|

|

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2025

Commission file number: 001-42389

BIOHARVEST SCIENCES INC.

(Exact name of Registrant as specified in its charter)

Not applicable

(Translation of Registrant’s name into English)

1140-625 Howe Street, Vancouver, British Columbia V6C 2T6, Canada

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

☐ Form 20-F ☒ Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐

|

|

SUBMITTED HEREWITH

Exhibits:

|

Exhibit |

Description |

|

Unaudited Interim Condensed Consolidated Financial Statements For the Three and Nine Months Ended September 30, 2025 |

|

|

Management’s Discussion and Analysis For the Three and Nine Months Ended September 30, 2025 |

|

|

Form 52-109F2 - Certification of Interim Filings – Full Certificate - CEO |

|

|

Form 52-109F2 - Certification of Interim Filings – Full Certificate - CFO |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

|

|

BIOHARVEST SCIENCES INC. |

|

|

(Registrant) |

|

|

|

|

Date: November 13, 2025 |

/s/ David Ryan |

|

|

Name: David Ryan |

|

|

Title: Vice-President, Investor Relations & Secretary |

BioHarvest Sciences Inc.

Unaudited Interim Condensed Consolidated Financial Statements

For the Three and Nine Months Ended September 30, 2025

Expressed in U.S. dollars in thousands

BioHarvest Sciences Inc.

Unaudited Interim Condensed Consolidated Financial Statements

For the Three and Nine Months Ended September 30, 2025

Expressed in U.S. dollars in thousands

TABLE OF CONTENTS

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Unaudited Interim Condensed Consolidated Statements of Financial Position |

|

U.S. dollars in thousands |

|

|

Note |

As of September 30, |

As of December 31, |

|

2025 |

2024 |

||

|

|

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

|

$ 10,966 |

$ 2,390 |

|

Trade accounts receivable |

|

1,377 |

1,116 |

|

Other accounts receivable |

|

1,062 |

695 |

|

Inventory |

|

4,434 |

3,655 |

|

Total current assets |

|

17,839 |

7,856 |

|

|

|

|

|

|

Non-current assets |

|

|

|

|

Restricted cash |

|

405 |

371 |

|

Property, plant and equipment, net |

|

8,243 |

7,750 |

|

Right-of-use assets, net |

3 |

8,701 |

9,024 |

|

Total non-current assets |

|

17,349 |

17,145 |

|

Total assets |

|

$ 35,188 |

$ 25,001 |

|

|

|

|

|

|

Liabilities |

|

|

|

|

Current liabilities |

|

|

|

|

Trade accounts payable |

|

$ 3,485 |

$ 3,525 |

|

Other accounts payable |

|

2,740 |

3,609 |

|

Deferred revenue |

|

438 |

906 |

|

Lease liabilities |

3 |

1,445 |

772 |

|

Loans |

6 |

3,699 |

3,905 |

|

Liability for Agricultural Research Organization |

9 |

437 |

1,140 |

|

Accrued liabilities |

|

946 |

401 |

|

Total current liabilities |

|

13,190 |

14,258 |

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

Lease liabilities |

3 |

9,875 |

9,141 |

|

Loans |

6 |

2,343 |

- |

|

Liability for Agricultural Research Organization |

9 |

2,045 |

272 |

|

Total non-current liabilities |

|

14,263 |

9,413 |

|

|

|

|

|

|

Shareholders’ equity (deficit) |

|

|

|

|

Share capital and contributed surplus |

4 |

113,084 |

97,748 |

|

Accumulated deficit |

|

(105,349) |

(96,418) |

|

Total Shareholders’ equity (deficit) |

|

7,735 |

1,330 |

|

|

|

|

|

|

Total liabilities and shareholders’ equity (deficit) |

|

$ 35,188 |

$ 25,001 |

Going concern (Note 1B)

|

November 13, 2025 |

|

|

‘Zaki Rakib’ |

‘Ilan Sobel’ |

|

Date of approval of the financial statements |

|

|

Chairman of the Board

|

Chief Executive Officer |

The accompanying notes are an integral part of these Interim Unaudited Condensed Consolidated Financial Statements.

3

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Unaudited Interim Condensed Consolidated Statements of Loss and Other Comprehensive Loss |

|

U.S. dollars in thousands (except of share and per share data) |

|

|

Three-month period ended September 30, |

Nine-month period ended September 30, |

||

|

2025 |

2024 |

2025 |

2024 |

|

|

$ 9,067 |

$ 6,539 |

$ 25,442 |

$ 17,910 |

|

|

Cost of revenues |

3,497 |

2,825 |

10,191 |

8,091 |

|

Gross profit |

5,570 |

3,714 |

15,251 |

9,819 |

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

Research and development |

1,432 |

1,278 |

4,014 |

3,400 |

|

Sales and marketing |

4,122 |

3,417 |

11,790 |

8,793 |

|

General and administrative |

936 |

1,121 |

3,901 |

2,928 |

|

Total operating expenses |

(6,490) |

(5,816) |

(19,705) |

(15,121) |

|

|

|

|

|

|

|

Operating loss |

(920) |

(2,102) |

(4,454) |

(5,302) |

|

Finance expenses |

1,530 |

587 |

4,337 |

4,655 |

|

Net loss before tax |

(2,450) |

(2,689) |

(8,791) |

(9,957) |

|

Taxes on income |

63 |

- |

140 |

- |

|

Net loss and comprehensive loss |

$ (2,513) |

$ (2,689) |

$ (8,931) |

$ (9,957) |

|

|

|

|

|

|

|

Basic and Diluted loss per share |

(0.14) |

(0.16) |

(0.51) |

(0.63) |

|

Weighted Average Number of Shares Outstanding |

17,424,564 |

17,341,577 |

17,421,194 |

15,813,051 |

The accompanying notes are an integral part of these Interim Unaudited Condensed Consolidated Financial Statements.

4

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Unaudited Interim Condensed Consolidated Statements of Changes in Shareholders’ Equity (Deficit) |

|

U.S. dollars in thousands |

|

For the nine-month period ended September 30, 2025: | ||||

|

|

Number of shares |

Share Capital and contributed surplus |

Accumulated deficit |

Total equity |

|

17,327,716 |

$ 97,748 |

$ (96,418) |

$ 1,330 |

|

|

Share based compensation |

- |

449 |

- |

449 |

|

Exercise of options and warrants by employees and consultants |

10,948 |

71 |

- |

71 |

|

Issuance of shares in lieu of vested RSUs |

5,714 |

- |

- |

- |

|

Warrants extension (Notes 4c and 4d) |

- |

549 |

- |

549 |

|

Conversion of Convertible Loans |

1,169,758 |

7,236 |

- |

7,236 |

|

Exercise of warrants |

1,102,244 |

7,031 |

- |

7,031 |

|

Comprehensive loss for the period |

- |

- |

(8,931) |

(8,931) |

|

Balance, September 30, 2025 |

19,616,380 |

$ 113,084 |

$ (105,349) |

$ 7,735 |

|

For the nine-month period ended September 30, 2024: | ||||

|

|

Number of shares |

Share Capital and contributed surplus |

Accumulated deficit |

Total equity (deficit) |

|

Balance, December 31, 2023 |

13,676,798 |

$ 68,652 |

$ (83,505) |

$ (14,853) |

|

Exercise of options and warrants by employees and consultants |

106,132 |

408 |

- |

408 |

|

Share based compensation |

- |

454 |

- |

454 |

|

Conversion of Convertible Loans |

2,940,882 |

20,527 |

- |

20,527 |

|

Issuance of warrants |

- |

2,296 |

- |

2,296 |

|

Reclassification of warrants |

- |

934 |

- |

934 |

|

Issuance of units of securities |

603,904 |

4,330 |

- |

4,330 |

|

Comprehensive loss for the period |

- |

- |

(9,957) |

(9,957) |

|

Balance, September 30, 2024 |

17,327,716 |

$ 97,601 |

$ (93,462) |

$ 4,139 |

The accompanying notes are an integral part of these Interim Unaudited Condensed Consolidated Financial Statements.

5

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Unaudited Interim Condensed Consolidated Statements of Cash Flows |

|

U.S. dollars in thousands |

|

|

Nine-months period ended September 30, |

|

|

|

2025 |

2024 |

|

|

|

|

|

Net loss |

$ (8,931) |

$ (9,957) |

|

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

Depreciation and Amortization |

1,191 |

910 |

|

Fair value adjustments of Convertible loans |

- |

3,482 |

|

Fair value adjustments of derivative liability - Warrants |

- |

408 |

|

Interest over Agricultural Research Organization liability |

212 |

288 |

|

Re-assessment of Liability for Agricultural Research Organization |

(396) |

- |

|

Finance expense (income), net |

2,915 |

296 |

|

Share based compensation |

449 |

454 |

|

Changes in assets and liabilities items: |

|

|

|

Change in trade accounts receivable |

(261) |

(355) |

|

Change in other accounts receivable |

(367) |

(440) |

|

Change in inventory |

(779) |

(722) |

|

Changes in trade accounts payable, other accounts payable and accrued liabilities |

1,461 |

(*) 1,298 |

|

Changes in deferred revenue |

(468) |

(*) 43 |

|

Net cash used in operating activities |

(4,974) |

(4,295) |

|

|

|

|

|

Cash flow from investing activities: |

|

|

|

Purchase of property and equipment |

(1,701) |

(2,442) |

|

Deposit of restricted cash for bank guarantee, net of drawing |

4 |

(185) |

|

Net cash used in investing activities |

(1,697) |

(2,627) |

|

|

|

|

|

Cash flow from financing activities |

|

|

|

Repayments of lease liabilities |

(901) |

(412) |

|

Proceeds from loans, net of repayments |

10,306 |

- |

|

Exercise of warrants by investors |

5,839 |

- |

|

Net proceeds from issuance of units of securities |

- |

4,330 |

|

Exercise of options and warrants by employees and consultants |

- |

408 |

|

Net cash provided by financing activities |

15,244 |

4,326 |

|

|

|

|

|

Exchange rate differences on cash and cash equivalents |

3 |

9 |

|

Increase (decrease) in cash and cash equivalents |

8,573 |

(2,596) |

|

Cash and cash equivalents at the beginning of the year |

2,390 |

5,355 |

|

Cash and cash equivalents at the end of the year |

$ 10,966 |

$ 2,768 |

|

|

|

|

|

Significant non-cash transactions: |

|

|

|

Conversion of Convertible loans into shares |

7,603 |

20,527 |

|

Exercise of warrants |

1,397 |

- |

|

Reclassification of warrants as an equity instrument |

- |

934 |

|

Purchase of property in installment agreement |

- |

1,721 |

|

Recognition of right-of-use assets and lease liabilities |

399 |

8,648 |

The accompanying notes are an integral part of these Interim Unaudited Condensed Consolidated Financial Statements.

6

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 1 - GENERAL:

A.Description of the Company and its operations:

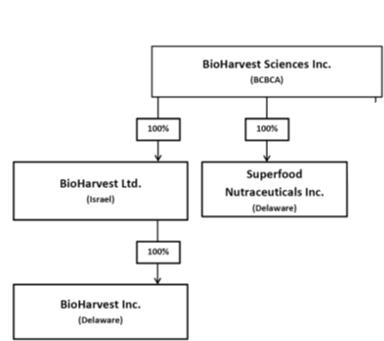

(*) Certain comparative amounts have been reclassified to conform to the current period presentation BioHarvest Sciences Inc. (the “Company” or “BioHarvest Sciences”), together with its wholly owned subsidiaries, was incorporated under the Business Corporations Act of British Columbia on April 19, 2013. The Company fully owns BioHarvest Ltd. (“BioHarvest”), a company incorporated in Israel, and Superfood Nutraceuticals Inc. (“Superfood”) a company incorporated in Delaware, USA.

BioHarvest was incorporated in January 2007 and commenced its activity in July 2007.

In July 2014, BioHarvest Ltd incorporated a Delaware based wholly owned subsidiary, BioHarvest Inc (“BioHarvest Inc”).

On October 28, 2020, BioHarvest Sciences incorporated a Delaware based wholly owned subsidiary, Superfood Nutraceuticals Inc. (“Superfood”).

The Company is publicly listed and traded on the Nasdaq Stock Market under the symbol BHST, traded on the Frankfurt Stock Exchange under the symbol 8MV0, traded on the Munich Stock Exchange under the symbol 8MV0, traded on the Stuttgart Stock Exchange under the symbol 8MV0 and traded on the Dusseldorf Stock Exchange under the symbol 8MV0.

On February 14, 2025, the Company completed a voluntary delisting process of its common shares from the Canadian Securities Exchange and continue to be listed on the Nasdaq Stock Market.

The registered address of the Company is 1140-625 Howe St., Vancouver, BC V6C 2T6, Canada.

Description of Business

The Company is a biotechnology company that has developed the Botanical Synthesis Platform Technology, which enables the Company to grow, at an industrial scale, the active and beneficial ingredients in certain fruits and plants without the need to grow the plant itself. The Botanical Synthesis Platform Technology is the only non-genetically modified organism platform that can produce plant cells with significantly higher concentrations of active ingredients (as compared to those that are produced naturally), as well as extremely high levels of solubility and bio-availability. The Botanical Synthesis Platform Technology is economical, ensures consistency and avoids the negative environmental impacts associated with traditional agriculture by providing consistent product production, a year-round production cycle and products that are devoid of sugar, calories and contaminants, such as pesticides, heavy metals and residues.

The Company is currently focused on utilizing the Botanical Synthesis Platform Technology to develop the next generation of science-based and clinically proven therapeutic solutions through two business units:

1.The Products Business Unit, comprises:

(a)Nutraceuticals: Research, development, manufacturing, marketing and sales of science-based health and wellness nutraceutical solutions (capsules, powders, chews and other delivery mechanisms such as coffee, teas and protein bars);

(b)Cosmeceuticals: Research and development for future manufacturing, marketing and sales of science-based therapeutic cosmeceutical solutions.

2.The CDMO Services Business Unit comprising a Contract Development and Manufacturing Operation (“CDMO”) that offers customers from the pharmaceutical, cosmeceutical, nutraceutical and nutrition industries the development and future manufacturing of specific plant-based active molecules, via an end-to-end service agreement.

7

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 1 - GENERAL (Continued):

B. Going concern:

The Company has incurred losses from operations since its inception. As of September 30, 2025, the Company has an accumulated deficit of $105,349. The Company generated negative cash flows from operating activities of $4,974 and a loss in the amount of $8,931 for the nine-month period ended September 30, 2025. As of the date of the issuance of these unaudited interim condensed consolidated financial statements, the Company has not yet commenced generating sufficient sales to fund its operations and therefore depends on fundraising from new and existing investors to finance its activities. These factors raise a substantial doubt about the Company’s ability to continue as a going concern.

The Company’s management plans to fund near-term anticipated activities based on proceeds from capital fund raising, debt instruments in the form of convertible loans, short-term loans, long-term loans and future revenues.

During September 2025, the Company completed an Equity Offering resulting in net proceeds and debts reduction of approximately $14,202 (Notes 4f, 4g, 4h and 4i).

On November 10, 2025, the Company completed a Public Offering resulting in gross proceeds of approximately $19,928. After deducting underwriting fees and transaction-related costs the Company received net proceeds of approximately $18,437 (Note 10c).

The net proceeds from the Equity Offering, the Public Offering and other subsequent events (Notes 10a, 10b) are expected to significantly strengthen the Company’s position of liquidity and support ongoing operations. These events are considered in management’s assessment of the Company’s ability to continue as going concern.

The unaudited interim condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

The accompanying unaudited interim condensed consolidated financial statements of the Company were authorized for issue by the Board of Directors on November 13, 2025.

8

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 1 - GENERAL (Continued):

C. War in Israel:

The Company’s principal place of business, operations and its facilities, where most of its employees are employed, are located in Rehovot and Yavne, Israel. In addition, the majority of the Company’s key employees and senior management are Israeli citizens.

On October 7, 2023, Hamas terrorists infiltrated Israel’s southern border from the Gaza Strip and conducted a series of attacks on civilian and military targets. Following the attack, Israel declared war against Hamas and the Israeli military began to call-up reservists for an active duty.

At the same time, there is also a war between Israel and Hezbollah in Lebanon. On November 27, 2024, a ceasefire agreement was signed by Israel and Lebanon until February 18, 2025. A large-scale fighting between Israel and Hezbollah has not resumed despite the ceasefire’s expiry and the lack of a follow-up agreement.

In June 2025, a significant escalation in hostilities occurred between Israel and Iran, resulting in widespread military operations. On June 24, 2025, Israel and Iran agreed on an immediate ceasefire.

On October 9, 2025, the Israeli Cabinet approved a U.S. brokered cease fire and hostage exchange agreement between Israel and Hamas in Gaza, which came into effect on October 10, 2025.

As of the date of these unaudited interim condensed consolidated financial statements, these events have had no material impact on the Company’s operations.

9

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 2 - BASIS OF PREPARATION:

These financial statements have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standard Board and Interpretations (collectively IFRS Accounting Standards). These interim unaudited condensed consolidated financial statements have been prepared in accordance with International Accounting Standards IAS 34 Interim Financial Reporting.

These unaudited interim condensed consolidated financial statements do not include all the information required for annual consolidated financial statements and should be read in conjunction with the Company’s annual financial statements as of December 31, 2024. The significant accounting policies applied in the annual financial statements of the Company as of December 31, 2024, are applied consistently in these unaudited interim consolidated financial statements.

New IFRSs adopted in the period

The following amendments are effective for the period beginning January 1, 2025:

On August 15, 2023, the IASB issued Lack of Exchangeability which amended IAS 21 The Effects of Changes in Foreign Exchange Rates (the Amendments).

These Amendments are applicable for annual reporting periods beginning on or after 1 January 2025. The Amendments introduce requirements to assess when a currency is exchangeable into another currency and when it is not. The Amendments require an entity to estimate the spot exchange rate when it concludes that a currency is not exchangeable into another currency. The Amendments also introduce additional disclosure requirements when an entity estimates a spot exchange rate because a currency is not exchangeable into another currency. IAS 21, prior to the Amendments, did not include explicit requirements for the determination of the exchange rate when a currency is not exchangeable into another currency, which led to diversity in practice. When applying for the Amendments, an entity is not permitted to restate comparative information. These Amendments have had no material effect on the unaudited interim condensed consolidated financial statements.

10

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 3 - LEASES:

The Company leases several facilities in Israel from which it operates. The Company also leases certain items of property and equipment which contain a lease of vehicles.

All leases are stated in Israeli New Shekel (“NIS” or “ILS”) and accounted for by recognizing a right-of-use asset and a lease liability except for:

a. Leases with low value assets; and

b. Leases with a duration of 12 months or less.

On January 16, 2025, the Company amend its lease agreement with the lessor for its Yavne manufacturing facility, until September 2025, subject to 2 extension options for an additional 6 months each. The average monthly fees are NIS 101 ($28), including an annual increase and other adjustments, subject to the Consumer Price Index published by the Israeli Central Bureau of Statistics.

At the commencement of the lease, the Company believes it is probable the 2 extension options for an additional total of 1 year will be exercised. During September 2025, the Company exercised the first extension option for additional 6 months.

On June 1, 2025, the Company amend its lease agreement with the lessor for its Rehovot laboratories and offices facilities, until May 2028. The Company has the option to terminate the lease agreement (partially or completely) within the lease period. The average monthly fees are NIS 63 ($18) subject to the Consumer Price Index published by the Israeli Central Bureau of Statistics.

At the commencement of the lease, the Company believes it is probable that the lease agreement will be partially terminated early.

11

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 4 - SHARE CAPITAL:

|

|

Number of shares |

|

|

|

September 30, 2025 |

December 31, 2024 |

|

|

Issued and outstanding |

Issued and outstanding |

|

Common shares |

19,616,380 |

17,327,716 |

a.The Company is authorized to issue an unlimited number of common shares.

b.On May 27, 2024, the Company’s shareholders approved a 35-for-1 share consolidation, (hereinafter referred to as the 35:1 Share Consolidation) of the Company’s common shares pursuant to which the holders of the Company’s common shares received one common share in exchange for every 35 common shares held. The 35:1 Share Consolidation was approved by the Canadian Securities Exchange and is effective from June 3, 2024. All common shares (issued and unissued) were consolidated on the basis that every 35 common shares of no-par value were consolidated into 1 common share of no-par value.

c.On April 11, 2025, the Company extended the expiry date of 493,239 Early Conversion Warrants and 257,143 Major Investor Warrants by additional 24 months in connection with the new loan facilities (Note 6C) (referring to the Company’s annual financial statements as of December 31, 2024, for further details regarding Early Conversion Warrants and Major Investor Warrants).

d.On June 3, 2025, the Company extended the expiry date of 9,794 Early Conversion Warrants by additional 24 months in connection with the new loan facilities (Note 6C) (referring to the Company’s annual financial statements as of December 31, 2024, for further details regarding Early Conversion Warrants).

e.On June 10, 2025, the Company issued 5,714 common shares in lieu of vested RSUs.

f.On September 19, 2025, as part of the Equity Offering, the Company issued 1,146,474 common shares as a result of the conversion of convertible loans (Note 6D). The net increase in share capital and premium as a result of this transaction is $7,085.

g.On September 19, 2025, as part of the Equity Offering, the Company issued 1,102,244 common shares as a result of the exercise of 836,361 Early Conversion Warrants, 143,921 Major Investor warrants and 121,962 warrants issued on June 28, 2024 (Note 6C) (referring to the Company’s annual financial statements as of December 31, 2024, for further details regarding Early Conversion Warrants, Major Investor Warrants and warrants issued on June 28, 2024). The net increase in share capital and premium as a result of this transaction is $7,031. The exercise price of the exercised warrants was reduced from $7.77 and $11.52 to $6.50 per share (Note 6D).

h.On September 19, 2025, as part of the Equity Offering, the Company issued 10,948 common shares as a result of exercise of warrants (Note 5g). The net increase in share capital and premium as a result of this transaction is $71.

i.On September 29, 2025, as part of the Equity Offering, the Company issued 23,284 common shares as a result of the conversion of convertible loans (Note 6D). The net increase in share capital and premium as a result of this transaction is $151.

j.Following September 30, 2025, the Company completed several equity transactions, including a Public Offering, resulting in issuance of 3,037,919 common shares for aggregate gross proceeds of $21,045 (Note 10).

12

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 4 - SHARE CAPITAL (Continued)

k.The following table summarizes information about the warrants outstanding as of September 30, 2025:

|

Warrants Outstanding | ||||

|

September 30, 2025 |

|

Exercise Price |

|

Expiry Date |

|

117,110 |

|

$7.77 |

|

October 30, 2025 |

|

257,143 |

|

$7.77 |

|

October 30, 2027 |

|

29,016 |

|

$11.52 |

|

December 28, 2025 |

|

141,787 |

|

$7.77 |

|

October 30, 2025 |

|

276,566 |

|

$7.77 |

|

October 30, 2027 |

|

81,508 |

|

$7.77 |

|

December 22, 2025 |

|

22,994 |

|

$7.77 |

|

December 22, 2027 |

|

926,124 |

|

- |

|

- |

NOTE 5 - SHARE BASED COMPENSATION:

a.Options granted under the Company’s 2025 Equity Incentive Plan (“Plan”) are exercisable within 10 years from the date of grant upon payment of the exercise price as indicated in the Plan.

b.On August 14, 2025, the Company granted employees and consultants 60,140 options to purchase shares of the Company at $9.22 per share under the Company’s share option plan. 43,712 options will vest quarterly over a 3-year period, 11,428 options will vest quarterly over a 2-year period and 5,000 options will vest monthly over a 2-year period. The total value of the options granted is $284.

c.On August 25, 2025, the Company granted employees, consultants and directors 18,572 options to purchase shares of the Company at $8.30 per share under the Company’s share option plan. The options will vest quarterly over a 3-year period. The total value of the options granted is $79.

d.A summary of activity related to options granted to purchase the Company’s shares under the Company’s Plan is as follows:

|

|

September 30, 2025 |

December 31, 2024 |

||

|

Number of Options |

Weighted Average Exercise Price |

Number of Options |

Weighted Average Exercise Price |

|

|

Options outstanding at beginning of period |

1,902,090 |

6.30 |

1,807,456 |

6.15 |

|

Changes during the period: |

|

|

|

|

|

Granted |

78,712 |

9.00 |

214,885 |

6.23 |

|

Exercised |

- |

- |

(106,132) |

3.67 |

|

Forfeited |

(16,667) |

6.68 |

(14,119) |

5.89 |

|

Options outstanding at end of period |

1,964,135 |

6.32 |

1,902,090 |

6.30 |

|

Options exercisable at period end |

1,724,405 |

6.22 |

1,620,445 |

6.04 |

The options outstanding on September 30, 2025, had a weighted-average contractual life of 5.95 years (September 30, 2024: 6.55 years)

13

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 5 - SHARE BASED COMPENSATION (Continued):

e.A summary of activity related to warrants granted to purchase the Company’s shares, accounted for as share-based compensation, is as follows:

|

|

September 30, 2025 |

December 31, 2024 |

||

|

Number of Options |

Weighted Average Exercise Price |

Number of Options |

Weighted Average Exercise Price |

|

|

Warrants outstanding at beginning of period |

73,557 |

7.54 |

64,986 |

7.66 |

|

Changes during the period: |

|

|

|

|

|

Issued |

- |

- |

8,571 |

6.65 |

|

Exercised |

(10,948) |

7.66 |

- |

- |

|

Expired |

- |

- |

- |

- |

|

Warrants outstanding at end of period |

62,609 |

7.52 |

73,557 |

7.54 |

The following table summarizes information about the warrants outstanding as of September 30, 2025:

|

Warrants Outstanding | ||

|

September 30, 2025 |

Exercise Price |

Expiry Date |

|

54,038 |

$7.66 |

October 25, 2027 |

|

8,571 |

$6.66 |

April 26, 2026 |

|

62,609 |

|

|

f.On April 11, 2025, the Company extended the expiry date of 64,986 warrants by additional 24 months in connection with the new loan facilities (Note 6C).

g.On September 19, 2025, as part of the Equity Offering, the Company reduced the exercise price of 10,948 warrants that were exercised from $7.66 to $6.50 per share (Notes 4h and 6D).

14

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 6 - LOANS:

A.Short-term loans:

During the nine-month period ended September 30, 2025, the Company borrowed from private investors $1,677 under the following terms:

1) The Company will pay a 16% annual interest rate, with equal payments to be made monthly against both principal and interest.

2) The Company will pay a 20% annual interest rate with a payment of both principal and interest at the end of the loan term.

Any loan amount will have a term of 12 months from the date the funds are received.

A summary of movements of principal and interest during the nine-month period ending September 30, 2025, is as follows:

|

|

16% |

20% |

Total |

|

Balance as of January 1, 2024 |

- |

- |

- |

|

Proceeds from drawing loans |

1,510 |

1,907 |

3,417 |

|

Accrued interest recognized in Profit or loss |

26 |

34 |

60 |

|

Repayment of principal and interest |

(103) |

- |

(103) |

|

Balance as of December 31, 2024 |

1,433 |

1,941 |

3,374 |

|

Proceeds from drawing loans |

1,040 |

637 |

1,677 |

|

Accrued interest recognized in Profit or loss |

204 |

393 |

597 |

|

Repayment of principal and interest |

(1,999) |

- |

(1,999) |

|

Debt redemption upon issuance of convertible loan facility (*) |

- |

(573) |

(573) |

|

Balance as of September 30, 2025 |

678 |

2,398 |

3,076 |

The outstanding balance is presented as short-term loan.

(*) On September 19, 2025, existing lenders redeemed their principal and accrued interest upon issuance of convertible loan facility (Note 6D).

15

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 6 - LOANS (Continued):

B.Unconverted portion of Convertible loan A:

On maturity date of Convertible loan A (referring to the Company’s annual financial statements as of December 31, 2024, for further details regarding convertible loan A). an amount of $521 of unconverted portion of Principal Loan Amount and any interest accrued up to the maturity date is due for immediate payment. The Company accrue interest of 9% per annum over the due amount from the maturity date up to the date it will fully repay.

The Company and the lender mutually agreed to fully repay the outstanding loan balance on October 30, 2025.

|

|

Unconverted Principal Loan Amount and interest |

Interest up to fully repay |

Total |

|

Balance as of January 1, 2024 |

- |

- |

- |

|

Reclassification of unconverted portion of Principal Loan Amount and interest |

521 |

- |

521 |

|

Accrued interest recognized in Profit or loss |

- |

10 |

10 |

|

Balance as of December 31, 2024 |

521 |

10 |

531 |

|

Accrued interest recognized in Profit or loss |

- |

37 |

37 |

|

Balance as of September 30, 2025 |

521 |

47 |

568 |

The outstanding balance is presented as short-term loan.

C.Returning investor notes:

During the nine-month period ended September 30, 2025, the Company received $3,925 as part of new loan facilities, available for lenders who participated in convertible loan B (referring to the Company’s annual financial statements as of December 31, 2024, for further details regarding convertible loan B).

On April 11, 2025, the Company announced the first closing date of the offer and issued notes for an aggregate amount of $3,848.

On June 3, 2025, the Company announced the second closing date of the offer and issued notes for an aggregate amount of $77.

The loans bear interest at a rate of 5%, 10% and 12% per annum, paid on a quarterly or annually basis. The term of the loans is 24 months from the closing dates.

Any accrued interest for the period between proceeds of the loans and issuance of the notes will be added to the principal amount of the notes as incremental principal.

As additional compensation, the Company extended 503,033 Early Conversion Warrants, 257,143 Major Investor Warrants and 64,986 warrants that were accounted as shared based compensation held by the lenders for additional 24 months (Notes 4c, 4d and 5f) (referring to the Company’s annual financial statements as of December 31, 2024, for further details regarding Early Conversion Warrants and Major Investor Warrants).

16

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 6 - LOANS (Continued):

C.Returning investor notes (Continued):

The Company accounted for these transactions in accordance with the treatment of an issuance of freestanding instruments issued together. Firstly, the Company measured the value of the liability loan component (principal and interest), at fair value. Secondly, the remainder of the transaction price was allocated to the hybrid instrument as an equity component which represents the value of the warrant extension for 24 months.

The initial adjustments to the fair value of the liability component were accounted for as discount debt to the notes and as an equity reserve. The discount debt is amortized to profit and loss on straight line basis over the contractual life of the notes to reflect its fair value at each reporting period.

|

|

5% |

10% |

12% |

Total |

|

Balance as of December 31, 2024 |

- |

- |

- |

- |

|

Proceeds from drawing loans |

500 |

2,039 |

1,386 |

3,925 |

|

Accrued interest recognized as incremental principal |

2 |

1 |

19 |

22 |

|

Repayment of principal and interest |

- |

(97) |

- |

(97) |

|

Recognition of debt discount |

(37) |

(331) |

(181) |

(549) |

|

Amortization of debt discount |

37 |

102 |

111 |

250 |

|

Accrued interest recognized in Profit or loss |

11 |

97 |

81 |

189 |

|

Debt redemption upon exercising of Early conversion warrants (*) |

(513) |

(185) |

(699) |

(1,397) |

|

Balance as of September 30, 2025 |

- |

1,626 |

717 |

2,343 |

The outstanding balance is presented as long-term loan.

(*) On September 19, 2025, lenders redeemed some or all of their outstanding loan balance by cash-less exercising of warrants. 198,738 Early conversion warrants, 5,230 warrants issued on June 28, 2024 and 10,948 warrants that were accounted as shared based compensation, were exercised as part of the cash-less transactions (Note 4g, 4h and 5g).

17

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 6 - LOANS (Continued):

D.Convertible loan facility:

During the nine-month period ended September 30, 2025, the Company received $6,800 as part of a new convertible loan facility. In addition, existing lenders under the Short-term loans redeemed their outstanding loan balance of $573 by entering to the convertible loan facility (Note 6A), as well as pre-funded $200 entered to the convertible loan facility.

The convertible loan facility will bear interest at a rate of 8% per annum, paid on an annual basis. The term of the convertible loan is 36 months from the closing date (the “Maturity Date”). The lender may, at any time following 12 months from the closing date (the “First Anniversary”), prior to the Maturity Date, elect to convert any unconverted portion of the principal amount together with the accrued interest into common shares at the Conversion Price (as defined below).

The conversion price is the price per share (the “Conversion Price”) that is equal to Closing Market Average (as defined below) of the Company’s common shares on the date of conversion less a discount of 20% but in any event not less than the Closing Market Price on the date of issuance (the “Floor Price”) and not higher than three times the Floor Price if converted after the First Anniversary and before 24 months following the closing date (the “Second Anniversary”) and five times the Floor Price if converted after the Second Anniversary.

The closing market average is the average of the published closing price (the “Closing Market Average”) of the common shares of the Company for the 20 days prior to conversion.

Any accrued interest for the period between proceeds of the funds and issuance of the convertible notes will be added to the principal amount of the convertible notes as incremental principal.

In case of an equity offering of not less than $1,000 is made by the Company (the “Equity Offering”) after the Closing Date, the holder will have the option to convert the entire principal amount and any interest accrued up to and including the closing date of the Equity Offering into common shares at the same price as the Equity Offering.

On September 19, 2025, the Company announced the first closing of $7,452 convertible loans.

On September 29, 2025, the Company announced the second closing of $151 convertible loans.

As of September 30, 2025, $55 out of the total amount received was not issued and remain open.

On each closing date, the Company offered the convertible loan holders the opportunity to convert any unconverted portion of the principal amount together with the accrued interest into common shares at a conversion price of $6.50.

18

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 6 - LOANS (Continued):

D.Convertible loan facility:

On September 19, 2025, the Company issued 1,146,474 common shares as a result of the conversion of $7,452 at a conversion price of $6.5.

On September 29, 2025, the Company issued 23,284 common shares as a result of the conversion of $151 at a conversion price of $6.5.

The Company recorded finder’s fees of $503 in connection with the transactions.

|

Balance as of December 31, 2024 |

- |

|

Proceeds from drawing loans |

6,800 |

|

Accrued interest recognized as incremental principal |

85 |

|

Debt redemption upon issuance of convertible loan facility (Note 6A) |

573 |

|

Pre-funded proceed entering as convertible notes |

200 |

|

Conversion of convertible notes into common shares |

(7,603) |

|

Balance as of September 30, 2025 |

55 |

The outstanding balance is presented as short-term loan.

19

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 7 - RELATED PARTIES TRANSACTIONS:

Related parties including the Company’s CEO, CFO, Chairman of the Board and Directors.

Related party transactions:

|

|

Three months ended September 30, 2025 |

Nine months ended September 30, 2025 |

Three months ended September 30, 2024 |

Nine months ended September 30, 2024 |

|

Compensation for key management personnel of the Company: | ||||

|

CEO Management fees |

170 |

572 |

115 |

319 |

|

Chairman of the Board Management fees |

105 |

419 |

99 |

330 |

|

CFO Management fees |

71 |

174 |

8 |

23 |

|

Directors Management fees |

54 |

161 |

- |

- |

|

Share based compensation to CEO |

- |

- |

- |

- |

|

Share based compensation to Chairman of the Board |

- |

- |

- |

- |

|

Share based compensation to CFO |

1 |

4 |

- |

- |

|

Other related party transactions: |

|

|

||

|

Accrued interest to a close member of the Chairman of the Board |

28 |

90 |

- |

- |

|

Accrued interest to CFO |

8 |

24 |

- |

- |

|

Issuance of shares to Directors (*) |

11 |

11 |

- |

142 |

|

Issuance of units of securities to Directors (**) |

- |

- |

- |

50 |

|

Share-based compensation to Directors (Note 5c) |

11 |

19 |

9 |

14 |

Related party balances:

|

|

As of September 30, |

|

|

|

2025 |

2024 |

|

Due to the CEO |

296 |

115 |

|

Due to the Chairman of the Board |

709 |

- |

|

Due to the CFO |

269 |

- |

Bonus plan

The Company’s Chairman of the Board, CEO, CFO and key management employees are entitled to receive an annual bonus based on performance.

(*) Issuance of shares to Directors

On March 28, 2024, in connection with the issuance of convertible loan A (referring to the Company’s annual financial statements as of December 31, 2024, for further details regarding convertible loan A), a director of the Company converted his carrying amount which consist of principal and accrued interest into 21,744 common shares.

On September 19, 2025, as part of the Equity Offering, a director of the Company exercised 1,750 warrants.

(**) Issuance of unit of securities

On June 28, 2024, in connection with a private placement financing, an independent director of the Company participated by investing an aggregate amount of $50 which resulted in the issuing of 7,000 units.

20

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 8 - OPERATING SEGMENTS:

The Company has two operating segments or business units: the Products business unit and the CDMO Services business unit. In identifying these operating segments, management generally follows the Company service lines representing its main products and services.

The Company’s chief operational decision maker reviews the Company’s internal reports for performance evaluation and resource allocations. The Company’s management determined the operational segments based on these reports. The chief operational decision maker examines the performance of the operating segments based on the measurement of operating profit. No information was presented on the assets and liabilities of the segments because these items are not analyzed by the main operational decision maker in segmentation.

The Company’s chief operating decision maker is the chief executive officer.

Segment description

1.Products business unit

oNutraceuticals: Research, development, manufacturing, marketing and sales of science-based health and wellness nutraceutical solutions (capsules, powders, chews and other delivery mechanisms such as coffee, teas and protein bars);

oCosmeceuticals: Research and development for future manufacturing, marketing, and sales of science-based therapeutic cosmeceutical solutions.

2.CDMO Services business unit

Offering customers from the pharmaceuticals, cosmeceuticals, nutraceuticals, and nutrition industries through an end-to-end service agreement for development and manufacturing of specific plant-based active molecules.

Segment information

|

|

For the three months ended September 30, 2025 |

||

|

|

Products |

CDMO Services |

Total |

|

Revenues |

8,393 |

674 |

9,067 |

|

Cost of revenues |

3,336 |

161 |

3,497 |

|

Research and development |

1,156 |

276 |

1,432 |

|

Segment loss (profit) |

1,078 |

(158) |

920 |

|

Finance expense, net |

|

|

1,530 |

|

Tax expenses |

|

|

63 |

|

Net loss and comprehensive loss |

|

|

2,513 |

21

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 8 - OPERATING SEGMENTS (Continued):

|

|

For the nine months ended September 30, 2025 |

||

|

|

Products |

CDMO Services |

Total |

|

Revenues |

24,134 |

1,308 |

25,442 |

|

Cost of revenues |

9,775 |

416 |

10,191 |

|

Research and development |

3,047 |

967 |

4,014 |

|

Segment loss |

4,051 |

403 |

4,454 |

|

Finance expense, net |

|

|

4,337 |

|

Tax expenses |

|

|

140 |

|

Net loss and comprehensive loss |

|

|

8,931 |

|

|

For the three months ended September 30, 2024 |

||

|

|

Products |

CDMO Services |

Total |

|

Revenues |

6,457 |

82 |

6,539 |

|

Cost of revenues |

2,825 |

- |

2,825 |

|

Research and development |

1,023 |

255 |

1,278 |

|

Segment loss |

1,795 |

307 |

2,102 |

|

Finance expenses, net |

|

|

587 |

|

Tax expenses |

|

|

- |

|

Net loss and comprehensive loss |

|

|

2,689 |

|

|

For the nine months ended September 30, 2024 |

||

|

|

Products |

CDMO Services |

Total |

|

Revenues |

17,678 |

232 |

17,910 |

|

Cost of revenues |

7,984 |

107 |

8,091 |

|

Research and development |

2,843 |

557 |

3,400 |

|

Segment loss |

4,760 |

542 |

5,302 |

|

Finance expense, net |

|

|

4,655 |

|

Tax expenses |

|

|

- |

|

Net loss and comprehensive loss |

|

|

9,957 |

22

|

BioHarvest Sciences Inc. and its subsidiaries |

|

Notes to the Unaudited Interim Condensed Consolidated Financial Statements |

|

U.S. dollars in thousands, except per share data |

NOTE 8 - OPERATING SEGMENTS (Continued):

Entity wide disclosures

|

|

External revenue by location For the nine months ended September 30, |

|

|

|

2025 |

2024 |

|

Israel |

2,833 |

1,589 |

|

North America |

22,609 |

16,321 |

|

|

25,442 |

17,910 |

|

|

External revenue by location For the three months ended September 30, |

|

|

|

2025 |

2024 |

|

Israel |

1,231 |

530 |

|

North America |

7,836 |

6,009 |

|

|

9,067 |

6,539 |

Additional information about revenue

There is no single customer for which revenue amounts to 10% or more of total revenue reported in these financial statements for the three and nine months ended September 30, 2025, and 2024.

NOTE 9 - LIABILITY FOR AGRICULTURAL RESEARCH ORGANIZATION:

In March 2007, the Company entered into a Research and Exclusive License Agreement (the “Agreement”) with The Agricultural Research Organization - Volcani Institute (the “ARO”). The ARO granted the Company an exclusive worldwide license to use its patent as part of the manufacturing of red grape cell powder only. The ARO is entitled to receive 3% royalties from any sale of red grape cell powder products by the Company until the end of February 2026.

In September 2025, the Company and ARO executed an amendment to the existing agreement, establishing updated payment terms. Under the revised terms, the total amount payable was set at $3,600. The Company is required to remit payments equal to 1% of its quarterly revenue from sales of red grape cell powder products until the total payable amount is fully settled. Accordingly, the Company reassessed and remeasured the related liability to reflect the amended terms.

NOTE 10 - SUBSEQUENT EVENTS:

a)On October 14, 2025, the Company issued 1,786 common shares as a result of exercise of options by employees and consultants. The proceeds from this transaction are $9.

b)Following September 30, 2025, until November 13, 2025, the Company issued 189,279 common shares as a result of exercise of warrants. The proceeds from these transactions are $1,108.

c)On November 10, 2025, the Company completed a Public Offering (the “Public Offering”) of 2,846,854 common shares at a price of $7.00 per share. The gross proceeds from this transaction are approximately $19,928. After deducting underwriting discounts, commissions, and other transaction-related costs totaling approximately $1,491, the Company received net proceeds of approximately $18,437.

23

|

BioHarvest Sciences Inc. Management’s Discussion and Analysis For the three and nine months ended September 30, 2025 (Expressed in U.S. dollars)

|

INTRODUCTION

The following Management’s Discussion and Analysis (“MD&A”) for BioHarvest Sciences Inc., together with its wholly owned subsidiaries (“BioHarvest Sciences” or “the Company”) prepared as of November 13, 2025, in accordance with International Financial Reporting Standards as issued by the International Accounting Standard Board and Interpretations (collectively IFRS Accounting Standards). All amounts (other than per share amounts) are stated in U.S. dollars rounded to the nearest thousand, unless otherwise indicated.

The following information should be read in conjunction with the audited consolidated financial statements of the Company (the “consolidated financial statements”) for the year ended December 31, 2024, and the related notes to those consolidated financial statements.

Statements in this report that are not historical facts are forward-looking statements involving known and unknown risks and uncertainties, which could cause actual results to vary considerably from these statements. Readers are cautioned not to put undue reliance on forward-looking statements.

The Company is publicly listed and traded on the Nasdaq Stock Market under the symbol BHST, traded on the Frankfurt Stock Exchange under the symbol 8MV0, traded on the Munich Stock Exchange under the symbol 8MV0, traded on the Stuttgart Stock Exchange under the symbol 8MV0 and traded on the Dusseldorf Stock Exchange under the symbol 8MV0.

Continuous disclosure materials are available on our website at www.bioharvest.com. This additional information is not incorporated into this Management’s Discussion and Analysis and does not constitute a part of this Management’s Discussion and Analysis.

1

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This MD&A contains certain information that may constitute “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) which are based upon the Company’s current internal expectations, estimates, projections, assumptions and beliefs. Such statements can be identified by the use of forward-looking terminology such as “expect,” “likely”, “may,” “will,” “should,” “intend,” or “anticipate”, “potential”, “proposed”, “estimate” and other similar words, including negative and grammatical variations thereof, or statements that certain events or conditions “may” or “will” happen, or by discussions of strategy. Forward-looking statements include estimates, plans, expectations, opinions, forecasts, projections, targets, guidance, or other statements that are not statements of fact. The forward-looking statements included in this MD&A are made only as of the date of this MD&A. Forward-looking statements in this MD&A may include, but are not limited to, statements with respect to: a) licensing risks; b) regulatory risks; c) change in laws, regulations and guidelines; d) market risks; e) expansion of facilities; f) history of net losses; and g) competition. Certain of the forward-looking statements and forward-looking information and other information contained herein concerning the, nutraceutical, pharmaceutical and cosmeceutical industries, the general expectations of the Company concerning these industries and concerning the Company are based on estimates prepared by the Company using data from publicly available governmental sources, from market research and industry analysis and on assumptions based on data and knowledge of these industries, which the Company believes to be reasonable. The Company is not aware of any misstatement regarding any industry or government data presented herein. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. The Company’s forward-looking statements are expressly qualified in their entirety by this cautionary statement. In particular, but without limiting the foregoing, disclosure in this MD&A under “Nature of the Business and Overview of Operations” as well as statements regarding the Company’s objectives, plans and goals, including future operating results and economic performance may make reference to or involve forward-looking statements. A number of factors could cause actual events, performance or results to differ materially from what is projected in the forward-looking statements. See “Risk and Uncertainties” for further details. The purpose of forward-looking statements is to provide the reader with a description of management’s expectations, and such forward-looking statements may not be appropriate for any other purpose. You should not place undue reliance on forward- looking statements contained in this MD&A. The Company undertakes no obligation to update or revise any forward-looking statements.

2

GOING CONCERN

The Company has incurred losses from operations since its inception. As of September 30, 2025, the Company has an accumulated deficit of $105,349. The Company generated negative cash flows from operating activities of $4,974 and a loss in the amount of $8,931 for the nine-month period ended September 30, 2025. As of the date of the issuance of the unaudited interim condensed consolidated financial statements, the Company has not yet commenced generating sufficient sales to fund its operations and therefore depends on fundraising from new and existing investors to finance its activities. These factors raise a substantial doubt about the Company’s ability to continue as a going concern.

The Company’s management plans to fund near-term anticipated activities based on proceeds from capital fund raising, debt instruments in the form of convertible loans, short-term loans, long-term loans and future revenues.

During September 2025, the Company completed an Equity Offering resulting in net proceeds and debts reduction of approximately $14,202.

On November 10, 2025, the Company completed a Public Offering (the “Public Offering”) of 2,846,854 common shares at a price of $7.00 per share. The gross proceeds from this transaction are approximately $19,928. After deducting underwriting discounts, commissions, and other transaction-related costs totaling approximately $1,491, the Company received net proceeds of approximately $18,437 (see also ‘Significant Developments’ item 7).

The net proceeds from the Equity Offering, the Public Offering and other subsequent events (see also ‘Significant Developments’ items 5-6) are expected to significantly strengthen the Company’s position of liquidity and support ongoing operations. These events are considered in management’s assessment of the Company’s ability to continue as going concern.

The unaudited interim condensed consolidated financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

3

NATURE OF BUSINESS AND OVERVIEW OF OPERATIONS

1.Summary

BioHarvest Sciences Inc. (the “Company” or “BioHarvest Sciences”) was incorporated under the Business Corporations Act of British Columbia on April 19, 2013.

2.Corporate Structure

3.Overview of the business

The Company is a biotechnology company that has developed the Botanical Synthesis Platform Technology, which enables the Company to grow, in bioreactors at an industrial scale, the active and beneficial ingredients in certain fruits and plants without the need to grow the plant itself. The Botanical Synthesis Platform Technology is a non-genetically modified organism platform that can produce plant cells with higher concentrations of active ingredients (as compared to those that are produced naturally), as well as high levels of solubility and bio-availability. The Botanical Synthesis Platform Technology is economical, ensures consistency and avoids the negative environmental impacts associated with traditional agriculture by providing consistent product production, a year-round production cycle and products that are devoid of sugar, calories and contaminants, such as pesticides, heavy metals and residues.

4

The Company is currently focused on utilizing the Botanical Synthesis Platform Technology to develop the next generation of science-based and clinically proven health solutions through two business units:

1.The Products Business Unit, comprising:

(a)Nutraceuticals: Research, development, manufacturing, marketing and sales of science-based health and wellness nutraceutical solutions which are manufactured and sold as dietary supplements and/or functional food (capsules, powders, chews and other delivery mechanisms such as coffee, teas and protein bars);

(b)Cosmeceuticals: Research and development for future manufacturing, marketing and sales of science-based health and cosmeceutical solutions.

2.The CDMO Services Business Unit comprising a Contract Development and Manufacturing Operation (“CDMO”) that offers customers from the pharmaceuticals, cosmeceuticals, nutraceuticals and nutrition industries the development and future manufacturing of specific plant-based active molecules, via an end-to-end service agreement.

5

Products Business Unit Activities:

I.Nutraceuticals

The Company is engaged in the research and development of science-based health and wellness solutions for the nutraceutical industry. The Company’s first product entry into this market is a polyphenol/anti-oxidant superfruit product called VINIA®, which is a red grape powder that supplies the benefits of red wine consumption but without the sugar, calories and alcohol found in wine.

VINIA® is made of red grape (Vitis vinifera) cells grown in the Company’s proprietary bioreactor facility. VINIA® is a fine, dry pink-purple powder containing a matrix of polyphenols (with a high concentration of piceid resveratrol) in their natural state (as can be found in red wine) that has additive and synergistic benefits. One of the main active ingredients in VINIA® is piceid resveratrol, maintaining the quality and inherent benefits present in nature without any solvent extraction or genetic modification. VINIA® is soluble when integrated with various liquids or cosmetics.

The Company has invested over $80 million, primarily in R&D activities, to support the business. This investment has enabled the Company to develop a disruptive technology platform which mirrors nature and allows it to efficiently produce plant cells that are identical to those originally sourced from the parent plant, ensuring optimal bio-availability and efficacy of the secondary metabolites.

In terms of manufacturing capacity, the Company has established a 20-25 tons manufacturing facility and commenced implementation of the required technology and process improvements to drive significant cost reduction through economies of scale. This facility received Good Manufacturing Practice (GMP) approvals from the Israeli Ministry of Health in October 2021 as well as key ISO certifications. The Company completed the biological technology transfer to the new manufacturing facility in March 2022 and has commenced actively scaling up its manufacturing of VINIA® red grape cells at this new facility. This enables the Company to better meet the increasing demand for VINIA ® which is driven from the US market as a result of the Company’s marketing activities. The Company has continued to increase the capacity of its Bioreactors over the past 24 months and at the end of Q1, 2025, completed the transition to using 1,200L bioreactors.

In Q3 2025, VINIA® revenues increased by 30% versus the comparable period in the previous year. This continues to be a major demonstration of the Company’s ability to scale its VINIA® business using its Botanical Synthesis technology. Importantly, as a result of the aggressive scaling of the business and management’s focus on driving efficiencies where possible across the value chain, the Company continues to improve gross profit margin levels of the Products business unit, realizing a gross profit margin increase to 60% (for the Products business unit) during the third quarter of 2025 as compared to 56% during the comparable period in the previous year. Management continues to focus on accelerating revenue momentum and improving gross profit margins as well as marketing efficiencies.

The Company reached a major milestone on its VINIA® business at the end of October 2025 with achieving the milestone of $70 Million USD in cumulative sales, with the vast majority of sales occurring since launching in the US in May 2021 as well as achieving at the end of Q3 2025 more than 75,000 active users in its North America operations.

6

The Company expects continued momentum in its sales growth of VINIA® driven by its core capsule business as well as its pipeline of VINIA® driven innovation.

The Company has a well-developed innovation pipeline in its Products business unit. Over the course of the last 18 months, the Company has introduced a number of new products under the VINIA® brand disrupting major billion dollar categories The Company successfully launched VINIA® Superfood Coffee in 2024 and launched a VINIA® Superfood Tea line up of 4 flavors in December 2024, which continues to gain revenue momentum and in February 2025 was launched on Amazon and in June 2025, the Company launched 2 of these flavors (English Breakfast Tea and Matcha Green Tea) in a K-Cup compatible format via its web site and Amazon. The Company’s successful initial launch of its Keurig compatible VINIA Superfood Coffee pods and VINIA® Superfood Teas has demonstrated that its “VINIA Inside” strategy is working as the Company delivers on its promise to consumers of delivering “Superior Science, Superior Efficacy and Superior Taste” in billion dollar categories like tea and coffee where consumers are yearning for products with improved health and wellness credentials and have a high willingness to pay a premium for these products.

To continue its focus on disrupting billion-dollar categories, in June 2025, the Company launched its VINIA® supplement in a more potent formulation in a Chew like delivery mechanism. VINIA® 2X Formula Chew is enabling the VINIA® brand to target a younger consumer base with this chew delivery system and with a formula which has twice the potency. The Company utilizes this VINIA® 2X Formula Chew to target athletes and super active consumers who are looking for a more potent version of VINIA® to generate the incremental physical energy and mental alertness they require. Given the focus of this formulation to fit the needs of amateur and professional athletes, every batch of the product is 3rd party certified by “Informed Sport”. “Informed Sport” is the world’s leading testing and certification program for brands producing sports and nutritional supplements. Designed for elite sport, it protects athletes from inadvertent doping caused by supplements contaminated with banned substances. As such, it is recognized by sporting and governing bodies, anti-doping bodies and nutrition industry organizations, and the armed and special forces. The initial consumer feedback and revenue levels of VINIA 2X Formula Chew have been extremely encouraging with 4.8/5 verified rating on Amazon and the Company is optimistic that with continued marketing activities, this product will play an important role in the Company’s portfolio.

In November 2025, the Company initiated the launch of VINIA® Blood Flow Hydration Electrolyte Powdered Beverage Mix to disrupt the 17-billion-dollar US Electrolytes market where approximately 1/3 of the business is in powdered form. VINIA® Blood Flow Hydration Electrolyte Powdered Beverage is a highly differentiated proposition in the market. VINIA’s Blood Flow Hydration Solution focuses on ensuring its customers have improved blood flow to ensure that all their fluids and electrolytes can be efficiently transported to their body’s organs, tissues and millions of cells. The product will contain the equivalent of one capsule of VINIA Red Grape Powder plus a unique combination of naturally sourced electrolytes including sodium derived from sea salt, potassium from coconut water, and magnesium from the ocean bed. VINIA® Blood Flow Hydration Electrolyte is 3rd party certified by “Informed Sport” so that it can be utilized by professional athletes.

The Company on March 4, 2025, announced new ‘in-vitro’ test results for the Company’s proprietary new Olive Cell compound, which showed reduced fat accumulation in human liver cells.

7

Fat accumulation in the liver is a leading cause of non-alcohol fatty liver disease (NAFLD), which affects 30-40% of U.S. adults. The Company demonstrated that in human hepatic (liver) cells, the Olive Cell compound mitigated fat accumulation in a liver steatosis model as well as in experimental models of liver fibrosis. In addition, the Olive Cell compound also succeeded in reducing the level of collagen type 1 in XL-2 cells in an in-vitro fibrosis model. The Company attributes the positive test results of reducing fat accumulation in liver cells to the high levels of Verbascoside (a plant-derived polyphenol with known anti-inflammatory properties that have been researched for a variety of effects on the liver) in the Company’s Olive Cell compound. Based on these results and additional studies to be conducted in 2026, the Company expects to begin selling the Olive Cell product in 2026 as a nutraceutical product.

Contract Development and Manufacturing Organization (“CDMO”) Services Business Unit:

In Q1 2024, the Company announced the launch of its CDMO Services Business Unit, including its entry into two (2) development agreements to develop complex molecules.

This CDMO Services Business Unit allows pharmaceutical, cosmeceutical, nutraceutical and nutrition industry companies the opportunity to partner with the Company to utilize the Botanical Synthesis Platform Technology through a CDMO contracting model. The Botanical Synthesis Platform Technology enables the development and manufacturing of patentable plant-based small molecules, complex molecules and unique compositions, which include both small and complex molecules. The Botanical Synthesis Platform Technology can develop complex molecules, otherwise known as biologics, which have a number of unique advantages, including lower costs of development and manufacturing, a faster speed of development and non-immunogenic properties that enhance safety. As a result of these advantages, the Company has decided to name these unique plant-derived complex molecules BIOLOGICS+. BIOLOGICS+ will help address unmet needs in the health industry across pharmaceutical, nutraceutical, cosmeceutical and nutrition verticals.

On December 11, 2024, the Company announced a new partnership with Tate and Lyle, a global leader in sweetener, mouthfeel and fortification ingredients to develop the next-generation of proprietary plant-based molecules to address increasing consumer desire for affordable, nutritious and more sustainable plant-derived food and beverage ingredients. The new partnership between Tate & Lyle and the Company will focus on developing the next generation of sweeteners - botanical sweetening ingredients using plant-derived molecules.

On May 12, 2025, the Company announced that the Company’s previously announced CDMO contract with a Nasdaq-listed pharmaceutical company has progressed from Stage 1 to Stage 2 - providing further validation of the versatility of the Company’s Botanical Synthesis platform to develop active pharmaceutical compounds while concurrently paving the road for potential future volume manufacturing. Stage 1 of the contract, launched in early 2024, focused on sourcing the required plants to develop a compound used to produce an approved drug product. Completion of Stage 1 indicates that the Company’s research team successfully isolated the cells of the target plant and mirrored, magnified and multiplied those cells in petri dishes using the Company’s proprietary Botanical Synthesis platform. Stage 2 involves the delivery of a sufficient amount of biomass to be tested for suitability and involves the development of optimal growing conditions in liquid media. Upon successful completion, the company would transfer to small and medium scale production and ultimately enter production of commercial volumes of the target compound.

8

On May 21, 2025, the Company announced a new contract to develop a plant-based fragrance compound derived from a plant that is under significant threat due to over harvesting and habitat loss. This agreement is with a new commercial partner targeting the multi-billion-dollar fragrance and scents market.

On September 10, 2025, the Company announced the successful production of plant-derived exosomes in its large-scale bioreactors. This technological milestone expands the Company’s platform capabilities and introduces a potential new revenue stream for both its Nutraceuticals and CDMO business units.