hyzonmotors.com | 1 Hyzon Motors Inc. JP Morgan Auto Conference Thursday, August 10, 2023 at 11:00 a.m. Eastern PARTICIPANTS William Chapman Peterson – JP Morgan Parker Meeks – Chief Executive Officer, Hyzon

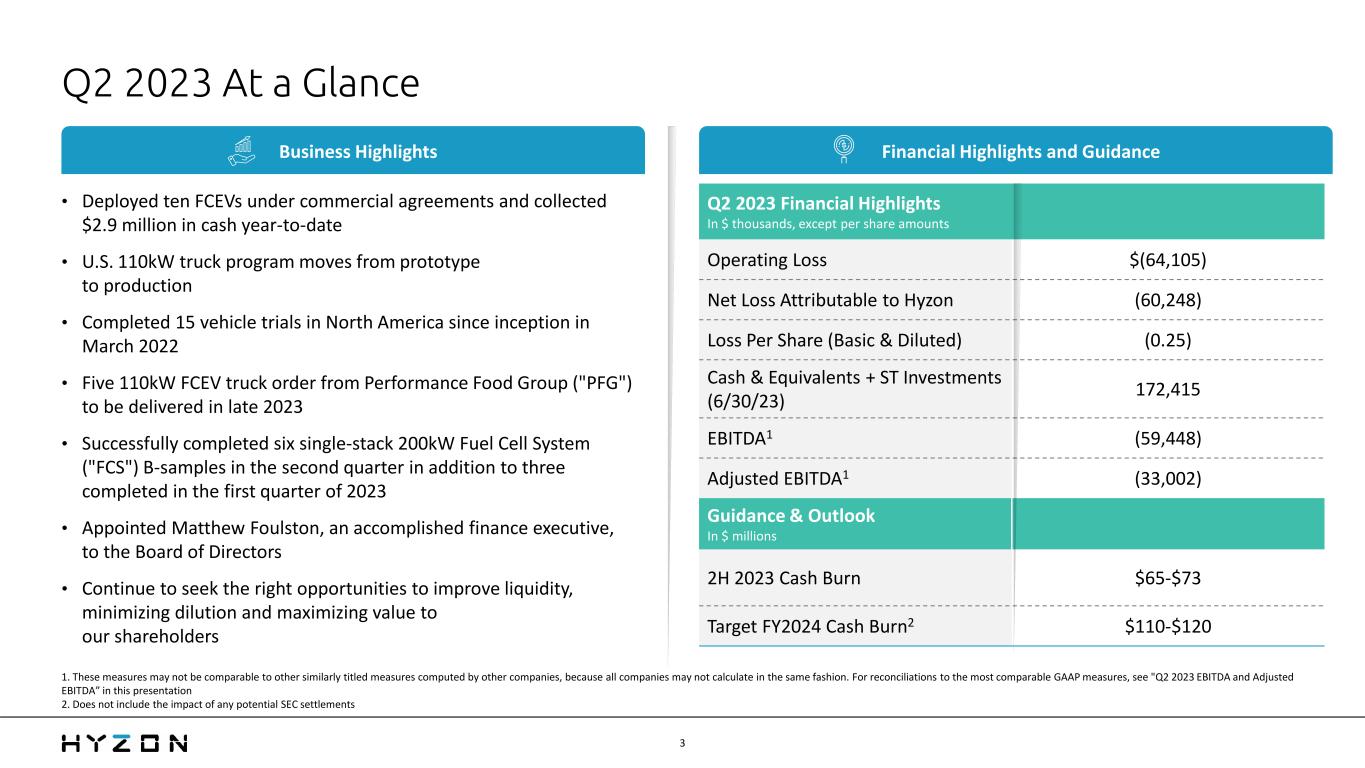

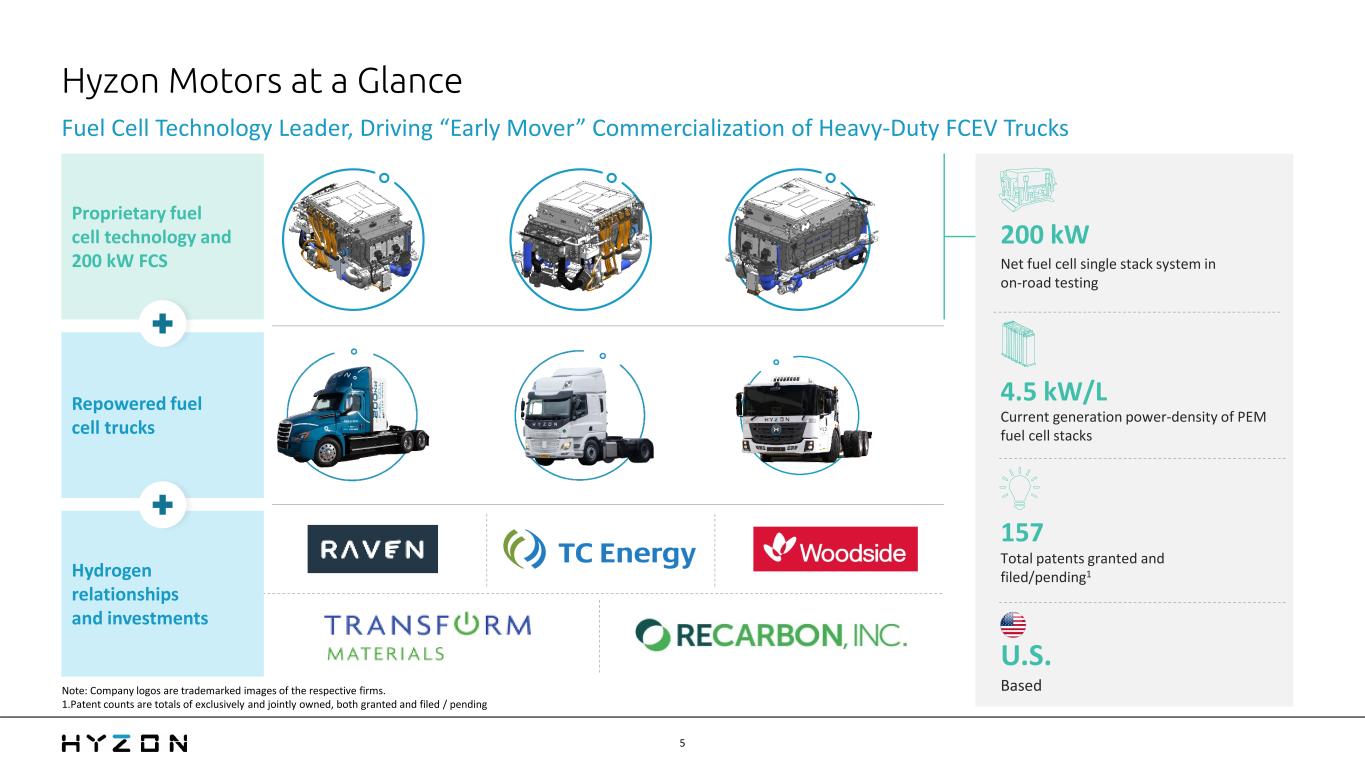

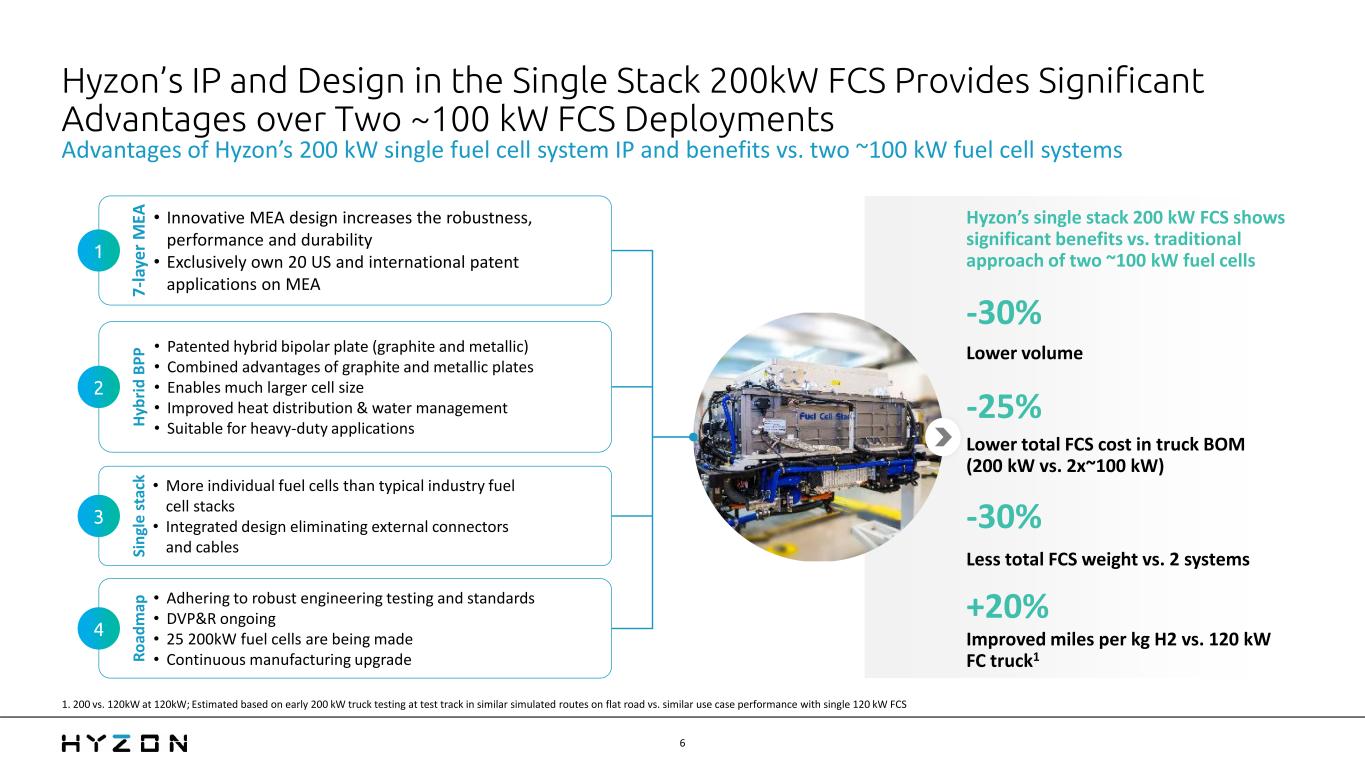

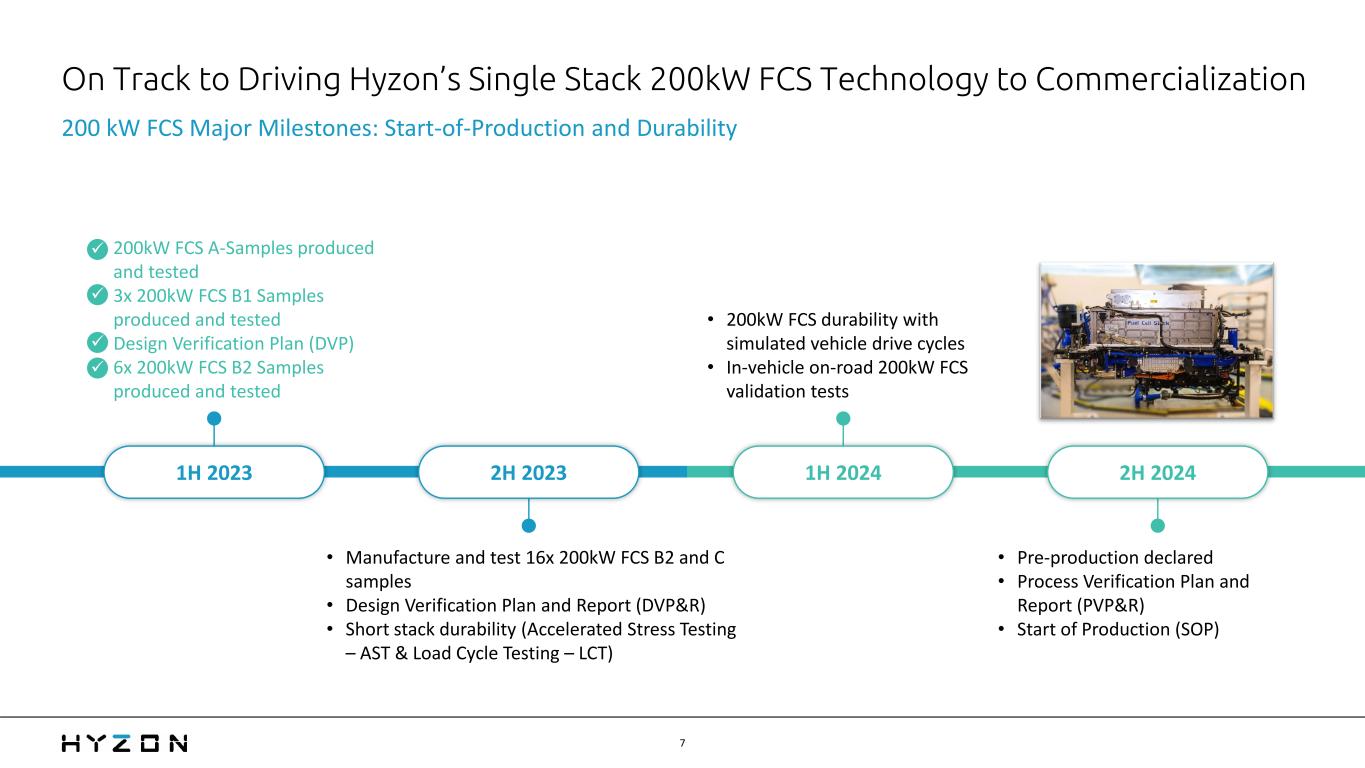

hyzonmotors.com | 2 William Chapman Peterson, JP Morgan Good...I guess it's the morning. Good morning and welcome to the second day of the J.P. Morgan Autos Conference. My name is Bill Peterson. I cover US Clean Tech here at the firm as well as Hyzon and we're really pleased to have Parker Meeks who is, I say, new CEO, but you've been there for a while. Parker Meeks, Chief Executive Officer Been about a year. William Chapman Peterson, JP Morgan About a year. So he's going to introduce the company. I guess for investors in the room who are not familiar with the Hyzon story, maybe you could spend a few minutes or several minutes if you like to kind of give us, start off with the overview of the company. You've got a couple placeholder slides here and then you can move to Q&A. Thanks for supporting the conference. Parker Meeks, Chief Executive Officer First of all, thanks, Bill, for having me. Thanks to everybody who's here to learn some more about us today. Hyzon's singular mission is to drive and accelerate the clean energy transition by putting our fuel cell technology into mobility. We're quite excited about what we believe is our leading 200kW single-stack fuel cell system and the advantages that that fuel cell system can provide, particularly in trucks, in terms of weight, volume, and cost. And, what we're focused on right now is driving forward the commercialization and start of production, or SOP, of that 200kW fuel cell system in our Bolingbrook, Chicago-area plant in the second half of 2024. So we're on track for that SOP today. As part of that journey, our goal for 2023 is to manufacture and test, successfully, 25 B-sample 200 kilowatt fuel cells in 2023. We were happy, at the end of June, to announce that we're on track for that. We have increased our prototype rate. So we assembled six B-samples, successfully tested, in Q2. That's up from three in Q1, and we're on track to increase that rate further in second half, to have 16 additional B-samples assembled, along with the durability testing that we're expected to complete. We should achieve a C-sample declaration by the end of the year, which is a pre-production fuel cell system. So why is that important? Why is it important for us to own the technology? Why is it important for us to believe that we have a leading fuel cell technology in a 200kW single-stack fuel cell system? And why does that matter?

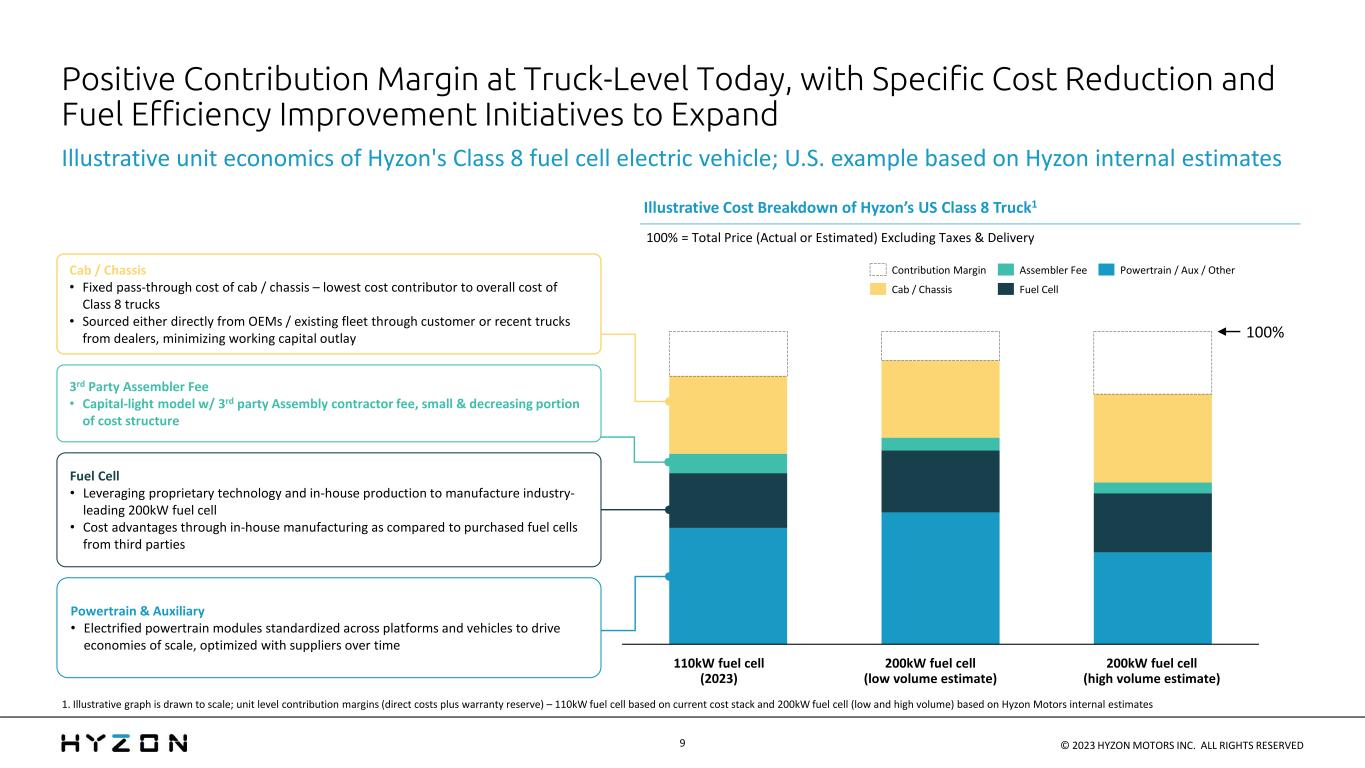

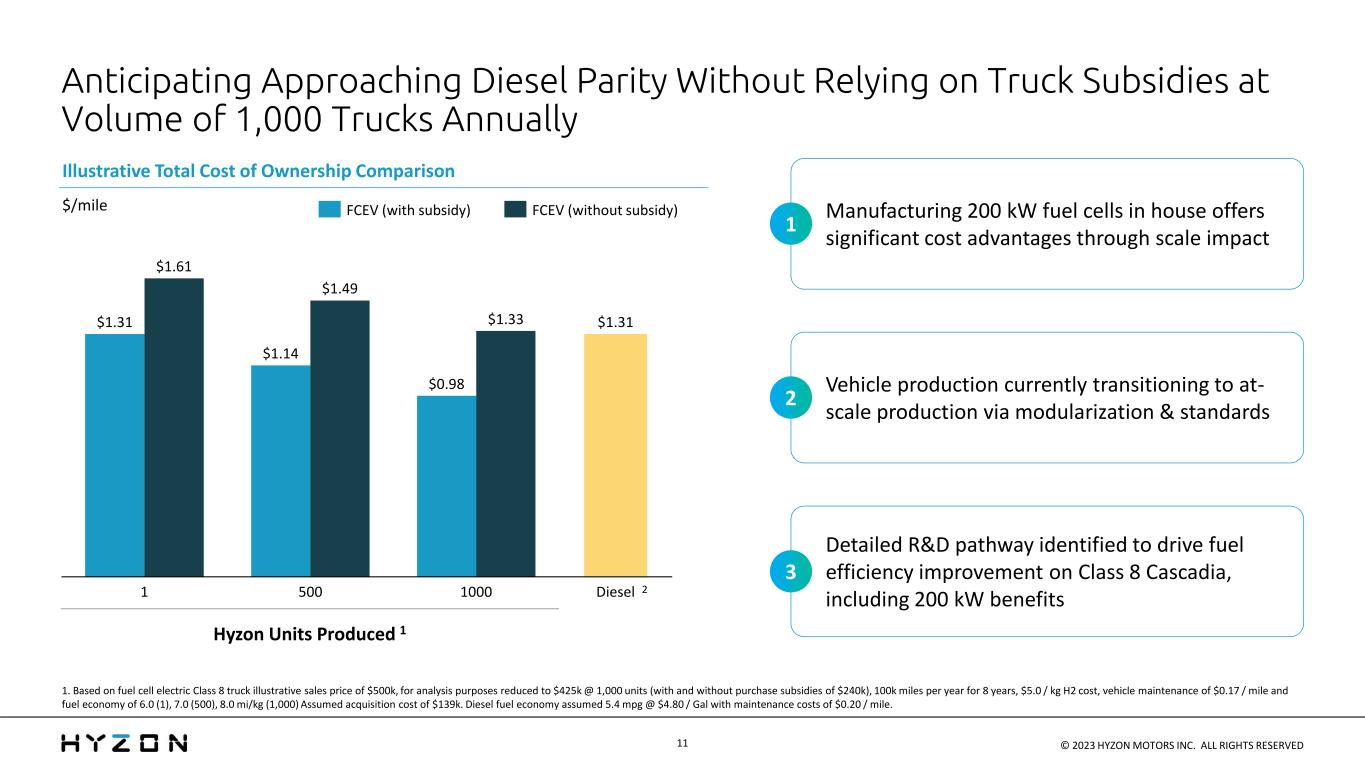

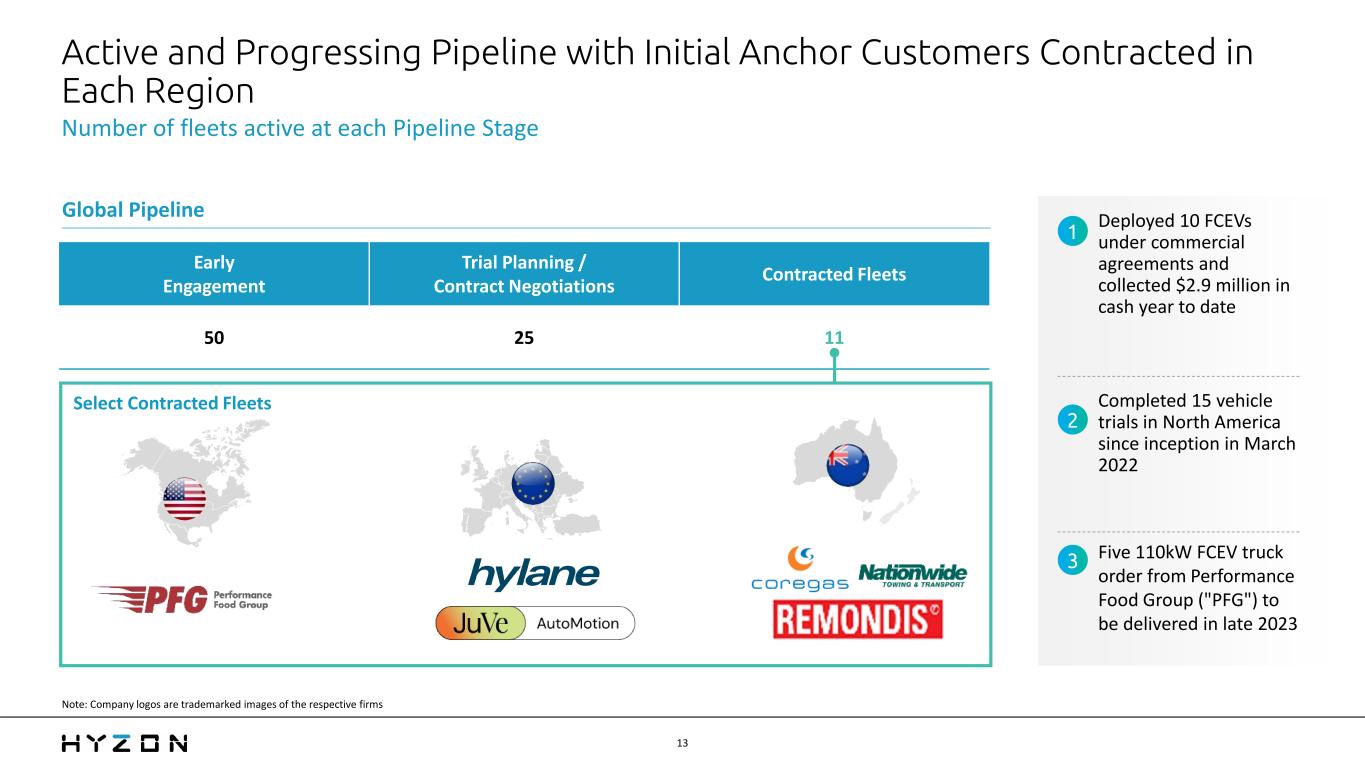

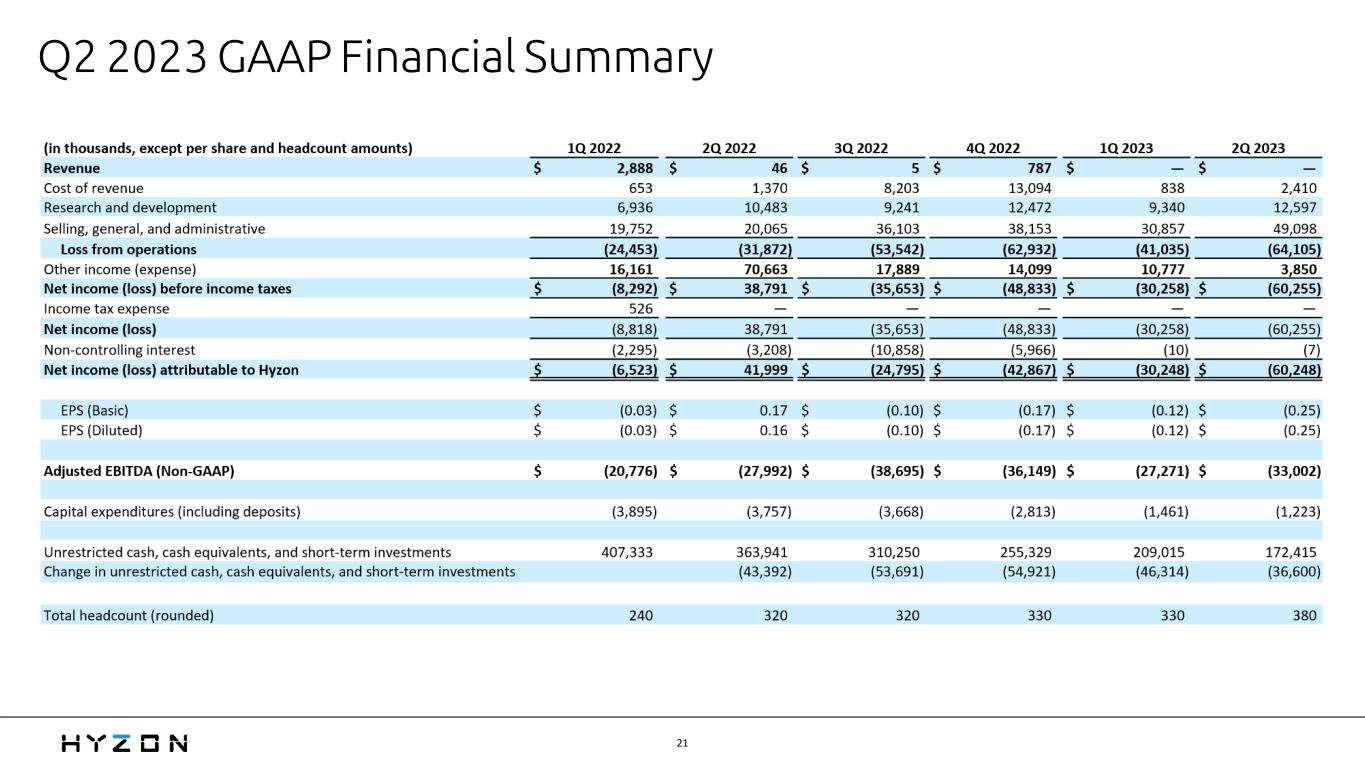

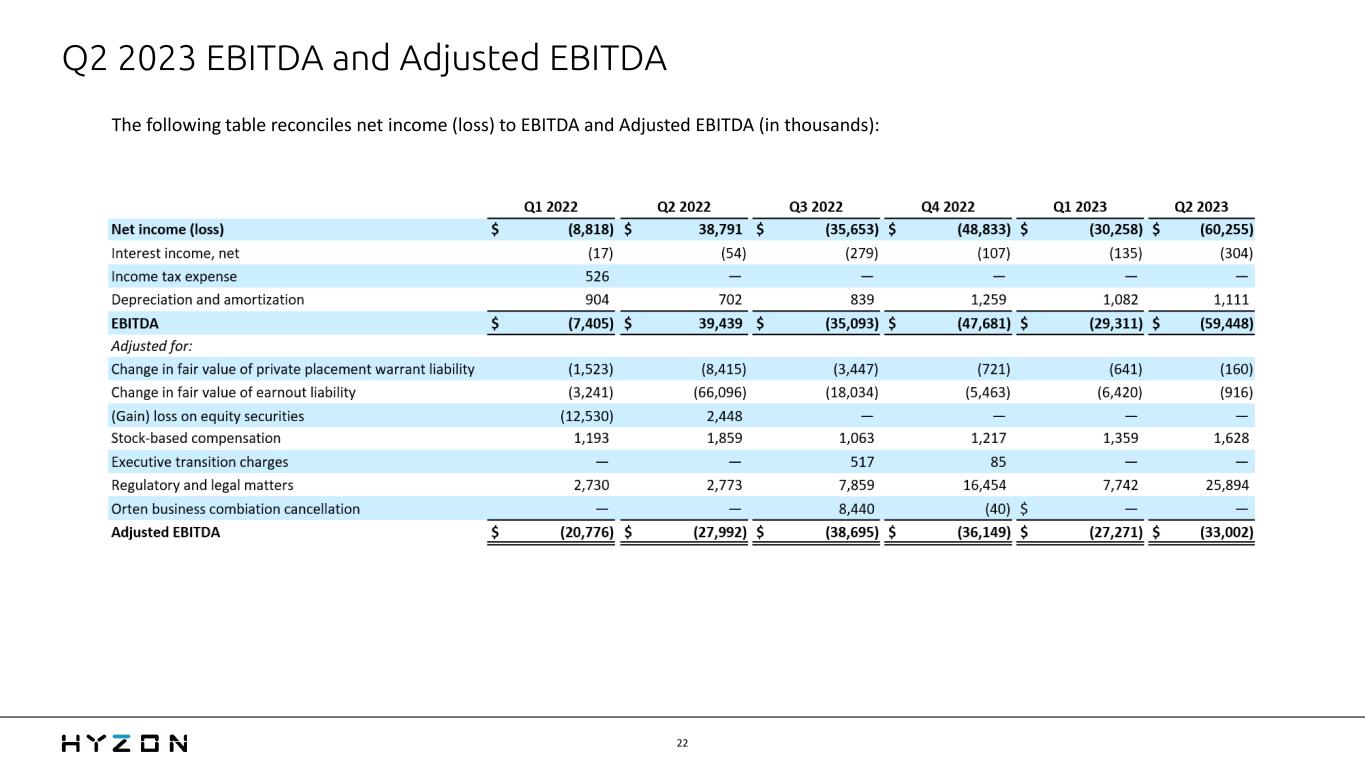

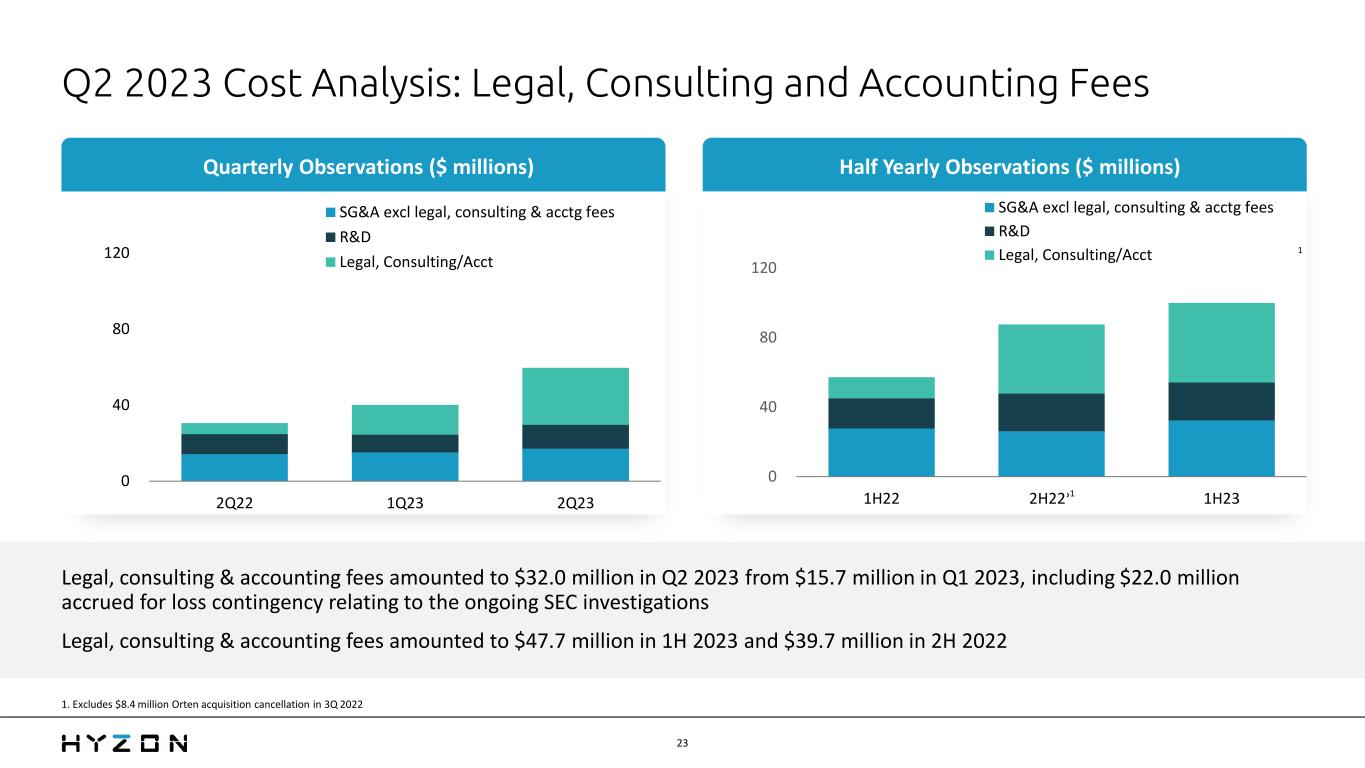

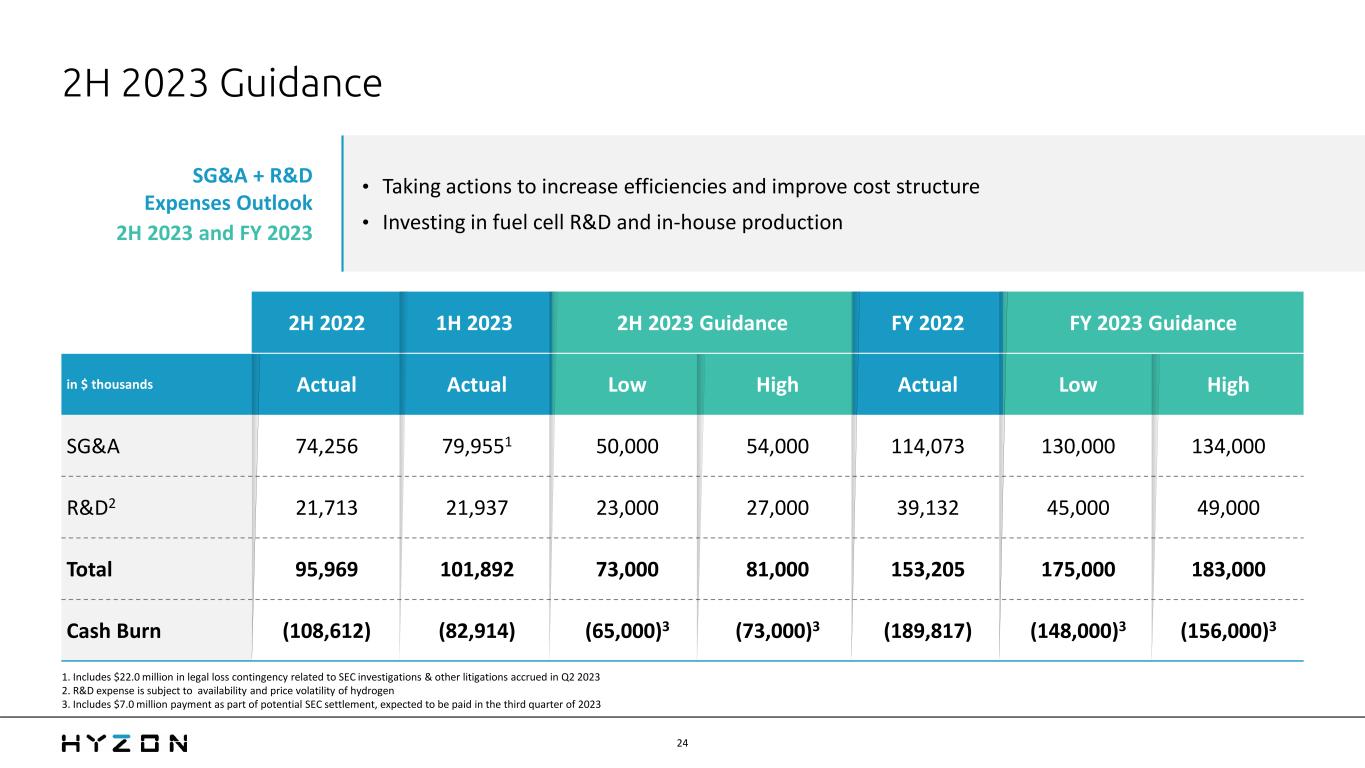

hyzonmotors.com | 3 It matters because of the economic advantages that that fuel cell system can provide in a truck. Because we are commercializing that in heavy-duty trucks to start. That's the market that's ready today. That's a market that we believe we're at TCO parity with diesel today, in our truck platform, with the inclusion of subsidies, at the truck level, and that also includes a positive contribution margin for Hyzon. That statement of saying we have a positive- contribution margin truck today, in a fuel cell truck, at a price that customers are willing to buy, is a fairly unique statement, from what we've seen. So the commercialization of the truck platforms, we also believe, is going well. We are commercializing three standard truck platforms, the conventional platform here in the US, the cabover platform in Europe, and the rigid platform, which is the base for our garbage truck, which is a tremendous use case for fuel cell trucks. Our Australia and New Zealand team has put that ISO-certified truck together. Our pipeline, we believe, is very strong. We have 11 fleets under contract globally today. We have 25 fleets that are, globally, at the trial and/or commercial negotiation stage, and in North America in particular, we've completed 15 fleet trials since March of 2022. And seven of those trials have been completed in 2023. The trial really is the critical point where there's been a lot of work done leading up to that trial, where the trial really is the pivot point, assuming it goes well, to drive into commercial negotiations. And so additionally, we are very, very focused on managing cash. We updated, in Q2, our cash burn. We're very excited about the progress in getting our cash burn down. So when you look at the trending of our cash burn from second half of 2022 to the guidance we gave for full year 2024, assuming we're able to achieve the $110 to $120 million cash burn for full year 2024, our half-year cash burn from second half of 2022, we'll have reduced by up to 50 percent. So we're comfortable with where we are with cash management and with cash burn. And in parallel, we announced in Q1 that we did proactively engage a financial advisor to launch a strategic review and a capital raise. We're quite pleased with where that stands. So a lot of progress. Hope that gives a good background on who we are. We're very excited, again, about our leading fuel cell technology, about the commercial progress we have and the pipeline we have in place to put that into trucks and the business model that we believe is a strong positive- contribution margin truck-level business model that can scale. William Chapman Peterson, JP Morgan Great. Maybe just a quick clarifier. I'm not sure which slide it was. When you use the term B-sample, what does that

hyzonmotors.com | 4 mean? What is A-sample, B-sample? What does that mean in the progression to high-volume production and commercial scale? Parker Meeks, Chief Executive Officer Glad to clarify that, Bill. So we use what is a pretty standard automotive terminology and process to essentially mature both our fuel cell technology and our truck platforms to commercialization. So think about A-sample as your initial prototypes, right? You're just assembling the first versions of, in this case, the fuel cell system. B-sample, you're into design verification planning. You're into initial durability testing. You're able to prove that the basic performance of that B-sample fuel cell system, both on a single unit and on multiple units, meets spec. C-sample, you're getting all the way to, essentially, production tools. You're assembling fuel cell systems with tooling and that is a pre-production spec. Going from a C-sample to a full SOP really gets into the level of durability testing, performance of the C-sample spec, repeatability of that across a number of systems, and that's what we're aiming to achieve in the second half of 2024. William Chapman Peterson, JP Morgan Okay. Let's take a step back. So I guess when people think about Hyzon, they may associate it with trucks, Hyzon Motors. Is this an accurate way to describe how you see Hyzon? I mean, ultimately, how should we think about the business model today and maybe perhaps several years from now? Parker Meeks, Chief Executive Officer That's a question I'd love to go really, really deep on. So Hyzon Motors is a fuel cell technology company. That is our competitive edge. The 200kW single-stack fuel cell system, again, outside of China, at least we're not aware of another company that's announced a 200kW or larger single-system fuel cell, single-stack fuel cell system, that is in trucks now. That technology is rooted in 20 years of development, right? Our MEA, our membrane electrode assembly, that is the film that goes into a single cell and the catalyst, the coating, that goes on the MEA. That's proprietary IP that drives single-cell performance. The reason why we can get to a 200 kilowatt single stack and others may not have yet is both the single-cell performance, the ability to put hundreds of those cells into a single-stack design, the bipolar plate, which is the frame for that cell, the metal and the graphite combination...

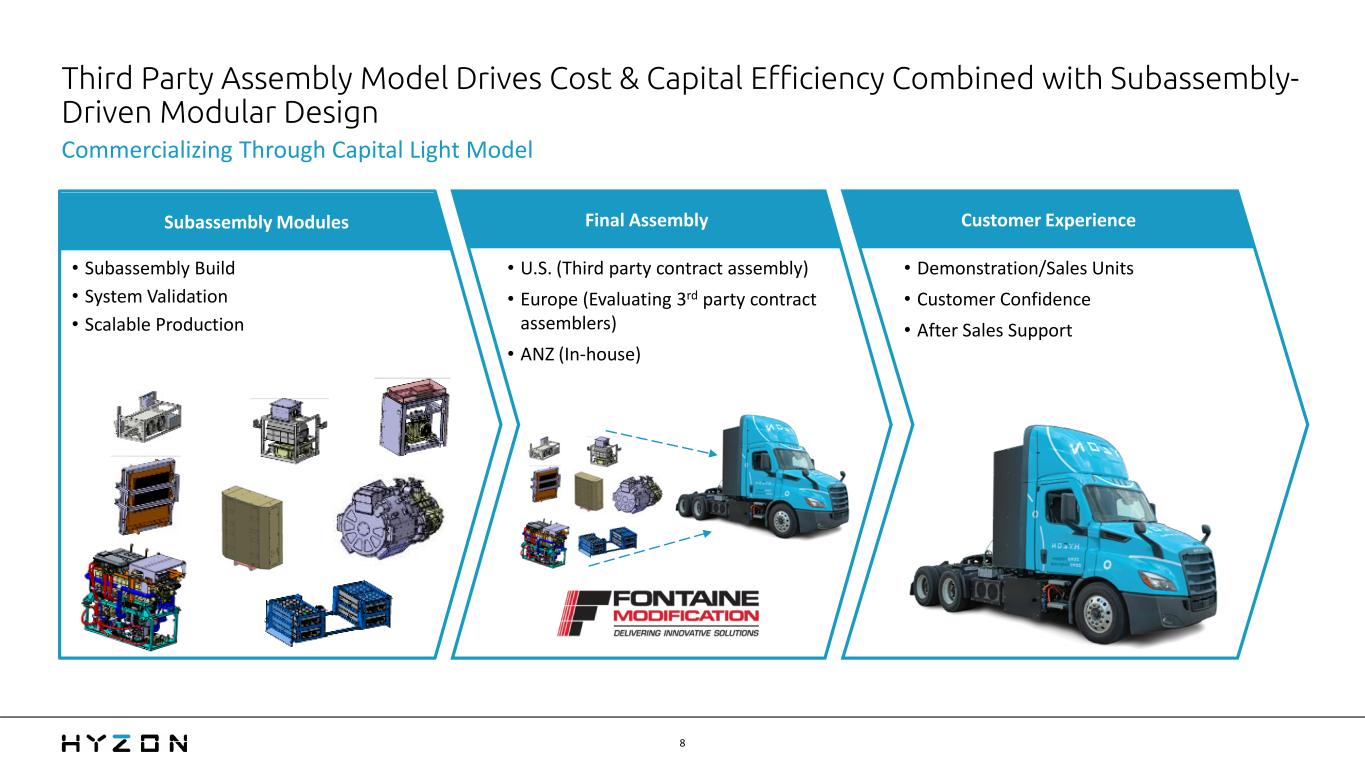

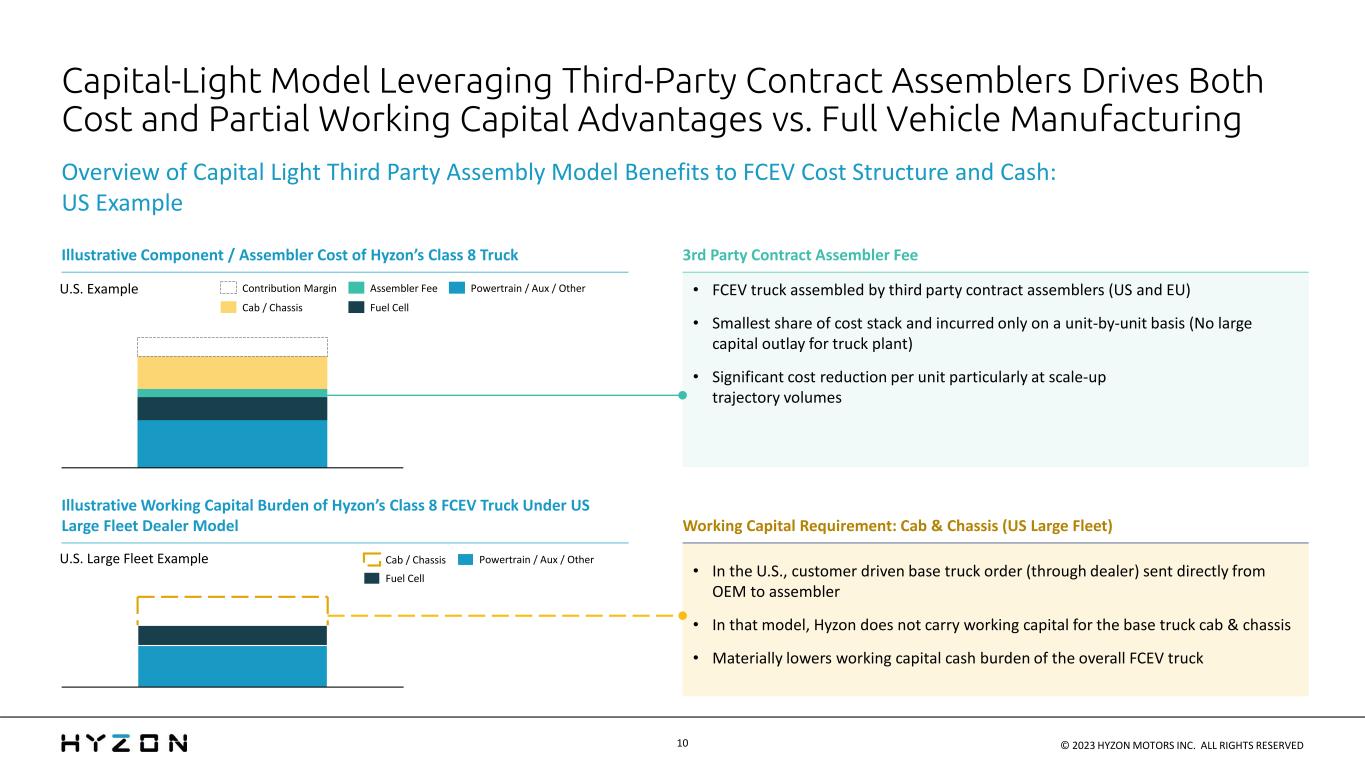

hyzonmotors.com | 5 And that entire design, the ability to get consistent power performance at a high power density level, to manage water out of the system, and for it to deliver 200 kilowatts of net power out consistently. That's the core of what Hyzon is. We are putting it into trucks today with a third-party assembly partner in the US called Fontaine. Fontaine does tens of thousands of trucks and trailer bodies a year. Charlotte, North Carolina is where those trucks will be assembled for us. We just announced, and are very proud of, the first production 110kW truck assembled with Fontaine. We're now going into production of the 110kW series now. And that third-party assembly model, we think, is the right model to scale. That foundation, we put out some slides that are in this deck as well, showing conceptually what our cost stack looks like and how we get to a positive margin on our trucks now, and that's because, when we put a truck together with Fontaine, we send the fuel cell. We also coordinate supply, the battery pack, the tanks and storage system, all the componentry, We pay Fontaine an assembly fee, that green line on the chart that's up on the screen here. That is all we pay to Fontaine. There's no big vehicle assembly plant. There's no big overhead on top of that and any burden of that at small scale. That, combined with having our own technology in-house...by the way, that technology, we estimate, comparing our one 200kW fuel cell system, our manufacturing cost for that, versus two 110kW systems, which...Most of our competitors, if not all today, are putting two 100kW to 150kW systems, complete systems, in their truck. Our cost to manufacture one 200 versus two of our 110s is 25 percent less. We're not paying someone margin on top of that. Where many competitors who are putting trucks together not only have a manufacturing cost difference to who's supplying them, but they may have one or two layers of third-party margin into what they're buying. On top of the fact that when we put a truck together with Fontaine in the US, for example, from a working capital standpoint, we actually never take control of that base truck. A brand-new diesel truck typically is already in a order book at a dealer for a large fleet. If you're a 5,000 truck fleet, you may have 1,000 trucks on order each year. That fleet basically says, "Take 5 or 10 or 15 of those trucks. Send them to Fontaine." Fontaine de-contents the diesel, puts our fuel cell and all the other componentry in and we don't have to carry that working capital. That's up to a third of the working capital stack. So the point is the technology enables an economic advantage, we think, right? It provides us with a business model where we have margin coming back to us at the truck level today for every truck that we sell. When you look at how that scales over time, we've put out information out where we believe, by the time we get to

hyzonmotors.com | 6 1,000 trucks a year, we'll go from having a truck today that's at or near TCO parity with diesel with subsidy to a truck which has expanded margin in it and is able to achieve TCO parity with diesel without truck subsidy at 1,000 trucks of production. So again, we just believe that the technology, first of all, we think it's ahead of many others. We think that it provides a business model combined with third-party assembly that allows us to scale with a strong foundation. William Chapman Peterson, JP Morgan Try to think about the IP one step further. You know, it sounds like you're alone in this 200kW currently and a lot of others are using a dual stack. What other advantages besides cost margin stacking? I'm presuming there's probably space limitations for a dual-stack. There's probably efficiency losses. What other benefits do you see, and I guess how durable is IP related to that? Parker Meeks, Chief Executive Officer First of all, I should take your last point first. The IP that's foundational for Hyzon has been developed over 20 years. There's over 150 patents that are tied to that IP, and that is Hyzon exclusive and owned for anything that moves in North America, Europe, Australia, and New Zealand. It's not just trucks. It's also, in the future, anything else that moves, such as planes, trains, mobile power, etc. And the other advantage is, I think, I talked about the cost advantage, 25 percent, 30 percent lower weight of a single 200 kilowatt versus two 110kWs, 30 percent lower volume. Think about fitting it in a truck. Two 110kWs, two120kWs, two150kWs, if you don't have the high-powered density technology that we have, where's that fuel cell going to go? Ours goes in the engine compartment. Additionally, fuel efficiency. So, it's still early to be clear. Early testing, our 200kW alpha truck is on the test track. We've accumulated first testing to put together numbers on fuel efficiency. We expect the 200kW to achieve a 20 percent fuel efficiency advantage over a 110kW truck because it's able to hit the optimum operating point for that fuel cell. You want a fuel cell to run at 60 percent utilization. At that operating point, fuel efficiency is at its max. We believe that it could be 20 percent of a gain having that single stack. We don't do two stacks, so we don't know, right? But from our understanding, the software controlling two stacks, keeping them at that same operating point, that is more of a challenge, obviously, than having a single stack ramping it and trying to hold it at 60.

hyzonmotors.com | 7 William Chapman Peterson, JP Morgan During the recent earnings call just a few days ago, you gave an update on your North American vehicle trials. So, I guess how do trials translate into sales, and how quickly can the pipeline grow? There's a slide that illustrates this but trying to get a feel for maybe including the timing of this. Parker Meeks, Chief Executive Officer So actually, if you back up to the pipeline slide. First, let me take a step back. So the trial, we focused a lot on the trial. It's because once we've reached the trial stage, with Hyzon's approach with engaging with our customers, this is a customer journey that's an executive level and a fleet-level journey, right? By the time we reach the trial, there's been months of work. This is not a, "Hey, nice to meet you. You want to do a trial?" We do months of work at the executive level, at the fleet level, at the technical level to make sure that when we do a trial, that's a trial to prove that our technology works. After that trial, we're into commercial negotiations and lining up the fuel. We're very proud of our pipeline today. Like I mentioned before, 11 fleets under contract globally today, 25 fleets globally at that critical trial planning contract commercial negotiation stage. In North America, like I said before, 15 trials completed since March of '22, seven trials completed in 2023. And so as we've worked through that process, those fleets that completed a trial, they've been through with us typically executive engagement on what's your decarbonization goal, engagement with their fleet team on what’s your route tree, simulating their routes, where should fuel cell win, where are your heaviest loads, your longest range, where fuel cell should outcompete BEV, and we focus on that. Where would you scale this? They're not going to sprinkle 100 trucks in 75 places, right? This is a facility-by-facility transformation. They're going to pick a facility, that's going to be hydrogen. Different facility, maybe battery electric. If you look at our near-term customers, these are back-to-base use cases. There's food and beverage, grocery, drayage, point-to-point freight. If I've got a 60-year-old warehouse, try putting 10 megawatts of power behind that fence. Unlikely to happen. That's probably going to be a hydrogen fuel cell-focused facility with longer-range routes. A new facility, they could potentially permit in the 10 to 20 megawatts of power that has to go into that. And so we've worked through all of that work to get to the trial stage.

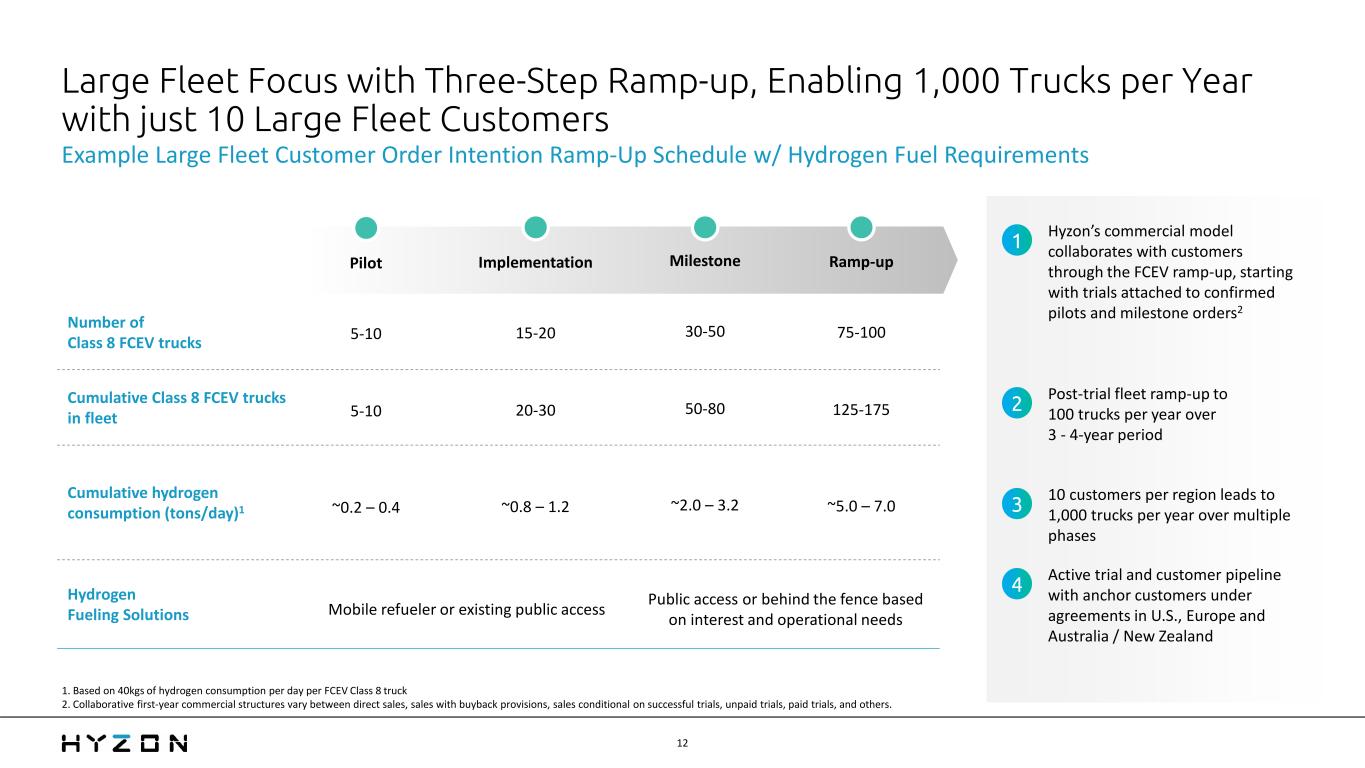

hyzonmotors.com | 8 For those customers that have completed trial, we're literally at the stage of commercial negotiations, lining fuel up, and determining is this a commitment that they can make. And what we look for is not just the first order. Let's sell them five trucks. We want to contract with, our target is 10 large fleets. We think it could get us to a thousand trucks a year. By scaling over multiple tranches, where it's going to start small, the first commitment is going to be typically 5 to 10, 15 trucks. The second tranche, maybe 15 to 20 trucks. Third tranche, 30 to 50, and the final tranche, 75 to 100. Even some orders, maybe two or three tranches. But the point is, it's a vision of where this can go. And so an example is, which we're very proud of, we announced our first major order in the US, Performance Food Group, PFG, the fifth largest private fleet in the country with a real decarbonization goal. PFG stated publicly that they aim to convert 20 percent of their fleet, which by last report figures was over 7,000 trucks to a decarbonized fuel by 2030. It's a material number of trucks, and they're a real leader that we're excited to be a partner with. That's going to be five trucks, five 110kW trucks delivered in 2023. A second tranche of fifteen 200kW trucks, which is pending a 200-kilowatt truck trial, and then an option for 30 trucks behind that. So that's the relationship that we want, doing a lot of work on the front end, doing a trial that succeeds, and then getting into a commercial order pattern and we're very excited about the potential for those trials completed to convert. William Chapman Peterson, JP Morgan Yeah. So coming back to trucks and maybe the different options as it relates to zero low and zero emission, right? You're obviously focused on hydrogen fuel cell, others are focusing on BEV, others may be focusing other, maybe natural gas or other means. Where does it fit in relative to those? And I guess to that end, there's obviously a lot of carrots and sticks. Port and drayage is one of these key applications that are trying to move faster, most likely. What's your view on fuel cell versus battery electric in that short-distance application? Parker Meeks, Chief Executive Officer First to say it, most fleets are going to have both. They’ll have fuel cell, and they'll have BEV. They may have other technologies in their fleets. So our focus is not it's only fuel cell, guys, and you're silly if you’re doing BEV. It's where fuel cell will win. We think it's very clear. Heavy loads, longer range, and where fueling time matters. So with most fleets, you've got three types of fleets. You got fleets that pack out. Meaning that they're carrying a lot of larger, lighter stuff - think shoes and chips and stuff like that. For fleets that pack out, range is really important, right? If you've got a truck that can only go 180 miles

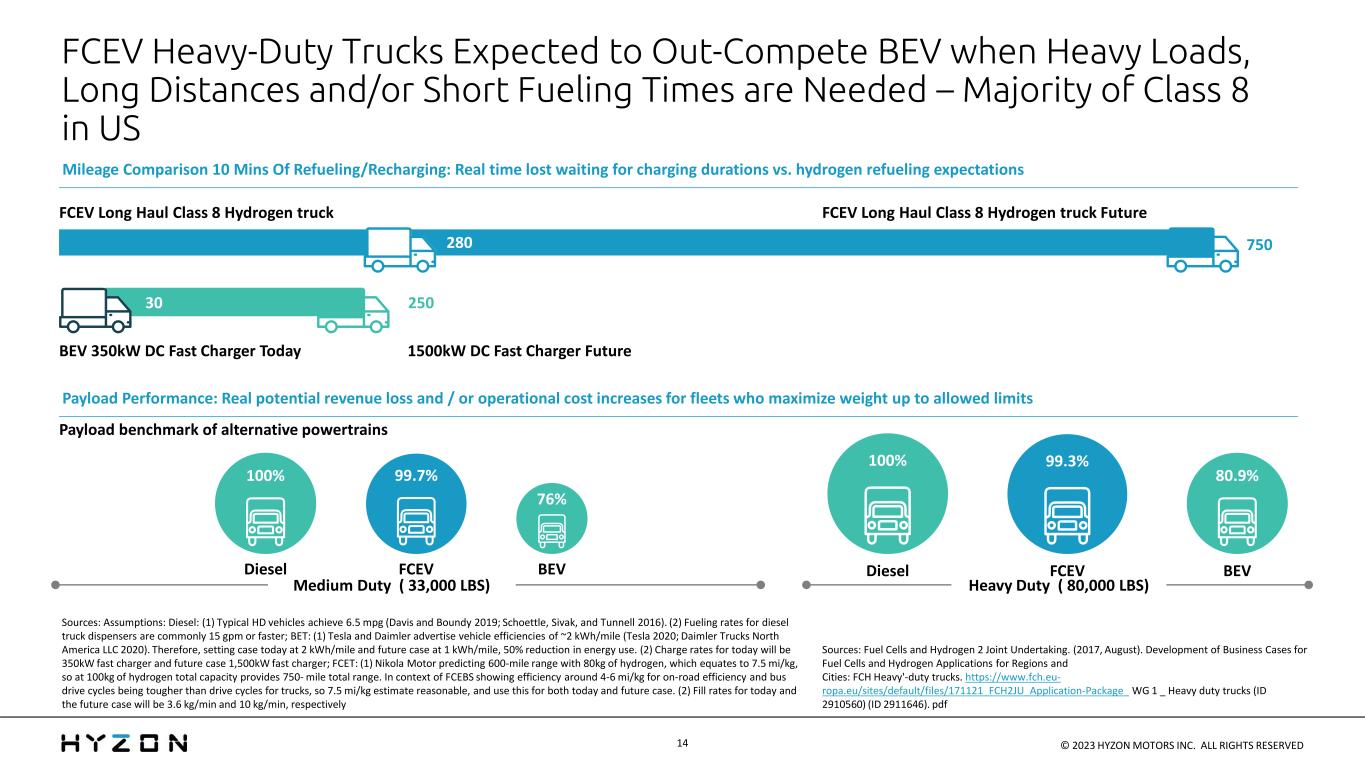

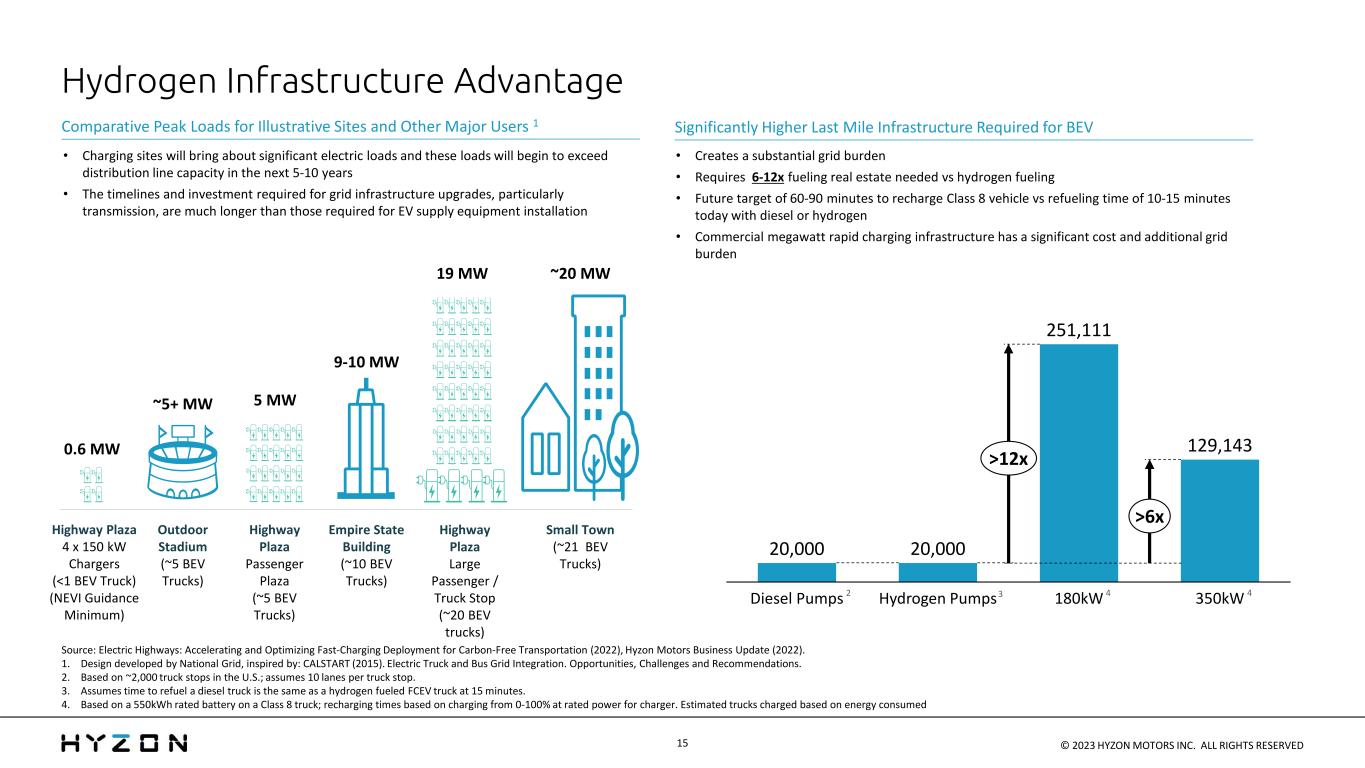

hyzonmotors.com | 9 of useful range, like a BEV truck, that's going to be a problem, right? Other fleets timeout, right? So they have lots of drops. They only have a certain amount of time, and that fueling time is really important, right? If they have to fuel in the middle of a route because range is a problem, they can't sit around for two or three hours and fuel, and our fueling time is expected to be 20 to 30 minutes. You can tell me all you want about one-megawatt chargers in the future. You're still going to have probably longer than that to charge. I'll get back to that later. And then, there are lots of fleets that actually max on weight. And our fuel cell truck, we expect to be anywhere from three to six thousand pounds lighter than a battery truck. That's real revenue in an industry - remember, trucking is a low margin business. Losing three to six thousand pounds of revenue is a big, big deal so on the shorter range routes...Things like drayage is a great example. There's lots of drayage that BEV can do. It's 60 mile loops, and you know, if they're able to potentially increase the size of their fleet and carry that extra cost, right, they can have trucks charging, assuming that the infrastructure is there. And again, I'll come back to that. But lots of drayage routes don't work. So for instance, in the Port of LA, Port of Long Beach, we've done a lot of work with drayage fleets. We actually have several HVIP vouchers for drayage fleets that we've already secured, and we do anticipate delivering into Port of LA, Port of Long Beach drayage in 2023. Some fleets, you've got trucks that need to go to San Diego. You've got trucks that need to climb out of the basin. If you're running those trucks on a hot seat, if you're doing 16 hour days, you're going to have to potentially double the size of your fleet to have BEV do the work if it can climb out with the range to get back, because if you're 180 miles of useful range on flat ground, you're climbing out of the basin fully loaded, it's going to suck that battery range down. So we truly do believe that, yes, there's an absolute use case for battery electric, but there's so much market opportunity. We estimate anywhere from 50 to 75 percent of the total Class 8 market, including long haul, is really only going to be serviced by things other than battery electric. And we think, from a true zero standpoint, fuel cell is one of the only solutions that we think will make sense. The last point I so want to make is on the screen right now, which is infrastructure. So even if you say you're going to solve the battery electric problem with megawatt chargers that don't exist today, right, when you look at a typical roadside truck stop, if you were to electrify that with these futuristic chargers to get charging time down to 30 to 45 minutes, you would take the same amount of power as a 100,000 person town. Try and put that in a random place

hyzonmotors.com | 10 near LA. Try and put that near the Port of LA, Port of Long Beach. You're going to brown out the port, potentially. I'll give another example to close the question. You can tell I've got a lot of passion for this. One of our competitors actually was talking openly about the challenges with them. They do a range of tech. They sold 300 - rough numbers, 250, 300 BEV trucks to a California fleet. They went to the local utility and said, hey, we'd like to get charger permits for these trucks. They said you can have permits for 20 trucks. " Okay, when can we get the other 200 or so?" " Six years." So it's not just a charger technology problem. It's not just a local...It's a substation problem. It's a transmission problem, so we just believe that there's so much that an off-grid solution that has the right range, has the right weight, that fuel cell trucks can give. William Chapman Peterson, JP Morgan Great. You talked about truck programs. The US truck, the European truck, the refuse truck from Australia. You also have a collaboration with Hyliion who spoke earlier. Can you give us an update on where we stand with that that project? Parker Meeks, Chief Executive Officer Absolutely. We're very excited about the partnership. Hyliion has a tremendous leading powertrain capability. They've been doing it...For those that don't know Hyliion, I'll do my best to describe. They’ve been developing CNG and CNG/electric trucks, amongst others. They’ve got a great team, a tremendous OEM quality powertrain setup. We believe our fuel cell technology, particularly our 200kW single stack, is a leading solution in the market. When we came together with Thomas and his team, it just made a lot of sense. They, and they will…I don't want to speak for them, but they've always said I think publicly that fuel cell was part of the future for them and we’re very proud to be the first fuel cell that they that they picked. So that platform…sorry that first truck is on track. I think we talked about that potentially being available for demonstration later on this year. So we're quite excited about bringing that to the market to see this collaboration

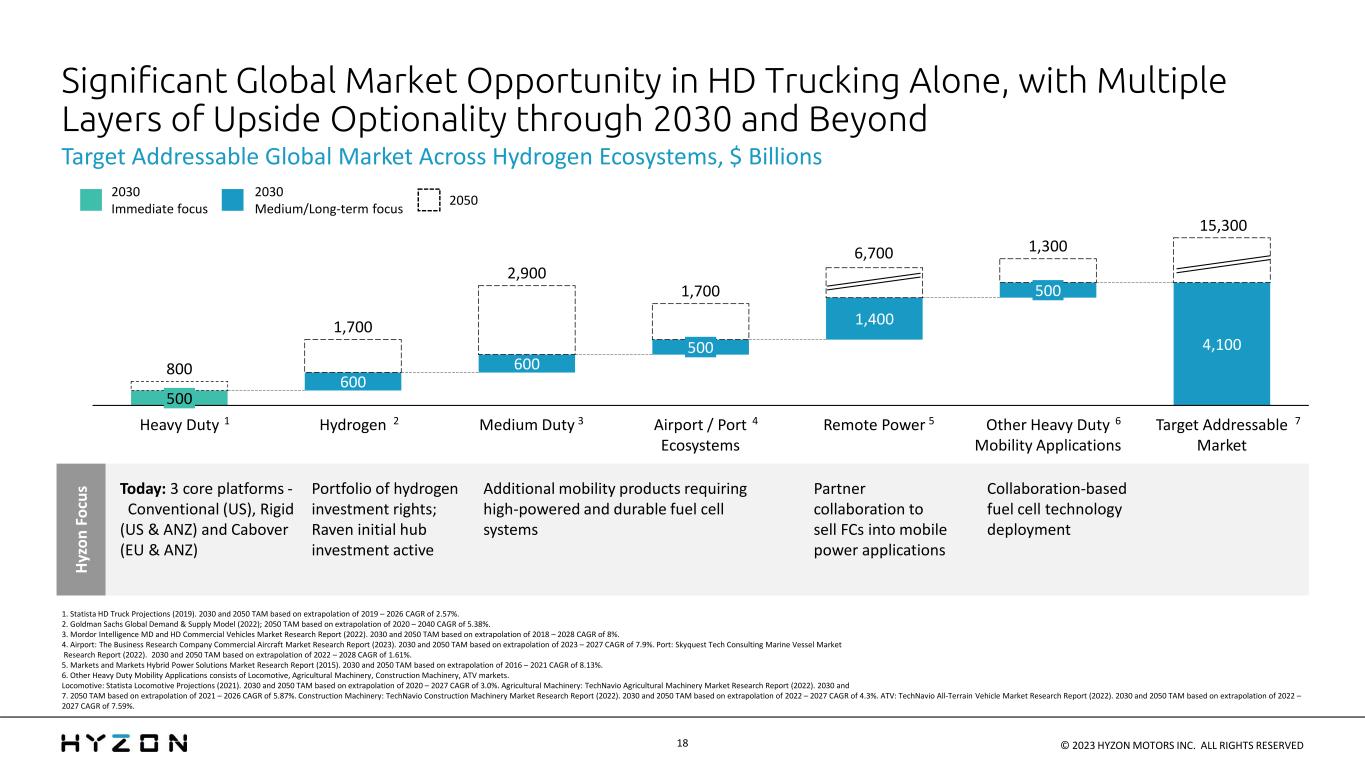

hyzonmotors.com | 11 and bringing strengths of two firms. William Chapman Peterson, JP Morgan Yeah, makes sense. So the fuel cells, I think in the past there were other applications for fuel cells. People would even talk about, possibly, aviation. Some other ones talk about rail, You have stationary... We know a lot of fuel cell companies talking about stationary or backup power. What is your view on those markets? Maybe you can help size, if that is of interest sometime down the road. What can those markets grow into? Parker Meeks, Chief Executive Officer First, I'll start from, what's the total addressable market, the TAM, that we see for fuel cells? We're clearly very focused on heavy duty trucking today. I want to be very clear about that. That's the market that has the subsidy availability now, the customer motivation, the ESG demand, and the technology is ready to go into trucking today. But, for the medium and long term, there’s tremendous TAM. We see $500 billion, roughly, globally, of TAM in heavy duty trucking today that’s available to whatever solutions go into that. The fuel cell trucking could… William Chapman Peterson, JP Morgan Trucking TAM, not fuel cell. Parker Meeks, Chief Executive Officer Sorry, heavy duty trucking, truck TAM. That's through 2030, but the total TAM across heavy duty, hydrogen itself, because we do have partnerships and the ability to invest with Raven SR and Transform Materials, Woodside, TC Energy, etc., in fuel. Medium duty trucks. Additionally, aviation, rail, mobile power, and then other off road. It's a $4 to $15 trillion 2050 potential. But the question is, what does that mean? A lot of that's off in the future. When are planes going to be on fuel cells? I don't know. We have worked with some aviation providers. We did sell some fuel cells into early aviation prototyping for planes, but when we look at our pathway, right, trucking is what we're focused on now. We already see how we would enter each one of those ecosystems. Aviation, for example. The entry point is not planes. Ground support equipment, fantastic use cases at the airport,

hyzonmotors.com | 12 between the class 6 trucks that cater, and the class 8 trucks that haul, and the refuse trucks that run around the airport, and the aircraft tugs. Next time you fly, if you're able to see it, look down. See what pushes the plane back. 200kW works great in that application. APUs, the box that powers up the plane when it's sitting there. Great 200kW fuel cell system application. So what we're looking at is each ecosystem, where can we put the same 200kW system that I'm producing soon, in second half 2024, hopefully, for trucks and put that directly into these other near-term solutions where there's an OEM partner. Same way that we're doing it with Fontaine. There's a third party that today has a great position in those markets, supplying aircraft tugs, APUs, GPUs to that market today that wants to have a fuel cell product. We just provide the fuel cell. We support the integration. We're selling the same fuel cell that we're selling into trucks. William Chapman Peterson, JP Morgan Yeah. I want to move on to sort of one of the key enablers, which is the hydrogen ecosystem, but I want to pause and see if anybody has any questions before moving forward. Any questions? Alright, so two years ago when we sort of picked up coverage of this space, there was a lot of excitement about BEVs, about fuel cells, about all these sort of all these zero emission programs. But, you've already spoken to some of the infrastructure challenges around, for example, BEVs, which is still present to this day and maybe still be present for the future. On the other hand, things like nat gas is more widely available, but it's not truly zero emission. But,hydrogen may be...I don't want to use the term Holy Grail, but I mean, it's promising as a fuel source, but its availability is not good now. So, I guess, as we think about that, you know, what is your view on, I guess where it stands today? And how will Hyzon enable the hydrogen ecosystem? And we can go a couple steps further, but maybe the first question is your partnerships and how you're going to enable your customers. Parker Meeks, Chief Executive Officer Yeah. That's great. So I've got a lot of passion for this, partly because my background actually is oil and gas and chemicals. That's a dirty secret about my past. I'm decarbonizing myself over time. But when I joined Hyzon, I joined as chief strategy officer, in part, to drive exactly this. How do we partner on the hydrogen production side? How do we partner on the dispensing side to build the ecosystem?

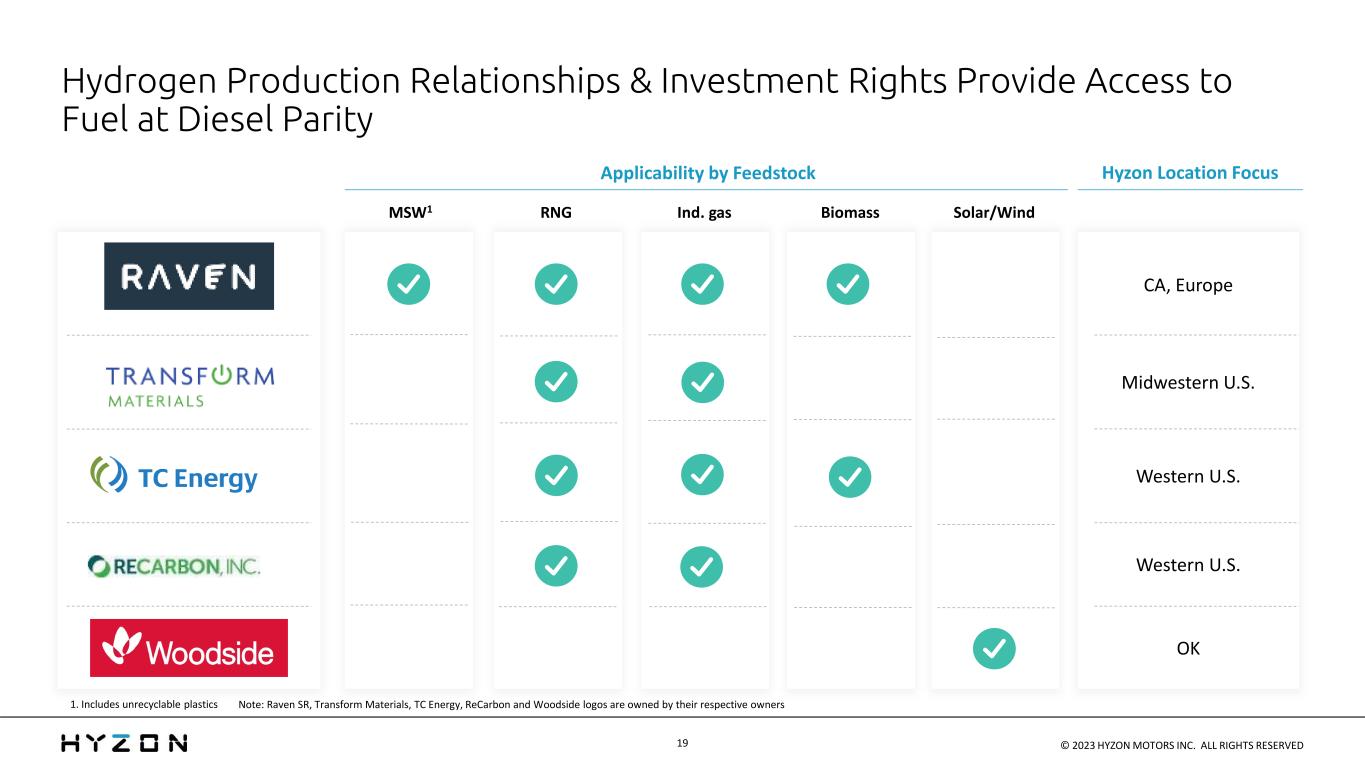

hyzonmotors.com | 13 We've spent a lot of time on production because, in our view, that's where the value is created. That's where the clean molecule is created. That's where the subsidy in most cases, many cases is applied. And so we have great partnerships that we have put in place in hydrogen production. Raven SR, Transform Materials. These are two technologies that are at the commercialization step scale. The next plant each one does is expected to be anywhere from, for Transform, a 1 to 2 ton per day and Raven, a 5 ton per day facility. Five tons a day, that kind of a scale. That's how the market's going to come to life anyway. Look at deliveries to single customers over the next two to three years. You're going to have these 5, 10, 15 truck allotments. A 5 ton a day facility can fuel 100 to 150 trucks. Our first plant with Raven is in the Bay Area of California. That's going to be 50 tons a day of solid waste, converting to 5 tons a day of fuel at what's expected to be, by CARB’s estimates, a -15 to +4 carbon score, so basically, a zero carbon fuel. And that fuel, Raven has talked about publicly, they expect that to be a cost structure full CAPEX amortized that is extremely competitive, even before the subsidies So we feel like we have strong partnerships. We have the right to invest where we choose to, up to 50 percent in the first 250 plants with Raven. Similar investment rights with Transform, similar investment potential with TC and with Woodside, where there's plants that they're doing that are focused on our trucks and we decide that's a good use of capital to get access to that very low-cost fuel. Dispensing, we haven't announced dispensing partnerships formally, but we do work closely with several significant counterparties who bring dispensing solutions, and the important thing people need to keep in mind, the large projects, the large supply needs to come. The public stations need to come over time. We're not waiting on that. We don't need that. Mobile fuelers are how this market is going to come to life. So we’ve…and that matches up very well with this multi- tranche order pattern that we look to put in place. If I'm delivering 10 trucks to a customer in the first year, you know, that can fairly easily be fueled by a mobile fueler as they're taking delivery of those trucks. And our partners, on their balance sheet, are putting the mobile fueler in place and supplying the fuel directly to the customer. We then talk about the second tranche, when that's going to confirm, and what the fueling solution is for that. For onsite dispensing, you really only need 30 to 40 trucks to make that onsite dispensing CAPEX spread economic so we can try to get that cost of fuel down towards that post-subsidy $6 a kilo that we need to drive TCO parity. So where our customers see it, they see our partnerships, they see who we can bring to the table. Not all customers

hyzonmotors.com | 14 need it. Our customers in Europe are more advanced in fuel. So Germany, for instance, great market, lots of fuel setup. Our channel partner there, Hylane, is doing a full service, right, including fuel. In Australia, New Zealand, the customers that are ahead, they're leading in Australia, New Zealand. Many of them either have fuel already or are putting fuel in place. In the US, we're very confident and our customers see it in our ability to bring the low-cost molecule in the relatively near term through our investment rights in these production projects, but really conserving our capital and having dispensing partners bring the mobile fueling solution to get them going now. William Chapman Peterson, JP Morgan Just squaring that, I mean, Raven's the most, I guess probably the most advanced. So what is the Chevron and Raven. What is the equity structure of that and what is your offtake? What is your ability to take some of that hydrogen? Parker Meeks, Chief Executive Officer Yeah, and so I think we announced that we're investing a total of $10 million in the project. That earns us a 20 percent investment right and offtake rights. 20 percent of the molecules are available to us through that at an effective equity cost basis. So when you do the math, a ton a day, that's anywhere from 20 to 30 trucks. That could be a starter allotment for up to six major fleets. So that's the way we look at is we invest the capital that we need to have the molecules we need to have the first allotment of trucks be able to offset either directly or indirectly our ability to provide fuel at that kind of a cost base. We may in the future invest more again. We have the right to invest up to 50 percent in the first 250 projects Raven does. We do think that given the price of hydrogen in the market today and the cost structure of Raven's plants, Transform's plants, etc., there's a tremendous additional value opportunity for Hyzon in the future when it makes sense for us to take more capital and put it in. Today, we're focusing our capital on the fuel cell plant and then working capital for trucks. William Chapman Peterson, JP Morgan It may actually be good to remind, right now, hydrogen is pretty expensive. You can, there's retail hydrogen in

hyzonmotors.com | 15 California you can buy for your Toyota Mirai, but when you think about a cost of ownership that’s competitive, I guess first of all, where are we today and where does it need to be as far as your math when you think about these kind of fleet cost of ownership discussions? Parker Meeks, Chief Executive Officer Yeah. Today, you pull up to one of the three, only three, heavy-duty fueling stations in the US, which are all in Southern California, you're going to pay between $25 and $29 a kilo. That doesn't work for anybody. It works today for trials. It works today for, you know, as a backup supply, basically. We need it to get down to $6 a kilo or less post-subsidy. So you've got the Inflation Reduction Act, $3 a kilo. That helps. LCFS in California today, depending on where it's falling, likely between $1 and $2 a kilo of additional benefit that you can stack. So let's call it $4 and $5 a kilo of total subsidy. So what you really need is a total cost to produce, locally distribute, and then amortize dispensing capital that the total cost stack, you know, is roughly $10, $11 a kilo that post-subsidy you can sell to a fleet at $6. Whenever we look at it, Raven's put out publicly before that their estimates previously for their first plant in Richmond, we get to an all-in amortized cost of hydrogen over a ten-year horizon of $5 a kilo at the plant gate before subsidy. So if you're at $1 to $2 a kilo to distribute that within 100 miles and then, call it, $2 to $3 a kilo for dispensing CAPEX, and you get that, call it, $4 a kilo of IRA, PTC along with the LCFS, you're there. So, it's to be proven to be clear. Raven's plant needs to come online. The PTC and the IRA has to be written. We've signed on to some letters recently advocating for what that should look like potentially. There's still work to do to confirm it. The good news is customers today that want to get experience, that have to make progress to meet a 2030 ESG goal, they're willing to pay, it's not $25 to $30 a kilo with our providers on mobile fuelers, but it's not $6 either. They're willing to pay more than diesel parity potentially for the first 5 to 15 trucks as long as they see a path by the second allotment to get to that $6. William Chapman Peterson, JP Morgan Yeah, it makes sense. Yeah, and there's obviously like Advanced Clean Fleet and other ones sticks along the way for people to get started as well.

hyzonmotors.com | 16 Parker Meeks, Chief Executive Officer That's right. William Chapman Peterson, JP Morgan I kinda want to wrap up on the financials. On the topic of capital raise, you spoke to a bit earlier, but is there a preferred means of raising capital for Hyzon at this point? Presumably you are prioritizing the most non-dilutive. What does that mean as you're looking at basically the back half of the year, perhaps into the first half of 2024? Parker Meeks, Chief Executive Officer First, you're absolutely right. Minimizing dilution, maximizing shareholder value is clearly the focus for us. But I'll start by going back to the cash capital need and timing. As I mentioned before, we're very happy with where we are in our cash burn. Our ability to get that cash burn down. So we announced in our Q1 call that we proactively engaged a financial advisor to start a capital infusion process. We did that before it became a critical need for a reason. We want to be able to look at market conditions, how the market moves, to engage with a leading set of strategic counterparties who have business models that are synergistic with ours. They play in the hydrogen ecosystem space in some way, and combining what they do or are planning to do with our fuel cell technology and or our fuel cell products, there's value there where a closer tie-up, potentially including providing capital in some form could make sense, could accelerate that to go forward. So we are progressed in that process. We are happy with how it's going, and we are also watching the market in parallel because, depending on the market condition, certain structures look more or less attractive. The timing of when it may make sense to do a certain liquidity event makes more or less sense. We really tried to get ahead of this thing by launching it when we did so we could look at the strategic counterparties that are interested, look at the value that we both see in the potential closer tie-up, look at the market condition, how that changes, and then, at the right time, put together the right investor or combination of investors, the right structure in that market condition, and the right initial one-time event or could be a multiple-phased event. William Chapman Peterson, JP Morgan Well Parker, that was a lot of good insights there. I appreciate again your time in supporting the conference, and we'll wrap it up there. Thanks.

hyzonmotors.com | 17 Parker Meeks, Chief Executive Officer Thanks so much, Bill. I appreciate it. [applause]