MOVING INFRASTRUCTURE FORWARD | NOVEMBER 2025 INVESTOR PRESENTATION EXHIBIT 99.1

2 I MOVING INFRASTRUCTURE FORWARD I 2025 FORWARD LOOKING STATEMENTS Some statements in this release, which are not historical facts, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward- looking statements include statements about Arcosa’s estimates, expectations, beliefs, intentions or strategies for the future. Arcosa uses the words “anticipates,” “assumes,” “believes,” “estimates,” “expects,” “intends,” “forecasts,” “may,” “will,” “should,” “guidance,” “outlook,” “strategy,” “plans,” “goal,” and similar expressions to identify these forward-looking statements. Forward-looking statements speak only as of the date of this release, and Arcosa expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, except as required by federal securities laws. Forward-looking statements are based on management’s current views and assumptions and involve risks and uncertainties that could cause actual results to differ materially from historical experience or our present expectations, including but not limited to assumptions, risks and uncertainties regarding the failure to successfully complete or integrate acquisitions, including Ameron and Stavola, or divest any business, or failure to achieve the expected benefits of acquisitions or divestitures; market conditions and customer demand for Arcosa’s business products and services; the impact of Arcosa's level of indebtedness; the cyclical nature of, and seasonal or weather impact on, the industries in which Arcosa competes; competition and other competitive factors; governmental and regulatory factors; changing technologies; availability of growth opportunities; market recovery; ability to improve margins; the impact of inflation and costs of materials; the impact of inflation and costs of materials; impacts from the Inflation Reduction Act and One Big Beautiful Bill Act; the delivery or satisfaction of any backlog or firm orders; the impact of pandemics on Arcosa’s business; the impact of tariffs; and Arcosa’s ability to execute its long- term strategy, and such forward-looking statements are not guarantees of future performance. For further discussion of such risks and uncertainties, see “Risk Factors” and the “Forward-Looking Statements” section of “Management's Discussion and Analysis of Financial Condition and Results of Operations” in Arcosa's Form 10-K for the year ended December 31, 2024 and as may be revised and updated by Arcosa's Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. NON-GAAP FINANCIAL MEASURES This presentation contains financial measures that have not been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”). Reconciliations of non- GAAP financial measures to the closest GAAP measure are provided in the Appendix.

HOW TO FIND US OUR WEBSITE www.arcosa.com NYSE TICKER ACA HEADQUARTERS Arcosa, Inc. 500 North Akard Street, Suite 400 Dallas, TX 75201 INVESTOR CONTACT InvestorResources@arcosa.com 3 I MOVING INFRASTRUCTURE FORWARD I 2025

01 03 04 OVERVIEW FINANCIAL HIGHLIGHTS 02 OUTLOOK TABLE OF CONTENTS 4 I MOVING INFRASTRUCTURE FORWARD I 2025 STRATEGIC TRANSFORMATION

OVERVIEW 01

ARCOSA’S VALUE PROPOSITION FOCUSED on margin expansion and cash flow generation EXPERIENCED management team with history of managing through economic cycles LEADING businesses serving critical infrastructure markets TRACK RECORD of executing on strategic priorities DISCIPLINED CAPITAL allocation process to grow in attractive markets and improve returns on capital 6 I MOVING INFRASTRUCTURE FORWARD I 2025

ARCOSA AT A GLANCE Revenues, Adjusted Net Income, and Adjusted EBITDA are for the twelve months ended 09/30/2025. See Adjusted Net Income and Adjusted EBITDA reconciliations in Appendix. Headcount is as of 12/31/2024. Adjusted Net Income Adjusted EBITDA Infrastructure-related Segments Employees Years of Operating History OUR THREE BUSINESS SEGMENTS Revenues$2.8B $186M $567M ~6,250 85+ 3 7 I MOVING INFRASTRUCTURE FORWARD I 2025

BUSINESS OVERVIEW ENGINEERED STRUCTURES TRANSPORTATION PRODUCTSCONSTRUCTION PRODUCTS Revenues and Adjusted Segment EBITDA and Margin for twelve months ended 9/30/2025. See Adjusted Segment EBITDA reconciliation in Appendix. NATURAL & RECYCLED AGGREGATES SPECIALTY MATERIALS & ASPHALT CONSTRUCTION SITE SUPPORT WIND TOWERS UTILITY STRUCTURES INLAND BARGES Arcosa’s three segments are made up of leading businesses that serve critical infrastructure markets REVENUES ADJ. SEGMENT EBITDA & MARGIN $1,317M $1,150M $366M $353M 27% $209M 18% $64M 18% REVENUES ADJ. SEGMENT EBITDA & MARGIN REVENUES ADJ. SEGMENT EBITDA & MARGIN MARINE COMPONENTS 8 I MOVING INFRASTRUCTURE FORWARD I 2025 TRAFFIC, LIGHTING & TELECOM STRUCTURES

STRATEGIC TRANSFORMATION 02

10 I MOVING INFRASTRUCTURE FORWARD I 2025 ARCOSA’S LONG-TERM VISION Reduce the complexity and cyclicality of the overall business Integrate sustainability initiatives into our long-term strategy Improve long-term returns on invested capital Grow in attractive markets where we can achieve sustainable competitive advantages Maintain a healthy balance sheet through prudent deleveraging

Construction Products 33% Engineered Structures 38% Transportation Products 29% We have made significant progress advancing our long-term vision 11 I MOVING INFRASTRUCTURE FORWARD I 2025 % Adjusted EBITDA, excluding corporate costs LTM Q3 20252018 Construction Products 56% Engineered Structures 34% Transportation. Products 10% Acquisitions Construction Products Engineered Structures Divestitures STEEL COMPONENTSTANK $219M $627M STRATEGIC TRANSFORMATION

~$2.7 billion of investment in Construction Products acquisitions as we seek to expand our growth platforms 12 I MOVING INFRASTRUCTURE FORWARD I 2025 ONGOING INVESTMENT IN OUR CONSTRUCTION PRODUCTS PLATFORM Q4 2024Q2 2022Q3 2021Q2 2021Q3 2020Q1 2020Q4 2018KEY ACQUISITIONS Natural Aggregates Recycled Aggregates FOB Asphalt Recycled AggregatesNatural AggregatesNatural AggregatesRecycled Aggregates Natural Aggregates Recycled Aggregates Natural Aggregates Specialty Materials Natural AggregatesPRODUCT LINE Expand exposure to northeast region Adding scaled and vertically aggregates and asphalt operations Entry into Southern California market Scaled entry into Phoenix Entry into attractive new geographies (TN, KY, and PA) Expanded presence in TX and along the Gulf Expanded presence in DFW Increased exposure to recycled aggregates Expanded presence in Houston Entry into recycled aggregates Added complementary scaled platform Diversified customer based and end-markets STRATEGIC FIT 5 active mines 3 recycled aggregates facilities 12 asphalt plants 4 crushing locations6 active mines14 active mines 5 crushing locations 1 active mines 12 locations 24 active mines 5 production facilitesLOCATION COUNT $1,200M$75M$150M$375M$87M$298M$315MPURCHASE PRICE 10.7X(1)7.8X10.7X12.9X(1)8.5X8.1X9.8XPURCHASE MULTIPLE Attractive fundamentals of Aggregates and Specialty Materials ● Attractive markets with long-term pricing and volume growth; less cyclical than other Arcosa businesses ● Sustainable competitive advantages, through reserve positions, permits, product portfolio, proprietary processing capabilities, and deep market knowledge ● Fragmented industry structure with ability to buy small to medium size assets at attractive multiples ● Ability to use acquisitions as growth platforms for future organic and bolt-on opportunities (1) Multiple shown net of estimated tax benefits

Enhances Arcosa’s overall profitability and financial profile Extends footprint into the nation’s largest MSA with a scaled and vertically integrated aggregates and FOB asphalt operation FY 2024: COMPLETED THE ACQUISITION OF STAVOLA (OCTOBER 1) AND SALE OF STEEL COMPONENTS (AUGUST 16) 13 I MOVING INFRASTRUCTURE FORWARD I 2025 1 Represents attractive valuation for a scaled aggregates-led business with premium financial attributes2 Increases Arcosa’s exposure to higher margin Construction Products Adjusted EBITDA3 Reduces the complexity and cyclicality of the portfolio 4 5 STEEL COMPONENTS Portfolio resilience supports our ability to maintain a healthy balance sheet through prudent deleveraging6

$1.2B ACQUISTION OF STAVOLA, A LEADING PROVIDER OF CONSTRUCTION MATERIALS OPERATING IN THE NORTHEAST BY THE NUMBERS COMPANY HIGHLIGHTS Operates third largest quarry in production in the region, allowing it to serve both external customers and internal asphalt demand Founded in 1948 with over 75 years of industry experience Footprint well located to service ~85% of NJ’s population with opportunities to grow across the broader MSA Strong positions in its core NJ – NY area market, the largest MSA in the U.S. Aggregates Asphalt Other ADJUSTED EBITDA 14 I MOVING INFRASTRUCTURE FORWARD I 2025 Business Breakdown 31% 59% 10% $283M ~$100M LTM Adj. EBITDA ~35% Adj. EBITDA Margin ~5.7M Tons of Annual Aggregates Sales ~2.6M Tons of Annual Asphalt Sales 5 Hard Rock Quarries 12 Asphalt Plants 3 Recycled Aggregates Facilities ~350M Tons of Estimated Aggregates Reserves Note: Amounts for Stavola are LTM 6/30/24; Other revenue generated primarily from mill and fill paving operation and other services, including earthwork, excavating and utility installation 56% 44% $100M REVENUE

15 I MOVING INFRASTRUCTURE FORWARD I 2025 STAVOLA EXPANDS AND DIVERSIFIES CONSTRUCTION PRODUCTS’ GEOGRAPHIC FOOTPRINT Our Aggregates Business Now Serves 13 of the 50 Largest MSAs Natural Aggregates Recycled Aggregates Asphalt Stavola Locations Incremental Presence from Stavola Construction Products Segment Existing Natural & Recycled Aggregates presence * * * * * Multiple locations

STAVOLA EXTENDS ARCOSA’S FOOTPRINT INTO THE NATION’S LARGEST MSA 16 I MOVING INFRASTRUCTURE FORWARD I 2025 Infrastructure 75–85% Residential 10–20% Non-residential 5–15% Aggregates Demand Asphalt Demand Infrastructure 80–90% Residential 5–10% Non-residential 5–10% Stavola’s Core Markets Are Over-Indexed to Infrastructure Demand 29M Tons ~80 – 90% of asphalt demand in Stavola’s core market is from maintenance projects, providing stability and low volatility 9M Tons Source: Third party research, USGS

Construction Products Pro Forma for Stavola1 Legacy Construction Products1 LTM REVENUE LTM ADJUSTED EBITDA LTM ADJ. EBITDA MARGIN STAVOLA ENHANCES SCALE AND MARGIN PROFILE OF OUR CONSTRUCTION PRODUCTS PORTFOLIO 17 I MOVING INFRASTRUCTURE FORWARD I 2025 Aggregates4 ~56% Asphalt ~14% Other2 ~12% % Revenue Pro Forma1 Portfolio Mix See Adjusted Segment EBITDA and Stavola Adjusted EBITDA reconciliation tables in the Appendix 1Reflects LTM 9/30/25 results 55% 35% 10% Construction Site Support Specialty Materials and Asphalt Aggregates 100% $M’s $M’s 1,019 1,317 248 353 24.3% 26.8% +$298 +$105 +250bps

OUTLOOK 03

We remain on track for double-digit growth in 2025 (1)Margin excludes the Steel Components business, which was divested on August 16, 2024 and included in continuing operations until the date of sale. Full year 2025 guidance ranges are inclusive of direct tariff impacts, as currently outlined, which are expected to be immaterial. See Adjusted EBITDA reconciliation in Appendix INCREASED MID-POINT OF 2025 ADJUSTED EBITDA GUIDANCE 439 8 FY-24 Previous 2025 Guidance 2025 Guidance 447 555 - 585 575 - 585 +32% +30% Adjusted EBITDA ($M) 19 I MOVING INFRASTRUCTURE FORWARD I 2025 MARGIN(1) 17.7% 2,482 88 FY-24 Previous 2025 Guidance 2025 Guidance 2,570 2,850 – 2,950 2,860 – 2,910 +16% +12% Revenues ($M) Steel Components 20.1% Steel Components

MARKET OUTLOOK CONSTRUCTION PRODUCTS ENGINEERED STRUCTURES TRANSPORTATION PRODUCTS 20 I MOVING INFRASTRUCTURE FORWARD I 2025 • On track for HSD aggregates pricing growth for 2025 • Infrastructure spending supported by federal funding from IIJA and healthy state DOT budgets • $350B of IIJA funds for highways and bridges through 2026 –~40% has been spent(1) • Timing of interest rate reductions and macro uncertainty are slowing recovery in residential and commercial end-markets • Record backlog for utility and related structures, driven by grid-hardening, replacing aging infrastructure, and connecting renewables to the grid • Additional demand catalysts from expansion of data centers and rise in electricity consumption • The direct impact of tariffs, as currently outlined, are expected to be immaterial to 2025 financial results • New orders of $117M provide improved backlog visibility for wind towers in 2026 and 2027 • Orders of $148M received in the third quarter • Total backlog of $326M • Both tank and hopper barge orders extend well into 2026 • Aging fleet and underinvestment in replacement support positive outlook for new barge construction • ~40% of the hopper fleet and ~30% of tank fleet are more than 20 years old(2) (1) ARTBA, August 2025; (2) The Waterways Journal: Mississippi River System Barge Fleet Survey 2023

CONSTRUCTION PRODUCTS MARKET OUTLOOK 21 I MOVING INFRASTRUCTURE FORWARD I 2025 Source: USGS – National Minerals Information Center Aggregates industry has positive fundamentals and beneficial pricing dynamics Texas is an important market for aggregatesAggregates pricing is consistently positive ■ Industry reported significant pricing strength over last few years despite declines in volume ■ Arcosa aggregates experienced low double-digit pricing growth in 2024 ■ We expect high-single-digit pricing growth in 2025 Top 15 States by Aggregate Volume ■ Texas consumed over 10% of total industry aggregates volume since 2008 ■ Construction spending outlook for Texas is favorable with 2026 fiscal year planned DOT lettings of $11B. Ten-Year outlook is $102B ■ Volumes from the top 15 states have been around 60% of total volume for the last 20 years ■ Arcosa is currently exposed to 9 of the top 15 states Denotes Arcosa presence Denotes Stavola presence % of share 0 2 4 6 8 10 12 14 16 0 500 1,000 1,500 2,000 2,500 3,000 3,500 Mm of tons $ per ton 1971 1975 1979 1983 1987 1991 1995 1999 2003 2007 2011 2015 2019 2023 Aggregate Volume Price Per Ton ($/ton) Texas California Missouri Florida Ohio Pennsylvania Michigan Alabama Indiana Virginia North Carolina Georgia New York Illinois Arizona 2004 2006 2008 2010 2012 2014 2016 2018 2020 2022 2024

ENGINEERED STRUCTURES MARKET OUTLOOK 22 I MOVING INFRASTRUCTURE FORWARD I 2025 (1) Power Insights (2025); (2) U.S. Energy Information Administration, Annual Energy Outlook 2023 (AEO2023) The outlook for utility transmission and wind towers remains positive with the anticipated increase in load growth over the next several years requiring new investment in power generation and electrical transmission infrastructure U.S. Net Electricity Generation by Fuel (Billion kWh)(2) Total U.S. and Canada Electric Transmission: Reported CAPEX ($B) North American Electric Transmission Capital Spend($’s Millions)(1) Total U.S. and Canada Electric Transmission: Reported CAPEX ($B) 0 15 30 45 60 75 90 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 Actual Forecast U.S. Net Electricity Generation by Fuel (Billion kWh)(2) 0 1,000 2,000 3,000 4,000 5,000 6,000 2000 2010 2020 2030 2040 2050 other nuclear coal natural gas wind solar historical projections “All of the above” approach to power generation required to meet expected load growth demands

Total U.S. and Canada Electric Transmission: Reported CAPEX ($B) TRANSPORTATION PRODUCTS MARKET OUTLOOK 23 I MOVING INFRASTRUCTURE FORWARD I 2025 (1) The Waterways Journal: Mississippi River System Barge Fleet Survey, 2024 Positive outlook as fleet replacement needs sustain market recovery for barge business Roughly 40% of the hopper fleet and 30% of the tank fleet is more than 20 years old Total U.S. and Canada Electric Transmission: Reported CAPEX ($B) Fleet age is increasing due to underinvestment since 2016 17.1 17.8 2022 2023 +4% Average Age of Hopper Fleet(1) (in Years) 15.4 17.7 2022 2023 +15% Average Age of Tank Fleet (1) (in Years) 0% 5% 10% 15% 20% 25% 30% 0-5 6-10 11-15 16-20 21-25 >25 Hopper Tank Fleet Age Distribution Based on Year Built (1) (%) Age in Years

FINANCIAL HIGHLIGHTS 04

STRONG TRACK RECORD OF GROWTH AND MARGIN EXPANSION WHILE TRANSFORMING PORTFOLIO (1) Margin excludes the gain on land sale in 2023. See Adjusted EBITDA and Adjusted Segment EBITDA reconciliations in Appendix. 25 I MOVING INFRASTRUCTURE FORWARD I 2025 73 92 138 180 199 223 282 353 82 129 116 125 149 159 209 64 64 78 116 64 64 -32 -44 -48 -46 -50 62 -58 -60-55 FY 2018 2019 2020 24 2021 2022 22 2023 2024 LTM 3Q 2025 187 241 284 283 325 368 447 567 27 17% ADJUSTED EBITDA ($M) Transportation Products Engineered Structures Gain on land sale Construction Products Corporate MARGIN 12.8% 17.4%13.9% 14.7% 13.9% 14.5% 15.1%(1) 20.0%

Q3 2025 CONSOLIDATED RESULTS (1)Margin excludes the Steel Components business, which was divested on August 16, 2024 and included in continuing operations until the date of sale. See Adjusted Net Income and Adjusted EBITDA reconciliations in Appendix. REVENUES ($M) ADJUSTED EBITDA ($M) 26 I MOVING INFRASTRUCTURE FORWARD I 2025 MARGIN(1) 18.4% 21.8% REPORTED ADJUSTED NET INCOME ($M) 16.6 73.0 Q3-24 Q3-25 +340% 44.6 77.3 Q3-24 Q3-25 +73% 626.8 797.8 13.6 Q3-24 Q3-25 640.4 +27% +25% Steel Components 115.3 174.2 -1.3 Q3-24 Q3-25 114.0 +51% +53% Steel Components Record Q3 performance underscores the success of our strategic portfolio transformation

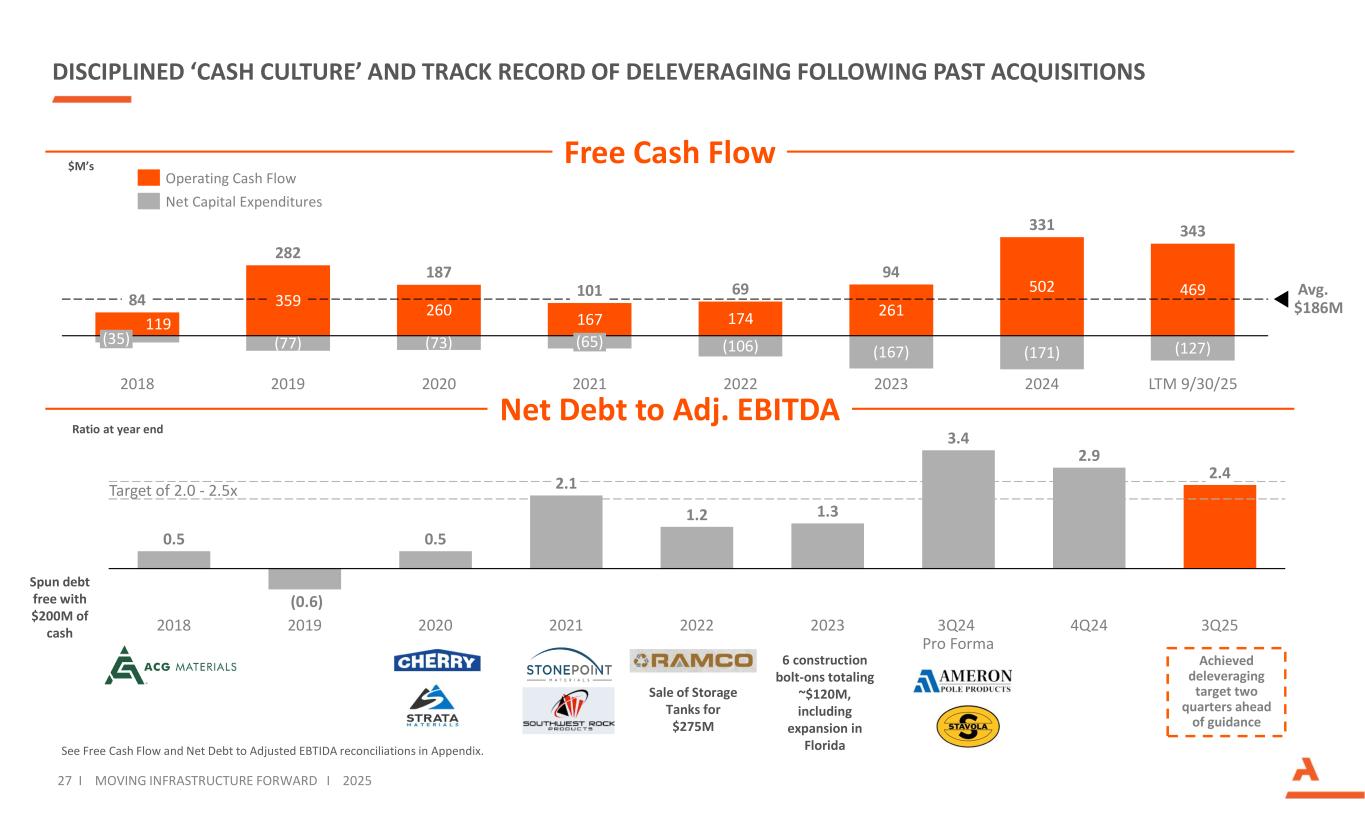

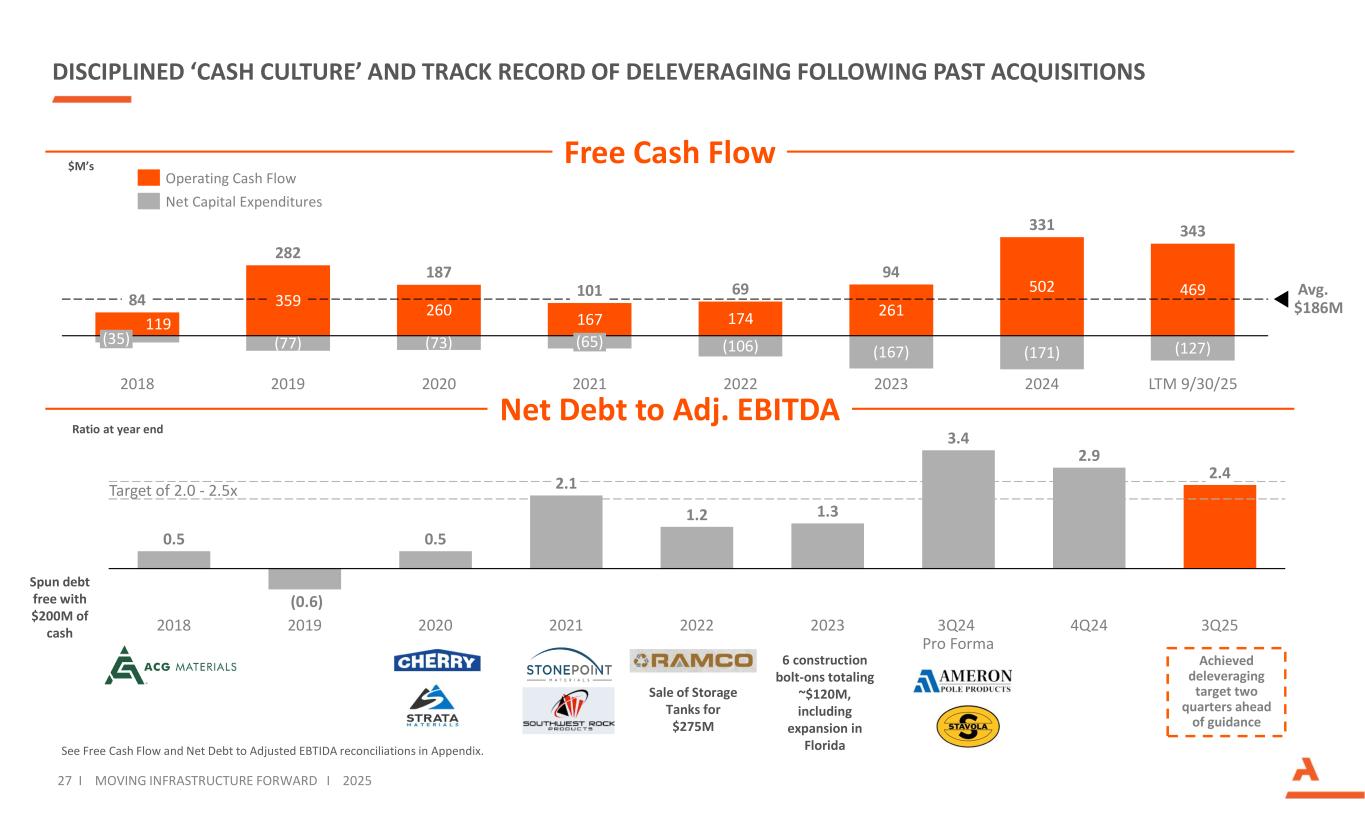

27 I MOVING INFRASTRUCTURE FORWARD I 2025 $M’s Ratio at year end Spun debt free with $200M of cash Sale of Storage Tanks for $275M 6 construction bolt-ons totaling ~$120M, including expansion in Florida DISCIPLINED ‘CASH CULTURE’ AND TRACK RECORD OF DELEVERAGING FOLLOWING PAST ACQUISITIONS Free Cash Flow Net Debt to Adj. EBITDA See Free Cash Flow and Net Debt to Adjusted EBTIDA reconciliations in Appendix. 119 359 260 167 174 261 502 469 (77) (73) (106) (167) (171) (127)(35) 2018 2019 2020 (65) 2021 2022 2023 2024 LTM 9/30/25 Avg. $186M84 282 187 101 69 94 331 343 Operating Cash Flow Net Capital Expenditures 0.5 (0.6) 0.5 2.1 1.2 1.3 3.4 2.9 2.4 2018 2019 2020 2021 2022 2023 3Q24 Pro Forma 4Q24 3Q25 Target of 2.0 - 2.5x Achieved deleveraging target two quarters ahead of guidance

APPENDIX

GUIDANCE SUMMARY FOR 2025 ADJUSTED EBITDA COMMENTARY CAPITAL EXPENDITURES OTHER • $575M to $585M range for full year 2025, previously $555M to $585M • 2024 full year Adjusted EBITDA was $439M, excluding $8M from the divested Steel Components business • Full year 2025 capex of $145M to $155M TAX RATE • Full year 2025 depreciation, depletion, and amortization expense of $224M to $226M • Full year 2025 corporate costs of ~$60M • Guidance includes direct impacts of tariffs, as currently outlined, which are expected to be immaterial • Full year 2025 effective tax rate of ~17-18%, previously 18-19% REVENUE • $2.86B to $2.91B range for full year 2025, previously $2.85B to $2.95B • 2024 full year revenue was $2.48B, excluding $88M from the divested Steel Components business 29 I MOVING INFRASTRUCTURE FORWARD I 2025

NON-GAAP MEASURES Refer to slides that follow for accompanying reconciliations “EBITDA” is defined as net income plus interest, taxes, depreciation, depletion, and amortization. “Adjusted EBITDA” is defined as EBITDA adjusted for certain items that are not reflective of the normal earnings of our business. GAAP does not define EBITDA or Adjusted EBITDA and they should not be considered as alternatives to earnings measures defined by GAAP, including net income. We use Adjusted EBITDA to assess the operating performance of our consolidated business, as a metric for incentive-based compensation, as a measure within our lending arrangements, and as a basis for strategic planning and forecasting as we believe that it closely correlates to long-term shareholder value. As a widely used metric by analysts, investors, and competitors in our industry, we believe Adjusted EBITDA also assists investors in comparing a company's performance on a consistent basis without regard to depreciation, depletion, amortization, and other items which can vary significantly depending on many factors. “Adjusted EBITDA Margin” is defined as Adjusted EBITDA divided by Revenues. GAAP does not define “Adjusted Net Income” and it should not be considered as an alternative to earnings measures defined by GAAP, including net income. We use this metric to assess the operating performance of our consolidated business. We adjust net income for certain items that are not reflective of the normal operations of our business to provide investors with what we believe is a more consistent comparison of earnings performance from period to period. “Segment EBITDA” is defined as segment operating profit plus depreciation, depletion, and amortization. “Adjusted Segment EBITDA” is defined as Segment EBITDA adjusted for certain items that are not reflective of the normal earnings of our business. GAAP does not define Segment EBITDA or Adjusted Segment EBITDA and they should not be considered as alternatives to earnings measures defined by GAAP, including segment operating profit. We use Adjusted Segment EBITDA to assess the operating performance of our businesses, as a metric for incentive-based compensation, and as a basis for strategic planning and forecasting as we believe that it closely correlates to long-term shareholder value. As a widely used metric by analysts, investors, and competitors in our industry we believe Adjusted Segment EBITDA also assists investors in comparing a company's performance on a consistent basis without regard to depreciation, depletion, amortization, and other items, which can vary significantly depending on many factors. “Adjusted Segment EBITDA Margin” is defined as Adjusted Segment EBITDA divided by Revenues. “Aggregates Freight-Adjusted Revenues” is defined as aggregates revenues less freight and delivery, which are pass-through activities, and other revenues, which are largely service related. We use this metric to calculate “Aggregates Freight-Adjusted Average Sales Price”, which is Aggregates Freight-Adjusted Revenues divided by shipments. “Aggregates Adjusted Cash Gross Profit” is defined as aggregates gross profit plus depreciation, depletion, and amortization and adjusted for certain items that are not reflective of the normal earnings of our business. “Aggregates Adjusted Cash Gross Profit Per Ton” is Aggregates Adjusted Cash Gross Profit divided by shipments. GAAP does not define these metrics and they should not be considered as alternatives to earnings measures defined by GAAP, including aggregates revenues and aggregates gross profit. We believe that this presentation is consistent with our competitors. These metrics are used by analysts and investors in comparing a company's performance on a consistent basis. GAAP does not define “Net Debt” and it should not be considered as an alternative to cash flow or liquidity measures defined by GAAP. The Company uses Net Debt, which it defines as total debt minus cash and cash equivalents to determine the extent to which the Company’s outstanding debt obligations would be satisfied by its cash and cash equivalents on hand. The Company also uses “Net Debt to Adjusted EBITDA”, which it defines as Net Debt divided by Adjusted EBITDA for the trailing twelve months as a metric of its current leverage position. We present this metric for the convenience of investors who use such metrics in their analysis and for shareholders who need to understand the metrics we use to assess performance and monitor our cash and liquidity positions. GAAP does not define “Free Cash Flow” and it should not be considered as an alternative to cash flow measures defined by GAAP, including cash flow from operating activities. We define Free Cash Flow as cash provided by operating activities less capital expenditures net of the proceeds from the disposition of property, plant, equipment, and other assets. We use this metric to assess the liquidity of our consolidated business. We present this metric for the convenience of investors who use such metrics in their analysis and for shareholders who need to understand the metrics we use to assess performance and monitor our cash and liquidity positions. 30 I MOVING INFRASTRUCTURE FORWARD I 2025

Reconciliation of Adjusted EBITDA and Adjusted Net Income 31 Moving Infrastructure Forward (1) Includes the impact of the fair value markup of acquired long-lived assets. (2) Expenses associated with acquisitions and divestitures, including the cost impact of the fair value markup of acquired inventory, advisory and professional fees, integration, separation, and other transaction costs. ($’s in millions) (unaudited) I MOVING INFRASTRUCTURE FORWARD I 2025 Full Year 2025 Guidance Twelve Months Ended September 30, Three Months Ended September 30, HighLow202520242025 $ 203.9$ 201.4$ 148.6$ 16.6$ 73.0Net income Add: 103.0101.0113.112.025.3Interest expense, net 44.841.347.92.514.1Provision for income taxes 226.0224.0226.345.256.2Depreciation, depletion, and amortization expense(1) 577.7567.7535.976.3168.6EBITDA Add (less): 6.16.14.723.03.6Loss on sale of businesses 1.41.427.512.00.1Impact of acquisition and divestiture-related expenses(2) 2.02.02.0—2.0Impairment charge (2.2)(2.2)(3.5)2.7(0.1)Other, net (income) expense $ 585.0$ 575.0$ 566.6$ 114.0$ 174.2Adjusted EBITDA 20.1 %20.1 %20.0 %17.8 %21.8 %Adjusted EBITDA Margin Twelve Months Ended September 30, Three Months Ended September 30, 202520242025 $ 148.6$ 16.6$ 73.0Net income 3.517.72.7Loss on sale of businesses, net of tax 32.610.30.1Impact of acquisition and divestiture-related expenses, net of tax(2) 1.4—1.5Impairment charge, net of tax $ 186.1$ 44.6$ 77.3Adjusted Net Income

32 Moving Infrastructure ForwardI MOVING INFRASTRUCTURE FORWARD I 2025 Reconciliation of Adjusted Segment EBITDA (1) Includes the impact of the fair value markup of acquired long-lived assets. (2) Expenses associated with acquisitions and divestitures, including the cost impact of the fair value markup of acquired inventory, advisory and professional fees, integration, separation, and other transaction costs. ($’s in millions) (unaudited) Twelve Months Ended December 31,Twelve Months Ended September 30, 20182019202020212022202320242025 Construction Products $ 50.4$ 52.7$ 74.7$ 83.2$ 96.5$ 138.6$ 133.9$ 173.6Operating Profit 21.938.060.188.7102.7111.7134.7167.2Add: Depreciation, depletion, and amortization expense(1) 72.390.7134.8171.9199.2250.3268.6340.8Segment EBITDA 0.81.42.97.6——12.210.5Add: Impact of acquisition and divestiture-related expenses(2) ——0.8———5.82.0Add: Impairment charge ——————(5.0)—Less: Gain on sale of businesses —————(5.0)——Less: Benefit from reduction in holdback obligation $ 73.1$ 92.1$ 138.5$ 179.5$ 199.2$ 245.3$ 281.6$ 353.3Adjusted Segment EBITDA 25.0 %20.9 %23.3 %22.5 %21.6 %24.5 %25.5 %26.3 %Adjusted Segment EBITDA Margin Engineered Structures $ 28.6$ 100.7$ 80.2$ 88.0$ 307.0$ 95.7$ 126.4$ 159.1Operating Profit 29.727.931.533.130.526.645.450.1Add: Depreciation and amortization expense(1) 58.3128.6111.7121.1337.5122.3171.8209.2Segment EBITDA ——2.81.00.6—1.6—Add: Impact of acquisition and divestiture-related expenses(2) 23.2—1.32.9————Add: Impairment charge ————(189.0)(6.4)(14.5)—Less: Gain on sale of businesses $ 81.5$ 128.6$ 115.8$ 125.0$ 149.1$ 115.9$ 158.9$ 209.2Adjusted Segment EBITDA 10.4 %15.4 %13.2 %13.4 %14.9 %13.3 %15.2 %18.2 %Adjusted Segment EBITDA Margin Transportation Products $ 48.4$ 46.8$ 54.6$ 6.4$ 11.5$ 45.8$ 30.2$ 52.0Operating Profit 15.516.318.017.815.816.012.67.4Add: Depreciation and amortization expense(1) 63.963.172.624.227.361.842.859.4Segment EBITDA —0.6——————Add: Impact of acquisition and divestiture-related expenses(2) ——5.0—————Add: Impairment charge ——————21.64.7Add: Loss on sale of business $ 63.9$ 63.7$ 77.6$ 24.2$ 27.3$ 61.8$ 64.4$ 64.1Adjusted Segment EBITDA 16.3 %13.7 %16.6 %7.9 %8.6 %14.3 %15.4 %17.5 %Adjusted Segment EBITDA Margin $ (32.5)$ (47.3)$ (57.7)$ (70.3)$ (66.0)$ (62.8)$ (92.9)$ (78.6)Operating Loss - Corporate ——4.611.510.42.232.717.0Add: Impact of acquisition and divestiture-related expenses - Corporate(2) ———8.7————Add: Legal settlement 0.53.64.94.75.15.22.31.6Add: Corporate depreciation expense $ 186.5$ 240.7$ 283.7$ 283.3$ 325.1$ 367.6$ 447.0$ 566.6Adjusted EBITDA

33 Moving Infrastructure ForwardI MOVING INFRASTRUCTURE FORWARD I 2025 Reconciliation of Net Debt to Adjusted EBITDA and Free Cash Flow ($’s in millions) (unaudited) (1) These periods include pro forma adjustments for acquisitions completed during the period, as previously disclosed. As of September 30, 2025 December 31, 2024(1) September 30, 2024 Pro Forma(1) December 31, 2023 December 31, 2022(1) December 31, 2021(1) December 31, 2020(1) December 31, 2019 December 31, 2018 $ 1,599.4$ 1,707.1$ 1,848.7$ 573.1$ 555.9$ 685.7$ 254.5$ 107.3$ 185.5Total debt excluding debt issuance costs 220.0187.3129.1104.8160.472.995.8240.499.4Cash and cash equivalents $ 1,379.4$ 1,519.8$ 1,719.6$ 468.3$ 395.5$ 612.8$ 158.7$ (133.1)$ 86.1Net Debt $ 566.6$ 515.2$ 500.1$ 367.6$ 329.1$ 298.4$ 291.4$ 240.7$ 186.5Adjusted EBITDA (trailing twelve months) 2.42.93.41.31.22.10.5-0.60.5Net Debt to Adjusted EBITDA Twelve Months Ended September 30, Year Ended December 31, 20252024202320222021202020192018 $ 469.3$ 502.0$ 261.0$ 174.3$ 166.5$ 259.9$ 358.8$ 118.5Cash Provided by Operating Activities (154.7)(189.7)(203.5)(138.0)(85.1)(82.1)(85.4)(44.8)Capital expenditures 28.118.336.632.220.09.68.910.2Proceeds from disposition of assets (126.6)(171.4)(166.9)(105.8)(65.1)(72.5)(76.5)(34.6)Net Capital Expenditures $ 342.7$ 330.6$ 94.1$ 68.5$ 101.4$ 187.4$ 282.3$ 83.9Free Cash Flow

34 Moving Infrastructure ForwardI MOVING INFRASTRUCTURE FORWARD I 2025 Reconciliation of Stavola and Steel Components Adjusted EBITDA (in millions) (unaudited) Twelve Months Ended December 30, Three Months Ended September 30, 20242024 Steel components: $ (19.5)$ (25.4)Operating Loss 5.91.1Add: Depreciation and amortization expense (13.6)(24.3)Steel components EBITDA 21.623.0Loss on sale of business $ 8.0$ (1.3)Steel components Adjusted EBITDA Twelve Months Ended September 30, 2025 Stavola: $ 48.7Operating Profit 45.6Add: Depreciation and amortization expense 94.3Stavola EBITDA 10.5Impact of acquisition and divestiture-related expenses(1) $ 104.8Stavola Adjusted EBITDA (1) Expenses associated with acquisitions and divestitures, including the cost impact of the fair value markup of acquired inventory, advisory and professional fees, integration, separation, and other transaction costs.

500 N. Akard Street, Suite 400 Dallas, Texas 75201 (972) 942-6500 ir.arcosa.com