UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended December 31, 2024

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ___________ to ___________

Commission file number: 001-41575

Lipella Pharmaceuticals Inc.

(Exact name of registrant as specified in its charter)

| Delaware | 20-2388040 | |

| (State or other jurisdiction of | (I.R.S. Employer | |

| incorporation or organization) | Identification No.) | |

7800 Susquehanna St., Suite 505

Pittsburgh, PA 15208

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (412) 894-1853

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class: | Trading Symbol |

Name of each exchange on which registered: |

| Common Stock, par value $0.0001 per share | LIPO | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act:

None

(Title of class)

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically, every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer | ☐ | Accelerated filer | ☐ |

| Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

The aggregate market value of common stock held by non-affiliates of the registrant, based on the closing price for the registrant’s common stock on June 30, 2024 (the last business day of the second quarter of the registrant’s current fiscal year), was $2,623,125.60.

The registrant had 2,548,811 shares of its common stock outstanding as of March 26, 2025.

References in this Annual Report on Form 10-K to the “Company,” “Lipella,” “we,” “us,” or “our” mean Lipella Pharmaceuticals Inc. unless otherwise expressly stated or the context indicates otherwise.

Documents Incorporated By Reference: None.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 10-K (this “Report”) contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements include information concerning our strategy, future operations, future financial position, future revenue, projected expenses, prospects and plans and objectives of management. Forward-looking statements include all statements that are not historical facts and can be identified by terms such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would” or similar expressions and the negatives of those terms.

Forward-looking statements contained in this Report include, but are not limited to, statements about the following:

| ● | the initiation, timing, progress preclinical and clinical trials for other product candidates, including statements regarding the timing of initiation and completion of studies or trials and related preparatory work, the period during which the results of the trials will become available and our research and development programs; |

| ● | the timing, scope or results of regulatory filings and approvals for our product candidates, including timing of final U.S. Food and Drug Administration (“FDA”) marketing and other regulatory approvals of our lead product candidates, LP-10 and LP-310; and our other product candidates, including, but not limited to, LP-410 and LP-50; |

| ● | our ability to achieve certain accelerated or “orphan drug” designations from the FDA; |

| ● | our estimates regarding the potential market opportunity for LP-10, LP310 or any of our other product candidates; |

| ● | our research and development programs for our product candidates; |

| ● | our plans and ability to successfully develop and commercialize LP-10, LP-310, or any of our other product candidates; |

| ● | our ability to identify and develop new product candidates; |

| ● | our ability to identify, recruit and retain key personnel; |

| ● | our commercialization, marketing and manufacturing capabilities and strategy; |

| ● | the implementation of our business model, strategic plans for our business, product candidates and technology; |

| ● | the scalability and commercial viability of our proprietary manufacturing methods and processes; |

| ● | the rate and degree of market acceptance and clinical utility of our product candidates and gene therapy, in general; |

| ● | our competitive position; |

| ● | our intellectual property position and our ability to protect and enforce our intellectual property; |

| ● | our financial performance; |

| ● | developments and projections relating to our competitors and our industry; |

| ● | our ability to establish and maintain collaborations or obtain additional funding; |

| ● | our estimates regarding expenses, future revenue, capital requirements and needs for or ability to obtain additional financing; |

| ● | the impact of laws and regulations; |

| ● | our expectations regarding the time during which an emerging growth company under the JOBS Act; and |

| ● | the impact of global economic and political developments on our business, including capital market disruptions, the Ukraine-Russia and Israel-Hamas wars, economic sanctions and economic slowdowns or recessions, including any that may result from such developments and public health concerns, which could harm our commercialization efforts as well as the value of our common stock and our ability to access capital markets. |

Forward-looking statements are subject to a number of risks, uncertainties and assumptions, including those described in “Risk Factors” and elsewhere in this Report. Moreover, we operate in a very competitive and rapidly changing environment, and new risks emerge from time to time. It is not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements we may make. In light of these risks, uncertainties and assumptions, the forward-looking events and circumstances discussed in this Report may not occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements. Given these uncertainties, you should not place undue reliance on these forward-looking statements. Also, forward-looking statements represent our management’s beliefs and assumptions only as of the date of this Report. You should read this Report and the documents that we have filed as exhibits hereto completely and with the understanding that our actual future results may be materially different from what we expect.

Except as required by law, we assume no obligation to update these forward-looking statements publicly, or to update the reasons actual results could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

For discussion of factors that we believe could cause our actual results to differ materially from expected and historical results, see “Item 1A - Risk Factors” below. These and other factors could cause results to differ materially from those expressed in the estimates made by the independent parties and by us.

TABLE OF CONTENTS

PART I

Item 1. Business

Overview

We are a clinical-stage biotechnology company that was incorporated under the laws of the State of Delaware in February 2005. We are focused on developing new drugs by reformulating the active agents in existing generic drugs and optimizing these reformulations for new applications.

We believe that our strategy combines many of the cost efficiencies and risk abatements derived from using existing generic drugs with potential patent protections for our proprietary formulations; this strategy allows us to expedite, protect, and monetize our product candidates. Additionally, we maintain a therapeutic focus on diseases with significant, unaddressed morbidity and mortality where no approved drug therapy currently exists. We believe that this focus can potentially help reduce the cost, time and risk associated with obtaining marketing approval. We have not yet commercialized any products, and we do not expect to generate revenue from sales of any product candidates for several years.

Our Product Candidates: LP-10, LP-310, LP-410, and LP-50

Consistent with our strategy, we are currently addressing two indications via development of our product candidates, which we have designated as LP-10 for the indication of hemorrhagic cystitis (“HC”) and LP-310 for the indication of oral lichen planus (“OLP”), which is chronic, uncontrolled urinary blood loss that results from certain chemotherapies (such as alkylating agents) or pelvic radiation therapy (also called “radiation cystitis”). Many radiation cystitis patients experience severe morbidity (and in some cases, mortality), and currently, there is no therapy for their condition approved by the FDA, or, to our knowledge, any other regulatory body. LP-310 employs a formulation similar to LP-10, for the treatment of OLP. OLP is a chronic, T-cell-mediated, autoimmune oral mucosal disease, and LP-310 contains tacrolimus which inhibits T-lymphocyte activation. Symptoms of OLP include painful burning sensations, bleeding and irritation with tooth brushing, painful, thickened patches on the tongue, and discomfort when speaking, chewing or swallowing. These symptoms frequently cause weight loss, nutritional deficiency, anxiety, depression, and scarring from erosive lesions. OLP can also be a precursor to cancer, predominately squamous cell carcinoma, with a malignant transformation rate of approximately one percent.

LP-10 is the development name of our reformulation of tacrolimus (an approved generic active agent) specifically optimized for topical deposition to the internal surface of the urinary bladder lumen using a proprietary drug delivery platform that we have developed and that we refer to as our metastable liposome drug delivery platform (our “Platform”). We are developing LP-10 and our Platform to be, to our knowledge, the first drug candidate and drug delivery technology that could be successful in treating cancer survivors who acquire HC. Our first issued U.S. patent covering LP-10 expires July 11, 2035, unless extended for regulatory delay (up to 14 years), our second issued U.S. patent covering the method of making LP-10 expires November 9, 2034, unless extended for regulatory delay, and our third U.S. patent covering particular LP-10 tacrolimus formulations expires November 9, 2034, unless extended for regulatory delay. Our issued Australian patent covering LP-10 expires October 22, 2034. The Canadian patent, issued on August 23, 2022, expires October 22, 2034. The European patent, issued on June 7, 2023, expires October 22, 2034. We also have a corresponding patent application pending in the U.S. (U.S.S.N. 18/924,830). We also have a pending U.S. patent application on an improvement to the technology. We have received FDA “orphan drug” designation covering LP-10 and plan to apply for additional regulatory designations in the event we achieve qualifying results in the current phase 2a clinical trial for LP-10. Market data exclusivity may be available in the US and other jurisdictions in which regulatory approval is obtained for the Company’s product, regardless of patent status.

The safety and efficacy of LP-10 was evaluated in a 13-subject, open-label, multi-center, dose-escalation, phase 2a clinical trial in patients experiencing complications associated with a rare but highly morbid disease called “radiation-induced hemorrhagic cystitis” or “radiation cystitis.” This phase 2a clinical trial commenced on February 15, 2021, and we reported the trial’s summary results in the first quarter of 2023. There is currently no FDA approved drug therapy available for radiation cystitis patients, who are all cancer survivors who received pelvic radiation therapy to treat solid pelvic tumors, including prostate and ovarian cancers and who are now dealing with therapy-associated complications, including urinary bleeding (a radiation cystitis symptom). LP-10’s active ingredient, tacrolimus, which has a well-known pharmacology and toxicology, addresses a reduction (or cessation) of uncontrolled urinary bleeding.

LP-310 is the development name of our oral, liposomal formulation of tacrolimus (the same approved generic active agent in LP-10) specifically optimized for local delivery to oral mucosa. We believe that our approach of using metastable liposomal tacrolimus as a treatment for OLP is novel. To date, upon review of relevant FDA public data resources on approved drugs and biologics, we are not aware of any other liposomal products developed to treat such disease. We received investigational new drug (“IND”) approval from the FDA regarding LP-310 in the third quarter of 2023. We initiated a Phase 2a multicenter dose escalation of using LP-310 for the treatment of OLP in 2024. In this first cohort, eight participants received a dose of 0.25 mg LP-310, with promising initial results. No product-related serious adverse events were reported. Pharmacokinetic data demonstrated that whole blood tacrolimus levels in all patients were either undetectable or minimal, highlighting LP-310’s potential to deliver localized therapeutic effects while minimizing systemic exposure. Additionally, all patients tolerated LP-310 without significant adverse reactions. The trial is expected to be completed in the second quarter of 2025. The top line data from the first two dose cohorts of this trial has been selected for podium presentation at the 2025 American Association of Oral Medicine and European Association of Oral Medicine Joint Meeting that will be held in Las Vegas, NV on May 15, 2025.

Our issued U.S. and Australian patents covering LP-310 expire July 11, 2035, November 9, 2034 and October 22, 2034, respectively. The Canadian patent, issued on August 23, 2022, expires October 22, 2034. The European patent, issued on June 7, 2023, expires October 22, 2034. We also have a corresponding patent application pending in the U.S. (U.S.S.N. 18/924,830). We also have a pending U.S. patent application on an improvement to the technology. As noted above, patent term extensions may be available in Europe, Canada and the US for regulatory delay. Market data exclusivity is also applicable in many jurisdictions, regardless of patent status. Approval of a 505(b)(1) or 505(b)(2) application can result in five or three years of such exclusivity, respectively.

In a third program, Lipella is also developing an oral, liposomal formulation of tacrolimus, LP-410, for the treatment of oral graft-versus-host disease (“GVHD”). LP-410 is an oral rinse, similar to LP-310, but will have a different containment system. Hematopoietic cell transplantation (“HCT”) is used to treat a wide range of malignancies, hematologic and immune deficiency states, and autoimmune diseases. GVHD is a clinical syndrome where donor-derived immunocompetent T-cells react against patient tissues directly or through exaggerated inflammatory responses following HCT. Oral GVHD is a rare and serious disease, with a prevalence of approximately 30,000 patients in the US annually in 2023 (Bachier et al., 2019; Bachier et al., 2021, Orphanet 2023). GVHD remains a major cause of morbidity and mortality with patients who undergo HCT treatment, with chronic GVHD being the leading cause of non-malignant fatality for such patients who receive such HCT treatments.

Topical and local management of symptomatic oral GVHD can reduce oral symptoms that can interfere with oral function and quality of life and can reduce the need for more intensive immunosuppressive systemic therapies. However, there is currently no FDA approved local drug treatment of oral GVHD (Martini et al., 2022).

Lipella has developed LP-410 for the topical delivery directly to the mouth surface. LP-410 targets the underlying mechanisms of oral GVHD, potentially providing a safe and effective treatment option for affected individuals. Lipella received orphan designation approval, on November 11, 2023, for tacrolimus for the treatment of oral GVHD. We received IND approval from the FDA for LP-410’s treatment of oral GVHD on March 5, 2024.The issued and pending patents regarding LP-310 are relevant to LP-410 as well. We plan to expand and specify patent coverage of LP-410 in the patent application currently pending in the U.S. (U.S.S.N. 18/924,830).

In a fourth program, Lipella is also developing an intravesical formulation of immunoglobulins including checkpoint inhibitors, referred to as LP-50. LP-50 is an intravesical formulation of immunoglobulins including local, intravesical PD-1 (i.e. checkpoint) inhibition, intended for the treatment of non-muscle invasive bladder cancer (“NMIBC”), offering the potential for increasing efficacy while minimizing systemic toxicity. Additional information regarding this preclinical program is included in the International Journal of Molecular Sciences 2024, 25(9), 4945, titled “Enhancing Therapeutic Efficacy and Safety of Immune Checkpoint Inhibition for Bladder Cancer: A Comparative Analysis of Injectable vs. Intravesical Administration,” as well as in US patent publication number 2024/0115503 titled “Intravesical Delivery of Hydrophilic Therapeutic Agents Using Liposomes.” We have a corresponding patent application pending in the U.S. (U.S.S.N 18/011,635).

Our Metastable Liposome Drug Delivery Platform

We have developed a proprietary technology, referred to as our Platform, which is optimized for local hydrophobic drug delivery to body cavities having endothelial surfaces. Our process employs liposomal technology protected by issued patents in the United States, Australia, and Canada. We also have a corresponding patent application pending in the U.S. (U.S.S.N. 18/924,830) and a corresponding European Patent, issued on June 7, 2023. This technology involves direct drug delivery to the urinary bladder mucosa, and, we believe, has the potential to improve efficacy (by increasing drug concentration at the site of injury) and to reduce the possibility of side effects (by reducing the drug’s exposure to unrelated organs). The first body-cavity application for which we intend to utilize our Platform is the urinary bladder, which has been designed to deliver LP-10. We are also developing an oral cavity product for the treatment of OLP and oral GVHD using our Platform (liposomal-tacrolimus). We are continuing to research and develop products for additional body cavities, including the anal-rectal cavity (radiation proctitis) and the esophagus (eosinophilic esophagitis). We have a pending U.S. patent application on a new embodiment of this technology.

We predict that our Platform will provide a superior approach for treating inflammatory urinary bladder conditions compared to other delivery mechanisms and that certain inherent features of the metastable liposomes, combined with our intravesical formulations, provides our Platform with several advantages over existing bladder drug delivery methodologies in current clinical practice for inflammatory bladder applications. These advantageous characteristics include the following:

| ● | non-inflammatory (without the use of ethanol or other alcohols for solubility); |

| ● | large payload capacity of hydrophobic agents (10% by mass); |

| ● | urothelial affinity, which results in efficient drug transfer; |

| ● | low systemic distribution (large particle size); |

| ● | reproducible manufacturing and scalability; and |

| ● | prior clinical experience utilizing the liposomal delivery vehicle. |

The following table summarizes our therapeutic candidate pipeline and discovery research programs:

Figure 1

Our Strengths

We believe we are uniquely positioned to employ liposome technology in the development of intravesical treatments for urinary bladder and oral indications due, in part, to our particular strengths, including:

| ● | our proprietary Platform, which we believe will allow us to develop a pipeline of products to treat urinary bladder diseases as well as diseases of other body cavities; |

| ● | our clinical development strategy intended to maximize efficiencies by repurposing existing therapeutics for new proprietary indications and formulations; |

| ● | our clinical programs, which are designed to qualify, and take advantage of, accelerated regulatory approval pathways and designations that provide marketing exclusivity; |

| ● | take advantage of product exclusivity through patent protection of our novel formulations and indications for use; |

| ● | our product candidates, LP-10, LP-310, LP-410 and LP-50, which are being developed to address HC, OLP, oral GVHD and NMIBC, in accordance with our capital-efficient strategy via: |

| ○ | the “505(b)(2) regulatory pathway” strategy, which refers to requests for marketing approval from the FDA upon submission of an abbreviated new drug application (“aNDA”) pursuant to Section 505 of the Federal Food, Drug, and Cosmetic Act, as amended (the “FDCA”) and permits us to rely on existing data pertaining to the generic active ingredient; we anticipate referencing relevant publicly available data, including the publicly disclosed FDA drug approval package for tacrolimus in the preparation and submission of our aNDA for LP-10 and LP-310; |

| ○ | a known mechanism of action being combined with a new drug delivery method (our Platform) and a new site of delivery; and |

| ○ | our receipt of FDA “orphan drug” designations covering LP-10 and LP-410; |

| ● | our in-house manufacturing pilot plant (our “Facility”), which positions us to maximize scalability, quality and reliability, and permits us to better develop and maintain our trade secrets; |

| ● | our experienced scientific team, which has expertise in urology and liposomal drug development; and |

| ● | our management team, which has a track record in clinical development of local therapeutics for urinary bladder indications. |

Our Strategy

We are, to our knowledge, currently developing the first drug candidate and proprietary drug delivery platform that could be successful in treating cancer survivors who acquire HC and we intend to apply our proprietary drug delivery technology to the oral mucosa for the treatment of OLP and oral GVHD. Our development programs are designed to address opportunities for capital efficient drug discovery and development, especially research programs that reposition existing therapeutics for new indications that exploit new formulations. The key elements of the strategy that we are employing to achieve our goals are:

| ● | Advance the development of our lead product candidates, LP-10, to treat HC patients, and LP-310, to treat OLP. We designed LP-10 as a differentiated therapy for the treatment of cancer survivors with HC risks. We believe that LP-10 could be approved by the FDA as an effective therapy against HC due to its ability to exploit the known irreversible local vasoconstriction of tacrolimus (the active ingredient of LP-10) and take advantage of tacrolimus’ well-known anti-inflammatory properties. Our Platform permits a relatively high local drug concentration while also avoiding potential systemic toxicity. LP-10 has completed a phase 2a open-label, dose-escalation clinical trial for patients experiencing moderate to severe HC. Based on these recent results and the preclinical profile, we believe LP-10 has the potential to deliver meaningful clinical benefits over the currently available standard of care. A phase 2a multi-center dose-escalation study of LP-310 for the treatment of OLP is expected to be completed in the second quarter of 2025 and the top line data from the first two dose cohorts of this trial has been selected for podium presentation at the 2025 American Association of Oral Medicine and European Association of Oral Medicine Joint Meeting that will be held in Las Vegas, NV on May 15, 2025. |

| ● | Leverage our differentiated research and discovery approach to expand our product candidate pipeline. We expect to maintain a pipeline of additional product candidates, including LP-410 and LP-50, consistent with our strategy of developing proprietary 505(b)(2) regulatory pathway assets to address highly morbid indications where no adequate treatment(s) exists. We believe that our drug design approach, which involves proprietary repositioning of existing therapeutics (i.e., development of new applications using existing, approved active agents), integrated with our Platform, will allow us to efficiently design and validate novel product candidates that target inflammatory conditions of mucosal membranes. |

| ● | Maximize the clinical impact and value of our pipeline by relying on the 505(b)(2) regulatory pathway and, accordingly, deliver value to the stockholders. We believe the targeted nature of our research and discovery approach fosters efficient and focused clinical development. We intend to continue to build a lean, experienced team to develop product candidates in a capital-efficient manner. We intend to retain the commercialization rights to product candidates; however, we may opportunistically enter into strategic collaborations in certain geographic or clinical settings to maximize the value of our product pipeline. |

| ● | Continue to seek new therapies for rare diseases that can be evaluated with relatively small clinical trials, with an intent to minimize clinical development costs. Rare diseases that present severe morbidity and mortality are potentially eligible for accelerated regulatory approval pathways, such as the FDA’s “orphan drug” designation and designations under one or more of the FDA’s expedited development and review programs, which are associated with significantly lower development costs to obtain marketing approval for promising drug candidates. |

Our product development strategy involves combining intellectual property protection for novel formulations and indications for approved active pharmaceutical ingredients (“APIs”) with regulatory efficiencies provided by obtaining FDA designations that make our product candidates eligible for certain incentives that expedite development and review. We believe that this product development strategy is more capital efficient compared to traditional discovery of a new chemical entity because the safety and mechanisms of the approved APIs for the novel formulations of our product candidates are better understood and established. In the United States, approval of API products follows the “505(b)(2) regulatory pathway”; which permits us to rely on existing research and development (“R&D”) data pertaining to the generic active ingredient. The 505(b)(2) regulatory pathway often provides an alternate path to FDA approval for new or improved formulations or new uses of previously approved products. Using a 505(b)(2) new drug application (“NDA”), we expect to reduce the cost, time and risk that would otherwise be associated with bringing these programs to market. See “Government Regulation Applicable To Our Business – The 505(b)(2) NDA Regulatory Pathway” below for more information.

LP-10 and the Intended Treatment of HC

We completed our phase 2a clinical trial of LP-10 and reported top-line results in January 2023. LP-10 relies on intravesical vasoconstrictive and anti-inflammatory drug therapy for our intended treatment of HC, a rare and severe consequence of cancer therapy for which there is currently no approved treatment. HC affects the bladder lining and is caused by the protein-cross-linking effects of chemotherapy as well as longer-term effects from radiation-induced damage to urothelial tissue. In HC patients, the urothelial damage results in significant urinary bleeding, inducing the need for blood transfusions. Those cancer patients who acquire HC suffer from pain and discomfort that accompanies their bleeding. Based on information from the American Cancer Society as well as published reports on the incidence of HC resulting from either chemo or radiation therapy, we believe there are approximately 60,000 patients annually in the United States who suffer from a severe form of radiation-induced HC and an estimated 60,000 patients annually with systemic chemotherapy-induced HC. We received “orphan drug” designation from the FDA for the use of tacrolimus (including LP-10) for the treatment of HC.

We believe that our approach of using metastable liposomal tacrolimus as a treatment for HC, which has not yet been approved by the FDA, is novel. To date, we are not aware of any other liposomal products developed for clinical urinary bladder instillation. The current standard of care for HC patients is limited to measures such as irrigation and cauterization, which seek to reduce or halt the urinary bleeding of HC but often do not work effectively. There is no approved treatment for HC, and there are currently no other drug treatments for HC in clinical development of which we are aware. LP-10 is designed to be an acute treatment for HC to be administered via urinary catheter either at a hospital or doctor’s office within 30 minutes, which would be repeated daily for a total of four instillations in the same number of days. LP-10 seeks to treat HC via two mechanisms: high local vasoconstriction and longer-term anti-inflammation.

On December 23, 2019, we received IND approval from the FDA for LP-10, including approval for LP-10’s proposed clinical protocol, and central investigational review board (“IRB”) approval of our IND-approved clinical protocol, as well as approval for the investigator’s brochure and patient’s informed consent associated with LP-10. From 2020 to 2022, we signed clinical trial agreements in connection with eight clinical sites to conduct the dose-escalation, phase 2a clinical trial of LP-10. We completed the phase 2a dose-escalation trial (reporting results in January 2023) and intend to apply for FDA accelerated approval pathways, and the design of a pivotal phase 2b well-controlled clinical trial. If successful, a pivotal phase 3 trial can be requested, and we believe the results of an LP-10 phase 3 trial could support the submission of an NDA for LP-10 to the FDA through the 505(b)(2) regulatory pathway and a Marketing Authorization Application to the EMA in Europe. However, there can be no assurance that we will obtain such designation from, or be permitted to use such pathway by, the FDA, who is ultimately responsible for making such determinations.

Background on HC

HC is characterized by the presence of sustained hematuria and lower urinary tract symptoms in the absence of active tumor and other conditions or infections that cause excessive bleeding, (Gorzynska et al. 2005). Urologic adverse events caused by HC include frequency, dysuria, urgency, nocturia, suprapubic pain, bladder infection, fatigue and both microscopic and gross hematuria.

Bleeding from HC ranges from non-visible (or microscopic) hematuria to gross (visible) hematuria with clots (Decker et al. 2009). Moderately severe cases of HC involve massive bleeding and clot formation. Severe HC is a challenging condition to treat and may give rise to serious complications, leading to prolonged hospitalization and/or mortality (Decker et al. 2009; Mukhtar and Woodhouse 2010) and HC cases resulting from chemotherapy are reported to have a mortality rate approaching 4% (Rastinehad et al. 2007). Even mild cases of HC can cause disabling symptoms (e.g., frequency, urgency and pelvic pain, often localized to the bladder or urethra) (Payne et al. 2013). A standardized grading system (Droller et al. 1982) to classify the severity of HC has been proposed, which is shown in Figure 2 below:

Figure 2

HC can be classified as early- or late-onset (Zwaans et al. 2016). HC can also develop weeks to months after treatment in 20%–25% of patients who receive high doses of cyclophosphamide. The effects of radiation-induced HC may be acute or delayed, occurring long after radiation treatment has ended, from two months to 15 years later (Zwaans et al. 2018; Manikandan et al. 2010).

Prevalence

At the suggestion of the FDA’s Office of Orphan Products Development, we have measured annual cyclophosphamide and ifosphamide use in a large commercial database for private health plans between 2008 and 2010 and, based on guidance from the FDA, applied a 40% rate of HC in such patient database. The information from the database, combined with the FDA’s recommended guidance, results in a prevalence of consequential HC to potentially reach 60,000 new cases per year in the United States. This methodology implicitly assumes that the prevalence of use observed in private health plans (including Medicare beneficiaries enrolled in private plans) is generalizable to the nation as a whole, and such figure represents our conservative estimate of the number of new cases per year after applying the FDA’s recommended 40% rate to the figures in such patient database. HC resulting from pelvic radiation therapy (occurring in the prostate, rectum and uterine corpus) is less common than HC resulting from chemotherapy and is believed to be proportional to the incidence of the “primary neoplasia” (the original malignancy). Such incidence of HC is based on a combined estimate of the incidence of both chemotherapy-induced HC and radiation-induced HC from (i) peer-reviewed literature estimating the proportion of cyclophosphamide and ifosphamide recipients that acquire chemotherapy-induced HC after undergoing chemotherapy, as applied to a national chemotherapy incidence measurement study, and (ii) peer-reviewed literature containing estimates of the proportion of cancers treated with pelvic radiation therapy and the number of years patients survive post-radiation therapy, in addition to pelvic cancer incidence estimates publicly available from sources such as the American Cancer Society. According to the American Cancer Society publication Cancer Facts & Figures 2023 (available at: https://www.cancer.org/content/dam/cancer-org/research/cancer-facts-and-statistics/annual-cancer-facts-and-figures/2023/2023-cancer-facts-and-figures.pdf), there are an estimated 288,300 new cases of prostate cancer in the U.S. each year, 153,020 new cases of rectum and colon cancer in the U.S. each year, and 66,200 cases new cases of uterine corpus cancer in the U.S. each year. Based, in part, on this data, we estimate the U.S. incidence of HC to be in the range of approximately 100,000 to 200,000 cases per year.

Existing Treatment Options

There is currently no standard therapy available for patients with HC, and there are no guidelines available on how HC should be optimally managed. Current HC treatments are regarded as ineffective, risky, or both. Such treatments include general medical management (e.g., estrogens, pentosan-polysulfate, and hyperbaric oxygen (“HBO”)), instillation therapy (e.g., aminocaproic-acid, alum, silver-nitrate, formalin, and fibrin glue), embolization and surgery (e.g., coagulation and cystectomy). The moderately severe cases of HC involve massive bleeding as well as clot formations that require evacuation. The most severe cases require surgical intervention (e.g., urinary diversion or cystectomy) (Sant 2002; Perez-Brayfield and Kirsch 2009). In addition, we believe current treatments pose significant patient risk: interventional fulguration of bleeding sites rarely works and exposes sick, frail patients to surgical risks; treatment with aminocaprotic acid often leads to dangerous clots; treatment with silver nitrate can cause bladder perforation or kidney failure; and treatment with formalin significantly reduces bladder functionality and causes excruciating pain (Vicente, Rios et al. 1990).

HBO treatments for HC may decrease and prevent the risk of bleeding but cannot treat ongoing bleeding, in part because therapy takes up to 40 sessions over a period of two to three months. Cystectomy causes significant morbidity and is generally an option of last resort; in some cases where cystectomy is conducted, old and/or frail patients can bleed to death. There are no other products in development of which we are aware that are indicated for the treatment of HC. Should LP-10 ultimately receive FDA market approval, we believe it will address this unmet medical need and provide a benefit over existing products while fitting into the existing treatment algorithm as a treatment for refractory HC.

LP-10’s Mechanisms of Action – Tacrolimus

LP-10’s API tacrolimus has been approved by the FDA for systemic use for inhibiting transplant rejection and as topical ointment for moderate to severe atopic dermatitis. Tacrolimus acts by inhibition of IL-2-dependent T-cell activation and has a direct inhibitory effect on cell-mediated immunity (Kino et al., 1987; Tamura et al., 2002). Tacrolimus prolongs the survival of the host and transplanted graft in animal transplant models of liver, kidney, heart, bone marrow, small bowel and pancreas, lung and trachea, skin, cornea and limb. In animals, tacrolimus has been demonstrated to suppress some humoral immunity and, to a greater extent, cell-mediated reactions such as allograft rejection, delayed type hypersensitivity, collagen-induced arthritis, experimental allergic encephalomyelitis and graft versus host disease. Tacrolimus inhibits T-lymphocyte activation, though the exact mechanism is not known. Experimental evidence suggests that tacrolimus binds to an intracellular protein named FKBP-12. A complex molecule comprising tacrolimus-FKBP-12, calcium, calmodulin and calcineurin is formed and the phosphatase activity of calcineurin is inhibited. This effect may prevent the dephosphorylation and translocation of the nuclear factor of activated T-cells, a nuclear component thought to initiate gene transcription for the formation of lymphokines (such as interleukin-2, gamma interferon). The net result is the inhibition of T-lymphocyte activation (i.e., immunosuppression).

The urothelium is the primary site of tissue damage in the general pathophysiology of cystitis (Erdogan et al. 2002). Recent studies have highlighted the overexpression of genes related to immune and inflammatory responses, including activation of CD4+ T-helper type-1-related chemokines in general cystitis (Trompeter et al. 2002; Almawi and Melemedjian 2000). Expression of chemokines precedes infiltration of immune cells and elevation of chemokines is an established signature of the inflammatory phenotype in bladder pain. Many of the symptoms of HC are related to inflammation of urothelial tissues. We believe that our application of the liposomal tacrolimus could potentially have a two-fold effect of (i) inhibiting calcineurin and the related response, and (ii) causing acute arteriole vasoconstriction to suppress HC (see Figure 2 above). Calcineurin inhibition is the well-known tacrolimus intracellular signal transduction mechanism that impairs the ability of certain immune cells to activate, and tacrolimus’ vasoconstrictive properties are referenced, for example, in section “5.7 Nephrotoxicity” of the Label (prescribing information) associated with the “PROGRAF® (tacrolimus) injection (for intravenous use) Initial U.S. Approval: 1994.”

Non-Clinical Study Results Involving Intravesical Tacrolimus

The following is a summary of non-clinical studies conducted with rats and dogs that were sponsored by the Company or conducted in collaboration with Company scientists. Results from animal studies are not always predictive of results of subsequent human clinical trials:

Effect of intravesical-tacrolimus on chemotherapy-induced HC

In September 2010, the effect of intravesical-tacrolimus was examined in a rat model for chemotherapy-induced, intraperitoneal injection of cyclophosphamide (200 mg/kg; i.p.) HC. This study demonstrated that cyclophosphamide-induced hyperactivity (i.e., decrease in inter-contraction interval) was suppressed in rats with intravesical LP-10 treatment but not in the rat groups left untreated (sham) or treated with empty liposomes (vehicle control) (Chuang et al. 2010). This result indicates that liposomal tacrolimus may mitigate cyclophosphamide injury in an animal model (Neurology and Urodynamics 30:421-427 (2011)).

Effect of intravesical-tacrolimus on radiation-induced HC

In October 2012, the efficacy of intravesical-tacrolimus was also examined in a rat model for radiation-induced HC. A 40 Gy radiation dose induced statistically significant reductions in the intermicturition interval recorded during metabolic urination patterns. Irradiated rats were randomly assigned to receive a single instillation of saline or intravesical-tacrolimus. Intravesical-tacrolimus increased the post-irradiation intermicturition intervals (p <0.001). Rat bladders that were harvested six weeks after the 40 Gy irradiation doses and two weeks after saline instillation showed edematous changes accompanying infiltration of inflammatory cells and hyperplastic urothelial changes. In contrast, bladder from group treated with intravesical-tacrolimus shows minimal edematous change, consistent with the hypothesis that the intravesical-tacrolimus had an anti-inflammatory effect (J. of Urology 194, 578-584 (2015)).

Pharmacokinetics of sphingomyelin formulated tacrolimus

A 2013 study examined levels of tacrolimus in blood, urine and bladder tissue following a single dose of liposome formulated tacrolimus instilled in the bladder of rats under anesthesia as compared to intravesical instillation of tacrolimus or intraperitoneal injection of tacrolimus in other rat groups. The tacrolimus dose was constant in all formulations at 200g/ml. At different times, blood, urine and bladder samples were collected. Tacrolimus levels in samples were analyzed using microparticle enzyme immunoassay. The area under curve (“AUC”) of liposome tacrolimus in serum at 0 to 24 hours was significantly lower than that of tacrolimus instillation or injection. Non-compartmental pharmacokinetic data analysis revealed maximum concentration of liposomal tacrolimus and tacrolimus in blood and urine at one and at two hours, respectively. Urine AUC (0–24 hours) after intravesical administration was significantly higher than in the intraperitoneal group (p < 0.05). Bladder tacrolimus AUC (0–24 hours) did not differ significantly between the groups. Single dose pharmacokinetics revealed that bladder instillation of liposome tacrolimus significantly decreased systemic exposure to instilled tacrolimus. This appears to indicate that a reduction in systemic exposure helps to limit the potential side effects of the tacrolimus by concentrating the dose to only one organ (J. of Urology Vol. 189, 1553-1558 (2013)).

LP-10 Toxicology Studies

In 2018, we completed chronic toxicology studies in rats and dogs, which were the two species of animals that we agreed to study in the course of our pre-IND communications with the FDA. The completion of such studies is normally required prior to requesting IND approval. The in-life phase of the toxicology rat study was performed between February and March 2018 and the in-life phase of the dog toxicology study was performed in March 2018. Such studies were company-sponsored and conducted by qualified vendors specializing in good laboratory practice in-vivo toxicology studies. The animals in such 2018 studies were assessed for morbidity, mortality, clinical observations and weekly body weight. Full sets of standard tissues, including urinary tract tissues, were collected and weighed and histopathology evaluations were conducted from all such animals. The studies concluded that no significant local and systemic toxicity resulted from the administration of LP-10 by intravesical instillation in either rats or dogs.

LP-10’s Addressable Market

LP-10 has been designed for the approximately one million cancer survivors in the United States today who have had pelvic radiation therapy and are at risk for HC. Based on the managed care database study that we sponsored in 2012 as part of our approved request for FDA “orphan drug” designation of tacrolimus for HC, approximately 60,000 of these patients annually experience severe chronic bladder bleeding that is often fatal. LP-10 has been developed to address this form of bleeding, as well as bladder bleeding associated with breast cancer patients who are taking systemic cyclophosphamide or ifosfamide, leading to chemotherapy-related cystitis experienced by an estimated 60,000 patients annually in the United States, inferring an addressable market in excess of 120,000 patients annually.

Figure 3

(1) American Cancer Society Cancer Facts and Figures 2023, (2) derived from a Company-sponsored study, (3) based on the Company’s 40% estimate, (4) American Cancer Society Cancer Treatment and Survivorship Fact and Figures 2022-2024, (5) based on the Company’s 30% estimate (6) 8% estimate, (7) based on the Company’s estimate, (8) $20,000 average revenue per each of an estimated 60,000 patients treated per year.

Figure 3 above illustrates the potential sources of revenue for LP-10. LP-10 is not currently approved for any indication; however, if clinical development is successful and we receive marketing approval for LP-10, we estimate the average LP-10 price to exceed $20,000 per patient-year domestically. This estimate is based on costs of HBO therapy, which is an option for patients with mild cases. HBO therapy can cost approximately $15,000 for a course of 30 sessions. Our price estimate also includes the potential for associated reductions in direct medical expenditures, especially for severe cases. We estimate the peak demand, at this price, to be, approximately 60,000 patients annually, which represents an approximate 50% market penetration in the U.S. Based on such price and demand estimates, we believe there is potential to receive up to $1.2 billion in annual gross revenue.

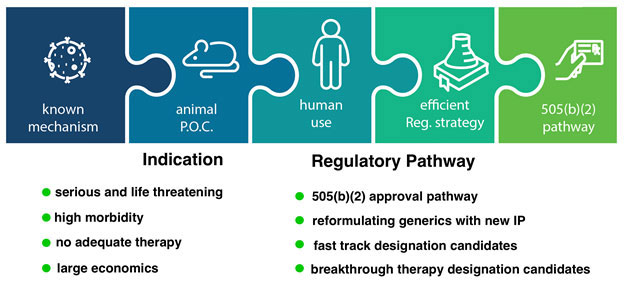

Our Lead Drug Candidates, LP-10, LP-310, and Our Product Pipeline

Five fundamental aspects of our LP-10 drug candidate make it an excellent fit for our strategy (see Figure 4 below). First, our API has a well-known mechanism of action. Second, published non-clinical studies involving animals, which are described above, demonstrate the potential for significant efficacy in our intended indication and route of administration. Third, we are fortunate to have had a successful human experience with intravesical tacrolimus (Dave et. al. Int Urol Nephrol 2015). Fourth, we believe we can take advantage of accelerated regulatory approval pathways for LP-10; we have already received “orphan drug” designation from the FDA that grants us product exclusivity, and we plan to apply for designations under one or more of the FDA’s expedited development and review programs. Fifth, we believe that the revenue potential for LP-10 could be significant. We believe our focus on capital-efficient drug development provides us with additional opportunities as we evaluate potential drug candidates for other rare diseases, especially those associated with locally delivering drugs to body cavities. When evaluating opportunities, we ensure that both the indication as well as the regulatory pathway are conducive to capital-efficient drug development. Our product candidate pipeline includes product candidates that could treat OLP (LP-310) and oral GVHD (LP-410). On November 10, 2023, we received the FDA’s IND approval for a Phase 2a dose escalation clinical trial regarding LP-310, and we were granted “orphan drug” designation for LP-410 the treatment of oral GVHD in November 2023. We submitted a Phase 2a IND for LP-310 treatment of OLP in the first quarter of 2024 and proceeded into clinical trial that is expected to be completed in the second quarter of 2025. We believe that our current product candidate pipeline could enable us to apply our drug delivery technology (our Platform) for multiple types of severe, rare diseases, and in the future, could enable us to address additional broader indications associated with endothelial inflammation. Local delivery often allows us to avert known risk factors by only locally applying the effective dose.

Figure 4

We are currently evaluating several potential product candidates for additional indications (including radiation proctitis and eosinophilic esophagitis).

LP-10’s Regulatory Status

In 2019, we completed the required manufacturing and toxicology program to submit an IND request to the FDA to begin testing LP-10 in human subjects. We submitted the IND request in September 2019 and received approval from the FDA within 30 days of submission to begin a clinical study involving LP-10. In December 2019, we received an advice letter from the FDA recommending several modifications to our proposed clinical protocol for LP-10, which we accommodated. We also submitted and received approval from the FDA for the trial’s associated investigator brochure and the proposed documentation of patient consent. Both of these documents, in addition to the clinical protocol, were submitted to Adverra, our central IRB, and we subsequently received IRB approval to conduct our clinical trial. In February 2020, the first patient was dosed in LP-10’s FDA phase 2a open-label, dose-escalation clinical trial for patients experiencing moderate to severe HC, which is intended to demonstrate proof-of-concept in humans. We reported summary results from LP-10’s phase 2a clinical trial in January 2023. We had a type-C meeting with the FDA on November 7, 2023, during which we agreed on a submission of a well-controlled phase 2b double-blind placebo-controlled trial with gross hematuria as assessed by patient report outcome as primary endpoint. This submission has been completed, and we are proceeding toward the initiation of a Phase2b clinical trial.

LP-10’s FDA “Orphan Drug” Designation Status

In 2010, we submitted a request to the FDA for “orphan drug” designation covering LP-10 and subsequently received approval for such designation in July 2012. This provides us with marketing exclusivity and permits us to benefit from shorter FDA review periods and reduced regulatory fees for LP-10. We intend to apply for similar “orphan drug” designations in additional jurisdictions, including Europe and Japan, as well as additional regulatory classifications, such as the FDA’s Breakthrough Therapy and Fast Track designations, in the United States. We expect that any designations that we have received, or may in the future receive, will confer additional advantages during LP-10’s development. However, there can be no assurance that we will obtain such designations from the FDA, who is ultimately responsible for making such determinations.

LP-10’s Clinical Status

Our multi-center, open-label dose-escalation phase 2a LP-10 clinical trial involved a total of thirteen subjects who received tacrolimus doses in one or two instillations of 2, 4 or 8mg via a pre-liposomal lyophilate reconstituted in 40 milliliters of sterile water. Subjects were cancer survivors with a history of pelvic radiotherapy who developed moderate to severe HC refractory to conventional therapy. The study was IRB-approved at nine clinical sites within the FDA’s jurisdiction.

Four subjects were enrolled in the 2mg group, four subjects were enrolled in the 4mg group, and five subjects were enrolled in the 8mg group. All subjects were male, with a median age of 67 years. Nine of the thirteen subjects had a history of prostate cancer and had been previously treated with external beam radiation. Two of the thirteen subjects had a history of lymphoma previously treated with radiation, and two had a history of bladder cancer previously treated with radiation.

The last subject of the LP-10 phase 2a study completed the last visit in October 2022. We reported top-line data from this trial in January 2023. All twenty-three LP-10 instillations in the 2mg, 4 mg and 8mg groups were well-tolerated by all thirteen subjects without related adverse events or elevated blood tacrolimus levels. For multiple subjects, hematuria and urinary symptoms improved, and cystoscopic bleeding and ulceration sites decreased. There was a complete response in three of the subjects, a partial response in seven of the subjects and no response in three of the subjects. We believe that such data and instillation safety findings indicate LP-10’s tolerability in HC patients and evidence LP-10’s potential use for the treatment of HC.

The results of the LP-10 phase-2a clinical trial have been published in the journal of International Urology and Nephrology, on September 19, 2023 (Hafron J. et al. Int. Urol. Nephrol. September 2023, Springer).

LP-310 and the Intended Treatment of OLP

LP-310 is currently in clinical development. LP-310 uses immunosuppressive and anti-inflammatory drug therapy to treat OLP, which is a chronic immune-mediated mucosal disease characterized by ulcerative lesions in the oral cavity. To date, upon review of relevant FDA public data resources on approved drugs and biologics, we are not aware of any other liposomal products developed to treat OLP. Patients are currently treated with off-label steroids for managing painful, erosive or ulcerative lesions. Yet, there are virtually no steroids formulated for topical drug delivery to lesions in the mouth. For severe and difficult-to-treat lesions, systemic steroids, and other immunosuppressive agents (e.g., hydroxychloroquin) are often needed, even though OLP is localized. Creams, gels and ointments do not adhere to oral mucosa and are easily swallowed, while mouthwashes and steroid inhalers have extremely short contact time with lesions. For severe and difficult-to-treat lesions, systemic steroids are often needed, even though OLP is localized. As a result, we believe there is great unmet medical need for this disease.

We believe that our approach of using metastable liposomal tacrolimus as a treatment for OLP, which has not yet been approved by the FDA, is novel. Tacrolimus has been used as an off-label oral treatment of OLP, and it has been shown to be effective based on systematic review and meta-analysis (Sun et al., 2019), which we believe is indicative of a rationale for using tacrolimus to treat OLP. Twenty-one trials involving 965 patients were included in this meta-analysis that concluded, in part, that treatment with tacrolimus may be an alternative approach when OLP does not respond to the standard protocols.

Background on OLP

OLP is a chronic T-cell-mediated mucosal disease that affects more than 1% of the global population, or more than 6 million people in the U.S. and Europe, according to González-Moles et. al., Oral Diseases 27(4):813-828 May 2021, “Worldwide prevalence of oral lichen planus: A systematic review and meta-analysis.” OLP is generally divided into three clinical subtypes: reticular, atrophic or erythematous, and erosive and/or ulcerative. Although lichen planus can be found on other areas of the body, such as with cutaneous lichen planus (“LP”), OLP has a chronic course, with little chance for spontaneous resolution, and most therapies that are currently available are palliative rather than curative. Based on peer-reviewed medical literature, OLP has a prevalence ranging from 1-2%, and females twice as likely as men to have the disease. The age on onset is generally between 30-60 years. Although cutaneous LP is associated with approximately 15% of OLP cases, OLP is associated with approximately 75% of patients with cutaneous LP.

Symptoms vary, but the disease is typically characterized by white reticular changes, erythema and painful ulcerative lesions in the oral cavity, accompanied by inflammation and severe pain. The precise cause is unknown, although an autoreactive immune process is suspected by most experts in the field. OLP is most frequently located bilaterally on the buccal mucosa (the inside lining of the cheeks and floor of the mouth), but can also appear on the tongue, palatal mucosa, gingiva and lips. Because of the long-lasting nature of the disease and painful symptoms, which can be spontaneous or triggered by acidic, crunchy and spicy food, patients require ongoing care and monitoring. Patients with OLP also have an approximately 1% likelihood of being diagnosed with oral cancer as a result of OLP (between 0.4% to 5% over a 20-year period, with an annual rate between 0.2% to 0.5%), making early detection and treatment imperative.

Some cases of OLP are caused by a hypersensitivity reaction to mercury and formaldehyde or medications such as ACE inhibitors, thiazide diuretics, beta blockers, gold salts, sulfasalazine, sulfonylureas and penicillamine. The new biologic agents such as TNF alpha inhibitors may also cause lichen planus-like eruptions. Patients with hypothyroidism, including Hashimoto thyroiditis, also develop OLP and it is unclear whether it is thyroid disease that predisposes an individual to OLP, or whether the drugs used to treat such disease also cause OLP. Hepatitis C virus infection has also been associated with the development of OLP in southern European countries. As mentioned above, we are not aware of any approved treatments for OLP, and we do not believe that current treatments are sufficiently effective.

LP-310’s Mechanisms of Action

LP-310 contains the API tacrolimus, like LP-10. Recent studies have highlighted that OLP pathophysiology is initiated by cellular-mediated immunity, most importantly, the increased production of T-helper 1(Th1) cytokines (Chamani et al., 2015). The oral mucosa is the primary site of tissue damage in the pathophysiology of OLP (Alrashdan et al., 2016). For a discussion of the tacrolimus API, on which LP-310 relies for its delivery to the oral cavity, and the effect tacrolimus has on T-lymphocyte activation, see “– LP-10’s Mechanisms of Action – Tacrolimus” above. We believe that our application of the liposomal tacrolimus to the oral cavity to address OLP could exploit this mechanism with a high local and low systemic distribution.

LP-310’s Addressable Market

LP-310 is not currently approved for any indication; however, if clinical development is successful and we receive marketing approval for LP-310, based upon the economics of existing oral cavity drug products, we project that the treatment of OLP will cost approximately $4,000 annually per patient. Most OLP patients are treated by dentists, who are relatively accessible compared to other medical specialists (in the United States there are approximately 200,000 dentists and ear, nose and throat physicians). Currently, dentists routinely recommend and prescribe instill agents as oral rinses and the procedure is simple and easy to teach. Given the absence of FDA approved treatment of OLP, we estimate revenue of approximately $4,000 per course of therapy, resulting in a total addressable market that exceeds $980 million. These estimates are based on the prices of other brand intravesical products as well as our preliminary estimates of the potential for reduction in medical expenditures associated with intractable cases.

LP-310’s Regulatory Status

On April 8, 2021, we successfully completed a pre-IND meeting to confirm the specific IND manufacturing, analytical, toxicology requirements for LP-310 as an oral rinse for the treatment of OLP. On October 17, 2023, the FDA approved an IND application for a multi-center, phase-2a, dose-escalation clinical trial to assess the safety and efficacy of LP-310 in patients with symptomatic OLP.

We began the clinical trial process for LP-310 and initiated the first clinical site in the second quarter of 2024. In the fourth quarter of 2024, we announced the completion of dosing for the first cohort in its multi-center Phase 2a clinical trial of LP-310. In this first cohort, eight participants received a dose of 0.25 mg LP-310, with promising initial results. No product-related serious adverse events were reported. Pharmacokinetic data demonstrated that whole blood tacrolimus levels in all patients were either undetectable or minimal, highlighting LP-310’s potential to deliver localized therapeutic effects while minimizing systemic exposure. Additionally, all patients tolerated LP-310 without significant adverse reactions.

The trial is expected to be completed in the second quarter of 2025. The top line data from the first two dose cohorts of this trial has been selected for podium presentation at the 2025 American Association of Oral Medicine and European Association of Oral Medicine Joint Meeting that will be held in Las Vegas, NV on May 15, 2025. Lipella anticipates the submission to the FDA of a request for Breakthrough Designation for LP-310 in the second half of 2025 and plans to commence a Phase 2b clinical trial for such product.

LP-410 and the Intended Treatment of oral GVHD

Lipella Pharmaceuticals Inc. is also developing an oral, liposomal formulation of tacrolimus, LP-410, for the treatment of oral GVHD. LP-410 is an oral rinse, similar to LP-310, but will have a different containment system. LP-410 targets the underlying mechanisms of oral GVHD, potentially providing a safe and effective treatment option for affected individuals. Lipella received “orphan drug” designation approval, on November 11, 2023, for tacrolimus for the treatment of oral GVHD. On March 5, 2024, the FDA approved an IND application for LP-410’s treatment of oral GVHD.

Background on oral GVHD

HCT is used to treat a wide range of malignancies, hematologic and immune deficiency states, and autoimmune diseases. GVHD is a clinical syndrome where donor-derived immunocompetent T cells react against patient tissues directly or through exaggerated inflammatory responses following HCT. Oral GVHD is a rare and serious disease, with a prevalence of approximately 30,000 patients in the US annually (Bachier et al., 2019; Bachier et al., 2021, Orphanet 2023). GVHD remains a major cause of morbidity and mortality with patients who undergo HCT treatment, with chronic GVHD being the leading cause of non-malignant fatality for such patients who receive HCT treatment.

Topical and local management of symptomatic oral GVHD can reduce oral symptoms that can interfere with oral function and quality of life and can reduce the need for more intensive immunosuppressive systemic therapies. However, there is currently no FDA approved local drug treatment of oral GVHD.

LP-50 and the Intended Treatment of NMIBC

Lipella is also developing an intravesical formulation of immunoglobulins including checkpoint inhibitors, LP-50, for the treatment of NMIBC. LP-50 offers the potential for increasing efficacy while minimizing systemic toxicity. Additional information regarding this preclinical program is included in the International Journal of Molecular Sciences 2024, 25(9), 4945, titled “Enhancing Therapeutic Efficacy and Safety of Immune Checkpoint Inhibition for Bladder Cancer: A Comparative Analysis of Injectable vs. Intravesical Administration,” as well as in US patent publication number 2024/0115503 titled “Intravesical Delivery of Hydrophilic Therapeutic Agents Using Liposomes.”

Facility

We have approximately 2,000 square feet of combined laboratory, office and warehouse space at our principal executive offices that we use in our research and development efforts. The lease for our principal executive offices has a five-year term that ends on May 31, 2024, and the lease provides us with an option to extend the term for an additional five years.

We believe our Facility contains all of the various components necessary to support our research, and it includes a current good manufacturing practices (“cGMP”)-capable manufacturing capability with a dedicated pilot-scale manufacturing. The space is divided into a production area and office space, with the production area subdivided into a clean space (Class 10,000) and sterile space (Class 100 (ISO class 5) clean room). Our Facility includes a pre-fabricated soft-wall, 6’x10’ class-100 clean room for aseptic formulation.

We maintain an internal LP-10 pilot manufacturing facility. We plan to file for an NDA utilizing the 505(b)(2) regulatory pathway for LP-10, which, if approved, may rapidly increase our manufacturing compliance needs. Even if we are able to pursue the 505(b)(2) regulatory pathway strategy, however, there is no assurance that we will be successful developing and/or commercializing LP-10 in a rapid or accelerated manner.

We are in a continuous process of complying with increasing regulatory requirements as the development of LP-10 and our other product candidates progresses. Currently, our manufacturing process primarily involves facility-dependent sterility protocols surrounding a five-step batch process. The simplicity of our process provides a strong incentive to continue investing internally in manufacturing compliance.

Compliance with stage-appropriate cGMPs is a prerequisite for FDA approval of a drug product for use in a clinical trial. cGMP regulations increase as a product candidate enters each subsequent clinical trial phase and as the scope of a proposed trial increases. Compliance with all cGMP regulations is a requirement for NDA approval and commercialization of LP-10. We expect to increase the cGMP manufacturing capabilities at our Facility to ensure full-scale compliant production of LP-10.

We believe that our manufacturing program will be able to support any future clinical trials involving LP-10. We currently lease industrial space used for cGMP manufacturing and analytical support. The space includes a non-porous epoxy floor, ideally suited for sterile environments, such as those used in hospital surgical rooms and sterile processing facilities. We have completed initial characterization and quality control release testing to confirm consistency of production of LP-10. Any applicable revised information and data will be provided to the FDA as part of an amended Chemistry, Manufacturing and Controls (“CMC”) section of the IND application prior to and in conjunction with use in any subsequent clinical trial.

Our Analytical Laboratory, Equipment & Supplies

Our current preparatory and biochemical/biophysical analysis capabilities include: ultra-centrifugation, high performance liquid chromatography; differential scanning calorimetry; gas chromatography; cross-polarization microscopy; fluorescent microscopy; near-infra-red imaging; and particle size analysis. In addition to the analytical equipment and sterile cleanroom, our Facility it contains a laminar flow hood for sterile procedures outside of the cleanroom, two Labconco lyophylizers (each with a 50-vile capacity), multiple incubators, a laboratory oven, an autoclave, various mass balances, vortexes, a heat stage for our optical microscope, various freezers and refrigerators, chemical and flammable storage cabinets, sterile disposables (including clothing, materials and vials), and raw materials, including APIs and lipids.

Suppliers

We obtain our raw material supply of LP-10 from multiple vendors who have a drug master file with the FDA. It is supplied as a white, lyophilized powder (a pre-liposomal lyophilate) formulated from sphingomyelin phospholipids, and tacrolimus. One vial of LP-10 drug product contains 80mg of tacrolimus and sphingomyelin (10% tacrolimus by weight) and is supplied to a clinic as a powder to be reconstituted with sterile water for injection prior to instillation. Quality control samples from each batch would be submitted for release testing according to established product specifications for identity and purity, residual solvent quantification, sterility assurance, and bacterial endotoxins.

Intellectual Property

Protection of our intellectual property is an important part of our business. On May 5, 2020, we were issued U.S. patent number 10,639,278 (the “278 Patent”) from the United States Patent and Trademark Office (“USPTO”), which does not expire until July 11, 2035. On June 14, 2022, we were issued U.S. patent number 11,357,725 (the “725 Patent”), which does not expire until November 9, 2034. Further, on May 28, 2020, we were issued one patent in Australia (No. 2014340137) (the “Australia Patent”), which does not expire until October 22, 2034. On August 23, 2022, we were issued a patent in Canada (No. 2,927,356) (the “Canadian Patent”), which does not expire until October 22, 2034. On June 7, 2023, we were issued a European patent (No. 3060197) (the “European Patent”), which does not expire until October 22, 2034. The European Patent was nationally validated in Switzerland, Spain, and Great Britain and a request for unitary effect was granted covering Austria, Belgium, Bulgaria, Denmark, Estonia, Finland, France, Germany, Italy, Latvia, Lithuania, Luxembourg, Malta, The Netherlands, Portugal, Slovenia, and Sweden. Each of the aforementioned patents cover aspects of our Platform technology relating to uses for delivering hydrophobic therapeutic, prophylactic or diagnostic agents to the body cavities, including LP-10 and LP-310, as well as methods of making formulations for delivering such hydrophobic agents. We are also actively prosecuting corresponding utility patent applications in the U.S. We intend to seek additional patent applications in the U.S. as well as in other jurisdictions, such as Europe, for our other proprietary technologies relating to intravesical immunoglobulin delivery and any future discoveries that we deem appropriate to protect. A U.S. patent application on the intravesical immunoglobulin delivery formulation is pending. Regulatory exclusivity should also be available in those countries in which regulatory approval is required, including Europe, Canada and others.

In addition to patents, we rely on trade secrets and know-how relating to our Platform technology and the product candidates we are developing using our Platform to develop and maintain our competitive position. However, trade secrets can be difficult to protect. We intend to protect our proprietary technology and processes, and maintain ownership of certain technologies, in part, through licenses as well as confidentiality agreements and invention assignment agreements with our employees, consultants and commercial partners.

Government Regulation Applicable to Our Business

In the United States, the FDA regulates drug products, including liposomally delivered products, under the FDCA, the Public Health Service Act (the “PHSA”), and regulations and guidance implementing these laws. The FDCA, PHSA and their corresponding regulations govern, among other things, the testing, manufacturing, safety, efficacy, labeling, packaging, storage, record keeping, distribution, reporting, advertising and other promotional practices involving drug products. Applications to the FDA are required before conducting human clinical testing of drug products. FDA approval also must be obtained before marketing of drug products. The process of obtaining regulatory approvals and the subsequent compliance with appropriate federal, state, local and foreign statutes and regulations require the expenditure of substantial time and financial resources and we may not be able to obtain the required regulatory approvals to successfully develop and commercialize our product candidates, including LP-10, LP-310, LP-410 and LP-50.

U.S. Drug Development Process

The FDA must approve a product candidate before it may be legally marketed in the United States. The process required by the FDA before a drug product candidate may be marketed in the United States generally involves the following:

| ● | completion of preclinical laboratory tests and in vivo studies in accordance with the FDA’s current good laboratory practice (“GLP”) regulations and applicable requirements for the humane use of laboratory animals or other applicable regulations; |

| ● | submission to the FDA of an application for an IND exemption, which allows human clinical trials to begin unless FDA objects within 30 days; |

| ● | approval by an independent IRB reviewing each clinical site before each clinical trial may be initiated; |

| ● | performance of adequate and well-controlled human clinical trials according to the FDA’s current GCP regulations, and any additional requirements for the protection of human research subjects and their health information, to establish the safety and efficacy of the proposed drug product candidate for its intended use; |

| ● | preparation and submission to the FDA of an NDA for marketing approval that includes substantial evidence of safety, purity and potency from results of nonclinical testing and clinical trials; |

| ● | review of the product by an FDA advisory committee, if applicable; |

| ● | satisfactory completion of an FDA inspection of the manufacturing facility or facilities where the drug product candidate is produced to assess compliance with cGMP requirements and to assure that the facilities, methods and controls are adequate to preserve the drug product candidate’s identity, safety, strength, quality, potency and purity; |

| ● | potential FDA audit of the nonclinical and clinical trial sites that generated the data in support of the NDA; and |

| ● | payment of user fees and FDA review and approval, or licensure, of the NDA. |

Before testing any drug product candidate in humans, including a liposomal intravesical product candidate, the product candidate must undergo preclinical testing. Preclinical tests, also referred to as nonclinical studies, include laboratory evaluations of product chemistry, toxicity and formulation, as well as in vivo studies to assess the potential safety and activity of the product candidate and to establish a rationale for therapeutic use. The conduct of the preclinical tests must comply with federal regulations and requirements including GLPs.

Concurrent with clinical trials, companies usually must complete some long-term preclinical testing, such as animal studies of reproductive adverse events and carcinogenicity, and must also develop additional information about the chemistry and physical characteristics of the drug and finalize a process for manufacturing the drug in commercial quantities in accordance with cGMP requirements. The manufacturing process must be capable of consistently producing quality batches of the drug candidate and, among other things, the manufacturer must develop methods for testing the identity, strength, quality and purity of the final drug product. Additionally, appropriate packaging must be selected and tested and stability studies must be conducted to demonstrate that the drug candidate does not undergo unacceptable deterioration over its shelf life.

The clinical trial sponsor must submit the results of the preclinical tests, together with manufacturing information, analytical data, any available clinical data or literature and a proposed clinical protocol, to the FDA as part of an IND. Some preclinical testing may continue even after the IND is submitted. The IND automatically becomes effective 30 days after receipt by the FDA, unless the FDA places the clinical trial on a clinical hold. In such a case, the IND sponsor and the FDA must resolve any outstanding concerns before the clinical trial can begin. The FDA also may impose clinical holds on a drug product candidate at any time before or during clinical trials due to safety concerns or non-compliance. If the FDA imposes a clinical hold, trials may not recommence without FDA authorization and then only under terms authorized by the FDA.

Human Clinical Trials Under an IND