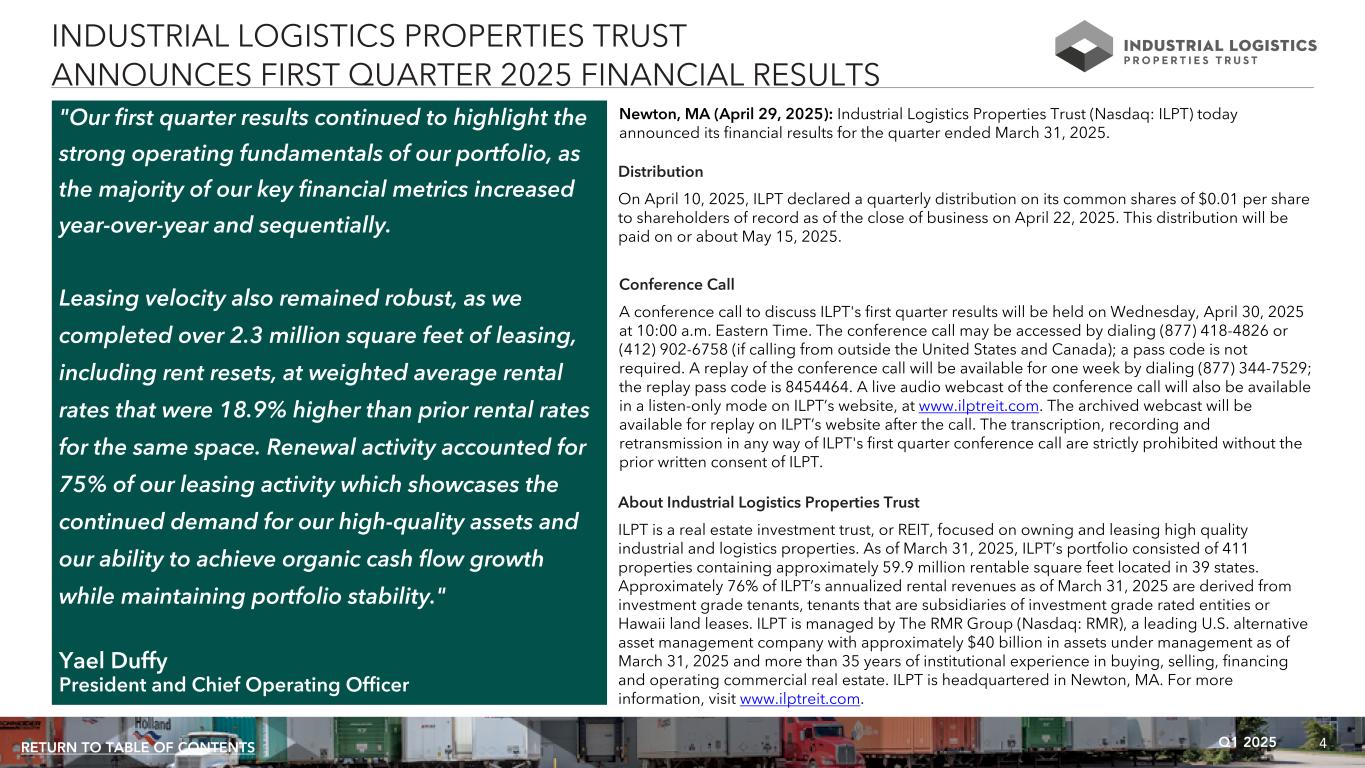

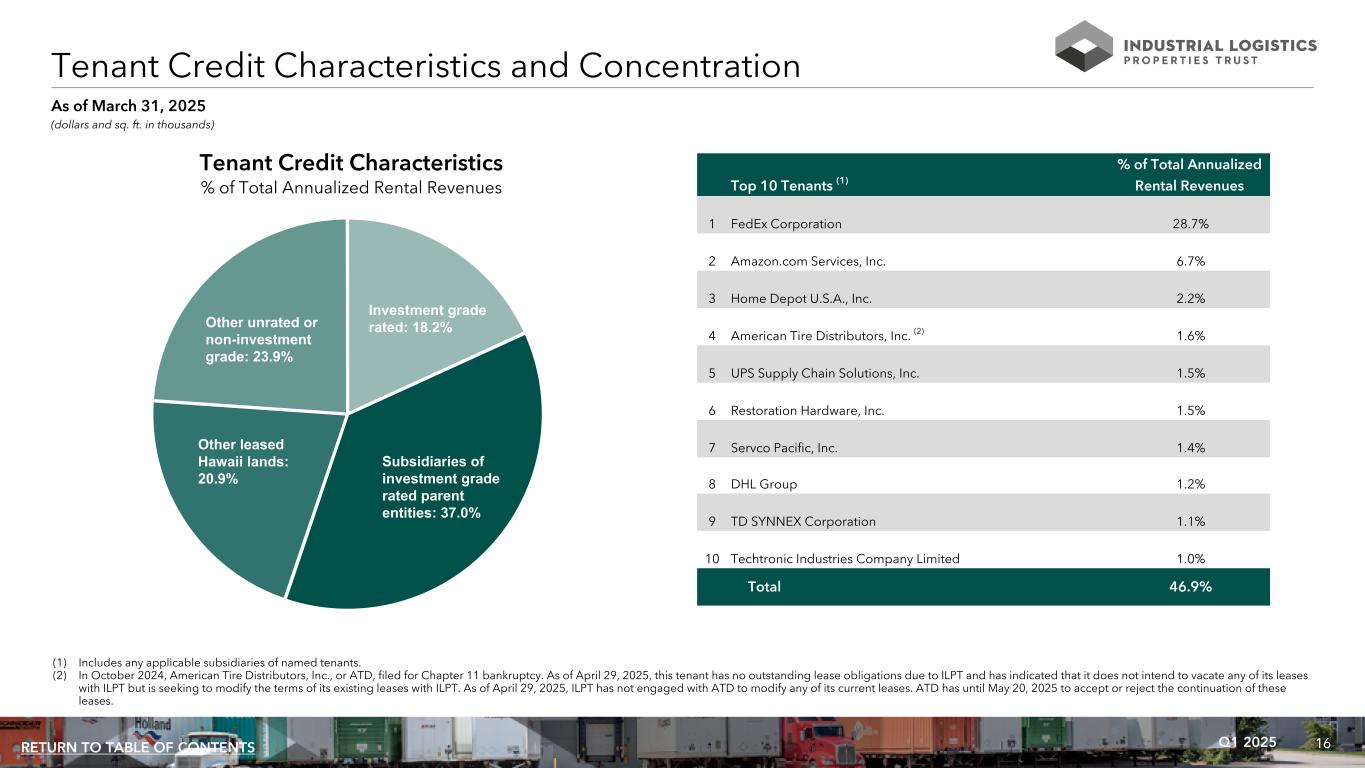

4Q1 2025RETURN TO TABLE OF CONTENTS "Our first quarter results continued to highlight the strong operating fundamentals of our portfolio, as the majority of our key financial metrics increased year-over-year and sequentially. Leasing velocity also remained robust, as we completed over 2.3 million square feet of leasing, including rent resets, at weighted average rental rates that were 18.9% higher than prior rental rates for the same space. Renewal activity accounted for 75% of our leasing activity which showcases the continued demand for our high-quality assets and our ability to achieve organic cash flow growth while maintaining portfolio stability." Yael Duffy President and Chief Operating Officer INDUSTRIAL LOGISTICS PROPERTIES TRUST ANNOUNCES FIRST QUARTER 2025 FINANCIAL RESULTS Newton, MA (April 29, 2025): Industrial Logistics Properties Trust (Nasdaq: ILPT) today announced its financial results for the quarter ended March 31, 2025. Distribution On April 10, 2025, ILPT declared a quarterly distribution on its common shares of $0.01 per share to shareholders of record as of the close of business on April 22, 2025. This distribution will be paid on or about May 15, 2025. Conference Call A conference call to discuss ILPT's first quarter results will be held on Wednesday, April 30, 2025 at 10:00 a.m. Eastern Time. The conference call may be accessed by dialing (877) 418-4826 or (412) 902-6758 (if calling from outside the United States and Canada); a pass code is not required. A replay of the conference call will be available for one week by dialing (877) 344-7529; the replay pass code is 8454464. A live audio webcast of the conference call will also be available in a listen-only mode on ILPT’s website, at www.ilptreit.com. The archived webcast will be available for replay on ILPT’s website after the call. The transcription, recording and retransmission in any way of ILPT's first quarter conference call are strictly prohibited without the prior written consent of ILPT. About Industrial Logistics Properties Trust ILPT is a real estate investment trust, or REIT, focused on owning and leasing high quality industrial and logistics properties. As of March 31, 2025, ILPT’s portfolio consisted of 411 properties containing approximately 59.9 million rentable square feet located in 39 states. Approximately 76% of ILPT’s annualized rental revenues as of March 31, 2025 are derived from investment grade tenants, tenants that are subsidiaries of investment grade rated entities or Hawaii land leases. ILPT is managed by The RMR Group (Nasdaq: RMR), a leading U.S. alternative asset management company with approximately $40 billion in assets under management as of March 31, 2025 and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. ILPT is headquartered in Newton, MA. For more information, visit www.ilptreit.com.

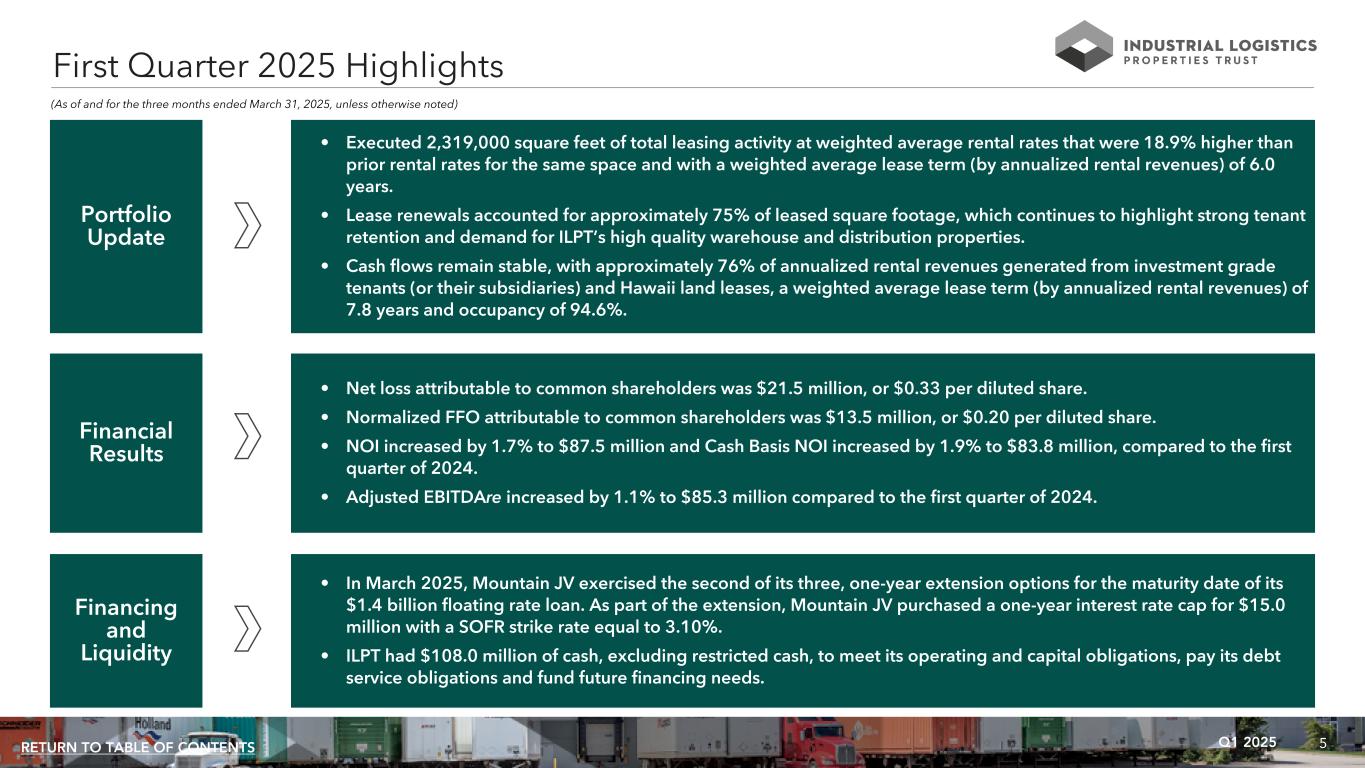

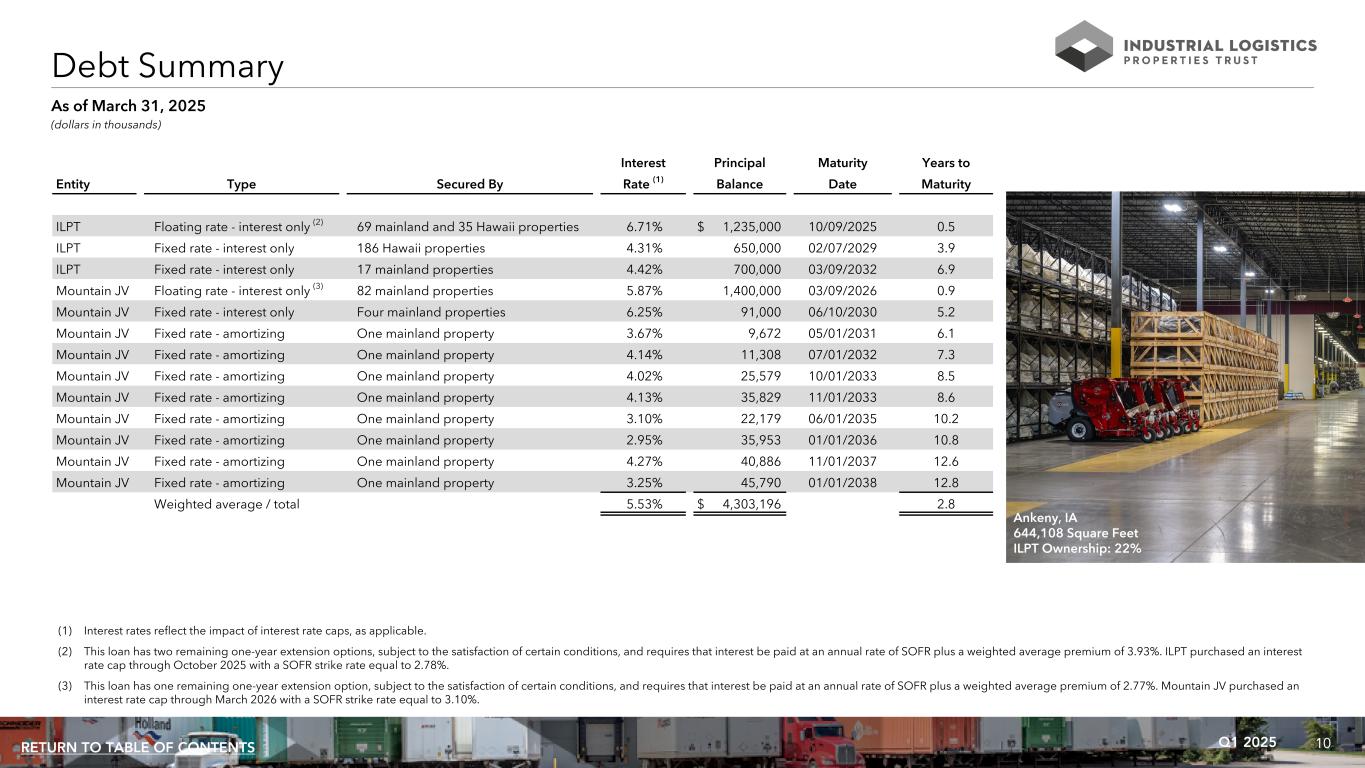

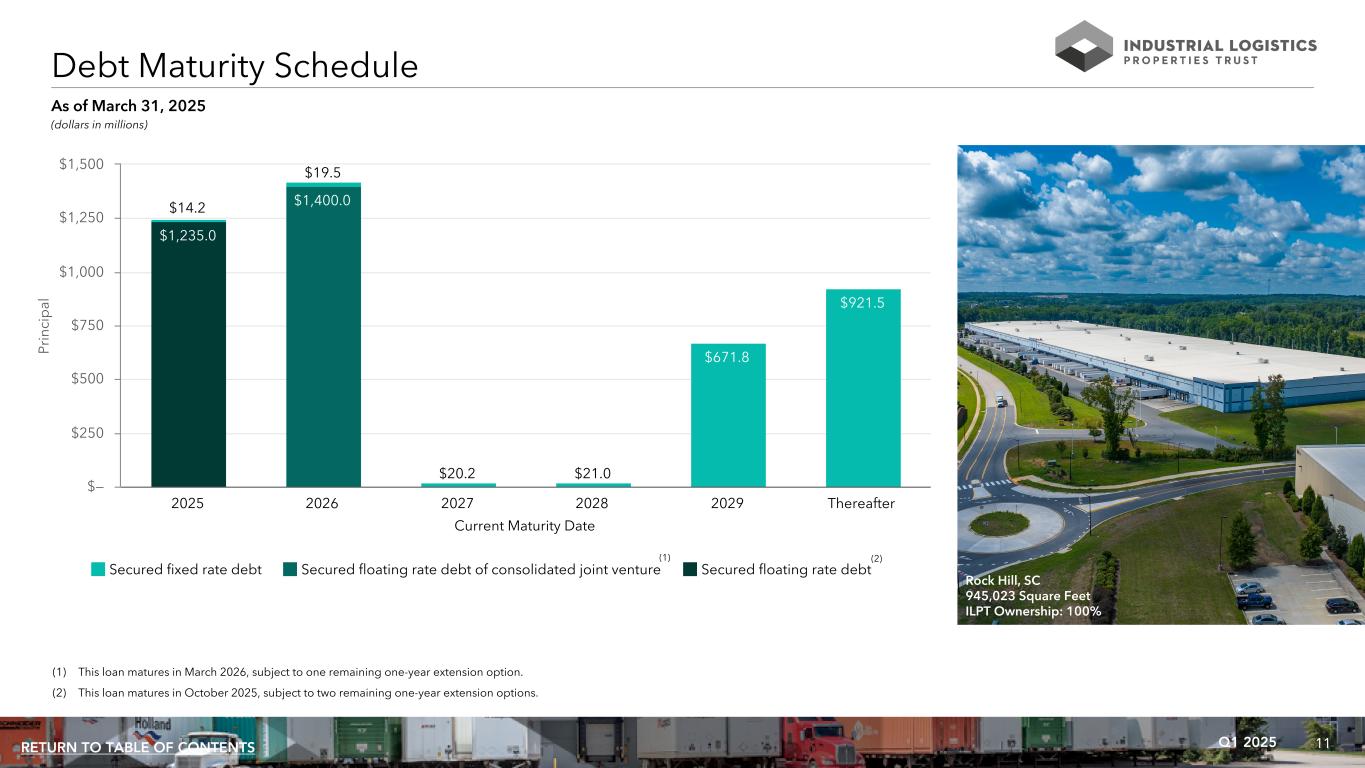

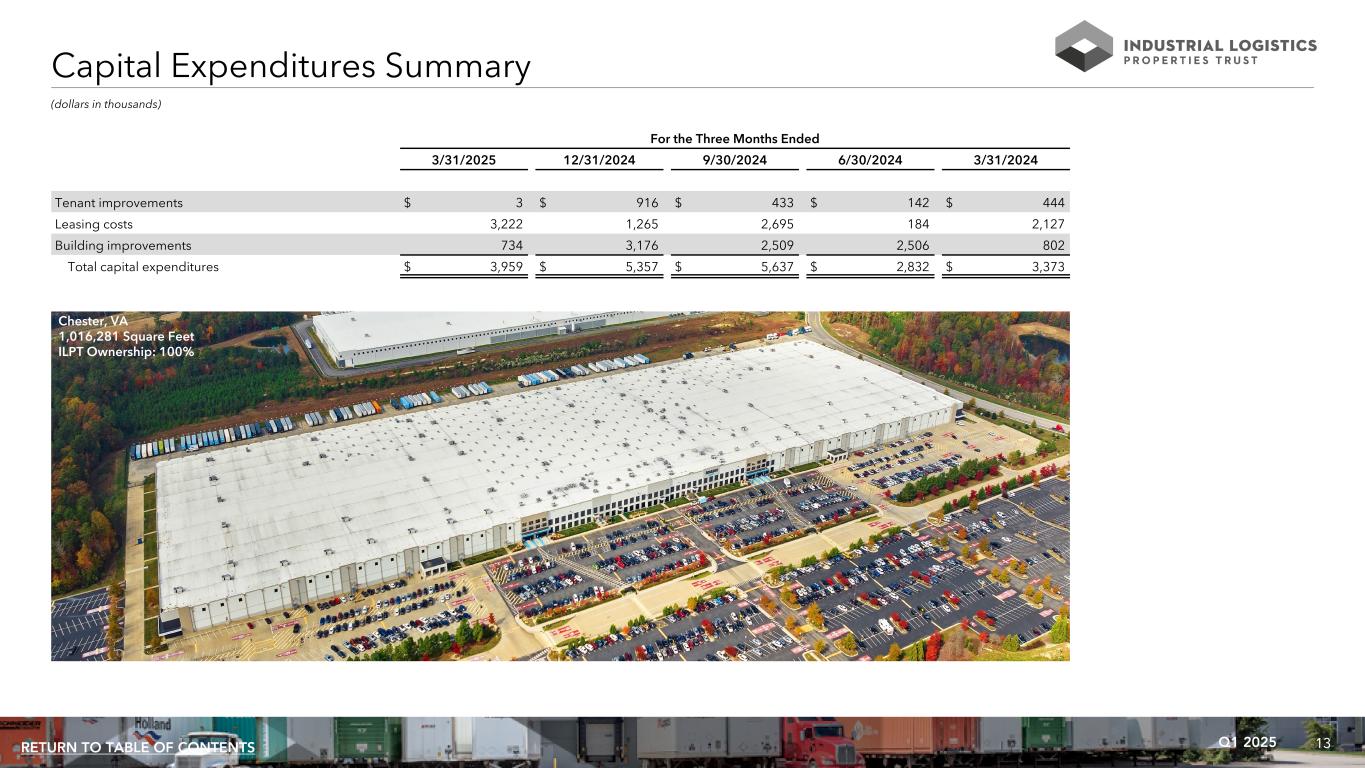

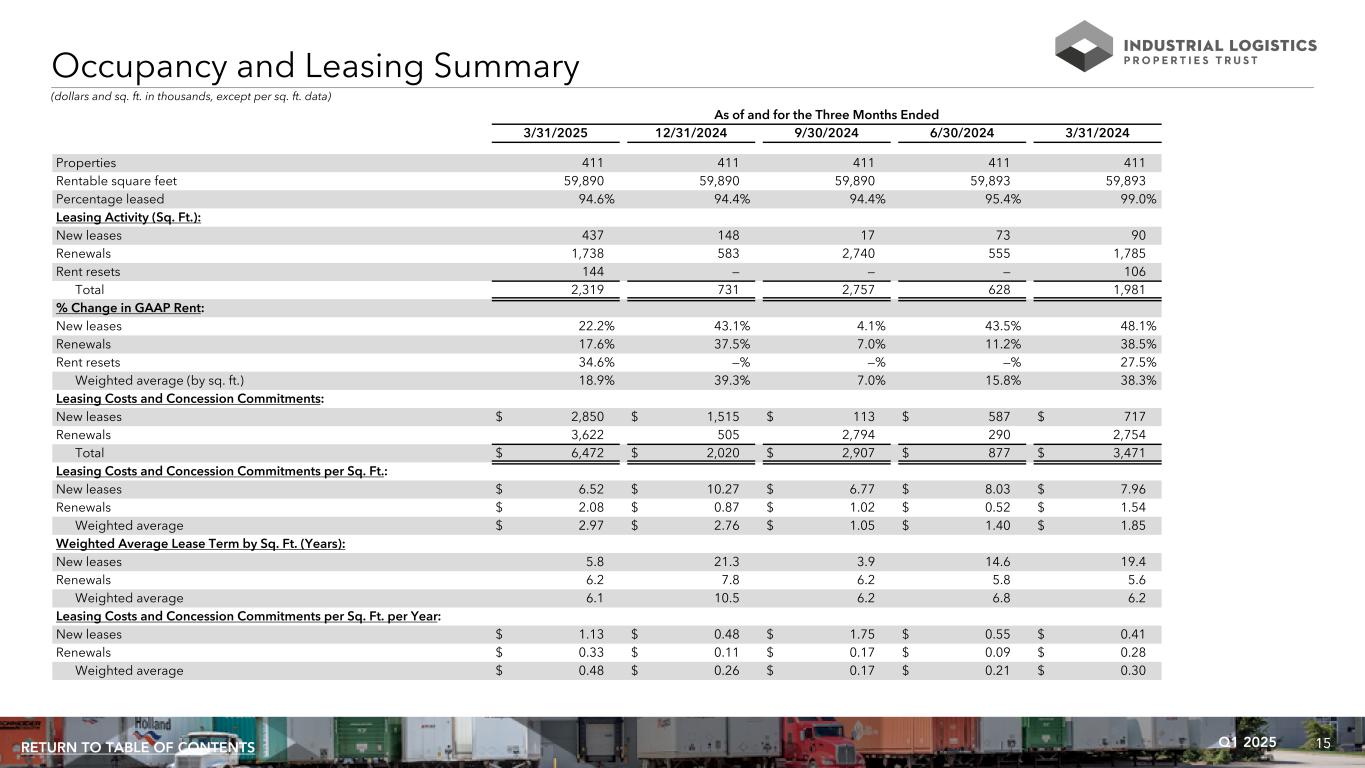

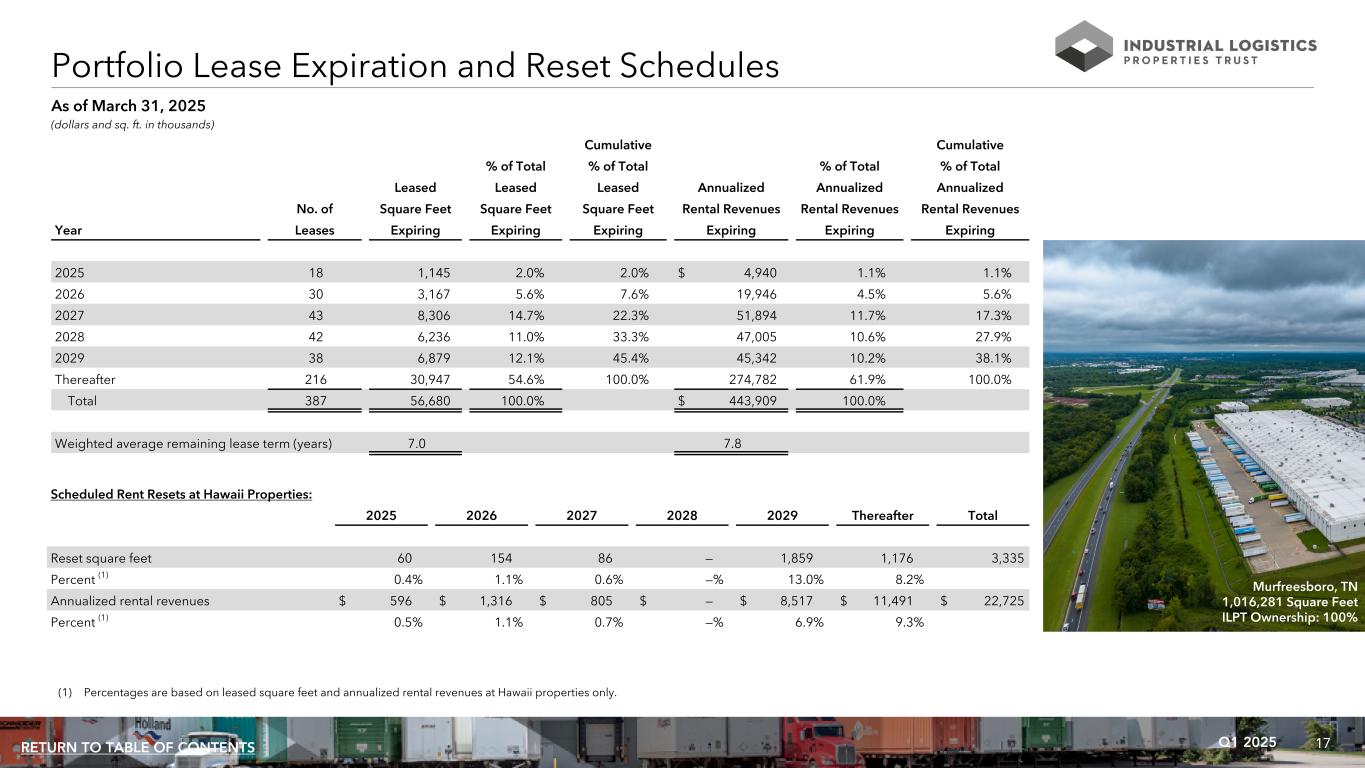

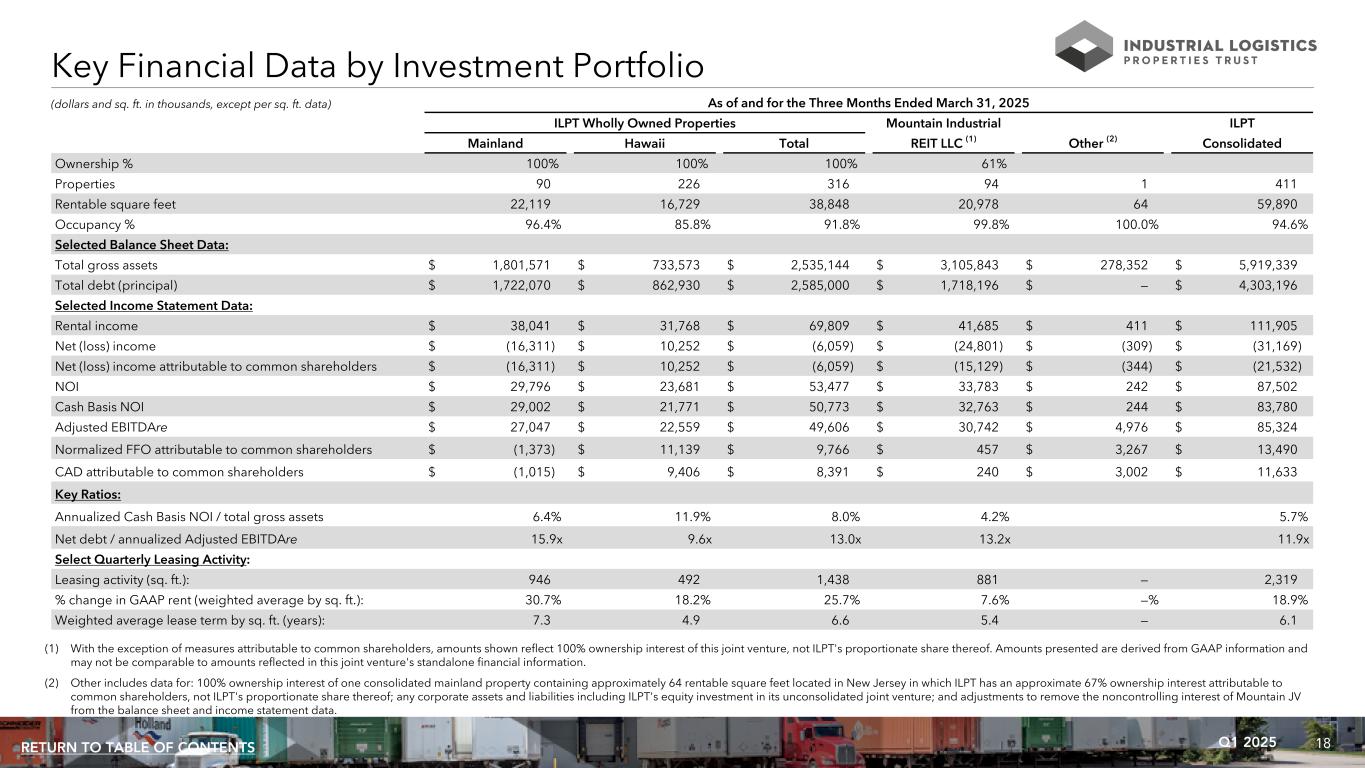

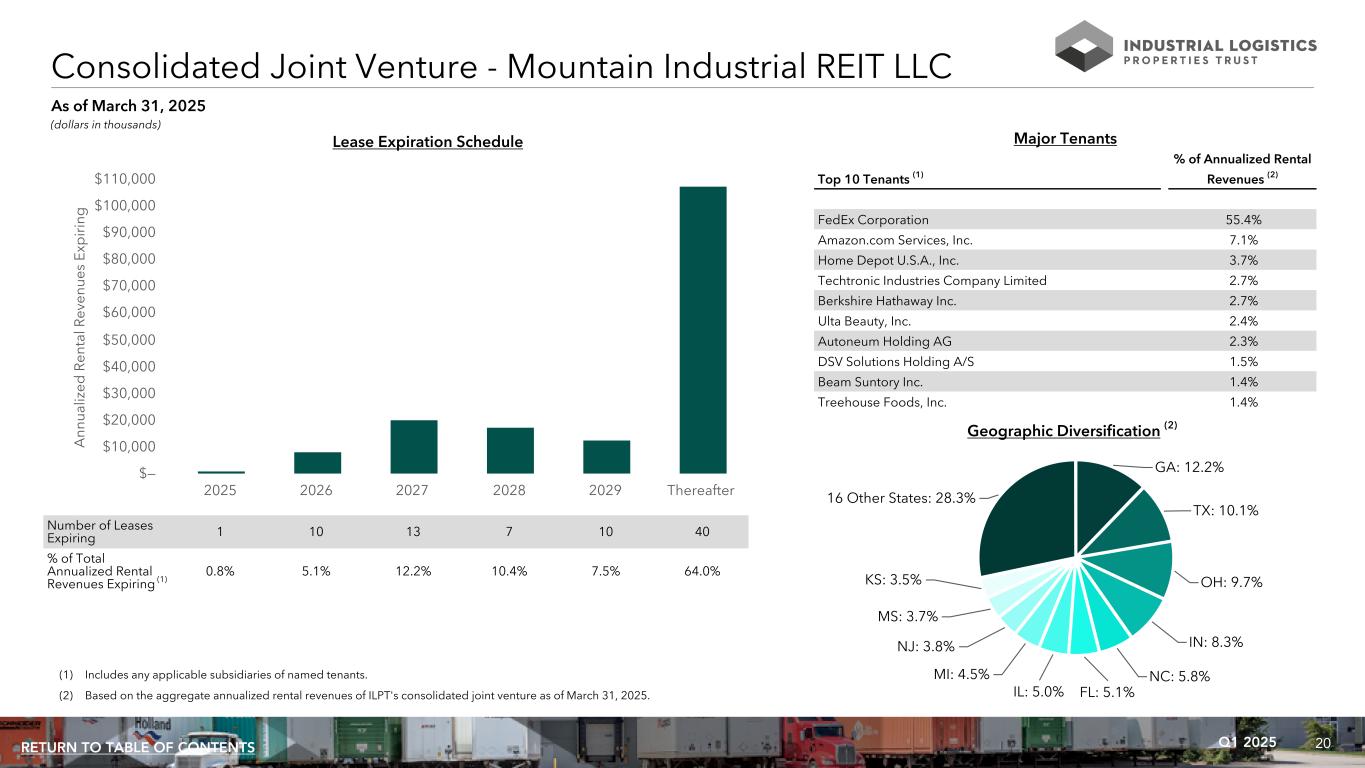

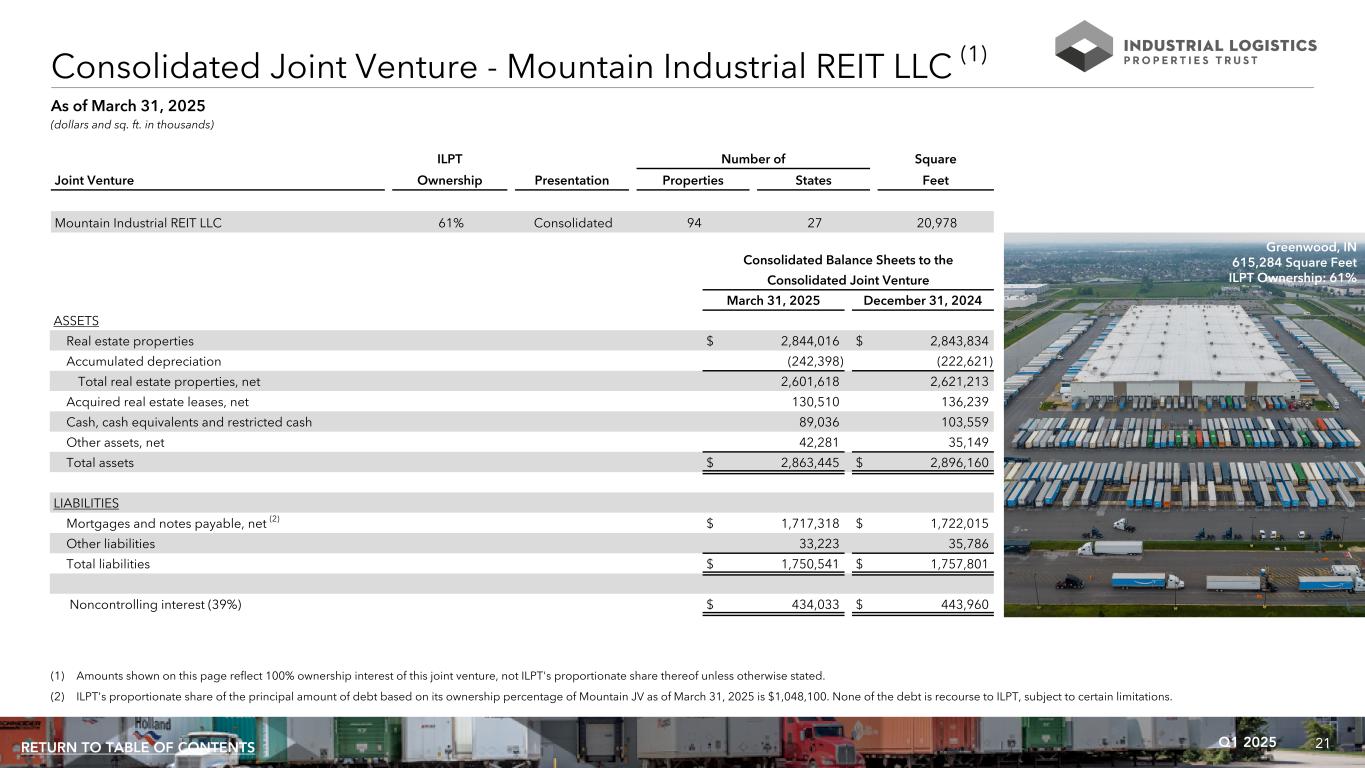

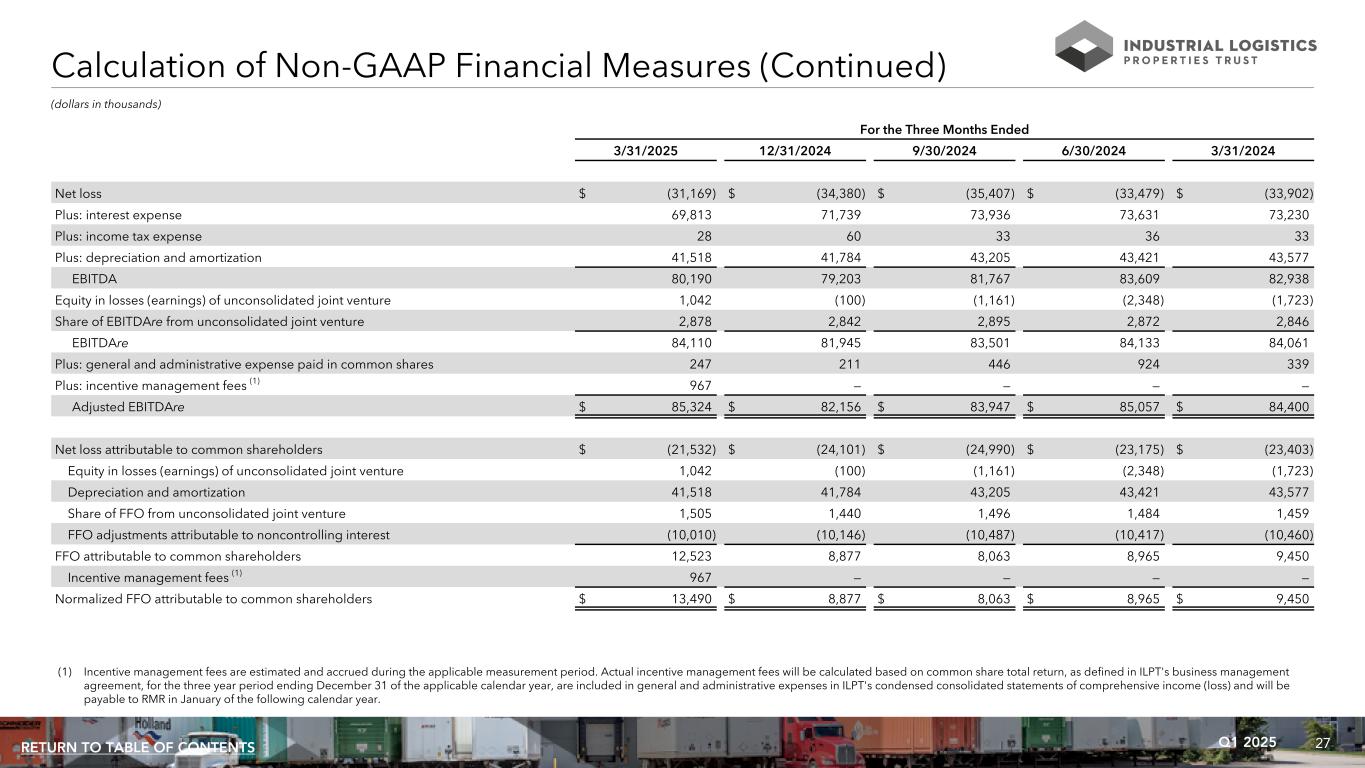

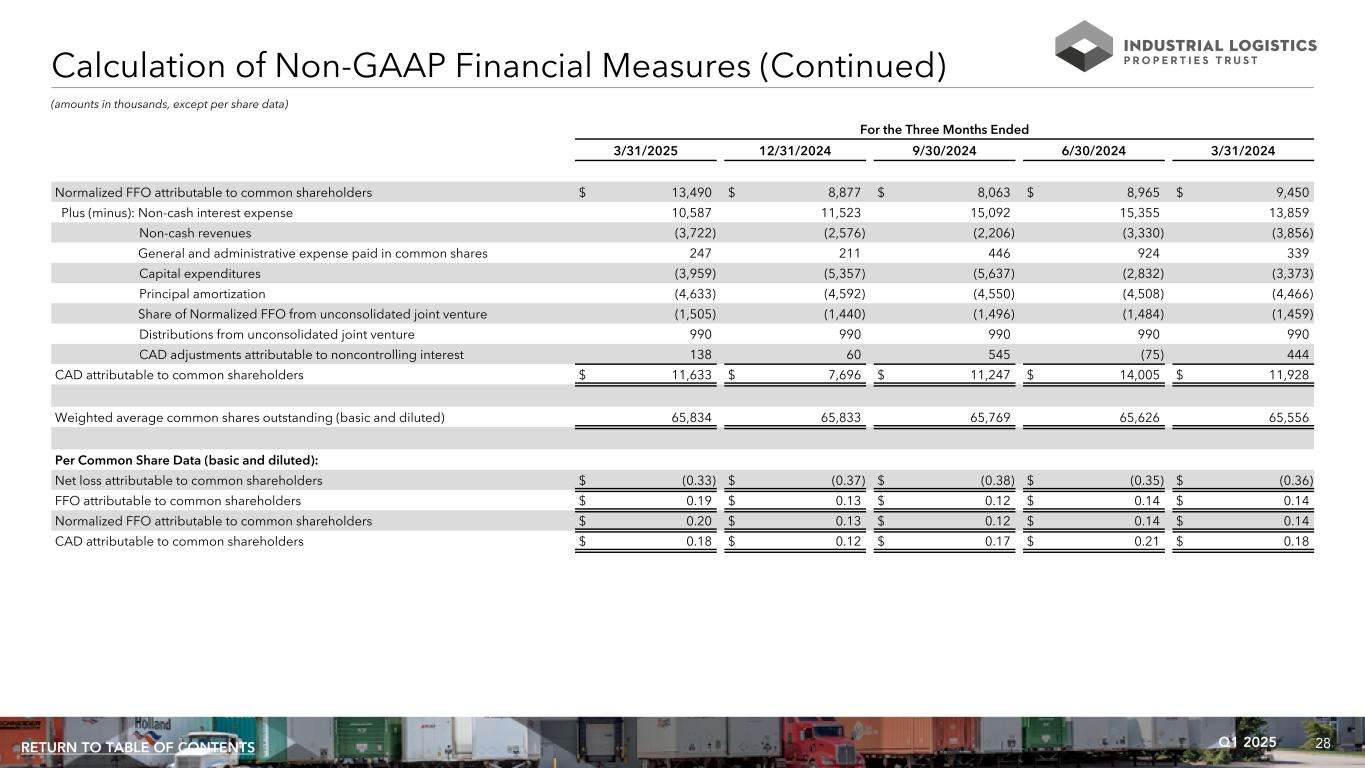

5Q1 2025RETURN TO TABLE OF CONTENTS Portfolio Update • Executed 2,319,000 square feet of total leasing activity at weighted average rental rates that were 18.9% higher than prior rental rates for the same space and with a weighted average lease term (by annualized rental revenues) of 6.0 years. • Lease renewals accounted for approximately 75% of leased square footage, which continues to highlight strong tenant retention and demand for ILPT’s high quality warehouse and distribution properties. • Cash flows remain stable, with approximately 76% of annualized rental revenues generated from investment grade tenants (or their subsidiaries) and Hawaii land leases, a weighted average lease term (by annualized rental revenues) of 7.8 years and occupancy of 94.6%. Financial Results • Net loss attributable to common shareholders was $21.5 million, or $0.33 per diluted share. • Normalized FFO attributable to common shareholders was $13.5 million, or $0.20 per diluted share. • NOI increased by 1.7% to $87.5 million and Cash Basis NOI increased by 1.9% to $83.8 million, compared to the first quarter of 2024. • Adjusted EBITDAre increased by 1.1% to $85.3 million compared to the first quarter of 2024. Financing and Liquidity • In March 2025, Mountain JV exercised the second of its three, one-year extension options for the maturity date of its $1.4 billion floating rate loan. As part of the extension, Mountain JV purchased a one-year interest rate cap for $15.0 million with a SOFR strike rate equal to 3.10%. • ILPT had $108.0 million of cash, excluding restricted cash, to meet its operating and capital obligations, pay its debt service obligations and fund future financing needs. First Quarter 2025 Highlights (As of and for the three months ended March 31, 2025, unless otherwise noted)

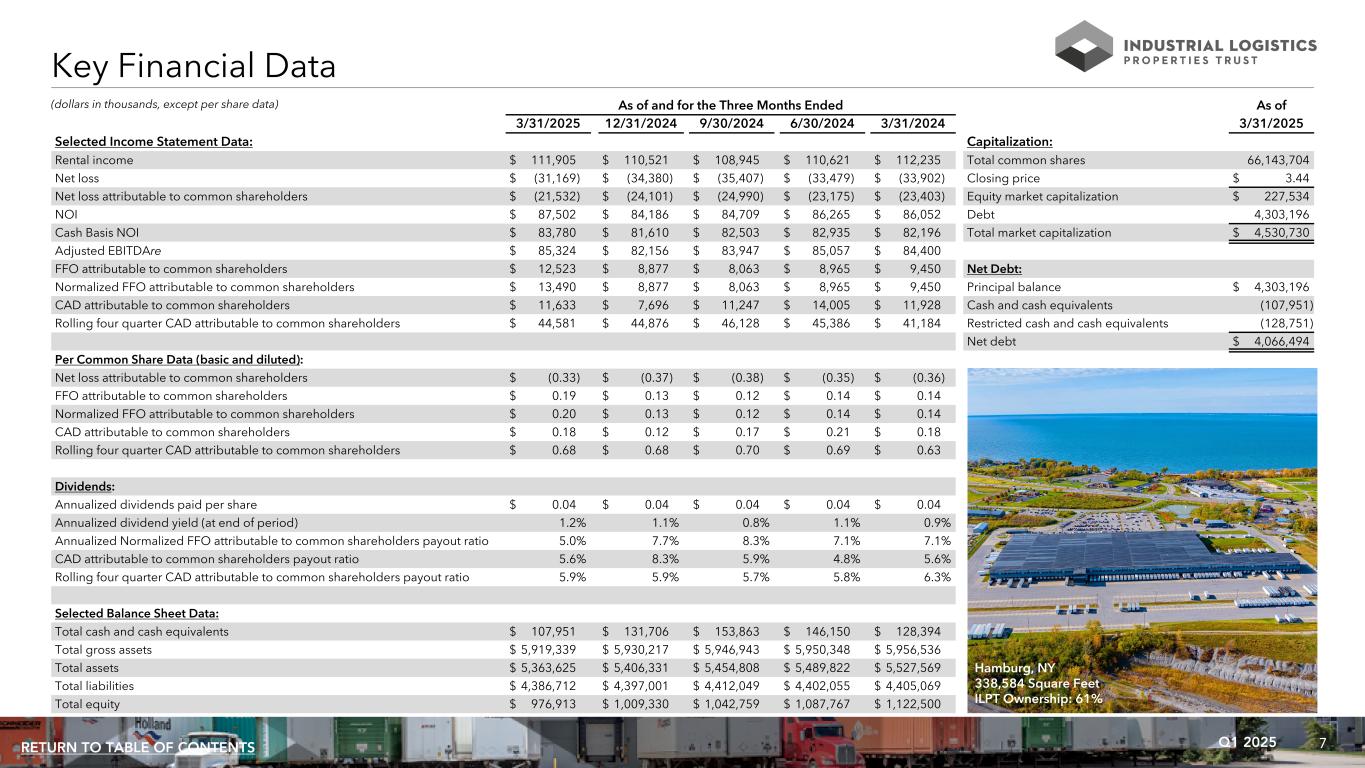

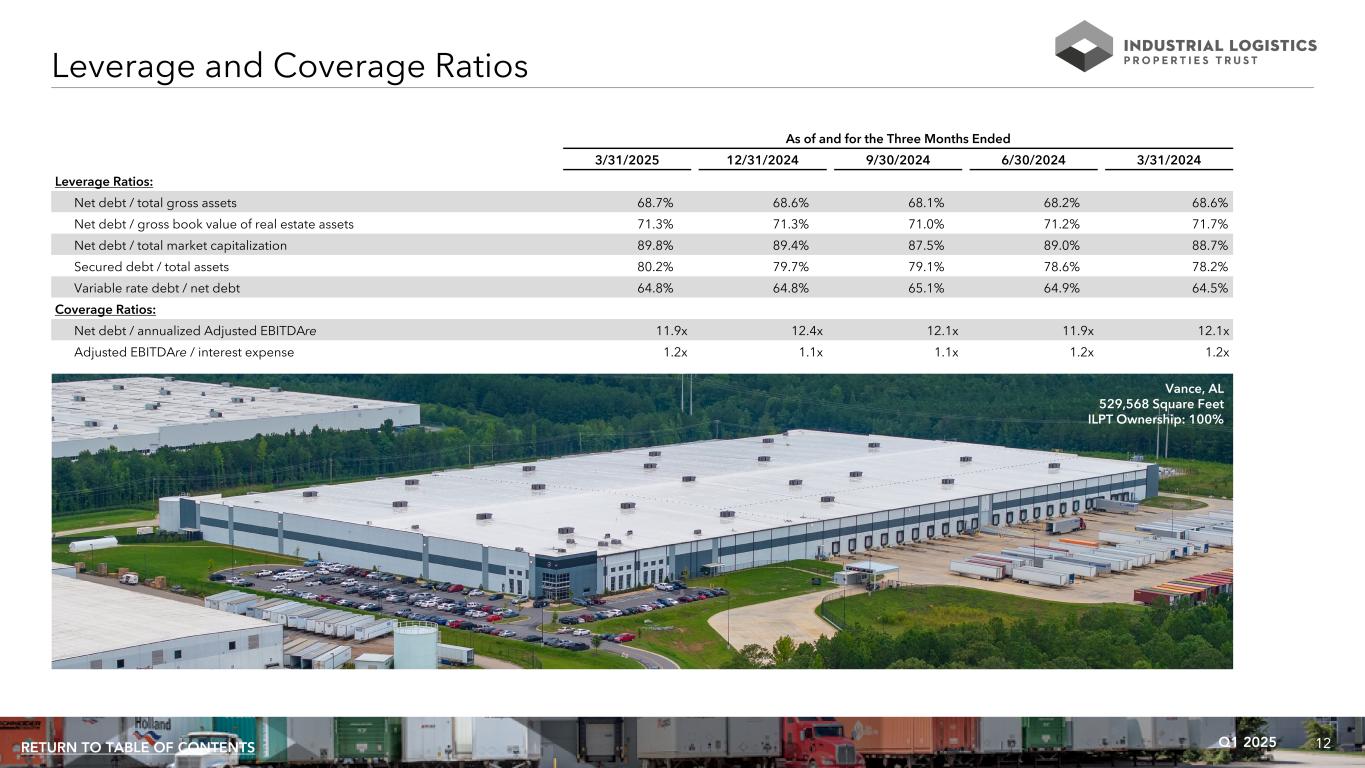

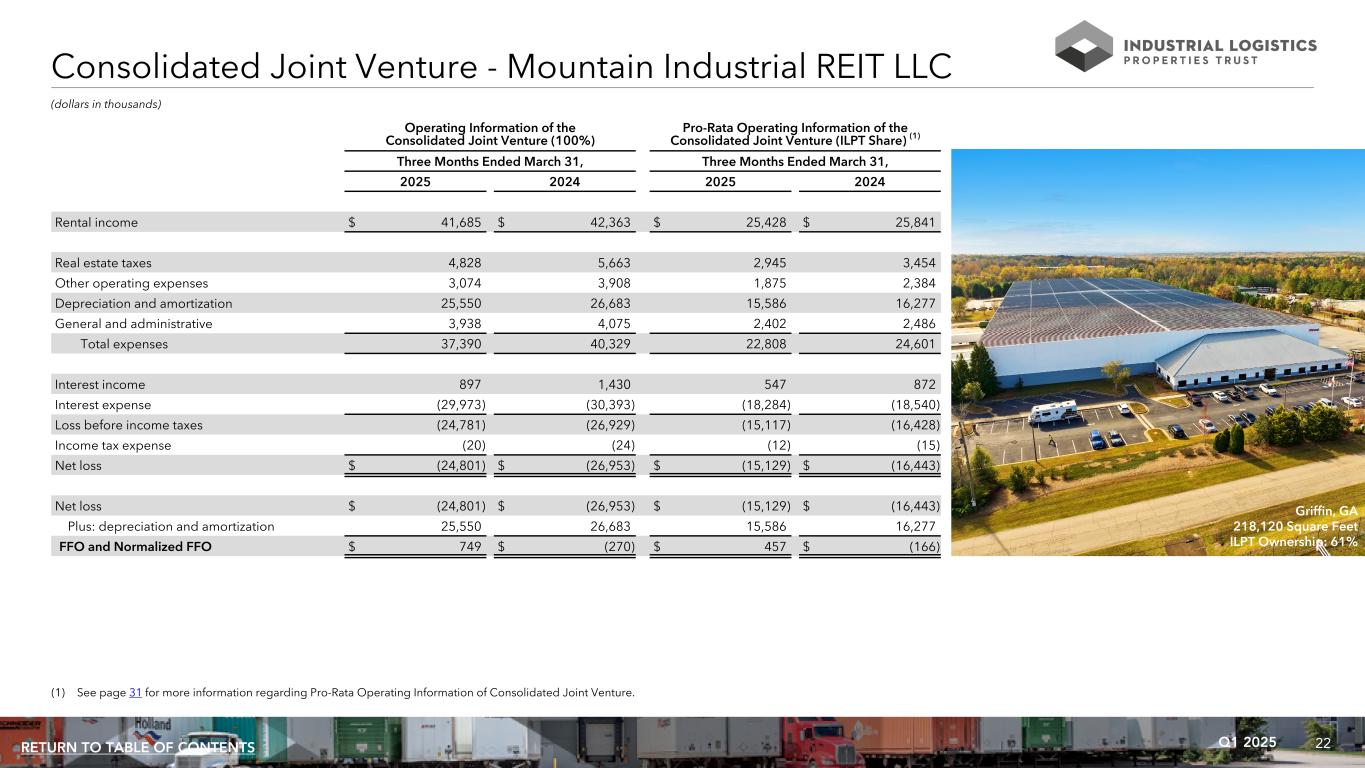

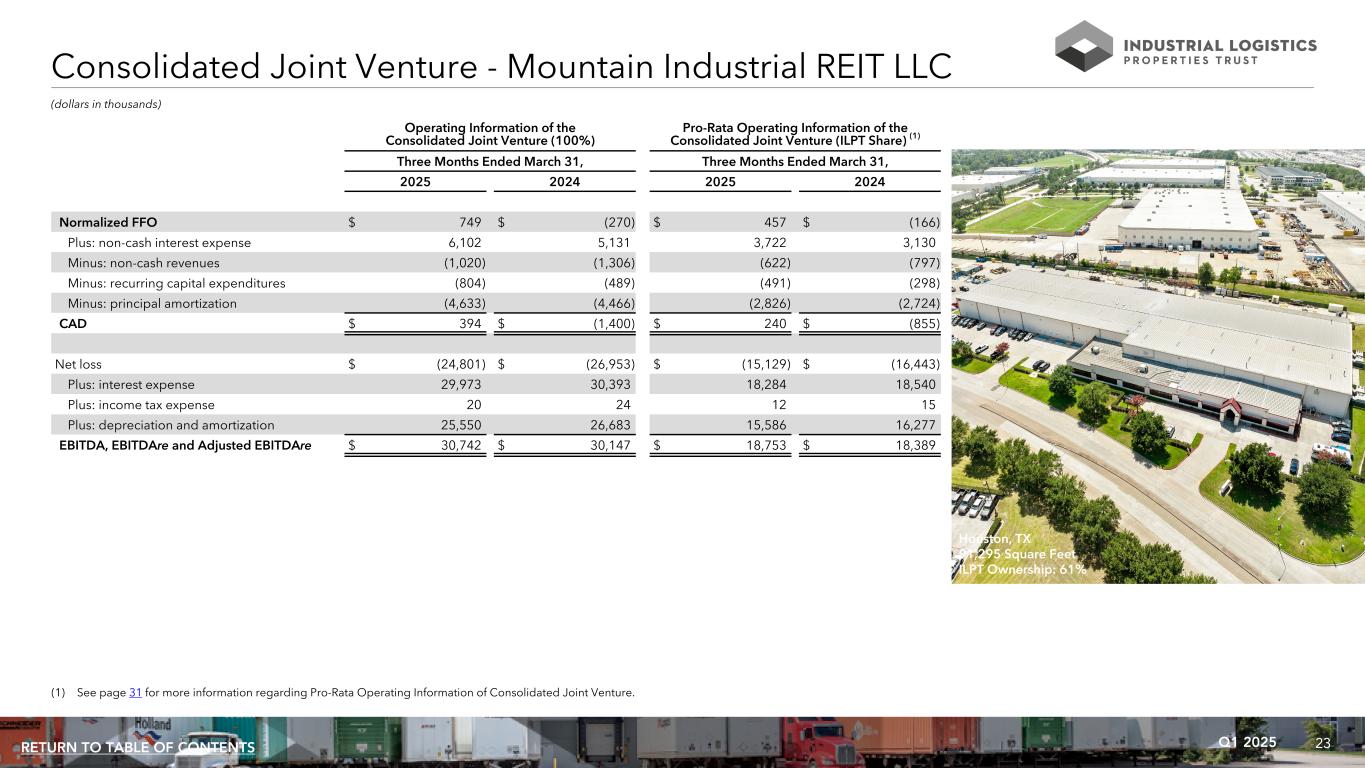

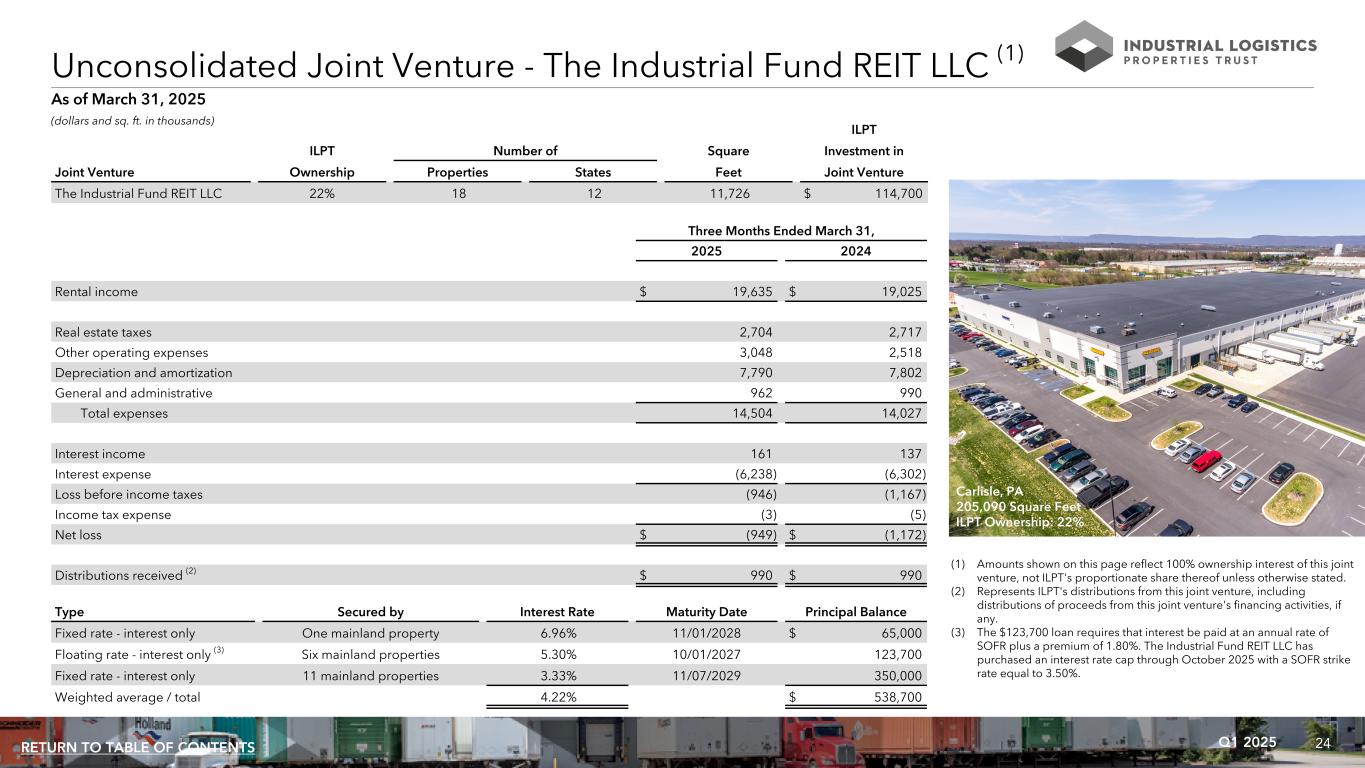

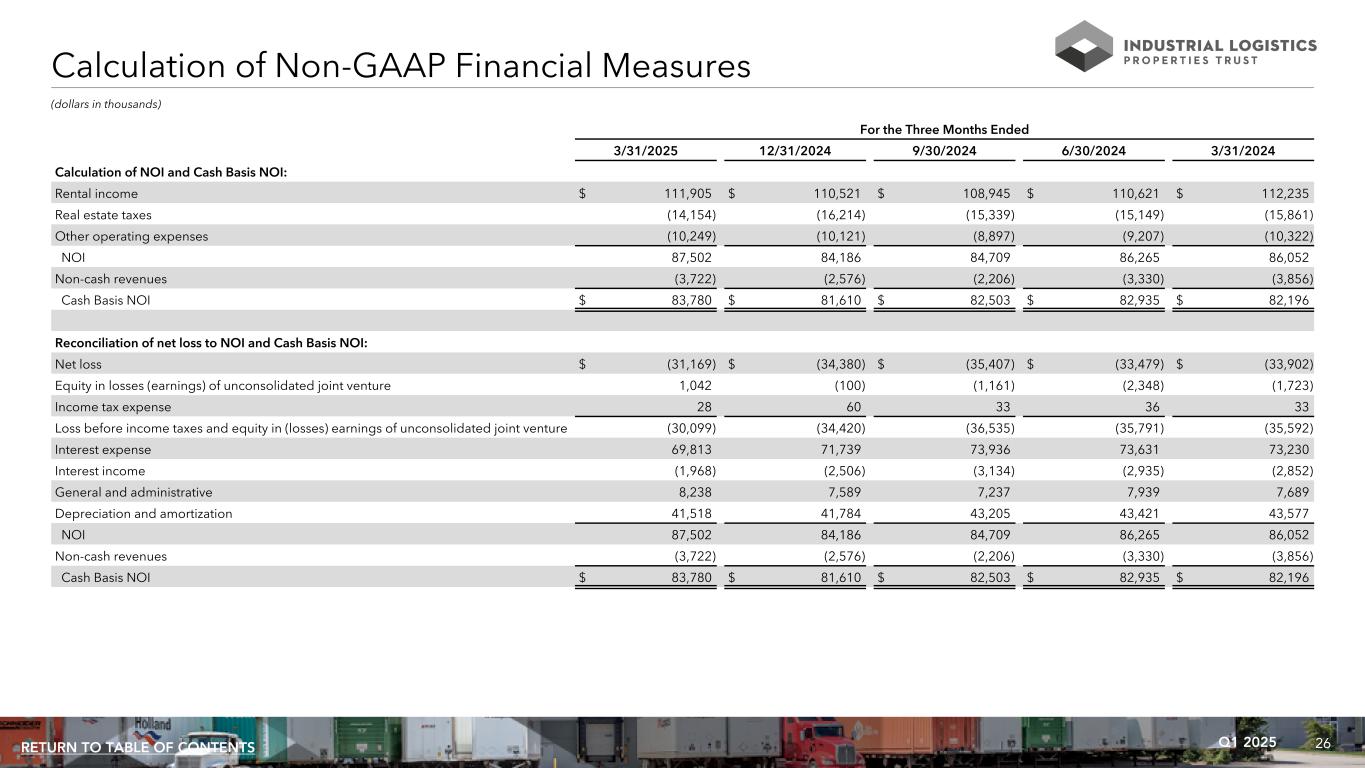

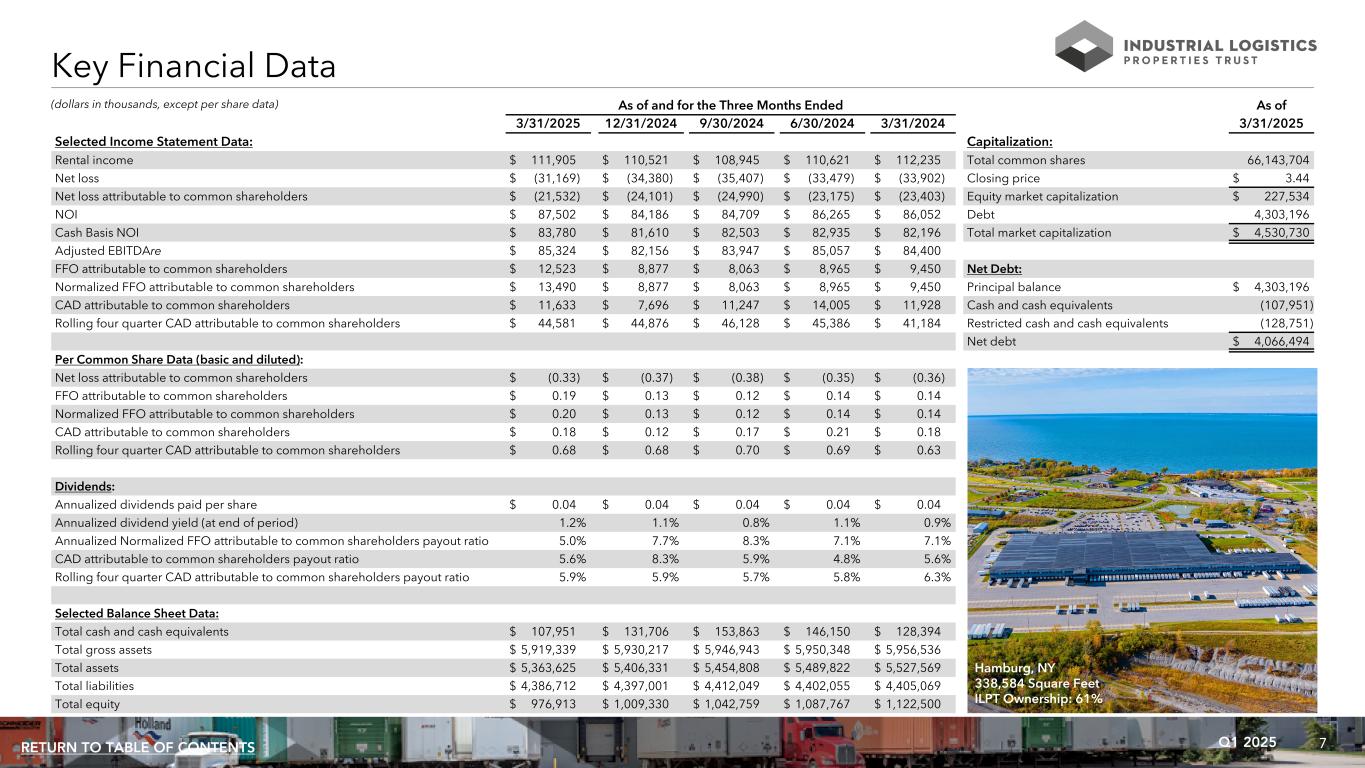

7Q1 2025RETURN TO TABLE OF CONTENTS As of and for the Three Months Ended As of 3/31/2025 12/31/2024 9/30/2024 6/30/2024 3/31/2024 3/31/2025 Selected Income Statement Data: Capitalization: Rental income $ 111,905 $ 110,521 $ 108,945 $ 110,621 $ 112,235 Total common shares 66,143,704 Net loss $ (31,169) $ (34,380) $ (35,407) $ (33,479) $ (33,902) Closing price $ 3.44 Net loss attributable to common shareholders $ (21,532) $ (24,101) $ (24,990) $ (23,175) $ (23,403) Equity market capitalization $ 227,534 NOI $ 87,502 $ 84,186 $ 84,709 $ 86,265 $ 86,052 Debt 4,303,196 Cash Basis NOI $ 83,780 $ 81,610 $ 82,503 $ 82,935 $ 82,196 Total market capitalization $ 4,530,730 Adjusted EBITDAre $ 85,324 $ 82,156 $ 83,947 $ 85,057 $ 84,400 FFO attributable to common shareholders $ 12,523 $ 8,877 $ 8,063 $ 8,965 $ 9,450 Net Debt: Normalized FFO attributable to common shareholders $ 13,490 $ 8,877 $ 8,063 $ 8,965 $ 9,450 Principal balance $ 4,303,196 CAD attributable to common shareholders $ 11,633 $ 7,696 $ 11,247 $ 14,005 $ 11,928 Cash and cash equivalents (107,951) Rolling four quarter CAD attributable to common shareholders $ 44,581 $ 44,876 $ 46,128 $ 45,386 $ 41,184 Restricted cash and cash equivalents (128,751) Net debt $ 4,066,494 Per Common Share Data (basic and diluted): Net loss attributable to common shareholders $ (0.33) $ (0.37) $ (0.38) $ (0.35) $ (0.36) FFO attributable to common shareholders $ 0.19 $ 0.13 $ 0.12 $ 0.14 $ 0.14 Normalized FFO attributable to common shareholders $ 0.20 $ 0.13 $ 0.12 $ 0.14 $ 0.14 CAD attributable to common shareholders $ 0.18 $ 0.12 $ 0.17 $ 0.21 $ 0.18 Rolling four quarter CAD attributable to common shareholders $ 0.68 $ 0.68 $ 0.70 $ 0.69 $ 0.63 Dividends: Annualized dividends paid per share $ 0.04 $ 0.04 $ 0.04 $ 0.04 $ 0.04 Annualized dividend yield (at end of period) 1.2% 1.1% 0.8% 1.1% 0.9% Annualized Normalized FFO attributable to common shareholders payout ratio 5.0% 7.7% 8.3% 7.1% 7.1% CAD attributable to common shareholders payout ratio 5.6% 8.3% 5.9% 4.8% 5.6% Rolling four quarter CAD attributable to common shareholders payout ratio 5.9% 5.9% 5.7% 5.8% 6.3% Selected Balance Sheet Data: Total cash and cash equivalents $ 107,951 $ 131,706 $ 153,863 $ 146,150 $ 128,394 Total gross assets $ 5,919,339 $ 5,930,217 $ 5,946,943 $ 5,950,348 $ 5,956,536 Total assets $ 5,363,625 $ 5,406,331 $ 5,454,808 $ 5,489,822 $ 5,527,569 Total liabilities $ 4,386,712 $ 4,397,001 $ 4,412,049 $ 4,402,055 $ 4,405,069 Total equity $ 976,913 $ 1,009,330 $ 1,042,759 $ 1,087,767 $ 1,122,500 (dollars in thousands, except per share data) Key Financial Data Hamburg, NY 338,584 Square Feet ILPT Ownership: 61%

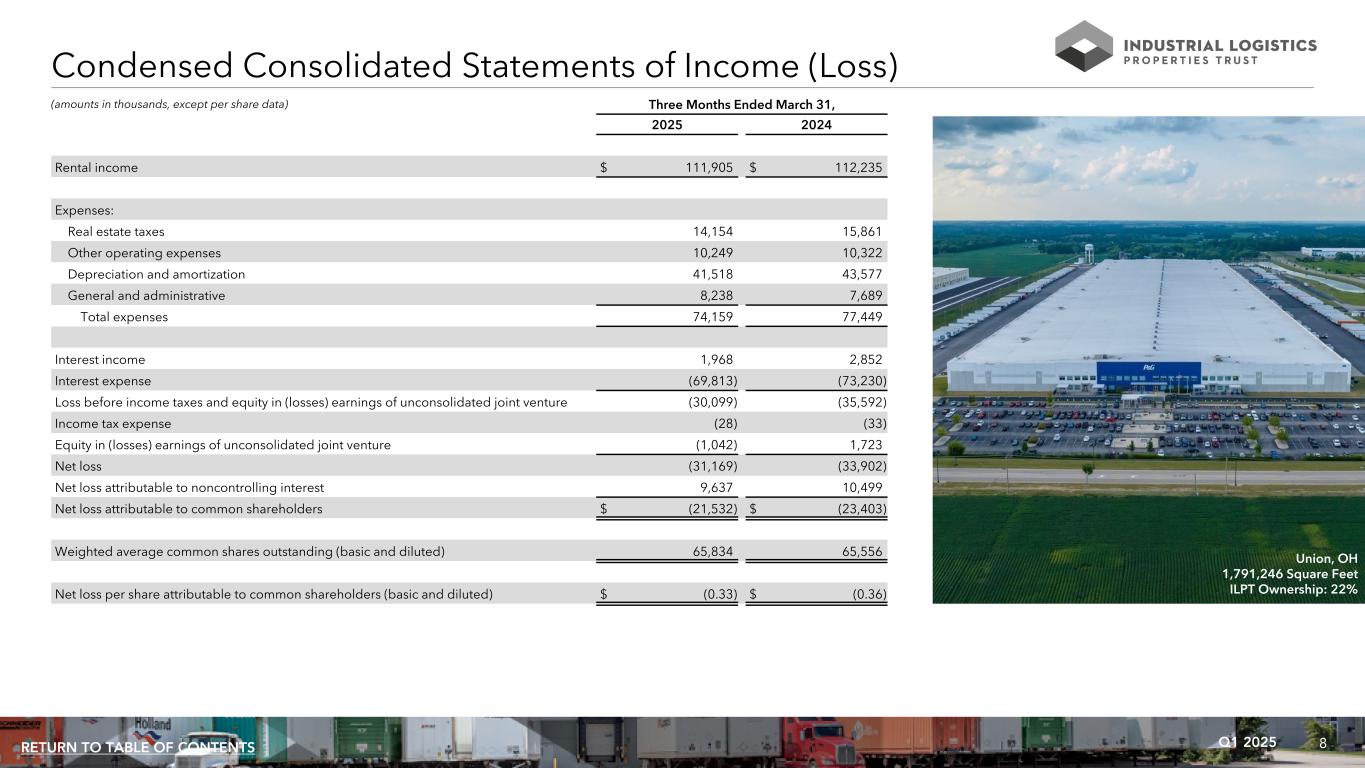

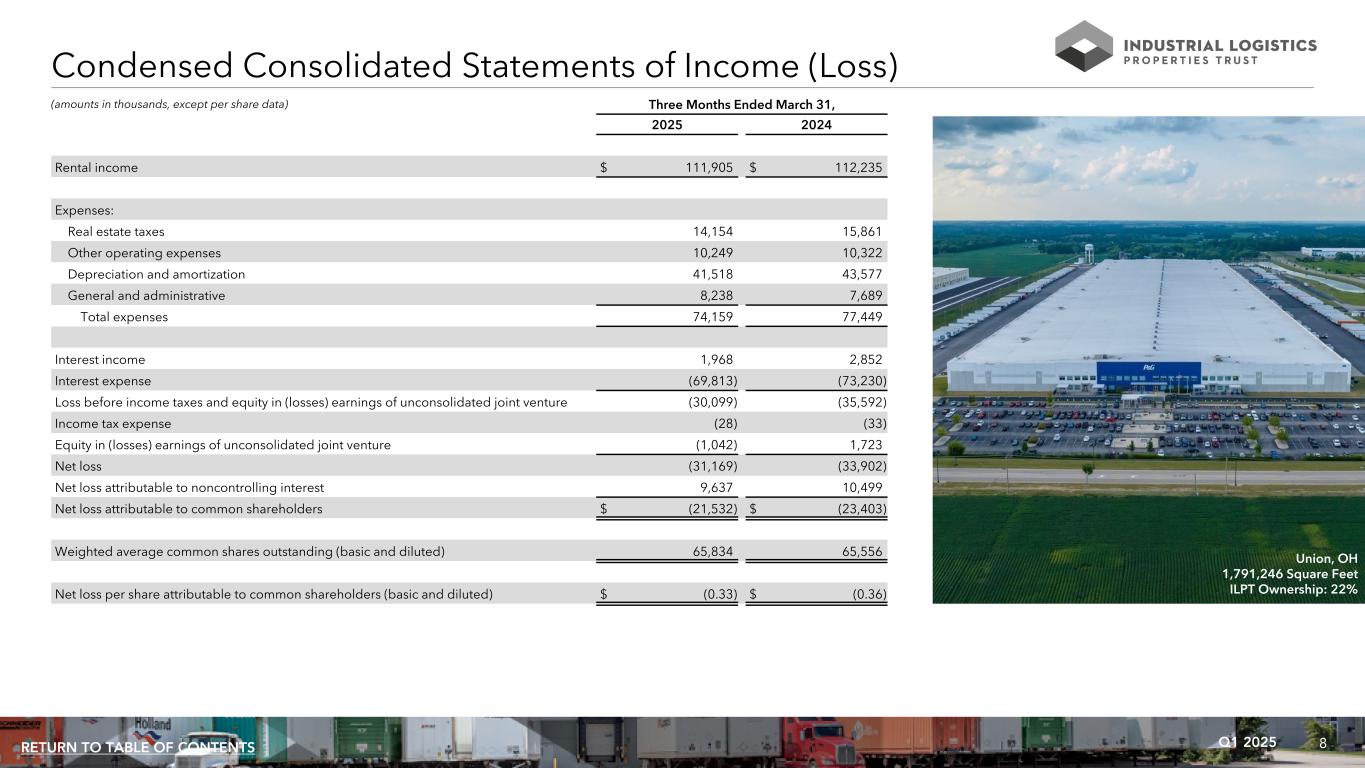

8Q1 2025RETURN TO TABLE OF CONTENTS Condensed Consolidated Statements of Income (Loss) Three Months Ended March 31, 2025 2024 Rental income $ 111,905 $ 112,235 Expenses: Real estate taxes 14,154 15,861 Other operating expenses 10,249 10,322 Depreciation and amortization 41,518 43,577 General and administrative 8,238 7,689 Total expenses 74,159 77,449 Interest income 1,968 2,852 Interest expense (69,813) (73,230) Loss before income taxes and equity in (losses) earnings of unconsolidated joint venture (30,099) (35,592) Income tax expense (28) (33) Equity in (losses) earnings of unconsolidated joint venture (1,042) 1,723 Net loss (31,169) (33,902) Net loss attributable to noncontrolling interest 9,637 10,499 Net loss attributable to common shareholders $ (21,532) $ (23,403) Weighted average common shares outstanding (basic and diluted) 65,834 65,556 Net loss per share attributable to common shareholders (basic and diluted) $ (0.33) $ (0.36) (amounts in thousands, except per share data) Union, OH 1,791,246 Square Feet ILPT Ownership: 22%