Q2 2025 Letter to shareholders Exhibit 99.2

Q2 2025 highlights Revenue was $500 million, an increase of 78% year-over-year Gross margin was 90.8%, an improvement of 130 basis points from the prior year GAAP profitable with Net income of $89 million and net margin of 18%, an improvement of $99 million from the prior year Adjusted EBITDA was $167 million and Adjusted EBITDA margin was 33%, an improvement of $127 million from the prior year 1 Operating cash flow was $111 million, an improvement of $83 million from the prior year Free Cash Flow was $111 million, an improvement of $84 million from the prior year2 Basic and diluted earnings per share were $0.48 and $0.45, respectively Capital expenditures were $0.5 million, 0.1% of revenue Cash, cash equivalents, and marketable securities were $2.06 billion as of June 30, 2025 Total fully diluted shares outstanding were 206.6 million as of June 30, 2025, up 0.3% from the prior quarter Financial highlights 2 Q2 2025 • Letter to Shareholders Daily Active Uniques (“DAUq”) averaged 110.4 million, an increase of 21% year-over-year Weekly Active Uniques (“WAUq”) averaged 416.4 million, an increase of 22% year-over-year Logged-in users grew 17% and Logged-out users grew 24% year-over-year U.S. DAUq grew 11% year-over-year and International DAUq grew 32% year-over-year Total U.S. revenue grew 79% year-over-year and International revenue grew 71% year-over- year, driven by broad strength across objectives, verticals, geographies, and channels Advertising revenue of $465 million grew 84% year-over-year, and Other revenue was $35 million, up 24% year-over-year Advertising revenue growth was driven by year-over-year growth in impressions and pricing Strong growth across both Brand and Performance revenue as we continue to invest in our ads stack and deliver outcomes for advertisers across all objectives Machine translation continues to drive international user growth and is available in 23 languages Over 70 million WAUq searched on Reddit in Q2 and Reddit Answers reached 6 million WAUq, up 5x from the prior quarter Business highlights

Dear fellow shareholders, It’s been another strong quarter for Reddit, with particularly strong performance on the revenue and profitability lines, and I’m proud of how the company is executing as we move into the second half of 2025. A personal highlight for me was meeting with advertisers in Cannes earlier this summer. That trip was a good barometer for how brands view Reddit today: they want to work with us, they understand our distinct role on the internet, and they recognize we deliver real value to their businesses. During a demo of Reddit Insights, our new AI- powered brand insights product, a client remarked, “This will be our Super Bowl ad next year.” Ok, on to the numbers: Revenue grew 78% year-over-year to $500 million—our fastest quarterly growth rate since 2022. Daily active users grew to 110 million, up 21% year-over-year, with growth in both the U.S. and international markets. This was driven mainly by product improvements and increased marketing activity. And this was our most profitable quarter yet. These results are a testament to our work, our users, and the power of Reddit’s communities. We’ll get to Q2 shortly, but what excites me most is what’s ahead. The world and the internet are rapidly changing, and I believe Reddit has a once-in-a-generation opportunity. For people, conversation and connection are becoming more valuable and rare. In a world increasingly dominated by algorithms and automation, the need for human voices has never been greater. We see this every day as nearly 50 million scrollers come to Reddit for their favorite communities, and 60 million seekers land on Reddit in search of better answers to their questions. In fact, ~80% of users in a recent survey¹ said they believe some questions can only be answered by humans, as opposed to AI-generated summaries. For LLMs and AI search engines, these conversations and the knowledge they create are essential for training. Platforms like Reddit, where people discuss every aspect of life—from the trivial to the transformative—are the backbone of building AI that actually works. That’s why Reddit is the #1 most cited domain for AI across all models, per data collected by Profound. In an automated world that depends on human knowledge, we view Reddit as one of the most important and differentiated data sources. We believe this validates what we’ve always thought: human conversation is not being replaced by AI; instead, it’s becoming more important. AI doesn’t invent knowledge—it learns from us. From real people, sharing real perspectives. You can’t have artificial intelligence without actual intelligence. And for brands, Reddit’s authenticity creates something rare: a direct connection with people when they’re seeking trustworthy opinions. As more of the content you see online is synthesized, summarized, and sanitized by AI, Reddit stands out for its honesty and subjectivity. For many questions, there isn’t a single objective answer; people want multiple viewpoints and lived experiences. This is why Reddit is synonymous with product and service recommendations—people turn to Reddit when they want to make informed decisions fast. 3 Q2 2025 • Letter to Shareholders ¹Source: Reddit Custom Survey, n=2,340, June 2025 (US, UK, AUS, CA).

We see tremendous potential to grow our user base and deepen engagement, and we’re moving quickly to align priorities and resources to capture that opportunity. As a first step, we clarified our product strategy and are investing in making Reddit a better experience for everyone who comes to the platform—whether they’re scrolling their favorite subreddit, seeking input on a purchase, or discovering a new community for the first time. To focus on the areas that matter most, we are deprioritizing a few initiatives, including our work on the user economy. It’s still an opportunity we believe in, but we’re concentrating our resources on the areas that will drive results for our most pressing needs: improving the core product, making Reddit a go-to search engine, and expanding internationally. Here’s what we’re working on right now: Let’s start with the core product: First impressions matter, and we want to make your first moments on Reddit sticky and worth coming back for. We’re zeroing in on a few key areas: making onboarding even more intuitive and search- forward, lowering barriers to log in and contribute, and using AI to help people find their home, whether that’s through real-time personalization or smarter community discovery. We’re also moving fast on human verification to preserve Reddit’s authenticity—something our users have repeatedly asked for, and we’re eager to deliver on. Second, search: Reddit is one of the few platforms positioned to become a true search destination. We offer something special: a breadth of conversations and knowledge you can’t find anywhere else. Every week, hundreds of millions of people come to Reddit looking for advice, and we’re turning more of that intent into active users of Reddit’s native search. We’re seeing good traction here as our core search product now has 70 million weekly users and Reddit Answers has grown to 6 million, up from 1 million last quarter. Next, we’re expanding Reddit Answers globally, integrating it more deeply into the core search experience, and making search a central feature across Reddit. We’re pairing these product updates with marketing initiatives to increase awareness and adoption of Reddit Answers worldwide. And finally, international expansion: Machine translation is now live in 23 languages, unlocking Reddit for millions of people across Asia, Europe, and Latin America. This is just the start of a growth flywheel—translation and marketing bring people in, localized content and app experience deepen relevancy, and scaled moderator recruitment creates stronger ecosystems. Our goal is for Reddit to be self-sustaining in these countries, and the early results are promising. Recently, we celebrated Reddit’s 20th year, and I’ve never been more excited about our business and potential than I am today. The internet is evolving, and our role as a community-powered platform for human connection is only becoming more critical. This next chapter is ours to write—and we’re finishing the first pages already. As I’ve said before, we control our own destiny—and we’re focused on building Reddit into the most human, trusted place on the internet. Thank you to our team, the moderators, and users for helping make Reddit what it is today. Steve Huffman Co-Founder & Chief Executive Officer 4 Q2 2025 • Letter to Shareholders

Reddit communities: real, relevant, and essential In a rapidly changing internet, real human conversation is becoming more rare, but it’s still what people seek most when making decisions or trying to understand the world. That’s where Reddit shines. With 20+ years of conversations across 100,000+ communities, Reddit is the internet’s largest archive of authentic dialogue, powering how people learn and decide and helping brands understand their audience and build better products. This same depth and breadth of human conversation also powers AI and leading large language models, making Reddit foundational to the next generation of technology. The internet’s most honest conversations… * Reddit Custom Survey, n=2,340, June 2025 (US, UK, AUS, CA). ** Profound, 2025. 5 Surface-level answers on Reddit? No chance. Redditors share firsthand experiences, creating a living, breathing knowledge base of 20+ billion posts and comments Some questions don’t have a single answer - they’re shaped through conversations that reflect nuance and lived experience ~80% of respondents in a recent survey* believe certain questions can only be answered by people, as opposed to AI-generated summaries Q2 2025 • Letter to Shareholders Reddit Answers uses authentic human conversations to deliver quick, relevant responses Reddit Insights gives advertisers real-time visibility into cultural, brand, and audience trends Search engines regularly rank Reddit posts high for quality and trust Large Language Models (LLMs) cite Reddit data as an essential source in AI-powered summaries and responses Reddit conversations and Reddit Community Intelligence™ unlock the collective wisdom of communities to power Reddit’s own features and those on other platforms: ...Fueling the tools people use every day When people search for answers online, they’re often finding the voices and insights of Reddit communities along the way. WIKIPEDIA.ORG YOUTUBE.COM FORBES.COM GARTNER.COM NERDWALLET.COM LINKEDIN.COM G2.COM TECHRADAR.COM PCMAG.COM % OF TOTAL CITATIONS #1 MOST CITED DOMAIN ON THE INTERNET FOR AI ACROSS ALL MODELS**

User & product highlights US DAUq INT’L DAUq 6M Reddit Answers WAUq 10X+ Growth in Reddit Answers average query volume from Q1 110.4M 21% We’re investing in our international playbook to grow global awareness and allow people to enjoy and contribute to Reddit across languages and regions Our focus is on fueling the community flywheel in key markets through investments in machine translation, marketing, and strengthening moderator and community relationships to drive local content creation Machine translation and localization now support 23 languages, reaching users across Asia Pacific, Europe, and Latin America Our focus markets, including France, Spain, and Brazil, drove over half of our international DAUq growth in Q2 Related Answers on the conversation page are driving more adoption and engagement, and we are testing core search integration to streamline the search experience Reddit Answers is available to all U.S. users and some international markets, including the U.K., Canada, Australia, and India, with others on the roadmap this year Reddit is becoming a go-to source for trusted, human insights and perspectives In Q2, over 70 million WAUq searched on Reddit and Reddit Answers reached 6 million WAUq We’re expanding Reddit Answers globally, adding support for new languages and deeper platform integration Internationalization & machine translation We believe Reddit has near universal appeal, and we’re focused on making it a home for all users, whether they’re coming for community or searching for answers Our priorities are centered on the core product, search, and internationalization - improving and personalizing the experience to deliver more value for all users In Q2, our user base grew to over 110 million DAUq and over 416 million WAUq (IN MILLIONS) Search & Reddit Answers 50.3 Q1 '25Q2 '24 Q3 '24 Q4 '24 Q2 '25 45.5 48.2 48.0 50.1 60.145.7 49.0 53.7 58.0 110.4 91.2 97.2 101.7 108.1 Q2 ‘25 DAUq year-over-year 6 Q2 2025 • Letter to Shareholders Searchers see Related Answers on the conversation page when they visit Reddit communities in their search journey

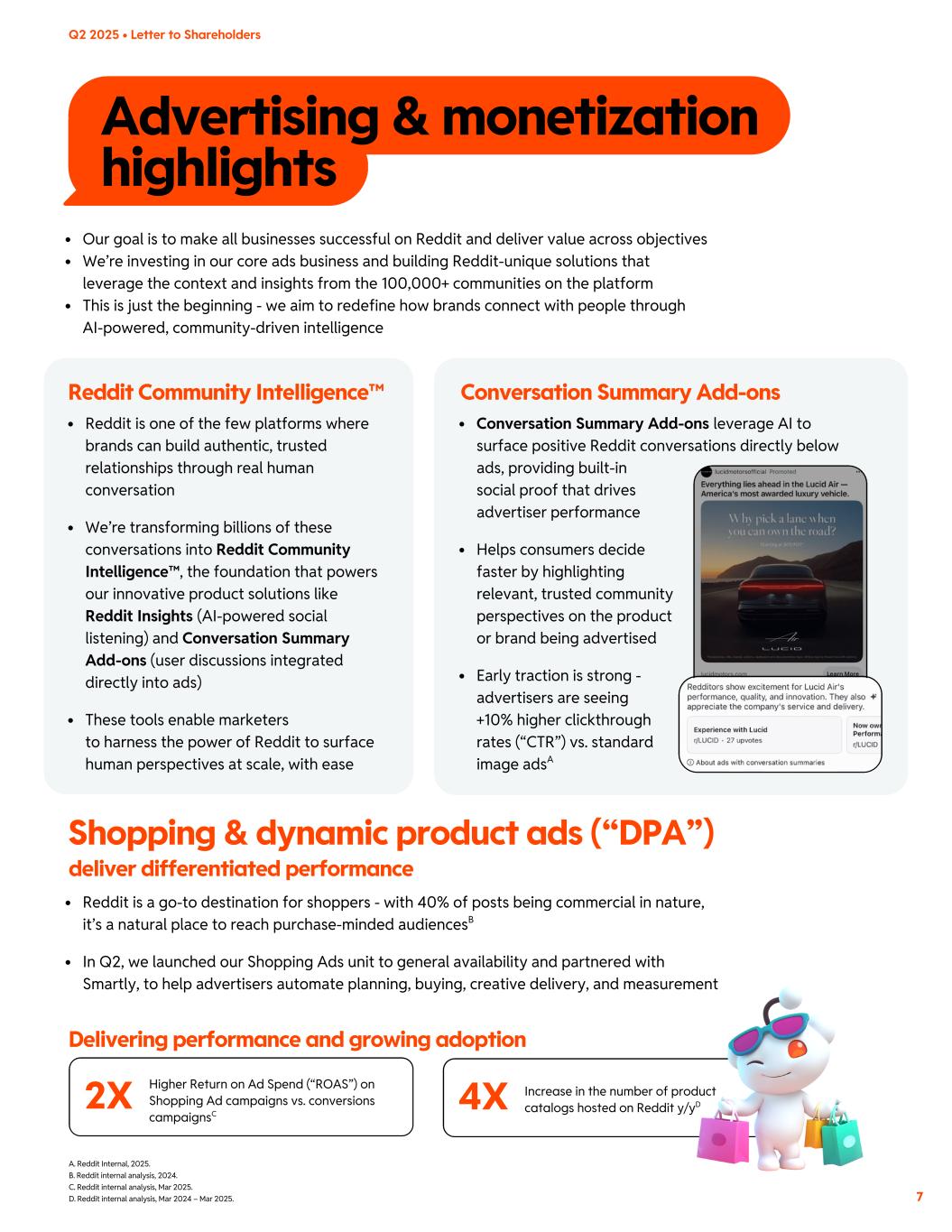

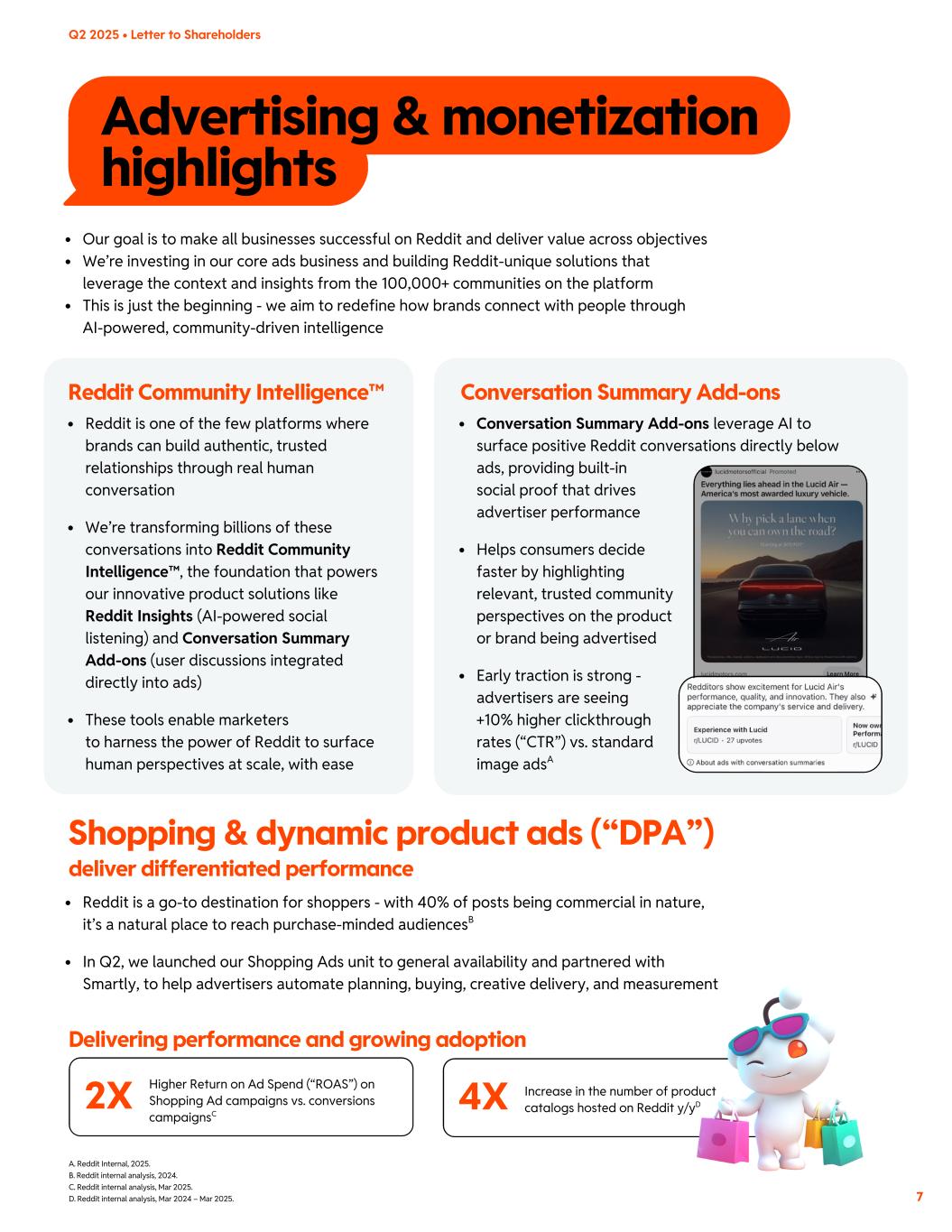

Advertising & monetization highlights Conversation Summary Add-ons leverage AI to surface positive Reddit conversations directly below ads, providing built-in social proof that drives advertiser performance Helps consumers decide faster by highlighting relevant, trusted community perspectives on the product or brand being advertised Early traction is strong - advertisers are seeing +10% higher clickthrough rates (“CTR”) vs. standard image adsA Reddit is one of the few platforms where brands can build authentic, trusted relationships through real human conversation We’re transforming billions of these conversations into Reddit Community Intelligence™, the foundation that powers our innovative product solutions like Reddit Insights (AI-powered social listening) and Conversation Summary Add-ons (user discussions integrated directly into ads) These tools enable marketers to harness the power of Reddit to surface human perspectives at scale, with ease A. Reddit Internal, 2025. B. Reddit internal analysis, 2024. C. Reddit internal analysis, Mar 2025. D. Reddit internal analysis, Mar 2024 – Mar 2025. 7 Our goal is to make all businesses successful on Reddit and deliver value across objectives We’re investing in our core ads business and building Reddit-unique solutions that leverage the context and insights from the 100,000+ communities on the platform This is just the beginning - we aim to redefine how brands connect with people through AI-powered, community-driven intelligence Reddit Community Intelligence™ Conversation Summary Add-ons Q2 2025 • Letter to Shareholders Reddit is a go-to destination for shoppers - with 40% of posts being commercial in nature, it’s a natural place to reach purchase-minded audiencesB In Q2, we launched our Shopping Ads unit to general availability and partnered with Smartly, to help advertisers automate planning, buying, creative delivery, and measurement 2X Higher Return on Ad Spend (“ROAS”) on Shopping Ad campaigns vs. conversions campaignsC 4X Increase in the number of product catalogs hosted on Reddit y/yD Shopping & dynamic product ads (“DPA”) deliver differentiated performance Delivering performance and growing adoption

Financial highlights Accelerated revenue growth Profitability on a GAAP basis Positive Adjusted EBITDA¹ 78% 47% SBC & RELATED TAXES NON-GAAP OPERATING EXPENSES³ D&A US REVENUE INT’L REVENUE $499.6M Q2 ‘25 REVENUE $4.53 Q2 ‘25 AVERAGE REVENUE PER UNIQUE (ARPU) Second quarter 2025 Industry-leading gross margins Sixth consecutive quarter of positive operating cash flow Disciplined share count dilution (IN MILLIONS) $427.7 $347.7 $80.0 $392.4 $313.9 $78.5 $499.6 $408.8 $90.8 $281.2 $228.1 $53.1 $348.4 $287.9 $60.4 Q3 '24 Q4 '24 Q1 '25 Q2 '25Q2 '24 Total revenue was $499.6 million, an increase of 78% year- over-year US ARPU INT’L ARPU $4.21 $3.63 $4.53 $3.08 $3.58 Q3 '24 Q4 '24 Q1 '25 Q2 '25Q2 '24 $7.04 $7.87$5.88$4.94 $6.27 $1.67 $1.73 $1.24 $1.32 $1.34 ARPU was $4.53, an increase of 47% year-over-year 90.8% Q2 ‘25 GROSS MARGIN 89.5% 90.1% 92.6% 90.5% 90.8% (AS A % OF TOTAL REVENUE) COST OF REVENUE (IN MILLIONS) Q3 '24 $34.6 Q4 '24 $31.8 Q1 '25 $37.1 Q2 '25 $45.9 Q2 '24 $29.5 Gross profit was $453.7 million, or a gross margin of 90.8%, an expansion of 130 bps from a gross margin of 89.5% in the prior year Total GAAP operating expenses were $386.0 million and total non-GAAP operating expenses were $287.2 million3 Q2 ‘25 OPERATING EXPENSES (IN MILLIONS) Q3 '24 Q4 '24 Q1 '25 Q2 '25Q2 '24 $66.7 $282.7 $4.0 $3.8 $3.9 $4.0$4.2 $212.2 $219.6 $83.3 $306.9 $241.8 $240.2 $287.2 $94.9 $107.2 $386.0 $351.4$343.0 $97.1 $386.0M 8 year-over-year year-over-year Q2 2025 • Letter to Shareholders

33% MARGIN18% MARGIN $166.7M 2.1x $89.3M 58.3% Q2 ‘25 NET INCOME (LOSS) Q3 '24 Q4 '24 Q1 '25 Q2 '25Q2 '24 (IN MILLIONS) Net income was $89.3 million, or a net margin of 18% $71.0 $89.3 $(10.1) $29.9 $26.2 NON-GAAP TOTAL COSTS³ Y/Y GROWTH REVENUE Y/Y GROWTH Total revenue grew over 2 times as fast as total adjusted costs and expenses³ year-over-year 53.6% 10.7% 67.9% 18.6% 71.3% 20.6% 61.5% 19.0% 77.7% 37.7% Q2 ‘25 REVENUE Y/Y GROWTH VS. NON-GAAP TOTAL COSTS AND EXPENSES³ Y/Y GROWTH Q3 '24 Q4 '24 Q1 '25 Q2 '25Q2 '24 Q2 ‘25 ADJUSTED EBITDA¹ Q3 '24 Q4 '24 Q1 '25 Q2 '25Q2 '24 (IN MILLIONS) Adjusted EBITDA¹ was $166.7 million, or a margin of 33%, an increase of $127.2 million from the prior year $39.5 $166.7 $94.1 $154.3 $115.3 Over 50% year-over-year incremental Adjusted EBITDA margin¹ for the eighth consecutive quarter 76.3% 14.0% 71.7% 27.0% (3.6%) 8.6% 36.1% 16.6% 70.4% 29.4% 6.7% 73.7% 58.3% 33.4% 17.9% Q2 ‘25 NON-GAAP INCREMENTAL ADJ. EBITDA Y/Y MARGIN¹ NON-GAAP INCR. ADJ. EBITDA Y/Y MARGIN¹ NET INCOME MARGIN Q2 '25 ADJ. EBITDA MARGIN Q1 '25Q4 '24Q3 '24Q2 '24 9 Q2 2025 • Letter to Shareholders

$111.3M Q3 ‘25 REVENUE $535M-$545M Q3 ‘25 ADJUSTED EBITDA $185M-$195M BASIC SHARES OUTSTANDING SHARES UNDERLYING STOCK-BASED AWARDS Q/Q DILUTION % $70.3 $89.2 0.4% 0.4% 0.2% 0.2% 0.1% $126.6 $110.8 71.6 $27.2 $28.4 $90.0 $127.6 $111.3 Q3 '24 Q4 '24 Q1 '25 Q2 '25Q2 '24 Operating cash flow was $111.3 million, an increase of $82.9 million year-over-year Free Cash Flow² was $110.8 million, an increase of $83.6 million year-over-year Capital expenditures were $0.5 million, or about 0.1% of revenue Q2 ‘25 OPERATING CASH FLOW OPERATING CASH FLOW FREE CASH FLOW² (IN MILLIONS)CAPEX AS % OF REVENUE 0.7% 206.6M Q2 ‘25 FULLY DILUTED SHARES OUTSTANDING 206.2 206.0 206.6205.0 206.4 Q3 '24 Q4 '24 Q1 '25 Q2 '25Q2 '24 180.3 187.1165.6 174.2 184.3 25.9 19.539.4 32.3 21.7 (0.1%) (0.1%) (0.1%) 0.3% (IN MILLIONS) Q2 fully diluted shares outstanding were 206.6 million, up 0.3% sequentially The guidance provided below is based on Reddit’s current estimates and is not a guarantee of future performance. This guidance is subject to significant risks and uncertainties that could cause actual results to differ materially, including the risk factors discussed in Reddit’s reports on file with the Securities and Exchange Commission (the “SEC”). Reddit undertakes no duty to update any forward-looking statements or estimates, except as required by applicable law. As we look ahead, we will share our internal thoughts on revenue and Adjusted EBITDA for the third quarter. In the third quarter of 2025, we estimate: Revenue in the range of $535 million to $545 million Adjusted EBITDA⁴ in the range of $185 million to $195 million Financial outlook 10 Q2 2025 • Letter to Shareholders

Reddit will host a conference call to discuss the results for the second quarter of 2025 on July 31, 2025, at 2:00 p.m. PT / 5:00 p.m. ET. A live webcast of the call can be accessed on Reddit’s Investor Relations website at https://investor.redditinc.com and investor relations subreddit r/RDDT. A replay of the webcast and transcript will be available on the same websites following the conclusion of the conference call. Reddit will solicit questions from the community at r/RDDT on July 31, 2025, and post responses following the earnings call at Reddit’s Investor Relations website at https://investor.redditinc.com and investor relations subreddit r/RDDT. Steve Huffman Co-Founder & Chief Executive Officer Drew Vollero Chief Financial Officer Earnings conference call & community update 11 Q2 2025 • Letter to Shareholders

Appendix Notes 1.The definition of Adjusted EBITDA, Adjusted EBITDA margin, and incremental Adjusted EBITDA margin and a reconciliation of net income (loss) to Adjusted EBITDA and Adjusted EBITDA margin can be found on subsequent pages of this appendix 2.The definition of Free Cash Flow and a reconciliation of Free Cash Flow to net cash provided by (used in) operating activities can be found on subsequent pages of this appendix 3.The definition of total adjusted costs and expenses and non-GAAP operating expenses and a reconciliation of total adjusted costs and expenses and non-GAAP operating expenses to the comparable U.S. GAAP measures can be found on subsequent pages of this appendix 4.We have not provided a reconciliation to the forward-looking U.S. GAAP equivalent measures for our non-GAAP guidance due to uncertainty regarding, and the potential variability of, reconciling items. Therefore, a reconciliation of these non-GAAP guidance measures to their corresponding U.S. GAAP guidance measures is not available without unreasonable effort About Reddit Reddit is a community of communities. It’s built on shared interests, passion, and trust, and is home to the most open and authentic conversations on the internet. Every day, Reddit users submit, vote, and comment on the topics they care most about. With 100,000+ active communities and 110+ million daily active unique visitors, Reddit is one of the internet’s largest sources of information. For more information, visit www.redditinc.com. Forward Looking Statements This letter contains forward-looking statements within the meaning of the Securities Act of 1933, as amended, the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995. Forward-looking statements generally relate to future events or Reddit's future financial or operating performance. In some cases, you can identify forward-looking statements because they contain words such as "may," "will," "should," "expects," "plans," "anticipates," "going to," "could," "intends," "target," "projects," "contemplates," "believes," "estimates," "predicts," "potential" or "continue" or the negative of these words or other similar terms or expressions that concern Reddit's expectations, strategy, priorities, plans or intentions. Forward-looking statements in this letter include, but are not limited to, statements regarding Reddit’s priorities, future financial and operating performance, including evolution of machine translation, international growth strategies to increase content consumption and improve local user experience, consumer product strategy with respect to growth and engagement, GAAP and non- GAAP guidance, strategies, and expectations of growth. Reddit's expectations and beliefs regarding these matters may not materialize, and actual results in future periods are subject to risks and uncertainties that could cause actual results to differ materially from those projected, including those more fully described under the caption “Risk Factors” and elsewhere in documents that Reddit files with the SEC from time to time, including Reddit’s Quarterly Report on Form 10-Q for the quarter ended June 30, 2025, which is 12 Q2 2025 • Letter to Shareholders

being filed with the SEC at or around the date hereof. The forward-looking statements in this letter are based on information available to Reddit as of the date hereof, and Reddit undertakes no obligation to update any forward-looking statements, except as required by law. A Note About Metrics We define a daily active unique (“DAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a 24-hour period. Average DAUq for a particular period is calculated by adding the number of DAUq on each day of that period and dividing that sum by the number of days in that period. We define a weekly active unique (“WAUq”) as a user whom we can identify with a unique identifier who has visited a page on the Reddit website, www.reddit.com, or opened a Reddit application at least once during a trailing seven-day period. Average quarterly WAUq for a particular period is calculated by adding the number of WAUq on each day of that period and dividing that sum by the number of days in that period. We define average revenue per unique (“ARPU”) as quarterly revenue in a given geography divided by the average DAUq in that geography. For the purposes of calculating ARPU, advertising revenue in a given geography is based on the geographic location in which advertising impressions are delivered, as this approximates revenue based on user activity, while other revenue in a given geography is based on the billing address of the customer. Use of Non-GAAP Financial Measures We use certain non-GAAP financial measures to supplement our consolidated financial statements, which are presented in accordance with U.S. GAAP, to evaluate our core operating performance. These non-GAAP financial measures include Adjusted EBITDA, Adjusted EBITDA margin, Free Cash Flow, Free Cash Flow margin, total adjusted costs and expenses, non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense. We use these non-GAAP financial measures to facilitate reviews of our operational performance and as a basis for strategic planning. By excluding certain items that are non- recurring or not reflective of the performance of our normal course of business, we believe that these non-GAAP financial measures provide meaningful supplemental information regarding our performance. Accordingly, we believe these non-GAAP financial measures are useful to investors and others because they allow investors to supplement their understanding of our financial trends and evaluate our ongoing and future performance in the same manner as management. However, there are a number of limitations related to the use of non-GAAP financial measures as they reflect the exercise of judgment by our management about which expenses are included or excluded in determining these non-GAAP measures. These non-GAAP measures should be considered in addition to, not as a substitute for or in isolation from, our financial results prepared in accordance with U.S. GAAP. Other companies, including companies in our industry, may calculate these non-GAAP financial measures differently or not at all, which reduces their usefulness as comparative measures. A reconciliation is provided below for each historical non-GAAP financial measure to the most directly comparable financial measure stated in accordance with U.S. GAAP. Reddit encourages investors to 13 Q2 2025 • Letter to Shareholders

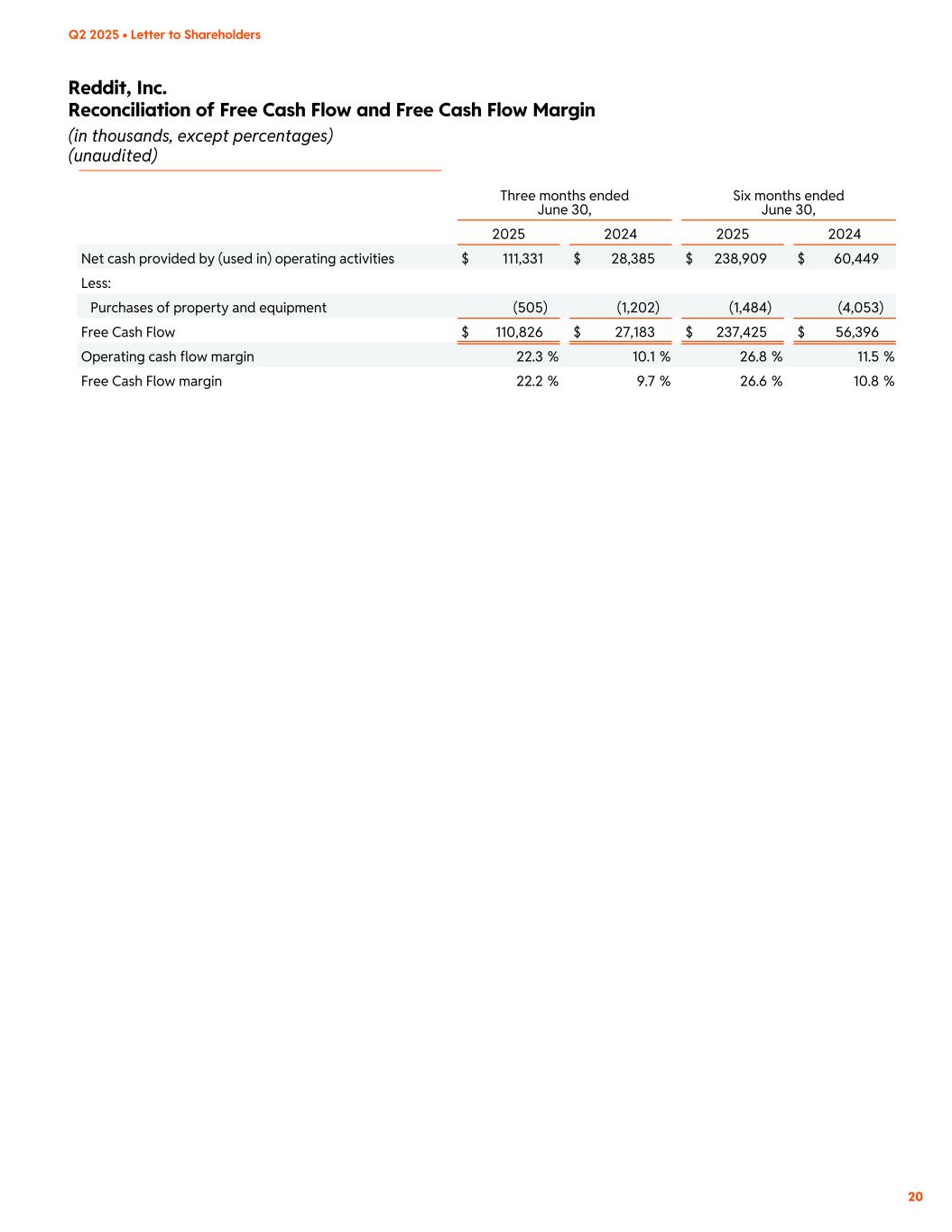

review the related U.S. GAAP financial measures and the reconciliation of these non-GAAP financial measures to their most directly comparable U.S. GAAP financial measures, and not to rely on any single financial measure to evaluate Reddit’s business. We have not provided a reconciliation to the forward- looking GAAP equivalent measures for our non-GAAP guidance due to uncertainty regarding, and the potential variability of, reconciling items. Therefore, a reconciliation of these non-GAAP guidance measures to their corresponding GAAP guidance measures is not available without unreasonable effort. Adjusted EBITDA is defined as net income (loss) excluding interest (income) expense, net, income tax expense (benefit), depreciation and amortization, stock-based compensation expense and related taxes, other (income) expense, net, and certain other non-recurring or non-cash items impacting net income (loss) that we do not consider indicative of our ongoing business performance. Other (income) expense, net consists primarily of realized gains and losses on sales of marketable securities, foreign currency transaction gains and losses, and other income and expense that are not indicative of our core operating performance. Adjusted EBITDA margin is defined as Adjusted EBITDA divided by revenue. Incremental Adjusted EBITDA margin is defined as the change in Adjusted EBITDA divided by the change in revenue over the same period. We consider the exclusion of certain non-recurring or non- cash items in calculating Adjusted EBITDA and Adjusted EBITDA margin to provide a useful measure for investors and others to evaluate our operating results in the same manner as management. Free Cash Flow represents net cash provided by (used in) operating activities less purchases of property and equipment. Free Cash Flow margin is defined as Free Cash Flow divided by revenue. We believe that Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth. Additionally, we believe that Free Cash Flow is an important measure since we use third-party infrastructure partners to host our services and therefore we do not incur significant capital expenditures to support revenue generating activities. Total adjusted costs and expenses represents cost of revenue and operating expenses excluding stock- based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items impacting cost of revenue and operating expenses that we do not consider indicative of our ongoing business performance. Non-GAAP operating expenses represents operating expenses excluding stock-based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items impacting operating expenses that we do not consider indicative of our ongoing business performance. Non-GAAP research and development expense, non- GAAP sales and marketing expense, and non-GAAP general and administrative expense represent their respective operating expense line items excluding stock-based compensation and related taxes, depreciation and amortization, and certain other non-recurring or non-cash items. We consider adjusted costs and expenses, non-GAAP operating expense, non-GAAP research and development expense, non-GAAP sales and marketing expense, and non-GAAP general and administrative expense to be useful measures as they exclude expenses that are not reflective of our operational performance and could mask underlying trends in our business. Investor Relations Jesse Rose ir@reddit.com Media Relations Gina Antonini press@reddit.com 14 Q2 2025 • Letter to Shareholders

Reddit, Inc. Key Operating Metrics by Geography (in millions, except percentages and ARPU) (unaudited) 15 Q2 2025 • Letter to Shareholders Three months ended June 30, Six months ended June 30, 2025 2024 % Change 2025 2024 % Change Revenue: Global $ 499.6 $ 281.2 78 % $ 892.0 $ 524.1 70 % Revenue: U.S. $ 408.8 $ 228.1 79 % $ 722.7 $ 427.8 69 % Revenue: International $ 90.8 $ 53.1 71 % $ 169.3 $ 96.3 76 % Three months ended June 30, 2025 2024 % Change DAUq: Global 110.4 91.2 21 % DAUq: U.S. 50.3 45.5 11 % DAUq: International 60.1 45.7 32 % Logged-in DAUq: Global 49.3 42.0 17 % Logged-in DAUq: U.S. 22.9 20.4 12 % Logged-in DAUq: International 26.4 21.6 22 % Logged-out DAUq: Global 61.1 49.2 24 % Logged-out DAUq: U.S. 27.4 25.1 9 % Logged-out DAUq: International 33.7 24.1 40 % WAUq: Global 416.4 342.3 22 % WAUq: U.S. 181.0 167.5 8 % WAUq: International 235.4 174.8 35 % ARPU: Global $ 4.53 $ 3.08 47 % ARPU: U.S. $ 7.87 $ 4.94 59 % ARPU: International $ 1.73 $ 1.24 40 %

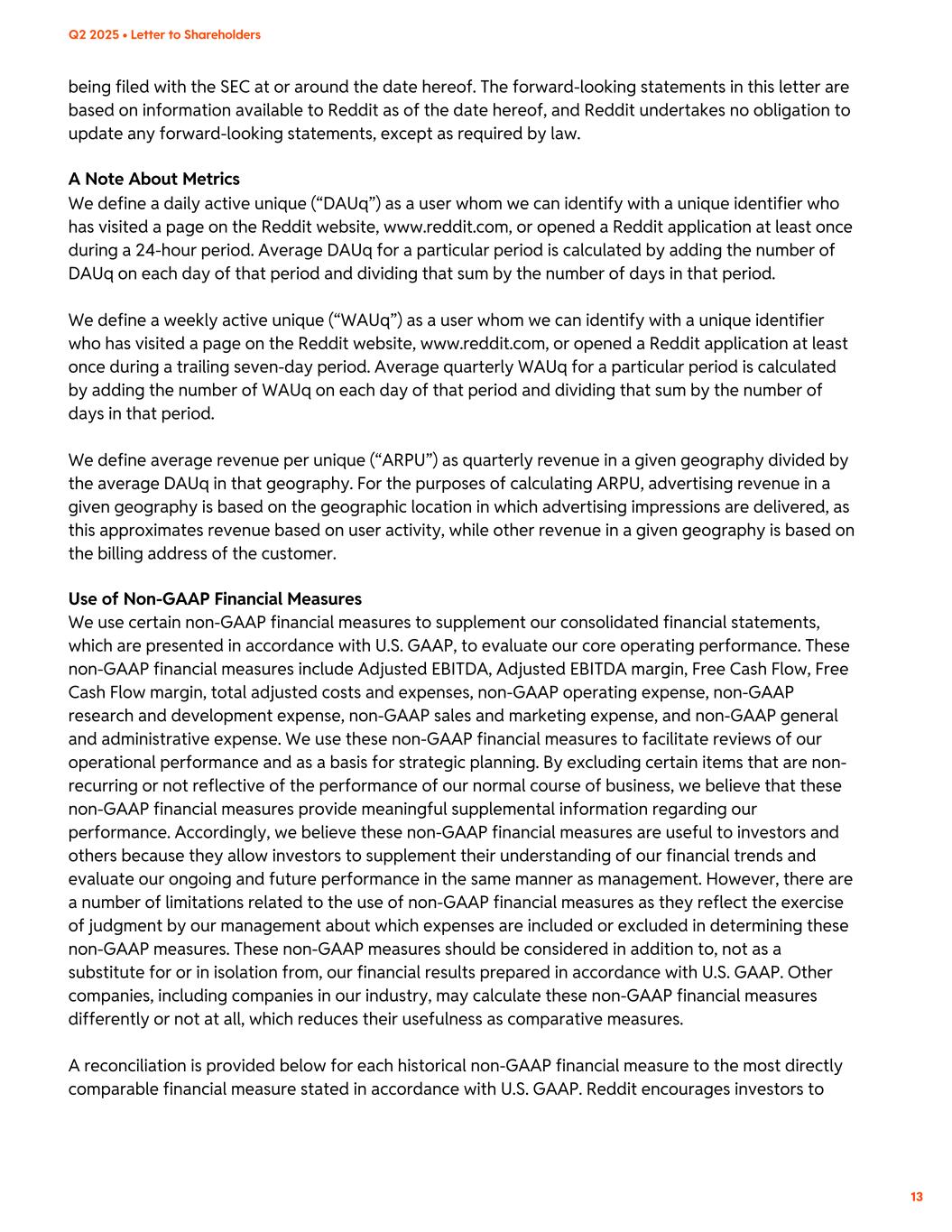

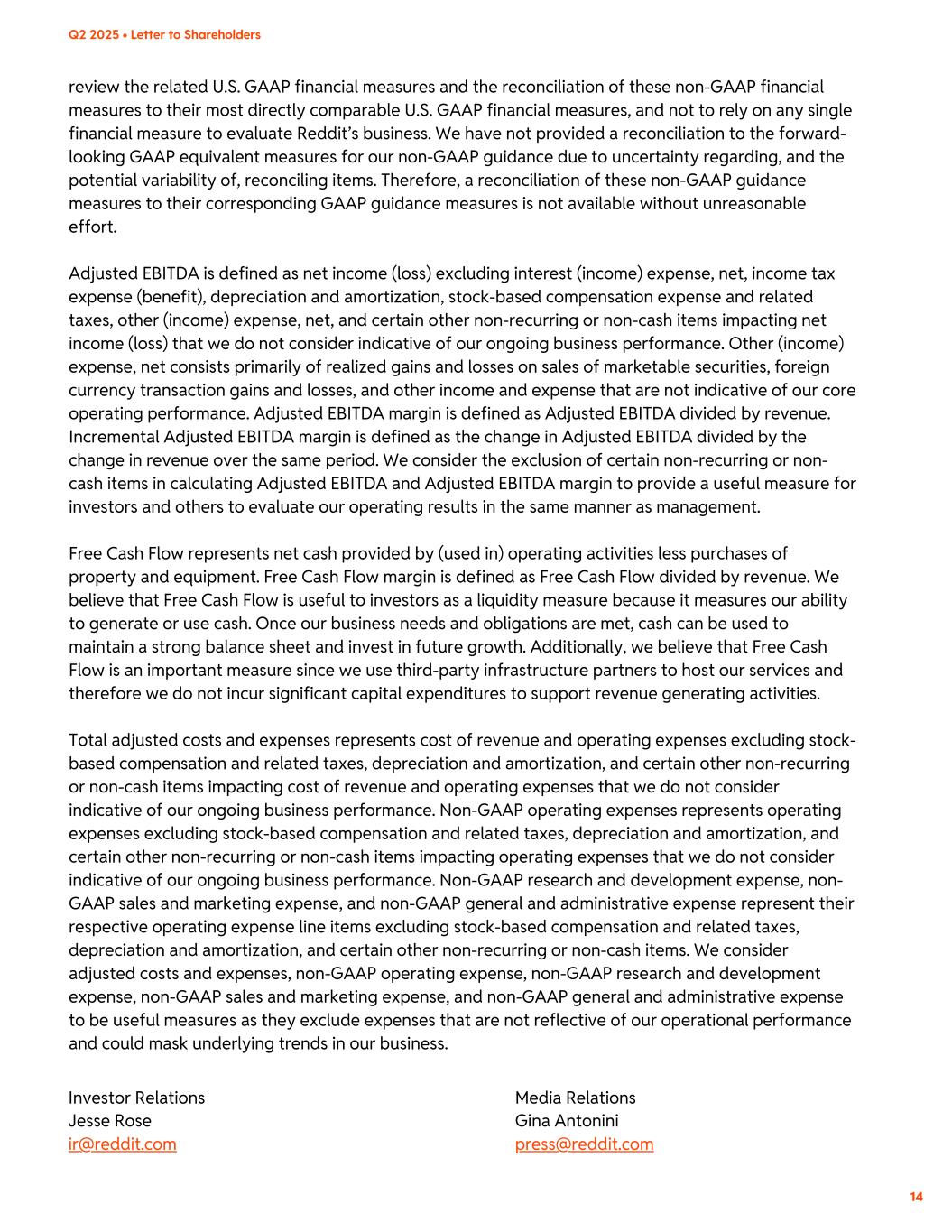

Reddit, Inc. Consolidated Balance Sheets (in thousands) (unaudited) 16 Q2 2025 • Letter to Shareholders June 30, 2025 December 31, 2024 Assets Current assets Cash and cash equivalents $ 734,060 $ 562,092 Marketable securities 1,325,881 1,278,717 Accounts receivable, net 407,228 349,534 Prepaid expenses and other current assets 62,761 33,058 Total current assets 2,529,930 2,223,401 Property and equipment, net 11,394 12,652 Operating lease right-of-use assets, net 22,118 23,249 Intangible assets, net 20,469 25,424 Goodwill 42,174 42,174 Other noncurrent assets 6,117 9,695 Total assets $ 2,632,202 $ 2,336,595 Liabilities and stockholders’ equity (deficit) Current liabilities Accounts payable $ 63,942 $ 45,423 Operating lease liabilities 6,572 6,137 Accrued expenses and other current liabilities 140,317 124,464 Total current liabilities 210,831 176,024 Operating lease liabilities, noncurrent 18,611 20,565 Other noncurrent liabilities 15,780 9,257 Total liabilities 245,222 205,846 Commitments and contingencies Stockholders’ equity (deficit): Preferred stock — — Class A common stock 13 12 Class B common stock 5 5 Class C common stock — — Additional paid-in capital 3,468,618 3,331,546 Accumulated other comprehensive income (loss) 3,727 24 Accumulated deficit (1,085,383) (1,200,838) Total stockholders’ equity (deficit) 2,386,980 2,130,749 Total liabilities and stockholders’ equity (deficit) $ 2,632,202 $ 2,336,595

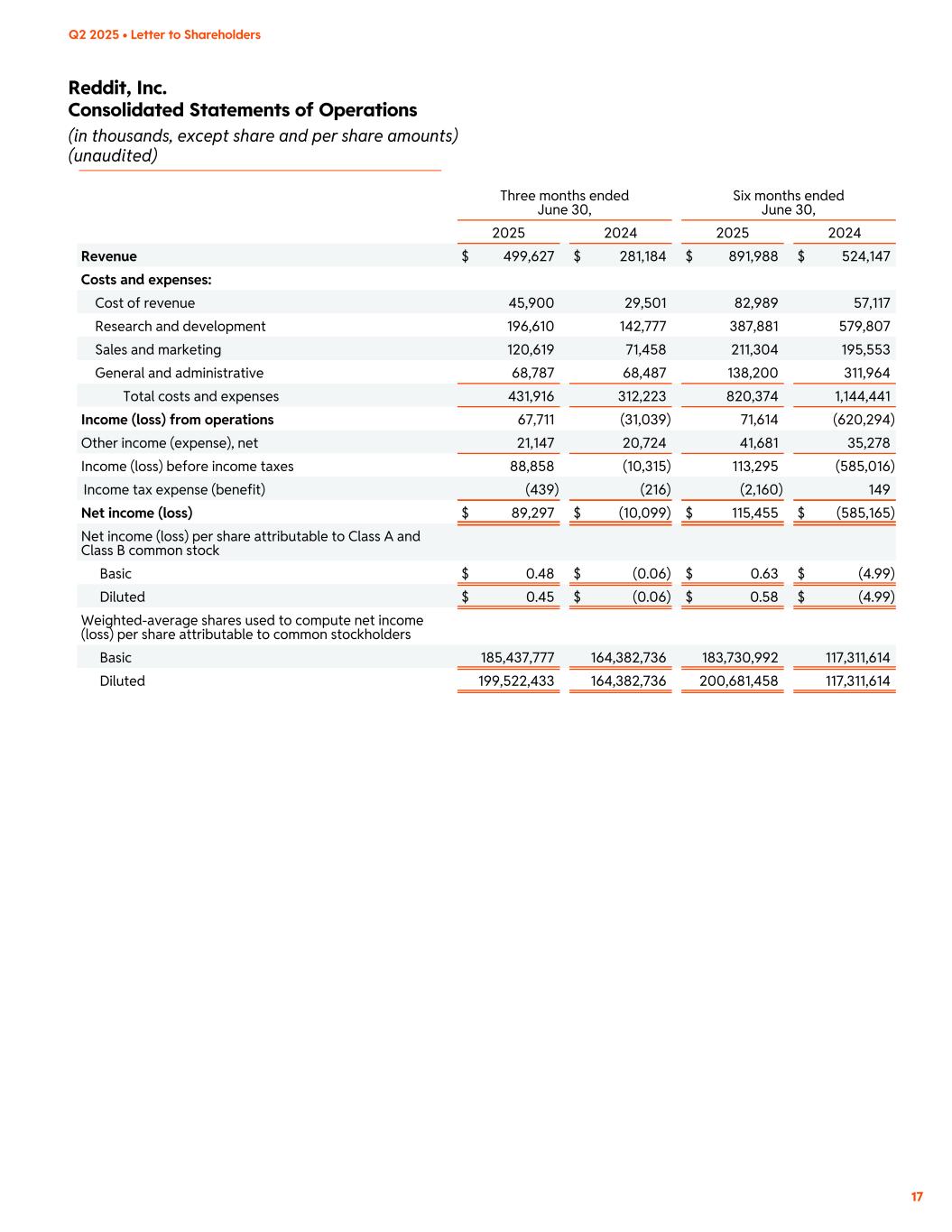

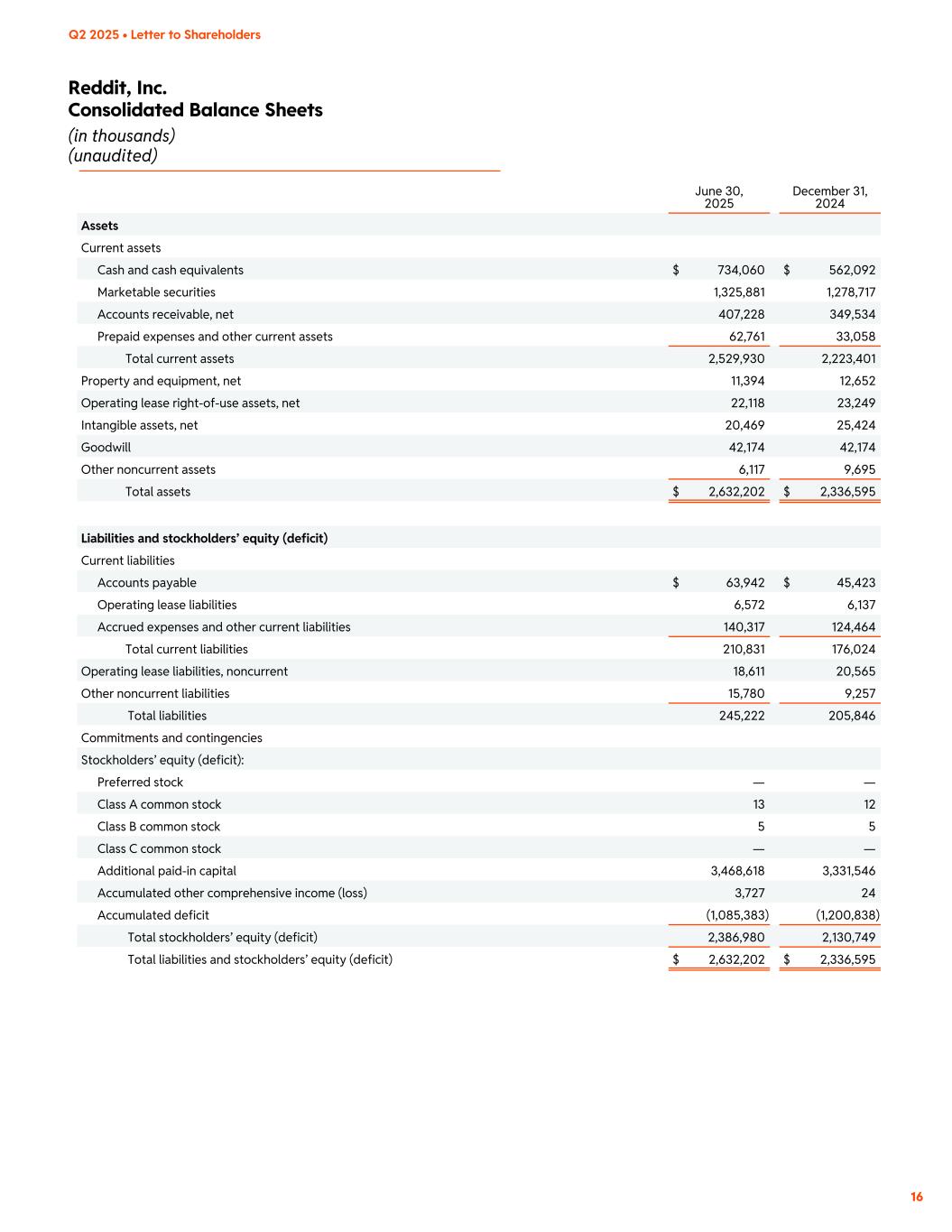

Reddit, Inc. Consolidated Statements of Operations (in thousands, except share and per share amounts) (unaudited) 17 Q2 2025 • Letter to Shareholders Three months ended June 30, Six months ended June 30, 2025 2024 2025 2024 Revenue $ 499,627 $ 281,184 $ 891,988 $ 524,147 Costs and expenses: Cost of revenue 45,900 29,501 82,989 57,117 Research and development 196,610 142,777 387,881 579,807 Sales and marketing 120,619 71,458 211,304 195,553 General and administrative 68,787 68,487 138,200 311,964 Total costs and expenses 431,916 312,223 820,374 1,144,441 Income (loss) from operations 67,711 (31,039) 71,614 (620,294) Other income (expense), net 21,147 20,724 41,681 35,278 Income (loss) before income taxes 88,858 (10,315) 113,295 (585,016) Income tax expense (benefit) (439) (216) (2,160) 149 Net income (loss) $ 89,297 $ (10,099) $ 115,455 $ (585,165) Net income (loss) per share attributable to Class A and Class B common stock Basic $ 0.48 $ (0.06) $ 0.63 $ (4.99) Diluted $ 0.45 $ (0.06) $ 0.58 $ (4.99) Weighted-average shares used to compute net income (loss) per share attributable to common stockholders Basic 185,437,777 164,382,736 183,730,992 117,311,614 Diluted 199,522,433 164,382,736 200,681,458 117,311,614

Reddit, Inc. Consolidated Statements of Cash Flows (in thousands) (unaudited) 18 Q2 2025 • Letter to Shareholders Three months ended June 30, Six months ended June 30, 2025 2024 2025 2024 Cash flows from operating activities Net income (loss) $ 89,297 $ (10,099) $ 115,455 $ (585,165) Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: Depreciation and amortization 3,934 3,770 7,897 7,513 Non-cash operating lease cost 1,514 1,335 2,982 2,588 Amortization of premium (accretion of discount) on marketable securities, net (6,691) (11,362) (15,575) (19,491) Stock-based compensation expense 89,070 64,266 174,484 641,774 Other adjustments 97 141 (41) 626 Changes in operating assets and liabilities: Accounts receivable (81,116) (24,793) (57,757) 5,194 Prepaid expenses and other assets (9,352) (6,270) (26,358) (20,182) Operating lease right-of-use assets and liabilities (1,589) (780) (3,369) (1,310) Accounts payable 19,991 18,220 18,945 16,042 Accrued expenses and other liabilities 6,176 (6,043) 22,246 12,860 Net cash provided by (used in) operating activities $ 111,331 $ 28,385 $ 238,909 $ 60,449 Cash flows from investing activities Purchases of property and equipment (505) (1,202) (1,484) (4,053) Purchases of marketable securities (556,457) (861,827) (1,061,303) (997,512) Maturities of marketable securities 552,532 343,404 1,017,594 596,059 Proceeds from sale of marketable securities — — 12,372 — Other investing activities 2,354 (12) 3,243 (27) Net cash provided by (used in) investing activities $ (2,076) $ (519,637) $ (29,578) $ (405,533) Cash flows from financing activities Proceeds from issuance of Class A common stock in initial public offering, net of underwriting discounts and commissions — — — 600,022 Proceeds from exercise of employee stock options 4,303 1,843 14,487 24,932 Taxes paid related to net share settlement of restricted stock units (15,225) (7,569) (51,900) (202,306) Payments of initial public offering costs — (3,585) — (6,338) Other financing activities — — — (4,450) Net cash provided by (used in) financing activities $ (10,922) $ (9,311) $ (37,413) $ 411,860 Net increase (decrease) in cash, cash equivalents, and restricted cash 98,333 (500,563) 171,918 66,776 Cash, cash equivalents, and restricted cash at the beginning of the period 635,727 968,565 562,142 401,226 Cash, cash equivalents, and restricted cash at the end of the period $ 734,060 $ 468,002 $ 734,060 $ 468,002 Cash and cash equivalents 734,060 467,952 734,060 467,952 Restricted cash — 50 — 50 Total cash, cash equivalents, and restricted cash $ 734,060 $ 468,002 $ 734,060 $ 468,002

Reddit, Inc. Reconciliation of Adjusted EBITDA and Adjusted EBITDA Margin (in thousands, except percentages) (unaudited) 19 Q2 2025 • Letter to Shareholders Three months ended June 30, Six months ended June 30, 2025 2024 2025 2024 Net income (loss) $ 89,297 $ (10,099) $ 115,455 $ (585,165) Add (deduct): Interest (income) expense, net (21,056) (20,941) (41,470) (36,388) Income tax expense (benefit) (439) (216) (2,160) 149 Depreciation and amortization 3,934 3,770 7,897 7,513 Stock-based compensation expense and related taxes 95,104 66,772 202,509 662,309 Other (income) expense, net (91) 217 (211) 1,110 Adjusted EBITDA $ 166,749 $ 39,503 $ 282,020 $ 49,528 Net margin 17.9 % (3.6) % 12.9 % (111.6) % Adjusted EBITDA margin 33.4 % 14.0 % 31.6 % 9.4 %

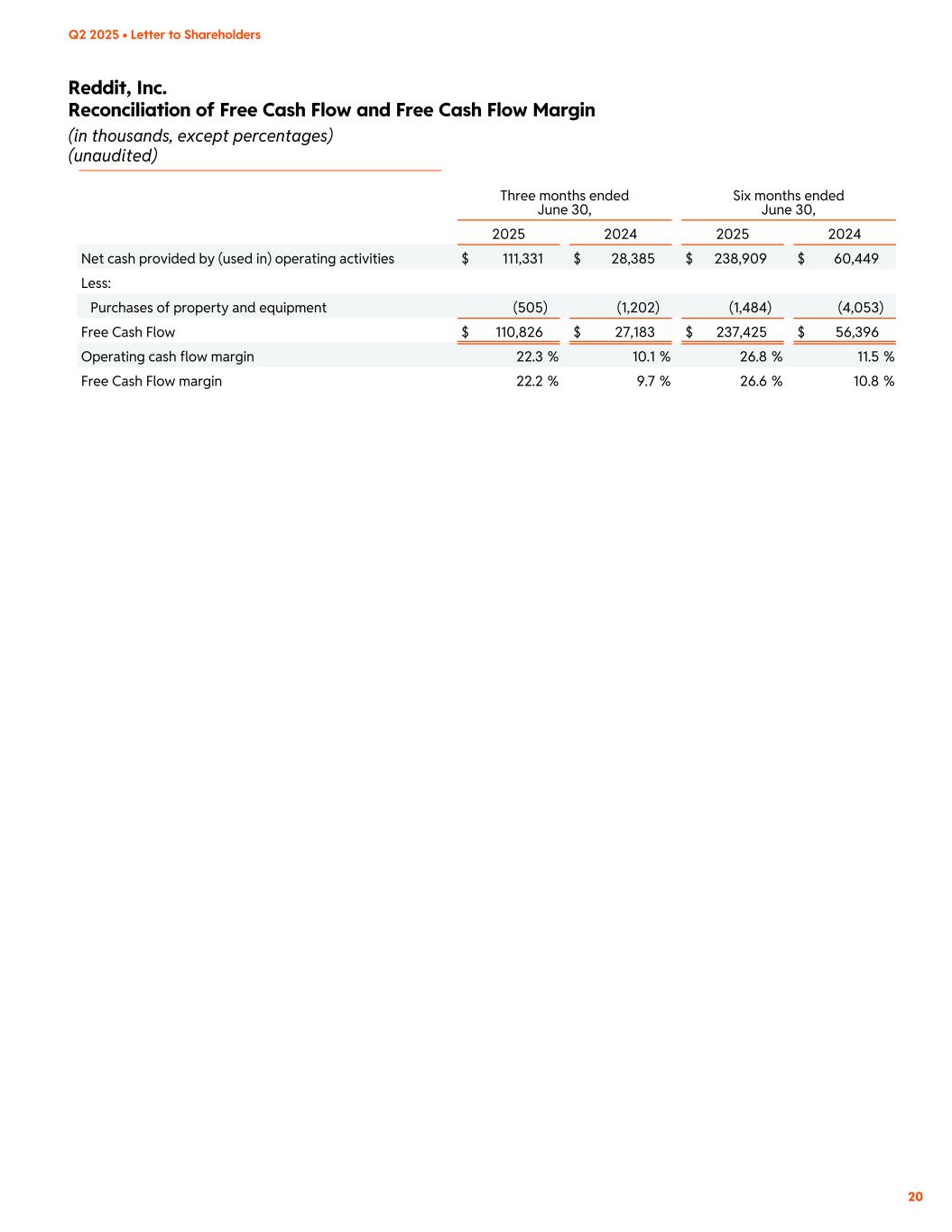

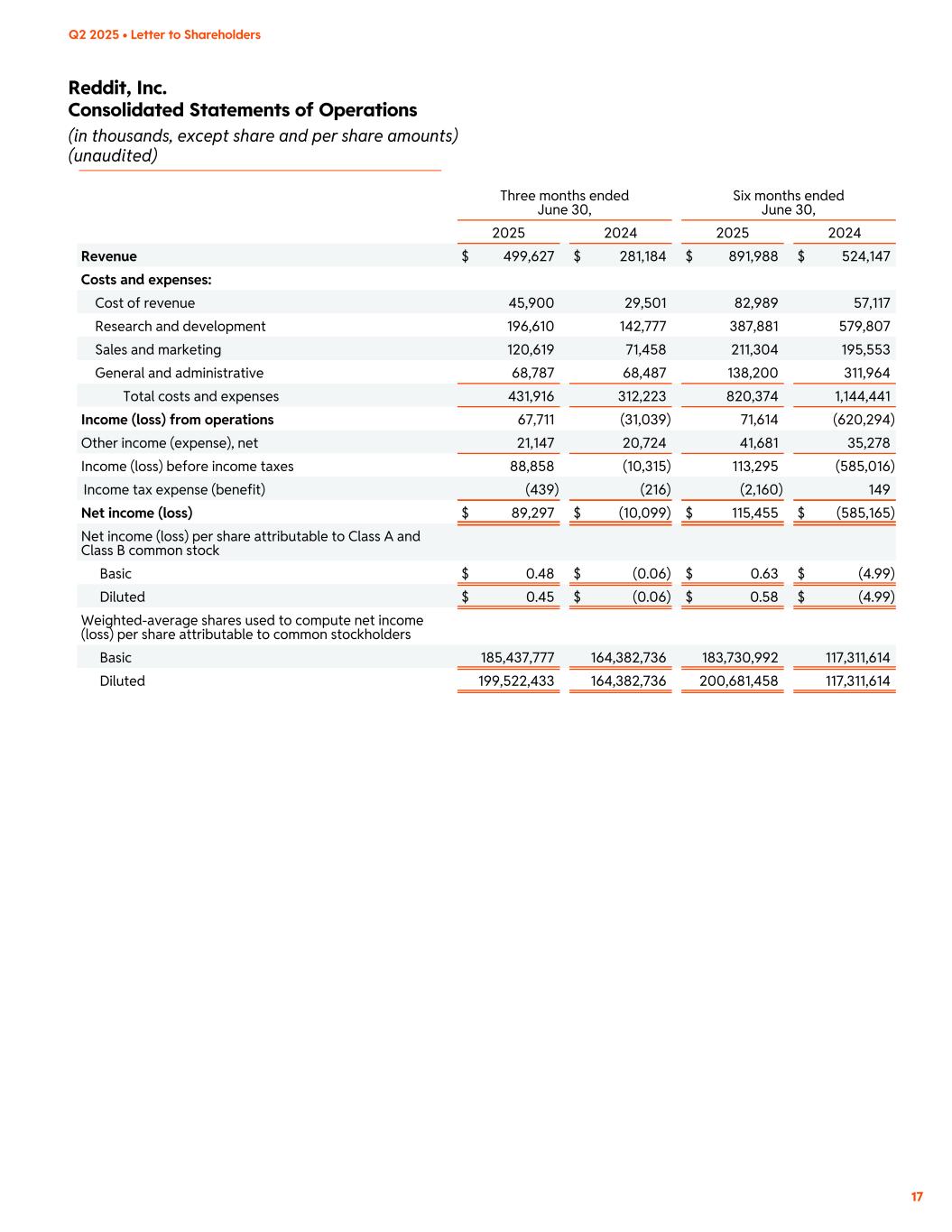

Reddit, Inc. Reconciliation of Free Cash Flow and Free Cash Flow Margin (in thousands, except percentages) (unaudited) 20 Q2 2025 • Letter to Shareholders Three months ended June 30, Six months ended June 30, 2025 2024 2025 2024 Net cash provided by (used in) operating activities $ 111,331 $ 28,385 $ 238,909 $ 60,449 Less: Purchases of property and equipment (505) (1,202) (1,484) (4,053) Free Cash Flow $ 110,826 $ 27,183 $ 237,425 $ 56,396 Operating cash flow margin 22.3 % 10.1 % 26.8 % 11.5 % Free Cash Flow margin 22.2 % 9.7 % 26.6 % 10.8 %

Reddit, Inc. Reconciliation of Non-GAAP Costs and Expenses (in thousands) (unaudited) 21 Q2 2025 • Letter to Shareholders Three months ended June 30, Six months ended June 30, 2025 2024 2025 2024 Total costs and expenses $ 431,916 $ 312,223 $ 820,374 $ 1,144,441 Less: Depreciation and amortization 3,934 3,770 7,897 7,513 Stock-based compensation expense and related taxes 95,104 66,772 202,509 662,309 Total adjusted costs and expenses $ 332,878 $ 241,681 $ 609,968 $ 474,619 Total operating expenses $ 386,016 $ 282,722 $ 737,385 $ 1,087,324 Less: Depreciation and amortization 3,934 3,770 7,897 7,513 Stock-based compensation expense and related taxes 94,900 66,711 202,088 661,990 Non-GAAP operating expenses $ 287,182 $ 212,241 $ 527,400 $ 417,821 Research and development expenses $ 196,610 $ 142,777 $ 387,881 $ 579,807 Less: Depreciation and amortization 2,510 2,242 5,050 4,419 Stock-based compensation expense and related taxes 59,629 31,326 124,816 358,423 Non-GAAP research and development expenses $ 134,471 $ 109,209 $ 258,015 $ 216,965 Sales and marketing expenses $ 120,619 $ 71,458 $ 211,304 $ 195,553 Less: Depreciation and amortization 1,216 1,216 2,418 2,379 Stock-based compensation expense and related taxes 11,153 7,357 25,373 70,981 Non-GAAP sales and marketing expenses $ 108,250 $ 62,885 $ 183,513 $ 122,193 General and administrative expenses $ 68,787 $ 68,487 $ 138,200 $ 311,964 Less: Depreciation and amortization 208 312 429 715 Stock-based compensation expense and related taxes 24,118 28,028 51,899 232,586 Non-GAAP general and administrative expenses $ 44,461 $ 40,147 $ 85,872 $ 78,663