falseWALT DISNEY CO/000174448900017444892023-09-192023-09-19

________________________________________________________________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): September 19, 2023

The Walt Disney Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

001-38842 |

83-0940635 |

| (State or other jurisdiction |

(Commission File Number) |

(IRS Employer |

| of incorporation) |

|

Identification No.) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

500 South Buena Vista Street

Burbank, California 91521

(Address of Principal Executive Offices and Zip Code)

(818) 560-1000

(Registrant’s telephone number, including area code)

Not applicable

(Former name or address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

|

|

|

|

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

|

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

|

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.01 par value |

|

DIS |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

|

|

|

|

|

| Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

________________________________________________________________________

Item 7.01 Regulation FD Disclosure.

The Walt Disney Company is providing the following update regarding its plans for capital expenditures at its Disney Parks, Experiences and Products (“DPEP”) segment. The Company is developing plans to accelerate and expand investment in its DPEP segment, to nearly double, as compared to the previous approximately 10-year period, consolidated capital expenditures for the segment over the course of an approximately 10-year period to approximately $60 billion in aggregate, including by investing in expanding and enhancing domestic and international parks and cruise line capacity, prioritizing projects anticipated to generate strong returns, consistent with the Company’s continuing approach to allocate capital in a disciplined and balanced manner.

We believe that the Company’s financial condition is strong and that its cash balances, other liquid assets, operating cash flows, access to capital markets and borrowing capacity under current bank facilities, taken together, provide adequate resources to fund ongoing operating requirements, contractual obligations, upcoming debt maturities as well as future capital expenditures related to the expansion of existing businesses and development of new projects.

Slides related to this matter are attached hereto as Exhibit 99.1.

Forward-Looking Statements

Certain statements and information in this Form 8-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding financial, performance or growth expectations (including future financial condition and available funding resources); business plans, strategic priorities and drivers of growth and profitability; capital expenditures and allocation; and other statements that are not historical in nature. Any information that is not historical in nature included in this 8-K is subject to change. These statements are made on the basis of management’s views and assumptions regarding future events and business performance as of the time the statements are made. Management does not undertake any obligation to update these statements.

Actual results may differ materially from those expressed or implied. Such differences may result from actions taken by the Company, including restructuring or strategic initiatives (including capital investments, asset acquisitions or dispositions, new or expanded business lines or cessation of certain operations), our execution of our business plans (including the content we create and IP we invest in, our pricing decisions, our cost structure and our management and other personnel decisions), our ability to quickly execute on cost rationalization while preserving revenue, the discovery of additional information or other business decisions, including based on the results of execution of our business plans, as well as from developments beyond the Company’s control, including:

•the occurrence of subsequent events;

•further deterioration in domestic and global economic conditions or a failure of conditions to improve as anticipated;

•deterioration in or pressures from competitive conditions, including competition to create or acquire content, competition for talent and competition for advertising revenue;

•consumer preferences and acceptance of our content, offerings, pricing model and price increases, and corresponding subscriber additions and churn, and the market for advertising sales on our DTC services and linear networks;

•health concerns and their impact on our businesses and productions;

•international, political or military developments;

•regulatory and legal developments;

•technological developments;

•labor markets and activities, including work stoppages;

•adverse weather conditions or natural disasters; and Such developments may further affect entertainment, travel and leisure businesses generally and may, among other things, affect (or further affect, as applicable):

•availability of content.

•our operations, business plans or profitability, including direct-to-consumer profitability;

•demand for our products and services;

•the performance of the Company’s content;

•our ability to create or obtain desirable content at or under the value we assign the content;

•the advertising market for programming;

•income tax expense; and

•performance of some or all Company businesses either directly or through their impact on those who distribute our products.

Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended October 1, 2022, including under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business,” quarterly reports on Form 10-Q, including under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and subsequent filings with the Securities and Exchange Commission.

The terms “Company,” “we,” and “our” are used above to refer collectively to The Walt Disney Company and the subsidiaries through which its various businesses are actually conducted.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

|

|

|

|

|

|

|

|

|

Exhibit

Number |

|

Description |

| 99.1 |

|

|

|

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The Walt Disney Company |

|

|

|

|

| By: |

|

/s/ Jolene E. Negre |

|

|

|

Jolene E. Negre |

|

|

|

Associate General Counsel and Secretary |

|

|

|

|

|

Dated: September 19, 2023

EX-99.1

2

dpephighlightsandupdates.htm

EXHIBIT 99.1

dpephighlightsandupdates

HIGHLIGHTS AND UPDATES SEPTEMBER 2023 DISNEY PARKS, EXPERIENCES AND PRODUCTS Exhibit 99.1

© Disney Forward-Looking Statements Certain statements in this presentation may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including statements regarding expectations; strategy or focus; guidance; priorities; plans or opportunities (including for expansion and growth) and potential impact on future performance; potential future growth or performance and anticipated drivers of growth or performance; future capital expenditures; trends; drivers of demand; efficiencies; goals; product or service offerings (including nature, timing and pricing); consumer sentiment, behavior or demand; total addressable market and related drivers; value of our intellectual property; and other statements that are not historical in nature. Any information that is not historical in nature included in this discussion is subject to change. These statements are made on the basis of management’s views and assumptions regarding future events and business performance as of the time the statements are made. Management does not undertake any obligation to update these statements. Actual results may differ materially from those expressed or implied. Such differences may result from actions taken by the Company, including restructuring or strategic initiatives (including capital investments, asset acquisitions or dispositions, new or expanded business lines or cessation of certain operations), our execution of our business plans (including the content we create and IP we invest in, our pricing decisions, our cost structure and our management and other personnel decisions), our ability to quickly execute on cost rationalization while preserving revenue, the discovery of additional information or other business decisions, as well as from developments beyond the Company’s control, including: • the occurrence of subsequent events; • further deterioration in domestic and global economic conditions or a failure of conditions to improve as anticipated; • deterioration in or pressures from competitive conditions, including competition to create or acquire content, competition for talent and competition for advertising revenue; • consumer preferences and acceptance of our content, offerings, pricing model and price increases, and corresponding subscriber additions and churn, and the market for advertising sales on our DTC services and linear networks; • health concerns and their impact on our businesses and productions; • international, political or military developments; • regulatory and legal developments; • technological developments; • labor markets and activities, including work stoppages; • adverse weather conditions or natural disasters; and • availability of content. Such developments may further affect entertainment, travel and leisure businesses generally and may, among other things, affect (or further affect, as applicable): • our operations, business plans or profitability, including direct-to-consumer profitability; • demand for our products and services; • the performance of the Company’s content; • our ability to create or obtain desirable content at or under the value we assign the content; • the advertising market for programming; • income tax expense; and • performance of some or all Company businesses either directly or through their impact on those who distribute our products. Additional factors are set forth in the Company’s Annual Report on Form 10-K for the year ended October 1, 2022, including under the captions “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and “Business,” quarterly reports on Form 10-Q, including under the captions “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations,” and subsequent filings with the Securities and Exchange Commission. The terms “Company,” “we,” and “our” are used above to refer collectively to The Walt Disney Company and the subsidiaries through which its various businesses are actually conducted.

STRONG HISTORICAL RESULTS $23.5 $25.3 $26.8 $28.7 $32.3 FY171 FY18 FY19 FY22 LTM2 6% CAGR 1. Reported GAAP revenue FY17 $23.0B. Intersegment share excluded from revenue and operating income for comparability purposes with previously restated periods, FY17 $0.5B 2. All references to LTM represent last twelve months of data as of the third quarter of FY23 Revenue Disney Parks, Experiences and Products Segment Revenue ($B)

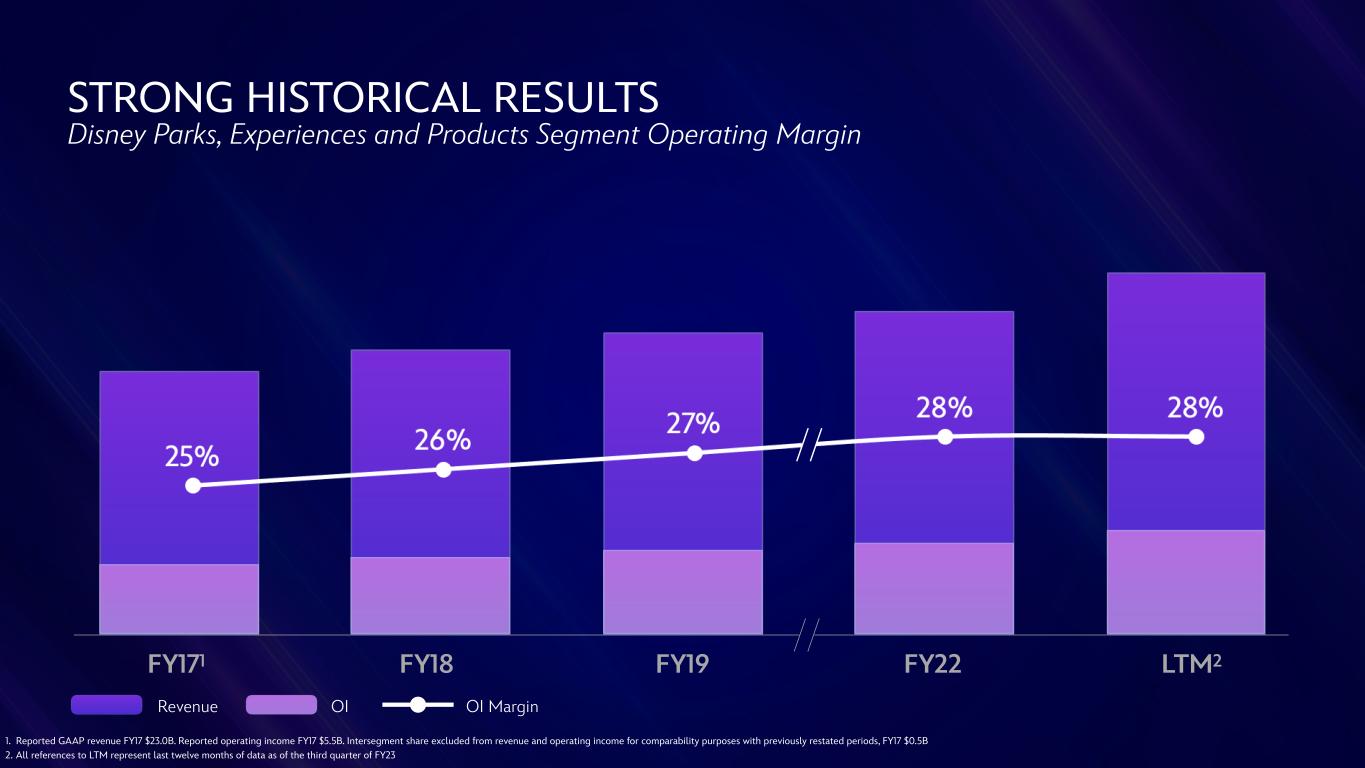

STRONG HISTORICAL RESULTS Disney Parks, Experiences and Products Segment Operating Income ($B) $23.5 $25.3 $26.8 $28.7 $32.3 $6.0 $6.7 $7.3 $7.9 $9.2 FY171 FY18 FY19 FY22 8% CAGR 1. Reported operating income FY17 $5.5B. Intersegment share excluded from revenue and operating income for comparability purposes with previously restated periods, FY17 $0.5B 2. All references to LTM represent last twelve months of data as of the third quarter of FY23 OIRevenue LTM2

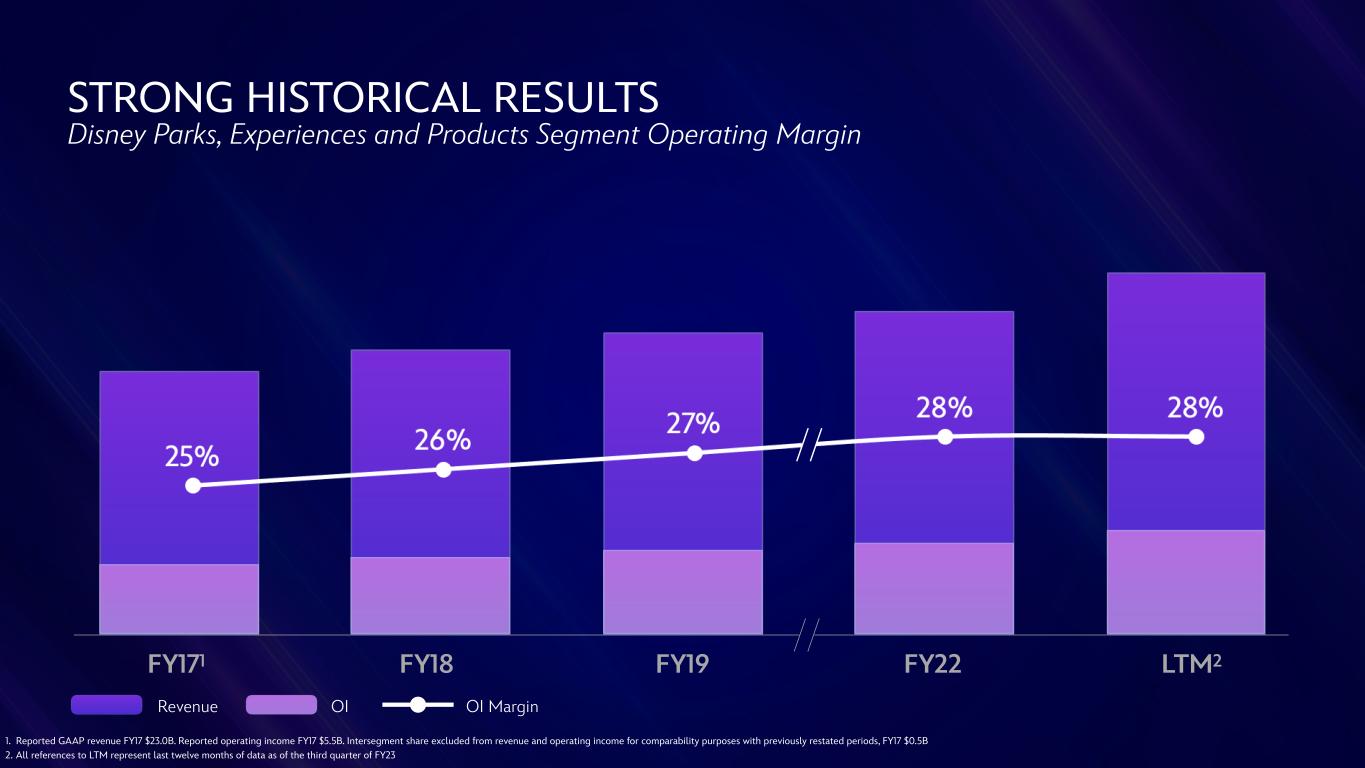

STRONG HISTORICAL RESULTS Disney Parks, Experiences and Products Segment Operating Margin FY171 FY18 FY19 FY22 OIRevenue OI Margin 1. Reported GAAP revenue FY17 $23.0B. Reported operating income FY17 $5.5B. Intersegment share excluded from revenue and operating income for comparability purposes with previously restated periods, FY17 $0.5B 2. All references to LTM represent last twelve months of data as of the third quarter of FY23 LTM2

5% CAGR 14% CAGR STRONG RESULTS FROM INVESTMENTS Domestic Parks Historical Operating Income Long Term Trend AGGREGATE INVESTMENT INCREASED 3X1 OPERATING INCOME INCREASED 4X2 FY06 FY09 FY10 FY11FY05 FY12FY07 FY08 FY13 FY14 FY15 FY16 FY17 FY18 FY19FY02 FY03 FY04 FY20 FY21 FY22 LTM 1. Comparing aggregate investment from FY12-LTM to FY02-FY11 2. Comparing operating income from LTM to FY12

FY19 OTHER COMMERCIAL STRATEGIES FY22 PRICING STRATEGIES 42% GROWTH COMMERCIAL TREMENDOUS PER CAPITA GUEST SPENDING GROWTH Domestic Parks

SUSTAINED IP INVESTMENTS FY12 - FY23 DOMESTIC PARKS FY12 - LTM ROIC +15ptsMargins OI 4x 3x Note: All data based on comparing value in LTM to value in FY12

TURBO-CHARGING DISNEY PARKS, EXPERIENCES & PRODUCTS ALMOST DOUBLING GLOBAL CAPEX NEXT 10 YEARS VS PRIOR 10 ACCELERATE STORYTELLING EXPAND FOOTPRINT ADVANCE COMMERCIAL LEVERAGE TALENT REACH NEW FANS

SCALE 1K+ ACRES OF LAND FOR POSSIBLE FUTURE DEVELOPMENT1 Note: Map depicts existing theme park sites and current and announced Disney Cruise Line ports 1. At existing theme park sites

AUSTRALIA FANS ASIA NORTH AMERICA EUROPE SOUTH AMERICA 700M+ ADDRESSABLE MARKET For every 1 park guest today, there are 10+ consumers with Disney affinity who do not visit the parks Note: Consumer opportunity based on analysis of minimum level of Disney branded spending and current parks visitation

DISNEY CRUISE LINE

2 SHIPS IN FLEET 23% CAGR 4 SHIPS IN FLEET MORE THAN DOUBLED CAPACITY Product Upgrades Product Upgrades FY06 FY09 FY10 FY11FY05 FY12FY07 FY08 FY13 FY14 FY15 FY16 FY17 FY18 FY19FY00 FY01 FY02 FY03 FY04FY98 FY99 Developing Family Cruise Market STRONG RESULTS FROM INVESTMENTS Disney Cruise Line Operating Income Long Term Trend

Q4 Booked Occupancy1 98% Return on Investment3 DOUBLE-DIGIT Yield vs Industry2 2X 1. As of Q3’23 Earnings Call 2. Based on FY23 through Q3 FY23 metrics 3. Based on historical results through Q3’23

DISNEY VACATION CLUB

Margins STRONG Expansion Strategy ~1K NEW KEYS Return on Investment DOUBLE-DIGIT Note: All data based on historical results through Q3’23

FORT WILDERNESS CABINS ~360 KEYS OPENING 2024 A r t i s t C o n c e p t O n l y

POLYNESIAN VILLAS ~270 KEYS OPENING 2024 A r t i s t C o n c e p t O n l y

TOP SALES WEEK OF ALL TIME1~340 KEYS OPENING SEPTEMBER 28TH A r t i s t C o n c e p t O n l y 1. Based on net written sales

INTERNATIONAL PARKS

INTERNATIONAL ATTENDANCE TO DATE 1.3+ Billion Notes: Based on all Disney International Parks (Tokyo Disney Resort, Disneyland Paris, Hong Kong Disneyland, Shanghai Disney Resort) through Q3’23 The Company earns royalties on revenues generated by the Tokyo Disney Resort, which is owned and operated by Oriental Land Co., Ltd., a third-party Japanese company

FY22 LTMFY19FY18 STRONG RECOVERY International Parks Operating Income 10% CAGR FY22 and LTM impacted by park closures

Q3 FY18-Q3 FY23 +69% International Parks1 Per Capita Guest Spending 1. Excludes Tokyo Disney Resort

$500M TOTAL SALES1HIGHEST SELLING FRANCHISE1NEW STORIES 1. Across Asia Parks portfolio (Shanghai Disney Resort, Hong Kong Disneyland, Tokyo Disney Resort)

Attendance REBOUND in Q3’23 RECORD REVENUE, OI, MARGINS of all International Sites1 HIGHEST YoY OI GROWTH Note: All data based on historical results through Q3’23 unless otherwise stated 1. Compares Q3’23 to Q3’22 OI among all Disney International Parks (Tokyo Disney Resort, Disneyland Paris, Hong Kong Disneyland, Shanghai Disney Resort)

MORE THAN DOUBLED GUEST SCORES Note: Metrics based on comparing FY18 (last full year of operation before close) average data to FY22 average data >50% PER-ROOM SPEND INCREASE 100%+ AVERAGE DAILY RATE GROWTH

Per Capita Guest Spending Growth for Last 8 Quarters RECORD Attendance and Pricing OPTIMIZATION In Discounted Tickets Before COVID to Today1 SIGNIFICANT REDUCTION Note: All data based on historical results through Q3’23 unless otherwise noted 1. Compares FY19 average full year to FY23 average YTD through Q3