falseQ312-3120230001740332http://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#AccruedLiabilitiesCurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherLiabilitiesNoncurrenthttp://fasb.org/us-gaap/2023#OtherAssetsCurrenthttp://fasb.org/us-gaap/2023#OtherAssetsNoncurrenthttp://fasb.org/us-gaap/2023#CostOfGoodsAndServicesSold00017403322023-01-012023-09-3000017403322023-10-20xbrli:shares00017403322023-09-30iso4217:USD00017403322022-12-31iso4217:USDxbrli:shares00017403322023-07-022023-09-3000017403322022-07-032022-10-0100017403322022-01-012022-10-0100017403322021-12-3100017403322022-10-010001740332us-gaap:CommonStockMember2023-07-010001740332us-gaap:AdditionalPaidInCapitalMember2023-07-010001740332us-gaap:RetainedEarningsMember2023-07-010001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-010001740332us-gaap:TreasuryStockCommonMember2023-07-0100017403322023-07-010001740332us-gaap:RetainedEarningsMember2023-07-022023-09-300001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-022023-09-300001740332us-gaap:CommonStockMember2023-07-022023-09-300001740332us-gaap:AdditionalPaidInCapitalMember2023-07-022023-09-300001740332us-gaap:TreasuryStockCommonMember2023-07-022023-09-300001740332us-gaap:CommonStockMember2023-09-300001740332us-gaap:AdditionalPaidInCapitalMember2023-09-300001740332us-gaap:RetainedEarningsMember2023-09-300001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300001740332us-gaap:TreasuryStockCommonMember2023-09-300001740332us-gaap:CommonStockMember2022-07-020001740332us-gaap:AdditionalPaidInCapitalMember2022-07-020001740332us-gaap:RetainedEarningsMember2022-07-020001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-020001740332us-gaap:TreasuryStockCommonMember2022-07-0200017403322022-07-020001740332us-gaap:RetainedEarningsMember2022-07-032022-10-010001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-07-032022-10-010001740332us-gaap:CommonStockMember2022-07-032022-10-010001740332us-gaap:AdditionalPaidInCapitalMember2022-07-032022-10-010001740332us-gaap:TreasuryStockCommonMember2022-07-032022-10-010001740332us-gaap:CommonStockMember2022-10-010001740332us-gaap:AdditionalPaidInCapitalMember2022-10-010001740332us-gaap:RetainedEarningsMember2022-10-010001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-10-010001740332us-gaap:TreasuryStockCommonMember2022-10-010001740332us-gaap:CommonStockMember2022-12-310001740332us-gaap:AdditionalPaidInCapitalMember2022-12-310001740332us-gaap:RetainedEarningsMember2022-12-310001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310001740332us-gaap:TreasuryStockCommonMember2022-12-310001740332us-gaap:RetainedEarningsMember2023-01-012023-09-300001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-09-300001740332us-gaap:CommonStockMember2023-01-012023-09-300001740332us-gaap:AdditionalPaidInCapitalMember2023-01-012023-09-300001740332us-gaap:TreasuryStockCommonMember2023-01-012023-09-300001740332us-gaap:CommonStockMember2021-12-310001740332us-gaap:AdditionalPaidInCapitalMember2021-12-310001740332us-gaap:RetainedEarningsMember2021-12-310001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2021-12-310001740332us-gaap:TreasuryStockCommonMember2021-12-310001740332us-gaap:RetainedEarningsMember2022-01-012022-10-010001740332us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-01-012022-10-010001740332us-gaap:CommonStockMember2022-01-012022-10-010001740332us-gaap:AdditionalPaidInCapitalMember2022-01-012022-10-010001740332us-gaap:TreasuryStockCommonMember2022-01-012022-10-010001740332us-gaap:DisposalGroupHeldforsaleNotDiscontinuedOperationsMemberrezi:GenesisCableMember2023-09-300001740332rezi:SftySAMember2023-08-09xbrli:pure0001740332rezi:BTXTechnologiesIncMember2023-01-230001740332rezi:TekniqueLimitedMember2022-12-230001740332rezi:ElectronicCustomerDistributorsIncMember2022-07-050001740332rezi:FirstAlertMember2022-03-31rezi:segment0001740332rezi:ProductsAndSolutionsSegmentMember2023-07-022023-09-300001740332rezi:ProductsAndSolutionsSegmentMember2022-07-032022-10-010001740332rezi:ProductsAndSolutionsSegmentMember2023-01-012023-09-300001740332rezi:ProductsAndSolutionsSegmentMember2022-01-012022-10-010001740332rezi:ADIGlobalDistributionSegmentMember2023-07-022023-09-300001740332rezi:ADIGlobalDistributionSegmentMember2022-07-032022-10-010001740332rezi:ADIGlobalDistributionSegmentMember2023-01-012023-09-300001740332rezi:ADIGlobalDistributionSegmentMember2022-01-012022-10-010001740332us-gaap:OperatingSegmentsMemberrezi:ProductsAndSolutionsSegmentMember2023-07-022023-09-300001740332us-gaap:OperatingSegmentsMemberrezi:ProductsAndSolutionsSegmentMember2022-07-032022-10-010001740332us-gaap:OperatingSegmentsMemberrezi:ProductsAndSolutionsSegmentMember2023-01-012023-09-300001740332us-gaap:OperatingSegmentsMemberrezi:ProductsAndSolutionsSegmentMember2022-01-012022-10-010001740332us-gaap:OperatingSegmentsMemberrezi:ADIGlobalDistributionSegmentMember2023-07-022023-09-300001740332us-gaap:OperatingSegmentsMemberrezi:ADIGlobalDistributionSegmentMember2022-07-032022-10-010001740332us-gaap:OperatingSegmentsMemberrezi:ADIGlobalDistributionSegmentMember2023-01-012023-09-300001740332us-gaap:OperatingSegmentsMemberrezi:ADIGlobalDistributionSegmentMember2022-01-012022-10-010001740332us-gaap:CorporateNonSegmentMember2023-07-022023-09-300001740332us-gaap:CorporateNonSegmentMember2022-07-032022-10-010001740332us-gaap:CorporateNonSegmentMember2023-01-012023-09-300001740332us-gaap:CorporateNonSegmentMember2022-01-012022-10-010001740332rezi:AirMemberrezi:ProductsAndSolutionsSegmentMember2023-07-022023-09-300001740332rezi:AirMemberrezi:ProductsAndSolutionsSegmentMember2022-07-032022-10-010001740332rezi:AirMemberrezi:ProductsAndSolutionsSegmentMember2023-01-012023-09-300001740332rezi:AirMemberrezi:ProductsAndSolutionsSegmentMember2022-01-012022-10-010001740332rezi:SafetyAndSecurityMemberrezi:ProductsAndSolutionsSegmentMember2023-07-022023-09-300001740332rezi:SafetyAndSecurityMemberrezi:ProductsAndSolutionsSegmentMember2022-07-032022-10-010001740332rezi:SafetyAndSecurityMemberrezi:ProductsAndSolutionsSegmentMember2023-01-012023-09-300001740332rezi:SafetyAndSecurityMemberrezi:ProductsAndSolutionsSegmentMember2022-01-012022-10-010001740332us-gaap:EnergyServiceMemberrezi:ProductsAndSolutionsSegmentMember2023-07-022023-09-300001740332us-gaap:EnergyServiceMemberrezi:ProductsAndSolutionsSegmentMember2022-07-032022-10-010001740332us-gaap:EnergyServiceMemberrezi:ProductsAndSolutionsSegmentMember2023-01-012023-09-300001740332us-gaap:EnergyServiceMemberrezi:ProductsAndSolutionsSegmentMember2022-01-012022-10-010001740332rezi:ProductsAndSolutionsSegmentMemberus-gaap:PublicUtilitiesInventoryWaterMember2023-07-022023-09-300001740332rezi:ProductsAndSolutionsSegmentMemberus-gaap:PublicUtilitiesInventoryWaterMember2022-07-032022-10-010001740332rezi:ProductsAndSolutionsSegmentMemberus-gaap:PublicUtilitiesInventoryWaterMember2023-01-012023-09-300001740332rezi:ProductsAndSolutionsSegmentMemberus-gaap:PublicUtilitiesInventoryWaterMember2022-01-012022-10-010001740332rezi:ADIGlobalDistributionSegmentMemberrezi:USAndCanadaMember2023-07-022023-09-300001740332rezi:ADIGlobalDistributionSegmentMemberrezi:USAndCanadaMember2022-07-032022-10-010001740332rezi:ADIGlobalDistributionSegmentMemberrezi:USAndCanadaMember2023-01-012023-09-300001740332rezi:ADIGlobalDistributionSegmentMemberrezi:USAndCanadaMember2022-01-012022-10-010001740332us-gaap:EMEAMemberrezi:ADIGlobalDistributionSegmentMember2023-07-022023-09-300001740332us-gaap:EMEAMemberrezi:ADIGlobalDistributionSegmentMember2022-07-032022-10-010001740332us-gaap:EMEAMemberrezi:ADIGlobalDistributionSegmentMember2023-01-012023-09-300001740332us-gaap:EMEAMemberrezi:ADIGlobalDistributionSegmentMember2022-01-012022-10-010001740332rezi:ADIGlobalDistributionSegmentMembersrt:AsiaPacificMember2023-07-022023-09-300001740332rezi:ADIGlobalDistributionSegmentMembersrt:AsiaPacificMember2022-07-032022-10-010001740332rezi:ADIGlobalDistributionSegmentMembersrt:AsiaPacificMember2023-01-012023-09-300001740332rezi:ADIGlobalDistributionSegmentMembersrt:AsiaPacificMember2022-01-012022-10-010001740332srt:MinimumMember2022-01-012022-12-310001740332srt:MaximumMember2022-01-012022-12-3100017403322022-01-012022-12-310001740332us-gaap:PensionPlansDefinedBenefitMember2023-07-022023-09-300001740332us-gaap:PensionPlansDefinedBenefitMember2023-01-012023-09-3000017403322023-04-022023-07-010001740332us-gaap:EmployeeStockOptionMember2023-07-010001740332us-gaap:PerformanceSharesMember2023-01-012023-09-300001740332us-gaap:PerformanceSharesMember2022-01-012022-10-010001740332us-gaap:RestrictedStockUnitsRSUMember2023-01-012023-09-300001740332us-gaap:RestrictedStockUnitsRSUMember2022-01-012022-10-010001740332rezi:KeyEmployeesMember2023-01-012023-09-300001740332rezi:NonEmployeeDirectorsMember2023-01-012023-09-300001740332rezi:ProductsAndSolutionsSegmentMember2022-12-310001740332rezi:ADIGlobalDistributionSegmentMember2022-12-310001740332rezi:ProductsAndSolutionsSegmentMember2023-09-300001740332rezi:ADIGlobalDistributionSegmentMember2023-09-300001740332us-gaap:PatentedTechnologyMember2023-09-300001740332us-gaap:PatentedTechnologyMember2022-12-310001740332us-gaap:CustomerRelationshipsMember2023-09-300001740332us-gaap:CustomerRelationshipsMember2022-12-310001740332us-gaap:TrademarksMember2023-09-300001740332us-gaap:TrademarksMember2022-12-310001740332us-gaap:ComputerSoftwareIntangibleAssetMember2023-09-300001740332us-gaap:ComputerSoftwareIntangibleAssetMember2022-12-310001740332rezi:CostOfGoodsSoldMember2023-07-022023-09-300001740332rezi:CostOfGoodsSoldMember2022-07-032022-10-010001740332rezi:CostOfGoodsSoldMember2023-01-012023-09-300001740332rezi:CostOfGoodsSoldMember2022-01-012022-10-010001740332us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-07-022023-09-300001740332us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-07-032022-10-010001740332us-gaap:SellingGeneralAndAdministrativeExpensesMember2023-01-012023-09-300001740332us-gaap:SellingGeneralAndAdministrativeExpensesMember2022-01-012022-10-010001740332rezi:A4OfSeniorUnsecuredNotesDue2029Member2023-09-300001740332rezi:A4OfSeniorUnsecuredNotesDue2029Member2022-12-310001740332rezi:SevenYearVariableRateTermLoanBDueInTwoThousandTwentyEightMember2023-09-300001740332rezi:SevenYearVariableRateTermLoanBDueInTwoThousandTwentyEightMember2022-12-310001740332rezi:AmendedAndRestatedTermBFacilityMemberrezi:AmendedAndRestatedCreditAgreementMember2021-02-122021-02-120001740332rezi:AmendedAndRestatedTermBFacilityMemberrezi:AmendedAndRestatedCreditAgreementMember2021-02-120001740332rezi:AmendedAndRestatedTermBFacilityMemberrezi:AmendedAndRestatedCreditAgreementMember2023-09-300001740332rezi:AmendedAndRestatedRevolvingCreditFacilityMemberrezi:AmendedAndRestatedCreditAgreementMember2021-02-122021-02-120001740332rezi:AmendedAndRestatedRevolvingCreditFacilityMemberrezi:AmendedAndRestatedCreditAgreementMember2021-02-120001740332rezi:SecuredOvernightFinancingRateSOFRMemberrezi:AmendedAndRestatedRevolvingCreditFacilityMemberrezi:AmendedAndRestatedCreditAgreementMember2023-06-302023-06-300001740332rezi:AmendedAndRestatedTermBFacilityMember2023-09-300001740332rezi:AmendedAndRestatedTermBFacilityMember2022-12-310001740332rezi:AmendedAndRestatedRevolvingCreditFacilityMemberrezi:SeniorCreditFacilitiesMember2022-12-310001740332rezi:AmendedAndRestatedRevolvingCreditFacilityMemberrezi:SeniorCreditFacilitiesMember2023-09-300001740332rezi:SeniorCreditFacilitiesMemberus-gaap:LetterOfCreditMember2023-09-300001740332rezi:SeniorCreditFacilitiesMemberus-gaap:LetterOfCreditMember2022-12-310001740332rezi:SwapAgreementsMember2021-03-31rezi:derivative0001740332rezi:SwapAgreementsMember2023-03-012023-04-300001740332rezi:SwapAgreementsMember2023-04-300001740332rezi:SwapAgreementsMember2023-03-310001740332rezi:SwapAgreementsMember2023-09-300001740332rezi:SwapAgreementsMember2023-06-230001740332rezi:SwapAgreementsMembersrt:MaximumMember2023-06-230001740332us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2023-09-300001740332us-gaap:InterestRateSwapMemberus-gaap:DesignatedAsHedgingInstrumentMemberus-gaap:OtherCurrentAssetsMember2022-12-310001740332us-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2023-09-300001740332us-gaap:InterestRateSwapMemberus-gaap:OtherAssetsMemberus-gaap:DesignatedAsHedgingInstrumentMember2022-12-310001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-01-012023-09-300001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-12-310001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-07-010001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-07-020001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-12-310001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2021-12-310001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-07-022023-09-300001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-07-032022-10-010001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-01-012022-10-010001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2023-09-300001740332us-gaap:AccumulatedGainLossNetCashFlowHedgeParentMember2022-10-010001740332rezi:AAndRTermBFacilityMember2023-09-300001740332rezi:AAndRTermBFacilityMember2022-12-310001740332us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2023-09-300001740332us-gaap:FairValueInputsLevel2Memberus-gaap:FairValueMeasurementsRecurringMember2022-12-310001740332rezi:HoneywellMemberus-gaap:IndemnificationGuaranteeMember2018-10-292018-10-290001740332srt:MaximumMemberrezi:HoneywellMemberus-gaap:IndemnificationGuaranteeMember2018-10-290001740332rezi:ReimbursementAgreementMemberrezi:HoneywellMember2022-12-310001740332rezi:HoneywellMemberrezi:TaxMattersAgreementMember2022-12-310001740332rezi:HoneywellMember2022-12-310001740332rezi:ReimbursementAgreementMemberrezi:HoneywellMember2023-01-012023-09-300001740332rezi:HoneywellMemberrezi:TaxMattersAgreementMember2023-01-012023-09-300001740332rezi:HoneywellMember2023-01-012023-09-300001740332rezi:ReimbursementAgreementMemberrezi:HoneywellMember2023-09-300001740332rezi:HoneywellMemberrezi:TaxMattersAgreementMember2023-09-300001740332rezi:HoneywellMember2023-09-300001740332us-gaap:IndemnificationGuaranteeMember2023-09-300001740332rezi:HoneywellMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2023-09-300001740332rezi:HoneywellMemberus-gaap:AccountsPayableAndAccruedLiabilitiesMember2022-12-310001740332rezi:HoneywellMemberrezi:ObligationsPayableUnderIndemnificationAgreementsMember2023-09-300001740332rezi:HoneywellMemberrezi:ObligationsPayableUnderIndemnificationAgreementsMember2022-12-310001740332us-gaap:OtherExpenseMember2023-07-022023-09-300001740332us-gaap:OtherExpenseMember2023-01-012023-09-300001740332us-gaap:OtherExpenseMember2022-07-032022-10-010001740332us-gaap:OtherExpenseMember2022-01-012022-10-010001740332rezi:TrademarkLicenseAgreementMemberrezi:HoneywellMember2023-07-022023-09-300001740332rezi:TrademarkLicenseAgreementMemberrezi:HoneywellMember2023-01-012023-09-300001740332rezi:TrademarkLicenseAgreementMemberrezi:HoneywellMember2022-07-032022-10-010001740332rezi:TrademarkLicenseAgreementMemberrezi:HoneywellMember2022-01-012022-10-0100017403322022-11-172022-11-1700017403322023-02-030001740332rezi:OptionsAndOtherRightsMember2023-07-022023-09-300001740332rezi:OptionsAndOtherRightsMember2023-01-012023-09-300001740332rezi:PerformanceBasedUnitAwardsMember2023-07-022023-09-300001740332rezi:PerformanceBasedUnitAwardsMember2023-01-012023-09-300001740332rezi:OptionsAndOtherRightsMember2022-07-032022-10-010001740332rezi:OptionsAndOtherRightsMember2022-01-012022-10-010001740332rezi:PerformanceBasedUnitAwardsMember2022-07-032022-10-010001740332rezi:PerformanceBasedUnitAwardsMember2022-01-012022-10-0100017403322023-08-030001740332us-gaap:CommonStockMember2023-07-022023-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

(Mark One)

☒ QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended September 30, 2023

or

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ______ to _____

Commission File Number 001-38635

Resideo Technologies, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

| Delaware |

|

82-5318796 |

| (State or other jurisdiction of incorporation or organization) |

|

(I.R.S. Employer Identification No.) |

| |

|

|

|

16100 N. 71st Street, Suite 550

Scottsdale, Arizona

|

|

85254 |

| (Address of principal executive offices) |

|

(Zip Code) |

|

|

|

(480) 573-5340 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class: |

|

Trading Symbol: |

|

Name of each exchange on which registered: |

| Common Stock, par value $0.001 per share |

|

REZI |

|

New York Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

|

|

|

|

|

|

|

| Large accelerated filer |

☒ |

Accelerated filer |

☐ |

| Non-accelerated filer |

☐ |

Smaller reporting company |

☐ |

|

|

Emerging growth company |

☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

The number of shares outstanding of the registrant’s common stock, par value $0.001 per share, as of October 20, 2023 was 146,087,992 shares.

TABLE OF CONTENTS

Part I. Financial Information

Item 1. Unaudited Consolidated Financial Statements.

Resideo Technologies, Inc.

Consolidated Balance Sheets

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions, except par value) |

September 30, 2023 |

|

December 31, 2022 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

| Cash and cash equivalents |

$ |

368 |

|

|

$ |

326 |

|

| Accounts receivable, net |

988 |

|

|

1,002 |

|

| Inventories, net |

970 |

|

|

975 |

|

| Other current assets |

289 |

|

|

199 |

|

|

|

|

|

| Total current assets |

2,615 |

|

|

2,502 |

|

|

|

|

|

| Property, plant and equipment, net |

380 |

|

|

366 |

|

| Goodwill |

2,687 |

|

|

2,724 |

|

| Intangible assets, net |

456 |

|

|

475 |

|

| Other assets |

321 |

|

|

320 |

|

|

|

|

|

| Total assets |

$ |

6,459 |

|

|

$ |

6,387 |

|

|

|

|

|

| LIABILITIES AND STOCKHOLDERS’ EQUITY |

|

|

|

| Current liabilities: |

|

|

|

| Accounts payable |

$ |

863 |

|

|

$ |

894 |

|

| Current portion of long-term debt |

12 |

|

|

12 |

|

| Accrued liabilities |

592 |

|

|

640 |

|

|

|

|

|

| Total current liabilities |

1,467 |

|

|

1,546 |

|

|

|

|

|

| Long-term debt |

1,397 |

|

|

1,404 |

|

| Obligations payable under Indemnification Agreements |

599 |

|

|

580 |

|

| Other liabilities |

351 |

|

|

328 |

|

|

|

|

|

| Total liabilities |

3,814 |

|

|

3,858 |

|

|

|

|

|

| COMMITMENTS AND CONTINGENCIES |

|

|

|

|

|

|

|

| Stockholders’ equity |

|

|

|

|

|

|

|

Common stock, $0.001 par value: 700 shares authorized, 151 and 146 shares issued and outstanding at September 30, 2023, respectively, and 148 and 146 shares issued and outstanding at December 31, 2022, respectively |

— |

|

|

— |

|

| Additional paid-in capital |

2,219 |

|

|

2,176 |

|

| Retained earnings |

728 |

|

|

600 |

|

| Accumulated other comprehensive loss, net |

(221) |

|

|

(212) |

|

| Treasury stock at cost |

(81) |

|

|

(35) |

|

| Total stockholders’ equity |

2,645 |

|

|

2,529 |

|

| Total liabilities and stockholders’ equity |

$ |

6,459 |

|

|

$ |

6,387 |

|

Refer to accompanying Notes to the Unaudited Consolidated Financial Statements.

Resideo Technologies, Inc.

Consolidated Statements of Operations

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| (in millions, except per share data) |

September 30, 2023 |

|

October 1, 2022 |

|

September 30, 2023 |

|

October 1, 2022 |

| Net revenue |

$ |

1,554 |

|

|

$ |

1,618 |

|

|

$ |

4,705 |

|

|

$ |

4,810 |

|

| Cost of goods sold |

1,137 |

|

|

1,188 |

|

|

3,432 |

|

|

3,475 |

|

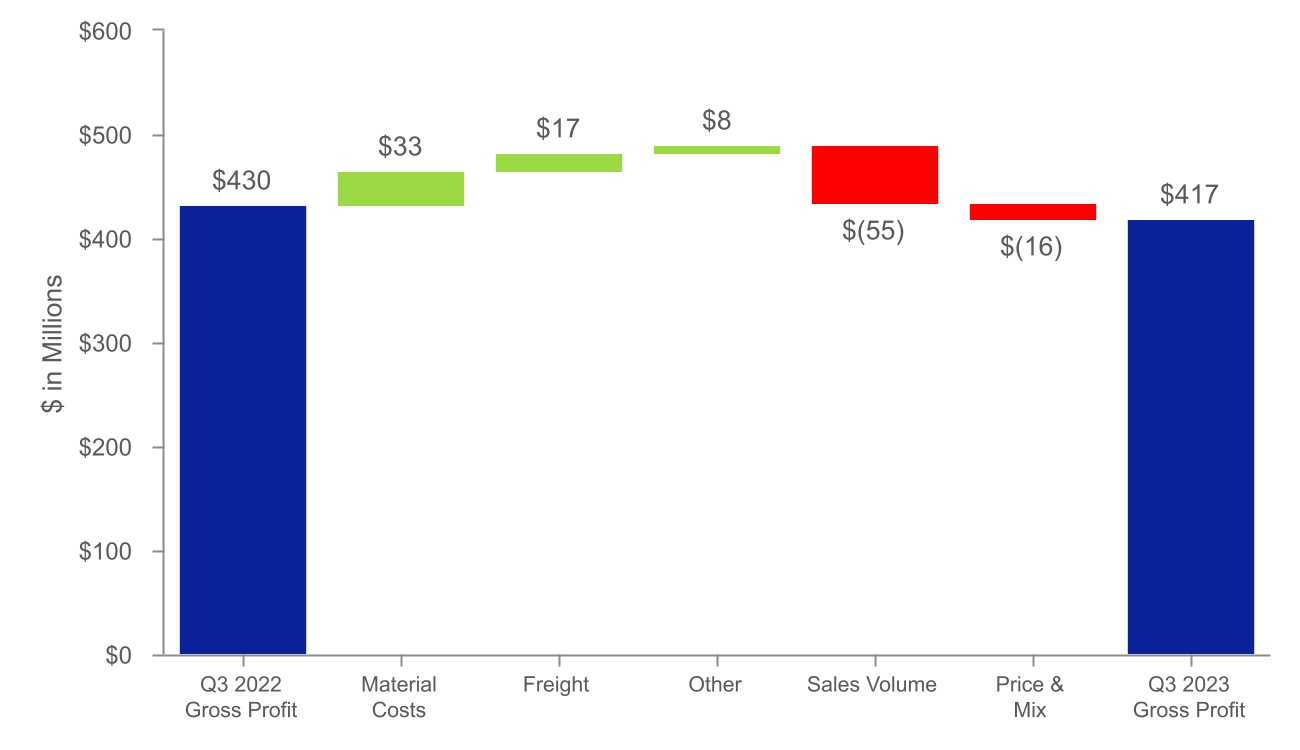

| Gross profit |

417 |

|

|

430 |

|

|

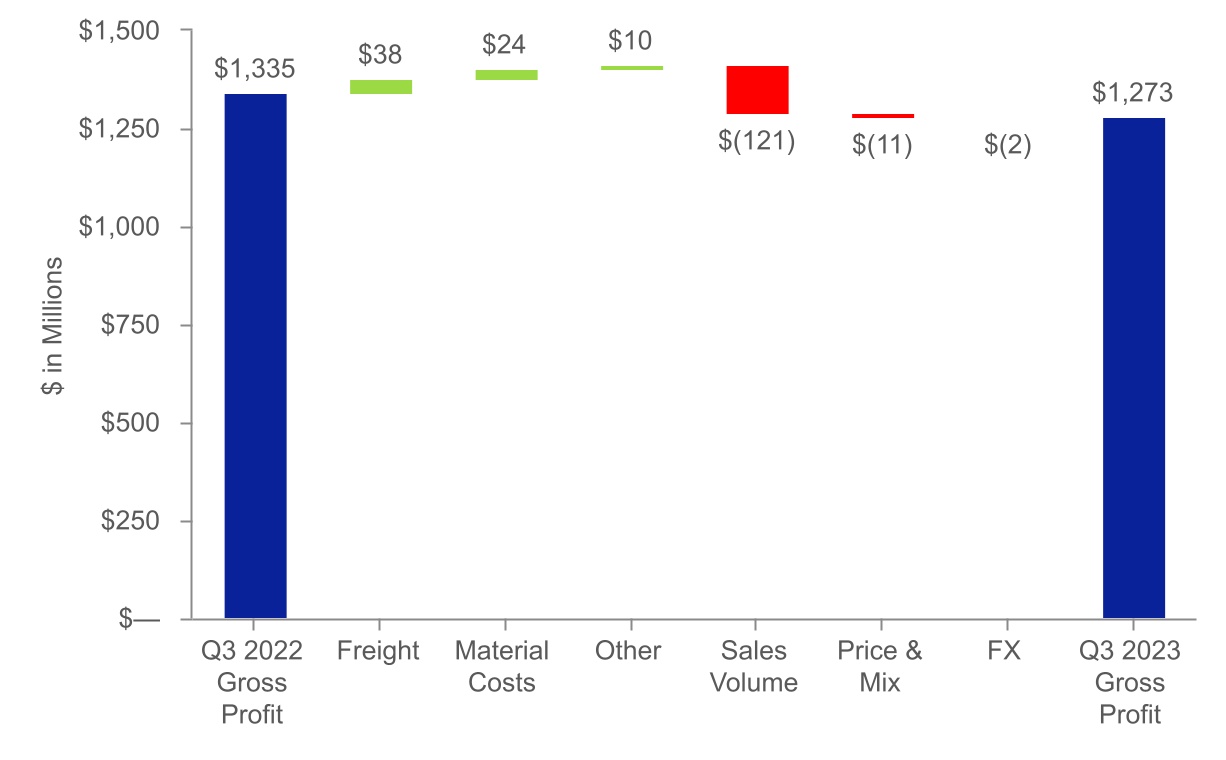

1,273 |

|

|

1,335 |

|

| Operating expenses: |

|

|

|

|

|

|

|

| Research and development expenses |

28 |

|

|

29 |

|

|

84 |

|

|

81 |

|

| Selling, general and administrative expenses |

233 |

|

|

236 |

|

|

719 |

|

|

716 |

|

| Intangible asset amortization |

9 |

|

|

10 |

|

|

28 |

|

|

25 |

|

| Restructuring and impairment expenses |

38 |

|

|

— |

|

|

42 |

|

|

— |

|

| Total operating expenses |

308 |

|

|

275 |

|

|

873 |

|

|

822 |

|

| Income from operations |

109 |

|

|

155 |

|

|

400 |

|

|

513 |

|

| Other expenses, net |

56 |

|

|

44 |

|

|

138 |

|

|

126 |

|

| Interest expense, net |

16 |

|

|

15 |

|

|

50 |

|

|

39 |

|

| Income before taxes |

37 |

|

|

96 |

|

|

212 |

|

|

348 |

|

| Provision for income taxes |

16 |

|

|

33 |

|

|

84 |

|

|

104 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income |

$ |

21 |

|

|

$ |

63 |

|

|

$ |

128 |

|

|

$ |

244 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per share: |

|

|

|

|

|

|

|

| Basic |

$ |

0.14 |

|

|

$ |

0.43 |

|

|

$ |

0.87 |

|

|

$ |

1.68 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted |

$ |

0.14 |

|

|

$ |

0.42 |

|

|

$ |

0.86 |

|

|

$ |

1.64 |

|

|

|

|

|

|

|

|

|

| Weighted average number of shares outstanding: |

|

|

|

|

|

|

|

| Basic |

147 |

|

146 |

|

147 |

|

145 |

| Diluted |

148 |

|

149 |

|

149 |

|

149 |

Refer to accompanying Notes to the Unaudited Consolidated Financial Statements.

Resideo Technologies, Inc.

Consolidated Statements of Comprehensive Income (Loss)

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| (in millions) |

September 30, 2023 |

|

October 1, 2022 |

|

September 30, 2023 |

|

October 1, 2022 |

| Comprehensive income (loss): |

|

|

|

|

|

|

|

| Net income |

$ |

21 |

|

|

$ |

63 |

|

|

$ |

128 |

|

|

$ |

244 |

|

| Other comprehensive loss, net of tax: |

|

|

|

|

|

|

|

| Foreign exchange translation loss |

(37) |

|

|

(86) |

|

|

(11) |

|

|

(165) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pension liability adjustments |

2 |

|

|

— |

|

|

6 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Changes in fair value of effective cash flow hedges |

(2) |

|

|

14 |

|

|

(4) |

|

|

38 |

|

| Total other comprehensive loss, net of tax |

(37) |

|

|

(72) |

|

|

(9) |

|

|

(127) |

|

| Comprehensive income (loss) |

$ |

(16) |

|

|

$ |

(9) |

|

|

$ |

119 |

|

|

$ |

117 |

|

Refer to accompanying Notes to the Unaudited Consolidated Financial Statements.

Resideo Technologies, Inc.

Consolidated Statements of Cash Flows

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

|

| (in millions) |

September 30, 2023 |

|

October 1, 2022 |

|

|

| Cash Flows From Operating Activities: |

|

|

|

|

|

| Net income |

$ |

128 |

|

|

$ |

244 |

|

|

|

| Adjustments to reconcile net income to net cash in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

| Depreciation and amortization |

71 |

|

|

69 |

|

|

|

| Restructuring and impairment expenses |

42 |

|

|

— |

|

|

|

| Stock-based compensation expense |

36 |

|

|

36 |

|

|

|

|

|

|

|

|

|

| Other, net |

2 |

|

|

8 |

|

|

|

|

|

|

|

|

|

| Changes in assets and liabilities, net of acquired companies: |

|

|

|

|

|

| Accounts receivable, net |

(9) |

|

|

(142) |

|

|

|

| Inventories, net |

(4) |

|

|

(129) |

|

|

|

| Other current assets |

(5) |

|

|

(38) |

|

|

|

|

|

|

|

|

|

| Accounts payable |

(14) |

|

|

5 |

|

|

|

| Accrued liabilities |

(114) |

|

|

(25) |

|

|

|

| Other, net |

44 |

|

|

(15) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash provided by operating activities |

177 |

|

|

13 |

|

|

|

| Cash Flows From Investing Activities: |

|

|

|

|

|

| Capital expenditures |

(74) |

|

|

(34) |

|

|

|

| Acquisitions, net of cash acquired |

(16) |

|

|

(660) |

|

|

|

| Other investing activities, net |

— |

|

|

(13) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash used in investing activities |

(90) |

|

|

(707) |

|

|

|

| Cash Flows From Financing Activities: |

|

|

|

|

|

| Common stock repurchases |

(28) |

|

|

— |

|

|

|

| Proceeds from issuance of A&R Term B Facility |

— |

|

|

200 |

|

|

|

| Repayments of long-term debt |

(9) |

|

|

(9) |

|

|

|

|

|

|

|

|

|

| Other financing activities, net |

(10) |

|

|

(9) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net cash (used in) provided by financing activities |

(47) |

|

|

182 |

|

|

|

| Effect of foreign exchange rate changes on cash, cash equivalents and restricted cash |

1 |

|

|

(12) |

|

|

|

| Net increase (decrease) in cash, cash equivalents and restricted cash |

41 |

|

|

(524) |

|

|

|

| Cash, cash equivalents and restricted cash at beginning of period |

329 |

|

|

779 |

|

|

|

| Cash, cash equivalents and restricted cash at end of period |

$ |

370 |

|

|

$ |

255 |

|

|

|

|

|

|

|

|

|

| Supplemental Cash Flow Information: |

|

|

|

|

|

| Interest paid |

$ |

81 |

|

|

$ |

38 |

|

|

|

| Taxes paid, net of refunds |

$ |

104 |

|

|

$ |

129 |

|

|

|

| Capital expenditures in accounts payable |

$ |

19 |

|

|

$ |

18 |

|

|

|

Refer to accompanying Notes to the Unaudited Consolidated Financial Statements.

Resideo Technologies, Inc.

Consolidated Statements of Stockholders’ Equity

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal Quarters |

Common Stock |

|

|

|

|

|

Accumulated Other

Comprehensive Loss |

|

Treasury Stock |

|

|

| (in millions, except shares in thousands) |

Shares |

|

Amount |

|

Additional

Paid-In Capital |

|

Retained

Earnings |

|

|

Shares |

|

Amount |

|

Total Stockholders’

Equity |

| Balance at July 2, 2023 |

147,649 |

|

|

$ |

— |

|

|

$ |

2,204 |

|

|

$ |

707 |

|

|

$ |

(184) |

|

|

2,902 |

|

|

$ |

(50) |

|

|

$ |

2,677 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

21 |

|

|

— |

|

|

— |

|

|

— |

|

|

21 |

|

| Other comprehensive loss, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(37) |

|

|

— |

|

|

— |

|

|

(37) |

|

| Common stock issuance, net of shares withheld for taxes |

284 |

|

|

— |

|

|

4 |

|

|

— |

|

|

— |

|

|

71 |

|

|

(1) |

|

|

3 |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

11 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

11 |

|

| Common stock repurchases |

(1,840) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,840 |

|

|

(30) |

|

|

(30) |

|

| Balance at September 30, 2023 |

146,093 |

|

|

$ |

— |

|

|

$ |

2,219 |

|

|

$ |

728 |

|

|

$ |

(221) |

|

|

4,813 |

|

|

$ |

(81) |

|

|

$ |

2,645 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at July 3, 2022 |

145,684 |

|

|

$ |

— |

|

|

$ |

2,147 |

|

|

$ |

498 |

|

|

$ |

(220) |

|

|

1,844 |

|

|

$ |

(31) |

|

|

$ |

2,394 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

63 |

|

|

— |

|

|

— |

|

|

— |

|

|

63 |

|

| Other comprehensive loss, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(72) |

|

|

— |

|

|

— |

|

|

(72) |

|

| Common stock issuance, net of shares withheld for taxes |

154 |

|

|

— |

|

|

2 |

|

|

— |

|

|

— |

|

|

21 |

|

|

— |

|

|

2 |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

13 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

13 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at October 1, 2022 |

145,838 |

|

|

$ |

— |

|

|

$ |

2,162 |

|

|

$ |

561 |

|

|

$ |

(292) |

|

|

1,865 |

|

|

$ |

(31) |

|

|

$ |

2,400 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Fiscal Year to Date Periods |

Common Stock |

|

|

|

|

|

Accumulated Other

Comprehensive Loss |

|

Treasury Stock |

|

|

| (in millions, except shares in thousands) |

Shares |

|

Amount |

|

Additional

Paid-In Capital |

|

Retained

Earnings |

|

|

Shares |

|

Amount |

|

Total Stockholders’

Equity |

| Balance at January 1, 2023 |

146,222 |

|

|

$ |

— |

|

|

$ |

2,176 |

|

|

$ |

600 |

|

|

$ |

(212) |

|

|

2,050 |

|

|

$ |

(35) |

|

|

$ |

2,529 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

128 |

|

|

— |

|

|

— |

|

|

— |

|

|

128 |

|

| Other comprehensive loss, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(9) |

|

|

— |

|

|

— |

|

|

(9) |

|

| Common stock issuance, net of shares withheld for taxes |

1,711 |

|

|

— |

|

|

7 |

|

|

— |

|

|

— |

|

|

923 |

|

|

(16) |

|

|

(9) |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

36 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

36 |

|

| Common stock repurchases |

(1,840) |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

1,840 |

|

|

(30) |

|

|

(30) |

|

| Balance at September 30, 2023 |

146,093 |

|

|

$ |

— |

|

|

$ |

2,219 |

|

|

$ |

728 |

|

|

$ |

(221) |

|

|

4,813 |

|

|

$ |

(81) |

|

|

$ |

2,645 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at January 1, 2022 |

144,808 |

|

|

$ |

— |

|

|

$ |

2,121 |

|

|

$ |

317 |

|

|

$ |

(165) |

|

|

1,440 |

|

|

$ |

(21) |

|

|

$ |

2,252 |

|

| Net income |

— |

|

|

— |

|

|

— |

|

|

244 |

|

|

— |

|

|

— |

|

|

— |

|

|

244 |

|

| Other comprehensive loss, net of tax |

— |

|

|

— |

|

|

— |

|

|

— |

|

|

(127) |

|

|

— |

|

|

— |

|

|

(127) |

|

| Common stock issuance, net of shares withheld for taxes |

1,030 |

|

|

— |

|

|

5 |

|

|

— |

|

|

— |

|

|

425 |

|

|

(10) |

|

|

(5) |

|

| Stock-based compensation expense |

— |

|

|

— |

|

|

36 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

36 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Balance at October 1, 2022 |

145,838 |

|

|

$ |

— |

|

|

$ |

2,162 |

|

|

$ |

561 |

|

|

$ |

(292) |

|

|

1,865 |

|

|

$ |

(31) |

|

|

$ |

2,400 |

|

Refer to accompanying Notes to the Unaudited Consolidated Financial Statements.

Resideo Technologies, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

Note 1. Nature of Operations and Basis of Presentation

Nature of Operations

Resideo Technologies, Inc. (“Resideo”, the “Company”, “we”, “us”, or “our”) is a leading manufacturer and developer of technology-driven products that provide critical comfort, energy, smoke and carbon monoxide detection home safety products, and security solutions to homes globally. We are also a leading wholesale distributor of low-voltage security products including access control, fire detection, fire suppression, security, and video products, and participate significantly in the broader related markets of audio, communications, data communications, networking, power, ProAV, smart home, and wire and cable. Our global footprint serves both commercial and residential end markets.

Basis of Consolidation and Reporting

The accompanying Unaudited Consolidated Financial Statements have been prepared in accordance with United States (“U.S.”) generally accepted accounting principles (“GAAP”) for interim financial information and with the instructions to Form 10-Q and Article 10 of Regulation S-X. Accordingly, the Unaudited Consolidated Financial Statements do not include all of the information and notes required by GAAP for complete financial statements. In the opinion of management, the Unaudited Consolidated Financial Statements included herein contain all adjustments, which consist of normal recurring adjustments, necessary to fairly present our financial position, results of operations and cash flows for the periods indicated. Operating results for the period from January 1, 2023 through September 30, 2023 are not necessarily indicative of the results that may be expected for the fiscal year ending December 31, 2023.

For additional information, refer to the consolidated financial statements and notes thereto included in our Annual Report on Form 10-K for the fiscal year ended December 31, 2022 (the “2022 Annual Report on Form 10-K”), filed with the United States Securities and Exchange Commission (the “SEC”) on February 21, 2023.

Reporting Period

We report financial information on a fiscal quarter basis using a modified four-four-five week calendar. Our fiscal calendar begins on January 1 and ends on December 31. We have elected the first, second and third quarters to end on a Saturday in order to not disrupt business processes. The effects of this election are generally not significant to reported results for any quarter and only exist within a reporting year.

Reclassification

For the purpose of comparability, certain prior period amounts have been reclassified to conform to current period classification.

Assets and Liabilities Held for Sale

On September 19 2023, we announced that we entered into a definitive agreement to sell the Genesis Wire & Cable (“Genesis”) business in a cash transaction to Southwire Company, LLC (the “buyer”) for $87.5 million, subject to customary adjustments. Genesis is reported within the Products and Solutions Segment. The divestiture does not represent a strategic shift, nor will it have a significant impact on our Unaudited Consolidated Statements of Operations. As such, we have reclassified the related assets and liabilities to held for sale within other current assets and accrued liabilities, respectively, on the Unaudited Consolidated Balance Sheets. The estimated fair value less costs exceeds the carrying amount for Genesis, therefore no impairment was recognized for the three and nine months ended September 30, 2023. The transaction closed in October 2023.

Resideo Technologies, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

The following is a summary of the major categories of assets and liabilities that have been classified as held for sale within other current assets and accrued liabilities on the Unaudited Consolidated Balance Sheets at September 30, 2023:

|

|

|

|

|

|

| (in millions) |

September 30, 2023 |

| Accounts receivables, net |

$ |

20 |

|

| Inventories, net |

14 |

|

| Property, plant and equipment, net |

7 |

|

| Goodwill |

40 |

|

| Other assets |

5 |

|

| Total assets held for sale |

$ |

86 |

|

|

|

| Accounts payable |

$ |

18 |

|

| Accrued liabilities |

8 |

|

| Other liabilities |

5 |

|

| Total liabilities held for sale |

$ |

31 |

|

Note 2. Summary of Significant Accounting Policies

Our significant accounting policies are detailed in Note 2. Summary of Significant Accounting Policies of the Annual Report on Form 10-K for the year ended December 31, 2022. There have been no significant changes to these policies that have had a material impact on the Unaudited Consolidated Financial Statements and accompanying notes for the three and nine months ended September 30, 2023.

We consider the applicability and impact of all recent accounting standards updates (“ASUs”) issued by the Financial Accounting Standards Board (“FASB”) and disclose only those that may have a material impact.

Adopted Accounting Pronouncements

In March 2020, the FASB issued ASU 2020-04, Reference Rate Reform (Topic 848): Facilitation of the Effects of Reference Rate Reform on Financial Reporting, and subsequent amendment to the initial guidance: ASU 2021-01, Reference Rate Reform (Topic 848): Scope (collectively, “Topic 848”). Topic 848 provides optional expedients and exceptions for applying GAAP to contracts, hedging relationships, and other transactions affected by reference rate reform if certain criteria are met. The amendments apply only to contracts, hedging relationships, and other transactions that reference London Interbank Offered Rate (“LIBOR”) or another reference rate expected to be discontinued because of reference rate reform. In December 2022, the FASB issued ASU 2022-06, Reference Rate Reform (Topic 848): Deferral of the Sunset Date of Topic 848. ASU 2022-06 defers the sunset date of Topic 848 from December 31, 2022 to December 31, 2024. This guidance may be applied prospectively to contract modifications made and hedging relationships entered into or evaluated on or before December 31, 2024. The impact of the adoption of this standard on our financial statements and related disclosures, including accounting policies, processes, and systems, was not material. Refer to Note 12. Long-Term Debt and Note 13. Derivative Financial Instruments to the Unaudited Consolidated Financial Statements for further discussion.

Note 3. Acquisitions

Pro forma results of operations for the following acquisitions have not been presented, as the impacts on our consolidated financial results were not material.

2023 Acquisitions

Sfty SA—On August 9, 2023, we acquired 100% of the outstanding equity of Sfty SA, a developer of cloud-based services providing alerts to multifamily homes and property managers with smoke, carbon monoxide and water leak detection products.

Resideo Technologies, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

We report Sfty SA’s results within the Products and Solutions segment. We have made a preliminary purchase price allocation that is subject to change as additional information is obtained.

BTX Technologies, Inc.—On January 23, 2023, we acquired 100% of the outstanding equity of BTX Technologies, Inc., (“BTX”) a leading distributor of professional audio, video, data communications, and broadcast equipment. We report BTX’s results within the ADI Global Distribution segment. We have made a preliminary purchase price allocation that is subject to change as additional information is obtained.

2022 Acquisitions

Teknique Limited—On December 23, 2022, we acquired 100% of the outstanding equity of Teknique Limited, a developer and producer of edge-based, artificial intelligence-enabled video camera solutions. We report Teknique Limited’s results within the Products and Solutions segment. Purchase consideration included cash and a note payable with the former owner. We have made a preliminary purchase price allocation that is subject to change as additional information is obtained.

Electronic Custom Distributors, Inc.—On July 5, 2022, we acquired 100% of the outstanding equity of Electronic Custom Distributors, Inc., a regional distributor of residential audio, video, automation, security, wire and telecommunication products. We report Electronic Customer Distributors, Inc.’s results within the ADI Global Distribution segment. We completed the accounting for the acquisition during the first quarter of 2023, which did not result in any adjustments.

First Alert, Inc.—On March 31, 2022, we acquired 100% of the outstanding equity of First Alert, Inc., a leading provider of home safety products. We report First Alert, Inc.’s results within the Products and Solutions segment. We completed the accounting for the acquisition during the first quarter of 2023, which did not result in any adjustments.

Note 4. Segment Financial Data

We monitor our business operations through our two operating segments: Products and Solutions and ADI Global Distribution.

These operating segments follow the same accounting policies used for the financial statements. We evaluate a segment’s performance on a GAAP basis, primarily operating income before corporate expenses.

Corporate expenses relate to functions within the corporate office that support the operating segments such as acquisition-related costs, legal, tax, treasury, human resources, IT, strategy, accounting, communications, innovation, business development, facilities management, corporate travel expenses and other executive costs. Additionally, included within Corporate are unallocated non-operating items such as pension expense, Reimbursement Agreement expense, interest income, interest expense, and other income (expense).

Segment information is consistent with how management reviews the businesses, makes investing and resource allocation decisions, and assesses operating performance.

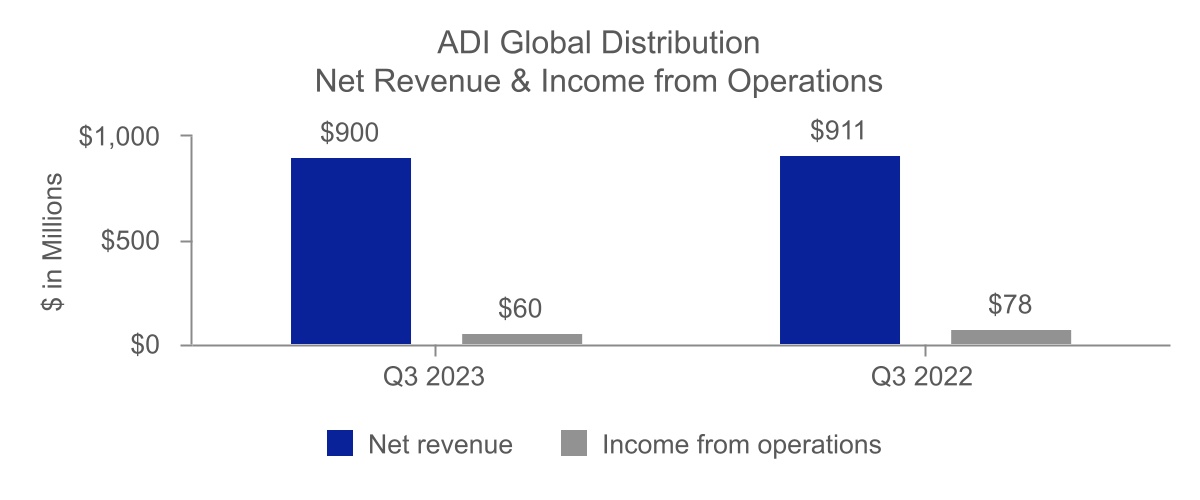

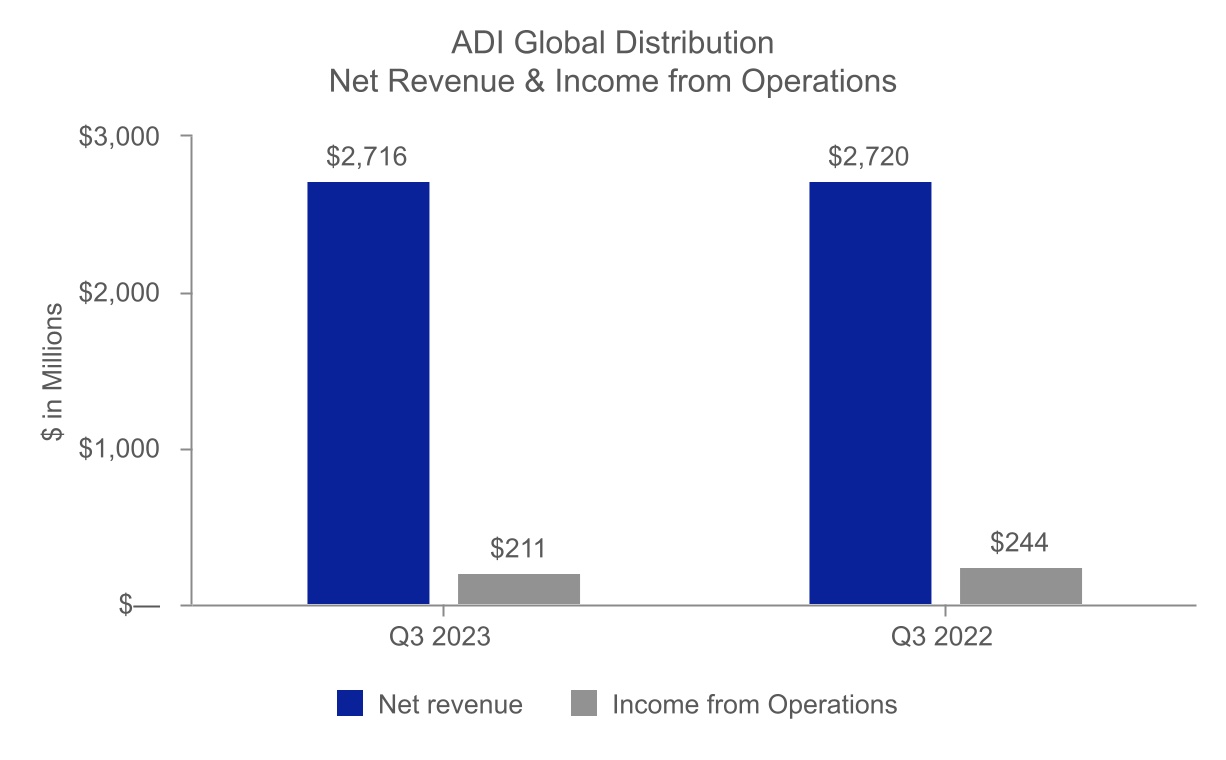

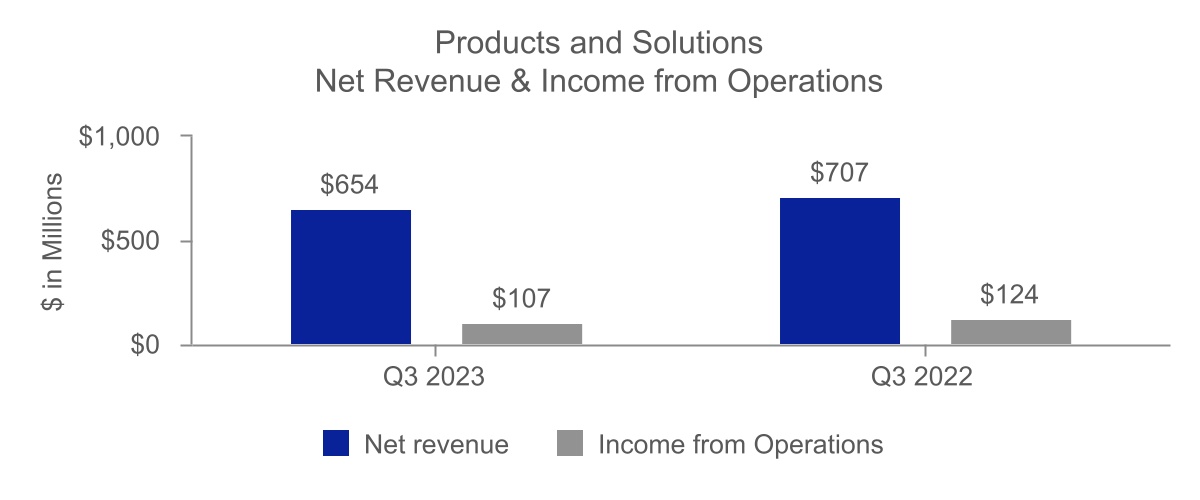

The following table represents summary financial data attributable to the segments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| (in millions) |

September 30, 2023 |

|

October 1, 2022 |

|

September 30, 2023 |

|

October 1, 2022 |

| Net revenue |

|

|

|

|

|

|

|

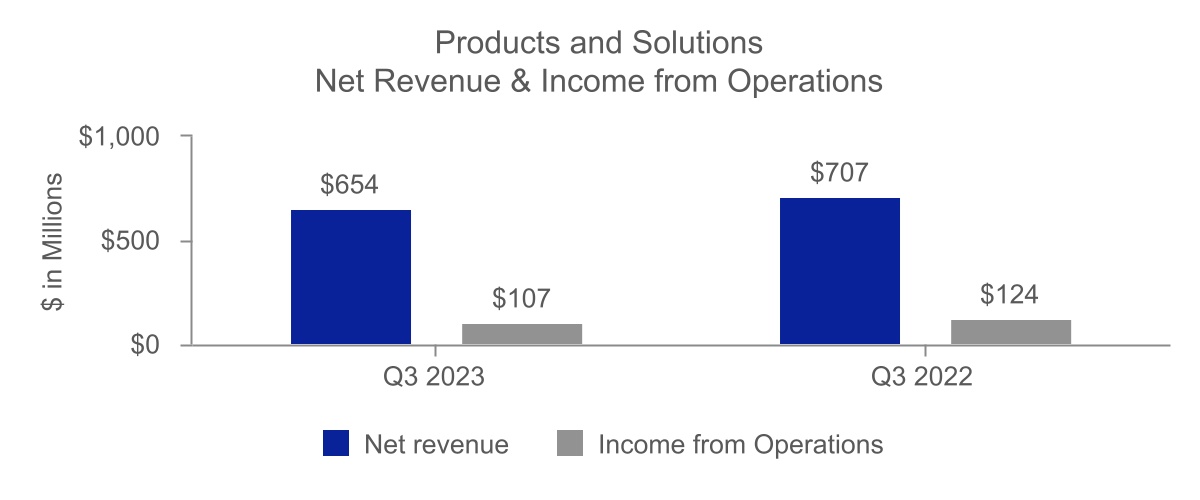

| Products and Solutions |

$ |

654 |

|

|

$ |

707 |

|

|

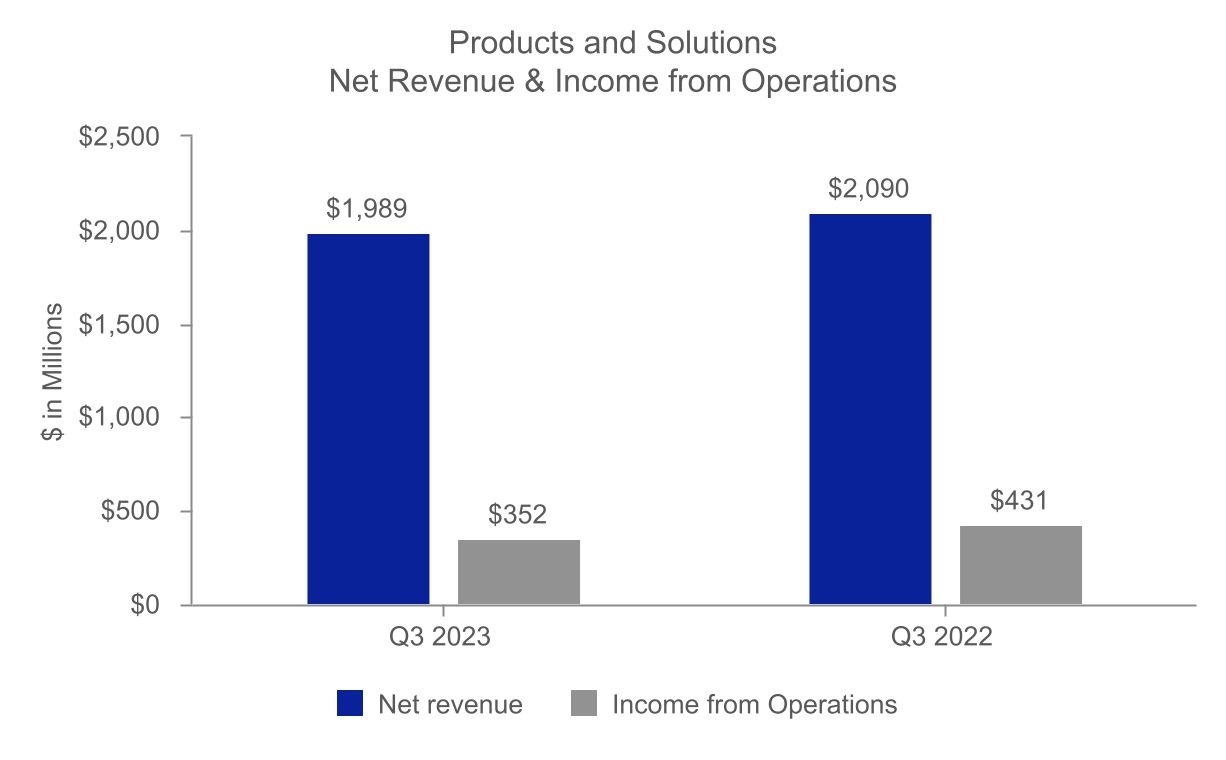

$ |

1,989 |

|

|

$ |

2,090 |

|

| ADI Global Distribution |

900 |

|

|

911 |

|

|

2,716 |

|

|

2,720 |

|

| Total net revenue |

$ |

1,554 |

|

|

$ |

1,618 |

|

|

$ |

4,705 |

|

|

$ |

4,810 |

|

Resideo Technologies, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| (in millions) |

September 30, 2023 |

|

October 1, 2022 |

|

September 30, 2023 |

|

October 1, 2022 |

| Income from operations |

|

|

|

|

|

|

|

| Products and Solutions |

$ |

107 |

|

|

$ |

124 |

|

|

$ |

352 |

|

|

$ |

431 |

|

| ADI Global Distribution |

60 |

|

|

78 |

|

|

211 |

|

|

244 |

|

| Corporate |

(58) |

|

|

(47) |

|

|

(163) |

|

|

(162) |

|

| Total income from operations |

$ |

109 |

|

|

$ |

155 |

|

|

$ |

400 |

|

|

$ |

513 |

|

The Company’s Chief Executive Officer, its Chief Operating Decision Maker, does not use segment assets information to allocate resources or to assess performance of the segments and therefore, total segment assets have not been reported.

Note 5. Revenue Recognition

We have two operating segments, Products and Solutions and ADI Global Distribution. Disaggregated revenue information for Products and Solutions is presented by product grouping, while ADI Global Distribution is presented by region.

The following table presents revenue by business line and geographic location, as we believe this presentation best depicts how the nature, amount, timing, and uncertainty of net revenue and cash flows are affected by economic factors:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| (in millions) |

September 30, 2023 |

|

October 1, 2022 |

|

September 30, 2023 |

|

October 1, 2022 |

| Products and Solutions |

|

|

|

|

|

|

|

| Air |

$ |

211 |

|

|

$ |

245 |

|

|

$ |

640 |

|

|

$ |

721 |

|

| Safety and Security |

245 |

|

|

248 |

|

|

721 |

|

|

670 |

|

| Energy |

123 |

|

|

142 |

|

|

391 |

|

|

455 |

|

| Water |

75 |

|

|

72 |

|

|

237 |

|

|

244 |

|

| Total Products and Solutions |

654 |

|

|

707 |

|

|

1,989 |

|

|

2,090 |

|

|

|

|

|

|

|

|

|

| ADI Global Distribution |

|

|

|

|

|

|

|

| U.S. and Canada |

780 |

|

|

792 |

|

|

2,354 |

|

|

2,335 |

|

EMEA (1) |

120 |

|

|

111 |

|

|

362 |

|

|

360 |

|

APAC (2) |

— |

|

|

8 |

|

|

— |

|

|

25 |

|

| Total ADI Global Distribution |

900 |

|

|

911 |

|

|

2,716 |

|

|

2,720 |

|

|

|

|

|

|

|

|

|

| Total net revenue |

$ |

1,554 |

|

|

$ |

1,618 |

|

|

$ |

4,705 |

|

|

$ |

4,810 |

|

(1)EMEA represents Europe, the Middle East and Africa.

(2)APAC represents Asia and Pacific countries.

Note 6. Restructuring

During the third quarter of 2023, we initiated additional restructuring programs (“2023 Plan”) in order to align our cost structure with market conditions. For the three and nine months ended September 30, 2023, we recognized restructuring and impairment expenses of $38 million and $42 million, respectively. These expenses primarily related to workforce reductions.

Restructuring and impairment expenses recognized were $25 million in the Product and Solutions segment, $10 million in the ADI Global Distribution segment and $3 million in the Corporate segment, respectively, for the three months ended September 30, 2023, and $27 million in the Product and Solutions segment, $12 million in the ADI Global Distribution segment and $3 million in the Corporate segment, respectively, for the nine months ended September 30, 2023.

Resideo Technologies, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

No restructuring and impairment expenses were recognized for the three and nine months ended October 1, 2022.

In 2022, we initiated certain restructuring programs to lower costs, increase gross and operating margins and position us for growth. Refer to Note 6. Restructuring Expenses in our 2022 Annual Report on Form 10-K for further discussion of our 2022 restructuring programs.

We expect to fully execute our restructuring initiatives and programs over the next 12 to 24 months, and we may incur future additional restructuring expenses associated with these plans. We are unable at this time to make a good faith determination of cost estimates, or ranges of cost estimates, associated with future phases of the plans or the total costs we may incur in connection with these plans.

The following table summarizes the status of our restructuring expenses included within accrued liabilities on the Unaudited Consolidated Balance Sheets.

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

|

Twelve Months Ended |

| (in millions) |

September 30, 2023 |

|

December 31, 2022 |

| Beginning of period |

$ |

27 |

|

|

$ |

9 |

|

| Charges |

36 |

|

|

26 |

|

Usage (1) |

(22) |

|

|

(5) |

|

| Other |

— |

|

|

(3) |

|

| End of period |

$ |

41 |

|

|

$ |

27 |

|

(1) Usage primarily relates to cash payments associated with employee termination costs.

Note 7. Pension Plans

As a result of a voluntary lump sum window offering and the purchase of a group annuity contract that transferred a portion of the assets and liabilities to an insurance company during the first quarter of 2023, we triggered settlement accounting and performed a remeasurement of our U.S. qualified defined benefit pension plan. As a result, we recognized non-cash pension settlement losses within other expense, net in the Unaudited Consolidated Statements of Operations of $3 million and $6 million for the three and nine months ended September 30, 2023, respectively. The loss for the three months ended September 30, 2023 is mainly related to an adjustment to our estimate of the losses from settlements that occurred during the first quarter of 2023. The corresponding remeasurement of our U.S. qualified defined benefit pension plan resulted in decreases of $80 million in plan assets and $75 million in liabilities for the nine months ended September 30, 2023.

Note 8. Stock-Based Compensation Plans

The Stock Incentive Plans, which consists of the Amended and Restated 2018 Stock Incentive Plan of Resideo Technologies, Inc. and its Affiliates and the 2018 Stock Incentive Plan for Non-Employee Directors of Resideo Technologies, Inc., provide for the grant of stock options, stock appreciation rights, restricted stock units, restricted stock, and other stock-based awards.

During the second quarter of 2023, the Amended and Restated 2018 Stock Incentive Plan of Resideo Technologies, Inc. and its Affiliates was further amended to increase the number of shares of our common stock available for issuance by 3.5 million shares for an aggregate of 19.5 million shares with no more than 7.5 million shares being available for grant in the form of stock options.

A summary of awards granted as part of our annual long-term compensation follows:

Resideo Technologies, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended September 30, 2023 |

|

Nine Months Ended October 1, 2022 |

|

Number of Stock Units Granted |

|

Weighted average grant date fair value per share |

|

Number of Stock Units Granted |

|

Weighted average grant date fair value per share |

Performance Stock Units (“PSUs”) |

553,071 |

|

$ |

29.89 |

|

|

669,551 |

|

$ |

36.11 |

|

Restricted Stock Units (“RSUs”) |

2,232,465 |

|

$ |

18.85 |

|

|

1,711,282 |

|

$ |

22.68 |

|

Annual RSU awards to our key employees generally have a three-year service or performance period. RSU awards to our non-employee directors have a one-year service period. The fair value is determined at the grant date. PSUs granted in 2023 were issued with the shares awarded per unit being based on the difference in performance between the total stockholders’ return of our common stock against that of the S&P 600 Industrials Index. PSUs granted prior to 2023 were issued with the shares awarded per unit being based on the difference in performance between the total stockholders’ return of our common stock against that of the S&P 400 Industrials Index.

Stock-based compensation expense, net of tax was $11 million and $36 million for the three and nine months ended September 30, 2023, respectively. For the three and nine months ended October 1, 2022, stock-based compensation expense, net of tax was $13 million and $36 million, respectively.

Note 9. Inventories, net

The following table summarizes the details of our inventories, net:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

|

September 30, 2023 |

|

December 31, 2022 |

| Raw materials |

|

$ |

229 |

|

|

$ |

251 |

|

| Work in process |

|

21 |

|

|

25 |

|

| Finished products |

|

720 |

|

|

699 |

|

|

|

|

|

|

|

|

|

|

|

| Total inventories, net |

|

$ |

970 |

|

|

$ |

975 |

|

Note 10. Goodwill and Intangible Assets, net

Our goodwill balance and changes in carrying value by segment are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Products and Solutions |

|

ADI Global Distribution |

|

Total |

Balance at December 31, 2022 |

$ |

2,072 |

|

|

$ |

652 |

|

|

$ |

2,724 |

|

| Acquisitions |

10 |

|

|

3 |

|

|

13 |

|

Adjustments(1) |

(42) |

|

|

— |

|

|

(42) |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Impact of foreign currency translation |

(6) |

|

|

(2) |

|

|

(8) |

|

| Balance at September 30, 2023 |

$ |

2,034 |

|

|

$ |

653 |

|

|

$ |

2,687 |

|

(1) Primarily relates to the divestiture of our Genesis business as discussed in Note 1. Nature of Operations and Basis of Presentation.

The following table summarizes the net carrying amount of intangible assets:

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

September 30, 2023 |

|

December 31, 2022 |

| Intangible assets subject to amortization |

$ |

276 |

|

|

$ |

295 |

|

| Indefinite-lived intangible assets |

180 |

|

|

180 |

|

| Total intangible assets |

$ |

456 |

|

|

$ |

475 |

|

Resideo Technologies, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

Intangible assets subject to amortization consisted of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, 2023 |

|

December 31, 2022 |

|

|

|

|

| (in millions) |

Gross

Carrying

Amount |

|

Accumulated

Amortization |

|

Net

Carrying

Amount |

|

Gross

Carrying

Amount |

|

Accumulated

Amortization |

|

Net

Carrying

Amount |

|

|

|

|

| Patents and technology |

$ |

57 |

|

|

$ |

(23) |

|

|

$ |

34 |

|

|

$ |

65 |

|

|

$ |

(28) |

|

|

$ |

37 |

|

|

|

|

|

| Customer relationships |

311 |

|

|

(129) |

|

|

182 |

|

|

313 |

|

|

(117) |

|

|

196 |

|

|

|

|

|

| Trademarks |

8 |

|

|

(8) |

|

|

— |

|

|

14 |

|

|

(8) |

|

|

6 |

|

|

|

|

|

| Software |

187 |

|

|

(127) |

|

|

60 |

|

|

175 |

|

|

(119) |

|

|

56 |

|

|

|

|

|

| Intangible assets subject to amortization |

$ |

563 |

|

|

$ |

(287) |

|

|

$ |

276 |

|

|

$ |

567 |

|

|

$ |

(272) |

|

|

$ |

295 |

|

|

|

|

|

Intangible assets amortization expense was $9 million and $28 million for the three and nine months ended September 30, 2023, respectively. For the three and nine months ended October 1, 2022, intangible assets amortization expense was $10 million and $25 million, respectively.

Note 11. Leases

Total operating lease costs are as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Nine Months Ended |

| (in millions) |

September 30, 2023 |

|

October 1, 2022 |

|

September 30, 2023 |

|

October 1, 2022 |

| Operating lease costs |

|

|

|

|

|

|

|

| Cost of goods sold |

$ |

5 |

|

|

$ |

3 |

|

|

$ |

15 |

|

|

$ |

13 |

|

| Selling, general and administrative expenses |

14 |

|

|

13 |

|

|

43 |

|

|

38 |

|

| Total operating lease costs |

$ |

19 |

|

|

$ |

16 |

|

|

$ |

58 |

|

|

$ |

51 |

|

Total operating lease costs include variable lease costs of $6 million and $18 million for the three and nine months ended September 30, 2023, respectively. For the three and nine months ended October 1, 2022, total operating lease costs include variable lease costs of $6 million and $15 million, respectively.

The following table summarizes the carrying amounts of our operating lease assets and liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

Financial Statement Line Item |

|

September 30, 2023 |

|

December 31, 2022 |

| Operating lease assets |

Other assets |

|

$ |

197 |

|

|

$ |

191 |

|

| Operating lease liabilities - current |

Accrued liabilities |

|

$ |

36 |

|

|

$ |

37 |

|

| Operating lease liabilities - non-current |

Other liabilities |

|

$ |

174 |

|

|

$ |

166 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Supplemental cash flow information related to operating leases was as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended |

| (in millions) |

September 30, 2023 |

|

October 1, 2022 |

|

|

| Cash paid for operating lease liabilities |

$ |

27 |

|

|

$ |

25 |

|

|

|

| Non-cash activities: operating lease assets obtained in exchange for new operating lease liabilities |

$ |

37 |

|

|

$ |

84 |

|

|

|

Resideo Technologies, Inc.

Notes to Consolidated Financial Statements

(Unaudited)

Note 12. Long-Term Debt

Long-term debt is comprised of the following:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (in millions) |

September 30, 2023 |

|

December 31, 2022 |

|

|

|

|

4.000% Senior Notes due 2029 |

$ |

300 |

|

|

$ |

300 |

|

|

|

|

|

|

|

|

|

| Variable rate A&R Term B Facility |

1,123 |

|

|

1,131 |

|

|

|

|

|

| Gross debt |

1,423 |

|

|

1,431 |

|

| Less: current portion of long-term debt |

(12) |

|

|

(12) |

|

| Less: unamortized deferred financing costs |

(14) |

|

|

(15) |

|

| Total long-term debt |

$ |

1,397 |

|

|

$ |

1,404 |

|

A&R Senior Credit Facilities

On February 12, 2021, we entered into an Amendment and Restatement Agreement with JP Morgan Chase Bank N.A. as administrative agent (the “A&R Credit Agreement”). The A&R Credit Agreement provides for (i) an initial seven-year senior secured Term B loan facility in an aggregate principal amount of $950 million, which was later amended to add $200 million in additional term loans (the “A&R Term B Facility”) and (ii) a five-year senior secured revolving credit facility in an aggregate principal amount of $500 million (the “A&R Revolving Credit Facility” and, together with the A&R Term B Facility, the “A&R Senior Credit Facilities”).

The A&R Senior Credit Facilities contain customary LIBOR replacement language, including, but not limited to, the use of rates based on secured overnight financing rate (“SOFR”), which is a broad measure of the cost of borrowing cash overnight collateralized by U.S. Treasury securities in the repurchase agreement market and is administered by the Federal Reserve Bank of New York. On June 30, 2023, we modified the calculation of interest under the A&R Senior Credit Facilities from being calculated based on LIBOR to being calculated based on SOFR. Therefore, the A&R Senior Credit Facilities bears interest at a rate per annum of Term SOFR plus a credit spread adjustment of 10 basis points for the A&R Revolving Credit Facility and varying credit spread adjustments for the A&R Term B Facility, based on the tenor of each individual borrowing. No other material terms of the A&R Senior Credit Facilities were amended.

At September 30, 2023 and December 31, 2022, the weighted average interest rate for the A&R Term B Facility, excluding the effect of the interest rate swaps, was 7.69% and 6.78%, respectively, and there were no borrowings and no letters of credit issued under the A&R Revolving Credit Facility. As of September 30, 2023, we were in compliance with all covenants related to the A&R Senior Credit Facilities.

We entered into certain interest rate swap agreements in March 2021, which were amended in June 2023, to transition from a hedge of LIBOR-based cash flows to a hedge of SOFR-based cash flows. These interest rate swap agreements effectively convert a portion of our variable-rate debt to fixed rate debt. Refer to Note 13. Derivative Financial Instruments for further discussion.