0001717547false00017175472024-05-012024-05-01

米国証券取引委員会

Washington, D.C. 20549

FORM 8-K

現行レポート

1934年米国証券取引所法第13条または第15条(d)に基づき

報告日(最も古いイベントの報告日):2024年5月1日

BrightSpire Capital, Inc.

(定款に明記された登録者の正確な名称)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| メリーランド |

|

001-38377 |

|

38-4046290 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

590 マディソン・アベニュー、33階

New York, NY 10022

(主たる事務所の所在地(郵便番号を含む)

登録者の電話番号(市外局番を含む(212) 547-2631

Not Applicable

(旧姓または旧住所(前回の報告から変更されている場合)

Form8-Kの提出が、以下の条項のいずれかに基づく登録者の提出義務を同時に満たすことを意図している場合は、以下の該当するチェックボックスをチェックしてください:

☐ 証券法規則425(17 CFR 230.425)に基づく書面によるコミュニケーション

☐ 取引所法の規則l4a-12(17 CFR 240.14a-12)に基づく資料の勧誘

☐ 取引所法の規則14d-2(b)(17 CFR 240.14d-2(b))に基づく開始前のコミュニケーション

☐ 取引所法の規則13e-4(c)(17 CFR 240.13e-4(c))に基づく開始前のコミュニケーション

法第12条(b)に従って登録された証券:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Title of each class |

|

Trading Symbol(s) |

|

登録されている各取引所の名称 |

| クラスa普通株式、額面1株当たり0.01ドル |

|

BRSP |

|

New York Stock Exchange |

登録者が1933年証券法規則405(本章230.405節)または1934年証券取引法規則12b-2(本章240.12b-2節)で定義される新興成長企業であるかどうかをチェックマークで示す。

Emerging growth company ☐

新興成長企業の場合、登録者が取引所法第13条(a)に従い提供される新規または改訂された財務会計基準に準拠するための移行期間の延長を利用しないことを選択した場合は、チェックマークで示す。☐

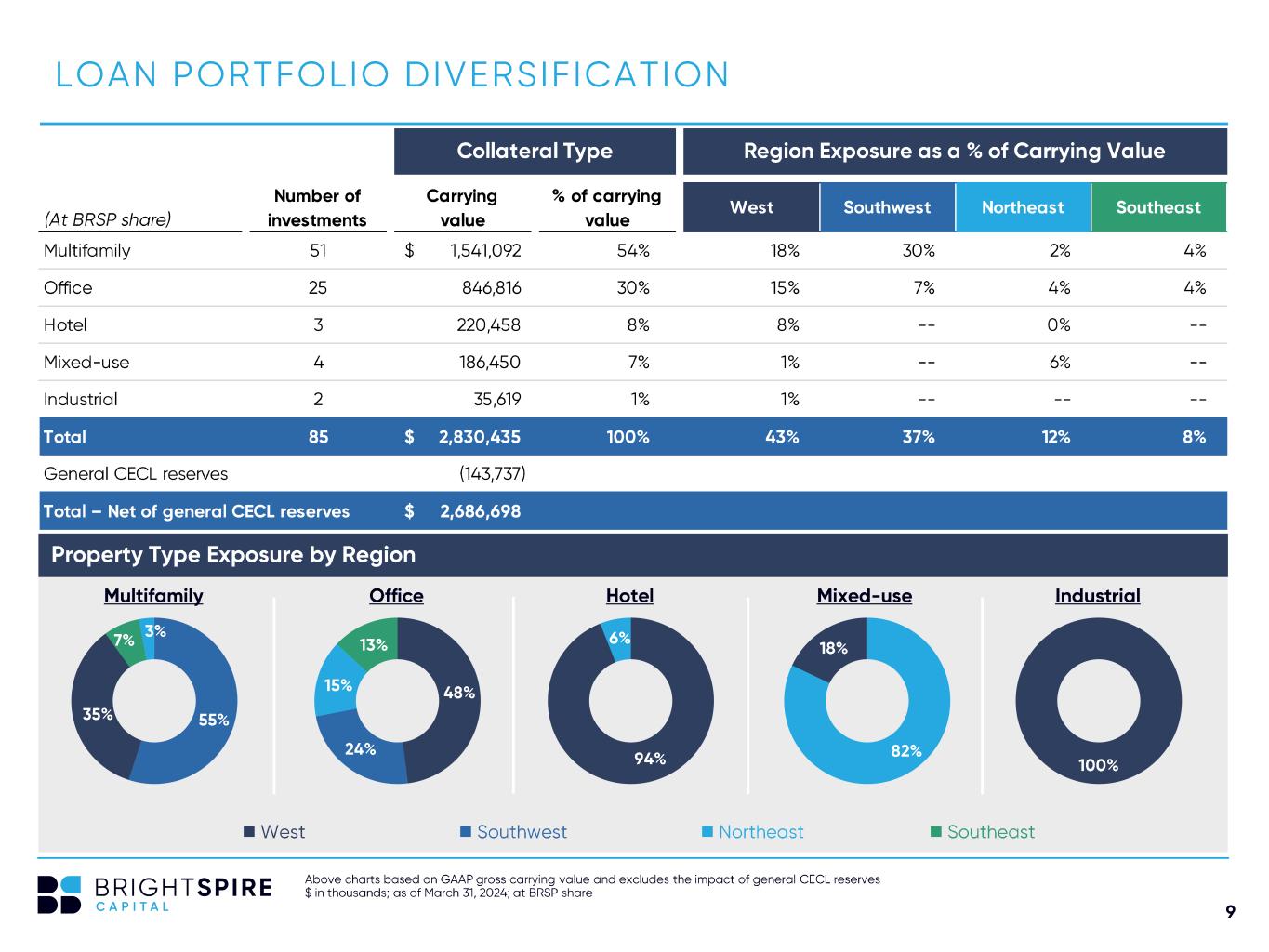

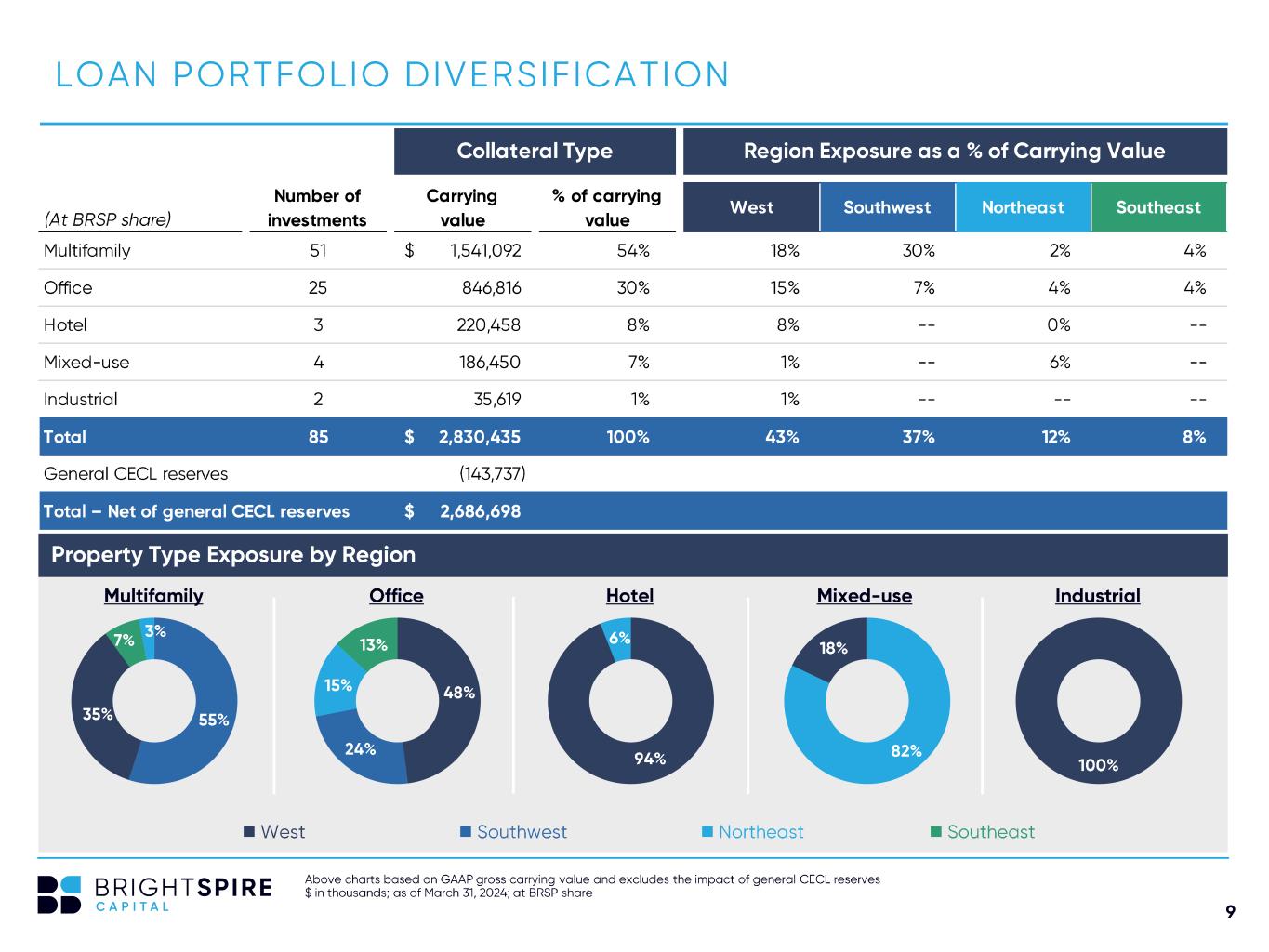

2024年5月1日、ブライトスパイア・キャピタル・インク(以下「当社」)は、2024年3月31日現在の財務状況および2024年3月31日に終了した第1四半期の業績を発表するプレスリリースを発表した。このプレスリリースのコピーは、本フォーム8-Kカレント・レポートの別紙99.1として添付されており、参照することにより本書に組み込まれる。

2024年5月1日、当社は2024年3月31日に終了した第1四半期の補足財務情報開示資料を当社ウェブサイト(www.brightspire.com)で公開した。補足財務情報開示プレゼンテーションのコピーは、本Current Report on Form 8-Kの別紙99.2として添付され、参照することにより本書に組み込まれる。

フォーム8-Kの一般的説明書B.2およびB.6に従ってフォーム8-Kの一般的説明書B.2およびB.6に従い、本フォーム8-Kの項目2.02および項目9.01に記載された情報(本フォーム8-Kの別紙99.1および99.2を含む)は、1934年証券取引所法(以下「取引所法」)第18条において「提出された」とみなされるものではなく、また、取引所法または1933年証券法(以下「改正証券法」)に基づき当社が提出するいかなる提出書類にも、当該提出書類に明示的に言及されている場合を除き、参照により組み込まれるものとはみなされません。

重要な企業情報を配布するためのウェブサイトの使用

当社のウェブサイトアドレスはwww.brightspire.com。当社はウェブサイトを重要な会社情報の配信チャネルとして利用しています。当社に関するプレスリリース、アナリスト向けプレゼンテーション、財務情報などの重要情報は、当社ウェブサイトのトップページにある「株主」のタブをクリックすると表示される「株主」サブページに定期的に掲載され、アクセスできます。当社はまた、当社に関するタイムクリティカルな情報への一般公開を迅速化するため、プレスリリースの配信や米国証券取引委員会への提出に先立ち、またはそれに代えて、ウェブサイトを利用して同じ情報を開示しています。したがって、投資家の皆様は、重要かつ一刻を争う情報については、当社ウェブサイトの「株主」サブページをご覧ください。また、当社ウェブサイトの閲覧者は、同ウェブサイトの「株主」サブページで新情報が公開された際に、電子メールやその他の方法で自動的に通知を受け取るよう登録することができます。

|

|

|

|

|

|

|

|

|

|

|

|

| Item 9.01 |

Financial Statements and Exhibits. |

(d) 証拠書類。本報告書(Form 8-K)には以下の添付資料を添付する。

|

|

|

|

|

|

|

|

|

|

|

|

|

| Exhibit No. |

|

Description |

| 99.1 |

|

|

| 99.2 |

|

|

| 104 |

|

カバーページ インタラクティブデータファイル(inline xbrlドキュメントに埋め込まれています。) |

SIGNATURE

1934年証券取引法の要件に従い、登録者は本報告書に正式に権限を付与された署名者により、登録者を代表して署名させた。

|

|

|

|

|

|

|

|

|

| Date: May 1, 2024 |

BRIGHTSPIRE CAPITAL, INC. |

|

|

|

|

By: |

/s/ David A. Palamé |

|

Name: |

David A. Palamé |

|

Title: |

General Counsel & Secretary |

EX-99.1

2

brspq124earningsreleasev.htm

EX-99.1

brspq124earningsreleasev

BrightSpire Capital, Inc. Announces First Quarter 2024 Financial Results NEW YORK, May 1, 2024 – BrightSpire Capital, Inc. (NYSE: BRSP) (“BrightSpire Capital” or the “Company”) today announced its financial results for the first quarter 2024 and certain updates. The Company reported first quarter 2024 GAAP net loss attributable to common stockholders of ($57.1) million, or ($0.45) per share, Distributable Earnings of $22.5 million, or $0.17 per share, and Adjusted Distributable Earnings of $29.7 million, or $0.23 per share. The Company reported GAAP net book value of $9.10 per share and undepreciated book value of $10.67 per share as of March 31, 2024. Michael J. Mazzei, Chief Executive Officer, commented, “We continue to remain focused on the balance sheet and maintaining ample liquidity until market conditions improve.” Supplemental Financial Report A First Quarter 2024 Supplemental Financial Report is available on the Shareholders – Events and Presentations section of the Company’s website at www.brightspire.com. This information will be furnished to the SEC in a Current Report on Form 8-K. We refer to “Distributable Earnings” and “Adjusted Distributable Earnings”, which are non-GAAP financial measures, in this release. A reconciliation to net income/(loss) attributable to BrightSpire Capital common stockholders, the most directly comparable GAAP measure, is included in our full detailed First Quarter 2024 Supplemental Financial Report and is available on our website at www.brightspire.com. First Quarter 2024 Conference Call The Company will conduct a conference call to discuss the financial results on May 1, 2024 at 10:00 a.m. ET / 7:00 a.m. PT. To participate in the event by telephone, please dial (877) 407-0784 ten minutes prior to the start time (to allow time for registration). International callers should dial (201) 689-8560. The call will also be broadcast live over the Internet and can be accessed on the Shareholders section of the Company’s website at www.brightspire.com. A webcast of the call will be available for 90 days on the Company’s website. For those unable to participate during the live call, a replay will be available starting May 1, 2024 at 1:00 p.m. ET / 10:00 a.m. PT, through May 8, 2024, at 11:59 p.m. ET / 8:59 p.m. PT. To access the replay, dial (844) 512-2921 and use conference ID code 13745217. International callers should dial (412) 317-6671 and enter the same conference ID. Dividend Announcement On March 15, 2024, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share to holders of Class A common stock for the first quarter of 2024, which was paid on April 15, 2024, to common stockholders of record on March 29, 2024. On December 14, 2023, the Company’s Board of Directors declared a quarterly cash dividend of $0.20 per share to holders of Class A common stock for the fourth quarter of 2023, which was paid on January 12, 2024, to common stockholders of record on December 31, 2023. Common Stock Repurchase Plan On April 25, 2024, the Company’s Board of Directors have authorized a stock repurchase program, under which the Company may repurchase up to $50 million of its outstanding Class A common stock until April 30, 2025 (the “Stock Repurchase Program”). Under the Stock Repurchase Program, the Company may repurchase shares in open market purchases, in privately negotiated transactions or otherwise. The Stock Repurchase Program will be utilized at management's discretion and in accordance with the requirements of the Securities and Exchange Commission. The timing and actual number of shares repurchased will depend on a variety of factors including price, corporate requirements and other conditions. The Stock Repurchase Program replaces in its entirety the Company’s prior repurchase program announced on May 3, 2023 and that expired on April 30, 2024. About BrightSpire Capital, Inc. BrightSpire Capital, Inc. (NYSE: BRSP) is internally managed and one of the largest publicly traded commercial real estate (CRE) credit REITs, focused on originating, acquiring, financing and managing a diversified portfolio consisting primarily of CRE Exhibit 99.1

debt investments and net leased properties predominantly in the United States. CRE debt investments primarily consist of first mortgage loans, which we expect to be the primary investment strategy. BrightSpire Capital is organized as a Maryland corporation and taxed as a REIT for U.S. federal income tax purposes. For additional information regarding the Company and its management and business, please refer to www.brightspire.com. Cautionary Statement Regarding Forward-Looking Statements This press release may contain forward-looking statements within the meaning of the federal securities laws. Forward-looking statements relate to expectations, beliefs, projections, future plans and strategies, anticipated events or trends and similar expressions concerning matters that are not historical facts. In some cases, you can identify forward-looking statements by the use of forward-looking terminology such as “may,” “will,” “should,” “expects,” “intends,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” or “potential” or the negative of these words and phrases or similar words or phrases which are predictions of or indicate future events or trends and which do not relate solely to historical matters. Forward-looking statements involve known and unknown risks, uncertainties, assumptions and contingencies, many of which are beyond our control, and may cause actual results to differ significantly from those expressed in any forward-looking statement. Among others, the following uncertainties and other factors could cause actual results to differ from those set forth in the forward-looking statements: operating costs and business disruption may be greater than expected; uncertainties regarding the ongoing impact of the novel coronavirus (COVID-19) and its adverse impact on the real estate market, the economy and the Company’s investments, financial condition and business operation; the Company's operating results may differ materially from the information presented in the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as well as in the Company’s other filings with the Securities and Exchange Commission; the fair value of the Company's investments may be subject to uncertainties (including impacts associated with accelerating inflationary trends, recent and potential further interest rate increases, the volatility of interest rates, credit spreads and the transition from LIBOR to SOFR, increased market volatility affecting commercial real estate businesses and public securities); the Company's use of leverage and interest rate mismatches between the Company’s assets and borrowings could hinder its ability to make distributions and may significantly impact its liquidity position; the ability to simplify the portfolio, realize substantial efficiencies as well as anticipated strategic and financial benefits, including, but not limited to expected cost savings through the internalization or expected returns on equity and/or yields on investments; the timing of and ability to generate additional liquidity and deploy available liquidity, including in senior mortgage loans; whether the Company will achieve its anticipated Distributable Earnings per share (as adjusted), or maintain or produce higher Distributable Earnings per share (as adjusted) in the near term or ever; the Company’s ability to maintain or grow the dividend at all in the future; defaults by borrowers in paying debt service on outstanding indebtedness; borrowers’ abilities to manage and stabilize properties; deterioration in the performance of the properties securing our investments (including the impact of higher interest expense, depletion of interest and other reserves or payment-in-kind concessions in lieu of current interest payment obligations, population shifts and migration, reduced demand for office, multifamily, hospitality or retail space) that may cause deterioration in the performance of our investments and, potentially, principal losses to us; adverse impacts on the Company's corporate revolver, including covenant compliance and borrowing base capacity; adverse impacts on the Company's liquidity, including available capacity under and margin calls on master repurchase facilities; lease payment defaults or deferrals, demands for protective advances and capital expenditures; the ability of the Company to refinance certain mortgage debt on similar terms to those currently existing or at all; the ability to execute CRE CLO’s on a go forward basis, including at a reduced cost of capital; the impact of legislative, regulatory, tax and competitive changes, regime changes and the actions of government authorities and in particular those affecting the commercial real estate finance and mortgage industry or our business; and the impact of the conflict between Russia and Ukraine, global trade tensions, and the implementation and expansion of economic and trade sanctions. The foregoing list of factors is not exhaustive. Additional information about these and other factors can be found in Part I, Item 1A of the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, as well as in BrightSpire Capital’s other filings with the Securities and Exchange Commission. Moreover, each of the factors referenced above are likely to also be impacted directly or indirectly by the ongoing impact of COVID-19 and investors are cautioned to interpret substantially all of such statements and risks as being heightened as a result of the ongoing impact of the COVID-19. We caution investors not to unduly rely on any forward-looking statements. The forward-looking statements speak only as of the date of this press release. BrightSpire Capital is under no duty to update any of these forward-looking statements after the date of this press release, nor to conform prior statements to actual results or revised expectations, and BrightSpire Capital does not intend to do so.

Investor Relations BrightSpire Capital, Inc. Addo Investor Relations Anne McGuinness 310-829-5400 brsp@addo.com

EX-99.2

3

brspq124earningssuppleme.htm

EX-99.2

brspq124earningssuppleme

Exhibit 99.2

• •

会社開示情報をすべてご覧になるには株探プレミアムの登録

◼ ◼ ◼ ◼

• • •

株探プレミアムに申し込む(初回無料体験付き)

プレミアム会員の方はこちらからログイン

株探プレミアムに申し込む(初回無料体験付き)

プレミアム会員の方はこちらからログイン