Document

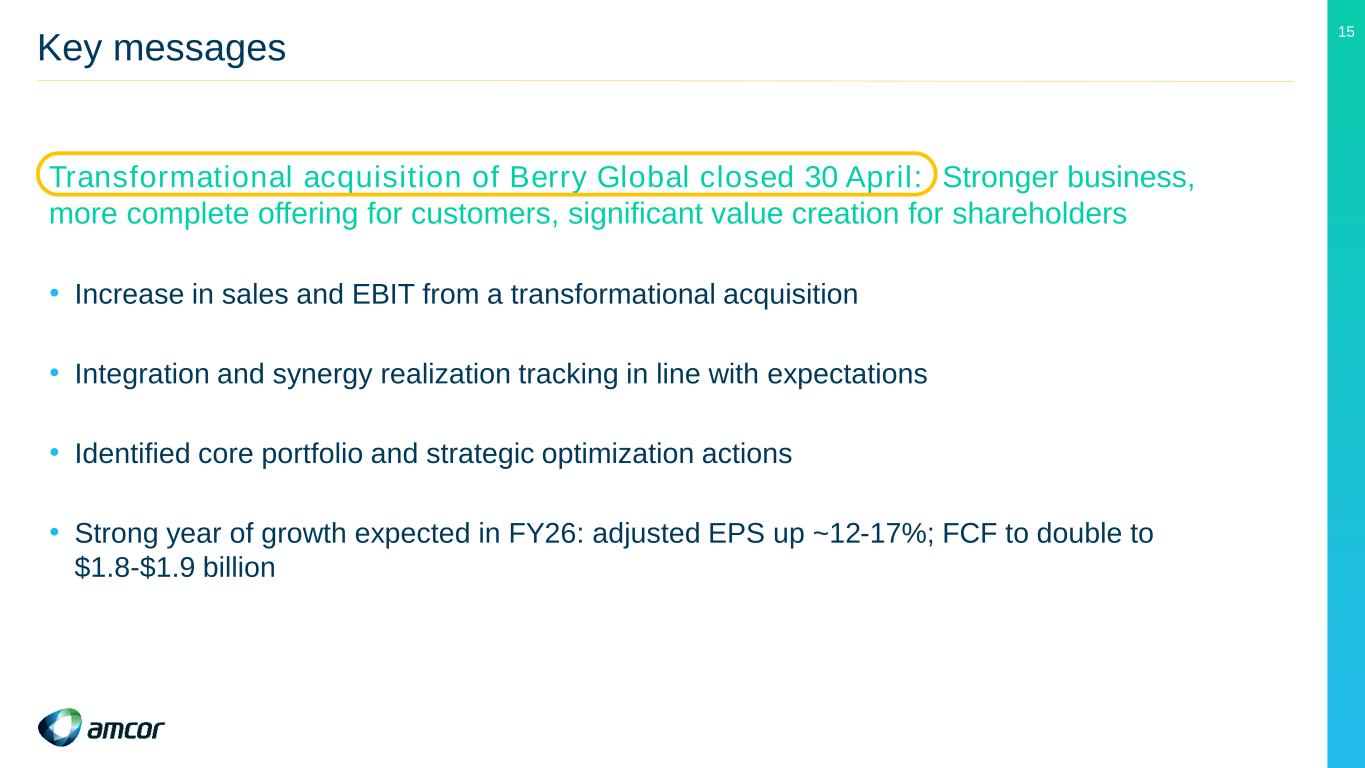

Amcor reports fiscal 2025 Q4 results. Expects strong earnings growth in fiscal 2026.

Fourth Quarter ending June 30, 2025 highlights:

•All-stock acquisition of Berry Global Group, Inc. ("Berry Global") closed on April 30, 2025;

•Identified Amcor's core portfolio and optimization actions;

•Net sales $5,082 million, up 43% excluding currency impact;

•GAAP Net Income ($39) million including acquisition related costs; and

•Adjusted EBITDA $789 million up 43% and adjusted EBIT $611 million up 34% excluding currency impact.

Fiscal Year ending June 30, 2025 highlights:

•Net sales $15,009 million, up 11% excluding currency impact;

•GAAP Net Income $511 million and GAAP diluted EPS 32.0 cps including acquisition related costs;

•Adjusted EBITDA $2,186 million, up 13%, and adjusted EBIT $1,723 million, up 12% excluding currency impact;

•Adjusted EPS 71.2 cps, up 3% excluding currency impact; and

•Adjusted Free Cash Flow $926 million, and annual dividend increased to 51 US cents per share.

Fiscal 2026 outlook:

•Adjusted EPS of 80-83 cps representing 12-17% constant currency growth; Free Cash Flow of $1.8-1.9 billion.

|

|

|

|

Milestone quarter leaves Amcor positioned to deliver strong earnings and free cash flow growth in FY26

Amcor CEO Peter Konieczny said, “This quarter marks a significant milestone for Amcor. The acquisition of Berry Global transforms our ability to create significant value for our customers and shareholders. This is clearly reflected in our expectation to deliver strong adjusted EPS growth of 12-17% and a significant increase in Free Cash Flow to $1.8 to $1.9 billion in fiscal 2026.

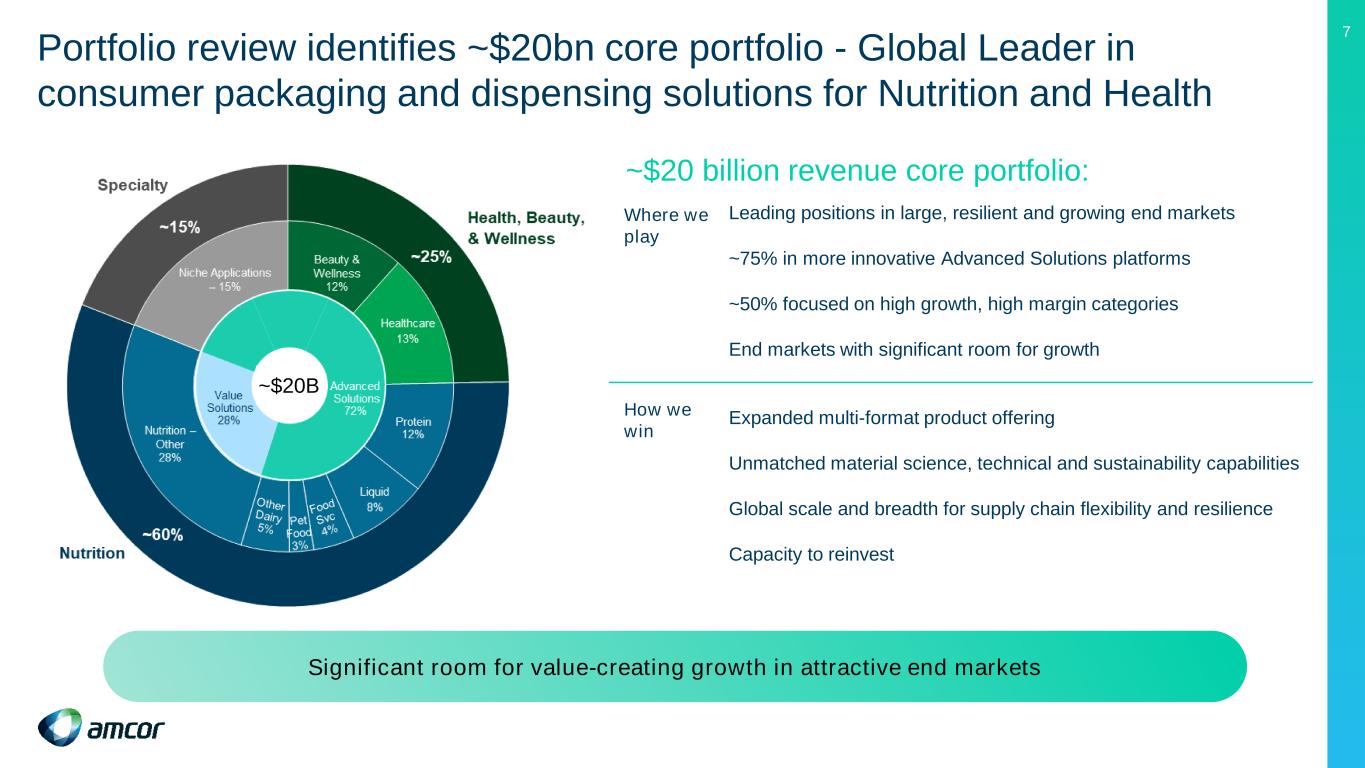

Feedback from our customers has been positive and has already resulted in business wins directly linked to this combination. Integration efforts began on Day 1 and I am proud of the excellent progress our teams have made. We are tracking well against our synergy targets and our delivery run rate is building as expected. In addition, through our strategic portfolio review, we have identified Amcor's $20 billion core portfolio of consumer packaging and dispensing solutions for nutrition and health along with optimization actions designed to further sharpen our focus on attractive categories and drive faster growth.

Our efforts share one common objective: to create an even stronger business, that is the global packaging partner of choice for our customers, and delivers higher levels of consistent organic growth and value for our shareholders."

|

Key Financials(1)(2)(3)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Twelve Months Ended June 30, |

|

| GAAP results |

|

|

|

|

|

2024 $ million |

|

2025 $ million |

|

2024 $ million |

|

2025 $ million |

|

| Net sales |

|

|

|

|

|

3,535 |

|

|

5,082 |

|

|

13,640 |

|

|

15,009 |

|

|

| Net income |

|

|

|

|

|

257 |

|

|

(39) |

|

|

730 |

|

|

511 |

|

|

| EPS (diluted US cents) |

|

|

|

|

|

17.8 |

|

|

(1.9) |

|

|

50.5 |

|

|

32.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Constant

currency ∆% |

|

Twelve Months Ended June 30, |

|

Constant

currency ∆% |

|

| Adjusted non-GAAP results |

|

2024 $ million |

|

2025 $ million |

|

|

2024 $ million |

|

2025 $ million |

|

|

| Net sales |

|

3,535 |

|

|

5,082 |

|

|

43 |

|

|

13,640 |

|

|

15,009 |

|

|

11 |

|

|

| EBITDA |

|

550 |

|

|

789 |

|

|

43 |

|

|

1,962 |

|

|

2,186 |

|

|

13 |

|

|

| EBIT |

|

454 |

|

|

611 |

|

|

34 |

|

|

1,560 |

|

|

1,723 |

|

|

12 |

|

|

| Net income |

|

305 |

|

|

408 |

|

|

34 |

|

|

1,015 |

|

|

1,136 |

|

|

13 |

|

|

EPS (diluted US cents)(4) |

|

21.1 |

|

|

20.0 |

|

|

(5) |

|

|

70.2 |

|

|

71.2 |

|

|

3 |

|

|

| Free Cash Flow |

|

837 |

|

|

943 |

|

|

|

|

952 |

|

|

926 |

|

|

|

|

All amounts referenced throughout this document are in US dollars unless otherwise indicated and numbers may not add up to the totals provided due to rounding. Further details related to combined volume commentary throughout this document can be found under "Presentation of combined volume performance."

(1) Adjusted non-GAAP results exclude items not considered representative of ongoing operations. Constant currency ∆% excludes movements in foreign exchange rates. Further details on non-GAAP measures and reconciliations to GAAP measures can be found under "Presentation of non-GAAP information” in this release.

(2) Due to closing of the combination between Amcor and Berry Global on April 30, 2025, unless otherwise specified, all results within this document for the three months ended 30 June 2025 do not include the results for the legacy Berry Global business for the month of April 2025. Results for the twelve months ended 30 June 2025 do not include results for the legacy Berry Global business for the months of July 2024 to April 2025.

(3) Unless otherwise specified, all results within this document for the three months ended 30 June 2024 and the twelve months ended June 30, 2024 reflect the historical results of the Amcor plc group which is considered the accounting acquirer in the combination between Amcor plc and Berry Global, which closed on April 30, 2025.

(4) For fiscal 2025, the sum of quarters do not equal the total year amount due to the impact of changes in average quarterly shares outstanding.

Berry Global acquisition

On April 30, 2025, the all-stock acquisition of Berry Global was completed at a fixed exchange ratio of 7.25 Amcor ordinary shares for each Berry share.

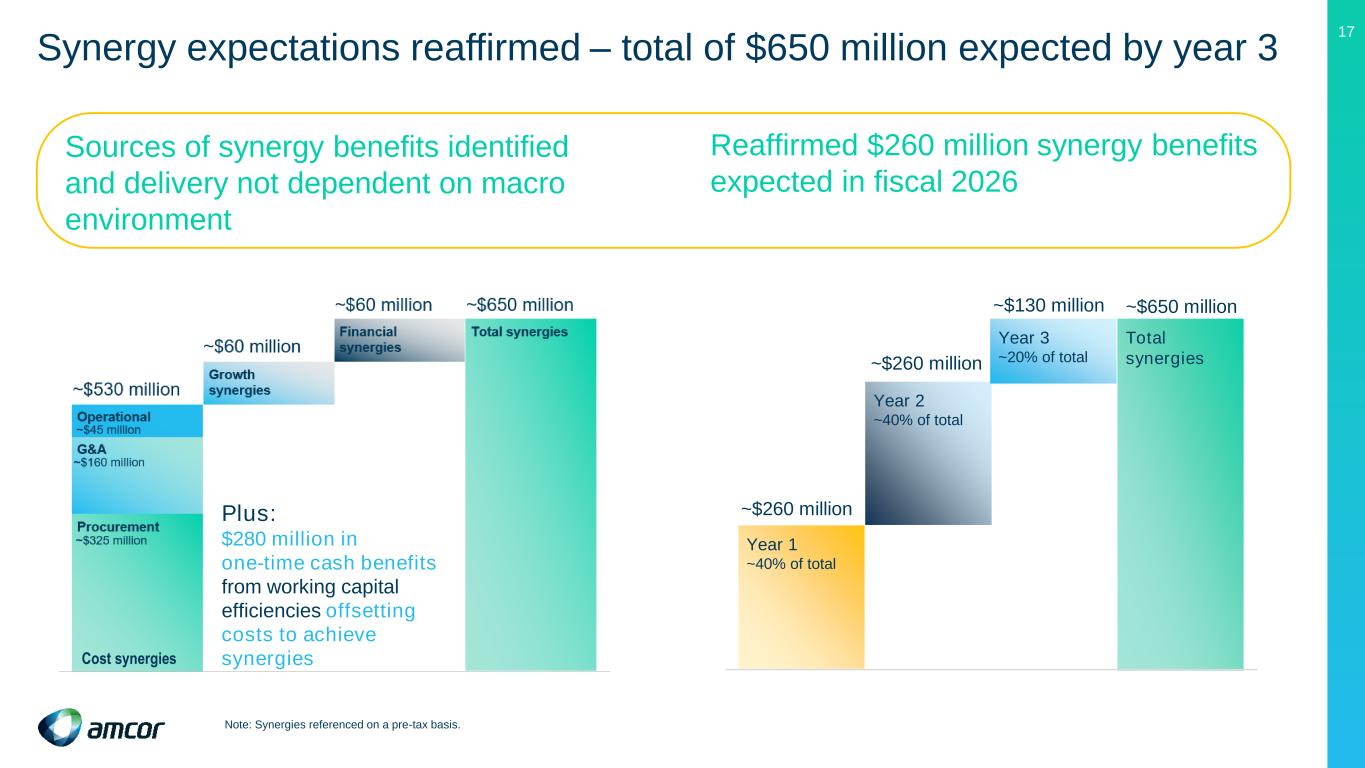

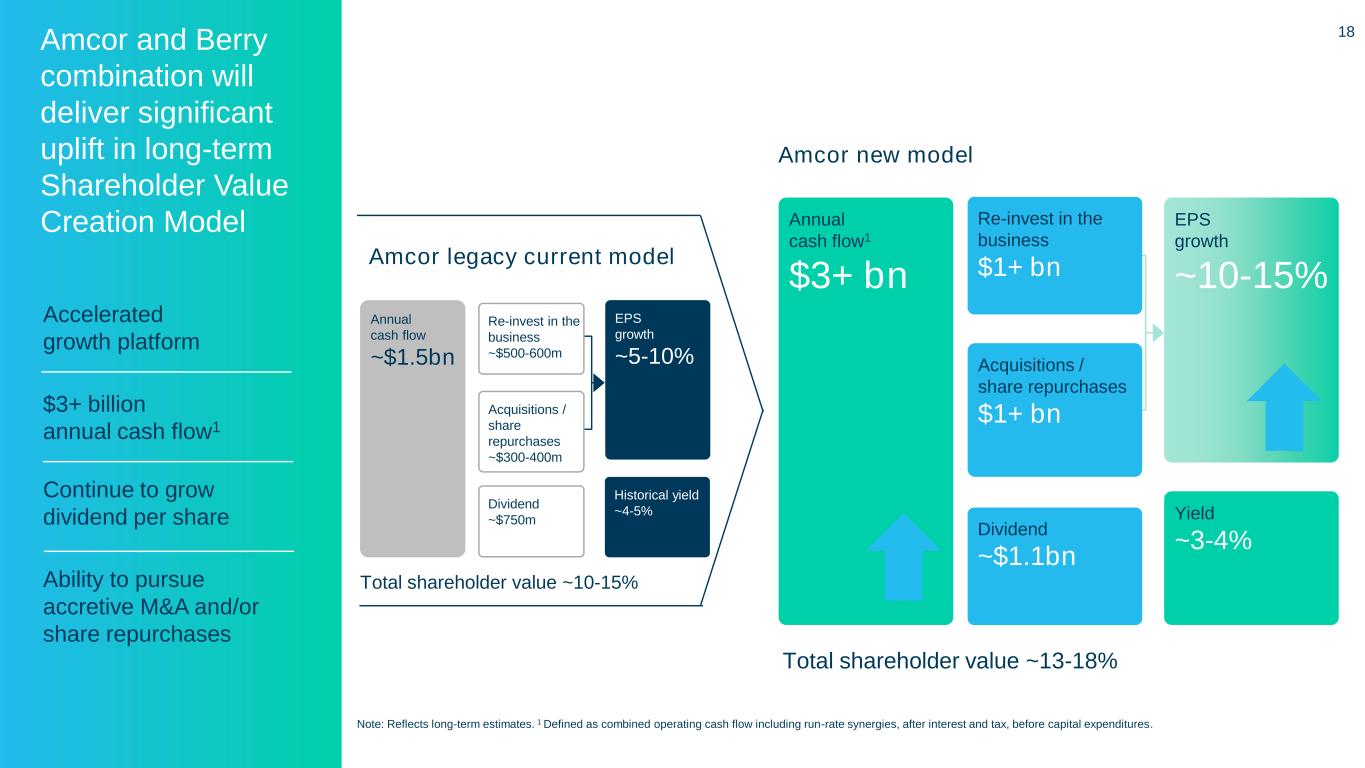

This transformational acquisition establishes Amcor as the global leader in consumer packaging and dispensing solutions for nutrition and health, with the unique material science and innovation capabilities to meet customers’ and consumers’ sustainability aspirations. With multiple new growth opportunities and $650 million of identified synergies through fiscal 2028, Amcor is well placed to deliver significant near- and long-term value for customers and shareholders.

Segment reporting

The Global Flexible Packaging Solutions segment includes Amcor’s legacy Flexible Packaging business and the newly acquired Berry Global Flexibles business.

The Global Rigid Packaging Solutions segment includes Amcor’s legacy Rigid Packaging business and the newly acquired Berry Global Consumer Packaging International and Consumer Packaging North America businesses.

Integration and synergies

Amcor believes the company is well placed to achieve the previously announced total synergy benefits of $650 million (pre-tax) by the end of the 2028 fiscal year. Integration is proceeding in line with expectations and Amcor's teams are on track to deliver $260 million of synergy benefits (pre-tax) in the 2026 fiscal year which represents 12% accretion as a direct result of the acquisition. Given the April 30, 2025 transaction closing date, synergies delivered in the final two months of fiscal 2025 were not material.

Portfolio review identifying Amcor’s core portfolio and strategic optimization actions

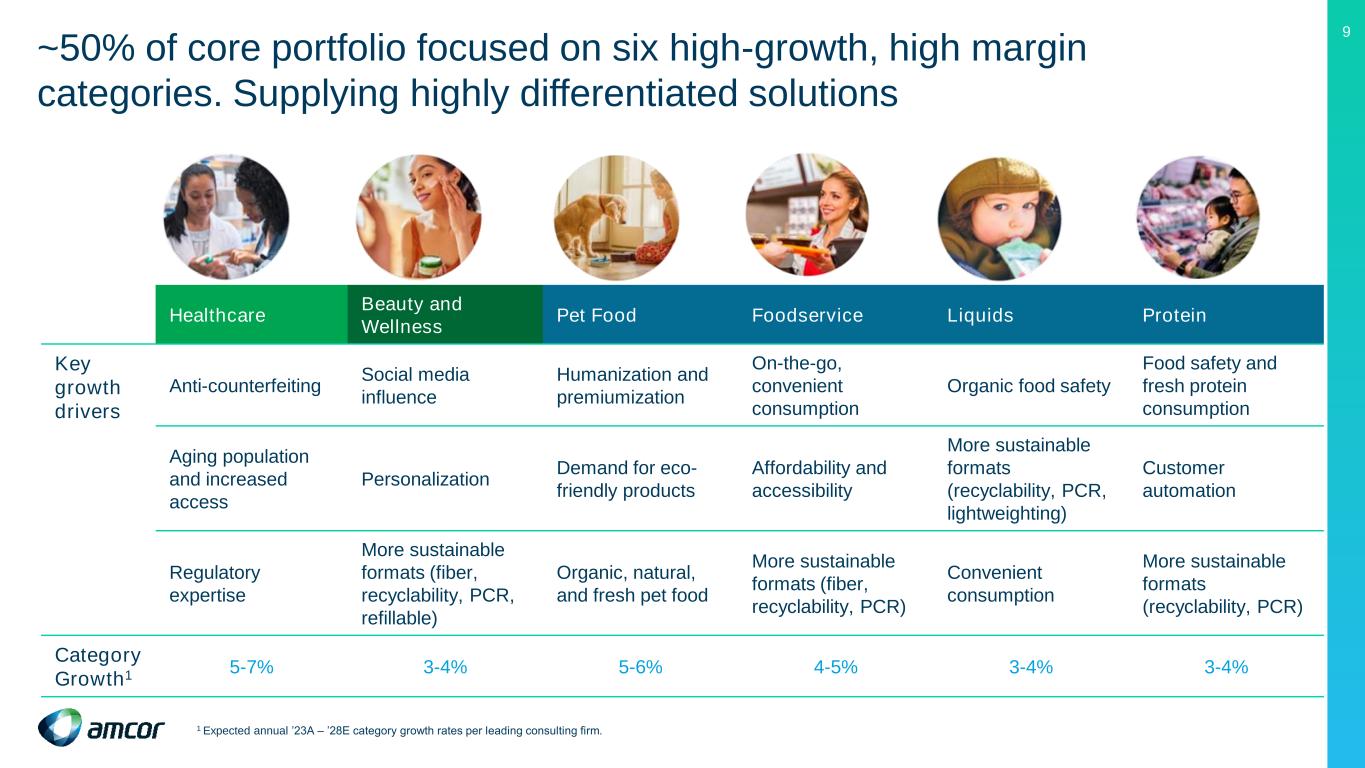

As previously communicated, the acquisition of Berry Global created a unique opportunity for the company to review its newly combined portfolio. Through this review, the company has identified its $20 billion core portfolio of consumer packaging and dispensing solutions for nutrition and health. This core portfolio is made up of leading positions in large, resilient, and growing health, beauty and wellness, nutrition and specialty end markets, where Amcor has global supply chain flexibility, an expanded multi-format product offering of innovative, high value solutions and significant room to grow.

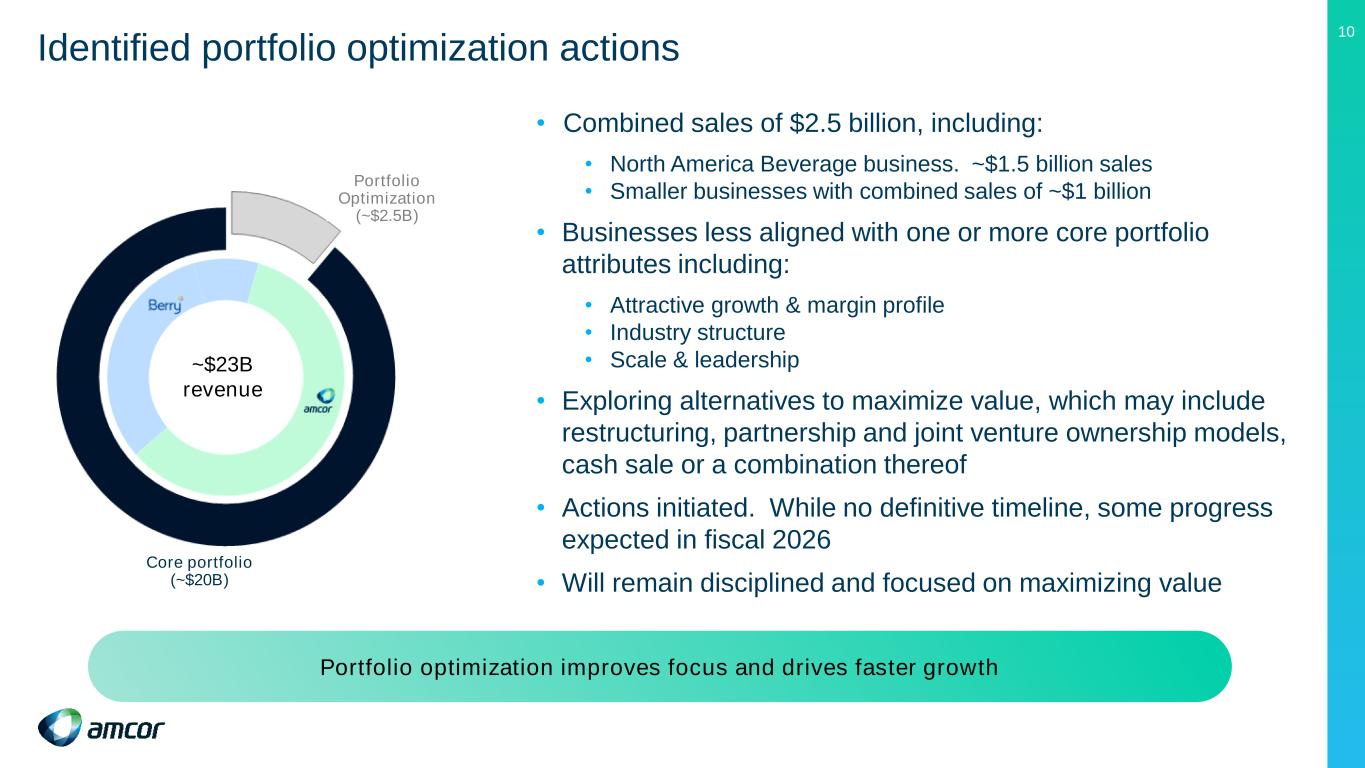

The Company also identified businesses with combined annual sales of approximately $2.5 billion that are less aligned with the core portfolio, including the $1.5 billion North America Beverage business and smaller businesses with combined annual sales of approximately $1 billion. Amcor is exploring alternatives to maximize value for each business, which may include restructuring, partnership and joint venture ownership models, cash sale or a combination thereof. The company believes these optimization actions will enhance focus on these businesses and ensure the core portfolio, drive higher levels of more consistent organic growth and create significant value for shareholders.

The Company has initiated actions and while there is no definitive timeline, some progress is expected in fiscal 2026. The Company will remain disciplined and focused on maximizing value through the process.

Shareholder returns

The Amcor Board of Directors today declared a quarterly cash dividend of 12.75 cents per share (compared with 12.5 cents per share in the same quarter last year). Combined with the last three quarterly dividends, this increases the annual dividend for fiscal 2025 to 51.0 cents per share. The dividend will be paid in US dollars to holders of Amcor’s ordinary shares trading on the NYSE. Holders of CDIs trading on the ASX will receive an unfranked dividend of 19.59 Australian cents per share, which reflects the quarterly dividend of 12.75 cents per share converted at an AUD:USD average exchange rate of 0.6509 over the five trading days ended August 12, 2025.

The ex-dividend date will be September 4, 2025 for holders of CDIs trading on the ASX and September 5, 2025 for holders of shares trading on the NYSE. For all shareholders, the record date will be September 5, 2025 and the payment date will be September 25, 2025.

Financial results - Segment information

Three months ended June 30, 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

Three Months Ended June 30, 2025 |

| Adjusted non-GAAP results |

Net sales

$ million |

EBIT

$ million |

EBIT / Sales % |

Net sales $ million |

EBIT

$ million |

EBIT / Sales % |

| Global Flexible Packaging Solutions |

2,686 |

|

403 |

|

15.0 |

|

3,205 |

|

450 |

|

14.1 |

|

| Global Rigid Packaging Solutions |

849 |

|

75 |

|

8.8 |

|

1,877 |

|

204 |

|

10.9 |

|

Other(1) |

— |

|

(24) |

|

|

— |

|

(43) |

|

|

| Total Amcor |

3,535 |

|

454 |

|

12.8 |

|

5,082 |

|

611 |

|

12.0 |

|

(1) Represents corporate expenses.

Net sales of $5,082 million were 44% higher than last year on a reported basis, including a favorable impact of approximately 1% related to movements in foreign exchange rates.

On a constant currency basis, net sales were 43% higher than last year, including approximately $1.5 billion of acquired sales net of divestments which represents growth of approximately 43%. The remaining year over year variation mainly reflects a favorable impact of approximately 1% related to the pass through of higher raw material costs. Price/mix had a favorable impact of approximately 1% driven by higher relative volume growth in high value categories, which partly offset an unfavorable volume impact of 1.7%.

Year over year volume performance was similar for both legacy businesses. On a combined basis (includes volume performance for the three months ended June 30, 2025 for the legacy Amcor business combined with volume performance for the period May 1, 2025 to 30 June, 2025 for the legacy Berry business) the Company estimates that volumes were approximately 1.7% lower than the prior year, and approximately 1.4% lower than the prior year excluding North America beverage.

Adjusted EBIT of $611 million was 34% higher than last year on a constant currency basis, including approximately $200 million of acquired EBIT net of divestments which represents growth of approximately 44%. The remaining year over year variation mainly reflects lower volumes, higher costs in North America beverage business and increased corporate expenses in line with expectations.

Twelve months ended June 30, 2025

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended June 30, 2024 |

Twelve Months Ended June 30, 2025 |

| Adjusted non-GAAP results |

Net sales

$ million |

EBIT

$ million |

EBIT / Sales % |

EBIT / Average funds employed %(1) |

Net sales $ million |

EBIT

$ million |

EBIT / Sales % |

EBIT / Average funds employed %(1) |

| Global Flexible Packaging Solutions |

10,332 |

|

1,395 |

|

13.5 |

|

|

10,872 |

|

1,458 |

|

13.4 |

|

|

| Global Rigid Packaging Solutions |

3,308 |

|

259 |

|

7.8 |

|

|

4,137 |

|

375 |

|

9.1 |

|

|

Other(2) |

— |

|

(94) |

|

|

|

— |

|

(110) |

|

|

|

| Total Amcor |

13,640 |

|

1,560 |

|

11.4 |

|

14.9 |

|

15,009 |

|

1,723 |

|

11.5 |

|

12.1 |

|

(1) Return on average funds employed includes shareholders' equity and net debt, calculated using a four quarter average and last twelve months adjusted EBIT.

(2) Represents corporate expenses.

Net sales of $15,009 million were 10% higher than last year on a reported basis, including an unfavorable impact of approximately 1% related to movements in foreign exchange rates.

On a constant currency basis, net sales were 11% higher than last year, including approximately $1.5 billion of acquired sales, net of divestments which represents growth of approximately 10%. The remaining year over year variation mainly reflects a favorable impact of approximately 1% related to the pass through of higher raw material costs. Volumes were up approximately 1% compared with the prior year and price/mix had an unfavorable impact of approximately 1% primarily due to lower volumes in high value healthcare categories in the first half of the year.

Adjusted EBIT of $1,723 million was 12% higher than last year on a constant currency basis including approximately $195 million of acquired EBIT net of divestments, which represents growth of approximately 13%. The remaining year over year variation mainly reflects an unfavorable price/mix impact on earnings, partly offset by benefits from strong cost performance and higher volumes.

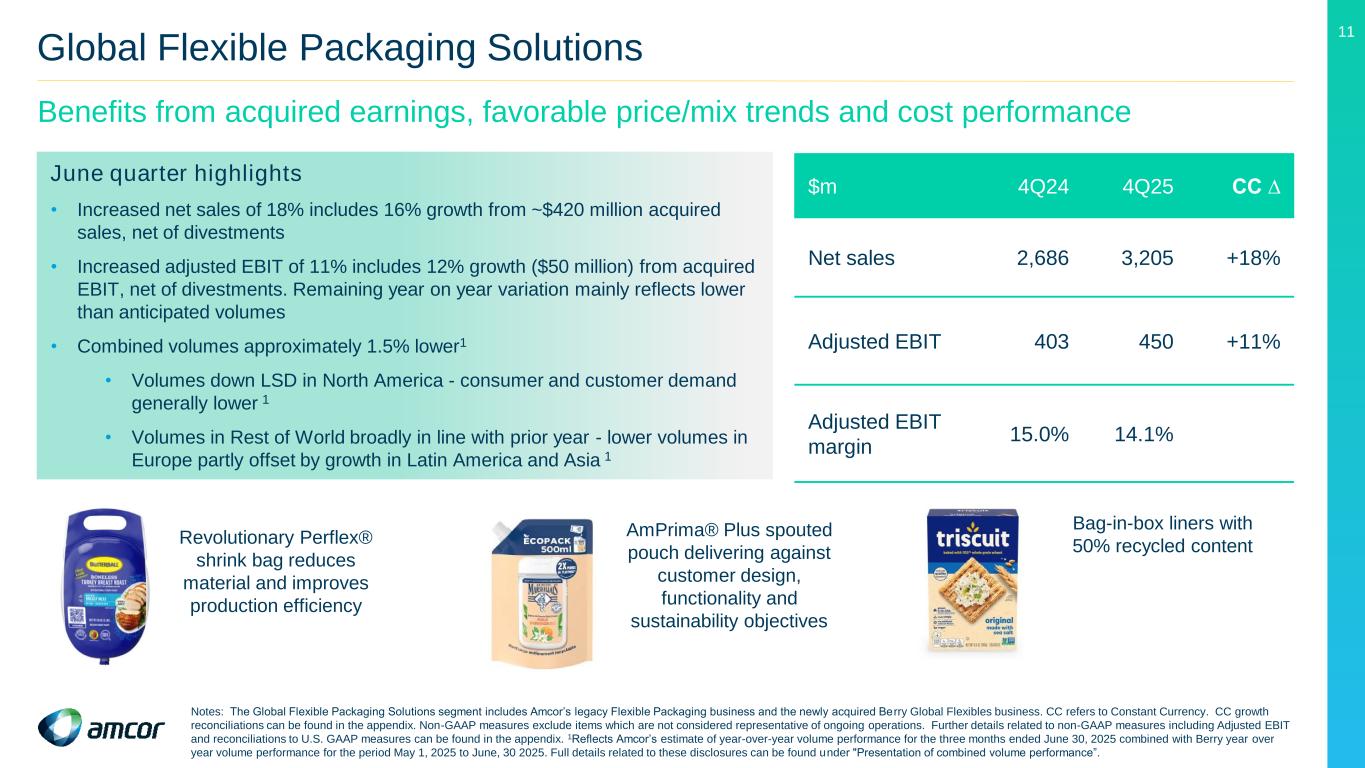

Global Flexible Packaging Solutions segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| June 2025 quarter |

|

Three Months Ended June 30, |

|

Reported ∆% |

|

Constant

currency ∆% |

|

2024 $ million |

|

2025 $ million |

|

|

| Net sales |

|

2,686 |

|

|

3,205 |

|

|

19 |

|

|

18 |

|

| Adjusted EBIT |

|

403 |

|

|

450 |

|

|

12 |

|

11 |

|

| Adjusted EBIT / Sales % |

|

15.0 |

|

|

14.1 |

|

|

|

|

|

Net sales of $3,205 million were 19% higher than last year on a reported basis, including a favorable impact of approximately 1% related to movements in foreign exchange rates.

On a constant currency basis, net sales were 18% higher than last year, reflecting approximately $420 million of acquired sales net of divestments which represents growth of approximately 16%. The remaining year over year variation mainly reflects a favorable impact of approximately 1% related to the pass through of higher raw material costs, a favorable price/mix impact of approximately 2%, reflecting higher relative volume growth in high value categories, and an unfavorable volume impact of approximately 1%.

On a combined basis (includes volume performance for the three months ended June 30, 2025 for the legacy Amcor business combined with volume performance for the period May 1, 2025 to 30 June, 2025 for the legacy Berry business) the Company estimates that overall volumes for the Global Flexible Packaging Solutions segment were approximately 1.5% lower than the prior year. In North America, volumes were down in the low single digit range. Volumes were higher across focus categories including healthcare, protein (meat and dairy), and liquids. This was offset by lower volumes in other categories including home & personal care, confectionary and unconverted films. Across the balance of the portfolio, volumes were broadly in line with the prior year. In Europe, volumes were lower with growth in pet care, ready meals, medical and dairy, offset by declines in coffee, snacks and confectionary and beauty and wellness. Volumes grew in the low single digit range across emerging markets.

Adjusted EBIT of $450 million was 11% higher than last year on a constant currency basis, reflecting approximately $50 million of acquired EBIT, net of divestments which represents growth of approximately 12%. The remaining year over year variation mainly reflects lower volumes and an unfavorable earnings impacts from price/mix, partly offset by favorable cost performance.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal 2025 |

|

Twelve Months Ended June 30, |

|

Reported ∆% |

|

Constant

currency ∆% |

|

2024 $ million |

|

2025 $ million |

|

|

| Net sales |

|

10,332 |

|

|

10,872 |

|

|

5 |

|

|

6 |

|

| Adjusted EBIT |

|

1,395 |

|

|

1,458 |

|

|

5 |

|

|

5 |

|

| Adjusted EBIT / Sales % |

|

13.5 |

|

|

13.4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales of $10,872 million were 5% higher than last year on a reported basis, including an unfavorable impact of approximately 1% related to movements in foreign exchange rates.

On a constant currency basis, net sales were 6% higher than last year, including approximately $410 million of acquired sales net of divestments which represents growth of approximately 4%. The remaining variation mainly reflects a favorable impact of approximately 1% related to the pass through of higher raw material costs, a favorable volume impact of approximately 2% with growth delivered across all key regions, partly offset by an unfavorable price/mix impact of approximately 1% primarily due to lower volumes in high value healthcare categories in the first half of the year.

Adjusted EBIT of $1,458 million was 5% higher than last year on a constant currency basis, including approximately $50 million of acquired EBIT net of divestments, which represents growth of approximately 3%. The remaining year over year variation mainly reflects benefits from higher volumes and strong cost performance partly offset by unfavorable earnings impacts from price/mix.

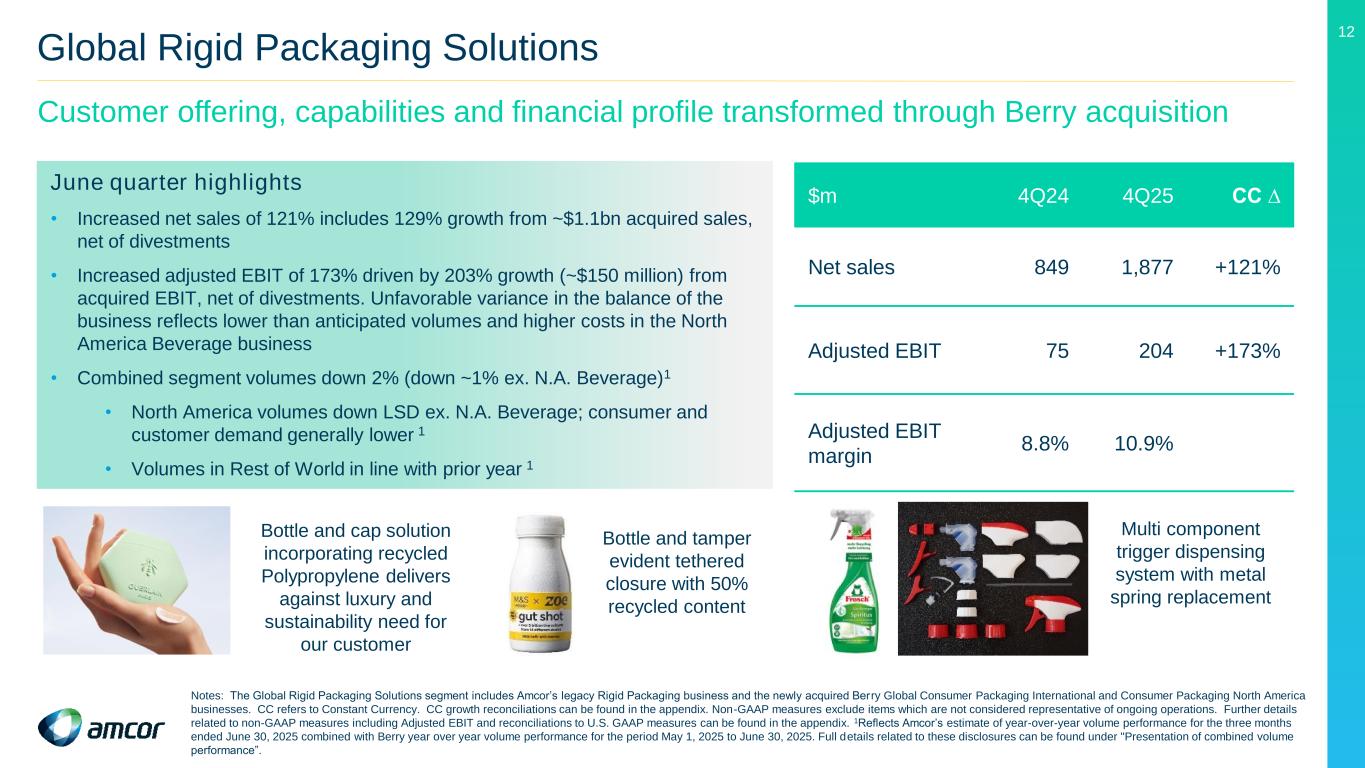

Global Rigid Packaging Solutions segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| June 2025 quarter |

|

Three Months Ended June 30, |

|

Reported ∆% |

|

Constant

currency ∆% |

|

2024 $ million |

|

2025 $ million |

|

|

| Net sales |

|

849 |

|

|

1,877 |

|

|

121 |

|

|

121 |

|

| Adjusted EBIT |

|

75 |

|

|

204 |

|

|

173 |

|

|

173 |

|

| Adjusted EBIT / Sales % |

|

8.8 |

|

|

10.9 |

|

|

|

|

|

Net sales of $1,877 million were 121% higher than last year on a reported and constant currency basis, including approximately $1.1 billion of acquired sales net of divestments which represents growth of approximately 129%. The remaining variation mainly reflects an unfavorable volume impact of approximately 4% and an unfavorable price/mix impact of approximately 4%. Movements in foreign exchange rates and the pass through of higher raw material costs had no material impact on sales for the quarter.

On a combined basis (includes volume performance for the three months ended June 30, 2025 for the legacy Amcor business combined with volume performance for the period May 1, 2025 to 30 June, 2025 for the legacy Berry business) the Company estimates that overall volumes for the Global Rigid Packaging Solutions segment were approximately 2% lower than the prior year and approximately 1% lower than the prior year excluding North America beverage. In North America, volumes declined at low single digit rates excluding North America beverage. Volumes were higher across healthcare, beauty and wellness and foodservice categories. This was more than offset by volume declines in food and specialty end markets. Across the balance of the portfolio, volumes in Europe were in line with the prior year with growth in food and healthcare end markets offset by lower volumes in beauty and wellness categories. Volumes were modestly higher across emerging markets.

Adjusted EBIT of $204 million was 173% higher than last year on a constant currency basis, including approximately $150 million of acquired EBIT net of divestments which represents growth of approximately 203%. The remaining year over year variation mainly reflects lower volumes and higher costs in the North America Beverage business driven by operating challenges at high volume sites.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal 2025 |

|

Twelve Months Ended June 30, |

|

Reported ∆% |

|

Constant

currency ∆% |

|

2024 $ million |

|

2025 $ million |

|

|

| Net sales |

|

3,308 |

|

|

4,137 |

|

|

25 |

|

|

26 |

|

| Adjusted EBIT |

|

259 |

|

|

375 |

|

|

45 |

|

|

47 |

|

| Adjusted EBIT / Sales % |

|

7.8 |

|

|

9.1 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales of $4,137 million were 25% higher than last year on a reported basis, including an unfavorable impact of 1% related to movements in foreign exchange rates.

On a constant currency basis, net sales were were 26% higher than last year, reflecting approximately $1.0 billion of acquired sales net of divestments which represents growth of approximately 31%. The remaining variation mainly reflects an unfavorable impact of approximately 1% related to the pass through of lower raw material costs, 2% lower volumes and an unfavorable price/mix impact of approximately 2%.

Adjusted EBIT of $375 million was approximately 47% higher than last year on a constant currency basis, reflecting approximately $150 million of acquired EBIT net of divestments, which represents growth of approximately 57%. The remaining year over year variation mainly reflects lower volumes and higher costs in the North American beverage business in the second half of the year.

Net interest and income tax expense

For the year ended June 30, 2025, GAAP net interest expense of $347 million compares with $310 million last year. Adjusted net interest expense of $332 million was $22 million higher than last year as a result of increased acquisition related net debt. GAAP income tax expense for the year ended June 20, 2025 was $135 million compared with $163 million last year. Adjusted tax expense was $248 million compared with $225 million last year. Adjusted tax expense for the year ended June 30, 2025 represents an effective tax rate of 17.8%, in line with the prior year.

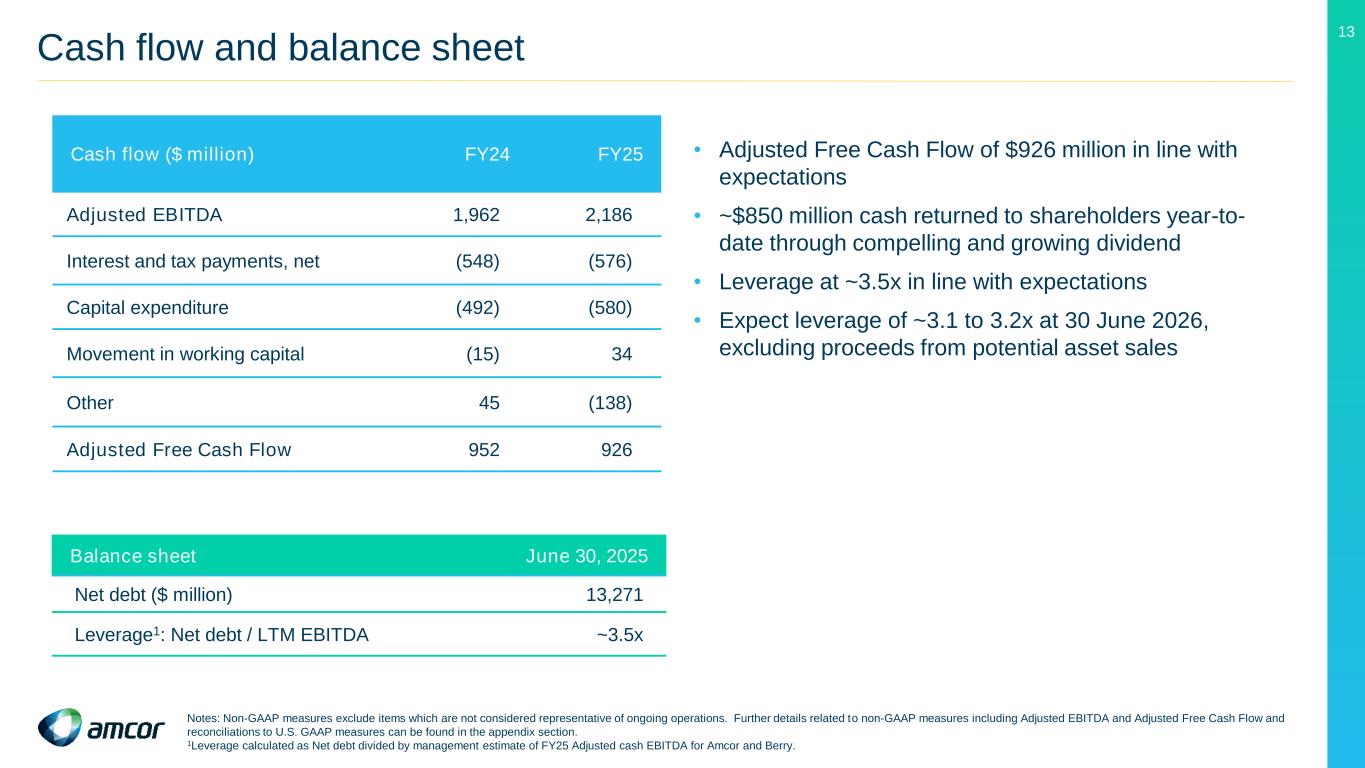

Adjusted Free Cash Flow and Net Debt

For the year ended June 30, 2025, adjusted free cash inflow of $926 million was in-line with the Company's guidance range and compares with $952 million last year. Net debt was $13,271 million at June 30, 2025, including acquisition related Berry Global debt of approximately $7.4 billion.

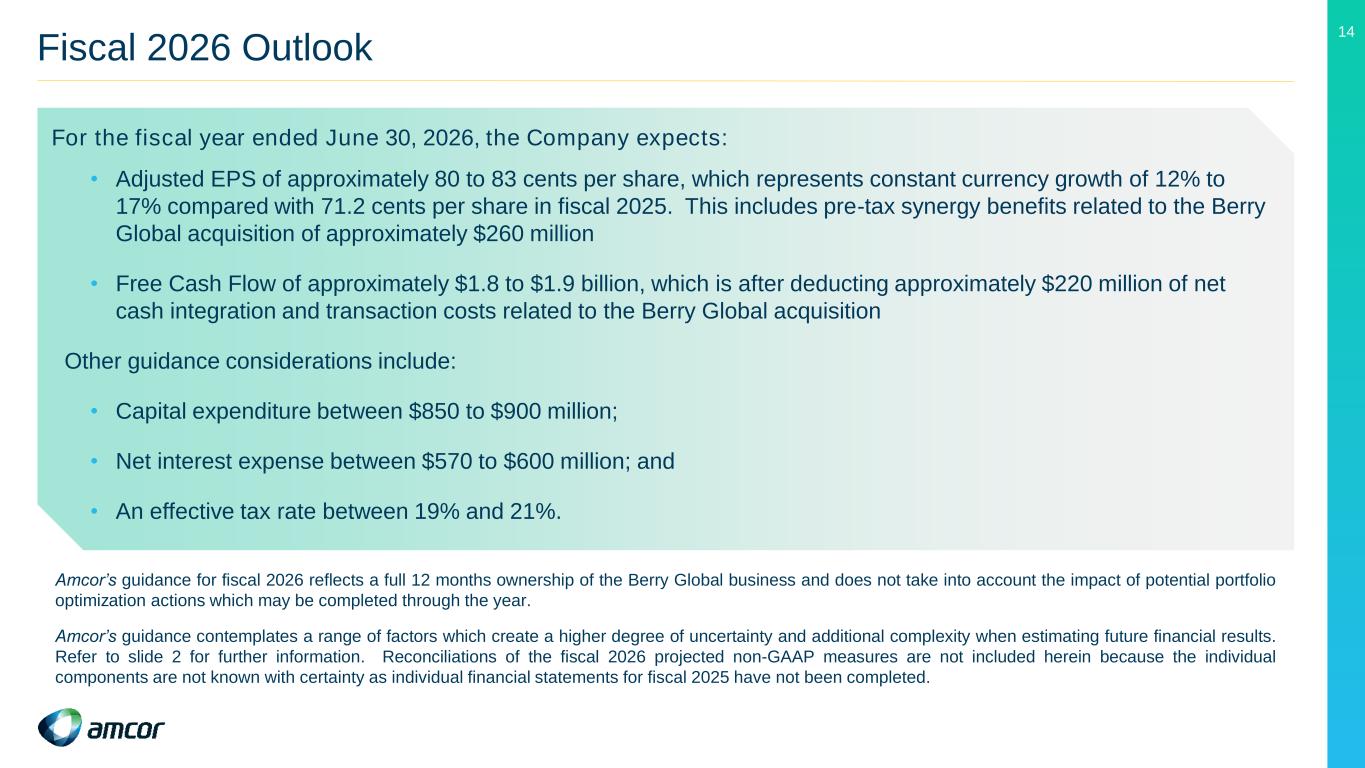

Fiscal 2026 Guidance

For the twelve month period ending June 30, 2026, the Company expects:

•Adjusted EPS of approximately 80 to 83 cents per share, which represents constant currency growth of 12% to 17% compared with 71.2 cents per share in fiscal 2025. This includes pre-tax synergy benefits related to the Berry Global acquisition of approximately $260 million.

•Free Cash Flow of approximately $1.8 billion to $1.9 billion, which is after deducting approximately $220 million of net cash integration and transaction costs related to the Berry Global acquisition.

Other guidance considerations include:

•Capital expenditure between $850 to $900 million;

•Net interest expense of approximately $570 to $600 million; and

•An effective tax rate between 19% and 21%.

Amcor’s guidance for fiscal 2026 reflects a full 12 months ownership of the Berry Global business and does not take into account the impact of potential portfolio optimization actions which may be completed through the year.

Amcor's guidance contemplates a range of factors which create a degree of uncertainty and complexity when estimating future financial results. Further information can be found under 'Cautionary Statements Regarding Forward-Looking Statements' in this release. Reconciliations of the fiscal 2026 projected non-GAAP measures are not included herein because the individual components are not known with certainty as individual financial statements for fiscal 2026 have not been completed.

Conference Call

Amcor is hosting a conference call with investors and analysts to discuss these results on Thursday August 14, 2025 at 8:00am US Eastern Daylight Time / 10:00pm Australian Eastern Standard Time. Investors are invited to listen to a live webcast of the conference call at our website, www.amcor.com, in the “Investors” section.

Those wishing to access the call should use the following toll-free numbers, with the Conference ID : 4169471

•USA: 800 715 9871 (toll free); 646 307 1963 (local)

•Australia: 1800 519 630 (toll free), 02 9133 7103 (local)

•United Kingdom: 0800 358 0970 (toll free), 020 3433 3846 (local)

•Singapore: 65 3159 5133 (local)

•Hong Kong: 852 3002 3410 (local)

From all other countries, the call can be accessed by dialing +1 646 307 1963 (toll).

A replay of the webcast will also be available in the 'Investors" section at www.amcor.com following the call.

About Amcor

Amcor is the global leader in developing and producing responsible consumer packaging and dispensing solutions across a variety of materials for nutrition, health, beauty and wellness categories. Our global product innovation and sustainability expertise enables us to solve packaging challenges around the world every day, producing a range of flexible packaging, rigid packaging, cartons and closures that are more sustainable, functional and appealing for our customers and their consumers. We are guided by our purpose of elevating customers, shaping lives and protecting the future. Supported by a commitment to safety, over 75,000 people generate $23 billion in annualized sales from operations that span over 400 locations in more than 40 countries. NYSE: AMCR; ASX: AMC

www.amcor.com I LinkedIn I YouTube Amcor plc UK Establishment Address: 83 Tower Road North, Warmley, Bristol, England, BS30 8XP, United Kingdom

Contact Information

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Investors |

|

|

|

|

|

| Tracey Whitehead |

|

Damien Bird |

|

Damon Wright |

Dustin Stilwell |

| Global Head of Investor Relations |

|

Vice President Investor Relations Asia Pacific |

|

Vice President Investor Relations North America |

Vice President Investor Relations North America |

| +61 408 037 590 |

|

+61 481 900 499 |

|

+1 224 313 7141 |

+1 812 306 2964 |

| tracey.whitehead@amcor.com |

|

damien.bird@amcor.com |

|

damon.wright@amcor.com |

dustin.stilwell@amcor.com |

|

|

|

|

|

|

| Media - Australia |

|

Media - Europe |

|

Media - North America |

|

| James Strong |

|

Ernesto Duran |

|

Julie Liedtke |

|

| Managing Director |

|

Head of Global Communications |

|

Director, Media Relations |

|

| Sodali & Co |

|

Amcor |

|

Amcor |

|

| +61 448 881 174 |

|

+41 78 698 69 40 |

|

+1 847 204 2319 |

|

| james.strong@sodali.com |

|

ernesto.duran@amcor.com |

|

julie.liedtke@amcor.com |

|

UK Overseas Company Number: BR020803

Registered Office: 3rd Floor, 44 Esplanade, St Helier, JE4 9WG, Jersey

Jersey Registered Company Number: 126984, Australian Registered Body Number (ARBN): 630 385 278

U.S. GAAP Condensed Consolidated Statements of Income (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Twelve Months Ended June 30, |

| ($ million, except per share amounts) |

|

2024 |

2025 |

|

2024 |

|

2025 |

| Net sales |

|

3,535 |

|

5,082 |

|

|

13,640 |

|

|

15,009 |

|

| Cost of sales |

|

(2,781) |

|

(4,187) |

|

|

(10,928) |

|

|

(12,175) |

|

| Gross profit |

|

754 |

|

895 |

|

|

2,712 |

|

|

2,834 |

|

| Selling, general, and administrative expenses |

|

(288) |

|

(408) |

|

|

(1,093) |

|

|

(1,205) |

|

| Amortization of acquired intangible assets |

|

(41) |

|

(130) |

|

|

(167) |

|

|

(246) |

|

| Research and development expenses |

|

(26) |

|

(38) |

|

|

(106) |

|

|

(120) |

|

| Restructuring, transaction and integration expenses, net |

|

(15) |

|

(236) |

|

|

(97) |

|

|

(307) |

|

| Other income/(expense), net |

|

11 |

|

4 |

|

|

(35) |

|

|

53 |

|

| Operating income |

|

395 |

|

87 |

|

|

1,214 |

|

|

1,009 |

|

| Interest expense, net |

|

(78) |

|

(125) |

|

|

(310) |

|

|

(347) |

|

| Other non-operating income/(loss), net |

|

1 |

|

(9) |

|

|

3 |

|

|

(12) |

|

| Income/loss before income taxes and equity in income/(loss) of affiliated companies |

|

318 |

|

(47) |

|

|

907 |

|

|

650 |

|

| Income tax expense |

|

(56) |

|

6 |

|

|

(163) |

|

|

(135) |

|

| Equity in income/(loss) of affiliated companies, net of tax |

|

(1) |

|

2 |

|

|

(4) |

|

|

3 |

|

| Net income/loss |

|

261 |

|

(39) |

|

|

740 |

|

|

518 |

|

| Net income attributable to non-controlling interests |

|

(4) |

|

— |

|

|

(10) |

|

|

(7) |

|

| Net income/loss attributable to Amcor plc |

|

257 |

|

(39) |

|

|

730 |

|

|

511 |

|

| USD:EUR average FX rate |

|

0.9287 |

|

0.8825 |

|

|

0.9245 |

|

|

0.9203 |

|

|

|

|

|

|

|

|

|

| Basic earnings per share attributable to Amcor |

|

0.178 |

|

(0.019) |

|

|

0.505 |

|

|

0.321 |

|

| Diluted earnings per share attributable to Amcor |

|

0.178 |

|

(0.019) |

|

|

0.505 |

|

|

0.320 |

|

| Weighted average number of shares outstanding – Basic |

|

1,439 |

|

2,035 |

|

|

1,439 |

|

|

1,589 |

|

| Weighted average number of shares outstanding – Diluted |

|

1,443 |

|

2,040 |

|

|

1,441 |

|

|

1,593 |

|

U.S. GAAP Condensed Consolidated Statements of Cash Flows (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended June 30, |

|

| ($ million) |

|

|

2024 |

|

2025 |

|

| Net income |

|

|

740 |

|

|

518 |

|

|

| Depreciation, amortization, and impairment |

|

|

595 |

|

|

722 |

|

|

| Net gain on disposal of businesses and investments |

|

|

— |

|

|

(8) |

|

|

Changes in operating assets and liabilities, excluding effect of acquisitions, divestitures, and

currency |

|

|

(120) |

|

|

(53) |

|

|

| Other non-cash items |

|

|

106 |

|

|

211 |

|

|

| Net cash provided by operating activities |

|

|

1,321 |

|

|

1,390 |

|

|

| Purchase of property, plant, and equipment and other intangible assets |

|

|

(492) |

|

|

(580) |

|

|

| Proceeds from sales of property, plant, and equipment and other intangible assets |

|

|

39 |

|

|

18 |

|

|

| Business acquisitions and Investments in affiliated companies, and other |

|

|

(23) |

|

|

(1,653) |

|

|

| Proceeds from divestitures |

|

|

— |

|

|

113 |

|

|

| Net debt proceeds/(repayments) |

|

|

(43) |

|

|

1,876 |

|

|

| Dividends paid |

|

|

(722) |

|

|

(845) |

|

|

| Share buy-back/cancellations |

|

|

(30) |

|

|

— |

|

|

| Purchase of treasury shares, proceeds from exercise of options and tax withholdings for share-based incentive plans |

|

|

(51) |

|

|

(107) |

|

|

|

|

|

|

|

|

|

| Other, including effects of exchange rate on cash and cash equivalents |

|

|

(100) |

|

|

27 |

|

|

| Net increase/decrease in cash and cash equivalents |

|

|

(101) |

|

|

239 |

|

|

| Cash and cash equivalents at the beginning of the year |

|

|

689 |

|

|

588 |

|

|

| Cash and cash equivalents at the end of the year |

|

|

588 |

|

|

827 |

|

|

U.S. GAAP Condensed Consolidated Balance Sheets (Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ million) |

|

June 30, 2024 |

|

June 30, 2025 |

| Cash and cash equivalents |

|

588 |

|

|

827 |

|

| Trade receivables, net |

|

1,846 |

|

|

3,426 |

|

| Inventories, net |

|

2,031 |

|

|

3,471 |

|

|

|

|

|

|

|

|

|

|

|

| Property, plant and equipment, net |

|

3,763 |

|

|

8,202 |

|

| Goodwill and other intangible assets, net |

|

6,736 |

|

|

18,679 |

|

| Other assets |

|

1,560 |

|

|

2,461 |

|

| Total assets |

|

16,524 |

|

|

37,066 |

|

| Trade payables |

|

2,580 |

|

|

3,490 |

|

| Short-term debt and current portion of long-term debt |

|

96 |

|

|

257 |

|

| Long-term debt, less current portion |

|

6,603 |

|

|

13,841 |

|

|

|

|

|

|

|

|

|

|

|

| Accruals and other liabilities |

|

3,292 |

|

|

7,738 |

|

| Shareholders' equity |

|

3,953 |

|

|

11,740 |

|

| Total liabilities and shareholders' equity |

|

16,524 |

|

|

37,066 |

|

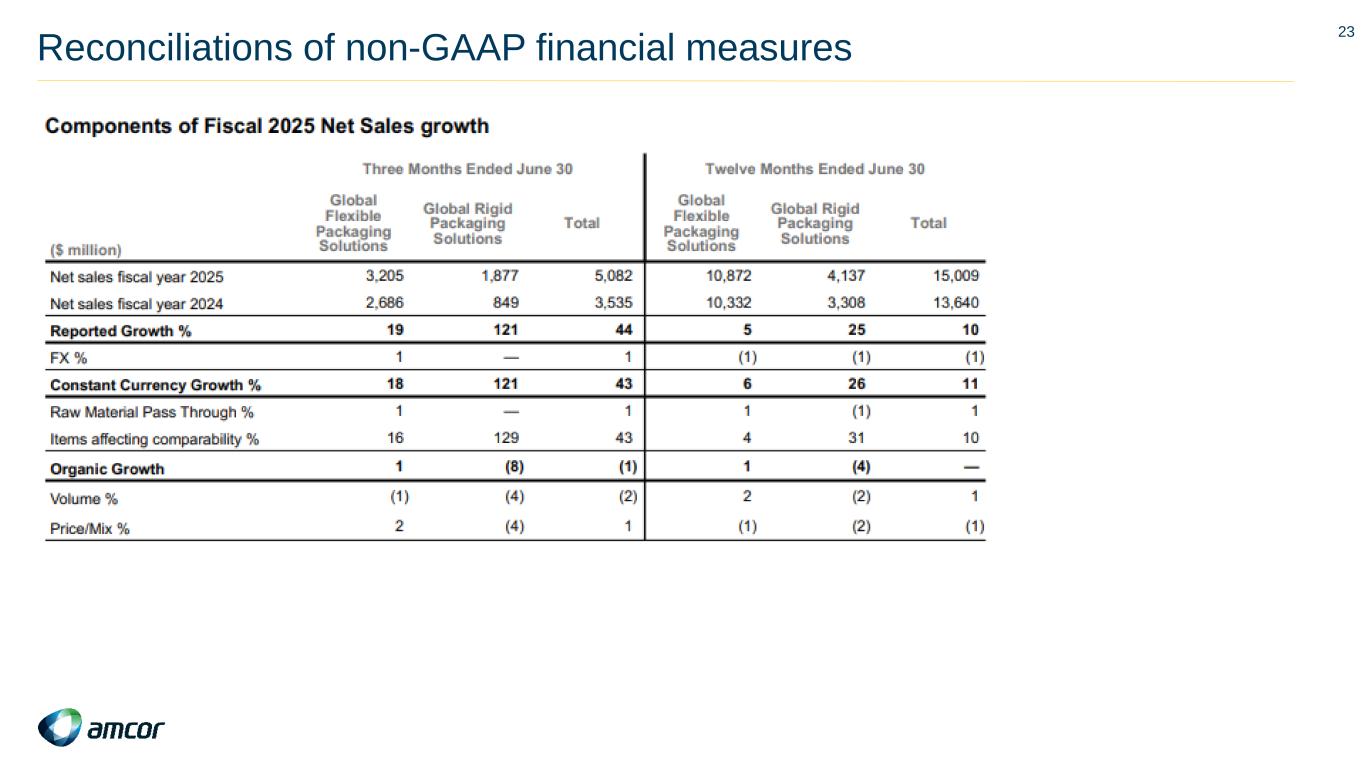

Components of Fiscal 2025 Net Sales growth

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30 |

|

Twelve Months Ended June 30 |

| ($ million) |

Global Flexible Packaging Solutions |

Global Rigid Packaging Solutions |

Total |

|

Global Flexible Packaging Solutions |

Global Rigid Packaging Solutions |

Total |

| Net sales fiscal year 2025 |

3,205 |

|

1,877 |

|

5,082 |

|

|

10,872 |

|

4,137 |

|

15,009 |

|

| Net sales fiscal year 2024 |

2,686 |

|

849 |

|

3,535 |

|

|

10,332 |

|

3,308 |

|

13,640 |

|

| Reported Growth % |

19 |

|

121 |

|

44 |

|

|

5 |

|

25 |

|

10 |

|

| FX % |

1 |

|

— |

|

1 |

|

|

(1) |

|

(1) |

|

(1) |

|

| Constant Currency Growth % |

18 |

|

121 |

|

43 |

|

|

6 |

|

26 |

|

11 |

|

| Raw Material Pass Through % |

1 |

|

— |

|

1 |

|

|

1 |

|

(1) |

|

1 |

|

| Items affecting comparability % |

16 |

|

129 |

|

43 |

|

|

4 |

|

31 |

|

10 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Organic Growth |

1 |

|

(8) |

|

(1) |

|

|

1 |

|

(4) |

|

— |

|

| Volume % |

(1) |

|

(4) |

|

(2) |

|

|

2 |

|

(2) |

|

1 |

|

| Price/Mix % |

2 |

|

(4) |

|

1 |

|

|

(1) |

|

(2) |

|

(1) |

|

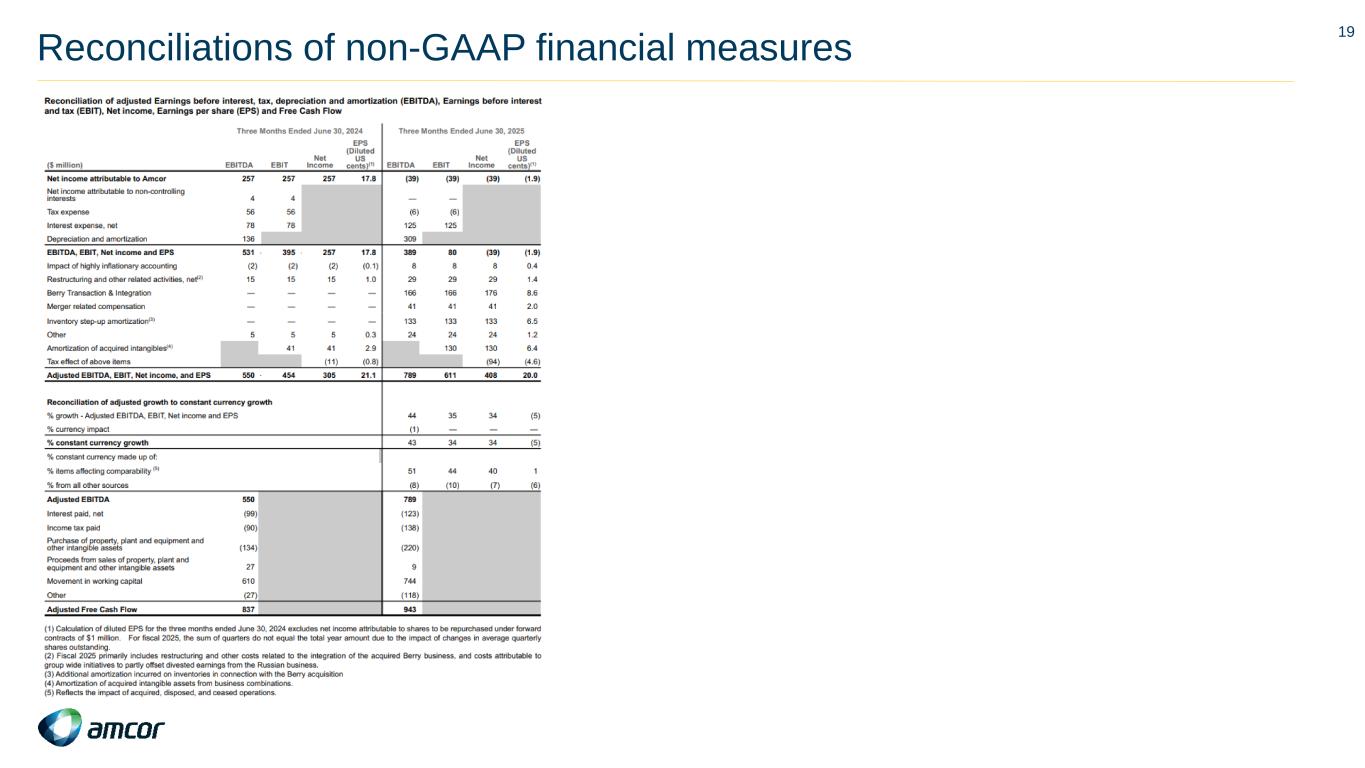

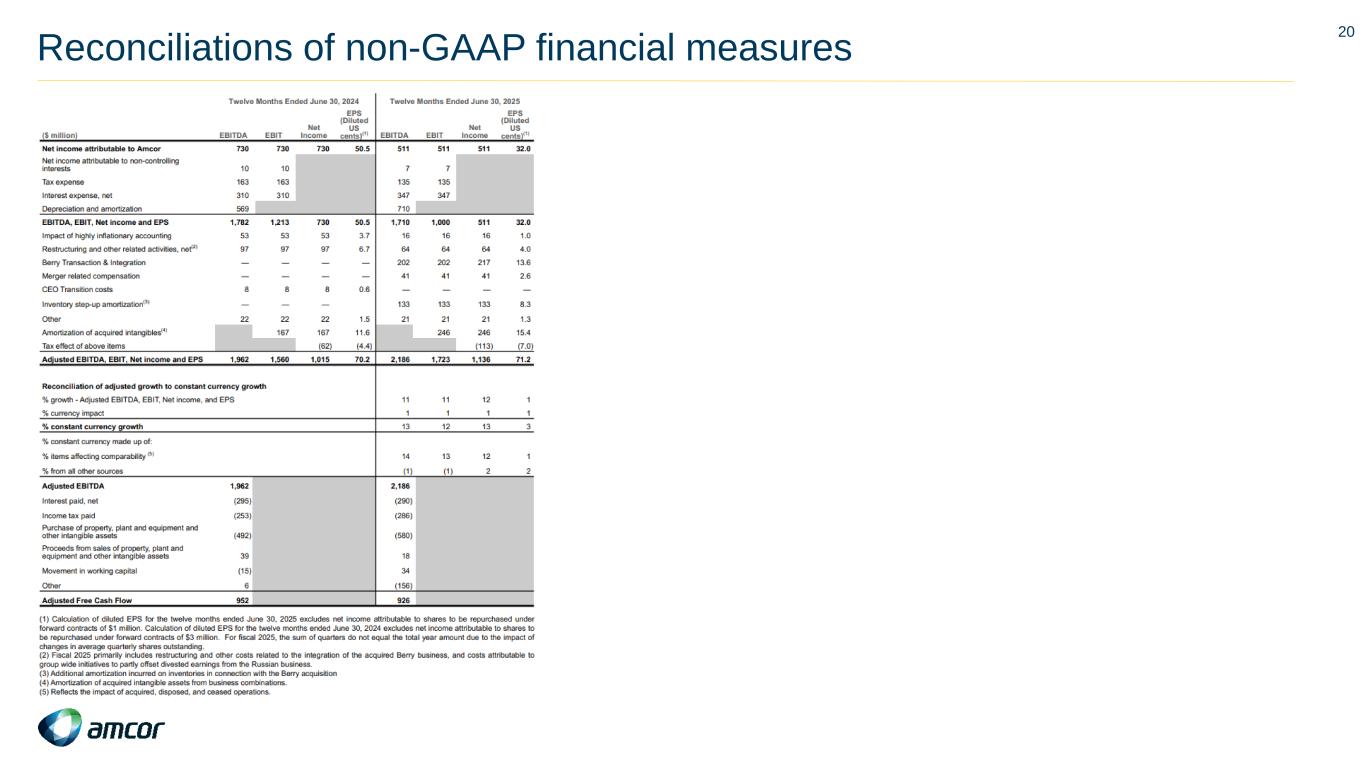

Reconciliation of Non-GAAP Measures

Reconciliation of adjusted Earnings before interest, tax, depreciation and amortization (EBITDA), Earnings before interest and tax (EBIT), Net income, Earnings per share (EPS) and Free Cash Flow

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

|

Three Months Ended June 30, 2025 |

| ($ million) |

|

EBITDA |

|

EBIT |

|

Net Income |

|

EPS (Diluted

US cents)(1)

|

|

EBITDA |

|

EBIT |

|

Net Income |

|

EPS (Diluted US cents)(1) |

| Net income attributable to Amcor |

|

257 |

|

|

257 |

|

|

257 |

|

|

17.8 |

|

|

(39) |

|

|

(39) |

|

|

(39) |

|

|

(1.9) |

|

| Net income attributable to non-controlling interests |

|

4 |

|

|

4 |

|

|

|

|

|

|

— |

|

|

— |

|

|

|

|

|

| Tax expense |

|

56 |

|

|

56 |

|

|

|

|

|

|

(6) |

|

|

(6) |

|

|

|

|

|

| Interest expense, net |

|

78 |

|

|

78 |

|

|

|

|

|

|

125 |

|

|

125 |

|

|

|

|

|

| Depreciation and amortization |

|

136 |

|

|

|

|

|

|

|

|

309 |

|

|

|

|

|

|

|

| EBITDA, EBIT, Net income and EPS |

|

531 |

|

— |

|

395 |

|

— |

|

257 |

|

|

17.8 |

|

|

389 |

|

|

80 |

|

|

(39) |

|

|

(1.9) |

|

| Impact of highly inflationary accounting |

|

(2) |

|

|

(2) |

|

|

(2) |

|

|

(0.1) |

|

|

8 |

|

|

8 |

|

|

8 |

|

|

0.4 |

|

Restructuring and other related activities, net(2) |

|

15 |

|

|

15 |

|

|

15 |

|

|

1.0 |

|

|

29 |

|

|

29 |

|

|

29 |

|

|

1.4 |

|

| Berry Transaction & Integration |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

166 |

|

|

166 |

|

|

176 |

|

|

8.6 |

|

| Merger related compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

41 |

|

|

41 |

|

|

41 |

|

|

2.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Inventory step-up amortization(3) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

133 |

|

|

133 |

|

|

133 |

|

|

6.5 |

|

| Other |

|

5 |

|

|

5 |

|

|

5 |

|

|

0.3 |

|

|

24 |

|

|

24 |

|

|

24 |

|

|

1.2 |

|

Amortization of acquired intangibles(4) |

|

|

|

41 |

|

|

41 |

|

|

2.9 |

|

|

|

|

130 |

|

|

130 |

|

|

6.4 |

|

| Tax effect of above items |

|

|

|

|

|

(11) |

|

|

(0.8) |

|

|

|

|

|

|

(94) |

|

|

(4.6) |

|

| Adjusted EBITDA, EBIT, Net income, and EPS |

|

550 |

|

— |

|

454 |

|

|

305 |

|

|

21.1 |

|

|

789 |

|

|

611 |

|

|

408 |

|

|

20.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of adjusted growth to constant currency growth |

|

|

|

|

|

|

|

|

| % growth - Adjusted EBITDA, EBIT, Net income and EPS |

|

44 |

|

|

35 |

|

|

34 |

|

|

(5) |

|

| % currency impact |

|

|

|

|

|

|

|

|

|

(1) |

|

|

— |

|

|

— |

|

|

— |

|

| % constant currency growth |

|

|

|

|

|

|

|

|

|

43 |

|

|

34 |

|

|

34 |

|

|

(5) |

|

| % constant currency made up of: |

|

|

|

|

|

|

|

|

% items affecting comparability (5) |

|

|

|

|

|

|

|

|

|

51 |

|

|

44 |

|

|

40 |

|

|

1 |

|

| % from all other sources |

|

|

|

|

|

|

|

|

|

(8) |

|

|

(10) |

|

|

(7) |

|

|

(6) |

|

| Adjusted EBITDA |

|

550 |

|

|

|

|

|

|

|

|

789 |

|

|

|

|

|

|

|

| Interest paid, net |

|

(99) |

|

|

|

|

|

|

|

|

(123) |

|

|

|

|

|

|

|

| Income tax paid |

|

(90) |

|

|

|

|

|

|

|

|

(138) |

|

|

|

|

|

|

|

| Purchase of property, plant and equipment and other intangible assets |

|

(134) |

|

|

|

|

|

|

|

|

(220) |

|

|

|

|

|

|

|

| Proceeds from sales of property, plant and equipment and other intangible assets |

|

27 |

|

|

|

|

|

|

|

|

9 |

|

|

|

|

|

|

|

| Movement in working capital |

|

610 |

|

|

|

|

|

|

|

|

744 |

|

|

|

|

|

|

|

| Other |

|

(27) |

|

|

|

|

|

|

|

|

(118) |

|

|

|

|

|

|

|

| Adjusted Free Cash Flow |

|

837 |

|

|

|

|

|

|

|

|

943 |

|

|

|

|

|

|

|

(1) Calculation of diluted EPS for the three months ended June 30, 2024 excludes net income attributable to shares to be repurchased under forward contracts of $1 million. For fiscal 2025, the sum of quarters do not equal the total year amount due to the impact of changes in average quarterly shares outstanding.

(2) Fiscal 2025 primarily includes restructuring and other costs related to the integration of the acquired Berry business, and costs attributable to group wide initiatives to partly offset divested earnings from the Russian business.

(3) Additional amortization incurred on inventories in connection with the Berry acquisition

(4) Amortization of acquired intangible assets from business combinations.

(5) Reflects the impact of acquired, disposed, and ceased operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Twelve Months Ended June 30, 2024 |

|

Twelve Months Ended June 30, 2025 |

| ($ million) |

|

EBITDA |

|

EBIT |

|

Net Income |

|

EPS (Diluted

US cents)(1)

|

|

EBITDA |

|

EBIT |

|

Net Income |

|

EPS (Diluted US cents)(1) |

| Net income attributable to Amcor |

|

730 |

|

|

730 |

|

|

730 |

|

|

50.5 |

|

|

511 |

|

|

511 |

|

|

511 |

|

|

32.0 |

|

| Net income attributable to non-controlling interests |

|

10 |

|

|

10 |

|

|

|

|

|

|

7 |

|

|

7 |

|

|

|

|

|

| Tax expense |

|

163 |

|

|

163 |

|

|

|

|

|

|

135 |

|

|

135 |

|

|

|

|

|

| Interest expense, net |

|

310 |

|

|

310 |

|

|

|

|

|

|

347 |

|

|

347 |

|

|

|

|

|

| Depreciation and amortization |

|

569 |

|

|

|

|

|

|

|

|

710 |

|

|

|

|

|

|

|

| EBITDA, EBIT, Net income and EPS |

|

1,782 |

|

|

1,213 |

|

|

730 |

|

|

50.5 |

|

|

1,710 |

|

|

1,000 |

|

|

511 |

|

|

32.0 |

|

| Impact of highly inflationary accounting |

|

53 |

|

|

53 |

|

|

53 |

|

|

3.7 |

|

|

16 |

|

|

16 |

|

|

16 |

|

|

1.0 |

|

Restructuring and other related activities, net(2) |

|

97 |

|

|

97 |

|

|

97 |

|

|

6.7 |

|

|

64 |

|

|

64 |

|

|

64 |

|

|

4.0 |

|

| Berry Transaction & Integration |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

202 |

|

|

202 |

|

|

217 |

|

|

13.6 |

|

| Merger related compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

41 |

|

|

41 |

|

|

41 |

|

|

2.6 |

|

| CEO Transition costs |

|

8 |

|

|

8 |

|

|

8 |

|

|

0.6 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Inventory step-up amortization(3) |

|

— |

|

|

— |

|

|

— |

|

|

|

|

133 |

|

|

133 |

|

|

133 |

|

|

8.3 |

|

| Other |

|

22 |

|

|

22 |

|

|

22 |

|

|

1.5 |

|

|

21 |

|

|

21 |

|

|

21 |

|

|

1.3 |

|

Amortization of acquired intangibles(4) |

|

|

|

167 |

|

|

167 |

|

|

11.6 |

|

|

|

|

246 |

|

|

246 |

|

|

15.4 |

|

| Tax effect of above items |

|

|

|

|

|

(62) |

|

|

(4.4) |

|

|

|

|

|

|

(113) |

|

|

(7.0) |

|

| Adjusted EBITDA, EBIT, Net income and EPS |

|

1,962 |

|

|

1,560 |

|

|

1,015 |

|

|

70.2 |

|

|

2,186 |

|

|

1,723 |

|

|

1,136 |

|

|

71.2 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Reconciliation of adjusted growth to constant currency growth |

|

|

|

|

|

|

|

|

| % growth - Adjusted EBITDA, EBIT, Net income, and EPS |

|

|

|

|

|

11 |

|

|

11 |

|

|

12 |

|

|

1 |

|

| % currency impact |

|

|

|

|

|

|

|

|

|

1 |

|

|

1 |

|

|

1 |

|

|

1 |

|

| % constant currency growth |

|

|

|

|

|

|

|

|

|

13 |

|

|

12 |

|

|

13 |

|

|

3 |

|

| % constant currency made up of: |

|

|

|

|

|

|

|

|

% items affecting comparability (5) |

|

|

|

|

|

|

|

|

|

14 |

|

|

13 |

|

|

12 |

|

|

1 |

|

| % from all other sources |

|

|

|

|

|

|

|

|

|

(1) |

|

|

(1) |

|

|

2 |

|

|

2 |

|

| Adjusted EBITDA |

|

1,962 |

|

|

|

|

|

|

|

|

2,186 |

|

|

|

|

|

|

|

| Interest paid, net |

|

(295) |

|

|

|

|

|

|

|

|

(290) |

|

|

|

|

|

|

|

| Income tax paid |

|

(253) |

|

|

|

|

|

|

|

|

(286) |

|

|

|

|

|

|

|

| Purchase of property, plant and equipment and other intangible assets |

|

(492) |

|

|

|

|

|

|

|

|

(580) |

|

|

|

|

|

|

|

| Proceeds from sales of property, plant and equipment and other intangible assets |

|

39 |

|

|

|

|

|

|

|

|

18 |

|

|

|

|

|

|

|

| Movement in working capital |

|

(15) |

|

|

|

|

|

|

|

|

34 |

|

|

|

|

|

|

|

| Other |

|

6 |

|

|

|

|

|

|

|

|

(156) |

|

|

|

|

|

|

|

| Adjusted Free Cash Flow |

|

952 |

|

|

|

|

|

|

|

|

926 |

|

|

|

|

|

|

|

(1) Calculation of diluted EPS for the twelve months ended June 30, 2025 excludes net income attributable to shares to be repurchased under forward contracts of $1 million. Calculation of diluted EPS for the twelve months ended June 30, 2024 excludes net income attributable to shares to be repurchased under forward contracts of $3 million. For fiscal 2025, the sum of quarters do not equal the total year amount due to the impact of changes in average quarterly shares outstanding.

(2) Fiscal 2025 primarily includes restructuring and other costs related to the integration of the acquired Berry business, and costs attributable to group wide initiatives to partly offset divested earnings from the Russian business.

(3) Additional amortization incurred on inventories in connection with the Berry acquisition

(4) Amortization of acquired intangible assets from business combinations.

(5) Reflects the impact of acquired, disposed, and ceased operations.

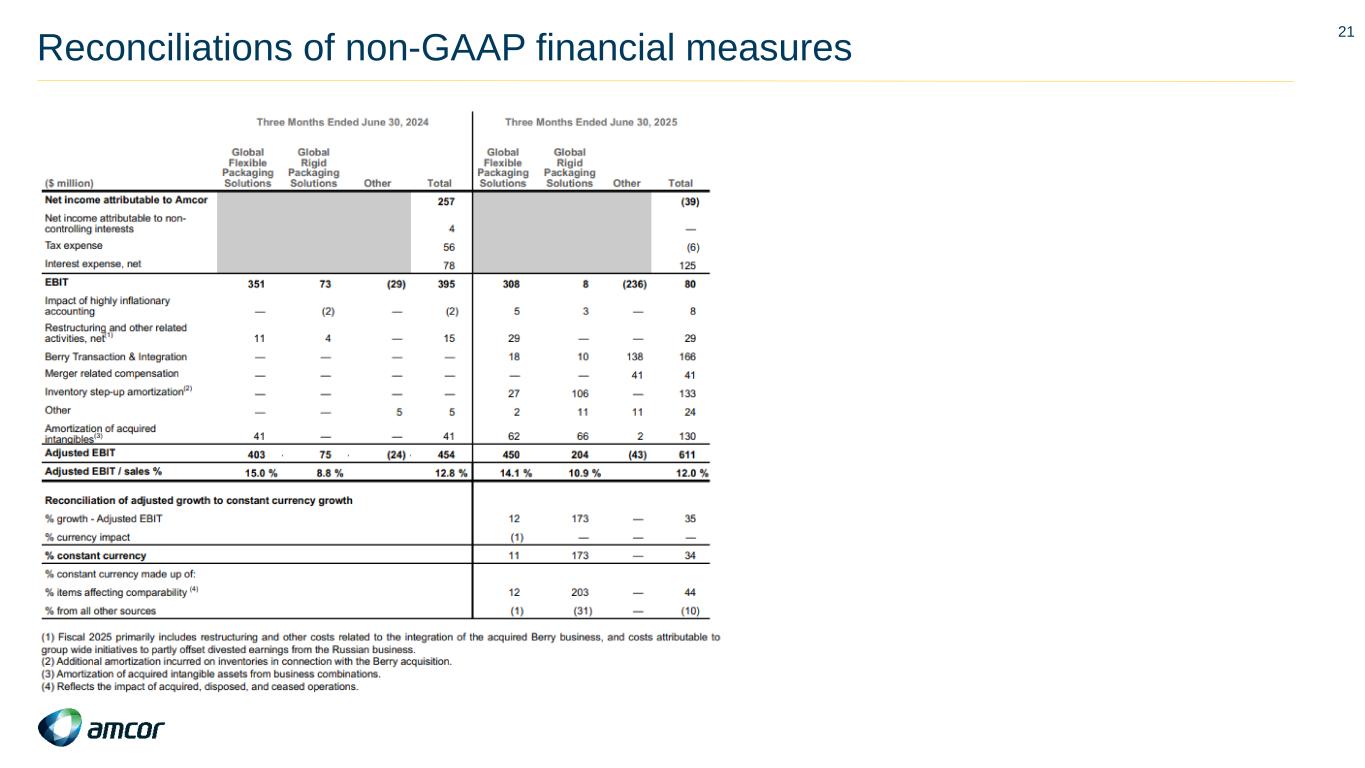

Reconciliation of adjusted EBIT by reporting segment

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, 2024 |

|

Three Months Ended June 30, 2025 |

| ($ million) |

|

Global Flexible Packaging Solutions |

|

Global Rigid Packaging Solutions |

|

Other |

|

Total |

|

Global Flexible Packaging Solutions |

|

Global Rigid Packaging Solutions |

|

Other |

|

Total |

| Net income attributable to Amcor |

|

|

|

|

|

|

|

257 |

|

|

|

|

|

|

|

|

(39) |

|

| Net income attributable to non-controlling interests |

|

|

|

|

|

|

|

4 |

|

|

|

|

|

|

|

|

— |

|

| Tax expense |

|

|

|

|

|

|

|

56 |

|

|

|

|

|

|

|

|

(6) |

|

| Interest expense, net |

|

|

|

|

|

|

|

78 |

|

|

|

|

|

|

|

|

125 |

|

| EBIT |

|

351 |

|

|

73 |

|

|

(29) |

|

|

395 |

|

|

308 |

|

|

8 |

|

|

(236) |

|

|

80 |

|

| Impact of highly inflationary accounting |

|

— |

|

|

(2) |

|

|

— |

|

|

(2) |

|

|

5 |

|

|

3 |

|

|

— |

|

|

8 |

|

Restructuring and other related activities, net(1) |

|

11 |

|

|

4 |

|

|

— |

|

|

15 |

|

|

29 |

|

|

— |

|

|

— |

|

|

29 |

|

| Berry Transaction & Integration |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

18 |

|

|

10 |

|

|

138 |

|

|

166 |

|

| Merger related compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

41 |

|

|

41 |

|

Inventory step-up amortization(2) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

27 |

|

|

106 |

|

|

— |

|

|

133 |

|

| Other |

|

— |

|

|

— |

|

|

5 |

|

|

5 |

|

|

2 |

|

|

11 |

|

|

11 |

|

|

24 |

|

Amortization of acquired intangibles(3) |

|

41 |

|

|

— |

|

|

— |

|

|

41 |

|

|

62 |

|

|

66 |

|

|

2 |

|

|

130 |

|

| Adjusted EBIT |

|

403 |

|

— |

|

75 |

|

— |

|

(24) |

|

— |

|

454 |

|

|

450 |

|

|

204 |

|

|

(43) |

|

|

611 |

|

| Adjusted EBIT / sales % |

|

15.0 |

% |

|

8.8 |

% |

|

|

|

12.8 |

% |

|

14.1 |

% |

|

10.9 |

% |

|

|

|

12.0 |

% |

| Reconciliation of adjusted growth to constant currency growth |

|

|

|

|

|

|

|

|

| % growth - Adjusted EBIT |

|

|

|

|

|

|

|

|

|

12 |

|

|

173 |

|

|

— |

|

|

35 |

|

| % currency impact |

|

|

|

|

|

|

|

|

|

(1) |

|

|

— |

|

|

— |

|

|

— |

|

| % constant currency |

|

|

|

|

|

|

|

|

|

11 |

|

|

173 |

|

|

— |

|

|

34 |

|

| % constant currency made up of: |

|

|

|

|

|

|

|

|

% items affecting comparability (4) |

|

|

|

|

|

|

|

|

|

12 |

|

|

203 |

|

|

— |

|

|

44 |

|

| % from all other sources |

|

|

|

|

|

|

|

|

|

(1) |

|

|

(31) |

|

|

— |

|

|

(10) |

|

(1) Fiscal 2025 primarily includes restructuring and other costs related to the integration of the acquired Berry business, and costs attributable to group wide initiatives to partly offset divested earnings from the Russian business.

(2) Additional amortization incurred on inventories in connection with the Berry acquisition.

(3) Amortization of acquired intangible assets from business combinations.

(4) Reflects the impact of acquired, disposed, and ceased operations.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

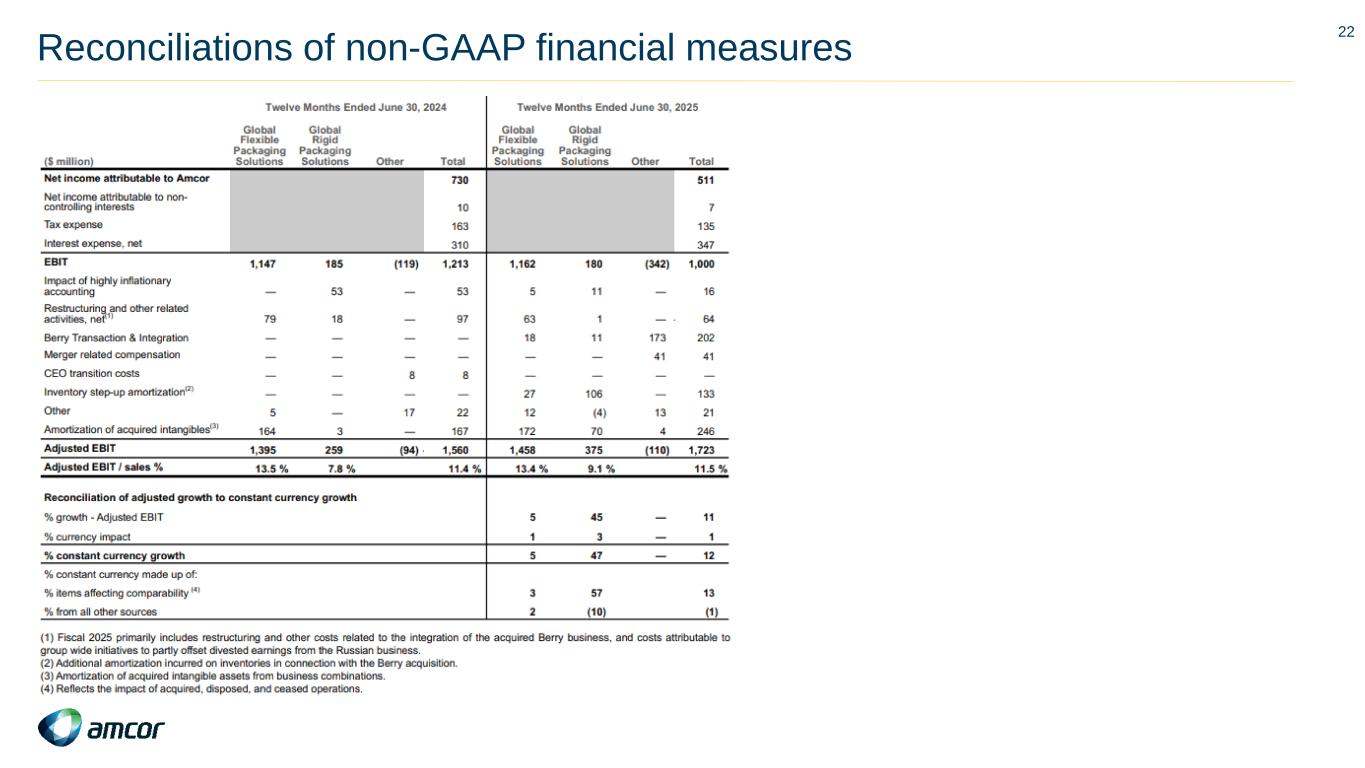

Twelve Months Ended June 30, 2024 |

|

Twelve Months Ended June 30, 2025 |

| ($ million) |

|

Global Flexible Packaging Solutions |

|

Global Rigid Packaging Solutions |

|

Other |

|

Total |

|

Global Flexible Packaging Solutions |

|

Global Rigid Packaging Solutions |

|

Other |

|

Total |

| Net income attributable to Amcor |

|

|

|

|

|

|

|

730 |

|

|

|

|

|

|

|

|

511 |

|

| Net income attributable to non-controlling interests |

|

|

|

|

|

|

|

10 |

|

|

|

|

|

|

|

|

7 |

|

| Tax expense |

|

|

|

|

|

|

|

163 |

|

|

|

|

|

|

|

|

135 |

|

| Interest expense, net |

|

|

|

|

|

|

|

310 |

|

|

|

|

|

|

|

|

347 |

|

| EBIT |

|

1,147 |

|

|

185 |

|

|

(119) |

|

|

1,213 |

|

|

1,162 |

|

|

180 |

|

|

(342) |

|

|

1,000 |

|

| Impact of highly inflationary accounting |

|

— |

|

|

53 |

|

|

— |

|

|

53 |

|

|

5 |

|

|

11 |

|

|

— |

|

|

16 |

|

Restructuring and other related activities, net(1) |

|

79 |

|

|

18 |

|

|

— |

|

|

97 |

|

|

63 |

|

|

1 |

|

|

— |

|

— |

|

64 |

|

| Berry Transaction & Integration |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

18 |

|

|

11 |

|

|

173 |

|

|

202 |

|

| Merger related compensation |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

41 |

|

|

41 |

|

| CEO transition costs |

|

— |

|

|

— |

|

|

8 |

|

|

8 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Inventory step-up amortization(2) |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

27 |

|

|

106 |

|

|

— |

|

|

133 |

|

| Other |

|

5 |

|

|

— |

|

|

17 |

|

|

22 |

|

|

12 |

|

|

(4) |

|

|

13 |

|

|

21 |

|

Amortization of acquired intangibles(3) |

|

164 |

|

|

3 |

|

|

— |

|

|

167 |

|

|

172 |

|

|

70 |

|

|

4 |

|

|

246 |

|

| Adjusted EBIT |

|

1,395 |

|

|

259 |

|

|

(94) |

|

— |

|

1,560 |

|

|

1,458 |

|

|

375 |

|

|

(110) |

|

|

1,723 |

|

| Adjusted EBIT / sales % |

|

13.5 |

% |

|

7.8 |

% |

|

|

|

11.4 |

% |

|

13.4 |

% |

|

9.1 |

% |

|

|

|

11.5 |

% |

| Reconciliation of adjusted growth to constant currency growth |

|

|

|

|

|

|

|

|

| % growth - Adjusted EBIT |

|

|

|

|

|

|

|

|

|

5 |

|

|

45 |

|

|

— |

|

|

11 |

|

| % currency impact |

|

|

|

|

|

|

|

|

|

1 |

|

|

3 |

|

|

— |

|

|

1 |

|

| % constant currency growth |

|

|

|

|

|

|

|

|

|

5 |

|

|

47 |

|

|

— |

|

|

12 |

|

| % constant currency made up of: |

|

|

|

|

|

|

|

|

% items affecting comparability (4) |

|

|

|

|

|

|

|

|

|

3 |

|

|

57 |

|

|

|

|

13 |

|

| % from all other sources |

|

|

|

|

|

|

|

|

|

2 |

|

|

(10) |

|

|

|

|

(1) |

|

(1) Fiscal 2025 primarily includes restructuring and other costs related to the integration of the acquired Berry business, and costs attributable to group wide initiatives to partly offset divested earnings from the Russian business.

(2) Additional amortization incurred on inventories in connection with the Berry acquisition.

(3) Amortization of acquired intangible assets from business combinations.

(4) Reflects the impact of acquired, disposed, and ceased operations.

Reconciliation of net debt

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ($ million) |

|

June 30, 2024 |

|

June 30, 2025 |

| Cash and cash equivalents |

|

(588) |

|

|

(827) |

|

| Short-term debt |

|

84 |

|

|

116 |

|

| Current portion of long-term debt |

|

12 |

|

|

141 |

|

| Long-term debt excluding current portion |

|

6,603 |

|

|

13,841 |

|

| Net debt |

|

6,111 |

|

|

13,271 |

|

Cautionary Statement Regarding Forward-Looking Statements

Unless otherwise indicated, references to "Amcor," the "Company," "we," "our," and "us" in this document refer to Amcor plc and its consolidated subsidiaries. This document contains certain statements that are "forward-looking statements" within the meaning of the safe harbor provisions of the U.S. Private Securities Litigation Reform Act of 1995. Forward-looking statements are generally identified with words like "believe," "expect," "target," "project," "may," "could," "would," "approximately," "possible," "will," "should," "intend," "plan," "anticipate," "commit," "estimate," "potential," "ambitions," "outlook," or "continue," the negative of these words, other terms of similar meaning, or the use of future dates. Such statements are based on the current expectations of the management of Amcor and are qualified by the inherent risks and uncertainties surrounding future expectations generally. Actual results could differ materially from those currently anticipated due to a number of risks and uncertainties. Neither Amcor nor any of its respective directors, executive officers, or advisors, provide any representation, assurance, or guarantee that the occurrence of the events expressed or implied in any forward-looking statements will actually occur or if any of them do occur, what impact they will have on the business, results of operations or financial condition of Amcor. Should any risks and uncertainties develop into actual events, these developments could have a material adverse effect on Amcor's business, including the ability to successfully realize the expected benefits of the merger of Amcor and Berry Global Group, Inc.