false2024FY0001745114trueP3YP1YP3Yxbrli:sharesiso4217:CHFiso4217:CHFxbrli:sharesmoln:segmentxbrli:puremoln:employeeiso4217:USDmoln:positionmoln:bankmoln:votemoln:planmoln:tranche00017451142024-01-012024-12-310001745114dei:BusinessContactMember2024-01-012024-12-310001745114moln:AmericanDepositorySharesTheNasdaqStockMarketLLCMember2024-01-012024-12-3100017451142024-12-3100017451142023-12-3100017451142023-01-012023-12-3100017451142022-01-012022-12-3100017451142022-12-3100017451142021-12-310001745114ifrs-full:IssuedCapitalMember2021-12-310001745114ifrs-full:AdditionalPaidinCapitalMember2021-12-310001745114ifrs-full:RetainedEarningsMember2021-12-310001745114ifrs-full:RetainedEarningsMember2022-01-012022-12-310001745114ifrs-full:AdditionalPaidinCapitalMember2022-01-012022-12-310001745114ifrs-full:IssuedCapitalMember2022-01-012022-12-310001745114ifrs-full:TreasurySharesMember2022-01-012022-12-310001745114ifrs-full:IssuedCapitalMember2022-12-310001745114ifrs-full:AdditionalPaidinCapitalMember2022-12-310001745114ifrs-full:TreasurySharesMember2022-12-310001745114ifrs-full:RetainedEarningsMember2022-12-310001745114ifrs-full:RetainedEarningsMember2023-01-012023-12-310001745114ifrs-full:AdditionalPaidinCapitalMember2023-01-012023-12-310001745114ifrs-full:IssuedCapitalMember2023-01-012023-12-310001745114ifrs-full:IssuedCapitalMember2023-12-310001745114ifrs-full:AdditionalPaidinCapitalMember2023-12-310001745114ifrs-full:TreasurySharesMember2023-12-310001745114ifrs-full:RetainedEarningsMember2023-12-310001745114ifrs-full:RetainedEarningsMember2024-01-012024-12-310001745114ifrs-full:AdditionalPaidinCapitalMember2024-01-012024-12-310001745114ifrs-full:IssuedCapitalMember2024-01-012024-12-310001745114ifrs-full:IssuedCapitalMember2024-12-310001745114ifrs-full:AdditionalPaidinCapitalMember2024-12-310001745114ifrs-full:TreasurySharesMember2024-12-310001745114ifrs-full:RetainedEarningsMember2024-12-310001745114moln:LaboratoryEquipmentMember2024-01-012024-12-310001745114ifrs-full:OfficeEquipmentMember2024-01-012024-12-310001745114ifrs-full:ComputerEquipmentMember2024-01-012024-12-310001745114ifrs-full:ComputerSoftwareMember2024-01-012024-12-310001745114moln:VSAOMember2024-01-012024-12-310001745114moln:VoluntaryComplementaryPlanMember2024-01-012024-12-310001745114moln:VoluntaryComplementaryPlanMember2023-01-012023-12-310001745114moln:CoDevelopmentAgreementWithOranoMedMember2024-01-012024-12-310001745114moln:A2021LicenseAndCollaborationAgreementWithNovartisDARPINConjugatedRadioligandTherapiesMember2024-12-310001745114moln:A2021LicenseAndCollaborationAgreementWithNovartisDARPINConjugatedRadioligandTherapiesMembermoln:NovartisMember2024-01-012024-12-310001745114moln:NovartisMember2024-01-012024-12-310001745114moln:A2021LicenseAndCollaborationAgreementWithNovartisDARPINConjugatedRadioligandTherapiesMembermoln:NovartisMember2023-01-012023-12-310001745114moln:A2021LicenseAndCollaborationAgreementWithNovartisDARPINConjugatedRadioligandTherapiesMembermoln:NovartisMember2022-01-012022-12-310001745114moln:NovartisOptionAndEquityRightsAgreementMember2022-01-012022-12-310001745114moln:NovartisOptionAndEquityRightsAgreementMembermoln:CommercialSupplyOfProductsMember2022-01-012022-12-310001745114moln:FederalOfficeOfPublicHealthMember2021-01-012021-12-310001745114moln:LicenseAndCollaborationAgreementWithFOPHMember2022-01-012022-12-310001745114moln:LicenseAndCollaborationAgreementWithAmgenIncMember2018-01-012018-12-310001745114moln:LicenseAndCollaborationAgreementWithAmgenIncMember2022-01-012022-12-310001745114country:CH2024-01-012024-12-310001745114country:CH2023-01-012023-12-310001745114country:CH2022-01-012022-12-310001745114country:US2024-01-012024-12-310001745114country:US2023-01-012023-12-310001745114country:US2022-01-012022-12-310001745114moln:LicenseAndCollaborationAgreementWithNovartisAGMember2024-01-012024-12-310001745114moln:LicenseAndCollaborationAgreementWithNovartisAGMember2023-01-012023-12-310001745114moln:LicenseAndCollaborationAgreementWithNovartisAGMember2022-01-012022-12-310001745114moln:LicenseAndCollaborationAgreementWithFOPHMember2024-01-012024-12-310001745114moln:LicenseAndCollaborationAgreementWithFOPHMember2023-01-012023-12-310001745114moln:LicenseAndCollaborationAgreementWithAmgenIncMember2024-01-012024-12-310001745114moln:LicenseAndCollaborationAgreementWithAmgenIncMember2023-01-012023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMembermoln:LabEquipmentMember2023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:OfficeEquipmentMember2023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2023-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMember2023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2023-12-310001745114ifrs-full:GrossCarryingAmountMember2023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMembermoln:LabEquipmentMember2024-01-012024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:OfficeEquipmentMember2024-01-012024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2024-01-012024-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMember2024-01-012024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2024-01-012024-12-310001745114ifrs-full:GrossCarryingAmountMember2024-01-012024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMembermoln:LabEquipmentMember2024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:OfficeEquipmentMember2024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2024-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMember2024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2024-12-310001745114ifrs-full:GrossCarryingAmountMember2024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMembermoln:LabEquipmentMember2023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:OfficeEquipmentMember2023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2023-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:RightofuseAssetsMember2023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2023-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMembermoln:LabEquipmentMember2024-01-012024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:OfficeEquipmentMember2024-01-012024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2024-01-012024-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:RightofuseAssetsMember2024-01-012024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2024-01-012024-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMember2024-01-012024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMembermoln:LabEquipmentMember2024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:OfficeEquipmentMember2024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2024-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:RightofuseAssetsMember2024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2024-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMember2024-12-310001745114moln:LabEquipmentMemberifrs-full:PropertyPlantAndEquipmentMember2024-12-310001745114ifrs-full:OfficeEquipmentMemberifrs-full:PropertyPlantAndEquipmentMember2024-12-310001745114ifrs-full:ComputerEquipmentMemberifrs-full:PropertyPlantAndEquipmentMember2024-12-310001745114ifrs-full:RightofuseAssetsMember2024-12-310001745114ifrs-full:LeaseholdImprovementsMemberifrs-full:PropertyPlantAndEquipmentMember2024-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMembermoln:LabEquipmentMember2022-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:OfficeEquipmentMember2022-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2022-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMember2022-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2022-12-310001745114ifrs-full:GrossCarryingAmountMember2022-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMembermoln:LabEquipmentMember2023-01-012023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:OfficeEquipmentMember2023-01-012023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:ComputerEquipmentMember2023-01-012023-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:RightofuseAssetsMember2023-01-012023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:GrossCarryingAmountMemberifrs-full:LeaseholdImprovementsMember2023-01-012023-12-310001745114ifrs-full:GrossCarryingAmountMember2023-01-012023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMembermoln:LabEquipmentMember2022-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:OfficeEquipmentMember2022-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2022-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:RightofuseAssetsMember2022-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2022-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMember2022-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMembermoln:LabEquipmentMember2023-01-012023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:OfficeEquipmentMember2023-01-012023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerEquipmentMember2023-01-012023-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:RightofuseAssetsMember2023-01-012023-12-310001745114ifrs-full:PropertyPlantAndEquipmentMemberifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:LeaseholdImprovementsMember2023-01-012023-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMember2023-01-012023-12-310001745114moln:LabEquipmentMemberifrs-full:PropertyPlantAndEquipmentMember2023-12-310001745114ifrs-full:OfficeEquipmentMemberifrs-full:PropertyPlantAndEquipmentMember2023-12-310001745114ifrs-full:ComputerEquipmentMemberifrs-full:PropertyPlantAndEquipmentMember2023-12-310001745114ifrs-full:RightofuseAssetsMember2023-12-310001745114ifrs-full:LeaseholdImprovementsMemberifrs-full:PropertyPlantAndEquipmentMember2023-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2023-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2024-01-012024-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2024-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2023-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2024-01-012024-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2024-12-310001745114ifrs-full:ComputerSoftwareMember2024-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2022-12-310001745114ifrs-full:GrossCarryingAmountMemberifrs-full:ComputerSoftwareMember2023-01-012023-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2022-12-310001745114ifrs-full:AccumulatedDepreciationAndAmortisationMemberifrs-full:ComputerSoftwareMember2023-01-012023-12-310001745114ifrs-full:ComputerSoftwareMember2023-12-310001745114moln:CashAndCashEquivalents1Memberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2024-12-310001745114ifrs-full:TradeReceivablesMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2024-12-310001745114moln:AccruedIncomeMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2024-12-310001745114moln:ShortTermTimeDepositsMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2024-12-310001745114ifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2024-12-310001745114moln:CashAndCashEquivalents1Memberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2023-12-310001745114ifrs-full:TradeReceivablesMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2023-12-310001745114moln:AccruedIncomeMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2023-12-310001745114moln:ShortTermTimeDepositsMemberifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2023-12-310001745114ifrs-full:FinancialAssetsAtAmortisedCostCategoryMember2023-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembermoln:TradePayablesMember2024-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembermoln:AccruedProjectCostsAndRoyaltiesMember2024-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMemberifrs-full:LeaseLiabilitiesMember2024-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembermoln:OtherNonEmployeeRelatedAccruedExpensesMember2024-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMember2024-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembermoln:TradePayablesMember2023-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembermoln:AccruedProjectCostsAndRoyaltiesMember2023-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMemberifrs-full:LeaseLiabilitiesMember2023-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMembermoln:OtherNonEmployeeRelatedAccruedExpensesMember2023-12-310001745114ifrs-full:FinancialLiabilitiesAtAmortisedCostCategoryMember2023-12-310001745114currency:EUR2024-12-310001745114currency:EUR2023-12-310001745114currency:USD2024-12-310001745114currency:USD2023-12-310001745114currency:CHF2024-12-310001745114currency:CHF2023-12-310001745114currency:GBP2024-12-310001745114currency:GBP2023-12-3100017451142024-10-252024-10-2500017451142024-10-2500017451142022-08-310001745114ifrs-full:OrdinarySharesMember2024-01-012024-12-310001745114ifrs-full:OrdinarySharesMember2024-12-310001745114srt:MinimumMember2024-12-310001745114srt:MaximumMember2024-12-310001745114ifrs-full:PotentialOrdinaryShareTransactionsMembersrt:MinimumMember2025-02-110001745114ifrs-full:PotentialOrdinaryShareTransactionsMembersrt:MaximumMember2025-02-110001745114moln:ConditionalShareCapitalMember2024-12-310001745114moln:ShareOptionsPSUsAndRSUsMember2024-01-012024-12-310001745114moln:ConditionalShareCapitalMember2023-12-310001745114moln:ShareOptionsPSUsAndRSUsMember2023-01-012023-12-310001745114moln:ShareOptionsPSUsAndRSUsMember2022-01-012022-12-310001745114moln:NovartisMember2023-12-310001745114moln:NovartisMember2024-12-310001745114moln:NovartisMember2022-12-310001745114moln:NovartisMember2023-01-012023-12-310001745114moln:ResearchAndDevelopmentExpense1Member2024-01-012024-12-310001745114moln:ResearchAndDevelopmentExpense1Member2023-01-012023-12-310001745114moln:ResearchAndDevelopmentExpense1Member2022-01-012022-12-310001745114ifrs-full:SellingGeneralAndAdministrativeExpenseMember2024-01-012024-12-310001745114ifrs-full:SellingGeneralAndAdministrativeExpenseMember2023-01-012023-12-310001745114ifrs-full:SellingGeneralAndAdministrativeExpenseMember2022-01-012022-12-310001745114moln:UniversityOfZurichMember2024-01-012024-12-310001745114ifrs-full:PresentValueOfDefinedBenefitObligationMember2023-12-310001745114ifrs-full:PresentValueOfDefinedBenefitObligationMember2022-12-310001745114ifrs-full:PresentValueOfDefinedBenefitObligationMember2024-01-012024-12-310001745114ifrs-full:PresentValueOfDefinedBenefitObligationMember2023-01-012023-12-310001745114ifrs-full:PresentValueOfDefinedBenefitObligationMember2024-12-310001745114ifrs-full:PlanAssetsMember2023-12-310001745114ifrs-full:PlanAssetsMember2022-12-310001745114ifrs-full:PlanAssetsMember2024-01-012024-12-310001745114ifrs-full:PlanAssetsMember2023-01-012023-12-310001745114ifrs-full:PlanAssetsMember2024-12-310001745114ifrs-full:Level1OfFairValueHierarchyMember2024-12-310001745114ifrs-full:Level1OfFairValueHierarchyMember2023-12-310001745114ifrs-full:Level2OfFairValueHierarchyMember2024-12-310001745114ifrs-full:Level2OfFairValueHierarchyMember2023-12-310001745114ifrs-full:ActuarialAssumptionOfDiscountRatesMember2024-12-310001745114ifrs-full:ActuarialAssumptionOfDiscountRatesMember2023-12-310001745114moln:ActuarialAssumptionOfInterestRateOnRetirementSavingsCapitalMember2024-12-310001745114moln:ActuarialAssumptionOfInterestRateOnRetirementSavingsCapitalMember2023-12-310001745114ifrs-full:ActuarialAssumptionOfExpectedRatesOfSalaryIncreasesMember2023-12-310001745114ifrs-full:ActuarialAssumptionOfExpectedRatesOfSalaryIncreasesMember2024-12-310001745114ifrs-full:ActuarialAssumptionOfLifeExpectancyAfterRetirementMember2024-12-310001745114ifrs-full:ActuarialAssumptionOfLifeExpectancyAfterRetirementMember2023-12-310001745114moln:ActiveMembersMember2024-01-012024-12-310001745114moln:ActiveMembersMember2023-01-012023-12-310001745114moln:PensionersMember2024-01-012024-12-310001745114moln:PensionersMember2023-01-012023-12-310001745114moln:ESOP2009AndESOP2014Member2024-01-012024-12-310001745114moln:ESOP2009AndESOP2014Member2024-12-310001745114moln:ESOP2009AndESOP2014Member2023-12-310001745114moln:RestrictedShareUnitsRSUMember2024-01-012024-12-310001745114moln:PerformanceShareUnitsPSUEmployeesExcludingManagementBoardMember2024-01-012024-12-310001745114moln:PerformanceShareUnitsPSUManagementBoardMember2024-01-012024-12-310001745114srt:MinimumMembermoln:PerformanceShareUnitsPSUEmployeesExcludingManagementBoardMember2024-01-012024-12-310001745114srt:MaximumMembermoln:PerformanceShareUnitsPSUEmployeesExcludingManagementBoardMember2024-01-012024-12-310001745114moln:PerformanceShareUnitsPSUMember2024-12-310001745114moln:RestrictedShareUnitsRSUMember2024-12-310001745114moln:PerformanceShareUnitsPSUMember2023-12-310001745114moln:RestrictedShareUnitsRSUMember2023-12-310001745114moln:RestrictedShareUnitsRSUMember2023-01-012023-12-310001745114moln:PerformanceShareUnitsPSUMember2024-01-012024-12-310001745114moln:PerformanceShareUnitsPSUMember2023-01-012023-12-310001745114srt:MinimumMember2024-01-012024-12-310001745114srt:MaximumMember2024-01-012024-12-310001745114srt:MinimumMember2023-01-012023-12-310001745114srt:MaximumMember2023-01-012023-12-310001745114srt:MinimumMembermoln:RestrictedShareUnitsRSUMember2024-01-012024-12-310001745114srt:MinimumMembermoln:RestrictedShareUnitsRSUMember2023-01-012023-12-310001745114moln:PerformanceShareUnitsPSUManagementBoardMember2023-01-012023-12-310001745114srt:MinimumMembermoln:PerformanceShareUnitsPSUEmployeesExcludingManagementBoardMember2023-01-012023-12-310001745114moln:ExercisePriceRangeThreeMember2024-12-310001745114moln:ExercisePriceRangeOneMember2023-12-310001745114moln:ExercisePriceRangeOneMember2023-01-012023-12-310001745114moln:ExercisePriceRangeTwoMember2023-12-310001745114moln:ExercisePriceRangeTwoMember2023-01-012023-12-310001745114moln:ExercisePriceRangeThreeMember2023-12-310001745114moln:MolecularPartnersIncMember2024-01-012024-12-310001745114moln:MolecularPartnersIncMember2023-01-012023-12-310001745114moln:MolecularPartnersIncMember2022-01-012022-12-310001745114moln:ExpiringIn2027Member2024-12-310001745114moln:ExpiringIn2027Member2023-12-310001745114moln:ExpiringIn2028Member2024-12-310001745114moln:ExpiringIn2028Member2023-12-310001745114moln:ExpiringIn2030Member2024-12-310001745114moln:ExpiringIn2030Member2023-12-310001745114moln:ExpiringIn2031Member2024-12-310001745114moln:ExpiringIn2031Member2023-12-310001745114srt:MinimumMember2024-01-012024-12-310001745114srt:MaximumMember2024-01-012024-12-310001745114moln:LeaseFacilitiesSchlierenMember2020-01-012020-12-310001745114ifrs-full:NotLaterThanOneYearMember2024-12-310001745114ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember2024-12-310001745114ifrs-full:LaterThanTwoYearsAndNotLaterThanFiveYearsMember2024-12-310001745114ifrs-full:LaterThanFiveYearsMember2024-12-310001745114ifrs-full:NotLaterThanOneYearMember2023-12-310001745114ifrs-full:LaterThanOneYearAndNotLaterThanTwoYearsMember2023-12-310001745114ifrs-full:LaterThanTwoYearsAndNotLaterThanFiveYearsMember2023-12-310001745114ifrs-full:LaterThanFiveYearsMember2023-12-310001745114currency:USDifrs-full:CurrencyRiskMember2024-01-012024-12-310001745114currency:USDifrs-full:CurrencyRiskMember2023-01-012023-12-310001745114currency:USDifrs-full:CurrencyRiskMember2022-01-012022-12-310001745114currency:EURifrs-full:CurrencyRiskMember2024-01-012024-12-310001745114currency:EURifrs-full:CurrencyRiskMember2023-01-012023-12-310001745114currency:EURifrs-full:CurrencyRiskMember2022-01-012022-12-310001745114currency:CHFifrs-full:InterestRateRiskMember2024-01-012024-12-310001745114currency:CHFifrs-full:InterestRateRiskMember2023-01-012023-12-310001745114currency:CHFifrs-full:InterestRateRiskMember2022-01-012022-12-310001745114currency:USDifrs-full:InterestRateRiskMember2024-01-012024-12-310001745114currency:USDifrs-full:InterestRateRiskMember2023-01-012023-12-310001745114currency:USDifrs-full:InterestRateRiskMember2022-01-012022-12-310001745114currency:EURifrs-full:InterestRateRiskMember2024-01-012024-12-310001745114currency:EURifrs-full:InterestRateRiskMember2023-01-012023-12-310001745114currency:EURifrs-full:InterestRateRiskMember2022-01-012022-12-310001745114moln:CashAndCashEquivalents1Memberifrs-full:CreditRiskMember2024-12-310001745114moln:CashAndCashEquivalents1Memberifrs-full:CreditRiskMember2023-12-310001745114ifrs-full:TradeReceivablesMemberifrs-full:CreditRiskMember2024-12-310001745114ifrs-full:TradeReceivablesMemberifrs-full:CreditRiskMember2023-12-310001745114moln:AccruedIncomeMemberifrs-full:CreditRiskMember2024-12-310001745114moln:AccruedIncomeMemberifrs-full:CreditRiskMember2023-12-310001745114moln:ShortTermTimeDepositsMemberifrs-full:CreditRiskMember2024-12-310001745114moln:ShortTermTimeDepositsMemberifrs-full:CreditRiskMember2023-12-310001745114ifrs-full:CreditRiskMember2024-12-310001745114ifrs-full:CreditRiskMember2023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

|

|

|

|

|

|

| ☐ |

REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

|

|

|

|

|

|

| ☒ |

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

OR

|

|

|

|

|

|

| ☐ |

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

|

|

|

|

|

|

| ☐ |

SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission File Number 001-40488

MOLECULAR PARTNERS AG

(Exact name of registrant as specified in its charter and translation of registrant’s name into English)

Switzerland

(Jurisdiction of incorporation or organization)

Wagistrasse 14

8952 Zurich-Schlieren

Switzerland

(Address of principal executive offices)

Patrick Amstutz

Chief Executive Officer

Molecular Partners AG

Wagistrasse 14

8952 Zurich-Schlieren

Switzerland

Tel: +41 44 755 77 00

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

|

American depositary shares (each representing

one ordinary share, CHF 0.10 nominal value per share)

|

|

MOLN |

|

The Nasdaq Stock Market LLC |

Ordinary shares, CHF 0.10 nominal value per shares |

|

* |

|

The Nasdaq Stock Market LLC |

* Not for trading, but only in connection with the listing on the Nasdaq Global Select Market of the American depositary shares.

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or ordinary shares as of the close of the period covered by the annual report.

Ordinary shares, CHF 0.10 nominal value per share: 40,363,095 ordinary shares outstanding as of December 31, 2024

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ☐ Yes ☒ No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ☐ Yes ☒ No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. ☒ Yes ☐ No

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

☒ Yes ☐ No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

|

☐ |

|

Accelerated filer |

|

☐ |

| Non-accelerated filer |

|

☒ |

|

Emerging growth company |

|

☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If the securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant in the filing reflect the correction of an error to previously filed financial statements. ☐

Indicate by checkmark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

U.S. GAAP ☐ |

|

International Financial Reporting Standards as issued

by the International Accounting Standards Board ☒

|

|

Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ☐ Item 17 ☐ Item 18

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ☐ Yes ☒ No

TABLE OF CONTENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

PAGE |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 1. |

|

|

|

|

Item 2. |

|

Offer Statistics and Expected Timetable |

|

|

Item 3. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 4. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 4A. |

|

|

|

|

Item 5. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 6. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 7. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 8. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 9. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 10. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 11. |

|

|

|

|

Item 12. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 13. |

|

|

|

|

Item 14. |

|

|

|

Item 15. |

|

|

|

|

Item 16A. |

|

|

|

|

Item 16B. |

|

|

|

|

Item 16C. |

|

|

|

|

Item 16D. |

|

|

|

|

Item 16E. |

|

|

|

|

Item 16F. |

|

|

|

|

Item 16G. |

|

|

|

|

Item 16H. |

|

|

|

|

| Item 16I. |

|

|

|

|

Item 16J. |

|

|

|

|

Item 16K. |

|

Cybersecurity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item 17. |

|

|

|

|

Item 18. |

|

|

|

|

Item 19. |

|

|

|

|

INTRODUCTION

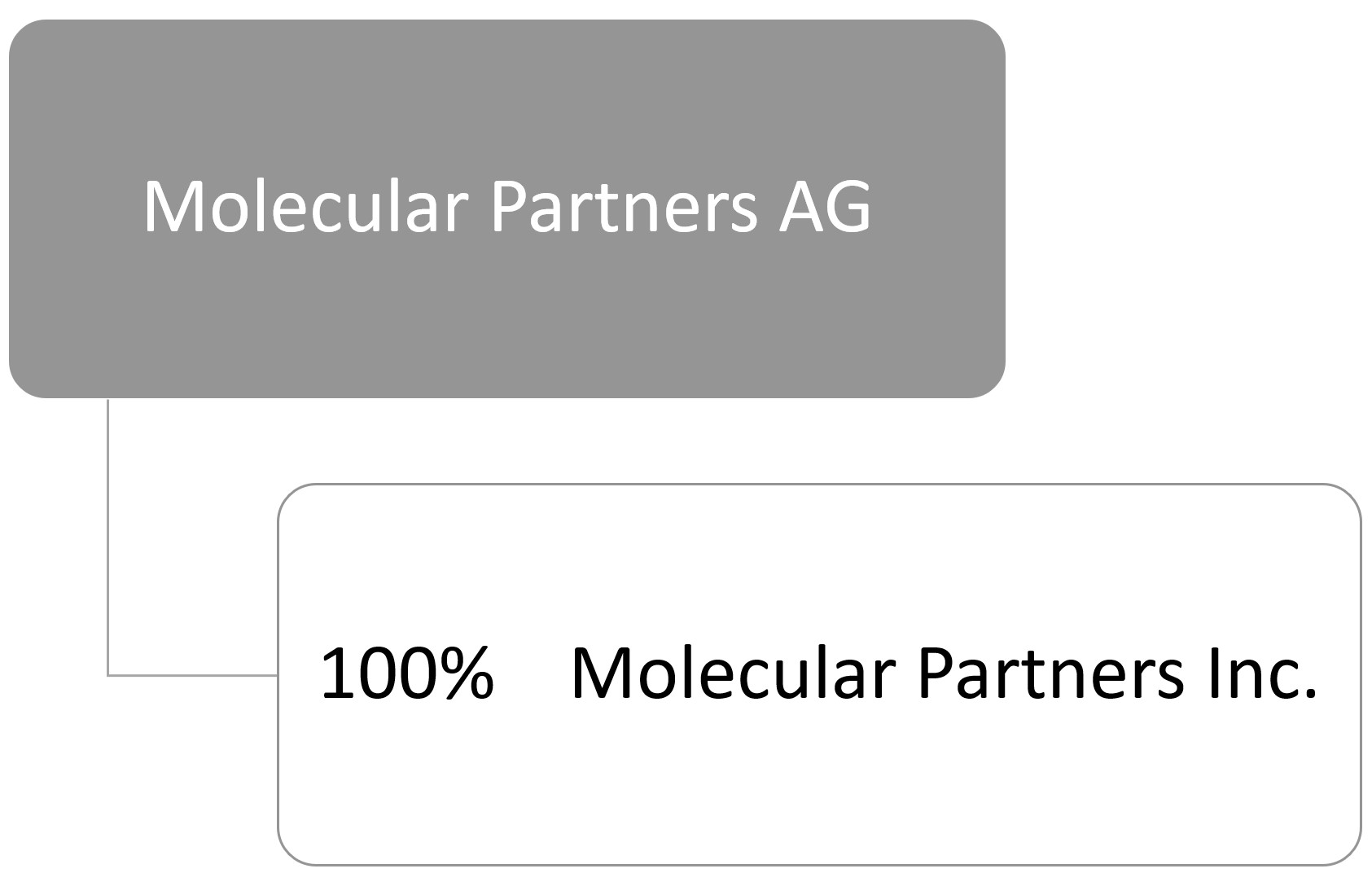

Unless the context requires otherwise, references in this Annual Report on Form 20-F to the “Company,” “Molecular Partners,” “we,” “us” and “our” refer to Molecular Partners AG and its wholly-owned subsidiary.

We own trademark registrations for “Molecular Partners®” and “DARPin®” in Switzerland, the European Union, the United States and Japan. All other trade names, trademarks and service marks of other companies appearing in this Annual Report on Form 20-F are the property of their respective holders. Solely for convenience, the trademarks and trade names in this Annual Report on Form 20-F may be referred to without the ® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

We present our consolidated financial statements in CHF and in accordance with IFRS® Accounting Standards ("IFRS") as issued by the International Accounting and Standards Board. None of the financial statements were prepared in accordance with generally accepted accounting principles in the United States.

The terms “dollar,” “USD” or “$” refer to U.S. dollars and the terms “Swiss Francs” or “CHF” refer to the legal currency of Switzerland. Unless otherwise indicated, all references to currency amounts in this Annual Report on Form 20-F are in U.S. dollars.

We have made rounding adjustments to some of the figures included in this Annual Report on Form 20-F. Accordingly, numerical figures shown as totals in some tables may not be an arithmetic aggregation of the figures that preceded them.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, that are based on our management’s beliefs and assumptions and on information currently available to our management. All statements other than present and historical facts and conditions contained in this Annual Report on Form 20-F, including statements regarding our future results of operations and financial positions, business strategy, plans and our objectives for future operations, are forward-looking statements. When used in this Annual Report on Form 20-F, the words “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “designed,” “may,” “might,” “plan,” “potential,” “predict,” “objective,” “should,” or the negative of these and similar expressions identify forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

•the initiation, timing, progress and results of our clinical trials and preclinical studies, and our research and development programs;

•our ability to advance product candidates into, and successfully complete, clinical trials;

•the timing of regulatory filings and the likelihood of favorable regulatory outcomes and approvals;

•the regulatory treatment of our product candidates;

•regulatory developments in the European Union, United States and other countries;

•the commercialization of our product candidates, if and once approved;

•the pricing and reimbursement of our product candidates, if and once approved;

•our ability to contract on commercially reasonable terms with third-party suppliers and manufacturers;

•the implementation of our business model and strategy and the development of our product candidates and platforms;

•the scope of protection we are able to establish, obtain and maintain for intellectual property rights covering our product candidates and technology and our ability to protect and enforce such rights;

•our ability to operate our business without infringing on, misappropriating or otherwise violating the intellectual property rights of others;

•the ability of third parties with whom we contract to successfully conduct, supervise and monitor clinical trials for our product candidates;

•estimates of our expenses, future revenues, earnings, capital requirements and our needs for additional financing;

•the timing and amount of milestone and royalty payments that we may receive under our strategic collaboration agreements;

•our ability to obtain additional funding for our operations;

•the potential benefits of our strategic collaboration agreements and our ability to enter into future strategic arrangements;

•our ability to maintain and establish collaborations or obtain additional funding;

•the rate and degree of market acceptance of, and pricing for, our product candidates;

•our financial performance;

•the impact of macro-economic factors, including inflation, the U.S Federal Reserve and other financial regulatory agencies raising interest rates, political conditions, changes in trade policies and geopolitical conflicts in Europe and the Middle East on our business, operations and prospects and on our clinical trials;

•our ability to attract and retain key scientific and management personnel;

•developments relating to our competitors and our industry, including competing therapies;

•the future trading price of the ADSs and impact of securities analysts reports on these prices; and

•other risks and uncertainties, including those listed under the caption “Risk Factors.”

You should refer to the section of this Annual Report on Form 20-F titled “Item 3.D-Risk Factors” for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report on Form 20-F will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material.

In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should read this Annual Report on Form 20-F and the documents that we reference in this Annual Report on Form 20-F and have filed as exhibits to this Annual Report on Form 20-F completely and with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this Annual Report on Form 20-F, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

This Annual Report on Form 20-F contains market data and industry forecasts that were obtained from industry publications. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. We have not independently verified any third-party information. While we believe the market position, market opportunity and market size information included in this Annual Report on Form 20-F is generally reliable, such information is inherently imprecise.

SUMMARY OF RISK FACTORS

Our business faces significant risks. If any of the following risks are realized, our business, financial condition and results of operations could be materially and adversely affected. You should carefully review and consider the full discussion of our risk factors set forth under the caption “Risk Factors” in Item 3.D. in Part I of this Annual Report on Form 20-F. An investment in our ADSs involves a high degree of risk. Any of the factors set forth under “Risk Factors” may limit our ability to successfully execute our business strategy. You should carefully consider all of the information set forth in this Annual Report on Form 20-F and, in particular, should evaluate the specific factors set forth under “Risk Factors” in deciding whether to invest in our securities. Among these risks are the following:

•We have incurred significant losses since our inception, we expect to incur losses in future periods and may not achieve profitability in the upcoming years. We may need substantial additional funding in order to complete the development and commercialization of our product candidates. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our product development or research operations.

•We may need substantial additional funding in order to complete the development and commercialization of our product candidates. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our product development or research operations.

•Raising additional capital may cause dilution to holders of our ordinary shares or ADSs, and an inability to raise capital may restrict our operations or require us to relinquish rights to our technologies or product candidates.

•We are heavily dependent on the success of our DARPin platform to identify and develop product candidates. If we or our collaborators are unable to successfully develop and commercialize product candidates based on our platform or experience significant delays in doing so, our business may be harmed.

•All of our product candidates are in preclinical or various stages of clinical development. Clinical drug development is a lengthy and expensive process with uncertain timelines and uncertain outcomes. If clinical trials of our product candidates, particularly MP0533, MP0317 and MP0712 and product candidates that we have licensed to our partners, are prolonged, delayed or not commercially viable, we or our collaborators may be unable to obtain required regulatory approvals, and therefore may be unable to commercialize our product candidates on a timely basis or at all, which will adversely affect our business.

•Preclinical drug development is uncertain. Some or all of our preclinical programs may experience delays or may never advance to clinical trials, which would adversely affect our ability to obtain regulatory approvals or commercialize these product candidates on a timely basis or at all, which would have an adverse effect on our business.

•Positive results from early preclinical studies of our product candidates would not necessarily be predictive of the results of later preclinical studies and any ongoing or future clinical trials of our product candidates. If we were to achieve positive results from preclinical studies, but were unable to then replicate those positive results in our later preclinical studies and ongoing or future clinical trials, we might be unable to successfully develop, obtain regulatory or marketing approval and commercialize our product candidates.

•Interim, topline and preliminary data from our clinical trials that we announce or publish may change as more patient data become available and are subject to audit and verification procedures that could result in material changes in the final data.

•Because the number of patients in certain of our clinical trials may be small, the results from such trials may be less reliable than results achieve in larger clinical trials.

•If any of our product candidates has negative side effects, public perception of our DARPin platform and commercial opportunities for all of our current and future product candidates could be adversely affected.

•We face significant competition for our drug discovery and development efforts, and if we do not compete effectively, our commercial opportunities will be reduced or eliminated.

•Our financial prospects are dependent upon the research, manufacture, development and marketing efforts of our licensees. Our licensees may act in their best interest rather than in our best interest, which could materially adversely affect our business, financial condition and results of operations.

•We rely on patents and other intellectual property rights to protect our product candidates and the DARPin technology, the prosecution, grant, enforcement, defense and maintenance of which may be challenging and costly. Failure to obtain, maintain, enforce or protect these rights adequately could harm our ability to compete and impair our business.

•Third parties may initiate legal proceedings alleging that we are infringing, misappropriating, or otherwise violating their intellectual property rights, the outcome of which would be uncertain and could have a material adverse effect on the success of our business. Intellectual property litigation could cause us to spend substantial resources and distract our personnel from their normal responsibilities and negative outcomes could result in adverse effects on our business.

•The base patents relating to the DARPin base technology we use to generate our DARPin product candidates has expired, and our competitors may use the technology claimed in such patents, which may materially adversely affect our business and competitive position.

•Certain significant shareholders own a substantial number of our securities and as a result, may be able to exercise significant influence over the outcome of shareholder votes. These shareholders may have different interests from us or your interests.

•We depend on our information technology systems and those of certain third parties, and any failure of these systems could harm our business. Security incidents and other disruptions could compromise sensitive information related to our business or prevent us from accessing critical information and expose us to liability, which could adversely affect our business, results of operations and financial condition.

PART I

Item 1. Identity of Directors, Senior Management and Advisers.

Not applicable.

Item 2. Offer Statistics and Expected Timetable.

Not applicable.

Item 3. Key Information.

A. [Reserved]

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Investing in the ADSs involves a high degree of risk. You should carefully consider the risks and uncertainties described below and the other information in this Annual Report on Form 20-F before making an investment decision. Our business, financial condition or results of operations could be adversely affected if any of these risks occurs, and as a result, the market price of the ADSs could decline and you could lose all or part of your investment. This report also contains forward-looking statements

that involve risks and uncertainties. See "Special Note Regarding Forward-Looking Statements." Our actual results could differ materially and adversely from those anticipated in these forward-looking statements as a result of certain factors.

Risks Related to Our Financial Position and Need for Additional Capital

We have incurred significant losses since our inception, we expect to incur losses in future periods and may not maintain profitability in the upcoming years. We may need substantial additional funding in order to complete the development and commercialization of our product candidates. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our product development or research operations.

Since our inception, we have incurred significant operating losses, including negative net results, attributable to shareholders. As of December 31, 2024, we had cumulative losses of CHF 246.3 million. For the year ended December 31, 2024, we recorded negative net result, attributable to shareholders of CHF 54.0 million and for the year ended December 31, 2023, we incurred positive net result, attributable to shareholders of CHF 62.0 million.

Our historical losses resulted principally from costs incurred in research and development, preclinical testing, clinical development of our product candidates as well as costs incurred for research programs and from general and administrative costs associated with our operations. In the future, we intend to continue to conduct research and development, preclinical testing, clinical trials and regulatory compliance activities that, together with anticipated selling, general and administrative expenses, may result in incurring losses in future periods. Our losses, among other things, will continue to cause our working capital and shareholders' equity to decrease. We anticipate that our expenses will increase substantially if and as we:

•initiate a new clinical trial of MP0317 (in combination with other therapies), one of our product candidates in our oncology program;

•continue to prepare for and complete and potentially expand the Phase 1 clinical trial of MP0533, our CD3 T-cell engaging candidate against acute myeloid leukemia or AML;

•continue to prepare for and potentially initiate a Phase 0 and Phase 1 clinical trial of MP0712, our DLL3 targeting Radio DARPin Therapy, or RDT against small cell lung cancer in collaboration with subsidiaries of Orano SA, or Orano Med.

•seek to enhance our Designed Ankyrin Repeat Protein, or DARPin, technology and build on our proprietary product pipeline;

•continue our research activities for MP0712 and other suitable candidates within the Radio DARPin Therapy, or RDT, space, such as the DLL3 program in collaboration with Orano Med;

•continue the research and development of our other clinical- and preclinical-stage product candidates and discovery stage programs including within the radioligand therapeutic space;

•continue the research and development of our other product candidates;

•seek regulatory approvals for any product candidates that successfully complete clinical trials;

•establish a sales, marketing and distribution infrastructure and scale-up manufacturing capabilities to commercialize any product candidates for which we may obtain regulatory approval;

•obtain, maintain, expand, protect and enforce our intellectual property and other proprietary rights and obtain licenses to third-party intellectual property;

•add clinical, regulatory, scientific, operational, financial, legal, intellectual property, compliance and management information systems and personnel, including personnel to support our product development and potential future commercialization efforts; and

•experience any delays or encounter any issues relating to any of the above, including failed studies, ambiguous trial results, safety issues, other regulatory challenges or third party supply or manufacturing issues.

Since our inception in 2004, we have invested most of our resources in developing our product candidates, building our intellectual property portfolio, developing our supply chain, conducting business planning, raising capital and providing general and administrative support for these operations. We do not currently have any approved products and have never generated any revenue from product sales.

To become profitable, we must succeed in developing and eventually commercializing products that generate significant revenue. This will require us or our licensees to be successful in a range of challenging activities, including completing preclinical testing and clinical trials of our product candidates, discovering and developing additional product candidates, obtaining regulatory approval for any product candidates that successfully complete clinical trials, establishing manufacturing and marketing capabilities and ultimately selling any products for which we may obtain regulatory approval. We are only in the preliminary stages of most of these activities. We may never succeed in these activities and, even if we do, may never generate revenue that is significant enough to sustain or increase profitability on a quarterly or annual basis. Our failure to become profitable would decrease the value of our company and could impair our ability to raise capital, maintain our research and development efforts, expand our business or continue our operations.

If we are required by the U.S. Food and Drug Administration, or FDA, the European Medicines Agency, or EMA, or other comparable foreign authorities to perform studies in addition to those we currently anticipate, or if there are any delays in completing our clinical trials or the development of any of our product candidates, our expenses could increase and revenue could be further delayed.

Even if we do generate product royalties or product sales, we may never sustain profitability on a quarterly or annual basis. Our failure to sustain profitability would depress the market price of the ADSs and could impair our ability to raise capital, expand our business, diversify our product offerings or continue our operations. A decline in the market price of the ADSs also could cause you to lose all or a part of your investment.

We may need substantial additional funding in order to complete the development and commercialization of our product candidates. Failure to obtain this necessary capital when needed may force us to delay, limit or terminate certain of our product development or research operations.

To date, we have funded our operations through public and private placements of equity securities, upfront, milestone, option exercise, reservation fee, expense reimbursement, sponsored research payments received from our collaborators, recharging of third party costs and interest income from the investment of our cash, cash equivalents and financial assets. We expect to require additional funding in the future to sufficiently finance our operations and advance development of our product candidates. On July 1, 2022, we entered into a sales agreement with Leerink Partners LLC (previously known as SVB Securities LLC), or the Sales Agreement, to sell ordinary shares from time to time at our discretion under an “at the market” program, with aggregate gross sales proceeds of up to $100.0 million.

We expect that our existing cash, cash equivalents, together with anticipated funding through collaborations, will enable us to fund our operating expenses and capital expenditure requirements wel into 2027. We have based this estimate on assumptions that may prove to be wrong, and we could use our capital resources sooner than we currently expect. Our future capital requirements for our product candidates will depend on many factors, including:

•the progress, timing and completion of preclinical testing and clinical trials for our current or any future product candidates;

•the number of potential new product candidates we identify and decide to develop;

•the costs involved in growing our organization to the size needed to allow for the research, development and potential commercialization of our current or any future product candidates;

•the costs involved in filing patent applications, maintaining and enforcing patents or defending against infringement, misappropriation or other claims raised by third parties;

•the maintenance of our existing license and collaboration agreements and the entry into new license and collaboration agreements;

•the time and costs involved in obtaining regulatory approval for our product candidates and any delays we may encounter as a result of evolving regulatory requirements or adverse results with respect to any of our product candidates;

•selling and marketing activities undertaken in connection with the potential commercialization of our current or any future product candidates, if approved, and costs involved in the creation of an effective sales and marketing organization; and

•the amount of revenues, if any, we may derive either directly or in the form of milestone and royalty payments from future sales of our product candidates, if approved.

Our ability to raise additional funds will depend on financial, economic and market conditions and other factors, over which we may have no or limited control. Further, as a Swiss corporation, we have less flexibility to raise capital than U.S. companies, particularly in a quick and efficient manner. As a result, we may not be able to access the capital markets as frequently as comparable U.S. companies. See the Risk Factor entitled “Our status as a Swiss corporation means that our shareholders enjoy certain rights that may limit our flexibility to raise capital, issue dividends and otherwise manage ongoing capital needs” for additional information related to our ability to timely raise capital. If adequate funds are not available on commercially acceptable terms or at all when needed, we may be forced to delay, reduce or terminate the development or commercialization of all or part of our research programs or product candidates or we may be unable to take advantage of future business opportunities.

The effects of health epidemics in regions where we, or the third parties on which we rely, have business operations could adversely impact our business, including our preclinical studies and clinical trials, as well as the business or operations of third parties with whom we conduct business.

Our business could be adversely affected by health epidemics in regions where we have concentrations of clinical trial sites or other business operations, and could cause significant disruption in the operations of third party manufacturers and contract research organizations, or CROs, upon whom we rely.

As a result of a pandemic, we may experience disruptions that could impact our business, preclinical studies and clinical trials, including:

•delay of submissions to, and approvals of, regulatory authorities;

•interruption or delays in the operations of regulatory authorities, which may impact review and approval timelines, including delays in receiving approval from local regulatory authorities to initiate our planned clinical trials;

•interruption of, or delays in receiving, supplies of our product candidates or target material from our contract manufacturing organizations, or CMOs, and other suppliers due to staffing shortages, shortages in supply of production materials, production slowdowns or stoppages and disruptions in delivery systems;

•interruptions in preclinical studies due to restricted or limited operations at our facilities; limitations on employee resources that would otherwise be focused on the conduct of our preclinical studies and clinical trials, including because of sickness of employees or their families or the desire of employees to avoid contact with large groups of people; and

•interruption or delays to our sourced discovery and clinical activities.

The extent to which any future health epidemic outbreaks of contagious disease ultimately impacts our business, preclinical studies and clinical trials will depend on future developments, which are highly uncertain and cannot be predicted with confidence, such as the ultimate geographic spread of the disease, the duration of the pandemic, the emergence of variants, the transition to endemic status, travel restrictions and social distancing in Switzerland, the United States and other countries, business closures or business disruptions and the effectiveness of actions taken in countries around the world to contain and treat the disease.

Raising additional capital may cause dilution to holders of our ordinary shares or ADSs, and an inability to raise capital may restrict our operations or require us to relinquish rights to our technologies or product candidates.

Until such time, if ever, as we can generate substantial product revenues, we expect to finance our operations with our existing cash, cash equivalents and current financial assets, proceeds from debt or equity offerings, revenue from our collaborations and interest income from the investment of our cash, cash equivalents and financial assets. In order to further advance the development of our product candidates, discover additional product candidates and pursue our other business objectives, however, we will need to seek additional funds.

We cannot guarantee that future financing will be available in sufficient amounts or on commercially reasonable terms, if at all. Moreover, the terms of any financing may adversely affect the holdings or the rights of holders of our ordinary shares or ADSs and the issuance of additional securities, whether equity or debt, by us, or the possibility of such issuance, may cause the market price of our ADSs and our ordinary shares to decline. The sale of additional equity or convertible securities would dilute all of our existing shareholders and the terms of these securities may include liquidation or other preferences that adversely affect the rights of our shareholders. The incurrence of indebtedness could result in increased fixed payment obligations and we may be required to agree to certain restrictive covenants, such as limitations on our ability to incur additional debt, limitations on our ability to acquire, sell or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. We could also be required to seek funds through arrangements with collaborators or others at an earlier stage than otherwise would be desirable and we may be required to relinquish rights to some of our technologies or product candidates or otherwise agree to terms unfavorable to us, any of which may have a material adverse effect on our business, operating results and prospects. Further, any additional fundraising efforts may divert our management from its day-to-day activities, which may adversely affect our ability to develop and commercialize our product candidates.

If we are unable to obtain funding on a timely basis, we may be required to significantly curtail, delay or discontinue one or more of our research or development programs or the commercialization of any of our product candidates, or be unable to expand our operations or otherwise capitalize on our business opportunities, as desired, which could materially affect our business, financial condition and results of operations.

Risks Related to the Development and Clinical Testing of Our Product Candidates

We are heavily dependent on the success of our DARPin platform to identify and develop product candidates. If we or our collaborators are unable to successfully develop and commercialize product candidates based on our platforms or experience significant delays in doing so, our business may be harmed.

We are heavily dependent on the success of our DARPin platform technology and the product candidates currently in our core programs. Our commercial prospects will be heavily dependent on product candidates identified and developed using our DARPin platform. To date, we have invested substantially all of our efforts and financial resources to identify, acquire intellectual property for, and develop our DARPin platform technology and our programs, including conducting preclinical studies and early-stage clinical trials, and providing general and administrative support for these operations.

We may not be successful in our efforts to further develop our DARPin platform technology and current product candidates. We are not permitted to market or promote any of our product candidates before we receive regulatory approval from the FDA, European Commission (granted on the basis of a positive opinion from the Committee for Medicinal Products for Human Use of the European Medicines Agency, or EMA and commonly referred to as EMA approval) or comparable foreign regulatory authorities, and we may never receive such regulatory approval for any of our product candidates. Each of our product candidates will require significant additional clinical development, management of preclinical, clinical, and manufacturing activities, regulatory approval, adequate manufacturing supply, a commercial organization, and significant marketing efforts before we generate any revenue from product sales, if at all.

All of our product candidates are in preclinical or various stages of clinical development. Clinical drug development is a lengthy and expensive process with uncertain timelines and uncertain outcomes. If clinical trials of our product candidates, particularly MP0533, MP0317, and MP0712 and product candidates that we have licensed to our partners, are prolonged, delayed or not commercially viable, we or our collaborators may be unable to obtain required regulatory approvals, and therefore may be unable to commercialize our product candidates on a timely basis or at all, which will adversely affect our business.

To obtain the requisite regulatory approvals to market and sell any of our product candidates, we or our collaborators for such candidates must demonstrate through extensive preclinical studies and clinical trials that our products are safe, pure and potent or effective in humans. Further, the process of obtaining regulatory approval is expensive, often takes many years following the commencement of clinical trials and can vary substantially based upon the type, complexity and novelty of the product candidates involved, as well as the target indications and patient population. Prior to obtaining approval to commercialize a product candidate in the United States or in other countries, we or our potential future collaborators must demonstrate with substantial evidence from adequate and well-controlled clinical trials, and to the satisfaction of the FDA or comparable foreign regulatory authorities, that such product candidates are safe and effective for their intended uses. Additionally, clinical testing is expensive and can take many years to complete, and its outcome is inherently uncertain. Failure can occur at any time during the clinical trial process and our future clinical trial results may not be successful.

We may experience delays in our ongoing clinical trials and we do not know whether planned clinical trials will begin on time, need to be redesigned, enroll patients on time or be completed on schedule, if at all.

Clinical trials can be delayed, suspended, or terminated for a variety of reasons, including the following:

•delays in or failure to obtain regulatory approval to commence a trial;

•delays in or failure to reach agreement on acceptable terms with prospective CROs and clinical trial sites, the terms of which can be subject to extensive negotiation and may vary significantly among different CROs and trial sites;

•delays in or failure to obtain institutional review board, or IRB, or ethics committee approval at each site;

•delays in or failure to recruit suitable patients to participate in a trial;

•failure to have patients complete a trial or return for post-treatment follow-up;

•clinical sites deviating from trial protocol or dropping out of a trial;

•adding new clinical trial sites;

•manufacturing sufficient quantities of product candidate for use in clinical trials;

•third-party actions claiming infringement by our product candidates in clinical trials and obtaining injunctions interfering with our progress;

•safety or tolerability concerns could cause us or our collaborators, as applicable, to suspend or terminate a trial if we or our collaborators find that the participants are being exposed to unacceptable health risks;

•changes in regulatory requirements, policies and guidelines;

•lower than anticipated retention rates of patients and volunteers in clinical trials;

•our third-party research contractors failing to comply with regulatory requirements or meet their contractual obligations to us in a timely manner, or at all;

•delays in establishing the appropriate dosage levels in clinical trials;

•the difficulty in certain countries in identifying the sub-populations that we are trying to treat in a particular trial, which may delay enrollment and reduce the power of a clinical trial to detect statistically significant results; and

•the quality or stability of the product candidate falling below acceptable standards.

We could encounter delays if a clinical trial is suspended or terminated by us, by the IRBs of the institutions in which such trials are being conducted or ethics committees, by the Data Review Committee, or DRC, or Data Safety Monitoring Board, or DSMB, for such trial or by the EMA, the FDA or other regulatory authorities. Such authorities may impose such a suspension or termination due to a number of factors, including failure to conduct the clinical trial in accordance with regulatory requirements or our clinical protocols, inspection of the clinical trial operations or trial site by the EMA, the FDA or other regulatory authorities resulting in the imposition of a clinical hold, unforeseen safety issues or adverse side effects, including those relating to the class to which our product candidates belong, failure to demonstrate a benefit from using a drug, changes in governmental regulations or administrative actions or lack of adequate funding to continue the clinical trial.

For example, we have faced and may face in the future bioburden during drug substance production campaigns or particles in drug product preparations at our CMOs which led or may lead to regulatory actions, including from the FDA. While we and our partners endeavor to maintain appropriate backup supply with respect to our product candidates, and not all such bioburden or particles result in regulatory action or delays, we cannot assure that any such issues would not result in delays in our clinical trials or product development or other adverse impacts on our business.

If we experience delays in the completion of, or termination of, any clinical trial of our product candidates, the commercial prospects of our product candidates will be harmed. In addition, any delays in completing our clinical trials will increase our costs, slow down our product candidate development and approval process and jeopardize our ability to commence product sales and generate revenues. Significant clinical trial delays could also allow our competitors to bring products to market before we do or shorten any periods during which we have the exclusive right to commercialize our product candidates and impair our ability to commercialize our product candidates and may harm our business and results of operations. Any of these occurrences may harm our business, financial condition and prospects significantly. In addition, many of the factors that cause, or lead to, a delay in the commencement or completion of clinical trials may also ultimately lead to the denial of regulatory approval of our product candidates or result in the development of our product candidates being stopped early.

Clinical trials must be conducted in accordance with the FDA, the EMA and other applicable regulatory authorities' legal requirements and regulations, and are subject to oversight by these governmental agencies, IRBs at the medical institutions where the clinical trials are conducted or ethics committees. In addition, clinical trials must be conducted with supplies of our product candidates produced under cGMP requirements and other regulations. Furthermore, we rely on CROs and clinical trial sites to ensure the proper and timely conduct of our clinical trials and while we have agreements governing their committed activities, we have limited influence over their actual performance. We depend on our collaborators and on medical institutions and CROs to conduct our clinical trials in compliance with GCP requirements. To the extent our collaborators or the CROs or investigators fail to enroll participants for our clinical trials, fail to conduct the study to GCP standards or are delayed for a significant time in the execution of trials, including achieving full enrollment, we may be affected by increased costs, program delays or both, which may harm our business.

Further, conducting clinical trials in multiple countries presents additional risks that may delay completion of our clinical trials. These risks include the failure of enrolled patients in foreign countries to adhere to clinical protocol as a result of differences in healthcare services or cultural customs, managing additional administrative burdens associated with adhering to GCP, regulations and other foreign regulatory schemes, as well as political and economic risks relevant to such foreign countries.

In addition, future clinical trials that could be conducted in countries outside Switzerland, the European Union and the United States may subject us to further delays and expenses as a result of increased shipment costs, additional regulatory requirements and the engagement of non-European Union and non-U.S. CROs, as well as expose us to risks associated with clinical investigators who are unknown to the FDA or the EMA, and different standards of diagnosis, screening and medical care.

We may not be successful in our efforts to use and expand our platform to build a pipeline of product candidates with commercial value.

A key element of our strategy is to use and expand our platform to build a pipeline of product candidates and progress these product candidates through clinical development. So far none of the product candidates originating from our platform has received marketing approval from the FDA or other regulatory authorities.

The scientific discoveries that form the basis for our efforts to discover and develop targeted oncology therapeutic candidates for cancer patients are relatively new. The scientific evidence to support the feasibility of developing product candidates based on these discoveries is both preliminary and limited. There can be no assurance that any development problems we may experience in the future related to our platform will not cause significant delays or unanticipated costs or that such development problems can be solved. Even if we are successful in building our pipeline of product candidates, the potential product candidates that we identify may not be suitable for clinical development or generate acceptable clinical data, including as a result of being shown to have characteristics that indicate that they are unlikely to be products that will receive marketing approval from the FDA or other regulatory authorities or achieve market acceptance.

Preclinical drug development is uncertain. Some or all of our preclinical programs may experience delays or may never advance to clinical trials, which would adversely affect our ability to obtain regulatory approvals or commercialize these product candidates on a timely basis or at all, which would have an adverse effect on our business.

In order to obtain FDA or EMA approval to market a new pharmaceutical or biological product we must demonstrate proof of safety, purity and potency or efficacy in humans. To meet these requirements we will have to conduct adequate and well-controlled clinical trials. Before we can commence clinical trials for a product candidate, we must complete extensive preclinical testing and studies that support our planned Investigational New Drug application, or IND, in the United States, or a Clinical Trial Authorization Application, or CTA, in Europe. We cannot be certain of the timely completion or outcome of our preclinical testing and studies and cannot predict if the FDA or EMA will accept our proposed clinical programs or if the outcome of our preclinical testing and studies will ultimately support the further development of these product candidates. Thus, we cannot be sure that we will be able to submit INDs or CTAs for our preclinical programs on the timelines we expect, if at all, and we cannot be sure that submission of INDs or CTAs will result in the FDA or EMA allowing clinical trials to begin.