SANGOMA TECHNOLOGIES CORPORATION Notice of Annual and Special Meeting of Shareholders and Management Information Circular November 5, 2025 To be held on December 16, 2025 via live audio webcast at 11:00 a.m. (Toronto time)

LETTER TO THE SHAREHOLDERS Dear Shareholders, As we reflect on Fiscal 2025, I am pleased to share how Sangoma continues to evolve into a more focused, efficient, and strategically aligned company. This past year was one of continued transformation — one in which we executed meaningfully against our operational priorities, improved internal systems, and took important steps to position ourselves for sustainable, long-term growth. Looking ahead, we have entered Fiscal 2026 with confidence in our direction and a disciplined focus on execution. While we expect revenue to be more tempered in the first half of the year, we are encouraged by the momentum building across our sales funnel and pipeline, and we anticipate growth accelerating in the back half of the year, all supported by our strong results in the first quarter. This trajectory reflects the foundational work we have done to optimize our structure, deepen our service capabilities, and enhance how we go to market. We remain committed to our strategic priorities: growing our services-led revenue base, driving operational efficiencies, and focusing our portfolio on high-value, scalable opportunities. Our efforts to simplify the business and reduce leverage are helping build a stronger foundation, one that enables flexibility and reinvestment in innovation. Most importantly, the platform we’ve built is allowing us to better serve our customers, deepen our vertical capabilities, and create enduring value. I am incredibly proud of the team at Sangoma. Their resilience, dedication, and focus have helped us navigate complexity while laying the groundwork for future momentum. I also want to thank you — our shareholders — for your continued support and belief in our vision. As we continue into Fiscal 2026, we do so with greater focus, improved agility, and a commitment to delivering on our potential. I look forward to keeping you updated on our progress. Warm regards, "Charles Salameh" CEO & Director Sangoma Technologies Corporation

TABLE OF CONTENTS NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS ................................................. 1 MANAGEMENT INFORMATION CIRCULAR ................................................................................................ 2 EXCHANGE RATE ............................................................................................................................................. 2 PROXY SOLICITATION AND VOTING ........................................................................................................... 2 VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES .................................. 5 PRINCIPAL HOLDERS OF VOTING SHARES ............................................................................................. 5 MATTERS TO BE ACTED UPON AT THE MEETING .................................................................................. 6 1 Presentation of Financial Statements ................................................................................................ 6 2 Election of Directors .............................................................................................................................. 6 3 Appointment of Auditors ....................................................................................................................... 11 4 Approval of Amended and Restated Omnibus Plan ........................................................................ 11 5 Other Business ...................................................................................................................................... 12 COMPENSATION ............................................................................................................................................... 12 1 Base Salary ............................................................................................................................................ 18 2 Short-Term Incentives ........................................................................................................................... 19 3 Long Term Incentive Plan .................................................................................................................... 20 SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS .............. 27 REPORT ON CORPORATE GOVERNANCE ............................................................................................... 28 EQUITY INCENTIVE PLANS ........................................................................................................................... 32 NASDAQ CORPORATE GOVERNANCE ...................................................................................................... 43 INDEBTEDNESS OF DIRECTORS, EXECUTIVE OFFICERS AND SENIOR OFFICERS ................... 43 INDEMNIFICATION AND DIRECTORS’ AND OFFICERS’ LIABILITY INSURANCE ............................. 43 INTEREST OF INFORMED PERSONS IN MATERIAL TRANSACTIONS ............................................... 43 INTEREST OF CERTAIN PERSONS IN MATTERS TO BE ACTED UPON ............................................ 44 SCHEDULE A AMENDED AND RESTATED OMNIBUS PLAN RESOLUTION ...................................... A-1 SCHEDULE B AMENDED AND RESTATED OMNIBUS PLAN ................................................................ B-1 SCHEDULE C BOARD MANDATE ................................................................................................................. C-1

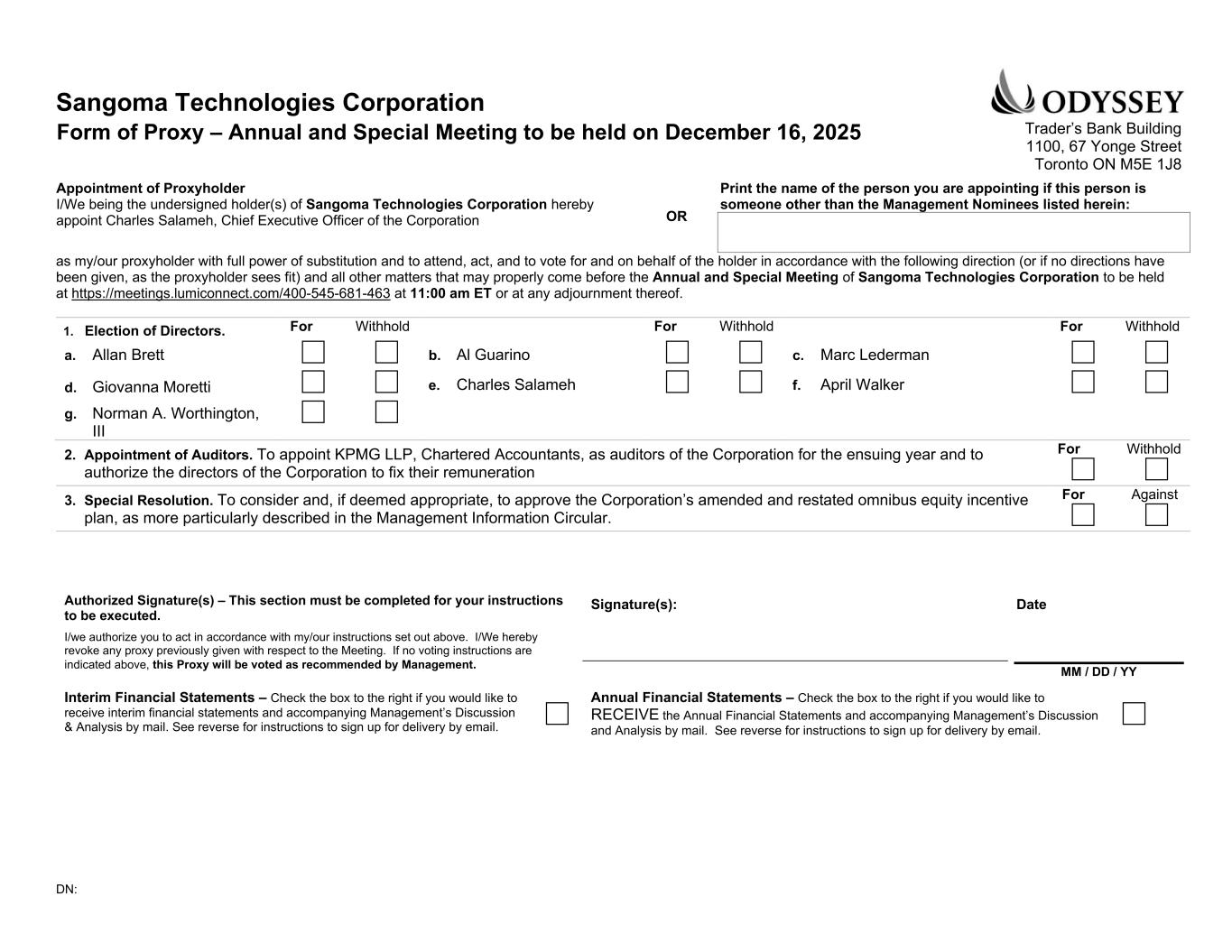

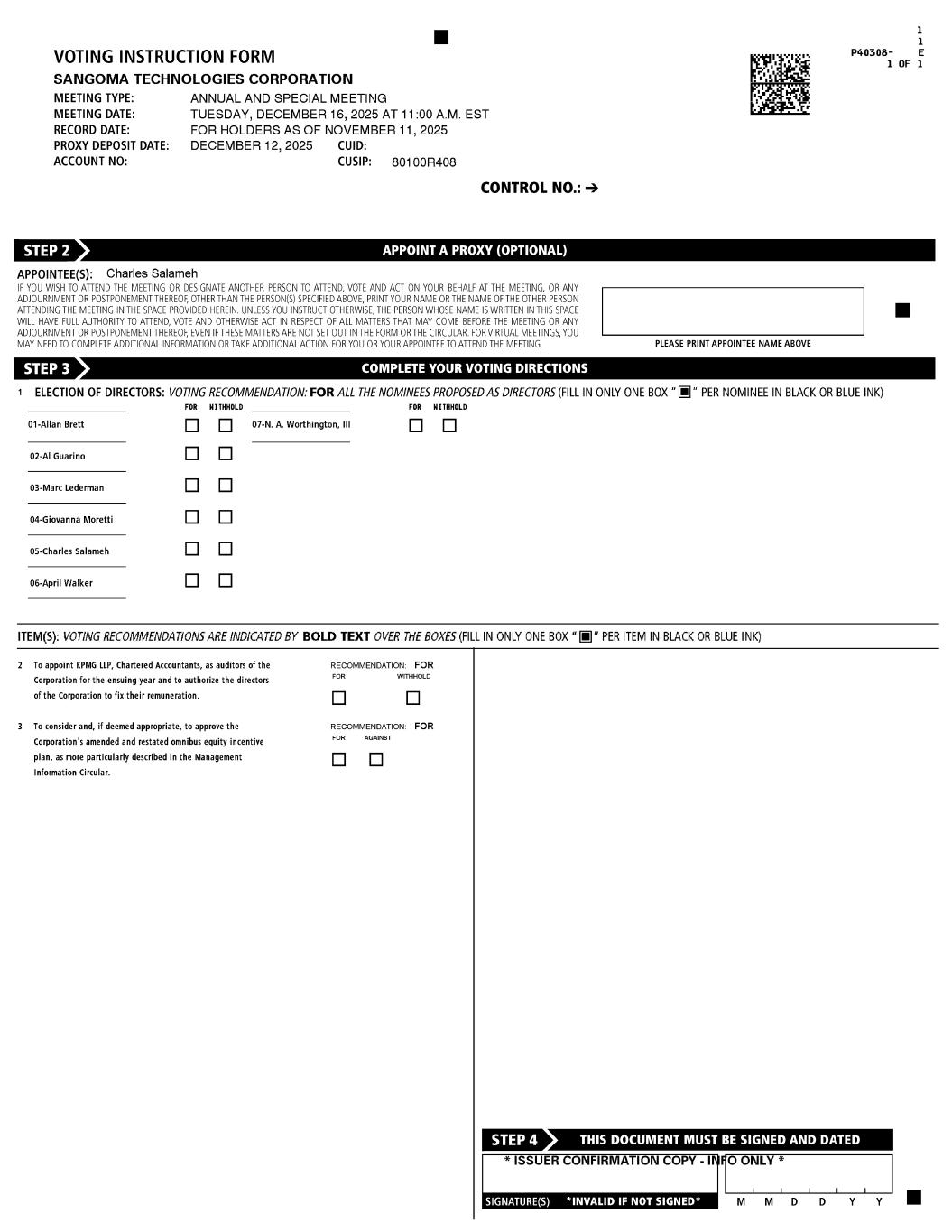

1 SANGOMA TECHNOLOGIES CORPORATION Suite 3400 Bay-Adelaide Centre, 333 Bay St Toronto, ON M5H 2S7 NOTICE OF ANNUAL AND SPECIAL MEETING OF SHAREHOLDERS NOTICE IS HEREBY GIVEN that the annual and special meeting (the “Meeting”) of holders (the “Shareholders”) of common shares (the “Common Shares”) of Sangoma Technologies Corporation (the “Corporation”) will be held virtually via live audio webcast at https://meetings.lumiconnect.com/400- 545-681-463 on Tuesday, December 16, 2025 at 11:00 a.m. (Toronto time) for the following purposes: (a) TO RECEIVE the consolidated audited financial statements of the Corporation for the financial year ended June 30, 2025, and the auditor’s report thereon; (b) TO ELECT members of the board of directors of the Corporation; (c) TO APPOINT KPMG LLP, Chartered Accountants, as auditors of the Corporation for the ensuing year and to authorize the directors of the Corporation to fix their remuneration; (d) TO CONSIDER and, if deemed appropriate, to approve the Corporation's amended and restated omnibus equity incentive plan, as more particularly described in the Circular; and (e) TO TRANSACT such other business as may properly be brought before the Meeting or any postponement or adjournment thereof. Shareholders of record at the close of business on November 11, 2025 (the “Record Date”) will be entitled to vote at the Meeting. Shareholders who are unable to be present in person at the Meeting are requested to sign, date and return the form of proxy or voting instruction form received in accordance with the instructions provided. It is important that Shareholders read the accompanying management information circular carefully. The Circular provides additional information relating to the matters to be dealt with at the Meeting and forms part of this notice. DATED at Toronto, Ontario this 5th day of November, 2025. BY ORDER OF THE BOARD OF DIRECTORS Per: “Charles Salameh” Name: Charles Salameh Title: Chief Executive Officer and Director

(This page has been left blank intentionally.)

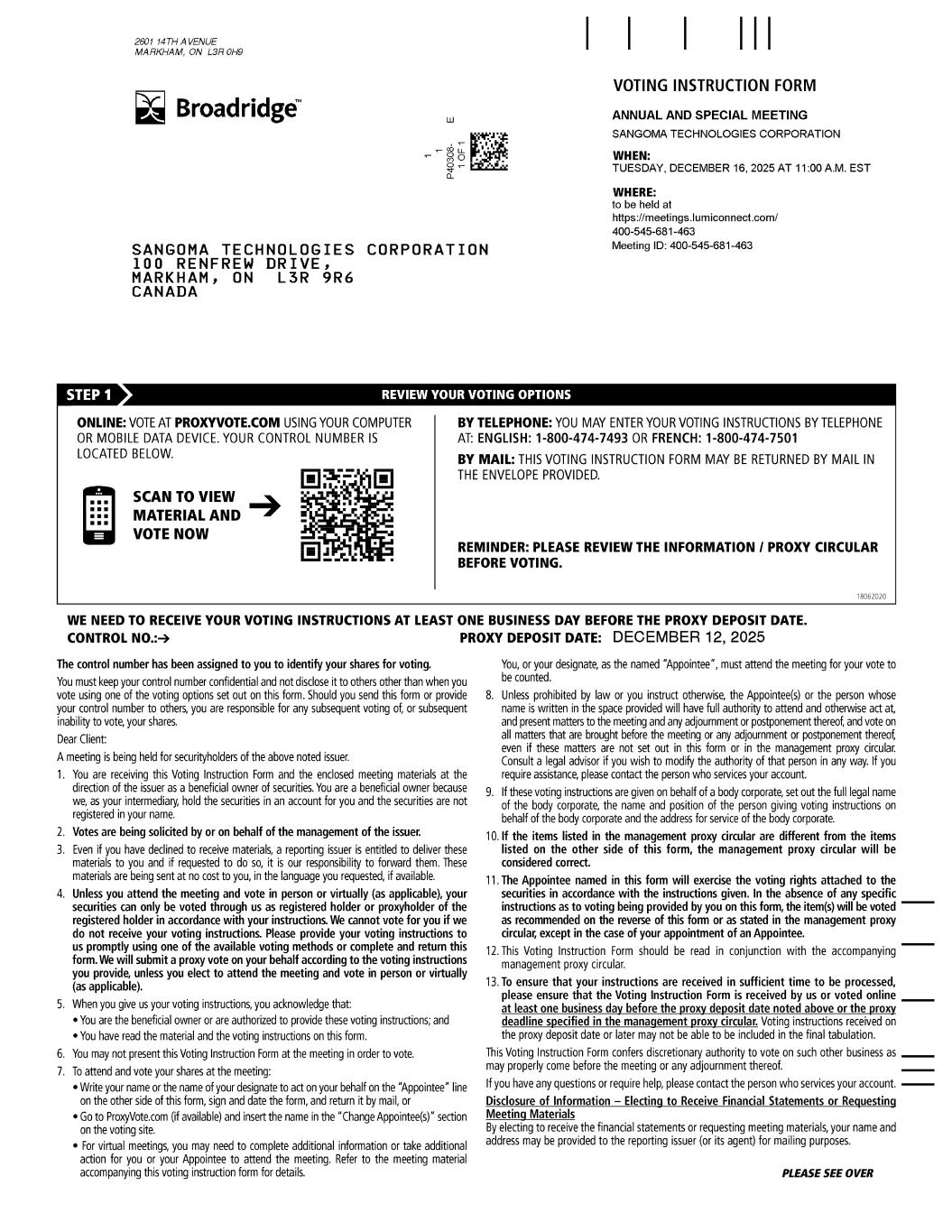

2 MANAGEMENT INFORMATION CIRCULAR Unless otherwise noted or the context otherwise indicates, the “Corporation”, “Sangoma”, “us”, “we” or “our” refer to Sangoma Technologies Corporation, together with its direct and indirect subsidiaries and predecessors or other entities controlled by it or them on a combined basis. Unless otherwise indicated herein, all references to dollars, “$” or “US$” are to U.S. dollars and all references to “C$” are to Canadian dollars. The board of directors of the Corporation is referred to herein as the “Board” or the “Directors”, and a “Director” means any one of them. Except as otherwise stated in this Management Information Circular (the “Circular”), the information contained herein is given as of November 5, 2025. No person is authorized to give any information or make any representation other than those contained in this Circular and, if given or made, such information or representation should not be relied upon as having been authorized by the Corporation. The delivery of this Circular shall not, under any circumstances, create an implication that there has not been any change in the information set forth herein since the date of this Circular. EXCHANGE RATE In this Circular, unless otherwise noted or the context otherwise indicates, all Canadian dollar amounts have been converted to U.S. dollars at the following Bank of Canada average exchange rates: Fiscal 2025: C$1.00 = US$0.7170 Fiscal 2024: C$1.00 = US$0.7380 Fiscal 2023: C$1.00 = US$0.7467 PROXY SOLICITATION AND VOTING Delivery of Proxy-Related Materials The Corporation is directly sending proxy-related materials to non-objecting beneficial owners. Management of the Corporation does not intend to pay for intermediaries to forward to objecting beneficial owners under National Instrument 54-101 – Communication With Beneficial Owners of Securities of a Reporting Issuer the proxy-related materials and Form 54-101F7 (Request for Voting Instructions Made by Intermediary) and, in the case of an objecting beneficial owner, the objecting beneficial owner will not receive the materials unless the objecting beneficial owner’s intermediary assumes the cost of delivery. Solicitation of Proxies This Circular is being furnished in connection with the solicitation by the management of the Corporation of proxies to be used at the Annual and Special Meeting, to be held on December 16, 2025, at the time and place and for the purposes set forth in the Notice of the Annual and Special Meeting of Shareholders (the “Notice”) or any adjournment or postponement thereof. The solicitation will be primarily by mail, but proxies may also be solicited personally or by telephone or electronic means by directors, officers or employees of the Corporation. None of these individuals will receive extra compensation for such efforts. The cost of solicitation will be borne by the Corporation. The Corporation has distributed, or made available for distribution, copies of the Notice, Circular and form of proxy to clearing agencies, securities dealers, banks and trust companies or their nominees (“Intermediaries”) for distribution to holders of Common Shares (“Beneficial Holders”) whose Common

3 Shares are held by or in custody of such Intermediaries. Such Intermediaries are required to forward such documents to Beneficial Holders. The solicitation of proxies from Beneficial Holders will be carried out by the Intermediaries or by the Corporation if the names and addresses of the Beneficial Holders are provided by the Intermediaries. The Corporation will reimburse reasonable expenses incurred by the Intermediaries in connection with the distribution of these materials. Virtual Meeting The Corporation is holding the Meeting as a completely virtual meeting, which will be conducted via live webcast, where all Shareholders regardless of geographic location and equity ownership will have an equal opportunity to participate at the Meeting and engage with Directors of the Corporation and management as well as other Shareholders. Shareholders will not be able to attend the Meeting in person. Registered Shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting online at https://meetings.lumiconnect.com/400-545-681-463. Beneficial Holders who have not duly appointed themselves as proxyholder will be able to attend as a guest and view the webcast but not be able to participate or vote at the Meeting. Voting at the Meeting Registered Shareholders may vote at the Meeting by completing a ballot online during the Meeting, as further described below. See "Participation in the Meeting". Beneficial Holders who have not duly appointed themselves as proxyholder will not be able to attend, participate or vote at the Meeting. This is because the Corporation and its transfer agent do not have a record of the Beneficial Holders of the Corporation, and, as a result, will have no knowledge of your shareholdings or entitlement to vote, unless you appoint yourself as proxyholder. If you are a Beneficial Holder and wish to vote at the Meeting, you have to appoint yourself as proxyholder, by inserting your own name in the space provided on the voting instruction form sent to you and must follow all of the applicable instructions provided by your intermediary. See "Appointment of a Third Party as Proxy" and "Participation in the Meeting". Appointment of a Third Party as Proxy The following applies to Shareholders who wish to appoint a person (a "third party proxyholder") other than the management nominees set forth in the form of proxy or voting instruction form as proxyholder, including Beneficial Holders who wish to appoint themselves as proxyholder to attend, participate or vote at the Meeting. Shareholders who wish to appoint a third party proxyholder to attend, participate or vote at the Meeting as their proxy and vote their Shares MUST submit their proxy or voting instruction form (as applicable) appointing such third party proxyholder AND register the third party proxyholder, as described below. Registering your proxyholder is an additional step to be completed AFTER you have submitted your proxy or voting instruction form. Failure to register the proxyholder will result in the proxyholder not receiving a Username to attend, participate or vote at the Meeting. • Step 1: Submit your proxy or voting instruction form: To appoint a third party proxyholder, insert such person's name in the blank space provided in the form of proxy or voting instruction form (if permitted) and follow the instructions for submitting such form of proxy or voting instruction form. This must be completed prior to registering such proxyholder, which is an additional step to be completed once you have submitted your form of proxy or voting instruction form. If you are a Beneficial Holder located in the United States, you must also provide Odyssey with a duly completed legal proxy if you wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as your proxyholder. See below under this section for additional details. • Step 2: Register your proxyholder: To register a proxyholder, shareholders MUST send an email to appointee@odysseytrust.com by 11:00am ET on December 12, 2025 and provide Odyssey with the required proxyholder contact information, amount of shares appointed, name in which the shares are registered if they are a Registered Shareholder, or name of broker where the shares are held if a Beneficial Holder, so that Odyssey may provide the proxyholder with a Username via email. Without a Username, proxyholders will not be able to attend, participate or vote at the Meeting.

4 If you are a Beneficial Holder and wish to attend, participate or vote at the Meeting, you have to insert your own name in the space provided on the voting instruction form sent to you by your intermediary, follow all of the applicable instructions provided by your intermediary AND register yourself as your proxyholder, as described above. By doing so, you are instructing your intermediary to appoint you as proxyholder. It is important that you comply with the signature and return instructions provided by your Intermediary. Please also see further instructions below under the heading "Participation in the Meeting". Legal Proxy – US Beneficial Shareholders If you are a Beneficial Holder located in the United States and wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as your proxyholder, in addition to the steps described above and below under "Participation in the Meeting", you must obtain a valid legal proxy from your Intermediary. Follow the instructions from your Intermediary included with the legal proxy form and the voting information form sent to you, or contact your Intermediary to request a legal proxy form or a legal proxy if you have not received one. After obtaining a valid legal proxy from your Intermediary, you must then submit such legal proxy to Odyssey. Requests for registration from Beneficial Holders located in the United States that wish to attend, participate or vote at the Meeting or, if permitted, appoint a third party as their proxyholder must be sent by e-mail to appointee@odysseytrust.com and received by 11:00 am ET on December 12, 2025. Revoking your Proxy A proxy is revocable. If you have given a proxy, you (or your attorney authorized in writing) may revoke the proxy by giving notice of the revocation in writing to Odyssey by e-mail to appointee@odysseytrust.com at any time up to and including the last business day before the Meeting. The notice of the revocation must be signed as follows: (a) if you are an individual, then the notice must be signed by you or your legal personal representative or trustee in bankruptcy and (b) if you are a corporation, then the notice must be signed by the corporation or by a representative duly appointed for the corporation. Participation in the Meeting The Corporation is holding the Meeting as a completely virtual meeting, which will be conducted via live webcast. Shareholders will not be able to attend the Meeting in person. In order to attend, participate or vote at the Meeting (including for voting and asking questions at the Meeting), Shareholders must have a valid Username. Registered Shareholders and duly appointed proxyholders will be able to attend, participate and vote at the Meeting online at https://meetings.lumiconnect.com/400-545-681-463. Such persons may then enter the Meeting by clicking "I have a login" and entering a Username and Password before the start of the Meeting: • Registered Shareholders: The control number located on the form of proxy (or in the email notification you received) is the Username. The Password to the Meeting is "sangoma2025" (case sensitive). If as a Registered Shareholder you are using your control number to login to the Meeting and you have previously voted, you do not need to vote again when the polls open. By voting at the meeting, you will revoke your previous voting instructions received prior to voting cutoff. • Duly appointed proxyholders: Odyssey will provide the proxyholder with a Username by e-mail after the voting deadline has passed. The Password to the Meeting is "sangoma2025" (case sensitive). Only Registered Shareholders and duly appointed proxyholders will be entitled to attend, participate and vote at the Meeting. Beneficial Holders who have not duly appointed themselves as proxyholder will be able to attend the meeting as a guest but not be able to participate or vote at the Meeting. Shareholders who wish to appoint a third party proxyholder to represent them at the Meeting (including Beneficial Holders who wish to appoint themselves as proxyholder to attend, participate or vote at the Meeting) MUST submit their duly completed proxy or voting instruction form AND register the proxyholder. See "Appointment of a Third Party as Proxy".

5 Voting of Proxies The Common Shares represented by the Form of Proxy will be voted or withheld from voting in accordance with the instructions of the Shareholder, and if the Shareholder specifies a choice with respect to any matter to be acted upon, the Common Shares will be voted accordingly. In the absence of such specification, such Common Shares will be voted at the Meeting as follows: • FOR the election of those persons listed in this Circular as the proposed Directors for the ensuing year; • FOR the appointment of KPMG LLP, Chartered Accountants, as auditor of the Corporation for the ensuing year and to authorize the Board to fix the auditor’s remuneration; and • FOR the approval of the amended and restated omnibus equity incentive plan. For more information on these issues, please see the section entitled “Matters to Be Acted Upon at the Meeting” in this Circular. The persons appointed under the Form of Proxy are conferred with discretionary authority with respect to amendments to or variations of matters identified in the Form of Proxy and the Notice of Meeting and with respect to any other matters which may properly brought before the Meeting or any adjournment or postponement thereof, in each instance, to the extent permitted by law, whether or not the amendment, variation or other matter that comes before the Meeting is routine and whether or not the amendment, variation or other matter that comes before the Meeting is contested. In the event that amendments or variations to matters identified in the Notice of Meeting are properly brought before the Meeting, it is the intention of the persons designated in the Form of Proxy to vote in accordance with their best judgment on such matter or business. As at the date of this Circular, the Directors know of no such amendments, variations or other matters. Quorum A quorum for the transaction of business at the Meeting or any adjournment or postponement thereof shall be two persons present and entitled to vote at the Meeting. VOTING SECURITIES AND PRINCIPAL HOLDERS OF VOTING SECURITIES At the Meeting, each holder of Common Shares of record at the close of business on the Record Date will be entitled to one vote for each Common Share held on all matters proposed to come before the Meeting. The Corporation is authorized to issue an unlimited number of Common Shares. The Common Shares are listed and posted for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “STC” and the Nasdaq Stock Market (“NASDAQ”) under the symbol “SANG”. As of the date of this Circular, there are 33,139,165 Common Shares issued and outstanding. PRINCIPAL HOLDERS OF VOTING SHARES To the knowledge of the Directors and executive officers of the Corporation, as of the date hereof, the only person or company that beneficially owns, or controls or directs, directly or indirectly, voting securities of the Corporation carrying 10% or more of the voting rights attached to the issued and outstanding Common Shares is: Name Type of Ownership Common Shares Percentage of Class Norman A. Worthington(1) Beneficial 6,431,733 19.41% Mawer Investment Management Ltd.(2) Beneficial 3,987,460 12.03% _______________ Notes: (1) Mr. Worthington beneficially owns, controls or directs, directly or indirectly all of the equity interests of Old Town Gelato, LLC, and Star2Star Holdings, LLC which hold 6,431,714 and 19 Common Shares, respectively (19.4%).

6 (2) Reflects Mawer Investment Management Ltd.'s beneficial holdings as set out in its Alternative Monthly Report dated as of September 30, 2025. MATTERS TO BE ACTED UPON AT THE MEETING 1 Presentation of Financial Statements The financial statements of the Corporation for the year ended June 30, 2025 and the auditors’ report thereon accompanying this Information Circular will be placed before the Shareholders at the Meeting. No formal action will be taken at the Meeting to approve the financial statements. 2 Election of Directors The Corporation’s articles provide that the Board is to consist of a minimum of three and a maximum of nine Directors, with the actual number to be determined from time to time by the Board. The Board currently consists of seven Directors and the present term of office of each Director of the Corporation will expire upon the election of Directors at the Meeting. It is proposed that each of the seven (7) persons whose name appears below under the heading “Director Nominees” be elected as a Director of the Corporation to serve, until the close of the next annual meeting of Shareholders or until his successor is elected or appointed, unless such office is earlier vacated in accordance with the Corporation’s by-laws. The persons named in the Form of Proxy, if not expressly directed to the contrary in such Form of Proxy, intend to vote for the election, as Directors, of the proposed nominees whose names are set out below under the heading “Director Nominees”. It is not contemplated that any of the proposed nominees will be unable to serve as a Director but, if that should occur for any reason prior to the Meeting, the persons named in the Form of Proxy reserve the right to vote for another nominee at their discretion. Majority Voting Policy In accordance with the requirements of the TSX, the Board has adopted a majority voting policy (the “Majority Voting Policy”), which requires that in an uncontested election of directors, if any nominee does not receive a greater number of votes “for” than votes “withheld” at a meeting of Shareholders, such nominee shall offer his or her resignation as a director to the Board promptly following the meeting of Shareholders at which the Director was elected. The Compensation, Nominating and Governance Committee (the “CNGC”) will consider such offer and make a recommendation to the Board as to whether or not to accept it. The Board shall accept the offer of resignation absent exceptional circumstances. The Board will make its decision within 90 days following the meeting of Shareholders and announce it in a press release. Should the Board determine not to accept the resignation, the press release will state the reasons for that decision. A Director who tenders a resignation pursuant to the Majority Voting Policy will not be part of any deliberations of any Board committee (including the CNGC) or the Board pertaining to the resignation offer. Advance Notice Provisions Amended and Restated By-Law No. 2 provides that Shareholders seeking to nominate candidates for election as Directors must provide timely written notice to Sangoma’s corporate secretary at Sangoma’s principal executive offices. The purpose of these provisions is to (i) ensure that all Shareholders receive adequate notice of Director nominations and sufficient time and information with respect to all nominees to make appropriate deliberations and register an informed vote; and (ii) facilitate an orderly and efficient process for annual or special meetings of Shareholders. Amended and Restated By-Law No. 2 fixes the deadline by which Shareholders must submit Director nominations to Sangoma prior to any annual or special meeting of Shareholders and sets forth the information that a Shareholder must include in a timely written notice to Sangoma for any Director nominee to be eligible for election at such annual or special meeting of Shareholders.

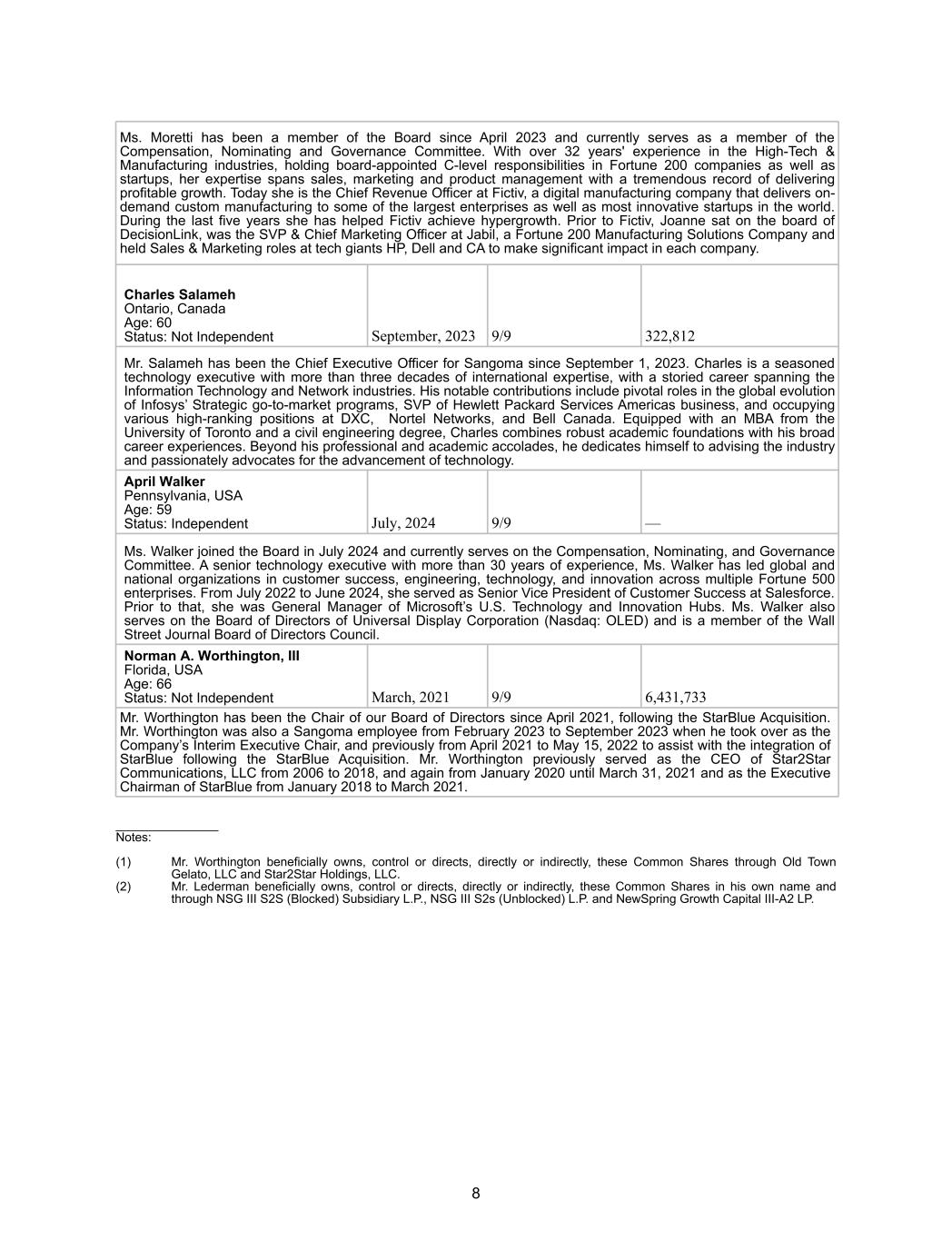

To be timely, a Shareholder’s notice must be received (i) in the case of an annual meeting of Shareholders, not less than 30 days prior to the date of the annual meeting; provided, however, that in the event that the annual meeting of Shareholders is to be held on a date that is less than 50 days after the date (the “Notice Date”) on which the first public announcement of the date of the annual meeting was made, notice by the Shareholder may be received not later than the close of business on the 10th day following the Notice Date; and (ii) in the case of a special meeting (which is not also an annual meeting) of Shareholders called for the purpose of electing Directors, not later than the close of business on the 15th day following the date on which the first public announcement of the date of the special meeting was made. The Advance Notice By-Law also prescribes the proper written form for a Shareholder’s notice. The Board may, in its sole discretion, waive any requirement under these provisions. About the Nominees The following table sets forth the names of, and certain other biographical information for, the seven individuals proposed to be nominated for election as Directors at the Meeting. As of the date of this Circular, Mr. Worthington, holds approximately 19.4% of the Common Shares issued or issuable to Star2Star Holdings, LLC ("Star2Star Holdings") and Mr. Worthington is therefore entitled to serve as Chair of the Board. Currently, Mr. Worthington serves on the Board pursuant to Star2Star Holdings’ nomination right. Nominee Director Since Board Meeting Attendance Number of Common Shares Beneficially Owned or Controlled Allan Brett Ontario, Canada Age: 57 Status: Independent January, 2017 9/9 51,857 Mr. Brett has been a member of our Board of Directors since January 2017 and currently serves as a member of the Audit Committee. Mr. Brett is a CPA, CA and CBV, and an experienced public company executive who currently serves as the CFO of The Descartes Systems Group Inc., a public company listed on the TSX and Nasdaq. From 1996 to January 2014, Mr. Brett was the CFO at Aastra Technologies Limited, a TSX listed company, through its sale to Mitel Networks Corporation in 2014. Al Guarino Ontario, Canada Age: 69 Status: Independent May, 2014 9/9 40,000 Mr. Guarino is a CPA and has been a member of our Board of Directors since May 2014. Mr. Guarino currently serves as a the Chair of the Audit Committee. Mr. Guarino is the Chief Financial Officer of Physiomed Health, one of Canada’s largest and fastest growing chains of healthcare clinics. He is a significant shareholder in several privately held enterprises ranging from health care, manufacturing, distribution, and automotive. Marc Lederman Pennsylvania, USA Age: 54 Status: Independent March, 2021 9/9 2,022,698 Mr. Lederman has been a member of our Board of Directors since March 2021, following the StarBlue Acquisition. Mr. Lederman currently serves as a member of the Audit Committee as well as Chair of the Compensation, Nominating and Governance Committee. Mr. Lederman is a co-founder of NewSpring Capital and a General Partner of the Firm’s dedicated growth equity funds. He serves as the member of the investment committee of all NewSpring Growth and NewSpring Mezzanine funds. Mr. Lederman has an extensive background in finance, investing, consulting, and accounting and was a Certified Public Accountant. Prior to co-founding NewSpring, he was a Manager in the Business Assurance and Advisory Services Group of Deloitte. Mr. Lederman is an active member of the Mid-Atlantic region’s private equity and venture capital community. Mr. Lederman received a BS in Accountancy from Villanova University and an MBA from The Wharton School of University of the Pennsylvania. Mr. Lederman has served on the board of directors on over a dozen technology and service companies over the past two decades. Giovanna (Joanne) Moretti Texas, USA Age: 63 Status: Independent April, 2023 9/9 — 7

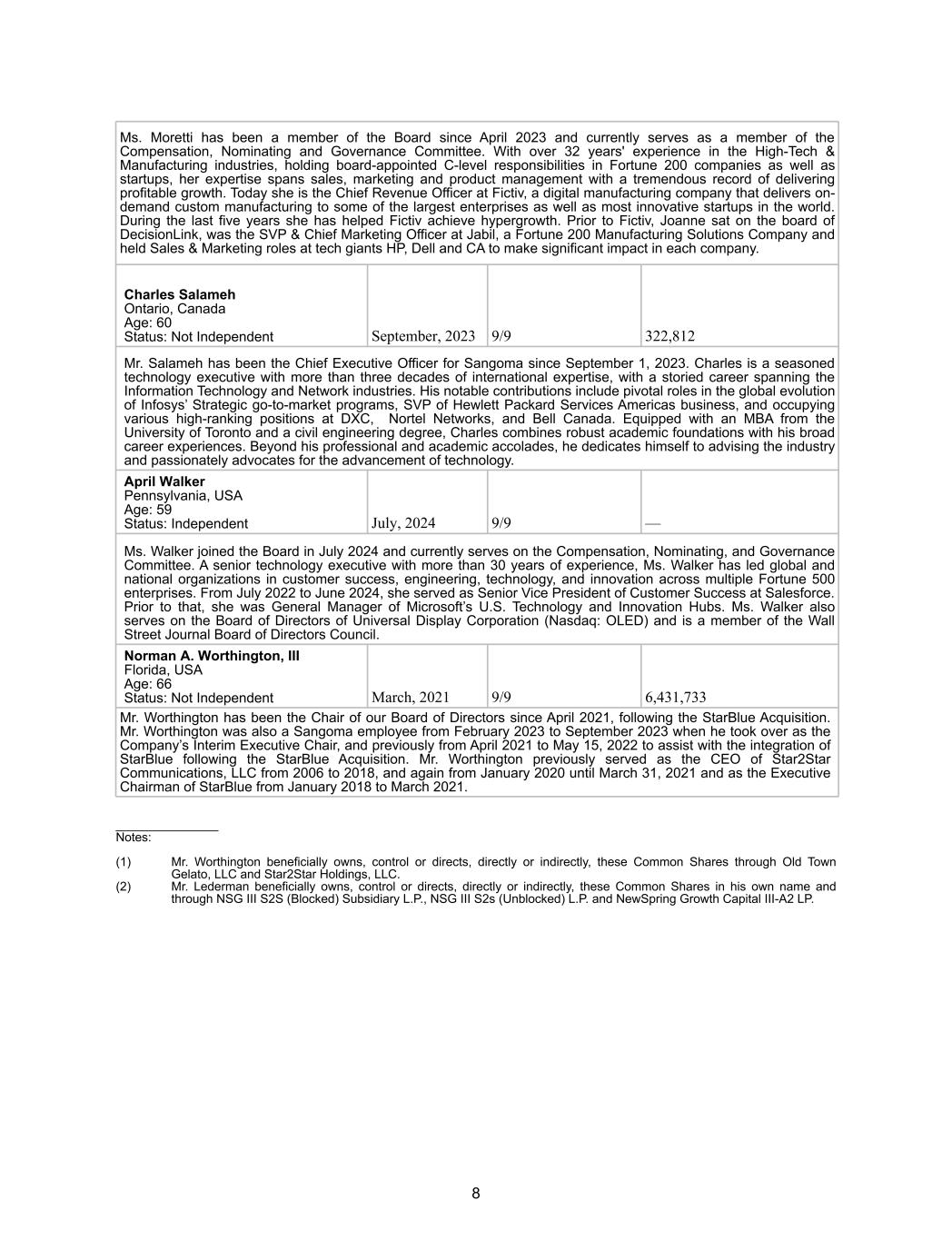

Ms. Moretti has been a member of the Board since April 2023 and currently serves as a member of the Compensation, Nominating and Governance Committee. With over 32 years' experience in the High-Tech & Manufacturing industries, holding board-appointed C-level responsibilities in Fortune 200 companies as well as startups, her expertise spans sales, marketing and product management with a tremendous record of delivering profitable growth. Today she is the Chief Revenue Officer at Fictiv, a digital manufacturing company that delivers on- demand custom manufacturing to some of the largest enterprises as well as most innovative startups in the world. During the last five years she has helped Fictiv achieve hypergrowth. Prior to Fictiv, Joanne sat on the board of DecisionLink, was the SVP & Chief Marketing Officer at Jabil, a Fortune 200 Manufacturing Solutions Company and held Sales & Marketing roles at tech giants HP, Dell and CA to make significant impact in each company. Charles Salameh Ontario, Canada Age: 60 Status: Not Independent September, 2023 9/9 322,812 Mr. Salameh has been the Chief Executive Officer for Sangoma since September 1, 2023. Charles is a seasoned technology executive with more than three decades of international expertise, with a storied career spanning the Information Technology and Network industries. His notable contributions include pivotal roles in the global evolution of Infosys’ Strategic go-to-market programs, SVP of Hewlett Packard Services Americas business, and occupying various high-ranking positions at DXC, Nortel Networks, and Bell Canada. Equipped with an MBA from the University of Toronto and a civil engineering degree, Charles combines robust academic foundations with his broad career experiences. Beyond his professional and academic accolades, he dedicates himself to advising the industry and passionately advocates for the advancement of technology. April Walker Pennsylvania, USA Age: 59 Status: Independent July, 2024 9/9 — Ms. Walker joined the Board in July 2024 and currently serves on the Compensation, Nominating, and Governance Committee. A senior technology executive with more than 30 years of experience, Ms. Walker has led global and national organizations in customer success, engineering, technology, and innovation across multiple Fortune 500 enterprises. From July 2022 to June 2024, she served as Senior Vice President of Customer Success at Salesforce. Prior to that, she was General Manager of Microsoft’s U.S. Technology and Innovation Hubs. Ms. Walker also serves on the Board of Directors of Universal Display Corporation (Nasdaq: OLED) and is a member of the Wall Street Journal Board of Directors Council. Norman A. Worthington, III Florida, USA Age: 66 Status: Not Independent March, 2021 9/9 6,431,733 Mr. Worthington has been the Chair of our Board of Directors since April 2021, following the StarBlue Acquisition. Mr. Worthington was also a Sangoma employee from February 2023 to September 2023 when he took over as the Company’s Interim Executive Chair, and previously from April 2021 to May 15, 2022 to assist with the integration of StarBlue following the StarBlue Acquisition. Mr. Worthington previously served as the CEO of Star2Star Communications, LLC from 2006 to 2018, and again from January 2020 until March 31, 2021 and as the Executive Chairman of StarBlue from January 2018 to March 2021. _______________ Notes: (1) Mr. Worthington beneficially owns, control or directs, directly or indirectly, these Common Shares through Old Town Gelato, LLC and Star2Star Holdings, LLC. (2) Mr. Lederman beneficially owns, control or directs, directly or indirectly, these Common Shares in his own name and through NSG III S2S (Blocked) Subsidiary L.P., NSG III S2s (Unblocked) L.P. and NewSpring Growth Capital III-A2 LP. 8

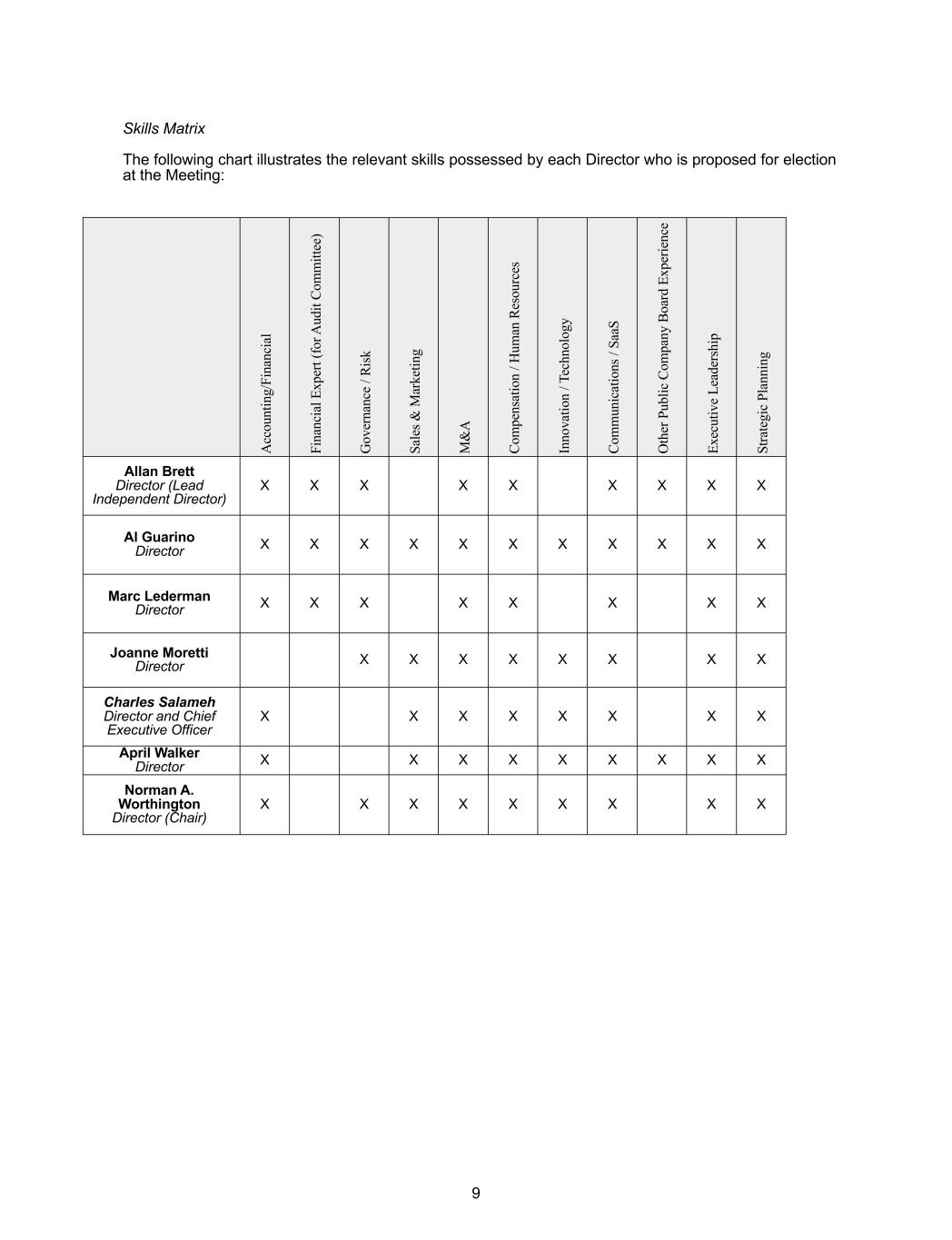

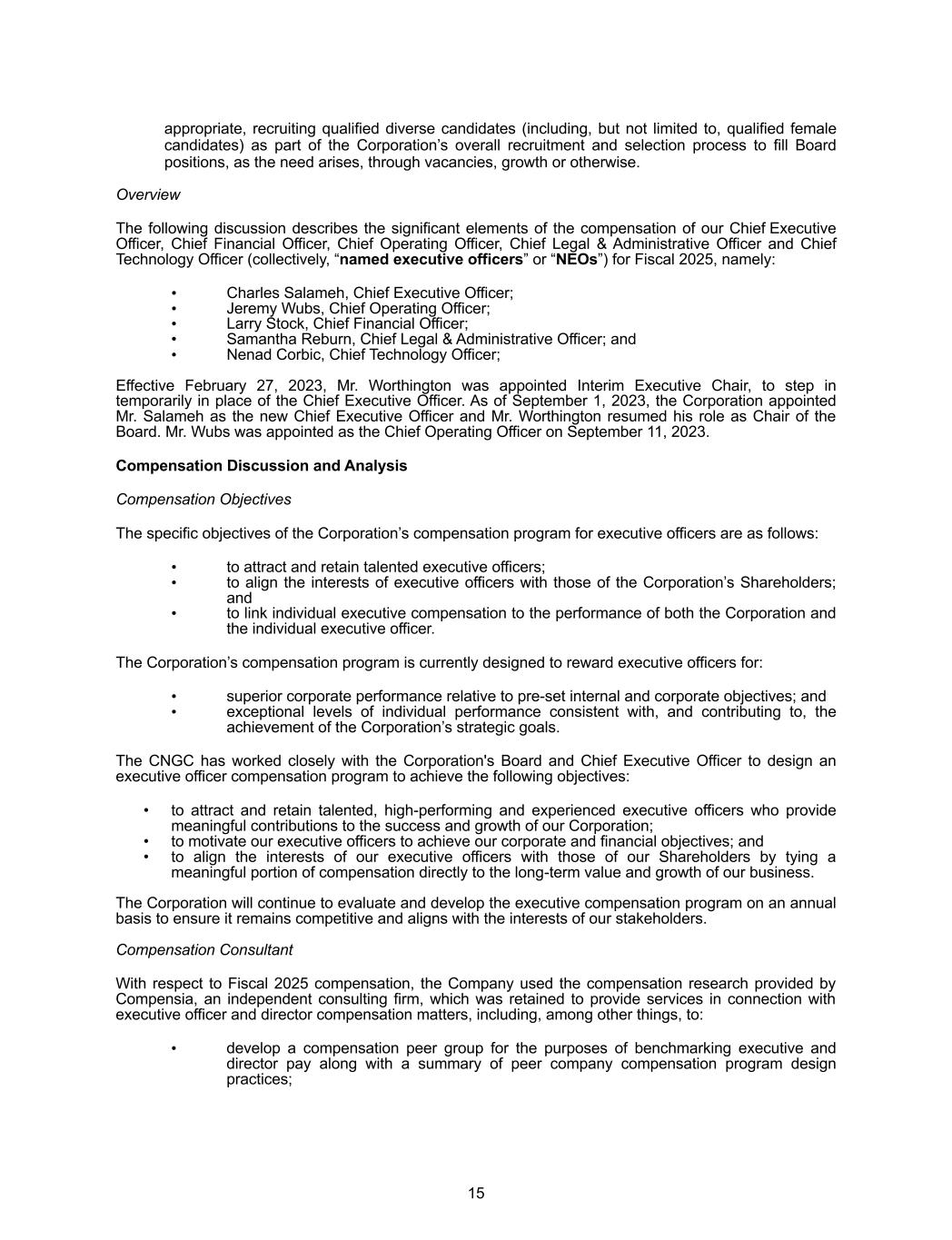

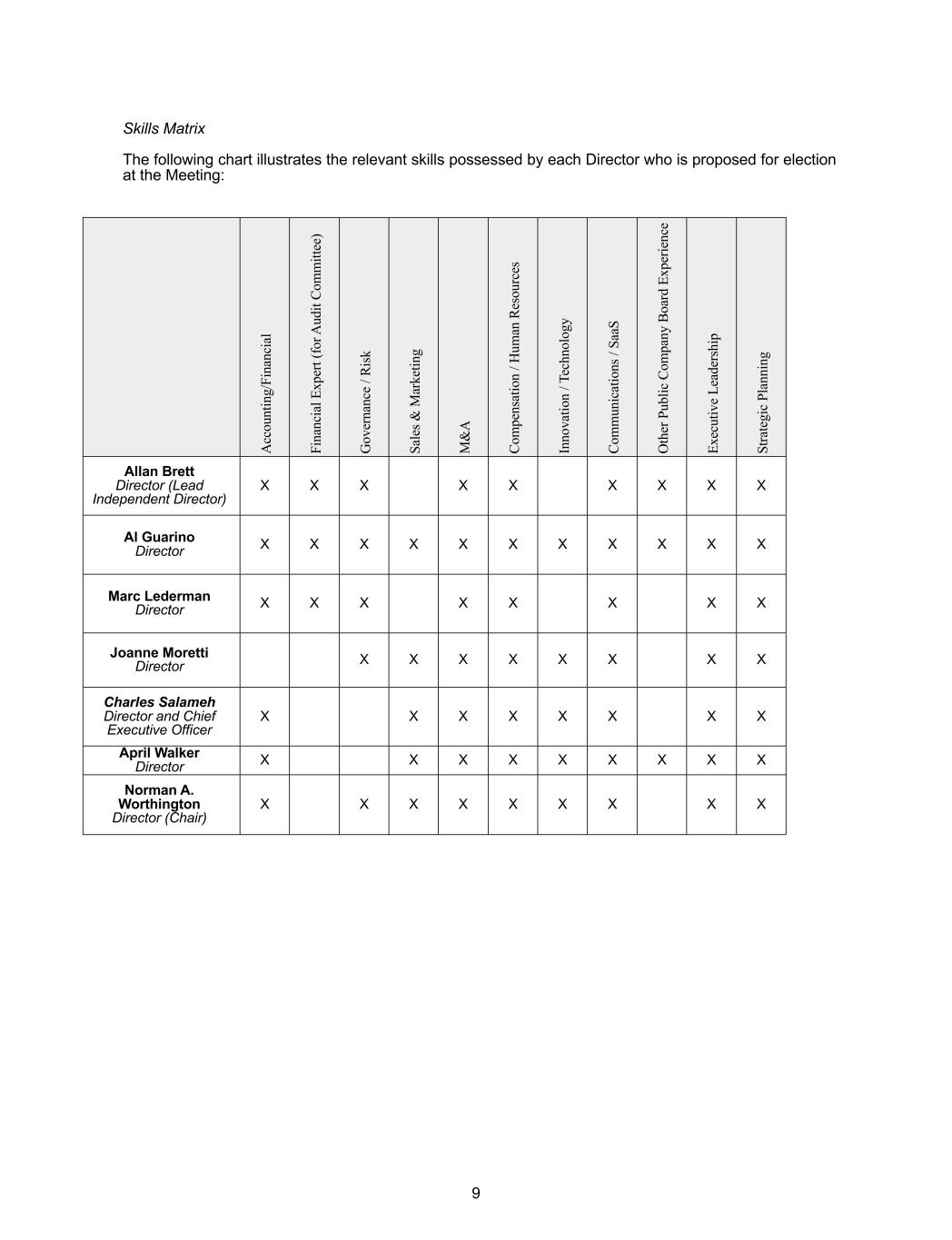

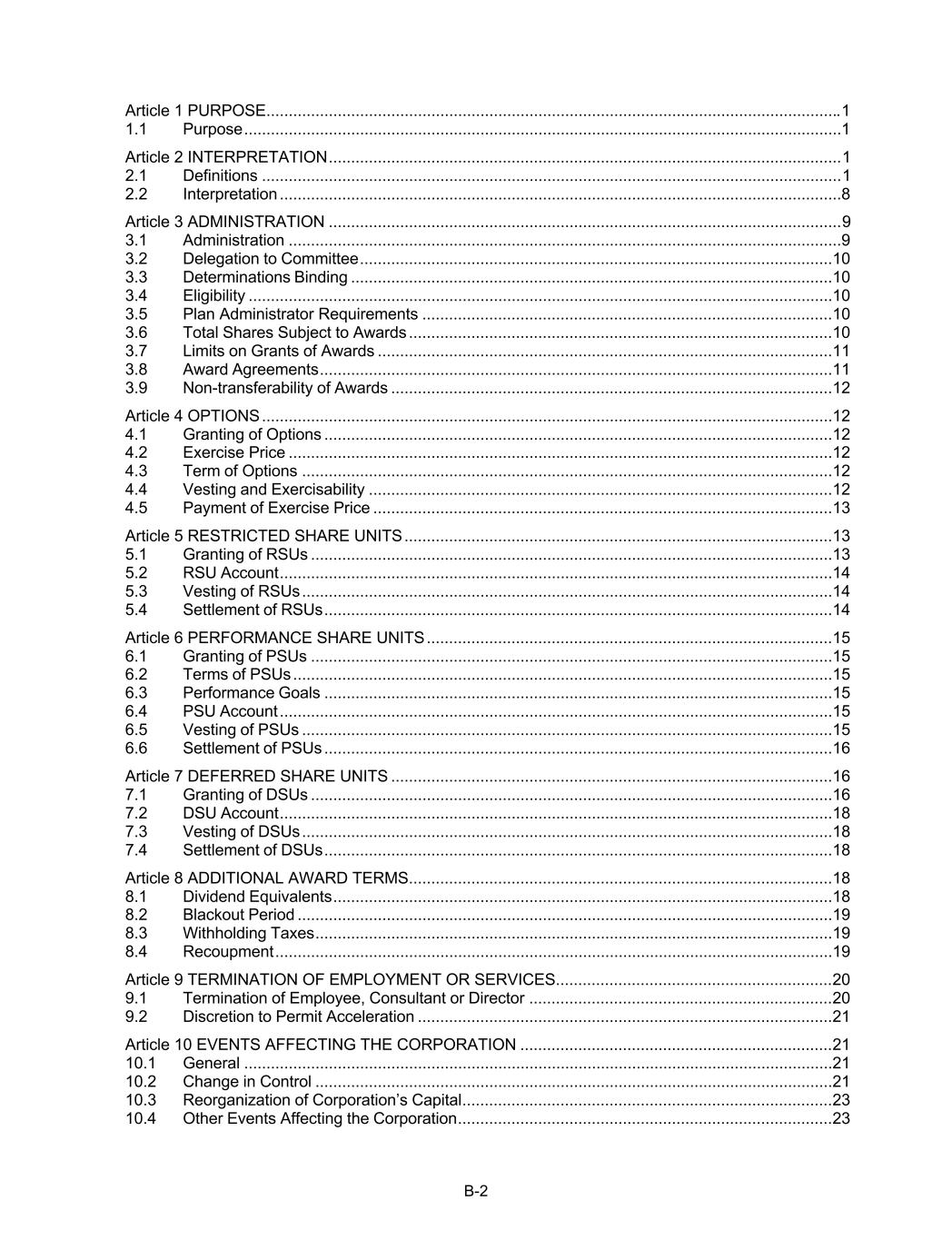

9 Skills Matrix The following chart illustrates the relevant skills possessed by each Director who is proposed for election at the Meeting: A cc ou nt in g/ Fi na nc ia l Fi na nc ia l E xp er t ( fo r A ud it Co m m itt ee ) G ov er na nc e / R isk Sa le s & M ar ke tin g M & A Co m pe ns at io n / H um an R es ou rc es In no va tio n / T ec hn ol og y Co m m un ic at io ns / Sa aS O th er P ub lic C om pa ny B oa rd E xp er ie nc e Ex ec ut iv e Le ad er sh ip St ra te gi c Pl an ni ng Allan Brett Director (Lead Independent Director) X X X X X X X X X Al Guarino Director X X X X X X X X X X X Marc Lederman Director X X X X X X X X Joanne Moretti Director X X X X X X X X Charles Salameh Director and Chief Executive Officer X X X X X X X X April Walker Director X X X X X X X X X Norman A. Worthington Director (Chair) X X X X X X X X X

10 Corporate Cease Trade Orders or Bankruptcies To the knowledge of the Corporation, no nominee proposed for election is, as of the date of this Circular, or has been, within 10 years before the date of this Circular, a director, chief executive officer or chief financial officer of any company that: (a) was subject to an order that was issued while the proposed director was acting in the capacity as director, chief executive officer or chief financial officer, or (b) was subject to an order that was issued after the proposed director ceased to be a director, chief executive officer or chief financial officer and which resulted from an event that occurred while that person was acting in the capacity as director, chief executive officer or chief financial officer. For purposes hereof, “order” means (a) a cease trade order; (b) an order similar to a cease trade order; or (c) an order that denied the relevant company access to any exemption under securities legislation, that was in effect for a period of more than 30 consecutive days. To the knowledge of the Corporation, no nominee proposed for election is, as of the date of this Circular, or has been, within 10 years before the date of this Circular, a director or executive officer of any company that, while the nominee was acting in such capacity, or within a year of the nominee ceasing to act in such capacity, became bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency or was subject to or instituted any proceedings, arrangement or compromise with creditors or had a receiver, receiver manager or director appointed to hold its assets. Personal Bankruptcies To the knowledge of the Corporation, no nominee proposed for election has, within the 10 years prior to the date of this Circular, become bankrupt, made a proposal under any legislation relating to bankruptcy or insolvency, or become subject to or instituted any proceedings, arrangement or compromise with creditors, or had a receiver, receiver manager or trustee appointed to hold the assets of the nominee. Penalties or Sanctions No nominee proposed for election has been subject to any penalties or sanctions imposed by a court relating to securities legislation or by a securities regulatory authority or has entered into a settlement agreement with a Canadian securities regulatory authority or been subject to any other penalties or sanctions imposed by a court or regulatory body that would likely be considered important to a reasonable securityholder in deciding whether to vote for such nominee. Star2Star Stock Purchase Agreement The Corporation entered into a stock purchase agreement dated January 28, 2021 (the “Star2Star SPA”) to acquire all the shares of StarBlue Inc. from Star2Star Holdings, and Blue Face Holdings Limited (together, the “Sellers”). Under the terms of the Star2Star SPA, the Corporation agreed to fix the Board at five Directors. Additionally, as long as Mr. Worthington and his Affiliates (as defined in the Star2Star SPA) continue to own at least 50% of the Common Shares (i) issued under the Star2Star SPA to Star2Star Holdings, and (ii) distributed or distributable by Star2Star Holdings to Mr. Worthington, then Mr. Worthington, or another individual designated by Mr. Worthington if he is unable to serve as a Director, shall have the right to be one of the Star2Star Director nominees. Mr. Worthington shall serve as Chair of the Board until the earlier to occur of (i) such time that he is no longer physically or mentally capable to serve in such capacity, (ii) such time as he no longer owns, directly or indirectly, at least 15% of the issued and outstanding Common Shares, and (iii) he is no longer a member of the Board. Star2Star Holdings, in its capacity as the Seller Representative (as defined in the Star2Star SPA) agreed to increase the size of the Board to seven.

11 The foregoing summary is qualified in its entirety by reference to the provisions of the Star2Star SPA, a copy of which is available on the Corporation’s profile on SEDAR+ at www.sedarplus.ca 3 Appointment of Auditors The audit committee of the Corporation (the “Audit Committee”) recommends to the Shareholders that KPMG LLP (“KPMG”) be appointed as the independent auditor of the Corporation, to hold office until the close of the next annual meeting of the Shareholders or until its successor is appointed, and that the Directors be authorized to fix the remuneration of the auditors. KPMG has been the auditor of the Corporation since September 27, 2022. The persons named in the Form of Proxy, if not expressly directed to the contrary in such Form of Proxy, will vote such proxies in favour of a resolution to appoint KPMG as auditors of the Corporation and to authorize the Directors to fix KPMG's remuneration. The persons named in the Form of Proxy, if not expressly directed to the contrary in such Form of Proxy, will vote such proxies in favour of a resolution to appoint KPMG as auditors of the Corporation and to authorize the Directors to fix KPMG’s remuneration. Audit Committee Information Reference is made to the Corporation’s current annual information form (“AIF”) for information relating to the Audit Committee, as required under Form 52-110F1 – Audit Committee Information Required in an AIF. The AIF is available on the Corporation’s profile on SEDAR+ at www.sedarplus.ca. Upon request, the Corporation will promptly provide a copy of the AIF free of charge to a securityholder of the Corporation. 4 Approval of the Amended and Restated Omnibus Plan The Board has approved the adoption of an amended and restated omnibus equity incentive plan (the “Amended and Restated Omnibus Plan”), which it believes is in the best interests of Sangoma and Shareholders. A description of the key terms of the Amended and Restated Omnibus Plan, which is qualified in its entirety by reference to the full text of the Amended and Restated Omnibus Plan attached hereto as Schedule "B", can be found under the heading “Equity Incentive Plan” below. If adopted, the Amended and Restated Omnibus Plan will amend and restate the Corporation’s existing omnibus equity incentive plan dated December 13, 2022 (the “Current Omnibus Plan”) in its entirety, except that any awards granted pursuant to the Current Omnibus Plan will continue to be governed by the Current Omnibus Plan. Proposed Amendments Under the Current Omnibus Plan, the maximum number of Common Shares that may be issued pursuant to the Current Omnibus Plan is 10% of the total number of issued and outstanding Shares from time to time. Under the Amended and Restated Omnibus Plan the maximum number of Common Shares that may be issued pursuant to the Amended and Restated Omnibus Plan (including, for greater certainty, in respect of any awards issued under the Current Omnibus Plan that are outstanding as of the date the Amended and Restated Omnibus Plan becomes effective) shall be fixed at 2,785,227, representing approximately 8% of the issued and outstanding Common Shares as of the date of this Circular. The Amended and Restated Omnibus Plan also provides that that (a) the Corporation shall not make grants of awards to non-employee directors, if after giving effect to such grants of awards, the aggregate number of Common Shares issuable to non-employee directors, at the time of such grant under all of the Corporation’s security-based compensation arrangement, would exceed 1% of the issued and outstanding Common Shares on a non-diluted basis, and (b) within any one financial year of the Corporation, the aggregate fair market value on the date of grant of all awards granted to any one non- employee director under all of the Corporation’s security-based compensation arrangements shall not exceed $150,000, provided that such limits shall not apply to (i) awards taken in lieu of any cash retainer

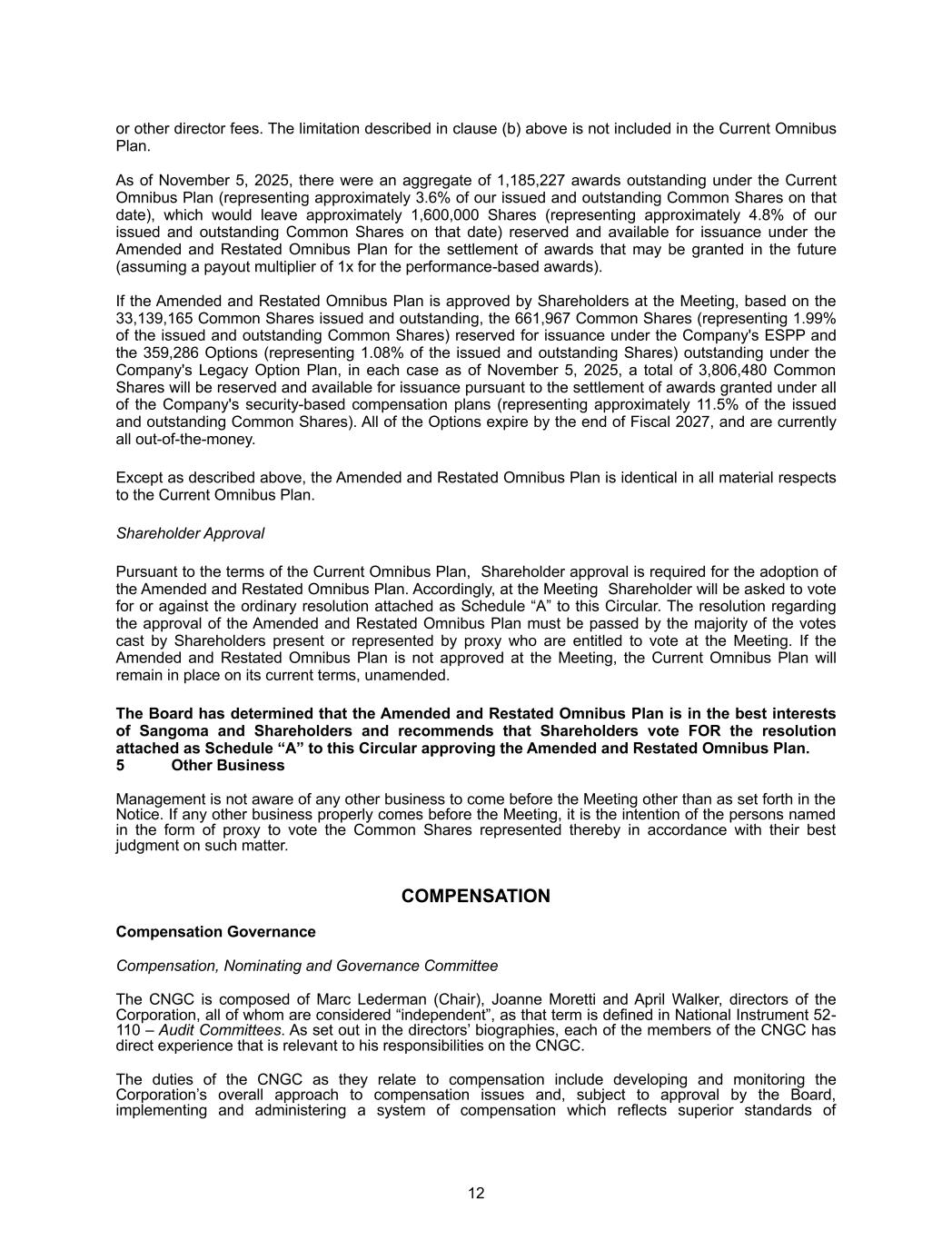

12 or other director fees. The limitation described in clause (b) above is not included in the Current Omnibus Plan. As of November 5, 2025, there were an aggregate of 1,185,227 awards outstanding under the Current Omnibus Plan (representing approximately 3.6% of our issued and outstanding Common Shares on that date), which would leave approximately 1,600,000 Shares (representing approximately 4.8% of our issued and outstanding Common Shares on that date) reserved and available for issuance under the Amended and Restated Omnibus Plan for the settlement of awards that may be granted in the future (assuming a payout multiplier of 1x for the performance-based awards). If the Amended and Restated Omnibus Plan is approved by Shareholders at the Meeting, based on the 33,139,165 Common Shares issued and outstanding, the 661,967 Common Shares (representing 1.99% of the issued and outstanding Common Shares) reserved for issuance under the Company's ESPP and the 359,286 Options (representing 1.08% of the issued and outstanding Shares) outstanding under the Company's Legacy Option Plan, in each case as of November 5, 2025, a total of 3,806,480 Common Shares will be reserved and available for issuance pursuant to the settlement of awards granted under all of the Company's security-based compensation plans (representing approximately 11.5% of the issued and outstanding Common Shares). All of the Options expire by the end of Fiscal 2027, and are currently all out-of-the-money. Except as described above, the Amended and Restated Omnibus Plan is identical in all material respects to the Current Omnibus Plan. Shareholder Approval Pursuant to the terms of the Current Omnibus Plan, Shareholder approval is required for the adoption of the Amended and Restated Omnibus Plan. Accordingly, at the Meeting Shareholder will be asked to vote for or against the ordinary resolution attached as Schedule “A” to this Circular. The resolution regarding the approval of the Amended and Restated Omnibus Plan must be passed by the majority of the votes cast by Shareholders present or represented by proxy who are entitled to vote at the Meeting. If the Amended and Restated Omnibus Plan is not approved at the Meeting, the Current Omnibus Plan will remain in place on its current terms, unamended. The Board has determined that the Amended and Restated Omnibus Plan is in the best interests of Sangoma and Shareholders and recommends that Shareholders vote FOR the resolution attached as Schedule “A” to this Circular approving the Amended and Restated Omnibus Plan. 5 Other Business Management is not aware of any other business to come before the Meeting other than as set forth in the Notice. If any other business properly comes before the Meeting, it is the intention of the persons named in the form of proxy to vote the Common Shares represented thereby in accordance with their best judgment on such matter. COMPENSATION Compensation Governance Compensation, Nominating and Governance Committee The CNGC is composed of Marc Lederman (Chair), Joanne Moretti and April Walker, directors of the Corporation, all of whom are considered “independent”, as that term is defined in National Instrument 52- 110 – Audit Committees. As set out in the directors’ biographies, each of the members of the CNGC has direct experience that is relevant to his responsibilities on the CNGC. The duties of the CNGC as they relate to compensation include developing and monitoring the Corporation’s overall approach to compensation issues and, subject to approval by the Board, implementing and administering a system of compensation which reflects superior standards of

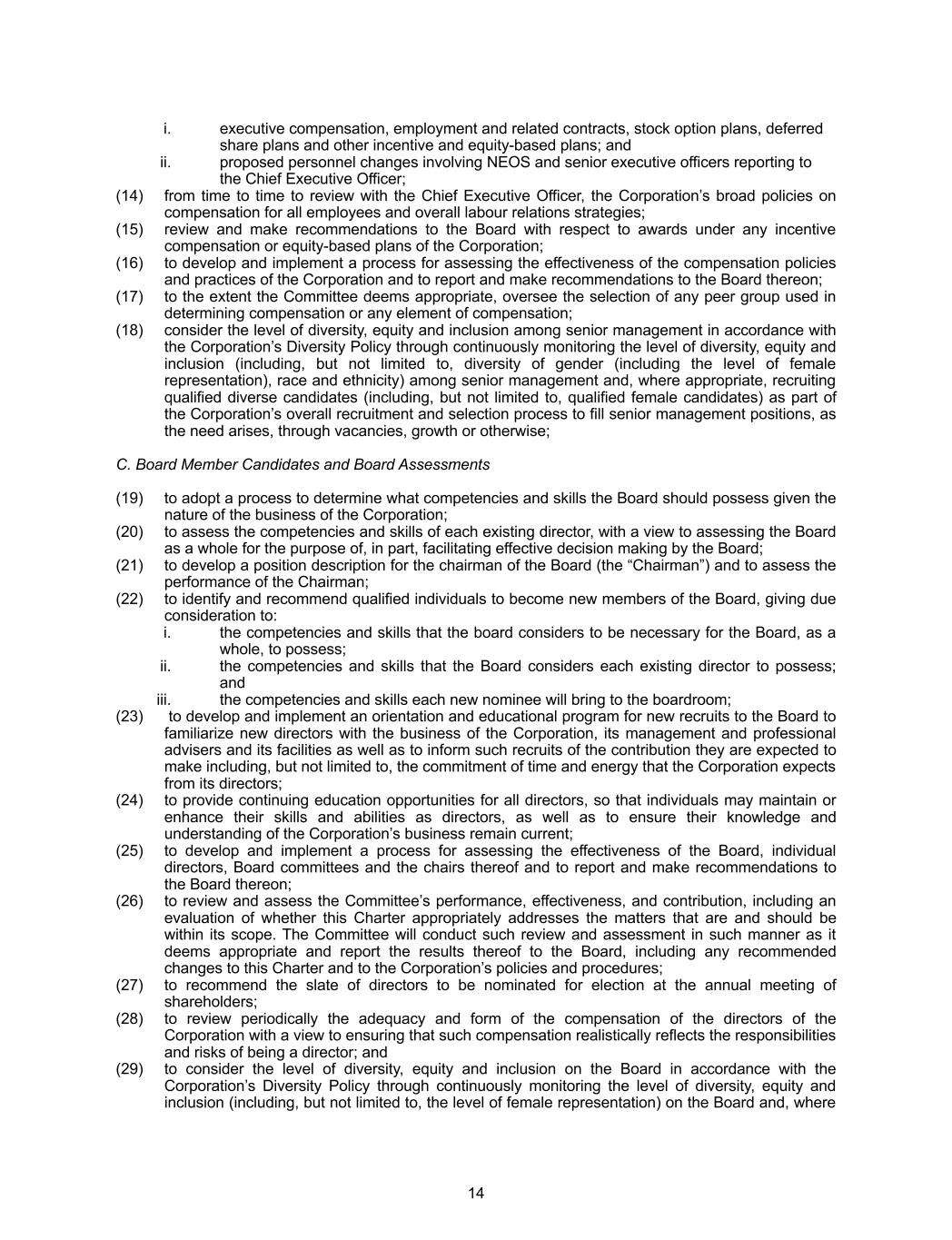

13 compensation practices. Periodically, the CNGC will review the adequacy and form of the compensation of the directors of the Corporation with a view to ensuring that such compensation realistically reflects the responsibilities and risks of being a director. The Board has adopted a written charter setting forth the purpose, composition, authority and responsibility of the CNGC, which includes the following duties: A. Corporate Governance and Compliance (1) to develop and monitor the Corporation’s overall approach to corporate governance compensation issues and, subject to approval by the Board, to implement and administer a system of corporate governance and compensation which reflects superior standards of such practices and to continue to develop the Corporation’s approach to such issues; (2) to undertake an annual review of corporate governance and compensation issues and practices as they affect the Corporation and make a comprehensive set of recommendations to the Board during each calendar year; (3) to advise the Board or any committees of the Board of corporate governance and compensation issues which the Committee determines ought to be considered by the Board or any such committee; (4) to review with the Board on a regular basis but not less than annually, the Board Charter, the charter of each of the committees of the Board and the methods and processes by which the directors fulfill their respective duties and responsibilities, including without limitation: i. the number and content of meetings of the directors; ii. the number of meetings of the independent directors at which members of management are not present; iii. the annual schedule of issues to be presented to the Board at its meetings or those of its committees; iv. material which is to be provided to the Board generally and with respect to meetings of the Board; and v. the communication process between the Board and Management; (5) to adopt and implement a communications policy for the Corporation as well as a black-out policy for directors, executives, and employees of the Corporation; (6) to recommend to the Board for adoption a business code of conduct to ensure ethical behavior and compliance with laws and regulations, to monitor compliance with such code of conduct and to consider and, if deemed appropriate, provide waivers from compliance with the code; (7) to recommend to the Directors certain human resources and compensation policies and guidelines; (8) to recommend to the Board a system which enables a committee or an individual director to engage separate independent counsel and advisors at the expense of the Corporation in appropriate circumstances and, upon the approval by the Board of such a process, to be responsible for the management and administration thereof; B. Engagement / Compensation of Senior Executives (9) to ensure that the Corporation has in place programs to attract and develop management of the highest calibre and a process to provide for the orderly succession of management, including receipt on an annual basis of any recommendations of the Chief Executive Officer in this regard; (10) to develop a position description for the Chief Executive Officer and to ensure that policy guidelines and systems are in place to provide for a comprehensive annual review of the performance of the Chief Executive Officer; (11) to review and approve corporate goals and objectives relevant to the compensation of the Chief Executive Officer and to evaluate the Chief Executive Officer’s performance in light of these goals and objectives; (12) to set the annual salary, bonus, and other benefits, direct and indirect, of the Chief Executive Officer, Named Executive Officers (as defined below) and other senior executive officers who report directly to the Chief Executive Officer, provided that the Chief Executive Officer may not be present during voting or deliberations on his or her compensation; (13) to implement and administer human resources and compensation policies approved by the directors concerning the following:

14 i. executive compensation, employment and related contracts, stock option plans, deferred share plans and other incentive and equity-based plans; and ii. proposed personnel changes involving NEOS and senior executive officers reporting to the Chief Executive Officer; (14) from time to time to review with the Chief Executive Officer, the Corporation’s broad policies on compensation for all employees and overall labour relations strategies; (15) review and make recommendations to the Board with respect to awards under any incentive compensation or equity-based plans of the Corporation; (16) to develop and implement a process for assessing the effectiveness of the compensation policies and practices of the Corporation and to report and make recommendations to the Board thereon; (17) to the extent the Committee deems appropriate, oversee the selection of any peer group used in determining compensation or any element of compensation; (18) consider the level of diversity, equity and inclusion among senior management in accordance with the Corporation’s Diversity Policy through continuously monitoring the level of diversity, equity and inclusion (including, but not limited to, diversity of gender (including the level of female representation), race and ethnicity) among senior management and, where appropriate, recruiting qualified diverse candidates (including, but not limited to, qualified female candidates) as part of the Corporation’s overall recruitment and selection process to fill senior management positions, as the need arises, through vacancies, growth or otherwise; C. Board Member Candidates and Board Assessments (19) to adopt a process to determine what competencies and skills the Board should possess given the nature of the business of the Corporation; (20) to assess the competencies and skills of each existing director, with a view to assessing the Board as a whole for the purpose of, in part, facilitating effective decision making by the Board; (21) to develop a position description for the chairman of the Board (the “Chairman”) and to assess the performance of the Chairman; (22) to identify and recommend qualified individuals to become new members of the Board, giving due consideration to: i. the competencies and skills that the board considers to be necessary for the Board, as a whole, to possess; ii. the competencies and skills that the Board considers each existing director to possess; and iii. the competencies and skills each new nominee will bring to the boardroom; (23) to develop and implement an orientation and educational program for new recruits to the Board to familiarize new directors with the business of the Corporation, its management and professional advisers and its facilities as well as to inform such recruits of the contribution they are expected to make including, but not limited to, the commitment of time and energy that the Corporation expects from its directors; (24) to provide continuing education opportunities for all directors, so that individuals may maintain or enhance their skills and abilities as directors, as well as to ensure their knowledge and understanding of the Corporation’s business remain current; (25) to develop and implement a process for assessing the effectiveness of the Board, individual directors, Board committees and the chairs thereof and to report and make recommendations to the Board thereon; (26) to review and assess the Committee’s performance, effectiveness, and contribution, including an evaluation of whether this Charter appropriately addresses the matters that are and should be within its scope. The Committee will conduct such review and assessment in such manner as it deems appropriate and report the results thereof to the Board, including any recommended changes to this Charter and to the Corporation’s policies and procedures; (27) to recommend the slate of directors to be nominated for election at the annual meeting of shareholders; (28) to review periodically the adequacy and form of the compensation of the directors of the Corporation with a view to ensuring that such compensation realistically reflects the responsibilities and risks of being a director; and (29) to consider the level of diversity, equity and inclusion on the Board in accordance with the Corporation’s Diversity Policy through continuously monitoring the level of diversity, equity and inclusion (including, but not limited to, the level of female representation) on the Board and, where

15 appropriate, recruiting qualified diverse candidates (including, but not limited to, qualified female candidates) as part of the Corporation’s overall recruitment and selection process to fill Board positions, as the need arises, through vacancies, growth or otherwise. Overview The following discussion describes the significant elements of the compensation of our Chief Executive Officer, Chief Financial Officer, Chief Operating Officer, Chief Legal & Administrative Officer and Chief Technology Officer (collectively, “named executive officers” or “NEOs”) for Fiscal 2025, namely: • Charles Salameh, Chief Executive Officer; • Jeremy Wubs, Chief Operating Officer; • Larry Stock, Chief Financial Officer; • Samantha Reburn, Chief Legal & Administrative Officer; and • Nenad Corbic, Chief Technology Officer; Effective February 27, 2023, Mr. Worthington was appointed Interim Executive Chair, to step in temporarily in place of the Chief Executive Officer. As of September 1, 2023, the Corporation appointed Mr. Salameh as the new Chief Executive Officer and Mr. Worthington resumed his role as Chair of the Board. Mr. Wubs was appointed as the Chief Operating Officer on September 11, 2023. Compensation Discussion and Analysis Compensation Objectives The specific objectives of the Corporation’s compensation program for executive officers are as follows: • to attract and retain talented executive officers; • to align the interests of executive officers with those of the Corporation’s Shareholders; and • to link individual executive compensation to the performance of both the Corporation and the individual executive officer. The Corporation’s compensation program is currently designed to reward executive officers for: • superior corporate performance relative to pre-set internal and corporate objectives; and • exceptional levels of individual performance consistent with, and contributing to, the achievement of the Corporation’s strategic goals. The CNGC has worked closely with the Corporation's Board and Chief Executive Officer to design an executive officer compensation program to achieve the following objectives: • to attract and retain talented, high-performing and experienced executive officers who provide meaningful contributions to the success and growth of our Corporation; • to motivate our executive officers to achieve our corporate and financial objectives; and • to align the interests of our executive officers with those of our Shareholders by tying a meaningful portion of compensation directly to the long-term value and growth of our business. The Corporation will continue to evaluate and develop the executive compensation program on an annual basis to ensure it remains competitive and aligns with the interests of our stakeholders. Compensation Consultant With respect to Fiscal 2025 compensation, the Company used the compensation research provided by Compensia, an independent consulting firm, which was retained to provide services in connection with executive officer and director compensation matters, including, among other things, to: • develop a compensation peer group for the purposes of benchmarking executive and director pay along with a summary of peer company compensation program design practices;

16 • benchmark executive and director pay levels to determine market pay levels, using both the compensation peer group (as listed below) and survey data for similarly-sized companies within our industry; • develop a market-based compensation framework to guide pay decisions; and • conduct research on the incentive program structure. Compensia was initially retained on June 10, 2022 and provides updated compensation research to the Company, typically on a bi-annual basis. Compensia is scheduled to provide updated compensation research in Fiscal 2026. The CNGC considered the information last provided by Compensia. The final decisions relating to compensation and incentive plan design were made by, and are the responsibility of, the CNGC. The following table summarizes the fees billed by independent compensation consultants in respect of services provided to the Corporation in Fiscal 2025 and 2024: Type of Fee 2025 2024 Executive Compensation-Related Fees - $22,560 All Other Fees - - Compensia does not provide any services to the Corporation other than directly to the CNGC or as approved and overseen by the CNGC. For Fiscal 2025, the Corporation, together with Compensia, determined that its peer group for the purpose of benchmarking executive and director compensation, includes the following comparable public companies: 8x8, Bandwidth, Brightcove, Cambium Networks, Coveo Solutions, Domo, Haivision Systems, Kaltura, LivePerson, Nuvera Communications, ON24, Ooma, Optiva, Ribbon Communications, Synchronoss Technologies, Vecima Networks, Veritone and Weave Communications. Principal Elements of Compensation The executive compensation program is intended to provide executives with an appropriate and competitively balanced mix of guaranteed cash (base salary) and performance-based (short-term – annual cash bonus; long-term – equity awards) incentive compensation. Short and long-term incentive awards are determined by the achievement of annual individual performance objectives and the performance of the Corporation. The Corporation’s executive compensation mix (the proportion of base salary, short and long-term incentive awards) is designed to reflect the relative impact of the executive’s role on the Corporation’s performance and considers how the compensation mix aligns with long-term shareholder value creation. For Fiscal 2025, payouts to NEOs were based on the CNGC’s assessment of performance based on expected revenues, adjusted EBITDA, and various other measures of individual performance throughout the year. Executives are eligible to receive a mix of restricted share units ("RSUs"), performance share units ("PSUs") and options, in satisfaction of the long-term incentive portion of their compensation. Compensation Risk The CNGC’s oversight includes setting objectives and evaluating individual and overall corporate performance and ensuring that total compensation for executive officers, including NEOs, is fair, reasonable and consistent with the objectives of the Corporation’s compensation program, and considers the implications of the risks associated with the Corporation’s compensation policies and practices. To mitigate risks associated with the compensation program and practices that could encourage an NEO or individual at a principal business unit or division to take inappropriate or excessive risks, the Corporation has implemented various policies and procedures, including:

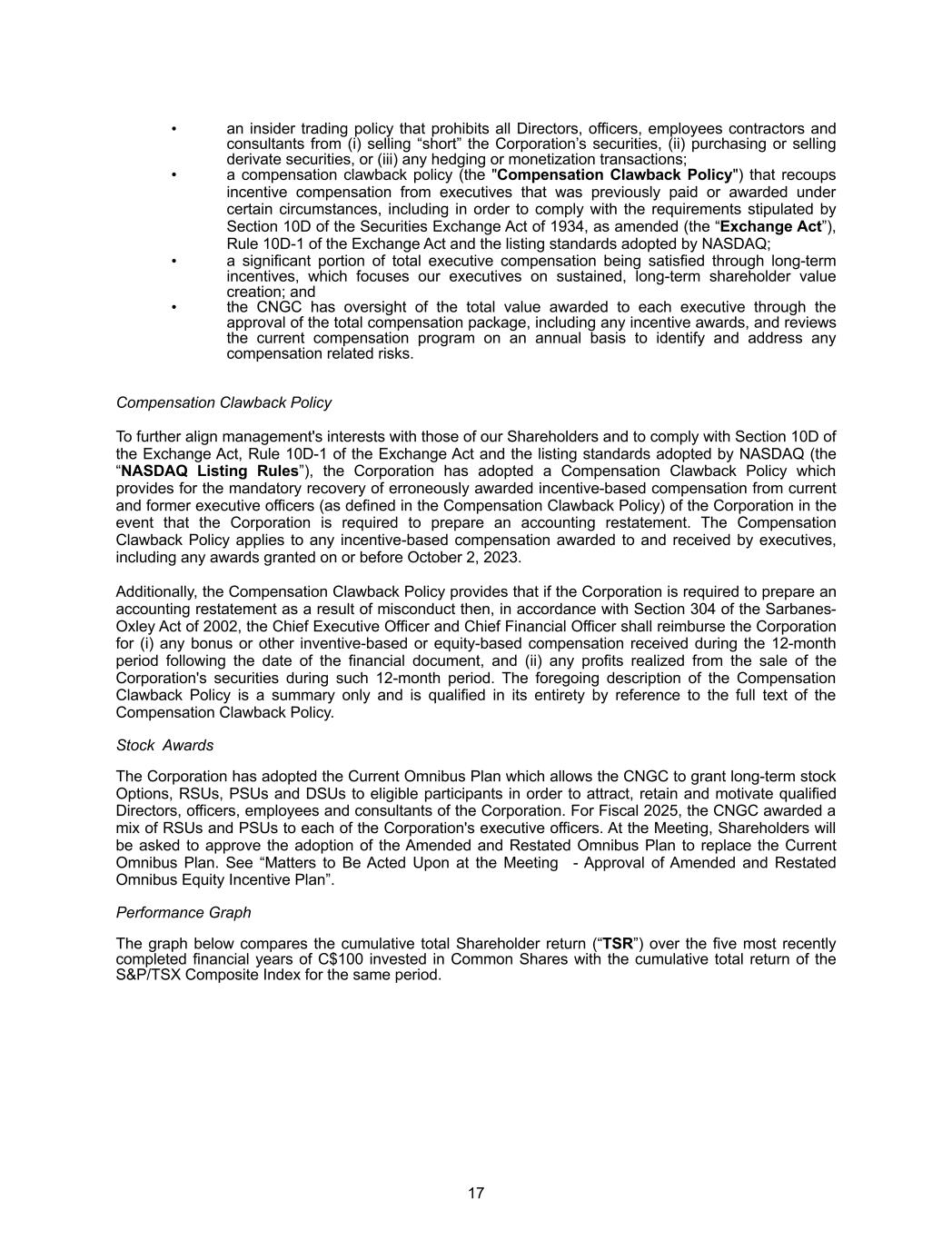

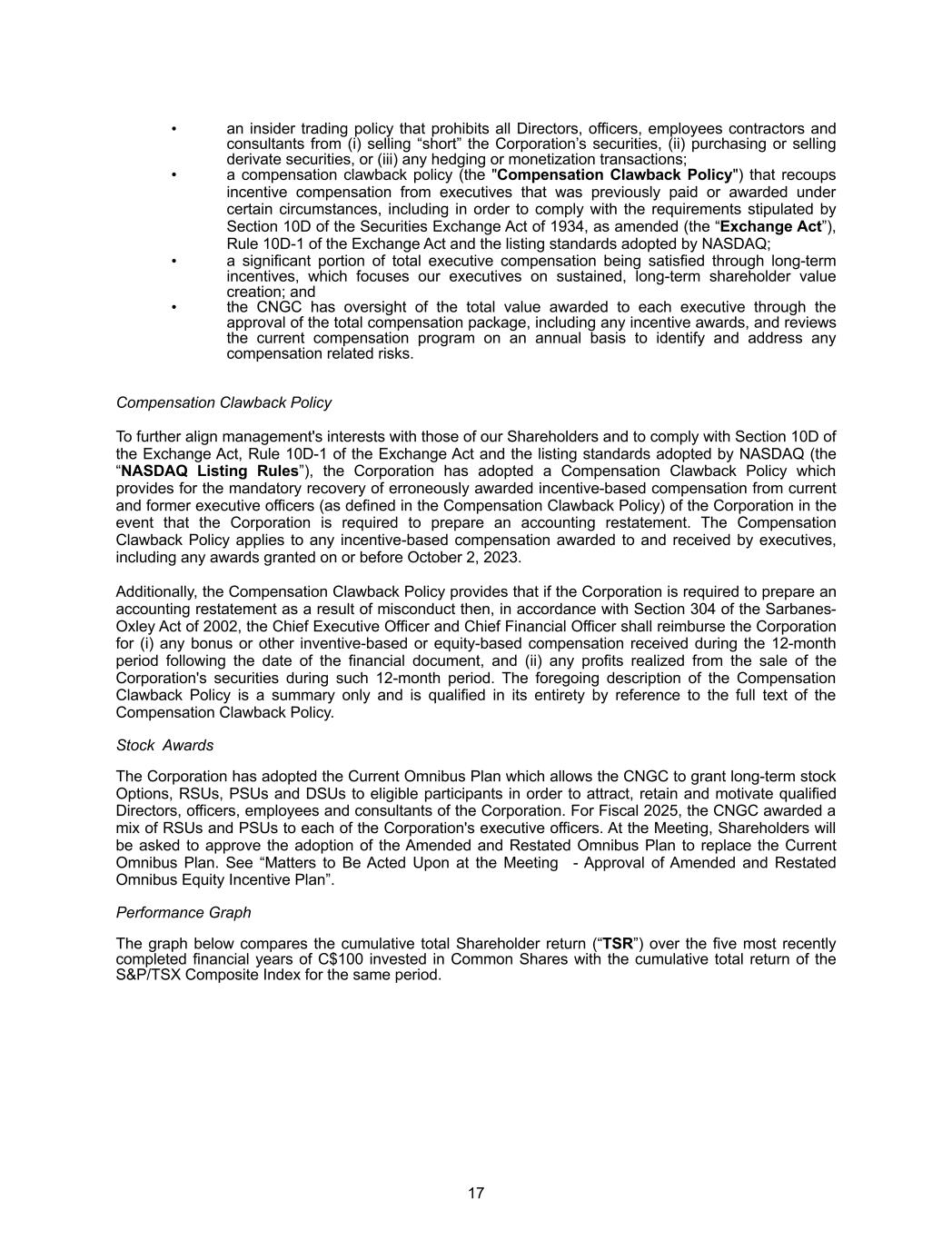

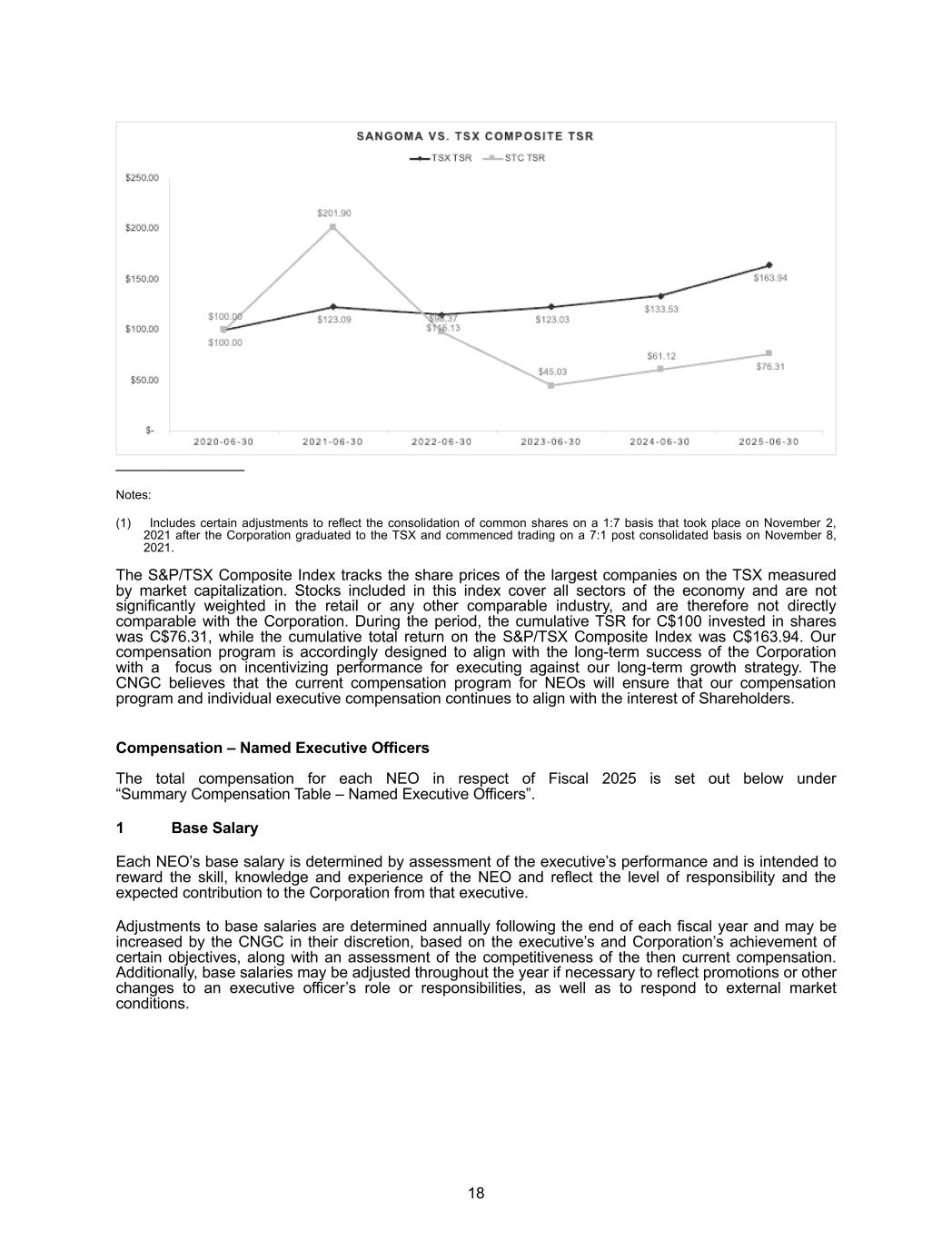

17 • an insider trading policy that prohibits all Directors, officers, employees contractors and consultants from (i) selling “short” the Corporation’s securities, (ii) purchasing or selling derivate securities, or (iii) any hedging or monetization transactions; • a compensation clawback policy (the "Compensation Clawback Policy") that recoups incentive compensation from executives that was previously paid or awarded under certain circumstances, including in order to comply with the requirements stipulated by Section 10D of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), Rule 10D-1 of the Exchange Act and the listing standards adopted by NASDAQ; • a significant portion of total executive compensation being satisfied through long-term incentives, which focuses our executives on sustained, long-term shareholder value creation; and • the CNGC has oversight of the total value awarded to each executive through the approval of the total compensation package, including any incentive awards, and reviews the current compensation program on an annual basis to identify and address any compensation related risks. Compensation Clawback Policy To further align management's interests with those of our Shareholders and to comply with Section 10D of the Exchange Act, Rule 10D-1 of the Exchange Act and the listing standards adopted by NASDAQ (the “NASDAQ Listing Rules”), the Corporation has adopted a Compensation Clawback Policy which provides for the mandatory recovery of erroneously awarded incentive-based compensation from current and former executive officers (as defined in the Compensation Clawback Policy) of the Corporation in the event that the Corporation is required to prepare an accounting restatement. The Compensation Clawback Policy applies to any incentive-based compensation awarded to and received by executives, including any awards granted on or before October 2, 2023. Additionally, the Compensation Clawback Policy provides that if the Corporation is required to prepare an accounting restatement as a result of misconduct then, in accordance with Section 304 of the Sarbanes- Oxley Act of 2002, the Chief Executive Officer and Chief Financial Officer shall reimburse the Corporation for (i) any bonus or other inventive-based or equity-based compensation received during the 12-month period following the date of the financial document, and (ii) any profits realized from the sale of the Corporation's securities during such 12-month period. The foregoing description of the Compensation Clawback Policy is a summary only and is qualified in its entirety by reference to the full text of the Compensation Clawback Policy. Stock Awards The Corporation has adopted the Current Omnibus Plan which allows the CNGC to grant long-term stock Options, RSUs, PSUs and DSUs to eligible participants in order to attract, retain and motivate qualified Directors, officers, employees and consultants of the Corporation. For Fiscal 2025, the CNGC awarded a mix of RSUs and PSUs to each of the Corporation's executive officers. At the Meeting, Shareholders will be asked to approve the adoption of the Amended and Restated Omnibus Plan to replace the Current Omnibus Plan. See “Matters to Be Acted Upon at the Meeting - Approval of Amended and Restated Omnibus Equity Incentive Plan”. Performance Graph The graph below compares the cumulative total Shareholder return (“TSR”) over the five most recently completed financial years of C$100 invested in Common Shares with the cumulative total return of the S&P/TSX Composite Index for the same period.

18 _______________ Notes: (1) Includes certain adjustments to reflect the consolidation of common shares on a 1:7 basis that took place on November 2, 2021 after the Corporation graduated to the TSX and commenced trading on a 7:1 post consolidated basis on November 8, 2021. The S&P/TSX Composite Index tracks the share prices of the largest companies on the TSX measured by market capitalization. Stocks included in this index cover all sectors of the economy and are not significantly weighted in the retail or any other comparable industry, and are therefore not directly comparable with the Corporation. During the period, the cumulative TSR for C$100 invested in shares was C$76.31, while the cumulative total return on the S&P/TSX Composite Index was C$163.94. Our compensation program is accordingly designed to align with the long-term success of the Corporation with a focus on incentivizing performance for executing against our long-term growth strategy. The CNGC believes that the current compensation program for NEOs will ensure that our compensation program and individual executive compensation continues to align with the interest of Shareholders. Compensation – Named Executive Officers The total compensation for each NEO in respect of Fiscal 2025 is set out below under “Summary Compensation Table – Named Executive Officers”. 1 Base Salary Each NEO’s base salary is determined by assessment of the executive’s performance and is intended to reward the skill, knowledge and experience of the NEO and reflect the level of responsibility and the expected contribution to the Corporation from that executive. Adjustments to base salaries are determined annually following the end of each fiscal year and may be increased by the CNGC in their discretion, based on the executive’s and Corporation’s achievement of certain objectives, along with an assessment of the competitiveness of the then current compensation. Additionally, base salaries may be adjusted throughout the year if necessary to reflect promotions or other changes to an executive officer’s role or responsibilities, as well as to respond to external market conditions.

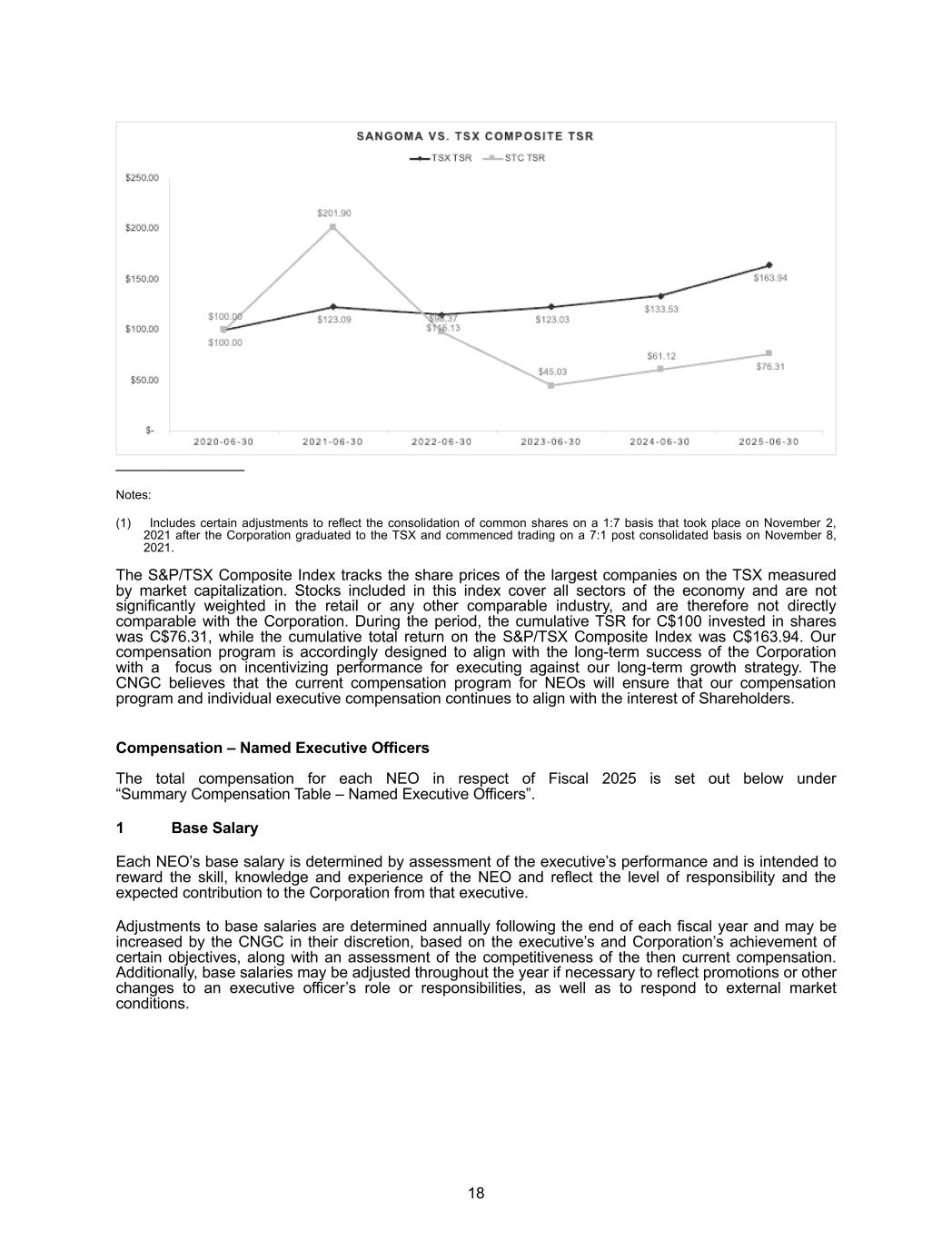

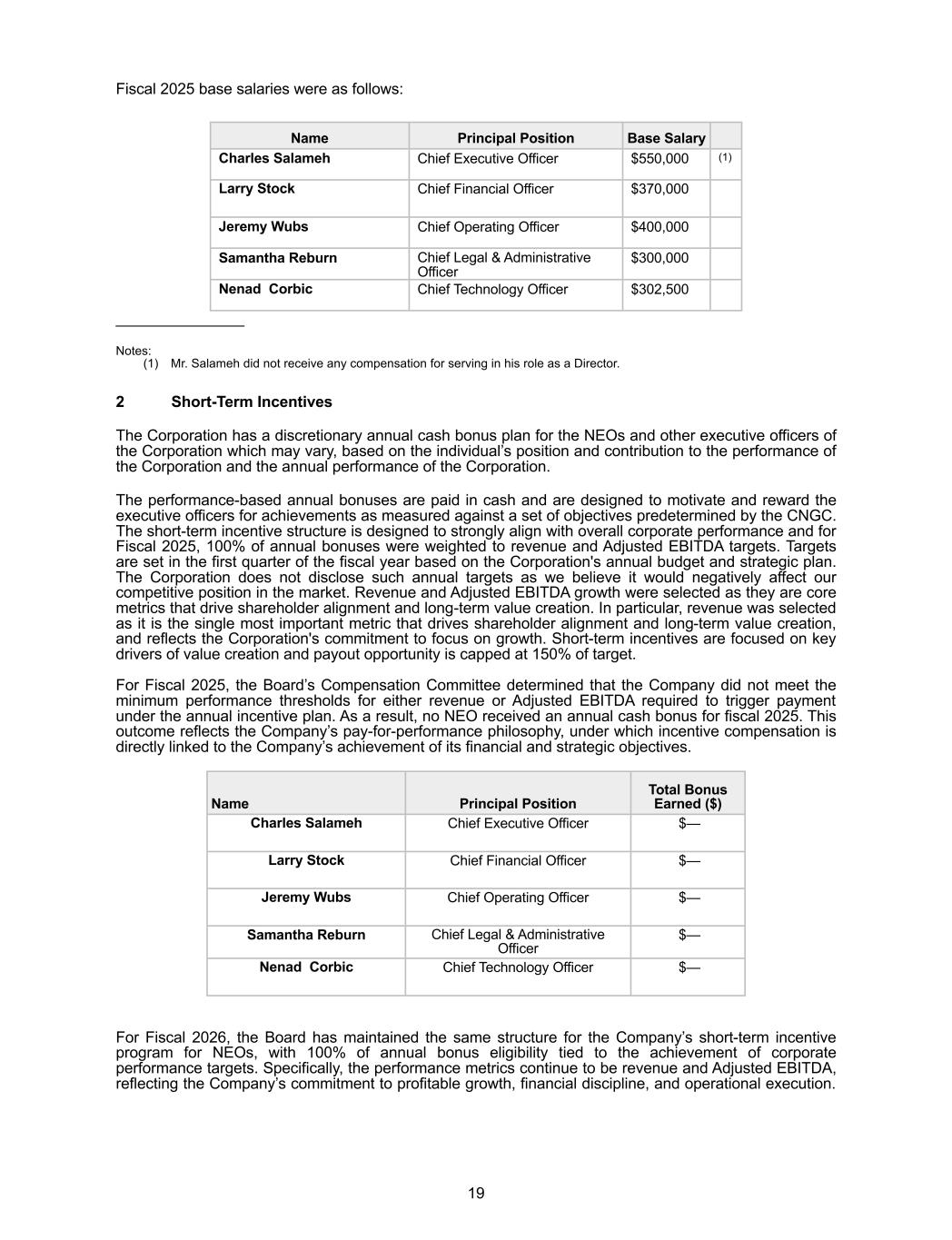

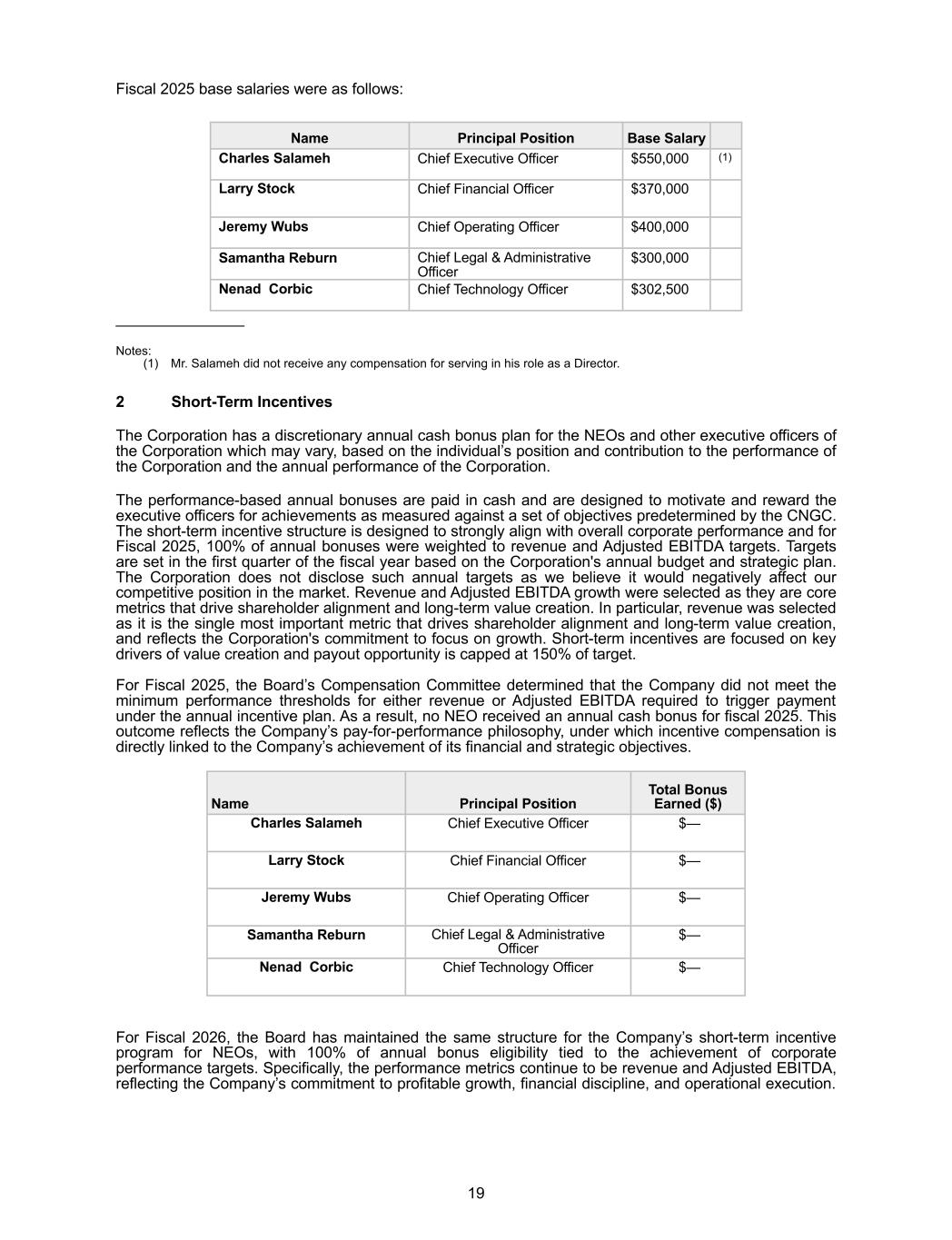

19 Name Principal Position Base Salary Charles Salameh Chief Executive Officer $550,000 (1) Larry Stock Chief Financial Officer $370,000 Jeremy Wubs Chief Operating Officer $400,000 Samantha Reburn Chief Legal & Administrative Officer $300,000 Nenad Corbic Chief Technology Officer $302,500 _______________ Notes: (1) Mr. Salameh did not receive any compensation for serving in his role as a Director. 2 Short-Term Incentives The Corporation has a discretionary annual cash bonus plan for the NEOs and other executive officers of the Corporation which may vary, based on the individual’s position and contribution to the performance of the Corporation and the annual performance of the Corporation. The performance-based annual bonuses are paid in cash and are designed to motivate and reward the executive officers for achievements as measured against a set of objectives predetermined by the CNGC. The short-term incentive structure is designed to strongly align with overall corporate performance and for Fiscal 2025, 100% of annual bonuses were weighted to revenue and Adjusted EBITDA targets. Targets are set in the first quarter of the fiscal year based on the Corporation's annual budget and strategic plan. The Corporation does not disclose such annual targets as we believe it would negatively affect our competitive position in the market. Revenue and Adjusted EBITDA growth were selected as they are core metrics that drive shareholder alignment and long-term value creation. In particular, revenue was selected as it is the single most important metric that drives shareholder alignment and long-term value creation, and reflects the Corporation's commitment to focus on growth. Short-term incentives are focused on key drivers of value creation and payout opportunity is capped at 150% of target. For Fiscal 2025, the Board’s Compensation Committee determined that the Company did not meet the minimum performance thresholds for either revenue or Adjusted EBITDA required to trigger payment under the annual incentive plan. As a result, no NEO received an annual cash bonus for fiscal 2025. This outcome reflects the Company’s pay-for-performance philosophy, under which incentive compensation is directly linked to the Company’s achievement of its financial and strategic objectives. Name Principal Position Total Bonus Earned ($) Charles Salameh Chief Executive Officer $— Larry Stock Chief Financial Officer $— Jeremy Wubs Chief Operating Officer $— Samantha Reburn Chief Legal & Administrative Officer $— Nenad Corbic Chief Technology Officer $— For Fiscal 2026, the Board has maintained the same structure for the Company’s short-term incentive program for NEOs, with 100% of annual bonus eligibility tied to the achievement of corporate performance targets. Specifically, the performance metrics continue to be revenue and Adjusted EBITDA, reflecting the Company’s commitment to profitable growth, financial discipline, and operational execution. Fiscal 2025 base salaries were as follows:

20 These metrics were selected because they are objective, measurable, and aligned with the Company’s strategic plan and shareholder interests. 3 Long Term Incentive Plan Equity-based awards allow the Corporation to motivate and retain our executive officers for their ongoing contributions to the Corporation. We believe that in providing a significant portion of an executive's total compensation in the form of long-term incentives, we are ensuring the continued alignment of management and Shareholder interests. In connection with the grants of equity-based awards, the CNGC determines the grant size and terms for the Chief Executive Officer, and all other NEOs, on the recommendation of the CEO. As part of their ongoing review of the Corporation's overall compensation practices, the CNGC will be determining the precise go-forward structure of long-term incentive compensation both in terms of quantum and instrument mix. In Fiscal 2025, executives were awarded a combination of 50% RSUs and 50% PSUs. Our long-term incentives are focused on value creation, and achievement of such long-term incentives is based on the Corporation's total shareholder return as compared to the Russell 2000. The payout opportunity for NEOs is capped at 150% of target, and the CNGC considers previous grants when determining an new grants.

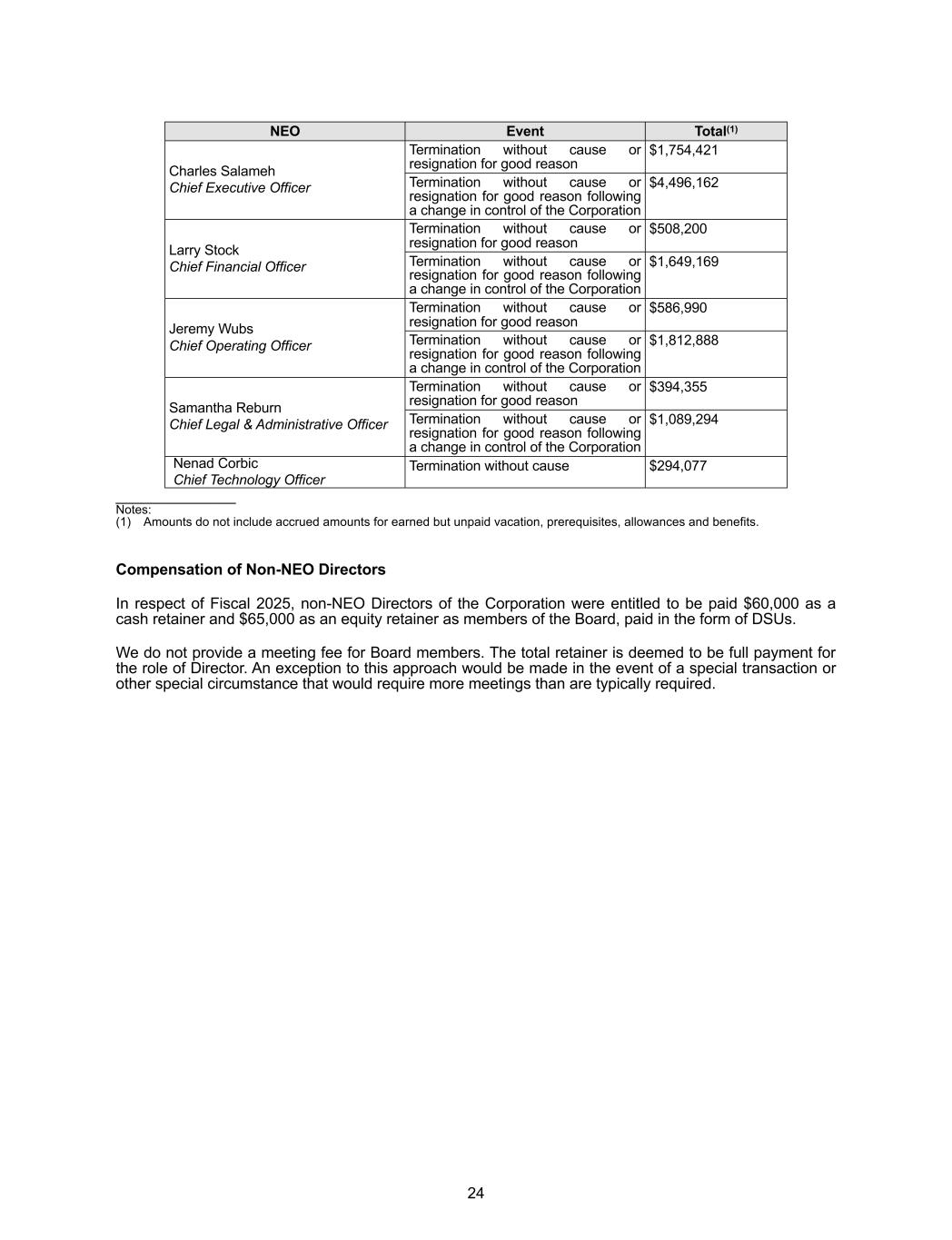

21 Summary Compensation Table – Named Executive Officers The following table sets forth the compensation earned by the NEOs in respect of Fiscal 2025, Fiscal 2024 and Fiscal 2023. Name and Principal Position Fiscal Year Salary ($) Share- based awards ($) Option- based awards ($) Non-equity incentive plan compensation Pension value ($) All other compensation ($)(6) Total compensation ($) Annual incentive plans ($) Long-term incentive plans ($) Charles Salameh Chief Executive Officer 2025 $550,000 $717,449 — $— — — — $1,267,449 2024 $460,066 (1) (2) 2,021,382 — $440,663 — — — $2,922,111 2023 $— $— — $— — — — $— Jeremy Wubs Chief Operating Officer 2025 $400,000 (2) (3) $434,818 — $— — — — $834,818 2024 $319,892 459,405 — $182,316 — — — $961,613 2023 $— $— — $— — — — $— Larry Stock Chief Financial Officer 2025 $370,000 $407,641 — $— — — — $777,641 2024 $355,000 $229,703 — $189,088 — — — $773,791 2023 $304,808 (4) $225,802 $240,000 — — — $770,610 Samantha Reburn Chief Legal & Administrative Officer 2025 $300,000 $326,113 $— — — — $626,113 2024 $221,400 $144,381 $75,523 — — — $441,304 2023 $164,274 $117,516 $75,000 — — — $356,790 Nenad Corbic Chief Technology Officer 2025 $302,500 $217,409 — $— — — — $519,909 2024 $290,816 $183,762 — $113,965 — — — $588,543 2023 $239,317 (5) $225,802 $157,500 — — — $622,619 _______________ Notes: (1) Mr. Salameh joined the Corporation as CEO on September 1, 2023. His Fiscal 2024 base salary represents an annualized base salary of $550,000. (2) For Fiscal 2024, 80% of the CEO's short-term incentive and 50% of the COO's short-term incentive were guaranteed. Beginning in Fiscal 2025, no portion of their bonuses were guaranteed. (3) Mr. Wubs joined the Corporation as COO on September 11, 2023. His Fiscal 2024 base salary represents an annualized base salary of $400,000. (4) Mr. Stock served as Chief Corporate Officer until October 3, 2022. Effective as of October 3, 2022, Mr. Stock was named Chief Financial Officer. Represents a base salary of $250,000 for the period of July 1, 2022 to October 3, 2022 and $340,000 for the period of October 3, 2022 to June 30, 2023. (5) Represents a base salary of C$275,000 for the period of July 1, 2022 to October 20, 2022 and C$340,000 for the period of October 20, 2022 to June 30, 2023. (6) None of the NEOs are entitled to perquisites or other personal benefits which, in the aggregate, are worth over C$50,000 or over 10% of their base salary.

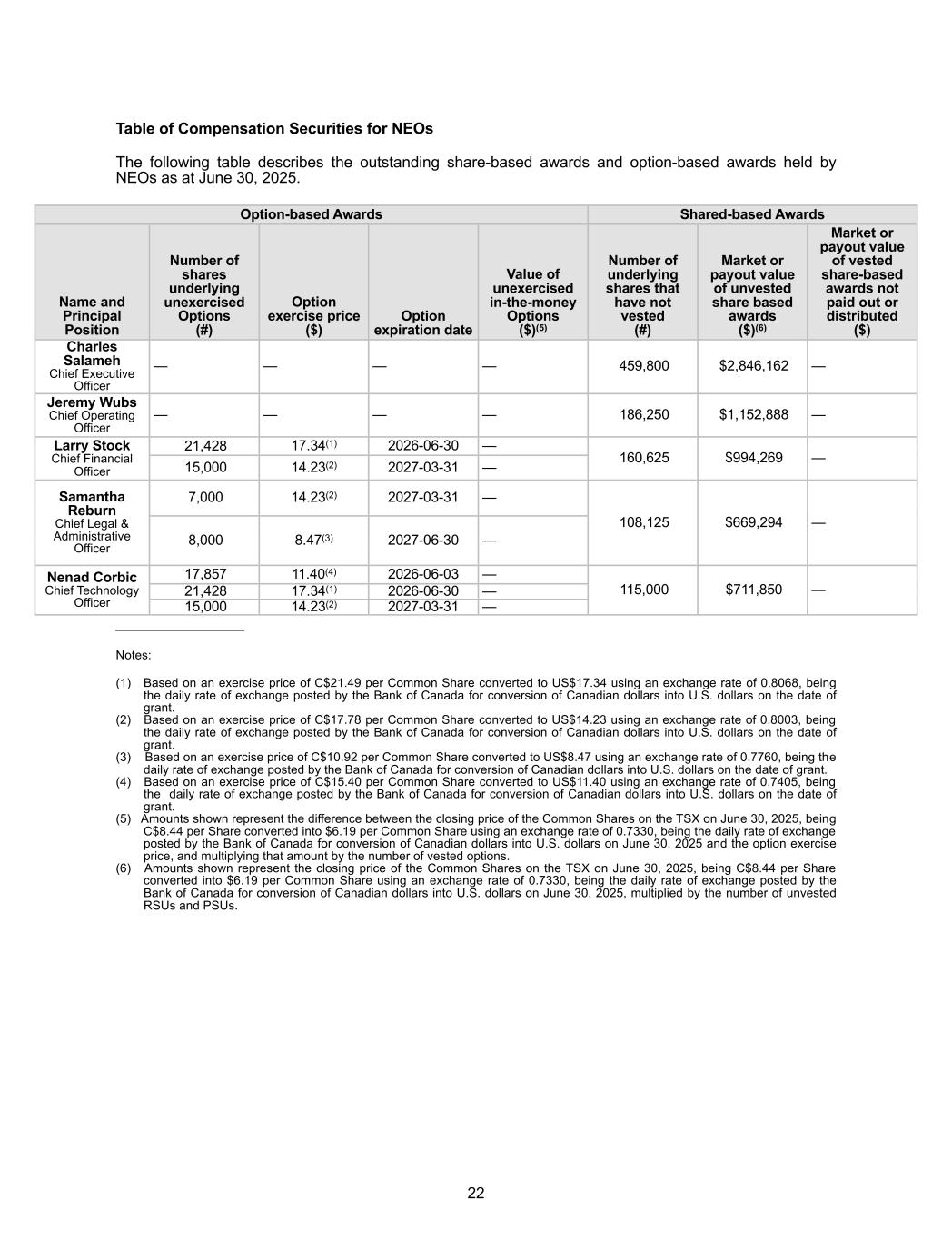

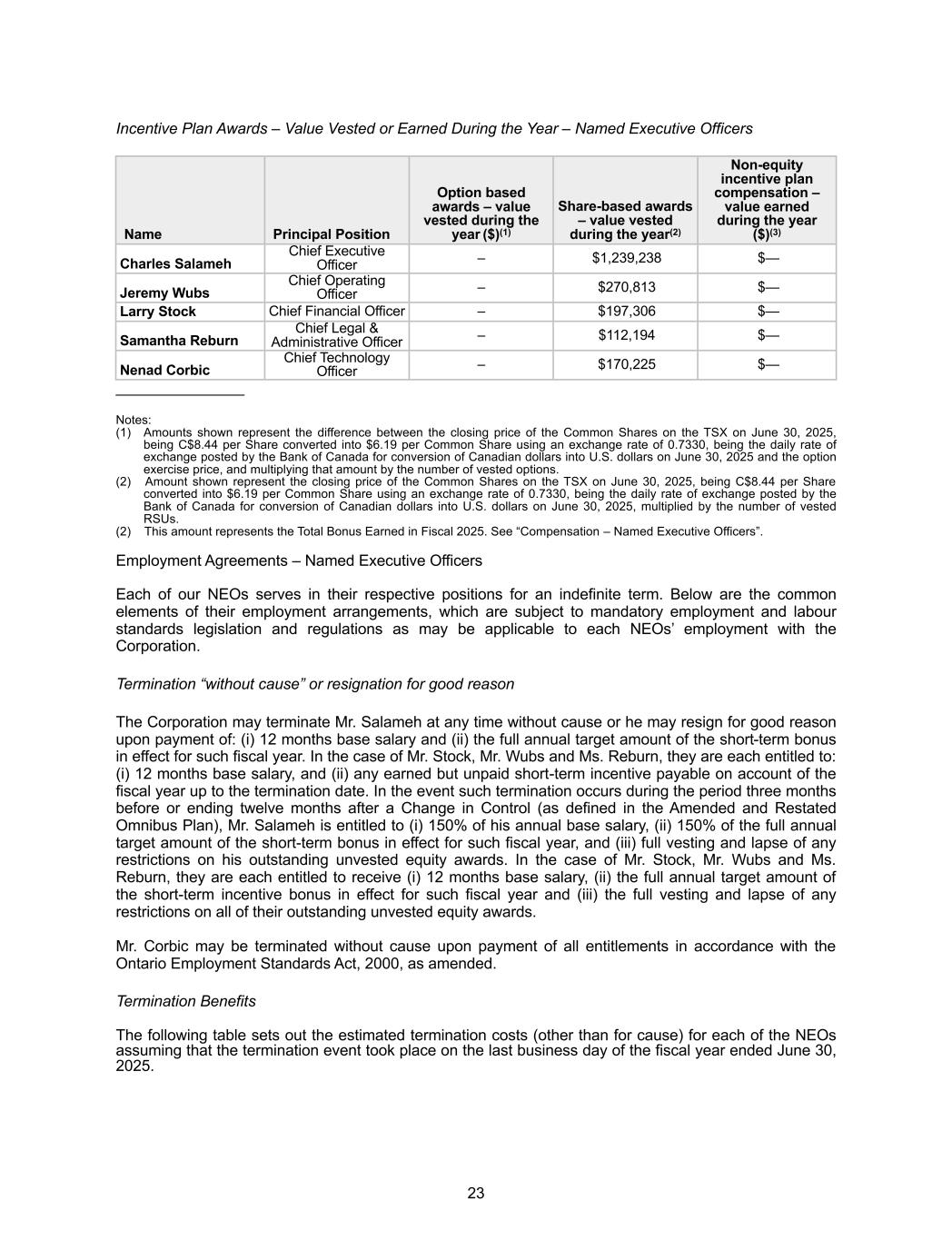

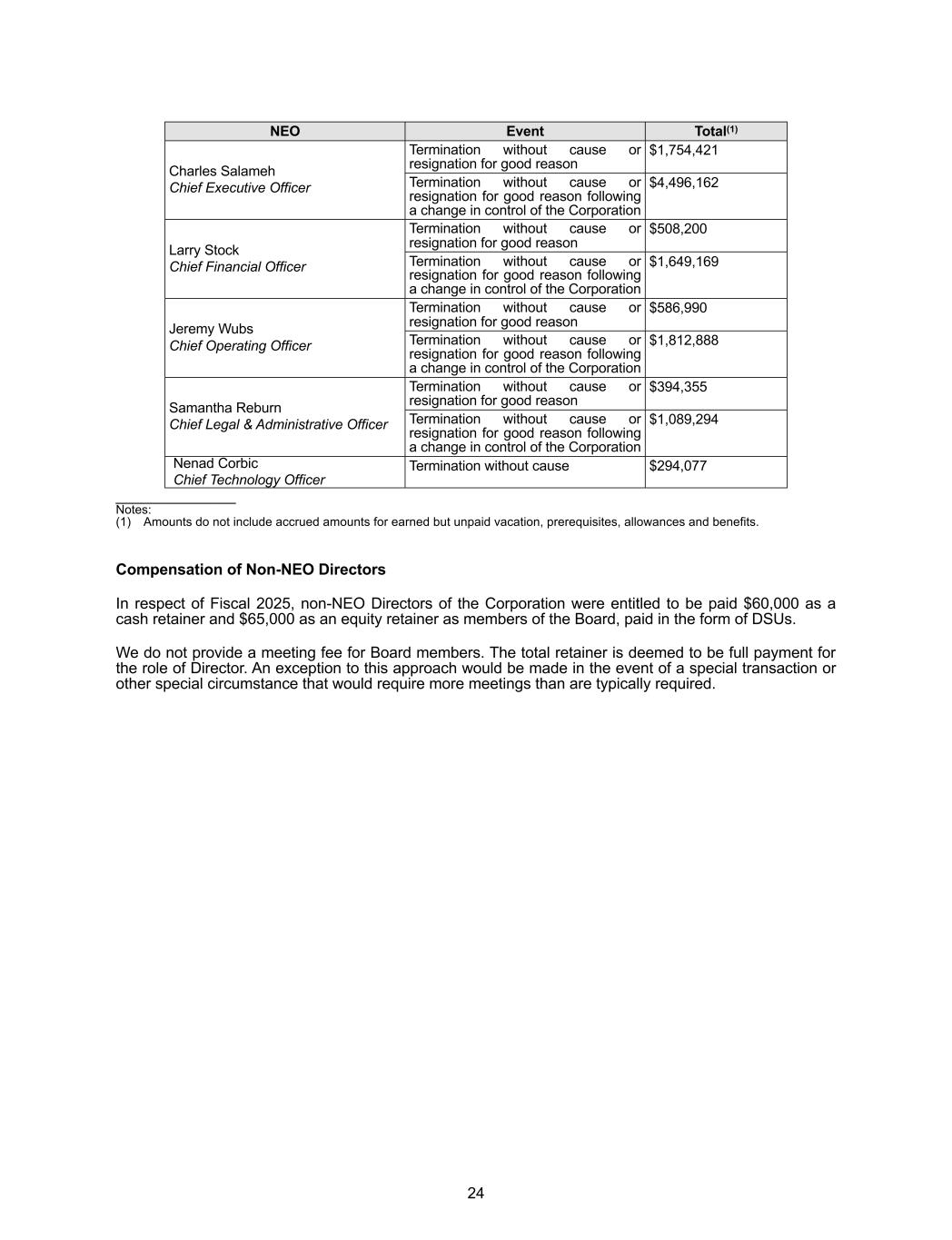

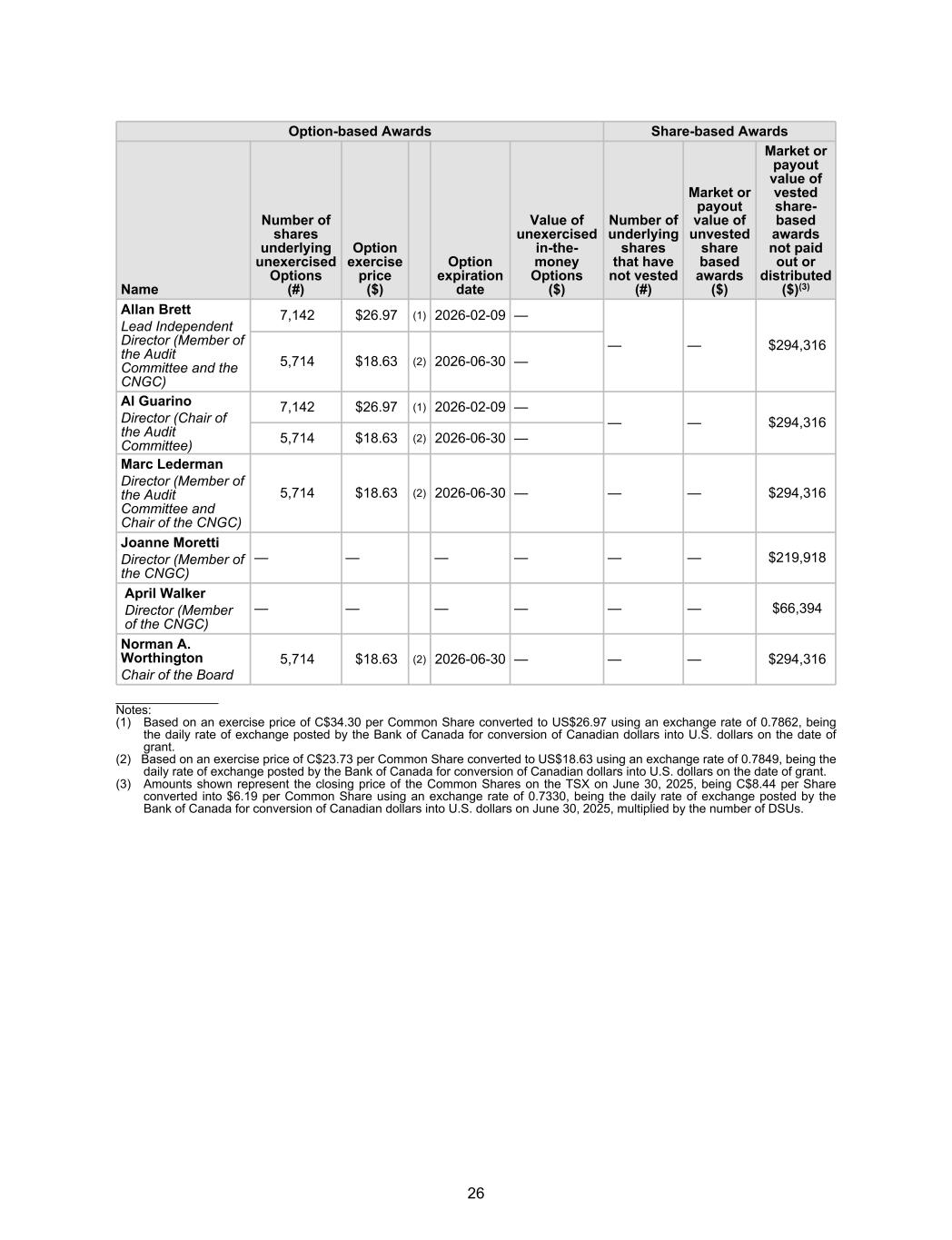

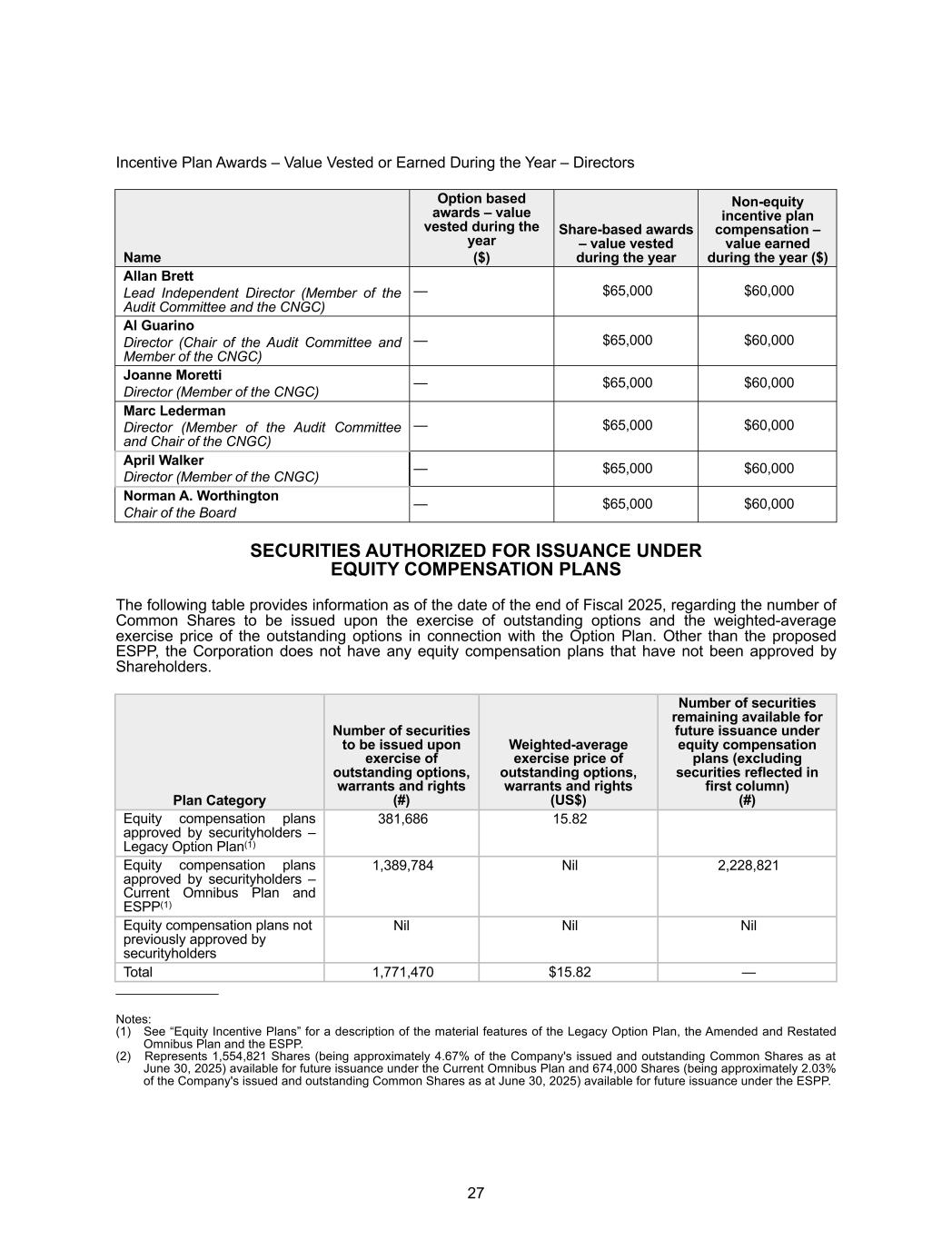

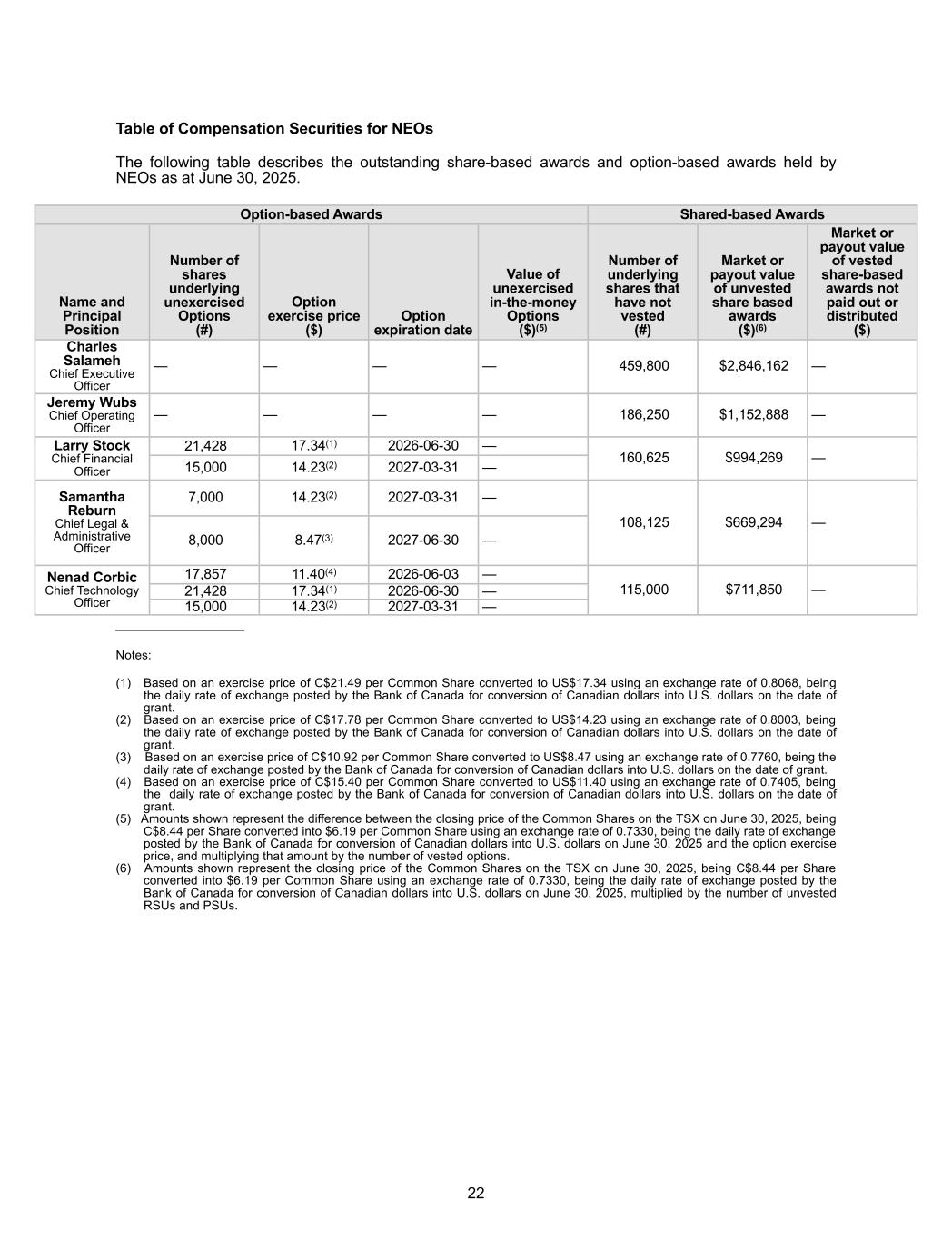

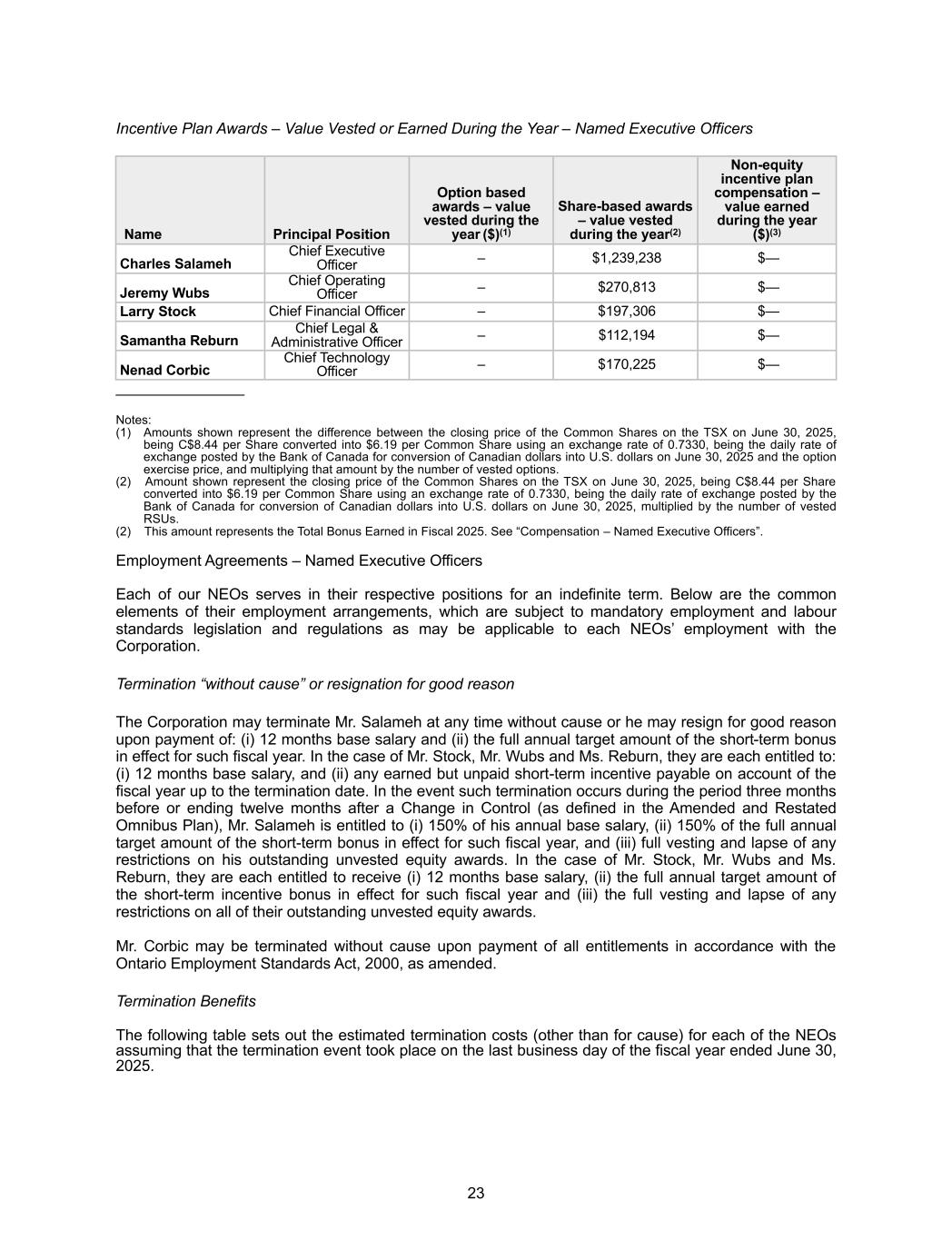

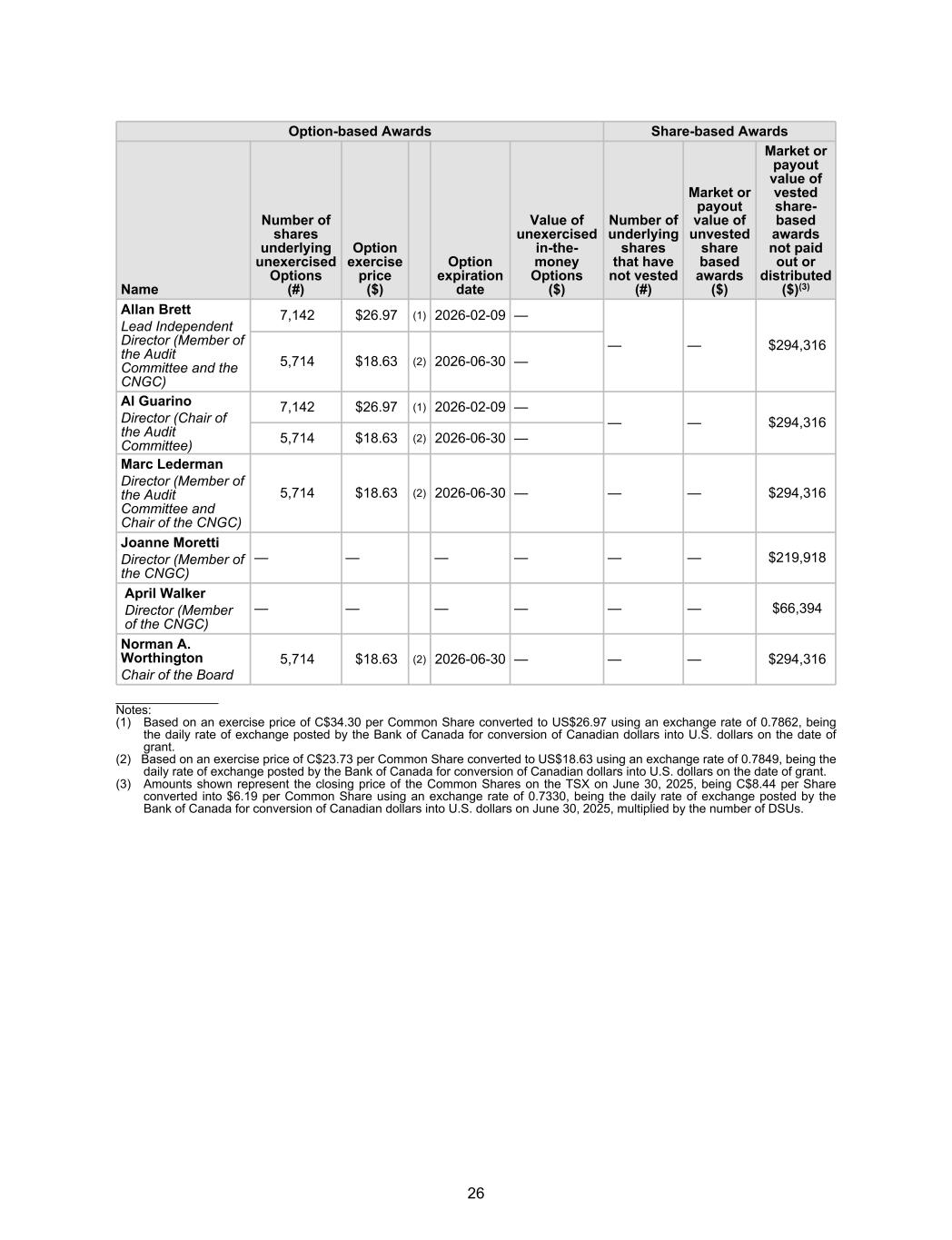

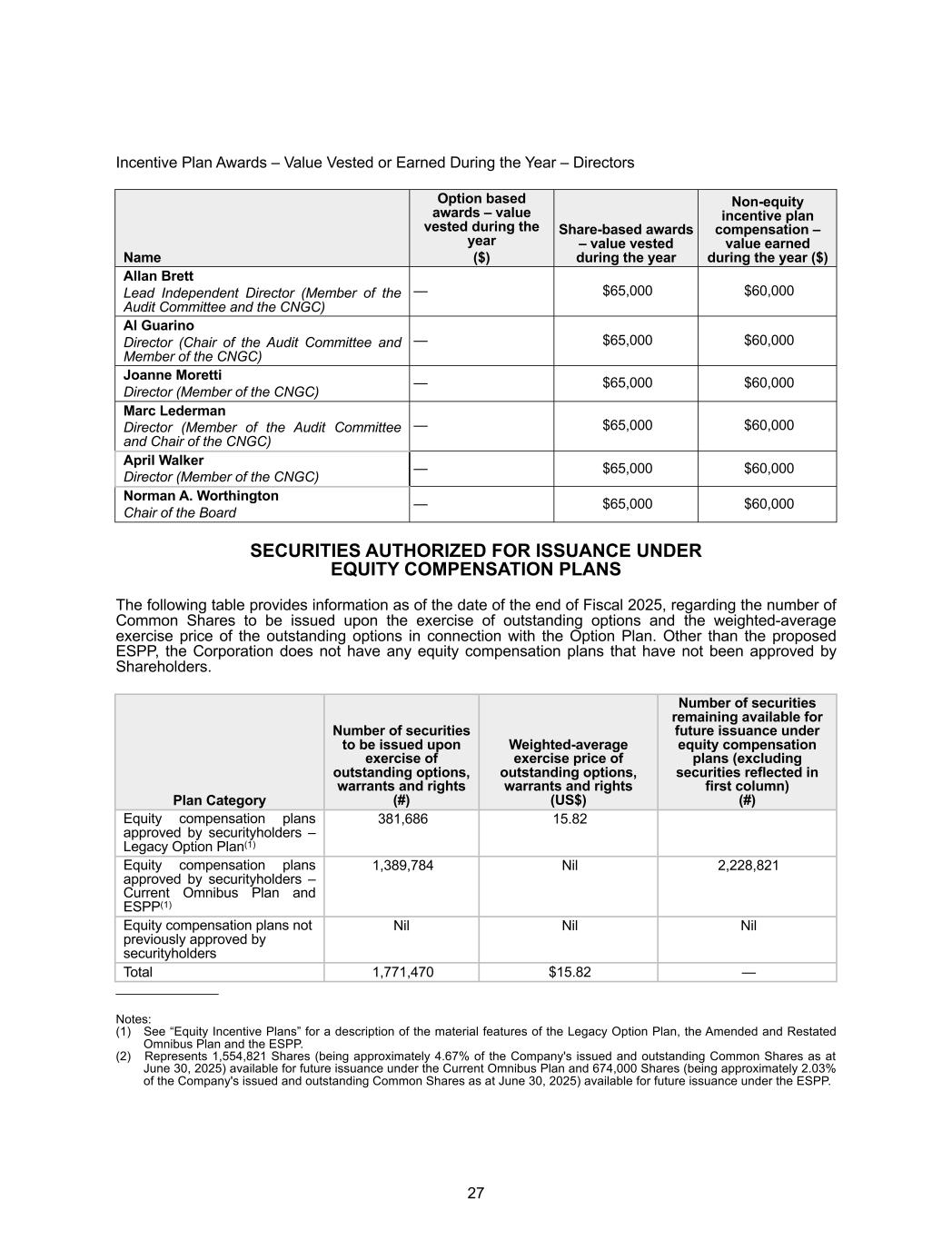

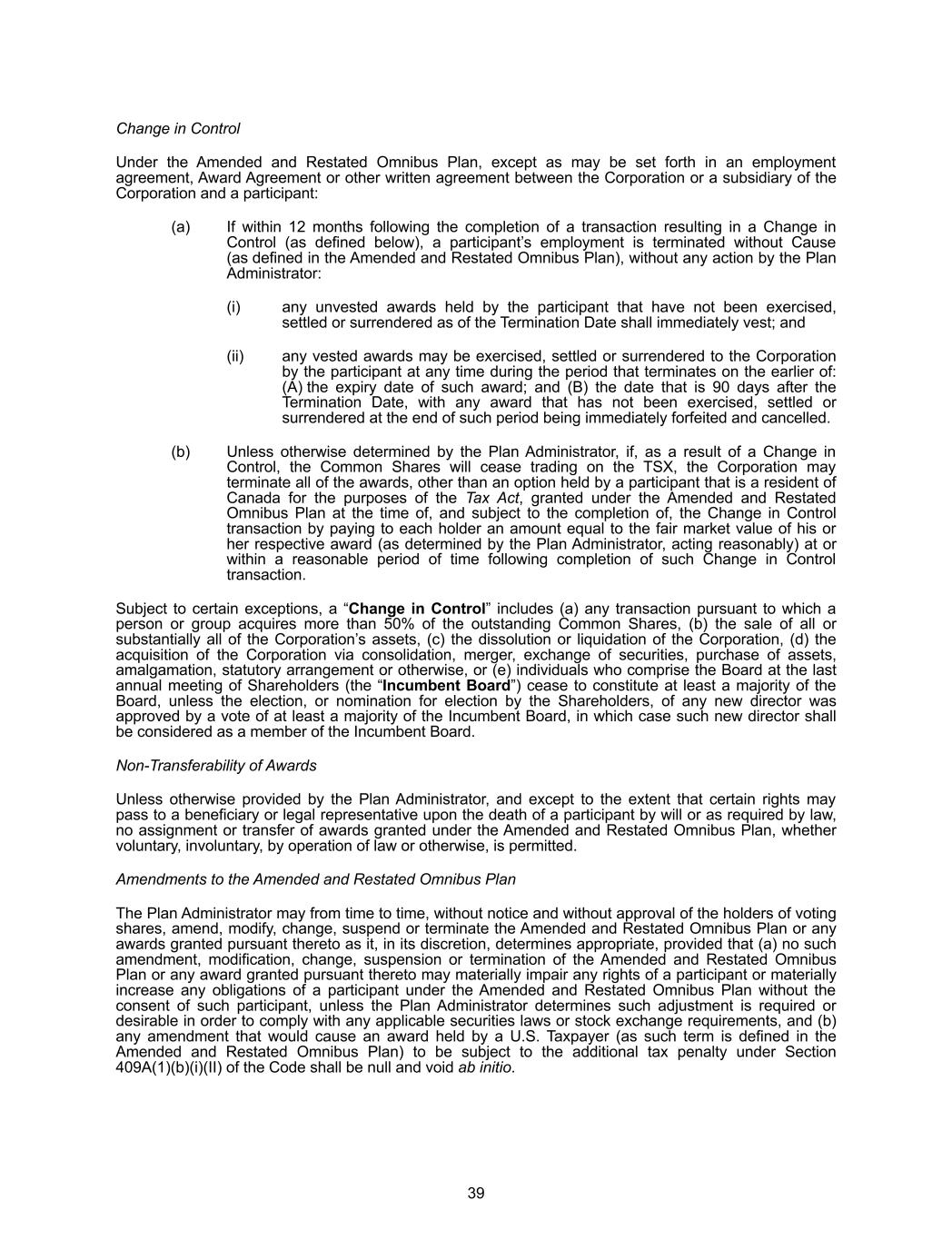

22 Table of Compensation Securities for NEOs The following table describes the outstanding share-based awards and option-based awards held by NEOs as at June 30, 2025. Option-based Awards Shared-based Awards Name and Principal Position Number of shares underlying unexercised Options (#) Option exercise price ($) Option expiration date Value of unexercised in-the-money Options ($)(5) Number of underlying shares that have not vested (#) Market or payout value of unvested share based awards ($)(6) Market or payout value of vested share-based awards not paid out or distributed ($) Charles Salameh Chief Executive Officer — — — — 459,800 $2,846,162 — Jeremy Wubs Chief Operating Officer — — — — 186,250 $1,152,888 — Larry Stock Chief Financial Officer 21,428 17.34(1) 2026-06-30 — 160,625 $994,269 — 15,000 14.23(2) 2027-03-31 — Samantha Reburn Chief Legal & Administrative Officer 7,000 14.23(2) 2027-03-31 — 108,125 $669,294 — 8,000 8.47(3) 2027-06-30 — Nenad Corbic Chief Technology Officer 17,857 11.40(4) 2026-06-03 — 115,000 $711,850 — 21,428 17.34(1) 2026-06-30 — 15,000 14.23(2) 2027-03-31 — _______________ Notes: (1) Based on an exercise price of C$21.49 per Common Share converted to US$17.34 using an exchange rate of 0.8068, being the daily rate of exchange posted by the Bank of Canada for conversion of Canadian dollars into U.S. dollars on the date of grant. (2) Based on an exercise price of C$17.78 per Common Share converted to US$14.23 using an exchange rate of 0.8003, being the daily rate of exchange posted by the Bank of Canada for conversion of Canadian dollars into U.S. dollars on the date of grant. (3) Based on an exercise price of C$10.92 per Common Share converted to US$8.47 using an exchange rate of 0.7760, being the daily rate of exchange posted by the Bank of Canada for conversion of Canadian dollars into U.S. dollars on the date of grant. (4) Based on an exercise price of C$15.40 per Common Share converted to US$11.40 using an exchange rate of 0.7405, being the daily rate of exchange posted by the Bank of Canada for conversion of Canadian dollars into U.S. dollars on the date of grant. (5) Amounts shown represent the difference between the closing price of the Common Shares on the TSX on June 30, 2025, being C$8.44 per Share converted into $6.19 per Common Share using an exchange rate of 0.7330, being the daily rate of exchange posted by the Bank of Canada for conversion of Canadian dollars into U.S. dollars on June 30, 2025 and the option exercise price, and multiplying that amount by the number of vested options. (6) Amounts shown represent the closing price of the Common Shares on the TSX on June 30, 2025, being C$8.44 per Share converted into $6.19 per Common Share using an exchange rate of 0.7330, being the daily rate of exchange posted by the Bank of Canada for conversion of Canadian dollars into U.S. dollars on June 30, 2025, multiplied by the number of unvested RSUs and PSUs.