1Q23 Shareholder Letter Exhibit 99.2

To Our AppLovin Shareholders: In the first quarter of 2023 we continued to execute against our growth initiatives and exceeded the top end of our guidance. After substantially completing our cost and Apps portfolio optimization projects, our team is focused on three key growth initiatives within our Software Platform segment: 1) upgrading our core machine learning AXON technology; 2) expanding our ad solutions into Connected-TV; and 3) extending our marketing platform to carriers and OEMs. Our solid financial performance in the first quarter was driven by our market leading solutions which led to record quarterly Software Platform revenue of $355 million, an increase of 16% over the prior quarter. Total revenue for the first quarter grew to $715 million, above the top end of our quarterly guidance by $10 million. Our net loss was $5 million, net margin was (1)%, and Adjusted EBITDA was $274 million, slightly above the top end of our quarterly guidance, at a 38% Adjusted EBITDA margin. During the quarter, we generated $289 million of net cash from operating activities and $283 million of Free Cash Flow, both of which primarily benefited from several large customer payments from prior periods. We had $1.2 billion of cash and cash equivalents at the end of the quarter. Year-to-date through May 8th, we repurchased $202 million of our Class A common stock and have $210 million remaining under our $750 million authorization. For the second quarter of 2023, we expect steady overall performance for the business, and our outlook is as follows: Financial Guidance Summary1 2Q23 Total Revenue $710 to $730 million Adjusted EBITDA $280 to $300 million Adjusted EBITDA Margin 39% - 41% AppLovin Corporation / 1Q23 Shareholder Letter 2 1 We have not provided the forward-looking GAAP equivalents for forward-looking non-GAAP metrics, specifically Adjusted EBITDA and Adjusted EBITDA margin, or a GAAP reconciliation as a result of the uncertainty regarding, and the potential variability of, reconciling items such as stock-based compensation expense. Accordingly, a reconciliation of these non-GAAP guidance metrics to their corresponding GAAP equivalents is not available without unreasonable effort. However, it is important to note that material changes to reconciling items could have a significant effect on future GAAP results. We have provided historical reconciliations of GAAP to non-GAAP metrics in tables at the end of this letter.

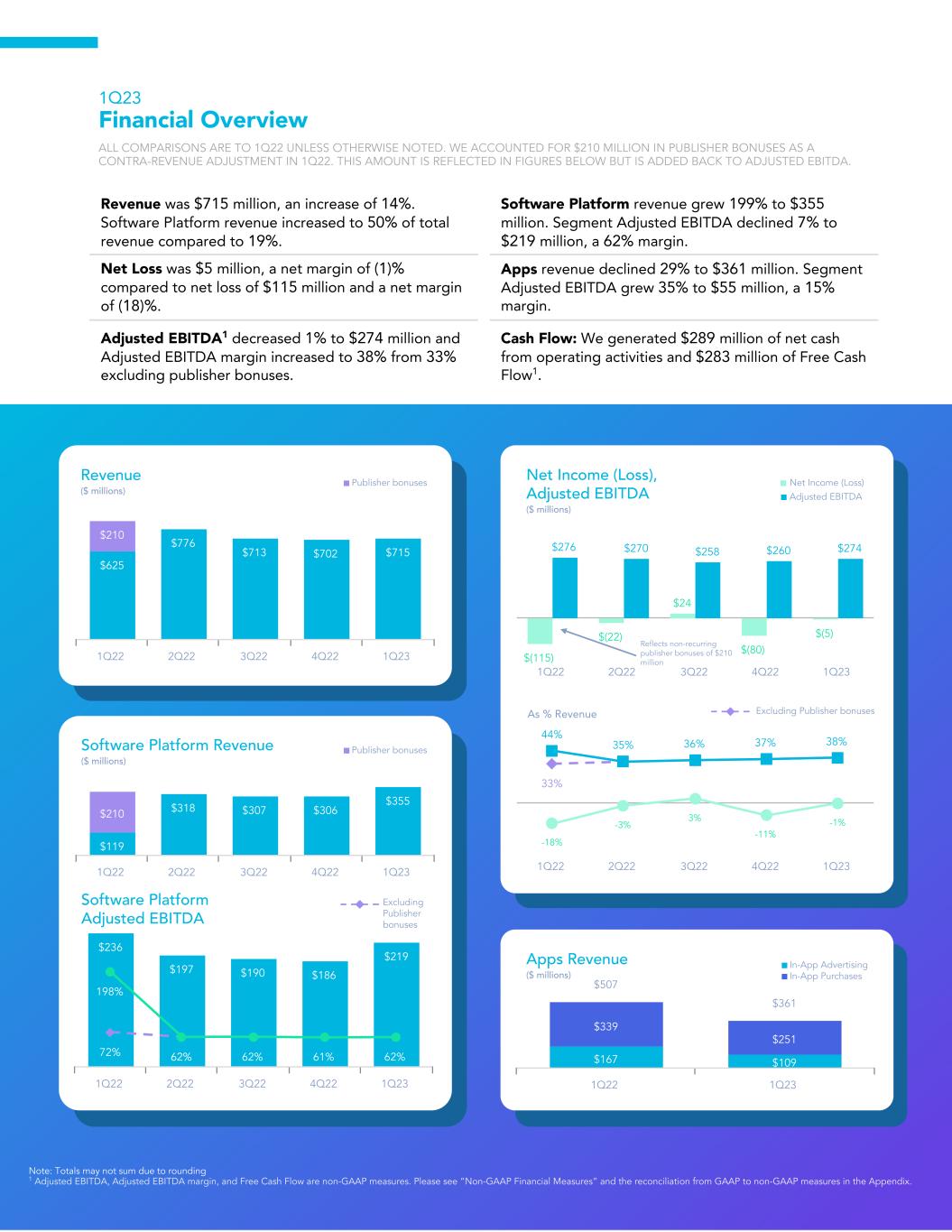

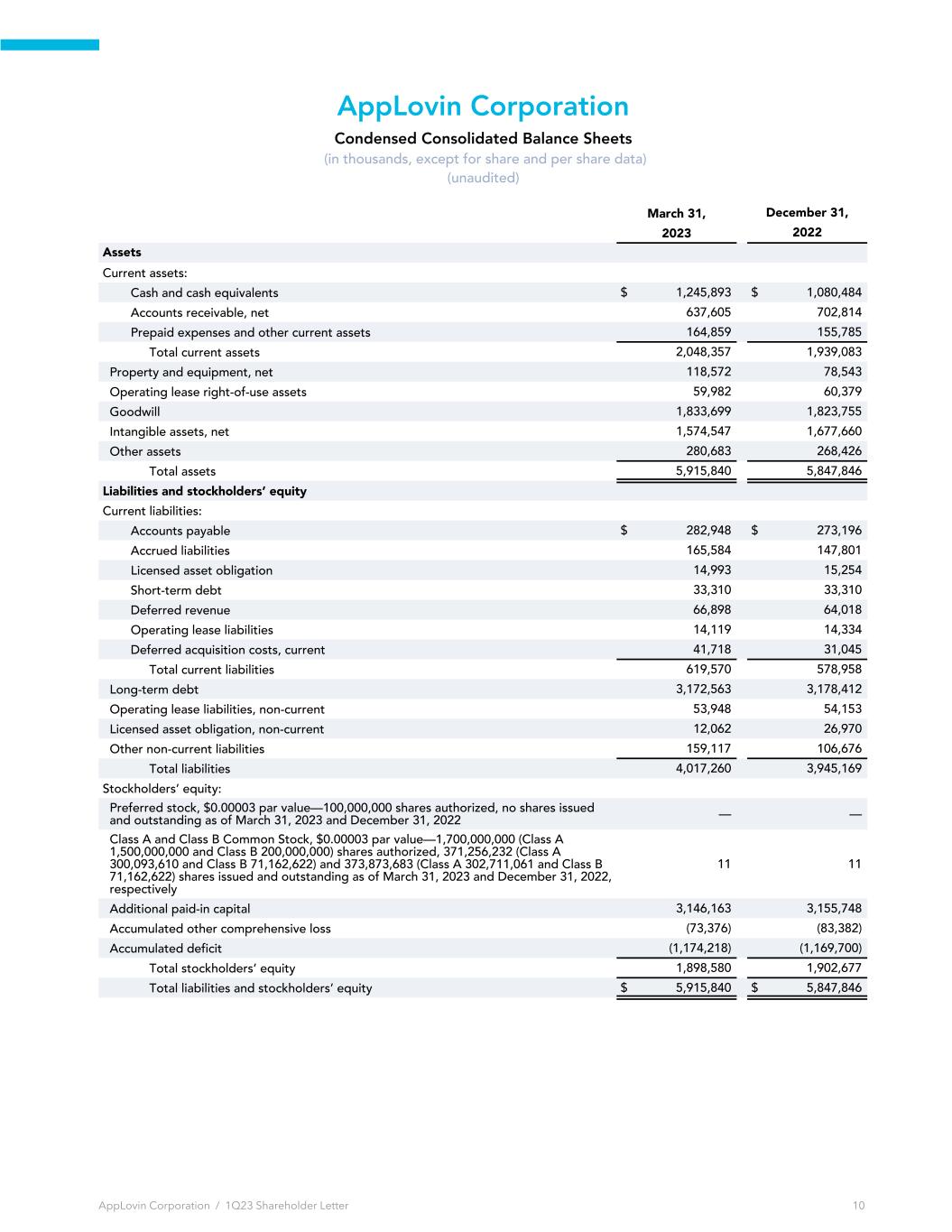

$625 $776 $713 $702 $715 $210 1Q22 2Q22 3Q22 4Q22 1Q23 Revenue ($ millions) Publisher bonuses $119 $318 $307 $306 $355 $210 1Q22 2Q22 3Q22 4Q22 1Q23 Software Platform Revenue ($ millions) Publisher bonuses $236 $197 $190 $186 $219 72% 62% 198% 62% 61% 62% 1Q22 2Q22 3Q22 4Q22 1Q23 Software Platform Adjusted EBITDA Excluding Publisher bonuses $(115) $(22) $24 $(80) $(5) $276 $270 $258 $260 $274 1Q22 2Q22 3Q22 4Q22 1Q23 Net Income (Loss), Adjusted EBITDA ($ millions) Net Income (Loss) Adjusted EBITDA Reflects non-recurring publisher bonuses of $210 million 33% 44% 35% 36% 37% 38% -18% -3% 3% -11% -1% 1Q22 2Q22 3Q22 4Q22 1Q23 As % Revenue Excluding Publisher bonuses $167 $109 $339 $251 $507 $361 1Q22 1Q23 Apps Revenue ($ millions) In-App Advertising In-App Purchases 1Q23 Financial Overview ALL COMPARISONS ARE TO 1Q22 UNLESS OTHERWISE NOTED. WE ACCOUNTED FOR $210 MILLION IN PUBLISHER BONUSES AS A CONTRA-REVENUE ADJUSTMENT IN 1Q22. THIS AMOUNT IS REFLECTED IN FIGURES BELOW BUT IS ADDED BACK TO ADJUSTED EBITDA. Revenue was $715 million, an increase of 14%. Software Platform revenue increased to 50% of total revenue compared to 19%. Software Platform revenue grew 199% to $355 million. Segment Adjusted EBITDA declined 7% to $219 million, a 62% margin. Net Loss was $5 million, a net margin of (1)% compared to net loss of $115 million and a net margin of (18)%. Apps revenue declined 29% to $361 million. Segment Adjusted EBITDA grew 35% to $55 million, a 15% margin. Adjusted EBITDA1 decreased 1% to $274 million and Adjusted EBITDA margin increased to 38% from 33% excluding publisher bonuses. Cash Flow: We generated $289 million of net cash from operating activities and $283 million of Free Cash Flow1. Note: Totals may not sum due to rounding 1 Adjusted EBITDA, Adjusted EBITDA margin, and Free Cash Flow are non-GAAP measures. Please see “Non-GAAP Financial Measures” and the reconciliation from GAAP to non-GAAP measures in the Appendix.

Software Platform Update In the first quarter, we achieved our highest quarterly Software Platform revenue at $355 million, growing 199% year-over-year (8% growth after excluding the impact of publisher bonuses in the prior year period). The 8% increase in revenue was primarily driven by partial stabilization in the mobile app ad market and continued improvements in our core advertising technology resulting in higher revenue per install from our advertising solutions, and a modest contribution from our acquisition of Wurl. Software Platform revenue increased 16% sequentially, performing above our expectations while Software Platform Adjusted EBITDA grew 18% to $219 million at an Adjusted EBITDA margin of 62%. Over the past four quarters, our Software Platform business has delivered consistent financial performance with strong margins at over 60% Adjusted EBITDA margin, illustrating the stability in our advertising solutions. We are excited by this segment’s prospects as we continue to invest in our team and technology. $119 $318 $307 $306 $355 $210 1Q22 2Q22 3Q22 4Q22 1Q23 Software Platform Revenue ($ millions) Publisher bonuses $236 $197 $190 $186 $219 72% 62% 198% 62% 61% 62% 1Q22 2Q22 3Q22 4Q22 1Q23 Software Platform Adjusted EBITDA ($ millions, as % revenue) Excluding Publisher bonuses AppLovin Corporation / 1Q23 Shareholder Letter 4

Apps Update In the first quarter, we substantially completed the operational optimization of our Apps portfolio which included reducing operating costs and renegotiating earn-out arrangements. We also added to our existing portfolio by investing in several new game launches. We will continue to invest in, launch, and closely manage new games which may temporarily reduce our Apps Adjusted EBITDA margin but provide an opportunity for future revenue and margin expansion. In the first quarter, our Apps segment revenue declined 29% year-over-year to $361 million due primarily to a decline in In-App Purchase (IAP) revenue. Apps Adjusted EBITDA increased 35% year-over-year to $55 million and Adjusted EBITDA margin improved to 15% from 8% due to a reduction in user acquisition spend and operating costs, and the sale of underperforming non- strategic assets as part of the optimization of the Apps segment. $507 $459 $407 $396 $361 1Q22 2Q22 3Q22 4Q22 1Q23 Apps Revenue ($ millions) $41 $73 $67 $74 $55 8% 16% 17% 19% 15% 1Q22 2Q22 3Q22 4Q22 1Q23 Apps Adjusted EBITDA ($ millions, as % revenue) AppLovin Corporation / 1Q23 Shareholder Letter 5

Conclusion We remain focused on investing in our team to deliver market leading advertising solutions. We believe the actions we continue to take to build our team, core technology and new solutions together with our strong financial position will position us well to deliver long-term shareholder value. Regards, Adam Foroughi, CEO Herald Chen, President & CFO AppLovin Corporation / 1Q23 Shareholder Letter 6

Appendix This shareholder letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements generally relate to future events or our future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as “may,” “will,” “should,” “expect,” “plan,” “anticipate,” “going to,” “could,” “intend,” “target,” “project,” “contemplate,” “believe,” “estimate,” “predict,” “potential,” or “continue,” or the negative of these words or other similar terms or expressions that concern our expectations, strategy, priorities, plans, or intentions. Forward-looking statements in this letter to shareholders include, but are not limited to, statements regarding our future financial performance, including our expected financial results and guidance, our goals and growth prospects; our expectations regarding the prospects and financial performance of each of our segments; and our expectations regarding our new game launches and any future transactions. Our expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties, including changes in our plans or assumptions, which could cause actual results to differ materially from those projected. These risks include our inability to forecast our business due to our limited operating history, the macroeconomic environment, fluctuations in our results of operations, our ability to execute on our operational and financial priorities, our ability to scale our Software Platform to support new users, the competitive mobile app ecosystem, our inability to adapt to emerging technologies and business models, and risks relating to our ongoing review of our Apps portfolio. The forward-looking statements contained in this letter are also subject to other risks and uncertainties, including those more fully described in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022. Additional information will also be set forth in our Quarterly Report on Form 10-Q for the fiscal quarter ended March 31, 2023. The forward-looking statements in this letter are based on information available to us as of the date hereof, and we disclaim any obligation to update any forward-looking statements, except as required by law. AppLovin Corporation / 1Q23 Shareholder Letter 7

Non-GAAP Financial Metrics To supplement our financial information presented in accordance with generally accepted accounting principles in the United States (“GAAP”), this shareholder letter includes certain financial measures that are not prepared in accordance with GAAP, including Adjusted EBITDA, Adjusted EBITDA margin, Free Cash Flow, and certain measures adjusted for publisher bonuses. A reconciliation of each such non- GAAP financial measure to the most directly comparable GAAP measure can be found below. We define Adjusted EBITDA for a particular period as net income (loss) before interest expense and loss on settlement of debt, other (income) expense, net (excluding certain recurring items), provision for (benefit from) income taxes, amortization, depreciation and write-offs and as further adjusted for non- operating foreign exchange (gains) losses, stock-based compensation expense, acquisition-related expense and transaction bonuses, publisher bonuses, MoPub acquisition transition services, restructuring costs, impairment and loss in connection with sale of long-lived assets, loss (gain) on extinguishments of acquisition-related contingent consideration, lease modification and abandonment of leasehold improvements, and change in the fair value of contingent consideration. We define Adjusted EBITDA margin as Adjusted EBITDA divided by revenue for the same period. We believe that the presentation of these non-GAAP financial measures provides useful information to investors regarding our results of operations and operating performance, as they are similar to measures reported by our public competitors and are regularly used by securities analysts, institutional investors, and other interested parties in analyzing operating performance and prospects. We define Free Cash Flow as net cash provided by operating activities less purchases of property and equipment and principal payments on finance leases. We subtract both purchases of property and equipment and payment of finance leases in our calculation of Free Cash Flow because we believe these items represent our ongoing requirements for property and equipment to support our business, regardless of whether we utilize a finance lease to obtain such property or equipment. Adjusted EBITDA and Adjusted EBITDA margin are key measures we use to assess our financial performance and are also used for internal planning and forecasting purposes. We believe Adjusted EBITDA and Adjusted EBITDA margin are helpful to investors, analysts, and other interested parties because they can assist in providing a more consistent and comparable overview of our operations across our historical financial periods. In addition, these measures are frequently used by analysts, investors, and other interested parties to evaluate and assess performance. We use Adjusted EBITDA and Adjusted EBITDA margin in conjunction with GAAP measures as part of our overall assessment of our performance, including the preparation of our annual operating budget and quarterly forecasts, to evaluate the effectiveness of our business strategies, and to communicate with our board of directors concerning our financial performance. We believe that the presentation of certain measures adjusted for publisher bonuses are useful in understanding the ongoing results of our operations and for comparability to prior periods. We use Free Cash Flow in addition to GAAP measures to help manage our business and prepare budgets and annual planning, and we believe Free Cash Flow provides useful supplemental information to help investors understand underlying trends in our business and our liquidity. These measures have certain limitations in that they do not include the impact of certain expenses that are reflected in our consolidated statement of operations that are necessary to run our business. Our definitions may differ from the definitions used by other companies and therefore comparability may be limited. In addition, other companies may not publish these or similar metrics. Thus, our non-GAAP AppLovin Corporation / 1Q23 Shareholder Letter 8

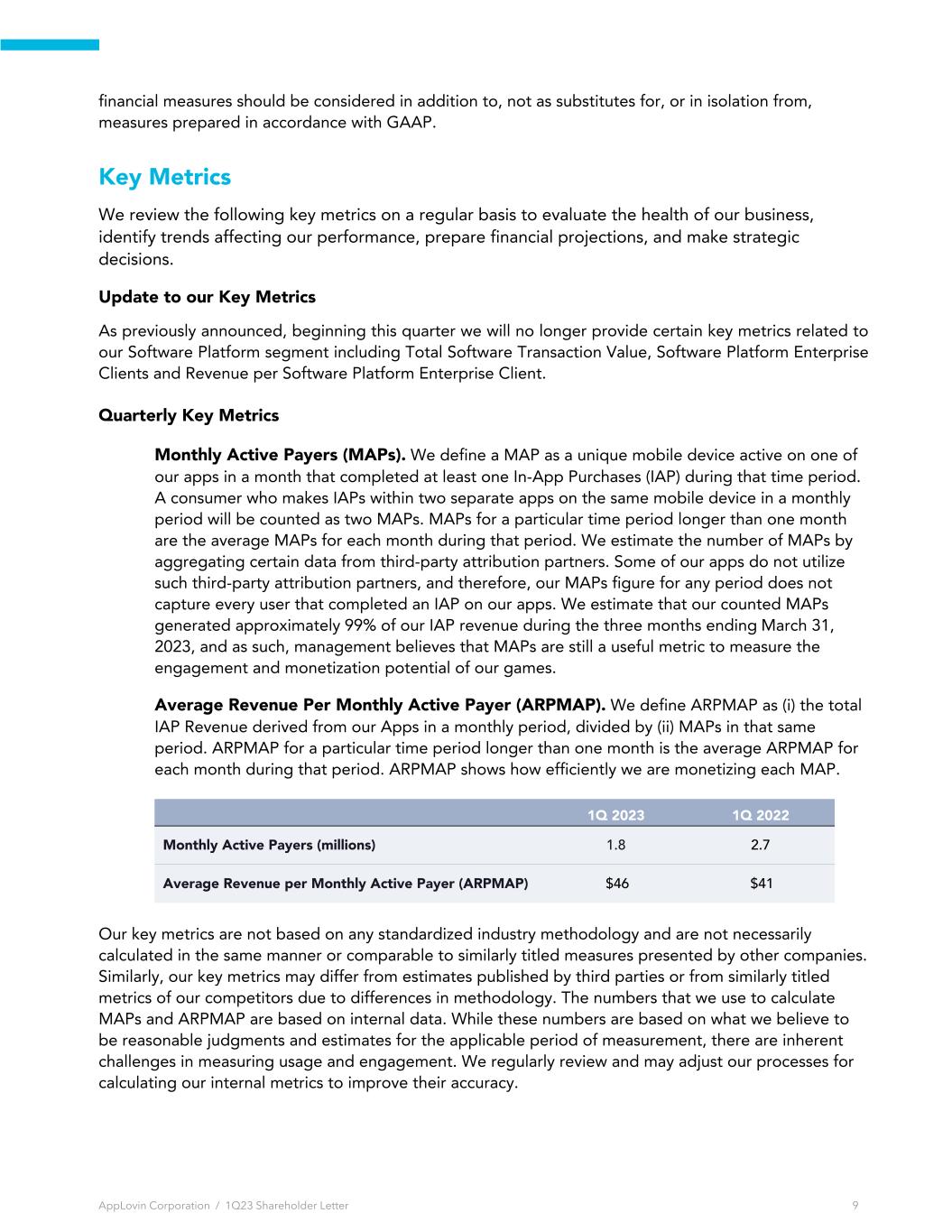

financial measures should be considered in addition to, not as substitutes for, or in isolation from, measures prepared in accordance with GAAP. Key Metrics We review the following key metrics on a regular basis to evaluate the health of our business, identify trends affecting our performance, prepare financial projections, and make strategic decisions. Update to our Key Metrics As previously announced, beginning this quarter we will no longer provide certain key metrics related to our Software Platform segment including Total Software Transaction Value, Software Platform Enterprise Clients and Revenue per Software Platform Enterprise Client. Quarterly Key Metrics Monthly Active Payers (MAPs). We define a MAP as a unique mobile device active on one of our apps in a month that completed at least one In-App Purchases (IAP) during that time period. A consumer who makes IAPs within two separate apps on the same mobile device in a monthly period will be counted as two MAPs. MAPs for a particular time period longer than one month are the average MAPs for each month during that period. We estimate the number of MAPs by aggregating certain data from third-party attribution partners. Some of our apps do not utilize such third-party attribution partners, and therefore, our MAPs figure for any period does not capture every user that completed an IAP on our apps. We estimate that our counted MAPs generated approximately 99% of our IAP revenue during the three months ending March 31, 2023, and as such, management believes that MAPs are still a useful metric to measure the engagement and monetization potential of our games. Average Revenue Per Monthly Active Payer (ARPMAP). We define ARPMAP as (i) the total IAP Revenue derived from our Apps in a monthly period, divided by (ii) MAPs in that same period. ARPMAP for a particular time period longer than one month is the average ARPMAP for each month during that period. ARPMAP shows how efficiently we are monetizing each MAP. 1Q 2023 1Q 2022 Monthly Active Payers (millions) 1.8 2.7 Average Revenue per Monthly Active Payer (ARPMAP) $46 $41 Our key metrics are not based on any standardized industry methodology and are not necessarily calculated in the same manner or comparable to similarly titled measures presented by other companies. Similarly, our key metrics may differ from estimates published by third parties or from similarly titled metrics of our competitors due to differences in methodology. The numbers that we use to calculate MAPs and ARPMAP are based on internal data. While these numbers are based on what we believe to be reasonable judgments and estimates for the applicable period of measurement, there are inherent challenges in measuring usage and engagement. We regularly review and may adjust our processes for calculating our internal metrics to improve their accuracy. AppLovin Corporation / 1Q23 Shareholder Letter 9

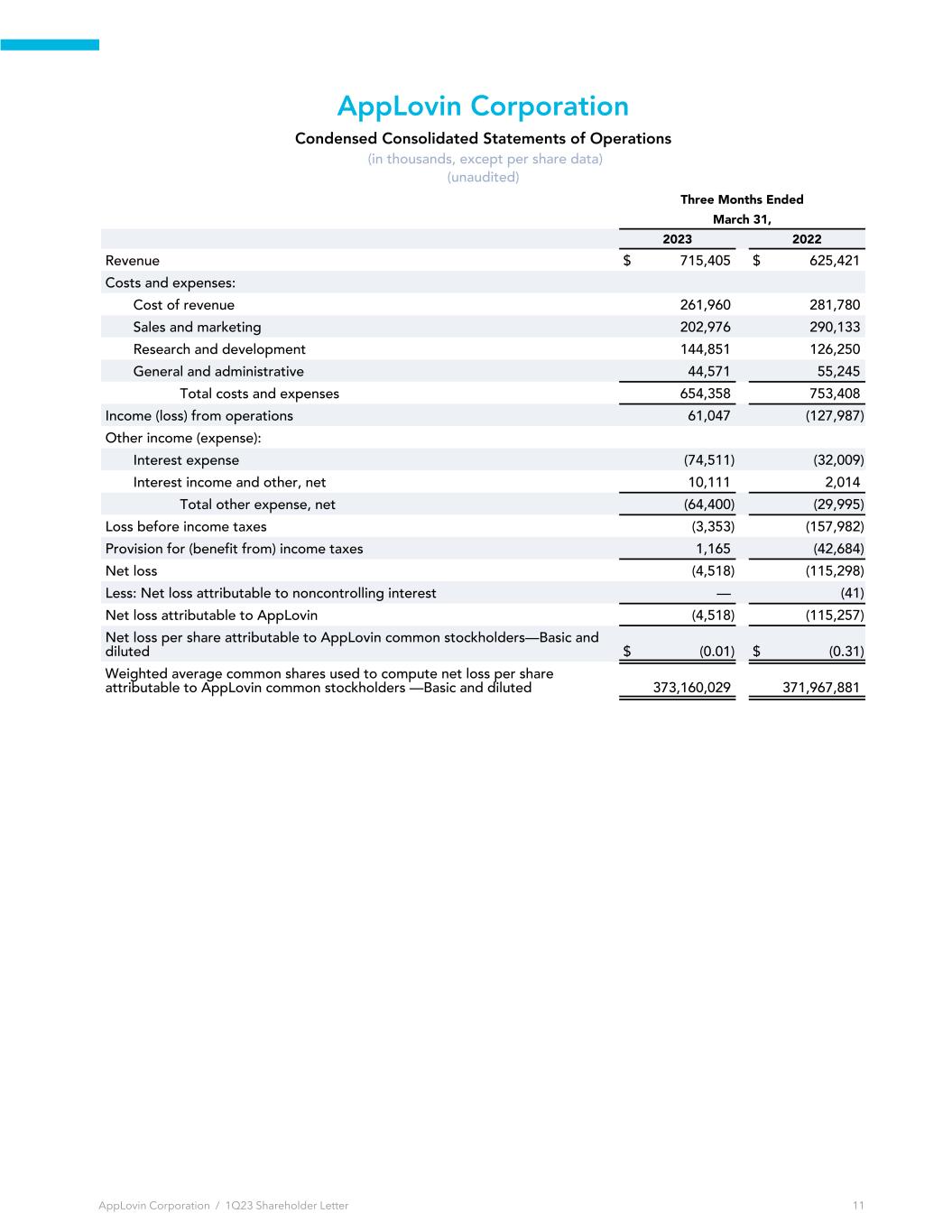

AppLovin Corporation Condensed Consolidated Balance Sheets (in thousands, except for share and per share data) (unaudited) March 31, December 31, 2023 2022 Assets Current assets: Cash and cash equivalents $ 1,245,893 $ 1,080,484 Accounts receivable, net 637,605 702,814 Prepaid expenses and other current assets 164,859 155,785 Total current assets 2,048,357 1,939,083 Property and equipment, net 118,572 78,543 Operating lease right-of-use assets 59,982 60,379 Goodwill 1,833,699 1,823,755 Intangible assets, net 1,574,547 1,677,660 Other assets 280,683 268,426 Total assets 5,915,840 5,847,846 Liabilities and stockholders’ equity Current liabilities: Accounts payable $ 282,948 $ 273,196 Accrued liabilities 165,584 147,801 Licensed asset obligation 14,993 15,254 Short-term debt 33,310 33,310 Deferred revenue 66,898 64,018 Operating lease liabilities 14,119 14,334 Deferred acquisition costs, current 41,718 31,045 Total current liabilities 619,570 578,958 Long-term debt 3,172,563 3,178,412 Operating lease liabilities, non-current 53,948 54,153 Licensed asset obligation, non-current 12,062 26,970 Other non-current liabilities 159,117 106,676 Total liabilities 4,017,260 3,945,169 Stockholders’ equity: Preferred stock, $0.00003 par value—100,000,000 shares authorized, no shares issued and outstanding as of March 31, 2023 and December 31, 2022 — — Class A and Class B Common Stock, $0.00003 par value—1,700,000,000 (Class A 1,500,000,000 and Class B 200,000,000) shares authorized, 371,256,232 (Class A 300,093,610 and Class B 71,162,622) and 373,873,683 (Class A 302,711,061 and Class B 71,162,622) shares issued and outstanding as of March 31, 2023 and December 31, 2022, respectively 11 11 Additional paid-in capital 3,146,163 3,155,748 Accumulated other comprehensive loss (73,376) (83,382) Accumulated deficit (1,174,218) (1,169,700) Total stockholders’ equity 1,898,580 1,902,677 Total liabilities and stockholders’ equity $ 5,915,840 $ 5,847,846 AppLovin Corporation / 1Q23 Shareholder Letter 10

AppLovin Corporation Condensed Consolidated Statements of Operations (in thousands, except per share data) (unaudited) Three Months Ended March 31, 2023 2022 Revenue $ 715,405 $ 625,421 Costs and expenses: Cost of revenue 261,960 281,780 Sales and marketing 202,976 290,133 Research and development 144,851 126,250 General and administrative 44,571 55,245 Total costs and expenses 654,358 753,408 Income (loss) from operations 61,047 (127,987) Other income (expense): Interest expense (74,511) (32,009) Interest income and other, net 10,111 2,014 Total other expense, net (64,400) (29,995) Loss before income taxes (3,353) (157,982) Provision for (benefit from) income taxes 1,165 (42,684) Net loss (4,518) (115,298) Less: Net loss attributable to noncontrolling interest — (41) Net loss attributable to AppLovin (4,518) (115,257) Net loss per share attributable to AppLovin common stockholders—Basic and diluted $ (0.01) $ (0.31) Weighted average common shares used to compute net loss per share attributable to AppLovin common stockholders —Basic and diluted 373,160,029 371,967,881 AppLovin Corporation / 1Q23 Shareholder Letter 11

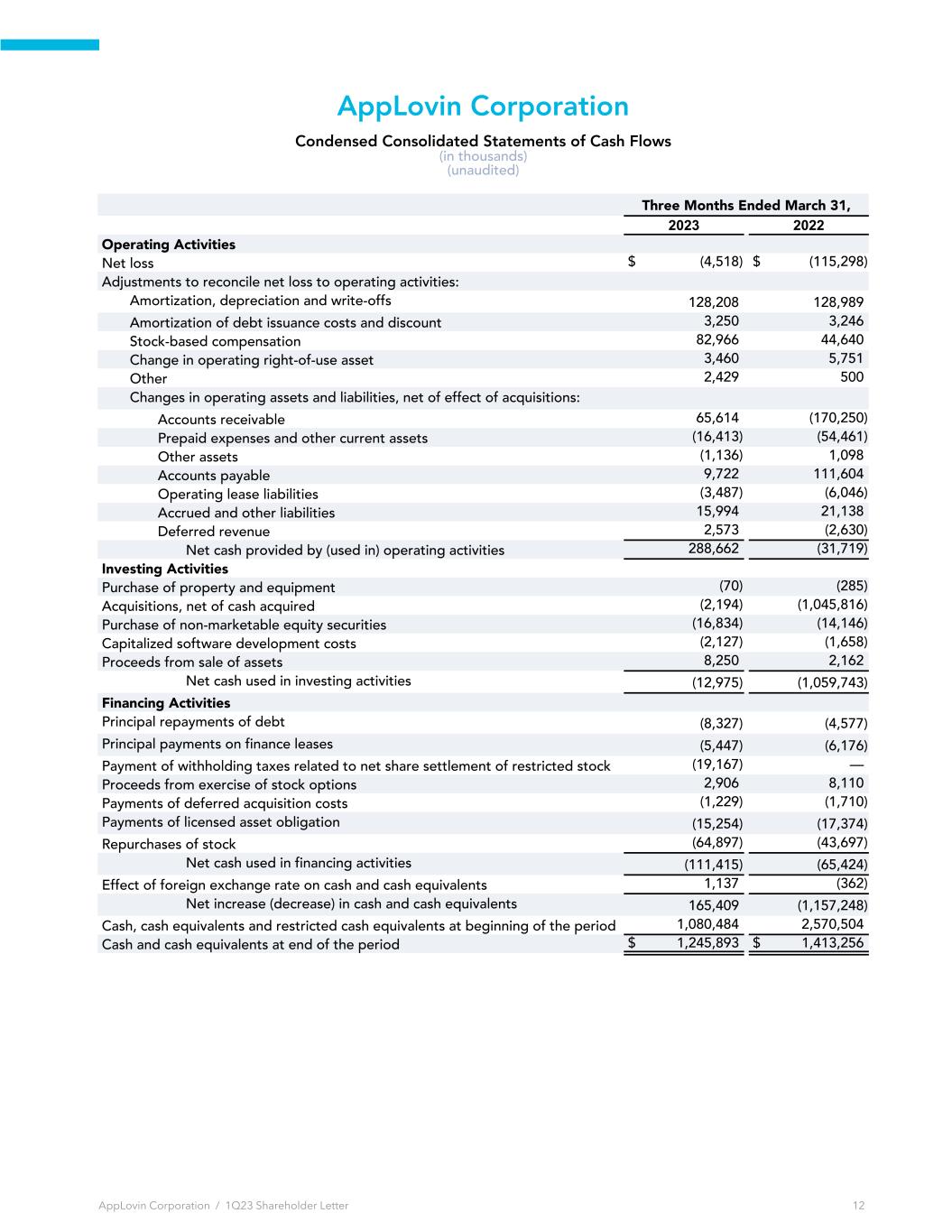

AppLovin Corporation Condensed Consolidated Statements of Cash Flows (in thousands) (unaudited) Three Months Ended March 31, 2023 2022 Operating Activities Net loss $ (4,518) $ (115,298) Adjustments to reconcile net loss to operating activities: Amortization, depreciation and write-offs 128,208 128,989 Amortization of debt issuance costs and discount 3,250 3,246 Stock-based compensation 82,966 44,640 Change in operating right-of-use asset 3,460 5,751 Other 2,429 500 Changes in operating assets and liabilities, net of effect of acquisitions: Accounts receivable 65,614 (170,250) Prepaid expenses and other current assets (16,413) (54,461) Other assets (1,136) 1,098 Accounts payable 9,722 111,604 Operating lease liabilities (3,487) (6,046) Accrued and other liabilities 15,994 21,138 Deferred revenue 2,573 (2,630) Net cash provided by (used in) operating activities 288,662 (31,719) Investing Activities Purchase of property and equipment (70) (285) Acquisitions, net of cash acquired (2,194) (1,045,816) Purchase of non-marketable equity securities (16,834) (14,146) Capitalized software development costs (2,127) (1,658) Proceeds from sale of assets 8,250 2,162 Net cash used in investing activities (12,975) (1,059,743) Financing Activities Principal repayments of debt (8,327) (4,577) Principal payments on finance leases (5,447) (6,176) Payment of withholding taxes related to net share settlement of restricted stock units (19,167) — Proceeds from exercise of stock options 2,906 8,110 Payments of deferred acquisition costs (1,229) (1,710) Payments of licensed asset obligation (15,254) (17,374) Repurchases of stock (64,897) (43,697) Net cash used in financing activities (111,415) (65,424) Effect of foreign exchange rate on cash and cash equivalents 1,137 (362) Net increase (decrease) in cash and cash equivalents 165,409 (1,157,248) Cash, cash equivalents and restricted cash equivalents at beginning of the period 1,080,484 2,570,504 Cash and cash equivalents at end of the period $ 1,245,893 $ 1,413,256 AppLovin Corporation / 1Q23 Shareholder Letter 12

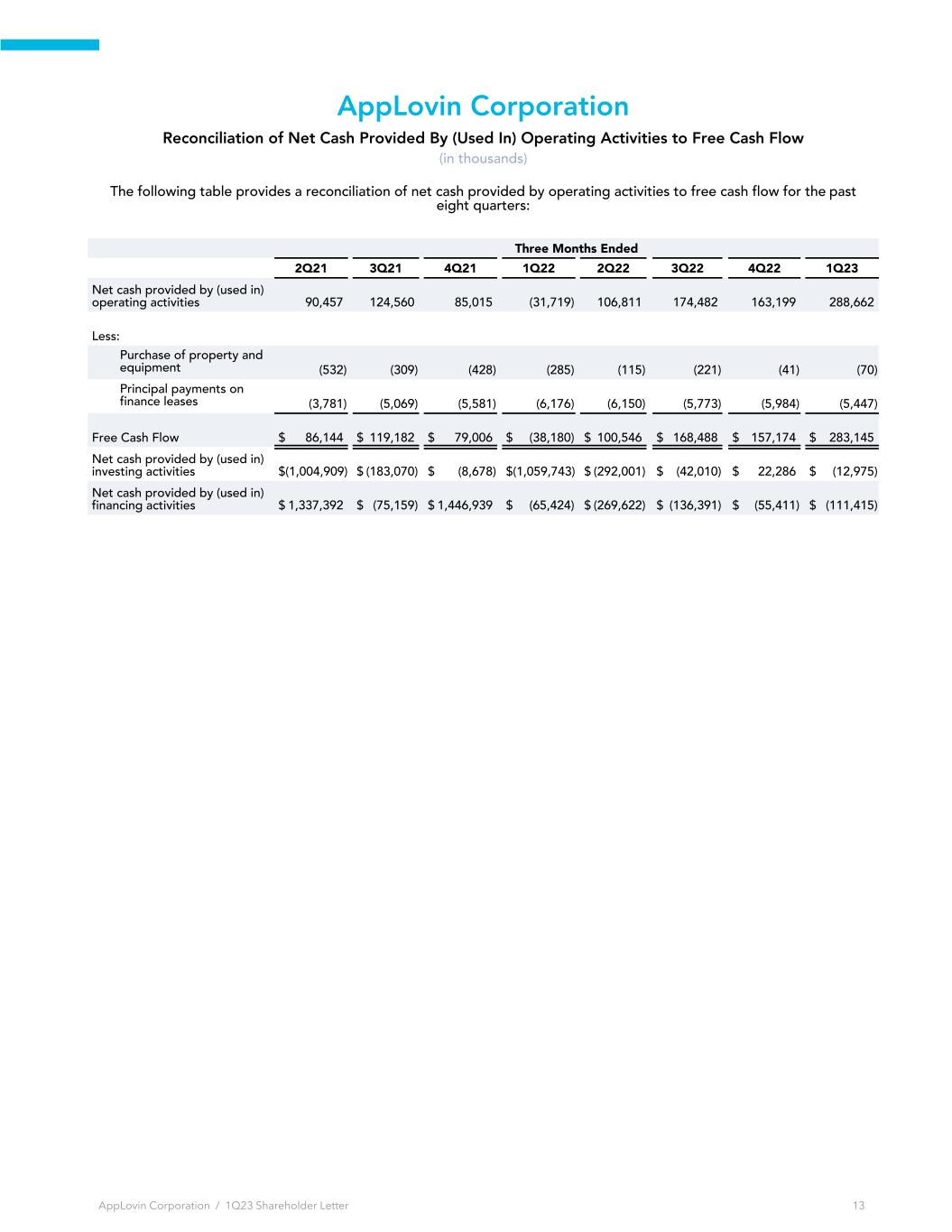

AppLovin Corporation Reconciliation of Net Cash Provided By (Used In) Operating Activities to Free Cash Flow (in thousands) The following table provides a reconciliation of net cash provided by operating activities to free cash flow for the past eight quarters: Three Months Ended 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 Net cash provided by (used in) operating activities 90,457 124,560 85,015 (31,719) 106,811 174,482 163,199 288,662 Less: Purchase of property and equipment (532) (309) (428) (285) (115) (221) (41) (70) Principal payments on finance leases (3,781) (5,069) (5,581) (6,176) (6,150) (5,773) (5,984) (5,447) Free Cash Flow $ 86,144 $ 119,182 $ 79,006 $ (38,180) $ 100,546 $ 168,488 $ 157,174 $ 283,145 Net cash provided by (used in) investing activities $ (1,004,909) $ (183,070) $ (8,678) $ (1,059,743) $ (292,001) $ (42,010) $ 22,286 $ (12,975) Net cash provided by (used in) financing activities $ 1,337,392 $ (75,159) $ 1,446,939 $ (65,424) $ (269,622) $ (136,391) $ (55,411) $ (111,415) AppLovin Corporation / 1Q23 Shareholder Letter 13

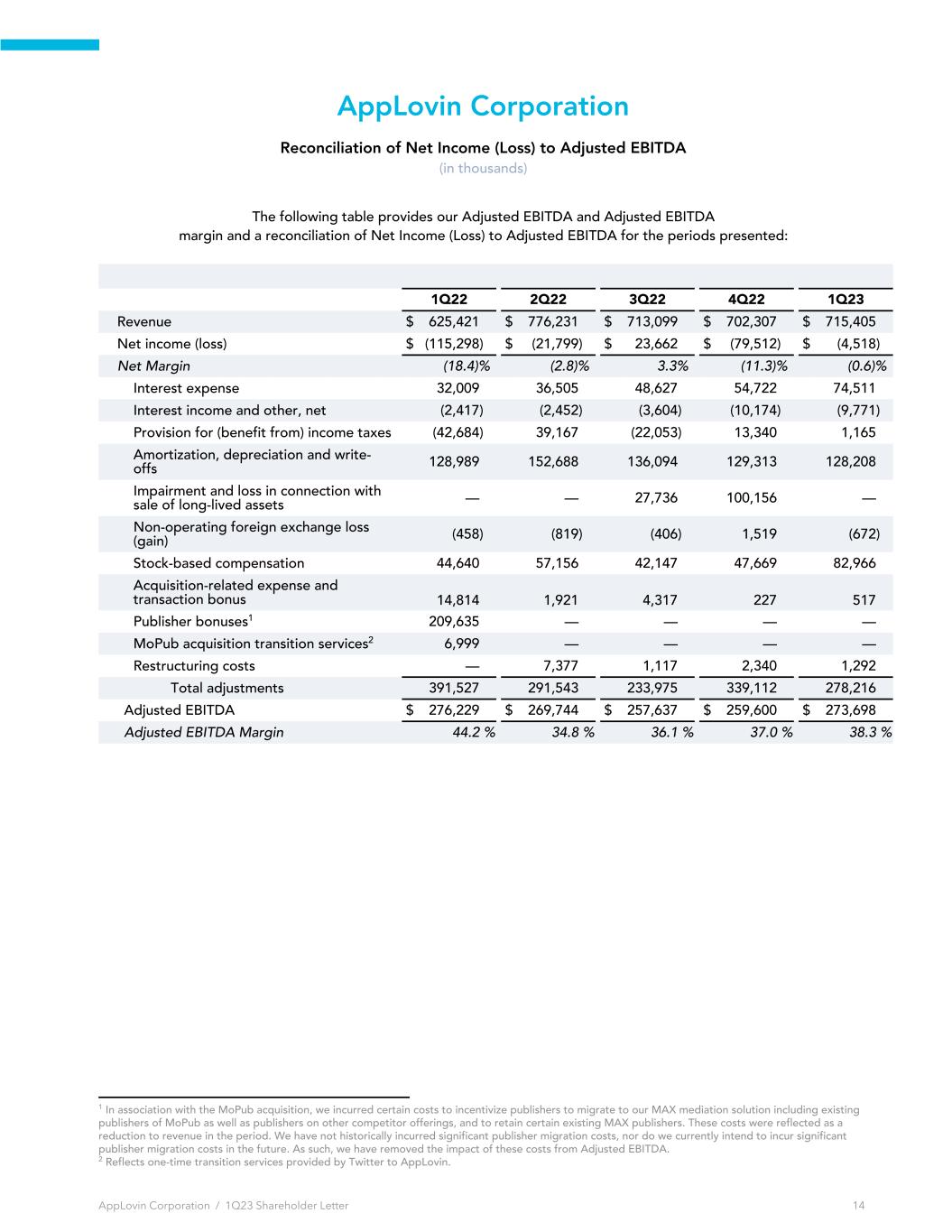

AppLovin Corporation Reconciliation of Net Income (Loss) to Adjusted EBITDA (in thousands) The following table provides our Adjusted EBITDA and Adjusted EBITDA margin and a reconciliation of Net Income (Loss) to Adjusted EBITDA for the periods presented: 1Q22 2Q22 3Q22 4Q22 1Q23 Revenue $ 625,421 $ 776,231 $ 713,099 $ 702,307 $ 715,405 Net income (loss) $ (115,298) $ (21,799) $ 23,662 $ (79,512) $ (4,518) Net Margin (18.4) % (2.8) % 3.3 % (11.3) % (0.6) % Interest expense 32,009 36,505 48,627 54,722 74,511 Interest income and other, net (2,417) (2,452) (3,604) (10,174) (9,771) Provision for (benefit from) income taxes (42,684) 39,167 (22,053) 13,340 1,165 Amortization, depreciation and write- offs 128,989 152,688 136,094 129,313 128,208 Impairment and loss in connection with sale of long-lived assets — — 27,736 100,156 — Non-operating foreign exchange loss (gain) (458) (819) (406) 1,519 (672) Stock-based compensation 44,640 57,156 42,147 47,669 82,966 Acquisition-related expense and transaction bonus 14,814 1,921 4,317 227 517 Publisher bonuses1 209,635 — — — — MoPub acquisition transition services2 6,999 — — — — Restructuring costs — 7,377 1,117 2,340 1,292 Total adjustments 391,527 291,543 233,975 339,112 278,216 Adjusted EBITDA $ 276,229 $ 269,744 $ 257,637 $ 259,600 $ 273,698 Adjusted EBITDA Margin 44.2 % 34.8 % 36.1 % 37.0 % 38.3 % AppLovin Corporation / 1Q23 Shareholder Letter 14 1 In association with the MoPub acquisition, we incurred certain costs to incentivize publishers to migrate to our MAX mediation solution including existing publishers of MoPub as well as publishers on other competitor offerings, and to retain certain existing MAX publishers. These costs were reflected as a reduction to revenue in the period. We have not historically incurred significant publisher migration costs, nor do we currently intend to incur significant publisher migration costs in the future. As such, we have removed the impact of these costs from Adjusted EBITDA. 2 Reflects one-time transition services provided by Twitter to AppLovin.

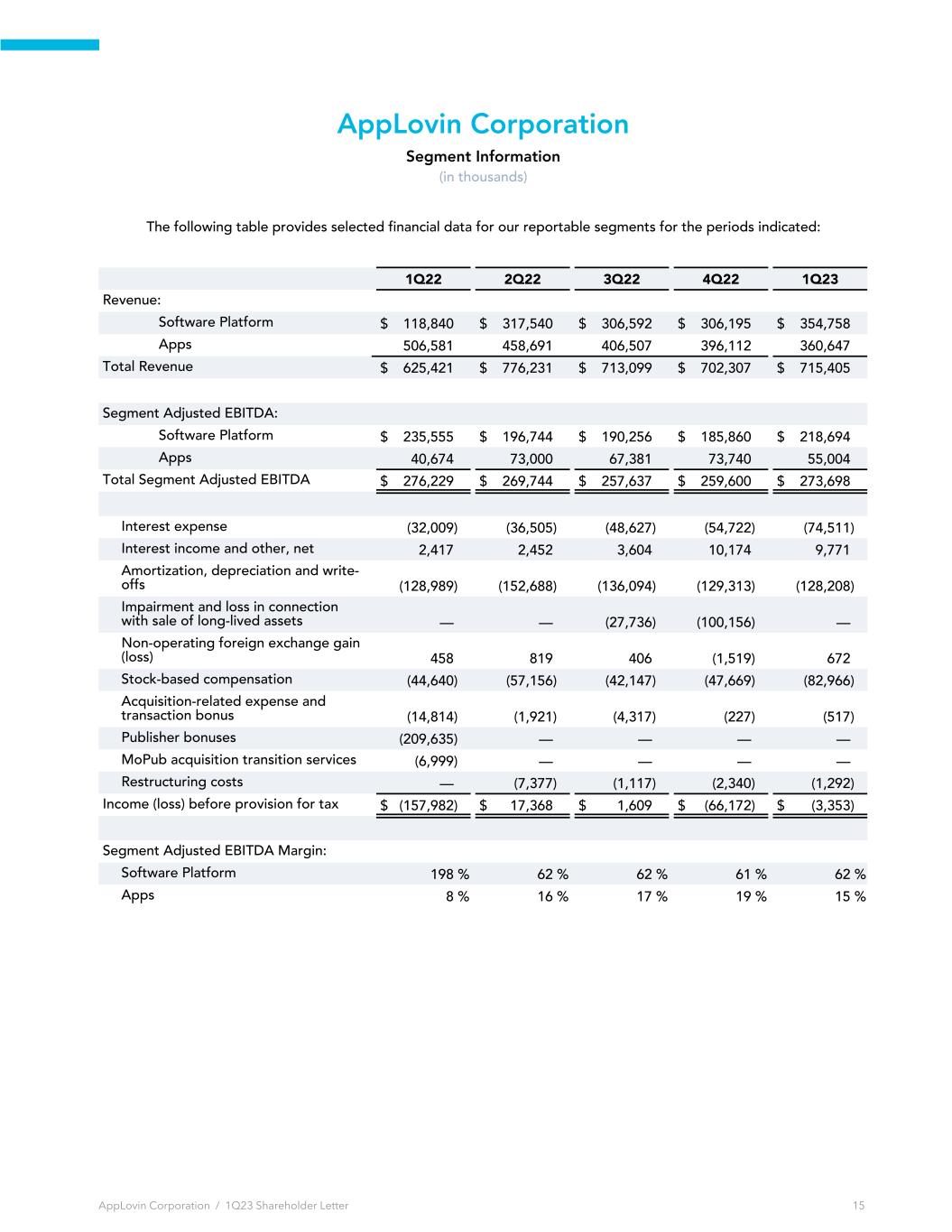

AppLovin Corporation Segment Information (in thousands) The following table provides selected financial data for our reportable segments for the periods indicated: 1Q22 2Q22 3Q22 4Q22 1Q23 Revenue: Software Platform $ 118,840 $ 317,540 $ 306,592 $ 306,195 $ 354,758 Apps 506,581 458,691 406,507 396,112 360,647 Total Revenue $ 625,421 $ 776,231 $ 713,099 $ 702,307 $ 715,405 Segment Adjusted EBITDA: Software Platform $ 235,555 $ 196,744 $ 190,256 $ 185,860 $ 218,694 Apps 40,674 73,000 67,381 73,740 55,004 Total Segment Adjusted EBITDA $ 276,229 $ 269,744 $ 257,637 $ 259,600 $ 273,698 Interest expense (32,009) (36,505) (48,627) (54,722) (74,511) Interest income and other, net 2,417 2,452 3,604 10,174 9,771 Amortization, depreciation and write- offs (128,989) (152,688) (136,094) (129,313) (128,208) Impairment and loss in connection with sale of long-lived assets — — (27,736) (100,156) — Non-operating foreign exchange gain (loss) 458 819 406 (1,519) 672 Stock-based compensation (44,640) (57,156) (42,147) (47,669) (82,966) Acquisition-related expense and transaction bonus (14,814) (1,921) (4,317) (227) (517) Publisher bonuses (209,635) — — — — MoPub acquisition transition services (6,999) — — — — Restructuring costs — (7,377) (1,117) (2,340) (1,292) Income (loss) before provision for tax $ (157,982) $ 17,368 $ 1,609 $ (66,172) $ (3,353) Segment Adjusted EBITDA Margin: Software Platform 198 % 62 % 62 % 61 % 62 % Apps 8 % 16 % 17 % 19 % 15 % AppLovin Corporation / 1Q23 Shareholder Letter 15