Document

i3 VERTICALS REPORTS THIRD QUARTER 2025 FINANCIAL RESULTS

NASHVILLE, Tenn. (August 7, 2025) – i3 Verticals, Inc. (Nasdaq: IIIV) (“i3 Verticals” or the “Company”) today reported its financial results for the fiscal third quarter ended June 30, 2025.

Highlights from continuing operations1 for the three and nine months ended June 30, 2025 vs. 2024

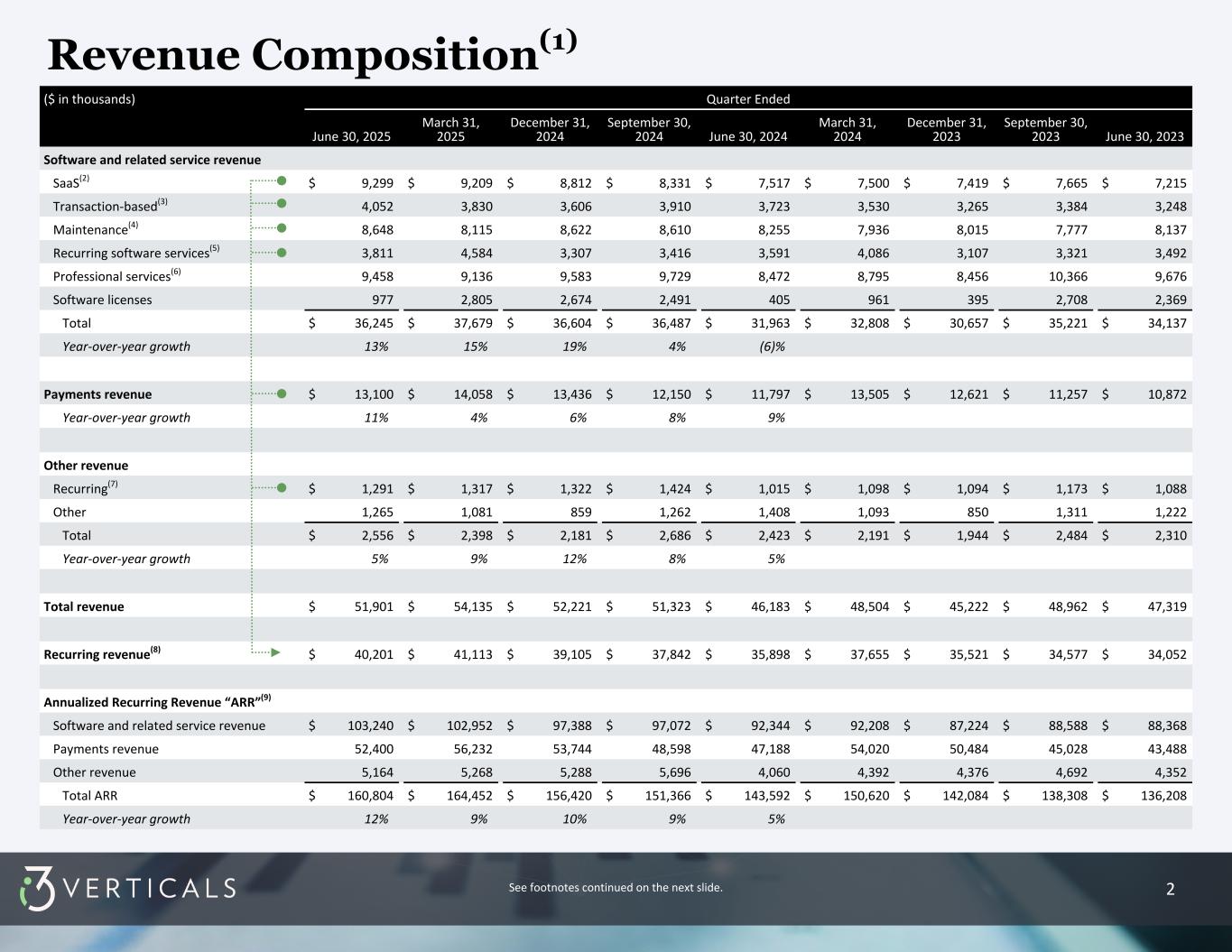

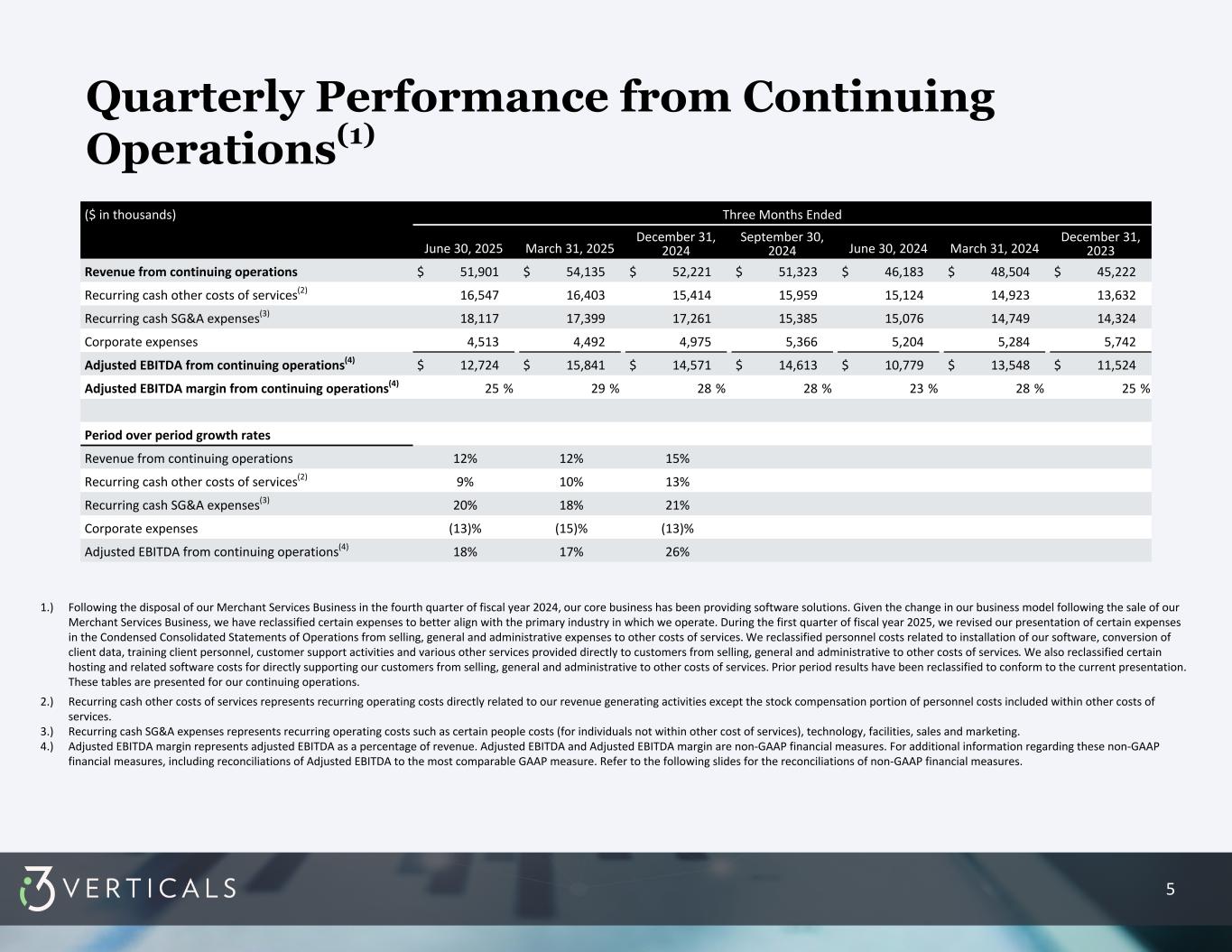

•Third quarter revenue from continuing operations was $51.9 million, an increase of 12.4% over the prior year's third quarter. Revenue from continuing operations for the nine months ended June 30, 2025, was $158.3 million, an increase of 13.1% over the prior year's first nine months.

•Third quarter net loss from continuing operations1 was $1.0 million, compared to net loss from continuing operations1 of $14.4 million in the prior year's third quarter. Net income from continuing operations for the nine months ended June 30, 2025, was $4.1 million, compared to a net loss from continuing operations of $22.4 million in the prior year's first nine months.

•Third quarter net loss from continuing operations attributable to i3 Verticals, Inc.1 was $0.4 million, compared to net loss from continuing operations attributable to i3 Verticals, Inc.1 of $11.8 million in the prior year's third quarter. Net income from continuing operations attributable to i3 Verticals, Inc.1 for the nine months ended June 30, 2025, was $2.5 million, compared to net loss from continuing operations attributable to i3 Verticals, Inc.1 of $17.7 million in the prior year's first nine months.

•Third quarter adjusted EBITDA from continuing operations1,2 was $12.7 million, an increase of 18.0% over the prior year's third quarter. Adjusted EBITDA from continuing operations1,2 for the nine months ended June 30, 2025, was $43.1 million, an increase of 20.3% over the prior year's first nine months.

•Third quarter adjusted EBITDA from continuing operations1,2 as a percentage of revenue was 24.5%, compared to 23.3% in the prior year's third quarter. Adjusted EBITDA from continuing operations1 a percentage of revenue for the nine months ended June 30, 2025, was 27.3%, compared to 25.6% in the prior year's first nine months.

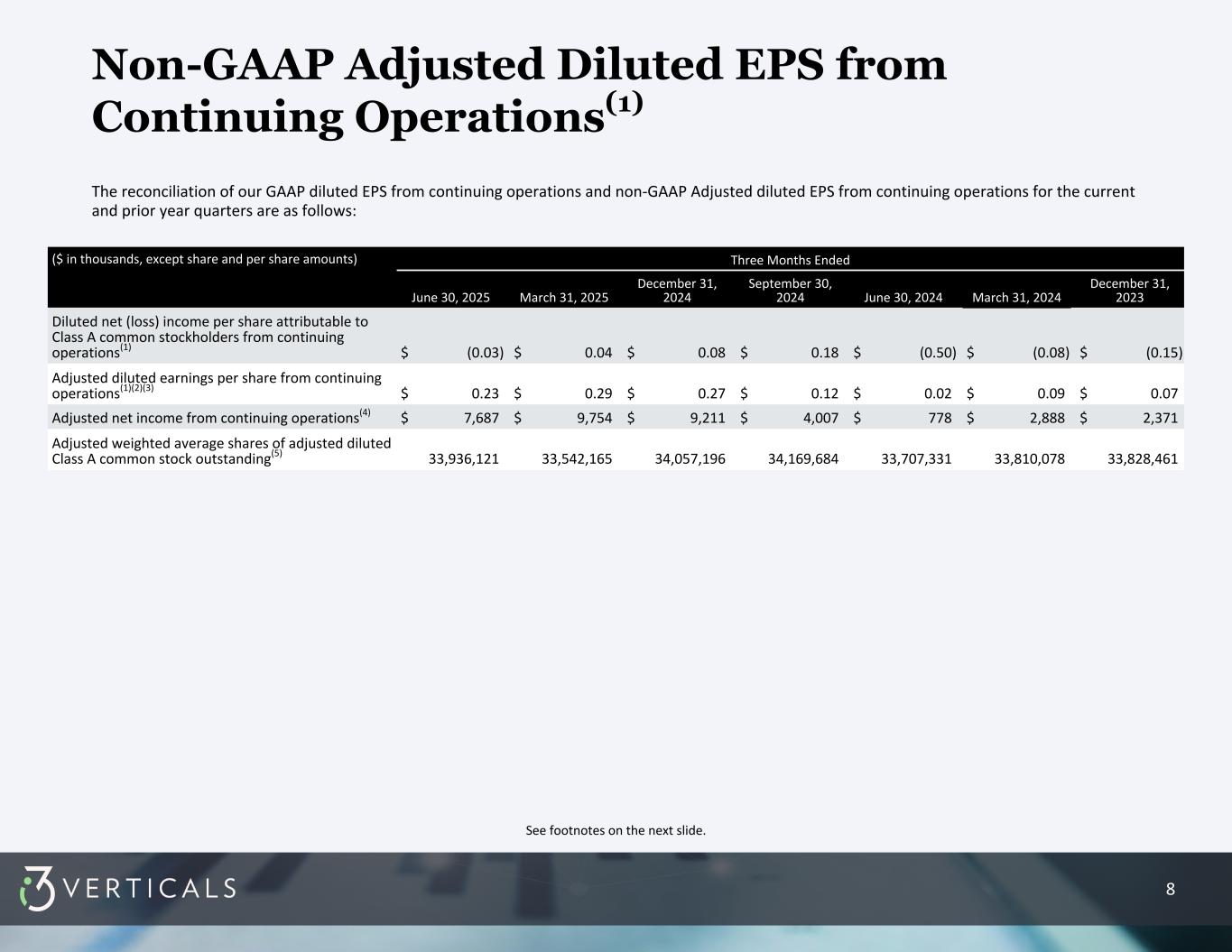

•Third quarter diluted net loss per share attributable to Class A common stockholders from continuing operations1,3 was $0.03, compared to diluted net loss per share attributable to Class A common stockholders from continuing operations1,3 of $0.50 in the prior year's third quarter. Diluted net income per share attributable to Class A common stockholders from continuing operations1,3 was $0.10 in the nine months ended June 30, 2025, compared to diluted net loss per share attributable to Class A common stockholders from continuing operations1,3 of $0.76 in the prior year's first nine months.

•Third quarter non-GAAP adjusted diluted earnings per share from continuing operations1,2,3, which gives effect to the Company's 25% estimated long-term effective tax rate4, was $0.23 compared to $0.02 for the prior year's third quarter. Non-GAAP adjusted diluted earnings per share from continuing operations1,2,3 for the nine months ended June 30, 2025, was $0.78 compared to $0.18 for the prior year's first nine months.

•Annualized Recurring Revenue ("ARR") from continuing operations1,5 for the three months ended June 30, 2025 and 2024 was $160.8 million and $143.6 million, respectively, representing a period-to-period growth rate of 12.0%.

See footnotes on the following page.

IIIV Reports Third Quarter 2025 Financial Results

Page 2

August 7, 2025

1.As a result of the sale of the Company’s merchant services business (the "Merchant Services Business"), which was completed on September 20, 2024, and the sale of the Company's Healthcare revenue cycle management business ("Healthcare RCM Business"), which was completed on May 5, 2025, the historical results of the Merchant Services Business and the Healthcare RCM Business have been reflected in discontinued operations in the consolidated statement of operations included in this earnings release, and continuing operations reflect the Company's remaining operations after giving effect to such classifications. Prior period results have been recast to reflect this presentation.

2.Represents a non-GAAP financial measure. For additional information regarding non-GAAP financial measures (including reconciliation information), see the attached schedules to this release.

3.Diluted net income (loss) per share attributable to Class A common stock from continuing operations and adjusted diluted earnings per share from continuing operations both exclude discontinued operations of the Merchant Services Business and the Healthcare RCM Business but include the consolidated cash interest expense.

4.Corporate income tax expense is based on non-GAAP adjusted income before taxes from continuing operations and is calculated using a tax rate of 25.0% for both the nine months ended June 30, 2025 and 2024, based on the estimated long-term effective tax rate, considering blended federal and state tax rates.

5.Annualized Recurring Revenue (ARR) is the annualized revenue derived from recurring sources where the Company has an ongoing contract with its customers. The Company believes revenue from recurring sources is a strategic priority. ARR is comprised of software-as-a-service (“SaaS”) arrangements, transaction-based software-revenue, software maintenance, recurring software-based services, payments revenue and other recurring revenue sources within the quarter. The sum of these revenue categories is multiplied by four to calculate ARR. ARR excludes revenue that is not recurring or is one-time in nature. The Company's management believes this metric provides useful information to investors by providing visibility regarding the ongoing revenue potential of the Company's business model and providing a clearer picture of its sustainable revenue base. Further, the Company's management uses ARR as a metric because it helps to assess the health and trajectory of the Company's business. The Company's management believes that focusing on ARR can orient the Company's sales and operations management towards long-term, reliable revenue growth. This focus on recurring revenue is particularly relevant for businesses operating under a subscription model, where customer retention and contract renewals play a significant role in long-term financial performance. ARR does not have a standardized definition and is therefore unlikely to be comparable to similarly titled measures presented by other companies. It should be reviewed independently of revenue and it is not a forecast. Additionally, ARR does not take into account seasonality. The active contracts at the end of a reporting period used in calculating ARR may or may not be extended or renewed by the Company's customers.

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 3

August 7, 2025

Greg Daily, Chairman and CEO of i3 Verticals, commented, “We are excited about the revenue growth we achieved in Q3 of our fiscal 2025. Our overall revenue growth of 12% compared to the prior year quarter has been fueled by recurring contracts. SaaS growth led the way and grew 24% this quarter over the prior year period. Additionally, revenue from payments increased by 11% compared to the prior year quarter.

“The divestiture of our Healthcare Revenue Cycle Management Business has been smooth, and I want to complement all the people who have worked hard to make that process a success.

“Looking forward, we remain well capitalized, with over $50 million in cash on hand, but have been disciplined. We plan to continue our investment in government technology and are excited about the mission in front of us: to enable state and local governments and related agencies to serve their constituents in an effective and efficient manner.”

2025 Outlook

The Company's practice is to provide annual guidance, excluding future acquisitions and transaction-related costs.

The Company is reaffirming the following previously issued outlook for the fiscal year ending September 30, 2025:

|

|

|

|

|

|

|

|

|

|

|

|

| (in thousands, except share and per share amounts) |

Outlook Range |

|

Fiscal year ending September 30, 2025 |

| Revenue |

$ |

207,000 |

|

- |

$ |

217,000 |

|

Adjusted EBITDA (non-GAAP) |

$ |

55,000 |

|

- |

$ |

61,000 |

|

Adjusted diluted earnings per share(1)(non-GAAP) |

$ |

0.96 |

|

- |

$ |

1.06 |

|

_______________________

1.Assumes an effective tax rate of 25.0% (non-GAAP), based on the estimated long-term effective tax rate, considering blended federal and state tax rates.

With respect to the “2025 Outlook” above, reconciliations of adjusted EBITDA from continuing operations and adjusted diluted earnings per share from continuing operations guidance to the closest corresponding GAAP measure on a forward-looking basis are not available without unreasonable efforts. This inability results from the inherent difficulty in forecasting generally and quantifying certain projected amounts that are necessary for such reconciliations. In particular, sufficient information is not available to calculate certain adjustments required for such reconciliations, including changes in the fair value of contingent consideration, income tax expense of i3 Verticals, Inc. and equity-based compensation expense. The Company expects these adjustments may have a potentially significant impact on future GAAP financial results.

Change in Segment Presentation

Prior to the disposition of the Healthcare RCM Business, the Company had two operating segments and reportable segments, a Public Sector segment and a Healthcare Segment, as was reflected in the Company’s condensed consolidated financial statements included in the Company’s Quarterly Report on Form 10-Q for the three and six months ended March 31, 2025, filed on May 9, 2025. After giving effect to the disposition of the Healthcare RCM Business, the Company has determined that it has one operating segment and reportable segment as of June 30, 2025, and will be updating its segment presentation in its consolidated financial statements to be included in the Company’s Quarterly Report on Form 10-Q for the three and nine months ended June 30, 2025, to reflect a single segment presentation.

Conference Call

The Company will host a conference call on Friday, August 8, 2025, at 8:30 a.m. EDT, to discuss financial results and operations. To listen to the call live via telephone, participants should dial (844) 887-9399 approximately 10 minutes prior to the start of the call. A telephonic replay will be available from 11:30 a.m. EDT on August 8, 2025, through August 15, 2025, by dialing (877) 344-7529 and entering Confirmation Code 4426770.

To listen to the call live via webcast, participants should visit the “Investors” section of the Company’s website, www.i3verticals.com, and go to the “Events” page approximately 10 minutes prior to the start of the call. The online replay will be available on this page of the Company’s website beginning shortly after the conclusion of the call and will remain available for 30 days.

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 4

August 7, 2025

Non-GAAP Measures

This press release contains information prepared in conformity with GAAP as well as non-GAAP information. It is management’s intent to provide non-GAAP financial information to enhance understanding of the Company's consolidated financial information as prepared in accordance with GAAP. This non-GAAP information should be considered by the reader in addition to, but not instead of, the financial statements prepared in accordance with GAAP. Each non-GAAP financial measure and the most directly comparable GAAP financial measure are presented for historical periods so as not to imply that more emphasis should be placed on the non-GAAP measure. The non-GAAP financial information presented may be determined or calculated differently by other companies.

Additional information about non-GAAP financial measures, and a reconciliation of those measures to the most directly comparable GAAP measures, is included in the financial schedules of this release.

About i3 Verticals

The Company provides mission-critical enterprise software solutions to its public sector customers. These comprehensive cloud-native solutions address a broad range of government functions, including courts, transportation, utilities, revenue and schools. The Company’s mission is to enable state and local governments and related agencies to serve their constituents in an effective and efficient manner. With thousands of software installations across all 50 states and Canada, i3 Verticals is a leader in the public sector vertical. More information about the Company can be found at www.i3verticals.com.

Forward-Looking Statements

This release contains forward-looking statements that are subject to risks and uncertainties. All statements other than statements of historical fact or relating to present facts or current conditions included in this release are forward-looking statements, including any statements regarding the Company's fiscal 2025 and fiscal 2025 financial outlook for continuing operations and statements of a general economic or industry specific nature. Forward-looking statements give the Company's current expectations and projections relating to its financial condition, results of operations, guidance, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “will,” “should,” “could have,” “exceed,” “significantly,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events.

The forward-looking statements contained in this release are based on assumptions that we have made in light of the Company's industry experience and its perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. As you review and consider information presented herein, you should understand that these statements are not guarantees of future performance or results. They depend upon future events and are subject to risks, uncertainties (many of which are beyond the Company's control) and assumptions. Factors that could cause actual results to differ from those expressed or implied by our forward-looking statements include, among other things: ongoing and future economic and geopolitical conditions, including the impact of inflation, elevated interest rates, and tariff and trade-related developments, competition in our industry and our ability to compete effectively, and regulatory developments; the successful integration of acquired businesses; our ability to execute on our strategy and achieve our goals following the completion of the sale of our Healthcare RCM Business and Merchant Services Business; and future decisions made by us and our competitors. All of these factors are difficult or impossible to predict accurately and many of them are beyond our control. For a further list and description of these and other important risks and uncertainties that may affect our future operations, see Part I, Item 1A - Risk Factors in our most recent Annual Report on Form 10-K filed with the Securities and Exchange Commission, which we have updated and may further update in Part II, Item 1A - Risk Factors in Quarterly Reports on Form 10-Q we have filed or will file hereafter.

Any forward-looking statement made by us in this release speaks only as of the date of this release and we undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise, except as may be required by law.

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 5

August 7, 2025

|

|

|

|

|

|

Contact: |

|

| Clay Whitson |

|

| Chief Strategy Officer |

|

| (888) 251-0987 |

|

investorrelations@i3verticals.com |

|

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 6

August 7, 2025

i3 Verticals, Inc. Consolidated Statements of Operations

(Unaudited)

($ in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Nine Months Ended June 30, |

|

2025 |

|

2024 |

|

% Change |

|

2025 |

|

2024 |

|

% Change |

|

|

|

|

|

|

|

|

|

|

|

|

| Revenue |

$ |

51,901 |

|

|

$ |

46,183 |

|

|

12% |

|

$ |

158,257 |

|

|

$ |

139,909 |

|

|

13% |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Other costs of services (excluding depreciation and amortization)(1) |

16,733 |

|

|

15,287 |

|

|

9% |

|

48,889 |

|

|

44,423 |

|

|

10% |

Selling, general and administrative(1) |

33,018 |

|

|

26,048 |

|

|

27% |

|

85,779 |

|

|

75,576 |

|

|

14% |

| Depreciation and amortization |

6,989 |

|

|

6,157 |

|

|

14% |

|

20,848 |

|

|

18,794 |

|

|

11% |

| Change in fair value of contingent consideration |

(26) |

|

|

1 |

|

|

n/m |

|

440 |

|

|

171 |

|

|

157% |

| Total operating expenses |

56,714 |

|

|

47,493 |

|

|

19% |

|

155,956 |

|

|

138,964 |

|

|

12% |

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from operations |

(4,813) |

|

|

(1,310) |

|

|

267% |

|

2,301 |

|

|

945 |

|

|

143% |

|

|

|

|

|

|

|

|

|

|

|

|

| Other (income) expenses |

|

|

|

|

|

|

|

|

|

|

|

| Interest expense |

806 |

|

|

7,906 |

|

|

(90)% |

|

1,932 |

|

|

22,307 |

|

|

(91)% |

| Other income |

(4,601) |

|

|

— |

|

|

n/m |

|

(7,020) |

|

|

(2,150) |

|

|

227% |

| Total other (income) expenses |

(3,795) |

|

|

7,906 |

|

|

n/m |

|

(5,088) |

|

|

20,157 |

|

|

n/m |

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before income taxes |

(1,018) |

|

|

(9,216) |

|

|

(89)% |

|

7,389 |

|

|

(19,212) |

|

|

n/m |

|

|

|

|

|

|

|

|

|

|

|

|

| (Benefit from) provision for income taxes |

(22) |

|

|

5,191 |

|

|

n/m |

|

3,272 |

|

|

3,153 |

|

|

4% |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income from continuing operations |

(996) |

|

|

(14,407) |

|

|

|

|

4,117 |

|

|

(22,365) |

|

|

|

| Net income from discontinued operations, net of income taxes |

19,421 |

|

|

6,109 |

|

|

|

|

18,185 |

|

|

18,951 |

|

|

|

| Net income (loss) |

18,425 |

|

|

(8,298) |

|

|

n/m |

|

22,302 |

|

|

(3,414) |

|

|

n/m |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income from continuing operations attributable to non-controlling interest |

(586) |

|

|

(2,608) |

|

|

|

|

1,653 |

|

|

(4,654) |

|

|

|

Net income from discontinued operations attributable to non-controlling interest |

6,129 |

|

|

1,855 |

|

|

|

|

5,865 |

|

|

5,809 |

|

|

|

| Net income (loss) attributable to non-controlling interest |

5,543 |

|

|

(753) |

|

|

n/m |

|

7,518 |

|

|

1,155 |

|

|

551% |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income from continuing operations attributable to i3 Verticals, Inc. |

(410) |

|

|

(11,799) |

|

|

|

|

2,464 |

|

|

(17,711) |

|

|

|

Net income from discontinued operations attributable to i3 Verticals, Inc. |

13,292 |

|

|

4,254 |

|

|

|

|

12,320 |

|

|

13,142 |

|

|

|

| Net income (loss) attributable to i3 Verticals, Inc. |

$ |

12,882 |

|

|

$ |

(7,545) |

|

|

n/m |

|

$ |

14,784 |

|

|

$ |

(4,569) |

|

|

n/m |

|

|

|

|

|

|

|

|

|

|

|

|

Net (loss) income per share attributable to Class A common stockholders from continuing operations: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

(0.02) |

|

|

$ |

(0.50) |

|

|

|

|

$ |

0.10 |

|

|

$ |

(0.76) |

|

|

|

| Diluted |

$ |

(0.03) |

|

|

$ |

(0.50) |

|

|

|

|

$ |

0.10 |

|

|

$ |

(0.76) |

|

|

|

| Net income per share attributable to Class A common stockholders from discontinued operations: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

$ |

0.55 |

|

|

$ |

0.18 |

|

|

|

|

$ |

0.52 |

|

|

$ |

0.56 |

|

|

|

| Diluted |

$ |

0.53 |

|

|

$ |

0.17 |

|

|

|

|

$ |

0.49 |

|

|

$ |

0.52 |

|

|

|

Weighted average shares of Class A common stock outstanding: |

|

|

|

|

|

|

|

|

|

|

|

Basic, for continuing operations |

24,345,826 |

|

|

23,420,811 |

|

|

|

|

23,909,714 |

|

|

23,339,598 |

|

|

|

Diluted, for continuing operations |

32,983,325 |

|

|

23,420,811 |

|

|

|

|

24,823,635 |

|

|

23,339,598 |

|

|

|

| Basic, for discontinued operations |

24,345,826 |

|

|

23,420,811 |

|

|

|

|

23,909,714 |

|

|

23,339,598 |

|

|

|

| Diluted, for discontinued operations |

33,936,121 |

|

|

33,707,331 |

|

|

|

|

34,183,267 |

|

|

33,781,826 |

|

|

|

See footnotes on the next page.

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 7

August 7, 2025

1.Following the disposal of the Company's Merchant Services Business in the fourth quarter of fiscal year 2024, the Company’s core business has been providing software solutions. Given the change in the Company's business model following the sale of the Company's Merchant Services Business, the Company has reclassified certain expenses to better align with the primary industry in which it operates. During the first quarter of fiscal year 2025, the Company revised its presentation of certain expenses in the Condensed Consolidated Statements of Operations from selling, general and administrative expenses to other costs of services. The Company reclassified personnel costs related to installation of the Company's software, conversion of client data, training client personnel, customer support activities and various other services provided directly to customers from selling, general and administrative to other costs of services. The Company also reclassified certain hosting and related software costs for directly supporting the Company's customers from selling, general and administrative to other costs of services. Prior period results have been reclassified to conform to the current presentation.

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 8

August 7, 2025

i3 Verticals, Inc. Consolidated Balance Sheets

(Unaudited)

($ in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

September 30, |

|

2025 |

|

2024 |

| Assets |

|

|

|

| Current assets |

|

|

|

| Cash and cash equivalents |

$ |

55,544 |

|

|

$ |

86,525 |

|

| Accounts receivable, net |

49,445 |

|

|

50,779 |

|

| Settlement assets |

18 |

|

|

632 |

|

| Prepaid expenses and other current assets |

12,770 |

|

|

9,973 |

|

| Current assets held for sale |

— |

|

|

5,484 |

|

| Total current assets |

117,777 |

|

|

153,393 |

|

| Property and equipment, net |

7,342 |

|

|

8,288 |

|

| Restricted cash |

250 |

|

|

2,424 |

|

| Capitalized software, net |

49,893 |

|

|

53,983 |

|

| Goodwill |

248,195 |

|

|

242,988 |

|

| Intangible assets, net |

138,708 |

|

|

140,748 |

|

| Deferred tax asset |

49,092 |

|

|

48,445 |

|

| Operating lease right-of-use assets |

5,159 |

|

|

6,331 |

|

| Other assets |

6,858 |

|

|

6,666 |

|

| Long-term assets held for sale |

— |

|

|

67,409 |

|

| Total assets |

$ |

623,274 |

|

|

$ |

730,675 |

|

|

|

|

|

| Liabilities and equity |

|

|

|

| Liabilities |

|

|

|

| Current liabilities |

|

|

|

| Accounts payable |

$ |

4,497 |

|

|

$ |

4,886 |

|

| Current portion of long-term debt |

— |

|

|

26,223 |

|

| Accrued expenses and other current liabilities |

21,915 |

|

|

88,252 |

|

| Settlement obligations |

18 |

|

|

632 |

|

| Deferred revenue |

29,758 |

|

|

38,361 |

|

| Current portion of operating lease liabilities |

2,023 |

|

|

2,305 |

|

| Current liabilities held for sale |

— |

|

|

4,072 |

|

| Total current liabilities |

58,211 |

|

|

164,731 |

|

| Long-term tax receivable agreement obligations |

35,117 |

|

|

29,347 |

|

| Operating lease liabilities, less current portion |

3,367 |

|

|

4,890 |

|

| Other long-term liabilities |

15,458 |

|

|

14,921 |

|

| Long-term liabilities held for sale |

— |

|

|

1,427 |

|

| Total liabilities |

112,153 |

|

|

215,316 |

|

Commitments and contingencies |

|

|

|

| Stockholders' equity |

|

|

|

Preferred stock, par value $0.0001 per share, 10,000,000 shares authorized; 0 shares issued and outstanding as of June 30, 2025 and September 30, 2024 |

— |

|

|

— |

|

Class A common stock, par value $0.0001 per share, 150,000,000 shares authorized; 23,780,915 and 23,882,035 shares issued and outstanding as of June 30, 2025 and September 30, 2024, respectively |

2 |

|

|

2 |

|

Class B common stock, par value $0.0001 per share, 40,000,000 shares authorized; 8,463,204 and 10,032,676 shares issued and outstanding as of June 30, 2025 and September 30, 2024, respectively |

1 |

|

|

1 |

|

| Additional paid-in capital |

268,111 |

|

|

279,335 |

|

| Accumulated earnings |

115,181 |

|

|

100,397 |

|

| Total stockholders' equity |

383,295 |

|

|

379,735 |

|

| Non-controlling interest |

127,826 |

|

|

135,624 |

|

| Total equity |

511,121 |

|

|

515,359 |

|

| Total liabilities and equity |

$ |

623,274 |

|

|

$ |

730,675 |

|

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 9

August 7, 2025

i3 Verticals, Inc. Consolidated Cash Flow Data

(Unaudited)

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

Nine Months Ended June 30, |

|

2025 |

|

2024 |

|

|

|

|

Net cash (used in) provided by operating activities(1) |

$ |

(8,276) |

|

|

$ |

33,266 |

|

| Net cash provided by (used in) investing activities |

$ |

78,774 |

|

|

$ |

(16,755) |

|

| Net cash used in financing activities |

$ |

(104,283) |

|

|

$ |

(15,215) |

|

___________________________________________________________

1.Cash used in operating activities during the nine months ended June 30, 2025, included $35,112 in cash paid for income taxes, primarily driven by the sale of the Merchant Services Business in the fourth quarter of fiscal year 2024.

Reconciliation of GAAP to Non-GAAP Financial Measures

The Company discloses the following non-GAAP financial measures in this earnings release:

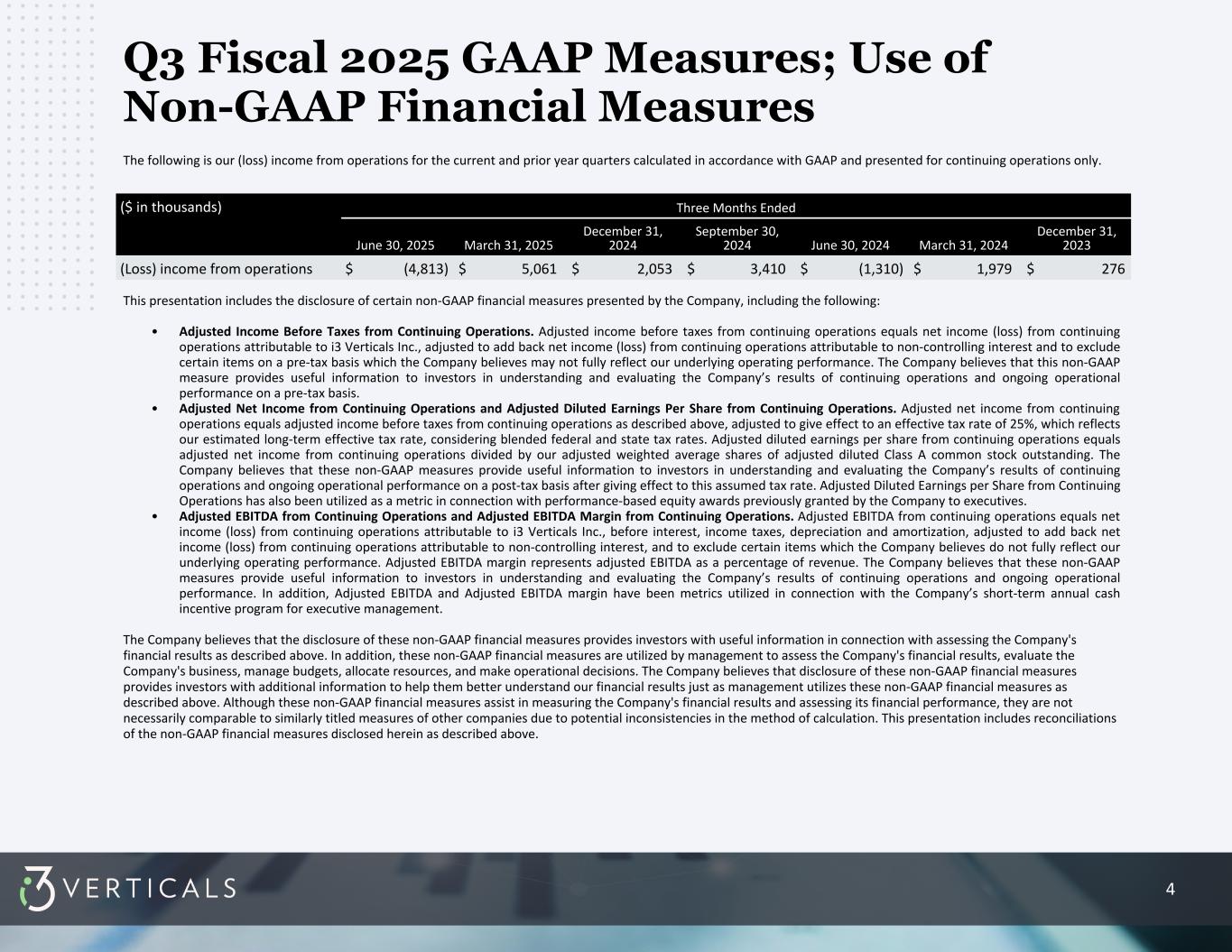

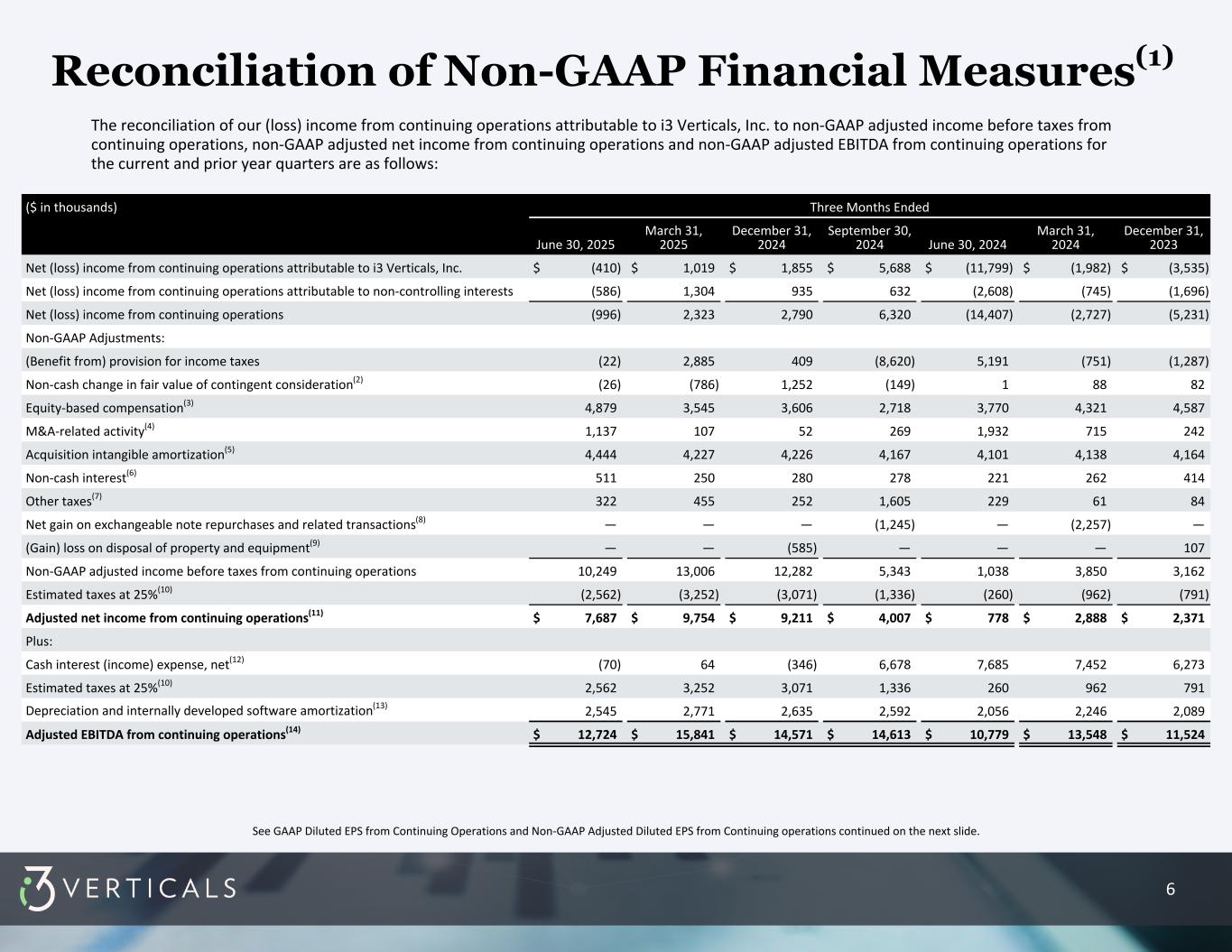

•Adjusted Income Before Taxes from Continuing Operations. Adjusted income before taxes from continuing operations equals net income (loss) from continuing operations attributable to i3 Verticals Inc., adjusted to add back net income (loss) from continuing operations attributable to non-controlling interest and to exclude certain items on a pre-tax basis which the Company believes may not fully reflect our underlying operating performance. The Company believes that this non-GAAP measure provides useful information to investors in understanding and evaluating the Company’s results of continuing operations and ongoing operational performance on a pre-tax basis.

•Adjusted Net Income from Continuing Operations and Adjusted Diluted Earnings per Share from Continuing Operations. Adjusted net income from continuing operations equals adjusted income before taxes from continuing operations as described above, adjusted to give effect to an effective tax rate of 25%, which reflects our estimated long-term effective tax rate, considering blended federal and state tax rates. Adjusted diluted earnings per share from continuing operations equals adjusted net income from continuing operations divided by our adjusted weighted average shares of adjusted diluted Class A common stock outstanding. The Company believes that these non-GAAP measures provide useful information to investors in understanding and evaluating the Company’s results of continuing operations and ongoing operational performance on a post-tax basis after giving effect to this assumed tax rate. Adjusted Diluted Earnings per Share from Continuing Operations has also been utilized as a metric in connection with performance-based equity awards previously granted by the Company to executives.

•Adjusted EBITDA from Continuing Operations and Adjusted EBITDA Margin from Continuing Operations. Adjusted EBITDA from continuing operations equals net income (loss) from continuing operations attributable to i3 Verticals Inc., before interest, income taxes, depreciation and amortization, adjusted to add back net income (loss) from continuing operations attributable to non-controlling interest, and to exclude certain items which the Company believes do not fully reflect our underlying operating performance. Adjusted EBITDA margin represents adjusted EBITDA as a percentage of revenue. The Company believes that these non-GAAP measures provide useful information to investors in understanding and evaluating the Company’s results of continuing operations and ongoing operational performance. In addition, Adjusted EBITDA and Adjusted EBITDA margin have been metrics utilized in connection with the Company’s short-term annual cash incentive program for executive management.

The Company believes that the disclosure of these non-GAAP financial measures provides investors with useful information in connection with assessing the Company's financial results as described above. In addition, these non-GAAP financial measures are utilized by management to assess the Company's financial results, evaluate the Company's business, manage budgets, allocate resources, and make operational decisions. The Company believes that disclosure of these non-GAAP financial measures provides investors with additional information to help them better understand our financial results just as management utilizes these non-GAAP financial measures as described above. Although these non-GAAP financial measures assist in measuring the Company's financial results and assessing its financial performance, they are not necessarily comparable to similarly titled measures of other companies due to potential inconsistencies in the method of calculation.

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 10

August 7, 2025

See below for reconciliations of the non-GAAP financial measures presented in this release.

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 11

August 7, 2025

i3 Verticals, Inc. Reconciliation of GAAP Net Income (Loss) from Continuing Operations to

Non-GAAP Adjusted Net Income from Continuing Operations and

Non-GAAP Adjusted EBITDA from Continuing Operations

(Unaudited)

($ in thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Nine Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

| Net (loss) income from continuing operations attributable to i3 Verticals, Inc. |

$ |

(410) |

|

|

$ |

(11,799) |

|

|

$ |

2,464 |

|

|

$ |

(17,711) |

|

| Net (loss) income from continuing operations attributable to non-controlling interest |

(586) |

|

|

(2,608) |

|

|

1,653 |

|

|

(4,654) |

|

Net (loss) income from continuing operations |

$ |

(996) |

|

|

$ |

(14,407) |

|

|

$ |

4,117 |

|

|

$ |

(22,365) |

|

| Non-GAAP adjustments: |

|

|

|

|

|

|

|

| (Benefit from) provision for income taxes |

(22) |

|

|

5,191 |

|

|

3,272 |

|

|

3,153 |

|

Non-cash change in fair value of contingent consideration(1) |

(26) |

|

|

1 |

|

|

440 |

|

|

171 |

|

Equity-based compensation from continuing operations(2) |

4,879 |

|

|

3,770 |

|

|

12,030 |

|

|

12,677 |

|

M&A-related activity(3) |

1,137 |

|

|

1,932 |

|

|

1,296 |

|

|

2,888 |

|

Acquisition intangible amortization(4) |

4,444 |

|

|

4,101 |

|

|

12,897 |

|

|

12,404 |

|

Non-cash interest expense(5) |

511 |

|

|

221 |

|

|

1,041 |

|

|

897 |

|

Other taxes(6) |

322 |

|

|

229 |

|

|

1,029 |

|

|

374 |

|

Net gain on exchangeable note repurchases and related transactions(7) |

— |

|

|

— |

|

|

— |

|

|

(2,257) |

|

(Gain) loss on disposal of property and equipment(8) |

— |

|

|

— |

|

|

(585) |

|

|

107 |

|

Non-GAAP adjusted income before taxes from continuing operations(9) |

$ |

10,249 |

|

|

$ |

1,038 |

|

|

$ |

35,537 |

|

|

$ |

8,049 |

|

Estimated taxes at 25%(10) |

(2,562) |

|

|

(260) |

|

|

(8,885) |

|

|

(2,012) |

|

Adjusted net income from continuing operations(11) |

$ |

7,687 |

|

|

$ |

778 |

|

|

$ |

26,652 |

|

|

$ |

6,037 |

|

Cash interest (income) expense, net(12) |

(70) |

|

|

7,685 |

|

|

(352) |

|

|

21,410 |

|

Estimated taxes at 25%(10) |

2,562 |

|

|

260 |

|

|

8,885 |

|

|

2,013 |

|

Depreciation and internally developed software amortization(13) |

2,545 |

|

|

2,056 |

|

|

7,951 |

|

|

6,391 |

|

Adjusted EBITDA from continuing operations(14) |

$ |

12,724 |

|

|

$ |

10,779 |

|

|

$ |

43,136 |

|

|

$ |

35,851 |

|

________________

1.Non-cash change in fair value of contingent consideration reflects the changes in management’s estimates of future cash consideration to be paid in connection with prior acquisitions from the amount estimated as of the later of the most recent balance sheet date forming the beginning of the income statement period or the original estimates made at the closing of the applicable acquisition.

2.Equity-based compensation expense related to stock options and restricted stock units issued under the Company's 2018 Equity Incentive Plan and 2020 Acquisition Equity Incentive Plan.

3.M&A-related activity is the net impact of professional service and related costs directly related to any merger, acquisition and disposition activity of the Company, which are recorded in selling, general and administrative in the condensed consolidated statements of operations, and revenue earned through post-sale non-recurring activities with divestitures, which are recorded in other income in the condensed consolidated statements of operations. i3 Verticals believes these activities are not reflective of the underlying operational performance of the Company. M&A-related income for the three months ending June 30, 2025, March 31, 2025, and December 31, 2024, were $4,237, $461, and $495, respectively. M&A-related expenses the three months ending June 30, 2025, March 31, 2025, and December 31, 2024, were $5,373, $570, and $546, respectively. There was no M&A-related income during fiscal year 2024

4.Acquisition intangible amortization reflects amortization of intangible assets and software acquired through acquisitions of business or other purchases of intangible assets.

5.Non-cash interest expense reflects amortization of debt issuance costs and any write-offs of debt issuance costs.

6.Other taxes consist of franchise taxes, commercial activity taxes, reserves for ongoing tax audit matters, the employer portion of payroll taxes related to stock option exercises and other non-income-based taxes. Taxes related to salaries are not included.

7.Net gain on exchangeable note repurchases and related transactions reflects the gain on repurchases of exchangeable notes and warrant unwinds, net of the loss on sale of bond hedge unwinds, which occurred during the nine months ended June 30, 2024.

8.(Gain) loss on disposal of property and equipment is related to the sale of buildings and automobiles purchased through acquisitions.

9.Represents a non-GAAP financial measure.

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 12

August 7, 2025

10.Corporate income tax expense is based on non-GAAP adjusted income before taxes from continuing operations and is calculated using a tax rate of 25.0% for both the nine months ended June 30, 2025 and 2024, based on the estimated long-term effective tax rate, considering blended federal and state tax rates.

11.Represents a non-GAAP financial measure.

12.Cash interest (income) expense, net, represents all interest expense net of interest income recorded on the Company's statement of operations other than non-cash interest expense, which represents amortization of debt issuance costs and any write-offs of debt issuance costs.

13.Depreciation and internally developed software amortization reflects depreciation on the Company's property, plant and equipment, net, and amortization expense on its internally developed capitalized software.

14.Represents a non-GAAP financial measure.

IIIV Reports Third Quarter Fiscal Year 2025 Financial Results

Page 13

August 7, 2025

i3 Verticals, Inc. GAAP Diluted EPS from Continuing Operations and

Non-GAAP Adjusted Diluted EPS from Continuing Operations

(Unaudited)

($ in thousands, except share and per share amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

Nine Months Ended June 30, |

|

2025 |

|

2024 |

|

2025 |

|

2024 |

Diluted net (loss) income per share attributable to Class A common stockholders from continuing operations(1) |

$ |

(0.03) |

|

|

$ |

(0.50) |

|

|

$ |

0.10 |

|

|

$ |

(0.76) |

|

Adjusted diluted earnings per share from continuing operations(1)(2)(3) |

$ |

0.23 |

|

|

$ |

0.02 |

|

|

$ |

0.78 |

|

|

$ |

0.18 |

|

Adjusted net income from continuing operations(3) |

$ |

7,687 |

|

|

$ |

778 |

|

|

$ |

26,652 |

|

|

$ |

6,037 |

|

Adjusted weighted average shares of adjusted diluted Class A common stock outstanding(4) |

33,936,121 |

|

|

33,707,331 |

|

|

34,183,267 |

|

|

33,781,826 |

|

________________

1.Diluted net (loss) income per share attributable to Class A common stockholders from continuing operations and adjusted diluted earnings per share from continuing operations both exclude the discontinued operations of the Merchant Services Business and the Healthcare RCM Business but include the consolidated cash interest expense.

2.Adjusted diluted earnings per share from continuing operations, a non-GAAP financial measure, is calculated using adjusted net income from continuing operations and the adjusted weighted average shares of adjusted diluted Class A common stock outstanding.

3.Adjusted net income from continuing operations, a non-GAAP financial measure, assumes that all net income from continuing operations during the period is available to the holders of the Company's Class A common stock. Further, adjusted diluted earnings per share from continuing operations assumes that all Common Units in i3 Verticals, LLC and the associated non-voting Class B common stock were exchanged for Class A common stock at the beginning of the period on a one-for-one basis.

4.Adjusted weighted average shares of adjusted diluted Class A common stock outstanding include 8,637,499 and 10,052,017 outstanding shares of Class A common stock issuable upon the exchange of Common Units in i3 Verticals, LLC and 952,796 and 234,503 shares resulting from estimated stock option exercises and restricted stock units vesting as calculated by the treasury stock method for the three months ended June 30, 2025 and 2024, respectively. Adjusted weighted average shares of adjusted diluted Class A common stock outstanding include 9,359,632 and 10,079,057 outstanding shares of Class A common stock issuable upon the exchange of Common Units in i3 Verticals, LLC and 913,921 and 363,171 shares resulting from estimated stock option exercises and restricted stock units vesting as calculated by the treasury stock method for the nine months ended June 30, 2025 and 2024, respectively.