UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 40-F

| ☐ | Registration statement pursuant to Section 12 of the Securities Exchange Act of 1934 |

| or | |

| ☒ | Annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 |

| For the fiscal year ended September 30, 2025 |

Commission File Number 001-41726 |

Electrovaya Inc.

(Exact name of Registrant as specified in its charter)

N/A

(Translation of Registrant’s name into English (if applicable))

| Ontario, Canada | 3692 | N/A | ||

| (Province or other jurisdiction of | (Primary Standard Industrial Classification | (I.R.S. Employer | ||

| incorporation or organization) | Code Number) | Identification Number) |

6688 Kitimat Road

Mississauga, Ontario L5N 1P8

(905) 855-4627

(Address and telephone number of Registrant’s principal executive offices)

Cogency Global Inc.

122 East 42nd Street, 18th Floor

New York, NY 10168

1-800-221-0102

(Name, address (including zip code) and telephone number (including

area code) of agent for service in the United States)

Securities registered or to be registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol | Name of each exchange on which registered | ||

| Common Shares, no par value | ELVA | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

For annual reports, indicate by check mark the information filed with this Form:

| ☒ Annual information form | ☒ Audited annual financial statements |

Indicate the number of outstanding shares of each of the registrant’s classes of capital or common stock as of the close of the period covered by the annual report: 42,108,920 outstanding as of September 30, 2025.

Indicate by check mark whether the registrant: (1) has filed all reports required to be filed by Section 13 or 15(d) of the Exchange Act during the preceding 12 months (or for such shorter period that the registrant was required to file such reports); and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ☒ Yes ☐ No

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

☒ Emerging growth company

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

| † | The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012. |

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

EXPLANATORY NOTE

Electrovaya Inc. is a “foreign private issuer” as defined in Rule 3b-4 under Securities Exchange Act of 1934, as amended (the “Exchange Act”), and is a Canadian issuer eligible to file its Annual Report pursuant to Section 13 of the Exchange Act on Form 40-F pursuant to the multi-jurisdictional disclosure system (the “MJDS”) adopted by the United States Securities and Exchange Commission (the “SEC”). The Company’s common shares are listed in the United States on the Nasdaq Capital Market (“NASDAQ”) under the trading symbol “ELVA” and in Canada on the Toronto Stock Exchange (“TSX” or the “Exchange”) under the trading symbol “ELVA”.

In this Annual Report, references to “we,” “our,” “us,” the “Registrant,” the “Company,” or “Electrovaya,” mean Electrovaya Inc. unless the context suggests otherwise.

FORWARD LOOKING STATEMENTS

The Exhibits filed with this Annual Report of the Registrant contain forward-looking statements, including statements that relate to, among other things, revenue, purchase orders, revenue guidance of more than 30% revenue growth (exceeding $83 million) over FY 2025 in FY 2026, order growth and customer demand in FY 2026, mass production schedules, , the Company’s ability to start production of cells at the Jamestown, New York facility by end of FY 2026, future business opportunities, use of proceeds, ability to deliver to customer requirements and revenue growth forecasts for the fiscal year ending September 30, 2026. Forward-looking statements can generally, but not always, be identified by the use of words such as “may”, “will”, “could”, “should”, “would”, “likely”, "possible", “expect”, “intend”, “estimate”, “anticipate”, “believe”, “plan”, “objective” and “continue” (or the negative thereof) and words and expressions of similar import. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, assumptions and analyses made by the Company in light of the experience and perception of historical trends, current conditions and expected future developments and other factors it believes are appropriate are necessarily applied in making forward looking statements and such statements are subject to risks and uncertainties, therefore actual results may differ materially from those expressed or implied in such statements and undue reliance should not be placed on such statements. Material assumptions made in disclosing the forward-looking statements included in the news release include, but are not limited to assumptions that the Company’s customers will deploy its products in accordance with communicated timing and volumes, that the Company’s customers will complete new distribution centers in accordance with communicated expectations, intentions and plans, the sum of anticipated new orders in FY 2026 based on customers’ historical patterns and additional demand communicated to the Company and its partners but not yet provided as a purchase order with the Company’s current firm purchase order backlog totaling approximately $100-125 million, a discount of approximately 25% used in the revenue modeling applied to the overall expected order pipeline to account for potential delays in customer orders, expected decreases in input and material costs combined with stable selling prices in FY 2026, and a stable political climate with respect to exports from Canada to the United States, the start up time for manufacturing in Jamestown NY is estimated towards the end of FY 2026 or first quarter of FY 2027, the ability to leverage IRA45X credits, the ability to receive incentives from the state of New York, the ability to improve margins from domestic manufacturing, and the ability to attract additional customers through domestic manufacturing. Factors that could cause actual results to differ materially from expectations include but are not limited to customers not placing orders roughly in accordance with historical ordering patterns and communicated intentions resulting in annual revenue growth in FY 2026 of more than 30% over FY 2025 (exceeding $83 million), the predictability of sales and success of the Company’s products in verticals other than material handling, the imposition of a tariff regime on Canadian exports by the United States, macroeconomic effects on the Company and its business and on the lithium battery industry generally, the Company’s liquidity and cash availability in excess of its operational requirements, and the ability to generate and sustain sales orders. Additional information about material factors that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found in the Company’s Annual Information Form for the year ended September 30, 2025 under “Risk Factors”, in the Company’s base shelf prospectus dated September 17, 2024, and in the Company’s most recent annual and interim Management’s Discussion and Analysis under “Qualitative And Quantitative Disclosures about Risk and Uncertainties” as well as in other public disclosure documents filed with Canadian and American securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained in this document, whether as a result of new information, future events or otherwise, except as required by law.

The revenue for the periods described herein constitute future-oriented financial information and financial outlooks (collectively, “FOFI”), and generally, is, without limitation, based on the assumptions and subject to the risks set out above under “Forward-Looking Statements”. Although management believes such assumptions to be reasonable, a number of such assumptions are beyond the Company’s control and there can be no assurance that the assumptions made in preparing the FOFI will prove accurate. FOFI is provided for the purpose of providing information about management’s current expectations and plans relating to the Company’s future performance and may not be appropriate for other purposes.

The FOFI does not purport to present the Company’s financial condition in accordance with IFRS, and it is expected that there may be differences between audited results and preliminary results, and the differences may be material. The inclusion of the FOFI in this news release disclosure should not be regarded as an indication that the Company considers the FOFI to be a reliable prediction of future events, and the FOFI should not be relied upon as such.

Readers are cautioned that the above list of cautionary statements is not exhaustive.

No assurance can be given that these expectations will prove to be correct and such forward-looking statements in the Exhibits filed with this Annual Report should not be unduly relied upon. The Registrant’s forward-looking statements contained in the Exhibits filed with this Annual Report are made as of the respective dates set forth in such Exhibits. Such forward-looking statements are based on the beliefs, expectations, and opinions of management on the date the statements are made. In preparing this Annual Report, the Registrant has not updated such forward-looking statements to reflect any change in circumstances or in management’s beliefs, expectations or opinions that may have occurred prior to the date hereof. Nor does the Registrant assume any obligation to update such forward-looking statements in the future as stated above. For the reasons set forth above, investors should not place undue reliance on forward-looking statements.

NOTICE TO UNITED STATES READERS - DIFFERENCES IN UNITED STATES AND CANADIAN REPORTING PRACTICES

The Registrant is permitted, under the MJDS, to prepare this Annual Report in accordance with Canadian disclosure requirements, which are different from those of the United States. The Registrant has historically prepared its consolidated financial statements in accordance with International Financial Reporting Standards (“IFRS”), as issued by the International Accounting Standards Board (“IASB”), in accordance with the standards of the Public Company Accounting Oversight Board (United States) (“PCAOB”) and auditor independence standards. Financial statements prepared in IFRS may differ from financial statements prepared in United States GAAP (“U.S. GAAP”) and from practices prescribed by the SEC. Therefore, the Registrant’s financial statements filed with this Annual Report may not be comparable to financial statements of United States companies prepared in accordance with U.S. GAAP.

Unless otherwise indicated, all dollar amounts in this Annual Report are in United States dollars.

PRINCIPAL DOCUMENTS

The following documents have been filed as part of this Annual Report:

A. Annual Information Form

The Registrant’s Annual Information Form for the fiscal year ended September 30, 2025 is filed as Exhibit 99.1 to this Annual Report.

B. Audited Annual Financial Statements

The Registrant’s consolidated audited annual financial statements for the fiscal years ended September 30, 2025 and 2024, including the reports of the independent registered public accounting firm with respect thereto, is filed as Exhibit 99.2 to this Annual Report.

C. Management’s Discussion and Analysis

The Registrant’s Management’s Discussion and Analysis for the year ended September 30, 2025 is filed as Exhibit 99.3 to this Annual Report.

TAX MATTERS

Purchasing, holding or disposing of securities of the Registrant may have tax consequences under the laws of the United States and Canada that are not described in this Annual Report.

DISCLOSURE CONTROLS AND PROCEDURES

The information provided in the sections entitled “Disclosure Controls” and “Internal Control Over Financial Reporting” in the Management’s Discussion and Analysis for the year ended September 30, 2025 filed as Exhibit 99.3 to this Annual Report.

MANAGEMENT’S REPORT ON

INTERNAL CONTROL OVER FINANCIAL REPORTING

The information provided in the sections entitled “Disclosure Controls” and “Internal Control Over Financial Reporting” in the Management’s Discussion and Analysis for the year ended September 30, 2025 filed as Exhibit 99.3 to this Annual Report.

ATTESTATION REPORT OF THE REGISTERED PUBLIC ACCOUNTING FIRM

This Annual Report does not include an attestation report of the Registrant’s registered public accounting firm. The Registrant qualifies as an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”), and therefore is exempt from the requirement under Section 404(b) of the Sarbanes-Oxley Act of 2002 that a public company’s registered public accounting firm provide an attestation report on management’s assessment of internal control over financial reporting. Accordingly, no such attestation report is included in, or filed with, this Annual Report.

CHANGES IN INTERNAL CONTROL OVER FINANCIAL REPORTING

There have been no changes in the Registrant’s internal control over financial reporting during the fiscal year ended September 30, 2025, that have materially affected, or are reasonably likely to materially affect, the Registrant’s internal control over financial reporting.

NOTICES PURSUANT TO REGULATION BTR

None.

CODE OF ETHICS

The Registrant has adopted a written “code of ethics” (as defined by the rules and regulations of the SEC), entitled “Code of Conduct” (the “Code”) that applies to all members of the board of directors, officers, employees, representatives and other associates of the Company and its subsidiaries worldwide. Adherence to this code is a condition of employment with or providing services to the Company.

The Code may be obtained upon request from Electrovaya Inc.’s head office at 6688 Kitimat Rd, Mississauga, Ontario, L5N 1P8, Canada or by viewing the Registrant’s web site at https://electrovaya.com/financial-summary/.

All amendments to the Code, and all waivers of the Code with respect to any director, executive officer or principal financial and accounting officers, will be posted on the Registrant’s web site within five business days following the date of the amendment or waiver and any amendment will be provided in print to any shareholder upon request.

AUDIT COMMITTEE

Our Board of Directors has established the Audit Committee in accordance with Rule 10A-3 under the Exchange Act and Rule 5605(c) of the Nasdaq Marketplace Rules for the purpose of overseeing our accounting and financial reporting processes and the audits of our annual financial statements.

The Audit Committee is comprised of Dr. James K. Jacobs (Chair), Steven Berkenfeld, and Kartick Kumar. Our Board of Directors has determined that the Audit Committee satisfies the composition requirements of Rule 5605(c)(2) of the Nasdaq Marketplace Rules and that each member of the Audit Committee is independent within the meaning of Rule 10A-3 under the Exchange Act and Rule 5605(a)(2) of the Nasdaq Marketplace Rules.

All three members of the Audit Committee are financially literate, meaning they are able to read and understand the Registrant’s financial statements and to understand the breadth and level of complexity of the issues that can reasonably be expected to be raised by the Registrant’s financial statements.

Our Board of Directors has determined that Steven Berkenfeld qualifies as an “audit committee financial expert” (as defined in paragraph (8)(b) of General Instruction B to Form 40-F).

The SEC has indicated that the designation or identification of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose any duties, obligations or liability on such person that are greater than those imposed on members of the audit committee and the board of directors who do not carry this designation or identification, or affect the duties, obligations or liability of any other member of the audit committee or board of directors.

PRINCIPAL ACCOUNTANT FEES AND SERVICES

The required disclosure is included under the heading “Audit Committee” in the Company’s Annual Information Form for the fiscal year ended September 30, 2025, filed as Exhibit 99.1 to this Annual Report.

PRE-APPROVAL OF AUDIT AND NON-AUDIT SERVICES PROVIDED BY

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee Charter sets out responsibilities regarding the provision of non-audit services by the Registrant’s external auditors and requires the Audit Committee to pre-approve all permitted non-audit services to be provided by the Registrant’s external auditors, in accordance with applicable law.

OFF-BALANCE SHEET ARRANGEMENTS

The Registrant currently has no off-balance sheet arrangements.

TABULAR DISCLOSURE OF CONTRACTUAL OBLIGATIONS

The following table lists, as of September 30, 2025, information with respect to the Registrant’s known contractual obligations (in thousands):

| Payments due by period | ||||||||||||||||||||

| Less than | More than | |||||||||||||||||||

| Contractual Obligations | Total | 1 year | 1-3 years | 3-5 years | 5 years | |||||||||||||||

| Long-Term Debt Obligations | $ | 22,517 | $ | — | $ | 20,579 | $ | 969 | $ | 969 | ||||||||||

| Capital Finance Lease Obligations | $ | — | $ | — | $ | — | $ | — | $ | — | ||||||||||

| Operating Lease Obligations | $ | 3,156 | $ | 761 | $ | 2,206 | $ | 189 | $ | — | ||||||||||

| Purchase Obligations | $ | 9,555 | $ | 9,555 | $ | — | $ | — | $ | — | ||||||||||

| Other Long-Term Liabilities Reflected on Balance Sheet | $ | 1,390 | $ | 196 | $ | 703 | $ | 225 | $ | 266 | ||||||||||

| Total | $ | 36,618 | $ | 10,512 | $ | 23,488 | $ | 1,383 | $ | 1,235 | ||||||||||

NASDAQ CORPORATE GOVERNANCE

The Registrant is a foreign private issuer and its common shares are listed on the NASDAQ.

NASDAQ Rule 5615(a)(3) permits a foreign private issuer to follow its home country practice in lieu of the requirements of the Rule 5600 Series, the requirement to distribute annual and interim reports set forth in Rule 5250(d), and the Direct Registration Program requirement set forth in Rules 5210(c) and 5255; provided, however, that such a company shall comply with the Notification of Material Noncompliance requirement (Rule 5625), the Voting Rights requirement (Rule 5640), have an audit committee that satisfies Rule 5605(c)(3), and ensure that such audit committee’s members meet the independence requirement in Rule 5605(c)(2)(A)(ii).

The Registrant has reviewed the NASDAQ corporate governance requirements and confirms that except as described below, the Registrant is in compliance with the NASDAQ corporate governance standards in all significant respects:

The Registrant does not follow Rule 5605(b)(2), which requires the company to have regularly scheduled meetings at which only independent directors present (“executive sessions”). In lieu of following Rule 5605(b)(2), the Registrant follows Canadian securities laws and the rules of the TSX.

The Registrant has a formal Audit Committee charter but does not follow Rule 5605(c)(1), which requires a company’s Audit Committee charter to include the items enumerated in Rule 5605(c)(1) and have the Audit Committee review and reassess the Charter on an annual basis. In lieu of following Rule 5605(c)(1), the Registrant follows applicable Canadian securities laws and the rules of the TSX with respect to audit committee charters.

The Registrant does not follow Rule 5605(d)(1), which requires companies to adopt a formal written compensation committee charter and have a compensation committee review and reassess the adequacy of the charter on an annual basis. In lieu of following Rule 5605(d)(1), the Registrant follows applicable Canadian securities laws and the rules of the TSX.

The Registrant does not follow Rule 5620(c), under which the Nasdaq minimum quorum requirement for a shareholder meeting is 33-1/3% of the outstanding shares of common stock. A quorum for a meeting of shareholders of the Registrant is two shareholders or proxyholders that hold or represent, as applicable, not less than 25% of the issued and outstanding shares entitled to be voted at the meeting. In lieu of following Rule 5620(c) (shareholder quorum), the Registrant follows applicable Ontario and Canadian corporate and securities laws and the rules of the TSX.

The foregoing is consistent with the laws, customs, and practices in the province of Ontario and Canada.

Further information about the Registrant’s governance practices is included on the Registrant’s website.

MINE SAFETY DISCLOSURE

Not applicable.

DISCLOSURE REGARDING FOREIGN JURISDICTIONS THAT PREVENT INSPECTIONS

The Registrant has adopted a compensation recovery policy (the “Clawback Policy”) as required by Nasdaq listing standards and pursuant to Rule 10D-1 of the Exchange Act. The Clawback Policy is incorporated by reference as Exhibit 97.

At no time during or after the fiscal year ended September 30, 2025, was the Registrant required to prepare an accounting restatement that required recovery of erroneously awarded compensation pursuant to the Clawback Policy. As of September 30, 2025, there was no outstanding balance of erroneously awarded compensation to be recovered from the application of the Clawback Policy to a prior restatement.

RECOVERY OF ERRONEOUSLY AWARDED COMPENSATION

None.

UNDERTAKING

The Registrant undertakes to make available, in person or by telephone, representatives to respond to inquiries made by the SEC staff, and to furnish promptly, when requested to do so by the SEC staff, information relating to: the securities registered pursuant to Form 40-F; the securities in relation to which the obligation to file an annual report on Form 40-F arises; or transactions in said securities.

CONSENT TO SERVICE OF PROCESS

The Registrant has previously filed with the SEC a written consent to service of process on Form F-X. Any change to the name or address of the Registrant’s agent for service shall be communicated promptly to the SEC by amendment to the Form F-X referencing the file number of the Registrant.

ADDITIONAL INFORMATION

Additional information relating to the Registrant may be found on the SEDAR+ System for Electronic Document Analysis and Retrieval at www.sedarplus.ca and on the SEC’s Electronic Data Gathering, Analysis and Retrieval (EDGAR) system at www.sec.gov.

SIGNATURES

Pursuant to the requirements of the Exchange Act, the Registrant certifies that it meets all of the requirements for filing on Form 40-F and has duly caused this Annual Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| ELECTROVAYA INC. | |||

| By: | /s/ Raj Das Gupta | ||

| Name: | Raj Das Gupta | ||

| Title: | Chief Executive Officer | ||

Date: December 19, 2025

EXHIBIT INDEX

- 1 -

Exhibit 99.1

ELECTROVAYA INC.

ANNUAL INFORMATION FORM

FOR THE YEAR ENDED SEPTEMBER 30, 2025

DECEMBER 10, 2025

-

ELECTROVAYA INC.

ANNUAL INFORMATION FORM

TABLE OF CONTENTS

| 1. | CORPORATE STRUCTURE | 2 | |

| 1.1 Name, Address and Incorporation | |||

| 1.2 Our Mission and Values | |||

| 1.3 Intercorporate Relationships | |||

| 2. | GENERAL DEVELOPMENT OF THE BUSINESS | 3 | |

| 2.1 Summary of the Business | |||

| 2.2 Three-Year History | |||

| 2.3 Narrative Description of the Business | |||

| 3. | CAPITAL STRUCTURE AND MARKET FOR SHARES | 11 | |

| 4. | DIVIDEND POLICY | 13 | |

| 5. | DIRECTORS AND OFFICERS | 14 | |

| 6. | TRANSFER AGENT AND REGISTRAR | 16 | |

| 7. | LEGAL PROCEEDINGS AND REGULATORY ACTIONS | 17 | |

| 8. | INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS | 17 | |

| 9. | MATERIAL CONTRACTS | 19 | |

| 10. | INTERESTS OF EXPERTS | 19 | |

| 11. | RISK FACTORS | 19 | |

| 12. | ADDITIONAL INFORMATION | 32 | |

| 13. | AUDIT COMMITTEE | 33 | |

| APPENDIX “A” AUDIT COMMITTEE CHARTER | A-1 | ||

ELECTROVAYA INC.

ANNUAL INFORMATION FORM

Unless otherwise indicated herein, the information set out in this annual information form (“AIF”) is current to December 10, 2025 and is presented in US dollars.

This AIF contains forward-looking statements including statements with respect to the effects of pandemics, geopolitical tensions, supply chains customer demand and order flow, other factors impacting revenue, the competitive position of the Company’s products, global trends in technology supply chains, the Company’s strategic objectives and financial plans, including the operations and strategic direction of Electrovaya Labs, the Company’s products, including high voltage battery systems for electric bus, truck and energy storage applications and low voltage battery systems for electric lift truck and robotic applications and the potential for revenue from new applications , cost implications, continually increasing the Company’s intellectual property portfolio, additional capital raising activities, the adequacy of financial resources to continue as a going concern, and also with respect to the Company’s markets, objectives, goals, strategies, intentions, beliefs, expectations and estimates generally. Forward-looking statements can generally be identified by the use of words such as “may”, “will”, “could”, “should”, “would”, “likely”, “possible”, “expect”, “intend”, “estimate”, “anticipate”, “believe”, “plan”, “objective” and “continue” (or the negatives thereof) and words and expressions of similar import. Readers and investors should note that any announced estimated and forecasted orders and volumes provided by customers and potential customers to Electrovaya also constitute forward-looking information and Electrovaya does not have (a) knowledge of the material factors or assumptions used by the customers or potential customers to develop the estimates or forecasts or as to their reliability and (b) the ability to monitor the performance of the business its customers and potential customers in order to confirm that the forecasts and estimates initially represented by them to Electrovaya remain valid. If such forecasts and estimates do not remain valid, or if firm irrevocable orders are not obtained, the potential estimated revenues of Electrovaya could be materially and adversely impacted.

Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, the outcome of such statements involve and are dependent on risks and uncertainties, and undue reliance should not be placed on such statements. Certain material factors or assumptions are applied in making forward-looking statements, and actual results may differ materially from those expressed or implied in such statements. Material assumptions used to develop forward-looking information in this AIF include, among other things, that that current customers will continue to make and increase orders for the Company’s products; that the Company’s alternate supply chain will be adequate to replace material supply and manufacturing; that the Company’s products will remain competitive with currently-available alternatives in the market; that the alternative energy market will continue to grow and the impact of that market on the Company; the purchase orders actually placed by customers of Electrovaya; customers not terminating or renewing agreements; general business and economic conditions (including but not limited to inflation, currency rates and creditworthiness of customers); the relative effect of the global geopolitical and supply chain challenges on the Company’s business, its customers, and the economy generally; the Company’s technology enabling a new category of solid state battery that meets the requirements for broader market adoption; the Company’s liquidity and capital resources, including the availability of additional capital resources to fund its activities; industry competition; changes in laws and regulations; legal and regulatory proceedings; the ability to adapt products and services to changes in markets; the ability to retain existing customers and attract new ones; the ability to attract and retain key executives and key employees; the granting of additional intellectual property protection; and the ability to execute strategic plans. Information about risks that could cause actual results to differ materially from expectations and about material factors or assumptions applied in making forward-looking statements may be found herein under the heading “Risk Factors”, and in other public disclosure documents filed with Canadian securities regulatory authorities. The Company does not undertake any obligation to update publicly or to revise any of the forward-looking statements contained or incorporated by reference in this document, whether as a result of new information, future events or otherwise, except as required by law.

-

| 1. | Corporate Structure |

| 1.1 | Name, Address and Incorporation |

The company’s full corporate name is Electrovaya Inc. (the “Company” or “Electrovaya”), which, as used herein, refers to Electrovaya Inc., its predecessor corporations and all its subsidiaries (unless the context otherwise requires).

Our registered and head office is located at 6688 Kitimat Road, Mississauga, Ontario L5N 1P8. Our telephone number and website address are (905) 855-4610 and www.electrovaya.com, respectively.

Electrovaya was incorporated under the Business Corporations Act (Ontario) in September 1996. The Company listed on the Toronto Stock Exchange in November 2000 under the ticker “EFL”. The Company changed the ticker symbol on the TSX to ELVA and began trading on the Nasdaq Stock exchanged on July 6, 2023.

Electrovaya is a leader in advanced lithium-ion battery technology, leveraging proprietary materials science and a robust intellectual property portfolio to deliver industry-leading safety and exceptional cycle life. Our solutions power mission-critical, heavy-duty applications—including material handling, robotics, heavy duty vehicles, and defense systems. Supported by a multidisciplinary team of engineers, we provide fully integrated energy solutions that combine cutting-edge cell design, battery management systems, and system-level innovation to meet the most demanding performance requirements.

| 1.2 | Our Mission and Values |

Electrovaya’s mission is to deliver the world’s best battery solutions for mission-critical applications, enabling the global energy transition and supporting resilient energy security. We aim to accelerate electrification across industrial, transportation, and defense sectors while creating long-term value for our shareholders. Through continuous innovation in advanced materials and proprietary technologies, we strive to enhance safety, performance, and longevity in every product we deliver.

-

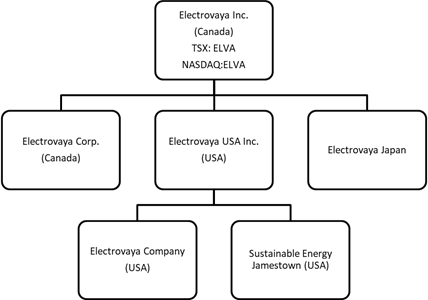

| 1.3 | Intercorporate Relationships |

The following diagram illustrates the intercorporate relationships between the Company and its material subsidiaries, and the percentage of votes attached to all voting securities of the material subsidiary owned, controlled, or directed, directly or indirectly, by the Company, and the subsidiary’s respective jurisdiction of formation.

| 2. | General Development of the Business |

| 2.1 | Summary of the Business |

Electrovaya is a technology-focused lithium-ion battery company engaged in the design, development and manufacturing of advanced battery cells, modules and systems. The Company’s products primarily are based on its proprietary Infinity Battery Technology, which incorporates ceramic-enhanced lithium-ion cell constructions and advanced materials that deliver high safety performance, long cycle life and strong durability in demanding operating environments. These characteristics make Electrovaya’s products suitable for mission-critical applications, including material-handling equipment, robotic and autonomous vehicles, heavy-duty electric vehicles, defense-related platforms and stationary energy-storage systems.

Electrovaya’s development activities draw upon capabilities in electrochemistry, materials science, mechanical and electrical engineering, and battery-management software. The Company maintains an expanding intellectual-property portfolio related to advanced materials, cell designs, ceramic components, separator technologies and system-level battery architectures. Electrovaya is also engaged in programs related to next-generation solid-state and hybrid solid-state battery technologies, as well as improvements to its existing Infinity platform.

-

The Company’s commercial offerings include low-voltage and high-voltage battery systems supplied to a range of industrial and transportation markets. These include material-handling equipment, robotic vehicles, airport ground-support equipment, construction and mining equipment, electric buses and trucks, and grid-connected or behind-the-meter energy-storage installations. While the material-handling sector has historically represented a significant share of the Company’s revenue, Electrovaya continues to expand into adjacent markets where long operating life, enhanced safety and reliable high-power performance are essential.

Electrovaya sells its products through a combination of original equipment manufacturer relationships, dealer networks and direct sales to large fleet operators and industrial customers. The Company is expanding its commercial reach in North America and internationally, targeting applications in which performance, safety and operational reliability serve as key purchasing criteria.

Electrovaya maintains research, engineering and manufacturing operations in Mississauga, Ontario. To support anticipated growth, as well as emerging energy-security and domestic-manufacturing priorities in North America, the Company is developing a lithium-ion cell and battery manufacturing facility located on a 52-acre site near Jamestown, New York. The site includes a 137,000-square-foot building that is intended to serve as the Company’s first U.S. cell manufacturing location. The project is supported in part by government incentives, including a direct loan from the Export-Import Bank of the United States. Following completion and commissioning, the facility is expected to increase production capacity and provide U.S.-based manufacturing capabilities aligned with evolving supply-chain and national energy-security objectives.

Additional information can be found in the Company’s Management’s Discussion and Analysis for the year ended September 30, 2025.

| 2.2 | Three-Year History |

During the last three years, Electrovaya has developed advanced lithium-ion battery cells and systems with unique performance attributes for use in a variety of heavy duty and mission critical applications. The first target market for these products was the material handling sector as it was an existing market that was relatively mature and willing to pay higher costs for better performing battery products. As of today, the majority of our battery systems are being utilized in the material handling industry. The Company demonstrated continuous improvements in the energy density of its commercial cell technologies and also has launched an increasing list of battery systems. These include battery systems for multiple classes of material handling vehicles, customized systems for robotic applications, airport ground equipment, high voltage battery systems that are targeting the electric bus, truck and energy storage applications and finally customized solutions for defense applications. Many of these battery systems have also gone through UL safety testing certification and the Company has maintained ISO9001 certification since 2022. Electrovaya has started making more deliveries to sectors other than material handling and is expecting these sectors to grow to become more material in future years. The company continues research and development activities for new battery systems, advances in battery management system technology and next generation solid state battery technology.

-

Listing on NASDAQ

In Fiscal 2023, Electrovaya achieved a significant milestone by listing its common shares on the Nasdaq Capital Market, enhancing the Company’s visibility and access to U.S. capital markets.

EXIM loan for Jamestown facility

Electrovaya has positioned itself to increase its domestic manufacturing capacity and support overall anticipated growth in demand for its products. In March 2025, the company was able to close the term loan from The Export-Import Bank of the United States (“EXIM”) for the amount of $50.8 million to support Electrovaya’s expansion in Jamestown New York. The Company made the first draw from EXIM facility in the month of September 30, 2025. The project is expected to be completed by the last quarter of FY 2026 or first quarter of FY 2027.

Bank of Montreal working capital facility

In March 2025, the Company also refinanced its working capital facility with the Bank of Montreal with a three-year senior secured asset-based lending facility. The facility provides an initial US $20 million with a further US $5 million accordion to support further growth. The facility lowers the Company’s cost of capital with reduced interest rates and fees, strengthening its financial position

Equity raises in the market

Over the past three years the Company has been active in the equity markets.

During the month of November 2023, the Company issued shares and warrants via private placement and raised $10.5 million in cash for the Company.

During the month of December 2024, the company issued additional 5,951,250 shares in a brokered offering in the market and raised a total of $12.8 million (net receipts).

During the month of November 2025 (i.e. FY 2026), the company issued 5,405,000 shares to the investors in a brokered offering, raising a total of $28.2 million.

OEM Partners

The Material Handling vertical has represented the largest segment for Electrovaya and over the last three years accounts for over 95% of its sales.

Electrovaya has developed extensive relationships with OEMs to support both the distribution of Electrovaya battery systems as well as the integration of Electrovaya battery products into specific vehicle programs.

In December 2020, Electrovaya and Raymond Corporation signed a Strategic Supply Agreement making Raymond Corporation, the Company’s partner in the material handling industry. In November 2023, the Company announced a new three year agreement that included the addition of Toyota Material Handling. This new agreement increased sales volumes and also included the capability to supply to additional affiliated companies.

-

In April 2024, Electrovaya announced a partnership with Sumitomo Corporation Power and Mobility (“SCPM”). Through this relationship Electrovaya and SCPM are actively marketing Electrovaya’s solutions to OEMs in Japan and elsewhere. The partnership resulted in an initial supply agreement with a global construction equipment manufacturer.

Product Launches

In 2024, Electrovaya developed customized battery systems for specific vehicle development programs for two of its OEM partners. These vehicles are expected to be launched in 2026.

On July 2025, the Company announced that it has launched multiple battery system products for a variety of robotic vehicle platforms. These battery systems developed in collaboration with three major OEM partners, with 2 based in the USA and 1 in Japan for a variety of robotic vehicle applications ranging from material handling to surveillance applications. Initial deliveries to all three OEMs will begin in the current quarter with anticipated commercial deliveries accelerating from FY 2026 onwards.

On July 29, 2025, the Company announced the launch of multiple battery system products designed specifically for airport ground support equipment (GSE). Developed in collaboration with a major original equipment manufacturer (OEM) supplier, these innovative systems support a broad range of electrified ground support equipment (GSE) applications, including airplane tuggers, baggage tractors, belt loaders, cargo loaders, and more.

Improvement in overall financial health of the Company

The Company has demonstrated a strong improvement in adjusted EBITDA performance over the past two fiscal years. In Fiscal 2025, Electrovaya achieved several significant financial milestones, including generating positive adjusted EBITDA of $8.8 million and net income of $3.3 million. Revenue for the year was $64 million, representing an increase of approximately 43% compared to the prior year. In addition, the successful equity raise of approximately $28 million in November 2025 has further strengthened the Company’s liquidity position and supported a solid overall financial foundation.

| 2.3 | Narrative Description of the Business |

| 2.3.1 | Overview of Products & Services |

Electrovaya developed and commercialized a lithium-ion battery technology that management believes enables significant enhancements to battery cycle life (longevity) and safety performance. Electrovaya has considerable internal data backing up these claims in addition to third party test data. The Company has been marketing the technology as its “Infinity Battery Technology” and has focused on applications that require either or both performance differentiations. This technology owned by the Company and is protected by a variety of patents and know-how based intellectual property and includes unique ceramic separator and cell design features amongst other proprietary attributes. The core building block of the technology is demonstrated at the lithium-ion cell level, where independent third party testing has validated the performance differentiation. While the Company does provide cell level products to some customers, the vast majority of sales are derived from battery systems which are electromechanical systems made up of multiple lithium-ion cells in combination with electronics and electromechanical components. These systems are customized for a variety of applications, the most mature being Material Handling Electric Vehicles (“MHEV”).

-

Battery System Products

Over the last 7 years, Electrovaya has developed an increasing number of battery systems based on its Infinity Technology. For MHEV applications, the Company provides over 50 distinct battery models, most of which have received UL 2580 or another type of certification. These systems include a variety of voltage classes and capacities and are designed to be compatible with various Class 1-5 material handling vehicles. The Company has deployed over 10,000 battery systems in this category and they are in use at some of the world’s largest companies’ distribution center networks.

Other products that the Company has recently developed include a variety of battery systems designed for airport ground support equipment (“GSE”), battery systems tailored for robotic applications and some specialized battery systems designed for mission critical defense applications. These other products are at relative infancy and are expected to be scaled in production over the coming years.

Products under Development

Electrovaya is developing new products including both new cell technologies and new battery systems. New cell technologies include a proprietary solid state battery development which has been underway for the last several years. The Company has filed multiple patents for this technology and has plans to file additional patents. Currently the solid state battery effort has led to small cells being produced and the Company is currently investing to scale these efforts to enable pre-commercial test samples to strategic customers. Electrovaya’s solid state cells feature proprietary ceramic separator technology that leverages some of the existing technology know-how from the Company’s existing technology portfolio. The advantages of the solid state battery technology include much higher energy density making the technology attractive for applications like airborne drones, aerospace and defense applications and consumer electronics. Management believes the technology is complimentary to the Infinity Technology and would serve distinct applications.

Other cell based development efforts include a high power version of its Infinity Battery technology to enable sub five minute charge rates. The Company believes that there is strong demand for this type of product for certain robotic applications.

Electrovaya continues to invest into new battery system products based on its core Infinity Technology. This includes new products to serve energy storage, robotic, defense and other speciality applications.

-

2.3.2 Sale of Products

Electrovaya’s largest vertical by sales volume continues to be the MHEV vertical. While the Company has focused the majority of its sales efforts primarily on this sector, we have recently developed new products designed to serve new verticals including heavy duty vehicles, robotics, airport ground support equipment (GSE) and energy storage systems. Our primary geographical focus is North America, however we have had recent sales activities in South America, Asia and Australia.

For our batteries powering MHEVs, there are two main market sales channels; the OEM Partners sales channel and the Direct sales channel. The Company also maintains strong relationships with the end users of its products even if the sale of its products was conducted by a distributer or OEM partner. These direct relationships are key to maintaining long term commitments and visibility for demand. The Company is actively pursuing additional OEM and distributer relationships for robotics, airport ground support equipment, electric bus, truck, diesel generator replacement and defense applications. The Company anticipates some contribution to revenue from these new market segments from the 2026 fiscal year, however with more significant contributions in 2027 and beyond due to production schedules of the targeted OEMs.

2.3.3 Competition

The battery industry is highly competitive. Electrovaya competes with a large number of market participants including pure-play battery providers, diversified technology and industrial vendors and strategic joint ventures. Our primary competitors are included in the following summary below:

| ● | MHEVs including forklifts and Automated Guided Vehicles. Competition in this group includes alternative power sources such as lithium ion batteries, lead acid batteries, hydrogen fuel cells and other power sources including fossil fuels. Our lead acid battery competitors include EnerSys, East Penn Manufacturing Company and Exide Technologies Inc. Our hydrogen fuel cell competitors include Plug Power, Ballard as well as forklift manufacturers Hyster Yale and Linde. Competitors in the lithium ion battery sector include East Penn, Flux Power and EnerSys. |

| ● | High Voltage Vehicle Battery Systems. Competition includes manufacturers and battery system integrators including Proterra, Nikola, Microvast, Akasol, Forsee Power, Toshiba and others. |

| ● | Stationary Energy Storage. Competition includes manufacturers and system integrators. We compete primarily with LG Chem, Panasonic, Tesla, SAFT, BYD, Fluence, Samsung, SK Innovation, Toshiba, Leclanche, and others. |

| ● | Other Electric Vehicle Battery Systems. We compete primarily with LG Chem, Johnson Controls, SAFT, Samsung, SK Innovation, BYD, CATL, Enersys, Panasonic, and others. |

| ● | Batteries for Robotic Applications: Electrovaya is launching battery systems for robotic applications. The competition for these solutions includes but is not limited to Toshiba, LG, Panasonic and others. |

-

| ● | Batteries for Airport Ground Equipment: Electrovaya is launch battery systems for airport ground equipment. The competition for these solutions includes but is not limited to Flux Power, Enersys, East Penn and others. |

To compete successfully, we intend to continue to build on the advantages offered by our technology.

2.3.4 Research and Development

Electrovaya continues to research, develop and commercialize improved lithium-ion batteries and associated technologies with longer life, higher energy density and increased safety. The Company primarily uses “NCM” (nickel cobalt manganese) based cells. When combined with other Electrovaya technologies including specialized electrolytes and ceramic composite separators, the end result is a cell with competitive advantages in performance, cycle life and safety. The Company also launched a cell product based on Lithium Iron Phosphate “LFP” cathodes targeting markets that call for this technology and also enabling lower cost alternatives to its core NMC based products.

Electrovaya is committed to investing in developing better products for our customers and pursuing research activities that prepare us for the future. To date, Electrovaya has invested more than $100 million in research & development and manufacturing advances and continues to invest in current and future technologies.

At the system level, our team of engineers continues to develop the mechanical, thermal, electrical, and control systems for innovative battery systems for our clients, enabling us to offer a complete solution for their specific power or energy requirements. Electrovaya has expanded its engineering team in the current fiscal year and is pursuing an aggressive product development plan.

The Electrovaya Labs division continues research into next generation cells and batteries in the areas of solid-state cells, electrode production, rapid charging and higher energy density batteries, and will generate additional intellectual property and patent applications in connection with the same. Electrovaya expanded the team at this division in 2024 and 2025 and expects to continue this trend. The Company continues to invest in a few key areas for this division including for solid state batteries and next generation ceramic separator development. These investments include both capital equipment and personnel.

2.3.5 Intellectual Property

Electrovaya has a program to enhance its intellectual properties and owns many patents. These patents cover our fundamental structural technology innovations, our system level designs including our intelligent battery management system for transportation, as well as some nanomaterial developments. Our patents are issued globally and typically across the United States and Canada. In some cases, we do file into other jurisdictions such as Europe, India, China, Japan and other countries where potential markets and/or manufacturing activities make patent protection desirable and economically justifiable. Electrovaya recently also acquired about 30 patents mainly on ceramic composite separators and lithium ion cells.

-

We seek to protect our intellectual property, including our technological innovations, products, software, manufacturing processes, business methods, know-how, trade secrets, trademarks and trade dress by law through patents, copyright and trademark law, by contract through non-disclosure agreements, and through safeguarding of trade secrets.

Our patent portfolio, trade secrets and proprietary know-how are an important component in protecting our battery innovations and our manufacturing processes. We further protect our trade secrets and proprietary know-how by keeping our facilities physically secure, disclosing relevant information only on a need-to-know basis and entering into non-disclosure agreements with our potential customers, employees, consultants and potential strategic partners, and by treating and marking the confidential information as confidential.

We will continue to apply for patents resulting from ongoing research and development activities, acquire, or license patents from third parties, if appropriate, and further develop the trade secrets related to our manufacturing processes and the design and operation of the equipment we use in our manufacturing processes.

2.3.6 Employees

As of September 30, 2025 we had approximately 123 full-time employees as well as contract employees and consultants. We believe we enjoy a good and productive relationship with our employees.

2.3.7 Manufacturing

The Company has a battery and battery systems research and manufacturing facility in Mississauga, Ontario. The location comprises approximately 62,000 square feet and is designed to enhance the Company’s productivity and efficiency. The facilities are focused on lithium ion battery production, which includes the assembly, integration and testing of lithium ion batteries as well as development and testing of new products and enhancements by our engineering team.

During the last quarter of FY 2026 or first quarter of FY2027, the Company anticipates that it will begin operations at its 137,000 square feet facility in Jamestown, New York. The facility will be focused on cell, pack and module manufacturing of lithium-ion batteries. The facility will produce both the Infinity and Infinity-HV battery lines and provide additional capacity as the Company expands into new verticals.

2.3.8 Safety

Safety is of paramount importance to the Company not only for our products but more importantly for our people. We have robust safety protocols in all areas. We have a Joint Health and Safety Committee which includes employees across disciplines and at all levels. This Committee regularly meets to ensure safety protocols are followed and updated when necessary.

Our products are designed and manufactured with safety as the primary concern. All components are vigorously tested prior to being included in the manufacturing process. Our products are assembled to the highest standard and are subject to a comprehensive end of line testing to ensure they adhere to our demanding safety standards.

-

Electrovaya recently achieved the UL2580 certification on a variety of battery systems, with UL LLC completing multiple system level tests on Electrovaya’s batteries, including fire propagation at both ambient and elevated temperatures, and other electrical and mechanical tests. Furthermore, UL completed full functional testing and provided UL991 and UL1998 certifications relating to Electrovaya’s latest battery management systems. Furthermore, Electrovaya achieved UL recognition for its latest NMC and LFP cells.

2.3.9 Quality

Quality is also an integral part of our culture and processes. We believe we have differentiated ourselves in the market by having the highest quality and safest product available.

Electrovaya received ISO9001:2015 Quality Management certification in 2022. Furthermore, our quality assurance management system has been tested and validated by a number of third parties including Toyota Material Handling and Raymond Corporation.

Our processes and systems are focused on ensuring that every product that is shipped to our customers conforms to our rigorous quality standards while being produced in a safe and environmentally conscious manner.

2.3.10 Sustainability

Our Company was founded 29 years ago with the express purpose to develop clean technology for a greener planet. Electrovaya is focused on contributing to the prevention of climate change through supplying the safest and longest lasting Li-Ion batteries in the marketplace. Our goal is to be a global leader in the supply of advanced lithium ion battery technologies.

Our processes and facilities embody our focus on sustainability. Waste is minimized and recycled where possible. Steps have been introduced to reduce our energy and water use.

| 3. | Capital Structure and Market for Shares |

Our authorized share capital consists of an unlimited number of common shares. Holders of common shares are entitled to receive notice of any meetings of our shareholders, to attend and to cast one vote per common share at all such meetings. The holders of our common shares are entitled to vote at all meetings of our shareholders, and each common share carries the right to one vote in person or by proxy. The holders of the common shares are also entitled to receive any dividends we may declare, and to receive our remaining property upon liquidation, dissolution or wind-up.

-

In June 2023, the Company, with the approval of shareholders, carried out a share consolidation at a ratio of 5 to 1. Subsequent to this, in July 2023, the Company listed its common shares on Nasdaq.

Our common shares are listed for trading on the Toronto Stock Exchange under the symbol “ELVA.TO” and on the Nasdaq under the symbol “ELVA”. The table below sets forth information relating to the trading of the common shares on the TSX and Nasdaq for the months indicated.

TSX (CDN)

| Date | High | Low | Volume |

| Sep 2025 | 10.43 | 7.88 | 3,209,400 |

| Aug 2025 | 8.47 | 5.86 | 1,361,900 |

| Jul 2025 | 7.00 | 4.22 | 1,112,600 |

| Jun 2025 | 5.00 | 4.09 | 597,200 |

| May 2025 | 4.60 | 3.62 | 386,900 |

| Apr 2025 | 3.85 | 3.13 | 208,000 |

|

Mar 2025

|

4.15 | 2.85 | 460,200 |

| Feb 2025 | 3.79 | 3.09 | 294,700 |

| Jan 2025 | 4.10 | 3.39 | 438,800 |

| Dec 2024 | 4.10 | 3.02 | 710,900 |

| Nov 2024 | 3.94 | 2.80 | 472,600 |

| Oct 2024 | 3.94 | 2.84 | 175,800 |

-

NASDAQ

| Date | High | Low | Volume |

| Sep 2025 | 7.49 | 5.71 | 11,655,900 |

| Aug 2025 | 6.20 | 4.16 | 5,457,500 |

| Jul 2025 | 5.14 | 3.11 | 4,270,600 |

| Jun 2025 | 3.71 | 2.98 | 1,909,400 |

| May 2025 | 3.44 | 2.55 | 1,440,200 |

| Apr 2025 | 2.77 | 2.25 | 562,700 |

| Mar 2025 | 2.92 | 1.80 | 1,498,600 |

| Feb 2025 | 2.68 | 2.11 | 1,089,100 |

| Jan 2025 | 2.89 | 2.31 | 1,938,900 |

| Dec 2024 | 2.91 | 2.11 | 2,697,800 |

| Nov 2024 | 2.78 | 1.73 | 1,762,200 |

| Oct 2024 | 2.36 | 2.05 | 301,600 |

| 4. | Dividend Policy |

We have never declared or paid any dividends on our common shares in the past; however, we may declare and pay dividends on our common shares in the future depending upon our financial performance.

-

| 5. | Directors and Officers |

The following table sets forth the names and municipalities of residence of our directors and officers, the position they hold with us and their principal occupation during the last five years:

| Name, Office (if any) and Principal Occupation | Director Since | Common Shares Beneficially Owned | Stock Options Held | Warrants |

|

Dr. Sankar Das Gupta, Mississauga, Ontario, Canada

Executive Chairman

|

1996 | 10,295,751 | 605,000 | 1,420,000 |

|

Dr. Carolyn M. Hansson(1)(2)

Director

Professor of Materials Engineering, Department of Mechanical and Mechatronics Engineering, University of Waterloo

|

2017 | 50,000 | 57,000 | — |

|

Dr. James K. Jacobs(1)(2), Toronto, Ontario, Canada

Director

Retired

|

2018 | 478,107 | 46,000 | — |

|

Kartick Kumar(1)(2)

Director

Managing Director, Climate Investments, King Philanthropies

|

2021 | 2 | 32,000 | — |

|

Dr. Rajshekar Das Gupta Oakville, Ontario, Canada

Director, Chief Executive Officer

|

2022 | 671,048 | 2,059,000 | 38,884 |

|

Steven Berkenfeld

New York, New York

USA

Director

|

2023 | — | 70,000 | — |

|

John Gibson

Hamilton, Ontario, Canada

Secretary and Chief Financial Officer

|

N/A

|

3,444

|

204,000

|

— |

| (1) | Audit Committee member. |

| (2) | Nominating, Corporate Governance and Compensation Committee member. |

All directors hold office until the close of the next annual meeting of the shareholders or until their successors are duly elected or appointed.

As of September 30, 2025, the directors and officers of the Company, as a group, beneficially own, directly or indirectly, or exercise control or direction over, an aggregate of 11,498,352 or approximately 27% of the issued and outstanding common shares of the Company.

In October, 2023, the board of directors accepted the nomination of Steven Berkenfeld to join as a director of the Company.

-

Cease Trade Orders, Bankruptcies, Penalties or Sanctions

Except as described below, to the best of management’s knowledge, no officer or director:

| (a) | is, as at the date of this AIF, or has been, within 10 years before the date of this AIF, a director, chief executive officer or chief financial officer of any company (including the Company) that: |

| (i) | was subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (ii) | was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer; or |

| (b) | is, as at the date of this AIF, or has been within 10 years before the date of the AIF, a director or executive officer of any company (including the Company) that, while that person was acting in that capacity, or within a year of that person ceasing to act in that capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or trustee appointed to hold its assets; or |

| (c) | has, within the 10 years before the date of the AIF, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the officer or director. |

On January 25, 2018, Litarion GmbH (“Litarion”), a former subsidiary of Electrovaya, commenced a voluntary structured insolvency process and an Administrator was put in place for the sale of the business. On April 30, 2018, the Administrator commenced insolvency proceedings and assumed control of the assets of Litarion. Sankar Das Gupta, Executive Chairman of the Corporation, was a managing director of Litarion until the Administrator’s appointment.

In June, 2021, the administrator of Litarion and the Company and its officers agreed to mutually settle all claims as part of the termination of the insolvency proceedings.

Except as described below, to the best of management’s knowledge, no officer or director has been subject to:

| (a) | any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a securities regulatory authority; or |

| (b) | any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable security holder in deciding whether to make an investment decision in the Company’s common shares. |

-

On June 30, 2017, the Company and Sankar Das Gupta, Executive Chairman of the Corporation, entered into a Settlement Agreement (the “Agreement”) with Staff of the Ontario Securities Commission (“OSC”) resolving issues the OSC identified with respect to the Company’s continuous disclosure between December 2015 and September 2016 (the “Time Period”). The Agreement settled allegations by the OSC regarding unbalanced news releases that did not adequately disclose the nature and risks of newly-announced business arrangements issued by the Company during the Time Period, that the Company did not update previously announced forward-looking information in its Management Discussion and Analysis during the Time Period, and that the Company did not provide an accurate description of its business in its annual information form filed during the Time Period.

The Company did not face a financial penalty in relation to the Agreement. Dr. Das Gupta agreed to pay an administrative penalty and upgrade his personal knowledge of continuous disclosure standards. Under the terms of the Agreement, the Company agreed to additional steps to comply with continuous disclosure requirements, including

| ● | a review of the Company’s corporate governance framework by an independent consultant and adopting all recommended changes that are accepted by OSC Staff; |

| ● | instituting a disclosure committee comprising 4 directors (2 of whom were required to be independent) for a period of 20 months, which committee was to approve all public disclosure made by the Corporation; |

| ● | naming an independent director as Chair of the disclosure committee for a period of 20 months; and |

| ● | naming an independent director as Chair of the Board for a period of 20 months. |

Under the terms of the Settlement Agreement, Dr. Das Gupta agreed to:

| ● | pay an administrative penalty of Cdn$250,000; |

| ● | a prohibition on acting as a director or officer of any reporting issuer, other than the Company or an affiliate, for a period of one year; |

| ● | pay the costs of the corporate governance consultant’s review; and |

| ● | participate in, and pay for, a corporate governance course on disclosure issues acceptable to staff of the OSC. |

| 6. | Transfer Agent and Registrar |

The transfer agent and registrar for the common shares of the Company is TSX Trust Company at its principal office in Toronto, Ontario.

-

| 7. | Legal Proceedings and Regulatory Actions |

The Company is not involved in any legal proceeding or regulatory action which it expects would have a material effect on the Company.

| 8. | Interest of Management and Others in Material Transactions |

Other than as disclosed in this AIF, no director, executive officer, person or company that beneficially owns or controls more than 10% of any class of the Company’s outstanding voting securities, or any associates or affiliates of persons had any material interest, direct or indirect, in any transaction within the three most recently completed financial years or during the current financial year that has materially affected or is reasonably expected to materially affect the company.

Purchase of Jamestown Property

On October 15, 2021, the Company, as purchaser, agreed to purchase the property municipally known as 1 Precision Way, Jamestown, NY 14701 (the “Property”) for a purchase price of $5 million. Among other factors, the Property was of interest to the Company for various reasons, including access to Government incentives, increased capacity, and access to the US market.

Prior to closing, it was determined that the Company would not have access to sufficient capital to finance the building purchase. The vendor had another buyer, therefore, in May 2022, prior to closing, the Company, as assignor, and Sustainable Energy Jamestown LLC (“SEJ”), as assignee, entered into an agreement to assign the agreement of purchase and sale for the Property to SEJ, with the intention that SEJ would complete the purchase of the Property. SEJ completed the purchase of the property in May 2022.

On November 1, 2022, the Company entered into an agreement with Sustainable Energy Jamestown (“SEJ”), a party related to shareholders of the Company for the purchase of the building at 1 Precision Way, Jamestown, NY. The purchase agreement sets the purchase price at $5,500 less any expenses incurred on behalf of the related party to date and the repayment of the deposit of $550.

On March 31, 2023, the Company completed the purchase of the membership interest in SEJ. The purchase of the site includes 52 acres of land, including a building previously utilized for the manufacturing of electronic components. The purchase price was paid by way of a $1.05 million Promissory Note payable to the members of Sustainable Energy Jamestown LLC with a term of 365 days bearing interest at 7.5% per annum payable at maturity and the assumption of a $4.4 million vendor promissory note (“VPN”) issued on July 1, 2022 with a 2 year term bearing interest at 2% per annum and secured against the property. At the time of the transaction, the balance of the VPN was $3.95 million with a payment due on maturity of $2.4 million. As part of the security interests granted to the Company’s existing lender for its consent to the transaction, Dr. Sankar Das Gupta pledged 7,000,000 Common Shares (1,400,000 post consolidation) of the Company.

In March 2025, the Company secured the direct loan for the amount of $50.8 million from Export-Import Bank of the United States. This financing will fund Electrovaya's battery manufacturing buildout including equipment, engineering and setup costs for the facility. Electrovaya has rapidly increasing demand for its products from a wide range of heavy duty and mission critical electrified applications, and it has been a priority of the Company to expand its manufacturing operations in the United States for these vital products. The Company’s manufacturing facility in Jamestown is scheduled to produce Electrovaya’s proprietary Infinity lithium-ion ceramic cells, which offer industry leading longevity and safety.

-

Personal Guarantees

On February 16, 2024, the Executive Chairman and Chief Executive Officer both exercised options of Electrovaya Inc. A sum of $507 from the Promissory Note was utilized to cover a portion of the options' purchase price. The remaining balance of the promissory note, amounting to $519, was then substituted with a new Promissory Note on February 28, 2024, carrying a 14% interest rate and maturing on July 31, 2025. The Promissory Note including interest accrued was repaid in full on December 30, 2024.

| September 30, | ||||

| 2025 | 2024 | |||

| Promissory Note | $nil | $519,000 | ||

Electrovaya Labs – Facility Usage Agreement

In May 2021, Electrovaya entered a month-to-month Facility Usage Agreement for the use of space and allocated staff of a third party research firm providing access to laboratory facilities, primarily for research associated with its Electrovaya Labs segment. The term of the agreement was for six months and could be terminated by either party upon 90 days notice.

In July 2021, the facility was acquired by an investor group controlled by the family of Dr. Das Gupta, the Chairman of the Company and a controlling shareholder, and which group included the Company’s current CEO, Dr. Raj Das Gupta. The Facility Usage Agreement was not changed on the change of ownership and remains in effect between the Company and the owner, such that the monthly payment of $25,000 is now with a related party of Electrovaya.

In June 2023, the Facility Usage Agreement was retroactively extended from January 1, 2023, for an additional three years. The agreement maintains a 2.5% annual rent increment while keeping all other terms and conditions unchanged.

Performance Option Grants

In September 2021, on the recommendation of the Compensation Committee of the Corporation, a committee composed entirely of independent directors, the Board of Directors of the Corporation determined that it is advisable and in the best interests of the Corporation to amend the terms of the compensation of certain key personnel to incentivize future performance, to encourage retention of their services, and to align their interests with those of the Corporation’s shareholders.

Dr. Sankar Das Gupta was granted 700,000 options which vest in two tranches of 200,000 options and one tranche of 300,000 options, based on reaching specific target market capitalizations. The fair value of these options on the day of grant is calculated using the Monte Carlo method of option valuation and expensed over the mean vesting period in accordance with IFRS 2.

-

Dr. Rajshekar Das Gupta was granted 900,000 options which vest in three tranches of 300,000 options based on reaching specific target market capitalizations. The fair value of these options on the day of issuance was calculated using the Monte Carlo method of option valuation and expensed over the mean vesting period in accordance with IFRS 2.

In April 2023, following the suggestion of the Company's Compensation Committee, consisting entirely of independent directors, the Company's Board of Directors awarded Dr. Rajshekar Das Gupta a total of six hundred thousand options. These options will vest in two phases: three hundred thousand options and three hundred thousand options, contingent upon achieving certain target market capitalizations.

| 9. | Material Contracts |

The Company does not have any material contracts that were required to be filed under section 12.2 of National Instrument 51-102 - Continuous Disclosure Obligations.

| 10. | Interests of Experts |

The auditor of the Company is MNP LLP (“MNP”), Chartered Accountants, Suite 1900, 1 Adelaide St East, Toronto, Ontario M5C 2V9. There are no registered or beneficial interests, direct or indirect, in any securities or other property of the Company or any of its subsidiaries held or received by MNP. MNP is independent in accordance with the auditors’ rules of Professional conduct in Canada.

| 11. | Risk Factors |

Our business of designing, developing and manufacturing lithium-ion advanced battery and battery systems for the transportation, electric grid stationary storage and mobile markets faces many risks of varying degrees of significance, which could affect our ability to achieve our strategic objectives. The risk factors described below are not the only risks and uncertainties that we face. Additional risks and uncertainties not presently known to us or that we currently consider immaterial may also impair our business operations. These risk factors could materially affect our future operating results and could cause actual events to differ materially from those described in our forward-looking statements. Additional risks the Company faces are disclosed in the Company’ Management’s Discussion and Analysis for the year ended September 30, 2025.

There is no assurance that we will be able to produce or generate and fulfill orders for large quantities of our products.

Electrovaya may not be able to establish anticipated levels of high-volume production on a timely, cost-effective basis, or at all. It has never manufactured batteries in substantially large quantities and it may not be able to maintain future commercial production at planned levels. As a result of the risks discussed within this AIF, among others, Electrovaya may not be able to generate or fulfill new sales orders or deliver them in a timely manner, which could have a material effect on its business and results of operations.

-

Our ability to generate positive cash flows