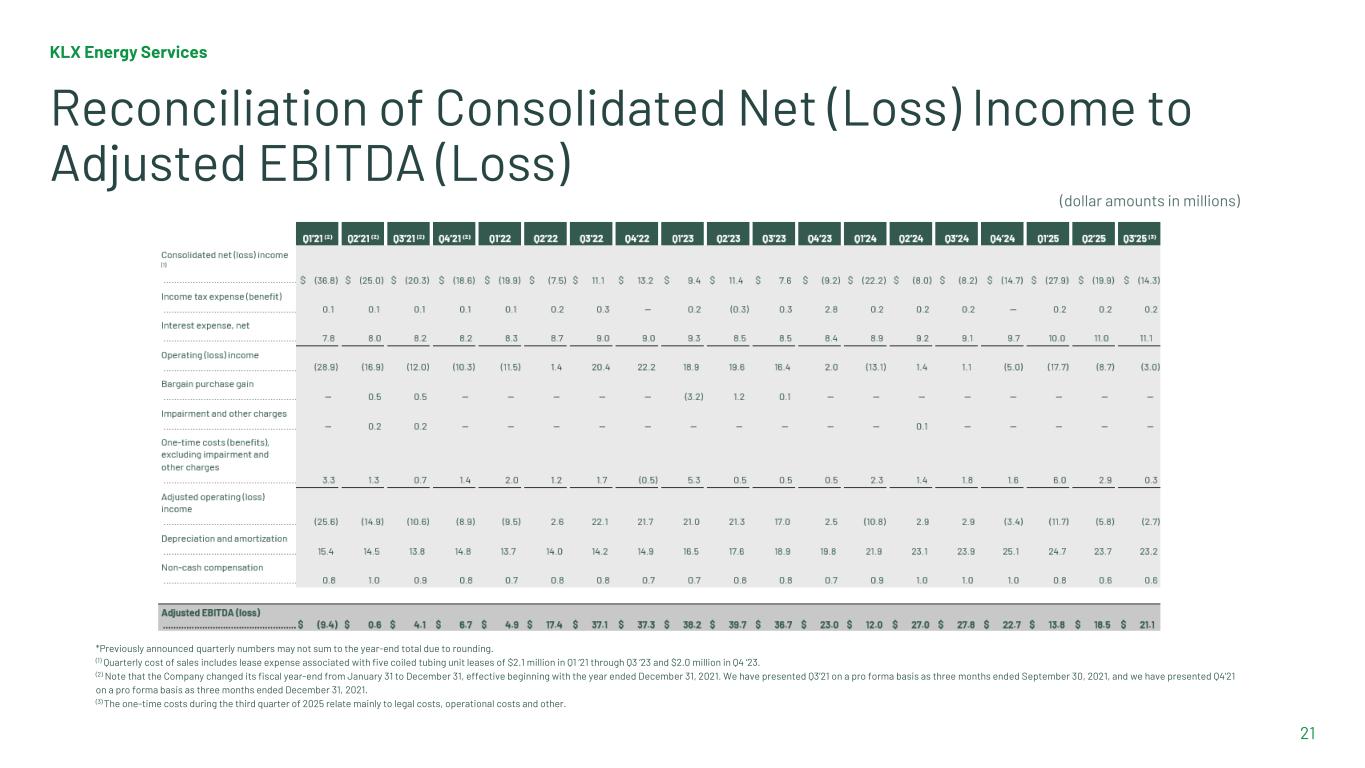

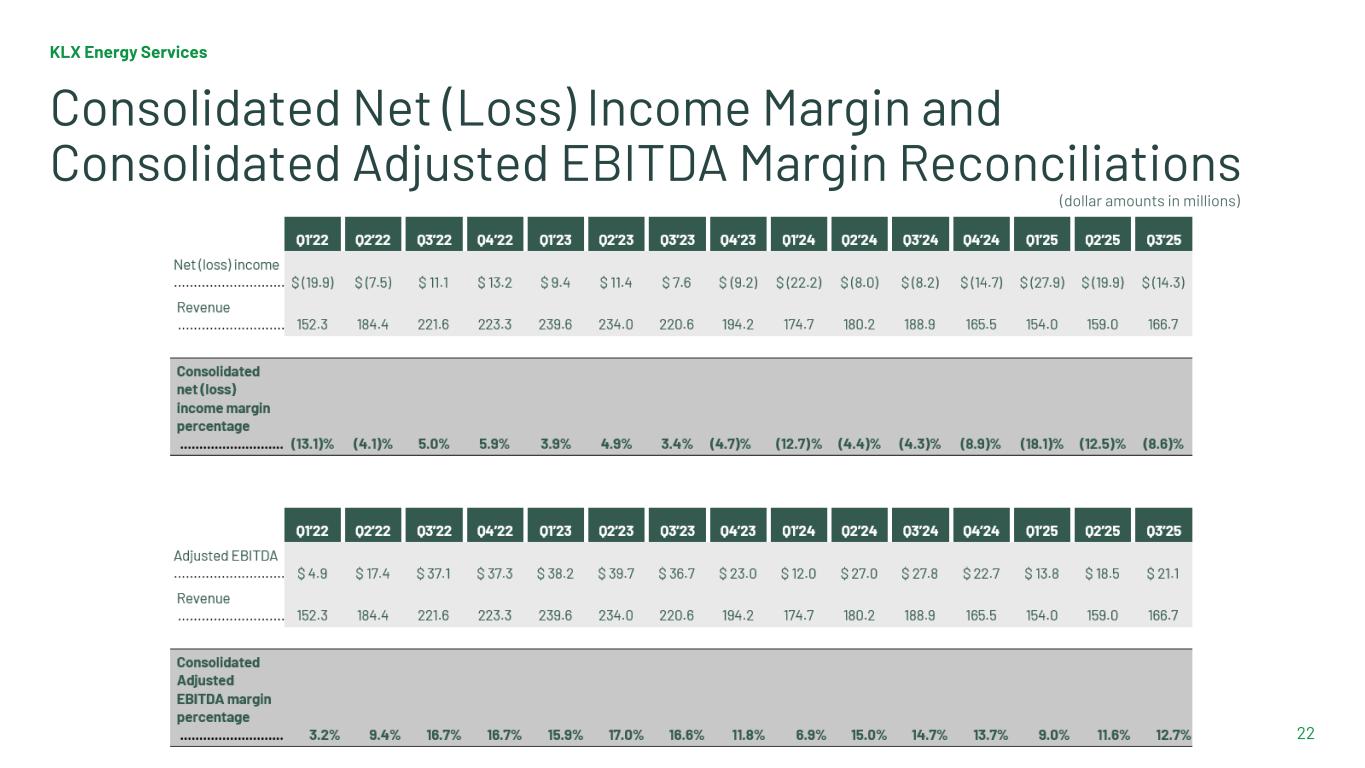

Forward-Looking Statements Cautionary Statement on Forward-looking Statements This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act. This presentation includes forward-looking statements that reflect our current expectations, projections and goals relating to our future results, performance and prospects. Forward-looking statements include all statements that are not historical in nature and are not current facts. When used in this presentation, the words “believe,” “expect,” “plan,” “intend,” “anticipate,” “estimate,” “predict,” “potential,” “continue,” “may,” “might,” “should,” “could,” “will” or the negative of these terms or similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on our current expectations and assumptions about future events and are based on currently available information as to the outcome and timing of future events with respect to, among other things: our operating cash flows; the availability of capital and our liquidity; our ability to renew and refinance our debt; our future revenue, income and operating performance; our ability to sustain and improve our utilization, revenue and margins; our ability to maintain acceptable pricing for our services; future capital expenditures; our ability to finance equipment, working capital and capital expenditures; our ability to execute our long-term growth strategy and to integrate our acquisitions; our ability to successfully develop our research and technology capabilities and implement technological developments and enhancements; and the timing and success of strategic initiatives and special projects. The Company’s actual experience and results may differ materially from the experience and results anticipated in such statements. Forward-looking statements are not assurances of future performance and actual results could differ materially from our historical experience and our present expectations or projections. Although we believe the expectations and assumptions reflected in these forward-looking statements are reasonable as and when made, no assurance can be given that these assumptions are accurate or that any of these expectations will be achieved (in full or at all). Our forward-looking statements involve significant risks, contingencies and uncertainties, most of which are difficult to predict and many of which are beyond our control. Known material factors that could cause actual results to differ materially from those in the forward-looking statements include, but are not limited to, risks associated with the following: a decline in demand for our services, declining commodity prices, overcapacity and other competitive factors affecting our industry; the cyclical nature and volatility of the oil and gas industry, which impacts the level of exploration, production and development activity and spending patterns by oil and natural gas exploration and production companies; a decline in, or substantial volatility of, crude oil and gas commodity prices, which generally leads to decreased spending by our customers and negatively impacts drilling, completion and production activity; inflation; increases in interest rates; the ongoing conflict in Ukraine and its continuing effects on global trade; the on-going conflict in Israel; supply chain issues; and other risks and uncertainties listed in our filings with the U.S. Securities and Exchange Commission, including our Current Reports on Form 8-K that we file from time to time, Quarterly Reports on Form 10-Q and Annual Report on Form 10-K. Readers are cautioned not to place undue reliance on forward- looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update or revise any forward-looking statements after the date they are made, whether as a result of new information, future events or otherwise, except as required by law. Disclaimer on Non-GAAP Financial Measures This presentation includes Adjusted EBITDA, Adjusted EBITDA margin, levered free cash flow, unlevered free cash flow and net debt measures. Each of the metrics are “non-GAAP financial measures” as defined in Regulation G of the Securities Exchange Act of 1934. Adjusted EBITDA is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. Adjusted EBITDA is not a measure of net earnings or cash flows as determined by GAAP. We define Adjusted EBITDA as net earnings (loss) before interest, taxes, depreciation and amortization, further adjusted for (i) goodwill and/or long-lived asset impairment charges, (ii) stock-based compensation expense, (iii) restructuring charges, (iv) transaction and integration costs related to acquisitions, and (v) other expenses or charges to exclude certain items that we believe are not reflective of the ongoing performance of our business. Adjusted EBITDA is used to calculate the Company’s leverage ratio, consistent with the terms of the Company’s ABL Facility. We believe Adjusted EBITDA is useful because it allows us to supplement the GAAP measures in order to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure. We exclude the items listed above in arriving at Adjusted EBITDA because these amounts can vary substantially from company to company within our industry depending upon accounting methods and book values of assets, capital structures and the method by which the assets were acquired. Adjusted EBITDA should not be considered as an alternative to, or more meaningful than, net income as determined in accordance with GAAP, or as an indicator of our operating performance or liquidity. Certain items excluded from Adjusted EBITDA are significant components in understanding and assessing a company’s financial performance, such as a company’s cost of capital and tax structure, as well as the historic costs of depreciable assets, none of which are components of Adjusted EBITDA. Our computations of Adjusted EBITDA may not be comparable to other similarly titled measures of other companies. Adjusted EBITDA margin is a supplemental non-GAAP financial measure that is used by management and external users of our financial statements, such as industry analysts, investors, lenders and rating agencies. Adjusted EBITDA margin is not a measure of net earnings or cash flows as determined by GAAP. Adjusted EBITDA margin is defined as the quotient of Adjusted EBITDA and total revenue. We believe Adjusted EBITDA margin is useful because it allows us to more effectively evaluate our operating performance and compare the results of our operations from period to period without regard to our financing methods or capital structure, as a percentage of revenues. We define unlevered free cash flow as net cash provided by operating activities less capital expenditures and proceeds from sale of property and equipment plus cash interest expense. We define levered free cash flow as net cash provided by operating activities less capital expenditures and proceeds from sale of property and equipment. Our management uses unlevered and levered free cash flow to assess the Company’s liquidity and ability to repay maturing debt, fund operations and make additional investments. We believe that each of unlevered and levered free cash flow provide useful information to investors because it is an important indicator of the Company’s liquidity, including its ability to reduce net debt and make strategic investments. We define net debt as total debt less cash and cash equivalents and restricted cash. We believe that net debt provides useful information to investors because it is an important indicator of the Company’s indebtedness. We define Consolidated net loss margin as the quotient of consolidated net loss and total revenue. We define Segment operating income (loss) margin as the quotient of segment operating income (loss) and segment revenue. We believe that Consolidated net loss margin and Segment operating income (loss) margin provide useful information to investors to understand and evaluate core operating performance and trends across fiscal periods. Additional information is available on our website, www.klx.com. KLX Energy Services 2

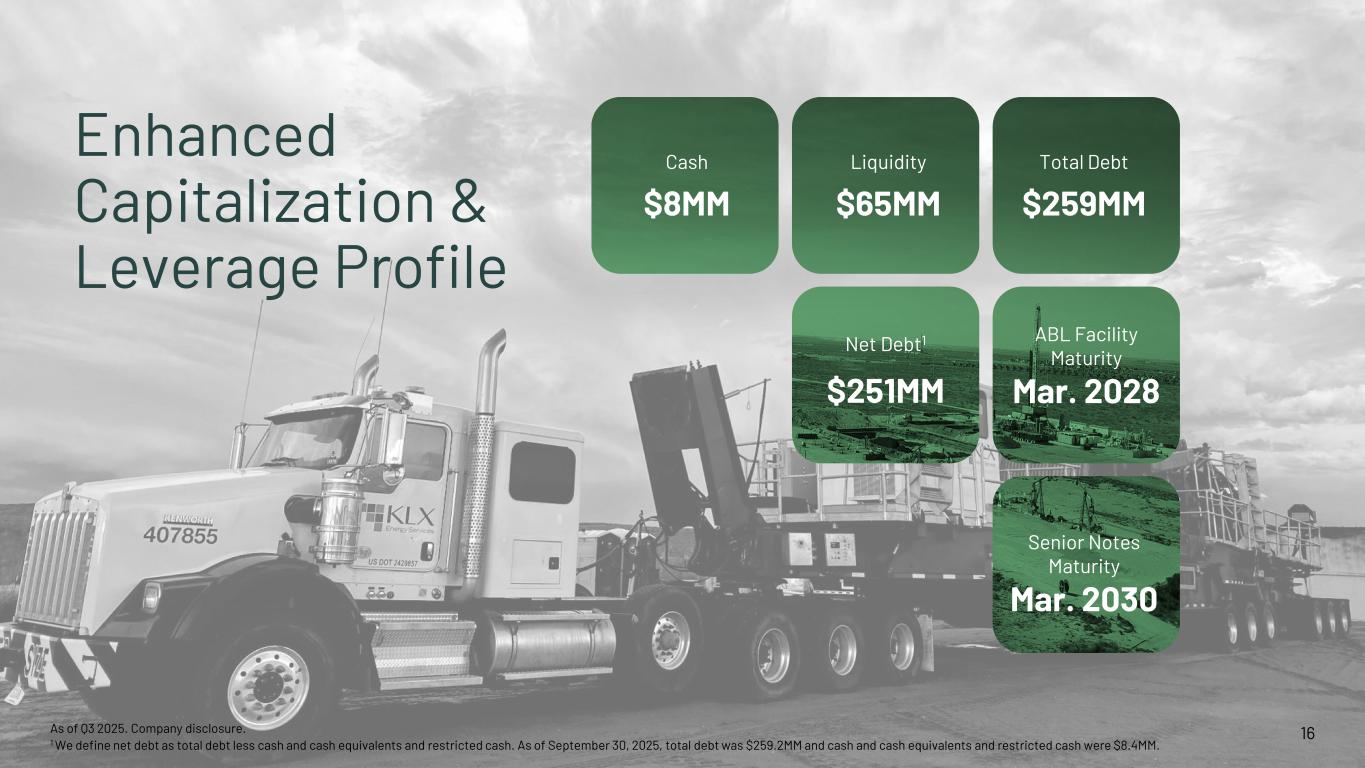

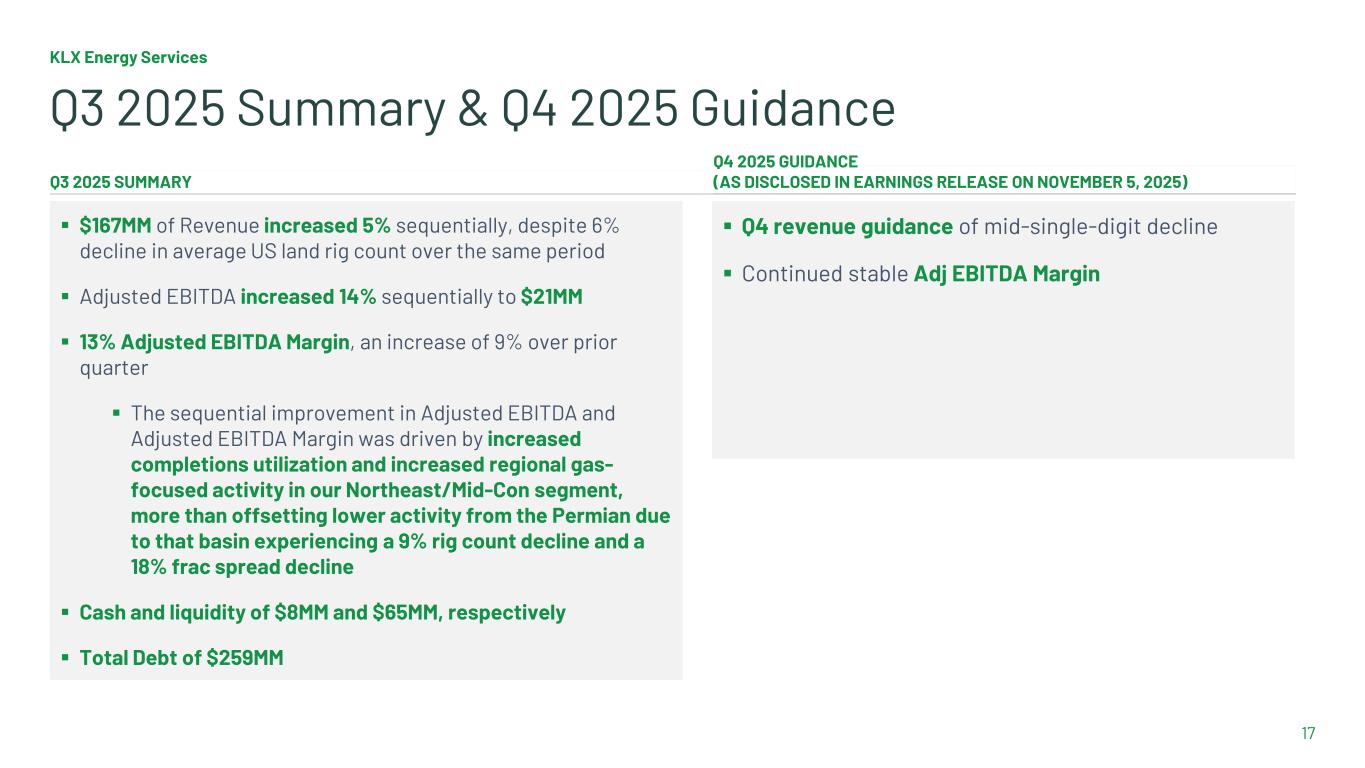

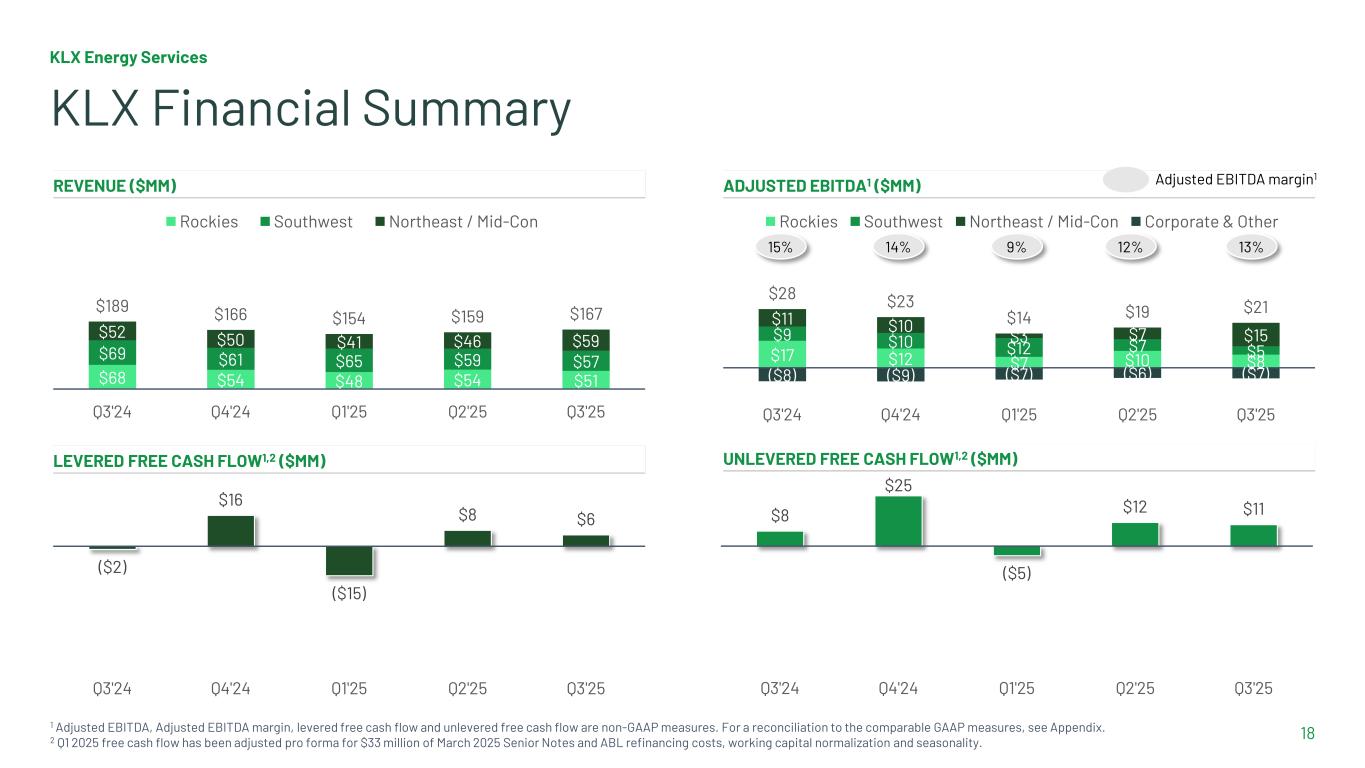

3 NEXT LEVEL READINESS KLX Energy Services is a leading U.S. onshore provider of value-added, technologically-differentiated oilfield services focused on completion, intervention and production activities for the most technically demanding wells. NASDAQ KLXE Headquartered in Houston, TX Employees ~1,620 LTM Revenue $645MM LTM Net Loss $77MM LTM Adjusted EBITDA $76MM Results reflect Q3 2025 LTM results and headcount is as of September 30,2025; LTM Adjusted EBITDA is a non-GAAP measure. For a reconciliation to the comparable GAAP measure, see Appendix.

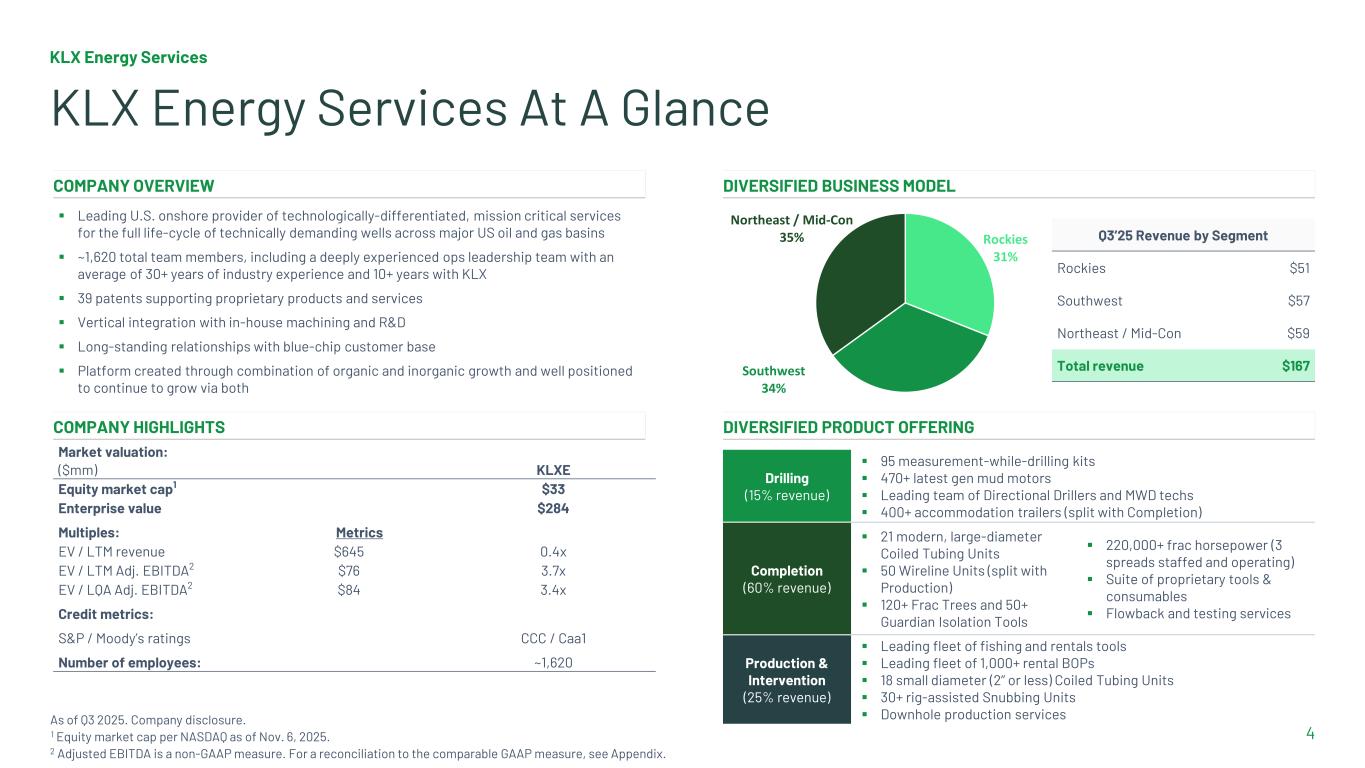

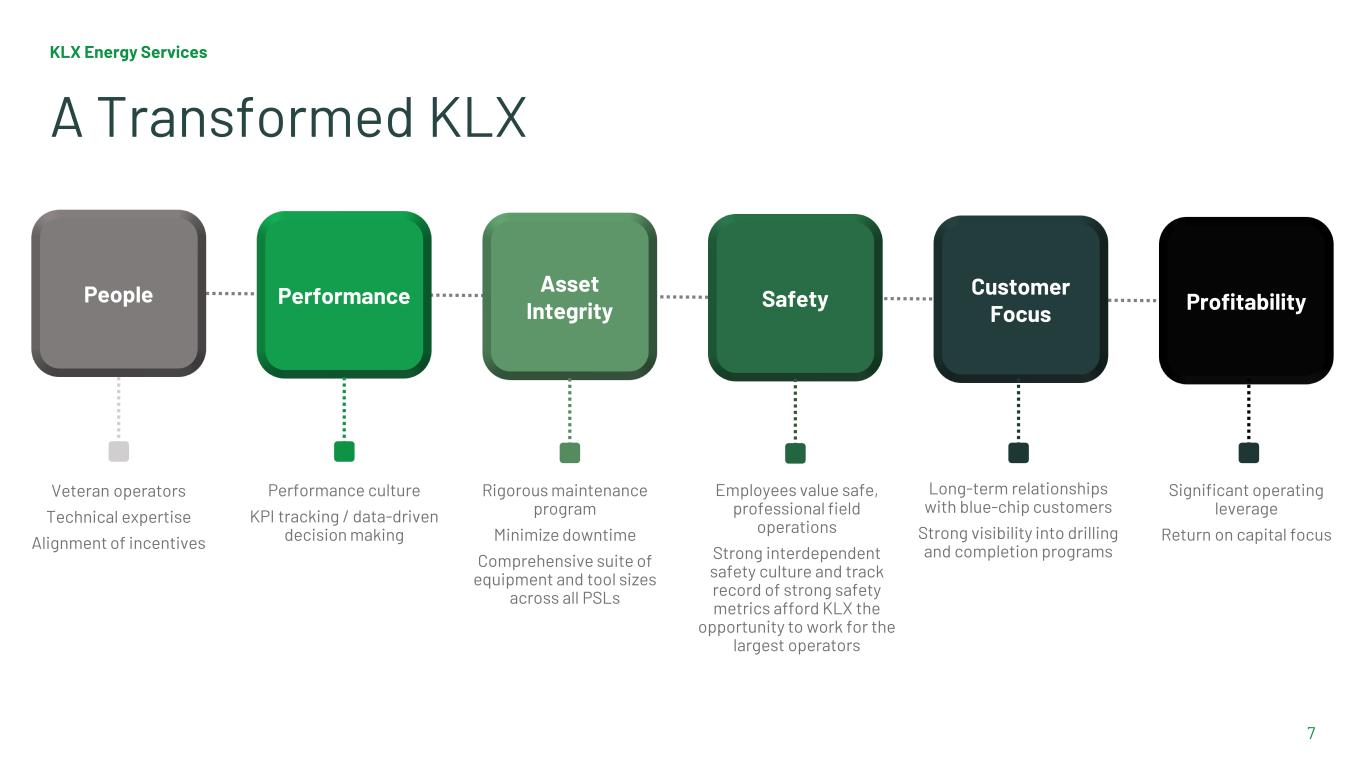

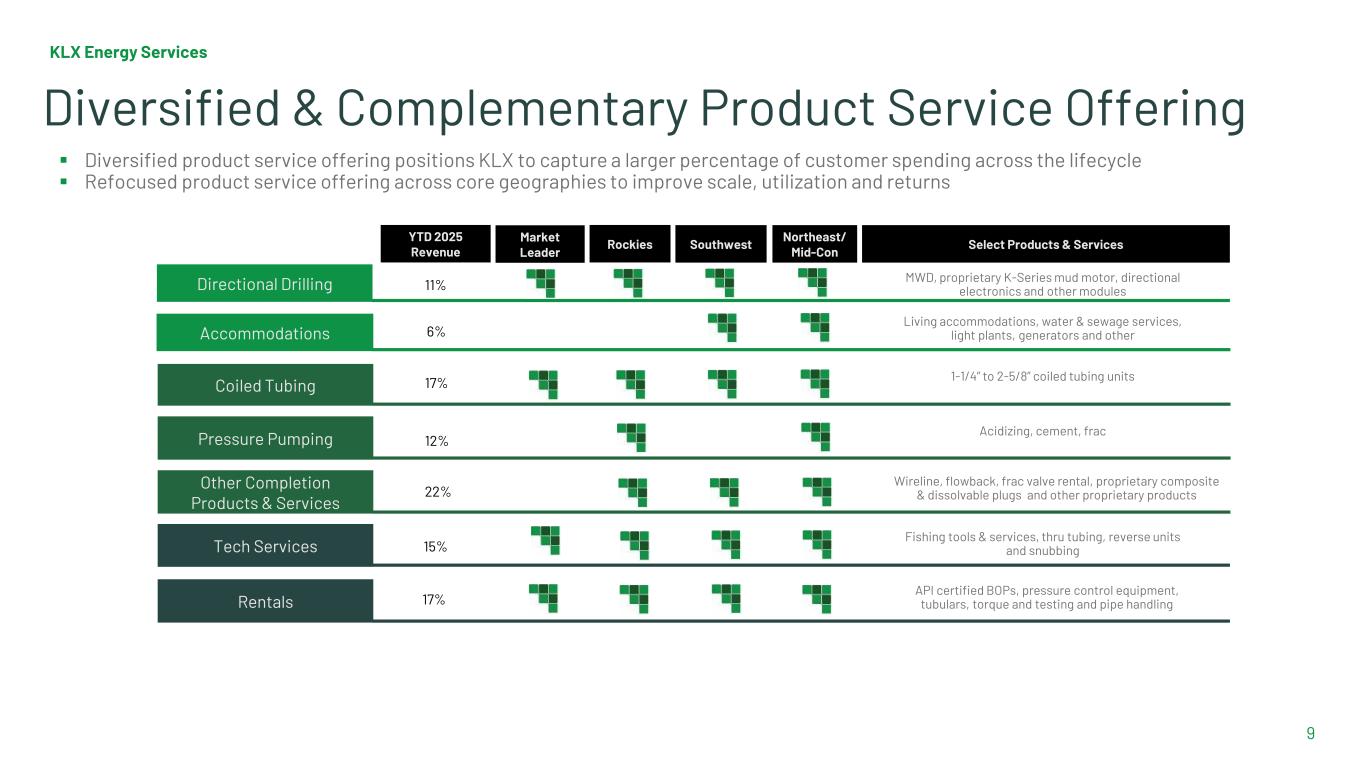

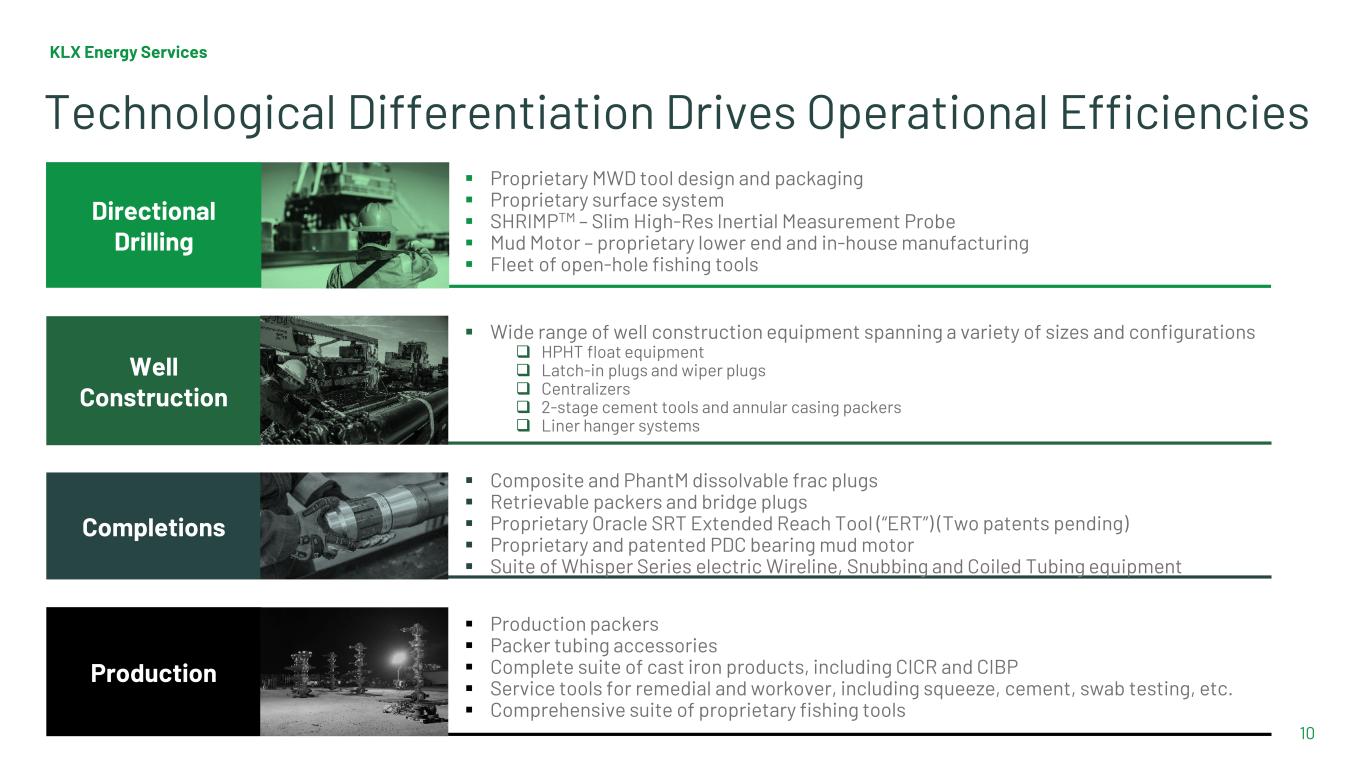

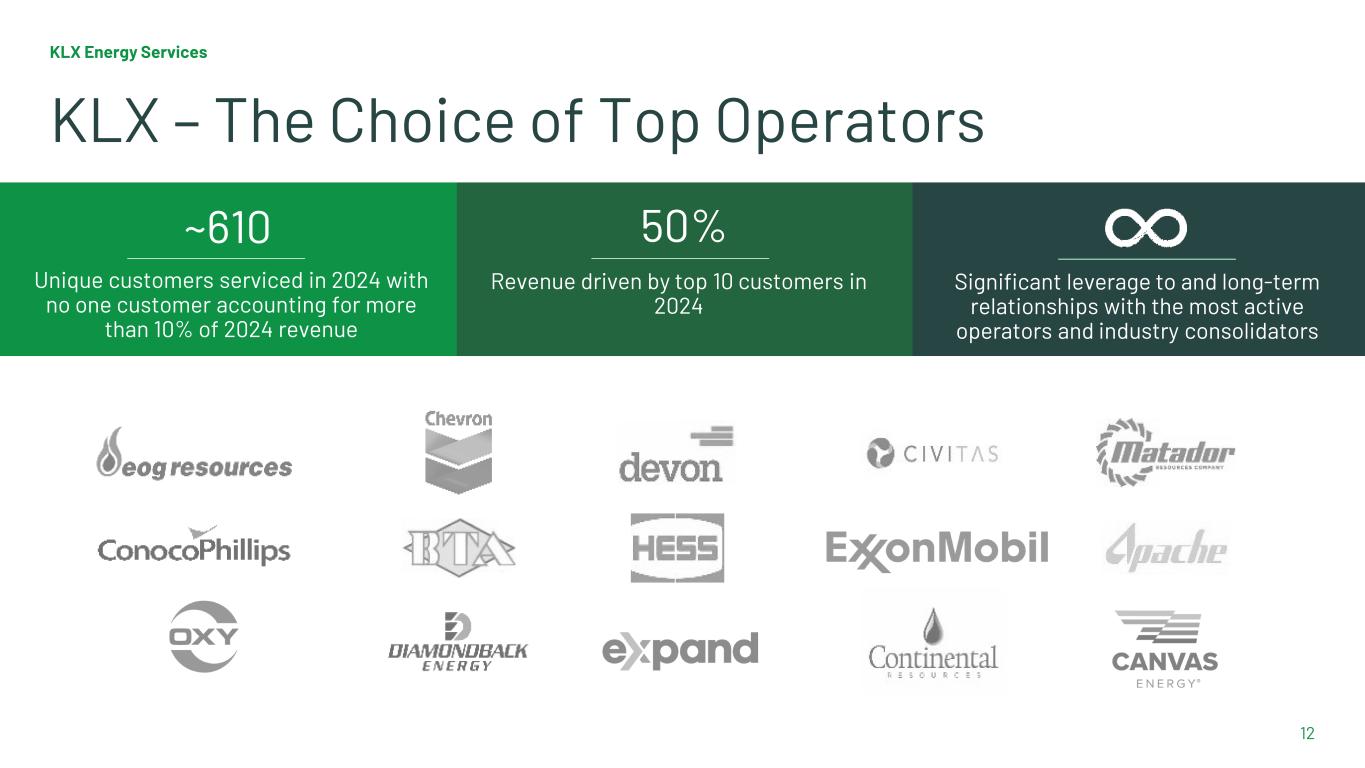

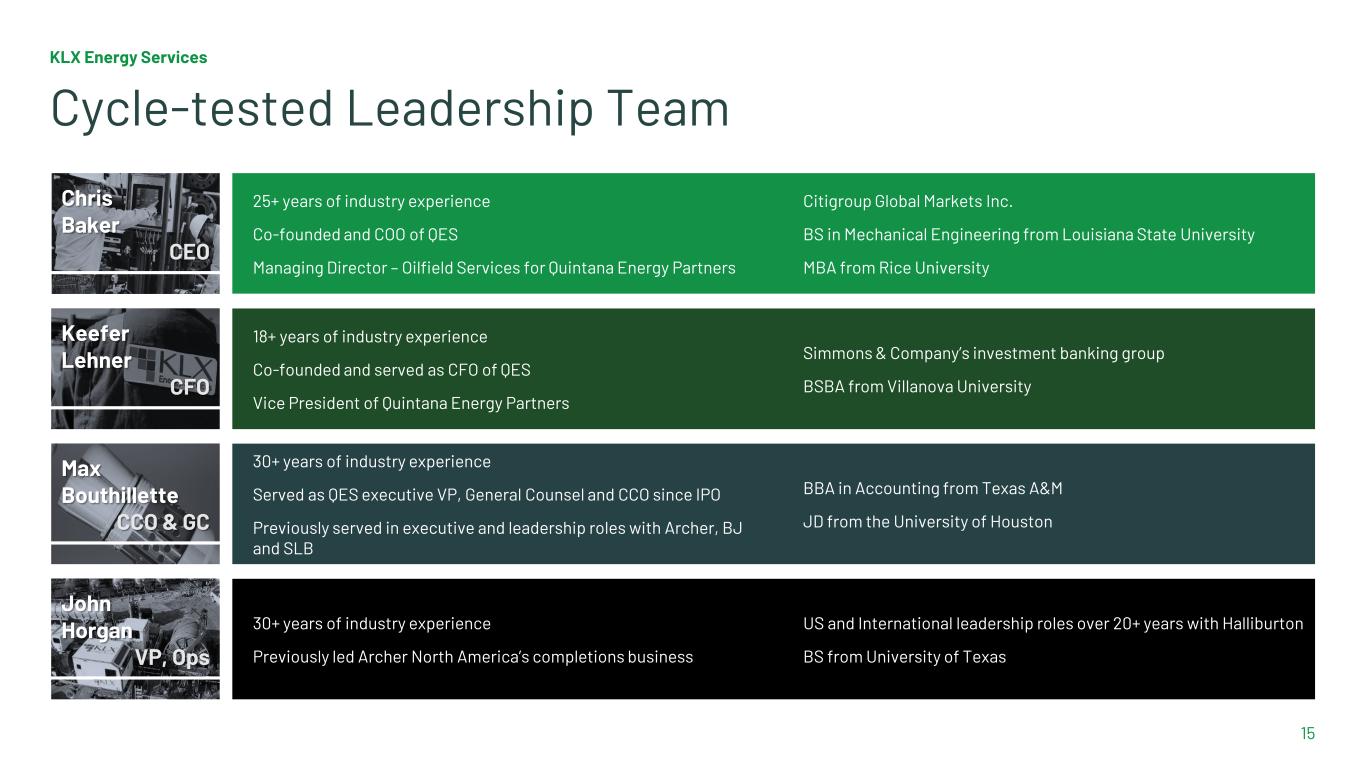

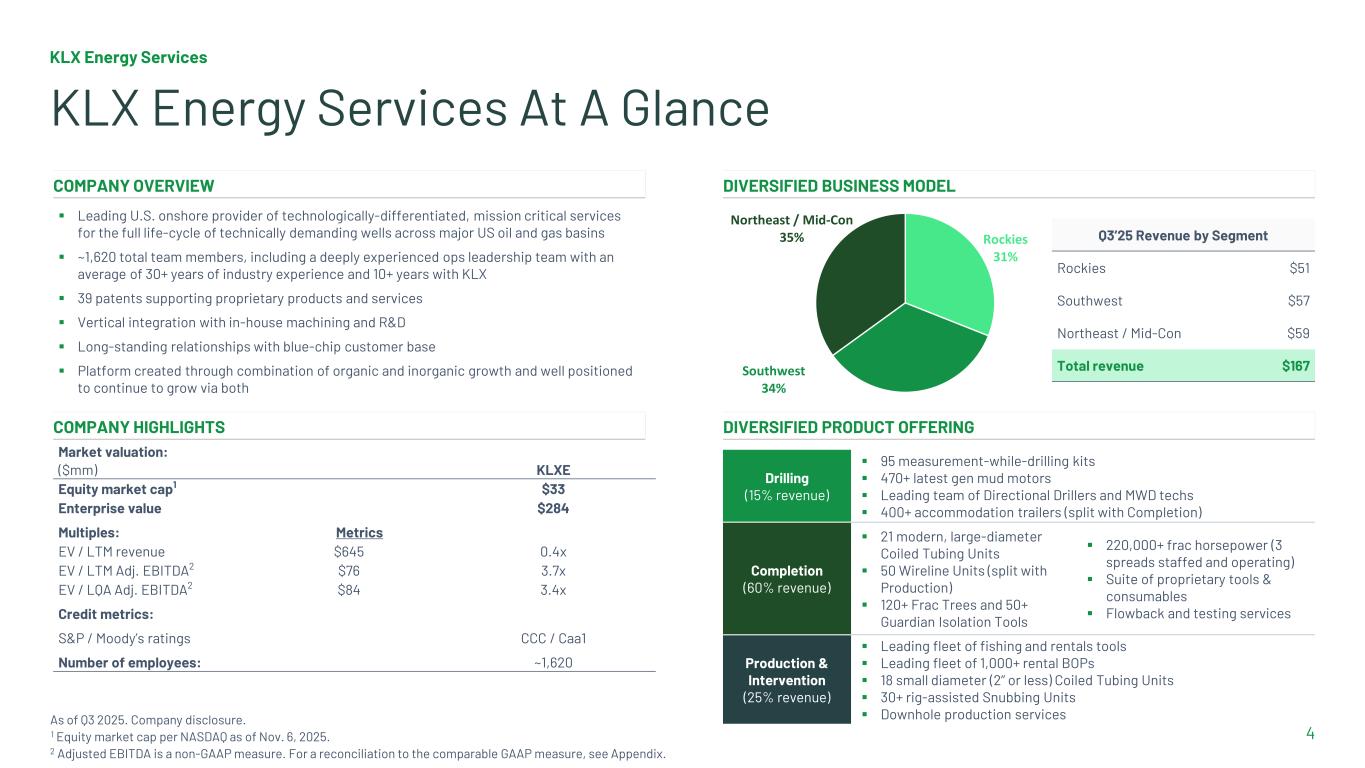

KLX Energy Services 4 KLX Energy Services At A Glance As of Q3 2025. Company disclosure. 1 Equity market cap per NASDAQ as of Nov. 6, 2025. 2 Adjusted EBITDA is a non-GAAP measure. For a reconciliation to the comparable GAAP measure, see Appendix. COMPANY OVERVIEW DIVERSIFIED BUSINESS MODEL Leading U.S. onshore provider of technologically-differentiated, mission critical services for the full life-cycle of technically demanding wells across major US oil and gas basins ~1,620 total team members, including a deeply experienced ops leadership team with an average of 30+ years of industry experience and 10+ years with KLX 39 patents supporting proprietary products and services Vertical integration with in-house machining and R&D Long-standing relationships with blue-chip customer base Platform created through combination of organic and inorganic growth and well positioned to continue to grow via both Rockies 31% Southwest 34% Northeast / Mid-Con 35% Q3’25 Revenue by Segment Rockies $51 Southwest $57 Northeast / Mid-Con $59 Total revenue $167 COMPANY HIGHLIGHTS DIVERSIFIED PRODUCT OFFERING Market valuation: ($mm) KLXE Equity market cap1 $33 Enterprise value $284 Multiples: Metrics EV / LTM revenue $645 0.4x EV / LTM Adj. EBITDA2 $76 3.7x EV / LQA Adj. EBITDA2 $84 3.4x Credit metrics: S&P / Moody’s ratings CCC / Caa1 Number of employees: ~1,620 Drilling (15% revenue) 95 measurement-while-drilling kits 470+ latest gen mud motors Leading team of Directional Drillers and MWD techs 400+ accommodation trailers (split with Completion) Completion (60% revenue) 21 modern, large-diameter Coiled Tubing Units 50 Wireline Units (split with Production) 120+ Frac Trees and 50+ Guardian Isolation Tools 220,000+ frac horsepower (3 spreads staffed and operating) Suite of proprietary tools & consumables Flowback and testing services Production & Intervention (25% revenue) Leading fleet of fishing and rentals tools Leading fleet of 1,000+ rental BOPs 18 small diameter (2’’ or less) Coiled Tubing Units 30+ rig-assisted Snubbing Units Downhole production services