UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section

13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 9, 2024

RENOVARO

INC.

(Exact name of registrant as specified in its charter)

RENOVARO BIOSCIENCES INC.

(Former name, if changed since last report)

| Delaware | 001-38751 | 45-2259340 | ||

| (State or other jurisdiction | (Commission File Number) | (I.R.S. Employer | ||

| of incorporation) | Identification No.) |

2080 Century Park East, Suite 906

Los Angeles, CA

90067

(Address of principal executive offices)

+1 (305) 918-1980

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class | Trading Symbol | Name of Each Exchange on Which Registered | ||

| Common Stock, par value $0.0001 per share | RENB | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement

As previously disclosed, on September 28, 2023, Renovaro Inc., a Delaware corporation (the “Company”) formerly known as Renovaro Biosciences Inc., entered into that certain Stock Purchase Agreement, dated September 28, 2023 (as amended, the “Stock Purchase Agreement”), by and among the Company, GEDi Cube Intl Ltd., a private company formed under the laws of England and Wales (“GEDi Cube”), the other sellers party thereto (together with the other shareholders of GEDi Cube who delivered to the Company a joinder to the Stock Purchase Agreement, the “Sellers” and each, a “Seller”), and Yalla Yalla Ltd., a private limited liability company registered and incorporated under the laws of Malta (“Yalla Yalla”), in its capacity as the representative of the Sellers.

On February 9, 2024, the parties to the Stock Purchase Agreement entered into a Second Amendment to Stock Purchase Agreement (the “Amendment”), pursuant to which the parties amended the Stock Purchase Agreement to increase (i) the number of directors comprising the Company’s Board of Directors (the “Board”) effective upon the Closing from nine to ten individuals; (ii) the number of directors to be designated by the Company to serve on the Board effective as of the Closing from four to five individuals; and (iii) the number of such directors designated by the Company who are required to qualify as an “independent director” under Listing Rule 5605(a) of the Nasdaq Stock Market from three to four individuals.

The foregoing description of the Amendment does not purport to be complete and is subject to, and qualified in its entirety by reference to full text of the Amendment, a copy of which is attached to this Current Report on Form 8-K as Exhibit 2.1 hereto, and is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

On February 13, 2024 (the “Closing Date”), the Company consummated the previously announced acquisition of GEDi Cube and the other transactions contemplated by the Stock Purchase Agreement (collectively, the “Transaction”). As a result of the Transaction, GEDi Cube became a wholly-owned subsidiary of the Company.

Pursuant to the Stock Purchase Agreement, as of the Closing Date, the Company acquired all the issued and outstanding equity interests of GEDi Cube owned by the Sellers as of the Closing Date (each, a “GEDi Cube Share” and, collectively, the “GEDi Cube Shares”) in exchange for which each Seller was entitled to receive (i) as of the Closing Date, such Seller’s pro rata percentage of an aggregate of 70,834,183 shares of common stock, par value $0.0001 per share, of the Company (“Common Stock”), which represents the 67,224,089 shares of Common Stock issued and outstanding as of the Closing Date (minus (a) 1 million shares of Common Stock previously issued to a consultant assisting with the Transaction and (b) 1 million shares of Common Stock previously issued to Avram Miller, a director of the Company, pursuant to his Advisory Agreement, dated October 11, 2023, by and between Mr. Miller and the Company) (the “Closing Consideration”) plus 5,610,100 shares of Common Stock representing the Seller’s Earnout Shares (defined below) resulting from the automatic conversion of the Company’s Series A Convertible Preferred (described below in Item 8.01) and, (ii) following the Closing Date, such Seller’s pro rata percentage of the shares of Common Stock (the “Earnout Shares” and, together with the Closing Consideration, the “Exchange Consideration”) to be issued to the Sellers upon the exercise or conversion of any of the Company’s derivative securities (subject to certain exceptions) that are outstanding at the Closing Date (the “Closing Derivative Securities”). Each Seller’s pro rata percentage of the Exchange Consideration is equal to the ratio of the aggregate number of GEDi Cube Shares owned by such Seller divided by the aggregate number of GEDi Cube Shares issued and outstanding, in each case, as of the Closing Date. No fractional shares of Common Stock were or will be issued in the Exchange Consideration, and no cash was or will be issued in exchange therefor. Any fractional share of Common Stock that a Seller would otherwise be entitled to receive is rounded down to the nearest whole share.

As previously disclosed, the issuance of shares of Common Stock in connection with the Transaction was approved by the Company’s stockholders at a special meeting of stockholders held on January 25, 2024.

As a result of the issuance of the Closing Consideration on the Closing Date and based on the number of shares of Common Stock outstanding as of the Closing Date, the Sellers hold approximately 49% of the issued and outstanding shares of Common Stock immediately following the closing of the Transaction and the conversion of the Series A Convertible Preferred Stock.

In connection with the closing of the Transaction, the Company entered into a registration rights agreement with the Sellers (the “Registrant Rights Agreement”), pursuant to which the Company granted the Sellers customary demand and piggyback registration rights with respect to its shares of Common Stock acquired in the Transaction. The Registration Rights Agreement also provides that the Company will pay certain expenses related to such registrations and will indemnify the Sellers against certain liabilities arising from such registrations. Under the Registration Rights Agreement, the Company further agreed to take such action as the Sellers may reasonably request, and to the extent required from time to time, to (i) enable such Sellers to sell their shares of Common Stock acquired in the Transaction without registration under the Securities Act within the limitation of the exemptions provided by Rule 144 under the Securities Act and, (ii) within two business days of receipt of written notice from any Seller wishing to transfer or sell any of such Seller’s shares without registration under the Securities Act within the limitation of the exemption provided by Rule 144, provide, execute or deliver, as applicable, all notifications, certifications, legal opinions, instruction letters, and any other documents or instruments reasonably requested by such Seller or the Company’s transfer agent for such Seller to be able to sell or transfer such shares within the limitation of the exemption provided by Rule 144.

The foregoing descriptions of the Stock Purchase Agreement and the Registration Rights Agreement do not purport to be complete and are qualified in their entirety by reference to the full text of the Stock Purchase Agreement, a copy of which is filed as Exhibit 2.1 to the Current Report on Form 8-K filed with the U.S. Securities and Exchange Commission by the Company on September 29, 2023 and the Registration Rights Agreement, a copy of which is attached as Exhibit 4.1 to this Current Report on Form 8-K.

Item 3.02 Unregistered Sales of Equity Securities.

As discussed above in Item 2.01, pursuant to the Stock Purchase Agreement, upon the closing of the Transaction, the Company issued 70,834,183 unregistered, restricted shares of Common Stock as the Closing Consideration to the Sellers, which shares were not registered under the Securities Act in reliance on the private offering exemption from the registration requirements of the Securities Act, including Section 4(a)(2) of the Securities Act or Rule 506 of Regulation D promulgated under the Securities Act, and Regulation S under the Securities Act, as applicable. The Company made this determination based on its receipt from the Sellers of representations and warranties supporting the Company’s reliance on such exemptions.

Item 5.02 Departure of Directors or Principal Officers; Election of Directors; Appointment of Principal Officers.

On February 11, 2024, Henrik Grønfeldt-Sørensen notified the Board of his decision to resign as a director of the Company, effective as of the closing of the Transaction. Mr. Grønfeldt-Sørensen’s decision is not a result of any disagreement on any matter relating to the Company’s operations, policies, or practices.

On February 11, 2024, the Board appointed Karen Brink, the Chief Growth Officer of GEDi Cube, to the Board, effective upon the closing of the Transaction, to fill the vacancy created by Mr. Grønfeldt-Sørensen’s resignation. Ms. Brink will serve as a director of the Company until the Company’s 2024 Annual Meeting of Stockholders or until her successor has been duly elected and qualified. Ms. Brink has not been appointed to serve on any committees of the Board at this time. Ms. Brink will enter into a standard indemnification agreement with the Company in the same form that the Company has entered into with its other directors.

Ms. Brink was designated by GEDi Cube for nomination and appointment as a director of the Company pursuant to the Stock Purchase Agreement. Other than as set forth in the Stock Purchase Agreement, there are no arrangements or understandings between Ms. Brink and any person pursuant to which she was selected to serve as a director.

In connection with Ms. Brink’s service as GEDi Cube’s Chief Growth Officer, she entered into a director’s service agreement with GEDi Cube on July 1, 2023, effective as of June 1, 2023 (the “Director’s Service Agreement”). Under the Director’s Service Agreement, Ms. Brink is paid a gross salary of €15,000 per month, and she is eligible to receive additional discretionary bonuses from time to time. GEDi Cube also agrees under the Director’s Service Agreement to reimburse Ms. Brink for all reasonable expenses incurred by Ms. Brink in the course of her service as Chief Growth Officer.

Ms. Brink is the sole owner of Yalla Yalla. Pursuant to the Stock Purchase Agreement, upon the closing of the Transaction, the Company issued to Yalla Yalla 27,226,486 unregistered, restricted shares of Common Stock (approximate dollar value as of the Closing Date: $52,275,000) as part of the Closing Consideration, in exchange for the GEDi Cube Shares held by Yalla Yalla.

There are no family relationships between Ms. Brink and any director or executive officer of the Company, and other than her Directors Service Agreement and ownership of Yalla Yalla described above, she does not have any direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

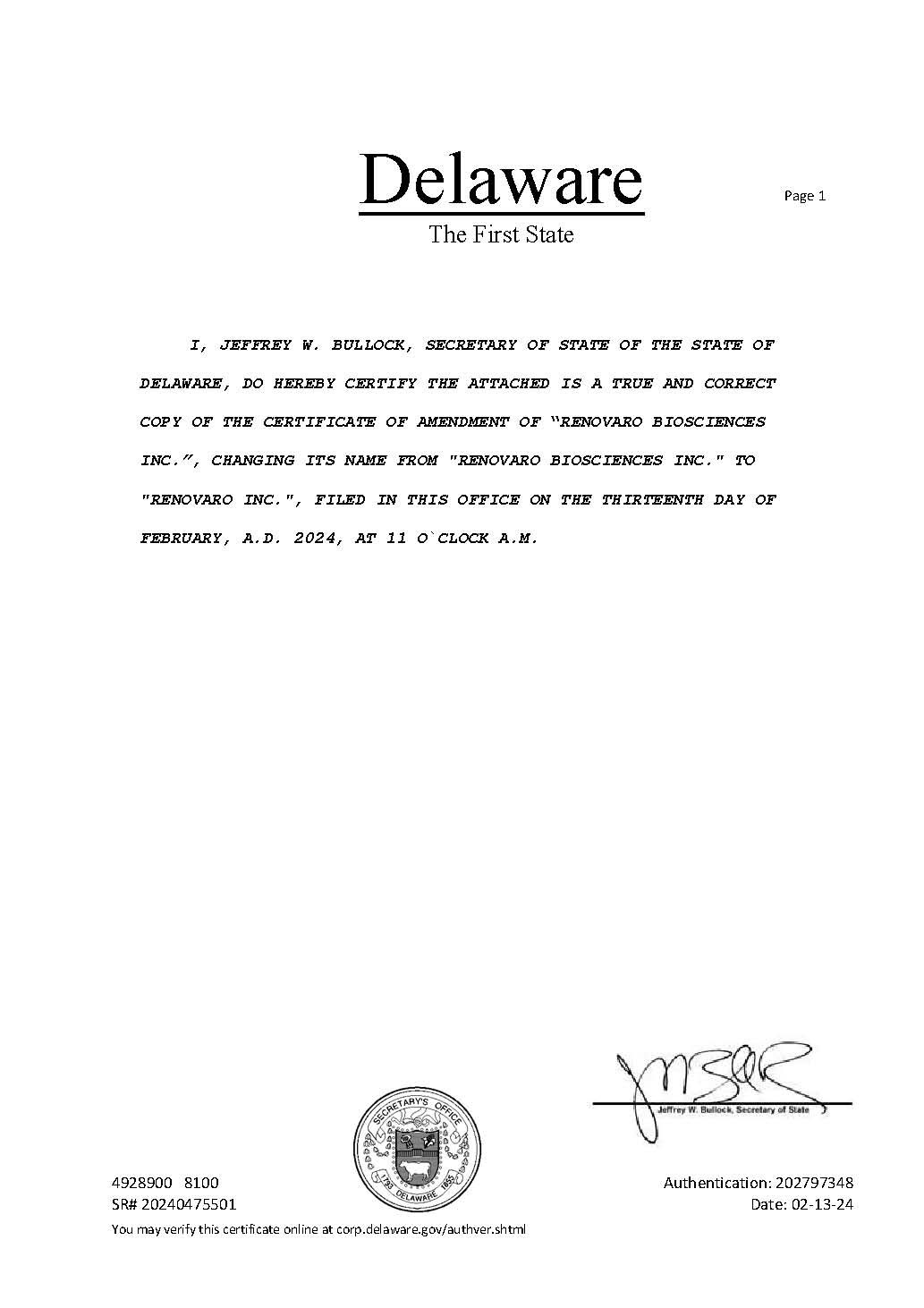

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

In connection with the closing of the Transaction, on February 13, 2024, the Company filed with the Secretary of State of the State of Delaware a Certificate of Amendment of Certificate of Incorporation (the “Name Change Amendment”) to change its corporate name from “Renovaro Biosciences Inc.” to “Renovaro Inc.”, effective immediately. The foregoing description of the Name Change Amendment does not purport to be complete and is subject to and qualified in its entirety by reference to the full text of the Name Change Amendment, a copy of which is attached to this Current Report on Form 8-K as Exhibit 3.1 hereto, and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

On February 13, 2024, the Company issued a press release announcing the closing of the Transaction. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and incorporated by reference herein.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of such section. Such information shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act, except as expressly set forth by specific reference in such filing.

Item 8.01 Other Events.

The closing of the Transaction triggered the automatic conversion of the Company’s Series A Convertible Preferred Stock, $0.0001 par value per share (the “Preferred Stock”) into 5,610,100 shares of Common Stock, and therefore there are no longer any shares of Preferred Stock outstanding. After the issuing the Closing Consideration to the Sellers in the Transaction and the conversion of the Preferred Stock, there are currently 143,668,372 shares of the Company’s Common Stock issued and outstanding.

Item 9.01 Financial Statements and Exhibits.

(a) Financial Statements of Business Acquired

The audited consolidated financial statements of Grace Systems B.V. (the predecessor of GEDi Cube) for the years ended December 31, 2022 and 2021 are set forth in the financial statements included on pages 155 through 166 of the Company’s Definitive Proxy Statement filed with the SEC on January 3, 2024, which are incorporated herein by reference. We will file an amendment to this Current Report on Form 8-K that includes its audited consolidated financial statements as of and for the year ended December 31, 2023 once such financial statements become available.

(b) Pro Forma Financial Information

The unaudited pro forma condensed combined financial statements of the Company and GEDi Cube for the three-month period ended September 30, 2023 and the year ended June 30, 2023 are attached to this Current Report on Form 8-K as Exhibit 99.2 and incorporated by reference herein. We will file an amendment to this Current Report on Form 8-K that includes its unaudited pro forma condensed combined financial statements as of and for the six-month period ended December 31, 2023 once such financial statements become available.

(d) Exhibits.

| EXHIBIT NO. | DESCRIPTION | LOCATION | ||

| 2.1 | Second Amendment to Stock Purchase Agreement, dated February 13, 2024, by and among Renovaro Inc., GEDi Cube Intl Ltd., the sellers party thereto and Yalla Yalla Ltd. | Filed herewith | ||

| 3.1 | Certificate of Amendment of Certificate of Incorporation, filed February 13, 2024 | Filed herewith | ||

| 4.1 | Registration Rights Agreement, dated February 13, 2024, by and among Renovaro Inc. and the Sellers | Filed herewith | ||

| 99.1 | Press Release of Renovaro Inc., dated February 13, 2024 | Filed herewith | ||

| 99.2 | Unaudited Pro Forma Condensed Combined Balance Sheet as of September 30, 2023 and Unaudited Pro Forma Condensed Combined Statements of Operations for the three months ended September 30, 2023 and the year ended June 30, 2023 | Filed herewith | ||

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| RENOVARO INC. | ||

| By: | /s/ Luisa Puche | |

| Name: Luisa Puche Title: Chief Financial Officer |

||

Date: February 14, 2024

EXHIBIT 2.1

SECOND AMENDMENT TO STOCK PURCHASE AGREEMENT

This Second Amendment (this “Amendment”) to the Stock Purchase Agreement, dated as of September 28, 2023 (the “Agreement”), by and among Renovaro Biosciences Inc., a Delaware corporation (“Buyer”), Gedi Cube Intl Ltd., a private limited company incorporated under the laws of England and Wales (“Company”), each of the shareholders of the Company signatory thereto (collectively, the “Sellers”) and Yalla Yalla Ltd., a private limited liability company registered and incorporated under the laws of Malta with company registration number C 103531, in its capacity as representative to the Sellers, is dated February 9, 2024. Capitalized terms used herein, which are not otherwise defined herein, shall have the meanings assigned to such terms in the Agreement.

WHEREAS, the undersigned desire to amend the Agreement pursuant to the terms of and subject to the conditions set forth in this Amendment; and

WHEREAS, pursuant to Section 11.8 of the Agreement, the Agreement may be amended or modified by the Parties before the Closing Date, if the amendment or modification is in writing and signed on behalf of each of the Parties to the Agreement.

NOW, THEREFORE, in consideration of the premises set forth above and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

1. Recitals. The foregoing recitals are hereby incorporated herein to the same extent as if hereinafter fully set forth in herein.

2. Amendment Regarding Post-Closing Board. Section 2.2 of the Agreement is hereby deleted in its entirety and replaced with the following:

“Post-Closing Board of Directors. The Parties shall take all necessary action, including causing certain directors of Buyer to resign, so that effective as of the Closing, Buyer’s board of directors (the “Post-Closing Buyer Board”) will consist of ten (10) individuals (such persons, the “Directors”): (i) one (1) of which shall be the Chief Executive Officer of Buyer, (ii) the five (5) persons that are designated by Buyer prior to the Closing, at least four (4) of whom shall qualify as an “independent director” under NASDAQ Listing Rule 5605(a), and (iii) the four (4) persons that are designated by Company prior to the Closing, at least two (2) of whom shall be required to qualify as an “independent director” under NASDAQ Listing Rule 5605(a); provided that the Post-Closing Buyer Board will meet all diversity and other requirements under applicable Law and the NASDAQ Listing Rules. The board of directors of Company immediately after the Closing shall be the same as the Post-Closing Buyer Board. At or prior to the Closing, Buyer will provide each Director with a customary director indemnification agreement, in form and substance reasonably acceptable to such Director, to be effective upon the Closing (or if later, such Director’s appointment).”

3. No Other Amendment. Except as specifically amended by the terms herein agreed to by the Parties, the Agreement, and all other provisions thereof, shall be unchanged and shall remain in full force and effect.

4. Miscellaneous. The provisions of Sections 11.1, 11.3 to 11.13, and 11.15 of the Agreement are hereby incorporated into this Amendment as if fully set forth herein and each reference to “Agreement” therein shall be deemed a reference to this Amendment.

[Remainder of Page Intentionally Left Blank;

Signature Pages Follow]

|

|

IN WITNESS WHEREOF, the undersigned, intending to be legally bound hereby, have duly executed this Amendment as of the date first above written.

| Buyer: | ||

| RENOVARO BIOSCIENCES INC. | ||

| By: | /s/ Mark Dybul | |

| Name: Mark Dybul | ||

| Title: Chief Executive Officer | ||

| Company: | ||

| GEDI CUBE INTL LTD. | ||

| By: | /s/ Karen Brink | |

| Name: Karen Brink | ||

| Title: Director | ||

| SELLERS’ REPRESENTATIVE: | ||

| YALLA YALLA LTD. | ||

| By: | /s/ Matthijs van Kranenburg | |

| Name: Matthijs van Kranenburg | ||

| Title: Director | ||

| SELLERS: | ||

| SEPA BEHEER BV | ||

| By: | /s/ Frank van Asch | |

| Name: F.Y. Van Asch | ||

| Title: Director | ||

| CK VA KALKEN BEHEER BV | ||

| By: | /s/ Coen van Kalken | |

| Name: CK van Kalken | ||

| Title: Director | ||

| DMZ INVEST I APS | ||

| By: | /s/ Flemming Segerlund | |

| Name: Flemming Segerlund | ||

| Title: CEO | ||

| TAEJ HOLDING B.V. | ||

| By: | /s/ Thomas Abeel | |

| Name: Thomas Abeel | ||

| Title: Director | ||

|

|

| Yalla Yalla LTD. | ||

| By: | /s/ Matthijs van Kranenburg | |

| Name: Matthijs van Kranenburg | ||

| Title: Director | ||

| MEDSEEK LIMITED | ||

| By: | /s/ Matthijs van Kranenburg | |

| Name: Matthijs van Kranenburg | ||

| Title: Director | ||

| SEA SIDE SEAMED LIMITED | ||

| By: | /s/ Matthijs van Kranenburg | |

| Name: Matthijs van Kranenburg | ||

| Title: Director | ||

| LAKSYA VENTURES, INC. | ||

| By: | /s/ Neil Persh | |

| Name: Neil Persh | ||

| Title: President | ||

| ALBERTUS CORNELIS MARIA PIJNENBERG | ||

| By: | /s/ Albertus Cornelis Maria Pijenberg | |

| Name: Albertus Cornelis Maria Pijenberg | ||

| ANTONIUS DENIS JORIS GABRIEL VAN DAM | ||

| By: | /s/ Antonius Denis Jorgis Gabriel van Dam | |

| Name: Borko Milojkovic | ||

| BORKO MILOJKOVIC | ||

| By: | /s/ S.B. Gleeson | |

| Name: Antonius Denis Jorgis Gabriel van Dam | ||

| BRIAN ERASMUS LIMITED | ||

| By: | /s/ Borko Milojkovic | |

| Name: S.B. Gleeson | ||

| Title: Director | ||

3

EXHIBIT 3.1

EXHIBIT 4.1

SELLER REGISTRATION RIGHTS AGREEMENT

THIS SELLER REGISTRATION RIGHTS AGREEMENT (this “Agreement”) is entered into as of February 13, 2024 (the “Execution Date”), by and among Renovaro Biosciences Inc., a Delaware corporation (together with its successors, the “Purchaser”), and the undersigned parties listed as “Investors” on the signature page hereto (the “Investors” and each an “Investor”).

WHEREAS, on September 28, 2023, the (i) Purchaser; (ii) Gedi Cube Intl Ltd, a private company formed under the laws of England and Wales (the “Company”); and (iii) the shareholders of the Company named as Sellers therein (including those joining the Stock Purchase Agreement after the initial signing thereof) (the “Sellers”), have entered into that certain Stock Purchase Agreement (as amended from time to time in accordance with the terms thereof, the “Stock Purchase Agreement”), pursuant to which, among other matters, Purchaser will acquire from Sellers, all of the issued shares and any other equity interests in or of the Company in exchange for the Exchange Shares, with the Company becoming a wholly-owned subsidiary of Purchaser, all upon the terms and subject to the conditions set forth in the Stock Purchase Agreement and in accordance with the applicable provisions of applicable law; and

WHEREAS, the parties desire to enter into this Agreement to provide the Investors with certain rights relating to the registration of the Exchange Consideration received by the Investors under the Stock Purchase Agreement.

NOW, THEREFORE, in consideration of the mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree as follows:

1. DEFINITIONS. Any capitalized term used but not defined in this Agreement shall have the meaning ascribed to such term in the Stock Purchase Agreement. The following capitalized terms used herein have the following meanings:

“Agreement” means this Agreement, as may be amended, restated, supplemented and/or otherwise modified from time to time.

“Business Day” means any day other than Saturday, Sunday, or a day on which banking institutions in New York, New York, the Netherlands and the United Kingdom are required or authorized by law to be closed.

“Stock Purchase Agreement” is defined in the recitals to this Agreement.

“Closing” means the closing of the transactions contemplated by the Stock Purchase Agreement.

“Commission” means the United States Securities and Exchange Commission, or any successor thereto, or any other federal agency administering the Securities Act and the Exchange Act at the time.

“Company” is defined in the recitals to this Agreement.

“Demand Registration” is defined in Section 2(a)(i).

“Demanding Holder” is defined in Section 2(a)(i).

“Disinterested Independent Director” means an independent director serving on Purchaser’s board of directors at the applicable time of determination that is disinterested in this Agreement (i.e., such independent director is not an Investor, an Affiliate of an Investor, or an officer, director, manager, employee, trustee or beneficiary of an Investor or its Affiliate, nor an immediate family member of any of the foregoing).

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated thereunder, all as the same shall be in effect at the time.

“Indemnified Party” is defined in Section 4(c).

“Indemnifying Party” is defined in Section 4(c).

“Investor(s)” is defined in the preamble to this Agreement, and includes any transferee of the Registrable Securities (so long as they remain Registrable Securities) of an Investor permitted under this Agreement.

“Investor Indemnified Party” is defined in Section 4(a).

“Maximum Number of Securities” is defined in Section 2(a)(iv).

“Piggy-Back Registration” is defined in Section 2(b)(i) .

“Pro Rata” is defined in Section 2(a)(iv).

“Purchaser” is defined in the recitals to this Agreement.

“Purchaser Common Stock” means Purchaser’s common stock, par value $0.0001.

“register,” “registered” and “registration” mean a registration or offering effected by preparing and filing a registration statement or similar document in compliance with the requirements of the Securities Act, and the applicable rules and regulations promulgated thereunder, and such registration statement becoming effective.

“Registrable Securities” means all of the Exchange Consideration, including the Exchange Shares, and any additional Earnout Stock issued after the Closing pursuant to Section 2.2.1 of the Stock Purchase Agreement. Registrable Securities also include any capital shares or other securities of Purchaser issued as a dividend or other distribution with respect to or in exchange for or in replacement of the foregoing securities. As to any particular Registrable Securities, such securities shall cease to be Registrable Securities when: (i) a Registration Statement with respect to the sale of such securities shall have become effective under the Securities Act and such securities shall have been sold, transferred, disposed of or exchanged in accordance with such Registration Statement; (ii) such securities shall have been otherwise transferred, new certificates for them not bearing a legend restricting further transfer shall have been delivered by Purchaser and subsequent public distribution of them shall not require registration under the Securities Act; (iii) such securities shall have ceased to be outstanding; or (iv) such securities are freely saleable under Rule 144 without volume or other restrictions or limitations applicable to the stockholder thereof. Notwithstanding anything to the contrary contained herein, a Person shall be deemed to be an “Investor holding Registrable Securities” (or words to that effect) under this Agreement only if they are an Investor or a transferee of the applicable Registrable Securities (so long as they remain Registrable Securities) of any Investor.

“Registration Statement” means a registration statement filed by Purchaser with the Commission in compliance with the Securities Act and the rules and regulations promulgated thereunder for a public offering and sale of equity securities, or securities or other obligations exercisable or exchangeable for, or convertible into, equity securities (other than a registration statement on Form S-4, F-4 or Form S-8, or their successors, or any registration statement covering only securities proposed to be issued in exchange for securities or assets of another entity).

“Rule 144” means Rule 144 promulgated under the Securities Act or any successor rule thereto.

“Securities Act” means the Securities Act of 1933, as amended, and the rules and regulations promulgated thereunder, all as the same shall be in effect at the time.

“Short Form Registration” is defined in Section 2(c).

“Specified Courts” is defined in Section 6(i).

“Underwriter” means a securities dealer who purchases any Registrable Securities as principal in an underwritten offering and not as part of such dealer’s market-making activities.

2. REGISTRATION RIGHTS.

(a) Demand Registration.

(i) Request for Registration. Subject to Section 2(d), at any time and from time to time after the Closing, Investors holding a majority-in-interest of the Registrable Securities then issued and outstanding may make a written demand for registration under the Securities Act of all or part of their Registrable Securities (a “Demand Registration”). Any demand for a Demand Registration shall specify the number of Registrable Securities proposed to be sold and the intended method(s) of distribution thereof. Within thirty (30) days following receipt of any request for a Demand Registration, Purchaser shall notify all other Investors holding Registrable Securities of the demand, and each Investor holding Registrable Securities who wishes to include all or a portion of such Investor’s Registrable Securities in the Demand Registration (each such Investor including shares of Registrable Securities in such registration, a “Demanding Holder”) shall so notify Purchaser within fifteen (15) days after the receipt by the Investor of the notice from Purchaser. Upon any such request, the Demanding Holders shall be entitled to have their Registrable Securities included in the Demand Registration, subject to Section 2(a)(iv) and the provisos set forth in Section 3(a)(i). Purchaser shall not be obligated to effect more than an aggregate of two (2) Demand Registrations under this Section 2(a)(i) in respect of all Registrable Securities. Notwithstanding anything in this Section 2(a) to the contrary, Purchaser shall not be obligated to effect a Demand Registration, (1) within sixty (60) days after the effective date of a previous registration effected with respect to the Registrable Securities pursuant to this Section 2(a) or (2) during any period (not to exceed one hundred eighty (180) days) following the closing of the completion of an offering of securities by Purchaser if such Demand Registration would cause Purchaser to breach a “lock-up” or similar provision contained in the underwriting agreement for such offering.

(ii) Effective Registration. A Registration will not count as a Demand Registration until the Registration Statement filed with the Commission with respect to such Demand Registration has been declared effective and Purchaser has complied in all material respects with its obligations under this Agreement with respect thereto; provided, however, that, if, after such Registration Statement has been declared effective, the offering of Registrable Securities pursuant to a Demand Registration is interfered with by any stop order or injunction of the Commission or any other governmental agency or court, the Registration Statement with respect to such Demand Registration will be deemed not to have been declared effective, unless and until, (1) such stop order or injunction is removed, rescinded or otherwise terminated, and (2) a majority-in-interest of the Demanding Holders thereafter elect to continue the offering; provided, further, that Purchaser shall not be obligated to file a second Registration Statement until a Registration Statement that has been filed is counted as a Demand Registration or is terminated.

(iii) Underwritten Offering. If a majority-in-interest of the Demanding Holders so elect and advise Purchaser as part of their written demand for a Demand Registration, the offering of such Registrable Securities pursuant to such Demand Registration shall be in the form of an underwritten offering. In such event, the right of any Demanding Holder to include its Registrable Securities in such registration shall be conditioned upon such Demanding Holder’s participation in such underwritten offering and the inclusion of such Demanding Holder’s Registrable Securities in the underwritten offering to the extent provided herein. All Demanding Holders proposing to distribute their Registrable Securities through such underwritten offering shall enter into an underwriting agreement in customary form with the Underwriter or Underwriters selected for such underwritten offering by Purchaser and reasonably acceptable to a majority-in-interest of the Investors initiating the Demand Registration.

(iv) Reduction of Offering. If the managing Underwriter or Underwriters for a Demand Registration that is to be an underwritten offering advises Purchaser and the Demanding Holders in writing that the dollar amount or number of Registrable Securities which the Demanding Holders desire to sell, taken together with all other shares of Purchaser Common Stock or other securities which Purchaser desires to sell and the shares of Purchaser Common Stock or other securities, if any, as to which Registration by Purchaser has been requested pursuant to written contractual piggy-back registration rights held by other security holders of Purchaser who desire to sell, exceeds the maximum dollar amount or maximum number of shares that can be sold in such offering without adversely affecting the proposed offering price, the timing, the distribution method, or the probability of success of such offering (such maximum dollar amount or maximum number of securities, as applicable, the “Maximum Number of Securities”), then Purchaser shall include in such Registration: (1) first, the Registrable Securities as to which Demand Registration has been requested by the Demanding Holders of any Persons who have exercised demand registration rights during the period under which the Demand Registration hereunder is ongoing (all pro rata in accordance with the number of securities that each applicable Person has requested be included in such registration, regardless of the number of securities held by each such Person, as long as they do not request to include more securities than they own (such proportion is referred to herein as “Pro Rata”)) that can be sold without exceeding the Maximum Number of Securities; (2) second, to the extent that the Maximum Number of Securities has not been reached under the foregoing clause (1), the shares of Purchaser Common Stock or other securities that Purchaser desires to sell that can be sold without exceeding the Maximum Number of Securities; (3) third, to the extent that the Maximum Number of Securities has not been reached under the foregoing clauses (1) and (2), the Registrable Securities of Investors as to which registration has been requested pursuant to Section 2(b), Pro Rata among the holders thereof based on the number of securities requested by such holders to be included in such registration, that can be sold without exceeding the Maximum Number of Securities; and (4) fourth, to the extent that the Maximum Number of Securities has not been reached under the foregoing clauses (1), (2) and (3), the shares of Purchaser Common Stock or other securities for the account of other Persons that Purchaser is obligated to register pursuant to written contractual arrangements with such Persons that can be sold without exceeding the Maximum Number of Securities. In the event that Purchaser securities that are convertible into shares of Purchaser Common Stock are included in the offering, the calculations under this Section 2(a)(iv) shall include such Purchaser securities on an as-converted to Purchaser Common Stock basis.

(v) Withdrawal. If a majority-in-interest of the Demanding Holders disapprove of the terms of any underwritten offering or are not entitled to include all of their Registrable Securities in any offering, such majority-in-interest of the Demanding Holders may elect to withdraw from such offering by giving written notice to Purchaser and the Underwriter or Underwriters of their request to withdraw prior to the effectiveness of the Registration Statement filed with the Commission with respect to such Demand Registration. If the majority-in-interest of the Demanding Holders withdraws from a proposed offering relating to a Demand Registration in such event, then such registration shall not count as a Demand Registration provided for in Section 2(a).

(b) Piggy-Back Registration.

(i) Piggy-Back Rights. Subject to Section 2(d), if, at any time after the Closing, Purchaser proposes to file a Registration Statement under the Securities Act with respect to the Registration of or an offering of equity securities, or securities or other obligations exercisable or exchangeable for, or convertible into, equity securities, by Purchaser for its own account or for security holders of Purchaser for their account (or by Purchaser and by security holders of Purchaser including pursuant to Section 2(a)), other than a Registration Statement (1) filed in connection with any employee share option or other benefit plan, (2) for an exchange offer or offering of securities solely to Purchaser’s existing security holders, (3) for an offering of debt that is convertible into equity securities of Purchaser, or (4) for a dividend reinvestment plan, then Purchaser shall (x) give written notice of such proposed filing to Investors holding Registrable Securities as soon as practicable but in no event less than ten (10) days before the anticipated filing date, which notice shall describe the amount and type of securities to be included in such offering or registration, the intended method(s) of distribution, and the name of the proposed managing Underwriter or Underwriters, if any, of the offering, and (y) offer to Investors holding Registrable Securities in such notice the opportunity to register the sale of such number of Registrable Securities as such Investors may request in writing within five (5) days following receipt of such notice (a “Piggy-Back Registration”). To the extent permitted by applicable securities laws with respect to such registration by Purchaser or another demanding security holder, Purchaser shall use its reasonable best efforts to cause (i) such Registrable Securities to be included in such registration and (ii) the managing Underwriter or Underwriters of a proposed underwritten offering to permit the Registrable Securities requested to be included in a Piggy-Back Registration on the same terms and conditions as any similar securities of Purchaser and to permit the sale or other disposition of such Registrable Securities in accordance with the intended method(s) of distribution thereof. All Investors holding Registrable Securities proposing to distribute their securities through a Piggy-Back Registration that involves an Underwriter or Underwriters shall enter into an underwriting agreement in customary form with the Underwriter or Underwriters selected for such Piggy-Back Registration.

(ii) Reduction of Offering. If the managing Underwriter or Underwriters for a Piggy-Back Registration that is to be an underwritten offering advises Purchaser and Investors holding Registrable Securities proposing to distribute their Registrable Securities through such Piggy-Back Registration in writing that the dollar amount or number of shares of Purchaser Common Stock or other Purchaser securities which Purchaser desires to sell, taken together with the shares of Purchaser Common Stock or other Purchaser securities, if any, as to which registration has been demanded pursuant to written contractual arrangements with Persons other than the Investors holding Registrable Securities hereunder, the Registrable Securities as to which registration has been requested under this Section 2(b), and the shares of Purchaser Common Stock or other Purchaser securities, if any, as to which registration has been requested pursuant to the written contractual piggy-back registration rights of other security holders of Purchaser, exceeds the Maximum Number of Securities, then Purchaser shall include in any such registration:

(1) If the registration is undertaken for Purchaser’s account: (a) first, the shares of Purchaser Common Stock or other securities that Purchaser desires to sell that can be sold without exceeding the Maximum Number of Securities; (b) second, to the extent that the Maximum Number of Securities has not been reached under the foregoing clauses (a), the shares of Purchaser Common Stock or other equity securities for the account of other Persons that Purchaser is obligated to register pursuant to separate written contractual arrangements with such Persons that can be sold without exceeding the Maximum Number of Securities;

(2) If the registration is a “demand” registration undertaken at the demand of Demanding Holders pursuant to Section 2(a): (a) first, the shares of Purchaser Common Stock or other securities for the account of the Demanding Holders, Pro Rata among the holders thereof based on the number of securities requested by such holders to be included in such registration, that can be sold without exceeding the Maximum Number of Securities; (b) second, to the extent that the Maximum Number of Securities has not been reached under the foregoing clause (a), the shares of Purchaser Common Stock or other securities that Purchaser desires to sell that can be sold without exceeding the Maximum Number of Securities; (c) third, to the extent that the Maximum Number of Securities has not been reached under the foregoing clauses (a) and (b), the Registrable Securities of Investors as to which registration has been requested pursuant to this Section 2(b), Pro Rata among the holders thereof based on the number of securities requested by such holders to be included in such registration, that can be sold without exceeding the Maximum Number of Securities; and (d) fourth, to the extent that the Maximum Number of Securities has not been reached under the foregoing clauses (a), (b) and (c), the shares of Purchaser Common Stock or other equity securities for the account of other Persons that Purchaser is obligated to register pursuant to separate written contractual arrangements with such Persons that can be sold without exceeding the Maximum Number of Securities;

(3) If the registration is a “demand” registration undertaken at the demand of Persons other than Demanding Holders under Section 2(a): (a) first, the shares of Purchaser Common Stock or other securities for the account of the demanding Persons that can be sold without exceeding the Maximum Number of Securities; (b) second, to the extent that the Maximum Number of Securities has not been reached under the foregoing clause (a), the shares of Purchaser Common Stock or other securities that Purchaser desires to sell that can be sold without exceeding the Maximum Number of Securities; (c) third, to the extent that the Maximum Number of Securities has not been reached under the foregoing clauses (a) and (b), the Registrable Securities of Investors as to which registration has been requested pursuant to this Section 2(b), Pro Rata among the holders thereof based on the number of securities requested by such holders to be included in such registration, that can be sold without exceeding the Maximum Number of Securities; and (d) fourth, to the extent that the Maximum Number of Securities has not been reached under the foregoing clauses (a), (b) and (c), the shares of Purchaser Common Stock or other equity securities for the account of other Persons that Purchaser is obligated to register pursuant to separate written contractual arrangements with such Persons that can be sold without exceeding the Maximum Number of Securities.

(4) In the event that Purchaser securities that are convertible into shares of Purchaser Common Stock are included in the offering, the calculations under this Section 2(b)(ii) shall include such Purchaser securities on an as-converted to Purchaser Common Stock basis. Notwithstanding anything to the contrary above, to the extent that the registration of an Investor’s Registrable Securities would prevent Purchaser or the demanding shareholders from effecting such registration and offering, such Investor shall not be permitted to exercise Piggy-Back Registration rights with respect to such registration and offering.

(c) Withdrawal. Any Investor holding Registrable Securities may elect to withdraw such Investor’s request for inclusion of Registrable Securities in any Piggy-Back Registration by giving written notice to Purchaser of such request to withdraw prior to the effectiveness of the Registration Statement. Purchaser (whether on its own determination or as the result of a withdrawal by Persons making a demand pursuant to written contractual obligations) may withdraw a Registration Statement at any time prior to the effectiveness of such Registration Statement without any liability to the applicable Investor, subject to the next sentence and the provisions of Section 4. Notwithstanding any such withdrawal, Purchaser shall pay all expenses incurred in connection with such Piggy-Back Registration as provided in Section 3(c) (subject to the limitations set forth therein) by Investors holding Registrable Securities that requested to have their Registrable Securities included in such Piggy-Back Registration.

(d) Short Form Registrations. After the Closing, subject to Section 2(d), Investors holding Registrable Securities may at any time and from time to time, request in writing that Purchaser register the resale of any or all of such Registrable Securities on Form S-3 or F-3 or any similar short-form registration which may be available at such time (“Short Form Registration”); provided, however, that Purchaser shall not be obligated to effect such request through an underwritten offering. Upon receipt of such written request, Purchaser will promptly give written notice of the proposed registration to all other Investors holding Registrable Securities, and, as soon as practicable thereafter, effect the registration of all or such portion of such Investors’ Registrable Securities as are specified in such request, together with all or such portion of the Registrable Securities, if any, of any other Investors joining in such request as are specified in a written request given within fifteen (15) days after receipt of such written notice from Purchaser; provided, however, that Purchaser shall not be obligated to effect any such registration pursuant to this Section 2(c): (i) if Short Form Registration is not available to Purchaser for such offering; or (ii) if Investors holding Registrable Securities, together with the holders of any other securities of Purchaser entitled to inclusion in such registration, propose to sell Registrable Securities and such other securities (if any) at any aggregate price to the public of less than $500,000.

(e) Restriction of Offerings. Notwithstanding anything to the contrary contained in this Agreement, the Investors shall not be entitled to request, and Purchaser shall not be obligated to effect, or to take any action to effect, any registration (including any Demand Registration or Piggy-Back Registration) pursuant to this Section 2 (i) with respect to any Registrable Securities that are subject to the transfer restrictions under Stock Purchase Agreement or not distributed to the Investors and (ii) during the six (6)-month period following the Closing.

3. REGISTRATION PROCEDURES.

(a) Filings; Information. Whenever Purchaser is required to effect the registration of any Registrable Securities pursuant to Section 2, Purchaser shall use its reasonable best efforts to effect the registration and sale of such Registrable Securities in accordance with the intended method(s) of distribution thereof as expeditiously as practicable, and in connection with any such request:

(i) Filing Registration Statement. Purchaser shall use its reasonable best efforts to, as expeditiously as possible after receipt of a request for a Demand Registration pursuant to Section 2(a), and in any event no later than ninety (90) days following receipt of such request for a Demand Registration, prepare and file with the Commission a Registration Statement on any form for which Purchaser then qualifies or which counsel for Purchaser shall deem appropriate and which form shall be available for the sale of all Registrable Securities to be registered thereunder in accordance with the intended method(s) of distribution thereof, and shall use its reasonable efforts to cause such Registration Statement to become effective and use its reasonable efforts to keep it effective for the period required by Section 3.1.3; provided, however, that Purchaser shall have the right to defer any Demand Registration for up to thirty (30) days, and any Piggy-Back Registration for such period as may be applicable to deferment of any demand registration to which such Piggy-Back Registration relates, in each case if Purchaser shall furnish to Investors requesting to include their Registrable Securities in such registration a certificate signed by the Chief Executive Officer or Chief Financial Officer of Purchaser stating that, in the good faith judgment of the Board of Directors of Purchaser, it would be materially detrimental to Purchaser and its shareholders for such Registration Statement to be effected at such time or the filing would require premature disclosure of material information which is not in the interests of Purchaser to disclose at such time; provided further, however, that Purchaser shall not have the right to exercise the right set forth in the immediately preceding proviso more than twice in any 365-day period in respect of a Demand Registration hereunder.

(ii) Copies. Purchaser shall, prior to filing a Registration Statement or prospectus, or any amendment or supplement thereto, furnish without charge to Investors holding Registrable Securities included in such registration, and such Investors’ legal counsel, copies of such Registration Statement as proposed to be filed, each amendment and supplement to such Registration Statement (in each case including all exhibits thereto and documents incorporated by reference therein), the prospectus included in such Registration Statement (including each preliminary prospectus), and such other documents as Investors holding Registrable Securities included in such registration or legal counsel for any such Investors may request in order to facilitate the disposition of the Registrable Securities owned by such Investors.

(iii) Amendments and Supplements. Purchaser shall prepare and file with the Commission such amendments, including post-effective amendments, and supplements to such Registration Statement and the prospectus used in connection therewith as may be necessary to keep such Registration Statement effective and in compliance with the provisions of the Securities Act until all Registrable Securities and other securities covered by such Registration Statement have been disposed of in accordance with the intended method(s) of distribution set forth in such Registration Statement or such securities have been withdrawn or until such time as the Registrable Securities cease to be Registrable Securities as defined by this Agreement.

(iv) Notification. After the filing of a Registration Statement pursuant to this Agreement, Purchaser shall promptly, and in no event more than two (2) Business Days after such filing, notify Investors holding Registrable Securities included in such Registration Statement of such filing, and shall further notify such Investors promptly and confirm such advice in writing in all events within two (2) Business Days after the occurrence of any of the following: (1) when such Registration Statement becomes effective; (2) when any post-effective amendment to such Registration Statement becomes effective; (3) the issuance or threatened issuance by the Commission of any stop order (and Purchaser shall take all actions required to prevent the entry of such stop order or to remove it if entered); and (4) any request by the Commission for any amendment or supplement to such Registration Statement or any prospectus relating thereto or for additional information or of the occurrence of an event requiring the preparation of a supplement or amendment to such prospectus so that, as thereafter delivered to the purchasers of the securities covered by such Registration Statement, such prospectus will not contain an untrue statement of a material fact or omit to state any material fact required to be stated therein or necessary to make the statements therein not misleading, and promptly make available to Investors holding Registrable Securities included in such Registration Statement any such supplement or amendment; except that before filing with the Commission a Registration Statement or prospectus or any amendment or supplement thereto, including documents incorporated by reference, Purchaser shall furnish to Investors holding Registrable Securities included in such Registration Statement and to the legal counsel for any such Investors, copies of all such documents proposed to be filed sufficiently in advance of filing to provide such Investors and legal counsel with a reasonable opportunity to review such documents and comment thereon; provided that such Investors and their legal counsel must provide any comments promptly (and in any event within five (5) Business Days) after receipt of such documents.

(v) State Securities Laws Compliance. Purchaser shall use its reasonable efforts to (i) register or qualify the Registrable Securities covered by the Registration Statement under such securities or “blue sky” laws of such jurisdictions in the United States as Investors holding Registrable Securities included in such Registration Statement (in light of their intended plan of distribution) may reasonably request and (ii) take such action necessary to cause such Registrable Securities covered by the Registration Statement to be registered with or approved by such other governmental authorities as may be necessary by virtue of the business and operations of Purchaser and do any and all other acts and things that may be necessary or advisable to enable Investors holding Registrable Securities included in such Registration Statement to consummate the disposition of such Registrable Securities in such jurisdictions; provided, however, that Purchaser shall not be required to qualify generally to do business in any jurisdiction where it would not otherwise be required to qualify but for this paragraph or take any action to which it would be subject to general service of process or to taxation in any such jurisdiction where it is not then otherwise subject.

(vi) Agreements for Disposition. To the extent required by the underwriting agreement or similar agreements, Purchaser shall enter into reasonable customary agreements (including, if applicable, an underwriting agreement in customary form) and take such other actions as are reasonably required in order to expedite or facilitate the disposition of such Registrable Securities.

(vii) Cooperation. The principal executive officer of Purchaser, the principal financial officer of Purchaser, the principal accounting officer of Purchaser and all other officers and members of the management of Purchaser shall reasonably cooperate in any offering of Registrable Securities hereunder, which cooperation shall include the preparation of the Registration Statement with respect to such offering and all other offering materials and related documents, and participation in meetings with Underwriters, attorneys, accountants and potential investors.

(viii) Records. Purchaser shall make available for inspection by Investors holding Registrable Securities included in such Registration Statement, any Underwriter participating in any disposition pursuant to such Registration Statement and any attorney, accountant or other professional retained by any Investor holding Registrable Securities included in such Registration Statement or any Underwriter, all financial and other records, pertinent corporate documents and properties of Purchaser, as shall be reasonably necessary to enable them to exercise their due diligence responsibility, and cause Purchaser’s officers, directors and employees to supply all information reasonably requested by any of them in connection with such Registration Statement; provided that Purchaser may require execution of a reasonable confidentiality agreement prior to sharing any such information.

(ix) Opinions and Comfort Letters. Purchaser shall request its counsel and accountants to provide customary legal opinions and customary comfort letters, to the extent so reasonably required by any underwriting agreement.

(x) Earnings Statement. Purchaser shall comply with all applicable rules and regulations of the Commission and the Securities Act, and make available to its shareholders if reasonably required, as soon as reasonably practicable, an earnings statement covering a period of twelve (12) months, which earnings statement shall satisfy the provisions of Section 11(a) of the Securities Act and Rule 158 thereunder.

(xi) Listing. Purchaser shall use its reasonable best efforts to cause all Registrable Securities that are shares of Purchaser Common Stock included in any registration to be listed on such exchanges or otherwise designated for trading in the same manner as similar securities issued by Purchaser are then listed or designated or, if no such similar securities are then listed or designated, in a manner satisfactory to Investors holding a majority-in-interest of the Registrable Securities included in such registration.

(xii) Road Show. If the registration involves the registration of Registrable Securities involving gross proceeds to Purchaser in excess of $25,000,000, Purchaser shall use its reasonable efforts to make available senior executives of Purchaser to participate in customary “road show” presentations that may be reasonably requested by the Underwriter in any underwritten offering.

(b) Obligations to Suspend Distribution. Upon receipt of any notice from Purchaser of the happening of any event of the kind described in Section 3(a)(iv)(4), or in the event that the financial statements contained in the Registration Statement become stale, or in the event that the Registration Statement or prospectus included therein contains a misstatement of material fact or omits to state a material fact due to a bona fide business purpose, or, in the case of a resale registration on Short Form Registration pursuant to Section 2(c) hereof, upon any suspension by Purchaser, pursuant to a written insider trading compliance program adopted by Purchaser’s Board of Directors, of the ability of all “insiders” covered by such program to transact in Purchaser’s securities because of the existence of material non-public information, each Investor holding Registrable Securities included in any registration shall immediately discontinue disposition of such Registrable Securities pursuant to the Registration Statement covering such Registrable Securities until such Investor receives the supplemented or amended prospectus contemplated by Section 3(a)(iv)(4) or the Registration Statement is updated so that the financial statements are no longer stale, or the restriction on the ability of “insiders” to transact in Purchaser’s securities is removed, as applicable, and, if so directed by Purchaser, each such Investor shall deliver to Purchaser all copies, other than permanent file copies then in such Investor’s possession, of the most recent prospectus covering such Registrable Securities at the time of receipt of such notice.

(c) Registration Expenses. Purchaser shall bear all reasonable costs and expenses incurred in connection with any Demand Registration pursuant to Section 2(a), any Piggy-Back Registration pursuant to Section 2(b), and any registration on Short Form Registration effected pursuant to Section 2(c), and all reasonable expenses incurred in performing or complying with its other obligations under this Agreement, whether or not the Registration Statement becomes effective, including: (i) all registration and filing fees; (ii) fees and expenses of compliance with securities or “blue sky” laws (including fees and disbursements of counsel in connection with blue sky qualifications of the Registrable Securities); (iii) printing expenses; (iv) Purchaser’s internal expenses (including all salaries and expenses of its officers and employees); (v) the fees and expenses incurred in connection with the listing of the Registrable Securities as required by Section 3Error! Reference source not found.; (vi) Financial Industry Regulatory Authority fees; (vii) fees and disbursements of counsel for Purchaser and fees and expenses for independent certified public accountants retained by Purchaser (including the expenses or costs associated with the delivery of any opinions or comfort letters requested pursuant to Section 3(a)Error! Reference source not found.); (viii) the reasonable fees and expenses of any special experts retained by Purchaser in connection with such registration; and (ix) the reasonable fees and expenses (up to a maximum of $15,000 in the aggregate in connection with such registration) of one legal counsel selected by Investors holding a majority-in-interest of the Registrable Securities included in such registration for such legal counsel’s review, comment and finalization of the proposed Registration Statement and other relevant documents. Purchaser shall have no obligation to pay any underwriting discounts or selling commissions attributable to the Registrable Securities being sold by the holders thereof, which underwriting discounts or selling commissions shall be borne by such holders. Additionally, in an underwritten offering, all selling security holders and Purchaser shall bear the expenses of the Underwriter pro rata in proportion to the respective amount of securities each is selling in such offering.

(d) Information. Investors holding Registrable Securities included in any Registration Statement shall provide such information requested by Purchaser, or the managing Underwriter, if any, in connection with the preparation of such Registration Statement, including amendments and supplements thereto, in order to effect the registration of any Registrable Securities under the Securities Act pursuant to Section 2 and in connection with the obligation to comply with federal and applicable state securities laws. Investors selling Registrable Securities in any offering must provide all questionnaires, powers of attorney, custody agreements, stock powers, and other documentation reasonably requested by Purchaser or the managing Underwriter.

4. INDEMNIFICATION AND CONTRIBUTION.

(a) Indemnification by Purchaser. Subject to the provisions of this Section 4(a) below, Purchaser agrees to indemnify and hold harmless each Investor, and each Investor’s officers, employees, affiliates, directors, partners, members, attorneys and agents, and each Person, if any, who controls an Investor (within the meaning of Section 15 of the Securities Act or Section 20 of the Exchange Act) (each, an “Investor Indemnified Party”), from and against any expenses, losses, judgments, claims, damages or liabilities, whether joint or several, arising out of or based upon any untrue statement of a material fact contained in any Registration Statement under which the sale of such Registrable Securities was registered under the Securities Act, any preliminary prospectus, final prospectus or summary prospectus contained in the Registration Statement, or any amendment or supplement to such Registration Statement, or arising out of or based upon any omission to state a material fact required to be stated therein or necessary to make the statements therein not misleading, or any violation by Purchaser of the Securities Act or any rule or regulation promulgated thereunder applicable to Purchaser and relating to action or inaction required of Purchaser in connection with any such registration (provided, however, that the indemnity agreement contained in this Section 4(a) shall not apply to amounts paid in settlement of any such claim, loss, damage, liability or action if such settlement is effected without the consent of Purchaser, such consent not to be unreasonably withheld, delayed or conditioned); and Purchaser shall promptly reimburse the Investor Indemnified Party for any legal and any other expenses reasonably incurred by such Investor Indemnified Party in connection with investigating and defending any such expense, loss, judgment, claim, damage, liability or action; provided, however, that Purchaser will not be liable in any such case to the extent that any such expense, loss, claim, damage or liability arises out of or is based upon any untrue statement or omission made in such Registration Statement, preliminary prospectus, final prospectus, or summary prospectus, or any such amendment or supplement, in reliance upon and in conformity with information furnished to Purchaser, in writing, by such selling holder or Investor Indemnified Party expressly for use therein. Purchaser also shall indemnify any Underwriter of the Registrable Securities, their officers, affiliates, directors, partners, members and agents and each Person who controls such Underwriter on substantially the same basis as that of the indemnification provided above in this Section 4(a).

(b) Indemnification by Investors Holding Registrable Securities. Subject to the provisions of this Section 4(b) below, each Investor selling Registrable Securities will, in the event that any registration is being effected under the Securities Act pursuant to this Agreement of any Registrable Securities held by such selling Investor, indemnify and hold harmless Purchaser, each of its directors and officers and each Underwriter (if any), and each other selling holder and each other Person, if any, who controls another selling holder or such Underwriter within the meaning of the Securities Act, against any losses, claims, judgments, damages or liabilities, whether joint or several, insofar as such losses, claims, judgments, damages or liabilities (or actions in respect thereof) arise out of or are based upon any untrue statement of a material fact contained in any Registration Statement under which the sale of such Registrable Securities was registered under the Securities Act, any preliminary prospectus, final prospectus or summary prospectus contained in the Registration Statement, or any amendment or supplement to the Registration Statement, or arise out of or are based upon any omission to state a material fact required to be stated therein or necessary to make the statement therein not misleading, if the statement or omission was made in reliance upon and in conformity with information furnished in writing to Purchaser by such selling Investor expressly for use therein (provided, however, that the indemnity agreement contained in this Section 4(b) shall not apply to amounts paid in settlement of any such claim, loss, damage, liability or action if such settlement is effected without the consent of the indemnifying Investor, such consent not to be unreasonably withheld, delayed or conditioned), and shall reimburse Purchaser, its directors and officers, each Underwriter and each other selling holder or controlling Person for any reasonable legal or other expenses reasonably incurred by any of them in connection with investigation or defending any such loss, claim, damage, liability or action. Each selling Investor’s indemnification obligations hereunder shall be several and not joint and shall be limited to the amount of any net proceeds actually received by such selling Investor.

(c) Conduct of Indemnification Proceedings. Promptly after receipt by any Person of any notice of any loss, claim, damage or liability or any action in respect of which indemnity may be sought pursuant to Section 4(a) or 4(b), such Person (the “Indemnified Party”) shall, if a claim in respect thereof is to be made against any other Person for indemnification hereunder, notify such other Person (the “Indemnifying Party”) in writing of the loss, claim, judgment, damage, liability or action; provided, however, that the failure by the Indemnified Party to notify the Indemnifying Party shall not relieve the Indemnifying Party from any liability which the Indemnifying Party may have to such Indemnified Party hereunder, except and solely to the extent the Indemnifying Party is actually prejudiced by such failure. If the Indemnified Party is seeking indemnification with respect to any claim or action brought against the Indemnified Party, then the Indemnifying Party shall be entitled to participate in such claim or action, and, to the extent that it wishes, jointly with all other Indemnifying Parties, to assume control of the defense thereof with counsel satisfactory to the Indemnified Party. After notice from the Indemnifying Party to the Indemnified Party of its election to assume control of the defense of such claim or action, the Indemnifying Party shall not be liable to the Indemnified Party for any legal or other expenses subsequently incurred by the Indemnified Party in connection with the defense thereof other than reasonable costs of investigation; provided, however, that in any action in which both the Indemnified Party and the Indemnifying Party are named as defendants, the Indemnified Party shall have the right to employ separate counsel (but no more than one such separate counsel) to represent the Indemnified Party and its controlling Persons who may be subject to liability arising out of any claim in respect of which indemnity may be sought by the Indemnified Party against the Indemnifying Party, with the fees and expenses of such counsel to be paid by such Indemnifying Party if, based upon the written opinion of counsel of such Indemnified Party, representation of both parties by the same counsel would be inappropriate due to actual or potential differing interests between them. No Indemnifying Party shall, without the prior written consent of the Indemnified Party (acting reasonably), consent to entry of judgment or effect any settlement of any claim or pending or threatened proceeding in respect of which the Indemnified Party is or could have been a party and indemnity could have been sought hereunder by such Indemnified Party, unless such judgment or settlement includes an unconditional release of such Indemnified Party from all liability arising out of such claim or proceeding.

(d) Contribution.

(i) If the indemnification provided for in the foregoing Sections 4(a), 4(b) and 4(c) is unavailable to any Indemnified Party in respect of any loss, claim, damage, liability or action referred to herein, then each such Indemnifying Party, in lieu of indemnifying such Indemnified Party, shall contribute to the amount paid or payable by such Indemnified Party as a result of such loss, claim, damage, liability or action in such proportion as is appropriate to reflect the relative fault of the Indemnified Parties and the Indemnifying Parties in connection with the actions or omissions which resulted in such loss, claim, damage, liability or action, as well as any other relevant equitable considerations. The relative fault of any Indemnified Party and any Indemnifying Party shall be determined by reference to, among other things, whether the untrue statement of a material fact or the omission to state a material fact relates to information supplied by such Indemnified Party or such Indemnifying Party and the parties’ relative intent, knowledge, access to information and opportunity to correct or prevent such statement or omission.

(ii) The parties hereto agree that it would not be just and equitable if contribution pursuant to this Section 4(d) were determined by pro rata allocation or by any other method of allocation which does not take account of the equitable considerations referred to in the immediately preceding Section 4(d)(i).

The amount paid or payable by an Indemnified Party as a result of any loss, claim, damage, liability or action referred to in the immediately preceding paragraph shall be deemed to include, subject to the limitations set forth above, any legal or other expenses incurred by such Indemnified Party in connection with investigating or defending any such action or claim. Notwithstanding the provisions of this Section 4(d), no Investor holding Registrable Securities shall be required to contribute any amount in excess of the dollar amount of the net proceeds (after payment of any underwriting fees, discounts, commissions or taxes) actually received by such Investor from the sale of Registrable Securities which gave rise to such contribution obligation. No Person guilty of fraudulent misrepresentation (within the meaning of Section 11(f) of the Securities Act) shall be entitled to contribution from any Person who was not guilty of such fraudulent misrepresentation.

5. RULE 144. Purchaser covenants that it shall file any reports required to be filed by it under the Securities Act and the Exchange Act and shall take such further action as Investors holding Registrable Securities may reasonably request, all to the extent required from time to time to enable such Investors to sell Registrable Securities without registration under the Securities Act within the limitation of the exemptions provided by Rule 144 under the Securities Act, as such Rule 144 may be amended from time to time, or any similar rule or regulation hereafter adopted by the Commission. Purchaser covenants that it shall, within two (2) Business Days of receipt of written notice from any Investor wishing to transfer or sell any of the Exchange Consideration without registration under the Securities Act within the limitation of the exemption provided by Rule 144, provide, execute or delivery, as applicable, all notifications, certifications, legal opinions, instruction letters, and any other documents or instruments reasonably requested by Investor or Purchaser’s transfer agent for such Investor to be able to sell or transfer such Exchange Consideration within the limitation of the exemption provided by Rule 144.

6. MISCELLANEOUS.

(a) Assignment. This Agreement and the rights, duties and obligations of Purchaser hereunder may not be assigned or delegated by Purchaser in whole or in part, unless Purchaser first provides Investors holding Registrable Securities at least ten (10) Business Days prior written notice; provided that no assignment or delegation by Purchaser will relieve Purchaser of its obligations under this Agreement unless Investors holding a majority-in-interest of the Registrable Securities provide their prior written consent, which consent must not be unreasonably withheld, delayed or conditioned. This Agreement and the rights, duties and obligations of Investors holding Registrable Securities hereunder may be freely assigned or delegated by such Investor in conjunction with and to the extent of any transfer of Registrable Securities by such Investor which is permitted under the Transaction Documents; provided that no assignment by any Investor of its rights, duties and obligations hereunder shall be binding upon or obligate Purchaser unless and until Purchaser shall have received (i) written notice of such assignment and (ii) the written agreement of the assignee, in a form reasonably satisfactory to Purchaser, to be bound by the terms and provisions of this Agreement (which may be accomplished by an addendum or certificate of joinder to this Agreement). This Agreement and the provisions hereof shall be binding upon and shall inure to the benefit of each of the parties, to the permitted assigns of the Investors or of any assignee of the Investors. This Agreement is not intended to confer any rights or benefits on any Persons that are not party hereto other than as expressly set forth in Section 4 and this Section 6(a).

(b) Notices.

(i) All notices, consents, waivers and other communications hereunder shall be in writing and shall be deemed to have been duly given when delivered (i) in person, (ii) by electronic means, including email, with affirmative confirmation of receipt, (iii) one (1) Business Day after being sent, if sent by reputable, nationally recognized overnight courier service or (iv) three (3) Business Days after being mailed, if sent by registered or certified mail, pre-paid and return receipt requested, in each case to the applicable party at the following addresses (or at such other address for a party as shall be specified by like notice):

|

If to Purchaser (following the Closing), to:

“Renovaro Biosciences Inc.” 9480 NE 2nd Avenue, #73 Miami, FL 33138 |

With copies to (which shall not constitute notice):

K&L Gates LLP Attention: Clayton E. Parker, Esq. 200 South Biscayne Boulevard, Suite 3900 Miami, FL 33131 Email: clayton.parker@klgates.com |

| If to an Investor, to: the address set forth underneath such Investor’s name on the signature page. | |