Document

|

|

|

|

|

|

|

|

|

|

|

CONTACTS: |

|

|

Investors |

|

|

Laura Rossi |

|

|

InvestorRelations@amerantbank.com |

|

|

(305) 460-8728 |

|

|

|

|

|

Media |

|

|

Silvia M. Larrieu |

|

|

MediaRelations@amerantbank.com |

|

|

(305) 441-8414 |

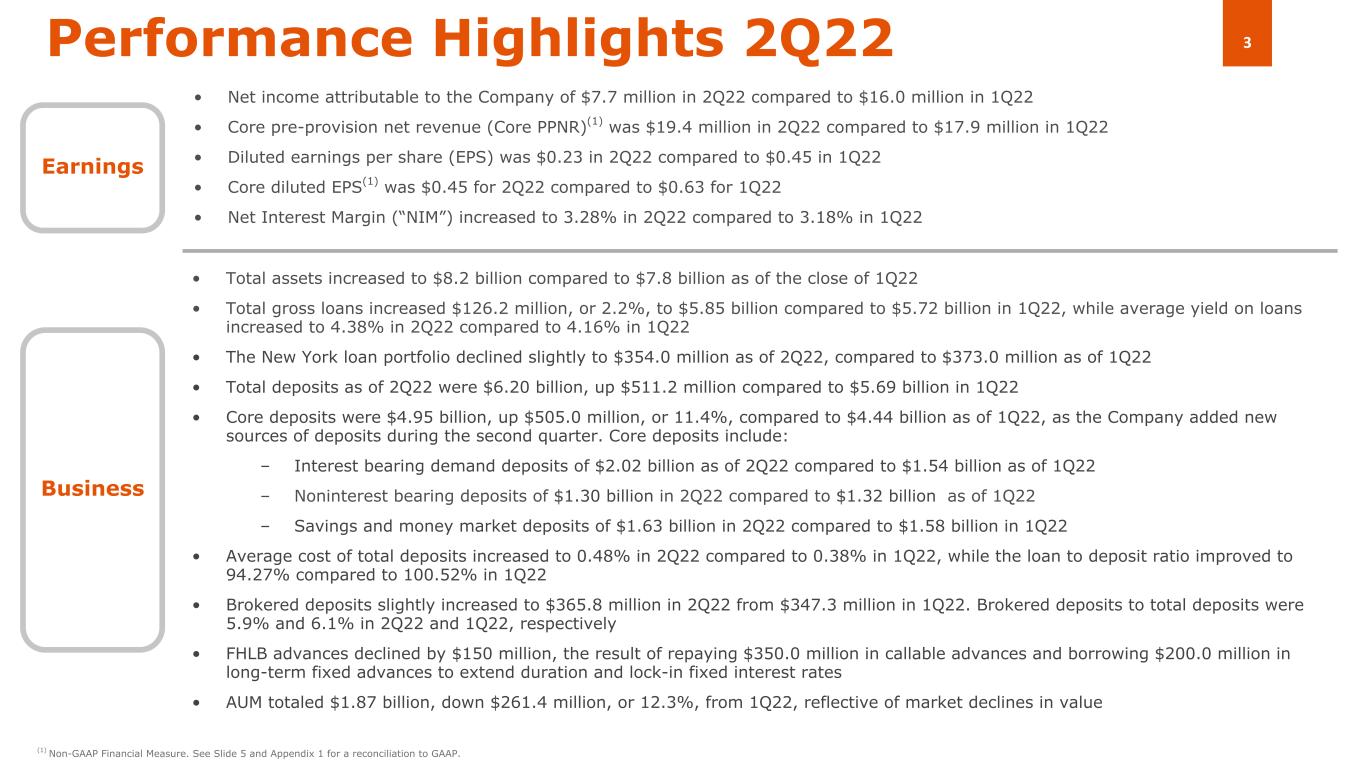

AMERANT REPORTS SECOND QUARTER 2022 NET INCOME OF $7.7 MILLION AND CORE PPNR1 OF $19.4 MILLION

Highlights include strong asset and deposit growth along with net interest margin expansion; also a significant reduction in non-performing loans

CORAL GABLES, FLORIDA, July 20, 2022. Amerant Bancorp Inc. (NASDAQ: AMTB) (the “Company” or “Amerant”) today reported net income attributable to the Company of $7.7 million in the second quarter of 2022, or $0.23 per diluted share, a decrease compared to net income attributable to the Company of $16.0 million, or $0.45 per diluted share, in the first quarter of 2022, and a decrease compared to the net income attributable to the Company of $16.0 million, or $0.42 per diluted share, in the second quarter of 2021. $8.0 million in non-routine charges recorded in 2Q22 was the primary driver for the decline quarter-over-quarter in net income.

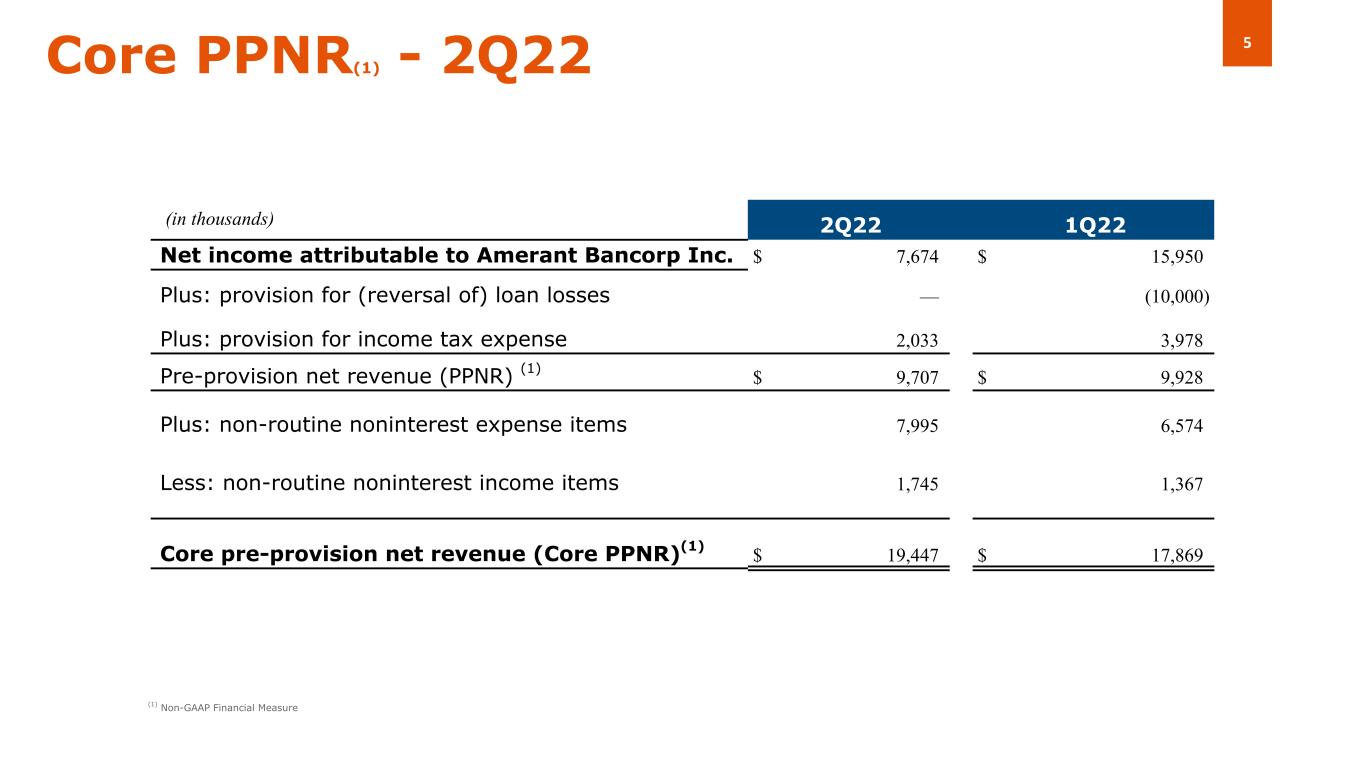

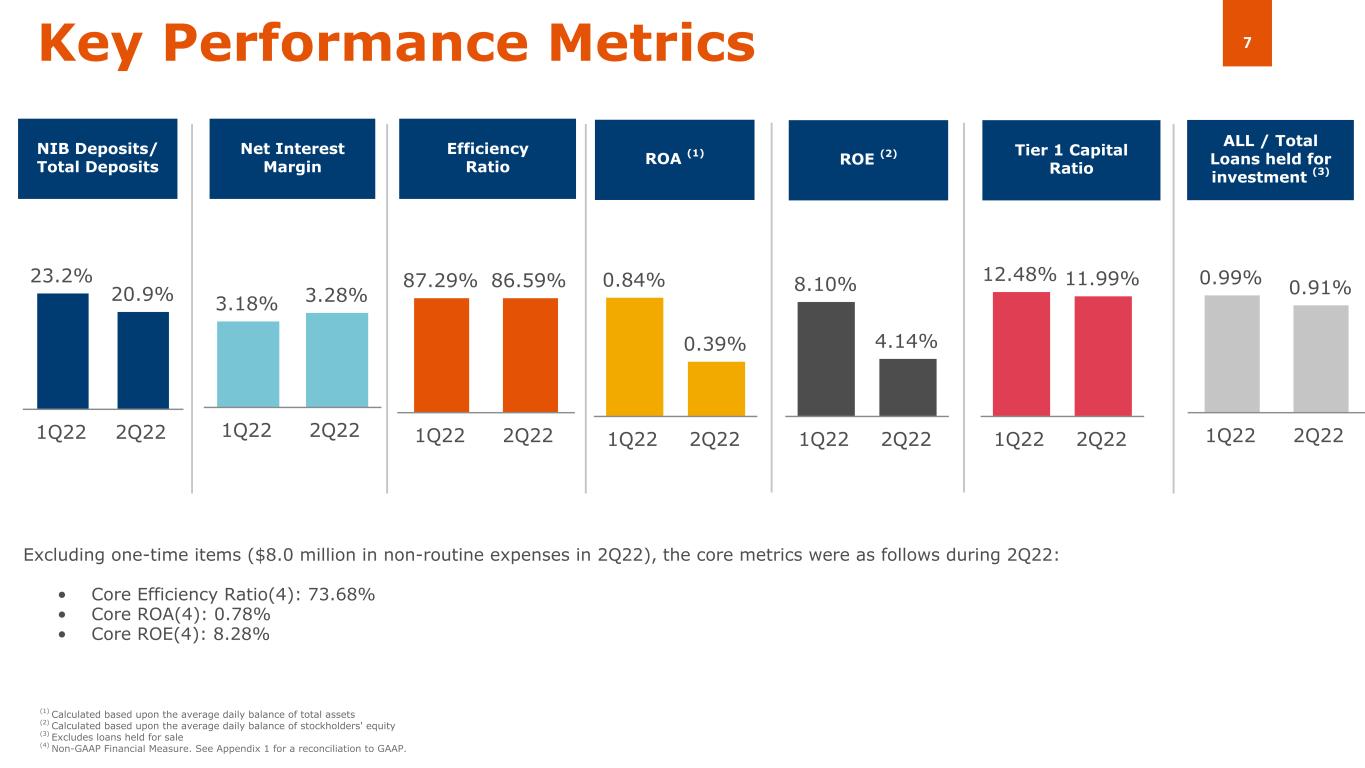

Core Pre-Provision Net Revenue (“Core PPNR”)1 grew to $19.4 million in the second quarter of 2022, a $1.5 million increase from $17.9 million in the first quarter of 2022, and a $2.5 million increase from $16.9 million in the second quarter of 2021. Return on assets (“ROA”) and return on equity (“ROE”) were 0.39% and 4.14%, respectively, in the second quarter of 2022, compared to 0.84% and 8.10%, respectively, in the first quarter of 2022, and 0.83% and 8.11%, respectively, in the second quarter of 2021.

Financial Highlights:

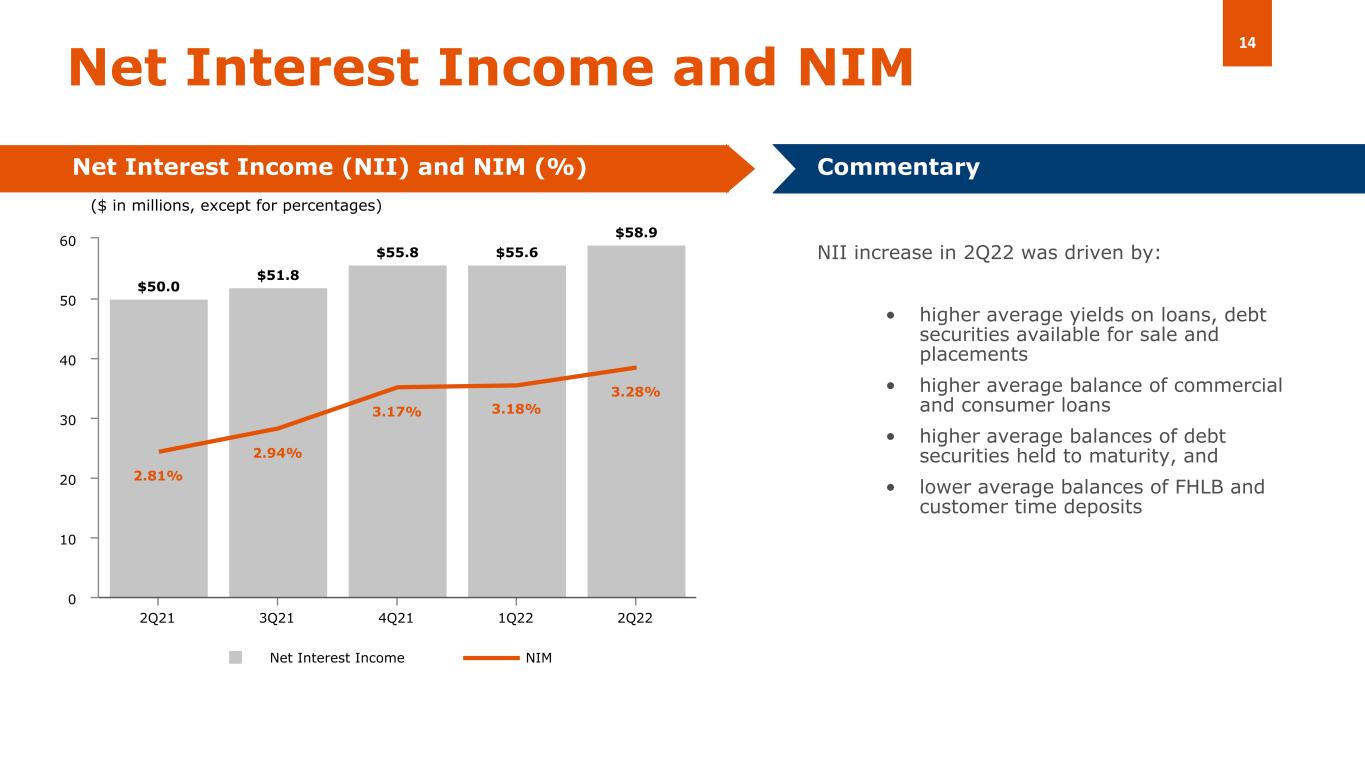

•Net Interest Margin (“NIM”) increased to 3.28% in 2Q22 compared to 3.18% in 1Q22.

•Total assets increased to $8.2 billion compared to $7.8 billion as of 1Q22.

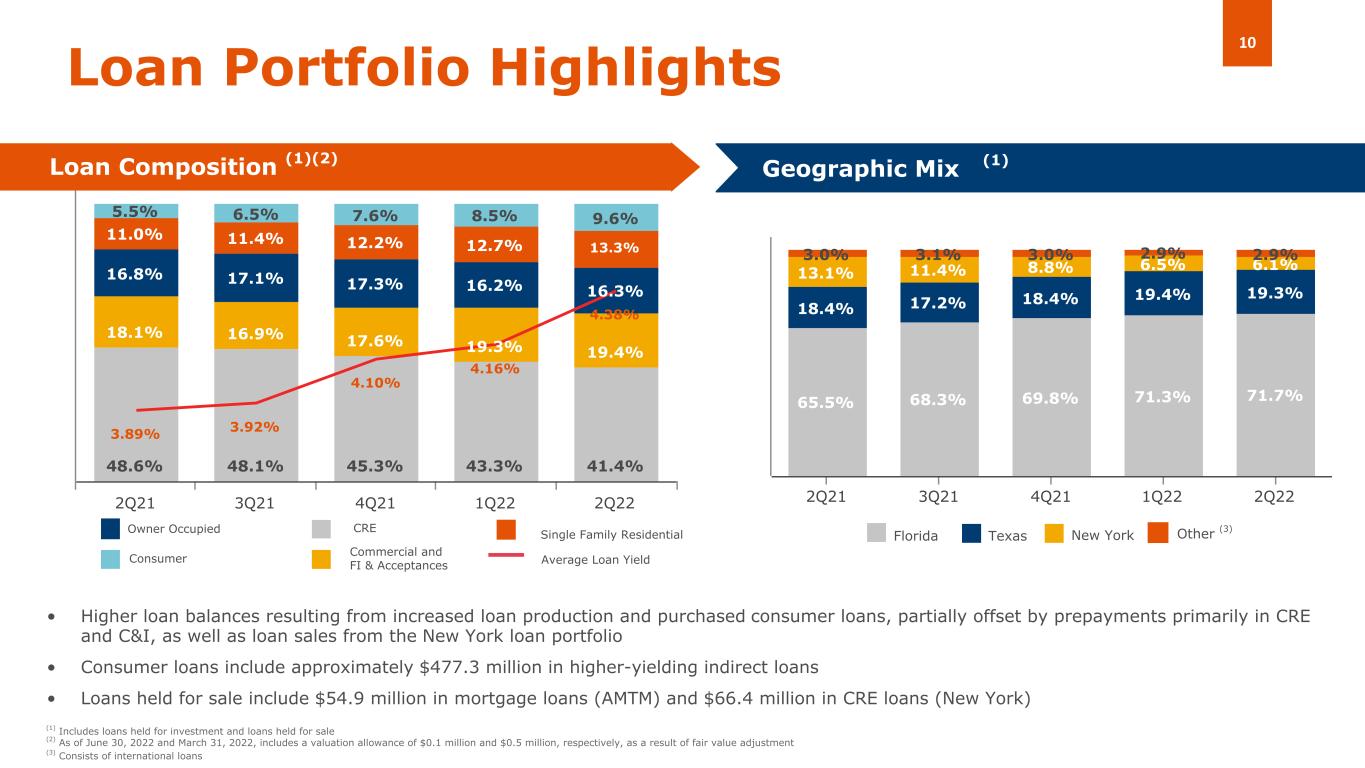

•Total gross loans increased $126.2 million, or 2.2%, to $5.85 billion compared to $5.72 billion in 1Q22, while average yield on loans increased to 4.38% in 2Q22 compared to 4.16% in 1Q22.

1 Non-GAAP measure, see “Non-GAAP Financial Measures” for more information and Exhibit 2 for a reconciliation to GAAP.

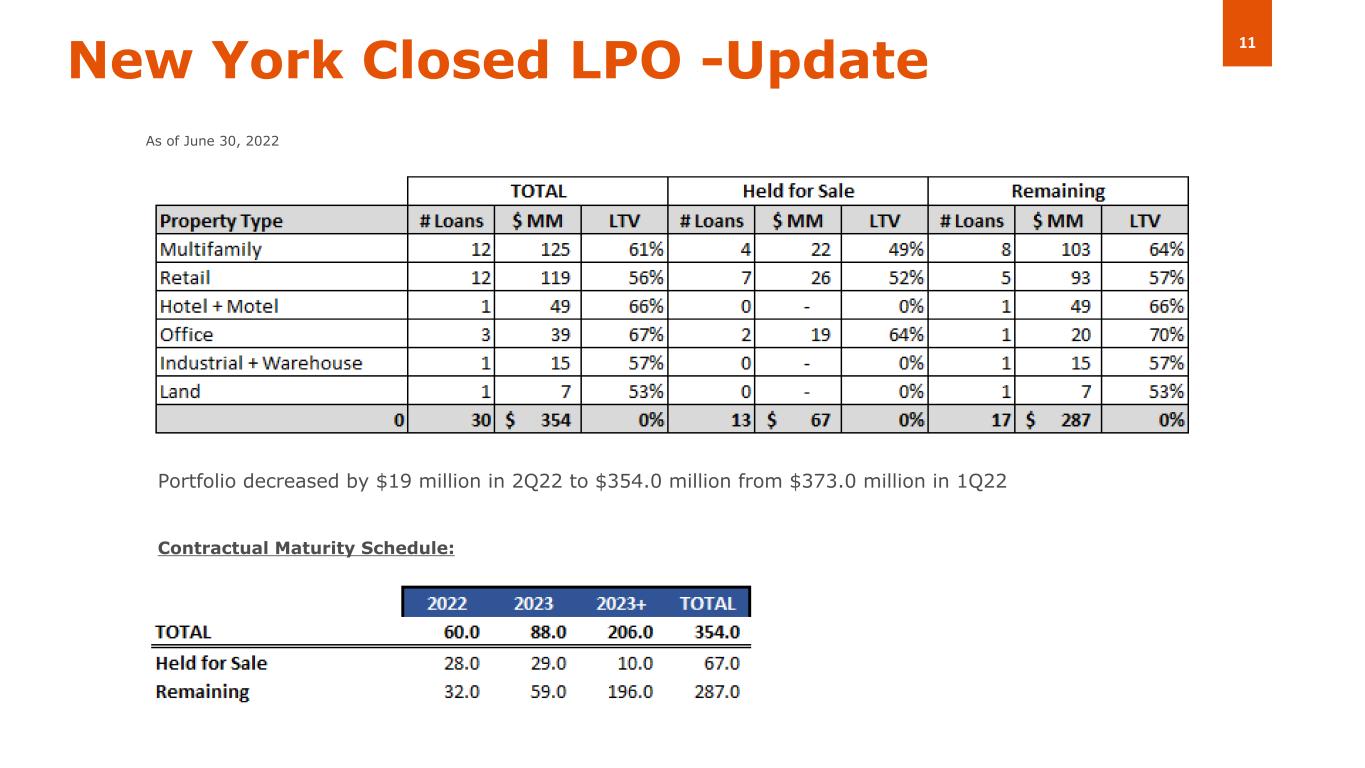

•The New York loan portfolio declined slightly to $354.0 million as of 2Q22, compared to $373.0 million in 1Q22.

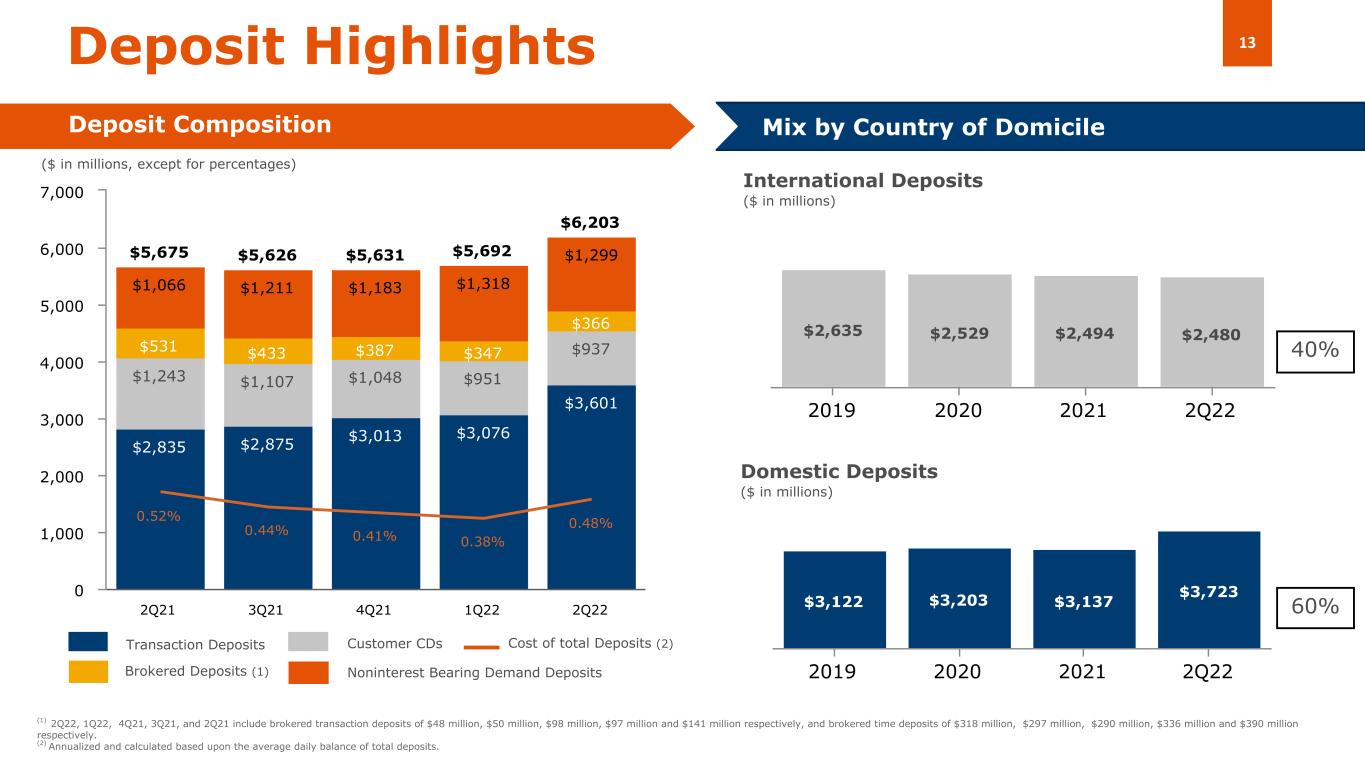

•Total deposits as of 2Q22 were $6.20 billion, up $511.2 million compared to $5.69 billion in 1Q22. Core deposits were $4.95 billion, up $505.0 million, or 11.4%, compared to 1Q22, as the Company added new sources of deposits during the second quarter.

•Average cost of total deposits increased to 0.48% in 2Q22 compared to 0.38% in 1Q22, while the loan to deposit ratio improved to 94.27% compared to 100.52% in 1Q22.

•FHLB advances declined by $150.0 million, the result of repaying $350.0 million in callable advances and borrowing $200.0 million in long-term fixed advances to extend duration and lock-in fixed interest rates.

•AUM totaled $1.87 billion, down $261.4 million, or 12.3%, from 1Q22, reflective of market declines in value.

“We are pleased to report continued momentum in our transformation toward becoming a stronger, top performing bank” stated Jerry Plush, Chairman and CEO. “The significant reduction in non-performing loans and other actions taken during the quarter that required us to record non-routine charges we believe will better position us for future success. The higher core PPNR for 2Q demonstrates our continued focus on profitable growth”.

Significant Actions:

•Reduced non-performing loans (“NPL”) to $25.2 million as of 2Q22 compared to $47.0 million as of 1Q22.

•As part of the NPL reduction, the Company received a $5.5 million payment and charged off the remaining $3.6 million on the previously disclosed Coffee Trader relationship. All future receipts, if any, will be recorded as recoveries.

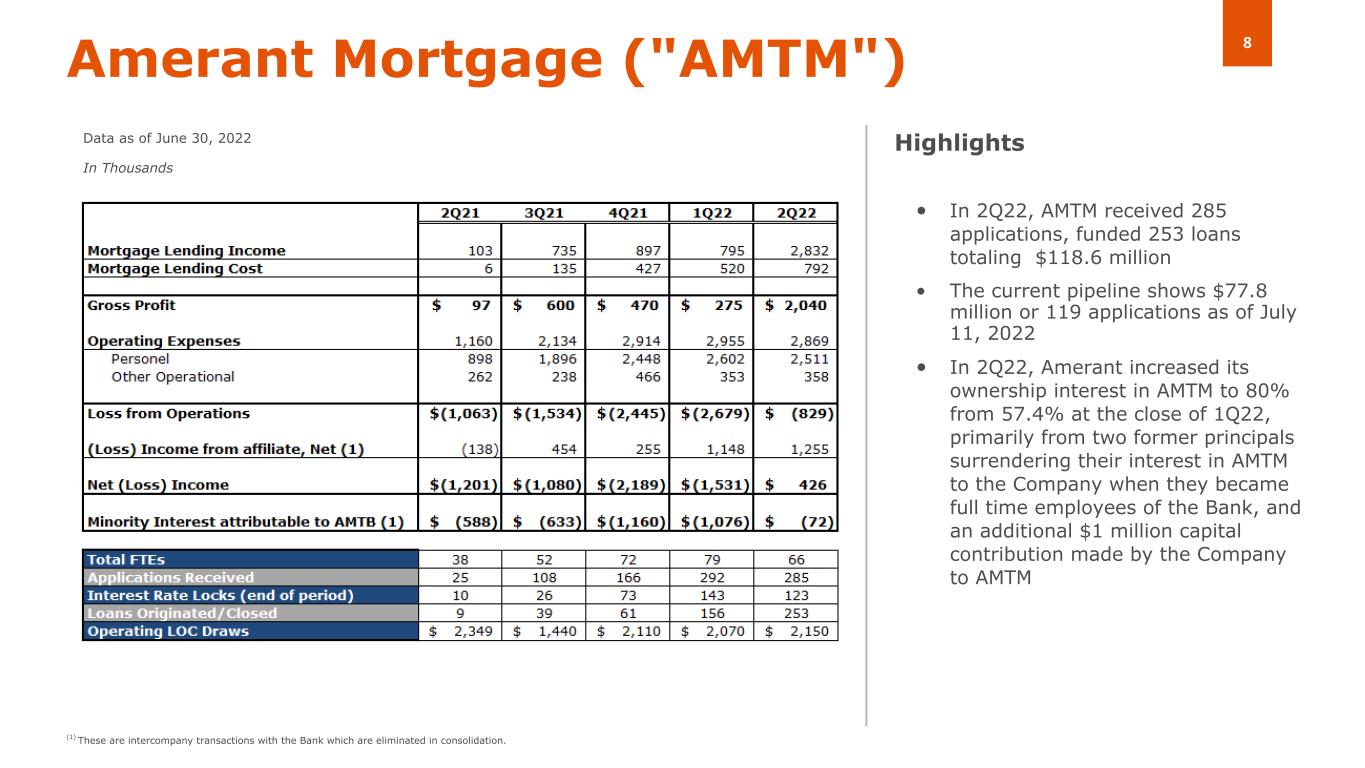

•Amerant Mortgage reported improved results; FTEs decreased from 79 in 1Q22 to 67 as of 2Q22; reached breakeven on a stand-alone basis in 2Q22 despite challenges related to the interest rate environment.

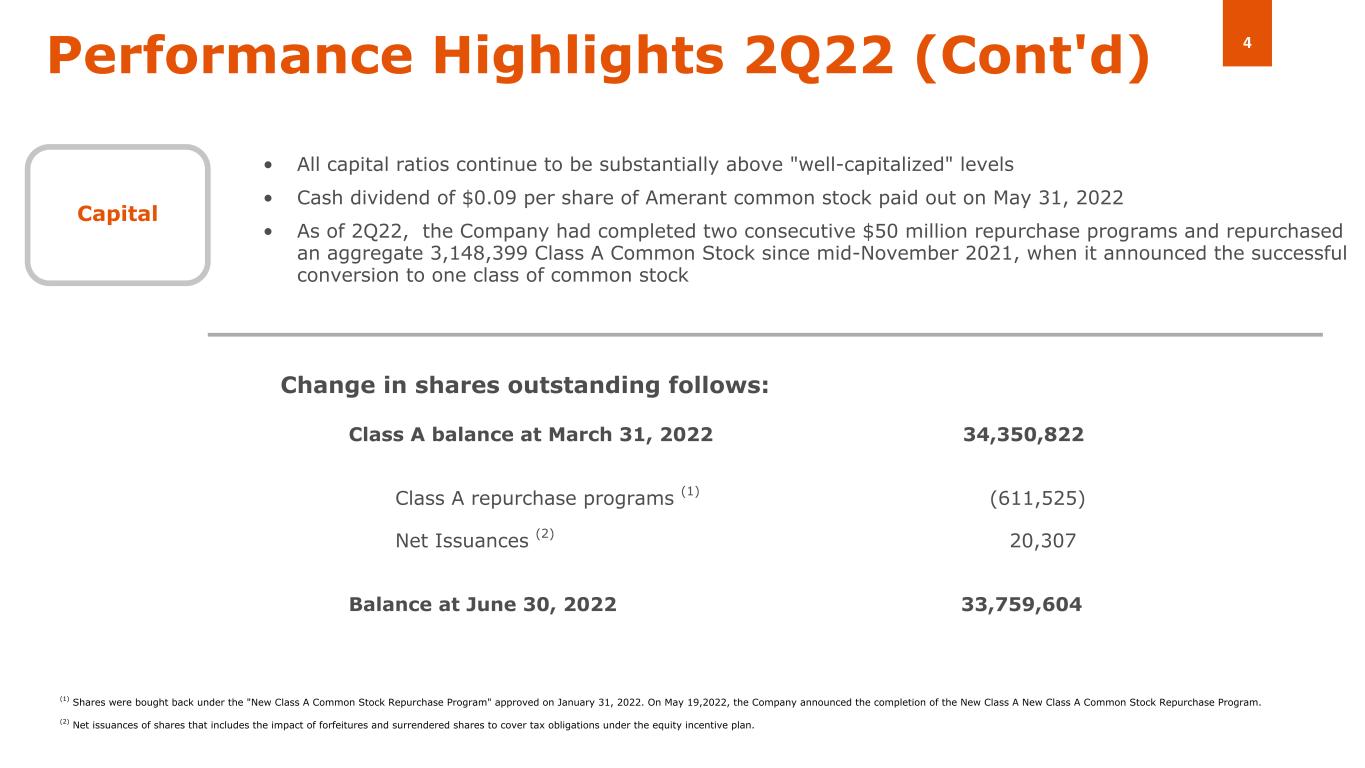

•Successfully completed the Company’s second $50 million Class A Common Stock repurchase program. The Company has now completed two consecutive $50 million stock repurchase programs and repurchased an aggregate 3,148,399 Class A Common Stock since mid-November 2021, when the Company announced the successful conversion to one class of common stock.

•Launched new white label equipment finance solution and started originations during 2Q22.

•Announced the closing of a banking center to occur in early 4Q22; $1.1 million in expected annual savings; recorded non-routine closure charges of $1.6 million in 2Q22.

•Recorded remaining $2.8 million in estimated contract termination costs in 2Q22 in connection with the conversion to FIS.

•Incurred $3.6 million in other non-routine charges, including $3.2 million in Other Real Estate Owned valuation (“OREO”) and $0.7 million in severance charges, partially offset by improved valuation of $0.3 million in loans held for sale.

•Continued executing on building brand awareness by entering into a new multi-year agreement to become the official Bank of the NBA’s Miami Heat; also entered into a new multi-year agreement as a proud partner of the NHL’s Florida Panthers.

•Announced four senior executive appointments to complete build out of senior management team, including new head of consumer banking, new chief digital officer, new chief legal and administrative officer and new chief people officer.

•Increased Tampa loan production office to 10 FTEs, with most of the team focused on commercial and industrial business origination.

Summary Results

The summary results of the second quarter ended 2Q22 were as follows:

•Net income attributable to the Company was $7.7 million in 2Q22, down 51.9% from $16.0 million in 1Q22, and down 51.9% from $16.0 million in 2Q21. Core PPNR1 was $19.4 million in 2Q22 compared to $17.9 million in 1Q22 and compared to Core PPNR of $16.9 million in 2Q21. $8.0 million in non-routine charges recorded in 2Q22 was the primary driver for the decline quarter-over-quarter in net income.

•Net Interest Income (“NII”) was $58.9 million, up $3.3 million, or 5.9%, from $55.6 million in 1Q22, and up $8.9 million, or 18.0%, from $50.0 million in 2Q21. Net interest margin (“NIM”) was 3.28% in 2Q22, up 10 basis points from 3.18% in 1Q22, and up 47 basis points from 2.81% in 2Q21.

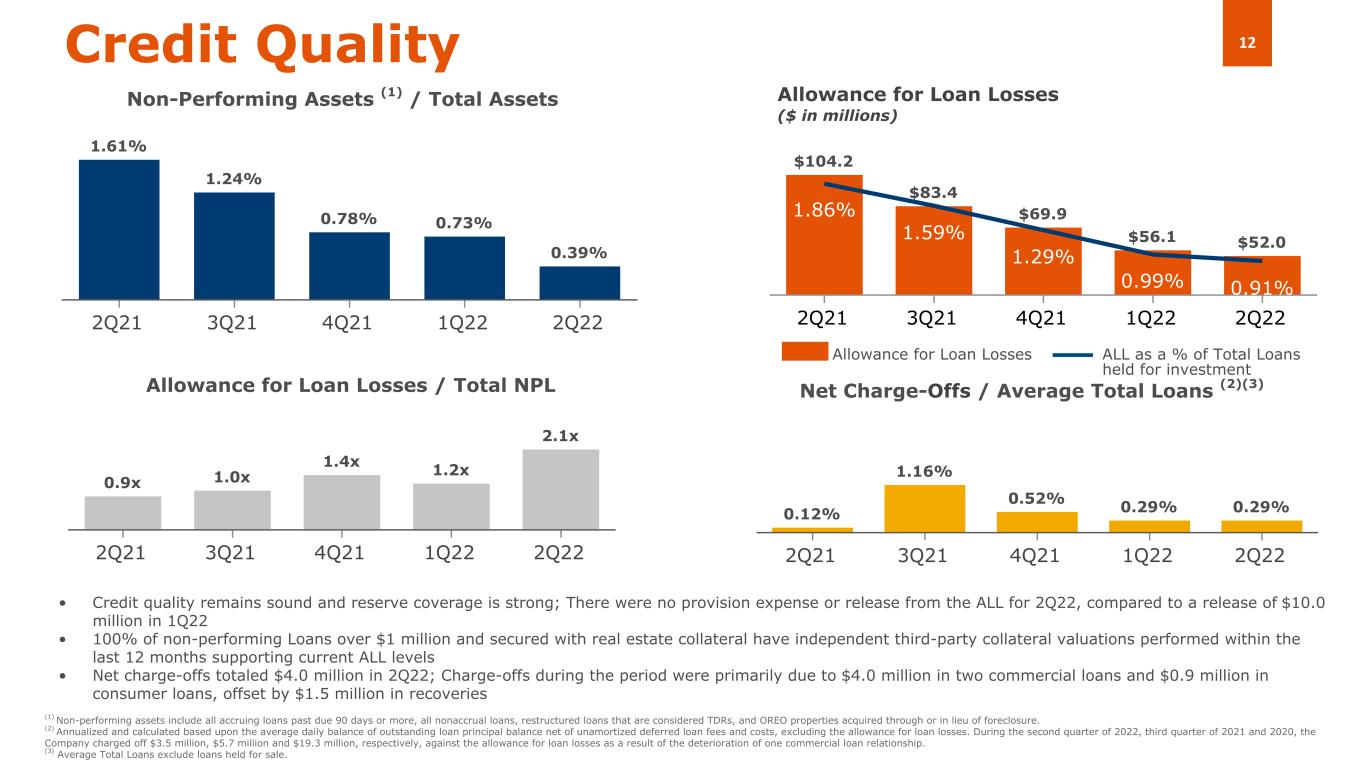

•Amerant had no provision expense or release from the allowance for loan losses (“ALL”) in 2Q22. The Company released $10.0 million and $5.0 million from the ALL in 1Q22 and second quarter of 2021, respectively. The ratio of allowance for loan losses to total loans held for investment was 0.91% as of 2Q22, compared with 0.99% as of 1Q22, and 1.86% as of 2Q21. The ratio of net charge-offs to average total loans held for investment was 0.29% in 2Q22, unchanged compared to 1Q22, and up from 0.12% in 2Q21. The ALL coverage of non-performing loans increased to 2.1x in 2Q22, up from 1.2x and 0.9x in 1Q22 and 2Q21, respectively.

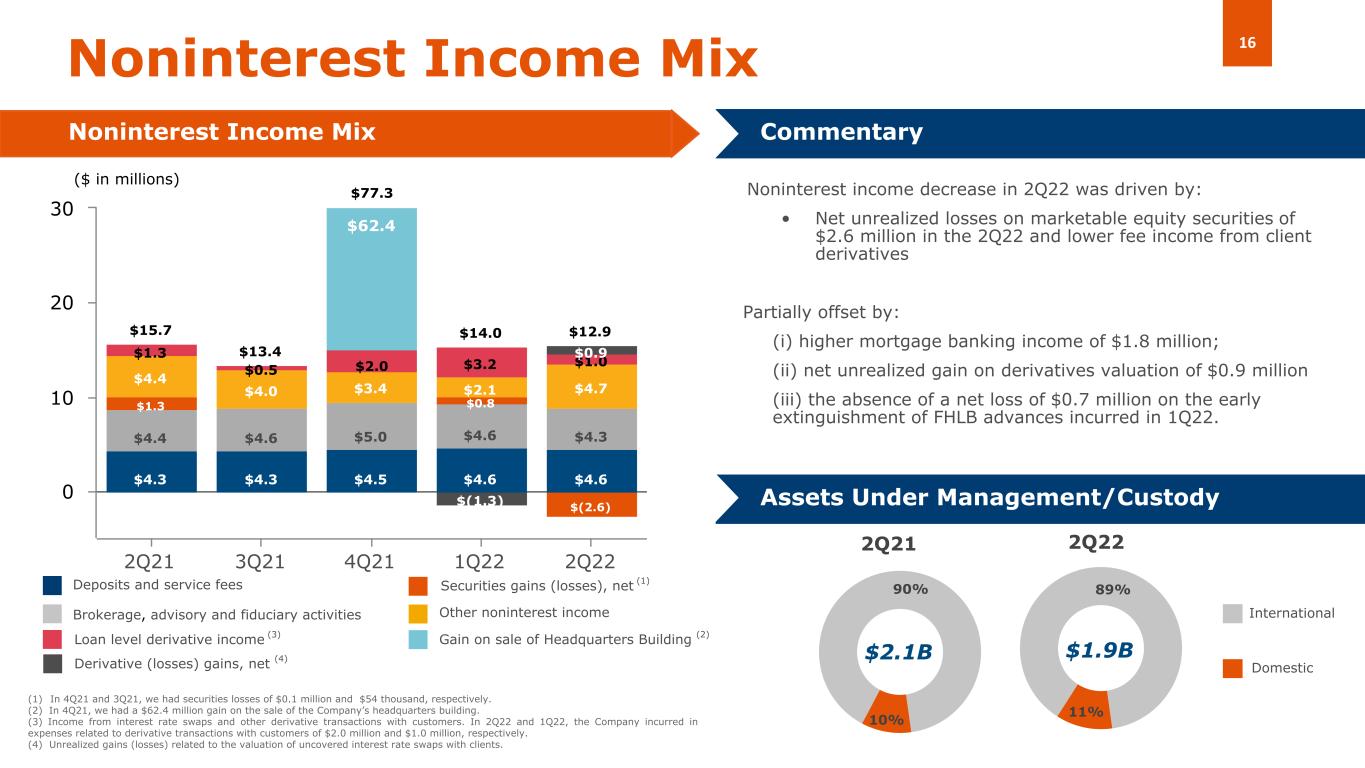

•Non-interest income was $12.9 million in 2Q22, down 7.8% from $14.0 million in 1Q22, and down 17.8% from $15.7 million in 2Q21 primarily driven by net unrealized losses on marketable equity securities of $2.6 million in 2Q22 compared to $0.8 million net unrealized gain in 1Q22.

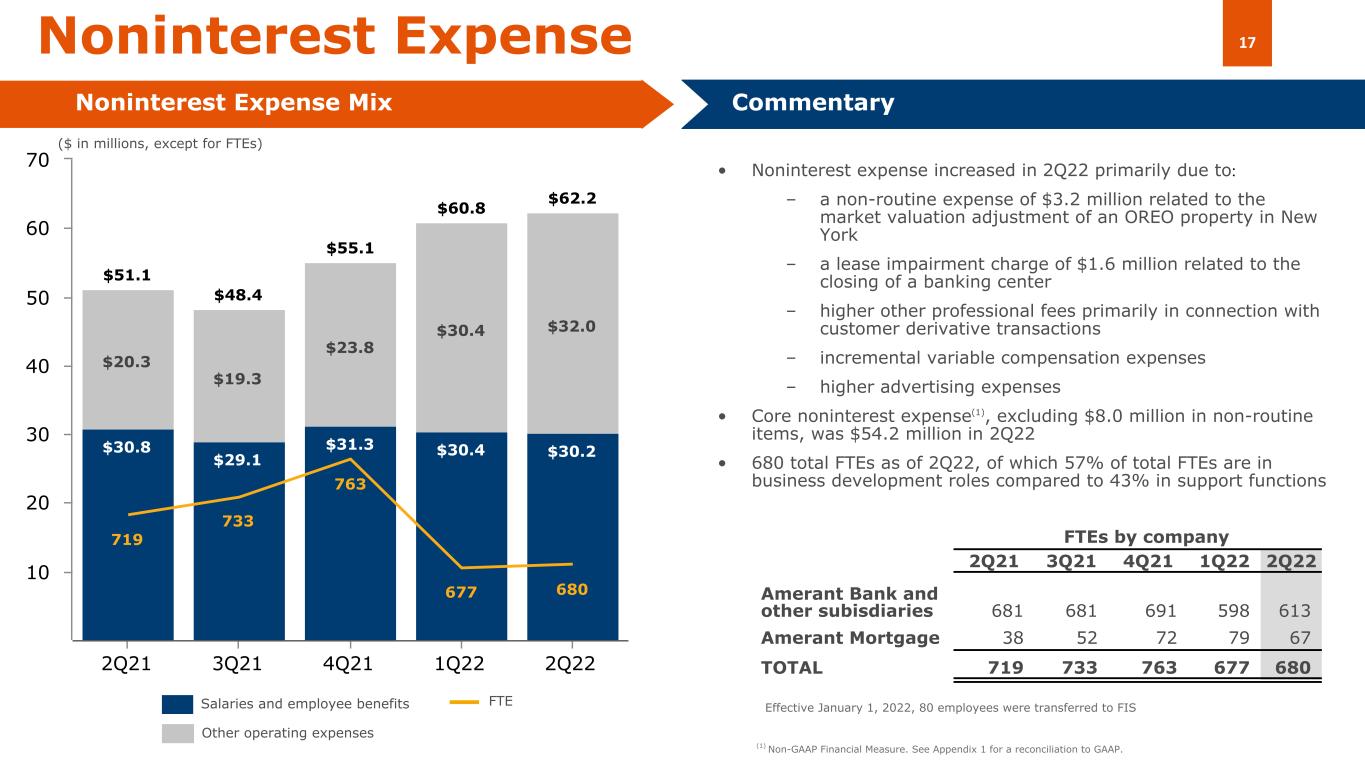

•Non-interest expense was $62.2 million, up 2.3% from $60.8 million in 1Q22 and up 21.7% from $51.1 million in 2Q21, as 2Q22 included $8.0 million in non-routine charges, including an expense of $3.2 million related to the market valuation of an OREO property in New York, $2.8 million in estimated contract termination costs in connection with the conversion to FIS, and a lease impairment charge of $1.6 million related to the closing of a banking center.

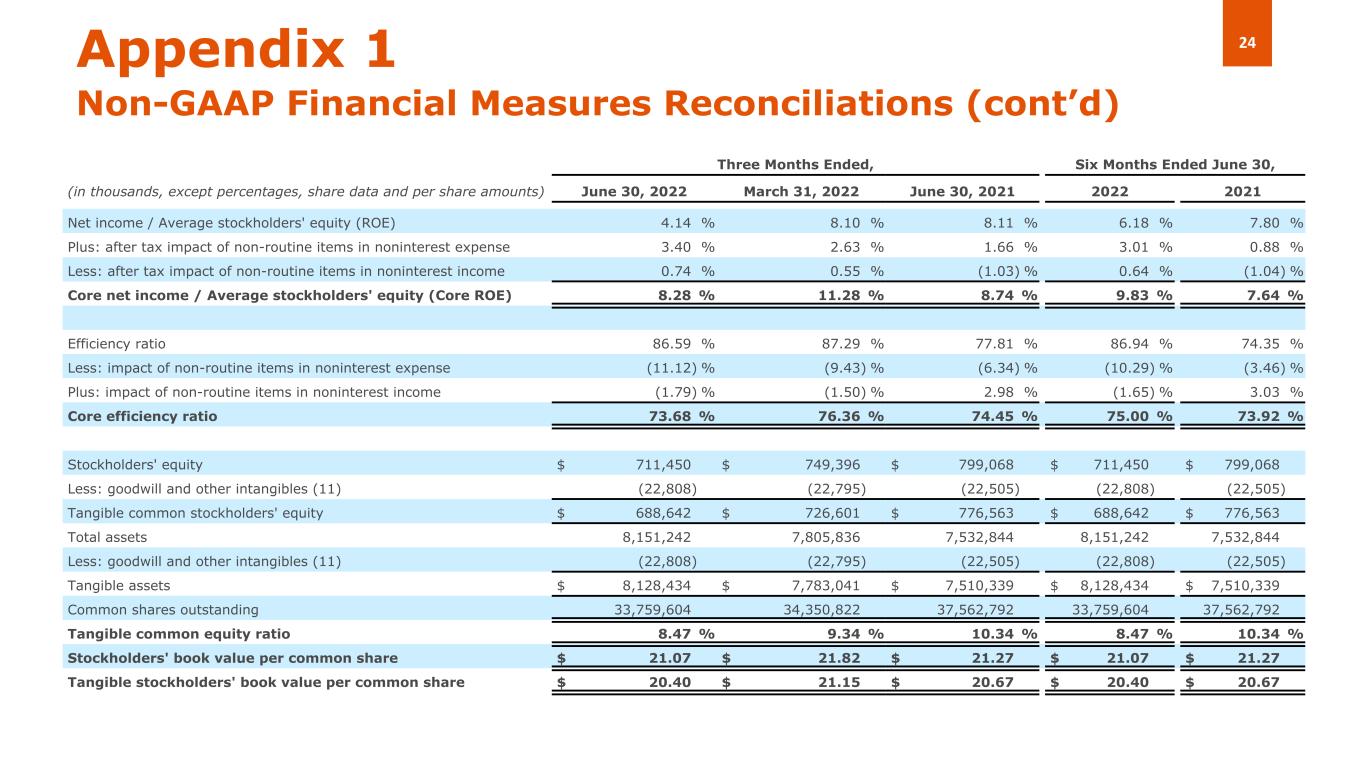

•The efficiency ratio was 86.6% in 2Q22, inclusive of non-routine charges, compared to 87.3% in 1Q22, and 77.8% in 2Q21. Core efficiency ratio1 was 73.7% in 2Q22, compared to 76.4% in 1Q22, and 74.5% in 2Q21.

•Total gross loans, which include loans held for sale, were $5.85 billion at the close of 2Q22, up $126.2 million, or 2.2%, compared to the close of 1Q22. Total deposits were $6.20 billion at the close of 2Q22, up by $511.2 million, or 8.98%, compared to the close of 1Q22, and up by $527.9 million, or 9.3%, compared to the close of the second quarter 2021.

•Stockholders’ book value per common share attributable to the Company was $21.07 at 2Q22, compared to $21.82 at 1Q22, and $21.27 at 2Q21. Tangible stockholders’ equity book value (“TBV”)1 per common share was $20.40 as of 2Q22, compared to $21.15 at

1Q22, and $20.67 at 2Q21. The decline in book value reflects an accumulated after-tax unrealized loss of $51.0 million at the close of 2Q22 compared to $24.4 million at the close of 1Q22 primarily on the valuation of the Company’s debt securities available for sale.

Credit Quality

The ALL was $52.0 million at the close of 2Q22, compared to $56.1 million at the close of 1Q22, and $104.2 million at the close of 2Q21. There were no provision expense or release from the ALL for 2Q22, compared to a release of $10.0 million in 1Q22, and a release of $5.0 million in 2Q21. The ALL decreased during 2Q22 primarily due to net charge-offs and movements within the reserve including requirements for loan growth, one loan downgraded to special mention and increase in specific reserves for one commercial non-performing loan. These requirements were offset by the upgrade of 2 commercial loans from special mention to pass, and reduction in ALL associated with the COVID-19 pandemic which was reduced from $4.9 million to $2.7 million during 2Q22.

Net charge-offs during 2Q22 totaled $4.0 million, compared to $3.8 million in 1Q22 and $1.8 million net charge-offs in 2Q21. Charge-offs during the period were primarily due to $4.0 million in two commercial loans and $0.9 million in consumer loans, offset by $1.5 million in recoveries.

Non-performing loans to total loans decreased significantly to 0.43% as of 2Q22, from 0.82% as of 1Q22, and from 2.16% as of 2Q21. Special mention loans increased $1.5 million compared to 1Q22, and decreased $54.8 million compared to 2Q21. The decrease in NPL was primarily due to pay downs and payoffs totaling $19.2 million and charge-offs totaling $4.4 million (including $3.6 million for the Coffee Trader remaining balance as previously mentioned), offset by $2.3 million due to the downgrade of one commercial loan. The increase in special mention loans was primarily due to the downgrade of one New York Commercial Real Estate (“CRE”) retail loan totaling $29.0 million, offset by upgrades of two commercial loans totaling $15.7 million and pay downs and payoffs of three commercial loans totaling $11.2 million.

Non-performing assets totaled $31.7 million at 2Q22, a decrease of $25.0 million or 44.1%, compared to 1Q22, and $89.8 million, or 73.9%, compared to 2Q21, due to the decrease in NPL as mentioned above and the change in valuation of OREO by $3.2 million. The ratio of non-performing assets to total assets was 39 basis points, down 34 basis points from 73 basis points in 1Q22 and 122 basis points from 161 basis points in 2Q21. In 2Q22, the ratio of ALL to non-performing loans improved to 2.07x, from 1.19x at 1Q22 and from 0.86x at the close of 2Q21.

Loans and Deposits

Total loans, including loans held for sale, as of 2Q22 were $5.85 billion, up $126.2 million, or 2.21%, and $279.8 million, or 5.0%, compared to 1Q22 and 4Q21, respectively. Loans held for sale as of 2Q22 totaled $121.3 million, compared to $85.7 million and $158.1 million as of 1Q22, and 4Q21, respectively. As of 2Q22, loans held for sale included $54.9 million in residential mortgage loans, and $66.4 million in CRE New York loans. Net loan growth during 2Q22 was primarily driven by origination and cross-sale efforts in Commercial & Industrial (C&I), partially offset by $272.0 million in pay downs recorded. This growth was also complemented with $130.2 million in loan purchases performed under the indirect lending program. Net loan growth year-to-date was driven by the same factors described above.

Total deposits as of 2Q22 were $6.2 billion, up $511.2 million, or 8.98%, and $572.0 million or 10.2%, compared to 1Q22 and 4Q21, respectively. The quarter-over-quarter increase in total deposits was primarily attributable to an increase in customer transaction account balances of $506.6 million, or 11.5%, compared to 1Q22, with mostly interest-bearing accounts contributing to such growth as the Company continued to seek additional sources of deposits during the period such as funds from escrow accounts and municipalities. Offsetting the increase in total deposits was a decrease of $19.3 million, or 1.5% in non-interest bearing deposits compared to 1Q22. The year-to-date increase in total deposits was primarily attributable to an increase in customer transactional account balances of $704.7 million, or 16.8%, compared to 4Q21, inclusive of the additional sources as mentioned above. Offsetting the year-to-date increase was a decrease of $111.2 million, or 10.6% in customer time deposits.

Customer time deposits decreased $14.0 million, or 1.5%, and $111.2 million, or 10.6% compared to the first quarter of 2022 and fourth quarter of 2021, respectively, as the Company continued to focus on increasing core deposits and emphasizing multi-product relationships versus single product higher-cost time deposits.

Core deposits, which consist of total deposits excluding all time deposits, as of 2Q22 were $4.9 billion, an increase of $505.0 million, or 11.4%, and $655.4 million, or 15.3% compared to 1Q22 and 4Q21, respectively. The $4.9 billion in core deposits includes interest-bearing deposits of $2.0 billion, which increased $476.0 million and $512.2 million compared to 1Q22 and 4Q21, respectively. Noninterest bearing demand deposits remained flat at $1.3 billion, compared to 1Q22 and increased $115.7 million or 9.8% compared to 4Q21. Domestic deposits totaled $3.7 billion, up $542.3 million, or 17.1%, and $585.2 million, or 18.7% compared to 1Q22, and 4Q21, respectively. Foreign deposits totaled $2.5 billion, slightly down by $31.2 million, or 1.2%, and $13.2 million, or 0.5% compared to 1Q22 and 4Q21, respectively.

Net Interest Income and Net Interest Margin

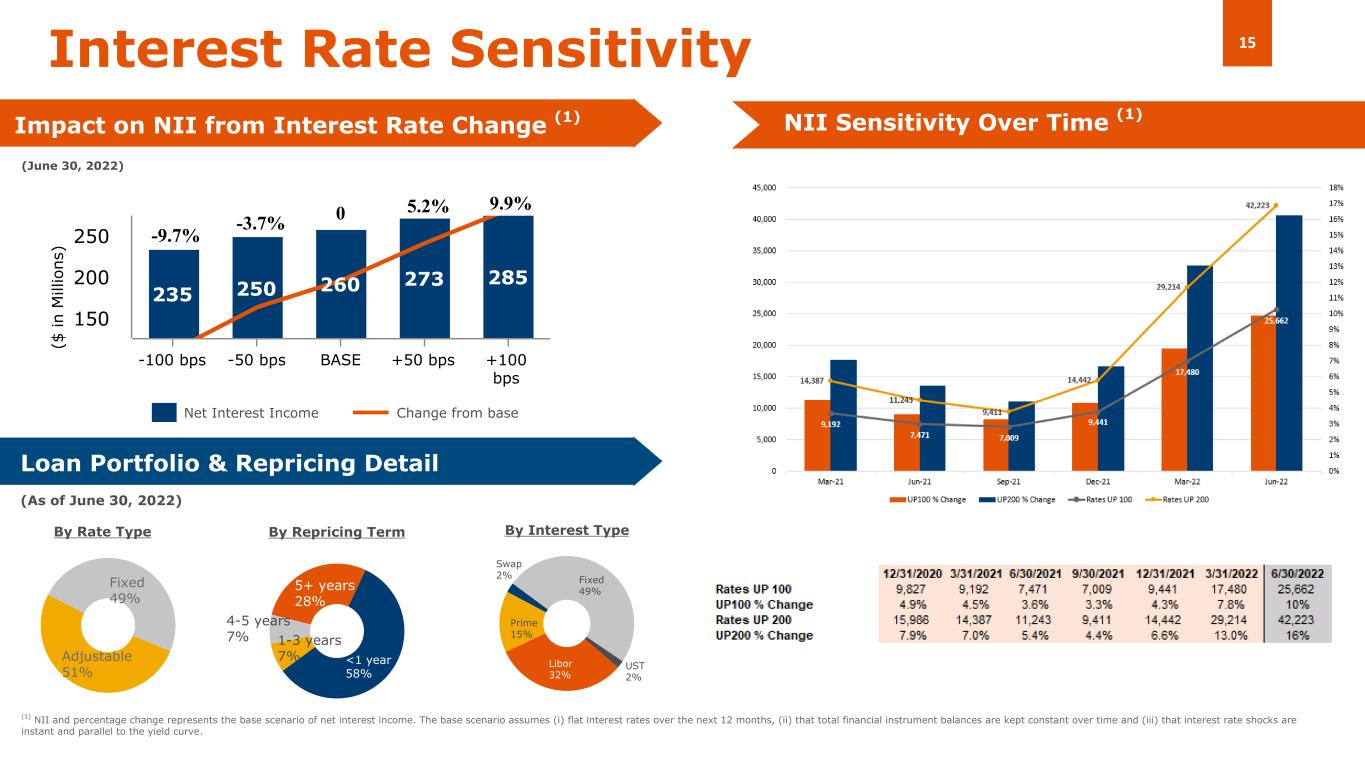

Second quarter 2022 NII was $58.9 million, up $3.3 million, or 5.9%, from $55.6 million in 1Q22 and up $9.0 million, or 17.96%, from $50.0 million in 2Q21. The quarter-over-quarter increase was primarily driven by: (i) higher average yields on loans, debt securities available for sale and placements; (ii) higher average balance of commercial and consumer loans; (iii) higher average balances of debt securities held to maturity; and (iv) lower average balances of FHLB advances and customer time deposits. These results were partially offset by: (i) higher average cost of total deposits and FHLB advances; (ii) lower average balances in available for sale debt securities; (iii) the full quarter impact of the cost related to the subordinated debt issued in March 2022; and (iv) higher average balances of brokered time deposits. The increase in average yields on interest earning assets includes the effect of the Federal Reserve’s actions to manage inflation in 2022 which consisted of raising its benchmark rate by a total of 150 basis points year to date.

The year-over-year increase in NII was primarily driven by: (i) higher average yields on loans, debt securities available for sale and placements; (ii) higher average balance of loans and held to maturity securities; (iii) lower average balances and rates on customer time deposits; and (iv) lower average balances of brokered time deposits and FHLB advances. Partially offsetting the year-over-year increase in NII were higher cost of interest bearing deposits, money market deposits, brokered time deposits and FHLB advances, and the cost of the subordinated debt in March 2022.

NIM was 3.28% in 2Q22, up 10 basis points from 3.18% in 1Q22, and up 47 basis points from 2.81% in 2Q21. The increase in NIM in 2Q22 includes the effect of higher market rates on loan yields as well as Amerant’s efforts to increase loan origination volumes. In 2Q22, the Company also continued seeking additional opportunities to improve NIM through the purchase of consumer loans under indirect lending programs. In addition, during 2Q22 the Company repaid $350.0 million in FHLB callable advances and borrowed $200.0 million in long-term fixed advances to extend duration of this portfolio and lock-in fixed interest rates.

Noninterest income

In 2Q22, noninterest income was $12.9 million, down $1.1 million, or 7.8%, from $14.0 million in 1Q22. The decrease was primarily driven by net unrealized losses on marketable equity securities of $2.6 million in 2Q22 and lower fee income from client derivatives. These results were partially offset by: (i) higher mortgage banking income of $1.8 million; (ii) net unrealized gain on derivatives valuation of $0.9 million; and (iii) the absence of a net loss of $0.7 million on the early extinguishment of FHLB advances incurred in 1Q22.

Noninterest income decreased $2.8 million, or 17.8%, in 2Q22 from $15.7 million in 2Q21. The year-over-year decrease in noninterest income was primarily driven by: (i) net unrealized losses on marketable equity securities of $2.6 million in 2Q22; (ii) the absence of a gain of $3.8 million on the sale of $95.1 million of PPP loans in 2Q21; and (iii) lower fee income from client derivatives. The decrease was partially offset by: (i) the absence of a loss of $2.5 million on the early extinguishment of $235.0 million of FHLB advances in 2Q21; (ii) higher income from mortgage banking; (iii) net unrealized gains on derivative valuation of $0.9 million in 2Q22; and (iv) higher deposit fees.

In 2Q22, the Company increased its ownership interest in Amerant Mortgage (“AMTM”) to 80% from 57.4% at the close of 1Q22, due to two former principals surrendering their interest in AMTM to the Company when they became full time employees of the Bank and an additional $1 million capital contribution made by the Company to AMTM in 2Q22. In 2Q22, AMTM had noninterest income totaling $2.4 million. In 2Q22,AMTM received 285 applications and funded 253 loans totaling $118.6 million. Total mortgage loans held for sale were $54.9 million as of 2Q22. FTEs at AMTM decreased to 67 in 2Q22 from 79 in 1Q22, as the company rebalanced its workforce in light of current market conditions.

The Company’s assets under management and custody (“AUM”) totaled $1.9 billion as of

2Q22, decreasing $261.4 million, or 12.3%, from $2.1 billion as of 1Q22, and decreasing $264.5 million, or 12.4% from $2.1 billion as of 2Q21. The quarter-over-quarter and year-over-year decrease in AUM was primarily driven by lower market valuations, due to decreased valuations in equity and fixed income markets.

Noninterest expense

Second quarter of 2022 noninterest expense was $62.2 million, up $1.4 million, or 2.3%, from $60.8 million in 1Q22. The increase was primarily driven by: (i) a non-routine charge of $3.2 million related to an OREO valuation in New York; (ii) a lease impairment charge of $1.6 million related to the closing of a banking center; (iii) higher other professional fees primarily in connection with customer derivative transactions; (iv) incremental variable compensation expenses; and (v) higher advertising expenses. This increase in noninterest expense was partially offset by: (i) $1.2 million lower estimated technology contract termination costs when compared to 1Q22, resulting from the upcoming transition to FIS; (ii) a $0.3 million reversal from the valuation allowance related to the change in fair value of New York loans held for sale; (iii) lower salaries and employee benefits resulting from fewer FTEs; (iv) lower consulting fees primarily driven by the absence of additional expenses in 1Q22 in connection with the engagement of FIS; and (vi) lower telecommunication and data processing expenses, primarily due to lower fees in connection with software services received from third-party vendors.

Second quarter of 2022 noninterest expense, was $60.8 million, up $11.1 million, or 21.7%, from $51.1 million in 2Q21. The increase was primarily driven by: (i) additional expenses related to the market valuation adjustment of an OREO property in New York; (ii) technology contract termination costs resulting from the transition to FIS supported systems and applications; (iii) higher advertising expenses resulting from the Company’s efforts to build brand awareness and drive digital and branch traffic; (iv) higher variable compensation and long term incentive plans; (v) higher professional fees primarily in connection with customer derivative transactions; (vi) higher net rent expense related to the leasing of the Company’s headquarters building and the aforementioned lease impairment charge. These increases were partially offset by: (i) lower severance expenses as 2Q21 included $3.3 million in connection with the departure of the Company’s former Chief Operating Officer and elimination of various support positions; and (ii) the absence of a $0.8 million lease impairment charge in connection with the closing of the NYC LPO in 2Q21.

In 2Q22, AMTM had noninterest expenses totaling $3.7 million, which includes $2.5 million in salaries and employee benefits and an aggregate of $1.2 million in residential mortgage loan operations, professional fees and other noninterest expenses.

The efficiency ratio was 86.59% in 2Q22, compared to 87.29% in 1Q22, and 77.81% in 2Q21. Core efficiency ratio1 decreased to 73.68% in 2Q22 compared to 76.36% in 1Q22 and 74.45% in 2Q21, primarily driven by higher NII.

Amerant continues to work on increasing operating efficiencies. As of 2Q22, total FTEs was 680 compared to 677 on 1Q22, resulting from business development hires, partially offset by reductions in staff in our mortgage banking operation. Also, the Company is focused on further strengthening its business structure as evidenced by the larger percentage of team members in business generation roles than in support functions.

Capital Resources and Liquidity

The Company’s capital continues to be strong and well in excess of the minimum regulatory requirements to be considered “well-capitalized” at 2Q22.

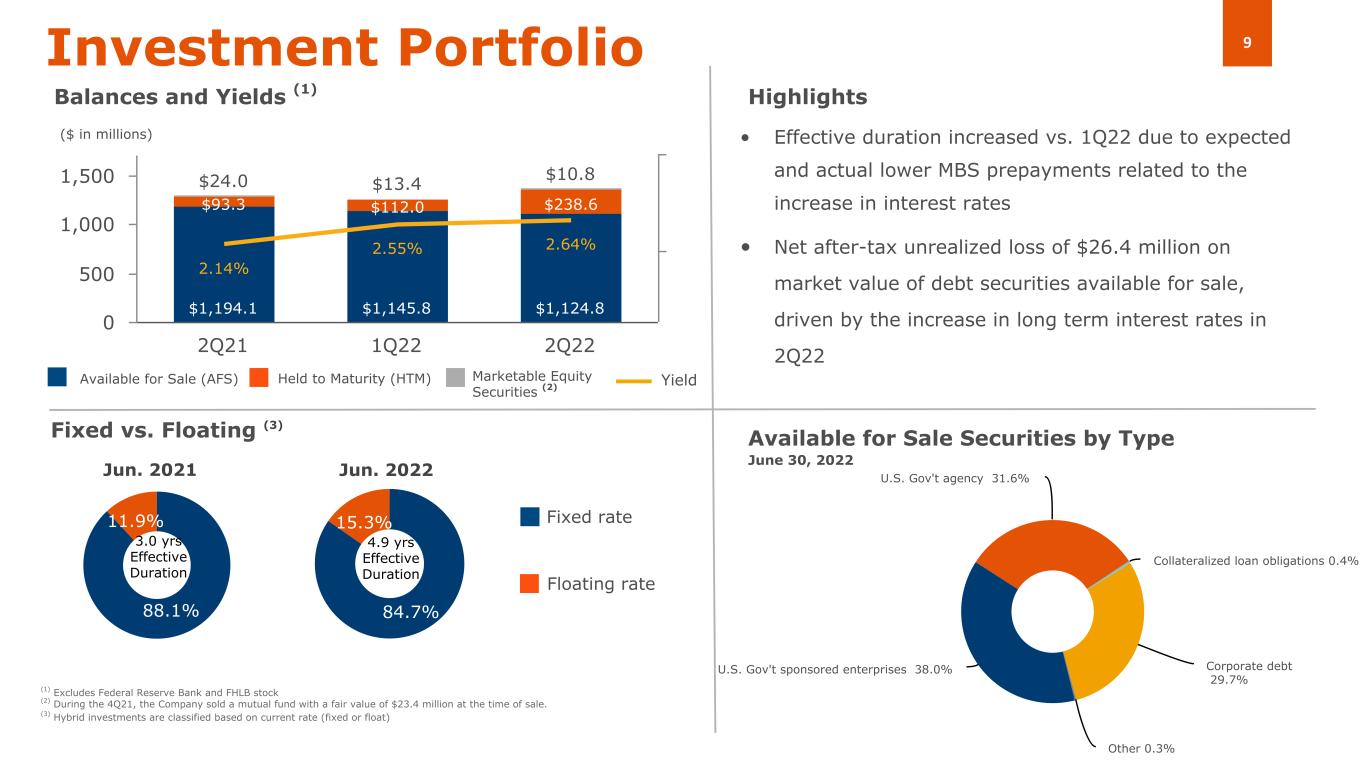

Stockholders’ equity attributable to the Company totaled $711.5 million as of 2Q22, down $37.9 million, or 5.1%, from $749.4 million as of 1Q22, and down $120.4 million, or 14.5% from $831.9 million as of 4Q21. The quarter-over-quarter decrease was primarily driven by: (i) an after-tax unrealized loss of $26.4 million on the market value of debt securities available for sale as a result of the increase of approximately 60 basis points recorded in the index market rates; (ii) an aggregate of $17.2 million of Class A Common Stock in 2Q22, under the Class A repurchase program launched in 2022, and (iii) $3.0 million of dividends declared and paid by the Company in 2Q22. These decreases were partially offset by net income of $7.7 million in 2Q22. The year-to-date decrease was driven by: (i) an aggregate of $72.1 million of Class A Common Stock repurchased in the first and second quarter of 2022, under the Class A Common Stock repurchase programs launched in 2021 and 2022; (ii) an after-tax unrealized loss of $66.1 million in the market value of debt securities available for sale as a result of the increase of approximately over 150 basis points recorded in the index market rates and; (iii) $6.2 million of dividends declared and paid by the Company in the first and second quarter of 2022. These decreases were partially offset by net income of $16.0 million and $7.7 million in the first and second quarter of 2022, respectively.

Book value per common share decreased to $21.07 at 2Q22 compared to $21.82 at 1Q22 and $23.18 at 4Q21. TBV1 per common share decreased to $20.40 at 2Q22 compared to $21.15 and $22.55 at 1Q22 and 4Q21, respectively. Both decreases were primarily driven by the factors described above.

Amerant’s liquidity position includes cash and cash equivalents of $354.1 million at the close of 2Q22, compared to $276.2 million and $274.2 million as of 1Q22 and 4Q21, respectively. Additionally, as of the end of 2Q22, 1Q22, and 4Q21, the Company, through its subsidiary Amerant Bank, had $1.5 billion, $1.3 billion and $1.4 billion, respectively, in available borrowing capacity with the FHLB.

1 Non-GAAP measure, see “Non-GAAP Financial Measures” for more information and Exhibit 2 for a reconciliation to GAAP.

Second Quarter 2022 Earnings Conference Call

The Company will hold an earnings conference call on Thursday, July 21, 2022 at 9:00 a.m. (Eastern Time) to discuss its second quarter 2022 results. The conference call and presentation materials can be accessed via webcast by logging on from the Investor Relations section of the Company’s website at https://investor.amerantbank.com. The online replay will remain available for approximately one month following the call through the above link.

About Amerant Bancorp Inc. (NASDAQ: AMTB)

Amerant Bancorp Inc. is a bank holding company headquartered in Coral Gables, Florida since 1979. The Company operates through its main subsidiary, Amerant Bank, N.A. (the “Bank”), as well as its other subsidiaries: Amerant Investments, Inc., Elant Bank and Trust Ltd., and Amerant Mortgage, LLC. The Company provides individuals and businesses in the U.S. with deposit, credit and wealth management services. The Bank, which has operated for over 40 years, is the largest community bank headquartered in Florida. The Bank operates 24 banking centers – 17 in South Florida and 7 in the Houston, Texas area, as well as an LPO in Tampa, Florida. For more information, visit investor.amerantbank.com.

FIS® and any associated brand names/logos are the trademarks of FIS and/or its affiliates.

Cautionary Notice Regarding Forward-Looking Statements

This press release contains “forward-looking statements” including statements with respect to the Company’s objectives, expectations and intentions and other statements that are not historical facts. All statements other than statements of historical fact are statements that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,” “assume,” “should,” “indicate,” “would,” “believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,” “point to,” “project,” “could,” “intend,” “target,” “goals,” “outlooks,” “modeled,” “dedicated,” “create,” and other similar words and expressions of the future.

Forward-looking statements, including those relating to our beliefs, plans, objectives, goals, expectations, anticipations, estimates and intentions, involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the Company’s actual results, performance, achievements, or financial condition to be materially different from future results, performance, achievements, or financial condition expressed or implied by such forward-looking statements. You should not rely on any forward-looking statements as predictions of future events. You should not expect us to update any forward-looking statements, except as required by law. All written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, together with those risks and uncertainties described in “Risk factors” in our annual report on Form 10-K for the fiscal year ended December 31, 2021, our quarterly report on Form 10-Q for the quarter ended March 31, 2022 and in our other filings with the U.S. Securities and Exchange Commission (the “SEC”), which are available at the SEC’s website www.sec.gov.

Interim Financial Information

Unaudited financial information as of and for interim periods, including the three and six month periods ended June 30, 2022 and 2021, may not reflect our results of operations for our fiscal year ending, or financial condition as of December 31, 2022, or any other period of time or date.

Non-GAAP Financial Measures

The Company supplements its financial results that are determined in accordance with accounting principles generally accepted in the United States of America (“GAAP”) with non-GAAP financial measures, such as “pre-provision net revenue (PPNR)”, “core pre-provision net revenue (Core PPNR)”, “core noninterest income”, “core noninterest expenses”, “core net income (loss)”, “core earnings (loss) per share (basic and diluted)”, “core return on assets (Core ROA)”, “core return on equity (Core ROE)”, “core efficiency ratio”, and “tangible stockholders’ equity book value per common share”. This supplemental information is not required by, or is not presented in accordance with GAAP. The Company refers to these financial measures and ratios as “non-GAAP financial measures” and they should not be considered in isolation or as a substitute for the GAAP measures presented herein.

We use certain non-GAAP financial measures, including those mentioned above, both to explain our results to shareholders and the investment community and in the internal evaluation and management of our businesses. Our management believes that these non-GAAP financial measures and the information they provide are useful to investors since these measures permit investors to view our performance using the same tools that our management uses to evaluate our past performance and prospects for future performance, especially in light of the additional costs we have incurred in connection with the Company’s restructuring activities that began in 2018 and continued in 2022, including the effect of non-core banking activities such as the sale of loans and securities, the valuation of securities, derivatives, loans held for sale and other real estate owned, the sale of our corporate headquarters in the fourth quarter of 2021, and other non-routine actions intended to improve customer service and operating performance. While we believe that these non-GAAP financial measures are useful in evaluating our performance, this information should be considered as supplemental and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Additionally, these non-GAAP financial measures may differ from similar measures presented by other companies.

Exhibit 2 reconciles these non-GAAP financial measures to reported results.

Exhibit 1- Selected Financial Information

The following table sets forth selected financial information derived from our unaudited and audited consolidated financial statements.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(in thousands) |

June 30, 2022 |

|

March 31, 2022 |

|

December 31, 2021 |

|

September 30, 2021 |

|

June 30, 2021 |

| Consolidated Balance Sheets |

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

8,151,242 |

|

|

$ |

7,805,836 |

|

|

$ |

7,638,399 |

|

|

$ |

7,489,305 |

|

|

$ |

7,532,844 |

|

| Total investments |

1,422,479 |

|

|

1,324,969 |

|

|

1,341,241 |

|

|

1,422,738 |

|

|

1,359,240 |

|

|

|

|

|

|

|

|

|

|

|

| Total gross loans (1) |

5,847,384 |

|

|

5,721,177 |

|

|

5,567,540 |

|

|

5,478,924 |

|

|

5,608,548 |

|

| Allowance for loan losses |

52,027 |

|

|

56,051 |

|

|

69,899 |

|

|

83,442 |

|

|

104,185 |

|

| Total deposits |

6,202,854 |

|

|

5,691,701 |

|

|

5,630,871 |

|

|

5,626,377 |

|

|

5,674,908 |

|

| Core deposits (2) |

4,948,445 |

|

|

4,443,414 |

|

|

4,293,031 |

|

|

4,183,587 |

|

|

4,041,867 |

|

| Advances from the FHLB and other borrowings |

830,524 |

|

|

980,047 |

|

|

809,577 |

|

|

809,095 |

|

|

808,614 |

|

| Senior notes |

59,052 |

|

|

58,973 |

|

|

58,894 |

|

|

58,815 |

|

|

58,736 |

|

| Subordinated notes (3) |

29,199 |

|

|

29,156 |

|

|

— |

|

|

— |

|

|

— |

|

| Junior subordinated debentures |

64,178 |

|

|

64,178 |

|

|

64,178 |

|

|

64,178 |

|

|

64,178 |

|

| Stockholders' equity (4)(5)(6)(7) |

711,450 |

|

|

749,396 |

|

|

831,873 |

|

|

812,662 |

|

|

799,068 |

|

Assets under management and custody (8) |

1,868,017 |

|

|

2,129,387 |

|

|

2,221,077 |

|

|

2,188,317 |

|

|

2,132,516 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended June 30, |

|

|

(in thousands, except percentages, share data and per share amounts) |

June 30, 2022 |

|

March 31, 2022 |

|

December 31, 2021 |

|

September 30, 2021 |

|

June 30, 2021 |

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Results of Operations |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

$ |

58,945 |

|

|

$ |

55,645 |

|

|

$ |

55,780 |

|

|

$ |

51,821 |

|

|

$ |

49,971 |

|

|

$ |

114,590 |

|

|

$ |

97,540 |

|

|

|

|

|

| (Reversal of) provision for loan losses |

— |

|

|

(10,000) |

|

|

(6,500) |

|

|

(5,000) |

|

|

(5,000) |

|

|

(10,000) |

|

|

(5,000) |

|

|

|

|

|

| Noninterest income |

12,931 |

|

|

14,025 |

|

|

77,290 |

|

|

13,434 |

|

|

15,734 |

|

|

26,956 |

|

|

29,897 |

|

|

|

|

|

| Noninterest expense |

62,241 |

|

|

60,818 |

|

|

55,088 |

|

|

48,404 |

|

|

51,125 |

|

|

123,059 |

|

|

94,750 |

|

|

|

|

|

| Net income attributable to Amerant Bancorp Inc. (9) |

7,674 |

|

|

15,950 |

|

|

65,469 |

|

|

17,031 |

|

|

15,962 |

|

|

23,624 |

|

|

30,421 |

|

|

|

|

|

| Effective income tax rate |

21.10 |

% |

|

21.10 |

% |

|

23.88 |

% |

|

24.96 |

% |

|

22.65 |

% |

|

21.10 |

% |

|

21.45 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common Share Data |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders' book value per common share |

$ |

21.07 |

|

|

$ |

21.82 |

|

|

$ |

23.18 |

|

|

$ |

21.68 |

|

|

$ |

21.27 |

|

|

$ |

21.07 |

|

|

$ |

21.27 |

|

|

|

|

|

| Tangible stockholders' equity (book value) per common share (10) |

$ |

20.40 |

|

|

$ |

21.15 |

|

|

$ |

22.55 |

|

|

$ |

21.08 |

|

|

$ |

20.67 |

|

|

$ |

20.40 |

|

|

$ |

20.67 |

|

|

|

|

|

| Basic earnings per common share |

$ |

0.23 |

|

|

$ |

0.46 |

|

|

$ |

1.79 |

|

|

$ |

0.46 |

|

|

$ |

0.43 |

|

|

$ |

0.69 |

|

|

$ |

0.81 |

|

|

|

|

|

| Diluted earnings per common share (11) |

$ |

0.23 |

|

|

$ |

0.45 |

|

|

$ |

1.77 |

|

|

$ |

0.45 |

|

|

$ |

0.42 |

|

|

$ |

0.68 |

|

|

$ |

0.81 |

|

|

|

|

|

| Basic weighted average shares outstanding |

33,675,930 |

|

|

34,819,984 |

|

|

36,606,969 |

|

|

37,133,783 |

|

|

37,330,000 |

|

|

34,244,797 |

|

|

37,473,144 |

|

|

|

|

|

| Diluted weighted average shares outstanding (11) |

33,914,529 |

|

|

35,114,043 |

|

|

37,064,769 |

|

|

37,518,293 |

|

|

37,692,982 |

|

|

34,511,126 |

|

|

37,768,470 |

|

|

|

|

|

| Cash dividend declared per common share (7) |

$ |

0.09 |

|

|

$ |

0.09 |

|

|

$ |

0.06 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

0.18 |

|

|

$ |

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended June 30, |

|

|

|

June 30, 2022 |

|

March 31, 2022 |

|

December 31, 2021 |

|

September 30, 2021 |

|

June 30, 2021 |

|

2022 |

|

2021 |

|

|

|

|

| Other Financial and Operating Data (12) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Profitability Indicators (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income / Average total interest earning assets (NIM) (13) |

3.28 |

% |

|

3.18 |

% |

|

3.17 |

% |

|

2.94 |

% |

|

2.81 |

% |

|

3.23 |

% |

|

2.74 |

% |

|

|

|

|

| Net income / Average total assets (ROA) (14) |

0.39 |

% |

|

0.84 |

% |

|

3.45 |

% |

|

0.90 |

% |

|

0.83 |

% |

|

0.61 |

% |

|

0.80 |

% |

|

|

|

|

| Net income / Average stockholders' equity (ROE) (15) |

4.14 |

% |

|

8.10 |

% |

|

32.04 |

% |

|

8.38 |

% |

|

8.11 |

% |

|

6.18 |

% |

|

7.80 |

% |

|

|

|

|

| Noninterest income / Total revenue (16) |

17.99% |

|

20.13% |

|

58.08% |

|

20.59% |

|

23.95% |

|

19.04% |

|

23.46% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Capital Indicators (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total capital ratio (17) |

13.21 |

% |

|

13.80 |

% |

|

14.56 |

% |

|

14.53 |

% |

|

14.17 |

% |

|

13.21 |

% |

|

14.17 |

% |

|

|

|

|

| Tier 1 capital ratio (18) |

11.99 |

% |

|

12.48 |

% |

|

13.45 |

% |

|

13.28 |

% |

|

12.92 |

% |

|

11.99 |

% |

|

12.92 |

% |

|

|

|

|

| Tier 1 leverage ratio (19) |

10.25 |

% |

|

10.67 |

% |

|

11.52 |

% |

|

11.18 |

% |

|

10.75 % |

|

10.25 |

% |

|

10.75 % |

|

|

|

|

| Common equity tier 1 capital ratio (CET1) (20) |

11.08 |

% |

|

11.55 |

% |

|

12.50 |

% |

|

12.31 |

% |

|

11.95 |

% |

|

11.08 |

% |

|

11.95 |

% |

|

|

|

|

| Tangible common equity ratio (21) |

8.47 |

% |

|

9.34 |

% |

|

10.63 |

% |

|

10.58 |

% |

|

10.35 |

% |

|

8.47 |

% |

|

10.35 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset Quality Indicators (%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-performing assets / Total assets (22) |

0.39 |

% |

|

0.73 |

% |

|

0.78 |

% |

|

1.24 |

% |

|

1.61 |

% |

|

0.39 |

% |

|

1.61 |

% |

|

|

|

|

| Non-performing loans / Total loans (1) (23) |

0.43 |

% |

|

0.82 |

% |

|

0.89 |

% |

|

1.51 |

% |

|

2.16 |

% |

|

0.43 |

% |

|

2.16 |

% |

|

|

|

|

| Allowance for loan losses / Total non-performing loans |

206.84 |

% |

|

119.34 |

% |

|

140.41 |

% |

|

100.84 |

% |

|

86.02 |

% |

|

206.84 |

% |

|

86.02 |

% |

|

|

|

|

| Allowance for loan losses / Total loans held for investment (1) |

0.91 |

% |

|

0.99 |

% |

|

1.29 |

% |

|

1.59 |

% |

|

1.86 |

% |

|

0.91 |

% |

|

1.86 |

% |

|

|

|

|

| Net charge-offs / Average total loans held for investment (24) |

0.29 |

% |

|

0.29 |

% |

|

0.52 |

% |

|

1.16 |

% |

|

0.12 |

% |

|

0.29 |

% |

|

0.06 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Efficiency Indicators (% except FTE) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Noninterest expense / Average total assets |

3.18 |

% |

|

3.20 |

% |

|

2.90 |

% |

|

2.55 |

% |

|

2.67 |

% |

|

3.19 |

% |

|

2.48 |

% |

|

|

|

|

| Salaries and employee benefits / Average total assets |

1.54 |

% |

|

1.60 |

% |

|

1.65 |

% |

|

1.53 |

% |

|

1.61 |

% |

|

1.57 |

% |

|

1.50 |

% |

|

|

|

|

| Other operating expenses/ Average total assets (25) |

1.64 |

% |

|

1.60 |

% |

|

1.25 |

% |

|

1.02 |

% |

|

1.06 |

% |

|

1.62 |

% |

|

0.98 |

% |

|

|

|

|

| Efficiency ratio (26) |

86.59 |

% |

|

87.29 |

% |

|

41.40 |

% |

|

74.18 |

% |

|

77.81 |

% |

|

86.94 |

% |

|

74.35 |

% |

|

|

|

|

| Full-Time-Equivalent Employees (FTEs) (27) |

680 |

|

677 |

|

763 |

|

733 |

|

719 |

|

680 |

|

719 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

Six Months Ended June 30, |

|

|

(in thousands, except percentages and per share amounts) |

June 30, 2022 |

|

March 31, 2022 |

|

December 31, 2021 |

|

September 30, 2021 |

|

June 30, 2021 |

|

2022 |

|

2021 |

|

|

|

|

| Core Selected Consolidated Results of Operations and Other Data (10) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Pre-provision net revenue (PPNR) |

$ |

9,707 |

|

|

$ |

9,928 |

|

|

$ |

79,141 |

|

|

$ |

17,485 |

|

|

$ |

15,397 |

|

|

$ |

19,635 |

|

|

$ |

33,504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Core pre-provision net revenue (Core PPNR) |

$ |

19,447 |

|

|

$ |

17,869 |

|

|

$ |

18,911 |

|

|

$ |

18,297 |

|

|

$ |

16,934 |

|

|

$ |

37,316 |

|

|

$ |

32,699 |

|

|

|

|

|

| Core net income |

$ |

15,358 |

|

|

$ |

22,216 |

|

|

$ |

19,339 |

|

|

$ |

17,669 |

|

|

$ |

17,199 |

|

|

$ |

37,574 |

|

|

$ |

29,788 |

|

|

|

|

|

| Core basic earnings per common share |

0.46 |

|

|

0.64 |

|

|

0.53 |

|

|

0.48 |

|

|

0.46 |

|

|

1.10 |

|

|

0.79 |

|

|

|

|

|

| Core earnings per diluted common share (11) |

0.45 |

|

|

0.63 |

|

|

0.52 |

|

|

0.47 |

|

|

0.46 |

|

|

1.09 |

|

|

0.79 |

|

|

|

|

|

| Core net income / Average total assets (Core ROA) (14) |

0.78 |

% |

|

1.17 |

% |

|

1.02 |

% |

|

0.93 |

% |

|

0.90 |

% |

|

0.97 |

% |

|

0.78 |

% |

|

|

|

|

| Core net income / Average stockholders' equity (Core ROE) (15) |

8.28 |

% |

|

11.28 |

% |

|

9.46 |

% |

|

8.69 |

% |

|

8.74 |

% |

|

9.83 |

% |

|

7.64 |

% |

|

|

|

|

| Core efficiency ratio (28) |

73.68 |

% |

|

76.36 |

% |

|

74.98 |

% |

|

72.95 |

% |

|

74.45 |

% |

|

75.00 |

% |

|

73.92 |

% |

|

|

|

|

__________________

(1) Total gross loans include loans held for investment net of unamortized deferred loan origination fees and costs. In addition, at June 30, 2022, March 31, 2022, December 31, 2021 and September 30, 2021, total loans include $66.4 million, $68.6 million, $143.2 million and $219.1 million, respectively, in loans held for sale carried at the lower of cost or estimated fair value. During the first quarter of 2022 and the fourth quarter of 2021, the Company sold approximately $57.3 million and $49.4 million, respectively, in loans held for sale carried at the lower of cost or estimated fair value related to the New York portfolio. In addition, as of June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021, total loans include $54.9 million, $17.1 million, $14.9 million, $5.8 million and $1.8 million, respectively, primarily in mortgage loans held for sale carried at fair value.

(2) Core deposits consist of total deposits excluding all time deposits.

(3) On March 9, 2022, the Company completed a $30.0 million offering of subordinated notes with a 4.25% fixed-to-floating rate and due March 15, 2032 (the “Subordinated Notes”). The Subordinated Notes will initially bear interest at a fixed rate of 4.25% per annum, from and including March 9, 2022, to but excluding March 15, 2027, with interest payable semi-annually in arrears. From and including March 15, 2027, to but excluding the stated maturity date or early redemption date, the interest rate will reset quarterly to an annual floating rate equal to the then-current benchmark rate, which will initially be the three-month Secured Overnight Financing Rate (“SOFR”) plus 251 basis points, with interest during such period payable quarterly in arrears. If three-month SOFR cannot be determined during the applicable floating rate period, a different index will be determined and used in accordance with the terms of the Notes. Subordinated notes are presented net of direct issuance costs which are deferred and amortized over 10 years. The Subordinated Notes have been structured to qualify as Tier 2 capital of the Company for regulatory capital purposes, and rank equally in right of payment to all of our existing and future subordinated indebtedness.

(4) In the first quarter of 2022, the Company repurchased an aggregate of 652,118 shares of Class A common stock at a weighted average price of $33.96 per share, under the Class A common stock repurchase program launched in 2021 (the “Class A Common Stock Repurchase Program”). The aggregate purchase price for these transactions was approximately $22.1 million, including transaction costs. On January 31, 2022, the Company announced the completion of the Class A Common Stock repurchase program. In addition, in the first quarter of 2022, the Company announced the launching of a new repurchase program pursuant to which the Company may purchase, from time to time, up to an aggregate amount of $50 million of its shares of Class A common stock (the “New Class A Common Stock Repurchase Program”). In the second and first quarters of 2022, the Company repurchased an aggregate of 611,525 shares and 991,362 shares, respectively, of Class A common stock at a weighted average price of $28.19 per share and $32.96 per share, respectively, under the new Class A Common Stock Repurchase Program. In the second and first quarters of 2022, the aggregate purchase price for these transactions was approximately $17.2 million and $32.7 million, respectively, including transaction costs. On May 19, 2022, the Company announced the completion of the New Class A Common Stock repurchase program.

(5) In the fourth quarter of 2021, the Company’s shareholders approved a clean-up merger, previously announced by the Company, pursuant to which a subsidiary of the Company merged with and into the Company (the “Merger”). Under the terms of the Merger, each outstanding share of Class B common stock was converted to 0.95 of a share of Class A common stock. In addition, any shareholder who owned fewer than 100 shares of Class A common stock upon completion of the Merger, received cash in lieu of Class A common stock. There were no authorized or outstanding Class B common stock at December 31, 2021. Furthermore, in connection with the Merger, the Company’s Board of Directors authorized the Class A Common Stock Repurchase Program which provided for the potential to repurchase up to $50 million of shares of Class A common stock. In the fourth quarter of 2021, the Company repurchased an aggregate of 1,175,119 shares of Class A common stock for an aggregate purchase price of $36.3 million, including $27.9 million repurchased under the Class A Common Stock Repurchase Program and $8.5 million shares cashed out in accordance with the terms of the Merger. The total weighted average market price of these transactions was $30.92 per share.

(6) On March 10, 2021, the Company’s Board of Directors approved a stock repurchase program which provided for the potential repurchase of up to $40 million of shares of the Company’s Class B common stock (the “ Class B Common Stock Repurchase Program”). In the third and second quarters of 2021, the Company repurchased an aggregate of 63,000 and 386,195 shares of Class B common stock, respectively, at a weighted average price per share of $18.55 and $16.62, respectively, under the Class B Common Stock Repurchase Program. In the third quarter of 2021, the Company’s Board of Directors terminated the Class B Common Stock Repurchase Program.

(7) In the second and first quarters of 2022, and in the fourth quarter of 2021, the Company’s Board of Directors declared a cash dividend of $0.09, $0.09 and $0.06 per share of the Company’s common stock, respectively. The dividend declared in the second quarter of 2022 was paid on May 31, 2022 to shareholders of record at the close of business on May 13, 2022.The dividend declared in the first quarter of 2022 was paid on February 28, 2022 to shareholders of record at the close of business on February 11, 2022. The dividend declared in the fourth quarter of 2021 was paid on or before January 15, 2022 to holders of record as of December 22, 2021. The aggregate amount paid in connection with these dividends in the second quarter of 2022, first quarter of 2022 and the fourth quarter of 2021 was $3.0 million, $3.2 million and $2.2 million, respectively.

(8) Assets held for clients in an agency or fiduciary capacity which are not assets of the Company and therefore are not included in the consolidated financial statements.

(9) In the three months ended June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021, net income exclude losses of $0.1 million, $1.1 million, $1.2 million, $0.6 million, and $0.8 million, respectively, attributable to the minority interest of Amerant Mortgage LLC. Beginning March 31, 2022, the minority interest share changed from 49% to 42.6%. This change had no impact to the Company’s financial condition or results of operations as of and for the first quarter ended March 31, 2022. In addition, in the second quarter of 2022, the minority interest share changed from 42.6% to 20%. In connection with the change in minority interest share in the second quarter of 2022, the Company reduced its additional paid-in capital for a total of $1.9 million with a corresponding increase to the equity attributable to noncontrolling interests.

(10)This presentation contains adjusted financial information determined by methods other than GAAP. This adjusted financial information is reconciled to GAAP in Exhibit 2 - Non-GAAP Financial Measures Reconciliation.

(11) In all the periods shown, potential dilutive instruments consisted of unvested shares of restricted stock, restricted stock units and performance share units. For all other periods presented, potential dilutive instruments were included in the diluted earnings per share computation because, when the unamortized deferred compensation cost related to these shares was divided by the average market price per share in those periods, fewer shares would have been purchased than restricted shares assumed issued. Therefore, in those periods, such awards resulted in higher diluted weighted average shares outstanding than basic weighted average shares outstanding, and had a dilutive effect in per share earnings.

(12) Operating data for the periods presented have been annualized.

(13) NIM is defined as NII divided by average interest-earning assets, which are loans, securities, deposits with banks and other financial assets which yield interest or similar income.

(14)Calculated based upon the average daily balance of total assets.

(15) Calculated based upon the average daily balance of stockholders’ equity.

(16) Total revenue is the result of net interest income before provision for loan losses plus noninterest income.

(17) Total stockholders’ equity divided by total risk-weighted assets, calculated according to the standardized regulatory capital ratio calculations.

(18) Tier 1 capital divided by total risk-weighted assets. Tier 1 capital is composed of Common Equity Tier 1 (CET1) capital plus outstanding qualifying trust preferred securities of $62.3 million at each of all the dates presented.

(19) Tier 1 capital divided by quarter to date average assets.

(20)CET1 capital divided by total risk-weighted assets.

(21) Tangible common equity ratio is calculated as the ratio of common equity less goodwill and other intangibles divided by total assets less goodwill and other intangible assets. Other intangible assets consist of, among other things, mortgage servicing rights and are included in other assets in the Company’s consolidated balance sheets.

(22)Non-performing assets include all accruing loans past due by 90 days or more, all nonaccrual loans, restructured loans that are considered “troubled debt restructurings” or “TDRs”, and OREO properties acquired through or in lieu of foreclosure.

(23)Non-performing loans include all accruing loans past due by 90 days or more, all nonaccrual loans and restructured loans that are considered TDRs.

(24)Calculated based upon the average daily balance of outstanding loan principal balance net of unamortized deferred loan origination fees and costs, excluding the allowance for loan losses. During the second and first quarters of 2022, and the fourth, third and second quarters of 2021, there were net charge offs of $4.0 million, $3.8 million, $7.0 million, $15.7 million, $1.8 million and $5.9 million, respectively. During the second quarter of 2022, the Company charged-off $3.6 million in connection with a loan relationship with a Miami-based U.S. coffee trader (“the Coffee Trader”). During the first quarter of 2022, the Company charged-off $3.3 million in two commercial loans, including $2.5 million related to a nonaccrual loan paid off during the period.

During the fourth quarter of 2021, the Company charged-off an aggregate of $4.2 million related to various commercial loans and $1.8 million related to one real estate loan. During the third quarter of 2021, the Company charged-off $5.7 million against the allowance for loan losses as result of the deterioration of one commercial loan relationship.

(25)Other operating expenses is the result of total noninterest expense less salary and employee benefits.

(26)Efficiency ratio is the result of noninterest expense divided by the sum of noninterest income and NII.

(27)As of June 30, 2022, March 31, 2022, December 31, 2021, September 30, 2021 and June 30, 2021, includes 67, 79, 72, 52 and 38 FTEs for Amerant Mortgage LLC, respectively. In addition, effective January 1, 2022, there were 80 employees who are no longer working for the Company as a result of the new agreement with Fidelity National Information Services, Inc.(“FIS”).

(28)Core efficiency ratio is the efficiency ratio less the effect of restructuring costs and other adjustments, described in Exhibit 2 - Non-GAAP Financial Measures Reconciliation.

Exhibit 2- Non-GAAP Financial Measures Reconciliation

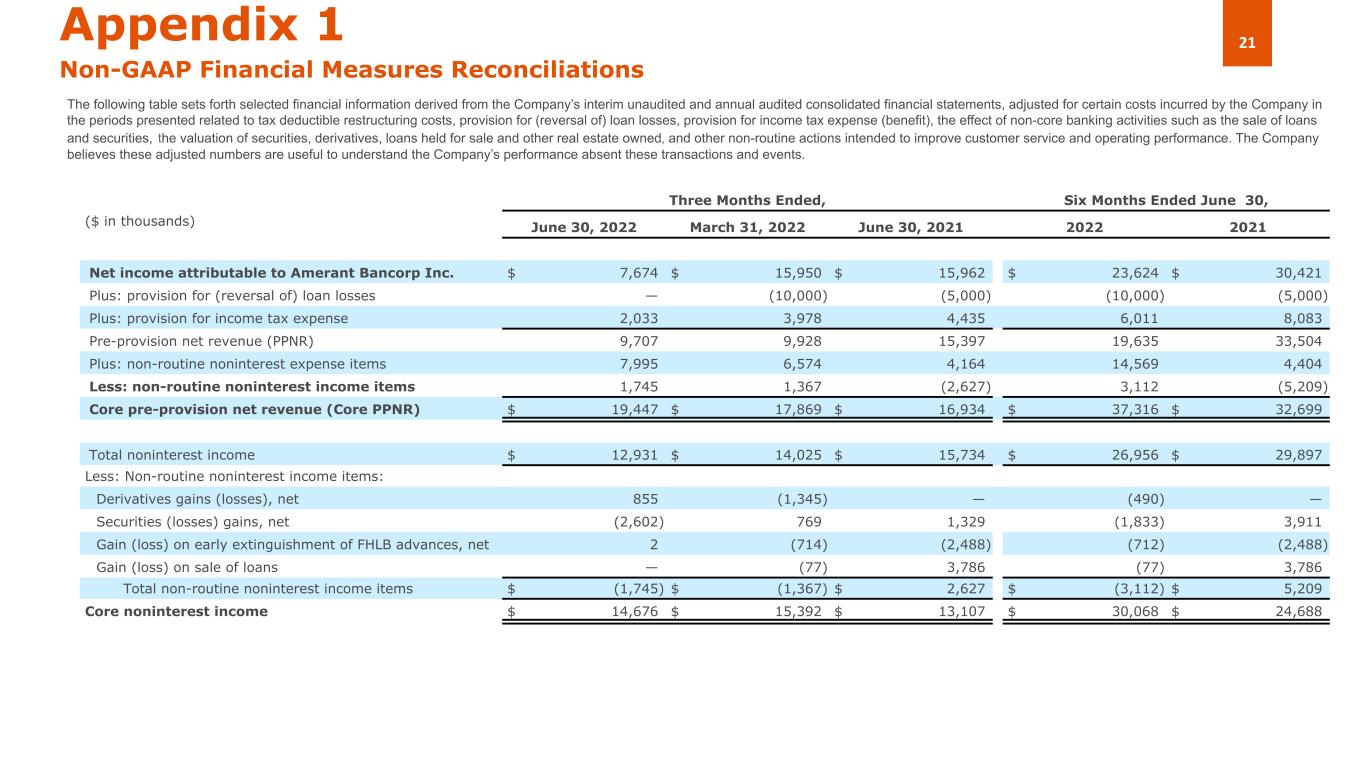

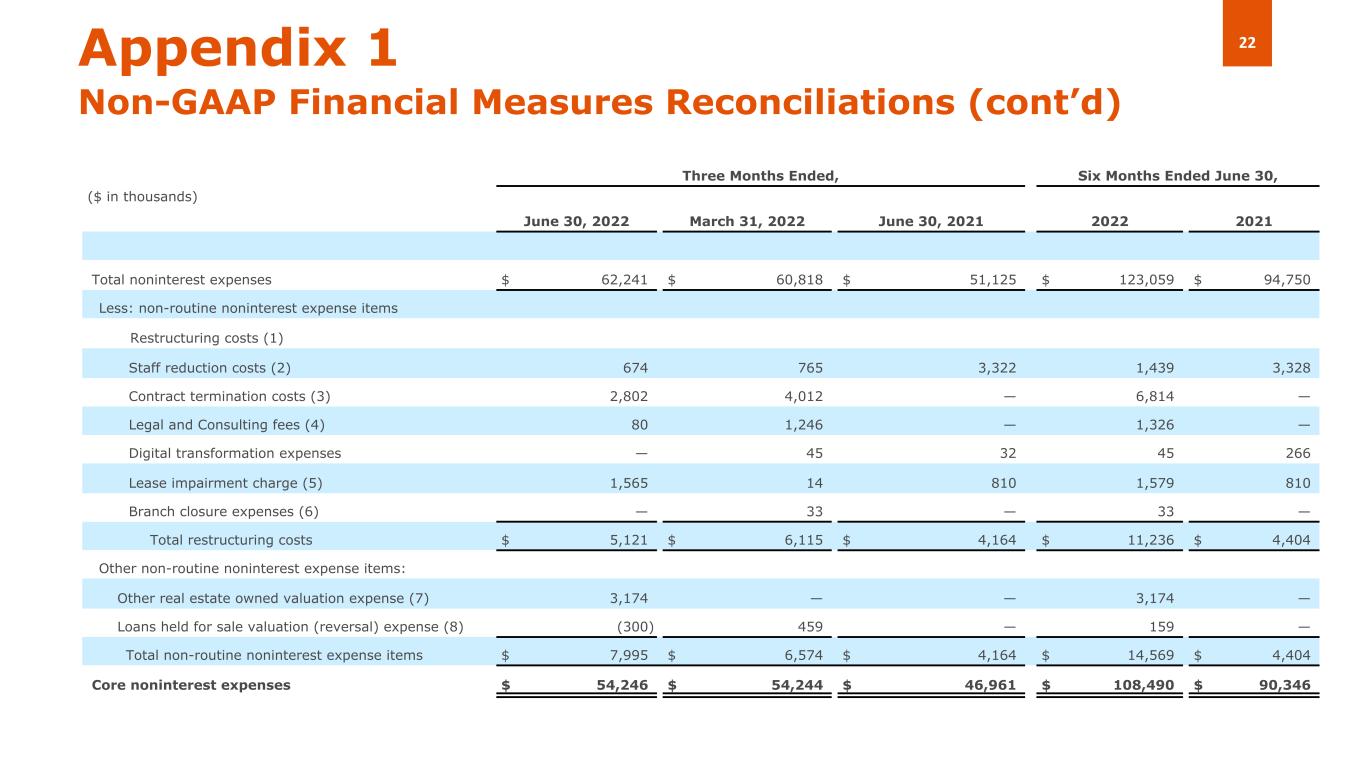

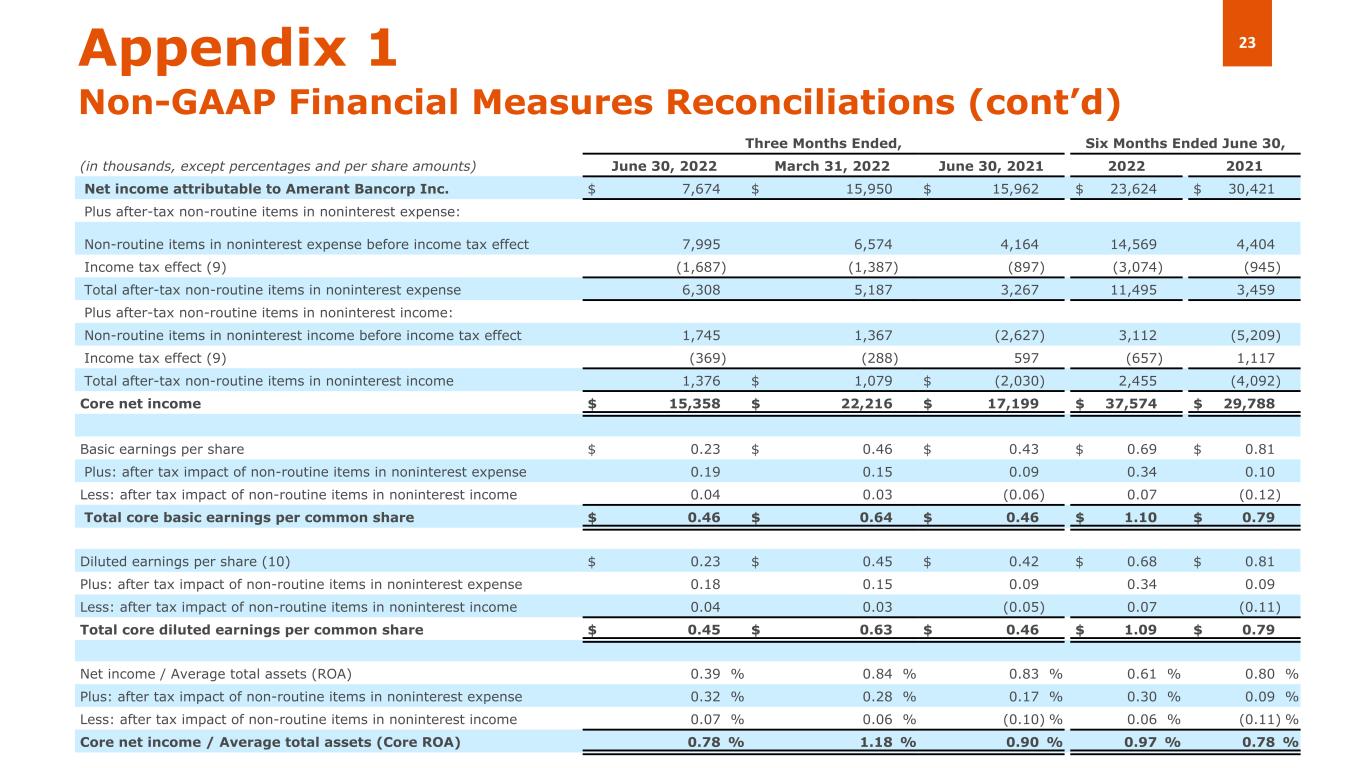

The following table sets forth selected financial information derived from the Company’s interim unaudited and annual audited consolidated financial statements, adjusted for certain costs incurred by the Company in the periods presented related to tax deductible restructuring costs, provision for (reversal of) loan losses, provision for income tax expense (benefit), the effect of non-core banking activities such as the sale of loans and securities, the valuation of securities, derivatives, loans held for sale and other real estate owned, the sale and leaseback of our corporate headquarters in the fourth quarter of 2021, and other non-routine actions intended to improve customer service and operating performance. The Company believes these adjusted numbers are useful to understand the Company’s performance absent these transactions and events.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended, |

|

Six Months Ended June 30, |

|

|

|

|

|

|

(in thousands) |

June 30, 2022 |

|

March 31, 2022 |

|

December 31, 2021 |

|

September 30, 2021 |

|

June 30, 2021 |

|

2022 |

|

2021 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net income attributable to Amerant Bancorp Inc. |

$ |

7,674 |

|

|

$ |

15,950 |

|

|

$ |

65,469 |

|

|

$ |

17,031 |

|

|

$ |

15,962 |

|

|

$ |

23,624 |

|

|

$ |

30,421 |

|

|

|

|

|

|

|

|

| Plus: (reversal of) provision for loan losses |

— |

|

|

(10,000) |

|

|

(6,500) |

|

|

(5,000) |

|

|

(5,000) |

|

|

(10,000) |

|

|

(5,000) |

|

|

|

|

|

|

|

|

| Plus: provision for income tax expense (1) |

2,033 |

|

|

3,978 |

|

|

20,172 |

|

|

5,454 |

|

|

4,435 |

|

|

6,011 |

|

|

8,083 |

|

|

|

|

|

|

|

|

| Pre-provision net revenue (PPNR) |

9,707 |

|

|

9,928 |

|

|

79,141 |

|

|

17,485 |

|

|

15,397 |

|

|

19,635 |

|

|

33,504 |

|

|

|

|

|

|

|

|

| Plus: non-routine noninterest expense items |

7,995 |

|

|

6,574 |

|

|

1,895 |

|

|

758 |

|

|

4,164 |

|

|

14,569 |

|

|

4,404 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: non-routine noninterest income items |

1,745 |

|

|

1,367 |

|

|

(62,125) |

|

|

54 |

|

|

(2,627) |

|

|

3,112 |

|

|

(5,209) |

|

|

|

|

|

|

|

|

| Core pre-provision net revenue (Core PPNR) |

$ |

19,447 |

|

|

$ |

17,869 |

|

|

$ |

18,911 |

|

|

$ |

18,297 |

|

|

$ |

16,934 |

|

|

$ |

37,316 |

|

|

$ |

32,699 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total noninterest income |

$ |

12,931 |

|

|

$ |

14,025 |

|

|

$ |

77,290 |

|

|

$ |

13,434 |

|

|

$ |

15,734 |

|

|

$ |

26,956 |

|

|

$ |

29,897 |

|

|

|

|

|

|

|

|

| Less: Non-routine noninterest income items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Less: gain on sale of Headquarters building (1) |

— |

|

|

— |

|

|

62,387 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|

|

| Derivatives gains (losses), net |

855 |

|

|

(1,345) |

|

|

— |

|

|

— |

|

|

— |

|

|

(490) |

|

|

— |

|

|

|

|

|

|

|

|

| Securities gains (losses), net |

(2,602) |

|

|

769 |

|

|

(117) |

|

|

(54) |

|

|

1,329 |

|

|

(1,833) |

|

|

3,911 |

|

|

|

|

|

|

|

|

| Loss on early extinguishment of FHLB advances, net |

2 |

|

|

(714) |

|

|

— |

|

|

— |

|

|

(2,488) |

|

|

(712) |

|

|

(2,488) |

|

|

|

|

|

|

|

|

| (Loss) gain on sale of loans |

— |

|

|

(77) |

|

|

(145) |

|

|

— |

|

|

3,786 |

|

|

(77) |

|

|

3,786 |

|

|

|

|

|

|

|

|

| Total non-routine noninterest income items |

$ |

(1,745) |

|

|

$ |

(1,367) |

|

|

$ |

62,125 |

|

|

$ |

(54) |

|

|

$ |

2,627 |

|

|

$ |

(3,112) |

|

|

$ |

5,209 |

|

|

|

|

|

|

|

|

| Core noninterest income |

$ |

14,676 |

|

|

$ |

15,392 |

|

|

$ |

15,165 |

|

|

$ |

13,488 |

|

|

$ |

13,107 |

|

|

$ |

30,068 |

|

|

$ |

24,688 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total noninterest expenses |

$ |

62,241 |

|

|

$ |

60,818 |

|

|

$ |

55,088 |

|

|

$ |

48,404 |

|

|

$ |

51,125 |

|

|

$ |

123,059 |

|

|

$ |

94,750 |

|

|

|

|

|

|

|

|

| Less: non-routine noninterest expense items |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Restructuring costs (2): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Staff reduction costs (3) |

674 |

|

|

765 |

|

|

26 |

|

|

250 |

|

|

3,322 |

|

|

1,439 |

|

|

3,328 |

|

|

|

|

|

|

|

|

| Contract termination costs (4) |

2,802 |

|

|

4,012 |

|

|

— |

|

|

— |

|

|

— |

|

|

6,814 |

|

|

— |

|

|

|

|

|

|

|

|

| Legal and Consulting fees (5) |

80 |

|

|

1,246 |

|

|

1,277 |

|

|

412 |

|

|

— |

|

|

1,326 |

|

|

— |

|

|

|

|

|

|

|

|

| Digital transformation expenses |

— |

|

|

45 |

|

|

50 |

|

|

96 |

|

|

32 |

|

|

45 |

|

|

266 |

|

|

|

|

|

|

|

|

| Lease impairment charge (6) |

1,565 |

|

|

14 |

|

|

— |

|

|

— |

|

|

810 |

|

|

1,579 |

|

|

810 |

|

|

|

|

|

|

|

|

| Branch closure expenses (7) |

— |

|

|

33 |

|

|

542 |

|

|

— |

|

|

— |

|

|

33 |

|

|

— |

|

|

|

|

|

|

|

|

| Total restructuring costs |

$ |

5,121 |

|

|

$ |

6,115 |

|

|

$ |

1,895 |

|

|

$ |

758 |

|

|

$ |

4,164 |

|

|

$ |

11,236 |

|

|

$ |

4,404 |

|

|

|

|

|

|

|

|

| Other non-routine noninterest expense items: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other real estate owned valuation expense (8) |

3,174 |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

3,174 |

|

|

— |

|

|

|

|

|

|

|

|

| Loans held for sale valuation (reversal) expense (9) |

(300) |

|

|

459 |

|

|

— |

|

|

— |

|

|

— |

|

|

159 |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total non-routine noninterest expense items |

$ |

7,995 |

|

|

$ |

6,574 |

|

|

$ |

1,895 |

|

|

$ |

758 |

|

|

$ |

4,164 |

|

|

$ |

14,569 |

|

|

$ |

4,404 |

|

|

|

|

|

|

|

|

| Core noninterest expenses |

$ |

54,246 |

|

|

$ |

54,244 |

|

|

$ |

53,193 |

|

|

$ |

47,646 |

|

|

$ |

46,961 |

|

|

$ |

108,490 |

|

|

$ |

90,346 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|