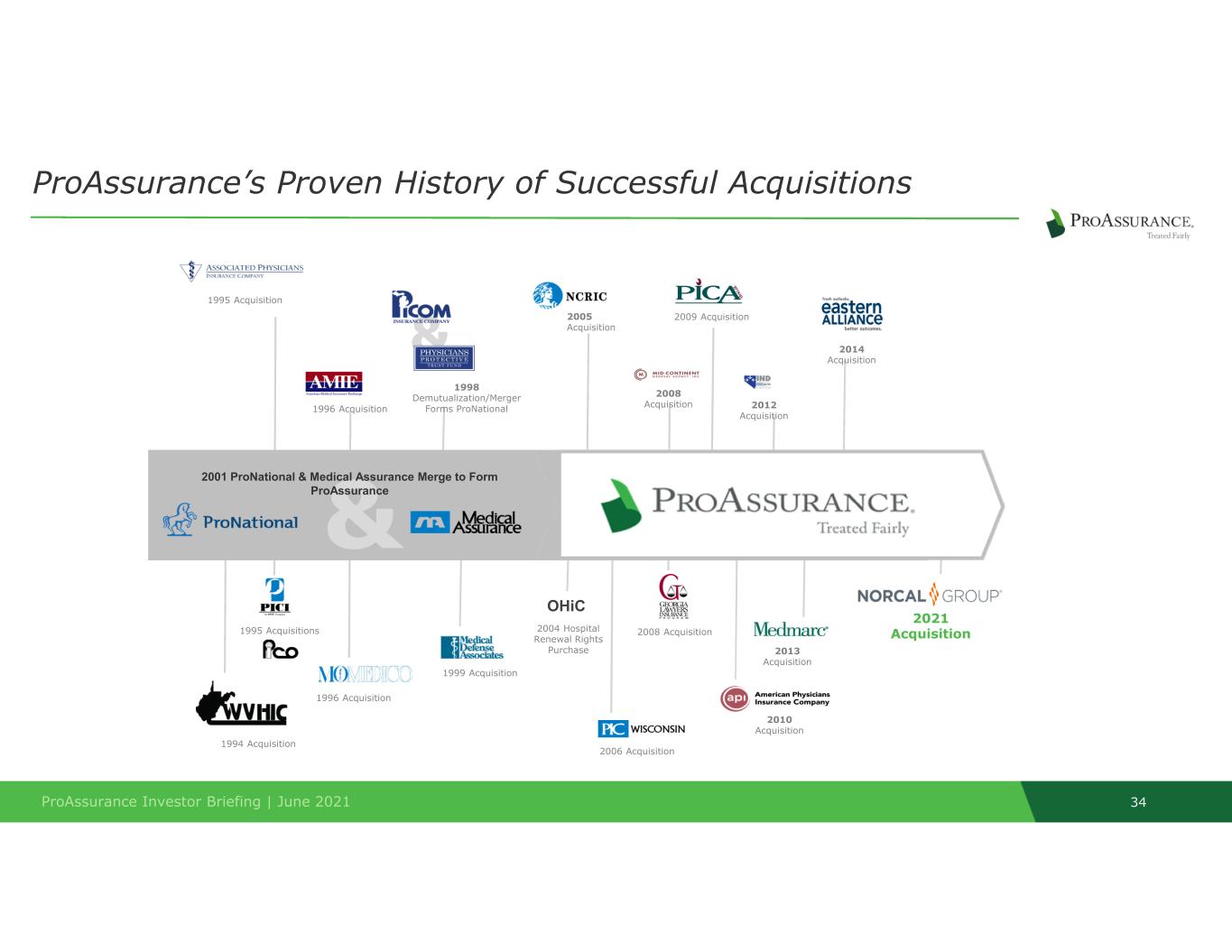

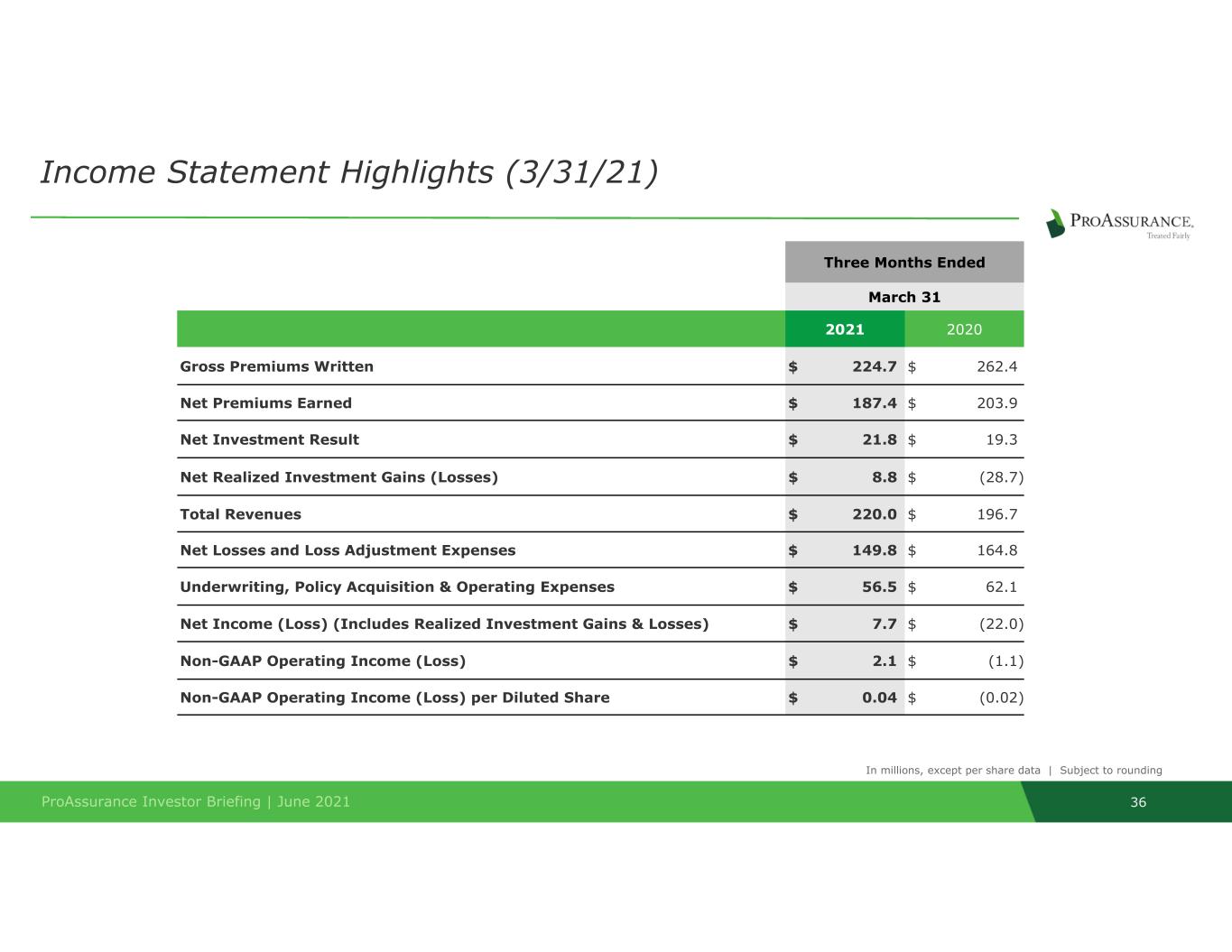

ProAssurance Investor Briefing | June 2021 34 ProAssurance’s Proven History of Successful Acquisitions & 1995 Acquisition 1996 Acquisition OHiC 1994 Acquisition 1998 Demutualization/Merger Forms ProNational 1995 Acquisitions 1996 Acquisition 1999 Acquisition 2004 Hospital Renewal Rights Purchase 2005 Acquisition 2006 Acquisition 2008 Acquisition 2008 Acquisition 2009 Acquisition 2010 Acquisition 2012 Acquisition 2013 Acquisition 2014 Acquisition & 2001 ProNational & Medical Assurance Merge to Form ProAssurance 2021 Acquisition ProAssurance Investor Briefing | June 2021 36 Income Statement Highlights (3/31/21) Three Months Ended March 31 2021 2020 Gross Premiums Written $ 224.7 $ 262.4 Net Premiums Earned $ 187.4 $ 203.9 Net Investment Result $ 21.8 $ 19.3 Net Realized Investment Gains (Losses) $ 8.8 $ (28.7) Total Revenues $ 220.0 $ 196.7 Net Losses and Loss Adjustment Expenses $ 149.8 $ 164.8 Underwriting, Policy Acquisition & Operating Expenses $ 56.5 $ 62.1 Net Income (Loss) (Includes Realized Investment Gains & Losses) $ 7.7 $ (22.0) Non-GAAP Operating Income (Loss) $ 2.1 $ (1.1) Non-GAAP Operating Income (Loss) per Diluted Share $ 0.04 $ (0.02) In millions, except per share data | Subject to rounding

Appendix

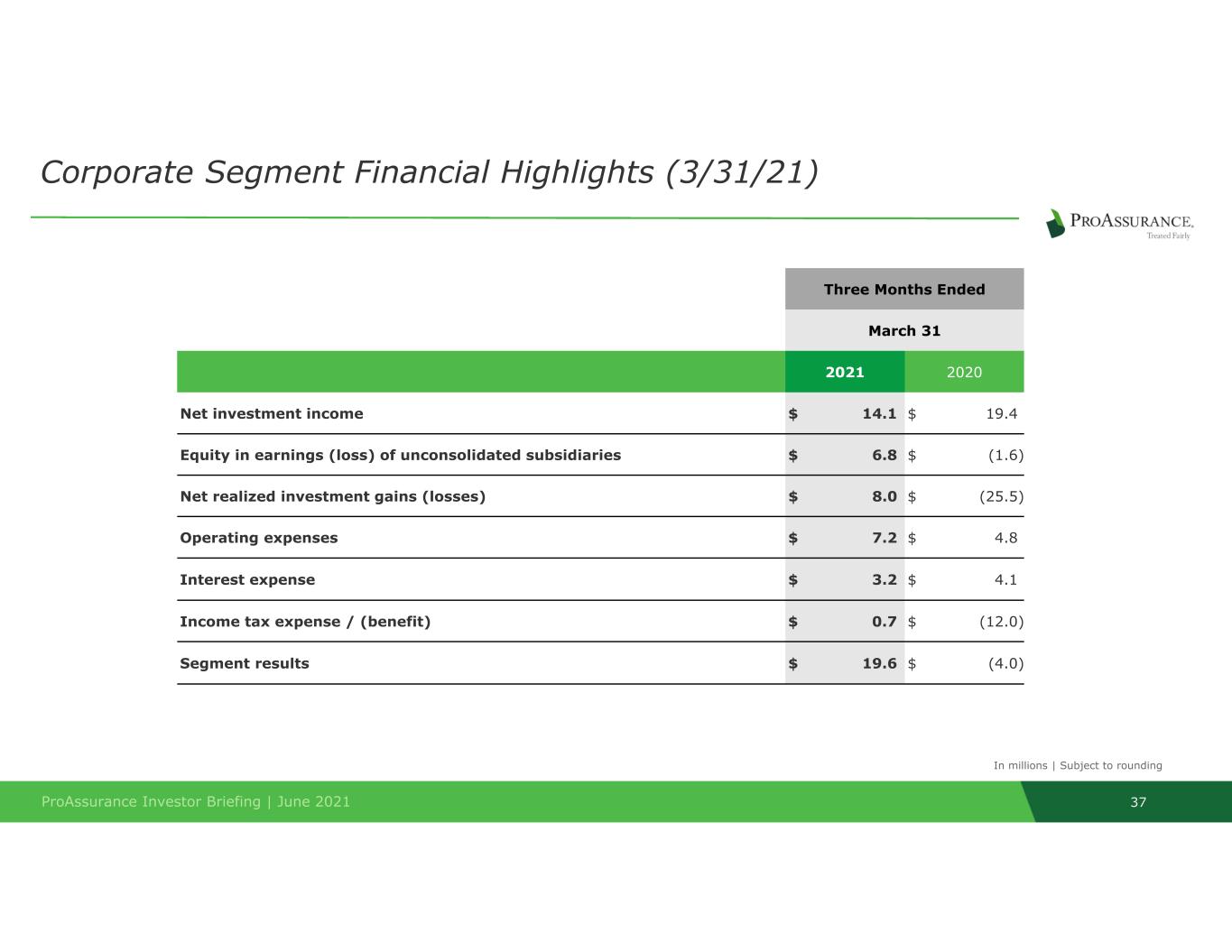

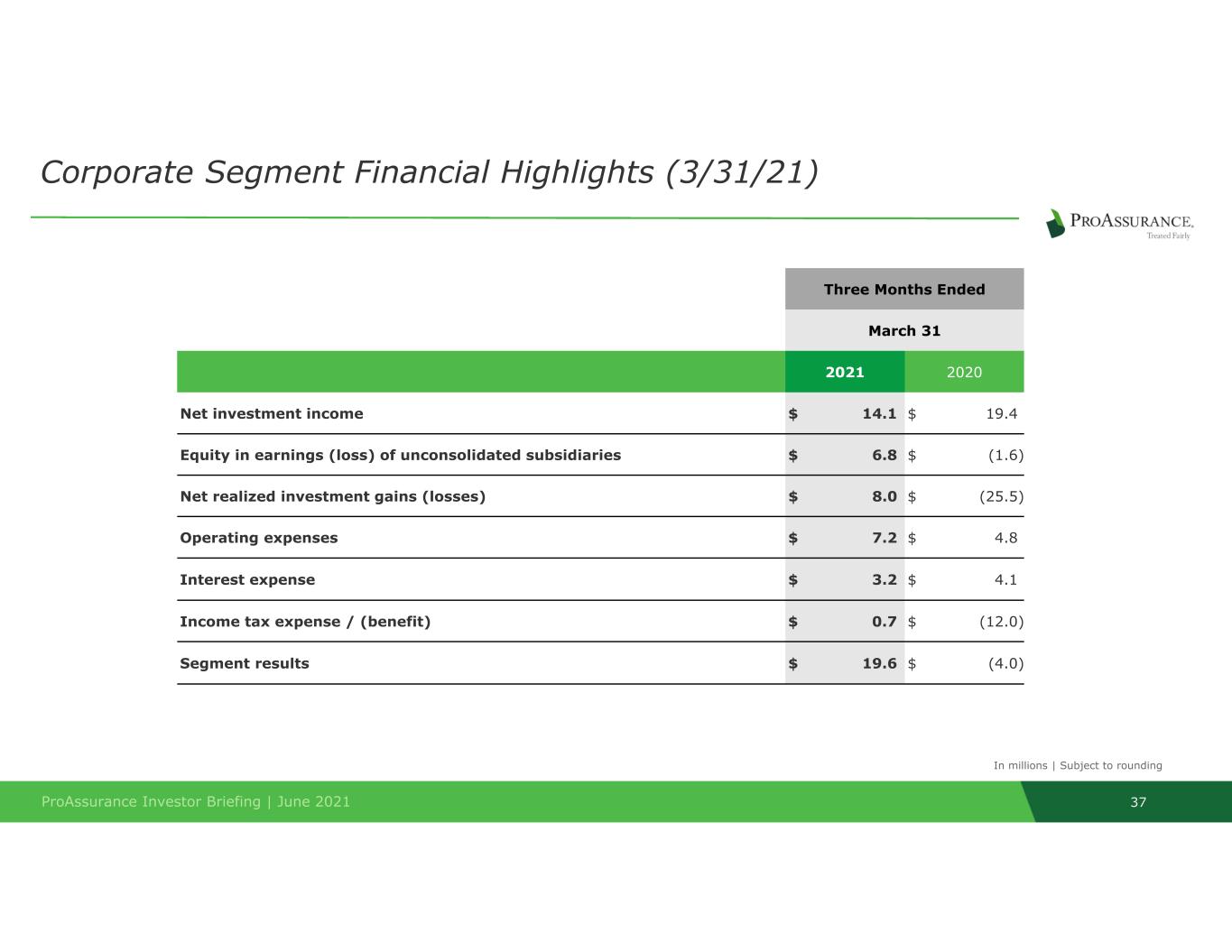

37ProAssurance Investor Briefing | June 2021 Corporate Segment Financial Highlights (3/31/21) Three Months Ended March 31 2021 2020 Net investment income $ 14.1 $ 19.4 Equity in earnings (loss) of unconsolidated subsidiaries $ 6.8 $ (1.6) Net realized investment gains (losses) $ 8.0 $ (25.5) Operating expenses $ 7.2 $ 4.8 Interest expense $ 3.2 $ 4.1 Income tax expense / (benefit) $ 0.7 $ (12.0) Segment results $ 19.6 $ (4.0) In millions | Subject to rounding ProAssurance Investor Briefing | June 2021 38 Current Accident Year Net Loss Ratio 89.8 % 94.2 % Effect of Prior Accident Year Reserve Development (2.3%) (2.0 %) Net Loss Ratio 87.5 % 92.2 % Underwriting Expense Ratio 22.8 % 24.6 % Combined Ratio 110.3 % 116.8 % Specialty P&C Financial Highlights (3/31/21) Three Months Ended March 31 2021 2020 Gross Premiums Written $ 138.3 $ 155.4 Net Premiums Earned $ 115.6 $ 120.4 Total Revenues $ 116.1 $ 122.1 Net Losses & Loss Adjustment Expenses $ (101.2) $ (110.9) Underwriting, Policy Acquisition & Operating Expenses $ (26.3) $ (29.6) Segment Results $ (11.5) $ (18.5) In millions, except ratios | Subject to rounding

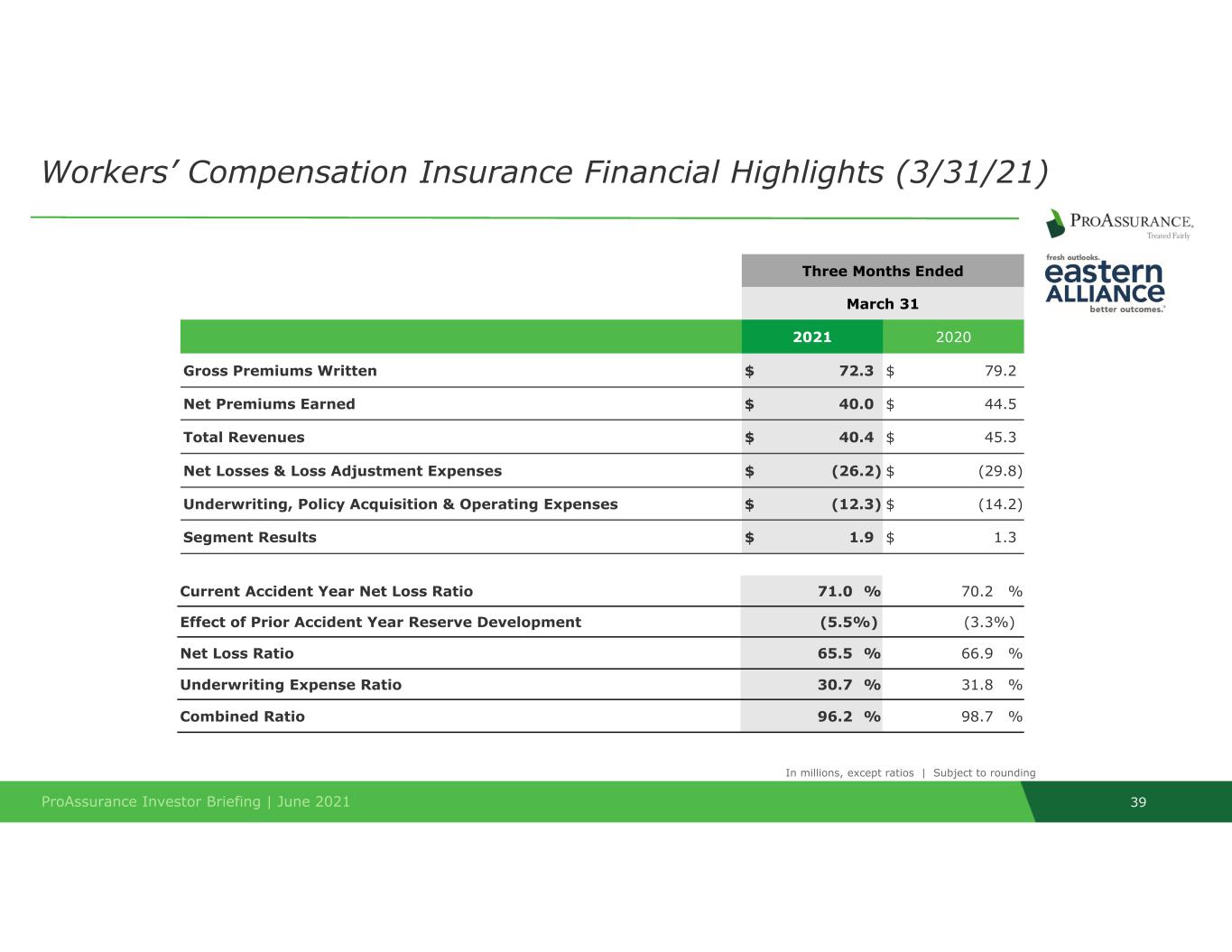

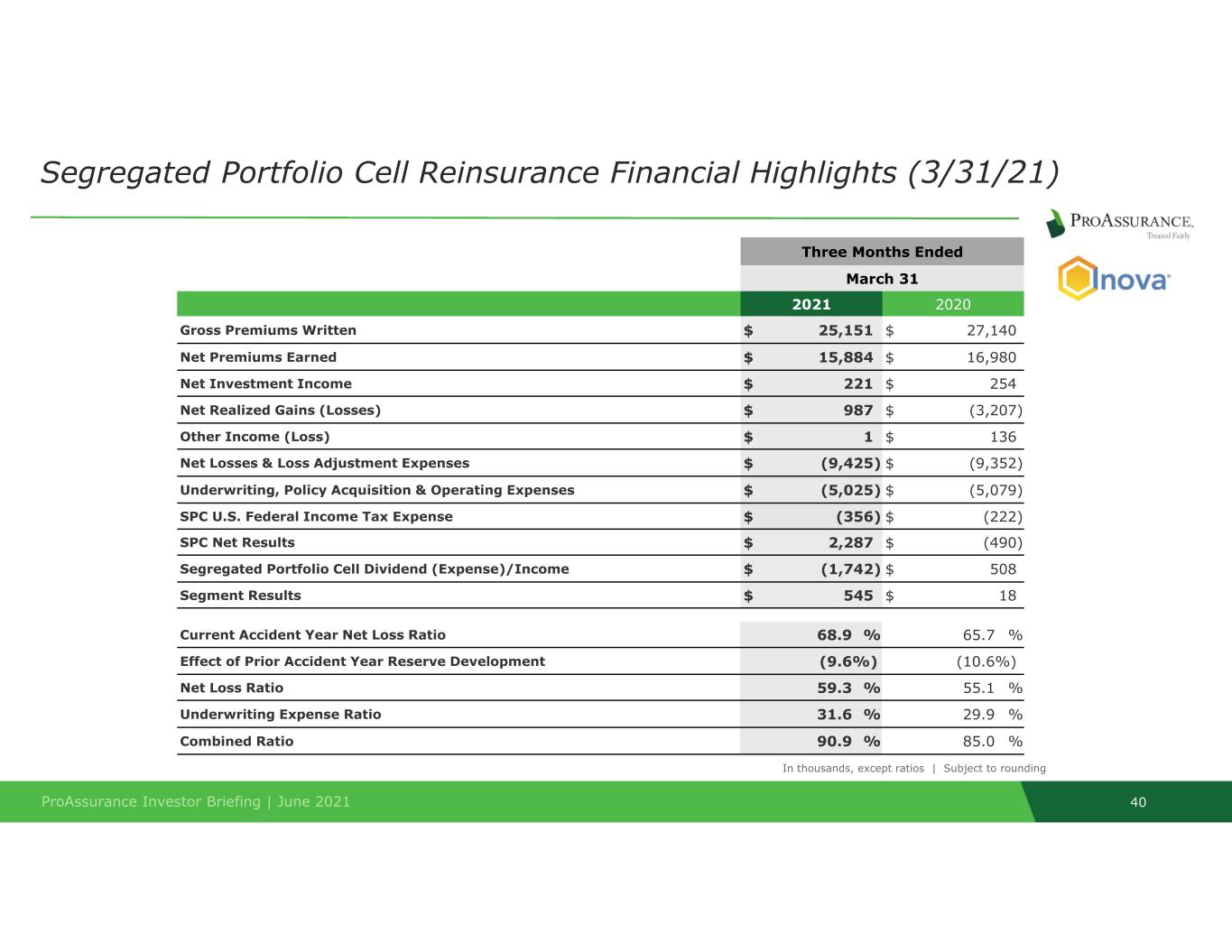

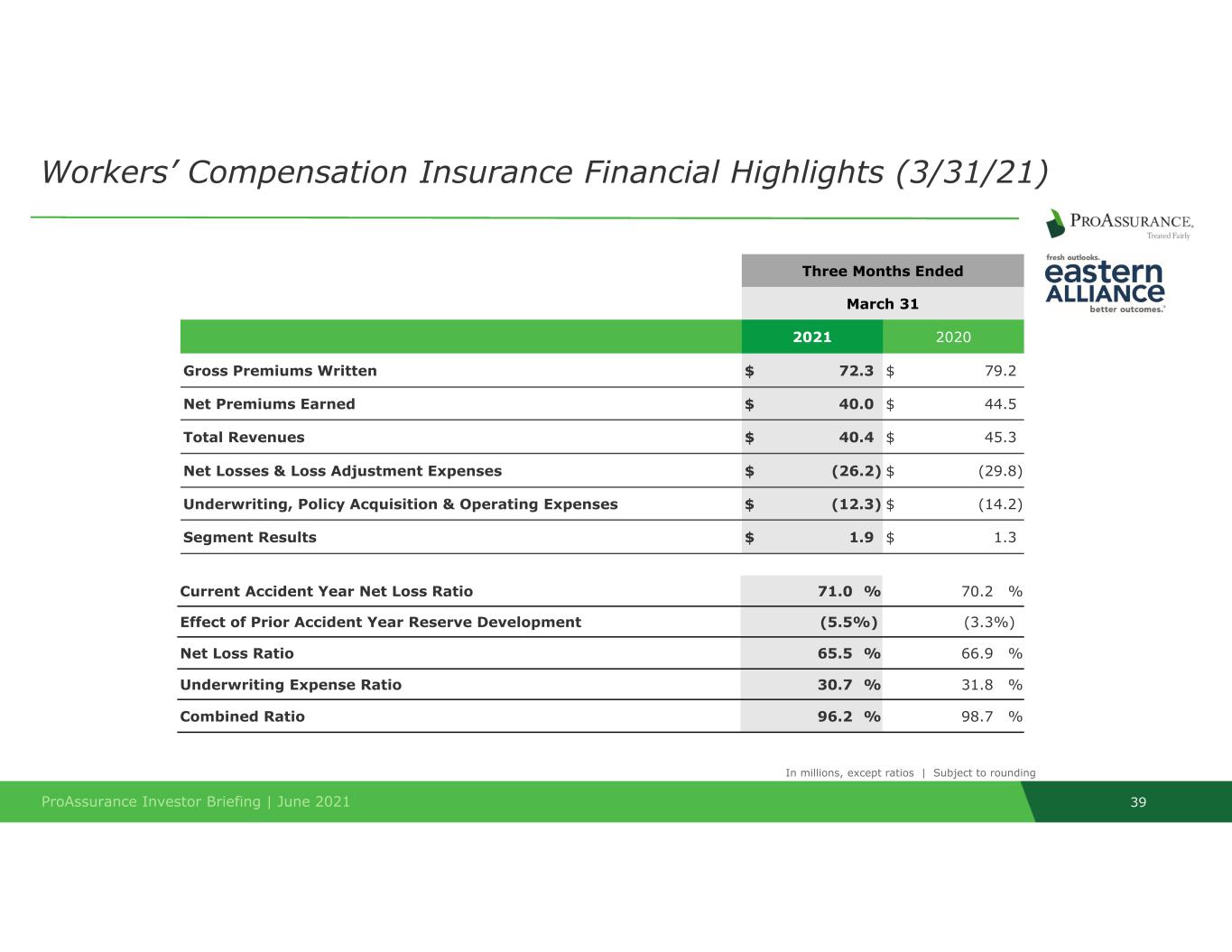

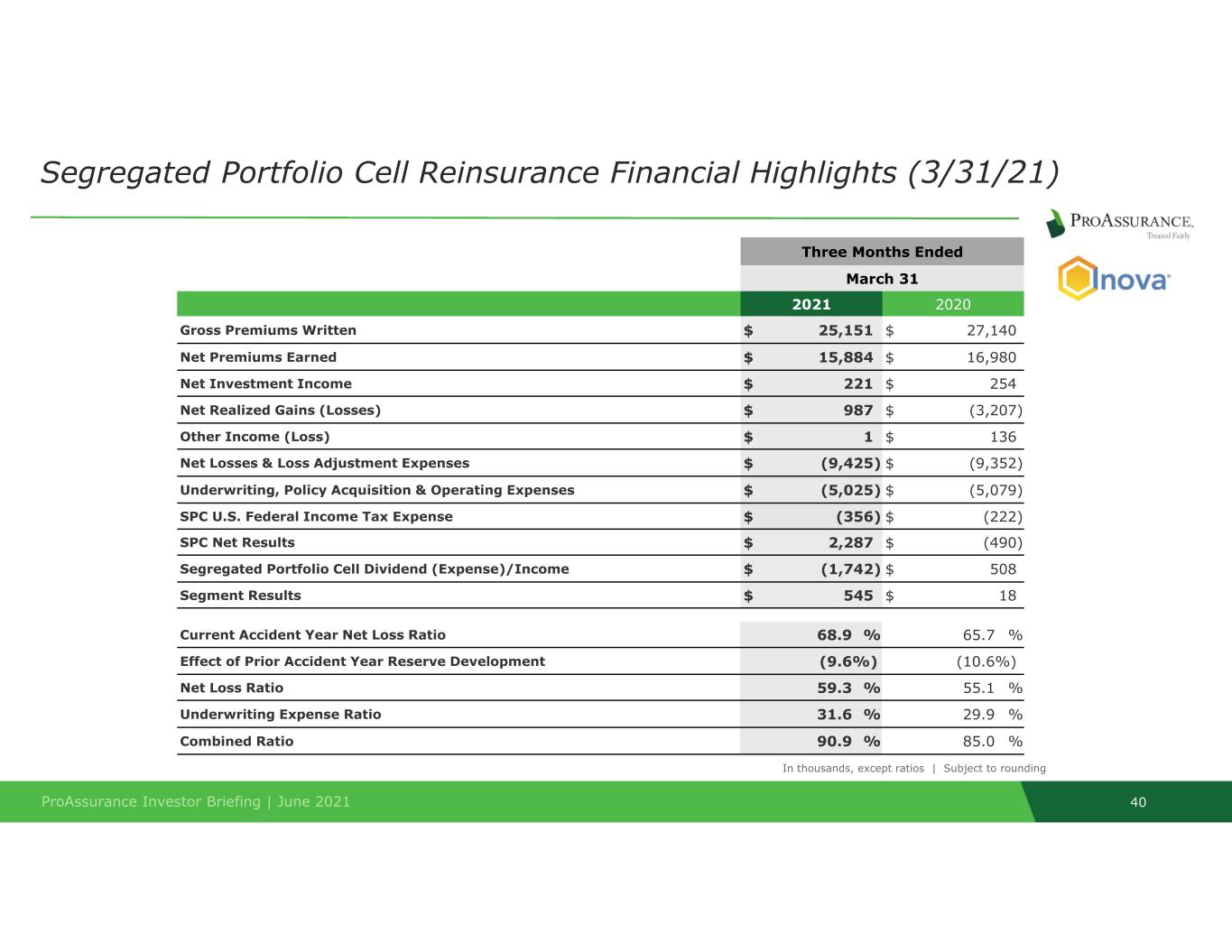

ProAssurance Investor Briefing | June 2021 39 Workers’ Compensation Insurance Financial Highlights (3/31/21) Three Months Ended March 31 2021 2020 Gross Premiums Written $ 72.3 $ 79.2 Net Premiums Earned $ 40.0 $ 44.5 Total Revenues $ 40.4 $ 45.3 Net Losses & Loss Adjustment Expenses $ (26.2) $ (29.8) Underwriting, Policy Acquisition & Operating Expenses $ (12.3) $ (14.2) Segment Results $ 1.9 $ 1.3 Current Accident Year Net Loss Ratio 71.0 % 70.2 % Effect of Prior Accident Year Reserve Development (5.5%) (3.3%) Net Loss Ratio 65.5 % 66.9 % Underwriting Expense Ratio 30.7 % 31.8 % Combined Ratio 96.2 % 98.7 % In millions, except ratios | Subject to rounding ProAssurance Investor Briefing | June 2021 40 Segregated Portfolio Cell Reinsurance Financial Highlights (3/31/21) Three Months Ended March 31 2021 2020 Gross Premiums Written $ 25,151 $ 27,140 Net Premiums Earned $ 15,884 $ 16,980 Net Investment Income $ 221 $ 254 Net Realized Gains (Losses) $ 987 $ (3,207) Other Income (Loss) $ 1 $ 136 Net Losses & Loss Adjustment Expenses $ (9,425) $ (9,352) Underwriting, Policy Acquisition & Operating Expenses $ (5,025) $ (5,079) SPC U.S. Federal Income Tax Expense $ (356) $ (222) SPC Net Results $ 2,287 $ (490) Segregated Portfolio Cell Dividend (Expense)/Income $ (1,742) $ 508 Segment Results $ 545 $ 18 In thousands, except ratios | Subject to rounding Current Accident Year Net Loss Ratio 68.9 % 65.7 % Effect of Prior Accident Year Reserve Development (9.6%) (10.6%) Net Loss Ratio 59.3 % 55.1 % Underwriting Expense Ratio 31.6 % 29.9 % Combined Ratio 90.9 % 85.0 %

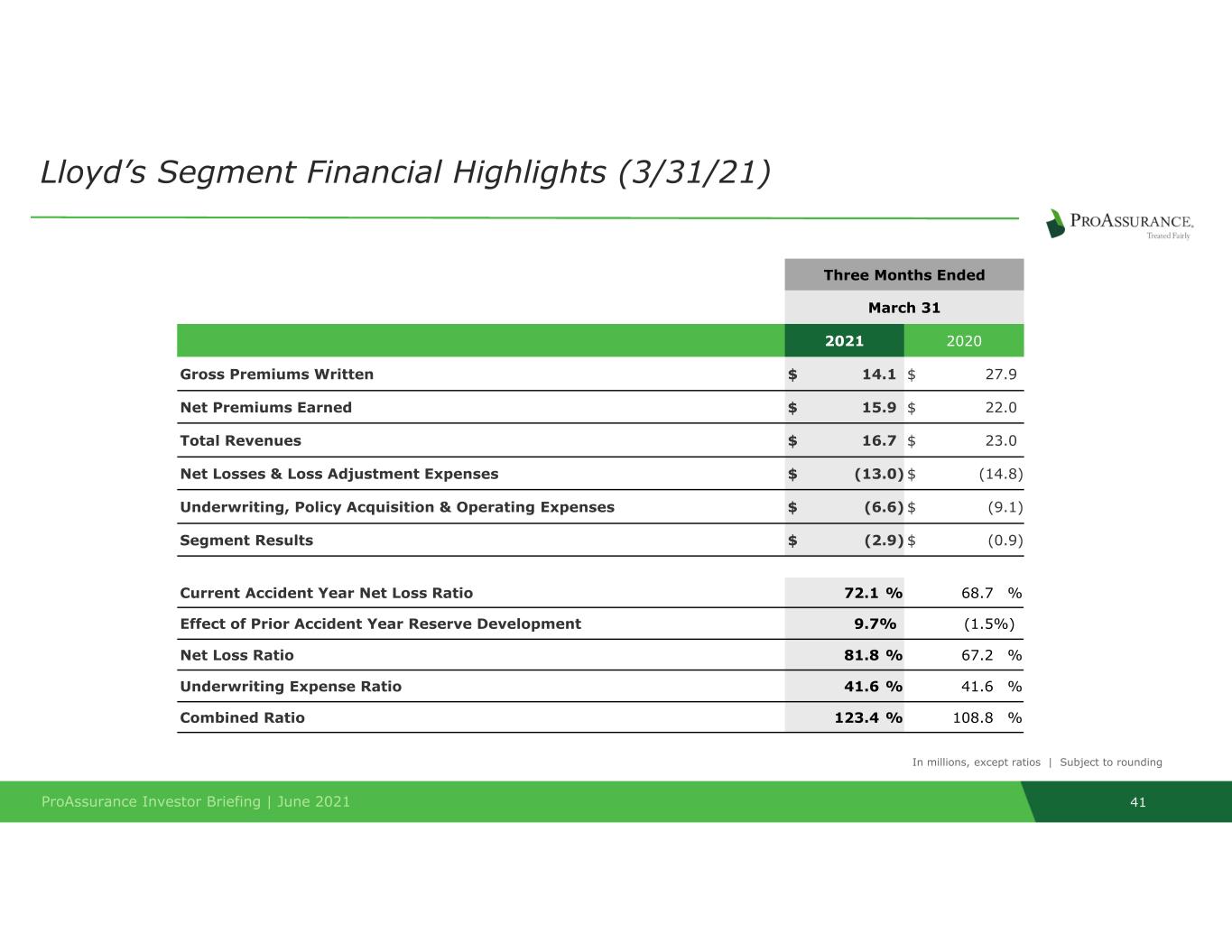

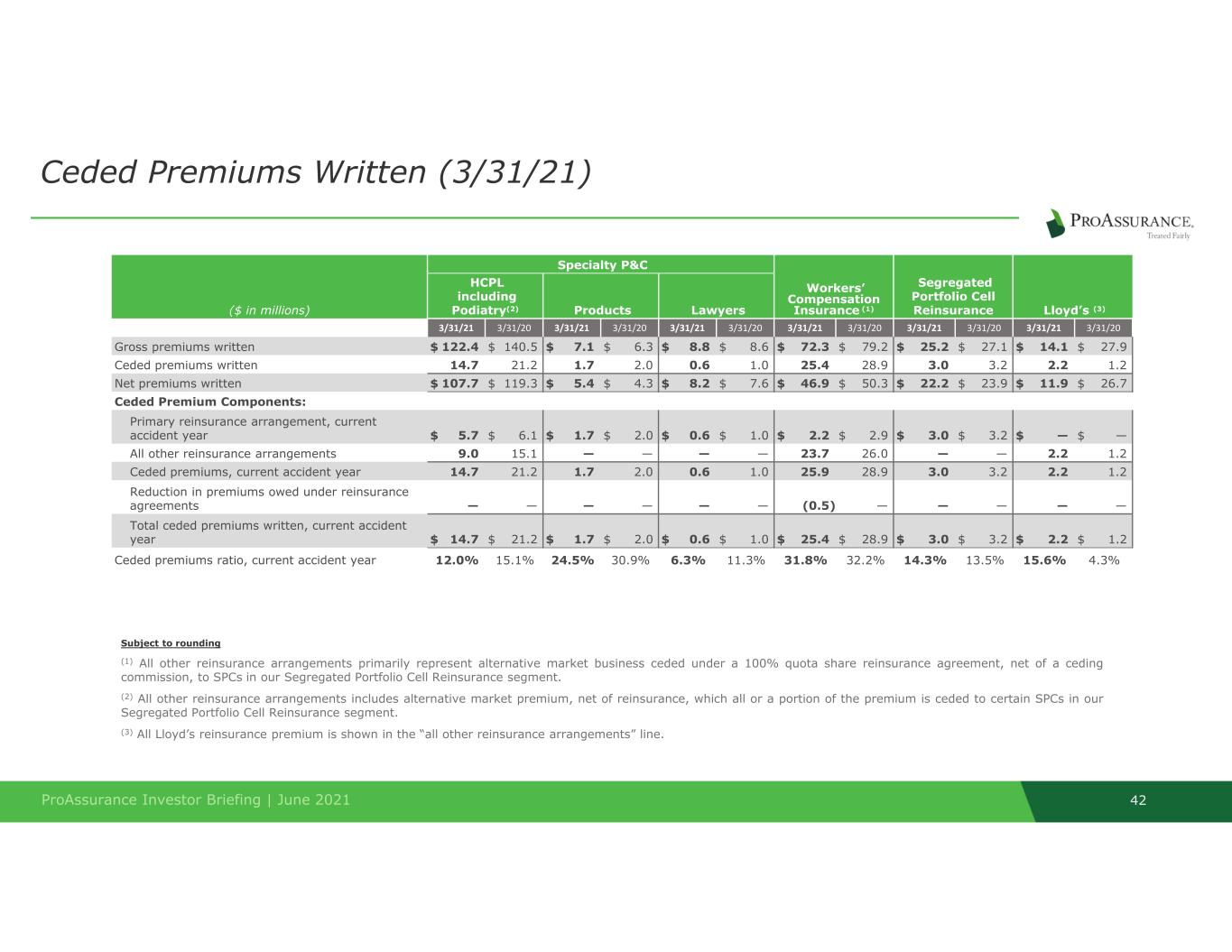

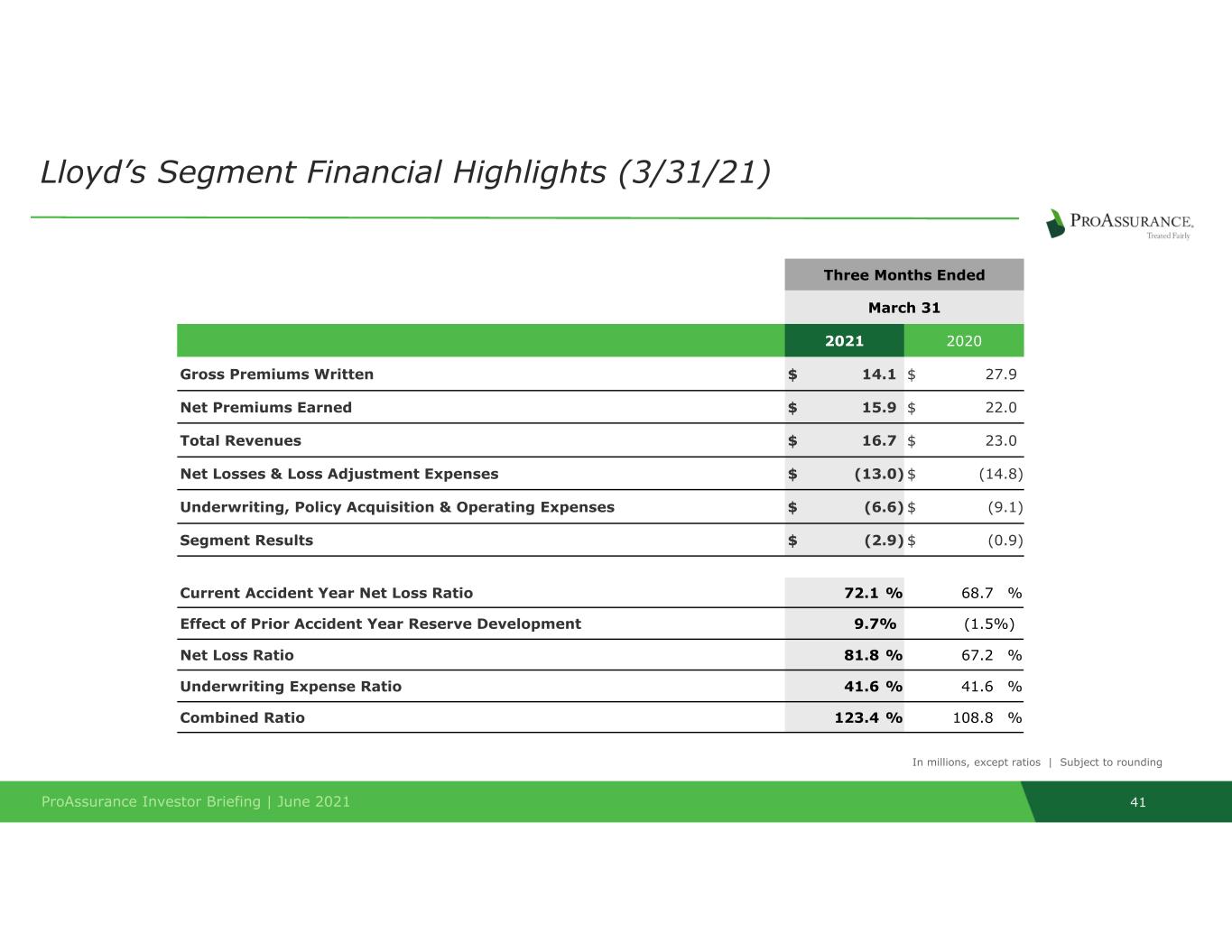

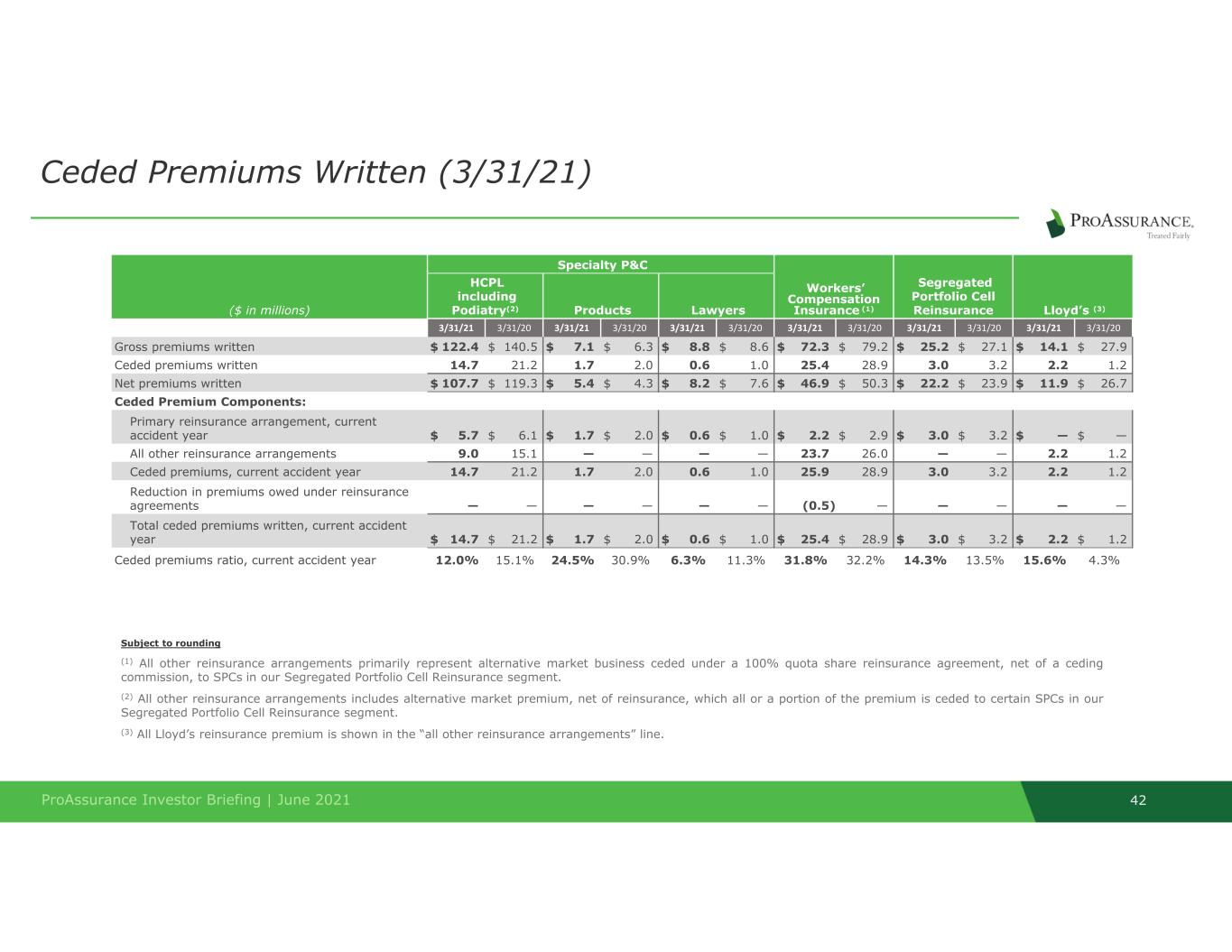

ProAssurance Investor Briefing | June 2021 41 Lloyd’s Segment Financial Highlights (3/31/21) Three Months Ended March 31 2021 2020 Gross Premiums Written $ 14.1 $ 27.9 Net Premiums Earned $ 15.9 $ 22.0 Total Revenues $ 16.7 $ 23.0 Net Losses & Loss Adjustment Expenses $ (13.0) $ (14.8) Underwriting, Policy Acquisition & Operating Expenses $ (6.6) $ (9.1) Segment Results $ (2.9) $ (0.9) Current Accident Year Net Loss Ratio 72.1 % 68.7 % Effect of Prior Accident Year Reserve Development 9.7% (1.5%) Net Loss Ratio 81.8 % 67.2 % Underwriting Expense Ratio 41.6 % 41.6 % Combined Ratio 123.4 % 108.8 % In millions, except ratios | Subject to rounding ProAssurance Investor Briefing | June 2021 42 Subject to rounding (1) All other reinsurance arrangements primarily represent alternative market business ceded under a 100% quota share reinsurance agreement, net of a ceding commission, to SPCs in our Segregated Portfolio Cell Reinsurance segment.

(2) All other reinsurance arrangements includes alternative market premium, net of reinsurance, which all or a portion of the premium is ceded to certain SPCs in our Segregated Portfolio Cell Reinsurance segment. (3) All Lloyd’s reinsurance premium is shown in the “all other reinsurance arrangements” line. Ceded Premiums Written (3/31/21) ($ in millions) Specialty P&C Workers’ Compensation Insurance (1) Segregated Portfolio Cell Reinsurance Lloyd’s (3) HCPL including Podiatry(2) Products Lawyers 3/31/21 3/31/20 3/31/21 3/31/20 3/31/21 3/31/20 3/31/21 3/31/20 3/31/21 3/31/20 3/31/21 3/31/20 Gross premiums written $ 122.4 $ 140.5 $ 7.1 $ 6.3 $ 8.8 $ 8.6 $ 72.3 $ 79.2 $ 25.2 $ 27.1 $ 14.1 $ 27.9 Ceded premiums written 14.7 21.2 1.7 2.0 0.6 1.0 25.4 28.9 3.0 3.2 2.2 1.2 Net premiums written $ 107.7 $ 119.3 $ 5.4 $ 4.3 $ 8.2 $ 7.6 $ 46.9 $ 50.3 $ 22.2 $ 23.9 $ 11.9 $ 26.7 Ceded Premium Components: Primary reinsurance arrangement, current accident year $ 5.7 $ 6.1 $ 1.7 $ 2.0 $ 0.6 $ 1.0 $ 2.2 $ 2.9 $ 3.0 $ 3.2 $ — $ — All other reinsurance arrangements 9.0 15.1 — — — — 23.7 26.0 — — 2.2 1.2 Ceded premiums, current accident year 14.7 21.2 1.7 2.0 0.6 1.0 25.9 28.9 3.0 3.2 2.2 1.2 Reduction in premiums owed under reinsurance agreements — — — — — — (0.5) — — — — — Total ceded premiums written, current accident year $ 14.7 $ 21.2 $ 1.7 $ 2.0 $ 0.6 $ 1.0 $ 25.4 $ 28.9 $ 3.0 $ 3.2 $ 2.2 $ 1.2 Ceded premiums ratio, current accident year 12.0% 15.1% 24.5% 30.9% 6.3% 11.3% 31.8% 32.2% 14.3% 13.5% 15.6% 4.3% 43ProAssurance Investor Briefing | June 2021 Investment Strategy and 2021 Outlook • Duration management remains paramount ◦ We will not extend duration in search of incremental yield • Optimizing our allocations for better risk-adjusted returns ◦ Ensures non-correlation of returns • Effective stewardship of capital ensures a position of financial strength through turbulent market cycles • Ongoing analysis of holdings to ensure lasting quality and profitability • Re-balancing NORCAL investment portfolio to align with ProAssurance allocations

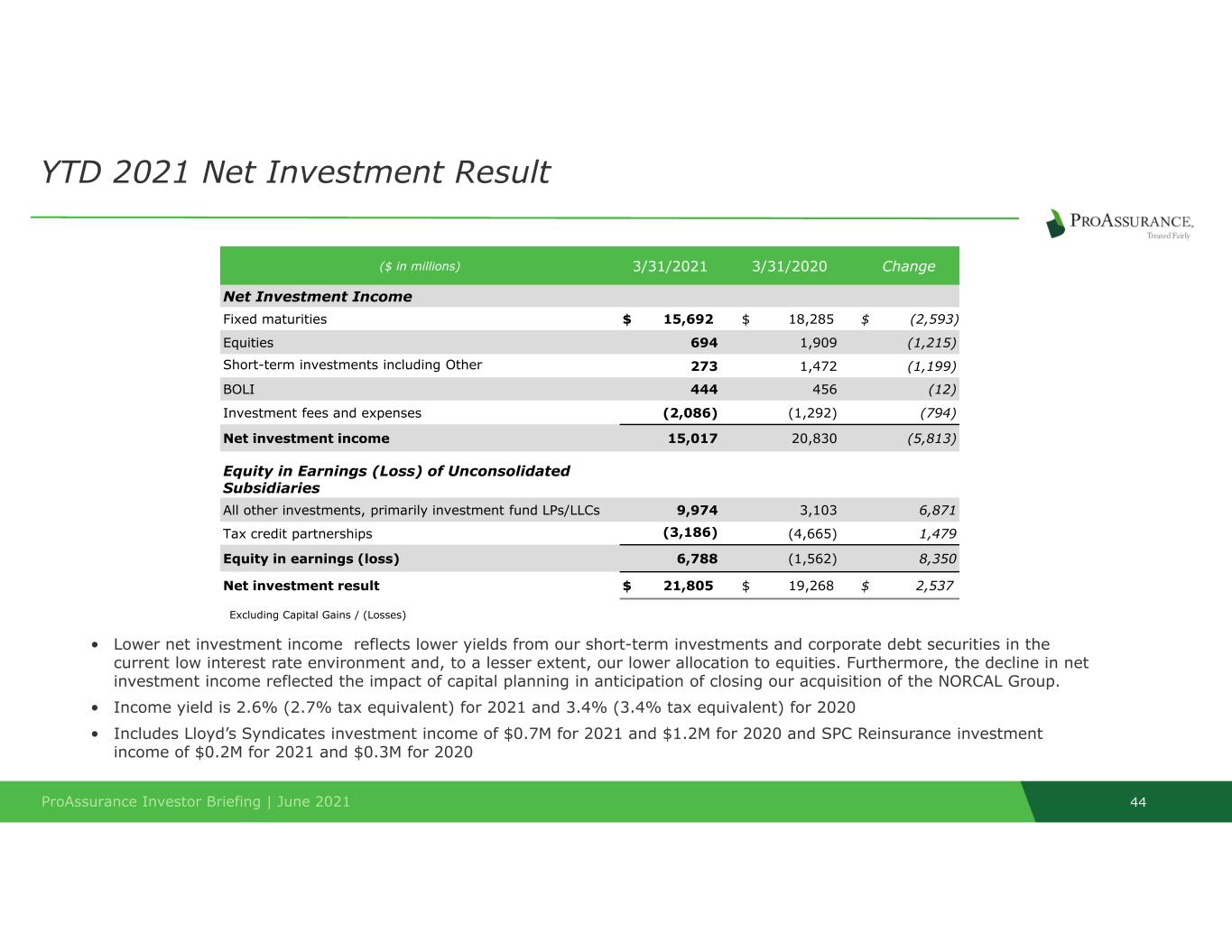

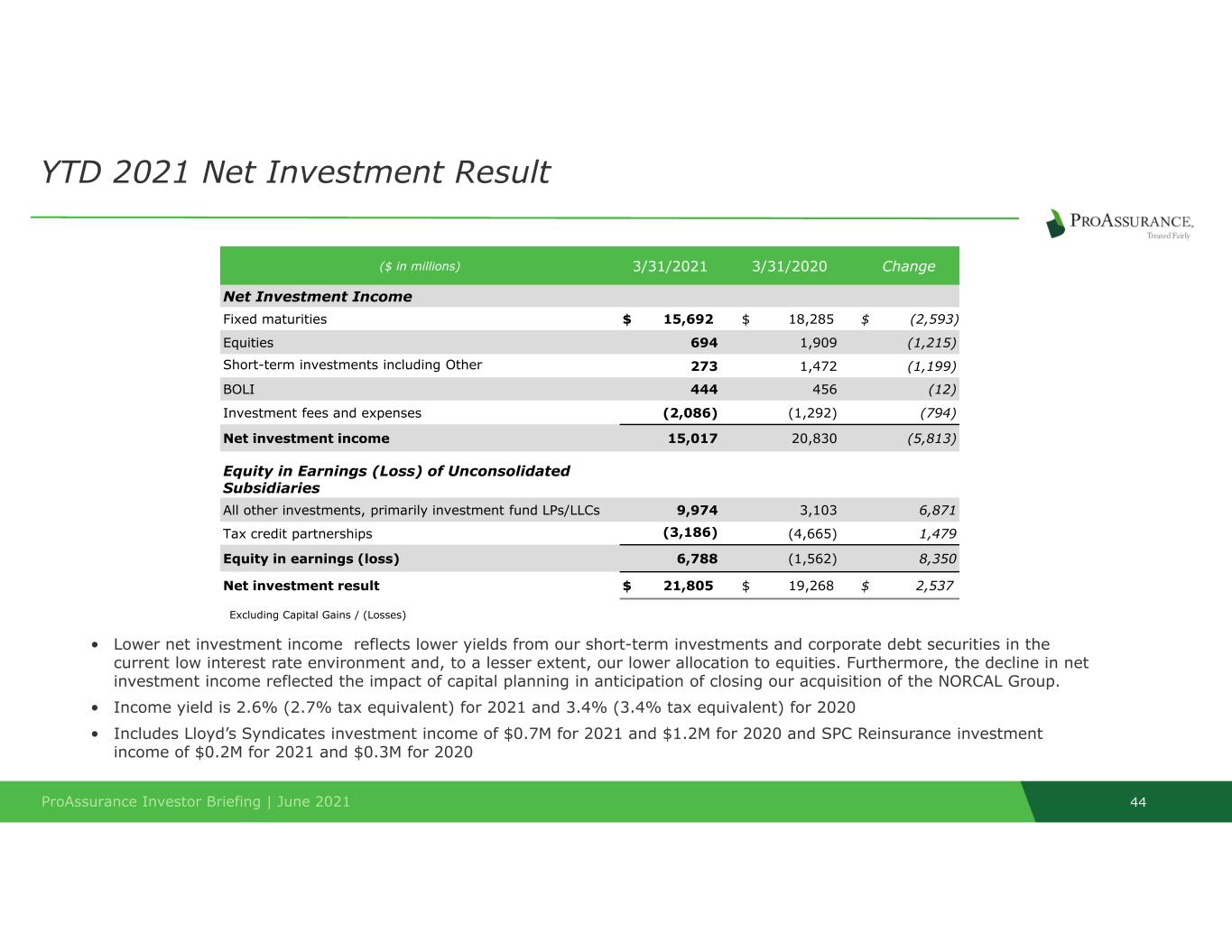

44ProAssurance Investor Briefing | June 2021 ($ in millions) 3/31/2021 3/31/2020 Change Net Investment Income Fixed maturities $ 15,692 $ 18,285 $ (2,593) Equities 694 1,909 (1,215) Short-term investments including Other 273 1,472 (1,199) BOLI 444 456 (12) Investment fees and expenses (2,086) (1,292) (794) Net investment income 15,017 20,830 (5,813) Equity in Earnings (Loss) of Unconsolidated Subsidiaries All other investments, primarily investment fund LPs/LLCs 9,974 3,103 6,871 Tax credit partnerships (3,186) (4,665) 1,479 Equity in earnings (loss) 6,788 (1,562) 8,350 Net investment result $ 21,805 $ 19,268 $ 2,537 YTD 2021 Net Investment Result • Lower net investment income reflects lower yields from our short-term investments and corporate debt securities in the current low interest rate environment and, to a lesser extent, our lower allocation to equities. Furthermore, the decline in net investment income reflected the impact of capital planning in anticipation of closing our acquisition of the NORCAL Group. • Income yield is 2.6% (2.7% tax equivalent) for 2021 and 3.4% (3.4% tax equivalent) for 2020 • Includes Lloyd’s Syndicates investment income of $0.7M for 2021 and $1.2M for 2020 and SPC Reinsurance investment income of $0.2M for 2021 and $0.3M for 2020 Excluding Capital Gains / (Losses)

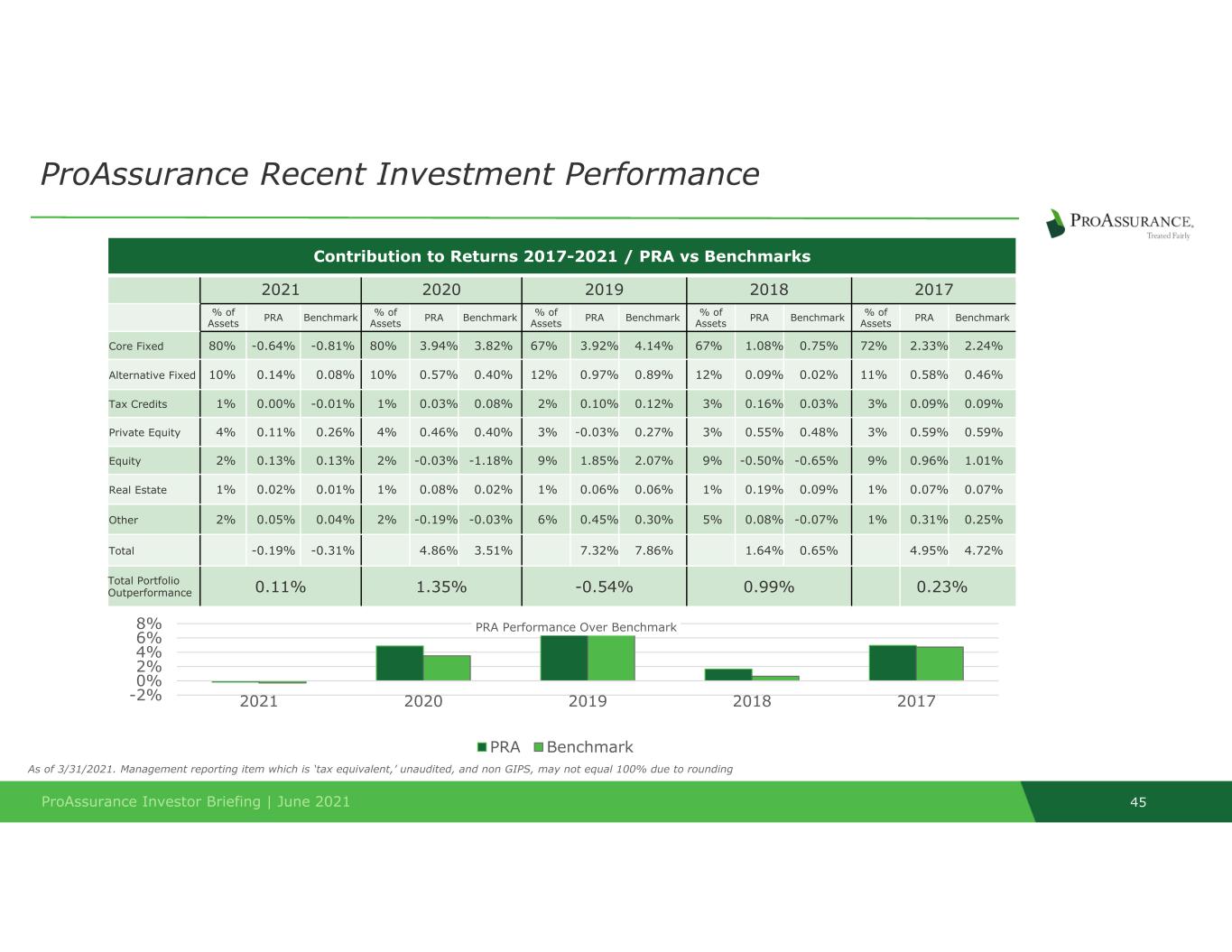

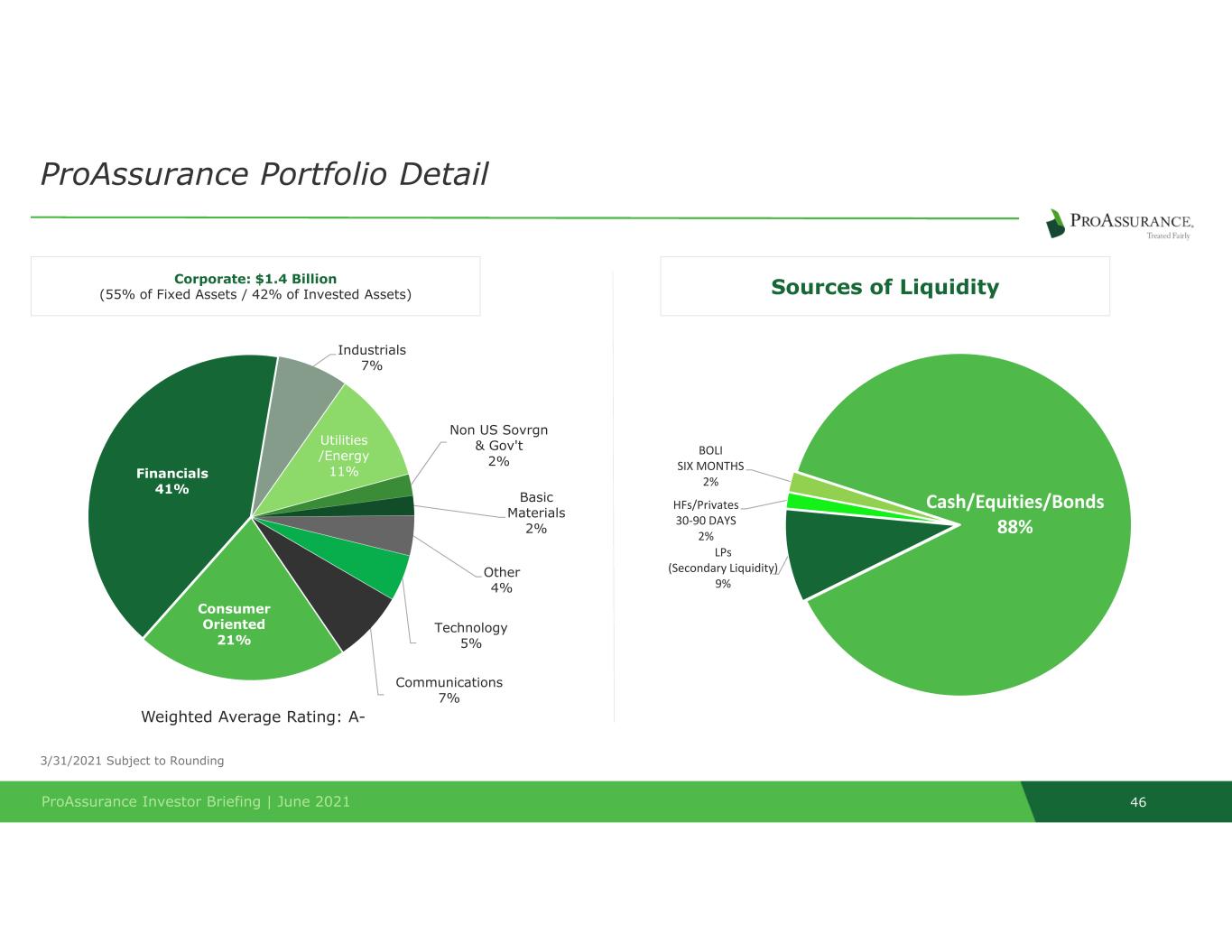

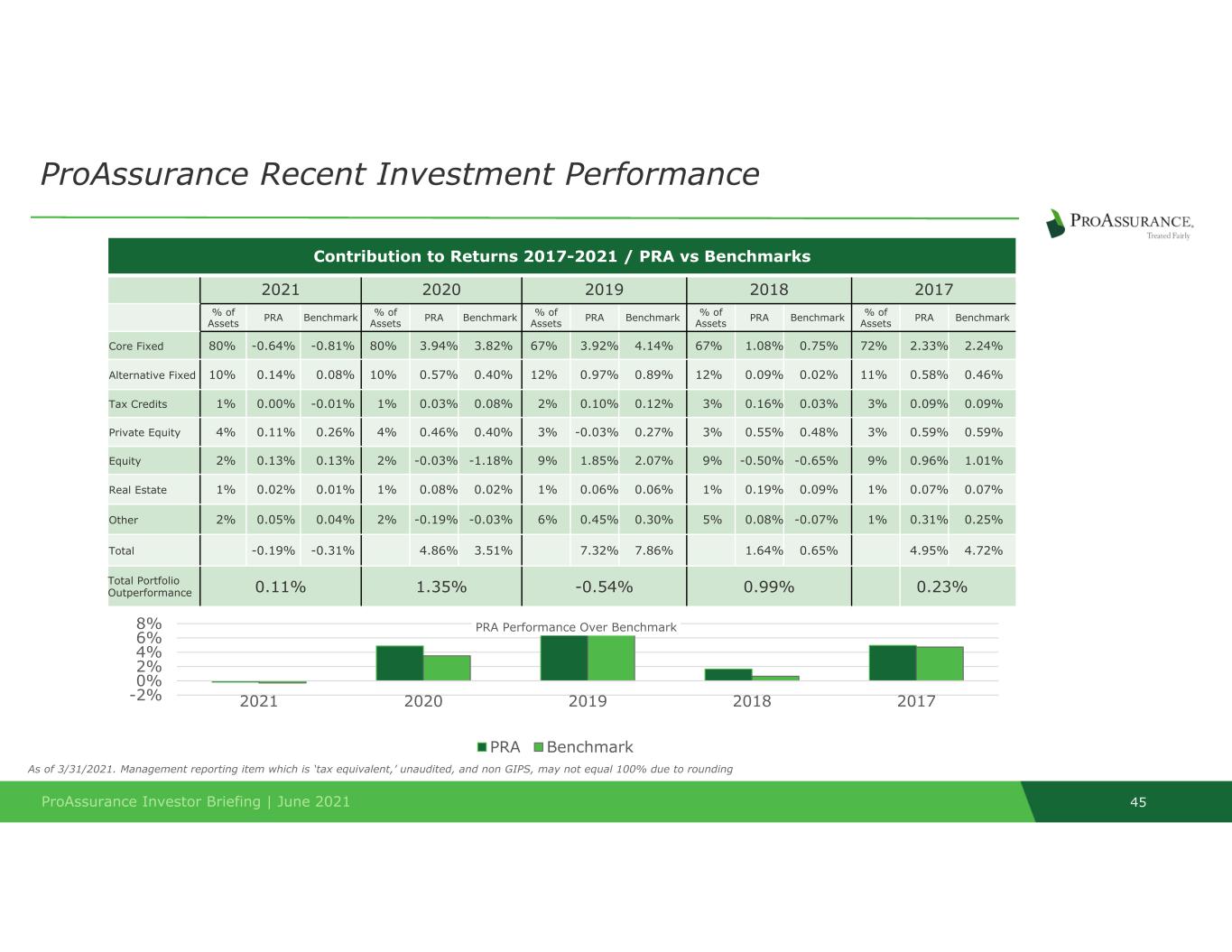

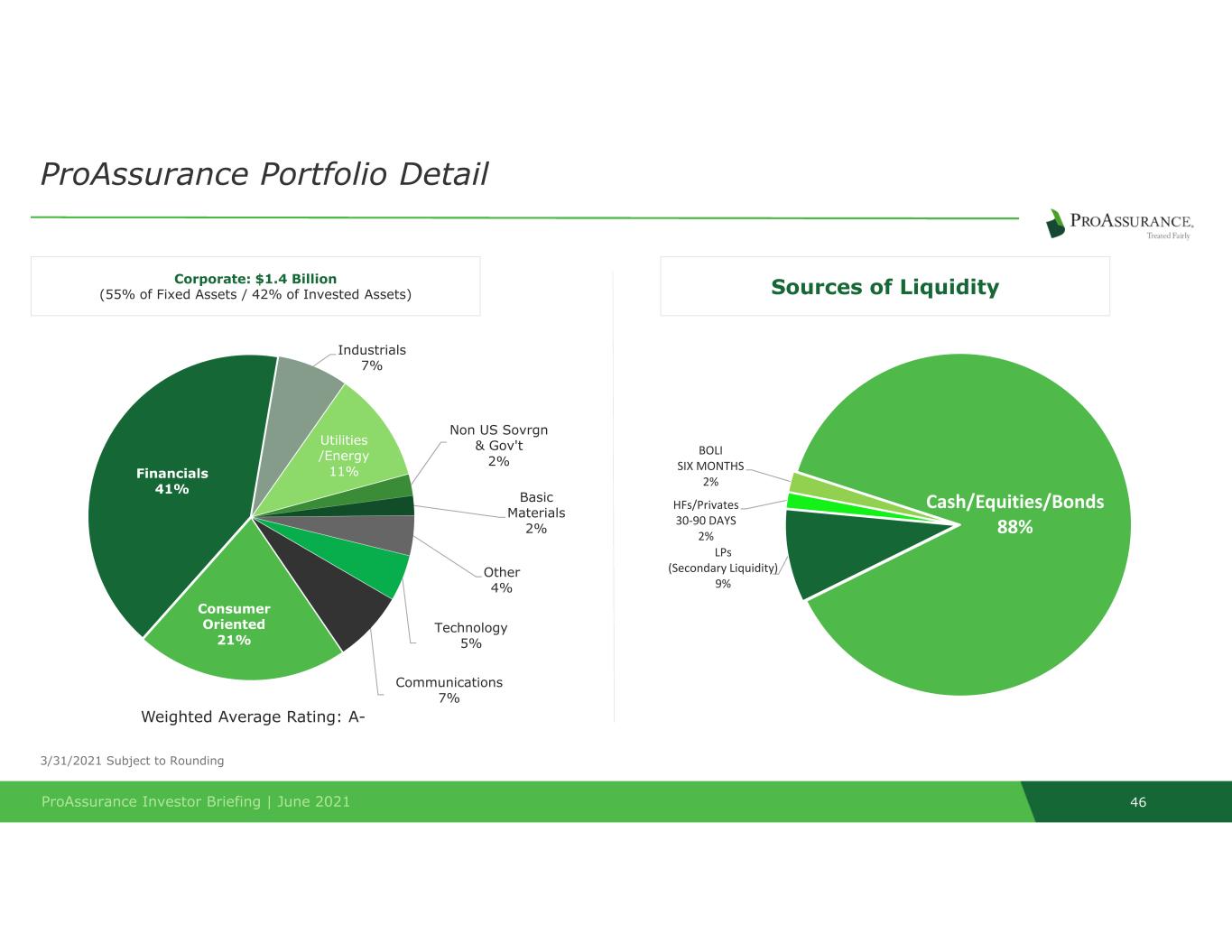

45ProAssurance Investor Briefing | June 2021 ProAssurance Recent Investment Performance Contribution to Returns 2017-2021 / PRA vs Benchmarks 2021 2020 2019 2018 2017 % of Assets PRA Benchmark % of Assets PRA Benchmark % of Assets PRA Benchmark % of Assets PRA Benchmark % of Assets PRA Benchmark Core Fixed 80% -0.64% -0.81% 80% 3.94% 3.82% 67% 3.92% 4.14% 67% 1.08% 0.75% 72% 2.33% 2.24% Alternative Fixed 10% 0.14% 0.08% 10% 0.57% 0.40% 12% 0.97% 0.89% 12% 0.09% 0.02% 11% 0.58% 0.46% Tax Credits 1% 0.00% -0.01% 1% 0.03% 0.08% 2% 0.10% 0.12% 3% 0.16% 0.03% 3% 0.09% 0.09% Private Equity 4% 0.11% 0.26% 4% 0.46% 0.40% 3% -0.03% 0.27% 3% 0.55% 0.48% 3% 0.59% 0.59% Equity 2% 0.13% 0.13% 2% -0.03% -1.18% 9% 1.85% 2.07% 9% -0.50% -0.65% 9% 0.96% 1.01% Real Estate 1% 0.02% 0.01% 1% 0.08% 0.02% 1% 0.06% 0.06% 1% 0.19% 0.09% 1% 0.07% 0.07% Other 2% 0.05% 0.04% 2% -0.19% -0.03% 6% 0.45% 0.30% 5% 0.08% -0.07% 1% 0.31% 0.25% Total -0.19% -0.31% 4.86% 3.51% 7.32% 7.86% 1.64% 0.65% 4.95% 4.72% Total Portfolio Outperformance 0.11% 1.35% -0.54% 0.99% 0.23% -2% 0% 2% 4% 6% 8% 2021 2020 2019 2018 2017 PRA Performance Over Benchmark PRA Benchmark As of 3/31/2021. Management reporting item which is ‘tax equivalent,’ unaudited, and non GIPS, may not equal 100% due to rounding 46ProAssurance Investor Briefing | June 2021 Utilities /Energy 11% Non US Sovrgn & Gov't 2% Basic Materials 2% Other 4% Technology 5% Communications 7% Consumer Oriented 21% Financials 41% Industrials 7% 3/31/2021 Subject to Rounding ProAssurance Portfolio Detail Corporate: $1.4 Billion (55% of Fixed Assets / 42% of Invested Assets) Weighted Average Rating: A- Cash/Equities/Bonds 88% LPs (Secondary Liquidity) 9% HFs/Privates 30‐90 DAYS 2% BOLI SIX MONTHS 2% Sources of Liquidity

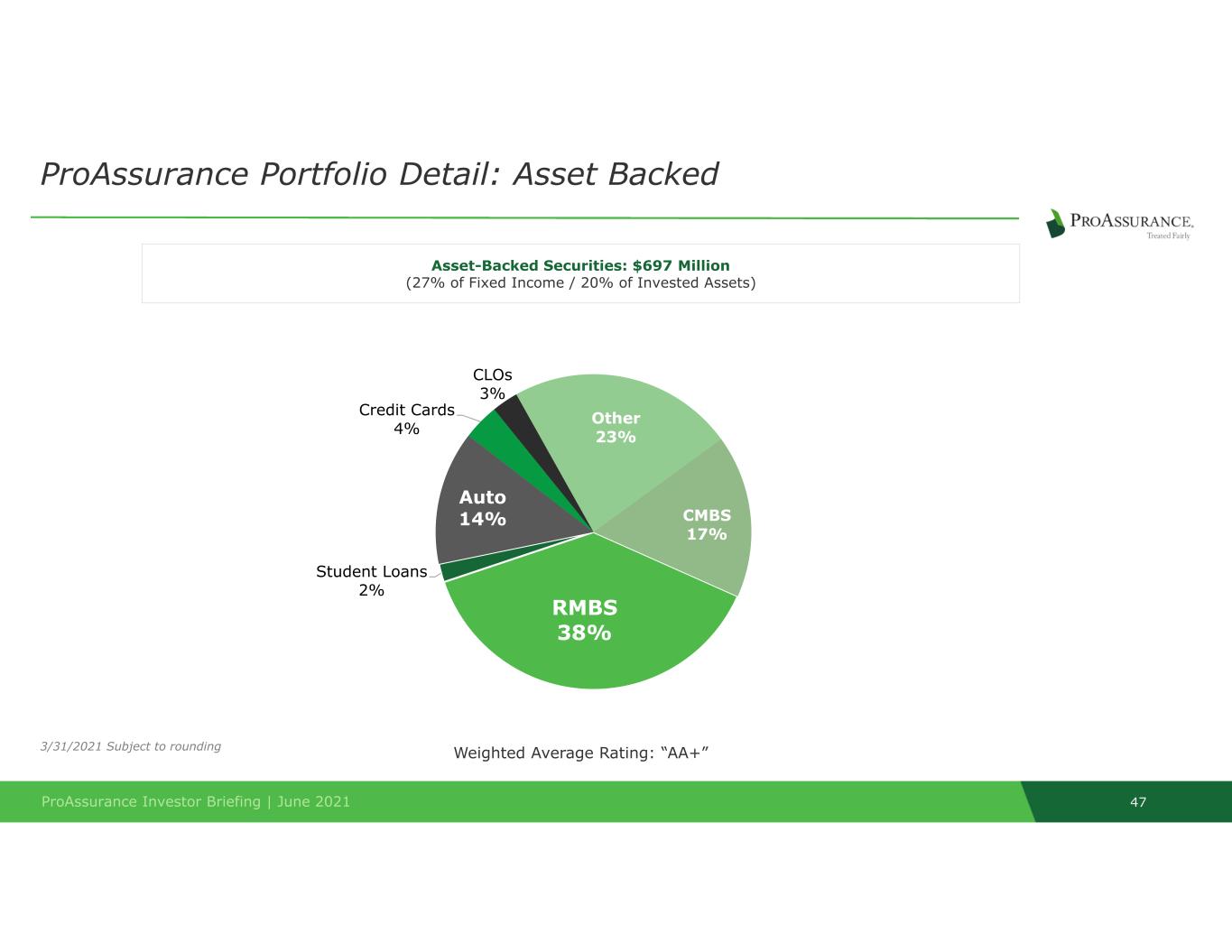

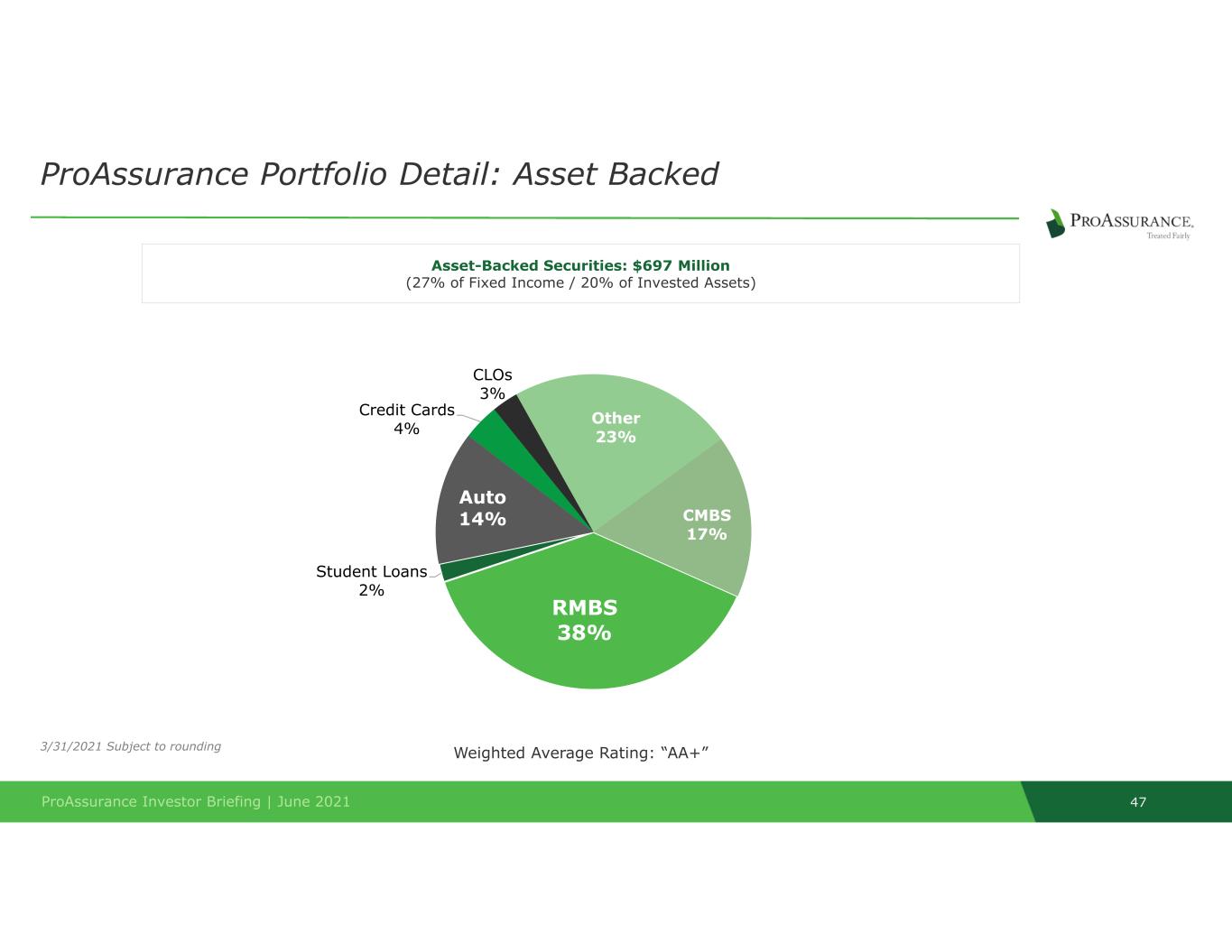

47ProAssurance Investor Briefing | June 2021 3/31/2021 Subject to rounding ProAssurance Portfolio Detail: Asset Backed Weighted Average Rating: “AA+” Asset-Backed Securities: $697 Million (27% of Fixed Income / 20% of Invested Assets) RMBS 38% Student Loans 2% Auto 14% Credit Cards 4% CLOs 3% Other 23% CMBS 17% 48ProAssurance Investor Briefing | June 2021 3/31/2021 Subject to rounding ProAssurance Portfolio Detail: Fixed-Trading Weighted Average Rating: “AA” Fixed Maturities: $45 Million (2% of Fixed Income / 1% of Invested Assets) All Fixed Trading Securities are owned by Lloyd’s Syndicate 1729 ABS & Other 1% Consumer Oriented 13% Financial 25% Government 46% Industrial 6% Technology 2% Utilities/Energy 5%

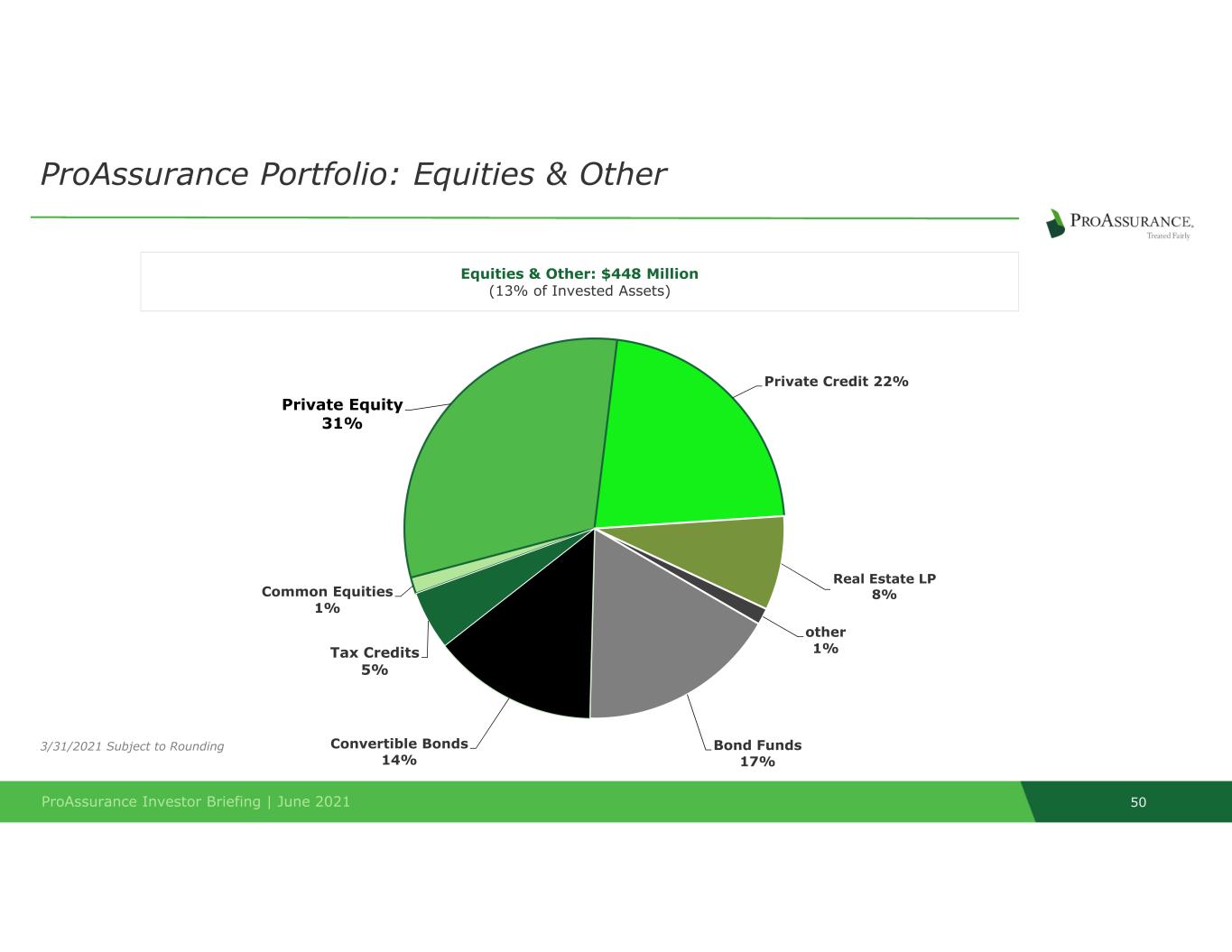

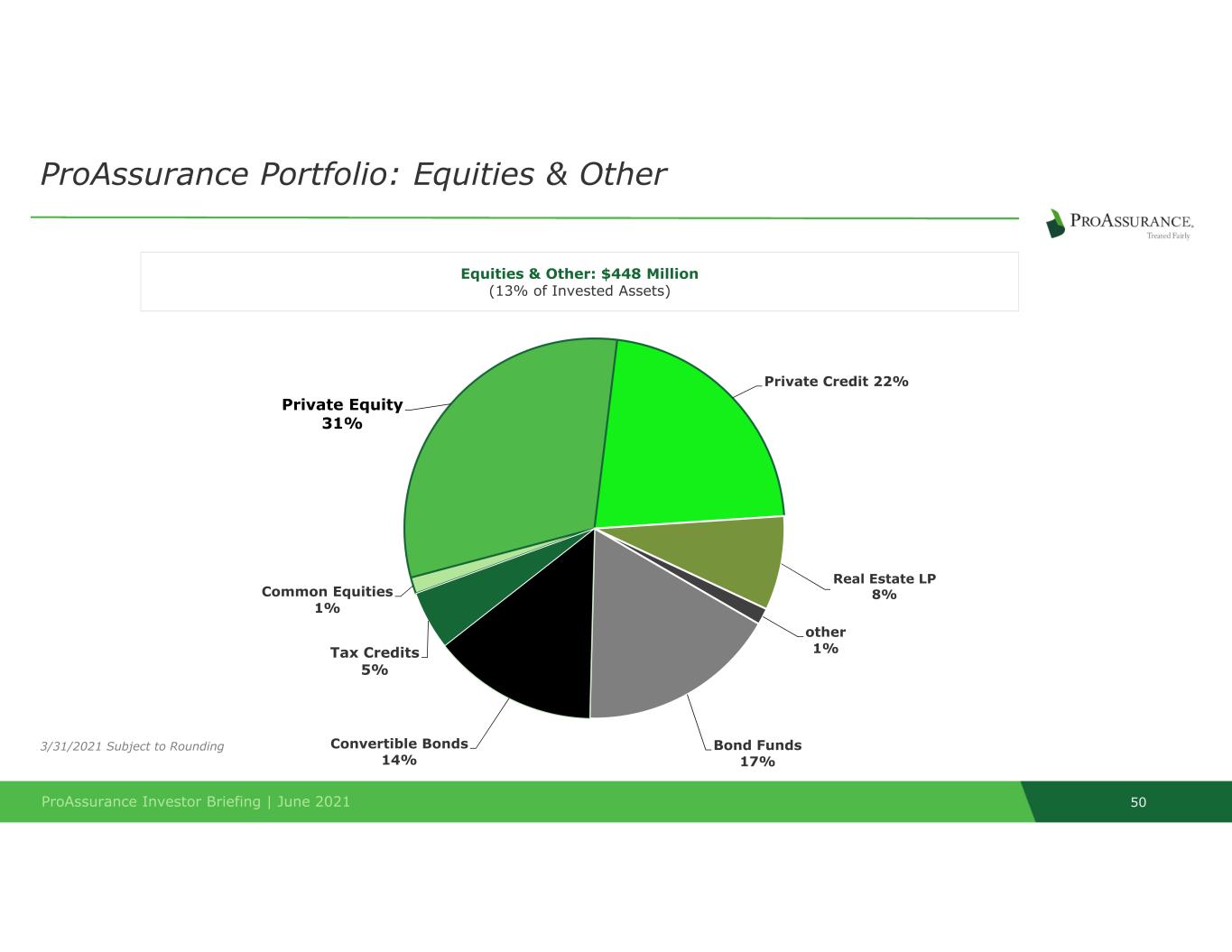

49ProAssurance Investor Briefing | June 2021 General Obligation 24% Pre-refunded 5% Special Revenue 71% 3/31/2021 Subject to rounding ProAssurance Portfolio Detail: Municipals Municipals: $322 Million (12% of Fixed Income / 9% Invested Assets) Weighted Average Rating: AA Top 10 Municipal Holdings in millions New York, NY $12 Connecticut State Housing $9 New York State Urban Dev Corp $9 Oregon State $7 Houston Tx Utility System $7 Utah State $5 California State $5 Iowa State Student $5 Met Govt Nashville and Davidson $5 Clifton Tx Higher Education Fin Corp $5 50ProAssurance Investor Briefing | June 2021 3/31/2021 Subject to Rounding ProAssurance Portfolio: Equities & Other Common Equities 1% Private Equity 31% Private Credit 22% Real Estate LP 8% other 1% Bond Funds 17% Convertible Bonds 14% Tax Credits 5% Equities & Other: $448 Million (13% of Invested Assets)

ProAssurance Investor Briefing | June 2021 51 Combined Tax Credits Portfolio Detail & Projections Year CapitalContributions GAAP Income/(Loss) from Operations, Disposition & Impairment Total Credits Tax Provision after Operating Losses/Impairments and Tax Credits Impact on Earnings 2021 $ 124,829 (15,555,614) (13,294,519) (16,561,198) 1,005,584 2022 $ 311,047 (7,447,141) (4,816,920) (6,380,821) (1,066,319) 2023 $ 51,338 (3,257,107) (167,210) (851,199) (2,405,908) 2024 $ 51,338 (1,910,214) (37,982) (439,128) (1,471,086) 2025 $ 41,159 (1,114,830) (22,205) (256,319) (858,511) 2026 $ 25,734 (154,259) (3,054) (35,449) (118,810) 2027 $ - 131,220 (79) 27,477 103,742 2028 $ - 4 - 1 3 This column represents our current estimated schedule of tax credits that we expect to receive from our tax credit partnerships. The actual amounts of credits provided by the tax credit partnerships may prove to be different than our estimates. These tax credits are included in our Tax Expense (Benefit) on our Income Statement (below the line) and result in a Tax Receivable (or a reduction to a Tax Liability) on our Balance Sheet.

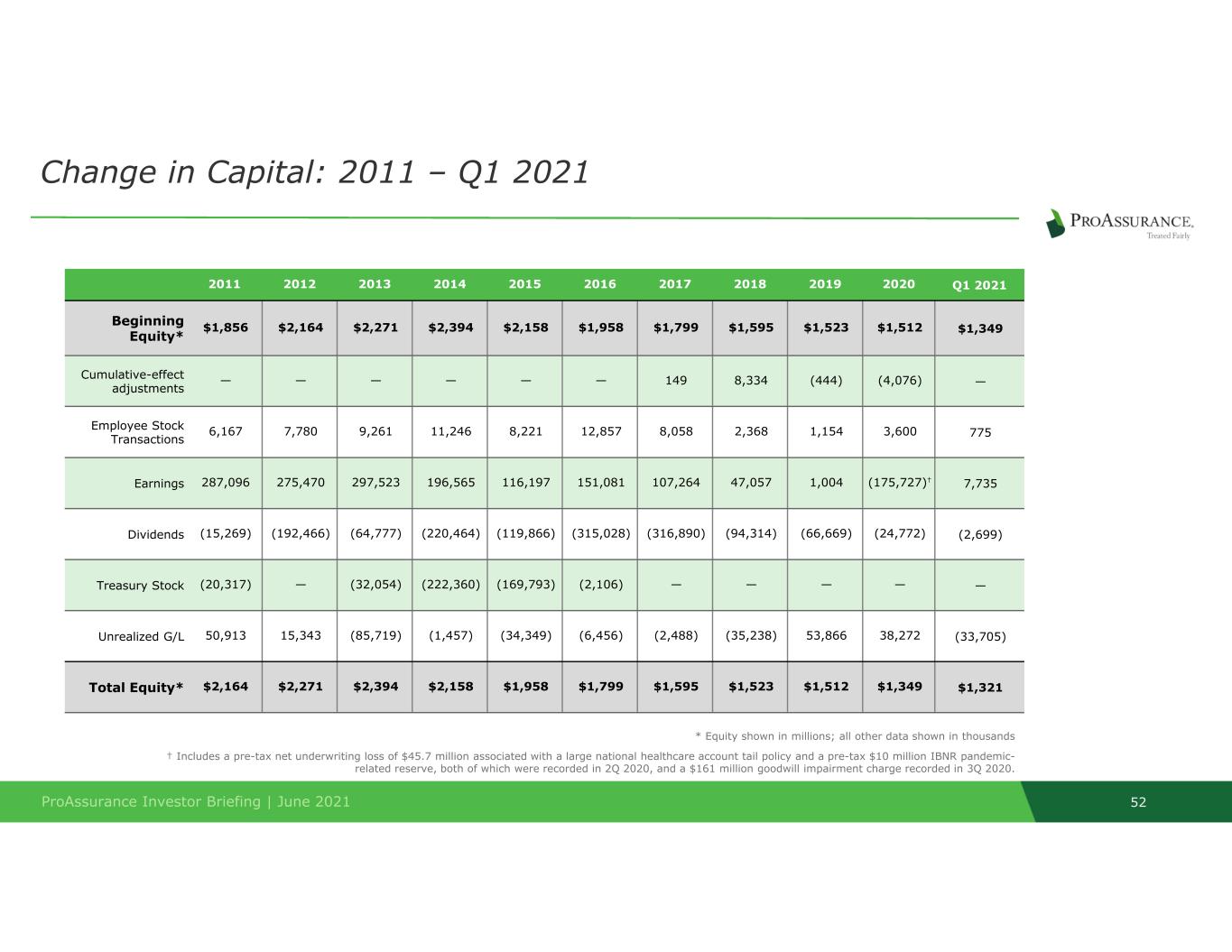

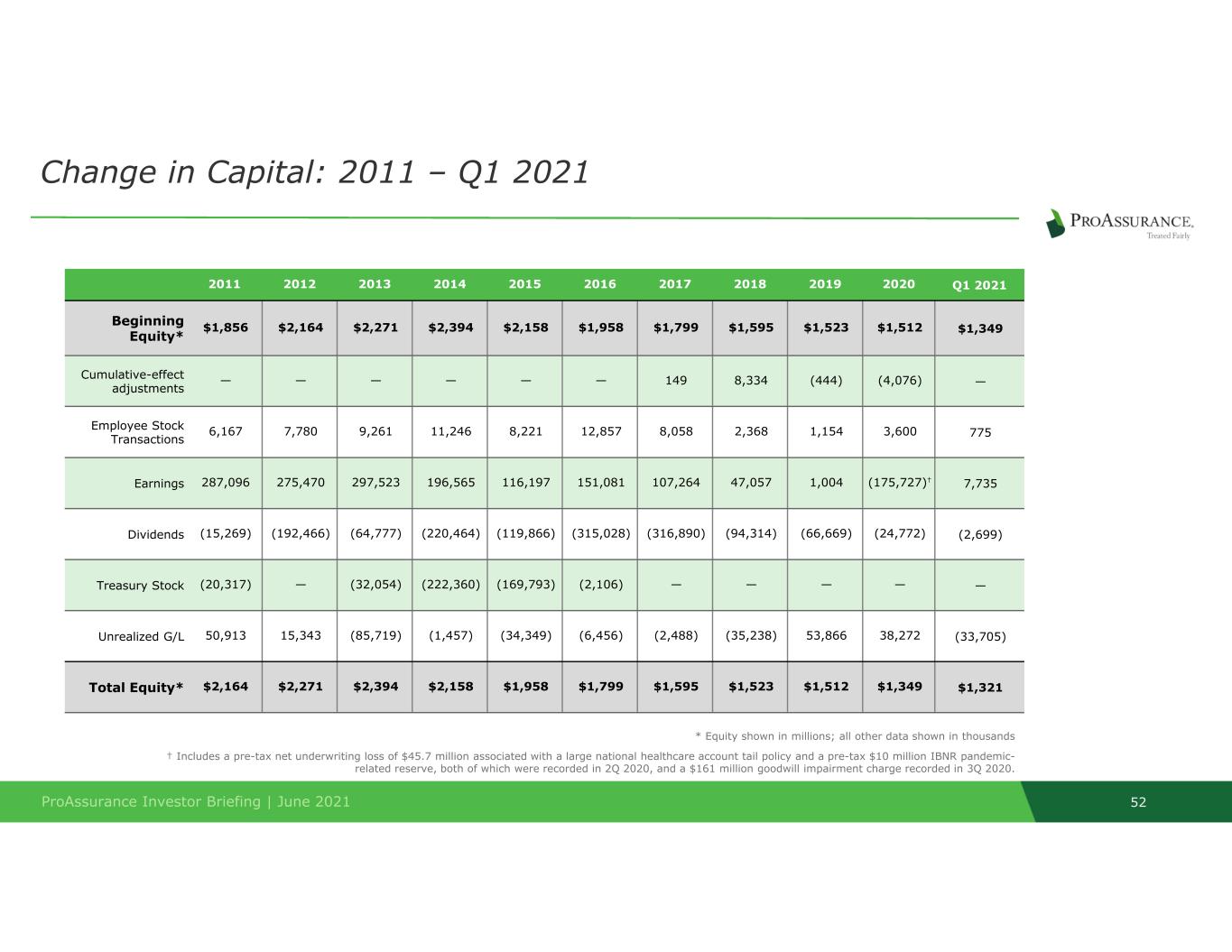

ProAssurance Investor Briefing | June 2021 52 Change in Capital: 2011 ‒ Q1 2021 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Q1 2021 Beginning Equity* $1,856 $2,164 $2,271 $2,394 $2,158 $1,958 $1,799 $1,595 $1,523 $1,512 $1,349 Cumulative-effect adjustments — — — — — — 149 8,334 (444) (4,076) — Employee Stock Transactions 6,167 7,780 9,261 11,246 8,221 12,857 8,058 2,368 1,154 3,600 775 Earnings 287,096 275,470 297,523 196,565 116,197 151,081 107,264 47,057 1,004 (175,727)† 7,735 Dividends (15,269) (192,466) (64,777) (220,464) (119,866) (315,028) (316,890) (94,314) (66,669) (24,772) (2,699) Treasury Stock (20,317) — (32,054) (222,360) (169,793) (2,106) — — — — — Unrealized G/L 50,913 15,343 (85,719) (1,457) (34,349) (6,456) (2,488) (35,238) 53,866 38,272 (33,705) Total Equity* $2,164 $2,271 $2,394 $2,158 $1,958 $1,799 $1,595 $1,523 $1,512 $1,349 $1,321 * Equity shown in millions; all other data shown in thousands † Includes a pre-tax net underwriting loss of $45.7 million associated with a large national healthcare account tail policy and a pre-tax $10 million IBNR pandemic- related reserve, both of which were recorded in 2Q 2020, and a $161 million goodwill impairment charge recorded in 3Q 2020.

ProAssurance Investor Briefing | June 2021 53 Forward Looking Statements Non-GAAP Measures This presentation contains Forward Looking Statements and other information designed to convey our projections and expectations regarding future results. There are a number of factors which could cause our actual results to vary materially from those projected in this presentation. The principal risk factors that may cause these differences are described in various documents we file with the Securities and Exchange Commission, such as our Current Reports on Form 8-K, and our regular reports on Forms 10-Q and 10-K, particularly in “Item 1A, Risk Factors.” Please review this presentation in conjunction with a thorough reading and understanding of these risk factors. This presentation contains Non-GAAP measures, and we may reference Non-GAAP measures in our remarks and discussions with investors. The primary Non-GAAP measure we reference is Non-GAAP operating income, a Non-GAAP financial measure that is widely used to evaluate performance within the insurance sector. In calculating Non-GAAP operating income, we have excluded the after-tax effects of net realized investment gains or losses and guaranty fund assessments or recoupments that do not reflect normal operating results. We believe Non-GAAP operating income presents a useful view of the performance of our insurance operations, but should be considered in conjunction with net income computed in accordance with GAAP. A reconciliation of these measures to GAAP measures is available in our regular reports on Forms 10-Q and 10-K and in our latest quarterly news release, all of which are available in the Investor Relations section of our website, Investor.ProAssurance.com. IMPORTANT SAFE HARBOR & NON-GAAP NOTICES