UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of April 2025

Commission File Number: 001-41085

SNOW

LAKE RESOURCES LTD.

(Translation of registrant’s name into English)

360 Main St 30th Floor

Winnipeg, Manitoba R3C 4G1 Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

☒ Form 20-F ☐ Form 40-F

INCORPORATION BY REFERENCE

Exhibits 99.1, 99.2, 99.3, 99.4 and 99.5 of this Form 6-K are incorporated by reference into the registrant’s Registration Statement on Form F-3 (File No. 333-272324).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| SNOW LAKE RESOURCES LTD. | |||

| Date: April 9, 2025 | By | /s/ Kyle Nazareth | |

| Kyle Nazareth | |||

| Chief Financial Officer | |||

EXHIBIT INDEX

Exhibit 99.1

February 18, 2025

Bazooka Resources Pty Ltd.

Unit 25, 22 Railway Road

Subiaco WA 6008

Australia

Dear Sirs:

Re: Acquisition of Buffalo Uranium Project, Wyoming

This letter of intent (the “LOI”) sets out the basis on which Snow Lake Resources Ltd. (“Snow Lake”) is prepared to enter into a share purchase agreement (the “Share Purchase Agreement”) with the shareholders (collectively the “Seller”) of Bazooka Resources Pty Ltd. (“Bazooka”), and with Bazooka, pursuant to which Snow Lake will purchase, and the Seller will sell, 100% of the issued and outstanding ordinary shares (the “Bazooka Shares”) of Bazooka, thereby acquiring a 100% indirect, undivided interest in the Buffalo Uranium Project (as defined hereafter).

Upon execution by the parties hereto, this LOI will constitute a legally binding agreement between us, enforceable in accordance with its terms.

| 1. | Structure of the Transaction |

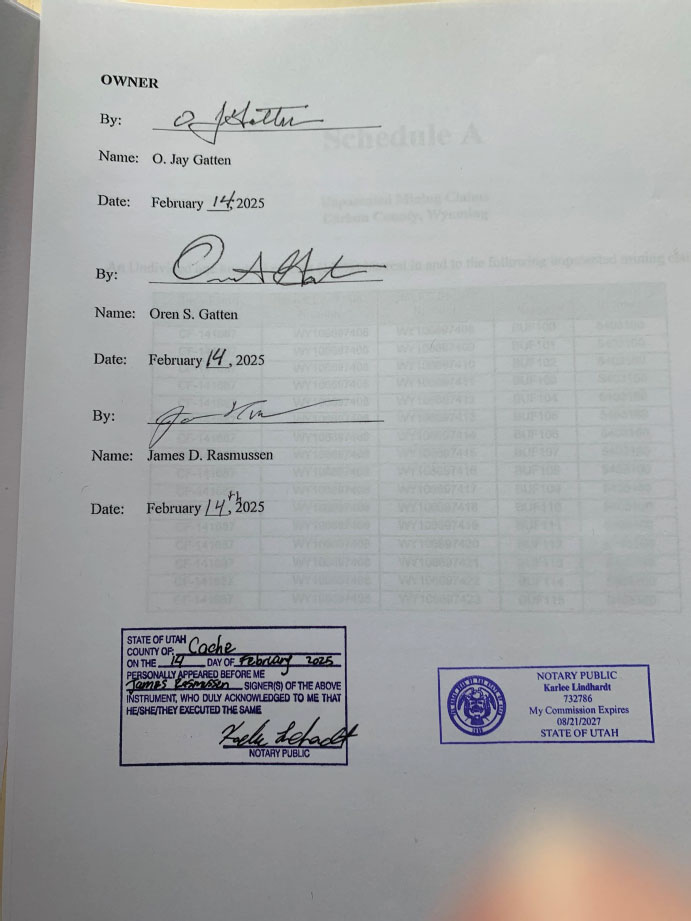

O. Jay Gatten, Oren S. Gatten and James D. Rasmussen (the “Claim Holders”) are currently the sole registered, legal and beneficial owners of 100% of right, title and interest in and to the mineral claims (the “Mineral Claims”), all as more particularly described in Schedule A hereto (the “Buffalo Uranium Project”).

The Claim Holders and Bazooka entered into an option to purchase mining property agreement (the “Option Agreement”) dated February 17, 2025, pursuant to which the Claim Holders granted Bazooka the sole and exclusive option to purchase a 100% undivided interest in and to the Mineral Claims, a copy of which is attached as Schedule B hereto.

Snow Lake will acquire its 100% indirect, undivided interest in the Buffalo Uranium Project through a purchase from the Seller of 100% of the Bazooka Shares.

| 2. | Share Purchase Agreement |

Snow Lake, the Seller, and Bazooka will use reasonable commercial efforts to enter into the Share Purchase Agreement within 45 calendar days of execution of this LOI (the “Deadline”), such Share Purchase Agreement to supersede this LOI in its entirety. If, for any reason, the parties are unable to enter into and execute the Share Purchase Agreement prior to the Deadline, then the parties agree to permit an additional 30 calendar days within which to enter into and execute the Share Purchase Agreement.

|

|

The Share Purchase Agreement will contain customary representations and warranties by each of the parties in favour of the other parties, and such other customary terms, covenants and conditions as would be customary for a transaction of this nature. Snow Lake and its counsel will have primary responsibility for preparing the Share Purchase Agreement.

| 3. | Consideration for the Acquisition of Bazooka |

Snow Lake will purchase the Bazooka Shares in consideration of:

| a) | Initial Cash Payment: Payment by Snow Lake to Bazooka of the amount of US$50,000 in cash upon execution of this LOI, which amount represents the amount paid by Bazooka to the Claim Holders in accordance with Section 1 (a) of the Option Agreement; |

| b) | Closing Cash Payment: Payment by Snow Lake to the Claim Holders of the amount of US$200,000 in cash on the Closing Date (as defined in the Option Agreement) and, for greater certainty, the Closing Date will coincide with and be the same date as the closing of the purchase of the Bazooka Shares by Snow Lake; and |

| c) | Closing Issuance of Snow Lake Shares: Allotting and issuing to the Seller on the Closing Date, an aggregate of that number of fully paid and non-assessable common shares of Snow Lake (the “Snow Lake Shares”) that have a value of US$400,000 calculated in accordance with the 10-day volume weighted average closing price of Snow Lake’s common shares for the 10 trading days immediately prior to the Closing Date; |

| d) | First Milestone Payment: Payment by Snow Lake to the Claim Holders of: |

| i) | the amount of US$450,000 in cash (the “First Milestone Payment”) on the date (the “First Publication Date”) that an SK-1300 compliant technical report is published and which indicates that there is a uranium mineral resource on the Buffalo Uranium Project of a minimum of 10 million pounds U3O8 with a minimum average grade >0.2% U3O8,, or 2.5 million pounds U3O8 with a minimum average grade >1.0% U3O8; |

or, at Snow Lake’s sole election;

| ii) | that number of Snow Lake Shares that have a value of US$450,000, based on the 10-day volume weighted average closing price of the common shares of Snow Lake for the 10 trading days immediately preceding the First Publication Date; |

all in accordance with Section 2 (a) of the Option Agreement;

|

|

| e) | Second Milestone Payment: Payment by Snow Lake to the Claim Holders of: |

| iii) | the amount of US$450,000 in cash (the “Second Milestone Payment”) on the date (the “Second Publication Date”) that an SK-1300 compliant technical report is published and which indicates that there is a uranium mineral resource on the Buffalo Uranium Project of a minimum of 20 million pounds U3O8, with a minimum average grade >0.2% U3O8, or 5 million pounds U3O8 with a minimum average grade >1.0% U3O8; |

or, at Snow Lake’s sole election;

that number of Snow Lake Shares that have a value of US$450,000, based on the 10-day volume weighted average closing price of the common shares of Snow Lake for the 10 trading days immediately preceding the Second Publication Date;

all in accordance with Section 2 (b) of the Option Agreement; and

| f) | Net Smelter Royalty: Snow Lake acknowledges that the Claim Holders retain a 1.5% net smelter royalty return (the “Royalty”) on the Mineral Claims, and that Bazooka will have the contractual right under the Option Agreement to purchase the Royalty from the Claim Holders at any time, and from time to time, for an aggregate amount of US$1.5 million in cash; |

subject, for subsections 3 (b) to (f) above, to the condition that Bazooka has elected to exercise the option under the Option Agreement, and has provided the Exercise Notice to the Claim Holders in accordance with the terms and conditions of Section 1 (b) of the Option Agreement.

| 4. | Representations & Warranties of the Seller and Bazooka |

The Seller and Bazooka jointly and severally represent and warrant to and in favour of Snow Lake, and acknowledges that Snow Lake is relying upon such representations and warranties in connection with the matters contemplated by this LOI:

| (a) | Incorporation - Bazooka: Bazooka is a corporation duly incorporated and validly existing under the laws of the jurisdiction in which it was incorporated, has all requisite corporate power and authority and is duly qualified and holds all necessary material permits, licenses and authorizations necessary or required to carry on its business as now conducted and to own, lease or operate its properties and assets and no steps or proceeding have been taken by any person, voluntary or otherwise, requiring or authorizing its dissolution or winding up, and Bazooka has all requisite power and authority to enter into this LOI, the Share Purchase Agreement, and to carry out its obligations hereunder and thereunder, as well as under the Option Agreement; |

|

|

| (b) | Authorized and Issued Share Capital: As at the date of this LOI, a total of 4,000,000 ordinary shares were issued and outstanding as fully paid ordinary shares of Bazooka; |

| (c) | No Options on Securities: No person, firm or corporation has or will have at the date of this LOI, any agreement or option, or right or privilege (whether pre-emptive or contractual) capable of becoming an agreement or option, for the purchase of any unissued shares or securities of Bazooka; |

| (d) | No Undisclosed Liabilities: Bazooka has no outstanding indebtedness or liabilities and is not party to or bound by any suretyship, guarantee, indemnification or assumption agreement, or endorsement of, or any other similar commitment with respect to the obligations, liabilities or indebtedness of any person, or incurred in the ordinary course of business since the date of the most recent financial statements of Bazooka; and |

| (e) | Option to Purchase Agreement: The Option Agreement is in full force and effect and Bazooka has made the initial payment of US$50,000 to the Claim Holders in accordance with Section 1 (a) of the Option Agreement; |

| (f) | Title to Mineral Claims: The Claim Holders are the sole registered and beneficial owners of 100% of right, title and interest in and to the Buffalo Uranium Project, sufficient to permit Snow Lake to explore the minerals relating thereto; and |

| (g) | Surface Rights & Access Agreements: The Claim Holders have the right to obtain all necessary surface rights, access rights and other necessary rights relating to the Mineral Claims, notwithstanding that the Claim Holders have not yet entered into surface rights and/or land access agreements with respect to the Mineral Claims. |

| 5. | Representations & Warranties of Snow Lake |

Snow Lake represents and warrants to and in favour of the Seller and Bazooka, and acknowledges that the Seller and Bazooka are relying upon such representations and warranties in connection with the matters contemplated by this LOI:

| a) | Incorporation: Snow Lake is a corporation duly incorporated and validly existing under the laws of the jurisdiction in which it was incorporated, has all requisite corporate power and authority and is duly qualified and holds all necessary material permits, licenses and authorizations necessary or required to carry on its business as now conducted and to own, lease or operate its properties and assets and no steps or proceeding have been taken by any person, voluntary or otherwise, requiring or authorizing its dissolution or winding up, and Snow Lake has all requisite power and authority to enter into this LOI, the Share Purchase Agreement, and to carry out its obligations hereunder and thereunder; and |

|

|

| b) | Authorized and Issued Share Capital: The authorized capital of Snow Lake consists of an unlimited number of common shares without par value, of which, as at the date of this LOI, a total of 98,529,516 common shares were issued and outstanding as fully paid and non-assessable common shares of Snow Lake. |

| 6. | Publicity |

As a Canadian company listed on NASDAQ, Snow Lake will make a public announcement regarding entering into the LOI, and a further announcement regarding entering into the Share Purchase Agreement. Snow Lake will allow Bazooka to review and provide reasonable comments on Snow Lake’s press releases prior to issuance.

If the foregoing accurately reflects our previous discussions please execute and return one copy of this LOI to us.

Sincerely,

Snow Lake Resources Ltd.

Frank Wheatley

Chief Executive Officer

Agreed to and acknowledged this 18th day of February 2025.

Bazooka Resources Pty. Ltd.

(on behalf of itself and on behalf of the Seller)

Mike Haynes

Director

|

|

Schedule A – Description of Mineral Claims

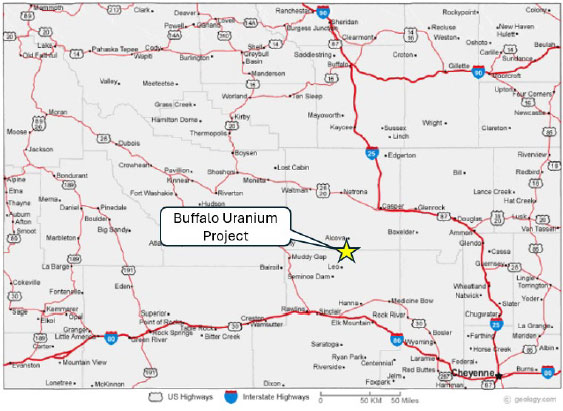

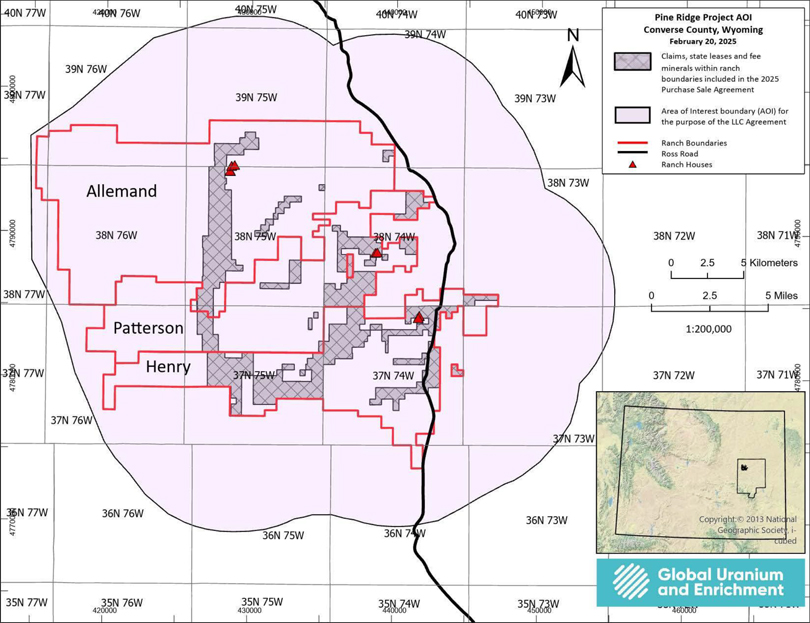

Figure 1. Location of the Buffalo Uranium Project, Wyoming.

|

|

The Mineral Claims are comprised of the following sixteen unpatented lode mining claims situated in Sections 13, 14 and 24 Township 27N & Range 84W, in Carbon County, Wyoming, as follows:

| Case

Filing Number |

MLRS

Lead File Number |

MLRS

Serial Number |

Claim Name |

Receipt Number |

| CF-141687 | WY106697408 | WY106697408 | BUF100 | 5403160 |

| CF-141687 | WY106697408 | WY106697409 | BUF101 | 5403160 |

| CF-141687 | WY106697408 | WY106697410 | BUF102 | 5403160 |

| CF-141687 | WY106697408 | WY106697411 | BUF103 | S403160 |

| CF-141687 | WY106697408 | WY106697412 | BUF104 | 5403160 |

| CF-141687 | WY106697408 | WY106697413 | BUF105 | 5403160 |

| CF-141687 | WY106697408 | WY106697414 | BUF106 | 5403160 |

| CF-141687 | WY106697408 | WY106697415 | BUF107 | 5403160 |

| CF-141687 | WY106697408 | WY106697416 | BUF108 | 5403160 |

| CF-141687 | WY106697408 | WY106697417 | BUF109 | 5403160 |

| CF-141687 | WY106697408 | WY106697418 | BUF110 | 5403160 |

| CF-141687 | WY106697408 | WY106697419 | BUF111 | 5403160 |

| CF-141687 | WY106697408 | WY106697420 | BUF112 | 5403160 |

| CF-141687 | WY106697408 | WY106697421 | BUF113 | 5403160 |

| CF-141687 | WY106697408 | WY106697422 | BUF114 | 5403160 |

| CF-141687 | WY106697408 | WY106697423 | BUF115 | 5403160 |

|

|

Schedule B – Option to Purchase Mining Property Agreement

|

|

OPTION TO PURCHASE MINING PROPERTY AGREEMENT

THIS OPTION TO PURCHASE MINING PROPERTY AGREEMENT (“Agreement”), is made and entered into this 17th day of February, 2025, (“Execution Date”) by and between O. Jay Gatten, Oren S. Gatten and James D. Rasmussen with address at 447 North 300 West Suite #3, Kaysville, Utah 84037 hereinafter collectively “OWNER”, and Bazooka Resources Pty Ltd, an Australian company, with address at Unit 25, 22 Railway Road, Subiaco WA, 6008, Australia (hereinafter “OPTIONEE”). For purposes herein, Owner and/or Optionee may be variously referred to as a “Party”, or together, as “Parties”.

WITNESSETH:

This Agreement is made and entered into with reference to the following facts:

A. Owner has sole and exclusive right, title and interest in and to that certain property located in Carbon County in the State of Wyoming, consisting of sixteen (16) unpatented mining claims, all as more particularly described in Schedule A attached hereto and incorporated herein by this reference, and commonly referred to as the “Buffalo Uranium Project” (the “Property”). As defined and used herein, the term “Property” shall include (i) any and all royalty rights and interests in or related to the Property, (ii) all prospecting, research, exploration, exploitation, operating and mining permits, licenses and leases associated therewith, if any, held or controlled by Owner, (iii) all easement, access, mineral, surface, water and ancillary or appurtenant rights attached or accruing thereto, if any, and (iv) any mining license or other form of substitute or successor mineral title or interest granted, obtained or issued in connection with or in place of or in substitution therefore, including, without limitation, any property issued to cover any internal gaps or fractions in respect of the mining claims.

B. Owner desires to grant Optionee, and Optionee desires to acquire an option to purchase the Property from Owner, upon the terms and conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the mutual covenants and promises hereinafter set forth, and other good and valuable consideration, receipt of which is hereby acknowledged, it is agreed by the parties as follows:

| 1. | Grant of Option; Consideration. Owner hereby grants Optionee the exclusive option to purchase the Property, together with other rights to conduct due diligence and mining-related activities on the Property, all pursuant to the terms of this Agreement (“Option”). |

a. Included in the rights granted hereunder, Optionee shall have an exclusive 45-day period to conduct further due diligence on the Property (“Due Diligence Period”). As full consideration for this Due Diligence Period, Optionee shall pay Owner the non-refundable sum of US$50,000 within 24 hours of execution of this Agreement (“Initial Option Consideration”), receipt and sufficiency of which is hereby acknowledged by Owner.

|

|

b. Within 45 calendar days of the Execution Date, Optionee shall advise Owner, in writing (the “Exercise Notice”), of its decision to either exercise or not exercise the Option to purchase the Property hereunder. In order to exercise the Option and purchase the Property, at Closing, Optionee shall pay to Owner a total of US$200,000 in cash (the “Exercise Price”). At Closing, Owner shall deliver to Optionee a quit claim deed (together with other appropriate documentation deemed necessary by counsel for Optionee), conveying to Optionee (or its nominee) the 100% interest in and to all sixteen (16) unpatented mining claims that comprise the Buffalo Uranium Project/Property (“Property Purchase Date”).

In furtherance of this Agreement, Owner agrees that it has, prior to the execution of this Agreement, provided to Optionee any and all of the information and documents related to the Property, whether in paper or electronic form, requested in Schedule B attached hereto (“Mining Disclosures”). Optionee shall keep all such information and documents confidential and not disclose them to any person who is not a principal or agent of Optionee with a “need to know”.

| 2. | Additional Consideration Upon Purchase of Property. |

As additional consideration hereunder, upon Purchase of the Property, Owner shall be entitled to receive:

| a. | A payment of cash and/or shares in Optionee’s parent company (at Optionee’s election) of US$450,000 within 5 business days of Optionee, or its parent company, publishing a Resource on the Property of more than 10 million pounds of U3O8 at a grade >0.2% U3O8, or 2,500,000 pounds of U3O8 at a grade >1.0% U3O8 (“Resource Milestone 1”). The share valuation, for purposes of this Agreement, shall be based on the 10-day volume weighted average closing price for the ten (10) trading days immediately preceding the date of the share issue (“10-day VWAP”); |

| b. | An additional payment of cash and/or shares in Optionee’s parent company (at Optionee’s election) of US$450,000 within 5 business days of Optionee, or its parent company, publishing a Resource on the Property of more than 20 million pounds of U3O8 at a grade >0.2% U3O8, or 5,000,000 pounds of U3O8 at a grade >1.0% U3O8 (“Resource Milestone 2”). The share valuation, for purposes of this Agreement, shall be based on the 10-day VWAP; and |

| c. | A 1.5% Net Smelter Returns (“NSR”) royalty payable on any production from the mining claims described in Schedule A as calculated and determined in accordance with Schedule C. At any time, Optionee may buy 100% of this royalty by paying Owner the sum of US$1,500,000 in cash. |

| 3. | Additional Option Terms and Conditions. The terms and conditions relating to the Option shall be as follows: |

(a) Payment of Option Exercise Price. The cash portion of the Option Exercise Price shall be payable by wire transfer, as provided in writing by the Owner before the due date.

(b) Option Expiry Date; Termination; Liquidated Damages. The Option to purchase the Property shall expire 45 calendar days after the Execution Date, at 5:00 p.m. Pacific Time (the “Expiry Date”). Thereafter, this Option shall be null, void and worthless, and this Agreement will stand terminated. In the event Optionee fails to exercise this Option before the Expiry Date, Owner shall be entitled to keep the full amount of the Consideration paid pursuant to Section 1 above. No other rights, remedies or damages of any nature will be available to Owner or payable by Optionee. The parties expressly agree these terms have been negotiated between them and are fair and reasonable in all respects.

|

|

(c) Area of Interest. An area of interest of three (3) miles within the exterior boundaries of the 16 unpatented mining claims described in Schedule A shall apply to this Agreement (the “Area of Interest”), whereby:

(i) Owner, or its affiliates, will not secure additional mineral rights within the Area of Interest without Optionee’s express permission; and

(ii) If Optionee, or its affiliates, secures additional mineral rights within the Area of Interest then any mineral resources delineated within the Area of Interest will be included in calculations to determine whether Resource Milestone 1 and Resource Milestone 2 have been satisfied. For clarity, no royalty will be payable to Owner on additional mineral rights secured within the Area of Interest.

| 4. | Representations and Warranties of the Parties: |

| (a) | The Owner represents and warrants by, through and under it only, in favor of Optionee that: |

(i) it is the sole and exclusive, undivided legal and beneficial owner of 100% interest in the Property;

(ii) No notices to, or consents, authorizations or approvals of any person or entity are required (which have not been given to or received by the Owner) for the execution, delivery and performance by the Owner of its obligations as contemplated hereunder;

(iii) This Agreement has been duly executed and delivered by and constitutes a valid and legally binding obligation of the Owner, enforceable against the Owner by Optionee in accordance with the terms hereof, subject to bankruptcy, insolvency, moratorium, reorganization and other laws of general application relating to or affecting creditors’ rights and to general equitable principles;

(iv) The Owner has not assigned, or agreed to assign, all or any part of its right, title or interest in and to the Property, or royalty interests, if any, to any other person or entity, or entered into any other contracts to sell, transfer, mortgage, or assign the Property, or any portion thereof, and during the term of this Agreement, Owner shall not take any action to adversely affect the rights of OPTIONEE hereunder;

(v) There are no disputes between the Owner and any other party in respect of the Property or the underlying claims;

(vi) Owner has full power and authority to sell, transfer and assign the Property to OPTIONEE, in accordance with the terms of this Agreement;

|

|

(vii) Owner is not in breach of any of its obligations under any agreement relating to the Property;

(viii) Owner is qualified to own and dispose of the Property;

(ix) The parties expressly agree that OPTIONEE shall not, by the terms thereof, assume liability for damages to the Property or responsibility for reclamation or environmental obligations accruing as a result of any actions or operations on the Property prior to the Closing and then, only for such operations as may be conducted on the Property by OPTIONEE after Closing, and Owner shall indemnify and hold OPTIONEE harmless from any and all claims, causes of action, penalties, fines, or other court costs and reasonable attorney’s fees, that may arise from, actions or operations conducted by Owner on the Property prior to the Closing of the Agreement.

| (b) | The OPTIONEE represents and warrants in favor of Owner that: |

(i) This Agreement has been duly executed and delivered by and constitutes a valid and legally binding obligation of OPTIONEE, enforceable against the OPTIONEE by Owner in accordance with the terms hereof, subject to bankruptcy, insolvency, moratorium, reorganization and other laws of general application relating to or affecting creditors’ rights and to general equitable principles;

(ii) From and after the date hereof, if OPTIONEE elects to exercise the Option to purchase the Property, OPTIONEE shall assume liability for damage to the Property and responsibility for reclamation or environmental obligations accruing as a result of any actions or operations on the Property from and after the date of the Closing of the purchase of the Property.

(iii) OPTIONEE shall indemnify and hold Owner harmless from any and all claims, causes of action, penalties, fines, or other court costs and reasonable attorneys’ fees, that may arise from, actions or operations conducted on the Property from and after the Property Purchase Date.

(c) The representations and warranties made herein by the Owner and OPTIONEE are true and correct as of the date of this Agreement and shall survive the consummation of the transactions contemplated hereby, and the Closing, as defined below.

| 5. | Closing. Upon exercise of the Option, the closing of the purchase of the Property (“Closing”) shall take place at 2:00 p.m. (Salt Lake City, Utah time ) or at such other time as may be mutually agreed upon by OPTIONEE and the Owner (the “Time of Closing”) on such date as may be mutually agreed upon in writing by OPTIONEE and the Owner (the “Closing Date”) at such place as is mutually agreed upon in writing by OPTIONEE and the Owner. |

| 6. | Conditions of Closing. OPTIONEE shall not be obligated to complete the purchase of the Property unless the following conditions have been satisfied on or before the Time of Closing on the Closing Date, or have been waived, in whole or in part, in writing, by OPTIONEE: |

(a) Revisions. The Property shall not have been revised, supplemented, restated or replaced and shall be in the form of the property description attached hereto as Schedules A;

|

|

(b) Title. The parties agree that Owner has furnished to OPTIONEE such monuments of title to the Property as Owner has in its possession. Should OPTIONEE’s independent examination of title show, in OPTIONEE’s opinion, defects in the rights and interests of Owner in and to the Property, then OPTIONEE shall have the right, but not any obligation either to extend the Closing Date for sixty (60) calendar days following the Expiry Date, as to the Property only, and for Owner to do what it deems necessary, at its sole expense, to perfect said title to OPTIONEE’s satisfaction,, or alternatively, OPTIONEE may terminate this Agreement and Owner shall, within fifteen (15) calendar days after Owner receives written notice of such termination due to title defects with regard to the Property, return to OPTIONEE the full Consideration paid hereunder, without interest or deduction.

(c) Execution of Documents. Execution and delivery of all necessary formal documentation, in form and content satisfactory to OPTIONEE, and its counsel, acting reasonably, including:

| (i) | Owner shall execute and deliver to OPTIONEE a Wyoming form Quit Claim Deed as to the Property, in a recordable form deemed appropriate to legal counsel for OPTIONEE; |

| (ii) | a duly executed Deed with Reservation of Royalty in the form attached to this Agreement as Schedule C (the “Deed”); and |

| (ii) | Such other documents, agreements and instruments of assignment, conveyance or transfer, or otherwise, as OPTIONEE or its legal counsel may, in writing, reasonably request in connection with the exercise of the Option, and the sale, transfer and assignment of the Property to OPTIONEE. |

(d) Execution. The Owner shall have taken all necessary action required to authorize the execution of and performance by the Owner of its obligations under this Agreement and all other agreements or documents contemplated herein.

| 7. | Material Agreements. During the period from the date hereof to and including the Closing, Owner shall provide to OPTIONEE copies of all material agreements relating to the Property, if any, which are in the Owner’s possession. See Schedule B attached hereto. |

| 8. | Investigations. The Owner has provided to OPTIONEE such data and other information relating to the Property as OPTIONEE has reasonably requested and which is in the Owner’s possession. During the period from the date hereof to and including the Closing, the Owner shall cause its appropriate and most knowledgeable personnel and agents to be available to discuss with OPTIONEE matters relating to the Property. |

| 9. | Assignment of Rights. The Owner agrees and acknowledges that, from and after the Execution Date, the rights and obligations of OPTIONEE pursuant to this Agreement, and all other documents and instruments to be executed by the Owner in favor of OPTIONEE may be assigned in whole or in part to any affiliate of OPTIONEE, without the consent of the Owner. The Owner agrees and acknowledges that the rights and obligations of the Owner pursuant to this Agreement and all other documents and instruments to be executed by OPTIONEE in favor of the Owner may not be assigned in whole or in part by the Owner without the prior written consent of OPTIONEE, acting reasonably. |

|

|

| 10. | Governing Law. This Agreement shall be solely and exclusively governed by and construed in accordance with the laws of Wyoming, and exclusive jurisdiction and venue for any and all purposes hereunder shall be in Casper, Wyoming. |

| 11. | Notices. Any notice, demand or other communication required or permitted to be given to any party hereunder shall be in writing and shall be either: |

(a) Personally delivered; or

(b) Sent by same day or next day FedEx courier; or

(c) Sent by electronic mail (email); or

(d) Sent by prepaid registered mail.

Any notice so given shall be sent to the parties at the following respective addresses:

If to OWNER:

Oren Gatten

447 North 300 West Suite #3,

Kaysville, Utah 84037

Phone: (801) 725-6920

E-mail: orengatten@namineservices.com

If to OPTIONEE:

Bazooka Resources Pty Ltd

Unit 25, 22 Railway Road

Subiaco, WA 6008, Australia

Phone: +61 8 9226 1356

E-mail: mhaynes@mqbventures.com

Any party may from time to time change its address by written notice to the other parties given in accordance with the provisions hereof. Any notice or communication sent by courier or given by personal delivery shall be deemed to be received on the date of delivery; any notice sent by email shall be deemed to be received on the date of the sending of the email, as the case may be; and any notice sent by prepaid registered mail shall be deemed to be received on the date shown on the postal receipt.

| 12. | Further Assurances. Each of the parties hereto covenants and agrees that at any time and from time to time hereafter it shall, upon the request of the other party, do, execute, acknowledge and deliver or cause to be done, executed, acknowledged and delivered all such further acts, deeds, assignments, transfers, conveyances, powers of attorney and assurances as may be required for the better carrying out and performance of all the terms of this agreement. |

|

|

| 13. | Interpretation. In this Agreement, unless there is something in the subject matter or context inconsistent herewith: |

(a) Singular and Plural. Words in the singular include the plural and such words shall be construed as if the plural had been used, words in the plural include the singular and such words shall be construed as if the, singular had been used, words importing the masculine gender include the female gender and the neuter and shall be construed as if the corresponding word importing the female gender or the neuter had been used, and words importing the neuter include the masculine gender and the female gender and shall be constructed as if the corresponding word importing the masculine gender or the female gender had been used, where the context or a party hereto so requires, and the rest of the sentence shall be construed as if the grammatical and terminological changes thereby rendered necessary had been made;

(b) Interpretation. “This Agreement”, “hereto”, “herein”, “hereby”, “‘hereunder”, “hereof” and similar expressions refer to this agreement and not to any particular section, paragraph, subparagraph, clause, sub clause or other portion of this agreement and include any and every agreement supplemental or ancillary to this agreement;

(c) Heirs. A reference to any one or more parties to this agreement shall be deemed to include a reference to the respective heirs, executors, administrators, personal representatives, successors and assigns of each such party; and

(d) Currency. Unless otherwise specifically provided, all references to dollar amounts in this agreement are in lawful money of the United States of America.

| 14. | Counterparts. This agreement may be executed in several counterparts, each of which so executed shall be deemed to be an original, and such counterparts together shall constituted but one and the same instrument. |

| 15. | Successors and Assigns. This agreement shall be binding upon and inure to the benefit of the parties hereto and their respective permitted successors and assigns. Nothing herein express or implied is intended to confer upon any person, other than the parties hereto and their respective permitted successors and assigns, any rights, remedies, obligations or liabilities under or by reason of this agreement. |

| 16. | Entire Agreement. This agreement and all other documents executed in connection with or pursuant to this agreement constitute the entire agreement between the parties hereto and supersede all prior agreements, representations, warranties, statements, promises, information, arrangements and understandings, whether oral or written, express or implied with respect to the subject matter hereof. |

| 17. | Amendment. No modification or amendment to this Agreement may be made unless agreed to by the parties hereto in writing. |

| 18. | Indemnity by Owner. Owner shall indemnify Optionee against any loss, damage, cost or expense that Optionee shall incur or suffer as a result of the breach, untruth or inaccuracy of any promise, agreement, covenant, warranty or representation made by Owner herein and for the benefit of Optionee. |

|

|

| 19. | Indemnity of Optionee. Optionee shall indemnify Owner against any loss, damage, cost or expense that Owner shall incur or suffer as a result of the breach, untruth or inaccuracy of any promise, agreement, covenant, warranty or representation made by Optionee herein to and for the benefit of Owner. |

| 20. | Broker’s /Finder’s Fees. The parties warrant to and with each other that the transaction evidenced by this Agreement was initiated, negotiated and completed by the parties hereto directly, as principals, and without the intervention of any broker, dealer, agent or finder, except as otherwise provided herein. Each party agrees to indemnify and hold the other party harmless from and against any loss, damage, cost or expense, including without limitation, attorneys’ fees and litigation expenses, resulting from any breach or breaches of the foregoing warranty. |

| 21. | Risk of Loss. Risk of loss, damage, or destruction of the Property shall remain with Owner until the Closing, at which time risk of loss, damage or destruction of the Property shall pass to Optionee. |

| 22. | Attorneys’ Fees and Costs. If any legal action or any arbitration or other proceeding is brought for the enforcement of this Agreement or because of an alleged dispute, breach, default or misrepresentation in connection with any of the provisions of this Agreement, the successful or prevailing party shall be entitled to recover reasonable attorneys’ fees and other costs and expenses incurred in that action or proceeding, in addition to any other relief to which it may be entitled. |

| 23. | Sole and Exclusive Method of Dispute Resolution. Any and all disputes or disagreements arising under or relating to this Agreement, whether to determine damages or seek any other remedy, or based on any claim of breach of or non-performance under this Agreement, of whatsoever nature or extent (“Disputes”), shall be resolved solely and exclusively by mediation or arbitration. Mediation or arbitration are the sole and exclusive dispute resolution protocols between the parties to this Agreement, and shall proceed as follows: |

a. Mediation. The Parties agree to negotiate in good faith regarding any Disputes. Any Disputes that cannot be resolved through good faith negotiations shall be subject to mediation. Mediation shall be conducted by one mediator who shall be selected jointly by the parties within ten (10) days after notice of the request for mediation, but if the parties cannot agree on a mediator, each Party shall select one mediator within five (5) days after the parties’ failure to agree upon a mediator and the two mediators so selected shall jointly appoint a single mediator to conduct the mediation. The mediation shall be non-binding and shall commence within 30 days after the selection of the mediator. Each Party shall attend the mediation personally and with any representatives they desire. The expenses of the mediation shall be shared equally by the parties. Each Party shall pay their respective attorney’s fees, if any. The mediation shall continue until the dispute is settled or the mediator declares impasse. Mediation shall take place in Casper, Wyoming.

b. Arbitration. If the mediator declares impasse or if any Disputes cannot be resolved through mediation, the remaining issue(s) shall be submitted to binding and non-appealable arbitration. Except as expressly provided otherwise in this Agreement, the Arbitration shall be conducted in accordance with the rules for the resolution of commercial disputes of the American Arbitration Association (“AAA”), but need not be conducted by the AAA or its arbitrators. The mediator shall provide a list of at least five (5) arbitrators, each of whom the mediator reasonably believes to be knowledgeable in the general subject(s) of the Dispute. The mediator shall, by blind drawing, determine which of the parties shall have the first strike. That Party may strike one of the five (5) arbitrators on the mediator’s list. The other Party may then strike a second arbitrator on that list. The Party which had the first strike shall then have another strike, to strike another arbitrator on that list, and the other Party shall then have another strike to strike a fourth arbitrator from that list. The remaining arbitrator shall conduct the arbitration. The prevailing Party in the arbitration shall be entitled, in addition to any award by the arbitrator, to payment of all attorney’s fees and costs incurred by the prevailing Party from the date of commencement of the arbitration protocol and proceedings.

|

|

c. Period for bringing claims. A written notice of a claim arising from a Dispute must be served on the other parties within sixty (60) days of the date a Party became aware of a breach of this Agreement or Dispute, or it shall be forever waived. The written notice shall identify and describe the nature of all claims asserted and the facts upon which such claims are based. The notice shall be sent to the other Party by certified or registered mail, return receipt requested, at the address set forth for the Party in this Agreement.

EACH PARTY, KNOWINGLY AND AFTER CONSULTATION WITH COUNSEL, FOR ITSELF, ITS SUCCESSSORS AND ASSIGNS, WAIVES ALL RIGHT TO TRIAL BY JURY OF ANY CLAIM ARISING WITH RESPECT TO THIS AGREEMENT OR ANY MATTER RELATED IN ANY WAY HERETO.

Executed by the parties hereto on the dates shown below:

Bazooka Resources Pty Ltd

| By: |

|

|

| Authorized Signatory | ||

| Michael Haynes | ||

| Print Name | ||

| Sole Director and Secretary | ||

| Title |

Date: February 17, 2025

|

|

Schedule A

Unpatented

Mining Claims

Carbon County, Wyoming

An Undivided one hundred percent (100%) interest in and to the following unpatented mining claims:

| Case

Filing Number |

MLRS

Lead File Number |

MLRS

Serial Number |

Claim Name |

Receipt Number |

| CF-141687 | WY106697408 | WY106697408 | BUF100 | 5403160 |

| CF-141687 | WY106697408 | WY106697409 | BUF101 | 5403160 |

| CF-141687 | WY106697408 | WY106697410 | BUF102 | 5403160 |

| CF-141687 | WY106697408 | WY106697411 | BUF103 | S403160 |

| CF-141687 | WY106697408 | WY106697412 | BUF104 | 5403160 |

| CF-141687 | WY106697408 | WY106697413 | BUF105 | 5403160 |

| CF-141687 | WY106697408 | WY106697414 | BUF106 | 5403160 |

| CF-141687 | WY106697408 | WY106697415 | BUF107 | 5403160 |

| CF-141687 | WY106697408 | WY106697416 | BUF108 | 5403160 |

| CF-141687 | WY106697408 | WY106697417 | BUF109 | 5403160 |

| CF-141687 | WY106697408 | WY106697418 | BUF110 | 5403160 |

| CF-141687 | WY106697408 | WY106697419 | BUF111 | 5403160 |

| CF-141687 | WY106697408 | WY106697420 | BUF112 | 5403160 |

| CF-141687 | WY106697408 | WY106697421 | BUF113 | 5403160 |

| CF-141687 | WY106697408 | WY106697422 | BUF114 | 5403160 |

| CF-141687 | WY106697408 | WY106697423 | BUF115 | 5403160 |

|

|

Schedule B

Mining Disclosure Requirements

Owner represents and warrants that, as of the date of the execution of this Agreement, Owner has provided to Optionee any and all of the following information and documents related to the Property, whether in paper or electronic form, in the possession or control of Owner:

| 1. | Regarding Owner’s right to hold or operate the Property: |

| a. | copy of agreement giving rights, which should show: |

| i. | brief description of title, deed, claim, lease or other right; |

| ii. | any conditions Optionee needs to meet to retain/maintain the Property in good standing; and |

| b. | Maps, if available. |

| 2. | Brief history of previous operations on the Property, including the names, addresses, phone numbers and e-mail addresses of previous operators, including period(s) of operations, if known. |

| 3. | Brief description of work completed on the Property, including: |

| a. | work completed by Owner and/or predecessor owner(s) on the Property; |

| b. | Owner’s and/or predecessor owner(s) proposed program of exploration and development; |

| c. | current state of exploration and/or development of the Property; |

| d. | identify all mines, including whether they are open-pit or underground; |

| e. | Description of any and all known reserves and protocols used to ascertain same. |

| 4. | Regarding plant and equipment: |

| a. | age; |

| b. | details as to modernization; |

| c. | physical condition, including subsurface improvements; |

| d. | total cost for each item of plant and equipment; and |

| e. | Source of power to or for each mining claim included in the Property. |

| 5. | Brief description of the rock formations and mineralization of existing or potential significance on the Property, including: |

| a. | Identity of principal metallic or other constituents, insofar as known. |

| 6. | Complete copy of every engineering, geological or metallurgical report concerning or relating to the Property, including government reports, if known and available to the Owner, including the name of the author and date of preparation of each report, if known. |

| 7. | Copies of all documents, such as title documents, operating permits and easements, to support any of the above information. |

Schedule C

Form of Deed with Reservation of Royalty

[See attached.]

APNs: N/A (Unpatented Mining Claims)

Recorded at the request of,

after recording return to:

_________ LLC

[Address]

The undersigned hereby confirm that there are no

social security numbers on this document.

DEED WITH RESERVATION OF ROYALTY

(Carbon County, Wyoming)

This Deed with Reservation of Royalty (the “Deed”) is dated effective _____________ ___, 20__ (the “Effective Date”), from O. Jay Gatten, Oren S. Gatten and James D. Rasmussen, all collectively “Grantor”, to ________LLC, a Wyoming limited liability company (“Grantee”), with an address of ________________. Grantor and Grantee are sometimes referred to individually as a “Party” and collectively as the “Parties.”

Recitals

| A. | Grantor owns sixteen (16) unpatented mining claims situated in Sections 13, 14 and 24 Township 27N & Range 84W, in Carbon County, Wyoming, which are more particularly described in Schedule A attached to and by this reference incorporated in this Agreement (the “Property”). |

| B. | Grantor, Grantee, and Grantee’s parent company, Bazooka Resources Pty Ltd, entered into an Option to Purchase Mining Property Agreement dated February ___, 2025 (the “Agreement”), pursuant to which, among other things, Grantor granted to Grantee the right and option to purchase all of Grantor’s right, title, and interest in and to the Property. |

| C. | The Parties have closed the purchase and sale of the Property contemplated in the Agreement and Grantor now wishes to convey to Grantee all of Grantor’s right, title, and interest in the Property, subject to the terms and conditions of this Deed. |

Conveyance

Now, therefore, in consideration of the Parties’ rights and obligations under the Agreement, and other good and valuable consideration, the receipt of sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Deed. Grantor does hereby grant, convey, and transfer to Grantee, and Grantee’s assigns and successors forever, all of Grantor’s right, title and interest in and to the Property, including after-acquired title, except and subject to Grantor’s reserved Royalty as provided in Section 2, and the Parties’ rights and obligations under this Deed.

2. Royalty. Grantor does hereby grant, reserve and retain to themselves, and Grantor’s assigns and successors forever, and Grantee agrees and covenants to pay and grants to Grantor, and Grantor’s assigns and successors, a production royalty (the “Royalty”) equal to one and one half percent (1.5%) of the Net Smelter Returns, as defined in Exhibit 1, from the production or sale of Minerals from the Property, subject to the Royalty-Buy Down Option described in Section 2.5 below.

2.1 Burden on Property. Grantee’s agreement and covenant to pay the Royalty are covenants coupled with an interest in the Property and shall burden and run with the Property, including any additions to the Property and all after-acquired title.

2.2 Payment of Royalty. Grantee shall calculate the Royalty quarterly and Royalty payments shall be due and payable by the thirtieth (30th) day following the end of each calendar quarter during which Grantee mines, removes or sells Minerals from the Property. Grantee shall quarterly deliver to Grantor a statement sufficient to allow Grantor to determine the method of calculation of each Royalty payment and the accuracy of such payment. Each statement which Grantee delivers to Grantor shall be deemed to be correct and binding on Grantor unless, within twelve (12) months following Grantor’s receipt of such statement, Grantor notifies Grantee in writing that they dispute the correctness of such statement and specifies its objections. If Grantee does not timely pay the Royalty, Grantor may give written notice to Grantee that Grantee is in default of its obligations under this Deed, and unless within five (5) business days following receipt by Grantee of such notice Grantor receives the delinquent Royalty payment, then Grantee shall pay interest on the delinquent payment at the Interest Rate which shall accrue from the day the delinquent Royalty payment was due to the date of payment of the Royalty and accrued interest.

2.3 Production Records. Grantee shall keep accurate, correct and true accounts, books and records of all of its activities, operations and the production and sale of Minerals on or from the Property.

2.4 Delivery of Payments. Grantee shall deliver all payments payable to the Grantor under this Deed to Grantor on or before the due date by check or wire transfer to an account which Grantor designates.

2.5 Royalty Buy-Down Option. Grantee shall have the option (the “Royalty Buy-Down Option”) to reduce the Royalty percentage rate held by Grantor to nil (0.0%), which shall be exercisable by Grantee at any time in its sole discretion. The total purchase price on Grantee’s exercise of the Royalty Buy-Down Option shall be One Million and Five Hundred Thousand Dollars (US$1,500,000). Grantee shall deliver written notice to Grantor of its exercise of the Royalty Buy-Down Option, and the parties shall close royalty reduction contemplated in this Section 2.5 not less than thirty (30) days following Grantee’s delivery of its notice.

3. Commingling. Grantee shall have the right to commingle Minerals from the Property with minerals mined from other properties. Before Grantee commingles any Minerals produced from the Property with minerals from other properties, the Minerals produced from the Property and other properties shall be measured and sampled in accordance with sound mining and metallurgical practices for metal, commercial minerals and other appropriate content. Grantee shall keep accounts and records of all such samples and measurements. From this information, Grantee shall determine the amount of the Royalty due and payable to Grantor for Minerals produced from the Property which are commingled with minerals from other properties.

4. Stockpiling. Grantee may stockpile any materials, Minerals or ores from the Property at such place or places as Grantee elects. Before Grantee stockpiles or stores materials, Minerals or ores off the Property, Grantee shall first execute and cause the owner of such other property to execute a written instrument which recognizes Grantor’s Royalty interest in and to the stockpiled materials, Minerals and ores and which assures and grants to Grantor and Grantee rights of access and use so as to process or retrieve such materials, Minerals or ores.

| 5. | Compliance with Laws, Reclamation, Environmental Obligations and Indemnities. |

5.1 Compliance with Laws. Grantee shall comply with all applicable federal, state and local laws, regulations and ordinances relating to Grantee’s activities and operations on or relating to the Property.

5.2 Reclamation, Environmental Obligations and Indemnities. Grantee shall perform all reclamation required under federal, state and local laws, regulations and ordinances relating to Grantee’s activities or operations on or relating to the Property. Grantee shall defend, indemnify and hold harmless Grantor from and against any and all actions, claims, costs, damages, expenses (including attorney’s fees and legal costs), liabilities and responsibilities arising from or relating to Grantee’s activities or operations on or relating to the Property, including those under laws, regulations and ordinances intended to protect or preserve the environment or to reclaim the Property. Grantee’s obligations under this Section 5.2 shall survive the abandonment, surrender or transfer of the Property.

6. No Development Covenants. Grantee shall have sole discretion to decide the timing, rate, manner and method of production of Minerals from the Property. Grantee may delay, suspend, curtail, cease and modify any and all operations as it in its sole discretion may deem appropriate. Grantor’s interest in the Property shall be solely that of a nonadministrative, nonexecutive and non-participating royalty holder and Grantor shall have no right to participate or influence management or decision-making regarding operations on the Property. The Parties expressly disclaim any implied covenants or obligations of diligence regarding operations on the Property, including without limitation exploration, development, mining and processing operations. Grantor acknowledges that it has received adequate consideration under the Agreement and in this Deed in lieu of any such implied covenants and obligations.

7. Nature of Relationship. Nothing in this Deed shall be deemed to constitute either Party the partner of the other, nor to constitute either Party the agent or legal representative of the other, nor to create any fiduciary relationship between them. It is not the intention of the parties to create, nor shall this Deed be construed to create, any mining, commercial or other partnership. Neither Party shall have any authority to act for or to assume any obligation or responsibility on behalf of the other Party, except as otherwise expressly provided in this Deed. The rights, duties, obligations and liabilities of the parties shall be several and not joint or collective. It is the express purpose and intention of the parties that Grantor shall receive only the Royalty interest in the Property and the contractual rights provided in this Deed and that Grantor shall have no other right, title or interest in and to the Property.

| 8. | General Provisions. |

8.1. Conflict. If a conflict arises between the provisions of this Deed and the provisions of the Agreement, the provisions of the Deed shall prevail.

8.2. Additional Documents. The Parties shall from time to time execute all such further instruments and documents and do all such further actions as may be necessary to effectuate the purposes of this Deed.

8.3. Binding Effect. All the covenants, conditions, and terms of this Deed shall bind and inure to the benefit of the Parties and their successors and assigns.

8.4. No Implied Covenants. The Parties agree that there are no implied covenants or duties relating to or affecting any of their respective rights or obligations under this Deed, and that the only covenants or duties which affect such rights and obligations shall be those expressly stated in this Deed.

8.5. Governing Law. This Deed is to be governed by and construed under the laws of the State of Nevada. Any dispute concerning the construction or enforcement of this Deed shall be heard in the Wyoming District Court, Casper, Wyoming.

8.6. No Waiver. No waiver of any breach or default of any one or more of the conditions, covenants or obligation of this Deed by any party shall be deemed to constitute or imply a waiver of a breach or default of any other covenant or obligation in this Deed or of a breach or default of the same covenant or obligation in the future.

8.7 Time of Essence. Time is of the essence in this Deed.

8.8 Notices. Any notices required or authorized to be given by this Deed shall be in writing and shall be sent either by commercial courier, facsimile, or by certified U.S. mail, postage prepaid and return receipt requested, addressed to the proper party at the address stated below or such address as the party shall have designated to the other parties in accordance with this Section. Such notice shall be effective on the date of receipt by the addressee party, except that any facsimiles received after 5:00 p.m. of the addressee’s local time shall be deemed delivered the next day.

| If to Grantor: | Oren Gatten | |

| 447 North 300 West Suite #3, | ||

| Kaysville, Utah 84037 | ||

| E-mail: orengatten@namineservices.com | ||

| If to Grantee: | Bazooka Resources Pty Ltd | |

| Unit 25, 22 Railway Road | ||

| Subiaco WA 6008 | ||

| Australia | ||

| Email: mhaynes@mqbventures.com |

8.9 Attorney’s Fees. If any legal action or proceeding (whether in arbitration or judicial) is commenced by any Party against any other Party in connection with the enforcement, execution, interpretation or negotiation of this Deed or for the breach of any covenant or obligation in this Deed, the prevailing Party in any such action or proceeding shall be entitled to recover from the other Party its reasonable attorney’s fees and costs, including any such fees and costs associated with an appeal of any award or judgment.

8.10 Definitions. As used in this Deed, the following terms shall have the meanings assigned to them as follows:

(a) “Affiliate” means any person that directly or indirectly Controls, is Controlled by, or is under common Control with, a Party.

(b) “Business Day” means a day other than a Saturday, Sunday or any other day on which the principal-chartered banks located in Casper, Wyoming, are not open for business.

(c) “Control” used as a verb means, when used with respect to an entity, the ability, directly or indirectly through one or more intermediaries, to direct or cause the direction of the management and policies of such entity through (a) the legal or beneficial ownership of voting securities or ownership interests, (b) the right to appoint managers, directors or corporate management, (c) contract, (d) membership agreement, (e) voting trust, or otherwise; and, when used with respect to an individual, means the actual or legal ability to control the actions of another, through family relationship, agency, contract or otherwise; and “Control” used as a noun means an interest which gives the holder the ability to exercise any of the foregoing powers.

(d) “Grantee” means __________________ LLC, a Wyoming limited liability company, and includes any subsequent holder of the Property.

(e) “Loss” means an insured loss of or damage to Minerals and Minerals Products, whether occurring on or off the Property and whether the Minerals and Minerals Products are in the possession of Grantee or its Affiliates or otherwise.

(f) “Minerals” means all minerals and mineral materials, including, without limitation, lithium, gold, silver, platinum and platinum group metals, base metals (including, for example, antimony, chromium, cobalt, copper, lead, manganese, mercury, nickel, molybdenum, titanium, tungsten, zinc), and other metals and mineral materials which are on, in, or under the Property.

(g) “Minerals and Minerals Products” means all Minerals mined from the Property and all concentrate, metal and other products derived from ore mined from the Property.

(h) “Net Smelter Returns” shall have the meaning ascribed to that term in the Exhibit 1 attached to and by this reference incorporated in this Deed.

(i) “Production” means the date on which the initial shipment of mineral product is transported from the Property for commercial sale or additional beneficiation for commercial sale. The transport and sale of bulk or test sample, not to exceed 40,000 tons of ore from the Property, and deliveries and sales from pilot or test operations shall not constitute Production.

(j) “Grantor” means O. Jay Gatten, Oren S. Gatten and James D. Rasmussen, and its successors and assigns.

8.11 Counterparts. This Deed may be executed in several counterparts, each of which shall be deemed to be an original, and all of which shall together constitute one and the same instrument, and delivery of an executed copy of this Deed by email transmission or by other means of electronic communication capable of producing a printed copy shall be deemed to be execution and delivery of this Deed as of the date first above written.

[Signature page follows.]

The Parties have executed this Deed effective on as of the Effective Date first written above.

Grantors:

| By: | |||

| Name: | [Grantor Name] | ||

| By: | |||

| Name: | [Grantor Name] | ||

| By: | |||

| Name: | [Grantor Name] | ||

| . . . |

Grantee:

| _____________ LLC, a Wyoming limited | |||

| liability company | |||

| By: | |||

| Name: | |||

| Title: |

| STATE OF ____________________________ | ) | |

| ) ss. | ||

| COUNTY OF __________________________ | ) |

The foregoing instrument was acknowledged before me on __________ ____, 20__, by _________________________.

Witness my hand and official seal.

| Notary Public | ||

| My Commission expires: | ||

| STATE OF ____________________________ | ) | |

| ) ss. | ||

| COUNTY OF __________________________ | ) |

The foregoing instrument was acknowledged before me on __________ ____, 20__, by ________________, as the _________of ________, LLC, a Wyoming limited liability company.

Witness my hand and official seal.

| Notary Public | ||

| My Commission expires: | ||

Schedule A

Description of Claims

The Claims are comprised of the following sixteen unpatented placer mining claims situated in Sections 13, 14 and 24 Township 27N & Range 84W, in Carbon County, Wyoming:

| Case

Filing Number |

MLRS

Lead File Number |

MLRS

Serial Number |

Claim Name |

Receipt Number |

| CF-141687 | WY106697408 | WY106697408 | BUF100 | 5403160 |

| CF-141687 | WY106697408 | WY106697409 | BUF101 | 5403160 |

| CF-141687 | WY106697408 | WY106697410 | BUF102 | 5403160 |

| CF-141687 | WY106697408 | WY106697411 | BUF103 | S403160 |

| CF-141687 | WY106697408 | WY106697412 | BUF104 | 5403160 |

| CF-141687 | WY106697408 | WY106697413 | BUF105 | 5403160 |

| CF-141687 | WY106697408 | WY106697414 | BUF106 | 5403160 |

| CF-141687 | WY106697408 | WY106697415 | BUF107 | 5403160 |

| CF-141687 | WY106697408 | WY106697416 | BUF108 | 5403160 |

| CF-141687 | WY106697408 | WY106697417 | BUF109 | 5403160 |

| CF-141687 | WY106697408 | WY106697418 | BUF110 | 5403160 |

| CF-141687 | WY106697408 | WY106697419 | BUF111 | 5403160 |

| CF-141687 | WY106697408 | WY106697420 | BUF112 | 5403160 |

| CF-141687 | WY106697408 | WY106697421 | BUF113 | 5403160 |

| CF-141687 | WY106697408 | WY106697422 | BUF114 | 5403160 |

| CF-141687 | WY106697408 | WY106697423 | BUF115 | 5403160 |

[End of Exhibit A]

Exhibit 1

Net Smelter Returns

| Grantee: | _________ LLC |

| Royalty Holder: | O. Jay Gatten, Oren S. Gatten and James D. Rasmussen (Grantor) |

“Net Smelter Returns” means: (1) the actual proceeds accrued by Grantee from the sale or other disposition of Minerals and Minerals Products to a refiner, smelter or other buyer; and (2) if there is a loss of Minerals and Minerals Products, an amount equal to the sum of the insurance proceeds received by Grantee for such loss (less any connected costs and expenses) in respect of the loss; less (3) the following expenses, to the extent incurred in respect of the Minerals and Minerals Products for which payment or credit is received during the applicable period:

| (a) | actual charges, costs (including assay and sampling costs specifically related to smelting and/or refining), and all penalties (less all umpire charges which the purchaser may be required to pay), if any, for smelting and/or refining; |

| (b) | charges and costs, if any, for transportation and insurance of doré or concentrates produced in Grantee’s mill or other processing plant to places where such doré or concentrates are smelted, refined and/or sold or otherwise disposed of; and |

| (c) | sales, use, gross receipts, severance, and other taxes, if any, payable with respect to severance, production, removal, sale or disposition of the minerals from the Property, but excluding any taxes on net income. |

Grantee shall be permitted to sell Minerals and Minerals Products in the form of raw ore, doré, concentrates or otherwise to an Affiliate of Grantee, provided that such sales shall be deemed, for the purposes of this Deed, to have been sold at prices and on terms no less favorable to Grantee than those that would be extended by an unaffiliated third person in an arm’s length transaction under similar circumstances. Grantee shall be permitted to contract with an Affiliate of Grantee or an unaffiliated third person for the smelting or other processing of Minerals and Minerals Products, provided that in the case of a contract with an Affiliate, such contract is on an arm’s length basis at market terms.

If Grantee sells concentrates, doré or ore without refining and smelting the same, then the Royalty shall be based on the value of the Minerals contained in the concentrates, doré and ore determined by utilizing: (1) the mine weights and assays for such concentrates, doré and ore; (2) a reasonable recovery rate for the refined Minerals recoverable from such concentrates, doré and ore (which shall be adjusted annually to reflect the actual recovery rate of refined metal from such concentrates, doré and ore); and (3) the monthly average price of the London Metals Exchange for the quarter in which the concentrates, doré and ore were sold.

Exhibit 99.2

OPTION TO PURCHASE MINING PROPERTY AGREEMENT

THIS OPTION TO PURCHASE MINING PROPERTY AGREEMENT (“Agreement”), is made and entered into this 17th day of February, 2025, (“Execution Date”) by and between O. Jay Gatten, Oren S. Gatten and James D. Rasmussen with address at 447 North 300 West Suite #3, Kaysville, Utah 84037 hereinafter collectively “OWNER”, and Bazooka Resources Pty Ltd, an Australian company, with address at Unit 25, 22 Railway Road, Subiaco WA, 6008, Australia (hereinafter “OPTIONEE”). For purposes herein, Owner and/or Optionee may be variously referred to as a “Party”, or together, as “Parties”.

WITNESSETH:

This Agreement is made and entered into with reference to the following facts:

A. Owner has sole and exclusive right, title and interest in and to that certain property located in Carbon County in the State of Wyoming, consisting of sixteen (16) unpatented mining claims, all as more particularly described in Schedule A attached hereto and incorporated herein by this reference, and commonly referred to as the “Buffalo Uranium Project” (the “Property”). As defined and used herein, the term “Property” shall include (i) any and all royalty rights and interests in or related to the Property, (ii) all prospecting, research, exploration, exploitation, operating and mining permits, licenses and leases associated therewith, if any, held or controlled by Owner, (iii) all easement, access, mineral, surface, water and ancillary or appurtenant rights attached or accruing thereto, if any, and (iv) any mining license or other form of substitute or successor mineral title or interest granted, obtained or issued in connection with or in place of or in substitution therefore, including, without limitation, any property issued to cover any internal gaps or fractions in respect of the mining claims.

B. Owner desires to grant Optionee, and Optionee desires to acquire an option to purchase the Property from Owner, upon the terms and conditions hereinafter set forth.

NOW, THEREFORE, in consideration of the mutual covenants and promises hereinafter set forth, and other good and valuable consideration, receipt of which is hereby acknowledged, it is agreed by the parties as follows:

| 1. | Grant of Option; Consideration. Owner hereby grants Optionee the exclusive option to purchase the Property, together with other rights to conduct due diligence and mining-related activities on the Property, all pursuant to the terms of this Agreement (“Option”). |

a. Included in the rights granted hereunder, Optionee shall have an exclusive 45-day period to conduct further due diligence on the Property (“Due Diligence Period”). As full consideration for this Due Diligence Period, Optionee shall pay Owner the non-refundable sum of US$50,000 within 24 hours of execution of this Agreement (“Initial Option Consideration”), receipt and sufficiency of which is hereby acknowledged by Owner.

b. Within 45 calendar days of the Execution Date, Optionee shall advise Owner, in writing (the “Exercise Notice”), of its decision to either exercise or not exercise the Option to purchase the Property hereunder. In order to exercise the Option and purchase the Property, at Closing, Optionee shall pay to Owner a total of US$200,000 in cash (the “Exercise Price”). At Closing, Owner shall deliver to Optionee a quit claim deed (together with other appropriate documentation deemed necessary by counsel for Optionee), conveying to Optionee (or its nominee) the 100% interest in and to all sixteen (16) unpatented mining claims that comprise the Buffalo Uranium Project/Property (“Property Purchase Date”).

In furtherance of this Agreement, Owner agrees that it has, prior to the execution of this Agreement, provided to Optionee any and all of the information and documents related to the Property, whether in paper or electronic form, requested in Schedule B attached hereto (“Mining Disclosures”). Optionee shall keep all such information and documents confidential and not disclose them to any person who is not a principal or agent of Optionee with a “need to know”.

| 2. | Additional Consideration Upon Purchase of Property. |

As additional consideration hereunder, upon Purchase of the Property, Owner shall be entitled to receive:

| a. | A payment of cash and/or shares in Optionee’s parent company (at Optionee’s election) of US$450,000 within 5 business days of Optionee, or its parent company, publishing a Resource on the Property of more than 10 million pounds of U3O8 at a grade >0.2% U3O8, or 2,500,000 pounds of U3O8 at a grade >1.0% U3O8 (“Resource Milestone 1”). The share valuation, for purposes of this Agreement, shall be based on the 10-day volume weighted average closing price for the ten (10) trading days immediately preceding the date of the share issue (“10-day VWAP”); |

| b. | An additional payment of cash and/or shares in Optionee’s parent company (at Optionee’s election) of US$450,000 within 5 business days of Optionee, or its parent company, publishing a Resource on the Property of more than 20 million pounds of U3O8 at a grade >0.2% U3O8, or 5,000,000 pounds of U3O8 at a grade >1.0% U3O8 (“Resource Milestone 2”). The share valuation, for purposes of this Agreement, shall be based on the 10-day VWAP; and |

| c. | A 1.5% Net Smelter Returns (“NSR”) royalty payable on any production from the mining claims described in Schedule A as calculated and determined in accordance with Schedule C. At any time, Optionee may buy 100% of this royalty by paying Owner the sum of US$1,500,000 in cash. |

| 3. | Additional Option Terms and Conditions. The terms and conditions relating to the Option shall be as follows: |

(a) Payment of Option Exercise Price. The cash portion of the Option Exercise Price shall be payable by wire transfer, as provided in writing by the Owner before the due date.

(b) Option Expiry Date; Termination; Liquidated Damages. The Option to purchase the Property shall expire 45 calendar days after the Execution Date, at 5:00 p.m. Pacific Time (the “Expiry Date”). Thereafter, this Option shall be null, void and worthless, and this Agreement will stand terminated. In the event Optionee fails to exercise this Option before the Expiry Date, Owner shall be entitled to keep the full amount of the Consideration paid pursuant to Section 1 above. No other rights, remedies or damages of any nature will be available to Owner or payable by Optionee. The parties expressly agree these terms have been negotiated between them and are fair and reasonable in all respects.

(c) Area of Interest. An area of interest of three (3) miles within the exterior boundaries of the 16 unpatented mining claims described in Schedule A shall apply to this Agreement (the “Area of Interest”), whereby:

(i) Owner, or its affiliates, will not secure additional mineral rights within the Area of Interest without Optionee’s express permission; and

(ii) If Optionee, or its affiliates, secures additional mineral rights within the Area of Interest then any mineral resources delineated within the Area of Interest will be included in calculations to determine whether Resource Milestone 1 and Resource Milestone 2 have been satisfied. For clarity, no royalty will be payable to Owner on additional mineral rights secured within the Area of Interest.

| 4. | Representations and Warranties of the Parties: |

| (a) | The Owner represents and warrants by, through and under it only, in favor of Optionee that: |

(i) it is the sole and exclusive, undivided legal and beneficial owner of 100% interest in the Property;

(ii) No notices to, or consents, authorizations or approvals of any person or entity are required (which have not been given to or received by the Owner) for the execution, delivery and performance by the Owner of its obligations as contemplated hereunder;

(iii) This Agreement has been duly executed and delivered by and constitutes a valid and legally binding obligation of the Owner, enforceable against the Owner by Optionee in accordance with the terms hereof, subject to bankruptcy, insolvency, moratorium, reorganization and other laws of general application relating to or affecting creditors’ rights and to general equitable principles;

(iv) The Owner has not assigned, or agreed to assign, all or any part of its right, title or interest in and to the Property, or royalty interests, if any, to any other person or entity, or entered into any other contracts to sell, transfer, mortgage, or assign the Property, or any portion thereof, and during the term of this Agreement, Owner shall not take any action to adversely affect the rights of OPTIONEE hereunder;

(v) There are no disputes between the Owner and any other party in respect of the Property or the underlying claims;

(vi) Owner has full power and authority to sell, transfer and assign the Property to OPTIONEE, in accordance with the terms of this Agreement;

(vii) Owner is not in breach of any of its obligations under any agreement relating to the Property;

(viii) Owner is qualified to own and dispose of the Property;

(ix) The parties expressly agree that OPTIONEE shall not, by the terms thereof, assume liability for damages to the Property or responsibility for reclamation or environmental obligations accruing as a result of any actions or operations on the Property prior to the Closing and then, only for such operations as may be conducted on the Property by OPTIONEE after Closing, and Owner shall indemnify and hold OPTIONEE harmless from any and all claims, causes of action, penalties, fines, or other court costs and reasonable attorney’s fees, that may arise from, actions or operations conducted by Owner on the Property prior to the Closing of the Agreement.

| (b) | The OPTIONEE represents and warrants in favor of Owner that: |

(i) This Agreement has been duly executed and delivered by and constitutes a valid and legally binding obligation of OPTIONEE, enforceable against the OPTIONEE by Owner in accordance with the terms hereof, subject to bankruptcy, insolvency, moratorium, reorganization and other laws of general application relating to or affecting creditors’ rights and to general equitable principles;

(ii) From and after the date hereof, if OPTIONEE elects to exercise the Option to purchase the Property, OPTIONEE shall assume liability for damage to the Property and responsibility for reclamation or environmental obligations accruing as a result of any actions or operations on the Property from and after the date of the Closing of the purchase of the Property.

(iii) OPTIONEE shall indemnify and hold Owner harmless from any and all claims, causes of action, penalties, fines, or other court costs and reasonable attorneys’ fees, that may arise from, actions or operations conducted on the Property from and after the Property Purchase Date.

(c) The representations and warranties made herein by the Owner and OPTIONEE are true and correct as of the date of this Agreement and shall survive the consummation of the transactions contemplated hereby, and the Closing, as defined below.

| 5. | Closing. Upon exercise of the Option, the closing of the purchase of the Property (“Closing”) shall take place at 2:00 p.m. (Salt Lake City, Utah time ) or at such other time as may be mutually agreed upon by OPTIONEE and the Owner (the “Time of Closing”) on such date as may be mutually agreed upon in writing by OPTIONEE and the Owner (the “Closing Date”) at such place as is mutually agreed upon in writing by OPTIONEE and the Owner. |

| 6. | Conditions of Closing. OPTIONEE shall not be obligated to complete the purchase of the Property unless the following conditions have been satisfied on or before the Time of Closing on the Closing Date, or have been waived, in whole or in part, in writing, by OPTIONEE: |

(a) Revisions. The Property shall not have been revised, supplemented, restated or replaced and shall be in the form of the property description attached hereto as Schedules A;

(b) Title. The parties agree that Owner has furnished to OPTIONEE such monuments of title to the Property as Owner has in its possession. Should OPTIONEE’s independent examination of title show, in OPTIONEE’s opinion, defects in the rights and interests of Owner in and to the Property, then OPTIONEE shall have the right, but not any obligation either to extend the Closing Date for sixty (60) calendar days following the Expiry Date, as to the Property only, and for Owner to do what it deems necessary, at its sole expense, to perfect said title to OPTIONEE’s satisfaction,, or alternatively, OPTIONEE may terminate this Agreement and Owner shall, within fifteen (15) calendar days after Owner receives written notice of such termination due to title defects with regard to the Property, return to OPTIONEE the full Consideration paid hereunder, without interest or deduction.

(c) Execution of Documents. Execution and delivery of all necessary formal documentation, in form and content satisfactory to OPTIONEE, and its counsel, acting reasonably, including:

| (i) | Owner shall execute and deliver to OPTIONEE a Wyoming form Quit Claim Deed as to the Property, in a recordable form deemed appropriate to legal counsel for OPTIONEE; |

| (ii) | a duly executed Deed with Reservation of Royalty in the form attached to this Agreement as Schedule C (the “Deed”); and |

| (ii) | Such other documents, agreements and instruments of assignment, conveyance or transfer, or otherwise, as OPTIONEE or its legal counsel may, in writing, reasonably request in connection with the exercise of the Option, and the sale, transfer and assignment of the Property to OPTIONEE. |